UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSRS

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

________

600 Lexington Avenue, 20th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Luis Berruga

Global X Management Company LLC

600 Lexington Ave, 20th Floor

New York, NY 10022

(Name and address of agent for service)

With a copy to:

Lisa Whittaker Global X Management Company LLC 600 Lexington Ave, 20th Floor New York, NY 10022 | Eric S. Purple, Esq. Stradley Ronon Stevens & Young, LLP 1250 Connecticut Avenue, N.W., Washington, DC 20036-2652 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: November 30, 2018

Date of reporting period: May 31, 2018

Item 1. Reports to Stockholders.

The registrant’s schedules as of the close of the reporting period, as set forth in §§ 210.12-12 through 210.12-14 of Regulation S-X [17 CFR §§ 210-12.12-12.14], are attached hereto.

Global X MLP ETF (ticker: MLPA)

Semi-Annual Report

May 31, 2018

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Shares may only be redeemed directly from the Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Fund voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

| Schedule of Investments | | May 31, 2018 (Unaudited) |

Global X MLP ETF

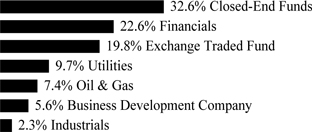

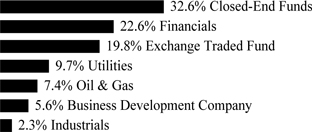

Sector Weightings†:

† Sector weightings percentages are based on the total market value of investments.

| | | Shares | | | Value | |

| MASTER LIMITED PARTNERSHIPS — 101.7% | | | | | | | | |

UNITED STATES — 101.7%

| | | | | | | | |

| Oil & Gas — 101.7% | | | | | | | | |

Andeavor Logistics | | | 943,852 | | | $ | 40,491,251 | |

| Antero Midstream Partners | | | 1,109,388 | | | | 33,558,987 | |

| Buckeye Partners | | | 1,068,974 | | | | 38,536,513 | |

| DCP Midstream | | | 1,031,906 | | | | 43,247,180 | |

| Enbridge Energy Partners | | | 2,738,783 | | | | 26,977,013 | |

| Energy Transfer Partners | | | 4,326,128 | | | | 82,153,171 | |

| EnLink Midstream Partners | | | 2,099,679 | | | | 35,904,511 | |

| Enterprise Products Partners | | | 3,277,076 | | | | 94,707,496 | |

| Equities Midstream Partners | | | 742,063 | | | | 41,429,377 | |

| Genesis Energy | | | 1,361,384 | | | | 29,895,993 | |

| Magellan Midstream Partners | | | 1,051,530 | | | | 73,501,947 | |

| MPLX | | | 1,642,583 | | | | 58,985,155 | |

| NuStar Energy | | | 1,003,345 | | | | 24,521,752 | |

| Phillips 66 Partners | | | 671,390 | | | | 35,113,697 | |

| Plains All American Pipeline | | | 2,451,412 | | | | 57,608,182 | |

| Shell Midstream Partners | | | 1,594,398 | | | | 35,698,571 | |

| Spectra Energy Partners | | | 1,038,593 | | | | 31,303,193 | |

| Tallgrass Energy Partners | | | 433,262 | | | | 18,920,552 | |

| TC PipeLines | | | 310,024 | | | | 7,539,784 | |

| Western Gas Partners | | | 846,257 | | | | 43,726,099 | |

| Williams Partners | | | 1,143,999 | | | | 45,531,160 | |

| | | | | | | | | |

TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | 899,351,584 | |

| (Cost $849,690,492) | | | | | | |

| TOTAL INVESTMENTS — 101.7% | | | | | | | | |

| (Cost $849,690,492) | | | | | | $ | 899,351,584 | |

Percentages are based on Net Assets of $884,553,833.

As of May 31, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended May 31, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

The accompanying notes are an integral part of the financial statements.

Statement Of Assets And Liabilities

May 31, 2018 (Unaudited)

| | | Global X MLP

ETF | |

| Assets: | | | | |

| Cost of Investments | | $ | 849,690,492 | |

| Investments, at Value | | $ | 899,351,584 | |

| Cash | | | 1,360,732 | |

| Receivable for Investment Securities Sold | | | 35,910,644 | |

| Receivable for Capital Shares Sold | | | 463,964 | |

| Prepaid Expenses | | | 9,769 | |

| Prepaid Tax Asset | | | 609 | |

| Total Assets | | | 937,097,302 | |

| Liabilities: | | | | |

| Payable for Investment Securities Purchased | | | 52,186,113 | |

| Payable due to Investment Adviser | | | 337,611 | |

| Franchise Tax Payable | | | 3,450 | |

| Other Accrued Expenses | | | 16,295 | |

| Total Liabilities | | | 52,543,469 | |

| Net Assets | | $ | 884,553,833 | |

| Net Assets Consist of: | | | | |

| Paid-in Capital | | $ | 952,300,811 | |

| Distributions in Excess of Net Investment Income, Net of Taxes | | | (12,714,893 | ) |

| Accumulated Net Realized Loss on Investments and Foreign Currency Transactions, Net of Taxes | | | (104,849,087 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments, Net of Taxes | | | 49,817,002 | |

| Net Assets | | $ | 884,553,833 | |

| Outstanding Shares of Beneficial Interest | | | | |

| (unlimited authorization — no par value) | | | 95,100,000 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 9.30 | |

The accompanying notes are an integral part of the financial statements.

Statement Of Operations

For the period ended May 31, 2018 (Unaudited)

| | | Global X MLP ETF | |

| Investment Income: | | | | |

| Distributions From Master Limited Partnership | | $ | 34,372,524 | |

| Less: Return of Capital Distributions | | | (34,372,524 | ) |

| Interest Income | | | 7,025 | |

| Total Investment Income | | | 7,025 | |

| Supervision and Administration Fees(1) | | | 1,852,232 | |

| Custodian Fees | | | 11,934 | |

| Total Expenses | | | 1,864,166 | |

| Net Expenses | | | 1,864,166 | |

| Net Investment Loss, Before Taxes | | | (1,857,141 | ) |

| Tax Benefit/(Expense), Net of Valuation Allowance | | | (8,363 | ) |

| Net Investment Loss, Net of Taxes | | | (1,865,504 | ) |

| Net Realized Loss on: | | | | |

| Investments | | | (42,346,896 | ) |

| Tax Benefit/(Expense), Net of Valuation Allowance | | | (163,081 | ) |

| Net Realized Loss on Investments | | | (42,509,977 | ) |

| Net Change in Unrealized Appreciation on: | | | | |

| Investments | | | 55,590,042 | |

Tax Benefit/(Expense), Net of Valuation

Allowance | | | 171,444 | |

| Net Change in Unrealized Appreciation on Investments | | | 55,761,486 | |

| Net Realized and Unrealized Loss on Investments and Foreign Currency Transactions and Translations | | | 13,251,509 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 11,386,005 | |

| (1) | The Supervision and Administration fees include fees paid by the Fund for the investment advisory services provided by the Adviser. (See Note 3 in Notes to Financial Statements.) |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| | | Global X MLP ETF | |

| | | Period Ended

May 31, 2018

(Unaudited) | | | Year Ended

November 30,

2017 | |

| Operations: | | | | | | | | |

| Net Investment Loss, Net of Taxes | | $ | (1,865,504 | ) | | $ | (1,909,552 | ) |

| Net Realized Loss on Investments, Net of Taxes | | | (42,509,977 | ) | | | 2,653,996 | |

| Net Change in Unrealized Appreciation on Investments, Net of Taxes | | | 55,761,486 | | | | (73,245,901 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 11,386,005 | | | | (72,501,457 | ) |

