united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 | Cincinnati, OH 45246 |

| (Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Bryan Ashmus

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 4/30/18 |

Item 1. Reports to Stockholders.

DANA LARGE CAP EQUITY FUND

DANA SMALL CAP EQUITY FUND

Semi-Annual Report

April 30, 2018

Dana Investment Advisors, Inc.

20700 Swenson Drive, Suite 400

Waukesha, WI 53186

(855) 280-9648

www.danafunds.com

Dear Fellow Shareholders,

Enclosed is the Semi-Annual report for the Dana Funds. Following on the heels of a very strong 2017 for the markets, the first fourth months of 2018 were anything but a repeat from what many investors have become accustomed to in the last few years. Volatility, basically non-existent in 2017, made a return in 2018, awakening some investors from their slumber after a prolonged upward trajectory in the stock market. After the dust settled in the first three months of 2018, we saw the first negative quarterly return for the S&P 500® Index (“S&P 500”) in over two years! There were many economic, political and social events for investors to digest in the last six months, some of which were more fluff than others. You can rest assured as you have hired a professional asset manager whose discipline for sticking to a defined investment process and avoiding outside noise has been rewarded over the long term. The fiscal year to date saw good growth as the Dana Funds combined to add approximately $30 million in new assets. We are grateful for all of the support and trust from our fellow shareholders. We welcome your comments and questions, and you may reach us via email at DanaFunds@danainvestments.com.

Economic and Market Recap

The U.S. equity market continued its upward trajectory in the final months of 2017 and into the New Year. The S&P 500 peaked toward the end of January and since then has predominantly moved sideways, albeit with greater volatility in comparison to 2017. Positive factors for the market include a solid economic backdrop, the passage of new U.S. tax legislation, and strong earnings growth driven by top-line acceleration and corporate tax cuts. The S&P 500 returned +3.82% during the six month period ending April 30, 2018.

Investors anticipated the continued upward trajectory in earnings growth and revisions and were willing to pay more for this growth, and Price-to-Earnings multiples expanded. Large cap stocks continued to outperform small cap stocks, as measured by the S&P 500 and the Russell 2000 Indexes, however, the gap was much smaller. This is a significant change from last year when earnings growth and stock performance favored large cap stocks. In terms of investment styles, Growth remained the clear leader versus Value styles. The Russell 1000 Growth Index outperformed the Russell 1000 Value Index by nearly 400 basis points during this six month period. This differential was even more pronounced for small cap stocks. The Russell 2000 Growth Index returned nearly 500 basis points more than the Russell 2000 Value Index.

Year-to-date, investors have reacted with greater caution. A key area of focus is the rise of interest rates in the wake of good economic and job growth reports. Greater political tensions are adding to investor concerns. These include an on-again, off-again North Korean Summit and trade tariffs.

Large Cap Fund Performance

The Dana Large Cap Equity Fund, Institutional Class, returned +3.81%, in line with the +3.82% return for the S&P 500 Index during the six month period ending April 30, 2018. Once again, stock selection was solid over this time period, despite the headwind of Growth strategies outperforming Value strategies. The Dana investment process focuses on companies that exhibit growth at relatively attractive valuations.

Holdings that contributed the most to performance ranged across a variety of sectors and industries. The Energy sector was the second strongest performing sector, and Valero Energy Corporation (VLO) was up over 40%. This refiner’s earnings were strong as supply remained short, driving favorable pricing and margin expansion. In the Consumer Staple sector, Dr. Pepper Snapple Group, Inc. (DPS) rallied over +40% in reaction to the proposed merger by Keurig Green Mountain Company, Inc. The Boeing Company (BA), the global leader in aerospace, was up approximately 30% during this period. BA’s backlog remains robust. PVH Corporation (PVH), a Consumer Discretionary company, and Broadridge Financial Solutions, Inc. (BR), an Information Technology company, round out the top five contributors to returns. Despite the strong performance in Boeing Company (BA), Industrial stocks lagged during

1

this period, driven by poor performance in Owens Corning (OC) and Stanley Black & Decker, Inc. (SWK). These housing-related companies pulled back in the first quarter. Lastly, the Consumer Discretionary was the weakest performing sector. This was almost entirely a result of two companies not owned in the Fund due to their relatively high valuations: Amazon, Inc. (AMZN) and Netflix, Inc. (NFLX).

The Dana Large Cap Equity Fund’s collective holdings have displayed consistent positive earnings growth. Overall, the Dana Large Cap Equity Fund holdings have seen positive earnings revisions to expected future income and revenue projections. We believe the Fund is well positioned for this environment. We are particularly optimistic should Value begin to outperform Growth within the equity market.

Small Cap Fund Performance

The Dana Small Cap Equity Fund, Institutional Class, posted a total return of -1.46%, lagging the +3.27% for the Russell 2000 Index. Quality and Value factors were out of favor this period while Momentum and Growth factors were rewarded. These proved to be headwinds for the Fund. Value simply was not rewarded, and expensive stocks, often those with very high price-to-earnings ratios or stocks with no earnings, outperformed securities with more attractive valuations and better fundamentals.

Several Information Technology holdings detracted from performance. Electronic equipment manufacturers Rogers Corporation (ROG) and Coherent, Inc. (COHR), and software company Progress Software Corporation (PRGS) pressured sector returns. Rogers surprised with strong sales growth that exceeded expectations, but earnings missed estimates on reduced gross margins, and the firm guided EPS downward. Coherent also reported strong sales growth that beat estimates, and management reiterated strength in end markets, yet guided gross margins lower. Progress Software reported a strong quarter, but an activist investor sold their 9% stake, pressuring the stock. Consumer Discretionary and Materials sectors also detracted from performance.

Conversely, holdings in the Industrials and Financials sectors outperformed. TriNet Group, Inc. (TNET) and Universal Insurance Holdings, Inc. (UVE) led those sectors, respectively. The overall top contributors to performance were within the Health Care sector: Sucampo Pharmaceuticals, Inc. (SCMP) and AMN Healthcare Services, Inc. (AMN). Sucampo was acquired by Mallinckrodt (MNK) at a significant premium, and AMN Healthcare, one of the largest health care staffing companies, continues to benefit from favorable trends.

The Dana Small Cap Equity Fund is consistently positioned in stocks with attractive relative valuations and growth prospects that we expect to benefit investors over the long term. As with the Large Cap Fund, we are particularly optimistic should value and quality factors come into focus for investors.

Respectfully submitted,

Mark R. Mirsberger, CPA

Chief Executive Officer – Dana Investment Advisors, Inc.

Duane Roberts, CFA

Portfolio Manager and Director of Equities – Dana Investment Advisors, Inc.

