UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22175 |

|

ALPS ETF TRUST |

(Exact name of registrant as specified in charter) |

|

1290 Broadway, Suite 1100, Denver, Colorado | | 80203 |

(Address of principal executive offices) | | (Zip code) |

|

Tané Tyler, Esq., Secretary ALPS ETF Trust 1290 Broadway, Suite 1100 Denver, Colorado 80203 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (303) 623-2577 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1 – June 30, 2009 | |

| | | | | | | | | |

Item 1. Report to Stockholders.

ALPS ETF Trust | | TABLE OF CONTENTS |

| | |

Shareholder Letter | | 2 |

| | |

Fund Description | | 3 |

| | |

Performance Overview | | 3 |

| | |

Disclosure of Fund Expenses | | 6 |

| | |

Financial Statements | | |

| | |

Schedule of Investments | | 7 |

| | |

Statement of Assets and Liabilities | | 10 |

| | |

Statement of Operations | | 11 |

| | |

Statements of Changes in Net Assets | | 12 |

| | |

Financial Highlights | | 13 |

| | |

Notes to Financial Statements | | 14 |

| | |

Additional Information | | 20 |

| | |

Trustees and Officers | | 22 |

Semi-Annual | June 30, 2009

1

ALPS ETF Trust | | SHAREHOLDER LETTER |

June 30, 2009

After more than 15 years as a service provider to the ETF industry it was with great pleasure that ALPS was able to launch its first ETF Trust in 2008.

In launching our ETF Trust we wanted to bring innovative solutions to the ETF industry that provide investors with access to a unique market segment or strategy. Our first portfolio - the Cohen & Steers Global Real Estate ETF - is one of the first ETFs to provide investors with access to global real estate securities. US real estate, while already a mainstream asset class only covers 1/3 of the global real estate universe. Furthermore, the global market continues to grow at a rapid pace as foreign countries are securitizing their private real estate holdings. As a result, a global real estate fund provides investors with a wider range of opportunities than a purely domestic fund while preserving the diversification and income benefits of US REITs.

By partnering with Cohen & Steers, we have secured a best in breed real estate manager with a great track record and reputation. Furthermore, the transparency(1), low cost and tax efficiency of the ETF structure provides access to global real estate in a very efficient manner. We believe access to global real estate, the benefits of the ETF structure, and the expertise of Cohen & Steers make for a powerful investment combination that will allow investors to build better portfolios.

An improving economic outlook and more open access to capital have allowed global real estate stocks to rebound sharply in recent months. Several global property markets, including many in Asia and Europe, have surged more than 50% since reaching multi-year lows in March of this year. While the fundamentals in many markets remain weak, the improving economic environment has encouraged many investors to reconsider a more traditional asset allocation in which exposure to global real estate may offer diversification, income and long-term growth benefits.

In the pages that follow our Fund managers have provided a performance overview. We thank you for your investment and for being a GRI shareholder.

Thomas A. Carter*

President, ALPS ETF Trust

(1) ETFs are considered transparent because their portfolio holdings are disclosed daily.

* Registered representative of ALPS Distributors, Inc.

Ordinary brokerage commissions apply.

www.alpsetfs.com | 866.513.5856

2

ALPS ETF Trust | | PERFORMANCE OVERVIEW |

FUND DESCRIPTION

The Cohen & Steers Global Realty Majors ETF (the “Fund”) seeks investment results that correspond generally to the performance (before the Fund’s fees and expenses) of an equity index called the Cohen & Steers Global Realty Majors Index (the “Index”). The Shares of the Fund are listed and trade on the American Stock Exchange under the ticker symbol “GRI.” The Fund will normally invest substantially all of its assets in the 75 stocks that comprise the Cohen & Steers Global Realty Majors Index. The Fund began trading on May 9, 2008.

The Index is a free-float, market-cap-weighted total return index of selected real estate equity securities maintained by Cohen & Steers. It is quoted intraday on a real-time basis by the Chicago Mercantile Exchange under the symbol GRM. The index’s free-float market capitalization approach and qualitative screening process emphasize companies that the Cohen & Steers Index Committee believes are leading the securitization of real estate globally.

PERFORMANCE OVERVIEW (as of June 30, 2009)

The performance of global property securities can best be described as a tale of two quarters. As the monetary and fiscal stimulus efforts began to take hold, steep losses from the first part of the year were transformed into gains by the end of the second quarter. Asia Pacific real estate stocks fared much better than their North American and European counterparts, suffering both smaller declines in the first quarter and posting larger gains in the second quarter. Europe was the next best performing region and was buoyed by strong second quarter performance into positive territory for the year. Despite a strong second quarter as well, North American property stocks, led by the United States, are still slightly negative year to date and represent the worst performing region globally.

US real estate securities rebounded sharply in April from multi-year lows as the economic environment stabilized. In addition, many REITs were able to get access to capital which had become increasingly scarce and expensive. These sources of funds were able to boost balance sheets and refinance debt, ultimately providing a catalyst to stock prices. The ability for property companies to access equity capital revealed pent up demand for the sector and most of the gains were concentrated in a relatively brief period of time in April, a time period which US REITs outperformed the broader equity markets. As recapitalization efforts diminished in May and June, performance moderated. US real estate securities were up 31% for the quarter, allowing them to recoup nearly all of the losses incurred earlier in the year and improving the year to date total return to -12%.

European real estate securities were also able to take advantage of better access to capital and an improved economic outlook. Property stocks in the region were up nearly 20% for the quarter and are now positive year to date. Among the realty majors,

3

the best performing countries so far in 2009 have been Switzerland (+6.8%), France (+4.4%) and the Netherlands (+4.4%). Property stocks in the United Kingdom, Europe’s largest real estate region, were up 19% for the quarter, but their -15% year to date returns are still lagging behind their US and Asian counterparts.

