Washington, D.C. 20549

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ADVISORSHARES TRUST

4800 Montgomery Lane

Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.843.3831

Annual Report

June30, 2019

Beginning on January1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other communications electronically. You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to continue receiving paper copies of your shareholder reports and for information about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC

It has been a volatile fiscal year. We witnessed significant market declines in the 4th quarter of 2018, only to see the market rocket back up over the first two quarters of 2019. Our largest ETF experienced some significant outflows due to under performance. And, while we have a diverse product line-up including both long and short strategies, the market declines of late 2018 drove many investors to the sidelines instead of making a greater allocation to our short ETFs.

During fiscal 2019, we made several changes to our ETF products. The Madrona Domestic ETF (ticker: FWDD) and the Madrona International Equity ETF (ticker: FWDI) were both closed. The Madrona Global Bond ETF (ticker: FWDB) changed to a new investment strategy based on the use of automated asset allocation algorithms provided by FolioBeyond. While AdvisorShares serves as the portfolio manager for FWDB, we leverage the expertise and investing guidelines of the FolioBeyond investment team and changed the ETF name, accordingly, to the FolioBeyond Smart Core Bond ETF. High profile investment manager DoubleLine chose us as their partner for their first equity ETF, taking over the sub-advisory duties of the Wilshire Buyback ETF, which was renamed the DoubleLine Value Equity ETF (ticker: DBLV). As the name indicates, the investment strategy was changed to focus on DoubleLine’s unique, fundamental value approach to equities.

Several new, innovative ETFs were launched over the last 12months. We partnered with Nasdaq Dorsey Wright in launching the Dorsey Wright Short ETF (ticker: DWSH) and the Dorsey Wright Micro-Cap ETF (ticker: DWMC). DWSH is an all-short equity strategy that uses an opposite approach to Dorsey Wright traditional relative strength model, shorting large cap U.S. equities that demonstrate the greatest relative weakness according to their proprietary methodology. DWMC invests in micro-cap stocks that exhibit superior relative strength within their model. Our most notable launch this year was the Pure Cannabis ETF (ticker: YOLO) managed by our own Dan Ahrens, who is also Portfolio Manager of the AdvisorShares Vice ETF (ticker: ACT). At launch, this was the first, actively managed cannabis ETF domiciled and listed in the U.S. and remains the only cannabis ETF with a federally chartered custodial banking relationship and investments in multi-state operators. Combined, these new ETFs have added nearly $100million to our assets under management.

Going forward, we remain tremendously optimistic about our ETF suite, as well as the prospects for our growth in the ETF industry. We expect to continue to grow our existing lineup of ETFs through new product innovation and development. Currently, we have plans to expand our exemptive relief capabilities, including licensing the use of non- or less-transparent actively managed ETFs. We look forward to continuing to serve you, our shareholders, and thank you for your ongoing support and interest in AdvisorShares.

Best regards,

Noah Hamman

CEO, AdvisorShares Investments

An investment in the Funds is subject to risk, including the possible loss of principal amount invested. ADRs are subject to the risk of change in political or economic conditions and exchange rates in foreign countries. Certain funds may participate in leveraged transactions to include selling securities short which creates the risk of magnified capital losses. Under certain market conditions, short sales can increase the volatility and decrease the liquidity of certain securities or positions and may lower the Fund’s return or result in a loss. There is no guarantee that the individualFund’s will achieve the stated investment objectives. The risks associated with each Fund include the risks associated with the underlying ETFs, which can result in higher volatility, and are detailed in each Fund’s prospectus and on each Fund’s webpage.

The views in this report were those of the Fund’s CEO as of June30, 2019 and may not reflect his views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

1

ADVISORSHARES TRUST

AdvisorShares Cornerstone Small Cap ETF (SCAP)

For the 12month period ending June30, 2019, the AdvisorShares Cornerstone Small Cap ETF (SCAP) returned-4.55% on a NAV basis and-4.65% on a Market Price basis. For the same period, the Russell 2000 Index returned-3.31%.

While the broader market was up in the last year, small cap stocks were much weaker than large capitalization peers during the period, as investors focused on companies that were perceived to be lower risk or driven by sustained growth opportunities. Additionally, many small capitalization companies have material exposure to China on both an import and export basis, and extended trade disputes with China and other countries have been a headwind. This divergence was particularly visible during the drawdown periods in October, December, and May.

SCAP seeks to identify companies which are demonstrating improving fundamentals and quality balance sheets. However, market sentiment appeared to focus on the macroeconomic exposure of many individual securities at the expense of their current fundamental performance. Within the portfolio, stock selection was the driver of our underperformance during the period, partly offset by our relative allocation to better-performing sectors. On a sector basis, our overweight position to Information Technology and underweight position to Health Care, as well as stock selection in Financials, Real Estate, and Communication Services were positive contributors to performance. Top contributing holdings included online health insurance marketplace eHealth, action vehicle component manufacturer Fox Factory, and communications software platform Bandwidth. Our underweight position to Utilities, overweight position to Energy, and stock selection in Consumer Discretionary and Information Technology more than offset our positive performance. Top detracting holdings included enhanced oil recovery company Denbury Resources, natural gas company CNX Resources, and Puerto Rican insurance company Triple-S Management.

Looking forward, we continue to believe that SCAP is well positioned for long-term success. We continue to face a changing environment, with some economic and policy uncertainty. We believe we have developed a methodical, disciplined, and diversified approach to managing small cap stocks with a focus on those companies which are demonstrating fundamental strength, which should continue to be an attractive way to invest in the asset class.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 6, 2016* to June 30, 2019

2

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | Since

Inception

7/6/2016* | | Predecessor

3 Year** | | Predecessor

5 Year** | | Predecessor

Since

Inception

6/30/2012** |

AdvisorShares Cornerstone Small Cap

ETF NAV | | -4.55 | % | | 14.01 | % | | 13.83 | % | | 9.34 | % | | 14.23 | % |

AdvisorShares Cornerstone Small Cap

ETF Market Price** | | -4.65 | % | | 13.99 | % | | N/A | | | N/A | | | N/A | |

Russell 2000 Index | | -3.31 | % | | 12.52 | % | | 12.30 | % | | 7.06 | % | | 11.38 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 3.06% and the net expense ratio is 0.90%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.90%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or theredemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. One cannot invest directly in an index.

3

ADVISORSHARES TRUST

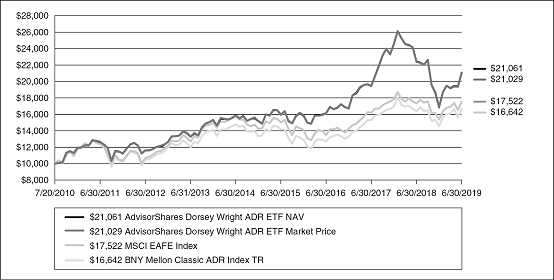

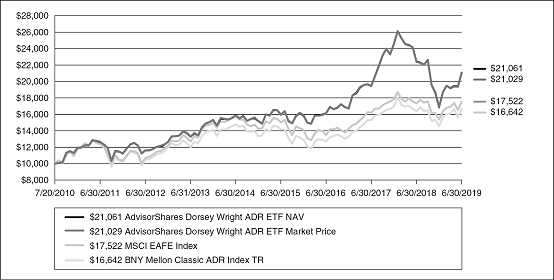

AdvisorShares Dorsey Wright ADR ETF (AADR)

The AdvisorShares Dorsey Wright ADR (AADR) ETF finished the year ended 6/30/2019 behind its benchmark, the BNY Mellon Classic ADR Index, after a very volatile 12months of performance. It was really a tale of two different performance cycles as AADR underperformed during the broader momentum underperformance at the end of calendar 2018 but rebounded to begin the current calendar year.

