UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22250

PIMCO ETF Trust

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

Trent W. Walker

Treasurer (Principal Financial & Accounting Officer)

PIMCO ETF Trust

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 400-4383

Date of fiscal year end: June 30

Date of reporting period: June 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| | | | | | | | |

Item 1. | | Reports to Shareholders. |

| |

| | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| |

| | • PIMCO ETF Trust |

Your Global Investment Authority

PIMCO ETF Trust

Annual Report

June 30, 2015

Index Exchange-Traded Funds

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

Actively-Managed Exchange-Traded Funds

PIMCO Diversified Income Active Exchange-Traded Fund

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

PIMCO Foreign Currency Strategy Active Exchange-Traded Fund

PIMCO Global Advantage® Inflation-Linked Bond Active Exchange-Traded Fund

PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund

PIMCO Low Duration Active Exchange-Traded Fund

PIMCO Short Term Municipal Bond Active Exchange-Traded Fund

PIMCO Total Return Active Exchange-Traded Fund

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO ETF Trust prospectus.

Chairman’s Letter

Dear Shareholder,

Please find enclosed the Annual Report for the PIMCO ETF Trust covering the twelve-month reporting period ended June 30, 2015. On the following pages, are specific details about the investment performance of each Fund and a discussion of the factors that most affected performance over the reporting period.

Highlights of the financial markets during our twelve-month reporting period include:

| | n | | Investor concerns over the potential for global deflation gradually receded as oil prices rose during the latter part of the reporting period after significantly declining in 2014 and early 2015. In addition, the outlook for economic growth brightened, particularly for developed market economies, led by continuing growth in the U.S. and improvement in Europe. Investors, however, were kept on edge by events in Greece, in which the debt crisis worsened sharply towards the latter part of the period and continues to be a concern outside of the reporting period as events remain fluid. Furthermore, Chinese equity markets experienced heightened volatility and data pointed to a slowing Chinese economy, prompting Chinese policymakers to lower interest rates. |

| | n | | U.S. Treasuries, as represented by the Barclays U.S. Treasury Index, returned 2.31% for the reporting period as yields at the front-end of the U.S. Treasury yield curve generally rose, while intermediate and longer-maturity yields declined. The benchmark ten-year U.S. Treasury note yielded 2.35% at the end of the reporting period, down from 2.53% on June 30, 2014. |

| | n | | U.S. Treasury Inflation-Protected Securities (“TIPS”), as represented by the Barclays U.S. TIPS Index, declined 1.73% over the reporting period. The collapse in oil prices that began in 2014 pushed inflation expectations to multi-year lows and caused U.S. TIPS to underperform nominal U.S. Treasuries by a large margin over the reporting period, despite the rise in oil prices towards the end of the period. Returns of global inflation-linked bonds (“ILBs”) outside of the U.S. varied across countries, depending on their respective inflation expectations. However, few ILB markets were able to keep pace with their nominal counterparts as global inflation expectations were similarly impacted by lower energy prices over the reporting period. |

| | n | | U.S. investment grade credit, as measured by the Barclays U.S. Credit Index, returned 0.93% over the reporting period. Global investment grade credit spreads widened amid a record pace of primary supply in the U.S. market. The U.S. short-dated high yield debt market, as measured by the BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained Index, declined 0.27% as the asset class was primarily negatively affected by lower oil prices in the second half of 2014, heightened volatility from macro events such as a potential Greek default and decline in the Chinese equity market; and generally volatile retail fund flows for high yield bond mutual funds. |

| | n | | Tax-exempt municipal bonds, as represented by the Barclays Municipal Bond Index, returned 3.00% over the reporting period. Positive municipal bond returns were driven by positive retail demand, improved fundamentals, and lower U.S. Treasury yields. Demand for municipal bonds was concentrated in high yield and longer-duration segments. Despite negative credit headlines and associated volatility surrounding select large issuers, general municipal credit trends have improved as states have been adding to payrolls and rebuilding their cash reserves. |

If you have any questions regarding the PIMCO ETF Trust, please contact your financial adviser, or call one of our shareholder associates at 888.400.4ETF (888.400.4383). We also invite you to visit our website at www.pimcoetfs.com to learn more about PIMCO ETFs.

