| Additional Information (unaudited) | IVA Funds |

Board Approval of Investment Advisory Agreement. At telephonic and in-person meetings held on May 12, 2010 and May 17, 2010, respectively, the Board of Trustees of the Trust (the “Board”), including all of the Trustees who are not “interested persons” of the Trust (the “Independent Trustees”) discussed the Investment Advisory Agreement (the “Agreement”) between the Trust, on behalf of the Funds, and International Value Advisers, LLC (the “Adviser”).

To assist the Board in its evaluation of the Agreement, the Independent Trustees received comprehensive written materials and other information, in adequate time in advance of the meeting, which outlined, among other matters, (i) information confirming the financial condition of the Adviser and the Adviser’s profitability derived from its relationship with each Fund, (ii) a description of the personnel and services provided by the Adviser, (iii) information on compliance matters; (iv) comparative information on investment performance of the Funds, and (v) information regarding brokerage and portfolio transactions of the Funds. The Independent Trustees also received information prepared independently by Lipper Inc. (“Lipper”) containing detailed contractual management fee, expense ratio and performance comparisons for each Fund with other mutual funds in their “peer group” and “universe” as determined by the Lipper methodology and a memorandum prepared by Sidley Austin LLP, Independent Trustees counsel, outlining the legal duties of the Independent Trustees in evaluating investment advisory arrangements.

In considering factors relating to the approval of the continuance of the Agreement, the Independent Trustees noted that Sidley Austin LLP had provided the Independent Trustees with assistance and advice. The Independent Trustees also took into account information furnished throughout the year at regular Board meetings, including reports on investment performance, shareholder services, distribution fees and expenses, regulatory compliance and other services provided to each Fund. The Independent Trustees also considered other matters they deemed important to the approval process, such as allocation of Fund brokerage commissions, and other direct and indirect benefits to the Adviser from its relationship with the Funds. The Independent Trustees noted that the Board met throughout the year with the portfolio managers of the Funds. The Independent Trustees, in their deliberations, recognized that for many of the Funds’ shareholders, the decision to purchase Fund shares included a decision to select the Adviser as the investment adviser for their investments and that there was a strong association in the minds of Fund shareholders between the Adviser and each Fund.

The Independent Trustees noted that with respect to the Agreement, although it related to both Funds, the Independent Trustees had considered each Fund separately. Among other factors, the Trustees noted that they considered the following:

The nature, extent and quality of services provided by the Adviser: The Independent Trustees reviewed the services that the Adviser provides to each Fund, including, but not limited to, making the day-to-day investment decisions for each Fund, and generally managing each Fund���s investments in accordance with the stated policies of the Fund. The Independent Trustees noted that throughout the year they discussed with officers and portfolio managers of the Funds the types of transactions that were being done on behalf of each Fund. Additionally, the Independent Trustees took into account the services provided by the Adviser to its other accounts that have investment mandates similar to the Funds. In particular, they noted the greater level of portfolio management, compliance and administrative oversight services required for the Funds, mutual funds registered under the Investment Company Act of 1940, as compared to the Adviser’s institutional accounts. The Independent Trustees also considered the education, background and experience of the Adviser’s personnel, noting in particular that the favorable history and reputation of the portfolio managers for the Funds have had, and are likely to continue to have, a favorable impact on the Funds. In this regard, the significant growth of the Funds during the period since inception was noted. The Independent Trustees additionally noted the Adviser’s ability to attract quality and experienced personnel. The Independent Trustees noted they also considered the administrative services provided by the Adviser, including compliance and accounting services, and oversight of third party service providers. After considering the above factors, the Independent Trustees concluded that the nature, quality and extent of services provided by the Adviser are adequate and appropriate and would continue to be suitable for each Fund.

