UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-22175

ALPS ETF TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Brendan Hamill, Esq., Secretary

ALPS ETF Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: 877-398-8461

Date of fiscal year end: June 30

Date of reporting period: July 1, 2021 – June 30, 2022

| Item 1. | Report to Stockholders. |

Table of Contents

| Performance Overview | 1 |

| Disclosure of Fund Expenses | 14 |

| Report of Independent Registered Public Accounting Firm | 15 |

| Financial Statements | |

| Schedule of Investments | 16 |

| Statements of Assets and Liabilities | 26 |

| Statements of Operations | 27 |

| Statements of Changes in Net Assets | 28 |

| Financial Highlights | 32 |

| Notes to Financial Statements | 36 |

| Additional Information | 44 |

| Board Considerations Regarding Approval of Investment Advisory Agreement | 46 |

| Trustees & Officers | 48 |

alpsfunds.com

| ALPS | O’Shares U.S. Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Performance Objective

The ALPS|O’Shares U.S. Quality Dividend ETF (the "Fund") seeks investment results that track the performance, before fees and expenses, of the O'Shares U.S. Quality Dividend Index (the "Underlying Index").

The Underlying Index is designed to measure the performance of publicly-listed large-capitalization and mid-capitalization dividend-paying issuers in the United States that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds, as determined by O'Shares Investment Advisers, LLC. The high quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines. The constituents of the Underlying Index are selected from the S-Network U.S. Equity Large-Cap 500 Index.

Performance Overview

The ALPS|O’Shares U.S. Quality Dividend ETF generated a total return of -2.38% for the trailing twelve-month period ended June 30, 2022, slightly underperforming the Fund’s Underlying Index, which returned -1.90%. The Fund outperformed both the S&P 500® Index (“S&P 500®”) and the Russell 1000® Value Index, which returned -10.62% and -6.82%, respectively for the same period.

The trailing twelve-month yield for the Fund’s underlying constituents as of June 30, 2022 was 1.88% vs. 1.70% for the S&P 500®.

The S&P 500® returned -10.62% for the trailing twelve-month (TTM) period ended June 30, 2022, in clear correction territory from its all-time high at the beginning of 2022. Persistent inflation with U.S. Consumer Price Index (CPI) surging to 9.1% in June, the war in Ukraine, and slowing global growth caused U.S. equity multiples and prices to contract, with growth-heavy sectors and companies falling the hardest. The Federal Reserve began to raise interest rates and tighten monetary policy early in January, which conceded a sharp rise in U.S. government bond yields where the U.S. government 10-year yield broke above 3.5%, both serving as a catalyst for equities to retreat. Main macroeconomic talking points throughout the TTM period centered on inflation no longer being transitory (i.e. persistent inflation), commodity prices surging, weakening consumer spending, along with GDP forecasts pointing towards a recession. Pro-cyclical sectors proved to be a safe haven amidst inflationary pressures, with energy benefitting from sustained higher oil and gas prices. Although the Federal Reserve looks to implement a soft-landing where monetary tightening won’t cause a severe recession, they will have their work cut out for them as the total assets of the Federal Reserve currently sit near peak levels following years of quantitative easing (QE). As earnings season approaches for Q2 2022, U.S. stocks have come to a fork in the road, where the positive scenario of sustained profits and earnings growth could lead to a bottom in equity prices. On the other hand, reduced margins and negative revisions to the earnings picture could lead to yet another round of sell-offs. Despite the uncertainty and recession fears heading into the second half of 2022, global travel has surpassed 2019 numbers in many metrics, commodity prices and oil have pulled back to more reasonable levels, and U.S. equity prices have reached bear market territory from their highs, leading to attractive valuations across sectors where much of the negative forecasts and fiscal tightening has been baked in.

When compared to the S&P 500®, the relative outperformance for the Fund was largely driven by an overweighting of +9.53% in Consumer Staples, which contributed +1.68% to the outperformance. However, the negative allocation effect was mainly attributed to the relative underweight of - 3.34% in Energy, which detracted -1.49% from performance. The Fund saw a positive impact (+7.24%) from security selection compared to the S&P 500®. The Fund’s Health Care positions exhibited the strongest positive contribution (+2.17%) to security selection (selection effect) for the year compared to the S&P 500®, with names in Financials detracting from the overall security selection effect (-0.35%).

The best performing stocks in the Fund for the period were Eli Lilly and Co. (LLY), which increased +43.26%, and AbbVie Inc. (ABBV), which gained +42.23%. Other top performers included Pfizer Inc. (PFE), which rose +38.42%, and Northrop Grumman Corp. (NOC), which climbed 33.83%. The largest detractors were T. Rowe Price Group (TROW), which decreased by -40.84%, Target Corp. (TGT), which fell -40.67%, and eBay Inc. (EBAY), losing -39.83%.

Looking forward we believe the Fund’s methodology of selecting large-cap and mid-cap companies in the U.S. with fundamental determinates including quality, low volatility and dividend growth, provides a cost-efficient core investment holding.

Performance (as of June 30, 2022)

| | 1 Year | 5 Year | Since Inception^ |

| ALPS | O'Shares U.S. Quality Dividend ETF – NAV | -2.38% | 9.11% | 9.60% |

| ALPS | O'Shares U.S. Quality Dividend ETF – Market Price* | -2.33% | 9.11% | 9.60% |

| O'Shares U.S. Quality Dividend Index** | -1.90% | 9.66% | 10.15% |

| Russell 1000® Value Index | -6.82% | 7.17% | 7.56% |

Total Expense Ratio (per the current prospectus) is 0.48%.

Performance data quoted represents past performance. The Fund adopted the historical performance of the O'Shares U.S. Quality Dividend ETF (the "Predecessor Fund") as the result of a reorganization in which the Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund on June 17, 2022. The returns presented for the Fund for periods prior to June 17, 2022 reflect the performance of the Predecessor Fund. At the time of the reorganization, the investment objectives of the Fund and the Predecessor Fund were identical and the investment strategies of the Fund and the Predecessor Fund were substantially the same. Previously, the Predecessor Fund had adopted the historical performance of the O’Shares FTSE U.S. Quality Dividend ETF (the “Previous Predecessor Fund”), a series of FQF Trust, as the result of a reorganization in which the Predecessor Fund acquired all of the assets, subject to liabilities, of the Previous Predecessor Fund on June 28, 2018. The returns presented for the Predecessor Fund for periods prior to June 28, 2018 reflect the performance of the Previous Predecessor Fund. At the time of the reorganization, the investment objectives of the Previous Predecessor Fund and the Predecessor Fund were identical and the investment strategies of the Previous Predecessor Fund and the Predecessor Fund were substantially the same. Effective June 1, 2020, the Predecessor Fund’s underlying index was changed to the Underlying Index from the FTSE USA Qual/Vol/Yield Factor 5% Capped Index (the “Former Index”). Thus, Predecessor Fund performance shown through May 31, 2020 reflects the Predecessor Fund seeking to track the performance of the Former Index, and Predecessor Fund performance shown beginning June 1, 2020 reflects the Predecessor Fund seeking to track the performance of the Underlying Index. In addition, the Underlying Index performance shown reflects the blended performance of the Former Index through May 31, 2020 and the Underlying Index thereafter. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends and capital gains distributions, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.alpsfunds.com or call 1.866.675.2639.

1 | June 30, 2022

| ALPS | O’Shares U.S. Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

NAV is an exchange-traded fund's per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund's NAV and the number of days it was less than the Fund's NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commencement date was July 14, 2015. |

| * | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time as of which the Fund calculates current net asset value per shares, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times. |

| ** | The O’Shares U.S. Quality Dividend Index performance information reflects the blended performance of the FTSE USA Qual/Vol/Yield Factor 5% Capped Index through May 31, 2020 and the O’Shares U.S. Quality Dividend Index thereafter. |

The O’Shares U.S. Quality Dividend Index is designed to measure the performance of publicly-listed large-capitalization and mid-capitalization dividend-paying issuers in the United States that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds. The high quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines. The index is reported on a total return basis, which assumes reinvestment of any dividends and distributions realized during a given time period.

The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund's shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or "authorized participants" may trade directly with the Fund, typically in blocks of 25,000 shares.

