UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22311

Schwab Strategic Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Strategic Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415)636-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

| Item 1: | Report(s) to Shareholders. |

Annual Report | December 31, 2019

Schwab Fixed-Income ETFs

| Schwab U.S. TIPS ETF | SCHP |

| Schwab Short-Term U.S. Treasury ETF | SCHO |

| Schwab Intermediate-Term U.S. Treasury ETF | SCHR |

| Schwab Long-Term U.S. Treasury ETF | SCHQ |

| Schwab U.S. Aggregate Bond ETF | SCHZ |

| Schwab 1-5 Year Corporate Bond ETF | SCHJ |

| Schwab 5-10 Year Corporate Bond ETF | SCHI |

| New Notice Regarding Shareholder Report Delivery Options |

| Beginning on January 1, 2021, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a bank or broker-dealer). Instead, the reports will be made available on a fund’s websitewww.schwabfunds.com/schwabetfs_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website link to access the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically. |

| If you would like to receive a fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request: |

| • If you invest through Charles Schwab & Co, Inc. (broker-dealer), by calling 1-866-345-5954 and using the unique identifier attached to this mailing; or |

| • If you invest through another financial intermediary (such as a bank or broker-dealer) by contacting them directly. |

| If you already receive shareholder reports and other fund documents electronically, you will not be affected by this change and you need not take any action. |

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM)

Distributor: SEI Investments Distribution Co. (SIDCO)

Schwab Fixed-Income ETFs | Annual Report

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

| Total Returns for the 12 Months Ended December 31, 2019 |

Schwab U.S. TIPS ETF

(Ticker Symbol: SCHP) | |

| Market Price Return1 | 8.52% |

| NAV Return1 | 8.36% |

| Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) | 8.43% |

| ETF Category: Morningstar Inflation-Protected Bond2 | 7.92% |

| Performance Details | pages 7-8 |

| |

Schwab Short-Term U.S. Treasury ETF

(Ticker Symbol: SCHO) | |

| Market Price Return1 | 3.46% |

| NAV Return1 | 3.53% |

| Bloomberg Barclays US Treasury 1-3 Year Index | 3.59% |

| ETF Category: Morningstar Short Government2 | 3.25% |

| Performance Details | pages 9-10 |

| |

Schwab Intermediate-Term U.S. Treasury ETF

(Ticker Symbol: SCHR) | |

| Market Price Return1 | 6.18% |

| NAV Return1 | 6.38% |

| Bloomberg Barclays US Treasury 3-10 Year Index | 6.43% |

| ETF Category: Morningstar Intermediate Government2 | 5.88% |

| Performance Details | pages 11-12 |

| |

Schwab Long-Term U.S. Treasury ETF

(Ticker Symbol: SCHQ) | |

| Market Price Return1 | -5.16%* |

| NAV Return1 | -4.91%* |

| Bloomberg Barclays US Long Treasury Index | -4.92%* |

| ETF Category: Morningstar Long Government2 | N/A |

| Performance Details | pages 13-14 |

| Total Returns for the 12 Months Ended December 31, 2019 |

Schwab U.S. Aggregate Bond ETF

(Ticker Symbol: SCHZ) | |

| Market Price Return1 | 8.64% |

| NAV Return1 | 8.64% |

| Bloomberg Barclays US Aggregate Bond Index | 8.72% |

| ETF Category: Morningstar Intermediate Core Bond2 | 8.06% |

| Performance Details | pages 15-16 |

| |

Schwab 1-5 Year Corporate Bond ETF

(Ticker Symbol: SCHJ) | |

| Market Price Return1 | 0.52%* |

| NAV Return1 | 0.50%* |

| Bloomberg Barclays US 1-5 Year Corporate Bond Index | 0.57%* |

| ETF Category: Morningstar Short-Term Bond2 | N/A |

| Performance Details | pages 17-18 |

| |

Schwab 5-10 Year Corporate Bond ETF

(Ticker Symbol: SCHI) | |

| Market Price Return1 | 0.67%* |

| NAV Return1 | 0.67%* |

| Bloomberg Barclays US 5-10 Year Corporate Bond Index | 0.76%* |

| ETF Category: Morningstar Corporate Bond2 | N/A |

| Performance Details | pages 19-20 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund(s) is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

TIPS generally have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The funds are not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the funds. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Total returns shown are since the fund’s inception date of October 10, 2019. |

| 1 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

Schwab Fixed-Income ETFs | Annual Report

Jonathan de St. Paer

President of Charles Schwab

Investment Management, Inc.

and the funds covered

in this report.

