UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22167

Allianz Funds Multi-Strategy Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Scott Whisten

1633 Broadway, New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code:212-739-3367

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

Item 1. Report to Shareholders

Allianz Funds

Multi-Strategy Trust

SHARE CLASSES A, C, R, P, INSTITUTIONAL, R6, ADMINISTRATIVE

Semiannual Report

March 31, 2020

AllianzGI Retirement 2020 Fund

AllianzGI Retirement 2025 Fund

AllianzGI Retirement 2030 Fund

AllianzGI Retirement 2035 Fund

AllianzGI Retirement 2040 Fund

AllianzGI Retirement 2045 Fund

AllianzGI Retirement 2050 Fund

AllianzGI Retirement 2055 Fund

AllianzGI Multi Asset Income Fund

AllianzGI Best Styles Global Equity Fund

AllianzGI Best Styles U.S. Equity Fund

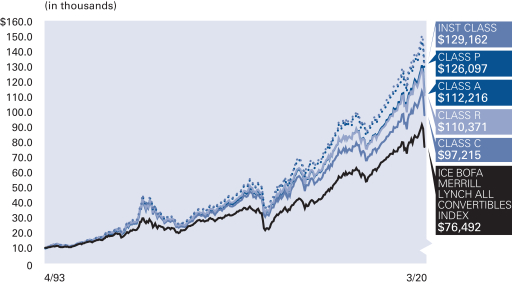

AllianzGI Convertible Fund

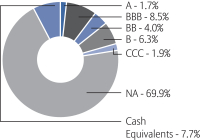

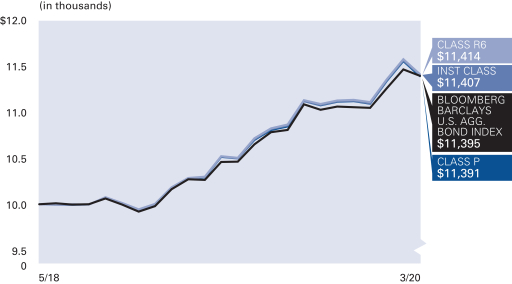

AllianzGI Core Bond Fund

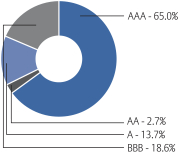

AllianzGI Core Plus Bond Fund

AllianzGI Emerging Markets Consumer Fund

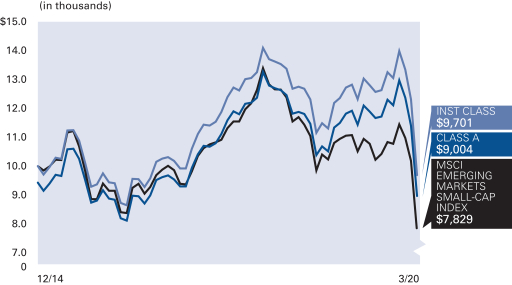

AllianzGI Emerging Markets Small-Cap Fund

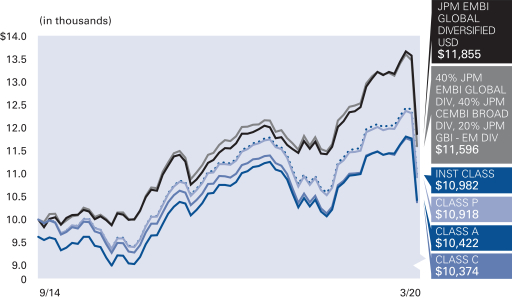

AllianzGI Emerging Markets SRI Debt Fund

AllianzGI Emerging Markets Value Fund (formerly AllianzGI NFJ Emerging Markets Value Fund)

AllianzGI Floating Rate Note Fund

AllianzGI Global Allocation Fund

AllianzGI Global Dynamic Allocation Fund

AllianzGI Global High Yield Fund

AllianzGI Global Sustainability Fund

AllianzGI Green Bond Fund

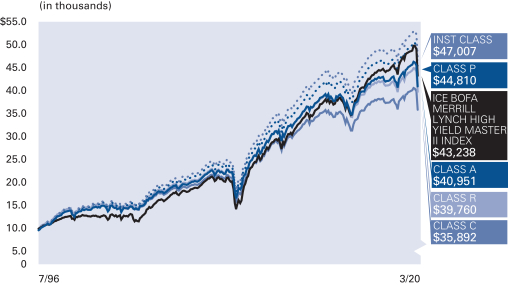

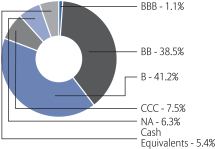

AllianzGI High Yield Bond Fund

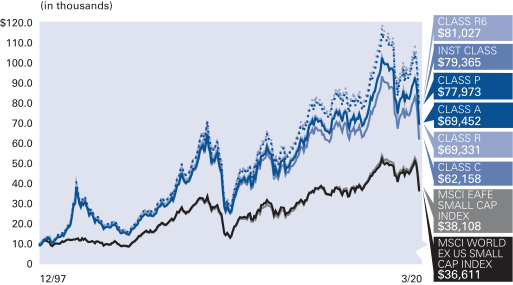

AllianzGI International Small-Cap Fund

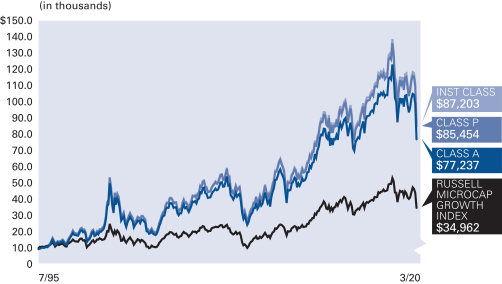

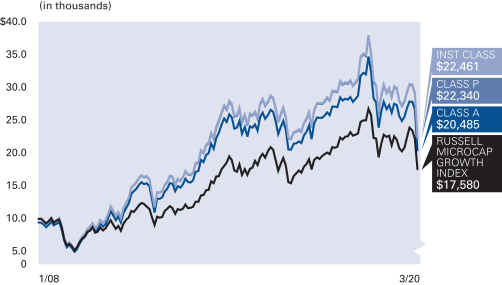

AllianzGI Micro Cap Fund

AllianzGI PerformanceFee Managed Futures Strategy Fund

AllianzGI PerformanceFee Structured US Equity Fund

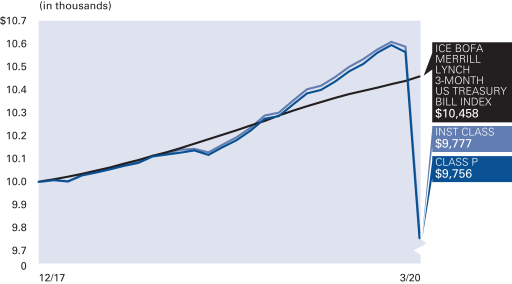

AllianzGI PerformanceFee Structured US Fixed Income Fund

AllianzGI Preferred Securities and Income Fund

AllianzGI Short Duration High Income Fund

AllianzGI Short Term Bond Fund

AllianzGI Structured Return Fund

AllianzGI U.S. Equity Hedged Fund

AllianzGI Ultra Micro Cap Fund

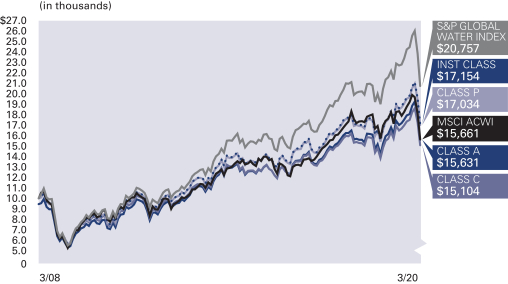

AllianzGI Water Fund (formerly AllianzGI Global Water Fund)

This material is authorized for use only when preceded or accompanied by the current Allianz Funds Multi-Strategy Trust prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in the Funds’ prospectuses and summary prospectuses. Please read the prospectus carefully before you invest.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (us.allianzgi.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at us.allianzgi.com/edelivery.

If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform a Fund at any time. If you invest through a financial intermediary, you should contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with a Fund or all funds held in your account if you invest through your financial intermediary.

Receive this report electronically and eliminate paper mailings.

To enroll, go to us.allianzgi.com/edelivery.

Table of Contents

A Word About Risk:A fund may be subject to various risks as described in its prospectus. Some of those risks may include, but are not limited to, the following: derivatives risk, smaller company risk, non-US investment risk, focused investment risk and specific sector investment risks. Use of derivative instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, counterparty risk, management risk and the risk that a fund is unable to close out a position when it is most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments. Investing in foreign securities may entail risk due to foreign economic and political developments; this risk may be enhanced when investing in emerging markets. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and additional volatility compared to a diversified equity portfolio. AllianzGI target-date funds seek to manage risk and return by blending two separately-managed portfolios: a return-generating portfolio for growth potential, and a defensive portfolio for principal protection. The balance grows increasingly defensive over time until the target date is reached, after which the Fund’s assets roll into a retirement income strategy. The principal values of the Funds are not guaranteed at any time, including the target date. Please refer to each Fund’s applicable current prospectus for complete details.

Letter from the President

Thomas J. Fuccillo

President & CEO

Dear Shareholder,

The lengthy US expansion appears to be in jeopardy, as activity came to a virtual halt in many areas of the economy toward the end of the six-month fiscal reporting period ended March 31, 2020. This was largely due to the rapid spread of the novel coronavirus (“COVID-19”) and its impact on global growth. Against this backdrop, global equities fell sharply. Meanwhile, the overall US bond market rallied sharply as investor risk aversion increased.

Six Months in Review

During the reporting period, US stocks, as measured by the Standard & Poor’s 500 Index, returned -12.31%. Two measures of stock performance in developed international and global markets, the MSCI EAFE (Europe, Australasia and Far East) Index (net) and the MSCI World Index (net), returned -16.52% and -14.30%, respectively, in dollar-denominated terms. Elsewhere, the MSCI Emerging Markets Index (net) returned -14.55%. With respect to the bond market, the Bloomberg Barclays US Credit Index returned -2.13%, whereas the Bloomberg Barclays Global High Yield Index returned -12.05%. The Bloomberg Barclays US Government Bond Index returned 2.68%, while the broader bond market index, as measured by the Bloomberg Barclays US Aggregate Bond Index, gained 3.33%. The Bloomberg Barclays Global Aggregate Index returned 2.50%.

