UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

| Valued Advisers Trust |

(Exact name of registrant as specified in charter)

| Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300 Indianapolis, IN 46208 |

(Address of principal executive offices) (Zip code)

Capitol Services, Inc. 615 S. Dupont Hwy. Dover, DE 19901 |

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group

2041 W. 141st Terrace

Suite 119

Leawood, KS 66224

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 10/31

Date of reporting period: 04/30/2012

Item 1. Reports to Stockholders.

|

For the period ending April 30, 2012

Geier Asset Management, Inc. 2205 Warwick Way, Suite 200 Marriottsville, Maryland 21104 410-997-8000 |

Investment Results - (Unaudited)

Total Returns*

(For the period ended April 30, 2012)

| Average Annual Returns | ||||||

| 6 Months | One Year | Since Inception (December 27, 2010) | ||||

Geier Strategic Total Return Fund | 0.58% | -2.10% | 2.29% | |||

S&P 500® Index** | 12.76% | 4.73% | 10.43% | |||

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 28, 2012, were 3.08% of average daily net assets (2.98% after fee waiver/expense reimbursements by the Adviser). The Adviser contractually has agreed to cap certain operating expenses of the Fund excluding interest, taxes, brokerages commissions, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales and expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940 (“Excluded Expenses”) to no more than 1.70% of the Fund’s average daily net assets. This limitation also excludes any “acquired fund fees and expenses” as that term is described in the Fund’s prospectus. Under certain circumstances, the Adviser may recover any expenses waived and/or reimbursed during the three-year period prior to the period in which such expenses are waived and/or reimbursed (the “Recoupment Right”). The foregoing expense limitation arrangements were in place as of October 31, 2011 and they extended to February 28, 2012. The Trust agreed to amend the expense limitation arrangements with the Adviser as of October 31, 2011 to: (i) extend the foregoing limitation arrangement to February 28, 2013 and (ii) provide that to the extent the Adviser were to reimburse the Fund for any Excluded Expenses, the Adviser would be entitled to include such reimbursed Excluded Expenses in the amounts that are subject to recovery under the Recoupment Right.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-747-4268.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-877-747-4268. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., Member FINRA.

1

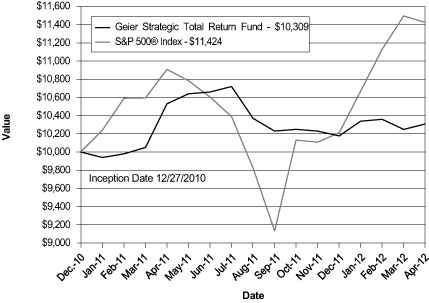

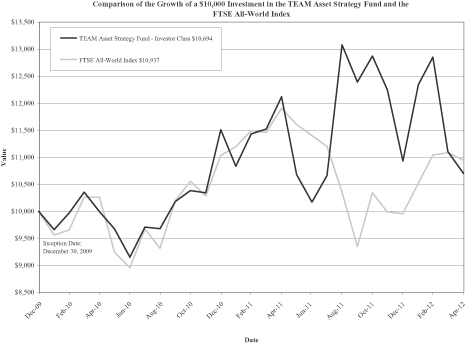

Comparison of the Growth of a $10,000 Investment in the Geier Strategic

Total Return Fund and the S&P 500® Index

The chart above assumes an initial investment of $10,000 made on December 27, 2010 (inception date of the Fund) and held through April 30, 2012. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares; although the performance does reflect the effect of the Fund paying certain taxes resulting from its failure to satisfy certain requirements under the Internal Revenue Code applicable to “regulated investment companies.” Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-877-747-4268. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

2

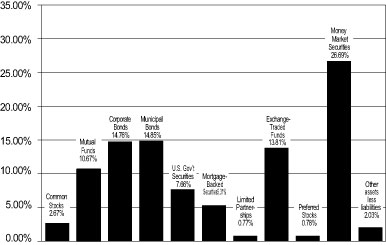

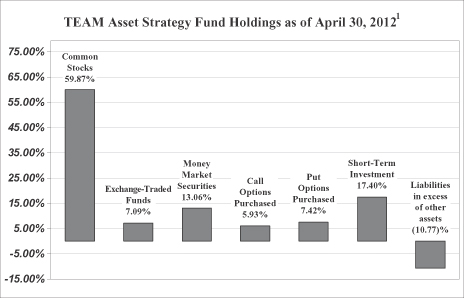

FUND HOLDINGS - (Unaudited)

Geier Strategic Total Return Fund Holdings as of April 30, 20121

The investment objective of the Geier Strategic Total Return Fund is to provide long-term total return from income and capital appreciation, with an emphasis on absolute return.

AVAILABILITY OF PORTFOLIO SCHEDULE - (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

ABOUT THE FUND’S EXPENSES - (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs (such as short-term redemption fees); and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, and held for the entire period from November 1, 2011 to April 30, 2012.

3

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Geier Strategic Total Return Fund | Beginning | Ending | Expenses Paid | |||||||||

Actual | $ | 1,000.00 | $ | 1,005.76 | $ | 9.71 | ||||||

Hypothetical** (5% return before expenses) | $ | 1,000.00 | $ | 1,015.18 | $ | 9.76 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average ac- count value over the period, multiplied by 182/366. |

| ** | Assumes a 5% return before expenses. |

4

Geier Strategic Total Return Fund

Schedule of Investments

April 30, 2012 - (Unaudited)

| Common Stocks - 2.67% | Shares | Fair Value | ||||||

Utilities - 2 .67% | ||||||||

CenterPoint Energy, Inc | 15,616 | $ | 315,599 | |||||

Duke Energy Corp | 14,492 | 310,564 | ||||||

Xcel Energy, Inc | 11,542 | 312,327 | ||||||

|

| |||||||

TOTAL COMMON STOCKS (Cost $909,865) | 938,490 | |||||||

|

| |||||||

Mutual Funds - 10.67% | ||||||||

Blackrock Build America Bond Fund (a) | 74,251 | 1,637,977 | ||||||

Central Fund of Canada, Ltd. - Class A (a) (e) | 100,000 | 2,123,000 | ||||||

|

| |||||||

TOTAL MUTUAL FUNDS (Cost $3,585,436) | 3,760,977 | |||||||

|

| |||||||

| Principal Amount | ||||||||

Corporate Bonds - 14.76% | ||||||||

Allied Waste North America, Inc., 6.875%, 06/01/2017 | $ | 250,000 | 259,964 | |||||

