UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22250

PIMCO ETF Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer and Principal Financial Officer

PIMCO ETF Trust

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 400-4383

Date of fiscal year end: June 30

Date of reporting period: June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| | | | | | | | |

Item 1. | | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

Your Global Investment Authority

PIMCO ETF Trust

Annual Report

June 30, 2013

Index Exchange-Traded Funds

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

PIMCO Broad U.S. Treasury Index Exchange-Traded Fund

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

PIMCO Australia Bond Index Exchange-Traded Fund

PIMCO Canada Bond Index Exchange-Traded Fund

PIMCO Germany Bond Index Exchange-Traded Fund

Actively Managed Exchange-Traded Funds

PIMCO Build America Bond Exchange-Traded Fund

PIMCO Enhanced Short Maturity Exchange-Traded Fund

PIMCO Foreign Currency Strategy Exchange-Traded Fund

PIMCO Global Advantage® Inflation-Linked Bond Exchange-Traded Fund

PIMCO Intermediate Municipal Bond Exchange-Traded Fund

PIMCO Short Term Municipal Bond Exchange-Traded Fund

PIMCO Total Return Exchange-Traded Fund

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO ETF Trust prospectus.

Chairman’s Letter

Dear Shareholder:

Please find enclosed the Annual Report for the PIMCO ETF Trust covering the twelve-month reporting period ended June 30, 2013. On the following pages, you’ll find specific details on investment performance and a discussion of the factors that most affected performance.

Over most of the reporting period, intervention by the Federal Reserve (“Fed”) and other developed market central banks including the European Central Bank, Bank of England and Bank of Japan, largely succeeded in suppressing market volatility and encouraged investors to move into riskier assets such as equities and high yield bonds. As a result, prices on these asset classes rose considerably through April 2013, propped up by aggressive central bank policies rather than strong economic fundamentals.

However, conditions in financial markets deteriorated rapidly beginning in mid-May as investors reacted to signals by the Fed that it might begin to slow the pace of its asset purchases later this year. Fed Chairman Ben Bernanke outlined a plan for eventually tapering quantitative easing (“QE”) purchases of U.S. Treasuries and mortgage-backed securities (“MBS”) as the U.S. economy begins to meet certain growth targets. In particular, this shift in tone fueled a broad-based sell-off within fixed income assets, undermining market liquidity, and sending yields higher across the risk spectrum.

Highlights of the financial markets during our twelve-month reporting period include:

| | n | | After reaching historic lows in July 2012, yields on U.S. Treasuries rose considerably beginning in mid-May through the end of the period primarily due to the possibility that the Fed would begin considering tapering its asset purchase program. As a result, bond markets sold off with yields increasing and bond prices declining. The benchmark ten-year U.S. Treasury note yielded 2.49% at the end of the reporting period, as compared to 1.64% on June 30, 2012. |

| | n | | U.S. Treasury Inflation-Protected Securities (“TIPS”) posted negative returns with the majority of the losses occurring in the last two months of the period when real rates rose following the Fed’s hawkish comments regarding a more aggressive than anticipated timeline for reducing accommodative policy. In addition, technical factors, such as liquidations by risk-parity type sellers amid heightened volatility and retail outflows, contributed to the sell-off. Breakeven inflation levels (or the difference between nominal and real yields) narrowed for shorter and intermediate maturities, but widened for longer maturities. In general, U.S. TIPS underperformed nominal U.S. Treasuries. |

| | n | | Global inflation-linked bonds (“ILBs”) showed mixed performance over the period. While most global ILBs suffered from weak demand for inflation protection, European ILBs were supported by the European Central Bank’s dovish Outright Monetary Transactions program that was announced earlier in the period. |

| | n | | Tax-exempt municipal bonds posted positive absolute returns over the period as demand outpaced supply. Select lower quality tax-exempt municipal sectors outperformed high-grade sectors as investors reached for yield by pushing further out the yield curve and down the credit spectrum. Taxable municipal bonds (or Build America Bonds) posted negative absolute returns, primarily due to the move to higher interest rates across the broader fixed income market as well as negative technical factors within the segment. |

| | n | | Despite increased market volatility and a dramatic rise in U.S. Treasury yields towards the latter part of the period, investment grade and high yield corporate bonds outperformed like-duration U.S. Treasuries as investor demand for risk assets remained elevated. Corporate bonds generally benefited from positive technical factors and reduced risk of disorderly deleveraging. |

PIMCO ETFs are designed to provide well-engineered solutions to meet a broad range of investor needs, offering access to PIMCO’s unique investment process and world-class portfolio management expertise in the ETF vehicle, which features portfolio transparency and intra-day pricing in a conveniently traded format. PIMCO ETFs include a range of actively-managed and Smart Passive strategies, providing investors access to a variety of sectors, geographical regions and investment objectives.

