united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

| Investment Company Act file number | 811-22208 |

| Valued Advisers Trust |

| (Exact name of registrant as specified in charter) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 | Cincinnati, OH 45246 |

| (Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Bryan Ashmus

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | 1/31 | |

| Date of reporting period: | 7/31/18 |

Item 1. Reports to Stockholders.

Golub Group Equity Fund

Semi-Annual Report

July 31, 2018

Fund Adviser:

Golub Group, LLC

1850 Gateway Drive, Suite 100

San Mateo, CA 94404

Toll Free (866) 954-6682

Investment Results (Unaudited)

Average Annual Total Returns as of July 31, 2018 (a)

| Six Months | One Year | Three Year | Five Year | Since Inception |

Golub Group Equity Fund | -0.77% | 8.49% | 9.10% | 10.19% | 13.83% |

S&P 500® Index(b) | 0.70% | 16.24% | 12.52% | 13.12% | 16.69% |

Total annual operating expenses, as disclosed in the most recent Golub Group Equity Fund (the “Fund”) prospectus dated May 31, 2018, were 1.35% of average daily net assets (1.27% after fee waivers/expense reimbursements by Golub Group, LLC (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund until May 31, 2019, so that Total Annual Fund Operating Expenses do not exceed 1.25%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees of Valued Advisers Trust (the “Trust”), and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies that have their own expenses. Each fee waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following the date in which the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the fee waiver or expense reimbursement.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (866) 954-6682.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Information pertaining to the Fund’s expense ratios as of July 31, 2018 can be found in the financial highlights. Total returns for periods less than one year are not annualized. |

(b) | The S&P 500® Index (“Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (866) 954-6682. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

1

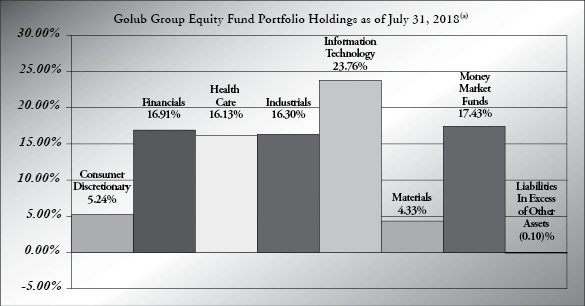

Fund Holdings (Unaudited)

(a) | As a percentage of net assets. As of July 31, 2018, the Fund held no securities in the Energy, Real Estate, Telecommunication Services or Utilities sectors. |

The investment objective of the Fund is to provide long-term capital appreciation. A secondary objective is to provide current income.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

2

Golub Group Equity Fund

Schedule of Investments (Unaudited)

July 31, 2018

Shares |

| Fair Value | ||||||

COMMON STOCKS — 82.67% | ||||||||

Consumer Discretionary — 5.24% | ||||||||

| 559 | Booking Holdings, Inc.(a) | $ | 1,134,054 | |||||

| 15,165 | Expedia Group, Inc. | 2,029,684 | ||||||

| 3,163,738 | ||||||||

Financials — 16.91% | ||||||||

| 71,930 | Bank of America Corporation | 2,221,198 | ||||||

| 32,135 | Bank of New York Mellon Corporation (The) | 1,718,258 | ||||||

| 21,970 | Berkshire Hathaway, Inc., Class B(a) | 4,347,205 | ||||||

| 26,610 | Citigroup, Inc. | 1,912,993 | ||||||

| 10,199,654 | ||||||||

Health Care — 16.13% | ||||||||

| 20,555 | Allergan plc | 3,783,970 | ||||||

| 9,950 | Laboratory Corporation of America Holdings(a) | 1,744,633 | ||||||

| 20,495 | Medtronic plc | 1,849,264 | ||||||

| 28,040 | Novartis AG - ADR | 2,352,556 | ||||||

| 9,730,423 | ||||||||

Industrials — 16.30% | ||||||||

| 35,905 | Colfax Corporation(a) | 1,159,732 | ||||||

| 8,275 | Deere & Company | 1,198,137 | ||||||

| 85,895 | Flowserve Corporation | 3,807,726 | ||||||

| 123,215 | General Electric Company | 1,679,420 | ||||||

| 5,725 | W.W. Grainger, Inc. | 1,984,056 | ||||||

| 9,829,071 | ||||||||

Information Technology — 23.76% | ||||||||

| 2,380 | Alphabet, Inc., Class A(a) | 2,920,783 | ||||||

| 10,835 | Apple, Inc. | 2,061,792 | ||||||

| 26,940 | Cognizant Technology Solutions Corporation, Class A | 2,195,609 | ||||||

| 9,350 | Facebook, Inc., Class A(a) | 1,613,623 | ||||||

| 20,295 | Fiserv, Inc.(a) | 1,531,867 | ||||||

| 20,685 | Microsoft Corporation | 2,194,265 | ||||||

| 13,250 | Visa, Inc., Class A | 1,811,805 | ||||||

| 14,329,744 | ||||||||

Materials — 4.33% | ||||||||

| 139,665 | Owens-Illinois, Inc.(a) | 2,608,942 | ||||||

Total Common Stocks (Cost $38,881,084) | 49,861,572 | |||||||

See accompanying notes which are an integral part of these financial statements. | 3 |

