UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22250

PIMCO ETF Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer and Principal Financial Officer

PIMCO ETF Trust

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 400-4383

Date of fiscal year end: June 30

Date of reporting period: June 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| | | | | | | | |

Item 1. | | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

Your Global Investment Authority

PIMCO ETF Trust

Annual Report

June 30, 2012

Index Exchange-Traded Funds

PIMCO 1-3 Year U.S. Treasury Index Fund

PIMCO 3-7 Year U.S. Treasury Index Fund

PIMCO 7-15 Year U.S. Treasury Index Fund

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund

PIMCO Broad U.S. Treasury Index Fund

PIMCO 1-5 Year U.S. TIPS Index Fund

PIMCO 15+ Year U.S. TIPS Index Fund

PIMCO Broad U.S. TIPS Index Fund

PIMCO 0-5 Year High Yield Corporate Bond Index Fund

PIMCO Investment Grade Corporate Bond Index Fund

PIMCO Australia Bond Index Fund

PIMCO Canada Bond Index Fund

PIMCO Germany Bond Index Fund

Actively Managed Exchange-Traded Funds

PIMCO Build America Bond Strategy Fund

PIMCO Enhanced Short Maturity Strategy Fund

PIMCO Global Advantage® Inflation-Linked Bond Strategy Fund

PIMCO Intermediate Municipal Bond Strategy Fund

PIMCO Short Term Municipal Bond Strategy Fund

PIMCO Total Return Exchange-Traded Fund

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO ETF Trust prospectus.

Chairman’s Letter

Dear Shareholder:

Please find enclosed the Annual Report for the PIMCO ETF Trust covering the twelve-month reporting period ended June 30, 2012. On the following pages, you’ll find specific details on investment performance and a discussion of the factors that most affected performance.

During our twelve-month reporting period, we introduced two new actively-managed exchange-traded funds (“ETFs”) as well as three new single-country Smart Passive index ETFs, which help expand investor access to PIMCO’s expertise through strategies and vehicles which appeal to a wide range of investor preferences:

| | n | | PIMCO Total Return Exchange-Traded Fund (Ticker: BOND), launched on February 29, 2012, is a diversified portfolio of high quality bonds that is actively managed in an effort to maximize return in a risk-controlled framework. BOND invests primarily in investment grade debt securities, and discloses all portfolio holdings on a daily basis. |

| | n | | PIMCO Global Advantage Inflation-Linked Bond Strategy Fund (Ticker: ILB), launched on April 30, 2012, is an actively-managed portfolio comprised of primarily high-quality inflation-linked bonds (which are fixed income securities tied to the consumer price index of a given country or region, and are designed to provide protection from inflation) that span developed and emerging markets. |

| | n | | PIMCO Canada Bond Index Fund (Ticker: CAD), launched on November 9, 2011, aims to provide focused exposure to the Canadian dollar-denominated, investment grade bond market. |

| | n | | PIMCO Germany Bond Index Fund (Ticker: BUND), launched on November 9, 2011, aims to provide focused exposure to euro-denominated, investment grade bonds issued by German issuers. |

| | n | | PIMCO Australia Bond Index Fund (Ticker: AUD), launched on October 31, 2011, aims to provide focused exposure to the Australian dollar-denominated, investment grade bond market. |

PIMCO ETFs are designed to provide well-engineered solutions to meet a broad range of investor needs, offering access to PIMCO’s unique investment process and world-class portfolio management expertise in the ETF vehicle, which features portfolio transparency and intra-day pricing in a conveniently traded format. PIMCO ETFs include a range of actively-managed and Smart Passive index strategies, providing investors access to a variety of sectors, geographical regions and investment objectives.

Highlights of the financial markets during our twelve-month reporting period include:

| | n | | Risk aversion drove down interest rates across developed markets, including in the U.S. and Germany where yields touched historic lows. By contrast, sovereign yields in Spain and Italy rose towards prohibitive levels. Yields on U.S. Treasury securities ended the period lower (with prices on these securities therefore higher), as investors looked to U.S. Treasuries for their perceived safety and quality due to increasing concern of a global economic slowdown and continued uncertainty in Europe. The benchmark ten-year U.S. Treasury note yielded 1.64% at the end of the reporting period, as compared to 3.16% on June 30, 2011. |

| | n | | U.S. Treasury Inflation-Protected Securities (“TIPS”) posted gains during the reporting period. Returns were driven primarily by declining intermediate and longer-dated real yields. Real yields longer than three years in maturity rallied due to overall tepid economic growth expectations and recognition that the Federal Reserve is likely to remain accommodative for a prolonged period of time. However, shorter term real yields sold off on weaker commodity prices, which translated into more muted short term inflation expectations. With nominal rates being fixed at nearly zero, any changes in short term inflation expectations cause the front end of the real yield curve to move. U.S. TIPS, however, underperformed nominal U.S. Treasuries as break-even inflation levels (or the difference between nominal and real yields) narrowed over the reporting period. |

| | n | | Municipal bonds, including both the tax-free and taxable Build America Bonds (“BABs”) sectors, struggled during the first half of the reporting period and were impacted by rising yields, an increase in new issuance, and sizeable redemptions out |

| | of municipal bond mutual funds. Yet, by the second half of the reporting period, municipal bond prices rallied as new issuances of tax-free municipal bonds declined, redemptions stabilized, and municipalities addressed budget concerns. |

| | n | | Investment grade corporate bonds lagged like-duration U.S. Treasuries amid renewed uncertainty in the eurozone and weak U.S. economic data, although corporate fundamentals generally remained robust. Despite uncertain market conditions, corporate bond issuance was resilient and primary market demand remained strong as investors continued to place a premium on liquidity. |

| | n | | High yield corporate bonds posted positive returns for the reporting period but underperformed like-duration U.S. Treasuries, as reignited contagion fears in Europe and worse than expected economic data in the U.S. weighed materially on risk assets, resulting in a flight-to-quality. |

If you have any questions regarding your PIMCO ETF Trust investment, please contact your financial advisor, or call one of our shareholder associates at (888) 400-4ETF. We also invite you to visit our website at www.pimcoetfs.com to learn more about PIMCO ETFs.

Thank you again for the trust you have placed in PIMCO. We are privileged to serve you through our ETF offerings.

| | |

| |

| | Sincerely,

Brent R. Harris President and Chairman of the Board, PIMCO ETF Trust July 25, 2012 |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 3 |

Important Information About the Funds

The PIMCO 0-5 Year High Yield Corporate Bond Index Fund, PIMCO 1-3 Year U.S. Treasury Index Fund, PIMCO 1-5 Year U.S. TIPS Index Fund, PIMCO 3-7 Year U.S. Treasury Index Fund, PIMCO 7-15 Year U.S. Treasury Index Fund, PIMCO 15+ Year U.S. TIPS Index Fund, PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund, PIMCO Australia Bond Index Fund, PIMCO Broad U.S. TIPS Index Fund, PIMCO Broad U.S. Treasury Index Fund, PIMCO Canada Bond Index Fund, PIMCO Germany Bond Index Fund and PIMCO Investment Grade Corporate Bond Index Fund are exchange-traded funds (“ETFs”) that seek to provide total return that closely corresponds, before fees and expenses, to the total return of a specified index (collectively, the “Index Funds”). Each Index Fund employs a representative sampling strategy in seeking to achieve its investment objective and as a result may not hold all of the securities that are included in the underlying index. The PIMCO Build America Bond Strategy Fund, PIMCO Enhanced Short Maturity Strategy Fund, PIMCO Global Advantage® Inflation-Linked Bond Strategy Fund, PIMCO Intermediate Municipal Bond Strategy Fund, PIMCO Short Term Municipal Bond Strategy Fund and PIMCO Total Return Exchange-Traded Fund unlike the Index Funds, are actively managed ETFs that do not seek to track the performance of a specified index (collectively, the “Active Funds” and together with the Index Funds, the “Funds”). Shares of the Funds will be listed and traded at market prices on NYSE Arca, Inc. (“NYSE Arca”) and other secondary markets. The market price for each Fund’s shares may be different from the Fund’s net asset value (“NAV”). Each Fund issues and redeems shares at its NAV only in blocks of a specified number of shares (“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Funds at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to a Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of a Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares from the Funds at NAV.

The Funds invest in particular segments of the securities markets, which are not representative of the broader securities markets. While we believe that bond funds have an important role to play in a well-diversified investment portfolio, an investment in a Fund alone should not constitute an entire investment program. It is important to note that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities held by the Funds are likely to decrease in value. The price volatility of fixed-income securities can also increase during periods of rising interest rates resulting in increased losses to the Funds. Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations.

The Funds may be subject to various risks in addition to those described above. Some of these risks may include, but are not limited to, the following: market trading risk, limited issuance risk, interest rate risk, credit risk, high yield risk, market risk, liquidity risk, equity-risk, mortgage-related and other asset-backed risk, foreign (non-U.S.) investment risk, currency risk, short sale risk, convertible securities risk, derivatives risk, issuer non-diversification risk, leveraging risk, management and tracking error risk, indexing risk, issuer risk, emerging markets risk, management risk, municipal project-specific risk, Australian securities risk, Canadian securities risk and German securities risk. A complete description of these and other risks is contained in each Fund’s prospectus. The use of derivatives may subject the Funds to greater volatility than investments in traditional securities. The Index Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a Fund could not close out a position when it would be most advantageous to do so. Certain derivative transactions may have a leveraging effect on an Index Fund. For example, a small investment in a derivative instrument may have a significant impact on an Index Fund’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price movement in a derivative instrument may cause an immediate and substantial loss or gain. An Index Fund may engage in such transactions regardless of whether the Index Fund owns the asset, instrument or components of the index underlying the derivative instrument. An Index Fund may invest a significant portion of its assets in these types of instruments. If it does, the Index Fund’s investment exposure could far exceed the value of its portfolio securities and its investment performance could be primarily dependent upon securities it does not own. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

On each individual Fund Summary page in this Annual Report (“Shareholder Report”), the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on: (i) Fund distributions; or (ii) the redemption of Fund shares. Each Fund’s performance is measured against the performance of a broad-based securities market index (benchmark index). Each Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The Index Funds may make available a complete schedule of portfolio holdings and the percentages they represent of the Index Fund’s net assets. On each business day, before commencement of trading on NYSE Arca, each Active Fund will disclose on www.pimcoetfs.com the identities and quantities of the Active Fund’s portfolio holdings that will form the basis for the Active Fund’s calculation of NAV at the end of the business day. The frequency at which the daily market prices were at a discount or premium to each Fund’s NAV is disclosed on www.pimcoetfs.com. Please see “Disclosure of Portfolio Holdings” in the Statement of Additional Information for information about the availability of the complete schedule of each Fund’s holdings. Fund fact sheets provide additional information regarding a Fund and may be requested by calling (888) 400-4ETF.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO ETF Trust as the policies and procedures that PIMCO will use when voting

proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 400-4ETF, on the Funds’ website at www.pimcoetfs.com, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PIMCO ETF Trust files a complete schedule of each Fund’s portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Funds’ Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. and is available without charge, upon request, by calling the Trust at (888) 400-4ETF and on the Funds’ website at www.pimcoetfs.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 5 |

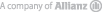

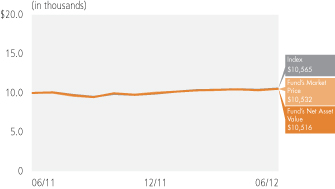

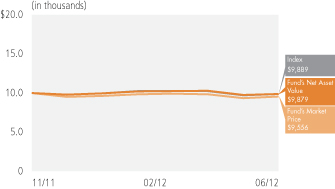

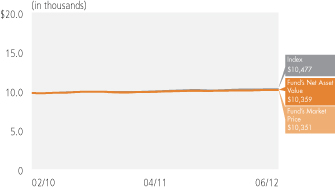

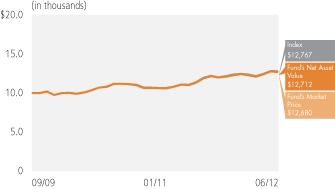

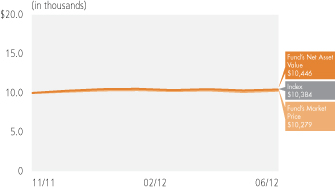

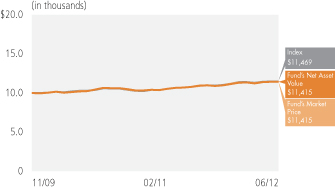

PIMCO 1-3 Year U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 98.4% | |

| Short-Term Instruments | | | 1.6% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(06/01/2009) | |

| | PIMCO 1-3 Year Treasury Index Fund (Based on Net Asset Value) | | | 0.74% | | | | 1.45% | |

| | PIMCO 1-3 Year Treasury Index Fund (At Market Price)(1) | | | 0.70% | | | | 1.44% | |

| | The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM± | | | 0.79% | | | | 1.55% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. Treasury securities, other than inflation-protection securities and STRIPS, with at least $1 billion in outstanding face value and a remaining term to final maturity of at least one year and less than three years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 1-3 Year U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-3 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the 1- to 3-year segment of the U.S. Treasury yield curve were mixed over the course of the reporting period: at the 1-year point and below yields increased slightly, while yields above the 1-year point declined. The move in yields resulted in overall negative price performance of the underlying securities, though coupon returns drove positive performance for both the Fund and the Underlying Index over the reporting period. |

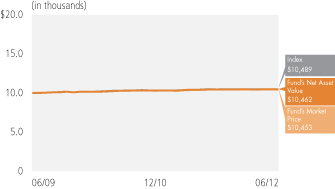

PIMCO 3-7 Year U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 94.3% | |

| Short-Term Instruments | | | 5.7% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 3-7 Year U.S. Treasury Index Fund (Based on Net Asset Value) | | | 6.67% | | | | 5.63% | |

| | PIMCO 3-7 Year U.S. Treasury Index Fund (At Market Price)(1) | | | 6.69% | | | | 5.63% | |

| | The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM± | | | 6.52% | | | | 5.69% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM is an unmanaged index comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury having a maturity of at least 3 years and less than 7 years.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 3-7 Year U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 3-7 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the 3- to 7-year segment of the U.S. Treasury yield curve were down over the course of the reporting period. The overall decline in yields of the underlying securities and coupon returns drove positive performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 7 |

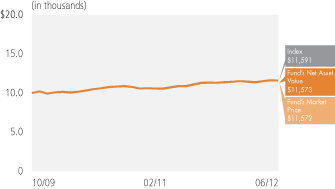

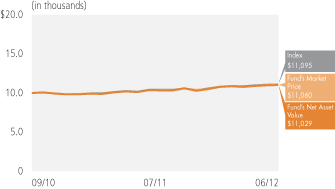

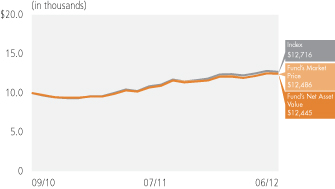

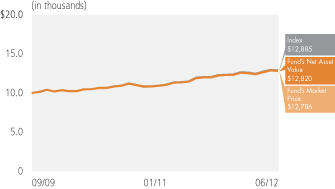

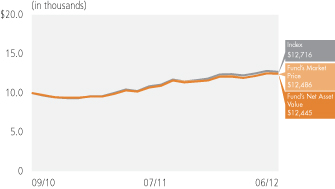

PIMCO 7-15 Year U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(09/10/2009) | |

| | PIMCO 7-15 Year U.S. Treasury Index Fund (Based on Net Asset Value) | | | 15.47% | | | | 9.17% | |

| | PIMCO 7-15 Year U.S. Treasury Index Fund (At Market Price)(1) | | | 15.41% | | | | 9.17% | |

| | The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM± | | | 15.38% | | | | 9.29% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM is an unmanaged index that tracks the performance of the direct Sovereign debt of the U.S. Government with at least $1 billion in outstanding face value and a remaining term to final maturity of at least 7 years and less than 15 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 7-15 Year U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 7-15 Year U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the 7- to 15-year segment of the U.S. Treasury yield curve were down over the course of the reporting period. The overall decline in yields of the underlying securities and coupon returns drove positive performance for both the Fund and the Underlying Index over the reporting period. |

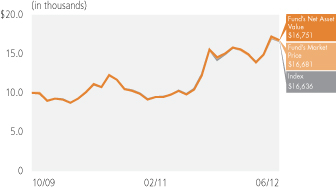

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(10/30/2009) | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund (Based on Net Asset Value) | | | 70.82% | | | | 21.34% | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund (At Market Price)(1) | | | 70.23% | | | | 21.15% | |

| | The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM± | | | 69.26% | | | | 21.01% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (“STRIPS”) representing the final principal payment of U.S. Treasury bonds. The principal STRIPS comprising the Underlying Index must have 25 years or more remaining term to final maturity and must be stripped from U.S. Treasury bonds having at least $1 billion in outstanding face value.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Long U.S. Treasury Principal STRIPS IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields in the 25+ year segment of the U.S. Treasury STRIPS yield curve were down over the reporting period. The fall in yields drove positive performance for the Fund and the Underlying Index over the course of the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 9 |

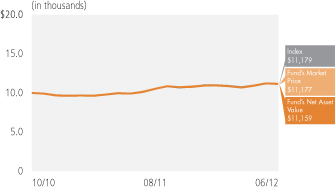

PIMCO Broad U.S. Treasury Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 97.2% | |

| Short-Term Instruments | | | 2.8% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(10/29/2010) | |

| | PIMCO Broad U.S. Treasury Index Fund (Based on Net Asset Value) | | | 12.69% | | | | 6.79% | |

| | PIMCO Broad U.S. Treasury Index Fund (At Market Price)(1) | | | 12.64% | | | | 6.90% | |

| | The BofA Merrill Lynch Liquid US Treasury IndexSM± | | | 12.66% | | | | 6.90% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Liquid U.S. Treasury IndexSM is an unmanaged index that tracks the performance of the three most recently issued 2-year, 3- year, 5-year, 7-year, 10-year and 30-year U.S. Treasury notes and bonds. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.15%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Broad U.S. Treasury Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Liquid U.S. Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund may invest the remainder of its assets in fixed-income instruments that are not component securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Yields at the 1-year point and below on the U.S. Treasury yield curve were up over the course of the reporting period, and down at all other points. The overall decline in yields of the underlying securities and coupon returns drove positive performance for both the Fund and the Underlying Index over the reporting period. |

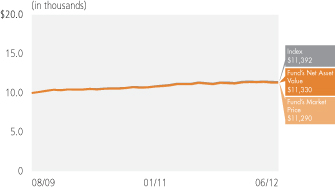

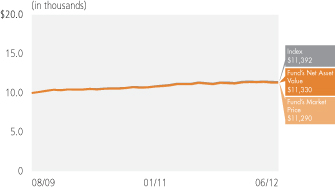

PIMCO 1-5 Year U.S. TIPS Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 99.9% | |

| Short-Term Instruments | | | 0.1% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(08/20/2009) | |

| | PIMCO 1-5 Year U.S. TIPS Index Fund (Based on Net Asset Value) | | | 1.71% | | | | 4.39% | |

| | PIMCO 1-5 Year U.S. TIPS Index Fund (At Market Price)(1) | | | 1.62% | | | | 4.37% | |

| | The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM± | | | 1.78% | | | | 4.61% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities with at least $1 billion in outstanding face value and a remaining term to final maturity of at least 1 year and less than 5 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 1-5 Year U.S. TIPS Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 1-5 Year U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, were mixed across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve: real yields were up from the 1- to 3-year points, but down otherwise. Overall, this drove positive performance for both the Fund and the Underlying Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also contributed positively to returns. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 11 |

PIMCO 15+ Year U.S. TIPS Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO 15+ Year U.S. TIPS Index Fund (Based on Net Asset Value) | | | 26.53% | | | | 15.73% | |

| | PIMCO 15+ Year U.S. TIPS Index Fund (At Market Price)(1) | | | 26.40% | | | | 15.71% | |

| | The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM± | | | 26.60% | | | | 15.87% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities with at least $1 billion in outstanding face value and a remaining term to final maturity greater than 15 years. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 15+ Year U.S. TIPS Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 15+ Year U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, declined in the longer maturity section of the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve, driving positive performance for both the Fund and the Underlying Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also contributed positively to returns. |

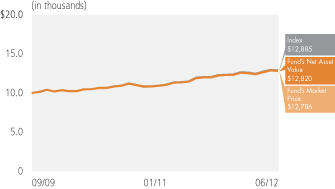

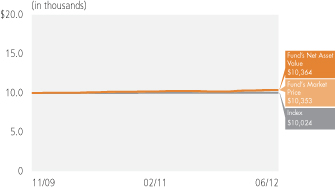

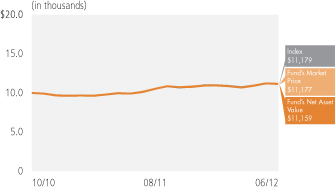

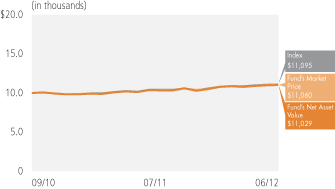

PIMCO Broad U.S. TIPS Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| U.S. Treasury Obligations | | | 100.0% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(09/03/2009) | |

| | PIMCO Broad U.S. TIPS Index Fund (Based on Net Asset Value) | | | 12.21% | | | | 9.75% | |

| | PIMCO Broad U.S. TIPS Index Fund (At Market Price)(1) | | | 12.07% | | | | 9.72% | |

| | The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM± | | | 12.33% | | | | 9.93% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities with at least $1 billion in outstanding face value. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Broad U.S. TIPS Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch U.S. Inflation-Linked Treasury IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Real yields, or the rates of return in excess of expected future inflation, were mixed across the U.S. Treasury Inflation-Protected Securities (“TIPS”) yield curve: real yields were up from the 1- to 3-year points, but down otherwise. Overall, this drove positive performance for both the Fund and the Underlying Index. A net positive inflation accrual, or change in the Consumer Price Index (“CPI”), applied to the principal of underlying securities over the reporting period also contributed positively to returns. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 13 |

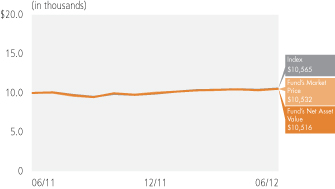

PIMCO 0-5 Year High Yield Corporate Bond Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Corporate Bonds & Notes | | | 93.2% | |

| Short-Term Instruments | | | 6.8% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(06/16/2011) | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Fund (Based on Net Asset Value) | | | 5.16% | | | | 5.41% | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Fund (At Market Price)(1) | | | 5.32% | | | | 5.80% | |

| | The BofA Merrill Lynch 0-5 Year US High Yield Constrained IndexSM± | | | 5.65% | | | | 5.75% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM tracks the performance of short-term U.S. dollar denominated below investment grade corporate debt issued in the U.S. domestic market with less than five years remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $100 million, issued publicly. Allocations to an individual issuer will not exceed 2%. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.55%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO 0-5 Year High Yield Corporate Bond Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in fixed-income instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | Over the reporting period, yields in the short term segment of the U.S. high yield market rose. However, coupon returns were greater than the negative price performance of underlying securities, resulting in net positive performance for the Fund and the Underlying Index. |

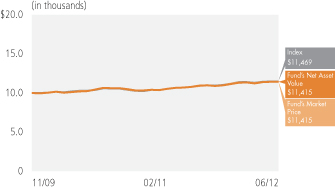

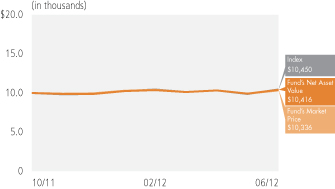

PIMCO Investment Grade Corporate Bond Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Industrials | | | 52.5% | |

| Banking & Finance | | | 33.8% | |

| Utilities | | | 13.1% | |

| Short-Term Instruments | | | 0.6% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(09/20/2010) | |

| | PIMCO Investment Grade Corporate Bond Index Fund (Based on Net Asset Value) | | | 9.20% | | | | 6.49% | |

| | PIMCO Investment Grade Corporate Bond Index Fund (At Market Price)(1) | | | 9.32% | | | | 6.57% | |

| | The BofA Merrill Lynch US Corporate IndexSM± | | | 9.15% | | | | 6.70% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch U.S. Corporate IndexSM is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity and at least $250 million outstanding. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.20%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Investment Grade Corporate Bond Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch U.S. Corporate IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Fund may invest the remainder of its assets in fixed-income instruments that are not component securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | A decrease in U.S. Treasury yields beyond the 1-year point as well as coupon returns offset a widening of option-adjusted spreads, driving positive performance for both the Fund and the Underlying Index over the reporting period. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 15 |

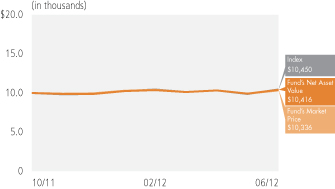

PIMCO Australia Bond Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Australia | | | 71.6% | |

| Supranational | | | 19.0% | |

| Germany | | | 4.3% | |

| United Kingdom | | | 3.0% | |

| Netherlands | | | 2.1% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | |

Cumulative Total Return for the period ended June 30, 2012 | |

| | | | | Fund Inception

(10/31/2011) | |

| | PIMCO Australia Bond Index Fund (Based on Net Asset Value) | | | 4.16% | |

| | PIMCO Australia Bond Index Fund (At Market Price)(1) | | | 3.36% | |

| | The BofA Merrill Lynch Diversified Australia Bond IndexSM± | | | 4.50% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Diversified Australia Bond IndexSM tracks the performance of large, Australian dollar (“AUD”)-denominated investment grade debt instruments publicly issued in the Australian domestic market, including sovereign, quasi government, corporate, securitized and collateralized securities. All qualifying securities must have at least one year remaining term to final maturity and a fixed coupon schedule. Qualifying Australian sovereign securities must have a minimum amount outstanding of AUD 1 billion. Qualifying non-sovereign securities must have a minimum amount outstanding of AUD 500 million and must be rated investment grade. Index constituents are capitalization-weighted adjusted, as necessary, to meet issuer concentration limits. The Underlying Index is rebalanced on the last calendar day of the month. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.51%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Australia Bond Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Diversified Australia Bond IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Underlying Index tracks the performance of large, Australian dollar-denominated investment grade debt instruments publicly issued in the Australian domestic market, including sovereign, quasi-government, corporate securitized and collateralized securities. Qualifying constituents must have an investment-grade rating (based on an average of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) and Fitch, Inc. (“Fitch”)), an investment grade country of risk (based on an average of Moody’s, S&P and Fitch foreign currency long term sovereign debt ratings), at least one year remaining term to final maturity and a fixed coupon schedule. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | The Fund commenced operations on October 31, 2011. |

| » | | Australian government yields declined over the reporting period while the Australian dollar weakened versus the U.S. dollar. The net result was positive performance for both the Fund and the Underlying Index. |

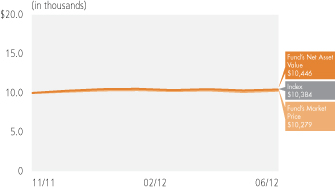

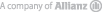

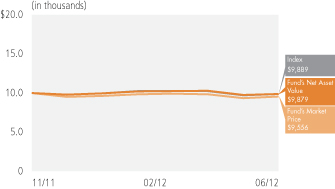

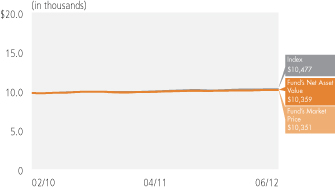

PIMCO Canada Bond Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | |

| Cumulative Total Return for the period ended June 30, 2012 | |

| | | | | Fund Inception

(11/09/2011) | |

| | PIMCO Canada Bond Index Fund (Based on Net Asset Value) | | | 4.18% | |

| | PIMCO Canada Bond Index Fund (At Market Price)(1) | | | 4.18% | |

| | The BofA Merrill Lynch Diversified Canada Government Bond IndexSM± | | | 3.57% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Diversified Canada Government Bond IndexSM tracks the performance of large, Canadian dollar (“CAD”)-denominated investment grade debt instruments publicly issued in the Canadian domestic market including Canadian sovereign and quasi-government securities. All Qualifying securities must have at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of CAD 1 billion for Canadian sovereign securities and a minimum amount outstanding of CAD 200 million for Canadian quasi-government-securities. Index constituents are capitalization-weighted adjusted, as necessary, to meet issuer concentration limits. The Underlying Index is rebalanced on the last calendar day of the month. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.52%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Canada Bond Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Diversified Canada Bond IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Underlying Index tracks the performance of large, Canadian dollar-denominated investment grade debt instruments publicly issued in the Canadian domestic market, including Canadian sovereign and quasi-government securities. Qualifying constituents must have an investment-grade rating (based on an average of the ratings of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) and Fitch, Inc. (“Fitch”)), an investment grade country of risk (based on an average of Moody’s, S&P and Fitch foreign currency long term sovereign debt ratings), at least one year remaining term to final maturity and a fixed coupon schedule. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | The Fund commenced operations on November 9, 2011. |

| » | | Canadian government yields rose from the 6-month to 3-year portion of the yield curve, but otherwise fell while the Canadian dollar strengthened slightly versus the U.S. dollar. The net result was positive performance for both the Fund and the Underlying Index. |

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 17 |

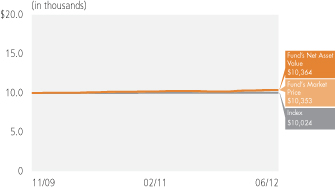

PIMCO Germany Bond Index Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Germany | | | 83.7% | |

| Netherlands | | | 16.3% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | |

| Cumulative Total Return for the period ended June 30, 2012 | |

| | | | | Fund Inception

(11/09/2011) | |

| | PIMCO Germany Bond Index Fund (Based on Net Asset Value) | | | -3.29 | % |

| | PIMCO Germany Bond Index Fund (At Market Price)(1) | | | -2.95 | % |

| | The BofA Merrill Lynch Diversified Germany Bond IndexSM± | | | -3.26 | % |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± The BofA Merrill Lynch Diversified Germany Bond IndexSM tracks the performance of large, Euro (“EUR”)-denominated investment grade debt instruments of German issuers publicly issued in the eurobond or Euro member domestic markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. All Qualifying securities must be an obligation of a German entity with at least one year remaining term to final maturity and a fixed coupon schedule. Qualifying German sovereign securities must have a minimum amount outstanding of EUR 1 billion. Qualifying non-sovereign securities must have a minimum amount outstanding of EUR 500 million and must be rated investment grade. Index constituents are capitalization-weighted adjusted, as necessary, to meet issuer concentration limits. The Underlying Index is rebalanced on the last calendar day of the month. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.49%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Germany Bond Index Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of The BofA Merrill Lynch Diversified Germany Bond IndexSM (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities of the Underlying Index. The Underlying Index tracks the performance of large, Euro-denominated investment grade debt instruments of German issuers publicly issued in the eurobond or Euromember domestic markets, including sovereign, quasi-government, corporate, securitized and collateralized securities. Qualifying constituents must be an obligation of a German entity with an investment-grade rating (based on an average of the ratings of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) and Fitch, Inc. (“Fitch”), at least one year remaining term to final maturity and a fixed coupon schedule. The Fund invests in a representative sample of securities included in the Underlying Index that collectively has an investment profile similar to the Underlying Index. Due to the use of representative sampling, the Fund may not hold all of the securities that are included in the Underlying Index. |

| » | | The Fund commenced operations on November 9, 2011. |

| » | | German government bond yields were down across the yield curve except at the 3-month point while the euro weakened versus the U.S. dollar. The net result was negative performance for both the Fund and the Underlying Index. |

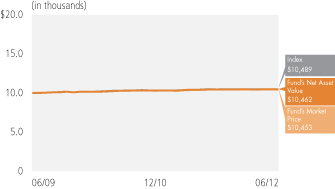

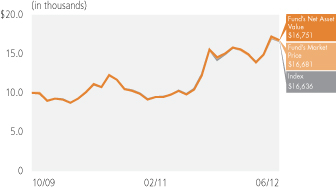

PIMCO Build America Bond Strategy Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| California | | | 39.6% | |

| New York | | | 14.2% | |

| Illinois | | | 12.6% | |

| New Jersey | | | 7.8% | |

| Short-Term Instruments | | | 5.4% | |

| Other | | | 20.4% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(09/20/2010) | |

| | PIMCO Build America Bond Strategy Fund (Based on Net Asset Value) | | | 22.27% | | | | 13.83% | |

| | PIMCO Build America Bond Strategy Fund (At Market Price)(1) | | | 23.04% | | | | 13.90% | |

| | Barclays Build America Bond Index± | | | 24.09% | | | | 15.61% | |

All Fund returns are net of fees and expenses.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Barclays Build America Bond Index is a subset of the Barclays Taxable Municipal Bond Index. The sub-Index consists of all direct pay Build America Bonds that satisfy the rules of the Barclays Taxable Municipal Bond Index. The Barclays Taxable Municipal Bond Index represents securities that are SEC-registered, taxable, dollar denominated, and have at least one year to final maturity, at least $250 million par amount outstanding and are determined to be investment-grade by Barclays. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.45%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Build America Bond Strategy Fund seeks maximum income, consistent with preservation of capital, by investing under normal circumstances at least 80% of its assets in taxable municipal debt securities publicly issued under the Build America Bond program. |

| » | | The Fund’s 30 Day SEC yield(a) after fees for June 30, 2012 was 4.11% while the estimated yield to maturity(b) was 4.58%. |

| » | | An underweight duration position (or sensitivity to changes in market interest rates) throughout the reporting period detracted from performance as yields fell across the yield curve. |

| » | | A focus on revenue municipal bonds relative to general obligation municipal bonds contributed to performance as revenue bonds outperformed general obligation issues during the reporting period. |

| » | | An overweight exposure to transportation and healthcare securities contributed to performance as returns in these sectors outperformed the general municipal bond market. |

| » | | An overweight exposure to electric bonds detracted from returns as these securities underperformed the general municipal bond market. |

| » | | An underweight to education securities detracted from returns as the sector outperformed the general municipal bond market. |

(a) The 30 Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission (“SEC”) that allows for fairer comparisons among bond funds. It is based on the most recent 30-day period covered by the Fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period, after the deduction of the Fund’s expenses.

(b) The Yield to Maturity (“YTM”) is the rate of return anticipated on a bond if it is held until the maturity date. The calculation of YTM takes into account the current market price, par value, coupon interest rate and time to maturity. PIMCO calculates a Fund’s estimated YTM by averaging the YTM of each security held in the Fund on a market weighted basis by selecting each security’s YTM from PIMCO’s analytics database or from Bloomberg. A Fund’s estimated YTM may differ from its distribution yield or SEC yield due to a number of factors, including unsettled trades and Fund expenses.

| | | | | | |

| | ANNUAL REPORT | | JUNE 30, 2012 | | 19 |

PIMCO Enhanced Short Maturity Strategy Fund

Cumulative Returns Through June 30, 2012

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown‡

| | | | |

| Corporate Bonds & Notes | | | 62.9% | |

| Short-Term Instruments | | | 8.8% | |

| U.S. Government Agencies | | | 8.4% | |

| Asset-Backed Securities | | | 7.8% | |

| Mortgage-Backed Securities | | | 5.1% | |

| Other | | | 7.0% | |

| ‡ | % of Total Investments as of 06/30/12 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2012 | |

| | | | | 1 Year | | | Fund Inception

(11/16/2009) | |

| | PIMCO Enhanced Short Maturity Strategy Fund (Based on Net Asset Value) | | | 1.13% | | | | 1.42% | |

| | PIMCO Enhanced Short Maturity Strategy Fund (At Market Price)(1) | | | 1.11% | | | | 1.41% | |

| | Citigroup 3-Month Treasury Bill Index± | | | 0.04% | | | | 0.09% | * |

All Fund returns are net of fees and expenses.

* Average annual total return since 11/30/2009.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

(1) The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated.

± Citigroup 3-Month Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 3 month Treasury Bill issues. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.35%. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. Performance data current to the most recent month-end is available at www.pimcoetfs.com.

Portfolio Insights

| » | | The PIMCO Enhanced Short Maturity Strategy Fund seeks maximum current income, consistent with preservation of capital and daily liquidity, by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of fixed income instruments of varying maturities, which may be represented by forwards. Fixed income instruments include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The Fund primarily invests in U.S. dollar-denominated investment grade debt securities, rated Baa or higher by Moody’s Investors Service, Inc. (“Moody’s”), or equivalently rated by Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, determined by PIMCO to be of comparable quality. |

| » | | As of June 29, 2012, the Fund’s 30 Day SEC yield(a) was 0.98% while the estimated yield to maturity(b) was 1.22%. |

| » | | An above-benchmark duration (or sensitivity to changes in market interest rates) with emphasis on the 1- to 5-year portion of the yield curve was positive for performance as the U.S. Treasury yield curve flattened with intermediate rates falling more than short-term rates rose. |

| » | | An allocation to investment grade corporates added to returns as the sector outperformed like-duration U.S. Treasuries over the reporting period. |