Turning to the US economy, gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 2.1% annual pace during each of the third and fourth quarters of 2019. The US Department of Commerce’s initial reading for first quarter 2020 GDP growth — released after the reporting period ended — was -4.8%. This marked the steepest quarterly decline since the fourth quarter of 2008.

The US Federal Reserve (the “Fed”) took a number of aggressive actions during the reporting period in an attempt to support the economy and keep the market functioning properly in the wake of COVID-19. First, on October 30, 2019, the Fed reduced the federal funds rate to a range between 1.50% and 1.75%. Second, on March 3, 2020, the Fed lowered the federal funds rate to a range between 1.00% and 1.25%. Then, on March 15, the Fed lowered the federal funds rate to a range between 0.00% and 0.25%. Finally, on March 23, the Fed said, “It has become clear that our economy will face severe disruptions … Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.” Such aggressive efforts included essentially unlimited purchases of Treasury securities and agency mortgages. Also in March 2020, the US government passed a $2 trillion fiscal stimulus bill to aid the economy.

| | | | | | |

| 2 | | March 31, 2020 | | | Semiannual Report | | |

Outlook

As of this writing, there is much uncertainty regarding the global economy given the spread of COVID-19. This has resulted in periods of elevated market volatility and a “flight to quality.” We have already seen mass quarantines, supply disruptions and market liquidity issues — all of which present headwinds on the global economy. In this environment, we believe investors should aim to keep their portfolios on track by having conviction and actively managing risk.

In addition to COVID-19, major political developments, including US President Donald Trump’s bid for a second term in office, warrant careful monitoring. In our view, this could contribute to wide “risk-on/risk-off” movements as sentiment swings between “riskier” and perceived “safer” asset classes. We expect low beta returns for the overall market, which makes pursuing alpha — in excess of market returns — all the more important.

In our view, central banks will remain a major market driver in 2020, even as their efforts to spark economic growth become less effective and today’s ultra-low interest rates provide less room to maneuver. Rates have been negative in Europe and Japan for some time, and the Fed has aggressively lowered rates amid weakening economic growth. Facing dwindling options, we believe central banks will likely continue offering additional stimulus with limited effect. Governments may need to shoulder some of the burden by increasing spending, reducing taxes or both.

On behalf of Allianz Global Investors U.S. LLC, the Funds’ investment adviser, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

Thomas J. Fuccillo

Trustee, President & Chief Executive Officer

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Receive this report electronically and eliminate paper mailings.

To enroll, go to us.allianzgi.com/edelivery.

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 3 |

Unaudited

AllianzGI Target-Date Funds*

For the period of October 1, 2019 through March 31, 2020, as provided by the Multi-Asset US Group.

Fund Insights

For the six-month period ended March 31, 2020, Class A shares at net asset value (“NAV”) of the AllianzGI Target-Date Funds (collectively, the “Funds” and each a “Fund”) returned between -4.22% and -13.73%, with shorter-dated Funds posting more favorable results. In terms of relative performance, all strategies outperformed their respective benchmarks (Morningstar Lifetime Moderate series) for the six-month period.

Market Overview

Global equities ratcheted steadily higher from the beginning of the reporting period until mid-February 2020, with sentiment lifted by growing optimism over a “phase one” trade deal between the US and China and better-than-expected corporate earnings. However, growing concerns about the impact of the novel coronavirus outbreak (“COVID-19”) led to a steep correction in February 2020, with the sell-off gathering pace in March 2020, as a growing number of countries imposed travel restrictions and lockdown measures. Global equities suffered their worst quarter since the 2008 financial crisis in the first quarter of 2020, with many markets entering an official bear market, defined as a decline of at least 20% from a recent peak.

Global government bond yields trended higher in the fourth quarter of 2019 amid growing optimism over the outlook for global growth, but tumbled in 2020 on growing speculation that the COVID-19 pandemic would force central banks to slash interest rates and reinstate asset-purchase programs. In the US, the 10-year Treasury yield closed the period around 100 basis points lower, while 10-year yields in the UK fell just over 10 basis points. However, German Bund yields rose slightly and peripheral euro-zone yields rose even more. Japanese government bonds also increased modestly. Meanwhile, corporate bonds fell sharply as the deteriorating economic outlook led to fears of rising downgrades and defaults.

Hopes that the global economy may be over the worst of the trade-related slowdown were dashed as the COVID-19 outbreak spread beyond China, forcing countries to impose travel restrictions and draconian quarantine measures. Flash estimates of purchasing managers’ indices for March 2020 revealed the impact that COVID-19 was having on the global economy. In the US, the purchasing managers’ composite index fell to an 11-year low while the composite survey for the euro zone fell to a record low. Elsewhere, Chinese industrial production plunged 13.5% over the first two months of the year, compared to the same period in 2019, and retail sales plummeted by 20.5% on a year-on-year basis. In response, central banks lowered interest rates and reinstated asset-purchase programs, but in general these measures failed to reassure financial markets. Instead, governments were forced to shoulder the burden for supporting economies, with many announcing massive fiscal measures.

In the currency markets, the period saw significant swings. The British pound was one of the strongest currencies in the final quarter of 2019, boosted by news that the UK had secured a Withdrawal Agreement with the EU, but lost the majority of these gains during the first quarter of 2020. Elsewhere, the US dollar, euro and Japanese yen all jostled for supremacy throughout the six-month reporting period, while many emerging market currencies weakened.

Portfolio Review

The Funds entered the year with an overweight to global equities and benefited from the overweight position against a backdrop of easing trade tensions supported risk assets into the year’s end. Selection effects in the international equity portion of the Funds further contributed, along with an overweight to corporate bonds, conversely, positions in the Japanese yen and Italian government bonds detracted modestly. In the first quarter of 2020, the Funds benefited from their less aggressive structure as compared to the external benchmarks. As compared to their internal strategic benchmarks, the overweight to equities across the Funds was the primary detractor as markets turned over toward the end of February 2020. The equity overweight was reduced in early March 2020, and was an underweight by mid-month. The underweight position by mid-month contributed to limiting the Funds’ participation in the market declines during the latter portion of the month. In addition to adjusting the Funds’ overall equity exposure, fixed income exposure which was overweight going into the month remained an overweight, further helping to mitigate losses as markets continued to sell-off during the period. The Funds remained defensively positioned into the period end, with an underweight to global equities, and an overweight to duration.

Outlook

The COVID-19 pandemic and severe disruptions in the oil market created a simultaneous supply and demand shock for a late-cycle global economy. One consequence is that economies are increasingly vulnerable to exogenous shocks that can exacerbate existing imbalances. As such, we maintain a cautious economic outlook and now expect a global recession in the next few months. We believe that the shape and magnitude of the anticipated recession will depend to an extent on the negative spillover from financial markets in holding back the real economy. The inflection point in financial markets in the context of the current crisis—in contrast to previous financial crises—will depend, in our opinion, on an array of factors, including (1) how the COVID-19 public health crisis unfolds and ultimately stabilizes; (2) continued credible intervention on the part of governments and public policy; (3) stabilization of corporate and macroeconomic data and (4) adjustment of valuations to recession-like levels.

Against this backdrop, we continue to see elevated risks of additional corrections in risky asset markets in the near term before a sustainable turnaround is achieved. Therefore, unless we see a very strong V-shaped recovery in markets and the economy, we expect to maintain our defensive positioning based on our trend-based and fundamental indicators. We believe that this will position us to be prepared for a persistent downturn in the near term. Of course, if the market rally at quarter-end following the very substantial fiscal package and the series of supports announced by the US Federal Reserve should persist, we will reincorporate risk back into the portfolios accordingly.

* The “Target-Date Funds” are the AllianzGI Retirement 2020 Fund, the AllianzGI Retirement 2025 Fund, the AllianzGI Retirement 2030 Fund, the AllianzGI Retirement 2035 Fund, the AllianzGI Retirement 2040 Fund, the AllianzGI Retirement 2045 Fund, the AllianzGI Retirement 2050 Fund, and the AllianzGI Retirement 2055 Fund.

| | | | | | |

| 4 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

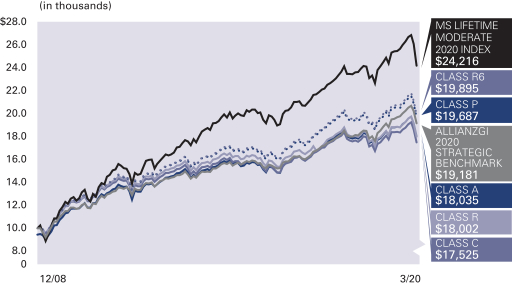

AllianzGI Retirement 2020 Fund

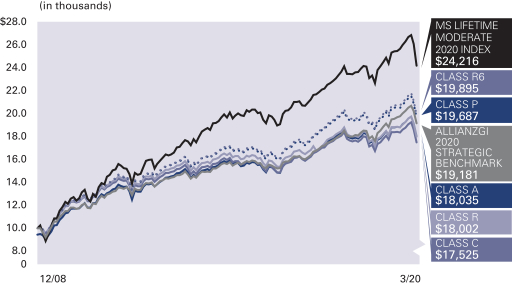

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2020 Fund Class A | | | –4.22% | | | | –0.83% | | | | 2.88% | | | | 4.17% | | | | 5.91% | |

| | AllianzGI Retirement 2020 Fund Class A (adjusted) | | | –9.49% | | | | –6.28% | | | | 1.72% | | | | 3.58% | | | | 5.38% | |

| | | AllianzGI Retirement 2020 Fund Class C | | | –4.59% | | | | –1.63% | | | | 2.10% | | | | 3.38% | | | | 5.11% | |

| | AllianzGI Retirement 2020 Fund Class C (adjusted) | | | –5.42% | | | | –2.48% | | | | 2.10% | | | | 3.38% | | | | 5.11% | |

| | AllianzGI Retirement 2020 Fund Class R | | | –4.37% | | | | –1.22% | | | | 2.07% | | | | 3.59% | | | | 5.36% | |

| | AllianzGI Retirement 2020 Fund Class P | | | –4.07% | | | | –0.59% | | | | 3.18% | | | | 4.46% | | | | 6.20% | |

| | AllianzGI Retirement 2020 Fund Class R6 | | | –4.05% | | | | –0.47% | | | | 3.27% | | | | 4.56% | | | | 6.30% | |

| | | AllianzGI Retirement 2020 Fund Administrative Class | | | –4.17% | | | | –0.80% | | | | 2.90% | | | | 4.20% | | | | 5.95% | |

| | Morningstar Lifetime Moderate 2020 Index | | | –5.79% | | | | –1.31% | | | | 3.72% | | | | 6.29% | | | | 8.18% | |

| | AllianzGI 2020 Strategic Benchmark | | | –3.16% | | | | 1.69% | | | | 3.96% | | | | 4.77% | | | | 5.96% | |

| | | Lipper Mixed-Asset Target 2020 Funds Average | | | –6.85% | | | | –3.19% | | | | 2.58% | | | | 5.30% | | | | 7.17% | |