Golub Group Equity Fund

Schedule of Investments (Unaudited) (continued)

July 31, 2018

Shares |

| Fair Value | ||||||

MONEY MARKET FUNDS — 17.43% | ||||||||

| 10,511,803 | Fidelity Investments Money Market Government Portfolio, Institutional Class, 1.84%(b) | $ | 10,511,803 | |||||

Total Money Market Funds (Cost $10,511,803) | 10,511,803 | |||||||

Total Investments — 100.10% (Cost $49,392,887) | 60,373,375 | |||||||

Liabilities in Excess of Other Assets — (0.10)% | (60,552 | ) | ||||||

NET ASSETS — 100.00% | $ | 60,312,823 | ||||||

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of July 31, 2018. |

ADR – American Depositary Receipt

The sectors shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

4 | See accompanying notes which are an integral part of these financial statements. |

Golub Group Equity Fund

Statement of Assets and Liabilities (Unaudited)

July 31, 2018

Assets | ||||

Investments in securities at fair value (cost $49,392,887) | $ | 60,373,375 | ||

Dividends receivable | 30,330 | |||

Prepaid expenses | 5,387 | |||

Total Assets | 60,409,092 | |||

Liabilities | ||||

Payable for fund shares redeemed | 22,000 | |||

Payable to Adviser | 46,154 | |||

Payable to Administrator | 9,350 | |||

Other accrued expenses | 18,765 | |||

Total Liabilities | 96,269 | |||

Net Assets | $ | 60,312,823 | ||

Net Assets consist of: | ||||

Paid-in capital | $ | 45,872,413 | ||

Accumulated net investment income | 7,567 | |||

Accumulated net realized gain from investments | 3,452,355 | |||

Net unrealized appreciation on investments | 10,980,488 | |||

Net Assets | $ | 60,312,823 | ||

Shares outstanding (unlimited number of shares authorized, no par value) | 3,128,999 | |||

Net asset value ("NAV"), offering and redemption price per share | $ | 19.28 | ||

See accompanying notes which are an integral part of these financial statements. | 5 |

Golub Group Equity Fund

Statement of Operations (Unaudited)

For the six months ended July 31, 2018

Investment Income | ||||

Dividend income (net of foreign taxes withheld of $26,593) | $ | 404,217 | ||

Total investment income | 404,217 | |||

Expenses | ||||

Investment Adviser | 291,484 | |||

Administration | 29,103 | |||

Fund accounting | 12,397 | |||

Transfer agent | 9,917 | |||

Audit and tax preparation | 8,828 | |||

Legal | 8,668 | |||

Printing | 6,216 | |||

Custodian | 5,113 | |||

Insurance | 4,038 | |||

Trustee | 3,586 | |||

Registration | 2,870 | |||

Miscellaneous | 8,379 | |||

Total expenses | 390,599 | |||

Fees contractually waived by Adviser | (26,322 | ) | ||

Net operating expenses | 364,277 | |||

Net investment income | 39,940 | |||

Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

Net realized gain on investment securities transactions | 1,783,840 | |||

Net change in unrealized depreciation of investment securities | (2,385,118 | ) | ||

Net realized and change in unrealized loss on investments | (601,278 | ) | ||

Net decrease in net assets resulting from operations | $ | (561,338 | ) | |

6 | See accompanying notes which are an integral part of these financial statements. |

Golub Group Equity Fund

Statements of Changes in Net Assets

For the | For the | |||||||

Increase (Decrease) in Net Assets due to: | ||||||||

Operations | ||||||||

Net investment income | $ | 39,940 | $ | 6,341 | ||||

Net realized gain on investment securities transactions | 1,783,840 | 4,778,617 | ||||||

Net change in unrealized appreciation (depreciation) of investment securities | (2,385,118 | ) | 4,959,470 | |||||

Net increase (decrease) in net assets resulting from operations | (561,338 | ) | 9,744,428 | |||||

Distributions From | ||||||||

Net realized gains | — | (4,486,398 | ) | |||||

Total distributions | — | (4,486,398 | ) | |||||

Capital Transactions | ||||||||

Proceeds from shares sold | 2,469,604 | 5,238,281 | ||||||

Reinvestment of distributions | — | 4,486,398 | ||||||

Amount paid for shares redeemed | (3,967,966 | ) | (6,428,589 | ) | ||||

Net increase (decrease) in net assets resulting from capital transactions | (1,498,362 | ) | 3,296,090 | |||||

Total Increase (Decrease) in Net Assets | (2,059,700 | ) | 8,554,120 | |||||

Net Assets | ||||||||

Beginning of period | 62,372,523 | 53,818,403 | ||||||

End of period | $ | 60,312,823 | $ | 62,372,523 | ||||

Accumulated net investment income (loss) | $ | 7,567 | $ | (32,373 | ) | |||

Share Transactions | ||||||||

Shares sold | 133,274 | 279,029 | ||||||

Shares issued in reinvestment of distributions | — | 246,235 | ||||||

Shares redeemed | (213,605 | ) | (341,724 | ) | ||||

Net increase (decrease) in shares outstanding | (80,331 | ) | 183,540 | |||||

See accompanying notes which are an integral part of these financial statements. | 7 |

