| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| Investment Company Act file number | 811-22153 |

| Dunham Funds |

| (Exact name of registrant as specified in charter) |

| 6256 Greenwich Dr. Ste. 550, San Diego, CA | 92122 |

| (Address of principal executive offices) | (Zip code) |

| Timothy Burdick |

| Ultimus Fund Solutions LLC., 4221 N 203rd St., Suite 100, Elkhorn, NE 68022 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-470-2619 |

Date of fiscal year end: 10/31

Date of reporting period: 10/31/24

Item 1. Reports to Stockholders.

0001420040df:C000059512Memberoef:MaterialsSectorMember2024-10-310001420040df:Russell2000GrowthTotalReturn2835AdditionalIndexMember2024-10-31

Dunham Corporate/Government Bond Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Corporate/Government Bond Fund ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/corpgov/. You can also request this information by contacting us at 1-800-442-4358. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $147 | 1.39% |

How did the Fund perform during the reporting period?

Sector allocation positively contributed to relative Fund performance over the fiscal year. The Fund's meaningful underweight to US Treasuries and off-benchmark exposure to corporate high-yield credit positively impacted relative performance from an allocation perspective. The largest detractor was the slight underweight to agency mortgage-backed securities, as that sector outperformed the overall index.

Credit selection positively contributed to relative Fund performance over the fiscal year. The Fund’s top two sectors from a credit selection standpoint were investment-grade corporate debt and asset-backed securities. Security selection within high-yield bank loans and non-agency residential mortgage-backed securities acted as a relative detractor to Fund performance for the fiscal year.

The Fund’s duration exposure has acted as a headwind to relative Fund performance throughout the fiscal year. The Fund's slight underweight to duration exposure relative to the benchmark index has generally detracted from Fund performance, as yields have declined over the fiscal year. Although the Sub-Adviser is confident in the duration exposure considering the high amount of interest rate volatility over the last fiscal year.

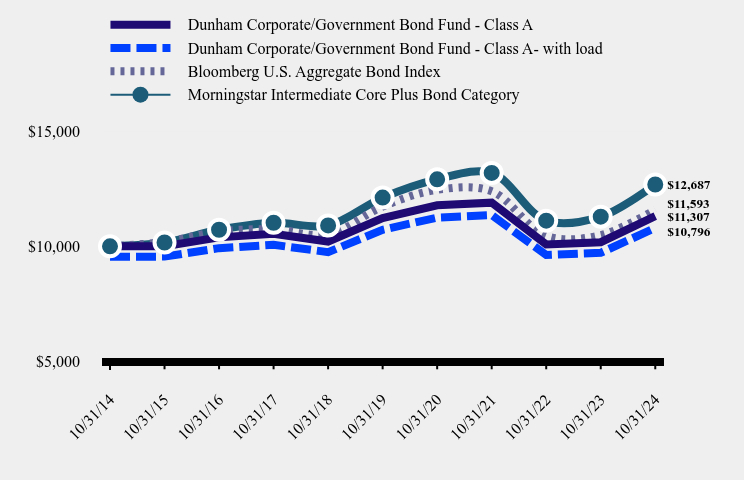

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Corporate/Government Bond Fund - Class A | Dunham Corporate/Government Bond Fund - Class A- with load | Bloomberg U.S. Aggregate Bond Index | Morningstar Intermediate Core Plus Bond Category |

|---|

| 10/31/14 | $10,000 | $9,547 | $10,000 | $10,000 |

| 10/31/15 | $10,004 | $9,551 | $10,196 | $10,164 |

| 10/31/16 | $10,388 | $9,918 | $10,641 | $10,718 |

| 10/31/17 | $10,541 | $10,064 | $10,737 | $11,024 |

| 10/31/18 | $10,207 | $9,745 | $10,517 | $10,905 |

| 10/31/19 | $11,229 | $10,720 | $11,727 | $12,118 |

| 10/31/20 | $11,780 | $11,247 | $12,453 | $12,913 |

| 10/31/21 | $11,896 | $11,358 | $12,393 | $13,189 |

| 10/31/22 | $10,078 | $9,621 | $10,450 | $11,112 |

| 10/31/23 | $10,178 | $9,718 | $10,487 | $11,288 |

| 10/31/24 | $11,307 | $10,796 | $11,593 | $12,687 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Corporate/Government Bond Fund | | | |

| Class A Without Load | 11.09% | 0.14% | 1.24% |

| Class A With Load | 6.13% | -0.78% | 0.77% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Morningstar Intermediate Core Plus Bond Category | 12.39% | 0.92% | 2.41% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $204,566,524 |

| Number of Portfolio Holdings | 577 |

| Total Advisory Fee | $1,463,270 |

| Portfolio Turnover | 53% |

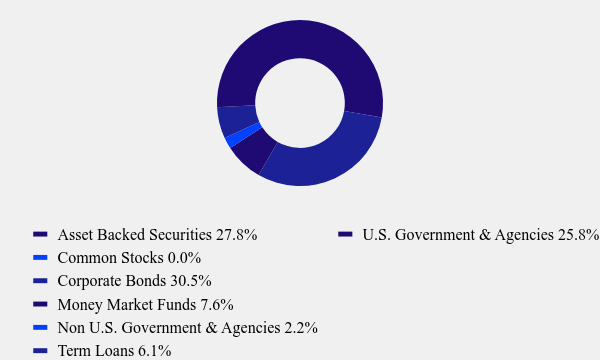

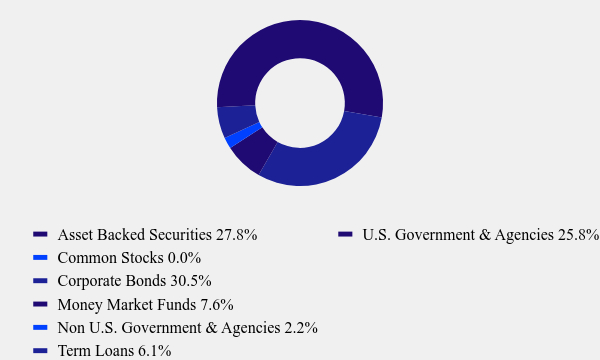

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 27.8% |

| Common Stocks | 0.0% |

| Corporate Bonds | 30.5% |

| Money Market Funds | 7.6% |

| Non U.S. Government & Agencies | 2.2% |

| Term Loans | 6.1% |

| U.S. Government & Agencies | 25.8% |

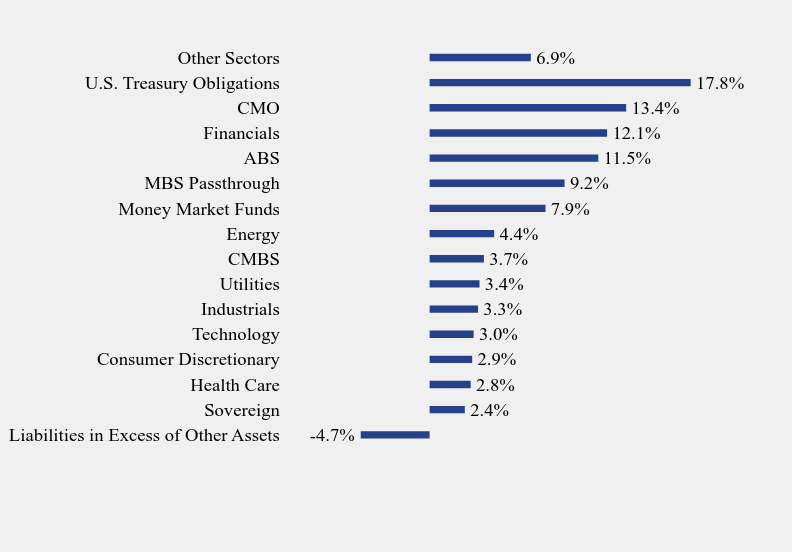

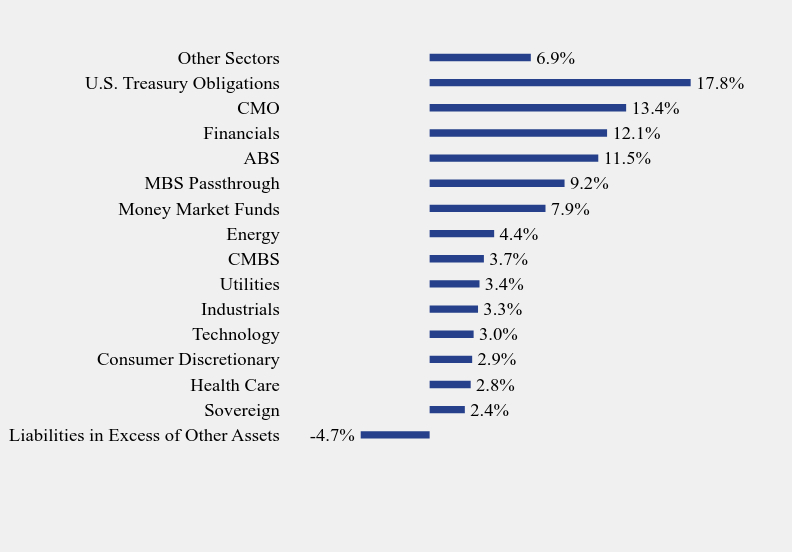

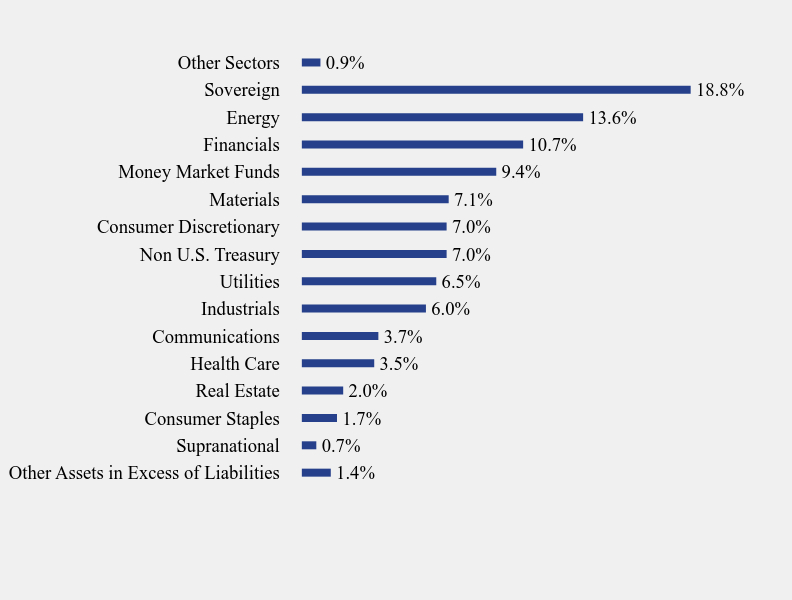

What did the Fund invest in? (As of October 31, 2024)

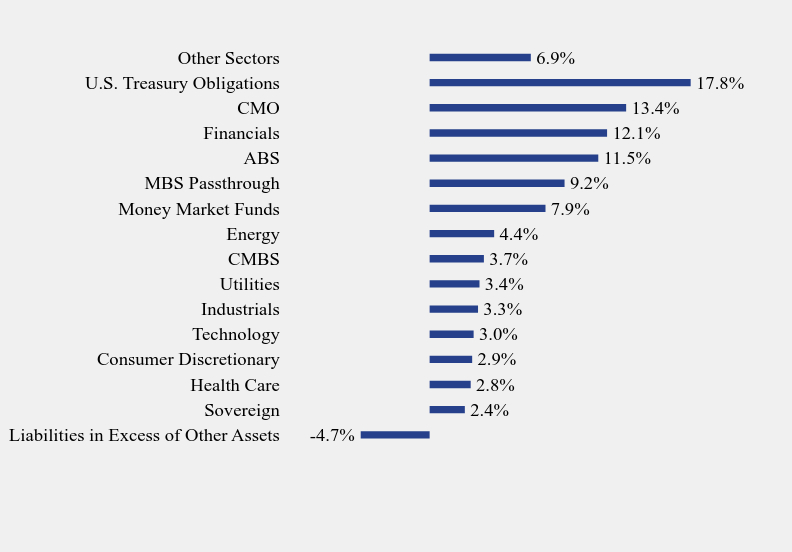

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.7% |

| Sovereign | 2.4% |

| Health Care | 2.8% |

| Consumer Discretionary | 2.9% |

| Technology | 3.0% |

| Industrials | 3.3% |

| Utilities | 3.4% |

| CMBS | 3.7% |

| Energy | 4.4% |

| Money Market Funds | 7.9% |

| MBS Passthrough | 9.2% |

| ABS | 11.5% |

| Financials | 12.1% |

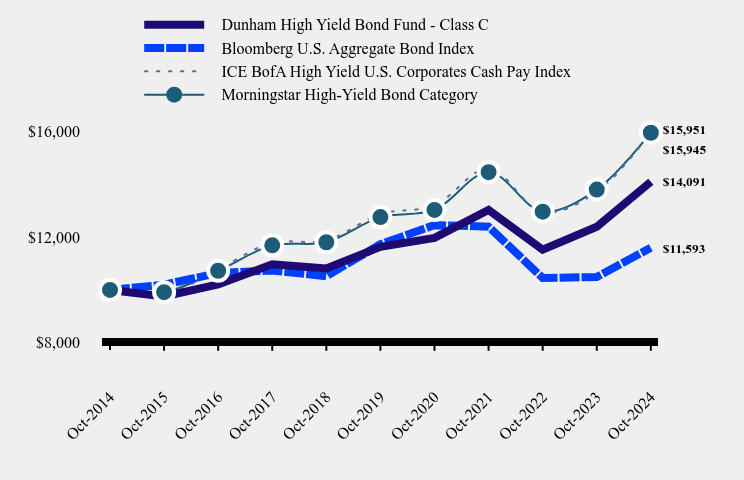

| CMO | 13.4% |

| U.S. Treasury Obligations | 17.8% |

| Other Sectors | 6.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note, 4.625%, 05/15/54 | 2.9% |

| United States Treasury Note, 4.250%, 02/15/54 | 2.3% |

| United States Treasury Note, 4.000%, 11/15/52 | 1.8% |

| United States Treasury Bond, 1.375%, 08/15/50 | 1.5% |

| United States Treasury Note, 3.625%, 02/15/53 | 1.4% |

| United States Treasury Note, 3.625%, 05/15/53 | 1.1% |

| United States Treasury Note, 4.000%, 07/31/29 | 1.1% |

| Freddie Mac Pool, 6.000%, 03/01/53 | 1.0% |

| Fannie Mae Pool, 4.000%, 03/01/53 | 1.0% |

| Freddie Mac Pool, 5.000%, 11/01/52 | 1.0% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

Effective March 1, 2024, the Dunham Corporate/ Government Bond Fund changed its investment strategy to invest up to 15% of its assets in derivative instruments, such as swaps (including credit default swap indices and single name credit default swaps), and forward and futures contracts, including interest rate futures. The Fund also may hold foreign exchange derivatives (including currency forwards of both developed and emerging market countries). These instruments may be used to reduce foreign currency risk and/or to enhance returns.

Dunham Corporate/Government Bond Fund - Class A (DACGX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/corpgov/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Corporate/Government Bond Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Corporate/Government Bond Fund ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/corpgov/. You can also request this information by contacting us at 1-800-442-4358. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $199 | 1.89% |

How did the Fund perform during the reporting period?

Sector allocation positively contributed to relative Fund performance over the fiscal year. The Fund's meaningful underweight to US Treasuries and off-benchmark exposure to corporate high-yield credit positively impacted relative performance from an allocation perspective. The largest detractor was the slight underweight to agency mortgage-backed securities, as that sector outperformed the overall index.

Credit selection positively contributed to relative Fund performance over the fiscal year. The Fund’s top two sectors from a credit selection standpoint were investment-grade corporate debt and asset-backed securities. Security selection within high-yield bank loans and non-agency residential mortgage-backed securities acted as a relative detractor to Fund performance for the fiscal year.

The Fund’s duration exposure has acted as a headwind to relative Fund performance throughout the fiscal year. The Fund's slight underweight to duration exposure relative to the benchmark index has generally detracted from Fund performance, as yields have declined over the fiscal year. Although the Sub-Adviser is confident in the duration exposure considering the high amount of interest rate volatility over the last fiscal year.

