- APLE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Apple Hospitality REIT (APLE) 424B3Prospectus supplement

Filed: 19 Nov 08, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-147414

SUPPLEMENT NO. 7 DATED NOVEMBER 19, 2008

TO PROSPECTUS DATED APRIL 25, 2008

APPLE REIT NINE, INC.

The following information supplements the prospectus of Apple REIT Nine, Inc. dated April 25, 2008 and is part of the prospectus. This Supplement updates the information presented in the prospectus.Prospective investors should carefully review the prospectus, Supplement No. 6 (which is cumulative and replaces all prior Supplements) and this Supplement No. 7.

| S-3 | ||

| S-4 | ||

| S-6 | ||

| S-7 | ||

| S-9 | ||

| S-11 | ||

| S-13 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | S-14 | |

| F-1 |

Certain forward-looking statements are included in the prospectus and in each supplement. These forward-looking statements may involve our plans and objectives for future operations, including future growth and availability of funds. These forward-looking statements are based on current expectations, which are subject to numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, the continuation of our offering of units, future economic, competitive and market conditions and future business decisions, together with local, national and international events (including, without limitation, acts of terrorism or war, and their direct and indirect effects on travel and the economy). All of these matters are difficult or impossible to predict accurately and many of them are beyond our control. Although we believe the assumptions relating to the forward-looking statements, and the statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

S-1

“Courtyard by Marriott,” “Fairfield Inn,” “Fairfield Inn & Suites,” “TownePlace Suites,” “SpringHill Suites,” “Marriott” and “Residence Inn” are each a registered trademark of Marriott International, Inc. or one of its affiliates. All references below to “Marriott” mean Marriott International, Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Marriott is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Marriott’s relationship with Apple REIT Nine, Inc., or otherwise. Marriott is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Nine, Inc. and receives no proceeds from the offering. Marriott has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this prospectus supplement, and the grant by Marriott of any franchise or other rights to Apple REIT Nine, Inc. shall not be construed as any expression of approval or disapproval. Marriott has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this prospectus supplement.

“Hampton Inn,” “Hampton Inn & Suites,” “Homewood Suites,” “Embassy Suites” and “Hilton Garden Inn” are each a registered trademark of Hilton Hotels Corporation or one of its affiliates. All references below to “Hilton” mean Hilton Hotels Corporation and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hilton is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Hilton’s relationship with Apple REIT Nine, Inc., or otherwise. Hilton is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Nine, Inc. and receives no proceeds from the offering. Hilton has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this prospectus supplement, and the grant by Hilton of any franchise or other rights to Apple REIT Nine, Inc. shall not be construed as any expression of approval or disapproval. Hilton has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this prospectus supplement.

S-2

We completed the minimum offering of units (with each unit consisting of one Common Share and one Series A Preferred Share) at $10.50 per unit on May 14, 2008. We are continuing the offering at $11 per unit in accordance with the prospectus. We registered to sell a total of 182,251,082 units. As of October 28, 2008, 148,894,043 units remain unsold. We will offer units until April 25, 2010, unless the offering is extended, provided that the offering will be terminated if all of the units are sold before then.

As of October 28, 2008, we had closed on the following sales of units in the offering:

Price Per Unit | Number of Units Sold | Gross Proceeds | Proceeds Net of Selling Commissions and Marketing Expense Allowance | |||||

$10.50 | 9,523,810 | $ | 100,000,000 | $ | 90,000,000 | |||

$11.00 | 23,833,229 | $ | 262,165,525 | $ | 235,948,973 | |||

Total | 33,357,039 | $ | 362,165,525 | $ | 325,948,973 | |||

Our distributions since initial capitalization through September 30, 2008 totaled $5.7 million and were paid at a monthly rate of $0.073334 per common share beginning in June 2008. For the same period our cash generated from operations was $1.3 million. Due to the inherent delay between raising capital and investing that same capital in income producing real estate, we have had significant amounts of cash earning interest at short term money market rates. As a result, the difference between distributions paid and cash generated from operations has been funded from proceeds from the offering of units, and this portion of distributions is expected to be treated as a return of capital for federal income tax purposes. In May, 2008, our Board of Directors established a policy for an annualized dividend rate of $0.88 per common share, payable in monthly distributions. We intend to continue paying dividends on a monthly basis, consistent with the annualized dividend rate established by our Board of Directors. Our Board of Directors, upon the recommendation of the Audit Committee, may amend or establish a new annualized dividend rate. Since a portion of distributions has to date been funded with proceeds from the offering of units, our ability to maintain our current intended rate of distribution will be based on our ability to fully invest our offering proceeds and thereby increase our cash generated from operations. Since there can be no assurance of our ability to acquire properties that provide income at this level, there can be no assurance as to the classification or duration of distributions at the current rate. Proceeds of the offering which are distributed are not available for investment in properties. See “Risk Factors—We may be unable to make distributions to our shareholders,” on page 28 of the prospectus.

S-3

Recent Purchases

On October 29, 2008, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of four hotels (one hotel is located in Beaumont, Texas and three hotels are located in Santa Clarita, California). The aggregate gross purchase price for these hotels, which contain a total of 417 guest rooms, was $59,966,188.

On October 31, 2008, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of two hotels located in Pueblo, Colorado and Allen, Texas. The aggregate gross purchase price for these two hotels, which contain a total of 231 guest rooms, was $26,525,000.

On November 7, 2008, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of a hotel located in Bristol, Virginia. The gross purchase price for the hotel, which contains a total of 175 guest rooms, was $18,650,000.

Loan Assumption

The purchase contracts for two of our hotels required us to assume separate loans secured by each hotel. The current aggregate outstanding principal balance of the assumed loans is $20,553,829. The assumed loans have a non-recourse structure, which means that the lender generally must rely on the properties, rather than the borrower, as the lender’s source of repayment in any collection action. There are exceptions to the non-recourse structure in certain situations, such as misappropriation of funds and environmental liabilities. In these situations, the lender would be permitted to seek repayment from the guarantor or indemnitor of the loans, which is one of our wholly-owned subsidiaries.

Further information about our recently purchased hotels is provided in other sections below.

Recent Purchase Contracts

We caused one of our indirect wholly-owned subsidiaries to enter into a series of purchase contracts and assignment of contracts for the potential purchase of 13 hotels.

The total gross purchase price for these hotels, which contain a total of 1,707 guest rooms, is approximately $262,636,000. Deposits totaling $2.9 million have been made and certain contracts require an additional aggregate deposit in the amount of $1.7 million after the end of our contractual review periods. A number of required conditions to closing currently remain unsatisfied under each of the purchase contracts. Accordingly, there can be no assurance at this time that any closings will occur under these purchase contracts. Upon a purchase, the deposit amounts would be credited against the applicable purchase price.

Further information about these purchase contracts, assignment of contracts and hotels is provided in the “Potential Acquisitions” section below.

Source of Funds and Related Party Payments

Our recent purchases, which resulted in our ownership of seven additional hotels, were funded by the proceeds from our ongoing offering of units. Our offering proceeds also have been used to fund the initial deposits required by the hotel purchase contracts and will be used for the related additional deposits.

S-4

We also used our offering proceeds to pay $2,102,824, representing 2% of the gross purchase price for our recent purchases, as a commission to Apple Suites Realty Group, Inc. This entity is owned by Glade M. Knight, who is one of our directors and our Chief Executive Officer.

We have entered into an advisory agreement with Apple Nine Advisors, Inc. to manage us and our assets. An annual fee ranging from 0.1% to 0.25% of total equity proceeds received by us in addition to certain reimbursable expenses will be payable for these services. Apple Nine Advisors, Inc. has entered into an agreement with Apple REIT Six, Inc. to provide certain management services to us. We will reimburse Apple Nine Advisors, Inc. for the cost of the services provided by Apple REIT Six, Inc. Apple Nine Advisors, Inc. in turn will pay Apple REIT Six, Inc. for the cost of the services provided by Apple REIT Six, Inc. Total advisory fees and reimbursable expenses incurred by us under the advisory agreement are included in general and administrative expenses and totaled approximately $271,000 for the nine months ended September 30, 2008. Apple Nine Advisors, Inc. is owned by Glade M. Knight, who is also the Chairman and Chief Executive Officer of Apple REIT Six, Inc.

