Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22311

Schwab Strategic Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marie Chandoha

Schwab Strategic Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415)636-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

| Item 1: | Report(s) to Shareholders. |

Table of Contents

| Schwab U.S. TIPS ETF | SCHP |

| Schwab Short-Term U.S. Treasury ETF | SCHO |

| Schwab Intermediate-Term U.S. Treasury ETF | SCHR |

| Schwab U.S. Aggregate Bond ETF | SCHZ |

| New Notice Regarding Shareholder Report Delivery Options |

| Beginning on January 1, 2021, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a bank or broker-dealer). Instead, the reports will be made available on a fund’s websitewww.schwabfunds.com/schwabetfs_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website link to access the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically as described below. |

| If you would like to continue to receive a fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request by contacting your financial intermediary. |

| If you already receive shareholder reports and other fund documents electronically, you will not be affected by this change and you need not take any action. If you do not receive shareholder reports and other fund documents electronically but would like to do so, contact your financial intermediary. |

| Total Returns for the 12 Months Ended December 31, 2018 | |

| Schwab U.S. TIPS ETF (Ticker Symbol: SCHP) | |

| Market Price Return1 | -1.42% |

| NAV Return1 | -1.31% |

| Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) | -1.26% |

| ETF Category: Morningstar Inflation-Protected Bond2 | -1.64% |

| Performance Details | pages 8-9 |

| Schwab Short-Term U.S. Treasury ETF (Ticker Symbol: SCHO) | |

| Market Price Return1 | 1.56% |

| NAV Return1 | 1.50% |

| Bloomberg Barclays US Treasury 1-3 Year Index | 1.56% |

| ETF Category: Morningstar Short Government2 | 1.14% |

| Performance Details | pages 10-11 |

| Schwab Intermediate-Term U.S. Treasury ETF (Ticker Symbol: SCHR) | |

| Market Price Return1 | 1.45% |

| NAV Return1 | 1.28% |

| Bloomberg Barclays US Treasury 3-10 Year Index | 1.35% |

| ETF Category: Morningstar Intermediate Government2 | 0.51% |

| Performance Details | pages 12-13 |

| Schwab U.S. Aggregate Bond ETF (Ticker Symbol: SCHZ) | |

| Market Price Return1 | -0.03% |

| NAV Return1 | -0.09% |

| Bloomberg Barclays US Aggregate Bond Index | 0.01% |

| ETF Category: Morningstar Intermediate-Term Bond2 | -0.50% |

| Performance Details | pages 14-15 |

| 1 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

President of Charles Schwab

Investment Management, Inc.

and the funds covered

in this report.

| Matthew Hastings, CFA, Vice President and Head of Taxable Bond Strategies, leads the portfolio management team for Schwab Fixed-Income ETFs and Schwab’s taxable bond funds. He also has overall responsibility for all aspects of the management of the funds. Prior to joining CSIM in 1999, Mr. Hastings was in fixed-income sales and trading at Lehman Brothers. He has worked in the fixed-income securities industry since 1996. |

| Steven Hung, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF. His primary focus is corporate bonds. Prior to joining CSIM in 1999, Mr. Hung was an associate in Schwab’s management training program for nine months. In that role, he worked as a clerk on the Options Trading Floor of the Pacific Coast Stock Exchange. |

| Mark McKissick, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the funds. His primary focus is taxable government securities. Prior to joining CSIM in 2016, Mr. McKissick worked for 17 years at Denver Investments, most recently as a director of fixed income and portfolio manager. He has worked in the fixed-income securities industry since 1992. |

| Alfonso Portillo, Jr., Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF. His primary focus is securitized products. Prior to joining CSIM in 2007, Mr. Portillo worked for ten years at Pacific Investment Management Company, most recently as a vice president and member of the mortgage- and asset-backed portfolio management team. He has worked in fixed-income asset management since 1996. |

| Weighted Average Maturity4 | 7.9 Yrs |

| Weighted Average Duration4 | 7.2 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Less than 0.05%. |

| 3 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 4 | See Glossary for definitions of maturity and duration. |

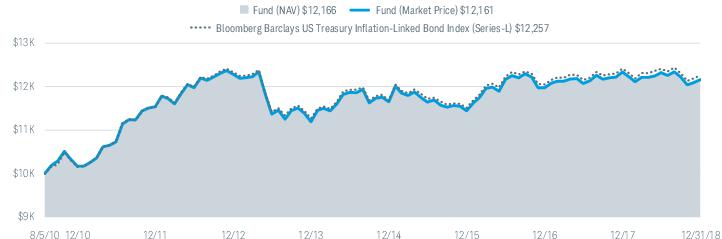

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab U.S. TIPS ETF (8/5/2010) | |||

| Market Price Return2 | -1.42% | 1.68% | 2.35% |

| NAV Return2 | -1.31% | 1.63% | 2.36% |

| Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) | -1.26% | 1.69% | 2.45% |

| ETF Category: Morningstar Inflation-Protected Bond3 | -1.64% | 1.14% | N/A |

| Fund Expense Ratio4: 0.05% | |||

| * | Inception (8/5/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

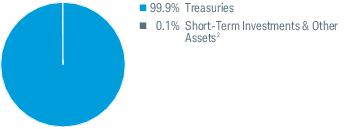

| Weighted Average Maturity3 | 2.0 Yrs |

| Weighted Average Duration3 | 1.9 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

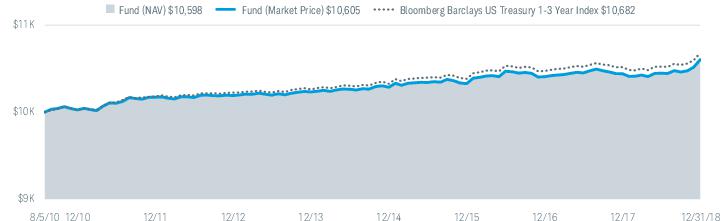

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab Short-Term U.S. Treasury ETF (8/5/2010) | |||

| Market Price Return2 | 1.56% | 0.72% | 0.70% |

| NAV Return2 | 1.50% | 0.72% | 0.69% |

| Bloomberg Barclays US Treasury 1-3 Year Index | 1.56% | 0.81% | 0.79% |

| ETF Category: Morningstar Short Government3 | 1.14% | 0.71% | N/A |

| Fund Expense Ratio4: 0.06% | |||

| * | Inception (8/5/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

| Weighted Average Maturity3 | 5.6 Yrs |

| Weighted Average Duration3 | 5.2 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab Intermediate-Term U.S. Treasury ETF (8/5/2010) | |||

| Market Price Return2 | 1.45% | 1.99% | 2.22% |

| NAV Return2 | 1.28% | 1.97% | 2.21% |

| Bloomberg Barclays US Treasury 3-10 Year Index | 1.35% | 2.05% | 2.31% |

| ETF Category: Morningstar Intermediate Government3 | 0.51% | 1.76% | N/A |

| Fund Expense Ratio4: 0.06% | |||

| * | Inception (8/5/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

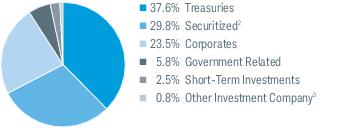

| Weighted Average Maturity4 | 8.0 Yrs |

| Weighted Average Duration4 | 5.7 Yrs |

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund may seek to obtain exposure to U.S. agency mortgage pass-through securities, in part or in full, through the use of “to-be-announced” or “TBA” transactions, which are standardized contracts for future delivery of mortgage pass-through securities in which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. These transactions represented approximately 3.3% of total investments on December 31, 2018. |

| 3 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 4 | See Glossary for definitions of maturity and duration. |

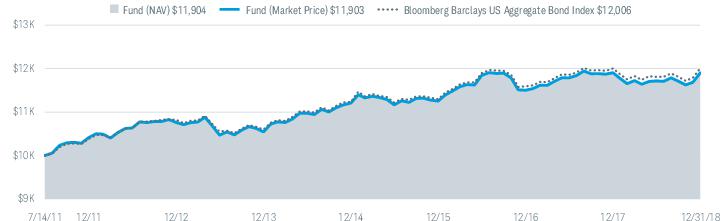

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab U.S. Aggregate Bond ETF (7/14/2011) | |||

| Market Price Return2 | -0.03% | 2.45% | 2.36% |

| NAV Return2 | -0.09% | 2.46% | 2.36% |

| Bloomberg Barclays US Aggregate Bond Index | 0.01% | 2.52% | 2.48% |

| ETF Category: Morningstar Intermediate-Term Bond3 | -0.50% | 2.27% | N/A |

| Fund Expense Ratio4: 0.04% | |||

| * | Inception (7/14/11) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

| Expense Ratio (Annualized)1 | Beginning Account Value at 7/1/18 | Ending Account Value (Net of Expenses) at 12/31/18 | Expenses Paid During Period 7/1/18-12/31/182 | |

| Schwab U.S. TIPS ETF | ||||

| Actual Return | 0.05% | $1,000.00 | $987.50 | $0.25 |

| Hypothetical 5% Return | 0.05% | $1,000.00 | $1,024.95 | $0.26 |

| Schwab Short-Term U.S. Treasury ETF | ||||

| Actual Return | 0.06% | $1,000.00 | $1,014.80 | $0.30 |

| Hypothetical 5% Return | 0.06% | $1,000.00 | $1,024.90 | $0.31 |

| Schwab Intermediate-Term U.S. Treasury ETF | ||||

| Actual Return | 0.06% | $1,000.00 | $1,025.40 | $0.31 |

| Hypothetical 5% Return | 0.06% | $1,000.00 | $1,024.90 | $0.31 |

| Schwab U.S. Aggregate Bond ETF | ||||

| Actual Return | 0.04% | $1,000.00 | $1,016.20 | $0.20 |

| Hypothetical 5% Return | 0.04% | $1,000.00 | $1,025.00 | $0.20 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights which covers a 12-month period. |

| 2 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 days of the period, and divided by 365 days of the fiscal year. |

| 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | 1/1/15– 12/31/15 | 1/1/14– 12/31/14 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $55.39 | $54.84 | $53.15 | $54.11 | $52.92 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss) | 1.511 | 1.171 | 0.991 | 0.171 | 0.64 | |

| Net realized and unrealized gains (losses) | (2.23) | 0.43 | 1.46 | (0.98) | 1.26 | |

| Total from investment operations | (0.72) | 1.60 | 2.45 | (0.81) | 1.90 | |

| Less distributions: | ||||||

| Distributions from net investment income | (1.40) | (1.05) | (0.76) | (0.15) | (0.71) | |

| Net asset value at end of period | $53.27 | $55.39 | $54.84 | $53.15 | $54.11 | |

| Total return | (1.31%) | 2.95% | 4.60% | (1.50%) | 3.56% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.05% | 0.05%2 | 0.07% | 0.07% | 0.07% | |

