At September 30, 2011 the Worldwide Fund had significant transfers of $2,520,674,349 from Level 1 to Level 2 as a result of significant market movements between the time at which foreign markets closed and the Worldwide Fund valued its securities. For the year ended September 30, 2011, there were no Level 3 assets or liabilities held in the Worldwide Fund.

The following is a summary of the inputs used in valuing the International Fund’s assets and liabilities at fair value:

At September 30, 2011 the International Fund had significant transfers of $1,035,251,234 from Level 1 to Level 2 as a result of significant market movements between the time at which foreign markets closed and the International Fund valued its securities. For the year ended September 30, 2011, there were no Level 3 assets or liabilities held in the International Fund.

The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on each Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments, at the date of valuation, resulting from changes in exchange rates.

| Notes to Financial Statements | IVA Funds |

The Funds adhere to the provisions of the FASB Accounting Standards Codification 740-10 (“ASC 740-10”), Accounting for Uncertainty in Income Taxes. This standard defines the threshold for recognizing tax positions in the financial statements as “more-likely-than-not” to be sustained by the applicable taxing authority and requires measurement of a tax position meeting the “more-likely-than-not” criterion, based on the largest benefit that is more than fifty percent realized. Management has analyzed each Fund’s tax positions taken on federal and state tax returns for all open tax years (current, 2010 and 2009) and determined that no provision for income tax would be required in the Funds’ financial statements. For the year ended September 30, 2011, the Funds did not incur any tax-related interest or penalties.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

Forward Foreign Currency Contracts. Each Fund engages in buying and selling forward foreign currency contracts to seek to manage the exposure of investments denominated in non-U.S. currencies against fluctuations in relative value. A forward foreign currency contract involves a privately negotiated obligation to purchase or sell (with delivery generally required) a specific currency at a future date, at a price set at the time of the contract.

Options Transactions. During the year ended September 30, 2011, the Worldwide Fund had written covered puts and/or covered calls on equity securities. Each Fund may write call options to seek to enhance investment return or to hedge against declines in the prices of portfolio securities or may write put options to hedge against increases in the prices of securities which it intends to purchase. A call option is covered if a Fund holds, on a share-for-share basis, either the underlying shares or a call on the same security as the call written where the exercise price of the call held is equal to or less than the exercise price of the call written (or greater than the exercise price of the call written if the difference is maintained by a Fund in cash, treasury bills or other high grade short-term obligations in a segregated account with its custodian). A put option is covered if a Fund maintains cash, treasury bills or other high grade short-term obligations with a value equal to the exercise price in a segregated account with its custodian, or holds on a share-for-share basis a put on the same equity security as the put written where the exercise price of the put held is equal to or greater than the exercise price of the put written, or lower than the exercise price of the put written if the difference is maintained in a segregated account with its custodian. At September 30, 2011, the Funds had no outstanding written puts or calls.

Premiums received for writing options that expire unexercised are recognized on the expiration date as realized gains. If an option is exercised, the premium received is subtracted from the cost of the purchase or added to the proceeds of the sale to determine whether the Fund has realized a gain or loss on the put or call. When a Fund enters into a closing transaction, the Fund will realize a gain or loss depending upon whether the amount from the closing transaction is greater or less than the premium received.

Futures Contracts. Each Fund uses interest rate futures contracts for investment purposes. In certain instances, the use of futures contracts can act as a hedge against the effect of interest rate fluctuations on foreign and U.S. securities and/or foreign exchange rates. A futures contract provides for the future sale by one party and purchase by another party of a specified quantity of the security or other financial instrument at a specified price and time.

When a purchase or sale of a futures contract is made by a Fund, the Fund is required to deposit with its futures commission merchant a specified amount of liquid assets (“initial margin”). The initial margin required for a futures contract is set by the exchange on which the contract is traded and may be modified during the term of the contract. The initial margin is in the nature of a performance bond or good faith deposit on the futures contract that is returned to the Fund upon termination of the contract, assuming all contractual obligations have been satisfied. Each Fund expects to earn taxable interest income on its initial margin deposits. At September 30, 2011, the Worldwide Fund and International Fund had $4,469,856 and $1,216,647 in initial margin deposits and $25,023,234 and $1,932,355 in additional cash with its futures commission merchant, respectively. These amounts are located in the Statements of Assets and Liabilities as foreign currency collateral and cash collateral on open futures contracts. The Worldwide Fund also holds securities for initial margin deposits at the futures commission merchant which can be located in the Schedule of Investments. A futures contract held by a Fund is valued daily at the official settlement price of the exchange on which it is traded. Each day, a Fund may pay or receive cash, as necessary, called “variation margin,” equal to the daily change in value of the futures contract. This process is known as “marking to market.” Variation margin does not represent a borrowing or loan by a Fund but is instead a settlement between a Fund and the broker of the amount one would owe the other if the futures contract expired in computing the daily NAVs. Each Fund marks to market its open futures positions.

Foreign Investment Risk. Each Fund invests in foreign investments. Foreign investments can involve additional risks relating to political, economic or regulatory conditions in foreign countries. These risks include fluctuations in foreign currencies; withholding or other taxes; trading, settlement, custodial, and other operational risks; and the less stringent investor protection

39

| Notes to Financial Statements | IVA Funds |

and disclosure standards of some foreign markets. Since foreign exchanges may be open on days when a Fund does not price its shares, the value of the investments in such Fund’s portfolio may change on days when shareholders will not be able to purchase or sell the Fund’s shares.

Indemnification. Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liability arising out of the performance of their duties to the Funds. The Funds have a variety of indemnification obligations under contracts with their service providers. The Funds’ maximum exposure under these arrangements is unknown. However, the Funds have not had prior claims or losses pursuant to these contracts and expect the risk of loss to be remote.

Note 2 – Investment Advisory Agreement and Distribution Agreement

International Value Advisers, LLC is the investment adviser of the Funds. The Adviser’s primary business is to provide investment management services to a variety of investment vehicles, including the Funds. The Adviser is responsible for all business activities and oversight of the investment decisions made for the Funds.

In return for providing investment advisory services to the Funds, each Fund pays the Adviser an investment advisory fee, calculated daily and paid monthly, at an annual rate of 0.90% of each Fund’s average daily net assets.