Overview of Owned Hotels

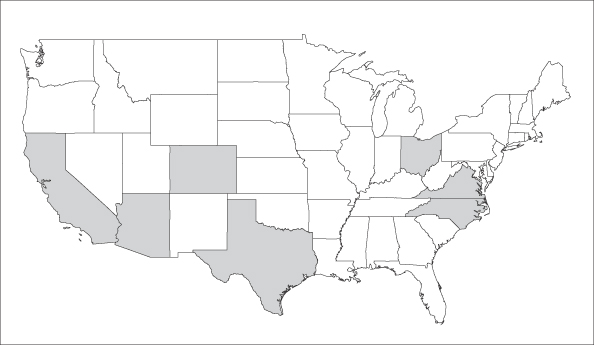

As a result of our recent purchases, we currently own 14 hotels, which are located in the states indicated in the map below:

S-5

ACQUISITIONS AND RELATED MATTERS

Each of our recently purchased hotels has been leased to one of our indirect wholly-owned subsidiaries, as the lessee, under a separate hotel lease agreement. For simplicity, the applicable lessee will be referred to below as the “lessee.”

Each hotel is managed under a separate management agreement between the applicable lessee and the manager. For simplicity, the applicable manager will be referred to below as the “manager.”

The hotel lease agreements and the management agreements are among the contracts described in another section below. The table below specifies the franchise, hotel owner, lessee and manager for our recently purchased hotels:

Hotel Location | Franchise (a) | Hotel Owner/Lessor | Lessee | Manager | ||||

Santa Clarita, California | Hampton Inn | Apple Nine Hospitality Ownership, Inc. | Apple Nine Hospitality Management, Inc. | Dimension Development Two, LLC(b) | ||||

Santa Clarita, California | Residence Inn | Apple Nine Hospitality Ownership, Inc. | Apple Nine Hospitality Management, Inc. | Dimension Development Two, LLC(b) | ||||

Santa Clarita, California | Fairfield Inn | Apple Nine Hospitality Ownership, Inc. | Apple Nine Hospitality Management, Inc. | Dimension Development Two, LLC(b) | ||||

Beaumont, Texas | Residence Inn | Apple Nine Hospitality Ownership, Inc. | Apple Nine Hospitality Texas Services II, Inc. | Texas Western Management Partners, L.P.(b) | ||||

Pueblo, Colorado | Hampton Inn & Suites | Apple Nine Hospitality Ownership, Inc. | Apple Nine Hospitality Management, Inc. | Dimension Development Two, LLC | ||||

Allen, Texas | Hilton Garden Inn | Apple Nine SPE Allen, Inc. | Apple Nine Services Allen, Inc. | Gateway Hospitality Group, Inc.(b) | ||||

Bristol, Virginia | Courtyard | Apple Nine SPE Bristol, Inc. | Apple Nine Services Bristol, Inc. | LBAM-Investor Group, L.L.C. |

Notes for Table:

| (a) | All brand and trade names, logos or trademarks contained, or referred to, in this prospectus supplement are the properties of their respective owners. These references shall not in any way be construed as participation by, or endorsement of, our offering by any of our franchisors or managers. |

| (b) | The hotels specified were purchased from an affiliate of the indicated manager. |

We have no material relationship or affiliation with the hotel sellers or managers, except for the relationship resulting from our purchases, our management agreements for the hotels we own, the pending purchase contracts and any related documents.

S-6

Purchase Contracts

We have entered into, or caused one of our subsidiaries to enter into, purchase contracts for 13 other hotels. The following table summarizes the hotel and contract information:

Purchase Contracts for Potential Acquisitions

Hotel | Franchise | Date of Purchase Contract | Number of Rooms | Gross Purchase Price | ||||||||

1. | Houston Texas | Marriott | October 29, 2008 | 206 | (a) | $ | 51,000,000 | |||||

2. | Fort Lauderdale, Florida | Hampton Inn | November 12, 2008 | 109 | 17,800,000 | |||||||

3. | Portsmouth, New Hampshire | Hampton Inn | November 12, 2008 | 126 | 15,800,000 | |||||||

4. | Pittsburgh, Pennsylvania | Hampton Inn | November 12, 2008 | 132 | 19,000,000 | |||||||

5. | Jackson, Tennessee | Courtyard | November 12, 2008 | 94 | 15,200,000 | |||||||

6. | Jackson, Tennessee | Hampton Inn & Suites | November 12, 2008 | 83 | 12,600,000 | |||||||

7. | Austin, Texas | Hampton Inn | November 12, 2008 | 124 | 18,000,000 | |||||||

8. | Austin, Texas | Homewood Suites | November 12, 2008 | 97 | 17,700,000 | |||||||

9. | Round Rock, Texas | Hampton Inn | November 12, 2008 | 93 | 11,500,000 | |||||||

10. | Orlando, Florida | Fairfield Inn & Suites | November 14, 2008 | 200 | (a) | (b) | ||||||

11. | Orlando, Florida | SpringHill Suites | November 14, 2008 | 200 | (a) | (b) | ||||||

12. | Baton Rouge, Louisiana | SpringHill Suites | November 14, 2008 | 119 | (a) | 15,100,000 | ||||||

13. | Rochester, Minnesota | Hampton Inn & Suites | November 14, 2008 | 124 | (a) | 14,136,000 | ||||||

Total | 1,707 | $ | 262,636,000 | |||||||||

Notes for Table:

| (a) | The hotels are currently under construction. The table shows the expected number of rooms upon hotel completion and the expected franchise. |

| (b) | These two hotels are covered by the same purchase contract with a purchase price of $54,800,000. |

In general, each purchase contract listed above required a deposit upon (or shortly after) execution. An additional deposit is typically due upon the expiration of the contract review period. If a closing occurs under a purchase contract, the initial and additional deposits are credited toward the purchase price. If a closing does not occur because the seller fails to satisfy a condition to closing or breaches the purchase contract, the applicable deposits would be refunded to us. The total of both the initial and additional deposits for the purchase contracts listed is $4.6 million.

The purchase contracts listed for 10 through 13 were purchase contracts originally executed by a subsidiary of Apple REIT Eight, Inc. One of our subsidiaries entered into a series of assignment of contracts with a subsidiary of Apple REIT Eight, Inc. to become the purchaser under these purchase contracts. In addition to our subsidiary assuming all of the rights and obligations under each purchase contract, we caused our subsidiary to reimburse the assignor for the following: (i) initial deposits totaling $1.2 million made by Apple REIT Eight, Inc.; and (ii) transactional costs totaling approximately $64,000 paid by Apple REIT Eight, Inc. to third parties. There are no additional deposits required under these purchase contracts. No consideration or fees were paid to Apple REIT Eight, Inc. or its subsidiaries for the assignment of the purchase contracts, except the reimbursement payments mentioned above. These reimbursement payments did not constitute or result in a profit for Apple REIT Eight, Inc. Our Chairman and Chief Executive Officer, Glade M. Knight is also the Chairman and Chief Executive Officer of Apple REIT Eight, Inc.

S-7

For each purchase contract listed above, there are material conditions to closing that presently remain unsatisfied. Accordingly, there can be no assurance at this time that a closing will occur under any of these purchase contracts.

Loan Information

Four of the purchase contracts listed above require our purchasing subsidiaries to assume loans that are secured by the hotels under contract. Each loan has a non-recourse structure, as previously described in another section above. The following table provides a summary of the loan information for the applicable hotels:

Loan Information for Potential Acquisitions (a)

Hotel | Franchise | Principal Balance of Loan | Annual Interest Rate | Maturity Date | ||||||

Portsmouth, New Hampshire | Hampton Inn | $ | 9,698,039 | 6.07 | % | April 2016 | ||||

Austin, Texas | Hampton Inn | 7,820,000 | 5.95 | % | March 2016 | |||||

Austin, Texas | Homewood Suites | 7,622,421 | 5.99 | % | March 2016 | |||||

Round Rock, Texas | Hampton Inn | 4,204,910 | 5.95 | % | May 2016 | |||||

Total | $ | 29,345,370 | ||||||||

Note for Table:

| (a) | All loans provide for monthly payments of principal and interest on an amortized basis. |

S-8

FOR OUR PROPERTIES

Hotel Lease Agreements

Each of our recently purchased hotels is covered by a separate hotel lease agreement between the owner (one of our indirect wholly-owned subsidiaries) and the applicable lessee (another one of our indirect wholly-owned subsidiaries, as specified in the previous section). Each lease provides for an initial term of 10 years. The applicable lessee has the option to extend its lease term for two additional five-year periods, provided it is not in default at the end of the prior term or at the time the option is exercised.