| Dividends and Distributions: | | | | | | | | |

| Net Investment Income | | | - | | | | (434,399 | ) |

| Return of Capital | | | (35,851,425 | ) | | | (41,617,826 | ) |

| Total Dividends and Distributions | | | (35,851,425 | ) | | | (42,052,225 | ) |

| Capital Share Transactions: | | | | | | | | |

| Issued | | | 326,658,651 | | | | 469,721,783 | |

| Redeemed | | | (110,593,260 | ) | | | (35,779,807 | ) |

| Increase in Net Assets from Capital Share Transactions | | | 216,065,391 | | | | 433,941,976 | |

| Total Increase (Decrease) in Net Assets | | | 191,599,971 | | | | 319,388,294 | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 692,953,862 | | | | 373,565,568 | |

| End of Period | | $ | 884,553,833 | | | $ | 692,953,862 | |

| Distributions in Excess of Net Investment Income, Net of Taxes | | $ | (12,714,893 | ) | | $ | (10,849,389 | ) |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Issued | | | 34,150,000 | | | | 43,800,000 | |

| Redeemed | | | (12,650,000 | ) | | | (3,450,000 | ) |

| Net Increase in Shares Outstanding from Share Transactions | | | 21,500,000 | | | | 40,350,000 | |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Year and Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of | | | Ratio of Investment Income/(Loss) to | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Expenses to Average Net Assets | | | Average Net Assets | |

| | | Net Asset

Value,

Beginning

of Period ($) | | | Net

Investment

Loss ($)* | | | Net Realized

and

Unrealized

Gain (Loss)

on

Investments

($) | | | Total from

Operations

($) | | | Distribution

from Net

Investment

Income ($) | | | Return of

Capital ($) | | | Total from

Distributions

($) | | | Net Asset

Value, End

of Period

($) | | | Total

Return

(%)** | | | Net

Assets

End of

Period

($)(000) | | | Before Net

Deferred

Tax Expense

(%) | | | Net Tax

Expense (%) | | | Total

Expenses

(%) | | | Before Net

Tax

Benefit (%) | | | Net Tax

Benefit (%) | | | Net

Investment

Loss (%) | | | Portfolio

Turnover

(%)† | |

| Global X MLP ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2018(Unaudited) | | | 9.42 | | | | (0.02 | ) | | | 0.29 | | | | 0.27 | | | | (0.00 | ) | | | (0.39 | ) | | | (0.39 | ) | | | 9.30 | | | | 2.90 | | | | 884,554 | | | | 0.46@ | | | | (0.00 | ) | | | 0.46@ | | | | (0.46)@ | | | | — | | | | (0.45)@ | | | | 11.74 | |

| 2017 | | | 11.24 | | | | (0.05 | ) | | | (0.98 | ) | | | (1.03 | ) | | | (0.00 | ) | | | (0.79 | ) | | | (0.79 | ) | | | 9.42 | | | | (9.85 | ) | | | 692,954 | | | | 0.46 | | | | (0.11 | ) | | | 0.35 | | | | (0.46 | ) | | | — | | | | (0.46 | ) | | | 35.11 | |

| 2016 | | | 10.56 | | | | (0.07 | ) | | | 1.58 | | | | 1.51 | | | | (0.02 | ) | | | (0.81 | ) | | | (0.83 | ) | | | 11.24 | | | | 15.34 | | | | 373,566 | | | | 0.47 | | | | 0.03 | | | | 0.50 | | | | (0.47 | ) | | | (0.23 | ) | | | (0.70 | ) | | | 37.20 | |

| 2015 | | | 16.45 | | | | (0.09 | ) | | | (4.83 | ) | | | (4.92 | ) | | | — | | | | (0.97 | ) | | | (0.97 | ) | | | 10.56 | | | | (31.08 | ) | | | 182,127 | | | | 0.45 | | | | (4.81 | ) | | | (4.36 | ) | | | (0.44 | ) | | | (0.18 | ) | | | (0.62 | ) | | | 47.44 | |

| 2014 | | | 16.11 | | | | (0.05 | ) | | | 1.32 | | | | 1.27 | | | | (0.60 | ) | | | (0.33 | ) | | | (0.93 | ) | | | 16.45 | | | | 7.95 | | | | 142,279 | | | | 0.47 | | | | 3.52 | | | | 3.99 | | | | (0.47 | ) | | | 0.17 | | | | (0.30 | ) | | | 30.65 | |

| 2013 | | | 14.85 | | | | (0.05 | ) | | | 2.22 | | | | 2.17 | | | | (0.26 | ) | | | (0.65 | ) | | | (0.91 | ) | | | 16.11 | | | | 14.85 | | | | 66,852 | | | | 0.47 | | | | 7.20 | | | | 7.67 | | | | (0.47 | ) | | | 0.18 | | | | (0.29 | ) | | | 14.15 | |

| * | Per share data calculated using average shares method. |

| ** | Total Return is based on the change in net asset value of a share during the year/period and assumes reinvestment of dividends and distributions at net asset value. Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| † | Portfolio turnover rate is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

| @ | Annualized |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

Notes To Financial Statements

May 31, 2018 (Unaudited)

1. ORGANIZATION

The Global X Funds (the "Trust") is a Delaware statutory trust formed on March 6, 2008. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. As of May 31, 2018, the Trust had eighty-nine portfolios, fifty-four of which were operational. The financial statements herein and the related notes pertain to the Global X MLP ETF (“MLP”) (the “Fund”). The Fund has elected non-diversified status.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Fund.

USE OF ESTIMATES – The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The preparation of financial statements in conformity with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the Reporting Period. Actual results could differ from those estimates, and could have a material impact on the Fund.

RETURN OF CAPITAL ESTIMATES – Distributions received by the Fund from underlying master limited partnership (“MLP”) investments generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from the MLPs and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded.

MLPs – The Fund invests in MLPs in addition to other exchange-traded securities. MLPs are publicly-traded partnerships engaged in the transportation, storage and processing of minerals and natural resources. By confining their operations to these specific activities, their interests, or units, are able to trade on public securities exchanges exactly like the shares of a corporation, without entity-level taxation. To qualify as an MLP, and to not be taxed as a corporation, a partnership must receive at least 90% of its income from qualifying sources as set forth in Section 7704(d) of the Internal Revenue Code of 1986, as amended (the “Code”). These qualifying sources include natural resource-based activities, such as the processing, transportation and storage of mineral or natural resources. MLPs generally have two classes of owners, the general partner and limited partners. The general partner of an MLP is typically owned by a major energy company, an investment fund, the direct management of the MLP, or is an entity owned by one or more of such parties. The general partner may be structured as a private or publicly-traded corporation or other entity. The general partner typically controls the operations and management of the MLP through an up to 2% equity interest in the MLP plus, in many cases, ownership of common units and subordinated units.

Limited partners typically own the remainder of the partnership, through ownership of common units, and have a limited role in the partnership’s operations and management. MLPs are typically structured such that common units and general partner interests have first priority to receive quarterly cash distributions up to an established minimum amount (“minimum quarterly distributions” or “MQD”). Common and general partner interests also accrue arrearages in distributions to the extent the MQD is not paid. Once common and general partner interests have been paid, subordinated units receive distributions of up to the MQD; however, subordinated units do not accrue arrearages. Distributable cash in excess of the MQD is paid to both common and subordinated units and is distributed to both common and subordinated units generally on a pro rata basis. The general partner is also eligible to receive incentive distributions if the general partner operates the business in a manner which results in distributions paid per common unit surpassing specified target levels. As the general partner increases cash distributions to the limited partners, the general partner receives an increasingly higher percentage of the incremental cash distributions.