* Cumulative return

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.16% for Class A shares, 1.91% for Class C shares, 1.41% for Class R shares, 0.76% for Class P shares, 0.66% for Class R6 shares and 1.01% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

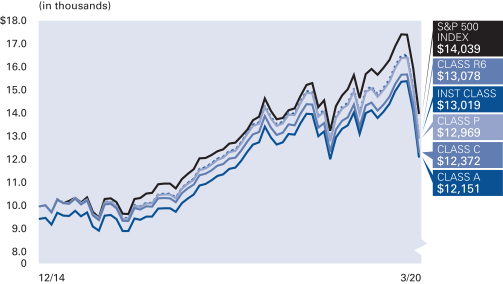

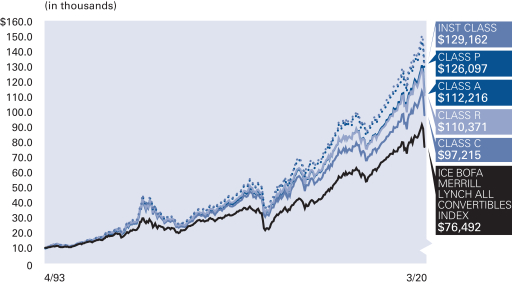

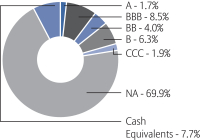

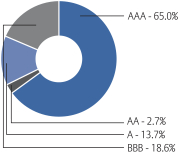

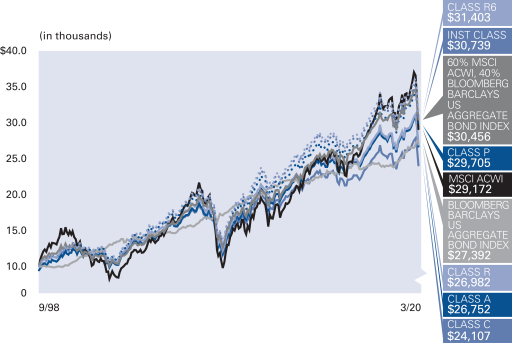

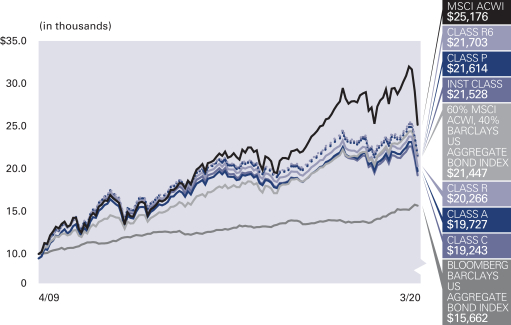

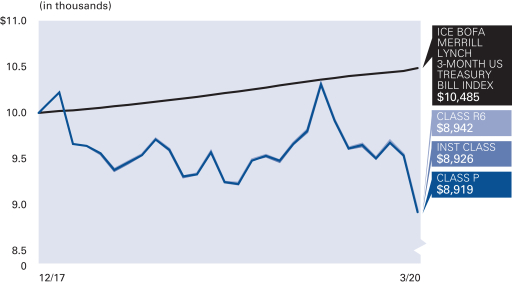

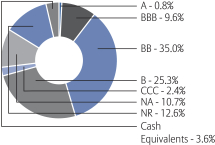

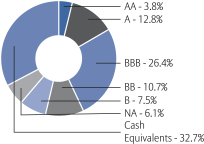

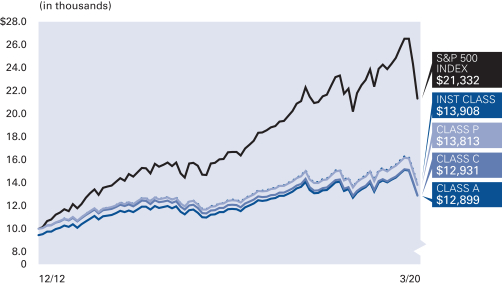

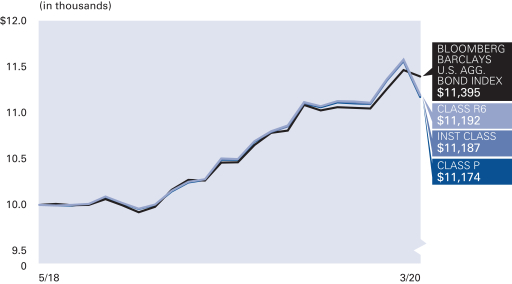

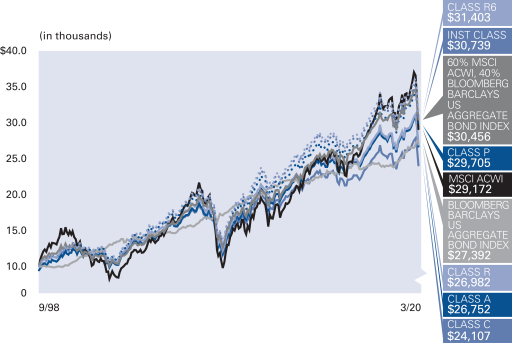

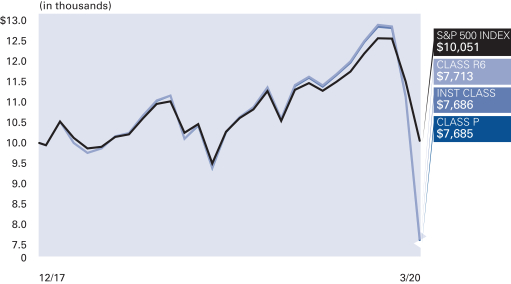

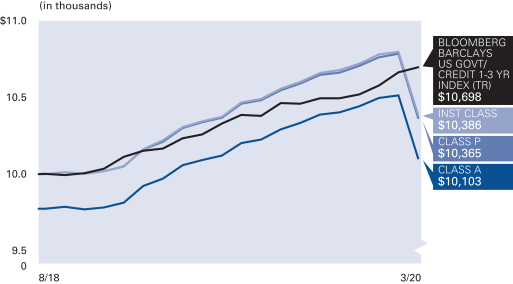

Cumulative Returns Through March 31, 2020

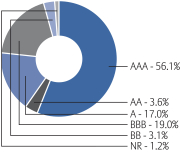

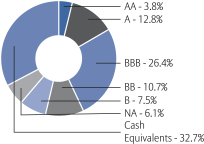

Fund Allocation (as of March 31, 2020 )

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 70.4% | |

| |

| AllianzGI Core Bond | | | 29.2% | |

| |

| AllianzGI Emerging Markets Small-Cap | | | 0.6% | |

| |

| Cash & Equivalents — Net | | | -0.2% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 5 |

Unaudited

AllianzGI Retirement 2020 Fund (cont’d)

| | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $957.80 | | $954.10 | | $956.30 | | $959.30 | | $959.50 | | $958.30 |

| | | | | | |

| Expenses Paid During Period | | $1.81 | | $5.47 | | $3.52 | | $0.34 | | $0.01 | | $1.57 |

| | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $1,023.15 | | $1,019.40 | | $1,021.40 | | $1,024.65 | | $1,024.99 | | $1,023.40 |

| | | | | | |

| Expenses Paid During Period | | $1.87 | | $5.65 | | $3.64 | | $0.35 | | $0.01 | | $1.62 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.37% for Class A, 1.12% for Class C, 0.72% for Class R, 0.07% for Class P, less than 0.005% for Class R6 and 0.32% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 6 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

AllianzGI Retirement 2025 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2025 Fund Class A | | | –6.46% | | | | –3.92% | | | | 2.78% | | | | 4.12% | |

| | AllianzGI Retirement 2025 Fund Class A (adjusted) | | | –11.60% | | | | –9.20% | | | | 1.62% | | | | 3.41% | |

| | AllianzGI Retirement 2025 Fund Class R | | | –6.65% | | | | –4.26% | | | | 2.41% | | | | 3.75% | |

| | AllianzGI Retirement 2025 Fund Class P | | | –6.36% | | | | –3.75% | | | | 3.08% | | | | 4.43% | |

| | AllianzGI Retirement 2025 Fund Class R6 | | | –6.32% | | | | –3.55% | | | | 3.20% | | | | 4.53% | |

| | | AllianzGI Retirement 2025 Fund Administrative Class | | | –6.45% | | | | –3.86% | | | | 2.84% | | | | 4.17% | |

| | Morningstar Lifetime Moderate 2025 Index | | | –7.25% | | | | –2.76% | | | | 3.80% | | | | 7.15% | |

| | AllianzGI 2025 Strategic Benchmark | | | –5.35% | | | | –0.77% | | | | 4.02% | | | | 5.05% | |

| | | Lipper Mixed-Asset Target 2025 Funds Average | | | –7.92% | | | | –4.24% | | | | 2.84% | | | | 6.05% | |