2

Investment Results (Unaudited) |

Average Annual Total Returns(a) as of April 30, 2018

Six | One | Three | Five | Since | Since | |

Dana Large Cap Equity Fund | ||||||

Institutional Class | 3.81% | 15.74% | 9.39% | N/A | N/A | 11.22% |

Investor Class | 3.67% | 15.45% | 9.09% | 11.99% | 13.82% | N/A |

S&P 500® Index(b) | 3.82% | 13.27% | 10.57% | 12.96% | 13.51% | 11.63% |

Expense Ratios(c) | ||||

Institutional Class | Investor | |||

Gross | 0.92% | 1.17% | ||

With Applicable Waivers | 0.74% | 0.99% | ||

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Large Cap Equity Fund (the “Large Cap Fund”) distributions or the redemption of Large Cap Fund shares. Current performance of the Large Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Large Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

(b) | The S&P 500® Index (“Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Large Cap Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds (“ETFs”) or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Large Cap Fund’s prospectus dated February 28, 2018. Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to reimburse or limit its fees and to assume other expenses of the Large Cap Fund until February 28, 2019, so that total annual fund operating expenses does not exceed 0.73% of the Large Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Large Cap Fund within three years following the date in which the expense was incurred, provided that the Large Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver or reimbursement. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Large Cap Fund’s expense ratios as of April 30, 2018 can be found on the financial highlights. |

The Large Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Large Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Large Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

3

Investment Results (Unaudited) |

Average Annual Total Returns(a) as of April 30, 2018

Six | One | Since | |

Dana Small Cap Equity Fund | |||

Institutional Class | -1.46% | 5.96% | 5.01% |

Investor Class | -1.58% | 5.76% | 4.72% |

Russell 2000® Index(b) | 3.27% | 11.54% | 12.48% |

Expense Ratios(c) | |||

Institutional Class | Investor | ||

Gross | 2.02% | 2.27% | |

With Applicable Waivers | 0.95% | 1.20% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Small Cap Equity Fund (the “Small Cap Fund”) distributions or the redemption of Small Cap Fund shares. Current performance of the Small Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual returns reflect any change in price per share and assume the reinvestment of all distributions. The Small Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

(b) | The Russell 2000® Index (“Russell Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Small Cap Fund’s portfolio. Individuals can not invest directly in the Russell Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Small Cap Fund’s prospectus dated February 28, 2018. The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Small Cap Fund until February 28, 2019, so that total annual fund operating expenses does not exceed 0.95% of the Small Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Small Cap Fund within three years following the date in which the fee waiver or expense reimbursement occurred, provided that the Small Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the fee waiver or expense reimbursement. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Small Cap Fund’s expense ratios as of April 30, 2018 can be found in the financial highlights. |

The Small Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Small Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

4

Fund Holdings (Unaudited)

April 30, 2018

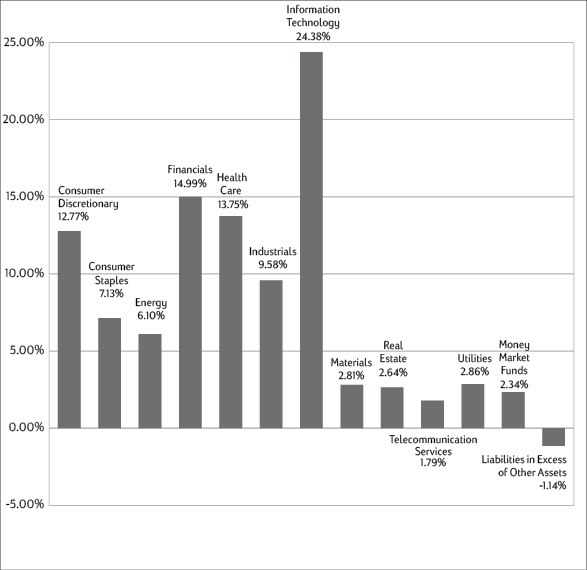

The following chart gives a visual breakdown of the Large Cap Fund by sector weighting as a percentage of net assets as of April 30, 2018.

5

Fund Holdings (Unaudited)

April 30, 2018

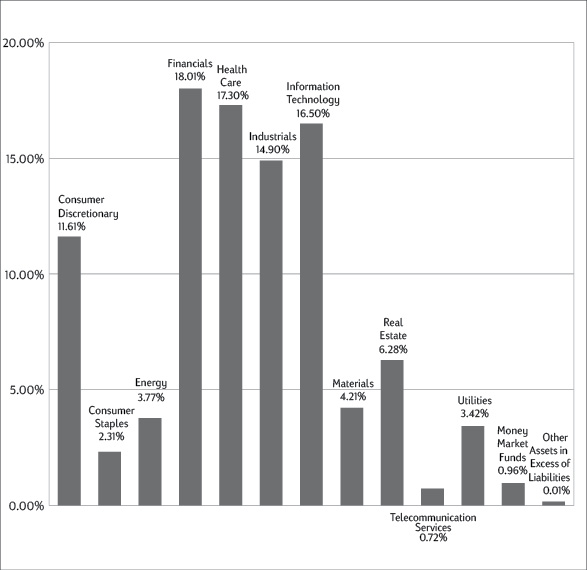

The following chart gives a visual breakdown of the Small Cap Fund by sector weighting as a percentage of net assets as of April 30, 2018.

Availability of Portfolio Schedule (Unaudited)

The Large Cap Fund and the Small Cap Fund (each a “Fund” and collectively the “Funds”) file their complete schedule of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available at the SEC’s website at www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

6

Dana Large Cap Equity Fund

Schedule of Investments

April 30, 2018 (Unaudited)

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.80% | ||||||||

| Consumer Discretionary — 12.77% | ||||||||

| 48,000 | Best Buy Company, Inc. | $ | 3,673,440 | |||||

| 108,000 | Comcast Corporation, Class A | 3,390,120 | ||||||

| 94,000 | D.R. Horton, Inc. | 4,149,160 | ||||||

| 22,800 | Home Depot, Inc. (The) | 4,213,440 | ||||||

| 22,600 | Lear Corporation | 4,225,522 | ||||||

| 25,600 | PVH Corporation | 4,087,552 | ||||||

| 32,800 | Royal Caribbean Cruises Ltd. | 3,548,632 | ||||||

| 27,287,866 | ||||||||

| Consumer Staples — 7.13% | ||||||||

| 29,000 | Dr. Pepper Snapple Group, Inc. | 3,478,840 | ||||||

| 300 | Ingredion, Inc. | 36,327 | ||||||

| 27,000 | Kimberly-Clark Corporation | 2,795,580 | ||||||

| 32,600 | Philip Morris International, Inc. | 2,673,200 | ||||||

| 55,000 | Sysco Corporation | 3,439,700 | ||||||

| 40,000 | Tyson Foods, Inc., Class A | 2,804,000 | ||||||

| 15,227,647 | ||||||||

| Energy — 6.10% | ||||||||

| 35,400 | Chevron Corporation | 4,428,894 | ||||||

| 52,200 | Exxon Mobil Corporation | 4,058,550 | ||||||

| 41,100 | Valero Energy Corporation | 4,559,223 | ||||||

| 13,046,667 | ||||||||

| Financials — 14.99% | ||||||||

| 16,224 | American Express Company | 1,602,120 | ||||||

| 128,000 | Bank of America Corporation | 3,829,760 | ||||||

| 22,000 | Chubb Ltd. | 2,984,740 | ||||||

| 43,000 | Citigroup, Inc. | 2,935,610 | ||||||

| 92,000 | Citizens Financial Group, Inc. | 3,817,080 | ||||||

| 23,000 | Comerica, Inc. | 2,175,340 | ||||||

| 32,000 | JPMorgan Chase & Company | 3,480,960 | ||||||

| 70,000 | Morgan Stanley | 3,613,400 | ||||||

| 36,000 | Prudential Financial, Inc. | 3,827,520 | ||||||

| 180,000 | Starwood Property Trust, Inc. | 3,772,800 | ||||||

| 32,039,330 | ||||||||

| Health Care — 13.75% | ||||||||

| 44,000 | AbbVie, Inc. | 4,248,200 | ||||||

| 23,000 | Amgen, Inc. | 4,013,040 | ||||||

| 61,000 | Baxter International, Inc. | 4,239,500 | ||||||

| 31,800 | Johnson & Johnson | 4,022,382 | ||||||

| 116,000 | Pfizer, Inc. | 4,246,760 | ||||||

See accompanying notes which are an integral part of these financial statements.