The ALPS | O’Shares U.S. Quality Dividend ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

2 | June 30, 2022

| ALPS | O’Shares U.S. Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Top 10 Holdings* (as of June 30, 2022)

| Johnson & Johnson | 5.79% |

| Procter & Gamble Co. | 5.06% |

| Verizon Communications, Inc. | 4.60% |

| Microsoft Corp. | 4.30% |

| Pfizer, Inc. | 4.12% |

| Home Depot, Inc. | 3.71% |

| Lockheed Martin Corp. | 3.45% |

| Apple, Inc. | 3.34% |

| McDonald's Corp. | 3.17% |

| UnitedHealth Group, Inc. | 2.83% |

| Total % of Top 10 Holdings | 40.37% |

| * | % of Total Investments (excluding short term investments) Future holdings are subject to change. |

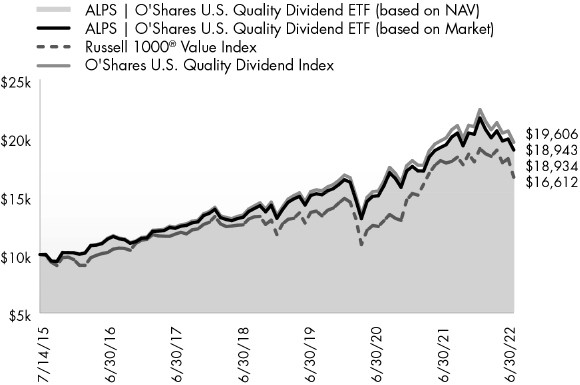

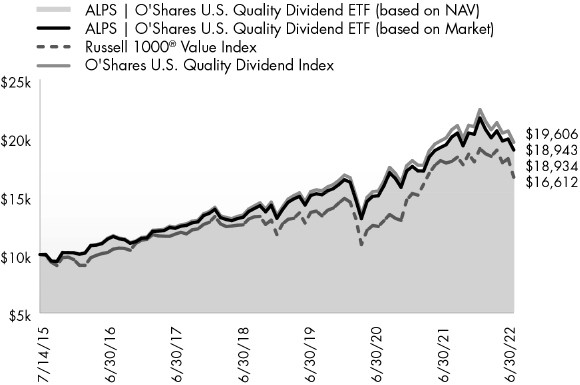

Growth of $10,000 (as of June 30, 2022)

Comparison of Change in Value of $10,000 Investment in the Fund and the Indexes

Sector Allocation* (as of June 30, 2022)

| Consumer, Non-cyclical | 42.39% |

| Industrial | 14.93% |

| Technology | 14.21% |

| Consumer, Cyclical | 13.23% |

| Communications | 8.94% |

| Financial | 6.30% |

| Total | 100.00% |

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund since inception with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and capital gains distributions. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3 | June 30, 2022

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Performance Objective

The ALPS|O’Shares U.S. Small-Cap Quality Dividend ETF (the "Fund") seeks investment results that track the performance, before fees and expenses, of the O'Shares U.S. Small-Cap Quality Dividend Index (the "Underlying Index").

The Underlying Index is designed to measure the performance of publicly-listed small-capitalization dividend-paying issuers in the United States that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds, as determined by O'Shares Investment Advisers, LLC. The high quality and low volatility factors are designed to reduce exposure to high dividend equities that have experienced large price declines, as may occur with some dividend investing strategies. The constituents of the Underlying Index are selected from the S-Network U.S. Equity Mid/Small-Cap 2500 Index.

Performance Overview

The ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF, generated a total return of -8.12% for the trailing twelve-month period ended June 30, 2022, relatively in-line with the Fund’s Underlying Index, net of fees, which returned -7.66%. The Fund outperformed the Russell 2000 Value Index, which returned -16.28% for the same period.

The trailing-twelve-month (TTM) yield for the Fund’s underlying constituents as of June 30, 2022 was 1.95% vs. 2.50% for the Russell 2000 Value Index.

The Russell 2000 Value Index returned -16.28% for the trailing twelve-month period ended June 30, 2022, in clear correction territory from its all-time high at the beginning of 2022. Persistent inflation with U.S. Consumer Price Index (CPI) surging to 9.1% in June, the war in Ukraine, and slowing global growth caused U.S. equity multiples and prices to contract, with growth-heavy sectors and companies falling the hardest. The Federal Reserve began to raise interest rates and tighten monetary policy early in January, which conceded a sharp rise in U.S. government bond yields where the U.S. government 10-year yield broke above 3.5%, both serving as a catalyst for equities to retreat. Main macroeconomic talking points throughout the TTM period centered on inflation no longer being transitory (i.e. persistent inflation), commodity prices surging, weakening consumer spending, along with GDP forecasts pointing towards a recession. Pro-cyclical sectors proved to be a safe haven amidst inflationary pressures, with energy benefitting from sustained higher oil and gas prices. Although the Federal Reserve looks to implement a soft-landing where monetary tightening won’t cause a severe recession, they will have their work cut out for them as the total assets of the Federal Reserve currently sit near peak levels following years of quantitative easing (QE). As earnings season approaches for Q2 2022, U.S. stocks have come to a fork in the road, where the positive scenario of sustained profits and earnings growth could lead to a bottom in equity prices. On the other hand, reduced margins and negative revisions to the earnings picture could lead to yet another round of sell-offs. Despite the uncertainty and recession fears heading into the second half of 2022, global travel has surpassed 2019 numbers in many metrics, commodity prices and oil have pulled back to more reasonable levels, and U.S. equity prices have reached bear market territory from their highs, leading to attractive valuations across sectors where much of the negative forecasts and fiscal tightening has been baked in.

Compared to the Russell 2000 value Index, the Fund saw a positive impact of +0.44% from its sector allocation effect for the period. The underperformance in the TTM period was largely driven by relative overweighting to Consumer Discretionary sector (+4.47% overweight), while the Fund’s underweight allocation (-2.36% underweight) to Health Care contributed +0.93% to relative outperformance. The Fund saw a positive impact of +10.06% from its overall security selection, with Consumer Discretionary sector companies exhibiting the strongest positive contribution (+3.85%) to Fund outperformance. Industrials sector securities lagged all other sectors compared to the Russell 2000 Value Index, detracting -0.61% from relative performance.

The best performing stocks in the Fund for the period were Weis Markets Inc. (WMK), which increased +47.21%, and Murphy USA (MUSA), which saw a gain of +44.55%. Other top performers included H&R Block (HRB), rising +44.03%, and Otter Trail Corp. (OTTR), which climbed +41.23%. The largest detractors were Healthcare Services Group (HCSG), which decreased -42.30%, New York Times (NYT), which fell -35.53%, and M.D.C. Holdings (MDC), which lost -33.40%.

Looking forward, we believe the Fund’s methodology of selecting small-cap companies in the U.S. with fundamental determinates including quality, low volatility and dividend growth, provides a cost-efficient core investment holding.

Performance (as of June 30, 2022)

| | 1 Year | 5 Year | Since Inception^ |

| ALPS | O'Shares U.S. Small-Cap Quality Dividend ETF – NAV | -8.12% | 6.75% | 6.59% |

| ALPS | O'Shares U.S. Small-Cap Quality Dividend ETF – Market Price* | -8.18% | 6.71% | 6.59% |

| O'Shares U.S. Small-Cap Quality Dividend Index** | -7.66% | 7.28% | 7.12% |

| Russell 2000® Value Index | -16.28% | 4.89% | 4.45% |

Total Expense Ratio (per the current prospectus) is 0.48%.

Performance data quoted represents past performance. The Fund adopted the historical performance of the O'Shares U.S. Small-Cap Quality Dividend ETF (the "Predecessor Fund") as the result of a reorganization in which the Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund on June 17, 2022. The returns presented for the Fund for periods prior to June 17, 2022 reflect the performance of the Predecessor Fund. At the time of the reorganization, the investment objectives of the Fund and the Predecessor Fund were identical and the investment strategies of the Fund and the Predecessor Fund were substantially the same. Effective May 4, 2018, the Predecessor Fund’s underlying index was changed from the FTSE USA Small Cap Qual/Vol/Yield Factor 3% Capped Index (the “Former Underlying Index 1”) to the FTSE USA Small Cap ex Real Estate 2Qual/Vol/Yield 3% Capped Factor Index (the “Former Underlying Index 2” and together with the Former Underlying Index 1, the “Former Underlying Indexes”). Effective June 1, 2020, the Predecessor Fund’s underlying index was changed from the Former Underlying Index 2 to the Underlying Index. Thus, Predecessor Fund performance shown prior to May 4, 2018 reflects the Predecessor Fund seeking to track the performance of the Former Underlying Index 1, Predecessor Fund performance shown from May 4, 2018 through May 31, 2020 reflects the Predecessor Fund seeking to track the performance of the Former Underlying Index 2, and Predecessor Fund performance shown beginning June 1, 2020 reflects the Predecessor Fund seeking to track the performance of the Underlying Index.