* Cumulative return

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.20% for Class A shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 90.3% | |

| |

| AllianzGI Core Bond | | | 4.0% | |

| |

| AllianzGI Emerging Markets Small-Cap | | | 0.6% | |

| |

| Cash & Equivalents — Net | | | 5.1% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 7 |

Unaudited

AllianzGI Retirement 2025 Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $935.40 | | $933.50 | | $936.40 | | $936.80 | | $935.50 |

| | | | | |

| Expenses Paid During Period | | $1.50 | | $3.19 | | $0.05 | | $0.01 | | $1.26 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $1,023.45 | | $1,021.70 | | $1,024.95 | | $1,024.99 | | $1,023.70 |

| | | | | |

| Expenses Paid During Period | | $1.57 | | $3.34 | | $0.05 | | $0.01 | | $1.32 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.31% for Class A, 0.66% for Class R, 0.01% for Class P, less than 0.005% for Class R6 and 0.26% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 8 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

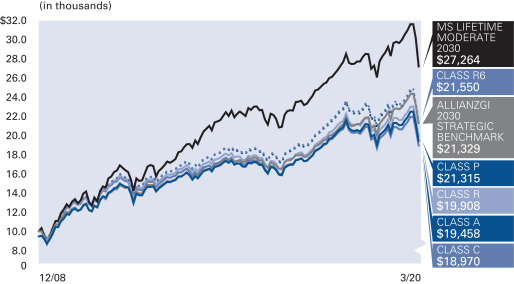

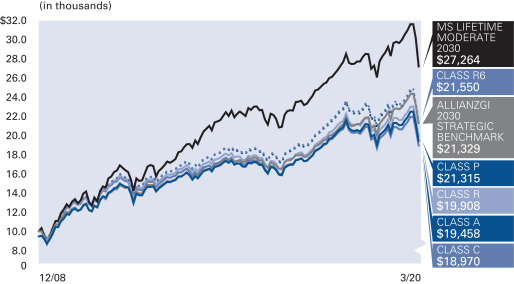

AllianzGI Retirement 2030 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2030 Fund Class A | | | –8.00% | | | | –5.78% | | | | 2.62% | | | | 4.37% | | | | 6.63% | |

| | AllianzGI Retirement 2030 Fund Class A (adjusted) | | | –13.06% | | | | –10.96% | | | | 1.46% | | | | 3.79% | | �� | | 6.09% | |

| | | AllianzGI Retirement 2030 Fund Class C | | | –8.33% | | | | –6.46% | | | | 1.85% | | | | 3.60% | | | | 5.86% | |

| | AllianzGI Retirement 2030 Fund Class C (adjusted) | | | –9.10% | | | | –7.25% | | | | 1.85% | | | | 3.60% | | | | 5.86% | |

| | AllianzGI Retirement 2030 Fund Class R | | | –8.17% | | | | –6.14% | | | | 2.25% | | | | 4.03% | | | | 6.31% | |

| | AllianzGI Retirement 2030 Fund Class P | | | –7.88% | | | | –5.50% | | | | 2.92% | | | | 4.68% | | | | 6.96% | |

| | AllianzGI Retirement 2030 Fund Class R6 | | | –7.82% | | | | –5.36% | | | | 3.03% | | | | 4.78% | | | | 7.06% | |

| | | AllianzGI Retirement 2030 Fund Administrative Class | | | –7.97% | | | | –5.68% | | | | 2.68% | | | | 4.44% | | | | 6.72% | |

| | Morningstar Lifetime Moderate 2030 Index | | | –9.41% | | | | –5.14% | | | | 3.72% | | | | 6.95% | | | | 9.32% | |

| | AllianzGI 2030 Strategic Benchmark | | | –7.40% | | | | –3.07% | | | | 4.00% | | | | 5.26% | | | | 6.97% | |

| | | Lipper Mixed–Asset Target 2030 Funds Average | | | –9.56% | | | | –6.05% | | | | 2.84% | | | | 6.00% | | | | 8.13% | |

* Cumulative return

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.21% for Class A shares, 1.96% for Class C shares, 1.46% for Class R shares, 0.81% for Class P shares, 0.71% for Class R6 shares and 1.06% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 89.0% | |

| |

| AllianzGI Best Styles U.S. Equity | | | 3.0% | |

| |

| AllianzGI International Growth | | | 2.1% | |

| |

| AllianzGI Best Styles Global Managed Volatility | | | 1.6% | |

| |

| AllianzGI Mid-Cap | | | 0.6% | |

| |

| AllianzGI Global Small-Cap Opportunities | | | 0.4% | |

| |

| Cash & Equivalents — Net | | | 3.3% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 9 |

Unaudited

AllianzGI Retirement 2030 Fund (cont’d)

| | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $920.00 | | $916.70 | | $918.30 | | $921.20 | | $921.80 | | $920.30 |

| | | | | | |

| Expenses Paid During Period | | $1.39 | | $4.98 | | $3.07 | | $0.01 | | $0.01 | | $1.15 |

| | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $1,023.55 | | $1,019.80 | | $1,021.80 | | $1,024.99 | | $1,024.99 | | $1,023.80 |

| | | | | | |

| Expenses Paid During Period | | $1.47 | | $5.25 | | $3.23 | | $0.01 | | $0.01 | | $1.21 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.29% for Class A, 1.04% for Class C, 0.64% for Class R, less than 0.005% for Class P, less than 0.005% for Class R6 and 0.24% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 10 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

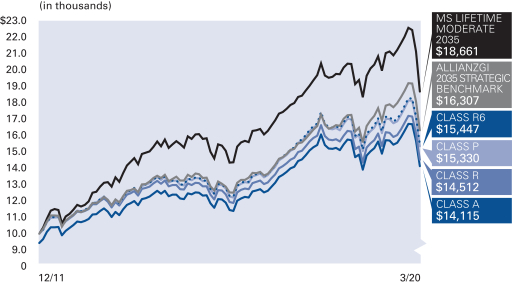

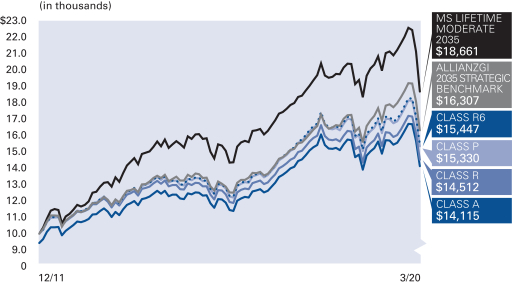

AllianzGI Retirement 2035 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2035 Fund Class A | | | –9.16% | | | | –7.24% | | | | 2.62% | | | | 4.97% | |

| | AllianzGI Retirement 2035 Fund Class A (adjusted) | | | –14.16% | | | | –12.35% | | | | 1.47% | | | | 4.25% | |

| | AllianzGI Retirement 2035 Fund Class R | | | –9.30% | | | | –7.53% | | | | 2.27% | | | | 4.61% | |

| | AllianzGI Retirement 2035 Fund Class P | | | –9.00% | | | | –6.88% | | | | 2.95% | | | | 5.30% | |

| | AllianzGI Retirement 2035 Fund Class R6 | | | –8.99% | | | | –6.87% | | | | 3.03% | | | | 5.39% | |

| | | AllianzGI Retirement 2035 Fund Administrative Class | | | –9.09% | | | | –7.13% | | | | 2.68% | | | | 5.02% | |

| | Morningstar Lifetime Moderate 2035 Index | | | –11.96% | | | | –8.08% | | | | 3.43% | | | | 7.82% | |

| | AllianzGI 2035 Strategic Benchmark | | | –9.16% | | | | –5.04% | | | | 3.92% | | | | 6.08% | |

| | | Lipper Mixed-Asset Target 2035 Funds Average | | | –11.33% | | | | –7.98% | | | | 2.84% | | | | 6.73% | |

* Cumulative return

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares.Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense, which include the Acquired Fund Fees and Expenses, ratios are 1.14% for Class A shares, 1.39% for Class R shares, 0.74% for Class P shares, 0.64% for Class R6 shares and 0.99% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 63.2% | |

| |

| AllianzGI Best Styles U.S. Equity | | | 10.2% | |

| |

| AllianzGI International Growth | | | 5.9% | |

| |

| AllianzGI Best Styles Global Managed Volatility | | | 5.0% | |

| |

| AllianzGI Focused Growth | | | 2.3% | |

| |

| AllianzGI Mid-Cap | | | 2.2% | |

| |

| AllianzGI Small-Cap | | | 1.4% | |

| |

| AllianzGI Mid-Cap Value | | | 1.3% | |

| |

| Other | | | 2.2% | |

| |

| Cash & Equivalents — Net | | | 6.3% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 11 |

Unaudited

AllianzGI Retirement 2035 Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $908.40 | | $907.00 | | $910.00 | | $910.10 | | $909.10 |

| | | | | |

| Expenses Paid During Period | | $1.53 | | $3.19 | | $0.10 | | $0.01 | | $1.29 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $1,023.40 | | $1,021.65 | | $1,024.90 | | $1,024.99 | | $1,023.65 |

| | | | | |

| Expenses Paid During Period | | $1.62 | | $3.39 | | $0.10 | | $0.01 | | $1.37 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.32% for Class A, 0.67% for Class R, 0.02% for Class P, less than 0.01% for Class R6 and 0.27% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 12 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

