united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22208 |

| Valued Advisers Trust |

| (Exact name of registrant as specified in charter) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

| (Address of principal executive offices) (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Bryan Ashmus

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | 5/31 | |

| Date of reporting period: | 11/30/18 |

Item 1. Reports to Stockholders.

BFS Equity Fund

SEMI-ANNUAL REPORT

November 30, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (855) 575-2430 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (855) 575-2430. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

185 Asylum Street ● City Place II ● Hartford, CT 06103 ● (855) 575-2430

BFS Equity Fund

Letter to Shareholders

Dear Fellow Shareholders,

Greetings in the New Year! This semi-annual report covers the six-month period June 1, 2018 through November 30, 2018.

On June 1, 2018, the BFS Equity Fund (the “Fund”) had net assets of $31.8 million. During the course of the six-month period, the net assets of the Fund increased over 10% to $35.1 million as of November 30, 2018. This growth was driven both by inflows from investors into the Fund as well as by the positive investment returns achieved by the Fund over the six months. As of November 30, 2018, there were approximately 600 investors in the Fund.

This report includes a commentary from the Lead Portfolio Manager, Tim Foster, and Co-Portfolio Managers, Tom Sargent and Keith LaRose. You will also find a listing of the portfolio holdings as of November 30, 2018, as well as financial statements and detailed information about the performance and positioning of the Fund.

As 2018 draws to a close, the year will be remembered as one of transition with respect to the direction of the economic and market cycles. Many of the positive forces that affected the U.S. economy this year have more than likely peaked – GDP growth, corporate earnings and EPS growth, and one of the longest bull markets in history. During the last quarter of the year, signs of reversal began to emerge.

While valuations do not seem stretched at this time and the economy is stronger than it has been for many years, we do see more volatility and higher risk in the next several years. This is due to three main factors: 1) higher interest rates and tighter monetary policy; 2) elevated corporate borrowing; and 3) geopolitical risks – especially trade issues between China and the U.S.

While there seem to be few clouds on the horizon, investors often get worried when the skies appear to be so blue. A major worry for investors is the slow but steady increase in interest rates. While interest rates remain quite low in historical terms, the yield on the 10-year U.S. Treasury note has doubled since the fall of 2016. With the Federal Reserve raising the Fed Funds rate again in December, some investors predict the 10-year U.S. Treasury note will reach 4% or more in 2019. Another risk is the Fed’s slow but steady

1

tightening of monetary policy. In addition to raising the level of short-term interest rates, the Federal Reserve is shrinking its balance sheet by approximately $300 billion this year and it is projected that the Fed will further reduce its balance sheet by an additional $430 billion in 2019. While interest rates are still attractive and there remains ample liquidity, the less accommodative Fed monetary policy might negatively affect numerous borrowers that have taken on excessive debt over the years.

On the international front, the risk of a trade war with China is still high, as neither China nor the U.S. appears ready to yield. A key point in the U.S. negotiating position seems to be China’s requirement that U.S. companies form joint venture subsidiaries with Chinese counterparts in China, forcing a transfer of U.S. technology to China. High-level representatives of the U.S. and China are expected to meet in January, but investors worry that the high stakes poker game between them leaves little room for either to save face.

In an effort to mitigate these and other risks, our investment strategy focuses on investing in quality growth stocks that are positioned to provide a margin of safety in the case of economic or market weakness over the longer term. Of the 41 companies which the Fund owned as of November 30, 2018, 34 paid dividends, and several are so-called “dividend aristocrats” – companies which have increased their dividend payouts annually for the past 25 years. We believe the Fund’s ownership of shares in quality companies with strong brands, sound business models, good balance sheets, professional management, and robust cash flows should be able to withstand market corrections, even bear markets, and perform well over the longer term.

The Portfolio Managers of the BFS Equity Fund and I are shareholders together with you. We thank you for the trust that you have placed in us to manage your assets.

Sincerely,

Stephen L. Willcox

President

Bradley, Foster & Sargent, Inc.

2

BFS Equity Fund

Portfolio Managers Letter

TO OUR SHAREHOLDERS

The period ended November 30, 2018 marked the fifth anniversary for the BFS Equity Fund (“the Fund”). During this five-year period, the Fund has improved its net asset value from $10.00 (November 8, 2013) to $15.47. For the six-month semi-annual period from June 1, 2018 to November 30, 2018, the Fund produced a total return of 3.41%. For the trailing twelve-month period, the Fund produced a return of 7.26%. The S&P 500® Index (“S&P 500”) produced a total return of 3.02% for the comparable six-month period and 6.27% for the comparable twelve-month period. Over the five plus years since inception, the Fund has produced average yearly returns of 9.31% on an annualized basis. The S&P 500 produced a 11.45% annualized total return for the comparable since inception period.

It has been a good five years to be in the market. Stocks have enjoyed a relatively stable period of low inflation, low interest rates and solid economic growth. This has led to a period of relatively low volatility in the market – despite a few minor setbacks of 10% or so, the market has continued to grind higher. The two primary drivers of the stock market worked positively in synch – the Price to Earnings ratio (P/E) for the market expanded from a low- to mid-teen multiple to a high-teen multiple over this five-year period, while corporate earnings surged. More recently, the market encountered a close to 10% correction early in the fourth quarter of this year. This 10% decline in the “P,” combined with the 20+% growth in earnings, in the “E,” for the past several quarters, knocked that market P/E multiple back to slightly below the mean level for the past thirty years and back to a reasonably attractive level.

MARKET COMMENTARY

While the volatility of the past few months may feel worrisome to most, the good news is that the market is now actually behaving much closer to the statistical norm. The complacency that was rampant last year and earlier this year has finally evaporated. The aforementioned decline in price and coincident pop in earnings has set the stage for a reasonably valued market that has room to move higher.

There is, and will always be, plenty to worry about in terms of where the market goes from here, but that is how value in the marketplace is created. Investors fell in love with the FAANG stocks: Facebook, Apple, Amazon, Netflix and Google (Alphabet); and for

3

most of the past few years it seemed they were truly one-way stocks. They just go up. It was the same for Bitcoin last year. Since its inception several years ago, the value of Bitcoin only went up. That is, until the last marginal buyer got in, and then it went down. It looked very similar for the FAANG names through the third quarter of this year. They all went up until the trade got too crowded and the last buyer emptied his wallet. Now they are all in correction territory. For the market as a whole, for market sectors (like tech, energy, financials or FAANG) and for individual stocks as well, the bar needs to be reset periodically both in terms of current market price, as well as current expectations for the future, in order to create new opportunity. That dynamic is currently underway.