The Adviser has contractually agreed to waive fees and/or reimburse expenses (exclusive of acquired fund fees and expenses, brokerage expenses, interest expense, taxes, organizational and extraordinary expenses) to limit the amount of each Fund’s total annual operating expenses to 1.40%, 2.15% and 1.15% of each Fund’s average daily net assets for Class A, Class C and Class I shares, respectively. This agreement is currently in effect through January 31, 2012, when it will be re-evaluated.

The Adviser will be permitted to recapture, on a class by class basis, expenses it has borne through the undertakings described above to the extent that the Funds’ expenses in later periods fall below the annual rates set forth in the relevant undertaking. The Board must approve any recoupment payment made to the Adviser. The Funds will not be obligated to pay any such deferred fees and expenses more than one year after the end of the fiscal year in which the fee and expense was deferred. For the year ended September 30, 2011, the Adviser recaptured $8,506 from the International Fund.

The Funds have adopted Distribution and Services Plans (“12b-1 Plans”), pursuant to Rule 12b-1 under the 1940 Act. Under those 12b-1 Plans, the Funds pay a distribution fee with respect to Class A and C shares calculated at the annual rate of 0.25% and 0.75%, respectively, of the average daily net assets of each respective class. The Funds also pay a service fee with respect to Class C shares calculated at the annual rate of 0.25% of the average daily net assets. Class I shares do not participate in 12b-1 Plans. Fees paid under the 12b-1 Plans for the year ended September 30, 2011 are disclosed in the Statements of Operations.

IVA Funds Distributors, LLC, a direct subsidiary of Foreside Distributors, LLC, serves as the Funds’ sole and exclusive distributor.

There is a maximum initial sales charge of 5.00% for Class A shares. Class A shares may be subject to a contingent deferred sales charge (“CDSC”) of 0.75% if $1,000,000 or more of Class A shares were initially purchased, a “finder’s fee” was paid to the dealer of record, and the Class A shares were subsequently redeemed within 18 months.

Class C shares may be subject to a CDSC of 1.00% if shares are redeemed within the first 12 months after purchase.

Note 3 – Investments

For the year ended September 30, 2011, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

|

|

|

| Worldwide

Fund

|

| International

Fund

|

|---|

| Purchases | | | | $ | 6,557,954,218 | | | $ | 1,753,889,169 | |

| Sales | | | | $ | 3,845,313,682 | | | $ | 945,990,398 | |

40

| Notes to Financial Statements | IVA Funds |

The cost basis of investments for federal income tax purposes is substantially similar to the cost basis under U.S. GAAP. The following information is presented on a federal tax basis as of September 30, 2011.

|

|

|

| Worldwide

Fund

|

| International

Fund

|

|---|

| Cost basis of investments | | | | $ | 9,356,897,235 | | | $ | 2,258,731,335 | |

| Gross unrealized appreciation | | | | $ | 490,910,772 | | | $ | 128,941,355 | |

| Gross unrealized depreciation | | | | | (727,122,792 | ) | | | (149,377,788 | ) |

| Net unrealized appreciation | | | | $ | (236,212,020 | ) | | $ | (20,436,433 | ) |

For the year ended September 30, 2011, written options transactions for the Worldwide Fund were as follows:

|

|

|

| Number of

Contracts

|

| Premiums

|

|---|

| Written options, outstanding September 30, 2010 | | | | | (19,552 | ) | | $ | (2,434,746 | ) |

| Options written | | | | | (11,129 | ) | | | (926,383 | ) |

| Options exercised | | | | | 24,094 | | | | 2,286,510 | |

| Options expired | | | | | 6,587 | | | | 1,074,619 | |

| Written options, outstanding September 30, 2011 | | | | | — | | | | — | |

Note 4 – Derivative Instruments and Hedging Activities

The Funds enter into transactions involving derivative financial instruments in connection with their investing activities. During the year ended September 30, 2011, these instruments included futures, written call and put options and forward foreign currency contracts. These instruments are subject to various risks similar to non-derivative instruments including market, credit and liquidity risks.

The use of derivative instruments may involve risks different from, or potentially greater than, the risks associated with investing directly in investments. Specifically, derivative instruments expose a Fund to the risk that the counterparty to an OTC derivatives contract will be unable or unwilling to make timely settlement payments or otherwise to honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction. If the counterparty defaults, a Fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or that, in the event of default, a Fund will succeed in enforcing them. During the year ended September 30, 2011, the Funds had exposure to OTC derivatives in the form of forward foreign currency contracts.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected in the Statements of Assets and Liabilities. The Funds bear the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract, movements in foreign investment security values and changes in interest rates. Credit risks may also arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts.

Options transactions involve elements of market risk. Price fluctuation on underlying equity securities may cause the written put or call options to be assigned on unfavorable terms to the Funds. Written put options involve elements of liquidity risk if a Fund is unable to enter into a closing transaction due to there being a lack of market makers for a particular equity security. Counterparty risk associated with pledged collateral to the executing counterparty is limited to the extent that the pledged collateral is held at the Funds’ custodian. Pledged cash collateral is subject to counterparty risk at the Funds’ custodian.

Futures transactions involve elements of market risk in excess of the amounts reflected in the Statements of Assets and Liabilities. A sale of a futures contract may result in losses in excess of the amount invested in the futures contract. There can be no guarantee that there will be a correlation between price movements in the futures contracts and in the securities positions covering those contracts. In addition, there are significant differences between securities markets and futures markets that could result in an imperfect correlation between the markets. The degree of imperfection of correlation depends on circumstances such as variations in speculative market demand for futures, including technical influences in futures trading, and differences between the financial instruments held by a Fund and the instruments underlying the standard contracts available for trading in such respects as interest rate levels, maturities and creditworthiness of issuers.

The Funds adhere to FASB Accounting Standards Codification 815-10-50 (“ASC 815-10-50”), Derivative Instruments and Hedging Activities. ASC 815-10-50 requires enhanced disclosure about a Fund’s derivative and hedging activities, including how such activities are accounted for and their effect on a Fund’s financial positions, performance and cash flow.

41

| Notes to Financial Statements | IVA Funds |

The following summary for each Fund is grouped by risk-type and provides information about the fair value and location of derivatives within the Statements of Assets and Liabilities at September 30, 2011.

