UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-22175

ALPS ETF TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Michael Lawlor, Esq., Secretary

ALPS ETF Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: 877-398-8461

Date of fiscal year end: November 30

Date of reporting period: December 1, 2022 – November 30, 2023

| Item 1. | Report to Stockholders. |

Table of Contents

| Performance Overview | |

| Alerian MLP ETF | 1 |

| Alerian Energy Infrastructure ETF | 4 |

| Disclosure of Fund Expenses | 7 |

| Report of Independent Registered Public Accounting Firm | 8 |

| Financial Statements | |

| Alerian MLP ETF | |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Alerian Energy Infrastructure ETF | |

| Schedule of Investments | 14 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | 19 |

| Notes to Financial Statements | 20 |

| Additional Information | 31 |

| Board Considerations Regarding Approval of Investment Advisory Agreement | 33 |

| Trustees & Officers | 35 |

alpsfunds.com

Alerian MLP ETF

| Performance Overview | November 30, 2023 (Unaudited) |

INVESTMENT OBJECTIVE

The Alerian MLP ETF (the “Fund” or “AMLP”) seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index (the “Underlying Index” or “AMZI”). The shares of the Fund are listed and trade on the NYSE Arca, Inc. (“NYSE”) under the ticker symbol AMLP. The Fund will normally invest at least 90% of its total assets in securities that comprise the Underlying Index.

The Underlying Index is a rules based, modified capitalization weighted, float-adjusted index intended to give investors a means of tracking the overall performance of the United States energy infrastructure Master Limited Partnership (“MLP”) asset class. The Underlying Index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

PERFORMANCE OVERVIEW

During the twelve-month period from December 1, 2022, to November 30, 2023, the Fund delivered a total return of 19.47% (19.82% NAV). This compares to the Fund’s Underlying Index, which increased 12.72% on a price-return basis and 22.18% on a total-return basis. The difference in performance between the AMZI and AMLP is primarily attributable to the Fund’s operating expenses and the tax impact of the Fund’s C-Corporation structure, including the accrual of approximately $121.6 million in income tax expense during the 12-month period.

During the period, the Fund paid four distributions:

| · | $0.7700 per share on February 14, 2023 |

| · | $0.8600 per share on May 16, 2023 |

| · | $0.8300 per share on August 15, 2023 |

| · | $0.8800 per share on November 14, 2023 |

The growing payouts from the Fund from February to November reflected strong distribution trends for AMZI constituents, with most names increasing their payouts during the year. Notably, there have been nine consecutive quarters without a distribution cut for an AMZI constituent. Comparing the latest distribution announcements for the third calendar quarter of 2023 (paid in the fourth calendar quarter in 2023) with the payouts from the same quarter in 2022, 86.31% of the Underlying Index by weighting grew their distributions and 13.69% maintained their payouts based on weightings through November 30, 2023.

In March 2023, the methodology for the Underlying Index was updated. Specifically, the maximum weight for individual constituents was raised from 10% to 12% to better reflect the market capitalization of constituents. The change was applied during the March quarterly rebalancing. Concurrently, DCP Midstream (DCP) was removed from the Underlying Index ahead of its acquisition by another entity, which reduced turnover resulting from the raised cap.

During the Fund's fiscal year, Magellan Midstream Partners (MMP), Crestwood Equity Partners (CEQP), and Holly Energy Partners (HEP) were also removed from the Underlying Index in relation to their acquisition by another entity.

Energy infrastructure MLPs outperformed both the S&P 500® and the broad energy sector as represented by the Energy Select Sector Index (IXE) during the Fund's fiscal year. Positive distribution trends, supported by ongoing free cash flow generation, enhanced appealing yields and served as tailwinds for the space. Additionally, the announced acquisition of Magellan Midstream Partners (MMP) by ONEOK (OKE) at a 22% premium in May 2023 was supportive for Fund performance. MMP was a large weighting in AMZI, and other constituents traded higher with the transaction news.

The fee-based business models of MLPs helped insulate companies from weaker commodity prices in 2023. Given an uncertain macroeconomic outlook, Alerian believes MLPs’ defensive qualities and generous yields could be supportive into 2024. Fee-based businesses drive stable cash flows, which in Alerian’s opinion should allow MLPs to generate free cash flow regardless of the commodity price environment. Alerian expects excess cash flow to support continued distribution growth and opportunistic buybacks in 2024 and beyond.

1 | November 30, 2023

Alerian MLP ETF

| Performance Overview | November 30, 2023 (Unaudited) |

Performance (as of November 30, 2023)

| | 1 Year | 5 Year | 10 Year | Since Inception^ |

| Alerian MLP ETF – NAV | 19.82% | 7.57% | 1.28% | 3.77% |

| Alerian MLP ETF – Market Price* | 19.47% | 7.57% | 1.27% | 3.77% |

| Alerian MLP Infrastructure Index | 22.18% | 9.72% | 2.04% | 6.09% |

| Alerian MLP Index | 23.29% | 10.33% | 2.29% | 5.99% |

Total Expense Ratio (per the current prospectus) is 0.85%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.alpsfunds.com or call 1.866.759.5679. The Fund accrues deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investment. This deferred tax liability is reflected in the daily Net Asset Value (NAV) and as a result the fund's after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commenced Investment Operations on August 24, 2010 with an Inception Date, the first day of trading on the NYSE ARCA, of August 25, 2010. |

| * | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time as of which the Fund calculates current net asset value per share, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times. |

The Alerian MLP Infrastructure Index is comprised of 11 midstream energy Master Limited Partnerships and provides investors with an unbiased benchmark for the infrastructure component of this emerging asset class. Total return assumes reinvestment of any dividends and distributions realized during a given time period.

The Alerian MLP Index is recognized as a leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is reported on a total-return basis (AMZX), which assumes reinvestment of any dividends and distributions realized during a given period.

The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund’s shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 25,000 shares.

The Alerian MLP ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

2 | November 30, 2023

Alerian MLP ETF

| Performance Overview | November 30, 2023 (Unaudited) |

Top 10 Holdings* (as of November 30, 2023)

| Energy Transfer LP | 18.90% |

| Plains All American Pipeline LP | 13.99% |

| MPLX LP | 13.69% |

| Enterprise Products Partners LP | 13.10% |

| Western Midstream Partners LP | 13.09% |

| EnLink Midstream LLC | 7.51% |

| Cheniere Energy Partners LP | 5.64% |

| Hess Midstream LP | 4.96% |

| NuStar Energy LP | 4.95% |

| Genesis Energy LP | 3.09% |

| Total % of Top 10 Holdings | 98.92% |

Future holdings are subject to change.

