united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22131

Miller Investment Trust

(Exact name of registrant as specified in charter)

20 William Street Wellesley, MA 02481

(Address of principal executive offices) (Zip code)

James Ash, Gemini Fund Services, LLC., 80 Arkay Drive Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 781-416-4000

Date of fiscal year end: 10/31

Date of reporting period:10/31/15

Item 1. Reports to Stockholders.

| |

|

| |

| |

| |

| Miller Convertible Bond Fund |

| Miller Convertible Plus Fund |

| Miller Intermediate Bond Fund |

| |

| |

| |

| |

| |

| |

| Annual Report |

| |

| October 31, 2015 |

| |

| |

| |

| 1-877- 441- 4434 |

| www.TheMillerFamilyOfFunds.com |

| |

| |

| |

| |

| |

| Investment Advisor |

| Wellesley Investment Advisors, Inc. |

| The Wellesley Office Park |

| 20 William Street |

| Wellesley, MA 02481 |

| 781-416-4000 |

| |

| |

| |

| |

| This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of Miller Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. |

| |

| Distributed by Northern Lights Distributors, LLC. Member FINRA |

| |

| |

| Miller Funds |

| TABLE OF CONTENTS |

| October 31, 2015 |

| Fund Name | Miller Convertible Bond

Fund | Miller Convertible Plus Fund | Miller Intermediate Bond Fund |

| Schedule of Investments | October 31, 2015 | October 31, 2015 | October 31, 2015 |

| Statement of Assets and Liabilities | October 31, 2015 | October 31, 2015 | October 31, 2015 |

| Statement of Operations | Year ended October 31, 2015 | Period from December 31, 2014 to October 31, 2015 | Period from December 31, 2014 to October |

| Statement of changes in Net Assets | Years ended October 31, 2015 and 2014 | Period from December 31, 2014 to October 31, 2015 | Period from December 31, 2014 to October 31, 2015 |

| Statement of Cash Flows | Not applicable | Period from December 31, 2014 to October 31, 2015 | Not applicable |

| Financial Highlights | Years ended October 31, 2015, 2014, 2013, 2012, and 2011 | Period from December 31, 2014 to October 31, 2015 | Period from December 31, 2014 to October 31, 2015 |

Dear Shareholder,

The Miller Convertible Bond Fund posted a positive absolute return for the fiscal year, one of our continuing goals. In addition, our new funds, the Miller Convertible Plus Fund and the Miller Intermediate Bond Fund have performed well during their brief ten month histories. Our funds’ performance since inception and for the year ended October 31, 2015 is as follows:

| | | One Year Ended | | Annualized Since |

| Miller Convertible Bond Fund | | October 31, 2015 | | Inception |

| A shares (MCFAX.LW) | | 0.49% | | 6.11 % (12/27/07) |

| I shares (MCIFX) | | 1.08% | | 6.71% (12/27/07) |

| C shares (MCFCX) | | 0.07% | | 7.08% (12/01/09) |

| | | | | |

| | | | | Annualized Since |

| Miller Convertible Plus Fund | | | | Inception |

| A shares (MCPAX) | | | | 5.88% (12/31/14) |

| I shares (MCPIX) | | | | 5.99% (12/31/14) |

| C shares (MCCCX) | | | | 5.14% (12/31/14) |

| | | | | |

| | | | | Annualized Since |

| Miller Intermediate Bond Fund | | | | Inception |

| A shares (MIFAX) | | | | 3.84% (12/31/14) |

| I shares (MIFIX) | | | | 3.92% (12/31/14) |

| C shares (MIFCX) | | | | 3.80% (12/31/14) |

The funds’ total assets under management for the period ended October 31, 2015 were as follows:

| Miller Convertible Bond Fund | $705,882,627 |

| Miller Convertible Plus Fund | $ 61,400,656 |

| Miller Intermediate Bond Fund | $ 42,356,849 |

Equities as measured by the S&P 500 Total Return Index1 returned 6.43% over the last year. The Barclays Aggregate Bond Index2 and the Bank of America/Merrill Lynch All Convertibles Ex Mandatory Index (V0A0)3 were up 1.85% and .62% respectively. The Miller Convertible Bond Fund I shares returned 1.64% over the time

period. One goal the Miller Convertible Bond Fund and the Miller Convertible Plus Fund is to outperform both the stocks and bonds over a full market cycle. However, sometimes there are shorter periods within a market cycle where we underperform both asset classes. This was also the case for the convertible bond benchmark index. While market conditions can change over short time periods, our investment philosophy does not. We strictly follow the principles that have served our investors well over the years, which are described below and in the funds’ prospectus.

Bond Strategy Review

We remain committed to the same strategy we have utilized since our company was founded in 1991. It is important to note that we do not change our investment strategy regardless of what the current investment climate is. We invest only in convertible bonds and notes (no convertible preferreds, mandatory preferreds, or other structures) which typically offer the return of the majority of principal within seven years of issuance. Before making an investment, we perform a thorough analysis of a company’s balance sheet and income statement. We seek to invest in profitable companies and we avoid companies that have unsafe debt loads. While we usually invest with the idea of holding bonds until the next liquidity date (maturity, put or call), we consider selling or reducing our exposure if one of the following scenarios occur:

| ● | An issuer’s credit quality deteriorates |

| ● | The bond loses its favorable risk/reward characteristics due to price appreciation |

| ● | We perceive an opportunity to increase portfolio diversification |

| ● | We believe more attractive investments are available |

Because one of our key risk management practices involves careful limits on prices we pay, we tend not to purchase convertibles that trade at prices substantially above par and thus have significantly negative yields to the next liquidity date. This discipline often results in the elimination of some of the most equity-sensitive convertibles. As a result, our performance tends to lag broader equity indices in rising markets but seeks to decline less in falling stock markets.

At the end of the period, the Miller Convertible Bond Fund owned 74 convertible bonds, with our largest holding representing 4.2% of the fund’s value. Our holdings span the convertible market, from investment-grade to small-cap, with a broad distribution of industries represented. Generally, half of our rated convertible bonds are investment grade.

Convertible Market Review and Comment

Convertible bonds faced a challenging environment over the last year. Although equities were higher and bond yields fell, credit spreads widened significantly. Equities, as measured by the S&P 500 Total Return Index, were up 6.43%. Yields on the 10-year Treasury bond went from 2.34% to 2.14%. Meanwhile, investment grade credit spreads widened 47 basis points and high yield credit spreads widened 1.78%.

The Miller Convertible Bond Fund’s total return for the year was comprised of 50% capital appreciation and 50% income. We typically look for a return distribution of 70% capital appreciation and 30% income. However, there can be times when our returns are balanced between the two. The year was characterized by high volatility, and as a result, our largest drawdown was 8.14%.4

All returns are as of October 31, 2015.

New Issuance

The new issue market remained healthy for the year ended October 31, 2015. Over $36 billion of new paper came to the market in that time period. Some of the new issues that met our criteria were convertible bonds issued by:

| ● | LinkedIn (2.31% of the Miller Convertible Bond Fund’s portfolio as of October 31, 2015), a social networking website used for professional networking; |

| ● | LGI Homes (4.24% of the Miller Convertible Bond Fund’s portfolio as of October 31, 2015), a designer and builder of homes in Texas, Arizona, Florida and Georgia; |

| ● | Redwood Trust (2.52% of the Miller Convertible Bond Fund’s portfolio as of October 31, 2015 a REIT engaged in residential and commercial mortgage banking activities; and |

| ● | ON Semiconductor (2.52% of the Miller Convertible Bond Fund’s portfolio as of October 31, 2015 a producer of analog, standard logic, and discrete semiconductors for data and power management. |

Potential catalysts for continued strength in convertible issuance include increased merger and acquisition activity, higher interest rates and corporations’ desires to buy back stock while simultaneously issuing convertibles.

As we look ahead, we continue to believe that a balanced portfolio of convertible bonds offer investors the best of both worlds: upside participation to improving equity markets and capital preservation should the equity markets correct. As always, we thank you for your confidence and trust in our management.

Sincerely,

Greg Miller, Co-Portfolio Manager

Michael Miller, Co-Portfolio Manager

| 1 | The Standard and Poor’s 500 Total Return Index is a free-float capitalization-weighted index, based on the common stock prices of 500 top publicly traded American companies, as determined by S&P, and considered by many to be the best representation of the market. |

| 2 | The Barclays U.S. Aggregate Bond index is a market capitalization-weighted index often used to represent investment grade bonds being traded in United States. |

| 3 | The Bank of America/Merrill Lynch All Convertibles Ex Mandatory Index (V0A0) represents all US convertibles, excluding mandatory convertibles, small issues and bankruptcies. |

| 4 | A drawdown is the peak-to-trough decline during a specific record period of an investment, fund or commodity. A drawdown is usually quoted as the percentage between the peak and the trough. |

Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

2649-NLD-12/8/2015

| Miller Convertible Bond Fund |

| PERFORMANCE OF A $10,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2015 |

| Annualized Total Returns as of October 31, 2015 |

| |

| | | | Since | Since |

| | | | Inception* | Inception** |

| | One Year | Five Year | (Class A and I) | (Class C) |

| Miller Convertible Bond Fund: | | | | |

| Class A, without sales charge | 0.49% | 6.23% | 6.11% | — |

| Class A, with sales charge of 5.75% | (5.30)% | 4.98% | 5.31% | — |

| Class I | 1.08% | 6.78% | 6.71% | — |

| Class C | 0.07% | 5.73% | — | 7.08% |

| Barclays Aggregate Bond Index | 1.96% | 3.03% | 4.51% | 3.71% |

| * | Class A and Class I shares commenced operations on December 27, 2007. |

| ** | Class C shares commenced operations on December 1, 2009. |

The Barclays Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated February 27, 2015, including underlying funds, are 1.45%, 0.95%, and 1.95% for Class A shares, Class I shares, and Class C shares, respectively. The graph does not reflect the deduction of taxes that a shareholder would have to pay on fund distributions or the redemption of the fund shares. For performance information current to the most recent month-end, please call 1-877-441-4434.

