- APLE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Apple Hospitality REIT (APLE) 424B3Prospectus supplement

Filed: 16 Sep 10, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-147414

SUPPLEMENT NO. 13 DATED SEPTEMBER 16, 2010

TO PROSPECTUS DATED SEPTEMBER 21, 2009

APPLE REIT NINE, INC.

The following information supplements the prospectus of Apple REIT Nine, Inc. dated September 21, 2009 and is part of the prospectus. This Supplement updates the information presented in the prospectus.Prospective investors should carefully review the prospectus, Supplement No. 11 (which is cumulative and replaces all prior Supplements), Supplement No. 12 and this Supplement No. 13.

TABLE OF CONTENTS

|

|

|

S-3 | ||

S-3 | ||

S-5 | ||

S-7 | ||

Financial and Operating Information for Our Recently Purchased Properties | S-8 |

Certain forward-looking statements are included in the prospectus and this supplement. These forward-looking statements may involve our plans and objectives for future operations, including future growth and availability of funds. These forward-looking statements are based on current expectations, which are subject to numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, the continuation of our offering of Units, future economic, competitive and market conditions and future business decisions, together with local, national and international events (including, without limitation, acts of terrorism or war, and their direct and indirect effects on travel and the economy). All of these matters are difficult or impossible to predict accurately and many of them are beyond our control. Although we believe the assumptions relating to the forward-looking statements, and the statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

S-1

“Courtyard by Marriott,” “Fairfield Inn,” “Fairfield Inn & Suites,” “TownePlace Suites,” “Marriott,” “SpringHill Suites” and “Residence Inn” are each a registered trademark of Marriott International, Inc. or one of its affiliates. All references below to “Marriott” mean Marriott International, Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Marriott is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Marriott’s relationship with Apple REIT Nine, Inc., or otherwise. Marriott is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Nine, Inc. and receives no proceeds from the offering. Marriott has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this prospectus supplement, and the grant by Marriott of any franchise or other rights to Apple REIT Nine, Inc. shall not be construed as any expression of approval or disapproval. Marriott has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this prospectus supplement. “Hampton Inn,” “Hampton Inn & Suites,” “Homewood Suites,” “Embassy Suites,” “Hilton Garden Inn” and “Home2 by Hilton” are each a registered trademark of Hilton Worldwide or one of its affiliates. All references below to “Hilton” mean Hilton Worldwide and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hilton is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Hilton’s relationship with Apple REIT Nine, Inc., or otherwise. Hilton is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Nine, Inc. and receives no proceeds from the offering. Hilton has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this prospectus supplement, and the grant by Hilton of any franchise or other rights to Apple REIT Nine, Inc. shall not be construed as any expression of approval or disapproval. Hilton has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this prospectus supplement. S-2

We completed the minimum offering of Units (with each Unit consisting of one Common Share and one Series A Preferred Share) at $10.50 per Unit on May 14, 2008. We are continuing the offering at $11 per Unit in accordance with the prospectus. We registered to sell a total of 182,251,082 Units. As of August 31, 2010, 30,277,044 Units remained unsold. Our offering of Units expires on April 25, 2011, provided that the offering will be terminated if all of the Units are sold before then. As of August 31, 2010, we had closed on the following sales of Units in the offering: Price Per Number of Gross Proceeds Net of Selling $10.50 9,523,810 $ 100,000,000 $ 90,000,000 $11.00 142,450,228 1,566,952,515 1,410,257,264 Total 151,974,038 $ 1,666,952,515 $ 1,500,257,264 Recent Purchases On August 31, 2010, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of three hotels located in Rogers, Arkansas, St. Louis, Missouri, and Kansas City, Missouri. On September 15, 2010, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of a hotel located in Alexandria, Louisiana. The aggregate gross purchase price for these hotels, which contain a total of 530 guest rooms, was approximately $52.6 million. Further information about our recently purchased hotels is provided in other sections below. Loan Assumptions The purchase contracts for three of the recently purchased hotels required us to assume loans secured by these hotels. The total outstanding aggregate principal balance of the assumed loans is $28.8 million. Each of the assumed loans has a non-recourse structure, which means that the lender generally must rely on the property, rather than the borrower, as the lender’s source of repayment in any collection action. There are exceptions to the non-recourse structure in certain situations, such as misappropriation of funds and environmental liabilities. In these situations, the lender would be permitted to seek repayment from the guarantor or indemnitor of the loan, which is one of our indirect wholly-owned subsidiaries. Recent Purchase Contracts We caused one of our indirect wholly-owned subsidiaries to enter into a series of purchase contracts for the potential purchase of 17 hotels. The total gross purchase price for these hotels, which contain a total of 2,376 guest rooms, is approximately $297.8 million. Deposits totaling $5.1 million have been made and certain contracts require an additional aggregate deposit in the amount of $8.2 million at or after the end of our contractual review periods. A number of required conditions to closing currently remain unsatisfied under each of the purchase contracts. Accordingly, there can be no assurance at this time that any closings will occur under these purchase contracts. Upon a purchase, the deposit amounts would be credited against the applicable purchase price. Further information about these purchase contracts and hotels is provided in the “Acquisitions and Related Matters” section below. Source of Funds and Related Party Payments Our recent purchases, which resulted in our ownership of four additional hotels, were funded primarily by the proceeds from our ongoing offering of Units. Our offering proceeds also have been S-3