The last six months of 2018 were very poor for AADR and momentum strategies in general. Fears of a global trade war combined with a surprise increase in the U.S. Dollar caused Emerging Markets to underperform their Developed Markets counterparts. We had been heavily invested in Emerging Markets because of the intermediate-term strength on a trailing basis. The weakness caused us to pare back our exposure and move to a more balanced allocation between Developed and Emerging Markets.

After global markets bottomed in December 2018, AADR rebounded nicely. We outperformed our benchmark over the prior six months, which has brought our relative performance closer to our benchmark. The health of momentum markets looks positive, and leaders have been outperforming laggards. This trend is more pronounced in Emerging rather than Developed markets, and that has helped the Fund’s performance. Our indicators are pointing to a more constructive environment for momentum, and we have a positive outlook for the Fund.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July20, 2010* to June 30, 2019

4

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

7/20/2010* |

AdvisorShares Dorsey Wright ADR ETF NAV | | -6.16 | % | | 9.27 | % | | 5.76 | % | | 8.68 | % |

AdvisorShares Dorsey Wright ADR ETF Market Price** | | -6.00 | % | | 9.23 | % | | 5.74 | % | | 8.66 | % |

MSCI EAFE Index (Net) | | 1.08 | % | | 9.11 | % | | 2.25 | % | | 6.47 | % |

BNY Mellon Classic ADR Index TR | | 1.69 | % | | 9.46 | % | | 2.42 | % | | 5.86 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.96% and the net expense ratio is 0.88%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.88%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The MSCI EAFE Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. One cannot invest directly in an index.

The BNY Mellon Classic ADR Index combines the over the counter (OTC) traded ADRs with exchange-listed ADRs bringing transparency to the available universe of American Depositary Receipts, including those issued by many of the world’s premier companies. One cannot invest directly in an index.

5

ADVISORSHARES TRUST

AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC)

The AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC) finished the year ended 6/30/2019 ahead of its benchmark, the Russell Micro-Cap Index. The Fund launched in a difficult environment where Micro Cap stocks underperformed Large Cap stocks by a large margin over the trailing year. Despite the relative weakness in Micro Caps, the Fund’s allocation to small companies with positive momentum characteristics allowed it to outperform.

The past fiscal year for the Fund was characterized by two distinct periods. The first period, which lasted from the Fund’s launch date to early 2019 was not a good environment for momentum stocks. During this period, stocks with poor momentum characteristics outperformed those with positive momentum. We saw this across the board in all cap ranges, as well as, internationally. The Fund underperformed its benchmark during this time. Momentum stocks performed much better from early 2019 to the Fund’s fiscal year end. With this backdrop, the Fund outperformed its benchmark by a wide margin and made up the underperformance difference from earlier in the year. The Fund continues to overweight growth areas like Technology and Healthcare where we can find small, dynamic companies that can deliver superior returns over time.

We are very positive on the outlook for the Fund over the coming months. We are in the part of the economic cycle when momentum stocks tend to perform very well. We also feel our momentum approach to stock selection works very well in the micro cap space. Small and micro cap stocks have underperformed large caps for quite some time, and we aren’t sure when that trend will reverse. We will continue to focus on the smallest capitalization stocks in our universe, so when leadership moves back to smaller companies, we will be well positioned.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 10, 2018* to June 30, 2019

6

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | Since

Inception

7/10/2018* |

AdvisorShares Dorsey Wright Micro-Cap ETF | | -6.79 | % |

AdvisorShares Dorsey Wright Micro-Cap ETF Market Price** | | -6.86 | % |

Russell Micro-Cap Index | | -12.82 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.12% and the net expense ratio is 0.99%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The Russell Micro-Cap Index measures the performance of the micro cap segment of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks.

7

ADVISORSHARES TRUST

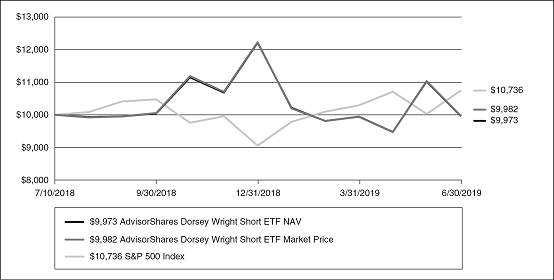

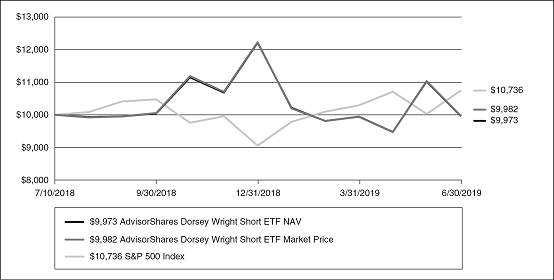

AdvisorShares Dorsey Wright Short ETF (DWSH)

The AdvisorShares Dorsey Wright Short ETF (DWSH) finished the year ended 6/30/2019 in-line with its benchmark, the S&P 500 Index. The past year was very volatile for equities in general, and that affected the performance of the Fund.

The Fund launched in a weak equity market in the latter half of 2018. As equity prices declined, the Fund’s short positions appreciated providing an effective hedge against declining equity prices. When the market rebounded, the Fund underperformed for a short period. The rebound was characterized by the momentum laggards performing better than the leaders. Our methodology is designed to bet against the laggards, so this is what caused the performance drag. As the recovery unfolded, the momentum laggards began to underperform once again and that caused the Fund to perform much better on a relative basis. Heading into the end of the fiscal year, the momentum leaders were outperforming the laggards by a wide margin, which is an ideal condition for the strategy.