The Asia Pacific property markets have been the best performers this year, up more than 25% year to date. Within the region, Hong Kong (+63%), Singapore (+39%) and Japan (+6%) have lead the way. The strong performance in Hong Kong and Singapore was fueled in large part by China’s expansive fiscal and monetary policies which helped deliver an influx of capital to the region. Japan, despite weak fundamentals, has shown some signs of stabilization including an increase in secondary market transactions and a decline in the inventory of unsold condo units. Australia, while still the worst performer in the group year to date (-13%), is showing some positive signs. GDP in Australia actually grew slightly in the first quarter due to government stimulus and an uptick in commodity prices.

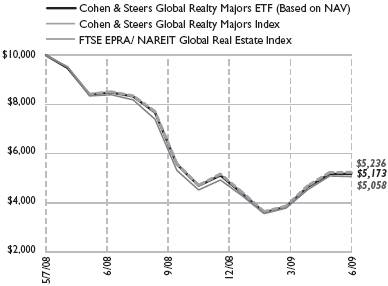

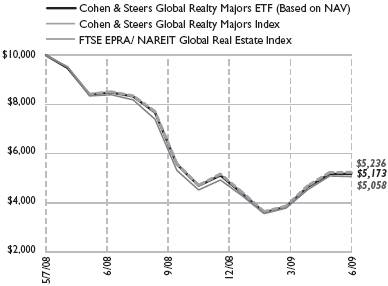

For the six months ended June 30, 2009 the Fund’s market price increased 0.36% and the Fund’s net asset value (“NAV”) increased 1.23%. Over the same time period the Fund’s benchmark was up 2.75%.

| | | | | | Since | |

| | Six | | One | | Inception | |

| | Months | | Year | | Annulized* | |

Fund Performance | | | | | | | |

NAV | | 1.23 | % | -38.45 | % | -43.68 | % |

Market Price | | 0.36 | % | -40.24 | % | -44.52 | % |

Index Performance | | | | | | | |

Cohen & Steers Global Realty Majors Index | | 1.31 | % | -37.80 | % | -43.17 | % |

FTSE/EPRA NAREIT Global Real Estate Index | | 2.75 | % | -39.36 | % | -44.86 | % |

* Fund Inception 5/7/08

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For most current month-end performance data please visit www.alpsfunds.com.

An investor cannot invest directly in an index.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding.

Market Price is the price at which a share can currently be traded in the market.

FTSE EPRA/NAREIT Global Real Estate Index: An unmanaged market-weighted total return index that consists of many companies from developed markets whose floats are larger than $100 million and which derive more than half of their revenue from property-related activities.

4

TOP 10 HOLDINGS as of June 30, 2009

Mitsui Fudosan Co., Ltd. | | 4.18 | % |

Mitsubishi Estate Co., Ltd. | | 4.00 | % |

Sun Hung Kai Properties, Ltd. | | 3.74 | % |

Westfield Group | | 3.69 | % |

Simon Property Group, Inc. | | 3.44 | % |

China Overseas Land & Investment, Ltd. | | 3.34 | % |

Unibail-Rodamco SE | | 3.05 | % |

Public Storage | | 3.02 | % |

Sumitomo Realty & Development Co., Ltd. | | 2.93 | % |

Vornado Realty Trust | | 2.57 | % |

Percent of Net Assets in Top Ten Holdings: | | 33.96 | % |

GEOGRAPHIC BREAKDOWN (% OF TOTAL INVESTMENTS) as of June 30, 2009

Australia | | 8.76 | % |

Belgium | | 0.48 | % |

Canada | | 0.84 | % |

France | | 5.02 | % |

Great Britain | | 8.19 | % |

Hong Kong | | 16.78 | % |

Japan | | 15.98 | % |

Netherlands | | 1.74 | % |

Singapore | | 6.24 | % |

Sweden | | 0.43 | % |

Switzerland | | 0.71 | % |

United States | | 34.83 | % |

GROWTH OF $10K as of June 30, 2009

Comparison of Change in Value of $10,000 Investment in Cohen & Steers Global Realty Majors ETF and Cohen & Steers Global Realty Majors Index.

5

ALPS ETF Trust | | DISCLOSURE OF FUND EXPENSES

For the Period Ended June 30, 2009 (Unaudited) |

Shareholder Expense Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs which may include creation and redemption fees or brokerage charges and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested at January 1, 2009 and held through the period ended June 30, 2009.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first table under the heading entitled “Expenses Paid during Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | Beginning | | Ending | | | | Expenses Paid | |

| | Account | | Account | | | | During | |

| | Value | | Value | | Expense | | Period(a) | |

| | 1/1/09 | | 6/30/09 | | Ratio | | 1/1/09-6/30/09 | |

Actual | | $ | 1,000.00 | | $ | 1,012.30 | | 0.55 | % | $ | 2.74 | |

Hypothetical | | $ | 1,000.00 | | $ | 1,022.07 | | 0.55 | % | $ | 2.75 | |

(a) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365.