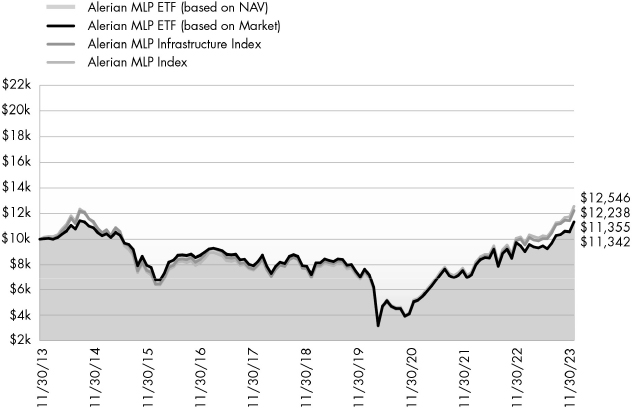

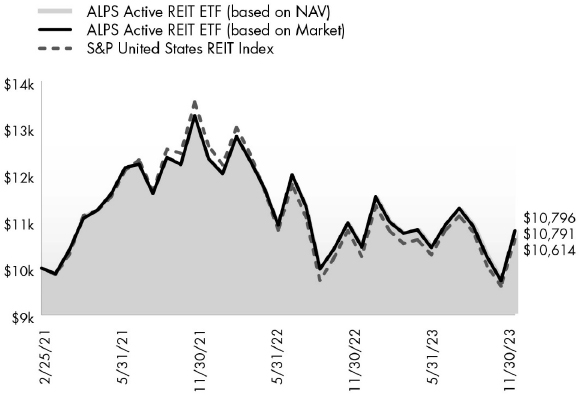

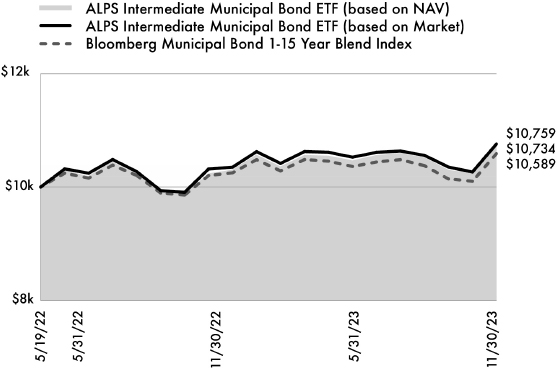

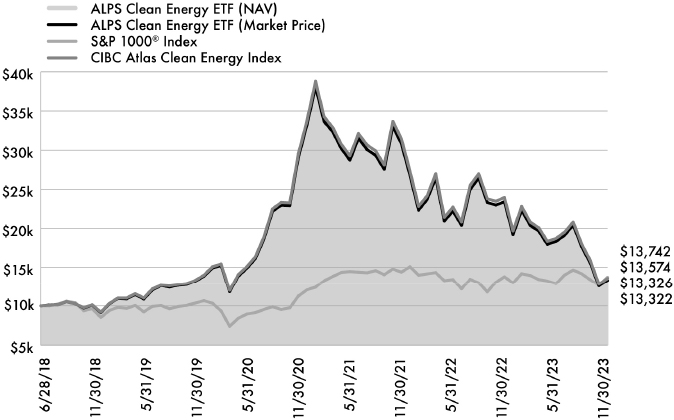

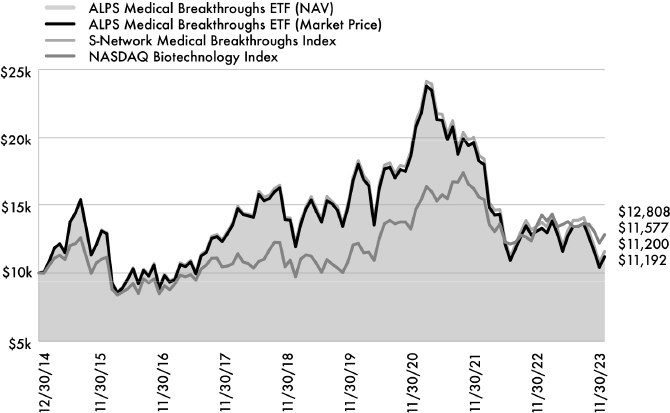

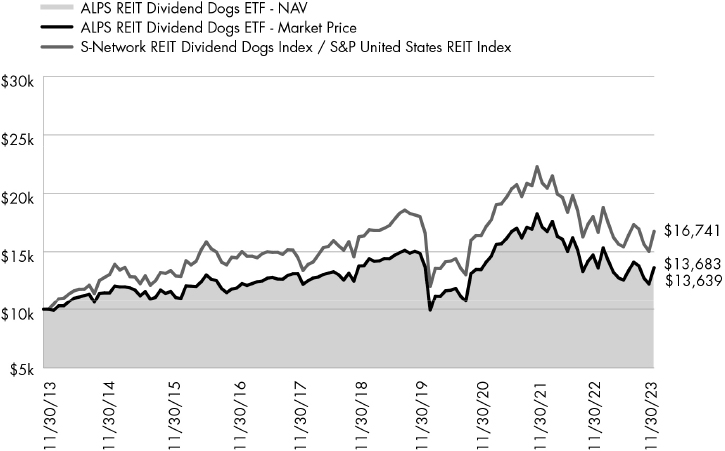

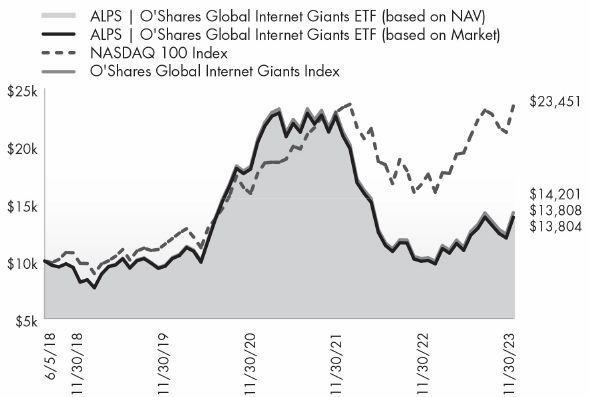

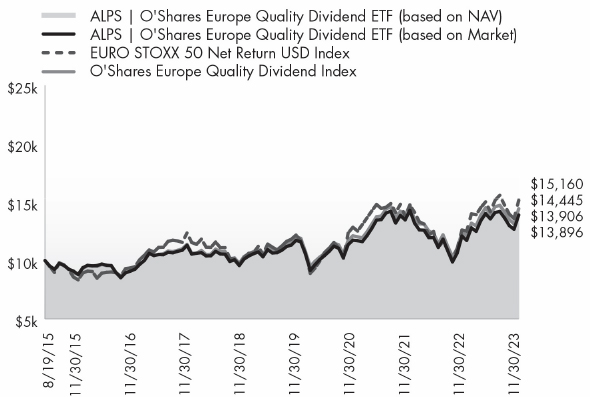

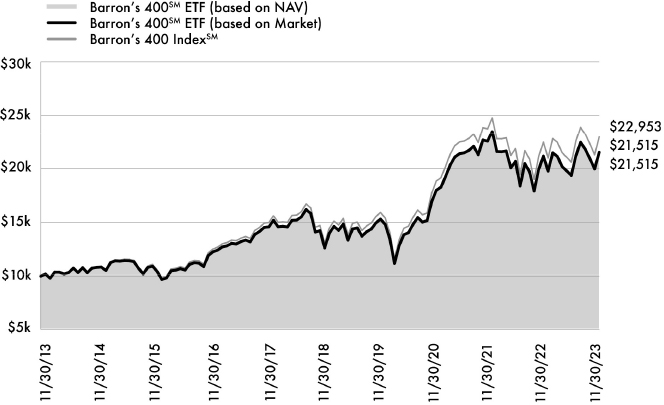

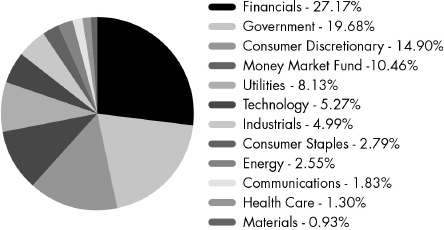

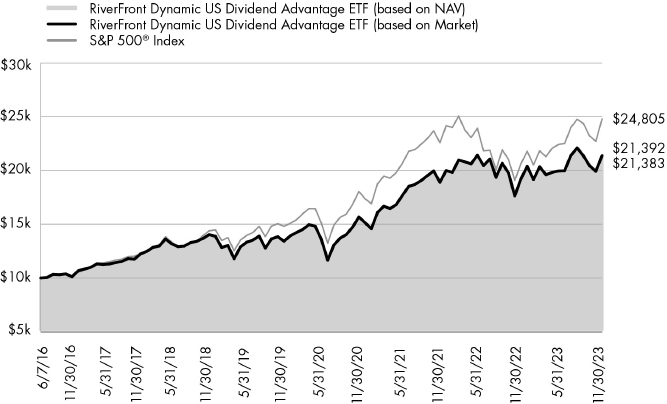

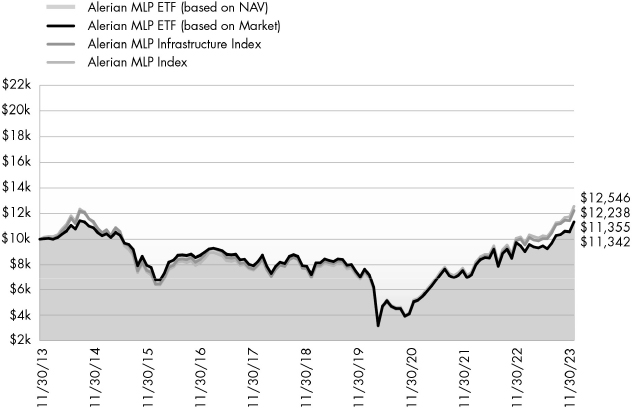

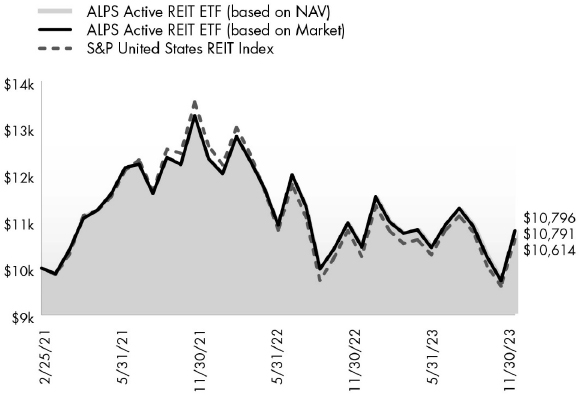

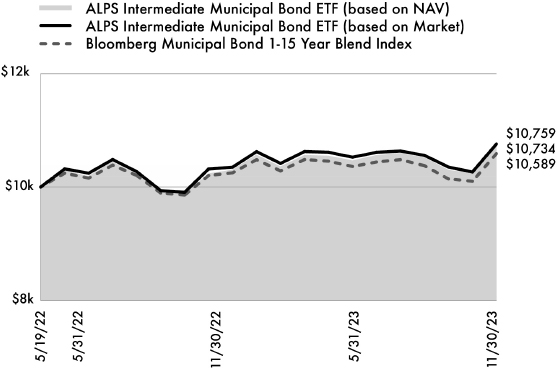

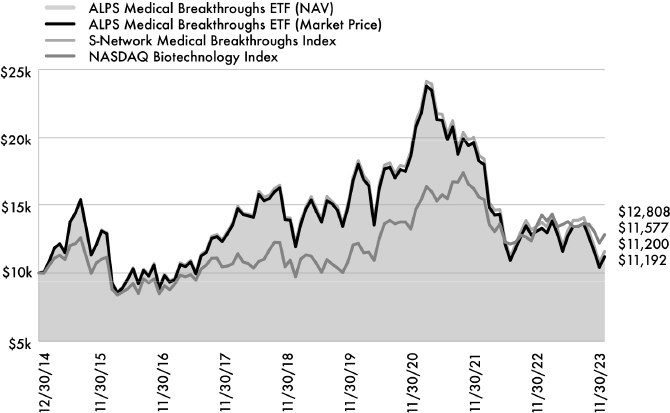

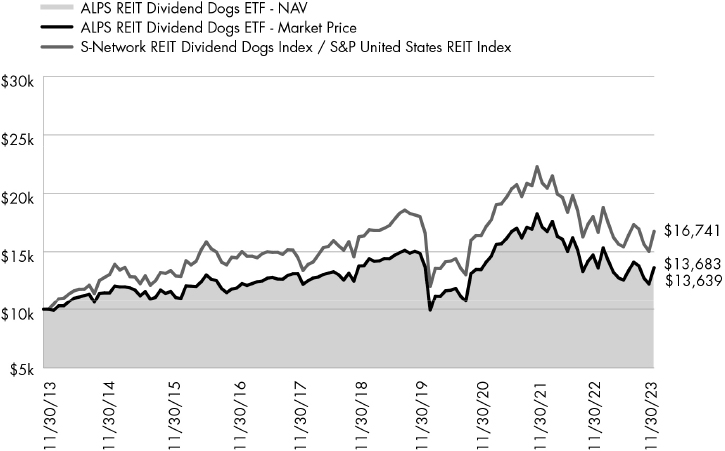

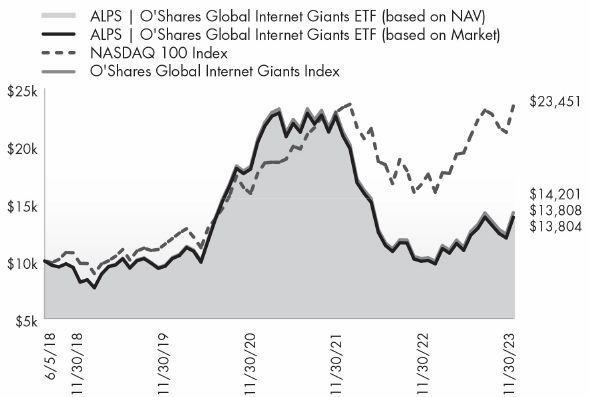

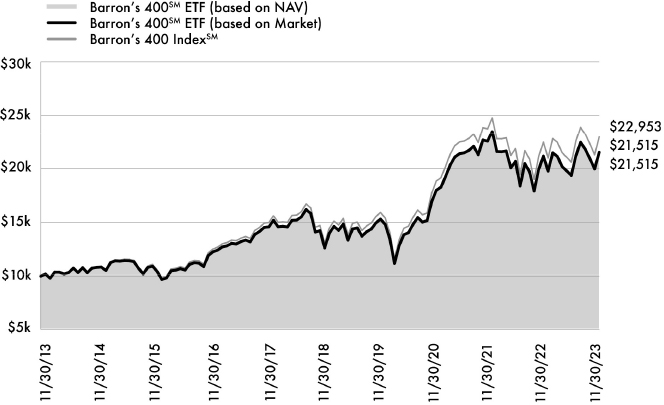

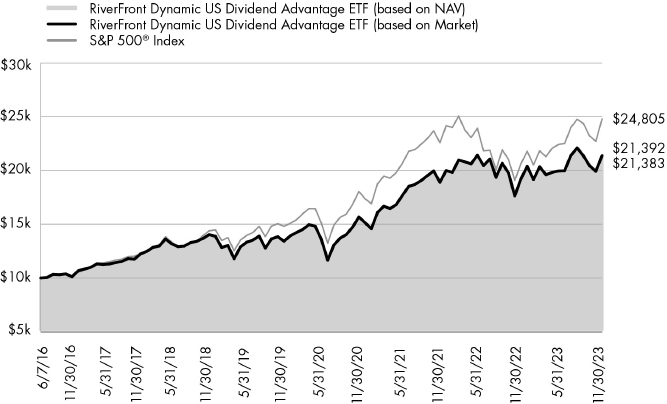

Growth of $10,000 (as of November 30, 2023)

Comparison of change in value of a $10,000 investment in the Fund and the Indexes

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and capital gains distributions. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3 | November 30, 2023

Alerian Energy Infrastructure ETF

| Performance Overview | November 30, 2023 (Unaudited) |

INVESTMENT OBJECTIVE

The Alerian Energy Infrastructure ETF (the “Fund” or “ENFR”) seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Midstream Energy Select Index (the “Underlying Index” or “AMEI”). As a secondary objective, the Fund seeks to provide total return through income and capital appreciation. The Shares of the Fund are listed and trade on the NYSE Arca, Inc. (“NYSE”) under the ticker symbol ENFR. The Fund will normally invest at least 90% of its total assets in securities that comprise the Underlying Index.

The Underlying Index is a composite of North American energy infrastructure companies engaged in midstream activities involving energy commodities, including gathering and processing, liquefaction, pipeline transportation, rail terminaling, and storage (also known as “midstream energy businesses”). Midstream energy companies include midstream Master Limited Partnerships ("MLPs") and midstream corporations, either based in the United States or Canada. The Underlying Index has a 25% limit for companies taxed as pass-through entities.

PERFORMANCE OVERVIEW

During the twelve-month period from December 1, 2022, to November 30, 2023, the Fund delivered a total return of 8.48% (8.63% NAV). This compares to the Fund’s Underlying Index, which increased 2.50% on a price-return basis and 9.23% on a total-return basis.

During the period, the Fund paid four quarterly distributions:

| · | $0.31493 per share on February 14, 2023 |

| · | $0.30782 per share on May 16, 2023 |

| · | $0.32030 per share on August 15, 2023 |

| · | $0.32156 per share on November 14, 2023 |

AMEI constituents largely increased their dividends during the fiscal year. It has been nine consecutive quarters since there was a dividend cut from an AMEI constituent. Comparing the latest dividend announcements for the third calendar quarter of 2023 (paid in the fourth calendar quarter of 2023) with the payouts from the same period in 2022, 90.62% of the Underlying Index by weighting grew their dividends and 8.66% maintained their payouts based on weightings through November 30, 2023. Constituents that do not pay a dividend accounted for 0.72% of the Underlying Index.

During the fiscal year, Delek Logistics (DKL) was removed from the Underlying Index during a quarterly rebalancing. Magellan Midstream Partners (MMP), Crestwood Equity Partners (CEQP), and Holly Energy Partners (HEP) were also removed from the Underlying Index in relation to their acquisition by another entity. There were no material changes to the methodology for the Underlying Index during the Fund's fiscal year.

