UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22227

IndexIQ ETF Trust

(Exact name of registrant as specified in charter)

800 Westchester Ave., Suite S-710

Rye Brook, NY 10573

(Address of principal executive offices) (Zip code)

Adam S. Patti

IndexIQ Advisors LLC

800 Westchester Ave., Suite S-710

Rye Brook, NY 10573

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-888-934-0777

Date of fiscal year end: April 30

Date of reporting period: April 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ANNUAL REPORT | APRIL 30, 2016

IndexIQ ETF Trust

IQ Hedge Multi-Strategy Tracker ETF (QAI)

IQ Hedge Macro Tracker ETF (MCRO)

IQ Hedge Market Neutral Tracker ETF (QMN)

IQ Hedge Long/Short Tracker ETF (QLS)

IQ Hedge Event-Driven Tracker ETF (QED)

IQ Global Resources ETF (GRES)

IQ Merger Arbitrage ETF (MNA)

IQ Real Return ETF (CPI)

IQ Australia Small Cap ETF (KROO)

IQ Canada Small Cap ETF (CNDA)

IQ Global Agribusiness Small Cap ETF (CROP)

IQ Global Oil Small Cap ETF (IOIL)

IQ U.S. Real Estate Small Cap ETF (ROOF)

IQ 50 Percent Hedged FTSE International ETF (HFXI)

IQ 50 Percent Hedged FTSE Europe ETF (HFXE)

IQ 50 Percent Hedged FTSE Japan ETF (HFXJ)

IQ Leaders GTAA Tracker ETF (QGTA)

The investment return and value of each of the Funds’ shares will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Consider the Funds’ investment objectives, risks, charges and expenses carefully before investing. The prospectus and the statement of additional information include this and other relevant information about the Funds and are available by visiting www.IQetfs.com or by calling 1-888-934-0777. Read the prospectus carefully before investing.

Each of the Funds’ performance that is current to the most recent month-end is available by visiting www.IQetfs.com or by calling 1-888-934-0777.

You may obtain a description of the IndexIQ ETF Trust proxy voting, policies, procedures and information regarding how each Fund voted proxies relating to portfolio securities during the 12-month period ending June 30 (available by August 31) without charge, upon request, by calling 1-888-934-0777 or by accessing the SEC’s website at www.sec.gov. Such reports may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

The Funds file their complete schedules of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s web site at www.sec.gov. The Funds’ Forms N-Q also may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Each Funds’ premium/discount information is available, free of charge, on the Funds’ website, www.IQetfs.com or by calling 1-888-934-0777.

The Funds are distributed by ALPS Distributors, Inc., which is not affiliated with IndexIQ or the Funds’ investment advisor.

IndexIQ® and IQ® are registered service marks of IndexIQ.

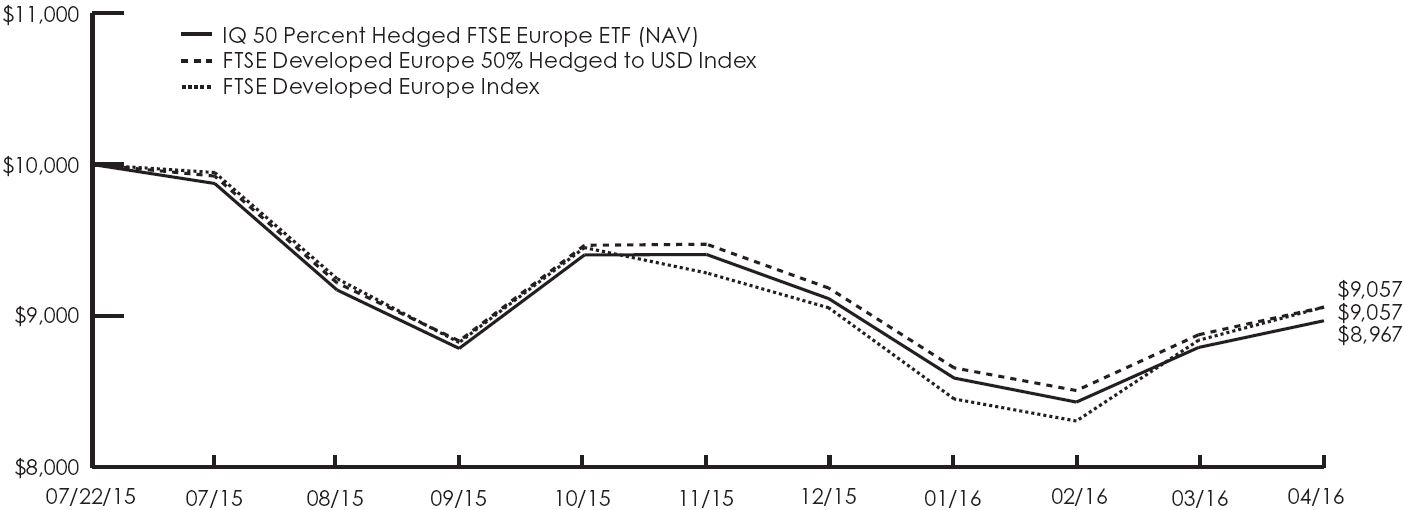

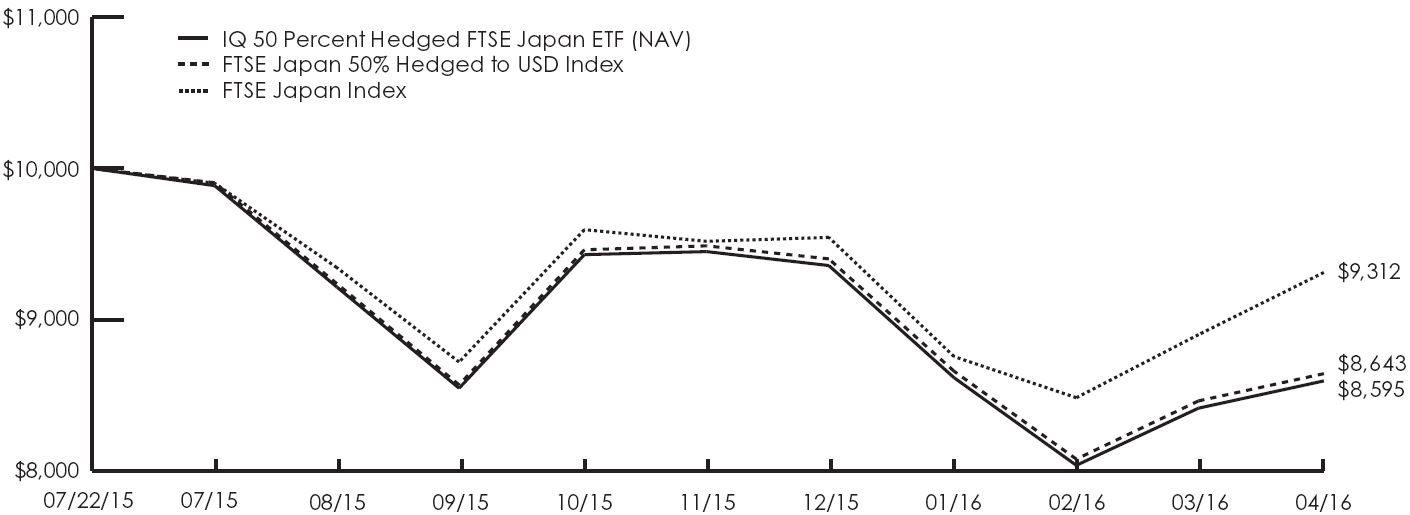

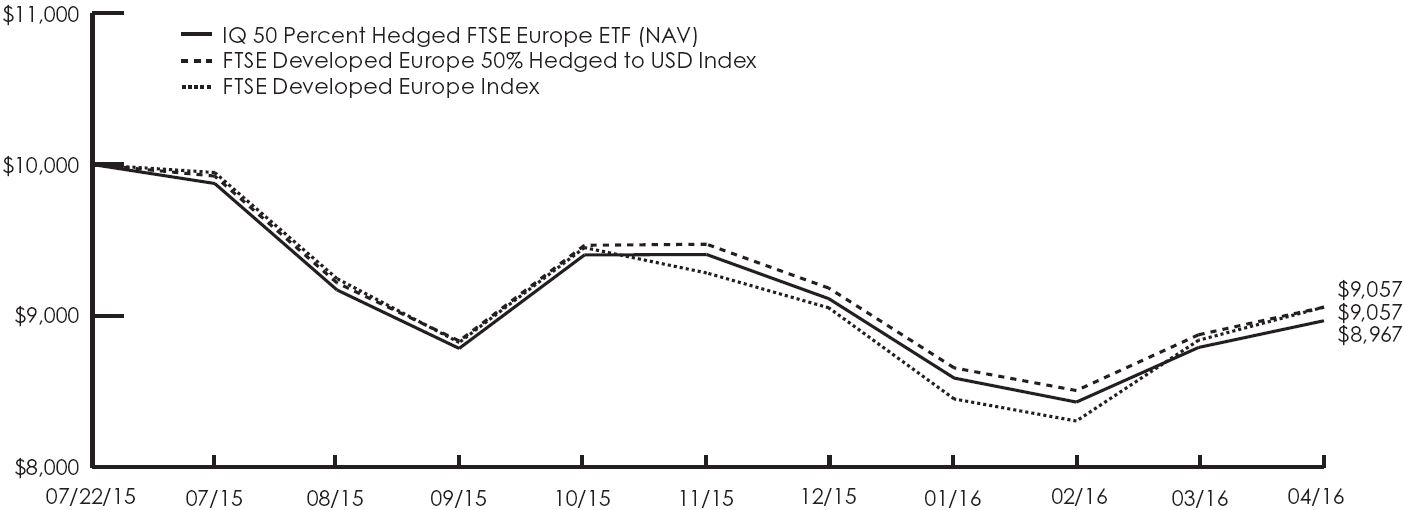

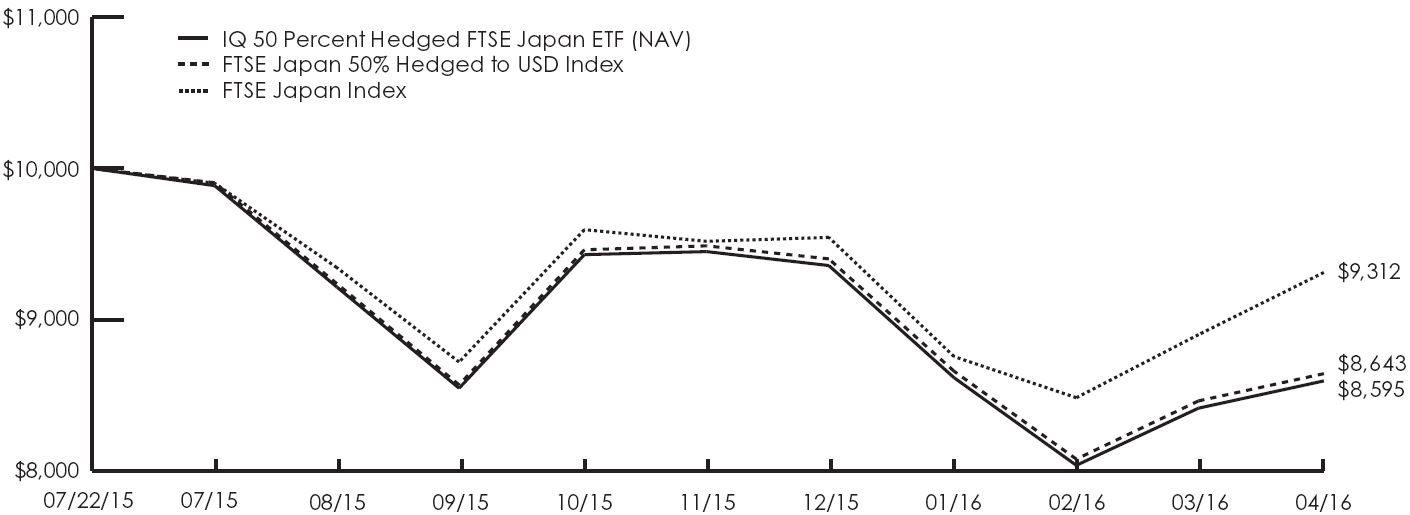

Help Preserve the Environment — Go Green!