Dear Shareholder,

For many of us, the beginning of a new year is not only a time of resolution setting, but also an opportunity for reflection. Looking back on 2019, there are a number of events that may stand out for investors. Most noteworthy perhaps for the fixed income market was the Federal Reserve (the Fed) cutting interest rates in 2019—not once, but three times. This was also the first time the Fed had done so since the end of 2008. Another key milestone was the performance of the stock market, which entered the new year continuing the longest bull market cycle in history, reaching 129 months by the end of 2019. In this environment, the Bloomberg Barclays US Aggregate Bond Index, a benchmark for the overall U.S. fixed income market, returned 8.7% for the year ended December 31, 2019, as falling yields pushed up bond prices. The S&P 500® Index, a bellwether for U.S. stocks, returned 31.5% for the same period, its second-best annual performance of the past two decades.

When there is strong and sustained investment performance such as this, many investors can’t imagine that the tide could quickly change and some of their gains could potentially be reversed. At Charles Schwab Investment Management, we know from our research in behavioral finance that one of the common pitfalls investors can be vulnerable to is known as “recency bias.” This is a tendency to be influenced by recent news, events, or experiences. This bias can often lead to an assumption that what has been happening will continue to happen. We believe it’s critical that investors remember that all market cycles, no matter how long and whether up or down, ultimately come to an end at some point.

That’s a key reason why we believe investors should focus on ensuring that they have an appropriate asset allocation for their stage in life, investment goals, and risk tolerance. The Schwab Fixed-Income ETFs are prime examples of how we can help in this regard, providing straightforward and cost-efficient options for gaining exposure to different segments of the fixed income market.

In October, we expanded our core fixed income offerings with the launch of three new bond ETFs. The Schwab 1-5 Year Corporate Bond ETF, Schwab 5-10 Year Corporate Bond ETF and Schwab Long-Term U.S. Treasury ETF complement our existing ETFs to give investors access to a broad spectrum of fixed income securities, including government and corporate bonds with short, intermediate or long-term exposure, as well as Treasury Inflation Protected Securities (TIPS). We take great pride in our role as one of the largest and fastest-growing ETF providers in the country, and our ETFs’ expense ratios remain among the lowest in the industry.

Thank you for investing with Charles Schwab Investment Management, and for trusting us to help you achieve your financial goals. For more information about the Schwab Fixed-Income ETFs, please continue reading this report. In addition, you can find further details about these funds by visiting our website at www.schwabfunds.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

“In October, we expanded our core fixed income offerings with the launch of three new bond ETFs.”

Past performance cannot guarantee future results.

Management views may have changed since the report date.

Schwab Fixed-Income ETFs | Annual Report

The Investment Environment

For the 12-month reporting period ended December 31, 2019, fixed-income markets generated positive returns. Equity markets were even more robust, particularly in the U.S., buoyed by steady, albeit slowing, economic growth, three interest rate cuts by the Federal Reserve (the Fed), and robust consumer spending. In this environment, the Bloomberg Barclays US Aggregate Bond Index returned 8.72% for the reporting period while the Bloomberg Barclays US Treasury 1-3 Year Index and the Bloomberg Barclays US Treasury 3-10 Year index returned 3.59% and 6.43%, respectively. Inflation-protected securities were particularly strong, with the Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) returning 8.43%.

Despite escalating trade tensions with China over much of the reporting period, the U.S. economy maintained steady growth in its tenth year of expansion, although at a declining pace. After concerns of economic weakness intensified late in 2018, the U.S. economic outlook brightened considerably in the first six months of 2019. In the third quarter of 2019, signs of slowing growth increased amid a weakening global economy, waning manufacturing activity, and the ongoing U.S.-China trade war. However, in the fourth quarter, a partial trade resolution between the U.S. and China relieved much of the pressure. U.S. gross domestic product (GDP) grew at an annual rate of 2.1% in the third quarter of 2019, up slightly from 2.0% in the second quarter, but down from 3.1% in the first quarter of 2019. The unemployment rate ended the reporting period at a 50-year low. After reaching a near 18-year high during the summer, consumer confidence edged lower by December, although it remained a stable source of GDP growth in the U.S. Inflation remained benign.

After raising interest rates four times in 2018, the Fed held rates unchanged through the first half of 2019. But amid growing signs of global economic weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the period—in July, September, and October. Following the October interest rate cut, the Fed signaled that further interest rate cuts would be unlikely provided the economy continues to expand moderately and the labor market remains strong. The federal funds target rate ended the reporting period in a range of 1.50% to 1.75%.

