UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-22175

ALPS ETF TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Richard C. Noyes, Esq., Secretary

ALPS ETF Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code:(303) 623-2577

Date of fiscal year end:November 30

Date of reporting period:November 30, 2019

| Item 1. | Report to Stockholders. |

Table of Contents

| Performance Overview | |

| Alerian MLP ETF | 1 |

| Alerian Energy Infrastructure ETF | 4 |

| Disclosure of Fund Expenses | 7 |

| Report of Independent Registered Public Accounting Firm | 8 |

| Financial Statements | |

| Alerian MLP ETF | |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Alerian Energy Infrastrcture ETF | |

| Schedule of Investments | 14 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | 19 |

| Notes to Financial Statements | 20 |

| Additional Information | 31 |

| Board Consideration Regarding Approval of Investment Advisory Agreements | 33 |

| Trustees and Officers | 35 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on the Funds’ website (www.alpsfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary.

alpsfunds.com

Alerian MLP ETF

| Performance Overview | November 30, 2019 (Unaudited) |

INVESTMENT OBJECTIVE

The Alerian MLP ETF (the “Fund” or “AMLP”) seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Total Return Index (the “Underlying Index” or “AMZI”). The shares of the Fund are listed and trade on the NYSE Arca, Inc. (“NYSE”) under the ticker symbol AMLP. The Fund will normally invest at least 90% of its total assets in securities that comprise the Underlying Index.

The Underlying Index is a rules based, modified capitalization weighted, float-adjusted index intended to give investors a means of tracking the overall performance of the United States energy infrastructure Master Limited Partnership (“MLP”) asset class. The Underlying Index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

PERFORMANCE OVERVIEW

During the twelve-month period ended November 30, 2019, the Fund delivered a total return of -10.79%. This compares to the Fund’s Underlying Index, which was down -17.42% on a price-return basis and -10.22% on a total-return basis. The difference in performance between the AMZI and AMLP is primarily attributable to the Fund’s operating expenses and the tax impact of the Fund’s C-Corporation structure.

During the period, the Fund paid four distributions:

| • | $0.1950 per share on February 21, 2019 |

| • | $0.1950 per share on May 16, 2019 |

| • | $0.1900 per share on August 15, 2019 |

| • | $0.1950 per share on November 21, 2019 |

For distributions reflecting the third calendar quarter of 2019, nine out of twenty constituents in the AMZI increased their respective distributions sequentially, while eleven MLPs maintained their respective distributions. The majority of AMZI constituents grew their respective third quarter 2019 distributions on a year-over-year basis.

During the period, Noble Midstream Partners (NBLX) was added to the Underlying Index, while Holly Energy Partners (HEP) was removed during quarterly rebalancings. Multiple constituents were removed from the Underlying Index in relation to their acquisition by other entities, including: Andeavor Logistics (ANDX), Antero Midstream Partners (AM), Buckeye Partners (BPL), Enbridge Energy Partners (EEP), and Spectra Energy Partners (SEP). EnLink Midstream (ENLC) acquired EnLink Midstream Partners (ENLK), resulting in the removal of ENLK and addition of ENLC to the Underlying Index. Western Gas Equity Partners (WGP) merged with Western Gas Partners, and Western Midstream Partners (WES) is the surviving entity in the Underlying Index. The methodology for the Underlying Index was updated in February to, among other things, better capture the investable universe, increase benchmarking efficiency, and minimize future index turnover.

In a challenging macro environment, MLPs as an asset class performed defensively relative to other energy sectors due to the fee-based nature of midstream cash flows. The strongest performing sector in the Underlying Index was Petroleum Transportation. Gathering and Processing was the weakest sector, as slowing production growth, particularly for natural gas, weighed more heavily on the names operating closest to the wellhead. The U.S. Energy Information Administration (EIA) expects U.S. energy production to continue growing in 2020, supporting midstream sector infrastructure and export opportunities, albeit at a more moderate rate than in recent years.

MLPs as an asset class rallied from late December 2018 until April 2019 alongside gains in West Texas Intermediate (WTI) crude to over $66 per barrel and improved performance from the broader markets. Despite increasing macroeconomic headwinds from April to July as a result of the worsening trade war between the U.S. and China and a pullback in oil prices, MLPs outperformed the S&P 500 Index and WTI crude. From July 22 through November 2019, the AMZI Index fell 22.62% on a price-return basis, which contrasted with a steady increase in broader markets. Negative energy sentiment, slowing production growth, and tax-loss selling contributed to MLP weakness during the period. Oil and natural gas prices remained volatile during the year, with natural gas prices dropping to a multi-year low in August as a result of oversupply.

Private equity involvement in midstream has served as a catalyst for the space. Private equity has invested billions of dollars in midstream at the company and asset level, with transactions spanning geographies and business lines. For example, Buckeye Partners (BPL) announced that it had agreed to be acquired in May by Australian fund manager, IFM Investors, at a 27.5% premium to its prior day closing price. Private valuations of energy infrastructure assets have often been at a premium to public equity market valuations, providing support to the midstream investment thesis and giving public companies the option to monetize their assets at favorable prices.

Amidst commodity price volatility, MLPs have focused on company-level improvements, including reducing leverage, self-funding the equity portion of capital expenditures, and eliminating incentive distribution rights (IDRs). AMZI constituents are also better able to afford their distributions with average distribution coverage of 1.4x for the third quarter of 2019 compared to 1.3x for the same quarter in 2018. Improved distribution coverage provides investors with added comfort around yields that were above historical averages at the end of the period. Company-level improvements and a constructive long-term outlook for U.S. energy production and exports support a positive outlook for midstream MLPs.

Alerian MLP ETF

| Performance Overview | November 30, 2019 (Unaudited) |

Performance(as of November 30, 2019)

| | 1 Year | 5 Year | Since Inception^ |

| Alerian MLP ETF – NAV | -10.79% | -8.36% | 0.14% |

| Alerian MLP ETF – Market Price* | -10.58% | -8.33% | 0.15% |

| Alerian MLP Infrastructure Total Return Index | -10.22% | -9.50% | 2.32% |

| Alerian MLP Total Return Index | -11.00% | -9.56% | 1.78% |

Total Expense Ratio (per the current prospectus) 0.85%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.alpsfunds.com or call 1.877.398.8461. The Fund accrues deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investment. This deferred tax liability is reflected in the daily NAV and as a result the fund's after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commenced Investment Operations on August 24, 2010 with an Inception Date, the first day of trading on the NYSE ARCA, of August 25, 2010. |

| * | Market Price is based on the midpoint of the bid-ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. |

The Alerian MLP Infrastructure Total Return Index is comprised of 23 midstream energy Master Limited Partnerships and provides investors with an unbiased benchmark for the infrastructure component of this emerging asset class. Total return assumes reinvestment of any dividends and distributions realized during a given time period.

The Alerian MLP Total Return Index is recognized as a leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is reported on a total-return basis (AMZX), which assumes reinvestment of any dividends and distributions realized during a given period.

The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund’s shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares.

The Alerian MLP ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

Alerian MLP ETF

| Performance Overview | November 30, 2019 (Unaudited) |

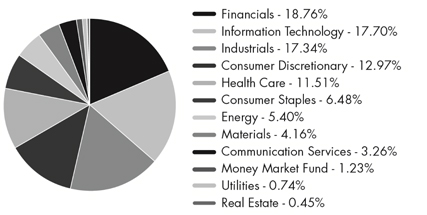

Top 10 Holdings*(as of November 30, 2019)

| Enterprise Products Partners LP | 10.62% |

| Magellan Midstream Partners LP | 10.08% |

| Energy Transfer LP | 9.98% |

| MPLX LP | 9.74% |

| Plains All American Pipeline LP | 9.34% |

| Western Midstream Partners LP | 6.08% |

| Phillips 66 Partners LP | 5.30% |

| Tallgrass Energy LP | 4.78% |

| NuStar Energy LP | 4.70% |

| Shell Midstream Partners LP | 4.13% |

| Total % of Top 10 Holdings | 74.75% |

Future holdings are subject to change.