Golub Group Equity Fund

Financial Highlights

(For a share outstanding during each period)

For the Six |

| |||||||||||||||||||||||

2018 | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

Selected Per Share Data | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 19.43 | $ | 17.79 | $ | 15.96 | $ | 17.98 | $ | 17.94 | $ | 15.76 | ||||||||||||

Investment operations: | ||||||||||||||||||||||||

Net investment income | 0.01 | — | (a) | 0.04 | 0.06 | 0.07 | 0.10 | (b) | ||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.16 | ) | 3.13 | 3.18 | 0.11 | 1.54 | 3.09 | |||||||||||||||||

Total from investment operations | (0.15 | ) | 3.13 | 3.22 | 0.17 | 1.61 | 3.19 | |||||||||||||||||

Less distributions to shareholders from: | ||||||||||||||||||||||||

Net investment income | — | — | (0.05 | ) | (0.05 | ) | (0.07 | ) | (0.10 | ) | ||||||||||||||

Net realized gains | — | (1.49 | ) | (1.34 | ) | (2.14 | ) | (1.50 | ) | (0.91 | ) | |||||||||||||

Total distributions | — | (1.49 | ) | (1.39 | ) | (2.19 | ) | (1.57 | ) | (1.01 | ) | |||||||||||||

Net asset value, end of period | $ | 19.28 | $ | 19.43 | $ | 17.79 | $ | 15.96 | $ | 17.98 | $ | 17.94 | ||||||||||||

Total Return(c) | (0.77 | )%(d) | 18.18 | % | 20.21 | % | 0.42 | % | 8.74 | % | 20.20 | % | ||||||||||||

Ratios and Supplemental Data: | ||||||||||||||||||||||||

Net assets, end of period (000 omitted) | $ | 60,313 | $ | 62,373 | $ | 53,818 | $ | 43,939 | $ | 46,249 | $ | 41,084 | ||||||||||||

Ratio of expenses to average net assets after expense waiver | 1.25 | %(e) | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | ||||||||||||

Ratio of expenses to average net assets before expense waiver | 1.34 | %(e) | 1.33 | % | 1.37 | % | 1.40 | % | 1.39 | % | 1.45 | % | ||||||||||||

Ratio of net investment income to average net assets after expense waiver | 0.14 | %(e) | 0.01 | % | 0.22 | % | 0.34 | % | 0.33 | % | 0.58 | % | ||||||||||||

Portfolio turnover rate | 14.88 | %(d) | 22.38 | % | 26.59 | % | 42.99 | % | 34.45 | % | 29.83 | % | ||||||||||||

(a) | Rounds to less than $0.005 per share. |

(b) | Net investment income per share is calculated by dividing net investment income by the average shares outstanding throughout the year. |

(c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(d) | Not annualized. |

(e) | Annualized. |

8 | See accompanying notes which are an integral part of these financial statements. |

Golub Group Equity Fund

Notes to the Financial Statements (Unaudited)

July 31, 2018

NOTE 1. ORGANIZATION

The Golub Group Equity Fund (the “Fund”) was organized as an open-end diversified series of Valued Advisers Trust (the “Trust”) on April 1, 2009. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Golub Group, LLC (the “Adviser”). The investment objective of the Fund is to provide long-term capital appreciation. A secondary objective is to provide current income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended July 31, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the six months ended July 31, 2018, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis.

9

Golub Group Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

July 31, 2018

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For financial statement and income tax purposes, the specific identification method is used for determining capital gains or losses. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

10

Golub Group Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

July 31, 2018

● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at net asset value (“NAV”) provided by the pricing service of the funds. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the owner might reasonably expect to receive upon the current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2018:

Valuation Inputs | ||||||||||||||||

Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks(a) | $ | 49,861,572 | $ | — | $ | — | $ | 49,861,572 | ||||||||

Money Market Funds | 10,511,803 | — | — | 10,511,803 | ||||||||||||

Total | $ | 60,373,375 | $ | — | $ | — | $ | 60,373,375 | ||||||||

(a) | Refer to Schedule of Investments for sector classifications. |

11

Golub Group Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

July 31, 2018

The Fund did not hold any investments at the end of the reporting period for which other significant observable inputs (Level 2) were used in determining fair value. The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period. There were no transfers between any levels as of July 31, 2018 based on hierarchy levels assigned at January 31, 2018.

NOTE 4. TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly, at an annual rate of 1.00% of the average daily net assets of the Fund. For the six months ended July 31, 2018, the Adviser earned a fee of $291,484 from the Fund before the waivers described below. At July 31, 2018, the Fund owed the Adviser $46,154.