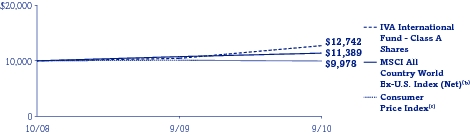

Investment performance of each Fund and the Adviser: The Independent Trustees considered the investment performance of each Fund compared to the Lipper peer funds, the Lipper universe funds, the peer funds selected by the Adviser and the relevant benchmark index. The Independent Trustees noted that the Funds only had been in operation since October 1, 2008, and that this was a relatively short period of time to evaluate performance. The Independent Trustees also noted the extreme volatility in the markets during the period since the Funds commenced operations. It was noted that the Lipper material only presented performance information for the year ended December 31, 2009. It was noted that, for the one year ended December 31, 2009, both the IVA Worldwide Fund and the IVA International Fund performed below the median of the Lipper peer group and Lipper universe funds, as well as the peer funds selected by the Adviser. Since inception through March 31, 2010, however, the Independent Trustees noted that the performance of the IVA Worldwide Fund and the IVA International Fund exceeded the median of the peer funds selected by the Adviser as well as the performance of each Fund’s benchmark index (the MSCI All Country World Index in the case of the IVA Worldwide Fund and the MSCI All Country World Ex-U.S. Index in the case of the IVA International Fund). The Independent Trustees considered the performance of the Funds in light of their investment approach,

43

| Additional Information (unaudited) | IVA Funds |

asset allocation, including current holdings of cash, and the overall financial market conditions. The Independent Trustees determined that each Fund’s performance, in light of all the considerations noted above, was satisfactory. The Independent Trustees determined that the Adviser continued to be an appropriate investment adviser for each Fund and concluded that each Fund’s performance supported the renewal of the Agreement.

Cost of the services provided and profits realized by the Adviser from its relationship with each Fund: The Independent Trustees considered the investment advisory fee payable by each Fund as well as total expense ratios. The Independent Trustees considered each Fund’s contractual management fee at common asset levels compared to the comparable Lipper funds. It was noted that the IVA Worldwide Fund’s advisory fee was slightly above the median and that IVA International Fund’s advisory fee was slightly below the median for the Lipper peer funds. The Independent Trustees also noted that the IVA Worldwide Fund’s actual total expense ratio was slightly higher than the median of the Lipper peer funds and lower than the median of the Lipper universe funds, and that the IVA International Fund’s actual total expense ratio was lower than the median of the Lipper peer and universe funds. The Independent Trustees noted that the total expense ratios for each Fund have continued to decline. The Independent Trustees concluded that, in light of market conditions, each Fund’s current expense structure is satisfactory.

The Independent Trustees also reviewed information regarding the profitability to the Adviser as a result of its relationship with each Fund. The Independent Trustees considered the level of the Adviser’s profits and whether the profits were reasonable. The Independent Trustees took into consideration other benefits to be derived by the Adviser in connection with the Agreement. Since the Adviser has no affiliates with business relationships with the Funds, the Independent Trustees noted that the Adviser receives no additional revenues from providing other services to the Funds. Moreover, the Independent Trustees noted that the Adviser’s interests are well-aligned with the Funds’ shareholders in the efficient management of the services and costs of the third-party service providers to the Funds. In addition, it was noted that the Adviser has no soft dollar arrangements which might offset expenses the Adviser would otherwise incur. Since the Adviser and the Funds had only recently commenced operations, the Independent Trustees considered the entrepreneurial risk and financial exposure assumed by the Adviser in developing and managing the Funds. They noted that the development and management of the Funds requires a high degree of knowledge, sophistication and judgment and potentially subjected the Adviser to substantial financial exposure. In this regard, the Independent Trustees noted in particular that the Adviser had contractually agreed to waive fees and/or reimburse expenses to limit the total operating expense ratio of each Fund. The Independent Trustees concluded that the profits realized by the Adviser from its relationship with each Fund were reasonable and consistent with fiduciary duties.

The extent to which economies of scale would be realized as the Funds grow and whether fee levels would reflect such economies of scale: The Independent Trustees considered whether there have been economies of scale in respect to the management of each Fund, whether each Fund appropriately benefited from any economies of scale and whether there is potential for realization of any further economies of scale. The Independent Trustees noted, as discussed above, that the Adviser had contractually agreed to waive fees and/or reimburse expenses in order to maintain operating expense ratios at competitive levels and acknowledged the Adviser’s intention, even though both Funds are currently operating at expense ratios below the expense limitation levels, to continue this expense limitation practice. The Independent Trustees noted that the total expense ratio of each Fund has continued to decline since the Funds commenced operations. The Independent Trustees concluded that the current fee structure for each Fund was reasonable, that shareholders sufficiently participated in economies of scale at the present time at current asset levels and that no changes were currently necessary.