With e-Delivery, you can:

| • | Receive email notifications when your most recent shareholder communications are available for review. |

| • | Access prospectuses, annual reports and semiannual reports online. |

It’s easy to enroll:

| 1. | Visit https://www.icsdelivery.com/live/ |

| 2. | Follow the simple enrollment instructions |

If you have questions about IndexIQ e-Delivery services, contact a representative at 888-934-0777.

| Shareholder Letter | 5 |

| Management’s Discussion of Fund Performance | 6 |

| Fund Expenses | 40 |

| Portfolio Summaries | 42 |

| Schedules of Investments | |

| IQ Hedge Multi-Strategy Tracker ETF | 46 |

| IQ Hedge Macro Tracker ETF | 50 |

| IQ Hedge Market Neutral Tracker ETF | 53 |

| IQ Hedge Long/Short Tracker ETF | 56 |

| IQ Hedge Event-Driven Tracker ETF | 58 |

| IQ Global Resources ETF | 60 |

| IQ Merger Arbitrage ETF | 64 |

| IQ Real Return ETF | 67 |

| IQ Australia Small Cap ETF | 68 |

| IQ Canada Small Cap ETF | 70 |

| IQ Global Agribusiness Small Cap ETF | 73 |

| IQ Global Oil Small Cap ETF | 75 |

| IQ U.S. Real Estate Small Cap ETF | 77 |

| IQ 50 Percent Hedged FTSE International ETF | 79 |

| IQ 50 Percent Hedged FTSE Europe ETF | 89 |

| IQ 50 Percent Hedged FTSE Japan ETF | 96 |

| IQ Leaders GTAA Tracker ETF | 102 |

| Statements of Assets and Liabilities | 104 |

| Statements of Operations | 107 |

| Statements of Changes in Net Assets | 110 |

| Financial Highlights | 115 |

| Notes to Financial Statements | 123 |

| Report of Independent Registered Public Accounting Firm | 141 |

| Supplemental Information | 142 |

| Board Review of Investment Advisory Agreement | 144 |

| Board of Trustees and Officers | 146 |

| Shareholder Letter (unaudited) |

Dear Shareholder:

We are pleased to present you with the annual report for IndexIQ ETF Trust for the 12 months ended April 30, 2016 (the “Reporting Period”).

It was a challenging Reporting Period for investors, as high levels of volatility and disparity were evident in the returns of various global asset classes. Indeed, the Reporting Period was marked by numerous global cross currents. The Chinese economic growth rate slowed, and this put pressure on China’s equity prices as well as on global commodity prices, specifically, oil and industrial metals. Greece was on the brink of defaulting on its debt obligations, but a last minute agreement allowed the nation to avert a default. The U.S. dollar gained strength through the first three quarters of the Reporting Period but then began to lose ground to other major currencies as it became more clear that the U.S. Federal Reserve would be unable to implement its intended schedule to increase interest rates. Overall, this was a turbulent Reporting Period, wherein U.S. large-cap equities were barely able to stay above water, and investment-grade bonds had solid results, but many other asset classes did not.

On the following pages, you will find a detailed discussion of the key factors influencing performance of each of the ETFs in the IndexIQ ETF Trust during the Reporting Period. You will also find a schedule of investments and financial statements for each.

Despite the macro challenges of the Reporting Period, we believe that the solutions provided by the ETFs of the IndexIQ ETF Trust give investors the opportunity to enhance portfolio construction in a liquid and transparent manner relative to typical alternative asset strategies, and we look forward to adding more new and innovative ETF solutions in the future.

We thank you for choosing the IndexIQ ETFs, and we honor the responsibility you have placed on us. For more information on our broad array of alternative investment solutions, please visit us at www.indexiq.com or call us at 888-934-0777.

Adam S. Patti

Chief Executive Officer

Registered Representative of NYLIFE Distributors LLC

| Management’s Discussion of Fund Performance (unaudited) |

IQ Hedge Multi-Strategy Tracker ETF

How did IQ Hedge Multi-Strategy Tracker ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, IQ the Fund returned –2.80% at NAV (net asset value) and –2.67% at market price.1 To compare, the Fund’s Underlying Index, the IQ Hedge Multi-Strategy Index,2 returned –1.50% for the same time period. The HFRI Fund of Funds Composite Index2 and S&P 500® Index2 returned –5.52% and 0.55%, respectively, for the same period.

What factors affected the Fund’s performance during the reporting period?

The Fund’s position in investment grade bonds, particularly investment grade corporate bonds, aggregate bonds and short-term Treasury bonds, via underlying ETFs, was the primary positive contributor to returns. The Fund’s short exposure to Brazil, via an underlying ETF, was also beneficial, as oil prices plummeted. However, losses on the Fund’s long exposure to China, via an underlying ETF, largely offset those gains. Similarly, via underlying ETFs, gains from short positions in Asia ex Japan equities were negated by losses from long positions in Emerging Small Cap equities. The Fund’s results were boosted by positions in U.S. large-capitalization value stock ETFs but gave back most of that from its positions in U.S. large-cap growth stock ETFs and U.S. small-capitalization value stock ETFs.

The Fund’s position in convertible bond ETFs detracted from its performance during the reporting period as did the Fund’s holding in a currency carry strategy ETF. Implemented via underlying ETFs, positions in emerging market equities in general were a net detractor from performance. The Fund’s position in a volatility-oriented ETP also dampened relative results.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally iShares iBoxx $ Investment Grade Corporate Bond ETF, iShares Russell 2000 Value ETF, and the Vanguard Small-Cap Value ETF.

How were the Fund’s assets allocated during the reporting period and why?

The Fund’s allocations are driven by quantitative models that determine the weights across the various hedge fund strategies represented in the Fund as well as the weights of the assets within these strategies. Given the rules-based nature of the process, there is no subjectivity involved in the allocation decision process.

During the reporting period, the Fund had positive, or long, allocations to the following hedge fund strategies: Long/Short Equity, Equity Market Neutral, Event Driven and Fixed Income Arbitrage. The Fund had negative, or short, allocations to the following hedge fund strategies: Emerging Markets and Global Macro. These allocations are driven by a proprietary model that overweights strategies with high price momentum, high correlation to the broad hedge fund universe and low total variance. The Fund underweights strategies with the opposite characteristics.

At the asset class level, the Fund was net long in bonds, particularly convertible bonds, aggregate bonds, short-term bonds and floating rate bank loans. The Fund was also net long in equities, particularly U.S. value-oriented equities, as well as real estate investment trusts (REITs). The Fund was net short volatility and currencies, especially the U.S. dollar, during the reporting period.

How did the Fund’s allocations change over the course of the reporting period?

Based on our proprietary quantitative models and via shifts in its underlying ETF positions, the Fund’s total bond exposure was relatively unchanged, however the allocation within fixed income changed, as the Fund gradually decreased its exposure to aggregate bonds and convertible bonds and increased its exposure to investment grade corporate bonds and Treasury inflation-protect securities (TIPS).

Via underlying ETFs, the Fund’s currency position shifted from long the euro and yen to small short exposures. The Fund’s equity allocation, implemented via underlying ETFs, increased in broad international, Japan and U.S. large-capitalization value equities. The Fund’s net real estate position went from a small positive to a small negative, via underlying ETFs.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 7 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

During the reporting period, which underlying ETFs had the highest total returns and which underlying ETFs had the lowest total returns?

In terms of total return, the best-performing underlying ETFs in the Fund were CurrencyShares Japanese Yen Trust (FXY) and iShares Silver Trust (SLV). During the reporting period, iShares China Large-Cap ETF (FXI) and iShares MSCI China ETF (MCHI) recorded the lowest total returns.

Which underlying ETFs were the strongest positive contributors to the Fund’s performance and which underlying ETFs were particularly weak?

On the basis of impact, which takes weightings and total returns into consideration, the underlying ETFs that made the greatest positive contributions to the Fund’s performance during the reporting period were iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD) and iShares Core U.C. Aggregate Bond ETF (AGG). The weakest contributors were SPDR Barclays Convertible Securities ETF (CWB) and SPDR S&P Emerging Markets Small Cap ETF (EWX).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

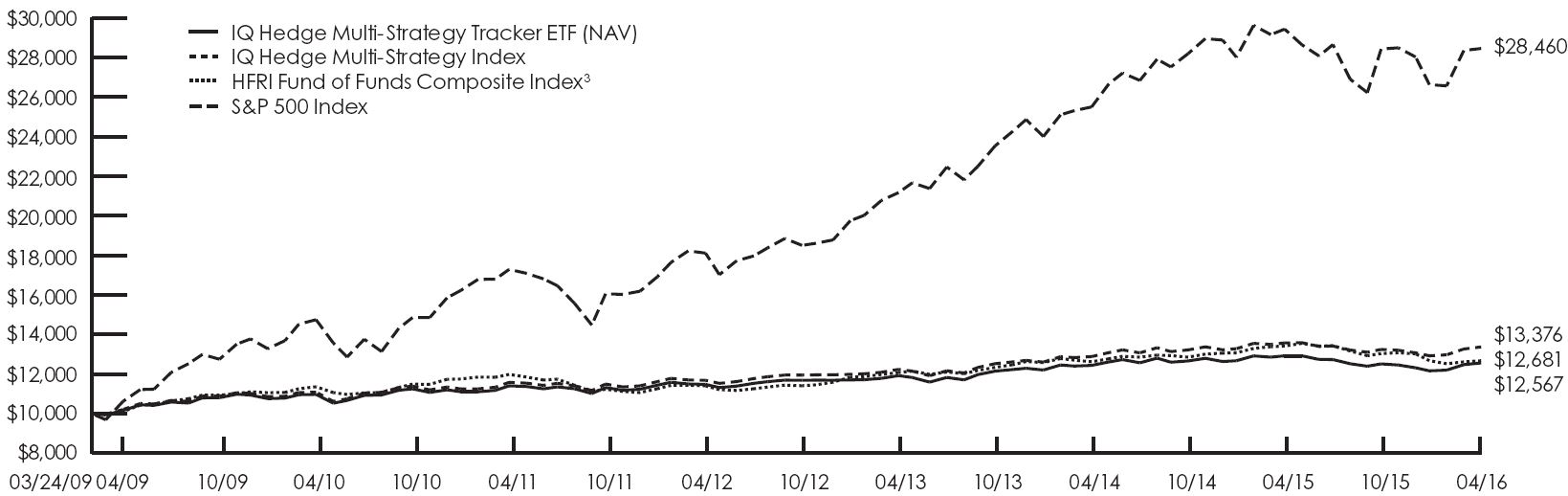

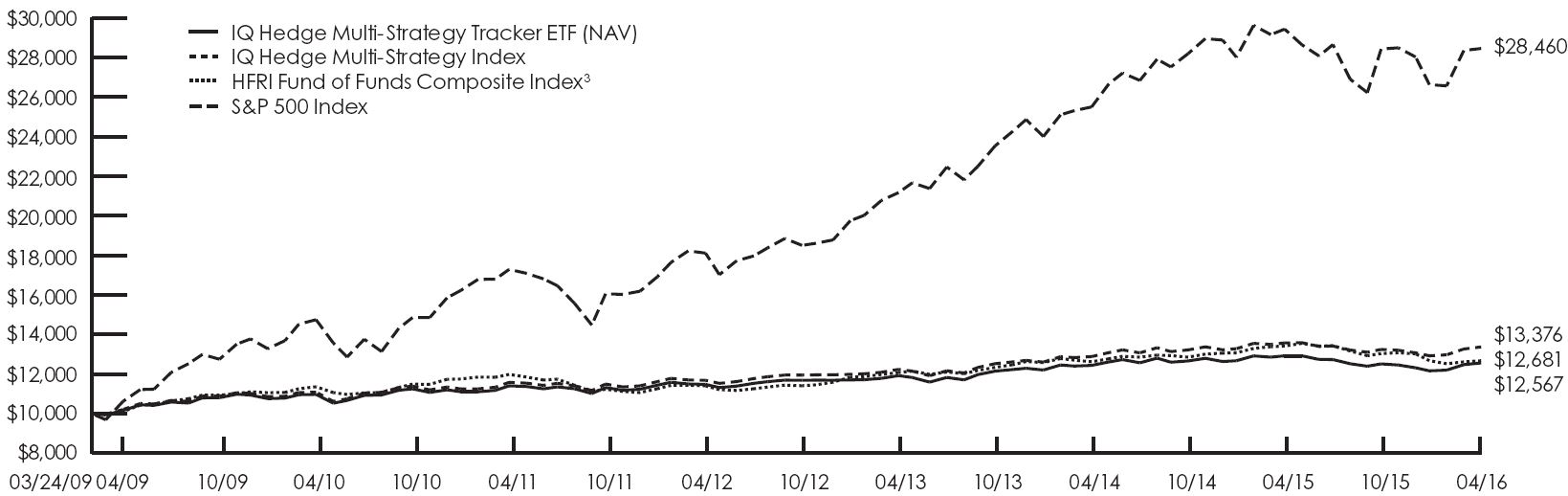

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Hedge Multi-Strategy Tracker ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Hedge Multi-Strategy Tracker ETF Market Price2 | | –2.67 | % | | 1.76 | % | | 1.98 | % | | 3.28 | % | | 25.77 | % |

| IQ Hedge Multi-Strategy Tracker ETF NAV | | –2.80 | % | | 1.76 | % | | 1.95 | % | | 3.27 | % | | 25.67 | % |

| IQ Hedge Multi-Strategy Index | | –1.50 | % | | 2.99 | % | | 2.91 | % | | 4.18 | % | | 33.76 | % |

| HFRI Fund of Funds Composite Index3 | | –5.52 | % | | 1.63 | % | | 1.13 | % | | 3.41 | % | | 26.81 | % |

| S&P 500 Index | | 0.55 | % | | 10.55 | % | | 10.30 | % | | 15.85 | % | | 184.60 | % |

| 1 | Fund Inception Date: 3/24/2009. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 3 | Data shown above for the HFRI Fund of Funds Composite Index is from 3/31/2009 to 4/30/2016. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

IQ Hedge Macro Tracker ETF

How did IQ Hedge Macro Tracker ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –2.97% at NAV (net asset value) and –2.60% at market price.1 To compare, the Fund’s Underlying Index, the IQ Hedge Macro Index,2 returned –2.35% for the same time period. The HFRI Fund of Funds Composite Index and the MSCI® World Index2 returned –5.52% and –3.61%, respectively, for the same period.