The Adviser has contractually agreed to waive its management fee or limit its fee and reimburse certain Fund operating expenses, until May 31, 2019, so that the ratio of total annual operating expenses does not exceed 1.25%. This operating expense limitation does not apply to interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a plan of distribution under Rule 12b-1, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses.” Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of investing in other investment companies, including exchange-traded funds, closed-end funds and money market funds that have their own expenses. For the six months ended July 31, 2018, the Adviser waived fees of $26,322. Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Fund within three years following the month in which that particular waiver or reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in effect at the time of the waiver and any expense limitation in place at the time of repayment. As of July 31, 2018, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements in the amount of $172,351 from the Fund no later than July 31, 2021.

The Trust retains Ultimus Fund Solutions, LLC (the “Administrator”) to provide the Fund with administration and compliance, fund accounting, and transfer agent services, including all regulatory reporting. Prior to April 12, 2018, Ultimus Asset Services, LLC, an affiliate of the Administrator, provided these services. For the six months ended July 31, 2018, the Administrator earned fees of $29,103 for administration services, $12,397 for fund accounting services and $9,917 for transfer agent services. At July 31, 2018, the Fund owed the Administrator $9,350 for such services.

12

Golub Group Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

July 31, 2018

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. There were no payments made to the Distributor by the Fund for the six months ended July 31, 2018.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “1940 Act”). The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 Expenses actually incurred. It is anticipated that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to achieve efficiently its investment objectives and to realize economies of scale. The Plan is not active and will not be activated prior to May 31, 2019.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the six months ended July 31, 2018, the cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $7,425,581 and $10,149,248, respectively.

NOTE 6. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. At July 31, 2018, Charles Schwab & Co., Inc. (“Schwab”) owned, as record shareholder, 95% of the outstanding shares of the Fund. It is not known whether Schwab or any of the underlying beneficial owners owned or controlled 25% or more of the voting securities of the Fund.

NOTE 7. FEDERAL TAX INFORMATION

At July 31, 2018, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

Gross Appreciation | $ | 12,515,817 | ||

Gross Depreciation | (1,535,848 | ) | ||

Net Appreciation on Investments | $ | 10,979,969 |

At July 31, 2018, the aggregate cost of securities for federal income tax purposes was $49,393,406.

13

Golub Group Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

July 31, 2018

The tax characterization of distributions for the fiscal year ended January 31, 2018 was as follows:

| 2018 | |||

Distributions paid from: | ||||

Ordinary Income* | $ | 110,328 | ||

Long-Term Capital Gains | 4,376,070 | |||

| $ | 4,486,398 | ||

* | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At January 31, 2018, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

Undistributed Long-Term Capital Gains | $ | 1,669,034 | ||

Accumulated Capital and Other Losses | (32,373 | ) | ||

Unrealized Appreciation (Depreciation) | 13,365,087 | |||

| $ | 15,001,748 |

At January 31, 2018, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

Under current tax law, net investment losses after December 31 and capital losses realized after October 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund deferred $32,373 of qualified late year ordinary losses.

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 9. SUBSEQUENT EVENT

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

14

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fee: and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example in the table below is based on an investment of $1,000 invested at the beginning of the period, and held for the six month period from February 1, 2018 to July 31, 2018.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning | Ending | Expenses |

Actual | $ 1,000.00 | $ 992.30 | $6.17 |

Hypothetical(b) | $ 1,000.00 | $ 1,018.60 | $6.26 |

(a) | Expenses are equal to the Fund’s annualized net expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 181/365. |

(b) | Assumes a 5% return before expenses. |

15

FACTS | WHAT DOES VALUED ADVISERS TRUST DO WITH YOUR PERSONAL INFORMATION? |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

■ Social Security number ■ account balances and account transactions ■ account transactions, transaction or loss history and purchase history ■ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Valued Advisers Trust chooses to share; and whether you can limit this sharing. |

Reasons we can share your personal information | Does Valued Advisers Trust share? |

For our everyday business purposes — | Yes |

For our marketing purposes — | Yes |

For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes – | No |

For our affiliates’ everyday business purposes – | No |

For nonaffiliates to market to you | No |

Questions? | Call 1-866-954-6682 |

16

Who we are | |

Who is providing this notice? | Valued Advisers Trust |

What we do | |

How does Valued Advisers Trust protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

How does Valued Advisers Trust collect my personal information? | We collect your personal information, for example, when you

■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account or provide account information ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

Why can’t I limit all sharing? | Federal law gives you the right to limit only

■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions | |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.

■ Valued Advisers Trust does not share your personal information with nonaffiliates so they can market to you. |

Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

■ Valued Advisers Trust doesn’t jointly market financial products or services to you. |

17

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, is available without charge upon request by (1) calling the Fund at (866) 954-6682 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

Trustees

Andrea N. Mullins, Chairperson

Ira P. Cohen

Mark J. Seger

Officers

Adam T. Kornegay, Principal Executive Officer and President

Bryan W. Ashmus, Principal Financial Officer and Treasurer

Brandon R. Kipp, Chief Compliance Officer

Carol J. Highsmith, Vice President and Secretary

Investment Adviser

Golub Group, LLC

1850 Gateway Drive, Suite 100

San Mateo, CA 94404

Distributor

Unified Financial Securities, LLC

9465 Counselors Row, Suite 200

Indianapolis, IN 46240

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

Legal Counsel

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

Custodian

Huntington National Bank

41 South High Street

Columbus, OH 43215

Administrator, Transfer Agent and Fund Accountant

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, LLC

Member FINRA/SIPC

BELMONT THETA INCOME FUND

Semi-Annual Report

July 31, 2018

Fund Adviser:

Belmont Capital, LLC

1875 Century Park E., Suite 1780

Los Angeles, CA 90067

(310) 203-2670

Investment Results (Unaudited)

Total Returns(a)

(For the period ended July 31, 2018)

| Since Inception |

Belmont Theta Income Fund - Institutional Class | 1.95% |

CBOE S&P 500 Iron Condor Index® (b) | 2.86% |

Total annual operating expenses based on estimated amounts for the current fiscal year, as disclosed in the Belmont Theta Income Fund (the “Fund”) prospectus dated April 16, 2018, were 2.40% of average daily net assets (1.99% after fee waivers/expense reimbursements by Belmont Capital, LLC (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund until May 31, 2020, so that Total Annual Fund Operating Expenses do not exceed 1.99%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees of Valued Advisers Trust (the “Trust”), and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including exchange-traded funds (“ETFs”), that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following such waiver or expense reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of fee waiver or expense reimbursement.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 789-1087.

(a) | Total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Information pertaining to the Fund’s expense ratios as of July 31, 2018 can be found in the financial highlights. Total returns for periods less than one year are not annualized. |

(b) | The CBOE S&P® 500 Iron Condor Index (“Index”) is designed to track the performance of a hypothetical option trading strategy that 1) sells a rolling monthly out-of-the-money (OTM) S&P 500 Index (SPX) put option (delta ≈ - 0.20) and a rolling monthly out-of-the-money (OTM) SPX call option (delta ≈ 0.20); 2) buys a rolling monthly OTM SPX put option (delta ≈ - 0.05) and a rolling monthly OTM SPX call option (delta ≈ 0.05) to reduce risk; and 3) holds a money market account invested in one-month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

1

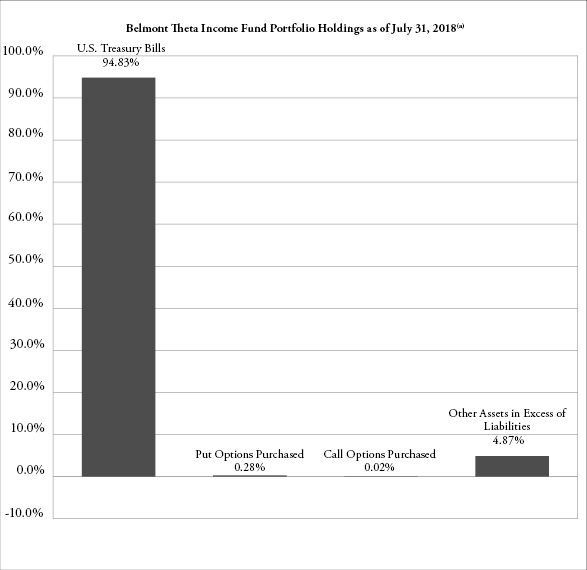

Fund Holdings (Unaudited)

July 31, 2018

(a) | As a percentage of net assets. |

The investment objective of the Fund is to seek long-term growth of capital and income generation with limited correlation to equity markets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of investments with the Securities and Exchange Commission (“SEC”) as of the end of the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

2

Belmont Theta Income Fund

Schedule of Investments

July 31, 2018 (Unaudited)

Principal |

| Fair Value | ||||||

U.S. GOVERNMENT & AGENCY OBLIGATIONS (a) — 94.83% | ||||||||

| $ | 250,000 | U.S. Treasury Bill, 1.95%, 12/13/2018 | $ | 248,109 | ||||

| 500,000 | U.S. Treasury Bill, 1.87%, 10/25/2018 | 497,696 | ||||||

| 1,000,000 | U.S. Treasury Bill, 1.89%, 10/18/2018 | 995,772 | ||||||

| 1,000,000 | U.S. Treasury Bill, 2.05%, 1/17/2019 | 990,095 | ||||||

| 500,000 | U.S. Treasury Bill, 2.04%, 1/24/2019 | 494,793 | ||||||

| 5,000 | U.S. Treasury Bill, 1.81%, 8/16/2018 | 4,996 | ||||||

| 275,000 | U.S. Treasury Bill, 1.97%, 11/15/2018 | 273,382 | ||||||

| 1,500,000 | U.S. Treasury Bill, 2.19%, 4/25/2019 | 1,474,955 | ||||||

| 1,250,000 | U.S. Treasury Bill, 1.81%, 8/9/2018 | 1,249,485 | ||||||

Total U.S. Government & Agency Obligations (Cost $6,231,503) | 6,229,283 | |||||||

Description | Number of | Notional | Exercise | Expiration | Fair Value | ||||||||||||

PUT OPTIONS PURCHASED — 0.28% | |||||||||||||||||

S&P 500 Index | 70 | $ | 19,714,030 | $ | 2,275.00 | September 2018 | $ | 17,850 | |||||||||