We see most of the current holdings in the Fund in that reset mode. Investors tend to reconsider when the second derivative changes in any of the market’s underpinnings. The 2019 economic backdrop remains positive, just a little less so than 2018. The 2019 corporate earnings outlook remains positive, but not the strong double-digit gains of 2018. The inflation outlook continues to look relatively benign, but CPI has been creeping up from 1% a couple of years ago to 2.2% currently. Real interest rates remain near zero, suggesting continued accommodative Fed policy, but less so than when real rates were negative just a few years ago. When a declining rate of change leads to the marginal buyer becoming the marginal seller, a correction is likely to ensue. The fourth quarter volatility we are experiencing now (which we believe to be more in the rearview mirror than a gaping hazard in the road ahead) is creating valuations that look quite reasonable again.

The real enemy of the market is excess, but fortunately, there is little excess to be had. Commodity prices have softened, not spiked. The yield curve is struggling to remain positively sloped, but has not sunk to a repressive level. Despite a modest widening of credit spreads, bank loan portfolios are in far better shape than prior cycle peaks. There are few real signs of speculation. The asset bubbles that had been floated, like Bitcoin, biotechs, bonds (near zero rates) and finally FAANG, have all burst. The market is healthier, and stocks remain our preferred vehicle for investment.

INVESTMENT STRATEGY

Stocks are now not expensive, but neither are they cheap. We have an imaginary temperature gauge for the BFSAX portfolio. That gauge can be controlled by dialing up the “heat” in the portfolio by adding new higher growth positions or increasing the weight of existing high growth positions, the likes of Amazon or Alphabet. As the market valuation becomes more expensive or there is a shift in structural forces, such as a repressive shift in the yield curve or economic growth exceeding its theoretical growth

4

rate, then we will likely choose to dial down the heat to take a more defensive posture – for example, trimming a stock like Adobe which is +45% year-to-date at the time of this report and sells at a P/E of 45x, then redeploying proceeds into a slower growing and higher yielding name like Chubb (-9.5% year to date, selling at a modest 14x and yielding nearly 2.2%). While no alarming economic data has surfaced in the past six months, we have seen a modest uptick in interest rates and flattening of the yield curve, a modest uptick in inflation and a modest decline in revenue growth rates for our portfolio holdings. Given that slight shift from economic tailwind to headwind, we are, on the margin, dialing down the heat in the BFSAX portfolio.

An ongoing course of action is to continually refocus on the underlying quality of each portfolio holding. An interesting case in point has been the unfortunate saga of General Electric (GE), a former holding of the Fund. GE is currently trading at a 20-year low as new management seeks to unwind many of the unsuccessful visions of prior leaders dating all the way back to the revered CEO, Jack Welch. As the “house that Jack built” slowly crumbled over the past 20 years, another company, Danaher, was laying new footings in the age of lean manufacturing to build an exemplary industry leader in the industrial and life sciences sectors. It is interesting that GE recently chose the former CEO of Danaher, Larry Culp, to spearhead their turnaround efforts. And it is no coincidence that Danaher now ranks as the Fund’s largest holding.

INVESTMENT COMMENTARY

While the recent correction in the overall market has been limited to about 10%, sector by sector some of the damage has been more severe. In particular, President Trump’s tough tariff stance has led to significant price pressure on the stocks of many of our leading industrials, putting some companies into bear market territory – down 20% or more. Despite the setback, we believe that as long as our economy continues to grow, leading global industrials like Caterpillar, Deere and Stanley Black & Decker will continue to grow and prosper. Similarly, Jerome Powell, the new chairman of the Federal Reserve, sounded quite hawkish last October 3rd when stating that rates for Fed Funds were well below the neutral rate. The prospect of an inverted yield curve sent financial stocks reeling. On November 28th, Mr. Powell moderated that view to suggest that the current Fed Funds rate may now be only slightly below the neutral rate. The Fed Funds rate has not changed between these comments, so we conjecture that Mr. Powell’s view of the robustness of the economy may have changed. The recent decline in the yield of the ten-year Treasury from 3.2% to less than 3.0% seems to reinforce that view. Rhetoric from the Beltway has

5

a long history of rattling markets and the BFSAX Fund is certainly not immune from being carried by that tide. As we have discussed in prior reports, however, our focus is on the individual companies within the BFSAX portfolio and it is our confidence in these companies that enables us to see through any current choppiness in the market.

Standard & Poor's recently reconfigured its 11-sector lineup, reclassifying a number of stocks. The telecommunication services sector has been eliminated and replaced by the new communication services sector, which includes the two prior tech sector heavyweights; Alphabet and Facebook. At the time of the change, the tech sector was reduced to a little more than 20% of the S&P 500, with the consumer discretionary sector reduced to just under 10%. The new communication services sector represented a little over 10% of the S&P 500.

Information Technology

The information technology sector was our heaviest weighted sector at 23.7%, an overweighting to the S&P 500 information technology sector weighting of 19.9%. In general, we see the information technology sector exhibiting the best prospects for growth versus all other S&P 500 sectors. The S&P 500 information technology sector slipped from its top performing position in the past several quarters, actually declining over the past six months. The Fund outperformed the S&P 500 information technology sector with the Fund’s information technology selections returning +2.9% over the past six months versus the S&P 500 information technology sector return of -2.1%. ADP was the Fund’s top performer (+14.5%), followed closely by Cisco (+13.7%), Microsoft (+13.1%) and Dolby Labs (+12.7%). Coherent (-26.6%) and TE Connectivity (-18.1%) reflected some of the sharp declines suffered by several technology companies over the period.

Healthcare

Healthcare advanced to the Fund’s second heaviest weighting at 20.2% versus the S&P 500 healthcare weighting of 15.8%. Healthcare runs a close second to information technology in terms of the best prospects for growth. Returns for the S&P 500 healthcare sector were the highest of all S&P 500 sectors at +16.3%, but the Fund managed to beat that with a return of +17.7%. Positive returns were across the board for the Fund’s healthcare holdings, and double-digit gains were mostly the rule for the sector with the best return of +24.4% coming from longstanding blue chip Johnson & Johnson. Also in

6

the 20+% return category were Illumina (+23.9%), Abbott (+21.4%) and Thermo Fisher Scientific (+20.0%). The Fund’s newest healthcare addition, Stryker, managed a modest +5.7% gain in the few days it has been held.

