EXHIBIT 4.17

EVALUATION OF THE P&NG RESERVES OF EAGLEFORD ENERGY INC. (As of August 31, 2011)

Copies: Eagleford Energy Inc. (2 copies) Sproule Associates Limited (1 copy) Electronic (1 copy) Project No.: 3391.18388 Prepared For: Eagleford Energy Inc. Authors: Attila A. Szabo, P.Eng., Project Leader Exclusivity: This report has been prepared for the exclusive use of Eagleford Energy Inc. It may not be reproduced, distributed, or made available to any other company or person, regulatory body, or organization without the knowledge and written consent of Sproule, and without the complete contents of the report being made available to that party.

Table of Contents — Page 1 Table of Contents Introduction Field Operations Historical Data, Interests and Burdens Evaluation Standards Evaluation Procedures Evaluation Results BOE Cautionary Statement Forward-Looking Statements Exclusivity Certification Permit to Practice Certificates Summary Table S-1 Summary of the Evaluation of the P&NG Reserves of Eagleford Energy Inc. (As of August 31, 2011) Before Income Tax Table S-2 Summary of Selected Price Forecasts (Effective August 31, 2011) Table S-3 Summary of Reserves and Net Present Values Total Proved Plus Probable Reserves Before Income Tax Table S-3A Summary of Reserves and Net Present Values Total Proved Developed Producing Reserves Before Income Tax Table S-3B Summary of Reserves and Net Present Values Total Probable Reserves Before Income Tax 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Table of Contents — Page 2 Discussion Reserves and Production Net Present Values Table D-1 Summary of the Evaluation of the P&NG Reserves by Property of Eagleford Energy Inc. (As of August 31, 2011) Before Income Tax Table D-2 Summary of Reserves and Net Present Values Total Proved Plus Probable Reserves Before Income Tax Table D-2A Summary of Reserves and Net Present Values Total Proved Developed Producing Reserves Before Income Tax Table D-2B Summary of Reserves and Net Present Values Total Probable Reserves Before Income Tax Constant Prices and Costs Table C-1 Summary of the Evaluation of the P&NG Reserves of Eagleford Energy Inc. (As of August 31, 2011) Before Income Tax Table C-2 Summary of the Evaluation of the P&NG Reserves by Property of Eagleford Energy Inc. (As of August 31, 2011) Before Income Tax Table C-3 Summary of the Reserves and Net Present Values Total Proved Plus Probable Reserves Before Income Tax Table C-3A Summary of Reserves and Net Present Values Total Proved Developed Producing Reserves Before Income Tax 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

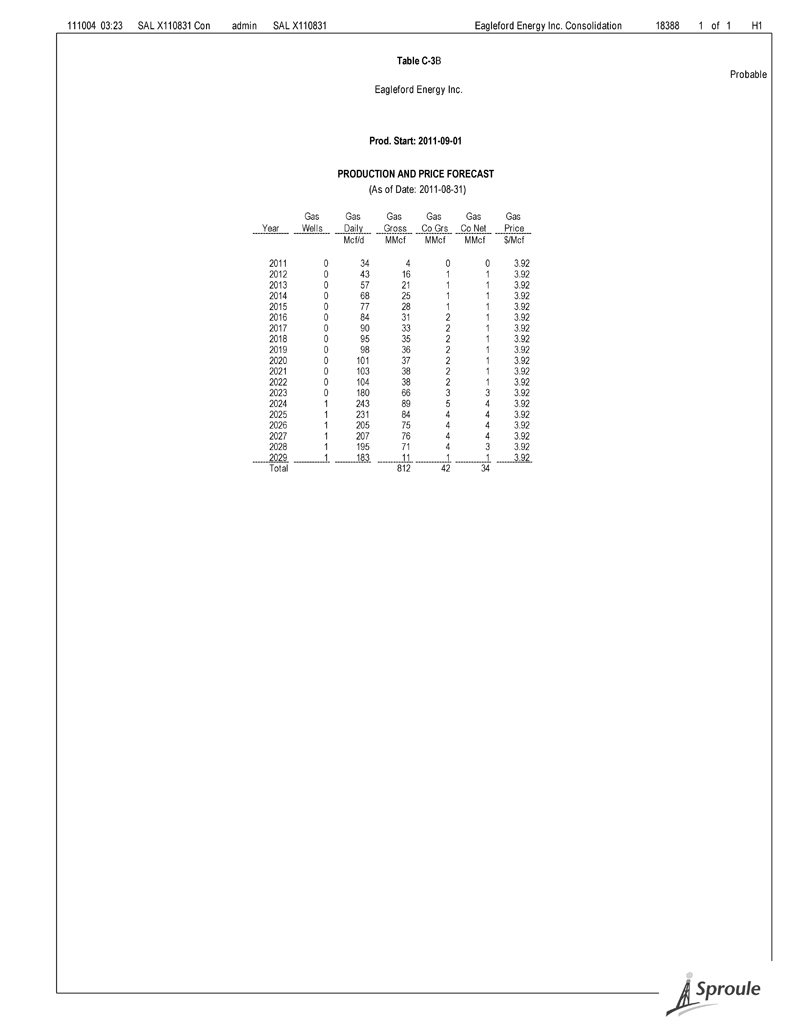

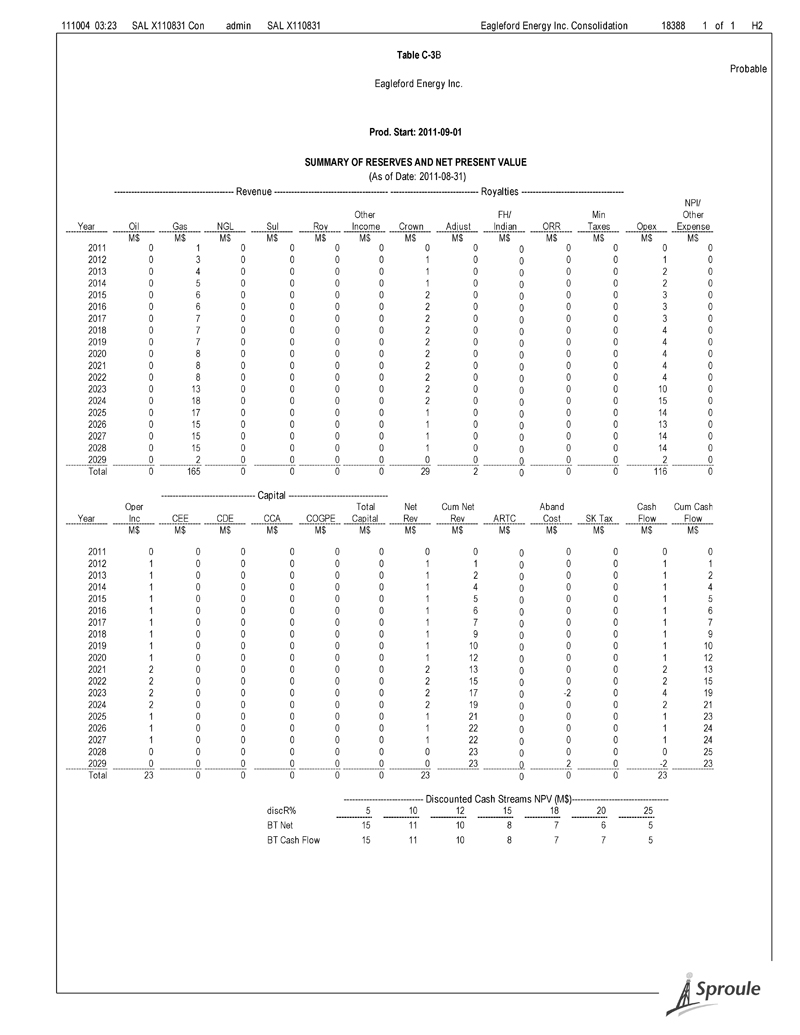

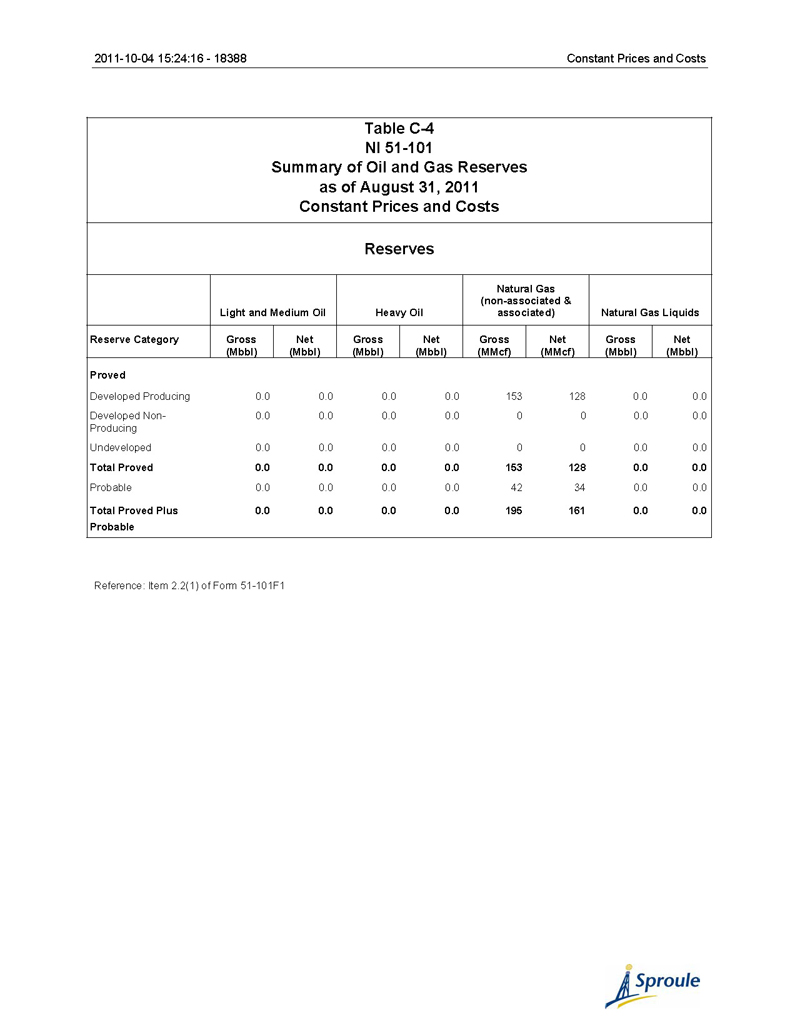

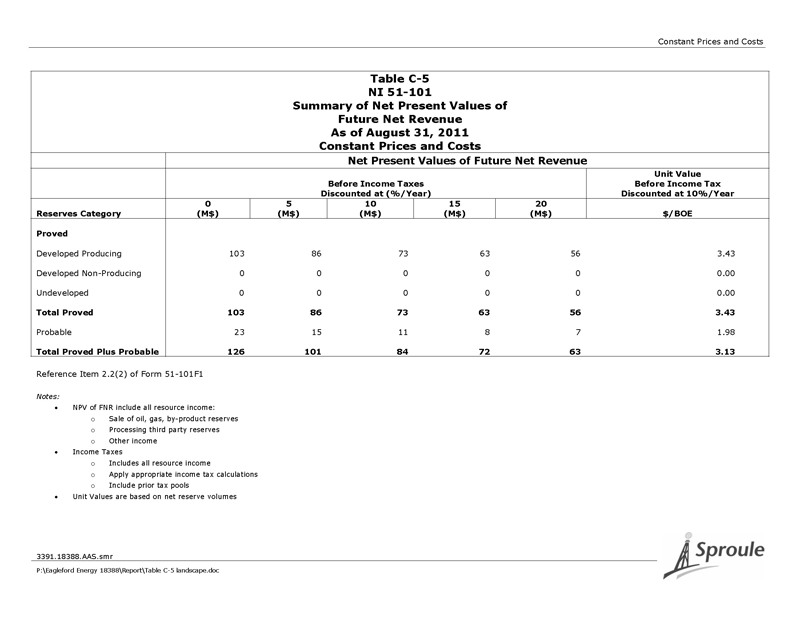

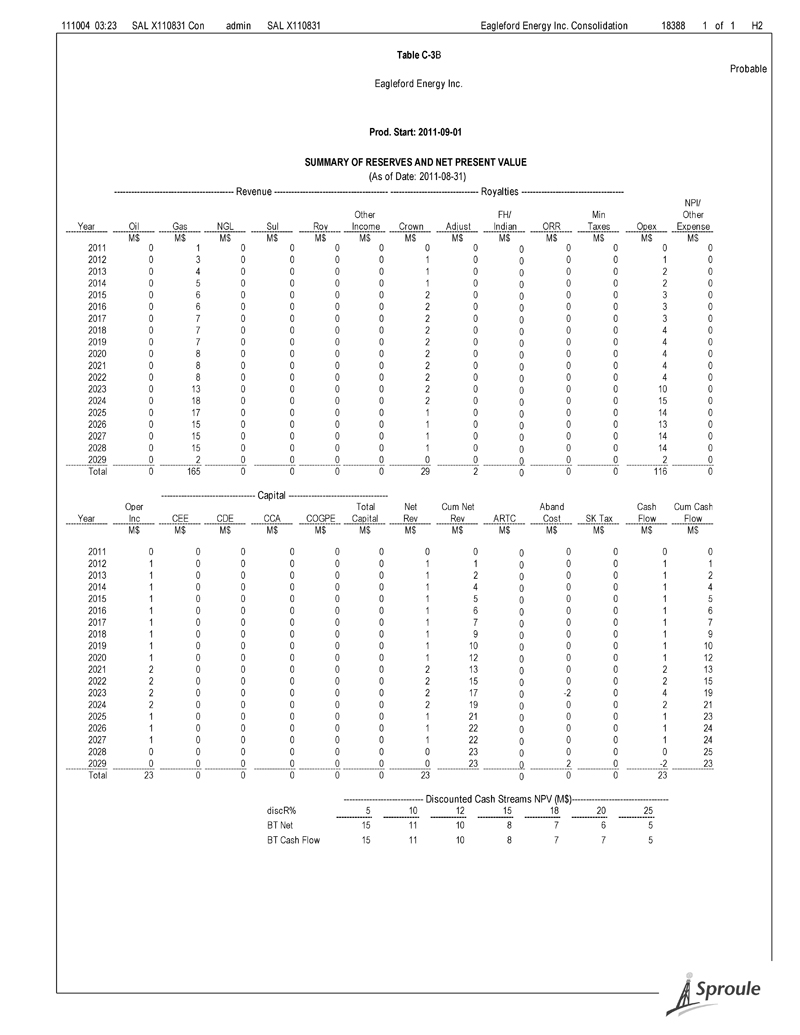

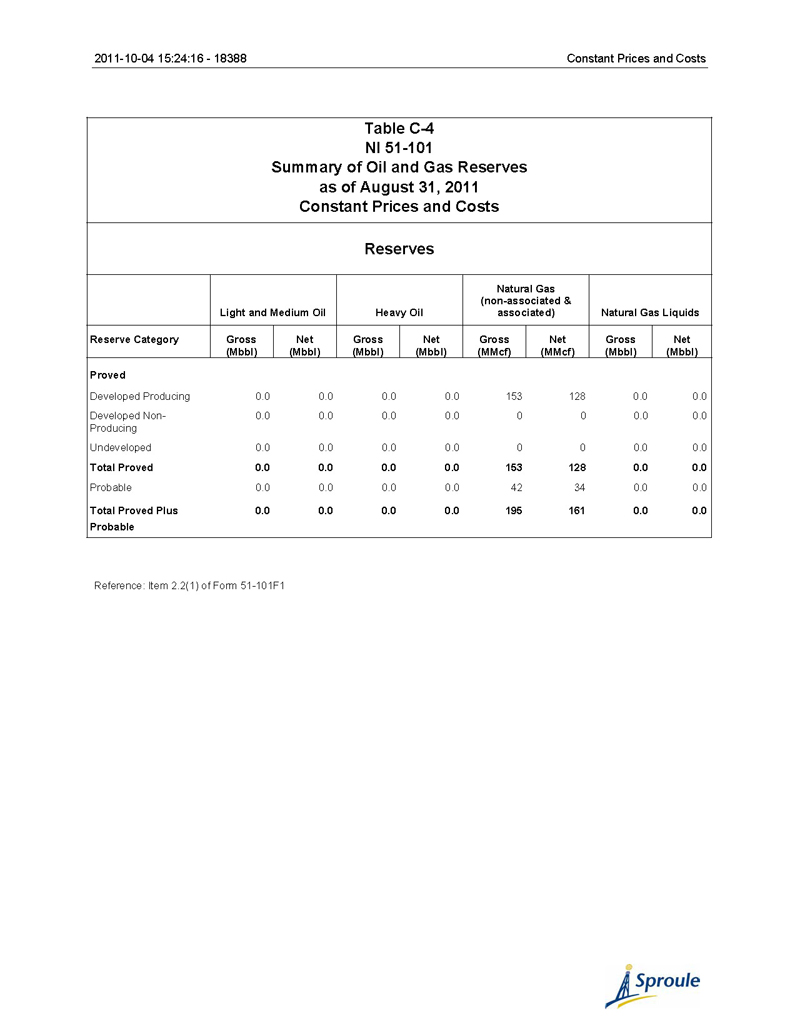

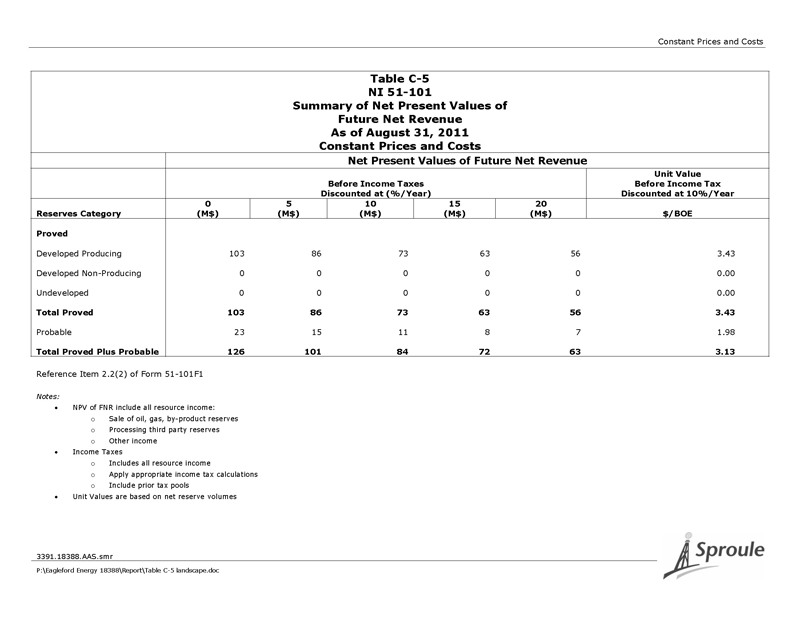

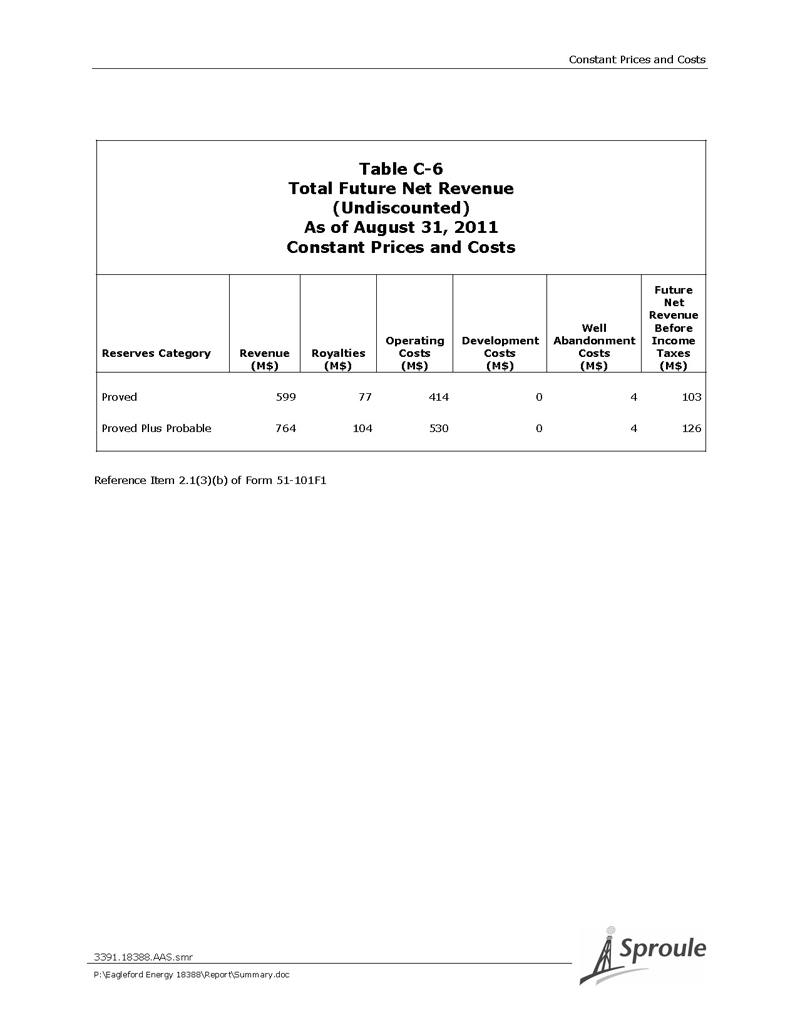

Table of Contents — Page 3 Table C-3B Summary of Reserves and Net Present Values Total Probable Reserves Before Income Tax Table C-4 Summary of Oil and Gas Reserves As of August 31, 2011 Constant Prices and Costs Table C-5 Summary of Net Present Values of Future Net Revenue As of August 31, 2011 Constant Prices and Costs Table C-6 Total Future Net Revenue (Undiscounted) As of August 31, 2011 Constant Prices and Costs Table C-7 Net Present Value of Future Net Revenue by Production Group As of August 31, 2011 Constant Prices and Costs Table C-8 Summary of Pricing Assumptions As of August 31, 2011 Constant Prices and Costs National Instrument 51-101 Forecast Prices and Costs Reconciliation Form 51-101F2 Report on Reserves Data by Independent Qualified Reserves Evaluator or Auditor Table 1 Summary of Oil and Gas Reserves As of August 31, 2011 Forecast Prices and Costs Table 2 Summary of Net Present Values of Future Net Revenue As of August 31, 2011 Forecast Prices and Costs 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

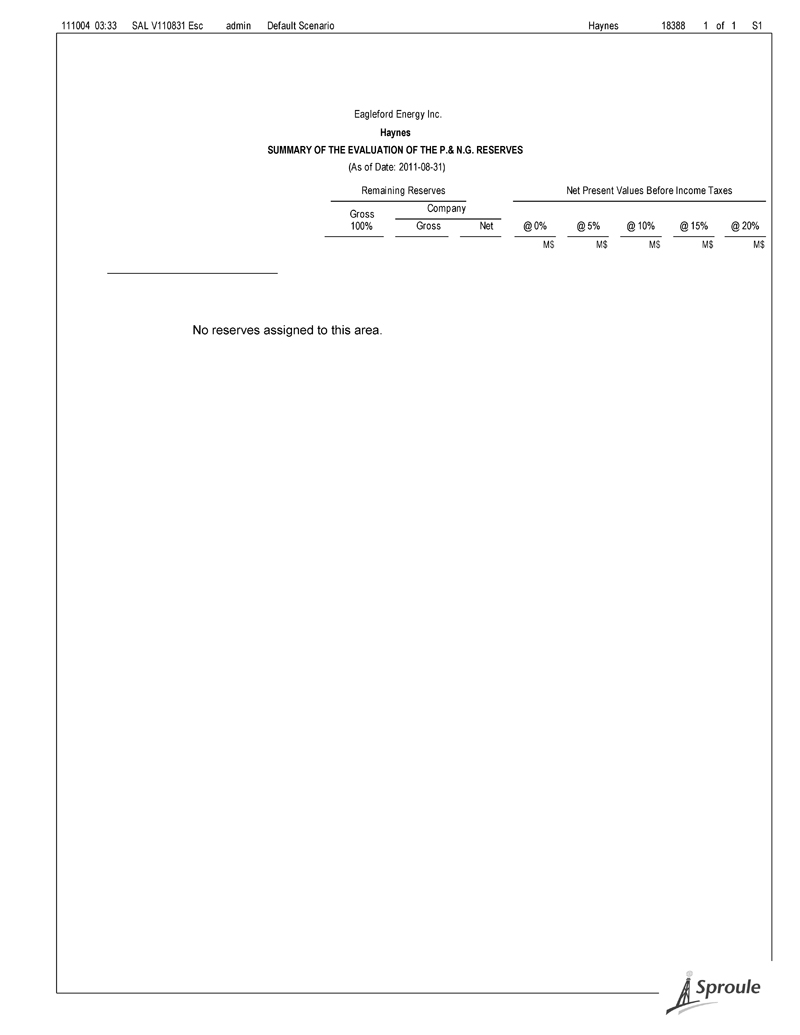

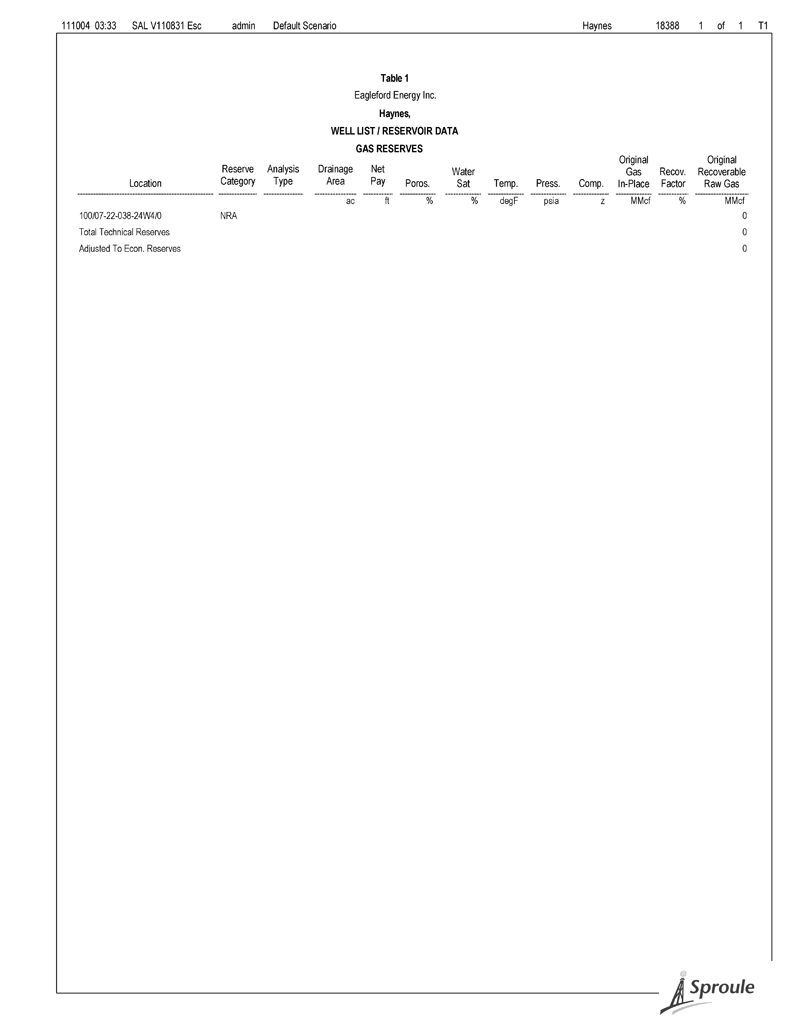

Table of Contents — Page 4 Table 3 Total Future Net Revenue (Undiscounted) As of August 31, 2011 Forecast Prices and Costs Table 4 Net Present Value of Future Net Revenue by Production Group As of August 31, 2011 Forecast Prices and Costs Table 5 Summary of Pricing and Inflation Rate Assumptions As of August 31, 2011 Forecast Prices and Costs Table 6 Reconciliation of Company Gross Reserves (Before Royalty) by Principal Product Type As of August 31, 2011 Forecast Prices and Costs Areas Alberta Area 1 Botha Area 2 Haynes Appendices Appendix A Definitions Appendix B Prices Appendix C Abbreviations Appendix D General Evaluation Parameters 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

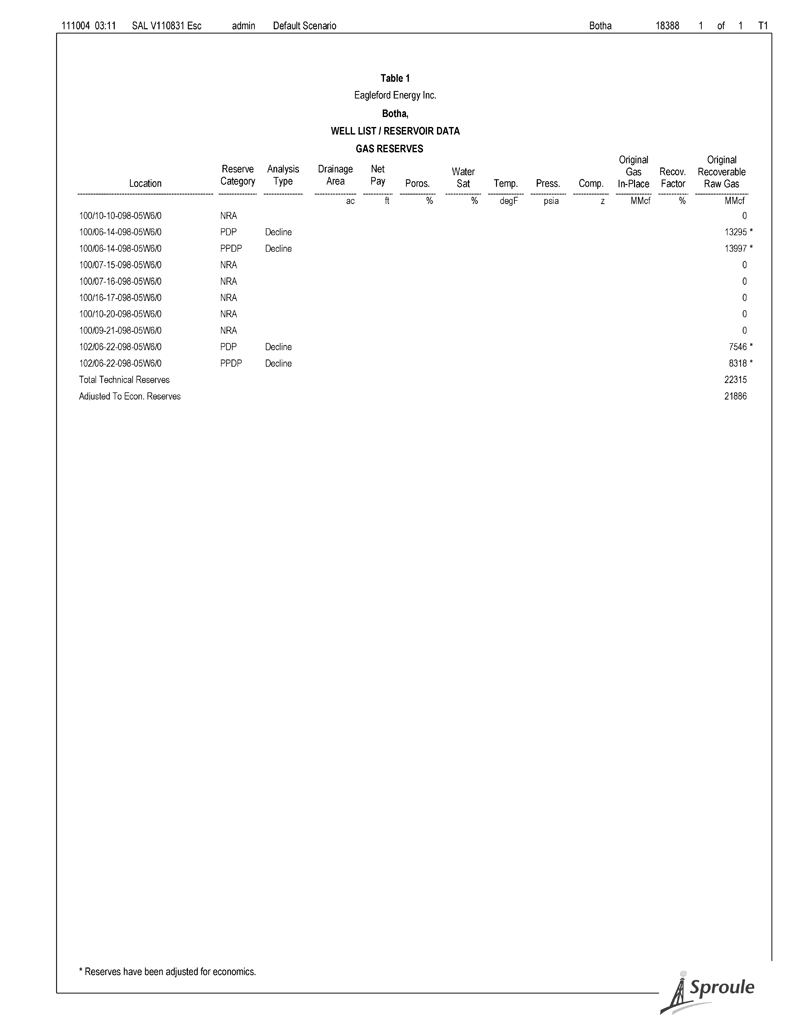

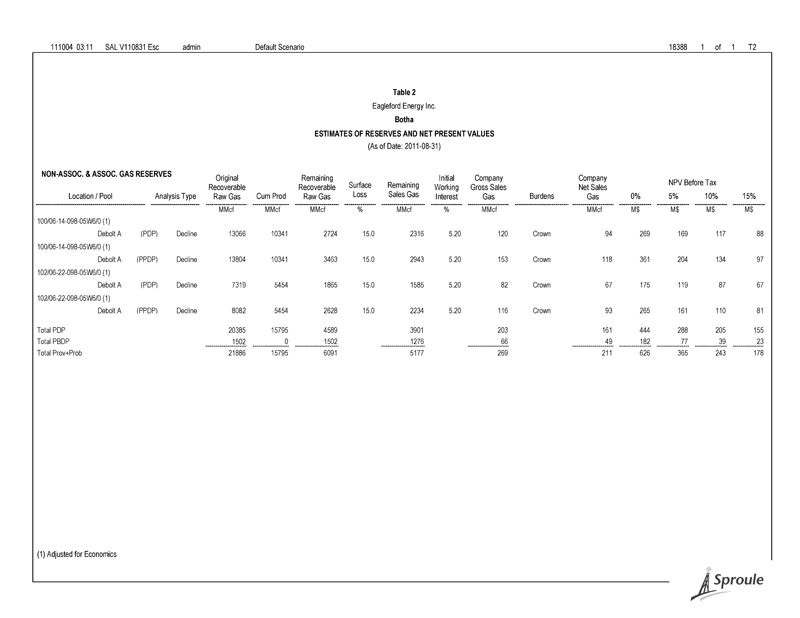

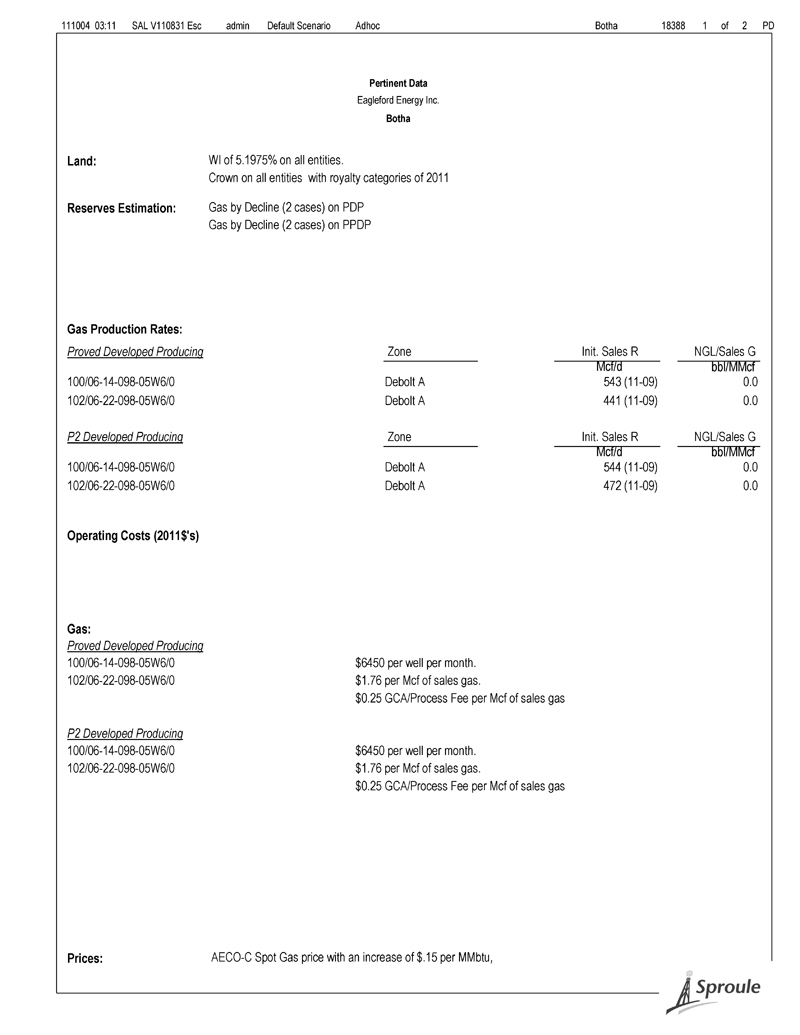

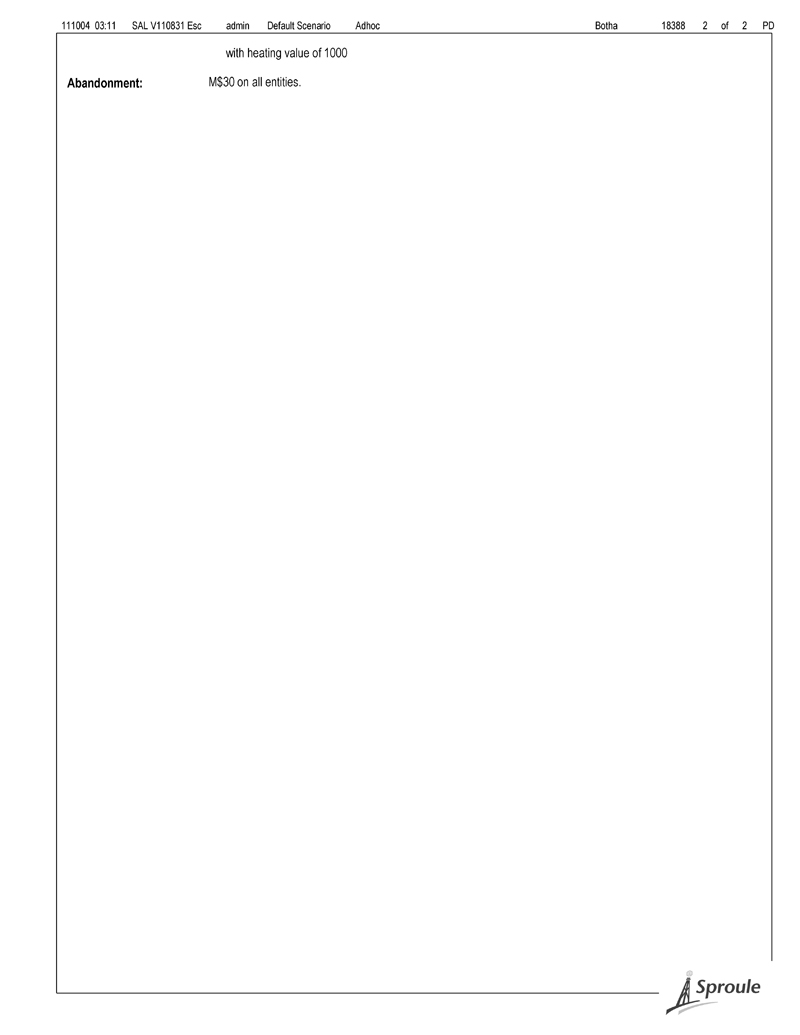

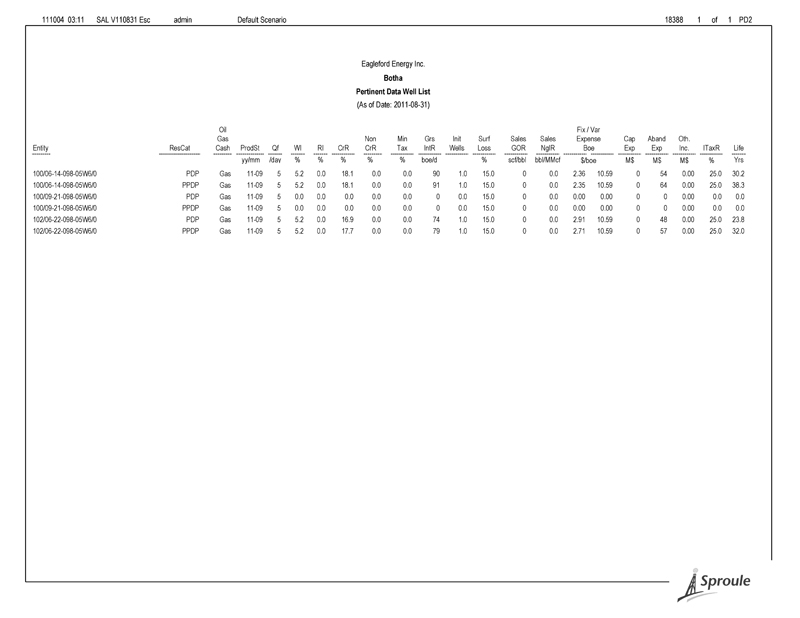

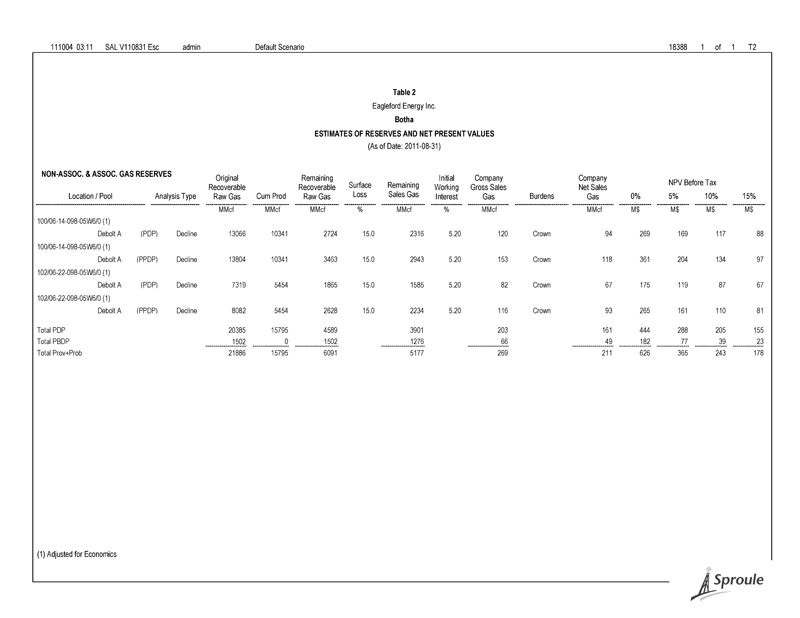

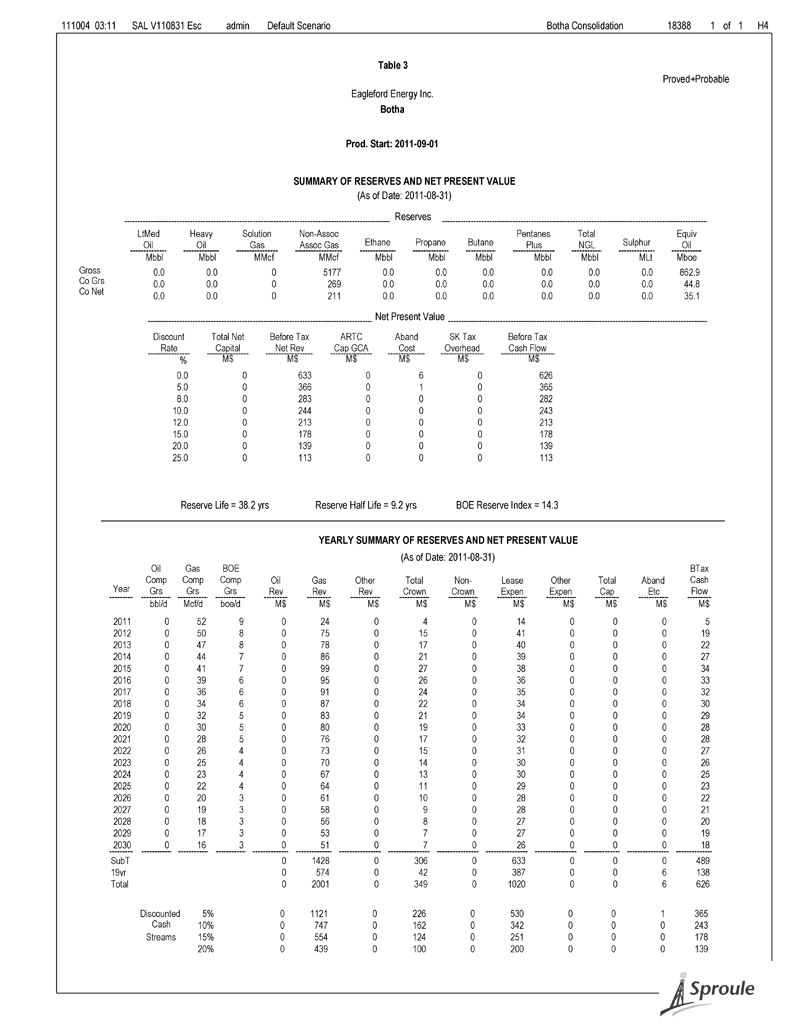

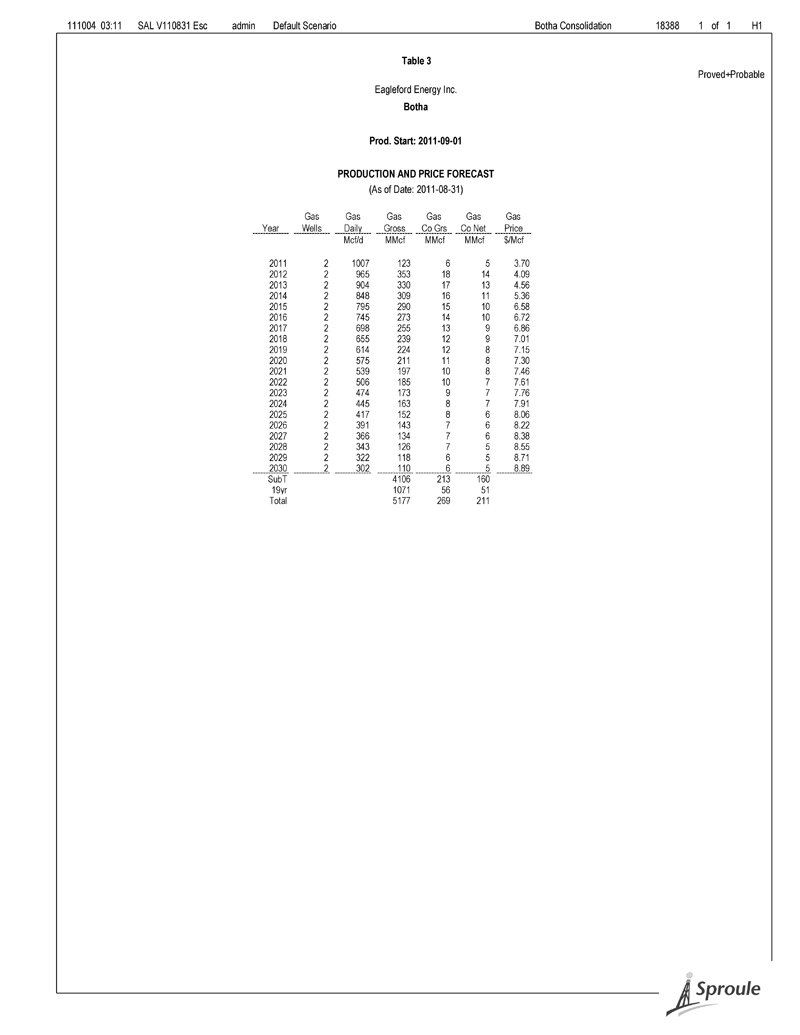

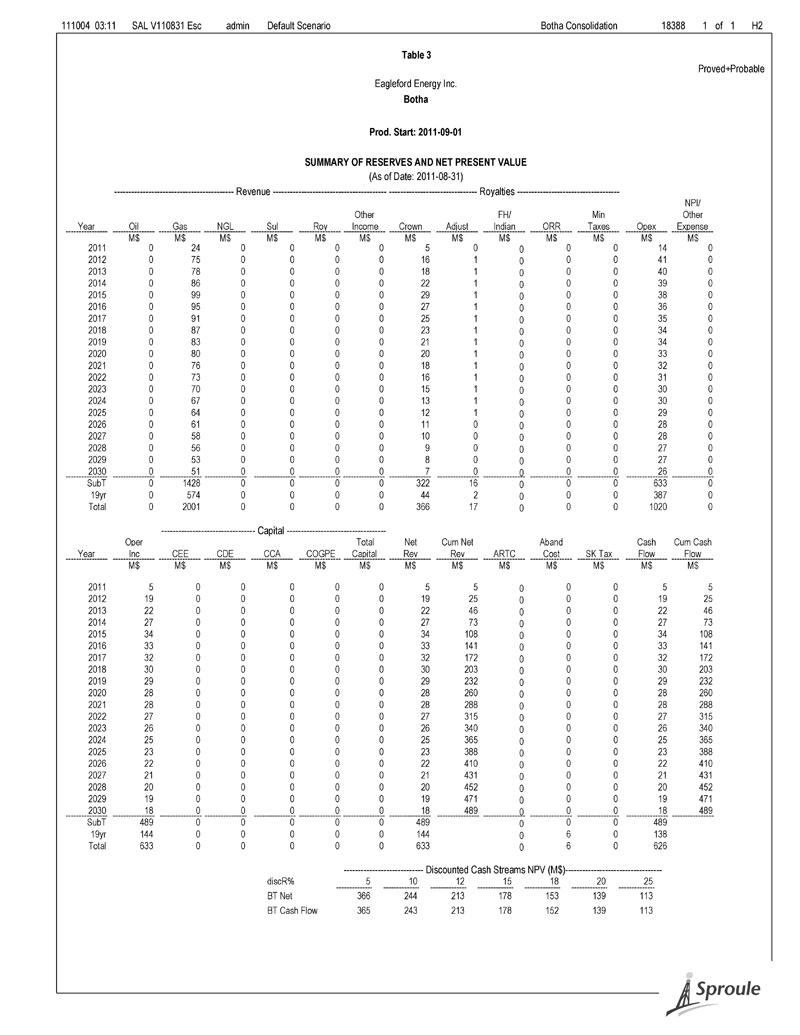

Introduction — Page 1 Introduction This report was prepared by Sproule Associates Limited (“Sproule”) at the request of Mr. James Cassina, President of Eagleford Energy Inc. Eagleford Energy Inc. is hereinafter referred to as "the Company". The effective date of this report is August 31, 2011, and it consists of an evaluation of the P&NG reserves of the Company's interests in Alberta, Canada. This report was prepared in September and October 2011 for the purpose of evaluating the Company’s P&NG reserves according to the Canadian Oil and Gas Evaluation Handbook (COGEH) reserve definitions that are consistent with the standards of National Instrument 51-101. This report was prepared for the Company’s corporate purposes. At the request of the Company, estimates of the Capital Gas Cost Allowance (GCA) and Tax pools have not been included. This report is included in one (1) volume and consists of an Introduction, Summary, Discussion, Constant Prices and Costs, National Instrument 51-101, and Appendices. The Introduction includes the summary of evaluation standards and procedures and pertinent author certificates; the Summary includes high-level summaries of the evaluation; and the Discussion includes general commentaries pertaining to the evaluation of the P&NG reserves. The Constant Prices and Costs section includes constant prices at August 31, 2011, for purposes of the Securities and Exchange Commission (SEC). The National Instrument 51-101 section presents Form 51-101F2 ― Report on Reserves Data by Independent Qualified Reserves Evaluator or Auditor, and Tables 1 to 5 using Forecast Prices and Costs and Table 6 - Reconciliation of Company Gross Reserves (Before Royalty) by Principal Product Type. Reserves definitions, product price forecasts, abbreviations, units, conversion factors and general evaluation parameters are included in Appendices A, B, C, and D. This report also contains detailed descriptions and evaluations for the individual properties (areas), on a property-by-property basis, including the following: Summary of the property evaluation; Summary of Pertinent Data; Table 1 – Well List/Reservoir Data; Table 2 - Summary of the estimates of proved and probable natural gas reserves and net present values; 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