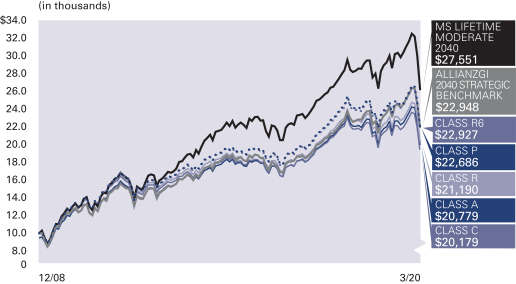

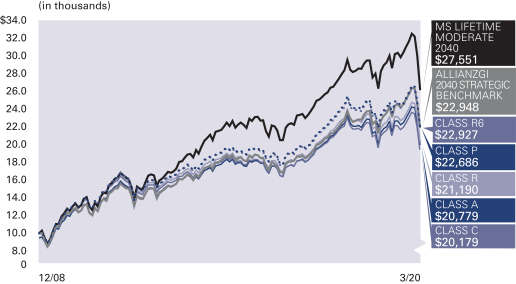

AllianzGI Retirement 2040 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2040 Fund Class A | | | –11.54% | | | | –9.69% | | | | 2.18% | | | | 4.53% | | | | 7.25% | |

| | AllianzGI Retirement 2040 Fund Class A (adjusted) | | | –16.41% | | | | –14.66% | | | | 1.03% | | | | 3.94% | | | | 6.71% | |

| | | AllianzGI Retirement 2040 Fund Class C | | | –11.88% | | | | –10.38% | | | | 1.41% | | | | 3.74% | | | | 6.44% | |

| | AllianzGI Retirement 2040 Fund Class C (adjusted) | | | –12.66% | | | | –11.18% | | | | 1.41% | | | | 3.74% | | | | 6.44% | |

| | AllianzGI Retirement 2040 Fund Class R | | | –11.72% | | | | –10.03% | | | | 1.81% | | | | 4.18% | | | | 6.90% | |

| | AllianzGI Retirement 2040 Fund Class P | | | –11.42% | | | | –9.40% | | | | 2.48% | | | | 4.83% | | | | 7.55% | |

| | AllianzGI Retirement 2040 Fund Class R6 | | | –11.36% | | | | –9.34% | | | | 2.59% | | | | 4.93% | | | | 7.65% | |

| | | AllianzGI Retirement 2040 Fund Administrative Class | | | –11.56% | | | | –9.66% | | | | 2.22% | | | | 4.57% | | | | 7.29% | |

| | Morningstar Lifetime Moderate 2040 Index | | | –14.08% | | | | –10.59% | | | | 3.06% | | | | 6.84% | | | | 9.42% | |

| | AllianzGI 2040 Strategic Benchmark | | | –10.89% | | | | –6.98% | | | | 3.64% | | | | 5.50% | | | | 7.67% | |

| | | Lipper Mixed-Asset Target 2040 Funds Average | | | –12.64% | | | | –9.51% | | | | 2.59% | | | | 6.21% | | | | 8.45% | |

* Cumulative return

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.09% for Class A shares, 1.84% for Class C shares, 1.34% for Class R shares, 0.69% for Class P shares, 0.59% for Class R6 shares and 0.94% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 40.7% | |

| |

| AllianzGI Best Styles U.S. Equity | | | 13.6% | |

| |

| AllianzGI International Growth | | | 10.6% | |

| |

| AllianzGI Best Styles Global Managed Volatility | | | 9.7% | |

| |

| AllianzGI Best Styles Global Equity | | | 7.5% | |

| |

| AllianzGI Focused Growth | | | 3.2% | |

| |

| AllianzGI Mid-Cap | | | 3.2% | |

| |

| AllianzGI Mid-Cap Value | | | 2.5% | |

| |

| Other | | | 5.5% | |

| |

| Cash & Equivalents — Net | | | 3.5% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 13 |

Unaudited

AllianzGI Retirement 2040 Fund (cont’d)

| | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $884.60 | | $881.20 | | $882.80 | | $885.80 | | $886.40 | | $884.40 |

| | | | | | |

| Expenses Paid During Period | | $1.70 | | $5.22 | | $3.34 | | $0.28 | | $0.01 | | $1.46 |

| | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $1,023.20 | | $1,019.45 | | $1,021.45 | | $1,024.70 | | $1,024.99 | | $1,023.45 |

| | | | | | |

| Expenses Paid During Period | | $1.82 | | $5.60 | | $3.59 | | $0.30 | | $0.01 | | $1.57 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.36% for Class A, 1.11% for Class C, 0.71% for Class R, 0.06% for Class P, less than 0.01% for Class R6 and 0.31% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 14 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

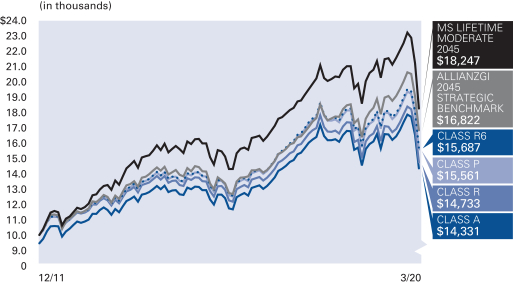

AllianzGI Retirement 2045 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | Since Inception† | |

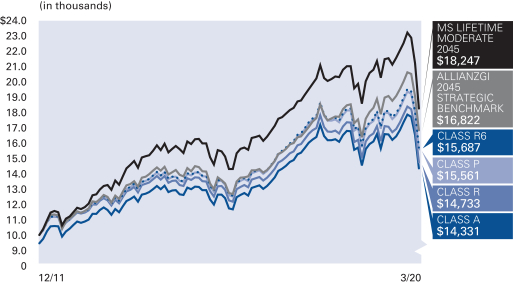

| | | AllianzGI Retirement 2045 Fund Class A | | | –12.71% | | | | –10.97% | | | | 1.99% | | | | 5.15% | |

| | AllianzGI Retirement 2045 Fund Class A (adjusted) | | | –17.51% | | | | –15.86% | | | | 0.85% | | | | 4.44% | |

| | AllianzGI Retirement 2045 Fund Class R | | | –12.89% | | | | –11.32% | | | | 1.64% | | | | 4.79% | |

| | AllianzGI Retirement 2045 Fund Class P | | | –12.57% | | | | –10.72% | | | | 2.31% | | | | 5.48% | |

| | AllianzGI Retirement 2045 Fund Class R6 | | | –12.52% | | | | –10.58% | | | | 2.44% | | | | 5.59% | |

| | | AllianzGI Retirement 2045 Fund Administrative Class | | | –12.71% | | | | –10.95% | | | | 2.06% | | | | 5.20% | |

| | Morningstar Lifetime Moderate 2045 Index | | | –15.32% | | | | –12.09% | | | | 2.76% | | | | 7.53% | |

| | AllianzGI 2045 Strategic Benchmark | | | –11.77% | | | | –7.97% | | | | 3.53% | | | | 6.48% | |

| | | Lipper Mixed-Asset Target 2045 Funds Average | | | –13.69% | | | | –10.61% | | | | 2.59% | | | | 6.87% | |

* Cumulative return

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares.Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.06% for Class A shares, 1.31% for Class R shares, 0.66% for Class P shares, 0.56% for Class R6 shares and 0.91% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 26.0% | |

| |

| AllianzGI Best Styles U.S. Equity | | | 13.2% | |

| |

| AllianzGI Best Styles Global Managed Volatility | | | 12.9% | |

| |

| AllianzGI International Growth | | | 12.5% | |

| |

| AllianzGI Best Styles Global Equity | | | 10.6% | |

| |

| AllianzGI Focused Growth | | | 4.0% | |

| |

| AllianzGI Mid-Cap | | | 4.0% | |

| |

| AllianzGI Global Small-Cap Opportunities | | | 2.9% | |

| |

| Other | | | 6.4% | |

| |

| Cash & Equivalents — Net | | | 7.5% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 15 |

Unaudited

AllianzGI Retirement 2045 Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $872.90 | | $871.10 | | $874.30 | | $874.80 | | $872.90 |

| | | | | |

| Expenses Paid During Period | | $1.78 | | $3.41 | | $0.37 | | $0.01 | | $1.55 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $1,023.10 | | $1,021.35 | | $1,024.60 | | $1,024.99 | | $1,023.35 |

| | | | | |

| Expenses Paid During Period | | $1.92 | | $3.69 | | $0.40 | | $0.01 | | $1.67 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.38% for Class A, 0.73% for Class R, 0.08% for Class P, less than 0.005% for Class R6 and 0.33% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 16 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

AllianzGI Retirement 2050 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

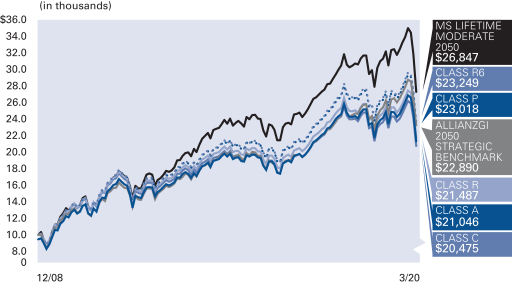

| | | AllianzGI Retirement 2050 Fund Class A | | | –13.27% | | | | –11.41% | | | | 1.84% | | | | 4.65% | | | | 7.37% | |

| | AllianzGI Retirement 2050 Fund Class A (adjusted) | | | –18.04% | | | | –16.28% | | | | 0.69% | | | | 4.06% | | | | 6.83% | |

| | | AllianzGI Retirement 2050 Fund Class C | | | –13.62% | | | | –12.12% | | | | 1.08% | | | | 3.86% | | | | 6.58% | |

| | AllianzGI Retirement 2050 Fund Class C (adjusted) | | | –14.41% | | | | –12.93% | | | | 1.08% | | | | 3.86% | | | | 6.58% | |

| | AllianzGI Retirement 2050 Fund Class R | | | –13.42% | | | | –11.73% | | | | 1.47% | | | | 4.30% | | | | 7.04% | |

| | AllianzGI Retirement 2050 Fund Class P | | | –13.13% | | | | –11.14% | | | | 2.15% | | | | 4.95% | | | | 7.69% | |

| | AllianzGI Retirement 2050 Fund Class R6 | | | –13.08% | | | | –11.06% | | | | 2.26% | | | | 5.05% | | | | 7.79% | |

| | | AllianzGI Retirement 2050 Fund Administrative Class | | | –13.27% | | | | –11.41% | | | | 1.89% | | | | 4.70% | | | | 7.43% | |

| | Morningstar Lifetime Moderate 2050 Index | | | –15.80% | | | | –12.71% | | | | 2.59% | | | | 6.50% | | | | 9.17% | |

| | AllianzGI 2050 Strategic Benchmark | | | –12.29% | | | | –8.54% | | | | 3.45% | | | | 5.46% | | | | 7.64% | |

| | | Lipper Mixed-Asset Target 2050+ Funds Average | | | –13.99% | | | | –10.96% | | | | 2.47% | | | | 6.26% | | | | 8.44% | |