Each lease provides for annual base rent and percentage rent. The annual base rent is payable in advance in equal monthly installments and will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Shown below is the annual base rent and the lease commencement date for our recently purchased hotels:

Hotel Location | Franchise | Annual Base Rent | Date of Lease Commencement | ||||

Santa Clarita, California | Hampton Inn | $ | 1,313,780 | October 29, 2008 | |||

Santa Clarita, California | Residence Inn | 1,466,370 | October 29, 2008 | ||||

Santa Clarita, California | Fairfield Inn | 724,283 | October 29, 2008 | ||||

Beaumont, Texas | Residence Inn | 1,441,097 | October 29, 2008 | ||||

Pueblo, Colorado | Hampton Inn & Suites | 892,184 | October 31, 2008 | ||||

Allen, Texas | Hilton Garden Inn | 1,532,670 | October 31, 2008 | ||||

Bristol, Virginia | Courtyard | 1,549,438 | November 7, 2008 | ||||

The annual percentage rent depends on a formula that compares fixed “suite revenue breakpoints” with a portion of “suite revenue,” which is equal to gross revenue from guest rentals less sales and room taxes and credit card fees. The suite revenue breakpoints will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Specifically, the annual percentage rent is equal to the sum of (a) 17% of all suite revenue for the year, up to the applicable suite revenue breakpoint; plus (b) 55% of the suite revenue for the year in excess of the applicable suite revenue breakpoint, as reduced by base rent paid for the year.

Management Agreements

Each of our hotels is being managed by the manager under a separate management agreement between the manager and the applicable lessee (which is one of our wholly-owned subsidiaries, as specified in the previous section). The manager is responsible for managing and supervising the daily operations of the hotel and for collecting revenues for the benefit of the applicable lessee. The fees and other terms of these agreements are the result of commercial negotiations between otherwise unrelated parties. We believe that such fees and terms are appropriate for the hotels and the markets in which they operate.

Franchise Agreements

In general, for the hotels franchised by Marriott International, Inc. or one of its affiliates, there is a relicensing franchise agreement between the applicable lessee (as specified in a previous section) and Marriott International, Inc. or an affiliate. Each relicensing franchise agreement provides for the payment of royalty fees and marketing contributions to the franchisor. A percentage of gross room revenues is used to determine these payments. In addition, we have caused Apple Nine Hospitality, Inc. or another one of our subsidiaries to provide a separate guaranty of the payment and performance of the applicable lessee under the relicensing franchise agreement.

For the hotels franchised by Hilton Hotels Corporation or one of its affiliates, there is a franchise license agreement between the applicable lessee and Hilton Hotels Corporation or an affiliate. Each franchise license

S-9

agreement provides for the payment of royalty fees and program fees to the franchisor. A percentage of gross room revenues is used to determine these payments. Apple Nine Hospitality, Inc. or another one of our subsidiaries has guaranteed the payment and performance of the lessee under the applicable franchise license agreement.

The fees and other terms of these agreements are the result of commercial negotiations between otherwise unrelated parties, and we believe that such fees and terms are appropriate for the hotels and the markets in which they operate. These agreements may be terminated for various reasons, including failure by the applicable lessee to operate in accordance with the standards, procedures and requirements established by the franchisor.

S-10

FINANCIAL AND OPERATING INFORMATION

FOR OUR PROPERTIES

Our hotels offer guest rooms and suites, together with related amenities, that are consistent with their operations. The hotels are located in developed or developing areas and in competitive markets. We believe the hotels are well-positioned to compete in their markets based on location, amenities, rate structure and franchise affiliation. In the opinion of management, each hotel is adequately covered by insurance. The following tables present further information about our hotels:

Table 1. General Information

Hotel Location | Franchise | Number of Rooms/ Suites | Gross Purchase Price | Average Daily Rate (Price) per Room/ Suite (a) | Federal Income Tax Basis for Depreciable Real Property Component of Hotel (b) | Purchase Date | |||||||||

Santa Clarita, California | Hampton Inn | 128 | $ | 17,129,348 | $ | 109 | $ | 15,358,348 | October 29, 2008 | ||||||

Santa Clarita, California | Residence Inn | 90 | 16,599,578 | 139-199 | 14,118,232 | October 29, 2008 | |||||||||

Santa Clarita, California | Fairfield Inn | 66 | 9,337,262 | 89-119 | 7,517,608 | October 29, 2008 | |||||||||

Beaumont, Texas | Residence Inn | 133 | 16,900,000 | 159-179 | 15,752,641 | October 29, 2008 | |||||||||

Pueblo, Colorado | Hampton Inn & Suites | 81 | 8,025,000 | 149-199 | 7,157,264 | October 31, 2008 | |||||||||

Allen, Texas | Hilton Garden Inn | 150 | 18,500,000 | 129-149 | 16,405,653 | October 31, 2008 | |||||||||

Bristol, Virginia | Courtyard | 175 | 18,650,000 | 119-189 | 17,115,637 | November 7, 2008 | |||||||||

Total | 823 | $ | 105,141,188 | ||||||||||||

Notes for Table 1:

| (a) | The amounts shown are subject to change, and exclude discounts that may be offered to corporate, frequent and other select customers. |

| (b) | The depreciable life is 39 years (or less, as may be permitted by federal tax laws) using the straight-line method. The modified accelerated cost recovery system will be used for the hotel’s personal property component. |

Table 2. Loan Information (a)

Hotel Location | Franchise | Outstanding Principal Balance of Loan | Annual Interest Rate | Maturity Date | ||||||

Allen, Texas | Hilton Garden Inn | $ | 10,786,698 | 5.37 | % | October 2015 | ||||

Bristol, Virginia | Courtyard | 9,767,131 | 6.59 | % | August 2016 | |||||

Total | $ | 20,553,829 | ||||||||

Note for Table 2:

| (a) | This table describes loans that (i) pre-dated our purchases, (ii) are secured by the indicated hotels, and (iii) were assumed by our purchasing subsidiary. The loans provide for monthly payments of principal and interest on an amortized basis. |

S-11

Table 3. Operating Information (a)

PART A

| Avg. Daily Occupancy Rates (%) | ||||||||||||||||||||||

Hotel Location | Franchise | 2003 | 2004 | 2005 | 2006 | 2007 | ||||||||||||||||

Santa Clarita, California | Hampton Inn | 78 | % | 79 | % | 83 | % | 82 | % | 78 | % | |||||||||||

Santa Clarita, California | Residence Inn | 83 | % | 87 | % | 91 | % | 91 | % | 89 | % | |||||||||||

Santa Clarita, California | Fairfield Inn | 78 | % | 85 | % | 89 | % | 88 | % | 83 | % | |||||||||||

Beaumont, Texas | Residence Inn | — | — | — | — | — | ||||||||||||||||

Pueblo, Colorado | Hampton Inn & Suites | 48 | % | 59 | % | 61 | % | 67 | % | 74 | % | |||||||||||

Allen Texas | Hilton Garden Inn | 58 | % | 67 | % | 73 | % | 73 | % | 68 | % | |||||||||||

Bristol, Virginia | Courtyard | — | 52 | % | 54 | % | 65 | % | 67 | % | ||||||||||||

| PART B | ||||||||||||||||||||||

| Revenue per Available Room/Suite ($) | ||||||||||||||||||||||

Hotel Location | Franchise | 2003 | 2004 | 2005 | 2006 | 2007 | ||||||||||||||||

Santa Clarita, California | Hampton Inn | $ | 66 | $ | 74 | $ | 83 | $ | 91 | $ | 86 | |||||||||||

Santa Clarita, California | Residence Inn | $ | 97 | $ | 100 | $ | 110 | $ | 120 | $ | 120 | |||||||||||

Santa Clarita, California | Fairfield Inn | $ | 65 | $ | 71 | $ | 82 | $ | 95 | $ | 88 | |||||||||||

Beaumont, Texas | Residence Inn | — | — | — | — | — | ||||||||||||||||

Pueblo, Colorado | Hampton Inn & Suites | $ | 34 | $ | 39 | $ | 42 | $ | 51 | $ | 70 | |||||||||||