Thank you again for the trust you have placed in us. We are privileged to serve you through our ETF offerings.

| | |

| | Sincerely,

Brent R. Harris Chairman of the Board,

PIMCO ETF Trust August 20, 2015 |

Important Information About the Funds

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund, PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund, PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund, PIMCO Broad U.S. TIPS Index Exchange-Traded Fund, PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund, and PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund are exchange-traded funds (“ETFs”) that seek to provide total return that closely corresponds, before fees and expenses, to the total return of a specified index (collectively, the “Index Funds”). Each Index Fund employs a representative sampling strategy in seeking to achieve its investment objective and as a result may not hold all of the securities that are included in the underlying index. The PIMCO Diversified Income Active Exchange-Traded Fund, PIMCO Enhanced Short Maturity Active Exchange-Traded Fund, PIMCO Foreign Currency Strategy Active Exchange-Traded Fund, PIMCO Global Advantage® Inflation-Linked Bond Active Exchange-Traded Fund, PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund, PIMCO Low Duration Active Exchange-Traded Fund, PIMCO Short Term Municipal Bond Active Exchange-Traded Fund and PIMCO Total Return Active Exchange-Traded Fund, unlike the Index Funds, are actively managed ETFs that do not seek to track the performance of a specified index (collectively, the “Active Funds” and together with the Index Funds, the “Funds”). Shares of the Funds will be listed and traded at market prices on NYSE Arca, Inc. (“NYSE Arca”) and other secondary markets. The market price for each Fund’s shares may be different from the Fund’s net asset value (“NAV”). Each Fund issues and redeems shares at its NAV only in blocks of a specified number of shares (“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Funds at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to a Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of a Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares from the Funds at NAV.

The Funds invest in particular segments of the securities markets, which are not representative of the broader securities markets. We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities held by the Funds are likely to decrease in value. A number of factors can cause interest rates to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). Accordingly, changes in interest rates can be sudden and significant, and there is no guarantee that Fund management will anticipate such movement accurately.

As of the date of this report, interest rates in the U.S. are at or near historically low levels. As such, bond funds may currently face an

increased exposure to the risks associated with a rising interest rate environment. This is especially true as the Fed ended its quantitative easing program in October 2014. Further, while the U.S. bond market has steadily grown over the past three decades, dealer inventories of corporate bonds have remained relatively stagnant. As a result, there has been a significant reduction in the ability of dealers to “make markets.” All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets, which could further reduce the net assets of a Fund.

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. If the performance of a Fund were to be negatively impacted by rising interest rates, the Fund could face increased redemptions by its shareholders, which could further reduce the net assets of the Fund.

The Funds may be subject to various risks in addition to those described above. Some of these risks may include, but are not limited to, the following: market trading risk, interest rate risk, call risk, inflation-indexed security risk, credit risk, high yield risk, market risk, municipal bond risk, issuer risk, liquidity risk, derivatives risk, commodity risk, equity risk, issuer non-diversification risk, mortgage-related and other asset-backed securities risk, foreign (non-U.S.) investment risk, emerging markets risk, currency risk, leveraging risk, management risk, municipal project-specific risk, short sale risk, convertible securities risk, management and tracking error risk and indexing risk. A complete description of these and other risks is contained in each Fund’s prospectus. The Index Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, leverage risk, management risk and the risk that a Fund may not be able to close out a position when it would be most advantageous to do so. Certain derivative transactions may have a leveraging effect on an Index Fund. For example, a small investment in a derivative instrument may have a significant impact on an Index Fund’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price movement in an asset, instrument or component of the index underlying a derivative instrument may cause an immediate and substantial loss or gain, which translates into heightened volatility for the Fund. An Index Fund may engage in such transactions regardless of whether the Index Fund owns the asset, instrument or components of the index underlying the derivative instrument. An Index Fund may invest a significant portion of its assets in these types of instruments. If it does, the Index Fund’s investment exposure could far exceed the value of its portfolio securities and its investment performance could be primarily dependent upon securities it does not own. Investing in foreign (non-U.S.) securities may entail risk due to foreign (non-U.S.) economic and political developments; this risk may

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 3 |

Important Information About the Funds (Cont.)

be increased when investing in emerging markets. For example, if a Fund invests in emerging market debt, it may face increased exposure to interest rate, liquidity, volatility, and redemption risk due to the specific economic, political, geographical, or legal background of the foreign issuer.