Industrial

The Fund’s third largest weighting, industrial, proved vexing over the past six months with two major headwinds challenging the sector. The U.S. dollar gained strength over the past six months, putting U.S. manufacturers at a price disadvantage to foreign competitors. In addition, the country’s President, who now Tweets himself “Tariff Man,” put U.S. industrials at a tremendous disadvantage by placing new tariffs on the incoming cost of commodities like steel. Retaliatory tariffs by many countries again raised the prices of U.S. manufactured goods sold abroad. The Fund’s overweighting, 15.1% versus the S&P 500 industrial weighting of 9.4%, did not help relative performance, nor did our stock selection, leading to a return of -4.7% versus -1.5% for the S&P 500 industrial. Prior winners for the Fund became losers during the period, with Raytheon (-15.6%) the Fund’s worst performer. Caterpillar became the poster child for the Trump tariff blues and lost -9.6%. Fortive, the Danaher industrial spin-off, eked out a modest gain of +4.8%. We have not lost faith in the sector and in fact see some of our best values in this sector. As long as the U.S. economy remains in a growth mode, we remain committed to Caterpillar, Deere, United Technologies, Raytheon and Stanley Black & Decker as global leaders providing essential equipment and services to meet the world’s needs in construction, food production, defense and transportation.

Financials

Financials ranked fourth largest among our sector weightings in the Fund, weighing in at 10.4% but underweighted to the S&P 500 financials weighting of 13.7%. Stock selection was helpful, with the Fund’s return of +4.4% better than the S&P 500 financials return of +0.2%. American Express (+15.0%) was the Fund’s best performer and Citigroup (-1.6%) was the Fund’s worst performer. In general, bank stocks were weak due to a flattening yield curve and investor concerns over declining credit worthiness in a decelerating economy.

Consumer Discretionary

Weighing in at 8.3%, consumer discretionary stocks were somewhat underweighted versus the S&P 500 consumer discretionary sector at 9.9%. The Fund outperformed the S&P 500 consumer discretionary sector with a return of +5.9% versus +2.2% for the S&P 500. The Fund’s biggest winner was Starbucks (+19.2%), which was purchased advantageously

7

after a sharp sell-off earlier in the year. The Fund’s biggest disappointment was home builder NVR (-8.1%). Rising mortgage rates this year put a very large damper on both existing and new home sales. The position was sold as we saw no near-term catalyst to improve home sales. Amazon is by far the largest component of the consumer discretionary sector and returned +3.7%. We reduced the Fund’s Amazon weighting at more favorable prices earlier in the year.

Communication Services

Communication services is a newly created S&P 500 sector. It includes media and social networking stocks, including: Alphabet, Disney and Facebook, which the Fund holds. Only Disney managed a meaningful positive return of +17.0%. Alphabet was relatively flat (+0.9%). Facebook, after a damaging data breach, lost -26.7%. The Fund’s sector return was -2.3% versus +5.4% for the S&P 500 sector.

Energy

One would typically think of energy as a classic late economic sector beneficiary as economic growth leads to more energy usage and higher prices. Rapid advances in shale drilling technology, however, ramped up U.S. production, which overwhelmed any OPEC attempt at raising prices through reduced production. Oil prices in the prior six months dove from near $80 per barrel to less than $50. The Fund was nearly equally weighted to the S&P 500 energy sector at 5.3% versus 5.4%. The Fund underperformed the index with a loss of -14.8% versus a loss in the S&P 500 sector index of -11.6%. We have always admired Schlumberger as the leading provider of drilling technology anywhere in the world. The stock appears very attractively valued to us and provides a healthy dividend yield, but market forces drove the price down -33.3%. Apache fell -11.2% and Chevron fell -2.5%, all contributing to the Fund’s negative performance in energy. Notwithstanding the advances in renewable energy and electric vehicles, oil will continue to be an essential fuel for many years. Oil has always been a volatile commodity and the current imbalance of supply and demand will surely correct. For the time being, we intend to maintain a roughly equal weighting of energy holdings in the Fund relative to the S&P 500 energy sector.

Consumer Staples

As we have discussed in prior reports, we have long admired the defensive characteristics of the consumer staples sector, but consumer spending continues to be extremely price-sensitive. With revenue growth for the sector diminishing and margin expansion

8

becoming more challenging, the Fund remains underweight the sector at 5.2% versus the S&P 500 weighting of 7.4%. The consumer staples sector provided positive returns over the past six months with the S&P 500 consumer staples sector gaining +15.2%, while the Fund’s sector performance trailed slightly at +13.3%. The Fund holds only two stocks in the sector: Costco, which gained +17.2%, and Mondelez, which gained +15.9%. The Fund briefly held Kraft Heinz believing a -30.0% decline in the stock price year-to-date prior to purchase had provided an attractive entry price, but a very disappointing quarterly earnings report shook our own confidence and we exited the position.

Materials, Utilities and Real Estate

The Fund had only two holdings across these sectors, both in materials. Mosaic, a fertilizer manufacturer, contributed +19.8%. Fertilizer stocks have always been notoriously volatile, so the Fund took its profits and exited the position. Ecolab, which we think of more as a services company, also contributed a positive return of +13.2%. Both names contributed to a substantial relative performance advantage of +20.3% for the Fund versus a loss for the S&P 500 materials sector of -5.1%.

The Fund had no exposure to utilities, which gained +11.1% for the S&P 500 sector index. The Fund eschewed REITs as well, which provided the S&P 500 real estate sector with a return of +9.4%. The decision to avoid these interest-sensitive sectors did not help the Fund’s performance relative to the S&P 500; however, that decision is consistent with our view of avoiding interest-sensitive sectors in a rising interest rate environment.