We are generally bullish on equity prices looking out through the rest of the year. However, we are in the part of the economic cycle where momentum tends to perform well, and the laggards tend to perform poorly. Even if the broad equity market continues to rise, the Fund can perform relatively well because we are focused on betting against the momentum laggards. Should the broad equity market begin to decline, the last year proved the Fund can be a very effective hedge in those conditions.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 10, 2018* to June 30, 2019

8

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | Since

Inception

7/10/2018* |

AdvisorShares Dorsey Wright Short ETF | | -0.27 | % |

AdvisorShares Dorsey Wright Short ETF Market Price** | | -0.18 | % |

S&P 500 Index | | 7.36 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.12% and the net expense ratio is 0.99%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

9

ADVISORSHARES TRUST

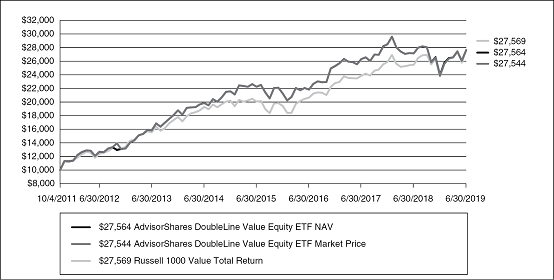

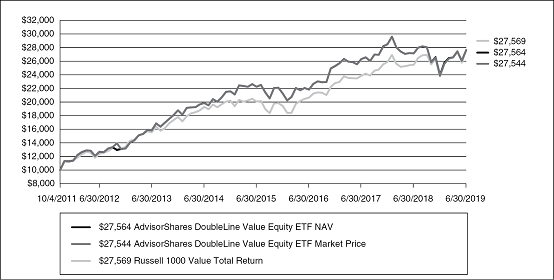

AdvisorShares DoubleLine Value Equity ETF (DBLV)

For the year ended June30, 2019, the AdvisorShares DoubleLine Value Equity ETF (DBLV) posted a return of 1.74% (NAV) while the Russell 1000 Value Index, its benchmark, returned 8.46%. On October11, 2018, the AdvisorShares Wilshire Buyback ETF (the “Predecessor Fund”) was renamed the AdvisorShares DoubleLine Value Equity ETF, reflecting a change in portfolio managers and investment strategy. Since October12, 2018 through June30, 2019, DBLV was up 5.88% (NAV), lagging the Russell 1000 Value Total Return Index, by 1.88%.

Since the portfolio management change in October 2018, DBLV benefitted from favorable individual stock performance, on average, but was adversely impacted by sector allocations. On a relative sector basis, the Fund’s overweight in Information Technology was a positive contributor to performance while underweights in the Financials, Real Estate and Utilities sectors, along with a modest overweight in the Energy sector, detracted from performance. From a stock perspective, the top 3 contributors to relative performance were Willis Towers Watson, PayPal and Dollar General, while the top 3 detractors from performance were Bayer AG, CVS Health and Halliburton. The Fund’s sector exposures primarily reflect the investment team’s fundamental, bottom-up investment process, which places an emphasis on individual stock selection.

Late in 2018, the markets pulled back significantly on concerns that the pace of interest rate tightening by the Fed was occurring too fast and threatening an economy already showing signs of deceleration from stagnating overseas growth, an ongoing trade war and a government shutdown. This was followed by a sharp rally since early 2019, driven largely by a dramatic reversal in Fed monetary policy, as Fed Chairman Jerome Powell pivoted to a more accommodative stance, fueling expectations for multiple rate cuts over the next two years. Even as the markets are near peaks or making new all-time highs currently, the U.S. economy remains as dependent as ever on government support to grow, which is far from ideal for equities. We view a cautious and defensive stance as prudent in the current environment since we are likely in the late innings of the current economic and market cycle; as of the beginning of July, the current expansion is now officially the longest in recorded U.S. economic history. That said, we remain constructive on the long-term outlook for the U.S. equity market and we continue to believe that lower-multiple value stocks should post better relative performance over the long run, especially after having lagged growth stocks for nearly a decade.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period October 4, 2011* to June 30, 2019

10

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

10/4/2011* |

AdvisorShares DoubleLine Value Equity ETF | | 1.74 | % | | 8.16 | % | | 6.83 | % | | 14.00 | % |

AdvisorShares DoubleLine Value Equity ETF Market Price** | | 1.63 | % | | 8.14 | % | | 6.80 | % | | 13.99 | % |

Russell 1000 Value Total Return | | 8.46 | % | | 10.19 | % | | 7.46 | % | | 14.00 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) and net expense ratio is 0.90%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.90%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The Russell 1000 Value Total Return Index measures the performance of the large-cap value segment of the U.S. equity market. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

11

ADVISORSHARES TRUST

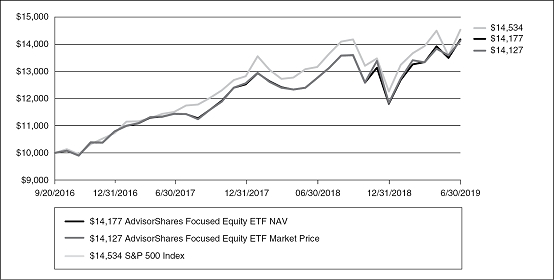

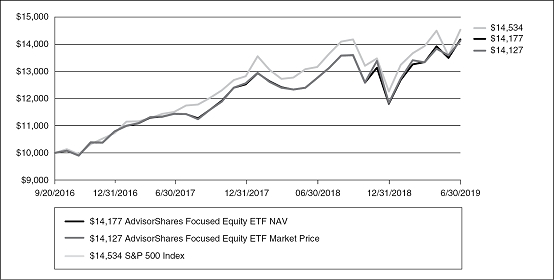

AdvisorShares Focused Equity ETF (CWS)

The AdvisorShares Focused Equity ETF (CWS) had solid 12-month performance over the period from July1, 2018 to June30, 2019. The Fund was aided by a healthy economic climate, low unemployment and stable inflation.

In the fourth quarter of 2018, the Fund dropped along with the rest of the stock market as investors recoiled from the Fed’s higher interest rate policy. However, once it became clear that the central bank would hold off on more interest rate hikes, CWS recovered impressively. The Fund continued to rally as it became clear that the Fed was leaning towards cutting interest rates. The ETF made new all-time highs into the middle of 2019. The portfolio was aided by a series of higher-than-expected earnings reports combined with increased guidance. Additionally, the fund’s conservative profile kept daily volatility below that of the overall market.

CWS performed especially well compared with the rest of the market in the spring of 2019. This is due to the Fund’s emphasis on high-quality defensive stocks. The climate is very advantageous for CWS to perform well for the rest of 2019 and into 2020. The U.S. economy continues to show impressive strength. Consumer spending remains robust while the corporate sector has demonstrated some weakness. Our concentrated portfolio is focused on sectors that will thrive even if the economy begins to falter as we head into the eleventh year of the U.S. economic expansion.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 20, 2016* to June 30, 2019

12

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | Since

Inception

9/20/2016* |

AdvisorShares Focused Equity ETF NAV | | 11.09 | % | | 13.40 | % |

AdvisorShares Focused Equity ETF Market Price** | | 10.74 | % | | 13.26 | % |

S&P 500 Index | | 10.42 | % | | 14.42 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.39% and the net expense ratio is 0.68%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

13

ADVISORSHARES TRUST

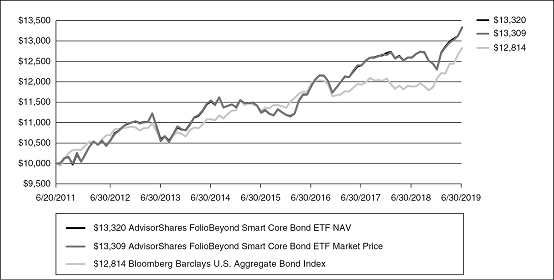

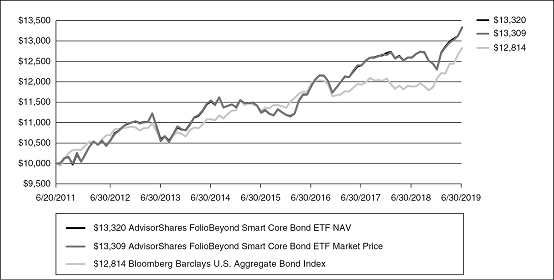

AdvisorShares FolioBeyond Smart Core Bond ETF (FWDB)

The AdvisorShares FolioBeyond Smart Core Bond ETF (FWDB) returned 5.82%, based on NAV and 5.80%, based on Market Price as compared to 7.87% for the Bloomberg Barclays U.S. Aggregate Bond Index for the 1-year period ended June 30th 2019. The current portfolio team took over management of the Fund on April1, 2019. The Fund was previously known as the AdvisorShares Madrona Global Bond ETF.