Unit

Units Sold

Proceeds

Commissions and Marketing

Expense Allowance

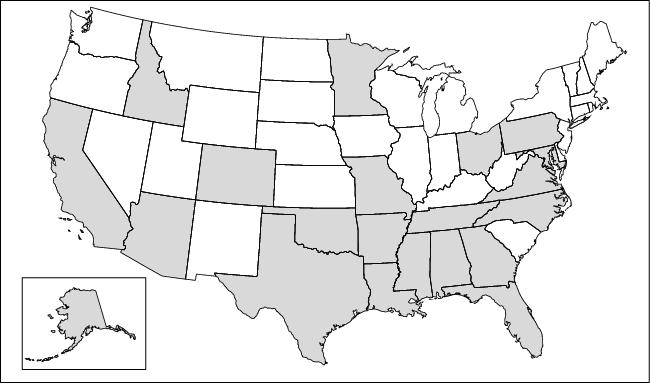

used to fund the initial deposits required by the hotel purchase contracts and will be used for the related additional deposits. We have entered into a property acquisition and disposition agreement with Apple Suites Realty Group, Inc. to acquire and dispose of our real estate assets. A fee of 2% of the gross purchase price or gross sale price in addition to certain reimbursable expenses will be payable for these services. This entity is owned by Glade M. Knight, who is our Chairman and Chief Executive Officer. We used our offering proceeds to pay $1,052,901 to Apple Suites Realty Group, Inc., representing 2% of the gross purchase price for our recent purchases. Overview of Owned Hotels As a result of our recent purchases, we currently own 52 hotels, which are located in the states indicated in the map below:

S-4

ACQUISITIONS AND RELATED MATTERS Each of our recently purchased hotels has been leased to one of our indirect wholly-owned subsidiaries, as the lessee, under a separate hotel lease agreement. For simplicity, the applicable lessee will be referred to below as the “lessee.” Each hotel is managed under a separate management agreement between the applicable lessee and the manager. For simplicity, the applicable manager will be referred to below as the “manager.” The hotel lease agreements and the management agreements are among the contracts described in another section below. The table below specifies the franchise, hotel owner, lessee and manager for our recently purchased hotels: Hotel Location Franchise (a) Hotel Lessee Manager 1. Rogers, Arkansas Hampton Inn Apple Nine Apple Nine Services Raymond Management Company, Inc. (b) 2. St. Louis, Missouri Hampton Inn Apple Nine Apple Nine Services Raymond Management Company, Inc. (b) 3. Kansas City, Missouri Hampton Inn Apple Nine Apple Nine Services Raymond Management Company, Inc. (b) 4. Alexandria, Louisiana Courtyard Sunbelt-CAL, LLC Apple Nine LBAM—Investor

Owner/Lessor

SPE Rogers, Inc.

Rogers, Inc.

St. Louis, LLC

St. Louis, Inc.

