UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22235

AQR Funds

(Exact name of registrant as specified in charter)

Two Greenwich Plaza, 4th Floor

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

William J. Fenrich, Esq.

Principal and Chief Legal Officer

AQR Capital Management, LLC

Two Greenwich Plaza

4th Floor

Greenwich, CT 06830

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: 203-742-3600

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 to December 31, 2017

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1.)

Annual Report

December 31, 2017

AQR Alternative Risk Premia Fund

AQR Diversified Arbitrage Fund

AQR Equity Market Neutral Fund

AQR Global Macro Fund

AQR Long-Short Equity Fund

AQR Multi-Strategy Alternative Fund

AQR Risk-Balanced Commodities Strategy Fund

AQR Risk Parity Fund

AQR Risk Parity II HV Fund

AQR Risk Parity II MV Fund

AQR Style Premia Alternative Fund

AQR Style Premia Alternative LV Fund

Table of Contents

Shareholder Letter (Unaudited)

| | | | |

| AQR ALTERNATIVE RISK PREMIA FUND | | | | |

Ronen Israel

Principal

Yao Hua Ooi

Principal

Dear Shareholder:

The AQR Alternative Risk Premia Fund (the “Fund”) Class I Shares returned +0.10% since its inception on September 19, 2017. The BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM, which is the Fund’s benchmark returned +0.32% over that same period.

The Fund invests in different asset groups, including derivatives such as futures and swaps: equities of major developed markets, country specific equity indices, bonds, and currencies. The Fund employs market-neutral and long-short strategies across these asset groups based on six investment styles:

Value – the tendency for cheap assets to outperform expensive ones

Momentum – the tendency for an asset’s recent relative performance to continue in the future

Carry – the tendency for higher-yielding assets to provide higher returns than lower-yielding assets

Defensive – the tendency for lower-risk and higher-quality assets to generate higher risk-adjusted returns

Trend – the tendency for an asset’s recent performance to continue in the future

Volatility – the tendency for options to be richly priced

The Fund gained, despite four of the six styles detracting. These gains were primarily driven by Defensive themes but Volatility strategies also contributed. Of the four styles that detracted, Carry was the largest due to currencies and fixed income trading. Value gains in currencies were offset by losses in Momentum while the opposite was true for fixed income. Trend gained from long positioning in equity index markets but reversals in currencies offset these gains, influenced by long positioning in the Canadian and Australian dollars, among others. From an asset group perspective, gains were led by equity indices and stocks and industries while currencies and fixed income detracted.

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017 AQR ALTERNATIVE RISK PREMIA FUND | |

| | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: QRPIX | | | 0.10% | | | | 9/19/2017 | |

| Fund - Class N: QRPNX | | | 0.10% | | | | 9/19/2017 | |

| Fund - Class R6: QRPRX | | | 0.20% | | | | 9/19/2017 | |

| | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.32% | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 2.58%, 2.83% and 2.48%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

2

Shareholder Letter (Unaudited)

| | | | |

| AQR ALTERNATIVE RISK PREMIA FUND | | | | |

|

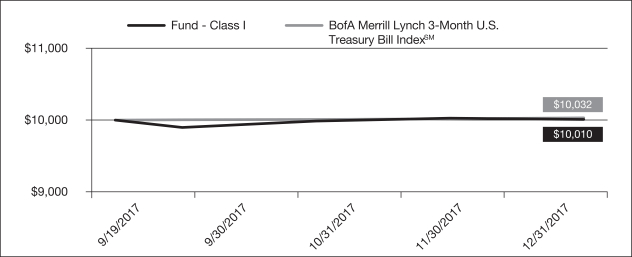

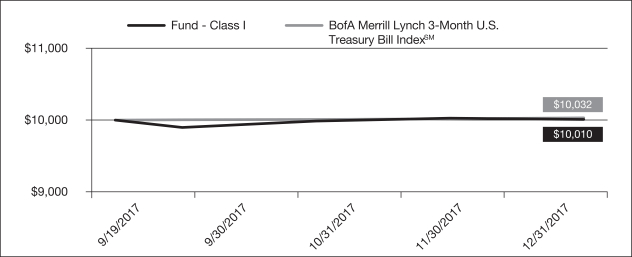

AQR ALTERNATIVE RISK PREMIA FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM VALUE OF $10,000 INVESTED ON 09/19/2017 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

3

Shareholder Letter (Unaudited)

| | | | |

| AQR DIVERSIFIED ARBITRAGE FUND | | | | |

Jacques Friedman

Principal

Ronen Israel

Principal

Mark Mitchell Ph.D.

Founding Principal, CNH Partners

Todd Pulvino, Ph.D.

Founding Principal, CNH Partners

Dear Shareholder:

The AQR Diversified Arbitrage Fund (the “Fund”) invests in arbitrage strategies, including merger arbitrage and convertible arbitrage, and event-driven strategies. The investment process seeks to efficiently capture a liquidity premium around corporate control and capital raising events by maintaining a diversified portfolio of corporate securities. Over the 2017 calendar year, the Fund’s Class I shares returned +5.92%, with all three core strategies contributing positive returns for the year. As described below, the event-driven strategy contributed the most, followed by merger arbitrage and convertible arbitrage.

Since its inception on January 15, 2009, the Fund’s correlation with overall equity and credit markets remains low. Based on monthly returns since inception through December 31, 2017, the Fund’s equity market beta (relative to the S&P 500 Total Return Index®) is 0.1, its annualized volatility is 2.9% and its Sharpe ratio is 0.8.

Fund Description

Unlike textbook arbitrage that requires no capital and where identical securities can simultaneously be bought and sold for different prices, corporate arbitrage investments require significant capital and involves the purchase and sale of related but not identical securities at advantageous prices. For example, in merger arbitrage, the target stock can often be purchased for a price that is less than the merger consideration offered by the acquiring company. Arbitrageurs attempt to capture this difference by buying the target stock, and in the case of a stock merger, short-selling the acquirer’s stock. Similarly, in the case of convertible arbitrage, investors typically purchase a convertible bond at a price below fundamental value and hedge the risk of the underlying equity call option that is embedded in the bond by short selling the issuer’s common stock. Arbitrageurs generally profit when the prices of securities purchased increase relative to their fundamental values.

Like merger arbitrage and convertible arbitrage, the event-driven strategies employed by the Fund involve the purchase of securities around corporate events at discounts to their fundamental values. For every investment, an attempt is made to hedge the embedded systematic risk. Where there is no direct hedge for a purchased security, correlated indirect hedges are employed. For example, systematic equity market risk is hedged by shorting S&P 500 futures. Similarly, for example, credit and interest rate risks are hedged using derivative contracts (credit default swap indices and Treasury futures). Although indirect hedges effectively mitigate systematic risk (e.g. beta) on average, they expose the Fund to basis risk – the basket of securities purchased around corporate events does not necessarily move in lockstep with the hedging instruments.

Performance Attribution

Over a long horizon, we expect arbitrage returns to have a low correlation to equity and credit markets and exceed short-term Treasury bill performance by an average of 3% to 4%. In some years, as in 2014 and 2015, arbitrage investments will fail to reach this excess return expectation. In other years, as in 2016 and 2017, arbitrage strategies will generate returns that are greater than the long-run expected average. Since its inception in 2009, the Fund has averaged 2.3% above short-term Treasury bills1 annually, slightly below expectations for the long-term horizon. Albeit below expectations, the Fund’s performance is not surprising given the macro-economic distortions caused by record low interest rates since the financial crisis, including suppression of convertible bond issuance.

The Fund’s +5.9% return in 2017 resulted from contributions of +2.7% from event-driven investments, +1.8% from merger arbitrage, and +1.4% from convertible arbitrage. Within the event-driven strategy, all of the individual sub-strategies generated positive returns in 2017 with the exception of the stub sub-strategy. Stubs occur when a publicly-traded parent company owns a substantial stake in a publicly-traded subsidiary. At times the market value of the parent company trades at a discount to the observable sum of its parts (“SOTP”). The stub strategy attempts to capture

| 1 | The ICE Bank of America Merrill Lynch US 3-Month Treasury Bill Index |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

4

Shareholder Letter (Unaudited)

| | | | |

| AQR DIVERSIFIED ARBITRAGE FUND | | | | |

this discount by buying shares of the parent company and selling short shares of the subsidiary, in hopes that the parent company will commence a corporate action (e.g. distribute its holdings in the subsidiary to parent company shareholders) thereby eliminating the discount. There is a risk that the perceived discount widens further or the timeline to capture the discount exceeds the investor’s time horizon. In 2017, losses in the stub sub-strategy were driven by a further widening of the discount of the Altaba traded price as compared to its SOTP value. As tax-reform uncertainty persisted through early 2017, investors questioned if the company would be able to implement a tax-efficient transaction to narrow the discount. Ultimately, following tax-reform in the fourth quarter, the discount to the SOTP contracted as the expected downside decreased commensurate with the drop in the corporate tax rate. Future catalysts that could further narrow the discount include, monetization of the Yahoo Japan stake, selling the intellectual property portfolio and a tri-party transaction with Alibaba.