Outside the U.S., major central banks maintained accommodative monetary policies. The European Central Bank held interest rates steady and launched an asset-purchase program to help stimulate the economy. The Bank of Japan maintained its short-term interest rate target of –0.1% throughout the period. Despite ongoing Brexit-related uncertainties, the Bank of England maintained its key official bank rate of 0.75% throughout the period, where it has remained since August 2018.

Yields of U.S. Treasury Securities: Effective Yields of Three-Month, Two-Year and 10-Year Treasuries

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Data source: Bloomberg L.P.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

Schwab Fixed-Income ETFs | Annual Report

The Investment Environment(continued)

Bond prices generally rose over the reporting period as yields fell. (Bond yields and bond prices move in opposite directions.) Short-term yields, which typically respond to changes in the federal funds rate, remained relatively flat for the first five months of the period before declining as the Fed implemented interest rate cuts, with the three-month Treasury yield falling from 2.45% at the outset of the period to 1.55% at the end of the period. Longer-term yields, which are influenced more by economic growth and inflation expectations, trended downward over most of the period before moderating in the last four months. During the reporting period, the U.S. Treasury yield curve flattened with portions of the yield curve inverting, which is often an indicator of a possible recession, before normalizing in the last quarter of the year. Over the reporting period, the 10-year Treasury yield fell from 2.69% to 1.92%. Outside the U.S., bond yields generally remained low.

Schwab Fixed-Income ETFs | Annual Report

| Matthew Hastings, CFA, Vice President and Head of Taxable Bond Strategies, leads the portfolio management team for Schwab Fixed-Income ETFs and Schwab’s taxable bond funds. He also has overall responsibility for all aspects of the management of the funds. Prior to joining CSIM in 1999, Mr. Hastings was in fixed-income sales and trading at Lehman Brothers. He has worked in the fixed-income securities industry since 1996. |

| Steven Hung, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF, Schwab 1-5 Year Corporate Bond ETF and Schwab 5-10 Year Corporate Bond ETF. His primary focus is corporate bonds. Prior to joining CSIM in 1999, Mr. Hung was an associate in Schwab’s management training program for nine months. In that role, he worked as a clerk on the options trading floor of the Pacific Coast Stock Exchange. |

| Mark McKissick, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. TIPS ETF, Schwab Short-Term U.S. Treasury ETF, Schwab Intermediate-Term U.S. Treasury ETF, Schwab Long-Term U.S. Treasury ETF and Schwab U.S. Aggregate Bond ETF. Prior to joining CSIM in 2016, Mr. McKissick worked at Denver Investments for 17 years, most recently as a director of fixed income and portfolio manager where he co-managed multiple bond strategies, as well as oversaw the firm’s fixed-income business including the investment process, client service and other administrative functions. |

| Alfonso Portillo, Jr., Senior Portfolio Manager, is responsible for the day-to-day co-management of the Schwab U.S. Aggregate Bond ETF. His primary focus is securitized products. Prior to joining CSIM in 2007, Mr. Portillo worked for ten years at Pacific Investment Management Company, most recently as a vice president and member of the mortgage- and asset-backed portfolio management team. He has worked in fixed-income asset management since 1996. |

Schwab Fixed-Income ETFs | Annual Report

The Schwab U.S. TIPS ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) (the index). To pursue this investment objective, the fund generally invests in securities that are included in the index and generally seeks to replicate the performance of the index by giving the same weight to a given security as the index does. For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the reporting period, the U.S. economy exhibited steady, although slowing, growth throughout the period. Inflation remained benign for most of the reporting period despite a tight labor market and continued low unemployment, a more dovish Federal Reserve (Fed), and a soaring stock market. After four interest rate hikes in 2018, the Fed held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the period—in July, September, and October. Consistent with U.S. Treasury securities yields across the board, yields on U.S. Treasury Inflation-Protected Securities (TIPS) fell and prices rose. (Bond yields and bond prices move in opposite directions.) For the year, TIPS outperformed non-inflation protected U.S. Treasury securities.