Kansas City, LLC

Kansas City, Inc.

Hospitality

Management, Inc.

Group, L.L.C. (b)

Note for Table:

| ||||||||||||||||||||

(a) |

|

| All brand and trade names, logos or trademarks contained, or referred to, in this prospectus supplement are the properties of their respective owners. These references shall not in any way be construed as participation by, or endorsement of, our offering by any of our franchisors or managers. | |||||||||||||||||

| ||||||||||||||||||||

(b) |

| The hotel specified was purchased from an affiliate of the indicated manager. | ||||||||||||||||||

We have no material relationship or affiliation with the sellers or managers, except for the relationship resulting from our purchases, our management agreements for the hotels we own, and any related documents.

S-5

Potential Acquisitions The following table provides a summary of the hotels covered by pending purchase contracts entered into since our Prospectus Supplement No. 12 dated August 19, 2010: Hotel Location Franchise Date of Number of Gross 1. Andover, Massachusetts SpringHill Suites August 30, 2010 136 $ 6,500,000 2. Indianapolis, Indiana SpringHill Suites September 10, 2010 130 12,800,000 3. Mishawaka, Indiana Residence Inn September 10, 2010 106 13,700,000 4. Phoenix, Arizona Courtyard September 10, 2010 164 16,000,000 5. Phoenix, Arizona Residence Inn September 10, 2010 129 14,000,000 6. Lake Forest/Mettawa, Illinois Residence Inn September 10, 2010 130 23,500,000 7. Lake Forest/Mettawa, Illinois Hilton Garden Inn September 10, 2010 170 30,500,000 8. Austin, Texas Hilton Garden Inn September 10, 2010 117 16,000,000 9. Novi, Michigan Hilton Garden Inn September 10, 2010 148 16,200,000 10. Warrenville, Illinois Hilton Garden Inn September 10, 2010 135 22,000,000 11. Schaumburg, Illinois Hilton Garden Inn September 10, 2010 166 20,500,000 12. Salt Lake City, Utah SpringHill Suites September 10, 2010 143 17,500,000 13. Austin, Texas Fairfield Inn & Suites September 10, 2010 150 17,750,000 14. Austin, Texas Courtyard September 10, 2010 145 20,000,000 15. Chandler, Arizona Courtyard September 10, 2010 150 17,000,000 16. Chandler, Arizona Fairfield Inn & Suites September 10, 2010 110 12,000,000 17. Tampa, Florida Embassy Suites September 10, 2010 147 21,800,000 Total 2,376 $ 297,750,000

Purchase

Contract

Rooms

Purchase

Price (a)

Notes for Table:

| ||||||||||||||||||||

(a) |

|

| Under each purchase contract, we are required to make an initial deposit to the seller. The aggregate initial deposits for the hotels listed above totaled $5.1 million. We are required to make additional deposits at or after the end of our contractual review periods. If we close on the purchase of a particular hotel, the initial deposit (and any additional deposit) will be applied to the purchase price. If a closing does not occur because the seller has failed to satisfy a closing condition or breaches the purchase contract, the deposits would be refunded to us. The total of both the initial and additional deposits for the purchase contracts listed above is approximately $13.3 million. | |||||||||||||||||

(Remainder of Page Intentionally Left Blank)