Comparison of services rendered and fees paid to those under other investment advisory contracts, such as contracts of the same and other investment advisers or other clients: The Independent Trustees compared the services rendered and the fees paid under the Agreement with those under other investment management contracts of other investment advisers managing funds deemed comparable. The Independent Trustees also considered the services rendered and fees paid under the Agreement as compared to the Adviser’s other management contracts with institutional and other accounts with similar investment mandates. As noted above, the Independent Trustees acknowledged the greater level of portfolio management, compliance and administrative oversight services required for the Funds, as well as the higher level of financial exposure assumed, as compared to the Adviser’s institutional accounts. The Independent Trustees determined that, on a comparative basis, the fee under the Agreement for each Fund was reasonable in relation to the services provided.

No single factor was cited as determinative to the decision of the Independent Trustees. Rather, after weighing all of the considerations and conclusions discussed above, the Trustees, including the Independent Trustees, unanimously approved the continuation of the Agreement for each Fund.

Proxy Voting. Information on how the Funds voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio transactions are available (1) without charge, upon request, by calling 866-941-4482, and (2) on the Securities and Exchange Commission (“SEC”) website at www.sec.gov by accessing the Funds’ Form N-PX and Statement of Additional Information in the Funds’ registration statement on Form N-1A.

44

| Additional Information (unaudited) | IVA Funds |

Schedules of Portfolio Holdings. The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the SEC’s website at www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. To obtain the Funds’ Form N-Q, shareholders can call 866-941-4482.

Trustees and Officers of the Funds. Additional information about Trustees and Officers of the Funds is included in the Statement of Additional Information which is available, without charge, upon request, by calling 866-941-4482.

45

| Fund Expenses (unaudited) | IVA Funds |

As a shareholder of the Funds, you may incur two types of costs: (1) transaction costs, including initial sales charges and/or redemption fees; and (2) ongoing costs, including investment advisory fees, distribution and/or service (12b-1) fees and other operating fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2010 and held for the six months ended September 30, 2010.

ACTUAL EXPENSES

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading titled “Expenses Paid During the Period.”

BASED ON ACTUAL TOTAL RETURN FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2010(a)

| | | | Actual

Total

Return | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period(b) | |

|---|

| Worldwide Fund | | | | | | | | | | | | | | |

| Class A | | | | | 4.50% | | $1,000.00 | | $1,045.00 | | 1.31% | | $6.72 | |

| Class C | | | | | 4.12% | | 1,000.00 | | 1,041.20 | | 2.06% | | 10.54 | |

| Class I | | | | | 4.63% | | 1,000.00 | | 1,046.30 | | 1.06% | | 5.44 | |

| International Fund | | | | | | | | | | | | | | |

| Class A | | | | | 5.34% | | $1,000.00 | | $1,053.40 | | 1.38% | | $7.10 | |

| Class C | | | | | 4.95% | | 1,000.00 | | 1,049.50 | | 2.15% | | 11.05 | |

| Class I | | | | | 5.47% | | 1,000.00 | | 1,054.70 | | 1.11% | | 5.72 | |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account values and expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Funds and other funds. To do so, compare the 5% hypothetical example relating to the Funds with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table below are meant to highlight your ongoing costs and do not reflect any transactional costs, such as initial sales charges (loads) or redemption fees, if any. Therefore, the table is useful in comparing ongoing costs only and will not help you determine your relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

BASED ON HYPOTHETICAL TOTAL RETURN FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2010

| | | | Hypothetical

Annualized

Total Return | Beginning

Account Value | | Ending

Account Value | | Annualized

Expense

Ratio | | Expenses

Paid During

the Period(b) | |

|---|

| Worldwide Fund | | | | | | | | | | | | | | |

| Class A | | | | | 5.00% | | $1,000.00 | | $1,018.50 | | 1.31% | | $6.63 | |

| Class C | | | | | 5.00% | | 1,000.00 | | 1,014.74 | | 2.06% | | 10.40 | |

| Class I | | | | | 5.00% | | 1,000.00 | | 1,019.75 | | 1.06% | | 5.37 | |

| International Fund | | | | | | | | | | | | | | |

| Class A | | | | | 5.00% | | $1,000.00 | | $1,018.15 | | 1.38% | | $6.98 | |

| Class C | | | | | 5.00% | | 1,000.00 | | 1,014.29 | | 2.15% | | 10.86 | |

| Class I | | | | | 5.00% | | 1,000.00 | | 1,019.50 | | 1.11% | | 5.62 | |

(a) | | Assumes reinvestment of all dividends and capital gain distributions, if any. |

(b) | | Expenses are equal to the Funds’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by 183 days in the most recent fiscal half-year, then divided by 365. |

46

| Important Tax Information (unaudited) | IVA Funds |

For the fiscal year ended September 30, 2010, the Funds will designate up to the maximum amount allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual’s tax bracket. Complete information will be reported in conjunction with Form 1099-DIV.