Worldwide Fund

|

|

|

|

|

| Asset

Derivatives

|

| Liability

Derivatives

|

|---|

Risk-Type Category

|

|

|

| Statements of Assets

and Liabilities Location

|

| Fair Value

|

| Fair Value

|

|---|

| Foreign exchange contracts | | | | Unrealized appreciation on open forward foreign currency contracts | | $ | 4,208,809 | | | $ | — | |

| Interest rate contracts | | | | Variation margin on open futures contracts | | | 4,466,881 | | | | (3,166,746 | ) |

| Total | | | | | | $ | 8,675,690 | | | $ | (3,166,746 | ) |

International Fund

|

|

|

|

|

| Asset Derivatives

|

|---|

Risk-Type Category

|

|

|

| Statements of Assets

and Liabilities Location

|

| Fair Value

|

|---|

| Foreign exchange contracts | | | | Unrealized appreciation on open forward foreign currency contracts | | $ | 588,474 | |

| Interest rate contracts | | | | Variation margin on open futures contracts | | | 1,215,890 | |

| Total | | | | | | $ | 1,804,364 | |

The following is a summary for each Fund grouped by risk-type that provides information about the effect of derivatives and hedging activities on the Funds’ Statements of Operations for the year ended September 30, 2011.

Worldwide Fund

Risk-Type Category

|

|

|

| Derivative Instrument

|

| Realized Gain (Loss)

|

| Change in

Unrealized

Appreciation/

(Depreciation)

|

|---|

| Equity contracts | | | | Written option contracts | | $ | 1,074,619 | | | $ | (296,442 | ) |

| Foreign exchange contracts | | | | Forward foreign currency contracts | | | (67,444,166 | ) | | | 32,517,143 | |

| Interest rate contracts | | | | Futures contracts | | | (106,469,165 | ) | | | 6,187,678 | |

| Total | | | | | | $ | (172,838,712 | ) | | $ | 38,408,379 | |

International Fund

Risk-Type Category

|

|

|

| Derivative Instrument

|

| Realized Loss

|

| Change in

Unrealized

Appreciation/

(Depreciation)

|

|---|

| Foreign exchange contracts | | | | Forward foreign currency contracts | | $ | (30,136,328 | ) | | $ | 8,348,922 | |

| Interest rate contracts | | | | Futures contracts | | | (7,576,022 | ) | | | 2,421,907 | |

| Total | | | | | | $ | (37,712,350 | ) | | $ | 10,770,829 | |

During the year ended September 30, 2011, the Worldwide Fund had average notional values of $1,501,803,995, $4,577,419 and $1,295,801,656 on open futures contracts to sell, written options and open forward foreign currency contracts to sell, respectively.

During the year ended September 30, 2011, the International Fund had average notional values of $233,208,696 and $439,657,468 on open futures contracts to sell and open forward foreign currency contracts to sell, respectively.

42

| Notes to Financial Statements | IVA Funds |

Note 5 – Shares of Beneficial Interest

At September 30, 2011 the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.001 per share. The Funds have the ability to issue multiple classes of shares. Each share of a class represents an identical interest and has the same rights, except that each class bears certain direct expenses specifically related to the distribution of its shares.

Transactions in shares of each class of each Fund were as follows:

IVA Worldwide Fund

|

|

|

| Year Ended

September 30, 2011

|

| Year Ended

September 30, 2010

|

|

|---|

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

Class A | | | | | | | | | | | | | | | | | | |

| Shares sold | | | | | 77,064,980 | | | $ | 1,305,447,075 | | | | 77,795,520 | | | $ | 1,174,278,323 | |

| Shares reinvested | | | | | 3,193,627 | | | | 52,918,403 | | | | 1,507,532 | | | | 22,236,101 | |

| Shares repurchased | | | | | (27,954,413 | ) | | | (470,342,110 | ) | | | (9,130,177 | ) | | | (137,632,053 | ) |

| Net Increase | | | | | 52,304,194 | | | $ | 888,023,368 | | | | 70,172,875 | | | $ | 1,058,882,371 | |

Class C | | | | | | | | | | | | | | | | | | |

| Shares sold | | | | | 47,513,071 | | | $ | 798,982,437 | | | | 45,884,824 | | | $ | 688,917,256 | |

| Shares reinvested | | | | | 1,080,716 | | | | 17,831,811 | | | | 455,739 | | | | 6,717,583 | |

| Shares repurchased | | | | | (9,895,422 | ) | | | (165,777,839 | ) | | | (2,889,049 | ) | | | (43,552,962 | ) |

| Net Increase | | | | | 38,698,365 | | | $ | 651,036,409 | | | | 43,451,514 | | | $ | 652,081,877 | |

Class I | | | | | | | | | | | | | | | | | | |

| Shares sold | | | | | 162,536,444 | | | $ | 2,756,422,981 | | | | 110,932,221 | | | $ | 1,672,159,208 | |

| Shares reinvested | | | | | 4,334,310 | | | | 71,819,512 | | | | 2,512,755 | | | | 37,038,015 | |

| Shares repurchased | | | | | (39,177,738 | ) | | | (660,210,158 | ) | | | (18,529,994 | ) | | | (281,487,898 | ) |

| Net Increase | | | | | 127,693,016 | | | $ | 2,168,032,335 | | | | 94,914,982 | | | $ | 1,427,709,325 | |

IVA International Fund

|

|

|

| Year Ended

September 30, 2011

|

| Year Ended

September 30, 2010

|

|

|---|

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

Class A | | | | | | | | | | | | | | | | | | |

| Shares sold | | | | | 12,031,409 | | | $ | 195,512,821 | | | | 11,307,887 | | | $ | 165,856,850 | |

| Shares reinvested | | | | | 447,147 | | | | 7,091,792 | | | | 249,054 | | | | 3,581,392 | |

| Shares repurchased | | | | | (4,011,657 | ) | | | (66,294,705 | ) | | | (3,303,420 | ) | | | (48,246,554 | ) |

| Net Increase | | | | | 8,466,899 | | | $ | 136,309,908 | | | | 8,253,521 | | | $ | 121,191,688 | |

Class C | | | | | | | | | | | | | | | | | | |

| Shares sold | | | | | 1,932,225 | | | $ | 31,162,113 | | | | 2,504,713 | | | $ | 36,434,960 | |

| Shares reinvested | | | | | 72,938 | | | | 1,148,042 | | | | 30,009 | | | | 430,928 | |

| Shares repurchased | | | | | (452,967 | ) | | | (7,372,331 | ) | | | (239,931 | ) | | | (3,491,252 | ) |

| Net Increase | | | | | 1,552,196 | | | $ | 24,937,824 | | | | 2,294,791 | | | $ | 33,374,636 | |