S-6

SUMMARY OF CONTRACTS Hotel Lease Agreements Each of our recently purchased hotels is covered by a separate hotel lease agreement between the owner (one of our indirect wholly-owned subsidiaries) and the applicable lessee (another one of our indirect wholly-owned subsidiaries, as specified in the previous section). Each lease provides for an initial term of 10 years. The applicable lessee has the option to extend its lease term for two additional five-year periods, provided it is not in default at the end of the prior term or at the time the option is exercised. Each lease provides for annual base rent and percentage rent. The annual base rent is payable in advance in equal monthly installments and will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Shown below are the annual base rent and the lease commencement date for our recently purchased hotels: Hotel Location Franchise Annual Date of Lease 1. Rogers, Arkansas Hampton Inn $ 805,911 August 31, 2010 2. St. Louis, Missouri Hampton Inn 1,778,985 August 31, 2010 3. Kansas City, Missouri Hampton Inn 1,072,218 August 31, 2010 4. Alexandria, Louisiana Courtyard 838,730 September 15, 2010 The annual percentage rent depends on a formula that compares fixed “suite revenue breakpoints” with a portion of “suite revenue,” which is equal to gross revenue from guest rentals less sales and room taxes and credit card fees. The suite revenue breakpoints will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Specifically, the annual percentage rent is equal to the sum of (a) 17% of all suite revenue for the year, up to the applicable suite revenue breakpoint; plus (b) 55% of the suite revenue for the year in excess of the applicable suite revenue breakpoint, as reduced by base rent paid for the year. Management Agreements Each of our hotels is being managed by the manager under a separate management agreement between the manager and the applicable lessee (which is one of our indirect wholly-owned subsidiaries, as specified in the previous section). The manager is responsible for managing and supervising the daily operations of the hotel and for collecting revenues for the benefit of the applicable lessee. The fees and other terms of these agreements are the result of commercial negotiations between otherwise unrelated parties. We believe that such fees and terms are appropriate for the hotels and the markets in which they operate. Franchise Agreements For the hotel franchised by Marriott International, Inc. or one of its affiliates, there is a relicensing franchise agreement between the lessee and Marriott International, Inc. or an affiliate. Each relicensing franchise agreement provides for the payment of royalty fees and marketing contributions to the franchisor. A percentage of gross room revenues is used to determine these payments. In addition, we have caused Apple Nine Hospitality, Inc. or another one of our subsidiaries to provide a separate guaranty of the payment and performance of the applicable lessee under the relicensing franchise agreement. For the hotels franchised by Hilton Worldwide or one of its affiliates, there is a franchise license agreement between the applicable lessee and Hilton Worldwide or an affiliate. Each franchise license agreement provides for the payment of royalty fees and program fees to the franchisor. A percentage of gross room revenues is used to determine these payments. Apple Nine Hospitality, Inc. or another one of our subsidiaries has guaranteed the payment and performance of the lessee under the applicable franchise license agreement. The fees and other terms of these agreements are the result of commercial negotiations between otherwise unrelated parties, and we believe that such fees and terms are appropriate for the hotels S-7

FOR OUR RECENTLY PURCHASED PROPERTIES

Base Rent

Commencement

and the markets in which they operate. These agreements may be terminated for various reasons, including failure by the applicable lessee to operate in accordance with the standards, procedures and requirements established by the franchisors. FINANCIAL AND OPERATING INFORMATION Our hotels offer guest rooms and suites, together with related amenities, that are consistent with their operations. The hotels are located in developed or developing areas and in competitive markets. We believe the hotels are well-positioned to compete in their markets based on location, amenities, rate structure and franchise affiliation. In the opinion of management, each hotel is adequately covered by insurance. The following tables present further information about our hotels: Table 1. General Information Hotel Location Franchise Number Gross Average Federal Purchase Date 1. Rogers, Arkansas Hampton Inn 122 $ 9,600,000 $109-129 $ 8,614,200 August 31, 2010 2. St. Louis, Missouri Hampton Inn 190 23,000,000 129-139 21,210,750 August 31, 2010 3. Kansas City, Missouri Hampton Inn 122 10,130,000 119-129 9,395,000 August 31, 2010 4. Alexandria, Louisiana (c) Courtyard 96 9,915,069 129 8,816,500 September 15, 2010 Total 530 $ 52,645,069

FOR OUR RECENTLY PURCHASED

PROPERTIES

of

Rooms/

Suites

Purchase

Price

Daily

Rate

(Price)

per

Room/

Suite (a)

Income Tax

Basis for

Depreciable

Real

Property

Component

of Hotel (b)

Notes for Table 1:

| ||||||||||||||||||||

(a) |

|

| The amounts shown are subject to change, and exclude discounts that may be offered to corporate, frequent and other select customers. | |||||||||||||||||

| ||||||||||||||||||||

(b) |

| The depreciable life is 39 years (or less, as may be permitted by federal tax laws) using the straight-line method. The modified accelerated cost recovery system will be used for the hotel’s personal property component. | ||||||||||||||||||

| ||||||||||||||||||||

(c) |

| The date that the hotel was acquired was the date the hotel began operations. | ||||||||||||||||||