The most profitable event-driven sub-strategy involves Special Purpose Acquisition Companies (“SPAC”). The SPACs contribution to the Fund’s return in 2017 was 2.52%, the vast majority of the 2.7% positive contribution from the even-driven investments. In a typical SPAC, the management team sells units, containing shares and warrants, to investors in an IPO and places proceeds from the sale into a trust account invested in Treasury bills. The management team then searches for an operating business to purchase using the IPO proceeds. Typically the management team has between 18 and 24 months to propose an acquisition to shareholders. If they fail, the trust account will be liquidated and the cash returned to shareholders. If the management team succeeds in finding a suitable business or asset to acquire, the shareholders either tender for their pro-rata portion of the trust or forfeit their rights to trust and accept shares in the new operating company. The option to tender for cash backed by Treasury bills in a trust account is the reason the SPAC strategy has very little downside risk. Yet shareholders retain upside potential via the warrants received in the IPO as well as the common stock should the management team propose a transaction that is favorably viewed by the market. The Fund’s strategy involves investing in SPACs in the IPO and either tendering the common shares for cash or selling the shares in the market when a transaction is proposed. Warrants obtained in the IPO are typically retained and generate significant profits when SPAC transactions are consummated. The Fund’s performance in the SPAC strategy was driven by 21 announced and 13 successfully completed acquirer transactions during 2017. New issuance for SPACs in 2017 was the most active since 2007 with 34 SPACs issued raising a combined $10 billion of capital. To put this in perspective, the second busiest year since 2007 was 2015 when 20 new SPACs raised $3.9 billion.

Merger arbitrage contributed +1.8% to the Fund’s returns in 2017. The largest individual contributor was Straight Path Communications (“Straight Path”) which contributed nearly 0.4% to the Fund’s 2017 return. Straight Path was the target of competing bids from AT&T and Verizon, and this resulted in the initial buyout offer of $95.63 being ultimately increased to $184.00 per Straight Path share. Other positive returns came from activists pushing for increased offers (e.g. Private Bancorp, Inc. and NXP Semiconductor) and from the majority of mergers in the portfolio being consummated as planned. These positive developments outweighed negative outcomes in the merger portfolio.

As in years past, regulatory action continued to be the primary source of merger failure, and therefore losses, in 2017. While the Trump administration was believed to be friendlier to business than the prior administration, the regulatory environment remained challenging in 2017 with the government taking steps to block a number of transactions. In the first quarter, two transformative transactions in the managed care space were abandoned following rulings from the United States District Court for the District of Columbia. The court blocked the mergers between Cigna Corporation and Anthem, Inc., and Humana, Inc. and Aetna, Inc., enforcing actions brought by the Department of Justice at the tail end of the Obama administration. Additionally in June, Rite Aid Corporation and Walgreens Boots Alliance, Inc. terminated their merger agreement sighting feedback from the Federal Trade Commission (“FTC”) that the parties would not be able to obtain FTC clearance to consummate the merger. In the fourth quarter, the Committee for Foreign Investment in the United Sates (“CFIUS”) came into focus as President Trump blocked the merger between Lattice Semiconductor Corp and Canyon Bridge Capital Partners, Inc., a private equity firm backed by Chinese investors, following a CFIUS recommendation to the president that the deal should not be allowed to proceed. This marked just the fourth time a sitting president made an executive order based on a CFIUS recommendation.

In addition to regulatory action, another source of failure that emerged in the 4th quarter involved acquirer shareholders pushing companies to abandon their planned acquisitions. There were five such campaigns waged in 2017, as acquirer shareholders questioned the merits of transactions that they believed offered little long-term value to shareholders. Of the five campaigns in 2017, two ultimately succeeded in getting companies to abandon their planned transactions, with Huntsman Corporation and Clariant AG walking away from their planned merger of equals, and SandRidge Energy Inc. abandoning its planned purchase of Bonanza Creek Energy Inc. In both situations, the companies said that it became clear they did not have the requisite shareholder support and would not be able to meet the voting conditions required under the merger agreement.

Despite these challenges, the investment environment for the merger arbitrage strategy remains promising. The median annualized spread exhibited little volatility in 2017, beginning the year at 3.2% and finishing the year at 3.8% with an intra-year peak of 5.5%. While stability in the median spread masked the idiosyncratic volatility mentioned above, it is reflective of

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

5

Shareholder Letter (Unaudited)

| | | | |

| AQR DIVERSIFIED ARBITRAGE FUND | | | | |

an environment where the failure rate is lower than the long-term historical average (2.5% vs. 4.2%). Merger deal flow remained robust in 2017, despite continuing to taper off from record deal flow witnessed in 2015. The fourth quarter saw an uptick in deal flow driven by the announcement of three “Mega-Mergers” (deals over $50B), which gives optimism for the potential investment landscape in 2018.

Convertible arbitrage contributed +1.4% to the Fund’s 2017 return. This positive return was driven primarily by a decrease in the discount between market price and theoretical value (“richening”) in the convertible bond market. At the beginning of 2017, the discount was approximately 0.1%. This discount disappeared at the beginning of the year and turned into a premium that persisted throughout the duration of 2017, finishing the year with the median market price exceeding the theoretical value by 1.0%. Positive returns generated by overall market richening were complimented by an absence of bankruptcies in the convertible portfolio throughout the year.

Although the current median cheapness is approximately -1% (“rich”) this does not mean the market is devoid of attractive opportunities. One reason for these opportunities is that cross-sectional dispersion exists in the marketplace. The second reason is model related; convertible bond models used to calculate theoretical values do not account for outcomes that are not specified in a bond’s indenture. For example, issuers of convertible bonds sometimes enter the market to retire existing bonds and may also issue new bonds in conjunction with the transaction. A company’s motivation to enter into transactions like these varies but is usually linked to reducing debt, lowering coupon payments, extending debt maturities, or increasing the conversion price of their convertible bonds. A company’s need to change its capital structure makes it a liquidity demander and allows bondholders to charge a premium for their participation in a transaction. The Fund participated in three such transactions in 2017, each of which generated returns in excess of those predicted by theoretical valuation models.

New issuance in the convertible market during the majority of 2017 was encouraging. As the Federal Reserve increased the federal funds rate at the end of 2016, and twice more in the first half of 2017, the convertible market saw strong new issuance with the domestic market growing by $10b during the first three quarters of the year. However, low issuance in the fourth quarter coupled with considerable maturities and redemptions erased those gains and the size of the domestic convertible market ended 2017 flat. However, if interest rates continue to increase, cash coupon rates required to issue non-convertible debt will increase, and it is anticipated that this will strengthen the incentive for companies to instead issue convertible bonds.

Looking Forward

2017 was another above average year for corporate arbitrage strategies, and while future returns are not expected to repeat 2016 and 2017 performance, we believe the overall environment remains conducive to positive returns. We are encouraged by new issuance in the convertible market during the majority of 2017 and are optimistic that a robust new issuance calendar will continue into 2018. Although the median bond in the convertible market remains rich, there are still attractive opportunities and the Fund is well positioned to increase exposure if the convertible market cheapens, or if activity in the new issue market returns to levels experienced throughout most of 2017. Even though merger arbitrage spreads are slightly below average, we are optimistic about the potential opportunity set in 2018. Following clarity around tax reform in the fourth quarter of 2017 we saw an increase in deal flow driven by the return of so-called Mega Mergers, and we are hopeful that the robust deal flow will continue. We are cognizant of the residual CFIUS risks that remain in a subset of deals, and have actively managed this risk by limiting our cumulative exposure to these transactions. In the event-driven strategies, we believe opportunities will continue to persist and that 2018 will see a continuation of the strong SPAC issuance experienced in 2017. With the uncertainty of tax reform no longer weighing on the minds of corporate boards we believe 2018 will bring more corporate control and capital raising events. Irrespective of where the Fund deploys capital in 2018, we will continue to hedge systematic equity, credit, and interest rate market risks, with the intention of delivering uncorrelated excess returns.2

| 2 | Note that the Fund uses various derivatives instruments (e.g., futures, options, forwards, and swaps), primarily to hedge systematic risks including credit risk and interest rate risk. While the purpose of employing derivatives instruments is to decrease the Fund’s overall risk, hedging instruments are imperfect tools and their effectiveness depends on the degree of price correlation between the derivative instruments and the assets being hedged. Imperfect correlation may be caused by several factors, including temporary price disparities between derivative markets and markets for the underlying assets. |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