High-yield bonds typically have a lower credit rating than other bonds. Lower-rated bonds generally involve a greater risk to principal than higher-rated bonds. Further, markets for lower-rated bonds are typically less liquid than for higher-rated bonds, and public information is usually less abundant in such markets. Thus, high yield investments increase the chance that a Fund will lose money. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. Mortgage- and Asset-Backed Securities represent ownership interests in “pools” of mortgages or other assets such as consumer loans or receivables. As a general matter, Mortgage- and Asset-Backed Securities are subject to interest rate risk, extension risk, prepayment risk, and credit risk. These risks largely stem from the fact that returns on Mortgage- and Asset-Backed Securities depend on the ability of the underlying assets to generate cash flow.

Certain Funds may invest in securities and instruments that are economically tied to Russia. Investments in Russia are subject to political, economic, legal, market and currency risks, as well as the risk that further economic sanctions may be imposed by the United States and/or other countries. Such sanctions—which may impact companies in many sectors, including energy, financial services and defense, among others—may negatively impact the Fund’s performance and/or ability to achieve its investment objective. For example, certain transactions may be prohibited and/or existing investments may become illiquid (e.g., in the event that transacting in certain existing investments is prohibited), which could cause the Fund to sell other portfolio holdings at a disadvantageous time or price in order to meet shareholder redemptions.

The geographical classification of foreign (non-U.S.) securities in this report are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

On each individual Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on: (i) Fund distributions; or (ii) the redemption of Fund shares. Each Fund’s performance is measured against the

performance of a broad-based securities market index (“benchmark index”). A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The Index Funds may make available a complete schedule of portfolio holdings and the percentages they represent of the Index Fund’s net assets. On each business day, before commencement of trading on NYSE Arca, each Active Fund will disclose on www.pimcoetfs.com the identities and quantities of the Active Fund’s portfolio holdings that will form the basis for the Active Fund’s calculation of NAV at the end of the business day. The frequency at which the daily market prices were at a discount or premium to each Fund’s NAV is disclosed on www.pimcoetfs.com. Please see “Disclosure of Portfolio Holdings” in the Statement of Additional Information for information about the availability of the complete schedule of each Fund’s holdings. Fund fact sheets provide additional information regarding a Fund and may be requested by calling (888) 400-4ETF and are available on the Fund’s website at www.pimcoetfs.com.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO ETF Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 400-4ETF, on the Funds’ website at www.pimcoetfs.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

PIMCO ETF Trust files a complete schedule of each Fund’s portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Funds’ Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and is available without charge, upon request, by calling the Trust at (888) 400-4ETF and on the Funds’ website at www.pimcoetfs.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

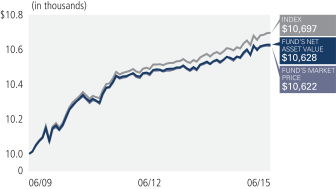

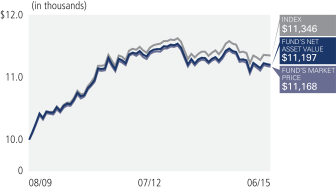

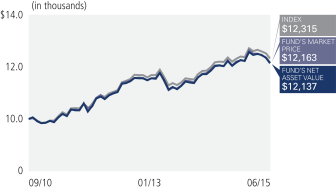

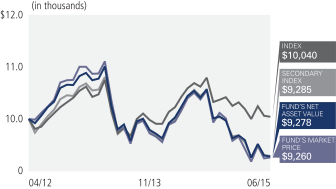

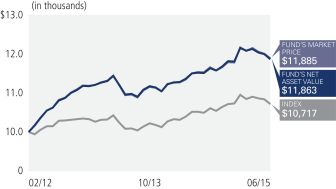

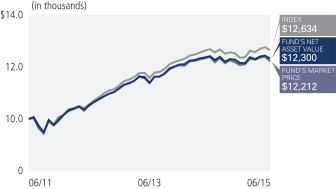

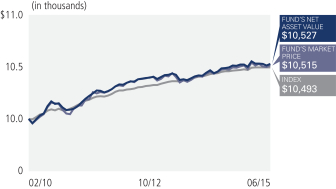

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 99.5% | |

| Short-Term Instruments | | | 0.5% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(06/01/2009) | |

| | PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 0.70% | | | | 0.72% | | | | 1.00% | |

| | PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | 0.70% | | | | 0.71% | | | | 0.99% | |

| | The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM± | | | 0.88% | | | | 0.82% | | | | 1.11% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. Treasury securities, other than inflation-protection securities and Separate Trading of Registered Interest and Principal of Securities (“STRIPS”), with at least $1 billion in outstanding face value and a remaining term to final maturity of at least one year and less than three years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Yields in the 1- to 3-year segment of the U.S. Treasury yield curve increased over the course of the reporting period, negatively impacting the price return of both the Fund and the Underlying Index. Returns due to income positively contributed to performance for both the Fund and the Underlying Index. The net result was positive performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 5 |

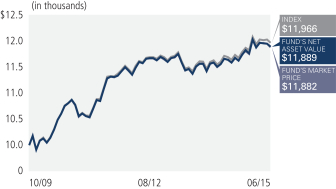

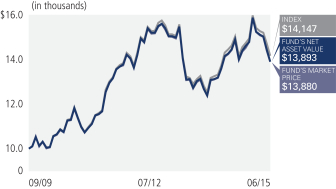

PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| † | % of Investments, at value as of 06/30/15. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 2.16% | | | | 2.55% | | | | 3.10% | |

| | PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | 2.15% | | | | 2.54% | | | | 3.09% | |

| | The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM± | | | 2.37% | | | | 2.67% | | | | 3.22% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 3 years and less than 7 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Changes in yields in the 3- to 7-year segment of the U.S. Treasury yield curve were mixed over the course of the reporting period, with a decline in 7-year yields positively impacting the price return of both the Fund and the Underlying Index. Returns due to income positively contributed to performance for both the Fund and the Underlying Index. |

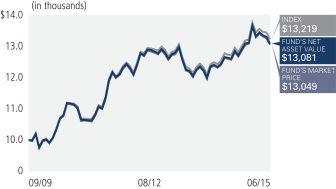

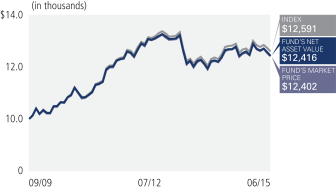

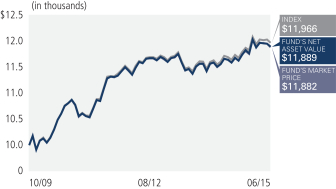

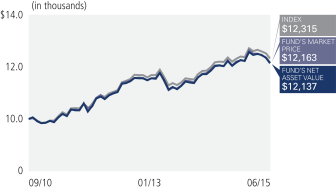

PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(09/10/2009) | |

| | PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 3.58% | | | | 4.12% | | | | 4.85% | |

| | PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | 3.58% | | | | 4.09% | | | | 4.84% | |

| | The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM± | | | 3.81% | | | | 4.33% | | | | 5.01% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 7 years and less than 15 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Yields in the 7- to 15-year segment of the U.S. Treasury yield curve declined over the course of the reporting period, positively impacting the price return of both the Fund and the Underlying Index. Returns due to income positively contributed to performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 7 |

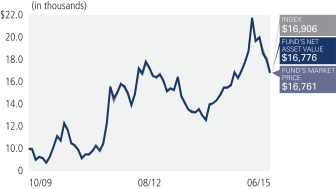

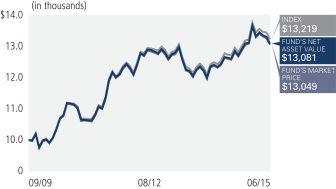

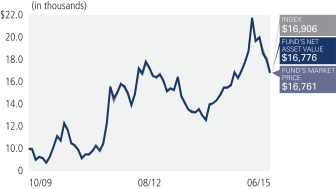

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (Based on Net Asset Value) | | | 8.64% | | | | 8.60% | | | | 9.56% | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (At Market Price)(1) | | | 8.20% | | | | 8.50% | | | | 9.54% | |

| | The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM± | | | 9.07% | | | | 8.84% | | | | 9.71% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (“STRIPS”) representing the final principal payment of U.S. Treasury bonds. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Yields in the 25+ year segment of the U.S. Treasury STRIPS yield curve declined over the reporting period, positively contributing to performance for both the Fund and the Underlying Index. |