What factors affected the Fund’s performance during the reporting period?

The Fund’s positions in investment grade bond ETFs, particularly those focused on investment grade corporate bonds and short-term Treasury bonds, were the primary positive contributors to returns. The Fund’s short exposure to Brazil and Russia, via underlying ETFs, were also beneficial, as oil prices plummeted. However, the losses on the Fund’s long exposure to China largely offset those gains.

The Fund benefited from its short exposure to commodities during the reporting period. However, its short position in the Japanese yen, via an underlying ETF, detracted from Fund performance. Also implemented via underlying ETFs, the Fund’s long positions in U.S. and emerging market small-capitalization equities detracted from performance as did exposure to an emerging market bond ETF.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally SPDR Dow Jones International Real Estate ETF, CurrencyShares Euro Trust, and the CurrencyShares Japanese Yen Trust.

How were the Fund’s assets allocated during the reporting period and why?

The Fund’s allocations are driven by quantitative models that determine the weights across the various hedge fund strategies represented in the Fund, as well as the weights of the assets within these strategies. Given the rules-based nature of the process, there is no subjectivity involved in the allocation decision process.

During the reporting period, the Fund had an overweight relative to the Underlying Index in the Emerging Markets hedge fund strategy and a proportionate underweight in the Global Macro hedge fund strategy. These allocations are driven by a proprietary quantitative model that overweights strategies with high price momentum, high correlation to the broad hedge fund universe and low total variance. The Fund underweights strategies with the opposite characteristics.

At the asset class level, the Fund was net long in bonds, particularly short-term U.S. Treasury bonds, investment grade U.S. corporate bonds and international bonds. The Fund was also net long in equities, particularly small-capitalization equities and emerging market equities. Amongst currencies, the Fund was long the euro and short the yen for a net short position in the U.S. dollar.

How did the Fund’s allocations change over the course of the reporting period?

Based on our proprietary quantitative models, the Fund’s total bond exposure was increased, and there was a change in the composition of underlying ETFs as well. Via underlying ETFs, the Fund reduced its exposure to international bonds and corporate bonds and increased its holdings in short-term U.S. Treasuries. The Fund’s currency position shifted from long the euro to a small short exposure. The Fund’s equity allocation, implemented via underlying ETFs, increased in emerging market small-capitalization equities, Japan equities and U.S. large-cap value equities. The Fund’s net real estate position drifted from a small negative to a larger negative.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 9 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

During the reporting period, which underlying ETFs had the highest total returns and which underlying ETFs had the lowest total returns?

In terms of total return, the best-performing underlying ETFs in the Fund were CurrencyShares Japanese Yen Trust (FXY) and iShares Silver Trust (SLV). During the reporting period, iShares China Large-Cap ETF (FXI) and iShares MSCI China ETF (MCHI) recorded the lowest total returns.

Which underlying ETFs were the strongest positive contributors to the Fund’s performance and which underlying ETFs were particularly weak?

On the basis of impact, which takes weightings and total returns into consideration, the underlying ETFs that made the greatest positive contributions to the Fund’s performance during the reporting period were iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD) and Power Shares DB Commodity Index Tracking fund (DBC). The weakest contributors were iShares China Large-Cap ETF (FXI) and SPDR S&P Emerging Markets Small Cap ETF (EWX).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

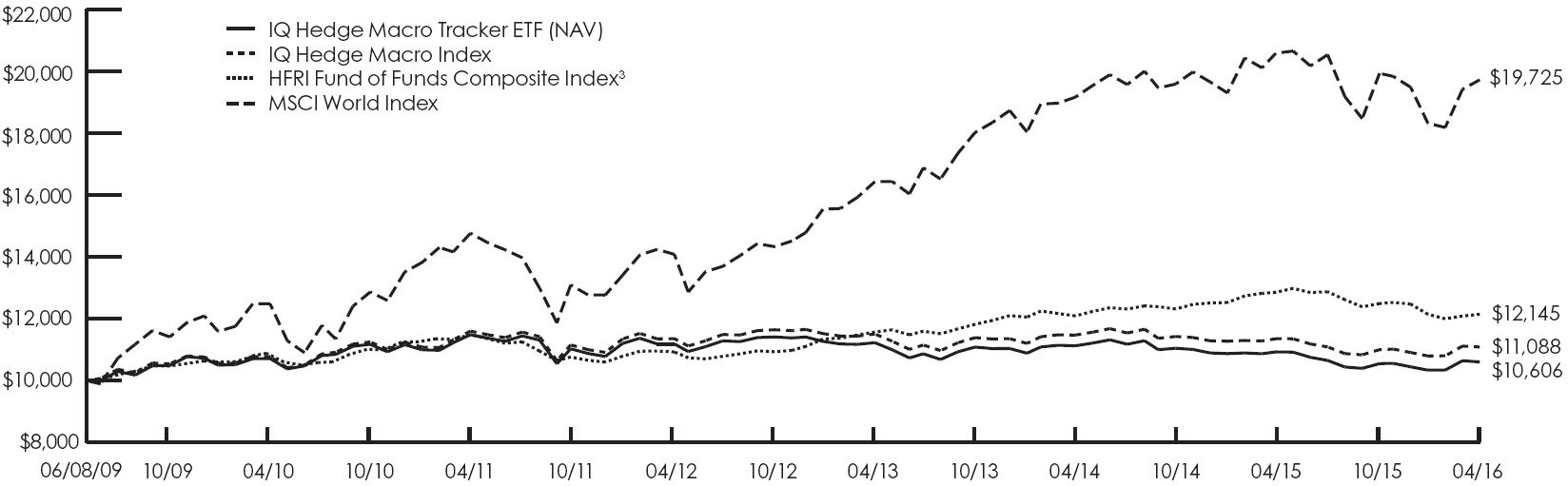

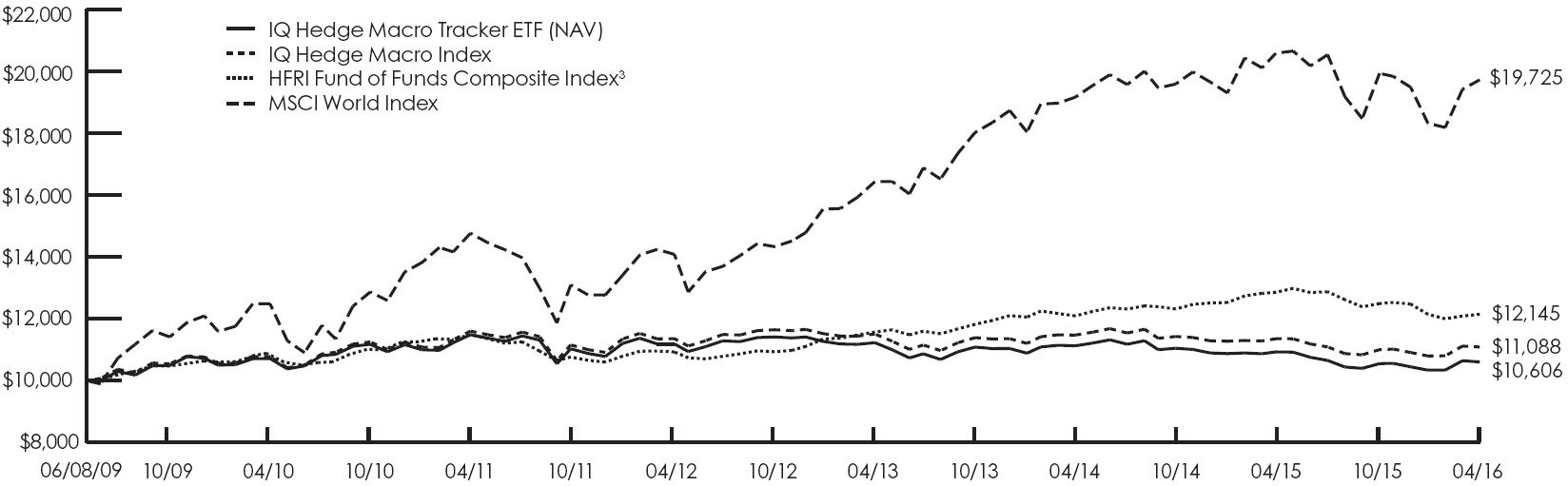

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Hedge Macro Tracker ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Hedge Macro Tracker ETF Market Price2 | | –2.60 | % | | –1.72 | % | | –1.52 | % | | 0.94 | % | | 6.65 | % |

| IQ Hedge Macro Tracker ETF NAV | | –2.97 | % | | –1.88 | % | | –1.59 | % | | 0.86 | % | | 6.06 | % |

| IQ Hedge Macro Index | | –2.35 | % | | –1.23 | % | | –0.90 | % | | 1.51 | % | | 10.88 | % |

| HFRI Fund of Funds Composite Index3 | | –5.52 | % | | 1.63 | % | | 1.13 | % | | 2.85 | % | | 21.45 | % |

| MSCI World Index | | –3.61 | % | | 6.86 | % | | 6.56 | % | | 10.35 | % | | 97.25 | % |

| 1 | Fund Inception Date: 6/08/2009. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 3 | Data shown above for the HFRI Fund of Funds Composite Index is from 5/31/2009 to 4/30/2016. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

IQ Hedge Market Neutral Tracker ETF

How did IQ Hedge Market Neutral Tracker ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –0.15% at NAV (net asset value) and –0.27% at market price.1 To compare, the Fund’s Underlying Index, the IQ Hedge Market Neutral Index,2 returned 1.17% for the same time period. The HFRI Equity Market Neutral Index2 and the Barclays Capital U.S. Short Term Treasury Bond Index2 returned 2.11% and 0.29%, respectively, for the same period.

What factors affected the Fund’s performance during the reporting period?

The Fund’s position in investment grade bonds, particularly investment grade corporate bonds, aggregate bonds and short-term Treasury bonds, via underlying ETFs, were the primary positive contributors to returns. The Fund’s short exposure to international bonds was also beneficial, as turbulence overseas led to bond price drops.

Gains from the Fund’s currency positions via underlying ETFs — long the euro and short the U.S. Dollar — were offset by its long exposure to a currency carry strategy. Similarly, gains from short positions in Asia ex Japan equity ETFs were negated by losses from long positions in international, European and emerging market equity ETFs. The Fund benefited from positions in U.S. large-capitalization value equity ETFs, but this was virtually offset by positions in U.S. small-cap value equity ETFs.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally Vanguard FTSE Pacific ETF, iShares MSCI All Country Asia ex Japan ETF, and the iShares Russell 1000 Growth ETF.

How were the Fund’s assets allocated during the reporting period and why?

The Fund’s allocations are driven by quantitative models that determine the weights across the various hedge fund strategies represented in the Fund as well as the weights of the assets within these strategies. Given the rules-based nature of the process, there is no subjectivity involved in the allocation decision process.