6

Shareholder Letter (Unaudited)

| | | | |

| AQR DIVERSIFIED ARBITRAGE FUND | | | | |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR DIVERSIFIED ARBITRAGE FUND | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: ADAIX | | | 5.92% | | | | 2.74% | | | | 0.93% | | | | 2.50% | | | | 1/15/2009 | |

| Fund - Class N: ADANX | | | 5.58% | | | | 2.46% | | | | 0.66% | | | | 2.22% | | | | 1/15/2009 | |

| Fund - Class R6: QDARX | | | 6.02% | | | | 2.82% | | | | na | | | | 0.69% | | | | 9/02/2014 | |

| | | | | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.86% | | | | | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 2.49% 2.74% and 2.40%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | |

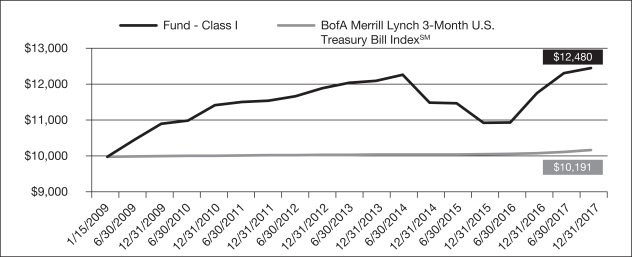

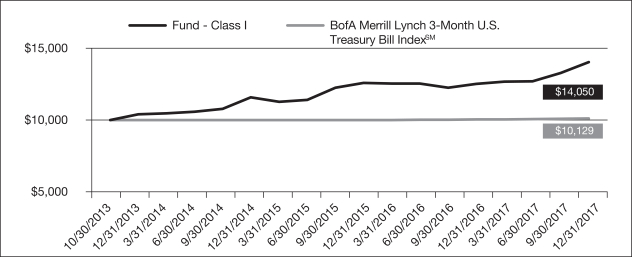

AQR DIVERSIFIED ARBITRAGE FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM

VALUE OF $10,000 INVESTED ON 01/15/2009 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

7

Shareholder Letter (Unaudited)

| | | | |

| AQR EQUITY MARKET NEUTRAL FUND | | | | |

Michele Aghassi

Principal

Andrea Frazzini

Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Dear Shareholders:

The AQR Equity Market Neutral Fund (the “Fund”) seeks to provide investors with returns from potential gains of its long and short equity positions. The Fund is designed to be market- or beta-neutral, meaning the Fund seeks to achieve returns that are not closely correlated with the returns of the equity markets in which the Fund invests. Accordingly, the Fund, on average, intends to target a portfolio beta of zero over a normal business cycle.

Since the Fund targets a beta of zero, an appropriate benchmark is U.S. cash returns, which remain at relatively low levels. In 2017, the Fund handily outperformed the BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM, its benchmark, with the Class I shares returning 5.84% versus the benchmark return of 0.86% during this period.

Fund returns were driven by the strong performance of our momentum, investor sentiment, and quality investment themes. In contrast, our valuation theme underperformed in 2017. Geographically, stocks in the U.S. contributed the most to overall returns, while stock selection in Denmark and France detracted most from returns. At the sector level, the stock selection strategy worked best in consumer discretionaries in 2017.

The Fund ended the year with a highly diversified stock portfolio of 683 long positions and 652 short positions, including its long/short equity positions within Total Return Basket Swaps. Securities remained globally diversified with nearly 40% of the Fund invested outside of the U.S. The Fund does take small industry views. As of the end of the year, our largest sector overweight was in industrials, while our largest underweight was in energy.

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR EQUITY MARKET NEUTRAL FUND | | | | |

| | | 1 Year | | | 3 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: QMNIX | | | 5.84% | | | | 9.63% | | | | 10.86% | | | | 10/7/2014 | |

| Fund - Class N: QMNNX | | | 5.56% | | | | 9.33% | | | | 10.56% | | | | 10/7/2014 | |

| Fund - Class R6: QMNRX | | | 5.91% | | | | 9.68% | | | | 10.91% | | | | 10/7/2014 | |

| | | | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.86% | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 2.24% 2.51% and 2.16%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

8

Shareholder Letter (Unaudited)

| | | | |

| AQR EQUITY MARKET NEUTRAL FUND | | | | |

| | | | |

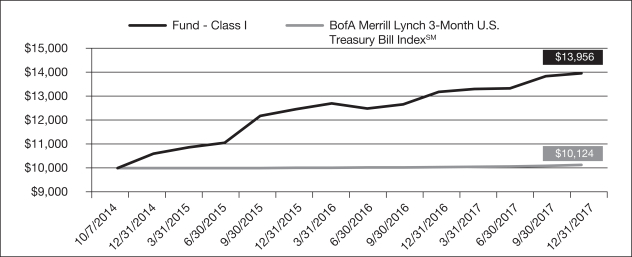

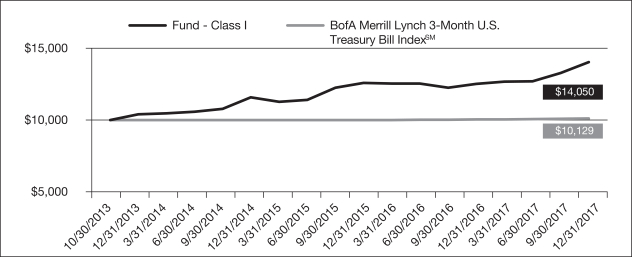

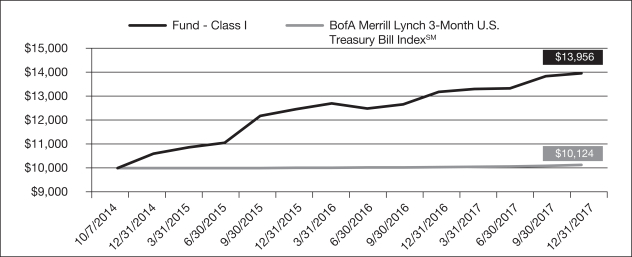

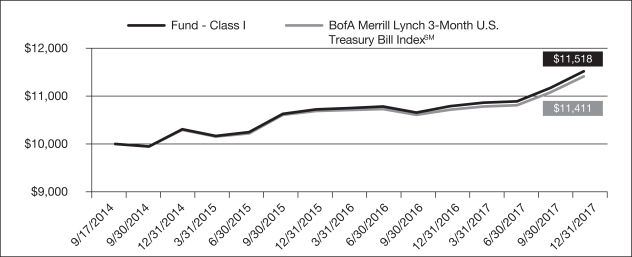

AQR EQUITY MARKET NEUTRAL FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM

VALUE OF $10,000 INVESTED ON 10/07/2014 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

9

Shareholder Letter (Unaudited)

John Liew

Founding Principal

Michael Katz

Principal

Jordan Brooks

Managing Director

David Kupersmith

Principal

Dear Shareholders:

The AQR Global Macro Fund (the “Fund”) invests across a wide range of asset classes, including fixed income, currencies, commodities and equities. Within each asset class, the Fund takes both relative value and directional positions. The strategy seeks to be long-term market-neutral, but can take directional views over the short- term. The targeted annualized volatility for the Fund is 10%, on average, which varies modestly over time based on attractiveness of opportunities within the different asset classes that the Fund trades. The Fund’s strategy trades predominately on macroeconomic news and trends, using a systematic, bottom-up approach that integrates both quantitative and discretionary trading signals.

Our investment philosophy is rooted in the insight that financial markets tend to underreact to macroeconomic news. This implies that macroeconomic news tends to have a persistent effect on asset prices. Our strategy seeks to take advantage of this tendency by investing across liquid markets on the basis of macroeconomic news and trends, an investment approach we call macro momentum. We form macro momentum views by evaluating both quantitative and discretionary indicators across a variety of dimensions, from growth and inflation to monetary policy and international trade. By integrating both quantitative and discretionary indicators of macro momentum in a bottom-up, risk-controlled portfolio construction, we capture the best features of both approaches while maintaining the benefits of a systematic and disciplined process.

Macro momentum is at the core of our investment philosophy and we also consider price momentum, value and carry indicators. This multifactor approach provides a more holistic picture of each asset’s attractiveness than trading on macro momentum alone. Macro momentum tends to drive asset positioning (long or short) in our portfolio, however the degree of agreement between macro momentum, on the one hand, and price momentum, value and carry, on the other, determines ultimate position sizing. The bottom-up portfolio construction – in which we evaluate the attractiveness of each asset across a large number of dimensions – allows us to build a highly diversified portfolio that does not depend on a few “best ideas.”

