UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22250

PIMCO ETF Trust

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive office)

Trent W. Walker

Treasurer (Principal Financial & Accounting Officer)

PIMCO ETF Trust

650 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 400-4383

Date of fiscal year end: June 30

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

PIMCO ETF Trust

Annual Report

June 30, 2017

Index Exchange-Traded Funds

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

Actively-Managed Exchange-Traded Funds

PIMCO Active Bond Exchange-Traded Fund

PIMCO Enhanced Low Duration Active Exchange-Traded Fund

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund

PIMCO Short Term Municipal Bond Active Exchange-Traded Fund

Table of Contents

| | * | Effective May 17, 2017 the Fund’s name was changed. Prior to May 17, 2017 the Fund’s name was PIMCO Total Return Active Exchange-Traded Fund. |

| | ** | Effective May 8, 2017 the Fund’s name was changed. Prior to May 8, 2017 the Fund’s name was PIMCO Low Duration Active Exchange-Traded Fund. |

This material is authorized for use only when preceded or accompanied by the current PIMCO ETF Trust prospectus.

Chairman’s Letter

Dear Shareholder,

Please find enclosed the Annual Report for the PIMCO ETF Trust covering the twelve-month reporting period ended June 30, 2017. The following pages contain specific details about the investment performance of each Fund and a discussion of the factors that most affected performance over the reporting period.

Highlights of the financial markets during the twelve-month reporting period include:

| | ∎ | | The outcome of Brexit in June 2016, whereby U.K. voters opted to leave the European Union, prompted market volatility to rise, sovereign yields to rally significantly and risk assets to generally underperform. Investor risk appetite returned later, however, as investors viewed the global economy as stable and expectations for further central bank easing helped anchor risk appetite. Improving commodity prices and fiscal stimulus in China also contributed to renewed investor confidence. |

| | ∎ | | Leading up to the U.S. presidential election on November 8, investors generally shook off a number of political developments, including new leadership in the U.K. and Brazil, and a coup attempt in Turkey. In this environment, volatility generally remained low and risk assets rallied. Central banks were featured prominently in the headlines as monetary policy concerns (in particular, the longevity of central bank support) lingered beneath the seemingly benign market environment. In December, the Federal Reserve (“Fed”) raised its key lending rate, the Federal Funds Rate, by 0.25% to a range of 0.50% to 0.75%. Furthermore, equities moved higher (U.S. stock indices set record highs), credit spreads tightened, and emerging market (“EM”) assets continued to gain over this period. |

| | ∎ | | Through early 2017, the robust risk sentiment that marked the post-U.S. election period broadly continued, though there were some signs of moderation towards the end of March. Early challenges in President Donald Trump’s policy agenda left some investors less optimistic about the potential for other highly anticipated agenda items such as tax reform and infrastructure spending. Still, solid fundamental data, relatively easy financial conditions, and optimism among businesses and consumers helped encourage positive investor sentiment. This environment provided an opportunity for the Fed to continue on its path towards policy normalization, and led the Fed to raise the Federal Funds Rate again in March by 0.25% to a range of 0.75% to 1.00%. |

| | ∎ | | Geopolitics, including elections in several countries as well as political controversy in both the U.S. and Brazil, dominated headlines and contributed to brief periods of market volatility throughout the last quarter of the reporting period. The Fed raised the Federal Funds Rate once again in June by 0.25% to a range of 1.00% to 1.25%, and unveiled details of its plan to gradually unwind its balance sheet, contributing to a flattening yield curve. A perceived hawkish shift in tone from other major central banks, including the European Central Bank, the Bank of England, and the Bank of Canada, spurred most developed market yields to rise even as longer-term interest rates actually fell in the U.S. The fundamental economic backdrop remained largely intact and the broader risk rally continued as equities marched higher, credit spreads tightened, and EM assets strengthened. |

If you have any questions regarding the PIMCO ETF Trust, please contact your financial adviser, or call one of our shareholder associates at 888.400.4ETF (888.400.4383). We also invite you to visit our website at www.pimcoetfs.com to learn more about PIMCO ETFs.