Ally Financial, Inc., 7.125%, 10/15/2017 | 250,000 | 241,097 | ||||||

Arch Coal, Inc., 8.750%, 08/01/2016 | 250,000 | 251,875 | ||||||

Citigroup, Inc., 0.745%, 06/09/2016 (b) | 250,000 | 216,534 | ||||||

Federal Farm Credit Bank, 5.875%, 08/16/2021 | 250,000 | 267,775 | ||||||

General Electric Capital Corp., 0.669%, 01/08/2016 (b) | 250,000 | 241,492 | ||||||

Goldman Sachs Capital II, 5.793%, 06/01/2043 (b) | 250,000 | 173,125 | ||||||

Icahn Enterprises Finance Corp., 7.750%, 01/15/2016 | 250,000 | 264,375 | ||||||

Kemper Corp., 6.000%, 05/15/2017 | 250,000 | 265,723 | ||||||

Lincoln National Corp., 7.000%, 05/17/2066 (b) | 250,000 | 245,000 | ||||||

Macys Retail Holdings, Inc., 7.450%, 10/15/2016 | 500,000 | 583,500 | ||||||

Netflix Inc., 8.500%, 11/15/2017 | 250,000 | 271,250 | ||||||

Quicksilver Resources, Inc., 8.250%, 08/01/2015 | 250,000 | 252,500 | ||||||

SLM Corp., 4.307%, 11/1/2016 (b) | 300,000 | 282,996 | ||||||

Steel Dynamics Inc., 7.750%, 4/15/2016 | 250,000 | 261,250 | ||||||

5

Geier Strategic Total Return Fund

Schedule of Investments - continued

April 30, 2012 - (Unaudited)

| Principal Amount | Fair Value | |||||||

Corporate Bonds - 14.76% - continued | ||||||||

Suntrust Banks, Inc., 5.250%, 11/05/2012 | $ | 100,000 | $ | 102,144 | ||||

Tesoro Corp., 6.500%, 06/01/2017 | 250,000 | 259,375 | ||||||

Tyson Foods, Inc., 6.600%, 04/01/2016 | 350,000 | 398,562 | ||||||

Whirlpool Corp., 6.500%, 06/15/2016 | 325,000 | 362,776 | ||||||

|

| |||||||

TOTAL CORPORATE BONDS (Cost $5,302,482) | 5,201,313 | |||||||

|

| |||||||

Municipal Bonds - 14.85% | ||||||||

California Qualified School Board, 4.760%, 09/01/2017 | 355,000 | 375,491 | ||||||

City of East Orange NJ, 5.300%, 04/01/2017 | 250,000 | 256,535 | ||||||

City of Garland, TX, 4.375%, 02/15/2025 | 100,000 | 108,166 | ||||||

City of Las Vegas NV, 5.900%, 05/01/2024 | 235,000 | 250,440 | ||||||

County of Mahoning OH, 5.500%, 12/01/2025 | 75,000 | 82,697 | ||||||

County of Reeves TX, 6.875%, 12/01/2020 | 250,000 | 254,285 | ||||||

County of Sonoma CA, 6.000%, 12/01/2029 | 325,000 | 355,605 | ||||||

County of Wayne MI, 9.250%, 12/01/2025 | 250,000 | 283,035 | ||||||

Government Development Bank for Puerto Rico, 3.670%, 05/01/2014 | 250,000 | 253,413 | ||||||

Indiana Bond Bank, 5.790%, 01/15/2025 | 250,000 | 258,838 | ||||||

Maricopa County Unified School District No 97-Deer Valley AZ, 5.250%, 07/01/2017 | 250,000 | 290,580 | ||||||

Medical Center Educational Building Corp., 3.000%, 06/01/2015 | 100,000 | 105,953 | ||||||

Metropolitan Nashville Airport Authority, 6.793%, 07/01/2029 | 130,000 | 143,892 | ||||||

State of Louisiana, 5.000%, 05/01/2019 | 300,000 | 370,371 | ||||||

Texas State University Systems, 5.000%, 03/15/2022 | 100,000 | 118,350 | ||||||

Texas Tech University, 5.000%, 08/15/2020 | 535,000 | 665,717 | ||||||

University of Arkansas, 3.000%, 12/01/2023 | 340,000 | 343,448 | ||||||

University of South Carolina, 5.000%, 05/01/2025 | 325,000 | 378,173 | ||||||

Vermont State Colleges, 6.101%, 07/01/2025 | 310,000 | 337,599 | ||||||

|

| |||||||

TOTAL MUNICIPAL BONDS (COST $5,112,826) | 5,232,588 | |||||||

|

| |||||||

See accompanying notes which are an integral part of these financial statements.

6

Geier Strategic Total Return Fund

Schedule of Investments - continued

April 30, 2012 - (Unaudited)

| Principal Amount | Fair Value | |||||||

U.S. Government Securities - 7.66% | ||||||||

U.S. Treasury N/B, 6.125%, 08/15/2029 | $250,000 | $ | 371,992 | |||||

U.S. Treasury N/B, 8.750%, 05/15/2020 | 1,500,000 | 2,326,992 | ||||||

|

| |||||||

TOTAL U.S. GOVERNMENT SECURITIES (Cost $2,420,206) | 2,698,984 | |||||||

|

| |||||||

Mortgage Backed Securities - 5.31% | ||||||||

Countrywide Alternative Loan Trust, 0.529%, 05/25/2034 (b) | 563,180 | 474,443 | ||||||

Credit Suisse First Boston Mortgage Securities Corp., 2.710%, 10/25/2033 (b) | 232,210 | 214,823 | ||||||

Freddie Mac REMICS, 0.000%, 06/15/2036 | 326,012 | 321,647 | ||||||

Government National Mortgage Association, 6.500%, 12/20/2041 (b) | 431,049 | 445,264 | ||||||

Morgan Stanley Mortgage Loan Trust, 2.730%, 10/25/2034 (b) | 247,510 | 215,411 | ||||||

Structured Asset Securities Corp., 2.770%, 04/25/2033 (b) | 212,741 | 199,000 | ||||||

|

| |||||||

TOTAL MORTGAGE BACKED SECURITIES (Cost $1,903,884) | 1,870,588 | |||||||

|

| |||||||

Limited Partnerships - 0.77% | ||||||||

Atlas Pipeline Partners, 8.750%, 06/15/2018 | 250,000 | 270,625 | ||||||

|

| |||||||

TOTAL LIMITED PARTNERSHIPS (Cost $263,548) | 270,625 | |||||||

|

| |||||||

See accompanying notes which are an integral part of these financial statements.

