LETTERTO SHAREHOLDERS

Dear Fellow Shareholder,

Rarely have investors witnessed market dislocation on the scale seen during the fiscal year ended March 31, 2009. The financial crisis that began with bank failures and a massive unwinding of debt pushed the global economy into a recession and sent stock prices sharply lower.

In this annual report, we review the performance of the financial markets and our mutual funds from April 1, 2008 through March 31, 2009. We also highlight some of the key factors that drove investment returns and share our outlook for the future.

In the United States, the S&P 500 Index fell 38.1%. Most of the decline occurred after the September collapse of the U.S. investment banking industry, which became overwhelmed by mortgage-related losses. The dramatic events triggered a sell-off in the stock and credit markets, which triggered write-downs and deleveraging in the financial system. Credit dried up and economic activity slowed, with GDP plunging at an annual rate of 6.3% in the fourth quarter of 2008 — the steepest drop since 1982. Policymakers took unprecedented steps to boost confidence in the financial system and economy, including cutting short-term interest rates from 2.25% to near zero. However, throughout the fall and winter, stock prices slid, credit remained tight and the recession that had started in 2007 deepened.

The picture was similarly bleak in developed markets overseas, where investors grappled with European bank failures and gloomy economic data. The euro zone fell into its first recession since the 1999 creation of the common currency, and the U.K. and Japanese economies also slipped into recession. The European Central Bank, Bank of England and Bank of Japan slashed their key interest rates to 1.5%, 0.5% and 0.1%, respectively. With little room for further cuts, U.K. and Japanese central bankers started purchasing government bonds to try to lower borrowing costs, a measure the U.S. Federal Reserve implemented as well. The MSCI EAFE Index lost 36.5% in local currencies and 46.2% in U.S. dollar terms. The dollar was essentially flat versus the yen but appreciated 16.1% and 27.8% versus the euro and pound, respectively. Dollar strength was due to a global flight to safety, while the yen benefited from the unwinding of carry trades — trades in which money had been borrowed at low Japanese interest rates to invest elsewhere at potentially higher returns.

In developing countries, the MSCI Emerging Markets Index fell 36.5% in local currencies and 46.9% in U.S. dollars. Emerging market equities were especially volatile due to rising risk aversion and deteriorating demand for commodity exports. As the global financial crisis unfolded, the Reuters/Jefferies CRB Index of nineteen commodities dropped approximately 53% from its July peak through the end of March. Recognizing that inflation was yesterday’s problem, governments in emerging countries joined their developed-market counterparts in trying to stimulate their economies. For example, China cut interest rates for the first time in six years, Brazil unveiled a $15.1 billion construction spending package and India more than doubled the limit on foreign investment in corporate bonds.

The downward volatility in the markets was obviously a headwind for our mutual funds, all of which posted declines. We were disappointed by the magnitude of the losses but take some comfort in the fact that the majority of our funds outperformed their benchmarks. Since Nicholas-Applegate was founded in 1984, we have adhered to our investment philosophy in all market environments. The consistency of our approach has served the funds well in the past, and it did so again this period.

The qualities of our firm help us attract and retain high-caliber people, and we welcomed several talented professionals to the company this period. We also continued to invest in our technology infrastructure, which supports risk management, trading, compliance and other vital operations. We will continue to fully resource our investment teams, as well as the critical functions that contribute to their success. Our shareholders should expect the same level of commitment and investment from us in these difficult times that we promised in good times, and we intend to deliver it. Our organization is healthy and stable, and we enjoy a strong working relationship with our well-capitalized parent company, Allianz Global Investors.

We close the books on this fiscal year with relief, and look forward to the future with optimism. We do not believe the global economy will slip into a depression given the massive, concerted fiscal and monetary response from governments around the world. Nonetheless, we think that the duration of the current downturn relies on the effectiveness of those measures. Until the credit markets resume lending and businesses have access to capital, it is difficult to anticipate returns for any asset class. Investors can take heart, however, as several asset classes, including high-yield corporate bonds and convertible securities, provide attractive investment opportunities. Spreads between high yield bonds, also known as junk bonds and below investment grade issues, and comparable Treasury issues, remain well above prior-cycle highs.

On behalf of everyone at the firm, thank you for your participation in the Nicholas-Applegate Institutional Funds. We appreciate the trust you have placed in us.

Best Regards,

Horacio A. Valeiras, CFA

President and Chief Investment Officer

March 31, 2009

TABLEOF CONTENTS

The Funds’ Review and Outlook, Performance and Schedules of Investments:

| | |

U.S. Ultra Micro Cap Fund | | 1 |

U.S. Micro Cap Fund | | 4 |

U.S. Emerging Growth Fund | | 9 |

U.S. Small to Mid Cap Growth Fund | | 13 |

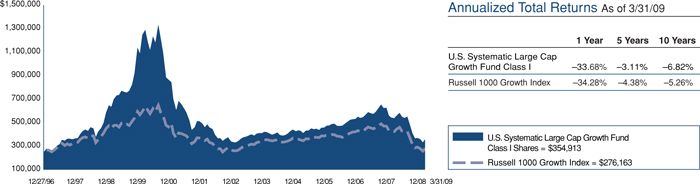

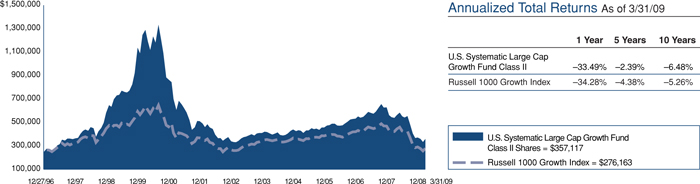

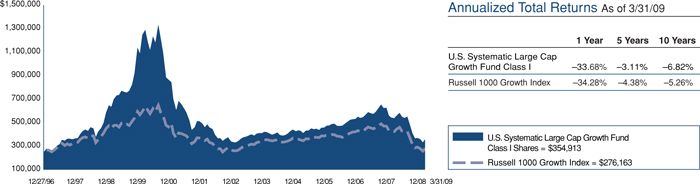

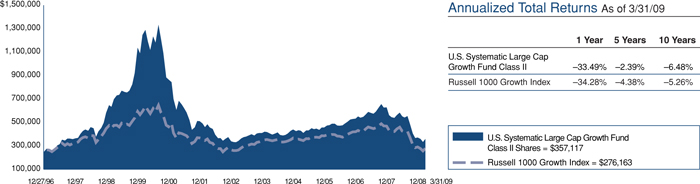

U.S. Systematic Large Cap Growth Fund | | 17 |

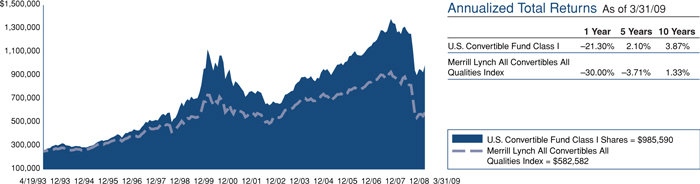

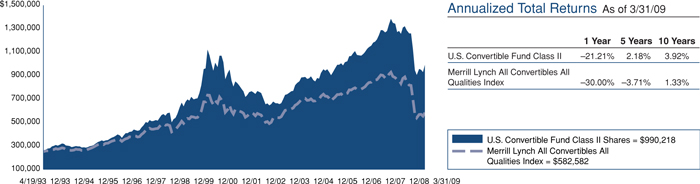

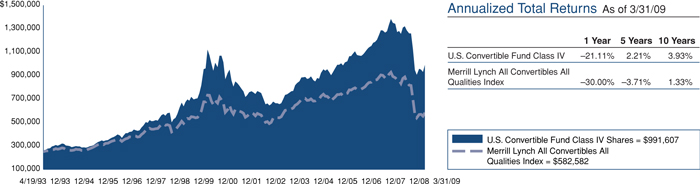

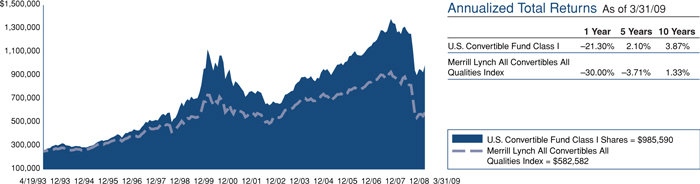

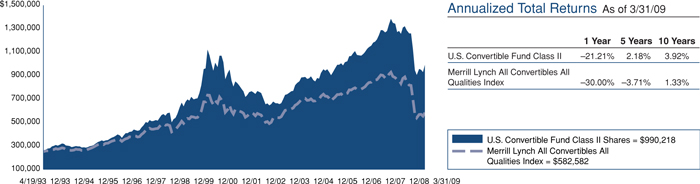

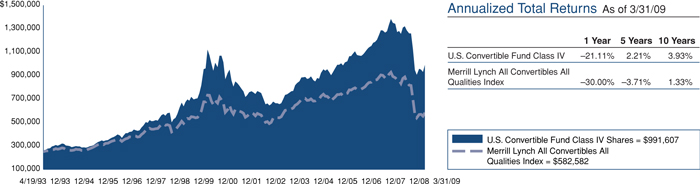

U.S. Convertible Fund | | 21 |

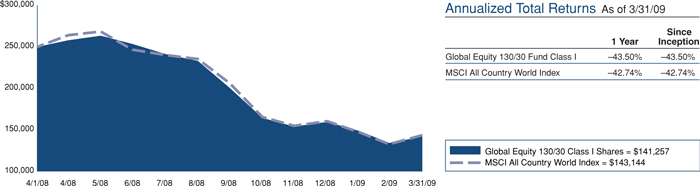

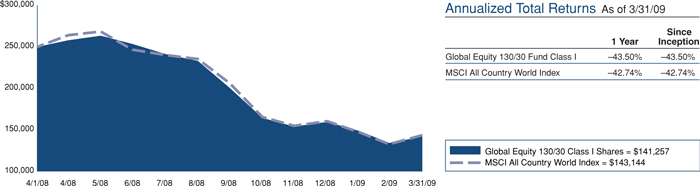

Global Equity 130/30 Fund | | 26 |

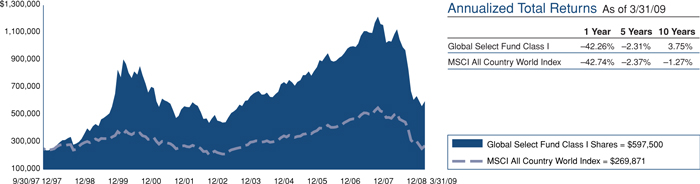

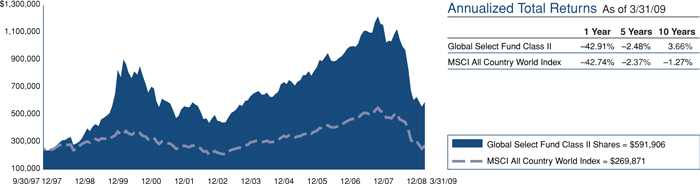

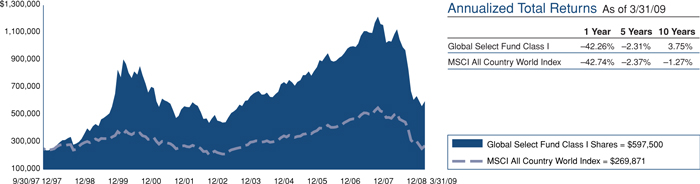

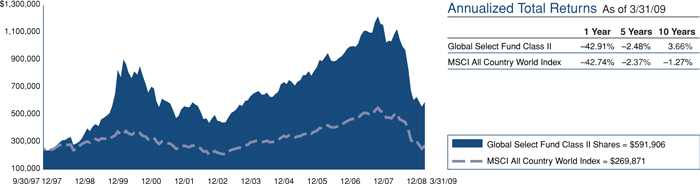

Global Select Fund | | 29 |

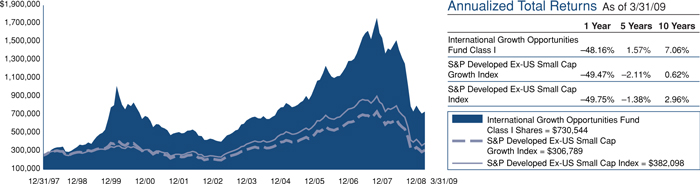

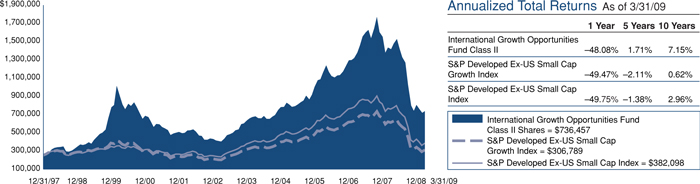

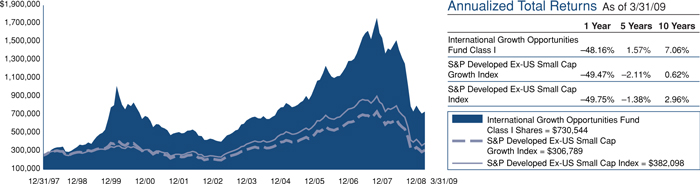

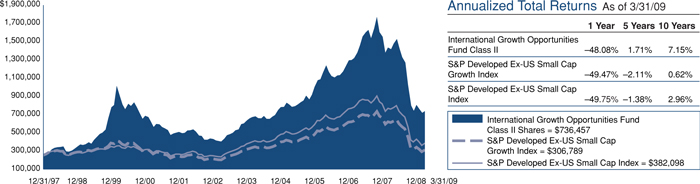

International Growth Opportunities Fund | | 33 |

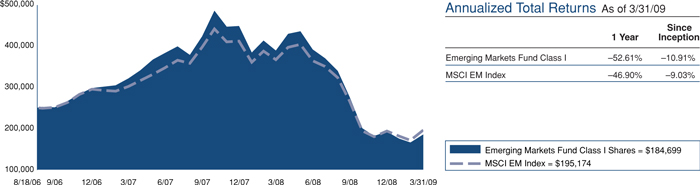

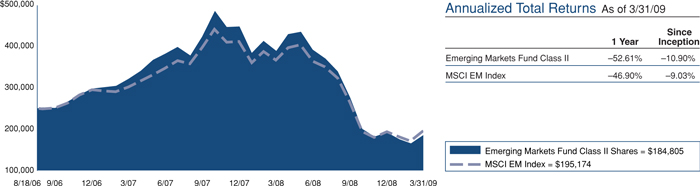

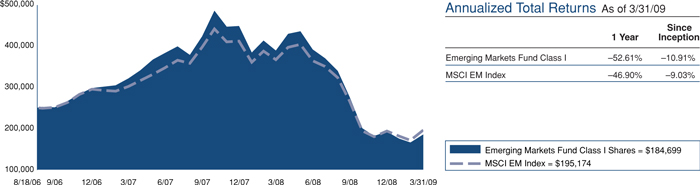

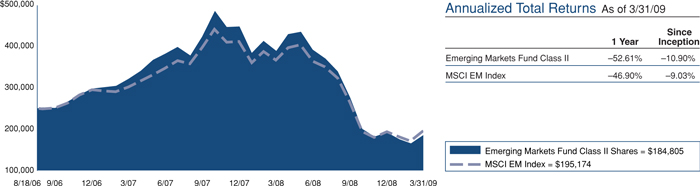

Emerging Markets Fund | | 37 |

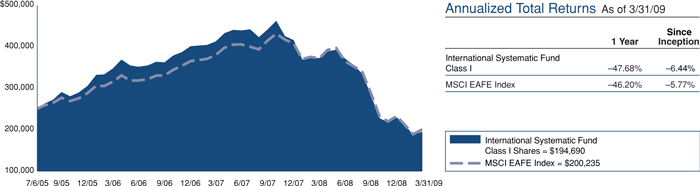

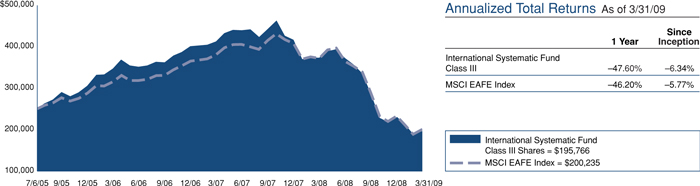

International Systematic Fund | | 41 |

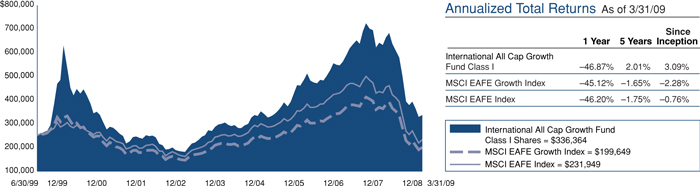

International All Cap Growth Fund | | 45 |

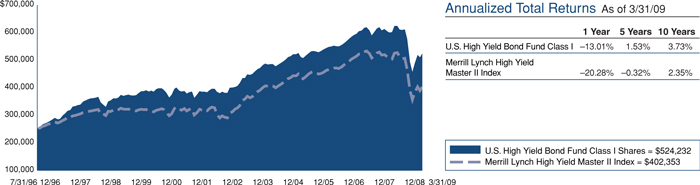

U.S. High Yield Bond Fund | | 49 |

The Funds’:

| | |

Financial Highlights | | 54 |

Statements of Assets and Liabilities | | 62 |

Statements of Operations | | 64 |

Statements of Changes in Net Assets | | 66 |

Statement of Cash Flows | | 70 |

Notes to Financial Statements | | 71 |

Report of Independent Registered Public Accounting Firm | | 81 |

Shareholder Expense Example | | 82 |

Supplementary Information | | 84 |

This report is authorized for distribution to shareholders and to others only when preceded or accompanied by a currently effective prospectus for Nicholas-Applegate Institutional Funds Class I, II, III & IV Shares. Distributor: Nicholas-Applegate Securities.

U.S. ULTRA MICRO CAP FUND

Management Team: John C. McCraw, Portfolio Manager; Robert S. Marren, Portfolio Manager

Chief Investment Officer: Horacio A. Valeiras, CFA Goal: The U.S. Ultra Micro Cap Fund seeks to maximize long-term capital appreciation by investing primarily in U.S. companies with market capitalizations below the weighted average of the Russell Microcap Growth Index at time of purchase.

Market Overview: The Russell Microcap Growth Index registered a loss during the twelve months ended March 31, 2009. The U.S. equity market was unusually weak and volatile, with stocks in all major styles, sectors and capitalization segments posting declines. Factors contributing to the sell-off included:

| | • | | Deterioration in the value of mortgage-linked securities, which led to the collapse or near collapse of several large financial institutions and caused the credit markets to seize up |

| | • | | Rapid falloff in economic activity, with the National Bureau of Economic Research officially declaring that the United States had been in recession since December 2007 |

| | • | | Disappointing corporate earnings, particularly from the financials sector given the huge amount of mortgage-related write-offs |

U.S. policymakers took unprecedented steps to jump-start the credit markets and economy. The Federal Reserve lowered interest rates to a record low and, with the Treasury Department, created special mechanisms for pumping liquidity into the financial system. On the fiscal front, President Obama signed a $787 billion economic stimulus package into law in February. Equities rallied in the last few weeks of the period on rising confidence in the government’s approach to addressing the crisis, as well as some positive news out of the banking and housing sectors.

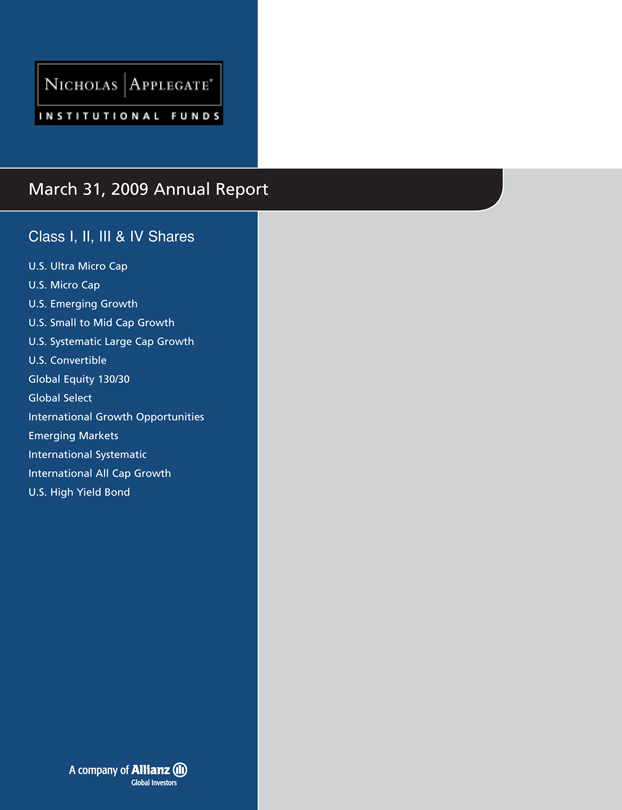

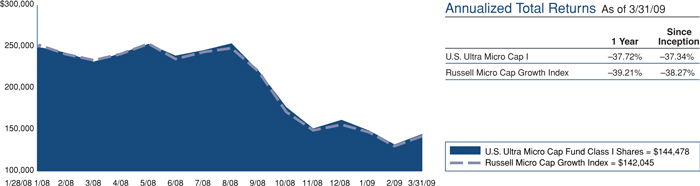

Performance: The Fund’s Class I shares lost 37.72% during the fiscal year ended March 31, 2009 but outperformed the Russell Microcap Growth Index, which fell 39.21%.

Portfolio Specifics: Consistent with our bottom-up investment process, the Fund’s outperformance was driven by stock selection, which was strongest in the consumer discretionary sector. Two of our best-performing holdings were Hot Topic and Citi Trends, apparel retailers whose stock prices advanced despite the weak consumer environment. Hot Topic experienced brisk sales of merchandise tied to the hit movie Twilight, while Citi Trends’ low prices attracted value-seeking customers. Stock selection was also strong in industrials and financials, where positive contributors included MYR Group, a supplier of services for the electrical infrastructure market; Graham Corp., a maker of equipment used in processing plants; and Life Partners, a provider of life settlement transactions.

Stock selection in the health care, energy and information technology sectors had the largest negative impact on relative results. In addition, an underweight in health care detracted, as this classic safe haven was one of the more resilient sectors in the benchmark.

Market Outlook: The stock market is likely to remain volatile in the months ahead given the challenging economic and earnings environment. Earnings estimates for 2009, already significantly reduced, are likely to decline further. The recession is expected to be longer and deeper than past contractions due to several factors, including tighter lending standards and higher job losses. That said, we are encouraged by the government’s aggressive monetary and fiscal policies, which should restore liquidity to the financial system and set the recovery process in motion.

Whatever direction the broad market takes, we believe that consistent application of our forward-looking investment philosophy will lead to strong returns in the Fund over time.

Comparison of Change in Value of a $250,000 Investment in U.S. Ultra Micro Cap Fund Class I Shares with the Russell Micro Cap Growth Index.

The graph above shows the value of a hypothetical $250,000 investment in the Fund’s Class I shares with the Russell Microcap Growth Index for the periods indicated. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. The Class I shares commenced operations on January 28, 2008. The total returns shown above do not show the effects of income taxes on an individuals’ investment. In most cases, taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. Past performance cannot guarantee future results.

The Russell Microcap Index measures performance of the microcap segment, representing less than 3% of the U.S. equity market. The Russell Microcap Index includes the smallest 1,000 securities in the small-cap Russell 2000 Index plus the next 1,000 securities. The Russell Microcap Growth Index isolates the securities in the Russell Microcap Index with purely growth characteristics. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index. Since markets can go down as well as up, investment return and principal value will fluctuate with market conditions. You may have a gain or loss when you sell your shares.