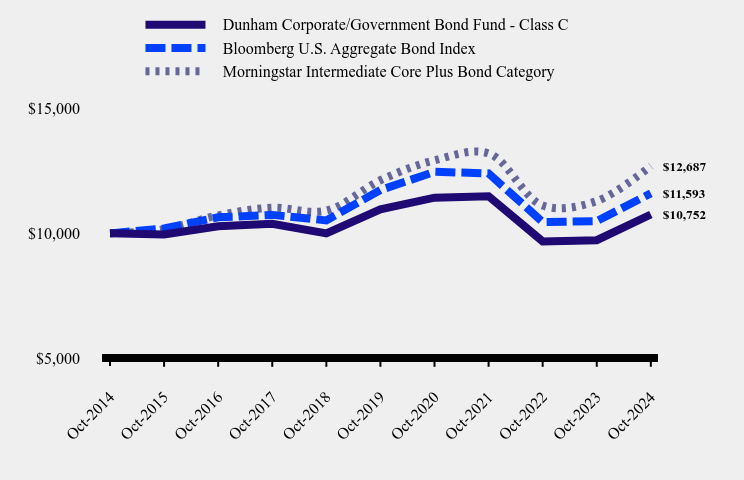

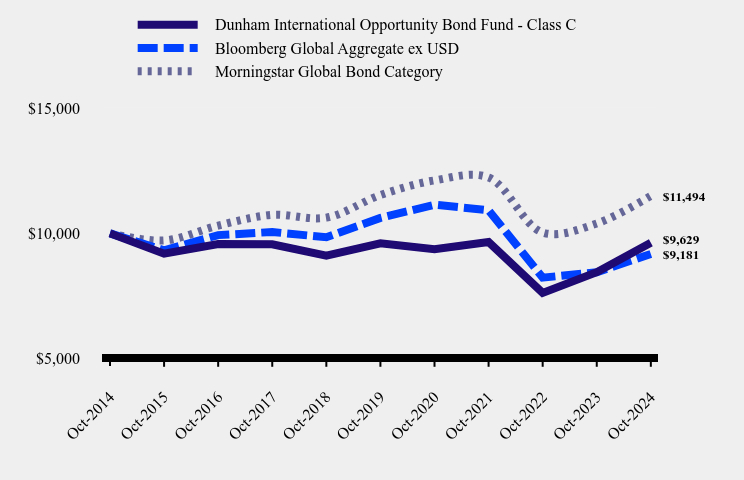

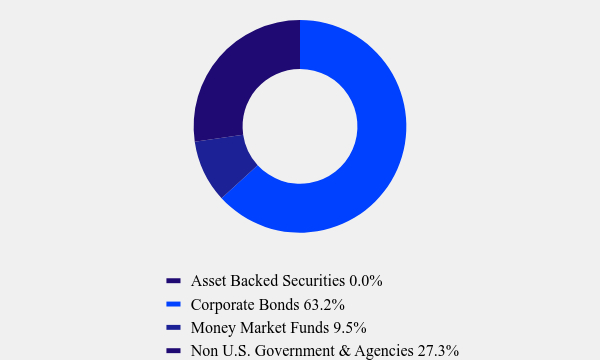

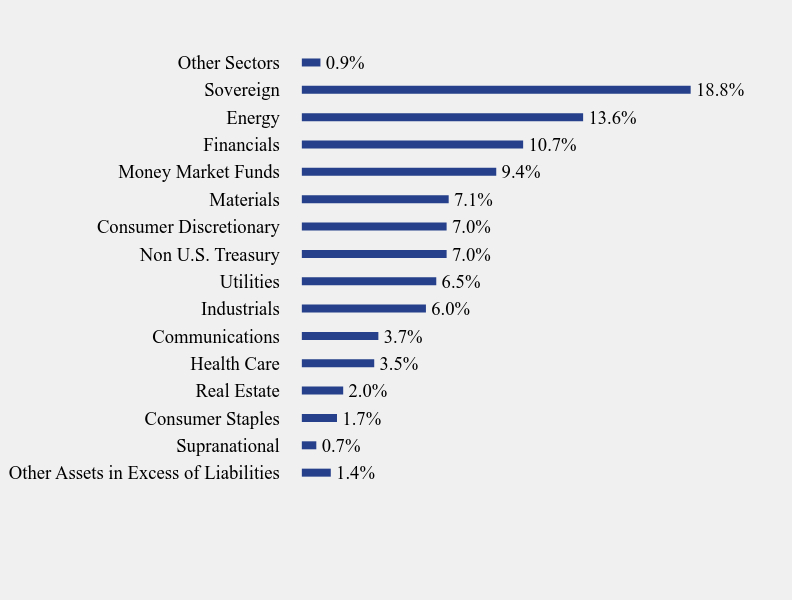

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Corporate/Government Bond Fund - Class C | Bloomberg U.S. Aggregate Bond Index | Morningstar Intermediate Core Plus Bond Category |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 |

| Oct-2015 | $9,955 | $10,196 | $10,164 |

| Oct-2016 | $10,281 | $10,641 | $10,718 |

| Oct-2017 | $10,381 | $10,737 | $11,024 |

| Oct-2018 | $10,000 | $10,517 | $10,905 |

| Oct-2019 | $10,954 | $11,727 | $12,118 |

| Oct-2020 | $11,423 | $12,453 | $12,913 |

| Oct-2021 | $11,479 | $12,393 | $13,189 |

| Oct-2022 | $9,679 | $10,450 | $11,112 |

| Oct-2023 | $9,727 | $10,487 | $11,288 |

| Oct-2024 | $10,752 | $11,593 | $12,687 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Corporate/Government Bond Fund | 10.54% | -0.37% | 0.73% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Morningstar Intermediate Core Plus Bond Category | 12.39% | 0.92% | 2.41% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $204,566,524 |

| Number of Portfolio Holdings | 577 |

| Total Advisory Fee | $1,463,270 |

| Portfolio Turnover | 53% |

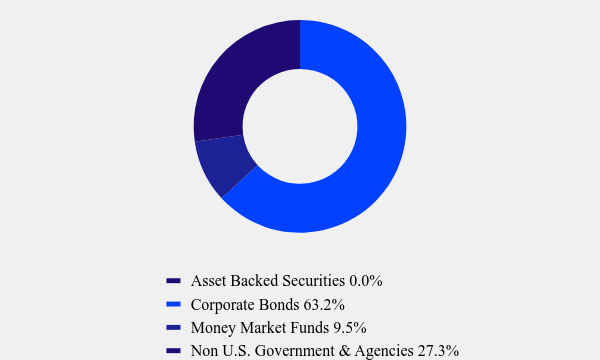

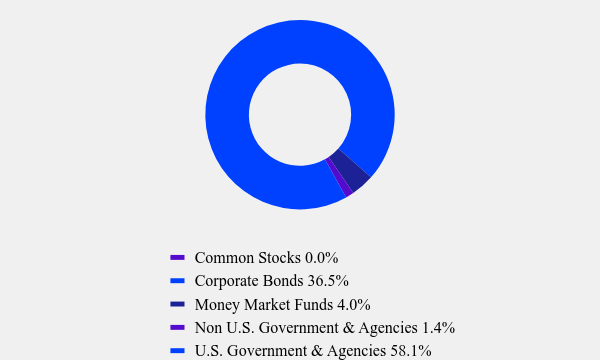

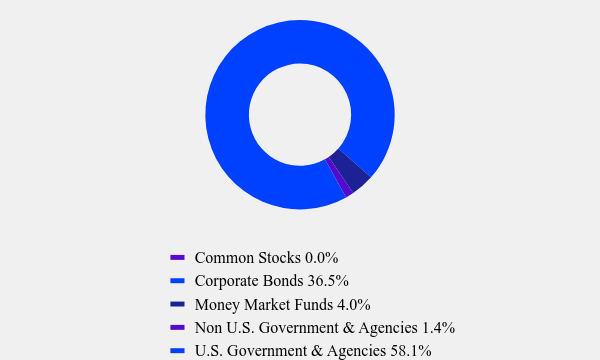

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 27.8% |

| Common Stocks | 0.0% |

| Corporate Bonds | 30.5% |

| Money Market Funds | 7.6% |

| Non U.S. Government & Agencies | 2.2% |

| Term Loans | 6.1% |

| U.S. Government & Agencies | 25.8% |

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.7% |

| Sovereign | 2.4% |

| Health Care | 2.8% |

| Consumer Discretionary | 2.9% |

| Technology | 3.0% |

| Industrials | 3.3% |

| Utilities | 3.4% |

| CMBS | 3.7% |

| Energy | 4.4% |

| Money Market Funds | 7.9% |

| MBS Passthrough | 9.2% |

| ABS | 11.5% |

| Financials | 12.1% |

| CMO | 13.4% |

| U.S. Treasury Obligations | 17.8% |

| Other Sectors | 6.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note, 4.625%, 05/15/54 | 2.9% |

| United States Treasury Note, 4.250%, 02/15/54 | 2.3% |

| United States Treasury Note, 4.000%, 11/15/52 | 1.8% |

| United States Treasury Bond, 1.375%, 08/15/50 | 1.5% |

| United States Treasury Note, 3.625%, 02/15/53 | 1.4% |

| United States Treasury Note, 3.625%, 05/15/53 | 1.1% |

| United States Treasury Note, 4.000%, 07/31/29 | 1.1% |

| Freddie Mac Pool, 6.000%, 03/01/53 | 1.0% |

| Fannie Mae Pool, 4.000%, 03/01/53 | 1.0% |

| Freddie Mac Pool, 5.000%, 11/01/52 | 1.0% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

Effective March 1, 2024, the Dunham Corporate/ Government Bond Fund changed its investment strategy to invest up to 15% of its assets in derivative instruments, such as swaps (including credit default swap indices and single name credit default swaps), and forward and futures contracts, including interest rate futures. The Fund also may hold foreign exchange derivatives (including currency forwards of both developed and emerging market countries). These instruments may be used to reduce foreign currency risk and/or to enhance returns.

Dunham Corporate/Government Bond Fund - Class C (DCCGX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/corpgov/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Corporate/Government Bond Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Corporate/Government Bond Fund ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/corpgov/. You can also request this information by contacting us at 1-800-442-4358. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $121 | 1.14% |

How did the Fund perform during the reporting period?

Sector allocation positively contributed to relative Fund performance over the fiscal year. The Fund's meaningful underweight to US Treasuries and off-benchmark exposure to corporate high-yield credit positively impacted relative performance from an allocation perspective. The largest detractor was the slight underweight to agency mortgage-backed securities, as that sector outperformed the overall index.

Credit selection positively contributed to relative Fund performance over the fiscal year. The Fund’s top two sectors from a credit selection standpoint were investment-grade corporate debt and asset-backed securities. Security selection within high-yield bank loans and non-agency residential mortgage-backed securities acted as a relative detractor to Fund performance for the fiscal year.

The Fund’s duration exposure has acted as a headwind to relative Fund performance throughout the fiscal year. The Fund's slight underweight to duration exposure relative to the benchmark index has generally detracted from Fund performance, as yields have declined over the fiscal year. Although the Sub-Adviser is confident in the duration exposure considering the high amount of interest rate volatility over the last fiscal year.

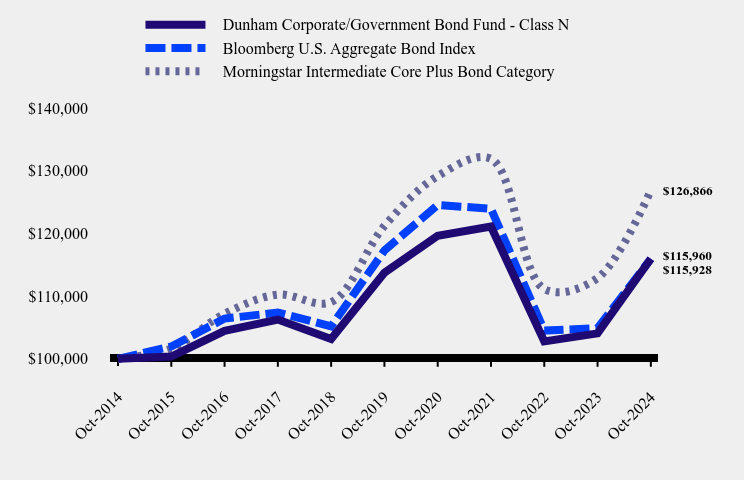

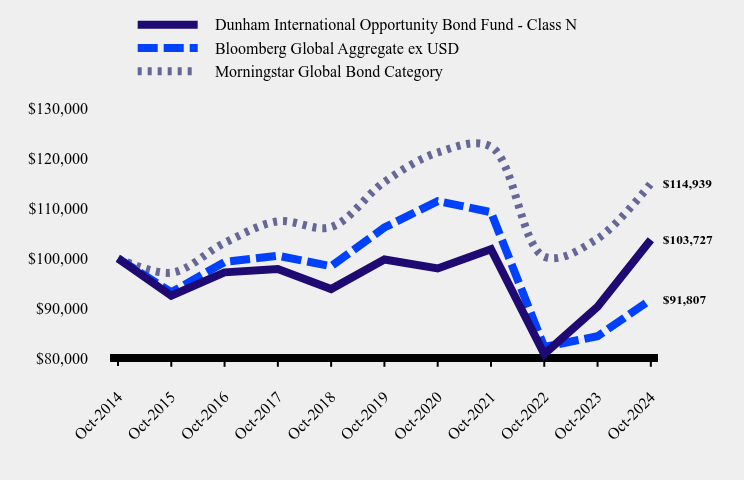

How has the Fund performed over the last ten years?

Total Return Based on $100,000 Investment

| Dunham Corporate/Government Bond Fund - Class N | Bloomberg U.S. Aggregate Bond Index | Morningstar Intermediate Core Plus Bond Category |

|---|

| Oct-2014 | $100,000 | $100,000 | $100,000 |

| Oct-2015 | $100,360 | $101,956 | $101,637 |

| Oct-2016 | $104,464 | $106,412 | $107,177 |

| Oct-2017 | $106,257 | $107,372 | $110,236 |

| Oct-2018 | $103,146 | $105,167 | $109,048 |

| Oct-2019 | $113,734 | $117,272 | $121,183 |

| Oct-2020 | $119,610 | $124,527 | $129,134 |

| Oct-2021 | $121,085 | $123,932 | $131,888 |

| Oct-2022 | $102,781 | $104,496 | $111,118 |

| Oct-2023 | $104,048 | $104,868 | $112,879 |

| Oct-2024 | $115,960 | $115,928 | $126,866 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Corporate/Government Bond Fund | 11.45% | 0.39% | 1.49% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Morningstar Intermediate Core Plus Bond Category | 12.39% | 0.92% | 2.41% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $204,566,524 |

| Number of Portfolio Holdings | 577 |

| Total Advisory Fee | $1,463,270 |

| Portfolio Turnover | 53% |

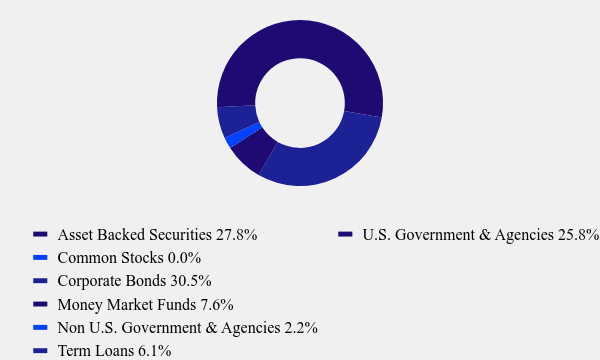

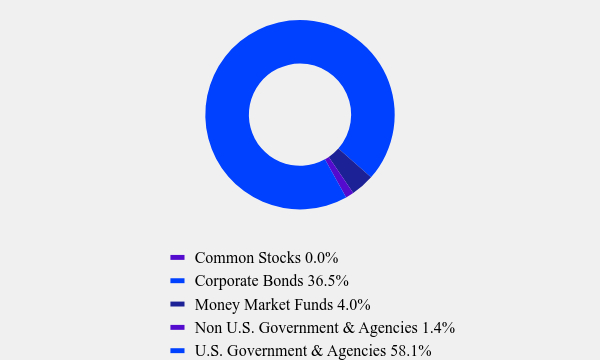

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 27.8% |

| Common Stocks | 0.0% |

| Corporate Bonds | 30.5% |

| Money Market Funds | 7.6% |

| Non U.S. Government & Agencies | 2.2% |

| Term Loans | 6.1% |

| U.S. Government & Agencies | 25.8% |

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.7% |

| Sovereign | 2.4% |

| Health Care | 2.8% |

| Consumer Discretionary | 2.9% |

| Technology | 3.0% |

| Industrials | 3.3% |

| Utilities | 3.4% |

| CMBS | 3.7% |

| Energy | 4.4% |

| Money Market Funds | 7.9% |

| MBS Passthrough | 9.2% |

| ABS | 11.5% |

| Financials | 12.1% |

| CMO | 13.4% |

| U.S. Treasury Obligations | 17.8% |

| Other Sectors | 6.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note, 4.625%, 05/15/54 | 2.9% |

| United States Treasury Note, 4.250%, 02/15/54 | 2.3% |

| United States Treasury Note, 4.000%, 11/15/52 | 1.8% |

| United States Treasury Bond, 1.375%, 08/15/50 | 1.5% |

| United States Treasury Note, 3.625%, 02/15/53 | 1.4% |

| United States Treasury Note, 3.625%, 05/15/53 | 1.1% |

| United States Treasury Note, 4.000%, 07/31/29 | 1.1% |

| Freddie Mac Pool, 6.000%, 03/01/53 | 1.0% |

| Fannie Mae Pool, 4.000%, 03/01/53 | 1.0% |

| Freddie Mac Pool, 5.000%, 11/01/52 | 1.0% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

Effective March 1, 2024, the Dunham Corporate/ Government Bond Fund changed its investment strategy to invest up to 15% of its assets in derivative instruments, such as swaps (including credit default swap indices and single name credit default swaps), and forward and futures contracts, including interest rate futures. The Fund also may hold foreign exchange derivatives (including currency forwards of both developed and emerging market countries). These instruments may be used to reduce foreign currency risk and/or to enhance returns.

Dunham Corporate/Government Bond Fund - Class N (DNCGX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/corpgov/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Dynamic Macro Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Dynamic Macro Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/dynamicmacrofund/. You can also request this information by contacting us at 1-800-442-4358.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $241 | 2.21% |

How did the Fund perform during the reporting period?

The lower equity exposure broadly detracted from relative performance. The Fund generally maintained a 70 percent average exposure to equities during the fiscal year. Given the strong performance in general of global equities, this lower average exposure detracted from relative performance.

Having both long and short exposure to bonds provided mixed results, but overall slightly detracted. The Fund had material shifts in bond exposure during the fiscal year, ranging from short exposure and a negative overall interest rate sensitivity to a positive exposure and a positive interest rate sensitivity. Outside of providing some positive benefits to the Fund in the first fiscal quarter, this exposure broadly slightly detracted from Fund performance in each of the other three fiscal quarters.

The commodity exposure remained near zero, neither detracting nor contributing. The Sub-Adviser’s signals did not identify that it should generate a positive allocation towards commodities, which meant that the allocation remained near zero during the fiscal year.