Energy infrastructure outperformed the broad energy sector as represented by the Energy Select Sector Index (IXE) during the Fund's fiscal year as fee-based business models and more generous yields were supportive for AMEI’s performance amid weaker oil and natural gas prices. Energy infrastructure also generally outperformed other income investments that may have been more challenged by rising interest rates, including REITs, utilities, and the corporate bond benchmark. Returns among AMEI constituents were mixed as MLPs generally led and Canadian corporations largely lagged.

Looking ahead, Alerian believes the vast majority of AMEI constituents are well positioned to continue generating free cash flow regardless of the commodity price environment. Alerian expects excess cash flow to support ongoing dividend growth and share repurchases in 2024 and beyond. AMEI constituents continue to opportunistically invest in clean energy solutions, including carbon capture, hydrogen, and renewable fuels. While the macro outlook may be clouded with uncertainty, Alerian believes that energy infrastructure’s fee-based business models and more defensive qualities should help the space through periods of market volatility.

4 | November 30, 2023

Alerian Energy Infrastructure ETF

| Performance Overview | November 30, 2023 (Unaudited) |

Performance (as of November 30, 2023)

| | 1 Year | 5 Year | 10 Year | Since Inception^ |

| Alerian Energy Infrastructure ETF - NAV | 8.63% | 9.69% | 4.11% | 4.02% |

| Alerian Energy Infrastructure ETF - Market Price* | 8.48% | 9.72% | 4.10% | 4.02% |

| Alerian Midstream Energy Select Index | 9.23% | 10.60% | 4.97% | 4.89% |

| Alerian MLP Index | 23.29% | 10.33% | 2.29% | 2.36% |

Total Expense Ratio (per the current prospectus) is 0.35%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Total return figures assume reinvestment of dividends and capital gains distributions, if any. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For most current month-end performance data please visit www.alpsfunds.com or call 1.866.759.5679.

Net Asset Value (NAV) is an exchange-traded fund’s per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of Fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commenced Investment Operations on November 1, 2013. |

| * | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time as of which the Fund calculates current net asset value per share, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times. |

The Alerian Midstream Energy Select Index is comprised of 25 equity securities of issuers headquartered or incorporated in the United States and Canada that engage in the transportation, storage, and processing of energy commodities. Total return assumes reinvestment of any dividends and distributions realized during a given time period.

The Alerian MLP Index is recognized as a leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is reported on a total-return basis (AMZX), which assumes reinvestment of any dividends and distributions realized during a given period.

The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund’s shares are not individually redeemable. Investors buy and sell shares of the Fund on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 25,000 shares.

The Alerian Energy Infrastructure ETF is not suitable for all investors. Investments in the Fund are subject to investment risks, including possible loss of the principal amount invested.

ALPS Portfolio Solutions Distributor, Inc., a FINRA member, is the distributor for the Fund.