6

ALPS ETF Trust | | SCHEDULE OF INVESTMENTS |

| | June 30, 2009 (Unaudited) |

Security Description | | Shares | | Value | |

| | | | | |

COMMON STOCKS (101.55%) | | | | | |

Australia (8.90%) | | | | | |

CFS Retail Property Trust | | 37,503 | | $ | 50,027 | |

Commonwealth Property Office Fund | | 30,335 | | 20,355 | |

Dexus Property Group | | 75,974 | | 46,066 | |

Mirvac Group | | 38,569 | | 33,676 | |

Stockland Trust Group | | 42,737 | | 110,908 | |

Westfield Group | | 20,074 | | 184,685 | |

| | | | 445,717 | |

| | | | | |

Belgium (0.48%) | | | | | |

Confinimmo | | 208 | | 24,215 | |

| | | | | |

Canada (0.86%) | | | | | |

Boardwalk Real Estate Investment Trust | | 529 | | 14,895 | |

RioCan Real Estate Investment Trust | | 2,132 | | 28,051 | |

| | | | 42,946 | |

| | | | | |

France (5.10%) | | | | | |

Fonciere des Regions | | 436 | | 32,770 | |

ICADE | | 362 | | 29,722 | |

Klepierre | | 1,562 | | 40,280 | |

Unibail-Rodamco | | 1,025 | | 152,628 | |

| | | | 255,400 | |

| | | | | |

Great Britain (8.32%) | | | | | |

British Land Co., Plc | | 15,934 | | 100,240 | |

Derwent London Plc | | 1,658 | | 25,530 | |

Great Portland Estates Plc | | 6,202 | | 22,470 | |

Hammerson Plc | | 13,123 | | 66,348 | |

Land Securities Group Plc | | 14,120 | | 109,582 | |

Liberty International Plc | | 7,707 | | 50,420 | |

Segro Plc | | 105,058 | | 41,956 | |

| | | | 416,546 | |

| | | | | |

Hong Kong (17.04%) | | | | | |

China Overseas Land & Investment, Ltd. | | 72,000 | | 167,225 | |

Hang Lung Properties, Ltd. | | 37,000 | | 122,457 | |

Henderson Land Development Co., Ltd. | | 18,000 | | 103,238 | |

Hongkong Land Holdings, Ltd. | | 22,000 | | 77,880 | |

The Link Real Estate Investment Trust | | 40,000 | | 85,367 | |

Sun Hung Kai Properties, Ltd. | | 15,000 | | 187,354 | |

The Wharf Holdings, Ltd. | | 26,000 | | 110,206 | |

| | | | 853,727 | |

| | | | | | |

7

Security Description | | Shares | | Value | |

| | | | | |

Japan (16.23%) | | | | | |

Aeon Mall Co., Ltd. | | 1,500 | | $ | 28,574 | |

Japan Real Estate Investment Corp. | | 8 | | 66,414 | |

Japan Retail Fund Investment Corp. | | 7 | | 32,357 | |

Mitsubishi Estate Co., Ltd. | | 12,000 | | 200,363 | |

Mitsui Fudosan Co., Ltd. | | 12,000 | | 209,318 | |

Nippon Building Fund, Inc. | | 9 | | 77,048 | |

Nomura Real Estate Office Fund, Inc. | | 5 | | 31,818 | |

NTT Urban Development Corp. | | 21 | | 20,350 | |

Sumitomo Realty & Development Co., Ltd. | | 8,000 | | 146,841 | |

| | | | 813,083 | |

| | | | | |

Netherlands (1.77%) | | | | | |

Corio N.V. | | 813 | | 39,525 | |

Eurocommercial Properties N.V. | | 625 | | 19,243 | |

Wereldhave N.V. | | 401 | | 29,811 | |

| | | | 88,579 | |

| | | | | |

Singapore (6.33%) | | | | | |

Ascendas Real Estate Investment Trust | | 23,066 | | 25,339 | |

CapitaLand, Ltd. | | 48,000 | | 123,039 | |

CapitaMall Trust | | 44,347 | | 42,896 | |

City Developments, Ltd. | | 12,000 | | 71,137 | |

Kerry Properties, Ltd. | | 12,500 | | 54,838 | |

| | | | 317,249 | |

| | | | | |

Sweden (0.43%) | | | | | |

Castellum AB | | 3,419 | | 21,667 | |

| | | | | |

Switzerland (0.72%) | | | | | |

PSP Swiss Property AG* | | 758 | | 36,173 | |

| | | | | |

United States (35.37%) | | | | | |

Alexandria Real Estate Equities, Inc. | | 714 | | 25,554 | |

AMB Property Corp. | | 2,455 | | 46,179 | |

Apartment Investment and Management Co. | | 2,293 | | 20,293 | |

AvalonBay Communities, Inc. | | 1,505 | | 84,190 | |

Boston Properties, Inc. | | 2,466 | | 117,628 | |

BRE Properties, Inc. | | 1,010 | | 23,998 | |

Brookfield Properties Corp. | | 3,980 | | 31,721 | |

Camden Property Trust | | 1,072 | | 29,587 | |

Digital Realty Trust, Inc. | | 1,431 | | 51,301 | |

Douglas Emmett, Inc. | | 2,332 | | 20,965 | |

Duke Realty Corp. | | 3,698 | | 32,431 | |

| | | | | | |

8

Security Description | | Shares | | Value | |

| | | | | |

United States (continued) | | | | | |

Equity Residential | | 5,114 | | $ | 113,684 | |

Essex Property Trust, Inc. | | 530 | | 32,982 | |

Federal Realty Investment Trust | | 1,124 | | 57,908 | |

HCP, Inc. | | 4,928 | | 104,424 | |

Host Hotels & Resorts, Inc. | | 10,654 | | 89,387 | |

Kimco Realty Corp. | | 5,554 | | 55,818 | |

Liberty Property Trust | | 1,915 | | 44,122 | |

The Macerich Co. | | 1,531 | | 26,961 | |

Mack-Cali Realty Corp. | | 1,317 | | 30,028 | |

ProLogis | | 7,921 | | 63,843 | |

Public Storage | | 2,308 | | 151,128 | |

Regency Centers Corp. | | 1,386 | | 48,385 | |

Simon Property Group, Inc. | | 3,352 | | 172,394 | |

SL Green Realty Corp. | | 1,266 | | 29,042 | |

UDR, Inc. | | 2,903 | | 29,988 | |

Ventas, Inc. | | 2,799 | | 83,578 | |

Vornado Realty Trust | | 2,863 | | 128,921 | |

Weingarten Realty Investors | | 1,736 | | 25,189 | |

| | | | 1,771,629 | |

| | | | | |

TOTAL COMMON STOCKS | | | | | |

(Cost $6,827,798) | | | | 5,086,931 | |

| | | | | |

TOTAL INVESTMENTS (101.55%) | | | | | |

(Cost $6,827,798) | | | | 5,086,931 | |

| | | | | |

NET LIABILITIES LESS OTHER ASSETS (-1.55%) | | | | (77,813 | ) |

| | | | | |

NET ASSETS (100.00%) | | | | $ | 5,009,118 | |

* Non-income producing security.

Common Abbreviations:

AB - Aktiebolag is the Swedish equivalent of the term corporation.

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by sharholders.

Ltd. - Limited

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

Plc - Public Limited Co.

See Notes to Financial Statements.