Performance. For the 12 months ended December 31, 2019, the fund’s market price return was 8.52% and its NAV return was 8.36% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned 8.43% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The fund closely tracked the performance of the index for the 12-month reporting period. The fund’s gains came primarily from price appreciation, although coupon income and inflation accrual generated by the fund’s holdings further boosted fund performance.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity4 | 8.0 Yrs |

| Weighted Average Duration4 | 7.4 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

TIPS generally have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Less than 0.05%. |

| 3 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 4 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

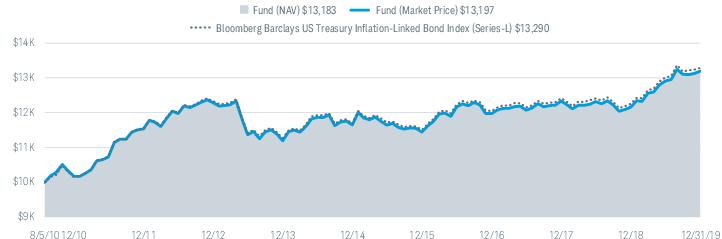

Performance of Hypothetical $10,000 Investment (August 5, 2010 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab U.S. TIPS ETF (8/5/2010) | | | |

| Market Price Return2 | 8.52% | 2.52% | 2.99% |

| NAV Return2 | 8.36% | 2.55% | 2.98% |

| Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) | 8.43% | 2.62% | 3.07% |

| ETF Category: Morningstar Inflation-Protected Bond3 | 7.92% | 2.15% | N/A |

| Fund Expense Ratio4: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (8/5/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

Schwab Fixed-Income ETFs | Annual Report

Schwab Short-Term U.S. Treasury ETF

The Schwab Short-Term U.S. Treasury ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the Bloomberg Barclays US Treasury 1-3 Year Index (the index). To pursue this investment objective, the fund generally invests in a representative sample of securities in the index. For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. U.S. bond returns for 2019 were strong nearly across the board, with the strongest performance coming from longer-term corporate bond markets and long-term U.S. Treasuries, although shorter-term U.S. Treasuries, Treasury Inflation-Protected Securities (TIPS), and government and asset-backed securities all posted positive gains. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the period, the U.S. economy exhibited steady, although slowing, growth throughout the period. After four interest rate hikes in 2018, the Federal Reserve (Fed) held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the period—in July, September, and October. Despite a tight labor market and continued low unemployment, a more dovish Fed, and a soaring stock market, inflation remained benign.

Over the reporting period, yields on short-term U.S. Treasuries declined and prices rose—more steeply over the first half of the year as the Fed reconsidered its interest rate policy and paused on further rate increases, then at a slower pace over the second half as the Fed implemented rate cuts. (Bond yields and bond prices move in opposite directions.) Over the reporting period, the yield on the 1-year U.S. Treasury bill fell relatively steadily, from 2.63% to 1.59%. The yield on the 2-year U.S. Treasury began the year at 2.48%, hit its one-year low of 1.39% in early October, and ended the year at 1.58%. The yield on the 3-year U.S. Treasury followed a similar pattern, beginning the year at 2.46%, hitting its low of 1.34% in early October, and closing the year at 1.62%. The spread between the 1-year and 3-year yields somewhat normalized from -0.17% to 0.03% for the year.

Performance. For the 12 months ended December 31, 2019, the fund’s market price return was 3.46% and its NAV return was 3.53% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned 3.59% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The fund closely tracked the performance of the index for the 12-month reporting period. The fund’s gains came primarily from coupon income generated by the fund’s holdings, with price appreciation further boosting the fund’s return.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity3 | 2.0 Yrs |

| Weighted Average Duration3 | 1.9 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Schwab Short-Term U.S. Treasury ETF

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

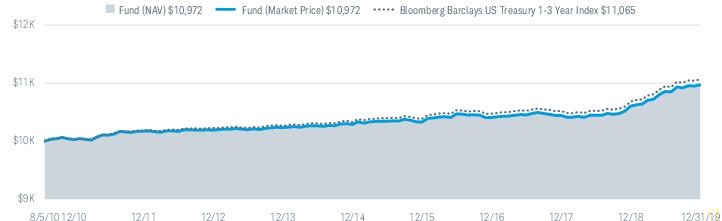

Performance of Hypothetical $10,000 Investment (August 5, 2010 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab Short-Term U.S. Treasury ETF (8/5/2010) | | | |

| Market Price Return2 | 3.46% | 1.30% | 0.99% |

| NAV Return2 | 3.53% | 1.31% | 0.99% |

| Bloomberg Barclays US Treasury 1-3 Year Index | 3.59% | 1.39% | 1.08% |

| ETF Category: Morningstar Short Government3 | 3.25% | 1.18% | N/A |

| Fund Expense Ratio4: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (8/5/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. Effective December 13, 2019, the management fee was reduced to 0.05%. For more information, see financial note 4 or refer to the prospectus supplement dated December 13, 2019. |