Class I | | | | | | | | | | | | | | | | | | |

| Shares sold | | | | | 57,781,854 | | | $ | 943,304,973 | | | | 47,025,199 | | | $ | 685,155,652 | |

| Shares reinvested | | | | | 1,800,200 | | | | 28,551,171 | | | | 683,742 | | | | 9,832,210 | |

| Shares repurchased | | | | | (11,669,292 | ) | | | (191,544,129 | ) | | | (4,011,301 | ) | | | (58,366,567 | ) |

| Net Increase | | | | | 47,912,762 | | | $ | 780,312,015 | | | | 43,697,640 | | | $ | 636,621,295 | |

43

| Notes to Financial Statements | IVA Funds |

Redemption Fees. The Funds impose a redemption fee of 2% of the total redemption amount on the Funds’ shares redeemed within 30 days of buying them or acquiring them by exchange. The purpose of the redemption fees is to deter excessive, short-term trading and other abusive trading practices, and to help offset the costs associated with the sale of portfolio securities to satisfy redemption and exchange requests made by “market timers” and other short-term shareholders, thereby insulating longer-term shareholders from such costs.

Note 6 – Income Tax Information and Distributions to Shareholders

The tax character of distributions paid during the fiscal year ended September 30, 2011 were as follows:

|

|

|

| Worldwide

Fund

|

| International

Fund

|

|---|

| Distributions Paid From: | | | | | | | | | | |

| Ordinary income | | | | $ | 126,265,844 | | | $ | 27,844,882 | |

| Long-Term gains | | | | $ | 78,719,966 | | | $ | 18,349,617 | |

As of September 30, 2011, the components of accumulated earnings on a tax basis were as follows:

|

|

|

| Worldwide

Fund

|

| International

Fund

|

|---|

| Undistributed net investment income | | | | $ | 204,128,599 | | | $ | 66,159,466 | |

| Undistributed realized gains | | | | | 326,725,567 | | | | 77,731,101 | |

Other book/tax temporary differences (a) | | | | | (188,376 | ) | | | (136,839 | ) |

Unrealized depreciation(b) | | | | | (232,377,701 | ) | | | (19,450,153 | ) |

| Total accumulated earnings/(losses) | | | | $ | 298,288,089 | | | $ | 124,303,575 | |

(a) | | Other book/tax temporary differences are attributable primarily to the tax treatment of offering costs. |

(b) | | The difference between book-basis and tax-basis unrealized depreciation is attributable primarily to the treatment of passive foreign investment companies, the tax deferral of losses on wash sales, forward foreign currency contracts and futures contracts. |

Reclassification. U.S. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. For the fiscal year ended September 30, 2011, the following reclassifications have been made:

|

|

|

| Worldwide

Fund

|

| International

Fund

|

|---|

| Undistributed net investment loss | | | | $ | (63,902,521 | ) | | $ | (4,230,591 | ) |

| Accumulated net realized gain | | | | $ | 39,860,826 | | | $ | 715,802 | |

| Paid-in-capital | | | | $ | 24,041,695 | | | $ | 3,514,789 | |

44

| Report of Independent Registered Public Accounting Firm | IVA Funds |

The Board of Trustees and Shareholders of

IVA Fiduciary Trust:

We have audited the accompanying statements of assets and liabilities of IVA Worldwide Fund and IVA International Fund (the “Funds”) (the Funds comprising IVA Fiduciary Trust), including the schedules of investments, as of September 30, 2011, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2011, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of IVA Worldwide Fund and IVA International Fund of IVA Fiduciary Trust at September 30, 2011, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

November 17, 2011

45

| Trustees and Officers (unaudited) | IVA Funds |

The business and affairs of each Fund are managed under the direction of its Board of Trustees (the “Board”). The Board approves all significant agreements between a Fund and the persons or companies that furnish services to a Fund, including agreements with its investment adviser, distributor, administrator, custodian and transfer agent. The day-to-day operations of the Funds are delegated to the Funds’ investment adviser and administrator. The name, address, age and principal occupations for the past five years of the Trustees and officers of the Trust are listed below, along with the number of portfolios in the Fund complex overseen by and the other directorships held by each Trustee. Each Trustee’s mailing address is c/o International Value Advisers, LLC, 717 Fifth Avenue, New York, NY 10022.

Independent Trustees(a)

Name (Birth Year)

| | | | Position(s)

Held with

the Trust

| | Term of

Office(b) and

Length of

Time Served

| | Principal

Occupation(s) During

Past 5 Years

| | Number of

Portfolios

in the Fund

Complex

Overseen

by Trustee

| | Other Directorships /

Trusteeships

Held by Trustee

|

|---|

| |

Adele R. Wailand

(1949) | | | | Trustee and

Chair of the

Board | | since 2008 | | Corporate Secretary,

Case, Pomeroy &

Company, Inc.

(real estate and

investments); Vice

President & General

Counsel, Case,

Pomeroy & Company,

Inc. (prior to 2011) | | 2 | | None. |

| |

Manu Bammi

(1962) | | | | Trustee | | since 2008 | | Founder and Chief

Executive Officer,

SmartAnalyst, Inc.

(provider of research

and analytics and

decision support

to businesses). | | 2 | | None. |

| |

Ronald S. Gutstein

(1971) | | | | Trustee | | since 2008 | | Institutional Trader

and Market Maker,

Access Securities

(an institutional

broker-dealer) | | 2 | | None. |

(a) | | Trustees who are not “interested persons” of the Trust as defined in the 1940 Act. |

(b) | | Each Trustee serves until resignation or removal from the Board. |

46

| Trustees and Officers (unaudited) | IVA Funds |

Interested Trustee

Name (Birth Year)

| | | | Position(s)

Held with

the Trust

| | Term of

Office(a) and

Length of

Time Served

| | Principal

Occupation(s) During

Past 5 Years

| | Number of

Portfolios

in the Fund

Complex

Overseen

by Trustee

|

|---|

| |

Michael W. Malafronte(b)