Allen Texas | Hilton Garden Inn | $ | 50 | $ | 62 | $ | 72 | $ | 77 | $ | 76 | |||||||||||

Bristol, Virginia | Courtyard | — | $ | 47 | $ | 50 | $ | 58 | $ | 66 | ||||||||||||

Note for Table 3:

| (a) | Information is shown for the last five years of hotel operations, if applicable. |

Table 4. Tax and Related Information

Hotel Location | Franchise | Tax Year | Real Property Tax Rate (c) | Real Property Tax | ||||||||

Santa Clarita, California | Hampton Inn | 2008 | (a) | 1.2 | % | $ | 156,423 | |||||

Santa Clarita, California | Residence Inn | 2008 | (a) | 1.2 | % | $ | 148,451 | |||||

Santa Clarita, California | Fairfield Inn | 2008 | (a) | 1.2 | % | $ | 83,504 | |||||

Beaumont, Texas | Residence Inn | 2007 | (b) | 2.4 | % | 3,710 | (d) | |||||

Pueblo, Colorado | Hampton Inn & Suites | 2007 | (b) | 2.4 | % | 55,984 | ||||||

Allen Texas | Hilton Garden Inn | 2007 | (b) | 1.7 | % | 239,886 | ||||||

Bristol, Virginia | Courtyard | 2008 | (b) | 1.1 | % | 74,486 | ||||||

Notes for Table 4:

| (a) | Represents 12-month period from July 1, 2008 through June 30, 2009. |

| (b) | Represents calendar year. |

| (c) | Property tax rate is an aggregate figure for county, city and other local taxing authorities (to the extent applicable). |

| (d) | The hotel property consisted of undeveloped land during the 2007 tax year, and the real property tax for 2007 is not necessarily indicative of property taxes expected for the hotel in the future. |

S-12

(in thousands except per share and other data) | Three Months Ended September 30, 2008 | Nine Months Ended September 30, 2008 | ||||||

| (unaudited) | ||||||||

Revenues: | ||||||||

Room revenue | $ | 609 | $ | 609 | ||||

Other revenue | 110 | 110 | ||||||

Total revenue | 719 | 719 | ||||||

Expenses: | ||||||||

Hotel operating expenses | 530 | 530 | ||||||

Taxes, insurance and other | 20 | 20 | ||||||

General and administrative expenses | 394 | 505 | ||||||

Depreciation | 267 | 267 | ||||||

Interest (income) expense, net | (1,480 | ) | (1,865 | ) | ||||

Total expenses | (269 | ) | (543 | ) | ||||

Net income | $ | 988 | $ | 1,262 | ||||

Per Share: | ||||||||

Earnings per common share | $ | 0.04 | $ | 0.13 | ||||

Distributions declared and paid per common share | $ | 0.22 | $ | 0.29 | ||||

Weighted-average common shares outstanding—basic and diluted | 22,580 | 9,705 | ||||||

Cash Flow From (Used In): | ||||||||

Operating activities | $ | 1,270 | ||||||

Investing activities | $ | (64,106 | ) | |||||

Financing activities | $ | 258,846 | ||||||

| September 30, 2008 | December 31, 2007 | |||||||

| (unaudited) | ||||||||

Balance Sheet Data: | ||||||||

Cash and cash equivalents | $ | 196,030 | $ | 20 | ||||

Investment in hotels, net | $ | 60,675 | $ | — | ||||

Total assets | $ | 260,452 | $ | 337 | ||||

Note payable | $ | — | $ | 151 | ||||

Shareholders’ equity | $ | 260,140 | $ | 31 | ||||

Other Data: | ||||||||

Number of hotels owned at end of period | 4 | — | ||||||

S-13

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(For the nine months period ended September 30, 2008)

Overview

The Company is a Virginia corporation that intends to qualify as a REIT for federal income tax purposes. The Company, which owned four properties as of September 30, 2008 and has a limited operating history, was formed to invest in hotels, residential apartment communities and other income-producing real estate in selected metropolitan areas in the United States. Initial capitalization occurred on November 9, 2007, when 10 Units, each Unit consisting of one common share and one Series A preferred share, were purchased by Apple Nine Advisors, Inc. (“A9A”) and 480,000 Series B convertible preferred shares were purchased by Glade M. Knight, the Company’s Chairman, Chief Executive Officer and President. The Company’s fiscal year end is December 31.

Hotels Owned

The Company commenced operations in July 2008 upon the purchase of its first hotel property. The following table summarizes the location, brand, manager, gross purchase price, number of hotel rooms and date acquired for each of the four hotels the Company owned at September 30, 2008. All dollar amounts are in thousands.

Location | Brand | Manager | Gross Purchase Price | Rooms | Date of Purchase | ||||||

| Tucson, AZ | Hilton Garden Inn | Western | $ | 18,375 | 125 | 7/31/2008 | |||||

| Santa Clarita, CA | Courtyard | Dimension | 22,700 | 140 | 9/24/2008 | ||||||

| Charlotte, NC | Homewood Suites | McKibbon | 5,750 | 112 | 9/24/2008 | ||||||

| Allen, TX | Hampton Inn & Suites | Gateway | 12,500 | 103 | 9/26/2008 | ||||||

| $ | 59,325 | 480 | |||||||||

The purchase price for the hotels acquired was funded primarily by the Company’s best-efforts offering of Units. The Company leases all of its hotels to its wholly-owned taxable REIT subsidiary (or a subsidiary thereof) under hotel lease agreements. The Company also used the proceeds of its offering to pay approximately $1.2 million, representing 2% of the gross purchase price for these hotels, as a commission to Apple Suites Realty Group, Inc. (“ASRG”), 100% owned by Glade M. Knight, the Company’s Chairman, Chief Executive Officer and President.

No goodwill was recorded in connection with any of the acquisitions.

Management and Franchise Agreements

Each of the Company’s hotels are operated and managed, under separate management agreements. The agreements provide for initial terms of 1-5 years. Fees associated with the agreements generally include the payment of base management fees, incentive management fees, accounting fees, and other fees for centralized services which are allocated among all of the hotels that receive the benefit of such services. Base management fees are calculated as a percentage of gross revenues. Incentive management fees are calculated as a percentage of operating profit in excess of a priority return to the Company, as defined in the management agreements. The Company has the option to terminate the management agreements if specified performance thresholds are not satisfied. For the nine months ended September 30, 2008 the Company incurred approximately $16,000 in management fee expense.

The managers listed in the table above are not affiliated with either Marriott or Hilton, and as a result, the hotels they manage were required to obtain separate franchise agreements with each respective franchisor. The

S-14

Hilton franchise agreements generally provide for a term of 17 to 20 years. Fees associated with the agreements generally include the payment of royalty fees and program fees. The Marriott franchise agreement provides for an initial term of 20 years. Fees associated with the agreement includes the payment of royalty fees, marketing fees, reservation fees and a communications support fee based on room revenues. For the nine months ended September 30, 2008 the Company incurred approximately $30,000 in franchise fees.

Results of Operations

During the period from the Company’s initial formation on November 9, 2007 to July 30, 2008, the Company owned no properties, had no revenue, exclusive of interest income and was primarily engaged in capital formation activities. Operations commenced on July 31, 2008 with the Company’s first property acquisition. During the remainder of the quarter, the Company purchased an additional three hotel properties. As a result, a comparison of 2008 operating results to prior year results is not meaningful. Hotel performance is impacted by many factors including local hotel competition, and local and national economic conditions in the United States. Since economic conditions throughout the United States have declined over the past several months, the Company anticipates weaker than originally anticipated results for the properties it has acquired into 2009.

Revenues

The Company’s principal source of revenue is hotel room revenue and other related revenue. Hotel operations included in the consolidated statements of operations are for the four hotels acquired through September 30, 2008 for their respective periods of ownership by the Company. For the three and nine month periods ended September 30, 2008, the Company had total revenue of approximately $719,000.

For the period acquired through September 30, 2008, the hotels achieved combined average occupancy of approximately 59%, average daily rate (“ADR”) of $104 and revenue per available room (“RevPAR”) of $62. ADR is calculated as room revenue divided by the number of rooms sold, and RevPAR is calculated as occupancy multiplied by ADR. These rates are consistent with industry and brand averages.

