UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22245

First Trust Exchange-Traded Fund III

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: July 31

Date of reporting period: January 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| | | | | | |

| First Trust Exchange-Traded Fund III | | |

| | | | |

| | | First Trust Horizon Managed Volatility Domestic ETF (HUSV) | | |

| | | |

| | | First Trust Horizon Managed Volatility Developed International ETF (HDMV) | | |

| | | | |

Semi-Annual Report For the Six Months Ended January 31, 2018 | | |

First Trust Exchange-Traded Fund III

Semi-Annual Report

January 31, 2018

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Horizon Investments, LLC (“Horizon” or the “Sub-Advisor”) and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of any series of First Trust Exchange-Traded Fund III (the “Trust”) described in this report (each such series is referred to as a “Fund” and collectively, the “Funds”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that any Fund described in this report will achieve its investment objective. Each Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in a Fund. See “Risk Considerations” in the Additional Information section of this report for a discussion of certain other risks of investing in the Funds.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on each Fund’s web page at www.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment. It includes details about each Fund’s portfolio and presents data and analysis that provide insight into each Fund’s performance and investment approach.

The statistical information that follows may help you understand each Fund’s performance compared to that of a relevant market benchmark.

It is important to keep in mind that the opinions expressed by personnel of the Advisor and/or Sub-Advisor are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in each Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Exchange-Traded Fund III

Semi-Annual Letter from the Chairman and CEO

January 31, 2018

Dear Shareholders,

First Trust is pleased to provide you with the semi-annual report for the Managed Volatility Funds of First Trust Exchange-Traded Fund III. This report contains detailed information about your investment for the six months ended January 31, 2018. We encourage you to read this report carefully and discuss it with your financial advisor.

As you are no doubt aware, 2017 was a very strong year for U.S. markets. The three major indices – the S&P 500® Index, the Dow Jones Industrial Average and the Nasdaq Composite – posted their best performance since 2013. And there was more good news for Wall Street as the year ended and analysts collected stock market data:

• The S&P 500® did something it had not previously done, finishing 2017 with 12 months of gains;

• The Dow Jones achieved a milestone as well, closing above 24,000 for the first time ever on November 30; and

• The Nasdaq Composite set a record by having 11 months of gains in 2017 (June was the only down month, and by just 0.86%).

Global markets were also strong in 2017. According to data from the MSCI AC World Index, which captures all sources of equity returns in 23 developed and 24 emerging markets, global stocks rose every month in 2017.

As 2017 ended, President Trump signed the “Tax Cuts and Jobs Act of 2017” tax reform bill. This action by the President was viewed as making good on his earlier campaign promise to accomplish sweeping tax reform and the hope is that this bill will boost economic activity to greater highs. As 2018 began, there was much enthusiasm for the tax reform package and the potential increase in take-home pay for many Americans, as well as the reduction in the federal corporate tax rate from 35% to 21%.

At First Trust, we are optimistic about the U.S. economy. The S&P 500® Index began 2018 with a strong start returning over 7.5% during the period from January 2 to January 26. We also continue to believe that you should invest for the long term and be prepared for market volatility, which can happen at any time. This can be accomplished by keeping current on your portfolio and investing goals by speaking regularly with your investment professional. It’s important to keep in mind that past performance of the U.S. and global stock markets or investment products can never guarantee future results. As we’ve said before, markets go up and they also go down, but savvy investors are prepared for either through careful attention to their portfolios and investment goals.

Thank you for giving First Trust the opportunity to be a part of your financial plan through your investment. We value our relationship with you and will report on your investment again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

|

| Fund Performance Overview (Unaudited) |

First Trust Horizon Managed Volatility Domestic ETF (HUSV)

The investment objective of First Trust Horizon Managed Volatility Domestic ETF (the “Fund”) is to provide capital appreciation. Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in common stocks of domestic companies listed and traded on U.S. national securities exchanges that Horizon Investments, LLC (“Horizon” or the “Sub-Advisor”) believes exhibit low future expected volatility. The goal of this strategy is to capture upside price movements in rising markets and reduce downside risk when markets decline. To implement this strategy, the Sub-Advisor employs volatility forecasting models to forecast future expected volatility. The strategy is largely quantitative and rules-based, but also includes multiple parameters over which the Sub-Advisor may exercise discretion (including, but not limited to, the number of holdings and the weightings of particular holdings) in connection with its active management of the Fund. Shares of the Fund are listed and trade on the NYSE Arca, Inc. under the ticker symbol “HUSV”. The first day of secondary market trading in shares of the Fund was August 25, 2016.

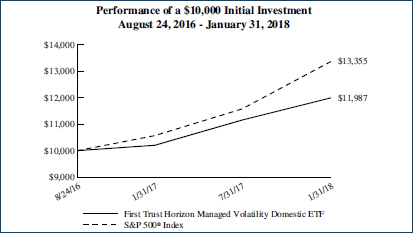

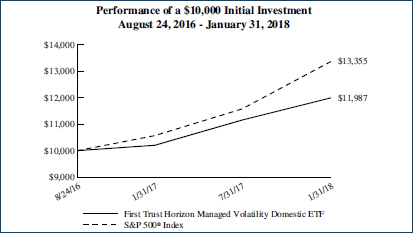

| | | | | | | | | | | | | | |

| | | | | | | Average Annual

Total Returns | | Cumulative

Total Returns |

| | | 6 Months Ended

1/31/18 | | 1 Year Ended

1/31/18 | | Inception (8/24/16)

to 1/31/18 | | Inception (8/24/16)

to 1/31/18 |

Fund Performance | | | | | | | | | | | | | | |

NAV | | | | 7.50 | % | | | | 17.51 | % | | 13.43% | | 19.88% |

Market Value | | | | 7.41 | % | | | | 17.51 | % | | 13.43% | | 19.88% |

Index Performance | | | | | | | | | | | | | | |

S&P 500® Index | | | | 15.43 | % | | | | 26.41 | % | | 22.28% | | 33.55% |

(See Notes to Fund Performance Overview Page 6.)

|

| Fund Performance Overview (Unaudited) (Continued) |

First Trust Horizon Managed Volatility Domestic ETF (HUSV) (Continued)

| | | | | |

| |

| Sector Allocation | | % of Total

Investments |

Financials | | | | 21.6% | |

Industrials | | | | 16.1 | |

Information Technology | | | | 13.4 | |

Utilities | | | | 12.7 | |

Real Estate | | | | 12.0 | |

Consumer Staples | | | | 9.6 | |

Health Care | | | | 7.2 | |

Energy | | | | 3.9 | |

Materials | | | | 3.5 | |

Total | | | | 100.0% | |

| | | | | |

| | | | | |

| |

| Top Ten Holdings | | % of Total

Investments |

Exxon Mobil Corp. | | | | 2.6% | |

Amphenol Corp., Class A | | | | 2.5 | |

Fidelity National Information Services, Inc. | | | | 2.5 | |

Coca-Cola (The) Co. | | | | 2.4 | |

Procter & Gamble (The) Co. | | | | 2.3 | |

Berkshire Hathaway, Inc., Class B | | | | 2.3 | |

Fiserv, Inc. | | | | 2.2 | |

VeriSign, Inc. | | | | 2.2 | |

PepsiCo, Inc. | | | | 2.1 | |

Accenture PLC, Class A | | | | 2.1 | |

Total | | | | 23.2% | |

| | | | | |

| | | | |

| | | | |

| | | | Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, the index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance. |

| | | | |

Frequency Distribution of Discounts and Premiums

Bid/Ask Midpoint vs. NAV through January 31, 2018

The following Frequency Distribution of Discounts and Premiums charts are provided to show the frequency at which the bid/ask midpoint price for the Fund was at a discount or premium to the daily NAV. The following tables are for comparative purposes only and represent the period August 25, 2016 (commencement of trading) through January 31, 2018. Shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares because shares are bought and sold at current market price. Data presented represents past performance and cannot be used to predict future results.

| | | | | | | | |

| Number of Days Bid/Ask Midpoint At/Above NAV |

For the Period | | 0.00%–0.49% | | 0.50%–0.99% | | 1.00%–1.99% | | >=2.00% |

8/25/16 – 7/31/17 | | 125 | | 1 | | 0 | | 0 |

8/1/17 – 1/31/18 | | 114 | | 0 | | 0 | | 0 |

| Number of Days Bid/Ask Midpoint Below NAV |

For the Period | | 0.00%–0.49% | | 0.50%–0.99% | | 1.00%–1.99% | | >=2.00% |

8/25/16 – 7/31/17 | | 108 | | 0 | | 0 | | 0 |

8/1/17 – 1/31/18 | | 13 | | 0 | | 0 | | 0 |

|

| Fund Performance Overview (Unaudited) (Continued) |

First Trust Horizon Managed Volatility Developed International ETF (HDMV)