Schwab Fixed-Income ETFs | Annual Report

Schwab Intermediate-Term U.S. Treasury ETF

The Schwab Intermediate-Term U.S. Treasury ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the Bloomberg Barclays US Treasury 3-10 Year Index (the index). To pursue this investment objective, the fund generally invests in a representative sample of securities included in the index. For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. U.S. bond returns for 2019 were strong nearly across the board, with the strongest performance coming from longer-term corporate bond markets and long-term U.S. Treasuries, although shorter-term U.S. Treasuries, Treasury Inflation-Protected Securities (TIPS), and government and asset-backed securities all posted positive gains. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the period, the U.S. economy exhibited steady, although slowing, growth throughout the period. After four interest rate hikes in 2018, the Federal Reserve (Fed) held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the period—in July, September, and October. Despite a tight labor market and continued low unemployment, a more dovish Fed, and a soaring stock market, inflation remained benign.

Over the reporting period, yields on intermediate-term U.S. Treasuries declined and prices rose—more steeply over the first half of the year as the Fed reconsidered its interest rate policy and paused on further rate increases, then stabilized over the second half as the Fed implemented rate cuts. (Bond yields and bond prices move in opposite directions.) Over the reporting period, the yield on the 3-year U.S. Treasury began the year at 2.46%, hit its one-year low of 1.34% in early October, and ended the year at 1.62%. The yield on the 5-year U.S. Treasury note began the year at 2.51%, hit its one-year low of 1.32% in early September, and ended the year at 1.69%. The yield on the 10-year U.S. Treasury began the year at 2.69%, hit its low of 1.47% in late August and early September, and ended the year at 1.92%.

Performance. For the 12 months ended December 31, 2019, the fund’s market price return was 6.18% and its NAV return was 6.38% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned 6.43% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The fund closely tracked the performance of the index for the 12-month reporting period. The fund’s gains came primarily from price appreciation, although coupon income generated by the fund’s holdings further boosted fund performance.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity3 | 5.6 Yrs |

| Weighted Average Duration3 | 5.2 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Schwab Intermediate-Term U.S. Treasury ETF

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

Performance of Hypothetical $10,000 Investment (August 5, 2010 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab Intermediate-Term U.S. Treasury ETF (8/5/2010) | | | |

| Market Price Return2 | 6.18% | 2.33% | 2.63% |

| NAV Return2 | 6.38% | 2.38% | 2.64% |

| Bloomberg Barclays US Treasury 3-10 Year Index | 6.43% | 2.46% | 2.74% |

| ETF Category: Morningstar Intermediate Government3 | 5.88% | 1.94% | N/A |

| Fund Expense Ratio4: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (8/5/10) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. Effective December 13, 2019, the management fee was reduced to 0.05%. For more information, see financial note 4 or refer to the prospectus supplement dated December 13, 2019. |

Schwab Fixed-Income ETFs | Annual Report

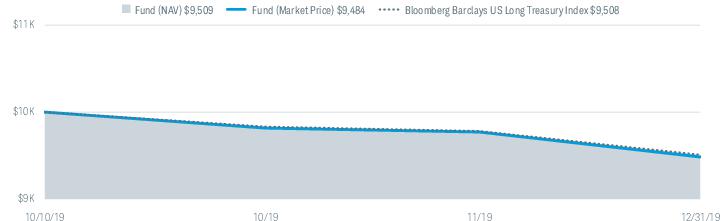

Schwab Long-Term U.S. Treasury ETF

The Schwab Long-Term U.S. Treasury ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of an index that measures the performance of the long-term U.S. Treasury bond market. To pursue this investment objective, the fund generally invests in securities that are included in Bloomberg Barclays US Long Treasury Index (the index) and generally seeks to replicate the performance of the index by giving the same weight to a given security as the index does. For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. U.S. bond returns for 2019 were strong nearly across the board, with the strongest performance coming from longer-term corporate bond markets and long-term U.S. Treasuries, although shorter-term U.S. Treasuries, Treasury Inflation-Protected Securities (TIPS), and government and asset-backed securities all posted positive gains. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the period, the U.S. economy exhibited steady, although slowing, growth throughout the period. After four interest rate hikes in 2018, the Federal Reserve (Fed) held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the year—in July, September, and October. Despite a tight labor market and continued low unemployment, a more dovish Fed, and a soaring stock market, inflation remained benign.