4 | June 30, 2022

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

In addition, the Underlying Index performance shown reflects the blended performance of the Former Underlying Index 1 through May 3, 2018, the Former Underlying Index 2 from May 4, 2018 through May 31, 2020 and the Underlying Index thereafter. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends and capital gains distributions, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.alpsfunds.com or call 1.866.675.2639.

NAV is an exchange-traded fund's per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund's NAV and the number of days it was less than the Fund's NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commencement date was December 30, 2016. |

| * | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time as of which the Fund calculates current net asset value per shares, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times. |

| ** | The O’Shares U.S. Small-Cap Quality Dividend Index performance information reflects the blended performance of the FTSE USA Small Cap Qual/Vol/Yield 3% Capped Factor Index through May 3, 2018, the FTSE USA Small Cap ex Real Estate 2Qual/Vol/Yield 3% Capped Factor Index from May 4, 2018 through May 31, 2020 and the O’Shares U.S. Small-Cap Quality Dividend Index thereafter. |

The O’Shares U.S. Small-Cap Quality Dividend Index is designed to reflect the performance of publicly-listed small-capitalization dividend paying issuers in the United States that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds. The quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines. The index is reported on a total return basis, which assumes reinvestment of any dividends and distributions realized during a given time period.

The Russell 2000® Value Index measures the performance of the small capitalization value sector of the U.S. equity market.

The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund's shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or "authorized participants" may trade directly with the Fund, typically in blocks of 25,000 shares.

The ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

5 | June 30, 2022

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Top 10 Holdings* (as of June 30, 2022)

| Service Corp. International | 2.52% |

| Erie Indemnity Co. | 2.51% |

| Amdocs, Ltd. | 2.44% |

| Bunge, Ltd. | 2.40% |

| Jack Henry & Associates, Inc. | 2.39% |

| Juniper Networks, Inc. | 2.32% |

| Premier, Inc. | 2.09% |

| Cboe Global Markets, Inc. | 2.07% |

| SEI Investments Co. | 2.04% |

| Gentex Corp. | 2.04% |

| Total % of Top 10 Holdings | 22.82% |

| * | % of Total Investments (excluding short term investments) Future holdings are subject to change. |

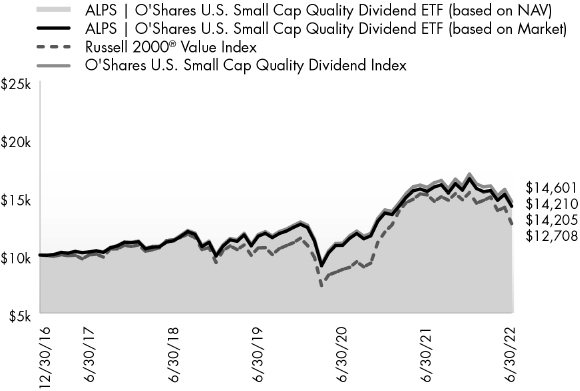

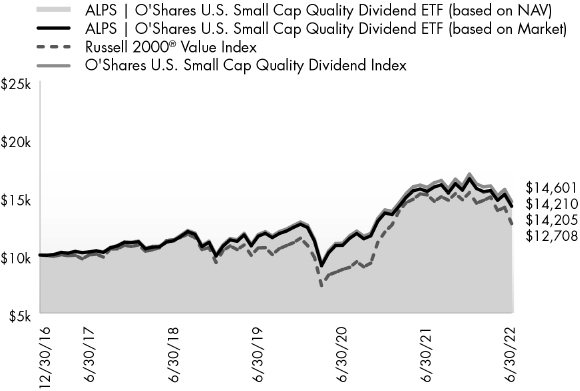

Growth of $10,000 (as of June 30, 2022)

Comparison of Change in Value of $10,000 Investment in the Fund and the Indexes

Sector Allocation* (as of June 30, 2022)

| Consumer, Non-cyclical | 24.04% |

| Financial | 22.87% |

| Industrial | 17.95% |

| Consumer, Cyclical | 11.97% |

| Technology | 11.09% |

| Utilities | 6.81% |

| Communications | 5.27% |

| Total | 100.00% |

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund since inception with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and capital gains distributions. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6 | June 30, 2022

| ALPS | O’Shares Global Internet Giants ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Performance Objective

The ALPS|O’Shares Global Internet Giants ETF (the "Fund") seeks investment results that track the performance, before fees and expenses, of the O'Shares Global Internet Giants Index (the "Underlying Index").

The Underlying Index is a rules-based index intended to give investors a means of tracking stocks exhibiting quality and growth characteristics in the "internet sector", as defined by O'Shares Investment Advisers, LLC.

Performance Overview

The ALPS|O’Shares Global Internet Giants ETF generated a total return of -52.52% for the twelve-month period ended June 30, 2022, in-line with the Fund’s Underlying Index, net of fees, which returned -52.36%. The Fund underperformed the NASDAQ 100 Index, which returned -20.38% for the same period.

The NASDAQ 100 Index returned -20.38% for the trailing twelve-month (TTM) period ended June 30, 2022, in clear correction territory from its all-time high at the beginning of 2022. Persistent inflation with U.S. Consumer Price Index (CPI) surging to 9.1% in June, the war in Ukraine, and slowing global growth caused global equity multiples and prices to contract, with growth-heavy sectors and companies falling the hardest. The Federal Reserve began to raise interest rates and tighten monetary policy early in January, which conceded a sharp rise in U.S. government bond yields where the U.S. government 10-year yield broke above 3.5%, both serving as a catalyst for equities to retreat. Main macroeconomic talking points throughout the TTM period centered on inflation no longer being transitory (i.e. persistent inflation), commodity prices surging, weakening consumer spending, along with GDP forecasts pointing towards a recession. Pro-cyclical sectors proved to be a safe haven amidst inflationary pressures, with energy benefitting from sustained higher oil and gas prices. Although the Federal Reserve looks to implement a soft-landing where monetary tightening won’t cause a severe recession, they will have their work cut out for them as the total assets of the Federal Reserve currently sit near peak levels following years of quantitative easing (QE). As earnings season approaches for Q2 2022, U.S. stocks have come to a fork in the road, where the positive scenario of sustained profits and earnings growth could lead to a bottom in equity prices. On the other hand, reduced margins and negative revisions to the earnings picture could lead to yet another round of sell-offs. Despite the uncertainty and recession fears heading into the second half of 2022, global travel has surpassed 2019 numbers in many metrics, commodity prices and oil have pulled back to more reasonable levels, and U.S. equity prices have reached bear market territory from their highs, leading to attractive valuations across sectors where much of the negative forecasts and fiscal tightening has been baked in.

The Fund underperformed the NASDAQ 100 Index, which returned -20.38% for the trailing twelve-month period ended June 30, 2022. The Fund holds roughly 73% U.S. equities and 27% foreign equities, with the majority of foreign holdings domiciled in China. The U.S. Dollar created a headwind for global equities, strengthening relative to global currencies and cementing its status as the global reserve currency, causing ex-U.S. markets to underperform. Global markets and economic activity were directly impacted by Russia’s invasion of Ukraine, as well as the combined impact of regulatory crackdowns and the zero COVID mandate in China pressuring supply chains. For emerging economies, higher energy prices and inflation was uncontrollable, disproportionately impacting yields and output compared to developed economies. Energy and natural gas shortages stemming from Russia have exacerbated inflation, adding to currency devaluation across ex-U.S. countries. Value outperformed growth equities in global markets for the trailing twelve-month period, with cyclical sectors leading due to company pricing power amidst higher prices. Although global growth prospects remain murky, quantitative tightening is well on its way, with China ahead of the pack and beginning to stimulate its economy through easing monetary policies.

The best performing stocks in the Fund for the period were Palo Alto Networks (PANW US), which increased by +33.12%, and Kuaishou Technology (1024 HK), which saw a gain of +21.38%. Other top performers included Fortinet (FTNT US), which rose +18.77%, and JD.com (9618 HK), which climbed +8.08%. The largest detractors were THG PLC (THG LN), which decreased -86.06%, Asana Inc. (ASAN US), which fell -85.21%, and Kingsoft Cloud Holdings Ltd (KC US), which lost -83.38%.

Looking forward, we believe the Fund’s rules-based approach of investing in some of the largest global companies that derive most of their revenue from the internet technology and e-commerce business segments with above-average growth potential provides a quality and differentiated investment holding.