Thank you again, for the trust you place in us. We are privileged to serve you through our ETF offerings.

| | |

| | Sincerely,

Brent R. Harris Chairman of the Board,

PIMCO ETF Trust August 24, 2017 |

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 3 |

Important Information About the Funds

PIMCO ETF Trust (the “Trust”) is an open-end management investment company that includes the PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund, PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund, PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund, PIMCO Broad U.S. TIPS Index Exchange-Traded Fund, PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund, and PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund, which are exchange-traded funds (“ETFs”) that seek to provide total return that closely corresponds, before fees and expenses, to the total return of a specified index (collectively, the “Index Funds”). Each Index Fund employs a representative sampling strategy in seeking to achieve its investment objective. In using this strategy, PIMCO seeks to invest in a combination of instruments such that the portfolio effectively provides exposure to the underlying index. The Fund may not track its underlying index with the same degree of accuracy as a fund that replicates the composition and weighting of the underlying index. The PIMCO Active Bond Exchange-Traded Fund, PIMCO Enhanced Low Duration Active Exchange-Traded Fund, PIMCO Enhanced Short Maturity Active Exchange-Traded Fund, PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund and PIMCO Short Term Municipal Bond Active Exchange-Traded Fund, unlike the Index Funds, are actively managed ETFs that do not seek to track the performance of a specified index (collectively, the “Active Funds” and together with the Index Funds, the “Funds”). Shares of the Funds will be listed and traded at market prices on NYSE Arca, Inc. (“NYSE Arca”) and other secondary markets. The market price for each Fund’s shares may be different from the Fund’s net asset value (“NAV”). Each Fund issues and redeems shares at its NAV only in blocks of a specified number of shares (“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Funds at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to a Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of a Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares from the Funds at NAV.

We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed income securities and other instruments held by the Funds are likely to decrease in value. A wide variety of factors can cause interest rates to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that management will anticipate such movement accurately. The Funds may lose money as a result of movements in interest rates.

As of the date of this report, interest rates in the U.S. and many parts of the world, including certain European countries, are at or near historically low levels. As such, bond funds may currently face an increased exposure to the risks associated with a rising interest rate environment. This is especially true as the Fed ended its quantitative easing program in October 2014 and has begun, and may continue, to raise interest rates. To the extent the Fed continues to raise interest rates, there is a risk that rates across the financial system may rise. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets.”

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact a Fund’s performance or cause a Fund to incur losses. As a result, there could be increased sales of shares which could further reduce the market price for a Fund’s shares.

The Funds may be subject to various risks as described in each Fund’s prospectus. Some of these risks may include, but are not limited to, the following: new/small fund risk, market trading risk, interest rate risk, call risk, inflation-indexed security risk, credit risk, high yield risk, market risk, municipal bond risk, issuer risk, liquidity risk, derivatives risk, equity risk, mortgage-related and other asset-backed securities risk, extension risk, prepayment risk, foreign (non-U.S.) investment risk, emerging markets risk, sovereign debt risk, currency risk, leveraging risk, management risk, municipal project-specific risk, short sale risk, convertible securities risk, tax-efficient investing risk, management and tracking error risk and indexing risk. A complete description of these and other risks is contained in each Fund’s prospectus.

Certain of the Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, leverage risk, management risk and the risk that a Fund may not be able to close out a position when it would be most advantageous to do so. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact a Fund’s ability to invest in derivatives, limit

a Fund’s ability to employ certain strategies that use derivatives and/or adversely affect the value or performance of derivatives and a Fund. Certain derivative transactions may have a leveraging effect on a Fund. For example, a small investment in a derivative instrument may have a

significant impact on a Fund’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price movement in an asset, instrument or component of the index underlying a derivative instrument may cause an immediate and substantial loss or gain, which translates into heightened volatility for the Fund. A Fund may engage in such transactions regardless of whether the Fund owns the asset, instrument or components of the index underlying the derivative instrument. A Fund may invest a significant portion of its assets in these types of instruments. If it does, the Fund’s investment exposure could far exceed the value of its portfolio securities and its investment performance could be primarily dependent upon securities it does not own. Investing in foreign (non-U.S.) securities may entail risk due to foreign (non-U.S.) economic and political developments; this risk may be increased when investing in emerging markets. For example, if a Fund invests in emerging market debt, it may face increased exposure to interest rate, liquidity, volatility, and redemption risk due to the specific economic, political, geographical, or legal background of the foreign (non-U.S.) issuer.

