| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act file number: 811-22211 |

| IVA FIDUCIARY TRUST |

| (Exact name of registrant as specified in charter) |

| 717 Fifth Avenue, 10th Floor, New York, NY 10022 |

| (Address of principal executive offices) (zip code) |

| Michael W. Malafronte |

| International Value Advisers, LLC |

| 717 Fifth Avenue |

| 10th Floor |

| New York, NY 10022 |

| (Name and address of agent for service) |

| Copy to: |

| Michael S. Caccese, Esq. |

| K&L Gates LLP |

| State Street Financial Center |

| One Lincoln Street |

| Boston, Massachusetts 02111-2950 |

| Brian F. Link, Esq. |

| State Street Bank and Trust Company |

| Mail Code: SUM0703 |

| 100 Summer Street, 7th Floor |

| Boston, MA 02111 |

| Registrant’s telephone number, including area code: (212) 584-3570 |

| Date of fiscal year end: September 30 |

| Date of reporting period: September 30, 2016 |

Item 1. Report to Shareholders.

| ||

IVA Worldwide Fund | ||

| IVA International Fund | ||

| Annual Report | ||

| September 30, 2016 | ||

| Advised by International Value Advisers, LLC | An investment in the Funds is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | |

| Contents | IVA Funds |

| 2 | An Owner’s Manual | ||

| 3 | Letter from the President | ||

| 4 | Letter from the Portfolio Managers | ||

| 9 | Management’s Discussion of Fund Performance | ||

| IVA Worldwide Fund | |||

| 12 | Performance | ||

| 13 | Portfolio Composition | ||

| 14 | Schedule of Investments | ||

| IVA International Fund | |||

| 22 | Performance | ||

| 23 | Portfolio Composition | ||

| 24 | Schedule of Investments | ||

| 32 | Statements of Assets and Liabilities | ||

| 33 | Statements of Operations | ||

| 34 | Statements of Changes in Net Assets | ||

| 35 | Financial Highlights | ||

| 41 | Notes to Financial Statements | ||

| 49 | Report of Independent Registered Public Accounting Firm | ||

| 50 | Trustees and Officers | ||

| 52 | Additional Information | ||

| 55 | Fund Expenses | ||

| 56 | Important Tax Information |

| 1 |

| An Owner’s Manual | IVA Funds |

| An Atypical Investment Strategy | ||

| We manage both the IVA Worldwide and IVA International Funds with a dual attempt that is unusual in the mutual fund world: in the short-term (12-18 months), our attempt is to try to preserve capital, while in the longer-term (5-10 years, i.e., over a full economic cycle), we seek to perform better than the MSCI All Country World Index, in the case of your IVA Worldwide Fund, and the MSCI All Country World (ex-U.S.) Index, in the case of your IVA International Fund. | ||

| The Worldwide Fund is typically used by investors who are looking for an “all weather fund” where we are given the latitude to decide how much we should have in the U.S. versus outside the U.S. The International Fund is typically used by investors who practice asset allocation and want to decide for themselves how much should be allocated to a domestic manager and how much should be allocated to a pure “international” (i.e., non-U.S.) manager, yet at the same time are looking for a lower risk – and lower volatility – exposure to international markets than may be obtained from a more traditional international fund. | ||

| We believe our investment approach is very different from the traditional approach of most mutual funds. We are trying to deliver returns that are as absolute as possible, i.e., returns that try to be as resilient as possible in down markets, while many of our competitors try to deliver good relative performance, i.e., try to beat an index, and thus would be fine with being down 15% if their benchmark is down 20%. | ||

| Why do we have such an unusual strategy (which, incidentally, is not easy to carry out)? Because we believe this strategy makes sense for many investors. We are fond of the quote by Mark Twain: “There are two times in a man’s life when he should not speculate: the first time is when he cannot afford to; the second time is when he can.” We realize that many investors cannot tolerate high volatility and appreciate that “life’s bills do not always come at market tops.” This strategy also appeals to us at International Value Advisers since we “eat our own cooking” for a significant part of our savings (invested in IVA products) and we have an extreme aversion to losing money. | ||

| An Eclectic Investment Approach | ||

| Here is how we try to implement our strategy: | ||

| We don’t hug benchmarks. In practical terms, this means we are willing to make big “negative bets,” i.e., having nothing or little in what has become big in the benchmark. Conversely, we will generally seek to avoid overly large positive bets. | |||

| We prefer having diversified portfolios (100 to 150 names). Because we invest on a global basis, we believe that diversification helps protect against weak corporate governance or insufficient disclosure, or simply against “unknown unknowns.” We like the flexibility to invest in small, medium and large companies, depending on where we see value. | |||

| We attempt to capture equity-type returns through fixed income securities but predominantly when credit markets (or sub-sets of them) are depressed and offer this potential. | |||

| We hold some gold, either in bullion form or via gold mining securities, as we believe gold provides a good hedge in either an inflationary or deflationary period, and it can help mitigate currency debasement over time. | |||

| We are willing to hold cash when we cannot find enough cheap securities that we like or when we find some, yet the broader market (Mr. Market) seems fully priced. We will seek to use that cash as ammunition for future bargains. | |||

| At the individual security level, we ask a lot of questions about “what can go wrong?” and will establish not only a “base case intrinsic value” but also a “worst case scenario” (What could prove us wrong? If we were wrong, are we likely to lose 25%, 30%, or even more of the money invested?). As a result, we will miss some opportunities, yet hopefully, we will also avoid instances where we experience a permanent impairment of value. |

| 2 |

| Letter from the President | IVA Funds |

| Dear Shareholder, This annual report covers the fiscal year ended September 30, 2016. The Funds’ investment adviser, International Value Advisers, LLC, remains pleased with the performance of our two mutual funds, the IVA Worldwide Fund and the IVA International Funds (the “Funds”). Active management as a whole and value investing as a style are being challenged. After an extended period of Central Bank manipulation, record profit margins and market highs, this does not come as a surprise. Investors have become wary of high management fees with, for the most part, little to show for it in returns. And in a lot of cases, their wariness is warranted. After having worked in the money management industry for over 20 years, I would argue that most active managers are actually closet index-huggers, essentially practicing passive investing but charging active fees. Looking at the value investing space, I see a lot of managers practicing a relative value approach or herding into only a few investments within a portfolio. At IVA, we continue to practice true active, value investing. This is one of the reasons I have always felt so proud of our firm and our strong commitment to our clients. | ||

| Our investment team is fortunate to be led by our Chief Investment Officer, Charles de Vaulx, and his co-Portfolio Manager Chuck de Lardemelle. After almost 30 years in the investment management business, Charles has, essentially, an unmatched reputation for investment acumen, long-term results, character and quality in the industry. As Chief Investment Officer, he leads our focus first on protecting our clients’ assets and second on outperforming a benchmark over a full economic cycle. This means the members of IVA’s investment team must be able to accurately calculate a company’s intrinsic value (and importantly its worst case scenario intrinsic value) and our two Portfolio Managers must be willing to only invest our capital when we identify an investment that affords us an unbalanced risk/return profile. We want to do comprehensive research to minimize drawdowns within our Funds and maximize the likelihood of earning an acceptable return. A lot of money management firms profess to do this, but in reality some of them are more concerned with amassing assets and forming new products (revenue streams) while they hug closely to a benchmark. This is acceptable in a free market, but these are the firms that should agonize the most over the movement away from active investment, as they will most certainly not survive the reckoning. How do I feel so confident that we at IVA are not part of the problem? We closed our products to new investors, thus concentrating more on the quality of our investments over expanding our business, and the employees at IVA collectively make up one of the largest investors in the Funds so we are personally impacted by our investment results. | |||

| Our portfolio managers did an excellent job covering all of the topics I have touched on here in our most recent conference call, which I would encourage everyone to read the transcript on our website. | |||

It is tremendously fulfilling to build IVA and the Funds. We expect that in the process we are nurturing a culture where everyone at IVA respects the work we are doing for our clients. Sincerely,  Michael W. Malafronte, President Effective February 22, 2011, the IVA Worldwide Fund and IVA International Fund are closed to new investors. Drawdown is the peak-to-trough decline during a specific record period of a fund. A drawdown is usually quoted as a percentage between the peak and the trough. | |||