Table 2. Loan Information (a)

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Hotel | Franchise | Assumed Principal | Annual | Maturity Date | |||||||||||||||||||||

1. | Rogers, Arkansas | Hampton Inn |

|

| $ |

| 8,336,824 |

|

| 5.20 | % |

|

| September 2015 | |||||||||||

| 2. | St. Louis, Missouri | Hampton Inn |

|

| 13,914,689 |

|

| 5.30 | % |

|

| September 2015 | ||||||||||||

3. | Kansas City, Missouri | Hampton Inn |

|

| 6,517,413 |

|

| 5.45 | % |

| October 2015 | ||||||||||||||

|

|

|

|

|

|

|

|

| |||||||||||||||||

|

|

|

|

| $ |

| 28,768,926 |

|

|

|

| ||||||||||||||

|

|

|

|

|

|

|

|

| |||||||||||||||||

Note for Table 2

| ||||||||||||||||||||

(a) |

|

| This table summarizes loans that (i) pre-dated our purchase, (ii) are secured by our hotels, and (iii) were assumed by our purchasing subsidiary. Each loan provides for monthly payments of principal and interest on an amortized basis. | |||||||||||||||||

S-8

Table 3. Operating Information (a) PART A

Hotel Location

Franchise

Avg. Daily Occupancy Rates (%)

2005

2006

2007

2008

2009

1.

Rogers, Arkansas

Hampton Inn

66

%

66

%

59

%

62

%

60

%

2.

St. Louis, Missouri

Hampton Inn

63

%

65

%

67

%

67

%

71

%

3.

Kansas City, Missouri

Hampton Inn

77

%

79

%

79

%

77

%

73

%

4.

Alexandria, Louisiana

Courtyard

—

—

—

—

—

PART B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||

Hotel Location | Franchise | Revenue per Available Room/Suite ($) | ||||||||||||||||||||||||||||||||||||||||||

2005 | 2006 | 2007 | 2008 | 2009 | ||||||||||||||||||||||||||||||||||||||||

1. | Rogers, Arkansas | Hampton Inn |

|

| $ |

| 66 |

|

| $ |

| 70 |

|

| $ |

| 64 |

|

| $ |

| 66 |

|

| $ |

| 57 | |||||||||||||||||

| 2. | St. Louis, Missouri | Hampton Inn |

|

| $ |

| 64 |

|

| $ |

| 65 |

|

| $ |

| 73 |

|

| $ |

| 72 |

|

| $ |

| 75 | ||||||||||||||||

3. | Kansas City, Missouri | Hampton Inn |

|

| $ |

| 66 |

|

| $ |

| 72 |

|

| $ |

| 78 |

|

| $ |

| 77 |

|

| $ |

| 67 | |||||||||||||||||

| 4. | Alexandria, Louisiana | Courtyard |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — | ||||||||||||||||||||||||||

Note for Table 3

| ||||||||||||||||||||

(a) |

|

| Operating data is presented for the last five years (or since the beginning of hotel operations). The hotel in Alexandria has no data because it was under construction and not open at that time. See Table 1. General Information above for the date the hotel was acquired. | |||||||||||||||||

Table 4. Tax and Related Information

Hotel Location

Franchise

Tax Year (a)

Real

Property

Tax Rate

Real

Property

Tax

1.

Rogers, Arkansas

Hampton Inn

2009

5.3

%

$

71,742

2.

St. Louis, Missouri

Hampton Inn

2009

9.3

%

103,588

3.

Kansas City, Missouri

Hampton Inn

2009

10.2

%

121,769

4.

Alexandria, Louisiana

Courtyard

2009

11.9

%

7,663

(b)

Note for Table 4:

| ||||||||||||||||||||

(a) |

|

| Represents a calendar year. | |||||||||||||||||

| ||||||||||||||||||||

(b) |

| The hotel property consisted of undeveloped land for a portion of the tax year, and the real property tax for tax year is not necessarily indicative of property taxes expected for the hotel in the future. | ||||||||||||||||||

S-9