The Fund’s benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM, was up +0.86% over the course of 2017. The Fund underperformed this benchmark, with the Class I shares losing -3.38% net of fees on the year. The Fund saw losses in equities (developed equity markets down -2.19% and emerging equity markets down -0.30%), currencies (developed currencies down -1.23% and emerging currencies down -0.04%) and commodities (down -0.32%). The Fund experienced gains in fixed income (developed interest rates up +2.20%, although somewhat offset by developed bond markets which was down -1.10% and yield curve which was down -0.40%).

Developed and emerging equity markets performed well in 2017. Widespread and consistent market performance can largely be attributed to positive developments across much of the global economy. According to the IMF’s most recent World Economic Outlook forecasts, global Gross Domestic Product (“GDP”) likely expanded by more than 3.6% in 2017, up from a post-financial crisis low of 3.2% in 20161 and a modest positive surprise relative to the IMF’s year earlier forecast of 3.4%.2 Should this forecast prove correct, 2017 would be the strongest year for the world economy since 2011.3 Furthermore, the strengthening global expansion in 2017 was unusually consistent across countries. Of the 193 countries covered by IMF forecasts, 62% were expected to show stronger growth in 2017 than the year before, a breadth of acceleration only exceeded in recent decades by years such as 1984, 2004, and 2010, all of which occurred near the start of expansions following major global downturns. In addition to boosting equity prices, strong global growth aided commodity prices higher as well, benefitting several emerging equity markets. Crude oil prices recovered to their strongest levels since late 2014, while industrial metals such as aluminum, copper, and zinc rallied significantly.4

| 1 | MF World Economic Outlook Database, October 2017. |

| 2 | The positive surprise was even more evident in private sector forecasts. The median forecast for 2017 global growth among economists polled by Bloomberg survey of economists was revised from 3.2% at the start of the year to 3.6% at the end of the year. |

| 3 | 2017 figures still contain some uncertainty, as data is still incomplete for the final months of the year. |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

10

Shareholder Letter (Unaudited)

Growth expectations and market sentiment received a further boost late in the year from passage of a major tax bill in the United States. The odds of passing a tax bill had seemed to decline following failed efforts to pass healthcare legislation in the third quarter. However, congressional Republicans were able to marshal an aggressive legislative push in December, and a significant re-write of the U.S. tax code reached President Trump’s desk before the end of the year. The bill included a large reduction in U.S. corporate tax rates, which should boost earnings for many companies. A provision allowing for immediate expensing for purchases of equipment may incentivize increased capital expenditures. The legislation also lowered income taxes for a large share of households, potentially supporting stronger consumer spending. Despite the positive risk sentiment and a Federal Reserve that hiked its key policy rates three times over the year, bond prices remained relatively range bound, with bearish developments countered by lower than expected inflation data in the U.S. and continued concerns over longer term growth prospects.

Developed Equity Markets

The developed equity markets strategy was the largest detractor, with losses concentrated in relative value views. A long U.K. equities position during the first and second quarters and a long Euro Stoxx 50 position during the fourth quarter led to losses. The long U.K. equities position was based on currency depreciation, positive growth surprises and positive price momentum. The Fund’s position performed poorly as U.K. equities were weighed down by a stronger pound.5 The long Euro Stoxx 50 position was driven by positive growth forecast revisions and surprises, monetary policy factors and attractive value. The Fund’s position performed poorly, as a stronger euro weighed on export prospects and political uncertainty increased in Spain, Germany and Italy.

Developed Currencies

The developed currency strategy detracted, with losses concentrated in the second and fourth quarters. A long position in the Japanese yen during the second quarter led to losses. The long position was supported by positive GDP forecast revisions, positive earnings revisions and attractive value. The yen underperformed the traded cross section, with losses concentrated in June, as developed market interest rates rose sharply, repricing interest differentials to the disadvantage of the Japanese currency. Over the fourth quarter, U.S. dollar positioning, which started the quarter short and ended long, performed poorly. Heading into the fourth quarter, the short position was driven by negative economic data surprises, negative price momentum and unattractive carry. By the end of the quarter, economic data surprises and carry turned more positive, aiding bullish positioning. The U.S. dollar rallied in October, benefiting from stronger than expected durable goods and GDP data, but then reversed course in November and December. The U.S. dollar sold off in November as the probability of a hawkish new Chair at the Fed was fully priced out following Jerome Powell’s nomination.

Developed Bond Markets

The Fund’s developed bond markets strategy also led to losses. A relative value long position in U.S. Treasuries in October and a long position in German bunds in December performed poorly. The long U.S. Treasury position was based on downside inflation surprises and revisions, downside growth surprises and unattractive carry and value relative to the traded cross section. U.S. Treasuries underperformed in October as growth data was better than expected and expectations for tax reform increased. The long German bunds position was based on bullish monetary policy factors, equity market underperformance, positive price momentum and attractive carry. German bunds underperformed in December as the EU continued to post strong growth data and maintained PMIs near all-time highs.

Developed Interest Rates

The Fund’s developed interest rates strategy was the largest contributor. Gains were seen in both relative value and directional views, with larger positive returns seen in a short U.S. interest rate swaps position in the third and fourth quarters and a short U.K. interest rate swaps position during the first three quarters of the year. The short U.S. interest rate swaps position was driven by currency depreciation, positive equity market performance, monetary policy factors and negative price momentum. The Fund’s position performed well, as the Fed was more hawkish than expected at its monetary policy meeting in September, growth data was better than expected and the Tax Cuts and Jobs Act was signed into law in December. The short U.K. interest rate swaps position was based on currency depreciation, positive equity market performance and unattractive value and carry. The Fund’s position performed well with U.K. interest rate swaps underperforming over the first three quarters as the Bank of England was more hawkish than expected, signaling that a rate hike was likely needed soon. The Bank of England went on to hike its key policy rate in November.

| 5 | A strong pound reduces the value of earnings from outside the U.K., which are significant for many companies in the FTSE 100. |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

11

Shareholder Letter (Unaudited)

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR GLOBAL MACRO FUND | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: QGMIX | | | -3.38% | | | | -0.57% | | | | -0.57% | | | | 4/8/2014 | |

| Fund - Class N: QGMNX | | | -3.67% | | | | -0.84% | | | | -0.84% | | | | 4/8/2014 | |

| Fund - Class R6: QGMRX | | | -3.41% | | | | -0.54% | | | | 0.24% | | | | 9/2/2014 | |

| | | | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.86% | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 2.03% 2.22% and 2.00%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

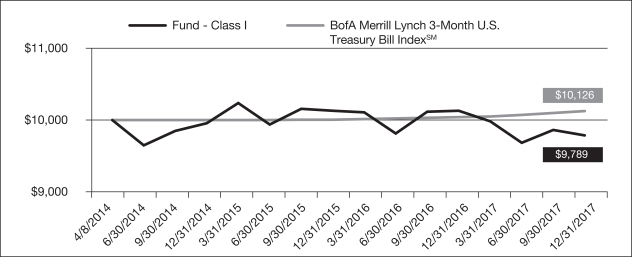

| | | | |

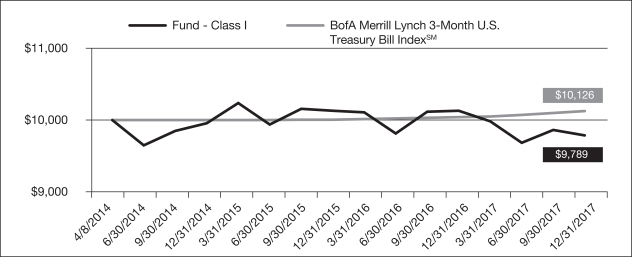

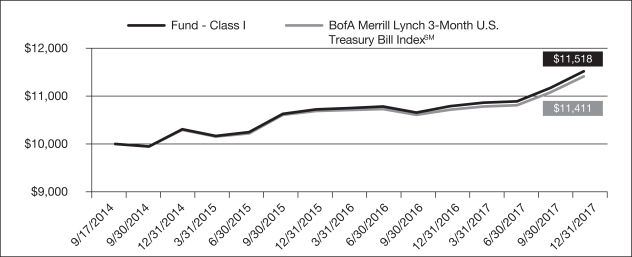

AQR GLOBAL MACRO FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM

VALUE OF $10,000 INVESTED ON 04/08/2014 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

12

Shareholder Letter (Unaudited)

| | | | |

| AQR LONG-SHORT EQUITY FUND | | | | |

Michele Aghassi

Principal

Andrea Frazzini

Principal

Jacques Friedman

Principal

Hoon Kim

Principal

Dear Shareholder:

The AQR Long-Short Equity Fund (the “Fund”) seeks to provide higher risk-adjusted returns with lower volatility relative to global equity markets. It does so using three different sources of return: 1) the potential gains from its long and short equity positions, 2) overall exposure to equity markets, and 3) the tactical variation of its net exposure to equity markets. The strategy primarily seeks to add alpha via its long/short (market-neutral) stock portfolio. It also manages its beta relative to the MSCI World Index** (“MSCI World”) to a long-term target of 0.5, and within a shorter-term range of 0.3 to 0.7, depending on our market views.