| 3 |

| Letter from the Portfolio Managers | IVA Funds |

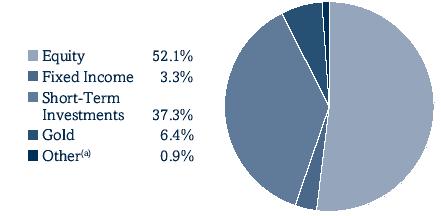

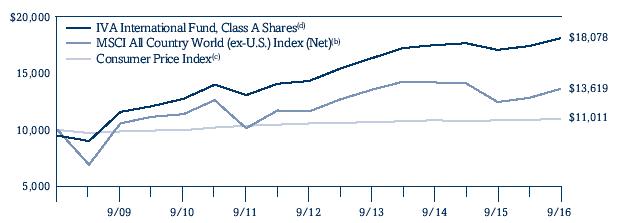

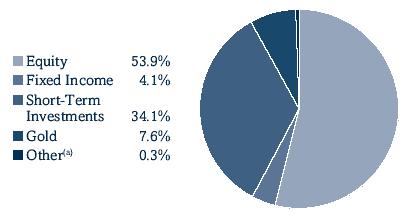

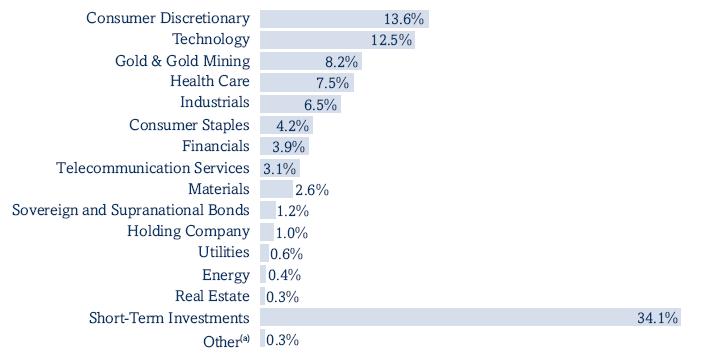

| October 31, 2016 Dear Shareholder, Over the period under review, October 1, 2015 to September 30, 2016, your Funds delivered positive returns (+6.75% for the IVA Worldwide Class A and +5.93% for the IVA International Class A), albeit less than their respective benchmarks (+11.96% for the MSCI All Country World Index and +9.26% for the MSCI All Country World (ex-U.S.) Index). Even though there were some bouts of volatility (late 2015, early 2016 and briefly after the Brexit vote), Central banks reasserted their sway over financial markets. It was Goldilocks all over again with a most soothing, seductive and intoxicating combination of moderate global economic growth, very supportive monetary policies and subdued volatility in many markets (equities, fixed income, currencies and commodities). We remain unimpressed. Markets seem far too sanguine about the prospect of “low interest rates forever.” We believe the nosebleed valuation levels many stocks and bonds trade for is simply the by-product of “insufficient uncertainty” about the future. (“The future is uncertain,” Ben Graham liked to remind us). We believe that policy makers are very misguided. The idea that the best policy response to poor economic performance is to create even higher levels of debt seems absurd to us. That seems both corrosive for society and painful for savers to have governments punish thrift and savings, while encouraging governments to further spend beyond their means. We believe historians will look back on this era and lament the huge damage inflicted by central bankers. Global markets may remain distorted for a while longer by unprecedented levels of liquidity as central bank balance sheets stay bloated with past asset purchases. Yet we are encouraged to maintain our very cautious stance (with only 52.1% and 53.9% invested in equities in the Worldwide Fund and International Fund, respectively, on September 30, 2016, while the cash levels were 37.3% and 34.1%, respectively) as we see that inflation expectations are beginning to perk up due to commodity base effects unwinding and tightening labor markets in many geographies. We also note that policy makers are slowly realizing that low or negative interest rates have very negative consequences, hurting many retirees, pensions, insurance companies and banks, not to mention the general misallocation of capital resulting from these low rates (in real estate, in equities with excessive share buybacks, in speculative grade bond markets…). Another factor increasing the probability that stocks and bonds might face significant headwinds in the years (or maybe even months?) to come is the rising tide of populism in many countries (in the U.K., Continental Europe and in the U.S.) and the growing resentment towards both rising wealth and income inequalities. With largely ineffective economic policies followed since the Great Financial Crisis, there is a growing chorus of voices arguing for new policies focused on fiscal spending (and/or “helicopter money”) instead of monetary policy. These policies, if followed, could result in rising interest rates, yet also stagflation, and could cause stocks and bonds to fall enough so as to become attractive to us. We would like nothing better than genuine bargains to surface in the years ahead so that we could put both Funds’ cash holdings to work! That cash has clearly diluted both Funds’ returns for the past few years and we are looking forward to showcasing the great attributes of cash: not only its ability to act as a buffer when stocks and bonds go down but also its “optionality value”, i.e. the dry powder needed to pounce and be used to scoop up genuine bargains whenever and wherever these opportunities may surface. |

| 4 |

| Letter from the Portfolio Managers | IVA Funds |

| Besides unattractive valuations and the possibility that policy makers may soon change tactics, we are also cautious today as we have seen many years of unprecedented credit growth in China (especially to struggling State-Owned Enterprises). We believe that China will suffer at some point as a result of these excesses. When, though, is hard to guess. There is also the possibility for the U.S. dollar to appreciate against many currencies in the years ahead, hurting on one hand the many U.S. companies that derive a significant portion of their earnings overseas but also the performance in U.S. dollar terms of many non-U.S. stocks if one were to be unhedged from a currency standpoint (the current hedging stance in both Funds is discussed in the Management’s Discussion of Fund Performance on the following pages). | |

Since our last Annual Report, we have been able to articulate several general thoughts and discuss a few individual names in your Funds’ portfolios in publications such as Value Investor Insight (June 30, 2016), Barron’s (“IVA’s Trifecta: Value Stocks, Cash, Gold”, July 16, 2016), during our semiannual conference calls (March 16 and September 13, 2016) and in two newsletters (“Do Low Rates Truly Justify Higher Valuations?”, December 2015 and “A History of Winning by Not Losing”, October 2016). If you have not already done so, we invite you to go on our ivafunds.com website to read some of those pieces. | |

| Among the questions we have tried to address in these publications and pieces: | |

Is value investing still relevant in today’s world? | |

| We have argued for many years now that value investing has been facing strong headwinds, due to: a more crowded and competitive field; greater and faster access to information through technology; much higher securities prices (stocks and high yield bonds in particular) due to ultralow, if not negative, interest rates; more and more companies (especially in the U.S.) implementing stock buybacks that appear accretive, even when done at elevated levels, as they are financed at almost zero percent interest rates; ��blind’ and rising investment flows into pools of securities comprising an index (Exchange Traded Funds or “ETFs”); and still vibrant merger and acquisition activity. Yet, in spite of these challenges, some of which are hopefully just temporary, we believe that the time-tested approach of trying to realistically appraise businesses and insisting on a margin of safety still works very well indeed. In fact, over the one year period under review, the performance of the equity-only component of both the Worldwide and the International Funds show a return of approximately 14.5% and 13.5%, respectively, while their benchmarks were up 11.8% and 8.9%, respectively. These numbers suggest that, on one hand, value investing has been difficult for us as ultra-low interest rates and high profit margins, along with our worries regarding certain macro-economic imbalances (China, Europe) have made it difficult to find enough genuine bargains to be fully invested (and indeed our cash has been very dilutive to both Funds’ returns). Yet, on the other hand, when we look at stocks that we have been willing to buy and hold, stocks that met our investment criteria and offered enough of a margin of safety, we are pleased to showcase that stock picking and value investing still work. People who claim that value stocks have underperformed for many years use, in our opinion, an overly simplistic and flawed definition of value investing, i.e. it is all about low price to book, low price to earnings and high dividend yielding stocks. This can be particularly flawed today as low interest rates have resulted in overinvestment and overcapacity in many sectors (steel, mining, retail, etc.) while high corporate profit margins and technology have opened many industries and business models to disruption. Ben Graham talked about the margin of safety as being a discount to what a rational buyer would pay, in cash, for 100 percent of a business. |

| 5 |

| Letter from the Portfolio Managers | IVA Funds |

| At IVA, we stick to that definition and avoid shortcuts. We try to be eclectic in our value approach, putting a lot of emphasis on the qualitative aspects of the business, the pricing power, the strength of the market, etc., rather than relying strictly on low price to book or a low P/E. So yes indeed, value investing is still very relevant today, but not at all a truncated and formulaic form of value investing. | |

The Fed Model: Should one pay up for stocks (or high yield bonds) in an ultra-low interest rate environment? | |

Basic math would suggest that, if the value of a business, and by extension of a stock, is the present value of the discounted cash flows to be generated by that business, it would stand to reason that the use of a lower discount rate would result in higher valuation for that business. So, it would appear that lower interest rates would lead to lower discount rates that would then lead to higher valuations. We believe that such a conclusion today would be way too hasty. The discount rate is said to be the sum of a risk-free rate plus an equity risk premium. With low risk-free rates today (1.7% on the 10-year U.S. government bond yields and zero percent on similar Japanese or German government bond yields), many new questions need to be thought through: Are these ultra-low rates artificially manipulated or are they truly at their natural equilibrium levels? Will these remain low for a long time (equities are very long duration assets after all) or will they normalize? If they remain low, are they not then signaling still massive imbalances in the world economy and possibly much lower earnings in the decades ahead? We are willing to consider that the risk-free rate is indeed lower now than 10 to 20 years ago. However, with many industries being disrupted today (retail with ecommerce, media with streaming, energy with the shale revolution, etc.) at a time of still elevated corporate profit margins (though those have come down for 5-6 quarters in a row in the U.S.), the equity risk premium ought to be a lot higher today than in the past. So, while 8, 15, 20 years ago we believed that for most stocks we should be shooting for an 8% type returna, we believe that today, and despite lower rates, we should still be insisting for those kinds of returns in light of all the risks out there. Today, we believe most stocks are not cheap enough to offer these types of returns. | |

Which active strategies are still relevant today and what could be the flaws associated with some passive strategies? | |

Many active strategies are flawed, with their goals of trying to beat a benchmark, rain or shine, year after year. A goal that does not correspond to the true investment needs of most clients (individual or institutional) and a goal that is also impossible to fulfill, as it is virtually impossible to constantly outperform, before fees (and even less after fees). While there are cycles during which many active equity strategies beat the passive ones (when Small beats Large, when International beats U.S., when Value beats Growth…), there are many other cycles when the opposite is also true. Conversely, we agree with Paul Smith, President and CEO of the CFA Institute; “The best managers are those with a goals-oriented approach… They need to focus on investment returns and not growth of assets under management. They need to experiment with portfolios that are not constrained and charge less. And above all, the word “benchmark” needs to be removed from the active manager’s lexicon.” a This refers to returns on securities in the Worldwide Fund or International Fund, not performance for the entire Worldwide Fund or International Fund. |

| 6 |

| Letter from the Portfolio Managers | IVA Funds |

| For many clients, we believe their genuine investing goals are actually asymmetrical. “Why risk what you have and need for what you don’t have and don’t need?” to quote Warren Buffet. And so, beating a benchmark should not be the primary investment goal compared to, say, a goal of preserving wealth in real terms. | ||

| At the recent Morningstar conference held in Chicago a few months ago, Dennis Lynch, who runs the Morgan Stanley Institutional Growth Fund, made the observation that only 15% of active managers are persistent market leaders. And then he added, The managers that tend to outperform have certain characteristics in common. They tend to be longer-term in nature, not traders; they are willing to be different to the benchmarks; most importantly, they also tend to have a lot of skin in the game. We could not agree more, we are big believers in eating our own cooking at IVA. Whilst we believe that certain subsets of markets are less inefficient than others (large-cap core, investment grade bonds) and might be accessed cheaply through passive vehicles, we also believe that other subsets still offer significant inefficiencies (small and mid-cap stocks in the U.S. and outside the U.S., high yield corporate bonds, real estate related securities, emerging markets) that can be profitability exploited by good active managers. | ||