High yield bonds typically have a lower credit rating than other bonds. Lower-rated bonds generally involve a greater risk to principal than higher-rated bonds. Further, markets for lower-rated bonds are typically less liquid than for higher-rated bonds, and public information is usually less abundant in markets for lower-rated bonds. Thus, high yield investments increase the chance that a Fund will lose money. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. Mortgage-related and asset-backed securities represent interests in “pools” of mortgages or other assets such as consumer loans or receivables. As a general matter, mortgage-related and asset-backed securities are subject to interest rate risk, extension risk, prepayment risk, and credit risk. These risks largely stem from the fact that returns on mortgage-related and asset-backed securities depend on the ability of the underlying assets to generate cash flow.

A Fund that invests in the municipal bond market is subject to certain risks associated with such investments. The amount of public information available about the municipal bonds held by a Fund is generally less than that for equities or corporate bonds, and the investment performance of the Fund may therefore be more dependent on the analytical abilities of PIMCO than if the Fund held other types of investments such as stocks or taxable bonds. The secondary market for municipal bonds also tends to be less well-developed or liquid than many other securities markets, which may adversely affect a Fund’s ability to sell its municipal bonds at attractive prices or value its municipal bonds.

The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns and as governmental cost burdens are reallocated among federal, state and local governments. In addition, laws enacted in the future by Congress or state legislatures or referenda could extend the time for payment of principal and/or interest, or impose other constraints on enforcement of such obligations, or on the ability of municipal issuers to levy taxes. Issuers of municipal securities might seek protection under the bankruptcy laws. In the event of bankruptcy of such an issuer, a Fund investing in the issuer’s securities could experience delays in collecting principal and interest, and the Fund may not, in all circumstances, be able to collect all principal and interest to which it is entitled. To enforce its rights in the event of a default in the payment of interest or repayment of principal, or both, a Fund may take possession of, and manage, the assets securing the issuer’s obligations on such securities, which may increase the Fund’s operating expenses. Any income derived from the Fund’s ownership or operation of such assets may not be tax-exempt.

The geographical classification of foreign (non-U.S.) securities in this report are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

On each individual Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on: (i) Fund distributions; or (ii) the sale of Fund shares. Each Fund’s performance is measured against the performance of at least one broad-based securities market index (“benchmark index”). A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. There is no assurance that any Fund, including any Fund that has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. High performance is defined as a significant increase in either 1) a Fund’s total return in excess of that of the Fund’s benchmark between reporting periods or 2) a Fund’s total return in excess of the Fund’s historical returns between reporting periods. Unusual performance is defined as a significant change in a Fund’s performance as compared to one or more previous reporting periods.

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 5 |

Important Information About the Funds (Cont.)

The following table discloses the inception dates of each Fund along with each Fund’s diversification status as of period end:

| | | | | | | | | | |

| Fund Name | | | | | Fund

Inception | | | Diversification

Status |

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund | | | | | | | 06/01/09 | | | Diversified |

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund | | | | | | | 10/30/09 | | | Diversified |

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund | | | | | | | 08/20/09 | | | Diversified |

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund | | | | | | | 09/03/09 | | | Diversified |

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund | | | | | | | 09/03/09 | | | Diversified |

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund | | | | | | | 06/16/11 | | | Diversified |

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund | | | | | | | 09/20/10 | | | Diversified |

PIMCO Active Bond Exchange-Traded Fund | | | | | | | 02/29/12 | | | Diversified |

PIMCO Enhanced Low Duration Active Exchange-Traded Fund | | | | | | | 01/22/14 | | | Diversified |

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | | | | | | | 11/16/09 | | | Diversified |

PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund | | | | | | | 11/30/09 | | | Diversified |

PIMCO Short Term Municipal Bond Active Exchange-Traded Fund | | | | | | | 02/01/10 | | | Diversified |

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. It is possible to lose money on investments in the Funds.