FWDB’s positive performance was generated primarily from municipal credit, long duration Treasuries, short-dated high yield corporate credit, and bank loans. The portfolio was rebalanced on average once a month as relative value relationships and other model factors varied over time.

We believe FolioBeyond’s automated asset allocation model is well-positioned to dynamically allocate to the most attractive asset classes in the fixed income markets, subject to constraints for return volatility, risk and subsector exposures. The algorithm optimizes exposure to the major factors that affect performance in the fixed income markets including value, momentum and volatility. Liquidity and tail risk are also captured through stress testing. Given the growth and breadth of large, liquid fixed income index ETFs in the marketplace, FolioBeyond is able to automatically optimize portfolio construction and dynamically rebalance across 20+ subsectors in an effort to extract significant positive alpha over the long run.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June20, 2011* to June 30, 2019

14

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

6/20/2011* |

AdvisorShares FolioBeyond Smart Core Bond ETF NAV | | 5.82 | % | | 3.85 | % | | 2.95 | % | | 3.64 | % |

AdvisorShares FolioBeyond Smart Core Bond ETF Market Price** | | 5.80 | % | | 3.82 | % | | 2.89 | % | | 3.63 | % |

Bloomberg Barclays U.S. Aggregate Bond Index | | 7.87 | % | | 2.31 | % | | 2.95 | % | | 3.14 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. FundNAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.68% and the net expense ratio is 1.41%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.95%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

Bloomberg Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. One cannot invest directly in an index.

15

ADVISORSHARES TRUST

AdvisorShares New Tech and Media ETF (FNG)

The AdvisorShares New Tech and Media ETF (FNG) returned-39.39% (NAV) for the fiscal year ended June30, 2019 while the S&P 500 returned 10.42% for the same time frame.

From October1, 2018 through December31, 2018, the Fund lost over 30%, recovered (with the rest of the market) in the first quarter of 2019, but then turned negative again between March and June. The Fund’s turnover was exceptionally high throughout the fiscal year, and we saw a whipsaw effect on a number of trades that were executed throughout the fiscal year. Additionally, the portfolio went through great periods of time without any allocation to the core FANG names and was traded on a more technical rather than fundamental basis.

For these reasons and others, FNG’s portfolio manager was replaced in June 2019 by Scott Freeze, the sub-advisor’s Chief Investment Officer. Upon taking over management duties, Freeze rebalanced FNG’s portfolio to reflect the core values of the Fund, namely holding the “FANG” names, and refocused on long term growth and greater fundamental stock selection. Under the new portfolio manager, FNG’s portfolio has become more concentrated, but also more balanced with a few exceptions.

For example, while Facebook (FB), Amazon (AMZN) and Netflix (NFLX) are well represented, you will see that Alphabet, Inc (GOOG) aka Google, is a very de-minimus percentage of FNG. This is based on portfolio management’s belief that GOOG is currently in a value phase as markets wait to see how the U.S. government’s pressure shakes out. At the same time Trade Desk (TTD) has been added to the portfolio to fill the gap that GOOG may see from decreased ad revenues. Since FB’s planned cryptocurrency project is still far off and isn’t a direct monetization platform, we do not have the same concerns of government intervention or of it having any impact on FB’s stock price or price growth in the near term. So it remains relatively weighted.

We would expect the current fiscal year to show a vastly different management style than the previous year. One with reduced holdings turnover and where portfolio changes are based on fundamental decision-making and company guidance, rather than short term technicals.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 11, 2017* to June 30, 2019

16

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | Since

Inception

7/11/2017* |

AdvisorShares New Tech and Media ETF NAV | | -39.39 | % | | -20.11 | % |

AdvisorShares New Tech and Media ETF Market Price** | | -39.89 | % | | -20.43 | % |

S&P 500 Index | | 10.42 | % | | 12.49 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.01% and the net expense ratio is 0.86%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.85%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

17

ADVISORSHARES TRUST

AdvisorShares Newfleet Multi-Sector Income ETF (MINC)

The AdvisorShares Newfleet Multi-Sector Income ETF (MINC) posted a return of 4.27%, based on NAV and 4.29%, based on Market Price as compared to 7.87% for the Bloomberg Barclays U.S. Aggregate Bond Index or 5.37% for the BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index for the 1-year period ended June 30th 2019. The indices mentioned are the two that are commonly referenced when comparing MINC’s performance relative to that of the overall bond market.

Positively, MINC benefitted from its multi-sector style of management in its ability to access different sectors of the bond market with domestic corporate High Yield and Investment Grade being the biggest contributors to overall performance. To the downside, although the Securitized sectors (Asset Backed, Residential Mortgage Backed and Commercial Mortgage Backed) delivered positive returns, they all underperformed relative to the benchmark(s). All three of those sectors constitute a large percentage of the portfolio’s weighting whereas the benchmark is more heavily weighted in Agency Mortgage Backed securities and U.S. Treasuries which both posted greater relative returns. With the decrease in rates over the past year, which saw rates decline almost 100 bps on the five year U.S. Treasury, MINC’s shorter duration relative to the benchmark was the largest detractor to performance. Lastly, the Fund’s small allocation to cash, for liquidity purposes, hurt performance as the portfolio would have been off being fully invested.

In the short to intermediate term, we are still constructive on credit spread sectors as the U.S. economy settles into what is commonly referred to as a Goldilocks growth rate of around 2% with little to no inflation present. The Federal Reserve, along with other major Central Banks across the globe, have pivoted towards more accommodation going forward, hoping they can collectively stem off any further weakening that has started to appear in economic data. In other words, the path of interest rates is more likely lower rather than higher moving forward which will have implications for our sector weightings as we transition away from a period where rising rates were the forecasted norm. We continue to like the Securitized sectors of the bond market along with concurrently not being fearful of corporate credit, carefully choosing our spots to invest within the Investment Grade, High Yield and Leveraged Loan sectors. Lastly there could be pockets of opportunity in the Emerging Markets sector, but that will be more focused on a few select opportunities that we screen as being cheap from a relative value perspective.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period March 19, 2013* to June 30, 2019

18

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

3/19/2013* |

AdvisorShares Newfleet Multi-Sector Income

ETF NAV | | 4.27 | % | | 2.47 | % | | 2.16 | % | | 2.22 | % |

AdvisorShares Newfleet Multi-Sector Income

ETF Market Price** | | 4.29 | % | | 2.45 | % | | 2.13 | % | | 2.20 | % |

Bloomberg Barclays Aggregate Bond Index | | 7.87 | % | | 2.31 | % | | 2.95 | % | | 2.67 | % |

BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index | | 5.37 | % | | 1.75 | % | | 1.85 | % | | 1.66 | % |

Performance data quoted represents past performance and is no guarantee of future results. Currentperformance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) and net expense ratio is 0.69%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The Bloomberg Barclays Aggregate Bond Index measures the performance of the U.S. investment grade bond market. One cannot invest directly in an index.

The BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index tracks the performance of US dollar denominated investment grade debt publicly issued in the US domestic market, including US Treasury, US agency, foreign government, supranational and corporate securities, with a remaining term to final maturity less than 5 years, calculated on a total return basis. One cannot invest directly in an index.

19

ADVISORSHARES TRUST

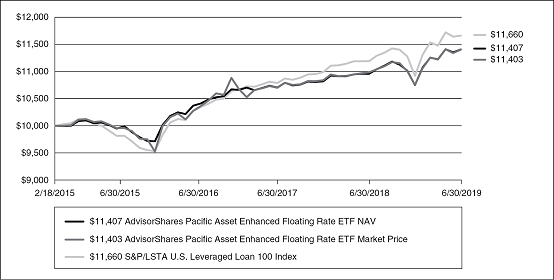

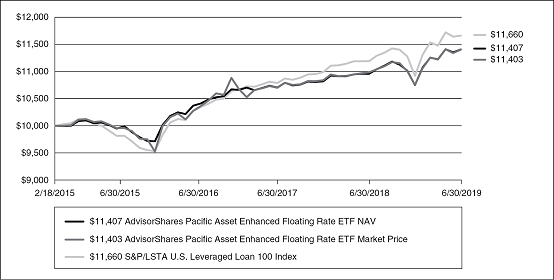

AdvisorShares Pacific Asset Enhanced Floating Rate ETF (FLRT)

The AdvisorShares Pacific Asset Enhanced Floating Rate ETF (FLRT) returned 3.82% on a market price basis and 4.09% on a NAV basis for the year ended June30, 2019, net of fees. The S&P/LSTA U.S. Leveraged Loan 100 Index gained 4.18%.

The Fund’s portfolio return was driven by our significant overweight to high yield bonds, which provide both increased return potential and liquidity to the portfolio. Security selection within the loan allocation was also a positive contributor to returns. The Retail sector performed well, with Neiman Marcus, Petsmart and Petco all providing strong returns after a difficult period the year before. Restaurants were also positive, driven by Chuck E Cheese and Golden Nugget. Our underweight to the Technology sector was negative for returns, as was our overweight to insurance brokers.

Looking ahead, we have a somewhat cautious outlook for the remainder of 2019. Business disruptions related to trade issues have slowed economic activity, especially in Europe and Asia. However, the U.S. consumer remains in good shape and low unemployment should continue to underpin solid consumer spending. Thus, we have a modestly defensive position in the FLRT portfolio and will look to gradually reduce our exposure to more cyclical names going forward.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period February 18, 2015* to June 30, 2019

20

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | Since

Inception

2/18/2015* |

AdvisorShares Pacific Asset Enhanced Floating Rate ETF NAV | | 4.09 | % | | 3.74 | % | | 3.06 | % |

AdvisorShares Pacific Asset Enhanced Floating Rate ETF Market Price** | | 3.82 | % | | 4.07 | % | | 3.06 | % |

S&P/LSTA U.S. Leveraged Loan 100 Index | | 4.18 | % | | 4.88 | % | | 3.60 | % |

S&P 500 Index | | 10.42 | % | | 14.19 | % | | 10.28 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.66% and the net expense ratio is 1.14%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.10%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P/LSTA U.S. Leveraged Loan 100 Index is designed to track the market-weighted performance of the largest institutional leveraged loans based on market weightings, spreads and interest payments. One cannot invest directly in an index.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

Bank Loan: funds that invest primarily in floating-rate bank loans instead of bonds. In exchange for their credit risk, they offer high interest payments that typically float above a common short-term benchmark.

21

ADVISORSHARES TRUST

AdvisorShares Pure Cannabis ETF (YOLO)

The AdvisorShares Pure Cannabis ETF (YOLO) was launched on April17, 2019 and therefore does not have a full 12-month period of performance. For the partial period since inception through June30, 2019, the Fund declined 7.92% based on market return and 8.06% based on Net Asset Value. Cannabis stocks as a whole have been quite negative in this short period since fund launch.

Cannabis stocks are extremely volatile, and individual security selection is extremely important. Positive performance came from one of the Fund’s top holdings in a U.S. based REIT, and from pharmaceutical or biotech companies. In this short period, the Canadian domiciled cannabis cultivators were mostly all negative.

As a specialty area of investing, cannabis stocks as a whole can perform with low correlation to the overall market. Following a sell-off and underperformance mid-2019, we are very bullish on cannabis growth prospects long term, and think they are poised for good performance in the next fiscal year with legislative and market developments. Additionally, as compared to existing competitor marijuana or cannabis funds, we feel that AdvisorShares Pure Cannabis ETF should out-perform in a positive market for cannabis stocks due to our active security selection and pure cannabis exposure.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | Since

Inception

4/17/2019* |

AdvisorShares Pure Cannabis ETF NAV | | -8.06% |

AdvisorShares Pure Cannabis ETF Market Price** | | -7.92% |

S&P 500 Index | | 1.83% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) and net expense ratio is 0.74%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.74%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

22

ADVISORSHARES TRUST

AdvisorShares Ranger Equity Bear ETF (HDGE)

For the 12-month period ended June30, 2019, the AdvisorShares Ranger Equity Bear ETF (HDGE) performance based on the NAV and market price were-18.16% and-17.87%, respectively.

After a strong start to the period, performance was negatively impacted by a dramatic and historical rebound in stocks in the first several months of 2019. In particular, low quality stocks out-performed other strategies such as value stocks by a wide margin. As the Fund shorts low quality stocks, the rebound in these securities served as a drag on performance.

In our view, three factors will drive market returns going forward. First, interest rates. Second, trade wars. Third, earnings growth. The focus of the Fund is on individual securities and thus the third factor will play an important role in the Fund’s performance. In particular, earnings growth has been driven by historical stock buybacks in the face of moderating revenue growth and peak profit margins. Identifying companies in a weak position to be able to buy back stock will help performance, in our view. In addition, given the expectations around interest rates, changes in trade policy, and peak profit margins, we expect there to be more volatility than in prior years.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period January26, 2011* to June 30, 2019

23

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

1/26/2011* |

AdvisorShares Ranger Equity Bear ETF NAV | | -18.16 | % | | -15.56 | % | | -11.53 | % | | -14.96 | % |

AdvisorShares Ranger Equity Bear ETF Market Price** | | -17.87 | % | | -15.55 | % | | -11.53 | % | | -14.95 | % |

S&P 500 Index | | 10.42 | % | | 14.19 | % | | 10.71 | % | | 12.55 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) and net expense ratio is 2.72%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.85%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

24

ADVISORSHARES TRUST

AdvisorShares Sabretooth ETF (BKCH)

The AdvisorShares Sabretooth ETF (BKCH) launched on February6, 2019 and performance from inception through June30, 2019 was up 8.16% based on NAV. The S&P 500 returned 8.61% for the same time frame.