| Net investment income (loss) | 2.80% | 2.13% | 1.78% | 0.31% | 1.10% | |

| Portfolio turnover rate3 | 17% | 19% | 16% | 19% | 20% | |

| Net assets, end of period (x 1,000) | $5,779,263 | $2,880,386 | $1,614,977 | $815,816 | $549,259 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries99.7% of net assets | ||

| U.S. Treasury Inflation Protected Securities | ||

| 1.38%, 01/15/20 | 103,125,329 | 102,492,405 |

| 0.13%, 04/15/20 | 264,626,197 | 258,722,723 |

| 1.25%, 07/15/20 | 158,477,548 | 158,186,284 |

| 1.13%, 01/15/21 | 181,275,518 | 180,537,915 |

| 0.13%, 04/15/21 | 230,091,270 | 223,853,072 |

| 0.63%, 07/15/21 | 192,421,991 | 190,379,214 |

| 0.13%, 01/15/22 | 212,385,456 | 206,244,889 |

| 0.13%, 04/15/22 | 224,194,379 | 216,994,285 |

| 0.13%, 07/15/22 | 219,049,584 | 212,880,638 |

| 0.13%, 01/15/23 | 220,071,908 | 212,706,348 |

| 0.63%, 04/15/23 | 219,577,586 | 216,172,315 |

| 0.38%, 07/15/23 | 218,300,373 | 213,604,407 |

| 0.63%, 01/15/24 | 217,678,192 | 214,412,403 |

| 0.13%, 07/15/24 | 214,012,571 | 205,416,931 |

| 0.25%, 01/15/25 | 214,519,361 | 205,518,212 |

| 2.38%, 01/15/25 | 140,866,555 | 152,364,241 |

| 0.38%, 07/15/25 | 214,281,632 | 206,777,965 |

| 0.63%, 01/15/26 | 192,968,207 | 188,088,242 |

| 2.00%, 01/15/26 | 102,610,640 | 109,569,188 |

| 0.13%, 07/15/26 | 180,971,161 | 170,031,550 |

| 0.38%, 01/15/27 | 179,579,942 | 170,735,398 |

| 2.38%, 01/15/27 | 82,556,770 | 91,209,462 |

| 0.38%, 07/15/27 | 177,455,348 | 168,733,848 |

| 0.50%, 01/15/28 | 175,982,170 | 168,054,942 |

| 1.75%, 01/15/28 | 82,650,062 | 87,842,655 |

| 3.63%, 04/15/28 | 69,596,264 | 85,526,259 |

| 0.75%, 07/15/28 | 172,814,861 | 169,296,392 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 2.50%, 01/15/29 | 79,745,855 | 90,883,292 |

| 3.88%, 04/15/29 | 84,683,342 | 107,906,221 |

| 3.38%, 04/15/32 | 32,173,920 | 41,353,529 |

| 2.13%, 02/15/40 | 43,556,073 | 51,261,906 |

| 2.13%, 02/15/41 | 55,430,387 | 65,609,694 |

| 0.75%, 02/15/42 | 97,387,306 | 88,588,731 |

| 0.63%, 02/15/43 | 71,982,139 | 63,261,478 |

| 1.38%, 02/15/44 | 108,637,678 | 112,469,426 |

| 0.75%, 02/15/45 | 121,057,490 | 108,511,932 |

| 1.00%, 02/15/46 | 88,925,646 | 84,462,157 |

| 0.88%, 02/15/47 | 87,222,837 | 80,192,188 |

| 1.00%, 02/15/48 | 85,442,790 | 81,075,286 |

| Total Treasuries | ||

| (Cost $5,920,186,053) | 5,761,928,023 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company0.0% of net assets | ||

| Money Market Fund 0.0% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 2.27%(a) | 68,157 | 68,157 |

| Total Other Investment Company | ||

| (Cost $68,157) | 68,157 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $5,761,928,023 | $— | $5,761,928,023 | |

| Other Investment Company1 | 68,157 | — | — | 68,157 | |

| Total | $68,157 | $5,761,928,023 | $— | $5,761,996,180 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $5,920,254,210) | $5,761,996,180 | |

| Receivables: | ||

| Investments sold | 72,398,263 | |

| Interest | 17,524,252 | |

| Fund shares sold | 2,663,255 | |

| Dividends | + | 9,533 |

| Total assets | 5,854,591,483 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 69,756,144 | |

| Investment adviser fees | 245,969 | |

| Fund shares redeemed | + | 5,326,510 |

| Total liabilities | 75,328,623 | |

| Net Assets | ||

| Total assets | 5,854,591,483 | |

| Total liabilities | – | 75,328,623 |

| Net assets | $5,779,262,860 | |

| Net Assets by Source | ||

| Capital received from investors | 5,976,860,225 | |

| Total distributable loss1 | (197,597,365) | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $5,779,262,860 | 108,500,000 | $53.27 | ||

| 1 | The SEC eliminated the requirement to disclose total distributable earnings by each of its components as previously disclosed as the previous presentation did not provide insight into the tax implications of distributions (see financial note 10 for additional information). |

| Investment Income | ||

| Dividends | $63,229 | |

| Interest | + | 131,924,140 |

| Total investment income | 131,987,369 | |

| Expenses | ||

| Investment adviser fees | 2,317,194 | |

| Total expenses | – | 2,317,194 |

| Net investment income | 129,670,175 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized losses on investments | (20,965,423) | |

| Net realized gains on in-kind redemptions | + | 1,194,915 |

| Net realized losses | (19,770,508) | |

| Net change in unrealized appreciation (depreciation) on investments | + | (167,659,366) |

| Net realized and unrealized losses | (187,429,874) | |

| Decrease in net assets resulting from operations | ($57,759,699) | |

| Operations | ||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||

| Net investment income | $129,670,175 | $46,731,565 | ||

| Net realized losses | (19,770,508) | (3,947,311) | ||

| Net change in unrealized appreciation (depreciation) | + | (167,659,366) | 23,021,737 | |

| Increase (decrease) in net assets resulting from operations | (57,759,699) | 65,805,991 | ||

| Distributions to Shareholders1 | ||||

| Total distributions | ($130,028,200) | ($46,465,385) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 68,000,000 | $3,701,238,840 | 24,750,000 | $1,367,959,304 | ||||

| Shares redeemed | + | (11,500,000) | (614,573,583) | (2,200,000) | (121,891,683) | |||

| Net transactions in fund shares | 56,500,000 | $3,086,665,257 | 22,550,000 | $1,246,067,621 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 52,000,000 | $2,880,385,502 | 29,450,000 | $1,614,977,275 | ||||

| Total increase | + | 56,500,000 | 2,898,877,358 | 22,550,000 | 1,265,408,227 | |||

| End of period2 | 108,500,000 | $5,779,262,860 | 52,000,000 | $2,880,385,502 | ||||

| 1 | For the period ended December 31, 2017, the fund distributed to shareholders $46,465,385 from net investment income. The SEC eliminated the requirement to disclose distributions to shareholders from net investment income and from net realized gains in 2018 (see financial note 10 for additional information). |

| 2 | End of period - Net assets include net investment income not yet distributed of $587,519 at December 31, 2017. The SEC eliminated the requirement to disclose undistributed net investment income in 2018. |

| 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | 1/1/15– 12/31/15 | 1/1/14– 12/31/14 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $50.03 | $50.41 | $50.43 | $50.55 | $50.51 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss) | 0.941 | 0.571 | 0.421 | 0.351 | 0.24 | |

| Net realized and unrealized gains (losses) | (0.20)2 | (0.39) | (0.03) | (0.13) | 0.04 | |

| Total from investment operations | 0.74 | 0.18 | 0.39 | 0.22 | 0.28 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.89) | (0.56) | (0.41) | (0.34) | (0.24) | |

| Net asset value at end of period | $49.88 | $50.03 | $50.41 | $50.43 | $50.55 | |

| Total return | 1.50% | 0.35% | 0.78% | 0.44% | 0.55% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.06% | 0.06% | 0.08%3 | 0.08% | 0.08% | |

| Net investment income (loss) | 1.89% | 1.13% | 0.83% | 0.69% | 0.49% | |

| Portfolio turnover rate4 | 65% | 65% | 66% | 89% | 109% | |

| Net assets, end of period (x 1,000) | $4,254,630 | $2,181,398 | $1,414,092 | $1,071,573 | $702,651 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries99.5% of net assets | ||

| Bonds | ||

| 8.50%, 02/15/20 | 3,874,000 | 4,124,297 |

| 8.75%, 05/15/20 | 2,894,000 | 3,133,264 |

| 8.75%, 08/15/20 | 5,964,000 | 6,548,053 |

| 7.88%, 02/15/21 | 4,417,000 | 4,905,717 |

| 8.00%, 11/15/21 | 11,903,000 | 13,711,931 |

| Notes | ||

| 1.25%, 01/31/20 | 74,316,000 | 73,249,159 |

| 1.38%, 01/31/20 | 74,561,000 | 73,594,037 |

| 2.00%, 01/31/20 | 89,269,000 | 88,695,377 |

| 1.38%, 02/15/20 | 31,302,000 | 30,874,043 |

| 3.63%, 02/15/20 | 59,568,000 | 60,221,852 |

| 1.25%, 02/29/20 | 26,560,000 | 26,153,819 |

| 1.38%, 02/29/20 | 49,913,000 | 49,220,847 |

| 2.25%, 02/29/20 | 69,300,000 | 69,029,297 |

| 1.63%, 03/15/20 | 31,448,000 | 31,099,738 |

| 1.13%, 03/31/20 | 22,668,000 | 22,276,623 |

| 1.38%, 03/31/20 | 42,127,000 | 41,513,197 |

| 2.25%, 03/31/20 | 38,842,000 | 38,687,239 |

| 1.50%, 04/15/20 | 31,608,000 | 31,190,676 |

| 1.13%, 04/30/20 | 31,617,000 | 31,026,034 |

| 1.38%, 04/30/20 | 41,904,000 | 41,263,982 |

| 2.38%, 04/30/20 | 57,390,000 | 57,245,404 |

| 1.50%, 05/15/20 | 30,410,000 | 29,981,765 |

| 3.50%, 05/15/20 | 41,277,000 | 41,796,187 |

| 1.38%, 05/31/20 | 31,436,000 | 30,933,147 |

| 1.50%, 05/31/20 | 45,174,000 | 44,516,683 |

| 1.50%, 06/15/20 | 28,925,000 | 28,508,723 |

| 1.63%, 06/30/20 | 45,276,000 | 44,673,794 |

| 1.88%, 06/30/20 | 33,598,000 | 33,271,863 |

| 2.50%, 06/30/20 | 27,024,000 | 27,006,582 |

| 1.50%, 07/15/20 | 31,332,000 | 30,847,333 |

| 1.63%, 07/31/20 | 44,782,000 | 44,156,626 |

| 2.00%, 07/31/20 | 29,672,000 | 29,433,233 |

| 2.63%, 07/31/20 | 48,128,000 | 48,192,860 |

| 1.50%, 08/15/20 | 28,615,000 | 28,152,242 |

| 2.63%, 08/15/20 | 45,306,000 | 45,380,330 |

| 1.38%, 08/31/20 | 43,682,000 | 42,868,082 |

| 2.13%, 08/31/20 | 55,931,000 | 55,571,600 |

| 2.63%, 08/31/20 | 65,911,000 | 66,008,837 |

| 1.38%, 09/15/20 | 25,552,000 | 25,074,397 |

| 1.38%, 09/30/20 | 36,445,000 | 35,736,743 |

| 2.00%, 09/30/20 | 54,497,000 | 54,027,602 |

| 2.75%, 09/30/20 | 19,450,000 | 19,526,356 |

| 1.63%, 10/15/20 | 30,125,000 | 29,661,946 |

| 1.38%, 10/31/20 | 42,611,000 | 41,755,451 |

| 1.75%, 10/31/20 | 28,517,000 | 28,133,803 |

| 2.88%, 10/31/20 | 222,545,000 | 223,970,679 |

| 1.75%, 11/15/20 | 28,892,000 | 28,494,171 |

| 2.63%, 11/15/20 | 125,526,000 | 125,788,329 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 1.63%, 11/30/20 | 96,256,000 | 94,691,840 |

