| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | FORM N-CSR |

| | CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | Investment Company Act file number: 811-22211 |

|

|

| | IVA FIDUCIARY TRUST |

|

|

| (Exact name of registrant as specified in charter) |

| | 717 Fifth Avenue, 10th Floor, New York, NY 10022 |

|

|

| (Address of principal executive offices) (zip code) |

| | | Michael W. Malafronte |

| International Value Advisers, LLC |

| 717 Fifth Avenue |

| 10th Floor |

| New York, NY 10022 |

| | (Name and address of agent for service) |

| | Copy to: |

| | Michael S. Caccese, Esq. |

| K&L Gates LLP |

| State Street Financial Center |

| One Lincoln Street |

| Boston, Massachusetts 02111-2950 |

| | Brian F. Link, Esq. |

| State Street Bank and Trust Company |

| Mail Code: JHT 1593 |

| 200 Clarendon Street |

| Boston, MA 02116 |

| | | Registrant’s telephone number, including area code: (212) 584-3570 |

| | | Date of fiscal year end: September 30 |

| Date of reporting period: September 30, 2013 |

| Item 1. Report to Shareholders. |

| | |

|

|

|

| | |

IVA Worldwide Fund |

| | | IVA International Fund |

| | | |

| | | |

| | | |

| | | Annual Report |

| | | September 30, 2013 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Advised by International Value Advisers, LLC | | An investment in the Funds is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

| | 2 | | An Owner’s Manual |

| | 3 | | Letter from the President |

| | 4 | | Letter from the Portfolio Managers |

| | 7 | | Management’s Discussion of Fund Performance |

| | | | IVA Worldwide Fund |

| | 10 | | Performance |

| | 11 | | Portfolio Composition |

| | 12 | | Schedule of Investments |

| | | | IVA International Fund |

| | 22 | | Performance |

| | 23 | | Portfolio Composition |

| | 24 | | Schedule of Investments |

| | 32 | | Statements of Assets and Liabilities |

| | 33 | | Statements of Operations |

| | 34 | | Statements of Changes in Net Assets |

| | 35 | | Financial Highlights |

| | 41 | | Notes to Financial Statements |

| | 49 | | Report of Independent Registered Public Accounting Firm |

| | 50 | | Trustees and Officers |

| | 52 | | Additional Information |

| | 55 | | Fund Expenses |

| | 56 | | Important Tax Information |

| An Owner’s Manual | IVA Funds |

An Atypical Investment Strategy

We manage both the IVA Worldwide and IVA International Funds with a dual attempt that is unusual in the mutual fund world: in the short-term (12-18 months), our attempt is to try to preserve capital, while in the longer-term (5-10 years, i.e., over a full economic cycle), we attempt to perform better than the MSCI All Country World Index, in the case of your IVA Worldwide Fund, and the MSCI All Country World Ex-U.S. Index, in the case of your IVA International Fund.

The Worldwide Fund is typically used by investors who are looking for an “all weather fund” where we are given the latitude to decide how much we should have in the U.S. versus outside the U.S. The International Fund is typically used by investors who practice asset allocation and want to decide for themselves how much should be allocated to a domestic manager and how much should be allocated to a pure “international” (i.e., non-U.S.) manager, yet at the same time are looking for a lower risk – and lower volatility – exposure to international markets than may be obtained from a more traditional international fund.

We believe our investment approach is very different from the traditional approach of most mutual funds. We are trying to deliver returns that are as absolute as possible, i.e., returns that try to be as resilient as possible in down markets, while many of our competitors try to deliver good relative performance, i.e., try to beat an index, and thus would be fine with being down 15% if their benchmark is down 20%.

Why do we have such an unusual strategy (which, incidentally, is not easy to carry out)? Because we believe this strategy makes sense for many investors. We are fond of the quote by Mark Twain: “There are two times in a man’s life when he should not speculate: the first time is when he cannot afford to; the second time is when he can.” We realize that many investors cannot tolerate high volatility and appreciate that “life’s bills do not always come at market tops.” This strategy also appeals to us at International Value Advisers since we “eat our own cooking” for a significant part of our savings (invested in IVA products) and we have an extreme aversion to losing money.

An Eclectic Investment Approach

Here is how we try to implement our strategy:

| | | We don’t hug benchmarks. In practical terms, this means we are willing to make big “negative bets,” i.e., having nothing or little in what has become big in the benchmark. Conversely, we will generally seek to avoid overly large positive bets. |

| | | |

| | | We prefer having diversified portfolios (100 to 150 names). Because we invest on a global basis, we believe that diversification helps protect against weak corporate governance or insufficient disclosure, or simply against “unknown unknowns.” |

| | | |

| | | We like the flexibility to invest in small, medium and large companies, depending on where we see value. |

| | | |

| | | We attempt to capture equity-type returns through fixed income securities but predominantly when credit markets (or sub-sets of them) are depressed and offer this potential. |

| | | |

| | | We hold some gold, either in bullion form or via gold mining securities, as we feel it provides a good hedge in either an inflationary or deflationary period, and it can help mitigate currency debasement over time. |

| | | |

| | | We are willing to hold cash when we cannot find enough cheap securities that we like or when we find some, yet the broader market (Mr. Market) seems fully priced. We will seek to use that cash as ammunition for future bargains. |

| | | |

| | | At the individual security level, we ask a lot of questions about “what can go wrong?” and will establish not only a “base case intrinsic value” but also a “worst case scenario” (What could prove us wrong? If we were wrong, are we likely to lose 25%, 30%, or even more of the money invested?). As a result, we will miss some opportunities, yet hopefully, we will also avoid instances where we experience a permanent impairment of value. |

| Letter from the President | IVA Funds |

| Dear Shareholder,

Your two mutual funds, the IVA Worldwide Fund and the IVA International Fund (“the Funds”), recently completed their fifth year of operation with both Funds outperforming their respective benchmark. The Funds’ investment adviser, International Value Advisers, LLC, (“IVA”) is pleased with the performance of both Funds since inception October 1, 2008 through September 30, 2013. Both the IVA Worldwide Fund Class A shares, at net asset value, and the IVA International Fund Class A shares, at net asset value, have significantly outperformed their benchmarks since inception (the MSCI All Country World Index (Net) and the MSCI All Country World (ex-U.S.) Index (Net); respectively). You can find a newsletter on the IVA website (www.ivafunds.com) titled “Five Years in Review” that describes this period of time for the Funds.

When IVA was founded in October of 2007, our primary objective was to build a firm where each of our employees understood that all of the work they do is to benefit the shareholder or client. We then are able to manage our firm and our clients’ assets with a very simple philosophy; which is, there is a pecking order to everything we do: client, firm, colleague, and then partner. This is always the progression. We have learned that if the client is taken care of, the other three fall into place; i.e., everything has to benefit the client. |

This client focus is the reason why we soft closed our products in 2011. We want our investment team to be market capitalization and asset class agnostic. So while our soft close, in some cases, may pose some operational challenges for a few of our existing advisors and shareholders, we are confident that the long term benefits far outweigh the risk and mediocrity that seem inevitable if a firm with our investment strategy grows too large. History suggests that money management firms whose asset size gets too big can experience unintended negative consequences, such as seeing their performance revert to the mean.

On a personal level, it has been a rewarding experience to help build IVA. We hope that in the process we are shaping a culture where everyone associated with IVA respects the work we are doing for our clients.

I want to offer thanks to all of my colleagues and to our shareholders for their continued support.

Sincerely,

Michael W. Malafronte, President

Effective February 22, 2011, the IVA Worldwide Fund and IVA International Fund are closed to new investors.

| Letter from the Portfolio Managers | IVA Funds |

| October 31, 2013

Dear Shareholder,

First and foremost, we are proud and honored that we celebrated the five year anniversary of your IVA Funds at the close of this past quarter. As we explained in a recent newsletter (“Five Years in Review” October 2013, available on our website), our ability to protect on the downside was a large contributor to both our absolute and relative outperformance over this five-year period. Overall good stock picking equally played a significant part in achieving our goals. We are also privileged to work with a great team, both our investment team where we are helped by ten analysts and four traders, as well as our colleagues who support our overall business in operations, compliance, accounting, sales and marketing, human resources and technology. As for our clients who have entrusted their capital with our stewardship, we thank you for your support and allowing us to do what we love to do, and doing it in our idiosyncratic way. Come to think of it, we, too, are clients as the forty three of us working for International Value Advisers, LLC (“IVA”) have well north of $100 million of our own money in the Funds and other products we manage.

Over the period under review, October 1, 2012 to September 30, 2013, central banks around the world continued to drown markets in liquidity and manipulate government debt prices. In Japan, in particular, political changes led to the Bank of Japan (BoJ) announcing very aggressive “quantitative easing” exercises, buying long term Japanese government bonds as well as other assets.

Central banks have indeed been successful in lifting asset prices. As a result of both corporate profits reaching new highs around the world and price/earnings multiple expansion, the MSCI All Country World Index returned 17.73% over this same period, in spite of a correction late May and June 2013.

Even though we argued over the past year that equities would probably be the best house in a bad neighborhood, we have not been fully invested in equities and, in fact, we have reduced our allocation to equities and simultaneously raised our cash levels as the year progressed. We have refused to “walk the walk” because the “best house” argument remains a relative argument and we, at IVA, try to deliver returns that are as absolute as possible. Today there is a school of thought that holds that ultra-low interest rates (often negative in real terms, i.e. adjusted for inflation) eliminates the need for a value investor to insist on a reasonable margin of safety, justifying holding on to stocks when they become fully priced or buying new ones without much of a discount. The seductive appeal of this argument does not sit well with us and we accept the challenge of that heightened tension that exists today between protecting capital on one hand and preserving purchasing power on the other. We recently penned a newsletter (“The Optionality of Cash” June 2013, on our website) where we argue that cash can help protect the portfolio on the downside but can also act as dry powder to “pounce” once we find compelling bargains again. We welcomed the brief correction that took place from May 22, 2013 through late June 2013 and were able to do a little buying. But the rally has resumed and we have again become net sellers. Let us be clear: we do not intend to be “long term owners of cash” (Dylan Grice) and hope to exploit some of the volatility which we believe will be with us for a while.