CLOSING COMMENTS

The stock market has now surpassed prior bull market gains both in terms of duration and magnitude. That in itself suggests a certain degree of caution, but as mentioned above, many stocks have already experienced substantial corrections, and powerful earnings have made for more attractive valuations. We are reminded of the story of The World According to Garp by John Irving. Garp is house shopping when a small plane crashes into the house he was contemplating purchasing. “I’ll take it!” Garp cries, because what is the probability THAT could ever happen again? We have had a couple of 10% downdrafts in 2018 and there is plausible evidence that those corrections may have reset the market to a level from which positive returns can be expected again. There are always many “ifs” in the equation, but if valuations are not excessive and companies can continue to grow their earnings and dividends, over time the stock market should move higher. Within the past 20 years, there have been two ferocious bear markets with stock market declines of 50% or more. We

9

don’t see the excessive valuations we saw prior to the “tech wreck” in 2002 and we don’t see the housing bubble and financial crisis precipitated in 2008. Corrections are part of the natural ebb and flow of economic cycles and investor psychology. There are certainly more corrections ahead in our future, but two modest corrections in 2018 are already behind us. We will keep an eye to the economy, an eye to inflation, an eye to the Fed and an eye toward speculative excess and in the meantime we will stay the course, owning what we believe to be profitable and enduring business enterprises.

We at Bradley, Foster & Sargent, Inc. look forward to serving you through our management of the BFS Equity Fund. Thank you for placing your capital under our care.

Timothy Foster | Keith LaRose | Thomas Sargent |

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from net investment income and net realized capital gains (the net profits earned upon the sale of securities that have grown in value), less the losses for the sale of securities that decreased in value and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During periods of reimbursement the Fund’s total return will be greater than it would be had the reimbursement not occurred. How the Fund did in the past is no guarantee of how it will do in the future.

10

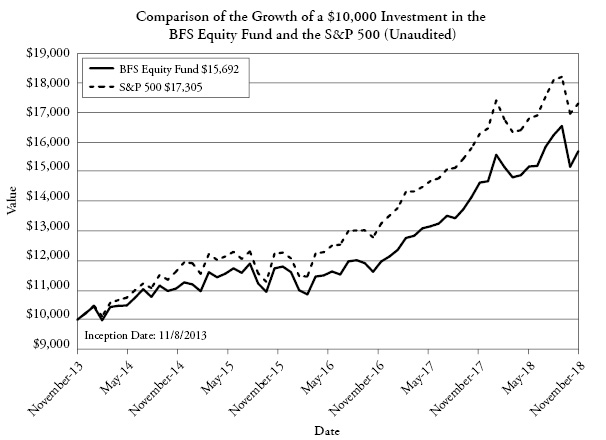

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in BFS Equity Fund, on November 8, 2013.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

The chart above assumes an initial investment of $10,000 made on November 8, 2013 (commencement of operations) held through November 30, 2018.THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call(855) 575-2430. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

11

BFS Equity Fund

SEMI-ANNUAL

PERFORMANCE REVIEW

(UNAUDITED)

The Fund performed ahead of the S&P 500 for the six-month period ended November 30, 2018, returning +3.41% versus +3.02% for the S&P 500. The Dow Jones Industrial Average surpassed the S&P 500 and the Fund with a +5.84% total return.

Key Detractors from Relative Results

1. | The Fund’s overweighting (15.1%) and underperformance (-4.7%) of the industrial sector was the largest detractor from the Fund’s performance relative to the S&P 500. |

2. | The Fund’s holding of Facebook (-26.7%) led to underperforming the communication services sector of the S&P 500. |

3. | The Fund’s absence of exposure to the positively performing utilities and real estate sectors provided a missed opportunity for positive returns. |

Key Contributors to Relative Results

1. | An overweight of the information technology sector (23.7%), the Fund’s largest weighting, as well as outperformance of the S&P 500 information technology sector returns (+2.9%) was a significant contributor to the Fund’s outperformance versus the S&P 500. |

2. | The healthcare sector was also a significant contributor to the Fund's outperformance versus the S&P 500 for the period. The large overweight (20.2% Fund healthcare sector weighting versus 15.8% for the S&P 500 healthcare sector) as well as stock selection (+17.7% Fund healthcare sector return versus 16.3% for the S&P 500 healthcare sector return) contributed to superior performance relative to the S&P 500. |

3. | Although a smaller weighting than the information technology and healthcare sectors, the Fund’s outperformance of +20.3% versus the S&P 500 materials sector performance of -5.1% also contributed to performance. |

FUND INFORMATION

November 30, 2018

ASSET ALLOCATION

TEN LARGEST HOLDINGS (%) | FUND |

Danaher | 3.4 |

Chubb | 3.1 |

Oracle | 2.9 |

Starbucks | 2.9 |

Citigroup | 2.8 |

Mettler-Toledo International | 2.7 |

First Data | 2.7 |

Caterpillar | 2.7 |

JP Morgan Chase | 2.7 |

Microsoft | 2.7 |

SECTOR | FUND | S&P 500 |

Information Technology | 23.7 | 19.9 |

Healthcare | 20.2 | 15.8 |

Industrial | 15.1 | 9.4 |

Financials | 10.4 | 13.7 |

Consumer Discretionary | 8.3 | 9.9 |

Communication Services | 6.9 | 9.9 |

Energy | 5.3 | 5.4 |

Consumer Staples | 5.2 | 7.4 |

Materials | 2.5 | 2.6 |

Cash Equivalents | 2.5 | 0.0 |

Utilities | 0.0 | 3.1 |

Real Estate | 0.0 | 2.9 |

12

BFS Equity Fund

Investment Results (Unaudited)

Average Annual Total Returns(a) (For the periods ended November 30, 2018)

| Six Months | One Year | Three Year | Five Year | Since Inception |

BFS Equity Fund | 3.41% | 7.26% | 9.99% | 8.95% | 9.31% |

S&P 500® Index(b) | 3.02% | 6.27% | 12.16% | 11.12% | 11.45% |

Dow Jones Industrial Average®(c) | 5.84% | 7.62% | 15.78% | 12.39% | 12.74% |

Total annual fund operating expenses, as disclosed in the BFS Equity Fund’s (the “Fund”) prospectus dated September 28, 2018, were 1.65% of average daily net assets (1.25% after fee waivers/expense reimbursements by Bradley, Foster & Sargent, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund until September 30, 2019, so that total annual fund operating expenses do not exceed 1.00%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees, and it will automatically terminate upon the termination of the investment advisory agreement between the Fund and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including exchange traded funds, that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following the month in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 575-2430.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Total returns for periods less than one year are not annualized. |

(b) | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The Dow Jones Industrial Average® is a widely recognized unmanaged index of equity prices and is representative of a narrower market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

13

BFS Equity Fund

Schedule of Investments (Unaudited)