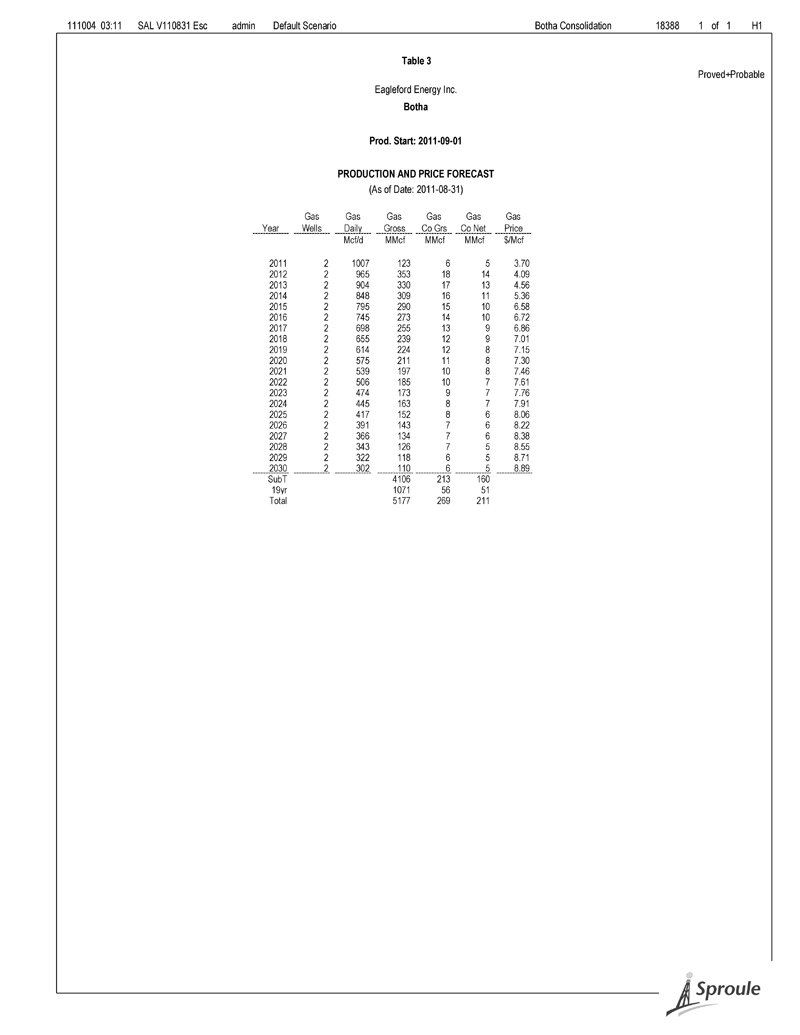

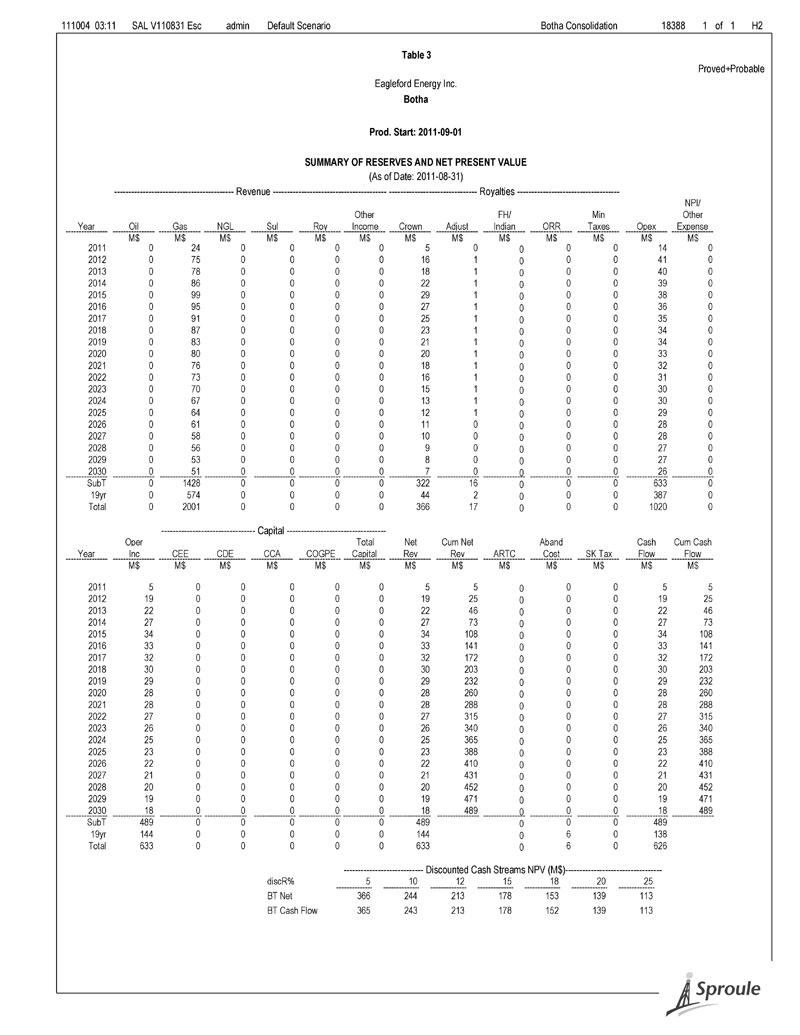

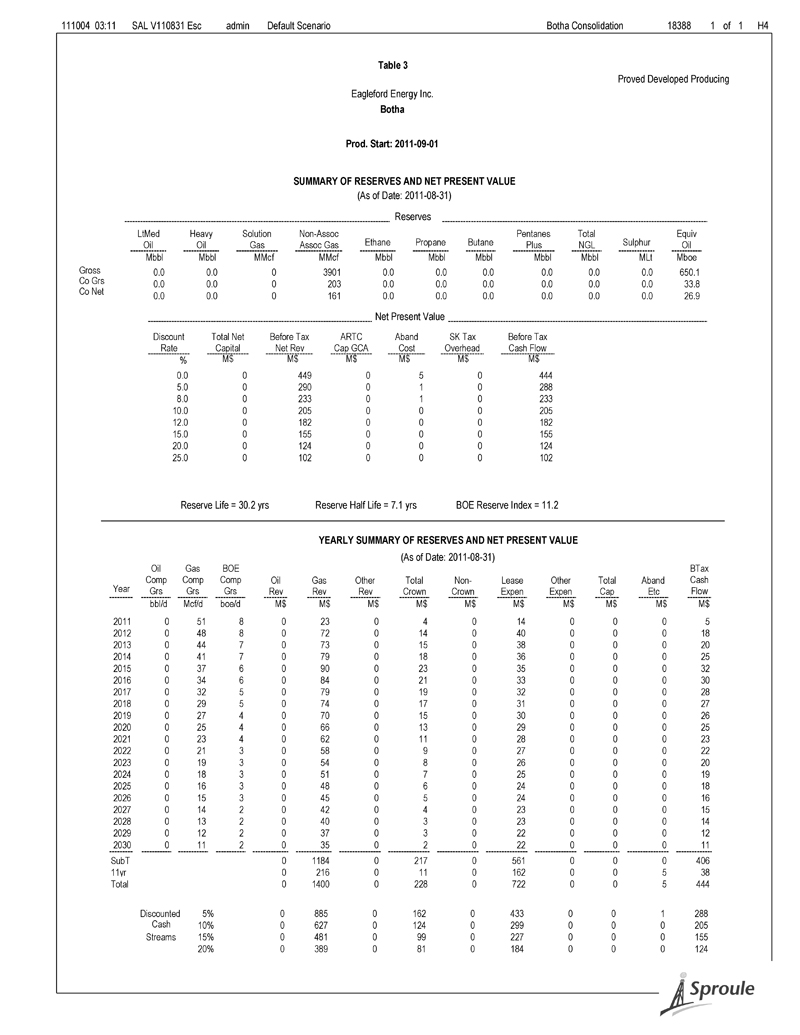

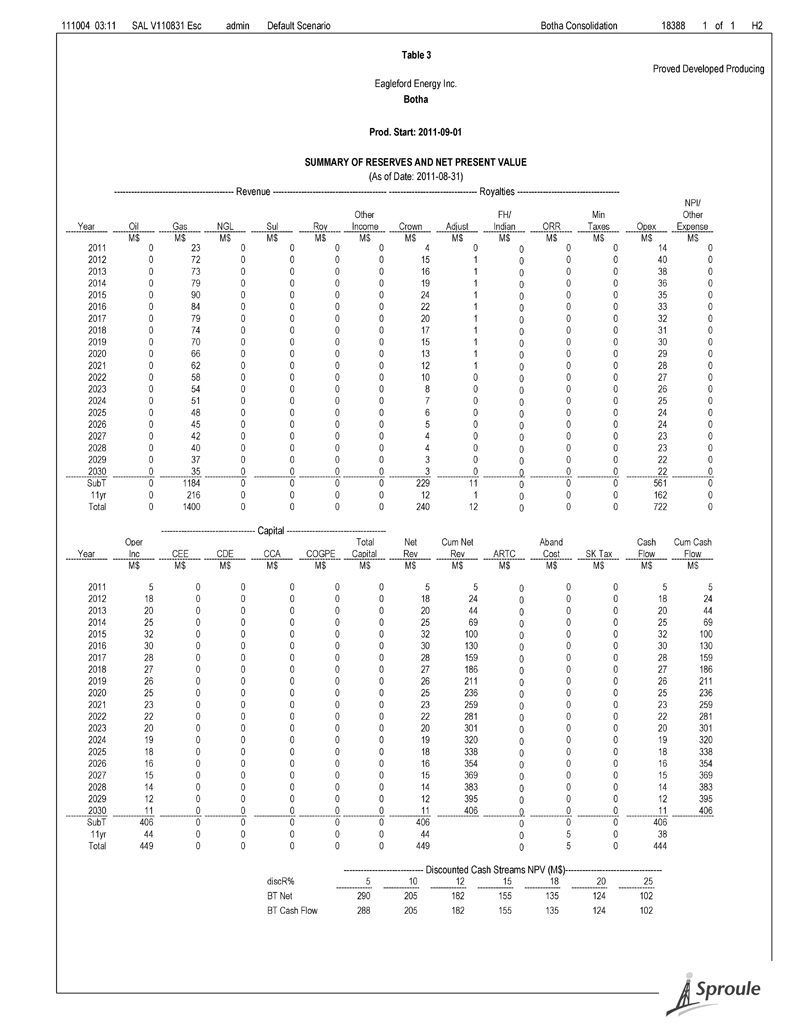

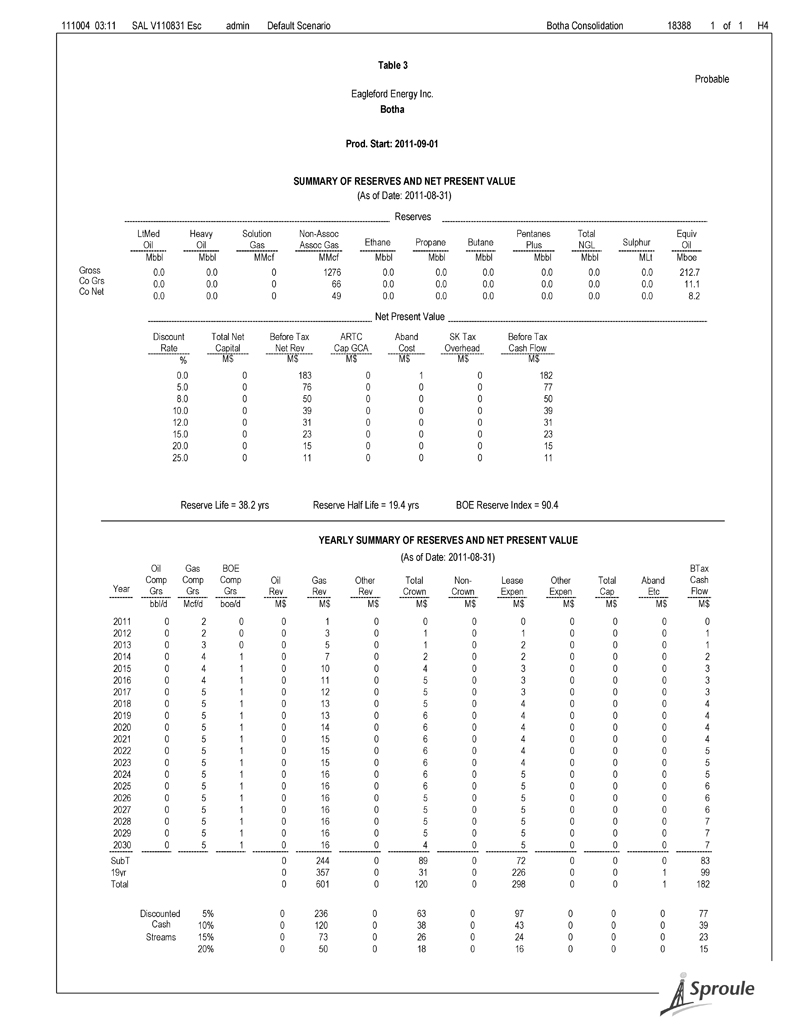

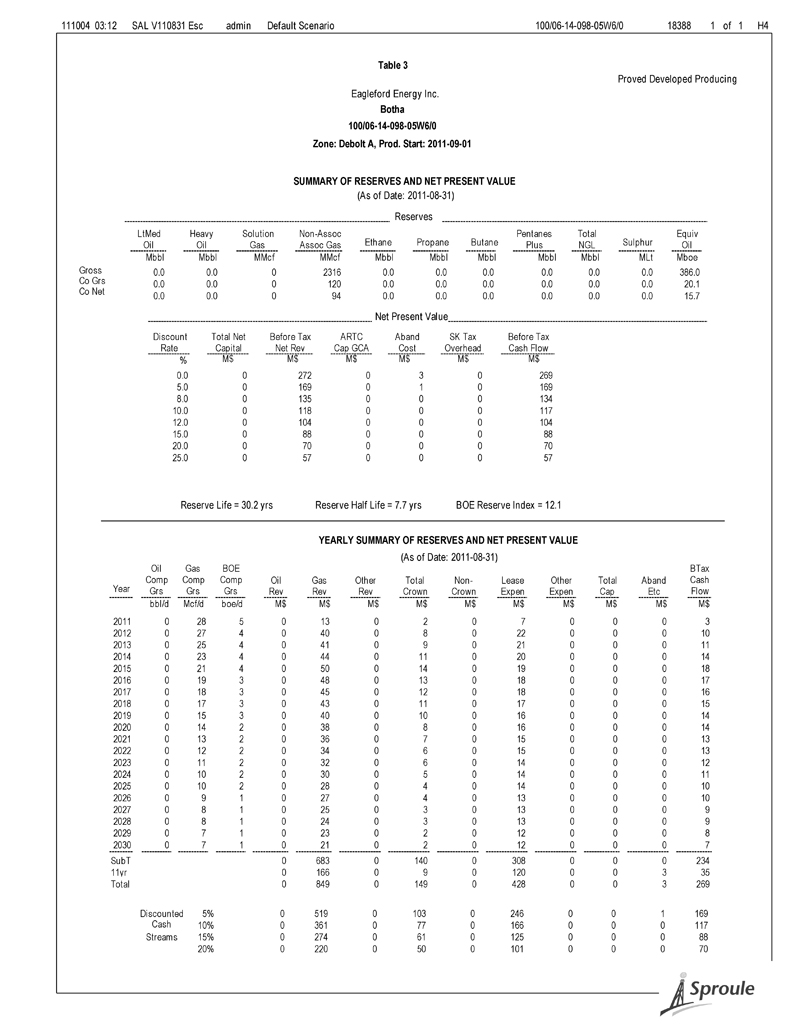

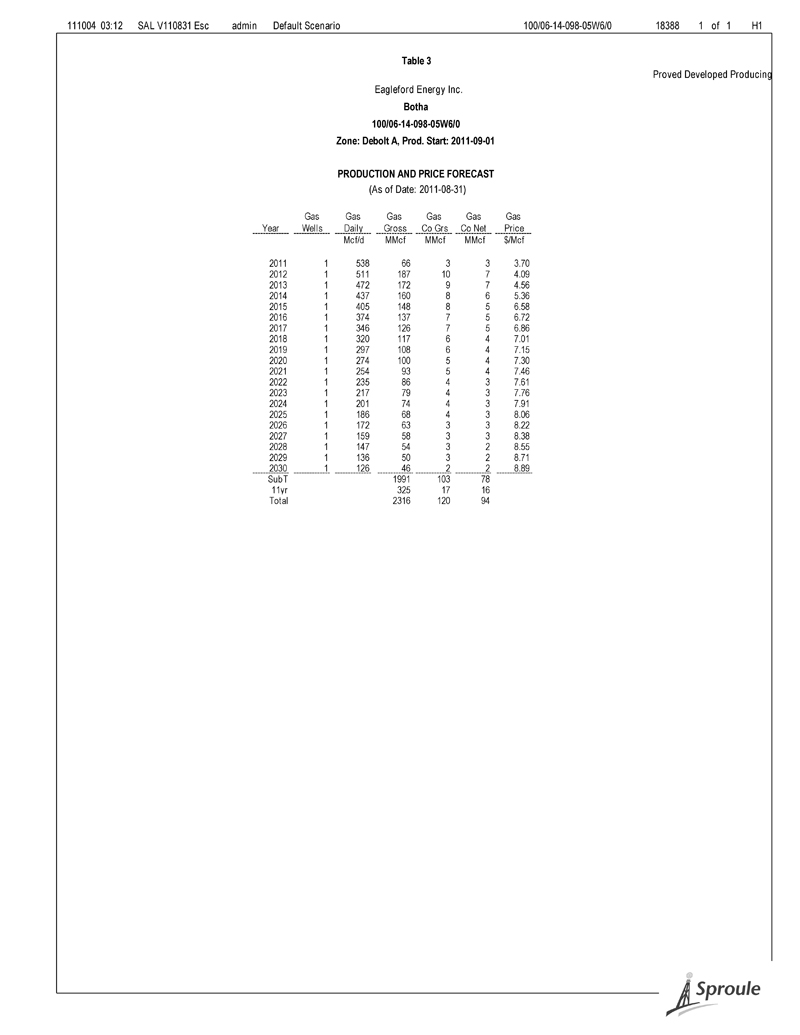

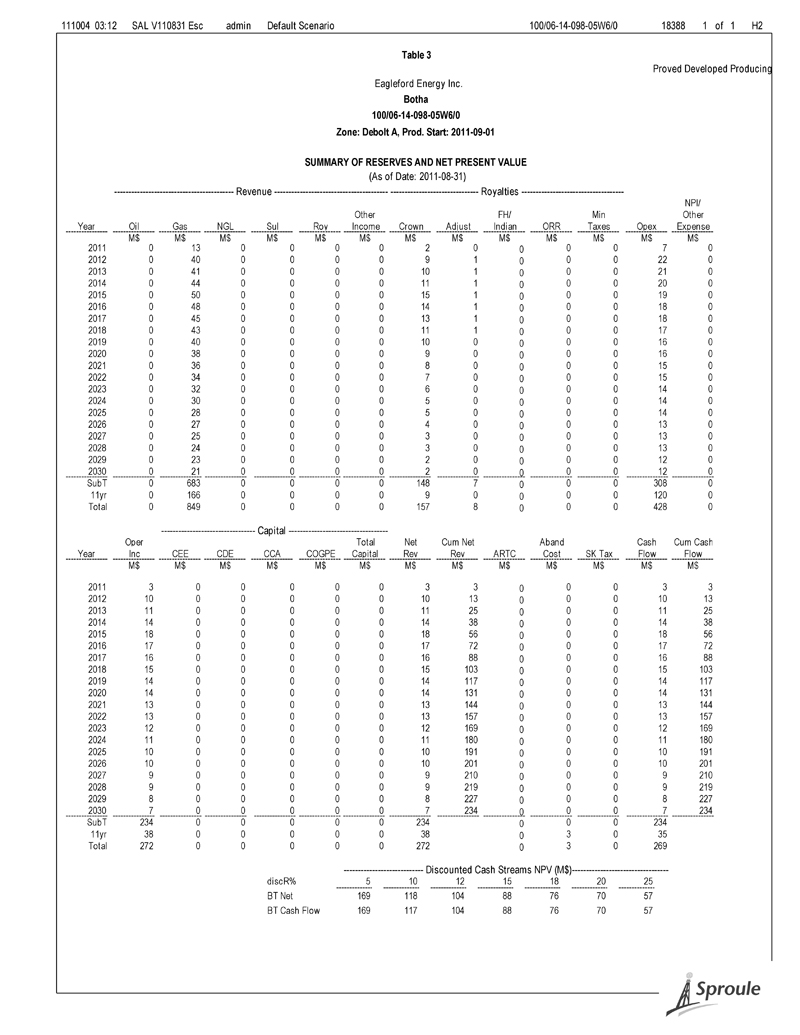

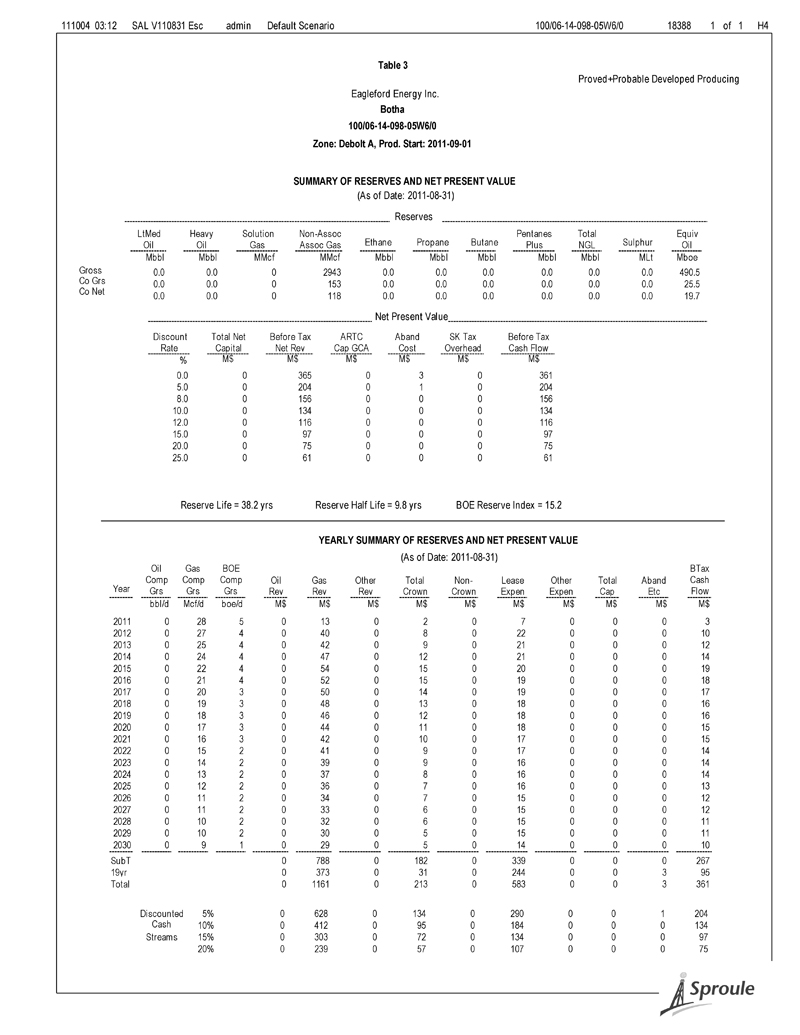

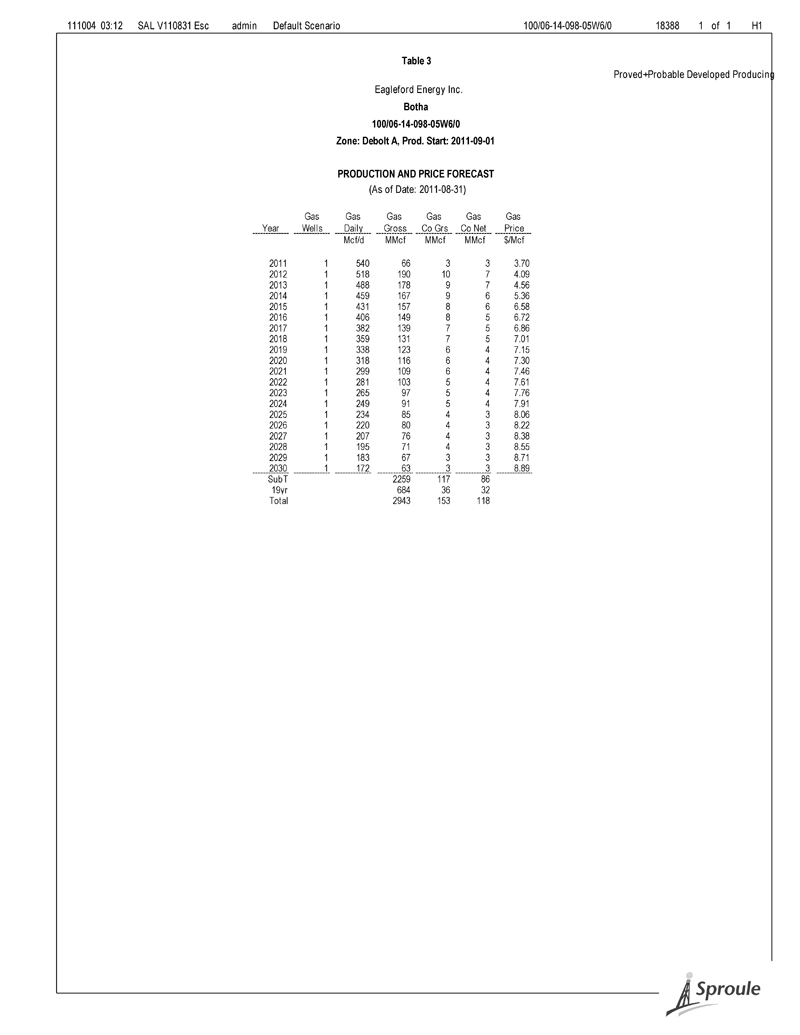

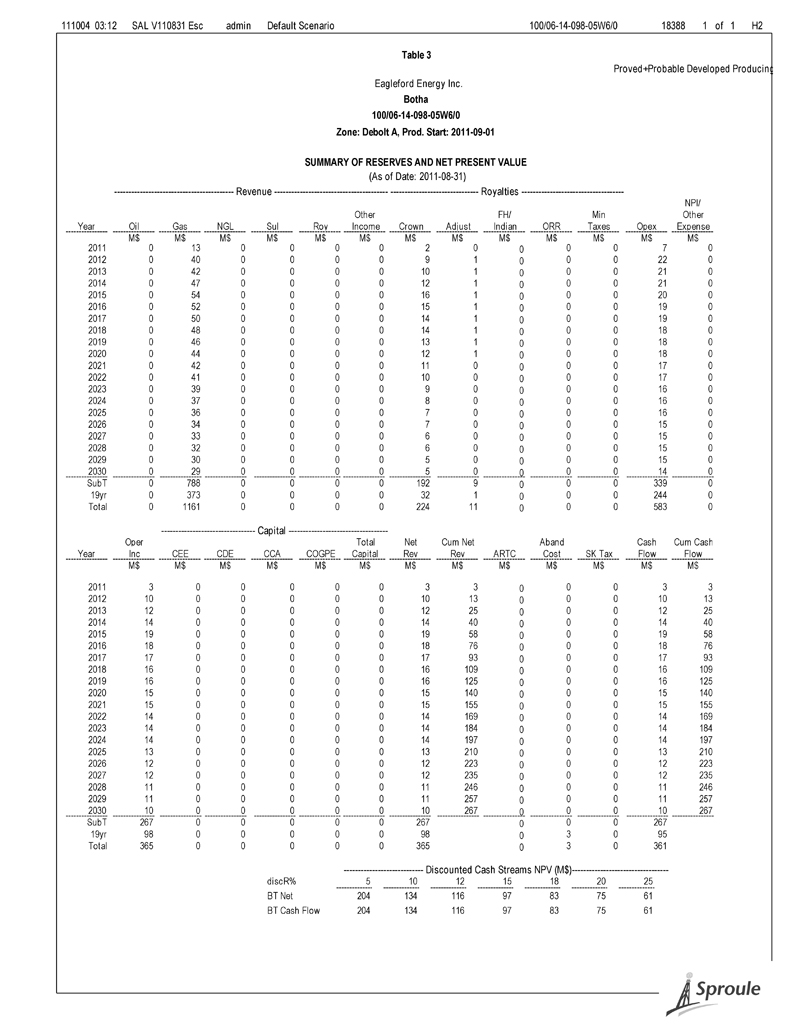

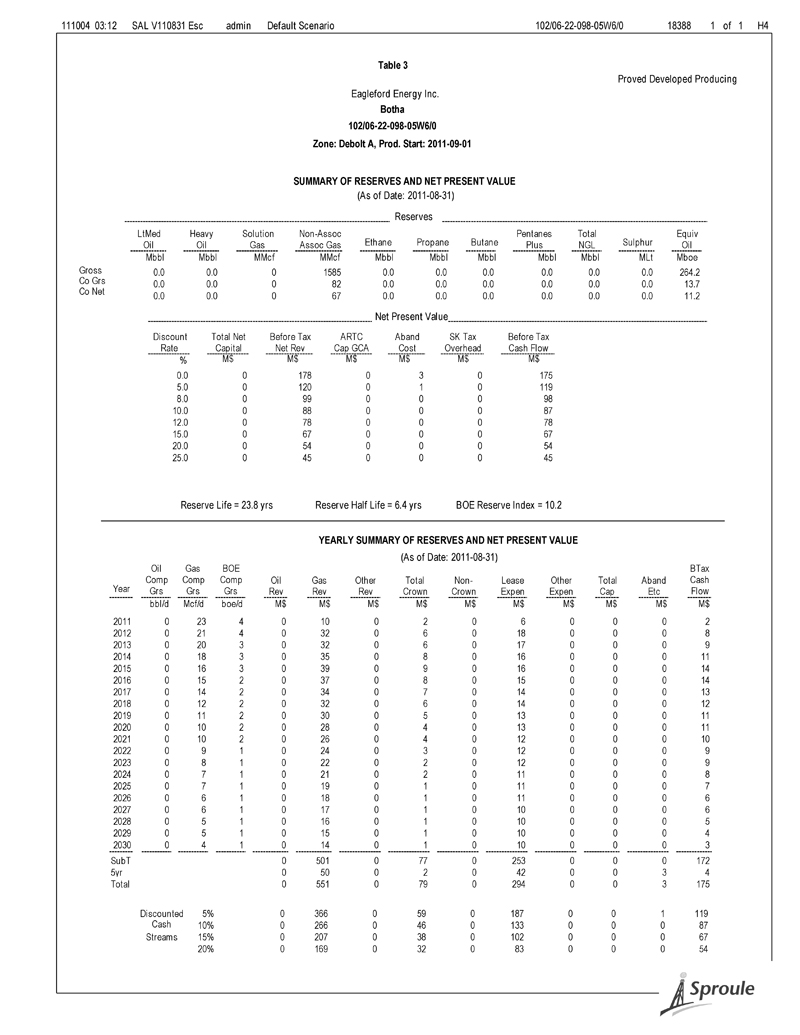

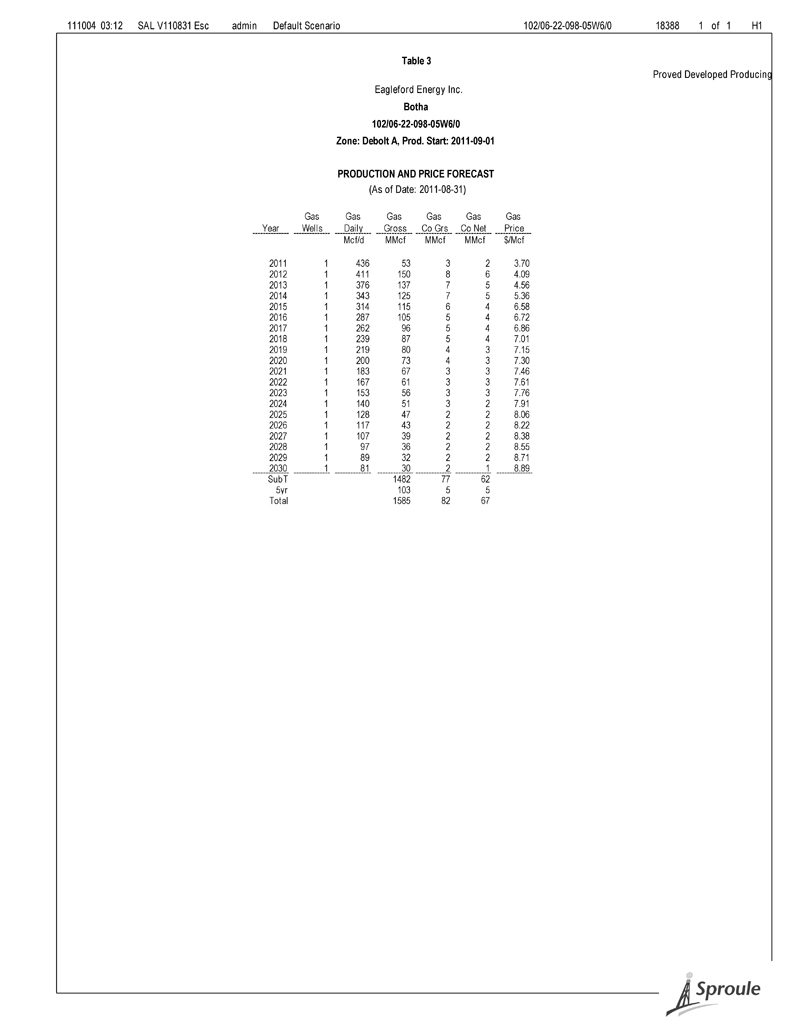

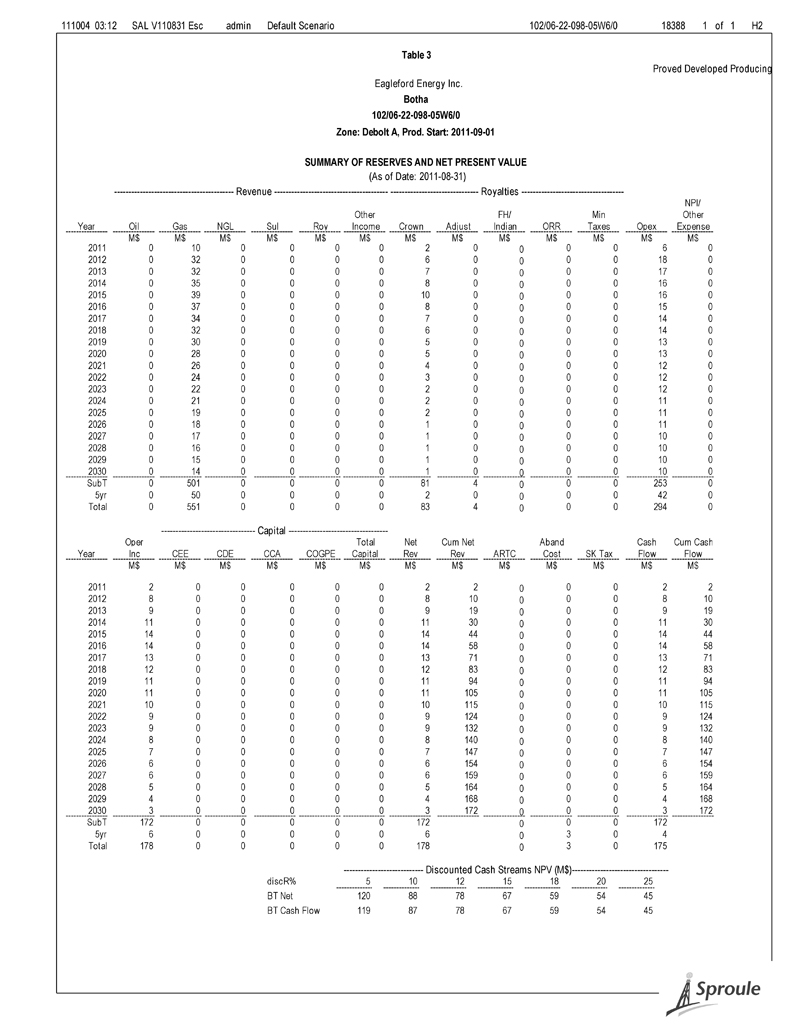

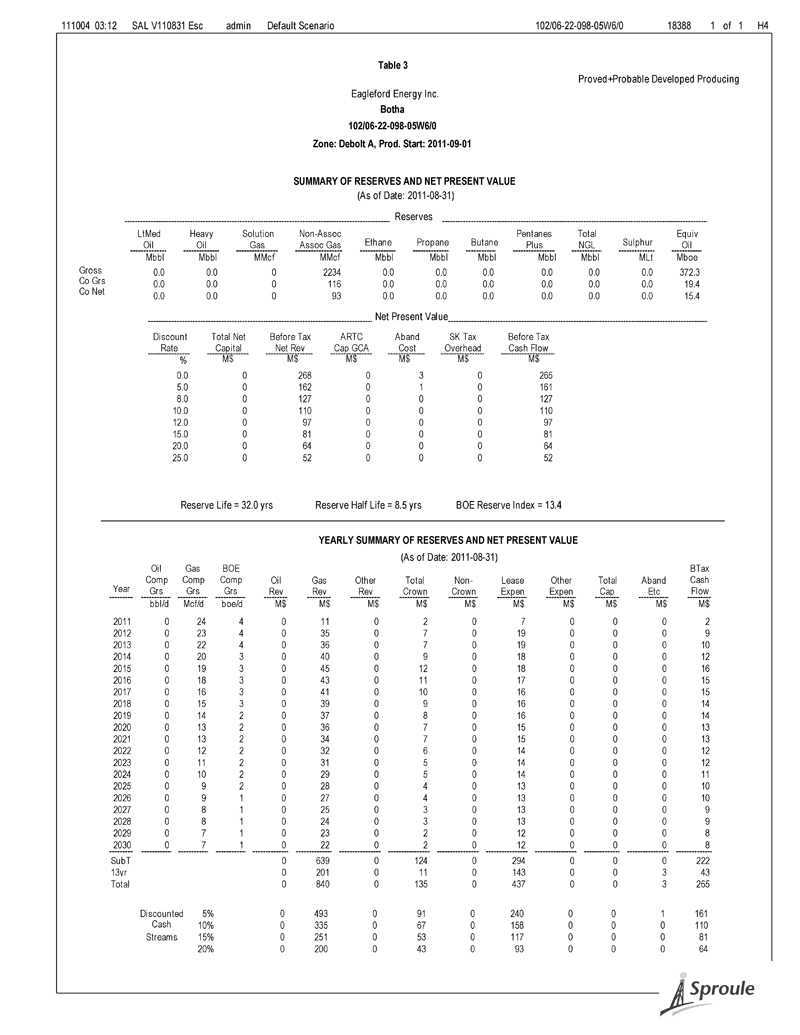

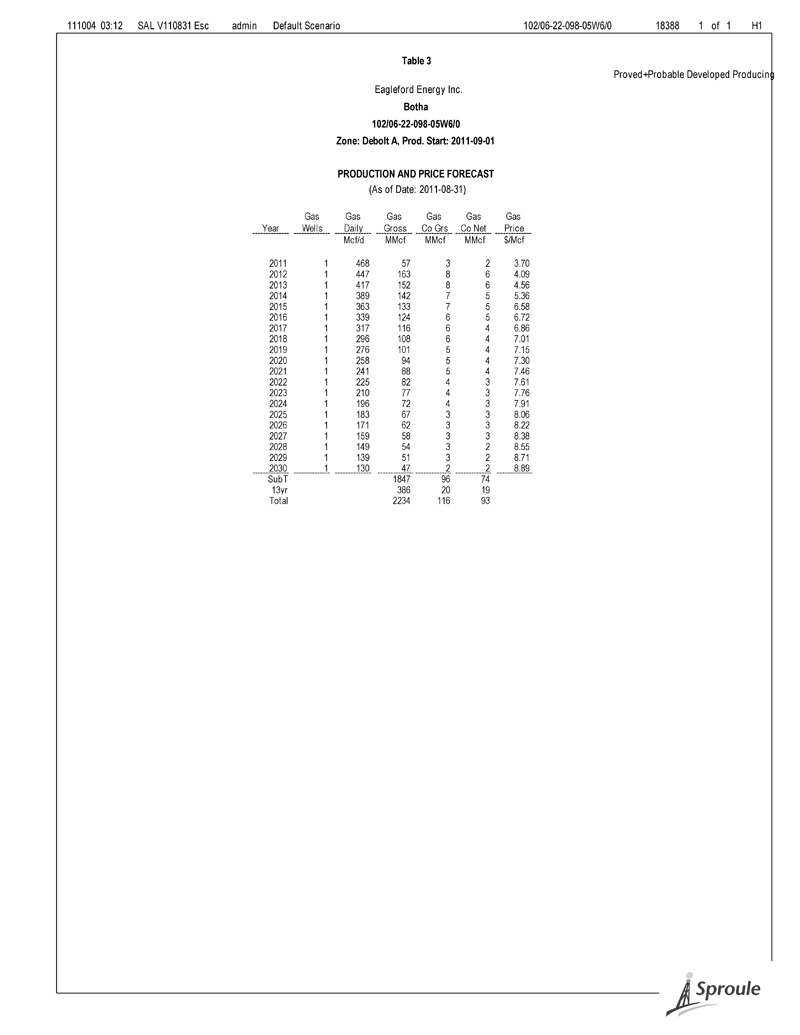

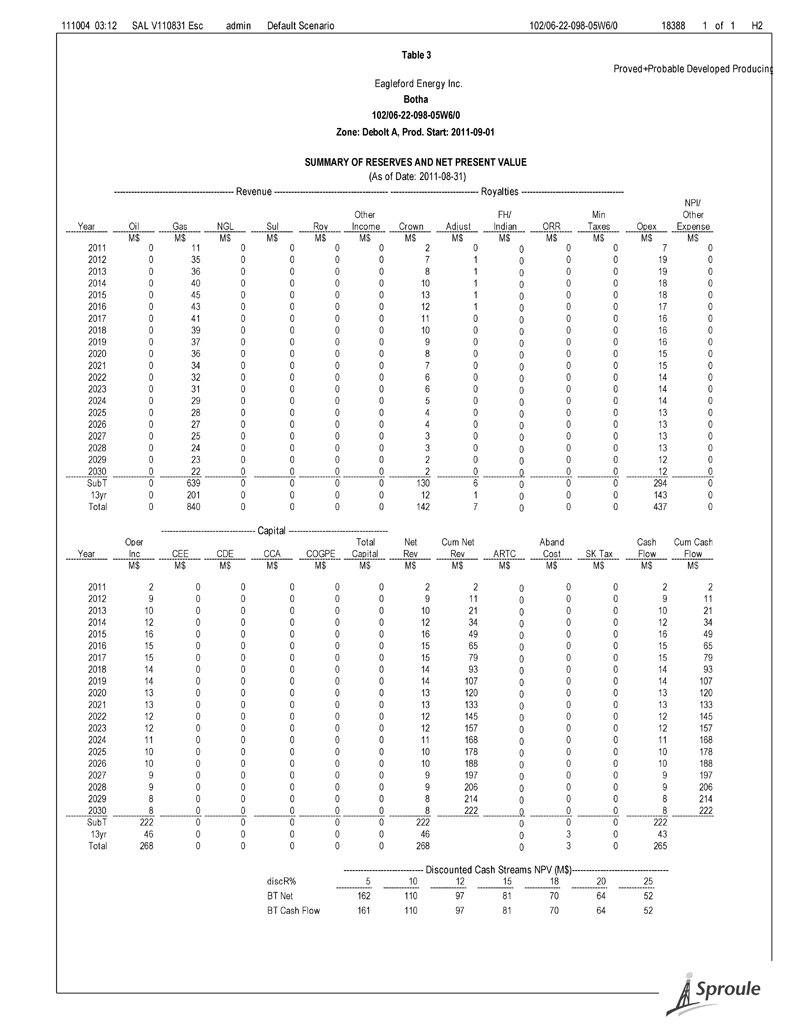

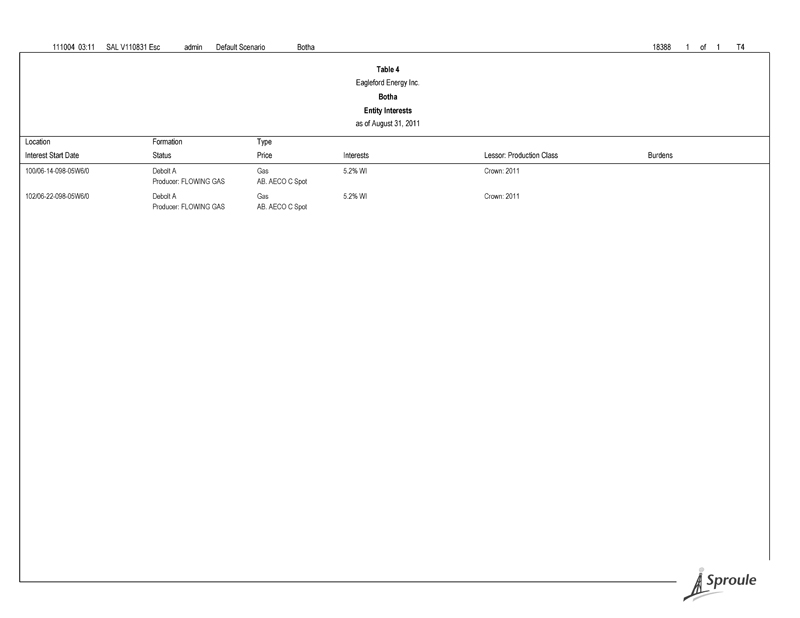

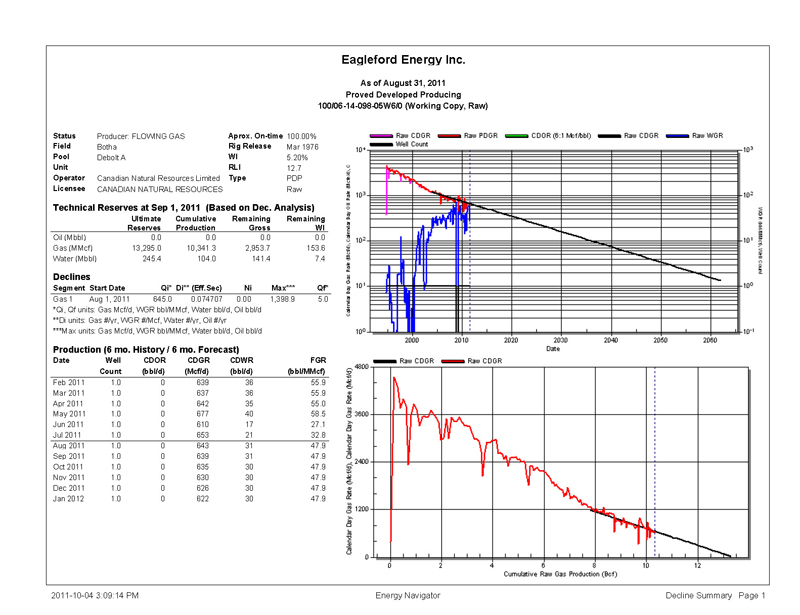

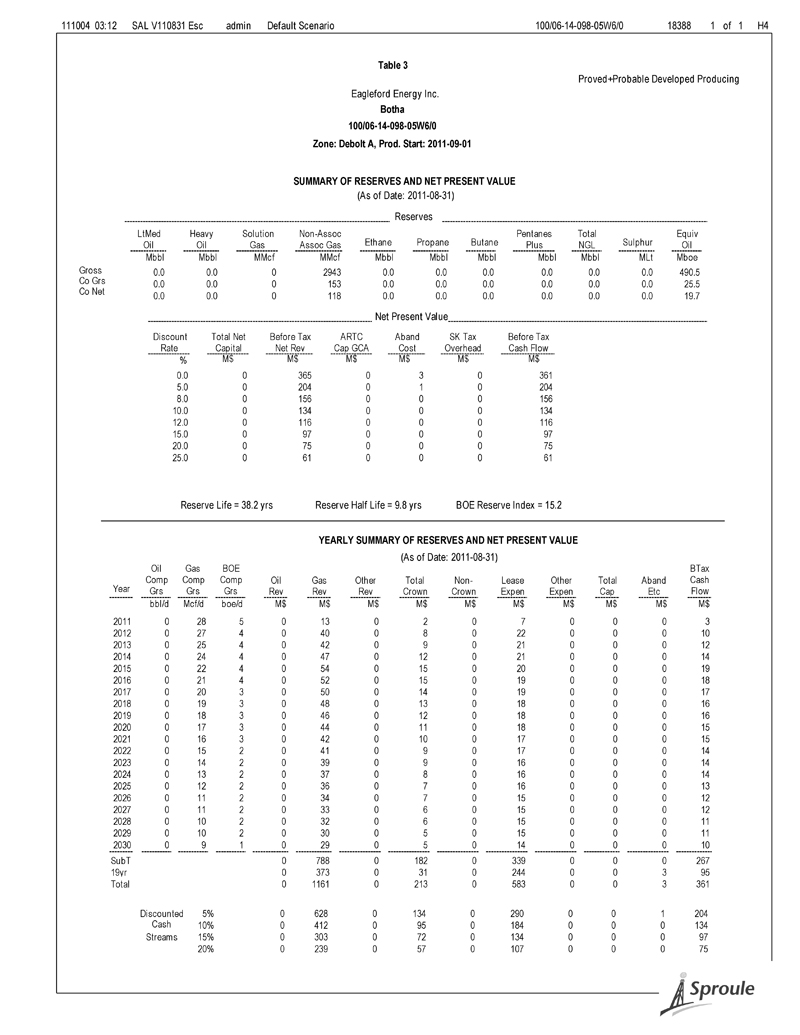

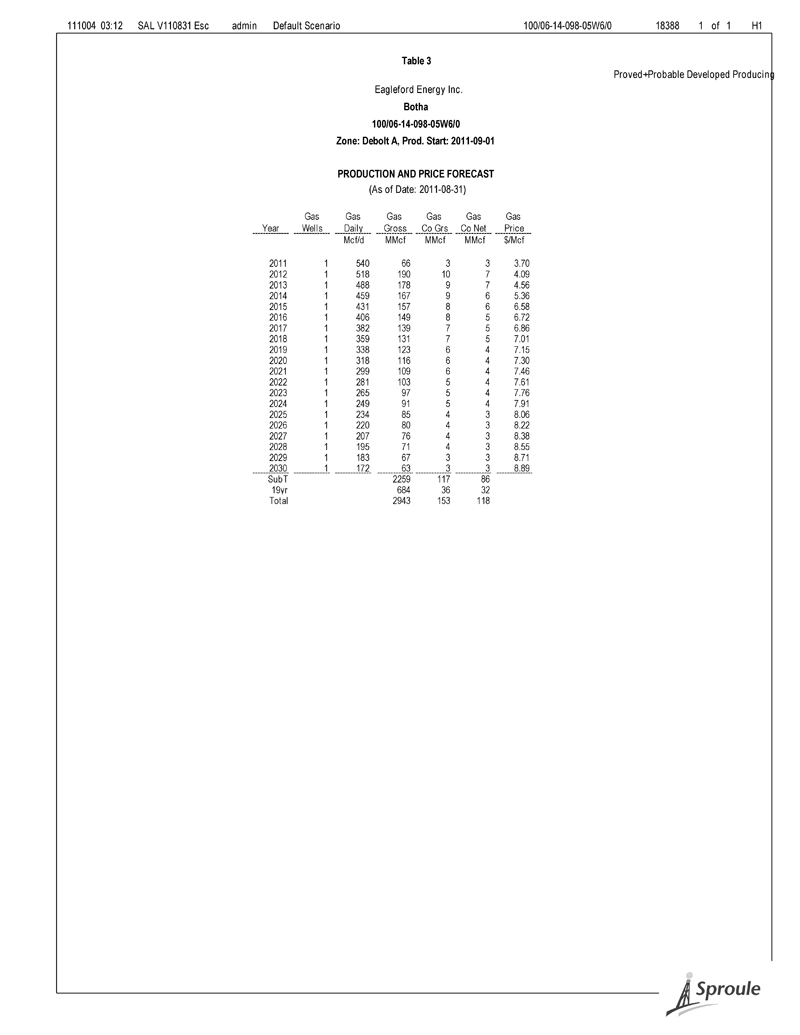

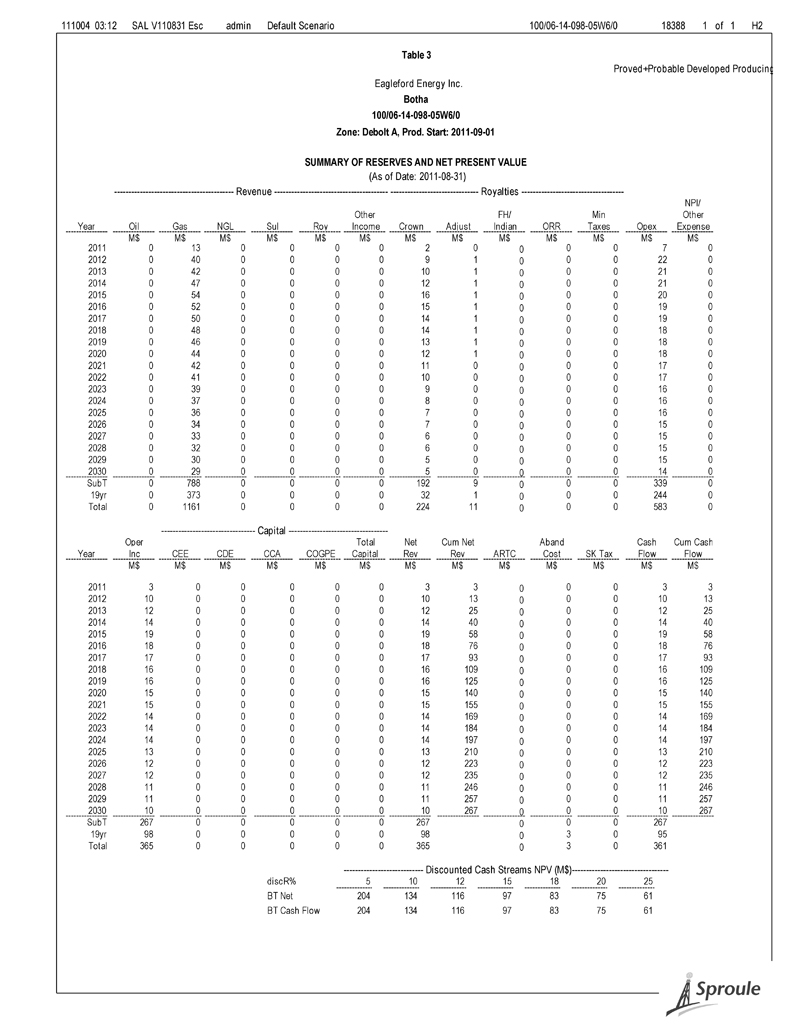

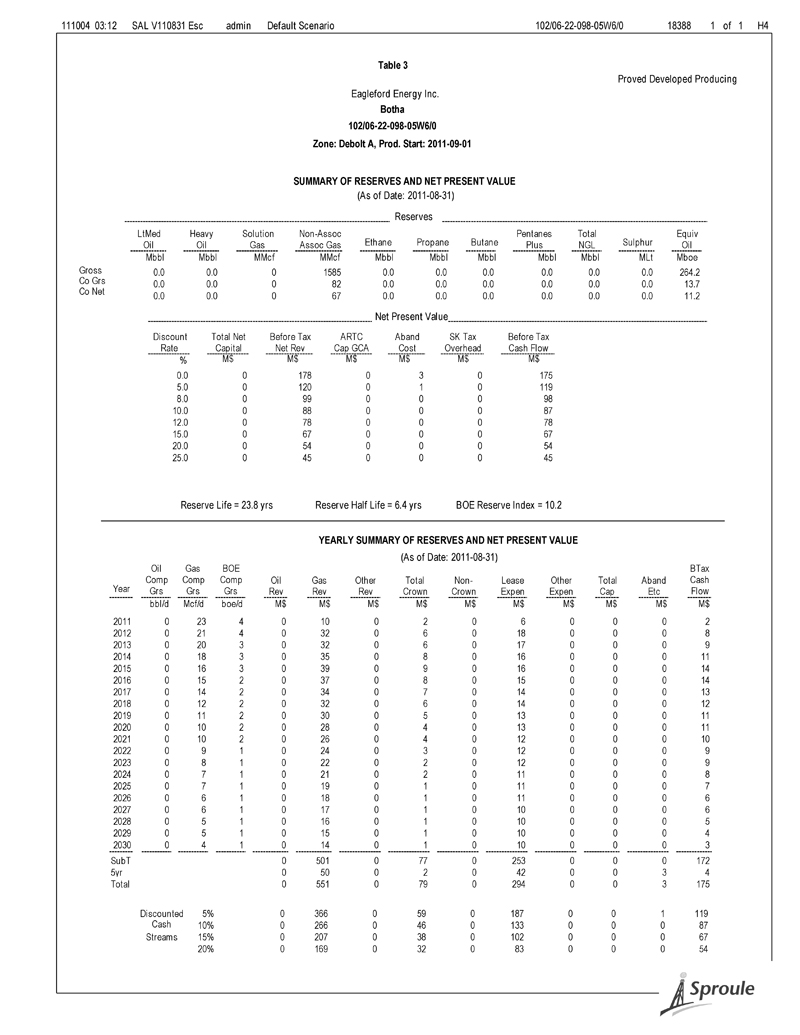

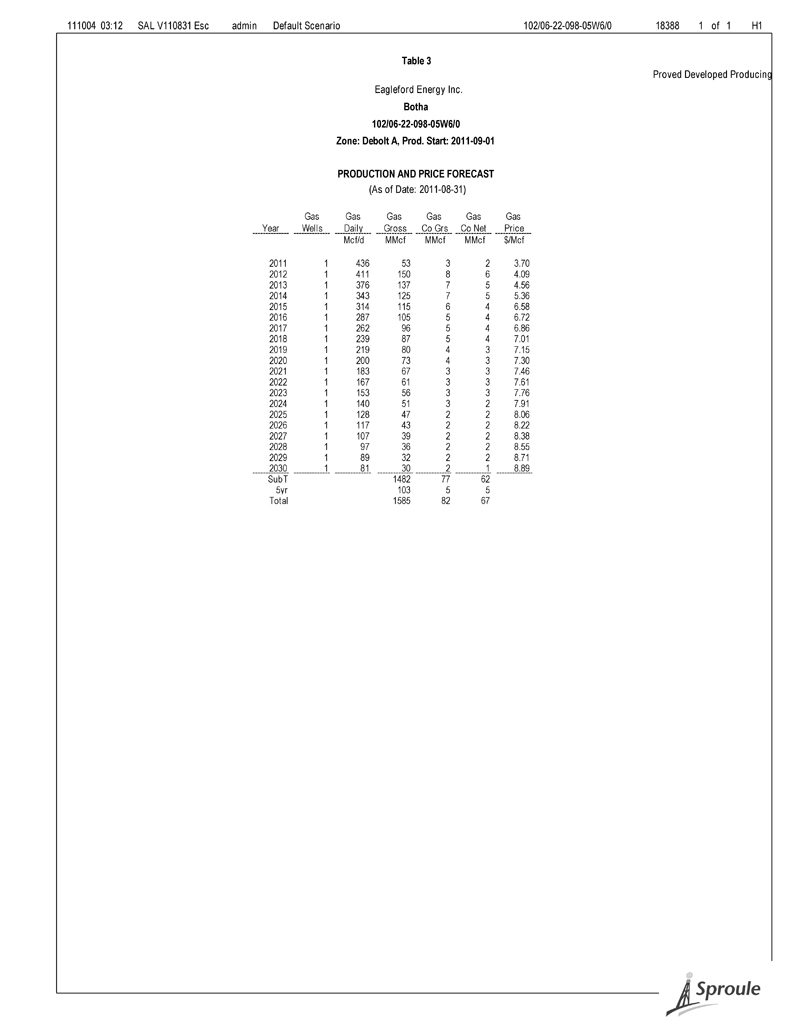

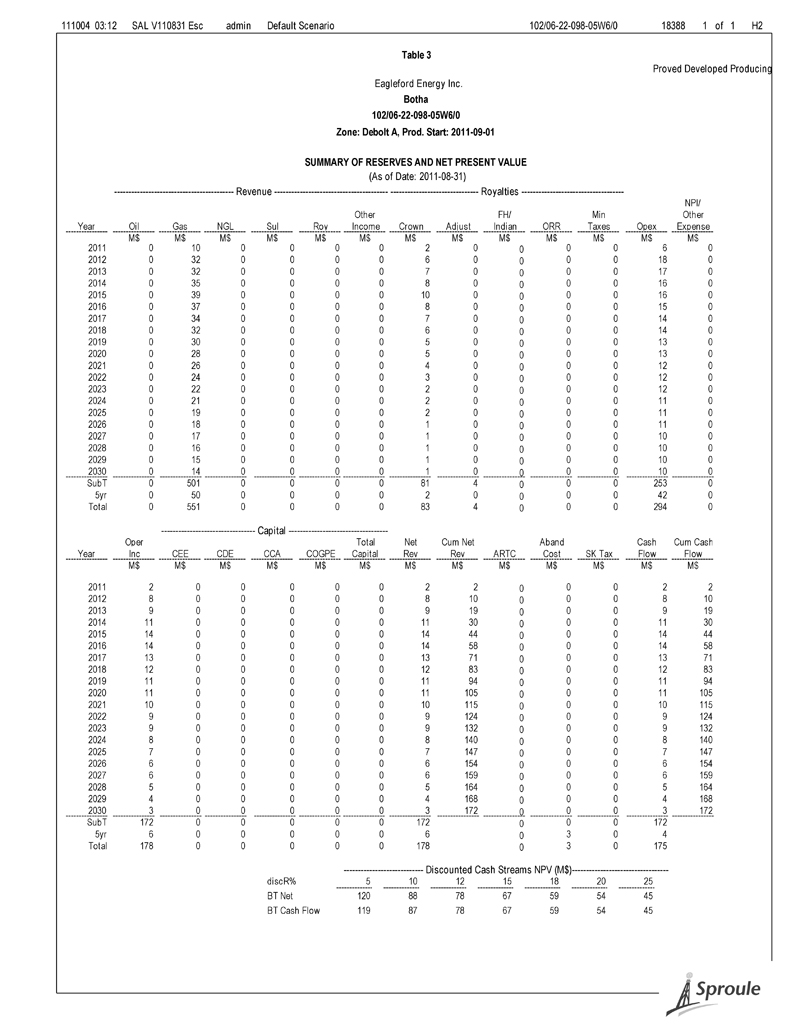

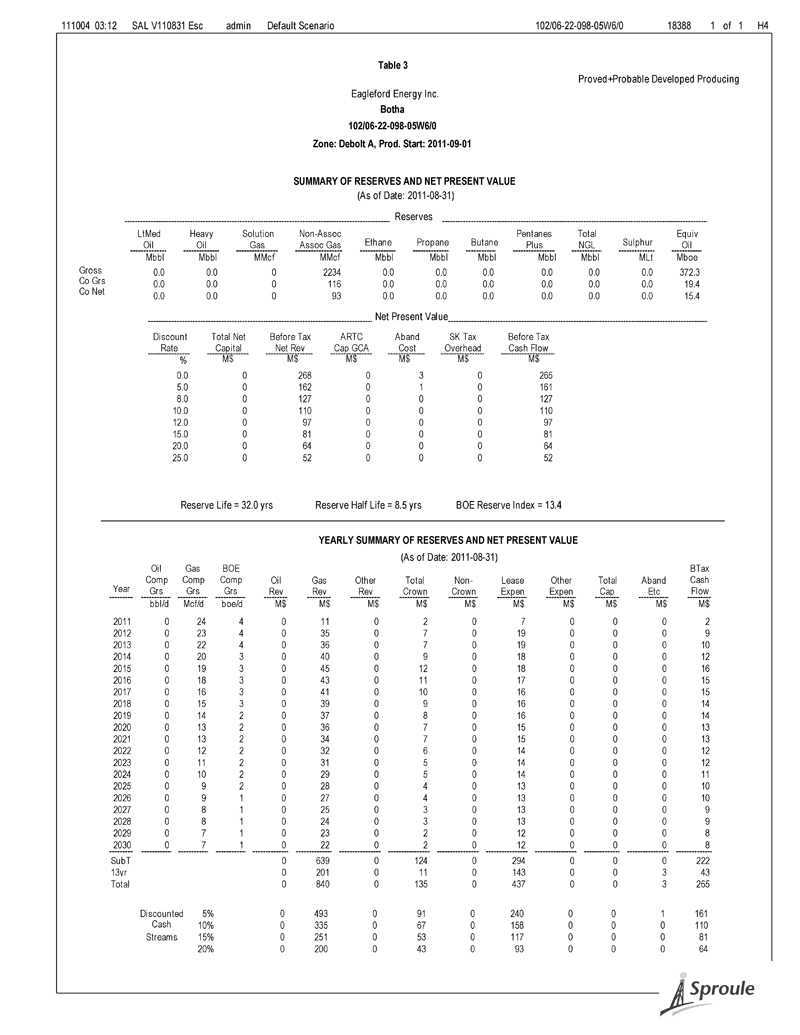

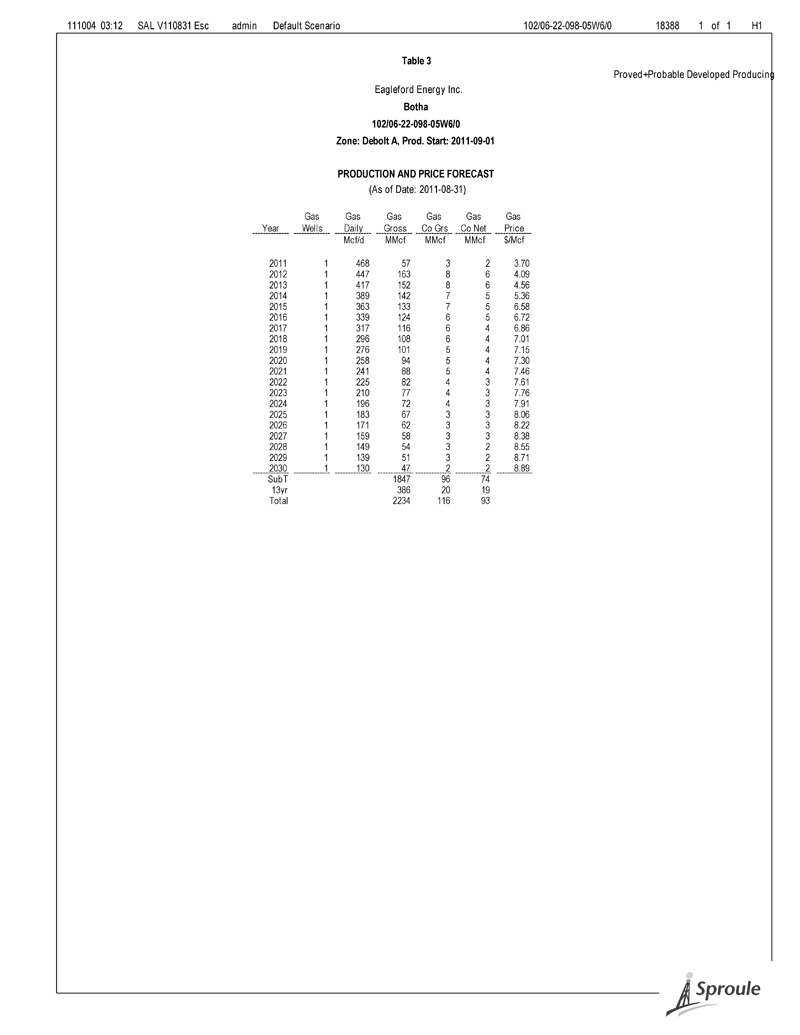

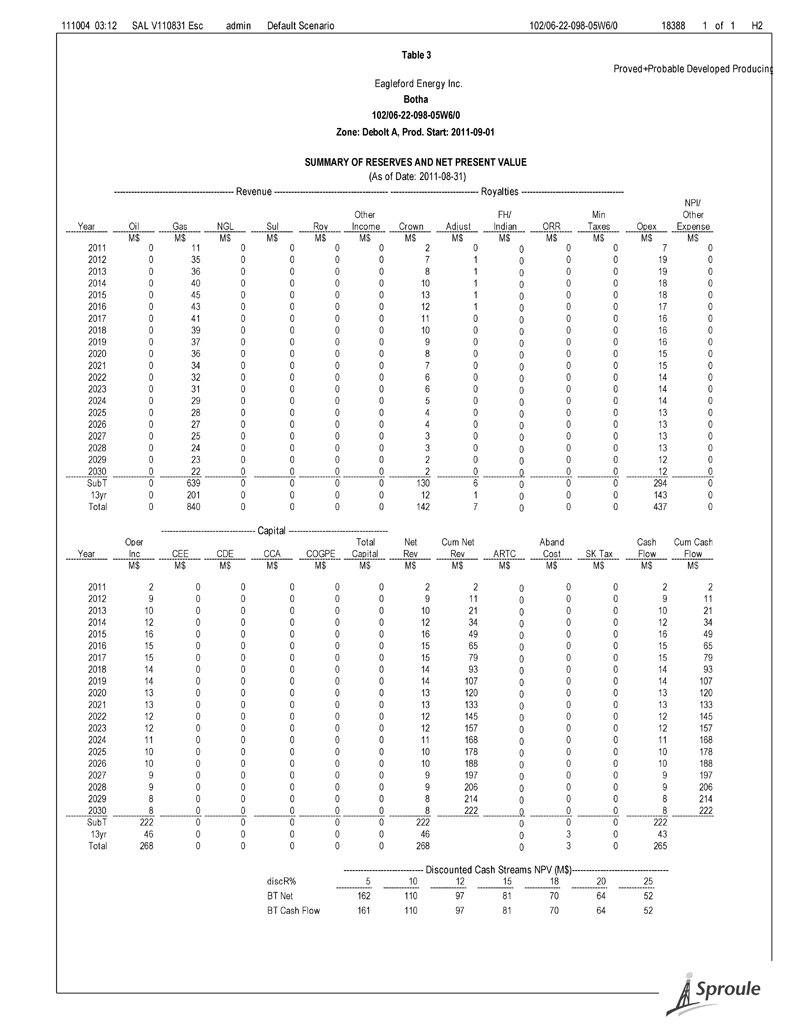

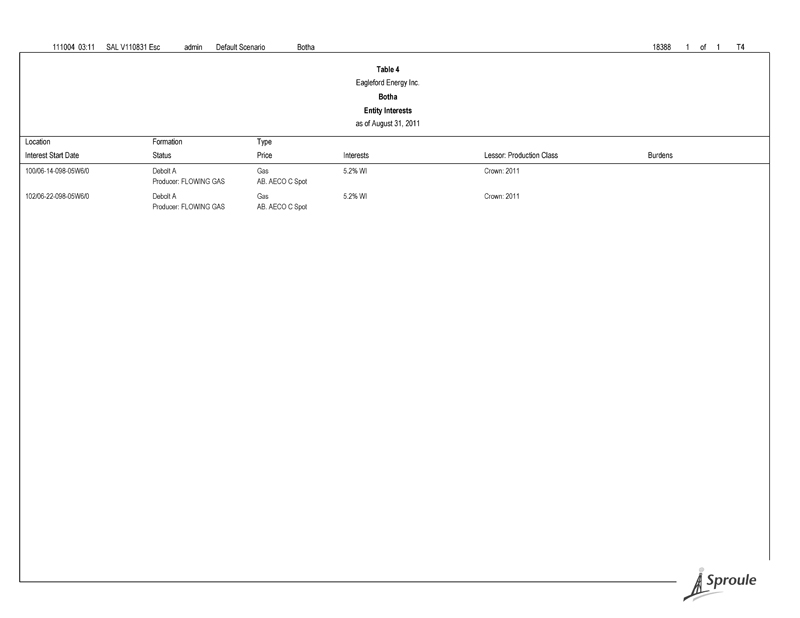

Introduction — Page 2 Table 3 - Forecasts of proved and probable natural gas production, revenue, and net present values, before income taxes; Table 4 – Entity Interests; Production history plots. Field Operations In the preparation of this evaluation, a field inspection of the properties was not performed. The relevant engineering data were made available by the Company or obtained from public sources and the non-confidential files at Sproule. No material information regarding the reserves evaluation would have been obtained by an on-site visit. Historical Data, Interests and Burdens 1. Al l historical production, revenue and expense data, product prices actually received, and other data that were obtained from the Company or from public sources were accepted as represented, without any further investigation by Sproule. 2. Property descriptions, details of interests held, and well data, as supplied by the Company, were accepted as represented. No investigation was made into either the legal titles held or any operating agreements in place relating to the subject properties. 3. Lessor and overriding royalties and other burdens were obtained from the Company. No further investigation was undertaken by Sproule. 4. Sproule reserves the right to review all calculations made, referred to or included in this report and to revise the estimates as a result of erroneous data supplied by the Company or information that exists but was not made available to us, which becomes known subsequent to the preparation of this report. Evaluation Standards This report has been prepared by Sproule using current geological and engineering knowledge, techniques and computer software. It has been prepared within the Code of Ethics of the Association of Professional Engineers, Geologists and Geophysicists of Alberta 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

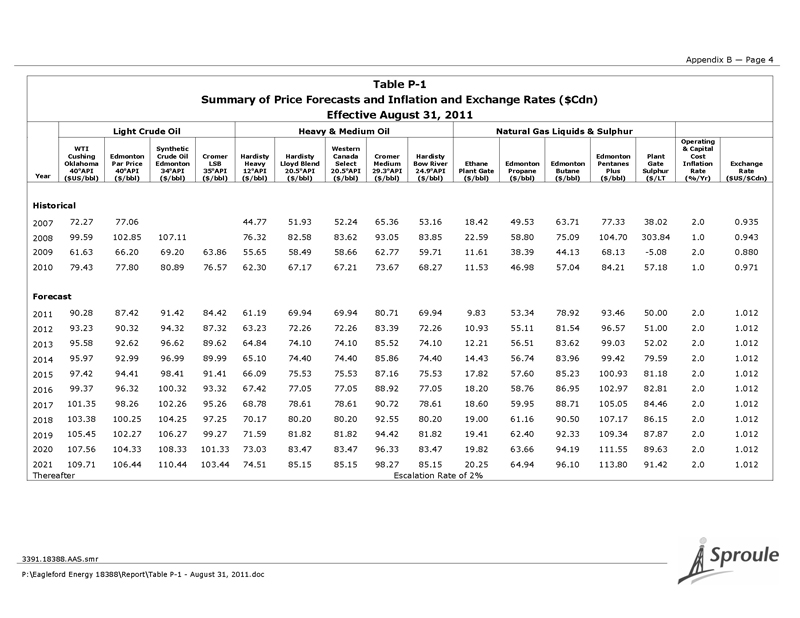

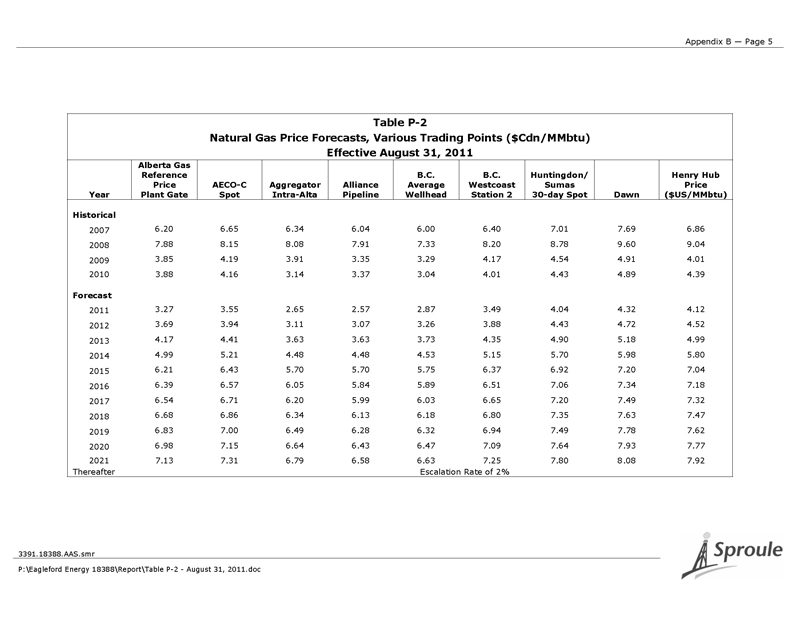

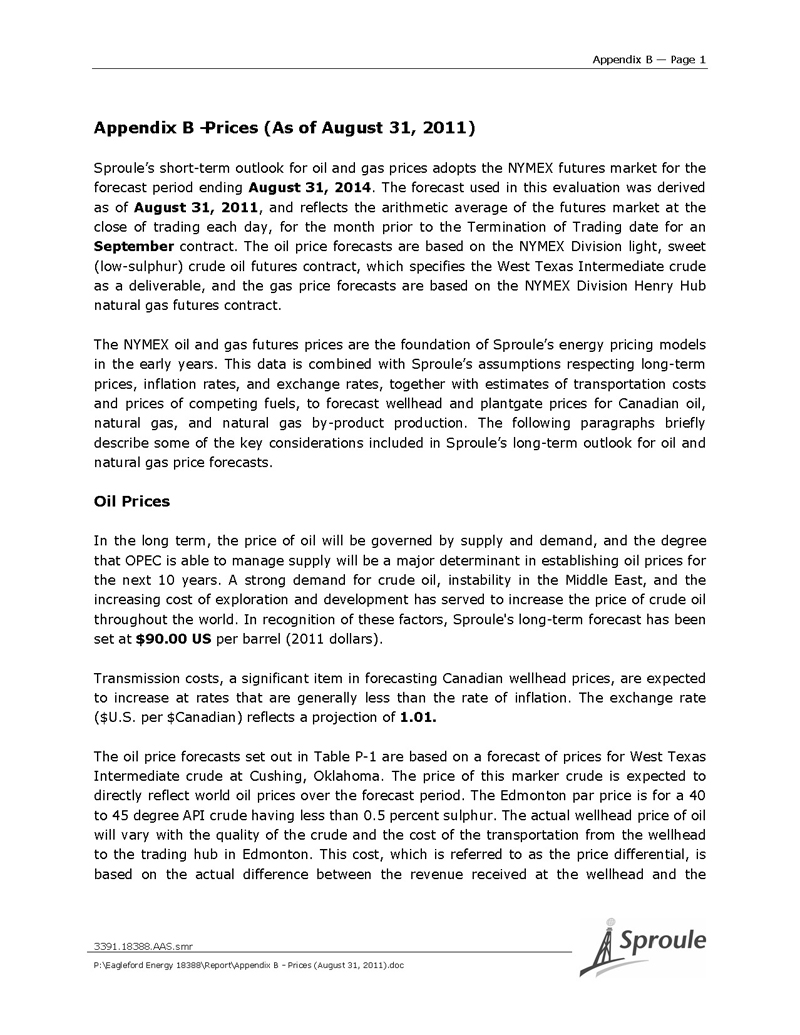

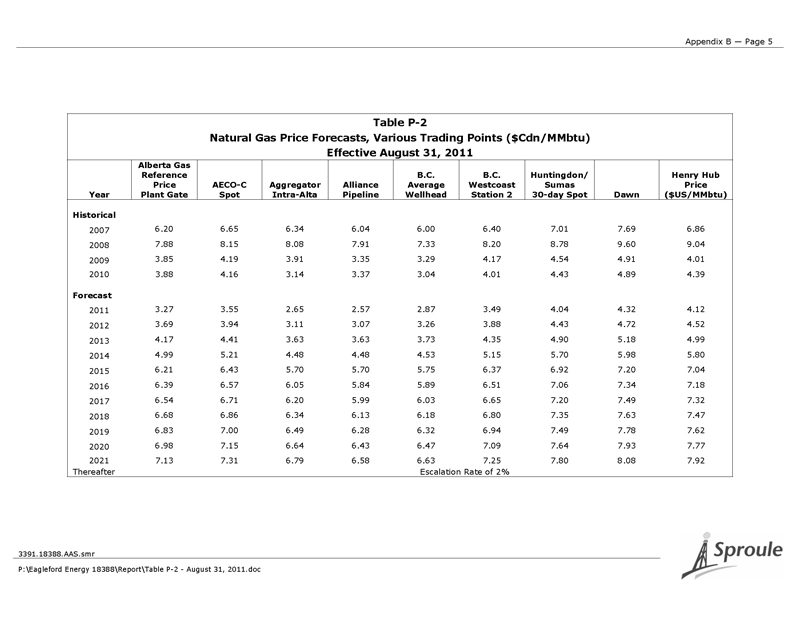

Introduction — Page 3 (“APEGGA”). This report adheres in all material aspects to the “best practices” recommended in the COGE Handbook which are in accordance with principles and definitions established by the Calgary Chapter of the Society of Petroleum Evaluation Engineers. The COGE Handbook is incorporated by reference in National Instrument 51-101. Evaluation Procedures 1. The Company provided Sproule with recent revenue statements to determine certain economic parameters. 2. The forecast of the natural gas price used in this evaluation was based on Sproule’s August 31, 2011 price forecasts. Further discussion is included in Appendix B. 3. The constant price used in this report complies with the Securities & Exchange Commission’s (SEC) regulations. It was calculated as the unweighted arithmetic average of the first-day-of-the-month price for each month within the 12-month period prior to the end of the reporting period. 4. Well abandonment and disconnect costs were included in this report at the entity level for wells which have reserves assigned. No allowances for reclamation or salvage values were made. Further discussion is included in Appendix D. 5. For this evaluation, Sproule worked on the reserves evaluation model, Value Navigator (ValNav). The functionality of the program is not the responsibility of Sproule, and results were accepted as calculated by the model. Sproule’s responsibility is limited to the quality of the data input and reasonableness of the outcoming results. Evaluation Results 1. The analysis of individual properties as reported herein was conducted within the context and scope of an evaluation of a unique group of properties in aggregate. Use of this report outside of this scope may not be appropriate. 2. The accuracy of reserves estimates and associated economic analysis is, in part, a function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Given the data provided at the time this report was prepared, the estimates presented herein are considered reasonable. However, they should be accepted with the understanding that reservoir and financial performance 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Introduction — Page 4 subsequent to the date of the estimates may necessitate revision. These revisions may be material. 