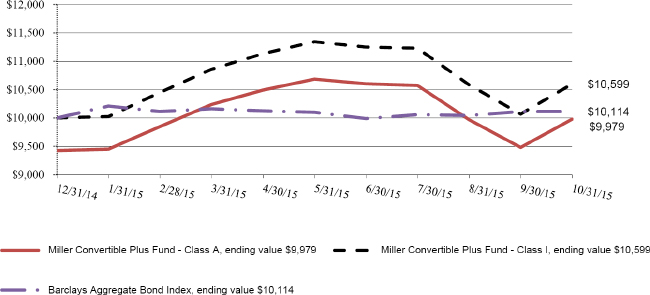

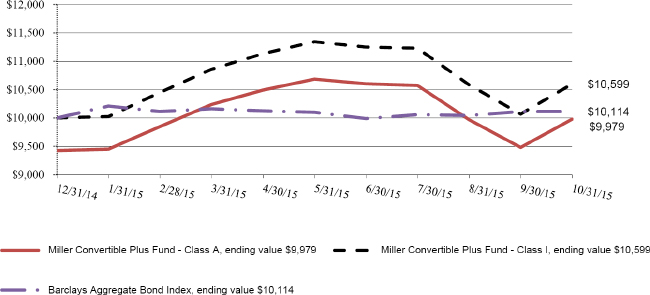

| Miller Convertible Plus Fund |

| PERFORMANCE OF A $10,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2015 |

| | Since |

| | Inception* |

| Miller Convertible Plus Fund: | |

| Class A, without sales charge | 5.88% |

| Class A, with sales charge of 5.75% | (0.21)% |

| Class I | 5.99% |

| Class C | 5.14% |

| Barclays Aggregate Bond Index | 1.14% |

| * | Class A, Class C, and Class I shares commenced operations on December 31, 2014. Returns are not annualized. |

The Barclays Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated February 27, 2015, including underlying funds, are 3.50%, 3.25%, and 4.25% for Class A shares, Class I shares, and Class C shares, respectively. The graph does not reflect the deduction of taxes that a shareholder would have to pay on fund distributions or the redemption of the fund shares. For performance information current to the most recent month-end, please call 1-877-441-4434.

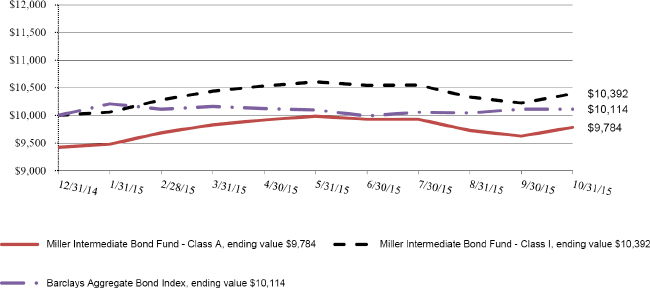

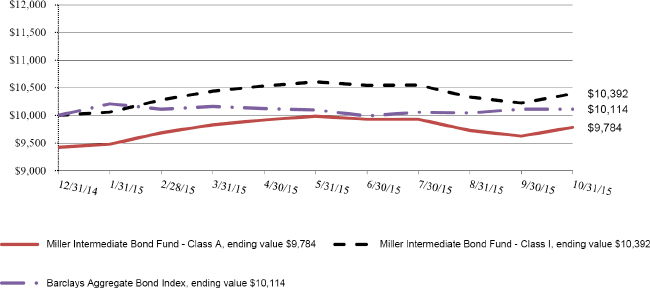

| Miller Intermediate Bond Fund |

| PERFORMANCE OF A $10,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2015 |

| | Since |

| | Inception* |

| Miller Intermediate Bond Fund: | |

| Class A, without sales charge | 3.84% |

| Class A, with sales charge of 5.75% | (2.16)% |

| Class I | 3.92% |

| Class C | 3.80% |

| Barclays Aggregate Bond Index | 1.14% |

| * | Class A, Class C, and Class I shares commenced operations on December 31, 2014. Returns are not annualized |

The Barclays Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated February 27, 2015, including underlying funds, are 1.71%, 1.46%, and 2.26% for Class A shares, Class I shares, and Class C shares, respectively. The graph does not reflect the deduction of taxes that a shareholder would have to pay on fund distributions or the redemption of the fund shares. For performance information current to the most recent month-end, please call 1-877-441-4434.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | | | |

| CONVERTIBLE BONDS - 92.72% | | | | | | | | | | | | |

| APPAREL - 0.96% | | | | | | | | | | | | |

| Iconix Brand Group, Inc. | | $ | 8,000,000 | | | 1.5000 | | 3/15/2018 | | $ | 6,795,000 | |

| | | | | | | | | | | | | |

| AUTO MANUFACTURERS - 2.95% | | | | | | | | | | | | |

| General Motors Co. - Societe Generale SA Synthetic | | | 6,500,000 | | | 0.0000 | | 11/16/2021 | | | 6,542,900 | |

| General Motors Co. - Societe Generale SA Synthetic | | | 14,300,000 | | | 0.0000 | | 11/16/2021 | | | 14,394,380 | |

| | | | | | | | | | | | 20,937,280 | |

| BIOTECHNOLOGY - 7.82% | | | | | | | | | | | | |

| Acorda Therapeutics, Inc. | | | 8,000,000 | | | 1.7500 | | 6/15/2021 | | | 8,540,000 | |

| Ani Pharmaceuticals, Inc. | | | 20,000,000 | | | 3.0000 | | 12/1/2019 | | | 19,250,000 | |

| Emergent Biosolutions, Inc. | | | 15,000,000 | | | 2.8750 | | 1/15/2021 | | | 18,468,750 | |

| United Therapeutics Corp. | | | 3,000,000 | | | 1.0000 | | 9/15/2016 | | | 9,196,875 | |

| | | | | | | | | | | | 55,455,625 | |

| COMMERCIAL SERVICES - 1.15% | | | | | | | | | | | | |

| Albany Molecular Research, Inc. | | | 1,000,000 | | | 2.2500 | | 11/15/2018 | | | 1,268,750 | |

| Carriage Services, Inc. | | | 2,000,000 | | | 2.7500 | | 3/15/2021 | | | 2,212,500 | |

| Huron Consulting Group, Inc. | | | 5,000,000 | | | 1.2500 | | 10/1/2019 | | | 4,646,875 | |

| | | | | | | | | | | | 8,128,125 | |

| COMPUTERS - 9.01% | | | | | | | | | | | | |

| Apple, Inc. - Wells Fargo & Co. Synthetic | | | 7,000,000 | | | 0.0000 | | 1/24/2020 | | | 8,921,500 | |

| Brocade Communications Systems, Inc. - 144A | | | 6,000,000 | | | 1.3750 | | 1/1/2020 | | | 5,913,750 | |

| Electronics For Imaging, Inc. | | | 18,000,000 | | | 0.7500 | | 9/1/2019 | | | 19,226,250 | |

| Intel Corp. - Wells Fargo & Co. Synthetic | | | 10,000,000 | | | 0.0000 | | 6/5/2020 | | | 11,877,000 | |

| SanDisk Corp. | | | 17,000,000 | | | 0.5000 | | 10/15/2020 | | | 18,009,375 | |

| | | | 63,947,875 | | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES - 1.41% | | | | | | | | | | | | |

| BGC Partners, Inc. | | | 4,000,000 | | | 4.5000 | | 7/15/2016 | | | 4,212,500 | |

| Encore Capital Group, Inc. | | | 6,500,000 | | | 2.8750 | | 3/15/2021 | | | 5,813,438 | |

| | | | | | | | | | | | 10,025,938 | |

| ELECTRICAL COMPONENTS & EQUIPMENT - 0.13% | | | | | | | | | | | | |

| SunPower Corp. | | | 1,000,000 | | | 0.8750 | | 6/1/2021 | | | 919,375 | |

| | | | | | | | | | | | | |

| ELECTRONICS - 2.99% | | | | | | | | | | | | |

| TTM Technologies, Inc. | | | 22,000,000 | | | 1.7500 | | 12/15/2020 | | | 21,202,500 | |

| | | | | | | | | | | | | |

| ENERGY-ALTERNATE SOURCES - 1.61% | | | | | | | | | | | | |

| Renewable Energy Group, Inc. | | | 13,800,000 | | | 2.7500 | | 6/15/2019 | | | 11,445,375 | |

| | | | | | | | | | | | | |

| ENGINEERING & CONSTRUCTION - 0.15% | | | | | | | | | | | | |

| Dycom Industries, Inc. - 144A | | | 1,000,000 | | | 0.7500 | | 9/15/2021 | | | 1,043,750 | |

| | | | | | | | | | | | | |

| FOREST PRODUCTS & PAPER - 1.32% | | | | | | | | | | | | |

| International Paper Co. - Wells Fargo & Co. Synthetic | | | 10,000,000 | | | 0.0000 | | 6/10/2020 | | | 9,338,000 | |

| | | | | | | | | | | | | |

| HEALTHCARE-PRODUCTS - 2.56% | | | | | | | | | | | | |

| Integra LifeSciences Holdings Corp. | | | 5,000,000 | | | 1.6250 | | 12/15/2016 | | | 5,965,625 | |

| Trinity Biotech Investment Ltd. - 144A | | | 14,000,000 | | | 4.0000 | | 4/1/2045 | | | 12,188,750 | |

| | | | | | | | | | | | 18,154,375 | |

| HOLDING COMPANIES-DIVERSIFIED - 2.50% | | | | | | | | | | | | |

| RWT Holdings, Inc. - 144A | | | 19,000,000 | | | 5.6250 | | 11/15/2019 | | | 17,765,000 | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | | | |

| HOME BUILDERS - 9.89% | | | | | | | | | | | | |

| KB Home | | $ | 10,000,000 | | | 1.3750 | | 2/1/2019 | | $ | 9,243,750 | |

| LGI Homes, Inc. - 144A | | | 21,000,000 | | | 4.2500 | | 11/15/2019 | | | 29,938,125 | |

| M/I Homes, Inc. | | | 12,000,000 | | | 3.0000 | | 3/1/2018 | | | 11,640,000 | |