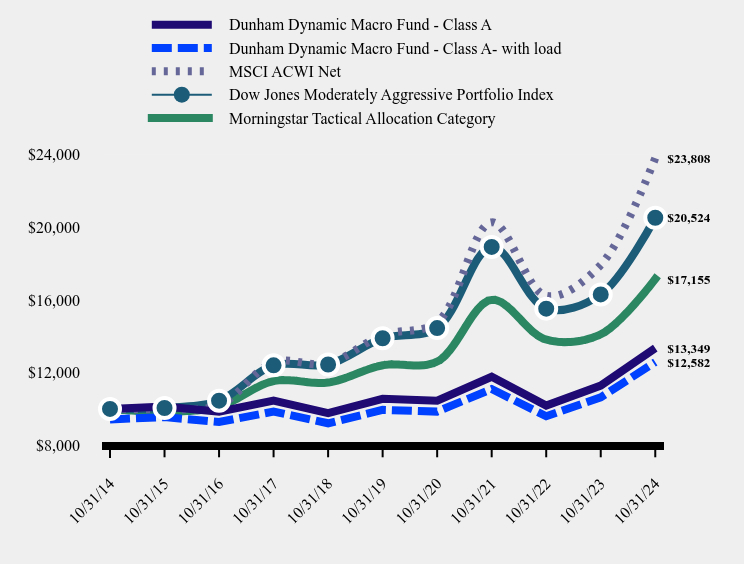

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Dynamic Macro Fund - Class A | Dunham Dynamic Macro Fund - Class A- with load | MSCI ACWI Net | Dow Jones Moderately Aggressive Portfolio Index | Morningstar Tactical Allocation Category |

|---|

| 10/31/14 | $10,000 | $9,426 | $10,000 | $10,000 | $10,000 |

| 10/31/15 | $10,134 | $9,552 | $9,997 | $10,054 | $9,844 |

| 10/31/16 | $9,845 | $9,279 | $10,201 | $10,457 | $10,137 |

| 10/31/17 | $10,455 | $9,854 | $12,568 | $12,403 | $11,530 |

| 10/31/18 | $9,773 | $9,211 | $12,503 | $12,448 | $11,457 |

| 10/31/19 | $10,559 | $9,952 | $14,078 | $13,890 | $12,401 |

| 10/31/20 | $10,453 | $9,853 | $14,766 | $14,452 | $12,610 |

| 10/31/21 | $11,772 | $11,096 | $20,270 | $18,918 | $15,997 |

| 10/31/22 | $10,183 | $9,598 | $16,225 | $15,522 | $13,819 |

| 10/31/23 | $11,285 | $10,636 | $17,929 | $16,303 | $14,111 |

| 10/31/24 | $13,349 | $12,582 | $23,808 | $20,524 | $17,155 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Dynamic Macro Fund | | | |

| Class A Without Load | 18.29% | 4.80% | 2.93% |

| Class A With Load | 11.49% | 3.57% | 2.32% |

| Dow Jones Moderately Aggressive Portfolio Index | 25.89% | 8.12% | 7.46% |

| Morningstar Tactical Allocation Category | 21.58% | 6.71% | 5.55% |

| MSCI ACWI Net | 32.79% | 11.08% | 9.06% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $78,677,152 |

| Number of Portfolio Holdings | 44 |

| Total Advisory Fee | $895,300 |

| Portfolio Turnover | 47% |

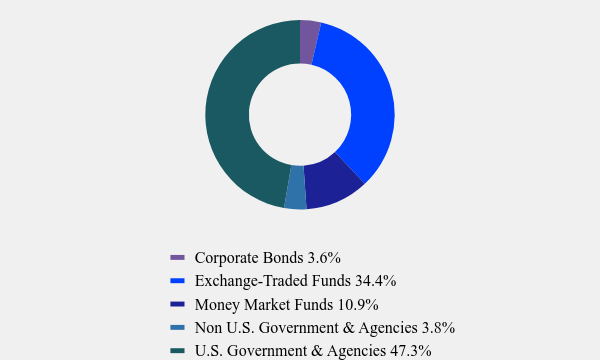

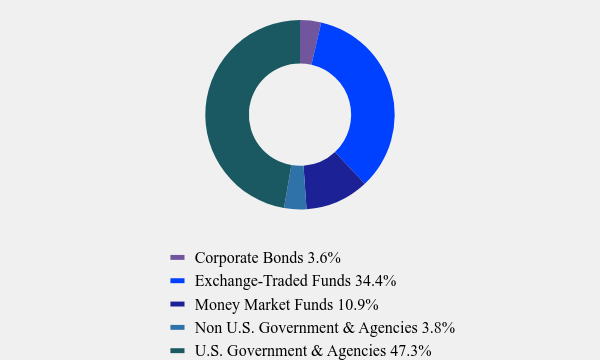

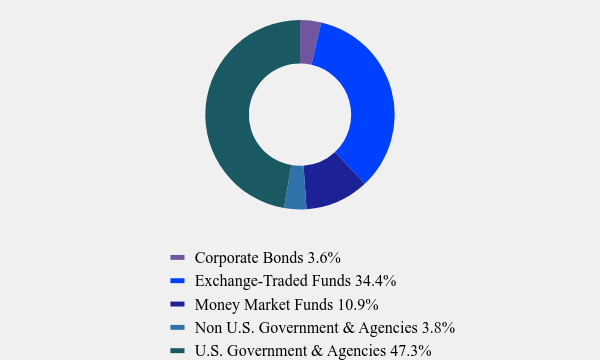

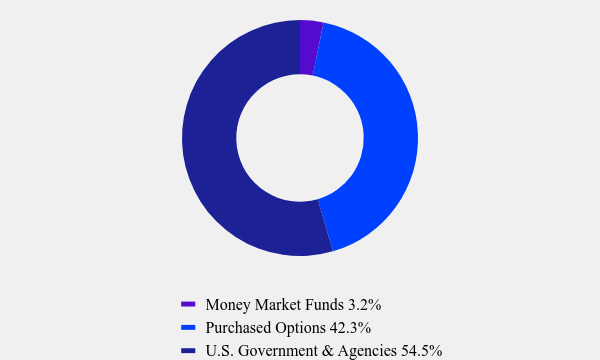

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 3.6% |

| Exchange-Traded Funds | 34.4% |

| Money Market Funds | 10.9% |

| Non U.S. Government & Agencies | 3.8% |

| U.S. Government & Agencies | 47.3% |

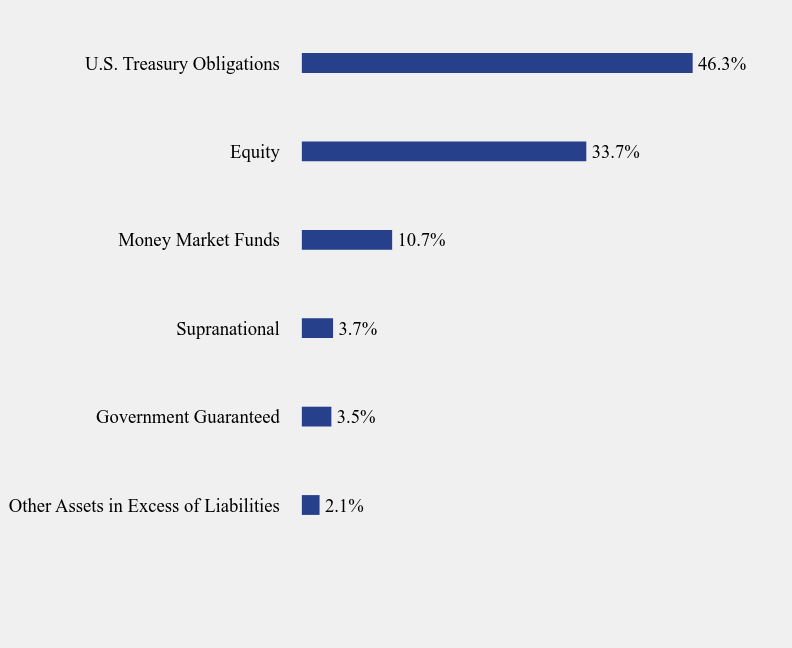

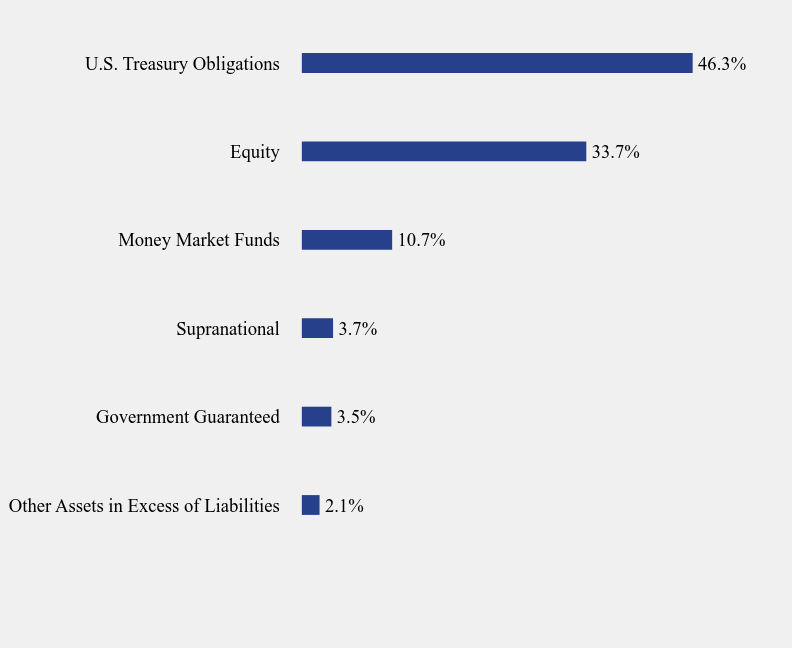

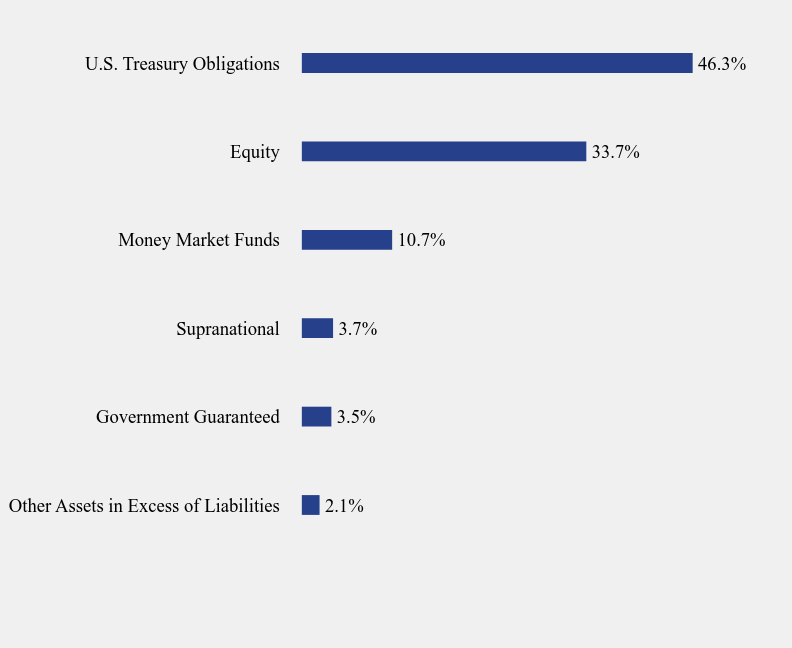

What did the Fund invest in? (As of October 31, 2024)

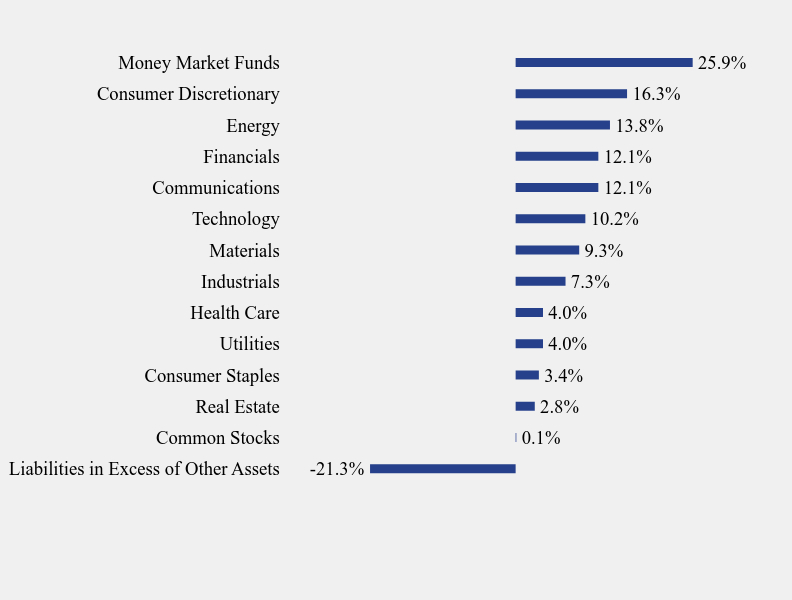

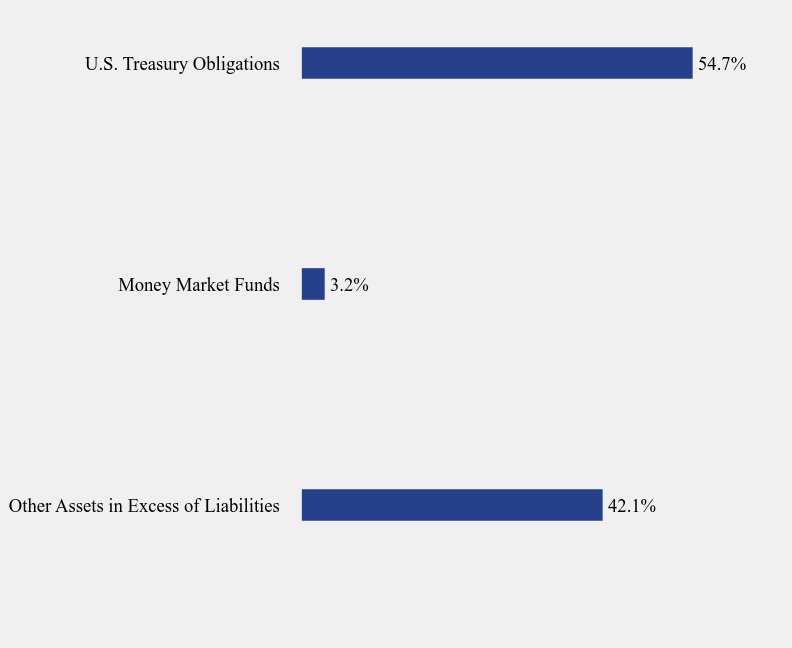

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.1% |

| Government Guaranteed | 3.5% |

| Supranational | 3.7% |

| Money Market Funds | 10.7% |

| Equity | 33.7% |

| U.S. Treasury Obligations | 46.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| SPDR S&P 500 ETF Trust | 9.7% |

| Invesco Nasdaq 100 ETF | 9.1% |

| Franklin FTSE Japan ETF | 6.5% |

| SPDR EURO STOXX 50 ETF | 4.3% |

| Franklin FTSE United Kingdom ETF | 4.0% |

| United States Treasury Note, 1.000%, 12/15/24 | 3.8% |

| United States Treasury Note, 1.125%, 02/28/25 | 3.5% |

| United States Treasury Note, 1.500%, 11/30/24 | 3.2% |

| United States Treasury Note, 1.125%, 01/15/25 | 3.2% |

| United States Treasury Note, 2.750%, 06/30/25 | 3.1% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Dynamic Macro Fund - Class A (DAAVX )

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/dynamicmacrofund/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Dynamic Macro Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Dynamic Macro Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/dynamicmacrofund/. You can also request this information by contacting us at 1-800-442-4358.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $318 | 2.93% |

How did the Fund perform during the reporting period?

The lower equity exposure broadly detracted from relative performance. The Fund generally maintained a 70 percent average exposure to equities during the fiscal year. Given the strong performance in general of global equities, this lower average exposure detracted from relative performance.

Having both long and short exposure to bonds provided mixed results, but overall slightly detracted. The Fund had material shifts in bond exposure during the fiscal year, ranging from short exposure and a negative overall interest rate sensitivity to a positive exposure and a positive interest rate sensitivity. Outside of providing some positive benefits to the Fund in the first fiscal quarter, this exposure broadly slightly detracted from Fund performance in each of the other three fiscal quarters.

The commodity exposure remained near zero, neither detracting nor contributing. The Sub-Adviser’s signals did not identify that it should generate a positive allocation towards commodities, which meant that the allocation remained near zero during the fiscal year.

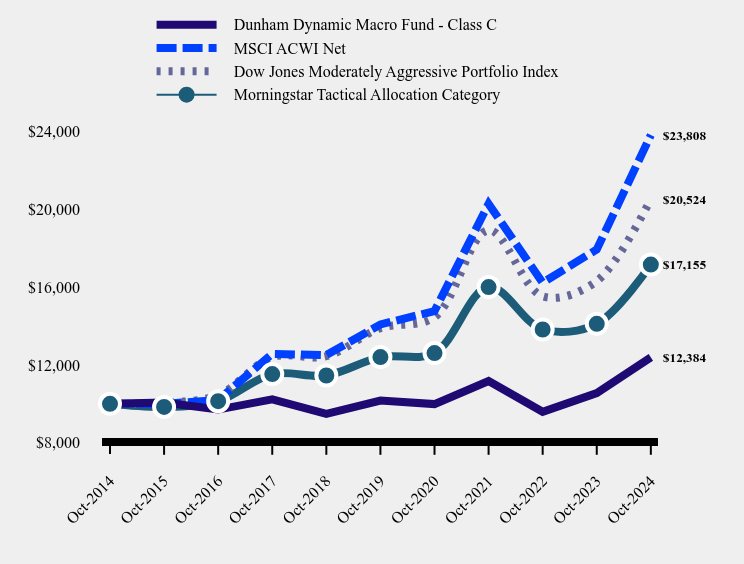

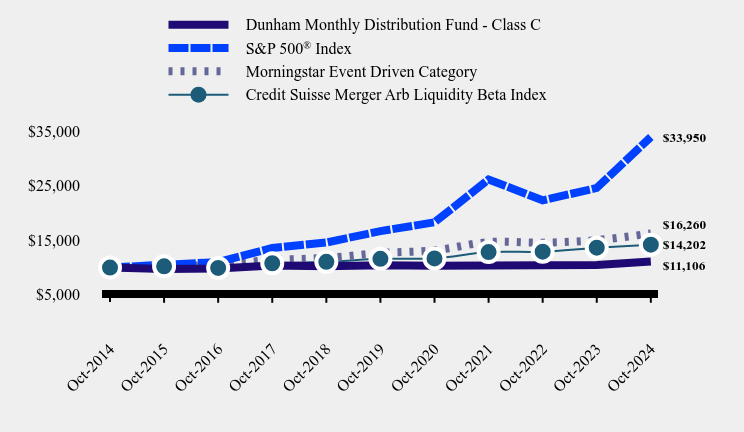

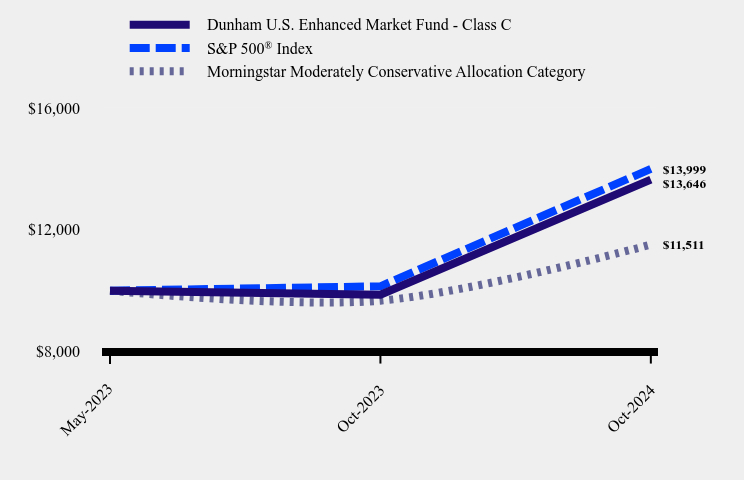

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Dynamic Macro Fund - Class C | MSCI ACWI Net | Dow Jones Moderately Aggressive Portfolio Index | Morningstar Tactical Allocation Category |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| Oct-2015 | $10,063 | $9,997 | $10,054 | $9,844 |

| Oct-2016 | $9,706 | $10,201 | $10,457 | $10,137 |

| Oct-2017 | $10,231 | $12,568 | $12,403 | $11,530 |

| Oct-2018 | $9,485 | $12,503 | $12,448 | $11,457 |

| Oct-2019 | $10,168 | $14,078 | $13,890 | $12,401 |

| Oct-2020 | $9,987 | $14,766 | $14,452 | $12,610 |

| Oct-2021 | $11,170 | $20,270 | $18,918 | $15,997 |

| Oct-2022 | $9,592 | $16,225 | $15,522 | $13,819 |

| Oct-2023 | $10,552 | $17,929 | $16,303 | $14,111 |

| Oct-2024 | $12,384 | $23,808 | $20,524 | $17,155 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Dynamic Macro Fund | 17.36% | 4.02% | 2.16% |

| Dow Jones Moderately Aggressive Portfolio Index | 25.89% | 8.12% | 7.46% |

| Morningstar Tactical Allocation Category | 21.58% | 6.71% | 5.55% |

| MSCI ACWI Net | 32.79% | 11.08% | 9.06% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $78,677,152 |

| Number of Portfolio Holdings | 44 |

| Total Advisory Fee | $895,300 |

| Portfolio Turnover | 47% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 3.6% |

| Exchange-Traded Funds | 34.4% |

| Money Market Funds | 10.9% |

| Non U.S. Government & Agencies | 3.8% |

| U.S. Government & Agencies | 47.3% |

What did the Fund invest in? (As of October 31, 2024)