| Many passive strategies have significant flaws as well: | ||

| Their goals (to deliver benchmark returns less a modest fee) do not typically match the true goals of most investors. How many clients would go talk to their financial advisers and suggest that their goal is to achieve an S&P 500 return over the next 20 years or that of a Bloomberg Barclays U.S. Aggregate Bond Index? | |||

| Many of them have way too much downside volatility for investors to tolerate. The S&P 500 recently lost 53% of its value (from September 2007 until March 2009), a drawdown that would be too painful for many to stomach. | |||

| Many of these benchmarks can be very “top heavy” at times and virtually guarantee large exposure to bubbles. The MSCI World Index had a 45% allocation to Japan in 1989 at the height of the Japanese bubble, the S&P 500 had a huge allocation to Technology, Media and Telecommunications stocks in March of 2000 and to Financials in 2007. It is obviously even more striking with more specialized ETFs: ‘Horizon Kinetics’ Steven Bregman recently gave the example of the iShares U.S. Energy ETF (IYE) noting that the top four holdings (Exxon, Chevron, Schlumberger and Occidental Petroleum) make up nearly 50% of the fund. | |||

| Are most investors able to measure the amount of true investment risk taken through most of the passive vehicles? We really doubt it. | |||

| Finally, the liquidity of many of the passive strategies remains untested and shall remain unknown until such time when they will face drawdowns and redemptions. |

| A quick word on DeVry Education Group, Inc., which is held by the Worldwide Fund: in mid-July we were invited by the company to put someone from our firm, Michael Malafronte, our Managing Partner, on the Board of DeVry. That came about as we started to question over the past year or so the company’s capital allocation moves, seemingly paying up for several acquisitions on one hand while not increasing its dividend, nor implementing significant share buybacks at prices that seem very attractive on the other hand. Whilst it is new for IVA to put someone on the Board of a company its Funds are invested in, it is not new for us at IVA, nor in our former lives, to react when we believe it is appropriate and in the best interests of our clients. | ||

| 7 |

| Letter from the Portfolio Managers | IVA Funds |

| In conclusion, we still believe that over the next five years, financial assets will deliver modest returns based on their elevated valuation levels today and a challenging global economic outlook. We believe that an eventual pickup in volatility and good stock picking should enable us to post respectable performance numbers as we keep following time-tested rules. | |

| We appreciate your continued confidence and thank you for your support. | |

| |

| Charles de Vaulx, Chief Investment Officer and Portfolio Manager | |

| |

| Chuck de Lardemelle, Portfolio Manager | |

| 8 |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

This period saw bouts of volatility, most notably at the end of 2015 and first 6 weeks of 2016, as investors grappled with the prospect of a slowdown in China, Emerging Market debt, sinking oil prices, widening credit spreads, falling earnings and political uncertainty in many areas. After this initial difficult period, global markets rebounded in 2016 as the price of oil came up, boosting commodity-linked and Emerging Market assets. This rebound and relative calm was briefly interrupted by Brexit. Although the possibility of the UK voting to Leave the EU had been on investors’ minds for months leading up to the vote, most everyone was surprised by the final result on June 24th. Markets recoiled, the British pound plummeted and the currency safe havens of the U.S. dollar and Japanese yen leapt. The violent reaction was short-lived. The third quarter of 2016 was marked by periods of volatility related to anxieties over Central Bank actions and inactions, but was mostly uneventful. This lasted until the last few weeks when concerns over Deutsche Bank hit a crescendo, dragging down European bank shares and igniting fears about their overall health. | |

| Over the period, our equity exposure increased from 51.5% to 52.1% in the Worldwide Fund and from 51.8% to 53.9% in the International Fund. We found some new equity opportunities over the period. In both Funds, we initiated a position in China, Baidu, Inc., Sponsored ADR (technology) and in France we bought the equity of Wendel SA (holding company), which until the first quarter of 2016 we held the fixed income of Wendel SA in both Funds. In Japan, we added multiple new names in both Funds, including F@N Communications, Inc. (technology), FANUC Corporation (industrials) and Seven & i Holdings Co., Ltd. (consumer staples). In the International Fund only, we initiated a position in Euler Hermes Group (France, financials) and in two U.K. names – Jardine Lloyd Thompson Group Plc (financials), Mitie Group Plc (industrials). In the Worldwide Fund only in the U.S., we added multiple new names, including Tiffany & Co. (consumer discretionary) and Bank of America Corp. (financials). | |

| While we were able to find new names, some of our existing names approached our intrinsic value estimates and in those cases we trimmed and even eliminated positions entirely. Names that came out of both Funds included Digital China Holdings Limited (China, technology) and Miura Co., Ltd. (Japan, industrials). In the International Fund, names that we eliminated included Danone SA (France, consumer staples) and Total SA (France, energy). In the Worldwide Fund in the U.S., names that we eliminated included Occidental Petroleum Corporation (energy) and Symantec Corporation (technology). | |

| As cracks widened in the high yield market during the period, we added a new oil services name in both Funds – Rowan Companies, Inc. In the Worldwide Fund, we also added Joy Global Inc., a mining equipment company. At the same time, as we found higher yielding opportunities, we eliminated our Wendel bonds which had become to us akin to quasi-cash in euros. Mostly as a result of this, our corporate bond exposure decreased from 5.3% to 2.8% in the Worldwide Fund and from 5.3% to 2.9% in the International Fund. We also reduced our short-dated bonds denominated in Singapore dollars in both Funds as Singapore is located in what we believe may be a “bad neighborhood” for a while – Asia. Our Singapore dollar bond exposure decreased from 3.2% to 0.5% in the Worldwide Fund and from 4.1% to 1.1% in the International Fund. | |

| In large part because of this reduction in quasi-cash fixed-income positions, our cash position increased in both Funds over the period. In the Worldwide Fund, it went from 35.2% to 37.3% and in the International Fund it went from 33.2% to 34.1%. | |

| Our exposure to gold through gold bullion increased from 4.6% to 6.4% in the Worldwide Fund and from 5.3% to 7.6% in the International Fund. The increase was through both appreciation and additional investment. We continue to believe that gold provides a good hedge against extreme outcomes, and in particular benefits from negative real interest rates. | |

| 9 |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

| IVA Worldwide Fund | ||

| The IVA Worldwide Fund Class A, at net asset value, returned 6.75% over the one-year period ended September 30, 2016 compared to the MSCI All Country World Index (Net) (the “Index”) return of 11.96% over the same period. | ||

| The Fund lagged the Index for the period, mostly due to the dilutive effect of our elevated cash position. Our equities outperformed, up 14.5%, compared to those in the Index* which were up 11.8%. Our names in the U.S. contributed the most to return, adding 3.0%, led by financials and technology. However, on a relative basis, our underweight to the U.S. detracted from performance, as the Index had approximately twice as much exposure and its U.S. names contributed 7.7% to return. South Korea added 2.0% to return, led by a top 10 name in the portfolio, Samsung Electronics Co., Ltd. (technology). Japan contributed 1.4%, led by another top 10 name, Astellas Pharma Inc. (health care). Our one holding in South Africa, Net 1 U.E.P.S Technologies, Inc. (technology), was down -48.8%, detracting -0.3 from return. Our names in Thailand and Hong Kong detracted a total of -0.1%. | ||

| The top five individual equity contributors to return this period were: Samsung Electronics Co., Ltd. (South Korea, technology), Astellas Pharma Inc. (Japan, health care), Berkshire Hathaway Inc. Class ‘A’ and ‘B’ (U.S., holding company), Hyundai Mobis Co., Ltd. (South Korea, consumer discretionary), Emerson Electric Co. (U.S., industrials). The top five individual detractors were: DeVry Education Group Inc. (U.S., consumer discretionary), Bolloré SA (France, industrials), Net 1 U.E.P.S. Technologies Inc. (South Africa, technology), Millennium & Copthorne Hotels Plc (UK, consumer discretionary), Financière de l’Odet SA (France, industrials). | ||

| Collectively, fixed income contributed 0.03%. Gold was up 17.7% and added 1.0%. | ||

| In an effort to neutralize part of our foreign exchange risk, we were partially hedged against several currencies over the period – the euro, Japanese yen, South Korean won and Australian dollar. Our currency hedges detracted -0.5%, hurt by our hedge on the Japanese yen as it appreciated over 2016. At the end of the period, our currency hedges were 43% Australian dollar, 25% euro, 25% Japanese yen, and 30% South Korean won. |

| 10 |

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

IVA International Fund | |

| The IVA International Fund Class A, at net asset value, returned 5.93% over the one-year period ended September 30, 2016 compared to the MSCI All Country World Index (ex-U.S.) (Net) (the “Index”) return of 9.26% over the same period. | |

| The Fund lagged the Index for the period, mostly due to the dilutive effect of our elevated cash position. Our equities outperformed, up 13.5%, compared to those in the Index* which were up 8.9%. Our names in Continental Europe contributed the most to return, up 15.9% and added 2.3%, compared to the Index whose names were up 2.4%, and added 0.8%. Our outperformance in Europe was led by our technology names in France. Japan contributed 2.3% to return, led by a top 10 name in the portfolio, Astellas Pharma Inc. (health care). South Korea added 2.1% to return, led by another top 10 name, Samsung Electronics Co., Ltd. (technology). Our one holding in South Africa, Net 1 U.E.P.S. Technologies, Inc. (technology), was down -48.5%, detracting -0.4% from return. Our only name in Thailand, Thaicom PCL (telecommunications services), was down -30.0% and detracted -0.2%. Our names in Hong Kong and China detracted a total of -0.4%. | |

| The top five individual equity contributors to return this period were: Samsung Electronics Co., Ltd. (South Korea, technology), Astellas Pharma Inc. (Japan, health care), Alten SA (France, technology), Hyundai Mobis Co., Ltd. (South Korea, consumer discretionary), Genting Malaysia Berhad (Malaysia, consumer discretionary). The top five individual detractors were: Net 1 U.E.P.S. Technologies, Inc. (South Africa, technology), Springland International Holdings Ltd. (China, consumer discretionary), Bolloré SA (France, industrials), Millennium & Copthorne Hotels Plc (UK, consumer discretionary), Financière de l’Odet SA (France, industrials). | |

| Collectively, fixed income contributed 0.02%. Gold was up 17.7% and added 1.2%. | |

| In an effort to neutralize part of our foreign exchange risk, we were partially hedged against several currencies over the period – the euro, Japanese yen, South Korean won and Australian dollar. Our currency hedges detracted -1.0%, hurt by our hedge on the Japanese yen as it appreciated over 2016. At the end of the period, our currency hedges were 43% Australian dollar, 20% euro, 35% Japanese yen, and 30% South Korean won. | |