1

U.S. ULTRA MICRO CAP FUND

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Common Stock - 97.7% | | | | | |

Airlines - 0.6% | | | | | |

Hawaiian Holdings, Inc.* | | 1,730 | | $ | 6,453 |

| | | | | |

Apparel Manufacturers - 2.0% | | | | | |

G-III Apparel Group, Ltd.* | | 2,317 | | | 12,790 |

Maidenform Brands, Inc.* | | 910 | | | 8,335 |

| | | | | |

| | | | | 21,125 |

| | | | | |

Applications Software - 2.1% | | | | | |

Ebix, Inc.* | | 932 | | | 23,160 |

| | | | | |

Building & Construction-Miscellaneous - 1.7% | | | | | |

MYR Group, Inc.* | | 1,220 | | | 18,605 |

| | | | | |

Building-Heavy Construction - 1.1% | | | | | |

Orion Marine Group, Inc.* | | 900 | | | 11,790 |

| | | | | |

Chemicals-Diversified - 1.1% | | | | | |

Aceto Corp. | | 2,020 | | | 12,039 |

| | | | | |

Commercial Services - 1.1% | | | | | |

Medifast, Inc.* | | 2,770 | | | 11,496 |

| | | | | |

Communications Software - 1.2% | | | | | |

Seachange International, Inc.* | | 2,300 | | | 13,156 |

| | | | | |

Computer Services - 1.0% | | | | | |

Virtusa Corp.* | | 1,700 | | | 10,540 |

| | | | | |

Computer Software - 1.1% | | | | | |

Double-Take Software, Inc.* | | 1,774 | | | 11,992 |

| | | | | |

Computers-Integrated Systems - 1.7% | | | | | |

NCI, Inc. Cl. A* | | 428 | | | 11,128 |

Radisys Corp.* | | 1,200 | | | 7,272 |

| | | | | |

| | | | | 18,400 |

| | | | | |

Diagnostic Equipment - 0.5% | | | | | |

Home Diagnostics, Inc.* | | 1,020 | | | 5,783 |

| | | | | |

Direct Marketing - 1.7% | | | | | |

APAC Customer Services, Inc.* | | 5,500 | | | 18,700 |

| | | | | |

Distribution/Wholesale - 1.7% | | | | | |

FGX International Holdings, Ltd.* | | 1,550 | | | 18,011 |

| | | | | |

Drug Delivery Systems - 0.5% | | | | | |

Depomed, Inc.* | | 2,400 | | | 5,664 |

| | | | | |

Electronic Components-Miscellaneous - 1.3% | | | | | |

NVE Corp.* | | 500 | | | 14,405 |

| | | | | |

Electronic Components-Semiconductors - 3.9% | | | | | |

Ceva, Inc.* | | 1,792 | | | 13,046 |

MIPS Technologies, Inc. Cl. A* | | 6,200 | | | 18,166 |

White Electronic Designs Corp.* | | 2,700 | | | 10,827 |

| | | | | |

| | | | | 42,039 |

| | | | | |

Enterprise Software/Services - 2.5% | | | | | |

Opnet Technologies, Inc.* | | 1,530 | | | 13,265 |

Taleo Corp. Cl. A* | | 1,200 | | | 14,184 |

| | | | | |

| | | | | 27,449 |

| | | | | |

Firearms & Ammunition - 1.0% | | | | | |

Smith & Wesson Holding Corp.* | | 1,800 | | | 10,836 |

| | | | | |

Fisheries - 0.8% | | | | | |

HQ Sustainable Maritime Industries, Inc.* | | 1,100 | | | 8,415 |

| | | | | |

Food-Miscellaneous/Diversified - 1.2% | | | | | |

Overhill Farms, Inc.* | | 3,343 | | | 12,770 |

| | | | | |

Health Care Cost Containment - 1.5% | | | | | |

Integramed America, Inc.* | | 2,640 | | | 16,078 |

| | | | | |

| | | | | |

| | | Number of

Shares | | Value |

Human Resources - 0.2% | | | | | |

On Assignment, Inc.* | | 976 | | $ | 2,645 |

| | | | | |

Instruments-Controls - 1.0% | | | | | |

Spectrum Control, Inc.* | | 1,473 | | | 10,355 |

| | | | | |

Insurance Brokers - 1.0% | | | | | |

Life Partners Holdings, Inc. | | 652 | | | 11,123 |

| | | | | |

Internet Applications Software - 1.7% | | | | | |

Clicksoftware Technologies, Ltd.* | | 4,900 | | | 18,228 |

| | | | | |

Machinery-General Industry - 0.6% | | | | | |

Intevac, Inc.* | | 1,300 | | | 6,773 |

| | | | | |

Medical Instruments - 2.0% | | | | | |

SenoRx, Inc.* | | 2,926 | | | 10,124 |

Vascular Solutions, Inc.* | | 1,820 | | | 11,138 |

| | | | | |

| | | | | 21,262 |

| | | | | |

Medical Products - 9.2% | | | | | |

Alphatec Holdings, Inc.* | | 3,737 | | | 6,614 |

Atrion Corp. | | 178 | | | 15,707 |

ATS Medical, Inc.* | | 7,735 | | | 19,338 |

Cantel Medical Corp.* | | 910 | | | 11,712 |

Exactech, Inc.* | | 1,078 | | | 12,386 |

Synovis Life Technologies, Inc.* | | 963 | | | 13,328 |

Vnus Medical Technologies, Inc.* | | 974 | | | 20,717 |

| | | | | |

| | | | | 99,802 |

| | | | | |

Medical-Biomedical/Genetics - 3.8% | | | | | |

CryoLife, Inc.* | | 1,722 | | | 8,920 |

Facet Biotech Corp.* | | 1,300 | | | 12,350 |

Ligand Pharmaceuticals, Inc. Cl. B* | | 3,400 | | | 10,132 |

Repligen Corp.* | | 2,000 | | | 9,580 |

| | | | | |

| | | | | 40,982 |

| | | | | |

Medical-Drugs - 0.5% | | | | | |

Array Biopharma, Inc.* | | 2,100 | | | 5,544 |

| | | | | |

Medical-Outpatient/Home Medical Care - 3.5% | | | | | |

Almost Family, Inc.* | | 500 | | | 9,545 |

America Service Group, Inc.* | | 1,420 | | | 18,460 |

NovaMed, Inc.* | | 4,470 | | | 10,147 |

| | | | | |

| | | | | 38,152 |

| | | | | |

Miscellaneous Manufacturers - 0.8% | | | | | |

FreightCar America, Inc. | | 500 | | | 8,765 |

| | | | | |

Networking Products - 0.9% | | | | | |

Extreme Networks* | | 6,200 | | | 9,424 |

| | | | | |

Oil Companies-Exploration & Production - 1.1% | | | | | |

Double Eagle Petroleum Co.* | | 1,071 | | | 5,537 |

RAM Energy Resources, Inc.* | | 8,220 | | | 6,001 |

| | | | | |

| | | | | 11,538 |

| | | | | |

Oil Field Machine & Equipment - 1.2% | | | | | |

T-3 Energy Services, Inc.* | | 1,120 | | | 13,194 |

| | | | | |

Oil-Field Services - 0.8% | | | | | |

Boots & Coots International Control, Inc.* | | 6,664 | | | 8,330 |

| | | | | |

Patient Monitoring Equipment - 1.6% | | | | | |

Somanetics Corp.* | | 1,138 | | | 17,275 |

| | | | | |

Physical Practice Management - 0.9% | | | | | |

IPC The Hospitalist Co., Inc.* | | 510 | | | 9,705 |

| | | | | |

Physical Therapy/Rehabilitation Centers - 1.3% | | | | | |

US Physical Therapy, Inc.* | | 1,410 | | | 13,649 |

| | | | | |

Private Corrections - 1.2% | | | | | |

Cornell Cos., Inc.* | | 815 | | | 13,342 |

| | | | | |

| | | | |

| See Accompanying Notes to Financial Statements. |

| | 2 | | |

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Property/Casualty Insurance - 3.0% | | | | | |