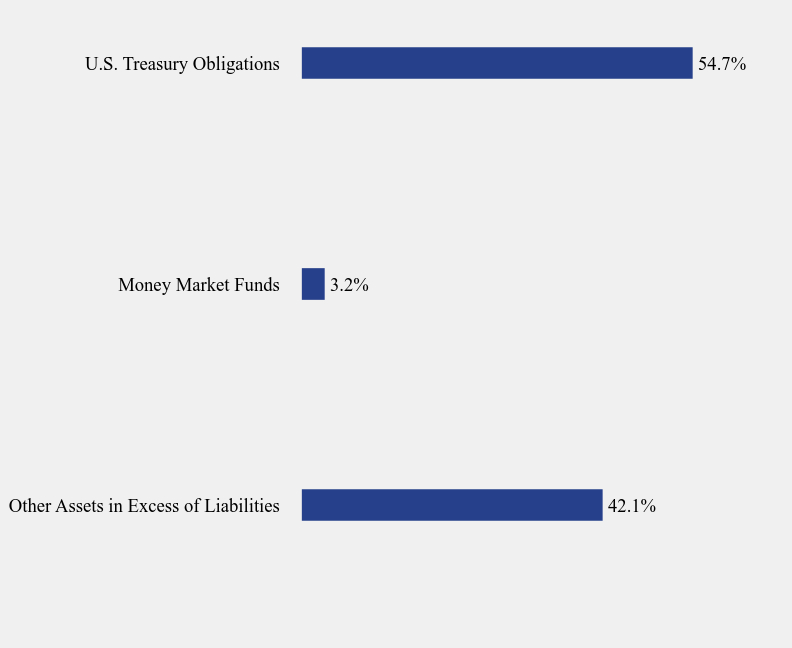

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.1% |

| Government Guaranteed | 3.5% |

| Supranational | 3.7% |

| Money Market Funds | 10.7% |

| Equity | 33.7% |

| U.S. Treasury Obligations | 46.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| SPDR S&P 500 ETF Trust | 9.7% |

| Invesco Nasdaq 100 ETF | 9.1% |

| Franklin FTSE Japan ETF | 6.5% |

| SPDR EURO STOXX 50 ETF | 4.3% |

| Franklin FTSE United Kingdom ETF | 4.0% |

| United States Treasury Note, 1.000%, 12/15/24 | 3.8% |

| United States Treasury Note, 1.125%, 02/28/25 | 3.5% |

| United States Treasury Note, 1.500%, 11/30/24 | 3.2% |

| United States Treasury Note, 1.125%, 01/15/25 | 3.2% |

| United States Treasury Note, 2.750%, 06/30/25 | 3.1% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Dynamic Macro Fund - Class C (DCAVX )

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/dynamicmacrofund/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Dynamic Macro Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Dynamic Macro Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/dynamicmacrofund/. You can also request this information by contacting us at 1-800-442-4358.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $212 | 1.94% |

How did the Fund perform during the reporting period?

The lower equity exposure broadly detracted from relative performance. The Fund generally maintained a 70 percent average exposure to equities during the fiscal year. Given the strong performance in general of global equities, this lower average exposure detracted from relative performance.

Having both long and short exposure to bonds provided mixed results, but overall slightly detracted. The Fund had material shifts in bond exposure during the fiscal year, ranging from short exposure and a negative overall interest rate sensitivity to a positive exposure and a positive interest rate sensitivity. Outside of providing some positive benefits to the Fund in the first fiscal quarter, this exposure broadly slightly detracted from Fund performance in each of the other three fiscal quarters.

The commodity exposure remained near zero, neither detracting nor contributing. The Sub-Adviser’s signals did not identify that it should generate a positive allocation towards commodities, which meant that the allocation remained near zero during the fiscal year.

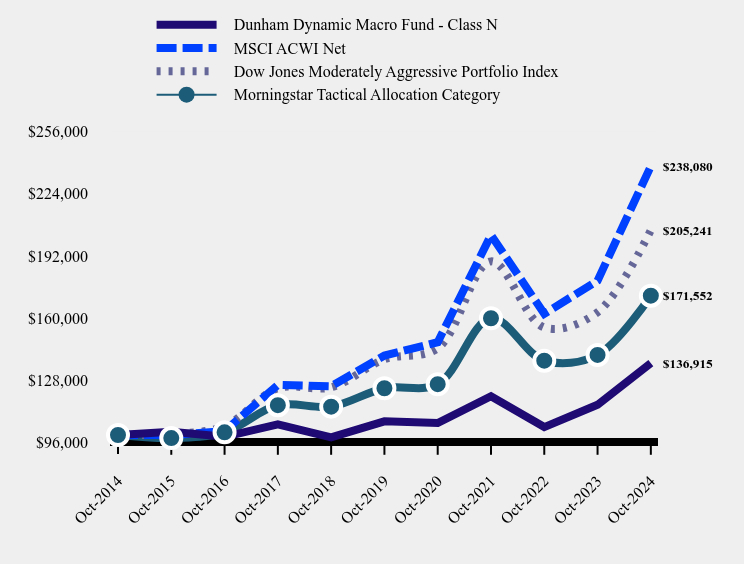

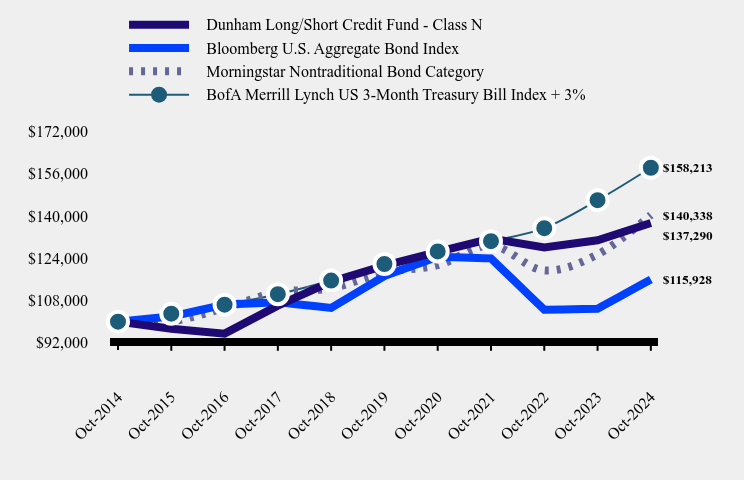

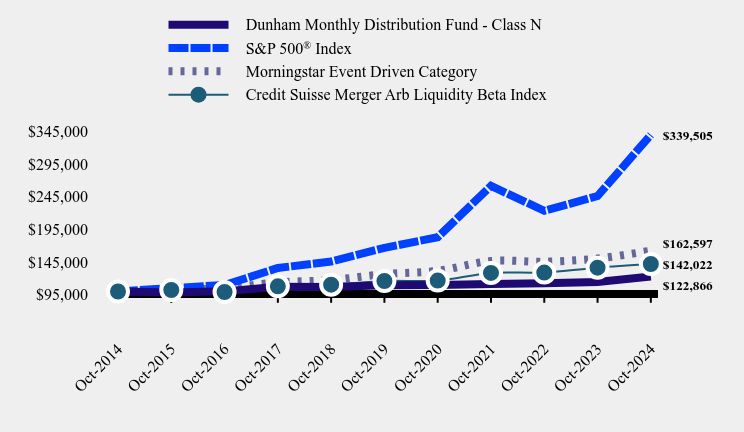

How has the Fund performed over the last ten years?

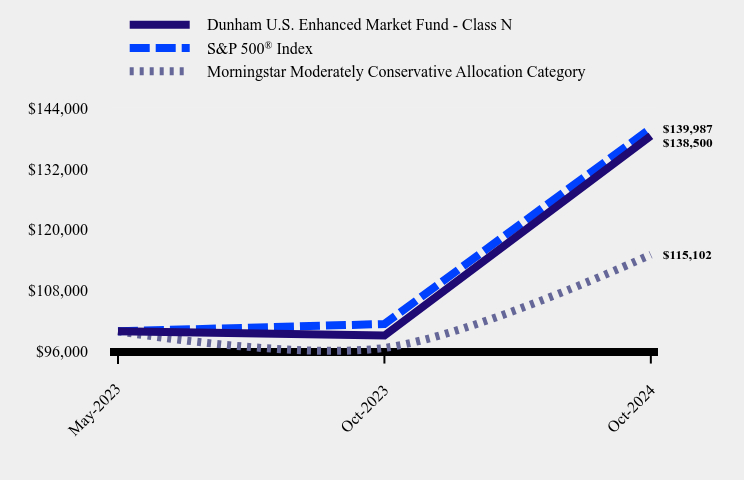

Total Return Based on $100,000 Investment

| Dunham Dynamic Macro Fund - Class N | MSCI ACWI Net | Dow Jones Moderately Aggressive Portfolio Index | Morningstar Tactical Allocation Category |

|---|

| Oct-2014 | $100,000 | $100,000 | $100,000 | $100,000 |

| Oct-2015 | $101,658 | $99,968 | $100,536 | $98,441 |

| Oct-2016 | $99,067 | $102,015 | $104,565 | $101,366 |

| Oct-2017 | $105,492 | $125,685 | $124,026 | $115,296 |

| Oct-2018 | $98,756 | $125,034 | $124,477 | $114,569 |

| Oct-2019 | $106,999 | $140,777 | $138,894 | $124,005 |

| Oct-2020 | $106,150 | $147,657 | $144,522 | $126,095 |

| Oct-2021 | $119,892 | $202,702 | $189,174 | $159,968 |

| Oct-2022 | $104,064 | $162,247 | $155,221 | $138,185 |

| Oct-2023 | $115,507 | $179,286 | $163,029 | $141,106 |

| Oct-2024 | $136,915 | $238,080 | $205,241 | $171,552 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Dynamic Macro Fund | 18.53% | 5.05% | 3.19% |

| Dow Jones Moderately Aggressive Portfolio Index | 25.89% | 8.12% | 7.46% |

| Morningstar Tactical Allocation Category | 21.58% | 6.71% | 5.55% |

| MSCI ACWI Net | 32.79% | 11.08% | 9.06% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $78,677,152 |

| Number of Portfolio Holdings | 44 |

| Total Advisory Fee | $895,300 |

| Portfolio Turnover | 47% |

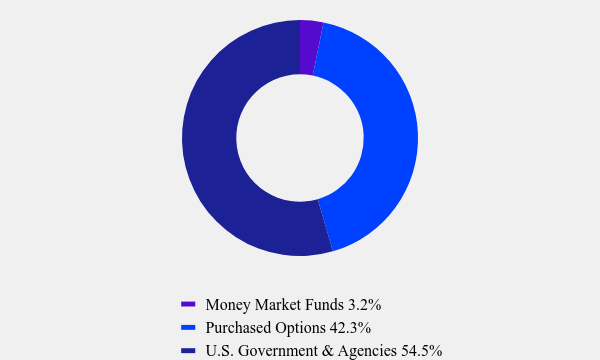

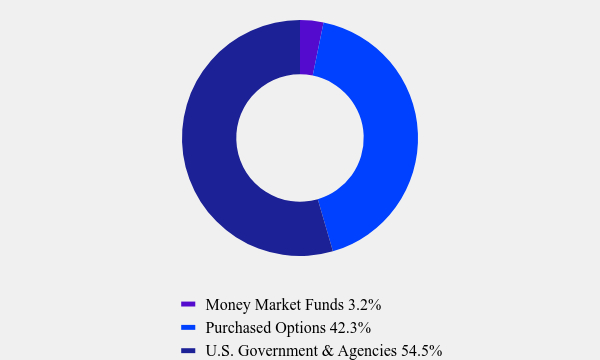

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 3.6% |

| Exchange-Traded Funds | 34.4% |

| Money Market Funds | 10.9% |

| Non U.S. Government & Agencies | 3.8% |

| U.S. Government & Agencies | 47.3% |

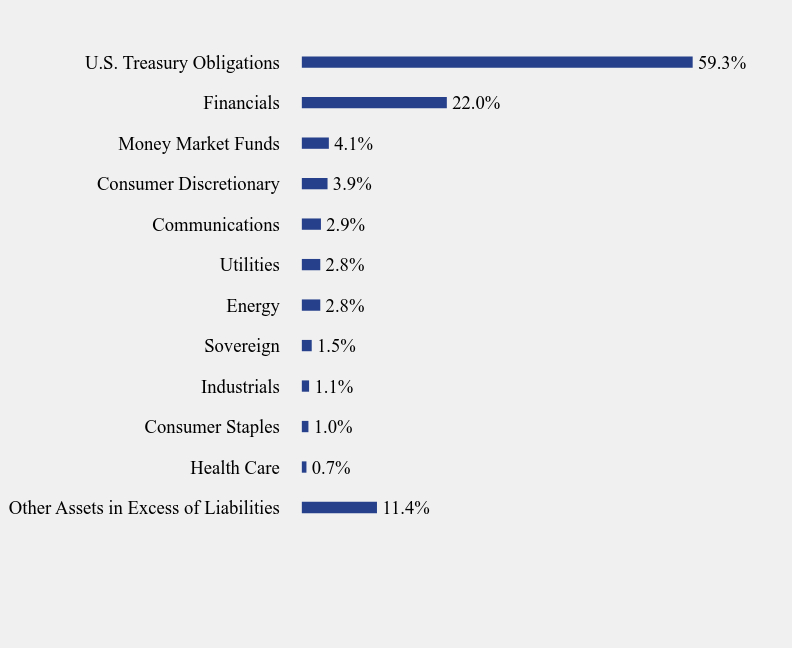

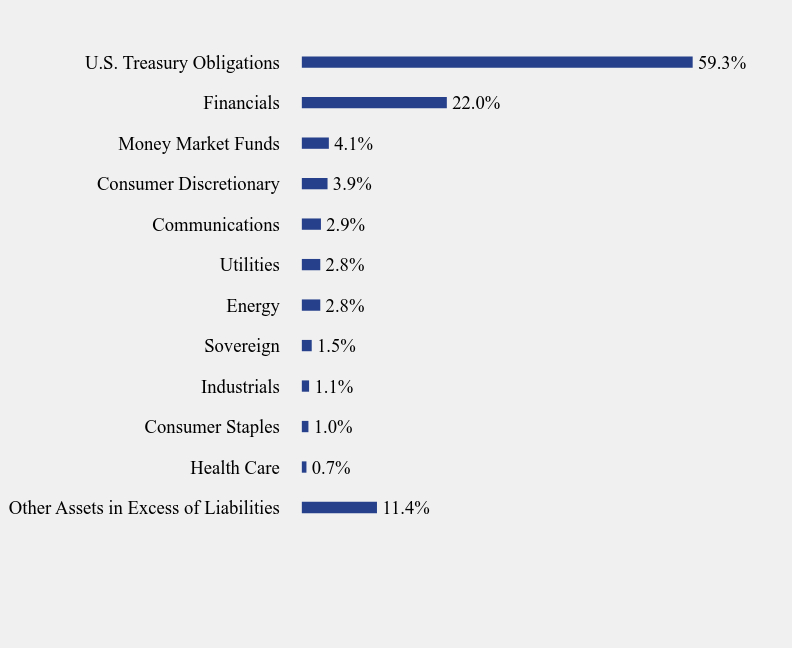

What did the Fund invest in? (As of October 31, 2024)

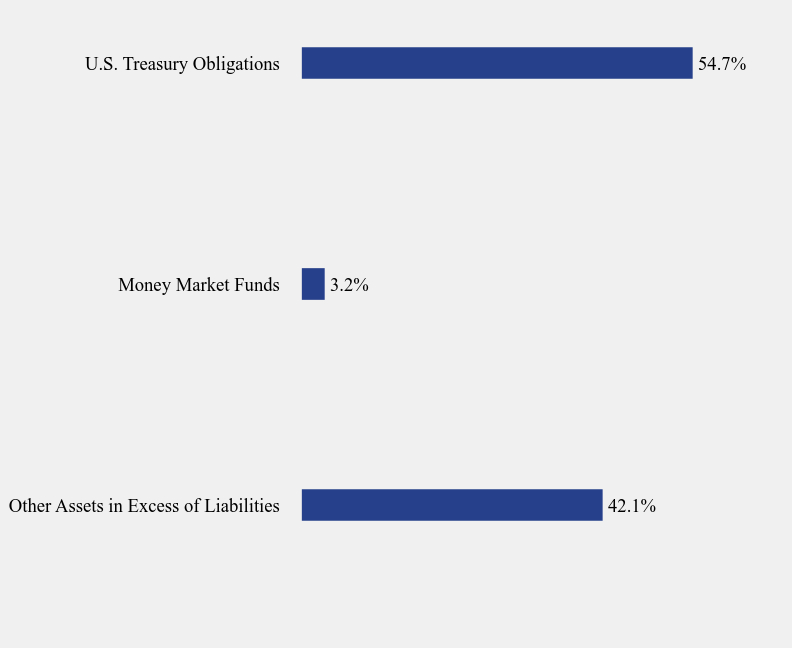

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.1% |

| Government Guaranteed | 3.5% |

| Supranational | 3.7% |

| Money Market Funds | 10.7% |

| Equity | 33.7% |

| U.S. Treasury Obligations | 46.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| SPDR S&P 500 ETF Trust | 9.7% |

| Invesco Nasdaq 100 ETF | 9.1% |

| Franklin FTSE Japan ETF | 6.5% |

| SPDR EURO STOXX 50 ETF | 4.3% |

| Franklin FTSE United Kingdom ETF | 4.0% |

| United States Treasury Note, 1.000%, 12/15/24 | 3.8% |

| United States Treasury Note, 1.125%, 02/28/25 | 3.5% |

| United States Treasury Note, 1.500%, 11/30/24 | 3.2% |

| United States Treasury Note, 1.125%, 01/15/25 | 3.2% |

| United States Treasury Note, 2.750%, 06/30/25 | 3.1% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Dynamic Macro Fund - Class N (DNAVX )

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/dynamicmacrofund/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Emerging Markets Stock Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Emerging Markets Stock Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/emergingmarket/. You can also request this information by contacting us at 1-800-442-4358.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $164 | 1.49% |

How did the Fund perform during the reporting period?

Emerging markets outperformed foreign developed markets over the fiscal year. Developed markets, as measured by the MSCI EAFE TR Index, rose 23.0 percent, underperforming emerging markets, as measured by the MSCI Emerging Markets TR Index, which rallied 25.3 percent.

Security selection detracted from Fund performance over the fiscal year. The Fund benefited from strong security selection within Taiwan, Brazil, and India. However, it was not enough to offset the adverse impact of security selection in China due to meaningful stimulus prompting an indiscriminate beta rally in the country.

Country allocation also detracted from Fund performance. The positive impact from allocation in Brazil, India, and Gulf markets was outweighed by the exposure to Thailand, Hong Kong, and a small position to cash.