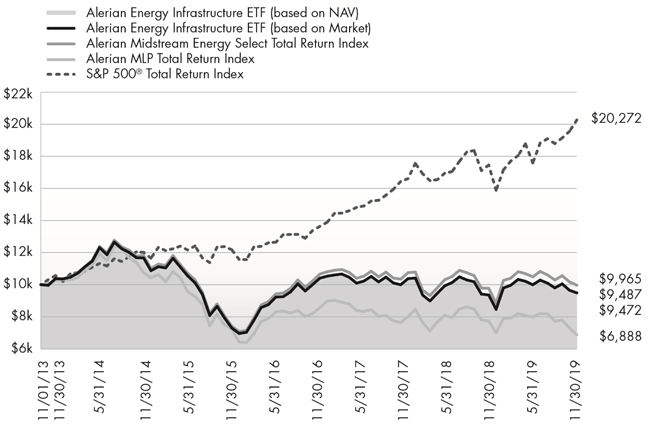

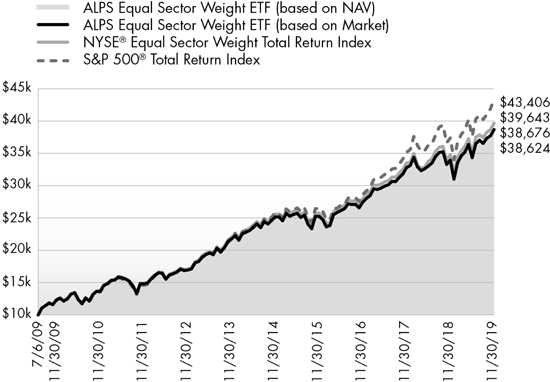

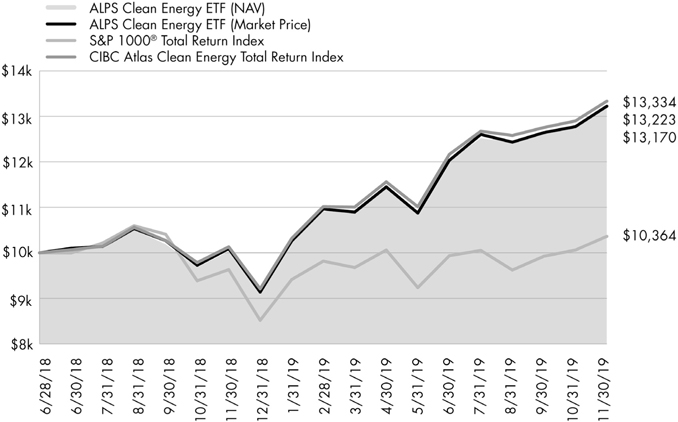

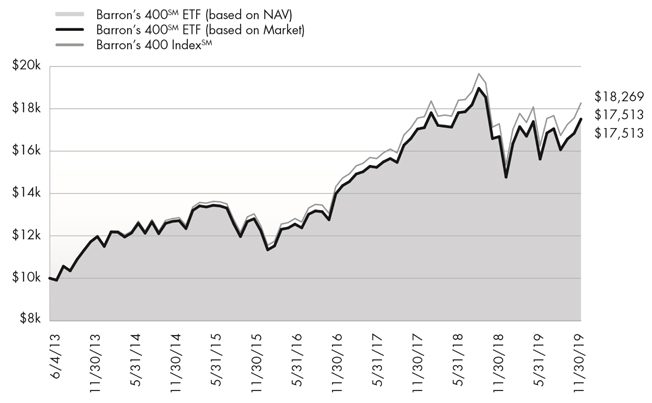

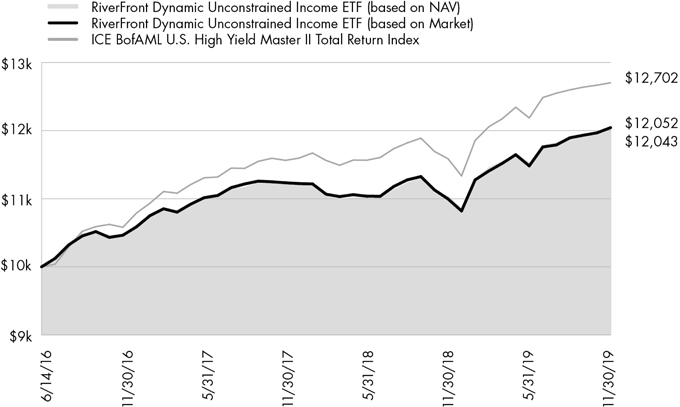

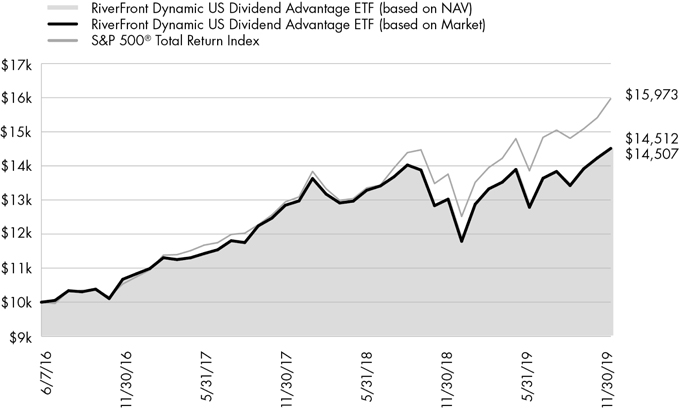

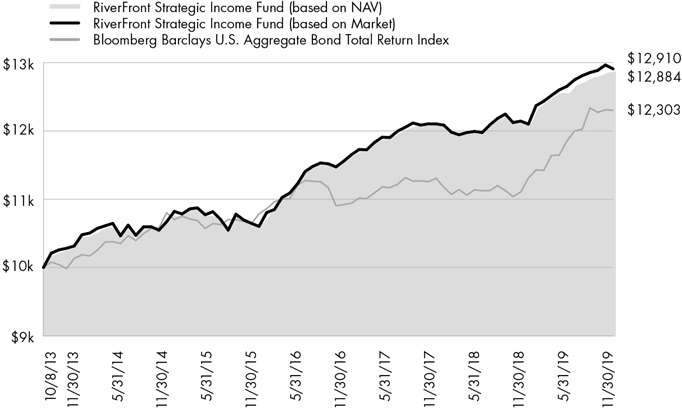

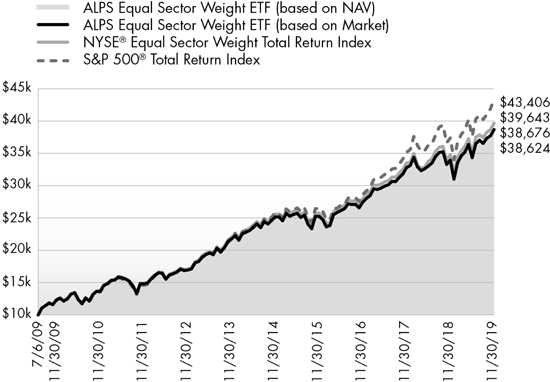

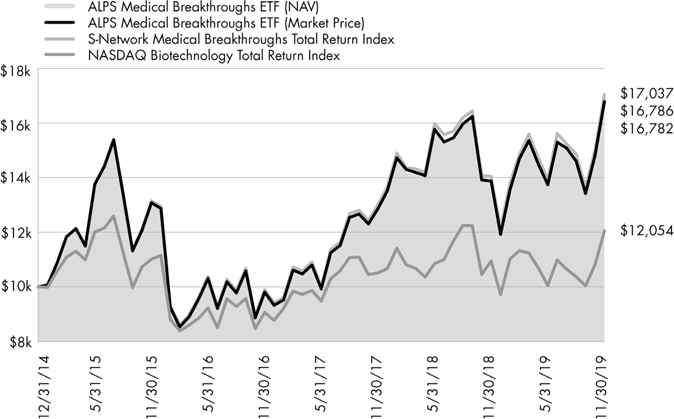

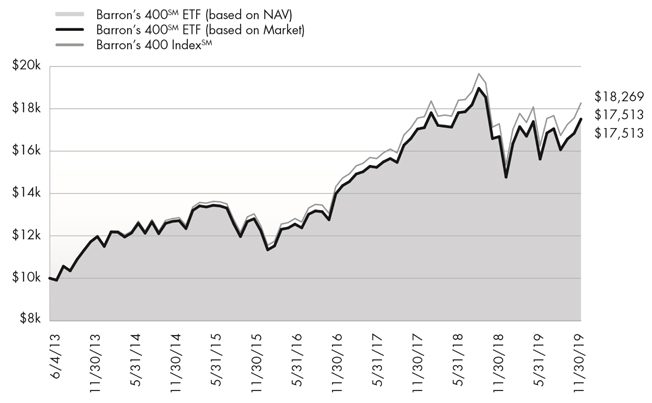

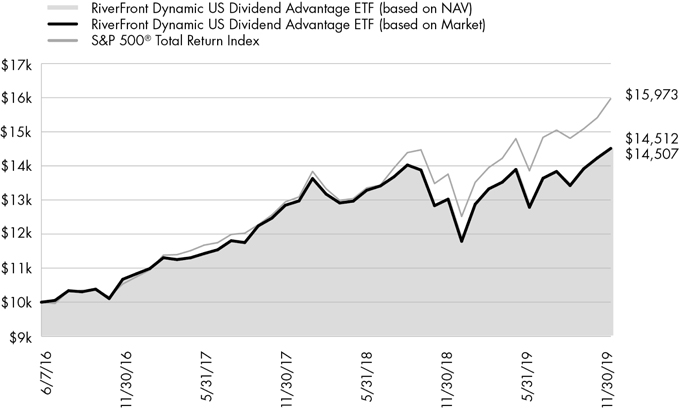

Growth of $10,000(as of November 30, 2019)