First Mercury Financial Corp.* | | 1,000 | | $ | 14,440 |

Meadowbrook Insurance Group, Inc. | | 3,007 | | | 18,343 |

| | | | | |

| | | | | 32,783 |

| | | | | |

REIT-Diversified - 1.5% | | | | | |

DuPont Fabros Technology, Inc. - REIT | | 2,400 | | | 16,512 |

| | | | | |

Research & Development - 1.2% | | | | | |

Exponent, Inc.* | | 525 | | | 13,298 |

| | | | | |

Retail-Apparel/Shoe - 2.3% | | | | | |

HOT Topic, Inc.* | | 1,002 | | | 11,212 |

The Wet Seal, Inc. Cl. A* | | 4,153 | | | 13,954 |

| | | | | |

| | | | | 25,166 |

| | | | | |

Retail-Automobile - 1.2% | | | | | |

America’s Car-Mart, Inc.* | | 985 | | | 13,386 |

| | | | | |

Retail-Discount - 1.6% | | | | | |

Citi Trends, Inc.* | | 768 | | | 17,580 |

| | | | | |

Retail-Drug Store - 1.3% | | | | | |

Allion Healthcare, Inc.* | | 3,069 | | | 14,117 |

| | | | | |

Retail-Restaurants - 3.0% | | | | | |

AFC Enterprises, Inc.* | | 2,230 | | | 10,057 |

Carrols Restaurant Group, Inc.* | | 3,200 | | | 11,232 |

Einstein Noah Restaurant Group, Inc.* | | 1,983 | | | 11,561 |

| | | | | |

| | | | | 32,850 |

| | | | | |

Retirement/Aged Care - 0.6% | | | | | |

Five Star Quality Care, Inc.* | | 5,700 | | | 5,928 |

| | | | | |

Satellite Telecommunications - 1.1% | | | | | |

RRSat Global Communications Network, Ltd. | | 1,000 | | | 12,000 |

| | | | | |

Savings & Loans/Thrifts-Eastern US - 1.4% | | | | | |

United Financial Bancorp, Inc. | | 1,167 | | | 15,276 |

| | | | | |

Semiconductor Components-Integrated Circuits - 1.2% | | | | | |

Techwell, Inc.* | | 1,986 | | | 12,532 |

| | | | | |

Semiconductor Equipment - 1.2% | | | | | |

Ultratech, Inc.* | | 1,076 | | | 13,439 |

| | | | | |

Telecommunication Equipment - 3.5% | | | | | |

Anaren, Inc.* | | 1,120 | | | 12,253 |

Applied Signal Technology, Inc. | | 780 | | | 15,779 |

Symmetricom, Inc.* | | 2,930 | | | 10,255 |

| | | | | |

| | | | | 38,287 |

| | | | | |

Telecommunication Equipment-Fiber Optics - 0.9% | | | | | |

Oplink Communications, Inc.* | | 1,200 | | | 9,240 |

| | | | | |

Therapeutics - 0.6% | | | | | |

Cypress Bioscience, Inc.* | | 910 | | | 6,470 |

| | | | | |

Transactional Software - 1.9% | | | | | |

Innerworkings, Inc.* | | 1,900 | | | 8,113 |

Yucheng Technologies, Ltd.* | | 1,959 | | | 12,479 |

| | | | | |

| | | | | 20,592 |

| | | | | |

Transport-Marine - 0.6% | | | | | |

Paragon Shipping, Inc. Cl. A | | 2,000 | | | 6,980 |

| | | | | |

Transport-Services - 0.7% | | | | | |

Vitran Corp., Inc.* | | 1,404 | | | 7,385 |

| | | | | |

Transport-Truck - 2.6% | | | | | |

Celadon Group, Inc.* | | 1,726 | | | 9,579 |

Saia, Inc.* | | 1,545 | | | 18,463 |

| | | | | |

| | | | | 28,042 |

| | | | | |

| | | | | | | |

| | | Number of

Shares | | Value | |

Web Hosting/Design - 0.6% | | | | | | | |

Terremark Worldwide, Inc.* | | | 2,400 | | $ | 6,456 | |

| | | | | | | |

Wireless Equipment - 1.1% | | | | | | | |

Globecomm Systems, Inc.* | | | 1,978 | | | 11,453 | |

| | | | | | | |

Total Common Stock (Cost: $1,225,403) | | | | | | 1,058,766 | |

| | | | | | | |

Limited Partnerships - 1.1% | | | | | | | |

Transport-Marine - 1.1% | | | | | | | |

Navios Maritime Partners LP* (Cost $12,426) | | | 1,500 | | | 12,600 | |

| | | | | | | |

| | |

| | | Principal

Amount | | | |

Short Term Investments - 4.8% | | | | | | | |

Time Deposit - 4.8% | | | | | | | |

Citibank London 0.100%, 04/01/09 (Cost: $52,038) | | $ | 52,038 | | | 52,038 | |

| | | | | | | |

Total Investments - 103.6% (Cost: $1,289,867) | | | | | | 1,123,404 | |

| | | | | | | |

Liabilities in Excess of Other Assets - (3.6%) | | | | | | (39,333 | ) |

| | | | | | | |

Net Assets - 100.0% | | | | | $ | 1,084,071 | |

| | | | | | | |

| * | Non-income producing securities. |

REIT - Real Estate Investment Trust

SCHEDULEOF INVESTMENTSBY SECTOR

as of March 31, 2009

| | | |

Sector | | Percent of

Net Assets | |

Consumer, Non-cyclical | | 32.6 | % |

Technology | | 17.8 | |

Industrial | | 13.8 | |

Consumer, Cyclical | | 12.1 | |

Communications | | 11.4 | |

Financial | | 7.0 | |

Energy | | 3.0 | |

Basic Materials | | 1.1 | |

Short Term Investments | | 4.8 | |

| | | |

Total Investments | | 103.6 | |

Liabilities in excess of other assets | | (3.6 | ) |

| | | |

Net Assets | | 100.0 | % |

| | | |

| | | | |

| See Accompanying Notes to Financial Statements. |

3 |

U.S. MICRO CAP FUND

Management Team: John C. McCraw, Portfolio Manager; Robert S. Marren, Portfolio Manager

Chief Investment Officer: Horacio A. Valeiras, CFA

Goal: The U.S. Micro Cap Fund seeks to maximize long-term capital appreciation by investing primarily in U.S. companies with market capitalizations similar to the Russell Microcap Growth Index at time of purchase.

Market Overview: The Russell Microcap Growth Index posted a loss in the fiscal year ended March 31, 2009. The decline was part of a broad sell-off in U.S. equities that was triggered by the worst financial crisis in decades.

Early in the period, key market indexes advanced on hopes that emergency steps taken by the Federal Reserve in early 2008 would contain the housing-induced credit crisis. Those hopes were dashed over the summer amid credit write-downs, rising inflation and downbeat news on the economy.

Market conditions rapidly deteriorated over the remainder of the fiscal year, when mounting losses on mortgage-related securities led to the bankruptcy, sale or government takeover of several major financial institutions. Banks found it difficult to lend because they needed to conserve capital in the uncertain environment. The credit markets froze, the economy ground to a near standstill and investors fled equities. Forced selling by hedge funds to meet redemptions and margin calls contributed to the downward spiral, driving stock prices even lower and fear levels higher. A key barometer of market volatility spiked to nearly twice the level it had reached after the 2001 terrorist attacks.

In response to the crisis, the Fed cut interest rates close to zero and the government pledged trillions of dollars in rescue and stimulus packages. These efforts, combined with some upbeat news on the housing and banking industries, drove equities higher near the end of the period.

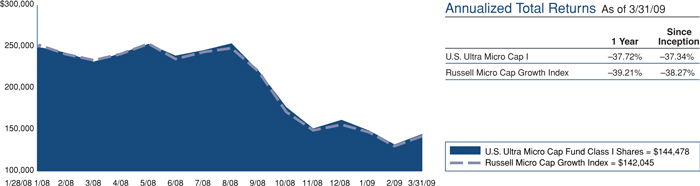

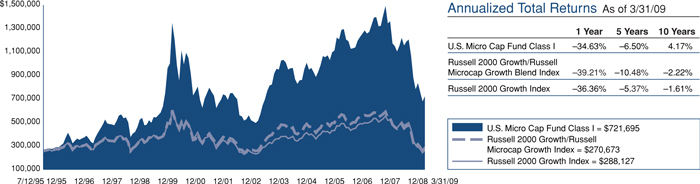

Performance: During the twelve months ended March 31, 2009, the Fund’s Class I shares declined 34.63%, outperforming the Russell Microcap Growth Index, which lost 39.21%.

Portfolio Specifics: Stock selection in the consumer discretionary sector had the largest positive impact on results versus the index. One of our best-performing stocks was Buffalo Wild Wings, a restaurant chain whose value-oriented pricing and targeted marketing programs helped drive sales growth in the weak economy. Several apparel retailers also contributed to relative strength in the consumer discretionary sector, including Jos. A. Bank Clothiers and Wet Seal.

Positioning in consumer staples was another key source of value added. This defensive sector was the most resilient in the index, and the Fund benefited from an overweight in the group. In addition, our stock selection was positive, led by a strong gain from American Italian Pasta, a manufacturer of dry pasta products.

Stock selection in the energy sector subtracted the most from relative results. One of our worst-performing holdings was a natural gas producer that was hurt by falling gas prices. An underweight in health care was another negative since, like consumer staples, health care is a defensive sector.

Market Outlook: The stock market is likely to remain volatile in the months ahead given the challenging economic and earnings environment. Earnings estimates for 2009, already significantly reduced, are likely to decline further. The recession is expected to be longer and deeper than past contractions due to several factors, including tighter lending standards and higher job losses. That said, we are encouraged by the government’s aggressive monetary and fiscal policies, which should restore liquidity to the financial system and set the recovery process in motion.

As events unfold, we are confident that our research-driven investment process will uncover exciting growth opportunities for the Fund.

Comparison of Change in Value of a $250,000 Investment in U.S. Micro Cap Fund Class I Shares with the Russell 2000 Growth/Russell Microcap Growth Blend Index and Russell 2000 Growth Index.

The graph above shows the value of a hypothetical $250,000 investment in the Fund’s Class I shares compared with the Russell 2000 Growth Index and a blended index comprised of the Russell 2000 Growth Index/Russell Microcap Growth Index. The Fund’s Class I shares calculate their performance based upon the historical performance of their corresponding series of

Nicholas-Applegate Mutual Funds (renamed ING Mutual Funds), adjusted to reflect all fees and expenses applicable to Class I shares. The Nicholas-Applegate Institutional Funds’ Class I shares were first available on May 7, 1999. Average annual total return figures include changes in principal value, reinvestment of dividends, and capital gain distributions. The total returns shown above do not show the effects of

7

U.S. MICRO CAP FUND

income taxes on an individual’s investment. In most cases, taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. Past performance cannot guarantee future results.

The Russell 2000 Growth Index is an unmanaged index comprised of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Growth Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

The Russell Microcap Growth Index isolates the smallest 1,000 securities in the Russell 2000 Index plus the next 1,000 securities. The Russell Microcap Growth Index isolates the securities in the

Russell Microcap Index with purely growth characteristics. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. The Russell 2000 Growth/Russell Microcap Growth Blend Index is a combination of the Russell 2000 Growth Index and the Russell Microcap Growth Index. The blended index exhibits Russell 2000 Growth performance from the inception of the Fund until August 2000, and Russell Microcap Growth performance thereafter. The Fund created the blended index because Russell Microcap Growth performance incepted in August 2000. One cannot invest directly in an index. Since markets can go down as well as up, investment return and principal value will fluctuate with market conditions. You may have a gain or loss when you sell your shares.

5

U.S. MICRO CAP FUND

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Common Stock - 99.1% | | | | | |