The Trustees are responsible generally for overseeing the management of the Trust. The Trustees authorize the Trust to enter into service agreements with the Adviser, the Distributor, the Administrator and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Trust and the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus nor a Fund’s summary prospectus, the Trust’s Statement of Additional Information (“SAI”), any contracts filed as exhibits to the Trust’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Trust or a Fund creates a contract between or among any shareholder of a Fund, on the one hand, and the Trust, a Fund, a service provider to the Trust or a Fund, and/or the Trustees or officers of the Trust, on the other hand. The Trustees (or the Trust and its officers, service providers or other delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus, summary prospectus or SAI with respect to a Fund or the Trust, and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which the Trust or a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to any Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in the Trust’s then-current prospectus or SAI.

The Index Funds may make available a complete schedule of portfolio holdings and the percentages they represent of the Index Fund’s net assets. On each business day, before commencement of trading on

NYSE Arca, each Active Fund will disclose on www.pimcoetfs.com the identities and quantities of the Active Fund’s portfolio holdings that will form the basis for the Active Fund’s calculation of NAV at the end of the business day. The frequency at which the daily market prices were at a discount or premium to each Fund’s NAV is disclosed on www.pimcoetfs.com. Please see “Disclosure of Portfolio Holdings” in the SAI for information about the availability of the complete schedule of each Fund’s holdings. Fund fact sheets provide additional information regarding a Fund and may be requested by calling (888) 400-4ETF and are available on the Fund’s website at www.pimcoetfs.com.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 400-4ETF, on the Funds’ website at www.pimcoetfs.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Trust files a complete schedule of each Fund’s holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Funds’ Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. A copy of the Funds’ Form N-Q is also available without charge, upon request, by calling the Trust at (888) 400-4ETF and on the Funds’ website at www.pimcoetfs.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

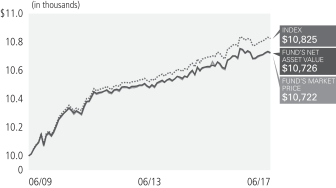

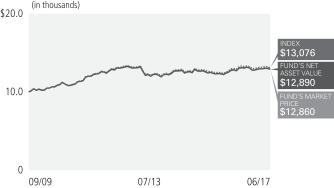

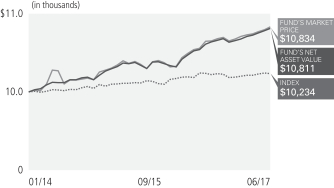

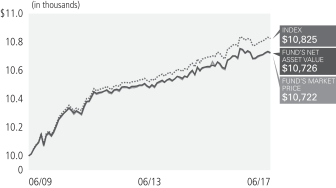

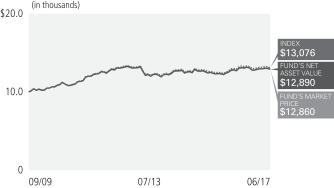

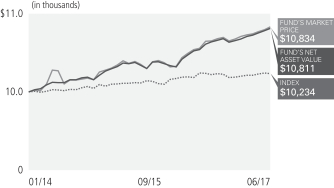

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown

as of 06/30/2017†§

| | | | |

U.S. Treasury Obligations | | | 99.8% | |

Short-Term Instruments | | | 0.2% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(06/01/2009) | |

| | PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund (Based on Net Asset Value) | | | (0.26)% | | | | 0.50% | | | | 0.86% | |

| | PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | (0.24)% | | | | 0.51% | | | | 0.86% | |

| | BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM± | | | (0.11)% | | | | 0.63% | | | | 0.98% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. Treasury securities, other than inflation-protection securities and STRIPS, with at least $1 billion in outstanding face value and a remaining term to final maturity of at least one year and less than three years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch 1-3 Year US Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Yields in the 1- to 3-year segment of the U.S. Treasury yield curve rose, negatively impacting the price return of both the Fund and the Underlying Index. Returns due to income contributed to performance for both the Fund and the Underlying Index. The net result was negative absolute performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 7 |