Performance (as of June 30, 2022)

| | 1 Year | Since Inception^ |

| ALPS | O'Shares Global Internet Giants ETF – NAV | -52.52% | 1.98% |

| ALPS | O'Shares Global Internet Giants ETF – Market Price* | -52.48% | 2.01% |

| O'Shares Global Internet Giants Index | -52.36% | 2.49% |

| NASDAQ 100 Index | -20.38% | 13.43% |

Total Expense Ratio (per the current prospectus) is 0.48%.

Performance data quoted represents past performance. The Fund adopted the historical performance of the O'Shares Global Internet Giants ETF (the "Predecessor Fund") as the result of a reorganization in which the Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund on June 17, 2022. The returns presented for the Fund for periods prior to June 17, 2022 reflect the performance of the Predecessor Fund. At the time of the reorganization, the investment objectives of the Fund and the Predecessor Fund were identical and the investment strategies of the Fund and the Predecessor Fund were substantially the same. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends and capital gains distributions, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.alpsfunds.com or call 1.866.675.2639.

7 | June 30, 2022

| ALPS | O’Shares Global Internet Giants ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

NAV is an exchange-traded fund's per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund's NAV and the number of days it was less than the Fund's NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commencement date was June 5, 2018. |

| * | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time as of which the Fund calculates current net asset value per shares, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times. |

The O’Shares Global Internet Giants Index is a rules-based index intended to give investors a means of tracking stocks exhibiting quality and growth characteristics in the internet technology and e-commerce business segments and pass screens for gross margin and cash burn sustainability. Companies included in the Underlying Index derive at least 50% of their revenues from a) internet technology companies whose principal business is to provide the technologies that support internet commerce; and b) internet commerce companies whose principal business is to sell products and services via the internet. The index is reported on a total return basis, which assumes reinvestment of any dividends and distributions realized during a given time period.

The NASDAQ 100 Index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund's shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or "authorized participants" may trade directly with the Fund, typically in blocks of 25,000 shares.

The ALPS | O’Shares Global Internet Giants ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

Top 10 Holdings* (as of June 30, 2022)

| Microsoft Corp. | 6.31% |

| Alphabet, Inc. | 6.17% |

| Amazon.com, Inc. | 4.77% |

| Meituan | 2.60% |

| Tencent Holdings, Ltd. | 2.46% |

| Snowflake, Inc. | 1.94% |

| Meta Platforms, Inc. | 1.91% |

| Pinduoduo, Inc. | 1.77% |

| Sea, Ltd. | 1.56% |

| Alibaba Group Holding, Ltd. | 1.55% |

| Total % of Top 10 Holdings | 31.04% |

Country Exposure* (as of June 30, 2022)

| United States | 70.36% |

| China | 14.02% |

| Israel | 3.51% |

| Germany | 2.81% |

| Singapore | 1.56% |

| Sweden | 1.18% |

| Canada | 1.13% |

| Norway | 1.08% |

| Argentina | 1.08% |

| Australia | 0.93% |

| Netherlands | 0.93% |

| New Zealand | 0.73% |

| Japan | 0.68% |

| Total | 100.00% |

| * | % of Total Investments (excluding short term investments) |

Future holdings are subject to change.

8 | June 30, 2022

| ALPS | O’Shares Global Internet Giants ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

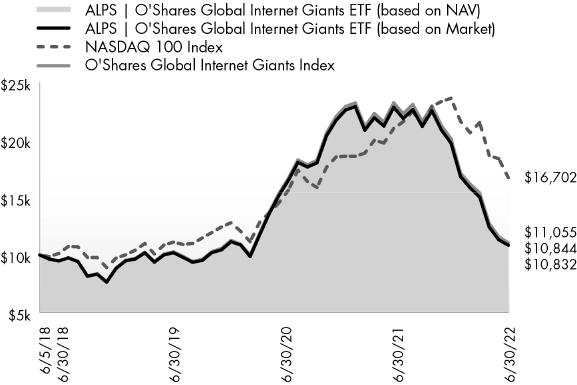

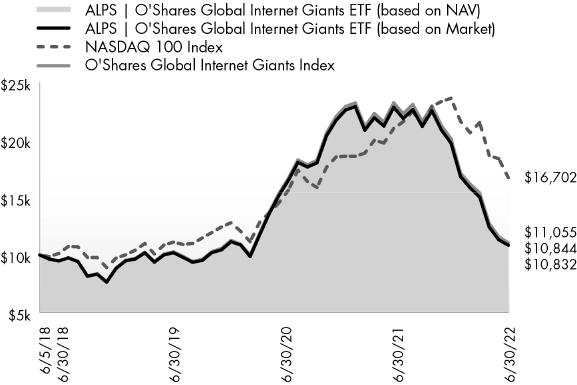

Growth of $10,000 (as of June 30, 2022)

Comparison of Change in Value of $10,000 Investment in the Fund and the Indexes

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund since inception with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and capital gains distributions. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9 | June 30, 2022

| ALPS | O’Shares Europe Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Performance Objective

The ALPS|O’Shares Europe Quality Dividend ETF (the "Fund") seeks investment results that track the performance, before fees and expenses, of the O'Shares Europe Quality Dividend Index (the "Underlying Index").

The Underlying Index is designed to measure the performance of publicly-listed large-capitalization and mid-capitalization dividend-paying issuers in Europe that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds, as determined by O'Shares Investment Advisers, LLC. The high quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines. The constituents of the Underlying Index are selected from the S-Network Europe Equity 500 Index.

Performance Overview

The ALPS|O’Shares Europe Quality Dividend ETF generated a total return of -17.29% for the trailing twelve-month (TTM) period ended June 30, 2022, relatively in-line with the Fund’s Underlying Index, net of fees, which returned -17.18%. The Fund outperformed both the Morningstar Developed Markets ex-North America Index (MSDINUS Index) and the Euro Stoxx 50 Net Return USD Index, which returned -18.72% and -23.13%, respectively for the same period.

The TTM yield for the Fund’s constituents as of 06/30/2022 was 2.78% vs. 3.51% for the MSDINUS Index.

European stocks, as represented by the Euro Stoxx 50 Net Return USD Index, returned -23.13% for the TTM period ended June 30, 2022. The U.S. Dollar created a headwind for international equities, strengthening relative to the Euro, causing ex-U.S. markets to underperform.

Eurozone markets and European economic activity were directly impacted by Russia’s invasion of Ukraine, which remains a key risk in the second half of 2022. Energy and natural gas shortages stemming from Russia have exacerbated inflation and kept energy prices high, with Eurozone Consumer Price Index (CPI) remaining above 5.4% through June of 2022. Value outperformed growth equities in international developed markets for the trailing twelve-month period, with cyclical sectors including Energy and Utilities outperforming due to company pricing power amidst higher prices. The ECB echoed the Fed’s hawkish tone in European markets, stating it would plan to enact the first rate hike in 11 years, with more aggressive hikes to follow as long as inflation stays elevated. Future growth prospects will remain predicated on central bank policies and a resolution to the war in Ukraine. Despite the uncertainty and recession fears heading into the second half of 2022, global travel has surpassed 2019 numbers in many metrics, valuations have normalized to attractive levels, and the potential resolution in Ukraine are positive catalysts to help spur economic activity in developed markets.

Compared to the Morningstar Developed Markets ex-North America Index, the Fund saw a slightly negative impact of -0.29% from its sector allocation where a relative overweight of +11.99% in Health Care contributed +0.87% to Fund outperformance. The Fund’s underweight of -9.66% in the Financials sector was the largest detractor compared to the MSDINUS Index. The Fund received a boost from security selection compared to the MSDINUS Index, with +2.38% of positive performance attributed to its selection effect.

From a geographical perspective, the highest contribution to return was attributed to holdings based in Denmark, which contributed -0.06% towards overall Fund performance. The Fund’s performance was adversely impacted by holdings based in Switzerland, which detracted -4.09% from the Fund.

The best performing stocks for the trailing twelve-month period were Novo Nordisk A/S (NOVOB DC), which increased +33.53%, Swedish Match AB (SWMA SS), which returned +20.61%, and Experian PLC (EXPN LN), which gained +17.57%. The worst performing stocks were Deutsche Post AG (DPW GR), losing -43.06%, Kone Oyj (KNEBV FH), which fell -40.03%, and Schindler Holding AG (SCHP SW), which decreased by -39.84%.