In the “Management’s Discussion of Fund Performance” (pages 7-9 in this Annual Report) we quantify for both the IVA Worldwide Fund and the IVA International Fund how their respective equity components performed during this past fiscal year ended September 30, 2013. The significant outperformance this year, in contrast to the underperformance the previous year, illustrates vividly that individual stock picking is “alive and well,” even in |

| Letter from the Portfolio Managers | IVA Funds |

today’s world of globalization and increased correlations. We will simply reiterate what we wrote in last year’s Annual Report:

“…we believe that stock picking will make a big difference in this low return world for the foreseeable future, with a particular emphasis on trying to identify those companies that may maintain their high margins going forward and those that may not. That requires having a team of analysts whose work goes way beyond the number crunching and increasingly studies the finer qualitative aspects of a business. As Albert Einstein said, ‘not everything that can be counted counts, and not everything that counts can be counted.’”

We reckon that the economic prospects may be slowly improving for the U.S. economy, but note that the “patient” may no longer be on “life support” yet still needs “training wheels” (in the form of quantitative easing). Given the continued appreciation of U.S. stock indices, valuation is now quite steep among U.S. equities, especially if one allows for the fact that corporate profits are rather elevated.

In a recent speech to the Economic Club of New York, former Fed Chairman Paul Volcker recalled that he entered the system as a neophyte economist in 1949: “Most striking then, as now, the Federal Reserve was committed to maintaining a pattern of very low interest rates, ranging from close to zero at the short end to 2½ percent or less for Treasury bonds. If you feel a bit impatient about the situation now, quite understandably so, recall that the earlier episode lasted 15 years.” A propos today, Paul Volcker noted: “Beneficial effects of the actual and potential monetization of public and private debt, the essence of the quantitative easing program, appear limited and diminishing over time. The old “pushing on a string” analogy is relevant. The risks of encouraging speculative distortions and the inflationary potential of the current approach plainly deserve attention.”

In a story on Bloomberg News November 1, 2013 (“Federal Reserve’s bubble alarm stuck on snooze”), Jonathan Weil quotes Larry Fink (CEO of BlackRock Inc.): “…it is imperative that the Fed begins to taper… we have seen real bubble-like markets again”; Bill Gross (Pimco): “All risk asset prices are artificially high”; Netflix’s CEO Reed Hastings comparing his company’s stock performance with the “momentum – investor – fueled euphoria”; and Tesla’s CEO Elon Musk saying that his company had “a higher valuation than we have any right to deserve.”

We commented on Japan earlier (particularly a newsletter in March, “The Real Game Changer for Japanese Equities”). We are agnostic as to whether “Abenomics” will be successful but are very intrigued by the big changes we have seen in corporate Japan in terms of capital allocation: more and more dividends being raised; more and more stock buybacks and hopefully more corporate activity and willingness by management to pay a little more attention to shareholders than they have in the past. We trimmed our exposure there as the rally unfolded, and remain well hedged on our yen exposure.

Europe remains difficult for us. The eurozone economics are witnessing some degree of stability but many weaknesses remain (worsening public debt, costly credit, vulnerable banks…). While many crisis-hit economies have been able to go from big current account deficit situations to current account surplus, it remains unclear how sustainable these are. Additionally, in a Union where each Member carries veto powers, political changes play a large role that we find difficult, if not impossible, to handicap. We believe that the risk of an anti-euro government taking over in one member country continues to grow. Also, while job cuts have been significant, unit labor costs remain higher in Spain and Italy compared to those in Germany. Even Mario Draghi, the head of the European Central Bank (ECB), recently confessed to remaining “very, very cautious about the recovery. I cannot share the enthusiasm.” He added that the recovery was “weak, fragile and uneven and from low levels.” From a valuation level, what we find is a tale of two markets: banks,

| Letter from the Portfolio Managers | IVA Funds |

utilities and telecom companies have suffered tremendous and very fundamental setbacks since 2007 and are therefore down substantially, dragging indices down; while high quality, global companies headquartered in Europe tend to trade at all-time highs and be very pricey. In the middle you’ll find a number of cyclical companies with debt, usually not that cheap, and where balance sheets are far from pristine. We continue to look for opportunities in the Old Continent but without much success over the period.

Emerging markets have performed poorly over the period, which did not come as a surprise to us. We have had almost no direct investments in the BRIC countries (Brazil, Russia, India and China) in recent time. However, we made our first investment in Brazil over the period; we also added a few names listed in Hong Kong doing business exclusively in China. But these markets are not cheap enough for us to make large commitments. In China, in particular, we worry about massive misallocation of capital and a potentially moribund banking sector.

Despite the recent correction, we are finding no opportunities in high yield debt either. In fact, we are witnessing the mirror image of 2008-2009. At that time high yield bonds were offering very attractive opportunities, many with returns better than equities and with less risk. Our remaining high yield exposure is of short duration (overall less than 3 years) and is comprised mostly of remnants of investments made in previous years.

Gold has acted poorly since September 2011 – it topped around $1900/oz. Gold may be flagging more disinflation in the next few months, especially if China’s economic growth keeps decelerating. Gold is also reacting to the possibility that real interest rates may rise in the future in various currencies. We trimmed our gold exposure earlier in 2013 as our equity exposure kept going down while our cash levels were increasing. We are keeping our options open as to what to do next there, if anything. We are pleased to have avoided gold mining stocks as we grew increasingly alarmed by rising production costs in the industry.

In conclusion, we are encouraged by the performance of your Funds over the period despite being underinvested in equities. Stock picking has been good and our big picture views (being wary of China and emerging markets, for instance) were vindicated. Our focus remains on preservation of capital during these uncertain times, believing that one of the most effective ways to compound wealth over time is to minimize losses and drawdowns. Like Ulysses during his odyssey, we are determined to ignore the sirens. We will keep insisting on appropriate discounts when we buy and hold securities. While we realize that “the purgatory of low returns” (James Montier) is not fun, we think that the challenges associated with that environment are much harder for our end clients and for the advisers that help those clients than they are for us. On our end, we are simply trying to remain disciplined and opportunistic but certainly will not change our ways on the basis that “this time is different.” On the contrary, we think that following time tested rules and principles will help us navigate the environment we are in.

We appreciate your continued confidence and thank you for your support.

Charles de Vaulx, Chief Investment Officer and Portfolio Manager

Chuck de Lardemelle, Portfolio Manager

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

Global equity markets delivered double-digit gains over this one year period, propelled by artificially low interest rates resulting from quantitative easing, and record high corporate profit margins. Equity markets temporarily corrected from May 22, 2013 to late June 2013 when the Federal Reserve indicated it might scale back its bond buying program later this year if the U.S. economy continues to improve and the unemployment rate falls below 7%. This boosted the yield on the 10-year U.S. Treasury note from 1.63% in early-May 2013 to 2.62% on September 30, 2013.

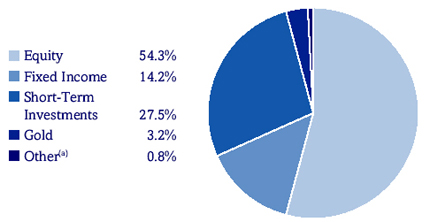

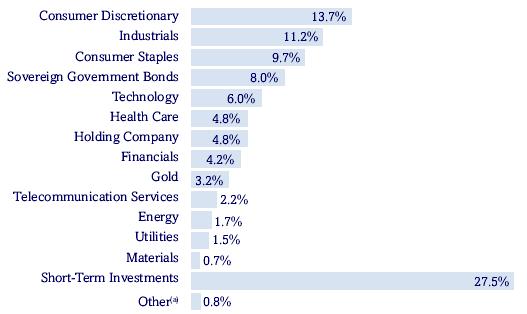

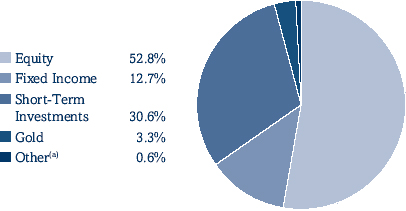

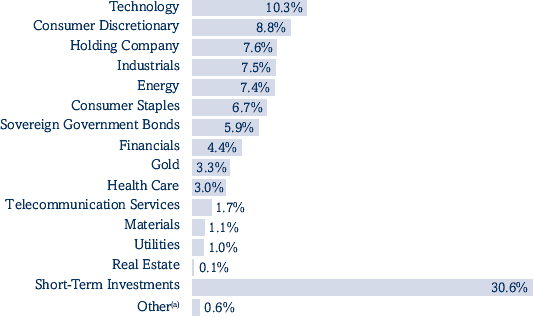

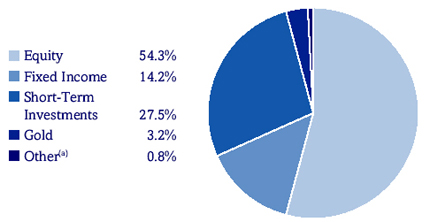

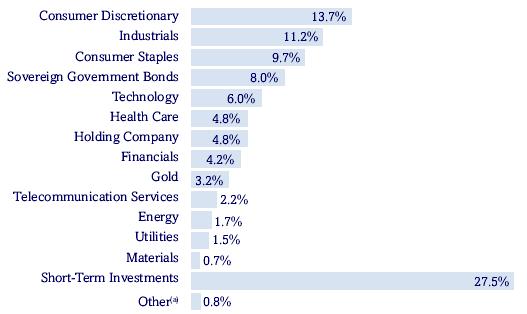

As global equity markets appreciated over this period and some of our holdings got closer to or even reached our intrinsic value estimate, we trimmed or sold out of those positions. This brought our total equity exposure down to 52.8% on September 30, 2013 from 63.0% on September 30, 2012 in the IVA Worldwide Fund, and to 54.3% from 57.1%, respectively, in the IVA International Fund. As a result, our total cash exposure rose in both Funds, to 30.6% in the IVA Worldwide Fund and to 27.5% in the IVA International Fund at period end. Even though both Funds were, on average, less than 60% invested in equities over this one year period, both Funds delivered solid absolute returns and kept close pace with their respective equity benchmark due to good stock picking.