If you have any questions regarding your PIMCO ETF Trust investment, please contact your financial advisor, or call one of our shareholder associates at 888.400.4ETF (888.400.4383). We also invite you to visit our website at www.pimcoetfs.com to learn more about PIMCO ETFs.

Thank you again for the trust you have placed in PIMCO. We are privileged to serve you through our ETF offerings.

| | |

| |

| | Sincerely,

Brent R. Harris President and Chairman of the Board, PIMCO ETF Trust July 25, 2013 |

Important Information About the Funds

The PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund, PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund, PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund, PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund, PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund, PIMCO Australia Bond Index Exchange-Traded Fund, PIMCO Broad U.S. TIPS Index Exchange-Traded Fund, PIMCO Broad U.S. Treasury Index Exchange-Traded Fund, PIMCO Canada Bond Index Exchange-Traded Fund, PIMCO Germany Bond Index Exchange-Traded Fund and PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund are exchange-traded funds (“ETFs”) that seek to provide total return that closely corresponds, before fees and expenses, to the total return of a specified index (collectively, the “Index Funds”). Each Index Fund employs a representative sampling strategy in seeking to achieve its investment objective and as a result may not hold all of the securities that are included in the underlying index. The PIMCO Build America Bond Exchange-Traded Fund, PIMCO Enhanced Short Maturity Exchange-Traded Fund, PIMCO Foreign Currency Strategy Exchange-Traded Fund, PIMCO Global Advantage® Inflation-Linked Bond Exchange-Traded Fund, PIMCO Intermediate Municipal Bond Exchange-Traded Fund, PIMCO Short Term Municipal Bond Exchange-Traded Fund and PIMCO Total Return Exchange-Traded Fund, unlike the Index Funds, are actively managed ETFs that do not seek to track the performance of a specified index (collectively, the “Active Funds” and together with the Index Funds, the “Funds”). Shares of the Funds will be listed and traded at market prices on NYSE Arca, Inc. (“NYSE Arca”) and other secondary markets. The market price for each Fund’s shares may be different from the Fund’s net asset value (“NAV”). Each Fund issues and redeems shares at its NAV only in blocks of a specified number of shares (“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Funds at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to a Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of a Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares from the Funds at NAV.

The Funds invest in particular segments of the securities markets, which are not representative of the broader securities markets. While we believe that bond funds have an important role to play in a well-diversified investment portfolio, an investment in a Fund alone should not constitute an entire investment program. It is important to note that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities held by the Funds are likely to decrease in value. The price volatility of fixed-income securities can also increase during periods of rising interest rates resulting in increased losses to the Funds. Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity

of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations.

The Funds may be subject to various risks in addition to those described above. Some of these risks may include, but are not limited to, the following: market trading risk, limited issuance risk, interest rate risk, inflation-indexed security risk, credit risk, high yield risk, market risk, municipal bond risk, liquidity risk, equity risk, mortgage-related and other asset-backed risk, foreign (non-U.S.) investment risk, currency risk, short sale risk, convertible securities risk, derivatives risk, issuer non-diversification risk, leveraging risk, management and tracking error risk, indexing risk, issuer risk, emerging markets risk, management risk, municipal project-specific risk, Australian securities risk, Canadian securities risk and German securities risk. A complete description of these and other risks is contained in each Fund’s prospectus. The use of derivatives may subject the Funds to greater volatility than investments in traditional securities. The Index Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a Fund could not close out a position when it would be most advantageous to do so. Certain derivative transactions may have a leveraging effect on an Index Fund. For example, a small investment in a derivative instrument may have a significant impact on an Index Fund’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price movement in a derivative instrument may cause an immediate and substantial loss or gain. An Index Fund may engage in such transactions regardless of whether the Index Fund owns the asset, instrument or components of the index underlying the derivative instrument. An Index Fund may invest a significant portion of its assets in these types of instruments. If it does, the Index Fund’s investment exposure could far exceed the value of its portfolio securities and its investment performance could be primarily dependent upon securities it does not own. A Fund’s investment in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be increased when investing in emerging markets. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

On each individual Fund Summary page in this Annual Report (“Shareholder Report”), the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on: (i) Fund distributions; or (ii) the redemption of Fund shares. Each Fund’s performance is measured against the performance of a broad-based securities market index (benchmark index).