Looking forward, we believe the Fund’s methodology of selecting large-cap and mid-cap companies in Europe with fundamental determinates including quality, low volatility and dividend growth, provides a cost-efficient core investment holding.

Performance (as of June 30, 2022)

| | 1 Year | 5 Year | Since Inception^ |

| ALPS | O'Shares Europe Quality Dividend ETF – NAV | -17.29% | 1.41% | 1.55% |

| ALPS | O'Shares Europe Quality Dividend ETF – Market Price* | -17.59% | 1.31% | 1.57% |

| O'Shares Europe Quality Dividend Index** | -17.18% | 1.88% | 1.98% |

| EURO STOXX 50 Net Return USD Index | -23.13% | 0.71% | 1.56% |

Total Expense Ratio (per the current prospectus) is 0.48%.

Performance data quoted represents past performance. The Fund adopted the historical performance of the O'Shares Europe Quality Dividend ETF (the "Predecessor Fund") as the result of a reorganization in which the Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund on June 17, 2022. The returns presented for the Fund for periods prior to June 17, 2022 reflect the performance of the Predecessor Fund. At the time of the reorganization, the investment objectives of the Fund and the Predecessor Fund were identical and the investment strategies of the Fund and the Predecessor Fund were substantially the same. Previously, the Predecessor Fund had adopted the historical performance of the O’Shares FTSE Europe Quality Dividend ETF (the “Previous Predecessor Fund”), a series of FQF Trust, as the result of a reorganization in which the Predecessor Fund acquired all of the assets, subject to liabilities, of the Previous Predecessor Fund on June 28, 2018. The returns presented for the Predecessor Fund for periods prior to June 28, 2018 reflect the performance of the Previous Predecessor Fund. At the time of the reorganization, the investment objectives of the Previous Predecessor Fund and the Predecessor Fund were identical and the investment strategies of the Previous Predecessor Fund and the Predecessor Fund were substantially the same.

10 | June 30, 2022

| ALPS | O’Shares Europe Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Effective June 1, 2020, the Predecessor Fund’s underlying index was changed to the Underlying Index from the FTSE Developed Europe Qual/Vol/Yield 5% Capped Factor Index (the “Former Index”). Thus, Predecessor Fund performance shown through May 31, 2020 reflects the Predecessor Fund seeking to track the performance of the Former Index, and Predecessor Fund performance shown beginning June 1, 2020 reflects the Predecessor Fund seeking to track the performance of the Underlying Index. In addition, the Underlying Index performance shown reflects the blended performance of the Former Index through May 31, 2020 and the Underlying Index thereafter. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends and capital gains distributions, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.alpsfunds.com or call 1.866.675.2639.

NAV is an exchange-traded fund's per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund's NAV and the number of days it was less than the Fund's NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commencement date was August 19, 2015. |

| * | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time as of which the Fund calculates current net asset value per shares, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times. |

| ** | The O’Shares Europe Quality Dividend Index performance information reflects the blended performance of the FTSE Developed Europe Qual/Vol/Yield 5% Capped Factor Index through May 31, 2020 and the O’Shares Europe Quality Dividend Index thereafter. |

The O’Shares Europe Quality Dividend Index is designed to reflect the performance of publicly-listed large-capitalization and mid-capitalization dividend paying issuers in Europe that meet certain market capitalization, liquidity, high quality, low volatility and high dividend yield thresholds. The quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines. The index is reported on a Net Total Return basis which assumes reinvestment of any dividends and distributions realized during a given time period (net of any amounts of withholding tax).

The EURO STOXX 50 Net Return USD Index represents the performance of the 50 largest companies among the 20 supersectors in terms of free-float market cap in Eurozone countries.

The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund's shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or "authorized participants" may trade directly with the Fund, typically in blocks of 25,000 shares.

The ALPS | O’Shares Europe Quality Dividend ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

11 | June 30, 2022

| ALPS | O’Shares Europe Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

Top 10 Holdings* (as of June 30, 2022)

| Nestle SA | 5.92% |

| Roche Holding AG | 5.70% |

| Novo Nordisk A/S | 5.50% |

| LVMH Moet Hennessy Louis Vuitton SE | 3.75% |

| AstraZeneca PLC | 3.42% |

| Unilever PLC | 3.38% |

| Novartis AG | 3.31% |

| L'Oreal SA | 2.82% |

| SAP SE | 2.69% |

| GSK PLC | 2.62% |

| Total % of Top 10 Holdings | 39.11% |

Country Exposure* (as of June 30, 2022)

| Switzerland | 24.03% |

| France | 19.37% |

| Great Britain | 17.56% |

| Germany | 10.43% |

| Sweden | 9.63% |

| Denmark | 9.45% |

| Netherlands | 4.54% |

| Spain | 3.18% |

| Finland | 1.81% |

| Total | 100.00% |

Sector Allocation* (as of June 30, 2022)

| Consumer, Non-cyclical | 54.37% |

| Industrial | 16.65% |

| Consumer, Cyclical | 10.87% |

| Financial | 5.91% |

| Technology | 4.76% |

| Communications | 4.19% |

| Utilities | 3.25% |

| Total | 100.00% |

| * | % of Total Investments (excluding short term investments) |

Future holdings are subject to change.

12 | June 30, 2022

| ALPS | O’Shares Europe Quality Dividend ETF | |

| Performance Overview | June 30, 2022 (Unaudited) |

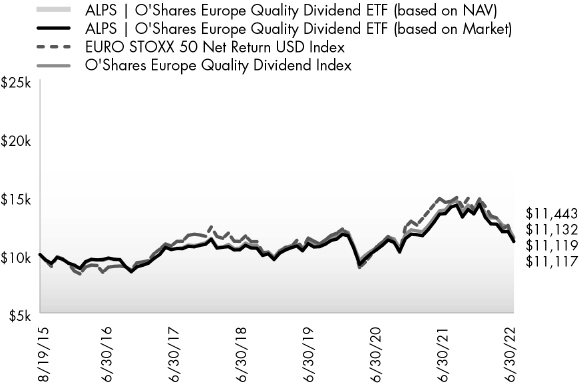

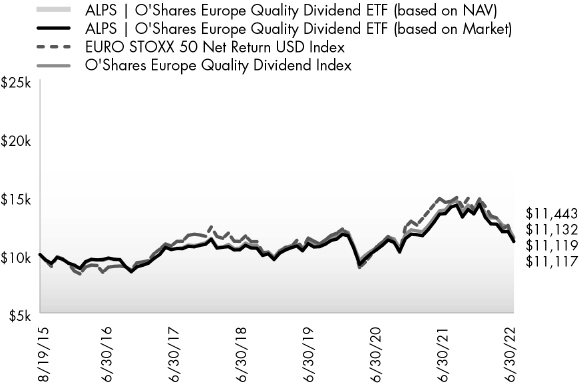

Growth of $10,000 (as of June 30, 2022)

Comparison of Change in Value of $10,000 Investment in the Fund and the Indexes

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund since inception with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and capital gains distributions. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13 | June 30, 2022

| ALPS ETF Trust | |

| Disclosure of Fund Expenses | June 30, 2022 (Unaudited) |

Shareholder Expense Example: As a shareholder of a Fund, you incur certain ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested at the beginning of the six month period and held through June 30, 2022.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as brokerage commissions and other fees to financial intermediaries. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | Beginning Account Value 1/1/22 | | | Ending Account Value 6/30/22(a) | | | Expense Ratio(a) | | | Expenses Paid During Period 1/1/22 - 6/30/22(b)(d) | |

| ALPS | O’Shares U.S. Quality Dividend ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 873.00 | | | | 0.48 | % | | $ | 2.23 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.41 | | | | 0.48 | % | | $ | 2.41 | |

| | | | | | | | | | | | | | | | | |

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 858.60 | | | | 0.48 | % | | $ | 2.21 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.41 | | | | 0.48 | % | | $ | 2.41 | |

| | | | | | | | | | | | | | | | | |

| ALPS | O’Shares Global Internet Giants ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 548.70 | | | | 0.48 | % | | $ | 1.84 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.41 | | | | 0.48 | % | | $ | 2.41 | |

| | | | | | | | | | | | | | | | | |

| ALPS | O’Shares Europe Quality Dividend ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 776.30 | | | | 0.48 | % | | $ | 2.11 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.41 | | | | 0.48 | % | | $ | 2.41 | |

| (a) | The actual return for the Fund prior to June 17, 2022 reflects the actual return of the respective Predecessor Fund. |

| (b) | Annualized based on the Fund's most recent fiscal half-year expenses. |

| (c) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365. |

| (d) | Expenses paid for the Fund prior to June 17, 2022 reflect the expenses of the respective Predecessor Fund. |