Investment Risks: There are risks associated with investing in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. | |

*The Index equity return excludes gold mining stocks. |

| 11 |

| IVA Worldwide Fund | IVA Funds |

| Performance (unaudited) | As of September 30, 2016 |

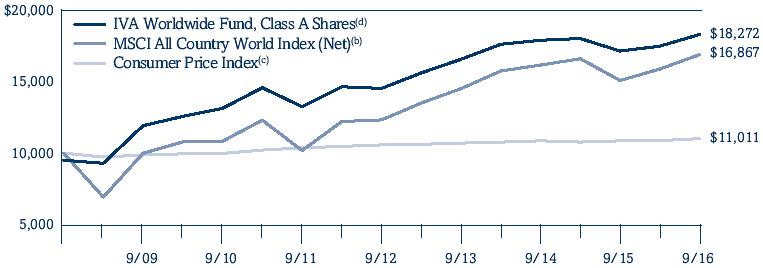

| Average Annual Total Returns as of September 30, 2016 | One Year | Five Year | Since Inception(a) | ||||||||

| Class A | 6.75 | % | 6.66 | % | 8.52 | % | |||||

| Class A (with a 5% maximum initial sales charge) | 1.40 | % | 5.57 | % | 7.83 | % | |||||

| Class C | 5.93 | % | 5.86 | % | 7.70 | % | |||||

| Class I | 6.96 | % | 6.92 | % | 8.77 | % | |||||

| MSCI All Country World Index (Net)(b) | 11.96 | % | 10.63 | % | 6.75 | % | |||||

| Consumer Price Index(c) | 1.45 | % | 1.23 | % | 1.21 | % | |||||

| Growth of a $10,000 Initial Investment |

| (a) | The Fund commenced investment operations on October 1, 2008. | |

| (b) | The MSCI All Country World Index (Net) is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. | |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. | |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2016. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. | |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. The expense ratios for the Fund are as follows: 1.25% (Class A shares); 2.00% (Class C shares); and 1.00% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2016. More recent expense ratios can be found in the Financial Highlights section of this Annual Report.

| 12 |

| IVA Worldwide Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of September 30, 2016 |

| Asset Allocation (As a Percent of Total Net Assets) |

| Sector Allocation (As a Percent of Total Net Assets) |

| Top 10 Positions (As a Percent of Total Net Assets)(b) | |

| Gold Bullion | 6.4 | % | |

| Astellas Pharma Inc. | 4.5 | % | |

| Samsung Electronics Co., Ltd. | 4.1 | % | |

| Berkshire Hathaway Inc., Class ‘A’, Class ‘B’ | 3.9 | % | |

| Nestlé SA | 2.4 | % | |

| News Corp., Class ‘A’ , Class ‘B’ | 2.1 | % | |

| DeVry Education Group Inc. | 1.8 | % | |

| Oracle Corp. | 1.7 | % | |

| Hyundai Mobis Co., Ltd. | 1.3 | % | |

| Mastercard Inc., Class ‘A’ | 1.3 | % | |

| Top 10 positions represent 29.5% of total net assets. | |

| (a) | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

| 13 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| COMMON STOCKS – 51.0% | |||||||||

| Bermuda | 0.7% | |||||||||

| 1,744,600 | Jardine Strategic Holdings Ltd. | $ | 57,048,420 | ||||||

| China | 0.6% | |||||||||

| 130,628 | Baidu, Inc., ADR (a) | 23,783,440 | |||||||

| 15,637,640 | Clear Media Ltd. | 14,898,943 | |||||||

| 70,615,000 | Springland International Holdings Ltd. | 11,653,241 | |||||||

| 50,335,624 | |||||||||

| France | 5.5% | |||||||||

| 1,002,160 | Alten SA | 70,068,287 | |||||||

| 3,932,539 | Altran Technologies SA | 58,135,816 | |||||||

| 26,020,294 | Bolloré SA | 90,466,482 | |||||||

| 3,078,007 | Bureau Veritas SA | 66,024,347 | |||||||

| 2,311,527 | Engie SA | 35,807,837 | |||||||

| 37,638 | Financière de l’Odet SA | 30,446,277 | |||||||

| 95,324 | Robertet SA | 34,623,944 | |||||||

| 59,614 | Séché Environnement SA | 2,029,111 | |||||||

| 300,945 | Sodexo SA | 35,835,036 | |||||||

| 271,986 | Thales SA | 25,050,840 | |||||||

| 43,294 | Wendel SA | 5,055,534 | |||||||

| 453,543,511 | |||||||||

| Germany | 0.6% | |||||||||

| 391,530 | Siemens AG | 45,829,763 | |||||||

| Hong Kong | 0.8% | |||||||||

| 3,625,587 | Henderson Land Development Co. Ltd. | 21,501,857 | |||||||

| 43,913,659 | Hongkong & Shanghai Hotels Ltd. | 43,594,344 | |||||||

| 65,096,201 | |||||||||

| Japan | 8.4% | |||||||||

| 23,857,700 | Astellas Pharma Inc. | 370,199,605 | |||||||

| 1,463,200 | Azbil Corp. | 43,864,977 | |||||||

| 1,215,200 | Benesse Holdings Inc. | 30,845,864 | |||||||

| 1,644,500 | Cosel Co., Ltd. | 19,752,488 | |||||||

| 588,100 | F@N Communications, Inc. | 4,297,442 | |||||||

| 299,400 | FANUC Corp. | 50,222,317 | |||||||

| 758,200 | Icom Inc. (b) | 14,998,759 | |||||||

| 211,200 | Medikit Co., Ltd. | 9,257,768 | |||||||

| 277,300 | Miraca Holdings Inc. | 13,700,242 | |||||||

| 182,700 | Nitto Kohki Co., Ltd. | 4,253,781 | |||||||

| 339,700 | Okinawa Cellular Telephone Co. | 10,250,796 | |||||||

| 1,088,800 | Rohto Pharmaceutical Co., Ltd. | 18,628,943 | |||||||

| 394,100 | Seven & i Holdings Co., Ltd. | 18,487,586 | |||||||

| 259,400 | Techno Medica Co., Ltd. | 4,121,034 | |||||||

| 964,200 | Toho Co., Ltd. | 31,758,079 | |||||||

| 11,678,300 | Yahoo Japan Corp. | 46,296,303 | |||||||

| 279,900 | Yokogawa Electric Corp. | 3,684,892 | |||||||

| 694,620,876 | |||||||||

| 14 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| Malaysia | 1.0% | |||||||||

| 78,779,400 | Genting Malaysia Berhad | $ | 86,675,437 | ||||||

| South Africa | 0.3% | |||||||||

| 2,835,280 | Net 1 U.E.P.S. Technologies Inc. (a)(b) | 24,269,997 | |||||||

| South Korea | 6.1% | |||||||||

| 424,433 | Hyundai Mobis Co., Ltd. | 105,978,186 | |||||||

| 413,975 | Hyundai Motor Co. | 50,931,686 | |||||||

| 244,132 | Kangwon Land, Inc. | 8,711,479 | |||||||

| 235,543 | Samsung Electronics Co., Ltd. | 341,760,307 | |||||||

| 507,381,658 | |||||||||

| Switzerland | 3.4% | |||||||||

| 506,495 | Compagnie Financière Richemont SA | 30,864,132 | |||||||

| 2,510,117 | Nestlé SA | 197,786,368 | |||||||

| 4,054,073 | UBS Group AG | 55,208,837 | |||||||

| 283,859,337 | |||||||||

| Thailand | 0.2% | |||||||||

| 26,416,400 | Thaicom PCL | 15,781,226 | |||||||

| United Kingdom | 2.3% | |||||||||

| 12,877,941 | Antofagasta Plc | 87,464,694 | |||||||

| 7,209,930 | HSBC Holdings Plc | 54,080,363 | |||||||

| 8,555,038 | Millennium & Copthorne Hotels Plc | 48,235,442 | |||||||

| 189,780,499 | |||||||||

| United States | 21.1% | |||||||||

| 14,919 | Alphabet Inc., Class A (a) | 11,995,771 | |||||||

| 47,199 | Alphabet Inc., Class C (a) | 36,687,311 | |||||||

| 972,501 | Amdocs Ltd. | 56,259,183 | |||||||

| 1,015,165 | American Capital Agency Corp. | 19,836,324 | |||||||

| 801,508 | American Express Co. | 51,328,572 | |||||||

| 382,926 | Aon Plc | 43,075,346 | |||||||

| 6,048,784 | Bank of America Corp. | 94,663,470 | |||||||

| 1,285 | Berkshire Hathaway Inc., Class ‘A’ (a) | 277,842,700 | |||||||

| 305,717 | Berkshire Hathaway Inc., Class ‘B’ (a) | 44,166,935 | |||||||

| 154,144 | Cimarex Energy Co. | 20,712,329 | |||||||

| 703,490 | CVS Health Corp. | 62,603,575 | |||||||

| 6,567,795 | DeVry Education Group Inc. (b) | 151,453,353 | |||||||

| 733,196 | Emerson Electric Co. | 39,966,514 | |||||||

| 1,508,484 | Expeditors International of Washington, Inc. | 77,717,096 | |||||||

