UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22250

PIMCO ETF Trust

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive office)

Bijal Y. Parikh

Treasurer (Principal Financial & Accounting Officer)

PIMCO ETF Trust

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Adam T. Teufel

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 877-4626

Date of fiscal year end: June 30

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

| | (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1). |

| | ☐ | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund |

| | ☐ | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund |

| | ☐ | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund |

| | ☐ | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund |

| | ☐ | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund |

| | ☐ | PIMCO Investment Grade Corporate Bond Exchange-Traded Fund |

| | ☐ | PIMCO Active Bond Exchange-Traded Fund |

| | ☐ | PIMCO Commodity Strategy Active Exchange-Traded Fund |

| | ☐ | PIMCO Enhanced Low Duration Active Exchange-Traded Fund |

| | ☐ | PIMCO Enhanced Short Maturity Active Exchange-Traded Fund |

| | ☐ | PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund |

| | ☐ | PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund |

| | ☐ | PIMCO Multisector Bond Active Exchange-Traded Fund |

| | ☐ | PIMCO Municipal Income Opportunities Active Exchange-Traded Fund |

| | ☐ | PIMCO Preferred and Capital Securities Active Exchange-Traded Fund |

| | ☐ | PIMCO Senior Loan Active Exchange-Traded Fund |

| | ☐ | PIMCO Short Term Municipal Bond Active Exchange-Traded Fund |

| | ☐ | PIMCO Ultra Short Government Active Exchange-Traded Fund |

PIMCO ETF TRUST

Annual Report

June 30, 2023

Index Exchange-Traded Funds

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund | ZROZ | NYSE Arca

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund | STPZ | NYSE Arca

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund | LTPZ | NYSE Arca

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund | TIPZ | NYSE Arca

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund | HYS | NYSE Arca

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund | CORP | NYSE Arca

Actively-Managed Exchange-Traded Funds

PIMCO Active Bond Exchange-Traded Fund | BOND | NYSE

PIMCO Enhanced Low Duration Active Exchange-Traded Fund | LDUR | NYSE Arca

PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund | EMNT | NYSE Arca

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | MINT | NYSE Arca

PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund | MUNI | NYSE Arca

PIMCO Multisector Bond Active Exchange-Traded Fund | PYLD | NYSE Arca

PIMCO Municipal Income Opportunities Active Exchange-Traded Fund | MINO | NYSE Arca

PIMCO Preferred and Capital Securities Active Exchange-Traded Fund | PRFD | NYSE Arca

PIMCO Senior Loan Active Exchange-Traded Fund | LONZ | NYSE Arca

PIMCO Short Term Municipal Bond Active Exchange-Traded Fund | SMMU | NYSE Arca

PIMCO Ultra Short Government Active Exchange-Traded Fund | BILZ | NYSE Arca

PIMCO Commodity Strategy Active Exchange-Traded Fund | CMDT | NYSE Arca

Table of Contents

| | (1) | Consolidated Schedule of Investments |

This material is authorized for use only when preceded or accompanied by the current PIMCO ETF Trust prospectus.

Dear Shareholder,

This annual report covers the 12-month reporting period ended June 30, 2023 (the “reporting period”). On the subsequent pages, you will find details regarding investment results and a discussion of certain factors that affected performance during the reporting period.

Amid elevated inflation in many countries during the reporting period, the global economy faced challenges from higher interest rates, tighter credit conditions stemming from the turmoil in the banking sector (especially in the United States (“U.S.”)), and geopolitical concerns. While the U.S. economy showed signs of resilience, some European economies experienced slower growth over the reporting period.

Continued central bank efforts to combat inflation

While inflation remained elevated over the reporting period, many central banks raised interest rates to rein in rising prices. The U.S. Federal Reserve (the “Fed”) raised the federal funds rate at 10 consecutive meetings, beginning in March 2022 through May 2023. In June 2023, the Fed then paused from raising rates in order to “assess additional information and its implications for monetary policy.” Meanwhile, the Bank of England and European Central Bank raised interest rates for the 13th and eighth consecutive time, respectively, as of June 2023. In contrast, the Bank of Japan maintained its accommodative monetary policy stance.

Mixed financial market returns

The yield on the benchmark 10-year U.S. Treasury rose over the reporting period, as did 10-year bond yields in most other developed market countries. The overall global credit bond market delivered positive total returns. Higher-rated global bonds underperformed lower-rated bonds. Global equities rallied, while commodity prices were volatile and produced mixed returns. The U.S. dollar weakened against the euro and the British pound, but appreciated against the Japanese yen.