14 | June 30, 2022

| ALPS ETF Trust |

| Report of Independent Registered Public Accounting Firm |

To the Board of Trustees of ALPS ETF Trust and the Shareholders of ALPS | O’Shares U.S. Quality Dividend ETF, ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF, ALPS | O’Shares Global Internet Giants ETF, and ALPS | O’Shares Europe Quality Dividend ETF

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of ALPS | O’Shares U.S. Quality Dividend ETF (previously, O’Shares U.S. Quality Dividend ETF), ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF (previously, O’Shares U.S. Small-Cap Quality Dividend ETF), ALPS | O’Shares Global Internet Giants ETF (previously, O’Shares Global Internet Giants ETF), and ALPS | O’Shares Europe Quality Dividend ETF (previously, O’Shares Europe Quality Dividend ETF), each a series of shares of beneficial interest in ALPS ETF Trust (the “Funds”), including the schedules of investments, as of June 30, 2022, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, the financial highlights as noted in the table below, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Funds as of June 30, 2022, and the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended and their financial highlights for each of the periods noted in the table below, in conformity with accounting principles generally accepted in the United States of America.

| Fund | Financial Highlights Presented |

| ALPS | O’Shares U.S. Quality Dividend ETF | For each of the years in the five-year period ended June 30, 2022 |

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | For each of the years in the five-year period ended June 30, 2022 |

| ALPS | O’Shares Global Internet Giants ETF | For each of the years in the four-year period ended June 30, 2022 and for the period from June 5, 2018 (commencement of operations) to June 30, 2018 |

| ALPS | O’Shares Europe Quality Dividend ETF | For each of the years in the five-year period ended June 30, 2022 |

Basis for Opinion

These financial statements are the responsibility of the Funds' management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2022 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the ALPS ETF Trust and the former OSI ETF Trust since 2017.

Philadelphia, Pennsylvania

August 24, 2022

15 | June 30, 2022

| ALPS | O’Shares U.S. Quality Dividend ETF | |

| Schedule of Investments | June 30, 2022 |

| Security Description | | Shares | | | Value | |

| COMMON STOCKS (99.86%) | | | | | | |

| Aerospace & Defense (5.50%) | | | | | | |

| General Dynamics Corp. | | | 11,185 | | | $ | 2,474,681 | |

| L3Harris Technologies, Inc. | | | 11,648 | | | | 2,815,322 | |

| Lockheed Martin Corp. | | | 59,025 | | | | 25,378,389 | |

| Northrop Grumman Corp. | | | 20,706 | | | | 9,909,270 | |

| Total Aerospace & Defense | | | | | | | 40,577,662 | |

| | | | | | | | | |

| Air Freight & Logistics (1.60%) | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 21,426 | | | | 2,088,178 | |

| United Parcel Service, Inc., | | | | | | | | |

| Class B | | | 52,719 | | | | 9,623,326 | |

| Total Air Freight & Logistics | | | | | | | 11,711,504 | |

| | | | | | | | | |

| Banks (0.25%) | | | | | | | | |

| JPMorgan Chase & Co. | | | 16,449 | | | | 1,852,322 | |

| | | | | | | | | |

| Beverages (3.76%) | | | | | | | | |

| Coca-Cola Co. | | | 231,977 | | | | 14,593,673 | |

| PepsiCo, Inc. | | | 78,583 | | | | 13,096,643 | |

| Total Beverages | | | | | | | 27,690,316 | |

| | | | | | | | | |

| Biotechnology (4.12%) | | | | | | | | |

| AbbVie, Inc. | | | 51,904 | | | | 7,949,617 | |

| Amgen, Inc. | | | 62,021 | | | | 15,089,709 | |

| Gilead Sciences, Inc. | | | 119,036 | | | | 7,357,615 | |

| Total Biotechnology | | | | | | | 30,396,941 | |

| | | | | | | | | |

| Building Products (0.23%) | | | | | | | | |

| Trane Technologies PLC | | | 12,891 | | | | 1,674,154 | |

| | | | | | | | | |

| Capital Markets (3.84%) | | | | | | | | |

| BlackRock, Inc. | | | 1,952 | | | | 1,188,846 | |

| Blackstone, Inc. | | | 107,101 | | | | 9,770,824 | |

| Moody's Corp. | | | 8,057 | | | | 2,191,262 | |

| MSCI, Inc. | | | 2,299 | | | | 947,533 | |

| S&P Global, Inc. | | | 24,454 | | | | 8,242,466 | |

| T Rowe Price Group, Inc. | | | 52,826 | | | | 6,001,562 | |

| Total Capital Markets | | | | | | | 28,342,493 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.90%) | | | | | | | | |

| Cintas Corp. | | | 9,221 | | | | 3,444,320 | |

| Waste Management, Inc. | | | 20,841 | | | | 3,188,256 | |

| Total Commercial Services & Supplies | | | | | | | 6,632,576 | |

| | | | | | | | | |

| Communications Equipment (2.05%) | | | | | | | | |

| Cisco Systems, Inc. | | | 329,299 | | | | 14,041,309 | |

| Motorola Solutions, Inc. | | | 5,275 | | | | 1,105,640 | |

| Total Communications Equipment | | | | | | | 15,146,949 | |

| | | | | | | | | |

| Diversified Telecommunication Services (4.60%) | | | | | | | | |

| Verizon Communications, Inc. | | | 667,021 | | | | 33,851,316 | |

| | | | | | | | | |

| Electrical Equipment (0.40%) | | | | | | | | |

| Emerson Electric Co. | | | 21,675 | | | | 1,724,030 | |

| Security Description | | Shares | | | Value | |

| Electrical Equipment (continued) | | | | | | | | |

| Rockwell Automation, Inc. | | | 6,309 | | | $ | 1,257,447 | |

| Total Electrical Equipment | | | | | | | 2,981,477 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (0.22%) | | | | | | | | |

| Amphenol Corp., Class A | | | 13,755 | | | | 885,547 | |

| TE Connectivity, Ltd. | | | 6,359 | | | | 719,521 | |

| Total Electronic Equipment, Instruments & Components | | | | | | | 1,605,068 | |

| | | | | | | | | |

| Entertainment (0.43%) | | | | | | | | |

| Activision Blizzard, Inc. | | | 41,099 | | | | 3,199,968 | |

| | | | | | | | | |

| Food & Staples Retailing (1.70%) | | | | | | | | |

| Costco Wholesale Corp. | | | 16,839 | | | | 8,070,596 | |

| Walmart, Inc. | | | 37,012 | | | | 4,499,919 | |

| Total Food & Staples Retailing | | | | | | | 12,570,515 | |

| | | | | | | | | |

| Food Products (1.76%) | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 13,683 | | | | 1,061,801 | |

| General Mills, Inc. | | | 29,915 | | | | 2,257,087 | |

| Hershey Co. | | | 14,054 | | | | 3,023,859 | |

| Hormel Foods Corp. | | | 38,496 | | | | 1,823,171 | |

| Mondelez International, Inc., | | | | | | | | |

| Class A | | | 77,663 | | | | 4,822,095 | |

| Total Food Products | | | | | | | 12,988,013 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (2.90%) | | | | | | | | |

| Abbott Laboratories | | | 133,086 | | | | 14,459,793 | |

| Baxter International, Inc. | | | 15,159 | | | | 973,663 | |

| Becton Dickinson and Co. | | | 4,661 | | | | 1,149,076 | |

| Medtronic PLC | | | 42,925 | | | | 3,852,518 | |

| Stryker Corp. | | | 4,691 | | | | 933,181 | |

| Total Health Care Equipment & Supplies | | | | | | | 21,368,231 | |

| | | | | | | | | |

| Health Care Providers & Services (3.10%) | | | | | | | | |

| Quest Diagnostics, Inc. | | | 15,231 | | | | 2,025,418 | |

| UnitedHealth Group, Inc. | | | 40,537 | | | | 20,821,020 | |

| Total Health Care Providers & Services | | | | | | | 22,846,438 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure (4.53%) | | | | | | | | |