During the reporting period, the Fund had an overweight relative to the Underlying Index in the Equity Market Neutral hedge fund strategy and a proportionate underweight in the Fixed Income Arbitrage hedge fund strategy. These allocations are driven by a proprietary quantitative model that overweights strategies with high price momentum, high correlation to the broad hedge fund universe and low total variance. The Fund underweights strategies with the opposite characteristics.

At the asset class level, the Fund was net long in bonds, particularly U.S. short-term Treasury bonds. The Fund was slightly net long in equities, with long positions in U.S. large-capitalization value equities and U.S. small-cap growth equities with a partial hedge in U.S. small-capitalization value equities. Internationally, the Fund was long Europe, short Asia ex Japan and long emerging markets equities with a short position in developed international equities.

How did the Fund’s allocations change over the course of the reporting period?

Based on our proprietary quantitative models, the Fund’s overall bond allocation was little changed over the course of the reporting period, but, within that, some of the Fund’s allocation from aggregate bonds and short-term U.S. Treasury bonds was moved into investment grade corporate bonds. The Fund’s overall equity allocation declined, as emerging markets went from a small positive to a small negative. The Fund also went more short in U.S. large-capitalization growth equities and less short in U.S. small-capitalization value equities.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 11 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

During the reporting period, which underlying ETFs had the highest total returns and which underlying ETFs had the lowest total returns?

In terms of total return, the best-performing underlying ETFs in the Fund were Guggenheim S&P 500 Pure Value ETF (RPV) and iShares MSCI Japan ETF (EWJ). During the reporting period, iShares MSCI All Country Asia ex Japan ETF (AAXJ) and Vanguard FTSE Emerging Markets ETF (VWO) recorded the lowest total returns.

Which underlying ETFs were the strongest positive contributors to the Fund’s performance and which underlying ETFs were particularly weak?

On the basis of impact, which takes weightings and total returns into consideration, the underlying ETFs that made the greatest positive contributions to the Fund’s performance during the reporting period were iShares MSCI All Country Asia ex Japan ETF (AAXJ) and iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD). The weakest contributors were iShares MSCI EAFE ETF (EFA) and Vanguard Small Cap Value Index Fund (VBR).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Hypothetical Growth of a $10,000 Investment (Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Hedge Market Neutral Tracker ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Hedge Market Neutral Tracker ETF Market Price2 | | –0.27 | % | | 0.35 | % | | 1.19 | % | | 4.31 | % |

| IQ Hedge Market Neutral Tracker ETF NAV | | –0.15 | % | | 0.47 | % | | 1.26 | % | | 4.56 | % |

| IQ Hedge Market Neutral Index | | 1.17 | % | | 1.66 | % | | 2.37 | % | | 8.75 | % |

| HFRI Equity Market Neutral Index3 | | 2.11 | % | | 3.62 | % | | 3.98 | % | | 14.99 | % |

| Barclays Capital U.S. Short Term Treasury Bond Index | | 0.29 | % | | 0.18 | % | | 0.18 | % | | 0.64 | % |

| 1 | Fund Inception Date: 10/04/2012. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 3 | Data shown above for the HFRI Equity Market Neutral Index is from 9/30/2012 to 4/30/2016. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

IQ Hedge Long/Short Tracker ETF

How did IQ Hedge Long/Short Tracker ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –3.46% at NAV (net asset value) and –8.23% at market price.1 To compare, the Fund’s Underlying Index, the IQ Hedge Long/Short Index,2 returned –2.10% for the same time period. The HFRI Equity Hedge Index2 and the Barclays Capital U.S. Short Term Treasury Bond Index2 returned –5.17% and 0.29%, respectively, for the same period.

What factors affected the Fund’s performance during the reporting period?

The Fund’s position in investment grade bond ETFs was the primary positive contributor to returns. The Fund’s exposure to floating rate senior loans, via an underlying ETF, detracted, largely offsetting those gains.

Similarly, gains from short positions in U.S. small-capitalization equities and long positions in U.S. large-capitalization value equities, via underlying ETFs, were negated by losses from long positions in U.S. small-capitalization growth equity ETFs. Emerging markets in general were a net detractor from Fund performance as was the Fund’s position in a volatility-oriented ETF.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally iShares Russell 2000 Value ETF, Vanguard Small-Cap Value ETF, and the iShares S&P Small-Cap 600 Value ETF.

How were the Fund’s assets allocated during the reporting period and why?

The Fund’s allocations are driven by quantitative models that determine the weights across the various hedge fund strategies represented in the Fund as well as the weights of the assets within these strategies. Given the rules-based nature of the process, there is no subjectivity involved in the allocation decision process.

At the asset class level, the Fund was net long in bonds, particularly investment grade bonds and floating rate senior loans. The Fund was also net long in equities, with long positions in U.S. growth-oriented equities and international equities. The Fund was short U.S. small-capitalization value-oriented equities.

How did the Fund’s allocations change over the course of the reporting period?

Based on our proprietary quantitative models and via shifts in its underlying ETF positions, the Fund’s total bond exposure was reduced, largely due to the reduction in the allocation to floating rate senior loans. Some of this reduction was absorbed by an increase in exposure to investment grade corporate bonds. The remaining weight was moved into equities, primarily in a core international equity ETF. The Fund’s allocation to U.S. large-capitalization value equities also increased.

During the reporting period, which underlying ETFs had the highest total returns and which underlying ETFs had the lowest total returns?

In terms of total return, the best-performing underlying ETFs in the Fund were Energy Select Sector SPDR Fund (XLE) and Financial Select Sector SPDR Fund (XLF). During the reporting period, Vanguard FTSE Emerging Markets ETF (VWO) and iShares MSCI Emerging Markets ETF (EEM) recorded the lowest total returns.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 13 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

Which underlying ETFs were the strongest positive contributors to the Fund’s performance and which underlying ETFs were particularly weak?

On the basis of impact, which takes weightings and total returns into consideration, the underlying ETFs that made the greatest positive contributions to the Fund’s performance during the reporting period were iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD) and Financial Select Sector SPDR Fund (XLF). The weakest contributors were iShares Russell 2000 Growth ETF (IWO) and PowerShares Senior Loan Portfolio (BKLN).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

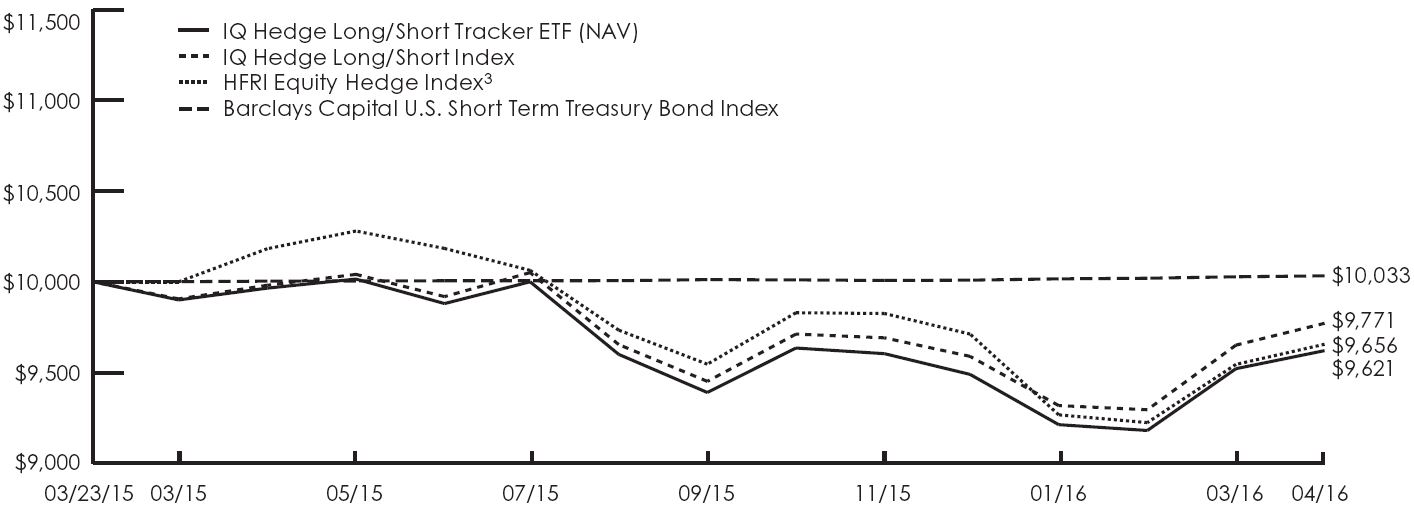

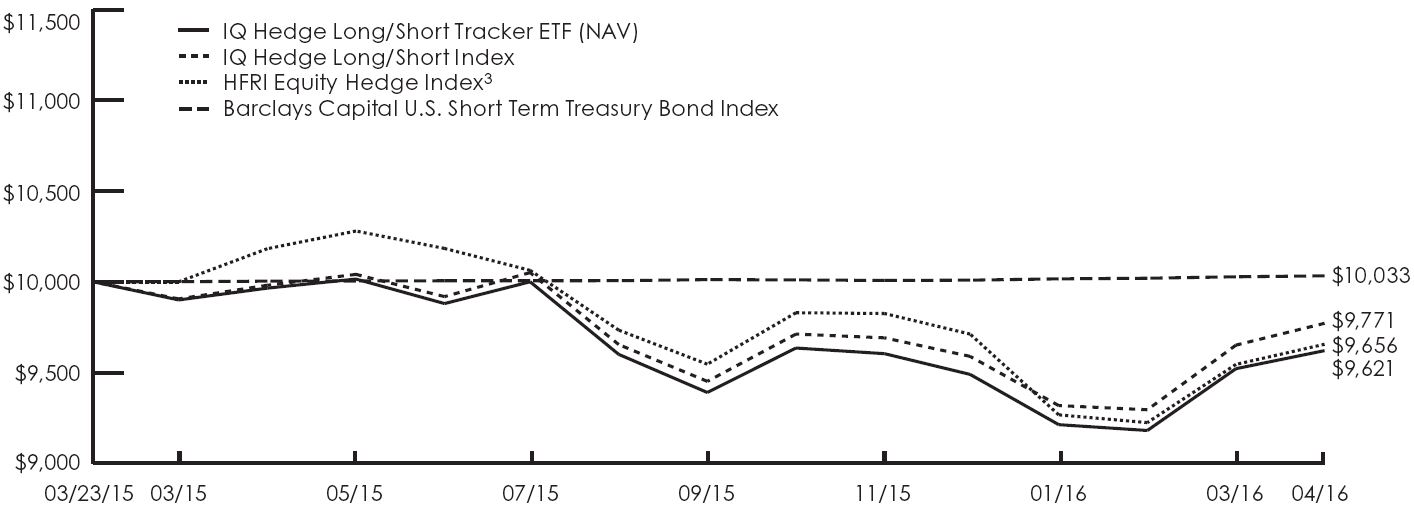

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Hedge Long/Short Tracker ETF

(as of April 30, 2016)

| | | 1 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Hedge Long/Short Tracker ETF Market Price2 | | –8.23 | % | | –4.18 | % | | –4.60 | % |

| IQ Hedge Long/Short Tracker ETF NAV | | –3.46 | % | | –3.44 | % | | –3.79 | % |

| IQ Hedge Long/Short Index | | –2.10 | % | | –2.07 | % | | –2.28 | % |

| HFRI Equity Hedge Index3 | | –5.17 | % | | –3.18 | % | | –3.44 | % |

| Barclays Capital U.S. Short Term Treasury Bond Index | | 0.29 | % | | 0.30 | % | | 0.33 | % |

| 1 | Fund Inception Date: 3/23/2015. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 3 | Data shown above for the HFRI Equity Hedge Index is from 3/31/2015 to 4/30/2016. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

IQ Hedge Event-Driven Tracker ETF

How did IQ Hedge Event-Driven Tracker ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –1.26% at NAV (net asset value) and –1.04% at market price.1 To compare, the Fund’s Underlying Index, the IQ Hedge Event-Driven Index,2 returned –0.63% for the same time period. The HFRI Event-Driven Index2 and the Barclays Capital U.S. Short Term Treasury Bond Index2 returned –5.22%, and 0.29%, respectively, for the same period.

What factors affected the Fund’s performance during the reporting period?

The Fund’s position in aggregate bonds, via underlying ETFs, was the primary positive contributor to returns. A short position in investment grade corporate bonds and a long position in convertible bonds, via underlying ETFs, detracted from the Fund’s performance. The Fund’s positions in equity ETFs had a small net negative contribution.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally iShares iBoxx $ Investment Grade Corporate Bond ETF, Vanguard FTSE Emerging Markets ETF, and the iShares MSCI Emerging Markets ETF.