5 | November 30, 2023

Alerian Energy Infrastructure ETF

| Performance Overview | November 30, 2023 (Unaudited) |

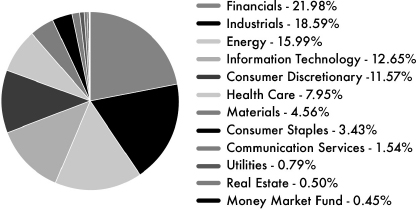

Top 10 Holdings* (as of November 30, 2023)

| Enbridge, Inc. | 8.99% |

| Energy Transfer LP | 8.62% |

| Enterprise Products Partners LP | 8.10% |

| ONEOK, Inc. | 8.07% |

| Cheniere Energy, Inc. | 5.86% |

| The Williams Cos., Inc. | 5.69% |

| Targa Resources Corp. | 4.87% |

| Keyera Corp. | 4.86% |

| Pembina Pipeline Corp. | 4.84% |

| TC Energy Corp. | 4.84% |

| Total % of Top 10 Holdings | 64.74% |

Future holdings are subject to change.

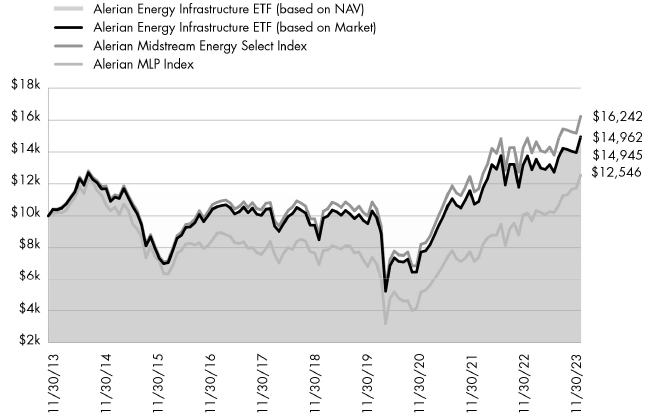

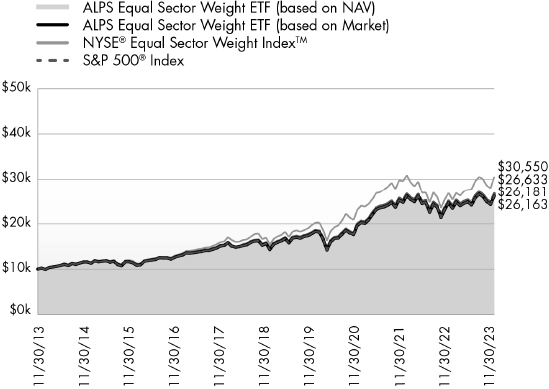

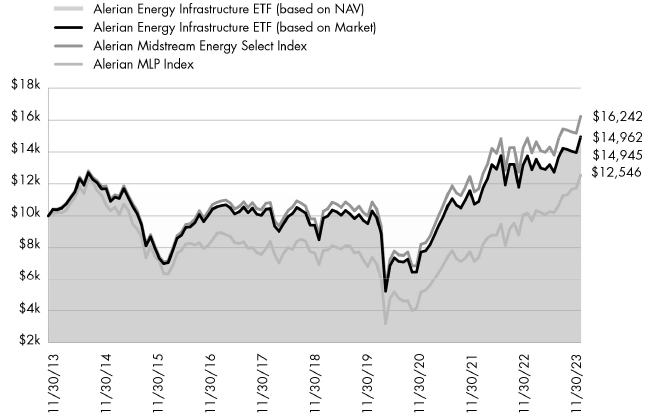

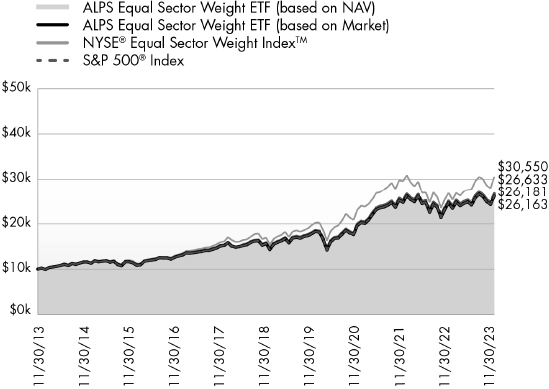

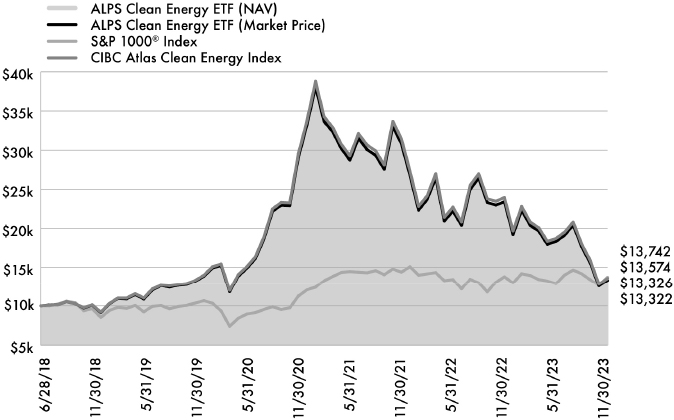

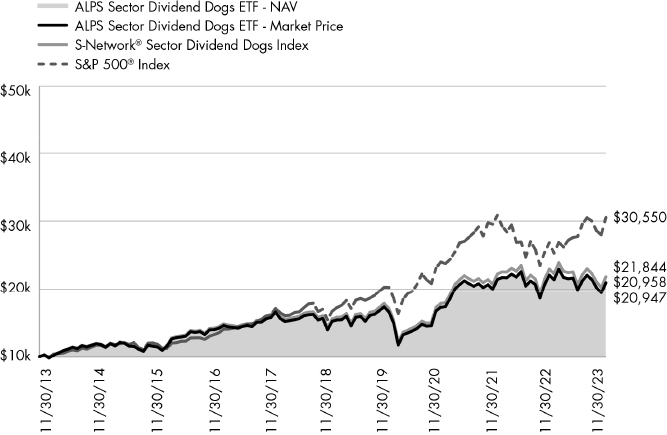

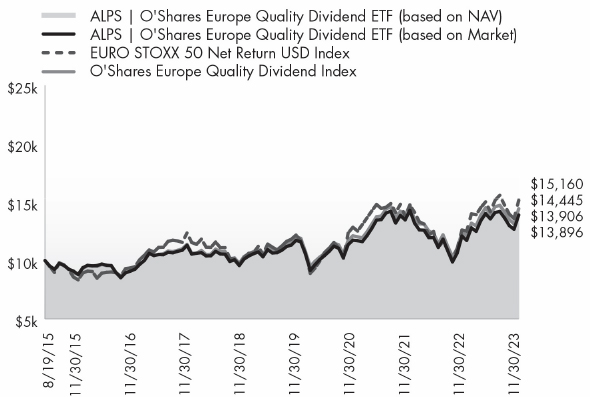

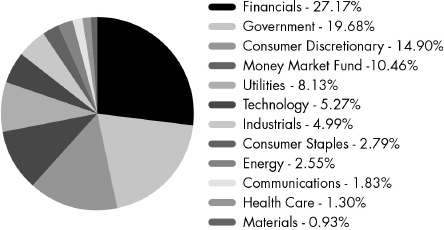

Growth of $10,000 (as of November 30, 2023)

Comparison of change in value of a $10,000 investment in the Fund and the Indexes

The chart above compares historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and capital gains distributions. Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6 | November 30, 2023

Alerian Exchange Traded Funds

| Disclosure of Fund Expenses | November 30, 2023 (Unaudited) |

Shareholder Expense Example: As a shareholder of a Fund, you incur certain ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested at the beginning of the six month period and held through November 30, 2023.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as brokerage commissions and other fees to financial intermediaries. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | Beginning Account Value 6/1/23 | Ending Account Value 11/30/23 | Expense Ratio(a) | Expenses Paid During Period 6/1/23 - 11/30/23 (b) |

| Alerian MLP ETF(c) | | | | |

| Actual | $1,000.00 | $1,228.60 | 0.85% | $4.75 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.81 | 0.85% | $4.31 |

| Alerian Energy Infrastructure ETF | | | | |

| Actual | $1,000.00 | $1,172.70 | 0.35% | $1.91 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.31 | 0.35% | $1.78 |

| (a) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. |

| (c) | Expenses for Alerian MLP ETF are calculated using the Fund's annualized net expense ratio, which represents the ongoing expenses of the Fund. Current and deferred tax benefit (expense) is not included in the ratio calculation. |

7 | November 30, 2023

Alerian Exchange Traded Funds

Report of Independent Registered Public Accounting Firm

To the Shareholders of Alerian MLP ETF and Alerian Energy Infrastructure ETF and Board of Trustees of ALPS ETF Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Alerian MLP ETF and Alerian Energy Infrastructure ETF (the “Funds”), each a series of ALPS ETF Trust, as of November 30, 2023, the related statements of operations and changes in net assets, the related notes, and the financial highlights for the year then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of November 30, 2023, the results of their operations, the changes in net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Funds’ financial statements and financial highlights for the years ended November 30, 2022, and prior, were audited by other auditors whose report dated January 27, 2023, expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2023, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by ALPS Advisors, Inc. since 2013.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