Both the long-short stock selection and the Fund’s overall exposure to global developed equity markets performed positively in 2017, with Class I returning 15.73% net of fees. The Fund’s custom benchmark (50% MSCI World + 50% BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM) delivered a more modest return of 11.16% over this period. As such, the Fund outperformed its benchmark.

The stock selection strategy contributed to the majority of the outperformance and returned 6.80% (gross of fees) for the year. Returns were driven by the strong performance of our momentum, investor sentiment, and quality investment themes. In contrast, our valuation theme underperformed. Geographically, stocks in the U.S. contributed the most to overall returns, while French stocks detracted the most from performance. At the sector level, the stock selection strategy worked best in consumer discretionary sector.

The Fund also benefited from its static long-term beta exposure of 0.5 to the MSCI World, given this index’s positive performance in 2017. However, our tactical market exposure (the desired deviation from a beta of 0.5) modestly detracted from performance.

The Fund ended the year with a highly diversified stock portfolio of 673 long positions and 665 short positions. Securities remained globally diversified, with nearly 40% of the Fund invested outside of the U.S. The stock selection strategy does take small industry views. As of the end of the year, our largest sector net long position was in industrials, while our largest net short position was in energy.

Our tactical market view was negative at the end of the year and as a consequence, our ex-ante beta to the MSCI World was 0.40, below our static long-term beta exposure of 0.5.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

13

Shareholder Letter (Unaudited)

| | | | |

| AQR LONG-SHORT EQUITY FUND | | | | |

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR LONG-SHORT EQUITY FUND | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: QLEIX | | | 15.73% | | | | 14.59% | | | | 15.78% | | | | 7/16/2013 | |

| Fund - Class N: QLENX | | | 15.47% | | | | 14.32% | | | | 15.49% | | | | 7/16/2013 | |

| Fund - Class R6: QLERX | | | 15.86%* | | | | 14.72% | | | | 15.23% | | | | 9/02/2014 | |

| | | | |

| 50% MSCI World Index**/50% BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 11.16% | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 2.09% 2.35% and 2.00%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | * | Total return information is based on net asset values calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at 12/31/2017 for financial reporting purposes, and as a result, the net asset values for shareholder transactions and the total returns based on those net asset values differ from the adjusted net asset values and total returns for financial reporting. |

| | | | |

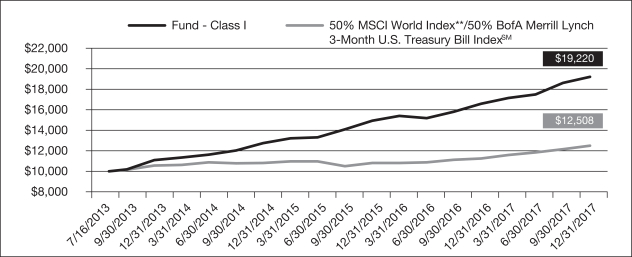

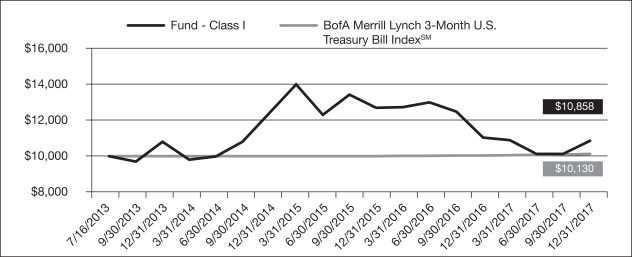

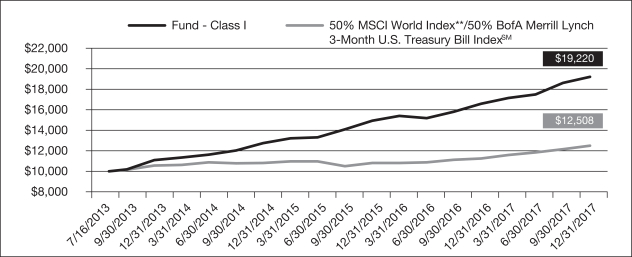

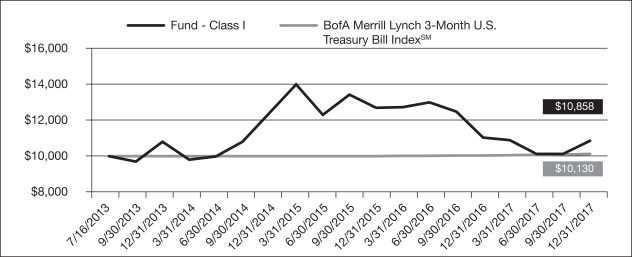

AQR LONG-SHORT EQUITY FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM

VALUE OF $10,000 INVESTED ON 07/16/2013 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | ** | MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

14

Shareholder Letter (Unaudited)

| | | | |

| AQR MULTI-STRATEGY ALTERNATIVE FUND | | | | |

Jacques Friedman

Principal

Ronen Israel

Principal

Michael Katz

Principal

John Liew

Founding Principal

Mark Mitchell, Ph.D.

Founding Principal, CNH Partners

Todd Pulvino, Ph.D.

Founding Principal, CNH Partners

Dear Shareholder:

The AQR Multi-Strategy Alternative Fund (the “Fund”) Class I shares returned +3.10% in 2017. For the year ended December 31,2017, the Fund realized +5.0% annualized daily volatility and a +0.3 correlation to equities. The BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM, which is the fund’s benchmark, returned+0.86% over this period. The hedge fund industry, as represented by the Credit Suisse Hedge Fund IndexSM (“CS Index”) and the HFRITM Fund Weighted Composite Index (“HFRI Index”) gained 7.12% and +8.54%, respectively, net of fees for the year. These indices have had correlations to global equities, as represented by the MSCI World Index**, of +0.7 and +0.9, respectively, over the past 24 months, which is quite similar to longer-term correlations, and, as such, this would indicate that much of their gains in 2017 were a function of passive equity exposure rather than more diversifying sources of gains.

Six of the Fund’s nine strategies had positive results for the year. The stock selection strategies, in aggregate, were the largest source of profits as each contributed positively. The arbitrage strategy group also contributed positively, while macro strategies detracted.

Following is a more detailed review of the three strategy groups:

Stock Selection Strategies – Long/Short Equity (+4.1%), Equity Market Neutral (+0.6%) and Dedicated Short Bias (+0.2%) all contributed positively. The net effect of the directional components of Long/Short Equity and Dedicated Short Bias contributed positively (+0.6%) as Long/Short Equity, through a dynamic timing sub-strategy, was overweight long market exposure. The remaining stock selection gains were generated by market-neutral themes executed within each of the three strategies. Among these underlying themes, the largest contributors came from momentum, low risk, and investor sentiment themes, while valuation themes generated losses.

Arbitrage Strategies – Both Event Driven (+0.7%) and Convertible Arbitrage (+0.7%) contributed to performance this year. Gains from merger arbitrage were not concentrated in any particular deal, but were rather widespread. The strategy was also helped by a benign rate of adverse deal terminations, although one deal, Rite Aid/Walgreens, had a more unfavorable impact than others. Gains in Convertible Arbitrage were similarly broad-based and were supported by a general richening of convertible securities relative to their fair value.