Expenses

For both the three and nine month periods ended September 30, 2008, hotel direct expenses totaled approximately $530,000 or 74% of total revenue. Hotel direct expenses consist of operating expense, hotel administrative expense, sales and marketing expense, utilities expense, repair and maintenance expense, franchise fees and management fees.

Taxes, insurance, and other expense for both the three and nine months ended September 30, 2008 totaled approximately $20,000 or 3% of total revenue.

General and administrative expense for the three and nine months ended September 30, 2008 totaled approximately $394,000 and $505,000, respectively. The principal components of general and administrative expense are advisory fees, legal fees, accounting fees and reporting expense.

Depreciation expense for the three and nine months ended September 30, 2008 totaled approximately $267,000. Depreciation expense represents depreciation expense of the Company’s hotel buildings and related improvements, and associated furniture, fixtures and equipment, for the respective periods owned.

For the three and nine month periods ended September 30, 2008, the Company recognized interest income of approximately $1.5 million and $1.9 million, respectively. Interest income represents earnings on excess cash invested in short term money market instruments and certificates of deposit. Interest expense during the nine month period ended September 30, 2008 totaled approximately $4,000 and primarily represents interest expense incurred on the Company’s short-term financing under a line of credit facility which was outstanding from November 14, 2007 to May 14, 2008.

S-15

Liquidity and Capital Resources

The Company’s principal source of liquidity will be cash on hand, the proceeds of the best-efforts offering and the cash flow generated from properties the Company has or will acquire and any short term investments. In addition, the Company may borrow funds, subject to the approval of the Company’s board of directors.

The Company is raising capital through a best-efforts offering of shares by David Lerner Associates, Inc., the managing dealer, which receives selling commissions and a marketing expense allowance based on proceeds of the shares sold. The minimum offering of 9,523,810 Units at $10.50 per Unit was sold as of May 14, 2008, with proceeds net of commissions and marketing expenses totaling $90 million. Subsequent to the minimum offering and through September 30, 2008, an additional 17.7 million Units, at $11 per Unit, were sold, with the Company receiving proceeds, net of commissions, marketing expenses and other offering costs of approximately $174.5 million. The Company is continuing its offering at $11.00 per Unit.

Each Unit consists of one common share and one Series A preferred share. The Series A preferred shares will have no voting rights, no conversion rights and no distribution rights. The only right associated with the Series A preferred shares will be a priority distribution upon the sale of the Company’s assets. The priority will be equal to $11.00 per Series A preferred share, and no more, before any distributions are made to the holders of any other shares. In the event the Company pays special dividends, the amount of the $11.00 priority will be reduced by the amount of any special dividends approved by the board. The Series A preferred shares will not be separately tradable from the common shares to which they relate.

Prior to the commencement of the Company’s best-efforts offering, the Company obtained an unsecured line of credit in a principal amount of $400,000 to fund certain start-up costs and offering expenses. The line of credit was fully paid during May 2008 with net proceeds from the Company’s best-efforts offering.

As of September 30, 2008, the Company had cash and cash equivalents totaling $196 million, primarily resulting from the sale of Units through that date. The Company intends to use funds generated from its best-efforts offering to invest in hotels, residential apartment communities and other income-producing real estate. As of September 30, 2008, the Company has 10 purchase contracts for real estate outstanding. Nine of the contracts are for hotels that are expected to close in the next three months. The 10th contract is for land that is subject to a feasibility study for the construction of a SpringHill Suites. Although the Company is working towards acquiring these hotels, there are many conditions to closing that have not been satisfied and there can be no assurance that all of the conditions to closing will be satisfied. Contract deposits paid for these hotels are included in other assets in the Company’s consolidated balance sheet as of September 30, 2008. The following table summarizes the location, brand, number of rooms, refundable contract deposits, and gross purchase price for each property. All dollar amounts are in thousands.

Location | Brand | Rooms | Deposits Paid | Gross Purchase Price | |||||||

| Twinsburg, OH | Hilton Garden Inn | 142 | $ | 400 | $ | 17,792 | |||||

| Lewisville, TX | Hilton Garden Inn | 165 | 400 | 28,000 | |||||||

| Duncanville, TX | Hilton Garden Inn | 142 | 400 | 19,500 | |||||||

| Allen, TX | Hilton Garden Inn | 150 | 400 | 18,500 | |||||||

| Bristol, VA | Courtyard | 175 | 300 | 18,650 | |||||||

| Santa Clarita, CA | Hampton Inn | 128 | 250 | 17,129 | |||||||

| Santa Clarita, CA | Residence Inn | 90 | 125 | 16,600 | (a) | ||||||

| Santa Clarita, CA | Fairfield Inn | 66 | 125 | 9,337 | (a) | ||||||

| Beaumont, TX | Residence Inn | 133 | 100 | 16,900 | |||||||

| Alexandria, VA | SpringHill Suites | — | — | 5,100 | (b) | ||||||

| 1,191 | $ | 2,500 | $ | 167,508 | |||||||

| (a) | These two hotels are covered by the same purchase contract. |

S-16

| (b) | Company has a contract to purchase the land only. The Company plans to complete a feasibility study for the construction of a SpringHill Suites prior to purchasing the land. |

Three of the hotels under contract require the Company to assume approximately $34.6 million in mortgage debt. Each of these loans provide for monthly payments of principal and interest on an amortized basis.

To maintain its REIT status the Company is required to distribute at least 90% of its ordinary income. Distributions since the initial capitalization through September 30, 2008 totaled approximately $5.7 million and were paid at a monthly rate of $0.073334 per common share beginning in June 2008. For the same period the Company’s cash generated from operations was approximately $1.3 million. Due to the inherent delay between raising capital and investing that same capital in income producing real estate, the Company has had significant amounts of cash earning interest at short term money market rates. As a result, the difference between distributions paid and cash generated from operations has been funded from proceeds from the offering of Units, and this portion of distributions is expected to be treated as a return of capital for federal income tax purposes. The Company intends to continue paying dividends on a monthly basis, at an annualized dividend rate of $0.88 per common share. Since a portion of distributions has to date been funded with proceeds from the offering of Units, the Company’s ability to maintain its current intended rate of distribution will be based on its ability to fully invest its offering proceeds and thereby increase its cash generated from operations. Since there can be no assurance of the Company’s ability to acquire properties that provide income at this level, there can be no assurance as to the classification or duration of distributions at the current rate. Proceeds of the offering which are distributed are not available for investment in properties.

The Company has on-going capital commitments to fund its capital improvements. The Company is required, under all of the hotel management agreements, to make available, for the repair, replacement, refurbishing of furniture, fixtures, and equipment, an amount of 5% of gross revenues provided that such amount may be used for the Company’s capital expenditures with respect to the hotels. The Company expects that this amount will be adequate to fund required repair, replacement, and refurbishments and to maintain the Company’s hotels in a competitive condition.

Related Party Transactions

The Company has significant transactions with related parties. These transactions cannot be construed to be at arms length and the results of the Company’s operations may be different than if conducted with non-related parties.

The Company has entered into a Property Acquisition and Disposition Agreement with ASRG, to acquire and dispose of real estate assets for the Company. A fee of 2% of the gross purchase price or gross sale price in addition to certain reimbursable expenses will be payable for these services. As of September 30, 2008, payments to ASRG for services under the terms of this contract have totaled $1.2 million since inception, which were capitalized as a part of the purchase price of the hotels.

The Company has entered into an advisory agreement with A9A to provide management of the Company and its assets. An annual fee ranging from 0.1% to 0.25% of total equity proceeds received by the Company in addition to certain reimbursable expenses will be payable for these services. A9A has entered into an agreement with Apple REIT Six, Inc. (“AR6”) to provide certain management services to the Company. The Company will reimburse A9A for the cost of the services provided by AR6. A9A will in turn reimburse AR6. Total advisory fees and reimbursable expenses incurred by the Company under the advisory agreement are included in general and administrative expenses and totaled approximately $271,000 for the nine months ended September 30, 2008.

ASRG and A9A are 100% owned by Glade M. Knight, Chairman, Chief Executive Officer and President of the Company. ASRG and A9A may purchase in the best efforts offering up to 2.5% of the total number of shares sold in the offering.