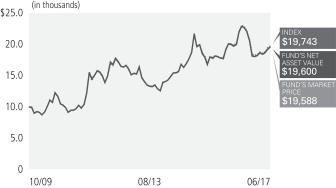

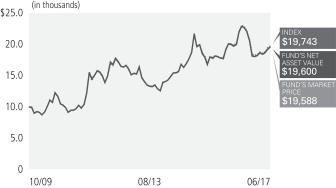

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

U.S. Treasury Obligations | | | 95.0% | |

Short-Term Instruments | | | 5.0% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (Based on Net Asset Value) | | | (10.88)% | | | | 3.19% | | | | 9.18% | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (At Market Price)(1) | | | (10.92)% | | | | 3.27% | | | | 9.17% | |

| | BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM± | | | (10.49)% | | | | 3.48% | | | | 9.27% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (“STRIPS”) representing the final principal payment of U.S. Treasury bonds. The principal STRIPS comprising the Underlying Index must have 25 years or more remaining term to final maturity and must be stripped from U.S. Treasury bonds having at least $1 billion in outstanding face value.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch Long US Treasury Principal STRIPS IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Yields in the 25+ year segment of the U.S. Treasury STRIPS yield curve rose, negatively impacting absolute performance for both the Fund and the Underlying Index. |

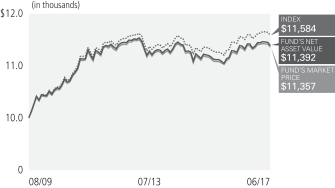

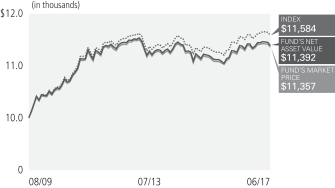

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

U.S. Treasury Obligations | | | 100.0% | |

Short-Term Instruments | | | 0.0% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(08/20/2009) | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 0.00% | | | | 0.11% | | | | 1.64% | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | 0.02% | | | | 0.12% | | | | 1.64% | |

| | BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM± | | | 0.19% | | | | 0.33% | | | | 1.87% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities with at least $1 billion in outstanding face value and a remaining term to final maturity of at least 1 year and less than 5 years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Real yields, or the rates of return in excess of expected future inflation, generally rose across the U.S. Treasury Inflation-Protected Securities (TIPS) yield curve, negatively impacting performance of both the Fund and the Underlying Index. |

| » | | A positive inflation accrual, or change in the Consumer Price Index (CPI), applied to the principal of the underlying TIPS, positively impacted performance of both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 9 |

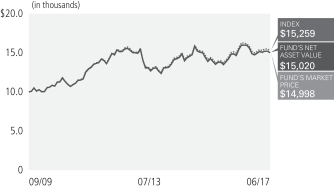

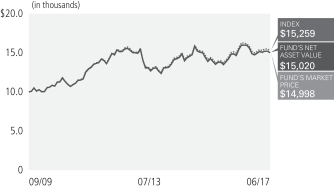

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

U.S. Treasury Obligations | | | 100.0% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | (2.82)% | | | | 0.34% | | | | 5.64% | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | (2.74)% | | | | 0.35% | | | | 5.64% | |

| | BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM± | | | (2.54)% | | | | 0.56% | | | | 5.84% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities with at least $1 billion in outstanding face value and a remaining term to final maturity greater than 15 years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Real yields, or the rates of return in excess of expected future inflation, generally rose across the U.S. Treasury Inflation-Protected Securities (TIPS) yield curve, negatively impacting performance of both the Fund and the Underlying Index. |

| » | | A positive inflation accrual, or change in the Consumer Price Index (CPI), applied to the principal of the underlying TIPS, positively impacted performance of both the Fund and the Underlying Index. |

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

U.S. Treasury Obligations | | | 99.7% | |

Short-Term Instruments | | | 0.3% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | (0.87)% | | | | 0.11% | | | | 3.49% | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | (0.91)% | | | | 0.12% | | | | 3.48% | |

| | BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM± | | | (0.75)% | | | | 0.30% | | | | 3.67% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± BofA Merrill Lynch US Inflation-Linked Treasury IndexSM is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities with at least $1 billion in outstanding face value.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch US Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Real yields, or the rates of return in excess of expected future inflation, generally rose across the U.S. Treasury Inflation-Protected Securities (TIPS) yield curve, negatively impacting performance of both the Fund and the Underlying Index. |

| » | | A positive inflation accrual, or change in the Consumer Price Index (CPI), applied to the principal of the underlying TIPS, positively impacted performance of both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 11 |