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

SECURITY VALUATION – Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent mean between the quoted bid and asked prices (absent both bid and asked prices on such exchange, the bid price may be used).

For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less will be valued at their market value. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security’s price cannot be obtained from an independent, third-party pricing agent, the Fund seeks to obtain a bid price from at least one independent broker.

Securities for which market prices are not "readily available" are valued in accordance with Fair Value Procedures established by the Board of Trustees (the “Board”). The Fund’s Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using the Fair Value Procedures include: the security's trading has been halted or suspended; the security has been de-listed from its primary trading exchange; the security's primary trading market is temporarily closed at a time when, under normal conditions it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Fund may fair value its securities if an event that may materially affect the value of the Fund’s securities that traded outside of the United States (a “Significant Event”) has occurred between the time of the security's last close and the time that the Fund calculates its net asset value. A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If Global X Management Company LLC (the “Adviser”) becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates its net asset value, it may request that a Committee meeting be called. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration all relevant information reasonably available to the Committee. As of May 31, 2018, there were no securities priced using the Fair Value Procedures.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

SECURITY VALUATION (continued)

Level 2 – Other significant observable inputs (including quoted prices in non-active markets, quoted prices for similar investments, fair value of investments for which the Fund has the ability to fully redeem tranches at net asset value as of the measurement date or within the near term, and short-term investments valued at amortized cost); and

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments and fair value of investments for which the Fund does not have the ability to fully redeem tranches at net asset value as of the measurement date or within the near term).

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

For the period ended May 31, 2018, there have been no significant changes to the Fund’s fair valuation methodology.

FEDERAL INCOME TAXES – The Fund is taxed as a regular C-corporation for federal income tax purposes and as such is obligated to pay federal and applicable state corporate income tax. Currently, the federal income tax rate for a corporation is 21 percent. For tax years beginning prior to December 31, 2017, the Fund may be subject to a 20 percent federal alternative minimum tax on their federal alternative taxable income to the extent its alternative minimum tax liability exceeds its regular federal income tax liability. This differs from most investment companies, which elect to be treated as “regulated investment companies” under Subchapter M of the Code in order to avoid paying entity-level income taxes. Under current law, the Fund is not eligible to elect treatment as a regulated investment company due to its investments primarily in MLPs invested in energy assets. As a result, the Fund will be obligated to pay applicable federal and state corporate income taxes on its taxable income as opposed to most other investment companies, which are not so obligated. The Fund expects that a portion of the distributions that are received from MLPs may be treated as a tax-deferred return of capital, thus reducing the Fund’s current tax liability. However, the amount of taxes currently paid by the Fund will vary depending on the amount of income and gains derived from investments and/or sales of MLP interests and such taxes have the potential to reduce an investor’s return from an investment in the Fund.

Cash distributions from MLPs to the Fund that exceed the Fund’s allocable share of such MLPs’ net taxable income are considered tax-deferred return of capital that will reduce the Fund’s adjusted tax basis in the equity securities of the MLP. These reductions in the Fund’s adjusted tax basis in MLP equity securities will increase the amount of gain (or decrease the amount of loss) recognized by the Fund on a subsequent sale of the securities. The Fund will accrue deferred income taxes for any future tax liability associated with (i) that portion of MLP distributions considered to be a tax-deferred return of capital as well as (ii) capital appreciation of its investments. Upon the sale of an MLP security, the Fund may be liable for previously deferred taxes. The Fund will rely to some extent on information provided by the MLPs, which may not necessarily be timely, to estimate deferred tax liability for purposes of financial statement reporting and determining the Fund’s NAV. From time to time, the Adviser will modify the estimates or assumptions related to the Fund’s deferred tax liabilities as new information becomes available. The Fund will generally compute deferred income taxes based on the federal income tax rate applicable to corporations and an estimated rate attributable to state taxes.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits within the income tax expense line in the accompanying Statement of Operations. Accrued interest and penalties, if any, are included within the related tax liability line in the Statement of Assets and Liabilities. For the period ended May 31, 2018, the Fund did not incur any interest or penalties.

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

FEDERAL INCOME TAXES (continued)

Since the Fund will be subject to taxation on its taxable income, the NAV of the Fund shares will also be reduced by the accrual of any current and deferred tax liabilities.

The Fund’s income tax expense/(benefit) consists of the following:

For the period ended May 31, 2018:

| | | Current | | | Deferred | | | Total | |

| | | MLP | | | MLP | | | MLP | |

| Federal | | $ | - | | | $ | 12,529,796 | | | $ | 12,529,796 | |

| State | | | - | | | | (66,150 | ) | | | (66,150 | ) |

| Valuation allowance | | | - | | | | (12,463,646 | ) | | | (12,463,646 | ) |

| Total tax expense (benefit) | | $ | - | | | $ | - | | | $ | - | |

For the period ended May 31, 2018, the Fund’s blended state income tax rate increased from 2.05% to 2.49% due to anticipated change in state apportionment of income and gains and a reduction of the federal tax benefit associated with state tax expenses due to the new lower corporate tax rates.

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes.

Components of the Fund’s deferred tax assets and liabilities are as follows:

For the period ended May 31, 2018:

| | | MLP | |

| Deferred tax assets: | | | | |

| Net operating loss carryforward | | $ | 9,637,225 | |

| Capital loss carryforward | | | 6,527,485 | |

| Other | | | 74,260 | |

| Less valuation allowance | | | (14,884,510 | ) |

| | | | | |

| Less Deferred tax liabilities: | | | | |

| Net unrealized gain on investment securities | | | (1,354,460 | ) |

| | | | | |

| Net Deferred Tax Asset | | $ | - | |

The Fund reviews the recoverability of its deferred tax assets based upon the weight of available evidence. When assessing the recoverability of its deferred tax assets, significant weight was given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized. Currently, any capital losses that may be generated by the Fund are eligible to be carried back up to three years and can be carried forward for five years to offset capital gains recognized by the Fund in those years. The Tax Cuts and Jobs Act (TCJA) was signed into law on December 22, 2017 and eliminated the net operating loss carryback ability and replaced the 20 year carryforward period with an indefinite carryforward period for any net operating losses arising in tax years ending after December 31, 2017. Therefore, net operating losses that may be generated by the Fund in the future are eligible to be carried forward indefinitely to offset income generated by the Fund in those years but are no longer eligible to be carried back. The TCJA also established a limitation for any net operating losses generated in tax years beginning after December 31, 2017 to the lesser of the aggregate of available net operating losses or 80% of taxable income before any net operating loss utilization.

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

FEDERAL INCOME TAXES (continued)

The Fund has estimated net operating loss carryforwards for federal income tax purposes as follows:

| | | Year Ended | | | Amount | | | Expiration | |

| Global X MLP ETF | | | 11/30/2016 | | | $ | 3,371,920 | | | | 11/30/2036 | |

| | | | 11/30/2017 | | | | 7,685,725 | | | | 11/30/2037 | |

| | | | 11/30/2018 | | | | 29,969,281 | | | | Indefinite | |

The Fund has estimated capital loss carryforwards for federal income tax purposes as follows:

| | | Year Ended | | | Amount | | | Expiration | |

| Global X MLP ETF | | | 11/30/2016 | | | $ | 14,027,424 | | | | 11/30/2021 | |

| | | | 11/30/2018 | | | | 13,760,934 | | | | 11/30/2023 | |

Based upon the Fund’s assessment, it has been determined that it is not more likely than not that a portion of the Fund’s deferred tax assets will be realized through future taxable income of the appropriate character. Accordingly, a valuation allowance has been established for a portion of the Fund’s deferred tax assets. The Fund will continue to assess the need for a valuation allowance in the future. Significant increases or declines in the fair value of its portfolio of investments may change the Fund’s assessment of the recoverability of these assets and may result in the recording or removal of a valuation allowance against all or a portion of the Fund’s gross deferred tax assets.