Our Japanese equity exposure fell to 8.6% on September 30, 2013 from 12.1% on September 30, 2012 in the IVA Worldwide Fund and to 16.9% from 21.0%, respectively, in the IVA International Fund. Japanese equity markets have been rising since November 2012 when Shinzo Abe was reelected as Prime Minister with an agenda to pursue aggressive monetary policies to weaken the Japanese yen and engineer inflation. Over the period, we sold or reduced our exposure to a number of holdings (such as Temp Holdings Co., Ltd.).

In the IVA Worldwide Fund, our U.S. equity exposure fell to 24.1% at period end from 30.7% on September 30, 2012. We sold a few positions that we believe reached full valuation such as Applied Materials, Inc. and Texas Instruments Inc.

Even though we were net sellers of equities over the year, primarily in the U.S. and Japan, we found a few opportunities in emerging market equities, specifically in Brazil and China (through Hong Kong listed equities) and we increased our exposure to a South Korean holding, E-Mart Co., Ltd. We also increased our exposure to a few holdings that we view as high quality yet reasonably priced such as Nestlé SA in Switzerland and Oracle Corp. in the U.S.

We still view gold as a hedge against extreme outcomes, inflation or deflation, and it also helps to protect against the effects of currency debasement. Over the period we sold our small allocation to gold mining stocks, therefore our exposure at period end consisted solely of gold bullion. As our equity exposure came down and cash levels increased, we reduced our gold exposure over the period to 3.3% in IVA Worldwide and 3.2% in IVA International on September 30, 2013, from 5.2% in IVA Worldwide and 5.1% in IVA International on September 30, 2012. Over the year our exposure to gold was one of the largest detractors from both Funds’ returns. It detracted -1.9% from the IVA Worldwide Fund return and -2.0% from the IVA International Fund return.

Within fixed income, a few of our corporate bonds were called over the period, predominantly in the U.S., as most of our exposure is comprised of remnants of our investments from 2008/2009. Our corporate bond exposure totaled 6.8% of the IVA Worldwide Fund as of September 30, 2013 compared to 9.2% on September 30, 2012, and in the IVA International Fund, our exposure totaled 6.2% versus 7.3%, respectively.

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

IVA Worldwide Fund

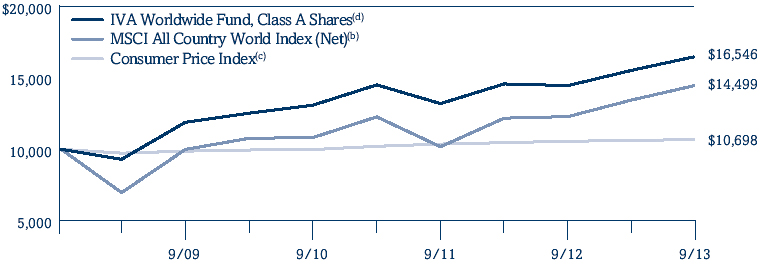

The IVA Worldwide Fund Class A, at net asset value, returned 14.02% over the one year period ending September 30, 2013 compared to the MSCI All Country World Index (Net) (the “Index”) return of 17.73% over the same period.

Because of good stock picking, particularly in the technology sector as well as the U.S. and France, our equities (ex-gold mining stocks) averaged a gain of 29.0% over the period versus the Index (ex-gold mining stocks) average return of 18.3%. By sector, our technology and industrials stocks contributed meaningfully to our return, adding 7.1%, due, in part, to solid gains from Bollore SA (industrials, France) and Temp Holdings Co., Ltd. (industrials, Japan). MasterCard Inc. Class ‘A’ (technology, U.S.) was also a key contributor to our return. There were no equity sectors that detracted from our return over the year, however, our significant underweight exposure to financials and health care stocks weighed on relative results. These two sectors added 7.4% to the Index return versus only 1.2% to the IVA Worldwide Fund return.

Geographically, our stocks in the U.S. and France added the most to our return, together 11.8% versus those in the Index adding 10.0%. We benefited from strong security selection in both countries (in particular our U.S. stocks averaged a return of 31.1% versus the Index at 19.2%) as well as overweight exposure to stocks in France. Berkshire Hathaway Inc. Class ‘A’, Class ‘B’ (holding company, U.S.) and The Washington Post Company Class ‘B’ (consumer discretionary, U.S.) were among our top five contributors to return. All equity countries contributed positively to our return this period, however, our Japanese equities underperformed those in the benchmark as we own mostly local, non-exporting stocks.

Within fixed income, our corporate bonds averaged a gain of 11.3% due to good performance from our Wendel bonds, which were among our top five contributors to return as they collectively added 0.6%. Our sovereign bonds averaged a return of -1.9% over the period and detracted about -0.1% from our return.

Our forward foreign currency contracts, which are used to hedge currency risk, contributed about 0.6% to our return, mainly due to our Japanese yen hedge which averaged 40% of our total yen exposure over the year.

The largest individual detractors from our return this period included: gold bullion (gold), IAMGOLD Corporation (gold mining), Benesse Holdings Inc. (consumer discretionary, Japan), Singapore government bonds (sovereign debt), Newcrest Mining Limited (gold mining), and Devon Energy Corp. (energy, U.S.).

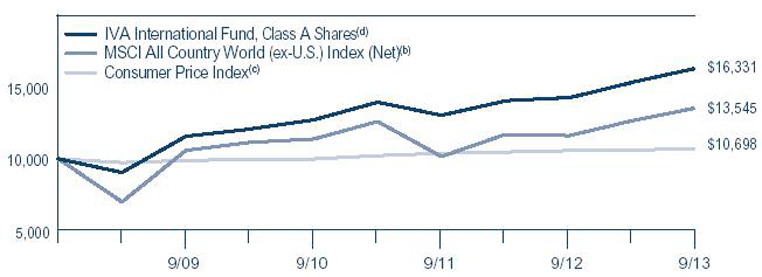

IVA International Fund

The IVA International Fund Class A, at net asset value, returned 14.09% over the one year period ending September 30, 2013 compared to the MSCI All Country World (ex-U.S.) Index (Net) (the “Index”) return of 16.48% over the same period.

Our equities (ex-gold mining stocks) averaged a return of 28.6% versus the Index (ex-gold mining stocks) average return of 17.5%. Security selection within the industrials sector was a significant plus, as these stocks collectively averaged a gain of 47.0% compared to the Index at 24.3%, and added 4.6% to our return. A number of the Fund’s top contributors to return were in this sector and included: Temp Holdings Co., Ltd. (industrials, Japan), Teleperformance SA (industrials, France), Bollore SA (industrials, France), and Financière de I’Odet SA (industrials, France). Because of our overweight exposure and strong performance, our consumer discretionary stocks added 3.7% to our return. All equity sectors contributed positively to our return over the period, however, our underweight exposure to the financials and health care sectors detracted from relative results as these two sectors added 7.4% to the Index return versus 1.4% to our return.

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

Our allocation to France provided the largest contribution to return, with our holdings averaging a return of 43.5% versus the Index average return of 32.0%, and added 6.5% to performance. This was led by good performance from a few industrials stocks mentioned above. Even though our Japanese equities underperformed those in the Index with an average return of 20.1% versus 31.5% respectively, as we own mostly local, non-exporting stocks, they still added 3.7% to our return in U.S. dollars. The only countries to detract from our return this period were India and Mexico, together almost -0.1%.

Within fixed income, our corporate bonds averaged a gain of 11.9% due to good performance from our Wendel bonds, which were among our top five contributors to return as they collectively added 0.5%. Our sovereign bonds averaged a return of -1.7% over the period and detracted about -0.2% from our return.

Our forward foreign currency contracts, which are used to hedge currency risk, contributed about 1.8% to our return, mainly due to our Japanese yen hedge which averaged 50% of our total yen exposure over the year.

The largest individual detractors from our return this period included: gold bullion (gold), IAMGOLD Corporation (gold mining), Benesse Holdings Inc. (consumer discretionary, Japan), Newcrest Mining Limited (gold mining), and Singapore government bonds (sovereign debt).

Investment Risks: There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

| IVA Worldwide Fund | IVA Funds |

| Performance (unaudited) | As of September 30, 2013 |

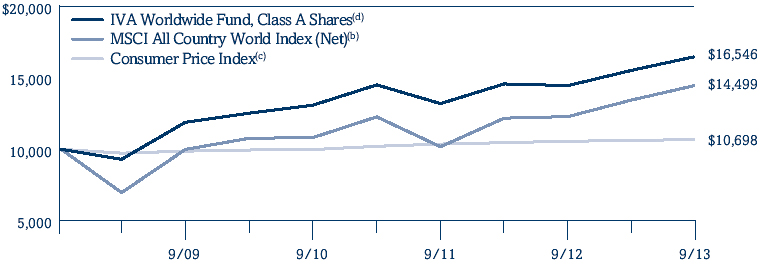

| Average Annual Total Returns as of September 30, 2013(a) | | One Year | | Five Year/

Since Inception(a) |

| | | | | |

| Class A | | | 14.02 | % | | | | 11.73 | % | |

| Class A (with a 5% maximum initial sales charge) | | | 8.33 | % | | | | 10.60 | % | |

| Class C | | | 13.13 | % | | | | 10.89 | % | |

| Class I | | | 14.28 | % | | | | 12.00 | % | |

| MSCI All Country World Index (Net)(b) | | | 17.73 | % | | | | 7.71 | % | |

| Consumer Price Index(c) | | | 1.18 | % | | | | 1.36 | % | |

| Growth of a $10,000 Initial Investment | |

| |

| (a) | The Fund commenced investment operations on October 1, 2008. |

| (b) | The MSCI All Country World Index (Net) is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2013. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. Shares redeemed within 30 days of purchase may be subject to a 2.00% redemption fee. The expense ratios for the Fund are as follows: 1.28% (Class A shares); 2.03% (Class C shares); and 1.03% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2013. More recent expense ratios can be found in the Financial Highlights section of this Annual Report.