| 683,969 | Flowserve Corp. | 32,994,664 | |||||||

| 377,869 | Goldman Sachs Group, Inc. | 60,938,934 | |||||||

| 424,081 | Hewlett Packard Enterprise Co. | 9,647,843 | |||||||

| 585,813 | HP Inc. | 9,097,676 | |||||||

| 1,139,510 | Liberty Interactive Corp. QVC Group, | 22,801,595 | |||||||

| 499,612 | Marsh & McLennan Cos., Inc. | 33,598,907 | |||||||

| See Notes to Financial Statements. | 15 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| United States | 21.1% (continued) | |||||||||

| 1,075,065 | Mastercard Inc., Class ‘A’ | $ | 109,409,365 | ||||||

| 9,126,206 | News Corp., Class ‘A’ | 127,584,360 | |||||||

| 3,066,288 | News Corp., Class ‘B’ | 43,602,615 | |||||||

| 3,485,211 | Oracle Corp. | 136,899,088 | |||||||

| 210,550 | Raymond James Financial Inc. | 12,256,115 | |||||||

| 1,858,325 | Teradata Corp. (a) | 57,608,075 | |||||||

| 697,352 | Tiffany & Co. | 50,648,676 | |||||||

| 479,847 | United Technologies Corp. | 48,752,455 | |||||||

| 1,744,148,847 | |||||||||

| TOTAL COMMON STOCKS | |||||||||

| (Cost — $3,258,918,186) | 4,218,371,396 | ||||||||

| PREFERRED STOCKS – 1.1% | |||||||||

| United States | 1.1% | |||||||||

| American Capital Agency Corp., | |||||||||

| 249,708 | Series ‘A’, 8% due 4/5/2017 (c) | 6,518,627 | |||||||

| Annaly Capital Management Inc.: | |||||||||

| 599,750 | Series ‘C’, 7.625% due 5/16/2017 (c) | 15,293,625 | |||||||

| 915,450 | Series ‘D’, 7.5% due 9/13/2017 (c) | 23,115,113 | |||||||

| 619,970 | Series ‘E’, 7.625% due 8/27/2017 (c) | 15,691,441 | |||||||

| Capstead Mortgage Corp., | |||||||||

| 380,207 | Series ‘E’, 7.5% due 5/13/2018 (c) | 9,621,138 | |||||||

| CYS Investments Inc.: | |||||||||

| 129,614 | Series ‘A’, 7.75% due 8/3/2017 (c) | 3,229,981 | |||||||

| 400,333 | Series ‘B’, 7.5% due 4/30/2018 (c) | 9,692,062 | |||||||

| MFA Financial Inc., | |||||||||

| 316,222 | Series ‘B’, 7.5% due 4/15/2018 (c) | 8,126,905 | |||||||

| TOTAL PREFERRED STOCKS | |||||||||

(Cost — $84,050,573) | 91,288,892 | ||||||||

| PRINCIPAL | |||||||||

| AMOUNT | |||||||||

| CORPORATE NOTES & BONDS – 2.8% | |||||||||

| South Africa | 0.6% | |||||||||

| Gold Fields Orogen Holding (BVI) Ltd., | |||||||||

| 46,980,000 | USD | 4.875% due 10/7/2020 (d) | 47,792,754 | ||||||

| Switzerland | 0.1% | |||||||||

| 8,900,000 | EUR | UBS AG, 7.152% due 12/21/2017 (e) | 10,758,883 | ||||||

| United States | 2.1% | |||||||||

| Brandywine Operating Partnership, LP, | |||||||||

| 6,070,000 | USD | 5.7% due 5/1/2017 | 6,203,546 | ||||||

| 9,684,000 | USD | Era Group Inc., 7.75% due 12/15/2022 | 8,134,560 | ||||||

| Intelsat Jackson Holdings Ltd.: | |||||||||

| 28,408,000 | USD | 7.5% due 4/1/2021 | 21,590,080 | ||||||

| 76,391,000 | USD | 5.5% due 8/1/2023 | 53,282,723 | ||||||

| 34,108,000 | USD | Joy Global Inc., 5.125% due 10/15/2021 | 37,475,278 | ||||||

| 297,116 | MFA Financial Inc., 8% due 4/15/2042 (f) | 7,775,526 | |||||||

| 16 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| United States | 2.1% (continued) | |||||||||

| Rowan Cos., Inc.: | |||||||||

| 37,800,000 | USD | 4.875% due 6/1/2022 | $ | 32,130,000 | |||||

| 4,748,000 | USD | 4.75% due 1/15/2024 | 3,893,360 | ||||||

| 170,485,073 | |||||||||

| TOTAL CORPORATE NOTES & BONDS | |||||||||

(Cost — $212,112,111) | 229,036,710 | ||||||||

| SOVEREIGN BONDS – 0.5% | |||||||||

| Singapore | 0.5% | |||||||||

| Government of Singapore: | |||||||||

| 1,136,000 | SGD | 0.5% due 4/1/2018 | 828,385 | ||||||

| 49,948,000 | SGD | 2.5% due 6/1/2019 | 38,051,608 | ||||||

| TOTAL SOVEREIGN BONDS | |||||||||

(Cost — $38,784,815) | 38,879,993 | ||||||||

| OUNCES | |||||||||

| COMMODITIES – 6.4% | |||||||||

| 404,671 | Gold Bullion (a) | 533,219,334 | |||||||

| TOTAL COMMODITIES | |||||||||

(Cost — $565,324,659) | 533,219,334 | ||||||||

| PRINCIPAL | |||||||||

| AMOUNT | |||||||||

| SHORT-TERM INVESTMENTS – 37.3% | |||||||||

| Commercial Paper | 37.3% | |||||||||

| Abbott Laboratories: | |||||||||

| 58,000,000 | USD | 0.65% due 10/18/2016 (d) | 57,988,110 | ||||||

| 49,000,000 | USD | 0.68% due 10/24/2016 (d) | 48,986,051 | ||||||

| Air Liquide US LLC: | |||||||||

| 30,000,000 | USD | 0.91% due 11/7/2016 (d) | 29,984,768 | ||||||

| 50,000,000 | USD | 0.91% due 11/8/2016 (d) | 49,973,892 | ||||||

| American Honda Finance Corp., | |||||||||

| 7,000,000 | USD | 0.5% due 10/6/2016 (d) | 6,999,586 | ||||||

| Apple Inc., | |||||||||

| 22,600,000 | USD | 0.43% due 10/31/2016 (d) | 22,592,001 | ||||||

| BASF SE, | |||||||||

| 1,300,000 | USD | 0.5% due 10/12/2016 (d) | 1,299,820 | ||||||

| Coca-Cola Co.: | |||||||||

| 28,900,000 | USD | 0.35% due 10/20/2016 (d) | 28,893,787 | ||||||

| 3,900,000 | USD | 0.4% due 10/20/2016 (d) | 3,899,162 | ||||||

| 50,000,000 | USD | 0.39% due 10/24/2016 (d) | 49,986,767 | ||||||

| Consolidated Edison Co. Inc., | |||||||||

| 15,000,000 | USD | 0.63% due 10/6/2016 (d) | 14,998,413 | ||||||

| Dover Corp.: | |||||||||

| 10,000,000 | USD | 0.65% due 10/18/2016 (d) | 9,997,800 | ||||||

| 30,000,000 | USD | 0.67% due 10/24/2016 (d) | 29,986,042 | ||||||

| See Notes to Financial Statements. | 17 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 37.3% (continued) | |||||||||