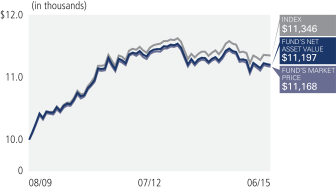

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 99.8% | |

| Short-Term Instruments | | | 0.2% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(08/20/2009) | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -2.27% | | | | 1.22% | | | | 1.91% | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | -2.27% | | | | 1.22% | | | | 1.92% | |

| | The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM± | | | -1.99% | | | | 1.45% | | | | 2.16% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 1 year and less than 5 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Real yields, or the rates of return in excess of expected future inflation, increased across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve, resulting in negative performance for both the Fund and the Underlying Index. A negative inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also had a negative impact on performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 9 |

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 99.8% | |

| Short-Term Instruments | | | 0.2% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -2.52% | | | | 5.07% | | | | 6.22% | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | -2.46% | | | | 5.10% | | | | 6.23% | |

| | The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM± | | | -2.00% | | | | 5.43% | | | | 6.53% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 15 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Real yields, or the rates of return in excess of expected future inflation, increased across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve, resulting in negative performance for both the Fund and the Underlying Index. A negative inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also had a negative impact on performance for both the Fund and the Underlying Index. |

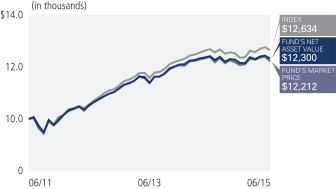

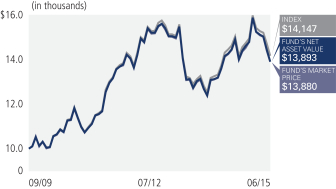

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| U.S. Treasury Obligations | | | 99.5% | |

| Short-Term Instruments | | | 0.5% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -2.02% | | | | 3.14% | | | | 4.04% | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | -1.97% | | | | 3.14% | | | | 4.05% | |

| | The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM± | | | -1.64% | | | | 3.40% | | | | 4.28% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities). It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO Broad U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Real yields, or the rates of return in excess of expected future inflation, increased across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve, resulting in negative performance for both the Fund and the Underlying Index. A negative inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also had a negative impact on performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 11 |

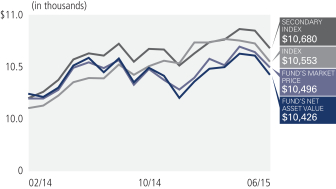

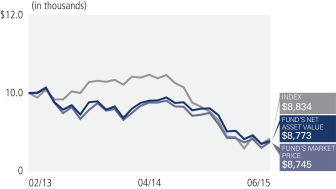

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| Corporate Bonds & Notes | | | 96.1% | |

| Short-Term Instruments | | | 3.7% | |

| U.S. Treasury Obligations | | | 0.2% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | Fund Inception

(06/16/2011) | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -0.82% | | | | 5.38% | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | -1.38% | | | | 5.25% | |

| | BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM± | | | -0.27% | | | | 6.04% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM tracks the performance of short-term U.S. dollar denominated below investment grade corporate debt issued in the U.S. domestic market with less than five years remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $100 million, issued publicly. Allocations to an individual issuer will not exceed 2%. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.55%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Yields in the short-term segment of the U.S. high yield market increased over the reporting period, which negatively impacted performance. Coupon income positively contributed to performance for both the Fund and the Underlying Index. The net result was negative overall performance for both the Fund and the Underlying Index. |

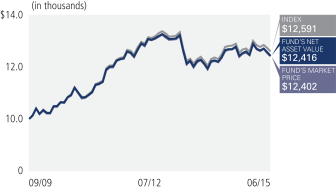

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| Industrials | | | 44.3% | |

| Banking & Finance | | | 38.7% | |

| Utilities | | | 15.4% | |

| Short-Term Instruments | | | 0.9% | |

| U.S. Treasury Obligations | | | 0.7% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | Fund Inception

(09/20/2010) | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 0.74% | | | | 4.44% | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | 0.85% | | | | 4.45% | |

| | BofA Merrill Lynch U.S. Corporate IndexSM± | | | 1.02% | | | | 4.70% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch U.S. Corporate IndexSM is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity and at least $250 million outstanding. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch U.S. Corporate IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | An increase in yields and wider option-adjusted spreads for investment grade corporate bonds combined to negatively impact price returns for both the Fund and the Underlying Index over the reporting period. Returns due to income positively contributed to performance for both the Fund and the Underlying Index, resulting in positive overall performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 13 |