| Meritage Homes Corp. | | | 11,000,000 | | | 1.8750 | | 9/15/2032 | | | 11,020,625 | |

| Toll Brothers Finance Corp. | | | 8,000,000 | | | 0.5000 | | 9/15/2032 | | | 8,305,000 | |

| | | | | | | | | | | | 70,147,500 | |

| INSURANCE - 0.14% | | | | | | | | | | | | |

| HCI Group, Inc. | | | 1,000,000 | | | 3.8750 | | 3/15/2019 | | | 973,125 | |

| | | | | | | | | | | | | |

| INTERNET - 5.73% | | | | | | | | | | | | |

| Google, Inc. - Goldman Sachs Group, Inc. Synthetic | | | 2,000,000 | | | 0.0000 | | 2/19/2021 | | | 2,154,220 | |

| Google, Inc. - UBS AG Synthetic | | | 11,500,000 | | | 0.0000 | | 2/15/2021 | | | 11,994,500 | |

| J2 Global, Inc. | | | 8,000,000 | | | 3.2500 | | 6/15/2029 | | | 10,190,000 | |

| LinkedIn Corp. - 144A | | | 15,000,000 | | | 0.5000 | | 11/1/2019 | | | 16,312,575 | |

| | | | | | | | | | | | 40,651,295 | |

| INVESTMENT COMPANIES - 1.52% | | | | | | | | | | | | |

| Ares Capital Corp. | | | 1,000,000 | | | 4.3750 | | 1/15/2019 | | | 1,027,500 | |

| BlackRock Capital Investment Corp | | | 1,000,000 | | | 5.5000 | | 2/15/2018 | | | 1,037,500 | |

| KCAP Financial, Inc. | | | 1,000,000 | | | 8.7500 | | 3/15/2016 | | | 1,001,250 | |

| New Mountain Finance Corp. | | | 4,000,000 | | | 5.0000 | | 6/15/2019 | | | 4,012,500 | |

| Prospect Capital Corp. | | | 3,000,000 | | | 4.7500 | | 4/15/2020 | | | 2,696,250 | |

| TCP Capital Corp. | | | 1,000,000 | | | 5.2500 | | 12/15/2019 | | | 1,000,625 | |

| | | | | | | | | | | | 10,775,625 | |

| MACHINERY - DIVERSIFIED - 0.12% | | | | | | | | | | | | |

| Chart Industries, Inc. | | | 1,000,000 | | | 2.0000 | | 8/1/2018 | | | 877,500 | |

| | | | | | | | | | | | | |

| MISCELLANEOUS MANUFACTURING - 2.90% | | | | | | | | | | | | |

| General Electric Co. - Barclays Bank PLC Synthetic | | | 20,000,000 | | | 0.0000 | | 8/18/2021 | | | 20,582,000 | |

| | | | | | | | | | | | | |

| OIL & GAS SERVICES - 3.04% | | | | | | | | | | | | |

| Helix Energy Solutions Group, Inc. | | | 8,000,000 | | | 3.2500 | | 3/15/2032 | | | 6,670,000 | |

| Newpark Resources, Inc. | | | 7,000,000 | | | 4.0000 | | 10/1/2017 | | | 6,693,750 | |

| SEACOR Holdings, Inc. | | | 10,000,000 | | | 3.0000 | | 11/15/2028 | | | 8,193,750 | |

| | | | | | | | | | | | 21,557,500 | |

| PHARMACEUTICALS - 6.50% | | | | | | | | | | | | |

| Horizon Pharma Investment, Ltd. - 144A | | | 9,750,000 | | | 2.5000 | | 3/15/2022 | | | 8,421,562 | |

| Impax Laboratories, Inc. - 144A | | | 19,000,000 | | | 2.0000 | | 6/15/2022 | | | 17,575,000 | |

| Jazz Investments, Ltd. | | | 19,000,000 | | | 1.8750 | | 8/15/2021 | | | 20,123,090 | |

| | | | | | | | | | | | 46,119,652 | |

| REAL ESTATE - 1.35% | | | | | | | | | | | | |

| Forestar Group, Inc. | | | 11,000,000 | | | 3.7500 | | 3/1/2020 | | | 9,590,625 | |

| | | | | | | | | | | | | |

| REIT - 9.19% | | | | | | | | | | | | |

| Apollo Commercial Real Estate Finance, Inc. | | | 11,000,000 | | | 5.5000 | | 3/15/2019 | | | 11,061,930 | |

| Blackstone Mortgage Trust, Inc. | | | 12,000,000 | | | 5.2500 | | 12/1/2018 | | | 12,592,500 | |

| Colony Capital, Inc. | | | 15,000,000 | | | 3.8750 | | 1/15/2021 | | | 14,503,125 | |

| PennyMac Corp. | | | 10,000,000 | | | 5.3750 | | 5/1/2020 | | | 9,100,000 | |

| Resource Capital Corp. | | | 3,000,000 | | | 6.0000 | | 12/1/2018 | | | 2,760,000 | |

| Resource Capital Corp. | | | 16,000,000 | | | 8.0000 | | 1/15/2020 | | | 15,210,000 | |

| | | | | | | | | | | | 65,227,555 | |

| RETAIL - 0.81% | | | | | | | | | | | | |

| GNC Holdings, Inc. - 144A | | | 7,000,000 | | | 1.5000 | | 8/15/2020 | | | 5,775,000 | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | | | |

| SEMICONDUCTORS - 2.70% | | | | | | | | | | | | |

| NVIDIA Corp. | | $ | 1,000,000 | | | 1.0000 | | 12/1/2018 | | $ | 1,466,875 | |

| ON Semiconductor Corp. - 144A | | | 18,000,000 | | | 1.0000 | | 12/1/2020 | | | 17,775,000 | |

| | | | | | | | | | | | 19,241,875 | |

| SOFTWARE - 2.74% | | | | | | | | | | | | |

| Akamai Technologies, Inc. | | | 2,000,000 | | | 0.0000 | | 2/15/2019 | | | 2,028,760 | |

| BroadSoft, Inc. - 144A | | | 5,000,000 | | | 1.0000 | | 9/1/2022 | | | 5,115,625 | |

| Synchronoss Technologies, Inc. | | | 9,000,000 | | | 0.7500 | | 8/15/2019 | | | 9,219,375 | |

| Verint Systems, Inc. | | | 3,000,000 | | | 1.5000 | | 6/1/2021 | | | 3,043,125 | |

| | | | | | | | | | | | 19,406,885 | |

| TELECOMMUNICATIONS - 4.51% | | | | | | | | | | | | |

| CalAmp Corp. - 144A | | | 20,000,000 | | | 1.6250 | | 5/15/2020 | | | 19,512,500 | |

| Finisar Corp. | | | 14,000,000 | | | 0.5000 | | 12/15/2033 | | | 12,556,250 | |

| | | | | | | | | | | | 32,068,750 | |

| TRANSPORTATION - 7.02% | | | | | | | | | | | | |

| Atlas Air Worldwide Holdings | | | 23,000,000 | | | 2.2500 | | 6/1/2022 | | | 19,478,125 | |

| Echo Global Logistics, Inc. | | | 21,800,000 | | | 2.5000 | | 5/1/2020 | | | 20,655,500 | |

| Hornbeck Offshore Services, Inc. | | | 13,000,000 | | | 1.5000 | | 9/1/2019 | | | 9,644,375 | |

| | | | | | | | | | | | 49,778,000 | |

| | | | | | | | | | | | | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | | | | 657,931,105 | |

| (Cost - $663,392,106) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 4.92% | | | | | | | | | | | | |

| United States Treasury Notes | | | 15,000,000 | | | 0.6250 | | 6/30/2017 | | | 14,994,630 | |

| United States Treasury Notes | | | 5,000,000 | | | 0.7500 | | 2/28/2018 | | | 4,985,320 | |

| United States Treasury Notes | | | 5,000,000 | | | 1.0000 | | 6/30/2019 | | | 4,954,070 | |

| United States Treasury Notes | | | 5,000,000 | | | 1.2500 | | 1/31/2020 | | | 4,965,330 | |

| United States Treasury Notes | | | 1,000,000 | | | 1.5000 | | 5/31/2020 | | | 1,001,927 | |

| United States Treasury Notes | | | 4,000,000 | | | 1.6250 | | 6/30/2020 | | | 4,024,064 | |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | | | | | | 34,925,341 | |

| (Cost - $34,829,801) | | | | | | | | | | | | |

| | | Shares | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 1.84% | | | | | | | | | | | | |

| MONEY MARKET FUND - 1.84% | | | | | | | | | | | | |

| Milestone Treasury Obligations Portfolio - Institutional Class + | | | 13,026,181 | | | 0.0100 | | | | | 13,026,181 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost - $13,026,181) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 99.48% | | | | | | | | | | | | |

| (Cost - $711,248,088) (a) | | | | | | | | | | $ | 705,882,627 | |

| OTHER ASSETS LESS LIABILITIES - 0.52% | | | | | | | | | | | 3,669,564 | |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 709,552,191 | |

| + | Variable rate security. Interest rate is as of October 31, 2015. |

REIT - Real Estate Investment Trusts.