November 30, 2018

| Shares | Fair Value | ||||||

COMMON STOCKS — 97.53% | ||||||||

Aerospace & Defense — 4.93% | ||||||||

Raytheon Company | 5,000 | $ | 876,700 | |||||

United Technologies Corporation | 7,000 | 852,880 | ||||||

| 1,729,580 | ||||||||

Banks — 5.46% | ||||||||

Citigroup, Inc. | 15,000 | 971,850 | ||||||

JPMorgan Chase & Company | 8,500 | 945,115 | ||||||

| 1,916,965 | ||||||||

Chemicals — 2.52% | ||||||||

Ecolab, Inc. | 5,500 | 882,695 | ||||||

Communications Equipment — 2.32% | ||||||||

Cisco Systems, Inc. | 17,000 | 813,790 | ||||||

Consumer Finance — 1.92% | ||||||||

American Express Company | 6,000 | 673,620 | ||||||

Electronic Equipment, Instruments & Components — 6.24% | ||||||||

Amphenol Corporation, Class A | 9,000 | 791,460 | ||||||

Dolby Laboratories, Inc., Class A | 10,000 | 704,000 | ||||||

TE Connectivity Ltd. | 9,000 | 692,370 | ||||||

| 2,187,830 | ||||||||

Energy Equipment & Services — 1.41% | ||||||||

Schlumberger Ltd. | 11,000 | 496,100 | ||||||

Entertainment — 2.63% | ||||||||

Walt Disney Company (The) | 8,000 | 923,920 | ||||||

Food & Staples Retailing — 2.64% | ||||||||

Costco Wholesale Corporation | 4,000 | 925,120 | ||||||

Food Products — 2.56% | ||||||||

Mondelez International, Inc., Class A | 20,000 | 899,600 | ||||||

Health Care Equipment & Supplies — 8.22% | ||||||||

Abbott Laboratories | 12,000 | 888,600 | ||||||

Danaher Corporation | 11,000 | 1,204,940 | ||||||

Stryker Corporation | 4,500 | 789,570 | ||||||

| 2,883,110 | ||||||||

14 | See accompanying notes which are an integral part of these financial statements. |

BFS Equity Fund

Schedule of Investments (Unaudited) (continued)

November 30, 2018

| Shares | Fair Value | ||||||

COMMON STOCKS — 97.53% - continued | ||||||||

Hotels, Restaurants & Leisure — 2.85% | ||||||||

Starbucks Corporation | 15,000 | $ | 1,000,800 | |||||

Insurance — 3.05% | ||||||||

Chubb Ltd. | 8,000 | 1,069,920 | ||||||

Interactive Media & Services — 4.22% | ||||||||

Alphabet, Inc., Class A(a) | 700 | 776,755 | ||||||

Facebook, Inc., Class A(a) | 5,000 | 703,050 | ||||||

| 1,479,805 | ||||||||

Internet & Direct Marketing Retail — 1.93% | ||||||||

Amazon.com, Inc.(a) | 400 | 676,068 | ||||||

IT Services — 5.24% | ||||||||

Automatic Data Processing, Inc. | 6,000 | 884,520 | ||||||

First Data Corporation, Class A(a) | 50,000 | 954,000 | ||||||

| 1,838,520 | ||||||||

Life Sciences Tools & Services — 7.26% | ||||||||

Illumina, Inc.(a) | 2,500 | 843,750 | ||||||

Mettler-Toledo International, Inc.(a) | 1,500 | 954,990 | ||||||

Thermo Fisher Scientific, Inc. | 3,000 | 748,650 | ||||||

| 2,547,390 | ||||||||

Machinery — 10.13% | ||||||||

Caterpillar, Inc. | 7,000 | 949,690 | ||||||

Deere & Company | 6,000 | 929,280 | ||||||

Fortive Corporation | 10,000 | 760,700 | ||||||

Stanley Black & Decker, Inc. | 7,000 | 915,950 | ||||||

| 3,555,620 | ||||||||

Oil, Gas & Consumable Fuels — 3.84% | ||||||||

Apache Corporation | 18,000 | 632,340 | ||||||

Chevron Corporation | 6,000 | 713,640 | ||||||

| 1,345,980 | ||||||||

Pharmaceuticals — 4.77% | ||||||||

Johnson & Johnson | 5,000 | 734,500 | ||||||

Zoetis, Inc. | 10,000 | 938,700 | ||||||

| 1,673,200 | ||||||||

Software — 8.10% | ||||||||

Adobe Systems, Inc.(a) | 3,500 | 878,115 | ||||||

Microsoft Corporation | 8,500 | 942,565 | ||||||

See accompanying notes which are an integral part of these financial statements. | 15 |

BFS Equity Fund

Schedule of Investments (Unaudited) (continued)

November 30, 2018

| Shares | Fair Value | ||||||

COMMON STOCKS — 97.53% - continued | ||||||||

Software — 8.10% - continued | ||||||||

Oracle Corporation | 21,000 | $ | 1,023,960 | |||||

| 2,844,640 | ||||||||

Specialty Retail — 1.80% | ||||||||

Home Depot, Inc. (The) | 3,500 | 631,120 | ||||||

Technology Hardware, Storage & Peripherals — 1.78% | ||||||||

Apple, Inc. | 3,500 | 625,030 | ||||||

Textiles, Apparel & Luxury Goods — 1.71% | ||||||||

NIKE, Inc., Class B | 8,000 | 600,960 | ||||||

Total Common Stocks (Cost $25,290,616) | 34,221,383 | |||||||

MONEY MARKET FUNDS — 2.46% | ||||||||

Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.14%(b) | 863,069 | 863,069 | ||||||

Total Money Market Funds (Cost $863,069) | 863,069 | |||||||

Total Investments — 99.99% (Cost $26,153,685) | 35,084,452 | |||||||

Other Assets in Excess of Liabilities — 0.01% | 1,835 | |||||||

NET ASSETS — 100.00% | $ | 35,086,287 | ||||||

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2018. |

The industries shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® ("GICS"). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

16 | See accompanying notes which are an integral part of these financial statements. |

BFS Equity Fund

Statement of Assets and Liabilities (Unaudited)

November 30, 2018

Assets | ||||

Investments in securities at fair value (cost $26,153,685) (Note 3) | $ | 35,084,452 | ||