9

ALPS ETF Trust | | STATEMENT OF ASSETS & LIABILITIES |

| | June 30, 2009 (Unaudited) |

ASSETS: | | | |

Investments, at value | | $ | 5,086,931 | |

Cash | | 5,390 | |

Foreign currency, at value (Cost $5,294) | | 5,299 | |

Foreign tax reclaims | | 2,293 | |

Interest and dividends receivable | | 26,542 | |

Total Assets | | 5,126,455 | |

| | | |

LIABILITIES: | | | |

Distributions payable | | 115,035 | |

Payable to advisor | | 2,302 | |

Total Liabilities | | 117,337 | |

NET ASSETS | | $ | 5,009,118 | |

| | | |

NET ASSETS CONSIST OF: | | | |

Paid-in capital | | $ | 7,744,214 | |

Overdistributed net investment income | | (7,723 | ) |

Accumulated net realized loss on investments and foreign currency transactions | | (986,695 | ) |

Net unrealized depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | (1,740,678 | ) |

NET ASSETS | | $ | 5,009,118 | |

| | | |

INVESTMENTS, AT COST | | $ | 6,827,798 | |

| | | |

PRICING OF SHARES | | | |

Net Assets | | $ | 5,009,118 | |

Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | 202,000 | |

Net Asset Value, offering and redemption price per share | | $ | 24.80 | |

See Notes to Financial Statements.

10

ALPS ETF Trust | | STATEMENT OF OPERATIONS |

| | For the Six Months Ended June 30, 2009 (Unaudited) |

INVESTMENT INCOME: | | | |

Dividends(a) | | $ | 127,473 | |

Total Investment Income | | 127,473 | |

| | | |

EXPENSES: | | | |

Investment advisory fee | | 12,031 | |

Total Net Expenses | | 12,031 | |

NET INVESTMENT INCOME | | 115,442 | |

| | | |

Net realized loss on investments | | (761,013 | ) |

Net realized gain on foreign currency transactions | | 3,636 | |

Net change in unrealized appreciation on investments | | 704,283 | |

| | | |

Net change in unrealized depreciation on translation of assets and liabilities in foreign currencies | | (904 | ) |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | (53,998 | ) |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 61,444 | |

(a) Net of foreign withholding tax of $8,990.

See Notes to Financial Statements.

11

ALPS ETF Trust | | STATEMENTS OF CHANGES IN NET ASSETS |

| | For the Six | | For the Period | |

| | Months Ended | | May 7, 2008 | |

| | June, 30 2009 | | (Inception) through | |

| | (Unaudited) | | December 31, 2008 | |

| | | | | |

OPERATIONS: | | | | | |

Net investment income | | $ | 115,442 | | $ | 93,943 | |

Net realized loss on investments and foreign currency transactions | | (757,377 | ) | (232,654 | ) |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency | | 703,379 | | (2,444,057 | ) |

Net increase/(decrease) in net assets resulting from operations | | 61,444 | | (2,582,768 | ) |

| | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | |

From net investment income | | (115,035 | ) | (98,737 | ) |

Total distributions | | (115,035 | ) | (98,737 | ) |

| | | | | |

SHARE TRANSACTIONS: | | | | | |

Proceeds from sale of shares | | — | | 7,644,214 | |

Net increase from share transactions | | — | | 7,644,214 | |

Net increase/(decrease) in net assets | | (53,591 | ) | 4,962,709 | |

| | | | | |

NET ASSETS: | | | | | |

Beginning of period | | 5,062,709 | | 100,000 | |

End of period* | | $ | 5,009,118 | | $ | 5,062,709 | |

* Including overdistributed net investment income of: | | $ | (7,723 | ) | $ | (8,130 | ) |

| | | | | |

Other Information: | | | | | |

SHARE TRANSACTIONS: | | | | | |

Beginning shares | | 202,000 | | 2,000 | |

Sold | | — | | 200,000 | |

Shares outstanding, end of period | | 202,000 | | 202,000 | |

See Notes to Financial Statements.

12

ALPS ETF Trust | FINANCIAL HIGHLIGHTS |

| For a Share Outstanding Throughout the Period Presented |

| | For the Six | | For the Period | |

| | Months Ended | | May 7, 2008 | |

| | June, 30 2009 | | (Inception) through | |

| | (Unaudited) | | December 31, 2008 | |

| | | | | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 25.06 | | $ | 50.00 | |

| | | | | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | |

Net investment income | | 0.57 | | 0.47 | |

Net realized and unrealized loss on investments | | (0.26 | ) | (24.92 | ) |

Total from Investment Operations | | 0.31 | | (24.45 | ) |

| | | | | |

LESS DISTRIBUTIONS: | | | | | |

From net investment income | | (0.57 | ) | (0.49 | ) |

Total Distributions | | (0.57 | ) | (0.49 | ) |

NET DECREASE IN NET ASSET VALUE | | (0.26 | ) | (24.94 | ) |

NET ASSET VALUE, END OF PERIOD | | $ | 24.80 | | $ | 25.06 | |

TOTAL RETURN(a) | | 1.23 | % | (48.90 | )% |

| | | | | |

RATIOS/ SUPPLEMENTAL DATA: | | | | | |

Net assets, end of period (in 000s) | | $ | 5,009 | | $ | 5,063 | |

| | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | |

Net investment income including reimbursement/waiver | | 5.27 | %(b) | 3.49 | %(b) |

Operating expenses including reimbursement/waiver | | 0.55 | %(b) | 0.55 | %(b) |

Operating expenses excluding reimbursement/waiver | | 0.55 | %(b) | 0.55 | %(b) |

PORTFOLIO TURNOVER RATE(c) | | 12 | % | 18 | % |

(a) Total return is calculated assuming an initial investment made at the net asset value at the beginning of the period and redemption at the net asset value on the last day of the period. The return presented does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Total return calculated for a period of less than one year is not annualized.

(b) Annualized.

(c) Portfolio turnover is not annualized and does not include securities received or delivered from processing creations or redemptions.

See Notes to Financial Statements.

13

ALPS ETF Trust | NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

1. ORGANIZATION

The ALPS ETF Trust (the “Trust”) is an investment company organized as a Delaware statutory trust on September 13, 2007 and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust consists of one separate Exchange Traded Fund (“ETF”), the Fund, which commenced operations on May 7, 2008.