Yields on long-term U.S. Treasuries declined relatively steadily over the first half of the year, as the Fed reconsidered its interest rate policy and paused on further rate increases, but became more volatile over the second half of the year as the Fed implemented rate cuts, U.S.-China trade tensions endured, and global uncertainties persisted. By year-end, as a partial U.S.-China trade resolution was announced and equity markets had regained their momentum, long-term yields had increased modestly from the lowest levels of the year. Over the fund’s reporting period from its inception on October 10, 2019 through December 31, 2019, the yield on the 10-year U.S. Treasury rose from 1.59% to 1.92% and the yield on the 30-year U.S. Treasury rose from 2.08% to 2.39%.

Performance. During the reporting period from fund inception on October 10, 2019 through December 31, 2019, the fund’s market price return was -5.16% and its NAV return was -4.91% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned -4.92% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. Over the reporting period from fund inception on October 10, 2019 through December 31, 2019, the fund closely tracked the performance of the index. Declining market value of long-term U.S. Treasury securities detracted from fund performance. Coupon income generated by the fund’s holdings contributed to fund performance, partially offsetting the impact of negative price return that detracted from performance.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity4 | 24.9 Yrs |

| Weighted Average Duration4 | 17.5 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Less than 0.05%. |

| 3 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 4 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Schwab Long-Term U.S. Treasury ETF

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

Performance of Hypothetical $10,000 Investment (October 10, 2019 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | Since Inception* |

| Fund: Schwab Long-Term U.S. Treasury ETF (10/10/2019) | |

| Market Price Return2 | -5.16% |

| NAV Return2 | -4.91% |

| Bloomberg Barclays US Long Treasury Index | -4.92% |

| ETF Category: Morningstar Long Government3 | N/A |

| Fund Expense Ratio4: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. Effective December 13, 2019, the management fee was reduced to 0.05%. For more information, see financial note 4 or refer to the prospectus supplement dated December 13, 2019. |

Schwab Fixed-Income ETFs | Annual Report

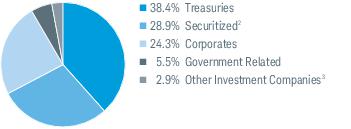

Schwab U.S. Aggregate Bond ETF

The Schwab U.S. Aggregate Bond ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of the Bloomberg Barclays US Aggregate Bond Index (the index). To pursue this investment objective, the fund generally invests in a representative sample of securities included in the index. In addition, for the 12-month reporting period ended December 31, 2019, the fund also held positions in TBAs, or “to-be-announced” securities. TBAs are mortgage-backed bonds that settle on a forward date and are used to gain exposure to the mortgage market. The average month-end position in these securities was 2.2% of the fund, with a minimum exposure of 1.7% and a maximum exposure of 3.3%. For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. U.S. bond returns for 2019 were strong nearly across the board, with the strongest performance coming from longer-term corporate bond markets and long-term U.S. Treasuries, although shorter-term U.S. Treasuries, Treasury Inflation-Protected Securities (TIPS), and government and asset-backed securities all posted positive gains. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the period, the U.S. economy exhibited steady, although slowing, growth throughout the period. After four interest rate hikes in 2018, the Federal Reserve (Fed) held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the period. Despite tight labor market and continued low unemployment, a more dovish Fed, and a soaring stock market, inflation remained benign.

Over much of the reporting period, the U.S. Treasury yield curve flattened. In late March, certain parts of the yield curve inverted as short-term yield exceeded long-term yields, raising recession concerns. But as trade tensions moderated, the Fed’s intentions became clearer, and investors regained their optimism, demand for longer-term U.S. Treasuries declined, driving yields higher, and by October the yield curve had regained its normal slope. Over the reporting period, the yield on the three-month U.S. Treasury fell from 2.45% to 1.55%, the yield on the 10-year U.S. Treasury fell from 2.69% to 1.92%, and the yield on the 30-year U.S. Treasury fell from 3.02% to 2.39%.