| �� | E.I. Du Pont de Nemours & Co.: | ||||||||

| 30,000,000 | USD | 0.73% due 10/12/2016 (d) | $ | 29,992,650 | |||||

| 31,700,000 | USD | 0.74% due 10/18/2016 (d) | 31,687,954 | ||||||

| Engie SA: | |||||||||

| 35,000,000 | USD | 0.68% due 10/3/2016 (d) | 34,998,921 | ||||||

| 83,700,000 | USD | 0.71% due 10/3/2016 (d) | 83,697,420 | ||||||

| 23,600,000 | USD | 0.67% due 10/4/2016 (d) | 23,599,017 | ||||||

| 15,000,000 | USD | 0.68% due 10/4/2016 (d) | 14,999,375 | ||||||

| 10,000,000 | USD | 0.69% due 10/11/2016 (d) | 9,998,747 | ||||||

| 40,000,000 | USD | 0.69% due 10/14/2016 (d) | 39,993,389 | ||||||

| 40,000,000 | USD | 0.71% due 10/18/2016 (d) | 39,991,200 | ||||||

| 1,000,000 | USD | 0.73% due 10/24/2016 (d) | 999,695 | ||||||

| 30,000,000 | USD | 0.66% due 10/25/2016 (d) | 29,990,438 | ||||||

| 28,200,000 | USD | 0.67% due 11/2/2016 (d) | 28,187,747 | ||||||

| Estée Lauder Companies Inc.: | |||||||||

| 25,000,000 | USD | 0.43% due 10/20/2016 (d) | 24,993,792 | ||||||

| 50,000,000 | USD | 0.47% due 10/26/2016 (d) | 49,983,353 | ||||||

| 20,000,000 | USD | 0.49% due 10/27/2016 (d) | 19,993,055 | ||||||

| Henkel Corp.: | |||||||||

| 13,250,000 | USD | 0.67% due 10/4/2016 (d) | 13,249,448 | ||||||

| 7,900,000 | USD | 0.57% due 10/5/2016 (d) | 7,899,583 | ||||||

| 25,000,000 | USD | 0.59% due 10/6/2016 (d) | 24,998,396 | ||||||

| 11,000,000 | USD | 0.57% due 10/11/2016 (d) | 10,998,622 | ||||||

| 50,000,000 | USD | 0.6% due 10/12/2016 (d) | 49,993,083 | ||||||

| 12,700,000 | USD | 0.6% due 11/8/2016 (d) | 12,693,368 | ||||||

| 18,000,000 | USD | 0.64% due 11/8/2016 (d) | 17,990,601 | ||||||

| Kraft Heinz Foods Co., | |||||||||

| 8,000,000 | USD | 0.85% due 10/3/2016 (d) | 7,999,387 | ||||||

| L’Oréal USA Inc.: | |||||||||

| 40,000,000 | USD | 0.47% due 10/3/2016 (d) | 39,998,867 | ||||||

| 23,100,000 | USD | 0.44% due 10/4/2016 (d) | 23,099,115 | ||||||

| 40,000,000 | USD | 0.41% due 10/5/2016 (d) | 39,998,056 | ||||||

| 7,000,000 | USD | 0.45% due 10/6/2016 (d) | 6,999,586 | ||||||

| 5,000,000 | USD | 0.4% due 10/7/2016 (d) | 4,999,650 | ||||||

| 35,000,000 | USD | 0.4% due 10/11/2016 (d) | 34,995,936 | ||||||

| 14,000,000 | USD | 0.4% due 10/12/2016 (d) | 13,998,203 | ||||||

| 26,800,000 | USD | 0.43% due 10/12/2016 (d) | 26,796,561 | ||||||

| 50,000,000 | USD | 0.4% due 10/13/2016 (d) | 49,992,958 | ||||||

| 10,000,000 | USD | 0.39% due 10/17/2016 (d) | 9,998,078 | ||||||

| 32,400,000 | USD | 0.45% due 10/17/2016 (d) | 32,393,773 | ||||||

| Microsoft Corp.: | |||||||||

| 40,000,000 | USD | 0.45% due 10/4/2016 (d) | 39,998,467 | ||||||

| 120,500,000 | USD | 0.5% due 11/15/2016 (d) | 120,428,557 | ||||||

| Mondelez International Inc., | |||||||||

| 14,200,000 | USD | 0.61% due 10/17/2016 (d) | 14,194,723 | ||||||

| Nestlé Capital Corp.: | |||||||||

| 30,000,000 | USD | 0.46% due 10/4/2016(d) | 29,998,943 | ||||||

| 20,000,000 | USD | 0.34% due 10/7/2016 (d) | 19,998,756 | ||||||

| 18 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 37.3% (continued) | |||||||||

| Nestlé Capital Corp.: (continued): | |||||||||

| 28,500,000 | USD | 0.46% due 10/11/2016 (d) | $ | 28,497,179 | |||||

| 30,000,000 | USD | 0.44% due 10/21/2016 (d) | 29,994,120 | ||||||

| 29,900,000 | USD | 0.45% due 10/24/2016 (d) | 29,893,243 | ||||||

| 25,000,000 | USD | 0.45% due 11/7/2016 (d) | 24,990,632 | ||||||

| 25,000,000 | USD | 0.45% due 11/9/2016 (d) | 24,990,083 | ||||||

| 50,000,000 | USD | 0.43% due 11/10/2016 (d) | 49,979,614 | ||||||

| Novartis Finance Corp.: | |||||||||

| 50,000,000 | USD | 0.48% due 10/4/2016 (d) | 49,998,083 | ||||||

| 44,700,000 | USD | 0.4% due 10/5/2016 (d) | 44,697,827 | ||||||

| 30,000,000 | USD | 0.46% due 10/6/2016 (d) | 29,998,225 | ||||||

| 35,000,000 | USD | 0.4% due 10/7/2016 (d) | 34,997,550 | ||||||

| 35,000,000 | USD | 0.45% due 10/18/2016 (d) | 34,992,825 | ||||||

| 54,000,000 | USD | 0.5% due 10/25/2016 (d) | 53,983,912 | ||||||

| 25,000,000 | USD | 0.5% due 10/26/2016 (d) | 24,992,218 | ||||||

| 35,000,000 | USD | 0.5% due 11/21/2016 (d) | 34,975,329 | ||||||

| Reed Elsevier Inc.: | |||||||||

| 25,000,000 | USD | 0.63% due 10/3/2016 (d) | 24,998,500 | ||||||

| 15,500,000 | USD | 0.63% due 10/4/2016 (d) | 15,498,751 | ||||||

| Roche Holdings, Inc.: | |||||||||

| 50,000,000 | USD | 0.44% due 10/17/2016 (d) | 49,990,390 | ||||||

| 50,000,000 | USD | 0.44% due 10/18/2016 (d) | 49,989,750 | ||||||

| 50,000,000 | USD | 0.44% due 10/19/2016 (d) | 49,989,101 | ||||||

| 25,000,000 | USD | 0.45% due 10/19/2016 (d) | 24,994,551 | ||||||

| 25,000,000 | USD | 0.44% due 10/20/2016 (d) | 24,994,208 | ||||||

| 25,000,000 | USD | 0.45% due 10/20/2016 (d) | 24,994,208 | ||||||

| 50,000,000 | USD | 0.45% due 10/21/2016 (d) | 49,987,750 | ||||||

| 4,500,000 | USD | 0.46% due 10/26/2016 (d) | 4,498,599 | ||||||

| 25,000,000 | USD | 0.46% due 10/27/2016 (d) | 24,991,881 | ||||||

| 25,000,000 | USD | 0.46% due 11/4/2016 (d) | 24,989,136 | ||||||

| 5,100,000 | USD | 0.48% due 11/7/2016 (d) | 5,097,572 | ||||||

| 25,000,000 | USD | 0.48% due 11/8/2016 (d) | 24,987,758 | ||||||

| Unilever Capital Corp.: | |||||||||

| 8,000,000 | USD | 0.4% due 10/3/2016 (d) | 7,999,773 | ||||||

| 30,000,000 | USD | 0.38% due 10/7/2016 (d) | 29,997,900 | ||||||

| 1,100,000 | USD | 0.45% due 10/11/2016 (d) | 1,099,872 | ||||||

| 20,000,000 | USD | 0.41% due 10/12/2016 (d) | 19,997,433 | ||||||

| 60,000,000 | USD | 0.45% due 10/13/2016 (d) | 59,991,550 | ||||||

| 25,000,000 | USD | 0.4% due 10/19/2016 (d) | 24,994,551 | ||||||

| 3,900,000 | USD | 0.48% due 10/24/2016 (d) | 3,898,890 | ||||||

| 18,900,000 | USD | 0.49% due 11/7/2016 (d) | 18,891,002 | ||||||

| 30,000,000 | USD | 0.5% due 11/8/2016 (d) | 29,985,310 | ||||||

| 30,000,000 | USD | 0.52% due 11/28/2016 (d) | 29,974,630 | ||||||

| United Healthcare Co.: | |||||||||

| 8,700,000 | USD | 0.51% due 10/3/2016 (d) | 8,699,550 | ||||||

| 25,100,000 | USD | 0.74% due 10/31/2016 (d) | 25,084,416 | ||||||

| 7,300,000 | USD | 0.74% due 11/4/2016 (d) | 7,294,840 | ||||||

| 70,000,000 | USD | 0.74% due 11/10/2016 (d) | 69,941,404 | ||||||

| See Notes to Financial Statements. | 19 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 37.3% (continued) | |||||||||

| United Parcel Service, Inc.: | |||||||||

| 50,000,000 | USD | 0.1% due 10/6/2016 (d) | $ | 49,997,041 | |||||

| 30,200,000 | USD | 0.1% due 10/7/2016 (d) | 30,197,886 | ||||||

| 41,300,000 | USD | 0.18% due 10/17/2016 (d) | 41,292,063 | ||||||

| 25,600,000 | USD | 0.2% due 11/1/2016 (d) | 25,589,919 | ||||||

| 33,700,000 | USD | 0.27% due 11/1/2016 (d) | 33,686,730 | ||||||

| �� | 50,000,000 | USD | 0.25% due 11/3/2016 (d) | 49,978,986 | |||||

| 50,000,000 | USD | 0.28% due 11/9/2016 (d) | 49,974,834 | ||||||

| Wal-Mart Stores, Inc.: | |||||||||

| 29,900,000 | USD | 0.31% due 10/12/2016 (d) | 29,896,462 | ||||||

| 50,000,000 | USD | 0.36% due 10/17/2016(d) | 49,991,098 | ||||||

| Walt Disney Co., | |||||||||

| 7,500,000 | USD | 0.41% due 11/4/2016 (d) | 7,496,741 | ||||||

| WEC Energy Group Inc., | |||||||||

| 12,900,000 | USD | 0.78% due 10/11/2016 (d) | 12,897,004 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | |||||||||

(Cost — $3,088,193,047) | 3,088,238,549 | ||||||||

| TOTAL INVESTMENTS — 99.1% | |||||||||

(Cost — $7,247,383,391) | 8,199,034,874 | ||||||||

| Other Assets In Excess of | |||||||||

Liabilities — 0.9% | 77,903,920 | ||||||||

| TOTAL NET ASSETS — 100.0% | $ | 8,276,938,794 | |||||||

| The IVA Worldwide Fund had the following open forward foreign currency contracts at September 30, 2016: | |||||||||

| USD | ||||||||||||||||||||

| SETTLEMENT | LOCAL | VALUE AT | NET | |||||||||||||||||

| FOREIGN | DATES | CURRENCY | USD | SEPTEMBER 30, | UNREALIZED | |||||||||||||||

| CURRENCY | COUNTERPARTY | THROUGH | AMOUNT | EQUIVALENT | 2016 | DEPRECIATION | ||||||||||||||

| Contracts to Sell: | ||||||||||||||||||||

| State Street | ||||||||||||||||||||

| Australian | Bank & | |||||||||||||||||||

dollar | Trust Co. | 12/05/2016 | AUD 96,944,000 | $ | 72,502,471 | $ | 74,093,316 | $ | (1,590,845 | ) | ||||||||||

| State Street | ||||||||||||||||||||

Bank & | ||||||||||||||||||||

| euro | Trust Co. | 12/05/2016 | EUR 115,748,000 | 129,602,862 | 130,384,262 | (781,400 | ) | |||||||||||||

| State Street | ||||||||||||||||||||

| Japanese | Bank & | |||||||||||||||||||

yen | Trust Co. | 12/05/2016 | JPY 17,790,300,000 | 172,312,827 | 175,873,942 | (3,561,115 | ) | |||||||||||||

| South | State Street | |||||||||||||||||||

Korean | Bank & | |||||||||||||||||||

won | Trust Co. | 10/07/2016 | KRW 168,497,000,000 | 150,701,956 | 152,975,455 | (2,273,499 | ) | |||||||||||||