January 29, 2024

8 | November 30, 2023

Alerian MLP ETF

| Schedule of Investments | November 30, 2023 |

| Security Description | | Shares | | | Value | |

| MASTER LIMITED PARTNERSHIPS (104.28%) | | | | | | | | |

| Gathering + Processing (26.66%) | | | | | | | | |

| EnLink Midstream LLC(a) | | | 42,966,669 | | | $ | 587,354,365 | |

| Hess Midstream LP, Class A | | | 11,918,456 | | | | 387,826,559 | |

| Western Midstream Partners LP(a) | | | 34,352,132 | | | | 1,024,380,576 | |

| Total Gathering + Processing | | | | | | | 1,999,561,500 | |

| | | | | | | | | |

| Liquefaction (5.89%) | | | | | | | | |

| Cheniere Energy Partners LP | | | 7,149,938 | | | | 441,437,172 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (33.38%) | | | | | | | | |

| Energy Transfer LP | | | 106,447,715 | | | | 1,478,558,761 | |

| Enterprise Products Partners LP | | | 38,261,519 | | | | 1,024,643,479 | |

| Total Pipeline Transportation | Natural Gas | | | | | | | 2,503,202,240 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (38.35%) | | | | | | | | |

| Delek Logistics Partners LP | | | 1,577,055 | | | | 80,682,134 | |

| Genesis Energy LP(a) | | | 19,258,907 | | | | 241,891,872 | |

| MPLX LP | | | 29,386,910 | | | | 1,071,446,738 | |

| NuStar Energy LP(a) | | | 20,352,065 | | | | 387,503,318 | |

| Plains All American Pipeline LP(a) | | | 68,927,828 | | | | 1,094,573,909 | |

| Total Pipeline Transportation | Petroleum | | | | | | | 2,876,097,971 | |

| | | | | | | | | |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $4,126,266,441) | | | | | | | 7,820,298,883 | |

| | | 7 Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.05%) | | | | | | | | | | | | |

| Money Market Fund (0.05%) | | | | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund - Premier Class | | | 5.31 | % | | | 4,014,921 | | | | 4,014,921 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $4,014,921) | | | | | | | | | | | 4,014,921 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (104.33%) | | | | | | | | | | | | |

| (Cost $4,130,281,362) | | | | | | | | | | $ | 7,824,313,804 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-4.33%) | | | | | | | | | | | (324,504,558 | ) |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 7,499,809,246 | |

| (a) | Affiliated Company. See Note 8 in Notes to Financial Statement. |

See Notes to Financial Statements.

9 | November 30, 2023

Alerian MLP ETF

| Statement of Assets and Liabilities | November 30, 2023 |

| ASSETS: | | | |

| Investments, at value | | $ | 4,488,609,764 | |

| Investments in affiliates, at value | | | 3,335,704,040 | |

| Receivable for investments sold | | | 161,622,270 | |

| Receivable for shares sold | | | 16,402,778 | |

| Franchise tax receivable | | | 316,704 | |

| Total Assets | | | 8,002,655,556 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 179,600,417 | |

| Income tax payable | | | 64,528,918 | |

| Deferred tax liability (Note 2) | | | 253,677,464 | |

| Payable to adviser | | | 5,039,511 | |

| Total Liabilities | | | 502,846,310 | |

| NET ASSETS | | $ | 7,499,809,246 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 8,309,052,387 | |

| Distributable earnings/(accumulated losses) | | | (809,243,141 | ) |

| NET ASSETS | | $ | 7,499,809,246 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 2,548,589,686 | |

| INVESTMENTS IN AFFILIATES, AT COST | | | 1,581,691,676 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Assets | | $ | 7,499,809,246 | |

| Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | | 169,807,420 | |

| Net Asset Value, offering and redemption price per share | | $ | 44.17 | |

See Notes to Financial Statements.

10 | November 30, 2023

Alerian MLP ETF

| Statement of Operations | For the Year Ended November 30, 2023 |

| INVESTMENT INCOME: | | | |

| Distributions from master limited partnerships | | $ | 566,931,504 | |

| Less return of capital distributions | | | (553,790,971 | ) |

| Total Investment Income | | | 13,140,533 | |

| | | | | |

| EXPENSES: | | | | |

| Investment adviser fee | | | 56,321,212 | |

| Total Expenses | | | 56,321,212 | |

| NET INVESTMENT LOSS, BEFORE INCOME TAXES | | | (43,180,679 | ) |

| Current income tax benefit/(expense) | | | 3,827,390 | |

| NET INVESTMENT LOSS | | | (39,353,289 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized loss on investments, before income taxes | | | (7,937,034 | ) |

| Net realized gain on affiliated investments, before income taxes | | | 1,071,129,432 | |

| Current income tax benefit/(expense) | | | (94,214,313 | ) |

| Net realized gain | | | 968,978,085 | |

| Net change in unrealized appreciation on investments, before income taxes | | | 639,433,193 | |

| Net change in unrealized depreciation on affiliated investments, before income taxes | | | (286,982,580 | ) |

| Deferred income tax benefit/(expense) | | | (31,263,528 | ) |

| Net change in unrealized appreciation | | | 321,187,085 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 1,290,165,170 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,250,811,881 | |

See Notes to Financial Statements.

11 | November 30, 2023

Alerian MLP ETF

Statements of Changes in Net Assets

| | | For the Year Ended November 30, 2023 | | | For the Year Ended November 30, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (39,353,289 | ) | | $ | (46,268,407 | ) |

| Net realized gain | | | 968,978,085 | | | | 48,112,230 | |

| Net change in unrealized appreciation | | | 321,187,085 | | | | 1,771,005,372 | |

| Net increase in net assets resulting from operations | | | 1,250,811,881 | | | | 1,772,849,195 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From distributable earnings | | | (559,281,783 | ) | | | – | |

| From tax return of capital | | | – | | | | (491,866,741 | ) |

| Total distributions | | | (559,281,783 | ) | | | (491,866,741 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from sale of shares | | | 1,459,261,841 | | | | 2,448,152,574 | |

| Cost of shares redeemed | | | (1,330,182,900 | ) | | | (2,030,110,111 | ) |

| Net increase from share transactions | | | 129,078,941 | | | | 418,042,463 | |

| | | | | | | | | |

| Net increase in net assets | | | 820,609,039 | | | | 1,699,024,917 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 6,679,200,207 | | | | 4,980,175,290 | |

| End of year | | $ | 7,499,809,246 | | | $ | 6,679,200,207 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Beginning shares | | | 166,932,420 | | | | 157,457,420 | |

| Shares sold | | | 36,325,000 | | | | 64,300,000 | |

| Shares redeemed | | | (33,450,000 | ) | | | (54,825,000 | ) |

| Shares outstanding, end of year | | | 169,807,420 | | | | 166,932,420 | |

See Notes to Financial Statements.

12 | November 30, 2023

Alerian MLP ETF

| Financial Highlights | For a Share Outstanding Throughout the Periods Presented |

| | | For the Year

Ended

November 30,

2023 (a) | | | For the Year

Ended

November 30, 2022 | | | For the Year

Ended

November 30, 2021 | | | For the Year

Ended

November 30, 2020 (a) | | | For the

Year Ended

November 30, 2019 (a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 40.01 | | | $ | 31.63 | | | $ | 25.02 | | | $ | 39.15 | | | $ | 47.75 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(b) | | | (0.24 | ) | | | (0.28 | ) | | | (0.27 | ) | | | (0.24 | ) | | | (0.35 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 7.74 | | | | 11.59 | | | | 9.68 | | | | (10.73 | ) | | | (4.35 | ) |

| Total from investment operations | | | 7.50 | | | | 11.31 | | | | 9.41 | | | | (10.97 | ) | | | (4.70 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Distributions from Income | | | (3.34 | ) | | | – | | | | – | | | | – | | | | – | |

| From tax return of capital | | | – | | | | (2.93 | ) | | | (2.80 | ) | | | (3.16 | ) | | | (3.90 | ) |

| Total distributions | | | (3.34 | ) | | | (2.93 | ) | | | (2.80 | ) | | | (3.16 | ) | | | (3.90 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 4.16 | | | | 8.38 | | | | 6.61 | | | | (14.13 | ) | | | (8.60 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 44.17 | | | $ | 40.01 | | | $ | 31.63 | | | $ | 25.02 | | | $ | 39.15 | |

| TOTAL RETURN(c) | | | 19.82 | % | | | 36.31 | % | | | 37.97 | % | | | (28.36 | )% | | | (10.79 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 7,499,809 | | | $ | 6,679,200 | | | $ | 4,980,175 | | | $ | 3,880,137 | | | $ | 7,249,005 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Expenses (excluding net current and deferred tax expenses/benefits and franchise tax expense) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| Expenses (including current and deferred tax expenses/benefits)(d) | | | 0.79 | % | | | 0.74 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| Expenses (including net current and deferred tax expenses/benefits)(e) | | | 2.67 | % | | | 5.03 | % | | | 0.87 | % | | | 0.90 | % | | | 0.87 | % |

| Net investment loss (excluding deferred tax expenses/benefits and franchise tax expense) | | | (0.65 | )% | | | (0.85 | )% | | | (0.85 | )% | | | (0.85 | )% | | | (0.77 | )% |

| Net investment loss (including deferred tax expenses/benefits)(d) | | | (0.59 | )% | | | (0.74 | )% | | | (0.85 | )% | | | (0.85 | )% | | | (0.77 | )% |

| PORTFOLIO TURNOVER RATE(f) | | | 40 | % | | | 26 | % | | | 20 | % | | | 23 | % | | | 34 | % |

| (a) | On May 18, 2020, the Alerian MLP ETF underwent a one for five reverse stock split. The capital share activity presented here has been retroactively adjusted to reflect this reverse split. |

| (b) | Based on average shares outstanding during the period. |

| (c) | Total return is calculated assuming an initial investment made at the net assets value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (d) | Includes amount of current and deferred tax benefit associated with net investment income/(loss). |

| (e) | Includes amount of current and deferred taxes/benefits for all components of the Statement of Operations. |

| (f) | Portfolio turnover for periods less than one year is not annualized and does not include securities received or delivered from processing creations or redemptions in-kind. |

See Notes to Financial Statements.