Macro Strategies – As a group, macro strategies generated negative returns as three of the four strategies in the group detracted. Global Macro was the largest source of losses (-2.1%) through difficult performance in both relative value equity index sub-strategies: one a global across-country sub-strategy and the other a within-country sub-strategy. Currencies also detracted but to a lesser degree. Partially offsetting gains were generated in the relative-value commodities and equity index directional timing sub-strategies. Managed Futures (-0.9%) also detracted with three of the four asset classes experiencing reversals over the course of the year and Fixed Income Relative Value (-0.5%) detracted as well due largely to its rates-based currency and relative value 10-year government bond sub-strategies. Emerging Markets (+0.4%) gained on both directional and relative value trading in emerging equity index strategies.

| ** | MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

15

Shareholder Letter (Unaudited)

| | | | |

| AQR MULTI-STRATEGY ALTERNATIVE FUND | | | | |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR MULTI-STRATEGY ALTERNATIVE FUND | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: ASAIX | | | 3.10% | | | | 3.98% | | | | 4.73% | | | | 3.60% | | | | 7/18/2011 | |

| Fund - Class N: ASANX | | | 2.73%* | | | | 3.71% | | | | 4.45% | | | | 3.34% | | | | 7/18/2011 | |

| Fund - Class R6: QSARX | | | 3.19% | | | | 4.07% | | | | na | | | | 5.58% | | | | 9/02/2014 | |

| | | | | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.86% | | | | | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 2.56% 2.82% and 2.47%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance

| | * | Total return information is based on net asset values calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at 12/31/2017 for financial reporting purposes, and as a result, the net asset values for shareholder transactions and the total returns based on those net asset values differ from the adjusted net asset values and total returns for financial reporting. |

| | | | |

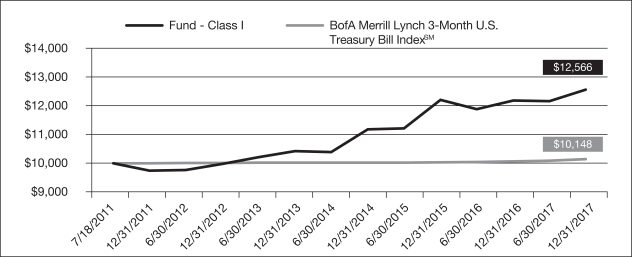

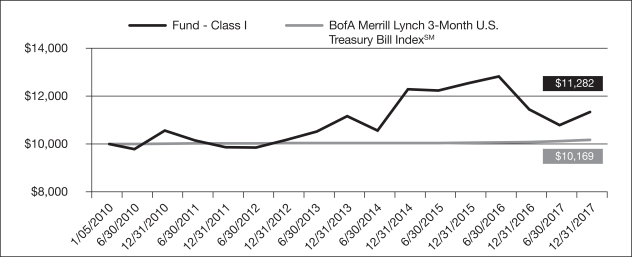

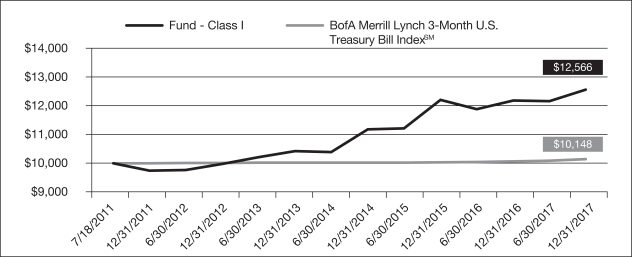

AQR MULTI-STRATEGY ALTERNATIVE FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM

VALUE OF $10,000 INVESTED ON 07/18/2011 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

16

Shareholder Letter (Unaudited)

| | | | |

| AQR RISK-BALANCED COMMODITIES STRATEGY FUND | | | | |

Brian Hurst

Principal

Ari Levine

Principal

Yao Hua Ooi

Principal

Dear Shareholder:

The AQR Risk-Balanced Commodities Strategy Fund (the “Fund”) Class I shares returned 10.41% in 2017, as rallies in base metals, the petroleum complex, and precious metals offset declines in agricultural commodities and softs. Base metals broadly rose with aluminum and copper leading the rally. The sector benefited from strong Chinese economic growth data. With the exceptions of natural gas, energies broadly rose in the year on Organization of the Petroleum Exporting Countries (OPEC) extending supply cuts through 2018 and stock draws. Distillates also rose through the year on larger than expected draws on strong industrial demand. Agriculturals fell on favorable global growing conditions. Softs broadly fell through 2017 on weaker than expected fundamentals in sugar, coffee, and cocoa.

While the Class I shares were up 10.41% in 2017, the Fund’s benchmark, the Bloomberg Commodity Index Total Return (“BCOM”) was up 1.7%, for an outperformance of 8.7% to the benchmark. This brings our three-year outperformance to 6.2% annualized, and our since inception outperformance to 2.1% annualized. Note that, while we use BCOM as a benchmark, we do not aim to replicate it. The Fund’s construction is sufficiently different that we would expect a difference in the performance of the Fund and this benchmark. Specifically, we expect the average magnitude of performance differences to be 10% per year on average, in either direction.

The outperformance in 2017 relative to the passive BCOM benchmark was due to a number of factors. The largest source of outperformance was the volatility targeting, since the Fund’s steady volatility target necessitated an average net exposure of greater than 100%. Differences in the allocations within the energies sector also contributed significantly to the outperformance. Holding deferred contracts also contributed to the outperformance.

The Fund began the year at a volatility target of 18.2% close to its 18% long run target. At year-end, the volatility target of the Fund was 15.1%.

The strategic portion of the portfolio returned 10.5%, while the return from tactical tilts was -0.1%. The strategic return in this attribution is the return to a long-only portfolio with risk-balanced sector weights and an annual volatility target of 18%. The tactical return is the return from the active views in the individual commodities and sectors. Negative returns from tactical tilts in agriculturals, precious metals and livestock were largely offset by positive tactical returns in base metals, energies and softs. At year-end, the Fund’s tactical positioning reflected a mostly bullish view on commodities, with a number of relative value views within and across sectors.

The Fund finished its fifth full year up 10.4% and outperformed the BCOM benchmark by 8.7%, with volatility targeting and within sector allocation as the main contributors. While short term results can be noisy, we believe the Fund’s broader diversification; strong risk management and active commodity selection can ultimately deliver more steady volatility and strong returns across market environments in the long term.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

17

Shareholder Letter (Unaudited)

| | | | |

| AQR RISK-BALANCED COMMODITIES STRATEGY FUND | | | | |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR RISK-BALANCED COMMODITIES STRATEGY FUND | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: ARCIX | | | 10.41% | | | | 1.20% | | | | -6.03% | | | | -5.74% | | | | 7/9/2012 | |

| Fund - Class N: ARCNX | | | 10.20% | | | | 0.91% | | | | -6.28% | | | | -5.99% | | | | 7/9/2012 | |

| Fund - Class R6: QRCRX | | | 10.55% | | | | 1.26% | | | | na | | | | -4.97% | | | | 9/2/2014 | |

| | | | | |

| Bloomberg Commodity Index Total ReturnSM | | | 1.70% | | | | | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 1.12% 1.41% and 1.06%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | |

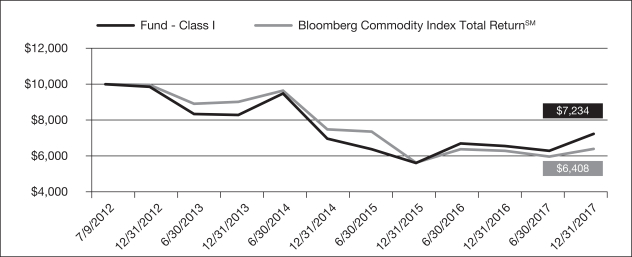

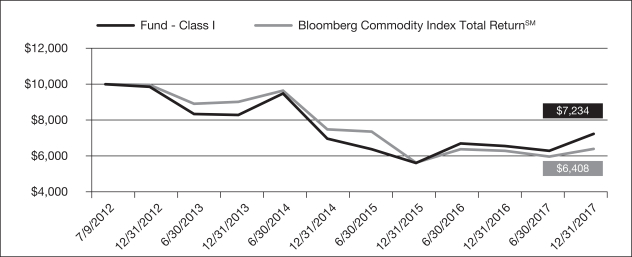

AQR RISK-BALANCED COMMODITIES STRATEGY FUND VS. BLOOMBERG COMMODITY INDEX TOTAL RETURNSM

VALUE OF $10,000 INVESTED ON 07/09/2012 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

18

Shareholder Letter (Unaudited)

John Liew

Founding Principal

Brian Hurst

Principal

Michael Mendelson

Principal

Yao Hua Ooi

Principal

John J. Huss

Principal

Dear Shareholder:

Through the use of securities and derivatives such as futures and swaps, the AQR Risk Parity Fund (the “Fund”) invests across a wide variety of global markets – including, during the period presented in this report, developed- and emerging-market equities, global developed nominal, emerging and developed government and inflation-linked government bonds, emerging market fixed-income, commodities, the credit spreads of corporate and sovereign debt and emerging market currencies – in an attempt to build a truly diversified portfolio where all markets matter, but no one market matters too much. Risk parity investing involves allocating to investments by risk, which means that instruments with less risk will generally be allocated more capital than instruments that are deemed riskier. As markets move through different risk regimes, the portfolio is dynamically adjusted with the goal of keeping overall portfolio risk and the balance of risk across asset classes fairly steady through time. We believe this leads to more consistent results, reduces tail risks, and enables the investor to remain invested through difficult market environments. In addition to adjusting position sizes to control for increasing or decreasing risk expectations, we also overlay modest asset tilts based on AQR’s proprietary expected-return models, which include signals based on carry, momentum, valuation, and other important economic variables. These tilts allow the portfolio to get over- and underweight a broad array of global markets. The ultimate goal is to build a portfolio that in the long run will deliver higher returns at a risk level similar to that of traditional portfolios by combining a better asset allocation with return-boosting tactical tilts.