3. The net present values of the reserves presented in this report simply represent discounted future cash flow values at several discount rates. Though net present values form an integral part of fair market value estimations, without consideration for other economic criteria, they are not to be construed as Sproule’s opinion of fair market value. 4. Due to rounding, certain totals may not be consistent from one presentation to the next. BOE Cautionary Statement BOE’s (or ‘McfGE’s’ or other applicable units of equivalency) may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl (or ‘An McfGE conversion ratio of 1 bbl:6 Mcf’) is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Forward-Looking Statements This report may contain forward-looking statements including expectations of future production revenues and capital expenditures. Information concerning reserves may also be deemed to be forward-looking as estimates involve the implied assessment that the reserves described can be profitably produced in future. These statements are based on current expectations that involve a number of risks and uncertainties, which could cause actual results to differ from those anticipated. These risks include, but are not limited to: the underlying risks of the oil and gas industry (i.e., corporate commitment, regulatory approval, operational risks in development, exploration and production); potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserves estimations; the uncertainty of estimates and projections relating to production; costs and expenses; health, safety and environmental factors; commodity prices; and exchange rate fluctuation. Exclusivity This report has been prepared for the exclusive use of Eagleford Energy Inc. It may not be reproduced, distributed, or made available to any other company or person, regulatory body, or organization without the knowledge and written consent of Sproule, and without the complete contents of the report being made available to that party. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Introduction — Page 5 Certification Report Preparation The report entitled “Evaluation of the P&NG Reserves of Eagleford Energy Inc. (As of August 31, 2011)” was prepared by the following Sproule personnel: Original Signed by Attila A. Szabo, P.Eng. _______________________________ Attila A. Szabo, P.Eng. Project Leader; Senior Petroleum Engineer and Partner _07_/_10_/2011 dd/mm/yr Sproule Executive Endorsement This report has been reviewed and endorsed by the following Executive of Sproule: Original Signed by Harry J. Helwerda, P.Eng., FEC _______________________________ Harry J. Helwerda, P.Eng., FEC Executive Vice-President and Director _07_/_10_/2011 dd/mm/yr Permit to Practice Sproule Associates Limited is a member of the Association of Professional Engineers, Geologists and Geophysicists of Alberta and our permit number is P00417. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Introduction — Page 6 Certificate Attila A. Szabo, B.Sc., P.Eng. I, Attila A. Szabo, Senior Petroleum Engineer and Partner, of Sproule, 900, 140 Fourth Ave SW, Calgary, Alberta, declare the following: 1. I hold the following degree: a. B.Sc., Chemical Engineering (1980), University of Calgary, Calgary, Alberta, Canada 2. I am a registered professional: a. Professional Engineer (P.Eng.) Province of Alberta, Canada 3. I am a member of the following professional organizations: a. Association of Professional Engineers, Geologists and Geophysicists of Alberta (APEGGA) b. Society of Petroleum Engineers (SPE) c. Society of Petroleum Evaluation Engineers (SPEE) 4. I am a qualified reserves evaluator and reserves auditor as defined in National Instrument 51-101. 5. My contribution to the report entitled “Evaluation of the P&NG Reserves of Eagleford Energy Inc. (As of August 31, 2011)” is based on my engineering knowledge and the data provided to me by the Company, from public sources, and from the non-confidential files of Sproule. I did not undertake a field inspection of the properties. 6. I have no interest, direct or indirect, nor do I expect to receive any interest, direct or indirect, in the properties described in the above-named report or in the securities of Eagleford Energy Inc. Original Signed by Attila A. Szabo, P.Eng. Attila A. Szabo, P.Eng. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Introduction — Page 7 Certificate Harry J. Helwerda, B.Sc., P.Eng., FEC I, Harry J. Helwerda, Executive Vice-President, and Director of Sproule, 900, 140 Fourth Ave SW, Calgary, Alberta, declare the following: 1. I hold the following degree: a. B.Sc. Civil Engineering (1978) University of Calgary, Calgary AB, Canada 2. I am a registered professional: a. Professional Engineer (P.Eng.) Province of Alberta, Canada 3. I have been bestowed with the designation Fellow Engineers Canada (FEC) 4. I am a member of the following professional organizations: a. Association of Professional Engineers, Geologists and Geophysicists of Alberta (APEGGA) b. Society of Petroleum Engineers (SPE) c. Society of Petroleum Evaluation Engineers (SPEE) 5. I am a qualified reserves evaluator and reserves auditor as defined in National Instrument 51-101. 6. My contribution to the report entitled “Evaluation of the P&NG Reserves of Eagleford Energy Inc. (As of August 31, 2011)” is based on my engineering knowledge and the data provided to me by the Company, from public sources, and from the non-confidential files of Sproule. I did not undertake a field inspection of the properties. 7. I have no interest, direct or indirect, nor do I expect to receive any interest, direct or indirect, in the properties described in the above-named report or in the securities of Eagleford Energy Inc. Original Signed by Harry J. Helwerda, P.Eng., FEC Harry J. Helwerda, P.Eng., FEC 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