How were the Fund’s assets allocated during the reporting period and why?

The Fund’s allocations are driven by quantitative models that determine the weights across the various hedge fund strategies represented in the Fund as well as the weights of the assets within these strategies. Given the rules-based nature of the process, there is no subjectivity involved in the allocation decision process.

At the asset class level, the Fund was net long in bonds, particularly convertible bonds and aggregate bonds, but had a short position in investment grade corporate bonds. The Fund was also net long equities, with long positions in U.S. growth-oriented equities and emerging markets equities.

How did the Fund’s allocations change over the course of the reporting period?

During the reporting period, the Fund’s allocations did not change significantly. The Fund had a small decrease in exposure to U.S. large-capitalization growth equities and an offsetting reduction in its short position in investment grade corporate bonds, via underlying ETFs.

During the reporting period, which underlying ETFs had the highest total returns and which underlying ETFs had the lowest total returns?

In terms of total return, the best-performing underlying ETFs in the Fund were iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD) and iShares Core U.S. Credit Bond ETF (CRED). During the reporting period, Vanguard FTSE Emerging Markets ETF (EEM) and iShares MSCI Emerging Markets ETF (VWO) recorded the lowest total returns.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 15 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

Which underlying ETFs were the strongest positive contributors to the Fund’s performance and which underlying ETFs were particularly weak?

On the basis of impact, which takes weightings and total returns into consideration, the underlying ETFs that made the greatest positive contributions to the Fund’s performance during the reporting period were iShares Core U.S. Aggregate Bond ETF (AGG) and Vanguard Total Bond Market Index Fund (BND). The weakest contributors were SPDR Barclays Convertible Securities ETF (CWB) and iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Hedge Event-Driven Tracker ETF

(as of April 30, 2016)

| | | 1 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Hedge Event-Driven Tracker ETF Market Price2 | | –1.04 | % | | –0.72 | % | | –0.79 | % |

| IQ Hedge Event-Driven Tracker ETF NAV | | –1.26 | % | | –0.87 | % | | –0.96 | % |

| IQ Hedge Event-Driven Index | | –0.63 | % | | –0.21 | % | | –0.23 | % |

| HFRI Event-Driven Index3 | | –5.22 | % | | –3.72 | % | | –4.03 | % |

| Barclays Capital U.S. Short Term Treasury Bond Index | | 0.29 | % | | 0.30 | % | | 0.33 | % |

| 1 | Fund Inception Date: 3/23/2015. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 3 | Data shown above for the HFRI Event-Driven Index is from 3/31/2015 to 4/30/2016. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

IQ Global Resources ETF

How did IQ Global Resources ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –6.78% at NAV (net asset value) and –6.41% at market price.1 To compare, the Fund’s Underlying Index, the IQ Global Resources Index,2 returned –4.75% for the same time period. The MSCI® World Index2 and the Bloomberg Commodity Index2 returned –4.17% and –17.45%, respectively, during the same period.

The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Underlying Index.

What factors affected the Fund’s performance during the reporting period?

The Fund seeks to invest in small-, mid- and large-capitalization significant exposure to global commodities and resources. During the first three fiscal quarters of the reporting period, the U.S. dollar strengthened relative to other global currencies, while global commodities prices, most notably oil prices, declined. These trends started to reverse during the fourth fiscal quarter, helping to recover from the drawdown earlier in the reporting period.

The Fund has exposure to 11 global currencies, and, in aggregate, the currency effect detracted from performance, with exposure to the British pound, Australian dollar and Canadian dollar detracting the most. The Fund maintained exposure to the U.S. dollar, euro and Japanese yen, which contributed positively to performance, helping dampen the overall currency effect.

From a sector and industry perspective, the Fund’s largest detractors from performance were industrial metals and precious metals. While the energy sector overall performed negatively for most of the reporting period, primarily due to the decline in oil prices, the Fund managed to generate positive returns in the energy sector. The Fund’s exposure to livestock generated the greatest positive sector return.

The Fund also utilizes U.S. and international equity market hedges, which, in aggregate, contributed positively to performance during the reporting period.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally E-mini S&P 500 Future, and the Mini MSCI EAFE Index Future.

During the reporting period, which industries had the highest total returns and which industries had the lowest total returns?

In terms of total return, the best-performing industries in the Underlying Index were precious metals, livestock grains, food and fiber. During the reporting period, coal, industrial metals and timber recorded the lowest total returns.

During the reporting period, which industries made the strongest contributions to the Fund’s absolute performance and which industries made the weakest contributions?

On the basis of impact, which takes weightings and total returns into account, the industries that made the strongest positive contributions to the Fund’s absolute performance were livestock, energy and water. The industries that made the weakest contributions to the Fund’s absolute performance were industrial metals, precious metals and timber.

During the reporting period, which individual stocks had the highest total returns and which stocks had the lowest total returns?

Within the Underlying Index, the stocks with the highest total return during the reporting period were Kinross Gold, Detour Gold and First Quantum Minerals. Both Kinross Gold and Detour Gold operate in precious metals mining, while First Quantum Minerals is a copper miner.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 17 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

The Underlying Index components with the lowest total returns for the reporting period were Horsehead Holding, Peabody Energy and Lonmin. Horsehead Holding operates in zinc mining; Peabody Energy operates in coal; and Lonmin is a precious metals miner.

Which individual stocks made the strongest contributions to the Fund’s absolute performance during the reporting period and which stocks made the weakest contributions?

On the basis of impact, which takes weightings and total returns into consideration, the stocks that made the strongest contributions to the Fund’s absolute performance during the reporting period were Hormel Foods and Tyson Foods, which are each meat and poultry producers; and Sandvik, which is a mining machinery company. The weakest contributors were BHP Billiton, an industrial metals company, as well as Glencore and Rio Tinto, which are each base metals companies.

Were there any changes in the Underlying Index during the reporting period?

The Underlying Index is reconstituted annually with periodic monthly rebalances. In turn, the Fund rebalances its sector weights each month according to a proprietary rotation methodology that overweights sectors with high price momentum and low valuation and underweights sectors with the opposite characteristics.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Hypothetical Growth of a $10,000 Investment (Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Global Resources ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Global Resources ETF Market Price2 | | –6.41 | % | | –2.75 | % | | –4.21 | % | | 1.29 | % | | 8.73 | % |

| IQ Global Resources ETF NAV | | –6.78 | % | | –3.06 | % | | –4.24 | % | | 1.25 | % | | 8.39 | % |

| IQ Global Resources Index | | –4.75 | % | | –2.20 | % | | –3.39 | % | | 2.21 | % | | 15.30 | % |

| MSCI World Index | | –4.17 | % | | 6.28 | % | | 5.96 | % | | 8.26 | % | | 67.73 | % |

| Bloomberg Commodity Index | | –17.45 | % | | –13.76 | % | | –13.32 | % | | –6.70 | % | | –36.38 | % |

| 1 | Fund Inception Date: 10/26/2009. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

IQ Merger Arbitrage ETF

How did IQ Merger Arbitrage ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –0.79% at NAV (net asset value) and –0.73% at market price.1 To compare, the Fund’s Underlying Index, the IQ Merger Arbitrage Index,2 returned 0.25% for the same time period. The S&P 500® Index2 and the MSCI® World Index2 returned 0.55% and –4.17%, respectively, for the same period.

What factors affected the Fund’s performance during the reporting period?

The Underlying Index seeks to capture the premium discount of merger targets. Through a proprietary merger selection process, the Underlying Index will select target companies satisfying all required selection criteria and will hold securities until the premium has been realized through a successful merger or when any of the selection criteria are violated during the monthly reconstitution.

Key risks of the strategy include potential withdrawal or cancellation of a pending merger, the failure to meet selection criteria pertaining to liquidity, deal age or size requirements, and the risks associated with deal payment through the use of the acquiring company’s stock. Any or all of these conditions can result in under-realization of the deal premium. During the reporting period, global merger and acquisition activity exceeded $7.2 trillion, with 44% completing successfully and 29% remaining open. The remaining deals were either terminated/withdrawn or did not progress past proposal. During the reporting period, less than 10% of Underlying Index constituents failed to complete the intended merger successfully. Close to 25% were removed due to failing to meet criteria necessary to remain in the Underlying Index. The majority of deals completed successfully.

Regulatory risks related to tax inversion deals persisted during the reporting period, most notably affecting the Allergan/Pfizer merger. (A tax inversion is a transaction used by a company whereby it becomes a subsidiary of a new parent company in another country for the purpose of falling under beneficial tax laws.)

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund used derivatives to obtain exposure to long and short positions of the Underlying Index. The long exposures included certain Underlying Index positions, such as investment grade corporate, sovereign, and local authority bonds; short term Treasury securities; equity volatility; and domestic small capitalization stocks. The short exposures included all of the Underlying Index positions, including principally Energy Select Sector SPDR Fund, Consumer Discretionary Select Sector SPDR Fund, and the Health Care Select Sector SPDR Fund.

During the reporting period, which sectors had the highest total returns and which sectors had the lowest total returns?

In terms of total return, the best-performing sectors in the Underlying Index were consumer staples, industrials and utilities. During the reporting period, energy, health care and materials recorded the lowest total returns.

During the reporting period, which sectors made the strongest contributions to the Fund’s absolute performance and which sectors made the weakest contributions?

On the basis of impact, which takes weightings and total returns into account, the sectors that made the strongest positive contributions to the Fund’s absolute performance were consumer discretionary, industrials and information technology. The sectors that made the weakest contributions to the Fund’s absolute performance were health care, energy and materials.

During the reporting period, which individual stocks had the highest total returns and which stocks had the lowest total returns?

Within the Underlying Index, the stocks with the highest total returns during the reporting period were Starwood Hotels, Integrated Silicon Solutions and Pep-Boys. Starwood Hotels operated in the hotels and hospitality industry. Integrated Silicon Solutions operated in semiconductors. Pep-Boys operated in automobile parts and retail.

The Underlying Index components with the lowest total returns for the reporting period were K+S, Allergan and Alere. K+S operates in agricultural chemicals. Allergan and Alere operate in biotechnology.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 19 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

Which individual stocks made the strongest contributions to the Fund’s absolute performance during the reporting period and which stocks made the weakest contributions?

On the basis of impact, which takes weightings and total returns into consideration, the stocks that made the strongest contributions to the Fund’s absolute performance during the reporting period were Time Warner, Baxalta and Starwood Hotels, the latter mentioned earlier. Time Warner operates in media services. Baxalta is a pharmaceutical company.

The weakest contributors were Allergan, mentioned earlier, Baker-Hughes and Office Depot. Baker-Hughes is an oil and gas services company. Office Depot is an office supply retailer.

Were there any changes in the Underlying Index during the reporting period?