The Fund is generally expected to remain long all of the markets in which it invests. The targeted annualized volatility for the Fund is 10%, on average, which varies over time based on our perceptions of tactical opportunities within the different asset classes it trades. The Fund started the year targeting a volatility level near its long-term average, as bullish views on equities and commodities were offset by bearish views on bonds. At the end of the year, the Fund had bullish views on equities, commodities, credit, and emerging currencies and bearish views on nominal and inflation-linked bonds. Despite being bullish most asset classes, the Fund’s exposure limits, designed to keep the fund from taking on too big of positions when volatility is forecasted to be very low, kept the Fund’s volatility target below its long-term average.

For the year ended December 31, 2017, the Fund’s Class I shares returned +16.36% and realized an annualized volatility of 6.8%. During this period, the Fund’s benchmark the BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM returned +0.86% and a “60/40 benchmark” consisting of 60% S&P 500 Index®/40% Barclays® U.S. Aggregate Bond Index returned +14.21% at an average realized volatility of 3.5%. The Fund’s net assets across all share classes were over $472 million at the end of 2017. The Fund experienced gains in all four major risk sources for the full year. To the net total return of +16.36% for 2017, equities contributed +8.6%, credit-related assets contributed +5.1%, inflation-sensitive assets contributed +2.4%, and fixed income contributed +0.2%. Tactical tilts contributed to performance with gains coming mostly from equities.

Equities contributed as developed and emerging equity markets rallied throughout the year on strong global growth data. U.S. equity markets outperformed on better-than-expected economic data as well as expectations, and ultimately the signing into law, of the Tax Cuts and Jobs Act, which will provide a meaningful cut to the corporate tax rate starting in 2018. Emerging equities outperformed developed, rallying on better-than-expected growth and economic data. Nominal bonds contributed over the year as carry and rolldown provided net gains as global yields were mostly unchanged on the year. Commodity markets rallied, led by gains in base metals, which rallied on supply curtailments and better-than-expected manufacturing data in China, and energies – oil prices ended 2017 at three-year highs. Inflation-linked bonds gained alongside nominals. Credit spreads contributed to performance, benefiting from strong growth, political stability, positive risk sentiment, and supportive central banks. Emerging currencies strengthen against the U.S. dollar as emerging countries generally experienced positive economic developments and less political uncertainty.

Tactical tilts in equities contributed to performance, driven mostly from sustained bullish trends and bullish timing views in both developed and emerging markets. Active views on nominal bonds detracted, as trends reversed and whipsawed throughout the year; bearish bond timing views also detracted as bonds gained on the year. Tactical tilts in commodities, credit spreads, and emerging

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

19

Shareholder Letter (Unaudited)

currencies added modestly to performance, while bearish views in inflation-linked bonds detracted slightly. Going forward, the portfolio is tactically underweight in fixed income and tactically overweight equities, inflation-sensitive assets, and credit-related assets. Total exposures ended the year higher than where they began, driven by decreased forecasted risk and less bearish tactical tilts in nominal bonds. All asset classes experienced increased year-over-year exposures.

As all major asset classes gained on the year, it is no surprise risk parity outperformed; years when everything goes up tend to be particularly fruitful for risk parity strategies. The greatest strength of risk parity is the limited, humble assumptions necessary to believe in the strategy. If you believe that taking market risk in the major asset classes is rewarded on average, that their risk-adjusted returns are more similar than they are different, and that they tend to pay off at somewhat different times, then the case for risk parity is a sound one. We remain confident that the diversification benefits of a risk parity approach provide a sound allocation for the wide variety of potential market environments we may face in the coming years.

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR RISK PARITY FUND | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: AQRIX | | | 16.36% | | | | 5.59% | | | | 4.76% | | | | 6.49% | | | | 9/29/2010 | |

| Fund - Class N: AQRNX | | | 16.13% | | | | 5.35% | | | | 4.47% | | | | 6.21% | | | | 9/29/2010 | |

| Fund - Class R6: AQRRX | | | 16.56% | | | | 5.68% | | | | na | | | | 3.84% | | | | 9/02/2014 | |

| | | | | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.86% | | | | | | | | | | | | | | | | | |

| | | | | |

| 60% S&P 500 Index®/40% Barclays® U.S. Aggregate Bond Index | | | 14.21% | | | | | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 1.01%, 1.28% and 0.95%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

20

Shareholder Letter (Unaudited)

| | | | |

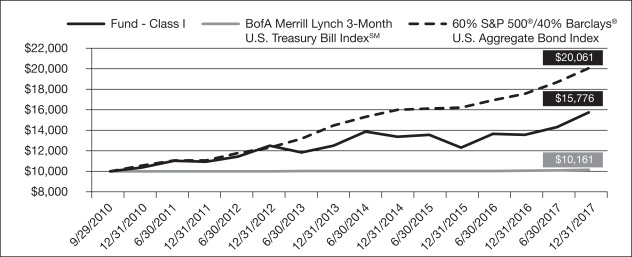

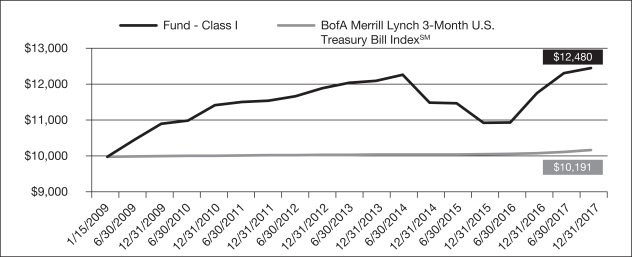

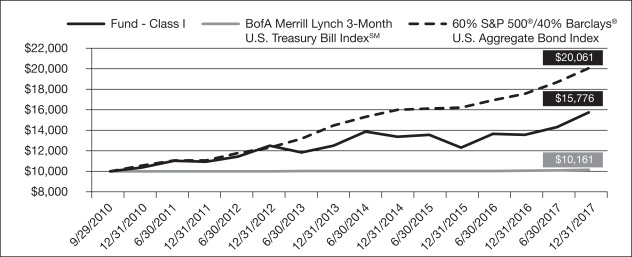

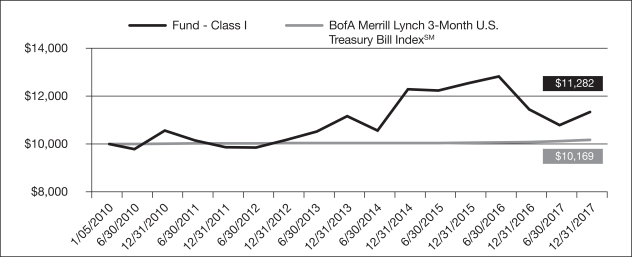

AQR RISK PARITY FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM/ 60% S&P 500®/

40% BARCLAYS® U.S. AGGREGATE BOND INDEX

VALUE OF $10,000 INVESTED ON 09/29/2010 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

21

Shareholder Letter (Unaudited)

| | | | |

| AQR RISK PARITY II HV FUND | | | | |

John Liew

Founding Principal

Brian Hurst

Principal

Michael Mendelson

Principal

Yao Hua Ooi

Principal

John J. Huss

Dear Shareholder:

Through the use of securities and derivatives such as futures and swaps, the AQR Risk Parity II HV Fund (the “Fund”) invests across a wide variety of global markets – including, during the period presented in this report, global developed- and emerging-market equities, global nominal and inflation-linked government bonds, and commodities – in an attempt to build a truly diversified portfolio where all markets matter, but no one market matters too much. Risk parity investing involves allocating to investments by risk, which means that instruments with less risk will generally be allocated more capital than instruments that are deemed riskier. As markets move through different risk regimes, the portfolio is dynamically adjusted with the goal of keeping overall portfolio risk and the balance of risk across asset classes fairly steady through time. We believe this leads to more consistent results, reduces tail risks, and enables the investor to remain invested through difficult market environments. In addition to adjusting position sizes to control for increasing or decreasing risk expectations, we also overlay modest portfolio tilts based on AQR’s proprietary expected-return models, which include signals based on carry, momentum, valuation and other important economic variables. These tilts allow the portfolio to get over- and underweight a broad array of global markets. The ultimate goal is to build a portfolio that in the long run will deliver higher returns at a risk level similar to that of traditional portfolios by combining a better asset allocation with return-boosting tactical tilts.