7

Dana Large Cap Equity Fund

Schedule of Investments (continued)

April 30, 2018 (Unaudited)

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.80% — (continued) | ||||||||

| Health Care — 13.75% — (continued) | ||||||||

| 25,000 | Stryker Corporation | $ | 4,235,500 | |||||

| 18,500 | UnitedHealth Group, Inc. | 4,373,400 | ||||||

| 29,378,782 | ||||||||

| Industrials — 9.58% | ||||||||

| 13,000 | Boeing Company (The) | 4,336,280 | ||||||

| 26,000 | Caterpillar, Inc. | 3,753,360 | ||||||

| 78,000 | Delta Air Lines, Inc. | 4,073,160 | ||||||

| 52,000 | Owens Corning | 3,405,480 | ||||||

| 8,500 | Parker-Hannifin Corporation | 1,399,270 | ||||||

| 24,800 | Stanley Black & Decker, Inc. | 3,511,432 | ||||||

| 20,478,982 | ||||||||

| Information Technology — 24.38% | ||||||||

| 4,179 | Alphabet, Inc., Class A(a) | 4,256,646 | ||||||

| 27,000 | Apple, Inc. | 4,462,020 | ||||||

| 39,000 | Broadridge Financial Solutions, Inc. | 4,181,190 | ||||||

| 61,000 | CDW Corporation | 4,348,690 | ||||||

| 100,000 | Cisco Systems, Inc. | 4,429,000 | ||||||

| 42,000 | DXC Technology Company | 4,328,520 | ||||||

| 23,000 | Facebook, Inc., Class A(a) | 3,956,000 | ||||||

| 92,000 | Intel Corporation | 4,749,040 | ||||||

| 22,400 | Lam Research Corporation | 4,145,344 | ||||||

| 23,600 | MasterCard, Inc., Class A | 4,207,172 | ||||||

| 46,600 | Microsoft Corporation | 4,358,032 | ||||||

| 10,000 | Oracle Corporation | 456,700 | ||||||

| 46,000 | TE Connectivity Ltd. | 4,220,500 | ||||||

| 52,098,854 | ||||||||

| Materials — 2.81% | ||||||||

| 300 | Albemarle Corporation | 29,088 | ||||||

| 25,700 | Packaging Corporation of America | 2,973,233 | ||||||

| 67,000 | Steel Dynamics, Inc. | 3,002,270 | ||||||

| 6,004,591 | ||||||||

| Real Estate — 2.64% | ||||||||

| 20,000 | American Tower Corporation, Class A | 2,727,200 | ||||||

| 45,000 | Prologis, Inc. | 2,920,950 | ||||||

| 5,648,150 | ||||||||

| Telecommunication Services — 1.79% | ||||||||

| 58,000 | AT&T, Inc. | 1,896,600 | ||||||

| 32,000 | T-Mobile US, Inc.(a) | 1,936,320 | ||||||

| 3,832,920 | ||||||||

8

See accompanying notes which are an integral part of these financial statements.

Dana Large Cap Equity Fund

Schedule of Investments (continued)

April 30, 2018 (Unaudited)

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.80% — (continued) | ||||||||

| Utilities — 2.86% | ||||||||

| 122,000 | CenterPoint Energy, Inc. | $ | 3,090,260 | |||||

| 76,000 | Exelon Corporation | 3,015,680 | ||||||

| 6,105,940 | ||||||||

| Total Common Stocks (Cost $178,182,511) | 211,149,729 | |||||||

MONEY MARKET FUNDS — 2.34% | ||||||||

| 5,002,774 | Federated Government Obligations Fund - Institutional Class, 1.58%(b) | 5,002,774 | ||||||

| Total Money Market Funds (Cost $5,002,774) | 5,002,774 | |||||||

| Total Investments — 101.14% (Cost $183,185,285) | 216,152,503 | |||||||

| Liabilities in Excess of Other Assets — (1.14)% | (2,432,479 | ) | ||||||

| NET ASSETS — 100.00% | $ | 213,720,024 | ||||||

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of April 30, 2018. |

See accompanying notes which are an integral part of these financial statements.

9

Dana Small Cap Equity Fund

Schedule of Investments

April 30, 2018 (Unaudited)

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.03% | ||||||||

| Consumer Discretionary — 11.61% | ||||||||

| 6,719 | Big Lots, Inc. | $ | 285,222 | |||||

| 3,939 | Columbia Sportswear Company | 326,976 | ||||||

| 2,770 | LCI Industries | 263,981 | ||||||

| 2,770 | Lithia Motors, Inc., Class A | 265,532 | ||||||

| 9,933 | Marcus Corporation (The) | 296,003 | ||||||

| 2,106 | Marriott Vacations Worldwide Corporation | 258,217 | ||||||

| 3,914 | TopBuild Corporation(a) | 311,946 | ||||||

| 4,706 | Weight Watchers International, Inc.(a) | 329,655 | ||||||

| 2,337,532 | ||||||||

| Consumer Staples — 2.31% | ||||||||

| 5,963 | Central Garden & Pet Company(a) | 223,553 | ||||||

| 9,952 | Chefs' Warehouse, Inc. (The)(a) | 241,336 | ||||||

| 464,889 | ||||||||

| Energy — 3.77% | ||||||||

| 17,535 | Callon Petroleum Company(a) | 243,912 | ||||||

| 8,762 | Matador Resources Company(a) | 286,868 | ||||||

| 12,706 | RPC, Inc. | 228,835 | ||||||

| 759,615 | ||||||||

| Financials — 18.01% | ||||||||

| 9,955 | Berkshire Hills Bancorp, Inc. | 377,792 | ||||||

| 12,532 | CenterState Bank Corporation | 363,177 | ||||||

| 10,256 | First Bancorp | 391,267 | ||||||

| 8,856 | First Merchants Corporation | 381,516 | ||||||

| 3,664 | Primerica, Inc. | 354,492 | ||||||

| 15,745 | Sterling Bancorp | 373,944 | ||||||

| 5,765 | Stifel Financial Corporation | 335,984 | ||||||

| 10,278 | United Community Banks, Inc. | 328,177 | ||||||

| 10,701 | Universal Insurance Holdings, Inc. | 347,247 | ||||||

| 6,337 | Western Alliance Bancorp(a) | 373,756 | ||||||

| 3,627,352 | ||||||||

| Health Care — 17.30% | ||||||||

| 5,063 | AMN Healthcare Services, Inc.(a) | 338,462 | ||||||

| 5,499 | ANI Pharmaceuticals, Inc.(a) | 326,366 | ||||||

| 10,425 | BioTelemetry, Inc.(a) | 398,235 | ||||||

| 21,150 | Corcept Therapeutics, Inc.(a) | 352,782 | ||||||

| 6,761 | Emergent BioSolutions, Inc.(a) | 350,625 | ||||||

| 20,100 | HMS Holdings Corporation(a) | 362,001 | ||||||

| 2,047 | Ligand Pharmaceuticals, Inc., Class B(a) | 316,978 | ||||||

| 4,026 | Masimo Corporation(a) | 361,253 | ||||||

10

See accompanying notes which are an integral part of these financial statements.