7

Geier Strategic Total Return Fund

Schedule of Investments - continued

April 30, 2012 - (Unaudited)

| Shares | Fair Value | |||||||

Exchange-Traded Funds - 13.81% | ||||||||

iShares Barclays 20+ Year Treasury Bond Fund | 20,000 | $ | 2,346,400 | |||||

iShares iBoxx $ Investment Grade Corporate Bond Fund | 10,000 | 1,164,800 | ||||||

Sprott Physical Gold Trust(c) | 50,000 | 711,000 | ||||||

Sprott Physical Silver Trust(c) | 50,000 | 644,000 | ||||||

|

| |||||||

TOTAL EXCHANGE-TRADED FUNDS (Cost $4,951,586) | 4,866,200 | |||||||

|

| |||||||

Preferred Stocks - 0.78% | ||||||||

Public Storage, 6.350%, callable 07/26/2016 | 10,000 | 273,400 | ||||||

|

| |||||||

TOTAL PREFERRED STOCKS (Cost $250,000) | 273,400 | |||||||

|

| |||||||

Money Market Securities - 26.69% | ||||||||

Fidelity Institutional Money Market Portfolio - Institutional Class, 0.24%(d) | 4,405,566 | 4,405,566 | ||||||

Fidelity Institutional Treasury Only Portfolio - Class I, 0.01%(d) | 5,000,000 | 5,000,000 | ||||||

|

| |||||||

TOTAL MONEY MARKET SECURITIES (Cost $9,405,566) | 9,405,566 | |||||||

|

| |||||||

TOTAL INVESTMENTS (Cost $34,105,399) - 97.97% | $ | 34,518,731 | ||||||

|

| |||||||

Other assets less liabilities - 2.03% | 715,818 | |||||||

|

| |||||||

TOTAL NET ASSETS - 100.00% | $ | 35,234,549 | ||||||

|

| |||||||

| (a) | Closed-end Fund. |

| (b) | Variable rate security, the coupon rate shown represents the rate at April 30, 2012. |

| (c) | Non-income producing. |

| (d) | Variable rate security; the rate shown represents the yield at April 30, 2012. |

| (e) | Passive foreign investment company. |

See accompanying notes which are an integral part of these financial statements.

8

Geier Strategic Total Return Fund

Statement of Assets and Liabilities

April 30, 2012 - (Unaudited)

Assets | ||||

Investments in securities, at fair value (cost $34,105,399) | $ | 34,518,731 | ||

Receivable for investments sold | 506,905 | |||

Interest receivable | 240,731 | |||

Prepaid expenses | 16,902 | |||

|

| |||

Total assets | 35,283,269 | |||

|

| |||

Liabilities | ||||

Payable to Adviser(a) | 31,924 | |||

Payable to administrator, fund accountant and transfer agent(a) | 7,114 | |||

Payable to custodian(a) | 1,371 | |||

Payable to trustees | 367 | |||

12b-1 fees accrued(a) | 7,182 | |||

Other accrued expenses | 762 | |||

|

| |||

Total liabilities | 48,720 | |||

|

| |||

Net Assets | $ | 35,234,549 | ||

|

| |||

Net Assets consist of: | ||||

Paid in capital | $ | 34,874,397 | ||

Accumulated undistributed net investment income | 23,249 | |||

Accumulated undistributed net realized gain (loss) from investment transactions | (76,429 | ) | ||

Net unrealized appreciation (depreciation) on investments | 413,332 | |||

|

| |||

Net Assets | $ | 35,234,549 | ||

|

| |||

Shares outstanding (unlimited number of shares authorized) | 3,460,141 | |||

|

| |||

Net asset value and offering price per share | $ | 10.18 | ||

|

| |||

Redemption price per share (b) (NAV * 99%) | $ | 10.08 | ||

|

|

| (a) | See Note 4 in the Notes to the Financial Statements. |

| (b) | The redemption price per share reflects a redemption fee of 1.00% on shares redeemed within 30 calendar days of purchase. |

See accompanying notes which are an integral part of these financial statements.

9

Geier Strategic Total Return Fund

Statement of Operations

For the six months ended April 30, 2012 - (Unaudited)

Investment Income | ||||

Dividend income (net of withholding tax $300) | $ | 171,987 | ||

Interest income | 317,885 | |||

|

| |||

Total Income | 489,872 | |||

|

| |||

Expenses | ||||

Investment Adviser fee(a) | 193,866 | |||

12b-1 fees(a) | 44,101 | |||

Registration expenses | 17,749 | |||

Transfer agent expenses(a) | 14,499 | |||

Administration expenses(a) | 14,268 | |||

Fund accounting expenses(a) | 12,432 | |||

Legal expenses | 11,339 | |||

Audit expenses | 7,527 | |||

Custodian expenses(a) | 4,392 | |||

Pricing expenses | 3,943 | |||

Trustee expenses | 3,235 | |||

Report printing expense | 3,071 | |||

Insurance expense | 1,513 | |||

Offering costs | 1,385 | |||

Miscellaneous expenses | 236 | |||

24f-2 expense | 58 | |||

|

| |||

Total Expenses | 333,614 | |||

Fees recouped by Adviser(a) | 9,593 | |||

|

| |||

Net operating expenses | 343,207 | |||

|

| |||

Net Investment Income (Loss) | 146,665 | |||

|

| |||

Realized & Unrealized Gain (Loss) | ||||

Net realized gain (loss) on investment securities | (76,446 | ) | ||

Change in unrealized appreciation (depreciation) on investment securities | 158,586 | |||

|

| |||

Net realized and unrealized gain (loss) on investment securities | 82,140 | |||

|

| |||

Net increase (decrease) in net assets resulting from operations | $ | 228,805 | ||

|

|

| (a) | See Note 4 in the Notes to the Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

10

Geier Strategic Total Return Fund

Statements of Changes in Net Assets

| For the Six Months Ended April 30, 2012 (Unaudited) | Period Ended Oct. 31, 2011(a) | |||||||

Operations | ||||||||

Net investment income (loss) | $ | 146,665 | $ | (13,906 | ) | |||

Net realized gain (loss) on investment securities | (76,446 | ) | 348,547 | |||||