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 3 |

Important Information About the Funds (Cont.)

government agency. It is possible to lose money on investments in the Funds.

The Index Funds may make available a complete schedule of portfolio holdings and the percentages they represent of the Index Fund’s net assets. On each business day, before commencement of trading on NYSE Arca, each Active Fund will disclose on www.pimcoetfs.com the identities and quantities of the Active Fund’s portfolio holdings that will form the basis for the Active Fund’s calculation of NAV at the end of the business day. The frequency at which the daily market prices were at a discount or premium to each Fund’s NAV is disclosed on www.pimcoetfs.com. Please see “Disclosure of Portfolio Holdings” in the Statement of Additional Information for information about the availability of the complete schedule of each Fund’s holdings. Fund fact sheets provide additional information regarding a Fund and may be requested by calling (888) 400-4ETF and are available on the Fund’s website at www.pimcoetfs.com.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO ETF

Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 400-4ETF, on the Funds’ website at www.pimcoetfs.com, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PIMCO ETF Trust files a complete schedule of each Fund’s portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Funds’ Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. and is available without charge, upon request, by calling the Trust at (888) 400-4ETF and on the Funds’ website at www.pimcoetfs.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

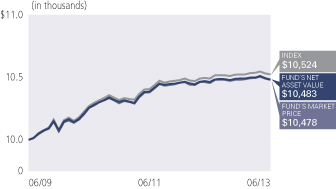

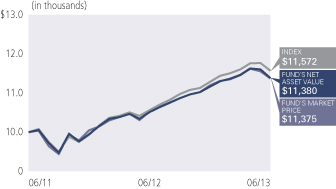

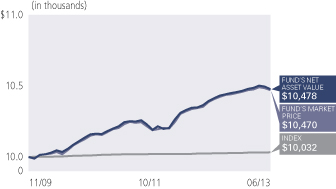

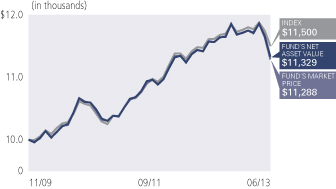

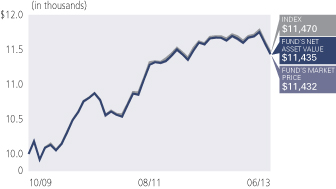

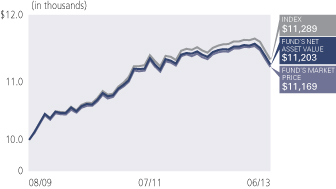

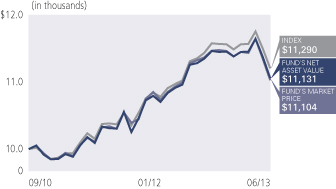

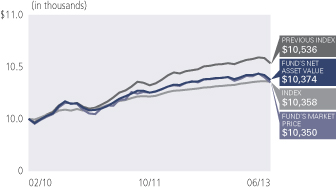

PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 99.7% | |

| Short-Term Instruments | | | 0.3% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | | | | | | |

| | | | | 1 Year | | | Fund Inception

(06/01/2009) | |

| | PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 0.20% | | | | 1.15% | |

| | PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | 0.24% | | | | 1.15% | |

| | The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM± | | | 0.33% | | | | 1.25% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. Treasury securities, other than inflation-protection securities and Separate Trading of Registered Interest and Principal of Securities (“STRIPS”), with at least $1 billion in outstanding face value and a remaining term to final maturity of at least one year and less than three years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 1-3 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Rising yields in the one- to three-year segment of the U.S. Treasury yield curve reduced bond valuations, though these negative price returns were overcome by returns from yield, resulting in positive total return performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 5 |

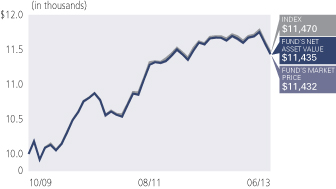

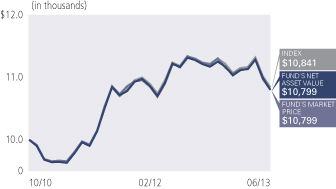

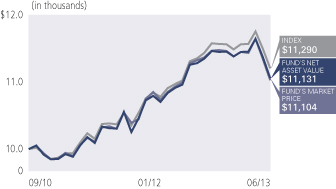

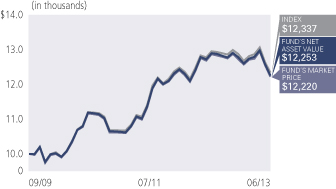

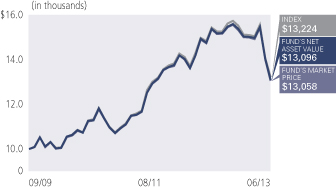

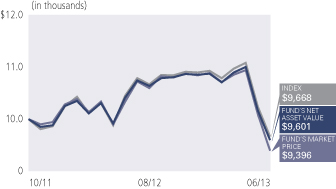

PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | | | | | | |

| | | | | 1 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -1.20% | | | | 3.73% | |

| | PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | -1.21% | | | | 3.72% | |

| | The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM± | | | -1.04% | | | | 3.81% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 3 years and less than 7 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 3-7 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the three- to seven-year segment of the U.S. Treasury yield curve moved higher, resulting in overall negative performance for both the Fund and the Underlying Index over the reporting period. |

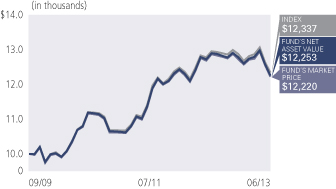

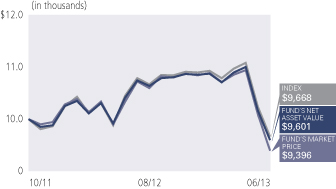

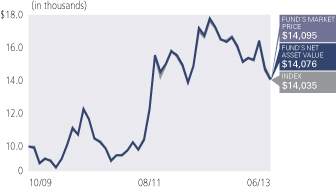

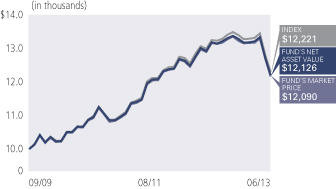

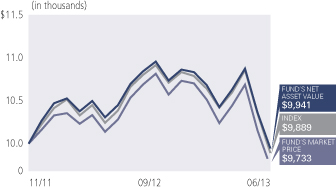

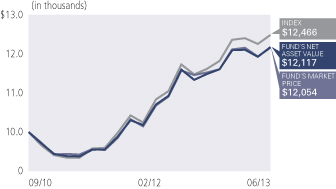

PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 98.7% | |

| Short-Term Instruments | | | 1.3% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | | | | | | |

| | | | | 1 Year | | | Fund Inception

(09/10/2009) | |

| | PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -3.61% | | | | 5.66% | |

| | PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | -3.63% | | | | 5.65% | |

| | The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM± | | | -3.37% | | | | 5.81% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 7 years and less than 15 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 7-15 Year U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the seven- to fifteen-year segment of the U.S. Treasury yield curve rose, resulting in negative performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 7 |

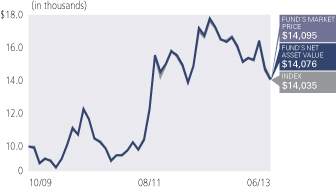

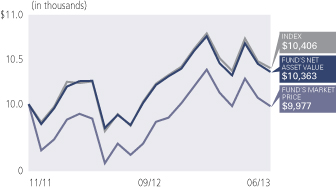

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -15.97% | | | | 9.78% | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | -15.51% | | | | 9.81% | |

| | The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM± | | | -15.63% | | | | 9.68% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM is an unmanaged index comprised of long maturity STRIPS representing the final principal payment of U.S. Treasury bonds. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the 25+ year segment of the U.S. Treasury STRIPS yield curve rose over the reporting period. The rise in yields drove negative performance for the Fund and the Underlying Index over the course of the reporting period. |

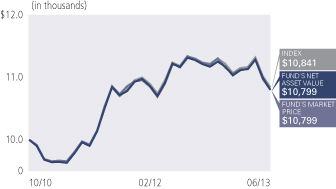

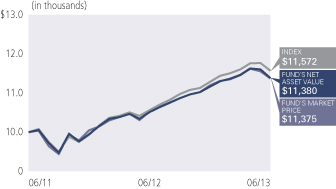

PIMCO Broad U.S. Treasury Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 97.3% | |

| Short-Term Instruments | | | 2.7% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(10/29/2010) | |

| | PIMCO Broad U.S. Treasury Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -3.23% | | | | 2.92% | |

| | PIMCO Broad U.S. Treasury Index Exchange-Traded Fund

(At Market Price)(1) | | | -3.39% | | | | 2.92% | |

| | The BofA Merrill Lynch Liquid U.S. Treasury IndexSM± | | | -3.02% | | | | 3.07% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Liquid U.S. Treasury IndexSM is an unmanaged index that tracks the performance of the three most recently issued 2-year, 3- year, 5-year, 7-year, 10-year and 30-year U.S. Treasury notes and bonds. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Broad U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Liquid U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund may invest the remainder of its assets in fixed-income instruments that are not component securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields at the one-year point and below on the U.S. Treasury yield curve were down over the course of the reporting period, and up above the one-year point. The change in yields drove negative performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 9 |

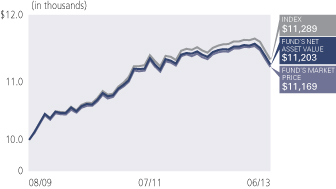

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 99.9% | |

| Short-Term Instruments | | | 0.1% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(08/20/2009) | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -1.13% | | | | 2.93% | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | -1.07% | | | | 2.93% | |

| | The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM± | | | -0.90% | | | | 3.16% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 1 year and less than 5 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, were mixed across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve: down below three years and higher at three years and above, resulting in negative performance for both the Fund and the Underlying Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period mitigated some of the negative price movement. |

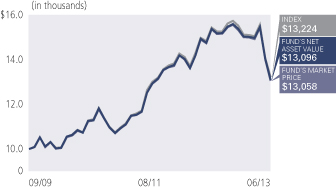

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -11.33% | | | | 7.94% | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | -11.41% | | | | 7.90% | |

| | The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM± | | | -10.86% | | | | 8.19% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 15 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, were higher at three years and above along the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve, resulting in negative performance for both the Fund and the Underlying Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period mitigated some of the negative price movement. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 11 |

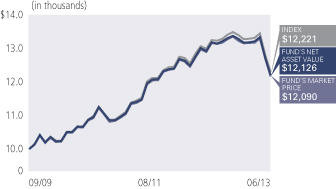

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 98.7% | |

| Short-Term Instruments | | | 1.3% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -5.41% | | | | 5.56% | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

(At Market Price)(1) | | | -5.45% | | | | 5.53% | |

| | The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM± | | | -5.15% | | | | 5.77% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities). It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Broad U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, were mixed across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve: down below three years and higher at three years and above, resulting in negative performance for both the Fund and the Underlying Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period mitigated some of the negative price movement. |

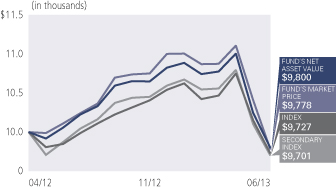

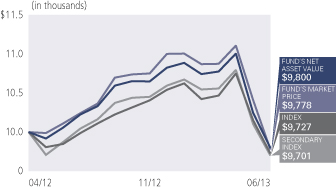

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Corporate Bonds & Notes | | | 86.2% | |

| U.S. Treasury Obligations | | | 9.3% | |

| Short-Term Instruments | | | 4.5% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(06/16/2011) | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 8.21% | | | | 6.78% | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | 8.01% | | | | 6.89% | |

| | The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM± | | | 9.53% | | | | 7.59% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM tracks the performance of short-term U.S. dollar denominated below investment grade corporate debt issued in the U.S. domestic market with less than five years remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $100 million, issued publicly. Allocations to an individual issuer will not exceed 2%. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.55%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in fixed-income instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Over the reporting period, yields in the short term segment of the U.S. high yield market fell. Coupon returns added to the positive price performance of underlying securities, resulting in positive performance for the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 13 |

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Industrials | | | 51.2% | |

| Banking & Finance | | | 32.6% | |

| Utilities | | | 13.8% | |

| Short-Term Instruments | | | 2.1% | |

| U.S. Treasury Obligations | | | 0.3% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(09/20/2010) | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 0.92% | | | | 4.45% | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | 0.40% | | | | 4.30% | |

| | The BofA Merrill Lynch U.S. Corporate IndexSM± | | | 1.75% | | | | 4.89% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch U.S. Corporate IndexSM is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity and at least $250 million outstanding. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch U.S. Corporate IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund may invest the remainder of its assets in fixed-income instruments that are not component securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | An increase in yields in U.S. Treasuries and investment grade corporate securities drove negative price returns, but tightening option-adjusted spreads and coupon returns mitigated this effect and pulled the overall return positive for both the Fund and the Underlying Index over the reporting period. |

PIMCO Australia Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Australia | | | 65.7% | |

| Supranational | | | 17.5% | |

| Germany | | | 6.5% | |

| Norway | | | 3.5% | |

| Other | | | 6.8% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(10/31/2011) | |

| | PIMCO Australia Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -7.81% | | | | -2.41% | |

| | PIMCO Australia Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | -9.09% | | | | -3.67% | |

| | The BofA Merrill Lynch Diversified Australia Bond IndexSM± | | | -7.48% | | | | -2.01% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Diversified Australia Bond IndexSM tracks the performance of large, Australian dollar (“AUD”)- denominated investment grade debt instruments publicly issued in the Australian domestic market, including sovereign, quasi government, corporate, securitized and collateralized securities. All qualifying securities must have at least one year remaining term to final maturity and a fixed coupon schedule. Qualifying Australian sovereign securities must have a minimum amount outstanding of AUD 1 billion. Qualifying non-sovereign securities must have a minimum amount outstanding of AUD 500 million and must be rated investment grade. Index constituents are capitalization-weighted adjusted, as necessary, to meet issuer concentration limits. The Underlying Index is rebalanced on the last calendar day of the month. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.45%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Australia Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Diversified Australia Bond IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Underlying Index tracks the performance of large, Australian dollar-denominated investment grade debt instruments publicly issued in the Australian domestic market, including sovereign, quasi-government, corporate, securitized and collateralized securities. Qualifying constituents must have an investment-grade rating (based on an average of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) and Fitch, Inc. (“Fitch”)), an investment grade country of risk (based on an average of Moody’s, S&P and Fitch foreign currency long term sovereign debt ratings), at least one year remaining term to final maturity and a fixed coupon schedule. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Rising Australian government yields over the reporting period, together with a weakening Australian dollar, resulted in negative performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 15 |

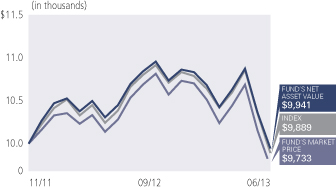

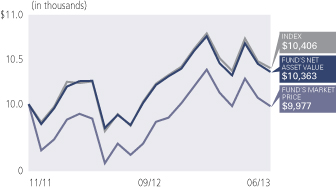

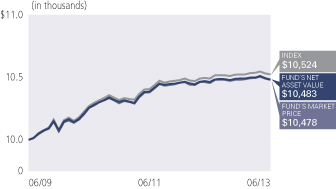

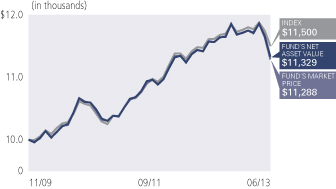

PIMCO Canada Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(11/09/2011) | |

| | PIMCO Canada Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | -4.83% | | | | -0.52% | |

| | PIMCO Canada Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | -5.31% | | | | -0.83% | |

| | The BofA Merrill Lynch Diversified Canada Government Bond IndexSM± | | | -4.77% | | | | -0.84% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Diversified Canada Government Bond IndexSM tracks the performance of large, Canadian dollar (“CAD”)-denominated investment grade debt instruments publicly issued in the Canadian domestic market including Canadian sovereign and quasi-government securities. All Qualifying securities must have at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of CAD 1 billion for Canadian sovereign securities and a minimum amount outstanding of CAD 200 million for Canadian quasi-government-securities. Index constituents are capitalization-weighted adjusted, as necessary, to meet issuer concentration limits. The Underlying Index is rebalanced on the last calendar day of the month. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.45%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Canada Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Diversified Canada Government Bond IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Underlying Index tracks the performance of large, Canadian dollar-denominated investment grade debt instruments publicly issued in the Canadian domestic market, including Canadian sovereign and quasi-government securities. Qualifying constituents must have an investment-grade rating (based on an average of the ratings of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) and Fitch, Inc. (“Fitch”)), an investment grade country of risk (based on an average of Moody’s, S&P and Fitch foreign currency long term sovereign debt ratings), at least one year remaining term to final maturity and a fixed coupon schedule. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Canadian government yields rose across the yield curve and the Canadian dollar weakened, resulting in negative performance for both the Fund and the Underlying Index over the reporting period. |

PIMCO Germany Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Germany | | | 80.3% | |

| Netherlands | | | 17.1% | |

| Ireland | | | 2.6% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(11/09/2011) | |

| | PIMCO Germany Bond Index Exchange-Traded Fund

(Based on Net Asset Value) | | | 4.89% | | | | 0.87% | |

| | PIMCO Germany Bond Index Exchange-Traded Fund

(At Market Price)(1) | | | 4.41% | | | | 0.80% | |

| | The BofA Merrill Lynch Diversified Germany Bond IndexSM± | | | 5.22% | | | | 1.08% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Diversified Germany Bond IndexSM tracks the performance of large, Euro (“EUR”)-denominated investment grade debt instruments of German issuers publicly issued in the eurobond or Euro member domestic markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. All Qualifying securities must be an obligation of a German entity with at least one year remaining term to final maturity and a fixed coupon schedule. Qualifying German sovereign securities must have a minimum amount outstanding of EUR 1 billion. Qualifying non-sovereign securities must have a minimum amount outstanding of EUR 500 million and must be rated investment grade. Index constituents are capitalization-weighted adjusted, as necessary, to meet issuer concentration limits. The Underlying Index is rebalanced on the last calendar day of the month. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.45%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Germany Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Diversified Germany Bond IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Underlying Index tracks the performance of large, euro-denominated investment grade debt instruments of German issuers publicly issued in the eurobond or Euro member domestic markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. Qualifying constituents must be an obligation of a German entity with an investment-grade rating (based on an average of the ratings of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) and Fitch, Inc. (“Fitch”), at least one year remaining term to final maturity and a fixed coupon schedule. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | German government bond yields were up across the yield curve while the euro strengthened versus the U.S. dollar. Coupon and currency returns outpaced the negative price performance, resulting in positive performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 17 |

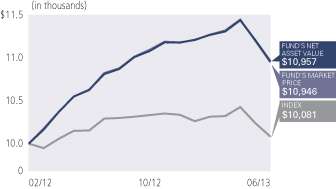

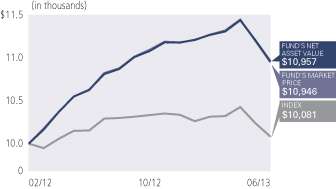

PIMCO Build America Bond Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| California | | | 42.9% | |

| New York | | | 19.1% | |

| Texas | | | 6.5% | |

| Illinois | | | 6.3% | |

| Ohio | | | 5.4% | |

| Other | | | 19.8% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(09/20/2010) | |

| | PIMCO Build America Bond Exchange-Traded Fund

(Based on Net Asset Value) | | | -2.63% | | | | 7.60% | |

| | PIMCO Build America Bond Exchange-Traded Fund

(At Market Price)(1) | | | -3.46% | | | | 7.31% | |

| | Barclays Build America Bond Index± | | | -1.96% | | | | 8.95% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Barclays Build America Bond Index is a subset of the Barclays Taxable Municipal Bond Index. The sub-Index consists of all direct pay Build America Bonds that satisfy the rules of the Barclays Taxable Municipal Bond Index. The Barclays Taxable Municipal Bond Index represents securities that are SEC-registered, taxable, dollar denominated, and have at least one year to final maturity, at least $250 million par amount outstanding and are determined to be investment-grade by Barclays. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.45%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Build America Bond Exchange-Traded Fund seeks maximum income, consistent with preservation of capital, by investing under normal circumstances at least 80% of its assets in taxable municipal debt securities publicly issued under the Build America Bond program. |

| » | | The Fund commenced operations on September 20, 2010. The Build America Bonds (“BABs”) program expired on December 31, 2010. |

| » | | Duration (or sensitivity to changes in market interest rates) was managed below the Fund’s benchmark index throughout the majority of the reporting period, which contributed to performance as yields generally moved higher across the taxable municipal yield curve. |

| » | | An overweight to revenue-backed municipal bonds contributed to returns as revenue bonds outperformed the general municipal bond market over the reporting period. |

| » | | An overweight to the transportation sector contributed to performance as the sector outperformed the general municipal bond market over the reporting period. |

| » | | An overweight to the water and sewer utility sector detracted from returns as the sector generally underperformed the general municipal bond market over the reporting period. |

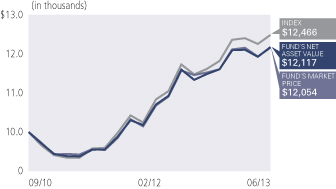

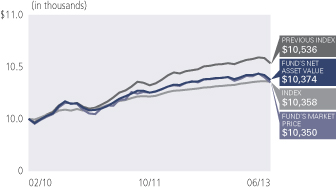

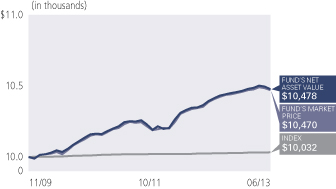

PIMCO Enhanced Short Maturity Exchange-Traded Fund

Cumulative Returns Through June 30, 2013

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Corporate Bonds & Notes | | | 50.1% | |

| U.S. Treasury Obligations | | | 16.1% | |

| Short-Term Instruments | | | 8.5% | |

| Asset-Backed Securities | | | 8.0% | |

| Sovereign Issues | | | 5.5% | |

| Other | | | 11.8% | |

| ‡ | % of Total Investments as of 06/30/13 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2013 | |

| | | | | 1 Year | | | Fund Inception

(11/16/2009) | |

| | PIMCO Enhanced Short Maturity Exchange-Traded Fund

(Based on Net Asset Value) | | | 1.09% | | | | 1.33% | |

| | PIMCO Enhanced Short Maturity Exchange-Traded Fund

(At Market Price)(1) | | | 1.13% | | | | 1.34% | |

| | Citigroup 3-Month Treasury Bill Index± | | | 0.08% | | | | 0.09% | ** |

All Fund returns are net of fees and expenses.

** Average annual total return since 11/30/2009.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Citigroup 3-Month Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 3 month Treasury Bill issues. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.35%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Enhanced Short Maturity Exchange-Traded Fund seeks maximum current income, consistent with preservation of capital and daily liquidity, by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of fixed income instruments of varying maturities, which may be represented by forwards. Fixed income instruments include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The Fund primarily invests in U.S. dollar-denominated investment grade debt securities, rated Baa or higher by Moody’s Investors Service, Inc. (“Moody’s”), or equivalently rated by Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, determined by PIMCO to be of comparable quality. |

| » | | An above-benchmark duration (or sensitivity to changes in market interest rates), specifically exposure to rates of less than two years, was positive as yields fell in this portion of the yield curve during the reporting period. |

| » | | Exposure to mortgage-backed securities (“MBS”) benefited performance as security selection in both Agency MBS and non-Agency MBS provided a source of positive return over the reporting period. |

| » | | An allocation to investment grade corporates added to returns as the sector outperformed like-duration U.S. Treasuries over the reporting period. |

| » | | Exposure to emerging markets external debt benefited performance as the sector outperformed like-duration U.S. Treasuries and provided incremental income throughout the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2013 | | 19 |

PIMCO Foreign Currency Strategy Exchange-Traded Fund

| | | | |

| Allocation Breakdown‡ | |

| Short-Term Instruments | | | 53.4% | |

| United States | | | 14.0% | |

| Mexico | | | 11.1% | |

| Canada | | | 8.3% | |