The Fund’s allocation has remained fairly balanced since inception and has had de minimus turnover. The initial portfolio was designed to be allocated to approximately 65% cloud securities and 35% blockchain securities. Within the Blockchain allocation, the primary focus was on financials and payment companies as we believe these companies may see an accretive reduction in costs by using blockchain technology. The portfolio was designed for the long term and has the flexibility to add new companies as they enter the market via IPO and warrant inclusion, however, we do not envision the new fiscal year to bring many portfolio changes. Since inception, we added Crowdstrike Holdings (CRWD) – as an IPO – and Service Now (NOW) to the Cloud portion and StoneCo (STNE) into the Blockchain portion of the portfolio.

While both the Cloud and Blockchain portions of the portfolio have had positive performance, the Cloud holdings have outperformed the Blockchain holdings through June30, 2019. We would expect the Cloud holdings to continue to outperform and become the driver for performance during the next twelve months.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | Since

Inception

2/6/2019* |

AdvisorShares Sabretooth ETF NAV | | 8.16 | % |

AdvisorShares Sabretooth ETF Market Price** | | 8.22 | % |

S&P 500 Index | | 8.61 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.97% and the net expense ratio is 0.85%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’sexpenses from exceeding 0.85%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

25

ADVISORSHARES TRUST

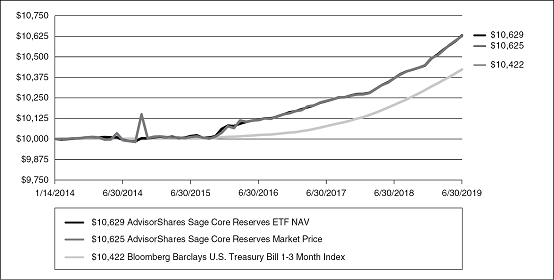

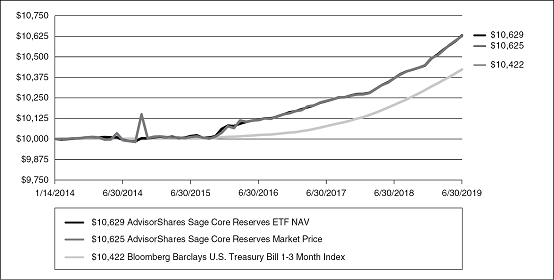

AdvisorShares Sage Core Reserves ETF (HOLD)

The AdvisorShares Sage Core Reserves ETF (HOLD) had a NAV based return of 2.74% during the one year period ending June30, 2019. This compares to the Bloomberg Barclays 1-3month T-bill Index, which returned 2.27% during the same time period.

The outperformance of the Fund was driven by both excess carry and slightly longer duration. The excess carry was achieved through the use of sectors outside the Bloomberg Barclays 1-3month T-bill Index, including corporate credit, asset-backed securities, and agency mortgage backed securities (MBS). Within each of these sectors there was a small allocation to floating rate securities which benefited from rising rates in the second half of 2018. The duration on the Fund was increased in the first part of 2019 in expectation of the Federal Reserve’s inability to hike rates as expected. This slightly longer duration benefited the Fund as rates declined significantly in the second quarter.

While the start of 2019 was flush with expectations for Fed rate hikes, things have played out much differently. Due to deteriorating economic conditions, the market is now pricing in multiple rate cuts during the remainder of 2019, which has caused a significant rally in rates across the curve. Risk assets have also benefited from both lower rates in the U.S. and, more broadly, the large amount of negative yielding debt worldwide. Rate cuts from the Fed will likely continue to drive risk assets tighter, at least in the near term. As the remainder of 2019 unfolds, it will be important to monitor economic changes and their implications on central bank policy, which may prove to be the primary driver of returns.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period January 14, 2014* to June 30, 2019

26

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

1/14/2014* |

AdvisorShares Sage Core Reserves ETF NAV | | 2.74 | % | | 1.74 | % | | 1.21 | % | | 1.13 | % |

AdvisorShares Sage Core Reserves ETF Market Price** | | 2.74 | % | | 1.65 | % | | 1.20 | % | | 1.12 | % |

Bloomberg Barclays U.S. Treasury Bill 1-3 Month Index | | 2.27 | % | | 1.33 | % | | 0.83 | % | | 0.76 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.65% and the net expense ratio is 0.35%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.35%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The Bloomberg Barclays U.S. Treasury Bill 1-3 Month Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3months and more than 1month, are rated investment grade, and have $250million or more of outstanding face value. The Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index is an unmanaged index considered representative of the performance of the U.S. Treasury Bill issued by the U.S. Government. One cannot invest directly in an index.

27

ADVISORSHARES TRUST

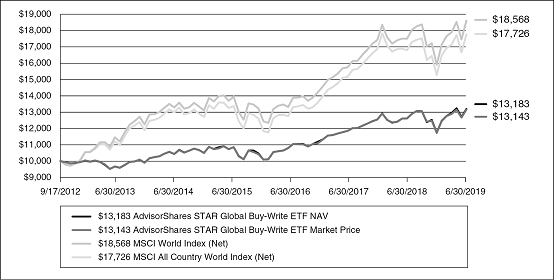

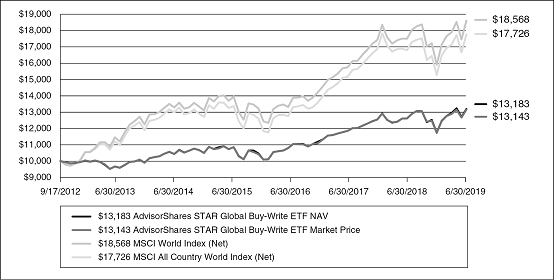

AdvisorShares STAR Global Buy-Write ETF (VEGA)

The AdvisorShares STAR Global Buy-Write ETF (VEGA) had a return of 4.62%, for NAV and 4.27%, for market price for the year ended June30, 2019. This compares to the returns of the MSCI World Index (net) of 6.33%, the MSCI ACWI Index (net) of 5.74%, the CBOE S&P 500 BuyWrite Index of 3.18% and the Bloomberg Barclays U.S. Aggregate Bond Index of 7.87%. While VEGA is global in nature, it has maintained a steady overweight in U.S. equities for some time now and VEGA’s outperformance versus the CBOE S&P 500 BuyWrite is significant during the period. The benchmarks referenced are given because each represents a component of VEGA’s strategy, though no one benchmark encapsulates the Fund’s strategy in its entirety.