The Underlying Index is reconstituted and rebalanced monthly. Intra-month removal of deals occurs only for completed transactions. All other deals are removed at the monthly rebalance. The timing of the rebalance can have both positive and potentially adverse effects, depending on the circumstance of the deal, the number of competing offers, and if new acquirers attempt to acquire existing targets. The Fund’s hedges are also reset at this time.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

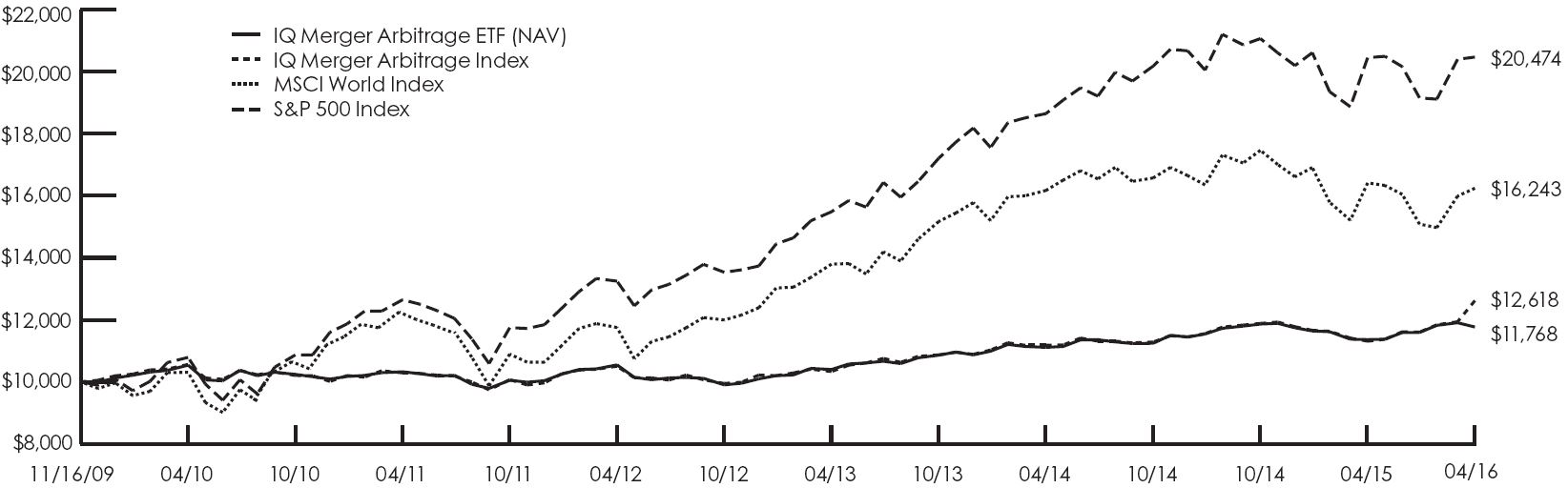

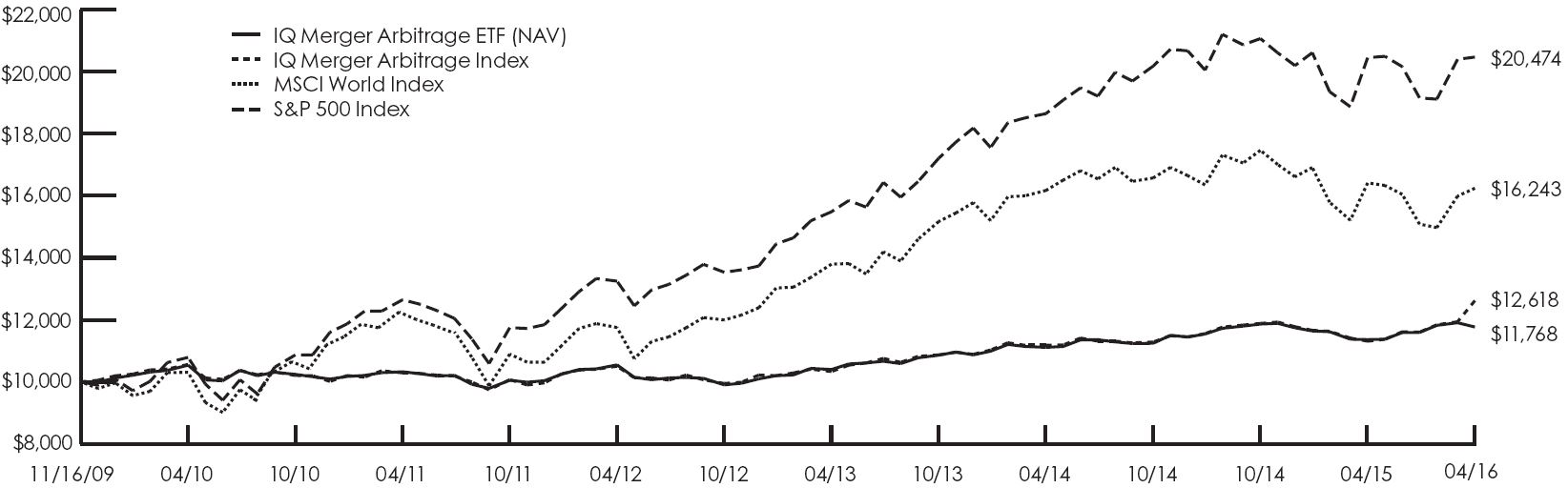

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Merger Arbitrage ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Merger Arbitrage ETF Market Price2 | | –0.73 | % | | 4.52 | % | | 2.78 | % | | 2.60 | % | | 17.97 | % |

| IQ Merger Arbitrage ETF NAV | | –0.79 | % | | 4.22 | % | | 2.65 | % | | 2.56 | % | | 17.68 | % |

| IQ Merger Arbitrage Index | | 0.25 | % | | 5.23 | % | | 3.71 | % | | 3.67 | % | | 26.18 | % |

| MSCI World Index | | –4.17 | % | | 6.28 | % | | 5.96 | % | | 7.80 | % | | 62.43 | % |

| S&P 500 Index | | 0.55 | % | | 10.55 | % | | 10.33 | % | | 11.74 | % | | 104.74 | % |

| 1 | Fund Inception Date: 11/16/2009. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

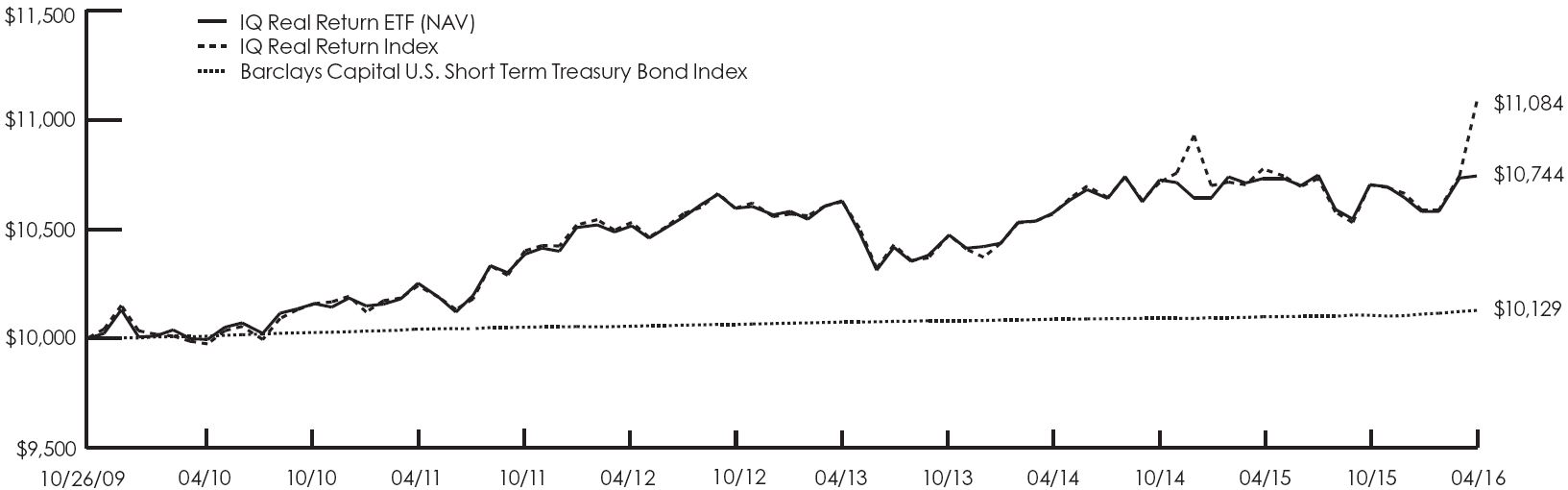

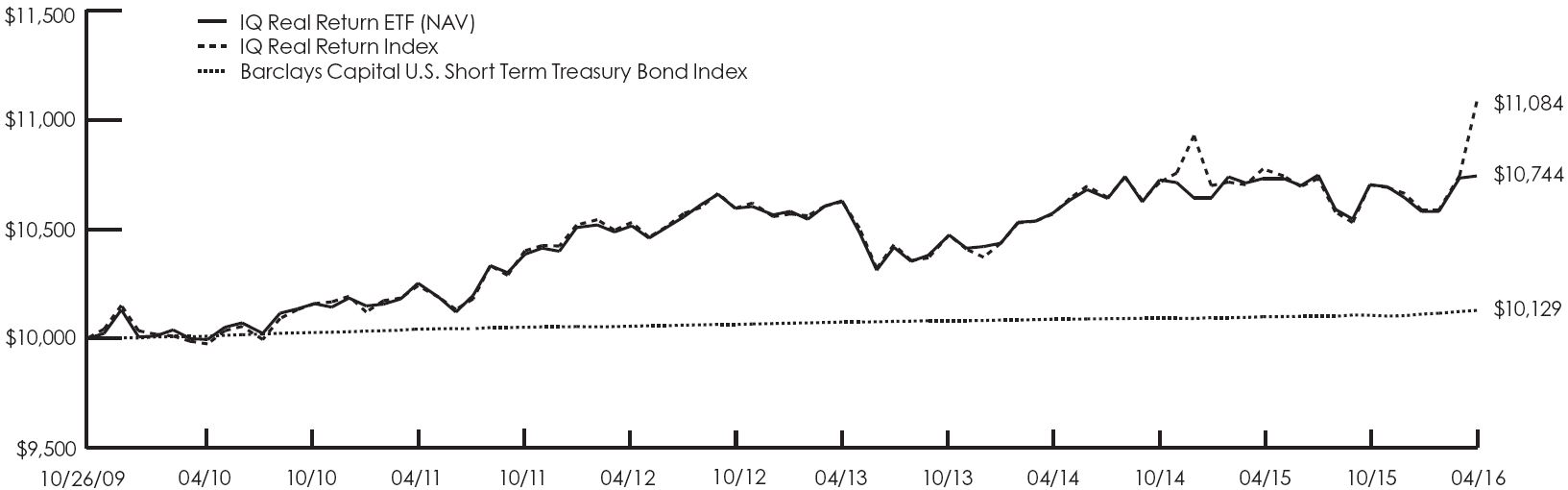

IQ Real Return ETF

How did IQ Real Return ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned 0.11% at NAV (net asset value) and –0.32% at market price.1 To compare, the Fund’s Underlying Index, the IQ Real Return Index,2 returned 0.49% for the same time period. The Barclays Capital U.S. Short Term Treasury Bond Index2 returned 0.29% for the same period.

What factors affected the Fund’s performance during the reporting period?

The Fund’s position in intermediate-term and long-term U.S. Treasury bonds, via underlying ETFs, was the primary positive contributor to returns. Also contributing positively were positions, via underlying ETFs, in U.S. small-capitalization equities and real estate investment trusts (REITs). The only detractor of note during the reporting period was the Fund’s position in a currency ETF focused on the British pound, as the currency declined on anxiety about the possible exit of Britain from the European Union.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund did not use derivatives during the reporting period.

How were the Fund’s assets allocated during the reporting period and why?

The Fund’s allocations are driven by quantitative models that determine the weights across the various hedge fund strategies represented in the Fund as well as the weights of the assets within these strategies. Given the rules-based nature of the process, there is no subjectivity involved in the allocation decision process.

During the reporting period, the Fund had a core position in a short-term U.S. Treasury bond ETF that ranged in allocation from 65% to 70% of Fund assets. The Fund’s next largest allocation was to equities, via underlying ETFs, with a weight that ranged from 12% to 15% of Fund assets. The Fund also held ETFs focused on intermediate-term and long-term U.S. Treasuries, REITs and the British pound.

How did the Fund’s allocations change over the course of the reporting period?

Based on our proprietary quantitative models and via shifts in its underlying ETF positions, the Fund’s short-term U.S. Treasury bond allocation decreased and its equity allocation increased during the reporting period. Via changes in its underlying ETF positions, the Fund’s allocation to intermediate-term U.S. Treasuries increased through the reporting period, absorbing the proceeds from the reduction in long-term U.S. Treasury bonds. The Fund’s position in the British pound ETF was reduced to zero by the end of the reporting period.

During the reporting period, which underlying ETFs had the highest total returns and which underlying ETFs had the lowest total returns?

In terms of total return, the best-performing underlying ETFs in the Fund were Vanguard REIT Index Fund (VNQ) and SPDR Dow Jones REIT ETF (RWR). During the reporting period, CurrencyShares British Pound Sterling (FXB) and iShares Russell 2000 ETF (IWM) recorded the lowest total returns.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 21 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

Which underlying ETFs were the strongest positive contributors to the Fund’s performance and which underlying ETFs were particularly weak?