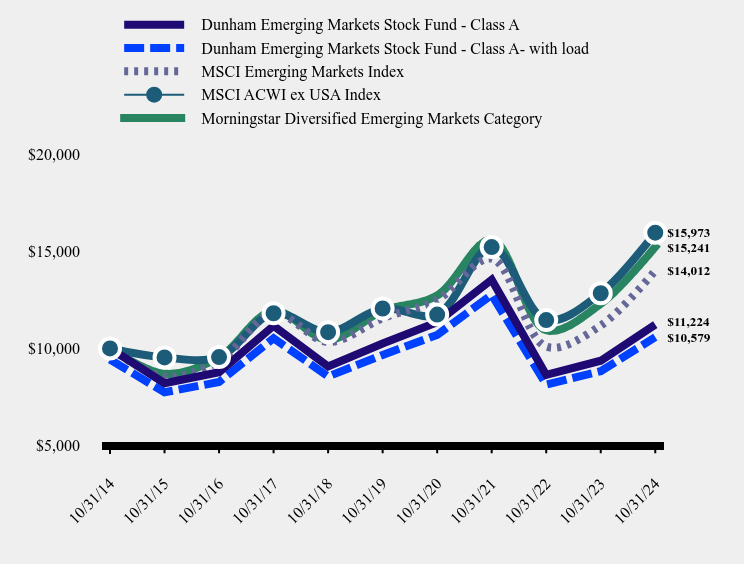

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Emerging Markets Stock Fund - Class A | Dunham Emerging Markets Stock Fund - Class A- with load | MSCI Emerging Markets Index | MSCI ACWI ex USA Index | Morningstar Diversified Emerging Markets Category |

|---|

| 10/31/14 | $10,000 | $9,426 | $10,000 | $10,000 | $10,000 |

| 10/31/15 | $8,206 | $7,735 | $8,547 | $9,532 | $8,691 |

| 10/31/16 | $8,767 | $8,263 | $9,339 | $9,554 | $9,544 |

| 10/31/17 | $11,165 | $10,524 | $11,809 | $11,812 | $11,930 |

| 10/31/18 | $9,074 | $8,552 | $10,331 | $10,838 | $10,453 |

| 10/31/19 | $10,252 | $9,663 | $11,556 | $12,060 | $11,928 |

| 10/31/20 | $11,346 | $10,694 | $12,509 | $11,745 | $12,737 |

| 10/31/21 | $13,544 | $12,766 | $14,631 | $15,228 | $15,591 |

| 10/31/22 | $8,631 | $8,135 | $10,091 | $11,463 | $10,945 |

| 10/31/23 | $9,363 | $8,825 | $11,181 | $12,847 | $12,301 |

| 10/31/24 | $11,224 | $10,579 | $14,012 | $15,973 | $15,241 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Emerging Markets Stock Fund | | | |

| Class A Without Load | 19.88% | 1.83% | 1.16% |

| Class A With Load | 13.01% | 0.63% | 0.56% |

| Morningstar Diversified Emerging Markets Category | 23.91% | 5.02% | 4.30% |

| MSCI ACWI ex USA Index | 24.33% | 5.78% | 4.79% |

| MSCI Emerging Markets Index | 25.31% | 3.93% | 3.43% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $115,054,605 |

| Number of Portfolio Holdings | 88 |

| Total Advisory Fee | $933,929 |

| Portfolio Turnover | 70% |

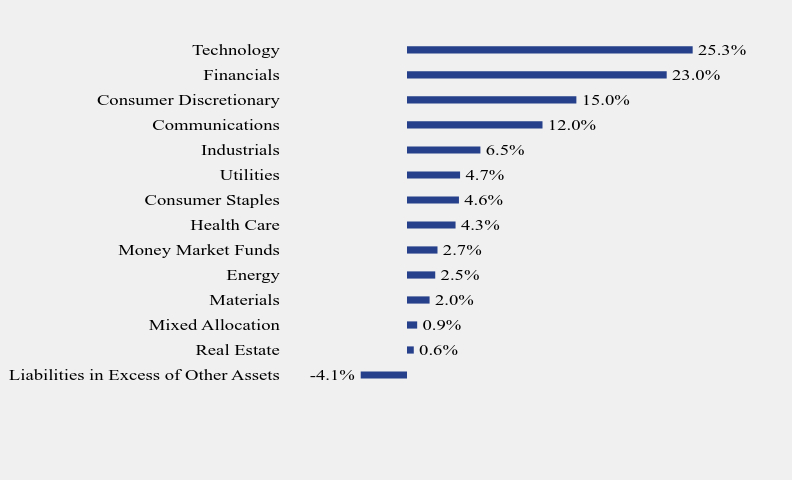

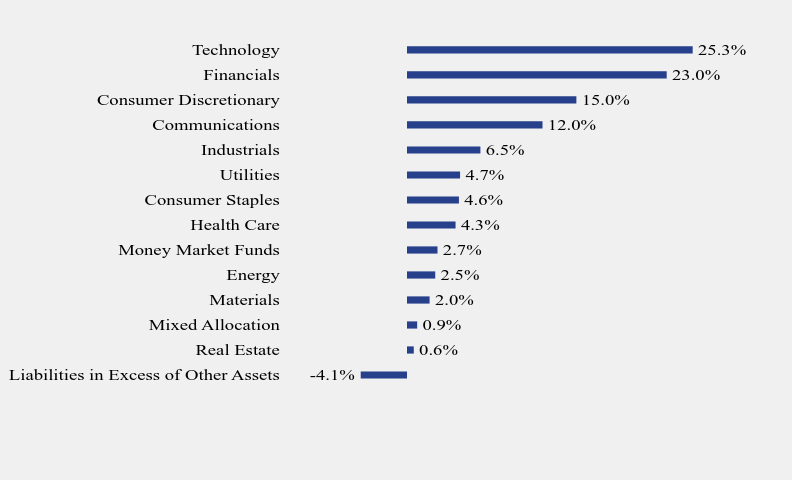

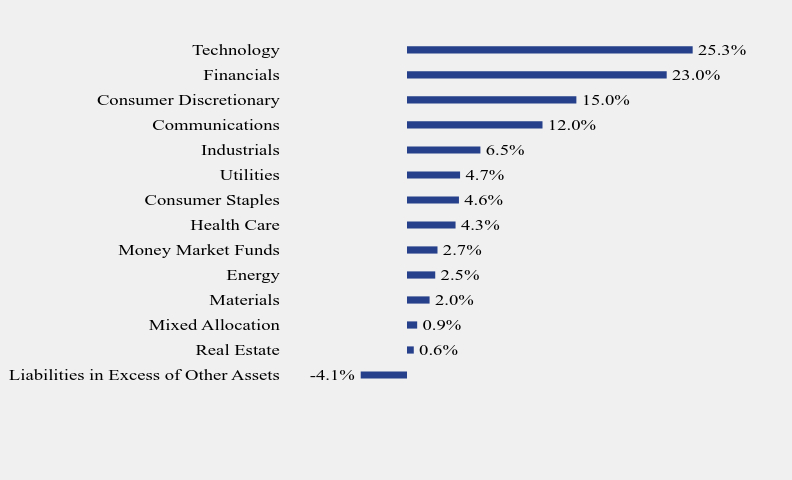

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.1% |

| Real Estate | 0.6% |

| Mixed Allocation | 0.9% |

| Materials | 2.0% |

| Energy | 2.5% |

| Money Market Funds | 2.7% |

| Health Care | 4.3% |

| Consumer Staples | 4.6% |

| Utilities | 4.7% |

| Industrials | 6.5% |

| Communications | 12.0% |

| Consumer Discretionary | 15.0% |

| Financials | 23.0% |

| Technology | 25.3% |

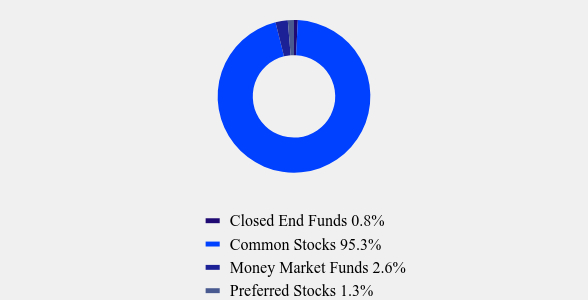

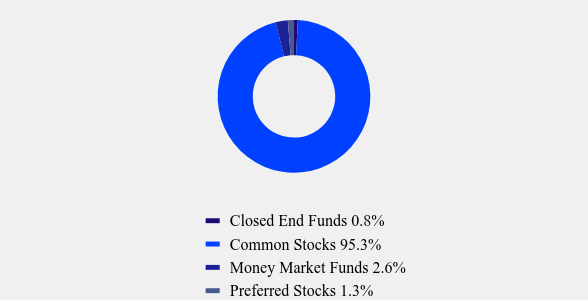

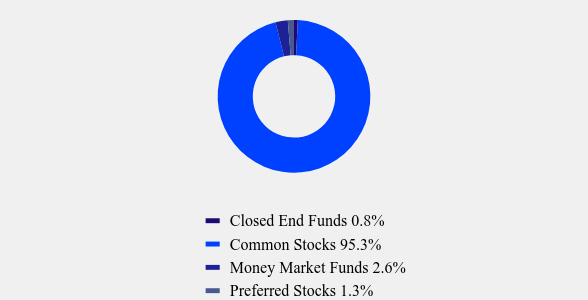

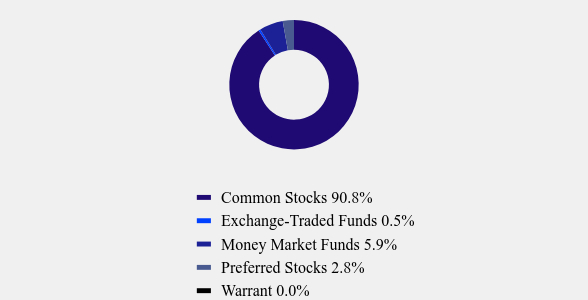

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 0.8% |

| Common Stocks | 95.3% |

| Money Market Funds | 2.6% |

| Preferred Stocks | 1.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Taiwan Semiconductor Manufacturing Company Ltd. | 11.8% |

| Tencent Holdings Ltd. | 6.2% |

| Alibaba Group Holding Ltd. | 3.5% |

| Samsung Electronics Company Ltd. | 3.2% |

| Trip.com Group Ltd. - ADR | 2.7% |

| Max Healthcare Institute Ltd. | 2.7% |

| Bharti Airtel Ltd. | 2.3% |

| Bank Central Asia Tbk P.T. | 2.2% |

| HDFC Bank Ltd. | 2.1% |

| Bank Rakyat Indonesia Persero Tbk P.T. | 2.1% |

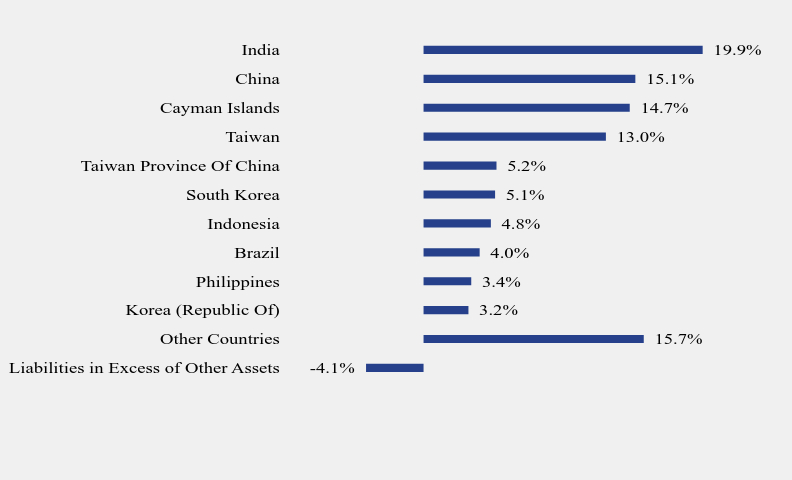

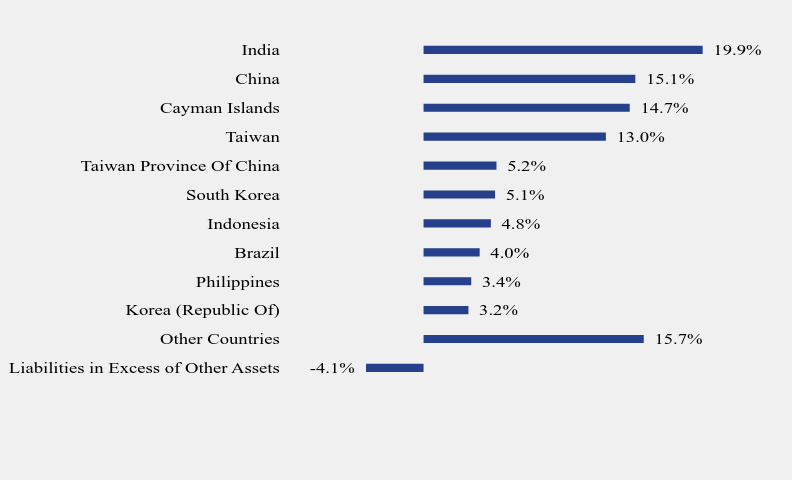

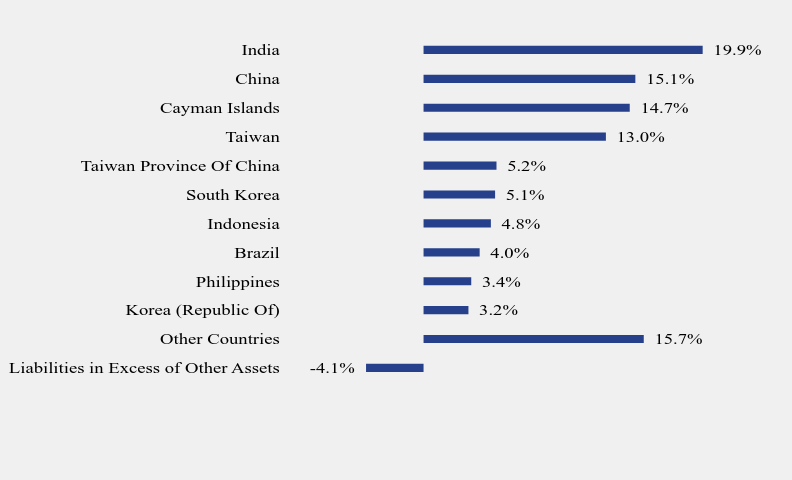

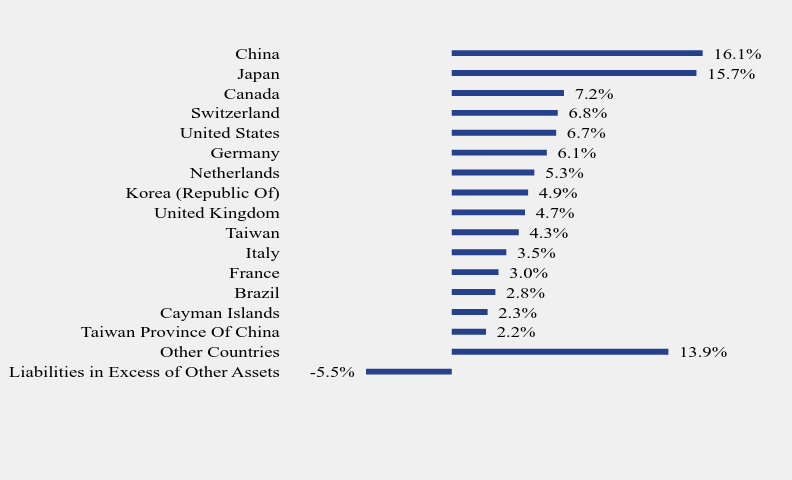

Country Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.1% |

| Other Countries | 15.7% |

| Korea (Republic Of) | 3.2% |

| Philippines | 3.4% |

| Brazil | 4.0% |

| Indonesia | 4.8% |

| South Korea | 5.1% |

| Taiwan Province Of China | 5.2% |

| Taiwan | 13.0% |

| Cayman Islands | 14.7% |

| China | 15.1% |

| India | 19.9% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Emerging Markets Stock Fund - Class A (DAEMX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/emergingmarket/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Emerging Markets Stock Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Emerging Markets Stock Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/emergingmarket/. You can also request this information by contacting us at 1-800-442-4358.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $245 | 2.24% |

How did the Fund perform during the reporting period?

Emerging markets outperformed foreign developed markets over the fiscal year. Developed markets, as measured by the MSCI EAFE TR Index, rose 23.0 percent, underperforming emerging markets, as measured by the MSCI Emerging Markets TR Index, which rallied 25.3 percent.

Security selection detracted from Fund performance over the fiscal year. The Fund benefited from strong security selection within Taiwan, Brazil, and India. However, it was not enough to offset the adverse impact of security selection in China due to meaningful stimulus prompting an indiscriminate beta rally in the country.

Country allocation also detracted from Fund performance. The positive impact from allocation in Brazil, India, and Gulf markets was outweighed by the exposure to Thailand, Hong Kong, and a small position to cash.