| McDonald's Corp. | | | 94,451 | | | | 23,318,063 | |

| Starbucks Corp. | | | 94,731 | | | | 7,236,501 | |

| Yum! Brands, Inc. | | | 25,487 | | | | 2,893,029 | |

| Total Hotels, Restaurants & Leisure | | | | | | | 33,447,593 | |

| | | | | | | | | |

| Household Durables (0.26%) | | | | | | | | |

| Garmin, Ltd. | | | 19,394 | | | | 1,905,461 | |

| | | | | | | | | |

| Household Products (7.04%) | | | | | | | | |

| Church & Dwight Co., Inc. | | | 16,730 | | | | 1,550,202 | |

| Clorox Co. | | | 11,833 | | | | 1,668,216 | |

| Colgate-Palmolive Co. | | | 95,273 | | | | 7,635,178 | |

| Kimberly-Clark Corp. | | | 28,246 | | | | 3,817,447 | |

| | | | | | | | | |

16 | June 30, 2022

| ALPS | O’Shares U.S. Quality Dividend ETF | |

| Schedule of Investments | June 30, 2022 |

| Security Description | | Shares | | | Value | |

| Household Products (continued) | | | | | | |

| Procter & Gamble Co. | | | 258,897 | | | $ | 37,226,799 | |

| Total Household Products | | | | | | | 51,897,842 | |

| | | | | | | | | |

| Industrial Conglomerates (2.89%) | | | | | | | | |

| 3M Co. | | | 96,880 | | | | 12,537,241 | |

| Honeywell International, Inc. | | | 50,450 | | | | 8,768,714 | |

| Total Industrial Conglomerates | | | | | | | 21,305,955 | |

| | | | | | | | | |

| Insurance (1.93%) | | | | | | | | |

| Allstate Corp. | | | 40,016 | | | | 5,071,227 | |

| Aon PLC, Class A | | | 6,952 | | | | 1,874,815 | |

| Chubb, Ltd. | | | 14,534 | | | | 2,857,094 | |

| Marsh & McLennan Cos., Inc. | | | 28,338 | | | | 4,399,475 | |

| Total Insurance | | | | | | | 14,202,611 | |

| | | | | | | | | |

| Internet & Direct Marketing Retail (0.13%) | | | | | | | | |

| eBay, Inc. | | | 23,728 | | | | 988,746 | |

| | | | | | | | | |

| IT Services (4.06%) | | | | | | | | |

| Accenture PLC, Class A | | | 36,190 | | | | 10,048,154 | |

| Automatic Data Processing, Inc. | | | 9,057 | | | | 1,902,332 | |

| Broadridge Financial Solutions, Inc. | | | 3,344 | | | | 476,687 | |

| Cognizant Technology | | | | | | | | |

| Solutions Corp., Class A | | | 16,966 | | | | 1,145,035 | |

| International Business | | | | | | | | |

| Machines Corp. | | | 8,560 | | | | 1,208,586 | |

| Mastercard, Inc., Class A | | | 10,514 | | | | 3,316,957 | |

| Paychex, Inc. | | | 16,068 | | | | 1,829,663 | |

| Visa, Inc., Class A | | | 50,843 | | | | 10,010,478 | |

| Total IT Services | | | | | | | 29,937,892 | |

| | | | | | | | | |

| Life Sciences Tools & Services (0.34%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 6,837 | | | | 812,030 | |

| Thermo Fisher Scientific, Inc. | | | 3,152 | | | | 1,712,419 | |

| Total Life Sciences Tools & Services | | | | | | | 2,524,449 | |

| | | | | | | | | |

| Machinery (1.69%) | | | | | | | | |

| Cummins, Inc. | | | 9,925 | | | | 1,920,785 | |

| Illinois Tool Works, Inc. | | | 57,768 | | | | 10,528,218 | |

| Total Machinery | | | | | | | 12,449,003 | |

| | | | | | | | | |

| Media (2.14%) | | | | | | | | |

| Comcast Corp., Class A | | | 402,918 | | | | 15,810,502 | |

| | | | | | | | | |

| Multiline Retail (0.89%) | | | | | | | | |

| Dollar General Corp. | | | 13,763 | | | | 3,377,991 | |

| Target Corp. | | | 22,565 | | | | 3,186,855 | |

| Total Multiline Retail | | | | | | | 6,564,846 | |

| | | | | | | | | |

| Personal Products (0.29%) | | | | | | | | |

| Estee Lauder Cos., Inc., Class A | | | 8,392 | | | | 2,137,191 | |

| | | | | | | | | |

| Pharmaceuticals (14.98%) | | | | | | | | |

| Eli Lilly & Co. | | | 61,558 | | | | 19,958,950 | |

| Security Description | | Shares | | | Value | |

| Pharmaceuticals (continued) | | | | | | |

| Johnson & Johnson | | | 240,181 | | | $ | 42,634,528 | |

| Merck & Co., Inc. | | | 168,992 | | | | 15,407,001 | |

| Pfizer, Inc. | | | 578,290 | | | | 30,319,745 | |

| Zoetis, Inc. | | | 12,213 | | | | 2,099,293 | |

| Total Pharmaceuticals | | | | | | | 110,419,517 | |

| | | | | | | | | |

| Road & Rail (1.84%) | | | | | | | | |

| CSX Corp. | | | 63,665 | | | | 1,850,105 | |

| Norfolk Southern Corp. | | | 10,165 | | | | 2,310,403 | |

| Union Pacific Corp. | | | 44,345 | | | | 9,457,902 | |

| Total Road & Rail | | | | | | | 13,618,410 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (2.85%) | | | | | | | | |

| Analog Devices, Inc. | | | 8,764 | | | | 1,280,333 | |

| Broadcom, Inc. | | | 1,915 | | | | 930,326 | |

| Intel Corp. | | | 92,364 | | | | 3,455,337 | |

| QUALCOMM, Inc. | | | 5,642 | | | | 720,709 | |

| Texas Instruments, Inc. | | | 95,094 | | | | 14,611,193 | |

| Total Semiconductors & Semiconductor Equipment | | | | | | | 20,997,898 | |

| | | | | | | | | |

| Software (5.45%) | | | | | | | | |

| Intuit, Inc. | | | 1,844 | | | | 710,751 | |

| Microsoft Corp. | | | 123,135 | | | | 31,624,763 | |

| Oracle Corp. | | | 112,751 | | | | 7,877,913 | |

| Total Software | | | | | | | 40,213,427 | |

| | | | | | | | | |

| Specialty Retail (4.78%) | | | | | | | | |

| Home Depot, Inc. | | | 99,678 | | | | 27,338,685 | |

| Lowe's Cos., Inc. | | | 30,131 | | | | 5,262,982 | |

| TJX Cos., Inc. | | | 45,686 | | | | 2,551,563 | |

| Total Specialty Retail | | | | | | | 35,153,230 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (3.34%) | | | | | | | | |

| Apple, Inc. | | | 179,753 | | | | 24,575,830 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods (0.57%) | | | | | | | | |

| NIKE, Inc., Class B | | | 40,981 | | | | 4,188,258 | |

| | | | | | | | | |

| Tobacco (2.02%) | | | | | | | | |

| Altria Group, Inc. | | | 105,123 | | | | 4,390,988 | |

| Philip Morris International, Inc. | | | 105,865 | | | | 10,453,110 | |

| Total Tobacco | | | | | | | 14,844,098 | |

| | | | | | | | | |

| Trading Companies & Distributors (0.48%) | | | | | | | | |

| Fastenal Co. | | | 71,279 | | | | 3,558,248 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $691,530,629) | | | | | | | 736,176,950 | |

17 | June 30, 2022

| ALPS | O’Shares U.S. Quality Dividend ETF | |

| Schedule of Investments | June 30, 2022 |

| | | 7 Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.18%) | | | | | |

| Money Market Fund | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | 1.45 | % | | | 1,342,751 | | | $ | 1,342,751 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $1,342,751) | | | | | | | | | | | 1,342,751 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (100.04%) | | | | | | | | | | | | |

| (Cost $692,873,380) | | | | | | | | | | $ | 737,519,701 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-0.04%) | | | | | | | | | | | (290,819 | ) |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 737,228,882 | |

See Notes to Financial Statements.