(1974) | | | | President and

Trustee | | since 2008 | | Managing Partner, the Adviser (since 2010); CEO and Research Analyst, the Adviser (2007-2010); Senior Research Analyst, Arnhold and S. Bleichroeder Advisers, LLC (“ASB”) (asset management advisory services) (2005-2007). | | 2 |

(a) | | Each Trustee serves until resignation or removal from the Board. |

(b) | | Mr. Malafronte is considered an interested trustee due to his position as Managing Partner of the Adviser. |

Officers of the Trust

Name (Birth Year) and Address(a)

| | | | Position(s)

Held with

the Trust

| | Term of

Office and

Length of

Time

Served(b)

| | Principal Occupation(s) During Past 5 Years

|

|---|

| |

Shanda Scibilia

(1971) | | | | Chief Compliance

Officer and Secretary | | since 2008 | | Chief Operating Officer and Chief Compliance Officer, the Adviser (since 2008); acting Chief Operating Officer and head of compliance, Oppenheimer & Close (from 1998 to 2008). |

| |

Stefanie J. Hempstead

(1973) | | | | Treasurer | | since 2008 | | Chief Financial Officer, the Adviser (since 2008); Senior Vice President, ASB (prior to 2008); Vice President, ASB Securities LLC (prior to 2008); Vice President and Treasurer, First Eagle Funds and First Eagle Variable Funds (prior to 2008). |

| |

Christopher Hine

(1978) | | | | Assistant Treasurer | | since 2010 | | Director of Accounting, the Adviser (since 2009); Manager, Citco Fund Services (2008); Assistant Vice President, ASB (from 2006 to 2007). |

(a) | | Each officer’s mailing address is c/o International Value Advisers, LLC, 717 Fifth Avenue, New York, NY 10022. |

(b) | | The term of office of each officer is indefinite. Length of time served represents time served as an officer of the Trust, although various positions may have been held during the period. |

47

| Additional Information (unaudited) | IVA Funds |

Board Approval of Investment Advisory Agreement. At telephonic and in-person meetings held on May 12, 2011 and May 16, 2011, respectively, the Board of Trustees of the Trust (the “Board”), including all of the Trustees who are not “interested persons” of the Trust (the “Independent Trustees”) discussed the Investment Advisory Agreement (the “Advisory Agreement”) related to the Funds.

To assist the Board in its evaluation of the Advisory Agreement, the Independent Trustees received comprehensive written materials and other information, in adequate time in advance of the meeting, which outlined, among other things, (i) information confirming the financial condition of International Value Advisers, LLC (the “Adviser”) and the Adviser’s profitability derived from its relationship with each Fund, (ii) information as to the advisory fees paid by each Fund and other funds and accounts to the Adviser, (iii) information as to the advisory fees paid by comparable funds to other advisers, (iv) a description of the personnel and services provided by the Adviser, (v) information on compliance matters; (vi) comparative information on investment performance of the Funds and (vii) information regarding brokerage and portfolio transactions of the Funds. The Independent Trustees reviewed the materials provided by the Adviser, which included, among other things, information prepared by Lipper Inc. (“Lipper”) containing detailed contractual management fee, expense ratio and performance comparisons for each Fund with other mutual funds in their “peer group” and “universe” as determined by the Lipper methodology, as well as for each Fund with other mutual funds in a peer group selected by the Adviser. The Independent Trustees also reviewed a memorandum prepared by Sidley Austin LLP, Independent Trustee counsel, outlining the legal duties of the Independent Trustees in evaluating investment advisory arrangements.

In addition, it was noted, the Independent Trustees took into account information furnished throughout the year at regular Board meetings, including reports on investment performance, shareholder services, distribution fees and expenses, regulatory compliance and other services provided to each Fund. The Independent Trustees also considered other matters they deemed important to the approval process, such as allocation of Fund brokerage commissions, and other direct and indirect benefits to the Adviser from its relationship with the Funds. The Independent Trustees noted that the Independent Trustees met throughout the year with the portfolio managers of the Funds. The Independent Trustees, in their deliberations, recognized that for many of the Funds’ shareholders, the decision to purchase Fund shares included a decision to select the Adviser as the investment adviser for their investments and that there was a strong association in the minds of Fund shareholders between the Adviser and each Fund.

In considering factors relating to the approval of the continuance of the Advisory Agreement, the Independent Trustees noted that Sidley Austin LLP had provided the Independent Trustees with assistance and advice. The Independent Trustees stated that with respect to the Advisory Agreement, although it related to both Funds, the Independent Trustees had considered each Fund separately. Among other factors, the Independent Trustees noted that they considered the following:

The nature, extent and quality of services provided by the Adviser: The Independent Trustees reviewed the services that the Adviser provides to each Fund, including, but not limited to, making the day-to-day investment decisions for each Fund, and generally managing each Fund’s investments in accordance with the stated policies of the Fund. The Independent Trustees noted that throughout the year they discussed with officers and portfolio managers of the Funds the types of transactions that were being done on behalf of each Fund. Additionally, the Independent Trustees took into account the services provided by the Adviser to its other accounts that have investment mandates similar to the Funds. In particular, they noted the greater level of portfolio management, compliance and administrative oversight services required for the Funds, mutual funds registered under the 1940 Act, as compared to the Adviser’s institutional accounts. The Independent Trustees also considered the education, background and experience of the Adviser’s personnel, noting in particular that the favorable history and reputation of the portfolio managers for the Funds have had, and are likely to continue to have, a favorable impact on the Funds. In this regard, the significant growth of the Funds during the period since inception was noted. The Independent Trustees additionally noted the Adviser’s ability to attract quality and experienced personnel and its continued investment in the growth of its business. The Independent Trustees also considered the administrative services provided by the Adviser, including compliance and accounting services, and oversight of third party service providers. After considering the above factors, the Independent Trustees concluded that the nature, quality and extent of services provided by the Adviser are adequate and appropriate and would continue to be suitable for each Fund.