Comparison of change in value of a $10,000 investment in the Fund and the Indexes

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund since inception with the performance of the Fund’s benchmark index. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Alerian Energy Infrastructure ETF

| Performance Overview | November 30, 2019 (Unaudited) |

INVESTMENT OBJECTIVE

The Alerian Energy Infrastructure ETF (the “Fund” or “ENFR”) seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Midstream Energy Select Total Return Index (the “Underlying Index” or “AMEI”). As a secondary objective, the Fund seeks to provide total return through income and capital appreciation. The Shares of the Fund are listed and trade on the NYSE Acra, Inc. (“NYSE”) under the ticker symbol ENFR. The Fund will normally invest at least 90% of its total assets in securities that comprise the Underlying Index.

The Underlying Index is a composite of North American energy infrastructure companies engaged in midstream activities involving energy commodities, including gathering and processing, liquefaction, pipeline transportation, rail terminaling, and storage (also known as “midstream energy businesses”). Midstream energy companies include midstream MLPs and midstream corporations, either based in the United States or Canada. The Underlying Index has a 25% limit for companies taxed as pass-through entities.

PERFORMANCE OVERVIEW

During the twelve-month period ending November 30, 2019, the Fund delivered a total return of 1.09%. This compares to the Fund’s Underlying Index, which fell -4.55% on a price-return basis but rose 1.93% on a total-return basis.

During the period, the Fund paid five distributions:

| • | $0.186280 per share on December 27, 2018 |

| • | $0.258920 per share on February 21, 2019 |

| • | $0.287530 per share on May 16, 2019 |

| • | $0.312260 per share on August 15, 2019 |

| • | $0.349570 per share on November 21, 2019 |

During the fiscal year ended November 30, 2019, CNX Midstream Partners (CNXM) and Equitrans Midstream (ETRN) were added to the Underlying Index. Several other index changes occurred due to merger and acquisition activity. Constituents removed in conjunction with their acquisition by another entity include: Andeavor Logistics (ANDX), Buckeye Partners (BPL), Dominion Energy Midstream Partners (DM), EQGP Holdings (EQGP), and Valero Energy Partners (VLP). Antero Midstream GP (AMGP) merged with Antero Midstream Partners, and Antero Midstream Corporation (AM) is the surviving entity in the Underlying Index. Western Gas Equity Partners (WGP) merged with Western Gas Partners, and Western Midstream Partners (WES) is the surviving entity in the Underlying Index. Additionally, EQM Midstream Partners (EQM) was briefly added to the Underlying Index and replaced by ETRN in a quarterly rebalancing. There were no methodology changes for the Underlying Index during the time period.

Canadian midstream corporations led performance for the fiscal year, and the strongest sector was Petroleum Transportation. Gathering and Processing was the weakest sector, as slowing production growth, particularly for U.S. natural gas, weighed more heavily on the names operating closest to the wellhead. The U.S. Energy Information Administration (EIA) expects U.S. energy production to continue growing in 2020, supporting midstream infrastructure and export opportunities, albeit at a more moderate rate than in recent years.

Relative to other energy sectors, midstream energy businesses ("midstream") continued to perform defensively in the challenging macro environment due to the fee-based nature of cash flows. Energy infrastructure companies rallied from late December 2018 until April 2019 alongside gains in broader markets and in West Texas Intermediate (WTI) crude to over $66 per barrel. Despite increasing macroeconomic headwinds from April to July as a result of the worsening trade war between the U.S. and China and a pullback in oil prices, midstream held up reasonably well, outperforming WTI crude. From July 22 through November 2019, the Underlying Index fell 12.06% on a price-return basis, which contrasted with a steady increase in broader markets. Negative energy sentiment, slowing oil and gas production growth, and tax-loss selling contributed to midstream weakness during the period. Oil and natural gas prices remained volatile, with natural gas prices dropping to a multi-year low in August as a result of oversupply.

Private equity involvement in midstream has served as a catalyst for the space. Private equity has invested billions of dollars in midstream at the company and asset level, with transactions spanning geographies and business lines. For example, Buckeye Partners (BPL) announced that it had agreed to be acquired in May by Australian fund manager, IFM Investors, at a 27.5% premium to its prior day closing price. Private valuations of energy infrastructure assets have often been at a premium to public equity market valuations, providing support to the midstream investment thesis and giving public companies the option to monetize their assets at favorable prices.

Amidst commodity price volatility, midstream energy infrastructure companies continue to focus on improvements within their control. Many constituents have made progress to reduce leverage and improve their balance sheets. With production growth in the U.S. moderating from lofty levels, companies are emphasizing capital discipline. More modest growth spending can support greater free cash flow generation and shareholder returns. To that end, five constituents have buyback programs in place, most of which were announced in 2019. Company-level improvements and a constructive long-term outlook for North American energy production and exports support a positive outlook for midstream.

Alerian Energy Infrastructure ETF

| Performance Overview | November 30, 2019 (Unaudited) |

Performance(as of November 30, 2019)

| | 1 Year | 5 Year | Since Inception^ |

| Alerian Energy Infrastructure ETF - NAV | 1.09% | -4.05% | -0.89% |

| Alerian Energy Infrastructure ETF - Market Price* | 1.35% | -4.07% | -0.86% |

| Alerian Midstream Energy Select Total Return Index | 1.93% | -3.30% | -0.06% |

| Alerian MLP Total Return Index** | -11.00% | -9.56% | -5.94% |

| S&P 500® Total Return Index** | 16.11% | 10.98% | 12.32% |

Total Expense Ratio (per the current prospectus) 0.65%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends and capital gains distributions, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For most current month-end performance data please visit www.alpsfunds.com or call 1.866.675.2639.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commenced Investment Operations on November 1, 2013. |

| * | Market Price is based on the midpoint of the bid-ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. |

| ** | Effective March 31, 2019, the Fund replaced the S&P 500 Total Return Index as the Fund’s primary benchmark for performance comparison purposes. The Adviser made this recommendation to the Board because the Fund’s new primary benchmark, the Alerian MLP Total Return Index, more closely aligns with the Fund’s investment strategies and investment restrictions. Returns for both benchmarks will be shown for a transition period. |

The Alerian Midstream Energy Select Total Return Index is comprised of 38 equity securities of issuers headquartered or incorporated in the United States and Canada that engage in the transportation, storage, and processing of energy commodities. Total return assumes reinvestment of any dividends and distributions realized during a given time period.

S&P 500® Total Return Index: the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. Total return assumes reinvestment of any dividends and distributions realized during a given time period.

The Alerian MLP Total Return Index is recognized as a leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is reported on a total-return basis (AMZX), which assumes reinvestment of any dividends and distributions realized during a given period.

The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund’s shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares.