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

Corporate Bonds & Notes | | | 80.9% | |

Short-Term Instruments | | | 19.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(06/16/2011) | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund (Based on Net Asset Value) | | | 10.88% | | | | 5.55% | | | | 5.53% | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund (At Market Price)(1) | | | 10.40% | | | | 5.42% | | | | 5.48% | |

| | BofA Merrill Lynch 0-5 Year US High Yield Constrained IndexSM± | | | 12.01% | | | | 6.17% | | | | 6.09% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 0-5 Year US High Yield Constrained IndexSM tracks the performance of short-term U.S. dollar denominated below investment grade corporate debt issued in the U.S. domestic market with less than five years remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $250 million, issued publicly. Prior to September 30, 2016, securities with minimum amount outstanding of $100 million qualified. Allocations to an individual issuer will not exceed 2%.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.55%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch 0-5 Year US High Yield Constrained IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Yields in the short-term segment of the U.S. high yield bond market decreased, which positively impacted price returns for these securities. Coupon income also positively contributed to performance for both the Fund and the Underlying Index. The result was positive performance for both the Fund and the Underlying Index. |

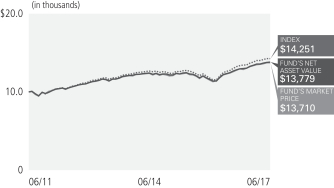

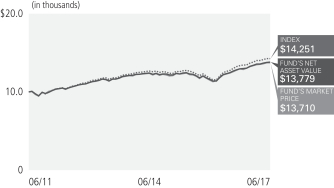

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

Industrials | | | 49.7% | |

Banking & Finance | | | 34.4% | |

Utilities | | | 12.7% | |

Short-Term Instruments | | | 3.1% | |

Sovereign Issues | | | 0.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(09/20/2010) | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund (Based on Net Asset Value) | | | 2.19% | | | | 3.99% | | | | 4.64% | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund (At Market Price)(1) | | | 1.81% | | | | 4.00% | | | | 4.67% | |

| | BofA Merrill Lynch US Corporate IndexSM± | | | 2.33% | | | | 4.05% | | | | 4.74% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± BofA Merrill Lynch US Corporate IndexSM is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity and at least $250 million outstanding.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the BofA Merrill Lynch US Corporate IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | An increase in bond yields negatively impacted price returns for both the Fund and the Underlying Index. |

| » | | Returns due to income positively contributed to performance, resulting in positive performance of both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 13 |

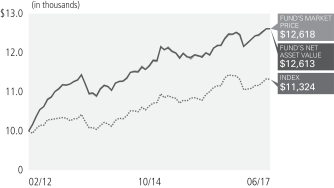

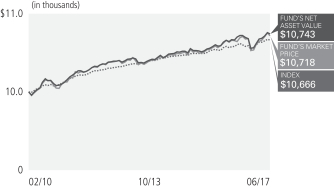

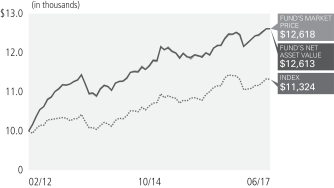

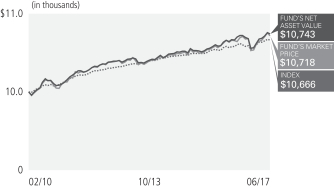

PIMCO Active Bond Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

U.S. Government Agencies | | | 35.5% | |

Corporate Bonds & Notes | | | 23.4% | |

U.S. Treasury Obligations | | | 21.6% | |

Asset-Backed Securities | | | 11.1% | |

Non-Agency Mortgage-Backed Securities | | | 4.1% | |

Municipal Bonds & Notes | | | 1.7% | |

Sovereign Issues | | | 1.7% | |

Short-Term Instruments | | | 0.9% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(02/29/2012) | |