Total income tax expense/(benefit) (current and deferred) during the period ended May 31, 2018, differs from the amount computed by applying the federal statutory income tax rate of 21% for the Global X MLP ETF to net investment and realized and unrealized gain/(losses) on investment before taxes as follows:

For the period ended May 31, 2018:

| | | MLP | |

| Income tax (benefit) at statutory rate | | $ | 2,391,061 | | | | 21.00 | % |

| State income taxes (net of federal benefit) | | | 283,512 | | | | 2.49 | % |

| Permanent differences, net | | | (190,114 | ) | | | -1.67 | % |

| Effect of tax rate change* | | | 9,993,477 | | | | 87.77 | % |

| Other adjustments | | | (14,290 | ) | | �� | -0.13 | % |

| Change in valuation allowance | | | (12,463,646 | ) | | | -109.46 | % |

| | | $ | - | | | | 0.00 | % |

* The tax rate change listed in the table above is reflective of the change in deferred tax assets and liabilities due to the federal corporate tax rate change enacted by the TCJA as of December 22, 2017 (date of enactment). Prior to enactment, the highest marginal federal income tax rate was 35%. For tax years beginning after December 31, 2017, corporations will be taxed at a flat rate of 21% and no longer subject to the 20% alternative minimum tax.

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

FEDERAL INCOME TAXES (continued)

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the Fund. No U.S. federal or state income tax returns are currently under examination. The tax years ended November 30, 2017, 2016, 2015, and 2014 remain subject to examination by tax authorities in the United States Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund has accrued a state franchise tax liability for the period ended May 31, 2018. State franchise taxes are separate and distinct from state income taxes. State franchise taxes are imposed on a corporation for the right to conduct business in the state and typically are based off the net worth or capital apportioned to a state. Due to the nature of the Fund’s investments, the Fund may be required to file franchise state tax returns in several states.

The adjusted cost basis of investment and gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| Global X Funds | | Federal

Tax Cost | | | Aggregated

Gross

Unrealized

Appreciation | | | Aggregated

Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation | |

| Global X MLP ETF | | $ | 893,585,469 | | | $ | 75,666,005 | | | $ | (69,899,890 | ) | | $ | 5,766,115 | |

The difference between cost amounts for financial statement purposes and tax purposes is due primarily to the recognition of partnership adjustments, differing cost relief methodologies, and wash sales adjustments from the Fund’s investments in MLPs.

SECURITY TRANSACTIONS AND INVESTMENT INCOME – Security transactions are accounted for on the trade date for financial reporting purposes. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from the settlement date.

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS – The Fund intends to declare and make quarterly distributions; however, the Board may determine to make distributions at its own discretion.

The Fund also expects that a portion of the distributions it receives from MLPs may be treated as a tax deferred return of capital, thus reducing the Fund’s current tax liability. The Fund’s quarterly distributions are in an amount that is approximately equal to the distributions the Fund receives from its investments, including the MLPs in which it invests, less the actual, estimated or anticipated expenses of the Fund, including taxes imposed on the Fund (if any). Based on its investment objective and strategies, the Fund’s distributions normally will be comprised of ordinary income, tax-deferred returns of capital, and/or capital gains for U.S. federal income tax purposes. If the fund pays return of capital distributions to shareholders, such distributions are not taxable income to the shareholder, but reduce the shareholder’s tax basis in the shareholder’s Fund shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of Fund shares. Shareholders who periodically receive the payment of dividends or other distributions consisting of a return of capital may be under the impression that they are receiving net profits from the Fund when, in fact, they are not. Shareholders should not assume that the source of the distributions is from the net profits of the Fund.

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES (concluded)

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS (continued)

For the year ended November 30, 2017, the Fund made the following tax basis distributions from MLP distributions received:

| | | MLP | |

| Net investment income | | $ | (434,399 | ) |

| Return of capital | | | (41,617,826 | ) |

| Total | | $ | (42,052,225 | ) |

CREATION UNITS –The Fund issues and redeems its shares (“Shares”) on a continuous basis at net asset value (“NAV”) and only in large blocks of 50,000 Shares, referred to as “Creation Units”. Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an Authorized Participant on the same day.

An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard redemption fee per transaction to Brown Brothers Harriman & Co. (“BBH”), the Fund’s custodian, on the date of such redemption, regardless of the number of Creation Units redeemed that day.

If a Creation Unit is purchased or redeemed for cash, an additional variable fee may be charged. The following table discloses the Creation Unit breakdown:

| | | Creation

Unit Shares | | | Creation Fee | | | Value at

May 31, 2018 | | | Redemption

Fee | |

| Global X MLP ETF | | | 50,000 | | | $ | 250 | | | $ | 465,000 | | | $ | 250 | |

CASH OVERDRAFT CHARGES – Per the terms of the agreement with BBH, if the Fund has a cash overdraft on a given day, it will be assessed an overdraft charge of LIBOR plus 2.00%. Cash overdraft charges are included in custodian fees on the Statements of Operations.

3. RELATED PARTY TRANSACTIONS AND SERVICE PROVIDER TRANSACTIONS

The Adviser serves as the investment adviser and the administrator for the Fund. Subject to the supervision of the Board, the Adviser is responsible for managing the investment activities of the Fund and the Fund’s business affairs and other administrative matters and provides or causes to be furnished all supervisory, administrative and other services reasonably necessary for the operation of the Fund, including certain distribution services, if any (provided pursuant to a separate Distribution Agreement), certain shareholder and distribution-related services (provided pursuant to a separate Rule 12b-1 Plan and related agreements) and investment advisory services (provided pursuant to a separate Investment Advisory Agreement), under what is essentially an "all-in" fee structure, respectively. For its Adviser’s services to the Fund, under the Supervision and Administration Agreement, the Fund pays a monthly fee to the Adviser at the annual rate (stated as a percentage of the average daily net assets of the Fund). In addition, the Fund bears other expenses that are not covered by the Supervision and Administration Agreement, which may vary and affect the total expense ratios of the Fund, such as taxes, brokerage fees, commissions, acquired fund fees, other transaction expenses, interest expenses and extraordinary expenses (such as litigation and indemnification expenses). The following table discloses the rate of supervision and administration fees paid by the Fund pursuant to the Supervision and Administration Agreement:

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

3. RELATED PARTY TRANSACTIONS AND SERVICE PROVIDER TRANSACTIONS (concluded)

| | | Supervision and | |

| | | Administration Fee | |

| Global X MLP ETF | | | 0.45 | % |

SEI Investments Global Funds Services (“SEIGFS”) serves as sub-administrator to the Fund. As sub-administrator, SEIGFS provides the Fund with required general administrative services, including, without limitation: office space, equipment, and personnel; clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and assistance with the preparation and filing of reports, registration statements, proxy statements and other materials required to be filed or furnished by the Fund under federal and state securities laws. As compensation for these services, SEIGFS receives certain out-of-pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser.

Cohen & Company, Ltd. (“Cohen”) prepares Federal Form 1120 and state tax returns for the Fund. In addition, among other things, Cohen has been engaged to assist the Fund in the calculation of the current and deferred tax provisions for financial statement purposes for the Fund’s year ended November 30, 2017.