Dana Small Cap Equity Fund

Schedule of Investments (continued)

April 30, 2018 (Unaudited)

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.03% — (continued) | ||||||||

| Health Care — 17.30% — (continued) | ||||||||

| 7,104 | Merit Medical Systems, Inc.(a) | $ | 344,544 | |||||

| 7,088 | Supernus Pharmaceuticals, Inc.(a) | 332,427 | ||||||

| 3,483,673 | ||||||||

| Industrials — 14.90% | ||||||||

| 12,485 | Air Transport Services Group, Inc.(a) | 252,696 | ||||||

| 4,209 | ASGN, Inc.(a) | 339,372 | ||||||

| 7,213 | Comfort Systems USA, Inc. | 304,389 | ||||||

| 15,621 | Harsco Corporation(a) | 319,449 | ||||||

| 6,359 | MasTec, Inc.(a) | 279,796 | ||||||

| 5,434 | Patrick Industries, Inc.(a) | 309,195 | ||||||

| 5,430 | SkyWest, Inc. | 308,967 | ||||||

| 6,431 | Tetra Tech, Inc. | 311,260 | ||||||

| 6,226 | TriNet Group, Inc.(a) | 321,573 | ||||||

| 12,677 | Wabash National Corporation | 254,301 | ||||||

| 3,000,998 | ||||||||

| Information Technology — 16.50% | ||||||||

| 4,936 | Advanced Energy Industries, Inc.(a) | 293,939 | ||||||

| 8,820 | Alarm.com Holdings, Inc.(a) | 356,152 | ||||||

| 8,730 | Bottomline Technologies (de), Inc.(a) | 345,010 | ||||||

| 1,448 | Coherent, Inc.(a) | 243,583 | ||||||

| 3,711 | Euronet Worldwide, Inc.(a) | 289,866 | ||||||

| 14,036 | Kulicke & Soffa Industries, Inc.(a) | 321,284 | ||||||

| 5,084 | Lumentum Holdings, Inc.(a) | 256,488 | ||||||

| 2,791 | MKS Instruments, Inc. | 285,798 | ||||||

| 8,315 | Progress Software Corporation | 307,073 | ||||||

| 6,697 | RealPage, Inc.(a) | 358,289 | ||||||

| 2,485 | Rogers Corporation(a) | 265,149 | ||||||

| 3,322,631 | ||||||||

| Materials — 4.21% | ||||||||

| 8,234 | AdvanSix, Inc.(a) | 294,942 | ||||||

| 11,018 | Ferro Corporation(a) | 242,506 | ||||||

| 7,430 | PolyOne Corporation | 310,946 | ||||||

| 848,394 | ||||||||

| Real Estate — 6.28% | ||||||||

| 2,815 | CoreSite Realty Corporation | 293,042 | ||||||

| 21,707 | Monmouth Real Estate Investment Corporation, Class A | 339,280 | ||||||

| 22,006 | Preferred Apartment Communities, Inc., Class A | 323,709 | ||||||

| 12,548 | STAG Industrial, Inc. | 308,304 | ||||||

| 1,264,335 | ||||||||

See accompanying notes which are an integral part of these financial statements.

11

Dana Small Cap Equity Fund

Schedule of Investments (continued)

April 30, 2018 (Unaudited)

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.03% — (continued) | ||||||||

| Telecommunication Services — 0.72% | ||||||||

| 12,941 | Vonage Holdings Corporation(a) | $ | 144,680 | |||||

| Utilities — 3.42% | ||||||||

| 4,480 | Chesapeake Utilities Corporation | 340,480 | ||||||

| 4,769 | Southwest Gas Holdings, Inc. | 348,089 | ||||||

| 688,569 | ||||||||

| Total Common Stocks (Cost $17,592,121) | 19,942,668 | |||||||

MONEY MARKET FUNDS — 0.96% | ||||||||

| 194,052 | Federated Government Obligations Fund - Institutional Class, 1.58%(b) | 194,052 | ||||||

| Total Money Market Funds (Cost $194,052) | 194,052 | |||||||

| Total Investments — 99.99% (Cost $17,786,173) | 20,136,720 | |||||||

| Other Assets in Excess of Liabilities — 0.01% | 2,502 | |||||||

| NET ASSETS — 100.00% | $ | 20,139,222 | ||||||

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of April 30, 2018. |

The sectors shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

12

See accompanying notes which are an integral part of these financial statements.

Dana Funds

Statements of Assets and Liabilities

April 30, 2018 (Unaudited)

| Dana Large Cap Equity Fund | Dana Small Cap Equity Fund | |||||||

| Assets | ||||||||

| Investments in securities at fair value (cost $183,185,285 and $17,786,173) | $ | 216,152,503 | $ | 20,136,720 | ||||

| Receivable for fund shares sold | 450,829 | — | ||||||

| Dividends receivable | 114,567 | 3,035 | ||||||

| Receivable from Adviser | — | 543 | ||||||

| Prepaid expenses | 27,474 | 21,426 | ||||||

| Total Assets | 216,745,373 | 20,161,724 | ||||||

| Liabilities | ||||||||

| Payable for fund shares redeemed | 164,854 | — | ||||||

| Payable for investments purchased | 2,730,227 | — | ||||||

| Payable to Adviser | 95,743 | — | ||||||

| Payable for Distribution Fees | 6,154 | 816 | ||||||

| Payable to Administrator | 17,331 | 12,457 | ||||||

| Other accrued expenses | 11,040 | 9,229 | ||||||

| Total Liabilities | 3,025,349 | 22,502 | ||||||

| Net Assets | $ | 213,720,024 | $ | 20,139,222 | ||||

| Net Assets consist of: | ||||||||

| Paid-in capital | 176,234,513 | 17,406,660 | ||||||

| Accumulated net investment income (loss) | 285,867 | (35,999 | ) | |||||

| Accumulated undistributed net realized gain from investment transactions | 4,232,426 | 418,014 | ||||||

| Net unrealized appreciation on investments | 32,967,218 | 2,350,547 | ||||||

| Net Assets | $ | 213,720,024 | $ | 20,139,222 | ||||

| Institutional Class: | ||||||||

| Net Assets | $ | 183,979,560 | $ | 16,259,381 | ||||

| Shares outstanding (unlimited number of shares authorized, no par value) | 8,128,913 | 1,443,822 | ||||||

| Net asset value, offering and redemption price per share | $ | 22.63 | $ | 11.26 | ||||

| Investor Class: | ||||||||

| Net Assets | $ | 29,740,464 | $ | 3,879,841 | ||||

| Shares outstanding (unlimited number of shares authorized, no par value) | 1,314,060 | 346,435 | ||||||

| Net asset value, offering and redemption price per share | $ | 22.63 | $ | 11.20 | ||||

See accompanying notes which are an integral part of these financial statements.

13

Dana Funds

Statements of Operations

For the six months ended April 30, 2018 (Unaudited)

| Dana Large Cap Equity Fund | Dana Small Cap Equity Fund | |||||||

| Investment Income | ||||||||

| Dividend income | $ | 2,084,913 | $ | 100,421 | ||||

| Total investment income | 2,084,913 | 100,421 | ||||||

| Expenses | ||||||||

| Investment Adviser | 702,450 | 83,947 | ||||||

| Administration | 51,259 | 22,044 | ||||||

| Distribution 12b-1, Investor Class | 44,505 | 6,826 | ||||||

| Fund accounting | 27,308 | 17,377 | ||||||

| Registration | 23,243 | 18,233 | ||||||

| Transfer agent | 13,562 | 11,638 | ||||||

| Custodian | 13,957 | 3,248 | ||||||

| Audit and tax preparation | 8,707 | 8,458 | ||||||

| Legal | 8,377 | 8,377 | ||||||

| Insurance | 8,987 | 2,154 | ||||||

| Printing | 8,601 | 1,872 | ||||||

| Trustee | 5,048 | 3,338 | ||||||

| Interest | 4,056 | 652 | ||||||

| Miscellaneous | 9,728 | 8,400 | ||||||

| Total expenses | 929,788 | 196,564 | ||||||

| Fees contractually waived and expenses reimbursed by Adviser | (147,919 | ) | (89,425 | ) | ||||

| Net operating expenses | 781,869 | 107,139 | ||||||

| Net investment income (loss) | 1,303,044 | (6,718 | ) | |||||

| Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||||||

| Net realized gain on investment securities transactions | 4,240,317 | 631,533 | ||||||

| Net change in unrealized appreciation (depreciation) on investment securities | 1,094,773 | (952,857 | ) | |||||

| Net realized and change in unrealized gain (loss) on investments | 5,335,090 | (321,324 | ) | |||||

| Net increase (decrease) in net assets resulting from operations | $ | 6,638,134 | $ | (328,042 | ) | |||

14

See accompanying notes which are an integral part of these financial statements.