The Funds may elect to pass through to shareholders the income tax credit for taxes paid to foreign countries. Foreign source income and foreign tax expense per outstanding share on September 30, 2010 are as follows:

|

|

|

| Foreign Source

Income

|

| Foreign Tax

Expense

|

|---|

| Worldwide Fund | | | | $ | 0.13 | | | $ | 0.01 | |

| International Fund | | | | $ | 0.20 | | | $ | 0.02 | |

If elected, the pass-through of the foreign tax credit will affect only those persons who are shareholders on the dividend record date in December 2010. These shareholders will receive more detailed information with their 2010 Form 1099-DIV.

47

www.ivafunds.com

Investment Adviser

International Value Advisers, LLC

645 Madison Avenue

New York, NY 10022

Distributor

IVA Funds Distributors, LLC

3 Canal Plaza, Suite 100

Portland, ME 04101

Custodian

State Street Bank and Trust Company

200 Newport Avenue

North Quincy, MA 02171

Transfer Agent

Boston Financial Data Services, Inc.

2000 Crown Colony Drive

Quincy, MA 02169

Counsel

K&L Gates LLP

State Street Financial Center

One Lincoln Street

Boston, MA 02111-2950

Independent Registered Public Accounting Firm

Ernst & Young LLP

200 Clarendon Street

Boston MA, 02116-5072

This report is submitted for the general information of the Funds’ shareholders. The report is not authorized for distribution to prospective investors in the Funds unless it is accompanied or preceded by the Funds’ current prospectus.

The commentary within An Owner’s Manual, the Letter from the President and the Letter from the Portfolio Managers reflects their current views and opinions as of the dates they were written. Any such views are subject to change at any time based upon market or other conditions and IVA Funds disclaims any responsibility to update such views.

Item 2. Code of Ethics.

(a) As of the end of the period covered by this Form N-CSR, the registrant has adopted a code of ethics, as defined in Item 2(b) of Form N-CSR, that applies to the registrant’s principal executive officer and principal financial officer.

(c) The registrant has not amended its code of ethics during the period covered by this Form N-CSR.

(d) The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this Form N-CSR.

(e)

Not applicable.

(f) A copy of the registrant’s code of ethics is filed as Exhibit 12(a)(1) to this Form N-CSR.

Item 3. Audit Committee Financial Expert.

(a)(1) The registrant’s Board of Trustees (the “Board”) has determined that the registrant has a member serving on the registrant’s Audit Committee that possess the attributes identified in Form N-CSR to qualify as an “audit committee financial expert.”

(a)(2) The audit committee financial expert is Manu Bammi and he has been deemed to be “independent” as that term is defined in Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The firm of Ernst &Young LLP (“E&Y”) serves as the independent registered public accounting firm for the registrant.

(a) Audit Fees.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate fees billed for professional services rendered by E&Y for the audit of the registrant’s seed money financial statements and the annual financial statements or for services that are normally provided by E&Y in connection with statutory and regulatory filings or engagements were $55,250 and $48,100, respectively.

(b) Audit-Related Fees.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate fees billed for assurance and related services rendered by E&Y that are reasonably related to the performance of the audit or review of the registrant’s financial statements and that are not reported under Audit Fees above were $0 and $0, respectively.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate Audit-Related Fees billed by E&Y that were required to be approved by the registrant’s

Audit Committee for audit-related services rendered to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant (the “Affiliated Service Providers”) that relate directly to the operations and financial reporting of the registrant was $0 and $0, respectively.