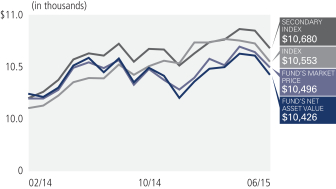

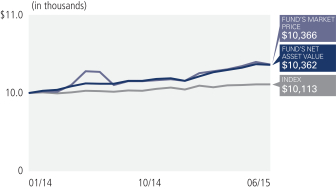

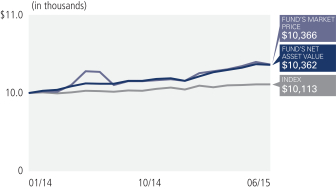

PIMCO Diversified Income Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| Corporate Bonds & Notes | | | 67.2% | |

| Sovereign Issues | | | 11.9% | |

| Short-Term Instruments | | | 9.4% | |

| U.S. Government Agencies | | | 3.2% | |

| Bank Loan Obligations | | | 2.6% | |

| Other | | | 5.7% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | Fund Inception

(01/22/2014) | |

| | PIMCO Diversified Income Active Exchange-Traded Fund

(Based on Net Asset Value) | | | -1.55% | | | | 2.55% | |

| | PIMCO Diversified Income Active Exchange-Traded Fund

(At Market Price)(1) | | | -0.47% | | | | 3.19% | |

| | Barclays Global Credit Hedged USD Index± | | | 1.53% | | | | 4.01% | |

| | 1/3 each — Barclays Global Aggregate Credit Component USD Hdgd, BofA Merrill Lynch Global High Yield BB-B Rated Constrained USD Hdgd, JPMorgan EMBI Global±± | | | 0.44% | | | | 4.35% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Barclays Global Credit Hedged USD contains investment grade and high yield credit securities from the Multiverse represented in U.S. Dollars on a hedged basis (Multiverse is the merger of two groups: the Global Aggregate and the Global High Yield). It is not possible to invest directly in an unmanaged index.

±± The benchmark is an equally weighted blend of the following three indices: Barclays Global Aggregate Credit Component, BofA Merrill Lynch Global High Yield BB-B Rated Constrained, JPMorgan EMBI Global; All USD Hedged. The Barclays Global Aggregate Credit Component provides a broad-based measure of the global investment-grade fixed income markets.The BofA Merrill Lynch Global High Yield, BB-B Rated Constrained Index tracks the performance of below investment grade bonds of corporate rated BB1 through B3, based on an average of Moody’s, S&P and Fitch. Qualifying bonds are capitalization-weighted provided the total allocation to an individual issuer (defined by Bloomberg tickers) does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face value of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. The index is rebalanced on the last calendar day of the month. The JPMorgan EMBI Global tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities, Brady bonds, loans, Eurobonds and local market instruments. This index only tracks the particular region or country. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.85%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO Diversified Income Active Exchange-Traded Fund seeks maximum total return, consistent with preservation of capital and prudent investment management, by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | The Fund’s overweight to Russian and Brazilian spread duration detracted from performance as spreads on Russian and Brazilian debt widened during the reporting period. |

| » | | The Fund’s overweight to financial bonds benefited performance as the financial sector posted positive returns during the reporting period. |

| » | | An underweight to high yield energy bonds benefited relative performance as prices of energy bonds declined during the reporting period. |

| » | | Tactical exposure to select equity positions detracted from relative performance during the reporting period. |

| » | | The Fund’s underweight to the long end of the U.S. Treasury yield curve negatively impacted performance during the first half of the reporting period, which was attributable primarily to the decline in long term interest rates during that time period. |

| » | | Short exposures to the euro and to the Japanese yen benefited relative performance as the U.S. dollar strengthened versus these currencies during the reporting period. |

