UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22211

______________________________________________

IVA FIDUCIARY TRUST

______________________________________________________________________

(Exact name of registrant as specified in charter)

717 Fifth Avenue, 10th Floor, New York, NY 10022

______________________________________________________________________

(Address of principal executive offices) (zip code)

|

Michael W. Malafronte International Value Advisers, LLC 717 Fifth Avenue |

(Name and address of agent for service) |

Copy to: |

Stuart E. Fross, Esq. Brian F. Link, Esq. |

Registrant’s telephone number, including area code: (212) 584-3570

Date of fiscal year end: September 30

Date of reporting period: March 31, 2012

Item 1. Report to Shareholders.

IVA International Fund

| Contents | IVA Funds |

| 2 | An Owner’s Manual | |||||

| 3 | Letter from the President | |||||

| 4 | Letter from the Portfolio Managers | |||||

| 6 | Management’s Discussion of Fund Performance | |||||

IVA Worldwide Fund | ||||||

| 8 9 10 | Performance Portfolio Composition Schedule of Investments | |||||

IVA International Fund | ||||||

| 18 19 20 | Performance Portfolio Composition Schedule of Investments | |||||

| 27 | Statements of Assets and Liabilities | |||||

| 28 | Statements of Operations | |||||

| 29 | Statements of Changes in Net Assets | |||||

| 30 | Financial Highlights | |||||

| 36 | Notes to Financial Statements | |||||

| 44 | Trustees and Officers | |||||

| 46 | Additional Information | |||||

| 47 | Fund Expenses | |||||

| An Owner’s Manual | IVA Funds |

| • | We don’t hug benchmarks. In practical terms, this means we are willing to make big “negative bets,” i.e., having nothing or little in what has become big in the benchmark. Conversely, we will generally seek to avoid overly large positive bets. |

| • | We prefer having diversified portfolios (100 to 150 names). Because we invest on a global basis, we believe that diversification helps protect against weak corporate governance or insufficient disclosure, or simply against “unknown unknowns.” |

| • | We like the flexibility to invest in small, medium and large companies, depending on where we see value. |

| • | We attempt to capture equity-type returns through fixed income securities but predominantly when credit markets (or sub-sets of them) are depressed and offer this potential. |

| • | We hold some gold, either in bullion form or via gold mining securities, as we feel it provides a good hedge in either an inflationary or deflationary period. |

| • | We are willing to hold cash when we cannot find enough cheap securities that we like or when we find some, yet the broader market (Mr. Market) seems fully priced. We will seek to use that cash as ammunition for future bargains. |

| • | At the individual security level, we ask a lot of questions about “what can go wrong?” and will establish not only a “base case intrinsic value” but also a “worst case scenario” (What could prove us wrong? If we were wrong, are we likely to lose 25%, 30%, or even more of the money invested?). As a result, we will miss some opportunities, yet hopefully, we will also avoid instances where we experience a permanent impairment of value. |

| Letter from the President | IVA Funds |

Michael W. Malafronte

Effective February 22, 2011, the IVA Worldwide Fund and IVA International Fund are closed to new investors.

| Letter from the Portfolio Managers | IVA Funds |

Charles de Vaulx

Chuck de Lardemelle

| Letter from the Portfolio Managers | IVA Funds |

particularly in technology/software and in large-cap, high quality names. In contrast, valuations in Europe and Japan are much more depressed and may be conducive to decent returns over the next decade, absent deflation and/or long term, unaddressed issues in their respective banking systems. Our belief, at this point, is that Europe will continue to muddle through and that when push comes to shove, actions will be taken to prevent a collapse of the euro and the European banking system. Markets have been selective, punishing companies exposed to the moribund parts of the European Union or Japanese economy or suffering from high financial leverage, and rewarding high quality, global franchises with high valuations.

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

| IVA Worldwide Fund | IVA Funds |

| Performance (unaudited) | As of March 31, 2012 |

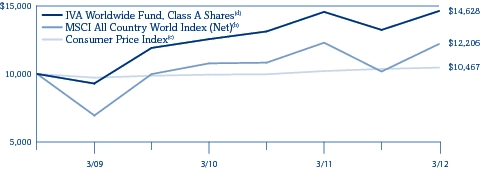

| Average Annual Total Returns as of March 31, 2012(a) | Six Months | One Year | Three Year | Since Inception | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A | 10.50 | % | 0.46 | % | 16.33 | % | 13.12 | % | ||||||||||

| Class A (with a 5% maximum initial sales charge) | 4.96 | % | –4.56 | % | 14.34 | % | 11.48 | % | ||||||||||

| Class C | 10.16 | % | –0.24 | % | 15.48 | % | 12.28 | % | ||||||||||

| Class I | 10.72 | % | 0.79 | % | 16.63 | % | 13.39 | % | ||||||||||

MSCI All Country World Index (Net)(b) | 19.91 | % | –0.73 | % | 20.75 | % | 5.86 | % | ||||||||||

Consumer Price Index(c) | 0.98 | % | 2.65 | % | 2.53 | % | 1.31 | % | ||||||||||

(a) | The Fund commenced investment operations on October 1, 2008. Total returns of periods of less than one year are not annualized. |

(b) | The MSCI All Country World Index (Net) is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

(c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

(d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2012. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

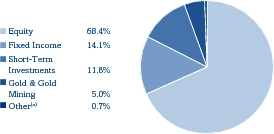

| IVA Worldwide Fund | IVA Funds |

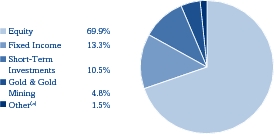

| Portfolio Composition (unaudited) | As of March 31, 2012 |

| POSITION NAMES(b) | ||||||

| Government of Singapore, 2.25% due 7/1/2013; 3.625% due 7/1/2014 | 4.6% | |||||

| Gold Bullion | 3.8% | |||||

| Wendel, 4.875% due 5/26/2016; 4.375% due 8/9/2017; 6.75% due 4/20/2018 | 3.6% | |||||

| Astellas Pharma Inc. | 3.1% | |||||

| Devon Energy Corp. | 2.5% | |||||

| Secom Co., Ltd. | 2.5% | |||||

| Genting Malaysia Berhad | 2.2% | |||||

| Sodexo SA | 2.1% | |||||

| Nestlé SA | 2.1% | |||||

| Microsoft Corp. | 1.9% | |||||

(a) | Other represents unrealized gains and losses on futures and forward currency contracts and other assets and liabilities. |

(b) | Short-Term Investments are not included. |

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

COMMON STOCKS – 70.2% | |||||||||||||||

| Australia – 0.5% | |||||||||||||||

| 1,262,084 | Newcrest Mining Ltd. | $ | 38,801,536 | ||||||||||||

| 5,349,787 | Spotless Group Ltd. | 13,022,702 | |||||||||||||

| 51,824,238 | |||||||||||||||

| Belgium – 0.2% | |||||||||||||||

| 279,580 | Sofina SA | 22,096,617 | |||||||||||||

| Canada – 0.4% | |||||||||||||||

| 3,310,650 | IAMGOLD Corp. | 43,998,539 | |||||||||||||

| Denmark – 0.3% | |||||||||||||||

| 902,100 | D/S Norden A/S | 26,839,072 | |||||||||||||

| France – 12.0% | |||||||||||||||

| 314,556 | Alten | 10,018,215 | |||||||||||||

| 194,708 | Bolloré | 40,510,391 | |||||||||||||

| 1,363,144 | Cap Gemini SA | 61,012,908 | |||||||||||||

| 1,826,440 | Carrefour SA | 43,785,705 | |||||||||||||

| 329,956 | Ciments Français SA | 23,609,337 | |||||||||||||

| 1,117,105 | CNP Assurances | 17,431,626 | |||||||||||||

| 39,665 | Financière de l’Odet SA | 16,018,483 | |||||||||||||

| 5,951 | Financière Marc de Lacharriere SA | 232,708 | |||||||||||||

| 6,931,778 | GDF Suez SA | 179,073,906 | |||||||||||||

| 2,668,790 | Lagardère SCA | 82,328,096 | |||||||||||||

| 1,090,764 | Publicis Groupe SA | 60,132,156 | |||||||||||||

| 87,281 | Robertet SA | 14,085,203 | |||||||||||||

| 60,960 | Séché Environnement SA | 2,604,927 | |||||||||||||

| 2,621,636 | Sodexo SA | 215,243,003 | |||||||||||||

| 2,959,000 | Teleperformance (a) | 84,551,990 | |||||||||||||

| 1,690,105 | Thales SA | 63,249,834 | |||||||||||||

| 2,835,230 | Total SA, ADR | 144,936,958 | |||||||||||||

| 8,178,323 | Vivendi SA | 150,086,190 | |||||||||||||

| 1,208,911,636 | |||||||||||||||

| Germany – 0.3% | |||||||||||||||

| 1,402,412 | Wirecard AG | 26,699,909 | |||||||||||||

| Hong Kong – 0.1% | |||||||||||||||

| 15,316,640 | Clear Media Ltd. (b) | 9,427,991 | |||||||||||||

| Italy – 0.4% | |||||||||||||||

| 13,448,650 | Mediaset S.p.A. | 37,092,599 | |||||||||||||

| Japan – 13.2% | |||||||||||||||

| 7,447,700 | Astellas Pharma Inc. | 305,934,276 | |||||||||||||

| 1,086,500 | Benesse Holdings Inc. | 54,147,789 | |||||||||||||

| 375,700 | Canon Inc. | 17,747,819 | |||||||||||||

| 3,220,400 | Cosel Co., Ltd. (a) | 44,821,805 | |||||||||||||

| 22,342 | Fuji Media Holdings Inc. | 38,410,856 | |||||||||||||

| 1,345,400 | Icom Inc. (a) | 32,639,401 | |||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Japan – 13.2% (continued) | |||||||||||||||