The Fund’s Shares are listed on the NYSE Arca. Unlike conventional mutual funds, the Fund issues and redeems Shares on a continuous basis, at NAV, only in large specified blocks of 50,000 Shares, each of which is called a “Creation Unit.” Creation Units are issued and redeemed principally in-kind for securities included in a specified index. Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of the Cohen & Steers Global Realty Majors Index.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by Company management and the evaluation of subsequent events through August 28, 2009, the issuance date of the financial statements. Actual results could differ from those estimates.

A. Portfolio Valuation

The Fund’s NAV is determined daily, as of the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. The NAV is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

The Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Trust’s Board of Trustees. Portfolio securities listed on any exchange other than the NASDAQ Stock Market, Inc. (“NASDAQ”) are valued at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and asked prices on such day. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. Portfolio securities traded in the over-the-counter market, but excluding securities traded on the NASDAQ, are valued at the closing bid prices.

14

ALPS ETF Trust | NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

Short-term investments that mature in less than 60 days are valued at amortized cost. Certain securities may not be able to be priced by pre-established pricing methods. Such securities may be valued by the Board of Trustees or its delegate at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre-established pricing source; a security with respect to which an event has occurred that is most likely to materially affect the value of the security after the market has closed but before the calculation of the Fund’s NAV or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, does not reflect the security’s “fair value.” As a general principle, the current “fair value” of a security would be the amount which the owner might reasonably expect to receive from the closing sale prices on the applicable exchange and fair value prices may not reflect the actual value of a security. A variety of factors may be considered in determining the fair value of such securities.

Valuing the Fund’s securities using fair value pricing will result in using prices for those securities that may differ from current market valuations. Use of fair value prices and certain market valuations could result in a difference between the prices used to calculate a Fund’s NAV and the prices used by the Index, which, in turn, could result in a difference between a Fund’s performance and the performance of the Index.

B. Foreign Currency Translation and Foreign Investments

The accounting records of the Fund are maintained in U.S. dollars. Portfolio securities and other assets and liabilities denominated in a foreign currency are translated to U.S. dollars at the prevailing rates of exchange at period end. Amounts related to the purchases and sales of securities and investment income are translated into U.S. dollars at the prevailing exchange rate on the respective dates of transactions. The effects of changes in foreign currency exchange rates on portfolio investments are included in the net realized and unrealized gains and losses on investments. Net gains and losses on foreign currency transactions include disposition of foreign currencies, and currency gains and losses between the accrual and receipt dates of portfolio investment income and between the trade and settlement dates of portfolio investment transactions.

C. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income, if any, is recorded on the accrual basis.

D. Federal Tax Information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations.

15

ALPS ETF Trust | NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

For the year ended December 31, 2008, permanent book and tax basis differences resulting primarily from differing treatment of foreign currency were identified and reclassified among the components of the Fund’s net assets as follows:

Accumulated Net | | Accumulated Net | | | |

Investment Loss | | Realized Gain | | Paid-In Capital | |

$ | (3,336 | ) | $ | 3,336 | | $ | 0 | |

| | | | | | | | |

Net investment income and net realized gains (losses), as disclosed on the Statement of Operations, and net assets were not affected by this reclassification.

At December 31, 2008, the Fund had available for tax purposes an unused capital loss carryover of $ 176,692, expiring December 31, 2016.

The Fund intends to defer to its fiscal year ending December 31, 2009 approximately $ 7,766 of losses recognized during the period from November 1, 2008 to December 31, 2008.

E. Dividends and Distributions to Shareholders

Dividends from net investment income of the Fund, if any, are declared and paid quarterly or as the Board of Trustees may determine from time to time. Distributions of net realized capital gains earned by the Fund, if any, are distributed at least annually.

Distributions from income and capital gains are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund. Characterizations of distributions are finalized at fiscal year end; accordingly tax basis balances have not been determined as of June 30, 2009.

The tax character of the distributions paid was as follows:

| | Period Ended | |

| | December 31, 2008 | |

Distributions paid from: | | | |

Ordinary income | | $ | 98,737 | |

Total | | $ | 98,737 | |

As of December 31, 2008, the components of distributable earnings on a tax basis for the Fund were as follows:

Undistributed net investment income | | $ | 15,448 | |

Accumulated net realized loss on investments and foreign currency transactions | | (184,458 | ) |

Net unrealized depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | (2,514,563 | ) |

Other Cumulative Effect of Timing Differences | | 2,068 | |

Total | | $ | (2,681,505 | ) |

16

ALPS ETF Trust | NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

The differences between book-basis and tax-basis are primarily due to the deferral of post October losses and the differing treatment of certain other investments.

F. Income Taxes

For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of the Internal Revenue Code by distributing substantially all of its investment company taxable net income including realized gain, not offset by capital loss carryforwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

In accordance with FASB Interpretation No. 48 (“FIN 48”) “Accounting for Uncertainty in Income Taxes,” the financial statement effects of a tax position taken or expected to be taken in a tax return are to be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. Management has concluded that the Fund has taken no uncertain tax positions that require adjustment to the financial statements to comply with the provisions of FIN 48. The Fund will file income tax returns in the U.S. federal jurisdiction and Colorado. For the year ended December 31, 2008, the Fund’s returns will be open to examination by the appropriate taxing authority.

G. Fair Value Measurements

The Fund has adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 defines fair value, establishes a three-tier hierarchy to measure fair value based on the extent of use of “observable inputs” as compared to “unobservable inputs” for disclosure purposes and requires additional disclosures about these valuations measurements. Inputs refer broadly to the assumptions that market participants would use in pricing a security. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the security developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the security developed based on the best information available in the circumstances.