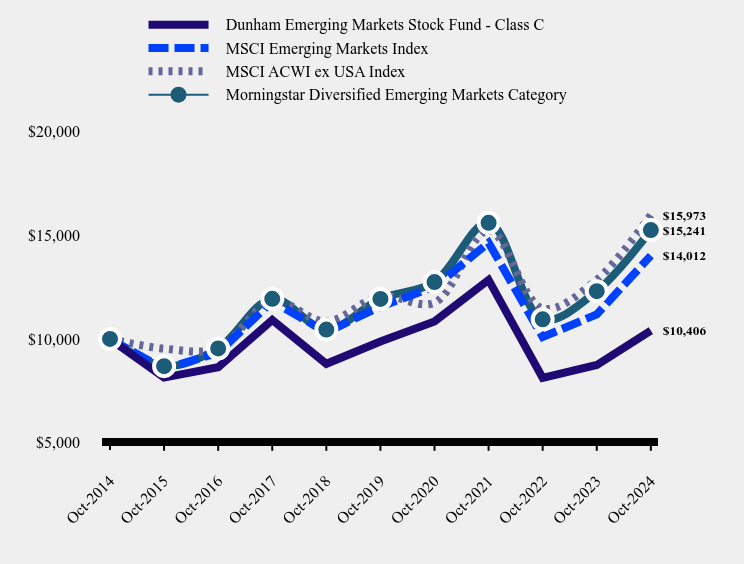

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Emerging Markets Stock Fund - Class C | MSCI Emerging Markets Index | MSCI ACWI ex USA Index | Morningstar Diversified Emerging Markets Category |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| Oct-2015 | $8,140 | $8,547 | $9,532 | $8,691 |

| Oct-2016 | $8,637 | $9,339 | $9,554 | $9,544 |

| Oct-2017 | $10,917 | $11,809 | $11,812 | $11,930 |

| Oct-2018 | $8,804 | $10,331 | $10,838 | $10,453 |

| Oct-2019 | $9,876 | $11,556 | $12,060 | $11,928 |

| Oct-2020 | $10,842 | $12,509 | $11,745 | $12,737 |

| Oct-2021 | $12,843 | $14,631 | $15,228 | $15,591 |

| Oct-2022 | $8,127 | $10,091 | $11,463 | $10,945 |

| Oct-2023 | $8,745 | $11,181 | $12,847 | $12,301 |

| Oct-2024 | $10,406 | $14,012 | $15,973 | $15,241 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Emerging Markets Stock Fund | 18.99% | 1.05% | 0.40% |

| Morningstar Diversified Emerging Markets Category | 23.91% | 5.02% | 4.30% |

| MSCI ACWI ex USA Index | 24.33% | 5.78% | 4.79% |

| MSCI Emerging Markets Index | 25.31% | 3.93% | 3.43% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $115,054,605 |

| Number of Portfolio Holdings | 88 |

| Total Advisory Fee | $933,929 |

| Portfolio Turnover | 70% |

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.1% |

| Real Estate | 0.6% |

| Mixed Allocation | 0.9% |

| Materials | 2.0% |

| Energy | 2.5% |

| Money Market Funds | 2.7% |

| Health Care | 4.3% |

| Consumer Staples | 4.6% |

| Utilities | 4.7% |

| Industrials | 6.5% |

| Communications | 12.0% |

| Consumer Discretionary | 15.0% |

| Financials | 23.0% |

| Technology | 25.3% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 0.8% |

| Common Stocks | 95.3% |

| Money Market Funds | 2.6% |

| Preferred Stocks | 1.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Taiwan Semiconductor Manufacturing Company Ltd. | 11.8% |

| Tencent Holdings Ltd. | 6.2% |

| Alibaba Group Holding Ltd. | 3.5% |

| Samsung Electronics Company Ltd. | 3.2% |

| Trip.com Group Ltd. - ADR | 2.7% |

| Max Healthcare Institute Ltd. | 2.7% |

| Bharti Airtel Ltd. | 2.3% |

| Bank Central Asia Tbk P.T. | 2.2% |

| HDFC Bank Ltd. | 2.1% |

| Bank Rakyat Indonesia Persero Tbk P.T. | 2.1% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.1% |

| Other Countries | 15.7% |

| Korea (Republic Of) | 3.2% |

| Philippines | 3.4% |

| Brazil | 4.0% |

| Indonesia | 4.8% |

| South Korea | 5.1% |

| Taiwan Province Of China | 5.2% |

| Taiwan | 13.0% |

| Cayman Islands | 14.7% |

| China | 15.1% |

| India | 19.9% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Emerging Markets Stock Fund - Class C (DCEMX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/emergingmarket/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Emerging Markets Stock Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Emerging Markets Stock Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/emergingmarket/. You can also request this information by contacting us at 1-800-442-4358.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $137 | 1.24% |

How did the Fund perform during the reporting period?

Emerging markets outperformed foreign developed markets over the fiscal year. Developed markets, as measured by the MSCI EAFE TR Index, rose 23.0 percent, underperforming emerging markets, as measured by the MSCI Emerging Markets TR Index, which rallied 25.3 percent.

Security selection detracted from Fund performance over the fiscal year. The Fund benefited from strong security selection within Taiwan, Brazil, and India. However, it was not enough to offset the adverse impact of security selection in China due to meaningful stimulus prompting an indiscriminate beta rally in the country.

Country allocation also detracted from Fund performance. The positive impact from allocation in Brazil, India, and Gulf markets was outweighed by the exposure to Thailand, Hong Kong, and a small position to cash.

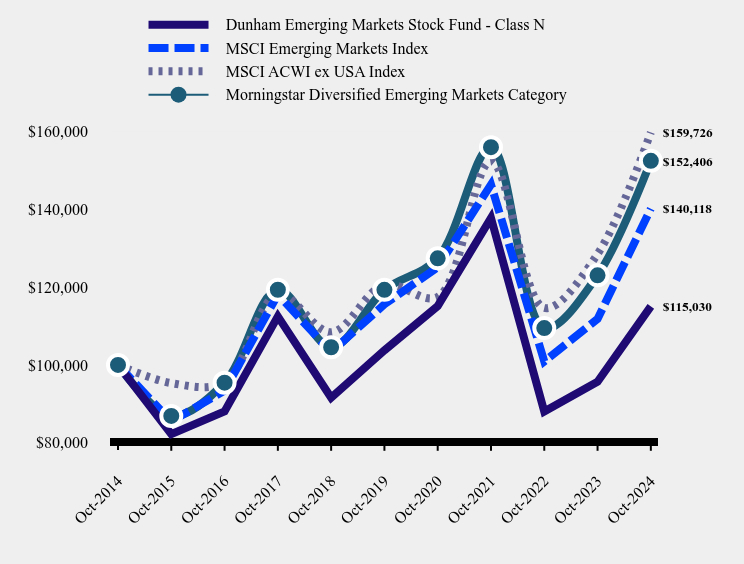

How has the Fund performed over the last ten years?

Total Return Based on $100,000 Investment

| Dunham Emerging Markets Stock Fund - Class N | MSCI Emerging Markets Index | MSCI ACWI ex USA Index | Morningstar Diversified Emerging Markets Category |

|---|

| Oct-2014 | $100,000 | $100,000 | $100,000 | $100,000 |

| Oct-2015 | $82,210 | $85,468 | $95,324 | $86,907 |

| Oct-2016 | $88,071 | $93,388 | $95,537 | $95,444 |

| Oct-2017 | $112,459 | $118,090 | $118,121 | $119,295 |

| Oct-2018 | $91,570 | $103,310 | $108,384 | $104,533 |

| Oct-2019 | $103,739 | $115,559 | $120,598 | $119,282 |

| Oct-2020 | $115,086 | $125,093 | $117,447 | $127,373 |

| Oct-2021 | $137,718 | $146,310 | $152,285 | $155,909 |

| Oct-2022 | $88,026 | $100,914 | $114,630 | $109,454 |

| Oct-2023 | $95,669 | $111,814 | $128,465 | $123,006 |

| Oct-2024 | $115,030 | $140,118 | $159,726 | $152,406 |

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Emerging Markets Stock Fund | 20.24% | 2.09% | 1.41% |

| Morningstar Diversified Emerging Markets Category | 23.91% | 5.02% | 4.30% |

| MSCI ACWI ex USA Index | 24.33% | 5.78% | 4.79% |

| MSCI Emerging Markets Index | 25.31% | 3.93% | 3.43% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $115,054,605 |

| Number of Portfolio Holdings | 88 |

| Total Advisory Fee | $933,929 |

| Portfolio Turnover | 70% |

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.1% |

| Real Estate | 0.6% |

| Mixed Allocation | 0.9% |

| Materials | 2.0% |

| Energy | 2.5% |

| Money Market Funds | 2.7% |

| Health Care | 4.3% |

| Consumer Staples | 4.6% |

| Utilities | 4.7% |

| Industrials | 6.5% |

| Communications | 12.0% |

| Consumer Discretionary | 15.0% |

| Financials | 23.0% |

| Technology | 25.3% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 0.8% |

| Common Stocks | 95.3% |

| Money Market Funds | 2.6% |

| Preferred Stocks | 1.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Taiwan Semiconductor Manufacturing Company Ltd. | 11.8% |

| Tencent Holdings Ltd. | 6.2% |

| Alibaba Group Holding Ltd. | 3.5% |

| Samsung Electronics Company Ltd. | 3.2% |

| Trip.com Group Ltd. - ADR | 2.7% |

| Max Healthcare Institute Ltd. | 2.7% |

| Bharti Airtel Ltd. | 2.3% |

| Bank Central Asia Tbk P.T. | 2.2% |

| HDFC Bank Ltd. | 2.1% |

| Bank Rakyat Indonesia Persero Tbk P.T. | 2.1% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -4.1% |

| Other Countries | 15.7% |

| Korea (Republic Of) | 3.2% |

| Philippines | 3.4% |

| Brazil | 4.0% |

| Indonesia | 4.8% |

| South Korea | 5.1% |

| Taiwan Province Of China | 5.2% |

| Taiwan | 13.0% |

| Cayman Islands | 14.7% |

| China | 15.1% |

| India | 19.9% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Emerging Markets Stock Fund - Class N (DNEMX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/emergingmarket/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Floating Rate Bond Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Floating Rate Bond Fund ("Fund") for the period of November 1, 2023 to December 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/floatingratebond/. You can also request this information by contacting us at 1-800-442-4358. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $136 | 1.29% |

|---|

How did the Fund perform during the reporting period?

The allocation to securitized asset pools, known as collateralized loan obligations (CLO), contributed meaningfully to positive Fund performance. CLOs within the Fund rallied amid a supportive technical environment.

The overweight to CCC rated credits contributed to Fund performance. The Fund maintained a higher allocation to CCC-rated securities versus the benchmark index. This exposure benefited the Fund as CCC rated securities rallied over the fiscal year.

Security selection within the loan allocation detracted from Fund Performance. Contributors within the loan allocation were broad-based over the fiscal year, however idiosyncratic overweight positions, such as positions in a cable provider and call center operator, weighed on Fund performance.

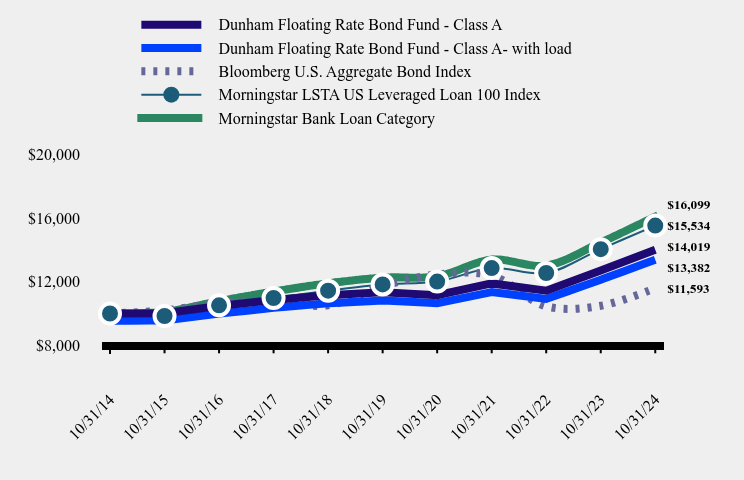

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Floating Rate Bond Fund - Class A | Dunham Floating Rate Bond Fund - Class A- with load | Bloomberg U.S. Aggregate Bond Index | Morningstar LSTA US Leveraged Loan 100 Index | Morningstar Bank Loan Category |

|---|

| 10/31/14 | $10,000 | $9,545 | $10,000 | $10,000 | $10,000 |

|---|

| 10/31/15 | $10,016 | $9,561 | $10,196 | $9,843 | $10,109 |

|---|

| 10/31/16 | $10,468 | $9,992 | $10,641 | $10,512 | $10,776 |

|---|

| 10/31/17 | $10,849 | $10,356 | $10,737 | $10,977 | $11,383 |

|---|

| 10/31/18 | $11,149 | $10,643 | $10,517 | $11,435 | $11,896 |

|---|

| 10/31/19 | $11,331 | $10,816 | $11,727 | $11,828 | $12,255 |

|---|

| 10/31/20 | $11,154 | $10,647 | $12,453 | $12,009 | $12,340 |

|---|

| 10/31/21 | $11,893 | $11,352 | $12,393 | $12,859 | $13,386 |

|---|

| 10/31/22 | $11,439 | $10,919 | $10,450 | $12,551 | $13,019 |

|---|

| 10/31/23 | $12,701 | $12,124 | $10,487 | $14,051 | $14,467 |

|---|

| 10/31/24 | $14,019 | $13,382 | $11,593 | $15,534 | $16,099 |

|---|

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Floating Rate Bond Fund | | | |

|---|

| Class A Without Load | 10.37% | 4.35% | 3.44% |

|---|

| Class A With Load | 5.44% | 3.39% | 2.96% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

|---|

| Morningstar Bank Loan Category | 11.28% | 5.61% | 4.88% |

|---|

| Morningstar LSTA US Leveraged Loan 100 Index | 10.55% | 5.60% | 4.50% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $142,344,370 |

|---|

| Number of Portfolio Holdings | 231 |

|---|

| Total Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $970,346 |

|---|

| Portfolio Turnover | 80% |

|---|

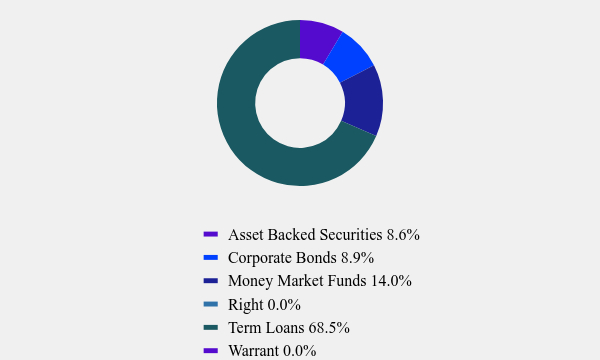

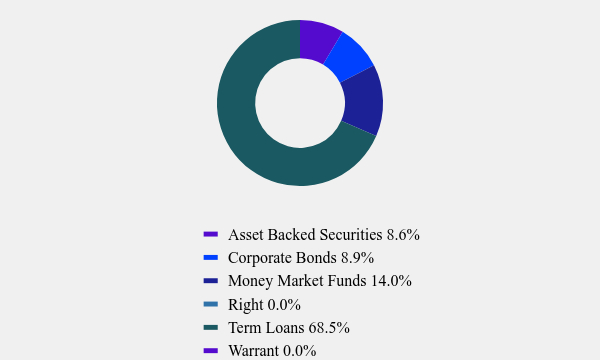

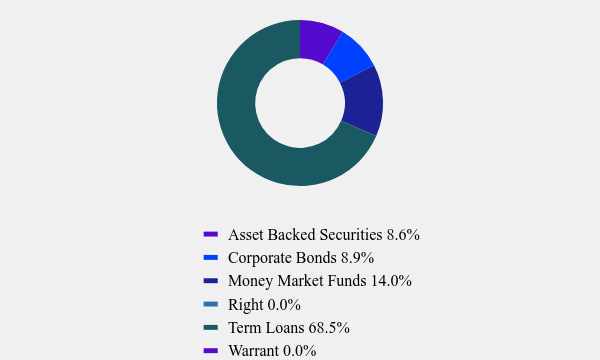

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 8.6% |

| Corporate Bonds | 8.9% |

| Money Market Funds | 14.0% |

| Right | 0.0% |

| Term Loans | 68.5% |

| Warrant | 0.0% |

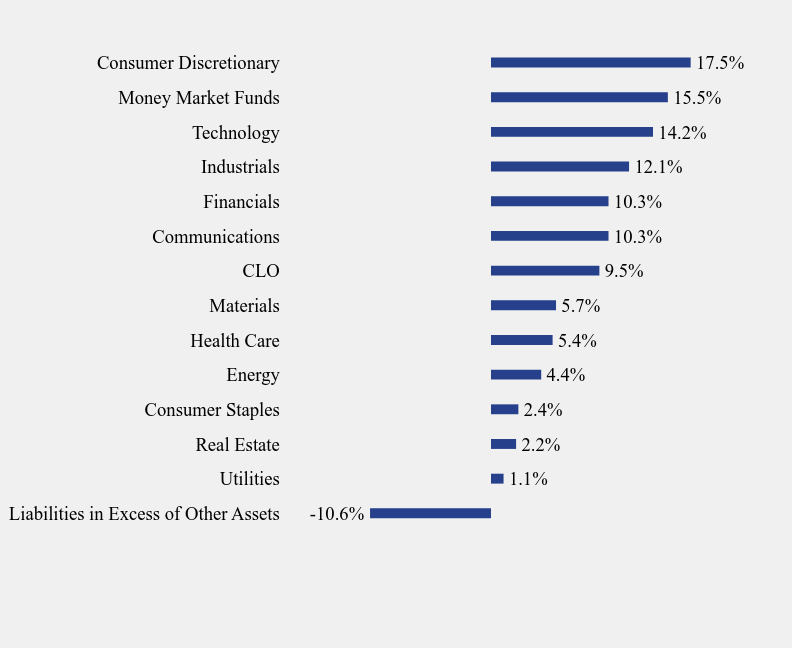

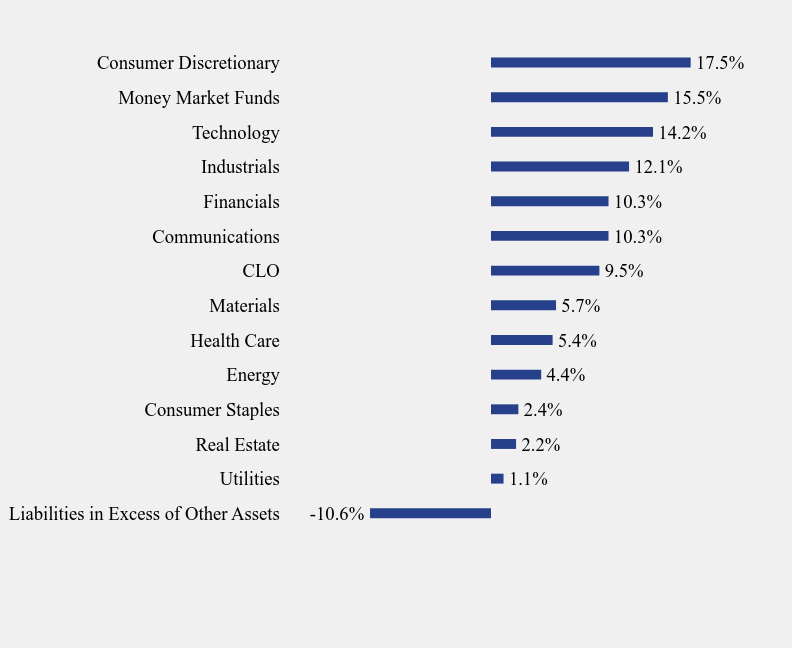

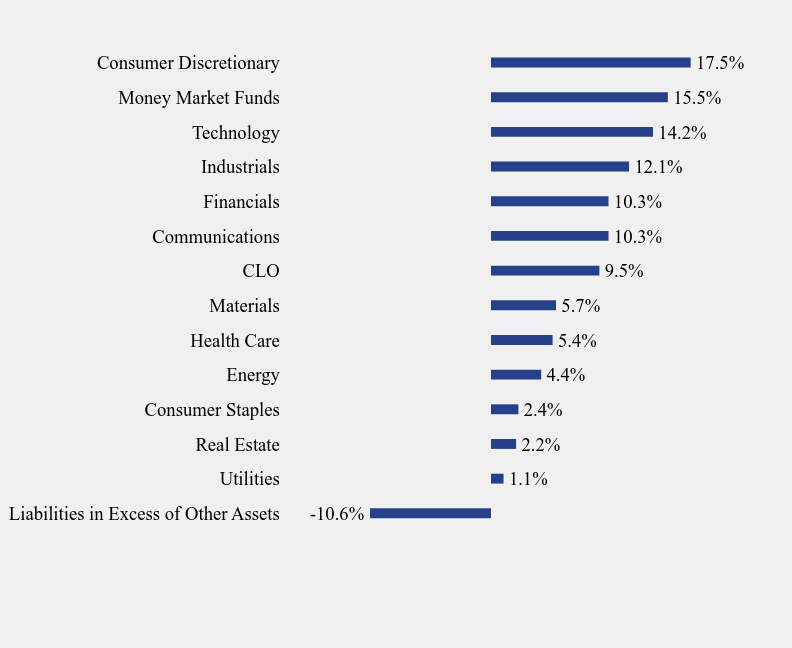

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Utilities | 1.1% |

| Real Estate | 2.2% |

| Consumer Staples | 2.4% |

| Energy | 4.4% |

| Health Care | 5.4% |

| Materials | 5.7% |

| CLO | 9.5% |

| Communications | 10.3% |

| Financials | 10.3% |

| Industrials | 12.1% |

| Technology | 14.2% |

| Money Market Funds | 15.5% |

| Consumer Discretionary | 17.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Fidelity Government Portfolio, Institutional Class | 12.4% |

| Mount Vernon Liquid Assets Portfolio | 3.1% |

| Rockford Tower CLO 2020-1 Ltd., D1R | 2.8% |

| Bristol Park CLO LTD, ER | 1.4% |

| Silver Point Clo 5 Ltd., D2 | 1.3% |

| THL Credit Wind River 2019-3 Clo Ltd., E2R | 1.1% |

| Atrium IX, ER | 1.1% |

| Apidos CLO XX, DR | 1.1% |

| LBM Acquisition, LLC | 0.9% |

| Osaic Holdings, Inc. | 0.8% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Floating Rate Bond Fund - Class A (DAFRX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/floatingratebond/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Floating Rate Bond Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Floating Rate Bond Fund ("Fund") for the period of November 1, 2023 to December 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/floatingratebond/. You can also request this information by contacting us at 1-800-442-4358. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $188 | 1.79% |

|---|

How did the Fund perform during the reporting period?