* Cumulative return

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which includes the Acquired Fund Fees and Expenses, are 1.05% for Class A shares, 1.80% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which includes the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

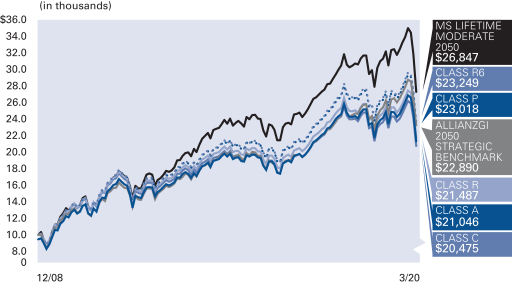

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 18.8% | |

| |

| AllianzGI Best Styles U.S. Equity | | | 17.0% | |

| |

| AllianzGI Best Styles Global Equity | | | 12.3% | |

| |

| AllianzGI International Growth | | | 12.3% | |

| |

| AllianzGI Best Styles Global Managed Volatility | | | 11.8% | |

| |

| AllianzGI Focused Growth | | | 5.0% | |

| |

| AllianzGIMid-Cap | | | 4.8% | |

| |

| AllianzGIMid-Cap Value | | | 4.1% | |

| |

| Other | | | 9.9% | |

| |

| Cash & Equivalents — Net | | | 4.0% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 17 |

Unaudited

AllianzGI Retirement 2050 Fund (cont’d)

| | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $867.30 | | $863.80 | | $865.80 | | $868.70 | | $869.20 | | $867.30 |

| | | | | | |

| Expenses Paid During Period | | $ 1.87 | | $ 5.36 | | $ 3.50 | | $ 0.47 | | $ 0.01 | | $ 1.63 |

| | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (3/31/20) | | $1,023.00 | | $1,019.25 | | $1,021.25 | | $1,024.50 | | $1,024.99 | | $1,023.25 |

| | | | | | |

| Expenses Paid During Period | | $ 2.02 | | $ 5.81 | | $ 3.79 | | $ 0.51 | | $ 0.01 | | $ 1.77 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 1.15% for Class C, 0.75% for Class R, 0.10% for Class P, less than 0.005% for Class R6 and 0.35% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 18 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

AllianzGI Retirement 2055 Fund

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2055 Fund Class A | | | –13.73% | | | | –11.89% | | | | 1.70% | | | | 5.12% | |

| | AllianzGI Retirement 2055 Fund Class A (adjusted) | | | –18.47% | | | | –16.74% | | | | 0.55% | | | | 4.40% | |

| | AllianzGI Retirement 2055 Fund Class R | | | –13.88% | | | | –12.24% | | | | 1.34% | | | | 4.76% | |

| | AllianzGI Retirement 2055 Fund Class P | | | –13.44% | | | | –11.52% | | | | 2.05% | | | | 5.47% | |

| | AllianzGI Retirement 2055 Fund Class R6 | | | –13.55% | | | | –11.54% | | | | 2.11% | | | | 5.55% | |

| | | AllianzGI Retirement 2055 Fund Administrative Class | | | –13.69% | | | | –11.85% | | | | 1.75% | | | | 5.17% | |

| | Morningstar Lifetime Moderate 2055 Index | | | –15.99% | | | | –12.97% | | | | 2.49% | | | | 7.26% | |

| | AllianzGI 2055 Strategic Benchmark | | | –12.29% | | | | –8.54% | | | | 3.45% | | | | 6.44% | |

| | | Lipper Mixed-Asset Target 2055+ Funds Average | | | –14.17% | | | | –11.15% | | | | 2.58% | | | | 7.06% | |

* Cumulative return

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.04% for Class A shares, 1.29% for Class R shares, 0.64% for Class P shares, 0.54% for Class R6 shares and 0.89% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

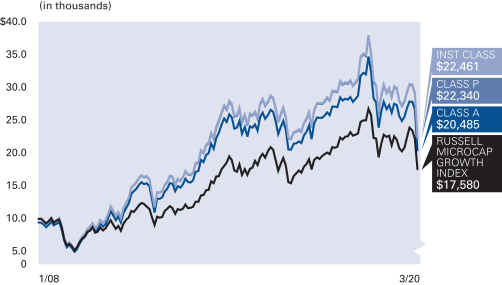

Cumulative Returns Through March 31, 2020

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Global Dynamic Allocation | | | 19.0% | |

| |

| AllianzGI Best Styles U.S. Equity | | | 14.2% | |

| |

| AllianzGI International Growth | | | 12.9% | |

| |

| AllianzGI Best Styles Global Managed Volatility | | | 12.3% | |

| |

| AllianzGI Best Styles Global Equity | | | 11.8% | |

| |

| AllianzGI Focused Growth | | | 4.6% | |

| |

| AllianzGIMid-Cap | | | 4.6% | |

| |

| AllianzGIMid-Cap Value | | | 3.8% | |

| |

| Other | | | 7.3% | |

| |

| Cash & Equivalents — Net | | | 9.5% | |

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 19 |

Unaudited

AllianzGI Retirement 2055 Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $862.70 | | $861.20 | | $865.60 | | $864.50 | | $863.10 |

| | | | | |

| Expenses Paid During Period | | $1.86 | | $3.49 | | $0.51 | | $0.01 | | $1.63 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (3/31/20) | | $1,023.00 | | $1,021.25 | | $1,024.45 | | $1,024.99 | | $1,023.25 |

| | | | | |

| Expenses Paid During Period | | $2.02 | | $3.79 | | $0.56 | | $0.01 | | $1.77 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 0.75% for Class R, 0.11% for Class P, less than 0.005% for Class R6 and 0.35% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 20 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

AllianzGI Multi Asset Income Fund

For the period of October 1, 2019 through March 31, 2020, as provided by the Multi-Asset US Group.

Fund Insights

For thesix-month period ended March 31, 2020, Class A shares at net asset value (“NAV”) of the AllianzGI Multi Asset Income Fund (the “Fund”) returned-16.14%, underperforming the Bloomberg Barclays U.S. Universal Bond Index (the “benchmark”), which returned 1.76%.

Market Overview

Global equities ratcheted steadily higher from the beginning of the reporting period untilmid-February 2020, with sentiment lifted by growing optimism over a “phase one” trade deal between the US and China and better-than-expected corporate earnings. However, growing concerns about the impact of the novel coronavirus outbreak(“COVID-19”) led to a steep correction in February 2020, with thesell-off gathering pace in March 2020, as a growing number of countries imposed travel restrictions and lockdown measures. Global equities suffered their worst quarter since the 2008 financial crisis in the first quarter of 2020, with many markets entering an official bear market, defined as a decline of at least 20% from a recent peak.

Global government bond yields trended higher in the fourth quarter of 2019 amid growing optimism over the outlook for global growth, but tumbled in 2020 on growing speculation that theCOVID-19 pandemic would force central banks to slash interest rates and reinstate asset-purchase programs. In the US, the10-year Treasury yield closed the period around 100 basis points lower, while10-year yields in the UK fell just over 10 basis points. However, German Bund yields rose slightly and peripheral euro-zone yields rose even more. Japanese government bonds also increased modestly. Meanwhile, corporate bonds fell sharply as the deteriorating economic outlook led to fears of rising downgrades and defaults.

Hopes that the global economy may be over the worst of the trade-related slowdown were dashed as theCOVID-19 outbreak spread beyond China, forcing countries to impose travel restrictions and draconian quarantine measures. Flash estimates of purchasing managers’ indices for March 2020 revealed the impact thatCOVID-19 was having on the global economy. In the US, the purchasing managers’ composite index fell to an11-year low while the composite survey for the euro zone fell to a record low. Elsewhere, Chinese industrial production plunged 13.5% over the first two months of the year, compared to the same period in 2019, and retail sales plummeted by 20.5% on ayear-on-year basis. In response, central banks lowered interest rates and reinstated asset-purchase programs, but in general these measures failed to reassure financial markets. Instead, governments were forced to shoulder the burden for supporting economies, with many announcing massive fiscal measures.

In the currency markets, the period saw significant swings. The British pound was one of the strongest currencies in the final quarter of 2019, boosted by news that the UK had secured a Withdrawal Agreement with the EU, but lost the majority of these gains during the first quarter of 2020. Elsewhere, the US dollar, euro and Japanese yen all jostled for supremacy throughout thesix-month reporting period, while many emerging market currencies weakened.

Portfolio Review

The Fund maintained its monthly distribution objective over the reporting period, and posted favorable results in the fourth quarter of 2019. Exposure to global equities and income-oriented fixed income such as high yields bonds and emerging market debt benefited from a favorable economic backdrop over the fourth quarter, which was supported by easing trade tensions, a prior contributor to global uncertainty. The Fund started the first quarter of 2020 with a portfolio designed to generate high income in alow-yield environment, with overweight positions in high dividend equities, short-term high yield bonds, emerging market debt and preferred securities. As markets reacted to theCOVID-19 pandemic in late February 2020, and then to plummeting oil prices, credit market liquidity vanished around the globe, spreads widened to levels not seen since 2009 and corporate bonds and emerging market debt suffered significant losses. Asset classes that ordinarily offer some relative downside protection, such as short-term high yield and real estate investment trusts, suffered outsized losses as well. This led the Fund to underperform its benchmark significantly. However, as credit spreads widened and the US Federal Reserve stepped into the bond market to shore up liquidity on March 23rd, the Fund was repositioned to have less equity risk and instead have a greater emphasis on short-term investment grade and high yield bonds. The Fund still targets a stable and relatively high monthly income distribution.