The three-tier hierarchy is summarized as follows:

1) Level 1 – quoted prices in active markets for identical securities

2) Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

3) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

17

ALPS ETF Trust | NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

The following is a summary of the inputs used as of June 30, 2009 in valuing the Fund’s assets:

Valuation Inputs | | Investments in Securities at Value | |

Level 1 - Quoted Prices | | | |

Common Stocks | | $ | 5,086,931 | |

Level 2 - Other Significant Observable Inputs | | — | |

Level 3 - Significant Unobservable Inputs | | — | |

Total | | $ | 5,086,931 | |

All securities of the Fund were valued using Level 1 inputs during the period ended June 30, 2009. Thus a reconciliation of assets in which significant unobservable inputs (Level 3) were used is not applicable for the Fund.

3. INVESTMENT ADVISORY FEE AND OTHER AFFILIATED TRANSACTIONS

ALPS Advisors, Inc. (the “Investment Adviser”) acts as the Fund’s investment adviser pursuant to an advisory agreement with the Trust on behalf of the Fund (the “Advisory Agreement”). Pursuant to the Advisory Agreement, the Fund pays the Investment Adviser a unitary fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.55% of the Fund’s average daily net assets. From time to time, the Investment Adviser may waive all or a portion of its fee.

Out of the unitary management fee, the Investment Adviser pays substantially all expenses of the Fund, including the fees of the Sub-Adviser, the licensing fee of the Index provider, and the cost of transfer agency, custody, fund administration, legal, audit and other services, except for interest expenses, distribution fees or expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business.

The Investment Adviser’s unitary management fee is designed to pay substantially all of the Fund’s expenses and to compensate the Investment Adviser for providing services for the Fund.

Mellon Capital Management Corporation acts as the Fund’s sub-adviser (the “Sub-Adviser”) pursuant to a sub-advisory agreement with the Investment Adviser (the “Sub-Advisory Agreement”). According to this agreement, the Investment Adviser pays the Sub-Adviser on a monthly basis, an annual rate of 0.10% of the Fund’s average daily net assets. The Investment Adviser will pay the Sub-Adviser a minimum of $62,500 per year after the Fund’s first year of operations and a minimum of $125,000 per year after the Fund’s second year of operations.

ALPS Fund Services, Inc. (“ALPS”) is the administrator of the Fund.

The Bank of New York Mellon is the custodian, fund accounting agent and transfer agent for the Fund.

18

ALPS ETF Trust | NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

Each Trustee who is not an officer or employee of ALPS Advisors, Inc., any sub-adviser or any of their affiliates (“Independent Trustees”) is paid a quarterly retainer of $3,500, $1,500 for each regularly scheduled Board meeting attended and $750 for each special meeting held outside of regularly scheduled meetings.

4. PURCHASES AND SALES OF SECURITIES

For the six months ended June 30, 2009, the cost of purchases and proceeds from sales of investment securities, excluding short-term investments and in-kind transactions, were as follows:

| | Purchases | | Sales | |

Cohen & Steers Global Realty Majors ETF | | $ | 630,529 | | $ | 546,333 | |

| | | | | | | |

For the six months ended June 30, 2009, the cost of in-kind purchases and proceeds from in-kind sales were as follows:

| | Purchases | | Sales | |

Cohen & Steers Global Realty Majors ETF | | $ | — | | $ | — | |

| | | | | | | |

Gains on in-kind transactions are not considered taxable for federal income tax purposes.

As of June 30, 2009, the costs of investments for federal income tax purposes and accumulated net unrealized appreciation/(depreciation) on investments were as follows:

Gross Appreciation (excess of value over tax cost) | | $ | 71,930 | |

Gross Depreciation (excess of tax cost over value) | | (1,891,520 | ) |

Net unrealized appreciation/(depreciation) | | $ | (1,819,590 | ) |

Cost of investment for income tax purposes | | $ | 6,906,521 | |

5. CREATIONS, REDEMPTIONS AND TRANSACTION FEES

The Fund issues and redeems Shares at NAV only in large blocks of 50,000 Shares (each block of 50,000 Shares is called a “Creation Unit”) or multiples thereof. As a practical matter, only broker-dealers or large institutional investors with creation and redemption agreements called Authorized Participants (“APs”) can purchase or redeem these Creation Units. Purchasers of Creation Units at NAV must pay a standard Creation Transaction Fee of $1,500 per transaction. The value of a Creation unit as of first creation was approximately $2,500,000. An AP who holds Creation Units and wishes to redeem at NAV would also pay a standard Redemption Transaction Fee of $1,500 per transaction. If a Creation Unit is purchased or redeemed for cash, a variable fee of up to four times the standard Creation or Redemption Transaction Fee may be charged to the AP making the transaction.

The creation fee, redemption fee and variable fee are not expenses of the Fund and do not impact the Fund’s expense ratio.

19

ALPS ETF Trust | ADDITIONAL INFORMATION |

| (Unaudited) |

PROXY VOTING POLICIES AND PROCEDURES

A description of the policies and procedures that the Fund uses to determine how to vote proxies and information on how the Fund voted proxies relating to portfolio securities during the period ending June 30, 2009 is available (1) without charge, upon request, by calling (866) 513-5856; (2) on the Trust’s website located at http://www.alpsetfs.com; and (3) on the SEC’s website at http://www.sec.gov.

PORTFOLIO HOLDINGS

The Trust will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Form N-Q will be available (1) by calling (866) 513-5856; (2) on the Trust’s website located at http://www.alpsetfs.com; (3) on the SEC’s website at http://www.sec.gov; and (4) for review and copying at the SEC’s Public Reference Room (“PRR”) in Washington D.C. Information regarding the operation of the PRR may be obtained by calling (800) SEC-0330.

RISK CONSIDERATIONS

You should consider the Fund’s investment objective, risks and charges carefully before investing. You can download the Fund’s prospectus at www.alpsetfs.com or contact ALPS Distributors, Inc. at 1-866-513-5856 to request a prospectus, which contains this and other information about the Fund. Read it carefully before you invest. ALPS Distributors, Inc. is the distributor of the Cohen & Steers Global Realty Majors ETF.