| 500 | Japan Petroleum Exploration Co., Ltd. | $ | 23,287 | ||||||||||||

| 2,607,570 | Kose Corp. | 59,069,636 | |||||||||||||

| 178,200 | Kyocera Corp. | 16,319,391 | |||||||||||||

| 21,410 | Medikit Co., Ltd. | 7,242,721 | |||||||||||||

| 1,443,900 | Meitec Corp. | 29,115,248 | |||||||||||||

| 957,300 | Milbon Co., Ltd. (a) | 27,584,396 | |||||||||||||

| 3,384,504 | Miura Co., Ltd. (a) | 87,710,053 | |||||||||||||

| 1,062,500 | Nifco Inc. | 29,036,789 | |||||||||||||

| 269,000 | Nintendo Co., Ltd. | 40,462,124 | |||||||||||||

| 186,800 | Nitto Kohki Co., Ltd. | 4,136,818 | |||||||||||||

| 14,748 | NTT DoCoMo, Inc. | 24,482,001 | |||||||||||||

| 5,390 | Okinawa Cellular Telephone Co. | 11,057,412 | |||||||||||||

| 4,572 | Pasona Group Inc. | 4,015,759 | |||||||||||||

| 5,081,600 | Secom Co., Ltd. | 248,646,611 | |||||||||||||

| 1,722,700 | Shiseido Co., Ltd. | 29,721,102 | |||||||||||||

| 4,174,800 | Shoei Co., Ltd. (a) | 17,048,235 | |||||||||||||

| 691,788 | Shofu Inc. | 7,296,495 | |||||||||||||

| 70,900 | SMC Corp. | 11,272,732 | |||||||||||||

| 889 | Techno Medica Co., Ltd. | 3,732,361 | |||||||||||||

| 2,018,500 | Temp Holdings Co., Ltd. | 18,997,360 | |||||||||||||

| 4,211,800 | Toho Co., Ltd. | 77,295,206 | |||||||||||||

| 221,256 | Yahoo Japan Corp. | 71,586,755 | |||||||||||||

| 1,319,554,438 | |||||||||||||||

| Malaysia – 2.2% | |||||||||||||||

| 175,569,400 | Genting Malaysia Berhad | 224,655,475 | |||||||||||||

| Norway – 1.0% | |||||||||||||||

| 12,306,550 | Orkla ASA | 97,376,205 | |||||||||||||

| South Africa – 0.5% | |||||||||||||||

| 6,161,759 | Net 1 U.E.P.S. Technologies Inc. (a)(b) | 55,702,301 | |||||||||||||

| South Korea – 3.3% | |||||||||||||||

| 148,559 | E-Mart Co., Ltd. | 32,778,562 | |||||||||||||

| 2,816,570 | Kangwon Land, Inc. | 62,518,632 | |||||||||||||

| 45,505 | Lotte Chilsung Beverage Co., Ltd. | 48,836,397 | |||||||||||||

| 37,932 | Lotte Confectionery Co., Ltd. | 55,539,639 | |||||||||||||

| 236,541 | Nong Shim Co., Ltd. | 47,494,001 | |||||||||||||

| 5,557,970 | SK Telecom Co., Ltd., ADR | 77,311,363 | |||||||||||||

| 38,450 | SK Telecom Co., Ltd. | 4,733,926 | |||||||||||||

| 11,764 | Teems Inc. | 96,766 | |||||||||||||

| 329,309,286 | |||||||||||||||

| Sweden – 0.1% | |||||||||||||||

| 512,381 | Securitas AB, Class ‘B’ | 4,941,187 | |||||||||||||

| Switzerland – 3.7% | |||||||||||||||

| 68,492 | Affichage Holding SA (b) | 12,064,061 | |||||||||||||

| 2,093,290 | Credit Suisse Group AG | 59,665,838 | |||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Switzerland – 3.7% (continued) | |||||||||||||||

| 3,360,495 | Nestlé SA | $ | 211,450,222 | ||||||||||||

| 125,796 | Schindler Holding AG | 15,133,982 | |||||||||||||

| 5,014,700 | UBS AG | 70,273,574 | |||||||||||||

| 368,587,677 | |||||||||||||||

| Taiwan – 0.1% | |||||||||||||||

| 2,603,000 | Taiwan Secom Co., Ltd. | 5,397,469 | |||||||||||||

| Thailand – 0.2% | |||||||||||||||

| 83,058,790 | Thai Beverage Public Co., Ltd. | 21,474,171 | |||||||||||||

| United Kingdom – 1.1% | |||||||||||||||

| 660,420 | Diageo Plc, ADR | 63,730,530 | |||||||||||||

| 5,786,320 | Inmarsat Plc | 42,601,798 | |||||||||||||

| 796,810 | Millennium & Copthorne Hotels Plc | 6,123,964 | |||||||||||||

| 112,456,292 | |||||||||||||||

| United States – 30.6% | |||||||||||||||

| 2,855,240 | Amdocs Ltd. (b) | 90,168,479 | |||||||||||||

| 1,780,530 | Aon Corp. | 87,352,802 | |||||||||||||

| 5,650,965 | Applied Materials, Inc. | 70,298,005 | |||||||||||||

| 1,063,790 | Automatic Data Processing Inc. | 58,710,570 | |||||||||||||

| 2,013,850 | Baker Hughes Inc. | 84,460,869 | |||||||||||||

| 1,497 | Berkshire Hathaway Inc., Class ‘A’ (b) | 182,484,300 | |||||||||||||

| 696,906 | BMC Software, Inc. (b) | 27,987,745 | |||||||||||||

| 2,586,440 | CA Inc. | 71,282,286 | |||||||||||||

| 279,720 | Cimarex Energy Co. | 21,110,468 | |||||||||||||

| 4,193,390 | Cisco Systems, Inc. | 88,690,198 | |||||||||||||

| 406,080 | Colgate-Palmolive Co. | 39,706,502 | |||||||||||||

| 327,421 | Contango Oil & Gas Co. (b) | 19,288,371 | |||||||||||||

| 121,807 | Contango ORE Inc. (a)(b) | 1,187,618 | |||||||||||||

| 1,148,050 | CVS Caremark Corp. | 51,432,640 | |||||||||||||

| 9,469,270 | Dell Inc. (b) | 157,189,882 | |||||||||||||

| 3,500,195 | Devon Energy Corp. | 248,933,868 | |||||||||||||

| 499,220 | Energizer Holdings Inc. (b) | 37,032,140 | |||||||||||||

| 348,980 | Goldman Sachs Group, Inc. | 43,402,643 | |||||||||||||

| 6,083,650 | Hewlett-Packard Co. | 144,973,379 | |||||||||||||

| 3,046,536 | Ingram Micro Inc., Class ‘A’ (b) | 56,543,708 | |||||||||||||

| 156,704 | JDA Software Group, Inc. (b) | 4,306,226 | |||||||||||||

| 1,641,450 | Liberty Interactive Corp., Series ‘A’ (b) | 31,335,280 | |||||||||||||

| 1,296,648 | Marsh & McLennan Cos., Inc. | 42,517,088 | |||||||||||||

| 382,883 | MasterCard Inc., Class ‘A’ | 161,017,617 | |||||||||||||

| 5,868,460 | Microsoft Corp. | 189,257,835 | |||||||||||||

| 27,520 | National CineMedia, Inc. | 421,056 | |||||||||||||

| 332,110 | Newmont Mining Corp. | 17,027,280 | |||||||||||||

| 5,473,625 | News Corp., Class ‘A’ | 107,775,676 | |||||||||||||

| 2,113,010 | News Corp., Class ‘B’ | 42,217,940 | |||||||||||||

| 3,874,680 | Oracle Corp. | 112,985,669 | |||||||||||||

| 550,920 | SEACOR Holdings Inc. (b) | 52,767,118 | |||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| United States – 30.6% (continued) | |||||||||||||||

| 5,115,002 | Sealed Air Corp. | $ | 98,770,689 | ||||||||||||

| 1,509,620 | Spansion, Inc., Class ‘A’ (b) | 18,387,172 | |||||||||||||

| 9,754,070 | Staples Inc. | 157,820,853 | |||||||||||||

| 3,492,316 | Symantec Corp. (b) | 65,306,309 | |||||||||||||

| 819,293 | Telephone & Data Systems, Inc. | 18,966,633 | |||||||||||||

| 2,429,246 | Texas Instruments Inc. | 81,646,958 | |||||||||||||

| 2,347,474 | Valassis Communications, Inc. (a)(b) | 53,991,902 | |||||||||||||

| 247,560 | Wal-Mart Stores, Inc. | 15,150,672 | |||||||||||||

| 1,904,920 | Walgreen Co. | 63,795,771 | |||||||||||||

| 351,571 | The Washington Post Co., Class ‘B’ | 131,336,378 | |||||||||||||

| 1,623,840 | Yahoo! Inc. (b) | 24,714,845 | |||||||||||||

| 3,073,753,440 | |||||||||||||||

TOTAL COMMON STOCKS (Cost — $6,636,729,233) | 7,040,098,542 | ||||||||||||||

CONVERTIBLE PREFERRED STOCKS – 0.7% | ||||||||||||||||||||

| United States – 0.7% | ||||||||||||||||||||

| 68,987 | USD | Bank of America Corp., Series ‘L’, 7.25% (Cost — $54,726,160) | 67,531,374 | |||||||||||||||||

| PRINCIPAL AMOUNT | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CORPORATE NOTES & BONDS – 7.6% | |||||||||||||||||||

| France – 3.6% | |||||||||||||||||||

| Wendel: | |||||||||||||||||||

| 56,800,000 | EUR | 4.875% due 5/26/2016 (c) | 75,564,755 | ||||||||||||||||

| 116,950,000 | EUR | 4.375% due 8/9/2017 | 149,737,128 | ||||||||||||||||

| 95,400,000 | EUR | 6.75% due 4/20/2018 | 132,006,258 | ||||||||||||||||

| 357,308,141 | |||||||||||||||||||

| Netherlands – 0.3% | |||||||||||||||||||

| 22,929,000 | EUR | UPC Holding BV, 8% due 11/1/2016 (c) | 31,803,615 | ||||||||||||||||

| Norway – 0.3% | |||||||||||||||||||

| 26,400,000 | USD | Golden Close Maritime Corp., Ltd., 11% due 12/9/2015 (d) | 28,512,000 | ||||||||||||||||

| Switzerland – 0.4% | |||||||||||||||||||

| UBS AG: | |||||||||||||||||||

| 18,179,000 | EUR | 4.28% due 4/15/2015 (e) | 20,123,621 | ||||||||||||||||

| 8,800,000 | EUR | 7.152% due 12/21/2017 (e) | 11,220,782 | ||||||||||||||||

| 9,107,000 | USD | UBS Preferred Funding Trust V, 6.243% due 5/15/2016 (e) | 8,902,092 | ||||||||||||||||

| 40,246,495 | |||||||||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| United Kingdom – 0.2% | |||||||||||||||||||

| 19,300,000 | USD | Inmarsat Finance Plc, 7.375% due 12/1/2017 (c) | $ | 20,699,250 | |||||||||||||||

| United States – 2.8% | |||||||||||||||||||

| 6,070,000 | USD | Brandywine Operating Partnership, LP, 5.7% due 5/1/2017 | 6,437,362 | ||||||||||||||||

| Cricket Communications Inc.: | |||||||||||||||||||

| 14,871,000 | USD | 10% due 7/15/2015 | 15,726,083 | ||||||||||||||||

| 2,000 | USD | 7.75% due 5/15/2016 | 2,120 | ||||||||||||||||

| 19,016,000 | USD | Denbury Resources Inc., 9.75% due 3/1/2016 | 20,965,140 | ||||||||||||||||