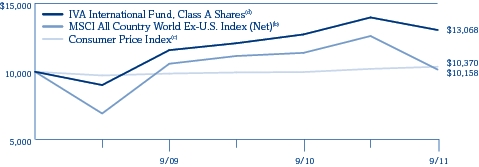

Investment performance of each Fund and the Adviser: The Independent Trustees considered the investment performance of each Fund compared to the Lipper peer funds, the Lipper universe funds, the peer funds selected by the Adviser and the relevant benchmark index. The Independent Trustees noted that the Funds have been in operation since October 1, 2008, and that this was a relatively short period of time to evaluate performance. The Independent Trustees also noted the extreme volatility in the markets during the period since the Funds commenced operations. It was noted that the Lipper material presented performance information since inception and for the year ended December 31, 2010. It was noted that, since inception and for the one year ended December 31, 2010, both the IVA Worldwide Fund and the IVA International Fund performed in the first quintile of the Lipper peer group and Lipper universe funds, and above the average and the median for the peer funds selected by the Adviser. Since inception through March 31, 2011, the Independent Trustees also noted that the performance of the IVA Worldwide Fund

48

| Additional Information (unaudited) | IVA Funds |

and the IVA International Fund exceeded the performance of each Fund’s benchmark index (the MSCI All Country World Index (Net) in the case of the IVA Worldwide Fund and the MSCI All Country World ex-U.S. Index (Net) in the case of the IVA International Fund). The Independent Trustees also noted each Fund’s favorable risk-adjusted performance since inception as indicated in the materials provided by the Adviser. The Independent Trustees considered the performance of the Funds in light of their investment approach, asset allocation and the overall financial market conditions. They also noted that the Adviser’s interests were well-aligned with the Funds’ shareholders as a result of the significant investment in the Funds by the Adviser’s partners. The Independent Trustees determined that each Fund’s performance, in light of all the considerations noted above, was satisfactory. The Trustees determined that the Adviser continued to be an appropriate investment adviser for each Fund and concluded that each Fund’s performance supported the renewal of the Advisory Agreement.

Cost of the services provided and profits realized by the Adviser from its relationship with each Fund: The Independent Trustees considered the investment advisory fee payable by each Fund as well as total expense ratios. The Independent Trustees considered each Fund’s contractual management fee at common asset levels compared to the comparable Lipper funds. It was noted that each Fund’s contractual advisory fee was above the median for the Lipper peer funds. The Independent Trustees noted that the contractual management fee for the IVA Worldwide Fund was slightly higher than the average and median of the Adviser peer funds and that the contractual fee rate for the IVA International Fund was slightly higher than the average and equal to the median of the Adviser peer funds. The Independent Trustees also noted that the IVA Worldwide Fund’s actual total expense ratio was slightly lower than the median of the Lipper peer and universe funds, and that the IVA International Fund’s actual total expense ratio was lower than the median of the Lipper peer and universe funds. They also noted that the total expense ratio for the Class A shares of both Funds was slightly higher than the average and median total expense ratio of the Adviser peer funds, while the total expense ratio for the Class I shares of both Funds was lower than the average and median total expense ratio of the Adviser peer funds. The Independent Trustees noted that the total expense ratios for each Fund had declined since the Funds commenced operations due to the growth in the assets of the Funds. The Independent Trustees concluded that each Fund’s current expense structure is satisfactory.

The Independent Trustees also reviewed information regarding the profitability to the Adviser of its relationship with each Fund. The Independent Trustees considered the level of the Adviser’s profits and whether the profits were reasonable. The Independent Trustees took into consideration other benefits to be derived by the Adviser in connection with the Advisory Agreement. Since the Adviser has no affiliates with business relationships with the Funds, the Independent Trustees noted that the Adviser receives no additional revenues from providing other services to the Funds. Moreover, the Independent Trustees noted that the Adviser’s interests are well-aligned with the Funds’ shareholders in the efficient management of the services and costs of the third-party service providers to the Funds. The Independent Trustees took into consideration the research the Adviser receives from brokers which benefits the Funds and other Adviser clients and which might offset expenses the Adviser would otherwise incur. The Independent Trustees also noted the Adviser’s willingness to close both Funds and its other investment products to most new investors in order to best execute its investment strategy on behalf of the existing Fund shareholders and investors, although this would be expected to limit the Adviser’s revenue and profitability. They further noted the continuing investment by the Adviser in both its infrastructure and staff. The Independent Trustees also considered the entrepreneurial risk and financial exposure assumed by the Adviser in developing and managing the Funds. They noted that the development and management of the Funds requires a high degree of knowledge, sophistication and judgment and potentially subjected the Adviser to substantial financial exposure. The Independent Trustees concluded that the profits realized by the Adviser from its relationship with each Fund were reasonable and consistent with fiduciary duties.

The extent to which economies of scale would be realized as the Funds grow and whether fee levels would reflect such economies of scale: The Independent Trustees noted that they considered whether there have been economies of scale in respect to the management of each Fund, whether each Fund appropriately benefitted from any economies of scale and whether there is potential for realization of any further economies of scale. The Independent Trustees noted that the Adviser had contractually agreed to waive fees and/or reimburse expenses in order to maintain operating expense ratios at competitive levels and acknowledged the Adviser’s intention, even though both Funds are currently operating at expense ratios below the expense limitation levels, to continue this expense limitation practice. The Independent Trustees noted that the total expense ratio of each Fund had declined since the Funds commenced operations due to the growth in the assets of the Funds. The Independent Trustees concluded that the current fee structure for each Fund was reasonable, that shareholders sufficiently participated in economies of scale at the present time at current asset levels and that no changes were currently necessary.

Comparison of services rendered and fees paid to those under other investment advisory contracts, such as contracts of the same and other investment advisers or other clients: The Independent Trustees noted that they compared the services rendered and the fees paid under the Advisory Agreement with those under other investment management contracts of other investment advisers managing funds deemed comparable. The Independent Trustees stated that they also considered the services rendered and fees paid under the Advisory Agreement as compared to the Adviser’s other management contracts with institutional and other accounts with similar investment mandates. As noted above, the Independent Trustees acknowledged the greater level of portfolio management, compliance and administrative oversight services required for the Funds, as well as the higher level of

49

| Additional Information (unaudited) | IVA Funds |

financial exposure assumed, as compared to the Adviser’s institutional accounts. The Trustees considered the lower fees that the Adviser’s institutional account clients were charged, and noted the substantial increase in regulatory requirements, board support services, attention to SEC filings, registered investment company compliance services and shareholder and adviser client services provided to the Funds that the Adviser would not be required to provide to the institutional accounts. In light of these substantive differences in services, the Trustees found that the institutional account fees, while similar to those of the Funds in amount, did not relate to similar services provided by the Adviser to the Funds, and that the Funds required significantly more resources than the institutional accounts. Therefore, the Trustees found that the institutional accounts were not comparable to the Funds.