Amid evolving conditions, we will continue to work diligently to navigate global markets and manage the assets that you have entrusted with us. We encourage you to speak with your financial advisor about your goals, and visit global.pimco.com for our latest insights.

| | |

| | Sincerely,

Peter G. Strelow Chairman of the Board

PIMCO ETF Trust |

| | |

| |

Total Returns of Certain Asset Classes for the

Period Ended June 30, 2023 |

| | |

| Asset Class (as measured by, currency) | | 12-Month |

| | |

U.S. large cap equities (S&P 500 Index, USD) | | 19.59% |

| | |

Global equities (MSCI World Index, USD) | | 18.51% |

| | |

European equities (MSCI Europe Index, EUR) | | 16.72% |

| | |

Emerging market equities (MSCI Emerging Markets Index, EUR) | | 1.75% |

| | |

Japanese equities (Nikkei 225 Index, JPY) | | 28.61% |

| | |

Emerging market local bonds (JPMorgan Government Bond Index-Emerging Markets Global Diversified Index, USD Unhedged) | | 11.38% |

| | |

Emerging market external debt (JPMorgan Emerging Markets Bond Index (EMBI) Global, USD Hedged) | | 6.85% |

| | |

Below investment grade bonds (ICE BofAML Developed Markets High Yield Constrained Index, USD Hedged) | | 9.48% |

| | |

Global investment grade credit bonds (Bloomberg Global Aggregate Credit Index, USD Hedged) | | 1.36% |

| | |

Fixed-rate, local currency government debt of investment grade countries (Bloomberg Global Treasury Index, USD Hedged) | | 0.07% |

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

| | | | |

| Important Information About the Funds | | | | |

PIMCO ETF Trust (the “Trust”) is an open-end management investment company that includes the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund, PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund, PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund, PIMCO Broad U.S. TIPS Index Exchange-Traded Fund, PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund, and PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund, which are exchange-traded funds (“ETFs”) that seek to provide total return that closely corresponds, before fees and expenses, to the total return of a specified index (collectively, the “Index Funds”). Each Index Fund employs a representative sampling strategy in seeking to achieve its investment objective. In using this strategy, PIMCO seeks to invest in a combination of instruments such that the portfolio effectively provides exposure to the underlying index. An Index Fund may not track its underlying index with the same degree of accuracy as a fund that replicates the composition and weighting of the underlying index. The PIMCO Active Bond Exchange-Traded Fund, PIMCO Commodity Strategy Active Exchange-Traded Fund, PIMCO Enhanced Low Duration Active Exchange-Traded Fund, PIMCO Enhanced Short Maturity Active Exchange-Traded Fund, PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund, PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund, PIMCO Multisector Bond Active Exchange-Traded Fund, PIMCO Municipal Income Opportunities Active Exchange-Traded Fund, PIMCO Preferred and Capital Securities Active Exchange-Traded Fund, PIMCO Senior Loan Active Exchange-Traded Fund, PIMCO Short Term Municipal Bond Active Exchange-Traded Fund, and PIMCO Ultra Short Government Active Exchange-Traded Fund unlike the Index Funds, are actively managed ETFs that do not seek to track the performance of a specified index (collectively, the “Active Funds” and together with the Index Funds, a “Fund” or the “Funds”). Shares of the Funds, except PIMCO Active Bond Exchange-Traded Fund, will be listed and traded at market prices on NYSE Arca, Inc. (“NYSE Arca”), and the shares of the PIMCO Active Bond Exchange-Traded Fund are listed and traded at market prices on the New York Stock Exchange (“NYSE”), each a national securities exchange, and other secondary markets. The market price for each Fund’s shares may be different from the Fund’s net asset value (“NAV”). Each Fund issues and redeems shares at its NAV only in blocks of a specified number of shares (“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Funds at NAV (“Authorized Participants”). These transactions are in exchange for certain securities similar to a Fund’s portfolio and/or cash. Except when aggregated in Creation Units, shares of a Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares from the Funds at NAV.

We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in

an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed income securities and other instruments held by the Funds are likely to decrease in value. A wide variety of factors can cause interest rates to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that Fund management will anticipate such movement accurately. The Funds may lose money as a result of movements in interest rates.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, continue to increase. In efforts to combat inflation, the U.S. Federal Reserve raised interest rates multiple times in 2022 and 2023. Thus, the Funds currently face a heightened level of risk associated with rising interest rates and/or bond yields. This could be driven by a variety of factors, including but not limited to central bank monetary policies, changing inflation or real growth rates, general economic conditions, increasing bond issuances or reduced market demand for low yielding investments. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets”.

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact a Fund’s performance or cause a Fund to incur losses. As a result, there could be increased sales of shares which could further reduce the market price for a Fund’s shares.

The Funds may be subject to various risks as described in each Fund’s prospectus and in the Principal and Other Risks in the Notes to Financial Statements.

Classifications of the Funds’ portfolio holdings in this report are made according to financial reporting standards. The classification of a particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments sections of this report may differ from the classification used for the Funds’ compliance calculations, including those used in the Funds’ prospectuses, investment objectives, regulatory, and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. Each Fund is separately monitored for compliance with respect to prospectus and regulatory requirements.

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JUNE 30, 2023 | | | 3 |

| | | | |

| Important Information About the Funds | | (Cont.) | | |

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

In February 2022, Russia launched an invasion of Ukraine. As a result, Russia and other countries, persons and entities that have provided material aid to Russia’s aggression against Ukraine, have been the subject of economic sanctions and import and export controls imposed by countries throughout the world, including the United States. Such measures have had and may continue to have an adverse effect on the Russian, Belarusian and other securities and economies, which may, in turn, negatively impact a Fund. The extent, duration and impact of Russia’s military action in Ukraine, related sanctions and retaliatory actions are difficult to ascertain, but could be significant and have severe adverse effects on the region, including significant adverse effects on the regional, European, and global economies and the markets for certain securities and commodities, such as oil and natural gas, as well as other sectors. Further, a Fund may have investments in securities and instruments that are economically tied to the region and may have been negatively impacted by the sanctions and counter-sanctions by Russia, including declines in value and reductions in liquidity. The sanctions may cause a Fund to sell portfolio holdings at a disadvantageous time or price or to continue to hold investments that a Fund may no longer seek to hold. PIMCO will continue to actively manage these positions in the best interests of a Fund and its shareholders.

A Fund may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR was traditionally an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced plans to ultimately phase out the use of LIBOR. Although the transition process away from LIBOR for many instruments has been completed, some LIBOR use is continuing and there are potential effects related to the transition away from LIBOR or continued use of LIBOR on the Fund, or on certain instruments in which the Fund invests, which can be difficult to ascertain, and may vary depending on factors that include, but are not limited to: (i) existing fallback or termination provisions in individual contracts and (ii) whether, how, and when industry participants adopt new reference rates for affected instruments. The transition of investments from LIBOR to a replacement rate as a result of amendment, application of existing fallbacks, statutory requirements or otherwise may also result in a reduction in the value of certain instruments held by the Fund or a reduction in the effectiveness of related Fund transactions such as hedges. In addition, an instrument’s transition to a replacement rate could result in variations in the reported yields of the Fund that holds such instrument. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to the Fund.

Engaging in a responsible investment strategy, which may select or exclude securities of certain issuers for reasons other than performance, carries the risk that a Fund may underperform funds that do not utilize a responsible investment strategy. The application of this strategy may affect a Fund’s exposure to certain sectors or types of investments, which could negatively impact the Fund’s performance. Responsible investing is qualitative and subjective by nature, and there is no guarantee that the criteria utilized or any judgment exercised in pursuing a responsible investment strategy will reflect the beliefs or values of any particular investor. In evaluating a company, the information and data obtained through voluntary or third-party reporting may be incomplete, inaccurate or unavailable, which could cause an incorrect assessment of a company’s business practices with respect to the environment, social responsibility and corporate governance (“ESG practices”). Socially responsible norms differ by region, and a company’s ESG practices or the assessment of a company’s ESG practices may change over time.

U.S. and global markets recently have experienced increased volatility, including as a result of the recent failures of certain U.S. and non-U.S. banks, which could be harmful to the Funds and issuers in which they invest. For example, if a bank at which a Fund or issuer has an account fails, any cash or other assets in bank or custody accounts, which may be substantial in size, could be temporarily inaccessible or permanently lost by the Fund or issuer. If a bank that provides a subscription line credit facility, asset-based facility, other credit facility and/or other services to an issuer or to a fund fails, the issuer or fund could be unable to draw funds under its credit facilities or obtain replacement credit facilities or other services from other lending institutions with similar terms.

Issuers in which a Fund may invest can be affected by volatility in the banking sector. Even if banks used by issuers in which the Funds invest remain solvent, continued volatility in the banking sector could contribute to, cause or intensify an economic recession, increase the costs of capital and banking services or result in the issuers being unable to obtain or refinance indebtedness at all or on as favorable terms as could otherwise have been obtained. Conditions in the banking sector are evolving, and the scope of any potential impacts to the Funds and issuers, both from market conditions and also potential legislative or regulatory responses, are uncertain. Such conditions and responses, as well as a changing interest rate environment, can contribute to decreased market liquidity and erode the value of certain holdings, including those of U.S. and non-U.S. banks. Continued market volatility and uncertainty and/or a downturn in market and economic and financial conditions, as a result of developments in the banking sector or otherwise (including as a result of delayed access to cash or credit facilities), could have an adverse impact on the Funds and issuers in which they invest.

On each Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on: (i) Fund distributions; or (ii) the sale of Fund shares. Each Fund’s performance is measured against the performance of at least one broad-based securities market index (“benchmark index”). A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. There is no assurance that any Fund, including any Fund that has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. High performance is defined as a significant increase in either 1) a Fund’s total return in excess of that of the Fund’s benchmark between reporting periods or 2) a Fund’s total return in excess of the Fund’s historical returns between reporting periods. Unusual performance is defined as a significant change in a Fund’s performance as compared to one or more previous reporting periods. Historical performance for a Fund may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The following table discloses the inception dates of each Fund along with each Fund’s diversification status as of period end:

| | | | | | | | | | | | |

| Fund Name | | | | | Fund

Inception | | | Diversification

Status | |

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund | | | | | | | 10/30/09 | | | | Diversified | |

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund | | | | | | | 08/20/09 | | | | Diversified | |

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund | | | | | | | 09/03/09 | | | | Diversified | |

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund | | | | | | | 09/03/09 | | | | Diversified | |

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund | | | | | | | 06/16/11 | | | | Diversified | |

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund | | | | | | | 09/20/10 | | | | Diversified | |

PIMCO Active Bond Exchange-Traded Fund | | | | | | | 02/29/12 | | | | Diversified | |

PIMCO Enhanced Low Duration Active Exchange-Traded Fund | | | | | | | 01/22/14 | | | | Diversified | |

PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund | | | | | | | 12/10/19 | | | | Diversified | |

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | | | | | | | 11/16/09 | | | | Diversified | |

PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund | | | | | | | 11/30/09 | | | | Diversified | |

PIMCO Multisector Bond Active Exchange-Traded Fund | | | | | | | 06/21/23 | | | | Diversified | |

PIMCO Municipal Income Opportunities Active Exchange-Traded Fund | | | | | | | 09/08/21 | | | | Diversified | |

PIMCO Preferred and Capital Securities Active Exchange-Traded Fund | | | | | | | 01/18/23 | | | | Diversified | |

PIMCO Senior Loan Active Exchange-Traded Fund | | | | | | | 06/08/22 | | | | Diversified | |

PIMCO Short Term Municipal Bond Active Exchange-Traded Fund | | | | | | | 02/01/10 | | | | Diversified | |

PIMCO Ultra Short Government Active Exchange-Traded Fund | | | | | | | 06/21/23 | | | | Diversified | |

PIMCO Commodity Strategy Active Exchange-Traded Fund | | | | | | | 05/09/23 | | | | Non-diversified | |

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in a Fund.

The Trustees are responsible generally for overseeing the management of the Trust. The Trustees authorize the Trust to enter into service agreements with the Adviser, the Distributor, the Administrator and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Trust and the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus nor a Fund’s summary prospectus, the Trust’s Statement of Additional Information (“SAI”), any contracts filed as exhibits to the Trust’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Trust or a Fund creates a

contract between or among any shareholder of a Fund, on the one hand, and the Trust, a Fund, a service provider to the Trust or a Fund, and/or the Trustees or officers of the Trust, on the other hand. The Trustees (or the Trust and its officers, service providers or other delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus, summary prospectus or SAI with respect to a Fund or the Trust, and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which the Trust or a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to any Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in the Trust’s then-current prospectus or SAI.

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JUNE 30, 2023 | | | 5 |

| | | | |

| Important Information About the Funds | | (Cont.) | | |

On each business day, before commencement of trading on NYSE Arca, each Fund will disclose on www.pimcoetfs.com the identities and quantities of the Fund’s portfolio holdings. The frequency at which the daily market prices were at a discount or premium to each Fund’s NAV is disclosed on www.pimcoetfs.com. Please see “Disclosure of Portfolio Holdings” in the SAI for information about the availability of the complete schedule of each Fund’s holdings. Fund fact sheets provide additional information regarding a Fund and may be requested by calling (888) 400-4ETF and are available on the Fund’s website at www.pimcoetfs.com.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 400-4ETF, on the Funds’ website at www.pimcoetfs.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Funds file their portfolio holdings information with the SEC on Form N-PORT within 60 days of the end of each fiscal quarter. The Funds’ complete schedules of securities holdings as of the end of each fiscal quarter will be made available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimcoetfs.com, and will be made available upon request by, calling PIMCO at (888) 400-4ETF.

SEC rules allow the Funds to fulfill their obligation to deliver shareholder reports to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Investors may elect to receive all future reports in paper free of charge by contacting their financial intermediary. Any election to receive reports in paper will apply to all funds held in the investor’s account at the financial intermediary.

In October 2020, the SEC adopted a rule related to the use of derivatives, short sales, reverse repurchase agreements and certain other transactions by registered investment companies that rescinds and withdraws the guidance of the SEC and its staff regarding asset segregation and cover transactions. Subject to certain exceptions, the rule requires funds that trade derivatives and other transactions that create future payment or delivery obligations to comply with a value-at-risk leverage limit and certain derivatives risk management program and reporting requirements. These requirements may limit the ability of the Funds to use derivatives and reverse repurchase agreements and

similar financing transactions as part of their investment strategies and may increase the cost of the Funds’ investments and cost of doing business, which could adversely affect investors. The rule went into effect on February 19, 2021. The compliance date for the new rule and related reporting requirements was August 19, 2022.

In December 2020, the SEC adopted a rule addressing fair valuation of fund investments. The new rule sets forth requirements for good faith determinations of fair value as well as for the performance of fair value determinations, including related oversight and reporting obligations. The new rule also defines “readily available market quotations” for purposes of the definition of “value” under the Investment Company Act of 1940 (the “Act”), and the SEC noted that this definition will apply in all contexts under the Act. The effective date for the rule was March 8, 2021. The compliance date for the new rule and the related reporting requirements was September 8, 2022.

In May 2022, the SEC proposed amendments to a current rule governing fund naming conventions. In general, the current rule requires funds with certain types of names to adopt a policy to invest at least 80% of their assets in the type of investment suggested by the name. The proposed amendments would expand the scope of the current rule in a number of ways that would result in an expansion of the types of fund names that would require the fund to adopt an 80% investment policy under the rule. Additionally, the proposed amendments would modify the circumstances under which a fund may deviate from its 80% investment policy and address the use and valuation of derivatives instruments for purposes of the rule. The proposal’s impact on the Funds will not be known unless and until any final rulemaking is adopted.

In May 2022, the SEC proposed a framework that would require certain registered funds (such as the Funds) to disclose their environmental, social, and governance (“ESG”) investing practices. Among other things, the proposed requirements would mandate that funds meeting three pre-defined classifications (i.e., integrated, ESG focused and/or impact funds) provide prospectus and shareholder report disclosure related to the ESG factors, criteria and processes used in managing the fund. The proposal’s impact on the Funds will not be known unless and until any final rulemaking is adopted.

In October 2022, the SEC adopted changes to the mutual fund and exchange-traded fund (“ETF”) shareholder report and registration statement disclosure requirements and the registered fund advertising rules, which will impact the disclosures provided to shareholders. The rule amendments are effective as of January 24, 2023, but the SEC is providing an 18-month compliance period following the effective date for such amendments other than those addressing fee and expense information in advertisements that might be materially misleading.

In November 2022, the SEC proposed rule amendments which, among other things, would require funds to adopt swing pricing in order to mitigate dilution of shareholders’ interests in a fund by requiring the adjustment of fund net asset value per share to pass on costs stemming from shareholder purchase or redemption activity. In addition the proposed rule would amend the liquidity rule framework. The proposal’s impact on the Funds will not be known unless and until any final rulemaking is adopted.

In November 2022, the SEC adopted amendments to Form N-PX under the Act to improve the utility to investors of proxy voting information reported by mutual funds, ETFs and certain other funds. The rule amendments will expand the scope of funds’ Form N-PX reporting obligations, subject managers to Form N-PX reporting obligations for “Say on Pay” votes, enhance Form N-PX disclosures, permit joint reporting by funds, managers and affiliated managers on Form N-PX; and require website availability of fund proxy voting records. The amendments will become effective on July 1, 2024. Funds and managers will be required to file their first reports covering the period from July 1, 2023 to June 30, 2024 on amended Form N-PX by August 31, 2024.

On May 19, 2023, a supplement was filed to provide notification of a change to the definition of “Capital Securities” for purposes of the PIMCO Preferred and Capital Securities Active Exchange-Traded Fund’s 80% policy. As of July 31, 2023, the definition of “Capital Securities” will include “(1) securities issued by U.S. and non U.S. financial institutions (including, but not limited to, banks and insurance companies) that can be used to satisfy their regulatory capital requirements and (2) securities, which may include instruments referred to as hybrid securities, that would be subordinated (i.e., fall lower in the capital structure) to at least one type of debt.”

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JUNE 30, 2023 | | | 7 |

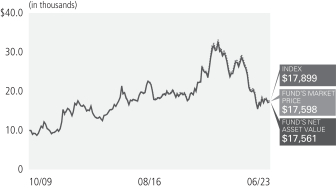

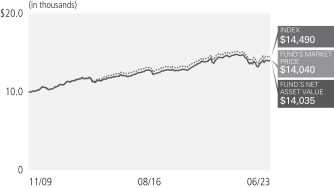

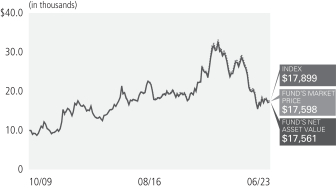

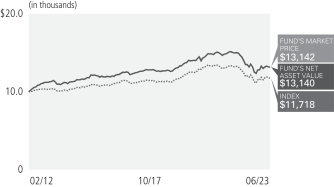

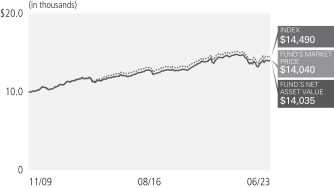

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

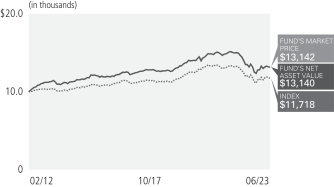

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

U.S. Treasury Obligations | | | 99.6% | |

| |

Short-Term Instruments | | | 0.4% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(10/30/2009) | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (Based on Net Asset Value) | | | (12.87)% | | | | (2.38)% | | | | 2.24% | | | | 4.21% | |

| | PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (At Market Price)(1) | | | (12.75)% | | | | (2.30)% | | | | 2.25% | | | | 4.22% | |

| | The ICE BofAML Long U.S. Treasury Principal STRIPS Index± | | | (12.98)% | | | | (2.24)% | | | | 2.46% | | | | 4.35% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± The ICE BofAML Long U.S. Treasury Principal STRIPS Index is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (STRIPS) representing the final principal payment of U.S. Treasury bonds.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.15%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the ICE BofA Long US Treasury Principal STRIPS Index (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | U.S. interest rate strategies including duration, curve positioning, and instrument selection contributed to performance due to underweight exposure to the back end of the curve, as U.S. Treasury yields rose. |

| » | | There were no other material contributors or detractors for this Fund. |

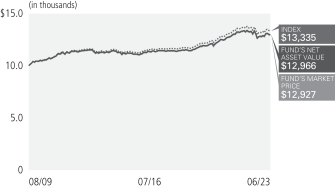

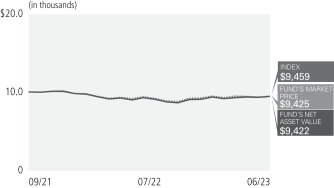

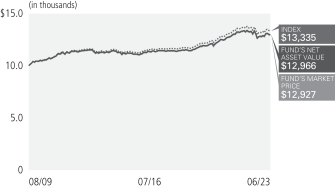

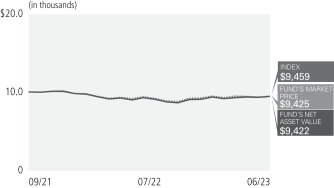

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

U.S. Treasury Obligations | | | 99.9% | |

| |

Short-Term Instruments | | | 0.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(08/20/2009) | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund (Based on Net Asset Value) | | | (0.71)% | | | | 2.42% | | | | 1.47% | | | | 1.88% | |

| | PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund (At Market Price)(1) | | | (0.67)% | | | | 2.42% | | | | 1.47% | | | | 1.88% | |

| | The ICE BofAML 1-5 Year U.S. Inflation-Linked Treasury Index± | | | (0.60)% | | | | 2.61% | | | | 1.68% | | | | 2.09% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± The ICE BofAML 1-5 Year U.S. Inflation-Linked Treasury Index is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 1 year and less than 5 years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.20%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the ICE BofA 1-5 Year US Inflation-Linked Treasury Index (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to U.S. real yields detracted from absolute performance for both the Fund and the 1-5 Year U.S. Treasury Inflation-Protected Securities (“TIPS”) Index, as real yields moved higher. |

| » | | No other material contributors or detractors over the period. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JUNE 30, 2023 | | | 9 |

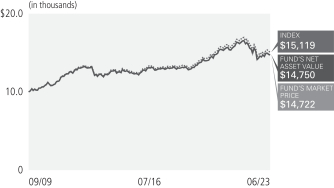

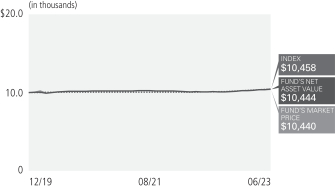

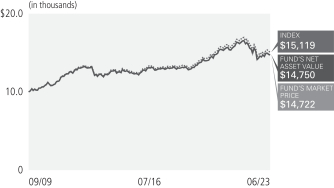

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

U.S. Treasury Obligations | | | 99.9% | |

| |

Short-Term Instruments | | | 0.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(09/03/2009) | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (Based on Net Asset Value) | | | (3.33)% | | | | 1.06% | | | | 2.50% | | | | 3.98% | |

| | PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (At Market Price)(1) | | | (3.27)% | | | | 1.06% | | | | 2.52% | | | | 3.98% | |

| | The ICE BofAML 15+ Year U.S. Inflation-Linked Treasury Index± | | | (3.49)% | | | | 1.20% | | | | 2.67% | | | | 4.17% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± The ICE BofAML 15+ Year US Inflation-Linked Treasury Index is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities) with a maturity of at least 15 years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.20%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the ICE BofA 15+ Year US Inflation-Linked Treasury Index (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to U.S. real yields detracted from absolute performance for both the Fund and the 15+ Year U.S. Treasury Inflation-Protected Securities (“TIPS”) Index, as real yields moved higher. |

| » | | No other material contributors or detractors over the period. |

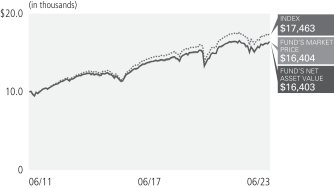

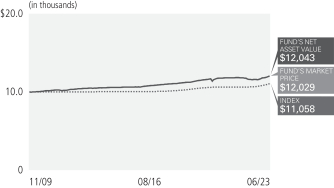

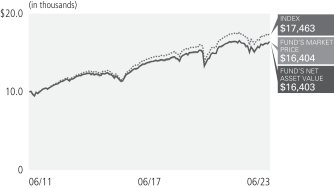

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

U.S. Treasury Obligations | | | 99.9% | |

| |

Short-Term Instruments | | | 0.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(09/03/2009) | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund (Based on Net Asset Value) | | | (1.06)% | | | | 2.31% | | | | 1.98% | | | | 2.96% | |

| | PIMCO Broad U.S. TIPS Index Exchange-Traded Fund (At Market Price)(1) | | | (0.94)% | | | | 2.31% | | | | 1.99% | | | | 2.96% | |

| | The ICE BofAML U.S. Inflation-Linked Treasury Index± | | | (1.41)% | | | | 2.47% | | | | 2.15% | | | | 3.14% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± The ICE BofAML U.S. Inflation-Linked Treasury Index is an unmanaged index comprised of TIPS (Treasury Inflation Protected Securities).

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.20%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO Broad U.S. TIPS Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the ICE BofA US Inflation-Linked Treasury Index (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. PIMCO uses an indexing approach in managing the Fund’s investments. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to U.S. real yields detracted from absolute performance for both the Fund and the U.S. Treasury Inflation-Protected Securities (“TIPS”) Index, as real yields moved higher. |

| » | | No other material contributors or detractors over the period. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JUNE 30, 2023 | | | 11 |

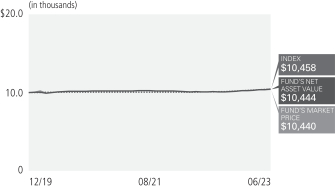

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

Corporate Bonds & Notes | | | 83.0% | |

| |

Short-Term Instruments | | | 15.3% | |

| |

Other | | | 1.7% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(06/16/2011) | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund (Based on Net Asset Value) | | | 8.99% | | | | 2.90% | | | | 3.72% | | | | 4.23% | |

| | PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund (At Market Price)(1) | | | 9.26% | | | | 3.06% | | | | 3.73% | | | | 4.26% | |

| | ICE BofAML 0-5 Year US High Yield Constrained Index± | | | 9.09% | | | | 3.35% | | | | 4.20% | | | | 4.76% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± The ICE BofAML 0-5 Year US High Yield Constrained Index tracks the performance of short-term U.S. dollar denominated below investment grade corporate debt issued in the U.S. domestic market with less than five years remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $250 million, issued publicly. Allocations to an individual issuer will not exceed 2%.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.55%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the ICE BofA 0-5 Year US High Yield Constrained Index (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Security selection within the forest products, paper, and packaging sector, specifically overweight exposure to a food and beverage package producer, contributed to performance, as spreads tightened amid the continued focus on deleveraging. |

| » | | Underweight exposure to duration contributed to performance, as rates rose amid the U.S. Federal Reserve rate hike cycle. |

| » | | Underweight exposure to the retailers sector contributed to performance, as the sector underperformed the broader high yield market amid secular headwinds to the industry. |

| » | | Security selection within the finance and insurance sector, specifically underweight exposure to a Chinese transportation and asset leasing company, detracted from performance, as spreads tightened amid China’s post-pandemic reopening. |

| » | | Security selection within the telecommunications sector, specifically overweight exposure to a U.S.-based satellite operator, detracted from performance, as the company underperformed amid its restructuring process. |

| » | | Security selection within commercial mortgage backed securities and real estate investment trusts, specifically underweight exposure to a firm focused in hotel properties, detracted from performance, as spreads tightened amid global recovery in travel. |

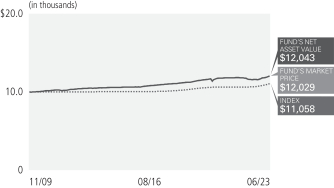

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

Industrials | | | 47.2% | |

| |

Banking & Finance | | | 35.0% | |

| |

Utilities | | | 12.9% | |

| |

U.S. Treasury Obligations | | | 4.2% | |

| |

Short-Term Instruments | | | 0.7% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(09/20/2010) | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund (Based on Net Asset Value) | | | 2.12% | | | | 2.01% | | | | 2.78% | | | | 3.14% | |

| | PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund (At Market Price)(1) | | | 2.15% | | | | 2.06% | | | | 2.83% | | | | 3.15% | |

| | ICE BofAML U.S. Corporate Index± | | | 1.69% | | | | 1.85% | | | | 2.69% | | | | 3.17% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± ICE BofAML US Corporate Index is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year remaining term to final maturity and at least $250 million outstanding.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.20%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO Investment Grade Corporate Bond Index Exchange-Traded Fund seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the ICE BofA US Corporate Index (the “Underlying Index”), by investing under normal circumstances at least 80% of its total assets (exclusive of collateral held from securities lending) in the component securities (“Component Securities”) of the Underlying Index. The Fund may invest the remainder of its assets in Fixed Income Instruments that are not Component Securities, but which PIMCO believes will help the Fund track its Underlying Index, as well as in cash and investment grade, liquid short-term instruments, forwards or derivatives, such as options, futures contracts or swap agreements, and shares of affiliated bond funds. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Security selection within the utilities sector, specifically overweight exposure to a U.S. electricity company, contributed to performance, as spreads tightened amid the reduction of capital expenditures, dividend payouts, and non-core assets. |

| » | | Security selection within the banks and brokerage sector, specifically underweight exposure to a select U.S. regional bank, contributed to performance, as spreads widened amid heightened deposit outflows in the second quarter of 2023. |

| » | | Underweight exposure to duration contributed to performance, as rates rose amid the U.S. Federal Reserve rate hike cycle. |

| » | | Security selection within emerging markets, specifically underweight exposure to a Middle Eastern oil company, detracted from performance, as spreads tightened amid rising energy prices. |

| » | | Underweight exposure to the automotive industry detracted from performance, as spreads tightened amid normalizing production and sales. |

| » | | Specialty finance positioning, particularly overweight exposure in March 2023 and underweight exposure in the third quarter of 2022, detracted from performance, as spreads widened in March 2023 amid growing volatility and spreads tightened in the third quarter of 2022 amid elevated profit levels in the financial sector. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JUNE 30, 2023 | | | 13 |

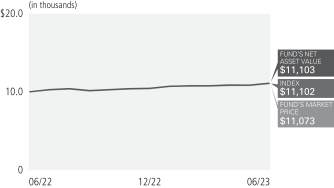

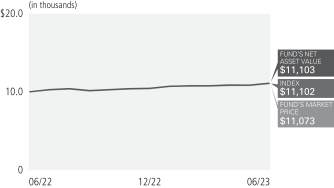

PIMCO Active Bond Exchange-Traded Fund

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

U.S. Government Agencies | | | 37.6% | |

| |

Corporate Bonds & Notes | | | 20.8% | |

| |

U.S. Treasury Obligations | | | 17.0% | |

| |

Asset-Backed Securities | | | 14.0% | |

| |

Non-Agency Mortgage-Backed Securities | | | 6.9% | |

| |

Municipal Bonds & Notes | | | 1.4% | |

| |

Preferred Securities | | | 1.2% | |

| |

Other | | | 1.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | | |

| | | | | 1 Year | | | 5 Years | | | 10 Years | | | Fund Inception

(02/29/2012) | |

| | PIMCO Active Bond Exchange-Traded Fund (Based on Net Asset Value) | | | (0.13)% | | | | 0.74% | | | | 1.83% | | | | 2.44% | |

| | PIMCO Active Bond Exchange-Traded Fund (At Market Price)(1) | | | (0.23)% | | | | 0.75% | | | | 1.84% | | | | 2.44% | |

| | Bloomberg U.S. Aggregate Index± | | | (0.94)% | | | | 0.77% | | | | 1.52% | | | | 1.41% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± Bloomberg U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.56%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO Active Bond Exchange-Traded Fund seeks current income and long-term capital appreciation, consistent with prudent investment management, by investing under normal circumstances at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Overweight exposure to investment grade corporate credit, particularly a preference for financials, contributed to relative performance, as spreads tightened. |

| » | | Underweight exposure to U.S. duration contributed to relative performance, as interest rates rose. |

| » | | Long exposure to senior securitized assets, particularly AAA-rated collateralized loan obligations, contributed to returns, as spreads tightened. |

| » | | Exposure to emerging market external debt contributed to relative performance, as spreads tightened. |

| » | | Short exposure to U.K. and U.S. breakeven inflation in July and August of 2022 detracted from relative performance, as breakeven inflation rates rose. |

| » | | Local rate exposure in Canada detracted from relative performance during the first half of the reporting period, as yields rose. |

| » | | There were no other material detractors for this Fund. |

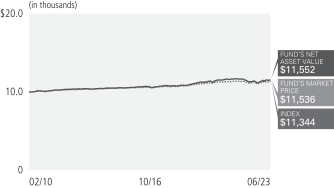

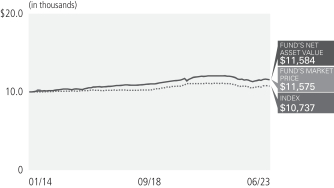

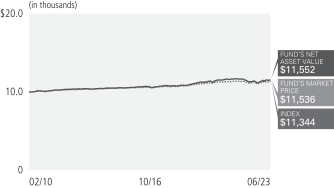

PIMCO Enhanced Low Duration Active Exchange-Traded Fund

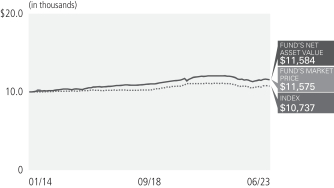

Cumulative Returns Through June 30, 2023

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2023†§

| | | | |

U.S. Treasury Obligations | | | 29.1% | |

| |

Corporate Bonds & Notes | | | 26.4% | |

| |

Asset-Backed Securities | | | 23.8% | |

| |

Non-Agency Mortgage-Backed Securities | | | 10.4% | |

| |

U.S. Government Agencies | | | 8.2% | |

| |

Short-Term Instruments | | | 1.5% | |

| |

Other | | | 0.6% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2023 | |

| | | | |

| | | | | 1 Year | | | 5 Years | | | Fund Inception

(01/22/2014) | |

| | PIMCO Enhanced Low Duration Active Exchange-Traded Fund (Based on Net Asset Value) | | | 0.54% | | | | 1.17% | | | | 1.60% | |

| | PIMCO Enhanced Low Duration Active Exchange-Traded Fund (At Market Price)(1) | | | 0.53% | | | | 1.12% | | | | 1.59% | |

| | ICE BofAML 1-3 Year U.S. Treasury Index± | | | 0.13% | | | | 0.95% | | | | 0.77% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Market Returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at market price and NAV, respectively.

| (1) | The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. |

± The ICE BofAML 1-3 Year U.S. Treasury Index is an unmanaged index comprised of U.S. Treasury securities, other than inflation-protection securities and STRIPS, with at least $1 billion in outstanding face value and a remaining term to final maturity of at least one year and less than three years.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed by authorized participants. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. Performance data current to the most recent month-end is available at www.pimcoetfs.com or via (888) 400-4ETF.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report) was 0.53%. See Financial Highlights for actual expense ratios as of the end of the period covered by the report.

Investment Objective and Strategy Overview

PIMCO Enhanced Low Duration Active Exchange-Traded Fund seeks maximum total return, consistent with preservation of capital and prudent investment management, by investing under normal circumstances at least 80% of its net assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights at NAV