| 3,408,000 | USD | Encore Acquisition Co., 9.5% due 5/1/2016 | 3,765,840 | ||||||||||||||||

| 6,114,000 | USD | Frontier Oil Corp., 8.5% due 9/15/2016 | 6,526,695 | ||||||||||||||||

| Intelsat Luxembourg SA: | |||||||||||||||||||

| 19,381,000 | USD | 11.25% due 2/4/2017 | 20,204,692 | ||||||||||||||||

| 19,271,000 | USD | 11.5% due 2/4/2017 (f) | 20,090,018 | ||||||||||||||||

| 3,418,000 | USD | Leucadia National Corp., 8.125% due 9/15/2015 | 3,845,250 | ||||||||||||||||

| Level 3 Financing Inc.: | |||||||||||||||||||

| 6,283,000 | USD | 8.75% due 2/15/2017 | 6,597,150 | ||||||||||||||||

| 1,740,000 | USD | 10% due 2/1/2018 | 1,914,000 | ||||||||||||||||

| 6,961,000 | USD | MetroPCS Wireless Inc., 7.875% due 9/1/2018 | 7,361,258 | ||||||||||||||||

| 37,016,000 | USD | Mohawk Industries Inc., 6.375% due 1/15/2016 (g) | 41,087,760 | ||||||||||||||||

| 4,384,000 | USD | Penn Virginia Corp., 10.375% due 6/15/2016 | 4,318,240 | ||||||||||||||||

| QVC Inc.: | |||||||||||||||||||

| 6,878,000 | USD | 7.125% due 4/15/2017 (c) | 7,359,460 | ||||||||||||||||

| 31,121,000 | USD | 7.5% due 10/1/2019 (c) | 34,310,902 | ||||||||||||||||

| 61,574,000 | USD | Sirius XM Radio, Inc., 8.75% due 4/1/2015 (c) | 70,194,360 | ||||||||||||||||

| 6,660,000 | USD | Vulcan Materials Co., 7% due 6/15/2018 | 7,176,150 | ||||||||||||||||

| 277,882,480 | |||||||||||||||||||

TOTAL CORPORATE NOTES & BONDS (Cost — $684,695,726) | 756,451,981 | ||||||||||||||||||

SOVEREIGN GOVERNMENT BONDS – 5.7% | |||||||||||||||||||

| Hong Kong – 1.0% | |||||||||||||||||||

| 754,850,000 | HKD | Government of Hong Kong, 2.66% due 12/17/2012 | 98,951,833 | ||||||||||||||||

| Singapore – 4.6% | |||||||||||||||||||

| Government of Singapore: | |||||||||||||||||||

| 452,998,000 | SGD | 2.25% due 7/1/2013 | 369,869,867 | ||||||||||||||||

| 109,425,000 | SGD | 3.625% due 7/1/2014 | 93,684,705 | ||||||||||||||||

| 463,554,572 | |||||||||||||||||||

| Taiwan – 0.1% | |||||||||||||||||||

| 353,000,000 | TWD | Government of Taiwan, 2% due 7/20/2015 | 12,375,638 | ||||||||||||||||

TOTAL SOVEREIGN GOVERNMENT BONDS | |||||||||||||||||||

| (Cost — $558,631,633) | 574,882,043 | ||||||||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| OUNCES | DESCRIPTION | FAIR VALUE | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

COMMODITIES – 3.8% | |||||||||||||||||||

| 228,185 | Gold Bullion (b) (Cost — $259,623,215) | $ | 380,806,828 | ||||||||||||||||

| PRINCIPAL AMOUNT | |||||||||||||||||||

SHORT-TERM INVESTMENTS – 10.5% | |||||||||||||||||||

| Commercial Paper – 10.0% | |||||||||||||||||||

| 20,000,000 | USD | DENTSPLY International, Inc., 0.43% due 4/18/2012 (c) | 19,995,939 | ||||||||||||||||

| Devon Energy Corp.: | |||||||||||||||||||

| 30,000,000 | USD | 0.27% due 4/2/2012 (c) | 29,999,775 | ||||||||||||||||

| 25,000,000 | USD | 0.3% due 4/2/2012 (c) | 24,999,792 | ||||||||||||||||

| 25,000,000 | USD | 0.3% due 4/5/2012 (c) | 24,999,167 | ||||||||||||||||

| 19,500,000 | USD | 0.29% due 4/9/2012 (c) | 19,498,743 | ||||||||||||||||

| 25,000,000 | USD | 0.29% due 4/10/2012 (c) | 24,998,187 | ||||||||||||||||

| 17,700,000 | USD | 0.29% due 4/11/2012 (c) | 17,698,574 | ||||||||||||||||

| 23,000,000 | USD | 0.29% due 4/12/2012 (c) | 22,997,962 | ||||||||||||||||

| 25,000,000 | USD | 0.29% due 4/13/2012 (c) | 24,997,583 | ||||||||||||||||

| 23,000,000 | USD | E. I. du Pont de Nemours and Co., 0.11% due 4/3/2012 (c) | 22,999,859 | ||||||||||||||||

| 47,300,000 | USD | Électricité de France SA, 0.3% due 4/13/2012 (c) | 47,295,270 | ||||||||||||||||

| Florida Power & Light Co.: | |||||||||||||||||||

| 20,000,000 | USD | 0.17% due 4/3/2012 (c) | 19,999,811 | ||||||||||||||||

| 40,000,000 | USD | 0.25% due 4/9/2012 | 39,997,778 | ||||||||||||||||

| 50,000,000 | USD | 0.2% due 4/10/2012 | 49,997,500 | ||||||||||||||||

| 25,000,000 | USD | 0.22% due 4/17/2012 | 24,997,556 | ||||||||||||||||

| GDF Suez SA: | |||||||||||||||||||

| 29,300,000 | USD | 0.2% due 4/10/2012 (c) | 29,298,535 | ||||||||||||||||

| 1,000,000 | USD | 0.2% due 4/16/2012 (c) | 999,917 | ||||||||||||||||

| 15,800,000 | USD | 0.2% due 4/18/2012 (c) | 15,798,508 | ||||||||||||||||

| Nestlé Capital Corp.: | |||||||||||||||||||

| 20,000,000 | USD | 0.03% due 4/5/2012 (c) | 19,999,933 | ||||||||||||||||

| �� | 44,400,000 | USD | 0.05% due 4/5/2012 (c) | 44,399,753 | |||||||||||||||

| NetJets Inc.: | |||||||||||||||||||

| 4,400,000 | USD | 0.1% due 4/11/2012 (c) | 4,399,878 | ||||||||||||||||

| 16,700,000 | USD | 0.1% due 4/13/2012 (c) | 16,699,443 | ||||||||||||||||

| 30,000,000 | USD | 0.1% due 4/16/2012 (c) | 29,998,750 | ||||||||||||||||

| 10,000,000 | USD | Novartis Finance Corp., 0.12% due 4/3/2012 (c) | 9,999,933 | ||||||||||||||||

| Philip Morris International Inc.: | |||||||||||||||||||

| 75,000,000 | USD | 0.15% due 4/2/2012 (c) | 74,999,687 | ||||||||||||||||

| 50,000,000 | USD | 0.12% due 4/3/2012 (c) | 49,999,667 | ||||||||||||||||

| 14,300,000 | USD | 0.12% due 4/4/2012 (c) | 14,299,857 | ||||||||||||||||

| 30,000,000 | USD | 0.16% due 4/26/2012 (c) | 29,996,667 | ||||||||||||||||

| 25,000,000 | USD | Reed Elsevier Plc., 0.44% due 4/16/2012 (c) | 24,995,417 | ||||||||||||||||

| United Parcel Service, Inc.: | |||||||||||||||||||

| 50,000,000 | USD | 0.02% due 4/2/2012 (c) | 49,999,979 | ||||||||||||||||

| 50,000,000 | USD | 0.02% due 4/4/2012 (c) | 49,999,937 | ||||||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Commercial Paper – 10.0% (continued) | |||||||||||||||||||

| 31,900,000 | USD | 0.02% due 4/9/2012 (c) | $ | 31,899,894 | |||||||||||||||

| Wal-Mart Stores, Inc.: | |||||||||||||||||||

| 50,000,000 | USD | 0.08% due 4/9/2012 (c) | 49,999,111 | ||||||||||||||||

| 46,300,000 | USD | 0.07% due 4/17/2012 (c) | 46,298,560 | ||||||||||||||||

| 1,009,556,922 | |||||||||||||||||||

| Treasury Bills – 0.5% | |||||||||||||||||||

| Japan – 0.4% | |||||||||||||||||||

| 3,390,000,000 | JPY | Government of Japan, due 5/21/2012 | 40,951,196 | ||||||||||||||||

| United States – 0.1% | |||||||||||||||||||

| 5,710,000 | USD | Government of the United States, due 6/7/2012 (h) | 5,709,372 | ||||||||||||||||

| 46,660,568 | |||||||||||||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost — $1,057,773,620) | 1,056,217,490 | ||||||||||||||||||

TOTAL INVESTMENTS — 98.5% (Cost — $9,252,179,587) | 9,875,988,258 | ||||||||||||||||||

| Other Assets In Excess of Liabilities — 1.5% | 151,178,299 | ||||||||||||||||||

TOTAL NET ASSETS — 100.0% | $ | 10,027,166,557 | |||||||||||||||||

| FOREIGN CURRENCY | | COUNTERPARTY | | SETTLEMENT DATES THROUGH | | | LOCAL CURRENCY AMOUNT | | USD EQUIVALENT | | USD VALUE AT MARCH 31, 2012 | | NET UNREALIZED APPRECIATION/ (DEPRECIATION) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Contracts to Sell: | |||||||||||||||||||||||||||||||

| Australian dollar | State Street Bank & Trust Co. | 06/08/2012 | AUD 2,557,000 | $ | 2,673,906 | $ | 2,629,334 | $ | 44,572 | ||||||||||||||||||||||

| euro | State Street Bank & Trust Co. | 06/08/2012 | EUR 851,710,000 | 1,135,014,297 | 1,136,303,898 | (1,289,601 | ) | ||||||||||||||||||||||||

| Japanese yen | State Street Bank & Trust Co. | 06/08/2012 | JPY 49,103,668,000 | 588,054,692 | 593,599,794 | (5,545,102 | ) | ||||||||||||||||||||||||

| South Korean won | State Street Bank & Trust Co. | 04/05/2012 | KRW 111,007,300,000 | 99,348,281 | 97,956,837 | 1,391,444 | |||||||||||||||||||||||||

Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (5,398,687 | ) | ||||||||||||||||||||||||||||

| DESCRIPTION | | NUMBER OF CONTRACTS | | EXPIRATION DATE | | USD MARKET VALUE OF SECURITIES UNDERLYING THE CONTRACTS | | NET UNREALIZED APPRECIATION | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Contracts to Sell: | |||||||||||||||||||

| Japanese government 10-year bond | 660 | 6/11/2012 | $ | 1,132,374,049 | $ | 1,034,546 | |||||||||||||

| U.S. Treasury 10-year note | 3,649 | 6/20/2012 | 472,488,484 | 5,245,437 | |||||||||||||||

Net Unrealized Appreciation on Futures Contracts | $ | 6,279,983 | |||||||||||||||||

| IVA Worldwide Fund | IVA Funds |

March 31, 2012

AUD — Australian dollar

EUR — euro

HKD — Hong Kong dollar

JPY — Japanese yen

KRW — South Korean won

SGD — Singapore dollar

TWD — Taiwan dollar

USD — United States dollar

| (a) | Issuer of the security is an affiliate of the IVA Worldwide Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA Worldwide Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. |

Schedule of Affiliates

| SECURITY | | SHARES HELD AT SEPTEMBER 30, 2011 | | SHARE ADDITIONS | | SHARE REDUCTIONS | | SHARES HELD AT MARCH 31, 2012 | | FAIR VALUE AT MARCH 31, 2012 | | REALIZED GAIN/(LOSS) | | DIVIDEND INCOME* | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contango Oil & Gas Co.** | 998,438 | — | 671,017 | 327,421 | — | $ | 7,114,785 | — | ||||||||||||||||||||||

| Contango ORE Inc. | 121,807 | — | — | 121,807 | $ | 1,187,618 | — | — | ||||||||||||||||||||||

| Cosel Co., Ltd. | 3,220,400 | — | — | 3,220,400 | 44,821,805 | — | $ | 505,579 | ||||||||||||||||||||||

| Icom Inc. | 1,065,300 | 280,100 | — | 1,345,400 | 32,639,401 | — | 150,696 | |||||||||||||||||||||||

| Milbon Co., Ltd. | 957,300 | — | — | 957,300 | 27,584,396 | — | 389,022 | |||||||||||||||||||||||

| Miura Co., Ltd. | 3,384,504 | — | — | 3,384,504 | 87,710,053 | — | 757,848 | |||||||||||||||||||||||

| Net 1 U.E.P.S. Technologies Inc. | 6,806,360 | — | 644,601 | 6,161,759 | 55,702,301 | (2,312,570 | ) | — | ||||||||||||||||||||||

| Shoei Co., Ltd. | 4,538,900 | — | 364,100 | 4,174,800 | 17,048,235 | (1,876,712 | ) | — | ||||||||||||||||||||||

| Teleperformance*** | 2,707,940 | 251,060 | — | 2,959,000 | 84,551,990 | — | — | |||||||||||||||||||||||

| Valassis Communications, Inc.*** | 1,704,314 | 643,160 | — | 2,347,474 | 53,991,902 | — | — | |||||||||||||||||||||||

| Total | $ | 405,237,701 | $ | 2,925,503 | $ | 1,803,145 | ||||||||||||||||||||||||

| * | Dividend income is net of withholding taxes. | |

| ** | Non-affiliated at March 31, 2012. | |

| *** | Non-affiliated at September 30, 2011. | |

| (b) | Non-income producing investment. | |

| (c) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. | |

| (d) | Security is deemed illiquid. As of March 31, 2012, the value of this security amounted to 0.3% of net assets. | |

| (e) | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. | |

| (f) | Payment-in-kind security for which part of the income earned may be paid as additional principal. | |

| (g) | Variable rate security. The interest rate shown reflects the rate currently in effect. | |

| (h) | Security is held at futures broker as collateral for open futures contracts sold. At March 31, 2012, portfolio securities valued at $5,709,372 were segregated to cover collateral requirements. |

| IVA International Fund | IVA Funds |

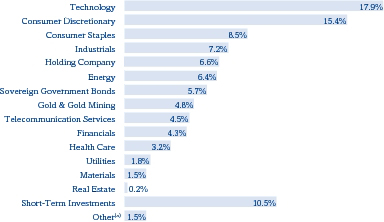

| Performance (unaudited) | As of March 31, 2012 |

| Average Annual Total Returns as of March 31, 2012(a) | Six Months | One Year | Three Year | Since Inception | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A | 7.75 | % | 0.63 | % | 15.99 | % | 11.89 | % | ||||||||||

| Class A (with a 5% maximum initial sales charge) | 2.35 | % | –4.41 | % | 14.02 | % | 10.27 | % | ||||||||||

| Class C | 7.31 | % | –0.17 | % | 15.07 | % | 11.02 | % | ||||||||||

| Class I | 7.82 | % | 0.84 | % | 16.26 | % | 12.16 | % | ||||||||||

MSCI All Country World Index (ex-U.S.) (Net)(b) | 15.37 | % | –7.18 | % | 19.12 | % | 4.64 | % | ||||||||||

Consumer Price Index(c) | 0.98 | % | 2.65 | % | 2.53 | % | 1.31 | % | ||||||||||

(a) | The Fund commenced investment operations on October 1, 2008. Total returns for periods of less than one year are not annualized. |

(b) | The MSCI All Country World Index (ex-U.S.) (Net) is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

(c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

(d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2012. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

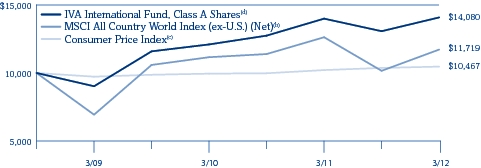

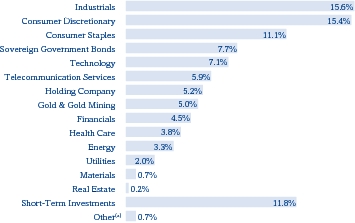

| IVA International Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of March 31, 2012 |

| POSITION NAMES (b) | ||||||

| Government of Singapore, 2.25% due 7/1/2013; 3.625% due 7/1/2014 | 5.6% | |||||

| Gold Bullion | 3.7% | |||||

| Wendel, 4.875% due 5/26/2016; 4.375% due 8/9/2017; 6.75% due 4/20/2018 | 3.4% | |||||

| Astellas Pharma Inc. | 3.2% | |||||

| Genting Malaysia Berhad | 2.5% | |||||

| Total SA, ADR | 2.5% | |||||

| Secom Co., Ltd. | 2.5% | |||||

| Sodexo SA | 2.4% | |||||

| Nestlé SA | 2.1% | |||||

| GDF Suez SA | 2.0% | |||||

(a) | Other represents unrealized gains and losses on futures and forward currency contracts and other assets and liabilities. |

(b) | Short-Term Investments are not included. |

| IVA International Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

COMMON STOCKS – 69.7% | |||||||||||||||

| Argentina – 0.1% | |||||||||||||||

| 871 | Nortel Inversora SA, Series ‘B’, ADR (a) | $ | 18,169 | ||||||||||||

| 198,730 | Telecom Argentina SA, ADR | 3,521,496 | |||||||||||||

| 3,539,665 | |||||||||||||||

| Australia – 1.6% | |||||||||||||||

| 550,969 | Newcrest Mining Ltd. | 16,939,002 | |||||||||||||

| 2,215,903 | Programmed Maintenance Services Ltd. | 5,784,263 | |||||||||||||

| 7,819,319 | Spotless Group Ltd. | 19,034,152 | |||||||||||||

| 41,757,417 | |||||||||||||||

| Belgium – 0.3% | |||||||||||||||

| 109,285 | Sofina SA | 8,637,344 | |||||||||||||

| Canada – 0.6% | |||||||||||||||

| 1,262,990 | IAMGOLD Corp. | 16,785,137 | |||||||||||||

| Denmark – 0.4% | |||||||||||||||

| 358,705 | D/S Norden A/S | 10,672,109 | |||||||||||||

| France – 20.2% | |||||||||||||||

| 659,087 | Alten | 20,991,096 | |||||||||||||

| 73,097 | Bolloré | 15,208,353 | |||||||||||||

| 522,036 | Cap Gemini SA | 23,365,789 | |||||||||||||

| 726,748 | Carrefour SA | 17,422,512 | |||||||||||||

| 98,740 | Ciments Français SA | 7,065,142 | |||||||||||||

| 407,930 | CNP Assurances | 6,365,456 | |||||||||||||

| 27,996 | Financière de l’Odet SA | 11,306,024 | |||||||||||||

| 446,640 | Financière Marc de Lacharriere SA | 17,465,444 | |||||||||||||

| 2,071,773 | GDF Suez SA | 53,521,691 | |||||||||||||

| 599,489 | Havas SA | 3,485,987 | |||||||||||||

| 898,750 | Lagardère SCA | 27,725,065 | |||||||||||||

| 577,980 | M6-Métropole Télévision SA | 10,445,041 | |||||||||||||

| 66,522 | Neopost SA | 4,278,096 | |||||||||||||

| 446,072 | Publicis Groupe SA | 24,591,269 | |||||||||||||

| 63,250 | Robertet SA | 10,207,137 | |||||||||||||

| 211,850 | Saft Groupe SA | 6,865,826 | |||||||||||||

| 184,710 | Séché Environnement SA | 7,892,979 | |||||||||||||

| 226,778 | Securidev SA (b) | 9,826,722 | |||||||||||||

| 1,031,207 | Société d’Edition de Canal Plus | 6,532,772 | |||||||||||||

| 768,923 | Sodexo SA | 63,130,540 | |||||||||||||

| 1,390,790 | Teleperformance | 39,741,150 | |||||||||||||

| 708,376 | Thales SA | 26,509,989 | |||||||||||||

| 1,289,690 | Total SA, ADR | 65,928,953 | |||||||||||||

| 2,609,541 | Vivendi SA | 47,889,532 | |||||||||||||

| 527,762,565 | |||||||||||||||

| Germany – 0.4% | |||||||||||||||

| 487,304 | Wirecard AG | 9,277,568 | |||||||||||||

| IVA International Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hong Kong – 1.3% | |||||||||||||||

| 36,621,030 | Clear Media Ltd. (a)(b) | $ | 22,541,677 | ||||||||||||

| 9,389,590 | Hongkong & Shanghai Hotels Ltd. | 12,744,272 | |||||||||||||

| 35,285,949 | |||||||||||||||

| India – 0.2% | |||||||||||||||

| 10,271,789 | South Indian Bank Ltd. | 4,980,139 | |||||||||||||

| Indonesia – 0.2% | |||||||||||||||

| 67,069,000 | PT Bank Bukopin Tbk | 4,840,938 | |||||||||||||

| Italy – 0.5% | |||||||||||||||

| 4,811,590 | Mediaset S.p.A. | 13,270,802 | |||||||||||||

| Japan – 24.3% | |||||||||||||||

| 528,900 | Arcs Co. Ltd. | 9,795,864 | |||||||||||||

| 885,100 | Ariake Japan Co., Ltd. | 17,056,113 | |||||||||||||

| 298,300 | As One Corp. | 6,613,272 | |||||||||||||

| 2,006,100 | Astellas Pharma Inc. | 82,405,944 | |||||||||||||

| 121,700 | The Bank of Okinawa Ltd. | 5,425,553 | |||||||||||||

| 410,700 | Benesse Holdings Inc. | 20,468,014 | |||||||||||||

| 140,600 | Canon Inc. | 6,641,851 | |||||||||||||

| 1,411,900 | Cosel Co., Ltd. | 19,650,946 | |||||||||||||

| 757,900 | Daiichikosho Co., Ltd. | 14,925,420 | |||||||||||||

| 8,826 | Fuji Media Holdings Inc. | 15,173,853 | |||||||||||||

| 1,298,200 | Hi Lex Corp. | 23,965,804 | |||||||||||||

| 587,782 | Hitachi Tool Engineering Ltd. | 5,993,573 | |||||||||||||

| 781,100 | Icom Inc. (b) | 18,949,484 | |||||||||||||

| 2,287,200 | Iino Kaiun Kaisha Ltd. | 10,362,450 | |||||||||||||

| 202,900 | Japan Petroleum Exploration Co., Ltd. | 9,450,036 | |||||||||||||

| 654,840 | Kose Corp. | 14,834,179 | |||||||||||||

| 56,200 | Kyocera Corp. | 5,146,744 | |||||||||||||

| 9,540 | Medikit Co., Ltd. | 3,227,256 | |||||||||||||

| 174,500 | Meitec Corp. | 3,518,672 | |||||||||||||

| 552,600 | Milbon Co., Ltd. | 15,923,052 | |||||||||||||

| 1,254,076 | Miura Co., Ltd. | 32,499,614 | |||||||||||||

| 366,700 | Nifco Inc. | 10,021,450 | |||||||||||||

| 115,100 | Nintendo Co., Ltd. | 17,312,976 | |||||||||||||

| 337,400 | Nitto Kohki Co., Ltd. | 7,471,961 | |||||||||||||

| 7,799 | NTT DoCoMo, Inc. | 12,946,510 | |||||||||||||

| 7,469 | Okinawa Cellular Telephone Co. | 15,322,414 | |||||||||||||

| 1,784 | Pasona Group Inc. | 1,566,954 | |||||||||||||

| 449,900 | San-A Co. Ltd. | 17,067,609 | |||||||||||||

| 144,200 | Sankyo Co. Ltd. | 7,073,239 | |||||||||||||

| 1,321,500 | Secom Co., Ltd. | 64,662,015 | |||||||||||||

| 10,600 | Secom Joshinetsu Co., Ltd. | 300,186 | |||||||||||||

| 353,900 | Shingakukai Co., Ltd. | 1,470,842 | |||||||||||||

| 672,400 | Shiseido Co., Ltd. | 11,600,667 | |||||||||||||

| 1,004,400 | Shoei Co., Ltd. | 4,101,573 | |||||||||||||

| 367,050 | Shofu Inc. | 3,871,386 | |||||||||||||

| IVA International Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Japan – 24.3% (continued) | |||||||||||||||

| 4,500 | SK Kaken Co., Ltd. | $ | 176,694 | ||||||||||||

| 35,500 | SMC Corp. | 5,644,316 | |||||||||||||

| 6,790 | So-net Entertainment Corp. | 24,897,487 | |||||||||||||

| 264,100 | Sugi Holdings Co. Ltd. | 8,075,838 | |||||||||||||

| 559 | Techno Medica Co., Ltd. | 2,346,895 | |||||||||||||

| 3,405,900 | Temp Holdings Co., Ltd. (b) | 32,055,045 | |||||||||||||

| 629,800 | Toho Co., Ltd. | 11,558,127 | |||||||||||||

| 144,200 | Tsuruha Holdings Inc. | 8,493,114 | |||||||||||||

| 75,633 | Yahoo Japan Corp. | 24,470,844 | |||||||||||||

| 634,535,836 | |||||||||||||||

| Malaysia – 2.9% | |||||||||||||||

| 3,178,400 | Aeon Co. Malaysia Berhad | 9,856,308 | |||||||||||||

| 51,574,200 | Genting Malaysia Berhad | 65,993,427 | |||||||||||||

| 75,849,735 | |||||||||||||||

| Netherlands – 0.1% | |||||||||||||||

| 18,146 | Hal Trust NV | 2,129,716 | |||||||||||||

| Norway – 1.5% | |||||||||||||||

| 4,989,530 | Orkla ASA | 39,479,911 | |||||||||||||

| Singapore – 0.8% | |||||||||||||||

| 4,406,291 | Haw Par Corp. Ltd. | 21,101,684 | |||||||||||||

| South Africa – 0.7% | |||||||||||||||

| 2,134,375 | Net 1 U.E.P.S. Technologies Inc. (a) | 19,294,750 | |||||||||||||

| South Korea – 5.2% | |||||||||||||||

| 70,345 | Binggrae Co., Ltd. | 3,513,991 | |||||||||||||

| 65,674 | E-Mart Co., Ltd. | 14,490,534 | |||||||||||||

| 61,768 | Fursys Inc. | 1,695,410 | |||||||||||||

| 1,078,570 | Kangwon Land, Inc. | 23,940,722 | |||||||||||||

| 13,427 | Lotte Chilsung Beverage Co., Ltd. | 14,409,984 | |||||||||||||

| 11,552 | Lotte Confectionery Co., Ltd. | 16,914,318 | |||||||||||||

| 41,991 | Lotte Samkang Co. Ltd. | 17,566,510 | |||||||||||||

| 78,155 | Nong Shim Co., Ltd. | 15,692,390 | |||||||||||||

| 1,859,560 | SK Telecom Co., Ltd., ADR | 25,866,480 | |||||||||||||

| 16,290 | SK Telecom Co., Ltd. | 2,005,609 | |||||||||||||

| 10,742 | Teems Inc. | 88,359 | |||||||||||||

| 136,184,307 | |||||||||||||||

| Sweden – 0.1% | |||||||||||||||

| 260,513 | Securitas AB, Class ‘B’ | 2,512,278 | |||||||||||||

| Switzerland – 5.0% | |||||||||||||||

| 20,950 | Affichage Holding SA (a) | 3,690,096 | |||||||||||||

| 9,890 | Banque Cantonale Vaudoise | 5,239,717 | |||||||||||||

| 774,550 | Credit Suisse Group AG | 22,077,292 | |||||||||||||

| 392,861 | Gategroup Holding AG | 14,405,339 | |||||||||||||

| IVA International Fund | IVA Funds |

March 31, 2012

| SHARES | DESCRIPTION | FAIR VALUE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Switzerland – 5.0% (continued) | |||||||||||||||

| 860,190 | Nestlé SA | $ | 54,125,171 | ||||||||||||

| 50,364 | Schindler Holding AG | 6,059,079 | |||||||||||||

| 1,765,840 | UBS AG | 24,745,625 | |||||||||||||

| 130,342,319 | |||||||||||||||

| Taiwan – 0.6% | |||||||||||||||

| 7,408,000 | Taiwan Secom Co., Ltd. | 15,360,911 | |||||||||||||

| Thailand – 0.4% | |||||||||||||||

| 37,712,930 | Thai Beverage Public Co., Ltd. | 9,750,370 | |||||||||||||

| United Kingdom – 2.3% | |||||||||||||||

| 240,330 | Diageo Plc, ADR | 23,191,845 | |||||||||||||

| 2,333,917 | Inmarsat Plc | 17,183,471 | |||||||||||||

| 135,494 | Jardine Lloyd Thompson Group Plc | 1,513,809 | |||||||||||||

| 1,360,720 | LSL Property Services Plc | 5,985,300 | |||||||||||||

| 1,450,900 | Millennium & Copthorne Hotels Plc | 11,151,040 | |||||||||||||

| 59,025,465 | |||||||||||||||

TOTAL COMMON STOCKS (Cost — $1,741,995,452) | 1,822,376,915 | ||||||||||||||

| PRINCIPAL AMOUNT | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CORPORATE NOTES & BONDS – 6.3% | |||||||||||||||||||

| France – 3.4% | |||||||||||||||||||

| Wendel: | |||||||||||||||||||

| 15,600,000 | EUR | 4.875% due 5/26/2016 (c) | 20,753,700 | ||||||||||||||||

| 35,800,000 | EUR | 4.375% due 8/9/2017 | 45,836,590 | ||||||||||||||||

| 15,300,000 | EUR | 6.75% due 4/20/2018 | 21,170,815 | ||||||||||||||||

| 87,761,105 | |||||||||||||||||||

| Netherlands – 0.3% | |||||||||||||||||||

| 6,311,000 | EUR | UPC Holding BV, 8% due 11/1/2016 (c) | 8,753,658 | ||||||||||||||||

| Norway – 1.2% | |||||||||||||||||||

| 11,000,000 | USD | Golden Close Maritime Corp., Ltd., 11% due 12/9/2015 (d) | 11,880,000 | ||||||||||||||||

| 104,000,000 | NOK | Stolt-Nielsen Ltd. SA, 7.09% due 6/22/2016 (d)(e) | 18,718,996 | ||||||||||||||||

| 30,598,996 | |||||||||||||||||||

| Switzerland – 0.6% | |||||||||||||||||||

| UBS AG: | |||||||||||||||||||

| 7,406,000 | EUR | 4.28% due 4/15/2015 (f) | 8,198,225 | ||||||||||||||||

| 3,750,000 | EUR | 7.152% due 12/21/2017 (f) | 4,781,583 | ||||||||||||||||

| 3,678,000 | USD | UBS Preferred Funding Trust V, 6.243% due 5/15/2016 (f) | 3,595,245 | ||||||||||||||||

| 16,575,053 | |||||||||||||||||||

| IVA International Fund | IVA Funds |

March 31, 2012

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| United Kingdom – 0.3% | |||||||||||||||||||

| 7,000,000 | USD | Inmarsat Finance Plc, 7.375% due 12/1/2017 (c) | $ | 7,507,500 | |||||||||||||||

| United States – 0.5% | |||||||||||||||||||

| Intelsat Luxembourg SA: | |||||||||||||||||||

| 6,992,000 | USD | 11.25% due 2/4/2017 | 7,289,160 | ||||||||||||||||

| 6,956,000 | USD | 11.5% due 2/4/2017 (g) | 7,251,630 | ||||||||||||||||

| 14,540,790 | |||||||||||||||||||

TOTAL CORPORATE NOTES & BONDS (Cost — $150,600,228) | 165,737,102 | ||||||||||||||||||

SOVEREIGN GOVERNMENT BONDS – 7.8% | |||||||||||||||||||

| Hong Kong – 1.5% | |||||||||||||||||||

| 289,350,000 | HKD | Government of Hong Kong, 2.66% due 12/17/2012 | 37,930,334 | ||||||||||||||||

| Singapore – 5.6% | |||||||||||||||||||

| Government of Singapore: | |||||||||||||||||||

| 150,582,000 | SGD | 2.25% due 7/1/2013 | 122,949,206 | ||||||||||||||||

| 27,701,000 | SGD | 3.625% due 7/1/2014 | 23,716,335 | ||||||||||||||||

| 146,665,541 | |||||||||||||||||||

| Taiwan – 0.2% | |||||||||||||||||||

| 171,000,000 | TWD | Government of Taiwan, 2% due 7/20/2015 | 5,994,997 | ||||||||||||||||

| Thailand – 0.5% | |||||||||||||||||||

| 350,527,000 | THB | Government of Thailand, 5.25% due 5/12/2014 | 11,778,253 | ||||||||||||||||

TOTAL SOVEREIGN GOVERNMENT BONDS | |||||||||||||||||||

| (Cost — $203,673,092) | 202,369,125 | ||||||||||||||||||

| OUNCES | |||||||||||||||||||

COMMODITIES – 3.7% | |||||||||||||||||||

| 58,095 | Gold Bullion (a) (Cost — $66,904,558) | 96,952,283 | |||||||||||||||||

| PRINCIPAL AMOUNT | |||||||||||||||||||

SHORT-TERM INVESTMENTS – 11.8% | |||||||||||||||||||

| Commercial Paper – 11.3% | |||||||||||||||||||

| Devon Energy Corp.: | |||||||||||||||||||

| 18,900,000 | USD | 0.27% due 4/2/2012 (c) | 18,899,858 | ||||||||||||||||

| 5,500,000 | USD | 0.29% due 4/9/2012 (c) | 5,499,645 | ||||||||||||||||

| 13,300,000 | USD | 0.35% due 4/30/2012 (c) | 13,296,250 | ||||||||||||||||

| 25,000,000 | USD | Florida Power & Light Co., 0.2% due 4/4/2012 (c) | 24,999,583 | ||||||||||||||||

| GDF Suez SA: | |||||||||||||||||||

| 37,000,000 | USD | 0.2% due 4/16/2012 (c) | 36,996,917 | ||||||||||||||||

| 14,200,000 | USD | 0.2% due 4/18/2012 (c) | 14,198,659 | ||||||||||||||||

| 10,400,000 | USD | Kraft Foods Inc., 0.3% due 4/4/2012 (c) | 10,399,740 | ||||||||||||||||

| IVA International Fund | IVA Funds |

March 31, 2012

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Commercial Paper – 11.3% (continued) | |||||||||||||||||||

| 32,300,000 | USD | Nestlé Capital Corp., 0.03% due 4/5/2012 (c) | $ | 32,299,892 | |||||||||||||||

| 30,000,000 | USD | Novartis Finance Corp., 0.12% due 4/3/2012 (c) | 29,999,800 | ||||||||||||||||

| 2,000,000 | USD | Novartis Securities Investment Ltd., 0.12% due 4/13/2012 (c) | 1,999,920 | ||||||||||||||||

| 5,000,000 | USD | Philip Morris International Inc., 0.08% due 4/5/2012 (c) | 4,999,956 | ||||||||||||||||

| 20,000,000 | USD | Sigma-Aldrich Corp., 0.1% due 4/2/2012 (c) | 19,999,944 | ||||||||||||||||

| 18,000,000 | USD | Wal-Mart Stores, Inc., 0.07% due 4/17/2012 (c) | 17,999,440 | ||||||||||||||||

| Wisconsin Energy Corp.: | |||||||||||||||||||

| 29,000,000 | USD | 0.23% due 4/2/2012 (c) | 28,999,815 | ||||||||||||||||

| 26,600,000 | USD | 0.26% due 4/4/2012 (c) | 26,599,424 | ||||||||||||||||

| 9,300,000 | USD | 0.32% due 4/3/2012 (c) | 9,299,835 | ||||||||||||||||

| 296,488,678 | |||||||||||||||||||

| Treasury Bills – 0.5% | |||||||||||||||||||

| Japan – 0.5% | |||||||||||||||||||

| 1,000,000,000 | JPY | Government of Japan, due 5/21/2012 | 12,079,999 | ||||||||||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost — $309,020,429) | 308,568,677 | ||||||||||||||||||

TOTAL INVESTMENTS — 99.3% (Cost — $2,472,193,759) | 2,596,004,102 | ||||||||||||||||||

| Other Assets In Excess of Liabilities — 0.7% | 18,604,295 | ||||||||||||||||||

TOTAL NET ASSETS — 100.0% | $ | 2,614,608,397 | |||||||||||||||||

| FOREIGN CURRENCY | | COUNTERPARTY | | SETTLEMENT DATES THROUGH | | | LOCAL CURRENCY AMOUNT | | USD EQUIVALENT | | USD VALUE AT MARCH 31, 2012 | | NET UNREALIZED APPRECIATION/ (DEPRECIATION) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Contracts to Sell: | |||||||||||||||||||||||||||||||

| Australian dollar | State Street Bank And Trust Co. | 06/08/2012 | AUD 4,672,000 | $ | 4,885,604 | $ | 4,804,164 | $ | 81,440 | ||||||||||||||||||||||

| British pound | State Street Bank And Trust Co. | 06/08/2012 | GBP 1,690,000 | 2,660,821 | 2,701,970 | (41,149 | ) | ||||||||||||||||||||||||

| euro | State Street Bank And Trust Co. | 06/08/2012 | EUR 257,050,000 | 342,552,542 | 342,941,750 | (389,208 | ) | ||||||||||||||||||||||||

| Japanese yen | State Street Bank And Trust Co. | 06/08/2012 | JPY 27,569,381,000 | 330,134,679 | 333,278,135 | (3,143,456 | ) | ||||||||||||||||||||||||

| South Korean won | State Street Bank And Trust Co. | 04/05/2012 | KRW 30,161,200,000 | 26,993,519 | 26,615,329 | 378,190 | |||||||||||||||||||||||||

Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (3,114,183 | ) | ||||||||||||||||||||||||||||

| IVA International Fund | IVA Funds |

March 31, 2012

| DESCRIPTION | | NUMBER OF CONTRACTS | | EXPIRATION DATE | | USD MARKET VALUE OF SECURITIES UNDERLYING THE CONTRACTS | | NET UNREALIZED APPRECIATION | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Contracts to Sell: | ||||||||||||||||||

| Japanese government 10-year bond | 195 | 6/11/2012 | $ | 334,565,060 | $ | 305,770 | ||||||||||||

AUD — Australian dollar

EUR — euro

GBP — British pound

HKD — Hong Kong dollar

JPY — Japanese yen

KRW — South Korean won

NOK — Norwegian krone

SGD — Singapore dollar

THB — Thai baht

TWD — Taiwan dollar

USD — United States dollar

| (a) | Non-income producing investment. |

| (b) | Issuer of the security is an affiliate of the IVA International Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA International Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. |

| SECURITY | | SHARES HELD AT SEPTEMBER 30, 2011 | | SHARE ADDITIONS | | SHARE REDUCTIONS | | SHARES HELD AT MARCH 31, 2012 | | FAIR VALUE AT MARCH 31, 2012 | | REALIZED LOSS | | DIVIDEND INCOME* | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Clear Media Ltd. | 36,621,030 | — | — | 36,621,030 | $ | 22,541,677 | — | — | ||||||||||||||||||||||

| Icom Inc. | 849,700 | 6,700 | 75,300 | 781,100 | 18,949,484 | $ | (200,920 | ) | $ | 87,434 | ||||||||||||||||||||

| Securidev SA | 202,718 | 24,060 | — | 226,778 | 9,826,722 | — | — | |||||||||||||||||||||||

| Temp Holdings Co., Ltd. | 3,329,400 | 76,500 | — | 3,405,900 | 32,055,045 | — | 228,803 | |||||||||||||||||||||||

| Total | $ | 83,372,928 | $ | (200,920 | ) | $ | 316,237 | |||||||||||||||||||||||

| * | Dividend income is net of withholding taxes. | |

| (c) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. | |

| (d) | Security is deemed illiquid. As of March 31, 2012, the value of illiquid securities amounted to 1.2% of net assets. | |

| (e) | Variable rate security. The interest rate shown reflects the rate currently in effect. | |

| (f) | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. | |

| (g) | Payment-in-kind security for which part of the income earned may be paid as additional principal. |

| Statements of Assets and Liabilities (unaudited) | IVA Funds |

| IVA Worldwide Fund | | IVA International Fund | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Assets: | ||||||||||

| Long-term investments, at cost: | ||||||||||

| Non-affiliated investments | $ | 7,772,222,909 | $ | 2,089,213,352 | ||||||

| Affiliated investments | 422,183,058 | 73,959,978 | ||||||||

| Short-term investments, at cost | 1,057,773,620 | 309,020,429 | ||||||||

| Foreign currency, at cost | 18,333,596 | 5,710,975 | ||||||||

| Foreign currency collateral for open futures contracts, at cost | 6,306,749 | 1,836,322 | ||||||||

| Long-term investments, at fair value: | ||||||||||

| Non-affiliated investments | $ | 8,414,533,067 | $ | 2,204,062,497 | ||||||

| Affiliated investments | 405,237,701 | 83,372,928 | ||||||||

| Short-term investments, at fair value | 1,056,217,490 | 308,568,677 | ||||||||

| Foreign currency, at fair value | 17,348,985 | 5,447,304 | ||||||||

| Foreign currency collateral for open futures contracts, at value | 7,189,450 | 2,051,719 | ||||||||

| Cash | 312,113 | 266,682 | ||||||||

| Cash collateral for open futures contracts | 5,417,490 | — | ||||||||

| Receivable for investments sold | 63,359,068 | 569,231 | ||||||||

| Dividends and interest receivable | 59,961,748 | 17,545,571 | ||||||||

| Receivable for fund shares sold | 21,852,227 | 7,358,168 | ||||||||

| Variation margin on open futures contracts receivable | 6,279,983 | 305,770 | ||||||||

| Unrealized appreciation on open forward foreign currency contracts | 1,391,444 | 378,190 | ||||||||

| Prepaid expenses and other assets | 108,337 | 25,123 | ||||||||

Total assets | $ | 10,059,209,103 | $ | 2,629,951,860 | ||||||

Liabilities: | ||||||||||

| Payable for fund shares repurchased | $ | 9,232,517 | $ | 5,670,147 | ||||||

| Unrealized depreciation on open forward foreign currency contracts | 6,790,131 | 3,492,373 | ||||||||

| Payable for investments purchased | 4,432,623 | 3,600,542 | ||||||||

| Accrued investment advisory fees | 7,640,378 | 1,967,942 | ||||||||

| Accrued distribution and service fees | 2,080,935 | 154,855 | ||||||||

| Accrued expenses and other liabilities | 1,865,962 | 457,604 | ||||||||

Total liabilities | 32,042,546 | 15,343,463 | ||||||||

Net Assets | $ | 10,027,166,557 | $ | 2,614,608,397 | ||||||

Net Assets Consist of: | ||||||||||

| Par value ($0.001 per share) | $ | 615,271 | $ | 166,605 | ||||||

| Additional paid-in-capital | 9,336,669,905 | 2,459,982,161 | ||||||||

| Undistributed (overdistributed) net investment income | 856,549 | (919,654 | ) | |||||||

| Accumulated net realized gain on investments, futures contracts and foreign currency transactions | 64,680,637 | 34,469,488 | ||||||||

| Unrealized appreciation from investments, futures contracts and foreign currency translation | 624,344,195 | 120,909,797 | ||||||||

Net Assets | $ | 10,027,166,557 | $ | 2,614,608,397 | ||||||

Net Asset Value Per Share: | ||||||||||

Class A | ||||||||||

| Net assets | $ | 2,861,521,865 | $ | 395,564,470 | ||||||

| Shares outstanding | 175,398,393 | 25,217,247 | ||||||||

| Net asset value per share | $ | 16.31 | $ | 15.69 | ||||||

| Maximum offering price per share (with a maximum initial sales charge of 5.00%) | $ | 17.17 | $ | 16.52 | ||||||

Class C | ||||||||||

| Net assets | $ | 1,729,578,243 | $ | 82,621,550 | ||||||

| Shares outstanding | 106,763,220 | 5,319,665 | ||||||||

| Net asset value per share | $ | 16.20 | $ | 15.53 | ||||||

Class I | ||||||||||

| Net assets | $ | 5,436,066,449 | $ | 2,136,422,377 | ||||||

| Shares outstanding | 333,109,145 | 136,067,756 | ||||||||

| Net asset value per share | $ | 16.32 | $ | 15.70 | ||||||

| Statements of Operations (unaudited) | IVA Funds |

| IVA Worldwide Fund | | IVA International Fund | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Investment Income: | ||||||||||

| Interest | $ | 32,978,837 | $ | 7,270,289 | ||||||

| Dividends: | ||||||||||

| Non-affiliated investments | 73,763,499 | 22,882,734 | ||||||||

| Affiliated investments | 1,938,865 | 340,040 | ||||||||

| Less: Foreign taxes withheld | (7,345,858 | ) | (2,881,786 | ) | ||||||

Total income | 101,335,343 | 27,611,277 | ||||||||

Expenses: | ||||||||||

| Investment advisory fees | 43,352,463 | 10,843,059 | ||||||||

| Distribution and service fees: | ||||||||||

| Class A | 3,501,752 | 464,730 | ||||||||

| Class C | 8,521,093 | 410,224 | ||||||||

| Custody fees | 1,874,540 | 674,110 | ||||||||

| Trustee fees | 94,986 | 22,514 | ||||||||

| Other expenses | 4,109,804 | 866,448 | ||||||||

Total expenses | 61,454,638 | 13,281,085 | ||||||||

Net investment income | 39,880,705 | 14,330,192 | ||||||||

Net Realized and Change in Unrealized Gain (Loss) on Investments, Futures Contracts and Foreign Currency: | ||||||||||

Net realized gain (loss) on: | ||||||||||

| Investments on: | ||||||||||

| Non-affiliated investments | 73,621,180 | 12,015,611 | ||||||||

| Affiliated investments | 2,295,503 | (200,920 | ) | |||||||

| Futures contracts | (7,778,969 | ) | (779,460 | ) | ||||||

| Foreign currency transactions | 48,231,908 | 28,029,145 | ||||||||

| Net realized gain | 116,369,622 | 39,064,376 | ||||||||

Net change in unrealized appreciation (depreciation) from: | ||||||||||

| Investments from: | ||||||||||

| Non-affiliated investments | 812,337,874 | 126,050,124 | ||||||||

| Affiliated investments | (13,238,338 | ) | 5,860,729 | |||||||

| Futures contracts | 4,979,848 | (910,120 | ) | |||||||

| Foreign currency translation | (9,212,088 | ) | (3,493,523 | ) | ||||||

| Net change in unrealized appreciation (depreciation) | 794,867,296 | 127,507,210 | ||||||||

Net realized and change in unrealized gain on investments, futures contracts and foreign currency | 911,236,918 | 166,571,586 | ||||||||

Increase in net assets resulting from operations | $ | 951,117,623 | $ | 180,901,778 | ||||||

| Statements of Changes in Net Assets (unaudited) | IVA Funds |

| IVA Worldwide Fund | | IVA International Fund | | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | |||||||||||||

Operations: | |||||||||||||||||||

| Net investment income | $ | 39,880,705 | $ | 80,128,819 | $ | 14,330,192 | $ | 27,630,969 | |||||||||||

| Net realized gain | 116,369,622 | 423,592,330 | 39,064,376 | 111,085,206 | |||||||||||||||

| Net change in net unrealized appreciation (depreciation) | 794,867,296 | (693,518,595 | ) | 127,507,210 | (133,788,156 | ) | |||||||||||||

Increase (decrease) in net assets resulting from operations | 951,117,623 | (189,797,446 | ) | 180,901,778 | 4,928,019 | ||||||||||||||

Distributions to Shareholders: | |||||||||||||||||||

| Net investment income: | |||||||||||||||||||

| Class A | (20,110,567 | ) | (8,689,921 | ) | (4,961,282 | ) | (442,574 | ) | |||||||||||

| Class C | — | — | (540,056 | ) | — | ||||||||||||||

| Class I | (49,104,499 | ) | (21,223,353 | ) | (32,039,991 | ) | (4,753,242 | ) | |||||||||||

| Net realized gain on investments: | |||||||||||||||||||

| Class A | (143,028,188 | ) | (56,581,235 | ) | (16,874,933 | ) | (7,516,993 | ) | |||||||||||

| Class C | (88,435,888 | ) | (32,155,518 | ) | (3,985,245 | ) | (1,672,714 | ) | |||||||||||

| Class I | (258,845,189 | ) | (86,335,783 | ) | (92,344,215 | ) | (31,808,976 | ) | |||||||||||

Decrease in net assets resulting from distributions | (559,524,331 | ) | (204,985,810 | ) | (150,745,722 | ) | (46,194,499 | ) | |||||||||||

Capital Share Transactions: | |||||||||||||||||||

| Proceeds from shares sold | 1,137,591,326 | 4,860,852,493 | 395,553,871 | 1,169,979,907 | |||||||||||||||

| Reinvestment of distributions | 403,223,839 | 142,569,726 | 122,389,472 | 36,791,005 | |||||||||||||||

| Cost of shares repurchased | (1,081,983,471 | ) | (1,296,330,107 | ) | (197,279,711 | ) | (265,211,165 | ) | |||||||||||

Increase in net assets from capital share transactions | 458,831,694 | 3,707,092,112 | 320,663,632 | 941,559,747 | |||||||||||||||

Increase in net assets | $ | 850,424,986 | $ | 3,312,308,856 | $ | 350,819,688 | $ | 900,293,267 | |||||||||||

Net Assets: | |||||||||||||||||||

| Beginning of period | $ | 9,176,741,571 | $ | 5,864,432,715 | $ | 2,263,788,709 | $ | 1,363,495,442 | |||||||||||

| End of period | $ | 10,027,166,557 | $ | 9,176,741,571 | $ | 2,614,608,397 | $ | 2,263,788,709 | |||||||||||

| Undistributed (overdistributed) net investment income | $ | 856,549 | $ | 30,190,910 | $ | (919,654 | ) | $ | 22,291,483 | ||||||||||

| Financial Highlights (unaudited) | IVA Funds |

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Year Ended September 30, 2010 | | Year Ended September 30, 2009 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net asset value, beginning of period | $ | 15.71 | $ | 16.03 | $ | 15.00 | $ | 12.00 | ||||||||||

Increase from investment operations:(a) | ||||||||||||||||||

Net investment income(b) | 0.07 | 0.16 | 0.21 | 0.34 | ||||||||||||||

| Net realized and unrealized gain | 1.50 | 0.00 | 1.27 | 2.70 | ||||||||||||||

| Increase from investment operations | 1.57 | 0.16 | 1.48 | 3.04 | ||||||||||||||

Decrease from distributions: | ||||||||||||||||||

| Net investment income | (0.12 | ) | (0.06 | ) | (0.10 | ) | (0.04 | ) | ||||||||||

| Net realized gain on investments | (0.85 | ) | (0.42 | ) | (0.35 | ) | — | |||||||||||

| Decrease from distributions | (0.97 | ) | (0.48 | ) | (0.45 | ) | (0.04 | ) | ||||||||||

Net asset value, end of period | $ | 16.31 | $ | 15.71 | $ | 16.03 | $ | 15.00 | ||||||||||

Total return(c) | 10.50 | % | 0.86 | % | 10.16 | % | 25.39 | % | ||||||||||

Ratios to average net assets: | ||||||||||||||||||

| Net operating expenses | 1.28 | %(d) | 1.29 | % | 1.31 | % | 1.36 | % | ||||||||||

| Net investment income | 0.82 | %(d) | 0.93 | % | 1.41 | % | 2.51 | % | ||||||||||

Supplemental data: | ||||||||||||||||||

| Portfolio turnover rate | 11.9 | % | 50.8 | % | 28.9 | % | 54.8 | % | ||||||||||

| Net assets, end of period (000’s) | $ | 2,861,522 | $ | 2,714,773 | $ | 1,931,625 | $ | 755,238 | ||||||||||

(a) | The amounts shown for a share outstanding may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. | |

(b) | Calculated using average daily shares outstanding. | |

(c) | Total return assumes reinvestment of all distributions and does not reflect an initial sales charge. Total returns for periods of less than one year are not annualized. | |

(d) | Annualized. |

| Financial Highlights (unaudited) | IVA Funds |

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Year Ended September 30, 2010 | | Year Ended September 30, 2009 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net asset value, beginning of period | $ | 15.54 | $ | 15.92 | $ | 14.92 | $ | 12.00 | ||||||||||

Increase from investment operations:(a) | ||||||||||||||||||

Net investment income(b) | 0.01 | 0.03 | 0.10 | 0.23 | ||||||||||||||

| Net realized and unrealized gain | 1.50 | 0.01 | 1.25 | 2.71 | ||||||||||||||

| Increase from investment operations | 1.51 | 0.04 | 1.35 | 2.94 | ||||||||||||||

Decrease from distributions: | ||||||||||||||||||

| Net investment income | — | — | (0.00 | )(c) | (0.02 | ) | ||||||||||||

| Net realized gain on investments | (0.85 | ) | (0.42 | ) | (0.35 | ) | — | |||||||||||

| Decrease from distributions | (0.85 | ) | (0.42 | ) | (0.35 | ) | (0.02 | ) | ||||||||||

Net asset value, end of period | $ | 16.20 | $ | 15.54 | $ | 15.92 | $ | 14.92 | ||||||||||

Total return(d) | 10.16 | % | 0.09 | % | 9.26 | % | 24.51 | % | ||||||||||

Ratios to average net assets: | ||||||||||||||||||

| Net operating expenses | 2.03 | %(e) | 2.04 | % | 2.06 | % | 2.12 | % | ||||||||||

| Net investment income | 0.07 | %(e) | 0.18 | % | 0.67 | % | 1.75 | % | ||||||||||

Supplemental data: | ||||||||||||||||||

| Portfolio turnover rate | 11.9 | % | 50.8 | % | 28.9 | % | 54.8 | % | ||||||||||

| Net assets, end of period (000’s) | $ | 1,729,578 | $ | 1,631,750 | $ | 1,055,144 | $ | 340,393 | ||||||||||

(a) | The amounts shown for a share outstanding may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. | |

(b) | Calculated using average daily shares outstanding. | |

(c) | Amount represents less than $0.005 per share. | |

(d) | Total return assumes reinvestment of all distributions and does not reflect a contingent deferred sales charge. Total returns for periods of less than one year are not annualized. | |

(e) | Annualized. |

| Financial Highlights (unaudited) | IVA Funds |

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Year Ended September 30, 2010 | | Year Ended September 30, 2009 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net asset value, beginning of period | $ | 15.73 | $ | 16.05 | $ | 15.02 | $ | 12.00 | ||||||||||

Increase from investment operations:(a) | ||||||||||||||||||

Net investment income(b) | 0.09 | 0.20 | 0.25 | 0.37 | ||||||||||||||

| Net realized and unrealized gain | 1.51 | 0.00 | 1.27 | 2.69 | ||||||||||||||

| Increase from investment operations | 1.60 | 0.20 | 1.52 | 3.06 | ||||||||||||||

Decrease from distributions: | ||||||||||||||||||

| Net investment income | (0.16 | ) | (0.10 | ) | (0.14 | ) | (0.04 | ) | ||||||||||

| Net realized gain on investments | (0.85 | ) | (0.42 | ) | (0.35 | ) | — | |||||||||||

| Decrease from distributions | (1.01 | ) | (0.52 | ) | (0.49 | ) | (0.04 | ) | ||||||||||

Net asset value, end of period | $ | 16.32 | $ | 15.73 | $ | 16.05 | $ | 15.02 | ||||||||||

Total return(c) | 10.72 | % | 1.09 | % | 10.40 | % | 25.62 | % | ||||||||||

Ratios to average net assets: | ||||||||||||||||||

| Net operating expenses | 1.03 | %(d) | 1.04 | % | 1.06 | % | 1.14 | % | ||||||||||

| Net investment income | 1.08 | %(d) | 1.18 | % | 1.65 | % | 2.78 | % | ||||||||||

Supplemental data: | ||||||||||||||||||

| Portfolio turnover rate | 11.9 | % | 50.8 | % | 28.9 | % | 54.8 | % | ||||||||||

| Net assets, end of period (000’s) | $ | 5,436,066 | $ | 4,830,219 | $ | 2,877,664 | $ | 1,267,395 | ||||||||||

(a) | The amounts shown for a share outstanding may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. | |

(b) | Calculated using average daily shares outstanding. | |

(c) | Total return assumes reinvestment of all distributions. Total returns for periods of less than one year are not annualized. | |

(d) | Annualized. |

| Financial Highlights (unaudited) | IVA Funds |

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Year Ended September 30, 2010 | | Year Ended September 30, 2009 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net asset value, beginning of period | $ | 15.56 | $ | 15.59 | $ | 14.59 | $ | 12.00 | ||||||||||

Increase from investment operations:(a) | ||||||||||||||||||

Net investment income(b) | 0.08 | 0.20 | 0.17 | 0.27 | ||||||||||||||

| Net realized and unrealized gain | 1.05 | 0.20 | 1.25 | 2.36 | ||||||||||||||

| Increase from investment operations | 1.13 | 0.40 | 1.42 | 2.63 | ||||||||||||||

Decrease from distributions: | ||||||||||||||||||

| Net investment income | (0.23 | ) | (0.02 | ) | (0.16 | ) | (0.04 | ) | ||||||||||

| Net realized gain on investments | (0.77 | ) | (0.41 | ) | (0.26 | ) | — | |||||||||||

| Decrease from distributions | (1.00 | ) | (0.43 | ) | (0.42 | ) | (0.04 | )�� | ||||||||||

Net asset value, end of period | $ | 15.69 | $ | 15.56 | $ | 15.59 | $ | 14.59 | ||||||||||

Total return(c) | 7.75 | % | 2.56%(d) | 9.96%(d) | 21.96%(d) | |||||||||||||

Ratios to average net assets: | ||||||||||||||||||

| Net operating expenses | 1.28 | %(e) | 1.30 | % | 1.39 | % | 1.40%(f) | |||||||||||

| Net investment income | 1.00 | %(e) | 1.19 | % | 1.13 | % | 2.14%(g) | |||||||||||

Supplemental data: | ||||||||||||||||||

| Portfolio turnover rate | 8.5 | % | 54.3 | % | 28.1 | % | 46.6 | % | ||||||||||

| Net assets, end of period (000’s) | $ | 395,564 | $ | 371,560 | $ | 240,245 | $ | 104,420 | ||||||||||

(a) | The amounts shown for a share outstanding may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. | |

(b) | Calculated using average daily shares outstanding. | |

(c) | Total return assumes reinvestment of all distributions and does not reflect an initial sales charge. Total returns for periods of less than one year are not annualized. | |

(d) | Total returns include the effect of certain contractual fee waivers and/or expense reimbursements. | |

(e) | Annualized. | |

(f) | Reflects certain contractual fee waivers and/or expense reimbursements (exclusive of acquired fund fees and expenses, brokerage expenses, interest expense, taxes, organizational and extraordinary expenses) to limit the amount of total operating expenses to 1.40%. The ratio of expenses to average net assets without the effect of fee waivers and/or reimbursements was 1.55% for the year ended September 30, 2009. | |

(g) | The ratio of net investment income to average net assets without the effect of certain contractual fee waivers and/or expense reimbursements was 1.99% for the year ended September 30, 2009. |

| Financial Highlights (unaudited) | IVA Funds |

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Year Ended September 30, 2010 | | Year Ended September 30, 2009 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net asset value, beginning of period | $ | 15.35 | $ | 15.48 | $ | 14.51 | $ | 12.00 | ||||||||||

Increase from investment operations:(a) | ||||||||||||||||||

Net investment income(b) | 0.02 | 0.07 | 0.06 | 0.17 | ||||||||||||||

| Net realized and unrealized gain | 1.03 | 0.21 | 1.23 | 2.36 | ||||||||||||||

| Increase from investment operations | 1.05 | 0.28 | 1.29 | 2.53 | ||||||||||||||

Decrease from distributions: | ||||||||||||||||||

| Net investment income | (0.10 | ) | — | (0.06 | ) | (0.02 | ) | |||||||||||

| Net realized gain on investments | (0.77 | ) | (0.41 | ) | (0.26 | ) | — | |||||||||||

| Decrease from distributions | (0.87 | ) | (0.41 | ) | (0.32 | ) | (0.02 | ) | ||||||||||

Net asset value, end of period | $ | 15.53 | $ | 15.35 | $ | 15.48 | $ | 14.51 | ||||||||||

Total return(c) | 7.31 | % | 1.76%(d) | 9.05%(d) | 21.10%(d) | |||||||||||||

Ratios to average net assets: | ||||||||||||||||||

| Net operating expenses | 2.03 | %(e) | 2.06 | % | 2.15%(f) | 2.15%(f) | ||||||||||||

| Net investment income | 0.23 | %(e) | 0.42 | % | 0.41%(g) | 1.38%(g) | ||||||||||||

Supplemental data: | ||||||||||||||||||

| Portfolio turnover rate | 8.5 | % | 54.3 | % | 28.1 | % | 46.6 | % | ||||||||||

| Net assets, end of period (000’s) | $ | 82,622 | $ | 79,196 | $ | 55,824 | $ | 19,028 | ||||||||||

(a) | The amounts shown for a share outstanding may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. | |

(b) | Calculated using average daily shares outstanding. | |

(c) | Total return assumes reinvestment of all distributions and does not reflect a contingent deferred sales charge. Total returns for periods of less than one year are not annualized. | |

(d) | Total returns include the effect of certain contractual fee waivers and/or expense reimbursements. | |

(e) | Annualized. | |

(f) | Reflects certain contractual fee waivers and/or expense reimbursements (exclusive of acquired fund fees and expenses, brokerage expenses, interest expense, taxes, organizational and extraordinary expenses) to limit the amount of total operating expenses to 2.15%. The ratio of expenses to average net assets without the effect of fee waivers and/or reimbursements was 2.17% and 2.49% for the years ended September 30, 2010 and 2009, respectively. | |

(g) | The ratio of net investment income to average net assets without the effect of certain contractual fee waivers and/or expense reimbursements was 0.38% and 1.04% for the years ended September 30, 2010 and 2009, respectively. |

| Financial Highlights (unaudited) | IVA Funds |

| Six Months Ended March 31, 2012 | | Year Ended September 30, 2011 | | Year Ended September 30, 2010 | | Year Ended September 30, 2009 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net asset value, beginning of period | $ | 15.60 | $ | 15.62 | $ | 14.62 | $ | 12.00 | ||||||||||

Increase from investment operations:(a) | ||||||||||||||||||

Net investment income(b) | 0.10 | 0.24 | 0.21 | 0.31 | ||||||||||||||

| Net realized and unrealized gain | 1.04 | 0.21 | 1.24 | 2.35 | ||||||||||||||

| Increase from investment operations | 1.14 | 0.45 | 1.45 | 2.66 | ||||||||||||||

Decrease from distributions: | ||||||||||||||||||

| Net investment income | (0.27 | ) | (0.06 | ) | (0.19 | ) | (0.04 | ) | ||||||||||

| Net realized gain on investments | (0.77 | ) | (0.41 | ) | (0.26 | ) | — | |||||||||||

| Decrease from distributions | (1.04 | ) | (0.47 | ) | (0.45 | ) | (0.04 | ) | ||||||||||

Net asset value, end of period | $ | 15.70 | $ | 15.60 | $ | 15.62 | $ | 14.62 | ||||||||||

Total return(c) | 7.82 | % | 2.86%(d) | 10.19%(d) | 22.28%(d) | |||||||||||||

Ratios to average net assets: | ||||||||||||||||||