| IVA Worldwide Fund | IVA Funds |

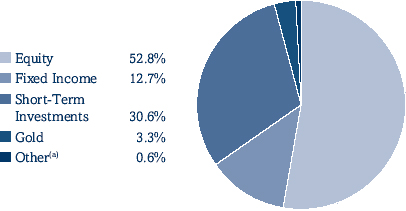

| Portfolio Composition (unaudited) | As of September 30, 2013 |

| Asset Allocation (As a Percent of Total Net Assets) | |

| Sector Allocation (As a Percent of Total Net Assets) | |

| Top 10 Positions (As a Percent of Total Net Assets)(b) | |

Government of Singapore, 3.625% due 7/1/2014, 2.875% due 7/1/2015, 3.75% due 9/1/2016 | | | 4.8 | % |

| |

Wendel, 4.875% due 5/26/2016, 4.375% due 8/9/2017, 6.75% due 4/20/2018 | | | 3.9 | % |

| |

| Gold Bullion | | | 3.3 | % |

| |

| Nestlé SA | | | 3.2 | % |

| |

| Astellas Pharma Inc. | | | 2.8 | % |

| |

| Berkshire Hathaway Inc., Class ‘A’, Class ‘B’ | | | 2.6 | % |

| |

| Devon Energy Corp. | | | 2.6 | % |

| |

| Genting Malaysia Berhad | | | 2.1 | % |

| |

| Oracle Corp. | | | 2.1 | % |

| |

| Expeditors International of Washington Inc. | | | 1.6 | % |

| |

| Top 10 positions represent 29.0% of total net assets. |

| (a) | Other represents unrealized gains and losses on options, forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| COMMON STOCKS – 51.7% | | | | |

| | | | | | | | | |

| Belgium | 0.3% | | | | | | | | |

| | | | 281,848 | | Sofina SA | | $ | 27,705,127 |

| |

| | | | | | | | | |

| |

| Brazil | 0.5% | | | | | | | | |

| | | | 3,105,414 | | Itaú Unibanco Holding SA, ADR | | | 43,848,446 |

| |

| | | | | | | | | |

| |

| China | 0.6% | | | | | | | | |

| | | | 15,826,640 | | Clear Media Ltd. (a) | | | 10,407,027 |

| |

| | | | 17,593,000 | | Digital China Holdings Ltd. | | | 21,549,208 |

| |

| | | | 25,576,000 | | Uni-President China Holdings Ltd. | | | 25,655,473 |

| |

| | | | | | | | | 57,611,708 |

| | | | | | | | |

| | | | | | | | | |

| |

| Denmark | 0.0% | | | | | | | | |

| | | | 105,523 | | D/S Norden A/S | | | 4,450,145 |

| |

| | | | | | | | | |

| |

| France | 7.2% | | | | | | | | |

| | | | 647,987 | | Alten | | | 27,745,324 |

| |

| | | | 175,516 | | Bolloré | | | 91,725,738 |

| |

| | | | 434,240 | | Cap Gemini SA | | | 25,830,695 |

| |

| | | | 603,762 | | Carrefour SA | | | 20,726,292 |

| |

| | | | 257,540 | | Ciments Français SA | | | 17,755,132 |

| |

| | | | 340,256 | | Eutelsat Communications Group, SA | | | 10,757,573 |

| |

| | | | 38,935 | | Financière de l’Odet SA | | | 39,238,925 |

| |

| | | | 69,300 | | Financière Marc de Lacharriere SA | | | 3,693,850 |

| |

| | | | 3,724,875 | | GDF Suez SA | | | 93,577,922 |

| |

| | | | 850,843 | | Lagardère SCA | | | 27,631,275 |

| |

| | | | 81,709 | | Publicis Groupe SA | | | 6,501,966 |

| |

| | | | 92,497 | | Robertet SA (a) | | | 18,645,057 |

| |

| | | | 60,007 | | Séché Environnement SA | | | 2,228,405 |

| |

| | | | 912,717 | | Sodexo SA | | | 85,162,060 |

| |

| | | | 935,034 | | Teleperformance | | | 45,235,011 |

| |

| | | | 672,369 | | Thales SA | | | 36,962,194 |

| |

| | | | 1,106,048 | | Total SA, ADR | | | 64,062,300 |

| | | | 2,010,186 | | Vivendi SA | | | 46,244,775 |

| |

| | | | | | | | | 663,724,494 |

| | | | | | | | |

| | | | | | | | | |

| |

| Germany | 0.6% | | | | | | | | |

| | | | 432,232 | | Siemens AG | | | 52,077,413 |

| |

| | | | 63,350 | | Wincor Nixdorf AG | | | 3,956,054 |

| |

| | | | | | | | | 56,033,467 |

| | | | | | | | |

| | | | | | | | | |

| |

| Japan | 8.6% | | | | | | | | |

| | | | 5,095,800 | | Astellas Pharma Inc. | | | 259,209,522 |

| |

| | | | 1,428,700 | | Azbil Corp. | | | 33,124,852 |

| |

| | | | 1,182,600 | | Benesse Holdings Inc. | | | 42,951,137 |

| |

| | | | 2,535,700 | | Cosel Co., Ltd. (a)(b) | | | 30,724,032 |

| |

| | | | 944,700 | | Icom Inc. (a)(b) | | | 22,326,040 |

| |

| | | | 770,470 | | Kose Corp. | | | 22,260,896 |

| |

| | | | 213,800 | | Medikit Co., Ltd. (a) | | | 7,177,781 |

| |

| 12 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| | | | | | | | | |

| |

| Japan | 8.6% (continued) | | | | | | | | |

| | | | 1,074,100 | | Meitec Corp. | | $ | 30,902,435 |

| |

| | | | 42,300 | | Milbon Co., Ltd. | | | 1,732,107 |

| |

| | �� | | 3,128,504 | | Miura Co., Ltd. (b) | | | 86,030,279 |

| |

| | | | 578,400 | | Nifco Inc. | | | 15,440,476 |

| |

| | | | 96,000 | | Nintendo Co., Ltd. | | | 10,870,136 |

| |

| | | | 183,800 | | Nitto Kohki Co., Ltd. | | | 3,444,322 |

| |

| | | | 1,184,300 | | NTT DoCoMo, Inc. | | | 19,181,094 |

| |

| | | | 436,900 | | Okinawa Cellular Telephone Co. | | | 11,103,069 |

| |

| | | | 1,162,900 | | Secom Co., Ltd. | | | 72,640,582 |

| |

| | | | 367,488 | | Shofu Inc. | | | 3,308,682 |

| |

| | | | 113,200 | | Sugi Holdings Co., Ltd. | | | 4,848,385 |

| |

| | | | 262,500 | | Techno Medica Co., Ltd. | | | 5,776,362 |

| |

| | | | 1,072,200 | | Temp Holdings Co., Ltd. | | | 27,029,977 |

| |

| | | | 2,110,600 | | Toho Co., Ltd. | | | 43,931,915 |

| |

| | | | 6,060,600 | | Yahoo Japan Corp. | | | 34,343,092 |

| |

| | | | | | | | | 788,357,173 |

| | | | | | | | |

| | | | | | | | | |

| |

| Malaysia | 2.1% | | | | | | | | |

| | | | 148,186,000 | | Genting Malaysia Berhad | | | 191,853,020 |

| |

| | | | | | | | | |

| |

| Norway | 0.7% | | | | | | | | |

| | | | 8,931,624 | | Orkla ASA | | | 65,057,187 |

| |

| | | | | | | | | |

| |

| Singapore | 0.0% | | | | | | | | |

| | | | 148,325 | | United Overseas Bank Ltd. | | | 2,443,807 |

| |

| | | | | | | | | |

| |

| South Africa | 0.8% | | | | | | | | |

| | | | 6,006,359 | | Net 1 U.E.P.S. Technologies Inc. (b)(c) | | | 72,136,372 |

| |

| | | | | | | | | |

| |

| South Korea | 2.6% | | | | | | | | |

| | | | 397,058 | | E-Mart Co., Ltd. | | | 89,411,251 |

| |

| | | | 1,745,970 | | Kangwon Land, Inc. | | | 46,302,506 |

| |

| | | | 37,054 | | Lotte Chilsung Beverage Co., Ltd. | | | 58,511,306 |

| |

| | | | 27,171 | | Lotte Confectionery Co., Ltd. | | | 43,107,502 |

| |

| | | | | | | | | 237,332,565 |

| | | | | | | | |

| | | | | | | | | |

| |

| Switzerland | 4.1% | | | | | | | | |

| | | | 68,115 | | APG SGA SA | | | 18,076,630 |

| |

| | | | 4,220,716 | | Nestlé SA | | | 295,195,761 |

| |

| | | | 116,420 | | Schindler Holding AG | | | 17,481,988 |

| |

| | | | 2,172,472 | | UBS AG | | | 44,441,568 |

| |

| | | | | | | | | 375,195,947 |

| | | | | | | | |

| | | | | | | | | |

| |

| Taiwan | 0.1% | | | | | | | | |

| | | | 2,561,000 | | Taiwan Secom Co., Ltd. | | | 6,132,472 |

| |

| | | | | | | | | |

| |

| United Kingdom | 0.5% | | | | | | | | |

| | | | 5,149,695 | | Millennium & Copthorne Hotels Plc | | | 46,269,497 |

| |

| See Notes to Financial Statements. | 13 |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| | | | | | | | | |

| |

| United States | 23.0% | | | | | | | | |

| | | | 1,237,876 | | Amdocs Ltd. | | $ | 45,355,777 |

| |

| | | | 2,398,368 | | Annaly Capital Management Inc. | | | 27,773,101 |

| |

| | | | 1,177,836 | | Aon Plc | | | 87,678,112 |

| |

| | | | 1,400,704 | | Baker Hughes Inc. | | | 68,774,566 |

| |

| | | | 1,339 | | Berkshire Hathaway Inc., Class ‘A’ (c) | | | 228,178,990 |

| |

| | | | 100,464 | | Berkshire Hathaway Inc., Class ‘B’ (c) | | | 11,403,669 |

| |

| | | | 505,024 | | Cimarex Energy Co. | | | 48,684,314 |

| |

| | | | 899,866 | | CVS Caremark Corp. | | | 51,067,395 |

| |

| | | | 4,088,040 | | Devon Energy Corp. | | | 236,125,190 |

| |

| | | | 1,847,155 | | DeVry Inc. | | | 56,449,057 |

| |

| | | | 1,044,320 | | Energen Corp. | | | 79,775,605 |

| |

| | | | 3,278,171 | | Expeditors International of Washington Inc. | | | 144,436,214 |