The investment objective of First Trust Horizon Managed Volatility Developed International ETF (the “Fund”) is to provide capital appreciation. Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in common stocks and depositary receipts of developed market companies listed and traded on non-U.S. exchanges that Horizon Investments, LLC (“Horizon” or the “Sub-Advisor”) believes exhibit low future expected volatility. The term “developed market companies” means those companies (i) whose securities are traded principally on a stock exchange in a developed market country, (ii) with a primary business office in a developed market country, or (iii) that have at least 50% of their assets in, or derive at least 50% of their revenues or profits from, a developed market country. The Sub-Advisor considers Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States to be developed market countries. However, this list may change in response to market and geopolitical events. Under normal market conditions, the Fund will invest in at least three countries and at least 40% of its net assets in countries other than the United States. Shares of the Fund are listed and trade on the NYSE Arca, Inc. under the ticket symbol “HDMV”. The first day of secondary market trading in shares of the Fund was August 25, 2016.

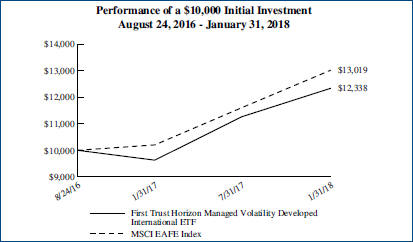

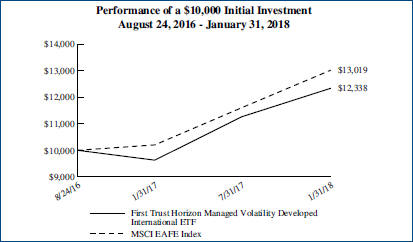

| | | | | | | | | | | | | | |

| | | | | | | Average Annual

Total Returns | | Cumulative

Total Returns |

| | | 6 Months Ended

1/31/18 | | 1 Year Ended

1/31/18 | | Inception (8/24/16)

to 1/31/18 | | Inception (8/24/16)

to 1/31/18 |

Fund Performance | | | | | | | | | | | | | | |

NAV | | | | 9.50 | % | | | | 28.14 | % | | 15.73% | | 23.39% |

Market Value | | | | 9.65 | % | | | | 27.92 | % | | 16.10% | | 23.95% |

Index Performance | | | | | | | | | | | | | | |

MSCI EAFE Index | | | | 12.14 | % | | | | 27.60 | % | | 20.14% | | 30.20% |

(See Notes to Fund Performance Overview Page 6.)

|

| Fund Performance Overview (Unaudited) (Continued) |

First Trust Horizon Managed Volatility Developed International ETF (HDMV) (Continued)

| | | | | |

| |

| Sector Allocation | | % of Total

Investments |

Financials | | | | 24.6% | |

Industrials | | | | 19.7 | |

Real Estate | | | | 11.2 | |

Consumer Staples | | | | 8.7 | |

Telecommunication Services | | | | 8.0 | |

Consumer Discretionary | | | | 7.5 | |

Utilities | | | | 5.9 | |

Energy | | | | 4.6 | |

Materials | | | | 4.3 | |

Health Care | | | | 3.3 | |

Information Technology | | | | 2.2 | |

Total | | | | 100.0% | |

| | | | | |

| | | | | |

| |

| Top Ten Holdings | | % of Total

Investments |

Singapore Exchange Ltd. | | | | 1.6% | |

Groupe Bruxelles Lambert S.A. | | | | 1.5 | |

Swisscom AG | | | | 1.4 | |

Hong Kong & China Gas Co., Ltd. | | | | 1.4 | |

Singapore Telecommunications Ltd. | | | | 1.4 | |

Swire Pacific Ltd., Class A | | | | 1.3 | |

Pargesa Holding S.A. | | | | 1.3 | |

Zurich Insurance Group AG | | | | 1.3 | |

MTR Corp., Ltd. | | | | 1.3 | |

CLP Holdings Ltd. | | | | 1.2 | |

Total | | | | 13.7% | |

| | | | | |

| | |

| | Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, the index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance. |

Frequency Distribution of Discounts and Premiums

Bid/Ask Midpoint vs. NAV through January 31, 2018

The following Frequency Distribution of Discounts and Premiums charts are provided to show the frequency at which the bid/ask midpoint price for the Fund was at a discount or premium to the daily NAV. The following tables are for comparative purposes only and represent the period August 25, 2016 (commencement of trading) through January 31, 2018. Shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares because shares are bought and sold at current market price. Data presented represents past performance and cannot be used to predict future results.

| | | | | | | | |

| Number of Days Bid/Ask Midpoint At/Above NAV |

For the Period | | 0.00%–0.49% | | 0.50%–0.99% | | 1.00%–1.99% | | >=2.00% |

8/25/16 – 7/31/17 | | 128 | | 99 | | 1 | | 0 |

8/1/17 – 1/31/18 | | 43 | | 80 | | 4 | | 0 |

| Number of Days Bid/Ask Midpoint Below NAV |

For the Period | | 0.00%–0.49% | | 0.50%–0.99% | | 1.00%–1.99% | | >=2.00% |

8/25/16 – 7/31/17 | | 6 | | 0 | | 0 | | 0 |

8/1/17 – 1/31/18 | | 0 | | 0 | | 0 | | 0 |

|

| Notes to Fund Performance Overview (Unaudited) |

Total returns for the periods since inception are calculated from the inception date of each Fund. “Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

Each Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of outstanding shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the stock exchange on which shares of the Fund are listed for trading as of the time that the Fund’s NAV is calculated. Since shares of each Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund, the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that all distributions have been reinvested in each Fund at NAV and Market Price, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike each Fund, the indices do not actually hold a portfolio of securities and therefore do not incur the expenses incurred by each Fund. These expenses negatively impact the performance of each Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The total returns presented reflect the reinvestment of dividends on securities in the indices. The returns presented do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. The investment return and principal value of shares of each Fund will vary with changes in market conditions. Shares of each Fund may be worth more or less than their original cost when they are redeemed or sold in the market. Each Fund’s past performance is no guarantee of future performance.

First Trust Exchange-Traded Fund III

First Trust Horizon Funds

January 31, 2018 (Unaudited)

Advisor

First Trust Advisors L.P. (“First Trust”) is the investment advisor. First Trust is responsible for the ongoing monitoring of each Fund’s investment portfolio, managing each Fund’s business affairs and providing certain administrative services necessary for the management of each Fund.

Sub-Advisor

Horizon Investments, LLC (“Horizon” or the “Sub-Advisor”) serves as the investment sub-advisor to the Funds.

Portfolio Management Team

The following persons serve as portfolio managers of the Funds:

Michael Dickson, PhD, Portfolio Manager of Horizon

Scott Ladner, Portfolio Manager of Horizon

Steven Clark, PhD, Portfolio Manager of Horizon

The portfolio managers are primarily and jointly responsible for the day-to-day management of the Funds. Each portfolio manager has served as part of the portfolio management team of the Funds since 2016.

First Trust Exchange-Traded Fund III

Understanding Your Fund Expenses

January 31, 2018 (Unaudited)

As a shareholder of First Trust Horizon Managed Volatility Domestic ETF or First Trust Horizon Managed Volatility Developed International ETF (each a “Fund” and collectively, the “Funds”), you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, if any, and other Fund expenses. This Example is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held through the six-month period ended January 31, 2018.

Actual Expenses

The first line in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this six-month period.