SEI Investments Distribution Co. (“SIDCO”) serves as the Fund’s underwriter and distributor of Creation Units pursuant to a Distribution Agreement. SIDCO has no obligation to sell any specific quantity of Fund Shares. SIDCO bears the following costs and expenses relating to the distribution of Shares: (i) the costs of processing and maintaining records of creations of Creation Units; (ii) all costs of maintaining the records required of a registered broker/dealer; (iii) the expenses of maintaining its registration or qualification as a dealer or broker under federal or state laws; (iv) filing fees; and (v) all other expenses incurred in connection with the distribution services as contemplated in the Distribution Agreement. SIDCO receives no fee from the Fund for its distribution services under the Distribution Agreement, rather, the Adviser compensates SIDCO for certain expenses, out-of-pocket costs, and transaction fees.

BBH serves as custodian of the Fund’s assets. As custodian, BBH has agreed to (1) make receipts and disbursements of money on behalf of the Fund, (2) collect and receive all income and other payments and distributions on account of the Fund’s portfolio investments, (3) respond to correspondence from shareholders, security brokers and others relating to its duties, and (4) make periodic reports to the Fund concerning the Fund’s operations. BBH does not exercise any supervisory function over the purchase and sale of securities. BBH also serves as the Fund’s transfer agent. As transfer agent, BBH has agreed to (1) issue and redeem Shares of the Fund, (2) make dividend and other distributions to shareholders of the Fund, (3) respond to correspondence by shareholders and others relating to its duties, (4) maintain shareholder accounts, and (5) make periodic reports to the Fund. As compensation for these services, BBH receives certain out-of pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser from its fees.

4. INVESTMENT TRANSACTIONS

For the period ended May 31, 2018, the purchases and sales of investments in securities excluding in-kind transactions, long-term U.S. Government, and short-term securities, were:

| 2018 | | Purchases | | | Sales and | |

| Global X MLP ETF | | $ | 95,821,709 | | | $ | 228,996,733 | |

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

4. INVESTMENT TRANSACTIONS (concluded)

For the period or year ended May 31, 2018 and November 30, 2017, in-kind transactions associated with creations and redemptions were, respectively:

| | | | | | Sales and | | | | |

| 2018 | | Purchases | | | Maturities | | | Realized Gain | |

| Global X MLP ETF | | $ | 327,203,848 | | | $ | - | | | $ | - | |

| | | | | | Sales and | | | | |

| 2017 | | Purchases | | | Maturities | | | Realized Gain | |

| Global X MLP ETF | | $ | 469,517,457 | | | $ | - | | | $ | - | |

For the period ended May 31, 2018, there were no purchases or sales of long term U.S. Government securities by the Fund.

5. CONCENTRATION OF RISKS

The Fund uses a replication strategy. A replication strategy is an indexing strategy that involves investing in the securities of an underlying index in approximately the same proportions as in the underlying index. The Fund may utilize a representative sampling strategy with respect to its underlying index when a replication strategy might be detrimental to its shareholders, such as when there are practical difficulties or substantial costs involved in compiling a portfolio of equity securities to follow their underlying indices, or, in certain instances, when securities in its underlying index become temporarily illiquid, unavailable or less liquid, or due to legal restrictions (such as diversification requirements that apply to the Fund but not its underlying index). A more complete description of risks is included in the Fund’s Prospectus and Statement of Additional Information.

Under normal circumstances, the Fund invests at least 80% of its total assets in securities of its underlying index, which are subject to certain risks, such as supply and demand risk, depletion and exploration risk, and the risk associated with the hazards inherent in midstream energy industry activities. A substantial portion of the cash flow received by the Fund is derived from investment in equity securities of MLPs. The amount of cash that an MLP has available for distributions and the tax character of such distributions are dependent upon the amount of cash generated by the MLP’s operations.

MLPs operating in the energy sector are subject to risks that are specific to the industry they serve.

Midstream - Midstream MLPs that provide crude oil, refined product and natural gas services are subject to supply and demand fluctuations in the markets they serve which may be impacted by a wide range of factors, including fluctuating commodity prices, weather, increased conservation or use of alternative fuel sources, increased governmental or environmental regulation, depletion, rising interest rates, declines in domestic or foreign production, accidents or catastrophic events, increasing operating expenses and economic conditions, among others.

Exploration and production - Exploration and production MLPs produce energy resources, including natural gas and crude oil. Exploration and production MLPs that own oil and gas reserves are particularly vulnerable to declines in the demand for and prices of crude oil and natural gas. Substantial downward adjustments in reserve estimates could have a material adverse effect on the value of such reserves and the financial condition of an MLP. Exploration and production MLPs seek to reduce cash flow volatility associated with commodity prices by executing multi-year hedging strategies that fix the price of gas and oil produced. There can be no assurance that the hedging strategies currently employed by these MLPs are currently effective or will remain effective.

Notes to Financial Statements (continued)

May 31, 2018 (Unaudited)

5. CONCENTRATION OF RISKS (concluded)

Marine shipping - Marine shipping MLPs are primarily marine transporters of natural gas, crude oil or refined petroleum products. Marine shipping companies are exposed to many of the same risks as other energy companies. The highly cyclical nature of the marine transportation industry may lead to volatile changes in charter rates and vessel values, which may adversely affect the revenues, profitability and cash flows of MLPs with marine transportation assets.

Propane - Propane MLPs are distributors of propane to homeowners for space and water heating. MLPs with propane assets are subject to earnings variability based upon weather conditions in the markets they serve, fluctuating commodity prices, customer conservation and increased use of alternative fuels, increased governmental or environmental regulation, and accidents or catastrophic events, among others.

Natural Resource - MLPs with coal, timber, fertilizer and other mineral assets are subject to supply and demand fluctuations in the markets they serve, which will be impacted by a wide range of domestic and foreign factors including fluctuating commodity prices, the level of their customers’ coal stockpiles, weather, increased conservation or use of alternative fuel sources, increased governmental or environmental regulation, depletion, declines in production, mining accidents or catastrophic events, health claims and economic conditions, among others.

6. LOANS OF PORTFOLIO SECURITIES

The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Security loans made pursuant to a securities lending agreement are required at all times to be secured by collateral equal to at least 102% for U.S.-based securities and 105% for foreign based securities. Such collateral received in connection with these loans will be cash and can be invested in repurchase agreements or U.S. Treasury obligations and is recognized in the Schedule of Investments and Statement of Assets and Liabilities. The obligation to return securities lending collateral is also recognized as a liability in the Statement of Assets and Liabilities. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. Lending securities entails a risk of loss to the Fund if and to the extent that the market value of the securities loans were to increase and the borrower did not increase the collateral accordingly, and the borrower fails to return the securities. The Fund could also experience delays and costs in gaining access to the collateral. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. As of May 31, 2018, the Fund had no securities on loan.

7. CONTRACTUAL OBLIGATIONS

The Fund enters into contracts in the normal course of business that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior gains or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

Pursuant to the Trust’s organizational documents, the Trustees of the Trust and the Trust’s officers are indemnified against certain liabilities that may arise out of the performance of their duties.

Notes to Financial Statements (Concluded)

May 31, 2018 (Unaudited)

8. SUBSEQUENT EVENTS

The Fund has been evaluated regarding the need for additional disclosures and/or adjustments resulting from subsequent events. Based on this evaluation, please note the additional disclosure:

On February 12, 2018, Global X Management Company LLC ("Global X"), the Fund’s current investment adviser, entered into an agreement and plan of merger (the "Acquisition Agreement") pursuant to which MAGI Merger Sub LLC, a direct, wholly-owned subsidiary of Horizons ETFs Management (USA) LLC ("Horizons") and an indirect, wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. ("Mirae"), would be merged with and into Global X (the "Transaction"), subject to certain conditions. Pursuant to the Acquisition Agreement, Horizons acquired all of the equity interests of Global X, and Global X became a direct, wholly-owned subsidiary of Horizons and an indirect, wholly-owned subsidiary of Mirae. In this manner, Global X is ultimately controlled by Mirae. The Transaction closed on July 2, 2018 (such closing date being the "Effective Date").