| |

| | | | 266,653 | | Goldman Sachs Group, Inc. | | | 42,187,171 |

| |

| | | | 79,863 | | Google Inc., Class ‘A’ (c) | | | 69,952,800 |

| |

| | | | 1,341,896 | | Hewlett-Packard Co. | | | 28,152,978 |

| |

| | | | 3,032,782 | | Ingram Micro Inc., Class ‘A’ (c) | | | 69,905,625 |

| |

| | | | 1,363,042 | | Liberty Interactive Corp., Series ‘A’ (c) | | | 31,990,596 |

| |

| | | | 690,229 | | Marsh & McLennan Cos., Inc. | | | 30,059,473 |

| |

| | | | 183,660 | | MasterCard Inc., Class ‘A’ | | | 123,562,775 |

| |

| | | | 2,999,705 | | Microsoft Corp. | | | 99,920,173 |

| |

| | | | 32,046 | | National CineMedia, Inc. | | | 604,387 |

| |

| | | | 273,079 | | News Corp., Class ‘B’ (c) | | | 4,486,688 |

| |

| | | | 1,082,005 | | Occidental Petroleum Corp. | | | 101,210,748 |

| |

| | | | 5,687,640 | | Oracle Corp. | | | 188,659,019 |

| |

| | | | 388,589 | | SEACOR Holdings Inc. | | | 35,143,989 |

| |

| | | | 668,659 | | Sealed Air Corp. | | | 18,180,838 |

| |

| | | | 3,645,033 | | Spansion, Inc., Class ‘A’ (b)(c) | | | 36,778,383 |

| |

| | | | 780,047 | | Telephone & Data Systems, Inc. | | | 23,050,389 |

| |

| | | | 149,199 | | The Washington Post Co., Class ‘B’ | | | 91,212,809 |

| |

| | | | 1,092,319 | | Twenty-First Century Fox Inc., Class ‘B’ | | | 36,483,455 |

| |

| | | | | | | | | 2,117,244,286 |

| | | | | | | | |

| | | | | | TOTAL COMMON STOCKS | | | |

| | | | | | (Cost — $3,665,267,691) | | | 4,755,395,713 |

| |

| | | | | | | | | |

| PREFERRED STOCKS – 0.7% |

| | | | | | | | | |

| |

| United States | 0.7% | | | | | | | | |

| | | | | | American Capital Agency Corp., | | | |

| | | 197,675 | USD | | Series ‘A’, 8% due 4/5/2017 (d) | | | 5,060,480 |

| |

| | | | | | Annaly Capital Management Inc.: | | | |

| | | 592,037 | USD | | Series ‘C’, 7.625% due 5/16/2017 (d) | | | 14,179,286 |

| |

| | | 722,129 | USD | | Series ‘D’, 7.5% due 9/13/2017 (d) | | | 16,933,925 |

| |

| | | | | | Apollo Residential Mortgage Inc., Series ‘A’, | | | |

| | | 371,500 | USD | | 8% due 9/20/2017 (d) | | | 8,574,220 |

| |

| | | | | | Capstead Mortgage Corp., Series ‘E’, | | | |

| | | 99,109 | USD | | 7.5% due 5/13/2018 (d) | | | 2,369,696 |

| |

| | | | | | CYS Investments Inc.: | | | |

| | | 13,221 | USD | | Series ‘A’, 7.75% due 8/3/2017 (d) | | | 298,530 |

| |

| | | 88,918 | USD | | Series ‘B’, 7.5% due 4/30/2018 (d) | | | 1,853,051 |

| |

| 14 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | | SHARES | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | | | | | | | | | |

| |

| United States | 0.7% (continued) | | | | | | | | | |

| | | | | | | Hatteras Financial Corp., Series ‘A’, | | | |

| | | | 556,125 | USD | | 7.625% due 8/27/2017 (d) | | $ | 12,679,650 |

| |

| | | | | | | MFA Financial Inc., Series ‘B’, | | | |

| | | | 74,302 | USD | | 7.5% due 4/15/2018 (d) | | | 1,708,946 |

| |

| | | | | | | TOTAL PREFERRED STOCKS | | | |

| | | | | | | (Cost — $64,989,926) | | | 63,657,784 |

| |

| | | | | | | | | | |

| CONVERTIBLE PREFERRED STOCK – 0.4% |

| | | | | | | | | | |

| |

| United States | 0.4% | | | | | | | | | |

| | | | | | | Bank of America Corp., | | | |

| | | | 36,288 | USD | | Series ‘L’, 7.25% | | | 39,191,040 |

| |

| | | | | | | TOTAL CONVERTIBLE | | | |

| | | | | | | PREFERRED STOCK | | | |

| | | | | | | (Cost — $28,023,838) | | | 39,191,040 |

| |

| | | PRINCIPAL | | | | | | |

| | | AMOUNT | | | | | | |

| | | | | | | | | | |

| CORPORATE NOTES & BONDS – 6.8% |

| | | | | | | | | | |

| |

| France | 3.9% | | | | | | | | | |

| | | | | | | Wendel: | | | |

| | | | 35,100,000 | EUR | | 4.875% due 5/26/2016 (e) | | | 50,220,190 |

| |

| | | | 116,950,000 | EUR | | 4.375% due 8/9/2017 | | | 165,572,898 |

| |

| | | | 95,400,000 | EUR | | 6.75% due 4/20/2018 | | | 145,549,596 |

| |

| | | | | | | | | | 361,342,684 |

| | | | | | | | | |

| | | | | | | | | | |

| |

| Norway | 0.3% | | | | | | | | | |

| | | | | | | Golden Close Maritime Corp. Ltd., | | | |

| | | | 24,489,696 | USD | | 11% due 12/9/2015 (a) | | | 25,928,466 |

| |

| | | | | | | | | | |

| |

| Switzerland | 0.3% | | | | | | | | | |

| | | | 8,800,000 | EUR | | UBS AG, 7.152% due 12/21/2017 (f) | | | 13,169,999 |

| |

| | | | | | | UBS Preferred Funding Trust V, | | | |

| | | | 8,892,000 | USD | | 6.243% due 5/15/2016 (f) | | | 9,503,325 |

| |

| | | | | | | | | | 22,673,324 |

| | | | | | | | | |

| | | | | | | | | | |

| |

| United Kingdom | 0.2% | | | | | | | | | |

| | | | | | | Inmarsat Finance Plc, | | | |

| | | | 19,300,000 | USD | | 7.375% due 12/1/2017 (e) | | | 20,313,250 |

| |

| | | | | | | | | | |

| |

| United States | 2.1% | | | | | | | | | |

| | | | | | | Brandywine Operating Partnership, LP, | | | |

| | | | 6,070,000 | USD | | 5.7% due 5/1/2017 | | | 6,697,893 |

| |

| | | | | | | Cloud Peak Energy Resources LLC, | | | |

| | | | 18,309,000 | USD | | 8.5% due 12/15/2019 | | | 19,865,265 |

| |

| | | | | | | Intelsat Luxembourg SA, | | | |

| | | | 24,975,000 | USD | | 7.75% due 6/1/2021 (e) | | | 25,942,781 |

| |

| | | | | | | Leucadia National Corp., | | | |

| | | | 3,418,000 | USD | | 8.125% due 9/15/2015 | | | 3,802,525 |

| |

| | | | | | | Level 3 Financing Inc., | | | |

| | | | 1,740,000 | USD | | 10% due 2/1/2018 | | | 1,870,500 |

| |

| See Notes to Financial Statements. | 15 |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | PRINCIPAL | | | | | | |

| | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | | | | | | | | | |

| |

| United States | 2.1% (continued) | | | | | | | | | |

| | | | | | | MetroPCS Wireless Inc., | | | |

| | | | 6,961,000 | USD | | 7.875% due 9/1/2018 | | $ | 7,552,685 |

| |

| |

| | | | | | | MFA Financial Inc., | | | |

| | | | 26,434 | USD | | 8% due 4/15/2042 (g) | | | 671,159 |

| |

| | | | | | | Mohawk Industries Inc., | | | |

| | | | 37,016,000 | USD | | 6.375% due 1/15/2016 (h) | | | 40,856,410 |

| |

| | | | | | | QVC Inc., | | | |

| | | | 31,121,000 | USD | | 7.5% due 10/1/2019 (e) | | | 33,499,765 |

| |

| | | | | | | Sealed Air Corp., | | | |

| | | | 38,288,000 | USD | | 8.125% due 9/15/2019 (e) | | | 42,882,560 |

| |

| | | | | | | Vulcan Materials Co., | | | |

| | | | 6,660,000 | USD | | 7% due 6/15/2018 | | | 7,542,450 |

| |

| | | | | | | | | | 191,183,993 |

| | | | | | | | | |

| | | | | | | TOTAL CORPORATE NOTES & BONDS | | | |

| | | | | | | (Cost — $544,981,242) | | | 621,441,717 |

| |

| | | | | | | | | | |

| SOVEREIGN GOVERNMENT BONDS – 5.9% | | | | | |

| | | | | | | | | | |

| |

| Hong Kong | 1.0% | | | | | | | | | |

| | | | | | | Government of Hong Kong, | | | |

| | | | 669,700,000 | HKD | | 1.52% due 12/21/2015 | | | 88,517,936 |

| |

| | | | | | | | | | |

| |

| Singapore | 4.8% | | | | | | | | | |

| | | | | | | Government of Singapore: | | | |

| |

| | | | 146,342,000 | SGD | | 3.625% due 7/1/2014 | | | 119,553,791 |

| |

| | | | 194,412,000 | SGD | | 2.875% due 7/1/2015 | | | 161,841,811 |

| |

| | | | 188,328,000 | SGD | | 3.75% due 9/1/2016 | | | 164,558,936 |

| |

| | | | | | | | | | 445,954,538 |

| | | | | | | | | |

| | | | | | | | | | |

| |

| Taiwan | 0.1% | | | | | | | | | |

| | | | | | | Government of Taiwan, | | | |

| | | | 349,300,000 | TWD | | 2% due 7/20/2015 | | | 12,074,507 |

| |

| | | | | | | TOTAL SOVEREIGN GOVERNMENT BONDS | | |

| | | | | | | (Cost — $541,346,663) | | | 546,546,981 |

| |

| | | | OUNCES | | | | | | |

| | | | | | | | | | |

| COMMODITIES – 3.3% | | | | | | | | | |

| | | | 226,914 | | | Gold Bullion (c) | | | 301,344,659 |

| |

| | | | | | | TOTAL COMMODITIES | | | |

| | | | | | | (Cost — $337,823,164) | | | 301,344,659 |

| |

| | | | PRINCIPAL | | | | | | |

| | | | AMOUNT | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENTS – 30.6% | | | | | |