VEGA was able to add alpha to performance through the use of option strategies in the portfolio. Specifically, using dynamic Covered Call writing, Protective Put usage and Volatility-Based Reinvestment. Those three differentiators were pivotal in VEGA’s performance, particularly in the Fourth Quarter of 2018, in which the Protective Puts were sold for gains twice and the Fund’s underlying portfolio was rebuilt by repurchasing back into the market when it was in decline. Those actions coupled with the continue Covered Call writing and dynamic hedging use, which allowed for price appreciation, were the contributing factors to VEGA’s performance during the period.

In the short to intermediate time horizon, we believe volatility will play a large factor in both the Equity and Fixed Income markets. This is why, after March 2019, we de-risked the portfolio, sidelining a portion of U.S. equity and non-U.S. equity positions into cash and keeping our Fixed Income duration low. As the market navigates the period ahead, we will look to the CBOE Volatility Index (VIX) for opportune moments of reinvestment back into the underlying portfolio. As we believe the Fixed Income market has overshot itself and will need to concede some of the recent gains, we expect to continue to target low duration for the Fixed Income portion of the portfolio.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 17, 2012* to June 30, 2019

28

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception

9/17/2012* |

AdvisorShares STAR Global Buy-Write ETF NAV | | 4.62 | % | | 6.89 | % | | 4.54 | % | | 4.16 | % |

AdvisorShares STAR Global Buy-Write ETF Market Price** | | 4.27 | % | | 6.80 | % | | 4.45 | % | | 4.11 | % |

MSCI World Index (Net) | | 6.33 | % | | 11.77 | % | | 6.60 | % | | 9.55 | % |

MSCI All Country World Index (Net) | | 5.74 | % | | 11.62 | % | | 6.16 | % | | 8.80 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. FundNAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the einvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.39% and the net expense ratio is 2.06%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.85%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The MSCI World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. One cannot invest directly in an index.

The MSCI All Country World Index (Net) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. One cannot invest directly in an index.

29

ADVISORSHARES TRUST

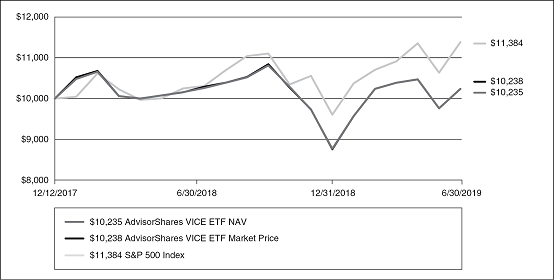

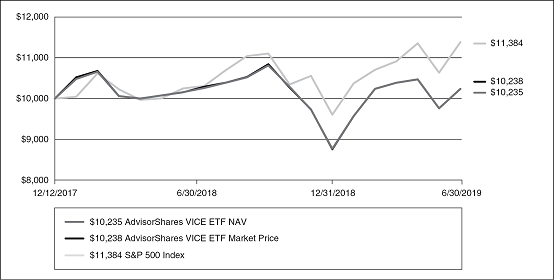

AdvisorShares Vice ETF (ACT)

The AdvisorShares Vice ETF (ACT) was launched with an inception date of December12, 2017. It now has a full fiscal year period of performance for the first time. For the 12-month timeframe July1, 2018 through June30, 2019, the Fund returned-0.50% market return and-0.22% based on Net Asset Value. During the same timeframe, the Standard & Poor’s 500 Index returned was positive. In the first 6months of 2019, the Fund had good gains of 16.95% market return and 16.70% on its Net Asset Value.

ACT focuses primarily on alcohol, tobacco and cannabis-related stocks. Its performance is subject in large part to the overall performance of those areas, although we aim for outperformance relative to those areas through good individual security selection and successful trading techniques. Top contributors to performance came primarily from certain alcohol producers and sellers, cannabis-related pharmaceutical or healthcare companies, and two particular tobacco companies overlapping seriously into cannabis that we have highly weighted.

On the other hand, the primary drag to performance was caused by the largest tobacco companies, known as “big tobacco”, particularly in the last half of 2018 when tobacco stock prices dropped very uncharacteristically. While everyone knows tobacco use continues to fall, tobacco company products remain wildly profitable, and the stocks themselves usually act very steady and dependable.

The overall market has continued in an extended bull market, and we should not expect “vice stocks” to keep up with technology-heavy growth stocks in an up market. In negative or stagnant markets, alcohol and tobacco stocks can often look attractive and show their “market-resistant” qualities. Cannabis-related stocks (as compared to actual cannabis growers and sellers), continue to show growth promise. We expect ACT to normally perform much like it has in early 2019, rather than its unusual underperformance in late 2018.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 12, 2017* to June 30, 2019

30

HISTORICAL PERFORMANCE

Total Return as of June 30, 2019

| | 1 Year | | Since

Inception

12/12/2017* |

AdvisorShares VICE ETF NAV | | -0.22 | % | | 1.51 | % |

AdvisorShares VICE ETF Market Price** | | -0.50 | % | | 1.53 | % |

S&P 500 Index | | 10.42 | % | | 8.73 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.18% and the net expense ratio is 0.75%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

31

ADVISORSHARES TRUST

Shareholder Expense Examples

As a shareholder of the Fund, you incur transaction cost and ongoing costs, including management fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an initial investment of $1,000 invested at January1, 2019 and held for the period ended June30, 2019.

Actual Expenses

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid” to estimate the expenses attributable to your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses for the period. You may use this information to compare the ongoing costs of investing in the Funds and other ETF funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

In addition, if these transactional costs were included, your costs would have been higher.

Fund Name | | Beginning

Account Value

1/1/2019 | | Ending

Account Value

6/30/2019 | | Annualized

Expense

Ratiofor

the Period | | Expenses

Paid(1) |

AdvisorShares Cornerstone Small Cap ETF | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,141.00 | | 0.90% | | $ | 4.78 |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,020.33 | | 0.90% | | $ | 4.51 |

AdvisorShares Dorsey Wright ADR ETF | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,245.80 | | 0.88% | | $ | 4.90 |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,020.43 | | 0.88% | | $ | 4.41 |

AdvisorShares Dorsey Wright Micro-Cap ETF | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,222.20 | | 0.99% | | $ | 5.45 |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,019.89 | | 0.99% | | $ | 4.96 |

AdvisorShares Dorsey Wright Short ETF | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 816.50 | | 0.99% | | $ | 4.46 |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,019.89 | | 0.99% | | $ | 4.96 |

AdvisorShares DoubleLine Value Equity ETF | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,151.00 | | 0.90% | | $ | 4.80 |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,020.33 | | 0.90% | | $ | 4.51 |

32

ADVISORSHARES TRUST

Shareholder Expense Examples (continued)

Fund Name | | Beginning

Account Value

1/1/2019 | | Ending

Account Value

6/30/2019 | | Annualized

Expense

Ratiofor

the Period | | Expenses

Paid(1) |

AdvisorShares Focused Equity ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,200.40 | | 0.74% | | $ | 4.04 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,021.12 | | 0.74% | | $ | 3.71 | |

AdvisorShares FolioBeyond Smart Core Bond ETF(4) | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,083.00 | | 0.95% | | $ | 4.91 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,020.08 | | 0.95% | | $ | 4.76 | |