| | PIMCO Active Bond Exchange-Traded Fund

(Based on Net Asset Value) | | | 2.00% | | | | 3.49% | | | | 4.45% | |

| | PIMCO Active Bond Exchange-Traded Fund

(At Market Price)(1) | | | 2.16% | | | | 3.50% | | | | 4.46% | |

| | Bloomberg Barclays U.S. Aggregate Index± | | | (0.31)% | | | | 2.21% | | | | 2.36% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Bloomberg Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.56%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO Active Bond Exchange-Traded Fund seeks current income and long-term capital appreciation, consistent with prudent investment management, by investing under normal circumstances at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Positions in U.S. Treasury Inflation-Protected Securities (TIPS) contributed to relative performance, as breakeven inflation rates rose. |

| » | | Positions in student loans contributed to relative performance, as total returns were positive. |

| » | | Overweight exposure to investment grade corporate credit risk, particularly financials, benefited relative performance, as the sector outperformed the broader market. |

| » | | Short exposure to a basket of Asian emerging markets currencies detracted from relative performance, as the currencies appreciated against the U.S. dollar. |

| » | | Long exposure to the Brazilian real contributed to relative performance, as the currency appreciated against the U.S. dollar. |

| » | | Short exposure to the French OAT-German Bund spread detracted from relative performance, as the spread narrowed. |

PIMCO Enhanced Low Duration Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

Corporate Bonds & Notes | | | 44.4% | |

U.S. Treasury Obligations | | | 38.4% | |

Asset-Backed Securities | | | 9.0% | |

U.S. Government Agencies | | | 2.6% | |

Short-Term Instruments | | | 1.8% | |

Other | | | 3.8% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | Fund Inception

(01/22/2014) | |

| | PIMCO Enhanced Low Duration Active Exchange-Traded Fund

(Based on Net Asset Value) | | | 2.54% | | | | 2.38% | |

| | PIMCO Enhanced Low Duration Active Exchange-Traded Fund

(At Market Price)(1) | | | 2.63% | | | | 2.43% | |

| | BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM± | | | (0.11)% | | | | 0.72% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. Treasury securities, other than inflation-protection securities and STRIPS, with at least $1 billion in outstanding face value and a remaining term to final maturity of at least one year and less than three years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.55%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO Enhanced Low Duration Active Exchange-Traded Fund seeks maximum total return, consistent with preservation of capital and prudent investment management, by investing under normal circumstances at least 80% of its net assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Exposure to investment grade corporate credit contributed to relative performance, as this sector generally posted positive excess returns. |

| » | | Underweight exposure to U.S. interest rates, particularly an underweight to the front end of the yield curve, contributed to relative performance, as interest rates rose. |

| » | | Positions in non-agency mortgage-backed securities (MBS) contributed to relative performance, as total returns in these securities were positive. |

| » | | Holdings of short- to intermediate-term U.S. Treasury Inflation-Protected Securities (TIPS) benefited performance, as the sector generally posted positive total returns. |

| » | | Overweight exposure to Australian duration detracted from relative performance, as interest rates in Australia rose. |

| » | | Overweight exposure to Mexican duration detracted from relative performance, as interest rates in Mexico rose. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2017 | | 15 |

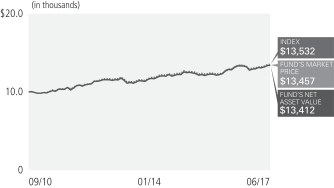

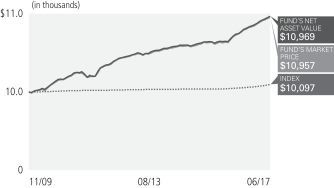

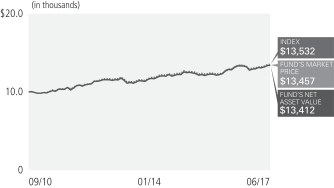

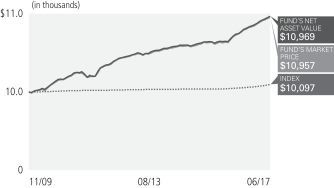

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

Corporate Bonds & Notes | | | 60.1% | |

Asset-Backed Securities | | | 14.5% | |

Short-Term Instruments | | | 12.6% | |

Sovereign Issues | | | 7.1% | |

U.S. Government Agencies | | | 3.4% | |

Non-Agency Mortgage-Backed Securities | | | 1.6% | |

Other | | | 0.7% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(11/16/2009) | |