18 | June 30, 2022

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | |

| Schedule of Investments | June 30, 2022 |

| Security Description | | Shares | | | Value | |

| COMMON STOCKS (99.81%) | | | | | | |

| Auto Components (3.71%) | | | | | | |

| BorgWarner, Inc. | | | 43,043 | | | $ | 1,436,345 | |

| Gentex Corp. | | | 113,016 | | | | 3,161,059 | |

| Lear Corp. | | | 3,500 | | | | 440,615 | |

| Standard Motor Products, Inc. | | | 16,488 | | | | 741,795 | |

| Total Auto Components | | | | | | | 5,779,814 | |

| | | | | | | | | |

| Building Products (2.12%) | | | | | | | | |

| A O Smith Corp. | | | 49,898 | | | | 2,728,423 | |

| Simpson Manufacturing Co., Inc. | | | 5,380 | | | | 541,282 | |

| Total Building Products | | | | | | | 3,269,705 | |

| | | | | | | | | |

| Capital Markets (13.11%) | | | | | | | | |

| Artisan Partners Asset | | | | | | | | |

| Management, Inc., Class A | | | 32,949 | | | | 1,171,996 | |

| Carlyle Group, Inc. | | | 71,805 | | | | 2,273,346 | |

| Cboe Global Markets, Inc. | | | 28,374 | | | | 3,211,653 | |

| Cohen & Steers, Inc. | | | 11,299 | | | | 718,503 | |

| Evercore, Inc., Class A | | | 11,410 | | | | 1,068,090 | |

| Hamilton Lane, Inc., Class A | | | 10,118 | | | | 679,727 | |

| Houlihan Lokey, Inc. | | | 39,263 | | | | 3,099,029 | |

| Lazard, Ltd., Class A | | | 49,800 | | | | 1,614,018 | |

| LPL Financial Holdings, Inc. | | | 3,750 | | | | 691,800 | |

| Moelis & Co., Class A | | | 38,474 | | | | 1,513,952 | |

| Morningstar, Inc. | | | 4,742 | | | | 1,146,758 | |

| SEI Investments Co. | | | 58,647 | | | | 3,168,111 | |

| Total Capital Markets | | | | | | | 20,356,983 | |

| | | | | | | | | |

| Commercial Services & Supplies (1.45%) | | | | | | | | |

| Brady Corp., Class A | | | 24,916 | | | | 1,177,031 | |

| Ennis, Inc. | | | 22,065 | | | | 446,375 | |

| Healthcare Services Group, Inc. | | | 14,925 | | | | 259,844 | |

| UniFirst Corp. | | | 2,069 | | | | 356,240 | |

| Total Commercial Services & Supplies | | | | | | | 2,239,490 | |

| | | | | | | | | |

| Communications Equipment (2.31%) | | | | | | | | |

| Juniper Networks, Inc. | | | 126,115 | | | | 3,594,278 | |

| | | | | | | | | |

| Construction & Engineering (0.56%) | | | | | | | | |

| MDU Resources Group, Inc. | | | 32,262 | | | | 870,751 | |

| | | | | | | | | |

| Consumer Finance (0.22%) | | | | | | | | |

| OneMain Holdings, Inc. | | | 9,003 | | | | 336,532 | |

| | | | | | | | | |

| Diversified Consumer Services (4.81%) | | | | | | | | |

| Graham Holdings Co., Class B | | | 1,441 | | | | 816,816 | |

| H&R Block, Inc. | | | 77,471 | | | | 2,736,276 | |

| Service Corp. International | | | 56,570 | | | | 3,910,117 | |

| Total Diversified Consumer Services | | | | | | | 7,463,209 | |

| | | | | | | | | |

| Electric Utilities (2.99%) | | | | | | | | |

| ALLETE, Inc. | | | 5,396 | | | | 317,177 | |

| Hawaiian Electric Industries, Inc. | | | 8,948 | | | | 365,973 | |

| IDACORP, Inc. | | | 6,990 | | | | 740,381 | |

| Security Description | | Shares | | | Value | |

| Electric Utilities (continued) | | | | | | |

| MGE Energy, Inc. | | | 5,274 | | | $ | 410,475 | |

| NRG Energy, Inc. | | | 10,031 | | | | 382,883 | |

| OGE Energy Corp. | | | 21,677 | | | | 835,865 | |

| Otter Tail Corp. | | | 6,116 | | | | 410,567 | |

| Pinnacle West Capital Corp. | | | 12,564 | | | | 918,680 | |

| PNM Resources, Inc. | | | 5,683 | | | | 271,534 | |

| Total Electric Utilities | | | | | | | 4,653,535 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (2.37%) | | | | | | | | |

| Avnet, Inc. | | | 26,945 | | | | 1,155,402 | |

| Littelfuse, Inc. | | | 3,722 | | | | 945,537 | |

| National Instruments Corp. | | | 30,955 | | | | 966,725 | |

| Vishay Intertechnology, Inc. | | | 34,789 | | | | 619,940 | |

| Total Electronic Equipment, Instruments & Components | | | | | | | 3,687,604 | |

| | | | | | | | | |

| Food & Staples Retailing (0.79%) | | | | | | | | |

| Casey's General Stores, Inc. | | | 3,937 | | | | 728,266 | |

| Weis Markets, Inc. | | | 6,599 | | | | 491,889 | |

| Total Food & Staples Retailing | | | | | | | 1,220,155 | |

| | | | | | | | | |

| Food Products (7.55%) | | | | | | | | |

| Bunge, Ltd. | | | 41,021 | | | | 3,720,194 | |

| Flowers Foods, Inc. | | | 93,245 | | | | 2,454,208 | |

| Ingredion, Inc. | | | 21,478 | | | | 1,893,500 | |

| J & J Snack Foods Corp. | | | 2,590 | | | | 361,719 | |

| Lamb Weston Holdings, Inc. | | | 16,886 | | | | 1,206,674 | |

| Lancaster Colony Corp. | | | 11,979 | | | | 1,542,656 | |

| Tootsie Roll Industries, Inc. | | | 15,860 | | | | 560,651 | |

| Total Food Products | | | | | | | 11,739,602 | |

| | | | | | | | | |

| Gas Utilities (2.79%) | | | | | | | | |

| National Fuel Gas Co. | | | 9,987 | | | | 659,641 | |

| New Jersey Resources Corp. | | | 7,860 | | | | 350,006 | |

| ONE Gas, Inc. | | | 5,389 | | | | 437,533 | |

| Southwest Gas Holdings, Inc. | | | 4,830 | | | | 420,596 | |

| Spire, Inc. | | | 6,009 | | | | 446,889 | |

| UGI Corp. | | | 52,235 | | | | 2,016,794 | |

| Total Gas Utilities | | | | | | | 4,331,459 | |

| | | | | | | | | |

| Health Care Providers & Services (6.35%) | | | | | | | | |

| Chemed Corp. | | | 3,402 | | | | 1,596,865 | |

| Encompass Health Corp. | | | 44,158 | | | | 2,475,056 | |

| National HealthCare Corp. | | | 36,295 | | | | 2,537,020 | |

| Premier, Inc., Class A | | | 90,892 | | | | 3,243,027 | |

| Total Health Care Providers & Services | | | | | | | 9,851,968 | |

| | | | | | | | | |

| Household Durables (1.90%) | | | | | | | | |

| Leggett & Platt, Inc. | | | 33,039 | | | | 1,142,489 | |

| MDC Holdings, Inc. | | | 10,806 | | | | 349,142 | |

| Whirlpool Corp. | | | 9,473 | | | | 1,467,084 | |

| Total Household Durables | | | | | | | 2,958,715 | |

19 | June 30, 2022

| ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | |

| Schedule of Investments | June 30, 2022 |

| Security Description | | Shares | | | Value | |

| Household Products (0.98%) | | | | | | |

| Reynolds Consumer Products, Inc. | | | 29,685 | | | $ | 809,510 | |

| WD-40 Co. | | | 3,571 | | | | 719,057 | |

| Total Household Products | | | | | | | 1,528,567 | |

| | | | | | | | | |

| Insurance (8.21%) | | | | | | | | |

| Erie Indemnity Co., Class A | | | 20,205 | | | | 3,883,199 | |

| Mercury General Corp. | | | 27,799 | | | | 1,231,496 | |

| Old Republic International Corp. | | | 139,140 | | | | 3,111,170 | |

| RLI Corp. | | | 15,095 | | | | 1,759,926 | |

| Safety Insurance Group, Inc. | | | 20,318 | | | | 1,972,878 | |

| Stewart Information Services Corp. | | | 16,021 | | | | 797,045 | |

| Total Insurance | | | | | | | 12,755,714 | |

| | | | | | | | | |

| IT Services (9.96%) | | | | | | | | |

| Amdocs, Ltd. | | | 45,384 | | | | 3,780,942 | |

| CSG Systems International, Inc. | | | 17,207 | | | | 1,026,914 | |

| Genpact, Ltd. | | | 37,463 | | | | 1,586,933 | |

| Jack Henry & Associates, Inc. | | | 20,607 | | | | 3,709,672 | |