Accordingly, in light of each of the findings and taken as a whole, the Independent Trustees determined that, on a comparative basis, the fee under the Advisory Agreement for each Fund was reasonable in relation to the services provided and could have been the product of an arm’s length bargain. No single factor was cited as determinative to the decision of the Independent Trustees. Rather, after weighing all of the consideration and conclusions discussed above, the Board, including the Independent Trustees, unanimously recommended approval of the continuation of the Advisory Agreement for each Fund.

Proxy Voting. Information on how the Funds voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio transactions are available (1) without charge, upon request, by calling 866-941-4482, and (2) on the Securities and Exchange Commission (“SEC”) website at www.sec.gov by accessing the Funds’ Form N-PX and Statement of Additional Information in the Funds’ registration statement on Form N-1A.

Schedules of Portfolio Holdings. The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the SEC’s website at www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. To obtain the Funds’ Form N-Q, shareholders can call 866-941-4482.

Trustees and Officers of the Funds. Additional information about Trustees and officers of the Funds is included in the Statement of Additional Information which is available, without charge, upon request, by calling 866-941-4482.

50

| Fund Expenses (unaudited) | IVA Funds |

As a shareholder of the Funds, you may incur two types of costs: (1) transaction costs, including initial sales charges and/or redemption fees; and (2) ongoing costs, including investment advisory fees, distribution and/or service (12b-1) fees and other operating fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2011 and held for the six months ended September 30, 2011.

ACTUAL EXPENSES

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading titled “Expenses Paid During the Period.”

BASED ON ACTUAL TOTAL RETURN FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2011(a)

| | | | Actual

Total

Return | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period(b) | |

|---|

Worldwide Fund | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | –9.09 | % | $1,000.00 | | $909.10 | | 1.28% | | $6.13 | |

| Class C | | | | | –9.44 | % | 1,000.00 | | 905.60 | | 2.03% | | 9.70 | |

| Class I | | | | | –8.97 | % | 1,000.00 | | 910.30 | | 1.03% | | 4.93 | |

International Fund | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | –6.60 | % | $1,000.00 | | $934.00 | | 1.29% | | $6.25 | |

| Class C | | | | | –6.97 | % | 1,000.00 | | 930.30 | | 2.04% | | 9.87 | |

| Class I | | | | | –6.47 | % | 1,000.00 | | 935.30 | | 1.04% | | 5.05 | |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account values and expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Funds and other funds. To do so, compare the 5% hypothetical example relating to the Funds with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table below are meant to highlight your ongoing costs and do not reflect any transactional costs, such as initial sales charges (loads) or redemption fees, if any. Therefore, the table is useful in comparing ongoing costs only and will not help you determine your relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

BASED ON HYPOTHETICAL TOTAL RETURN FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2011

| | | | Hypothetical

Annualized

Total Return | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period(b) | |

|---|

Worldwide Fund | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | 5.00 | % | $1,000.00 | | $1,018.65 | | 1.28% | | $6.48 | |

| Class C | | | | | 5.00 | % | 1,000.00 | | 1,014.89 | | 2.03% | | 10.25 | |

| Class I | | | | | 5.00 | % | 1,000.00 | | 1,019.90 | | 1.03% | | 5.22 | |

International Fund | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | 5.00 | % | $1,000.00 | | $1,018.60 | | 1.29% | | $6.53 | |

| Class C | | | | | 5.00 | % | 1,000.00 | | 1,014.84 | | 2.04% | | 10.30 | |

| Class I | | | | | 5.00 | % | 1,000.00 | | 1,019.85 | | 1.04% | | 5.27 | |

(a) | | Assumes reinvestment of all dividends and capital gain distributions, if any. |

(b) | | Expenses are equal to the Funds’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by 183 days in the most recent fiscal half-year, then divided by 365. |

51

| Important Tax Information (unaudited) | IVA Funds |

For the fiscal year ended September 30, 2011, the Funds will designate up to the maximum amount allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual’s tax bracket. Complete information will be reported in conjunction with Form 1099-DIV.

The Funds may elect to pass through to shareholders the income tax credit for taxes paid to foreign countries. Foreign source income and foreign tax expense per outstanding share on September 30, 2011 are as follows:

|

|

|

| Foreign Source

Income

|

| Foreign Tax

Expense

|

|

|---|

| Worldwide Fund | | | | $0.19 | | $ | 0.02 | | | | | |

| International Fund | | | | $0.32 | | $ | 0.03 | | | | | |

If elected, the pass-through of the foreign tax credit will affect only those persons who are shareholders on the dividend record date in December 2011. These shareholders will receive more detailed information along with their 2011 Form 1099-DIV.

52

www.ivafunds.com

Investment Adviser

International Value Advisers, LLC

717 Fifth Avenue

New York, NY 10022

Distributor

IVA Funds Distributors, LLC

3 Canal Plaza, Suite 100

Portland, ME 04101

Custodian

State Street Bank and Trust Company

200 Newport Avenue

North Quincy, MA 02171

Transfer Agent

Boston Financial Data Services, Inc.

2000 Crown Colony Drive

Quincy, MA 02169

Counsel

K&L Gates LLP

State Street Financial Center

One Lincoln Street

Boston, MA 02111-2950

Independent Registered Public Accounting Firm

Ernst & Young LLP

200 Clarendon Street

Boston, MA 02116-5072

This report is submitted for the general information of the Funds’ shareholders. The report is not authorized for distribution to prospective investors in the Funds unless it is accompanied or preceded by the Funds’ current prospectus, which includes information regarding the Funds’ risks, objectives, fees and expenses, experience of its management, and other information.

The commentary within An Owner’s Manual, the Letter from the President, the Letter from the Portfolio Managers, and the Management’s Discussion of Fund Performance reflects their current views and opinions as of the date of this report. Any such views are subject to change at any time based upon market or other conditions and IVA Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions are based on numerous factors, may not be relied on as an indication of trading intent. References to specific securities should not be construed as recommendations or investment advice.

Item 2. Code of Ethics.

(a) As of the end of the period covered by this Form N-CSR, the registrant has adopted a code of ethics, as defined in Item 2(b) of Form N-CSR, that applies to the registrant’s principal executive officer and principal financial officer.

(c) The registrant has not amended its code of ethics during the period covered by this Form N-CSR.