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (8,206,859 | ) | |||||||||||||||||

| 20 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| Abbreviations used in this schedule: | ||

| ADR | — | American Depositary Receipt | |

| AUD | — | Australian dollar | |

| EUR | — | euro | |

| JPY | — | Japanese yen | |

| KRW | — | South Korean won | |

| SGD | — | Singapore dollar | |

| USD | — | United States dollar | |

| (a) | Non-income producing investment. | ||

| (b) | Issuer of the security is an affiliate of the IVA Worldwide Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA Worldwide Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. | ||

| Schedule of Affiliates | ||||||||||||||||||||||||||||

| SECURITY | SHARES HELD AT SEPTEMBER 30, 2015 | SHARE ADDITIONS | SHARE REDUCTIONS | SHARES HELD AT SEPTEMBER 30, 2016 | FAIR VALUE AT SEPTEMBER 30, 2016 | REALIZED GAIN/(LOSS) | DIVIDEND INCOME* | |||||||||||||||||||||

| Cosel Co., | ||||||||||||||||||||||||||||

Ltd.** | 2,065,000 | — | 420,500 | 1,644,500 | — | $ | (2,252,610 | ) | $ | 345,093 | ||||||||||||||||||

| DeVry | ||||||||||||||||||||||||||||

Education | ||||||||||||||||||||||||||||

Group Inc. | 8,245,489 | — | 1,677,694 | 6,567,795 | $ | 151,453,353 | (25,061,662 | ) | 2,844,285 | |||||||||||||||||||

| Icom Inc. | 944,700 | — | 186,500 | 758,200 | 14,998,759 | (1,713,464 | ) | 270,799 | ||||||||||||||||||||

| Miura Co., | ||||||||||||||||||||||||||||

Ltd.** | 5,708,800 | — | 5,708,800 | — | — | 31,215,265 | — | |||||||||||||||||||||

| Net 1 U.E.P.S. | ||||||||||||||||||||||||||||

Technologies | ||||||||||||||||||||||||||||

Inc. | 3,559,811 | — | 724,531 | 2,835,280 | 24,269,997 | 2,393,838 | — | |||||||||||||||||||||

| Total | $ | 190,722,109 | $ | 4,581,367 | $ | 3,460,177 | ||||||||||||||||||||||

| * | Dividend income is gross of withholding taxes. | ||

| ** | Non-affiliated at September 30, 2016. | ||

| (c) | Cumulative redeemable preferred stock. The date shown represents the first optional call date. | ||

| (d) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. | ||

| (e) | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. | ||

| (f) | Senior unsecured note. The first call date is April 15, 2017. |

| See Notes to Financial Statements. | 21 |

| IVA International Fund | IVA Funds |

| Performance (unaudited) | As of September 30, 2016 |

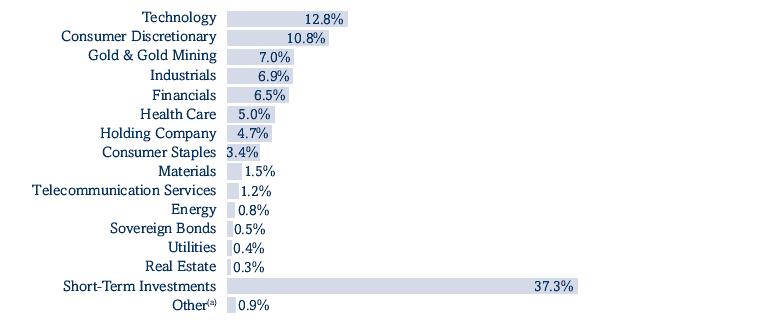

| Average Annual Total Returns as of September 30, 2016 | One Year | Five Year | Since Inception(a) | |||||||||

| Class A | 5.93 | % | 6.71 | % | 8.37 | % | ||||||

| Class A (with a 5% maximum initial sales charge) | 0.64 | % | 5.62 | % | 7.68 | % | ||||||

| Class C | 5.17 | % | 5.91 | % | 7.56 | % | ||||||

| Class I | 6.20 | % | 6.97 | % | 8.64 | % | ||||||

| MSCI All Country World (ex-U.S.) Index (Net)(b) | 9.26 | % | 6.04 | % | 3.94 | % | ||||||

| Consumer Price Index(c) | 1.45 | % | 1.23 | % | 1.21 | % | ||||||

| Growth of a $10,000 Initial Investment |

| (a) | The Fund commenced investment operations on October 1, 2008. | |

| (b) | The MSCI All Country World (ex-U.S.) Index (Net) is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. | |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. | |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2016. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. | |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. The gross and net expense ratios for the Fund are as follows: 1.25% (Class A shares); 2.00% (Class C shares); and 1.00% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2016. More recent expense ratios can be found in the Financial Highlights section of this Annual Report.

| 22 |

| IVA International Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of September 30, 2016 |

| Asset Allocation (As a Percent of Total Net Assets) |

| Sector Allocation (As a Percent of Total Net Assets) |

| Top 10 Positions (As a Percent of Total Net Assets)(b) | |

| Gold Bullion | 7.6 | % | |

| Samsung Electronics Co., Ltd. | 4.7 | % | |

| Astellas Pharma Inc. | 4.5 | % | |

| Nestlé SA | 2.7 | % | |

| News Corp., Class ‘A’, Class ‘B’ | 2.6 | % | |

| Alten SA | 2.2 | % | |

| Genting Malaysia Berhad | 1.8 | % | |

| Hyundai Mobis Co., Ltd. | 1.3 | % | |

| Antofagasta Plc | 1.2 | % | |

| Hongkong & Shanghai Hotels Ltd. | 1.2 | % | |

| Top 10 positions represent 29.8% of total net assets. | |||

| (a) | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

| 23 |

| IVA International Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| COMMON STOCKS - 53.9% | |||||||||

| Argentina | 0.0% | |||||||||

| 894 | Nortel Inversora SA, Series ‘B’, ADR | $ | 21,814 | ||||||

| Australia | 0.0% | |||||||||

| 1,380,029 | Programmed Maintenance Services Ltd. | 1,716,333 | |||||||

| Bermuda | 0.9% | |||||||||

| 1,059,026 | Jardine Strategic Holdings Ltd. | 34,630,150 | |||||||

| Canada | 0.3% | |||||||||

| 3,293,219 | Uranium Participation Corp. (a) | 9,839,871 | |||||||

| China | 2.5% | |||||||||

| 98,355 | Baidu, Inc., ADR (a) | 17,907,495 | |||||||

| 40,065,030 | Clear Media Ltd. (b) | 38,172,422 | |||||||

| 3,498,669 | Phoenix New Media Ltd., ADR (a) | 13,644,809 | |||||||

| 60,774,000 | Phoenix Satellite Television Holdings Ltd. | 12,771,597 | |||||||

| 110,297,000 | Springland International Holdings Ltd. | 18,201,764 | |||||||

| 100,698,087 | |||||||||

| France | 9.2% | |||||||||

| 1,253,460 | Alten SA | 87,638,495 | |||||||

| 2,206,728 | Altran Technologies SA | 32,622,673 | |||||||

| 12,564,730 | Bolloré SA | 43,684,630 | |||||||

| 1,914,694 | Bureau Veritas SA | 41,070,869 | |||||||

| 291,806 | DOM Security SA (b) | 13,538,144 | |||||||

| 1,487,919 | Engie SA | 23,049,335 | |||||||

| 187,236 | Euler Hermes Group | 15,917,884 | |||||||

| 28,772 | Financière de l’Odet SA | 23,274,358 | |||||||

| 81,926 | Robertet SA | 29,757,472 | |||||||

| 5,900 | Robertet SA-CI (c) | 1,564,317 | |||||||

| 306,687 | Séché Environnement SA | 10,438,854 | |||||||

| 177,354 | Sodexo SA | 21,118,434 | |||||||

| 219,073 | Thales SA | 20,177,372 | |||||||

| 30,477 | Wendel SA | 3,558,865 | |||||||

| 367,411,702 | |||||||||

| Germany | 0.8% | |||||||||

| 255,033 | Siemens AG | 29,852,379 | |||||||

| Hong Kong | 2.7% | |||||||||

| 41,158,000 | APT Satellite Holdings Ltd. | 28,494,980 | |||||||

| Asia Satellite Telecommunications | |||||||||

| 15,510,500 | Holdings Ltd. (a) | 21,396,827 | |||||||

| 1,932,386 | Henderson Land Development Co. Ltd. | 11,460,182 | |||||||

| 47,123,417 | Hongkong & Shanghai Hotels Ltd. | 46,780,763 | |||||||

| 108,132,752 | |||||||||

| 24 | See Notes to Financial Statements. |

| IVA International Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| India | 0.6% | |||||||||