Under the Investment Company Act of 1940, as amended (the "1940 Act"), the closing of the Transaction resulted in a change of control of Global X, and the assignment and automatic termination of the Investment Advisory Agreements between the Trust, on behalf of the Fund, and Global X (together, the "Current Advisory Agreements").

As of July 20, 2018, the shareholders of the Fund have approved a new Investment Advisory Agreement between the Trust and Global X.

Disclosure of Fund Expenses (Unaudited)

All exchange traded funds (“ETFs”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF management, administrative services, commissions, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns. In addition, a shareholder is responsible for any brokerage fees as a result of his or her investment in the Fund, which is not reflected in the table below.

Operating expenses such as these are deducted from an ETF’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of the ETF’s average net assets; this percentage is known as the ETF’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the six-month period shown and held for the entire period (December 1, 2017 to May 31, 2018).

The table below illustrates your Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| | | Beginning

Account

Value

12/1/2017 | | | Ending

Account

Value

5/31/2018 | | | Annualized

Expense

Ratios(2) | | | Expenses

Paid

During

Period(1) | |

| Global X MLP ETF | | | | | | | | | | | | | | | | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,029.20 | | | | 0.46 | % | | $ | 2.33 | |

| Hypothetical 5% Return | | | 1,000.00 | | | | 1,022.64 | | | | 0.46 | | | | 2.32 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period.) |

| (2) | During the period ended May 31, 2018 the Fund had a tax benefit. During periods/years when the Fund had a tax expense, expenses could be higher. |

Supplemental Information (Unaudited)

Net asset value, or “NAV”, is the price per Share at which the Fund issues and redeems Shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. The Fund’s Market Price may be at, above or below its NAV. The NAV of the Fund will fluctuate with changes in the market value of the Fund’s holdings. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on a given day, generally at the time NAV is calculated. A premium is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

Further information regarding premiums and discounts is available on the Fund’s website at www.GlobalXFunds.com.

Shareholder Voting Results (Unaudited)

On May 11, 2018, a special Meeting of Shareholders of the Trust was held to elect the following four nominees to serve as members of the Board. Shares were voted as follows:

| | | | | Number of

Shares Voted | | | % of

Shares Voted | | | % of Total

Outstanding

Shares | |

| Charles A. Baker | | For | | | 372,438,195 | | | | 97.28 | % | | | 68.98 | % |

| | | Withheld | | | 10,414,231 | | | | 2.72 | % | | | 1.93 | % |

| | | | | | | | | | | | | | | |

| Luis Berruga | | For | | | 359,303,234 | | | | 93.85 | % | | | 66.55 | % |

| | | Withheld | | | 23,552,191 | | | | 6.15 | % | | | 4.36 | % |

| | | | | | | | | | | | | | | |

| Sanjay Ram Bharwani | | For | | | 358,443,432 | | | | 93.62 | % | | | 66.39 | % |

| | | Withheld | | | 24,412,956 | | | | 6.38 | % | | | 4.48 | % |

| | | | | | | | | | | | | | | |

| Clifford J. Weber | | For | | | 372,088,624 | | | | 97.19 | % | | | 68.92 | % |

| | | Withheld | | | 10,759,838 | | | | 2.81 | % | | | 1.99 | % |

On May 11, 2018, a special Meeting of Shareholders of the Fund was held to approve a new investment advisory agreement for the Fund. Shares were voted as follows:

| | | | | | Number of

Shares Voted | | | % of

Shares Voted | | | % of Total

Outstanding

Shares | |

| Global X MLP ETF | | | For | | | | 58,814,115 | | | | 69.58 | % | | | 63.45 | % |

| | | | Against | | | | 246,676 | | | | 0.29 | % | | | 0.27 | % |

| | | | Abstain | | | | 220,659 | | | | 0.26 | % | | | 0.24 | % |

| | | | Broker Non-Vote | | | | 25,249,679 | | | | 29.87 | % | | | 27.24 | % |

notes

600 Lexington Avenue, 20th Floor

New York, NY 10022

1-888-GXFund-1

(1-888-493-8631)

www.globalxfunds.com

Investment Adviser and Administrator:

Global X Management Company LLC

600 Lexington Avenue, 20th Floor

New York, NY 10022

Distributor:

SEI Investments Distribution Co.

One Freedom Valley Drive

Oaks, PA 19456

Sub-Administrator:

SEI Investments Global Funds Services

One Freedom Valley Drive

Oaks, PA 19456

Counsel for Global X Funds and the Independent Trustees:

Stradley Ronon Stevens & Young, LLP

1250 Connecticut Avenue, N.W.

Suite 500

Washington, DC 20036

Custodian and Transfer Agent:

Brown Brothers Harriman & Co.

50 Post Office Square

Boston, MA 02110

Independent Registered Public Accounting Firm:

PricewaterhouseCoopers LLP

Two Commerce Square

Suite 1800

2001 Market Street

Philadelphia, PA 19103

This information must be preceded or accompanied by a current prospectus for the Fund described.

GLX-SA-005-0600

Global X MLP & Energy Infrastructure ETF (ticker: MLPX)

Global X SuperDividend® Alternatives ETF (ticker: ALTY)

Global X U.S. Preferred ETF (ticker: PFFD)

Semi-Annual Report

May 31, 2018

Table of Contents

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds use to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X MLP & Energy Infrastructure ETF

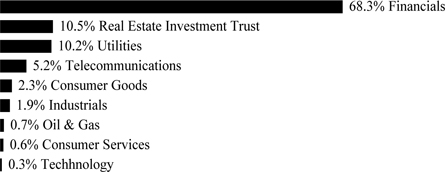

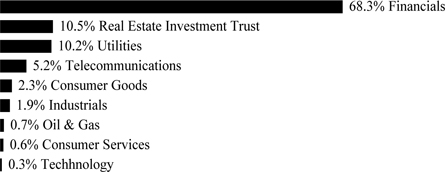

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Note 2 and 7 in Notes to Financial Statements for more detailed information.

| | | Shares | | | Value | |

| COMMON STOCK — 74.8% | | | | | | | | |

| Oil & Gas — 74.8% | | | | | | | | |

| Antero Midstream GP (A) | | | 772,755 | | | $ | 14,875,534 | |

| Archrock | | | 827,344 | | | | 9,555,824 | |

| Cheniere Energy * | | | 470,490 | | | | 31,344,044 | |

| Cheniere Energy Partners Holdings (A) | | | 212,291 | | | | 6,417,557 | |

| Enbridge ^ (A) | | | 1,250,234 | | | | 38,844,770 | |

| Enbridge Energy Management * | | | 805,609 | | | | 7,653,285 | |

| EnLink Midstream | | | 623,754 | | | | 10,915,695 | |

| Kinder Morgan | | | 2,492,911 | | | | 41,581,755 | |

| ONEOK | | | 545,226 | | | | 37,162,604 | |

| Plains GP Holdings, Cl A (B) | | | 829,941 | | | | 20,391,650 | |

| SemGroup, Cl A | | | 785,035 | | | | 19,861,386 | |

| Tallgrass Energy GP, Cl A | | | 570,114 | | | | 12,263,152 | |

| Targa Resources | | | 420,520 | | | | 20,449,888 | |

| TransCanada ^ | | | 955,665 | | | | 39,975,467 | |

| Williams | | | 1,161,653 | | | | 31,202,000 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $347,122,286) | | | | | | | 342,494,611 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS — 23.9% | | | | | | | | |