| 2.00%, 11/30/20 | 40,378,000 | 40,013,651 |

| 2.75%, 11/30/20 | 35,109,000 | 35,274,259 |

| 1.88%, 12/15/20 | 20,052,000 | 19,817,407 |

| 1.75%, 12/31/20 | 43,534,000 | 42,922,653 |

| 2.38%, 12/31/20 | 27,957,000 | 27,901,850 |

| 2.00%, 01/15/21 | 29,789,000 | 29,495,183 |

| 1.38%, 01/31/21 | 43,047,000 | 42,069,194 |

| 2.13%, 01/31/21 | 66,101,000 | 65,607,824 |

| 2.25%, 02/15/21 | 33,390,000 | 33,216,529 |

| 3.63%, 02/15/21 | 57,763,000 | 59,117,948 |

| 1.13%, 02/28/21 | 44,329,000 | 43,060,602 |

| 2.00%, 02/28/21 | 33,779,000 | 33,435,932 |

| 2.38%, 03/15/21 | 34,641,000 | 34,556,427 |

| 1.25%, 03/31/21 | 42,740,000 | 41,613,901 |

| 2.25%, 03/31/21 | 51,039,000 | 50,787,792 |

| 2.38%, 04/15/21 | 73,854,000 | 73,686,675 |

| 1.38%, 04/30/21 | 69,238,000 | 67,544,915 |

| 2.63%, 05/15/21 | 54,255,000 | 54,441,502 |

| 3.13%, 05/15/21 | 47,671,000 | 48,393,514 |

| 1.38%, 05/31/21 | 52,782,000 | 51,438,739 |

| 2.63%, 06/15/21 | 37,244,000 | 37,377,118 |

| 1.13%, 06/30/21 | 66,142,000 | 64,032,432 |

| 2.63%, 07/15/21 | 61,390,000 | 61,617,815 |

| 1.13%, 07/31/21 | 130,433,000 | 126,061,457 |

| 2.75%, 08/15/21 | 188,465,000 | 189,771,739 |

| 2.75%, 09/15/21 | 79,562,000 | 80,127,636 |

| 1.13%, 09/30/21 | 77,498,000 | 74,749,277 |

| 2.88%, 10/15/21 | 100,177,000 | 101,249,206 |

| 1.25%, 10/31/21 | 137,108,000 | 132,566,297 |

| 2.00%, 10/31/21 | 13,282,000 | 13,114,418 |

| 2.88%, 11/15/21 | 27,883,000 | 28,197,228 |

| 1.75%, 11/30/21 | 168,922,000 | 165,556,756 |

| 2.00%, 12/31/21 | 90,000,000 | 88,790,625 |

| Total Treasuries | ||

| (Cost $4,232,245,925) | 4,233,534,291 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company0.1% of net assets | ||

| Money Market Fund 0.1% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 2.27%(a) | 3,504,467 | 3,504,467 |

| Total Other Investment Company | ||

| (Cost $3,504,467) | 3,504,467 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $4,233,534,291 | $— | $4,233,534,291 | |

| Other Investment Company1 | 3,504,467 | — | — | 3,504,467 | |

| Total | $3,504,467 | $4,233,534,291 | $— | $4,237,038,758 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $4,235,750,392) | $4,237,038,758 | |

| Receivables: | ||

| Investments sold | 175,460,937 | |

| Interest | 21,237,076 | |

| Fund shares sold | 4,983,209 | |

| Dividends | + | 5,396 |

| Total assets | 4,438,725,376 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 183,895,533 | |

| Investment adviser fees | + | 199,977 |

| Total liabilities | 184,095,510 | |

| Net Assets | ||

| Total assets | 4,438,725,376 | |

| Total liabilities | – | 184,095,510 |

| Net assets | $4,254,629,866 | |

| Net Assets by Source | ||

| Capital received from investors | 4,274,695,617 | |

| Total distributable loss1 | (20,065,751) | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $4,254,629,866 | 85,300,000 | $49.88 | ||

| 1 | The SEC eliminated the requirement to disclose total distributable earnings by each of its components as previously disclosed as the previous presentation did not provide insight into the tax implications of distributions (see financial note 10 for additional information). |

| Investment Income | ||

| Dividends | $42,428 | |

| Interest | + | 53,300,191 |

| Total investment income | 53,342,619 | |

| Expenses | ||

| Investment adviser fees | 1,644,411 | |

| Total expenses | – | 1,644,411 |

| Net investment income | 51,698,208 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized losses on investments | (16,506,686) | |

| Net realized gains on in-kind redemptions | + | 158,873 |

| Net realized losses | (16,347,813) | |

| Net change in unrealized appreciation (depreciation) on investments | + | 19,233,560 |

| Net realized and unrealized gains | 2,885,747 | |

| Increase in net assets resulting from operations | $54,583,955 | |

| Operations | ||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||

| Net investment income | $51,698,208 | $20,456,466 | ||

| Net realized losses | (16,347,813) | (4,201,781) | ||

| Net change in unrealized appreciation (depreciation) | + | 19,233,560 | (11,926,446) | |

| Increase in net assets resulting from operations | 54,583,955 | 4,328,239 | ||

| Distributions to Shareholders1 | ||||

| Total distributions | ($51,440,855) | ($20,557,590) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 52,000,000 | $2,581,262,926 | 23,100,000 | $1,163,271,626 | ||||

| Shares redeemed | + | (10,300,000) | (511,174,627) | (7,550,000) | (379,735,412) | |||

| Net transactions in fund shares | 41,700,000 | $2,070,088,299 | 15,550,000 | $783,536,214 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 43,600,000 | $2,181,398,467 | 28,050,000 | $1,414,091,604 | ||||

| Total increase | + | 41,700,000 | 2,073,231,399 | 15,550,000 | 767,306,863 | |||

| End of period2 | 85,300,000 | $4,254,629,866 | 43,600,000 | $2,181,398,467 | ||||

| 1 | For the period ended December 31, 2017, the fund distributed to shareholders $20,557,590 from net investment income. The SEC eliminated the requirement to disclose distributions to shareholders from net investment income and from net realized gains in 2018 (see financial note 10 for additional information). |

| 2 | End of period - Net assets include distributions in excess of net investment income of ($27,075) at December 31, 2017. The SEC eliminated the requirement to disclose undistributed net investment income in 2018. |

| 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | 1/1/15– 12/31/15 | 1/1/14– 12/31/14 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $53.35 | $53.41 | $53.55 | $53.52 | $52.08 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss) | 1.211 | 0.891 | 0.791 | 0.851 | 0.77 | |

| Net realized and unrealized gains (losses) | (0.55)2 | (0.07) | (0.15) | 0.023 | 1.44 | |

| Total from investment operations | 0.66 | 0.82 | 0.64 | 0.87 | 2.21 | |

| Less distributions: | ||||||

| Distributions from net investment income | (1.12) | (0.88) | (0.78) | (0.84) | (0.77) | |

| Net asset value at end of period | $52.89 | $53.35 | $53.41 | $53.55 | $53.52 | |

| Total return | 1.28% | 1.54% | 1.16% | 1.62% | 4.27% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.06% | 0.06% | 0.09%4 | 0.10%5 | 0.10% | |

| Net investment income (loss) | 2.34% | 1.66% | 1.44% | 1.59% | 1.43% | |

| Portfolio turnover rate6 | 41% | 30% | 30% | 32% | 49% | |

| Net assets, end of period (x 1,000) | $3,480,449 | $1,165,708 | $790,506 | $441,747 | $254,226 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Treasuries99.5% of net assets | ||

| Bonds | ||

| 7.25%, 08/15/22 | 2,515,000 | 2,927,175 |

| 7.63%, 11/15/22 | 1,196,000 | 1,420,881 |

| 7.13%, 02/15/23 | 6,766,000 | 7,982,162 |

| 6.25%, 08/15/23 | 6,661,000 | 7,741,461 |

| 7.50%, 11/15/24 | 6,059,000 | 7,682,149 |

| 7.63%, 02/15/25 | 2,360,000 | 3,032,139 |

| 6.88%, 08/15/25 | 3,501,000 | 4,410,645 |

| 6.00%, 02/15/26 | 5,832,000 | 7,117,660 |

| 6.75%, 08/15/26 | 3,836,000 | 4,933,081 |

| 6.50%, 11/15/26 | 3,958,000 | 5,045,677 |

| 6.63%, 02/15/27 | 3,793,000 | 4,898,822 |

| 6.38%, 08/15/27 | 2,709,000 | 3,482,176 |

| 6.13%, 11/15/27 | 6,859,000 | 8,717,226 |

| 5.50%, 08/15/28 | 5,716,000 | 7,063,056 |

| 5.25%, 11/15/28 | 5,685,000 | 6,926,373 |

| Notes | ||

| 1.50%, 01/31/22 | 33,265,000 | 32,322,925 |

| 1.88%, 01/31/22 | 39,517,000 | 38,822,365 |

| 2.00%, 02/15/22 | 57,851,000 | 57,051,029 |

| 1.75%, 02/28/22 | 24,965,000 | 24,426,692 |

| 1.88%, 02/28/22 | 45,231,000 | 44,420,906 |

| 1.75%, 03/31/22 | 23,046,000 | 22,534,667 |

| 1.88%, 03/31/22 | 33,195,000 | 32,580,374 |

| 1.75%, 04/30/22 | 22,577,000 | 22,059,316 |

| 1.88%, 04/30/22 | 31,795,000 | 31,193,876 |

| 1.75%, 05/15/22 | 19,137,000 | 18,693,336 |

| 1.75%, 05/31/22 | 26,669,000 | 26,042,383 |

| 1.88%, 05/31/22 | 22,589,000 | 22,149,573 |

| 1.75%, 06/30/22 | 24,639,000 | 24,048,049 |

| 2.13%, 06/30/22 | 21,187,000 | 20,940,370 |

| 1.88%, 07/31/22 | 21,750,000 | 21,303,955 |

| 2.00%, 07/31/22 | 21,732,000 | 21,379,279 |

| 1.63%, 08/15/22 | 23,483,000 | 22,789,518 |

| 1.63%, 08/31/22 | 32,087,000 | 31,131,911 |

| 1.88%, 08/31/22 | 19,234,000 | 18,826,780 |

| 1.75%, 09/30/22 | 29,170,000 | 28,406,566 |

| 1.88%, 09/30/22 | 21,296,000 | 20,837,637 |

| 1.88%, 10/31/22 | 17,893,000 | 17,497,397 |

| 2.00%, 10/31/22 | 21,302,000 | 20,928,383 |

| 1.63%, 11/15/22 | 27,696,000 | 26,820,222 |

| 2.00%, 11/30/22 | 47,794,000 | 46,935,202 |

| 2.13%, 12/31/22 | 46,039,000 | 45,401,468 |

| 1.75%, 01/31/23 | 18,020,000 | 17,502,629 |

| 2.38%, 01/31/23 | 33,309,000 | 33,162,623 |

| 2.00%, 02/15/23 | 42,319,000 | 41,506,508 |

| 1.50%, 02/28/23 | 19,235,000 | 18,484,384 |

| 2.63%, 02/28/23 | 27,537,000 | 27,682,753 |

| 1.50%, 03/31/23 | 20,262,000 | 19,455,082 |

| 2.50%, 03/31/23 | 26,796,000 | 26,804,897 |

| 1.63%, 04/30/23 | 18,020,000 | 17,381,205 |

| 2.75%, 04/30/23 | 31,599,000 | 31,931,653 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 1.75%, 05/15/23 | 37,652,000 | 36,495,966 |

| 1.63%, 05/31/23 | 33,308,000 | 32,097,983 |

| 2.75%, 05/31/23 | 29,009,000 | 29,330,252 |

| 1.38%, 06/30/23 | 9,392,000 | 8,944,596 |

| 2.63%, 06/30/23 | 61,139,000 | 61,470,966 |

| 1.25%, 07/31/23 | 38,791,000 | 36,697,650 |

| 2.75%, 07/31/23 | 60,846,000 | 61,504,373 |

| 2.50%, 08/15/23 | 31,675,000 | 31,676,237 |

| 1.38%, 08/31/23 | 20,565,000 | 19,549,612 |

| 2.75%, 08/31/23 | 29,828,000 | 30,167,643 |

| 1.38%, 09/30/23 | 9,370,000 | 8,896,380 |

| 2.88%, 09/30/23 | 33,684,000 | 34,236,628 |

| 1.63%, 10/31/23 | 17,495,000 | 16,796,225 |

| 2.88%, 10/31/23 | 45,160,000 | 45,917,665 |

| 2.75%, 11/15/23 | 52,206,000 | 52,794,337 |

| 2.13%, 11/30/23 | 31,899,000 | 31,330,799 |

| 2.88%, 11/30/23 | 86,745,000 | 88,269,814 |

| 2.25%, 12/31/23 | 26,878,000 | 26,544,125 |

| 2.63%, 12/31/23 | 24,500,000 | 24,630,635 |

| 2.25%, 01/31/24 | 20,839,000 | 20,573,628 |

| 2.75%, 02/15/24 | 61,347,000 | 62,022,775 |

| 2.13%, 02/29/24 | 22,492,000 | 22,065,882 |

| 2.13%, 03/31/24 | 21,196,000 | 20,783,258 |

| 2.00%, 04/30/24 | 21,760,000 | 21,191,350 |

| 2.50%, 05/15/24 | 53,368,000 | 53,285,655 |

| 2.00%, 05/31/24 | 24,140,000 | 23,493,595 |

| 2.00%, 06/30/24 | 24,567,000 | 23,895,726 |

| 2.13%, 07/31/24 | 21,308,000 | 20,850,211 |

| 2.38%, 08/15/24 | 51,144,000 | 50,690,496 |

| 1.88%, 08/31/24 | 23,275,000 | 22,467,194 |

| 2.13%, 09/30/24 | 21,275,000 | 20,795,481 |

| 2.25%, 10/31/24 | 19,141,000 | 18,826,594 |

| 2.25%, 11/15/24 | 56,090,000 | 55,141,290 |

| 2.13%, 11/30/24 | 21,325,000 | 20,820,197 |

| 2.25%, 12/31/24 | 18,958,000 | 18,631,049 |

| 2.50%, 01/31/25 | 24,621,000 | 24,531,076 |

| 2.00%, 02/15/25 | 49,431,000 | 47,832,216 |

| 2.75%, 02/28/25 | 22,803,000 | 23,039,492 |

| 2.63%, 03/31/25 | 19,284,000 | 19,345,392 |

| 2.88%, 04/30/25 | 26,486,000 | 26,952,092 |

| 2.13%, 05/15/25 | 53,619,000 | 52,194,745 |

| 2.88%, 05/31/25 | 33,095,000 | 33,673,516 |

| 2.75%, 06/30/25 | 22,349,000 | 22,579,038 |

| 2.88%, 07/31/25 | 39,569,000 | 40,271,504 |

| 2.00%, 08/15/25 | 72,440,000 | 69,857,910 |

| 2.75%, 08/31/25 | 42,440,000 | 42,864,400 |

| 3.00%, 09/30/25 | 30,194,000 | 30,974,798 |

| 3.00%, 10/31/25 | 32,374,000 | 33,218,127 |

| 2.25%, 11/15/25 | 63,978,000 | 62,583,479 |

| 2.88%, 11/30/25 | 65,952,000 | 67,147,380 |

| 2.63%, 12/31/25 | 20,600,000 | 20,650,695 |

| 1.63%, 02/15/26 | 53,427,000 | 50,027,290 |

| 1.63%, 05/15/26 | 62,683,000 | 58,552,288 |

| 1.50%, 08/15/26 | 49,105,000 | 45,301,302 |

| 2.00%, 11/15/26 | 49,947,000 | 47,693,532 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 2.25%, 02/15/27 | 51,160,000 | 49,693,147 |

| 2.38%, 05/15/27 | 47,193,000 | 46,218,723 |

| 2.25%, 08/15/27 | 44,077,000 | 42,668,602 |

| 2.75%, 02/15/28 | 48,811,000 | 49,075,075 |

| 2.88%, 05/15/28 | 93,763,000 | 95,222,553 |

| 2.88%, 08/15/28 | 83,634,000 | 84,944,048 |

| 3.13%, 11/15/28 | 61,815,000 | 64,129,441 |

| Total Treasuries | ||

| (Cost $3,449,607,563) | 3,460,964,724 | |

| Security | Number of Shares | Value ($) |

| Other Investment Company0.1% of net assets | ||

| Money Market Fund 0.1% | ||

| State Street Institutional U.S. Government Money Market Fund, Premier Class 2.27%(a) | 3,844,608 | 3,844,608 |

| Total Other Investment Company | ||

| (Cost $3,844,608) | 3,844,608 | |

| (a) | The rate shown is the 7-day yield. |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Treasuries | $— | $3,460,964,724 | $— | $3,460,964,724 | |

| Other Investment Company1 | 3,844,608 | — | — | 3,844,608 | |

| Total | $3,844,608 | $3,460,964,724 | $— | $3,464,809,332 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at value (cost $3,453,452,171) | $3,464,809,332 | |

| Receivables: | ||

| Investments sold | 58,883,763 | |

| Fund shares sold | 50,233,747 | |

| Interest | 18,852,535 | |

| Dividends | + | 5,870 |

| Total assets | 3,592,785,247 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 112,170,619 | |

| Investment adviser fees | + | 165,451 |

| Total liabilities | 112,336,070 | |

| Net Assets | ||

| Total assets | 3,592,785,247 | |

| Total liabilities | – | 112,336,070 |

| Net assets | $3,480,449,177 | |

| Net Assets by Source | ||

| Capital received from investors | 3,492,036,093 | |

| Total distributable loss1 | (11,586,916) | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $3,480,449,177 | 65,800,000 | $52.89 | ||

| 1 | The SEC eliminated the requirement to disclose total distributable earnings by each of its components as previously disclosed as the previous presentation did not provide insight into the tax implications of distributions (see financial note 10 for additional information). |

| Investment Income | ||

| Dividends | $33,985 | |

| Interest | + | 53,646,623 |

| Total investment income | 53,680,608 | |

| Expenses | ||

| Investment adviser fees | 1,344,067 | |

| Total expenses | – | 1,344,067 |

| Net investment income | 52,336,541 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized losses on investments | (18,749,401) | |

| Net realized gains on in-kind redemptions | + | 439,240 |

| Net realized losses | (18,310,161) | |

| Net change in unrealized appreciation (depreciation) on investments | + | 32,708,262 |

| Net realized and unrealized gains | 14,398,101 | |

| Increase in net assets resulting from operations | $66,734,642 | |

| Operations | ||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||

| Net investment income | $52,336,541 | $16,436,695 | ||

| Net realized losses | (18,310,161) | (1,961,408) | ||

| Net change in unrealized appreciation (depreciation) | + | 32,708,262 | (2,252,440) | |

| Increase in net assets resulting from operations | 66,734,642 | 12,222,847 | ||

| Distributions to Shareholders1 | ||||

| Total distributions | ($52,237,145) | ($16,446,695) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 49,550,000 | $2,591,430,842 | 8,450,000 | $454,993,243 | ||||

| Shares redeemed | + | (5,600,000) | (291,186,748) | (1,400,000) | (75,567,594) | |||

| Net transactions in fund shares | 43,950,000 | $2,300,244,094 | 7,050,000 | $379,425,649 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/18-12/31/18 | 1/1/17-12/31/17 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 21,850,000 | $1,165,707,586 | 14,800,000 | $790,505,785 | ||||

| Total increase | + | 43,950,000 | 2,314,741,591 | 7,050,000 | 375,201,801 | |||

| End of period2 | 65,800,000 | $3,480,449,177 | 21,850,000 | $1,165,707,586 | ||||

| 1 | For the period ended December 31, 2017, the fund distributed to shareholders $16,446,695 from net investment income. The SEC eliminated the requirement to disclose distributions to shareholders from net investment income and from net realized gains in 2018 (see financial note 10 for additional information). |

| 2 | End of period - Net assets include net investment income not yet distributed of $25,741 at December 31, 2017. The SEC eliminated the requirement to disclose undistributed net investment income in 2018. |

| 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | 1/1/15– 12/31/15 | 1/1/14– 12/31/14 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $52.07 | $51.55 | $51.41 | $52.20 | $50.28 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss) | 1.351 | 1.181 | 1.061 | 1.001 | 1.00 | |

| Net realized and unrealized gains (losses) | (1.42) | 0.59 | 0.232 | (0.71) | 1.98 | |

| Total from investment operations | (0.07) | 1.77 | 1.29 | 0.29 | 2.98 | |

| Less distributions: | ||||||

| Distributions from net investment income | (1.41) | (1.25) | (1.15) | (1.08) | (1.06) | |

| Net asset value at end of period | $50.59 | $52.07 | $51.55 | $51.41 | $52.20 | |

| Total return | (0.09%) | 3.46% | 2.49% | 0.56% | 5.97% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.04% | 0.04% | 0.05%3 | 0.05% | 0.05% | |

| Net investment income (loss) | 2.67% | 2.26% | 2.01% | 1.92% | 1.96% | |

| Portfolio turnover rate4,5 | 71% | 101% | 119% | 104%6 | 74% | |

| Net assets, end of period (x 1,000) | $5,544,583 | $4,925,693 | $3,309,447 | $2,102,482 | $1,226,778 | |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Corporates24.1% of net assets | ||

| Financial Institutions 7.8% | ||

| Banking 5.6% | ||

| American Express Co. | ||

| 2.65%, 12/02/22 | 500,000 | 484,145 |

| 3.40%, 02/27/23(a) | 500,000 | 495,822 |

| 3.00%, 10/30/24(a) | 750,000 | 718,652 |

| 4.05%, 12/03/42 | 750,000 | 709,349 |

| American Express Credit Corp. | ||

| 2.20%, 03/03/20(a) | 500,000 | 494,709 |

| 2.38%, 05/26/20(a) | 1,000,000 | 989,716 |

| 2.60%, 09/14/20(a) | 500,000 | 495,005 |

| 2.25%, 05/05/21(a) | 1,000,000 | 978,905 |

| 3.30%, 05/03/27(a) | 750,000 | 729,113 |

| Australia & New Zealand Banking Group Ltd. | ||

| 2.30%, 06/01/21 | 1,000,000 | 976,275 |

| 2.63%, 05/19/22 | 1,000,000 | 974,925 |

| 2.63%, 11/09/22 | 750,000 | 728,734 |

| Banco Bilbao Vizcaya Argentaria S.A. | ||

| 3.00%, 10/20/20 | 250,000 | 246,631 |

| Bank of America Corp. | ||

| 5.63%, 07/01/20 | 3,750,000 | 3,877,511 |

| 5.88%, 01/05/21 | 800,000 | 842,181 |

| 2.63%, 04/19/21 | 1,250,000 | 1,233,407 |

| 5.00%, 05/13/21 | 3,250,000 | 3,374,726 |

| 2.33%, 10/01/21(a)(b) | 2,000,000 | 1,961,459 |

| 3.50%, 05/17/22(a)(b) | 250,000 | 250,122 |

| 2.50%, 10/21/22(a) | 2,250,000 | 2,167,530 |

| 3.30%, 01/11/23 | 2,900,000 | 2,857,689 |

| 3.12%, 01/20/23(a)(b) | 2,750,000 | 2,704,886 |

| 4.10%, 07/24/23 | 500,000 | 507,097 |

| 3.00%, 12/20/23(a)(b) | 500,000 | 486,274 |

| 3.95%, 04/21/25 | 500,000 | 484,868 |

| 3.88%, 08/01/25 | 2,500,000 | 2,475,292 |

| 3.25%, 10/21/27(a) | 1,000,000 | 926,689 |

| 3.71%, 04/24/28(a)(b) | 500,000 | 480,142 |

| 3.59%, 07/21/28(a)(b) | 250,000 | 237,338 |

| 3.42%, 12/20/28(a)(b) | 750,000 | 701,410 |

| 3.97%, 03/05/29(a)(b) | 1,000,000 | 973,145 |

| 6.11%, 01/29/37 | 250,000 | 275,532 |

| 4.24%, 04/24/38(a)(b) | 2,250,000 | 2,144,423 |

| 7.75%, 05/14/38 | 900,000 | 1,167,197 |

| 5.88%, 02/07/42 | 1,000,000 | 1,163,015 |

| 5.00%, 01/21/44 | 1,000,000 | 1,037,108 |

| 4.44%, 01/20/48(a)(b) | 750,000 | 722,473 |

| Bank of Montreal | ||

| 3.10%, 07/13/20 | 500,000 | 499,837 |

| 2.35%, 09/11/22 | 1,000,000 | 966,505 |

| 2.55%, 11/06/22(a) | 500,000 | 485,117 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Bank of New York Mellon Corp. | ||

| 2.60%, 08/17/20(a) | 2,100,000 | 2,086,677 |

| 4.15%, 02/01/21 | 500,000 | 510,466 |

| 2.60%, 02/07/22(a) | 1,000,000 | 982,733 |

| 2.20%, 08/16/23(a) | 500,000 | 475,078 |

| 3.95%, 11/18/25(a) | 500,000 | 507,783 |

| 3.44%, 02/07/28(a)(b) | 500,000 | 488,383 |

| 3.00%, 10/30/28(a) | 500,000 | 459,797 |

| Bank of Nova Scotia | ||

| 2.15%, 07/14/20 | 1,000,000 | 986,182 |

| 2.50%, 01/08/21 | 500,000 | 493,859 |

| 2.45%, 03/22/21 | 500,000 | 491,587 |

| 2.70%, 03/07/22 | 500,000 | 489,311 |

| Barclays Bank PLC | ||

| 5.14%, 10/14/20 | 1,000,000 | 1,011,251 |

| Barclays PLC | ||

| 3.25%, 01/12/21 | 1,500,000 | 1,471,230 |

| 4.34%, 05/16/24(a)(b) | 500,000 | 486,600 |

| 3.65%, 03/16/25 | 1,000,000 | 924,255 |

| 4.97%, 05/16/29(a)(b) | 500,000 | 482,977 |

| 5.25%, 08/17/45 | 1,000,000 | 927,566 |

| BB&T Corp. | ||

| 2.45%, 01/15/20(a) | 250,000 | 248,336 |

| 3.20%, 09/03/21(a) | 750,000 | 749,796 |

| 3.95%, 03/22/22(a) | 100,000 | 101,354 |

| BNP Paribas S.A. | ||

| 2.38%, 05/21/20 | 1,000,000 | 989,282 |

| 5.00%, 01/15/21 | 200,000 | 207,015 |

| 3.25%, 03/03/23 | 350,000 | 344,130 |

| 4.25%, 10/15/24 | 300,000 | 296,973 |

| BPCE S.A. | ||

| 2.65%, 02/03/21 | 1,500,000 | 1,473,205 |

| 4.00%, 04/15/24 | 1,000,000 | 1,006,765 |

| Branch Banking & Trust Co. | ||

| 3.63%, 09/16/25(a) | 1,000,000 | 981,317 |

| 3.80%, 10/30/26(a) | 500,000 | 496,047 |

| Capital One Financial Corp. | ||

| 4.75%, 07/15/21 | 1,050,000 | 1,076,650 |

| 3.05%, 03/09/22(a) | 500,000 | 488,031 |

| 3.50%, 06/15/23 | 2,000,000 | 1,966,148 |

| 3.20%, 02/05/25(a) | 500,000 | 467,407 |

| 4.20%, 10/29/25(a) | 750,000 | 722,648 |

| 3.75%, 07/28/26(a) | 300,000 | 275,226 |

| 3.80%, 01/31/28(a) | 250,000 | 231,475 |

| Capital One NA | ||

| 2.35%, 01/31/20(a) | 250,000 | 246,895 |

| 2.25%, 09/13/21(a) | 1,250,000 | 1,206,577 |

| Citigroup, Inc. | ||

| 2.40%, 02/18/20 | 1,000,000 | 991,192 |

| 2.65%, 10/26/20 | 2,750,000 | 2,714,630 |

| 2.90%, 12/08/21(a) | 1,000,000 | 984,512 |

| 4.50%, 01/14/22 | 1,850,000 | 1,891,540 |

| 2.75%, 04/25/22(a) | 2,000,000 | 1,944,268 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 3.14%, 01/24/23(a)(b) | 2,750,000 | 2,703,139 |

| 2.88%, 07/24/23(a)(b) | 1,500,000 | 1,452,806 |

| 5.50%, 09/13/25 | 1,000,000 | 1,050,857 |

| 3.70%, 01/12/26 | 750,000 | 722,199 |

| 3.20%, 10/21/26(a) | 1,000,000 | 924,127 |

| 4.30%, 11/20/26 | 1,000,000 | 963,205 |

| 4.45%, 09/29/27 | 1,000,000 | 964,848 |

| 3.67%, 07/24/28(a)(b) | 3,750,000 | 3,546,379 |

| 3.88%, 01/24/39(a)(b) | 1,500,000 | 1,342,510 |

| 5.30%, 05/06/44 | 1,000,000 | 1,000,041 |

| 4.65%, 07/30/45 | 1,200,000 | 1,173,236 |

| 4.75%, 05/18/46 | 250,000 | 231,968 |

| Citizens Bank NA | ||

| 2.25%, 03/02/20(a) | 250,000 | 247,405 |

| 2.20%, 05/26/20(a) | 250,000 | 246,557 |

| 2.55%, 05/13/21(a) | 250,000 | 244,661 |

| Cooperatieve Rabobank UA | ||

| 2.50%, 01/19/21 | 750,000 | 737,208 |

| 3.88%, 02/08/22 | 1,500,000 | 1,517,234 |

| 4.63%, 12/01/23 | 450,000 | 456,766 |

| 3.38%, 05/21/25 | 500,000 | 490,621 |

| 4.38%, 08/04/25 | 250,000 | 245,887 |

| 5.25%, 05/24/41 | 750,000 | 827,818 |

| 5.25%, 08/04/45 | 750,000 | 776,140 |

| Credit Suisse AG | ||

| 3.63%, 09/09/24 | 300,000 | 294,581 |

| Credit Suisse Group Funding Guernsey Ltd. | ||

| 2.75%, 03/26/20 | 1,250,000 | 1,236,884 |

| 3.13%, 12/10/20 | 750,000 | 743,010 |

| 3.45%, 04/16/21 | 2,250,000 | 2,243,137 |

| 3.80%, 09/15/22 | 500,000 | 496,777 |

| 3.75%, 03/26/25 | 2,500,000 | 2,387,155 |

| 4.55%, 04/17/26 | 250,000 | 247,901 |

| Credit Suisse USA, Inc. | ||

| 7.13%, 07/15/32 | 250,000 | 314,887 |

| Deutsche Bank AG | ||

| 3.13%, 01/13/21 | 2,000,000 | 1,936,555 |

| 3.30%, 11/16/22 | 500,000 | 463,788 |

| 3.95%, 02/27/23 | 1,500,000 | 1,413,683 |

| Discover Bank | ||

| 4.65%, 09/13/28(a) | 1,000,000 | 983,204 |

| Discover Financial Services | ||

| 3.85%, 11/21/22 | 1,500,000 | 1,490,933 |

| Fifth Third Bancorp | ||

| 8.25%, 03/01/38 | 600,000 | 797,579 |

| Fifth Third Bank | ||

| 3.85%, 03/15/26(a) | 500,000 | 493,011 |

| Goldman Sachs Capital I | ||

| 6.35%, 02/15/34 | 350,000 | 391,605 |

| Goldman Sachs Group, Inc. | ||

| 5.38%, 03/15/20 | 1,700,000 | 1,738,316 |

| 6.00%, 06/15/20 | 250,000 | 258,887 |

| 2.75%, 09/15/20(a) | 3,000,000 | 2,970,207 |

| 2.63%, 04/25/21(a) | 700,000 | 682,147 |

| 5.25%, 07/27/21 | 1,262,000 | 1,310,543 |

| 2.35%, 11/15/21(a) | 1,500,000 | 1,447,307 |

| 5.75%, 01/24/22 | 1,100,000 | 1,152,221 |

| 2.88%, 10/31/22(a)(b) | 1,000,000 | 971,599 |

| 3.63%, 01/22/23 | 1,000,000 | 985,183 |

| 3.85%, 07/08/24(a) | 650,000 | 635,886 |

| 3.50%, 01/23/25(a) | 1,000,000 | 948,675 |

| 4.25%, 10/21/25 | 1,000,000 | 958,459 |

| 5.95%, 01/15/27 | 265,000 | 279,491 |

| 3.85%, 01/26/27(a) | 2,250,000 | 2,118,619 |

| 3.69%, 06/05/28(a)(b) | 1,000,000 | 930,361 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 3.81%, 04/23/29(a)(b) | 500,000 | 467,351 |

| 6.45%, 05/01/36 | 500,000 | 558,006 |

| 6.75%, 10/01/37 | 1,500,000 | 1,696,743 |

| 4.41%, 04/23/39(a)(b) | 1,000,000 | 918,337 |

| 6.25%, 02/01/41 | 1,000,000 | 1,142,711 |

| 4.80%, 07/08/44(a) | 500,000 | 477,190 |

| 4.75%, 10/21/45(a) | 1,000,000 | 953,576 |

| HSBC Bank USA NA | ||

| 4.88%, 08/24/20 | 500,000 | 512,412 |

| HSBC Holdings PLC | ||

| 3.40%, 03/08/21 | 250,000 | 249,429 |

| 5.10%, 04/05/21 | 850,000 | 879,274 |

| 2.95%, 05/25/21 | 1,000,000 | 987,453 |

| 4.25%, 03/14/24 | 1,200,000 | 1,192,268 |

| 4.30%, 03/08/26 | 1,850,000 | 1,826,544 |

| 3.90%, 05/25/26 | 2,200,000 | 2,110,053 |

| 4.29%, 09/12/26(a)(b) | 500,000 | 492,914 |

| 4.58%, 06/19/29(a)(b) | 1,500,000 | 1,488,552 |

| 6.50%, 05/02/36 | 500,000 | 570,458 |

| 6.50%, 09/15/37 | 500,000 | 568,281 |

| 6.80%, 06/01/38 | 750,000 | 888,245 |

| 5.25%, 03/14/44 | 595,000 | 591,800 |

| HSBC USA, Inc. | ||

| 2.75%, 08/07/20 | 2,500,000 | 2,473,371 |

| 5.00%, 09/27/20 | 400,000 | 408,585 |

| Huntington National Bank | ||

| 2.40%, 04/01/20(a) | 1,000,000 | 989,696 |

| 3.55%, 10/06/23(a) | 500,000 | 498,684 |

| ING Groep N.V. | ||

| 3.15%, 03/29/22 | 3,000,000 | 2,951,968 |

| JPMorgan Chase & Co. | ||

| 4.95%, 03/25/20 | 1,000,000 | 1,021,344 |

| 4.25%, 10/15/20 | 500,000 | 509,140 |

| 2.55%, 10/29/20(a) | 2,500,000 | 2,472,863 |

| 4.63%, 05/10/21 | 6,250,000 | 6,434,184 |

| 2.30%, 08/15/21(a) | 2,000,000 | 1,952,021 |

| 4.35%, 08/15/21 | 2,250,000 | 2,303,334 |

| 3.20%, 01/25/23 | 1,291,000 | 1,272,911 |

| 3.38%, 05/01/23 | 2,000,000 | 1,957,432 |

| 3.88%, 02/01/24 | 1,200,000 | 1,203,894 |

| 3.80%, 07/23/24(a)(b) | 1,500,000 | 1,503,644 |

| 4.02%, 12/05/24(a)(b) | 350,000 | 353,019 |

| 3.13%, 01/23/25(a) | 1,000,000 | 953,484 |

| 3.30%, 04/01/26(a) | 3,575,000 | 3,407,836 |

| 2.95%, 10/01/26(a) | 500,000 | 462,236 |

| 4.13%, 12/15/26 | 250,000 | 244,329 |

| 3.78%, 02/01/28(a)(b) | 2,700,000 | 2,623,647 |

| 3.54%, 05/01/28(a)(b) | 1,750,000 | 1,670,205 |

| 4.20%, 07/23/29(a)(b) | 500,000 | 499,064 |

| 6.40%, 05/15/38 | 1,150,000 | 1,400,957 |

| 5.50%, 10/15/40 | 500,000 | 554,919 |

| 5.40%, 01/06/42(c) | 600,000 | 660,365 |

| 4.85%, 02/01/44 | 500,000 | 510,281 |

| 4.26%, 02/22/48(a)(b) | 500,000 | 466,149 |

| 4.03%, 07/24/48(a)(b) | 500,000 | 448,565 |

| 3.96%, 11/15/48(a)(b) | 1,000,000 | 887,330 |

| 3.90%, 01/23/49(a)(b) | 250,000 | 219,810 |

| JPMorgan Chase Bank NA | ||

| 3.09%, 04/26/21(a)(b) | 250,000 | 249,037 |

| KeyCorp | ||

| 2.90%, 09/15/20 | 400,000 | 397,203 |

| 4.10%, 04/30/28 | 1,750,000 | 1,754,066 |

| Lloyds Bank PLC | ||

| 6.38%, 01/21/21 | 500,000 | 528,262 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Lloyds Banking Group PLC | ||

| 3.10%, 07/06/21 | 1,250,000 | 1,226,520 |

| 4.50%, 11/04/24 | 1,000,000 | 966,846 |

| 4.65%, 03/24/26 | 1,500,000 | 1,412,405 |

| 4.38%, 03/22/28 | 1,500,000 | 1,425,685 |

| 4.34%, 01/09/48 | 500,000 | 396,014 |

| Mitsubishi UFJ Financial Group, Inc. | ||

| 2.95%, 03/01/21 | 1,150,000 | 1,138,801 |

| 2.19%, 09/13/21 | 2,500,000 | 2,414,295 |

| 3.85%, 03/01/26 | 750,000 | 746,925 |

| 3.29%, 07/25/27 | 1,100,000 | 1,053,067 |

| 3.96%, 03/02/28 | 250,000 | 251,152 |

| Mizuho Financial Group, Inc. | ||

| 2.95%, 02/28/22 | 500,000 | 490,403 |

| 2.60%, 09/11/22 | 750,000 | 725,796 |

| 3.66%, 02/28/27 | 600,000 | 590,739 |

| 3.17%, 09/11/27 | 500,000 | 471,559 |

| 4.25%, 09/11/29(a)(b) | 500,000 | 507,794 |

| Morgan Stanley | ||

| 2.65%, 01/27/20 | 3,000,000 | 2,978,257 |

| 2.80%, 06/16/20 | 500,000 | 496,928 |

| 5.75%, 01/25/21 | 1,000,000 | 1,042,954 |

| 5.50%, 07/28/21 | 1,500,000 | 1,572,918 |

| 2.63%, 11/17/21 | 1,250,000 | 1,220,535 |

| 4.88%, 11/01/22 | 1,000,000 | 1,031,388 |

| 3.13%, 01/23/23 | 2,000,000 | 1,955,730 |

| 4.10%, 05/22/23 | 750,000 | 751,831 |

| 3.88%, 04/29/24 | 1,000,000 | 995,932 |

| 4.00%, 07/23/25 | 2,000,000 | 1,974,789 |

| 5.00%, 11/24/25 | 1,000,000 | 1,021,145 |

| 4.35%, 09/08/26 | 2,000,000 | 1,946,741 |

| 3.63%, 01/20/27 | 1,000,000 | 951,378 |

| 3.59%, 07/22/28(a)(b) | 2,000,000 | 1,893,063 |

| 3.77%, 01/24/29(a)(b) | 500,000 | 478,930 |

| 7.25%, 04/01/32 | 500,000 | 631,012 |

| 6.38%, 07/24/42 | 500,000 | 613,929 |

| 4.30%, 01/27/45 | 850,000 | 796,858 |

| 4.38%, 01/22/47 | 300,000 | 284,602 |

| National Australia Bank Ltd. | ||

| 2.50%, 05/22/22 | 1,000,000 | 971,040 |

| 3.00%, 01/20/23 | 250,000 | 245,260 |

| 2.88%, 04/12/23 | 500,000 | 484,894 |

| 3.38%, 01/14/26 | 1,000,000 | 976,808 |

| PNC Bank NA | ||

| 2.60%, 07/21/20(a) | 250,000 | 247,863 |

| 2.45%, 11/05/20(a) | 250,000 | 247,002 |

| 2.15%, 04/29/21(a) | 500,000 | 488,199 |

| 2.55%, 12/09/21(a) | 750,000 | 731,998 |

| 2.95%, 01/30/23(a) | 1,000,000 | 974,474 |

| 3.50%, 06/08/23(a) | 250,000 | 250,645 |

| 3.80%, 07/25/23(a) | 1,000,000 | 1,004,143 |

| 3.10%, 10/25/27(a) | 300,000 | 286,495 |

| 4.05%, 07/26/28 | 1,000,000 | 1,005,723 |

| Regions Bank | ||

| 6.45%, 06/26/37 | 250,000 | 293,185 |

| Regions Financial Corp. | ||

| 3.20%, 02/08/21(a) | 800,000 | 795,339 |

| 2.75%, 08/14/22(a) | 1,750,000 | 1,689,800 |

| Royal Bank of Canada | ||

| 2.50%, 01/19/21 | 500,000 | 494,414 |

| 2.75%, 02/01/22 | 1,500,000 | 1,476,649 |

| 3.70%, 10/05/23 | 250,000 | 251,166 |

| Royal Bank of Scotland Group PLC | ||

| 6.13%, 12/15/22 | 1,500,000 | 1,521,510 |

| 5.13%, 05/28/24 | 1,000,000 | 970,692 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 4.80%, 04/05/26 | 800,000 | 782,112 |

| 4.89%, 05/18/29(a)(b) | 1,000,000 | 956,310 |

| Santander Holdings USA, Inc. | ||

| 3.70%, 03/28/22(a) | 1,500,000 | 1,474,256 |

| 4.50%, 07/17/25(a) | 750,000 | 743,620 |

| 4.40%, 07/13/27(a) | 1,000,000 | 947,867 |

| Santander UK Group Holdings PLC | ||

| 3.37%, 01/05/24(a)(b) | 3,750,000 | 3,561,379 |

| State Street Corp. | ||

| 3.55%, 08/18/25 | 500,000 | 499,277 |

| 2.65%, 05/19/26 | 750,000 | 702,960 |

| Sumitomo Mitsui Banking Corp. | ||

| 2.45%, 01/16/20 | 585,000 | 580,433 |

| 3.40%, 07/11/24 | 500,000 | 494,320 |

| Sumitomo Mitsui Financial Group, Inc. | ||

| 2.93%, 03/09/21 | 3,000,000 | 2,969,355 |

| 2.85%, 01/11/22 | 500,000 | 491,023 |

| 3.10%, 01/17/23 | 1,000,000 | 981,498 |

| 3.94%, 10/16/23 | 250,000 | 254,560 |

| 2.63%, 07/14/26 | 1,350,000 | 1,235,826 |

| 3.01%, 10/19/26 | 1,000,000 | 938,983 |

| 3.94%, 07/19/28 | 250,000 | 250,130 |

| 4.31%, 10/16/28 | 150,000 | 154,326 |

| SunTrust Bank | ||

| 2.45%, 08/01/22(a) | 500,000 | 482,438 |

| 3.69%, 08/02/24(a)(b) | 500,000 | 498,329 |

| SunTrust Banks, Inc. | ||

| 4.00%, 05/01/25(a) | 1,000,000 | 1,004,029 |

| Svenska Handelsbanken AB | ||

| 2.40%, 10/01/20 | 800,000 | 787,887 |

| 2.45%, 03/30/21 | 500,000 | 490,337 |

| 3.35%, 05/24/21 | 500,000 | 499,899 |

| Synchrony Bank | ||

| 3.00%, 06/15/22(a) | 750,000 | 701,385 |

| Synchrony Financial | ||

| 3.95%, 12/01/27(a) | 1,000,000 | 843,802 |

| Synovus Financial Corp. | ||

| 3.13%, 11/01/22(a) | 750,000 | 708,742 |

| Toronto-Dominion Bank | ||

| 2.50%, 12/14/20 | 1,500,000 | 1,485,634 |

| 3.50%, 07/19/23 | 2,000,000 | 2,015,029 |

| UBS AG | ||

| 4.88%, 08/04/20 | 1,000,000 | 1,023,381 |

| US Bancorp | ||

| 3.00%, 03/15/22(a) | 600,000 | 596,509 |

| 2.95%, 07/15/22(a) | 1,500,000 | 1,480,328 |

| 3.60%, 09/11/24(a) | 1,000,000 | 995,957 |

| 3.15%, 04/27/27(a) | 500,000 | 479,507 |

| 3.90%, 04/26/28(a) | 1,250,000 | 1,266,702 |

| US Bank NA | ||

| 2.00%, 01/24/20(a) | 500,000 | 495,408 |

| 2.80%, 01/27/25(a) | 500,000 | 480,830 |

| Wachovia Corp. | ||

| 5.50%, 08/01/35 | 750,000 | 809,596 |

| Wells Fargo & Co. | ||

| 2.15%, 01/30/20 | 1,000,000 | 989,282 |

| 2.60%, 07/22/20 | 1,250,000 | 1,238,164 |

| 2.55%, 12/07/20 | 750,000 | 739,638 |

| 2.50%, 03/04/21 | 250,000 | 245,970 |

| 4.60%, 04/01/21 | 1,100,000 | 1,126,780 |

| 2.10%, 07/26/21 | 2,500,000 | 2,422,843 |

| 3.50%, 03/08/22 | 500,000 | 498,559 |

| 2.63%, 07/22/22 | 1,750,000 | 1,688,305 |

| 3.07%, 01/24/23(a) | 1,000,000 | 974,475 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 3.45%, 02/13/23 | 500,000 | 489,973 |

| 3.00%, 04/22/26 | 1,000,000 | 932,741 |

| 4.10%, 06/03/26 | 2,000,000 | 1,954,913 |

| 3.00%, 10/23/26 | 1,000,000 | 926,675 |

| 4.30%, 07/22/27 | 1,000,000 | 985,406 |

| 5.38%, 02/07/35 | 1,000,000 | 1,100,704 |

| 5.38%, 11/02/43 | 400,000 | 418,299 |

| 5.61%, 01/15/44 | 500,000 | 543,385 |

| 4.65%, 11/04/44 | 1,250,000 | 1,179,332 |

| 3.90%, 05/01/45 | 500,000 | 459,882 |

| 4.40%, 06/14/46 | 500,000 | 459,710 |

| 4.75%, 12/07/46 | 1,000,000 | 965,038 |

| Wells Fargo Bank NA | ||

| 2.60%, 01/15/21 | 250,000 | 246,967 |

| 3.33%, 07/23/21(a)(b) | 500,000 | 499,625 |

| 3.63%, 10/22/21(a) | 250,000 | 251,579 |

| Westpac Banking Corp. | ||

| 2.60%, 11/23/20 | 500,000 | 493,757 |

| 2.00%, 08/19/21 | 500,000 | 484,211 |

| 2.50%, 06/28/22 | 250,000 | 242,432 |

| 2.75%, 01/11/23 | 1,250,000 | 1,213,671 |

| 3.65%, 05/15/23 | 250,000 | 251,654 |

| 2.85%, 05/13/26 | 600,000 | 558,186 |

| 2.70%, 08/19/26 | 250,000 | 230,543 |

| 3.35%, 03/08/27 | 250,000 | 240,821 |

| 3.40%, 01/25/28 | 500,000 | 482,446 |

| 311,969,893 | ||

| Brokerage/Asset Managers/Exchanges 0.2% | ||

| Ameriprise Financial, Inc. | ||

| 3.70%, 10/15/24 | 475,000 | 475,167 |

| 2.88%, 09/15/26(a) | 250,000 | 233,027 |

| BlackRock, Inc. | ||

| 4.25%, 05/24/21 | 150,000 | 154,472 |

| 3.50%, 03/18/24 | 1,250,000 | 1,264,430 |

| Brookfield Finance, Inc. | ||

| 3.90%, 01/25/28(a) | 500,000 | 472,892 |

| 4.70%, 09/20/47(a) | 250,000 | 230,742 |

| CME Group, Inc. | ||

| 3.00%, 03/15/25(a) | 1,050,000 | 1,023,253 |

| 5.30%, 09/15/43(a) | 500,000 | 584,820 |

| 4.15%, 06/15/48(a) | 200,000 | 203,073 |

| E*TRADE Financial Corp. | ||

| 4.50%, 06/20/28(a) | 250,000 | 246,827 |

| Intercontinental Exchange, Inc. | ||

| 2.75%, 12/01/20(a) | 1,000,000 | 993,834 |

| 3.45%, 09/21/23(a) | 150,000 | 150,682 |

| 4.00%, 10/15/23 | 500,000 | 512,151 |

| 3.75%, 09/21/28(a) | 500,000 | 498,760 |

| 4.25%, 09/21/48(a) | 250,000 | 246,025 |

| Invesco Finance PLC | ||

| 3.75%, 01/15/26 | 650,000 | 634,769 |

| Jefferies Group LLC | ||

| 5.13%, 01/20/23 | 700,000 | 716,378 |

| 6.25%, 01/15/36 | 150,000 | 150,796 |

| Jefferies Group LLC/Jefferies Group Capital Finance, Inc. | ||

| 4.85%, 01/15/27 | 700,000 | 670,006 |

| Legg Mason, Inc. | ||

| 4.75%, 03/15/26 | 250,000 | 255,843 |

| Nasdaq, Inc. | ||

| 3.85%, 06/30/26(a) | 300,000 | 290,175 |

| Nomura Holdings, Inc. | ||

| 6.70%, 03/04/20(c) | 1,000,000 | 1,038,900 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| Raymond James Financial, Inc. | ||

| 3.63%, 09/15/26 | 200,000 | 188,787 |

| 4.95%, 07/15/46 | 850,000 | 819,645 |

| TD Ameritrade Holding Corp. | ||

| 2.95%, 04/01/22(a) | 300,000 | 296,918 |

| 3.30%, 04/01/27(a) | 450,000 | 430,866 |

| 12,783,238 | ||

| Finance Companies 0.2% | ||

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust | ||

| 4.63%, 10/30/20 | 250,000 | 251,854 |

| 4.50%, 05/15/21 | 400,000 | 401,377 |

| 5.00%, 10/01/21 | 250,000 | 254,092 |

| 3.95%, 02/01/22(a) | 750,000 | 737,355 |

| 3.65%, 07/21/27(a) | 1,200,000 | 1,044,900 |

| Air Lease Corp. | ||

| 2.50%, 03/01/21 | 350,000 | 341,379 |

| 3.88%, 04/01/21(a) | 250,000 | 250,447 |

| 3.50%, 01/15/22 | 250,000 | 246,198 |

| 3.75%, 02/01/22(a) | 250,000 | 247,566 |

| 4.25%, 09/15/24(a) | 750,000 | 734,027 |

| 3.63%, 04/01/27(a) | 950,000 | 851,140 |

| Aircastle Ltd. | ||

| 5.13%, 03/15/21 | 250,000 | 254,203 |

| 5.50%, 02/15/22 | 250,000 | 255,964 |

| 5.00%, 04/01/23 | 250,000 | 251,220 |

| 4.40%, 09/25/23(a) | 250,000 | 246,140 |

| 4.13%, 05/01/24(a) | 150,000 | 141,714 |

| GATX Corp. | ||

| 4.55%, 11/07/28(a) | 200,000 | 197,626 |

| 5.20%, 03/15/44(a) | 250,000 | 255,270 |

| GE Capital International Funding Co. | ||

| 2.34%, 11/15/20 | 1,450,000 | 1,399,960 |

| 3.37%, 11/15/25 | 1,000,000 | 889,636 |

| 4.42%, 11/15/35 | 1,700,000 | 1,427,865 |

| International Lease Finance Corp. | ||

| 8.25%, 12/15/20 | 250,000 | 269,067 |

| 4.63%, 04/15/21 | 500,000 | 505,039 |

| 5.88%, 08/15/22 | 250,000 | 262,077 |

| 11,716,116 | ||

| Financial Other 0.0% | ||

| CME Group, Inc. | ||

| 3.00%, 09/15/22 | 200,000 | 199,443 |

| ORIX Corp. | ||

| 2.90%, 07/18/22 | 500,000 | 488,793 |

| 688,236 | ||

| Insurance 1.2% | ||

| Aetna, Inc. | ||

| 2.75%, 11/15/22(a) | 250,000 | 240,059 |

| 3.50%, 11/15/24(a) | 1,500,000 | 1,452,184 |

| 4.50%, 05/15/42(a) | 500,000 | 465,796 |

| 4.75%, 03/15/44(a) | 550,000 | 526,648 |

| Aflac, Inc. | ||

| 3.63%, 06/15/23 | 750,000 | 752,951 |

| 4.75%, 01/15/49(a) | 250,000 | 255,722 |

| Allied World Assurance Co. Holdings Ltd. | ||

| 4.35%, 10/29/25(a) | 500,000 | 493,622 |

| Allstate Corp. | ||

| 3.28%, 12/15/26(a) | 250,000 | 245,438 |

| 4.50%, 06/15/43 | 800,000 | 818,515 |

| American Financial Group, Inc. | ||

| 4.50%, 06/15/47(a) | 450,000 | 405,330 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| American International Group, Inc. | ||

| 3.30%, 03/01/21(a) | 500,000 | 498,562 |

| 4.88%, 06/01/22 | 200,000 | 207,668 |

| 3.75%, 07/10/25(a) | 500,000 | 479,407 |

| 4.20%, 04/01/28(a) | 1,000,000 | 965,183 |

| 3.88%, 01/15/35(a) | 250,000 | 215,331 |

| 4.50%, 07/16/44(a) | 1,000,000 | 895,655 |

| 4.80%, 07/10/45(a) | 500,000 | 468,113 |

| 4.38%, 01/15/55(a) | 750,000 | 625,177 |

| Anthem, Inc. | ||

| 4.35%, 08/15/20 | 250,000 | 254,500 |

| 2.50%, 11/21/20 | 250,000 | 246,678 |

| 3.13%, 05/15/22 | 250,000 | 246,521 |

| 3.30%, 01/15/23 | 750,000 | 738,669 |

| 3.50%, 08/15/24(a) | 250,000 | 245,528 |

| 4.63%, 05/15/42 | 750,000 | 725,464 |

| 4.65%, 01/15/43 | 500,000 | 487,435 |

| 4.65%, 08/15/44(a) | 750,000 | 723,918 |

| 4.38%, 12/01/47(a) | 250,000 | 233,433 |

| Aon Corp. | ||

| 8.21%, 01/01/27 | 100,000 | 117,250 |

| Aon PLC | ||

| 4.00%, 11/27/23(a) | 500,000 | 506,548 |

| 3.50%, 06/14/24(a) | 500,000 | 488,838 |

| 3.88%, 12/15/25(a) | 1,500,000 | 1,482,446 |

| 4.75%, 05/15/45(a) | 250,000 | 246,217 |

| Assurant, Inc. | ||

| 6.75%, 02/15/34 | 151,000 | 171,018 |

| AXA Equitable Holdings, Inc. | ||

| 4.35%, 04/20/28(a)(d) | 250,000 | 236,695 |

| 5.00%, 04/20/48(a)(d) | 500,000 | 445,120 |

| Berkshire Hathaway Finance Corp. | ||

| 4.25%, 01/15/21 | 300,000 | 307,803 |

| 5.75%, 01/15/40 | 100,000 | 119,764 |

| 4.30%, 05/15/43 | 350,000 | 356,273 |

| 4.20%, 08/15/48(a) | 250,000 | 248,510 |

| Berkshire Hathaway, Inc. | ||

| 3.00%, 02/11/23 | 250,000 | 247,861 |

| 2.75%, 03/15/23(a) | 950,000 | 933,141 |

| 3.13%, 03/15/26(a) | 2,000,000 | 1,940,336 |

| Brighthouse Financial, Inc. | ||

| 3.70%, 06/22/27(a) | 500,000 | 423,228 |

| 4.70%, 06/22/47(a) | 200,000 | 149,435 |

| Chubb Corp. | ||

| 6.00%, 05/11/37 | 250,000 | 303,297 |

| Chubb INA Holdings, Inc. | ||

| 2.88%, 11/03/22(a) | 1,000,000 | 992,068 |

| 2.70%, 03/13/23 | 750,000 | 733,333 |

| 3.15%, 03/15/25 | 1,000,000 | 978,520 |

| 3.35%, 05/03/26(a) | 750,000 | 734,375 |

| 4.35%, 11/03/45(a) | 1,750,000 | 1,805,885 |

| Cigna Corp. | ||

| 3.20%, 09/17/20(d) | 750,000 | 747,225 |

| 3.75%, 07/15/23(a) | 750,000 | 748,275 |

| 4.13%, 11/15/25(a)(d) | 500,000 | 500,037 |

| 4.38%, 10/15/28(a) | 1,000,000 | 1,007,528 |

| 4.80%, 08/15/38(a)(d) | 500,000 | 492,600 |

| 4.90%, 12/15/48(a) | 1,000,000 | 982,193 |

| Cigna Holding Co. | ||

| 4.00%, 02/15/22(a) | 400,000 | 404,366 |

| 3.05%, 10/15/27(a) | 300,000 | 274,939 |

| 3.88%, 10/15/47(a) | 250,000 | 209,584 |

| Hartford Financial Services Group, Inc. | ||

| 5.13%, 04/15/22 | 1,000,000 | 1,049,065 |

| 5.95%, 10/15/36 | 300,000 | 340,961 |

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| 6.10%, 10/01/41 | 350,000 | 404,584 |

| 4.40%, 03/15/48(a) | 800,000 | 749,102 |

| Humana, Inc. | ||

| 3.85%, 10/01/24(a) | 750,000 | 750,350 |

| 4.95%, 10/01/44(a) | 250,000 | 257,730 |

| 4.80%, 03/15/47(a) | 250,000 | 251,153 |

| Lincoln National Corp. | ||

| 4.00%, 09/01/23 | 500,000 | 510,251 |

| 3.80%, 03/01/28(a) | 750,000 | 728,792 |

| Loews Corp. | ||

| 3.75%, 04/01/26(a) | 250,000 | 247,997 |

| Manulife Financial Corp. | ||

| 4.15%, 03/04/26 | 350,000 | 353,823 |

| Marsh & McLennan Cos., Inc. | ||

| 3.50%, 06/03/24(a) | 500,000 | 493,119 |

| 3.75%, 03/14/26(a) | 250,000 | 247,436 |

| MetLife, Inc. | ||

| 4.75%, 02/08/21 | 258,000 | 266,291 |

| 3.60%, 04/10/24 | 1,315,000 | 1,325,004 |

| 5.70%, 06/15/35 | 500,000 | 564,187 |

| 6.40%, 12/15/36(a) | 1,000,000 | 1,018,360 |

| 5.88%, 02/06/41 | 250,000 | 294,970 |

| 4.60%, 05/13/46(a) | 250,000 | 250,320 |

| Principal Financial Group, Inc. | ||

| 4.63%, 09/15/42 | 100,000 | 96,990 |

| 4.35%, 05/15/43 | 250,000 | 232,764 |

| Prudential Financial, Inc. | ||

| 5.38%, 06/21/20 | 1,000,000 | 1,030,823 |

| 4.50%, 11/16/21 | 250,000 | 258,193 |

| 6.63%, 12/01/37 | 1,750,000 | 2,120,326 |

| 5.88%, 09/15/42(a)(b) | 1,000,000 | 1,011,250 |

| 5.63%, 06/15/43(a)(b) | 700,000 | 686,406 |

| 5.38%, 05/15/45(a)(b) | 750,000 | 704,700 |

| The Progressive Corp. | ||

| 4.00%, 03/01/29(a) | 500,000 | 515,040 |

| 3.70%, 01/26/45 | 300,000 | 275,293 |

| Travelers Cos., Inc. | ||

| 6.25%, 06/15/37 | 750,000 | 936,108 |

| 4.60%, 08/01/43 | 200,000 | 207,835 |

| 4.00%, 05/30/47(a) | 150,000 | 144,346 |

| UnitedHealth Group, Inc. | ||

| 2.70%, 07/15/20 | 1,000,000 | 996,649 |

| 1.95%, 10/15/20 | 250,000 | 245,701 |

| 2.88%, 03/15/22(a) | 1,000,000 | 992,499 |

| 3.35%, 07/15/22 | 500,000 | 502,541 |

| 2.88%, 03/15/23 | 500,000 | 492,836 |

| 3.75%, 07/15/25 | 750,000 | 759,856 |

| 6.63%, 11/15/37 | 500,000 | 647,844 |

| 6.88%, 02/15/38 | 750,000 | 981,539 |

| 4.75%, 07/15/45 | 1,000,000 | 1,060,439 |

| 4.20%, 01/15/47(a) | 1,250,000 | 1,245,084 |

| 4.25%, 04/15/47(a) | 250,000 | 248,431 |

| Unum Group | ||

| 5.63%, 09/15/20 | 350,000 | 362,291 |

| Voya Financial, Inc. | ||

| 3.65%, 06/15/26 | 1,000,000 | 946,852 |

| 5.70%, 07/15/43 | 200,000 | 216,710 |

| XLIT Ltd. | ||

| 6.25%, 05/15/27 | 685,000 | 785,002 |

| 5.25%, 12/15/43 | 250,000 | 267,802 |

| 5.50%, 03/31/45 | 750,000 | 778,258 |

| 63,102,118 | ||

| Security Rate, Maturity Date | Face Amount ($) | Value ($) |

| REITs 0.6% | ||

| Alexandria Real Estate Equities, Inc. | ||

| 4.30%, 01/15/26(a) | 250,000 | 250,340 |

| AvalonBay Communities, Inc. | ||

| 3.50%, 11/15/24(a) | 700,000 | 696,356 |

| 3.35%, 05/15/27(a) | 250,000 | 241,172 |