144A- Security exempt from registration under Rule 144a of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| (a) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $706,182,354 and differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized Appreciation: | | $ | 40,426,489 | |

| Unrealized Depreciation: | | | (40,726,216 | ) |

| Net Unrealized Depreciation: | | $ | (299,727 | ) |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Notional | | | Termination | | Payable for Open | |

| TOTAL RETURN SWAP | | Amount | | | Date | | Swap Contracts | |

| | | | | | | | | | | |

| Agreement with ReFlow Fund, LLC dated March 1, 2015 to receive total return of the Fund, based on its daily change in NAV less USD-1M LIBOR plus an annualized spread of 1.95%. | | $ | 47,967,604 | | | 12/31/2015 | | $ | (64,298 | ) |

| PORTFOLIO ANALYSIS (Unaudited) |

| As of October 31, 2015 |

| | | % of Net | |

| Sector | | Assets | |

| Financial | | | 25.71 | % |

| Consumer, Non-Cyclical | | | 18.02 | % |

| Consumer, Cyclical | | | 11.66 | % |

| Technology | | | 11.53 | % |

| Industrial | | | 10.40 | % |

| Communications | | | 8.25 | % |

| Government | | | 4.92 | % |

| Energy | | | 4.65 | % |

| Diversified | | | 2.50 | % |

| Short-Term Investments | | | 1.84 | % |

| Assets Less Liabilities | | | 0.52 | % |

| | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| SCHEDULE OF INVESTMENTS |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | | | |

| CONVERTIBLE BONDS - 133.45% | | | | | | | | | | | | |

| APPAREL - 1.96% | | | | | | | | | | | | |

| Iconix Brand Group, Inc. * | | $ | 1,000,000 | | | 1.5000 | | 3/15/2018 | | $ | 849,375 | |

| | | | | | | | | | | | | |

| AUTO MANUFACTURERS - 1.86% | | | | | | | | | | | | |

| General Motors Co. - Societe Generale SA Synthetic * | | | 800,000 | | | 0.0000 | | 11/16/2021 | | | 805,280 | |

| | | | | | | | | | | | | |

| BANKS - 1.04% | | | | | | | | | | | | |

| Goldman Sachs Group, Inc. - Kansas City Southern Synthetic * | | | 500,000 | | | 0.0000 | | 2/16/2021 | | | 450,015 | |

| | | | | | | | | | | | | |

| BIOTECHNOLOGY - 12.85% | | | | | | | | | | | | |

| Acorda Therapeutics, Inc. * | | | 1,500,000 | | | 1.7500 | | 6/15/2021 | | | 1,601,250 | |

| ANI Pharmaceuticals, Inc. * | | | 2,200,000 | | | 3.0000 | | 12/1/2019 | | | 2,117,500 | |

| Emergent BioSolutions, Inc. * | | | 1,500,000 | | | 2.8750 | | 1/15/2021 | | | 1,846,875 | |

| | | | | | | | | | | | 5,565,625 | |

| COMPUTERS - 9.27% | | | | | | | | | | | | |

| Brocade Communications Systems, Inc. - 144A * | | | 300,000 | | | 1.3750 | | 1/1/2020 | | | 295,688 | |

| Electronics For Imaging, Inc. * | | | 1,500,000 | | | 0.7500 | | 9/1/2019 | | | 1,602,188 | |

| Sandisk Corp. * | | | 2,000,000 | | | 0.5000 | | 10/15/2020 | | | 2,118,750 | |

| | | | | | | | | | | | 4,016,626 | |

| DIVERSIFIED FINIANCIAL SERVICES - 1.03% | | | | | | | | | | | | |

| Encore Capital Group, Inc. * | | | 500,000 | | | 2.8750 | | 3/15/2021 | | | 447,187 | |

| | | | | | | | | | | | | |

| ELECTRICAL COMPONENTS & EQUIPMENT - 2.12% | | | | | | | | | | | | |

| SunPower Corp. * | | | 1,000,000 | | | 0.8750 | | 6/1/2021 | | | 919,375 | |

| | | | | | | | | | | | | |

| ELECTRONICS - 4.90% | | | | | | | | | | | | |

| TTM Technologies, Inc. * | | | 2,200,000 | | | 1.7500 | | 12/15/2020 | | | 2,120,250 | |

| | | | | | | | | | | | | |

| ENERGY-ALTERNATE SOURCES - 1.40% | | | | | | | | | | | | |

| Renewable Energy Group, Inc. * | | | 733,000 | | | 2.7500 | | 6/15/2019 | | | 607,932 | |

| | | | | | | | | | | | | |

| FOREST PRODUCTS & PAPER - 2.18% | | | | | | | | | | | | |

| International Paper Co. - Barclays Bank PLC Synthetic * | | | 1,000,000 | | | 0.0000 | | 7/23/2021 | | | 945,200 | |

| | | | | | | | | | | | | |

| HEALTHCARE PRODUCTS - 3.62% | | | | | | | | | | | | |

| Trinity Biotech Investment Ltd. - 144A * | | | 1,800,000 | | | 4.0000 | | 4/1/2045 | | | 1,567,125 | |

| | | | | | | | | | | | | |

| HOLDING COMPANIES-DIVERSIFIED - 4.32% | | | | | | | | | | | | |

| RWT Holdings, Inc. - 144A * | | | 2,000,000 | | | 5.6250 | | 11/15/2019 | | | 1,870,000 | |

| | | | | | | | | | | | | |

| HOME BUILDERS - 10.51% | | | | | | | | | | | | |

| CalAtlantic Group, Inc. * | | | 500,000 | | | 0.2500 | | 6/1/2019 | | | 460,000 | |

| LGI Homes, Inc. - 144A * | | | 1,500,000 | | | 4.2500 | | 11/15/2019 | | | 2,138,437 | |

| M/I Homes, Inc. * | | | 1,500,000 | | | 3.0000 | | 3/1/2018 | | | 1,455,000 | |

| Meritage Homes Corp. * | | | 500,000 | | | 1.8750 | | 9/15/2032 | | | 500,938 | |

| | | | | | | | | | | | 4,554,375 | |

| INTERNET - 8.66% | | | | | | | | | | | | |

| Google, Inc. - Goldman Sachs Group, Inc. Synthetic * | | | 450,000 | | | 0.0000 | | 2/19/2021 | | | 484,699 | |

| Google, Inc. - UBS AG Synthetic * | | | 540,000 | | | 0.0000 | | 2/15/2021 | | | 563,220 | |

| J2 Global, Inc. * | | | 500,000 | | | 3.2500 | | 6/15/2029 | | | 636,875 | |

| LinkedIn Corp. - 144A * | | | 1,900,000 | | | 0.5000 | | 11/1/2019 | | | 2,066,260 | |

| | | | | | | | | | | | 3,751,054 | |

| INVESTMENT COMPANIES - 1.16% | | | | | | | | | | | | |

| New Mountain Finance Corp. * | | | 500,000 | | | 5.0000 | | 6/15/2019 | | | 501,563 | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | |

| MISCELLANEOUS MANUFACTURING - 5.23% | | | | | | | | | | | | |

| General Electric Co. - Barclays Bank PLC Synthetic * | | $ | 2,200,000 | | | 0.0000 | | 8/18/2021 | | $ | 2,264,020 | |

| | | | | | | | | | | | | |

| OIL & GAS SERVICES - 0.95% | | | | | | | | | | | | |

| Seacor Holdings, Inc. * | | | 500,000 | | | 3.0000 | | 11/15/2028 | | | 409,687 | |

| | | | | | | | | | | | | |

| PHARMACEUTICALS - 11.72% | | | | | | | | | | | | |

| Horizon Pharma Investment, Ltd. - 144A * | | | 1,526,000 | | | 2.5000 | | 3/15/2022 | | | 1,318,082 | |

| Impax Laboratories, Inc. - 144A * | | | 2,000,000 | | | 2.0000 | | 6/15/2022 | | | 1,850,000 | |

| Jazz Investments, Ltd. * | | | 1,800,000 | | | 1.8750 | | 8/15/2021 | | | 1,906,398 | |

| | | | | | | | | | | | 5,074,480 | |

| REITS - 18.36% | | | | | | | | | | | | |

| Apollo Commercial Real Estate * | | | 1,800,000 | | | 5.5000 | | 3/15/2019 | | | 1,810,135 | |

| Blackstone Mortgage Trust, Inc. * | | | 1,700,000 | | | 5.2500 | | 12/1/2018 | | | 1,783,937 | |

| Colony Financials, Inc. * | | | 1,500,000 | | | 3.8750 | | 1/15/2021 | | | 1,450,313 | |

| PennyMac Corp. * | | | 1,000,000 | | | 5.3750 | | 5/1/2020 | | | 910,000 | |

| Resource Capital Corp. * | | | 2,100,000 | | | 8.0000 | | 1/15/2020 | | | 1,996,313 | |

| | | | | | | | | | | | 7,950,698 | |

| RETAIL - 0.95% | | | | | | | | | | | | |

| GNC Holdings, Inc. - 144A * | | | 500,000 | | | 1.5000 | | 8/15/2020 | | | 412,500 | |

| | | | | | | | | | | | | |

| SEMICONDUCTORS - 4.56% | | | | | | | | | | | | |

| ON Semiconductor Corp. - 144A * | | | 2,000,000 | | | 1.0000 | | 12/1/2020 | | | 1,975,000 | |

| | | | | | | | | | | | | |

| SOFTWARE - 8.27% | | | | | | | | | | | | |

| BroadSoft, Inc. - 144A * | | | 1,800,000 | | | 1.0000 | | 9/1/2022 | | | 1,841,625 | |

| Synchronoss Technologies, Inc. * | | | 1,700,000 | | | 0.7500 | | 8/15/2019 | | | 1,741,437 | |

| | | | | | | | | | | | 3,583,062 | |

| TELECOMMUNICATIONS - 6.57% | | | | | | | | | | | | |

| CalAmp Corp. - 144A * | | | 2,000,000 | | | 1.6250 | | 5/15/2020 | | | 1,951,250 | |

| Finisar Corp. * | | | 1,000,000 | | | 0.5000 | | 12/15/2033 | | | 896,875 | |

| | | | | | | | | | | | 2,848,125 | |

| TRANSPORTATION - 9.96% | | | | | | | | | | | | |

| Atlas Air Worldwide Holdings, Inc. * | | | 2,200,000 | | | 2.2500 | | 6/1/2022 | | | 1,863,125 | |

| Echo Global Logistics, Inc. * | | | 2,200,000 | | | 2.5000 | | 5/1/2020 | | | 2,084,500 | |

| Hornbeck Offshore Services, Inc. * | | | 500,000 | | | 1.5000 | | 9/1/2019 | | | 370,937 | |

| | | | | | | | | | | | 4,318,562 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | | | | | |

| (Cost - $59,079,208) | | | | | | | | | | | 57,807,116 | |

| | | | | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 4.60% | | | | | | | | | | | | |

| United States Treasury Notes * | | | 500,000 | | | 0.6250 | | 6/30/2017 | | | 499,821 | |

| United States Treasury Notes * | | | 1,000,000 | | | 0.6250 | | 4/30/2018 | | | 992,461 | |

| United States Treasury Notes * | | | 500,000 | | | 1.3750 | | 2/29/2020 | | | 498,985 | |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | | | | | | 1,991,267 | |

| (Cost - $1,993,173) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 3.70% | | | | | | | | | | | | |

| MONEY MARKET FUND - 3.70% | | Shares | | | | | | | | | |

| Milestone Treasury Obligations Portfolio - Institutional Class + | | | 1,602,273 | | | 0.0100 | | | | | 1,602,273 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost - $1,602,273) | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Market Value | |

| | | | | |

| TOTAL INVESTMENTS - 141.75% | | | | |

| (Cost - $62,674,654) (a) | | $ | 61,400,656 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (41.75)% | | | (18,083,443 | ) |

| NET ASSETS - 100.00% | | $ | 43,317,213 | |

| * | All or a portion of this security is seggregated as collateral for the Line of Credit as of October 31, 2015. |

| + | Variable rate security. Interest rate is as of October 31, 2015. |

REITS - Real Estate Investment Trusts.