Outlook

TheCOVID-19 pandemic and severe disruptions in the oil market created a simultaneous supply and demand shock for a late-cycle global economy. One consequence is that economies are increasingly vulnerable to exogenous shocks that can exacerbate existing imbalances. As such, we maintain a cautious economic outlook and now expect a global recession in the next few months. We believe that the shape and magnitude of the anticipated recession will depend to an extent on the negative spillover from financial markets in holding back the real economy. The inflection point in financial markets in the context of the current crisis—in contrast to previous financial crises—will depend, in our opinion, on an array of factors, including (1) how theCOVID-19 public health crisis unfolds and ultimately stabilizes; (2) continued credible intervention on the part of governments and public policy; (3) stabilization of corporate and macroeconomic data and (4) adjustment of valuations to recession-like levels.

Against this backdrop, we continue to see elevated risks of additional corrections in risky asset markets in the near term before a sustainable turnaround is achieved. Therefore, unless we see a very strong V-shaped recovery in markets and the economy, we expect to maintain our defensive positioning based on our trend-based and fundamental indicators. We believe that this will position us to be prepared for a persistent downturn in the near term. Of course, if the market rally atquarter-end following the very substantial fiscal package and the series of supports announced by the US Federal Reserve should persist, we will reincorporate risk back into the portfolio accordingly.

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 21 |

Unaudited

AllianzGI Multi Asset Income Fund (cont’d)

Average Annual Total Return for the period ended March 31, 2020

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

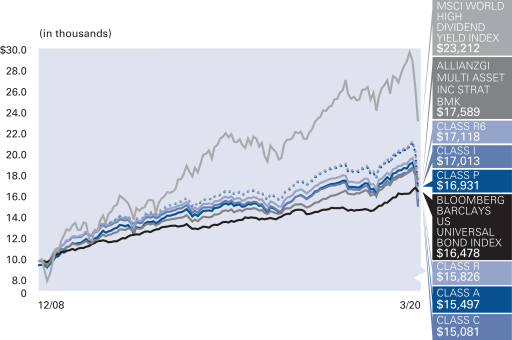

| | | AllianzGI Multi Asset Income Fund Class A | | | –16.14% | | | | –11.59% | | | | 0.36% | | | | 2.81% | | | | 4.49% | |

| | AllianzGI Multi Asset Income Fund Class A (adjusted) | | | –20.75% | | | | –16.45% | | | | –0.77% | | | | 2.23% | | | | 3.97% | |

| | | AllianzGI Multi Asset Income Fund Class C | | | –16.41% | | | | –12.21% | | | | –0.38% | | | | 2.05% | | | | 3.72% | |

| | AllianzGI Multi Asset Income Fund Class C (adjusted) | | | –17.23% | | | | –13.05% | | | | –0.38% | | | | 2.05% | | | | 3.72% | |

| | AllianzGI Multi Asset Income Fund Class R | | | –16.24% | | | | –11.88% | | | | 0.02% | | | | 2.47% | | | | 4.16% | |

| | AllianzGI Multi Asset Income Fund Class P | | | –15.93% | | | | –11.31% | | | | 0.67% | | | | 3.12% | | | | 4.79% | |

| | AllianzGI Multi Asset Income Fund Institutional Class | | | –15.98% | | | | –11.24% | | | | 0.71% | | | | 3.16% | | | | 4.84% | |

| | AllianzGI Multi Asset Income Fund Class R6 | | | –15.94% | | | | –11.18% | | | | 0.77% | | | | 3.22% | | | | 4.89% | |

| | | AllianzGI Multi Asset Income Fund Administrative Class | | | –16.12% | | | | –12.63% | | | | 0.01% | | | | 2.63% | | | | 4.34% | |

| | Bloomberg Barclays U.S. Universal Bond Index | | | 1.76% | | | | 7.15% | | | | 3.35% | | | | 4.05% | | | | 4.54% | |

| | AllianzGI Multi Asset Income Strategic Benchmark | | | –1.40% | | | | 3.66% | | | | 3.56% | | | | 4.26% | | | | 5.15% | |

| | MSCI World High Dividend Yield Index | | | –16.27% | | | | –12.73% | | | | 2.11% | | | | 5.57% | | | | 7.77% | |

| | | Lipper Mixed-Asset Target Today Funds Average | | | –5.80% | | | | –1.97% | | | | 2.04% | | | | 3.90% | | | | 5.23% | |

* Cumulative return

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 107 and 108 for more information. The Fund’s gross expense ratios, which include the Acquired Fund Fees and Expenses, are 1.13% for Class A shares, 1.88% for Class C shares, 1.38% for Class R shares, 0.73% for Class P shares, 0.68% for Institutional Class, 0.63% for Class R6 shares and 0.98% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2021. The Fund’s expense ratios net of this reduction, which include the Acquired Fund Fees and Expenses, are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.60% for Institutional Class, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2020, as further revised or supplemented from time to time.