Total Put Options Purchased (Cost $23,886) |

| 17,850 | |||||||||||||||

CALL OPTIONS PURCHASED — 0.02% | |||||||||||||||||

S&P 500 Index | 70 | $ | 19,714,030 | $ | 2,950.00 | August 2018 | $ | 1,575 | |||||||||

Total Call Options Purchased (Cost $3,280) | 1,575 | ||||||||||||||||

Total Investments — 95.13% (Cost $6,258,669) | 6,248,708 | ||||||||||||||||

Other Assets in Excess of Liabilities — 4.87% | 319,928 | ||||||||||||||||

NET ASSETS — 100.00% | $ | 6,568,636 | |||||||||||||||

(a) | The rate shown represents effective yield at time of purchase. |

See accompanying notes which are an integral part of these financial statements. | 3 |

Belmont Theta Income Fund

Schedule of Open Written Option Contracts

July 31, 2018 (Unaudited)

Description | Number of | Notional | Exercise | Expiration | Fair Value | ||||||||||||

Written Call Options | |||||||||||||||||

S&P 500 Index | (70 | ) | $ | (19,714,030 | ) | $ | 2,860.00 | August 2018 | $ | (31,150 | ) | ||||||

Total Written Call Options (Premiums Received $30,514) | (31,150 | ) | |||||||||||||||

Written Put Options | |||||||||||||||||

S&P 500 Index | (70 | ) | $ | (19,714,030 | ) | $ | 2,660.00 | August 2018 | $ | (20,300 | ) | ||||||

Total Written Put Options (Premiums Received $44,414) | (20,300 | ) | |||||||||||||||

Total Written Options (Premiums Received $74,928) | $ | (51,450 | ) | ||||||||||||||

4 | See accompanying notes which are an integral part of these financial statements. |

Belmont Theta Income Fund

Statement of Assets and Liabilities

July 31, 2018 (Unaudited)

Assets | ||||

Investments in securities at fair value (cost $6,258,669) | $ | 6,248,708 | ||

Cash held at broker for option transactions | 80,692 | |||

Cash | 299,288 | |||

Interest receivable | 562 | |||

Receivable from Adviser | 11,138 | |||

Deferred offering cost | 5,712 | |||

Prepaid expenses | 1,137 | |||

Total Assets | 6,647,237 | |||

Liabilities | ||||

Options written, at value (premium received $74,928) | 51,450 | |||

Payable to Administrator | 6,056 | |||

Other accrued expenses | 21,095 | |||

Total Liabilities | 78,601 | |||

Net Assets | $ | 6,568,636 | ||

Net Assets consist of: | ||||

Paid-in capital | 6,522,790 | |||

Accumulated net investment loss | (1,404 | ) | ||

Accumulated undistributed net realized gain from investments | 33,733 | |||

Net unrealized appreciation (depreciation) on: | ||||

Investments | (9,961 | ) | ||

Written options | 23,478 | |||

Net Assets | $ | 6,568,636 | ||

Shares outstanding (unlimited number of shares authorized, no par value) | 322,115 | |||

Net asset value ("NAV") and offering price per share | $ | 20.39 | ||

See accompanying notes which are an integral part of these financial statements. | 5 |

Belmont Theta Income Fund

Statement of Operations

For the period ended July 31, 2018 (a) (Unaudited)

Investment Income | ||||

Dividend income | $ | 242 | ||

Interest income | 10,544 | |||

Total investment income | 10,786 | |||

Expenses | ||||

Organizational | 19,000 | |||

Investment Adviser | 10,011 | |||

Administration | 9,000 | |||

Fund accounting | 6,054 | |||

Audit and tax preparation | 6,000 | |||

Offering | 5,898 | |||

Legal | 4,746 | |||

Report printing | 3,333 | |||

Transfer agent | 3,000 | |||

Trustee | 2,272 | |||

Custodian | 1,000 | |||

Interest | 804 | |||

Other | 9,169 | |||

Total expenses | 80,287 | |||

Fees contractually waived and expenses reimbursed by Adviser | (68,097 | ) | ||

Net operating expenses | 12,190 | |||

Net investment loss | (1,404 | ) | ||

Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

Net realized gain (loss) on: | ||||

Investment securities | (5,815 | ) | ||

Written options | 39,548 | |||

Change in unrealized appreciation (depreciation) on: | ||||

Investment securities | (9,961 | ) | ||

Written options | 23,478 | |||

Net realized and change in unrealized gain on investments | 47,250 | |||

Net increase in net assets resulting from operations | $ | 45,846 | ||

(a) | For the period April 30, 2018 (commencement of operations) through July 31, 2018. |

6 | See accompanying notes which are an integral part of these financial statements. |