The allocation to securitized asset pools, known as collateralized loan obligations (CLO), contributed meaningfully to positive Fund performance. CLOs within the Fund rallied amid a supportive technical environment.

The overweight to CCC rated credits contributed to Fund performance. The Fund maintained a higher allocation to CCC-rated securities versus the benchmark index. This exposure benefited the Fund as CCC rated securities rallied over the fiscal year.

Security selection within the loan allocation detracted from Fund Performance. Contributors within the loan allocation were broad-based over the fiscal year, however idiosyncratic overweight positions, such as positions in a cable provider and call center operator, weighed on Fund performance.

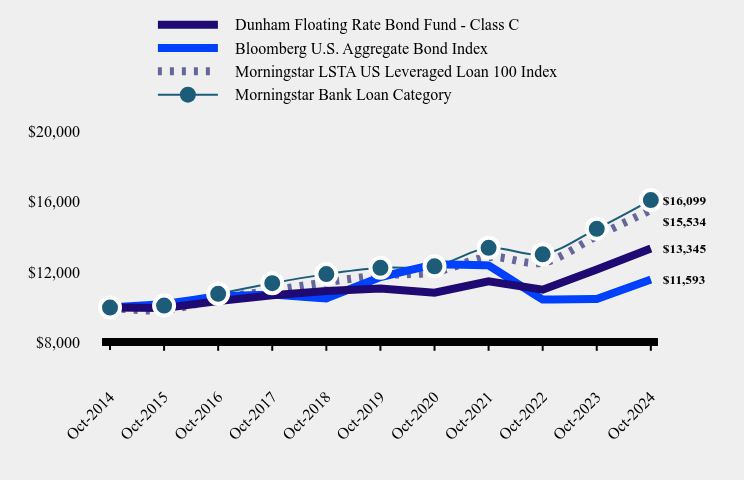

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Floating Rate Bond Fund - Class C | Bloomberg U.S. Aggregate Bond Index | Morningstar LSTA US Leveraged Loan 100 Index | Morningstar Bank Loan Category |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

| Oct-2015 | $9,977 | $10,196 | $9,843 | $10,109 |

|---|

| Oct-2016 | $10,364 | $10,641 | $10,512 | $10,776 |

|---|

| Oct-2017 | $10,696 | $10,737 | $10,977 | $11,383 |

|---|

| Oct-2018 | $10,938 | $10,517 | $11,435 | $11,896 |

|---|

| Oct-2019 | $11,073 | $11,727 | $11,828 | $12,255 |

|---|

| Oct-2020 | $10,845 | $12,453 | $12,009 | $12,340 |

|---|

| Oct-2021 | $11,493 | $12,393 | $12,859 | $13,386 |

|---|

| Oct-2022 | $11,012 | $10,450 | $12,551 | $13,019 |

|---|

| Oct-2023 | $12,152 | $10,487 | $14,051 | $14,467 |

|---|

| Oct-2024 | $13,345 | $11,593 | $15,534 | $16,099 |

|---|

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Floating Rate Bond Fund | 9.82% | 3.80% | 2.93% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

|---|

| Morningstar Bank Loan Category | 11.28% | 5.61% | 4.88% |

|---|

| Morningstar LSTA US Leveraged Loan 100 Index | 10.55% | 5.60% | 4.50% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $142,344,370 |

|---|

| Number of Portfolio Holdings | 231 |

|---|

| Total Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $970,346 |

|---|

| Portfolio Turnover | 80% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 8.6% |

| Corporate Bonds | 8.9% |

| Money Market Funds | 14.0% |

| Right | 0.0% |

| Term Loans | 68.5% |

| Warrant | 0.0% |

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Utilities | 1.1% |

| Real Estate | 2.2% |

| Consumer Staples | 2.4% |

| Energy | 4.4% |

| Health Care | 5.4% |

| Materials | 5.7% |

| CLO | 9.5% |

| Communications | 10.3% |

| Financials | 10.3% |

| Industrials | 12.1% |

| Technology | 14.2% |

| Money Market Funds | 15.5% |

| Consumer Discretionary | 17.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Fidelity Government Portfolio, Institutional Class | 12.4% |

| Mount Vernon Liquid Assets Portfolio | 3.1% |

| Rockford Tower CLO 2020-1 Ltd., D1R | 2.8% |

| Bristol Park CLO LTD, ER | 1.4% |

| Silver Point Clo 5 Ltd., D2 | 1.3% |

| THL Credit Wind River 2019-3 Clo Ltd., E2R | 1.1% |

| Atrium IX, ER | 1.1% |

| Apidos CLO XX, DR | 1.1% |

| LBM Acquisition, LLC | 0.9% |

| Osaic Holdings, Inc. | 0.8% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Floating Rate Bond Fund - Class C (DCFRX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/floatingratebond/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

Dunham Floating Rate Bond Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Floating Rate Bond Fund ("Fund") for the period of November 1, 2023 to December 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/floatingratebond/. You can also request this information by contacting us at 1-800-442-4358. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $107 | 1.02% |

|---|

How did the Fund perform during the reporting period?

The allocation to securitized asset pools, known as collateralized loan obligations (CLO), contributed meaningfully to positive Fund performance. CLOs within the Fund rallied amid a supportive technical environment.

The overweight to CCC rated credits contributed to Fund performance. The Fund maintained a higher allocation to CCC-rated securities versus the benchmark index. This exposure benefited the Fund as CCC rated securities rallied over the fiscal year.

Security selection within the loan allocation detracted from Fund Performance. Contributors within the loan allocation were broad-based over the fiscal year, however idiosyncratic overweight positions, such as positions in a cable provider and call center operator, weighed on Fund performance.

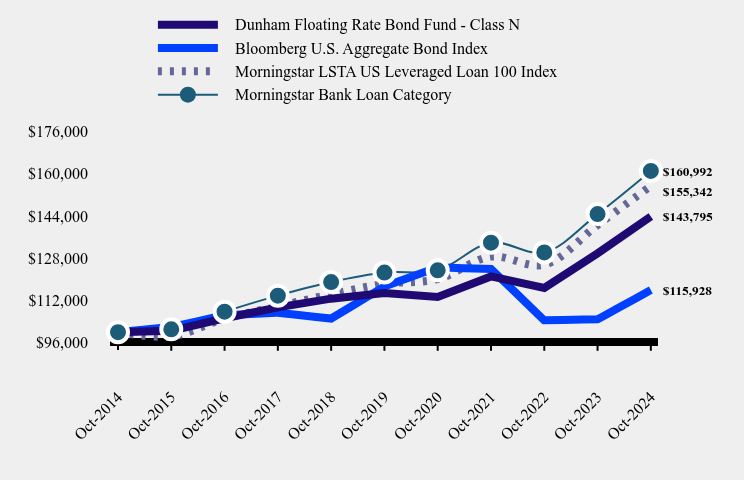

How has the Fund performed over the last ten years?

Total Return Based on $100,000 Investment

| Dunham Floating Rate Bond Fund - Class N | Bloomberg U.S. Aggregate Bond Index | Morningstar LSTA US Leveraged Loan 100 Index | Morningstar Bank Loan Category |

|---|

| Oct-2014 | $100,000 | $100,000 | $100,000 | $100,000 |

|---|

| Oct-2015 | $100,513 | $101,956 | $98,428 | $101,092 |

|---|

| Oct-2016 | $105,276 | $106,412 | $105,122 | $107,762 |

|---|

| Oct-2017 | $109,388 | $107,372 | $109,772 | $113,826 |

|---|

| Oct-2018 | $112,689 | $105,167 | $114,348 | $118,964 |

|---|

| Oct-2019 | $114,809 | $117,272 | $118,282 | $122,546 |

|---|

| Oct-2020 | $113,304 | $124,527 | $120,093 | $123,398 |

|---|

| Oct-2021 | $121,089 | $123,932 | $128,591 | $133,862 |

|---|

| Oct-2022 | $116,762 | $104,496 | $125,512 | $130,186 |

|---|

| Oct-2023 | $129,821 | $104,868 | $140,515 | $144,669 |

|---|

| Oct-2024 | $143,795 | $115,928 | $155,342 | $160,992 |

|---|

Calculations assume the reinvestment of dividends and capital gains, if any.

Average Annual Total Returns ( As of October 31, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Dunham Floating Rate Bond Fund | 10.76% | 4.61% | 3.70% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

|---|

| Morningstar Bank Loan Category | 11.28% | 5.61% | 4.88% |

|---|

| Morningstar LSTA US Leveraged Loan 100 Index | 10.55% | 5.60% | 4.50% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.dunham.com for more recent performance information.

Key Fund Statistics ( As of October 31, 2024)

| Total Net Assets | $142,344,370 |

|---|

| Number of Portfolio Holdings | 231 |

|---|

| Total Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $970,346 |

|---|

| Portfolio Turnover | 80% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 8.6% |

| Corporate Bonds | 8.9% |

| Money Market Funds | 14.0% |

| Right | 0.0% |

| Term Loans | 68.5% |

| Warrant | 0.0% |

What did the Fund invest in? (As of October 31, 2024)

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Utilities | 1.1% |

| Real Estate | 2.2% |

| Consumer Staples | 2.4% |

| Energy | 4.4% |

| Health Care | 5.4% |

| Materials | 5.7% |

| CLO | 9.5% |

| Communications | 10.3% |

| Financials | 10.3% |

| Industrials | 12.1% |

| Technology | 14.2% |

| Money Market Funds | 15.5% |

| Consumer Discretionary | 17.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Fidelity Government Portfolio, Institutional Class | 12.4% |

| Mount Vernon Liquid Assets Portfolio | 3.1% |

| Rockford Tower CLO 2020-1 Ltd., D1R | 2.8% |

| Bristol Park CLO LTD, ER | 1.4% |

| Silver Point Clo 5 Ltd., D2 | 1.3% |

| THL Credit Wind River 2019-3 Clo Ltd., E2R | 1.1% |

| Atrium IX, ER | 1.1% |

| Apidos CLO XX, DR | 1.1% |

| LBM Acquisition, LLC | 0.9% |

| Osaic Holdings, Inc. | 0.8% |

Holdings, Sector Weightings and/ or Asset Weightings, as applicable, are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

No material changes occurred during the year ended October 31, 2024.

Dunham Floating Rate Bond Fund - Class N (DNFRX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://Dunham.onlineprospectus.net/Dunham/floatingratebond/ ) or by calling 1-800-442-4358, including its:

Prospectus

Financial information

Holdings

Proxy voting information

Funds Distributed by Dunham & Associates Investment Counsel, Inc., a Registered Investment Adviser and Broker/Dealer. Member FINRA / SIPC.

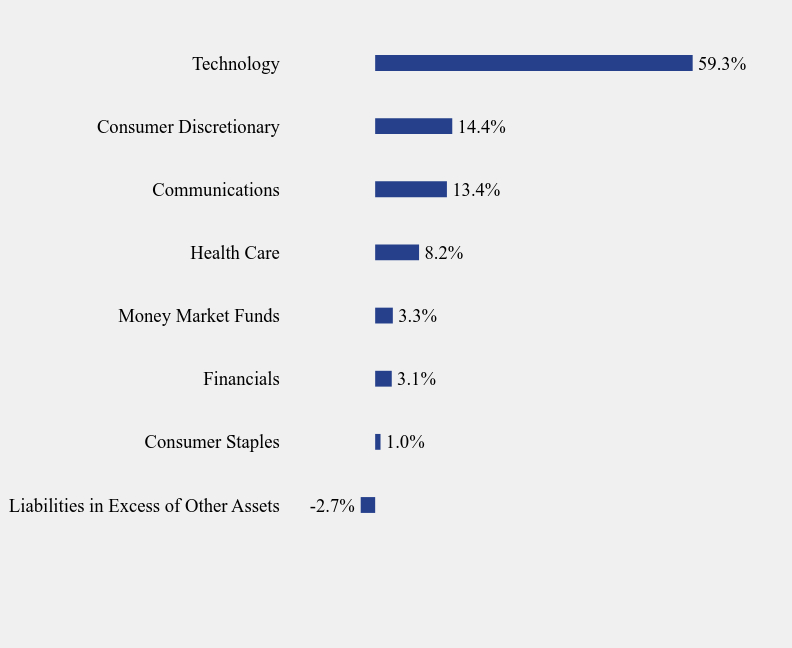

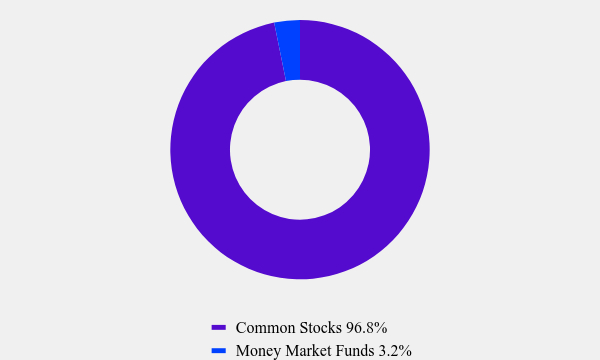

Dunham Focused Large Cap Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Dunham Focused Large Cap Growth Fund ("Fund") for the period of November 1, 2023 to December 31, 2024. You can find additional information about the Fund at https://Dunham.onlineprospectus.net/Dunham/focusedlargecapgrowth/. You can also request this information by contacting us at 1-800-442-4358. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $178 | 1.46% |

|---|

How did the Fund perform during the reporting period?

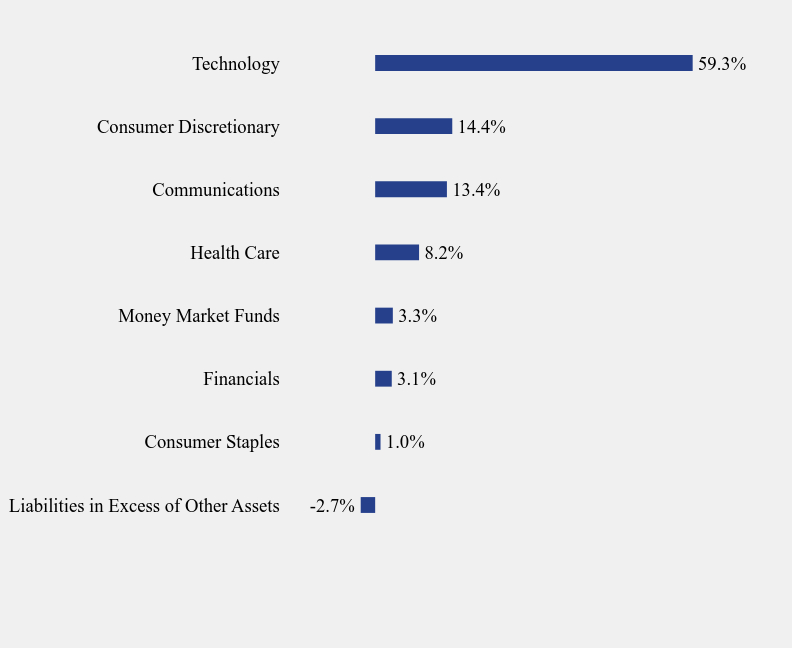

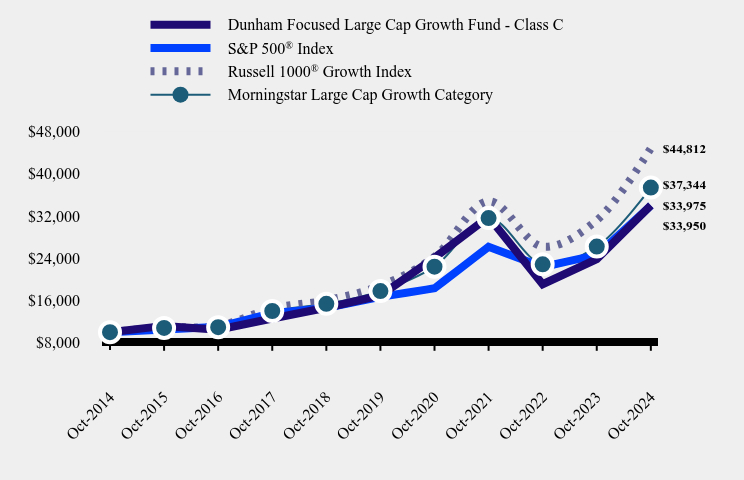

The exposure to “large capitalization” stocks with a “growth” style contributed positively to Fund performance over the fiscal year. Large cap growth companies broadly outpaced other styles and capitalizations as large growth stocks increased nearly 8 percent more than small cap growth stocks over the 12-month period ended October 31, 2024.

Stock selection provided mixed results over the fiscal year. The Fund holds a concentrated amount of stocks, and this resulted in the performance for the Fund within each sector to be significantly different from the benchmark – some positive and some negative, but overall very similar performance.

The Fund had no direct exposure to stocks in the materials, real estate, utilities, or energy sectors, which generally contributed positively to relative performance. The Fund did not have holdings directly in any of these sectors, which generally increased less than the Fund or benchmark as a whole, so this helped relative performance.