144a- Security exempt from registration under Rule 144a of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| (a) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $62,545,494 and differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized Appreciation: | | $ | 1,875,739 | |

| Unrealized Depreciation: | | | (3,020,577 | ) |

| Net Unrealized Depreciation: | | $ | (1,144,838 | ) |

| | | Notional | | | Termination | | Receivable from | |

| TOTAL RETURN SWAP | | Amount | | | Date | | Open Swap Contracts | |

| | | | | | | | | | | |

| Agreement with ReFlow Fund, LLC dated January 9, 2015 to receive total return of the Fund, based on its daily change in NAV less USD-1M LIBOR plus an annualized spread of 1.95%. | | $ | 3,592,643 | | | 11/30/2015 | | $ | 249,347 | |

| PORTFOLIO ANALYSIS (Unaudited) |

| As of October 31, 2015 |

| | | % of Net | |

| Sector | | Assets | |

| Financial | | | 33.27 | % |

| Consumer, Non-Cyclical | | | 28.18 | % |

| Technology | | | 22.10 | % |

| Industrial | | | 16.99 | % |

| Consumer, Cyclical | | | 13.42 | % |

| Communications | | | 12.82 | % |

| Government | | | 4.60 | % |

| Diversified | | | 4.32 | % |

| Short-Term Investments | | | 3.70 | % |

| Energy | | | 2.35 | % |

| Liabilities in Excess of Assets | | | (41.75 | )% |

| | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| SCHEDULE OF INVESTMENTS |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | | | |

| CONVERTIBLE BONDS - 48.32% | | | | | | | | | | | | |

| AUTO MANUFACTURERS - 1.66% | | | | | | | | | | | | |

| General Motors Co. - Societe Generale SA Synthetic | | $ | 700,000 | | | 0.0000 | | 11/16/2021 | | $ | 704,620 | |

| | | | | | | | | | | | | |

| BANKS - 0.42% | | | | | | | | | | | | |

| Goldman Sachs Group, Inc. - Kansas City Southern Synthetic | | | 200,000 | | | 0.0000 | | 2/16/2021 | | | 180,006 | |

| | | | | | | | | | | | | |

| BIOTECHNOLOGY - 2.55% | | | | | | | | | | | | |

| ANI Pharmaceuticals, Inc. | | | 1,000,000 | | | 3.0000 | | 12/1/2019 | | | 962,500 | |

| Emergent BioSolutions, Inc. | | | 100,000 | | | 2.8750 | | 1/15/2021 | | | 123,125 | |

| | | | | | | | | | | | 1,085,625 | |

| COMPUTERS - 3.00% | | | | | | | | | | | | |

| Electronics For Imaging, Inc. | | | 500,000 | | | 0.7500 | | 9/1/2019 | | | 534,063 | |

| SanDisk Corp. | | | 700,000 | | | 0.5000 | | 10/15/2020 | | | 741,562 | |

| | | | | | | | | | | | 1,275,625 | |

| DIVERSIFIED FINANCIAL SERVICES - 1.05% | | | | | | | | | | | | |

| Encore Capital Group, Inc. | | | 500,000 | | | 2.8750 | | 3/15/2021 | | | 447,188 | |

| | | | | | | | | | | | | |

| ELECTRONICS - 2.26% | | | | | | | | | | | | |

| TTM Technologies, Inc. | | | 1,000,000 | | | 1.7500 | | 12/15/2020 | | | 963,750 | |

| | | | | | | | | | | | | |

| FOREST PRODUCTS & PAPER - 1.32% | | | | | | | | | | | | |

| International Paper Co. - Wells Fargo & Co Synthetic | | | 600,000 | | | 0.0000 | | 6/10/2020 | | | 560,280 | |

| | | | | | | | | | | | | |

| HEALTHCARE PRODUCTS - 1.23% | | | | | | | | | | | | |

| Trinity Biotech Investment, Ltd. - 144A | | | 600,000 | | | 4.0000 | | 4/1/2045 | | | 522,375 | |

| | | | | | | | | | | | | |

| HOLDING COMPANIES-DIVERSIFIED - 0.88% | | | | | | | | | | | | |

| RWT Holdings, Inc. - 144A | | | 400,000 | | | 5.6250 | | 11/15/2019 | | | 374,000 | |

| | | | | | | | | | | | | |

| HOME BUILDERS - 2.92% | | | | | | | | | | | | |

| LGI Homes, Inc. - 144A | | | 600,000 | | | 4.2500 | | 11/15/2019 | | | 855,375 | |

| M/I Homes, Inc. | | | 400,000 | | | 3.0000 | | 3/1/2018 | | | 388,000 | |

| | | | | | | | | | | | 1,243,375 | |

| INTERNET - 2.84% | | | | | | | | | | | | |

| Google, Inc. - Goldman Sachs Group, Inc. Synthetic | | | 400,000 | | | 0.0000 | | 2/19/2021 | | | 430,844 | |

| J2 Global, Inc. | | | 100,000 | | | 3.2500 | | 6/15/2029 | | | 127,375 | |

| LinkedIn Corp. - 144A | | | 600,000 | | | 0.5000 | | 11/1/2019 | | | 652,503 | |

| | | | | | | | | | | | 1,210,722 | |

| MISCELLANEOUS MANUFACTURING - 2.66% | | | | | | | | | | | | |

| General Electric Co. - Barclays Bank PLC Synthetic | | | 1,100,000 | | | 0.0000 | | 8/18/2021 | | | 1,132,010 | |

| | | | | | | | | | | | | |

| OIL & GAS SERVICES - 0.77% | | | | | | | | | | | | |

| Seacor Holdings, Inc. | | | 400,000 | | | 3.0000 | | 11/15/2028 | | | 327,750 | |

| | | | | | | | | | | | | |

| PHARMACEUTICALS - 5.90% | | | | | | | | | | | | |

| Horizon Pharma Investment, Ltd. - 144A | | | 610,000 | | | 2.5000 | | 3/15/2022 | | | 526,887 | |

| Impax Laboratories, Inc. - 144A | | | 1,000,000 | | | 2.0000 | | 6/15/2022 | | | 925,000 | |

| Jazz Investments, Ltd. | | | 1,000,000 | | | 1.8750 | | 8/15/2021 | | | 1,059,110 | |

| | | | | | | | | | | | 2,510,997 | |

| REITS - 6.38% | | | | | | | | | | | | |

| Apollo Commercial Real Estate | | | 700,000 | | | 5.5000 | | 3/15/2019 | | | 703,941 | |

| Blackstone Mortgage Trust, Inc. | | | 300,000 | | | 5.2500 | | 12/1/2018 | | | 314,813 | |

| Colony Financials, Inc. | | | 300,000 | | | 3.8750 | | 1/15/2021 | | | 290,062 | |

| PennyMac Corp. | | | 500,000 | | | 5.3750 | | 5/1/2020 | | | 455,000 | |

| Resource Capital Corp. | | | 1,000,000 | | | 8.0000 | | 1/15/2020 | | | 950,625 | |

| | | | | | | | | | | | 2,714,441 | |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | | | |

| SEMICONDUCTORS - 2.32% | | | | | | | | | | | | |

| ON Semiconductor Corp. - 144A | | $ | 1,000,000 | | | 1.0000 | | 12/1/2020 | | $ | 987,500 | |

| | | | | | | | | | | | | |

| SOFTWARE - 2.89% | | | | | | | | | | | | |

| BroadSoft, Inc. - 144A | | | 400,000 | | | 1.0000 | | 9/1/2022 | | | 409,250 | |

| Synchronoss Technologies, Inc. | | | 800,000 | | | 0.7500 | | 8/15/2019 | | | 819,500 | |

| | | | | | | | | | | | 1,228,750 | |

| TELECOMMUNICATIONS - 2.71% | | | | | | | | | | | | |

| CalAmp Corp. - 144A | | | 1,000,000 | | | 1.6250 | | 5/15/2020 | | | 975,625 | |

| Finisar Corp. | | | 200,000 | | | 0.5000 | | 12/15/2033 | | | 179,375 | |

| | | | | | | | | | | | 1,155,000 | |

| TRANSPORTATION - 4.56% | | | | | | | | | | | | |

| Atlas Air Worldwide Holdings, Inc. | | | 1,000,000 | | | 2.2500 | | 6/1/2022 | | | 846,875 | |

| Echo Global Logistics, Inc. | | | 1,000,000 | | | 2.5000 | | 5/1/2020 | | | 947,500 | |

| Hornbeck Offshore Services, Inc. | | | 200,000 | | | 1.5000 | | 9/1/2019 | | | 148,375 | |

| | | | | | | | | | | | 1,942,750 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | | | | | |

| (Cost - $20,728,978) | | | | | | | | | | | 20,566,764 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS & NOTES - 15.06% | | | | | | | | | | | | |

| AEROSPACE/DEFENSE - 0.67% | | | | | | | | | | | | |

| L-3 Communications Corp. | | | 300,000 | | | 3.9500 | | 5/28/2024 | | | 286,917 | |