Receivable for fund shares sold | 458 | |||

Dividends receivable | 36,347 | |||

Tax reclaims receivable | 792 | |||

Prepaid expenses | 20,980 | |||

Total Assets | 35,143,029 | |||

Liabilities | ||||

Payable for fund shares redeemed | 4,000 | |||

Payable to Adviser (Note 4) | 12,463 | |||

Payable to Administrator (Note 4) | 6,750 | |||

Distribution (12b-1) fees accrued (Note 4) | 14,470 | |||

Other accrued expenses | 19,059 | |||

Total Liabilities | 56,742 | |||

Net Assets | $ | 35,086,287 | ||

Net Assets consist of: | ||||

Paid-in capital | $ | 25,046,118 | ||

Accumulated earnings | 10,040,169 | |||

Net Assets | $ | 35,086,287 | ||

Shares outstanding (unlimited number of shares authorized, no par value) | 2,268,692 | |||

Net asset value, offering and redemption price per share (Note 2) | $ | 15.47 | ||

See accompanying notes which are an integral part of these financial statements. | 17 |

BFS Equity Fund

Statement of Operations (Unaudited)

For the six months ended November 30, 2018

Investment Income | ||||

Dividend income (net of foreign taxes withheld of $594) | $ | 259,475 | ||

Total investment income | 259,475 | |||

Expenses | ||||

Investment Adviser fees (Note 4) | 129,562 | |||

Distribution (12b-1) fees (Note 4) | 43,187 | |||

Administration fees (Note 4) | 19,000 | |||

Legal fees | 13,393 | |||

Registration expenses | 12,937 | |||

Fund accounting fees (Note 4) | 12,500 | |||

Transfer agent fees (Note 4) | 9,000 | |||

Audit and tax preparation fees | 8,750 | |||

Printing and postage expenses | 5,795 | |||

Trustee fees (Note 4) | 3,007 | |||

Insurance expenses | 2,563 | |||

Custodian fees | 2,100 | |||

Miscellaneous expenses | 13,032 | |||

Total expenses | 274,826 | |||

Fees contractually waived by Adviser | (58,786 | ) | ||

Net operating expenses | 216,040 | |||

Net investment income | 43,435 | |||

Net Realized and Change in Unrealized Gain on Investments | ||||

Net realized gain on investment securities transactions | 358,174 | |||

Net change in unrealized appreciation on investments | 654,965 | |||

Net realized and change in unrealized gain on investments | 1,013,139 | |||

Net increase in net assets resulting from operations | $ | 1,056,574 | ||

18 | See accompanying notes which are an integral part of these financial statements. |

BFS Equity Fund

Statements of Changes in Net Assets

Increase (Decrease) in Net Assets due to: | For the | For the | ||||||

Operations | ||||||||

Net investment income | $ | 43,435 | $ | 76,860 | ||||

Net realized gain on investment securities transactions | 358,174 | 968,655 | ||||||

Net change in unrealized appreciation on investments | 654,965 | 3,076,603 | ||||||

Net increase in net assets resulting from operations | 1,056,574 | 4,122,118 | ||||||

Distributions to Shareholders(Note 2) | — | (97,004 | ) | |||||

Capital Transactions | ||||||||

Proceeds from shares sold | 3,460,669 | 3,055,217 | ||||||

Reinvestment of distributions | — | 84,293 | ||||||

Amount paid for shares redeemed | (1,180,800 | ) | (2,599,930 | ) | ||||

Net increase in net assets resulting from capital transactions | 2,279,869 | 539,580 | ||||||

Total Increase in Net Assets | 3,336,443 | 4,564,694 | ||||||

Net Assets | ||||||||

Beginning of period | 31,749,844 | 27,185,150 | ||||||

End of period | $ | 35,086,287 | $ | 31,749,844 | ||||

Share Transactions | ||||||||

Shares sold | 222,046 | 213,569 | ||||||

Shares issued in reinvestment of distributions | — | 5,801 | ||||||

Shares redeemed | (75,899 | ) | (185,706 | ) | ||||

Net increase in shares outstanding | 146,147 | 33,664 | ||||||

| (a) | The presentation of Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018. For the year ended May 31, 2018, distributions from earnings consisted of $78,543 from net investment income and $18,461 from net realized gains. As of May 31, 2018, accumulated net investment income was $25,353. |

See accompanying notes which are an integral part of these financial statements. | 19 |

BFS Equity Fund

Financial Highlights

(For a share outstanding during each period)

For the Six | For the | For the | For the | For the | For the | |||||||||||||||||||

Selected Per Share Data: | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 14.96 | $ | 13.01 | $ | 11.55 | $ | 11.69 | $ | 10.73 | $ | 10.00 | ||||||||||||

Income from investment operations: | ||||||||||||||||||||||||

Net investment income | 0.02 | 0.04 | 0.04 | 0.04 | 0.02 | 0.04 | ||||||||||||||||||

Net realized and unrealized gain/(loss) on investments | 0.49 | 1.96 | 1.47 | (0.15 | ) | 0.97 | 0.70 | |||||||||||||||||

Total from investment operations | 0.51 | 2.00 | 1.51 | (0.11 | ) | 0.99 | 0.74 | |||||||||||||||||

Less distributions to shareholders from: | ||||||||||||||||||||||||

Net investment income | — | (0.04 | ) | (0.05 | ) | (0.03 | ) | (0.03 | ) | (0.01 | ) | |||||||||||||

Net realized gains | — | (0.01 | ) | — | — | — | — | |||||||||||||||||

Total distributions | — | (0.05 | ) | (0.05 | ) | (0.03 | ) | (0.03 | ) | (0.01 | ) | |||||||||||||

Net asset value, end of period | $ | 15.47 | $ | 14.96 | $ | 13.01 | $ | 11.55 | $ | 11.69 | $ | 10.73 | ||||||||||||

Total Return(b) | 3.41 | %(c) | 15.36 | % | 13.15 | % | (0.91 | )% | 9.27 | % | 7.36 | %(c) | ||||||||||||

Ratios and Supplemental Data: | ||||||||||||||||||||||||

Net assets, end of period (000 omitted) | $ | 35,086 | $ | 31,750 | $ | 27,185 | $ | 23,884 | $ | 20,167 | $ | 12,745 | ||||||||||||

Ratio of net expenses to average net assets | 1.25 | %(d) | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | %(d) | ||||||||||||