The Fund’s shares will change in value, and you could lose money by investing in the Fund. An investment in the Fund involves risks similar to those of investing in any fund of equity securities traded on an exchange. Investors buying or selling Fund shares on the secondary market may incur brokerage commissions. In addition, investors who sell Fund shares may receive less than the shares’ net asset value. Unlike shares of open-ended funds, investors are generally not able to purchase ETF shares directly from the Fund and individual ETF shares are not redeemable. However, specified large blocks of shares called creation units can be purchased from, or redeemed to, the Fund.

You should anticipate that the value of the Fund’s shares will decline, more or less, in correlation with any decline in the value of its corresponding Index.

The Fund’s return may not match the return of its corresponding Index for a number of reasons. For example, the Fund incurs operating expenses not applicable to its corresponding Index, and may incur costs in buying and selling securities, especially when rebalancing the Fund’s portfolio holdings to reflect changes in composition of its corresponding Index. In addition the Fund’s portfolio holdings may not exactly replicate the securities included in its corresponding Index or the ratios between the securities included in such Index.

The Fund is exposed to additional market risk due to its policy of investing principally in the securities included in its corresponding Index. As a result of this policy, securities held by the Fund will generally not be bought or sold in response to market fluctuations and the

20

securities may be issued by companies concentrated in a particular industry. Therefore, the Fund will generally not sell a stock because the stock’s issuer is in financial trouble, unless that stock is removed or is anticipated to be removed from the Fund’s Index.

The Fund relies on a license and related sublicense that permits it to use its corresponding Index and associated trade names and trademarks in connection with the name and investment strategies of the Fund. Such license and related sublicense may be terminated by the Index provider and, as a result, the Fund may lose its ability to use such intellectual property. In the event the license is terminated or the index provider does not have rights to license such intellectual property, it may have a significant effect on the operation of the Fund.

The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

The Fund is not actively managed. The Fund may be affected by a general decline in certain market segments relating to its Index. The Fund invests in securities included in, or representative of, its index regardless of such investment’s merit. The Fund does not attempt to take defensive positions in declining markets.

The Fund invests in securities of foreign companies and, therefore, is subject to certain risks associated with possible adverse economic, political and social occurrences outside of the United States of America.

The Fund’s NAV is determined on the basis of the U.S. dollar. You may lose money if the local currency of a foreign market depreciates against the U.S. dollar, even if the local currency value of the Fund’s holdings goes up.

The Fund invests in securities of non-U.S. issuers. Investing in securities of non-U.S. issuers, which are generally denominated in non-U.S. currencies, may involve certain risks not typically associated with investing in securities of U.S. issuers such as there being less publicly available information about non-U.S. issuers or markets and non-U.S. markets being less smaller, less liquid and more volatile than the U.S. market. These risks may be more pronounced to the extent that the Fund invests a significant amount of its assets in companies located in one region.

The Fund invests in companies that are considered to be “passive foreign investment companies” and could be subject to U.S. federal income tax and additional interest charges on gains and certain distributions with respect to those equity interests.

The Fund invests in companies in the real estate industry, including real estate investment trusts and is subject to the risks associated with investing in real estate such as possible declines in the value of real estate, adverse general and local economic conditions and changes in interest rates and environmental problems.

21

ALPS ETF Trust | TRUSTEES AND OFFICERS |

| (Unaudited) |

INDEPENDENT TRUSTEES

| | | | | | | | Number of | | |

| | | | | | | | Portfolios | | |

| | | | | | | | in Fund | | |

Name, Address and | | Position(s) | | Term of Office | | | | Complex | | Other |

Age of Management | | Held | | and Length of | | Principal Occupation(s) | | Overseen by | | Directorships |

Trustee* | | with Trust | | Time Served** | | During Past 5 Years | | Trustees*** | | Held by Trustees |

Mary K. Anstine,

age 68 | | Trustee | | Since March 2008 | | Ms. Anstine was President/Chief Executive Officer of HealthONE Alliance, Denver, Colorado, and former Executive Vice President of First Interstate Bank of Denver. Ms. Anstine is also Trustee/Director of the AV Hunter Trust and Colorado Uplift Board. Ms. Anstine was formerly a Director of the Trust Bank of Colorado (later purchased and now known as Northern Trust Bank), HealthONE, and a member of the American Bankers Association Trust Executive Committee. | | 10 | | Ms. Anstine is a Trustee of ALPS Variable Insurance Trust (1 fund); Financial Investors Variable Insurance Trust (5 funds); Financial Investors Trust (3 funds); Reaves Utility Income Fund; and West-core Trust (12 funds). |

Jeremy W. Deems,

age 32 | | Trustee | | Since March 2008 | | Mr. Deems is the Co-President and Chief Financial Officer of Green Alpha Advisors, LLC. Prior to joining Green Alpha Advisors, Mr. Deems was CFO and Treasurer of Forward Management, LLC, ReFlow Management Co., LLC, ReFlow Fund, LLC, a private investment fund, and Sutton Place Management, LLC, an administrative services company, from 2004 to June 2007. Prior to this, Mr. Deems served as Controller of Forward Management, LLC, ReFlow Management Co., LLC, ReFlow Fund, LLC and Sutton Place Management, LLC. | | 5 | | Mr. Deems is a Trustee of ALPS Variable Insurance Trust (1 fund); Financial Investors Trust (3 funds); and Reaves Utility Income Fund. |

22

| | | | | | | | Number of | | |

| | | | | | | | Portfolios | | |

| | | | | | | | in Fund | | |

Name, Address and | | Position(s) | | Term of Office | | | | Complex | | Other |

Age of Management | | Held | | and Length of | | Principal Occupation(s) | | Overseen by | | Directorships |

Trustee* | | with Trust | | Time Served** | | During Past 5 Years | | Trustees*** | | Held by Trustees |

Rick A. Pederson,

age 56 | | Trustee | | Since March 2008 | | Mr. Pederson is Chairman, Ross Consulting Group, 1982 to present; President, Foundation Properties, Inc., 1994 to present; Partner, Western Capital Partners, 2000 to present; Partner, Bow River Capital Partners, 2003 to present; Principal, The Pauls Corp., 2008 to present; Director, Neenan Co., 2002 to present; Director, Nexcore LLC, 2004 to present; Director, Urban Land Conservancy, 2004 to present; Director, Guaranty Bank and Trust/Centennial Bank, 1997 to 2007; Director, Winter Park Rec. Association, 2002 to 2008. | | 2 | | Mr. Pederson is Trustee of Westcore Trust (12 funds) |