Dana Funds

Statements of Changes in Net Assets

| Dana Large Cap Equity Fund | Dana Small Cap Equity Fund | |||||||||||||||

| For the Six Months Ended April 30, 2018 (Unaudited) | For the Year Ended October 31, 2017 | For the Six Months Ended April 30, 2018 (Unaudited) | For the Year Ended October 31, 2017 | |||||||||||||

| Increase (Decrease) in Net Assets due to: | ||||||||||||||||

| Operations | ||||||||||||||||

| Net investment income (loss) | $ | 1,303,044 | $ | 2,094,303 | $ | (6,718 | ) | $ | (13,430 | ) | ||||||

| Net realized gain on investment securities transactions | 4,240,317 | 13,094,901 | 631,533 | 63,928 | ||||||||||||

| Net change in unrealized appreciation (depreciation) of investment securities | 1,094,773 | 25,349,579 | (952,857 | ) | 2,944,021 | |||||||||||

| Net increase (decrease) in net assets resulting from operations | 6,638,134 | 40,538,783 | (328,042 | ) | 2,994,519 | |||||||||||

| Distributions From | ||||||||||||||||

| Net investment income: | ||||||||||||||||

| Class A(a) | — | (18,088 | ) | |||||||||||||

| Institutional Class | (1,019,357 | ) | (1,652,850 | ) | (4,138 | ) | (12,219 | ) | ||||||||

| Investor Class(a) | (184,023 | ) | (466,217 | ) | — | (3,424 | ) | |||||||||

| Net realized gains: | ||||||||||||||||

| Institutional Class | (5,035,893 | ) | — | — | — | |||||||||||

| Investor Class | (1,329,377 | ) | — | — | — | |||||||||||

| Total distributions | (7,568,650 | ) | (2,137,155 | ) | (4,138 | ) | (15,643 | ) | ||||||||

| Capital Transactions - Class A(a) | ||||||||||||||||

| Proceeds from shares sold | — | 88,095 | ||||||||||||||

| Shares redeemed in connection with class consolidation | — | (1,435,747 | ) | |||||||||||||

| Reinvestment of distributions | — | 16,810 | ||||||||||||||

| Amount paid for shares redeemed | — | (331,496 | ) | |||||||||||||

| Total – Class A | — | (1,662,338 | ) | |||||||||||||

See accompanying notes which are an integral part of these financial statements.

15

Dana Funds

Statements of Changes in Net Assets (continued)

| Dana Large Cap Equity Fund | Dana Small Cap Equity Fund | |||||||||||||||

| For the Six Months Ended April 30, 2018 (Unaudited) | For the Year Ended October 31, 2017 | For the Six Months Ended April 30, 2018 (Unaudited) | For the Year Ended October 31, 2017 | |||||||||||||

| Capital Transactions - Institutional Class | ||||||||||||||||

| Proceeds from shares sold | $ | 77,384,005 | $ | 43,190,437 | $ | 4,024,439 | $ | 6,663,858 | ||||||||

| Reinvestment of distributions | 4,774,416 | 163,064 | 3,493 | 11,845 | ||||||||||||

| Amount paid for shares redeemed | (30,868,239 | ) | (76,805,815 | ) | (1,490,992 | ) | (1,194,695 | ) | ||||||||

| Proceeds from redemption fees(b) | — | 4,007 | — | — | ||||||||||||

| Total – Institutional Class | 51,290,182 | (33,448,307 | ) | 2,536,940 | 5,481,008 | |||||||||||

| Capital Transactions - Investor Class(a) | ||||||||||||||||

| Proceeds from shares sold | 1,560,197 | 1,374,972 | 197,445 | 2,501,527 | ||||||||||||

| Shares issued in connection with class consolidation | — | 1,435,747 | — | — | ||||||||||||

| Reinvestment of distributions | 1,512,919 | 459,195 | — | 3,424 | ||||||||||||

| Amount paid for shares redeemed | (14,960,895 | ) | (3,707,148 | ) | (3,050,038 | ) | (356,670 | ) | ||||||||

| Total – Investor Class | (11,887,779 | ) | (437,234 | ) | (2,852,593 | ) | 2,148,281 | |||||||||

| Net increase (decrease) in net assets resulting from capital transactions | 39,402,403 | (35,547,879 | ) | (315,653 | ) | 7,629,289 | ||||||||||

| Total Increase (Decrease) in Net Assets | 38,471,887 | 2,853,749 | (647,833 | ) | 10,608,165 | |||||||||||

| Net Assets | ||||||||||||||||

| Beginning of period | 175,248,137 | 172,394,388 | 20,787,055 | 10,178,890 | ||||||||||||

| End of period | $ | 213,720,024 | $ | 175,248,137 | $ | 20,139,222 | $ | 20,787,055 | ||||||||

| Accumulated net investment income (loss) | $ | 285,867 | $ | 186,203 | $ | (35,999 | ) | $ | (25,143 | ) | ||||||

16

See accompanying notes which are an integral part of these financial statements.

Dana Funds

Statements of Changes in Net Assets (continued)

| Dana Large Cap Equity Fund | Dana Small Cap Equity Fund | |||||||||||||||

| For the Six Months Ended April 30, 2018 (Unaudited) | For the Year Ended October 31, 2017 | For the Six Months Ended April 30, 2018 (Unaudited) | For the Year Ended October 31, 2017 | |||||||||||||

| Share Transactions - Class A(a) | ||||||||||||||||

| Shares sold | — | 4,307 | ||||||||||||||

| Shares redeemed in connection with class consolidation | — | (64,455 | ) | |||||||||||||

| Shares issued in reinvestment of distributions | — | 835 | ||||||||||||||

| Shares redeemed | — | (16,663 | ) | |||||||||||||

| Total Class A | — | (75,976 | ) | |||||||||||||

| Share Transactions - Institutional Class | ||||||||||||||||

| Shares sold | 3,323,113 | 2,049,462 | 348,630 | 628,613 | ||||||||||||

| Shares issued in reinvestment of distributions | 208,208 | 8,132 | 298 | 1,113 | ||||||||||||

| Shares redeemed | (1,332,766 | ) | (3,965,578 | ) | (130,749 | ) | (110,673 | ) | ||||||||

| Total Institutional Class | 2,198,555 | (1,907,984 | ) | 218,179 | 519,053 | |||||||||||

| Share Transactions - Investor Class(a) | ||||||||||||||||

| Shares sold | 67,446 | 66,528 | 17,008 | 240,680 | ||||||||||||

| Shares issued in connection with class consolidation | — | 64,333 | — | — | ||||||||||||

| Shares issued in reinvestment of distributions | 66,009 | 22,704 | — | 323 | ||||||||||||

| Shares redeemed | (628,237 | ) | (184,163 | ) | (266,030 | ) | (33,941 | ) | ||||||||

| Total Investor Class | (494,782 | ) | (30,598 | ) | (249,022 | ) | 207,062 | |||||||||