AdvisorShares New Tech and Media ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 823.20 | | 0.85% | | $ | 3.84 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,020.58 | | 0.85% | | $ | 4.26 | |

AdvisorShares Newfleet Multi-Sector Income ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,037.70 | | 0.75% | | $ | 3.79 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,021.08 | | 0.75% | | $ | 3.76 | |

AdvisorShares Pacific Asset Enhanced Floating Rate ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,061.30 | | 1.10% | | $ | 5.62 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,019.34 | | 1.10% | | $ | 5.51 | |

AdvisorShares Pure Cannabis ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 919.40 | | 0.74% | | $ | 1.44 | (2) |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,021.12 | | 0.74% | | $ | 3.71 | |

AdvisorShares Ranger Equity Bear ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 757.60 | | 1.73% | | $ | 7.54 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,016.22 | | 1.73% | | $ | 8.65 | |

AdvisorShares Sabretooth ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,081.60 | | 0.85% | | $ | 3.49 | (3) |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,020.58 | | 0.85% | | $ | 4.26 | |

AdvisorShares Sage Core Reserves ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,017.50 | | 0.35% | | $ | 1.75 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,023.06 | | 0.35% | | $ | 1.76 | |

AdvisorShares STAR Global Buy-Write ETF(4) | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,123.20 | | 1.85% | | $ | 9.74 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,015.62 | | 1.85% | | $ | 9.25 | |

AdvisorShares Vice ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,167.00 | | 0.75% | | $ | 4.03 | |

Hypothetical (assuming a 5% return before expenses) | | $ | 1,000.00 | | $ | 1,021.08 | | 0.75% | | $ | 3.76 | |

33

ADVISORSHARES CORNERSTONE SMALL CAP ETF

Schedule of Investments June30, 2019 |

Investments | | Shares | | Value |

COMMON STOCKS — 100.7% |

Aerospace/Defense — 0.3% | | | | | |

AeroVironment, Inc.*(a) | | 237 | | $ | 13,455 |

Airlines — 1.6% | | | | | |

SkyWest, Inc. | | 1,043 | | | 63,279 |

Spirit Airlines, Inc.* | | 368 | | | 17,564 |

Total Airlines | | | | | 80,843 |

Apparel — 0.3% | | | | | |

Crocs, Inc.*(a) | | 729 | | | 14,398 |

Auto Parts & Equipment — 0.4% |

Methode Electronics, Inc. | | 739 | | | 21,113 |

Banks — 6.8% | | | | | |

Cadence BanCorp | | 902 | | | 18,762 |

Community Trust Bancorp, Inc. | | 436 | | | 18,438 |

Eagle Bancorp, Inc. | | 549 | | | 29,717 |

First BanCorp (Puerto Rico) | | 2,319 | | | 25,602 |

First Bancorp/Southern Pines NC | | 523 | | | 19,048 |

First Financial Corp. | | 406 | | | 16,305 |

First Mid Bancshares, Inc. | | 426 | | | 14,876 |

Flagstar Bancorp, Inc. | | 539 | | | 17,862 |

Great Southern Bancorp, Inc. | | 349 | | | 20,888 |

Live Oak Bancshares, Inc. | | 1,107 | | | 18,985 |

Metropolitan Bank Holding Corp.* | | 448 | | | 19,712 |

National Bank Holdings Corp., Class A | | 477 | | | 17,315 |

Nicolet Bankshares, Inc.* | | 384 | | | 23,831 |

OFG Bancorp (Puerto Rico) | | 1,274 | | | 30,283 |

PCSB Financial Corp. | | 1,113 | | | 22,538 |

TriState Capital Holdings, Inc.* | | 1,097 | | | 23,410 |

Total Banks | | | | | 337,572 |

Beverages — 0.8% | | | | | |

Boston Beer Co., Inc. (The), Class A*(a) | | 59 | | | 22,288 |

MGP Ingredients, Inc.(a) | | 291 | | | 19,296 |

Total Beverages | | | | | 41,584 |

Biotechnology — 4.8% | | | | | |

Acorda Therapeutics, Inc.*(a) | | 710 | | | 5,446 |

Arcus Biosciences, Inc.*(a) | | 1,899 | | | 15,097 |

Arena Pharmaceuticals, Inc.* | | 486 | | | 28,494 |

Halozyme Therapeutics, Inc.* | | 1,131 | | | 19,431 |

Innoviva, Inc.*(a) | | 1,262 | | | 18,375 |

Ligand Pharmaceuticals, Inc.*(a) | | 122 | | | 13,926 |

Myriad Genetics, Inc.*(a) | | 659 | | | 18,307 |

NeoGenomics, Inc.*(a) | | 1,156 | | | 25,363 |

NuCana PLC (UnitedKingdom)*(a)(b) | | 1,353 | | | 14,044 |

Investments | | Shares | | Value |

COMMON STOCKS(continued) |

Biotechnology(continued) | | | | | |

PDL BioPharma, Inc.* | | 6,260 | | $ | 19,656 |

Veracyte, Inc.* | | 1,020 | | | 29,080 |

Zymeworks, Inc. (Canada)* | | 1,434 | | | 31,548 |

Total Biotechnology | | | | | 238,767 |

Building Materials — 0.9% | | | | | |

Caesarstone Ltd. | | 1,273 | | | 19,133 |

Gibraltar Industries, Inc.* | | 586 | | | 23,651 |

Total Building Materials | | | | | 42,784 |

Chemicals — 2.0% | | | | | |

Balchem Corp. | | 189 | | | 18,894 |

Innospec, Inc. | | 221 | | | 20,164 |

Intrepid Potash, Inc.* | | 5,801 | | | 19,492 |

Materion Corp. | | 342 | | | 23,191 |

Rogers Corp.* | | 104 | | | 17,948 |

Total Chemicals | | | | | 99,689 |

Coal — 0.3% | | | | | |

Natural Resource Partners LP | | 454 | | | 16,099 |

Commercial Services — 5.1% | | | | | |

2U, Inc.*(a) | | 451 | | | 16,976 |

Adtalem Global Education, Inc.* | | 280 | | | 12,614 |

Barrett Business Services, Inc. | | 210 | | | 17,346 |

Cardtronics PLC, Class A* | | 549 | | | 14,999 |

Career Education Corp.* | | 1,294 | | | 24,677 |

FTI Consulting, Inc.* | | 266 | | | 22,301 |

Heidrick & Struggles International, Inc. | | 472 | | | 14,146 |

HMS Holdings Corp.* | | 869 | | | 28,147 |

Kelly Services, Inc., Class A | | 745 | | | 19,512 |

LiveRamp Holdings, Inc.* | | 362 | | | 17,550 |

Medifast, Inc. | | 95 | | | 12,188 |

Rent-A-Center, Inc.* | | 1,053 | | | 28,041 |

Rosetta Stone, Inc.* | | 1,006 | | | 23,017 |

Total Commercial Services | | | | | 251,514 |

Computers — 4.3% | | | | | |

Carbon Black, Inc.* | | 1,070 | | | 17,890 |

Endava PLC (United Kingdom)*(b) | | 837 | | | 33,681 |

Globant SA (Argentina)* | | 212 | | | 21,423 |