The Alerian Energy Infrastructure ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

Alerian Energy Infrastructure ETF

| Performance Overview | November 30, 2019 (Unaudited) |

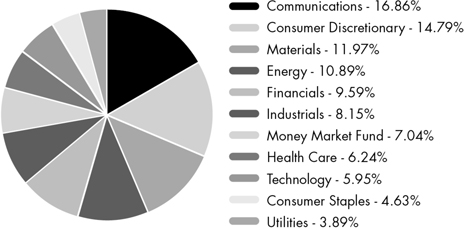

Top 10 Holdings*(as of November 30, 2019)

| Enbridge, Inc. | 12.00% |

| TC Energy Corp. | 8.82% |

| Enterprise Products Partners LP | 8.49% |

| Kinder Morgan, Inc. | 6.95% |

| Energy Transfer LP | 5.81% |

| Cheniere Energy, Inc. | 5.38% |

| The Williams Cos., Inc. | 4.94% |

| ONEOK, Inc. | 4.92% |

| Pembina Pipeline Corp. | 4.91% |

| Targa Resources Corp. | 4.90% |

| Total % of Top 10 Holdings | 67.12% |

| * | % of Total Investments (excluding investments purchased with collateral from securities loaned) |

Future holdings are subject to change.

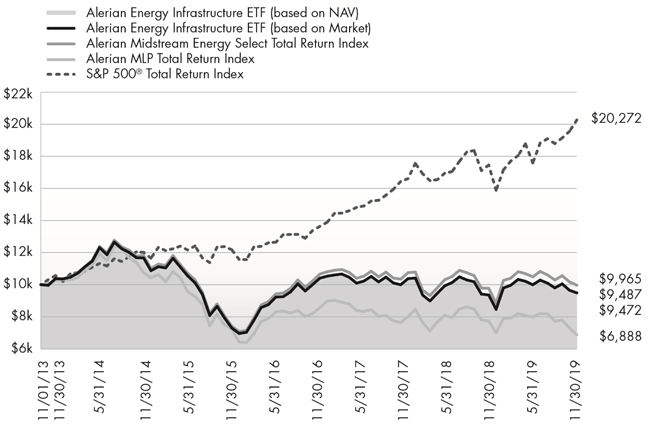

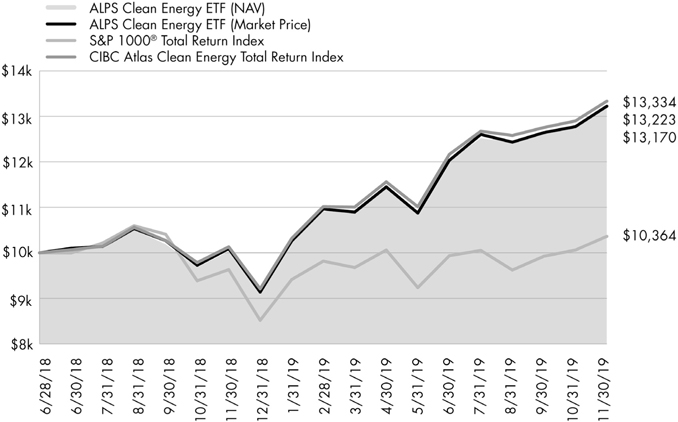

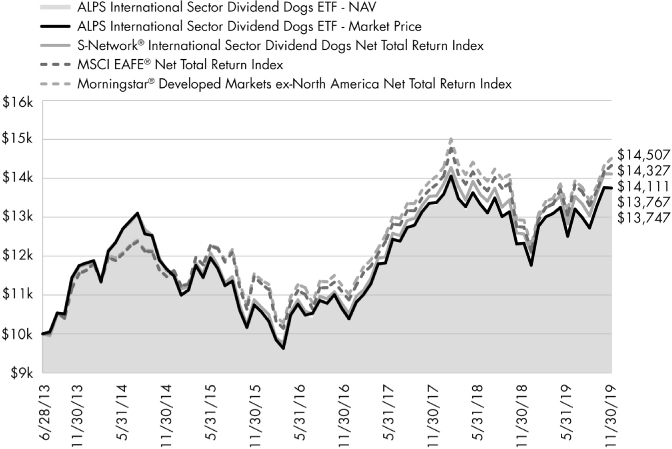

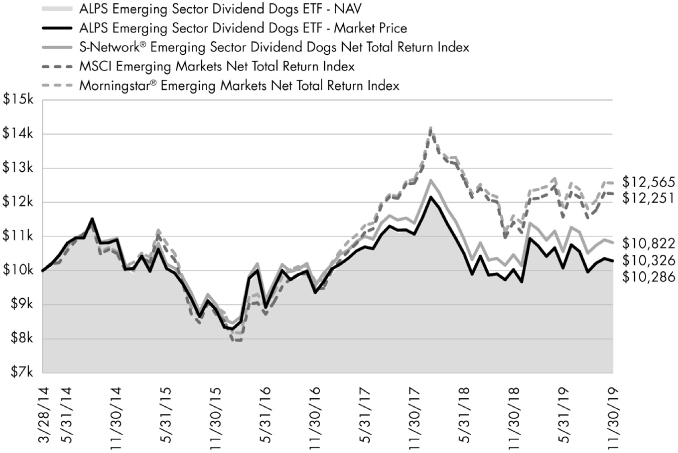

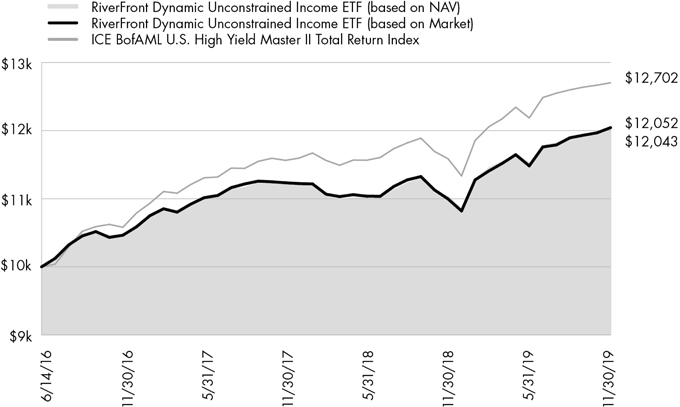

Growth of $10,000(as of November 30, 2019)

Comparison of change in value of a $10,000 investment in the Fund and the Indexes

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund since inception with the performance of the Fund’s benchmark index. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Alerian Exchange Traded Funds

| Disclosure of Fund Expenses | November 30, 2019 (Unaudited) |

Shareholder Expense Example: As a shareholder of a Fund, you incur two types of costs: (1) transaction costs which may include creation and redemption fees or brokerage charges, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested at the beginning of the (six month) period and held through November 30, 2019.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as creation and redemption fees or brokerage charges. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | Beginning Account Value 6/1/19 | Ending Account Value 11/30/19 | Expense Ratio(a) | Expenses Paid During Period 6/1/19 - 11/30/19(b) |

| Alerian MLP ETF | | | | |

| Actual | $1,000.00 | $851.90 | 0.86% | $3.99 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.76 | 0.86% | $4.36 |

| | | | | |

| Alerian Energy Infrastructure ETF | | | | |

| Actual | $1,000.00 | $946.90 | 0.65% | $3.17 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.81 | 0.65% | $3.29 |

| (a) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. |

Alerian Exchange Traded Funds

Report of Independent Registered Public Accounting Firm

To the shareholders and the Board of Trustees of ALPS ETF Trust:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Alerian MLP ETF and Alerian Energy Infrastructure ETF (the “Funds”), two of the funds constituting the ALPS ETF Trust, as of November 30, 2019, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of Alerian MLP ETF and Alerian Energy Infrastructure ETF of ALPS ETF Trust as of November 30, 2019, and the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of November 30, 2019, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

DELOITTE & TOUCHE LLP

Denver, Colorado

January 24, 2020

We have served as the auditor of one or more investment companies advised by ALPS Advisors, Inc. since 2007.