Performance. For the 12 months ended December 31, 2019, the fund’s market price return and NAV return were 8.64% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned 8.72% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The fund closely tracked the performance of the index for the 12-month reporting period, which meant keeping the fund’s credit quality, duration, and sector allocations aligned to the index. All bond sectors contributed positively, with gains primarily coming from price appreciation, although coupon income generated by the fund’s holdings further boosted fund performance. As a result of increased assets under management (AUM), the fund was able to increase its number of credit and securitized positions, providing it improved tracking of its index.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity4 | 7.9 Yrs |

| Weighted Average Duration4 | 5.9 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund may seek to obtain exposure to U.S. agency mortgage pass-through securities, in part or in full, through the use of “to-be-announced” or “TBA” transactions, which are standardized contracts for future delivery of mortgage pass-through securities in which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. These transactions represented approximately 1.8% of total investments on December 31, 2019. |

| 3 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 4 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Schwab U.S. Aggregate Bond ETF

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

Performance of Hypothetical $10,000 Investment (July 14, 2011 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 5 Years | Since Inception* |

| Fund: Schwab U.S. Aggregate Bond ETF (7/14/2011) | | | |

| Market Price Return2 | 8.64% | 2.90% | 3.08% |

| NAV Return2 | 8.64% | 2.97% | 3.08% |

| Bloomberg Barclays US Aggregate Bond Index | 8.72% | 3.05% | 3.20% |

| ETF Category: Morningstar Intermediate Core Bond3 | 8.06% | 2.72% | N/A |

| Fund Expense Ratio4: 0.04% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (7/14/11) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. |

Schwab Fixed-Income ETFs | Annual Report

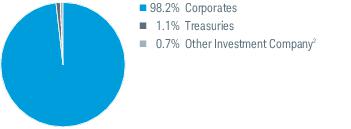

Schwab 1-5 Year Corporate Bond ETF

The Schwab 1-5 Year Corporate Bond ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of an index that measures the performance of the short-term U.S. corporate bond market. To pursue this investment objective, the fund generally invests in a representative sample of securities included in the Bloomberg Barclays US 1-5 Year Corporate Bond Index (the index). For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. U.S. bond returns for 2019 were strong nearly across the board, with the strongest performance coming from longer-term corporate bond markets and long-term U.S. Treasuries, although shorter-term U.S. Treasuries, Treasury Inflation-Protected Securities (TIPS), and government and asset-backed securities all posted positive gains. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the period, the U.S. economy exhibited steady, although slowing, growth throughout the period. After four interest rate hikes in 2018, the Federal Reserve (Fed) held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the year—in July, September, and October. Despite a tight labor market and continued low unemployment, a more dovish Fed, and a soaring stock market, inflation remained benign.

Over the fund’s reporting period from its inception on October 10, 2019 through December 31, 2019, yields on U.S. corporate debt fell, driving prices higher. (Bond yields and bond prices move in opposite directions.) Credit spreads between corporate bonds and U.S. Treasuries tightened, reflecting improving creditworthiness and a favorable environment for corporate bonds. Contributors to this tightening included the Fed’s interest rate cuts, strong corporate earnings, abating recessionary fears, and the easing of trade tensions that came with the December announcement of a partial trade resolution between the U.S. and China.

Performance. During the reporting period from fund inception on October 10, 2019 through December 31, 2019, the fund’s market price return was 0.52% and its NAV return was 0.50% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned 0.57% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. Over the reporting period from fund inception on October 10, 2019 through December 31, 2019, the fund closely tracked the performance of the index. The fund’s gains came both from price appreciation and coupon income generated by the fund’s holdings.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity3 | 2.8 Yrs |

| Weighted Average Duration3 | 2.6 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Schwab 1-5 Year Corporate Bond ETF

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

Performance of Hypothetical $10,000 Investment (October 10, 2019 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | Since Inception* |

| Fund: Schwab 1-5 Year Corporate Bond ETF (10/10/2019) | |

| Market Price Return2 | 0.52% |

| NAV Return2 | 0.50% |

| Bloomberg Barclays US 1-5 Year Corporate Bond Index | 0.57% |

| ETF Category: Morningstar Short-Term Bond3 | N/A |

| Fund Expense Ratio4: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. Effective December 13, 2019, the management fee was reduced to 0.05%. For more information, see financial note 4 or refer to the prospectus supplement dated December 13, 2019. |

Schwab Fixed-Income ETFs | Annual Report

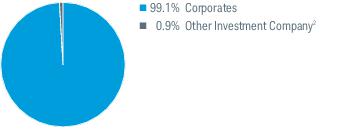

Schwab 5-10 Year Corporate Bond ETF

The Schwab 5-10 Year Corporate Bond ETF (the fund) seeks to track as closely as possible, before fees and expenses, the total return of an index that measures the performance of the intermediate-term U.S. corporate bond market. To pursue this investment objective, the fund generally invests in a representative sample of securities included in the Bloomberg Barclays US 5-10 Year Corporate Bond Index (the index). For more information about the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