13 | November 30, 2023

Alerian Energy Infrastructure ETF

| Schedule of Investments | November 30, 2023 |

| Security Description | | Shares | | | Value | |

| CANADIAN ENERGY INFRASTRUCTURE COMPANIES (25.58%) | | | | | | | | |

| Gathering + Processing (4.86%) | | | | | | | | |

| Keyera Corp. | | | 255,451 | | | $ | 6,432,633 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (4.84%) | | | | | | | | |

| TC Energy Corp.(a) | | | 170,697 | | | | 6,401,688 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (13.83%) | | | | | | | | |

| Enbridge, Inc. | | | 340,568 | | | | 11,891,456 | |

| Pembina Pipeline Corp. | | | 191,503 | | | | 6,405,779 | |

| Total Pipeline Transportation | Petroleum | | | | | | | 18,297,235 | |

| | | | | | | | | |

| Storage (2.05%) | | | | | | | | |

| Gibson Energy, Inc.(a) | | | 179,410 | | | | 2,707,776 | |

| | | | | | | | | |

| TOTAL CANADIAN ENERGY INFRASTRUCTURE COMPANIES | | | | | | | | |

| (Cost $34,984,145) | | | | | | | 33,839,332 | |

| Security Description | | Shares | | | Value | |

| EXCHANGE TRADED FUND (1.04%) | | | | | | | | |

| Exchange Traded Fund (1.04%) | | | | | | | | |

| Energy Select Sector SPDR Fund | | | 16,220 | | | | 1,371,888 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUND | | | | | | | | |

| (Cost $1,372,009) | | | | | | | 1,371,888 | |

| Security Description | | Shares | | | Value | |

| U.S. ENERGY INFRASTRUCTURE COMPANIES (33.14%) | | | | | | | | |

| Gathering + Processing (13.38%) | | | | | | | | |

| Kinetik Holdings, Inc. | | | 16,022 | | | | 582,560 | |

| ONEOK, Inc. | | | 155,023 | | | | 10,673,333 | |

| Targa Resources Corp. | | | 71,184 | | | | 6,438,593 | |

| Total Gathering + Processing | | | | | | | 17,694,486 | |

| | | | | | | | | |

| Liquefaction (6.57%) | | | | | | | | |

| Cheniere Energy, Inc. | | | 42,589 | | | | 7,757,586 | |

| NextDecade Corp.(a)(b) | | | 114,052 | | | | 569,120 | |

| Tellurian, Inc.(a)(b) | | | 610,629 | | | | 371,873 | |

| Total Liquefaction | | | | | | | 8,698,579 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (13.19%) | | | | | | | | |

| DT Midstream, Inc. | | | 108,448 | | | | 6,212,986 | |

| Equitrans Midstream Corp. | | | 516,335 | | | | 4,843,222 | |

| Kinder Morgan, Inc. | | | 363,949 | | | | 6,394,584 | |

| Total Pipeline Transportation | Natural Gas | | | | | | | 17,450,792 | |

| | | | | | | | | |

| TOTAL U.S. ENERGY INFRASTRUCTURE COMPANIES | | | | | | | | |

| (Cost $37,577,001) | | | | | | | 43,843,857 | |

| Security Description | | Shares | | | Value | |

| U.S. ENERGY INFRASTRUCTURE MLPS (23.14%) | | | | | | | | |

| Gathering + Processing (5.69%) | | | | | | | | |

| Hess Midstream LP, Class A | | | 75,089 | | | $ | 2,443,396 | |

| MPLX LP | | | 96,165 | | | | 3,506,176 | |

| Western Midstream Partners LP | | | 52,796 | | | | 1,574,377 | |

| Total Gathering + Processing | | | | | | | 7,523,949 | |

| | | | | | | | | |

| Pipeline Transportation | Natural Gas (16.72%) | | | | | | | | |

| Energy Transfer LP | | | 820,803 | | | | 11,400,953 | |

| Enterprise Products Partners LP | | | 400,101 | | | | 10,714,705 | |

| Total Pipeline Transportation | Natural Gas | | | | | | | 22,115,658 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (0.73%) | | | | | | | | |

| Genesis Energy LP | | | 29,567 | | | | 371,361 | |

| NuStar Energy LP | | | 31,316 | | | | 596,257 | |

| Total Pipeline Transportation | Petroleum | | | | | | | 967,618 | |

| | | | | | | | | |

| TOTAL U.S. ENERGY INFRASTRUCTURE MLPS | | | | | | | | |

| (Cost $26,820,584) | | | | | | | 30,607,225 | |

| Security Description | | Shares | | | Value | |

| U.S. GENERAL PARTNERS (17.12%) | | | | | | | | |

| Gathering + Processing (12.30%) | | | | | | | | |

| Antero Midstream Corp. | | | 377,592 | | | | 5,029,525 | |

| EnLink Midstream LLC | | | 271,389 | | | | 3,709,888 | |

| The Williams Cos., Inc. | | | 204,542 | | | | 7,525,100 | |

| Total Gathering + Processing | | | | | | | 16,264,513 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (4.82%) | | | | | | | | |

| Plains GP Holdings LP, Class A | | | 394,836 | | | | 6,380,550 | |

| TOTAL U.S. GENERAL PARTNERS | | | | | | | | |

| (Cost $16,839,645) | | | | | | | 22,645,063 | |

See Notes to Financial Statements.

14 | November 30, 2023

Alerian Energy Infrastructure ETF

| Schedule of Investments | November 30, 2023 |

| | | 7 Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (1.65%) | | | | | | | | | | | | |

| Money Market Fund (0.02%) | | | | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund (Premier Class) | | | | | | | | | | | | |

| (Cost $23,088) | | | 5.31 | % | | | 23,088 | | | $ | 23,088 | |

| | | | | | | | | | | | | |

| Investments Purchased with Collateral from Securities Loaned (1.63%) | | | | | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 5.37% | | | | | | | | | | | | |

| (Cost $2,154,762) | | | | | | | 2,154,762 | | | $ | 2,154,762 | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $2,177,850) | | | | | | | | | | | 2,177,850 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (101.67%) | | | | | | | | | | | | |

| (Cost $119,771,234) | | | | | | | | | | $ | 134,485,215 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-1.67%) | | | | | | | | | | | (2,211,014 | ) |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 132,274,201 | |

| (a) | Security, or a portion of the security position is currently on loan. The total market value of securities on loan is $2,518,665. |

| (b) | Non-income producing security. |

See Notes to Financial Statements.

15 | November 30, 2023

Alerian Energy Infrastructure ETF

| Statement of Assets and Liabilities | November 30, 2023 |

| ASSETS: | | | |

| Investments, at value* | | $ | 134,485,215 | |

| Receivable for investments sold | | | 1,359,137 | |

| Receivable for shares sold | | | 1,142,626 | |

| Dividends receivable | | | 186,476 | |

| Total Assets | | | 137,173,454 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 2,708,255 | |

| Payable to adviser | | | 36,236 | |

| Payable for collateral upon return of securities loaned | | | 2,154,762 | |

| Total Liabilities | | | 4,899,253 | |

| NET ASSETS | | $ | 132,274,201 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 119,835,434 | |

| Distributable earnings | | | 12,438,767 | |

| NET ASSETS | | $ | 132,274,201 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 119,771,234 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Assets | | $ | 132,274,201 | |

| Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | | 5,700,000 | |

| Net Asset Value, offering and redemption price per share | | $ | 23.21 | |

| * | Includes $2,518,665 of securities on loan. |

See Notes to Financial Statements.

16 | November 30, 2023

Alerian Energy Infrastructure ETF

| Statement of Operations | For the Year Ended November 30, 2023 |

| INVESTMENT INCOME: | | | |

| Dividends* | | $ | 5,982,955 | |

| Securities lending income | | | 18,051 | |

| Total Investment Income | | | 6,001,006 | |

| | | | | |

| EXPENSES: | | | | |

| Investment adviser fees | | | 437,057 | |

| Total Expenses | | | 437,057 | |

| NET INVESTMENT INCOME | | | 5,563,949 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized gain on investments(a) | | | 4,010,651 | |

| Net realized loss on foreign currency transactions | | | (5,038 | ) |

| Net realized gain | | | 4,005,613 | |

| Net change in unrealized depreciation on investments | | | (96,931 | ) |

| Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currencies | | | 3,763 | |

| Net change in unrealized depreciation | | | (93,168 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCIES | | | 3,912,445 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 9,476,394 | |

| * Net of foreign tax withholding. | | $ | 316,136 | |

| (a) | Includes realized gain or loss as a result of in-kind transactions (See Note 4 in Notes to Financial Statements). |

See Notes to Financial Statements.