Hypothetical Example for Comparison Purposes

The second line in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as brokerage commissions. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

August 1, 2017 | | Ending

Account Value

January 31, 2018 | | Annualized

Expense Ratio

Based on the

Six-Month

Period | | Expenses Paid

During the

Six-Month

Period (a) |

First Trust Horizon Managed Volatility Domestic ETF (HUSV) | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,075.00 | | | | | 0.70 | % | | | | $3.66 | |

Hypothetical (5% return before expenses) | | | | $1,000.00 | | | | | $1,021.68 | | | | | 0.70 | % | | | | $3.57 | |

| | |

First Trust Horizon Managed Volatility Developed International ETF (HDMV) | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,095.00 | | | | | 0.80 | % | | | | $4.22 | |

Hypothetical (5% return before expenses) | | | | $1,000.00 | | | | | $1,021.17 | | | | | 0.80 | % | | | | $4.08 | |

| (a) | Expenses are equal to the annualized expense ratios, multiplied by the average account value over the period (August 1, 2017 through January 31, 2018), multiplied by 184/365 (to reflect the six-month period). |

First Trust Horizon Managed Volatility Domestic ETF (HUSV)

Portfolio of Investments

January 31, 2018 (Unaudited)

| | | | | | | | |

Shares | | Description | | Value | |

COMMON STOCKS – 88.0% | |

| | | | Aerospace & Defense – 6.6% | | | | |

| | 11,892 | | Harris Corp. | | $ | 1,895,347 | |

| | 5,271 | | Lockheed Martin Corp. | | | 1,870,414 | |

| | 3,701 | | Northrop Grumman Corp. | | | 1,260,302 | |

| | 5,220 | | Raytheon Co. | | | 1,090,667 | |

| | | | | | | | |

| | | | | | | 6,116,730 | |

| | | | | | | | |

| | | | Banks – 1.2% | | | | |

| | 20,140 | | U.S. Bancorp. | | | 1,150,800 | |

| | | | | | | | |

| | | | Beverages – 5.8% | | | | |

| | 46,542 | | Coca-Cola (The) Co. | | | 2,214,934 | |

| | 5,323 | | Constellation Brands, Inc., Class A | | | 1,168,239 | |

| | 16,479 | | PepsiCo, Inc. | | | 1,982,423 | |

| | | | | | | | |

| | | | | | | 5,365,596 | |

| | | | | | | | |

| | | | Capital Markets – 3.9% | | | | |

| | 8,039 | | Cboe Global Markets, Inc. | | | 1,080,361 | |

| | 7,593 | | Moody’s Corp. | | | 1,228,471 | |

| | 16,635 | | Nasdaq, Inc. | | | 1,345,938 | |

| | | | | | | | |

| | | | | | | 3,654,770 | |

| | | | | | | | |

| | | | Chemicals – 3.5% | | | | |

| | 8,119 | | Air Products & Chemicals, Inc. | | | 1,366,996 | |

| | 13,705 | | Ecolab, Inc. | | | 1,886,904 | |

| | | | | | | | |

| | | | | | | 3,253,900 | |

| | | | | | | | |

| | | | Commercial Services & Supplies – 3.5% | | | | |

| | 24,758 | | Republic Services, Inc. | | | 1,703,350 | |

| | 17,409 | | Waste Management, Inc. | | | 1,539,478 | |

| | | | | | | | |

| | | | | | | 3,242,828 | |

| | | | | | | | |

| | | | Consumer Finance – 1.9% | | | | |

| | 17,294 | | American Express Co. | | | 1,719,024 | |

| | | | | | | | |

| | | | Diversified Financial Services – 2.3% | | | | |

| | 9,921 | | Berkshire Hathaway, Inc., Class B (a) | | | 2,126,864 | |

| | | | | | | | |

| | | | Electric Utilities – 6.9% | | | | |

| | 10,360 | | Alliant Energy Corp. | | | 411,810 | |

| | 11,221 | | American Electric Power Co., Inc. | | | 771,780 | |

| | 11,303 | | Duke Energy Corp. | | | 887,286 | |

| | 5,119 | | Entergy Corp. | | | 402,814 | |

| | 12,009 | | Eversource Energy | | | 757,648 | |

| | 9,360 | | Exelon Corp. | | | 360,454 | |

| | 3,591 | | NextEra Energy, Inc. | | | 568,886 | |

| | 7,805 | | Pinnacle West Capital Corp. | | | 624,010 | |

| | 16,567 | | PPL Corp. | | | 527,990 | |

| | 10,237 | | Southern (The) Co. | | | 461,791 | |

| | 14,706 | | Xcel Energy, Inc. | | | 671,182 | |

| | | | | | | | |

| | | | | | | 6,445,651 | |

| | | | | | | | |

| | | | | | | | |

Shares | | Description | | Value | |

| | | | Electrical Equipment – 1.5% | | | | |

| | 18,015 | | AMETEK, Inc. | | $ | 1,374,544 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components – 2.5% | | | | |

| | 25,319 | | Amphenol Corp., Class A | | | 2,348,844 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies – 3.0% | | | | |

| | 17,747 | | Baxter International, Inc. | | | 1,278,317 | |

| | 15,105 | | Danaher Corp. | | | 1,529,834 | |

| | | | | | | | |

| | | | | | | 2,808,151 | |

| | | | | | | | |

| | | | Household Products – 2.3% | | | | |

| | 24,717 | | Procter & Gamble (The) Co. | | | 2,134,066 | |

| | | | | | | | |

| | | | Industrial Conglomerates – 3.4% | | | | |

| | 11,745 | | Honeywell International, Inc. | | | 1,875,324 | |

| | 4,399 | | Roper Technologies, Inc. | | | 1,234,315 | |

| | | | | | | | |

| | | | | | | 3,109,639 | |

| | | | | | | | |

| | | | Insurance – 12.3% | | | | |

| | 18,417 | | AFLAC, Inc. | | | 1,624,379 | |

| | 16,526 | | American International Group, Inc. | | | 1,056,342 | |

| | 8,051 | | Aon PLC | | | 1,144,611 | |

| | 22,731 | | Arthur J. Gallagher & Co. | | | 1,552,982 | |

| | 33,671 | | Loews Corp. | | | 1,739,107 | |

| | 13,336 | | Marsh & McLennan Cos., Inc. | | | 1,113,823 | |

| | 19,171 | | Torchmark Corp. | | | 1,741,685 | |

| | 9,095 | | Willis Towers Watson PLC | | | 1,459,475 | |

| | | | | | | | |

| | | | | | | 11,432,404 | |

| | | | | | | | |

| | | | Internet Software & Services – 2.2% | | | | |

| | 17,418 | | VeriSign, Inc. (a) | | | 2,001,677 | |

| | | | | | | | |

| | | | IT Services – 8.7% | | | | |

| | 12,334 | | Accenture PLC, Class A | | | 1,982,074 | |

| | 22,155 | | Cognizant Technology Solutions Corp., Class A | | | 1,727,647 | |

| | 22,525 | | Fidelity National Information Services, Inc. | | | 2,305,659 | |

| | 14,593 | | Fiserv, Inc. (a) | | | 2,055,278 | |

| | | | | | | | |

| | | | | | | 8,070,658 | |

| | | | | | | | |

| | | | Machinery – 1.2% | | | | |

| | 15,069 | | Fortive Corp. | | | 1,145,545 | |

| | | | | | | | |

| | | | Multi-Utilities – 5.5% | | | | |

| | 10,403 | | Ameren Corp. | | | 589,122 | |

| | 13,152 | | Centerpoint Energy, Inc. | | | 370,624 | |

| | 15,307 | | CMS Energy Corp. | | | 684,988 | |

| | 6,353 | | Consolidated Edison, Inc. | | | 510,527 | |

| | 7,679 | | Dominion Energy, Inc. | | | 586,983 | |

| | 7,267 | | DTE Energy Co. | | | 767,686 | |

| | 9,527 | | NiSource, Inc. | | | 235,126 | |

| | | | |

| | See Notes to Financial Statements | | Page 9 |

First Trust Horizon Managed Volatility Domestic ETF (HUSV)

Portfolio of Investments (Continued)