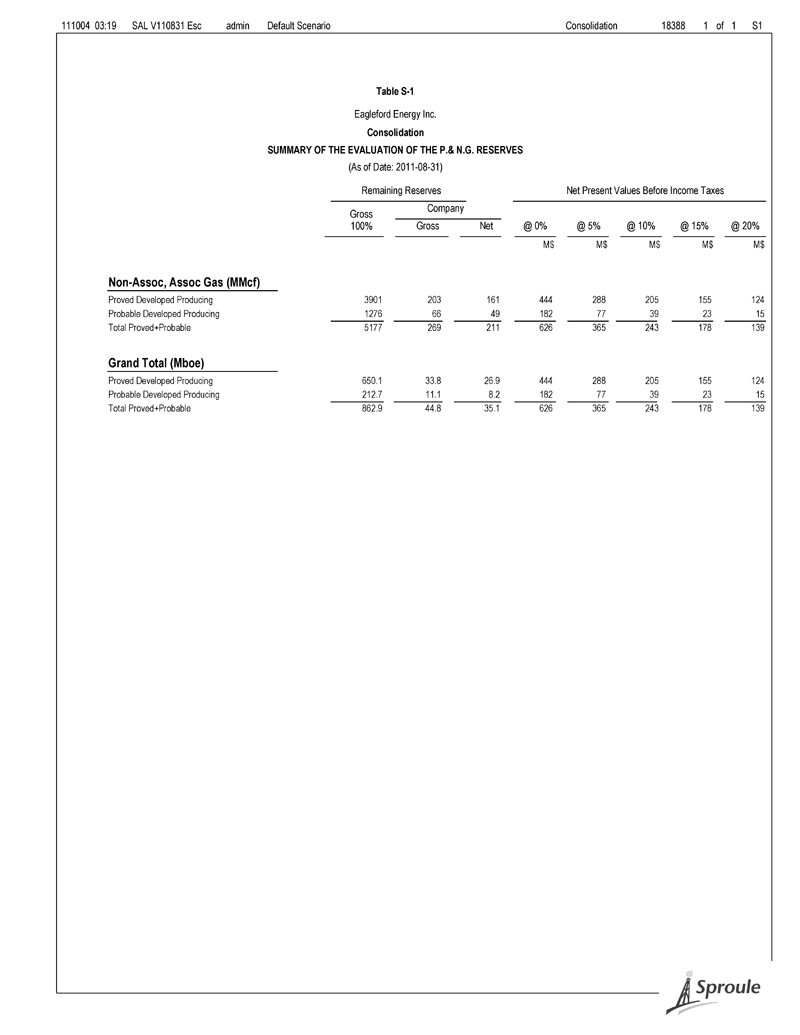

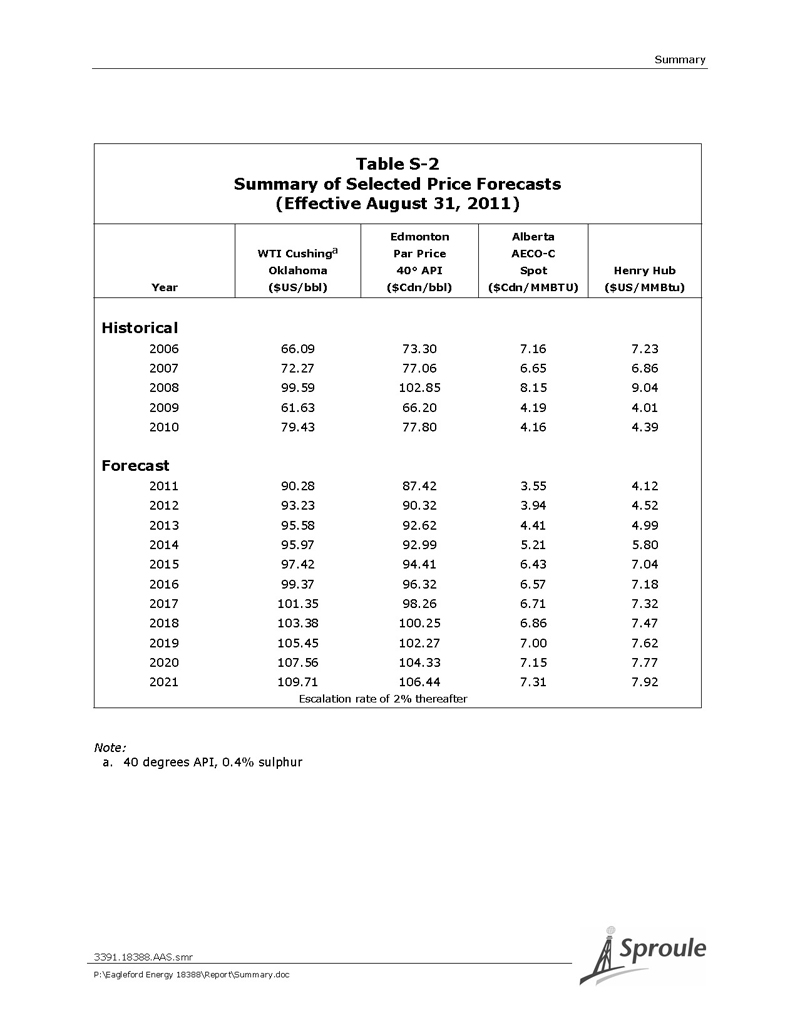

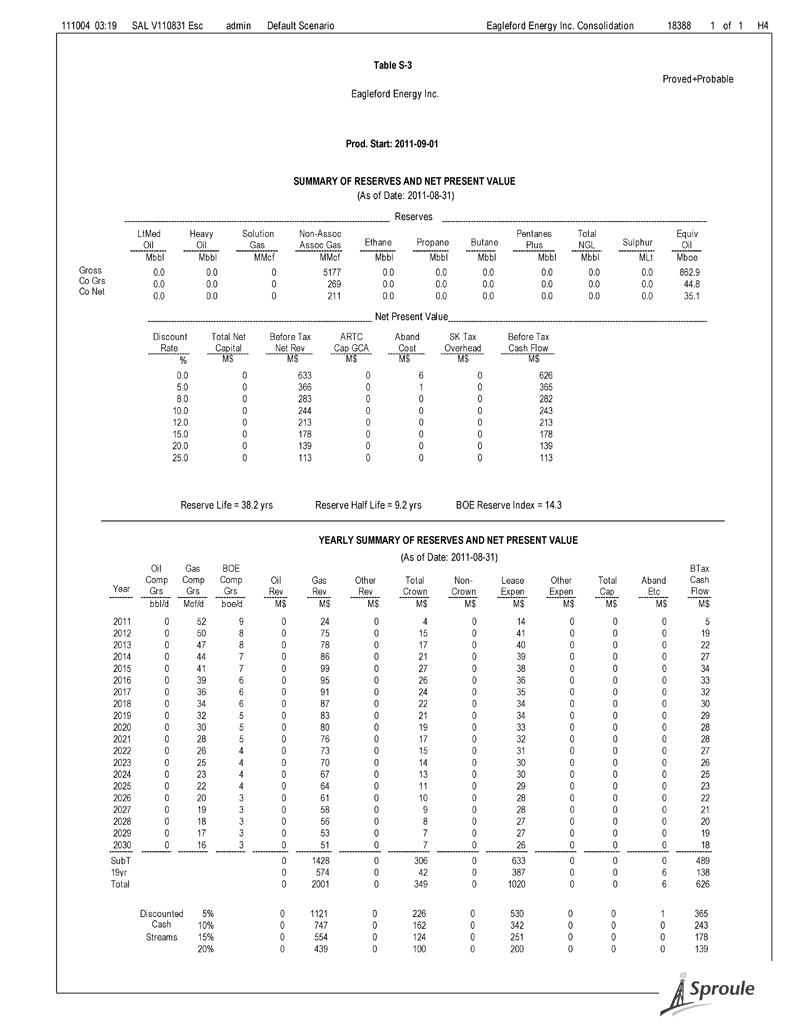

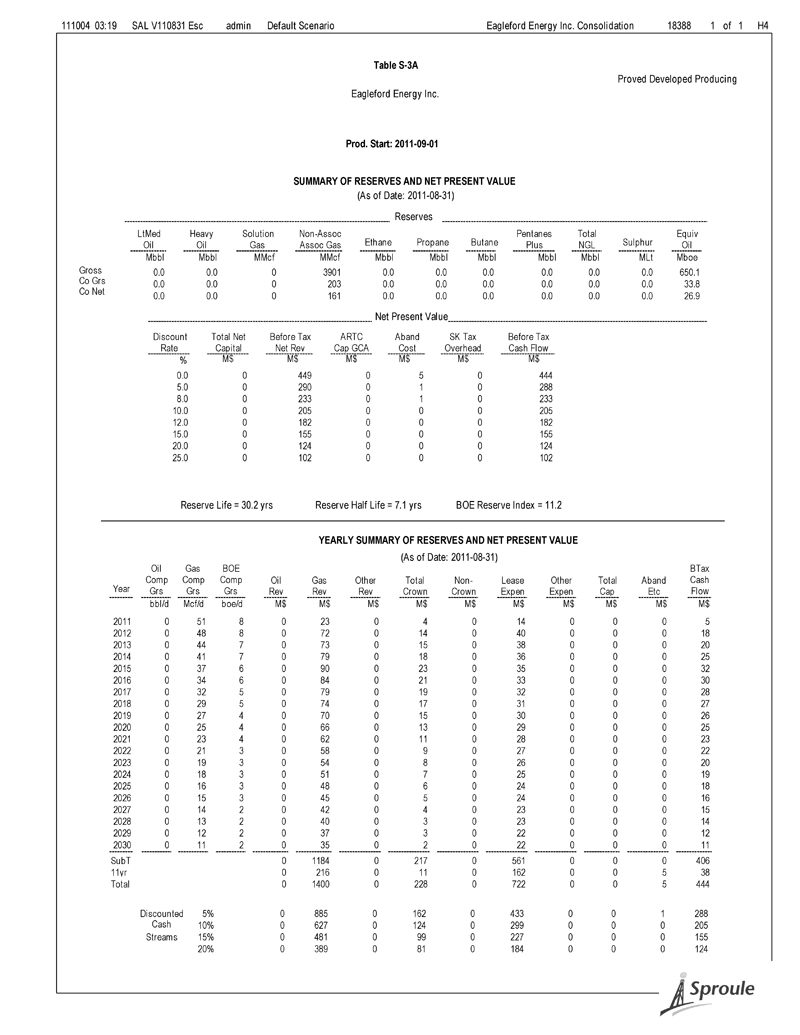

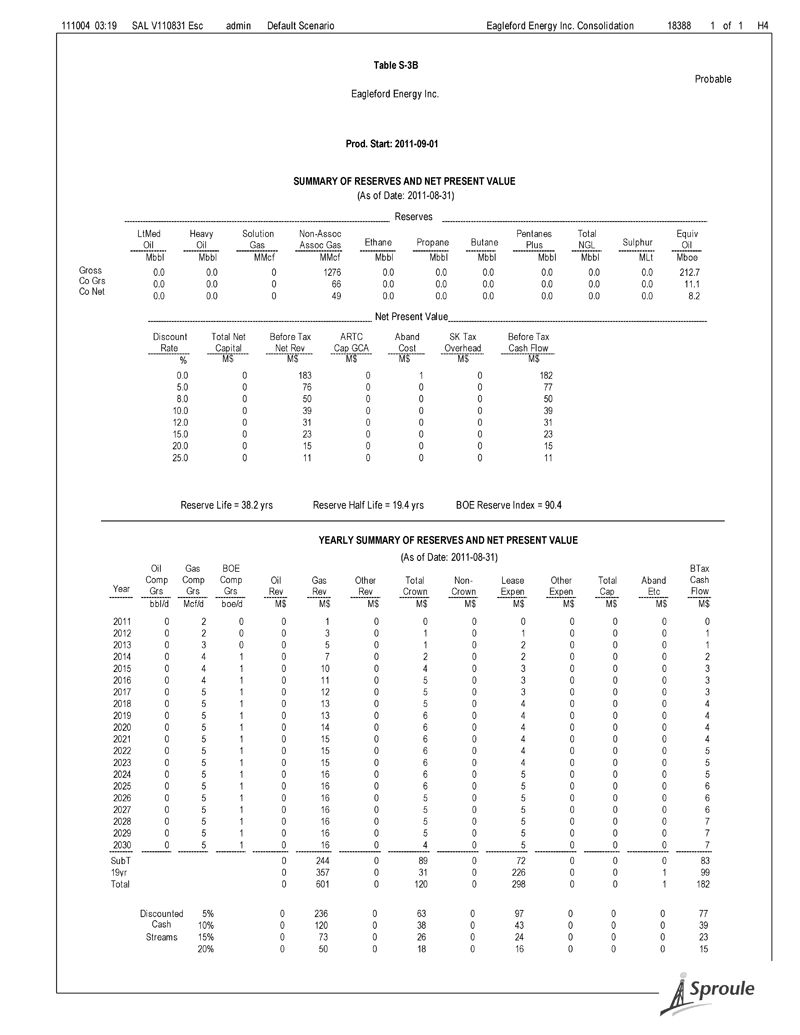

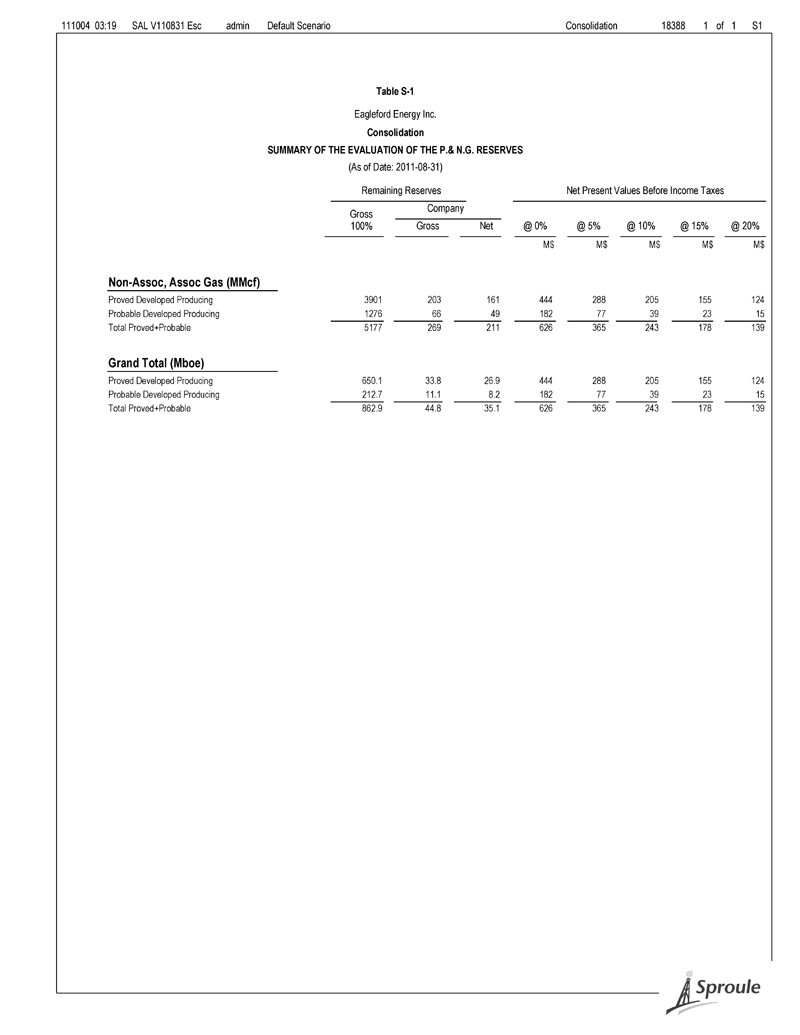

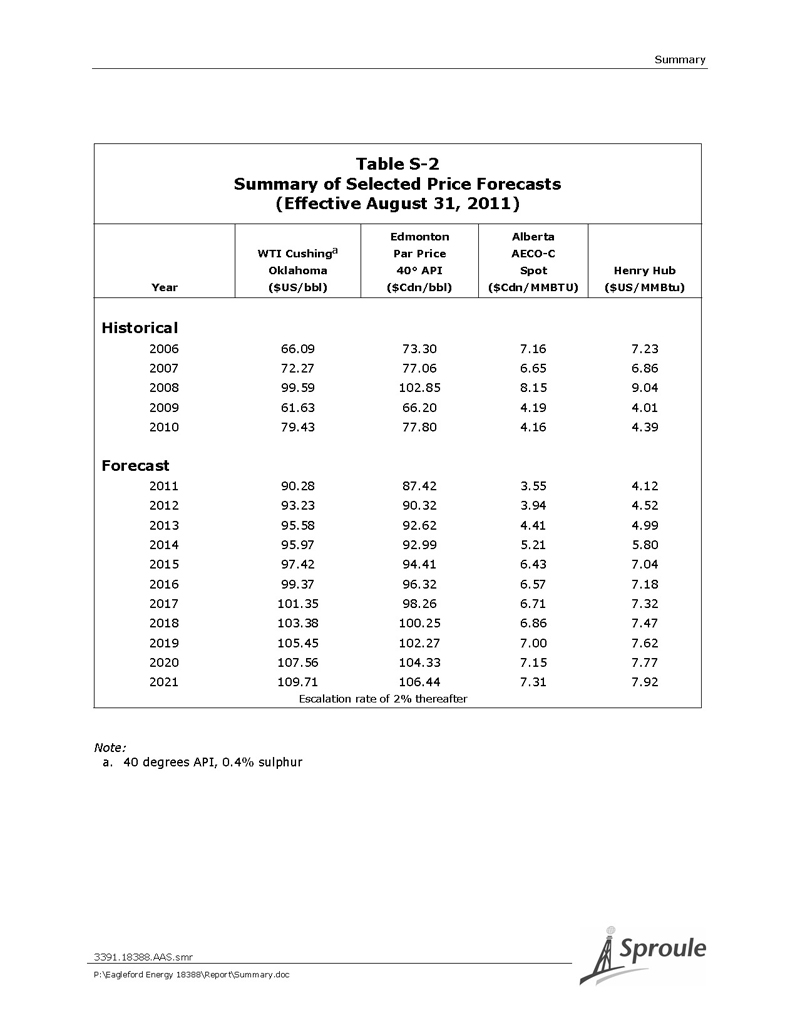

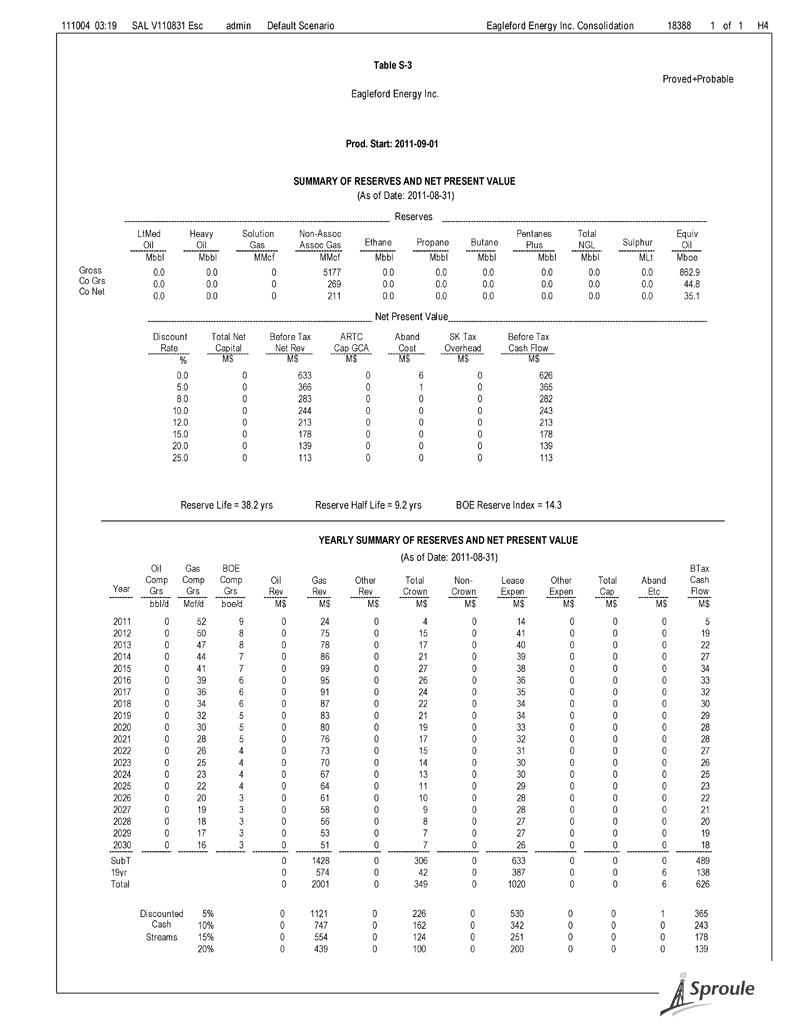

Summary — Page 1 Summary Table S-1 summarizes our evaluation, before income taxes, of the P&NG reserves of Eagleford Energy Inc., as of August 31, 2011. Changes to royalties enacted by legislation in Alberta have been included in the report. The reserves definitions and ownership classification used in this evaluation are the standards defined by COGEH reserve definitions and consistent with NI 51-101 and used by Sproule. The natural gas reserves are presented in millions of cubic feet, at base conditions of 14.65 psia and 60 degrees Fahrenheit. The net present values of the reserves are presented (on a before tax basis) in Canadian dollars and are based on annual projections of net revenue, which were discounted at various rates using the mid-period discounting method. These rates are 5, 10, 15 and 20 percent and undiscounted. The price forecasts that formed the basis for the revenue projections in the evaluation were based on Sproule’s August 31, 2011 pricing model. Table S-2 presents a summary of selected forecasts. Summary forecasts of production and net revenue for the various reserves categories are presented in Tables S-3 through S-3B, respectively. Well abandonment and disconnect costs have been included in this report at the entity level for all wells assigned reserves and are summarized in the Corporate totals for the various reserves categories. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

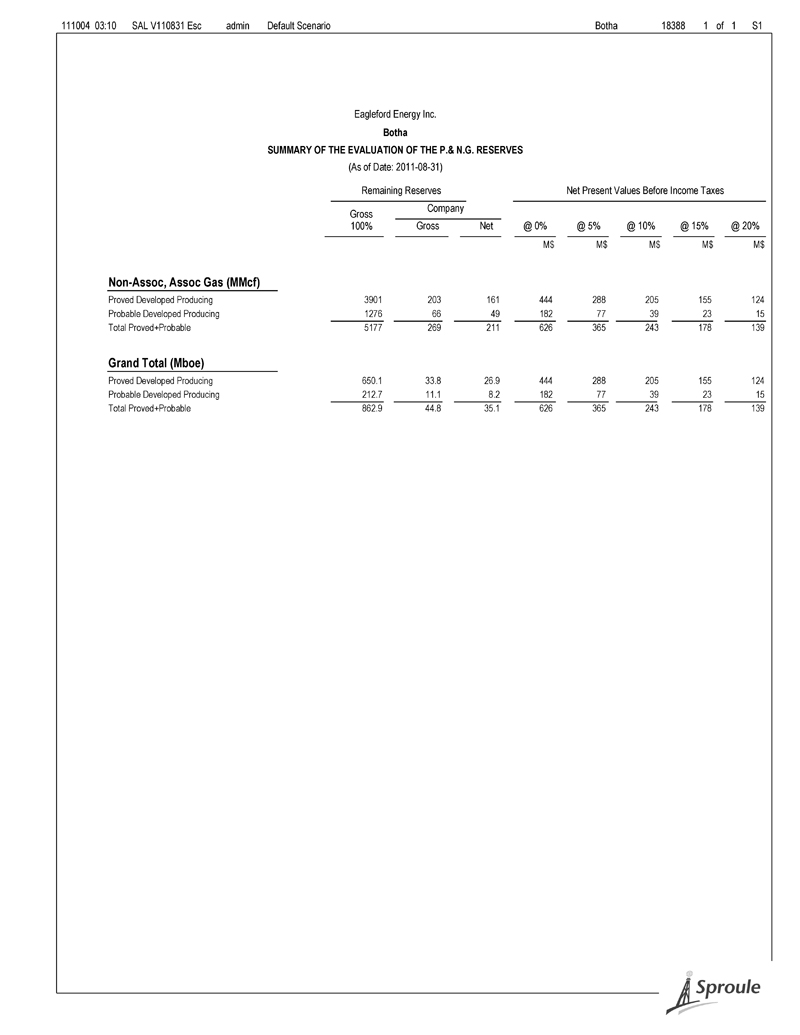

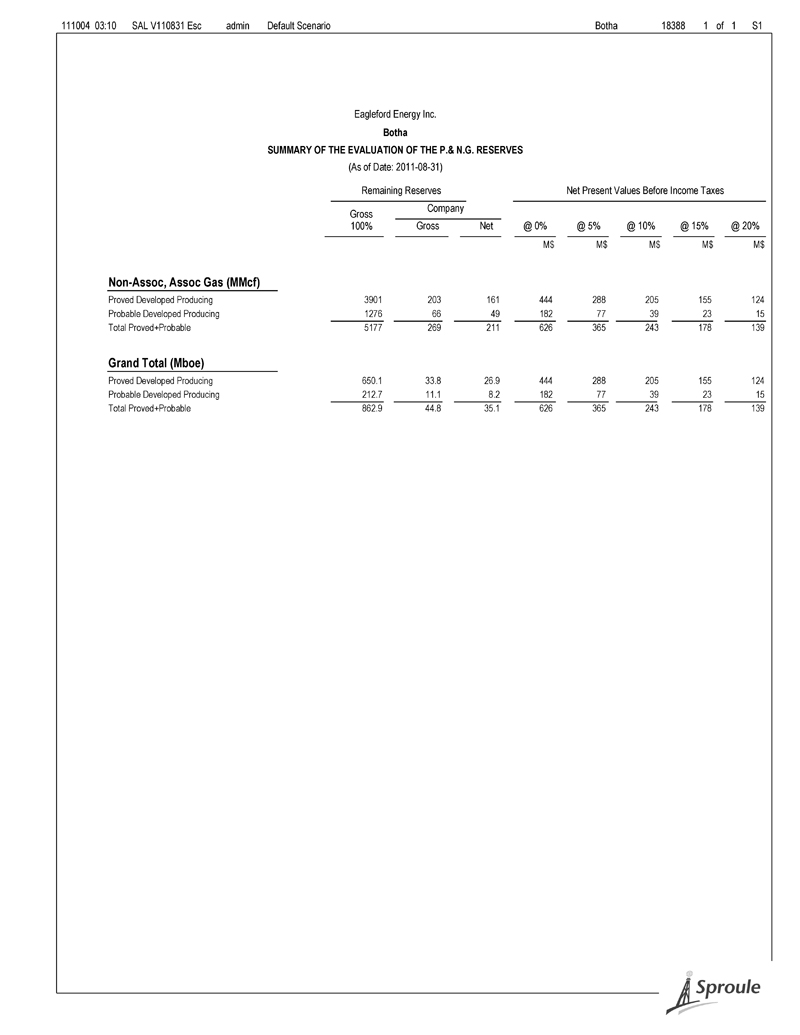

111004 03:19 SAL V110831 Esc admin Default Scenario Consolidation 18388 1 of 1 S1 Table S-1 Eagleford Energy Inc. Consolidation SUMMARY OF THE EVALUATION OF THE P.& N.G. RESERVES (As of Date: 2011-08-31) Remaining Reserves Net Present Values Before Income Taxes Company Gross 100% Gross Net @ 0% @ 5% @ 10% @ 15% @ 20% M$ M$ M$ M$ M$ Non-Assoc, Assoc Gas (MMcf) Proved Developed Producing 3901 203 161 444 288 205 155 124 Probable Developed Producing 1276 66 49 182 77 39 23 15 Total Proved+Probable 5177 269 211 626 365 243 178 139 Grand Total (Mboe) Proved Developed Producing 650.1 33.8 26.9 444 288 205 155 124 Probable Developed Producing 212.7 11.1 8.2 182 77 39 23 15 Total Proved+Probable 862.9 44.8 35.1 626 365 243 178 139

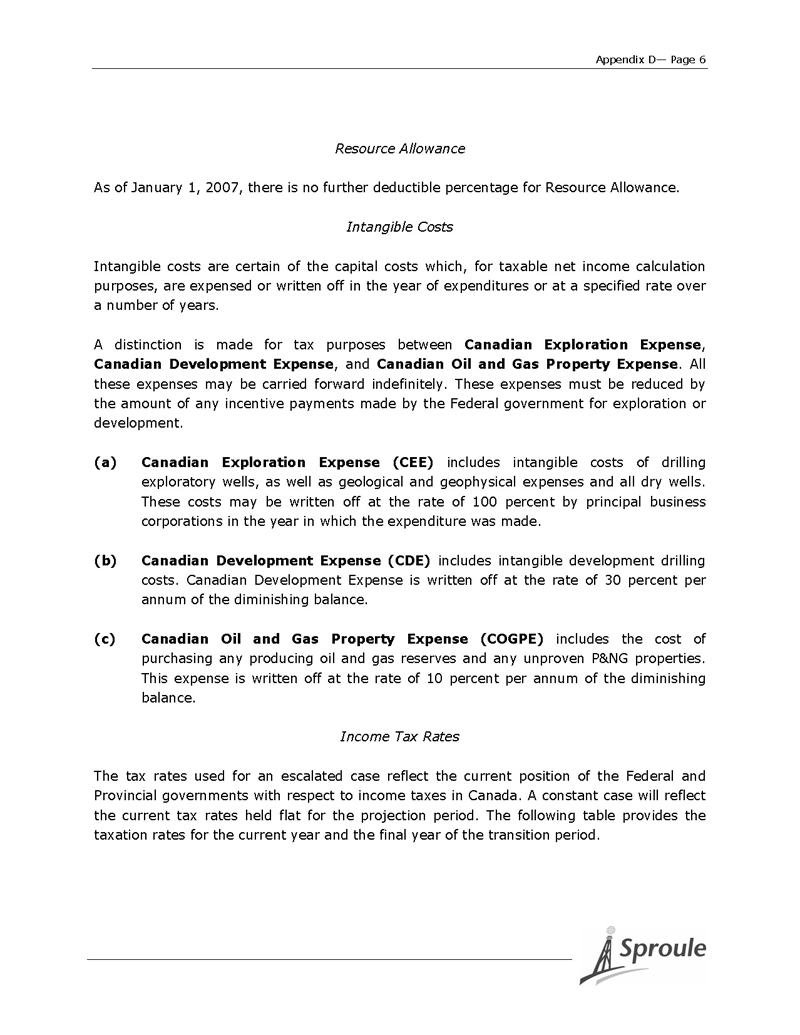

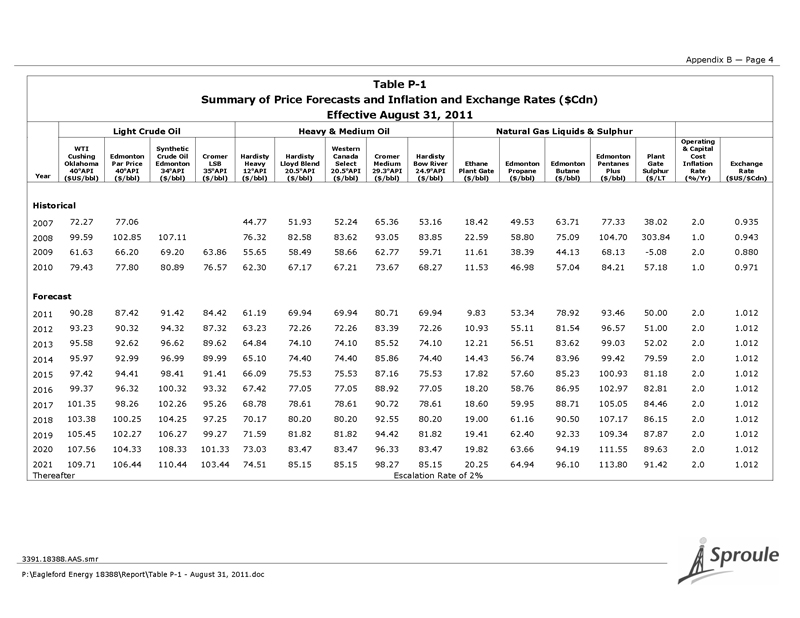

Summary Table S-2 Summary of Selected Price Forecasts (Effective August 31, 2011) Edmonton Alberta WTI Cushinga Par Price AECO-C Oklahoma 40° API Spot Henry Hub Year ($US/bbl) ($Cdn/bbl) ($Cdn/MMBTU) ($US/MMBtu) Historical 2006 66.09 73.30 7.16 7.23 2007 72.27 77.06 6.65 6.86 2008 99.59 102.85 8.15 9.04 2009 61.63 66.20 4.19 4.01 2010 79.43 77.80 4.16 4.39 Forecast 2011 90.28 87.42 3.55 4.12 2012 93.23 90.32 3.94 4.52 2013 95.58 92.62 4.41 4.99 2014 95.97 92.99 5.21 5.80 2015 97.42 94.41 6.43 7.04 2016 99.37 96.32 6.57 7.18 2017 101.35 98.26 6.71 7.32 2018 103.38 100.25 6.86 7.47 2019 105.45 102.27 7.00 7.62 2020 107.56 104.33 7.15 7.77 2021 109.71 106.44 7.31 7.92 Escalation rate of 2% thereafter Note: a. 40 degrees API, 0.4% sulphur 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

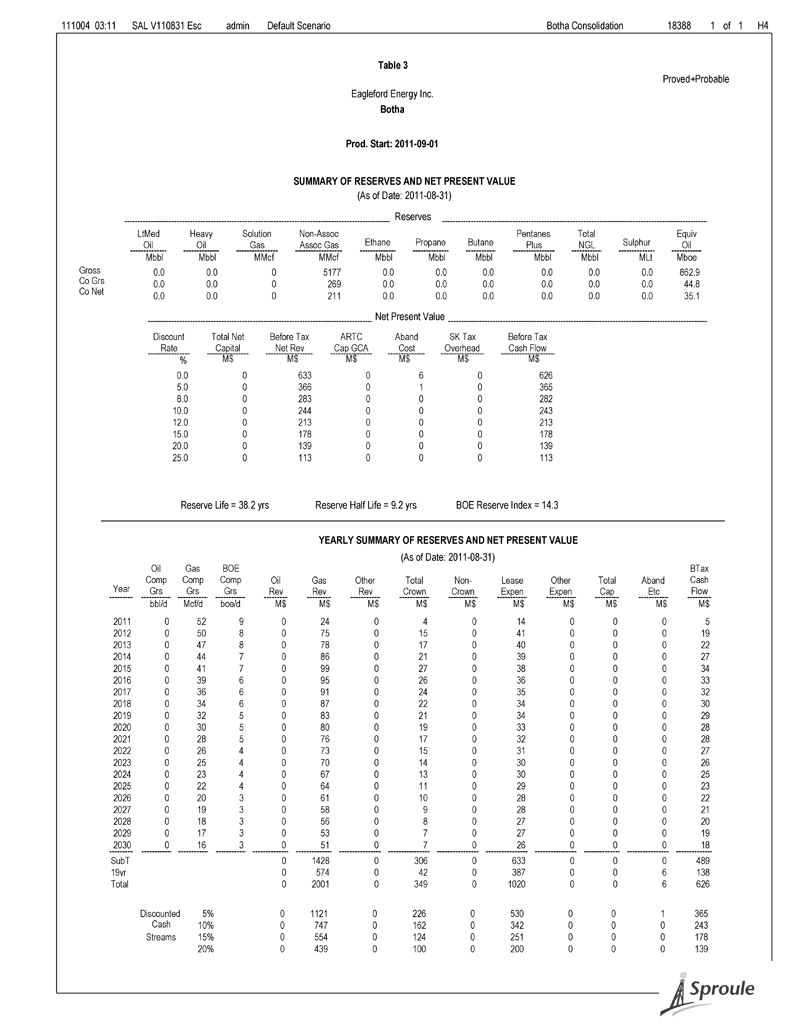

111004 03:19 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table S-3 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 5177 0.0 0.0 0.0 0.0 0.0 0.0 862.9 Co Grs 0.0 0.0 0 269 0.0 0.0 0.0 0.0 0.0 0.0 44.8 Co Net 0.0 0.0 0 211 0.0 0.0 0.0 0.0 0.0 0.0 35.1 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 633 0 6 0 626 5.0 0 366 0 1 0 365 8.0 0 283 0 0 0 282 10.0 0 244 0 0 0 243 12.0 0 213 0 0 0 213 15.0 0 178 0 0 0 178 20.0 0 139 0 0 0 139 25.0 0 113 0 0 0 113 Reserve Life = 38.2 yrs Reserve Half Life = 9.2 yrs BOE Reserve Index = 14.3 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 52 9 0 24 0 4 0 14 0 0 0 5 2012 0 50 8 0 75 0 15 0 41 0 0 0 19 2013 0 47 8 0 78 0 17 0 40 0 0 0 22 2014 0 44 7 0 86 0 21 0 39 0 0 0 27 2015 0 41 7 0 99 0 27 0 38 0 0 0 34 2016 0 39 6 0 95 0 26 0 36 0 0 0 33 2017 0 36 6 0 91 0 24 0 35 0 0 0 32 2018 0 34 6 0 87 0 22 0 34 0 0 0 30 2019 0 32 5 0 83 0 21 0 34 0 0 0 29 2020 0 30 5 0 80 0 19 0 33 0 0 0 28 2021 0 28 5 0 76 0 17 0 32 0 0 0 28 2022 0 26 4 0 73 0 15 0 31 0 0 0 27 2023 0 25 4 0 70 0 14 0 30 0 0 0 26 2024 0 23 4 0 67 0 13 0 30 0 0 0 25 2025 0 22 4 0 64 0 11 0 29 0 0 0 23 2026 0 20 3 0 61 0 10 0 28 0 0 0 22 2027 0 19 3 0 58 0 9 0 28 0 0 0 21 2028 0 18 3 0 56 0 8 0 27 0 0 0 20 2029 0 17 3 0 53 0 7 0 27 0 0 0 19 2030 0 16 3 0 51 0 7 0 26 0 0 0 18 SubT 0 1428 0 306 0 633 0 0 0 489 19yr 0 574 0 42 0 387 0 0 6 138 Total 0 2001 0 349 0 1020 0 0 6 626 Discounted 5% 0 1121 0 226 0 530 0 0 1 365 Cash 10% 0 747 0 162 0 342 0 0 0 243 Streams 15% 0 554 0 124 0 251 0 0 0 178 20% 0 439 0 100 0 200 0 0 0 139

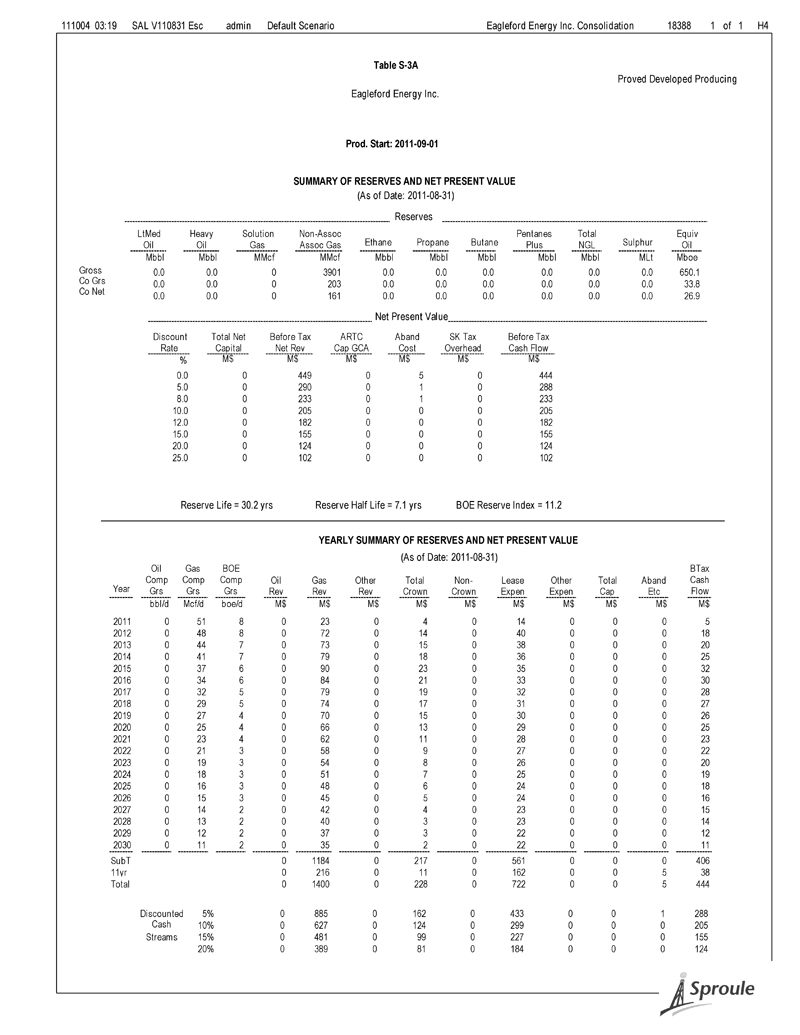

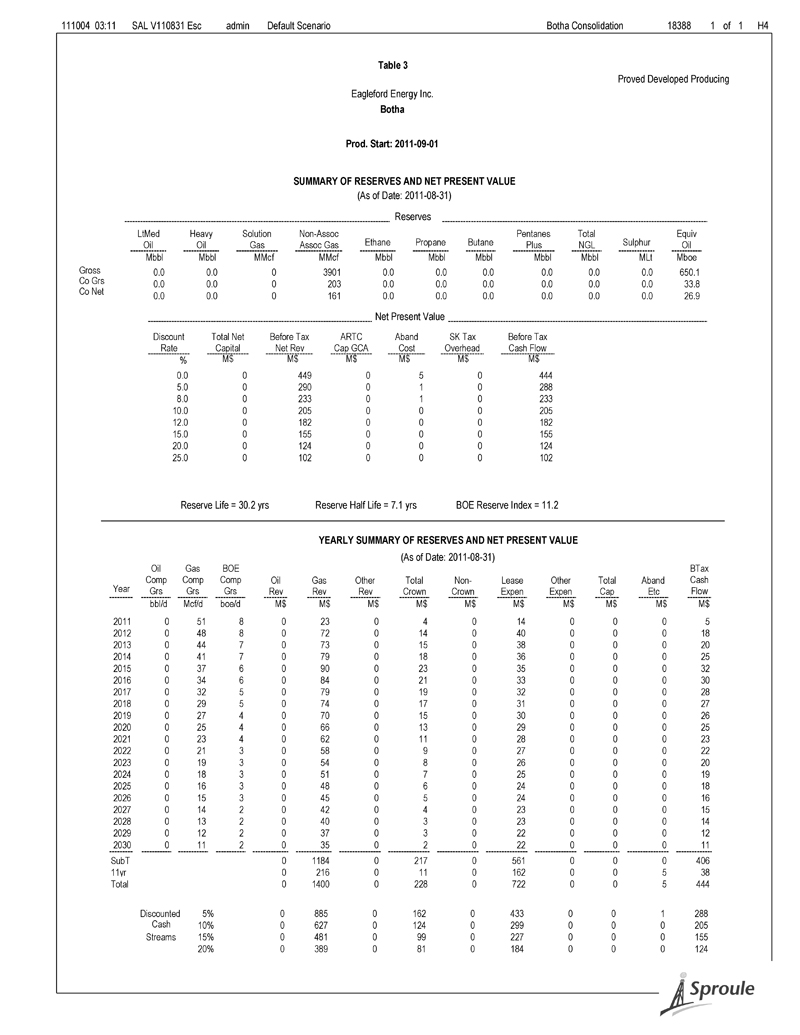

111004 03:19 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table S-3A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 3901 0.0 0.0 0.0 0.0 0.0 0.0 650.1 Co Grs 0.0 0.0 0 203 0.0 0.0 0.0 0.0 0.0 0.0 33.8 Co Net 0.0 0.0 0 161 0.0 0.0 0.0 0.0 0.0 0.0 26.9 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 449 0 5 0 444 5.0 0 290 0 1 0 288 8.0 0 233 0 1 0 233 10.0 0 205 0 0 0 205 12.0 0 182 0 0 0 182 15.0 0 155 0 0 0 155 20.0 0 124 0 0 0 124 25.0 0 102 0 0 0 102 Reserve Life = 30.2 yrs Reserve Half Life = 7.1 yrs BOE Reserve Index = 11.2 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 51 8 0 23 0 4 0 14 0 0 0 5 2012 0 48 8 0 72 0 14 0 40 0 0 0 18 2013 0 44 7 0 73 0 15 0 38 0 0 0 20 2014 0 41 7 0 79 0 18 0 36 0 0 0 25 2015 0 37 6 0 90 0 23 0 35 0 0 0 32 2016 0 34 6 0 84 0 21 0 33 0 0 0 30 2017 0 32 5 0 79 0 19 0 32 0 0 0 28 2018 0 29 5 0 74 0 17 0 31 0 0 0 27 2019 0 27 4 0 70 0 15 0 30 0 0 0 26 2020 0 25 4 0 66 0 13 0 29 0 0 0 25 2021 0 23 4 0 62 0 11 0 28 0 0 0 23 2022 0 21 3 0 58 0 9 0 27 0 0 0 22 2023 0 19 3 0 54 0 8 0 26 0 0 0 20 2024 0 18 3 0 51 0 7 0 25 0 0 0 19 2025 0 16 3 0 48 0 6 0 24 0 0 0 18 2026 0 15 3 0 45 0 5 0 24 0 0 0 16 2027 0 14 2 0 42 0 4 0 23 0 0 0 15 2028 0 13 2 0 40 0 3 0 23 0 0 0 14 2029 0 12 2 0 37 0 3 0 22 0 0 0 12 2030 0 11 2 0 35 0 2 0 22 0 0 0 11 SubT 0 1184 0 217 0 561 0 0 0 406 11yr 0 216 0 11 0 162 0 0 5 38 Total 0 1400 0 228 0 722 0 0 5 444 Discounted 5% 0 885 0 162 0 433 0 0 1 288 Cash 10% 0 627 0 124 0 299 0 0 0 205 Streams 15% 0 481 0 99 0 227 0 0 0 155 20% 0 389 0 81 0 184 0 0 0 124

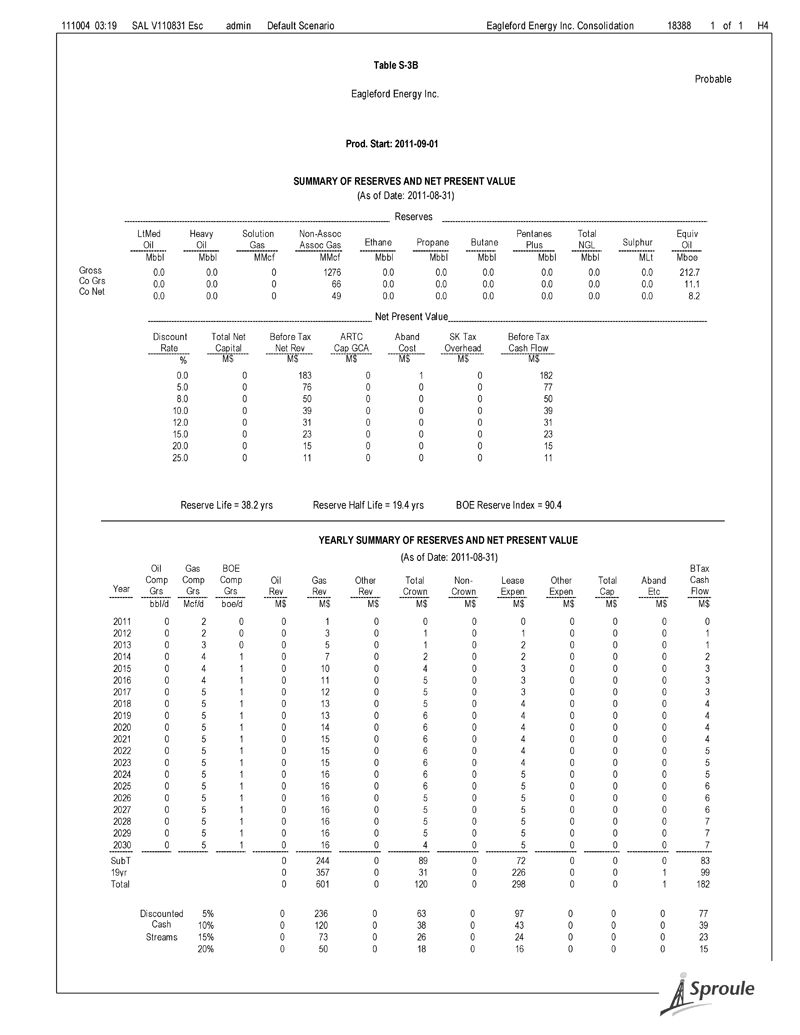

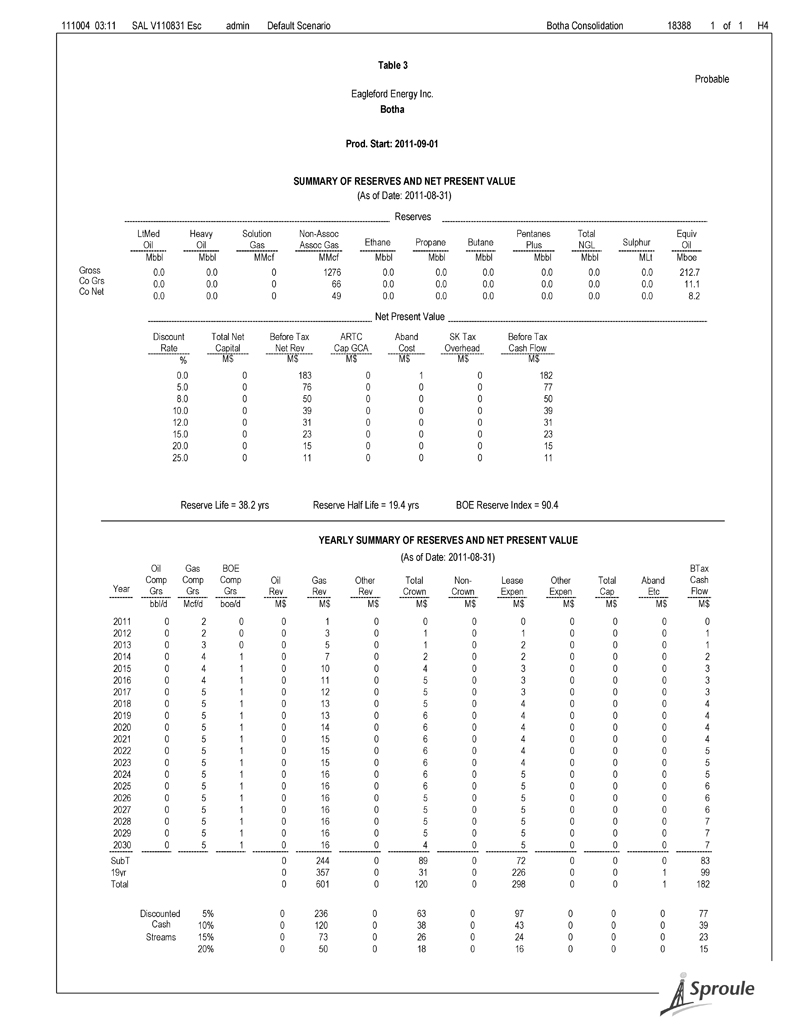

111004 03:19 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table S-3B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 1276 0.0 0.0 0.0 0.0 0.0 0.0 212.7 Co Grs 0.0 0.0 0 66 0.0 0.0 0.0 0.0 0.0 0.0 11.1 Co Net 0.0 0.0 0 49 0.0 0.0 0.0 0.0 0.0 0.0 8.2 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 183 0 1 0 182 5.0 0 76 0 0 0 77 8.0 0 50 0 0 0 50 10.0 0 39 0 0 0 39 12.0 0 31 0 0 0 31 15.0 0 23 0 0 0 23 20.0 0 15 0 0 0 15 25.0 0 11 0 0 0 11 Reserve Life = 38.2 yrs Reserve Half Life = 19.4 yrs BOE Reserve Index = 90.4 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 2 0 0 1 0 0 0 0 0 0 0 0 2012 0 2 0 0 3 0 1 0 1 0 0 0 1 2013 0 3 0 0 5 0 1 0 2 0 0 0 1 2014 0 4 1 0 7 0 2 0 2 0 0 0 2 2015 0 4 1 0 10 0 4 0 3 0 0 0 3 2016 0 4 1 0 11 0 5 0 3 0 0 0 3 2017 0 5 1 0 12 0 5 0 3 0 0 0 3 2018 0 5 1 0 13 0 5 0 4 0 0 0 4 2019 0 5 1 0 13 0 6 0 4 0 0 0 4 2020 0 5 1 0 14 0 6 0 4 0 0 0 4 2021 0 5 1 0 15 0 6 0 4 0 0 0 4 2022 0 5 1 0 15 0 6 0 4 0 0 0 5 2023 0 5 1 0 15 0 6 0 4 0 0 0 5 2024 0 5 1 0 16 0 6 0 5 0 0 0 5 2025 0 5 1 0 16 0 6 0 5 0 0 0 6 2026 0 5 1 0 16 0 5 0 5 0 0 0 6 2027 0 5 1 0 16 0 5 0 5 0 0 0 6 2028 0 5 1 0 16 0 5 0 5 0 0 0 7 2029 0 5 1 0 16 0 5 0 5 0 0 0 7 2030 0 5 1 0 16 0 4 0 5 0 0 0 7 SubT 0 244 0 89 0 72 0 0 0 83 19yr 0 357 0 31 0 226 0 0 1 99 Total 0 601 0 120 0 298 0 0 1 182 Discounted 5% 0 236 0 63 0 97 0 0 0 77 Cash 10% 0 120 0 38 0 43 0 0 0 39 Streams 15% 0 73 0 26 0 24 0 0 0 23 20% 0 50 0 18 0 16 0 0 0 15

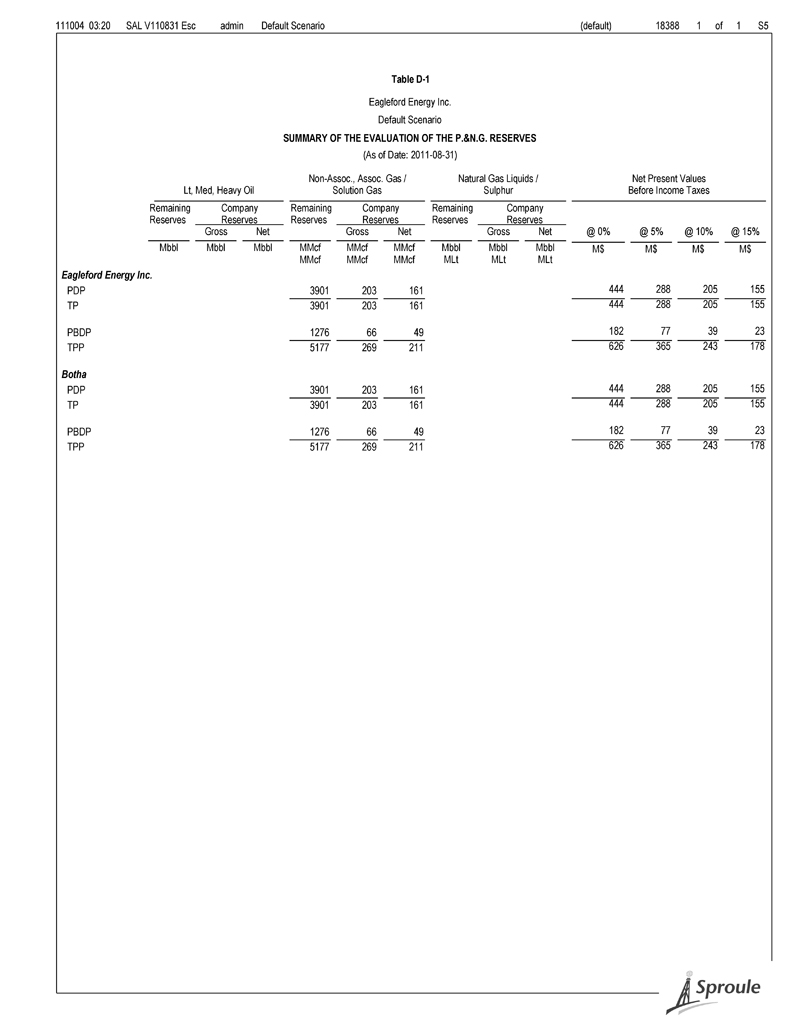

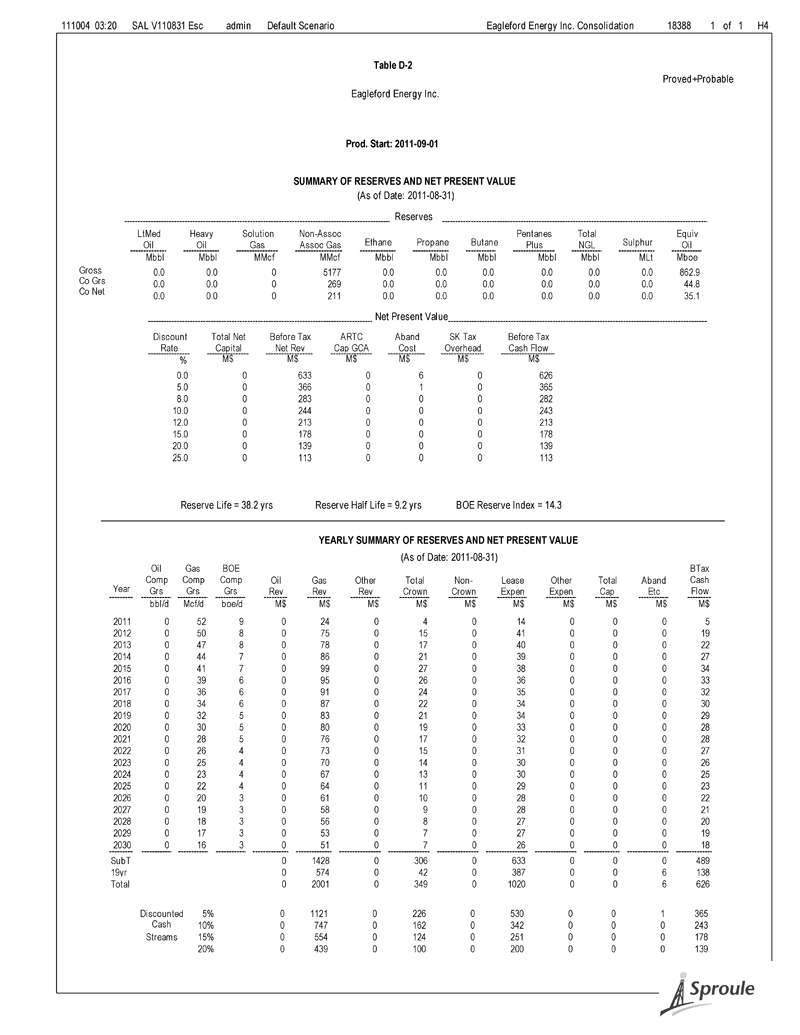

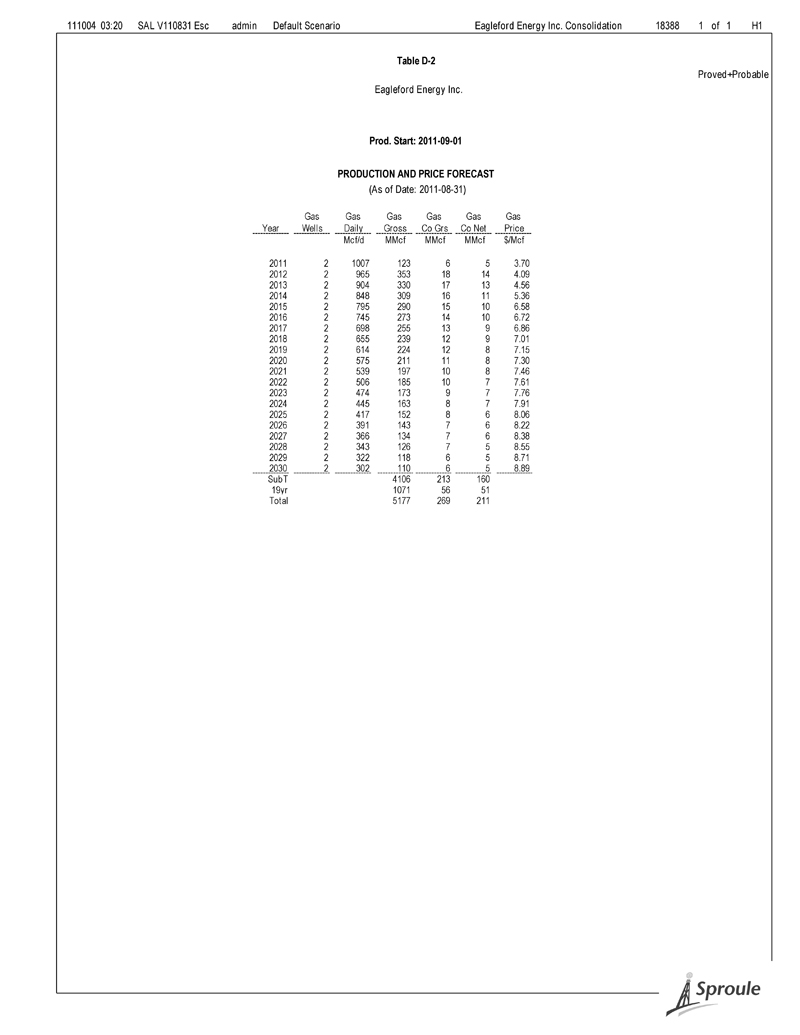

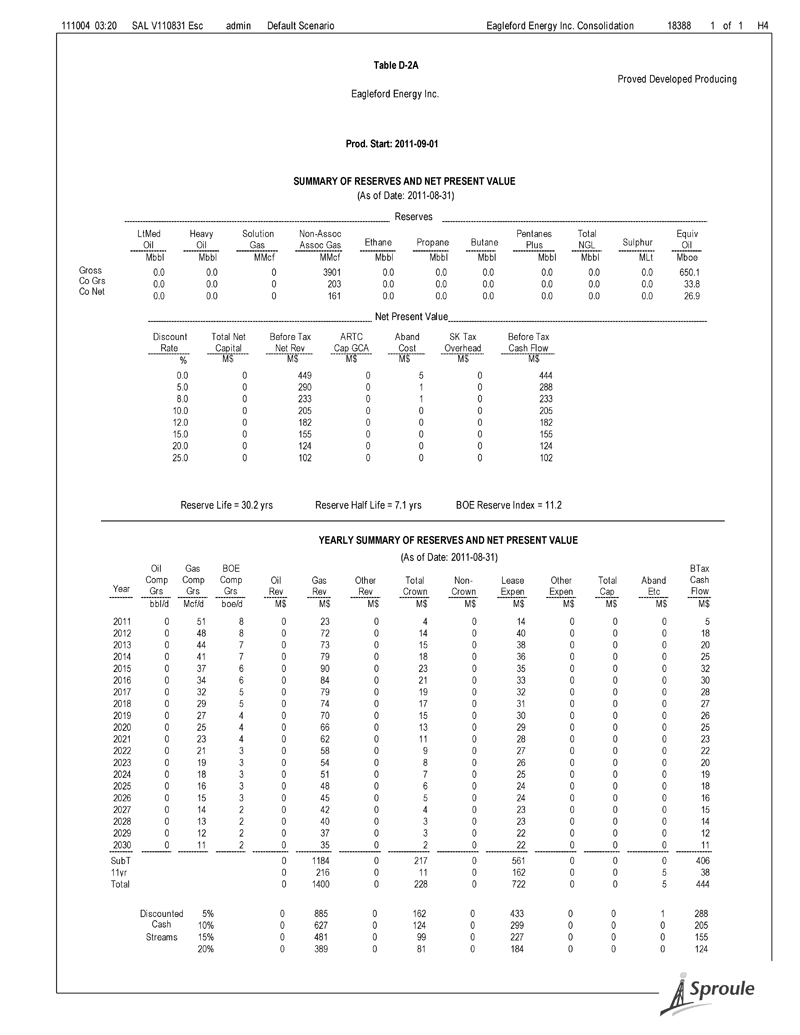

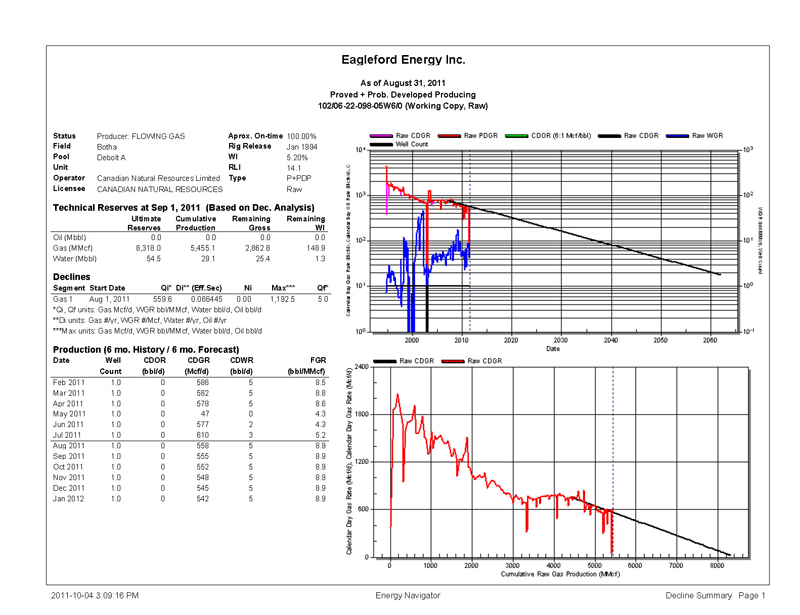

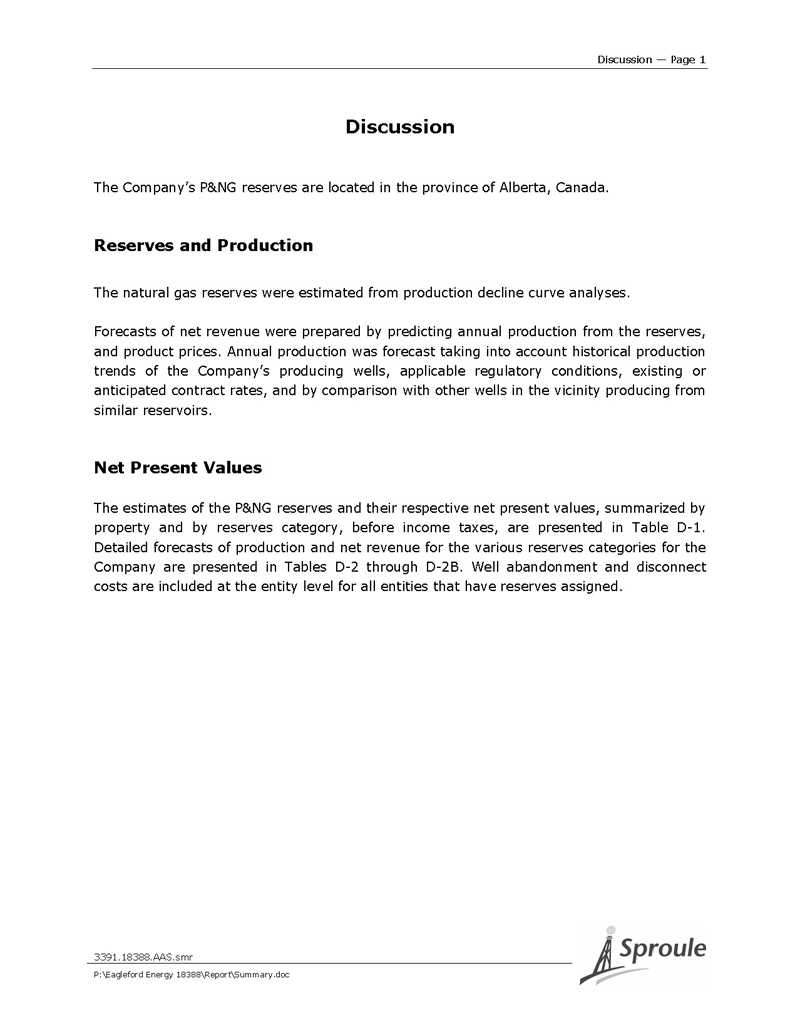

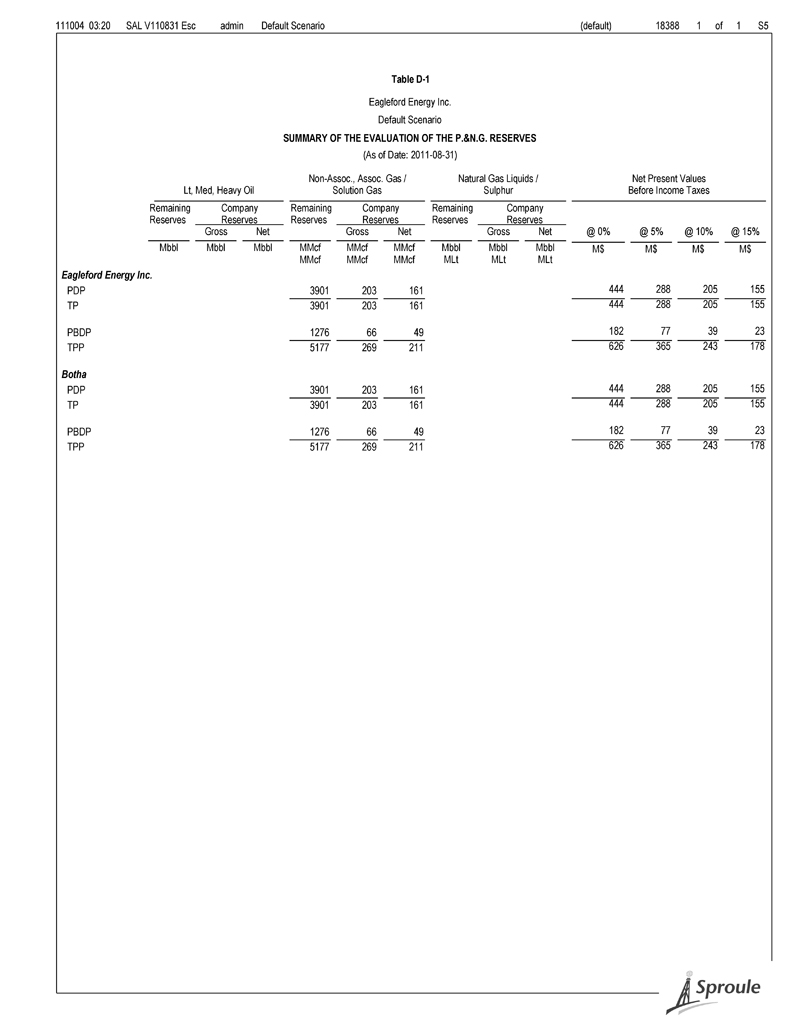

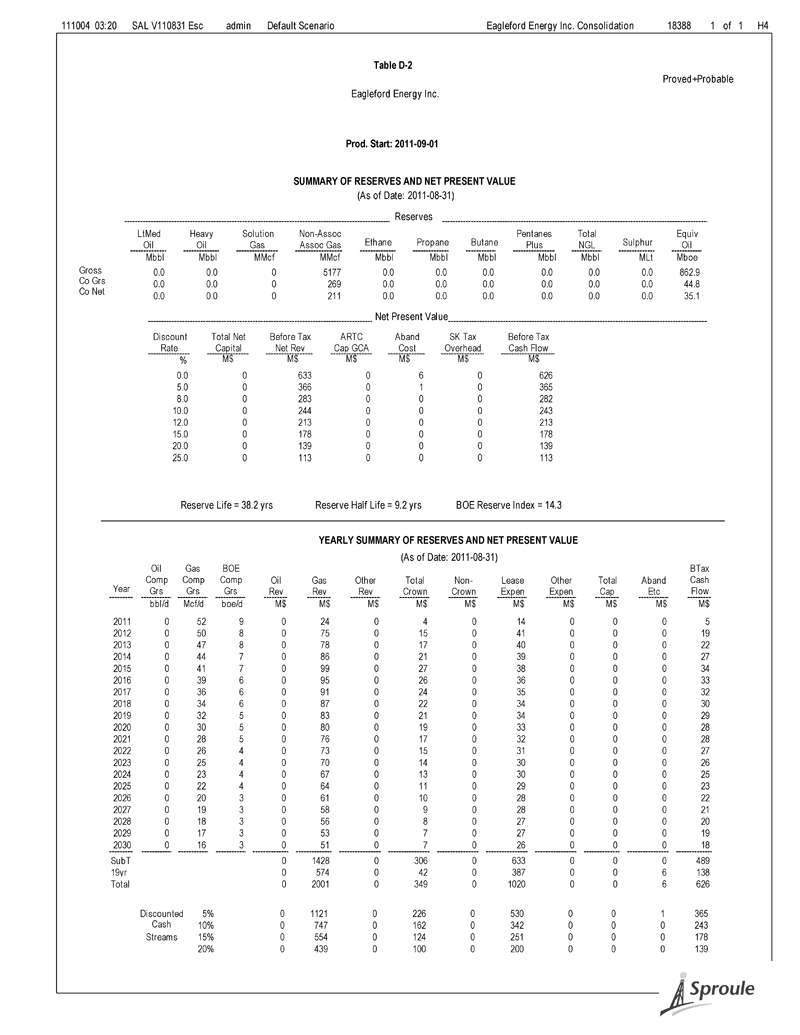

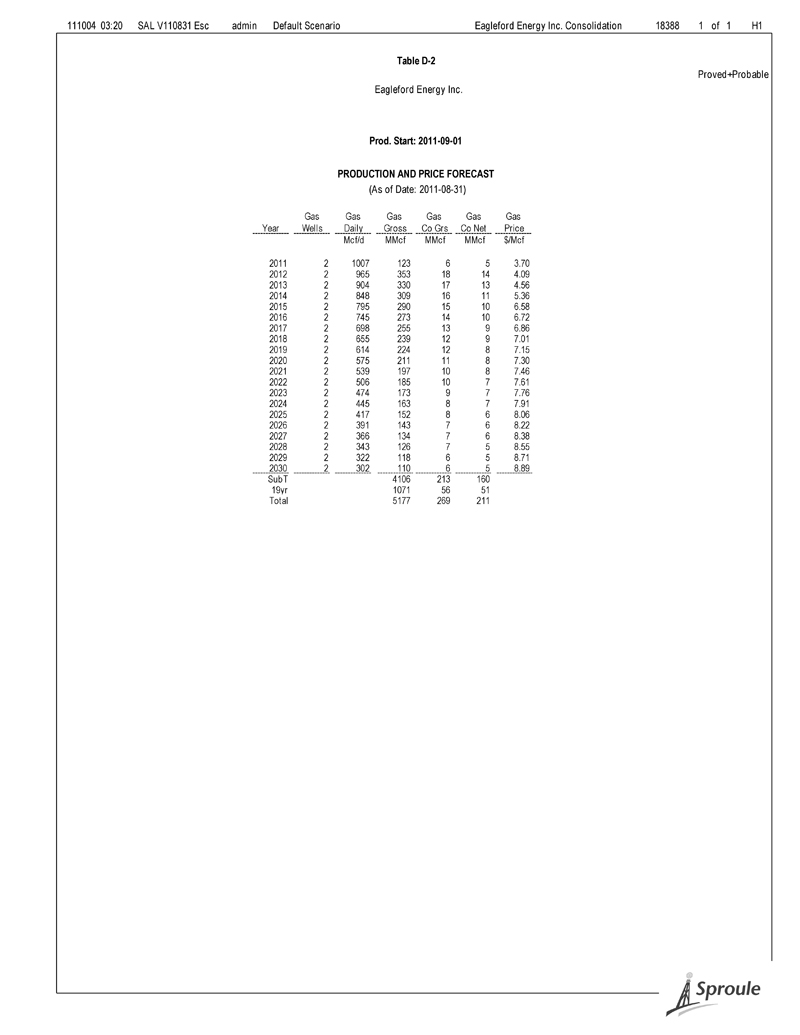

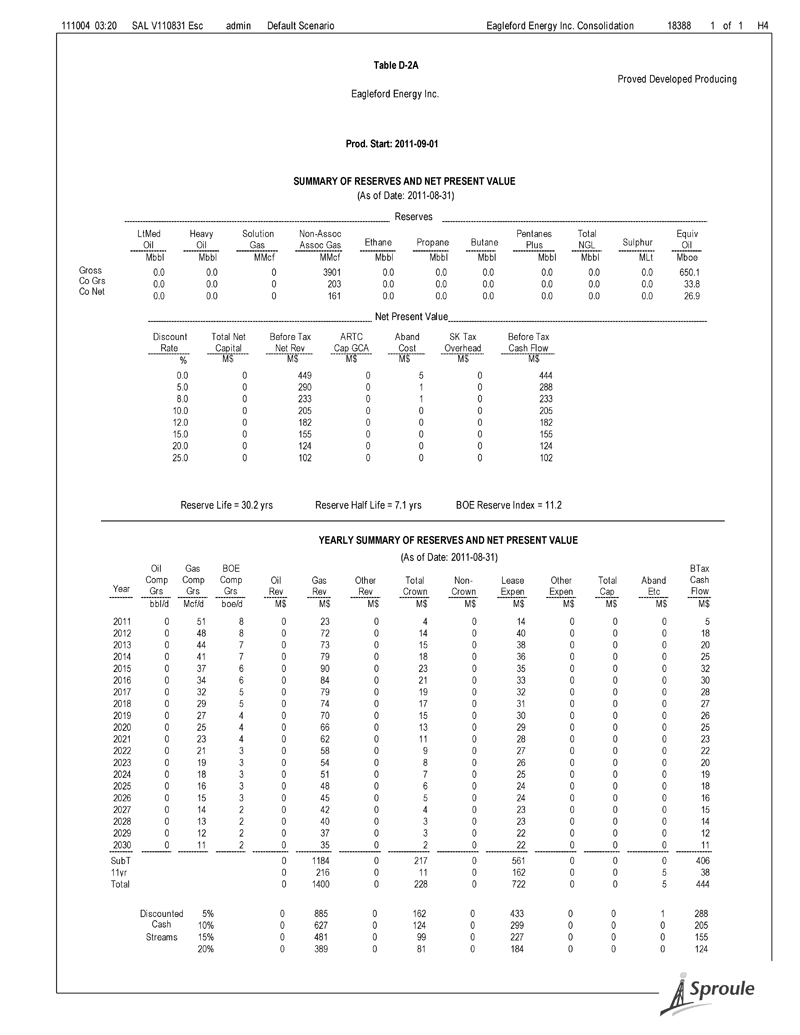

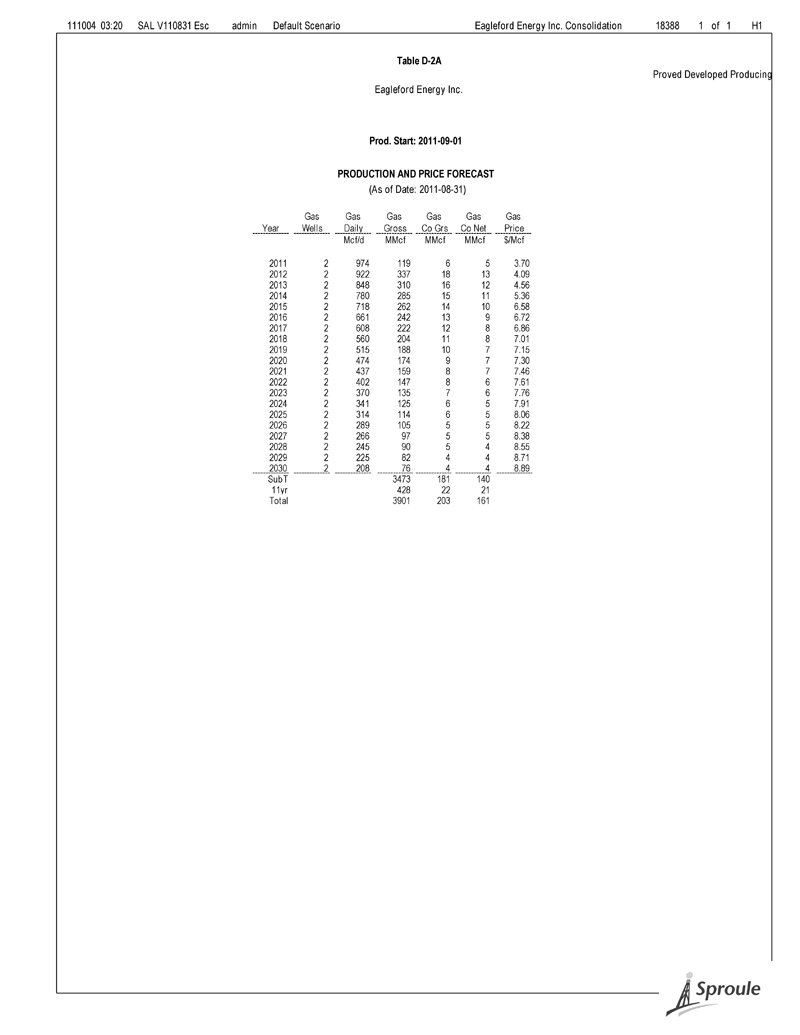

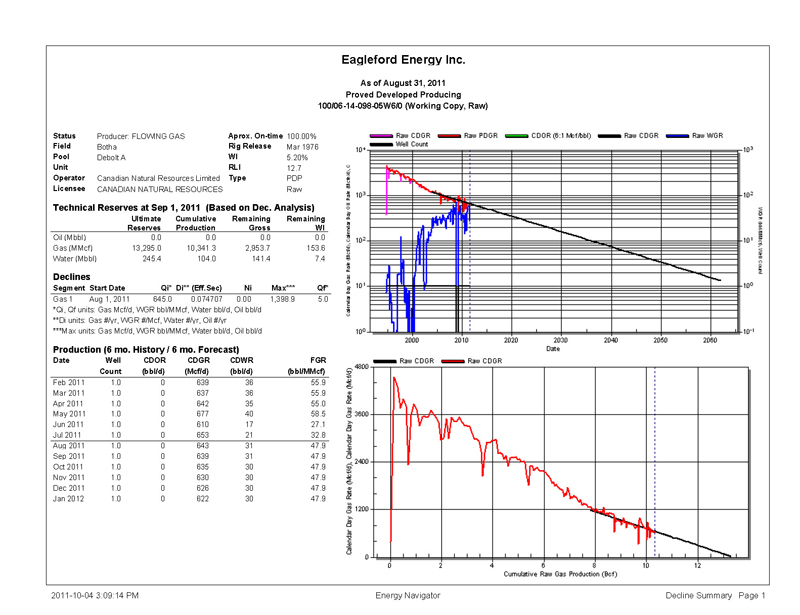

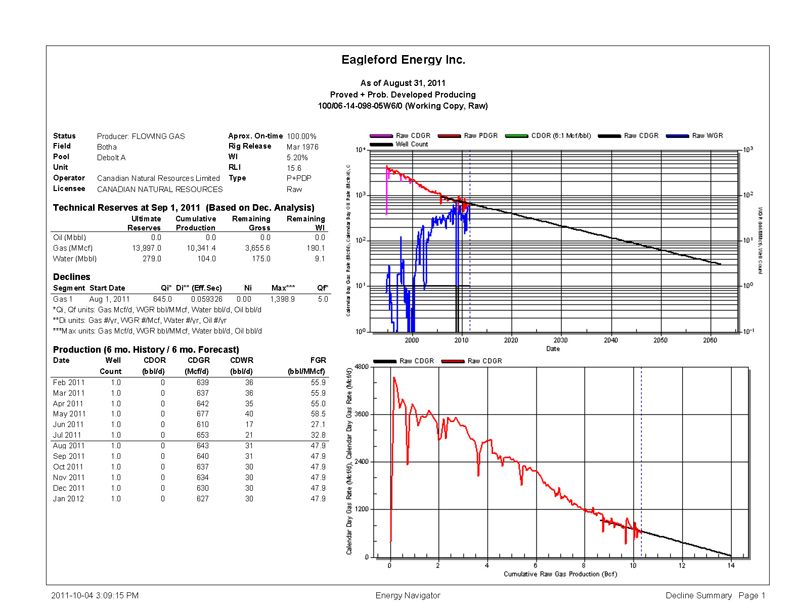

Discussion — Page 1 Discussion The Company’s P&NG reserves are located in the province of Alberta, Canada. Reserves and Production The natural gas reserves were estimated from production decline curve analyses. Forecasts of net revenue were prepared by predicting annual production from the reserves, and product prices. Annual production was forecast taking into account historical production trends of the Company’s producing wells, applicable regulatory conditions, existing or anticipated contract rates, and by comparison with other wells in the vicinity producing from similar reservoirs. Net Present Values The estimates of the P&NG reserves and their respective net present values, summarized by property and by reserves category, before income taxes, are presented in Table D-1. Detailed forecasts of production and net revenue for the various reserves categories for the Company are presented in Tables D-2 through D-2B. Well abandonment and disconnect costs are included at the entity level for all entities that have reserves assigned. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