Aerospace/Defense - 0.6% | | | | | |

National Presto Industries, Inc. | | 4,200 | | $ | 256,242 |

| | | | | |

Airlines - 0.5% | | | | | |

Hawaiian Holdings, Inc.* | | 58,100 | | | 216,713 |

| | | | | |

Alternative Waste Technology - 1.4% | | | | | |

Calgon Carbon Corp.* | | 38,760 | | | 549,229 |

| | | | | |

Apparel Manufacturers - 0.8% | | | | | |

Maidenform Brands, Inc.* | | 34,700 | | | 317,852 |

| | | | | |

Applications Software - 2.2% | | | | | |

Ebix, Inc.* | | 12,100 | | | 300,685 |

EPIQ Systems, Inc.* | | 33,220 | | | 598,957 |

| | | | | |

| | | | | 899,642 |

| | | | | |

Auto Repair Centers - 1.0% | | | | | |

Monro Muffler, Inc. | | 15,100 | | | 412,683 |

| | | | | |

Batteries/Battery Systems - 0.9% | | | | | |

Greatbatch, Inc.* | | 17,900 | | | 346,365 |

| | | | | |

Broadcast Services/Programming - 1.0% | | | | | |

DG FastChannel, Inc.* | | 21,400 | | | 401,678 |

| | | | | |

Chemicals-Diversified - 0.6% | | | | | |

Aceto Corp. | | 39,600 | | | 236,016 |

| | | | | |

Coal - 0.6% | | | | | |

James River Coal Co.* | | 21,200 | | | 261,608 |

| | | | | |

Commercial Banks-Southern US - 0.8% | | | | | |

Bank of the Ozarks, Inc. | | 13,900 | | | 320,812 |

| | | | | |

Commercial Services - 2.5% | | | | | |

HMS Holdings Corp.* | | 22,361 | | | 735,677 |

Medifast, Inc.* | | 65,300 | | | 270,995 |

| | | | | |

| | | | | 1,006,672 |

| | | | | |

Commercial Services-Finance - 0.9% | | | | | |

CBIZ, Inc.* | | 51,200 | | | 356,864 |

| | | | | |

Communications Software - 0.8% | | | | | |

Seachange International, Inc.* | | 57,100 | | | 326,612 |

| | | | | |

Computer Software - 0.7% | | | | | |

Double-Take Software, Inc.* | | 40,200 | | | 271,752 |

| | | | | |

Computers-Integrated Systems - 1.5% | | | | | |

NCI, Inc. Cl. A* | | 10,400 | | | 270,400 |

Netscout Systems, Inc.* | | 45,200 | | | 323,632 |

| | | | | |

| | | | | 594,032 |

| | | | | |

Computers-Memory Devices - 0.8% | | | | | |

STEC, Inc.##,* | | 41,400 | | | 305,118 |

| | | | | |

Computers-Peripheral Equipment - 1.0% | | | | | |

Compellent Technologies, Inc.* | | 37,100 | | | 402,906 |

| | | | | |

Disposable Medical Products - 1.6% | | | | | |

ICU Medical, Inc.* | | 11,700 | | | 375,804 |

Merit Medical Systems, Inc.* | | 23,500 | | | 286,935 |

| | | | | |

| | | | | 662,739 |

| | | | | |

Distribution/Wholesale - 1.9% | | | | | |

FGX International Holdings, Ltd.* | | 37,200 | | | 432,264 |

MWI Veterinary Supply, Inc.* | | 11,700 | | | 333,216 |

| | | | | |

| | | | | 765,480 |

| | | | | |

Electronic Components-Miscellaneous - 0.6% | | | | | |

NVE Corp.* | | 9,000 | | | 259,290 |

| | | | | |

Electronic Components-Semiconductors - 0.7% | | | | | |

Ceva, Inc.* | | 39,700 | | | 289,016 |

| | | | | |

| | | | | |

| | | Number of

Shares | | Value |

Electronic Measure Instruments - 1.2% | | | | | |

Axsys Technologies, Inc.* | | 11,658 | | $ | 490,102 |

| | | | | |

Electronic Security Devices - 0.6% | | | | | |

American Science & Engineering, Inc. | | 4,500 | | | 251,100 |

| | | | | |

Engineering/R & D Services - 1.2% | | | | | |

Stanley, Inc.* | | 19,400 | | | 492,566 |

| | | | | |

Enterprise Software/Services - 2.1% | | | | | |

Opnet Technologies, Inc.* | | 46,200 | | | 400,554 |

Taleo Corp. Cl. A* | | 37,548 | | | 443,817 |

| | | | | |

| | | | | 844,371 |

| | | | | |

Finance-Consumer Loans - 0.8% | | | | | |

Portfolio Recovery Associates, Inc.##,* | | 11,600 | | | 311,344 |

| | | | | |

Finance-Investment Bankers/Brokers - 1.0% | | | | | |

SWS Group, Inc. | | 27,300 | | | 423,969 |

| | | | | |

Firearms & Ammunition - 0.7% | | | | | |

Smith & Wesson Holding Corp.* | | 46,900 | | | 282,338 |

| | | | | |

Food-Miscellaneous/Diversified - 3.5% | | | | | |

American Italian Pasta Co.##,* | | 23,738 | | | 826,320 |

Diamond Foods, Inc. | | 20,300 | | | 566,979 |

| | | | | |

| | | | | 1,393,299 |

| | | | | |

Food-Wholesale/Distribution - 1.6% | | | | | |

Nash Finch Co. | | 10,500 | | | 294,945 |

Spartan Stores, Inc. | | 23,270 | | | 358,591 |

| | | | | |

| | | | | 653,536 |

| | | | | |

Footwear & Related Apparel - 1.1% | | | | | |

Steven Madden, Ltd.* | | 23,000 | | | 431,940 |

| | | | | |

Hazardous Waste Disposal - 0.6% | | | | | |

American Ecology Corp. | | 17,400 | | | 242,556 |

| | | | | |

Human Resources - 0.2% | | | | | |

On Assignment, Inc.* | | 28,400 | | | 76,964 |

| | | | | |

Insurance Brokers - 0.9% | | | | | |

Life Partners Holdings, Inc.## | | 21,976 | | | 374,911 |

| | | | | |

Internet Applications Software - 1.9% | | | | | |

Art Technology Group, Inc.* | | 152,500 | | | 388,875 |

S1 Corp.* | | 75,170 | | | 387,126 |

| | | | | |

| | | | | 776,001 |

| | | | | |

Internet Infrastructure Software - 2.6% | | | | | |

AsiaInfo Holdings, Inc.* | | 42,700 | | | 719,495 |

TeleCommunication Systems, Inc. Cl. A* | | 36,000 | | | 330,120 |

| | | | | |

| | | | | 1,049,615 |

| | | | | |

Machinery-General Industry - 0.4% | | | | | |

Intevac, Inc.* | | 28,100 | | | 146,401 |

| | | | | |

Medical Information Systems - 0.7% | | | | | |

Computer Programs & Systems, Inc. | | 8,100 | | | 269,487 |

| | | | | |

Medical Labs & Testing Services - 1.0% | | | | | |

Bio-Reference Labs, Inc.* | | 18,460 | | | 385,999 |

| | | | | |

Medical Products - 3.6% | | | | | |

Cantel Medical Corp.* | | 23,200 | | | 298,584 |

Exactech, Inc.* | | 26,400 | | | 303,336 |

Hanger Orthopedic Group, Inc.* | | 29,300 | | | 388,225 |

Synovis Life Technologies, Inc.* | | 32,360 | | | 447,862 |

| | | | | |

| | | | | 1,438,007 |

| | | | | |

| | | | |

| See Accompanying Notes to Financial Statements. |

| 6 |

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Medical-Biomedical/Genetics - 3.8% | | | | | |

CryoLife, Inc.* | | 37,800 | | $ | 195,804 |

Halozyme Therapeutics, Inc.##,* | | 35,900 | | | 196,014 |

Immunogen, Inc.* | | 35,300 | | | 250,630 |

Ligand Pharmaceuticals, Inc. Cl. B* | | 73,000 | | | 217,540 |

NPS Pharmaceuticals, Inc.* | | 46,800 | | | 196,560 |

Seattle Genetics, Inc.* | | 45,900 | | | 452,574 |

| | | | | |

| | | | | 1,509,122 |

| | | | | |

Medical-Drugs - 2.9% | | | | | |

Array Biopharma, Inc.* | | 72,600 | | | 191,664 |

Medivation, Inc.##,* | | 14,600 | | | 266,742 |

Optimer Pharmaceuticals, Inc.##,* | | 21,800 | | | 287,542 |

Pharmasset, Inc.* | | 24,500 | | | 240,345 |

Vivus, Inc.* | | 43,200 | | | 186,624 |

| | | | | |

| | | | | 1,172,917 |

| | | | | |

Medical-Nursing Homes - 1.0% | | | | | |

Sun Healthcare Group, Inc.* | | 46,100 | | | 389,084 |

| | | | | |

Medical-Outpatient/Home Medical Care - 1.6% | | | | | |

Almost Family, Inc.##,* | | 13,200 | | | 251,988 |

LHC Group, Inc.* | | 17,900 | | | 398,812 |

| | | | | |

| | | | | 650,800 |

| | | | | |

Miscellaneous Manufacturers - 0.5% | | | | | |

FreightCar America, Inc. | | 11,000 | | | 192,830 |

| | | | | |

MRI/Medical Diagnostic Imaging Centers - 1.1% | | | | | |

Alliance Imaging, Inc.* | | 63,800 | | | 433,840 |

| | | | | |

Networking Products - 1.9% | | | | | |

BigBand Networks, Inc.* | | 37,700 | | | 246,935 |

Extreme Networks* | | 148,500 | | | 225,720 |

Switch & Data Facilities Co., Inc.* | | 35,500 | | | 311,335 |

| | | | | |

| | | | | 783,990 |

| | | | | |

Oil Companies-Exploration & Production - 0.5% | | | | | |

Carrizo Oil & Gas, Inc.* | | 12,400 | | | 110,112 |

GMX Resources, Inc.* | | 12,200 | | | 79,300 |

| | | | | |

| | | | | 189,412 |

| | | | | |

Oil-Field Services - 2.6% | | | | | |

Boots & Coots International Control, Inc.* | | 233,900 | | | 292,375 |

Hornbeck Offshore Services, Inc.* | | 17,000 | | | 259,080 |

Matrix Service Co.* | | 17,340 | | | 142,535 |

Willbros Group, Inc.* | | 35,500 | | | 344,350 |

| | | | | |

| | | | | 1,038,340 |

| | | | | |

Patient Monitoring Equipment - 1.6% | | | | | |

CardioNet, Inc.* | | 23,100 | | | 648,186 |

| | | | | |

Pharmacy Services - 0.7% | | | | | |

SXC Health Solutions Corp.* | | 12,300 | | | 264,942 |

| | | | | |

Physical Practice Management - 0.9% | | | | | |

IPC The Hospitalist Co., Inc.* | | 18,900 | | | 359,667 |

| | | | | |

Power Conversion/Supply Equipment - 1.1% | | | | | |

Powell Industries, Inc.* | | 12,800 | | | 451,968 |

| | | | | |

Private Corrections - 0.9% | | | | | |

Cornell Cos., Inc.* | | 22,400 | | | 366,688 |

| | | | | |

Property/Casualty Insurance - 2.2% | | | | | |

First Mercury Financial Corp.* | | 28,100 | | | 405,764 |

Meadowbrook Insurance Group, Inc. | | 81,200 | | | 495,320 |

| | | | | |

| | | | | 901,084 |

| | | | | |

Research & Development - 1.3% | | | | | |

Exponent, Inc.* | | 20,000 | | | 506,600 |

| | | | | |

| | | | | |

| | | Number of

Shares | | Value |

Retail-Apparel/Shoe - 3.2% | | | | | |

HOT Topic, Inc.* | | 38,900 | | $ | 435,291 |

JOS. A Bank Clothiers, Inc.##,* | | 16,100 | | | 447,741 |

The Wet Seal, Inc. Cl. A* | | 125,900 | | | 423,024 |

| | | | | |

| | | | | 1,306,056 |

| | | | | |

Retail-Appliances - 0.5% | | | | | |

Conn’s, Inc.* | | 13,100 | | | 183,924 |

| | | | | |

Retail-Discount - 1.0% | | | | | |

Citi Trends, Inc.* | | 18,300 | | | 418,887 |

| | | | | |

Retail-Pet Food & Supplies - 1.0% | | | | | |

PetMed Express, Inc.* | | 23,600 | | | 388,928 |

| | | | | |

Retail-Restaurants - 3.4% | | | | | |

Buffalo Wild Wings, Inc.##,* | | 12,200 | | | 446,276 |

CKE Restaurants, Inc. | | 39,700 | | | 333,480 |

Domino’s Pizza, Inc.* | | 54,900 | | | 359,595 |

Red Robin Gourmet Burgers, Inc.* | | 14,000 | | | 246,820 |

| | | | | |

| | | | | 1,386,171 |

| | | | | |

Savings & Loans/Thrifts-Eastern US - 0.8% | | | | | |

United Financial Bancorp, Inc. | | 23,300 | | | 304,997 |

| | | | | |

Schools - 1.2% | | | | | |

K12, Inc.##,* | | 13,800 | | | 191,130 |

Lincoln Educational Services Corp.* | | 15,600 | | | 285,792 |

| | | | | |

| | | | | 476,922 |

| | | | | |

Semiconductor Components-Integrated Circuits - 2.0% | | | | | |

O2Micro International, Ltd. -ADR* | | 61,570 | | | 210,569 |

Pericom Semiconductor Corp.* | | 36,700 | | | 268,277 |

Techwell, Inc.* | | 54,100 | | | 341,371 |

| | | | | |

| | | | | 820,217 |

| | | | | |

Semiconductor Equipment - 1.0% | | | | | |

Ultratech, Inc.* | | 30,900 | | | 385,941 |

| | | | | |

Telecommunication Equipment - 0.7% | | | | | |

Anaren, Inc.* | | 24,300 | | | 265,842 |

| | | | | |

Telecommunication Equipment-Fiber Optics - 0.6% | | | | | |

Harmonic, Inc.* | | 34,800 | | | 226,200 |

| | | | | |

Textile-Apparel - 0.3% | | | | | |

Perry Ellis International, Inc.* | | 31,000 | | | 107,260 |

| | | | | |

Therapeutics - 1.9% | | | | | |

Allos Therapeutics, Inc.* | | 25,000 | | | 154,500 |

Cypress Bioscience, Inc.* | | 49,700 | | | 353,367 |

Questcor Pharmaceuticals, Inc.* | | 48,600 | | | 239,112 |

| | | | | |

| | | | | 746,979 |

| | | | | |

Transport-Air Freight - 0.7% | | | | | |

Atlas Air Worldwide Holdings, Inc.* | | 16,600 | | | 288,010 |

| | | | | |

Transport-Marine - 1.0% | | | | | |

Genco Shipping & Trading, Ltd.## | | 19,400 | | | 239,396 |

Safe Bulkers, Inc. | | 50,800 | | | 160,528 |

| | | | | |

| | | | | 399,924 |

| | | | | |

Transport-Services - 0.6% | | | | | |

Vitran Corp., Inc.* | | 42,800 | | | 225,128 |

| | | | | |

Transport-Truck - 2.2% | | | | | |

Marten Transport, Ltd.* | | 22,200 | | | 414,696 |

Saia, Inc.* | | 39,400 | | | 470,830 |

| | | | | |

| | | | | 885,526 |

| | | | | |

Ultra Sound Imaging Systems - 0.7% | | | | | |

SonoSite, Inc.* | | 16,700 | | | 298,596 |

| | | | | |

| | |

See Accompanying Notes to Financial Statements. | | |

U.S. MICRO CAP FUND

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | | | |

| | | Number of

Shares | | Value | |

Veterinary Diagnostics - 0.8% | | | | | | | |

Neogen Corp.* | | | 14,500 | | $ | 316,535 | |

| | | | | | | |

Water Treatment Systems - 0.7% | | | | | | | |

Energy Recovery, Inc.##,* | | | 39,200 | | | 297,920 | |

| | | | | | | |

Web Hosting/Design - 0.5% | | | | | | | |

Terremark Worldwide, Inc.* | | | 73,400 | | | 197,446 | |

| | | | | | | |

Wireless Equipment - 0.6% | | | | | | | |

Globecomm Systems, Inc.* | | | 40,950 | | | 237,100 | |

| | | | | | | |

Total Common Stock (Cost: $47,783,540) | | | | | | 39,817,806 | |

| | | | | | | |

| | |

| | | Principal

Amount | | | |

Short Term Investments - 10.8% | | | | | | | |

Repurchase Agreement - 10.1% | | | | | | | |

Credit Suisse Securities, LLC, 0.150% dated 3/31/09, to be repurchased at $4,061,632 on 4/01/09 (collateralized by U.S. Treasury Bill, 0.000% due 6/18/09)** | | $ | 4,061,615 | | | 4,061,615 | |

| | | | | | | |

Time Deposit - 0.7% | | | | | | | |

Citibank London 0.100%, 04/01/09 | | | 266,834 | | | 266,834 | |

| | | | | | | |

Total Short Term Investments (Cost: $4,328,449) | | | | | | 4,328,449 | |

| | | | | | | |

Total Investments - 109.9% (Cost: $52,111,989) | | | | | | 44,146,255 | |

| | | | | | | |

Liabilities in Excess of Other Assets - (9.9%) | | | | | | (3,968,632 | ) |

| | | | | | | |

Net Assets - 100.0% | | | | | $ | 40,177,623 | |

| | | | | | | |

| ## | All or a portion of the Fund’s holdings in this security was on loan as of March 31, 2009. |

| * | Non-income producing securities. |

| ** | All of the security is purchased with cash collateral proceeds from securities loans. |