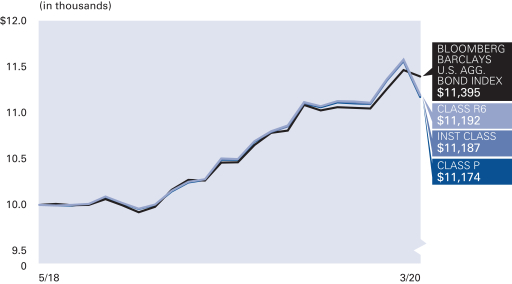

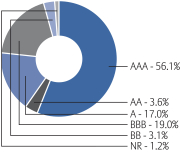

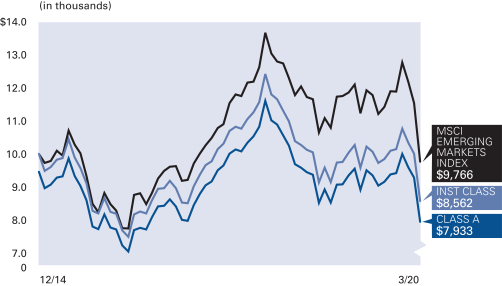

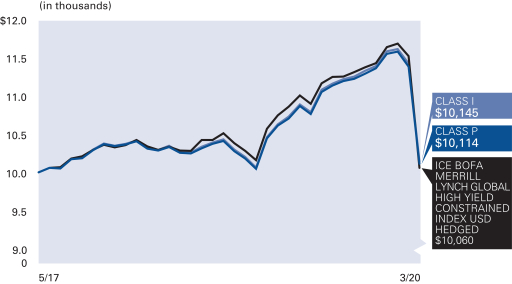

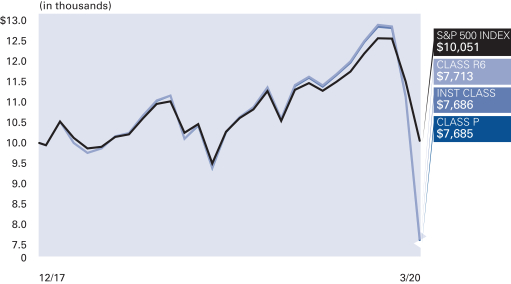

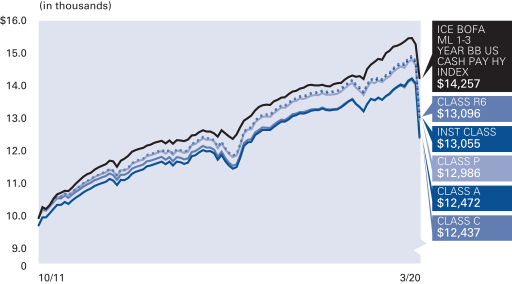

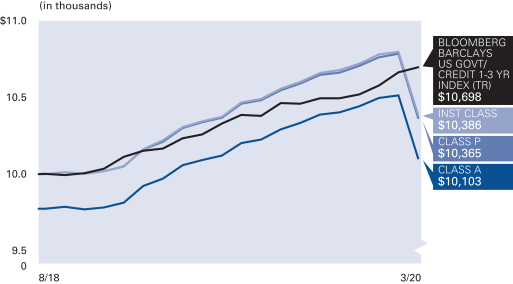

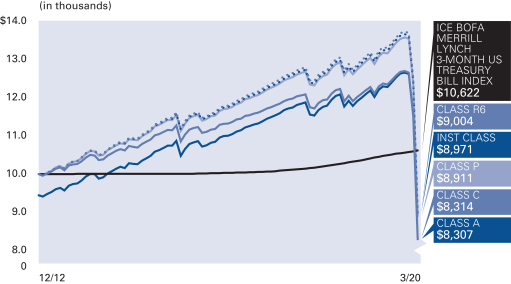

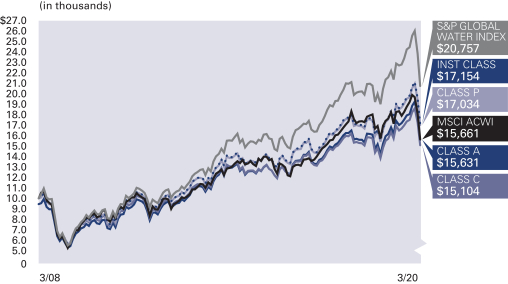

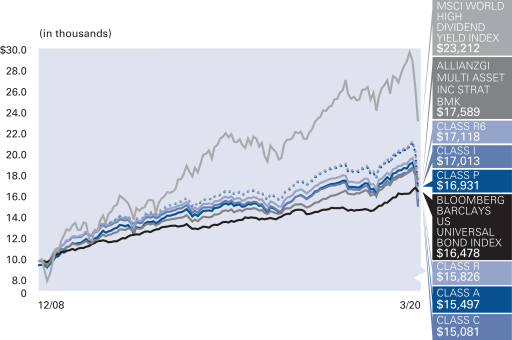

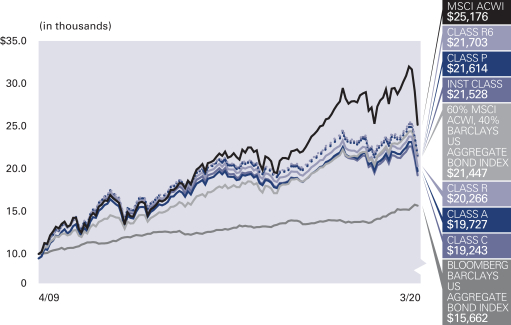

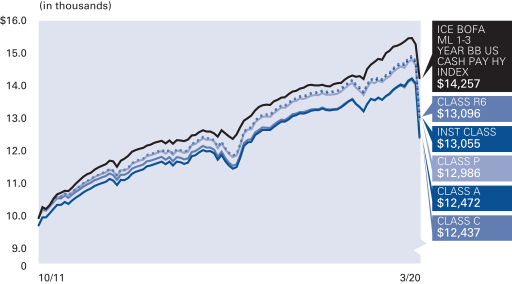

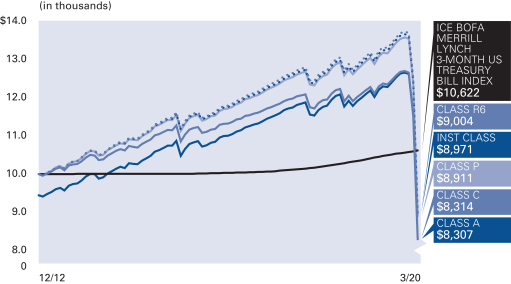

Cumulative Returns Through March 31, 2020

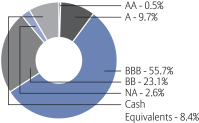

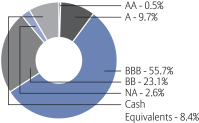

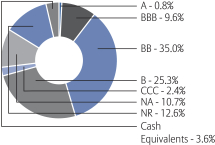

Fund Allocation (as of March 31, 2020)

| | | | |

| |

| AllianzGI Short Duration High Income | | | 20.7% | |

| |

| AllianzGI Emerging Markets SRI Debt | | | 12.6% | |

| |

| AllianzGI Short Term Bond | | | 12.2% | |

| |

| AllianzGI Global High Yield | | | 10.2% | |

| |

| AllianzGI Preferred Securities & Income | | | 10.1% | |

| |

| AllianzGI Floating Rate Note | | | 5.7% | |

| |

| PIMCO Preferred and Capital Security | | | 4.6% | |

| |

| Other | | | 18.5% | |

| |

| Cash & Equivalents — Net | | | 5.4% | |

| | | | | | |

| 22 | | March 31, 2020 | | | Semiannual Report | | |

Unaudited

AllianzGI Multi Asset Income Fund (cont’d)

| | | | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| | | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

| Ending Account Value (3/31/20) | | $838.60 | | $835.90 | | $837.60 | | $840.70 | | $840.20 | | $840.60 | | $838.80 |

| | | | | | | |

| Expenses Paid During Period | | $2.48 | | $5.92 | | $4.09 | | $1.10 | | $0.69 | | $0.64 | | $2.25 |

| | | | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| | | | | | | |

| Beginning Account Value (10/1/19) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

| Ending Account Value (3/31/20) | | $1,022.30 | | $1,018.55 | | $1,020.55 | | $1,023.80 | | $1,024.25 | | $1,024.30 | | $1,022.55 |

| | | | | | | |

| Expenses Paid During Period | | $2.73 | | $6.51 | | $4.50 | | $1.21 | | $0.76 | | $0.71 | | $2.48 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.54% for Class A, 1.29% for Class C, 0.89% for Class R, 0.24% for Class P, 0.15% for Institutional Class, 0.14% for Class R6 and 0.49% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/366. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| | Semiannual Report | | | March 31, 2020 | | 23 |

Unaudited

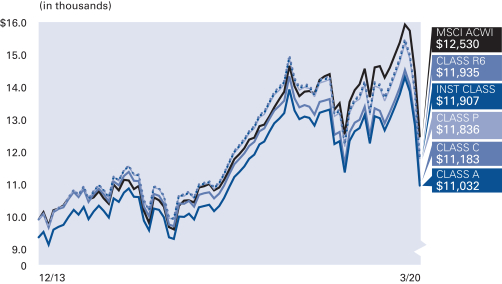

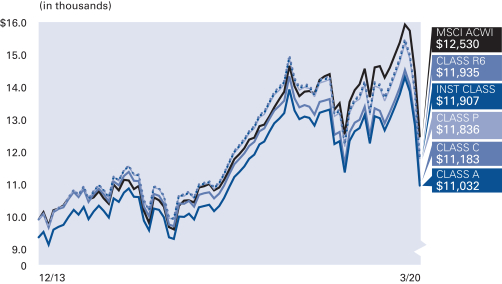

AllianzGI Best Styles Global Equity Fund

For the period of October 1, 2019 through March 31, 2020, as provided by Christian McCormick, Senior Product Specialist.

Fund Insights

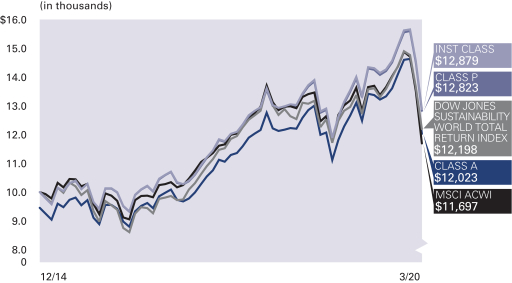

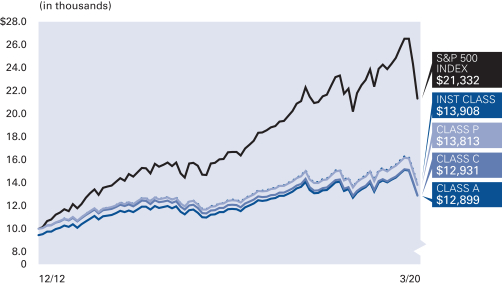

For thesix-month period ended March 31, 2020, Class A shares at net asset value (“NAV”) of the AllianzGI Best Styles Global Equity Fund (the “Fund”) returned-15.49%, underperforming the MSCI ACWI (the “benchmark”), which returned-14.33%.

Market Overview

Global equities across all regions generated strong absolute performance in the fourth quarter 2019, but after a steady start to 2020, global equities changed direction inmid-February amid growing evidence that the novel coronavirus outbreak (“COVID-19”) was spreading beyond China. The extended factory shutdowns in China also started to impact the global supply chain. Thesell-off gathered pace as the quarter progressed, with a growing number of countries employing travel restrictions and draconian quarantine measures to try to control the spread of the virus and avoid overloading health care systems. As fears increased that the global economy was heading for a severe recession, most markets entered an official bear market, defined as a retreat of at least 20% from a recent peak. The steep decline meant that global equities suffered their worst quarter since the 2008 financial crisis.

Portfolio Review

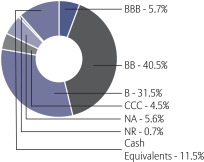

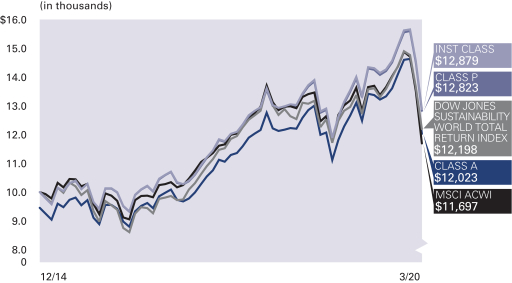

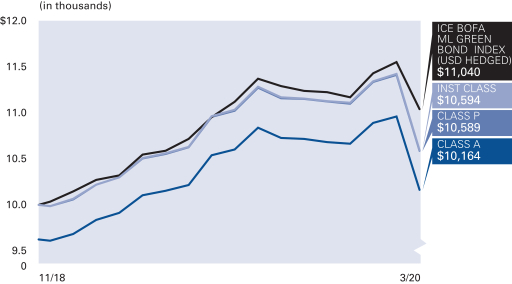

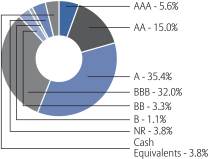

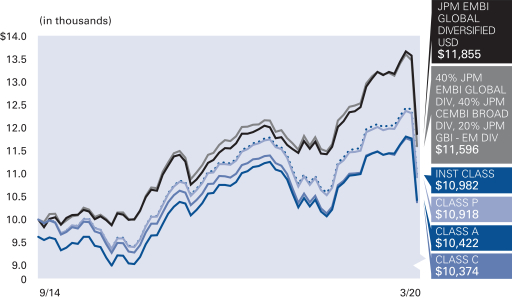

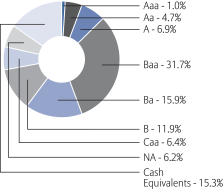

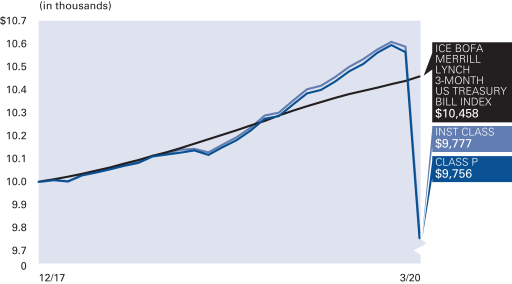

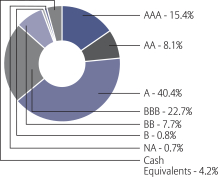

Over the reporting period, in what was a noisy and mainly beta driven market, style performance was as expected and somewhat balanced. Unfortunately, on the downside, Value and Small caps had a larger magnitude of detraction versus positive performance in other styles during the first quarter of 2020, which was a reversal from the fourth quarter 2019. Value underperformed by 5.2% and the smallest quintile in the benchmark universe by market cap underperformed by 5.7%. On the flip side, Quality and Low Volatility did well, which was to be expected. However, Revisions and Momentum also outperformed. Momentum did well, as it already consisted of many high quality and low risk names that have been outperforming for the past year, and the performance of Revisions seem to reflect confidence that most sell side analysts had a good understanding of how various companies would be affected by COVID-19 and the corresponding economic fallout.