January 31, 2018 (Unaudited)

| | | | | | | | |

Shares | | Description | | Value | |

COMMON STOCKS (Continued) | | | | |

| | | | Multi-Utilities (Continued) | | | | |

| | 5,721 | | Public Service Enterprise Group, Inc. | | $ | 296,748 | |

| | 5,162 | | Sempra Energy | | | 552,437 | |

| | 8,020 | | WEC Energy Group, Inc. | | | 515,686 | |

| | | | | | | | |

| | | | | | | 5,109,927 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels – 3.9% | | | | |

| | 9,804 | | Chevron Corp. | | | 1,228,931 | |

| | 27,759 | | Exxon Mobil Corp. | | | 2,423,361 | |

| | | | | | | | |

| | | | | | | 3,652,292 | |

| | | | | | | | |

| | | | Pharmaceuticals – 4.2% | | | | |

| | 13,211 | | Eli Lilly & Co. | | | 1,076,036 | |

| | 9,216 | | Johnson & Johnson | | | 1,273,559 | |

| | 41,524 | | Pfizer, Inc. | | | 1,538,049 | |

| | | | | | | | |

| | | | | | | 3,887,644 | |

| | | | | | | | |

| | | | Tobacco – 1.5% | | | | |

| | 12,856 | | Philip Morris International, Inc. | | | 1,378,549 | |

| | | | | | | | |

| | | | Water Utilities – 0.2% | | | | |

| | 2,754 | | American Water Works Co., Inc. | | | 229,050 | |

| | | | | | | | |

| | | | Total Common Stocks | | | 81,759,153 | |

| | | | | | | | |

| | | | (Cost $74,989,645) | | | | |

REAL ESTATE INVESTMENT TRUSTS – 12.0% | |

| | | | Equity Real Estate Investment Trusts – 12.0% | |

| | 12,453 | | Alexandria Real Estate Equities, Inc. | | | 1,615,154 | |

| | 27,854 | | Apartment Investment & Management Co., Class A | | | 1,165,412 | |

| | 7,885 | | AvalonBay Communities, Inc. | | | 1,343,604 | |

| | 22,961 | | Equity Residential | | | 1,414,627 | |

| | 12,253 | | Mid-America Apartment Communities, Inc. | | | 1,168,569 | |

| | 19,028 | | Realty Income Corp. | | | 1,012,099 | |

| | 36,178 | | UDR, Inc. | | | 1,321,582 | |

| | 18,388 | | Ventas, Inc. | | | 1,029,176 | |

| | 17,319 | | Welltower, Inc. | | | 1,038,621 | |

| | | | | | | | |

| | | | Total Real Estate Investment Trusts | | | 11,108,844 | |

| | | | | | | | |

| | | | (Cost $11,604,402) | | | | |

| | | | Total Investments – 100.0% | | | 92,867,997 | |

| | | | (Cost $86,594,047) (b) | | | | |

| | | | Net Other Assets and Liabilities – 0.0% | | | 24,495 | |

| | | | | | | | |

| | | | Net Assets – 100.0% | | $ | 92,892,492 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Aggregate cost for financial reporting purposes approximates the aggregate cost for federal income tax purposes. As of January 31, 2018, the aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost was $7,363,770 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $1,089,820. The net unrealized appreciation was $6,273,950. |

Valuation Inputs

A summary of the inputs used to value the Fund’s investments as of January 31, 2018 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | | | | | | | | | | |

| | | Total

Value at

1/31/2018 | | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs |

| | | |

Common Stocks* | | | $81,759,153 | | | | $81,759,153 | | | $— | | $— |

Real Estate Investment Trusts* | | | 11,108,844 | | | | 11,108,844 | | | — | | — |

| | | |

Total Investments | | | $92,867,997 | | | | $92,867,997 | | | $— | | $— |

| | | |

| * | See Portfolio of Investments for industry breakout. |

All transfers in and out of the Levels during the period are assumed to occur on the last day of the period at their current value. There were no transfers between Levels at January 31, 2018.

| | | | |

| Page 10 | | See Notes to Financial Statements | | |

First Trust Horizon Managed Volatility Developed International ETF (HDMV)

Portfolio of Investments

January 31, 2018 (Unaudited)

| | | | | | | | |

Shares | | Description | | Value | |

COMMON STOCKS (a) – 91.8% | |

| | | | Australia – 1.4% | | | | |

| | 10,612 | | Amcor Ltd. | | $ | 124,505 | |

| | 3,851 | | ASX Ltd. | | | 169,866 | |

| | 4,767 | | Wesfarmers Ltd. | | | 168,285 | |

| | 6,817 | | Woolworths Ltd. | | | 148,040 | |

| | | | | | | | |

| | | | | | | 610,696 | |

| | | | | | | | |

| | | | Belgium – 3.5% | | | | |

| | 6,960 | | Ageas | | | 367,596 | |

| | 5,625 | | Groupe Bruxelles Lambert S.A. | | | 662,615 | |

| | 6,679 | | Proximus S.A.D.P. | | | 225,219 | |

| | 936 | | Solvay S.A. | | | 135,442 | |

| | 2,168 | | Telenet Group Holding N.V. (b) | | | 166,750 | |

| | | | | | | | |

| | | | | | | 1,557,622 | |

| | | | | | | | |

| | | | Bermuda – 0.4% | | | | |

| | 18,771 | | CK Infrastructure Holdings Ltd. | | | 167,130 | |

| | | | | | | | |

| | | | Cayman Islands – 0.8% | | | | |

| | 27,170 | | CK Hutchison Holdings Ltd. | | | 366,775 | |

| | | | | | | | |

| | | | Denmark – 0.3% | | | | |

| | 1,143 | | Carlsberg A.S., Class B | | | 146,781 | |

| | | | | | | | |

| | | | France – 14.1% | | | | |

| | 2,878 | | Accor S.A. | | | 163,830 | |

| | 1,854 | | Air Liquide S.A. | | | 249,864 | |

| | 1,213 | | Arkema S.A. | | | 154,967 | |

| | 8,369 | | AXA S.A. | | | 275,297 | |

| | 6,548 | | Bureau Veritas SA | | | 191,942 | |

| | 2,790 | | Cie de Saint-Gobain | | | 162,164 | |

| | 9,241 | | CNP Assurances | | | 236,806 | |

| | 1,913 | | Danone S.A. | | | 164,973 | |

| | 1,614 | | Eiffage S.A. | | | 195,697 | |

| | 1,798 | | Eurazeo S.A. | | | 189,188 | |

| | 376 | | Hermes International | | | 207,830 | |

| | 1,622 | | Imerys S.A. | | | 173,790 | |

| | 9,042 | | Lagardere SCA | | | 282,000 | |

| | 2,345 | | Legrand S.A. | | | 195,124 | |

| | 808 | | L’Oreal S.A. | | | 183,681 | |

| | 503 | | LVMH Moet Hennessy Louis Vuitton SE | | | 157,749 | |

| | 27,728 | | Orange S.A. | | | 500,722 | |

| | 1,337 | | Pernod Ricard S.A. | | | 212,972 | |

| | 1,729 | | Safran SA | | | 195,215 | |

| | 2,207 | | Sanofi | | | 194,876 | |

| | 1,703 | | Schneider Electric SE | | | 159,592 | |

| | 2,986 | | SCOR SE | | | 133,647 | |

| | 809 | | SEB S.A. | | | 167,134 | |

| | 8,193 | | Suez | | | 122,166 | |

| | 1,428 | | Thales S.A. | | | 160,202 | |

| | 7,979 | | TOTAL S.A. | | | 461,982 | |

| | 14,641 | | Veolia Environnement S.A. | | | 368,822 | |

| | 2,274 | | Vinci S.A. | | | 245,626 | |

| | 986 | | Wendel S.A. | | | 183,748 | |

| | | | | | | | |

| | | | | | | 6,291,606 | |

| | | | | | | | |

| | | | | | | | |

Shares | | Description | | Value | |

| | | |

| | | | Germany – 6.5% | | | | |

| | 1,367 | | Allianz SE | | $ | 345,380 | |

| | 2,007 | | BASF SE | | | 235,026 | |

| | 2,043 | | Bayerische Motoren Werke AG | | | 233,281 | |

| | 1,372 | | Beiersdorf AG | | | 162,675 | |

| | 576 | | Continental AG | | | 172,848 | |

| | 3,103 | | Daimler AG | | | 284,047 | |

| | 3,626 | | Deutsche Post AG | | | 171,386 | |

| | 9,357 | | Deutsche Telekom AG | | | 164,093 | |

| | 4,171 | | Evonik Industries AG | | | 164,676 | |

| | 2,065 | | Fresenius Medical Care AG & Co., KGaA | | | 238,433 | |

| | 775 | | Muenchener Rueckversicherungs- Gesellschaft AG in Muenchen | | | 182,385 | |