| | | | | | | | | | |

| |

| Commercial Paper | 30.2% | | | | | | | | | |

| | | | | | | Air Liquide US LLC: | | | |

| | | | 63,000,000 | USD | | 0.09% due 10/7/2013 (e) | | | 62,999,055 |

| |

| | | | 65,000,000 | USD | | 0.08% due 10/23/2013 (e) | | | 64,996,822 |

| |

| 16 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | PRINCIPAL | | | | | | |

| | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | | | | | | | | | |

| |

| Commercial Paper | 30.2% (continued) | | | | | | | | | |

| | | | | | | American Honda Finance Corp., | | | |

| | | | 35,000,000 | USD | | 0.09% due 10/7/2013 (e) | | $ | 34,999,475 |

| |

| | | | 15,000,000 | USD | | AT&T Inc., 0.24% due 10/28/2013 (e) | | | 14,997,300 |

| |

| | | | 15,200,000 | USD | | Coca-Cola Co., 0.04% due 10/4/2013 (e) | | | 15,199,949 |

| |

| | | | | | | Coca-Cola Enterprises, Inc.: | | | |

| | | | 13,500,000 | USD | | 0.16% due 10/1/2013 (e) | | | 13,500,000 |

| |

| | | | 13,100,000 | USD | | 0.16% due 10/7/2013 (e) | | | 13,099,651 |

| |

| | | | 30,700,000 | USD | | 0.16% due 10/28/2013 (e) | | | 30,696,316 |

| |

| | | | | | | Consolidated Edison Co. Inc.: | | | |

| | | | 38,700,000 | USD | | 0.2% due 10/3/2013 (e) | | | 38,699,570 |

| |

| | | | 58,600,000 | USD | | 0.2% due 10/7/2013 (e) | | | 58,598,047 |

| |

| | | | 19,000,000 | USD | | 0.2% due 10/9/2013 (e) | | | 18,999,156 |

| |

| | | | 19,300,000 | USD | | 0.2% due 10/10/2013 (e) | | | 19,299,035 |

| |

| | | | | | | Devon Energy Corp., | | | |

| | | | 40,000,000 | USD | | 0.16% due 10/21/2013 (e) | | | 39,996,444 |

| |

| | | | | | | Diageo Capital Plc: | | | |

| | | | 60,000,000 | USD | | 0.17% due 10/7/2013 (e) | | | 59,998,300 |

| |

| | | | 65,000,000 | USD | | 0.19% due 10/10/2013 (e) | | | 64,996,913 |

| |

| | | | 40,000,000 | USD | | 0.18% due 10/15/2013 (e) | | | 39,997,200 |

| |

| | | | | | | E.I. du Pont de Nemours & Co.: | | | |

| | | | 25,000,000 | USD | | 0.05% due 10/9/2013 (e) | | | 24,999,722 |

| |

| | | | 10,200,000 | USD | | 0.05% due 10/21/2013 (e) | | | 10,199,717 |

| |

| | | | | | | Electricité de France SA: | | | |

| | | | 50,000,000 | USD | | 0.13% due 10/9/2013 (e) | | | 49,998,556 |

| |

| | | | 33,796,000 | USD | | 0.18% due 10/28/2013 (e) | | | 33,791,438 |

| |

| | | | 50,000,000 | USD | | 0.1% due 10/30/2013 (e) | | | 49,995,972 |

| |

| | | | 50,000,000 | USD | | 0.14% due 11/27/2013 (e) | | | 49,988,917 |

| |

| | | | 4,000,000 | USD | | 0.21% due 1/10/2014 (e) | | | 3,997,439 |

| |

| | | | | | | GDF Suez SA: | | | |

| | | | 25,000,000 | USD | | 0.19% due 10/7/2013 (e) | | | 24,999,208 |

| |

| | | | 11,500,000 | USD | | 0.18% due 10/15/2013 (e) | | | 11,499,195 |

| |

| | | | 36,000,000 | USD | | 0.18% due 10/16/2013 (e) | | | 35,997,300 |

| |

| | | | | | | Google Inc.: | | | |

| | | | 11,300,000 | USD | | 0.03% due 10/16/2013 (e) | | | 11,299,859 |

| |

| | | | 24,100,000 | USD | | 0.03% due 10/25/2013 (e) | | | 24,099,518 |

| |

| | | | | | | Johnson & Johnson: | | | |

| | | | 6,000,000 | USD | | 0.03% due 10/4/2013 (e) | | | 5,999,985 |

| |

| | | | 20,000,000 | USD | | 0.03% due 10/7/2013 (e) | | | 19,999,900 |

| |

| | | | 20,000,000 | USD | | 0.03% due 10/10/2013 (e) | | | 19,999,850 |

| |

| | | | 50,000,000 | USD | | 0.03% due 10/18/2013 (e) | | | 49,999,292 |

| |

| | | | 13,500,000 | USD | | 0.03% due 10/21/2013 (e) | | | 13,499,775 |

| |

| | | | | | | L’Oréal USA Inc.: | | | |

| | | | 15,000,000 | USD | | 0.04% due 10/8/2013 (e) | | | 14,999,883 |

| |

| | | | 20,000,000 | USD | | 0.04% due 10/9/2013 (e) | | | 19,999,822 |

| |

| | | | 17,500,000 | USD | | 0.04% due 10/16/2013 (e) | | | 17,499,708 |

| |

| | | | 14,600,000 | USD | | 0.04% due 10/17/2013 (e) | | | 14,599,740 |

| |

| | | | 20,000,000 | USD | | 0.04% due 10/22/2013 (e) | | | 19,999,533 |

| |

| See Notes to Financial Statements. | 17 |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | PRINCIPAL | | | | | | |

| | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | | | | | | | | | |

| |

| Commercial Paper | 30.2% (continued) | | | | | | | | | |

| | | | | | | Merck & Co. Inc., | | | |

| | | | 19,000,000 | USD | | 0.04% due 10/22/2013, (e) | | $ | 18,999,557 |

| |

| | | | | | | Mondelez International Inc.: | | | |

| | | | 35,000,000 | USD | | 0.23% due 10/23/2013 (e) | | | 34,995,081 |

| |

| | | | 64,200,000 | USD | | 0.23% due 10/24/2013 (e) | | | 64,190,566 |

| |

| | | | 38,000,000 | USD | | 0.23% due 10/25/2013 (e) | | | 37,994,173 |

| |

| | | | 20,000,000 | USD | | 0.27% due 11/6/2013 (e) | | | 19,994,600 |

| |

| | | | 29,700,000 | USD | | 0.26% due 11/7/2013 (e) | | | 29,692,063 |

| |

| | | | 20,300,000 | USD | | 0.27% due 11/7/2013 (e) | | | 20,294,367 |

| |

| | | | | | | Nestlé Capital Corp.: | | | |

| | | | 75,000,000 | USD | | 0.01% due 10/29/2013 (e) | | | 74,999,417 |

| |

| | | | 80,000,000 | USD | | 0.03% due 12/3/2013 (e) | | | 79,995,592 |

| |

| | | | 20,000,000 | USD | | 0.03% due 12/4/2013 (e) | | | 19,998,844 |

| |

| | | | 25,000,000 | USD | | 0.02% due 12/5/2013 (e) | | | 24,998,532 |

| |

| | | | 31,600,000 | USD | | 0.03% due 12/6/2013 (e) | | | 31,598,117 |

| |

| | | | | | | Nestle Finance International Ltd.: | | | |

| | | | 20,000,000 | USD | | 0.05% due 10/16/2013 | | | 19,999,583 |

| |

| | | | 10,000,000 | USD | | 0.06% due 10/25/2013 | | | 9,999,600 |

| |

| | | | 76,000,000 | USD | | 0.05% due 10/28/2013 | | | 75,997,150 |

| |

| | | | | | | NetJets Inc., | | | |

| | | | 16,500,000 | USD | | 0.03% due 10/2/2013 (e) | | | 16,499,986 |

| |

| | | | | | | Novartis Finance Corp., | | | |

| | | | 60,000,000 | USD | | 0.05% due 10/2/2013 (e) | | | 59,999,917 |

| |

| | | | | | | Orange & Rockland Utilities Inc., | | | |

| | | | 3,300,000 | USD | | 0.2% due 10/3/2013 (e) | | | 3,299,963 |

| |

| | | | | | | Philip Morris International Inc.: | | | |

| | | | 25,700,000 | USD | | 0.06% due 10/16/2013 (e) | | | 25,699,357 |

| |

| | | | 50,000,000 | USD | | 0.04% due 10/17/2013 (e) | | | 49,999,111 |

| |

| | | | | | | Praxair Inc.: | | | |

| | | | 20,000,000 | USD | | 0.02% due 10/3/2013 | | | 19,999,978 |

| |

| | | | 47,447,000 | USD | | 0.02% due 10/4/2013 | | | 47,446,921 |

| |

| | | | 2,500,000 | USD | | 0.05% due 10/16/2013 | | | 2,499,948 |

| |

| | | | 52,900,000 | USD | | 0.03% due 10/17/2013 | | | 52,899,295 |

| |

| | | | | | | Procter & Gamble Co., | | | |

| | | | 25,000,000 | USD | | 0.05% due 10/2/2013 (e) | | | 24,999,965 |

| |

| | | | | | | Reed Elsevier Plc: | | | |

| | | | 25,000,000 | USD | | 0.12% due 10/1/2013 (e) | | | 25,000,000 |

| |

| | | | 25,000,000 | USD | | 0.17% due 10/4/2013 (e) | | | 24,999,646 |

| |

| | | | 11,700,000 | USD | | 0.2% due 10/7/2013 (e) | | | 11,699,610 |

| |

| | | | 35,000,000 | USD | | 0.17% due 10/15/2013 (e) | | | 34,997,686 |

| |

| | | | | | | Roche Holding Inc.: | | | |

| | | | 50,000,000 | USD | | 0.03% due 10/15/2013 (e) | | | 49,999,417 |

| |

| | | | 50,000,000 | USD | | 0.03% due 10/16/2013 (e) | | | 49,999,375 |

| |

| | | | 15,900,000 | USD | | 0.03% due 10/17/2013 (e) | | | 15,899,788 |

| |

| | | | 25,000,000 | USD | | 0.02% due 10/18/2013 (e) | | | 24,999,764 |

| |

| | | | 30,000,000 | USD | | 0.05% due 10/24/2013 (e) | | | 29,999,042 |

| |

| 18 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | PRINCIPAL | | | | | | |