Belmont Theta Income Fund

Statement of Changes in Net Assets

For the | ||||

Increase (Decrease) in Net Assets due to: | ||||

Operations | ||||

Net investment loss | $ | (1,404 | ) | |

Net realized gain on investment securities transactions | 33,733 | |||

Net change in unrealized appreciation of investment securities | 13,517 | |||

Net increase in net assets resulting from operations | 45,846 | |||

Capital Transactions - Institutional Class: | ||||

Proceeds from shares sold | 6,555,394 | |||

Amount paid for shares redeemed | (32,604 | ) | ||

Total Institutional Class | 6,522,790 | |||

Net increase in net assets resulting from capital transactions | 6,522,790 | |||

Total Increase in Net Assets | 6,568,636 | |||

Net Assets | ||||

Beginning of period | — | |||

End of period | $ | 6,568,636 | ||

Accumulated net investment loss | $ | (1,404 | ) | |

Share Transactions - Institutional Class: | ||||

Shares sold | 323,722 | |||

Shares redeemed | (1,607 | ) | ||

Net increase in shares | 322,115 | |||

(a) | For the period April 30, 2018 (commencement of operations) through July 31, 2018. |

See accompanying notes which are an integral part of these financial statements. | 7 |

Belmont Theta Income Fund

Financial Highlights

(For a share outstanding during each period)

For the | ||||

Selected Per Share Data: | ||||

Net asset value, beginning of period | $ | 20.00 | ||

Investment operations: | ||||

Net investment loss | (0.00 | )(b) | ||

Net realized and unrealized gain on investments | 0.39 | |||

Total from investment operations | 0.39 | |||

Net asset value, end of period | $ | 20.39 | ||

Total Return (c) | 1.95 | %(d) | ||

Ratios and Supplemental Data: | ||||

Net assets, end of period (000) | $ | 6,569 | ||

Ratio of net expenses to average net assets | 2.13 | %(e)(f) | ||

Ratio of expenses to average net assets before waiver and reimbursement | 14.03 | %(e) | ||

Ratio of net investment income (loss) to average net assets | (0.25 | )%(e) | ||

Portfolio turnover rate | 0 | %(d) | ||

(a) | For the period April 30, 2018 (commencement of operations) through July 31, 2018. |

(b) | Amount is less than $0.005. |

(c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(d) | Not annualized. |

(e) | Annualized. |

(f) | This ratio includes the impact of broker interest fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 1.99% for the period ended July 31, 2018. |

8 | See accompanying notes which are an integral part of these financial statements. |

Belmont Theta Income Fund

Notes to the Financial Statements

July 31, 2018 (Unaudited)

NOTE 1. ORGANIZATION

The Belmont Theta Income Fund (the “Fund”) is an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund commenced operations on April 30, 2018. The Fund’s investment adviser is Belmont Capital, LLC d/b/a Belmont Capital GroupTM (the “Adviser”). The investment objective of the Fund is to seek long-term growth of capital and income generation with limited correlation to equity markets.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a “regulated investment company” (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the period ended July 31, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period ended July 31, 2018, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes.

9

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

July 31, 2018 (Unaudited)

Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to shareholders on at least an annual basis. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

Options – The Fund utilizes an option premium collection strategy that implements a put spread and a call spread on the S&P 500® Index (SPX) to create a number of defined-risk trades. A defined-risk trade is essentially where a series of financial instruments (such as options) are entered into where the terms and conditions of the financial instruments are, in combination, designed to limit the overall risk. Stock index options are put options and call options on various stock indices. In most respects, they are identical to listed options on common stocks. The option holder who exercises the index option receives an amount of cash if the closing level of the stock index upon which the option is based is greater than, in the case of a call, or less than, in the case of a put, the exercise price of the option. Options trading is a highly specialized activity that entails greater than ordinary investment risk. Options may be more volatile than the underlying investments, and therefore may be subject to greater fluctuation than an investment in the underlying instruments themselves.

In implementing its option premium collection strategy, the Fund will sell (write) a put option (creating a short position) while simultaneously purchasing another put option at a different strike price (creating a long position) – the combination of these two put option positions creates a defined-risk trade. Additionally, the Fund will sell (write) a call option (creating another short position) while simultaneously purchasing another call option at a different strike price (creating another long position) – the combination of these two call options positions creates another defined-risk trade for the Fund. The Fund’s put spreads and call spreads each contain the following characteristics: (i) the long and short options of each spread have the same number of contracts, (ii) the long option of each spread will have a further out-of-the-money strike price than the short option; (iii) the long option of each spread will have at least the same or longer expiration date than the short option.

The Fund generally utilizes weekly and monthly SPX options with expirations of 90 days or less. SPX options are European-style options, which means that they can be exercised only at expiration. Based on the Adviser’s assessment of market conditions, the Adviser may close one or more sides of a spread at any time for purposes of risk management of the Fund.

10

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

July 31, 2018 (Unaudited)

The Adviser monitors all SPX option strikes for the optimal sale of put spreads and call spreads. Once the Fund has entered into a position, the Adviser attempts to realize as much of the net premium as possible. The Fund may decide to close its option spread positions prior to expiration, which may result in realizing less than the net option premium initially collected. Positions are generally re-set on a monthly basis, but the Adviser may determine to close and/or adjust option spreads prior to expiration for purposes of risk management. The Adviser may at times determine to take a temporary defensive position and not implement its option spread writing investment strategy. The option premium collection strategy may result in the generation of positive returns for the Fund; however, the loss potential if the strategy is not effective may be greater than the profit potential. The Fund may lose significantly more than the premium it receives in highly volatile market conditions.