(default) 18388 1 of 1 S5 Table D-1 Eagleford Energy Inc. Default Scenario SUMMARY OF THE EVALUATION OF THE P.&N.G. RESERVES (As of Date: 2011-08-31) Non-Assoc., Assoc. Gas / Natural Gas Liquids / Net Present Values Lt, Med, Heavy Oil Solution Gas Sulphur Before Income Taxes Remaining Company Remaining Company Remaining Company Reserves Reserves Reserves Reserves Reserves Reserves Gross Net Gross Net Gross Net @ 0% @ 5% @ 10% @ 15% Mbbl Mbbl Mbbl MMcf MMcf MMcf Mbbl Mbbl Mbbl M$ M$ M$ M$ MMcf MMcf MMcf MLt MLt MLt Eagleford Energy Inc. PDP 3901 203 161 444 288 205 155 TP 3901 203 161 444 288 205 155 PBDP 1276 66 49 182 77 39 23 TPP 5177 269 211 626 365 243 178 Botha PDP 3901 203 161 444 288 205 155 TP 3901 203 161 444 288 205 155 PBDP 1276 66 49 182 77 39 23 TPP 5177 269 211 626 365 243 178

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table D-2 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 5177 0.0 0.0 0.0 0.0 0.0 0.0 862.9 Co Grs 0.0 0.0 0 269 0.0 0.0 0.0 0.0 0.0 0.0 44.8 Co Net 0.0 0.0 0 211 0.0 0.0 0.0 0.0 0.0 0.0 35.1 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 633 0 6 0 626 5.0 0 366 0 1 0 365 8.0 0 283 0 0 0 282 10.0 0 244 0 0 0 243 12.0 0 213 0 0 0 213 15.0 0 178 0 0 0 178 20.0 0 139 0 0 0 139 25.0 0 113 0 0 0 113 Reserve Life = 38.2 yrs Reserve Half Life = 9.2 yrs BOE Reserve Index = 14.3 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 52 9 0 24 0 4 0 14 0 0 0 5 2012 0 50 8 0 75 0 15 0 41 0 0 0 19 2013 0 47 8 0 78 0 17 0 40 0 0 0 22 2014 0 44 7 0 86 0 21 0 39 0 0 0 27 2015 0 41 7 0 99 0 27 0 38 0 0 0 34 2016 0 39 6 0 95 0 26 0 36 0 0 0 33 2017 0 36 6 0 91 0 24 0 35 0 0 0 32 2018 0 34 6 0 87 0 22 0 34 0 0 0 30 2019 0 32 5 0 83 0 21 0 34 0 0 0 29 2020 0 30 5 0 80 0 19 0 33 0 0 0 28 2021 0 28 5 0 76 0 17 0 32 0 0 0 28 2022 0 26 4 0 73 0 15 0 31 0 0 0 27 2023 0 25 4 0 70 0 14 0 30 0 0 0 26 2024 0 23 4 0 67 0 13 0 30 0 0 0 25 2025 0 22 4 0 64 0 11 0 29 0 0 0 23 2026 0 20 3 0 61 0 10 0 28 0 0 0 22 2027 0 19 3 0 58 0 9 0 28 0 0 0 21 2028 0 18 3 0 56 0 8 0 27 0 0 0 20 2029 0 17 3 0 53 0 7 0 27 0 0 0 19 2030 0 16 3 0 51 0 7 0 26 0 0 0 18 SubT 0 1428 0 306 0 633 0 0 0 489 19yr 0 574 0 42 0 387 0 0 6 138 Total 0 2001 0 349 0 1020 0 0 6 626 Discounted 5% 0 1121 0 226 0 530 0 0 1 365 Cash 10% 0 747 0 162 0 342 0 0 0 243 Streams 15% 0 554 0 124 0 251 0 0 0 178 20% 0 439 0 100 0 200 0 0 0 139

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H1 Table D-2 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 PRODUCTION AND PRICE FORECAST (As of Date: 2011-08-31) Gas Gas Gas Gas Gas Gas Year Wells Daily Gross Co Grs Co Net Price Mcf/d MMcf MMcf MMcf $/Mcf 2011 2 1007 123 6 5 3.70 2012 2 965 353 18 14 4.09 2013 2 904 330 17 13 4.56 2014 2 848 309 16 11 5.36 2015 2 795 290 15 10 6.58 2016 2 745 273 14 10 6.72 2017 2 698 255 13 9 6.86 2018 2 655 239 12 9 7.01 2019 2 614 224 12 8 7.15 2020 2 575 211 11 8 7.30 2021 2 539 197 10 8 7.46 2022 2 506 185 10 7 7.61 2023 2 474 173 9 7 7.76 2024 2 445 163 8 7 7.91 2025 2 417 152 8 6 8.06 2026 2 391 143 7 6 8.22 2027 2 366 134 7 6 8.38 2028 2 343 126 7 5 8.55 2029 2 322 118 6 5 8.71 2030 2 302 110 6 5 8.89 SubT 4106 213 160 19yr 1071 56 51 Total 5177 269 211

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H2 Table D-2 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) ------------------------------------------ Revenue ---------------------------------------- ------------------------------- Royalties ------------------------------------ NPI/ Other FH/ Min Other Year Oil Gas NGL Sul Roy Income Crown Adjust Indian ORR Taxes Opex Expense M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 24 0 0 0 0 5 0 0 0 0 14 0 2012 0 75 0 0 0 0 16 1 0 0 0 41 0 2013 0 78 0 0 0 0 18 1 0 0 0 40 0 2014 0 86 0 0 0 0 22 1 0 0 0 39 0 2015 0 99 0 0 0 0 29 1 0 0 0 38 0 2016 0 95 0 0 0 0 27 1 0 0 0 36 0 2017 0 91 0 0 0 0 25 1 0 0 0 35 0 2018 0 87 0 0 0 0 23 1 0 0 0 34 0 2019 0 83 0 0 0 0 21 1 0 0 0 34 0 2020 0 80 0 0 0 0 20 1 0 0 0 33 0 2021 0 76 0 0 0 0 18 1 0 0 0 32 0 2022 0 73 0 0 0 0 16 1 0 0 0 31 0 2023 0 70 0 0 0 0 15 1 0 0 0 30 0 2024 0 67 0 0 0 0 13 1 0 0 0 30 0 2025 0 64 0 0 0 0 12 1 0 0 0 29 0 2026 0 61 0 0 0 0 11 0 0 0 0 28 0 2027 0 58 0 0 0 0 10 0 0 0 0 28 0 2028 0 56 0 0 0 0 9 0 0 0 0 27 0 2029 0 53 0 0 0 0 8 0 0 0 0 27 0 2030 0 51 0 0 0 0 7 0 0 0 0 26 0 SubT 0 1428 0 0 0 0 322 16 0 0 0 633 0 19yr 0 574 0 0 0 0 44 2 0 0 0 387 0 Total 0 2001 0 0 0 0 366 17 0 0 0 1020 0 --------------------------------- Capital ----------------------------------- Oper Total Net Cum Net Aband Cash Cum Cash Year Inc CEE CDE CCA COGPE Capital Rev Rev ARTC Cost SK Tax Flow Flow M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 5 0 0 0 0 0 5 5 0 0 0 5 5 2012 19 0 0 0 0 0 19 25 0 0 0 19 25 2013 22 0 0 0 0 0 22 46 0 0 0 22 46 2014 27 0 0 0 0 0 27 73 0 0 0 27 73 2015 34 0 0 0 0 0 34 108 0 0 0 34 108 2016 33 0 0 0 0 0 33 141 0 0 0 33 141 2017 32 0 0 0 0 0 32 172 0 0 0 32 172 2018 30 0 0 0 0 0 30 203 0 0 0 30 203 2019 29 0 0 0 0 0 29 232 0 0 0 29 232 2020 28 0 0 0 0 0 28 260 0 0 0 28 260 2021 28 0 0 0 0 0 28 288 0 0 0 28 288 2022 27 0 0 0 0 0 27 315 0 0 0 27 315 2023 26 0 0 0 0 0 26 340 0 0 0 26 340 2024 25 0 0 0 0 0 25 365 0 0 0 25 365 2025 23 0 0 0 0 0 23 388 0 0 0 23 388 2026 22 0 0 0 0 0 22 410 0 0 0 22 410 2027 21 0 0 0 0 0 21 431 0 0 0 21 431 2028 20 0 0 0 0 0 20 452 0 0 0 20 452 2029 19 0 0 0 0 0 19 471 0 0 0 19 471 2030 18 0 0 0 0 0 18 489 0 0 0 18 489 SubT 489 0 0 0 0 0 489 0 0 0 489 19yr 144 0 0 0 0 0 144 0 6 0 138 Total 633 0 0 0 0 0 633 0 6 0 626 ---------------------------- Discounted Cash Streams NPV (M$)----------------------------------discR% 5 10 12 15 18 20 25 BT Net 366 244 213 178 153 139 113 BT Cash Flow 365 243 213 178 152 139 113

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table D-2A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 3901 0.0 0.0 0.0 0.0 0.0 0.0 650.1 Co Grs 0.0 0.0 0 203 0.0 0.0 0.0 0.0 0.0 0.0 33.8 Co Net 0.0 0.0 0 161 0.0 0.0 0.0 0.0 0.0 0.0 26.9 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 449 0 5 0 444 5.0 0 290 0 1 0 288 8.0 0 233 0 1 0 233 10.0 0 205 0 0 0 205 12.0 0 182 0 0 0 182 15.0 0 155 0 0 0 155 20.0 0 124 0 0 0 124 25.0 0 102 0 0 0 102 Reserve Life = 30.2 yrs Reserve Half Life = 7.1 yrs BOE Reserve Index = 11.2 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 51 8 0 23 0 4 0 14 0 0 0 5 2012 0 48 8 0 72 0 14 0 40 0 0 0 18 2013 0 44 7 0 73 0 15 0 38 0 0 0 20 2014 0 41 7 0 79 0 18 0 36 0 0 0 25 2015 0 37 6 0 90 0 23 0 35 0 0 0 32 2016 0 34 6 0 84 0 21 0 33 0 0 0 30 2017 0 32 5 0 79 0 19 0 32 0 0 0 28 2018 0 29 5 0 74 0 17 0 31 0 0 0 27 2019 0 27 4 0 70 0 15 0 30 0 0 0 26 2020 0 25 4 0 66 0 13 0 29 0 0 0 25 2021 0 23 4 0 62 0 11 0 28 0 0 0 23 2022 0 21 3 0 58 0 9 0 27 0 0 0 22 2023 0 19 3 0 54 0 8 0 26 0 0 0 20 2024 0 18 3 0 51 0 7 0 25 0 0 0 19 2025 0 16 3 0 48 0 6 0 24 0 0 0 18 2026 0 15 3 0 45 0 5 0 24 0 0 0 16 2027 0 14 2 0 42 0 4 0 23 0 0 0 15 2028 0 13 2 0 40 0 3 0 23 0 0 0 14 2029 0 12 2 0 37 0 3 0 22 0 0 0 12 2030 0 11 2 0 35 0 2 0 22 0 0 0 11 SubT 0 1184 0 217 0 561 0 0 0 406 11yr 0 216 0 11 0 162 0 0 5 38 Total 0 1400 0 228 0 722 0 0 5 444 Discounted 5% 0 885 0 162 0 433 0 0 1 288 Cash 10% 0 627 0 124 0 299 0 0 0 205 Streams 15% 0 481 0 99 0 227 0 0 0 155 20% 0 389 0 81 0 184 0 0 0 124

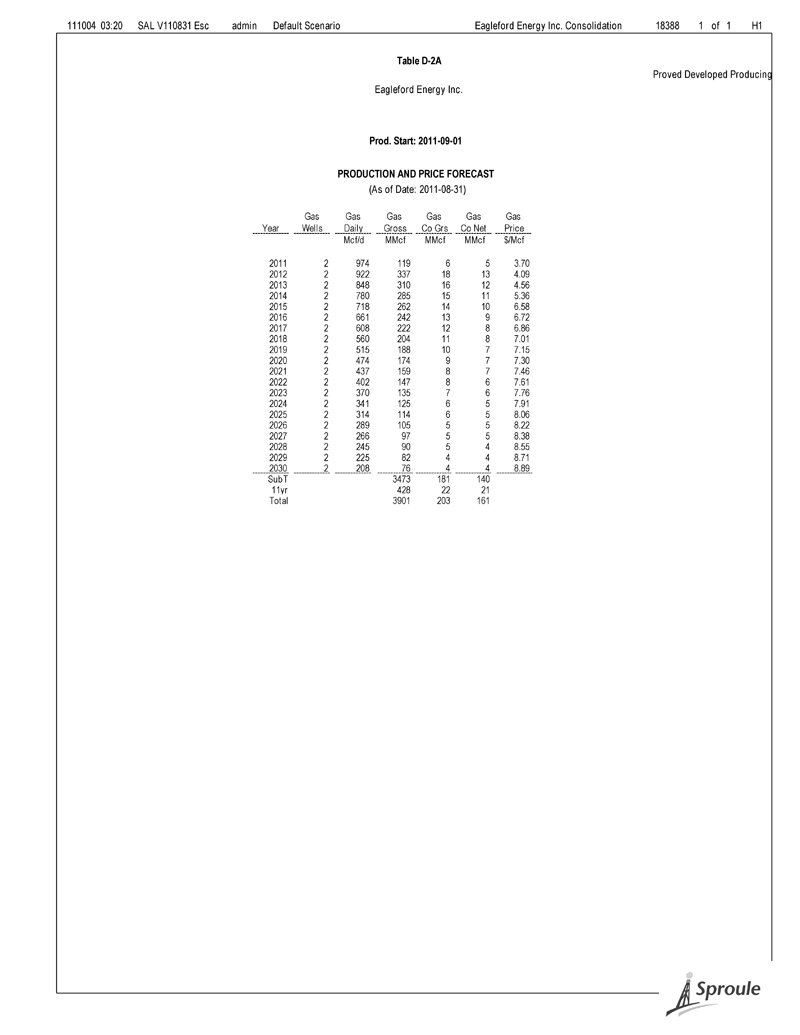

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H1 Table D-2A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 PRODUCTION AND PRICE FORECAST (As of Date: 2011-08-31) Gas Gas Gas Gas Gas Gas Year Wells Daily Gross Co Grs Co Net Price Mcf/d MMcf MMcf MMcf $/Mcf 2011 2 974 119 6 5 3.70 2012 2 922 337 18 13 4.09 2013 2 848 310 16 12 4.56 2014 2 780 285 15 11 5.36 2015 2 718 262 14 10 6.58 2016 2 661 242 13 9 6.72 2017 2 608 222 12 8 6.86 2018 2 560 204 11 8 7.01 2019 2 515 188 10 7 7.15 2020 2 474 174 9 7 7.30 2021 2 437 159 8 7 7.46 2022 2 402 147 8 6 7.61 2023 2 370 135 7 6 7.76 2024 2 341 125 6 5 7.91 2025 2 314 114 6 5 8.06 2026 2 289 105 5 5 8.22 2027 2 266 97 5 5 8.38 2028 2 245 90 5 4 8.55 2029 2 225 82 4 4 8.71 2030 2 208 76 4 4 8.89 SubT 3473 181 140 11yr 428 22 21 Total 3901 203 161

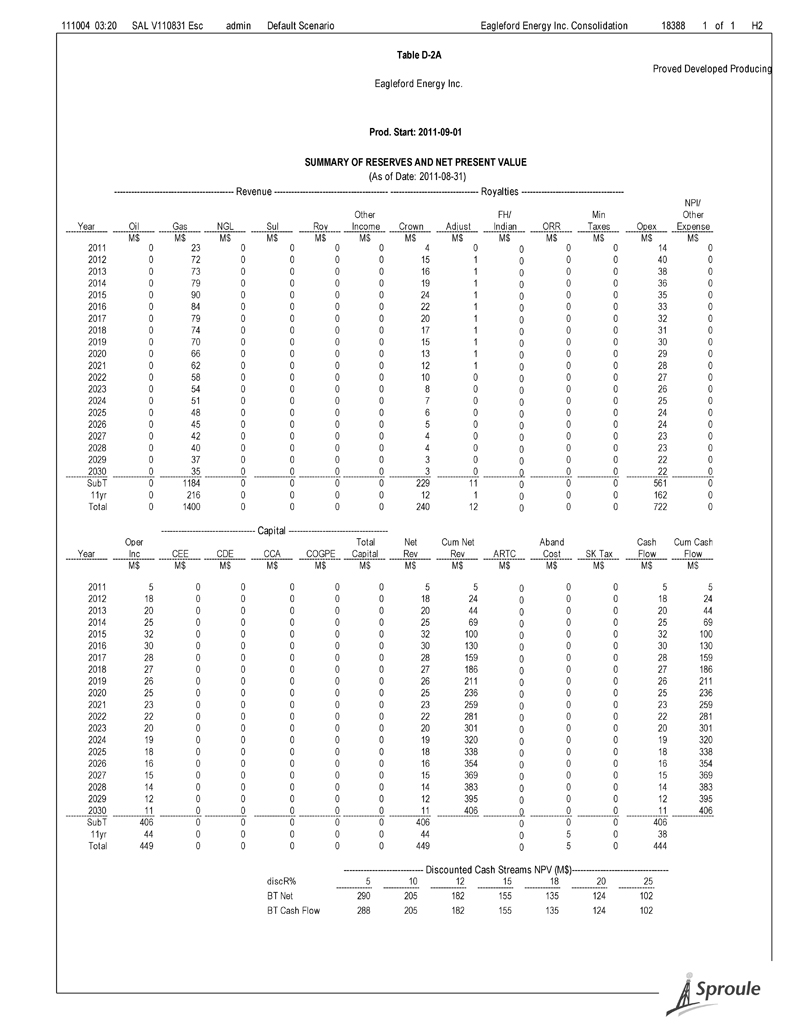

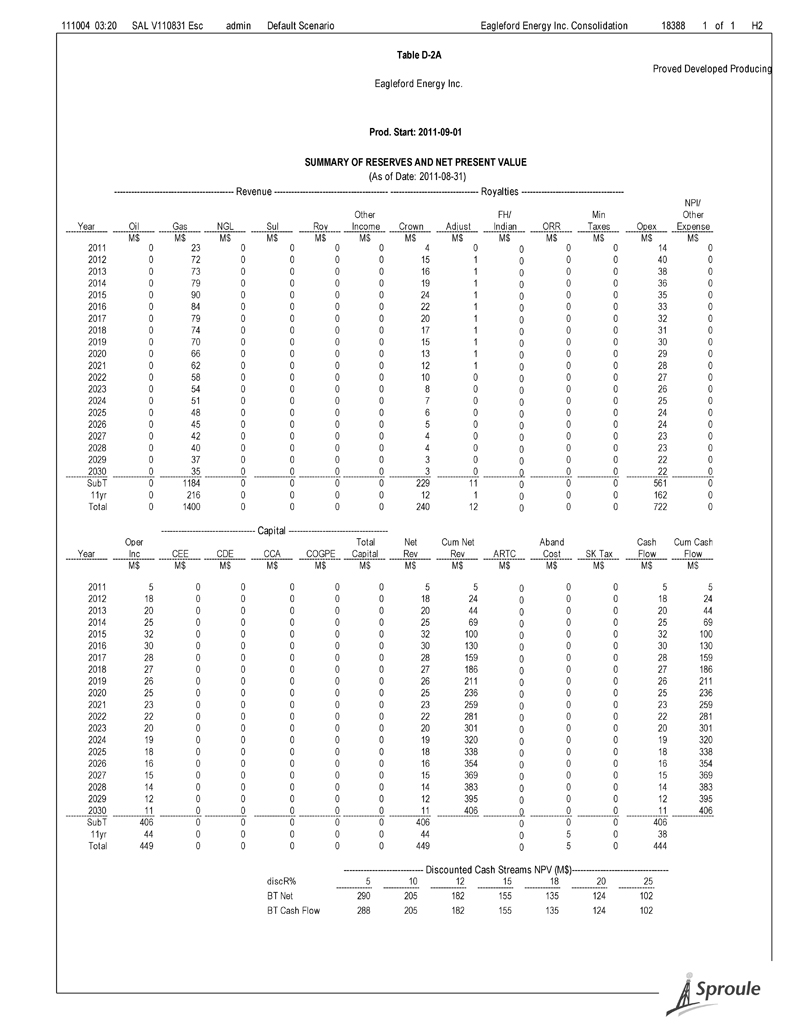

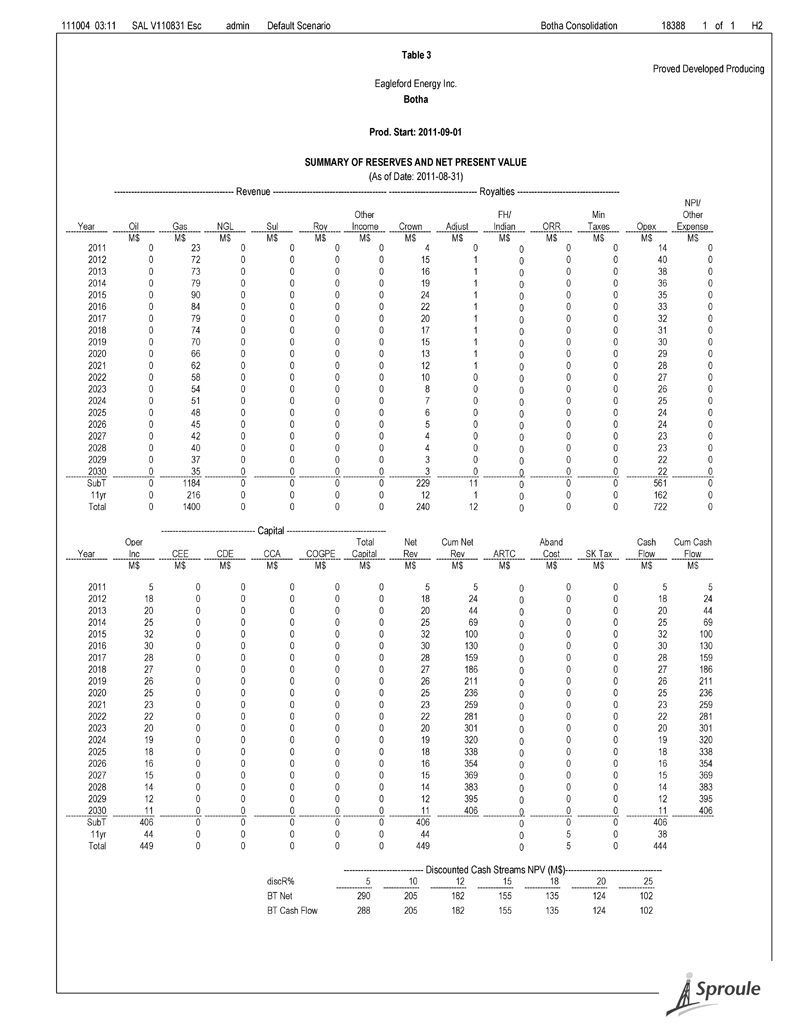

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H2 Table D-2A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) ------------------------------------------ Revenue ---------------------------------------- ------------------------------- Royalties ------------------------------------ NPI/ Other FH/ Min Other Year Oil Gas NGL Sul Roy Income Crown Adjust Indian ORR Taxes Opex Expense M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 23 0 0 0 0 4 0 0 0 0 14 0 2012 0 72 0 0 0 0 15 1 0 0 0 40 0 2013 0 73 0 0 0 0 16 1 0 0 0 38 0 2014 0 79 0 0 0 0 19 1 0 0 0 36 0 2015 0 90 0 0 0 0 24 1 0 0 0 35 0 2016 0 84 0 0 0 0 22 1 0 0 0 33 0 2017 0 79 0 0 0 0 20 1 0 0 0 32 0 2018 0 74 0 0 0 0 17 1 0 0 0 31 0 2019 0 70 0 0 0 0 15 1 0 0 0 30 0 2020 0 66 0 0 0 0 13 1 0 0 0 29 0 2021 0 62 0 0 0 0 12 1 0 0 0 28 0 2022 0 58 0 0 0 0 10 0 0 0 0 27 0 2023 0 54 0 0 0 0 8 0 0 0 0 26 0 2024 0 51 0 0 0 0 7 0 0 0 0 25 0 2025 0 48 0 0 0 0 6 0 0 0 0 24 0 2026 0 45 0 0 0 0 5 0 0 0 0 24 0 2027 0 42 0 0 0 0 4 0 0 0 0 23 0 2028 0 40 0 0 0 0 4 0 0 0 0 23 0 2029 0 37 0 0 0 0 3 0 0 0 0 22 0 2030 0 35 0 0 0 0 3 0 0 0 0 22 0 SubT 0 1184 0 0 0 0 229 11 0 0 0 561 0 11yr 0 216 0 0 0 0 12 1 0 0 0 162 0 Total 0 1400 0 0 0 0 240 12 0 0 0 722 0 --------------------------------- Capital ----------------------------------- Oper Total Net Cum Net Aband Cash Cum Cash Year Inc CEE CDE CCA COGPE Capital Rev Rev ARTC Cost SK Tax Flow Flow M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 5 0 0 0 0 0 5 5 0 0 0 5 5 2012 18 0 0 0 0 0 18 24 0 0 0 18 24 2013 20 0 0 0 0 0 20 44 0 0 0 20 44 2014 25 0 0 0 0 0 25 69 0 0 0 25 69 2015 32 0 0 0 0 0 32 100 0 0 0 32 100 2016 30 0 0 0 0 0 30 130 0 0 0 30 130 2017 28 0 0 0 0 0 28 159 0 0 0 28 159 2018 27 0 0 0 0 0 27 186 0 0 0 27 186 2019 26 0 0 0 0 0 26 211 0 0 0 26 211 2020 25 0 0 0 0 0 25 236 0 0 0 25 236 2021 23 0 0 0 0 0 23 259 0 0 0 23 259 2022 22 0 0 0 0 0 22 281 0 0 0 22 281 2023 20 0 0 0 0 0 20 301 0 0 0 20 301 2024 19 0 0 0 0 0 19 320 0 0 0 19 320 2025 18 0 0 0 0 0 18 338 0 0 0 18 338 2026 16 0 0 0 0 0 16 354 0 0 0 16 354 2027 15 0 0 0 0 0 15 369 0 0 0 15 369 2028 14 0 0 0 0 0 14 383 0 0 0 14 383 2029 12 0 0 0 0 0 12 395 0 0 0 12 395 2030 11 0 0 0 0 0 11 406 0 0 0 11 406 SubT 406 0 0 0 0 0 406 0 0 0 406 11yr 44 0 0 0 0 0 44 0 5 0 38 Total 449 0 0 0 0 0 449 0 5 0 444 ---------------------------- Discounted Cash Streams NPV (M$)----------------------------------discR% 5 10 12 15 18 20 25 BT Net 290 205 182 155 135 124 102 BT Cash Flow 288 205 182 155 135 124 102

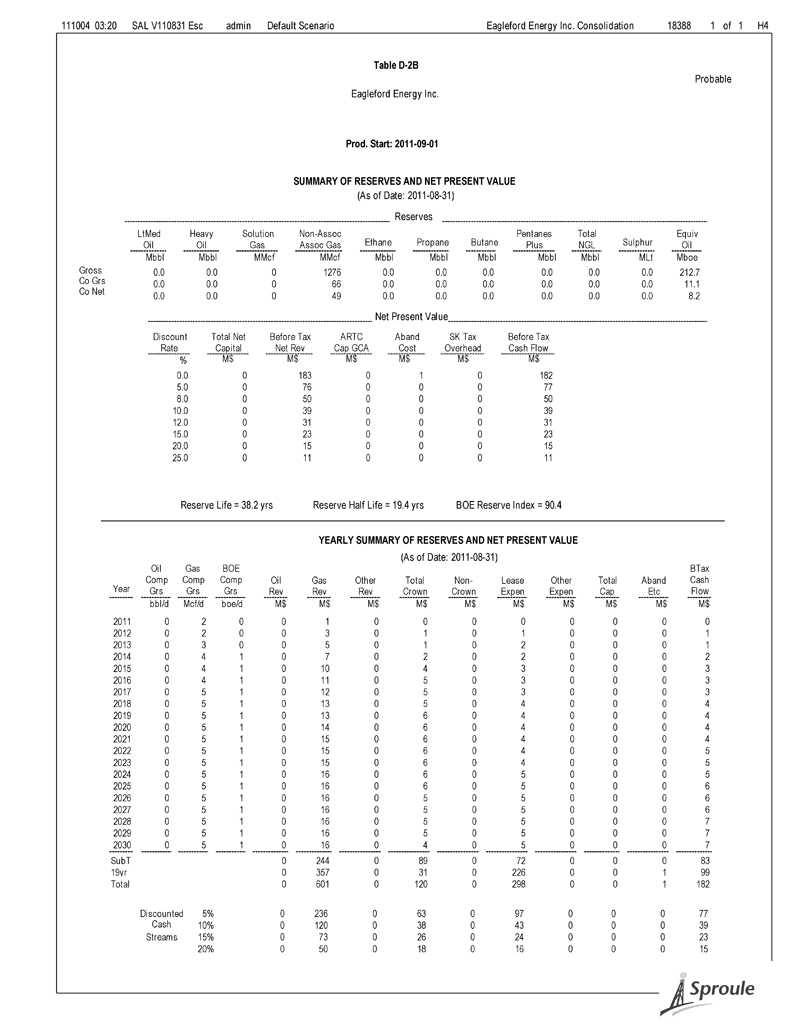

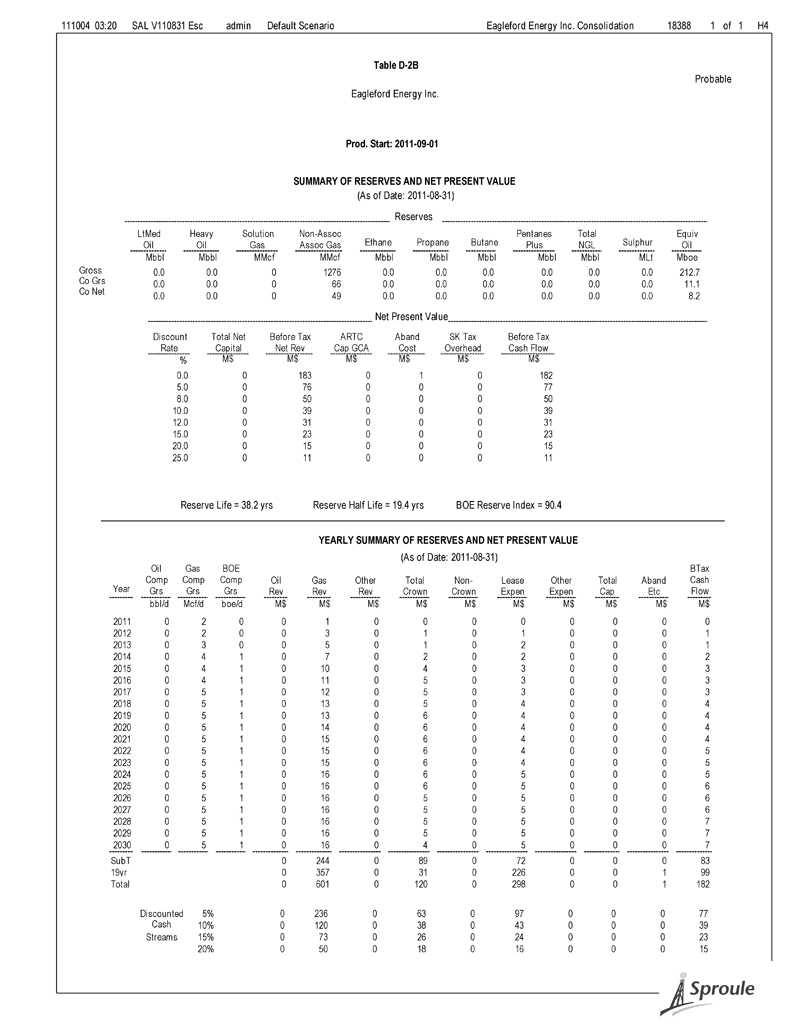

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table D-2B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 1276 0.0 0.0 0.0 0.0 0.0 0.0 212.7 Co Grs 0.0 0.0 0 66 0.0 0.0 0.0 0.0 0.0 0.0 11.1 Co Net 0.0 0.0 0 49 0.0 0.0 0.0 0.0 0.0 0.0 8.2 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 183 0 1 0 182 5.0 0 76 0 0 0 77 8.0 0 50 0 0 0 50 10.0 0 39 0 0 0 39 12.0 0 31 0 0 0 31 15.0 0 23 0 0 0 23 20.0 0 15 0 0 0 15 25.0 0 11 0 0 0 11 Reserve Life = 38.2 yrs Reserve Half Life = 19.4 yrs BOE Reserve Index = 90.4 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 2 0 0 1 0 0 0 0 0 0 0 0 2012 0 2 0 0 3 0 1 0 1 0 0 0 1 2013 0 3 0 0 5 0 1 0 2 0 0 0 1 2014 0 4 1 0 7 0 2 0 2 0 0 0 2 2015 0 4 1 0 10 0 4 0 3 0 0 0 3 2016 0 4 1 0 11 0 5 0 3 0 0 0 3 2017 0 5 1 0 12 0 5 0 3 0 0 0 3 2018 0 5 1 0 13 0 5 0 4 0 0 0 4 2019 0 5 1 0 13 0 6 0 4 0 0 0 4 2020 0 5 1 0 14 0 6 0 4 0 0 0 4 2021 0 5 1 0 15 0 6 0 4 0 0 0 4 2022 0 5 1 0 15 0 6 0 4 0 0 0 5 2023 0 5 1 0 15 0 6 0 4 0 0 0 5 2024 0 5 1 0 16 0 6 0 5 0 0 0 5 2025 0 5 1 0 16 0 6 0 5 0 0 0 6 2026 0 5 1 0 16 0 5 0 5 0 0 0 6 2027 0 5 1 0 16 0 5 0 5 0 0 0 6 2028 0 5 1 0 16 0 5 0 5 0 0 0 7 2029 0 5 1 0 16 0 5 0 5 0 0 0 7 2030 0 5 1 0 16 0 4 0 5 0 0 0 7 SubT 0 244 0 89 0 72 0 0 0 83 19yr 0 357 0 31 0 226 0 0 1 99 Total 0 601 0 120 0 298 0 0 1 182 Discounted 5% 0 236 0 63 0 97 0 0 0 77 Cash 10% 0 120 0 38 0 43 0 0 0 39 Streams 15% 0 73 0 26 0 24 0 0 0 23 20% 0 50 0 18 0 16 0 0 0 15

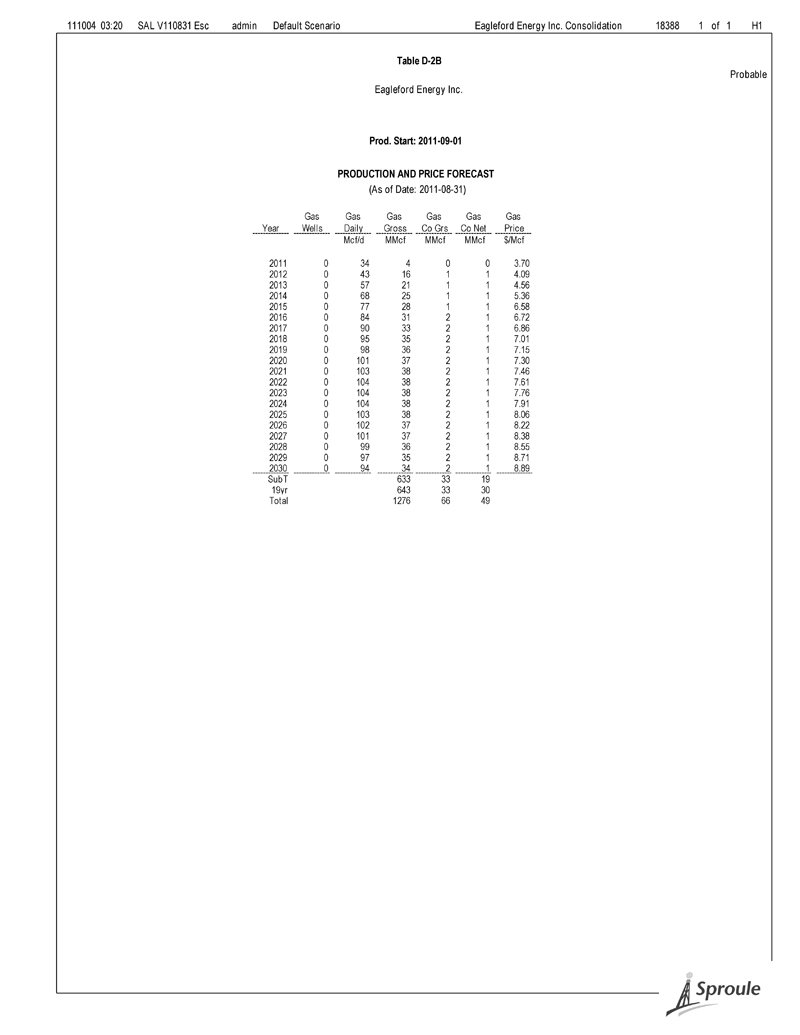

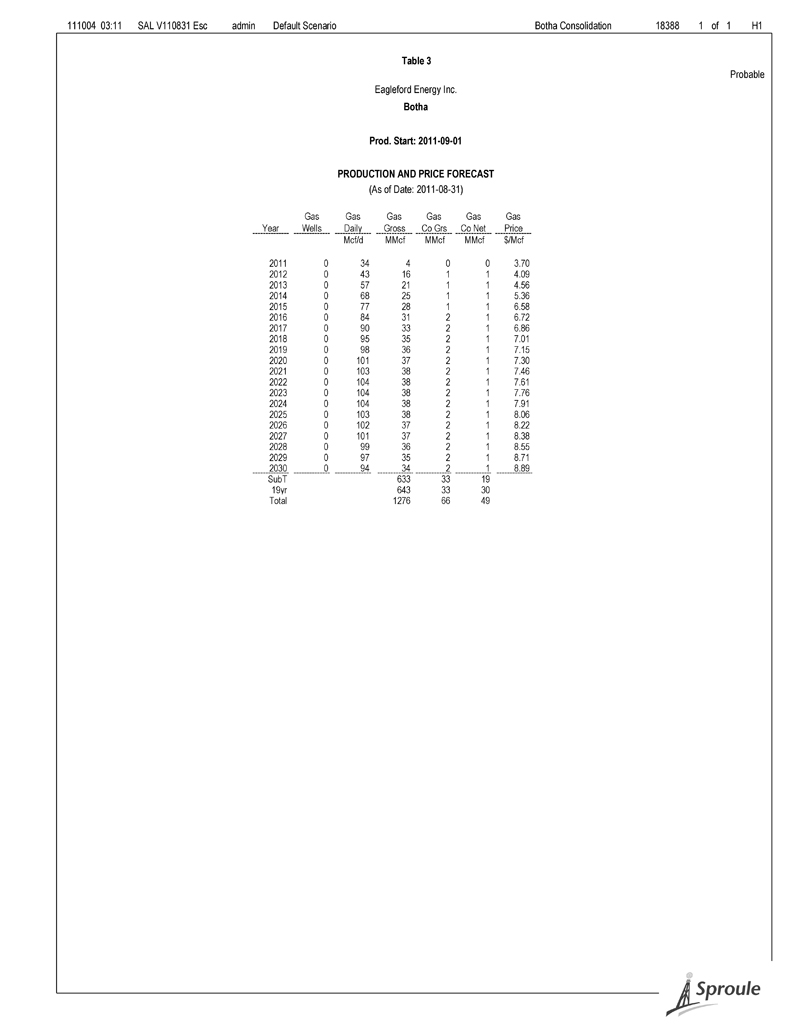

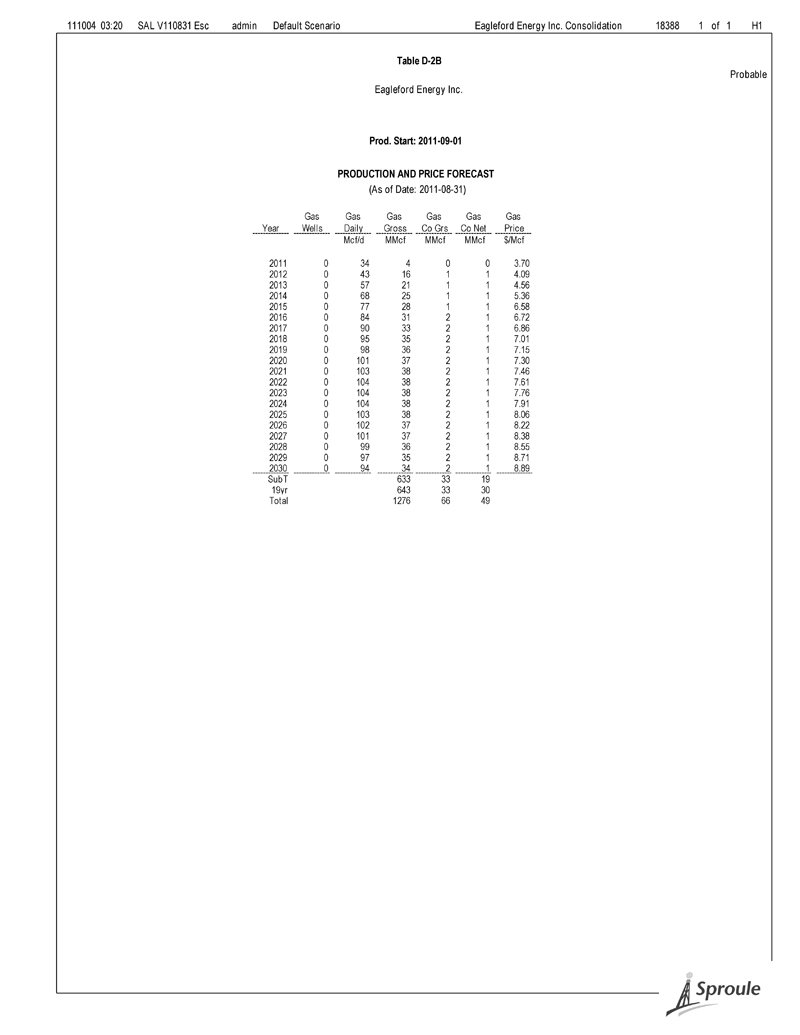

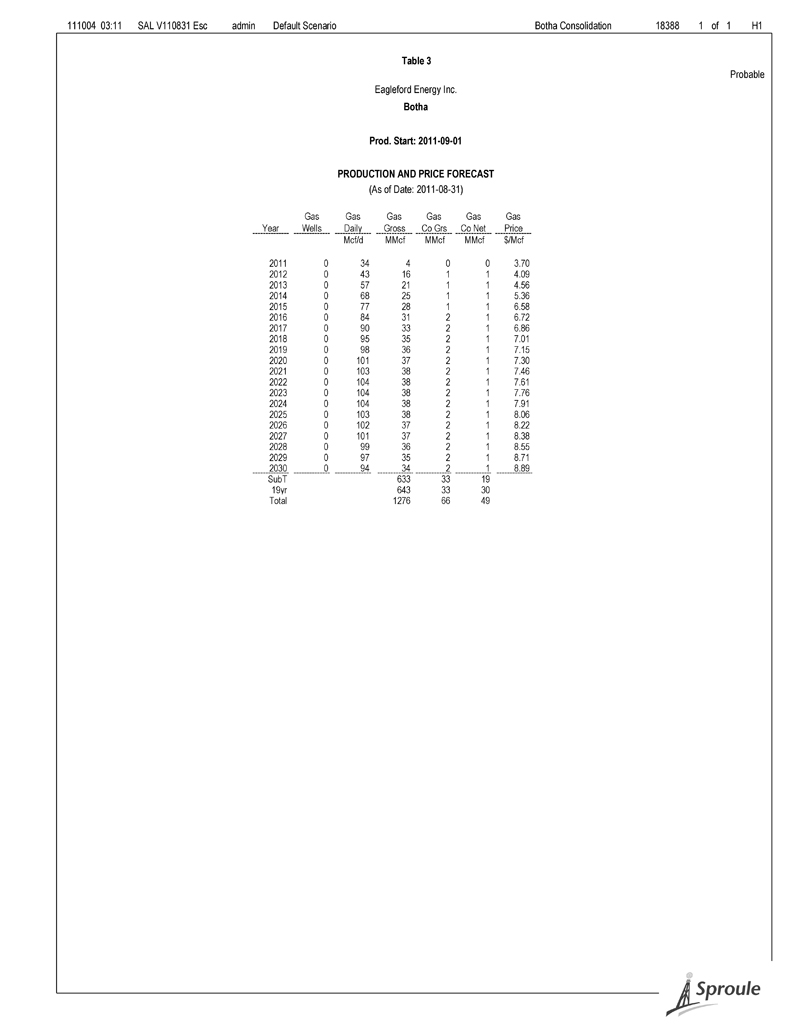

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H1 Table D-2B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 PRODUCTION AND PRICE FORECAST (As of Date: 2011-08-31) Gas Gas Gas Gas Gas Gas Year Wells Daily Gross Co Grs Co Net Price Mcf/d MMcf MMcf MMcf $/Mcf 2011 0 34 4 0 0 3.70 2012 0 43 16 1 1 4.09 2013 0 57 21 1 1 4.56 2014 0 68 25 1 1 5.36 2015 0 77 28 1 1 6.58 2016 0 84 31 2 1 6.72 2017 0 90 33 2 1 6.86 2018 0 95 35 2 1 7.01 2019 0 98 36 2 1 7.15 2020 0 101 37 2 1 7.30 2021 0 103 38 2 1 7.46 2022 0 104 38 2 1 7.61 2023 0 104 38 2 1 7.76 2024 0 104 38 2 1 7.91 2025 0 103 38 2 1 8.06 2026 0 102 37 2 1 8.22 2027 0 101 37 2 1 8.38 2028 0 99 36 2 1 8.55 2029 0 97 35 2 1 8.71 2030 0 94 34 2 1 8.89 SubT 633 33 19 19yr 643 33 30 Total 1276 66 49