Change in unrealized appreciation (depreciation) on investment securities | 158,586 | 254,746 | ||||||

|

|

|

| |||||

Net increase (decrease) in net assets resulting from operations | 228,805 | 589,387 | ||||||

|

|

|

| |||||

Distributions | ||||||||

From net investment income | (217,686 | ) | — | |||||

From net realized gain | (240,354 | ) | — | |||||

|

|

|

| |||||

Total distributions | (458,040 | ) | — | |||||

|

|

|

| |||||

Capital Share Transactions | ||||||||

Proceeds from shares sold | 4,259,679 | 36,352,943 | ||||||

Reinvestment of distributions | 45,555 | — | ||||||

Amount paid for shares redeemed | (3,428,935 | ) | (2,354,928 | ) | ||||

Proceeds from redemption fees collected (b) | 10 | 73 | ||||||

|

|

|

| |||||

Net increase (decrease) in net assets resulting from share transactions | 876,309 | 33,998,088 | ||||||

|

|

|

| |||||

Total Increase (Decrease) in Net Assets | 647,074 | 34,587,475 | ||||||

|

|

|

| |||||

Net Assets | ||||||||

Beginning of period | 34,587,475 | — | ||||||

|

|

|

| |||||

End of period | $ | 35,234,549 | $ | 34,587,475 | ||||

|

|

|

| |||||

Accumulated undistributed net investment income (loss) included in net assets at end of period | $ | 23,249 | $ | 94,270 | ||||

|

|

|

| |||||

Capital Share Transactions | ||||||||

Shares sold | 418,155 | 3,603,863 | ||||||

Shares issued in reinvestment of distributions | 4,537 | — | ||||||

Shares redeemed | (337,852 | ) | (228,562 | ) | ||||

|

|

|

| |||||

Net increase (decrease) from capital share transactions | 84,840 | 3,375,301 | ||||||

|

|

|

| |||||

| (a) | For the period December 27, 2010 (commencement of operations) to October 31, 2011. |

| (b) | The Fund charges a redemption fee of 1.00% on shares redeemed within 30 calendar days of purchase. |

See accompanying notes which are an integral part of these financial statements.

11

Geier Strategic Total Return Fund

Financial Highlights

(For a share outstanding throughout each period)

| For the Six Months Ended April 30, 2012 (Unaudited) | Period Ended Oct. 31, 2011 (a) | |||||||

Selected Per Share Data | ||||||||

Net asset value, beginning of period | $ | 10.25 | $ | 10.00 | ||||

|

|

|

| |||||

Income from investment operations: | ||||||||

Net investment income (loss) | 0.04 | — | ||||||

Net realized and unrealized gains (losses) | 0.02 | 0.25 | ||||||

|

|

|

| |||||

Total income (loss) from investment operations | 0.06 | 0.25 | ||||||

|

|

|

| |||||

Less Distributions to Shareholders: | ||||||||

From net investment income | (0.06 | ) | — | |||||

From net realized gain | (0.07 | ) | — | |||||

|

|

|

| |||||

Total distributions | (0.13 | ) | — | |||||

|

|

|

| |||||

Paid in capital from redemption fees(b) | — | — | ||||||

|

|

|

| |||||

Net asset value, end of period | $ | 10.18 | $ | 10.25 | ||||

|

|

|

| |||||

Total Return(c) | 0.58 | %(d) | 2.50 | % (d) | ||||

Ratios and Supplemental Data | ||||||||

Net assets, end of year (000) | $ | 35,235 | $ | 34,587 | ||||

Ratio of expenses to average net assets | 1.95 | %(e) | 2.65 | % (e)(f) | ||||

Ratio of expenses to average net assets before reimbursement | 1.89 | %(e) | 2.97 | % (e)(g) | ||||

Ratio of net investment income (loss) to average net assets | 0.83 | %(e) | (0.06 | )%(e)(f) | ||||

Ratio of net investment income (loss) to average net assets before reimbursement | 0.89 | %(e) | (0.37 | )%(e)(h) | ||||

Portfolio turnover rate | 55.27 | %(d) | 502.14 | % (d) | ||||

| (a) | For the period December 27, 2010 (commencement of operations) through October 31, 2011. |

| (b) | Redemption fees resulted in less than $0.005 per share in each period. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (d) | Not Annualized. |

| (e) | Annualized. |

| (f) | The expense ratio and net investment income ratio includes the effect of federal tax expense of 0.70%, which is the portion of federal tax expense not reimbursed by the Adviser. |

| (g) | The expense ratio before reimbursements includes taxes of 0.92%, a portion of which was voluntarily reimbursed by the Adviser. |

| (h) | The net investment income (loss) ratio includes federal tax expense of (0.92)%, a portion of which was voluntarily reimbursed by the Adviser. |

See accompanying notes which are an integral part of these financial statements.

12

Geier Strategic Total Return Fund

Notes to the Financial Statements

April 30, 2012 - (Unaudited)

NOTE 1. ORGANIZATION

The Geier Strategic Total Return Fund (the “Fund”) is an open-end, non-diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund’s investment Adviser is Geier Asset Management, Inc. (the “Adviser”). The investment objective of the Fund is to provide long-term total return from income and capital appreciation, with an emphasis on absolute return.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation - All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Taxes - The Fund intends to qualify each year as a “regulated investment company” (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended April 30, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses - Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (as determined by the Board).

13

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES - continued

Security Transactions and Related Income - The Fund follows industry practice and records security transactions on the trade date. The First In, First Out method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions from Limited Partnerships are recognized on the ex-date. Income or loss from Limited Partnerships is reclassified in the components of net assets upon receipt of K-1’s. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Redemption Fees - The Fund charges a 1.00% redemption fee for shares redeemed within 30 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily NAV calculation.

Dividends and Distributions - The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to its shareholders on at least an annual basis. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. Generally Accepted Accounting Principles in the United States of America (“GAAP”) establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

14

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS - continued

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 - quoted prices in active markets for identical securities |

| • | Level 2 - other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, exchange-traded funds, preferred stocks, and limited partnerships, are generally valued by using market quotations, furnished by a pricing service. Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security is classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations

15

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS - continued

or when the market is considered inactive. When this happens, the security is classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review by the Board. These securities are categorized as Level 3 securities.

Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities are categorized as Level 1 securities.

Fixed income securities such as corporate bonds, municipal bonds, U.S. government securities, and mortgage-backed securities when valued using market quotations in an active market, will be categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional- size trading units of debt securities without regard to sale or bid prices. These securities will generally be categorized as Level 2 securities. If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review of the Board. These securities will be categorized as Level 3 securities.

Short-term investments in fixed income securities, (those with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity), including certificates of deposit and U.S. government securities, are valued by using the amortized cost method of valuation, which the Board has determined will represent fair value. These securities will be classified as Level 2 securities.

If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review of the Board. These securities will be categorized as Level 3 securities.

16

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS - continued

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Fund would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Fund’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Fund is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available. Any fair value pricing done outside the Fund’s approved pricing methods must be approved by the Pricing Committee of the Board.