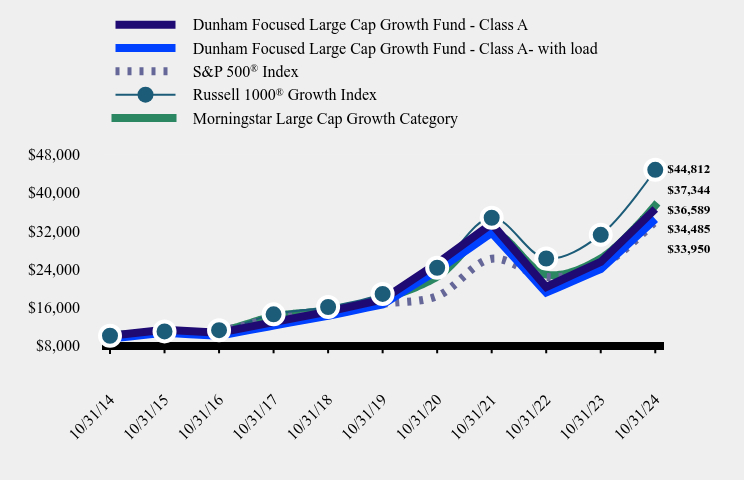

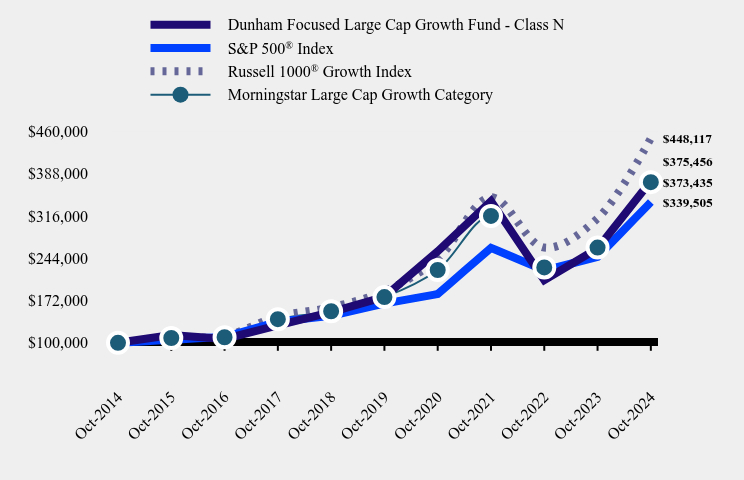

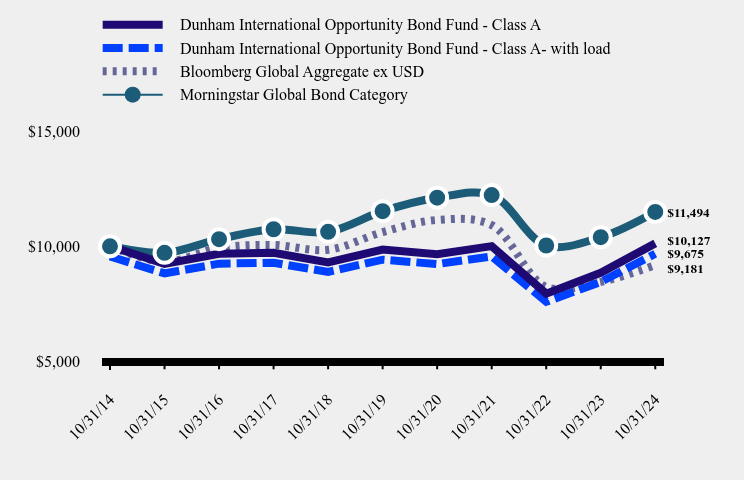

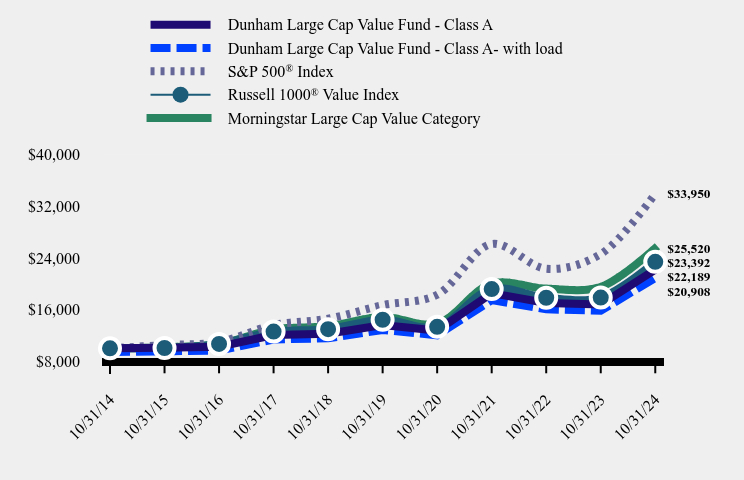

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Dunham Focused Large Cap Growth Fund - Class A | Dunham Focused Large Cap Growth Fund - Class A- with load | S&P 500® Index | Russell 1000® Growth Index | Morningstar Large Cap Growth Category |

|---|

| 10/31/14 | $10,000 | $9,425 | $10,000 | $10,000 | $10,000 |

|---|

| 10/31/15 | $11,268 | $10,619 | $10,520 | $10,918 | $10,813 |

|---|

| 10/31/16 | $10,610 | $9,999 | $10,994 | $11,167 | $10,945 |

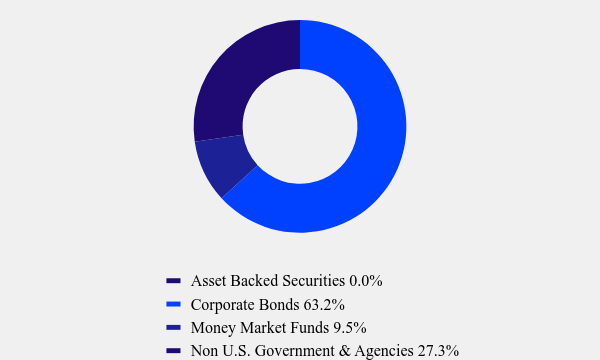

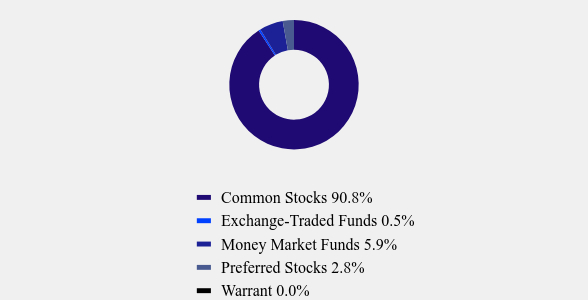

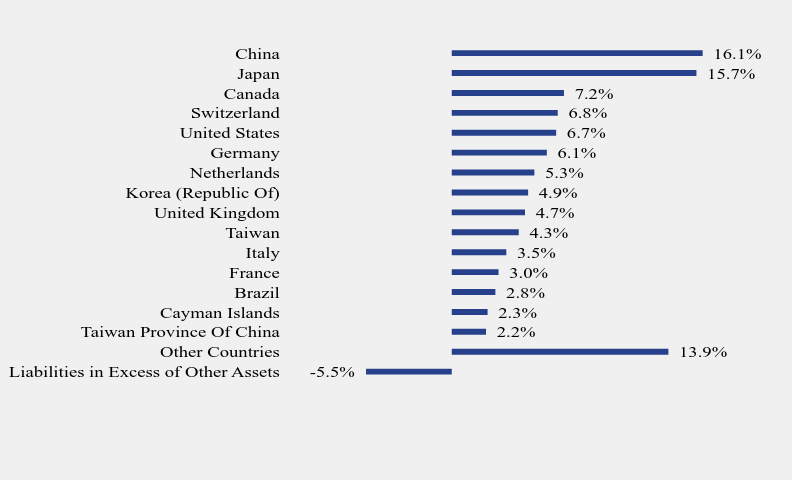

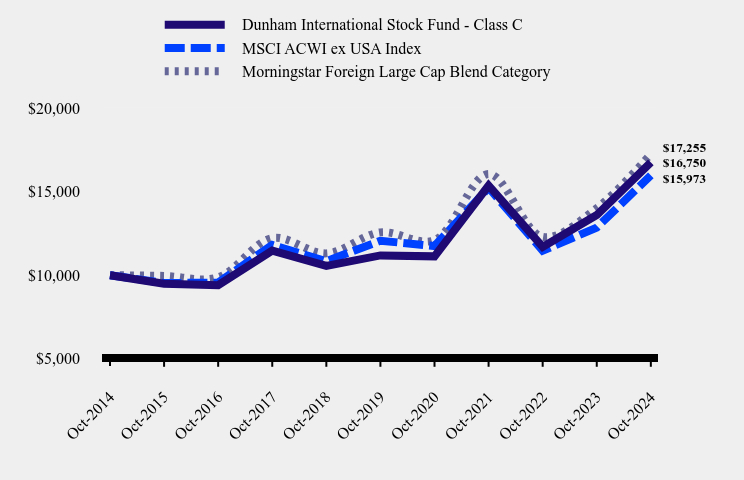

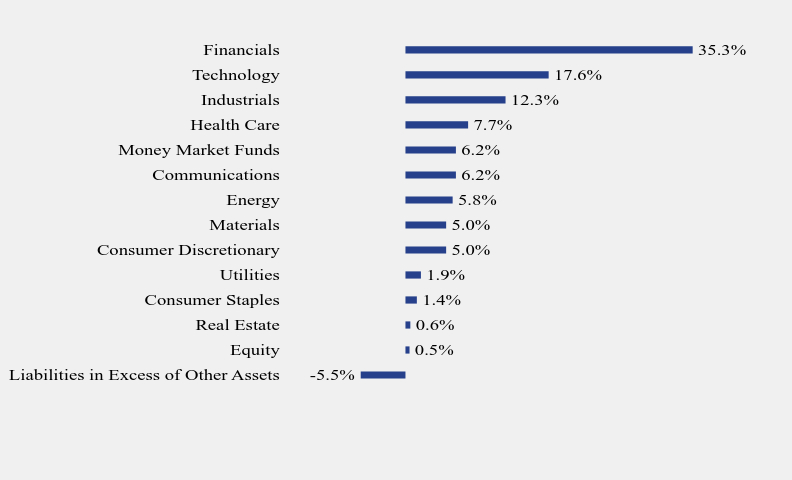

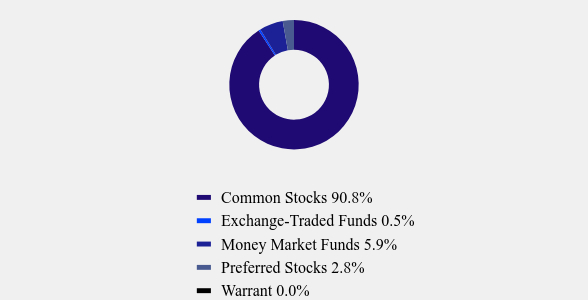

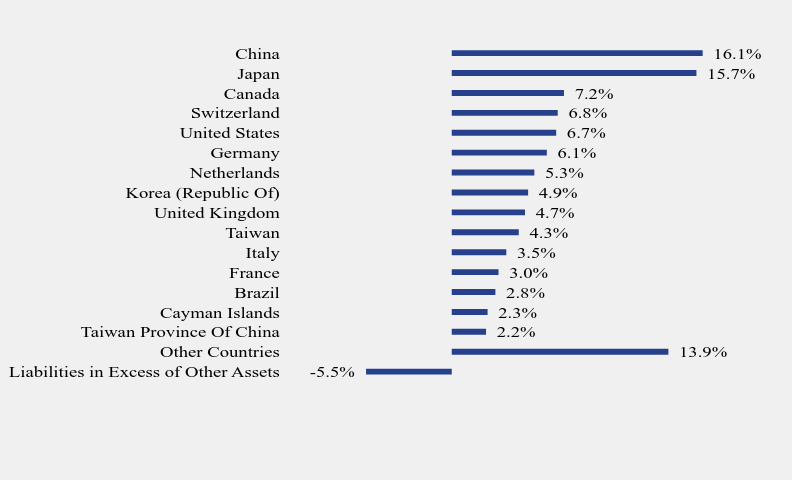

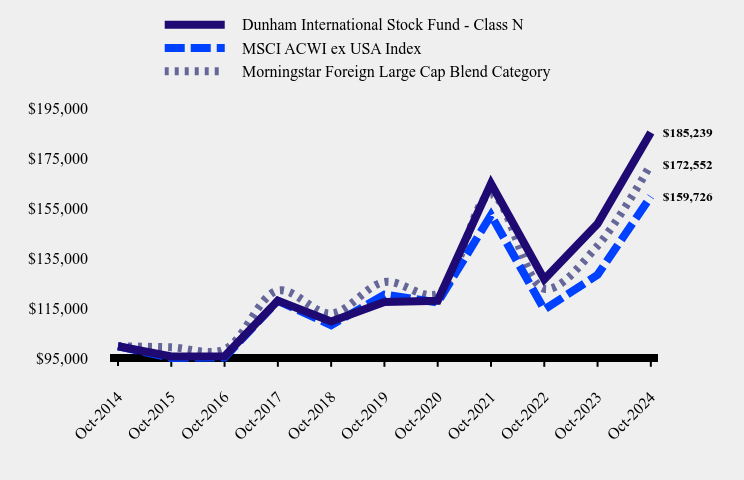

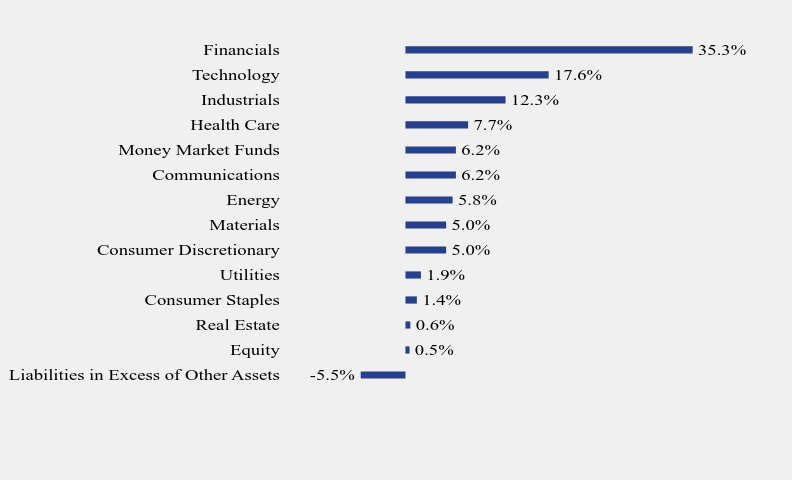

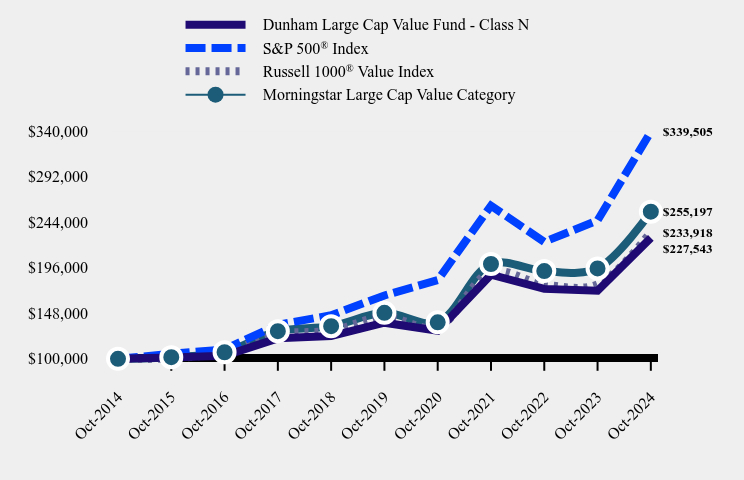

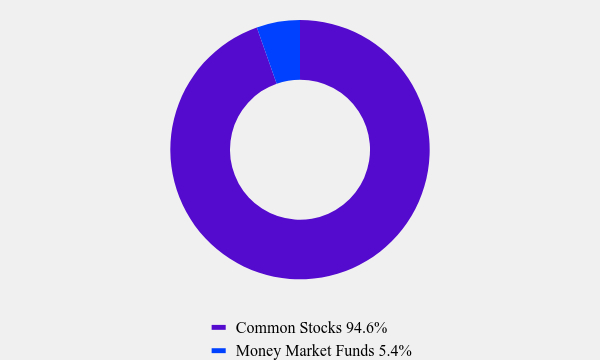

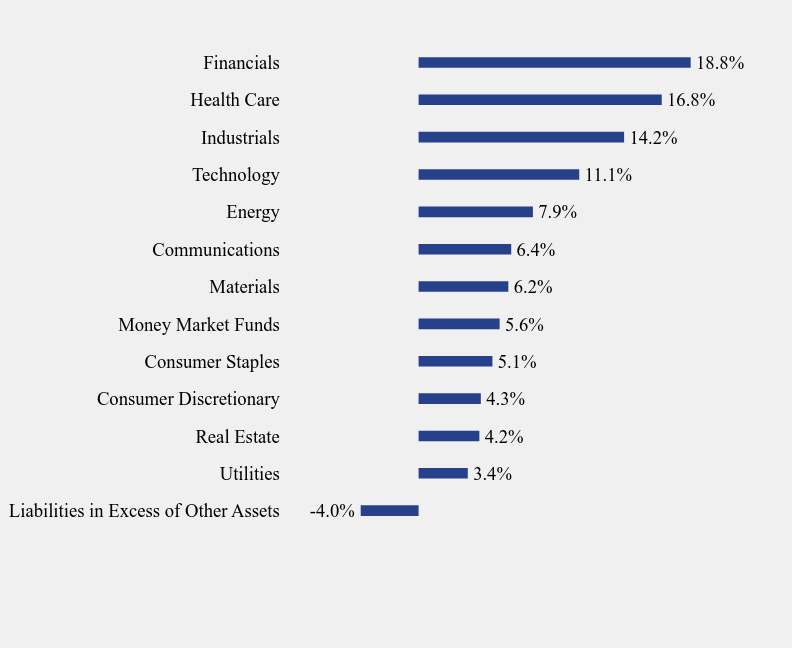

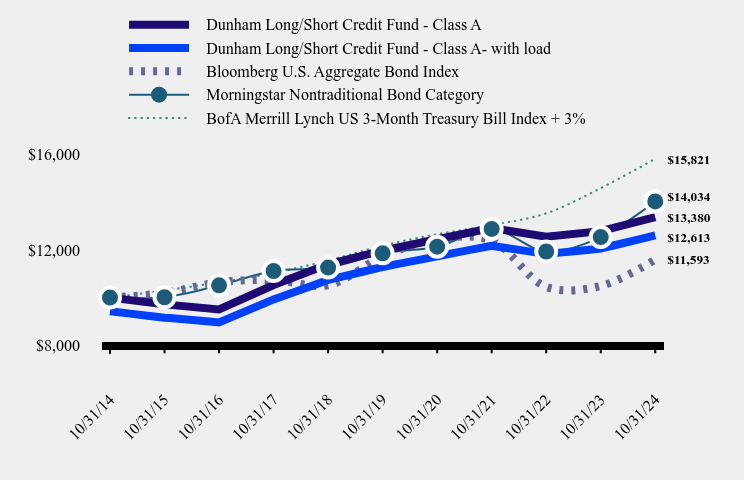

|---|