S-17

Mr. Knight is also Chairman and Chief Executive Officer of Apple REIT Six, Inc., Apple REIT Seven, Inc. and Apple REIT Eight, Inc., other REITS. Members of the Company’s Board of Directors are also on the Board of Directors of Apple REIT Six, Inc., Apple REIT Seven, Inc. and Apple REIT Eight, Inc.

Series B Convertible Preferred Stock

The Company has authorized 480,000 shares of Series B convertible preferred stock. The Company has issued 480,000 Series B convertible preferred shares to Glade M. Knight, chairman, chief executive officer and president of the Company, in exchange for the payment by him of $0.10 per Series B convertible preferred share, or an aggregate of $48,000. The Series B convertible preferred shares are convertible into common shares pursuant to the formula and on the terms and conditions set forth below.

There are no dividends payable on the Series B convertible preferred shares. Holders of more than two-thirds of the Series B convertible preferred shares must approve any proposed amendment to the articles of incorporation that would adversely affect the Series B convertible preferred shares.

Upon the Company’s liquidation, the holder of the Series B convertible preferred shares is entitled to a priority liquidation payment before any distribution of liquidation proceeds to the holders of the common shares. However, the priority liquidation payment of the holder of the Series B convertible preferred shares is junior to the holders of the Series A preferred shares distribution rights. The holder of a Series B convertible preferred share is entitled to a liquidation payment of $11 per number of common shares each Series B convertible preferred share would be convertible into according to the formula described below. In the event that the liquidation of the Company’s assets results in proceeds that exceed the distribution rights of the Series A preferred shares and the Series B convertible preferred shares, the remaining proceeds will be distributed between the common shares and the Series B convertible preferred shares, on an as converted basis.

Each holder of outstanding Series B convertible preferred shares shall have the right to convert any of such shares into common shares of the Company upon and for 180 days following the occurrence of any of the following events:

(1) substantially all of the Company’s assets, stock or business is sold or transferred through exchange, merger, consolidation, lease, share exchange, sale or otherwise, other than a sale of assets in liquidation, dissolution or winding up of the Company;

(2) the termination or expiration without renewal of the advisory agreement, or if the Company ceases to use ASRG to provide property acquisition and disposition services; or

(3) the Company’s common shares are listed on any securities exchange or quotation system or in any established market.

S-18

Upon the occurrence of any conversion event, each Series B convertible preferred share may be converted into a number of common shares based upon the gross proceeds raised through the date of conversion in the Company’s $2 billion offering according to the following table:

Gross Proceeds Raised from Sales of Units through Date of Conversion | Number of Common Shares through Conversion of One Series B Convertible Preferred Share | |

$200 million | 1.83239 | |

$300 million | 3.19885 | |

$400 million | 4.83721 | |

$500 million | 6.11068 | |

$600 million | 7.29150 | |

$700 million | 8.49719 | |

$800 million | 9.70287 | |

$900 million | 10.90855 | |

$ 1 billion | 12.11423 | |

$ 1.1 billion | 13.31991 | |

$ 1.2 billion | 14.52559 | |

$ 1.3 billion | 15.73128 | |

$ 1.4 billion | 16.93696 | |

$ 1.5 billion | 18.14264 | |

$ 1.6 billion | 19.34832 | |

$ 1.7 billion | 20.55400 | |

$ 1.8 billion | 21.75968 | |

$ 1.9 billion | 22.96537 | |

$ 2 billion | 24.17104 |

In the event that after raising gross proceeds of $2 billion, the Company raises additional gross proceeds in a subsequent public offering, each Series B convertible preferred share may be converted into an additional number of common shares based on the additional gross proceeds raised through the date of conversion in a subsequent public offering according to the following formula: (X/100 million) x 1.20568, where X is the additional gross proceeds rounded down to the nearest 100 million.

No additional consideration is due upon the conversion of the Series B convertible preferred shares. The conversion into common shares of the Series B convertible preferred shares will result in dilution of the shareholders’ interests.

Expense related to the issuance of 480,000 Series B convertible preferred shares to Mr. Knight will be recognized at such time when the number of common shares to be issued for conversion of the Series B shares can be reasonably estimated and the event triggering the conversion of the Series B shares to common shares occurs. The expense will be measured as the difference between the fair value of the common stock for which the Series B shares can be converted and the amounts paid for the Series B shares. Although the fair market value cannot be determined at this time, expense if the maximum offering is achieved could range from $0 to in excess of $127 million (assumes $11 per unit fair market value). Based on equity raised through September 30, 2008, if a triggering event had occurred, expense would have ranged from $0 to $9.7 million (assumes $11 per unit fair market value).

Impact of Inflation

Operators of hotels, in general, possess the ability to adjust room rates daily to reflect the effects of inflation. Competitive pressures may, however, limit the operators’ ability to raise room rates. Currently the Company is not experiencing any material impact from inflation.

S-19

Business Interruption

Being in the real estate industry, the Company is exposed to natural disasters on both a local and national scale. Although management believes there is adequate insurance to cover this exposure, there can be no assurance that such events will not have a material adverse effect on the Company’s financial position or results of operations.

Seasonality

The hotel industry historically has been seasonal in nature. Seasonal variations in occupancy at its hotels may cause quarterly fluctuations in its revenues. To the extent that cash flow from operations is insufficient during any quarter, due to temporary or seasonal fluctuations in revenue, the Company expects to utilize cash on hand to make distributions.

Recent Accounting Pronouncements

In September 2006, the FASB issued Statement No. 157,Fair Value Measurements (“SFAS 157”). SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The Statement applies under other accounting pronouncements that require or permit fair value measurements. Accordingly, this Statement does not require any new fair value measurements. In February 2008, the FASB released FASB Staff Position (FSP) FAS 157-2—Effective Date of FASB Statement No. 157, which defers the effective date of SFAS 157 to fiscal years beginning after November 15, 2008 for all nonfinancial assets and liabilities, except those items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The effective date of the statement related to those items not covered by the deferral (all financial assets and liabilities or nonfinancial assets and liabilities recorded at fair value on a recurring basis) is for fiscal years beginning after November 15, 2007. The adoption of this statement did not have and is not anticipated to have a material impact on the Company’s results of operations and financial position.

In February 2007, FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities(“SFAS 159”). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value. The objective of the guidance is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS 159 is effective as of the beginning of the first fiscal year that begins after November 15, 2007. SFAS 159 is effective for the Company beginning January 1, 2008. The Company has elected not to use the fair value measurement provisions of SFAS 159 and therefore, adoption of this standard did not have an impact on the financial statements.

In March 2008, FASB issued SFAS No. 161,Disclosures about Derivative Instruments and Hedging Activities, an Amendment of FASB Statement No. 133 (“SFAS 161”). SFAS 161 is intended to improve transparency in financial reporting by requiring enhanced disclosures of an entity’s derivative instruments and hedging activities and their effects on the entity’s financial position, financial performance, and cash flows. SFAS 161 applies to all derivative instruments within the scope of SFAS No. 133,Accounting for Derivative Instruments and Hedging Activities (“SFAS 133”). It also applies to non-derivative hedging instruments and all hedged items designated and qualifying as hedges under SFAS 133. SFAS 161 is effective prospectively for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company does not currently have any instruments that qualify within the scope of SFAS 133, and therefore the adoption of this statement is not anticipated to have a material impact on the Company’s financial statements.

Subsequent Events

In October 2008, the Company declared and paid approximately $2.1 million in dividend distributions to its common shareholders, or $0.073334 per outstanding common share.

S-20

During October 2008, the Company closed on the issuance of 6.1 million Units through its ongoing best-efforts offering, representing gross proceeds to the Company of $67.4 million and proceeds net of selling and marketing costs of $60.6 million.

Subsequent to September 30, 2008, the Company entered into a series of contracts for the potential purchase of 14 hotels. The following table summarizes the hotel and contract information. All dollar amounts are in thousands.