| | | | | | | | | | | | | |

| AIRLINES - 0.36% | | | | | | | | | | | | |

| Allegiant Travel Co. | | | 150,000 | | | 5.5000 | | 7/15/2019 | | | 153,900 | |

| | | | | | | | | | | | | |

| CHEMICALS - 0.95% | | | | | | | | | | | | |

| Celanese US Holdings LLC | | | 200,000 | | | 4.6250 | | 11/15/2022 | | | 201,750 | |

| Chemtura Corp. | | | 200,000 | | | 5.7500 | | 7/15/2021 | | | 204,000 | |

| | | | | | | | | | | | 405,750 | |

| ELECTRICAL COMPONENTS & EQUIPMENT - 0.46% | | | | | | | | | | | | |

| Anixter, Inc. | | | 190,000 | | | 5.1250 | | 10/1/2021 | | | 195,225 | |

| | | | | | | | | | | | | |

| ELECTRONICS - 0.59% | | | | | | | | | | | | |

| Jabil Circuit, Inc. | | | 250,000 | | | 4.7000 | | 9/15/2022 | | | 252,563 | |

| | | | | | | | | | | | | |

| HOME BUILDERS - 0.96% | | | | | | | | | | | | |

| DR Horton, Inc. | | | 200,000 | | | 4.3750 | | 9/15/2022 | | | 205,000 | |

| MDC Holdings, Inc. | | | 200,000 | | | 5.5000 | | 1/15/2024 | | | 205,000 | |

| | | | | | | | | | | | 410,000 | |

| INVESTMENT COMPANIES - 1.66% | | | | | | | | | | | | |

| FS Investment Corp. | | | 350,000 | | | 4.0000 | | 7/15/2019 | | | 352,513 | |

| PennantPark Investment Co. | | | 350,000 | | | 4.5000 | | 10/1/2019 | | | 352,212 | |

| | | | | | | | | | | | 704,725 | |

| IRON/STEEL - 1.22% | | | | | | | | | | | | |

| Carpenter Technology Corp. | | | 350,000 | | | 4.4500 | | 3/1/2023 | | | 341,933 | |

| Commercial Metals Co. | | | 200,000 | | | 4.8750 | | 5/15/2023 | | | 178,000 | |

| | | | | | | | | | | | 519,933 | |

| MACHINERY-CONSTRUCTION & MINING - 0.84% | | | | | | | | | | | | |

| Joy Global, Inc. | | | 400,000 | | | 5.1250 | | 10/15/2021 | | | 357,810 | |

| | | | | | | | | | | | | |

| MINING - 0.87% | | | | | | | | | | | | |

| Newmont Mining Corp. | | | 400,000 | | | 3.5000 | | 3/15/2022 | | | 369,759 | |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Principal | | | Interest Rate | | | | | |

| Security | | Amount | | | (%) | | Maturity Date | | Market Value | |

| | | | | | | | | | | |

| MISCELLANEOUS MANUFACTURING - 0.90% | | | | | | | | | | | | |

| Trinity Industries, Inc. | | $ | 400,000 | | | 4.5500 | | 10/1/2024 | | $ | 380,918 | |

| | | | | | | | | | | | | |

| OIL & GAS - 0.36% | | | | | | | | | | | | |

| Atwood Oceanics Inc. | | | 200,000 | | | 6.5000 | | 2/1/2020 | | | 155,000 | |

| | | | | | | | | | | | | |

| OIL & GAS SERVICES - 1.52% | | | | | | | | | | | | |

| FMC Technologies, Inc. | | | 400,000 | | | 3.4500 | | 10/1/2022 | | | 368,932 | |

| Oceaneering International, Inc. | | | 300,000 | | | 4.6500 | | 11/15/2024 | | | 279,477 | |

| | | | | | | | | | | | 648,409 | |

| RETAIL - 1.70% | | | | | | | | | | | | |

| Coach, Inc. | | | 350,000 | | | 4.2500 | | 4/1/2025 | | | 332,186 | |

| Staples, Inc. | | | 400,000 | | | 4.3750 | | 1/12/2023 | | | 390,486 | |

| | | | | | | | | | | | 722,672 | |

| SEMICONDUCTORS - 1.41% | | | | | | | | | | | | |

| KLA-Tencor Corp. | | | 350,000 | | | 4.6500 | | 11/1/2024 | | | 353,062 | |

| Micron Technology, Inc. - 144A | | | 250,000 | | | 5.2500 | | 8/1/2023 | | | 244,872 | |

| | | | | | | | | | | | 597,934 | |

| TELECOMMUNICATIONS - 0.59% | | | | | | | | | | | | |

| Juniper Networks, Inc. | | | 250,000 | | | 4.5000 | | 3/15/2024 | | | 250,322 | |

| | | | | | | | | | | | | |

| TOTAL CORPORATE BONDS & NOTES (Cost - $6,585,871) | | | | | | | | | | | 6,411,837 | |

| | | | | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 35.26% | | | | | | | | | | | | |

| United States Treasury Notes | | | 600,000 | | | 0.6250 | | 12/31/2016 | | | 600,941 | |

| United States Treasury Notes | | | 800,000 | | | 0.5000 | | 1/31/2017 | | | 799,776 | |

| United States Treasury Notes | | | 850,000 | | | 0.5000 | | 2/28/2017 | | | 849,336 | |

| United States Treasury Notes | | | 900,000 | | | 0.6250 | | 6/30/2017 | | | 899,678 | |

| United States Treasury Notes | | | 600,000 | | | 1.0000 | | 12/15/2017 | | | 602,449 | |

| United States Treasury Notes | | | 600,000 | | | 0.8750 | | 1/15/2018 | | | 600,395 | |

| United States Treasury Notes | | | 400,000 | | | 0.7500 | | 2/28/2018 | | | 398,825 | |

| United States Treasury Notes | | | 850,000 | | | 1.0000 | | 3/15/2018 | | | 852,197 | |

| United States Treasury Notes | | | 600,000 | | | 1.3750 | | 12/31/2018 | | | 604,891 | |

| United States Treasury Notes | | | 600,000 | | | 1.6250 | | 12/31/2019 | | | 605,414 | |

| United States Treasury Notes | | | 600,000 | | | 1.2500 | | 1/31/2020 | | | 595,840 | |

| United States Treasury Notes | | | 850,000 | | | 1.3750 | | 2/29/2020 | | | 848,274 | |

| United States Treasury Notes | | | 2,000,000 | | | 1.1250 | | 4/30/2020 | | | 1,971,328 | |

| United States Treasury Notes | | | 700,000 | | | 1.3750 | | 8/31/2020 | | | 696,254 | |

| United States Treasury Notes | | | 600,000 | | | 2.1250 | | 12/31/2021 | | | 611,586 | |

| United States Treasury Notes | | | 600,000 | | | 1.5000 | | 1/31/2022 | | | 588,918 | |

| United States Treasury Notes | | | 850,000 | | | 1.7500 | | 2/28/2022 | | | 846,259 | |

| United States Treasury Notes | | | 600,000 | | | 1.6250 | | 11/15/2022 | | | 589,363 | |

| United States Treasury Notes | | | 600,000 | | | 2.2500 | | 11/15/2024 | | | 606,559 | |

| United States Treasury Notes | | | 850,000 | | | 2.0000 | | 2/15/2025 | | | 840,299 | |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | | | | | | 15,008,582 | |

| (Cost - $15,007,994) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 0.87% | | | | | | | | | | | | |

| MONEY MARKET FUND - 0.87% | | Shares | | | | | | | | | |

| Milestone Treasury Obligations Portfolio - Institutional Class + | | | 369,666 | | | 0.0100 | | | | | 369,666 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost - $369,666) | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2015 |

| | | Market Value | |

| | | | | |

| TOTAL INVESTMENTS - 99.51% | | | | |

| (Cost - $42,692,509) (a) | | $ | 42,356,849 | |

| OTHER ASSETS LESS LIABILITIES - 0.49% | | | 208,423 | |

| NET ASSETS - 100.00% | | $ | 42,565,272 | |

| + | Variable rate security. Interest rate is as of October 31, 2015. |

REITS - Real Estate Investment Trusts.

144a - Security exempt from registration under Rule 144a of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| (a) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $42,717,393 and differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized Appreciation: | | $ | 749,807 | |

| Unrealized Depreciation: | | | (1,110,351 | ) |

| Net Unrealized Depreciation: | | $ | (360,544 | ) |

| PORTFOLIO ANALYSIS (Unaudited) |

| As of October 31, 2015 |

| | | % of Net | |

| Sector | | Assets | |

| Government | | | 35.26 | % |

| Financial | | | 16.15 | % |

| Industrial | | | 10.29 | % |

| Consumer, Non-Cyclical | | | 9.68 | % |

| Technology | | | 9.61 | % |

| Consumer, Cyclical | | | 5.94 | % |

| Communications | | | 5.13 | % |

| Basic Materials | | | 3.04 | % |

| Energy | | | 2.66 | % |

| Diversified | | | 0.88 | % |

| Short-Term Investments | | | 0.87 | % |

| Assets Less Liabilities | | | 0.49 | % |

| | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

| Miller Funds |

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2015 |

| | | Miller | | | Miller | | | Miller | |

| | | Convertible | | | Convertible | | | Intermediate | |

| | | Bond Fund | | | Plus Fund | | | Bond Fund | |

| Assets: | | | | | | | | | | | | |

| Investments in Securities at Cos | | $ | 711,248,088 | | | $ | 62,674,654 | | | $ | 42,692,509 | |

| Investments in Securities at Value | | $ | 705,882,627 | | | $ | 61,400,656 | | | $ | 42,356,849 | |

| Segregated Cash- Collateral for Loan | | | — | | | | 56,035 | | | | — | |

| Interest Receivable | | | 4,947,367 | | | | 461,865 | | | | 279,291 | |

| Receivable from Fund Shares Sold | | | 1,646,843 | | | | 21,000 | | | | 21,000 | |