ADR - American Depository Receipt

SCHEDULE OF INVESTMENTS BY SECTOR

as of March 31, 2009

| | | |

Sector | | Percent of

Net Assets | |

Consumer, Non-cyclical | | 36.0 | % |

Industrial | | 16.3 | |

Technology | | 13.5 | |

Consumer, Cyclical | | 12.7 | |

Communications | | 9.8 | |

Financial | | 6.5 | |

Energy | | 3.7 | |

Basic Materials | | 0.6 | |

Short Term Investments | | 10.8 | |

| | | |

Total Investments | | 109.9 | |

Liabilities in excess of other assets | | (9.9 | ) |

| | | |

Net Assets | | 100.0 | % |

| | | |

| | | | |

See Accompanying Notes to Financial Statements. | | | | |

| | 8 | | |

U.S. EMERGING GROWTH FUND

Management Team: John C. McCraw, Portfolio Manager; Robert S. Marren, Portfolio Manager

Chief Investment Officer: Horacio A. Valeiras, CFA

Goal: The U.S. Emerging Growth Fund seeks to maximize long-term capital appreciation through investments primarily in U.S. companies with market capitalizations similar to the Russell 2000 Growth Index at time of purchase.

Market Overview: U.S. equity indexes, including the Russell 2000 Growth Index, registered declines during the twelve months ended March 31, 2009. Stock prices tumbled in response to:

| | • | | Turmoil in the credit markets, as losses on subprime mortgages threatened the solvency of large financial institutions and bank lending effectively ceased |

| | • | | Mounting evidence that the credit crisis was wreaking havoc on the economy, including the first back-to-back contraction in quarterly consumer spending since reports were first kept in 1947 |

| | • | | Uncertainty about the terms and potential impact of government programs created to stabilize the financial system and economy |

Weak earnings reports and a lack of visibility into future earnings added to the selling pressure. The fourth quarter of 2008 marked the sixth consecutive quarter of earnings declines for small and large companies across corporate America.

Stocks advanced near the end of the period on positive news about bank profits, signs of life in the housing market and rising optimism that the government’s fiscal and monetary policies would spur growth. Those policies included a $787 billion economic stimulus package, near-zero interest rates, a plan to reduce toxic assets on banks’ balance sheets and government purchases of longer-term Treasuries.

Performance: The Fund’s Class I shares fell 42.45% during the fiscal year ended March 31, 2009, while the Russell 2000 Growth Index declined 36.36%.

Portfolio Specifics: Stock selection in the consumer discretionary sector had a positive effect on performance versus the index. Several of our restaurant stocks did particularly well, including Cracker Barrel Old Country Store. Cracker Barrel’s sales and earnings were resilient, supported by the strength of the company’s brand, disciplined cost management and lower food inflation. Stock selection in the telecommunication services and utilities sectors was also positive.

Health care was one of the best-performing sectors in the index, and an underweight in the group hurt results versus the benchmark. When the economy is weak, investors tend to favor the stable demand characteristics of health care companies, and this period was no exception. Stock selection in health care was another area of relative weakness. One of the worst-performing holdings in the Fund was a provider of life sciences tools that reported disappointing operating results. Stock selection in the industrials and information technology sectors also weighed on performance versus the index.

Market Outlook: The stock market is likely to remain volatile in the months ahead given the challenging economic and earnings environment. Earnings estimates for 2009, already significantly reduced, are likely to decline further. The recession is expected to be longer and deeper than past contractions due to several factors, including tighter lending standards and higher job losses. That said, we are encouraged by the government’s aggressive monetary and fiscal policies, which should restore liquidity to the financial system and set the recovery process in motion.

Despite the uncertainty in the market, we believe that our focus on individual stock selection will lead to strong, long-term performance in the Fund.

Comparison of Change in Value of a $250,000 Investment in U.S. Emerging Growth Fund Class I Shares with the Russell 2000 Growth Index.

The graph above shows the value of a hypothetical $250,000 investment in the Fund’s Class I shares compared with the Russell 2000 Growth Index for the periods indicated. The Fund calculates performance based upon the historical performance of a corresponding series of Nicholas-Applegate Mutual Funds (renamed ING Mutual Funds), adjusted to reflect all fees and expenses applicable to Class I shares. The Nicholas-Applegate Institutional Funds’ Class I shares were first available on May 7, 1999. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. The total returns shown above do not show the effects of income taxes on an individual’s investment. In most cases, taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains

you may realize if you sell your shares. Past performance cannot guarantee future results.

The Russell 2000 Growth Index is an unmanaged index comprised of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. Index returns include reinvestment of dividends. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. One cannot invest directly in an index. Since markets can go down as well as up, investment returns and principal value will fluctuate with market conditions. You may have a gain or loss when you sell your shares.

9

U.S. EMERGING GROWTH FUND

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Common Stock - 97.6% | | | | | |

Aerospace/Defense - 1.1% | | | | | |

Cubic Corp. | | 2,000 | | $ | 50,660 |

National Presto Industries, Inc. | | 600 | | | 36,606 |

| | | | | |

| | | | | 87,266 |

| | | | | |

Aerospace/Defense-Equipment - 1.8% | | | | | |

BE Aerospace, Inc.* | | 5,700 | | | 49,419 |

Orbital Sciences Corp.* | | 3,800 | | | 45,182 |

Triumph Group, Inc. | | 1,300 | | | 49,660 |

| | | | | |

| | | | | 144,261 |

| | | | | |

Agricultural Chemicals - 0.5% | | | | | |

Intrepid Potash, Inc.* | | 2,400 | | | 44,280 |

| | | | | |

Airlines - 1.4% | | | | | |

Continental Airlines, Inc. Cl. B* | | 4,400 | | | 38,764 |

Hawaiian Holdings, Inc.* | | 12,400 | | | 46,252 |

JetBlue Airways Corp.* | | 8,000 | | | 29,200 |

| | | | | |

| | | | | 114,216 |

| | | | | |

Alternative Waste Technology - 0.6% | | | | | |

Calgon Carbon Corp.* | | 3,300 | | | 46,761 |

| | | | | |

Apparel Manufacturers - 0.4% | | | | | |

G-III Apparel Group, Ltd.* | | 5,200 | | | 28,704 |

| | | | | |

Applications Software - 0.7% | | | | | |

Compuware Corp.* | | 8,300 | | | 54,697 |

| | | | | |

Batteries/Battery Systems - 0.5% | | | | | |

Greatbatch, Inc.* | | 2,100 | | | 40,635 |

| | | | | |

Beverages-Wine/Spirits - 0.4% | | | | | |

Central European Distribution Corp.* | | 2,800 | | | 30,128 |

| | | | | |

Broadcast Services/Programming - 0.6% | | | | | |

DG FastChannel, Inc.* | | 2,600 | | | 48,802 |

| | | | | |

Building-Heavy Construction - 0.6% | | | | | |

Chicago Bridge & Iron Co. | | 8,000 | | | 50,160 |

| | | | | |

Chemicals-Diversified - 0.7% | | | | | |

Olin Corp. | | 3,900 | | | 55,653 |

| | | | | |

Chemicals-Specialty - 1.5% | | | | | |

Ashland, Inc. | | 4,600 | | | 47,518 |

Cytec Industries, Inc. | | 2,300 | | | 34,546 |

NewMarket Corp. | | 900 | | | 39,870 |

| | | | | |

| | | | | 121,934 |

| | | | | |

Coal - 0.5% | | | | | |

Massey Energy Co. | | 3,900 | | | 39,468 |

| | | | | |

Coffee - 0.5% | | | | | |

Green Mountain Coffee Roasters, Inc.* | | 900 | | | 43,200 |

| | | | | |

Commercial Services - 0.8% | | | | | |

HMS Holdings Corp.* | | 1,900 | | | 62,510 |

| | | | | |

Commercial Services-Finance - 0.6% | | | | | |

Wright Express Corp.* | | 2,700 | | | 49,194 |

| | | | | |

Computer Aided Design - 0.5% | | | | | |

Parametric Technology Corp.* | | 3,700 | | | 36,926 |

| | | | | |

Computer Software - 0.6% | | | | | |

Double-Take Software, Inc.* | | 7,400 | | | 50,024 |

| | | | | |

Computers-Integrated Systems - 0.5% | | | | | |

Netscout Systems, Inc.* | | 5,900 | | | 42,244 |

| | | | | |

Computers-Peripheral Equipment - 0.8% | | | | | |

Synaptics, Inc.* | | 2,400 | | | 64,224 |

| | | | | |

| | | | | |

| | | Number of

Shares | | Value |

Consulting Services - 0.6% | | | | | |

Watson Wyatt Worldwide, Inc. Cl. A | | 1,000 | | $ | 49,370 |

| | | | | |

Consumer Products-Miscellaneous - 0.6% | | | | | |

Tupperware Brands Corp. | | 2,700 | | | 45,873 |

| | | | | |

Containers-Paper/Plastic - 0.7% | | | | | |

Rock-Tenn Co. Cl. A | | 2,200 | | | 59,510 |

| | | | | |

Diagnostic Kits - 0.7% | | | | | |

Inverness Medical Innovations, Inc.* | | 2,100 | | | 55,923 |

| | | | | |

Disposable Medical Products - 0.5% | | | | | |

Merit Medical Systems, Inc.* | | 3,300 | | | 40,293 |

| | | | | |

Distribution/Wholesale - 1.3% | | | | | |

Beacon Roofing Supply, Inc.* | | 3,600 | | | 48,204 |

LKQ Corp.* | | 3,800 | | | 54,226 |

| | | | | |

| | | | | 102,430 |

| | | | | |

Diversified Manufacturing Operations - 0.6% | | | | | |

Brink’s Co. | | 1,900 | | | 50,274 |

| | | | | |

Diversified Operations - 0.4% | | | | | |

Compass Diversified Holdings | | 4,000 | | | 35,680 |

| | | | | |

E-Commerce/Services - 0.6% | | | | | |

IAC/InterActiveCorp* | | 3,300 | | | 50,259 |

| | | | | |

Electric-Integrated - 0.5% | | | | | |

Unisource Energy Corp. | | 1,400 | | | 39,466 |

| | | | | |

Electronic Components-Semiconductors - 3.1% | | | | | |

Macrovision Solutions Corp.* | | 5,600 | | | 99,624 |

ON Semiconductor Corp.* | | 9,300 | | | 36,270 |

PMC - Sierra, Inc.* | | 7,600 | | | 48,488 |

Skyworks Solutions, Inc.* | | 8,200 | | | 66,092 |

| | | | | |

| | | | | 250,474 |

| | | | | |

Electronic Design Automations - 0.5% | | | | | |

Mentor Graphics Corp.* | | 8,800 | | | 39,072 |

| | | | | |

Electronic Measure Instruments - 0.5% | | | | | |

Itron, Inc.* | | 800 | | | 37,880 |

| | | | | |

E-Marketing/Information - 1.2% | | | | | |

Digital River, Inc.* | | 1,600 | | | 47,712 |

Valueclick, Inc.* | | 6,100 | | | 51,911 |

| | | | | |

| | | | | 99,623 |

| | | | | |

Enterprise Software/Services - 3.4% | | | | | |

Lawson Software, Inc.* | | 9,200 | | | 39,100 |

Mantech International Corp. Cl. A* | | 1,200 | | | 50,280 |

Novell, Inc.* | | 11,300 | | | 48,138 |

Sybase, Inc.* | | 2,000 | | | 60,580 |

Taleo Corp. Cl. A* | | 6,500 | | | 76,830 |

| | | | | |

| | | | | 274,928 |

| | | | | |

Entertainment Software - 0.6% | | | | | |

Take-Two Interactive Software, Inc.* | | 5,400 | | | 45,090 |

| | | | | |

E-Services/Consulting - 0.6% | | | | | |

Websense, Inc.* | | 4,300 | | | 51,600 |

| | | | | |

Finance-Consumer Loans - 1.2% | | | | | |

Ocwen Financial Corp.* | | 4,600 | | | 52,578 |

Portfolio Recovery Associates, Inc.* | | 1,800 | | | 48,312 |

| | | | | |

| | | | | 100,890 |

| | | | | |

Finance-Investment Bankers/Brokers - 0.6% | | | | | |

SWS Group, Inc. | | 2,900 | | | 45,037 |

| | | | | |

Food-Miscellaneous/Diversified - 0.6% | | | | | |

Diamond Foods, Inc. | | 1,900 | | | 53,067 |

| | | | | |

See Accompanying Notes to Financial Statements.