(a) | Effective October 13, 2017, the outstanding Class A shares of the Dana Large Cap Equity Fund were exchanged for Class N shares of the Dana Large Cap Equity Fund and immediately following the class exchange Class N shares were re-designated as Investor Class shares. |

(b) | Prior to February 28, 2017, the Funds charged a 2.00% redemption fee on shares redeemed within 60 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

17

Dana Large Cap Equity Fund – Institutional Class Financial Highlights Selected data for a share outstanding throughout each period. |

| Six Months Ended April 30, 2018 | Years Ended October 31, | Period Ended October 31, | ||||||||||||||||||||||

| (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013(a) | |||||||||||||||||||

| Net asset value, at beginning of period | $ | 22.64 | $ | 17.67 | $ | 18.22 | $ | 18.52 | $ | 17.19 | $ | 17.14 | ||||||||||||

| Income from investment operations: | ||||||||||||||||||||||||

| Net investment income | 0.14 | 0.32 | 0.26 | (b) | 0.19 | 0.26 | — | (b)(c) | ||||||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.73 | 4.96 | (0.56 | ) | 0.52 | (d) | 2.44 | 0.05 | ||||||||||||||||

| Total from investment operations | 0.87 | 5.28 | (0.30 | ) | 0.71 | 2.70 | 0.05 | |||||||||||||||||

| Distributions from: | ||||||||||||||||||||||||

| Net investment income | (0.14 | ) | (0.31 | ) | (0.25 | ) | (0.19 | ) | (0.25 | ) | — | |||||||||||||

| Net realized gain | (0.74 | ) | — | — | (0.83 | ) | (1.12 | ) | — | |||||||||||||||

| Total from distributions | (0.88 | ) | (0.31 | ) | (0.25 | ) | (1.02 | ) | (1.37 | ) | — | |||||||||||||

| Redemption fees | — | — | (c) | — | (c) | 0.01 | — | — | ||||||||||||||||

| Net asset value, at end of period | $ | 22.63 | $ | 22.64 | $ | 17.67 | $ | 18.22 | $ | 18.52 | $ | 17.19 | ||||||||||||

| Total Return (e) | 3.81 | %(f) | 30.11 | % | (1.66 | )% | 3.89 | % | 16.60 | % | 0.29 | %(f) | ||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||||||

| Net assets at end of period (thousands) | $ | 183,980 | $ | 134,291 | $ | 138,540 | $ | 117,663 | $ | 6,919 | $ | 273 | ||||||||||||

| Before waiver: | ||||||||||||||||||||||||

| Ratio of expenses to average net assets | 0.88 | %(g) | 0.92 | % | 0.91 | % | 1.00 | % | 1.68 | % | 1.53 | %(g) | ||||||||||||

| After waiver: | ||||||||||||||||||||||||

| Ratio of expenses to average net assets | 0.73 | %(g) | 0.74 | %(h) | 0.73 | % | 0.73 | % | 0.73 | % | 0.73 | %(g) | ||||||||||||

| Ratio of net investment income to average net assets | 1.33 | %(g) | 1.48 | % | 1.45 | % | 1.25 | % | 1.34 | % | 0.49 | %(g) | ||||||||||||

| Portfolio turnover (i) | 23 | %(f) | 50 | % | 69 | % | 45 | % | 57 | % | 70 | %(f) | ||||||||||||

(a) | The Dana Large Cap Equity Fund’s Institutional Class commenced operations on October 29, 2013. |

(b) | Per share net investment income has been determined on the basis of average shares outstanding during the period. |

(c) | The amount is less than $0.005 per share. |

(d) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

(e) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(f) | Not annualized |

(g) | Annualized |

(h) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.73% for the for the fiscal year ended October 31, 2017. |

(i) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

18

See accompanying notes which are an integral part of these financial statements.

Dana Large Cap Equity Fund – Investor Class Financial Highlights Selected data for a share outstanding throughout each period. |

| Six Months Ended April 30, 2018 | Years Ended October 31, | |||||||||||||||||||||||

| (Unaudited) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||||

| Net asset value, at beginning of period | $ | 22.64 | $ | 17.68 | $ | 18.23 | $ | 18.54 | $ | 17.19 | $ | 13.88 | ||||||||||||

| Income from investment operations: | ||||||||||||||||||||||||

| Net investment income | 0.13 | 0.24 | 0.22 | (a) | 0.18 | 0.19 | 0.21 | (a) | ||||||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.71 | 4.98 | (0.57 | ) | 0.49 | (b) | 2.46 | 3.40 | ||||||||||||||||

| Total from investment operations | 0.84 | 5.22 | (0.35 | ) | 0.67 | 2.65 | 3.61 | |||||||||||||||||

| Distributions from: | ||||||||||||||||||||||||

| Net investment income | (0.11 | ) | (0.26 | ) | (0.20 | ) | (0.15 | ) | (0.18 | ) | (0.22 | ) | ||||||||||||

| Net realized gain | (0.74 | ) | — | — | (0.83 | ) | (1.12 | ) | (0.08 | ) | ||||||||||||||

| Total from distributions | (0.85 | ) | (0.26 | ) | (0.20 | ) | (0.98 | ) | (1.30 | ) | (0.30 | ) | ||||||||||||

| Redemption fees | — | — | — | (c) | — | (c) | — | (c) | — | (c) | ||||||||||||||

| Net asset value, at end of period | $ | 22.63 | $ | 22.64 | $ | 17.68 | $ | 18.23 | $ | 18.54 | $ | 17.19 | ||||||||||||

| Total Return (d) | 3.67 | %(e) | 29.72 | % | (1.91 | )% | 3.61 | % | 16.23 | % | 26.35 | % | ||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||||||

| Net assets at end of period (thousands) | $ | 29,740 | $ | 40,957 | $ | 32,514 | $ | 36,909 | $ | 29,197 | $ | 18,306 | ||||||||||||

| Before waiver | ||||||||||||||||||||||||

| Ratio of expenses to average net assets | 1.13 | %(f) | 1.17 | % | 1.16 | % | 1.25 | % | 1.93 | % | 1.99 | % | ||||||||||||

| After waiver | ||||||||||||||||||||||||

| Ratio of expenses to average net assets | 0.98 | %(f) | 0.99 | %(g) | 0.98 | % | 0.98 | % | 0.98 | % | 0.98 | % | ||||||||||||

| Ratio of net investment income to average net assets | 1.12 | %(f) | 1.20 | % | 1.22 | % | 1.00 | % | 1.09 | % | 1.33 | % | ||||||||||||

| Portfolio turnover (h) | 23 | %(e) | 50 | % | 69 | % | 45 | % | 57 | % | 70 | % | ||||||||||||

(a) | Per share net investment income has been determined on the basis of average shares outstanding during the year. |

(b) | The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the year. |

(c) | The amount is less than $0.005 per share. |

(d) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(e) | Not annualized |

(f) | Annualized |

(g) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.98% for the fiscal year ended October 31, 2017. |