| Oil & Gas — 23.9% | | | | | | | | |

| Andeavor Logistics | | | 67,012 | | | | 2,874,815 | |

| Antero Midstream Partners | | | 65,743 | | | | 1,988,726 | |

| Boardwalk Pipeline Partners | | | 92,819 | | | | 982,953 | |

| Buckeye Partners | | | 110,590 | | | | 3,986,770 | |

| Crestwood Equity Partners | | | 36,284 | | | | 1,219,142 | |

| DCP Midstream | | | 68,313 | | | | 2,862,998 | |

| Enable Midstream Partners | | | 64,197 | | | | 1,061,818 | |

| Energy Transfer Partners | | | 859,056 | | | | 16,313,474 | |

| EnLink Midstream Partners | | | 122,283 | | | | 2,091,039 | |

| Enterprise Products Partners | | | 724,336 | | | | 20,933,310 | |

| Equities Midstream Partners | | | 44,213 | | | | 2,468,412 | |

| Genesis Energy | | | 80,504 | | | | 1,767,868 | |

| Holly Energy Partners | | | 33,756 | | | | 991,751 | |

| Magellan Midstream Partners | | | 172,659 | | | | 12,068,864 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X MLP & Energy Infrastructure ETF

| | | Shares / Face

Amount | | | Value | |

| MASTER LIMITED PARTNERSHIPS — continued |

| Oil & Gas — continued | | | | | | | | |

| MPLX | | | 217,769 | | | $ | 7,820,085 | |

| NuStar Energy | | | 58,207 | | | | 1,422,579 | |

| Phillips 66 Partners | | | 39,800 | | | | 2,081,540 | |

| Plains All American Pipeline | | | 330,645 | | | | 7,770,158 | |

| Shell Midstream Partners | | | 93,232 | | | | 2,087,465 | |

| Spectra Energy Partners | | | 61,528 | | | | 1,854,454 | |

| Tallgrass Energy Partners | | | 34,793 | | | | 1,519,410 | |

| TC PipeLines | | | 39,273 | | | | 955,119 | |

| Valero Energy Partners | | | 16,472 | | | | 675,187 | |

| Western Gas Partners | | | 75,918 | | | | 3,922,683 | |

| Williams Partners | | | 193,358 | | | | 7,695,648 | |

| | | | | | | | | |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $105,012,680) | | | | | | | 109,416,268 | |

| | | | | | | | | |

|

| SHORT-TERM INVESTMENT(B)(C) — 0.2% |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 1.680% | | | | | | | | |

| (Cost $750,138) | | | 750,138 | | | | 750,138 | |

| | | | | | | | | |

|

| REPURCHASE AGREEMENTS(B) — 4.2% |

| Chase Securities | | | | | | | | |

| 1.700%, dated 05/31/18, to be repurchased on 06/01/18, repurchase price $6,243,077 (collateralized by U.S. Treasury Obligations, ranging in par value $205,429 - $2,455,769, 1.875%, 1/31/2022, with a total market value of $6,551,974) | | $ | 6,242,782 | | | | 6,242,782 | |

| | | | | | | | | |

| Royal Bank of Canada | | | | | | | | |

| 1.760%, dated 05/31/18, to be repurchased on 06/01/18, repurchase price $12,888,290 (collateralized by U.S. Treasury Obligations, ranging in par value $1,268,146 - $2,323,903, 1.625%, 5/15/2026, with a total market value of $14,294,219) | | | 12,887,660 | | | | 12,887,660 | |

| | | | | | | | | |

| TOTAL REPURCHASE AGREEMENTS | | | | | | | | |

| (Cost $19,130,442) | | | | | | | 19,130,442 | |

| TOTAL INVESTMENTS — 103.1% | | | | | | | | |

| (Cost $472,015,546) | | | | | | $ | 471,791,459 | |

Percentages are based on Net Assets of $457,411,037.

| * | Non-income producing security. |

| ^ | Canadian security listed on the New York Stock Exchange and Toronto Stock Exchange. |

| (A) | This security or a partial position of this security is on loan at May 31, 2018. The total value of securities on loan at May 31, 2018 was $19,605,404. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of May 31, 2018, was $19,880,580. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of May 31, 2018. |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X MLP & Energy Infrastructure ETF

Cl — Class

The following is a summary of the level of inputs used as of May 31, 2018, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 342,494,611 | | | $ | — | | | $ | — | | | $ | 342,494,611 | |

| Master Limited Partnerships | | | 109,416,268 | | | | — | | | | — | | | | 109,416,268 | |

| Short-Term Investment | | | 750,138 | | | | — | | | | — | | | | 750,138 | |

| Repurchase Agreements | | | — | | | | 19,130,442 | | | | — | | | | 19,130,442 | |

| Total Investments in Securities | | $ | 452,661,017 | | | $ | 19,130,442 | | | $ | — | | | $ | 471,791,459 | |

For the period ended May 31, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X SuperDividend® Alternatives ETF

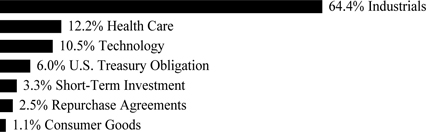

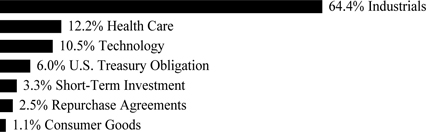

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments.

| | | Shares | | | Value | |

| CLOSED-END FUNDS — 32.5% | | | | | | | | |

| AllianzGI NFJ Dividend Interest & Premium Strategy Fund | | | 26,344 | | | $ | 341,155 | |

| BlackRock Income Trust | | | 56,260 | | | | 326,871 | |

| Brookfield Real Assets Income Fund | | | 15,235 | | | | 347,663 | |

| Eaton Vance Risk-Managed Diversified Equity Income Fund | | | 38,066 | | | | 354,775 | |

| Eaton Vance Tax Managed Global Buy Write Opportunities Fund | | | 30,301 | | | | 351,492 | |

| Eaton Vance Tax-Managed Buy-Write Opportunities Fund | | | 23,431 | | | | 360,134 | |

| Morgan Stanley Emerging Markets Domestic Debt Fund | | | 44,040 | | | | 310,042 | |

| Nuveen Mortgage Opportunity Term Fund | | | 15,139 | | | | 352,890 | |

| Stone Harbor Emerging Markets Income Fund | | | 21,803 | | | | 305,024 | |

| Templeton Emerging Markets Income Fund | | | 30,943 | | | | 325,211 | |

| Voya Global Equity Dividend and Premium Opportunity Fund | | | 44,505 | | | | 322,216 | |

| Western Asset Emerging Markets Debt Fund | | | 22,876 | | | | 310,427 | |

| Western Asset Mortgage Defined Opportunity Fund | | | 14,386 | | | | 351,306 | |

| TOTAL CLOSED-END FUNDS | | | | | | | | |

| (Cost $4,373,967) | | | | | | | 4,359,206 | |

| | | | | | | | | |

| COMMON STOCK — 31.7% | | | | | | | | |

| Financials — 22.6% | | | | | | | | |

| Apollo Investment | | | 43,407 | | | | 246,986 | |

| Ares Capital | | | 16,066 | | | | 271,194 | |

| BlackRock Capital Investment | | | 35,285 | | | | 220,178 | |

| Hercules Capital | | | 21,068 | | | | 261,033 | |

| Main Street Capital | | | 6,671 | | | | 256,300 | |

| New Mountain Finance | | | 18,479 | | | | 256,858 | |

| PennantPark Floating Rate Capital | | | 18,383 | | | | 250,560 | |

| PennantPark Investment | | | 35,296 | | | | 256,602 | |

| Prospect Capital | | | 39,761 | | | | 268,784 | |

| Solar Capital | | | 12,164 | | | | 262,864 | |

| TCP Capital | | | 16,073 | | | | 236,755 | |

| TPG Specialty Lending | | | 12,675 | | | | 236,516 | |

| | | | | | | | 3,024,630 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X SuperDividend® Alternatives ETF