Market Highlights. U.S. bond returns for 2019 were strong nearly across the board, with the strongest performance coming from longer-term corporate bond markets and long-term U.S. Treasuries, although U.S. shorter-term Treasuries, Treasury Inflation-Protected Securities (TIPS), and government and asset-backed securities all posted positive gains. Despite continuing signs of global economic weakness and escalating trade tensions with China over much of the period, the U.S. economy exhibited steady, although slowing, growth throughout the period. After four interest rate hikes in 2018, the Federal Reserve (Fed) held rates unchanged for the first half of the year. But amid growing signs of global weakness that threatened to dampen U.S. economic growth, along with continued low inflation and weakness in manufacturing, the Fed enacted three interest rate cuts by the end of the year—in July, September, and October. Despite a tight labor market and continued low unemployment, a more dovish Fed, and a soaring stock market, inflation remained benign.

Over the fund’s reporting period from its inception on October 10, 2019 through December 31, 2019, yields on U.S. corporate debt fell, driving prices higher. (Bond yields and bond prices move in opposite directions.) Credit spreads between corporate bonds and U.S. Treasuries tightened, reflecting improving creditworthiness and a favorable environment for corporate bonds. Contributors to this tightening included the Fed’s interest rate cuts, strong corporate earnings, abating recessionary fears, and the easing of trade tensions that came with the December announcement of a partial trade resolution between the U.S. and China. Longer-term corporate bonds performed more strongly than shorter-term bonds.

Performance. During the reporting period from fund inceptions on October 10, 2019 through December 31, 2019, the fund’s market price return and NAV return were 0.67% (for an explanation of market price and NAV returns, please refer to footnote 2 on the following page). The index returned 0.76% during the same period. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. Over the reporting period from fund inception on October 10, 2019 through December 31, 2019, the fund closely tracked the performance of the index. The fund’s gains came both from price appreciation and coupon income generated by the fund’s holdings.

Portfolio Composition % of Investments1

By Security Type

| Weighted Average Maturity3 | 7.1 Yrs |

| Weighted Average Duration3 | 6.2 Yrs |

Management views and portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of operational and transaction costs incurred by the fund.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 3 | See Glossary for definitions of maturity and duration. |

Schwab Fixed-Income ETFs | Annual Report

Schwab 5-10 Year Corporate Bond ETF

Performance and Fund Factsas of December 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabetfs_prospectus.

Performance of Hypothetical $10,000 Investment (October 10, 2019 – December 31, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | Since Inception* |

| Fund: Schwab 5-10 Year Corporate Bond ETF (10/10/2019) | |

| Market Price Return2 | 0.67% |

| NAV Return2 | 0.67% |

| Bloomberg Barclays US 5-10 Year Corporate Bond Index | 0.76% |

| ETF Category: Morningstar Corporate Bond3 | N/A |

| Fund Expense Ratio4: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV). Brokerage commissions will reduce returns.

Index ownership — Bloomberg Index Services Limited and its affiliates (collectively, Bloomberg) and Bloomberg’s licensors, including Barclays Bank PLC (Barclays), own all proprietary rights in the Bloomberg Barclays Indices. The fund is not sponsored, endorsed, sold or promoted by Bloomberg or Barclays. Neither Bloomberg nor Barclays endorses or recommends the fund. Neither Bloomberg nor Barclays guarantees the timeliness, accurateness or completeness of any data or information relating to the Bloomberg Barclays Indices, and neither shall be liable in any way in respect of the use or accuracy of the Bloomberg Barclays Indices.

| * | Inception (10/10/19) represents the date that the shares began trading in the secondary market. |

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. |

| 2 | ETF performance must be shown based on both a Market Price and a Net Asset Value (NAV) basis. The fund’s per share net asset value (NAV) is the value of one share of the fund. NAV is calculated by taking the fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the fund, and the Market Price Return is based on the market price per share of the fund. The price used to calculate market return (Market Price) is determined using the Official Closing Price of the primary stock exchange (generally, 4:00 p.m. Eastern time) and may not represent the returns you would receive if shares were traded at other times. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all passively- and actively-managed ETFs within the category as of the report date. |

| 4 | As stated in the prospectus. Effective December 13, 2019, the management fee was reduced to 0.05%. For more information, see financial note 4 or refer to the prospectus supplement dated December 13, 2019. |

Schwab Fixed-Income ETFs | Annual Report

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and, (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning July 1, 2019 and held through December 31, 2019.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in a fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.