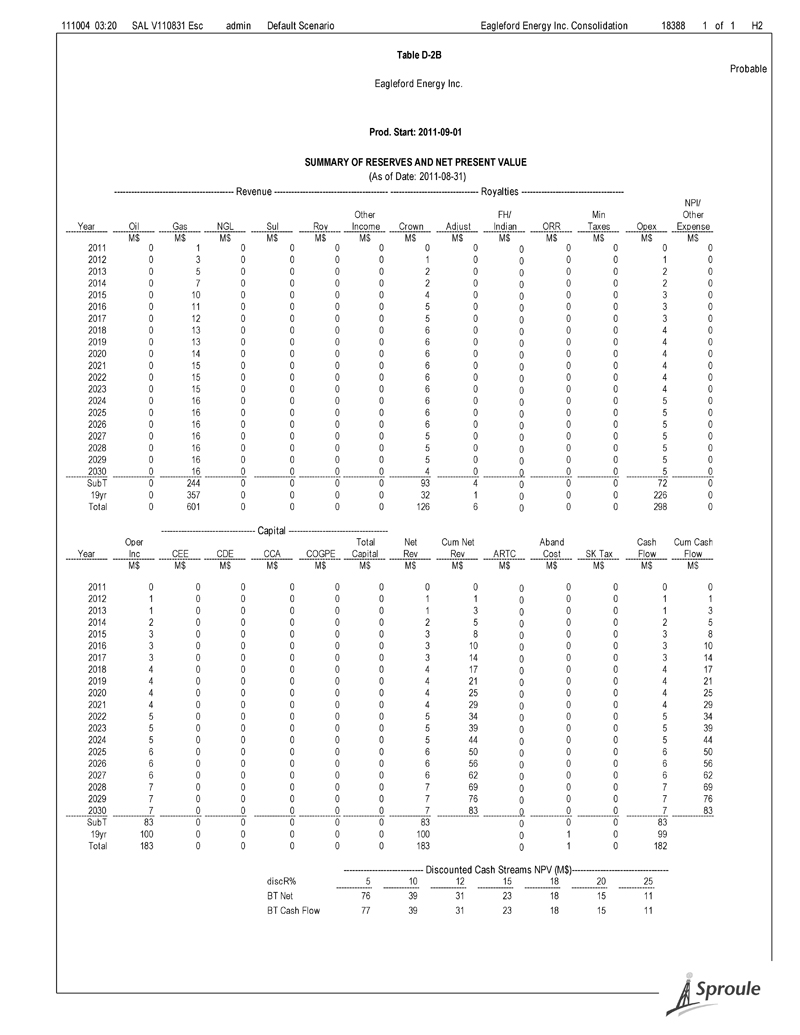

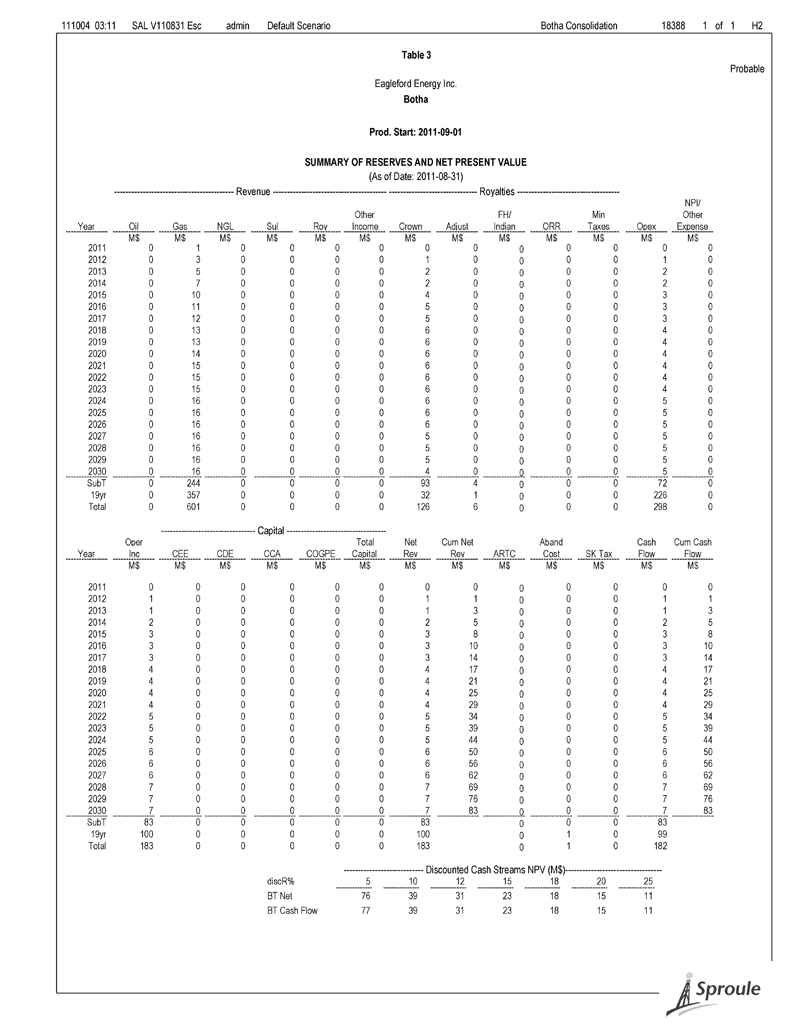

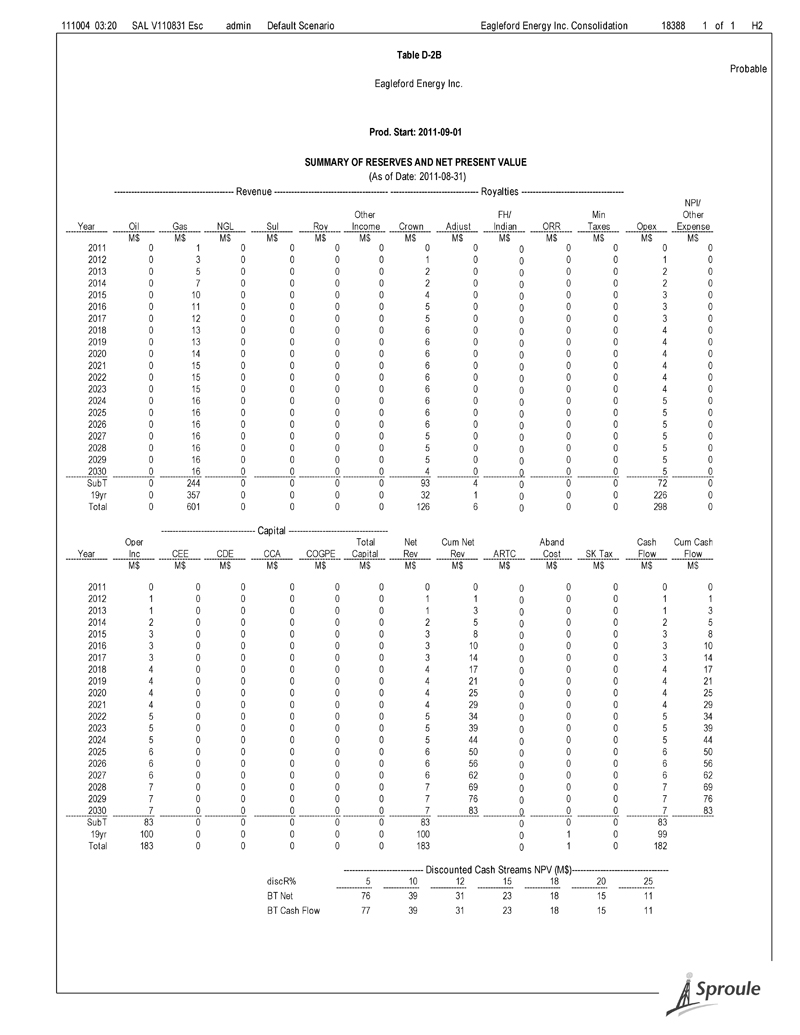

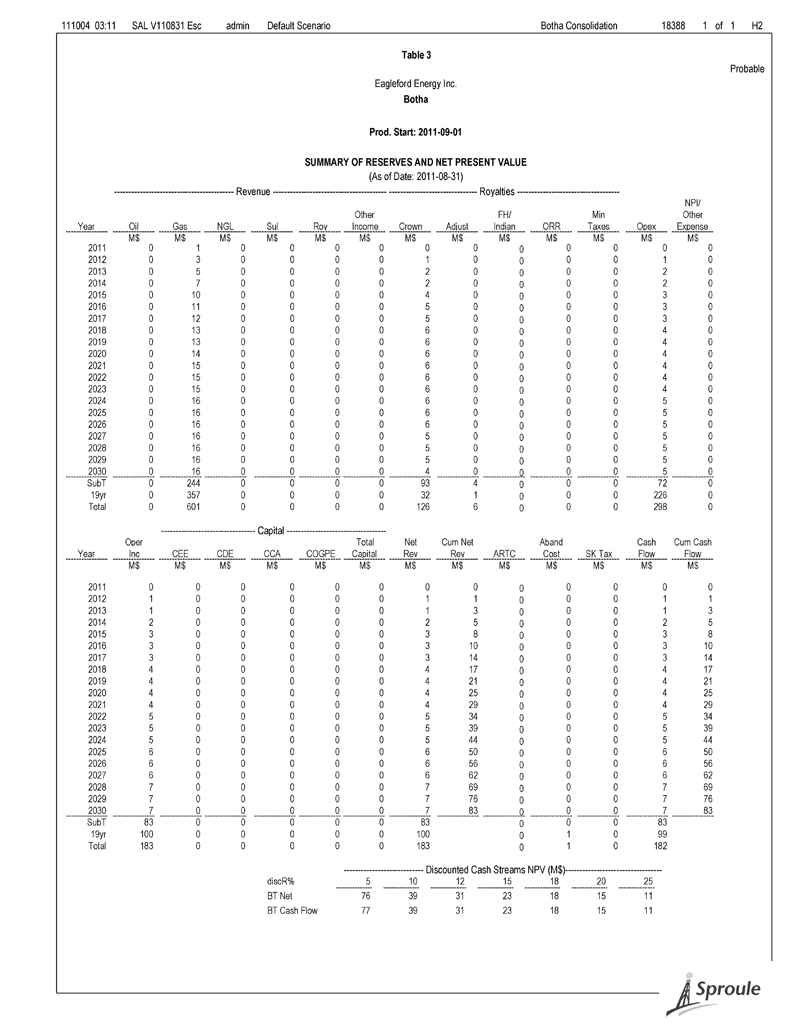

111004 03:20 SAL V110831 Esc admin Default Scenario Eagleford Energy Inc. Consolidation 18388 1 of 1 H2 Table D-2B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) ------------------------------------------ Revenue ---------------------------------------- ------------------------------- Royalties ------------------------------------ NPI/ Other FH/ Min Other Year Oil Gas NGL Sul Roy Income Crown Adjust Indian ORR Taxes Opex Expense M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 1 0 0 0 0 0 0 0 0 0 0 0 2012 0 3 0 0 0 0 1 0 0 0 0 1 0 2013 0 5 0 0 0 0 2 0 0 0 0 2 0 2014 0 7 0 0 0 0 2 0 0 0 0 2 0 2015 0 10 0 0 0 0 4 0 0 0 0 3 0 2016 0 11 0 0 0 0 5 0 0 0 0 3 0 2017 0 12 0 0 0 0 5 0 0 0 0 3 0 2018 0 13 0 0 0 0 6 0 0 0 0 4 0 2019 0 13 0 0 0 0 6 0 0 0 0 4 0 2020 0 14 0 0 0 0 6 0 0 0 0 4 0 2021 0 15 0 0 0 0 6 0 0 0 0 4 0 2022 0 15 0 0 0 0 6 0 0 0 0 4 0 2023 0 15 0 0 0 0 6 0 0 0 0 4 0 2024 0 16 0 0 0 0 6 0 0 0 0 5 0 2025 0 16 0 0 0 0 6 0 0 0 0 5 0 2026 0 16 0 0 0 0 6 0 0 0 0 5 0 2027 0 16 0 0 0 0 5 0 0 0 0 5 0 2028 0 16 0 0 0 0 5 0 0 0 0 5 0 2029 0 16 0 0 0 0 5 0 0 0 0 5 0 2030 0 16 0 0 0 0 4 0 0 0 0 5 0 SubT 0 244 0 0 0 0 93 4 0 0 0 72 0 19yr 0 357 0 0 0 0 32 1 0 0 0 226 0 Total 0 601 0 0 0 0 126 6 0 0 0 298 0 --------------------------------- Capital ----------------------------------- Oper Total Net Cum Net Aband Cash Cum Cash Year Inc CEE CDE CCA COGPE Capital Rev Rev ARTC Cost SK Tax Flow Flow M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 0 0 0 0 0 0 0 0 0 0 0 0 2012 1 0 0 0 0 0 1 1 0 0 0 1 1 2013 1 0 0 0 0 0 1 3 0 0 0 1 3 2014 2 0 0 0 0 0 2 5 0 0 0 2 5 2015 3 0 0 0 0 0 3 8 0 0 0 3 8 2016 3 0 0 0 0 0 3 10 0 0 0 3 10 2017 3 0 0 0 0 0 3 14 0 0 0 3 14 2018 4 0 0 0 0 0 4 17 0 0 0 4 17 2019 4 0 0 0 0 0 4 21 0 0 0 4 21 2020 4 0 0 0 0 0 4 25 0 0 0 4 25 2021 4 0 0 0 0 0 4 29 0 0 0 4 29 2022 5 0 0 0 0 0 5 34 0 0 0 5 34 2023 5 0 0 0 0 0 5 39 0 0 0 5 39 2024 5 0 0 0 0 0 5 44 0 0 0 5 44 2025 6 0 0 0 0 0 6 50 0 0 0 6 50 2026 6 0 0 0 0 0 6 56 0 0 0 6 56 2027 6 0 0 0 0 0 6 62 0 0 0 6 62 2028 7 0 0 0 0 0 7 69 0 0 0 7 69 2029 7 0 0 0 0 0 7 76 0 0 0 7 76 2030 7 0 0 0 0 0 7 83 0 0 0 7 83 SubT 83 0 0 0 0 0 83 0 0 0 83 19yr 100 0 0 0 0 0 100 0 1 0 99 Total 183 0 0 0 0 0 183 0 1 0 182 ---------------------------- Discounted Cash Streams NPV (M$)----------------------------------discR% 5 10 12 15 18 20 25 BT Net 76 39 31 23 18 15 11 BT Cash Flow 77 39 31 23 18 15 11

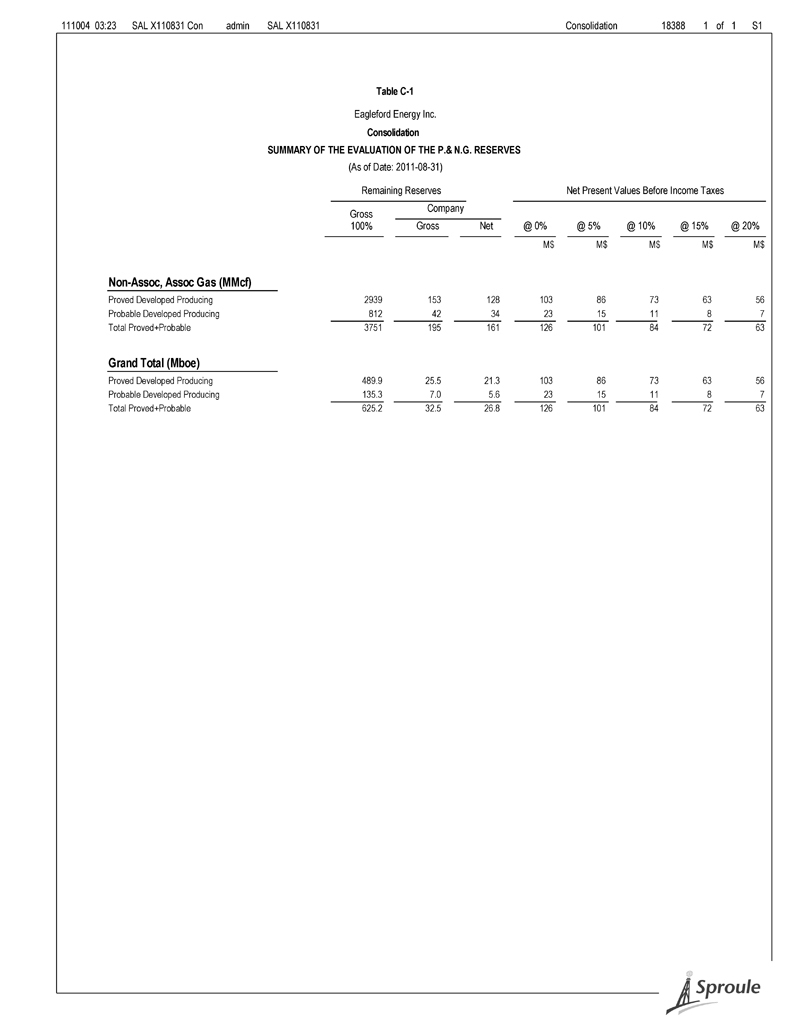

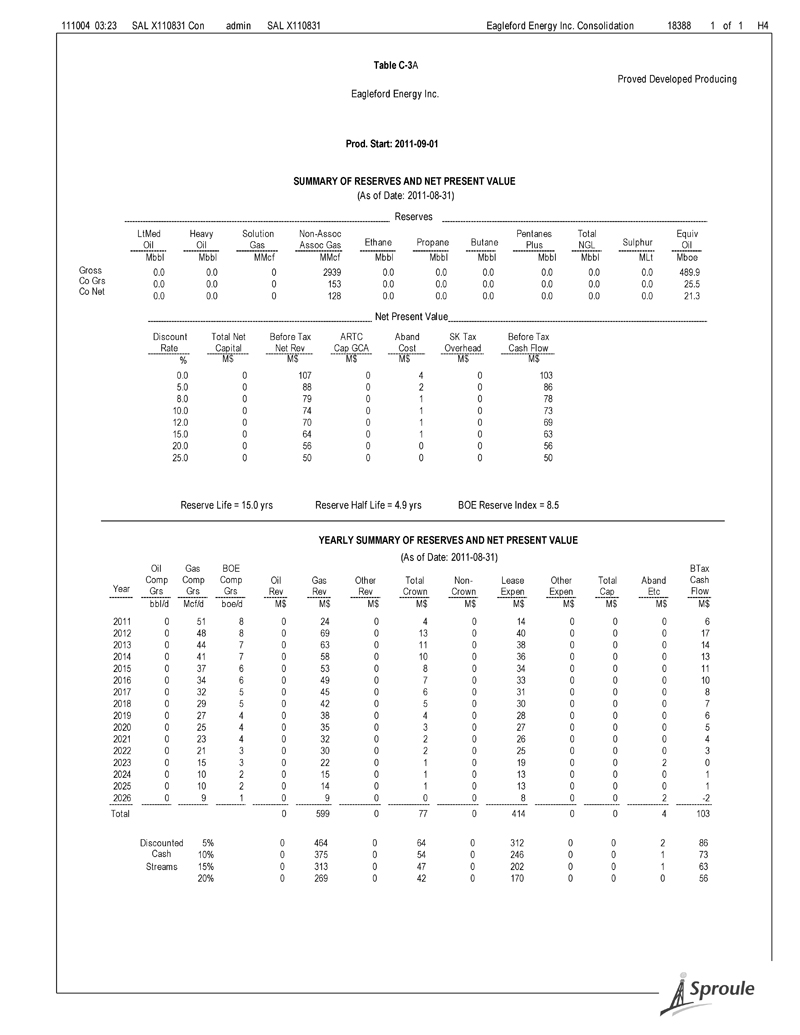

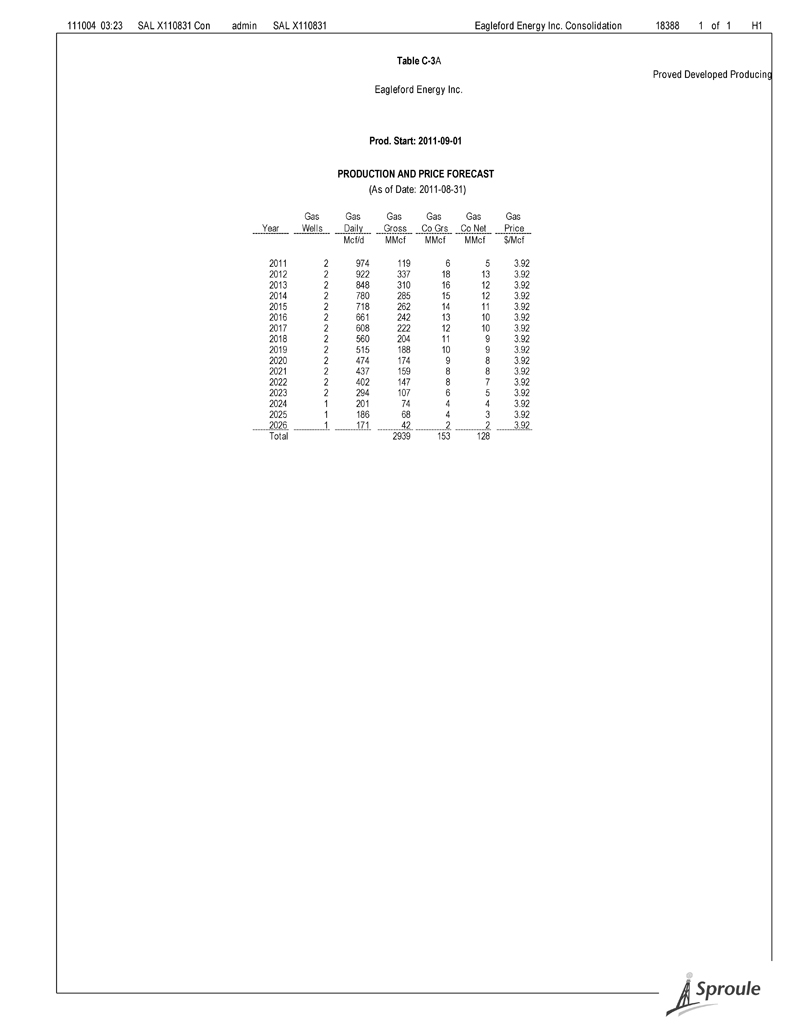

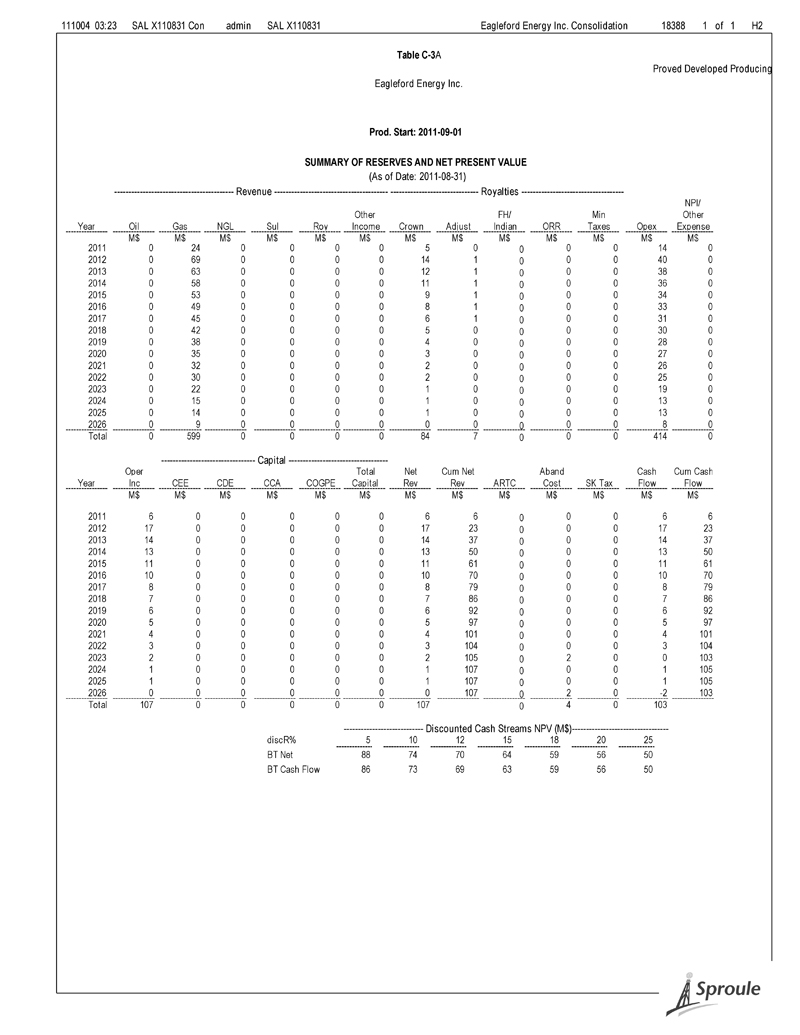

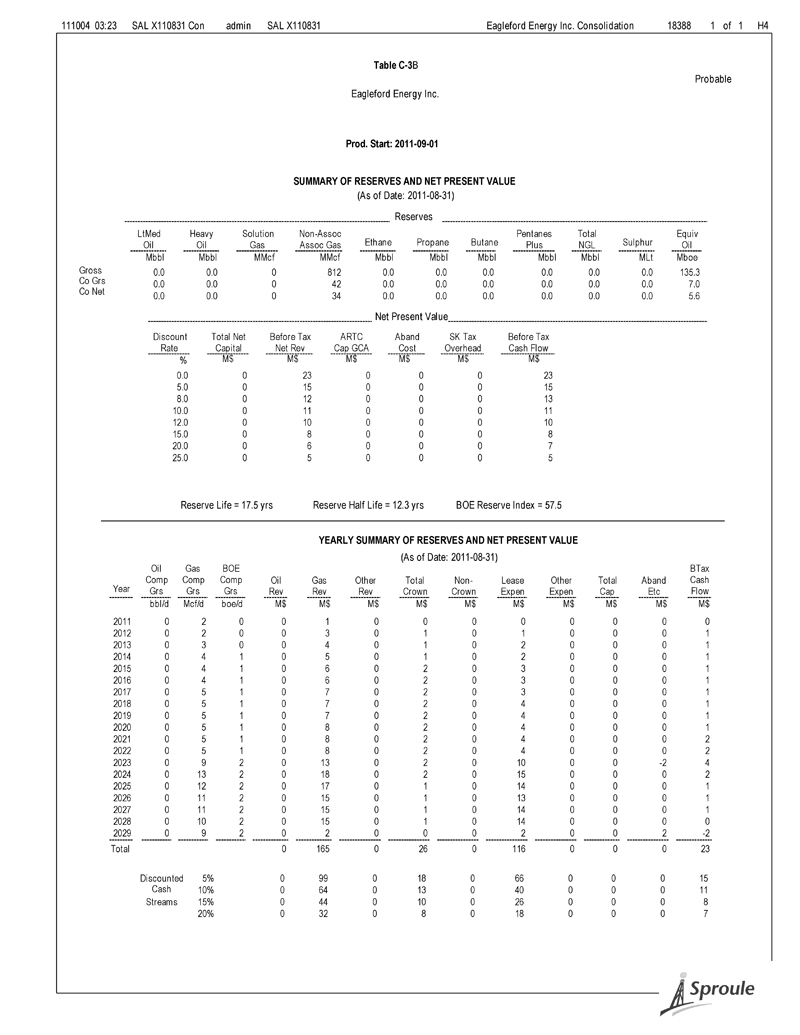

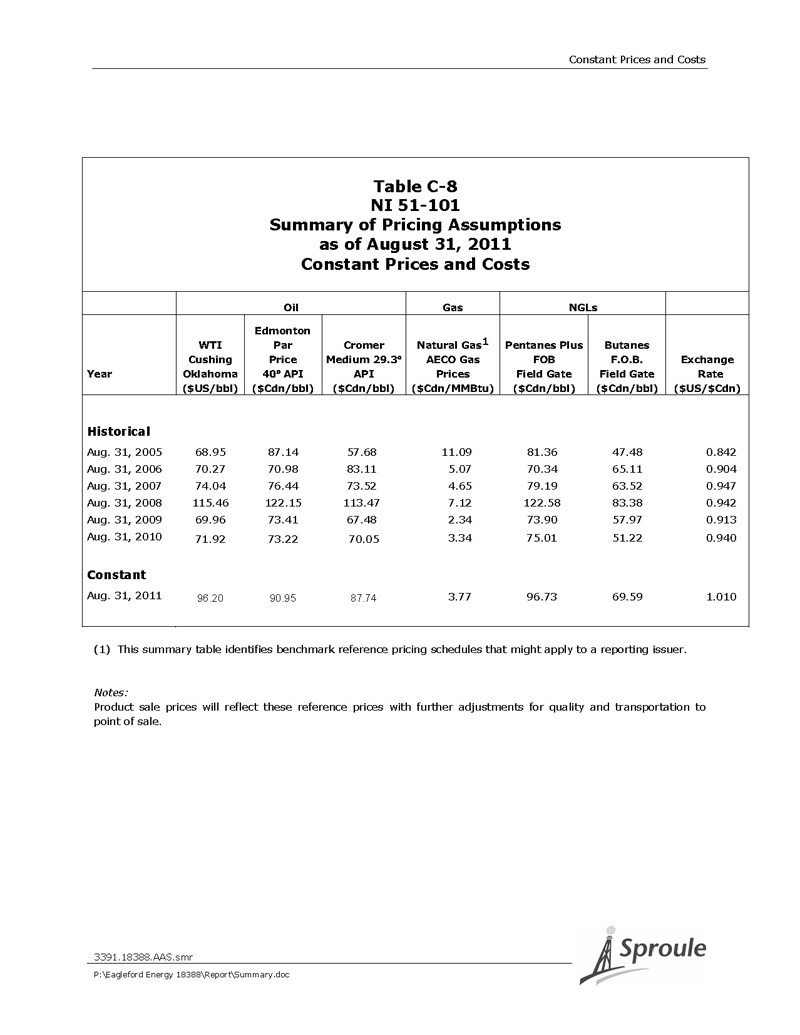

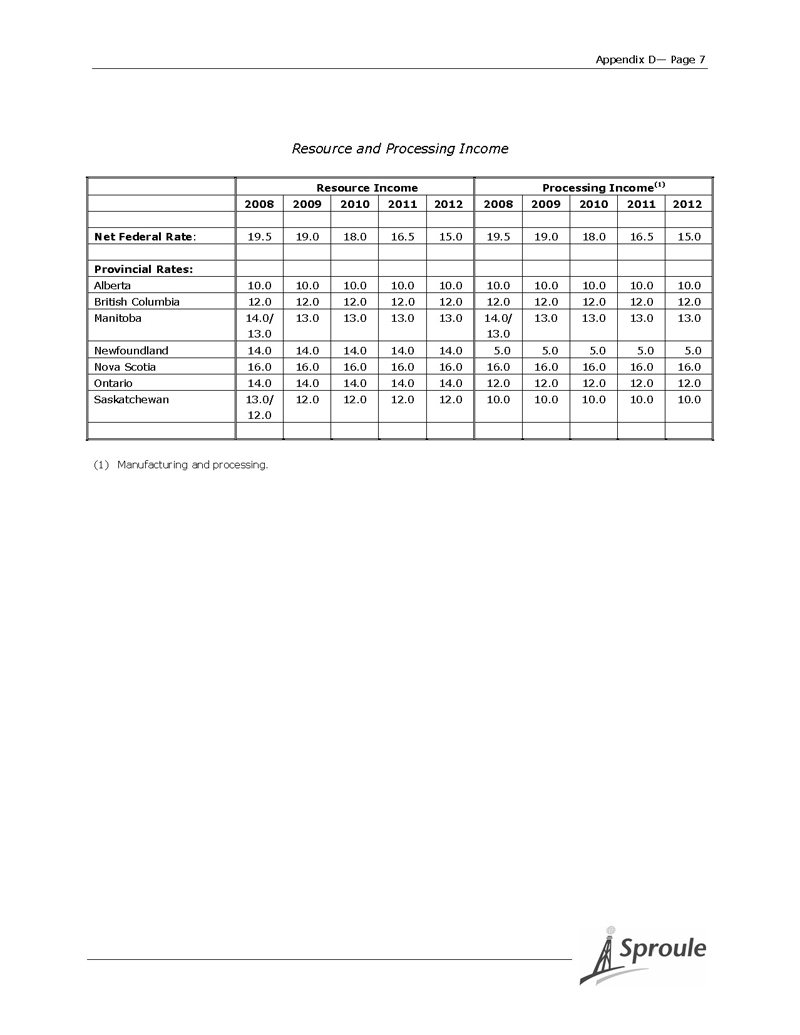

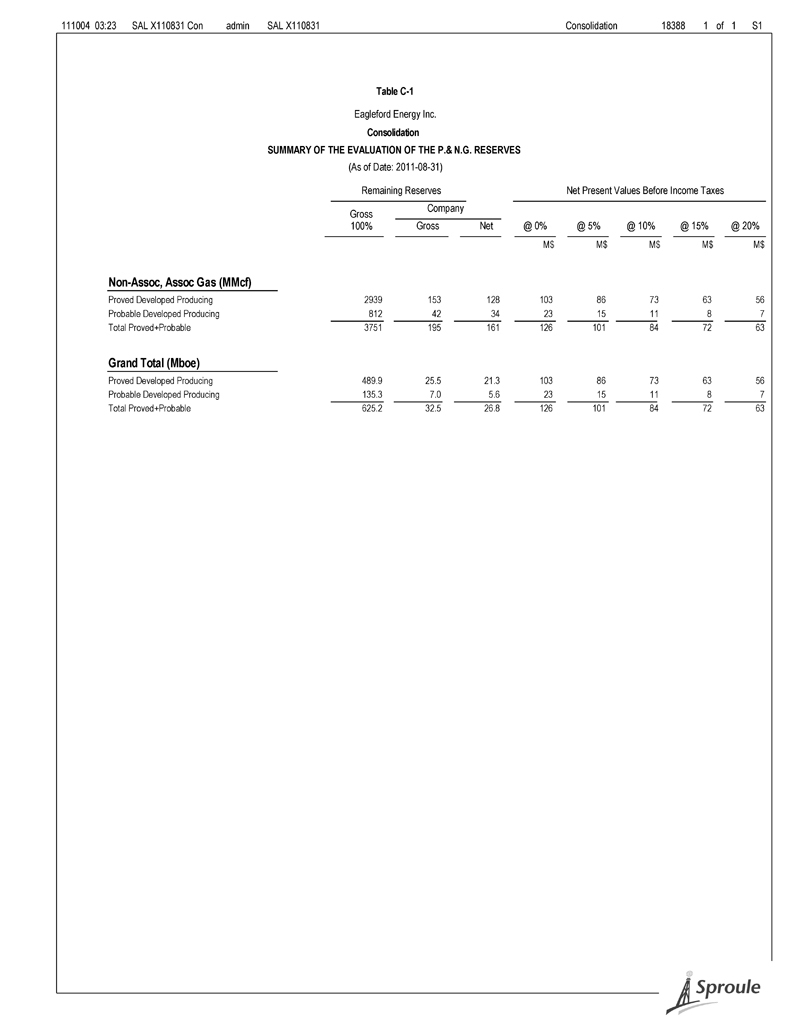

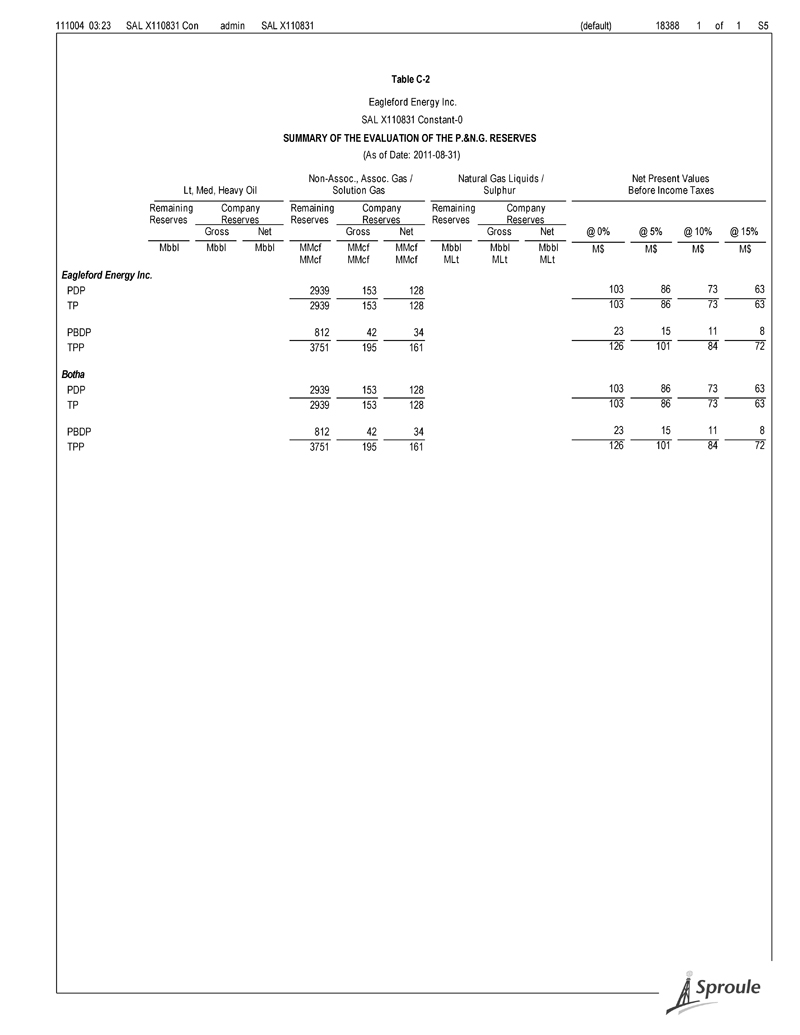

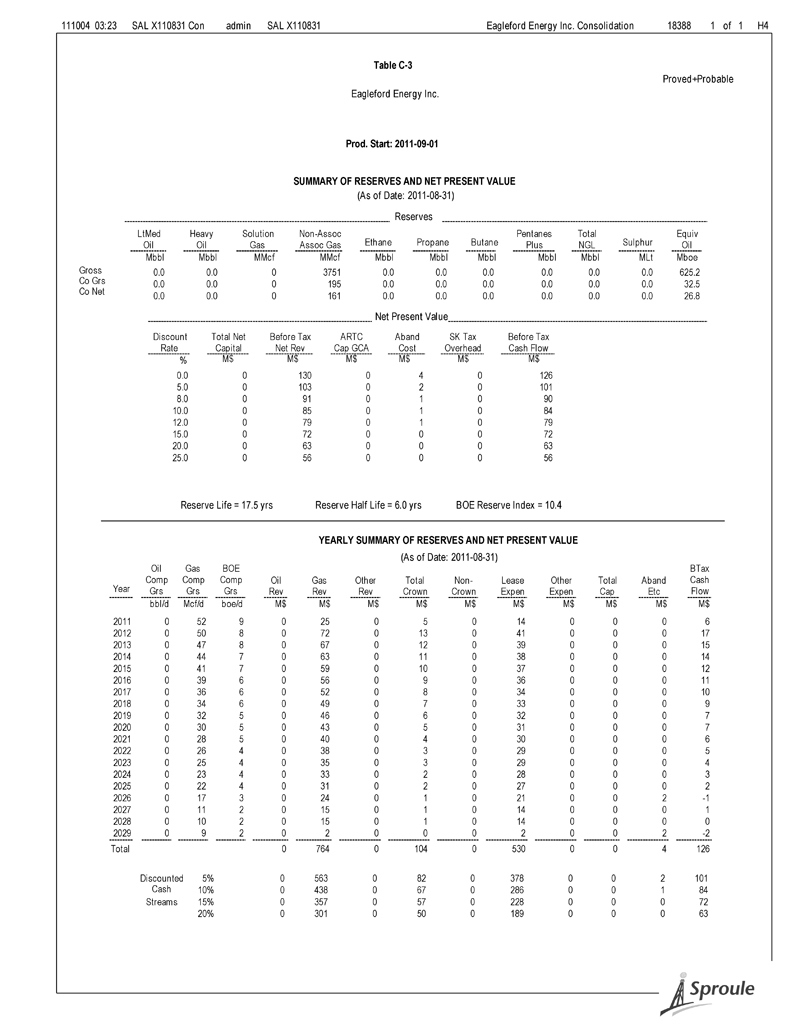

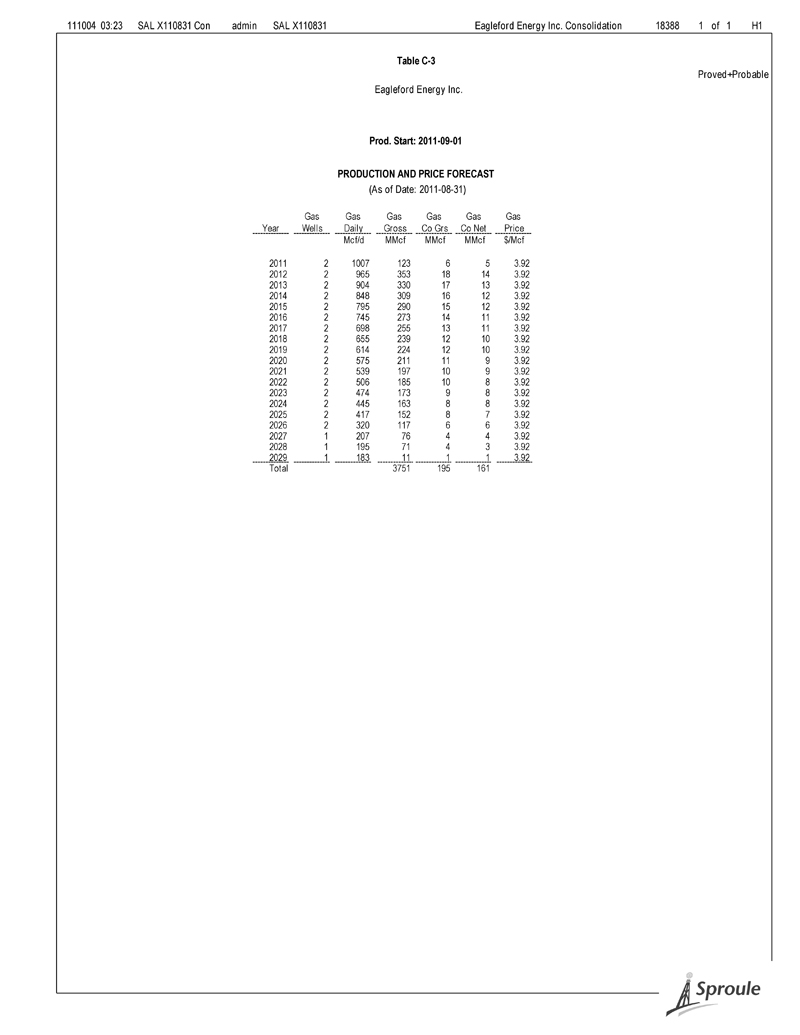

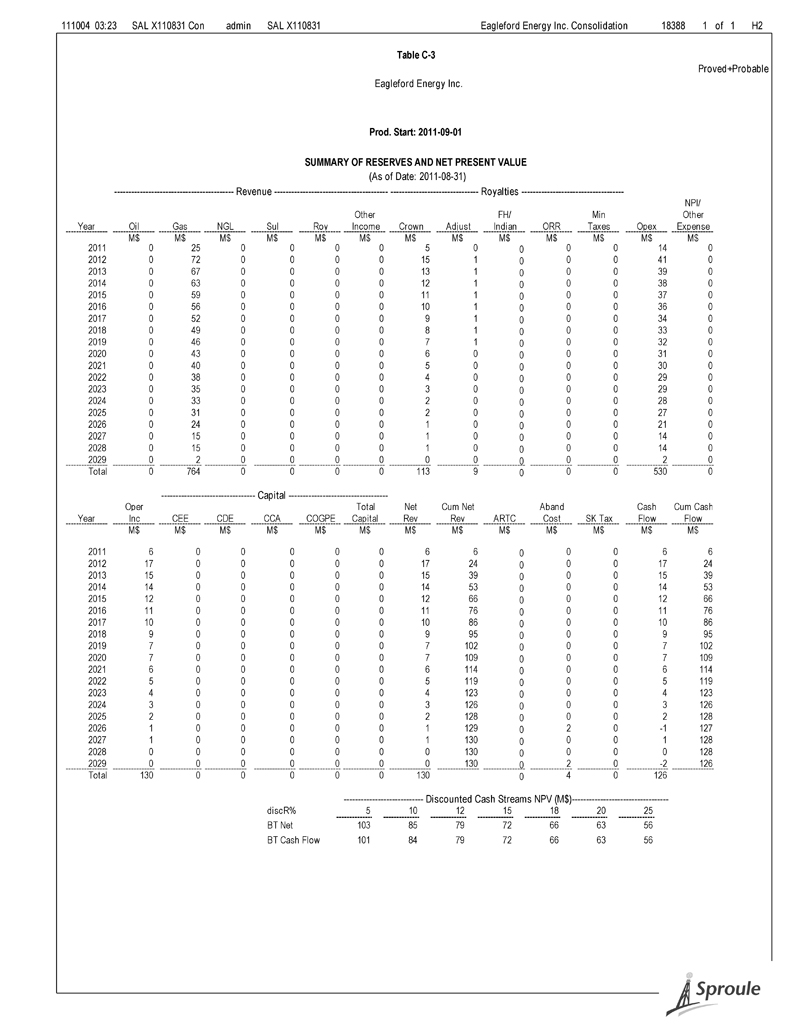

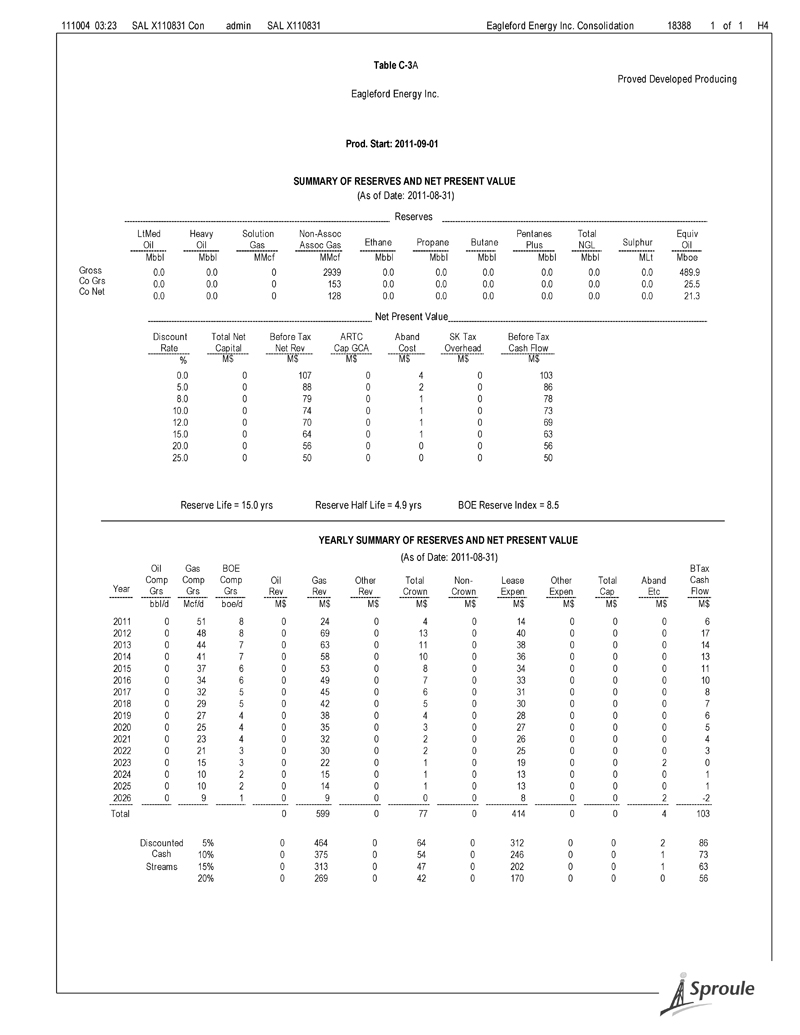

Constant Prices and Costs Constant Prices and Costs The constant price used in this report complies with the Securities & Exchange Commission’s (SEC) regulations. It was calculated as the unweighted arithmetic average of the first-day-of-the-month price for each month within the 12-month period prior to the end of the reporting period. Table C-1, on the following page, summarizes our evaluation, based on constant prices and costs, before income taxes, of the P&NG reserves of Eagleford Energy Inc., as of August 31, 2011. The table presents summaries of the P&NG reserves for the various reserves categories valuation. Table C-2 is also included and summarizes the reserves and values by property for the constant price case, before income taxes. Tables C-3 through C-3B show the cash flow forecasts for the constant price case for the various reserves categories. The natural gas constant price used in this specific evaluation was based on the August 31, 2011 actual posted price as determined by Sproule. The constant price used in this report is as follows: Natural Gas: AECO-C Spot 3.77 $/MMbtu Appropriate adjustments have been made to the natural gas price to account for quality and transportation, and to reflect actual historical prices received for each property. This blending of constant prices may result in the appearance of varying constant prices in the Corporate cash flows. The remaining assumptions relating to the calculation and evaluation of the reserves are the same as those presented in the detailed evaluation. It is important to note that the estimate of the reserves to be recovered from a gas field is the sum of all the cumulative production until an economic limit is reached. The economic limit is a function of the production forecast, future prices and operating costs (including royalties and taxes) to maintain production. Consequently, when estimates of future prices and costs are changed, economic limits are also altered. In the evaluation process, production forecasts are truncated at the economic limits and thus, reserves estimates vary 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