| | | AMOUNT | | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | | |

| | | | | | | | | | |

| |

| Commercial Paper | 30.2% (continued) | | | | | | | | | |

| | | | | | | Telstra Corp. Ltd., | | | |

| | | | 20,000,000 | USD | | 0.12% due 11/25/2013 (e) | | $ | 19,996,333 |

| |

| | | | | | | United Parcel Service, Inc.: | | | |

| |

| | | | 50,000,000 | USD | | 0.02% due 10/1/2013 (e) | | | 50,000,000 |

| |

| | | | 50,000,000 | USD | | 0.01% due 10/10/2013 (e) | | | 49,999,875 |

| |

| | | | 35,000,000 | USD | | 0.055% due 10/11/2013 (e) | | | 34,999,465 |

| |

| | | | 50,000,000 | USD | | 0.001% due 10/15/2013 (e) | | | 49,999,981 |

| |

| | | | | | | Vodafone Group Plc: | | | |

| | | | 10,000,000 | USD | | 0.2% due 10/22/2013 (e) | | | 9,998,833 |

| |

| | | | 5,000,000 | USD | | 0.3% due 1/2/2014 (e) | | | 4,995,887 |

| |

| | | | 2,500,000 | USD | | 0.3% due 1/3/2014 (e) | | | 2,497,909 |

| |

| | | | | | | Wal-Mart Stores, Inc.: | | | |

| | | | 80,000,000 | USD | | 0.05% due 10/2/2013 (e) | | | 79,999,889 |

| |

| | | | 80,000,000 | USD | | 0.04% due 10/8/2013 (e) | | | 79,999,378 |

| |

| | | | 10,300,000 | USD | | 0.04% due 10/17/2013 (e) | | | 10,299,817 |

| |

| | | | 12,000,000 | USD | | 0.05% due 10/28/2013 (e) | | | 11,999,550 |

| |

| | | | 55,000,000 | USD | | 0.06% due 10/28/2013 (e) | | | 54,997,525 |

| |

| | | | 29,000,000 | USD | | 0.05% due 10/30/2013 (e) | | | 28,998,832 |

| |

| | | | 14,700,000 | USD | | 0.06% due 11/13/2013 (e) | | | 14,698,946 |

| |

| | | | | | | Walt Disney Co., | | | |

| | | | 24,927,000 | USD | | 0.06% due 11/20/2013 (e) | | | 24,924,923 |

| |

| | | | | | | | | | 2,781,630,716 |

| | | | | | | | | |

| | | | | | | | | | |

| |

| Treasury Bills | 0.4% | | | | | | | | | |

| | | | | | | United States Treasury Bill, | | | |

| | | | 34,281,000 | USD | | due 12/5/2013 (i) | | | 34,280,691 |

| |

| | | | | | | TOTAL SHORT-TERM INVESTMENTS | | |

| | | | | | | (Cost — $2,815,912,368) | | | 2,815,911,407 |

| |

| | | | | | | TOTAL INVESTMENTS — 99.4% | | | |

| | | | | | | (Cost — $7,998,344,892) | | | 9,143,489,301 |

| |

| | | | | | | Other Assets In Excess of Liabilities — 0.6% | | | 59,028,482 |

| |

| | | | | | | TOTAL NET ASSETS — 100.0% | | $ | 9,202,517,783 |

| | | | | | | | | |

| | | | | | | | | | |

| |

| Schedule of Written Put Options – (0.0%) | | | | | | | | | | |

| | | | | | | EXPIRATION | | | STRIKE | | | | FAIR | |

| CONTRACTS | | | DESCRIPTION | | | DATE | | | PRICE | | | | VALUE | |

| |

| (327) | | | Apple, Inc. | | | 1/17/2015 | | $ | 430.00 | | | $ | (1,536,083 | ) |

| |

| (422) | | | Apple, Inc. | | | 1/17/2015 | | | 440.00 | | | | (2,185,960 | ) |

| |

| | | | | | | Total Written Put Options | | | | | |

| | | | | | | (Premiums received — $5,976,952) | | | $ | (3,722,043 | ) |

| |

| See Notes to Financial Statements. | 19 |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2013 |

|

The IVA Worldwide Fund had the following open forward foreign currency contracts at September 30, 2013:

| | | | | | | | | | | | | | USD | | | | |

| | | | | | | SETTLEMENT | | LOCAL | | | | | VALUE AT | | NET |

| FOREIGN | | | | | | DATES | | CURRENCY | | USD | | SEPTEMBER 30, | | UNREALIZED |

| CURRENCY | | | COUNTERPARTY | | | THROUGH | | AMOUNT | | EQUIVALENT | | 2013 | | DEPRECIATION |

| |

| Contracts to Sell: | | | | | | | | | | | | | | | |

| | | | State Street | | | | | | | | | | | | | | | | |

| euro | | | Bank & Trust Co. | | | 12/05/2013 | | EUR 338,980,000 | | $ | 446,327,045 | | $ | 458,667,104 | | | $ | (12,340,059 | ) |

| |

| | | | State Street | | | | | | | | | | | | | | | | |

Japanese yen | | | Bank & Trust Co. | | | 12/05/2013 | | JPY 39,674,200,000 | | | 397,804,692 | | | 403,773,208 | | �� | | (5,968,516 | ) |

| |

South Korean won | | | State Street

Bank & Trust Co. | | | 10/07/2013 | | KRW 76,229,000,000 | | | 69,136,488 | | | 70,899,406 | | | | (1,762,918 | ) |

| |

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | | | $ | (20,071,493 | ) |

| |

Abbreviations used in this schedule:

| ADR | — | American Depositary Receipt |

| EUR | — | euro |

| HKD | — | Hong Kong dollar |

| JPY | — | Japanese yen |

| KRW | — | South Korean won |

| SGD | — | Singapore dollar |

| TWD | — | Taiwan dollar |

| USD | — | United States dollar |

| (a) | | Security is deemed illiquid. As of September 30, 2013, the value of these illiquid securities amounted to 1.3% of total net assets. |

| 20 | See Notes to Financial Statements. |

| IVA Worldwide Fund | IVA Funds |

| Schedule of Investments |

| September 30, 2013 |

|

| (b) | | Issuer of the security is an affiliate of the IVA Worldwide Fund as defined by the Investment Company Act of 1940. An affiliate is deemed as a company in which the IVA Worldwide Fund indirectly or directly has ownership of at least 5% of the company’s outstanding voting securities. See Schedule of Affiliates below for additional information. |

| |

| Schedule of Affiliates | | | | | | | | | | | | | | | | | | | | |

| | | SHARES | | | | | | SHARES | | | | | | | | | | | | | | | | |

| | | HELD AT | | | | | | HELD AT | | | FAIR VALUE AT | | | | | | | | | | |

| | | SEPTEMBER 30, | | SHARE | | SHARE | | SEPTEMBER 30, | | | SEPTEMBER 30, | | REALIZED | | DIVIDEND |

| SECURITY | | 2012 | | ADDITIONS | | REDUCTIONS | | 2013 | | | 2013 | | GAIN/(LOSS) | | INCOME* |

| |

Cosel Co., Ltd. | | 3,187,600 | | — | | 651,900 | | 2,535,700 | | | | $ | 30,724,032 | | | | $ | (2,068,468 | ) | | | $ | 606,900 | |

| |

| Icom Inc. | | 1,306,300 | | — | | 361,600 | | 944,700 | | | | | 22,326,040 | | | | | (1,627,934 | ) | | | | 304,645 | |

| |

Milbon Co., Ltd.** | | 951,200 | | — | | 908,900 | | 42,300 | | | | | — | | | | | 9,774,495 | | | | | 591,698 | |

| |

| Miura Co., Ltd. | | 3,271,704 | | — | | 143,200 | | 3,128,504 | | | | | 86,030,279 | | | | | (709,849 | ) | | | | 1,263,228 | |

| |

Net 1 U.E.P.S. Technologies Inc. | | 6,324,803 | | — | | 318,444 | | 6,006,359 | | | | | 72,136,372 | | | | | (2,830,689 | ) | | | | — | |

| |

Spansion, Inc., Class ‘A’*** | | 1,368,809 | | 2,283,744 | | 7,520 | | 3,645,033 | | | | | 36,778,383 | | | | | (21,255 | ) | | | | — | |

| |

| Teleperformance** | | 2,928,862 | | 19,444 | | 2,013,272 | | 935,034 | | | | | — | | | | | 21,007,798 | | | | | 698,267 | |

| |

Temp Holdings Co., Ltd.** | | 3,016,200 | | 941,500 | | 2,885,500 | | 1,072,200 | | | | | — | | | | | 40,928,064 | | | | | 488,317 | |

| |

| Total | | | | | | | | | | | | $ | 247,995,106 | | | | $ | 64,452,162 | | | | $ | 3,953,055 | |

| |

| * | | Dividend income is net of withholding taxes. |

| ** | | Non-affiliated at September 30, 2013. |

| *** | | Non-affiliated at September 30, 2012. |

| | | |

| (c) | | Non-income producing investment. |

| (d) | | Cumulative redeemable preferred stock. The date shown represents the first optional call date. |

| (e) | | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. |

| (f) | | Fixed-to-float perpetual bond. The security has no maturity date. The date shown represents the next call date. |

| (g) | | Senior unsecured note. The first call date is April 15, 2017. |

| (h) | | Variable rate security. The interest rate shown reflects the rate currently in effect. |

| (i) | | This security is held at the custodian as collateral for written put options. As of September 30, 2013, portfolio securities valued at $34,280,691 were segregated to cover collateral requirements. |