17 | November 30, 2023

Alerian Energy Infrastructure ETF

Statements of Changes in Net Assets

| | | For the Year Ended November 30, 2023 | | | For the Year Ended November 30, 2022 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 5,563,949 | | | $ | 2,947,799 | |

| Net realized gain | | | 4,005,613 | | | | 803,934 | |

| Net change in unrealized appreciation/(depreciation) | | | (93,168 | ) | | | 17,050,272 | |

| Net increase in net assets resulting from operations | | | 9,476,394 | | | | 20,802,005 | |

| | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | |

| From distributable earnings | | | (1,902,116 | ) | | | (1,089,790 | ) |

| From tax return of capital | | | (5,303,713 | ) | | | (4,610,796 | ) |

| Total distributions | | | (7,205,829 | ) | | | (5,700,586 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from sale of shares | | | 8,337,471 | | | | 79,527,083 | |

| Cost of shares redeemed | | | (20,419,761 | ) | | | (12,029,422 | ) |

| Net increase/(decrease) from share transactions | | | (12,082,290 | ) | | | 67,497,661 | |

| Net increase/(decrease) in net assets | | | (9,811,725 | ) | | | 82,599,080 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 142,085,926 | | | | 59,486,846 | |

| End of year | | $ | 132,274,201 | | | $ | 142,085,926 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Beginning shares | | | 6,275,000 | | | | 3,200,000 | |

| Shares sold | | | 375,000 | | | | 3,650,000 | |

| Shares redeemed | | | (950,000 | ) | | | (575,000 | ) |

| Shares outstanding, end of year | | | 5,700,000 | | | | 6,275,000 | |

See Notes to Financial Statements.

18 | November 30, 2023

Alerian Energy Infrastructure ETF

| Financial Highlights | For a Share Outstanding Throughout the Periods Presented |

| | | For the Year

Ended

November 30, 2023 | | | For the Year

Ended

November 30, 2022 | | | For the Year

Ended

November 30, 2021 | | | For the Year

Ended

November 30, 2020 | | | For the Year

Ended

November 30, 2019 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 22.64 | | | $ | 18.59 | | | $ | 14.51 | | | $ | 19.19 | | | $ | 20.34 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.97 | | | | 0.61 | | | | 1.08 | | | | 0.90 | | | | 0.88 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.86 | | | | 4.57 | | | | 4.49 | | | | (4.50 | ) | | | (0.64 | ) |

| Total from investment operations | | | 1.83 | | | | 5.18 | | | | 5.57 | | | | (3.60 | ) | | | 0.24 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.33 | ) | | | (0.21 | ) | | | (0.74 | ) | | | (0.45 | ) | | | (0.50 | ) |

| Tax return of capital | | | (0.93 | ) | | | (0.92 | ) | | | (0.75 | ) | | | (0.63 | ) | | | (0.89 | ) |

| Total distributions | | | (1.26 | ) | | | (1.13 | ) | | | (1.49 | ) | | | (1.08 | ) | | | (1.39 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 0.57 | | | | 4.05 | | | | 4.08 | | | | (4.68 | ) | | | (1.15 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 23.21 | | | $ | 22.64 | | | $ | 18.59 | | | $ | 14.51 | | | $ | 19.19 | |

| TOTAL RETURN(b) | | | 8.63 | % | | | 28.21 | % | | | 38.93 | % | | | (18.82 | )% | | | 1.09 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 132,274 | | | $ | 142,086 | | | $ | 59,487 | | | $ | 36,988 | | | $ | 51,809 | |

| Ratio of expenses to average net assets | | | 0.35 | % | | | 0.35 | % | | | 0.51 | %(c) | | | 0.65 | % | | | 0.65 | % |

| Ratio of net investment income to average net assets | | | 4.46 | % | | | 2.84 | % | | | 5.84 | % | | | 5.91 | % | | | 4.23 | % |

| PORTFOLIO TURNOVER RATE(d) | | | 28 | % | | | 26 | % | | | 34 | % | | | 34 | % | | | 26 | % |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total return is calculated assuming an initial investment made at the net assets value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (c) | Effective July 1, 2021, the Fund's Advisory Fee changed from 0.65% to 0.35%. |

| (d) | Portfolio turnover for periods less than one year is not annualized and does not include securities received or delivered from processing creations or redemptions in-kind. |

See Notes to Financial Statements.

19 | November 30, 2023

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2023 |

1. ORGANIZATION

ALPS ETF Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As of November 30, 2023, the Trust consisted of twenty-three separate portfolios. Each portfolio represents a separate series of the Trust. This report pertains to the Alerian MLP ETF and the Alerian Energy Infrastructure ETF (each a “Fund” and collectively, the “Funds”).

The investment objective of the Alerian MLP ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The investment objective of the Alerian Energy Infrastructure ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Midstream Energy Select Index. The investment advisor uses a “passive management” or indexing investment approach to try to achieve each Fund’s investment objective. Each Fund is considered non-diversified and may invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Each Fund’s Shares (“Shares”) are listed on the NYSE Arca, Inc. (the “NYSE Arca”). Each Fund issues and redeems Shares, at net asset value (“NAV”), in blocks of 25,000 Shares, each of which is called a “Creation Unit”. Creation Units are issued and redeemed principally in-kind for securities included in the Underlying Index. Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Pursuant to the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. Each Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946.

A. Portfolio Valuation

Each Fund’s NAV is determined daily, as of the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading. The NAV is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

Portfolio securities listed on any exchange other than the NASDAQ Stock Market LLC (“NASDAQ”) are valued at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and ask prices on such day. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. Portfolio securities traded in the over-the-counter market, but excluding securities traded on the NASDAQ, are valued at the last quoted sale price in such market.

The Funds’ investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Trust’s Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board designated ALPS Advisors, Inc. (the "Adviser") as the valuation designee ("Valuation Designee") for each Fund to perform the fair value determinations relating to Fund investments. The Adviser may carry out its designated responsibilities as Valuation Designee through various teams and committees. When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Funds may be valued in good faith by the Valuation Designee. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre-established primary pricing source or the pricing source is not willing to provide a price; a security with respect to which an event has occurred that is most likely to materially affect the value of the

20 | November 30, 2023

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2023 |

security after the market has closed but before the calculation of the Funds’ NAV or make it difficult or impossible to obtain a reliable market quotation; or a security whose price, as provided by the pricing service, does not reflect the security’s “fair value” due to the security being de-listed from a national exchange or the security’s primary trading market is temporarily closed at a time when, under normal conditions, it would be open. As a general principle, the current “fair value” of a security would be the amount which the owner might reasonably expect to receive from the sale on the applicable exchange or principal market. A variety of factors may be considered in determining the fair value of such securities.

B. Fair Value Measurements

Each Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Valuation techniques used to value the Funds’ investments by major category are as follows:

Equity securities, including restricted securities, and Limited Partnerships for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in open-end mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Various inputs are used in determining the value of the Funds’ investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used to value each Fund’s investments as of November 30, 2023:

Alerian MLP ETF

| Investments in Securities at Value | | Level 1 - Quoted and Unadjusted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | Total | |

| Master Limited Partnerships* | | $ | 7,820,298,883 | | | $ | – | | | $ | – | | | $ | 7,820,298,883 | |

| Short Term Investments | | | 4,014,921 | | | | – | | | | – | | | | 4,014,921 | |

| Total | | $ | 7,824,313,804 | | | $ | – | | | $ | – | | | $ | 7,824,313,804 | |

21 | November 30, 2023

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2023 |

Alerian Energy Infrastructure ETF

| Investments in Securities at Value | | Level 1 - Quoted and Unadjusted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | Total | |

| Canadian Energy Infrastructure Companies* | | $ | 33,839,332 | | | $ | – | | | $ | – | | | $ | 33,839,332 | |

| Exchange Traded Fund | | | 1,371,888 | | | | – | | | | – | | | | 1,371,888 | |

| U.S. Energy Infrastructure Companies* | | | 43,843,857 | | | | – | | | | – | | | | 43,843,857 | |

| U.S. Energy Infrastructure MLPs* | | | 30,607,225 | | | | – | | | | – | | | | 30,607,225 | |

| U.S. General Partners* | | | 22,645,063 | | | | – | | | | – | | | | 22,645,063 | |

| Short Term Investments | | | 2,177,850 | | | | – | | | | – | | | | 2,177,850 | |

| Total | | $ | 134,485,215 | | | $ | – | | | $ | – | | | $ | 134,485,215 | |

| * | For a detailed breakdown of sectors, see the accompanying Schedule of Investments. |

The Funds did not have any securities that used significant unobservable inputs (Level 3) in determining fair value and there were no transfers into or out of Level 3 during the year ended November 30, 2023.

C. Foreign Currency Translation

The books and records of the Funds are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

D. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the specific identification in accordance with GAAP. Dividend income and capital gains distributions, if any, are recorded on the ex-dividend date, net of any foreign taxes withheld. Interest income, if any, is recorded on the accrual basis, including amortization of premiums and accretion of discounts.

E. Dividends and Distributions to Shareholders

Each Fund intends to declare and make quarterly distributions, or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Alerian Energy Infrastructure ETF, if any, are distributed at least annually. Distributions from net investment income and capital gains are determined in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Funds, timing differences and differing characterization of distributions made by the Funds.

Distributions received from each Fund’s investments in Master Limited Partnerships (“MLPs”) may be comprised of both income and return of capital. Each Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

The Funds each expect a portion of its distributions to shareholders might be comprised of tax deferred return of capital. Return of capital distributions are not taxable income to the shareholder, but reduce the investor’s tax basis in the investor’s Fund Shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of Fund Shares. Shareholders who periodically receive the payment of dividends or other distributions consisting of a return of capital may be under the impression that they are receiving net profits from the Funds when, in fact, they are not. Shareholders should not assume that the source of the distributions is from the net profits of the Funds.

F. Federal Income Taxation and Tax Basis Information

Alerian MLP ETF

The Fund is taxed as a regular C-corporation for federal income tax purposes and as such is obligated to pay federal and state income tax. This treatment differs from most investment companies, which elect to be treated as “regulated investment companies” under the Internal Revenue Code of 1986, as amended (the “Code”) in order to avoid paying entity level income taxes. Under current law, the Fund is not eligible to elect treatment as a regulated investment company due to its investments primarily in MLPs invested in energy assets. The Fund expects that substantially all of the distributions it receives from MLPs may be treated as a tax-deferred return of capital, thus reducing the Fund’s current tax liability. However, the amount of taxes paid by the Fund will vary depending on the amount of income and gains derived from investments and/or sales of MLP interests and such taxes will reduce your return from an investment in the Fund.

22 | November 30, 2023

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2023 |

Since the Fund will be subject to taxation on its taxable income, the NAV of the Fund shares will also be reduced by the accrual of any deferred tax liabilities. The Underlying Index however is calculated without any deductions for taxes. As a result, the Fund's after tax performance could differ significantly from the Underlying Index even if the pretax performance of the Fund and the performance of Underlying Index are closely related.

Cash distributions from MLPs to the Fund that exceed the Fund’s allocable share of such MLP’s net taxable income are considered a tax deferred return of capital that will reduce the Fund’s adjusted tax basis in the equity securities of the MLP. These reductions in the Fund’s adjusted tax basis in the MLP equity securities will increase the amount of any taxable gain (or decrease the amount of any tax loss) recognized by the Fund on a subsequent sale of the securities. A portion of any gain or loss recognized by the Fund on a sale of an MLP equity security (or by an MLP on a sale of an underlying asset) may be separately computed and treated as ordinary income or loss under the Code to the extent attributable to assets of the MLP that give rise to depreciation recapture, intangible drilling and development cost recapture, or other "unrealized receivables" or "inventory items" under the Code. Any such gain may exceed net taxable gain realized on the sale and will be recognized even if there is a net taxable loss on the sale. The Fund's net capital losses may only be used to offset capital gains and therefore cannot be used to offset gains that are treated as ordinary income. Thus, the Fund could recognize both gain that is treated as ordinary income and a capital loss on a sale of an MLP equity security (or on an MLP's sale of an underlying asset) and would not be able to use the capital loss to offset that gain. The Fund will accrue deferred income taxes for any future tax liability associated with (i) that portion of MLP distributions considered to be a tax-deferred return of capital as well as (ii) capital appreciation of its investments. Upon the sale of an MLP security, the Fund may be liable for previously deferred taxes. The Fund will rely to some extent on information provided by the MLPs, which is not necessarily timely, to estimate the deferred tax liability for purposes of financial statement reporting and determining the Fund’s NAV. From time to time, the Adviser will modify the estimates or assumptions related to the Fund’s deferred tax liability as new information becomes available and may consider, among other matters, the duration of statutory carryforward periods, shareholder transactions, underlying index constituent changes and market conditions. The Fund will generally compute deferred income taxes based on the federal income tax rate applicable to corporations and an assumed rate attributable to state taxes.

The Fund’s income tax expense/(benefit) consists of the following:

| Alerian MLP ETF | | Year ended November 30, 2023 | |

| | | Current | | | Deferred | | | Total | |

| Federal | | $ | 97,635,529 | | | $ | 186,084,970 | | | $ | 283,720,499 | |

| State | | | 6,017,270 | | | | (322,957 | ) | | | 5,694,313 | |

| Valuation Allowance | | | – | | | | (167,764,361 | ) | | | (167,764,361 | ) |

| Total tax expense/(benefit) | | $ | 103,652,799 | | | $ | 17,997,652 | | | $ | 121,650,451 | |

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes.

Components of the Fund’s deferred tax assets and liabilities are as follows:

| Alerian MLP ETF | | As of November 30, 2023 | | | As of November 30, 2022 | |

| Deferred tax assets: | | | | | | | | |

| Capital loss carryforward | | $ | 524,032,603 | | | $ | 752,720,954 | |

| Net operating loss carryforward | | | 24,884,154 | | | | 14,189,498 | |

| Income recognized from MLP investments | | | 1,632,443,967 | | | | 1,503,943,492 | |

| Other deferred tax assets | | | 9,788,597 | | | | - | |

| Valuation allowance | | | (91,895,116 | ) | | | (259,659,477 | ) |

| Less Deferred tax liabilities: | | | | | | | | |

| Net unrealized gain on investment securities | | | (2,352,863,780 | ) | | | (2,246,799,456 | ) |

| Other deferred tax liabilities | | | (67,889 | ) | | | (74,823 | ) |

| Net Deferred Tax Asset/(Liability) | | $ | (253,677,464 | ) | | $ | (235,679,812 | ) |

Due to the activities of the MLPs that the Fund is invested in, the Fund is required to pay franchise tax in certain states. Generally speaking, franchise tax expense is a tax on equity of a corporation, or base minimum fees, imposed by various jurisdictions. The amounts of the tax are estimated throughout the year based upon the Fund's estimate of underlying activities conducted in the states and reconciled to actual amounts paid upon the filing of the tax returns for the states. These taxes are paid as either estimated tax payments, extension payments, or with the tax return filings of the various states.

23 | November 30, 2023

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2023 |

The capital loss carryforward is available to offset future taxable income. The capital loss can be carried forward for 5 years and, accordingly, would begin to expire as of November 30, 2025. The Fund has net capital loss carryforwards for federal income tax purposes as follows:

| Alerian MLP ETF | | Period-Ended | | Amount | | | Expiration |

| Federal | | 11/30/2020 | | $ | 873,745,966 | | | 11/30/2025 |

| Federal | | 11/30/2021 | | | 673,784,686 | | | 11/30/2026 |

| Federal | | 11/30/2022 | | | 818,305,025 | | | 11/30/2027 |

| Total | | | | $ | 2,365,835,677 | | | |

The net operating loss carryforward is available to offset future taxable income. The Fund has no net operating loss carryforwards for federal income tax purposes and has state tax net operating loss carryforwards of various amounts per state. The Deferred Tax Assets associated with these state tax net operating losses are as follows:

| Alerian MLP ETF | | Period-Ended | | Amount | | | Expiration |

| State | | 11/30/2012 | | $ | 348,319 | | | Varies by State |

| State | | 11/30/2013 | | | 1,709,988 | | | Varies by State |

| State | | 11/30/2014 | | | 666,282 | | | Varies by State |

| State | | 11/30/2015 | | | 3,032,279 | | | Varies by State |

| State | | 11/30/2016 | | | 6,027,665 | | | Varies by State |

| State | | 11/30/2017 | | | 5,100,371 | | | Varies by State |

| State | | 11/30/2018 | | | 1,729,340 | | | Varies by State |

| State | | 11/30/2019 | | | 1,535,401 | | | Varies by State |

| State | | 11/30/2020 | | | 1,768,627 | | | Varies by State |

| State | | 11/30/2021 | | | 2,599,259 | | | Varies by State |

| State | | 11/30/2022 | | | 366,623 | | | Varies by State |

| Total | | | | $ | 24,884,154 | | | |

The Fund reviews the recoverability of its deferred tax assets based upon the weight of available evidence. When assessing the recoverability of its deferred tax assets, significant weight was given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized. Currently, any capital losses that may be generated by the Fund are eligible to be carried back up to three years and can be carried forward for five years to offset capital gains recognized by the Fund in those years.

Based upon the Fund’s assessment, it has determined that it is “more-likely-than-not” that a portion of its deferred tax assets will not be realized through future taxable income of the appropriate character. Accordingly, a valuation allowance has been established for a portion of the Fund's capital loss carryforward asset not expected to be utilized. The Fund will continue to assess the need for a valuation allowance in the future. Significant increases in the fair value of its portfolio of investments may change the Fund’s assessment of the recoverability of these assets and may result in the removal of the valuation allowance against all or a portion of the Fund’s gross deferred tax assets.

Total income tax expense/(benefit) (current and deferred) differs from the amount computed by applying the federal statutory income tax rate of 21% to net investment income and realized and unrealized gain/(losses) on investment before taxes as follows:

| Alerian MLP ETF | | As of November 30, 2023 | |

| Income tax expense at statutory rate | | $ | 288,217,090 | |

| State income taxes (net of federal benefit) | | | 15,783,317 | |

| Permanent differences, net | | | (19,500,558 | ) |

| Effect of tax rate change (state level) | | | 4,914,963 | |

| Valuation allowance | | | (167,764,361 | ) |

| Net income tax expense | | $ | 121,650,451 | |

The Fund recognizes interest accrued related to unrecognized tax benefits and penalties as income tax expense. For the year ended November 30, 2023, the Fund had no penalties or interest.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits

24 | November 30, 2023

Alerian Exchange Traded Funds

| Notes to Financial Statements | November 30, 2023 |