17

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS - continued

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2012:

| Valuation Inputs | ||||||||||||||||

| Level 1 - | Level 2 - | |||||||||||||||

| Quoted | Other | Level 3 - | ||||||||||||||

| Prices in | Significant | Significant | ||||||||||||||

| Active | Observable | Unobservable | ||||||||||||||

Assets | Markets | Inputs | Inputs | Total | ||||||||||||

Common Stocks | $ | 938,490 | $ | — | $ | — | $ | 938,490 | ||||||||

Mutual Funds | 3,760,977 | — | — | 3,760,977 | ||||||||||||

Corporate Bonds | — | 5,201,313 | — | 5,201,313 | ||||||||||||

Municipal Bonds | — | 5,232,588 | — | 5,232,588 | ||||||||||||

U.S. Government Securities | — | 2,698,984 | — | 2,698,984 | ||||||||||||

Mortgage-Backed Securities | — | 1,870,588 | — | 1,870,588 | ||||||||||||

Limited Partnerships | — | 270,625 | — | 270,625 | ||||||||||||

Exchange-Traded Funds | 4,866,200 | — | — | 4,866,200 | ||||||||||||

Preferred Stock | 273,400 | — | — | 273,400 | ||||||||||||

Money Market Securities | 9,405,566 | — | — | 9,405,566 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | $ | 19,244,633 | $ | 15,274,098 | $ | — | $ | 34,518,731 | ||||||||

|

|

|

|

|

|

|

| |||||||||

The Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period. The Trust recognizes significant transfers between fair value hierarchy levels at the reporting period end. There were no significant transfers between any Levels for the period ended April 30, 2012.

18

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Adviser, under the terms of the management agreement (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.10% of the Fund’s average net assets. For the six months ended April 30, 2012, the Adviser earned fees of $193,866 from the Fund before the reimbursement/recoupment described below.

The Adviser contractually has agreed to cap certain operating expenses of the Fund excluding interest, taxes, brokerage commissions, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales and expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940 (“Excluded Expenses”). This limitation also excludes any “acquired fund fees and expenses” as that term is described in the Fund’s prospectus.

Under certain circumstances, the Adviser may recover any expenses waived and/ or reimbursed during the three-year period prior to the period in which such expenses are waived and/or reimbursed (the “Recoupment Right”). The Trust agreed to amend the expense limitation arrangements with the Adviser as of October 31, 2011 to: (i) extend the foregoing limitation arrangement to February 28, 2013 and (ii) provide that to the extent the Adviser were to reimburse the Fund for any Excluded Expenses, the Adviser would be entitled to include such reimbursed Excluded Expenses in the amounts that are subject to recovery under the Recoupment Right. For the six months ended April 30, 2012, $67,659 may be subject to potential repayment to the Adviser by the Fund through October 31, 2015. For the six months ended April 30, 2012, the Adviser recouped fees of $9,593. At April 30, 2012, the Adviser was owed $31,924 from the Fund for advisory services. The amended expense limitation agreement was executed on December 30, 2011.

The Trust retains Huntington Asset Services, Inc. (“HASI”), to manage the Fund’s business affairs and to provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the six months ended April 30, 2012, HASI earned fees of $14,268 for administrative services provided to the Fund. At April 30, 2012, the Fund owed HASI $2,356 for administrative services. Certain officers of the Trust are members of management and/or employees of HASI. HASI operates as a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the “Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the six months ended April 30, 2012, the Custodian earned fees of $4,392 for custody services provided to the Fund. At April 30, 2012, the Fund owed the Custodian $1,371 for custody services.

19

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES - continued

The Trust retains HASI to act as the Fund’s transfer agent and to provide fund accounting services. For six months ended April 30, 2012, HASI earned fees of $14,499 from the Fund for transfer agent services. For the six months ended April 30, 2012, HASI earned fees of $12,432 from the Fund for fund accounting services. At April 30, 2012, the Fund owed HASI $2,743 for transfer agent services. At April 30, 2012, the Fund owed HASI $2,015 for fund accounting services.

Unified Financial Securities, Inc. (the “Distributor”) acts as the principal distributor of the Fund’s shares. There were no payments made to the Distributor by the Fund for the six months ended April 30, 2012. A Trustee of the Trust is a member of management of Huntington National Bank, a subsidiary of Huntington Bancshares, Inc. (the parent of the Distributor) and officers of the Trust are officers of the Distributor and such persons may be deemed to be affiliates of the Distributor.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/ or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts. The Fund or Adviser may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 expenses actually incurred. It is anticipated that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to efficiently achieve its investment objectives and to realize economies of scale. For the six months ended April 30, 2012, the 12b-1 expense incurred by the Fund was $44,101. The Fund owed $7,182 for 12b-1 fees as of April 30, 2012.

The Law Offices of John H. Lively and Associates, Inc., a member firm of The 1940 Act Law Group, serves as legal counsel to the Trust. John H. Lively, Interim Secretary of the Trust, is the owner of The Law Offices of John H. Lively & Associates, Inc., but he receives no direct compensation from the Trust or the Funds for serving as an officer of the Trust.

20

Geier Strategic Total Return Fund

Notes to the Financial Statements - continued

April 30, 2012 - (Unaudited)

NOTE 5. INVESTMENT TRANSACTIONS

For the six months ended April 30, 2012, purchases and sales of investment securities were as follows:

Purchases | ||||

U.S. Government Obligations | $ | — | ||

Other | 18,293,660 | |||

Sales | ||||

U.S. Government Obligations | $ | 1,150,780 | ||

Other | 11,580,502 |

As of April 30, 2012, the net unrealized appreciation (depreciation) of investments

for tax purposes was as follows:

| Amount | ||||

Gross Appreciation | $ | 627,449 | ||

Gross (Depreciation) | (324,533 | ) | ||

|

| |||

Net Appreciation (Depreciation) on Investments | $ | 302,916 | ||

|

| |||

At April 30, 2012, the aggregate cost of securities for federal income tax purposes, was $34,215,815.

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At April 30, 2012, the Trust is not aware of any shareholder that beneficially owned greater than 25% of the outstanding shares of the Fund.

21

Geier Strategic Total Return Fund

Notes to the Financial Statements

April 30, 2012 - (Unaudited)

NOTE 8. DISTRIBUTIONS TO SHAREHOLDERS

On December 28, 2011, the Fund paid an income distribution of $0.0605 per share and a short-term capital gain of $0.0668 per share to shareholders of record on December 27, 2011.

At October 31, 2011, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

Undistributed ordinary income | $454,446 | |||

Unrealized appreciation (depreciation) | 144,330 | |||

|

| |||

| $598,776 | ||||

|

|

At October 31, 2011, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses or gains on passive foreign investment companies.