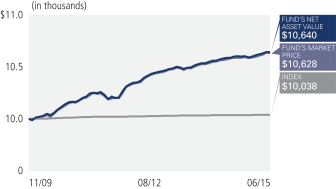

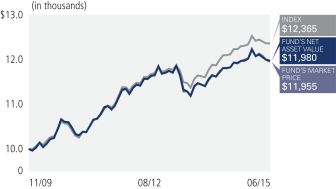

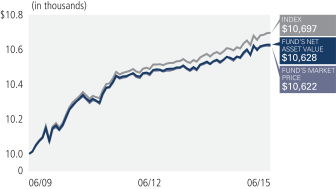

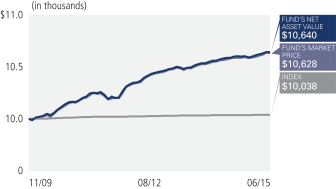

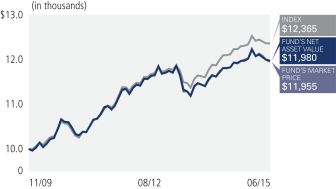

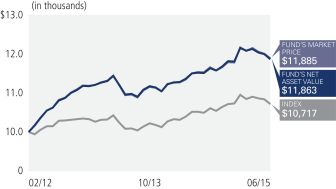

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| Corporate Bonds & Notes | | | 65.4% | |

| Asset-Backed Securities | | | 8.8% | |

| Mortgage-Backed Securities | | | 7.4% | |

| Short-Term Instruments | | | 6.9% | |

| U.S. Treasury Obligations | | | 3.9% | |

| Other | | | 7.6% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | 5 Year | | | Fund Inception

(11/16/2009) | |

| | PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

(Based on Net Asset Value) | | | 0.53% | | | | 1.13% | | | | 1.13% | |

| | PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

(At Market Price)(1) | | | 0.55% | | | | 1.13% | | | | 1.13% | |

| | Citi 3-Month Treasury Bill Index± | | | 0.02% | | | | 0.06% | | | | 0.07% | * |

All Fund returns are net of fees and expenses.

* Average annual total return since 11/30/2009.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Citigroup 3-Month U.S. Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 3 month Treasury Bill issues. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.35%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO Enhanced Short Maturity Active Exchange-Traded Fund seeks maximum current income, consistent with preservation of capital and daily liquidity, by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The Fund primarily invests in U.S. dollar-denominated investment grade debt securities, rated Baa or higher by Moody’s Investors Service, Inc. (“Moody’s”), or equivalently rated by Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, determined by PIMCO to be of comparable quality. |

Portfolio Insights

| » | | Exposure to investment grade credit benefited performance as these securities generally posted positive total returns during the reporting period. |

| » | | Exposure to securities with longer maturities relative to the Citigroup 3-Month Treasury Bill Index, the Fund’s benchmark index, benefited performance due to higher carry relative to the benchmark’s underlying constituents during the reporting period. |

| » | | Exposure to U.S. dollar denominated emerging market bonds benefited performance as these securities generally posted positive total returns during the reporting period. |

| » | | An overweight to commercial mortgage-backed securities benefited performance as these securities generally posted positive total returns during the reporting period. |

| » | | There were no detractors deemed to be notable during the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2015 | | 15 |

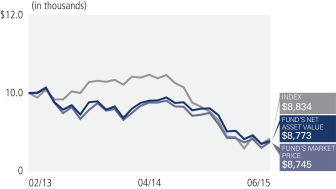

PIMCO Foreign Currency Strategy Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| Short-Term Instruments | | | 32.0% | |

| Denmark | | | 16.1% | |

| Poland | | | 12.8% | |

| Brazil | | | 8.4% | |

| Italy | | | 7.6% | |

| Japan | | | 7.2% | |

| Netherlands | | | 5.3% | |

| Other | | | 10.6% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | Fund Inception

(02/11/2013) | |

| | PIMCO Foreign Currency Strategy Active Exchange-Traded Fund

(Based on Net Asset Value) | | | -11.30% | | | | -5.97% | |

| | PIMCO Foreign Currency Strategy Active Exchange-Traded Fund

(At Market Price)(1) | | | -10.83% | | | | -6.00% | |

| | BofA Merrill Lynch 1-3 Year Trade-Weighted Global Government Index± | | | -15.58% | | | | -5.74% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-3 Year Trade-Weighted Global Government Index tracks the performance of a fixed-weighted blend of select short-dated sovereign indices whose securities are publicly issued and denominated in the issuer’s own domestic market and currency. The weights of constituent markets are re-set on each calendar month-end rebalancing date with the following weights: Canada (9.1%); Euro member countries (57.6%); Japan (13.6%); Sweden (4.2%); Switzerland (3.6%) and the U.K. (11.9%). It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.65%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview

| » | | The PIMCO Foreign Currency Strategy Active Exchange-Traded Fund seeks maximum total return, consistent with prudent investment management, by investing under normal circumstances at least 80% of its assets in currencies of, or Fixed Income Instruments denominated in the currencies of, foreign (non-U.S.) countries, including, but not limited to, a combination of short-term Fixed Income Instruments, money market securities, currency forwards backed by high-quality, low duration securities and derivative instruments, such as options, futures contracts or swap agreements. “Foreign Currency Strategy” in the Fund’s name refers to the Fund’s proprietary investment strategy of seeking exposure to foreign (non-U.S.) currencies likely to outperform the U.S. dollar over the long-term. Assets not invested in currencies, currency forwards, Fixed Income Instruments denominated in currencies of non-U.S. countries or related derivative instruments may be invested in other types of Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. |

Portfolio Insights

| » | | Exposure to the euro, Swedish krona, Norwegian krone, Canadian dollar and New Zealand dollar detracted from performance as these developed market currencies depreciated relative to the U.S. dollar during the reporting period. |

| » | | Short exposure to the Swiss franc during the first month of the year detracted from performance as this currency appreciated over the month relative to the U.S. dollar. |

| » | | Exposure to the British pound contributed positively to performance as this currency appreciated relative to the U.S. dollar during the reporting period. |

| » | | Exposure to the Chinese renminbi contributed positively to performance as this currency appreciated relative to the U.S. dollar during the reporting period. |

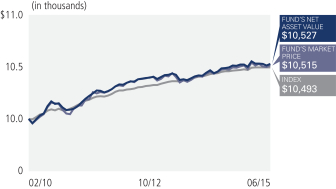

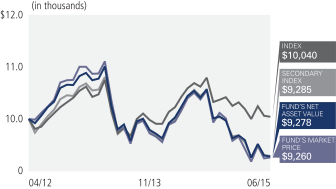

PIMCO Global Advantage® Inflation-Linked Bond Active Exchange-Traded Fund

Cumulative Returns Through June 30, 2015

Allocation Breakdown†

| | | | |

| United States | | | 35.2% | |

| Brazil | | | 10.2% | |

| Italy | | | 9.3% | |

| France | | | 7.1% | |

| United Kingdom | | | 6.9% | |

| Mexico | | | 5.9% | |

| Japan | | | 5.0% | |

| Other | | | 20.4% | |

| † | % of Investments, at value as of 06/30/2015. Financial derivative instruments, if any, are excluded. |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2015 | |

| | | | | 1 Year | | | Fund Inception

(04/30/2012) | |

| | PIMCO Global Advantage® Inflation-Linked Bond Active Exchange-Traded Fund

(Based on Net Asset Value) | | | -11.96% | | | | -2.34% | |

| | PIMCO Global Advantage® Inflation-Linked Bond Active Exchange-Traded Fund

(At Market Price)(1) | | | -11.82% | | | | -2.40% | |

| | Barclays Universal Government Inflation-Linked Bond Index± | | | -6.02% | | | | 0.13% | |

| | PIMCO Global Advantage Inflation-Linked Bond Index (USD Unhedged)

(NY Close)±± | | | -12.03% | | | | -2.32% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The Barclays Universal Government Inflation-Linked Bond Index combines the World, Euro and EM government indices to measure the performance of the major developed and emerging government inflation-linked bond markets. The index includes inflation-linked government bonds from 19 countries; in order of size, the US, UK, France, Brazil, Italy, Japan, Canada, Sweden, Germany, Argentina, Mexico, Greece, South Africa, Australia, Turkey, Colombia, Chile, Poland and South Korea. The index is market capitalization weighted and rebalances monthly. It is not possible to invest directly in an unmanaged index.

±± The PIMCO Global Advantage Inflation-Linked Bond Index® (USD Unhedged) (NY Close) represents the global bond market for inflation-linked government debt encompassing both developed and emerging markets. The index adheres to the principals of the PIMCO Global Advantage Indices when applicable to the global inflation-linked bond market. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.61%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Investment Objective and Strategy Overview