| | 2,530 | | SAP SE | | | 285,308 | |

| | 5,130 | | Vonovia SE | | | 252,919 | |

| | | | | | | | |

| | | | | | | 2,892,457 | |

| | | | | | | | |

| | | | Hong Kong – 7.2% | | | | |

| | 63,089 | | Bank of East Asia (The) Ltd. | | | 272,997 | |

| | 52,491 | | CLP Holdings Ltd. | | | 535,804 | |

| | 9,939 | | Hang Seng Bank Ltd. | | | 236,575 | |

| | 318,739 | | Hong Kong & China Gas Co., Ltd. | | | 629,928 | |

| | 99,353 | | MTR Corp., Ltd. | | | 568,990 | |

| | 651,625 | | PCCW Ltd. | | | 375,682 | |

| | 58,166 | | Swire Pacific Ltd., Class A | | | 581,835 | |

| | | | | | | | |

| | | | | | | 3,201,811 | |

| | | | | | | | |

| | | | Italy – 2.1% | | | | |

| | 4,479 | | Atlantia S.p.A. | | | 148,365 | |

| | 17,472 | | Eni S.p.A. | | | 314,235 | |

| | 21,026 | | Poste Italiane S.p.A. (c) | | | 173,963 | |

| | 33,992 | | Snam S.p.A. | | | 165,393 | |

| | 26,173 | | Terna Rete Elettrica Nazionale S.p.A | | | 157,536 | |

| | | | | | | | |

| | | | | | | 959,492 | |

| | | | | | | | |

| | | | Japan – 15.6% | | | | |

| | 17,300 | | Aeon Co., Ltd. | | | 294,355 | |

| | 4,400 | | Canon, Inc. | | | 175,283 | |

| | 1,600 | | Central Japan Railway Co. | | | 302,647 | |

| | 2,200 | | East Japan Railway Co. | | | 218,549 | |

| | 4,300 | | Hankyu Hanshin Holdings, Inc. | | | 173,111 | |

| | 12,400 | | ITOCHU Corp. | | | 242,957 | |

| | 24,700 | | Japan Post Bank Co., Ltd. | | | 333,270 | |

| | 7,200 | | Japan Tobacco, Inc. | | | 238,219 | |

| | 6,000 | | Keihan Holdings Co., Ltd. | | | 189,613 | |

| | 3,500 | | Keio Corp. | | | 166,071 | |

| | 5,800 | | Kintetsu Group Holdings Co., Ltd. | | | 228,982 | |

| | 10,400 | | Mitsui & Co., Ltd. | | | 182,336 | |

| | 127,300 | | Mizuho Financial Group, Inc. | | | 239,394 | |

| | 12,500 | | NEC Corp. | | | 376,706 | |

| | 27,200 | | Nissan Motor Co., Ltd. | | | 289,889 | |

| | 8,400 | | Nisshin Seifun Group, Inc. | | | 168,277 | |

| | | | |

| | See Notes to Financial Statements | | Page 11 |

First Trust Horizon Managed Volatility Developed International ETF (HDMV)

Portfolio of Investments (Continued)

January 31, 2018 (Unaudited)