22

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (877) 747-4268 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES R. Jeffrey Young, Chairman Dr. Merwyn R. Vanderlind Ira Cohen

OFFICERS R. Jeffrey Young, Principal Executive Officer and President John C. Swhear, Chief Compliance Officer, AML Officer and Vice-President Carol J. Highsmith, Vice President Matthew J. Miller, Vice President William J. Murphy, Principal Financial Officer and Treasurer John H. Lively, Interim Secretary

INVESTMENT ADVISER Geier Asset Management, Inc. 2205 Warwick Way, Suite 200 Marriottsville, MD 21104

DISTRIBUTOR Unified Financial Securities, Inc. 2960 North Meridian Street, Suite 300 Indianapolis, IN 46208 | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Cohen Fund Audit Services, Ltd. 800 Westpoint Pkwy., Suite 1100 Westlake, OH 44145

LEGAL COUNSEL The Law Offices of John H. Lively & Associates, Inc., A member firm of The 1940 Act Law GroupTM 2041 West 141st Terrace, Suite 119 Leawood, KS 66224

CUSTODIAN Huntington National Bank 41 S. High St. Columbus, OH 43215

ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT Huntington Asset Services, Inc. 2960 North Meridian Street, Suite 300 Indianapolis, IN 46208 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

Semi-Annual Report

April 30, 2012

Fund Adviser:

Granite Investment Advisors

11 South Main Street, Suite 501

Concord, New Hampshire 03301

Toll Free (888) 442-9893

Investment Results – (Unaudited)

Total Returns*

(For the period ended April 30, 2012)

| Since Inception (December 22, 2011) | ||

Granite Value Fund | 10.10% | |

S&P 500® Index** | 13.18% | |

Russell 1000® Value Index** | 11.42% |

Total Annual Operating Expenses, as estimated for the Fund’s first fiscal period ending October 31, 2012 and disclosed in the Fund’s prospectus, are 1.45% of average daily net assets. Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2013, so that Total Annual Fund Operating Expenses does not exceed 1.35% . This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expense”).

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-866-442-9893.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index and the Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing. The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

1

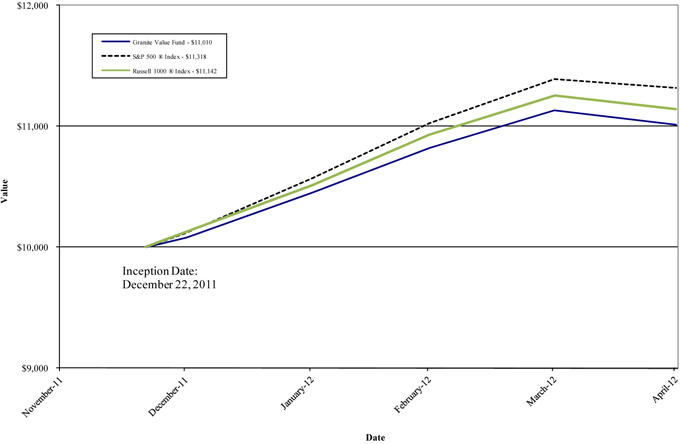

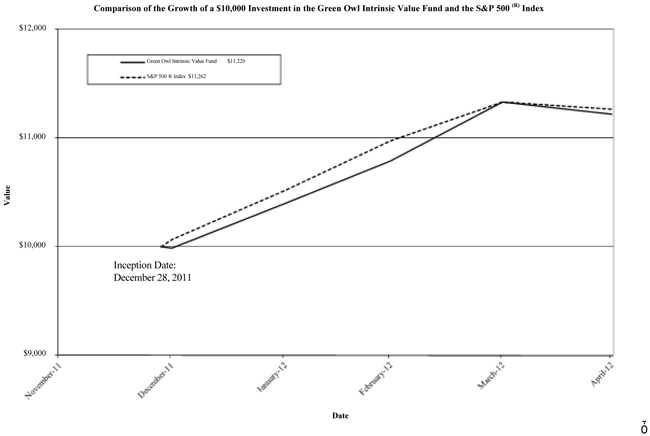

Comparison of the Growth of a $10,000 Investment in the Granite Value Fund, the Russell 1000 ® Value Index, and the S&P 500 ® Index

The chart above assumes an initial investment of $10,000 made on December 22, 2011 (commencement of Fund operations) and held through April 30, 2012. The S&P 500® Index and Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-888-442-9893. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

2

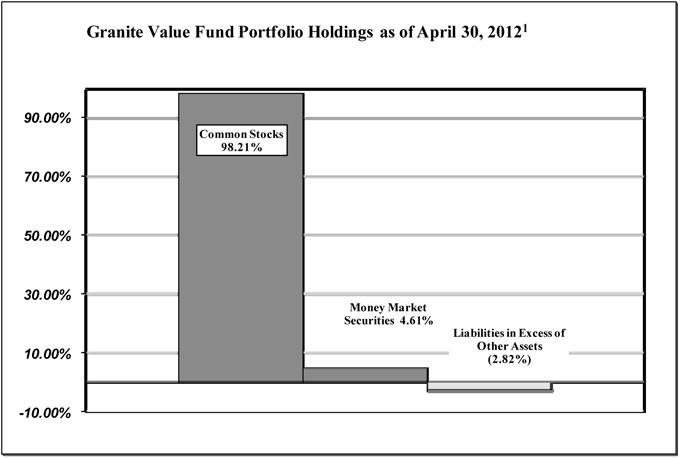

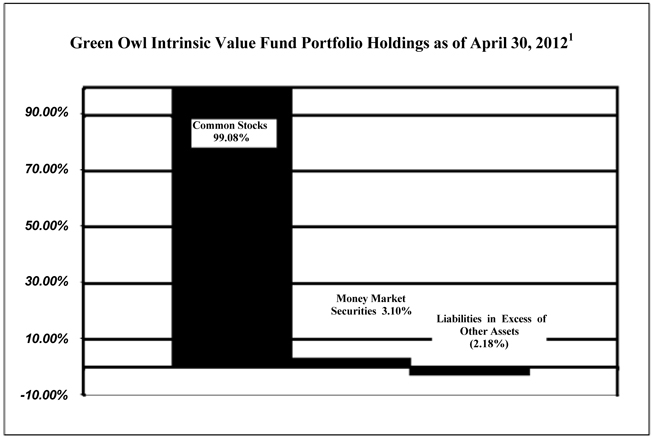

Fund Holdings – (Unaudited)

1 As a percentage of net assets.

The investment objective of the Granite Value Fund is to seek long-term capital appreciation

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Fund’s Expenses – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning and held for the entire period from December 22, 2011 (Commencement of Fund operations) to April 30, 2012.