The Fund is required to pledge collateral for the option trades and it will hold cash, money market instruments, or treasury bills as collateral for all such options trades. The Fund’s custodian will segregate such collateral for the benefit of the counterparty. Therefore, the Fund must typically maintain a large percentage of cash and cash equivalents within the Fund. The Fund’s option spread positions will effectively lever the portfolio and will target a notional exposure of no greater than three times the pledged collateral value.

Derivative Transactions – The following tables identify the location and fair value of derivative instruments on the Statement of Assets and Liabilities as of July 31, 2018, and the effect of derivative instruments on the Statement of Operations for the fiscal year ended July 31, 2018.

As of July 31, 2018:

| Location of Derivatives on Statement of Assets and Liabilities | ||||||||

| Derivatives | Asset Derivatives | Liability Derivatives | Fair Value | |||||

| Equity Risk: | ||||||||

| Options Purchased | Investments in securities at fair value | $ | 19,425 | |||||

| Options Written | Options written at fair value | 51,450 | ||||||

11

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

July 31, 2018 (Unaudited)

For the period ended July 31, 2018:

| Derivatives | Location of Gain (Loss) on Derivatives on Statement of Operations | Contracts Opened/ Written | Contracts Closed/ Expired | Realized Gain (Loss) on Derivatives | Change in Unrealized Appreciation (Depreciation) on Derivatives | |||||||||||||

| Equity Risk: | ||||||||||||||||||

| Options Purchased | Net realized gain (loss) and change in unrealized appreciation (depreciation) on investment securities | 240 | 100 | $ | (5,815 | ) | $ | (7,741 | ) | |||||||||

| Options Written | Net realized gain (loss) and change in unrealized appreciation (depreciation) on written option contracts | 220 | 80 | 39,548 | 23,478 | |||||||||||||

The Fund is not subject to a master netting arrangement and its policy is to not offset assets and liabilities related to its investment in derivatives.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

12

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

July 31, 2018 (Unaudited)

● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at net asset value (“NAV”). These securities are categorized as Level 1 securities.

Option contracts in which the Fund invests are generally traded on an exchange. Exchange-traded options on securities and indices purchased or sold by a Fund generally will be valued at the mean of the last bid and ask prices. If there is no such reported ask on the valuation date, options are valued at the most recent bid price. If there is no such reported bid on the valuation date, options are valued at the most recent ask price. The options will generally be categorized as Level 1 securities. If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined by the Adviser, in conformity with policies adopted by and subject to review of the Board. These securities will generally be categorized as Level 2 or 3 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Adviser would appear to be the amount that the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event

13

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

July 31, 2018 (Unaudited)

occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2018:

Valuation Inputs | ||||||||||||||||

Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

U.S. Treasury Bills | $ | — | $ | 6,229,283 | $ | — | $ | 6,229,283 | ||||||||

Put Options Purchased | 17,850 | — | — | 17,850 | ||||||||||||

Call Options Purchased | 1,575 | — | — | 1,575 | ||||||||||||

Total | $ | 19,425 | $ | 6,229,283 | $ | — | $ | 6,248,708 | ||||||||

Valuation Inputs | ||||||||||||||||

Liabilities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Written Call Options | $ | (31,150 | ) | $ | — | $ | — | $ | (31,150 | ) | ||||||

Written Put Options | (20,300 | ) | — | — | (20,300 | ) | ||||||||||

Total | $ | (51,450 | ) | $ | — | $ | — | $ | (51,450 | ) | ||||||

The Fund did not hold any investments during the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period. There were no transfers between any levels as of July 31, 2018 based on input levels assigned at April 30, 2018.

NOTE 4. TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly at an annual rate of 1.75% of the average daily net assets of the Fund. For the period ended July 31, 2018, the Adviser earned a fee of $10,011 from the Fund before the waivers described below.

The Adviser has contractually agreed to waive its management fee and/or reimburse certain operating expenses, until May 31, 2020, but only to the extent necessary so that the Fund’s net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, other expenditures which are capitalized in accordance with generally accepted accounting principles, and indirect expenses (such as “acquired funds fees and expenses”) do not exceed 1.99%.

14

Belmont Theta Income Fund

Notes to the Financial Statements (continued)

July 31, 2018 (Unaudited)

Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Fund within the three years following the date the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. The contractual agreement is in effect through May 31, 2020. The expense cap may not be terminated prior to this date except by the Board. For the period ended July 31, 2018, the Adviser waived fees or reimbursed expenses totaling $68,097. At July 31, 2018, the Adviser owed the Fund $11,138. As of July 31, 2018, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements of $68,097 from the Fund, pursuant to the aforementioned conditions, no later than July 31, 2021.

The Trust retains Ultimus Fund Solutions, LLC (the “Administrator”) to provide the Fund with administration and compliance, fund accounting, and transfer agent services, including all regulatory reporting. For the period ended July 31, 2018, the Administrator earned fees of $9,000 for administration services, $6,054 for fund accounting services and $3,000 for transfer agent services. At July 31, 2018, the Administrator was owed $6,056 for these services.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares.

NOTE 5. PURCHASES AND SALES OF SECURITIES