Location | Brand | Date of Purchase Contract | Rooms | Gross Purchase Price | Initial Refundable Deposit | ||||||||

| Hillsboro, OR | Embassy Suites | 10/3/2008 | 165 | $ | 32,500 | $ | 100 | (a) | |||||

| Hillsboro, OR | Hampton Inn & Suites | 10/3/2008 | 106 | 14,500 | 100 | (a) | |||||||

| Pueblo, CO | Hampton Inn & Suites | 10/6/2008 | 81 | 8,025 | 100 | ||||||||

| Durham, NC | Homewood Suites | 10/10/2008 | 122 | 19,050 | 500 | ||||||||

| Clovis, CA | Hampton Inn & Suites | 10/17/2008 | 86 | 11,150 | 5 | (a) | |||||||

| Clovis, CA | Homewood Suites | 10/17/2008 | 83 | 12,435 | 5 | (a) | |||||||

| Panama City, FL | Hampton Inn & Suites | 10/17/2008 | 95 | 11,600 | 100 | (a) | |||||||

| Dothan, AL | Hilton Garden Inn | 10/20/2008 | 104 | 11,601 | 3 | (a) | |||||||

| Albany, GA | Fairfield Inn & Suites | 10/20/2008 | 87 | 7,920 | 3 | (a) | |||||||

| Hattiesburg, MS | Residence Inn | 10/20/2008 | 84 | 9,793 | 3 | (a) | |||||||

| Panama City, FL | TownePlace Suites | 10/20/2008 | 103 | 10,640 | 3 | (a) | |||||||

| Johnson City, TN | Courtyard | 10/20/2008 | 90 | 9,880 | 3 | (a) | |||||||

| Troy, AL | Courtyard | 10/20/2008 | 90 | 8,696 | 3 | (a) | |||||||

| Houston, TX | Marriott | 10/29/2008 | 206 | 51,000 | 100 | (a) | |||||||

| 1,502 | $ | 218,790 | $ | 1,028 | |||||||||

| (a) | These hotels are currently under development. The table shows the expected number of rooms upon hotel completion and the expected franchise. |

Subsequent to September 30, 2008, the Company closed on the purchase of 9 hotels. The following table summarizes the hotel information. All dollar amounts are in thousands.

Location | Brand | Date of Purchase | Gross Purchase Price | Rooms | |||||||

| Twinsburg, OH | Hilton Garden Inn | 10/7/2008 | $ | 17,792 | 142 | ||||||

| Lewisville, TX | Hilton Garden Inn | 10/16/2008 | 28,000 | 165 | |||||||

| Duncanville, TX | Hilton Garden Inn | 10/21/2008 | 19,500 | 142 | (a) | ||||||

| Santa Clarita, CA | Hampton Inn | 10/29/2008 | 17,129 | 128 | |||||||

| Santa Clarita, CA | Residence Inn | 10/29/2008 | 16,600 | 90 | |||||||

| Santa Clarita, CA | Fairfield Inn | 10/29/2008 | 9,337 | 66 | |||||||

| Beaumont, TX | Residence Inn | 10/29/2008 | 16,900 | 133 | |||||||

| Pueblo, CO | Hampton Inn & Suites | 10/31/2008 | 8,025 | 81 | |||||||

| Allen, TX | Hilton Garden Inn | 10/31/2008 | 18,500 | 150 | (a) | ||||||

| $ | 151,783 | $ | 1,097 | ||||||||

| (a) | The Company assumed approximately $24.8 million of mortgage indebtedness, associated with these hotels. The loans provide for monthly payments of principal and interest on an amortized basis. |

S-21

Financial Statements of Company

Apple REIT Nine, Inc. (Unaudited)

F-1

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| September 30, 2008 | December 31, 2007 | |||||||

| (unaudited) | ||||||||

ASSETS | ||||||||

Investment in real estate, net of accumulated depreciation of $267 and $— | $ | 60,675 | $ | — | ||||

Cash and cash equivalents | 196,030 | 20 | ||||||

Due from third party managers | 298 | — | ||||||

Other assets | 3,449 | 317 | ||||||

Total Assets | $ | 260,452 | $ | 337 | ||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

Liabilities | ||||||||

Note payable | $ | — | $ | 151 | ||||

Accounts payable and accrued expenses | 312 | 155 | ||||||

Total Liabilities | 312 | 306 | ||||||

Shareholders’ Equity | ||||||||

Preferred stock, authorized 30,000,000 shares; none issued and outstanding | — | — | ||||||

Series A preferred stock, no par value, authorized 400,000,000 shares; issued and outstanding 27,232,724 and 10 shares | — | — | ||||||

Series B convertible preferred stock, no par value, authorized 480,000 shares; issued and outstanding 480,000 shares | 48 | 48 | ||||||

Common stock, no par value, authorized 400,000,000 shares; issued and outstanding 27,232,724 and 10 shares | 264,528 | — | ||||||

Distributions greater than net income | (4,436 | ) | (17 | ) | ||||

Total Shareholders’ Equity | 260,140 | 31 | ||||||

Total Liabilities and Shareholders’ Equity | $ | 260,452 | $ | 337 | ||||

See accompanying notes to consolidated financial statements.

The Company was initially capitalized on November 9, 2007 and commenced operations on July 31, 2008.

F-2

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except per share data)

| Three Months Ended September 30, 2008 | Nine Months Ended September 30, 2008 | |||||||

Revenues: | ||||||||

Room revenue | $ | 609 | $ | 609 | ||||

Other revenue | 110 | 110 | ||||||

Total revenue | 719 | 719 | ||||||

Expenses: | ||||||||

Operating expense | 250 | 250 | ||||||

Hotel administrative expense | 68 | 68 | ||||||

Sales and marketing | 80 | 80 | ||||||

Utilities | 47 | 47 | ||||||

Repair and maintenance | 39 | 39 | ||||||

Franchise fees | 30 | 30 | ||||||

Management fees | 16 | 16 | ||||||

Taxes, insurance and other | 20 | 20 | ||||||

General and administrative | 394 | 505 | ||||||

Depreciation expense | 267 | 267 | ||||||

Total expenses | 1,211 | 1,322 | ||||||

Operating loss | (492 | ) | (603 | ) | ||||

Interest income, net | 1,480 | 1,865 | ||||||

Net income | $ | 988 | $ | 1,262 | ||||

Basic and diluted earnings per common share | $ | 0.04 | $ | 0.13 | ||||

Weighted average common shares outstanding—basic and diluted | 22,580 | 9,705 | ||||||

Distributions declared and paid per common share | $ | 0.22 | $ | 0.29 | ||||

See accompanying notes to consolidated financial statements.

The Company was initially capitalized on November 9, 2007 and commenced operations on July 31, 2008.

F-3

CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

(in thousands)

| Nine Months Ended September 30, 2008 | ||||

Cash flows from operating activities: | ||||

Net income | $ | 1,262 | ||

Adjustments to reconcile net income to cash provided by (used in) operating activities: | ||||

Depreciation | 267 | |||

Stock option expense | 26 | |||

Changes in operating assets and liabilities: | ||||

Increase in other assets | (57 | ) | ||

Increase in funds due from third party managers | (263 | ) | ||

Increase in accounts payable and accrued expenses | 35 | |||

Net cash provided by operating activities: | 1,270 | |||

Cash flows used in investing activities: | ||||

Cash paid for the acquisition of hotel properties | (60,819 | ) | ||

Deposits and other disbursements for potential acquisitions | (3,287 | ) | ||

Net cash used in investing activities | (64,106 | ) | ||

Cash flows from financing activities: | ||||

Net proceeds from issuance of common shares | 264,678 | |||

Distributions paid to common shareholders | (5,681 | ) | ||

Payoff of the line of credit, net of borrowings | (151 | ) | ||

Net cash provided by financing activities | 258,846 | |||

Increase in cash and cash equivalents | 196,010 | |||

Cash and cash equivalents, beginning of period | 20 | |||

Cash and cash equivalents, end of period | $ | 196,030 | ||

See accompanying notes to consolidated financial statements.

The Company was initially capitalized on November 9, 2007 and commenced operations on July 31, 2008.

F-4

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| 1. | BASIS OF PRESENTATION |

The accompanying unaudited consolidated financial statements have been prepared in accordance with the rules and regulations for reporting on Form 10-Q. Accordingly, they do not include all of the information required by accounting principles generally accepted in the United States for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. These unaudited financials should be read in conjunction with the Company’s audited consolidated financial statements included in its registration statement filed on Form S-11 with the Securities and Exchange Commission (File No. 333-147414). Operating results for the three months and nine months ended September 30, 2008 are not necessarily indicative of the results that may be expected for the twelve month period ending December 31, 2008.

| 2. | ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Organization

Apple REIT Nine, Inc. together with its wholly owned subsidiaries (the “Company”) is a Virginia corporation that intends to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. The Company was formed to invest in hotels, residential apartment communities and other income-producing real estate in selected metropolitan areas in the United States. Initial capitalization occurred on November 9, 2007, when 10 Units, each Unit consisting of one common share and one Series A preferred share, were purchased by Apple Nine Advisors, Inc. (“A9A”) and 480,000 Series B convertible preferred shares were purchased by Glade M. Knight, the Company’s Chairman, Chief Executive Officer and President (see Note 4 and 6). The Company began operations on July 31, 2008 when it purchased its first hotel. The Company’s fiscal year end is December 31. The consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany accounts and transactions have been eliminated.