(d) The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this Form N-CSR.

(e)

Not applicable.

(f) A copy of the registrant’s code of ethics is filed as Exhibit 12(a)(1) to this Form N-CSR.

Item 3. Audit Committee Financial Expert.

(a)(1) The registrant’s Board of Trustees (the “Board”) has determined that the registrant has a member serving on the registrant’s Audit Committee that possess the attributes identified in Form N-CSR to qualify as an “audit committee financial expert.”

(a)(2) The audit committee financial expert is Manu Bammi and he has been deemed to be “independent” as that term is defined in Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The firm of Ernst &Young LLP (“E&Y”) serves as the independent registered public accounting firm for the registrant.

(a) Audit Fees.

For the fiscal years ended September 30, 2010 and September 30, 2011, the aggregate fees billed for professional services rendered by E&Y for the audit of the registrant’s annual financial statements and/or for services that are normally provided by E&Y in connection with statutory and regulatory filings or engagements were $48,100 and $53,400, respectively.

(b) Audit-Related Fees.

For the fiscal years ended September 30, 2010 and September 30, 2011, the aggregate fees billed for assurance and related services rendered by E&Y that are reasonably related to the performance of the audit or review of the registrant’s financial statements and that are not reported under Audit Fees above were $0 and $0, respectively.

For the twelve month periods ended September 30, 2010 and September 30, 2011, the aggregate Audit-Related Fees billed by E&Y that were required to be approved by the registrant’s Audit Committee for audit-related services rendered to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant (the

“Affiliated Service Providers”) that relate directly to the operations and financial reporting of the registrant were $0 and $0, respectively.

(c) Tax Fees.

For the fiscal years ended September 30, 2010 and September 30, 2011, the aggregate fees billed for tax compliance, tax advice and tax planning by E&Y were $13,600 and $20,393, respectively. Services for which fees in the Tax Fees category are billed include E&Y’s review of the registrant’s U.S. federal income tax returns and the required state corporate income tax returns, as well as E&Y’s review of excise tax distribution calculations.

For the twelve month periods ended September 30, 2010 and September 30, 2011, the aggregate Tax Fees billed by E&Y that were required to be approved by the registrant’s Audit Committee for tax compliance, tax advice and tax planning services rendered on behalf of Affiliated Service Providers that relate directly to the operations and financial reporting of the registrant were $0 and $0, respectively.

(d) All Other Fees.

For the fiscal years ended September 30, 2010 and September 30, 2011, the aggregate fees billed by E&Y to the registrant for all services other than services reported under Audit Fees, Audit-Related Fees, and Tax Fees were $0 and $0, respectively.

For the twelve month periods ended September 30, 2010 and September 30, 2011, the aggregate fees in this category billed by E&Y that were required to be approved by the registrant’s Audit Committee for services rendered on behalf of Affiliated Service Providers that relate directly to the operations and financial reporting of the registrant were $0 and $0, respectively.

(e)(1) Audit Committee’s Pre-Approval Policies and Procedures.

The registrant’s Audit Committee has the sole authority to pre-approve all audit and non-audit services to be provided by E&Y to the registrant, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)B of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Pre-approval of audit and non-audit services is not required if the engagement to render the services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee (the “Pre-Approval Procedures”). The registrant’s Audit Committee adopted Pre-Approval Procedures on November 9, 2009, which generally permit:

Audit-Related Services consisting of: (i) consultations regarding accounting, operational or regulatory implications, or regulatory/compliance matters of proposed or actual transactions affecting the operations or financial reporting and (ii) other auditing procedures and issuance of special purpose reports;

Tax Services consisting of: (i) recurring tax services and (ii) consultations regarding tax consequences of proposed or actual transactions; and

Other Non-Audit Services including: (i) business support, (ii) other control and regulatory compliance projects and (iii) training.

All such services are subject to a per calendar quarterly limitation.

(e)(2) Percentage of Services.

None of the services described in each of paragraphs (b) through (d) of this Item were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) For the fiscal years ended September 30, 2010 and September 30, 2011, the aggregate non-audit fees billed by E&Y for services rendered to the registrant were $13,600 and $20,393, respectively.

For the twelve month periods ended September 30, 2010 and September 30, 2011, the aggregate non-audit fees billed by E&Y for services rendered to the Affiliated Service Providers were $0 and $0, respectively.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to the registrant.

Item 6. Schedule of Investments.

(a) The audited schedules of investments are included in the report to shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to the registrant.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to the registrant.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to the registrant.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant does not have procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees. The Nominating and Governance

Committee may, in its sole discretion, consider nominees recommended by each Fund’s shareholders.

Item 11. Controls and Procedures.

(a) Within 90 days of the filing date of this Form N-CSR, Michael W. Malafronte, the registrant’s President and Chief Executive Officer, and Stefanie J. Hempstead, the registrant’s Treasurer and Chief Financial Officer, reviewed the registrant’s Disclosure Controls and Procedures and Internal Control over Financial Reporting (the “Procedures”) (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) and evaluated their effectiveness. Based on their review, Mr. Malafronte and Ms. Hempstead determined that the Procedures are reasonably designed to ensure that information required to be disclosed by the registrant on Form N-CSR is accumulated and communicated to the registrant’s management to allow timely decisions regarding required disclosure.

(b) There were no changes in the registrant’s Procedures (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s Procedures.

Item 12. Exhibits.

(a)(1) Code of Ethics referred to in Item 2 is filed herewith.

(a)(2) The certifications required by Rule 30a-2(a) of the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”) are filed herewith.

(a)(3) Not applicable.

(b) The certifications required by Rule 30a-2(b) of the 1940 Act and Section 906 of the Sarbanes-Oxley Act are filed herewith.

The certifications provided pursuant to Rule 30a-2(b) of the 1940 Act and Section 906 of the Sarbanes-Oxley Act are not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. Such certifications will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent that the registrant specifically incorporates them by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

IVA FIDUCIARY TRUST

By:

/s/ Michael W. Malafronte

Michael W. Malafronte

President and Chief Executive Officer

Date:

November 29, 2011

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By:

/s/ Michael W. Malafronte

Michael W. Malafronte

President and Chief Executive Officer

Date:

November 29, 2011

By:

/s/ Stefanie J. Hempstead

Stefanie J. Hempstead

Treasurer and Chief Financial Officer

Date:

November 29, 2011