On the basis of impact, which takes weightings and total returns into consideration, the underlying ETFs that made the greatest positive contributions to the Fund’s performance during the reporting period were Vanguard REIT Index Fund (VNQ) and iShares 7-10 Year Treasury Bond ETF (IEF). The weakest contributors were CurrencyShares British Pound Sterling (FXB) and iShares 1-3 Year Treasury Bond ETF (SHY).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Hypothetical Growth of a $10,000 Investment (Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Real Return ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Real Return ETF Market Price2 | | –0.32 | % | | 0.36 | % | | 0.96 | % | | 1.10 | % | | 7.41 | % |

| IQ Real Return ETF NAV | | 0.11 | % | | 0.36 | % | | 0.94 | % | | 1.11 | % | | 7.44 | % |

| IQ Real Return Index | | 0.49 | % | | 0.76 | % | | 1.38 | % | | 1.59 | % | | 10.84 | % |

| Barclays Capital U.S. Short Term Treasury Bond Index | | 0.29 | % | | 0.18 | % | | 0.17 | % | | 0.20 | % | | 1.29 | % |

| 1 | Fund Inception Date: 10/26/2009. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

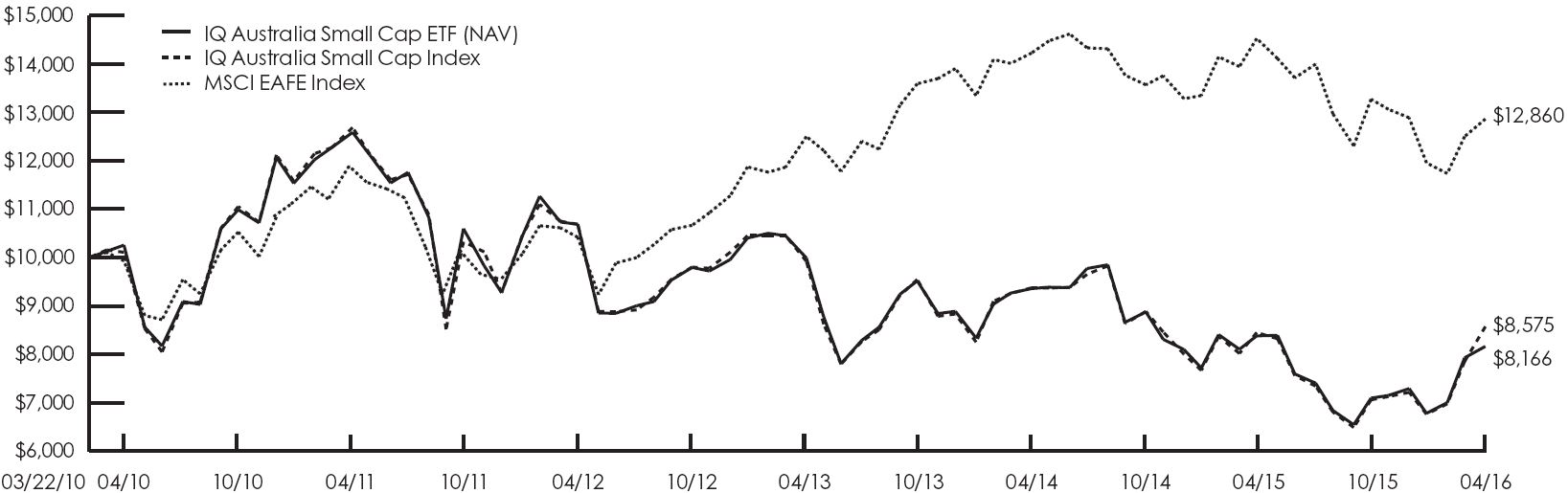

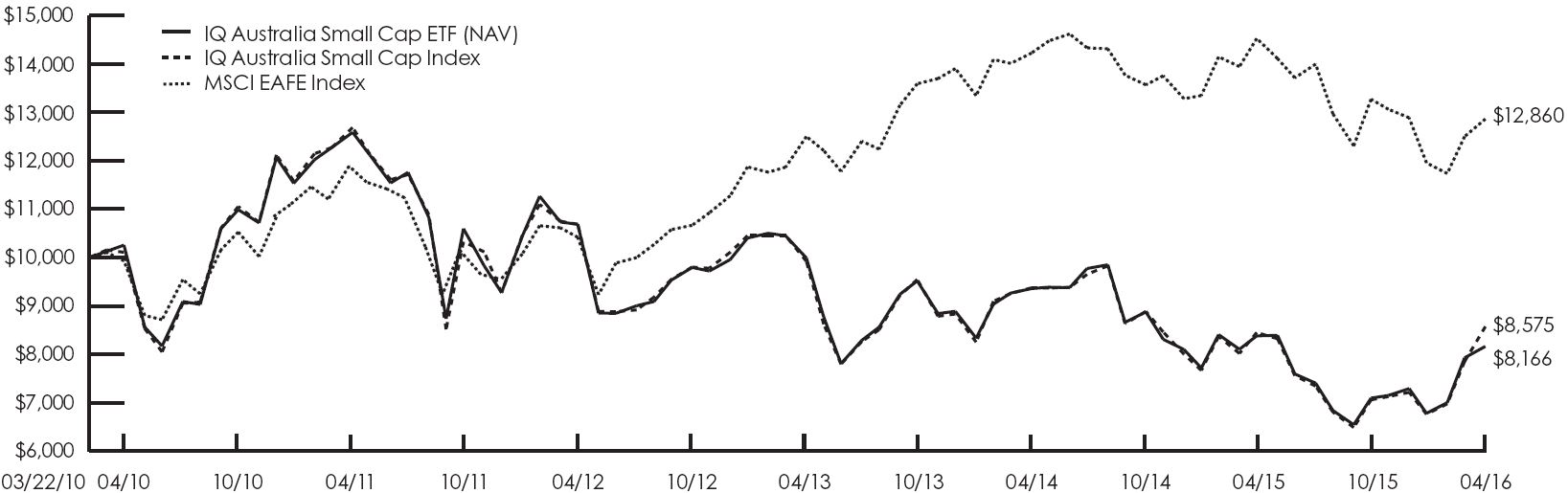

IQ Australia Small Cap ETF

How did IQ Australia Small Cap ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –2.59% at NAV (net asset value) and –3.70% at market price.1 To compare, the Fund’s Underlying Index, the IQ Australia Small Cap Index,2 returned –1.70% for the same time period. The MSCI® EAFE Index2 returned –9.32% for the same period.

What factors affected the Fund’s performance during the reporting period?

The Underlying Index seeks to capture the performance of the small-capitalization Australian equity market. The investable universe is limited to the 100 companies that satisfy the market capitalization and liquidity requirements of the Underlying Index selection criteria, and Underlying Index components are weighted by their float-adjusted market capitalization.

During the first three fiscal quarters of the reporting period, the Australian dollar depreciated versus the U.S. dollar. In the fourth fiscal quarter, the Australian dollar appreciated versus the U.S. dollar.

From a sector perspective, the Underlying Index was heavily weighted in materials, consumer discretionary and industrials, which accounted for approximately 50% of the weight of the Underlying Index during the Reporting Period. Although energy accounted for a smaller weighting in the Underlying Index, it was a key negative contributor to both the Underlying Index’s and the Fund’s overall performance, thus mirroring the impact the energy sector has had on the global economy. The effect of the negative total return of the energy sector was somewhat mitigated by the positive contribution made by exposure to the materials sector.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund did not use derivatives during the reporting period.

During the reporting period, which sectors had the highest total returns and which sectors had the lowest total returns?

In terms of total return, the best-performing sectors in the Underlying Index were telecommunication services, materials and information technology. During the reporting period, energy, utilities and consumer staples recorded the lowest total returns.

During the reporting period, which sectors made the strongest contributions to the Fund’s absolute performance and which sectors made the weakest contributions?

On the basis of impact, which takes weightings and total returns into account, the sectors that made the strongest positive contributions to the Fund’s absolute performance were materials, information technology and financials. The sectors that made the weakest contributions to the Fund’s absolute performance were energy, consumer discretionary and health care.

During the reporting period, which individual stocks had the highest total returns and which stocks had the lowest total returns?

Within the Underlying Index, the stocks with the highest total returns during the reporting period were Regis Resources and Evolution Mining, each a precious metals mining company, and APN Outdoor Group, an advertising and marketing firm.

The Underlying Index components with the lowest total returns for the reporting period were Slater & Gordon, a professional services firm; Liquefied Natural Gas, a midstream oil and gas company; and Dick Smith Holdings, a consumer electronics and appliances company.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 23 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

Which individual stocks made the strongest contributions to the Fund’s absolute performance during the reporting period and which stocks made the weakest contributions?

On the basis of impact, which takes weightings and total returns into consideration, the stocks that made the strongest contributions to the Fund’s absolute performance during the reporting period were steel producer Bluescope Steel and precious metals companies Northern Star Resources and Evolution Mining. The weakest contributors were Slater & Gordon and Liquefied Natural Gas, each mentioned earlier, and Ansell, a health and safety protection solutions provider.

Were there any changes in the Underlying Index during the reporting period?

The Underlying Index is reconstituted and rebalanced quarterly, with weights reflecting the then-current float-adjusted market capitalizations. During the reporting period, PanAust, iiNET, Veda Group, iProperty Group and Recall Holdings were removed from the Underlying Index in connection with their acquisition by other companies. Additionally, Underlying Index constituents that were acquired by other Underlying Index constituents include Amcom Telecommunications and M2Group, which were each acquired by Vocus Communications, as well as Sirius Resources, which was acquired by Independence Group.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Australia Small Cap ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Australia Small Cap ETF Market Price2 | | –3.70 | % | | –6.39 | % | | –8.49 | % | | –3.32 | % | | –18.61 | % |

| IQ Australia Small Cap ETF NAV | | –2.59 | % | | –6.50 | % | | –8.29 | % | | –3.26 | % | | –18.34 | % |

| IQ Australia Small Cap Index | | –1.70 | % | | –5.72 | % | | –7.63 | % | | –2.48 | % | | –14.25 | % |

| MSCI EAFE Index | | –9.32 | % | | 1.48 | % | | 1.69 | % | | 4.20 | % | | 28.60 | % |

| 1 | Fund Inception Date: 3/22/2010. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