Significant Accounting Policies

Cash and Cash Equivalents

Cash and cash equivalents consist of highly liquid investments with original maturities of three months or less. The fair market value of cash and cash equivalents approximates their carrying value. As of September 30, 2008, all cash and cash equivalents were held at two institutions, Wachovia Bank, N.A. and BB&T Corporation. Cash balances may at times exceed federal depository insurance limits.

Investments in Real Estate

Real estate is stated at cost, net of depreciation, and includes real estate brokerage commissions paid to Apple Suites Realty Group, Inc. (“ASRG”), a related party owned by Glade M. Knight, Chairman, CEO and President of the Company. Repair and maintenance costs are expensed as incurred while significant improvements, renovations, and replacements are capitalized. Depreciation is computed using the straight-line method over estimated useful lives of the assets, which are 39 years for buildings, ten years for major improvements and three to seven years for furniture and equipment.

The Company considers expenditures to be capital in nature based on the following criteria: (1) for a single asset, the cost must be at least $500, including all normal and necessary costs to place the asset in service, and the useful life must be at least one year; (2) for group purchases of 10 or more identical assets, the unit cost for each asset must be at least $50, including all normal and necessary costs to place the asset in service, and the useful life must be at least one year; (3) for major repairs to buildings, the repair must be at least $2,500 and the useful life of the asset must be substantially extended.

F-5

The purchase price of real estate properties acquired is allocated to the various components, such as land, buildings and improvements, intangible assets and in-place leases as appropriate, in accordance with Statement of Financial Accounting Standards No. 141, “Business Combinations”. The purchase price is allocated based on the fair value of each component at the time of acquisition. Generally, the Company does not acquire real estate assets that have in-place leases as lease terms for hotel properties are very short term in nature. There has been no allocation of purchase price to intangible assets such as management contracts and franchise agreements as such contracts are generally at current market rates and any other value attributable to these contracts are not considered material.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued FASB Statement No. 141R, Business Combinations (“SFAS 141R”). SFAS 141R revises Statement 141, Business Combinations, by requiring an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with limited exceptions. This method replaces the cost-allocation process, which required the cost of an acquisition to be allocated to the individual assets acquired and liabilities assumed based on their estimated fair values. A significant change included in SFAS 141R is the requirement that costs incurred to effect an acquisition must be accounted for separately as expenses. These costs were previously capitalized as part of the cost of the acquisition. Another significant change is the requirement that pre-acquisition contingencies be recognized at fair value as of the date of acquisition if it is more likely than not that they will meet the definition of an asset or liability. SFAS 141R will be adopted by the Company in the first quarter of 2009. The adoption of this standard will impact the results of operation for the Company when it acquires real estate properties. In addition to other acquisition related costs, the Company will be required to expense the commission paid to ASRG (see Note 4).

Income Taxes

The Company intends to make an election to be treated, and expects to qualify, as a REIT under the Internal Revenue Code of 1986, as amended. As a REIT, the Company will be allowed a deduction for the amount of dividends paid to its shareholders, thereby subjecting the distributed net income of the Company to taxation only at the shareholder level. The Company’s continued qualification as a REIT will depend on its compliance with numerous requirements, including requirements as to the nature of its income and distribution of dividends.

The Company has established Apple Nine Hospitality Management, Inc. as a 100% owned taxable REIT subsidiary (“TRS”). The TRS will lease all hotels from the Company and be subject to income tax at regular corporate rates on any income that it would earn.

Start Up Costs

Start up costs are expensed as incurred.

Use of Estimates

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Revenue Recognition

Revenue is recognized as earned, which is generally defined as the date upon which a guest occupies a room or utilizes the hotel’s services.

Comprehensive Income

The Company recorded no comprehensive income other than net income for the period ended September 30, 2008.

F-6

Sales and Marketing Costs

Sales and marketing costs are expensed when incurred. These costs represent the expense for franchise advertising and reservation systems under the terms of the hotel management and franchise agreements and general and administrative expenses that are directly attributable to advertising and promotion.

Offering Costs

The Company is raising capital through a best-efforts offering of Units by David Lerner Associates, Inc., the managing underwriter, which receives a selling commission and a marketing expense allowance based on proceeds of the shares sold. Additionally, the Company has incurred other offering costs including legal, accounting and reporting services. These offering costs are recorded by the Company as a reduction of shareholders’ equity. Prior to the commencement of the Company’s offering, these costs were deferred and recorded as prepaid expense. As of September 30, 2008, the Company had sold 27.2 million Units for gross proceeds of $294.8 million and proceeds net of offering costs of $264.5 million.

Earnings Per Common Share

Basic earnings per common share is computed as net income divided by the weighted average number of common shares outstanding during the year. Diluted earnings per share is calculated after giving effect to all potential common shares that were dilutive and outstanding for the year. There were no shares with a dilutive effect for the three months and nine months ended September 30, 2008. Series B convertible preferred shares are not included in earnings per common share calculations until such time that such shares are converted to common shares (see Note 6).

Recent Accounting Pronouncements

In September 2006, the FASB issued Statement No. 157,Fair Value Measurements (“SFAS 157”). SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The Statement applies under other accounting pronouncements that require or permit fair value measurements. Accordingly, this Statement does not require any new fair value measurements. In February 2008, the FASB released FASB Staff Position (FSP) FAS 157-2—Effective Date of FASB Statement No. 157, which defers the effective date of SFAS 157 to fiscal years beginning after November 15, 2008 for all nonfinancial assets and liabilities, except those items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The effective date of the statement related to those items not covered by the deferral (all financial assets and liabilities or nonfinancial assets and liabilities recorded at fair value on a recurring basis) is for fiscal years beginning after November 15, 2007. The adoption of this statement did not have and is not anticipated to have a material impact on the Company’s results of operations and financial position.

In February 2007, FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities(“SFAS 159”). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value. The objective of the guidance is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS 159 is effective as of the beginning of the first fiscal year that begins after November 15, 2007. SFAS 159 is effective for the Company beginning January 1, 2008. The Company has elected not to use the fair value measurement provisions of SFAS 159 and therefore, adoption of this standard did not have an impact on the financial statements.

In March 2008, FASB issued SFAS No. 161,Disclosures about Derivative Instruments and Hedging Activities, an Amendment of FASB Statement No. 133 (“SFAS 161”). SFAS 161 is intended to improve

F-7

transparency in financial reporting by requiring enhanced disclosures of an entity’s derivative instruments and hedging activities and their effects on the entity’s financial position, financial performance, and cash flows. SFAS 161 applies to all derivative instruments within the scope of SFAS No. 133,Accounting for Derivative Instruments and Hedging Activities (“SFAS 133”). It also applies to non-derivative hedging instruments and all hedged items designated and qualifying as hedges under SFAS 133. SFAS 161 is effective prospectively for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company does not currently have any instruments that qualify within the scope of SFAS 133, and therefore the adoption of this statement is not anticipated to have a material impact on the Company’s financial statements.

| 3. | REAL ESTATE INVESTMENTS |

The Company acquired four hotels in 2008. The following table sets forth the location, brand, manager, gross purchase price, number of hotel rooms and date of purchase by the Company for each hotel acquired. All dollar amounts are in thousands.

Location | Brand | Manager | Gross Purchase Price | Rooms | Date of Purchase | ||||||

| Tucson, AZ | Hilton Garden Inn | Western | $ | 18,375 | 125 | 7/31/2008 | |||||

| Santa Clarita, CA | Courtyard | Dimension | 22,700 | 140 | 9/24/2008 | ||||||

| Charlotte, NC | Homewood Suites | McKibbon | 5,750 | 112 | 9/24/2008 | ||||||