3

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

Granite Value Fund | Beginning Account Value | Ending Account Value | Expenses Paid | |||

Actual* | $1,000.00 | $1,101.00 | $5.08 | |||

Hypothetical** | $1,000.00 | $1,018.15 | $6.78 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.35%, multiplied by the average account value over the period, multiplied by 131/366 (to reflect the period since commencement of operations on December 22, 2011) |

| ** | Assumes a 5% return before expenses. The hypothetical example is calculated based on a six month period from November 1, 2011 to April 30, 2012. Accordingly, expenses are equal to the Fund’s annualized expense ratio of 1.35% multiplied by the average account value over the six month period, multiplied by 182/366 (to reflect the partial year period). |

4

Granite Value Fund

Schedule of Investments

April 30, 2012

(Unaudited)

Shares | Fair Value | |||||||

Common Stocks - 98.21% | ||||||||

Consumer Discretionary - 10.97% | ||||||||

Comcast Corp. - Class A | 2,350 | $ | 71,275 | |||||

General Motors Co. (a) | 3,740 | 86,020 | ||||||

Staples, Inc. | 5,140 | 79,156 | ||||||

TRW Automotive Holdings Corp. (a) | 1,780 | 81,364 | ||||||

|

| |||||||

| 317,815 | ||||||||

|

| |||||||

Consumer Staples - 8.82% | ||||||||

Coca-Cola Co. / The | 1,040 | 79,373 | ||||||

Unilever PLC (b) | 2,550 | 87,516 | ||||||

Wal-Mart Stores, Inc. | 1,505 | 88,660 | ||||||

|

| |||||||

| 255,549 | ||||||||

|

| |||||||

Energy - 16.98% | ||||||||

Apache Corp. | 935 | 89,704 | ||||||

Exxon Mobil Corp. | 1,500 | 129,510 | ||||||

QEP Resources, Inc. | 3,020 | 93,046 | ||||||

Royal Dutch Shell PLC (b) | 1,275 | 91,214 | ||||||

Unit Corp. (a) | 2,090 | 88,303 | ||||||

|

| |||||||

| 491,777 | ||||||||

|

| |||||||

Financials - 13.56% | ||||||||

Aflac, Inc. | 1,655 | 74,541 | ||||||

American Express Co. | 1,300 | 78,273 | ||||||

Berkshire Hathaway, Inc. - Class B (a) | 1,425 | 114,641 | ||||||

Goldman Sachs Group, Inc. / The | 615 | 70,817 | ||||||

JPMorgan Chase & Co. | 1,270 | 54,585 | ||||||

|

| |||||||

| 392,857 | ||||||||

|

| |||||||

Health Care - 11.27% | ||||||||

Abbott Laboratories | 1,300 | 80,678 | ||||||

Johnson & Johnson | 1,345 | 87,546 | ||||||

Sanofi (b) | 2,060 | 78,651 | ||||||

UnitedHealth Group, Inc. | 1,415 | 79,452 | ||||||

|

| |||||||

| 326,327 | ||||||||

|

| |||||||

Industrials - 11.76% | ||||||||

Boeing Co. / The | 1,145 | 87,936 | ||||||

General Dynamics Corp. | 850 | 57,375 | ||||||

General Electric Co. | 5,610 | 109,844 | ||||||

Lockheed Martin Corp. | 945 | 85,560 | ||||||

|

| |||||||

| 340,715 | ||||||||

|

| |||||||

See accompanying notes which are an integral part of these financial statements.

5

Granite Value Fund

Schedule of Investments - continued

April 30, 2012

(Unaudited)

| Shares | Fair Value | |||||||

Common Stocks - 98.21% - continued | ||||||||

Information Technology - 18.39% | ||||||||

Accenture PLC - Class A | 1,135 | $ | 73,718 | |||||

Apple, Inc. (a) | 120 | 70,109 | ||||||

Cisco Systems, Inc. | 4,175 | 84,126 | ||||||

Hewlett-Packard Co. | 3,330 | 82,451 | ||||||

International Business Machines Corp. (IBM) | 275 | 56,947 | ||||||

Microsoft Corp. | 2,475 | 79,249 | ||||||

Western Union | 4,685 | 86,110 | ||||||

|

| |||||||

| 532,710 | ||||||||

|

| |||||||

Materials -1.87% | ||||||||

Freeport-McMoRan Copper & Gold, Inc. | 1,410 | 54,003 | ||||||

|

| |||||||

Telecommunication Services - 1.93% | ||||||||

Sprint Nextel Corp. (a) | 22,505 | 55,812 | ||||||

|

| |||||||

Utilities - 2.66% | ||||||||

Calpine Corp. (a) | 4,110 | 77,063 | ||||||

|

| |||||||

TOTAL COMMON STOCKS (Cost $2,711,504) | 2,844,628 | |||||||

|

| |||||||

Money Market Securities - 4.61% | ||||||||

Fidelity Institutional Money Market Funds - Prime Money Market Portfolio, 0.19% (c) | 133,547 | 133,547 | ||||||

|

| |||||||

TOTAL MONEY MARKET SECURITIES (Cost $133,547) | 133,547 | |||||||

|

| |||||||

TOTAL INVESTMENTS (Cost $2,845,051) -102.82% | $ | 2,978,175 | ||||||

|

| |||||||

Liabilities in excess of other assets - (2.82)% | (81,550 | ) | ||||||

|

| |||||||

TOTAL NET ASSETS - 100.00% | $ | 2,896,625 | ||||||

|

| |||||||

| (a) | Non-income producing. |

| (b) | American Depositary Receipt. |

| (c) | Variable rate security; the rate shown represents the 7-day yield at April 30, 2012. |

See accompanying notes which are an integral part of these financial statements.

6

Granite Value Fund

Statement of Assets and Liabilities

April 30, 2012

(Unaudited)

Assets | ||||

Investments in securities, at value (cost $2,845,051) | $ | 2,978,175 | ||

Receivable from Adviser (a) | 32,037 | |||

Dividends receivable | 2,193 | |||

Receivable for tax reclaim | 136 | |||

Interest receivable | 20 | |||

Prepaid expenses | 4,783 | |||

Deferred offering costs | 15,661 | |||

Deferred organization costs | 5,111 | |||

|

| |||

Total assets | 3,038,116 | |||

|

| |||

Liabilities | ||||

Payable for investments purchased | 129,568 | |||

Payable to administrator, fund accountant, and transfer agent (a) | 9,578 | |||

Payable to trustees | 601 | |||

Payable to custodian (a) | 1,494 | |||

Other accrued expenses | 250 | |||

|

| |||

Total liabilities | 141,491 | |||

|

| |||

Net Assets | $ | 2,896,625 | ||

|

| |||

Net Assets consist of: | ||||

Paid in capital | $ | 2,753,133 | ||

Accumulated undistributed net investment income (loss) | 2,856 | |||

Accumulated net realized gain (loss) from investments | 7,512 | |||

Net unrealized appreciation (depreciation) on investments | 133,124 | |||

|

| |||

Net Assets | $ | 2,896,625 | ||

|

| |||

Shares outstanding (unlimited number of shares authorized; no par value) | 263,086 | |||

|

| |||

Net Asset Value, offering and redemption price per share | $ | 11.01 | ||

|

| |||

Redemption price per share (Net Asset Value * 98%) (b) | $ | 10.79 | ||

|

|

| (a) | See Note 4 in the Notes to the Financial Statements. |

| (b) | The Funds charge a 2% redemption fee on shares redeemed within 60 calendar days of purchase. Shares are redeemed at the net asset value if held longer than 60 calendar days. |

See accompanying notes which are an integral part of these financial statements.

