UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22250

PIMCO ETF Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer and Principal Financial Officer

PIMCO ETF Trust

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 400-4383

Date of fiscal year end: June 30

Date of reporting period: June 30, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

Annual Report June 30, 2010

PIMCO ETF Trust

Index Exchange-Traded Funds

PIMCO 1-3 Year U.S. Treasury Index Fund

PIMCO 1-5 Year U.S. TIPS Index Fund

PIMCO 3-7 Year U.S. Treasury Index Fund

PIMCO 7-15 Year U.S. Treasury Index Fund

PIMCO 15+ Year U.S. TIPS Index Fund

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund

PIMCO Broad U.S. TIPS Index Fund

Actively Managed Exchange-Traded Funds

PIMCO Enhanced Short Maturity Strategy Fund

PIMCO Intermediate Municipal Bond Strategy Fund

PIMCO Short Term Municipal Bond Strategy Fund

Table of Contents

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO ETF Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at 1-888-400-4ETF (1-888-400-4383), on the Funds’ website at www.pimcoetfs.com, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PIMCO ETF Trust files a complete schedule of each Fund’s portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Funds’ Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. and is available without charge, upon request, by calling the Trust at 1-888-400-4ETF (1-888-400-4383) and on the Funds’ website at www.pimcoetfs.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PIMCO ETF Trust is distributed by Allianz Global Investors Distributors LLC, 1345 Avenue of the Americas, New York, NY 10105-4800, www.pimcoetfs.com, 1-888-400-4ETF (1-888-400-4383).

Chairman’s Letter

Dear Shareholder,

We are pleased to provide you with the Annual Report for the PIMCO ETF Trust covering the twelve-month fiscal reporting period ended June 30, 2010. Since launching our ETF platform more than a year ago on June 1, 2009, total PIMCO ETF strategies include four U.S. Treasury index funds, three U.S. Treasury Inflation-Protected Securities (“TIPS”) index funds, an actively-managed enhanced cash fund, and two actively-managed municipal bond funds.

Current PIMCO ETF offerings are included in the table below, as of the end of the reporting period:

| | |

| PIMCO ETF | | NYSE Ticker |

| PIMCO 1-3 Year U.S. Treasury Index Fund | | TUZ |

| PIMCO 3-7 Year U.S. Treasury Index Fund | | FIVZ |

| PIMCO 7-15 Year U.S. Treasury Index Fund | | TENZ |

| PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund | | ZROZ |

| PIMCO 1-5 Year U.S. TIPS Index Fund | | STPZ |

| PIMCO Broad U.S. TIPS Index Fund | | TIPZ |

| PIMCO 15+ Year U.S. TIPS Index Fund | | LTPZ |

| PIMCO Enhanced Short Maturity Strategy Fund | | MINT |

| PIMCO Intermediate Municipal Bond Strategy Fund | | MUNI |

| PIMCO Short Term Municipal Bond Strategy Fund | | SMMU |

As with all PIMCO investment products, our ETF platform benefits from PIMCO’s four decades of investment management experience, strong analytics and brand appeal. PIMCO ETFs employ our diligent and innovative investment management techniques, including portfolio construction, risk management, and outstanding trade execution capabilities. In addition, PIMCO is a multi-vehicle investment manager, offering a full spectrum of investment strategies to help meet our clients’ needs and giving us the flexibility to apply PIMCO’s thought leadership and expertise across the capital structure.

Highlights of the financial markets during the twelve-month fiscal reporting period include:

| n | | Yields on U.S. Treasury securities declined, resulting in higher prices on these securities, as increased market volatility and uncertainty drove investors to higher-quality assets during the latter part of the reporting period. The benchmark ten-year U.S. Treasury note yielded 2.94% at the end of the reporting period, as compared to 3.53% on June 30, 2009. |

| n | | U.S. TIPS posted positive returns during the reporting period as real yields declined across all maturity sectors. Break-even inflation levels (or the difference between nominal and real yields) widened in the shorter to intermediate maturity range and TIPS outperformed their nominal counterparts overall. |

| n | | Municipal bonds posted positive returns with municipal bond yields declining from their elevated levels at the beginning of the reporting period. Taxable Build America Bonds performed well and provided investors with an attractive alternative to corporate bonds. |

On the following pages, you’ll find specific details on total return investment performance and a discussion of the factors that affected performance during the reporting period. If you have any questions regarding your PIMCO ETF Trust investment, please contact your advisor, or call one of our shareholder associates at 1-888-400-4ETF (1-888-400-4383). We also invite you to visit our updated ETF website at www.pimcoetfs.com to learn more about PIMCO ETFs.

Thank you for the trust you have placed in PIMCO. We are privileged to serve you through our ETF offerings.

Sincerely,

Brent R. Harris

Chairman of the Board and President, PIMCO ETF Trust

August 10, 2010

| | | | | | |

| | Annual Report | | June 30, 2010 | | 1 |

Important Information About the Funds

This material is authorized for use only when preceded or accompanied by the current PIMCO ETF Trust prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in each Fund’s prospectus. Please read the prospectus carefully before you invest or send money.

The PIMCO 1-3 Year U.S. Treasury Index Fund, PIMCO 1-5 Year U.S. TIPS Index Fund, PIMCO 3-7 Year U.S. Treasury Index Fund, PIMCO 7-15 Year U.S. Treasury Index Fund, PIMCO 15+ Year U.S. TIPS Index Fund, PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund and PIMCO Broad U.S. TIPS Index Fund are exchange-traded funds (“ETFs”) that seek to provide total return that closely corresponds, before fees and expenses, to the total return of a specified index (collectively, the “Index Funds”). Each Index Fund employs a representative sampling strategy in seeking to achieve its investment objective and as a result may not hold all of the securities that are included in the underlying index. The PIMCO Enhanced Short Maturity Strategy Fund, PIMCO Intermediate Municipal Bond Strategy Fund and PIMCO Short Term Municipal Bond Strategy Fund, unlike the Index Funds, are actively managed ETFs that do not seek to track the performance of a specified index (collectively, the “Active Funds” and together with the Index Funds, the “Funds”). Shares of the Funds will be listed and traded at market prices on NYSE Arca, Inc. (“NYSE Arca”) and other secondary markets. The market price for each Fund’s shares may be different from the Fund’s net asset value (“NAV”). Each Fund issues and redeems shares at its NAV only in blocks of a specified number of shares (“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Funds at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to a Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of a Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares from the Funds at NAV.

The Funds invest in particular segments of the securities markets, which are not representative of the broader securities markets. While we believe that bond funds have an important role to play in a well-diversified investment portfolio, an investment in a Fund alone should not constitute an entire investment program. It is important to note that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities held by the Funds are likely to decrease in value. The price volatility of fixed-income securities can also increase during periods of rising interest rates resulting in increased losses to the Funds. Bond funds and individual bonds with a longer duration (a measure of the expected life of a security) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations.

The Funds may be subject to various risks in addition to those described above. Some of these risks may include, but are not limited to, the following: market trading risk, interest rate risk, credit risk, market risk, liquidity risk, derivatives risk, leveraging risk, management and tracking error risk, indexing risk, issuer risk, mortgage-related and other asset backed risk, foreign (non-U.S.) investment risk, management risk and municipal project-specific risk. A complete description of these and other risks is contained in each Fund’s prospectus. The Index Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a fund could not close out a position when it would be most advantageous to do so. An Index Fund could lose more than the principal amount invested in these derivative instruments. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

On each individual Fund Summary page in this Annual Report, the Cumulative Returns chart measures performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the redemption of Fund shares. The Cumulative Returns Chart measures each Fund’s performance against the performance of a specified index. Each Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The Index Funds may make available a complete schedule of portfolio holdings and the percentages they represent of the Index Fund’s net assets. On each business day, before commencement of trading on NYSE Arca, each Active Fund will disclose on www.pimcoetfs.com the identities and quantities of the Active Fund’s portfolio holdings that will form the basis for the Active Fund’s calculation of NAV at the end of the business day. Please see “Disclosure of Portfolio Holdings” in the Statement of Additional Information for information about the availability of the complete schedule of each Fund’s holdings. Fund fact sheets provide additional information regarding a Fund and may be requested by calling 1-888-400-4ETF (1-888-400-4383).

The following disclosure provides important information regarding a Fund’s Expense Example (“Example” or “Expense Example”), which appears in this Annual Report. Please refer to this information when reviewing the Expense Example for a Fund.

EXAMPLE

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other exchange-traded funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which for most Funds is from January 1, 2010 to June 30, 2010; with the exception of the PIMCO Short Term Municipal Bond Strategy Fund, which is from February 1, 2010 (the date the Fund commenced operations) to June 30, 2010.

ACTUAL EXPENSES

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the row titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other exchange-traded funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other exchange-traded funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of shares of the Funds. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different exchange-traded funds. In addition, if these transactional costs were included, your costs would have been higher. The expense ratio may vary period to period because of various factors, such as an increase in expenses not covered by the management fee (such as expenses of the independent trustees and their counsel, extraordinary expenses and interest expense).

| | | | | | |

| | Annual Report | | June 30, 2010 | | 3 |

Important Information About the Funds (Cont.)

FREQUENCY OF DISCOUNTS AND PREMIUMS: MARKET PRICE VS. NAV AS OF JUNE 30, 2010

The following chart is provided to show the frequency at which the daily market prices on the NYSE Arca, Inc. (the “Exchange”), the primary listing exchange for shares of the Funds were at a discount or premium to each Fund’s NAV. The “Market Price” of each Fund generally is determined using the midpoint between the highest bid and the lowest offer on the Exchange, as of the time that each Fund’s NAV is calculated. Each Fund’s Market Price may at times be at, above or below its NAV. The NAV of each Fund will fluctuate with changes in the market value of its portfolio holdings. The Market Price of each Fund will fluctuate in accordance with changes in its NAV, as well as supply and demand.

The discount or premium is the percentage difference between the NAV and the Market Price of each Fund. A discount is the amount that each Fund is trading below the reported NAV, expressed as a percentage of the NAV. A premium is the amount that each Fund is trading above the reported NAV, expressed as a percentage of NAV.

Each column in the chart shows the number of trading days in which each Fund traded within the premium/discount range indicated.

Frequency Distribution of Discounts and Premiums: Market Price vs. NAV (July 1, 2009 through June 30, 2010)

| | | | | | | | | | | | |

| | | Number of Trading Days Market Price Above NAV | | Number of Trading Days Market Price Below NAV |

| | | 0-99 Basis Points | | 100-199 Basis Points | | >200 Basis Points | | 0-99 Basis Points | | 100-199 Basis Points | | >200 Basis Points |

| PIMCO 1-3 Year U.S. Treasury Index Fund | | 148 | | 0 | | 0 | | 104 | | 0 | | 0 |

Frequency Distribution of Discounts and Premiums: Market Price vs. NAV (since inception through June 30, 2010)

| | | | | | | | | | | | |

| | | Number of Trading Days Market Price Above NAV | | Number of Trading Days Market Price Below NAV |

| | | 0-99 Basis Points | | 100-199 Basis Points | | >200 Basis Points | | 0-99 Basis Points | | 100-199 Basis Points | | >200 Basis Points |

| PIMCO 1-5 Year U.S. TIPS Index Fund | | 195 | | 0 | | 0 | | 22 | | 0 | | 0 |

| PIMCO 3-7 Year U.S. Treasury Index Fund | | 77 | | 0 | | 0 | | 90 | | 0 | | 0 |

| PIMCO 7-15 Year U.S. Treasury Index Fund | | 142 | | 0 | | 0 | | 60 | | 1 | | 0 |

| PIMCO 15+ Year U.S. TIPS Index Fund | | 136 | | 0 | | 0 | | 70 | | 1 | | 0 |

| PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund | | 126 | | 0 | | 0 | | 41 | | 0 | | 0 |

| PIMCO Broad U.S. TIPS Index Fund | | 132 | | 1 | | 0 | | 74 | | 0 | | 0 |

| PIMCO Enhanced Short Maturity Strategy Fund | | 132 | | 1 | | 0 | | 23 | | 0 | | 0 |

| PIMCO Intermediate Municipal Bond Strategy Fund | | 96 | | 0 | | 0 | | 51 | | 0 | | 0 |

| PIMCO Short Term Municipal Bond Strategy Fund | | 63 | | 0 | | 0 | | 42 | | 0 | | 0 |

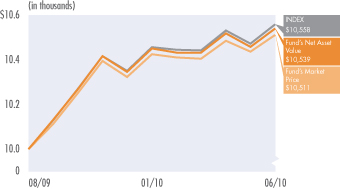

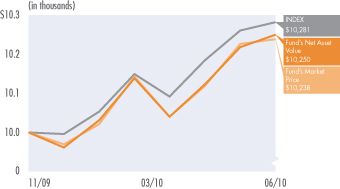

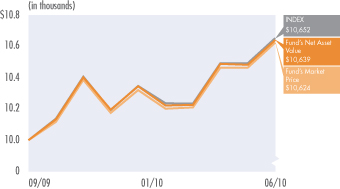

PIMCO 1-3 Year U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 99.7% |

| Short-Term Instruments | | 0.3% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | | | |

| Average Annual Total Return for the period ended June 30, 2010 |

| | | | | 1 Year | | Fund Inception

(06/01/09) |

| | PIMCO 1-3 Year U.S. Treasury Index Fund (Based on Net Asset Value) | | 2.56% | | 2.31% |

| | PIMCO 1-3 Year U.S. Treasury Index Fund (At Market Price)(1) | | 2.54% | | 2.33% |

| | The BofA Merrill Lynch 1-3 Year US Treasury IndexSM(2)(3) | | 2.69% | | 2.46% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If broker age commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch 1-3 Year US Treasury IndexSM is an unmanaged index that tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. Government having a maturity of at least 1 year and less than 3 years. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch 1-3 Year US Treasury IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch 1-3 Year US Treasury IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,018.04 | | $ | 1,024.35 |

| Expenses Paid During Period+ | | $ | 0.45 | | $ | 0.45 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.09% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.09% for the Fund reflects net annualized expenses after application of an expense waiver of 0.14%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO 1-3 Year U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-3 Year US Treasury IndexSM (the “Index”) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | Yields in the one to three year segment of the U.S. Treasury yield curve declined during the reporting period. Both the overall decrease in yields and coupon returns drove positive performance for the Fund and its Index during the reporting period. |

| | | | | | |

| | Annual Report | | June 30, 2010 | | 5 |

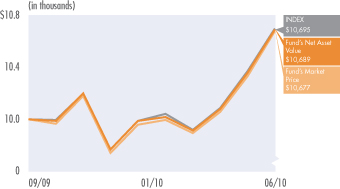

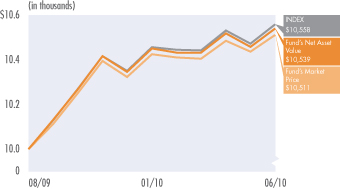

PIMCO 1-5 Year U.S. TIPS Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 100.0% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 |

| | | | | Fund Inception

(08/20/09) |

| | PIMCO 1-5 Year U.S. TIPS Index Fund (Based on Net Asset Value) | | 5.17% |

| | PIMCO 1-5 Year U.S. TIPS Index Fund (At Market Price)(1) | | 5.21% |

| | The BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM(2)(3) | | 5.44% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 1 year and less than 5 years. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index Values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the underlying Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to PIMCO or the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,018.66 | | $ | 1,023.80 |

| Expenses Paid During Period+ | | $ | 1.00 | | $ | 1.00 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.20% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.20% for the Fund reflects net annualized expenses after application of an expense waiver of 0.03%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO 1-5 Year U.S. TIPS Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-5 Year US Inflation-Linked Treasury IndexSM (“the Index”) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, declined across the one to five year segment of the Treasury Inflation-Protected Securities (“TIPS”) yield curve, driving positive performance for both the Fund and Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also contributed positively to returns. |

PIMCO 3-7 Year U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 99.8% |

| Short-Term Instruments | | 0.2% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 |

| | | | | Fund Inception

(10/30/09) |

| | PIMCO 3-7 Year U.S. Treasury Index Fund (Based on Net Asset Value) | | 4.85% |

| | PIMCO 3-7 Year U.S. Treasury Index Fund (At Market Price)(1) | | 4.84% |

| | The BofA Merrill Lynch 3-7 Year US Treasury IndexSM(2)(3) | | 4.90% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch 3-7 Year US Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 3 years and less than 7 years. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch 3-7 Year US Treasury IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch 3-7 Year US Treasury IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index Values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the underlying Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to PIMCO or the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value (06/30/10) | | $ | 1,057.39 | | $ | 1,024.05 |

Expenses Paid During Period+ | | $ | 0.77 | | $ | 0.75 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.15% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.15% for the Fund reflects net annualized expenses after application of an expense waiver of 0.26%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO 3-7 Year U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 3-7 Year US Treasury IndexSM (the “Index”) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | Following a brief up and down move between the waning months of 2009 and the first several months of 2010, yields in the three to seven year segment of the U.S. Treasury yield curve rose through early April 2010, but turned down sharply through June 2010. Both the overall decrease in yields and coupon returns drove positive performance for the Fund and its Index during the reporting period. |

| | | | | | |

| | Annual Report | | June 30, 2010 | | 7 |

PIMCO 7-15 Year U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 100.0% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 | | |

| | | | | Fund Inception

(09/10/09) |

| | PIMCO 7-15 Year U.S. Treasury Index Fund (Based on Net Asset Value) | | 7.54% |

| | PIMCO 7-15 Year U.S. Treasury Index Fund (At Market Price)(1) | | 7.66% |

| | The BofA Merrill Lynch 7-15 Year US Treasury IndexSM(2)(3) | | 7.47% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch 7-15 Year US Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 7 years and less than 15 years. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch 7-15 Year US Treasury IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch 7-15 Year US Treasury IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index Values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the underlying Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to PIMCO or the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,094.17 | | $ | 1,024.05 |

| Expenses Paid During Period+ | | $ | 0.78 | | $ | 0.75 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.15% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.15% for the Fund reflects net annualized expenses after application of an expense waiver of 0.71%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO 7-15 Year U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 7-15 Year US Treasury IndexSM (“the Index) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | Following a brief up and down move between the waning months of 2009 and the first several months of 2010, yields in the seven to fifteen year segment of the U.S. Treasury yield curve rose through early April 2010, but turned down sharply through June 2010. Both the overall decrease in yields and coupon returns drove positive performance for the Fund and its Index during the reporting period. |

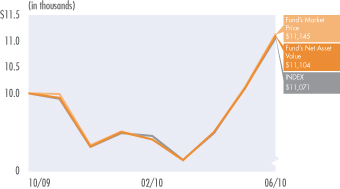

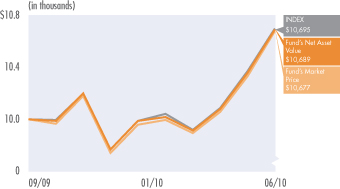

PIMCO 15+ Year U.S. TIPS Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 100.0% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 |

| | | | | Fund Inception (09/03/09) |

| | PIMCO 15+ Year U.S. TIPS Index Fund (Based on Net Asset Value) | | 10.95% |

| | PIMCO 15+ Year U.S. TIPS Index Fund (At Market Price)(1) | | 10.87% |

| | The BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM(2)(3) | | 11.00% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 15 years. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index Values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the underlying Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to PIMCO or the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,072.35 | | $ | 1,023.80 |

| Expenses Paid During Period+ | | $ | 1.03 | | $ | 1.00 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.20% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.20% for the Fund reflects net annualized expenses after application of an expense waiver of 0.50%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO 15+ Year U.S. TIPS Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 15+ Year US Inflation-Linked Treasury IndexSM (“the Index”) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, declined across the 15+ year segment of the Treasury Inflation-Protected Securities (“TIPS”) yield curve, driving positive performance for both the Fund and Index. Yields in this area of the curve initially declined through December 2010, rose in early April 2010, then declined sharply through June 2010. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also contributed positively to returns. |

| | | | | | |

| | Annual Report | | June 30, 2010 | | 9 |

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 100.0% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 |

| | | | | Fund Inception (10/30/09) |

| | PIMCO 25+ Year Zero Coupon Year U.S. Treasury Index Fund (Based on Net Asset Value) | | 11.02% |

| | PIMCO 25+ Year Zero Coupon Year U.S. Treasury Index Fund (At Market Price)(1) | | 11.43% |

| | The BofA Merrill Lynch Long US Treasury Principal STRIPS IndexSM(2)(3) | | 10.71% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch Long US Treasury Principal STRIPS IndexSM is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (“STRIPS”) representing the final principal payment of U.S. Treasury bonds. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch Long US Treasury Principal STRIPS IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch Long US Treasury Principal STRIPS IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index Values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the underlying Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to PIMCO or the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,236.75 | | $ | 1,024.05 |

| Expenses Paid During Period+ | | $ | 0.83 | | $ | 0.75 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.15% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.15% for the Fund reflects net annualized expenses after application of an expense waiver of 0.68%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Long US Treasury Principal STRIPS IndexSM (“the Index”) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | After a brief period at the beginning of 2010 during which yields were range-bound, yields in the 25 to 30 year segment of the U.S. Treasury STRIPS curve turned down sharply after March 2010. Both the overall decrease in yields and amortization of the discount to par drove positive performance for the Fund and its Index during the reporting period. |

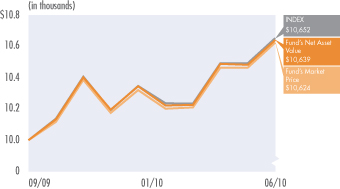

PIMCO Broad U.S. TIPS Index Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| U.S. Treasury Obligations | | 100.0% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 | | |

| | | | | Fund Inception

(09/03/09) |

| | PIMCO Broad U.S. TIPS Index Fund (Based on Net Asset Value) | | 7.91% |

| | PIMCO Broad U.S. TIPS Index Fund (At Market Price)(1) | | 7.97% |

| | The BofA Merrill Lynch US Inflation-Linked Treasury IndexSM(2)(3) | | 8.01% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The BofA Merrill Lynch US Inflation-Linked Treasury IndexSM is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities). It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

(3) “BofA Merrill Lynch” and “The BofA Merrill Lynch US Inflation-Linked Treasury IndexSM” are reprinted with permission. ©Copyright 2010 Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”). All rights reserved. “BofA Merrill Lynch” and “The BofA Merrill Lynch US Inflation-Linked Treasury IndexSM” are service marks of BofA Merrill Lynch and/or its affiliates and have been licensed for use for certain purposes by PIMCO on behalf of the Fund that is based on the Index, and is not issued, sponsored, endorsed or promoted by BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates nor is BofA Merrill Lynch and/or BofA Merrill Lynch’s affiliates an adviser to the Fund. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates make no representation, express or implied, regarding the advisability of investing in this product or the Index and do not guarantee the quality, accuracy or completeness of the Index, Index Values or any Index related data included herein, provided herewith or derived therefrom and assume no liability in connection with their use. As the Index provider, BofA Merrill Lynch is licensing certain trademarks, the underlying Index and trade names which are composed by BofA Merrill Lynch without regard to PIMCO, this product or any investor. BofA Merrill Lynch and BofA Merrill Lynch’s affiliates do not provide investment advice to PIMCO or the Fund and are not responsible for the performance of the Fund. BofA Merrill Lynch compiles and publishes the Index. PIMCO has entered into a license agreement with BofA Merrill Lynch to use the Index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,043.59 | | $ | 1,023.80 |

| Expenses Paid During Period+ | | $ | 1.01 | | $ | 1.00 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.20% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.20% for the Fund reflects net annualized expenses after application of an expense waiver of 0.41%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO Broad U.S. TIPS Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch US Inflation-Linked Treasury IndexSM (“the Index”) by investing under normal circumstances at least 80% of its total assets in the component securities of the Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, declined across the entire Treasury Inflation-Protected Securities (“TIPS”) yield curve, driving positive performance for both the Fund and Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also contributed positively to returns. |

| | | | | | |

| | Annual Report | | June 30, 2010 | | 11 |

PIMCO Enhanced Short Maturity Strategy Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| Corporate Bonds & Notes | | 50.1% |

| U.S. Government Agencies | | 25.2% |

| Short-Term Instruments | | 16.6% |

| U.S. Treasury Obligations | | 4.5% |

| Sovereign Issues | | 2.2% |

| Other | | 1.4% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | | |

Cumulative Total Return for the period ended June 30, 2010 | | | |

| | | | | Fund Inception

(11/16/09) | |

| | PIMCO Enhanced Short Maturity Strategy Fund (Based on Net Asset Value) | | 0.69% | |

| | PIMCO Enhanced Short Maturity Strategy Fund (At Market Price)(1) | | 0.68% | |

| | Citigroup 3-Month Treasury Bill Index(2) | | 0.06% | * |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The Citigroup 3-Month Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 3 month Treasury Bill issues. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

* Average annual total return since 11/30/09.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,006.81 | | $ | 1,023.06 |

| Expenses Paid During Period+ | | $ | 1.74 | | $ | 1.76 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.35% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.35% for the Fund reflects net annualized expenses after application of an expense waiver of 0.06%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO Enhanced Short Maturity Strategy Fund seeks maximum current income, consistent with preservation of capital and daily liquidity, by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of fixed income instruments of varying maturities, which may be represented by forwards. |

| » | | Above benchmark index U.S. duration (or sensitivity to changes in market interest rates) was positive for returns as interest rates moved lower across the yield curve. |

| » | | Exposure to U.S. Agency mortgage-backed securities was positive for performance as the sector posted strong returns over the period. |

| » | | Exposure to the corporate sector added to returns as the sector posted strong performance over the period. |

| » | | As of June 30, 2010, the 30 Day SEC Yield(a) was 0.66% and the Estimated Yield to Maturity(b) was 1.14%. |

(a) The 30 Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission (“SEC”) that allows for fairer comparisons among bond funds. It is based on the most recent 30-day period covered by the Fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period, after the deduction of the Fund’s expenses.

(b) The Yield to Maturity (“YTM”) is the rate of return anticipated on a bond if it is held until the maturity date. The calculation of YTM takes into account the current market price, par value, coupon interest rate and time to maturity. PIMCO calculates a Fund’s Estimated YTM by averaging the YTM of each security held in the Fund on a market weighted basis by selecting each security’s YTM from PIMCO’s analytics database or from Bloomberg. A Fund’s estimated YTM may differ from its distribution yield or SEC yield due to a number of factors, including unsettled trades and Fund expenses.

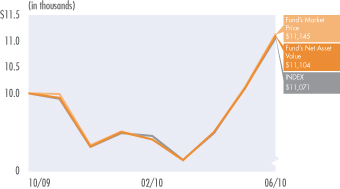

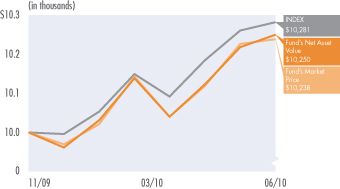

PIMCO Intermediate Municipal Bond Strategy Fund

Cumulative Returns Through June 30, 2010

$10,000 invested at the beginning of the first full month since inception of the Fund.

Allocation Breakdown‡

| | |

| Texas | | 14.6% |

| Washington | | 7.2% |

| Illinois | | 7.1% |

| Massachusetts | | 5.7% |

| New York | | 5.5% |

| Indiana | | 5.3% |

| Other | | 54.6% |

| | ‡ | % of Total Investments as of 06/30/10 |

| | | | |

| Cumulative Total Return for the period ended June 30, 2010 | | |

| | | | | Fund Inception

(11/30/09) |

| | PIMCO Intermediate Municipal Bond Strategy Fund (Based on Net Asset Value) | | 2.50% |

| | PIMCO Intermediate Municipal Bond Strategy Fund (At Market Price)(1) | | 2.38% |

| | Barclays Capital 1-15 Year Municipal Bond Index(2) | | 2.81% |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The Barclays Capital 1-15 Year Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from 1 to 17 years. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

| Beginning Account Value (01/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,028.95 | | $ | 1,023.06 |

| Expenses Paid During Period+ | | $ | 1.76 | | $ | 1.76 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.35% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio of 0.35% for the Fund reflects net annualized expenses after application of an expense waiver of 0.56%.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO Intermediate Municipal Bond Strategy Fund seeks attractive tax-exempt income, consistent with preservation of capital, by investing under normal circumstances at least 80% of its total assets in a diversified portfolio of debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax. |

| » | | The Fund’s effective duration (or sensitivity to changes in market interest rates) was managed above its benchmark index throughout most of the reporting period, which was positive for performance, as municipal yields moved lower over the period. |

| » | | An overweight to dedicated revenue municipal bonds versus general obligation municipal bonds added to returns as the revenue bonds outperformed general obligation bonds over the period. |

| » | | Exposure to the pre-refunded sector and the transportation sector added to returns, while exposure to the education sector detracted from returns. |

| » | | The Fund’s 30 Day SEC Yield(a) after fees for June 30, 2010 was 2.14%. The yield was 3.29% on a fully tax adjusted basis assuming a federal tax rate of 35.0%, or 2.38% assuming a federal tax rate of 10.0%. Your tax adjusted yield may differ depending on your tax bracket. |

(a) The 30 Day SEC Yield is a standard yield calculation developed by the SEC that allows for fairer comparisons among bond funds. It is based on the most recent 30-day period covered by the Fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period, after the deduction of the Fund’s expenses.

| | | | | | |

| | Annual Report | | June 30, 2010 | | 13 |

PIMCO Short Term Municipal Bond Strategy Fund

| | |

| Allocation Breakdown‡ | | |

| California | | 10.4% |

| Texas | | 8.5% |

| Illinois | | 8.4% |

| New York | | 7.3% |

| Pennsylvania | | 7.2% |

| Florida | | 5.8% |

| Other | | 52.4% |

| | ‡ | % of Total Investments as of 06/30/10 |

A line graph is not included since the Fund has less than six months of performance.

| | | |

| Cumulative Total Return for the period ended June 30, 2010 | |

| | | Fund Inception

(02/01/10) | |

| PIMCO Short Term Municipal Bond Strategy Fund (Based on Net Asset Value) | | 0.70 | % |

| PIMCO Short Term Municipal Bond Strategy Fund (At Market Price)(1) | | 0.70 | % |

| Barclays Capital 1-3 Year Municipal Bond Index(2) | | 0.98 | % |

All Fund returns are net of fees and expenses.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated.

(2) The Barclays Capital 1-3 Year Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from 1 to 4 years. It is an unmanaged index representative of the tax exempt bond market. It is not possible to invest directly in an unmanaged index. The Index does not reflect deductions for fees, expenses or taxes.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance data current to the most recent month-end is available at www.pimcoetfs.com or by calling 1-888-400-4ETF.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance†† |

| | | | | (5% return before expenses) |

| Beginning Account Value (02/01/10) | | $ | 1,000.00 | | $ | 1,000.00 |

| Ending Account Value (06/30/10) | | $ | 1,006.96 | | $ | 1,023.06 |

| Expenses Paid During Period+ | | $ | 1.43 | | $ | 1.76 |

+ Expenses for the Fund are equal to the net annualized expense ratio of 0.35% multiplied by the average account value over the period, multiplied by 149/365 (to reflect the period since the Fund commenced operations on 02/01/10). The Fund’s hypothetical expenses reflect an amount as if the Fund had been operational for the entire fiscal half year. The annualized expense ratio of 0.35% for the Fund reflects net annualized expenses after application of an expense waiver of 1.82%.

†† Hypothetical Performance reflects a beginning account value as of 01/01/10.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO Short Term Municipal Bond Strategy Fund seeks attractive tax-exempt income, consistent with preservation of capital, by investing under normal circumstances at least 80% of its total assets in a diversified portfolio of debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax. |

| » | | The Fund commenced operations on February 1, 2010. |

| » | | The Fund’s effective duration was managed above its benchmark index throughout the reporting period, which was positive for performance, as municipal yields moved lower over the period. |

| » | | An overweight to dedicated revenue municipal bonds versus general obligation bonds detracted from returns as the revenue bonds underperformed general obligation municipal bonds over the period. |

| » | | Exposure to the education and special tax sectors, which underperformed the general obligation municipal bond index, detracted from performance. |

| » | | The Fund’s 30 Day SEC Yield(a) after fees for June 30, 2010 was 1.03%. The yield was 1.58% on a fully tax adjusted basis assuming a federal tax rate of 35.0%, or 1.14% assuming a federal tax rate of 10.0%. Your tax adjusted yield may differ depending on your tax bracket. |

(a) The 30 Day SEC Yield is a standard yield calculation developed by the SEC that allows for fairer comparisons among bond funds. It is based on the most recent 30-day period covered by the Fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period, after the deduction of the Fund’s expenses.

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Annual Report | | June 30, 2010 | | 15 |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | |

| Selected Per Share Data for the Year or Period Ended: | | Net Asset Value

Beginning of

Year or Period | | Net Investment

Income (a) | | Net Realized/

Unrealized

Gain (Loss) on

Investments (b) | | |

Total

Income

(Loss) from

Investment

Operations | | | Dividends from

Net Investment

Income | | | Distributions from

Net Realized

Capital Gains | |

| | | | | | |

PIMCO 1-3 Year U.S. Treasury Index Fund | | | | | | | | | | | | | | | | | | | | | | |

06/30/2010 | | $ | 49.94 | | $ | 0.43 | | $ | 0.84 | | | $ | 1.27 | | | $ | (0.43 | ) | | $ | (0.02 | ) |

06/01/2009 - 06/30/2009 | | | 50.00 | | | 0.03 | | | (0.06 | ) | | | (0.03 | ) | | | (0.03 | ) | | | 0.00 | |

| | | | | | |

PIMCO 1-5 Year U.S. TIPS Index Fund | | | | | | | | | | | | | | | | | | | | | | |

08/20/2009 - 06/30/2010 | | $ | 50.00 | | $ | 0.86 | | $ | 1.71 | | | $ | 2.57 | | | $ | (0.78 | ) | | $ | 0.00 | ^ |

| | | | | | |

PIMCO 3-7 Year U.S. Treasury Index Fund | | | | | | | | | | | | | | | | | | | | | | |

10/30/2009 - 06/30/2010 | | $ | 75.34 | | $ | 1.08 | | $ | 2.53 | | | $ | 3.61 | | | $ | (1.04 | ) | | $ | 0.00 | |

| | | | | | |

PIMCO 7-15 Year U.S. Treasury Index Fund | | | | | | | | | | | | | | | | | | | | | | |

09/10/2009 - 06/30/2010 | | $ | 75.67 | | $ | 1.94 | | $ | 3.65 | | | $ | 5.59 | | | $ | (1.98 | ) | | $ | (0.05 | ) |

| | | | | | |

PIMCO 15+ Year U.S. TIPS Index Fund | | | | | | | | | | | | | | | | | | | | | | |

09/03/2009 - 06/30/2010 | | $ | 50.01 | | $ | 1.22 | | $ | 4.20 | | | $ | 5.42 | | | $ | (1.26 | ) | | $ | 0.00 | ^ |

| | | | | | |

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund | | | | | | | | | | | | | | | | | | | | | | |

10/30/2009 - 06/30/2010 | | $ | 76.98 | | $ | 2.24 | | $ | 5.93 | | | $ | 8.17 | | | $ | (2.13 | ) | | $ | 0.00 | |

| | | | | | |

PIMCO Broad U.S. TIPS Index Fund | | | | | | | | | | | | | | | | | | | | | | |

09/03/2009 - 06/30/2010 | | $ | 50.01 | | $ | 0.96 | | $ | 2.97 | | | $ | 3.93 | | | $ | (0.92 | ) | | $ | (0.07 | ) |

| | | | | | |

PIMCO Enhanced Short Maturity Strategy Fund | | | | | | | | | | | | | | | | | | | | | | |

11/16/2009 - 06/30/2010 | | $ | 100.00 | | $ | 0.32 | | $ | 0.37 | | | $ | 0.69 | | | $ | (0.35 | ) | | $ | 0.00 | |

| | | | | | |

PIMCO Intermediate Municipal Bond Strategy Fund | | | | | | | | | | | | | | | | | | | | | | |

11/30/2009 - 06/30/2010 | | $ | 50.00 | | $ | 0.63 | | $ | 0.61 | | | $ | 1.24 | | | $ | (0.61 | ) | | $ | 0.00 | |

| | | | | | |

PIMCO Short Term Municipal Bond Strategy Fund | | | | | | | | | | | | | | | | | | | | | | |

02/01/2010 - 06/30/2010 | | $ | 50.00 | | $ | 0.21 | | $ | 0.14 | | | $ | 0.35 | | | $ | (0.22 | ) | | $ | 0.00 | |

| ^ | A zero amount may reflect amounts rounding to less than one cent. |

| (a) | Per share amounts based on average number of shares outstanding during the year or period. |

| (b) | Results do not accord with activity as a result of the timing of creations/redemptions. |

| (c) | Portfolio turnover rate excludes securities received or delivered from in kind processing of creations or redemptions. |

| | | | | | |

| 16 | | PIMCO ETF Trust | | | | See Accompanying Notes |

| | | | | | | | | | | | | | | | | | | | | | | |

Total

Distributions | | | Net Asset

Value End

of Year

or Period | | Total

Return | | | Net Assets

End of