Ratio of expenses to average net assets before waiver and reimbursement | 1.59 | %(d) | 1.65 | % | 1.75 | % | 1.86 | % | 2.26 | % | 3.93 | %(d) | ||||||||||||

Ratio of net investment income to average net assets | 0.25 | %(d) | 0.26 | % | 0.35 | % | 0.43 | % | 0.30 | % | 0.68 | %(d) | ||||||||||||

Portfolio turnover rate | 14.90 | %(c) | 38.17 | % | 47.82 | % | 49.38 | % | 51.17 | % | 46.50 | %(c) | ||||||||||||

| (a) | For the period November 8, 2013 (commencement of operations) to May 31, 2014. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions, if any. |

| (c) | Not annualized. |

| (d) | Annualized. |

20 | See accompanying notes which are an integral part of these financial statements. |

BFS Equity Fund

Notes to the Financial Statements (Unaudited)

November 30, 2018

NOTE 1. ORGANIZATION

The BFS Equity Fund (the “Fund”) was organized as an open-end diversified series of Valued Advisers Trust (the “Trust”) on July 23, 2013 and commenced operations on November 8, 2013. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Bradley, Foster & Sargent, Inc. (the "Adviser"). The investment objective of the Fund is long-term appreciation through growth of principal and income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates –The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended November 30, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the six months ended November 30, 2018, the Fund did not incur any interest or penalties.

Expenses– Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis.

21

BFS Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

November 30, 2018

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method, if applicable. Withholding taxes on foreign dividends have been provided for in accordance with the Fund's understanding of the applicable country’s tax rules and rates.

Dividends and Distributions –The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share ("NAV") of the Fund.

Share Valuation – The net asset value of the Fund is calculated each day The New York Stock Exchange is open by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding for the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

All investments in securities are recorded at their estimated fair value. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

22

BFS Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

November 30, 2018

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below.

● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

● | Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of

23

BFS Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

November 30, 2018

quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund's investments as of November 30, 2018:

Valuation Inputs | ||||||||||||||||

Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks(a) | $ | 34,221,383 | $ | — | $ | — | $ | 34,221,383 | ||||||||

Money Market Funds | 863,069 | — | — | 863,069 | ||||||||||||

Total | $ | 35,084,452 | $ | — | $ | — | $ | 35,084,452 | ||||||||

(a) | Refer to Schedule of Investments for industry classifications. |

NOTE 4. TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund. For the six months ended November 30, 2018, the Adviser earned a fee of $129,562 from the Fund before the waivers described below. At November 30, 2018, the Fund owed the Adviser $12,463.

The Adviser has contractually agreed to waive its management fee and/or reimburse certain operating expenses until September 30, 2019, but only to the extent necessary so that the Fund’s net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “acquired funds fees and expenses”) do not exceed 1.00%.

Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Fund within the three years following the month in which the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. The contractual agreement is in effect through September 30, 2019. The expense cap may not be terminated prior to this date except by the Board. For the six months ended November 30, 2018, the Adviser waived fees of $58,786. As of November 30, 2018, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements of $366,185, pursuant to the aforementioned conditions, no later than November 30, 2021.

The Trust retains Ultimus Fund Solutions, LLC ("Ultimus" or "Administrator") to provide the Fund with administration and compliance (including a chief compliance officer), fund accounting, and transfer agent services, including all regulatory reporting.

24

BFS Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

November 30, 2018

For the six months ended November 30, 2018, the Administrator earned fees of $19,000 for administration services, $12,500 for fund accounting services and $9,000 for transfer agent services. At November 30, 2018, the Fund owed the Administrator $6,750 for such services.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “1940 Act”). The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. For the six months ended November 30, 2018, 12b-1 fees incurred by the Fund were $43,187. The Fund owed $14,470 for 12b-1 fees as of November 30, 2018.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the six months ended November 30, 2018, purchases and sales of investment securities, other than short-term investments, were $7,152,919 and $4,977,097, respectively.

There were no purchases or sales of long-term U.S. government obligations during the six months ended November 30, 2018.

NOTE 6. FEDERAL TAX INFORMATION

At November 30, 2018, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

Gross unrealized appreciation | $ | 9,731,901 | ||

Gross unrealized depreciation | (819,674 | ) | ||

Net unrealized appreciation on investments | $ | 8,912,227 | ||

Tax cost of investments | $ | 26,172,225 |

The difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

25

BFS Equity Fund

Notes to the Financial Statements (Unaudited) (continued)

November 30, 2018

At May 31, 2018, the Fund’s most recent fiscal year end, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

Undistributed ordinary income | $ | 25,353 | ||

Undistributed long-term capital gains | 700,980 | |||

Unrealized appreciation | 8,257,262 | |||

Total | $ | 8,983,595 |

The tax character of distributions for the fiscal year ended May 31, 2018 was as follows:

| 2018 | |||

Distributions paid from: | ||||

Ordinary income | $ | 78,543 | ||

Net long-term capital gains | 18,461 | |||

Total distributions paid | $ | 97,004 | ||

During the fiscal year ended May 31, 2018, the Fund utilized $249,214 of its capital loss carryforward.

NOTE 7. RECENT ACCOUNTING PRONOUNCEMENT

In August 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2018-13, which changes the fair value measurement disclosure requirements of FASB Accounting Standards Codification Topic 820, Fair Value Measurement. The update to Topic 820 includes new, eliminated, and modified disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods, although early adoption is permitted. Management has evaluated the implications of certain provisions of ASU 2018-13 and has determined to early adopt all aspects related to the removal and modification of certain fair value measurement disclosures under the ASU effective immediately.

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

26

BFS Equity Fund

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2018 through November 30, 2018.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

Beginning | Ending | Expenses Paid | Annualized | |

Actual | $ 1,000.00 | $ 1,034.10 | $ 6.37 | 1.25% |

Hypothetical(b) | $ 1,000.00 | $ 1,018.80 | $ 6.33 | 1.25% |

| (a) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

27

BFS Equity Fund

Investment Advisory Agreement Approval

(Unaudited)

At a meeting held on June 6-7, 2018, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (the “BFS Agreement”) between Valued Advisers Trust (the “Trust”) and Bradley, Foster & Sargent, Inc. (“BFS”) with respect to the BFS Equity Fund (the “Fund”). BFS provided written information to the Board to assist the Board in its considerations.