| See Notes to Financial Statements. | 21 |

| IVA International Fund | IVA Funds |

| Performance (unaudited) | As of September 30, 2013 |

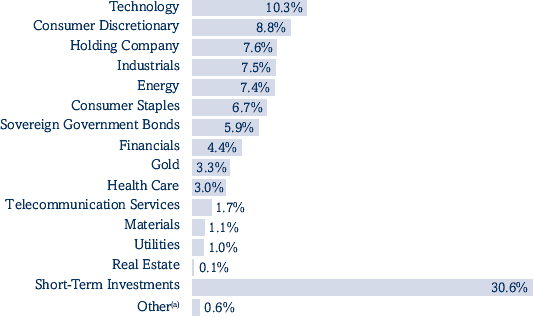

| | | | | | | | | Five Year/ |

| Average Annual Total Returns as of September 30, 2013(a) | | | One Year | | Since Inception(a) |

| Class A | | | | 14.09 | % | | | | 11.44 | % | |

| Class A (with a 5% maximum initial sales charge) | | | | 8.38 | % | | | | 10.31 | % | |

| Class C | | | | 13.18 | % | | | | 10.59 | % | |

| Class I | | | | 14.34 | % | | | | 11.72 | % | |

| MSCI All Country World (ex-U.S.) Index (Net)(b) | | | | 16.48 | % | | | | 6.26 | % | |

| Consumer Price Index(c) | | | | 1.18 | % | | | | 1.36 | % | |

| Growth of a $10,000 Initial Investment | |

| |

| (a) | The Fund commenced investment operations on October 1, 2008. |

| (b) | The MSCI All Country World (ex-U.S.) Index (Net) is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2008, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2013. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. Shares redeemed within 30 days of purchase may be subject to a 2.00% redemption fee. The gross and net expense ratios for the Fund are as follows: 1.27% (Class A shares); 2.02% (Class C shares); and 1.02% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2013. More recent expense ratios can be found in the Financial Highlights section of this Annual Report.

| IVA International Fund | IVA Funds |

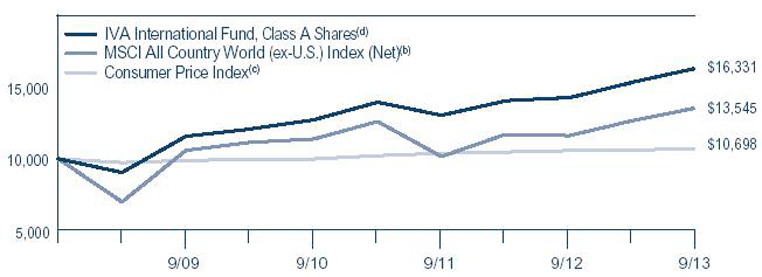

| Portfolio Composition (unaudited) | As of September 30, 2013 |

| Asset Allocation (As a Percent of Total Net Assets) | |

| Sector Allocation (As a Percent of Total Net Assets) | |

| Top 10 Positions (As a Percent of Total Net Assets)(b) | |

| Government of Singapore, 3.625% due 7/1/2014, 2.875% due 7/1/2015, 3.75% due 9/1/2016 | | | 6.3 | % |

| |

| Nestlé SA | | | 3.9 | % |

| |

Wendel, 4.875% due 5/26/2016, 4.375% due 8/9/2017, 6.75% due 4/20/2018 | | | 3.4 | % |

| |

| Gold Bullion | | | 3.2 | % |

| |

| Astellas Pharma Inc. | | | 3.1 | % |

| |

| Genting Malaysia Berhad | | | 2.9 | % |

| |

| E-Mart Co., Ltd. | | | 1.7 | % |

| |

| GDF Suez SA | | | 1.5 | % |

| |

| Sodexo SA | | | 1.4 | % |

| |

| Total SA, ADR | | | 1.4 | % |

| |

| Top 10 positions represent 28.8% of total net assets. |

| (a) | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| COMMON STOCKS – 54.3% | | | | | | | | |

| |

| Argentina | 0.0% | | | | | | | | |

| | | | 871 | | Nortel Inversora SA, Series ‘B’, ADR (a) | | $ | 16,715 |

| |

| | | | | | | | | |

| |

| Australia | 0.1% | | | | | | | | |

| | | | 1,337,089 | | Programmed Maintenance Services Ltd. | | | 3,505,111 |

| |

| | | | | | | | | |

| |

| Belgium | 0.4% | | | | | | | | |

| | | | 125,166 | | Sofina SA | | | 12,303,582 |

| |

| | | | | | | | | |

| |

| Brazil | 1.0% | | | | | | | | |

| | | | 2,226,335 | | Itaú Unibanco Holding SA, ADR | | | 31,435,850 |

| |

| | | | | | | | | |

| |

| China | 2.3% | | | | | | | | |

| | | | 39,557,030 | | Clear Media Ltd. (b)(c) | | | 26,011,276 |

| |

| | | | 11,394,000 | | Digital China Holdings Ltd. | | | 13,956,214 |

| |

| | | | 27,368,000 | | Phoenix Satellite Television Holdings Ltd. | | | 9,774,412 |

| |

| | | | 24,303,000 | | Springland International Holdings Ltd. | | | 13,160,639 |

| |

| | | | 12,132,000 | | Uni-President China Holdings Ltd. | | | 12,169,698 |

| |

| | | | | | | | | 75,072,239 |

| | | | | | | | |

| | | | | | | | | |

| |

| Denmark | 0.1% | | | | | | | | |

| | | | 56,392 | | D/S Norden A/S | | | 2,378,179 |

| |

| | | | | | | | | |

| |

| France | 14.9% | | | | | | | | |

| | | | 916,276 | | Alten | | | 39,232,846 |

| |

| | | | 62,585 | | Bolloré | | | 32,707,305 |

| |

| | | | 310,700 | | Cap Gemini SA | | | 18,481,938 |

| |

| | | | 323,157 | | Carrefour SA | | | 11,093,521 |

| |

| | | | 105,330 | | Ciments Français SA | | | 7,261,583 |

| |

| | | | 517,541 | | CNP Assurances | | | 9,322,572 |

| |

| | | | 202,661 | | Eutelsat Communications Group, SA | | | 6,407,354 |

| |

| | | | 29,687 | | Financière de l’Odet SA | | | 29,918,735 |

| |

| | | | 492,234 | | Financière Marc de Lacharriere SA | | | 26,237,208 |

| |

| | | | 1,962,917 | | GDF Suez SA | | | 49,313,251 |

| |

| | | | 505,143 | | Lagardère SCA | | | 16,404,607 |

| |

| | | | 230,121 | | M6-Métropole Télévision SA | | | 4,935,968 |

| |

| | | | 47,926 | | Publicis Groupe SA | | | 3,813,695 |

| |

| | | | 73,288 | | Robertet SA (b) | | | 14,773,008 |

| |

| | | | 562,656 | | Saft Groupe SA | | | 15,520,652 |

| |

| | | | 298,912 | | Séché Environnement SA | | | 11,100,320 |

| |

| | | | 226,778 | | Securidev SA (b)(c) | | | 9,351,164 |

| |

| | | | 2,181,095 | | Societe d’Edition de Canal Plus | | | 16,523,894 |

| |

| | | | 488,374 | | Sodexo SA | | | 45,568,271 |

| |

| | | | 565,590 | | Teleperformance | | | 27,362,075 |

| |

| | | | 482,674 | | Thales SA | | | 26,534,076 |

| |

| | | | 787,575 | | Total SA, ADR | | | 45,616,344 |

| |

| | | | 1,078,962 | | Vivendi SA | | | 24,821,760 |

| |

| | | | | | | | | 492,302,147 |

| | | | | | | | |

| 24 | See Notes to Financial Statements. |

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2013 |

|

| | | | SHARES | | DESCRIPTION | | | FAIR VALUE |

| | | | | | | | | |

| |

| Germany | 0.9% | | | | | | | | |

| | | | 220,979 | | Siemens AG | | $ | 26,624,625 |

| |

| | | | 54,199 | | Wincor Nixdorf AG | | | 3,384,596 |

| |

| | | | | | | | | 30,009,221 |

| | | | | | | | |

| | | | | | | | | |

| |

| Hong Kong | 1.1% | | | | | | | | |

| | | | 20,767,761 | | Hongkong & Shanghai Hotels Ltd. | | | 31,382,323 |

| |

| | | | 13,962,000 | | Midland Holdings Ltd. | | | 5,742,568 |

| |

| | | | | | | | | 37,124,891 |

| | | | | | | | |

| | | | | | | | | |

| |

| India | 0.2% | | | | | | | | |

| | | | 17,614,307 | | South Indian Bank Ltd. | | | 5,570,853 |

| |

| | | | | | | | | |

| |

| Indonesia | 0.1% | | | | | | | | |

| | | | 88,168,000 | | PT Bank Bukopin Tbk | | | 4,872,843 |

| |

| | | | | | | | | |

| |

| Japan | 16.9% | | | | | | | | |

| | | | 295,600 | | Arcs Co. Ltd. | | | 5,479,253 |

| |

| | | | 764,900 | | As One Corp. | | | 15,757,897 |

| |

| | | | 1,986,500 | | Astellas Pharma Inc. | | | 101,047,865 |

| |

| | | | 955,200 | | Azbil Corp. | | | 22,146,608 |

| |

| | | | 60,900 | | The Bank of Okinawa Ltd. | | | 2,425,591 |

| |

| | | | 627,200 | | Benesse Holdings Inc. | | | 22,779,429 |

| |

| | | | 71,400 | | Canon Inc. | | | 2,273,585 |

| |

| | | | 1,398,400 | | Cosel Co., Ltd. (b) | | | 16,943,836 |

| |

| | | | 864,500 | | Daiichikosho Co., Ltd. | | | 23,561,682 |

| |

| | | | 1,401,300 | | Hi Lex Corp. | | | 30,693,310 |

| |

| | | | 650,000 | | Icom Inc. (b) | | | 15,361,412 |

| |

| | | | 491,140 | | Kose Corp. | | | 14,190,321 |

| |

| | | | 95,400 | | Medikit Co., Ltd. (b) | | | 3,202,808 |

| |

| | | | 174,500 | | Meitec Corp. | | | 5,020,459 |

| |

| | | | 325,300 | | Milbon Co., Ltd. | | | 13,320,438 |

| |

| | | | 1,497,276 | | Miura Co., Ltd. | | | 41,173,376 |

| |