| Receivable from Open Swap Contracts | | | — | | | | 249,347 | | | | — | |

| Prepaid Expenses and Other Assets | | | 54,357 | | | | 41,754 | | | | 43,559 | |

| Total Assets | | | 712,531,194 | | | | 62,230,657 | | | | 42,700,699 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Loan Payable | | | — | | | | 18,600,000 | | | | — | |

| Redemptions Payable | | | 326,259 | | | | 2,600 | | | | 88,495 | |

| Payable for Securities Purchased | | | 1,882,716 | | | | 189,866 | | | | — | |

| Payable for Open Swap Contracts | | | 64,298 | | | | — | | | | — | |

| Interest Payable | | | — | | | | 18,773 | | | | — | |

| Accrued Advisory Fees | | | 445,391 | | | | 71,622 | | | | 16,608 | |

| Accrued Distribution Fees | | | 126,261 | | | | 65 | | | | 188 | |

| Accrued Expenses and Other Liabilities | | | 134,078 | | | | 30,518 | | | | 30,136 | |

| Total Liabilities | | | 2,979,003 | | | | 18,913,444 | | | | 135,427 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 709,552,191 | | | $ | 43,317,213 | | | $ | 42,565,272 | |

| | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | |

| At October 31, 2015, Net Assets consisted of: | | | | | | | | | | | | |

| Paid-in-Capital | | $ | 707,377,735 | | | $ | 43,962,937 | | | $ | 42,573,907 | |

| Undistributed Net Investment Income | | | 7,496,092 | | | | 30,674 | | | | 129,963 | |

| Accumulated Net Realized Gain from Security Transactions and Swaps | | | 465,544 | | | | 348,253 | | | | 197,062 | |

| Net Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | (5,365,461 | ) | | | (1,273,998 | ) | | | (335,660 | ) |

| Swaps | | | (421,719 | ) | | | 249,347 | | | | — | |

| Net Assets | | $ | 709,552,191 | | | $ | 43,317,213 | | | $ | 42,565,272 | |

| | | | | | | | | | | | | |

| Net Asset Value Per Share | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | | |

| Net Assets | | $ | 159,608,023 | | | $ | 82,231 | | | $ | 863,122 | |

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | | | 13,133,785 | | | | 3,917 | | | | 55,806 | |

| Net Asset Value and Redemption Price per Share | | $ | 12.15 | | | $ | 20.99 | | | $ | 15.47 | |

| Maximum Offering Price Per Share (Includes a Maximum Sales Charge of 5.75%) | | $ | 12.89 | | | $ | 22.28 | | | $ | 16.41 | |

| | | | | | | | | | | | | |

| Class I Shares | | | | | | | | | | | | |

| Net Assets | | $ | 480,547,702 | | | $ | 43,168,153 | | | $ | 41,597,162 | |

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | | | 39,538,473 | | | | 2,054,684 | | | | 2,688,452 | |

| Net Asset Value; Offering and Redemption Price per Share | | $ | 12.15 | | | $ | 21.01 | | | $ | 15.47 | |

| | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | | |

| Net Assets | | $ | 69,396,466 | | | $ | 66,829 | | | $ | 104,988 | |

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | | | 5,747,737 | | | | 3,200 | | | | 6,745 | |

| Net Asset Value; Offering and Redemption Price per Share | | $ | 12.07 | | | $ | 20.88 | | | $ | 15.57 | |

The accompanying notes are an integral part of these financial statements.

| Miller Funds |

| STATEMENT OF OPERATIONS |

| For the Year Ended October 31, 2015 |

| | | Miller | | | Miller | | | Miller | |

| | | Convertible | | | Convertible | | | Intermediate | |

| | | Bond Fund | | | Plus Fund * | | | Bond Fund * | |

| Investment Income: | | | | | | | | | | | | |

| Interest Income | | $ | 27,024,803 | | | $ | 1,361,670 | | | $ | 734,747 | |

| Other Income | | | 1,409,887 | | | | — | | | | — | |

| Total Investment Income | | | 28,434,690 | | | | 1,361,670 | | | | 734,747 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment Advisory Fees | | | 5,313,832 | | | | 731,358 | | | | 240,328 | |

| Distribution Fees (Class A) | | | 1,328,062 | | | | 73 | | | | 382 | |

| Distribution Fees (Class C) | | | 676,304 | | | | 413 | | | | 147 | |

| Non 12b-1 Shareholder Servicing Fees | | | 306,277 | | | | 90 | | | | 283 | |

| Administration Fees | | | 252,400 | | | | 13,514 | | | | 16,039 | |

| Transfer Agent Fees | | | 217,480 | | | | 28,667 | | | | 31,101 | |

| Custody Fees | | | 92,260 | | | | 15,747 | | | | 6,656 | |

| Printing Expense | | | 88,146 | | | | 5,504 | | | | 6,109 | |

| Trustees’ Fees | | | 86,002 | | | | 20,602 | | | | 20,591 | |

| Registration and Filing Fees | | | 75,605 | | | | 60,966 | | | | 60,911 | |

| Legal Fees | | | 44,738 | | | | 82,866 | | | | 44,589 | |

| Audit Fees | | | 42,499 | | | | 20,749 | | | | 20,694 | |

| Chief Compliance Officer Fees | | | 27,423 | | | | 8,772 | | | | 5,829 | |

| Insurance Expense | | | 25,616 | | | | 466 | | | | 469 | |

| Interest Expense | | | — | | | | 144,652 | | | | — | |

| Miscellaneous Expenses | | | 40,777 | | | | 3,442 | | | | 3,279 | |

| Total Expenses | | | 8,617,421 | | | | 1,137,881 | | | | 457,407 | |

| Less: Fees Waived by Adviser | | | — | | | | (221,204 | ) | | | (140,113 | ) |

| Net Expenses | | | 8,617,421 | | | | 916,677 | | | | 317,294 | |

| Net Investment Income | | | 19,817,269 | | | | 444,993 | | | | 417,453 | |

| | | | | | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Investments | | | 3,287,657 | | | | 713,966 | | | | 220,240 | |

| Swaps | | | (879,835 | ) | | | (446,357 | ) | | | — | |

| Total Net Realized Gain | | | 2,407,822 | | | | 267,609 | | | | 220,240 | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | (16,869,736 | ) | | | (1,273,998 | ) | | | (335,660 | ) |

| Swaps | | | (628,104 | ) | | | 249,347 | | | | — | |

| Total Net Change in Unrealized Depreciation | | | (17,497,840 | ) | | | (1,024,651 | ) | | | (335,660 | ) |

| Net Realized and Unrealized Loss on Investments | | | (15,090,018 | ) | | | (757,042 | ) | | | (115,420 | ) |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting From Operations | | $ | 4,727,251 | | | $ | (312,049 | ) | | $ | 302,033 | |

| * | The Miller Convertible Plus Fund and the Miller Intermediate Bond Fund commenced operations on December 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | October 31, 2015 | | | October 31, 2014 | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 19,817,269 | | | $ | 17,225,893 | |

| Net Realized Gain on Investments and Swaps | | | 2,407,822 | | | | 23,838,784 | |

| Net Change in Unrealized Depreciation on Investments and Swaps | | | (17,497,840 | ) | | | (4,553,580 | ) |

| Net Increase in Net Assets Resulting From Operations | | | 4,727,251 | | | | 36,511,097 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Net Investment Income | | | | | | | | |

| Class A ($0.32 and $0.27 per share, respectively) | | | (7,008,661 | ) | | | (6,245,394 | ) |

| Class I ($0.39 and $0.37 per share, respectively) | | | (11,319,535 | ) | | | (6,823,259 | ) |

| Class C ($0.26 and $0.22 per share, respectively) | | | (1,406,241 | ) | | | (1,021,158 | ) |

| | | | (19,734,437 | ) | | | (14,089,811 | ) |

| Net Realized Gains | | | | | | | | |

| Class A ($0.34 and $0.49 per share, respectively) | | | (8,138,665 | ) | | | (8,976,604 | ) |

| Class I ($0.34 and $0.49 per share, respectively) | | | (9,691,316 | ) | | | (5,378,769 | ) |

| Class C ($0.34 and $0.49 per share, respectively) | | | (1,759,008 | ) | | | (1,798,742 | ) |

| | | | (19,588,989 | ) | | | (16,154,115 | ) |

| Total Distributions to Shareholders | | | (39,323,426 | ) | | | (30,243,926 | ) |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued (4,692,244 and 11,458,068 shares, respectively) | | | 58,306,872 | | | | 145,363,288 | |

| Distributions Reinvested (1,152,368 and 1,136,576 shares, respectively) | | | 14,033,646 | | | | 14,108,137 | |

| Cost of Shares Redeemed (16,713,346 and 6,060,830 shares, respectively) | | | (204,447,155 | ) | | | (77,012,865 | ) |

| Total Class A Shares | | | (132,106,637 | ) | | | 82,458,560 | |

| Class I | | | | | | | | |

| Proceeds from Shares Issued (22,030,137 and 19,765,705 shares, respectively) | | | 270,474,868 | | | | 252,847,395 | |

| Distributions Reinvested (1,408,855 and 721,998 shares, respectively) | | | 17,168,778 | | | | 9,028,166 | |

| Cost of Shares Redeemed (11,518,685 and 3,139,186 shares, respectively) | | | (142,433,826 | ) | | | (40,049,294 | ) |

| Total Class I Shares | | | 145,209,820 | | | | 221,826,267 | |

| Class C | | | | | | | | |

| Proceeds from Shares Issued (1,165,866 and 1,980,820 shares, respectively) | | | 14,423,058 | | | | 25,159,159 | |

| Distributions Reinvested (243,192 and 216,029 shares, respectively) | | | 2,946,420 | | | | 2,661,284 | |

| Cost of Shares Redeemed (942,888 and 435,701 shares, respectively) | | | (11,681,650 | ) | | | (5,513,393 | ) |

| Total Class C Shares | | | 5,687,828 | | | | 22,307,050 | |

| Total Beneficial Interest Transactions | | | 18,791,011 | | | | 326,591,877 | |