Counsel reminded the Trustees of their fiduciary duties and responsibilities as summarized in a memorandum from his firm, including the factors to be considered, and the application of those factors to BFS and the BFS Agreement. In assessing the factors and reaching its decision, the Board took into consideration information furnished by BFS and the Trust’s other service providers for the Board’s review and consideration throughout the year, as well as information specifically prepared or presented in connection with the annual renewal process, including: (i) reports regarding the services and support provided to the Fund and its shareholders by BFS; (ii) quarterly assessments of the investment performance of the Fund by personnel of BFS; (iii) commentary on the reasons for the performance; (iv) presentations by BFS addressing its investment philosophy, investment strategy, personnel, and operations; (v) compliance and audit reports concerning the Fund and BFS; (vi) disclosure information contained in the registration statement of the Trust and the Form ADV of BFS; and (vii) a memorandum from trust counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the BFS Agreement. The Board also requested and received materials including, without limitation: (a) documents containing information about BFS, including its financial information; a description of its personnel and the services it provides to the Fund; information on BFS’ investment advice and performance; summaries of the Fund’s expenses, compliance program, current legal matters, and other general information; (b) comparative expense and performance information for other mutual funds with strategies similar to the Fund; and (c) the benefits to be realized by BFS from its relationship with the Fund. The Board did not identify any particular information that was most relevant to its consideration of the BFS Agreement, and each Trustee may have afforded different weight to the various factors.

1. | The nature, extent, and quality of the services to be provided by BFS. The Board considered BFS’s responsibilities under the BFS Agreement. The Trustees considered the services being provided by BFS to the BFS Fund including, without limitation: the quality of its investment advisory services (including research and recommendations with respect to portfolio securities), its process for formulating investment recommendations and assuring compliance with the BFS Fund’s investment objectives and limitations, its coordination of services for the BFS Fund among the BFS Fund’s service providers, and its efforts to promote the BFS Fund and grow its assets. The Trustees considered BFS’s continuity of, and commitment to retain qualified personnel, commitment to maintain and enhance its resources and systems, and options that allow the BFS Fund to maintain its goals, and BFS’s continued cooperation with the Board and counsel for the BFS Fund. The Trustees considered BFS’s personnel, including their education and experience. |

28

BFS Equity Fund

Investment Advisory Agreement Approval (Unaudited)(continued)

After considering the foregoing information and further information in the meeting materials provided by BFS, the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by BFS were satisfactory and adequate for the BFS Fund.

2. | Investment Performance of the BFS Fund and BFS. The Trustees compared the performance of the BFS Fund with the performance of funds with similar objectives managed by other investment advisers, with aggregated peer group data, as well as with the performance of the BFS Fund’s benchmark. The Trustees also considered the consistency of BFS’s management of the BFS Fund with its investment objectives, strategies, and limitations. The Trustees noted that the BFS Fund had underperformed as compared to its benchmark for the three year and since inception periods, but was performing above the benchmark for the first quarter of 2018 and for the one-year period. They also noted that the BFS Fund had underperformed as compared to its Morningstar category for the year-to-date, one-year and three-year periods ended March 31, 2018. The Board reviewed the performance of BFS in managing a composite with investment strategies similar to that of the BFS Fund and observed that the BFS Fund’s performance was above the composite for the year-to-date period ended March 31, 2018, and for the calendar year 2017. The Trustees took into consideration discussions with representatives of BFS regarding the reasons for the performance of the BFS Fund. After further reviewing and discussing these and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the BFS Fund and BFS was satisfactory. |

3. | The costs of the services to be provided and profits to be realized by BFS from the relationship with the BFS Fund. The Trustees considered: (1) BFS’s financial condition; (2) the asset level of the BFS Fund; (3) the overall expenses of the BFS Fund; and (4) the nature and frequency of management fee payments. The Trustees reviewed information provided by BFS regarding its profits associated with managing the BFS Fund, noting that BFS is currently waiving a large portion of its management fee. The Trustees also considered potential benefits for BFS in managing the BFS Fund. The Trustees then compared the fees and expenses of the BFS Fund (including the management fee) to other comparable mutual funds. The Trustees noted that the BFS Fund’s management fee was above the average and median management fees of peers in its category. The Trustees also noted that the BFS Fund’s net expense ratio was also above that of the average and median of peers in its category, taking into consideration BFS’s contractual commitment to limit the expenses of the BFS Fund. Based on the foregoing, the Board concluded that the fees to be paid to BFS by the BFS Fund and the profits to be realized by BFS, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by BFS. |

29

BFS Equity Fund

Investment Advisory Agreement Approval (Unaudited)(continued)

4. | The extent to which economies of scale would be realized as the BFS Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the BFS Fund’s investors. The Board considered the BFS Fund’s fee arrangements with BFS. The Board considered that while the management fee remained the same at all asset levels, the BFS Fund’s shareholders experienced benefits from the BFS Fund’s expense limitation arrangement. The Trustees noted that once the BFS Fund’s expenses fell below the cap set by the arrangement, the shareholders would continue to benefit from economies of scale under the BFS Fund’s arrangements with other service providers to the BFS Fund, and the Trustees attributed this benefit, in part, to the direct and indirect efforts of BFS at the inception of the BFS Fund to ensure that a cost structure was in place that was beneficial for the BFS Fund as it grew. In light of its ongoing consideration of the BFS Fund’s asset and fees levels and expectations for growth, the Board determined that the BFS Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by BFS. |

5. | Possible conflicts of interest and benefits to BFS. In considering BFS’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the BFS Fund; the basis of decisions to buy or sell securities for the BFS Fund and/or BFS’s other accounts; and the substance and administration of BFS’s code of ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to BFS’s potential conflicts of interest. The Trustees noted that BFS may utilize soft dollars and the Trustees noted BFS’s policies and processes for managing the conflicts of interest that could arise from soft dollar arrangements. The Trustees noted other potential benefits to BFS, including the fact that the BFS Fund provides an attractive vehicle for smaller accounts, which may increase the total assets under management by BFS. Based on the foregoing, the Board determined that the standards and practices of BFS relating to the identification and mitigation of potential conflicts of interest and the benefits to be realized by BFS in managing the BFS Fund were satisfactory. |

After additional consideration of the factors delineated in the memorandum provided by counsel and further discussion among the Board members, the Board determined to approve the continuation of the BFS Agreement.

30

FACTS | WHAT DOES VALUED ADVISERS TRUST DO WITH YOUR PERSONAL INFORMATION? |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |