| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act file number: 811-22211 |

| IVA FIDUCIARY TRUST |

| (Exact name of registrant as specified in charter) |

| 717 Fifth Avenue, 10th Floor, New York, NY 10022 |

| (Address of principal executive offices) (zip code) |

| Michael W. Malafronte |

| International Value Advisers, LLC |

| 717 Fifth Avenue |

| 10th Floor |

| New York, NY 10022 |

| (Name and address of agent for service) |

| Copy to: |

| Stuart E. Fross, Esq. |

| K&L Gates LLP |

| State Street Financial Center |

| One Lincoln Street |

| Boston, Massachusetts 02111-2950 |

| Brian F. Link, Esq. |

| State Street Bank and Trust Company |

| Mail Code: JHT 1593 |

| 200 Clarendon Street |

| Boston, MA 02116 |

| Registrant’s telephone number, including area code: (212) 584-3570 |

| Date of fiscal year end: September 30 |

| Date of reporting period: March 31, 2013 |

| Item 1. Report to Shareholders. |

| ||

IVA Worldwide Fund | ||

| IVA International Fund | ||

| Semi-Annual Report | ||

| March 31, 2013 | ||

Advised by International Value Advisers, LLC | An investment in the Funds is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

| Contents | IVA Funds |

| 2 | An Owner’s Manual | ||

| 3 | Letter from the President | ||

| 4 | Letter from the Portfolio Managers | ||

| 7 | Management’s Discussion of Fund Performance | ||

| IVA Worldwide Fund | |||

| 10 | Performance | ||

| 11 | Portfolio Composition | ||

| 12 | Schedule of Investments | ||

| IVA International Fund | |||

| 20 | Performance | ||

| 21 | Portfolio Composition | ||

| 22 | Schedule of Investments | ||

| 29 | Statements of Assets and Liabilities | ||

| 30 | Statements of Operations | ||

| 31 | Statements of Changes in Net Assets | ||

| 32 | Financial Highlights | ||

| 38 | Notes to Financial Statements | ||

| 46 | Trustees and Officers | ||

| 48 | Additional Information | ||

| 49 | Fund Expenses |

| 1 |

| An Owner’s Manual | IVA Funds |

An Atypical Investment Strategy

We manage both the IVA Worldwide and IVA International Funds with a dual attempt that is unusual in the mutual fund world: in the short-term (12-18 months), our attempt is to try to preserve capital, while in the longer-term (5-10 years, i.e., over a full economic cycle), we attempt to perform better than the MSCI All Country World Index, in the case of your IVA Worldwide Fund, and the MSCI All Country World Ex-U.S. Index, in the case of your IVA International Fund.

The Worldwide Fund is typically used by investors who are looking for an “all weather fund” where we are given the latitude to decide how much we should have in the U.S. versus outside the U.S. The International Fund is typically used by investors who practice asset allocation and want to decide for themselves how much should be allocated to a domestic manager and how much should be allocated to a pure “international” (i.e., non-U.S.) manager, yet at the same time are looking for a lower risk – and lower volatility – exposure to international markets than may be obtained from a more traditional international fund.

We believe our investment approach is very different from the traditional approach of most mutual funds. We are trying to deliver returns that are as absolute as possible, i.e., returns that try to be as resilient as possible in down markets, while many of our competitors try to deliver good relative performance, i.e., try to beat an index, and thus would be fine with being down 15% if their benchmark is down 20%.

Why do we have such an unusual strategy (which, incidentally, is not easy to carry out)? Because we believe this strategy makes sense for many investors. We are fond of the quote by Mark Twain: “There are two times in a man’s life when he should not speculate: the first time is when he cannot afford to; the second time is when he can.” We realize that many investors cannot tolerate high volatility and appreciate that “life’s bills do not always come at market tops.” This strategy also appeals to us at International Value Advisers since we “eat our own cooking” for a significant part of our savings (invested in IVA products) and we have an extreme aversion to losing money.

An Eclectic Investment Approach

Here is how we try to implement our strategy:

| We don’t hug benchmarks. In practical terms, this means we are willing to make big “negative bets,” i.e., having nothing or little in what has become big in the benchmark. Conversely, we will generally seek to avoid overly large positive bets. | |

| We prefer having diversified portfolios (100 to 150 names). Because we invest on a global basis, we believe that diversification helps protect against weak corporate governance or insufficient disclosure, or simply against “unknown unknowns.” | |

| We like the flexibility to invest in small, medium and large companies, depending on where we see value. | |

| We attempt to capture equity-type returns through fixed income securities but predominantly when credit markets (or sub-sets of them) are depressed and offer this potential. | |

| We hold some gold, either in bullion form or via gold mining securities, as we feel it provides a good hedge in either an inflationary or deflationary period. | |

| We are willing to hold cash when we cannot find enough cheap securities that we like or when we find some, yet the broader market (Mr. Market) seems fully priced. We will seek to use that cash as ammunition for future bargains. | |

| At the individual security level, we ask a lot of questions about “what can go wrong?” and will establish not only a “base case intrinsic value” but also a “worst case scenario” (What could prove us wrong? If we were wrong, are we likely to lose 25%, 30%, or even more of the money invested?). As a result, we will miss some opportunities, yet hopefully, we will also avoid instances where we experience a permanent impairment of value. |

| 2 |

| Letter from the President | IVA Funds |

| Dear Shareholder, Your two mutual funds, the IVA Worldwide Fund and the IVA International Fund (“the Funds”), recently completed the first six months of their fifth year of operation. The very difficult markets of 2008 and early 2009 are in the past (but not forgotten) as many major global equity indices reached new highs in early 2013. These new market highs are partially being propelled by government and central bankers’ aggressive assault on interest rates (downward), exchange rates and asset prices. In light of this manipulation we read more and more about the equity market’s strength and less and less about the cumulative risks associated with these policies, the tepid global GDP growth, the still destructive rate of unemployment in this country and abroad, and the need for most European financial institutions to inject additional equity capital into their balance sheets (Germany’s largest bank by assets announced an equity sale as I began writing this letter). It is important to keep in mind that Charles de Vaulx and Chuck de Lardemelle have navigated market environments like this before and IVA remains committed to attempting to deliver returns that are as absolute as possible; returns that are as resilient as possible in down markets. While Charles, Chuck and their team of investment analysts calculate intrinsic values in search of return, we will not pursue investments while ignoring their risks. Even though markets, television pundits, and newspapers are focusing less on historically high margins, central bank assistance in propelling interest rates lower and asset prices higher, and the waning commitment to austerity across Italy, Spain, Ireland and Portugal, we are acutely aware that risks abound in today’s financial markets. While these risks are widespread, the most troubling conclusion for IVA is that most stocks appear to be fully priced. When investing at IVA, the price of a stock, which equates to a percentage ownership of a company at a known set of valuation metrics, is the most important principle. Today, as risks appear abundant and as equity markets are hitting new highs, we remain committed to only making investments on our clients’ behalf when the price of a security affords us a sufficient discount to our estimate of intrinsic value and will divorce emotion from the construction of our portfolios. |

Strengthening IVA continues to be a rewarding experience. We hope that in the process, we are shaping a culture where everyone associated with IVA respects the work we are doing for our clients.

I want to offer thanks to all of my colleagues and to our shareholders for their continued support.

Sincerely,

Michael W. Malafronte, President

Effective February 22, 2011, the IVA Worldwide Fund and IVA International Fund are closed to new investors.

| 3 |

| Letter from the Portfolio Managers | IVA Funds |

| May 1, 2013 Dear Shareholder, Over the period under review, October 1, 2012 to March 31, 2013, central bankers around the world have continued to drown markets in liquidity and manipulate government debt prices. In Japan, in particular, political changes led to the nomination of three new Bank of Japan (BoJ) board members. The BoJ then announced a very aggressive printing exercise, buying long-term Japanese government bonds as well as other assets. The short-term consequences of these moves were a sharp Japanese yen devaluation (from ¥78 per USD on October 1, 2012, to ¥94 on March 31, 2013 and ¥99 currently) and a strong rally in Japanese equities. Both the IVA International and IVA Worldwide Funds have a sizeable portion of their assets invested in Japan; despite the fact that these investments were mostly in shares of local companies with few exports and very strong balance sheets, this rally, coupled with partial hedges in place on the currency, helped deliver a solid absolute return for this period. While valuations in Japan were severely depressed before these events (the market as a whole was selling below book value), corporate governance and capital allocation in general remain dreadful in that country. Valuations are still reasonable today even after a 55% rally on the Nikkei 225 Index (which is comprised of Japan’s top 225 blue-chip companies on the Tokyo Stock Exchange) from October 1, 2012 to May 1, 2013. For the rally to continue and prove sustainable however, some pick up in consumption and the economy in Japan would be beneficial, as well as structural reforms in a number of areas; there are signs that this could be happening on the consumption side, none on the reform side so far. While potentially boosting consumption and GDP growth in the short-term, these policies may have negative consequences longer term in Japan. For instance, if consumption picks up, this would lead to less saving and therefore Japan may find itself in a situation where it needs to borrow from foreigners to fund very large budget deficits. Given the amount of Japanese government bonds (JGBs) currently outstanding (over 200% of GDP), the stated goal of 2% inflation and 10-year JGB yields currently below 0.6%, attracting foreign capital to fund budget deficits may not be so easy... We have trimmed and continue to reduce our exposure to Japan, holding on to the higher quality companies we already own as long as valuations remain reasonable while selling less liquid investments or stakes in companies where management has not demonstrated an ability to allocate capital properly over the last few years. While the current policy may help in the short-term in Japan, it may carry the seeds of severe wealth destruction through inflation or hyperinflation five to 10 years down the road. A large current account deficit, over 3% of GDP, would be, in our opinion, highly problematic for Japan and could potentially trigger a crisis. Time will tell; it is possible that the negative side effects of global quantitative easing (read printing money hand over fist, market manipulation and financial repression) will show up in Japan first. In the meantime, we continue to enjoy this rally, taking some profits along the way. |

| 4 |

| Letter from the Portfolio Managers | IVA Funds |

Europe continues to be a source of frustration for us at IVA. In the midst of a double dip recession with difficult, if not intractable political issues, you’d think this part of the world would be a fertile hunting ground for value investors. What we find, however, is a tale of two markets: banks, utilities and telecom companies have suffered tremendous and very fundamental setbacks since 2007 and are therefore down substantially, dragging indices down; while high quality, global companies headquartered in Europe tend to trade at all-time highs and be very pricey. In the middle you’ll find a number of cyclical companies with debt, usually not that cheap, and where balance sheets are far from pristine; the somewhat deflationary setup in Europe (the European Central Bank is now shrinking its balance sheet while loans to the private sector in Europe are contracting modestly) warrants caution on indebted cyclical companies.

We have done well recently with a number of small and mid-caps in Europe that were misunderstood. We continue to look for opportunities in the Old Continent but without much success over the period.

For the IVA Worldwide Fund, in the U.S., we have emphasized quality of capital allocation and management. In a world of anemic global growth constrained by too much debt, reinvesting free cash flow properly will make even more of a difference than in the past. While we found a number of opportunities in the second half of last year, they are now few and far between, given the continued appreciation of U.S. stock indices.

Emerging markets have performed poorly on a relative basis for a while now; we had almost no direct investment in the BRIC countries (Brazil, Russia, India and China) in recent time. However, we made our first investment in Brazil over the period; we are also currently adding a name listed in Hong Kong doing business exclusively in China. But these markets are not cheap enough for us to make large commitments. In China in particular, we worry about massive misallocation of capital and a potentially moribund banking sector.

No opportunities to report in high yield debt either! In fact, we are witnessing the mirror image of 2008-2009. At that time high yield bonds were offering very attractive opportunities, more than equity-like returns with less risk than equities. Not the case today. We view equity-like returns currently at roughly 6%, versus 8-10% in the past; despite our lowering the bar, we cannot find decent credits today yielding 6%. Our remaining high yield exposure is of short duration overall (less than 3 years) and comprised mostly of remnants of investments made in previous years.

A word on gold: the yellow metal has acted poorly since September 2011 – it topped around $1900/oz, and did not go up when the Swiss Central Bank decided to peg the Swiss franc to the euro at the time. Since then, Bernanke announced more printing and so has the BoJ. Yet gold has continued to drift down, finally capitulating a few weeks ago, mid-April, when gold fell from $1560/oz to $1322/oz, the intraday low price of gold, in two days.

We look at gold as a currency that central bankers cannot debase. The gold price remains reasonable in our opinion vis-à-vis U.S. dollars in circulation (physical dollars printed by the U.S. Federal Reserve). On the other hand gold, at over $1800/oz was expensive vis-a-vis housing in the U.S. (as measured by the number of ounces of gold necessary to buy a median-priced house in the U.S.) or the median wage in the U.S. We have, for the most part, avoided miners and continue to do so. So far we have not taken advantage of the weak price of gold to add to our position; partly because the price was not cheap enough, partly because we have fewer equities in the portfolio, so less gold was required. We believe

| 5 |

| Letter from the Portfolio Managers | IVA Funds |

that gold remains a reasonably priced hedge worth having in a portfolio, especially in this age of “quantitative easing.”

In conclusion, while equities may look attractive relative to government paper, we prefer to err on the side of caution. The argument in favor of equities is a relative one, and markets are being manipulated very heavily these days. Only time will reveal the extent of asset misallocations triggered by these policies. The recent track record of central bankers (1995 to today) does not inspire confidence. We also note the unusual divergence between commodity prices and equity indices of late: from October 1, 2012 to May 1, 2013, the Commodity Research Bureau Index (CRB) was down 9% while the MSCI All Country World Index (Net) was up 12%.

Diversification, strong franchises, capable management teams, solid balance sheets, and discipline when it comes to price; these simple characteristics and principles shall see us through this treacherous investment landscape.

We appreciate your continued confidence and thank you for your support.

Charles de Vaulx, Chief Investment Officer and Portfolio Manager

Chuck de Lardemelle, Portfolio Manager

| 6 |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

Global equity markets delivered strong returns over this six month period ending March 31, 2013, with the Dow Jones Industrial Average closing at a record high in March. U.S. equity markets continued to react positively to money printing by the Federal Reserve as well as some signs (housing, job creation) that the economic recovery is gaining some traction. Japanese equity markets surged over the period as Japan’s new Prime Minister pledged aggressive monetary policies and urged the central bank to commit to a 2% annual inflation target by 2015 or early 2016. Also, worldwide and despite a recession in the euro zone, corporate profits appeared to be holding up nicely.

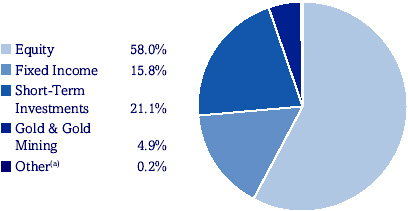

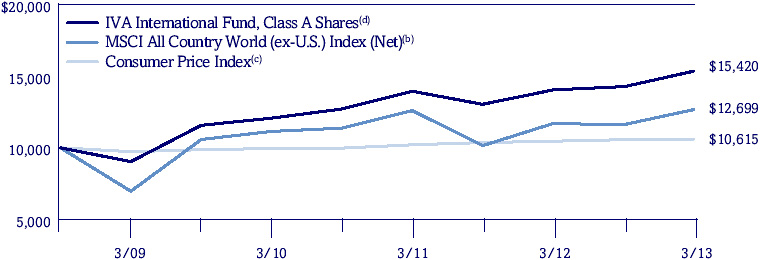

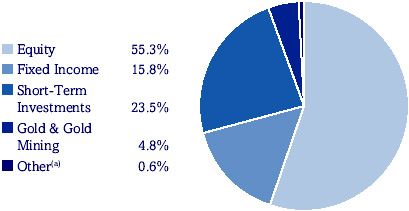

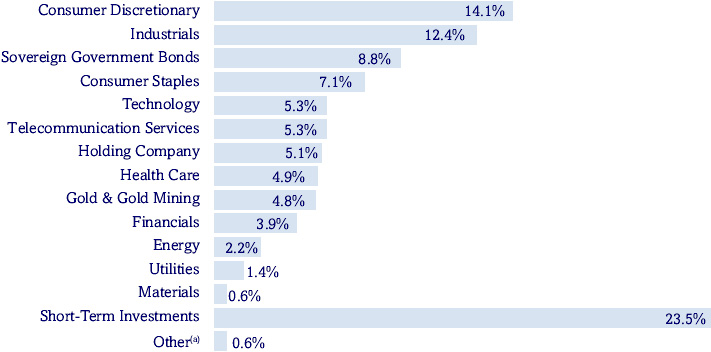

As global equity markets rose, we trimmed or sold a few stocks that were close to or met our intrinsic value estimate. In the IVA Worldwide Fund, our total equity exposure declined to 58.0% on March 31, 2013 from 63.0% on September 30, 2012, while our total cash exposure increased to 21.1% from 15.8% over the same period. In the IVA International Fund, our total equity exposure fell to 55.3% on March 31, 2013 from 57.1% on September 30, 2012, while our total cash exposure rose to 23.5% from 22.2% over the same period.

Japanese equities were a large contributor to both Funds’ return this period following the election of a new Prime Minister, Shinzo Abe, in December 2012. Over this six month period, while the Japanese yen weakened -20.8% versus the U.S. dollar, the TOPIX Total Return Index rose about 41.8% in JPY (17.3% in USD), making it one of the best performing global equity markets. As we acknowledged that this new Prime Minister was eager to weaken the yen, we increased our hedge against the yen by about 10 percentage points in both Funds in January 2013 and as of March 31, 2013, our hedge was 40.8% in the IVA Worldwide Fund and 50.9% in the IVA International Fund.

Over the reporting period gold bullion averaged a return of about -9.9% and was the largest individual detractor from both Funds’ return. Because we were net sellers of equities over the period, we simultaneously reduced our exposure to gold by trimming our gold mining stocks. As of March 31, 2013, our gold exposure represented 4.9% of the IVA Worldwide Fund and 4.8% of the IVA International Fund, with gold mining stocks being 0.1% of that total in both Funds.

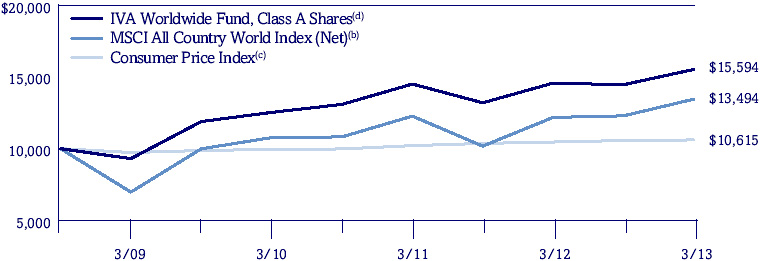

IVA Worldwide Fund

The IVA Worldwide Fund Class A shares, at net asset value, returned 7.46% for the six month period ending March 31, 2013. The MSCI All Country World Index (Net) (the “Index”) returned 9.57% over the same period.

Our equities (ex-gold mining stocks) averaged gains of 13.3% versus the Index at 9.6% over the period, due to good security selection among technology stocks, as well as U.S. and French equities. Our technology stocks averaged a return of 16.9% versus those in the Index at 2.3% and added 2.2% to the return, led by Dell Inc. (technology, U.S.) and Applied Materials, Inc. (technology, U.S.). We trimmed our exposure to this sector over the period, from 15.0% to 12.4%, and sold securities such as JDA Software Group, Inc. (the Company was the target of a tender offer for cash) and Symantec Corp. The consumer discretionary and industrials sectors delivered solid returns over the period, and together added 3.2% to our return versus the benchmark adding 3.0%, led by Teleperformance (industrials, France) and the Washington Post Co. Class “B” (consumer discretionary, U.S.), which were among our top individual contributors to return. The only equity sector to detract from our return was utilities, -0.2%, due to poor performance from GDF Suez SA (utilities, France). Our underweight exposure to financials was among the largest detractors from relative results, as this sector added 3.2% to the benchmark’s return versus 0.7% to our return.

| 7 |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

By country, our equities in the U.S. performed well, averaging gains of 15.4% versus the Index at 10.1%, and contributed 4.6% to our return, led by Berkshire Hathaway Inc., Class “A” and Class “B” (holding company, U.S.). Additionally, our equities in France performed well, averaging a return of 16.5% versus the Index at 11.1% and added 1.6% to our return. Our Japanese equities also added 0.6% to the return. The only country to detract from our return over the period was South Africa, -0.1%, as Net 1 U.E.P.S. Technologies Inc. (technology, South Africa) was among our worst individual contributors to return since its share price fell following news it was subject to an investigation by the U.S. Department of Justice.

Over the period, our fixed income holdings collectively averaged a return of 2.7% and added 0.5% to the return, with our corporate bonds averaging a positive return of 5.0%, while our sovereign bonds averaged a negative return of -0.8%.

Our forward foreign currency contracts, which are used to hedge currency risk, contributed about 0.6% to return over the period. Individually, our Japanese yen hedge added 0.7% to the return, while our euro and South Korean won hedges collectively detracted approximately -0.1% from the return.

Other individual detractors from return this period included: IAMGOLD Corp. (gold mining, Canada) and Devon Energy Corp. (energy, U.S.).

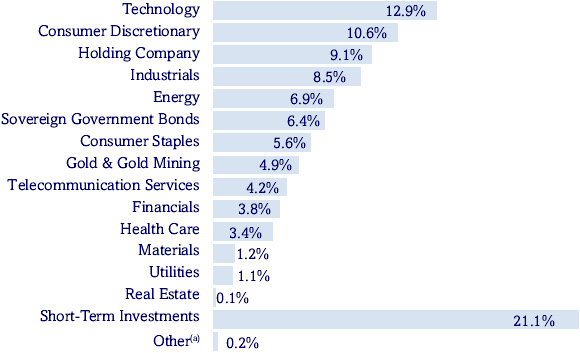

IVA International Fund

The IVA International Fund Class A shares, at net asset value, returned 7.73% for the six month period ending March 31, 2013. The MSCI All Country World (ex-U.S.) Index (Net) (the “Index”) returned 9.20% over the same period.

Our equities (ex-gold mining stocks) averaged a return of 13.7% versus the Index at 9.2%, due to solid returns from consumer discretionary and industrials stocks, as well as our French equities. Our consumer discretionary stocks averaged gains of 19.3% versus those in the Index at 16.4% and added 2.5% to our return, led by Sodexo SA (consumer discretionary, France) and Lagardère SCA (consumer discretionary, France). Additionally, our industrials stocks performed well and added 2.3% to the return, led by gains from Teleperformance (industrials, France), Temp Holdings Co., Ltd. (industrials, Japan), and Bolloré (industrials, France). These three companies were among our top individual contributors to return and together added 1.6% to the return. The only equity sector to detract from our return was utilities, -0.3%, as GDF Suez SA (utilities, France) was among our worst individual contributors to return. Our underweight exposure to financials was among the largest detractors from relative results as this sector added 3.7% to the benchmark’s return versus 0.7% to our return.

By country, our equities in France led gains by averaging a return of 17.1% versus those in the Index at 11.1% and added 3.1% to our return. Additionally, our Japanese equities added 1.7% to the return. The only country to detract from our return over the period was South Africa, -0.2%, as Net 1 U.E.P.S. Technologies Inc. (technology, South Africa) was among our worst individual contributors to return since its share price fell following news it was subject to an investigation by the U.S. Department of Justice.

Over the period, our fixed income holdings collectively averaged a return of 2.2% and added 0.4% to the return, with our corporate bonds averaging a positive return of 5.4%, while our sovereign bonds averaged a negative return of -0.4%.

| 8 |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

Our forward foreign currency contracts, which are used to hedge currency risk, contributed about 1.5% to return over the period. Individually, our Japanese yen hedge added 1.6% to the return, while our Australian dollar, euro, and South Korean won hedges collectively detracted approximately -0.1% from the return.

Other individual detractors from return this period included: IAMGOLD Corp. (gold mining, Canada) and Newcrest Mining Ltd. (gold mining, Australia).

Investment Risks: There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

| 9 |

| IVA Worldwide Fund | IVA Funds |

| Performance (unaudited) | As of March 31, 2013 |

| Average Annual Total Returns as of March 31, 2013(a) | Six Months | One Year | Three Year | Since Inception | ||||||||||||||||

| Class A | 7.46 | % | 6.61 | % | 7.48 | % | 11.64 | % | ||||||||||||

| Class A (with a 5% maximum initial sales charge) | 2.10 | % | 1.27 | % | 5.65 | % | 10.38 | % | ||||||||||||

| Class C | 7.00 | % | 5.75 | % | 6.68 | % | 10.80 | % | ||||||||||||

| Class I | 7.53 | % | 6.80 | % | 7.74 | % | 11.89 | % | ||||||||||||

| MSCI All Country World Index (Net)(b) | 9.57 | % | 10.55 | % | 7.78 | % | 6.89 | % | ||||||||||||

| Consumer Price Index(c) | 0.48 | % | 1.48 | % | 2.24 | % | 1.34 | % | ||||||||||||

| Growth of a $10,000 Initial Investment |

| (a) | The Fund commenced investment operations on October 1, 2008. Total returns for periods of less than one year are not annualized. |

| (b) | The MSCI All Country World Index (Net) is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global, developed and emerging markets. The Index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2013. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. The expense ratios for the Fund are as follows: 1.28% (Class A shares); 2.03% (Class C shares); and 1.03% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2013. More recent expense ratios can be found in the Financial Highlights section of this Semi-Annual Report.

| 10 |

| IVA Worldwide Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of March 31, 2013 |

| Asset Allocation (As a Percent of Total Net Assets) |

| Sector Allocation (As a Percent of Total Net Assets) | |

| Top 10 Positions (As a Percent of Total Net Assets)(b) |

| Government of Singapore, 2.25% due 7/1/2013; 3.625% due 7/1/2014 | 5.3 | % | ||

| Gold Bullion | 4.8 | % | ||

| Berkshire Hathaway Inc., Class ‘A’, Class ‘B’ | 3.9 | % | ||

| Wendel, 4.875% due 5/26/2016; 4.375% due 8/9/2017; 6.75% due 4/20/2018 | 3.9 | % | ||

| Astellas Pharma Inc. | 3.2 | % | ||

| Devon Energy Corp. | 2.4 | % | ||

| Nestlé SA | 2.2 | % | ||

| Genting Malaysia Berhad | 2.0 | % | ||

| Expeditors International of Washington Inc. | 1.8 | % | ||

| Applied Materials, Inc. | 1.5 | % | ||

| Top 10 positions represent 31.0% of total net assets. | |

| (a) | Other represents unrealized gains and losses on options, forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

| 11 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| COMMON STOCKS – 57.3% | |||||||||

| Belgium | 0.3% | |||||||||

| 281,848 | Sofina SA | $ | 25,470,739 | ||||||

| Brazil | 0.3% | |||||||||

| 1,474,928 | Itaú Unibanco Holding SA, ADR | 26,253,718 | |||||||

| Canada | 0.1% | |||||||||

| 1,199,750 | IAMGOLD Corp. | 8,638,200 | |||||||

| Denmark | 0.2% | |||||||||

| 684,445 | D/S Norden A/S | 22,125,774 | |||||||

| France | 8.3% | |||||||||

| 338,105 | Alten | 13,392,065 | |||||||

| 174,856 | Bolloré | 67,241,790 | |||||||

| 355,198 | Cap Gemini SA | 16,163,535 | |||||||

| 747,066 | Carrefour SA | 20,450,128 | |||||||

| 257,540 | Ciments Français SA | 14,690,689 | |||||||

| 38,935 | Financière de l’Odet SA | 28,859,798 | |||||||

| 58,975 | Financière Marc de Lacharriere SA | 3,082,852 | |||||||

| 5,186,282 | GDF Suez SA | 99,853,556 | |||||||

| 1,560,342 | Lagardère SCA | 57,453,608 | |||||||

| 522,069 | Publicis Groupe SA | 35,006,614 | |||||||

| 92,497 | Robertet SA (b) | 16,255,584 | |||||||

| 60,007 | Séché Environnement SA | 2,130,685 | |||||||

| 912,717 | Sodexo SA | 85,056,601 | |||||||

| 1,382,098 | Teleperformance | 58,898,285 | |||||||

| 804,532 | Thales SA | 34,027,413 | |||||||

| 1,592,082 | Total SA, ADR | 76,388,094 | |||||||

| 4,488,062 | Vivendi SA | 92,710,011 | |||||||

| 721,661,308 | |||||||||

| Germany | 0.5% | |||||||||

| 338,518 | Siemens AG | 36,463,102 | |||||||

| 184,277 | Wincor Nixdorf AG | 9,153,355 | |||||||

| 45,616,457 | |||||||||

| Hong Kong | 0.1% | |||||||||

| 15,826,640 | Clear Media Ltd. (b) | 10,907,823 | |||||||

| Japan | 10.5% | |||||||||

| 5,121,200 | Astellas Pharma Inc. | 275,277,761 | |||||||

| 935,100 | Benesse Holdings Inc. | 39,734,424 | |||||||

| 2,780,900 | Cosel Co., Ltd. (c) | 31,904,945 | |||||||

| 1,097,300 | Icom Inc. (b)(c) | 27,859,425 | |||||||

| 1,231,370 | Kose Corp. | 28,607,916 | |||||||

| 213,800 | Medikit Co., Ltd. (b) | 7,211,080 | |||||||

| 1,488,200 | Meitec Corp. | 37,562,683 | |||||||

| 737,200 | Milbon Co., Ltd. (c) | 25,960,780 | |||||||

| 3,128,504 | Miura Co., Ltd. (c) | 80,659,470 | |||||||

| 12 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| Japan | 10.5% (continued) | |||||||||

| 844,800 | Nifco Inc. | $ | 19,232,022 | ||||||

| 218,100 | Nintendo Co., Ltd. | 23,516,386 | |||||||

| 183,800 | Nitto Kohki Co., Ltd. | 3,524,290 | |||||||

| 11,843 | NTT DoCoMo, Inc. | 17,562,892 | |||||||

| 436,900 | Okinawa Cellular Telephone Co. | 10,442,715 | |||||||

| 4,501 | Pasona Group Inc. | 2,280,743 | |||||||

| 1,629,600 | Secom Co., Ltd. | 83,873,288 | |||||||

| 367,488 | Shofu Inc. | 3,704,744 | |||||||

| 56,800 | SMC Corp. | 10,969,608 | |||||||

| 113,200 | Sugi Holdings Co., Ltd. | 4,034,482 | |||||||

| 875 | Techno Medica Co., Ltd. | 5,093,748 | |||||||

| 3,935,900 | Temp Holdings Co., Ltd. (c) | 67,357,889 | |||||||

| 1,948,400 | Toho Co., Ltd. | 40,650,742 | |||||||

| 138,540 | Yahoo Japan Corp. | 63,651,724 | |||||||

| 910,673,757 | |||||||||

| Malaysia | 2.0% | |||||||||

| 148,186,000 | Genting Malaysia Berhad | 175,631,397 | |||||||

| Norway | 0.9% | |||||||||

| 9,854,646 | Orkla ASA | 79,064,663 | |||||||

| Singapore | 0.2% | |||||||||

| 1,147,069 | United Overseas Bank Ltd. | 18,847,314 | |||||||

| South Africa | 0.5% | |||||||||

| 6,006,359 | Net 1 U.E.P.S. Technologies Inc. (a)(c) | 44,447,057 | |||||||

| South Korea | 2.1% | |||||||||

| 143,765 | E-Mart Co., Ltd. | 28,362,770 | |||||||

| 1,413,610 | Kangwon Land, Inc. | 39,069,304 | |||||||

| 37,054 | Lotte Chilsung Beverage Co., Ltd. | 49,789,439 | |||||||

| 27,171 | Lotte Confectionery Co., Ltd. | 43,030,112 | |||||||

| 1,059,520 | SK Telecom Co., Ltd., ADR | 18,933,622 | |||||||

| 179,185,247 | |||||||||

| Switzerland | 3.0% | |||||||||

| 68,115 | APG SGA SA | 16,574,913 | |||||||

| 2,672,347 | Nestlé SA | 193,254,631 | |||||||

| 116,420 | Schindler Holding AG | 17,058,909 | |||||||

| 2,172,472 | UBS AG | 33,297,659 | |||||||

| 260,186,112 | |||||||||

| Taiwan | 0.1% | |||||||||

| 2,561,000 | Taiwan Secom Co., Ltd. | 5,781,038 | |||||||

| United Kingdom | 0.6% | |||||||||

| 1,687,525 | Inmarsat Plc | 18,012,868 | |||||||

| 3,529,321 | Millennium & Copthorne Hotels Plc | 30,513,341 | |||||||

| 48,526,209 | |||||||||

| See Notes to Financial Statements. | 13 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| United States | 27.6% | |||||||||

| 1,237,876 | Amdocs Ltd. | $ | 44,873,005 | ||||||

| 1,443,597 | Annaly Capital Management Inc. | 22,938,756 | |||||||

| 1,177,836 | Aon Plc | 72,436,914 | |||||||

| 9,657,661 | Applied Materials, Inc. | 130,185,270 | |||||||

| 1,721,346 | Baker Hughes Inc. | 79,887,668 | |||||||

| 1,723 | Berkshire Hathaway Inc., Class ‘A’ (a) | 269,270,440 | |||||||

| 683,771 | Berkshire Hathaway Inc., Class ‘B’ (a) | 71,248,938 | |||||||

| 351,088 | Cimarex Energy Co. | 26,486,079 | |||||||

| 61,514 | Contango ORE Inc. (a)(b) | 573,618 | |||||||

| 899,866 | CVS Caremark Corp. | 49,483,631 | |||||||

| 4,235,886 | Dell Inc. | 60,700,246 | |||||||

| 3,695,560 | Devon Energy Corp. | 208,503,495 | |||||||

| 1,847,155 | DeVry Inc. | 58,647,171 | |||||||

| 631,019 | Energen Corp. | 32,819,298 | |||||||

| 411,908 | Energizer Holdings Inc. | 41,079,585 | |||||||

| 419,759 | Era Group Inc. (a) | 8,814,939 | |||||||

| 4,297,452 | Expeditors International of Washington Inc. | 153,462,011 | |||||||

| 266,653 | Goldman Sachs Group, Inc. | 39,237,989 | |||||||

| 147,784 | Google Inc., Class ‘A’ (a) | 117,344,930 | |||||||

| 1,341,896 | Hewlett-Packard Co. | 31,990,801 | |||||||

| 3,032,782 | Ingram Micro Inc., Class ‘A’ (a) | 59,685,150 | |||||||

| 1,363,042 | Liberty Interactive Corp., Series ‘A’ (a) | 29,141,838 | |||||||

| 690,229 | Marsh & McLennan Cos., Inc. | 26,207,995 | |||||||

| 183,660 | MasterCard Inc., Class ‘A’ | 99,383,936 | |||||||

| 4,177,034 | Microsoft Corp. | 119,504,943 | |||||||

| 32,046 | National CineMedia, Inc. | 505,686 | |||||||

| 377,509 | News Corp., Class ‘A’ | 11,521,575 | |||||||

| 1,359,743 | News Corp., Class ‘B’ | 41,825,695 | |||||||

| 1,082,005 | Occidental Petroleum Corp. | 84,796,732 | |||||||

| 3,461,044 | Oracle Corp. | 111,930,163 | |||||||

| 388,589 | SEACOR Holdings Inc. | 28,631,238 | |||||||

| 928,111 | Sealed Air Corp. | 22,376,756 | |||||||

| 1,361,289 | Spansion, Inc., Class ‘A’ (a) | 17,519,789 | |||||||

| 780,047 | Telephone & Data Systems, Inc. | 16,435,590 | |||||||

| 2,296,814 | Texas Instruments Inc. | 81,490,961 | |||||||

| 276,531 | The Washington Post Co., Class ‘B’ | 123,609,357 | |||||||

| 193,740 | Zebra Technologies Corp. (a) | 9,130,966 | |||||||

| 2,403,683,154 | |||||||||

TOTAL COMMON STOCKS | |||||||||

(Cost — $4,216,333,637) | 4,986,699,967 | ||||||||

| CONVERTIBLE PREFERRED STOCKS – 0.8% | |||||||||

| United States | 0.8% | |||||||||

Bank of America Corp., | |||||||||

| 55,340 USD | Series ‘L’, 7.25% | 67,412,974 | |||||||

TOTAL CONVERTIBLE | |||||||||

PREFERRED STOCKS | |||||||||

(Cost — $43,391,116) | 67,412,974 | ||||||||

| 14 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| CORPORATE NOTES & BONDS – 9.4% | |||||||||

| France | 3.9% | |||||||||

| Wendel: | |||||||||

| 35,100,000 | EUR | 4.875% due 5/26/2016 (d) | $ | 47,242,611 | |||||

| 116,950,000 | EUR | 4.375% due 8/9/2017 | 154,222,433 | ||||||

| 95,400,000 | EUR | 6.75% due 4/20/2018 | 138,797,521 | ||||||

| 340,262,565 | |||||||||

| Netherlands | 0.4% | |||||||||

| 22,929,000 | EUR | UPC Holding BV, 8% due 11/1/2016 (d) | 30,330,911 | ||||||

| Norway | 0.3% | |||||||||

| Golden Close Maritime Corp. Ltd., | |||||||||

| 26,400,000 | USD | 11% due 12/9/2015 (b) | 28,281,000 | ||||||

| Switzerland | 0.3% | |||||||||

| 8,800,000 | EUR | UBS AG, 7.152% due 12/21/2017 (e) | 12,354,847 | ||||||

| UBS Preferred Funding Trust V, 6.243% | |||||||||

| 8,892,000 | USD | due 5/15/2016 (e) | 9,236,565 | ||||||

| 21,591,412 | |||||||||

| United Kingdom | 0.2% | |||||||||

| Inmarsat Finance Plc, 7.375% due | |||||||||

| 19,300,000 | USD | 12/1/2017 (d) | 20,651,000 | ||||||

| United States | 4.3% | |||||||||

| Brandywine Operating Partnership, LP, | |||||||||

| 6,070,000 | USD | 5.7% due 5/1/2017 | 6,848,617 | ||||||

| Cloud Peak Energy Resources LLC, | |||||||||

| 18,309,000 | USD | 8.5% due 12/15/2019 | 19,956,810 | ||||||

| Encore Acquisition Co., | |||||||||

| 3,408,000 | USD | 9.5% due 5/1/2016 | 3,582,660 | ||||||

| Intelsat Luxembourg SA: | |||||||||

| 46,121,000 | USD | 11.25% due 2/4/2017 | 49,176,516 | ||||||

| 51,283,000 | USD | 11.5% due 2/4/2017 (f) | 54,488,187 | ||||||

| 24,975,000 | USD | 7.75% due 6/1/2021 (d) | 25,474,500 | ||||||

| Leucadia National Corp., 8.125% | |||||||||

| 3,418,000 | USD | due 9/15/2015 | 3,892,248 | ||||||

| Level 3 Financing Inc., 10% due | |||||||||

| 1,740,000 | USD | 2/1/2018 | 1,931,400 | ||||||

| MetroPCS Wireless Inc., 7.875% due | |||||||||

| 6,961,000 | USD | 9/1/2018 | 7,639,697 | ||||||

| Mohawk Industries Inc., 6.375% due | |||||||||

| 37,016,000 | USD | 1/15/2016 (g) | 41,457,920 | ||||||

| QVC Inc.: | |||||||||

| 6,878,000 | USD | 7.125% due 4/15/2017 (d) | 7,124,783 | ||||||

| 31,121,000 | USD | 7.5% due 10/1/2019 (d) | 34,405,915 | ||||||

| Sealed Air Corp., 8.125% due | |||||||||

| 38,288,000 | USD | 9/15/2019 (d) | 43,504,740 | ||||||

| See Notes to Financial Statements. | 15 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| United States | 4.3% (continued) | |||||||||

| Sirius XM Radio, Inc., 8.75% due | |||||||||

| 61,574,000 | USD | 4/1/2015 (d) | $ | 68,808,945 | |||||

| Vulcan Materials Co., 7% due | |||||||||

| 6,660,000 | USD | 6/15/2018 | 7,592,400 | ||||||

| 375,885,338 | |||||||||

| TOTAL CORPORATE NOTES & BONDS | |||||||||

(Cost — $743,536,377) | 817,002,226 | ||||||||

| SOVEREIGN GOVERNMENT BONDS – 6.4% | |||||||||

| Hong Kong | 1.0% | |||||||||

| Government of Hong Kong, 1.52% due | |||||||||

| 669,700,000 | HKD | 12/21/2015 | 89,346,075 | ||||||

| Singapore | 5.3% | |||||||||

| Government of Singapore: | |||||||||

| 412,719,000 | SGD | 2.25% due 7/1/2013 | 334,485,565 | ||||||

| 146,342,000 | SGD | 3.625% due 7/1/2014 | 123,065,086 | ||||||

| 457,550,651 | |||||||||

| Taiwan | 0.1% | |||||||||

| Government of Taiwan, 2% due | |||||||||

| 349,300,000 | TWD | 7/20/2015 | 12,008,538 | ||||||

| TOTAL SOVEREIGN GOVERNMENT BONDS | |||||||||

(Cost — $539,449,411) | 558,905,264 | ||||||||

| OUNCES | |||||||||

| COMMODITIES – 4.8% | |||||||||

| 264,541 | Gold Bullion (a) | 422,331,445 | |||||||

| TOTAL COMMODITIES | |||||||||

(Cost — $409,784,346) | 422,331,445 | ||||||||

| SHORT-TERM INVESTMENTS – 21.1% | |||||||||

| Commercial Paper | 20.7% | |||||||||

| Coca-Cola Co., | |||||||||

| 50,000,000 | USD | 0.09% due 4/25/2013 (d) | 49,997,000 | ||||||

| Consolidated Edison Co. Inc., | |||||||||

| 73,900,000 | USD | 0.25% due 4/2/2013 (d) | 73,899,487 | ||||||

| Danaher Corp.: | |||||||||

| 20,000,000 | USD | 0.12% due 4/16/2013 (d) | 19,999,000 | ||||||

| 40,000,000 | USD | 0.12% due 4/17/2013 (d) | 39,997,867 | ||||||

| Diageo Capital Plc: | |||||||||

| 15,000,000 | USD | 0.25% due 4/2/2013 (d) | 14,999,896 | ||||||

| 54,900,000 | USD | 0.25% due 4/11/2013 (d) | 54,896,187 | ||||||

| 20,000,000 | USD | 0.26% due 4/12/2013 (d) | 19,998,411 | ||||||

| Dover Corp.: | |||||||||

| 18,000,000 | USD | 0.11% due 4/1/2013 (d) | 18,000,000 | ||||||

| 34,900,000 | USD | 0.12% due 4/4/2013 (d) | 34,899,651 | ||||||

| Électricité de France SA: | |||||||||

| 42,900,000 | USD | 0.15% due 4/5/2013 (d) | 42,899,285 | ||||||

| 16 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 20.7% (continued) | |||||||||

| Électricité de France SA (continued) | |||||||||

| 35,000,000 | USD | 0.15% due 4/11/2013 (d) | $ | 34,998,542 | |||||

| Florida Power & Light Co., | |||||||||

| 27,500,000 | USD | 0.19% due 4/9/2013 (d) | 27,498,839 | ||||||

| GDF Suez SA: | |||||||||

| 38,000,000 | USD | 0.2% due 4/8/2013 (d) | 37,998,522 | ||||||

| 41,100,000 | USD | 0.19% due 4/10/2013 (d) | 41,098,048 | ||||||

| Johnson Controls Inc., | |||||||||

| 20,000,000 | USD | 0.3% due 4/3/2013 (d) | 19,999,667 | ||||||

| Merck & Co. Inc.: | |||||||||

| 72,900,000 | USD | 0.09% due 4/4/2013 (d) | 72,899,453 | ||||||

| 50,000,000 | USD | 0.09% due 4/5/2013 (d) | 49,999,500 | ||||||

| 75,000,000 | USD | 0.09% due 4/22/2013 (d) | 74,996,062 | ||||||

| Nestlé Capital Corp.: | |||||||||

| 50,000,000 | USD | 0.03% due 4/5/2013 (d) | 49,999,833 | ||||||

| 50,000,000 | USD | 0.05% due 4/8/2013 (d) | 49,999,514 | ||||||

| 31,600,000 | USD | 0.04% due 4/11/2013 (d) | 31,599,649 | ||||||

| 50,000,000 | USD | 0.04% due 4/12/2013 (d) | 49,999,389 | ||||||

| NetJets Inc.: | |||||||||

| 15,500,000 | USD | 0.08% due 4/4/2013 (d) | 15,499,897 | ||||||

| 50,000,000 | USD | 0.08% due 4/12/2013 (d) | 49,998,778 | ||||||

| 27,500,000 | USD | 0.08% due 4/22/2013 (d) | 27,498,717 | ||||||

| Philip Morris International Inc.: | |||||||||

| 25,000,000 | USD | 0.02% due 4/16/2013 (d) | 24,999,792 | ||||||

| 25,000,000 | USD | 0.02% due 4/18/2013 (d) | 24,999,764 | ||||||

| Procter & Gamble Co., | |||||||||

| 40,000,000 | USD | 0.1% due 4/3/2013 (d) | 39,999,778 | ||||||

| Siemens Capital Co. LLC, | |||||||||

| 20,000,000 | USD | 0.12% due 4/24/2013 (d) | 19,998,467 | ||||||

| Unilever Capital Corp.: | |||||||||

| 41,900,000 | USD | 0.1% due 4/2/2013 (d) | 41,899,883 | ||||||

| 30,000,000 | USD | 0.09% due 4/11/2013 (d) | 29,999,250 | ||||||

| 11,000,000 | USD | 0.1% due 4/11/2013 (d) | 10,999,694 | ||||||

| United Parcel Service, Inc.: | |||||||||

| 40,000,000 | USD | 0.05% due 4/2/2013 (d) | 39,999,944 | ||||||

| 10,000,000 | USD | 0.02% due 4/3/2013 (d) | 9,999,989 | ||||||

| 5,900,000 | USD | 0.04% due 4/3/2013 (d) | 5,899,987 | ||||||

| 29,600,000 | USD | 0.02% due 4/5/2013 (d) | 29,599,934 | ||||||

| 50,000,000 | USD | 0.02% due 4/10/2013 (d) | 49,999,750 | ||||||

| 30,000,000 | USD | 0.05% due 4/12/2013 (d) | 29,999,542 | ||||||

| 23,500,000 | USD | 0.04% due 4/15/2013 (d) | 23,499,634 | ||||||

| 87,000,000 | USD | 0.05% due 4/15/2013 (d) | 86,998,308 | ||||||

| 30,000,000 | USD | 0.04% due 4/17/2013 (d) | 29,999,467 | ||||||

| Wal-Mart Stores, Inc.: | |||||||||

| 20,000,000 | USD | 0.09% due 4/2/2013 (d) | 19,999,950 | ||||||

| 40,300,000 | USD | 0.08% due 4/3/2013 (d) | 40,299,821 | ||||||

| 19,800,000 | USD | 0.09% due 4/8/2013 (d) | 19,799,653 | ||||||

| 60,000,000 | USD | 0.08% due 4/9/2013 (d) | 59,998,933 | ||||||

| 40,000,000 | USD | 0.09% due 4/9/2013 (d) | 39,999,200 | ||||||

| 70,000,000 | USD | 0.08% due 4/10/2013 (d) | 69,998,600 | ||||||

| 17 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 20.7% (continued) | |||||||||

| Wal-Mart Stores, Inc. (continued) | |||||||||

| 30,000,000 | USD | 0.07% due 4/11/2013 (d) | $ | 29,999,417 | |||||

| Wisconsin Energy Corp., | |||||||||

| 16,900,000 | USD | 0.26% due 4/3/2013 (d) | 16,899,756 | ||||||

| 1,799,559,707 | |||||||||

| Treasury Bills — 0.4% | |||||||||

| United States Treasury Bill, | |||||||||

| 34,264,000 | USD | due 6/6/2013 (h) | 34,258,669 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | |||||||||

(Cost — $1,833,818,376) | 1,833,818,376 | ||||||||

| TOTAL INVESTMENTS — 99.8% | |||||||||

(Cost — $7,786,313,263) | 8,686,170,252 | ||||||||

| Other Assets In Excess of Liabilities — 0.2% | 18,525,089 | ||||||||

| TOTAL NET ASSETS — 100.0% | $ | 8,704,695,341 | |||||||

| Schedule of Written Put Options – (0.1%) | ||||||||||||||

| EXPIRATION | STRIKE | FAIR | ||||||||||||

| CONTRACTS | DESCRIPTION | DATE | PRICE | VALUE | ||||||||||

| (327) | Apple, Inc. | 1/17/2015 | $430.00 | $ | (2,419,800 | ) | ||||||||

| (422) | Apple, Inc. | 1/17/2015 | 440.00 | (3,364,395 | ) | |||||||||

| Total Written Put Options | ||||||||||||||

(Premiums received — $5,976,952) | $ | (5,784,195 | ) | |||||||||||

The IVA Worldwide Fund had the following open forward foreign currency contracts at March 31, 2013:

| USD | NET | ||||||||||||||

| SETTLEMENT | LOCAL | VALUE AT | UNREALIZED | ||||||||||||

| FOREIGN | DATES | CURRENCY | USD | MARCH | APPRECIATION/ | ||||||||||

| CURRENCY | COUNTERPARTY | THROUGH | AMOUNT | EQUIVALENT | 31, 2013 | (DEPRECIATION) | |||||||||

| Contracts to Sell: | |||||||||||||||

| State Street Bank & | |||||||||||||||

| euro | Trust Co. | 06/07/2013 | EUR 369,269,000 | $480,502,767 | $473,565,624 | $ | 6,937,143 | ||||||||

State Street Bank & | |||||||||||||||

| Japanese yen | Trust Co. | 06/07/2013 | JPY 34,958,900,000 | 361,749,464 | 371,539,162 | (9,789,698 | ) | ||||||||

State Street Bank & | |||||||||||||||

| South Korean won | Trust Co. | 04/05/2013 | KRW 57,626,000,000 | 52,621,979 | 51,782,586 | 839,393 | |||||||||

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (2,013,162 | ) | ||||||||||||

| Abbreviations used in this schedule: |

| ADR | — | American Depositary Receipt |

| EUR | — | euro |

| HKD | — | Hong Kong dollar |

| JPY | — | Japanese yen |

| KRW | — | South Korean won |

| SGD | — | Singapore dollar |

| TWD | — | Taiwan dollar |

| USD | — | United States dollar |

| 18 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments (unaudited) March 31, 2013 |

| (a) | Non-income producing investment. | |

| (b) | Security is deemed illiquid. As of March 31, 2013, the value of these illiquid securities amounted to 1.0% of total net assets. | |

| (c) | Issuer of the security is an affiliate of the IVA Worldwide Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA Worldwide Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. |

| Schedule of Affiliates | |||||||||||||||||||||||||||||||

| SHARES | SHARES | ||||||||||||||||||||||||||||||

| HELD AT | HELD AT | FAIR VALUE AT | |||||||||||||||||||||||||||||

| SEPTEMBER 30, | SHARE | SHARE | MARCH 31, | MARCH 31, | REALIZED | DIVIDEND | |||||||||||||||||||||||||

| SECURITY | 2012 | ADDITIONS | REDUCTIONS | 2013 | 2013 | GAIN/(LOSS) | INCOME* | ||||||||||||||||||||||||

| Cosel Co., Ltd. | 3,187,600 | — | 406,700 | 2,780,900 | $ | 31,904,945 | $ | (1,506,700 | ) | $ | 354,601 | ||||||||||||||||||||

| Icom Inc. | 1,306,300 | — | 209,000 | 1,097,300 | 27,859,425 | (1,098,577 | ) | 108,106 | |||||||||||||||||||||||

| Milbon Co., Ltd. | 951,200 | — | 214,000 | 737,200 | 25,960,780 | 790,325 | 354,657 | ||||||||||||||||||||||||

| Miura Co., Ltd. | 3,271,704 | — | 143,200 | 3,128,504 | 80,659,470 | (709,849 | ) | 616,247 | |||||||||||||||||||||||

| Net 1 U.E.P.S. | |||||||||||||||||||||||||||||||

Technologies Inc. | 6,324,803 | — | 318,444 | 6,006,359 | 44,447,057 | (2,830,689 | ) | — | |||||||||||||||||||||||

| Teleperformance** | 2,928,862 | — | 1,546,764 | 1,382,098 | — | 11,644,467 | — | ||||||||||||||||||||||||

Temp Holdings Co., Ltd. | 3,016,200 | 941,500 | 21,800 | 3,935,900 | 67,357,889 | (2,491 | ) | 309,810 | |||||||||||||||||||||||

| Total | $ | 278,189,566 | $ | 6,286,486 | $ | 1,743,421 | |||||||||||||||||||||||||

| * | Dividend income is net of withholding taxes. | |

| ** | Non-affiliated at March 31, 2013. | |

| (d) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. | |

| (e) | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. | |

| (f) | Payment-in-kind security for which part of the income earned may be received as additional principal. | |

| (g) | Variable rate security. The interest rate shown reflects the rate currently in effect. | |

| (h) | This security is held at the custodian as collateral for written put options. As of March 31, 2013, portfolio securities valued at $34,258,669 were segregated to cover collateral requirements. |

| See Notes to Financial Statements. | 19 |

| IVA International Fund | IVA Funds |

| Performance (unaudited) | As of March 31, 2013 |

| Average Annual Total Returns as of March 31, 2013(a) | Six Months | One Year | Three Year | Since Inception | |||||||||||||

| Class A | 7.73 | % | 9.51 | % | 8.43 | % | 11.36 | % | |||||||||

| Class A (with a 5% maximum initial sales charge) | 2.34 | % | 4.01 | % | 6.59 | % | 10.11 | % | |||||||||

| Class C | 7.30 | % | 8.75 | % | 7.62 | % | 10.52 | % | |||||||||

| Class I | 7.85 | % | 9.84 | % | 8.71 | % | 11.64 | % | |||||||||

| MSCI All Country World (ex-U.S.) Index (Net)(b) | 9.20 | % | 8.36 | % | 4.41 | % | 5.46 | % | |||||||||

| Consumer Price Index(c) | 0.48 | % | 1.48 | % | 2.24 | % | 1.34 | % | |||||||||

| Growth of a $10,000 Initial Investment | |

| (a) | The Fund commenced investment operations on October 1, 2008. Total returns for periods of less than one year are not annualized. | |

| (b) | The MSCI All Country World (ex-U.S.) Index (Net) is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global, developed and emerging markets outside the United States. The Index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. | |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. | |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2013. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482. |

| The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. The gross and net expense ratios for the Fund are as follows: 1.27% (Class A shares); 2.02% (Class C shares); and 1.02% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2013. More recent expense ratios can be found in the Financial Highlights section of this Semi-Annual Report. |

| 20 |

| IVA International Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of March 31, 2013 |

| Asset Allocation (As a Percent of Total Net Assets) |

| Sector Allocation (As a Percent of Total Net Assets) |

| Top 10 Positions (As a Percent of Total Net Assets)(b) |

| Government of Singapore, 2.25% due 7/1/2013; 3.625% due 7/1/2014 | 6.9 | % | ||

| Gold Bullion | 4.7 | % | ||

| Astellas Pharma Inc. | 3.3 | % | ||

Wendel, 4.875% due 5/26/2016; 4.375% due 8/9/2017; 6.75% due 4/20/2018 | 3.3 | % | ||

| Genting Malaysia Berhad | 2.8 | % | ||

| Nestlé SA | 2.7 | % | ||

| Temp Holdings Co., Ltd. | 1.7 | % | ||

| Sodexo SA | 1.5 | % | ||

| Total SA, ADR | 1.5 | % | ||

| GDF Suez SA | 1.4 | % | ||

| Top 10 positions represent 29.8% of total net assets. |

| (a) Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) Short-Term Investments are not included. |

| 21 |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| COMMON STOCKS – 55.4% | |||||||||

| Argentina | 0.0% | |||||||||

| 871 | Nortel Inversora SA, Series ‘B’, ADR | $ | 12,734 | ||||||

| Australia | 0.1% | |||||||||

| 1,404,747 | Programmed Maintenance Services Ltd. | 3,744,136 | |||||||

| Belgium | 0.3% | |||||||||

| 113,055 | Sofina SA | 10,216,835 | |||||||

| Brazil | 0.7% | |||||||||

| 1,182,268 | Itaú Unibanco Holding SA, ADR | 21,044,370 | |||||||

| Canada | 0.1% | |||||||||

| 406,159 | IAMGOLD Corp. | 2,924,345 | |||||||

| Denmark | 0.4% | |||||||||

| 324,139 | D/S Norden A/S | 10,478,309 | |||||||

| France | 16.2% | |||||||||

| 714,532 | Alten | 28,302,033 | |||||||

| 61,254 | Bolloré | 23,555,546 | |||||||

| 263,439 | Cap Gemini SA | 11,987,977 | |||||||

| 409,770 | Carrefour SA | 11,217,013 | |||||||

| 101,800 | Ciments Français SA | 5,806,912 | |||||||

| 463,225 | CNP Assurances | 6,356,472 | |||||||

| 28,922 | Financière de l’Odet SA | 21,437,860 | |||||||

| 471,961 | Financière Marc de Lacharriere SA | 24,671,230 | |||||||

| 2,206,306 | GDF Suez SA | 42,478,889 | |||||||

| 761,157 | Lagardère SCA | 28,026,687 | |||||||

| 663,977 | M6-Métropole Télévision SA | 10,319,823 | |||||||

| 92,888 | Neopost SA | 5,564,669 | |||||||

| 337,623 | Publicis Groupe SA | 22,638,843 | |||||||

| 73,288 | Robertet SA (b) | 12,879,761 | |||||||

| 523,669 | Saft Groupe SA | 13,492,437 | |||||||

| 286,364 | Séché Environnement SA | 10,168,003 | |||||||

| 226,778 | Securidev SA (b)(c) | 7,558,085 | |||||||

| 2,043,924 | Societe d’Edition de Canal Plus | 14,200,430 | |||||||

| 465,350 | Sodexo SA | 43,366,223 | |||||||

| 753,298 | Teleperformance | 32,101,892 | |||||||

| 544,102 | Thales SA | 23,012,613 | |||||||

| 937,370 | Total SA, ADR | 44,975,013 | |||||||

| 1,898,013 | Vivendi SA | 39,207,303 | |||||||

| 483,325,714 | |||||||||

| Germany | 0.9% | |||||||||

| 185,425 | Siemens AG | 19,972,854 | |||||||

| 153,563 | Wincor Nixdorf AG | 7,627,738 | |||||||

| 27,600,592 | |||||||||

| 22 | See Notes to Financial Statements. |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| Hong Kong | 1.9% | |||||||||

| 39,557,030 | Clear Media Ltd. (b)(c) | $ | 27,262,962 | ||||||

| 17,474,261 | Hongkong & Shanghai Hotels Ltd. | 29,939,604 | |||||||

| 57,202,566 | |||||||||

| India | 0.2% | |||||||||

| 10,271,789 | South Indian Bank Ltd. | 4,668,136 | |||||||

| Indonesia | 0.4% | |||||||||

| 125,025,500 | PT Bank Bukopin Tbk | 11,579,414 | |||||||

| Japan | 19.4% | |||||||||

| 286,800 | Arcs Co. Ltd. | 6,416,326 | |||||||

| 346,200 | As One Corp. | 7,918,082 | |||||||

| 1,820,300 | Astellas Pharma Inc. | 97,845,838 | |||||||

| 117,700 | The Bank of Okinawa Ltd. | 5,026,335 | |||||||

| 483,800 | Benesse Holdings Inc. | 20,557,710 | |||||||

| 67,500 | Canon Inc. | 2,473,841 | |||||||

| 1,489,900 | Cosel Co., Ltd. | 17,093,451 | |||||||

| 796,000 | Daiichikosho Co., Ltd. | 21,604,929 | |||||||

| 1,360,300 | Hi Lex Corp. | 27,484,895 | |||||||

| 757,900 | Icom Inc. (b)(c) | 19,242,375 | |||||||

| 209,900 | Japan Petroleum Exploration Co., Ltd. | 8,239,024 | |||||||

| 660,240 | Kose Corp. | 15,339,086 | |||||||

| 95,400 | Medikit Co., Ltd. (b) | 3,217,666 | |||||||

| 462,993 | Megane Top Co. Ltd. | 6,423,422 | |||||||

| 174,500 | Meitec Corp. | 4,404,440 | |||||||

| 462,800 | Milbon Co., Ltd. | 16,297,679 | |||||||

| 1,452,676 | Miura Co., Ltd. | 37,453,069 | |||||||

| 390,400 | Nifco Inc. | 8,887,525 | |||||||

| 199,300 | Nintendo Co., Ltd. | 21,489,297 | |||||||

| 349,000 | Nitto Kohki Co., Ltd. | 6,691,932 | |||||||

| 8,068 | NTT DoCoMo, Inc. | 11,964,655 | |||||||

| 773,400 | Okinawa Cellular Telephone Co. | 18,485,685 | |||||||

| 1,784 | Pasona Group Inc. | 903,987 | |||||||

| 537,000 | San-A Co. Ltd. | 24,472,619 | |||||||

| 150,800 | Sankyo Co. Ltd. | 7,048,600 | |||||||

| 728,200 | Secom Co., Ltd. | 37,479,460 | |||||||

| 10,600 | Secom Joshinetsu Co., Ltd. | 270,250 | |||||||

| 353,900 | Shingakukai Co., Ltd. | 1,274,469 | |||||||

| 306,950 | Shofu Inc. | 3,094,445 | |||||||

| 4,500 | SK Kaken Co., Ltd. | 233,880 | |||||||

| 36,700 | SMC Corp. | 7,087,757 | |||||||

| 188,300 | Sugi Holdings Co., Ltd. | 6,711,069 | |||||||

| 576 | Techno Medica Co., Ltd. | 3,353,142 | |||||||

| 3,012,300 | Temp Holdings Co., Ltd. | 51,551,658 | |||||||

| 658,300 | Toho Co., Ltd. | 13,734,543 | |||||||

| See Notes to Financial Statements. | 23 |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| Japan | 19.4% (continued) | |||||||||

| 503,300 | Transcosmos Inc. | $ | 7,474,514 | ||||||

| 63,336 | Yahoo Japan Corp. | 29,099,506 | |||||||

| 578,347,161 | |||||||||

| Malaysia | 2.8% | |||||||||

| 71,200,000 | Genting Malaysia Berhad | 84,386,888 | |||||||

| Netherlands | 0.1% | |||||||||

| 18,146 | Hal Trust NV | 2,326,047 | |||||||

| Norway | 1.4% | |||||||||

| 5,230,093 | Orkla ASA | 41,961,481 | |||||||

| Singapore | 1.4% | |||||||||

| 4,800,291 | Haw Par Corp. Ltd. | 29,877,249 | |||||||

| 739,224 | United Overseas Bank Ltd. | 12,146,076 | |||||||

| 42,023,325 | |||||||||

| South Africa | 0.6% | |||||||||

| 2,363,278 | Net 1 U.E.P.S. Technologies Inc. (a)(c) | 17,488,257 | |||||||

| South Korea | 2.9% | |||||||||

| 92,190 | E-Mart Co., Ltd. | 18,187,763 | |||||||

| 61,768 | Fursys Inc. (b) | 1,399,024 | |||||||

| 866,620 | Kangwon Land, Inc. | 23,951,613 | |||||||

| 11,093 | Lotte Chilsung Beverage Co., Ltd. | 14,905,658 | |||||||

| 10,786 | Lotte Confectionery Co., Ltd. | 17,081,549 | |||||||

| 706,203 | SK Telecom Co., Ltd., ADR | 12,619,848 | |||||||

| 88,145,455 | |||||||||

| Switzerland | 3.7% | |||||||||

| 21,310 | APG SGA SA | 5,185,516 | |||||||

| 1,121,991 | Nestlé SA | 81,138,399 | |||||||

| 52,104 | Schindler Holding AG | 7,634,748 | |||||||

| 1,178,237 | UBS AG | 18,058,936 | |||||||

| 112,017,599 | |||||||||

| Taiwan | 0.6% | |||||||||

| 7,663,000 | Taiwan Secom Co., Ltd. | 17,297,968 | |||||||

| United Kingdom | 1.3% | |||||||||

| 1,146,259 | Inmarsat Plc | 12,235,322 | |||||||

| 2,916,070 | Millennium & Copthorne Hotels Plc | 25,211,376 | |||||||

| 37,446,698 | |||||||||

| TOTAL COMMON STOCKS | |||||||||

(Cost — $1,410,585,331) | 1,654,238,030 | ||||||||

| 24 | See Notes to Financial Statements. |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| CORPORATE NOTES & BONDS – 7.0% | |||||||||

| France | 3.3% | |||||||||

| Wendel: | |||||||||

| 19,650,000 | EUR | 4.875% due 5/26/2016 (d) | $ | 26,447,786 | |||||

| 36,400,000 | EUR | 4.375% due 8/9/2017 | 48,000,826 | ||||||

| 17,000,000 | EUR | 6.75% due 4/20/2018 | 24,733,311 | ||||||

| 99,181,923 | |||||||||

| Netherlands | 0.3% | |||||||||

| UPC Holding BV, | |||||||||

| 6,311,000 | EUR | 8% due 11/1/2016 (d) | 8,348,309 | ||||||

| Norway | 1.2% | |||||||||

| Golden Close Maritime Corp. Ltd., | |||||||||

| 11,400,000 | USD | 11% due 12/9/2015 (b) | 12,212,250 | ||||||

| Stolt-Nielsen Ltd. SA, | |||||||||

| 19,000,000 | NOK | 6.86% due 9/4/2019 (b)(e) | 3,326,199 | ||||||

| Stolt-Nielsen Ltd. SA, | |||||||||

| 107,500,000 | NOK | 6.63% due 6/22/2016 (b)(e) | 18,848,091 | ||||||

| 34,386,540 | |||||||||

| Switzerland | 0.4% | |||||||||

| 4,350,000 | EUR | UBS AG, 7.152% due 12/21/2017 (f) | 6,107,226 | ||||||

| UBS Preferred Funding Trust V, | |||||||||

| 4,338,000 | USD | 6.243% due 5/15/2016 (f) | 4,506,097 | ||||||

| 10,613,323 | |||||||||

| United Kingdom | 0.2% | |||||||||

| Inmarsat Finance Plc, | |||||||||

| 7,000,000 | USD | 7.375% due 12/1/2017 (d) | 7,490,000 | ||||||

| United States | 1.6% | |||||||||

| Intelsat Luxembourg SA: | |||||||||

| 15,541,000 | USD | 11.25% due 2/4/2017 | 16,570,591 | ||||||

| 21,587,000 | USD | 11.5% due 2/4/2017 (g) | 22,936,188 | ||||||

| 8,622,000 | USD | 7.75% due 6/1/2021 (d) | 8,794,440 | ||||||

| 48,301,219 | |||||||||

| TOTAL CORPORATE NOTES & BONDS | |||||||||

(Cost — $191,597,499) | 208,321,314 | ||||||||

| SOVEREIGN GOVERNMENT BONDS — 8.8% | |||||||||

| Hong Kong | 1.3% | |||||||||

| Government of Hong Kong, | |||||||||

| 279,650,000 | HKD | 1.52% due 12/21/2015 | 37,308,690 | ||||||

| Singapore | 6.9% | |||||||||

| Government of Singapore: | |||||||||

| 159,764,000 | SGD | 2.25% due 7/1/2013 | 129,479,747 | ||||||

| 92,738,000 | SGD | 3.625% due 7/1/2014 | 77,987,249 | ||||||

| 207,466,996 | |||||||||

| See Notes to Financial Statements. | 25 |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Taiwan | 0.2% | |||||||||

| Government of Taiwan, | |||||||||

| 171,000,000 | TWD | 2% due 7/20/2015 | $ | 5,878,786 | |||||

| Thailand | 0.4% | |||||||||

| Government of Thailand, | |||||||||

| 362,607,000 | THB | 5.25% due 5/12/2014 | 12,718,312 | ||||||

| TOTAL SOVEREIGN GOVERNMENT BONDS | |||||||||

(Cost — $263,065,635) | 263,372,784 | ||||||||

| OUNCES | |||||||||

| COMMODITIES – 4.7% | |||||||||

| 89,167 | Gold Bullion (a) | 142,351,665 | |||||||

| TOTAL COMMODITIES | |||||||||

(Cost — $144,407,962) | 142,351,665 | ||||||||

| PRINCIPAL AMOUNT | |||||||||

| SHORT-TERM INVESTMENTS — 23.5% | |||||||||

| Commercial Paper | 23.5% | |||||||||

| Coca-Cola Enterprises, Inc., | |||||||||

| 4,200,000 | USD | 0.18% due 4/4/2013 (d) | 4,199,937 | ||||||

| Consolidated Edison Co. Inc.: | |||||||||

| 15,100,000 | USD | 0.25% due 4/1/2013 (d) | 15,100,000 | ||||||

| 36,100,000 | USD | 0.25% due 4/2/2013 (d) | 36,099,749 | ||||||

| Danaher Corp., | |||||||||

| 20,000,000 | USD | 0.12% due 4/17/2013 (d) | 19,998,933 | ||||||

| Diageo Capital Plc: | |||||||||

| 29,300,000 | USD | 0.24% due 4/3/2013 (d) | 29,299,609 | ||||||

| 15,000,000 | USD | 0.25% due 4/11/2013 (d) | 14,998,958 | ||||||

| 30,000,000 | USD | 0.26% due 4/12/2013 (d) | 29,997,617 | ||||||

| Dover Corp.: | |||||||||

| 12,000,000 | USD | 0.11% due 4/1/2013 (d) | 12,000,000 | ||||||

| 28,500,000 | USD | 0.12% due 4/2/2013 (d) | 28,499,905 | ||||||

| 12,400,000 | USD | 0.12% due 4/4/2013 (d) | 12,399,876 | ||||||

| Électricité de France SA, | |||||||||

| 15,000,000 | USD | 0.15% due 4/11/2013 (d) | 14,999,375 | ||||||

| Florida Power & Light Co., | |||||||||

| 25,000,000 | USD | 0.19% due 4/10/2013 (d) | 24,998,813 | ||||||

| Johnson Controls Inc., | |||||||||

| 10,000,000 | USD | 0.3% due 4/3/2013 (d) | 9,999,833 | ||||||

| Merck & Co. Inc.: | |||||||||

| 7,100,000 | USD | 0.09% due 4/4/2013 (d) | 7,099,947 | ||||||

| 25,000,000 | USD | 0.09% due 4/5/2013 (d) | 24,999,750 | ||||||

| 25,000,000 | USD | 0.09% due 4/22/2013 (d) | 24,998,688 | ||||||

| Nestlé Capital Corp., | |||||||||

| 15,400,000 | USD | 0.05% due 4/8/2013 (d) | 15,399,850 | ||||||

| NetJets Inc.: | |||||||||

| 24,500,000 | USD | 0.08% due 4/3/2013 (d) | 24,499,891 | ||||||

| 35,000,000 | USD | 0.08% due 4/22/2013 (d) | 34,998,367 | ||||||

| 26 | See Notes to Financial Statements. |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 23.5% (continued) | |||||||||

| Philip Morris International Inc., | |||||||||

| 25,000,000 | USD | 0.02% due 4/19/2013 (d) | $ | 24,999,750 | |||||

| Procter & Gamble Co., | |||||||||

| 20,000,000 | USD | 0.1% due 4/3/2013 (d) | 19,999,889 | ||||||

| Siemens Capital Co. LLC: | |||||||||

| 12,100,000 | USD | 0.12% due 4/24/2013 (d) | 12,099,072 | ||||||

| 36,900,000 | USD | 0.13% due 4/24/2013 (d) | 36,896,935 | ||||||

| United Parcel Service, Inc.: | |||||||||

| 14,800,000 | USD | 0.02% due 4/3/2013 (d) | 14,799,984 | ||||||

| 14,300,000 | USD | 0.03% due 4/4/2013 (d) | 14,299,964 | ||||||

| 41,400,000 | USD | 0.02% due 4/5/2013 (d) | 41,399,908 | ||||||

| 2,200,000 | USD | 0.04% due 4/15/2013 (d) | 2,199,966 | ||||||

| 20,000,000 | USD | 0.04% due 4/17/2013 (d) | 19,999,644 | ||||||

| Wal-Mart Stores, Inc.: | |||||||||

| 30,000,000 | USD | 0.09% due 4/2/2013 (d) | 29,999,925 | ||||||

| 20,600,000 | USD | 0.08% due 4/3/2013 (d) | 20,599,908 | ||||||

| 20,000,000 | USD | 0.08% due 4/8/2013 (d) | 19,999,689 | ||||||

| 20,000,000 | USD | 0.09% due 4/9/2013 (d) | 19,999,600 | ||||||

| 20,000,000 | USD | 0.08% due 4/10/2013 (d) | 19,999,600 | ||||||

| 10,000,000 | USD | 0.07% due 4/11/2013 (d) | 9,999,806 | ||||||

| 10,000,000 | USD | Wisconsin Energy Corp., | |||||||

0.26% due 4/3/2013 (d) | 9,999,856 | ||||||||

| TOTAL SHORT-TERM INVESTMENTS | |||||||||

(Cost — $701,882,594) | 701,882,594 | ||||||||

| TOTAL INVESTMENTS — 99.4% | |||||||||

(Cost — $2,711,539,021) | 2,970,166,387 | ||||||||

| Other Assets In Excess of Liabilities — 0.6% | 17,707,318 | ||||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,987,873,705 | |||||||

The IVA International Fund had the following open forward foreign currency contracts at March 31, 2013:

| USD | NET | ||||||||||||||||||

| SETTLEMENT | LOCAL | VALUE AT | UNREALIZED | ||||||||||||||||

| FOREIGN | DATES | CURRENCY | USD | MARCH 31, | APPRECIATION/ | ||||||||||||||

| CURRENCY | COUNTERPARTY | THROUGH | AMOUNT | EQUIVALENT | 2013 | (DEPRECIATION) | |||||||||||||

| Contracts to Sell: | |||||||||||||||||||

State Street Bank & | |||||||||||||||||||

| Australian dollar | Trust Co. | 06/07/2013 | AUD 995,000 | $ | 1,003,059 | $ | 1,030,900 | $ | (27,841 | ) | |||||||||

State Street Bank & | |||||||||||||||||||

| euro | Trust Co. | 06/07/2013 | EUR 150,905,000 | 196,312,315 | 193,526,726 | 2,785,589 | |||||||||||||

State Street Bank & | |||||||||||||||||||

| Japanese yen | Trust Co. | 06/07/2013 | JPY 27,707,500,000 | 286,804,237 | 294,472,118 | (7,667,881 | ) | ||||||||||||

State Street Bank & | |||||||||||||||||||

| South Korean won | Trust Co. | 04/05/2013 | KRW 18,988,000,000 | 17,331,272 | 17,062,572 | 268,700 | |||||||||||||

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (4,641,433 | ) | ||||||||||||||||

| See Notes to Financial Statements. | 27 |

| IVA International Fund | IVA Funds |

| Schedule of Investments (unaudited) |

| March 31, 2013 |

| Abbreviations used in this schedule: |

| ADR | — | American Depositary Receipt |

| AUD | — | Australian dollar |

| EUR | — | euro |

| HKD | — | Hong Kong dollar |

| JPY | — | Japanese yen |

| KRW | — | South Korean won |

| NOK | — | Norwegian krone |

| SGD | — | Singapore dollar |

| THB | — | Thai baht |

| TWD | — | Taiwan dollar |

| USD | — | United States dollar |

| (a) | Non-income producing investment. | |

| (b) | Security is deemed illiquid. As of March 31, 2013, the value of these illiquid securities amounted to 3.5% of total net assets. | |

| (c) | Issuer of the security is an affiliate of the IVA International Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA International Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. |

| Schedule of Affiliates | |||||||||||||||||||||||||||||||

| SHARES | SHARES | ||||||||||||||||||||||||||||||

| HELD AT | HELD AT | FAIR VALUE AT | |||||||||||||||||||||||||||||

| SEPTEMBER 30, | SHARE | SHARE | MARCH 31, | MARCH 31, | REALIZED | DIVIDEND | |||||||||||||||||||||||||

| SECURITY | 2012 | ADDITIONS | REDUCTIONS | 2013 | 2013 | GAIN/(LOSS) | INCOME* | ||||||||||||||||||||||||

| Clear Media Ltd. | 36,621,030 | 2,936,000 | — | 39,557,030 | $ | 27,262,962 | — | — | |||||||||||||||||||||||

| Icom Inc. | 765,600 | — | 7,700 | 757,900 | 19,242,375 | $ | (3,962 | ) | $ | 74,662 | |||||||||||||||||||||

| Net 1 U.E.P.S. Technologies Inc.** | 2,230,235 | 133,043 | — | 2,363,278 | 17,488,257 | — | — | ||||||||||||||||||||||||

| Securidev SA | 226,778 | — | — | 226,778 | 7,558,085 | — | — | ||||||||||||||||||||||||

| Temp Holdings Co., Ltd. *** | 3,405,900 | 120,500 | 514,100 | 3,012,300 | — | 4,126,837 | 258,166 | ||||||||||||||||||||||||

| Total | $ | 71,551,679 | $ | 4,122,875 | $ | 332,828 | |||||||||||||||||||||||||

| * | Dividend income is net of withholding taxes. | |

| ** | Non-affiliated at September 30, 2012. | |

| *** | Non-affiliated at March 31, 2013. | |

| (d) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the ”1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. | |

| (e) | Variable rate security. The interest rate shown reflects the rate currently in effect. | |

| (f) | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. | |

| (g) | Payment-in-kind security for which part of the income earned may be received as additional principal. |

| 28 | See Notes to Financial Statements. |

| Statements of Assets and Liabilities (unaudited) | IVA Funds |

| March 31, 2013 | ||

| IVA | IVA | |||||||||

| Worldwide | International | |||||||||

| Fund | Fund | |||||||||

| Assets: | ||||||||||

Long-term investments, at cost: | ||||||||||

Non-affiliated investments | $ | 5,691,333,986 | $ | 1,935,896,160 | ||||||

Affiliated investments | 261,160,901 | 73,760,267 | ||||||||

Short-term investments, at cost | 1,833,818,376 | 701,882,594 | ||||||||

Foreign currency, at cost | 884 | 286,892 | ||||||||

Long-term investments, at fair value: | ||||||||||

Non-affiliated investments | $ | 6,574,162,310 | $ | 2,196,732,114 | ||||||

Affiliated investments | 278,189,566 | 71,551,679 | ||||||||

Short-term investments, at fair value | 1,833,818,376 | 701,882,594 | ||||||||

Foreign currency, at fair value | 883 | 286,418 | ||||||||

Cash | 843,841 | 561,623 | ||||||||

Cash collateral for written options | 3,000 | — | ||||||||

Dividends and interest receivable | 46,090,388 | 15,152,876 | ||||||||

Receivable for investments sold | 21,985,191 | 14,747,916 | ||||||||

Receivable for fund shares sold | 8,623,554 | 7,046,820 | ||||||||

Unrealized appreciation on open forward foreign currency contracts | 839,393 | 268,700 | ||||||||

Prepaid expenses | 109,335 | 29,215 | ||||||||

| Total assets | $ | 8,764,665,837 | $ | 3,008,259,955 | ||||||

| Liabilities: | ||||||||||

Payable for investments purchased | $ | 32,745,454 | $ | 9,573,710 | ||||||

Payable for fund shares repurchased | 8,796,017 | 3,062,319 | ||||||||

Written options (premiums received: $5,976,952 and $0) | 5,784,195 | — | ||||||||

Unrealized depreciation on open forward foreign currency contracts | 2,852,555 | 4,910,133 | ||||||||

Accrued investment advisory fees | 6,662,124 | 2,265,256 | ||||||||

Accrued distribution and service fees | 1,658,084 | 149,993 | ||||||||

Accrued expenses and other liabilities | 1,472,067 | 424,839 | ||||||||

| Total liabilities | 59,970,496 | 20,386,250 | ||||||||

| Net Assets | $ | 8,704,695,341 | $ | 2,987,873,705 | ||||||

| Net Assets Consist of: | ||||||||||

Par value ($0.001 per share) | $ | 516,314 | $ | 181,859 | ||||||

Additional paid-in-capital | 7,797,525,591 | 2,697,837,690 | ||||||||

Distributions in excess of net investment income | (34,530,249 | ) | (14,444,871 | ) | ||||||

Accumulated net realized gain on investments and foreign currency transactions | 43,325,911 | 50,382,436 | ||||||||