| | | | | | | | | |

| Increase (Decrease) in Net Assets | | | (15,805,164 | ) | | | 332,859,048 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Year | | | 725,357,355 | | | | 392,498,307 | |

| End of Year (undistributed net investment income of $7,496,092 and $7,377,090 respectively) | | $ | 709,552,191 | | | $ | 725,357,355 | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| STATEMENT OF CHANGES IN NET ASSETS |

| | | Period | |

| | | Ended | |

| | | October 31, 2015 * | |

| Operations: | | | | |

| Net Investment Income | | $ | 444,993 | |

| Net Realized Gain on Investments and Swaps | | | 267,609 | |

| Net Change in Unrealized Depreciation on Investments and Swaps | | | (1,024,651 | ) |

| Net Decrease in Net Assets Resulting From Operations | | | (312,049 | ) |

| | | | | |

| Distributions to Shareholders From: | | | | |

| Net Investment Income | | | | |

| Class A ($0.19) | | | (281 | ) |

| Class I ($0.20) | | | (305,691 | ) |

| Class C ($0.15) | | | (221 | ) |

| Total Distributions to Shareholders | | | (306,193 | ) |

| | | | | |

| Beneficial Interest Transactions: | | | | |

| Class A | | | | |

| Proceeds from Shares Issued (4,393 shares) | | | 95,550 | |

| Distributions Reinvested (12 shares) | | | 281 | |

| Cost of Shares Redeemed (489 shares) | | | (10,963 | ) |

| Total Class A Shares | | | 84,868 | |

| Class I | | | | |

| Proceeds from Shares Issued (2,206,267 shares) | | | 47,045,002 | |

| Distributions Reinvested (13,605 shares) | | | 304,193 | |

| Cost of Shares Redeemed (165,188 shares) | | | (3,569,357 | ) |

| Total Class I Shares | | | 43,779,838 | |

| Class C | | | | |

| Proceeds from Shares Issued (12,174 shares) | | | 267,505 | |

| Distributions Reinvested (9 shares) | | | 221 | |

| Cost of Shares Redeemed (8,983 shares) | | | (196,977 | ) |

| Total Class C Shares | | | 70,749 | |

| Total Beneficial Interest Transactions | | | 43,935,455 | |

| | | | | |

| Increase in Net Assets | | | 43,317,213 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of Period | | | — | |

| End of Period (undistributed net investment income of $30,674 | | $ | 43,317,213 | |

| * | The Miller Convertible Plus Fund commenced operations on December 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| STATEMENT OF CHANGES IN NET ASSETS |

| | | Period | |

| | | Ended | |

| | | October 31, 2015 * | |

| Operations: | | | | |

| Net Investment Income | | $ | 417,453 | |

| Net Realized Gain on Investments | | | 220,240 | |

| Net Change in Unrealized Depreciation on Investments | | | (335,660 | ) |

| Net Increase in Net Assets Resulting From Operations | | | 302,033 | |

| | | | | |

| Distributions to Shareholders From: | | | | |

| Net Investment Income | | | | |

| Class A ($0.11) | | | (2,793 | ) |

| Class I ($0.12) | | | (279,341 | ) |

| Total Distributions to Shareholders | | | (282,134 | ) |

| | | | | |

| Beneficial Interest Transactions: | | | | |

| Class A | | | | |

| Proceeds from Shares Issued (55,625 shares) | | | 855,954 | |

| Distributions Reinvested (181 shares) | | | 2,793 | |

| Total Class A Shares | | | 858,747 | |

| Class I | | | | |

| Proceeds from Shares Issued (2,930,522 shares) | | | 45,358,137 | |

| Distributions Reinvested (17,842 shares) | | | 278,011 | |

| Cost of Shares Redeemed (259,912 shares) | | | (4,055,795 | ) |

| Total Class I Shares | | | 41,580,353 | |

| Class C | | | | |

| Proceeds from Shares Issued (19,323 shares) | | | 305,015 | |

| Cost of Shares Redeemed (12,579 shares) | | | (198,742 | ) |

| Total Class C Shares | | | 106,273 | |

| Total Beneficial Interest Transactions | | | 42,545,373 | |

| | | | | |

| Increase in Net Assets | | | 42,565,272 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of Period | | | — | |

| End of Period (undistributed net investment income of $129,963 | | $ | 42,565,272 | |

| * | The Miller Intermediate Bond Fund commenced operations on December 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| STATEMENT OF CASH FLOWS |

| For the Period Ended October 31, 2015 * |

| Cash flows from operating activities: | | | | |

| Net decrease in net assets resulting from operations | | $ | (312,049 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (109,180,291 | ) |

| Proceeds from sales of investments | | | 49,040,896 | |

| Proceeds from sales of short term investments, net | | | (1,602,273 | ) |

| Net realized gain from investments and swaps | | | (267,609 | ) |

| Net change in unrealized depreciation from investments and swaps | | | 1,024,651 | |

| Net accretion of discounts | | | (490,466 | ) |

| | | | | |

| Changes in assets and liabilities | | | | |

| (Increase)/decrease in assets: | | | | |

| Interest receivable | | | (461,865 | ) |

| Receivable from open swap contracts | | | (249,347 | ) |

| Prepaid expenses and other assets | | | (41,754 | ) |

| Increase/(decrease) in liabilities: | | | | |

| Payable for securities purchased | | | 189,866 | |

| Interest payable | | | 18,773 | |

| Accrued advisory fees | | | 71,622 | |

| Distribution fee payable | | | 65 | |

| Other accrued expenses payable | | | 30,518 | |

| Net cash used in operating activities | | | (62,229,263 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Net borrowings under of line of credit, net | | | 18,600,000 | |

| Proceeds from shares sold | | | 47,408,057 | |

| Payment on shares redeemed | | | (3,777,297 | ) |

| Cash distributions paid | | | (1,497 | ) |

| Net cash provided by financing activities | | | 62,229,263 | |

| | | | | |

| Net increase in cash | | | — | |

| Cash at beginning of period | | | — | |

| Cash at end of period | | | — | |

| | | | | |

| Supplemental disclosure of non-cash activity: | | | | |

| Noncash financing activities not including herein consists of reinvestment of dividends | | $ | 304,695 | |

| * | The Miller Convertible Plus Fund commenced operations on December 31, 2014. |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| FINANCIAL HIGHLIGHTS |

| |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented. |

| | | Class A | |

| | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 12.75 | | | $ | 12.55 | | | $ | 10.70 | | | $ | 10.76 | | | $ | 11.22 | |

| Increase (decrease) from operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.23 | | | | 0.37 | | | | 0.31 | | | | 0.23 | | | | 0.13 | |

| Net gain (loss) from securities (both realized and unrealized) | | | (0.17 | ) | | | 0.59 | | | | 1.84 | | | | 0.25 | | | | (0.24 | ) |

| Total from operations | | | 0.06 | | | | 0.96 | | | | 2.15 | | | | 0.48 | | | | (0.11 | ) |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.32 | ) | | | (0.27 | ) | | | (0.30 | ) | | | (0.24 | ) | | | (0.32 | ) |

| Net realized gain | | | (0.34 | ) | | | (0.49 | ) | | | — | | | | (0.30 | ) | | | (0.03 | ) |

| Total distributions | | | (0.66 | ) | | | (0.76 | ) | | | (0.30 | ) | | | (0.54 | ) | | | (0.35 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 12.15 | | | $ | 12.75 | | | $ | 12.55 | | | $ | 10.70 | | | $ | 10.76 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (b) | | | 0.49 | % | | | 7.98 | % | | | 20.33 | % | | | 4.18 | % | | | (0.92 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 159,608 | | | $ | 305,994 | | | $ | 219,218 | | | $ | 165,595 | | | $ | 213,763 | |

| Ratio of expenses to average net assets, before reimbursement/recapture | | | 1.44 | % | | | 1.45 | % | | | 1.50 | % | | | 1.48 | % | | | 1.48 | % |

| net of reimbursement/recapture | | | 1.44 | % | | | 1.45 | % | | | 1.50 | % | | | 1.48 | % | | | 1.53 | % (c) |

| Ratio of net investment income to average net assets | | | 3.10 | % | | | 2.87 | % | | | 2.69 | % | | | 2.12 | % | | | 1.17 | % (c) |

| Portfolio turnover rate | | | 81 | % | | | 78 | % | | | 104 | % | | | 59 | % | | | 69 | % |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, excluding the effect of sales loads. Total returns for periods less than one year are not annualized. Had the Adviser not absorbed a portion of the expenses during certain years, total returns would have been lower. |

| (c) | Such ratio includes Adviser’s recapture of waived/reimbursed fees from prior years. |

The accompanying notes are an integral part of the financial statements.

| Miller Convertible Bond Fund |

| FINANCIAL HIGHLIGHTS |

| |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented. |

| | | Class I | |

| | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 12.76 | | | $ | 12.59 | | | $ | 10.73 | | | $ | 10.82 | | | $ | 11.29 | |

| Increase (decrease) from operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.45 | | | | 0.43 | | | | 0.37 | | | | 0.28 | | | | 0.19 | |

| Net gain (loss) from securities (both realized and unrealized) | | | (0.33 | ) | | | 0.60 | | | | 1.85 | | | | 0.25 | | | | (0.23 | ) |

| Total from operations | | | 0.12 | | | | 1.03 | | | | 2.22 | | | | 0.53 | | | | (0.04 | ) |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.39 | ) | | | (0.37 | ) | | | (0.36 | ) | | | (0.32 | ) | | | (0.40 | ) |

| Net realized gain | | | (0.34 | ) | | | (0.49 | ) | | | — | | | | (0.30 | ) | | | (0.03 | ) |

| Total distributions | | | (0.73 | ) | | | (0.86 | ) | | | (0.36 | ) | | | (0.62 | ) | | | (0.43 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 12.15 | | | $ | 12.76 | | | $ | 12.59 | | | $ | 10.73 | | | $ | 10.82 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (b) | | | 1.08 | % | | | 8.49 | % | | | 20.95 | % | | | 4.79 | % | | | (0.39 | )% |

| | | | | | | | | | | | | | | | | | | | | |