| | | | | | | | |

Shares | | Description | | Value | |

COMMON STOCKS (a) (Continued) | |

| | | | Japan (Continued) | | | | |

| | 21,500 | | NTT DOCOMO, Inc. | | $ | 532,626 | |

| | 2,800 | | Secom Co., Ltd. | | | 213,956 | |

| | 17,700 | | Sekisui House Ltd. | | | 323,941 | |

| | 5,600 | | Seven & i Holdings Co., Ltd. | | | 230,114 | |

| | 3,300 | | Sumitomo Mitsui Financial Group, Inc. | | | 147,453 | |

| | 4,500 | | Takeda Pharmaceutical Co., Ltd. | | | 264,427 | |

| | 6,800 | | Tobu Railway Co., Ltd. | | | 228,286 | |

| | 45,000 | | Tokyo Electric Power Co., Holdings, Inc. (b) | | | 182,193 | |

| | 10,200 | | Tokyu Corp. | | | 170,420 | |

| | 3,000 | | Toyota Motor Corp. | | | 205,551 | |

| | 2,400 | | West Japan Railway Co. | | | 179,742 | |

| | 31,600 | | Yamada Denki Co., Ltd. | | | 187,279 | |

| | 21,000 | | Yamaguchi Financial Group, Inc. | | | 245,837 | |

| | | | | | | | |

| | | | | | | 6,931,484 | |

| | | | | | | | |

| | | | Jersey – 0.4% | | | | |

| | 7,879 | | Experian PLC | | | 181,565 | |

| | | | | | | | |

| | | | Netherlands – 5.6% | | | | |

| | 4,253 | | AerCap Holdings NV (b) | | | 230,087 | |

| | 3,702 | | Akzo Nobel N.V. | | | 346,647 | |

| | 2,855 | | Heineken Holding N.V. | | | 303,065 | |

| | 3,743 | | Heineken N.V. | | | 420,843 | |

| | 14,937 | | ING Groep N.V. | | | 293,568 | |

| | 1,742 | | Koninklijke DSM N.V. | | | 179,987 | |

| | 21,664 | | RELX N.V. | | | 481,859 | |

| | 4,781 | | Wolters Kluwer N.V. | | | 253,045 | |

| | | | | | | | |

| | | | | | | 2,509,101 | |

| | | | | | | | |

| | | | Norway – 0.6% | | | | |

| | 24,811 | | Orkla ASA | | | 258,187 | |

| | | | | | | | |

| | | | Singapore – 4.6% | | | | |

| | 50,800 | | CapitaLand Ltd. | | | 148,705 | |

| | 12,100 | | Oversea-Chinese Banking Corp., Ltd. | | | 119,266 | |

| | 21,900 | | Singapore Airlines Ltd. | | | 188,816 | |

| | 114,000 | | Singapore Exchange Ltd. | | | 712,609 | |

| | 58,700 | | Singapore Technologies Engineering Ltd. | | | 150,800 | |

| | 223,200 | | Singapore Telecommunications Ltd. | | | 602,323 | |

| | 62,700 | | StarHub Ltd. | | | 138,133 | |

| | | | | | | | |

| | | | | | | 2,060,652 | |

| | | | | | | | |

| | | | Spain – 1.4% | | | | |

| | 1,685 | | Amadeus IT Group S.A. | | | 130,709 | |

| | 5,081 | | Enagas S.A. | | | 138,468 | |

| | 5,949 | | Gas Natural SDG S.A. | | | 137,416 | |

| | 10,687 | | Repsol S.A. | | | 201,083 | |

| | | | | | | | |

| | | | | | | 607,676 | |

| | | | | | | | |

| | | | Sweden – 4.2% | | | | |

| | 7,793 | | Industrivarden AB, Class C | | | 207,585 | |

| | | | | | | | |

Shares | | Description | | Value | |

| | | |

| | | | Sweden (Continued) | | | | |

| | 3,295 | | Investor AB, Class B | | $ | 161,030 | |

| | 5,675 | | Kinnevik AB, Class B | | | 206,982 | |

| | 4,406 | | L E Lundbergforetagen AB, Class B | | | 355,616 | |

| | 7,514 | | Securitas AB, Class B | | | 139,077 | |

| | 19,216 | | Skandinaviska Enskilda Banken AB, Class A | | | 242,739 | |

| | 6,275 | | Swedbank AB, Class A | | | 160,381 | |

| | 5,052 | | Swedish Match AB | | | 204,647 | |

| | 38,356 | | Telia Co., AB | | | 192,513 | |

| | | | | | | | |

| | | | | | | 1,870,570 | |

| | | | | | | | |

| | | | Switzerland – 13.0% | | | | |

| | 9,109 | | ABB Ltd. | | | 253,966 | |

| | 2,483 | | Adecco Group AG | | | 204,349 | |

| | 2,692 | | Baloise Holding AG | | | 440,496 | |

| | 1,640 | | Cie Financiere Richemont S.A. | | | 157,384 | |

| | 413 | | Geberit AG | | | 195,684 | |

| | 1,131 | | Kuehne + Nagel International AG | | | 207,669 | |

| | 2,212 | | Nestle S.A. | | | 191,124 | |

| | 2,898 | | Novartis AG | | | 262,167 | |

| | 6,307 | | Pargesa Holding S.A. | | | 575,304 | |

| | 369 | | Partners Group Holding AG | | | 286,835 | |

| | 595 | | Roche Holding AG | | | 146,680 | |

| | 1,962 | | Schindler Holding AG | | | 492,002 | |

| | 769 | | Swiss Life Holding AG | | | 288,762 | |

| | 4,784 | | Swiss Prime Site AG | | | 462,595 | |

| | 2,366 | | Swiss Re AG | | | 233,359 | |

| | 1,154 | | Swisscom AG | | | 630,345 | |

| | 8,377 | | UBS Group AG | | | 170,105 | |

| | 1,742 | | Zurich Insurance Group AG | | | 572,525 | |

| | | | | | | | |

| | | | | | | 5,771,351 | |

| | | | | | | | |

| | | | United Kingdom – 10.1% | | | | |

| | 42,966 | | Aviva PLC | | | 313,079 | |

| | 32,149 | | BP PLC | | | 228,736 | |

| | 8,145 | | Compass Group PLC | | | 171,446 | |

| | 1,981 | | Croda International PLC | | | 126,122 | |

| | 6,737 | | Diageo PLC | | | 242,247 | |

| | 8,169 | | GlaxoSmithKline PLC | | | 153,150 | |

| | 17,484 | | HSBC Holdings PLC | | | 186,458 | |

| | 2,614 | | InterContinental Hotels Group PLC | | | 174,885 | |

| | 78,593 | | Legal & General Group PLC | | | 301,963 | |

| | 4,782 | | London Stock Exchange Group PLC | | | 266,632 | |

| | 29,778 | | National Grid PLC | | | 340,230 | |

| | 22,534 | | RELX PLC | | | 498,481 | |

| | 7,828 | | Royal Dutch Shell PLC, Class A | | | 273,697 | |

| | 7,215 | | Royal Dutch Shell PLC, Class B | | | 255,696 | |

| | 25,942 | | RSA Insurance Group PLC | | | 228,222 | |

| | 4,284 | | Schroders PLC | | | 226,274 | |

| | 10,177 | | Smith & Nephew PLC | | | 183,368 | |

| | 2,335 | | Unilever PLC | | | 132,614 | |

| | | | |

| Page 12 | | See Notes to Financial Statements | | |

First Trust Horizon Managed Volatility Developed International ETF (HDMV)

Portfolio of Investments (Continued)

January 31, 2018 (Unaudited)

| | | | | | | | |

Shares | | Description | | Value | |

COMMON STOCKS (a) (Continued) | |

| | | | United Kingdom (Continued) | |

| | 56,855 | | Vodafone Group PLC | | $ | 181,310 | |

| | | | | | | | |

| | | | | | | 4,484,610 | |

| | | | | | | | |

| | | | Total Common Stocks | | | 40,869,566 | |

| | | | | | | | |

| | | | (Cost $37,334,078) | | | | |

|

REAL ESTATE INVESTMENT TRUSTS (a) – 8.0% | |

| | | | France – 3.4% | | | | |

| | 3,983 | | Fonciere Des Regions | | | 437,394 | |

| | 1,038 | | Gecina S.A. | | | 202,588 | |

| | 4,336 | | ICADE | | | 469,967 | |

| | 5,119 | | Klepierre | | | 233,819 | |

| | 689 | | Unibail-Rodamco SE | | | 176,731 | |

| | | | | | | | |

| | | | | | | 1,520,499 | |

| | | | | | | | |

| | | | Hong Kong – 0.5% | | | | |

| | 23,637 | | Link REIT | | | 209,095 | |

| | | | | | | | |

| | | | Singapore – 2.9% | | | | |

| | 186,900 | | Ascendas Real Estate Investment Trust | | | 393,234 | |

| | 85,938 | | CapitaLand Commercial Trust | | | 122,507 | |

| | 172,700 | | CapitaLand Mall Trust | | | 276,467 | |

| | 321,500 | | Suntec Real Estate Investment Trust | | | 507,322 | |

| | | | | | | | |

| | | | | | | 1,299,530 | |

| | | | | | | | |

| | | | United Kingdom – 1.2% | | | | |

| | 13,446 | | British Land (The) Co., PLC | | | 127,644 | |

| | 12,450 | | Land Securities Group PLC | | | 177,090 | |

| | 26,167 | | Segro PLC | | | 216,009 | |

| | | | | | | | |

| | | | | | | 520,743 | |

| | | | | | | | |

| | | | Total Real Estate Investment Trusts | | | 3,549,867 | |

| | | | | | | | |

| | | | (Cost $3,114,596) | | | | |

| | | | Total Investments – 99.8% | | | 44,419,433 | |

| | | | (Cost $40,448,674) (d) | | | | |

| | | | Net Other Assets and Liabilities – 0.2% | | | 74,114 | |

| | | | | | | | |

| | | | Net Assets – 100.0% | | $ | 44,493,547 | |

| | | | | | | | |

| (a) | Portfolio securities are categorized based upon their country of incorporation. For a breakdown of the portfolio securities by sector, please see the Fund Performance Overview. |

| (b) | Non-income producing security. |

| (c) | This security is restricted in the U.S. and cannot be offered for public sale without first being registered under the Securities Act of 1933, as amended. This security is not restricted on the foreign exchange where it trades freely without any additional registration. As such, it does not require the additional disclosure required of restricted securities. |

| (d) | Aggregate cost for financial reporting purposes approximates the aggregate cost for federal income tax purposes. As of January 31, 2018, the aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost was $4,074,657 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $103,898. The net unrealized appreciation was $3,970,759. |

Valuation Inputs

A summary of the inputs used to value the Fund’s investments as of January 31, 2018 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | | | | | | | | | | |

| | | Total

Value at

1/31/2018 | | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs |

| | | |

Common Stocks* | | | $40,869,566 | | | | $40,869,566 | | | $— | | $— |

Real Estate Investment Trusts* | | | 3,549,867 | | | | 3,549,867 | | | — | | — |

| | | |

Total Investments | | | $44,419,433 | | | | $44,419,433 | | | $— | | $— |

| | | |

| * | See Portfolio of Investments for country breakout. |

All transfers in and out of the Levels during the period are assumed to occur on the last day of the period at their current value. There were no transfers between Levels at January 31, 2018.

| | | | | |

| |

Currency Exposure Diversification | | % of Total

Investments |

EUR | | | | 36.2% | |

JPY | | | | 15.6 | |

CHF | | | | 13.0 | |

GBP | | | | 11.7 | |

HKD | | | | 8.9 | |

SGD | | | | 7.6 | |

SEK | | | | 4.2 | |

AUD | | | | 1.4 | |

NOK | | | | 0.6 | |

USD | | | | 0.5 | |

DKK | | | | 0.3 | |

Total | | | | 100.0% | |

| | | | | |

Currency Abbreviations

| | | | |

| | AUD | | Australian Dollar |

| | CHF | | Swiss Franc |

| | DKK | | Danish Krone |

| | EUR | | Euro |

| | GBP | | British Pound Sterling |

| | HKD | | Hong Kong Dollar |

| | JPY | | Japanese Yen |

| | NOK | | Norwegian Krone |

| | SEK | | Swedish Krona |

| | SGD | | Singapore Dollar |

| | USD | | United States Dollar |

| | | | |

| | See Notes to Financial Statements | | Page 13 |

First Trust Exchange-Traded Fund III

Statements of Assets and Liabilities

January 31, 2018 (Unaudited)

| | | | | | | | |

| | | First Trust

Horizon

Managed

Volatility

Domestic

ETF

(HUSV) | | | First Trust

Horizon

Managed

Volatility

Developed

International

ETF

(HDMV) | |

ASSETS: | | | | | | | | |

Investments, at value | | $ | 92,867,997 | | | $ | 44,419,433 | |

Cash | | | 20,492 | | | | 14,298 | |

Receivables: | | | | | | | | |

Fund shares sold | | | 1,175,853 | | | | — | |

Dividends | | | 59,474 | | | | 39,406 | |

Dividend reclaims | | | — | | | | 51,031 | |

| | | | | | | | |

Total Assets. | | | 94,123,816 | | | | 44,524,168 | |

| | | | | | | | |

LIABILITIES: | | | | | | | | |

Due to custodian foreign currency | | | — | | | | 774 | |

Payables: | | | | | | | | |

Investment securities purchased | | | 1,175,895 | | | | — | |

Investment advisory fees | | | 55,429 | | | | 29,847 | |

| | | | | | | | |

Total Liabilities | | | 1,231,324 | | | | 30,621 | |

| | | | | | | | |

NET ASSETS | | $ | 92,892,492 | | | $ | 44,493,547 | |

| | | | | | | | |

NET ASSETS consist of: | | | | | | | | |

Paid-in capital | | $ | 85,155,291 | | | $ | 39,941,262 | |

Par value | | | 39,500 | | | | 12,500 | |

Accumulated net investment income (loss) | | | 57,202 | | | | (301,179 | ) |

Accumulated net realized gain (loss) on investments and foreign currency transactions | | | 1,366,549 | | | | 864,703 | |

Net unrealized appreciation (depreciation) on investments and foreign currency translation | | | 6,273,950 | | | | 3,976,261 | |

| | | | | | | | |

NET ASSETS | | $ | 92,892,492 | | | $ | 44,493,547 | |

| | | | | | | | |

NET ASSET VALUE, per share | | $ | 23.52 | | | $ | 35.59 | |

| | | | | | | | |

Number of shares outstanding (unlimited number of shares authorized, par value $0.01 per share) | | | 3,950,002 | | | | 1,250,002 | |

| | | | | | | | |

Investments, at cost | | $ | 86,594,047 | | | $ | 40,448,674 | |

| | | | | | | | |

Foreign currency, at cost (proceeds) | | $ | — | | | $ | (815 | ) |

| | | | | | | | |

| | | | |

| Page 14 | | See Notes to Financial Statements | | |

First Trust Exchange-Traded Fund III

Statements of Operations

For the Six Months Ended January 31, 2018 (Unaudited)

| | | | | | | | |

| | | First Trust

Horizon

Managed

Volatility

Domestic

ETF

(HUSV) | | | First Trust

Horizon

Managed

Volatility

Developed

International

ETF

(HDMV) | |

INVESTMENT INCOME: | | | | | | | | |

Dividends | | $ | 861,433 | | | $ | 402,966 | |

Interest | | | 821 | | | | 650 | |

Foreign withholding tax on dividend income | | | — | | | | (23,348 | ) |

| | | | | | | | |

Total investment income | | | 862,254 | | | | 380,268 | |

| | | | | | | | |

| | |

EXPENSES: | | | | | | | | |

Investment advisory fees | | | 289,995 | | | | 150,887 | |

| | | | | | | | |

Total expenses | | | 289,995 | | | | 150,887 | |

| | | | | | | | |

NET INVESTMENT INCOME (LOSS) | | | 572,259 | | | | 229,381 | |

| | | | | | | | |

| | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investments | | | (1,084,249 | ) | | | 111,372 | |

In-kind redemptions | | | 3,672,137 | | | | 1,387,451 | |

Foreign currency transactions | | | — | | | | 9,404 | |

| | | | | | | | |

Net realized gain (loss) | | | 2,587,888 | | | | 1,508,227 | |

| | | | | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | 2,945,755 | | | | 1,960,001 | |

Foreign currency translation | | | — | | | | 1,702 | |

| | | | | | | | |

Net change in unrealized appreciation (depreciation) | | | 2,945,755 | | | | 1,961,703 | |

| | | | | | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | 5,533,643 | | | | 3,469,930 | |

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 6,105,902 | | | $ | 3,699,311 | |

| | | | | | | | |

| | | | |

| | See Notes to Financial Statements | | Page 15 |

First Trust Exchange-Traded Fund III

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | First Trust Horizon Managed

Volatility Domestic ETF

(HUSV) | | | First Trust Horizon Managed

Volatility Developed International ETF

(HDMV) | |

| | | Six Months

Ended

1/31/2018

(Unaudited) | | | Period

Ended

7/31/2017 (a) | | | Six Months

Ended

1/31/2018

(Unaudited) | | | Period

Ended

7/31/2017 (a) | |

OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 572,259 | | | $ | 669,823 | | | $ | 229,381 | | | $ | 570,655 | |

Net realized gain (loss) | | | 2,587,888 | | | | 3,345,502 | | | | 1,508,227 | | | | 1,983,888 | |

Net change in unrealized appreciation (depreciation) | | | 2,945,755 | | | | 3,328,195 | | | | 1,961,703 | | | | 2,014,558 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 6,105,902 | | | | 7,343,520 | | | | 3,699,311 | | | | 4,569,101 | |

| | | | | | | | | | | | | | | | |

| | | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | |

Net investment income | | | (578,650 | ) | | | (606,955 | ) | | | (601,441 | ) | | | (540,901 | ) |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (578,650 | ) | | | (606,955 | ) | | | (601,441 | ) | | | (540,901 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

SHAREHOLDER TRANSACTIONS: | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | 56,637,855 | | | | 115,380,446 | | | | 25,047,317 | | | | 51,798,537 | |

Cost of shares redeemed | | | (32,071,960 | ) | | | (59,317,666 | ) | | | (13,396,552 | ) | | | (26,081,825 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from shareholder transactions | | | 24,565,895 | | | | 56,062,780 | | | | 11,650,765 | | | | 25,716,712 | |

| | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | 30,093,147 | | | | 62,799,345 | | | | 14,748,635 | | | | 29,744,912 | |

| | | | |

NET ASSETS: | | | | | | | | | | | | | | | | |

Beginning of period | | | 62,799,345 | | | | — | | | | 29,744,912 | | | | — | |

| | | | | | | | | | | | | | | | |

End of period | | $ | 92,892,492 | | | $ | 62,799,345 | | | $ | 44,493,547 | | | $ | 29,744,912 | |

| | | | | | | | | | | | | | | | |

Accumulated net investment income (loss) at end of period | | $ | 57,202 | | | $ | 63,593 | | | $ | (301,179 | ) | | $ | 70,881 | |

| | | | | | | | | | | | | | | | |

| | | | |

CHANGES IN SHARES OUTSTANDING: | | | | | | | | | | | | | | | | |

Shares outstanding, beginning of period | | | 2,850,002 | | | | — | | | | 900,002 | | | | — | |

Shares sold | | | 2,500,000 | | | | 5,650,002 | | | | 750,000 | | | | 1,750,002 | |

Shares redeemed | | | (1,400,000 | ) | | | (2,800,000 | ) | | | (400,000 | ) | | | (850,000 | ) |

| | | | | | | | | | | | | | | | |

Shares outstanding, end of period | | | 3,950,002 | | | | 2,850,002 | | | | 1,250,002 | | | | 900,002 | |

| | | | | | | | | | | | | | | | |

| (a) | Inception date is August 24, 2016, which is consistent with the commencement of operations and is the date the initial creation units were established. |

| | | | |

| Page 16 | | See Notes to Financial Statements | | |

First Trust Exchange-Traded Fund III

Financial Highlights

For a share outstanding throughout each period

First Trust Horizon Managed Volatility Domestic ETF (HUSV)

| | | | | | | | | | |

| | | Six Months

Ended

1/31/2018

(Unaudited) | | Period

Ended

7/31/2017 (a) |

Net asset value, beginning of period | | | $ | 22.03 | | | | $ | 19.96 | |

| | | | | | | | | | |

Income from investment operations: | | | | | | | | | | |

Net investment income (loss) | | | | 0.15 | | | | | 0.24 | |

Net realized and unrealized gain (loss) | | | | 1.50 | | | | | 2.05 | |

| | | | | | | | | | |

Total from investment operations | | | | 1.65 | | | | | 2.29 | |

| | | | | | | | | | |

| | |

Distributions paid to shareholders from: | | | | | | | | | | |

Net investment income | | | | (0.16 | ) | | | | (0.22 | ) |

| | | | | | | | | | |

Net asset value, end of period | | | $ | 23.52 | | | | $ | 22.03 | |

| | | | | | | | | | |

Total return (b) | | | | 7.50 | % | | | | 11.51 | % |

| | |

Ratios to average net assets/supplemental data: | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $ | 92,892 | | | | $ | 62,799 | |

Ratio of total expenses to average net assets | | | | 0.70 | % (c) | | | | 0.70 | % (c) |

Ratio of net investment income (loss) to average net assets | | | | 1.38 | % (c) | | | | 1.50 | % (c) |

Portfolio turnover rate (d) | | | | 60 | % | | | | 149 | % |

| (a) | Inception date is August 24, 2016, which is consistent with the commencement of operations and is the date the initial creation units were established. |

| (b) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all distributions at net asset value during the period, and redemption at net asset value on the last day of the period. The returns presented do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than a year. |

| (d) | Portfolio turnover is calculated for the time period presented and is not annualized for periods of less than a year and does not include securities received or delivered from processing creations or redemptions and in-kind transactions. |

| | | | |

| | See Notes to Financial Statements | | Page 17 |

First Trust Exchange-Traded Fund III

Financial Highlights (Continued)