* | The business address of the Trustee is c/o ALPS Advisors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203. |

** | This is the period for which the Trustee began serving the Trust. Each Trustee serves an indefinite term, until his successor is elected. |

*** | The Fund Complex includes all series of the Trust and any other investment companies for which ALPS Advisors, Inc. provides investment advisory services. |

23

INTERESTED TRUSTEE

| | | | | | | | Number of | | |

| | | | | | | | Portfolios | | |

| | | | | | | | in Fund | | |

Name, Address and | | Position(s) | | Term of Office | | | | Complex | | Other |

Age of Management | | Held | | and Length of Time | | Principal Occupation(s) | | Overseen by | | Directorships |

Trustee* | | with Trust | | Served** | | During Past 5 Years | | Trustees*** | | Held by Trustees |

Thomas A. Carter, age 42 | | Trustee and President | | Since March 2008 | | Mr. Carter is Managing Director of ALPS. He joined ALPS in 1994 and is responsible for ALPS’ corporate sales, closed-end fund development and exchange-traded fund management. Before joining ALPS in 1994, Tom was with Deloitte & Touche LLP, where he worked with a diverse group of clients, primarily within the financial services industry. Tom is a Certified Public Accountant and received his Bachelor of Science in Accounting from the University of Colorado at Boulder. | | 7 | | N/A |

* | The business address of the Trustee is c/o ALPS Advisors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203. |

** | This is the period for which the Trustee began serving the Trust. Each Trustee serves an indefinite term, until his successor is elected. |

*** | Mr. Carter is an interested person of the Trust because of his affiliation with ALPS. |

24

OFFICERS

Name, Address | | Position(s) | | | | |

and Age of | | Held | | Length of | | |

Executive Officer* | | with Trust | | Time Served** | | Principal Occupation(s) During Past 5 Years |

Michael Akins,

age 32 | | Chief Compliance Officer (“CCO”) | | Since March 2008 | | Mr. Akins joined ALPS as Deputy Compliance Officer in April 2006. Prior to joining ALPS, Mr. Akins served as Compliance Officer and AVP for UMB Financial Corporation. Before joining UMB, Mr. Akins served as an account manager for State Street Corporation. Because of his affiliation with ALPS and ADI, Mr. Akins is deemed an affiliate of the Trust as defined under the 1940 Act. Mr. Akins is currently the CCO of ALPS Variable Insurance Trust, Financial Investors Trust, Financial Investors Variable Insurance Trust, Reaves Utility Income Fund, Clough Global Allocation Fund, Clough Global Opportunities Fund and the Clough Global Equity Fund. |

Kimberly R. Storms,

age 37 | | Treasurer | | Since March 2008 | | Ms. Storms is Director of Fund Administration and Vice-President of ALPS. Ms. Storms joined ALPS in 1998 as Assistant Controller. Because of her position with ALPS, Ms. Storms is deemed an affiliate of the Trust as defined under the 1940 Act. Ms. Storms is also Treasurer of ALPS Variable Insurance Trust; Assistant Treasurer of the Liberty All-Star Equity Fund, Liberty All-Star Growth Fund, and Financial Investors Trust; and Assistant Secretary of Ameristock Mutual Fund, Inc. |

William Parmentier,

age 56 | | Vice President | | Since March 2008 | | Mr. Parmentier is Chief Investment Officer, ALPS Advisors, Inc. (since 2006); President of the Liberty All-Star Funds (since April 1999); Senior Vice President (2005-2006), Banc of America Investment Advisors, Inc. |

Tané T. Tyler,

age 42 | | Secretary | | Since December 2008 | | Ms. Tyler is Vice President, General Counsel and Secretary of ALPS. Ms. Tyler joined ALPS in 2004. Secretary, Liberty All-Star Equity Fund and Liberty All-Star Growth Fund from December 2006-2008; Secretary, Reaves Utility Income Fund from December 2004-2007; Secretary, Westcore Funds from February 2005-2007; Secretary, First Funds from November 2004 to January 2007; Secretary, Financial Investors Variable Insurance Trust from December 2004–December 2006; Vice President and Associate Counsel, Oppenheimer Funds from January 2004 to August 2004; Vice President and Assistant General Counsel, INVESCO Funds from September 1991 to December 2003. |

* | The business address of each Officer is c/o ALPS Advisors, Inc., 1290 Broadway, Suite 1100, Denver, Colorado 80203. |

** | This is the period for which the Officer began serving the Trust. Each Officer serves an indefinite term, until his successor is elected. |

25

Item 2. Code of Ethics.

Not Applicable to this Report.

Item 3. Audit Committee Financial Expert.

Not Applicable to this Report.

Item 4. Principal Accountant Fees and Services.

Not Applicable to this Report.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Schedule of Investments is included as part of the Report to Stockholders filed under Item 1 of this Form N-CSR.

(b) Not applicable

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

2

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

No material changes to the procedures by which the shareholders may recommend nominees to the Registrant’s Board of Trustees have been implemented after the Registrant’s last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

Item 11. Controls and Procedures.

(a) The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) No changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) occurred during the Registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable to this Report.

(a)(2) The certifications required by Rule 30a-2(a) of the Investment Company Act of 1940, as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto as Exhibit 99.Cert.

(a)(3) Not applicable.

(b) The certifications by the Registrant’s principal executive officer and principal financial officer, as required by Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto as Exhibit 99.906Cert.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ALPS ETF TRUST

By: | /s/ Thomas A. Carter | |

| Thomas A. Carter (Principal Executive Officer) |

| President |

| |

Date: | September 4, 2009 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/ Thomas A. Carter | |

| Thomas A. Carter (Principal Executive Officer) |

| President |

| |

Date: | September 4, 2009 |

| |

| |

By: | /s/ Kimberly R. Storms | |

| Kimberly R. Storms (Principal Financial Officer) |

| Treasurer |

| |

Date: | September 4, 2009 |

4