(h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

19

Dana Small Cap Equity Fund – Institutional Class Financial Highlights Selected data for a share outstanding throughout each period. |

| Six Months Ended April 30, 2018 (Unaudited) | Year Ended October 31, 2017 | Period | ||||||||||

| Net asset value, at beginning of period | $ | 11.43 | $ | 9.30 | $ | 10.00 | ||||||

| Income from investment operations: | ||||||||||||

| Net investment income (loss) | — | (b) | — | 0.01 | ||||||||

| Net realized and unrealized gain (loss) on investments | (0.17 | ) | 2.14 | (b) | (0.70 | )(c) | ||||||

| Total from investment operations | (0.17 | ) | 2.14 | (0.69 | ) | |||||||

| Distributions from: | ||||||||||||

| Net investment income | — | (b) | (0.01 | ) | (0.01 | ) | ||||||

| Total from distributions | — | (0.01 | ) | (0.01 | ) | |||||||

| Redemption fees | — | — | — | (b) | ||||||||

| Net asset value, at end of period | $ | 11.26 | $ | 11.43 | $ | 9.30 | ||||||

| Total Return (d) | (1.46 | )%(e) | 23.08 | % | (6.87 | )%(e) | ||||||

| Ratios/Supplemental Data: | ||||||||||||

| Net assets at end of period (thousands) | $ | 16,259 | $ | 14,011 | $ | 6,575 | ||||||

| Before waiver: | ||||||||||||

| Ratio of expenses to average net assets | 1.81 | %(f) | 2.02 | % | 4.11 | %(f) | ||||||

| After waiver: | ||||||||||||

| Ratio of expenses to average net assets | 0.96 | %(f)(g) | 0.95 | % | 0.95 | %(f) | ||||||

| Ratio of net investment income to average net assets | (0.01 | )%(f) | — | % | 0.12 | %(f) | ||||||

| Portfolio turnover (h) | 40 | %(e) | 58 | % | 54 | %(e) | ||||||

(a) | For the period November 3, 2015 (commencement of operations) through October 31, 2016. |

(b) | The amount is less than $0.005 per share. |

(c) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

(d) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(e) | Not annualized |

(f) | Annualized |

(g) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.95% for the six months ended April 30, 2018. |

(h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

20

Dana Small Cap Equity Fund – Investor Class Financial Highlights Selected data for a share outstanding throughout each period. |

| Six Months Ended April 30, 2018 (Unaudited) | Year Ended October 31, 2017 | Period | ||||||||||

| Net asset value, at beginning of period | $ | 11.38 | $ | 9.28 | $ | 10.00 | ||||||

| Income from investment operations: | ||||||||||||

| Net investment income (loss) | (0.03 | ) | (0.01 | ) | — | (b) | ||||||

| Net realized and unrealized gain (loss) on investments | (0.15 | ) | 2.12 | (0.71 | )(c) | |||||||

| Total from investment operations | (0.18 | ) | 2.11 | (0.71 | ) | |||||||

| Distributions from: | ||||||||||||

| Net investment income | — | (0.01 | ) | (0.01 | ) | |||||||

| Total from distributions | — | (0.01 | ) | (0.01 | ) | |||||||

| Redemption fees | — | — | — | (b) | ||||||||

| Net asset value, at end of period | $ | 11.20 | $ | 11.38 | $ | 9.28 | ||||||

| Total Return (d) | (1.58 | )%(e) | 22.73 | % | (7.13 | )%(e) | ||||||

| Ratios/Supplemental Data: | ||||||||||||

| Net assets at end of period (thousands) | $ | 3,880 | $ | 6,776 | $ | 3,604 | ||||||

| Before waiver: | ||||||||||||

| Ratio of expenses to average net assets | 2.06 | %(f) | 2.27 | % | 4.53 | %(f) | ||||||

| After waiver: | ||||||||||||

| Ratio of expenses to average net assets | 1.21 | %(f)(g) | 1.20 | % | 1.20 | %(f) | ||||||

| Ratio of net investment loss to average net assets | (0.23 | )%(f) | (0.25 | )% | (0.10 | )%(f) | ||||||

| Portfolio turnover (h) | 40 | %(e) | 58 | % | 54 | %(e) | ||||||

(a) | For the period November 3, 2015 (commencement of operations) through October 31, 2016. |

(b) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

(c) | The amount is less than $0.005 per share. |

(d) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(e) | Not annualized |

(f) | Annualized |

(g) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 1.20% for the six months ended April 30, 2018. |

(h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

21

Dana Funds

Notes to the Financial Statements

April 30, 2018 (Unaudited)

NOTE 1. ORGANIZATION

The Dana Large Cap Equity Fund (the “Large Cap Fund”) and the Dana Small Cap Equity Fund (the “Small Cap Fund”) (each a “Fund” and collectively, the “Funds”) are each an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (“Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. Each Fund is one of a series of funds currently authorized by the Board. The investment adviser to the Funds is Dana Investment Advisors, Inc. (the “Adviser”). Each Fund seeks long-term growth of capital.

The Large Cap Fund and Small Cap Fund currently offer Investor Class shares and Institutional Class shares. Effective at the close of business on October 13, 2017, Class A shares were consolidated into Class N shares of the Large Cap Fund which were subsequently re-designated Investor Class shares. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as declared by the Board. Prior to February 28, 2017, all share classes imposed a 2.00% redemption fee on shares redeemed within 60 days of purchase.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. These policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Funds make no provision for federal income or excise tax. Each Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. Each Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

22

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2018 (Unaudited)

For the six months ended April 30, 2018, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the statements of operations when incurred. During the period, the Funds did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis. Expenses attributable to any class are borne by that class. Income, realized gains and losses, unrealized appreciation and depreciation, and expenses are allocated to each class based on the net assets in relation to the relative net assets of the Fund.

Security Transactions and Related Income – The Funds follow industry practice and record security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method, if applicable. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds intend to distribute substantially all of their net investment income quarterly. The Funds intend to distribute their net realized long-term and short-term capital gains, if any, annually. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Funds.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained

23

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2018 (Unaudited)

and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below.

● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

● | Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number

24

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2018 (Unaudited)

of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Funds’ investments as of April 30, 2018:

| Large Cap Fund | Valuation Inputs | |||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks* | $ | 211,149,729 | $ | — | $ | — | $ | 211,149,729 | ||||||||

| Money Market Funds | 5,002,774 | — | — | 5,002,774 | ||||||||||||

| Total | $ | 216,152,503 | $ | — | $ | — | $ | 216,152,503 | ||||||||

| Small Cap Fund | Valuation Inputs | |||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks* | $ | 19,942,668 | $ | — | $ | — | $ | 19,942,668 | ||||||||

| Money Market Funds | 194,052 | — | — | 194,052 | ||||||||||||

| Total | $ | 20,136,720 | $ | — | $ | — | $ | 20,136,720 | ||||||||

* | Refer to Schedule of Investments for sector classifications. |

The Funds did not hold any investments at the end of the reporting period for which other significant observable inputs (Level 2) were used in determining fair value. The Funds did not hold any investments during the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Funds did not hold any derivative instruments during the reporting period.

The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period. There were no transfers between any levels as of April 30, 2018 based on input levels assigned at October 31, 2017.

NOTE 4. TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement for each Fund, manages the Funds’ investments subject to oversight of the Board. As compensation for its management services, the Funds are obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.70% and 0.80% of the average daily net assets of the Large Cap Fund and the Small Cap Fund, respectively. For the six months ended April 30, 2018, the Adviser earned fees of $702,450 from the Large Cap Fund and $83,947 from the Small Cap Fund before the waivers described below. At April 30, 2018, the Large Cap Fund owed the Adviser $95,743 and the Adviser owed the Small Cap Fund $543.