For a share outstanding throughout each period

First Trust Horizon Managed Volatility Developed International ETF (HDMV)

| | | | | | | | | | |

| | | Six Months

Ended

1/31/2018

(Unaudited) | | Period

Ended

7/31/2017 (a) |

Net asset value, beginning of period | | | $ | 33.05 | | | | $ | 29.89 | |

| | | | | | | | | | |

Income from investment operations: | | | | | | | | | | |

Net investment income (loss) | | | | 0.24 | | | | | 0.63 | |

Net realized and unrealized gain (loss) | | | | 2.86 | | | | | 3.13 | |

| | | | | | | | | | |

Total from investment operations | | | | 3.10 | | | | | 3.76 | |

| | | | | | | | | | |

| | |

Distributions paid to shareholders from: | | | | | | | | | | |

Net investment income | | | | (0.56 | ) | | | | (0.60 | ) |

| | | | | | | | | | |

Net asset value, end of period | | | $ | 35.59 | | | | $ | 33.05 | |

| | | | | | | | | | |

Total return (b) | | | | 9.50 | % | | | | 12.68 | % |

| | |

Ratios to average net assets/supplemental data: | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $ | 44,494 | | | | $ | 29,745 | |

Ratio of total expenses to average net assets | | | | 0.80 | % (c) | | | | 0.80 | % (c) |

Ratio of net investment income (loss) to average net assets | | | | 1.22 | % (c) | | | | 2.74 | % (c) |

Portfolio turnover rate (d) | | | | 55 | % | | | | 150 | % |

| (a) | Inception date is August 24, 2016, which is consistent with the commencement of operations and is the date the initial creation units were established. |

| (b) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all distributions at net asset value during the period, and redemption at net asset value on the last day of the period. The returns presented do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than a year. |

| (d) | Portfolio turnover is calculated for the time period presented and is not annualized for periods of less than a year and does not include securities received or delivered from processing creations or redemptions and in-kind transactions. |

| | | | |

| Page 18 | | See Notes to Financial Statements | | |

|

| Notes to Financial Statements |

First Trust Exchange-Traded Fund III

January 31, 2018 (Unaudited)

1. Organization

First Trust Exchange-Traded Fund III (the “Trust”) is an open-end management investment company organized as a Massachusetts business trust on January 9, 2008, and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Trust consists of thirteen funds that are currently offering shares. This report covers the following funds, each a non-diversified series of the Trust:

First Trust Horizon Managed Volatility Domestic ETF – (NYSE Arca, Inc. (“NYSE Arca”) ticker “HUSV”)

First Trust Horizon Managed Volatility Developed International ETF – (NYSE Arca ticker “HDMV”)

Each fund represents a separate series of shares of beneficial interest in the Trust (each a “Fund” and collectively, the “Funds”). Unlike conventional mutual funds, each Fund issues and redeems shares on a continuous basis, at net asset value (“NAV”), only in large specified blocks consisting of 50,000 shares called a “Creation Unit.” Creation Units are issued and redeemed in-kind for securities in which a Fund invests and, in certain circumstances, for cash. Except when aggregated in Creation Units, the shares are not redeemable securities of a Fund.

Each Fund is an actively managed exhange-traded fund. The investment objective of each Fund is to provide capital appreciation.

Under normal market conditions, HUSV seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in common stocks of domestic companies listed and traded on U.S. national securities exchanges that Horizon Investments, LLC (“Horizon” or the “Sub-Advisor”) believes exhibit low future expected volatility.

Under normal market conditions, HDMV seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in common stocks and depositary receipts of developed market companies listed and traded on non-U.S. exchanges that Horizon believes exhibit low future expected volatility.

There can be no assurance that a Fund will achieve its investment objective. The Funds may not be appropriate for all investors.

2. Significant Accounting Policies

The Funds are each considered an investment company and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

A. Portfolio Valuation

Each Fund’s NAV is determined daily as of the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. If the NYSE closes early on a valuation day, the NAV is determined as of that time. Foreign securities are priced using data reflecting the earlier closing of the principal markets for those securities. Each Fund’s NAV is calculated by dividing the value of all assets of each Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

Each Fund’s investments are valued daily at market value or, in the absence of market value with respect to any portfolio securities, at fair value. Market value prices represent last sale or official closing prices from a national or foreign exchange (i.e., a regulated market) and are primarily obtained from third-party pricing services. Fair value prices represent any prices not considered market value prices and are either obtained from a third-party pricing service or are determined by the Pricing Committee of the Funds’ investment advisor, First Trust Advisors L.P. (“First Trust” or the “Advisor”), in accordance with valuation procedures adopted by the Trust’s Board of Trustees, and in accordance with provisions of the 1940 Act. Investments valued by the Advisor’s Pricing Committee, if any, are footnoted as such in the footnotes to the Portfolio of Investments. Each Fund’s investments are valued as follows:

Common stocks, real estate investment trusts (“REITs”) and other equity securities listed on any national or foreign exchange (excluding The Nasdaq Stock Market LLC (“Nasdaq”) and the London Stock Exchange Alternative Investment Market (“AIM”)) are valued at the last sale price on the exchange on which they are principally traded or, for Nasdaq and AIM securities, the official closing price. Securities traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the securities exchange representing the principal market for such securities.

|

| Notes to Financial Statements (Continued) |

First Trust Exchange-Traded Fund III

January 31, 2018 (Unaudited)

Securities traded in an over-the-counter market are fair valued at the mean of their most recent bid and asked price, if available, and otherwise at their closing bid price.

Certain securities may not be able to be priced by pre-established pricing methods. Such securities may be valued by the Trust’s Board of Trustees or its delegate, the Advisor’s Pricing Committee, at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended) for which a third-party pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market or fair value price is not available from a pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of a Fund’s NAV or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the third-party pricing service, does not reflect the security’s fair value. As a general principle, the current fair value of a security would appear to be the amount which the owner might reasonably expect to receive for the security upon its current sale. When fair value prices are used, generally they will differ from market quotations or official closing prices on the applicable exchanges. A variety of factors may be considered in determining the fair value of such securities, including, but not limited to, the following:

1) the type of security;

2) the size of the holding;

3) the initial cost of the security;

4) transactions in comparable securities;

5) price quotes from dealers and/or third-party pricing services;

6) relationships among various securities;

7) information obtained by contacting the issuer, analysts, or the appropriate stock exchange;

8) an analysis of the issuer’s financial statements; and

9) the existence of merger proposals or tender offers that might affect the value of the security.

If the securities in question are foreign securities, the following additional information may be considered:

1) the value of similar foreign securities traded on other foreign markets;

2) ADR trading of similar securities;

3) closed-end fund trading of similar securities;

4) foreign currency exchange activity;

5) the trading prices of financial products that are tied to baskets of foreign securities;

6) factors relating to the event that precipitated the pricing problem;

7) whether the event is likely to recur; and

8) whether the effects of the event are isolated or whether they affect entire markets, countries or regions.

Because foreign markets may be open on different days than the days during which investors may transact in the shares of a Fund, the value of the Fund’s securities may change on the days when investors are not able to transact in the shares of the Fund. The value of securities denominated in foreign currencies is converted into U.S. dollars using exchange rates determined daily as of the close of regular trading on the NYSE.

The Funds are subject to fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the measurement date. The three levels of the fair value hierarchy are as follows:

| | • | | Level 1 – Level 1 inputs are quoted prices in active markets for identical investments. An active market is a market in which transactions for the investment occur with sufficient frequency and volume to provide pricing information on an ongoing basis. |

| | • | | Level 2 – Level 2 inputs are observable inputs, either directly or indirectly, and include the following: |

| | o | Quoted prices for similar investments in active markets. |

| | o | Quoted prices for identical or similar investments in markets that are non-active. A non-active market is a market where there are few transactions for the investment, the prices are not current, or price quotations vary substantially either over time or among market makers, or in which little information is released publicly. o Inputs other than quoted prices that are observable for the investment (for example, interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks, and default rates). |

| | o | Inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

|

| Notes to Financial Statements (Continued) |

First Trust Exchange-Traded Fund III

January 31, 2018 (Unaudited)

| | • | | Level 3 – Level 3 inputs are unobservable inputs. Unobservable inputs may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the investment. |

The inputs or methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments. A summary of the inputs used to value each Fund’s investments as of January 31, 2018, is included with each Fund’s Portfolio of Investments.

B. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the accrual basis.

Withholding taxes and tax reclaims on foreign dividends have been provided for with HDMV’s understanding of the applicable country’s tax rules and rates.

Distributions received from each Fund’s investments in REITs may be comprised of return of capital, capital gains, and income. The actual character of the amounts received during the year are not known until after the REIT’s fiscal year end. Each Fund records the character of distributions received from the REITs during the year based on estimates available. The characterization of distributions received by a Fund may be subsequently revised based on information received from the REITs after their tax reporting periods conclude.

C. Foreign Currency