| | PIMCO Enhanced Short Maturity Exchange-Traded Fund

(Based on Net Asset Value) | | | 2.05% | | | | 1.14% | | | | 1.24% | |

| | PIMCO Enhanced Short Maturity Exchange-Traded Fund

(At Market Price)(1) | | | 2.01% | | | | 1.14% | | | | 1.23% | |

| | Citi 3-Month Treasury Bill Index± | | | 0.46% | | | | 0.15% | | | | 0.13%¨ | |

All Fund returns are net of fees and expenses.

¨ Average annual total return since 11/30/2009.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Citi 3-Month Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 3 month Treasury Bill issues.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or call (888) 400-4ETF.

The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented, is 0.36%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus.

Investment Objective and Strategy Overview

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund seeks maximum current income, consistent with preservation of capital and daily liquidity, by investing under normal circumstances at least 80% of its net assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The Fund primarily invests in U.S. dollar-denominated investment grade debt securities, rated Baa or higher by Moody’s Investors Service, Inc. (“Moody’s”), or equivalently rated by Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, determined by PIMCO to be of comparable quality. Fund strategies may change from time to time. The Fund may invest, without limitation, in U.S. dollar-denominated securities and instruments of foreign issuers. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance during the reporting period:

| » | | Exposure to investment grade corporate credit contributed to relative performance, as this sector generally posted positive excess returns. |

| » | | U.S. interest rate strategies contributed to performance relative to the Fund’s benchmark by, generating higher carry from yield curve roll-down. |

| » | | Exposure to securitized debt benefited performance, as these securities generally posted positive excess returns. |

| » | | Holdings of U.S. dollar-denominated emerging market debt benefited performance, as the sector generally posted positive excess returns. |

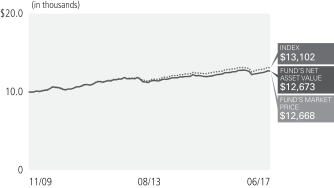

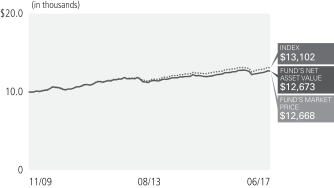

PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2017

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of 06/30/2017†§

| | | | |

Municipal Bonds & Notes | | | | |

Health, Hospital & Nursing Home Revenue | | | 16.0% | |

Ad Valorem Property Tax | | | 13.2% | |

College & University Revenue | | | 9.0% | |

Highway Revenue Tolls | | | 8.8% | |

Water Revenue | | | 8.0% | |

Electric Power & Light Revenue | | | 5.0% | |

Income Tax Revenue | | | 4.7% | |

Port, Airport & Marina Revenue | | | 4.1% | |

Tobacco Settlement Funded | | | 3.9% | |

Natural Gas Revenue | | | 3.3% | |

Miscellaneous Taxes | | | 3.3% | |

Miscellaneous Revenue | | | 2.9% | |

Lease (Appropriation) | | | 2.4% | |

Sales Tax Revenue | | | 2.0% | |

Appropriations | | | 2.0% | |

Industrial Revenue | | | 1.7% | |

Transit Revenue | | | 1.6% | |

General Fund | | | 1.1% | |

Sewer Revenue | | | 1.1% | |

Economic Development Revenue | | | 1.0% | |

Other | | | 3.8% | |

Short-Term Instruments | | | 0.7% | |

U.S. Treasury Obligations | | | 0.4% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2017 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(11/30/2009) | |

| | PIMCO Intermediate Municipal Bond Exchange-Traded Fund (Based on Net Asset Value) | | | (0.69)% | | | | 2.11% | | | | 3.17% | |

| | PIMCO Intermediate Municipal Bond Exchange-Traded Fund

(At Market Price)(1) | | | (0.76)% | | | | 2.10% | | | | 3.17% | |

| | Bloomberg Barclays 1-15 Year Municipal Bond Index± | | | (0.15)% | | | | 2.70% | | | | 3.63% | |

All Fund returns are net of fees and expenses.