| 432,763 | Bajaj Holdings and Investment Ltd. | $ | 12,369,300 | ||||||

| 36,092,522 | South Indian Bank Ltd. | 11,871,827 | |||||||

| 24,241,127 | |||||||||

| Indonesia | 0.3% | |||||||||

| 293,703,500 | PT Bank Bukopin Tbk | 13,727,617 | |||||||

| Japan | 14.8% | |||||||||

| 1,347,406 | Arcland Sakamoto Co., Ltd. | 15,001,443 | |||||||

| 552,600 | As One Corp. | 23,923,022 | |||||||

| 11,553,400 | Astellas Pharma Inc. | 179,273,950 | |||||||

| 1,349,300 | Azbil Corp. | 40,450,392 | |||||||

| 75,000 | The Bank of Okinawa Ltd. | 2,218,826 | |||||||

| 830,500 | Benesse Holdings Inc. | 21,080,884 | |||||||

| 1,269,700 | Cosel Co., Ltd. | 15,250,674 | |||||||

| 498,600 | Daiseki Co., Ltd. | 9,656,826 | |||||||

| 302,700 | Earth Chemical Co., Ltd. | 14,223,810 | |||||||

| 4,078,800 | F@N Communications, Inc. (b) | 29,805,146 | |||||||

| 178,300 | FANUC Corp. | 29,908,614 | |||||||

| 833,300 | Hi-Lex Corp. | 22,516,069 | |||||||

| 673,600 | Icom Inc. | 13,325,197 | |||||||

| 105,400 | Medikit Co., Ltd. | 4,620,117 | |||||||

| 260,200 | Miraca Holdings Inc. | 12,855,402 | |||||||

| 792,700 | Nitto Kohki Co., Ltd. | 18,456,335 | |||||||

| 273,300 | Okinawa Cellular Telephone Co. | 8,247,108 | |||||||

| 1,027,700 | Rohto Pharmaceutical Co., Ltd. | 17,583,546 | |||||||

| 174,200 | San-A Co., Ltd. | 8,675,213 | |||||||

| 295,100 | Sankyo Co., Ltd. | 10,010,788 | |||||||

| 10,600 | Secom Joshinetsu Co., Ltd. | 339,727 | |||||||

| 280,500 | Seven & i Holdings Co., Ltd. | 13,158,508 | |||||||

| 493,475 | Shingakukai Co., Ltd. | 2,491,585 | |||||||

| 306,950 | Shofu Inc. | 4,261,975 | |||||||

| 4,500 | SK Kaken Co., Ltd. | 473,054 | |||||||

| 554,500 | Techno Medica Co., Ltd. (b) | 8,809,225 | |||||||

| 648,100 | Toho Co., Ltd. | 21,346,620 | |||||||

| 259,400 | Transcosmos Inc. | 6,804,438 | |||||||

| 8,503,800 | Yahoo Japan Corp. | 33,711,628 | |||||||

| 224,300 | Yokogawa Electric Corp. | 2,952,917 | |||||||

| 591,433,039 | |||||||||

| Malaysia | 1.8% | |||||||||

| 65,578,000 | Genting Malaysia Berhad | 72,150,864 | |||||||

| Mexico | 0.1% | |||||||||

| 274,660 | Corporativo Fragua, SAB de CV | 3,031,356 | |||||||

| Singapore | 2.1% | |||||||||

| 27,783,600 | First Resources Ltd. | 37,283,851 | |||||||

| 7,013,020 | Haw Par Corp. Ltd. | 46,438,052 | |||||||

| 83,721,903 | |||||||||

| See Notes to Financial Statements. | 25 |

| IVA International Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| SHARES | DESCRIPTION | FAIR VALUE | |||||||

| South Africa | 0.5% | |||||||||

| 2,266,837 | Net 1 U.E.P.S. Technologies Inc. (a) | $ | 19,404,125 | ||||||

| South Korea | 6.8% | |||||||||

| 81,948 | Fursys Inc. | 2,429,384 | |||||||

| 204,828 | Hyundai Mobis Co., Ltd. | 51,144,232 | |||||||

| 201,455 | Hyundai Motor Co. | 24,785,175 | |||||||

| 165,120 | Kangwon Land, Inc. | 5,892,056 | |||||||

| 129,178 | Samsung Electronics Co., Ltd. | 187,430,376 | |||||||

| 271,681,223 | |||||||||

| Switzerland | 4.2% | |||||||||

| 365,408 | Compagnie Financière Richemont SA | 22,266,756 | |||||||

| 1,344,167 | Nestlé SA | 105,914,548 | |||||||

| 2,885,691 | UBS Group AG | 39,297,676 | |||||||

| 167,478,980 | |||||||||

| Thailand | 0.5% | |||||||||

| 31,211,100 | Thaicom PCL | 18,645,592 | |||||||

| United Kingdom | 3.2% | |||||||||

| 7,119,376 | Antofagasta Plc | 48,353,541 | |||||||

| 5,648,399 | HSBC Holdings Plc | 42,367,605 | |||||||

| 159,140 | Jardine Lloyd Thompson Group Plc | 2,087,444 | |||||||

| 5,853,788 | Millennium & Copthorne Hotels Plc | 33,005,119 | |||||||

| 1,357,451 | Mitie Group Plc | 3,374,643 | |||||||

| 129,188,352 | |||||||||

| United States | 2.6% | |||||||||

| 4,172,840 | News Corp., Class ‘A’ | 58,336,303 | |||||||

| 3,126,489 | News Corp., Class ‘B’ | 44,458,674 | |||||||

| 102,794,977 | |||||||||

| TOTAL COMMON STOCKS | |||||||||

(Cost — $1,912,667,964) | 2,149,802,243 | ||||||||

| PRINCIPAL | |||||||||

| AMOUNT | |||||||||

| CORPORATE NOTES & BONDS – 2.9% | |||||||||

| Norway | 0.3% | |||||||||

| Stolt-Nielsen Ltd., | |||||||||

| 77,500,000 | NOK | 5.83% due 3/19/2018 (c)(d) | 9,936,172 | ||||||

| Singapore | 0.3% | |||||||||

| DBS Capital Funding II Corp., | |||||||||

| 7,750,000 | SGD | 5.75% due 6/15/2018 (e) | 5,964,664 | ||||||

| United Overseas Bank Ltd., | |||||||||

| 8,250,000 | SGD | 4.9% due 7/23/2018 (e) | 6,254,628 | ||||||

| 12,219,292 | |||||||||

| South Africa | 0.6% | |||||||||

| Gold Fields Orogen Holding (BVI) Ltd., | |||||||||

| 23,118,000 | USD | 4.875% due 10/7/2020 (f) | 23,517,941 | ||||||

| 26 | See Notes to Financial Statements. |

| IVA International Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Switzerland | 0.1% | |||||||||

| 4,500,000 | EUR | UBS AG, 7.152% due 12/21/2017 (e) | $ | 5,439,885 | |||||

| United Kingdom | 0.3% | |||||||||

| Avanti Communications Group Plc, | |||||||||

| 12,136,000 | USD | 10% due 10/1/2019 (c)(f) | 9,708,800 | ||||||

| United States | 1.3% | |||||||||

| Intelsat Jackson Holdings Ltd.: | |||||||||

| 13,500,000 | USD | 7.5% due 4/1/2021 | 10,260,000 | ||||||

| 37,375,000 | USD | 5.5% due 8/1/2023 | 26,069,062 | ||||||

| Rowan Cos., Inc.: | |||||||||

| 17,838,000 | USD | 4.875% due 6/1/2022 | 15,162,300 | ||||||

| 1,990,000 | USD | 4.75% due 1/15/2024 | 1,631,800 | ||||||

| 53,123,162 | |||||||||

| TOTAL CORPORATE NOTES & BONDS | |||||||||

(Cost — $117,859,525) | 113,945,252 | ||||||||

| SOVEREIGN AND SUPRANATIONAL BONDS – 1.2% | |||||||||

| Luxembourg | 0.1% | |||||||||

| European Investment Bank, | |||||||||

| 37,500,000 | NOK | 1.125% due 5/15/2020 | 4,712,665 | ||||||

| Singapore | 1.1% | |||||||||

| Government of Singapore: | |||||||||

| 6,786,000 | SGD | 2.375% due 4/1/2017 | 5,014,400 | ||||||

| 26,781,000 | SGD | 0.5% due 4/1/2018 | 19,529,038 | ||||||

| 26,781,000 | SGD | 2.5% due 6/1/2019 | 20,402,421 | ||||||

| 44,945,859 | |||||||||

| TOTAL SOVEREIGN AND SUPRANATIONAL BONDS | |||||||||

(Cost — $50,092,947) | 49,658,524 | ||||||||

| OUNCES | |||||||||

| COMMODITIES – 7.6% | |||||||||

| 230,926 | Gold Bullion (a) | 304,281,526 | |||||||

| TOTAL COMMODITIES | |||||||||

(Cost — $323,023,521) | 304,281,526 | ||||||||

| PRINCIPAL | |||||||||

| AMOUNT | |||||||||

| SHORT-TERM INVESTMENTS – 34.1% | |||||||||

| Commercial Paper | 34.1% | |||||||||

| Abbott Laboratories: | |||||||||

| 20,000,000 | USD | 0.65% due 10/6/2016 (f) | 19,998,817 | ||||||

| 15,000,000 | USD | 0.6% due 10/7/2016 (f) | 14,998,950 | ||||||

| 42,100,000 | USD | 0.65% due 10/17/2016 (f) | 42,091,909 | ||||||

| 15,000,000 | USD | 0.67% due 10/21/2016 (f) | 14,996,325 | ||||||

| 13,900,000 | USD | 0.68% due 10/24/2016 (f) | 13,896,043 | ||||||

| See Notes to Financial Statements. | 27 |

| IVA International Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2016 |

| PRINCIPAL | |||||||||

| AMOUNT | DESCRIPTION | FAIR VALUE | |||||||

| Commercial Paper | 34.1% (continued) | |||||||||

| Apple Inc.: | |||||||||

| 20,000,000 | USD | 0.41% due 10/5/2016 (f) | $ | 19,998,956 | |||||

| 15,300,000 | USD | 0.44% due 10/21/2016 (f) | 15,296,448 | ||||||

| 12,700,000 | USD | 0.43% due 10/24/2016 (f) | 12,696,596 | ||||||

| 45,000,000 | USD | 0.46% due 11/7/2016 (f) | 44,980,002 | ||||||

| 30,500,000 | USD | Coca-Cola Co., 0.4% due 10/20/2016 (f) | 30,493,442 | ||||||

| Consolidated Edison Co. Inc., | |||||||||

| 10,000,000 | USD | 0.63% due 10/6/2016 (f) | 9,998,942 | ||||||

| Dover Corp.: | |||||||||

| 25,000,000 | USD | 0.6% due 10/3/2016 (f) | 24,999,229 | ||||||

| 16,700,000 | USD | 0.61% due 10/6/2016 (f) | 16,698,928 | ||||||

| 10,000,000 | USD | 0.65% due 10/18/2016 (f) | 9,997,800 | ||||||