(c) Tax Fees.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate fees billed for tax compliance, tax advice and tax planning by E&Y were $14,963 and $13,600, respectively. Services for which fees in the Tax Fees category are billed include E&Y’s review of the registrant’s U.S. federal income tax returns and the required state corporate income tax returns, as well as E&Y’s review of excise tax distribution calculations.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate Tax Fees billed by E&Y that were required to be approved by the registrant’s Audit Committee for tax compliance, tax advice and tax planning services rendered on behalf of Affiliated Service Providers that relate directly to the operations and financial reporting of the registrant were $0 and $0, respectively.

(d) All Other Fees.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate fees billed by E&Y to the registrant for all services other than services reported under Audit Fees, Audit-Related Fees, and Tax Fees were $0 and $0, respectively.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate fees in this category billed by E&Y that were required to be approved by the registrant’s Audit Committee for services rendered on behalf of Affiliated Service Providers that relate directly to the operations and financial reporting of the registrant was $0 and $0, respectively.

(e)(1) Audit Committee Pre-Approval Policies and Procedures.

The registrant’s Audit Committee has the sole authority to pre-approve all audit and non-audit services to be provided by E&Y to the registrant, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)B of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Pre-approval of audit and non-audit services is not required if the engagement to render the services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee (the “Pre-Approval Procedures”). The registrant’s Audit Committee adopted Pre-Approval Procedures on November 9, 2009, which generally permit:

Audit-Related Services consisting of: (i) consultations regarding accounting, operational or regulatory implications, or regulatory/compliance matters of proposed or actual transactions affecting the operations or financial reporting and (ii) other auditing procedures and issuance of special purpose reports;

Tax Services consisting of: (i) recurring tax services and (ii) consultations regarding tax consequences of proposed or actual transactions; and

Other Non-Audit Services including: (i) business support, (ii) other control and regulatory compliance projects and (iii) training.

All such services are subject to a per calendar quarterly limitation.

(e)(2) Percentage of Services.

None of the services described in each of paragraphs (b) through (d) of this Item were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate non-audit fees billed by E&Y for services rendered to the registrant were $14,963 and $13,600, respectively.

For the fiscal period from the commencement of operations on October 1, 2008 through September 30, 2009 and for the fiscal year ended September 30, 2010, the aggregate non-audit fees billed by E&Y for services rendered to the Affiliated Service Providers was $0 and $0, respectively.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to the registrant.

Item 6. Schedule of Investments.

(a) The audited schedules of investments are included in the report to shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to the registrant.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to the registrant.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to the registrant.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant does not have procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees. The Nominating and Governance Committee may, in its sole discretion, consider nominees recommended by each Fund’s shareholders.

Item 11. Controls and Procedures.

(a) Within 90 days of the filing date of this Form N-CSR, Michael W. Malafronte, the registrant’s President and Chief Executive Officer, and Stefanie J. Hempstead, the registrant’s Treasurer and Chief Financial Officer, reviewed the registrant’s Disclosure Controls and Procedures and Internal Control over Financial Reporting (the “Procedures”) (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) and evaluated their effectiveness. Based on their review, Mr. Malafronte and Ms. Hempstead determined that the Procedures are reasonably designed to ensure that information required to be disclosed by the registrant on Form N-CSR is accumulated and communicated to the registrant’s management to allow timely decisions regarding required disclosure.

(b) There were no changes in the registrant’s Procedures (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s Procedures.

Item 12. Exhibits.

(a)(1) Code of Ethics referred to in Item 2 is filed herewith.

(a)(2) The certifications required by Rule 30a-2(a) of the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”) are filed herewith.

(a)(3) Not applicable.

(b) The certifications required by Rule 30a-2(b) of the 1940 Act and Section 906 of the Sarbanes-Oxley Act are filed herewith.

The certifications provided pursuant to Rule 30a-2(b) of the 1940 Act and Section 906 of the Sarbanes-Oxley Act are not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. Such certifications will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent that the registrant specifically incorporates them by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

IVA FIDUCIARY TRUST

By:

/s/ Michael W. Malafronte

Michael W. Malafronte

President and Chief Executive Officer

Date:

December 2, 2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By:

/s/ Michael W. Malafronte

Michael W. Malafronte

President and Chief Executive Officer

Date:

December 2, 2010

By:

/s/ Stefanie J. Hempstead

Stefanie J. Hempstead

Treasurer and Chief Financial Officer

Date:

December 2, 2010