The Fund is generally expected to remain long all of the markets in which it invests. The targeted annualized volatility for the Fund is 15%, on average, which varies over time based on our perceptions of tactical opportunities within the different asset classes it trades. The Fund started the year targeting a volatility level near its long-term average, as bullish views on equities and commodities were offset by bearish views on bonds. At the end of the year, the Fund had bullish views on equities and commodities and bearish views on nominal and inflation-linked bonds. Despite being bullish most asset classes, the Fund’s exposure limits, designed to keep the fund from taking on too big of positions when volatility is forecasted to be very low, kept the Fund’s volatility target below its long-term average.

For the year ended December 31, 2017, the Fund’s Class I shares returned +19.03% and realized an annualized volatility of 9.4%. During this period, the Fund’s benchmark the BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM returned +0.86% and a “60/40 benchmark” consisting of 60% S&P 500 Index®/40% Barclays® U.S. Aggregate Bond Index returned +14.21% at an average realized volatility of 3.5%. The Fund’s net assets across all share classes were over $55 million at the end of 2017. The Fund experienced gains in all three major risk sources for the full year. To the net total return of +19.03% for 2017, equities contributed +14.3%, inflation-sensitive assets contributed +4.5%, and fixed income contributed +0.2%. Tactical tilts contributed to performance with gains concentrated in equities.

Equities contributed as developed and emerging equity markets rallied throughout the year on strong global growth data. U.S. equity markets outperformed on better-than-expected economic data as well as expectations, and ultimately the signing into law, of the Tax Cuts and Jobs Act, which will provide a meaningful cut to the corporate tax rate starting in 2018. Emerging equities outperformed developed, rallying on better-than-expected growth and economic data. Nominal bonds contributed over the year as carry and rolldown provided net gains as global yields were mostly unchanged on the year. Commodity markets rallied, led by gains in base metals, which rallied on supply curtailments and better-than-expected manufacturing data in China, and energies – oil prices ended 2017 at three-year highs. Inflation-linked bonds gained alongside nominals.

Tactical tilts in equities contributed to performance, driven mostly from sustained bullish trends and bullish timing views in both developed and emerging markets. Active views on nominal bonds detracted, as trends reversed and whipsawed throughout the year; bearish bond timing views also detracted as bonds gained on the year. Tactical tilts in commodities added modestly to performance, while bearish views in inflation-linked bonds detracted slightly. Going forward, the portfolio is tactically underweight in fixed income and tactically overweight equities and commodities. Total exposures ended the year higher than where they began, driven by decreased forecasted risk and less bearish tactical tilts in nominal bonds. All asset classes experienced increased year-over-year exposures.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

22

Shareholder Letter (Unaudited)

| | | | |

| AQR RISK PARITY II HV FUND | | | | |

As all major asset classes gained on the year, it is no surprise risk parity outperformed; years when everything goes up tend to be particularly fruitful for risk parity strategies. The greatest strength of risk parity is the limited, humble assumptions necessary to believe in the strategy. If you believe that taking market risk in the major asset classes is rewarded on average, that their risk-adjusted returns are more similar than they are different, and that they tend to pay off at somewhat different times, then the case for risk parity is a sound one. We remain confident that the diversification benefits of a risk parity approach provide a sound allocation for the wide variety of potential market environments we may face in the coming years.

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2017

AQR RISK PARITY II HV FUND | |

| | | 1 Year | | | 3 Year | | | 5 year | | | Since

Inception | | | Date of

Inception | |

| Fund - Class I: QRHIX | | | 19.03% | | | | 5.18% | | | | 4.31% | | | | 4.67% | | | | 11/5/2012 | |

| Fund - Class N: QRHNX | | | 18.52% | | | | 4.80% | | | | 3.98% | | | | 4.34% | | | | 11/5/2012 | |

| Fund - Class R6: QRHRX | | | 19.17% | | | | 5.21% | | | | na | | | | 3.05% | | | | 9/2/2014 | |

| | | | | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill IndexSM | | | 0.86% | | | | | | | | | | | | | | | | | |

| | | | | |

| 60% S&P 500 Index®/40% Barclays® U.S. Aggregate Bond Index | | | 14.21% | | | | | | | | | | | | | | | | | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/R6 shares are 1.68%, 1.96% and 1.62%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

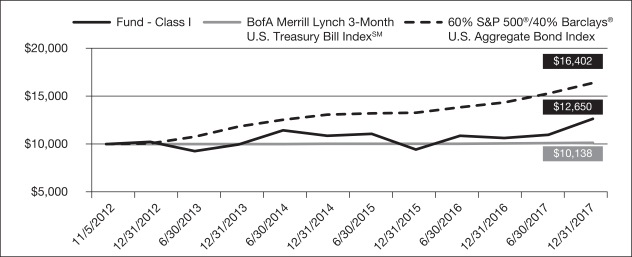

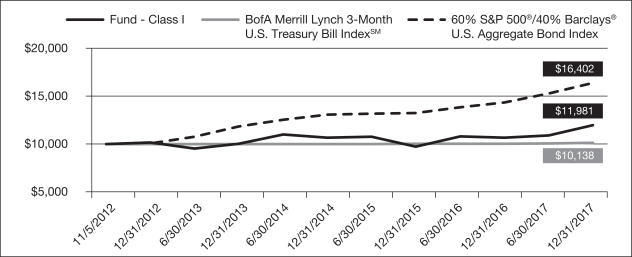

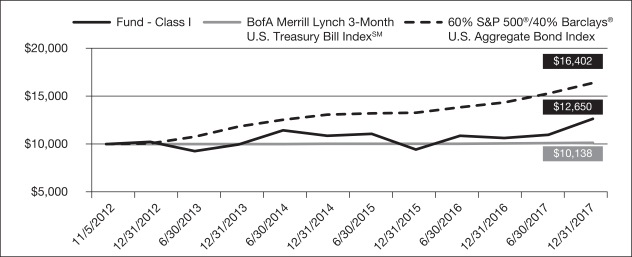

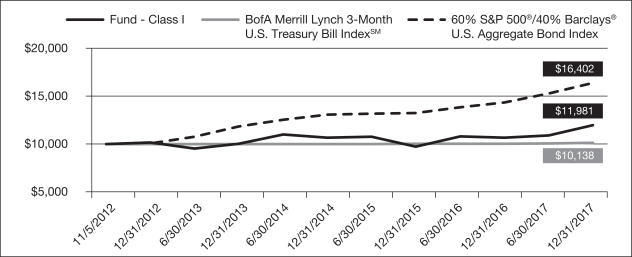

AQR RISK PARITY II HV FUND VS. BOFA MERRILL LYNCH 3-MONTH U.S. TREASURY BILL INDEXSM/ 60% S&P 500®/

40% BARCLAYS® U.S. AGGREGATE BOND INDEX

VALUE OF $10,000 INVESTED ON 11/05/2012 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2017 | | |

| | | | | | | | | | |

23

Shareholder Letter (Unaudited)

| | | | |

| AQR RISK PARITY II MV FUND | | | | |

John Liew

Founding Principal

Brian Hurst

Principal

Michael Mendelson

Principal

Yao Hua Ooi

Principal

John J. Huss

Dear Shareholder:

Through the use of securities and derivatives such as futures and swaps, the AQR Risk Parity II MV Fund (the “Fund”) invests across a wide variety of global markets – including, during the period presented in this report, global developed- and emerging-market equities, global nominal and inflation-linked government bonds, and commodities – in an attempt to build a truly diversified portfolio where all markets matter, but no one market matters too much. Risk parity investing involves allocating to investments by risk, which means that instruments with less risk will generally be allocated more capital than instruments that are deemed riskier. As markets move through different risk regimes, the portfolio is dynamically adjusted with the goal of keeping overall portfolio risk and the balance of risk across asset classes fairly steady through time. We believe this leads to more consistent results, reduces tail risks, and enables the investor to remain invested through difficult market environments. In addition to adjusting position sizes to control for increasing or decreasing risk expectations, we also overlay modest portfolio tilts based on AQR’s proprietary expected-return models, which include signals based on carry, momentum, valuation and other important economic variables. These tilts allow the portfolio to get over- and underweight a broad array of global markets. The ultimate goal is to build a portfolio that in the long run will deliver higher returns at a risk level similar to that of traditional portfolios by combining a better asset allocation with return-boosting tactical tilts.