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Food-Wholesale/Distribution - 1.2% | | | | | |

Spartan Stores, Inc. | | 3,100 | | $ | 47,771 |

United Natural Foods, Inc.* | | 2,800 | | | 53,116 |

| | | | | |

| | | | | 100,887 |

| | | | | |

Footwear & Related Apparel - 1.2% | | | | | |

Deckers Outdoor Corp.* | | 1,000 | | | 53,040 |

Steven Madden, Ltd.* | | 2,300 | | | 43,194 |

| | | | | |

| | | | | 96,234 |

| | | | | |

Hazardous Waste Disposal - 0.4% | | | | | |

American Ecology Corp. | | 2,500 | | | 34,850 |

| | | | | |

Human Resources - 0.5% | | | | | |

Emergency Medical Services Corp. Cl. A* | | 1,200 | | | 37,668 |

| | | | | |

Instruments-Scientific - 0.6% | | | | | |

FEI Co.* | | 3,200 | | | 49,376 |

| | | | | |

Internet Applications Software - 0.9% | | | | | |

Cybersource Corp.* | | 4,900 | | | 72,569 |

| | | | | |

Internet Infrastructure Equipment - 0.6% | | | | | |

Avocent Corp.* | | 3,900 | | | 47,346 |

| | | | | |

Internet Infrastructure Software - 0.8% | | | | | |

AsiaInfo Holdings, Inc.* | | 3,900 | | | 65,715 |

| | | | | |

Intimate Apparel - 0.8% | | | | | |

The Warnaco Group, Inc.* | | 2,700 | | | 64,800 |

| | | | | |

Life/Health Insurance - 0.6% | | | | | |

Delphi Financial Group, Inc. Cl. A | | 3,800 | | | 51,148 |

| | | | | |

Machinery-Construction & Mining - 0.6% | | | | | |

Bucyrus International, Inc. Cl. A | | 3,300 | | | 50,094 |

| | | | | |

Machinery-General Industry - 0.5% | | | | | |

Wabtec Corp. | | 1,600 | | | 42,208 |

| | | | | |

Marine Services - 1.1% | | | | | |

Aegean Marine Petroleum Network, Inc. | | 5,300 | | | 88,775 |

| | | | | |

Medical Instruments - 1.5% | | | | | |

Integra LifeSciences Holdings Corp.* | | 1,400 | | | 34,622 |

NuVasive, Inc.* | | 1,500 | | | 47,070 |

Thoratec Corp.* | | 1,600 | | | 41,104 |

| | | | | |

| | | | | 122,796 |

| | | | | |

Medical Labs & Testing Services - 0.4% | | | | | |

Bio-Reference Labs, Inc.* | | 1,500 | | | 31,365 |

| | | | | |

Medical Products - 4.0% | | | | | |

American Medical Systems Holdings, Inc.* | | 6,800 | | | 75,820 |

China Medical Technologies, Inc. - ADR | | 2,600 | | | 35,802 |

Exactech, Inc.* | | 3,600 | | | 41,364 |

Haemonetics Corp.* | | 900 | | | 49,572 |

Hanger Orthopedic Group, Inc.* | | 3,700 | | | 49,025 |

PSS World Medical, Inc.* | | 3,300 | | | 47,355 |

Wright Medical Group, Inc.* | | 2,100 | | | 27,363 |

| | | | | |

| | | | | 326,301 |

| | | | | |

Medical Sterilize Product - 0.7% | | | | | |

STERIS Corp. | | 2,500 | | | 58,200 |

| | | | | |

| | | | | |

| | | Number of

Shares | | Value |

Medical-Biomedical/Genetics - 6.9% | | | | | |

Alexion Pharmaceuticals, Inc.* | | 2,000 | | $ | 75,320 |

Alnylam Pharmaceuticals, Inc.* | | 2,000 | | | 38,080 |

Bio-Rad Laboratories, Inc. Cl. A* | | 600 | | | 39,540 |

Cubist Pharmaceuticals, Inc.* | | 2,700 | | | 44,172 |

Medicines Co.* | | 4,500 | | | 48,780 |

Myriad Genetics, Inc.* | | 1,800 | | | 81,846 |

OSI Pharmaceuticals, Inc.* | | 1,700 | | | 65,042 |

Regeneron Pharmaceuticals, Inc.* | | 3,100 | | | 42,966 |

Seattle Genetics, Inc.* | | 4,400 | | | 43,384 |

Sequenom, Inc.* | | 2,300 | | | 32,706 |

United Therapeutics Corp.* | | 700 | | | 46,263 |

| | | | | |

| | | | | 558,099 |

| | | | | |

Medical-Drugs - 1.5% | | | | | |

Eurand NV* | | 4,600 | | | 51,244 |

Pharmasset, Inc.* | | 3,200 | | | 31,392 |

Sepracor, Inc.* | | 2,500 | | | 36,650 |

| | | | | |

| | | | | 119,286 |

| | | | | |

Medical-Nursing Homes - 0.7% | | | | | |

Sun Healthcare Group, Inc.* | | 6,400 | | | 54,016 |

| | | | | |

Medical-Outpatient/Home Medical Care - 1.6% | | | | | |

Almost Family, Inc.* | | 1,900 | | | 36,271 |

Gentiva Health Services, Inc.* | | 2,500 | | | 38,000 |

LHC Group, Inc.* | | 2,400 | | | 53,472 |

| | | | | |

| | | | | 127,743 |

| | | | | |

MRI/Medical Diagnostic Imaging Centers - 0.4% | | | | | |

Alliance Imaging, Inc.* | | 5,300 | | | 36,040 |

| | | | | |

Oil & Gas Drilling - 0.5% | | | | | |

Atwood Oceanics, Inc.* | | 2,700 | | | 44,793 |

| | | | | |

Oil Companies-Exploration & Production - 3.3% | | | | | |

Arena Resources, Inc.* | | 2,800 | | | 71,344 |

Comstock Resources, Inc.* | | 1,600 | | | 47,680 |

EXCO Resources, Inc.* | | 4,700 | | | 47,000 |

GMX Resources, Inc.* | | 2,500 | | | 16,250 |

Quicksilver Resources, Inc.* | | 7,800 | | | 43,212 |

Whiting Petroleum Corp.* | | 1,600 | | | 41,360 |

| | | | | |

| | | | | 266,846 |

| | | | | |

Oil-Field Services - 1.0% | | | | | |

Cal Dive International, Inc.* | | 6,100 | | | 41,297 |

Global Industries, Ltd.* | | 10,900 | | | 41,856 |

| | | | | |

| | | | | 83,153 |

| | | | | |

Patient Monitoring Equipment - 1.0% | | | | | |

CardioNet, Inc.* | | 1,500 | | | 42,090 |

Mindray Medical International, Ltd. - ADR | | 2,200 | | | 40,722 |

| | | | | |

| | | | | 82,812 |

| | | | | |

Pharmacy Services - 0.6% | | | | | |

Catalyst Health Solutions, Inc. | | 2,400 | | | 47,568 |

| | | | | |

Physical Practice Management - 0.5% | | | | | |

IPC The Hospitalist Co., Inc.* | | 2,300 | | | 43,769 |

| | | | | |

Power Conversion/Supply Equipment - 0.5% | | | | | |

Powell Industries, Inc.* | | 1,200 | | | 42,372 |

| | | | | |

Printing-Commercial - 0.8% | | | | | |

VistaPrint, Ltd.* | | 2,300 | | | 63,227 |

| | | | | |

Private Corrections - 0.7% | | | | | |

Cornell Cos., Inc.* | | 3,500 | | | 57,295 |

| | | | | |

See Accompanying Notes to Financial Statements.

U.S. EMERGING GROWTH FUND

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Property/Casualty Insurance - 1.5% | | | | | |

Amtrust Financial Services, Inc. | | 6,500 | | $ | 62,075 |

Tower Group, Inc. | | 2,600 | | | 64,038 |

| | | | | |

| | | | | 126,113 |

| | | | | |

Real Estate Management/Service - 0.5% | | | | | |

Jones Lang LaSalle, Inc. | | 1,900 | | | 44,194 |

| | | | | |

Retail-Apparel/Shoe - 4.5% | | | | | |

Aeropostale, Inc.* | | 2,100 | | | 55,776 |

Collective Brands, Inc.* | | 3,700 | | | 36,038 |

Guess ?, Inc. | | 3,500 | | | 73,780 |

HOT Topic, Inc.* | | 4,000 | | | 44,760 |

JOS. A Bank Clothiers, Inc.* | | 1,500 | | | 41,715 |

Phillips-Van Heusen Corp. | | 2,600 | | | 58,968 |

The Childrens Place Retail Stores, Inc.* | | 2,500 | | | 54,725 |

| | | | | |

| | | | | 365,762 |

| | | | | |

Retail-Miscellaneous/Diversified - 0.6% | | | | | |

Pricesmart, Inc. | | 2,600 | | | 46,826 |

| | | | | |

Retail-Restaurants - 5.6% | | | | | |

Buffalo Wild Wings, Inc.* | | 1,700 | | | 62,186 |

CEC Entertainment, Inc.* | | 2,000 | | | 51,760 |

Chipotle Mexican Grill, Inc. Cl. A* | | 600 | | | 39,828 |

CKE Restaurants, Inc. | | 7,900 | | | 66,360 |

Cracker Barrel Old Country Store, Inc. | | 2,300 | | | 65,872 |

Domino’s Pizza, Inc.* | | 8,500 | | | 55,675 |

Jack in the Box, Inc.* | | 2,500 | | | 58,225 |

Wendy’s/Arby’s Group, Inc. | | 10,600 | | | 53,318 |

| | | | | |

| | | | | 453,224 |

| | | | | |

Schools - 0.7% | | | | | |

Corinthian Colleges, Inc.* | | 2,800 | | | 54,460 |

| | | | | |

Semiconductor Components-Integrated Circuits - 1.4% | | | | | |

Pericom Semiconductor Corp.* | | 7,200 | | | 52,632 |

TriQuint Semiconductor, Inc.* | | 25,800 | | | 63,726 |

| | | | | |

| | | | | 116,358 |

| | | | | |

Semiconductor Equipment - 0.7% | | | | | |

Tessera Technologies, Inc.* | | 4,000 | | | 53,480 |

| | | | | |

Telecommuications Services - 1.3% | | | | | |

NTELOS Holdings Corp. | | 2,400 | | | 43,536 |

Premiere Global Services, Inc.* | | 6,800 | | | 59,976 |

| | | | | |

| | | | | 103,512 |

| | | | | |

Theaters - 0.8% | | | | | |

Cinemark Holdings, Inc. | | 6,800 | | | 63,852 |

| | | | | |

Therapeutics - 2.0% | | | | | |

Cypress Bioscience, Inc.* | | 5,800 | | | 41,238 |

Medarex, Inc.* | | 8,100 | | | 41,553 |

Onyx Pharmaceuticals, Inc.* | | 1,600 | | | 45,680 |

Questcor Pharmaceuticals, Inc.* | | 6,700 | | | 32,964 |

| | | | | |

| | | | | 161,435 |

| | | | | |

Transactional Software - 0.8% | | | | | |

Solera Holdings, Inc.* | | 2,500 | | | 61,950 |

| | | | | |

Transport-Air Freight - 0.8% | | | | | |

Atlas Air Worldwide Holdings, Inc.* | | 3,700 | | | 64,195 |

| | | | | |

Transport-Marine - 1.5% | | | | | |

Diana Shipping, Inc. | | 3,300 | | | 38,907 |

Genco Shipping & Trading, Ltd. | | 3,900 | | | 48,126 |

Gulfmark Offshore, Inc.* | | 1,500 | | | 35,790 |

| | | | | |

| | | | | 122,823 |

| | | | | |

See Accompanying Notes to Financial Statements.