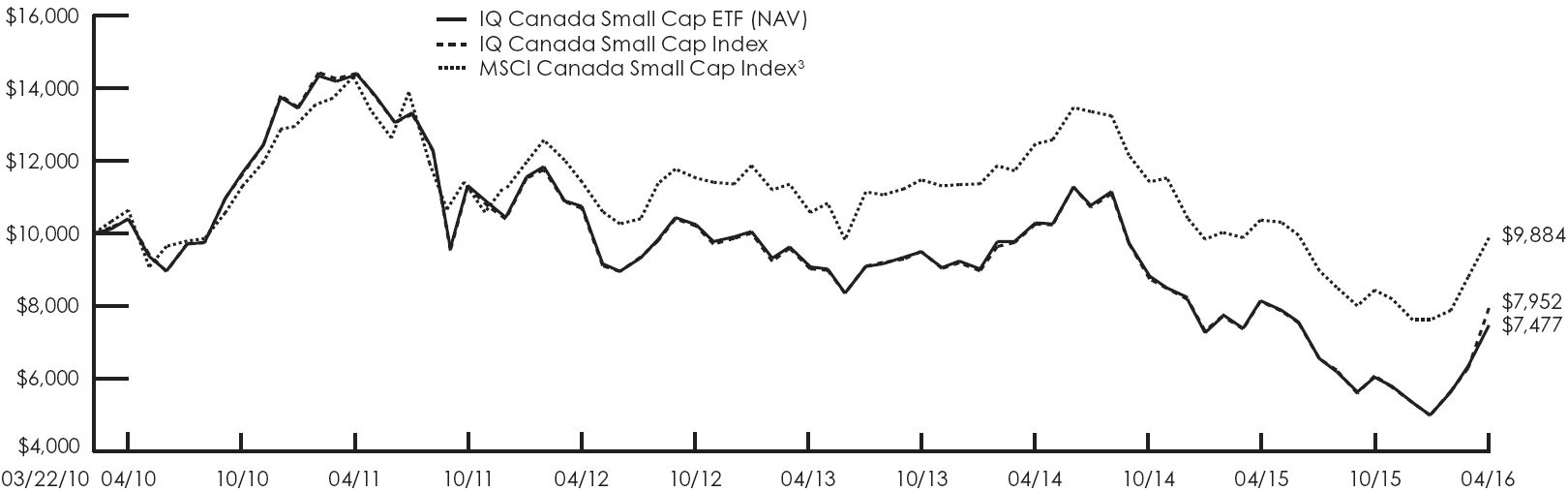

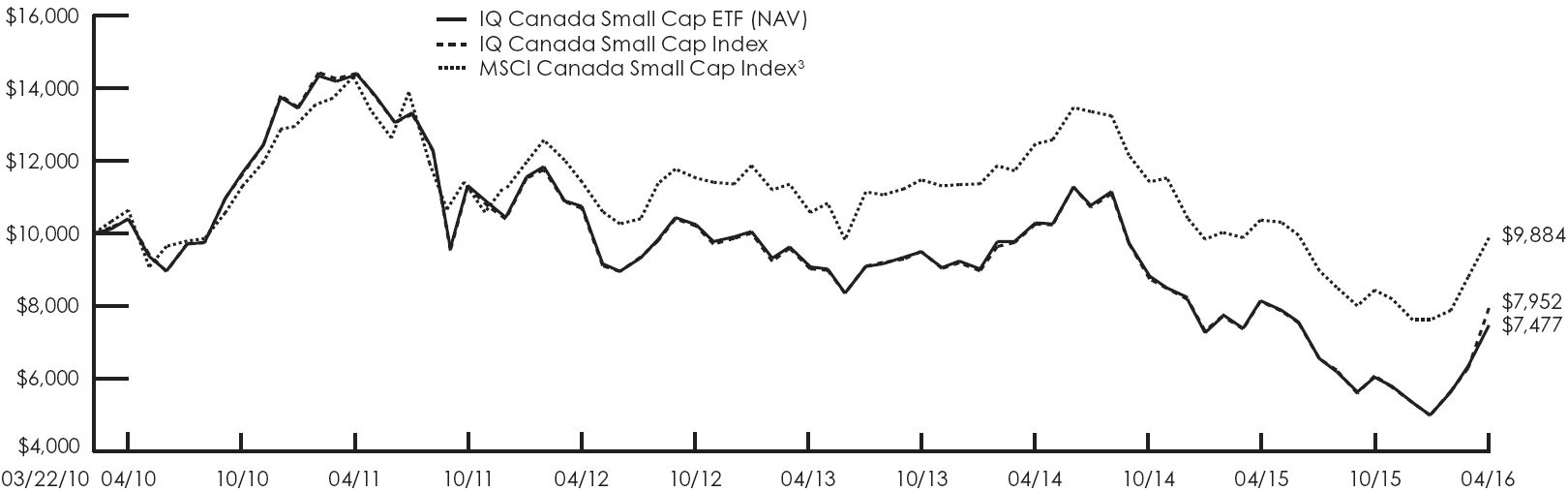

IQ Canada Small Cap ETF

How did IQ Canada Small Cap ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned –8.29% at NAV (net asset value) and –10.39% at market price.1 To compare, the Fund’s Underlying Index, the IQ Canada Small Cap Index,2 returned –7.43% for the same time period. The MSCI Canada Small Cap Index2 returned –7.38% for the same period.

What factors affected the Fund’s performance during the reporting period?

The Underlying Index seeks to capture the performance of the small-capitalization Canadian equity market. The investable universe is limited to the 100 companies that satisfy the market capitalization and liquidity requirements of the Underlying Index selection criteria, and Underlying Index components are weighted by their float-adjusted market capitalization.

The Canadian dollar depreciated versus the U.S. dollar during the first three quarters of the reporting period but reversed and appreciated versus the U.S. dollar during the fourth quarter of the reporting period. Overall, the lack of relative currency strength, negatively impacted the Underlying Index’s returns when presented in U.S. dollar terms. Also, the Underlying Index has a large weighting in energy, the weakest performing sector during the reporting period, impacted by the decline in oil prices. That said, the materials sector, also a large weighting in the Underlying Index, performed strongly during the reporting period. The Fund’s exposure to the materials sector contributed positively to relative results, nearly offsetting the detracting effect of exposure to the energy sector.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund did not use derivatives during the reporting period.

During the reporting period, which sectors had the highest total returns and which sectors had the lowest total returns?

In terms of total return, the best-performing sectors in the Underlying Index were materials, telecommunication services and financials. During the reporting period, energy, health care and information technology recorded the lowest total returns.

During the reporting period, which sectors made the strongest contributions to the Fund’s absolute performance and which sectors made the weakest contributions?

On the basis of impact, which takes weightings and total returns into account, the sectors that made the strongest positive contributions to the Fund’s absolute performance were materials, telecommunication services and consumer staples. The sectors that made the weakest contributions to the Fund’s absolute performance were energy, consumer discretionary and health care.

During the reporting period, which individual stocks had the highest total returns and which stocks had the lowest total returns?

Within the Underlying Index, the stocks with the highest total returns during the reporting period were Kinross Gold, Yamana Gold and First Majestic Silver, each precious metals miners. Kinross Gold is involved in the exploration, development and production of gold. Yamana Gold is an intermediate gold producer. First Majestic Silver is a silver producing mining company.

The Underlying Index components with the lowest total returns for the reporting period were Pacific Exploration and Production, Calfrac Well Services and Sherritt International. Pacific Exploration and Production provides oilfield services. The company focuses on exploration, development and production of natural gas and crude oil. Calfrac Well Services provides specialized oilfield services. Sherritt International owns an interest in a nickel/cobalt metals business. The company also owns assets that provide for the input requirements of the metals refinery and also produce fertilizer.

| 1 | The price used to calculate the market price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 2 | See page 25 for more information on this index. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

Which individual stocks made the strongest contributions to the Fund’s absolute performance during the reporting period and which stocks made the weakest contributions?

On the basis of impact, which takes weightings and total returns into consideration, the stocks that made the strongest contributions to the Fund’s absolute performance during the reporting period were Kinross Gold and Yamana Gold, mentioned above as well as Detour Gold, which explores for and produces gold in Canada. The weakest contributors were Veresen, a midstream oil and gas services company; Concordia Healthcare, a biotechnology and pharmaceuticals firm; and HudBay Minerals, a base and precious metals mining company.

Were there any changes in the Underlying Index during the reporting period?

The Underlying Index is reconstituted and rebalanced quarterly, with weights reflecting the then-current float-adjusted market capitalization. During the reporting period, precious metals mining companies AuRico Gold and Alamos Gold merged to form Alamos Gold and precious metals mining company Lake Shore Gold was acquired by Tahoe Resources. In turn, AuRico Gold and Lake Shore Gold were subsequently removed from the Underlying Index.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Hypothetical Growth of a $10,000 Investment

(Since Inception Through 4/30/2016)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

Fund Performance History

IQ Canada Small Cap ETF

(as of April 30, 2016)

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception1 |

| | | Average

Annual | | Average

Annual | | Average

Annual | | Average

Annual | | Cumulative |

| IQ Canada Small Cap ETF Market Price2 | | –10.39 | % | | –6.88 | % | | –12.74 | % | | –5.04 | % | | –27.10 | % |

| IQ Canada Small Cap ETF NAV | | –8.29 | % | | –6.29 | % | | –12.26 | % | | –4.65 | % | | –25.23 | % |

| IQ Canada Small Cap Index | | –7.43 | % | | –5.21 | % | | –11.33 | % | | –3.68 | % | | –20.48 | % |

| MSCI Canada Small Cap Index3 | | –7.38 | % | | –4.01 | % | | –7.18 | % | | –0.19 | % | | –1.16 | % |

| 1 | Fund Inception Date: 3/22/2010. |

| 2 | The price used to calculate the Market Price returns is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. |

| 3 | The MSCI Canada Small Cap Index has replaced the MSCI EAFE Index as the Fund’s benchmark index. The new index more closely aligns with the Fund’s investment strategies. |

| Management’s Discussion of Fund Performance (unaudited) (continued) |

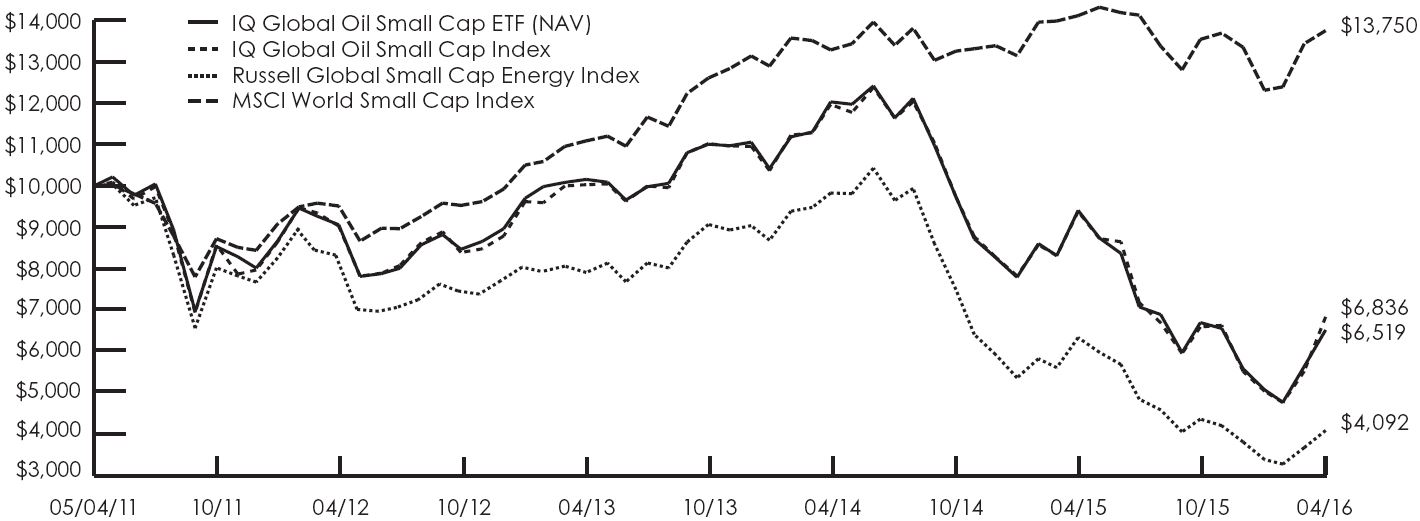

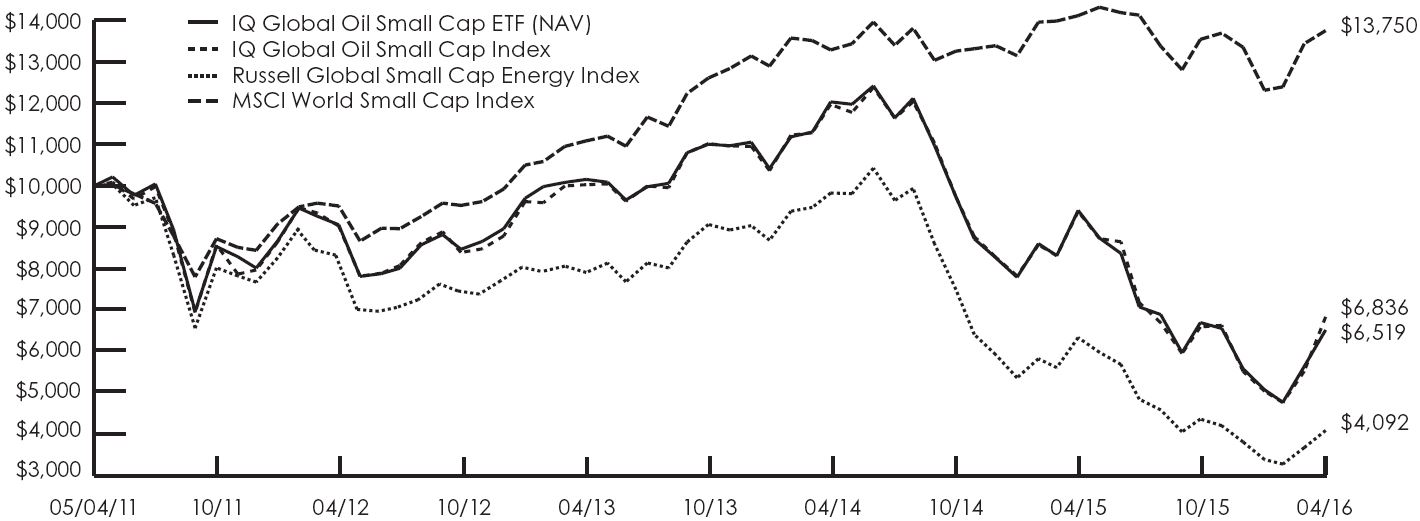

IQ Global Agribusiness Small Cap ETF

How did IQ Global Agribusiness Small Cap ETF (the “Fund”) perform during the 12 months ended April 30, 2016?

For the 12 months ended April 30, 2016, the Fund returned 11.93% at NAV (net asset value) and 9.66% at market price.1 To compare, the Fund’s Underlying Index, the IQ Global Agribusiness Small Cap Index,2 returned 12.39% for the same time period. The Russell Global Small Cap Agriculture Fishing & Ranching Index and the MSCI World Small Cap Index2 returned 3.46% and –2.56%, respectively, during the same period.

What factors affected the Fund’s performance during the reporting period?

The Underlying Index applies size, liquidity and business operations rules to select small capitalization agribusiness companies and uses a float-adjusted market capitalization weighting methodology.