7

Granite Value Fund

Statement of Operations

For the period ended April 30, 2012 (a)

(Unaudited)

Investment Income | ||||

Dividend income (net of foreign withholding tax of $85) | $ | 11,211 | ||

Interest income | 66 | |||

|

| |||

Total Investment Income | 11,277 | |||

|

| |||

Expenses | ||||

Investment advisor fee (b) | 6,198 | |||

Transfer agent expenses (b) | 17,624 | |||

Aministration expenses (b) | 13,421 | |||

Fund accounting expenses (b) | 8,948 | |||

Offering expenses | 8,704 | |||

Audit expenses | 6,238 | |||

Legal expenses | 5,407 | |||

Miscellaneous expenses | 4,178 | |||

Organizational expenses | 3,639 | |||

Custodian expenses (b) | 3,175 | |||

Report printing expenses | 3,120 | |||

Trustee expenses | 2,444 | |||

Registration expenses | 1,360 | |||

Pricing expenses | 894 | |||

24f-2 expenses | 43 | |||

Overdraft fees expenses | 5 | |||

|

| |||

Total Expenses | 85,398 | |||

Less: Fees waived and reimbursed by Adviser | (76,977 | ) | ||

|

| |||

Net operating expenses | 8,421 | |||

|

| |||

Net Investment Income | 2,856 | |||

|

| |||

Realized & Unrealized Gain on Investments | ||||

Net realized gain (loss) on investment securities | 7,512 | |||

Change in unrealized appreciation (depreciation) on investment securities | 133,124 | |||

|

| |||

Net realized and unrealized gain (loss) on investment securities | 140,636 | |||

|

| |||

Net increase (decrease) in net assets resulting from operations | $ | 143,492 | ||

|

|

| (a) | For the period December 22, 2011 (commencement of operations) to April 30, 2012. |

| (a) | See Note 4 in the Notes to the Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

8

Granite Value Fund

Statements of Changes In Net Assets

| For the Period Ended April 30, 2012 (Unaudited) (a) | ||||

Increase (Decrease) in Net Assets due to: | ||||

Operations | ||||

Net investment income (loss) | $ | 2,856 | ||

Net realized gain (loss) on investment securities | 7,512 | |||

Change in unrealized appreciation (depreciation) on investment securities | 133,124 | |||

|

| |||

Net increase (decrease) in net assets resulting from operations | 143,492 | |||

|

| |||

Capital Share Transactions | ||||

Proceeds from shares sold | 2,753,176 | |||

Proceeds from redemption fees collected (b) | 1 | |||

Amount paid for shares redeemed | (44 | ) | ||

|

| |||

Net increase in net assets resulting from capital share transactions | 2,753,133 | |||

|

| |||

Total Increase in Net Assets | 2,896,625 | |||

|

| |||

Net Assets | ||||

Beginning of period | — | |||

|

| |||

End of period | $ | 2,896,625 | ||

|

| |||

Undistributed net investment income included in net assets at end of period | $ | 2,856 | ||

|

| |||

Capital Share Transactions | ||||

Shares sold | 263,090 | |||

Shares redeemed | (4 | ) | ||

|

| |||

Net increase from capital share transactions | 263,086 | |||

|

| |||

| (a) | For the period December 22, 2011 (commencement of operations) to April 30, 2012. |

| (b) | The Funds charge a 2% redemption fee on shares redeemed within 60 calendar days of purchase. Shares are redeemed at the net asset value if held longer than 60 calendar days. |

See accompanying notes which are an integral part of these financial statements.

9

Granite Value Fund

Financial Highlights

(For a share outstanding during each period)

| For the Period Ended April 30, 2012 (Unaudited) (a) | ||||

Selected Per Share Data: | ||||

Net asset value, beginning of period | $ | 10.00 | ||

|

| |||

Income from investment operations: | ||||

Net investment income | 0.01 | |||

Net realized and unrealized gain on investments | 1.00 | |||

|

| |||

Total from investment operations | 1.01 | |||

|

| |||

Paid in capital from redemption fees (b) | — | |||

|

| |||

Net asset value, end of period | $ | 11.01 | ||

|

| |||

Total Return (c) | 10.10 | % (d) | ||

Ratios and Supplemental Data: | ||||

Net assets, end of period (000) | $ | 2,897 | ||

Ratio of net expenses to average net assets | 1.35 | % (e) | ||

Ratio of expenses to average net assets before waiver and reimbursement | 13.70 | % (e) | ||

Ratio of net investment income to average net assets | 0.46 | % (e) | ||

Ratio of net investment income to average net assets before waiver and reimbursement | (11.89 | )%(e) | ||

Portfolio turnover rate | 14.51 | % (d) | ||

| (a) | For the period December 22, 2011 (commencement of operations) to April 30, 2012. |

| (b) | Resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Not annualized. |

| (e) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

10

Granite Value Fund

Notes to the Financial Statements

April 30, 2012

(Unaudited)

NOTE 1. ORGANIZATION

The Granite Value Fund (the “Fund”) is an open-end diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Trustees. The Fund’s investment adviser is Granite Investment Advisors, Inc. (the “Adviser”). The investment objective of the Fund is to provide long-term capital appreciation.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the period ended April 30, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Trustees).

Security Transactions and Related Income - The Fund follows industry practice and records security transactions on the trade date. The first in first out (“FIFO”) method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions - The Fund intends to distribute substantially all of its net investment income, if any, as dividends to its shareholders on at least an annual basis. The Fund intends to distribute its net realized long term capital gains and its net realized short term capital gains, if any, at least once a year. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

11

Granite Value Fund

Notes to the Financial Statements - continued

April 30, 2012

(Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. Accounting principles generally accepted in the United States of America (“GAAP”) establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such as a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – quoted prices in active markets for identical securities |