| | | | | | |

| | | Number of

Shares | | Value |

Transport-Rail - 0.5% | | | | | | |

Genesee & Wyoming, Inc. Cl. A* | | | 2,100 | | $ | 44,625 |

| | | | | | |

Transport-Services - 0.5% | | | | | | |

Bristow Group, Inc.* | | | 1,900 | | | 40,717 |

| | | | | | |

Transport-Truck - 1.4% | | | | | | |

Old Dominion Freight Line, Inc.* | | | 2,200 | | | 51,678 |

Saia, Inc.* | | | 5,400 | | | 64,530 |

| | | | | | |

| | | | | | 116,208 |

| | | | | | |

Ultra Sound Imaging Systems - 0.3% | | | | | | |

SonoSite, Inc.* | | | 1,600 | | | 28,608 |

| | | | | | |

Water Treatment Systems - 0.4% | | | | | | |

Energy Recovery, Inc.* | | | 4,800 | | | 36,480 |

| | | | | | |

Wire & Cable Products - 0.6% | | | | | | |

General Cable Corp.* | | | 2,400 | | | 47,568 |

| | | | | | |

Wireless Equipment - 0.4% | | | | | | |

InterDigital, Inc.* | | | 1,300 | | | 33,566 |

| | | | | | |

Total Common Stock (Cost: $9,971,831) | | | | | | 7,935,333 |

| | | | | | |

| | |

| | | Principal

Amount | | |

Short Term Investments - 1.9% | | | | | | |

Time Deposit - 1.9% | | | | | | |

Citibank London | | | | | | |

0.100%, 04/01/09 (Cost: $150,185) | | $ | 150,185 | | | 150,185 |

| | | | | | |

Total Investments - 99.5% (Cost: $10,122,016) | | | | | | 8,085,518 |

| | | | | | |

Other Assets in Excess of Liabilities - 0.5% | | | | | | 41,819 |

| | | | | | |

Net Assets - 100.0% | | | | | $ | 8,127,337 |

| | | | | | |

| * | Non-income producing securities. |

| ADR | - American Depository Receipt |

SCHEDULEOF INVESTMENTSBY SECTOR

as of March 31, 2009

| | | |

Sector | | Percent of

Net Assets | |

Consumer, Non-cyclical | | 32.4 | % |

Consumer, Cyclical | | 16.4 | |

Industrial | | 14.9 | |

Technology | | 13.4 | |

Communications | | 7.1 | |

Energy | | 5.3 | |

Financial | | 4.5 | |

Basic Materials | | 2.7 | |

Utilities | | 0.5 | |

Diversified | | 0.4 | |

Short Term Investments | | 1.9 | |

| | | |

Total Investments | | 99.5 | |

Other assets in excess of liabilities | | 0.5 | |

| | | |

Net Assets | | 100.0 | % |

| | | |

U.S. SMALLTO MID CAP GROWTH FUND

Management Team: John C. McCraw, Portfolio Manager; Robert S. Marren, Portfolio Manager

Chief Investment Officer: Horacio A. Valeiras, CFA

Goal: The U.S. Small to Mid Cap Growth Fund seeks to maximize long-term capital appreciation by investing primarily in stocks from a universe of U.S. companies with small to mid (SMID) market capitalizations similar to the Russell 2500 Growth Index at time of purchase.

Market Overview: The small- to mid-cap growth segment of the U.S. stock market, as measured by the Russell 2500 Growth Index, posted a loss during the twelve months ended March 31, 2009. The decline was part of a widespread sell-off that pressured U.S. equities across styles, sectors and capitalization ranges. Market conditions were volatile, with strong gains early and late in the fiscal year sandwiching dramatic losses in between.

Stocks advanced in April and May, lifted by hopes that expansionary monetary policy from the Federal Reserve would contain the credit crisis which had erupted in 2007. Despite the optimism, the market retreated over the summer due to continued stress in the credit markets, rising inflation and worries about the economy. Then, in September, an unprecedented series of events sent the stock market into a tailspin. Losses on mortgage-related assets forced a major securities firm into bankruptcy, and several other large financial institutions were taken over by the government or sold. Needing to conserve capital, banks pared back lending and credit dried up. Equities continued to plunge throughout most of the fall and winter on growing evidence that the financial crisis had pushed the economy into a deep recession.

The government took bold steps to shore up the financial system and economy, including slashing interest rates, cutting taxes and buying longer-term Treasuries. These actions, along with some good news out of the banking and housing sectors, caused stocks to soar near the end of the period.

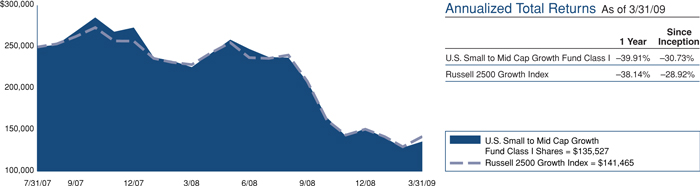

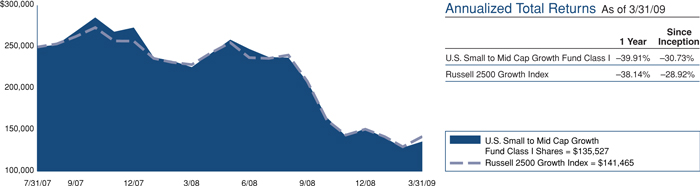

Performance: During the fiscal year ended March 31, 2009, the Fund’s Class I shares lost 39.91% and the Russell 2500 Growth Index fell 38.14%.

Portfolio Specifics: Our positioning in energy stocks had a favorable impact on relative results. Amid a steep drop in oil prices, energy was the worst-performing sector in the index, and the Fund was underweight in the group. Our stock selection also added value, helped by positions in Patriot Coal, a coal producer, and Petrohawk Energy, an oil and gas company. Another major source of relative strength was stock selection in the consumer staples sector, where Green Mountain Coffee Roasters was a top performer. This coffee retailer/wholesaler consistently exceeded earnings estimates, driven by strong sales of its single-cup brewing machines.

Stock selection in the health care and consumer discretionary sectors had the largest negative effect on performance versus the index. Major detractors included a biotech firm whose lead drug candidate faced safety issues and an apparel manufacturer with a heavy debt burden. Stock selection and an underweight in information technology were also unfavorable. Information technology was one of the index’s most resilient sectors, supported by the generally strong balance sheets of tech companies.

Market Outlook: The stock market is likely to remain volatile in the months ahead given the challenging economic and earnings environment. Earnings estimates for 2009, already significantly reduced, are likely to decline further. The recession is expected to be longer and deeper than past contractions due to several factors, including tighter lending standards and higher job losses. That said, we are encouraged by the government’s aggressive monetary and fiscal policies, which should restore liquidity to the financial system and set the recovery process in motion.

As always, we believe that our strategy of investing in companies exhibiting sustainable, timely and positive change will result in strong returns in the Fund over time.

Comparison of Change in Value of a $250,000 Investment in U.S. Small to Mid Cap Growth Fund Class I with the Russell 2500 Growth Index.

The graph above shows the value of a hypothetical $250,000 investment in the Fund’s Class I shares with the Russell 2500 Growth Index for the periods indicated. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. The Class I shares commenced operations on July 31, 2007. The total returns shown above do not show the effects of income taxes on an individuals’ investment. In most cases, taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. Past performance cannot guarantee future results.

The Russell 2500 Growth Index is an unmanaged index comprised of those Russell 2500 companies with higher price-to-book ratios and

higher forecasted growth values. The Russell 2500 Index is an unmanaged index generally representative of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. Unless otherwise noted, index returns reflect the reinvestment of income, dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index. Since markets can go down as well as up, investment return and principal value will fluctuate with market conditions. You may have a gain or loss when you sell your shares.

13

U.S. SMALLTO MID CAP GROWTH FUND

SCHEDULEOF INVESTMENTS

As of March 31, 2009

| | | | | |

| | | Number of

Shares | | Value |

Common Stock - 99.4% | | | | | |

Aerospace/Defense-Equipment - 0.7% | | | | | |

Orbital Sciences Corp.* | | 1,810 | | $ | 21,521 |

| | | | | |

Agricultural Chemicals - 0.6% | | | | | |

Intrepid Potash, Inc.* | | 1,000 | | | 18,450 |

| | | | | |

Airlines - 1.2% | | | | | |

Allegiant Travel Co.* | | 350 | | | 15,911 |

Continental Airlines, Inc. Cl. B* | | 1,460 | | | 12,863 |

JetBlue Airways Corp.* | | 2,660 | | | 9,709 |

| | | | | |

| | | | | 38,483 |

| | | | | |

Alternative Waste Technology - 0.7% | | | | | |

Calgon Carbon Corp.* | | 1,600 | | | 22,672 |

| | | | | |

Applications Software - 3.4% | | | | | |

Compuware Corp.* | | 4,230 | | | 27,876 |

Ebix, Inc.* | | 1,100 | | | 27,335 |

Nuance Communications, Inc.* | | 1,970 | | | 21,394 |

Red Hat, Inc.* | | 1,600 | | | 28,544 |

| | | | | |

| | | | | 105,149 |

| | | | | |

Auto-Medium & Heavy Duty Trucks - 0.9% | | | | | |

Navistar International Corp.* | | 800 | | | 26,768 |

| | | | | |

Batteries/Battery Systems - 0.6% | | | | | |

Greatbatch, Inc.* | | 1,000 | | | 19,350 |

| | | | | |

Broadcast Services/Programming - 0.8% | | | | | |

DG FastChannel, Inc.* | | 1,300 | | | 24,401 |

| | | | | |

Building-Heavy Construction - 0.4% | | | | | |

Chicago Bridge & Iron Co. | | 2,200 | | | 13,794 |

| | | | | |

Chemicals-Specialty - 1.3% | | | | | |

Ashland, Inc. | | 2,300 | | | 23,759 |

Cytec Industries, Inc. | | 1,100 | | | 16,522 |

| | | | | |

| | | | | 40,281 |

| | | | | |

Coal - 0.6% | | | | | |

Massey Energy Co. | | 1,700 | | | 17,204 |

| | | | | |

Coffee - 0.5% | | | | | |

Green Mountain Coffee Roasters, Inc.* | | 300 | | | 14,400 |

| | | | | |

Commercial Banks-Southern US - 0.8% | | | | | |

Bank of the Ozarks, Inc. | | 1,100 | | | 25,388 |

| | | | | |

Commercial Services-Finance - 0.6% | | | | | |

Wright Express Corp.* | | 1,000 | | | 18,220 |

| | | | | |

Computers-Peripheral Equipment - 0.9% | | | | | |