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Industrials — 0.7% | | | | | | | | |

| Macquarie Infrastructure | | | 2,357 | | | $ | 91,216 | |

| Utilities — 8.4% | | | | | | | | |

| Avangrid | | | 3,475 | | | | 184,488 | |

| CenterPoint Energy | | | 5,798 | | | | 151,502 | |

| Duke Energy | | | 2,017 | | | | 155,632 | |

| Entergy | | | 2,217 | | | | 179,377 | |

| FirstEnergy | | | 5,423 | | | | 186,659 | |

| PPL | | | 4,356 | | | | 119,006 | |

| Southern | | | 3,445 | | | | 154,681 | |

| | | | | | | | 1,131,345 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $4,432,883) | | | | | | | 4,247,191 | |

| | | | | | | | | |

| EXCHANGE TRADED FUND — 19.7% | | | | | | | | |

Global X SuperDividend® REIT ETF (A) (Cost $2,569,281) | | | 175,135 | | | | 2,645,414 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS — 10.1% | | | | | | | | |

| Industrials — 1.6% | | | | | | | | |

| Icahn Enterprises | | | 3,183 | | | | 218,959 | |

| Oil & Gas — 7.4% | | | | | | | | |

| DCP Midstream | | | 4,934 | | | | 206,783 | |

| Enable Midstream Partners | | | 10,650 | | | | 176,151 | |

| Energy Transfer Partners | | | 9,547 | | | | 181,298 | |

| EnLink Midstream Partners | | | 10,232 | | | | 174,967 | |

| Genesis Energy | | | 6,464 | | | | 141,949 | |

| NuStar Energy | | | 4,308 | | | | 105,288 | |

| | | | | | | | 986,436 | |

| Utilities — 1.1% | | | | | | | | |

| Suburban Propane Partners | | | 6,566 | | | | 153,710 | |

| | | | | | | | | |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $1,239,313) | | | | | | | 1,359,105 | |

| | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES — 5.6% | | | | | | | | |

| Goldman Sachs BDC | | | 11,534 | | | | 236,332 | |

| Golub Capital BDC | | | 13,944 | | | | 258,103 | |

| TCG BDC | | | 14,093 | | | | 256,211 | |

| | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | | | | | |

| (Cost $782,995) | | | | | | | 750,646 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 99.6% | | | | | | | | |

| (Cost $13,398,439) | | | | | | $ | 13,361,562 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X SuperDividend® Alternatives ETF

Percentages are based on Net Assets of $13,413,094.

| (A) | Affiliated investment. |

| ETF — Exchange Traded Fund |

| REIT — Real Estate Investment Trust |

As of May 31, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended May 31, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

The following is a summary of the Fund’s transactions with affiliates for the period ended May 31, 2018:

Value at

11/30/2017 | | | Purchases at

Cost | | | Proceeds

from Sales | | | Changes in

Unrealized

Appreciation | | | Realized

Gain | | | Value at

5/31/2018 | | | Dividend

Income | |

| Global X SuperDividend® REIT ETF | | | | | | | | | | | | | | | | | |

| $ | 2,253,799 | | | $ | 449,431 | | | $ | (2,051 | ) | | $ | (55,614 | ) | | $ | (151 | ) | | $ | 2,645,414 | | | $ | 117,894 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X U.S. Preferred ETF

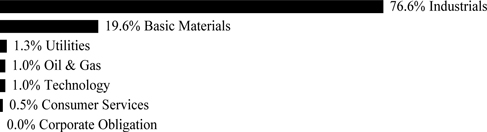

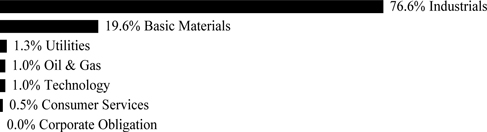

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments.

| | | Shares | | | Value | |

| PREFERRED STOCK — 99.5% | | | | | | | | |

| BERMUDA— 1.3% | | | | | | | | |

| Financials — 1.3% | | | | | | | | |

| Aspen Insurance Holdings, 5.950%, VAR ICE LIBOR USD 3 Month+4.060% | | | 5,792 | | | $ | 150,360 | |

| Aspen Insurance Holdings, 5.625% | | | 4,375 | | | | 106,881 | |

| Axis Capital Holdings, 5.500% | | | 11,523 | | | | 283,005 | |

| PartnerRe, 7.250% | | | 6,178 | | | | 172,366 | |

| RenaissanceRe Holdings, 5.375% | | | 5,795 | | | | 143,137 | |

| TOTAL BERMUDA | | | | | | | 855,749 | |

| GERMANY— 1.6% | | | | | | | | |

| Financials — 1.6% | | | | | | | | |

| Deutsche Bank Contingent Capital Trust II, 6.550%(A) | | | 16,728 | | | | 410,672 | |

| Deutsche Bank Contingent Capital Trust V, 8.050%(A) | | | 28,909 | | | | 734,867 | |

| TOTAL GERMANY | | | | | | | 1,145,539 | |

| NETHERLANDS— 2.7% | | | | | | | | |

| Financials — 2.7% | | | | | | | | |

| Aegon, 6.500% | | | 10,478 | | | | 269,075 | |

| Aegon, 6.375% | | | 20,890 | | | | 537,918 | |

| Aegon, 4.000%, VAR ICE LIBOR USD 3 Month+0.875% | | | 4,875 | | | | 118,024 | |

| ING Groep, 6.375% | | | 20,890 | | | | 536,037 | |

| ING Groep, 6.125% | | | 14,643 | | | | 377,497 | |

| TOTAL NETHERLANDS | | | | | | | 1,838,551 | |

| UNITED KINGDOM— 3.6% | | | | | | | | |

| Financials — 3.6% | | | | | | | | |

| Barclays Bank, Ser 5, 8.125% | | | 52,127 | | | | 1,360,515 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | May 31, 2018 (Unaudited) |

Global X U.S. Preferred ETF

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| HSBC Holdings, 6.200% | | | 27,241 | | | $ | 701,456 | |

| Prudential, 6.500% | | | 6,310 | | | | 166,395 | |

| Royal Bank of Scotland Group, Ser S, 6.600% | | | 13,835 | | | | 352,239 | |

| TOTAL UNITED KINGDOM | | | | | | | 2,580,605 | |

| UNITED STATES— 90.3% | | | | | | | | |

| Consumer Goods — 2.3% | | | | | | | | |

| Becton Dickinson and, 6.125% | | | 25,799 | | | | 1,502,018 | |

| Dillard's Capital Trust I, 7.500% | | | 3,886 | | | | 99,326 | |

| | | | | | | | 1,601,344 | |

| Consumer Services — 0.6% | | | | | | | | |

| eBay, 6.000% | | | 15,683 | | | | 411,522 | |

| Financials — 58.8% | | | | | | | | |

| Allstate, 6.750% | | | 8,083 | | | | 209,026 | |

| Allstate, 5.100%, VAR ICE LIBOR USD 3 Month+3.165% | | | 10,477 | | | | 272,402 | |