The Adviser has contractually agreed to waive its management fee and/or reimburse certain operating expenses through February 28, 2019, but only to the extent necessary so that the Funds’ net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect

25

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2018 (Unaudited)

expenses (such as “acquired funds fees and expenses”) do not exceed 0.73% for Institutional Class and Investor Class for the Large Cap Fund and do not exceed 0.95% for the Institutional Class and Investor Class for the Small Cap Fund.

Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the applicable Fund within the three years following the date in which the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. The contractual agreement is in effect through February 28, 2019. The expense cap may not be terminated prior to this date except by the Board. For the six months ended April 30, 2018, the Adviser waived fees of $147,919 from the Large Cap Fund and $89,425 from the Small Cap Fund. As of April 30, 2018, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements of $888,480 and $413,349 from the Large Cap Fund and Small Cap Fund, respectively, pursuant to the aforementioned conditions, no later than April 30, 2021.

The Trust retains Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”), to provide the Funds with administration, compliance, fund accounting, and transfer agent services, including all regulatory reporting. Prior to April 12, 2018, Ultimus Asset Services, LLC, an affiliate of the Administrator, provided these services. Expenses incurred by the Funds for these services are allocated to the individual Funds based on each Fund’s relative net assets.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Funds’ shares. For the six months ended April 30, 2018, fees for administration and compliance, fund accounting, and transfer agent services, and amounts due to the Administrator at April 30, 2018 were as follows:

| Large Cap Fund | Small Cap Fund | |||||||

| Administration | $ | 51,259 | $ | 22,044 | ||||

| Fund accounting | 27,308 | 17,377 | ||||||

| Transfer agent | 13,562 | 11,638 | ||||||

| Payable to Ultimus | 17,331 | 12,457 | ||||||

The Trust, with respect to each Fund, has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “1940 Act”). The Plan provides that the Funds will pay the Distributor and any registered securities dealer, financial institution or any other person (a “Recipient”) a shareholder servicing fee aggregating at a rate of 0.25% of the average daily net assets for the Investor Class shares in connection with the promotion and distribution of the Funds’ shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts. The Funds, or the Adviser, may pay all, or a portion, of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is paid

26

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2018 (Unaudited)

regardless of 12b-1 expenses actually incurred. It is anticipated that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to achieve efficiently its investment objectives and to realize economies of scale. For the six months ended April 30, 2018, Investor Class shares 12b-1 expense incurred by the Large Cap Fund was $44,505 and Investor Class shares 12b-1 expense incurred by the Small Cap Fund was $6,826. The Large Cap Fund owed $6,154 for Investor Class 12b-1 fees as of April 30, 2018 and the Small Cap Fund owed $816 for Investor Class shares 12b-1 fees as of April 30, 2018.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the six months ended April 30, 2018, purchases and sales of investment securities, other than short-term investments were as follows:

| Large Cap Fund | Small Cap Fund | |||||||||

Purchases | $ | 79,488,075 | $ | 8,261,246 | ||||||

Sales | $ | 46,223,505 | $ | 8,456,127 | ||||||

There were no purchases or sales of long-term U.S. government obligations during the six months ended April 30, 2018.

NOTE 6. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. At April 30, 2018, Charles Schwab & Co., Inc. (“Schwab”) owned, as record shareholder for the beneficial owners of such shares, 66% and 72% of the outstanding shares of the Large Cap Fund and Small Cap Fund, respectively.

NOTE 7. FEDERAL TAX INFORMATION

At April 30, 2018, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| Large Cap Fund | Small Cap Fund | |||||||

| Gross Unrealized Appreciation | $ | 36,354,056 | $ | 2,891,667 | ||||

| Gross Unrealized Depreciation | (3,394,719 | ) | (542,128 | ) | ||||

| Net Unrealized Appreciation | $ | 32,959,337 | $ | 2,349,539 | ||||

At April 30, 2018, the aggregate cost of securities for federal income tax purposes was $183,193,166 for the Large Cap Fund and $17,787,181 for the Small Cap Fund.

At April 30, 2018, the difference between book basis and tax basis unrealized appreciation for the Large Cap Fund and Small Cap Fund was attributable primarily to the tax deferral of losses on wash sales and the return of capital adjustments from real estate investment trusts.

27

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2018 (Unaudited)

At October 31, 2017, the Funds’ most recent fiscal year end, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Large Cap Fund | Small Cap Fund | |||||||

| Undistributed Ordinary Income | $ | 186,203 | $ | — | ||||

| Undistributed Long-Term Capital Gains | 6,365,260 | — | ||||||

| Accumulated Capital and Other Losses | — | (230,776 | ) | |||||

| Unrealized Appreciation (Depreciation) | 31,864,564 | 3,295,518 | ||||||

| Total Accumulated Earnings (Deficit) | $ | 38,416,027 | $ | 3,064,742 | ||||

The tax character of distributions for the fiscal year ended October 31, 2017 was as follows:

| Large Cap Fund | Small Cap Fund | |||||||

| Distributions paid from: | ||||||||

| Ordinary Income | $ | 2,137,155 | $ | 11,650 | ||||

| Return of Capital | — | 3,993 | ||||||

| $ | 2,137,155 | $ | 15,643 | |||||

As of October 31, 2017, the Small Cap Fund had available for tax purposes unused capital loss carryforwards of $203,266 of short-term capital losses with no expiration, which is available to offset against future taxable net capital gains. To the extent that these carryforwards are used to offset future gains, it is probable that the amount offset will not be distributed to shareholders.

During the fiscal year ended October 31, 2017, the Large Cap Fund and the Small Cap Fund utilized short-term capital loss carryforwards in the amount of $6,777,950 and $62,524, respectively.

For the tax year ended October 31, 2017, the Small Cap Fund deferred Qualified Late Year Ordinary losses of $27,510.

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Funds indemnify their officers and trustees for certain liabilities that may arise from performance of their duties to the Funds. Additionally, in the normal course of business, the Funds enter into contracts that contain a variety of representations and warranties which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

Management of the Funds has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

28

Summary of Fund Expenses (Unaudited)

As a shareholder of one of the Funds, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Each Fund’s example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2017 through April 30, 2018.

Actual Expenses

The first line of the table for each class provides information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each class provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table for each class is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

29

Summary of Fund Expenses (Unaudited) (continued)

Beginning | Ending | Expenses | Annualized | ||

Large Cap Fund | |||||

Institutional Class | Actual | $ 1,000.00 | $ 1,038.10 | $3.71 | 0.73% |

Hypothetical (b) | $ 1,000.00 | $ 1,021.15 | $3.68 | 0.73% | |

Investor Class | Actual | $ 1,000.00 | $ 1,036.70 | $4.97 | 0.98% |

Hypothetical (b) | $ 1,000.00 | $ 1,019.92 | $4.93 | 0.98% | |

Beginning | Ending | Expenses | Annualized | ||

Small Cap Fund | |||||

Institutional Class | Actual | $ 1,000.00 | $ 985.40 | $4.71 | 0.96% |

Hypothetical (b) | $ 1,000.00 | $ 1,020.05 | $4.79 | 0.96% | |

Investor Class | Actual | $ 1,000.00 | $ 984.20 | $5.93 | 1.21% |

Hypothetical (b) | $ 1,000.00 | $ 1,018.82 | $6.03 | 1.21% | |

(a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratios reflect reimbursement of expenses by the Fund’s investment adviser for the period beginning November 1, 2017 to April 30, 2018. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such reimbursements. |

(b) | Hypothetical assumes 5% annual return before expenses. |

30

| FACTS | WHAT DOES VALUED ADVISERS TRUST DO WITH YOUR PERSONAL INFORMATION? |