Alerian MLP ETF

| Schedule of Investments | November 30, 2019 |

| Security Description | | Shares | | | Value | |

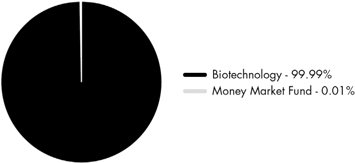

| MASTER LIMITED PARTNERSHIPS (99.99%) | |

| Gathering + Processing (25.99%) | | | | | | | | |

| Crestwood Equity Partners LP(a) | | | 6,085,104 | | | $ | 193,019,499 | |

| DCP Midstream LP(a) | | | 11,141,993 | | | | 235,207,472 | |

| Enable Midstream Partners LP | | | 11,022,664 | | | | 101,298,282 | |

| EnLink Midstream LLC(a) | | | 31,906,442 | | | | 151,555,599 | |

| MPLX LP | | | 29,881,226 | | | | 706,690,995 | |

| Noble Midstream Partners LP(a) | | | 2,659,429 | | | | 55,449,095 | |

| Western Midstream Partners LP(a) | | | 24,851,215 | | | | 440,612,042 | |

| Total Gathering + Processing | | | | | | | 1,883,832,984 | |

| | | | | | | | | |

| Liquefaction (2.69%) | | | | | | | | |

| Cheniere Energy Partners LP | | | 5,016,021 | | | | 194,972,736 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (27.47%) | |

| Energy Transfer LP | | | 61,277,221 | | | | 723,683,980 | |

| Enterprise Products Partners LP | | | 29,252,366 | | | | 769,922,273 | |

| EQM Midstream Partners LP | | | 10,241,477 | | | | 237,295,022 | |

| TC PipeLines LP(a) | | | 6,669,422 | | | | 260,040,764 | |

| Total Pipeline Transportation | Natural Gas | | | | 1,990,942,039 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (43.84%) | |

| Genesis Energy LP(a) | | | 13,464,005 | | | | 255,950,735 | |

| Magellan Midstream Partners LP(a) | | | 12,507,128 | | | | 731,291,774 | |

| NGL Energy Partners LP(a) | | | 14,363,958 | | | | 142,634,103 | |

| NuStar Energy LP(a) | | | 12,085,135 | | | | 341,042,510 | |

| Phillips 66 Partners LP | | | 6,895,894 | | | | 384,308,173 | |

| Plains All American Pipeline LP(a) | | | 38,916,716 | | | | 677,150,858 | |

| Shell Midstream Partners LP(a) | | | 15,238,972 | | | | 299,598,190 | |

| Tallgrass Energy LP(a) | | | 19,336,412 | | | | 346,315,139 | |

| Total Pipeline Transportation | Petroleum | | | | 3,178,291,482 | |

| | | | | | | | | |

| TOTAL MASTER LIMITED PARTNERSHIPS | |

| (Cost $8,080,872,512) | | | | | | | 7,248,039,241 | |

| | | 7 Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.06%) | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | 1.56 | % | | | 4,325,390 | | | $ | 4,325,390 | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (Cost $4,325,390) | | | | | | | | | | | 4,325,390 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (100.05%) | | | | | | | | | |

| (Cost $8,085,197,902) | | | | | | | | | | $ | 7,252,364,631 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-0.05%) | | | (3,359,504 | ) |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 7,249,005,127 | |

| (a) | Affiliated Company. See Note 8 in Notes to Financial Statements. |

See Notes to Financial Statements.

Alerian MLP ETF

| Statement of Assets and Liabilities | November 30, 2019 |

| ASSETS: | | | |

| Investments, at value | | $ | 3,122,496,851 | |

| Investments in affiliates, at value | | | 4,129,867,780 | |

| Receivable for investments sold | | | 2,738,491 | |

| Deferred tax asset (Note 2) | | | – | (a) |

| Income tax receivable | | | 1,935,889 | |

| Total Assets | | | 7,257,039,011 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for shares redeemed | | | 2,739,722 | |

| Franchise tax payable | | | 132,738 | |

| Payable to adviser | | | 5,161,424 | |

| Total Liabilities | | | 8,033,884 | |

| NET ASSETS | | $ | 7,249,005,127 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 10,003,052,829 | |

| Distributable earnings | | | (2,754,047,702 | ) |

| NET ASSETS | | $ | 7,249,005,127 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 3,377,693,980 | |

| INVESTMENTS IN AFFILIATES, AT COST | | | 4,707,503,922 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Assets | | $ | 7,249,005,127 | |

| Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | | 926,062,100 | |

| Net Asset Value, offering and redemption price per share | | $ | 7.83 | |

| (a) | Net Deferred Tax Asset of $393,545,939 is offset 100% by Valuation Allowance. |

See Notes to Financial Statements.

Alerian MLP ETF

| Statement of Operations | For the Year Ended November 30, 2019 |

| INVESTMENT INCOME: | | | |

| Distributions from master limited partnerships | | $ | 709,320,352 | (a) |

| Less return of capital distributions | | | (702,615,910 | ) |

| Total Investment Income | | | 6,704,442 | |

| | | | | |

| EXPENSES: | | | | |

| Franchise tax expense | | | 320,629 | |

| Investment adviser fee | | | 72,786,010 | |

| Total Expenses | | | 73,106,639 | |

| NET INVESTMENT LOSS, BEFORE INCOME TAXES | | | (66,402,197 | ) |

| Current income tax benefit/(expense) | | | (112,428 | ) |

| NET INVESTMENT LOSS | | | (66,514,625 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized loss on investments, before income taxes | | | (529,707,372 | ) |

| Net realized loss on affiliated investments, before income taxes | | | (576,103,311 | ) |

| Current income tax benefit/(expense) | | | (1,872,463 | ) |

| Net realized loss | | | (1,107,683,146 | ) |

| Net change in unrealized appreciation on investments, before income taxes | | | 179,149,699 | |

| Net change in unrealized appreciation on affiliated investments, before income taxes | | | 199,671,951 | |

| Current income tax benefit/(expense) | | | 641,575 | |

| Net change in unrealized appreciation | | | 379,463,225 | |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (728,219,921 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (794,734,546 | ) |

| (a) | Includes return of capital distributions and dividend income from affiliated investments in the amount of $428,915,248 and $6,704,442, respectively. |

See Notes to Financial Statements.

Alerian MLP ETF

Statements of Changes in Net Assets

| | | For the Year Ended November 30, 2019 | | | For the Year Ended November 30, 2018 | |

| OPERATIONS: | | | | | | | | |

| Net investment loss | | $ | (66,514,625 | ) | | $ | (83,458,686 | ) |

| Net realized gain/(loss) | | | (1,107,683,146 | ) | | | 1,173,533,843 | |

| Net change in unrealized appreciation/(depreciation) | | | 379,463,225 | | | | (1,009,447,065 | ) |

| Net increase/(decrease) in net assets resulting from operations | | | (794,734,546 | ) | | | 80,628,092 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From distributable earnings | | | – | | | | (763,495,134 | ) |

| From tax return of capital | | | (704,785,128 | ) | | | – | |

| Total distributions | | | (704,785,128 | ) | | | (763,495,134 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from sale of shares | | | 1,923,590,589 | | | | 3,121,090,140 | |

| Cost of shares redeemed | | | (1,874,813,815 | ) | | | (3,143,758,848 | ) |

| Net increase/(decrease) from share transactions | | | 48,776,774 | | | | (22,668,708 | ) |

| | | | | | | | | |

| Net decrease in net assets | | | (1,450,742,900 | ) | | | (705,535,750 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 8,699,748,027 | | | | 9,405,283,777 | |

| End of year | | $ | 7,249,005,127 | | | $ | 8,699,748,027 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Beginning shares | | | 910,762,100 | | | | 907,362,100 | |

| Shares sold | | | 209,850,000 | | | | 301,050,000 | |

| Shares redeemed | | | (194,550,000 | ) | | | (297,650,000 | ) |

| Shares outstanding, end of period | | | 926,062,100 | | | | 910,762,100 | |

See Notes to Financial Statements.

Alerian MLP ETF

| Financial Highlights | For a Share Outstanding Throughout the Periods Presented |

| | | For the Year Ended November 30, 2019 | | | For the Year Ended November 30, 2018 | | | For the Year Ended November 30, 2017 | | | For the Year Ended November 30, 2016 | | | For the Year Ended November 30, 2015 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.55 | | | $ | 10.37 | | | $ | 12.31 | | | $ | 12.25 | | | $ | 18.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | (0.07 | ) | | | (0.09 | ) | | | (0.22 | ) | | | 0.04 | | | | (0.13 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.87 | ) | | | 0.08 | | | | (0.86 | ) | | | 1.04 | | | | (4.53 | ) |

| Total from investment operations | | | (0.94 | ) | | | (0.01 | ) | | | (1.08 | ) | | | 1.08 | | | | (4.66 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains | | | – | | | | (0.81 | ) | | | – | | | | – | | | | – | |

| From tax return of capital | | | (0.78 | ) | | | – | | | | (0.86 | ) | | | (1.02 | ) | | | (1.19 | ) |

| Total distributions | | | (0.78 | ) | | | (0.81 | ) | | | (0.86 | ) | | | (1.02 | ) | | | (1.19 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.72 | ) | | | (0.82 | ) | | | (1.94 | ) | | | 0.06 | | | | (5.85 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 7.83 | | | $ | 9.55 | | | $ | 10.37 | | | $ | 12.31 | | | $ | 12.25 | |

| TOTAL RETURN(b) | | | (10.79 | )% | | | (0.55 | )% | | | (9.27 | )% | | | 9.76 | % | | | (26.84 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 7,249,005 | | | $ | 8,699,748 | | | $ | 9,405,284 | | | $ | 9,378,019 | | | $ | 7,203,754 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Expenses (excluding net current and deferred tax expenses/benefits and franchise tax expense) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| Expenses (including net current and deferred tax expenses/benefits)(c) | | | 0.87 | % | | | 0.85 | % | | | 0.41 | % | | | 1.42 | % | | | (11.40 | )% |

| Expenses (including current and deferred tax expenses/benefits)(d) | | | 0.85 | % | | | 0.85 | % | | | 1.81 | % | | | (0.36 | )% | | | 1.57 | % |

| Net investment loss (excluding deferred tax expenses/benefits and franchise tax expense) | | | (0.77 | )% | | | (0.85 | )% | | | (0.85 | )% | | | (0.85 | )% | | | (0.85 | )% |

| Net investment income/(loss)(including deferred tax expenses/benefits)(d) | | | (0.77 | )% | | | (0.85 | )% | | | (1.81 | )% | | | 0.36 | % | | | (1.57 | )% |

| PORTFOLIO TURNOVER RATE(e) | | | 34 | % | | | 26 | % | | | 23 | % | | | 31 | % | | | 21 | % |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total return is calculated assuming an initial investment made at the net assets value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (c) | Includes amount of current and deferred taxes/benefits for all components of the Statement of Operations. |

| (d) | Includes amount of current and deferred tax benefit associated with net investment income/(loss). |

| (e) | Portfolio turnover for periods less than one year is not annualized and does not include securities received or delivered from processing creations or redemptions in-kind. |

See Notes to Financial Statements.

Alerian Energy Infrastructure ETF

| Schedule of Investments | November 30, 2019 |

| Security Description | | Shares | | | Value | |

| CANADIAN ENERGY INFRASTRUCTURE COMPANIES (35.09%) | |

| Gathering + Processing (3.41%) | | | | | | | | |

| Keyera Corp. | | | 72,338 | | | $ | 1,765,019 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (8.70%) | |

| TC Energy Corp. | | | 89,136 | | | | 4,509,478 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (21.18%) | |

| Enbridge, Inc. | | | 162,006 | | | | 6,134,835 | |

| Inter Pipeline, Ltd. | | | 140,469 | | | | 2,326,521 | |

| Pembina Pipeline Corp. | | | 71,976 | | | | 2,513,173 | |

| Total Pipeline Transportation | Petroleum | | | | | | | 10,974,529 | |

| | | | | | | | | |

| Storage (1.80%) | | | | | | | | |

| Gibson Energy, Inc. | | | 49,527 | | | | 930,658 | |

| | | | | | | | | |

| TOTAL CANADIAN ENERGY INFRASTRUCTURE COMPANIES | |

| (Cost $17,927,185) | | | | | | | 18,179,684 | |

| | | | | | | | | |

| U.S. ENERGY INFRASTRUCTURE COMPANIES (27.71%) | |

| Gathering + Processing (9.69%) | | | | | | | | |

| ONEOK, Inc. | | | 35,394 | | | | 2,514,744 | |

| Targa Resources Corp. | | | 68,558 | | | | 2,504,424 | |

| Total Gathering + Processing | | | | | | | 5,019,168 | |

| | | | | | | | | |

| Liquefaction (5.76%) | | | | | | | | |

| Cheniere Energy, Inc.(a) | | | 45,447 | | | | 2,751,361 | |

| Tellurian, Inc.(a)(b) | | | 32,037 | | | | 233,550 | |

| Total Liquefaction | | | | | | | 2,984,911 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (9.43%) | | | | | | | | |

| Equitrans Midstream Corp. | | | 133,490 | | | | 1,330,895 | |

| Kinder Morgan, Inc. | | | 181,269 | | | | 3,554,685 | |

| Total Pipeline Transportation | Natural Gas | | | | 4,885,580 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (0.80%) | | | | | | | | |

| SemGroup Corp., Class A | | | 26,913 | | | | 413,653 | |

| | | | | | | | | |

| Storage (2.03%) | | | | | | | | |

| Macquarie Infrastructure Corp. | | | 25,056 | | | | 1,051,099 | |

| | | | | | | | | |

| TOTAL U.S. ENERGY INFRASTRUCTURE COMPANIES | |

| (Cost $17,030,045) | | | | | | | 14,354,411 | |

| | | | | | | | | |

| U.S. ENERGY INFRASTRUCTURE MLPS (25.19%) | |

| Gathering + Processing (3.51%) | | | | | | | | |

| CNX Midstream Partners LP | | | 4,668 | | | | 67,686 | |

| Crestwood Equity Partners LP | | | 5,491 | | | | 174,174 | |

| Enable Midstream Partners LP | | | 9,955 | | | | 91,486 | |

| MPLX LP | | | 43,375 | | | | 1,025,819 | |

| Noble Midstream Partners LP | | | 2,336 | | | | 48,706 | |

| Security Description | | Shares | | | Value | |

| Gathering + Processing (continued) | | | | | | | | |

| Summit Midstream Partners LP | | | 4,611 | | | $ | 14,110 | |

| Western Midstream Partners LP | | | 22,452 | | | | 398,074 | |

| Total Gathering + Processing | | | | | | | 1,820,055 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (14.12%) | | | | | |

| Energy Transfer LP | | | 251,656 | | | | 2,972,058 | |

| Enterprise Products Partners LP | | | 164,948 | | | | 4,341,431 | |

| Total Pipeline Transportation | Natural Gas | | | | | | | 7,313,489 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (7.56%) | | | | | |

| BP Midstream Partners LP | | | 5,315 | | | | 77,599 | |

| Genesis Energy LP | | | 12,168 | | | | 231,314 | |

| Holly Energy Partners LP | | | 5,081 | | | | 113,611 | |

| Magellan Midstream Partners LP | | | 25,320 | | | | 1,480,460 | |

| NGL Energy Partners LP | | | 12,987 | | | | 128,961 | |

| NuStar Energy LP | | | 10,919 | | | | 308,134 | |

| Phillips 66 Partners LP | | | 6,230 | | | | 347,198 | |

| Shell Midstream Partners LP | | | 13,773 | | | | 270,777 | |

| Tallgrass Energy LP | | | 53,621 | | | | 960,352 | |

| Total Pipeline Transportation | Petroleum | | | | | | | 3,918,406 | |

| | | | | | | | | |

| TOTAL U.S. ENERGY INFRASTRUCTURE MLPS | |

| (Cost $16,951,202) | | | | | | | 13,051,950 | |

| | | | | | | | | |

| U.S. GENERAL PARTNERS (10.64%) | | | | |

| Gathering + Processing (6.47%) | | | | | | | | |

| Antero Midstream Corp. | | | 87,875 | | | | 402,467 | |

| EnLink Midstream LLC | | | 88,790 | | | | 421,753 | |

| The Williams Cos., Inc. | | | 111,289 | | | | 2,528,486 | |

| Total Gathering + Processing | | | | | | | 3,352,706 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (4.17%) | | | | | |

| Plains GP Holdings LP | | | 123,781 | | | | 2,162,454 | |

| | | | | | | | | |

| TOTAL U.S. GENERAL PARTNERS | | | | | | | | |

| (Cost $9,506,964) | | | | | | | 5,515,160 | |

See Notes to Financial Statements.

Alerian Energy Infrastructure ETF

| Schedule of Investments | November 30, 2019 |

| | | 7 Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.51%) | | | | | | | | |

| Money Market Fund (0.08%) | | | | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | | | | | | | | | | |

| (Cost $39,357) | | | 1.56 | % | | | 39,357 | | | $ | 39,357 | |

| | | | | | | | | | | | | |

| Investments Purchased with Collateral from Securities Loaned (0.43%) | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 1.63% | | | | | | | | | | | | |

| (Cost $223,456) | | | | | | | 223,456 | | | | 223,456 | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | |

| (Cost $262,813) | | | | | | | | | | | 262,813 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (99.14%) | | | | | | | | | | | | |

| (Cost $61,678,209) | | | | | | | | | | $ | 51,364,018 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (0.86%) | | | | 444,713 | |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 51,808,731 | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position is currently on loan. The total market value of securities on loan is $210,193. |

See Notes to Financial Statements.

Alerian Energy Infrastructure ETF

| Statement of Assets and Liabilities | November 30, 2019 |

| ASSETS: | | | |

| Investments, at value | | $ | 51,364,018 | |

| Foreign currency, at value (Cost $678) | | | 678 | |

| Receivable for Investments Sold | | | 660,598 | |

| Dividends receivable | | | 106,688 | |

| Total Assets | | | 52,131,982 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 69,827 | |

| Payable to adviser | | | 29,968 | |

| Payable for collateral upon return of securities loaned | | | 223,456 | |

| Total Liabilities | | | 323,251 | |

| NET ASSETS | | $ | 51,808,731 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 62,377,589 | |

| Distributable earnings | | | (10,568,858 | ) |

| NET ASSETS | | $ | 51,808,731 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 61,678,209 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Assets | | $ | 51,808,731 | |

| Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | | 2,700,000 | |

| Net Asset Value, offering and redemption price per share | | $ | 19.19 | |

See Notes to Financial Statements.

Alerian Energy Infrastructure ETF

| Statement of Operations | For the Year Ended November 30, 2019 |

| INVESTMENT INCOME: | | | |

| Dividends* | | $ | 2,899,093 | |

| Securities lending income | | | 39,910 | |

| Total Investment Income | | | 2,939,003 | |

| | | | | |

| EXPENSES: | | | | |

| Investment adviser fees | | | 391,551 | |

| Total Expenses | | | 391,551 | |

| NET INVESTMENT INCOME | | | 2,547,452 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized gain on investments | | | 381,598 | |

| Net realized gain on foreign currency transactions | | | 3,686 | |

| Net realized gain | | | 385,284 | |

| Net change in unrealized depreciation on investments | | | (1,916,250 | ) |

| Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currencies | | | 107 | |

| Net change in unrealized depreciation | | | (1,916,143 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS AND FOREIGN CURRENCIES | | | (1,530,859 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,016,593 | |

| * Net of foreign tax withholding. | | $ | 168,199 | |

See Notes to Financial Statements.

Alerian Energy Infrastructure ETF

Statements of Changes in Net Assets

| | | For the Year Ended November 30, 2019 | | | For the Year Ended November 30, 2018 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 2,547,452 | | | $ | 1,615,960 | |

| Net realized gain/(loss) | | | 385,284 | | | | (1,675,089 | ) |

| Net change in unrealized depreciation | | | (1,916,143 | ) | | | (3,099,925 | ) |

| Net increase/(decrease) in net assets resulting from operations | | | 1,016,593 | | | | (3,159,054 | ) |

| | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | |

| From distributable earnings | | | (1,375,978 | ) | | | (882,519 | ) |

| From tax return of capital | | | (2,575,568 | ) | | | (207,836 | ) |

| Total distributions | | | (3,951,546 | ) | | | (1,090,355 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from sale of shares | | | 28,422,425 | | | | 11,228,448 | |

| Cost of shares redeemed | | | (15,378,212 | ) | | | (7,649,908 | ) |

| Net increase from share transactions | | | 13,044,213 | | | | 3,578,540 | |

| Net increase/(decrease) in net assets | | | 10,109,260 | | | | (670,869 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 41,699,471 | | | | 42,370,340 | |

| End of period | | $ | 51,808,731 | | | $ | 41,699,471 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Beginning shares | | | 2,050,000 | | | | 1,900,000 | |

| Shares sold | | | 1,400,000 | | | | 500,000 | |

| Shares redeemed | | | (750,000 | ) | | | (350,000 | ) |

| Shares outstanding, end of period | | | 2,700,000 | | | | 2,050,000 | |

See Notes to Financial Statements.

Alerian Energy Infrastructure ETF

| Financial Highlights | For a Share Outstanding Throughout the Periods Presented |

| | | For the Year Ended November 30, 2019 | | | For the Year Ended November 30, 2018 | | | For the Year Ended November 30, 2017 | | | For the Year Ended November 30, 2016 | | | For the Year Ended November 30, 2015 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 20.34 | | | $ | 22.30 | | | $ | 22.95 | | | $ | 18.97 | | | $ | 28.55 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.88 | | | | 0.85 | | | | 0.79 | | | | 0.80 | | | | 0.83 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.64 | ) | | | (2.23 | ) | | | (0.72 | ) | | | 3.95 | | | | (9.78 | ) |

| Total from investment operations | | | 0.24 | | | | (1.38 | ) | | | 0.07 | | | | 4.75 | | | | (8.95 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.50 | ) | | | (0.47 | ) | | | (0.47 | ) | | | (0.63 | ) | | | (0.48 | ) |

| Tax return of capital | | | (0.89 | ) | | | (0.11 | ) | | | (0.25 | ) | | | (0.14 | ) | | | (0.15 | ) |

| Total distributions | | | (1.39 | ) | | | (0.58 | ) | | | (0.72 | ) | | | (0.77 | ) | | | (0.63 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.15 | ) | | | (1.96 | ) | | | (0.65 | ) | | | 3.98 | | | | (9.58 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 19.19 | | | $ | 20.34 | | | $ | 22.30 | | | $ | 22.95 | | | $ | 18.97 | |

| TOTAL RETURN(b) | | | 1.09 | % | | | (6.27 | )% | | | 0.21 | % | | | 25.63 | % | | | (31.83 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 51,809 | | | $ | 41,699 | | | $ | 42,370 | | | $ | 18,357 | | | $ | 12,331 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

| Ratio of net investment income to average net assets | | | 4.23 | % | | | 3.86 | % | | | 3.39 | % | | | 4.04 | % | | | 3.31 | % |

| PORTFOLIO TURNOVER RATE(c) | | | 26 | % | | | 73 | % | | | 37 | % | | | 38 | % | | | 47 | % |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total return is calculated assuming an initial investment made at the net assets value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (c) | Portfolio turnover for periods less than one year is not annualized and does not include securities received or delivered from processing creations or redemptions in-kind. |

See Notes to Financial Statements.

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2019 |

1. ORGANIZATION

ALPS ETF Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As of November 30, 2019, the Trust consisted of sixteen separate portfolios. Each portfolio represents a separate series of the Trust. This report pertains to the Alerian MLP ETF and the Alerian Energy Infrastructure ETF (each a “Fund” and collectively, the “Funds”).

The investment objective of the Alerian MLP ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Total Return Index. The investment objective of the Alerian Energy Infrastructure ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Midstream Energy Select Total Return Index. The investment advisor uses a “passive management” or indexing investment approach to try to achieve each Fund’s investment objective. Each Fund is considered non-diversified and may invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Each Fund’s Shares (“Shares”) are listed on the NYSE Arca, Inc. (“the NYSE Arca”). Each Fund issues and redeems Shares at net asset value (“NAV”), in blocks of 50,000 Shares, each of which is called a “Creation Unit”. Creation Units are issued and redeemed principally in-kind for securities included in the Underlying Index. Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Pursuant to the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. Each Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”)Accounting Standards Codification Topic 946.

A. Portfolio Valuation

Each Fund’s NAV is determined daily, as of the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading. The NAV is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

Portfolio securities listed on any exchange other than the NASDAQ Stock Market LLC (“NASDAQ”) are valued at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and ask prices on such day. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. Portfolio securities traded in the over-the-counter market, but excluding securities traded on the NASDAQ, are valued at the latest quoted sale price in such market.

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2019 |

The Funds’ investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Trust’s Board of Trustees (the “Board”). When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Funds may be valued in good faith by or under the direction of the Board. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre-established primary pricing source or the pricing source is not willing to provide a price; a security with respect to which an event has occurred that is most likely to materially affect the value of the security after the market has closed but before the calculation of the Funds’ NAV or make it difficult or impossible to obtain a reliable market quotation; or a security whose price, as provided by the pricing service, does not reflect the security’s “fair value” due to the security being de-listed from a national exchange or the security’s primary trading market is temporarily closed at a time when, under normal conditions, it would be open. As a general principle, the current “fair value” of a security would be the amount which the owner might reasonably expect to receive from the sale on the applicable exchange or principal market. A variety of factors may be considered in determining the fair value of such securities.

B. Fair Value Measurements

Each Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Valuation techniques used to value the Funds’ investments by major category are as follows:

Equity securities, including restricted securities, and Limited Partnerships for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in open-end mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Various inputs are used in determining the value of the Funds’ investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2019 |

The following is a summary of the inputs used to value each Fund’s investments at November 30, 2019:

Alerian MLP ETF

| Investments in Securities at Value | | Level 1 - Quoted and Unadjusted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Master Limited Partnerships* | | $ | 7,248,039,241 | | | $ | – | | | $ | – | | | $ | 7,248,039,241 | |

| Short Term Investments | | | 4,325,390 | | | | – | | | | – | | | | 4,325,390 | |

| Total | | $ | 7,252,364,631 | | | $ | – | | | $ | – | | | $ | 7,252,364,631 | |

Alerian Energy Infrastructure ETF

| Investments in Securities at Value | | Level 1 - Quoted and Unadjusted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Canadian Energy Infrastructure Companies* | | $ | 18,179,684 | | | $ | – | | | $ | – | | | $ | 18,179,684 | |

| U.S. Energy Infrastructure Companies* | | | 14,354,411 | | | | – | | | | – | | | | 14,354,411 | |

| U.S. Energy Infrastructure MLPs* | | | 13,051,950 | | | | – | | | | – | | | | 13,051,950 | |

| U.S. General Partners* | | | 5,515,160 | | | | – | | | | – | | | | 5,515,160 | |

| Short Term Investments | | | 262,813 | | | | – | | | | – | | | | 262,813 | |

| Total | | $ | 51,364,018 | | | $ | – | | | $ | – | | | $ | 51,364,018 | |

| * | For a detailed breakdown of sectors, see the accompanying Schedule of Investments. |

The Funds did not have any securities that used significant unobservable inputs (Level 3) in determining fair value and there were no transfers into or out of Level 3 during the year ended November 30, 2019.

C. Foreign Currency Translation

The books and records of the Funds are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

D. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded using the specific identification method. Dividend income and capital gains distributions, if any, are recorded on the ex-dividend date, net of any foreign taxes withheld. Interest income, if any, is recorded on the accrual basis, including amortization of premiums and accretion of discounts.

E. Dividends and Distributions to Shareholders

Each Fund intends to declare and make quarterly distributions, or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Alerian Energy Infrastructure ETF, if any, are distributed at least annually. Distributions from net investment income and capital gains are determined in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Funds, timing differences and differing characterization of distributions made by the Funds.

Distributions received from each Fund’s investments in Master Limited Partnerships (“MLPs”) may be comprised of both income and return of capital. Each Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

The Funds each expect a portion of its distributions to shareholders might be comprised of tax deferred return of capital. Return of capital distributions are not taxable income to the shareholder, but reduce the investor’s tax basis in the investor’s Fund Shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of Fund Shares. Shareholders who periodically receive the payment of dividends or other distributions consisting of a return of capital may be under the impression that they are receiving net profits from the Funds when, in fact, they are not. Shareholders should not assume that the source of the distributions is from the net profits of the Funds.

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2019 |

F. Federal Income Taxation and Tax Basis Information

Alerian MLP ETF

The Fund is taxed as a regular C-corporation for federal income tax purposes and as such is obligated to pay federal and state income tax. This treatment differs from most investment companies, which elect to be treated as “regulated investment companies” under the Internal Revenue Code of 1986, as amended (the “Code”) in order to avoid paying entity level income taxes. Under current law, the Fund is not eligible to elect treatment as a regulated investment company due to its investments primarily in MLPs invested in energy assets. The Fund expects that substantially all of the distributions it receives from MLPs may be treated as a tax-deferred return of capital, thus reducing the Fund’s current tax liability. However, the amount of taxes paid by the Fund will vary depending on the amount of income and gains derived from investments and/or sales of MLP interests and such taxes will reduce your return from an investment in the Fund.

Since the Fund will be subject to taxation on its taxable income, the NAV of the Fund shares will also be reduced by the accrual of any deferred tax liabilities. The Underlying Index however is calculated without any deductions for taxes. As a result, the Fund's after tax performance could differ significantly from the Underlying Index even if the pretax performance of the Fund and the performance of Underlying Index are closely related.

Cash distributions from MLPs to the Fund that exceed the Fund’s allocable share of such MLP’s net taxable income are considered a tax deferred return of capital that will reduce the Fund’s adjusted tax basis in the equity securities of the MLP. These reductions in the Fund’s adjusted tax basis in the MLP equity securities will increase the amount of any taxable gain (or decrease the amount of any tax loss) recognized by the Fund on a subsequent sale of the securities. The Fund will accrue deferred income taxes for any future tax liability associated with (i) that portion of MLP distributions considered to be a tax-deferred return of capital as well as (ii) capital appreciation of its investments. Upon the sale of an MLP security, the Fund may be liable for previously deferred taxes. The Fund will rely to some extent on information provided by the MLPs, which is not necessarily timely, to estimate the deferred tax liability for purposes of financial statement reporting and determining the Fund’s NAV. From time to time, the Adviser will modify the estimates or assumptions related to the Fund’s deferred tax liability as new information becomes available. The Fund will generally compute deferred income taxes based on the federal income tax rate applicable to corporations and an assumed rate attributable to state taxes.

The Fund’s income tax expense/(benefit) consists of the following:

| Alerian MLP ETF | | Year ended November 30, 2019 | |

| | | Current | | | Deferred | | | Total | |

| Federal | | $ | (331,761 | ) | | $ | (167,457,643 | ) | | $ | (167,789,404 | ) |

| State | | | 1,675,077 | | | | (18,386,851 | ) | | | (16,711,774 | ) |

| Valuation Allowance | | | – | | | | 185,844,494 | | | | 185,844,494 | |

| Total tax expense/(benefit) | | $ | 1,343,316 | | | $ | – | | | $ | 1,343,316 | |

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes.

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2019 |

Components of the Fund’s deferred tax assets and liabilities are as follows:

| Alerian MLP ETF | | As of November 30, 2019 | |

| Deferred tax assets: | | | | |

| Capital loss carryforward | | $ | 146,683,921 | |

| Net operating loss carryforward | | | 232,556,855 | |

| Income recognized from MLP investments | | | 884,705,820 | |

| Other deferred tax assets | | | 769,513 | |

| Valuation allowance | | | (393,545,939 | ) |

| Less Deferred tax liabilities: | | | | |

| Net unrealized gain on investment securities | | | (871,170,170 | ) |

| Net Deferred Tax Asset/Liability | | $ | – | |

Due to the activities of the MLPs that the fund is invested in, the Fund is required to pay franchise tax in certain states. Generally speaking, franchise tax expense is a tax on equity of a corporation, or base minimum fees, imposed by various jurisdictions. The amounts of the tax are estimated throughout the year based upon the Fund's estimate of underlying activities conducted in the states and reconciled to actual amounts paid upon the filing of the tax returns for the states. These taxes are paid as either estimated tax payments, extension payments, or with the tax return filings of the various states.

The net operating loss carryforward is available to offset future taxable income. The Fund has net operating loss carryforwards for federal income tax purposes as follows:

| Alerian MLP ETF | | Period-Ended | | Amount | | | Expiration |

| Federal | | 11/30/2015 | | | 155,497,942 | | | 11/30/2035 |

| Federal | | 11/30/2016 | | | 481,506,187 | | | 11/30/2036 |

| Federal | | 11/30/2017 | | | 343,920,174 | | | 11/30/2037 |

| Total | | | | $ | 980,924,303 | | | |

The Fund also has state tax net operating loss carryforwards of various amounts per state. The Deferred Tax Assets associated with these state tax net operating losses are as follows:

| Alerian MLP ETF | | Period-Ended | | Amount | | | Expiration |

| State | | 11/30/2013 | | $ | 474,788 | | | Varies by State (5-20 years) |

| State | | 11/30/2014 | | | 1,500,663 | | | Varies by State (5-20 years) |

| State | | 11/30/2015 | | | 7,185,746 | | | Varies by State (5-20 years) |

| State | | 11/30/2016 | | | 11,572,162 | | | Varies by State (5-20 years) |

| State | | 11/30/2017 | | | 5,829,393 | | | Varies by State (5-20 years) |

| Total | | | | $ | 26,562,752 | | | |