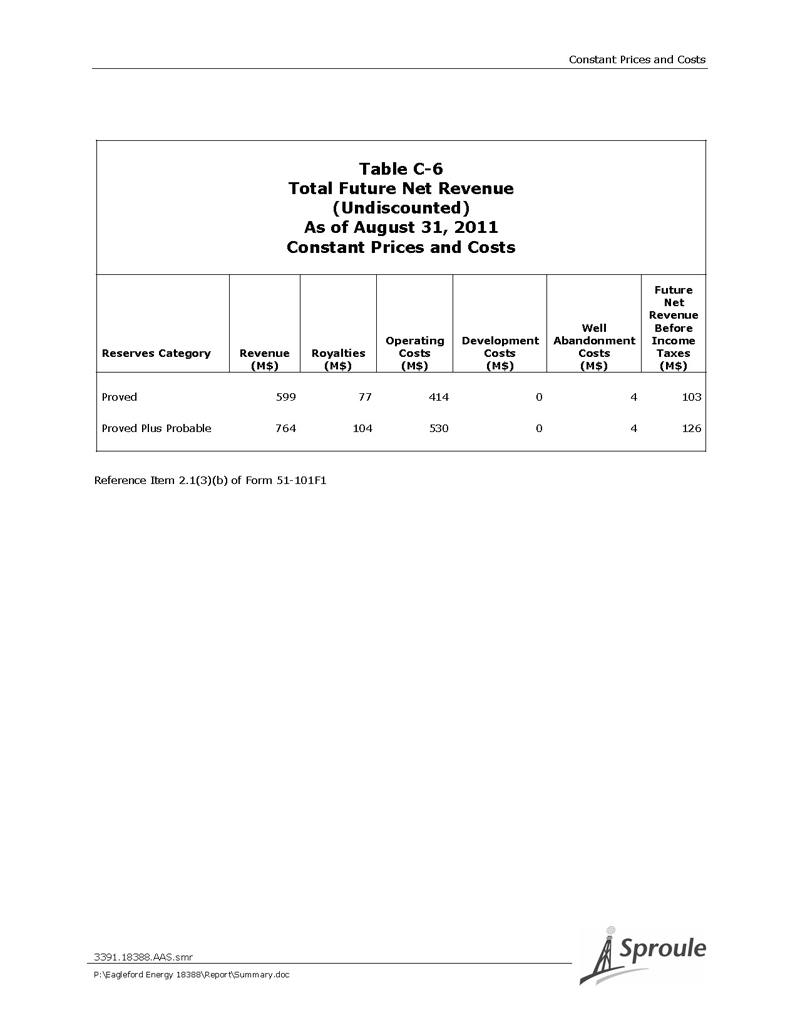

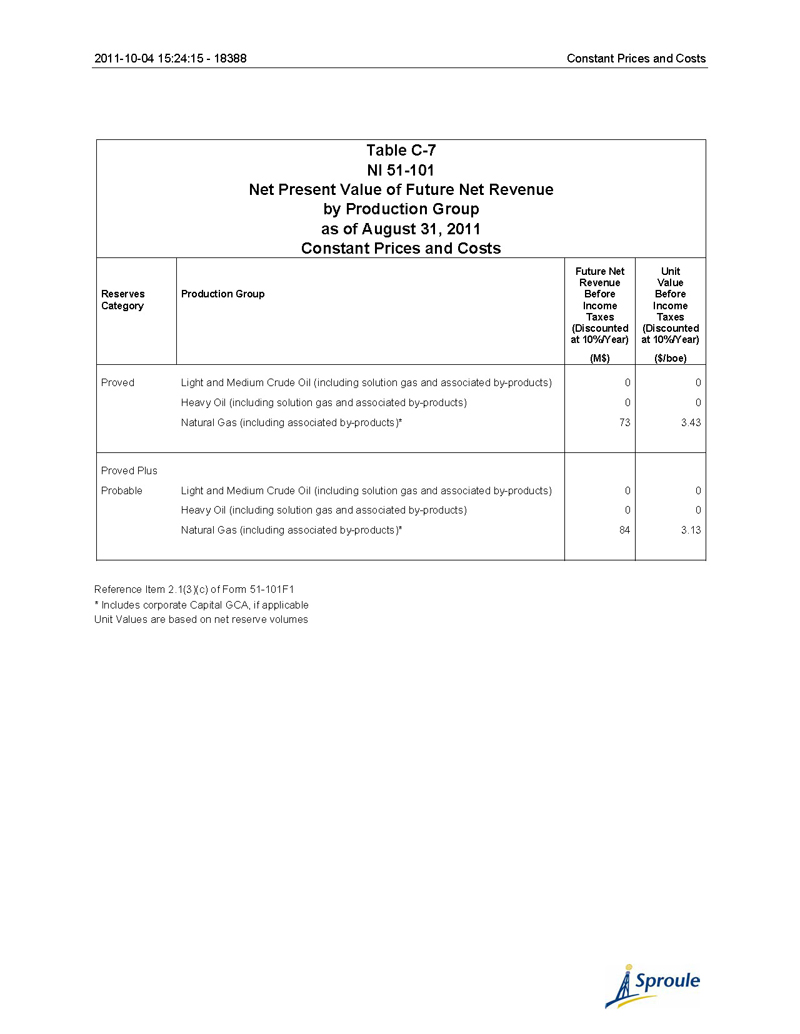

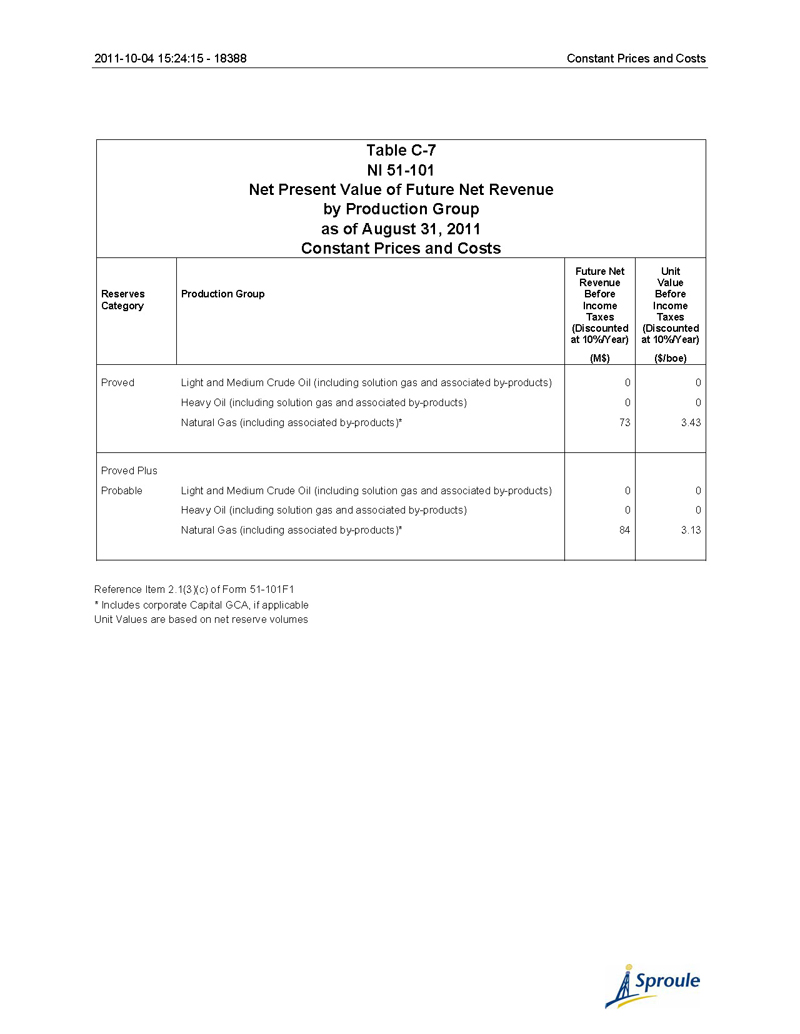

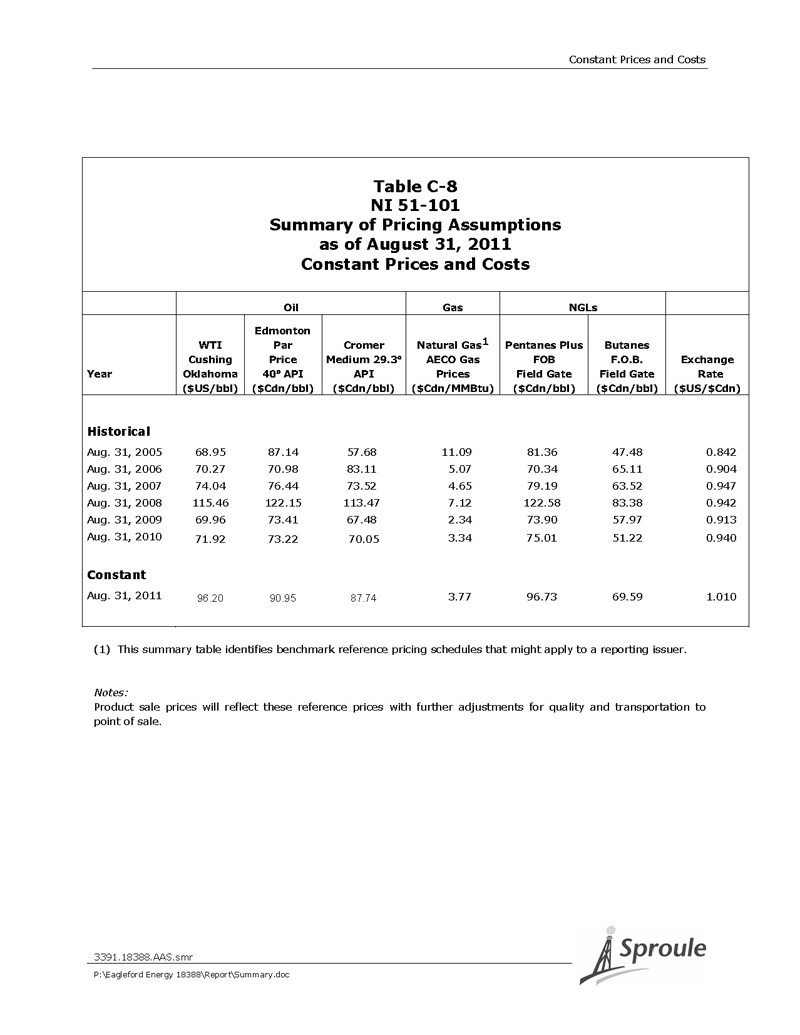

Constant Prices and Costs with price and cost sensitivities, as is the case between forecast and constant prices and cost forecasts. Also, some entities may have reserves assigned to them under one price and cost scenario, but under less favourable price and cost projections, the net present values of the hydrocarbons that could be recovered may not be sufficient to offset the capital investment. Those entities whose undiscounted net present value became negative under less favourable price and cost projections were not included in the summary tables. The values of the reserves presented in this constant price and cost evaluation should not be taken out of context, as they were prepared to comply with the Securities & Exchange Commission’s (SEC) regulations; therefore, they do not reflect our opinion of the market value of these reserves. Table C-4 presents a summary of the various reserves categories. Table C-5 presents a summary of net present values of future net revenue, before income taxes. Table C-6 presents the total future net revenue (undiscounted) for the total proved and total proved plus probable reserves categories. Table C-7 presents the net present value of future net revenue by production group for the total proved and total proved plus probable reserves categories. Table C-8 presents the summary of pricing assumptions for constant prices and costs. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

111004 03:23 SAL X110831 Con admin SAL X110831 Consolidation 18388 1 of 1 S1 Table C-1 Eagleford Energy Inc. Consolidation SUMMARY OF THE EVALUATION OF THE P.& N.G. RESERVES (As of Date: 2011-08-31) Remaining Reserves Net Present Values Before Income Taxes Company Gross 100% Gross Net @ 0% @ 5% @ 10% @ 15% @ 20% M$ M$ M$ M$ M$ Non-Assoc, Assoc Gas (MMcf) Proved Developed Producing 2939 153 128 103 86 73 63 56 Probable Developed Producing 812 42 34 23 15 11 8 7 Total Proved+Probable 3751 195 161 126 101 84 72 63 Grand Total (Mboe) Proved Developed Producing 489.9 25.5 21.3 103 86 73 63 56 Probable Developed Producing 135.3 7.0 5.6 23 15 11 8 7 Total Proved+Probable 625.2 32.5 26.8 126 101 84 72 63

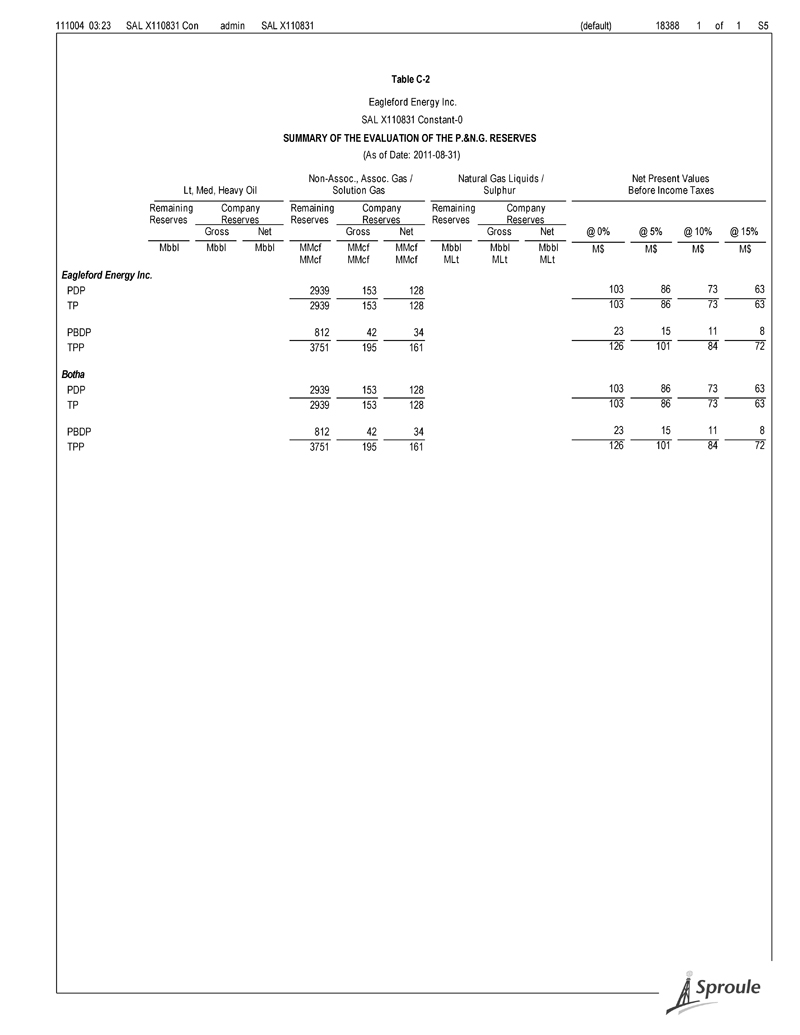

(default) 18388 1 of 1 S5 Table C-2 Eagleford Energy Inc. SAL X110831 Constant-0 SUMMARY OF THE EVALUATION OF THE P.&N.G. RESERVES (As of Date: 2011-08-31) Non-Assoc., Assoc. Gas / Natural Gas Liquids / Net Present Values Lt, Med, Heavy Oil Solution Gas Sulphur Before Income Taxes Remaining Company Remaining Company Remaining Company Reserves Reserves Reserves Reserves Reserves Reserves Gross Net Gross Net Gross Net @ 0% @ 5% @ 10% @ 15% Mbbl Mbbl Mbbl MMcf MMcf MMcf Mbbl Mbbl Mbbl M$ M$ M$ M$ MMcf MMcf MMcf MLt MLt MLt Eagleford Energy Inc. PDP 2939 153 128 103 86 73 63 TP 2939 153 128 103 86 73 63 PBDP 812 42 34 23 15 11 8 TPP 3751 195 161 126 101 84 72 Botha PDP 2939 153 128 103 86 73 63 TP 2939 153 128 103 86 73 63 PBDP 812 42 34 23 15 11 8 TPP 3751 195 161 126 101 84 72

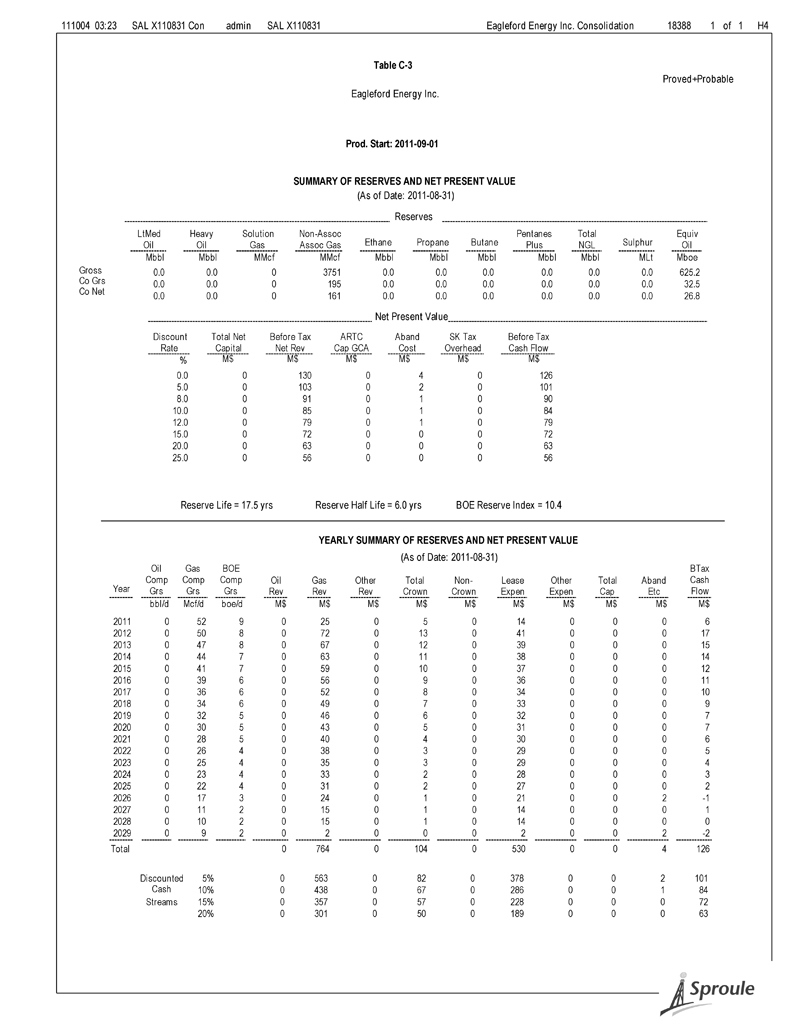

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table C-3 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 3751 0.0 0.0 0.0 0.0 0.0 0.0 625.2 Co Grs 0.0 0.0 0 195 0.0 0.0 0.0 0.0 0.0 0.0 32.5 Co Net 0.0 0.0 0 161 0.0 0.0 0.0 0.0 0.0 0.0 26.8 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 130 0 4 0 126 5.0 0 103 0 2 0 101 8.0 0 91 0 1 0 90 10.0 0 85 0 1 0 84 12.0 0 79 0 1 0 79 15.0 0 72 0 0 0 72 20.0 0 63 0 0 0 63 25.0 0 56 0 0 0 56 Reserve Life = 17.5 yrs Reserve Half Life = 6.0 yrs BOE Reserve Index = 10.4 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 52 9 0 25 0 5 0 14 0 0 0 6 2012 0 50 8 0 72 0 13 0 41 0 0 0 17 2013 0 47 8 0 67 0 12 0 39 0 0 0 15 2014 0 44 7 0 63 0 11 0 38 0 0 0 14 2015 0 41 7 0 59 0 10 0 37 0 0 0 12 2016 0 39 6 0 56 0 9 0 36 0 0 0 11 2017 0 36 6 0 52 0 8 0 34 0 0 0 10 2018 0 34 6 0 49 0 7 0 33 0 0 0 9 2019 0 32 5 0 46 0 6 0 32 0 0 0 7 2020 0 30 5 0 43 0 5 0 31 0 0 0 7 2021 0 28 5 0 40 0 4 0 30 0 0 0 6 2022 0 26 4 0 38 0 3 0 29 0 0 0 5 2023 0 25 4 0 35 0 3 0 29 0 0 0 4 2024 0 23 4 0 33 0 2 0 28 0 0 0 3 2025 0 22 4 0 31 0 2 0 27 0 0 0 2 2026 0 17 3 0 24 0 1 0 21 0 0 2 -1 2027 0 11 2 0 15 0 1 0 14 0 0 0 1 2028 0 10 2 0 15 0 1 0 14 0 0 0 0 2029 0 9 2 0 2 0 0 0 2 0 0 2 -2 Total 0 764 0 104 0 530 0 0 4 126 Discounted 5% 0 563 0 82 0 378 0 0 2 101 Cash 10% 0 438 0 67 0 286 0 0 1 84 Streams 15% 0 357 0 57 0 228 0 0 0 72 20% 0 301 0 50 0 189 0 0 0 63

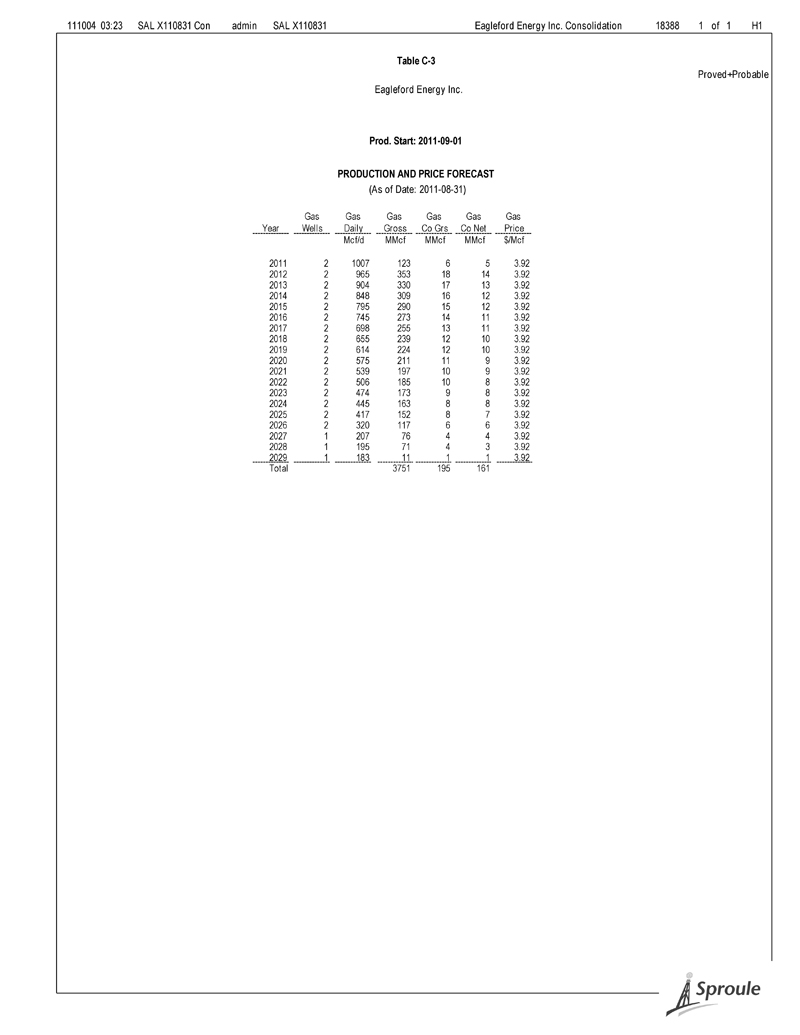

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H1 Table C-3 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 PRODUCTION AND PRICE FORECAST (As of Date: 2011-08-31) Gas Gas Gas Gas Gas Gas Year Wells Daily Gross Co Grs Co Net Price Mcf/d MMcf MMcf MMcf $/Mcf 2011 2 1007 123 6 5 3.92 2012 2 965 353 18 14 3.92 2013 2 904 330 17 13 3.92 2014 2 848 309 16 12 3.92 2015 2 795 290 15 12 3.92 2016 2 745 273 14 11 3.92 2017 2 698 255 13 11 3.92 2018 2 655 239 12 10 3.92 2019 2 614 224 12 10 3.92 2020 2 575 211 11 9 3.92 2021 2 539 197 10 9 3.92 2022 2 506 185 10 8 3.92 2023 2 474 173 9 8 3.92 2024 2 445 163 8 8 3.92 2025 2 417 152 8 7 3.92 2026 2 320 117 6 6 3.92 2027 1 207 76 4 4 3.92 2028 1 195 71 4 3 3.92 2029 1 183 11 1 1 3.92 Total 3751 195 161

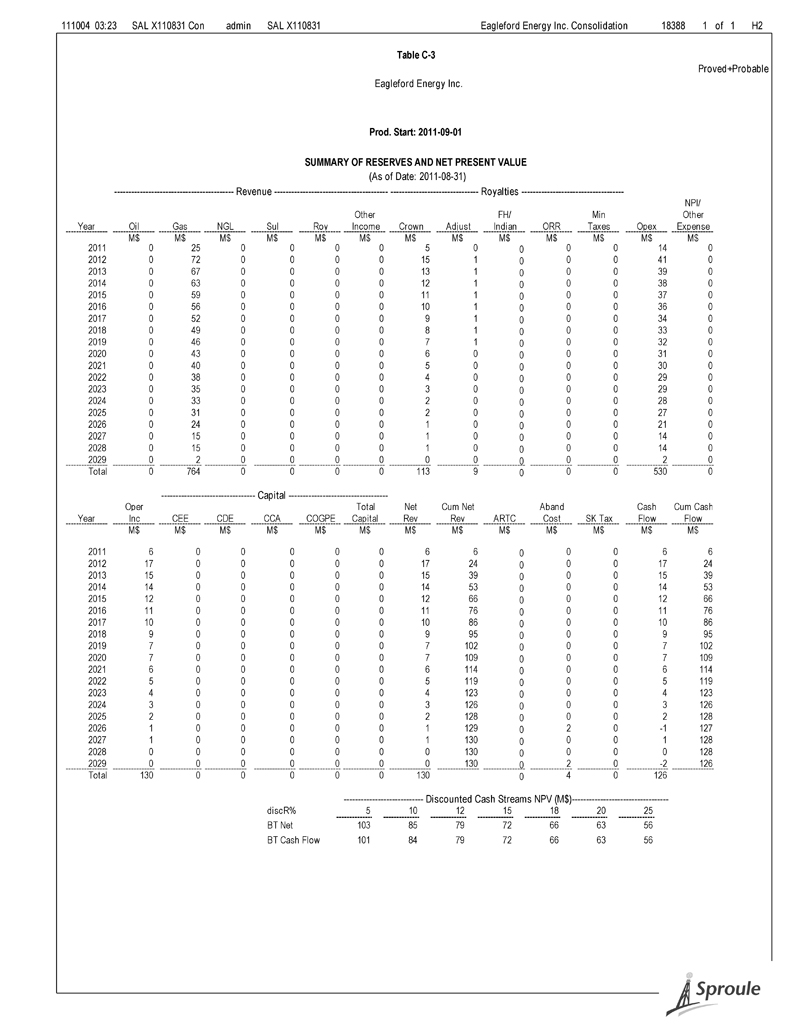

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H2 Table C-3 Proved+Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) ------------------------------------------ Revenue ---------------------------------------- ------------------------------- Royalties ------------------------------------ NPI/ Other FH/ Min Other Year Oil Gas NGL Sul Roy Income Crown Adjust Indian ORR Taxes Opex Expense M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 25 0 0 0 0 5 0 0 0 0 14 0 2012 0 72 0 0 0 0 15 1 0 0 0 41 0 2013 0 67 0 0 0 0 13 1 0 0 0 39 0 2014 0 63 0 0 0 0 12 1 0 0 0 38 0 2015 0 59 0 0 0 0 11 1 0 0 0 37 0 2016 0 56 0 0 0 0 10 1 0 0 0 36 0 2017 0 52 0 0 0 0 9 1 0 0 0 34 0 2018 0 49 0 0 0 0 8 1 0 0 0 33 0 2019 0 46 0 0 0 0 7 1 0 0 0 32 0 2020 0 43 0 0 0 0 6 0 0 0 0 31 0 2021 0 40 0 0 0 0 5 0 0 0 0 30 0 2022 0 38 0 0 0 0 4 0 0 0 0 29 0 2023 0 35 0 0 0 0 3 0 0 0 0 29 0 2024 0 33 0 0 0 0 2 0 0 0 0 28 0 2025 0 31 0 0 0 0 2 0 0 0 0 27 0 2026 0 24 0 0 0 0 1 0 0 0 0 21 0 2027 0 15 0 0 0 0 1 0 0 0 0 14 0 2028 0 15 0 0 0 0 1 0 0 0 0 14 0 2029 0 2 0 0 0 0 0 0 0 0 0 2 0 Total 0 764 0 0 0 0 113 9 0 0 0 530 0 --------------------------------- Capital ----------------------------------- Oper Total Net Cum Net Aband Cash Cum Cash Year Inc CEE CDE CCA COGPE Capital Rev Rev ARTC Cost SK Tax Flow Flow M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 6 0 0 0 0 0 6 6 0 0 0 6 6 2012 17 0 0 0 0 0 17 24 0 0 0 17 24 2013 15 0 0 0 0 0 15 39 0 0 0 15 39 2014 14 0 0 0 0 0 14 53 0 0 0 14 53 2015 12 0 0 0 0 0 12 66 0 0 0 12 66 2016 11 0 0 0 0 0 11 76 0 0 0 11 76 2017 10 0 0 0 0 0 10 86 0 0 0 10 86 2018 9 0 0 0 0 0 9 95 0 0 0 9 95 2019 7 0 0 0 0 0 7 102 0 0 0 7 102 2020 7 0 0 0 0 0 7 109 0 0 0 7 109 2021 6 0 0 0 0 0 6 114 0 0 0 6 114 2022 5 0 0 0 0 0 5 119 0 0 0 5 119 2023 4 0 0 0 0 0 4 123 0 0 0 4 123 2024 3 0 0 0 0 0 3 126 0 0 0 3 126 2025 2 0 0 0 0 0 2 128 0 0 0 2 128 2026 1 0 0 0 0 0 1 129 0 2 0 -1 127 2027 1 0 0 0 0 0 1 130 0 0 0 1 128 2028 0 0 0 0 0 0 0 130 0 0 0 0 128 2029 0 0 0 0 0 0 0 130 0 2 0 -2 126 Total 130 0 0 0 0 0 130 0 4 0 126 ---------------------------- Discounted Cash Streams NPV (M$)----------------------------------discR% 5 10 12 15 18 20 25 BT Net 103 85 79 72 66 63 56 BT Cash Flow 101 84 79 72 66 63 56

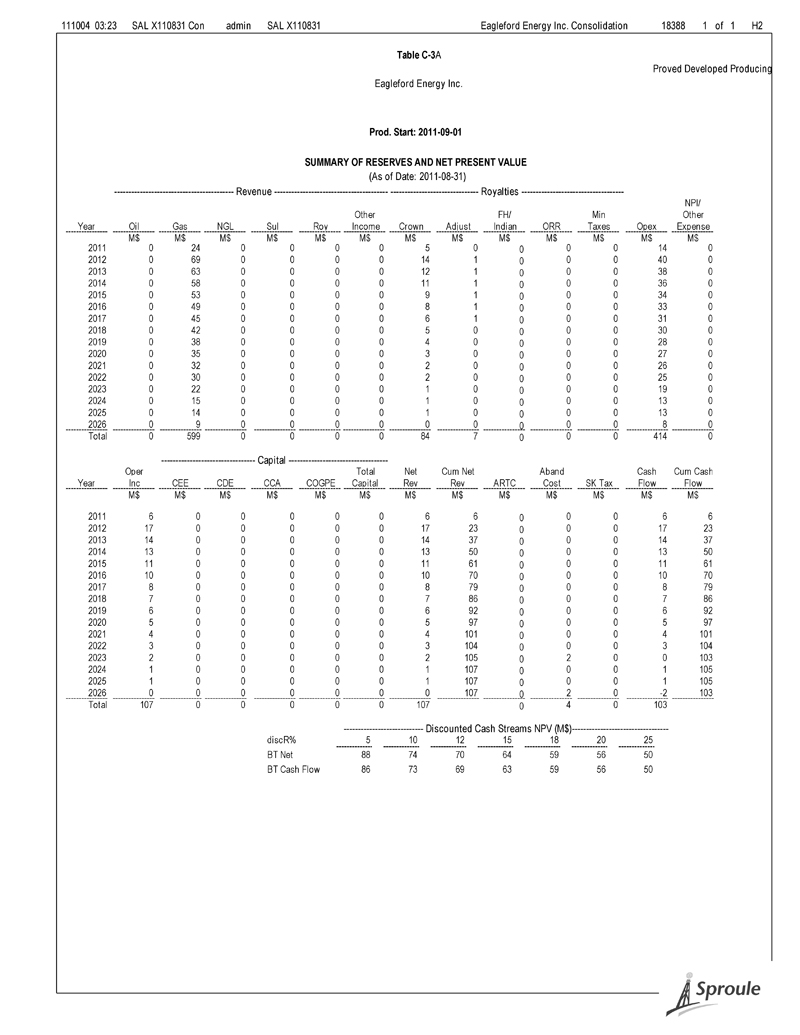

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table C-3A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 2939 0.0 0.0 0.0 0.0 0.0 0.0 489.9 Co Grs 0.0 0.0 0 153 0.0 0.0 0.0 0.0 0.0 0.0 25.5 Co Net 0.0 0.0 0 128 0.0 0.0 0.0 0.0 0.0 0.0 21.3 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 107 0 4 0 103 5.0 0 88 0 2 0 86 8.0 0 79 0 1 0 78 10.0 0 74 0 1 0 73 12.0 0 70 0 1 0 69 15.0 0 64 0 1 0 63 20.0 0 56 0 0 0 56 25.0 0 50 0 0 0 50 Reserve Life = 15.0 yrs Reserve Half Life = 4.9 yrs BOE Reserve Index = 8.5 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 51 8 0 24 0 4 0 14 0 0 0 6 2012 0 48 8 0 69 0 13 0 40 0 0 0 17 2013 0 44 7 0 63 0 11 0 38 0 0 0 14 2014 0 41 7 0 58 0 10 0 36 0 0 0 13 2015 0 37 6 0 53 0 8 0 34 0 0 0 11 2016 0 34 6 0 49 0 7 0 33 0 0 0 10 2017 0 32 5 0 45 0 6 0 31 0 0 0 8 2018 0 29 5 0 42 0 5 0 30 0 0 0 7 2019 0 27 4 0 38 0 4 0 28 0 0 0 6 2020 0 25 4 0 35 0 3 0 27 0 0 0 5 2021 0 23 4 0 32 0 2 0 26 0 0 0 4 2022 0 21 3 0 30 0 2 0 25 0 0 0 3 2023 0 15 3 0 22 0 1 0 19 0 0 2 0 2024 0 10 2 0 15 0 1 0 13 0 0 0 1 2025 0 10 2 0 14 0 1 0 13 0 0 0 1 2026 0 9 1 0 9 0 0 0 8 0 0 2 -2 Total 0 599 0 77 0 414 0 0 4 103 Discounted 5% 0 464 0 64 0 312 0 0 2 86 Cash 10% 0 375 0 54 0 246 0 0 1 73 Streams 15% 0 313 0 47 0 202 0 0 1 63 20% 0 269 0 42 0 170 0 0 0 56

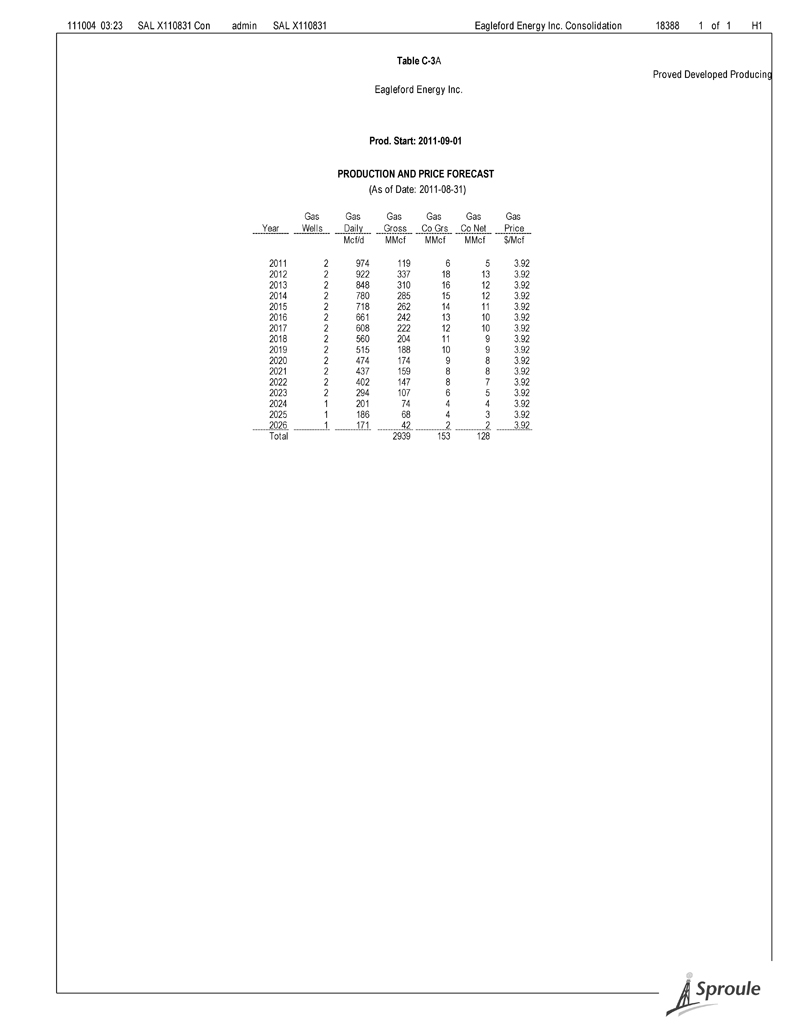

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H1 Table C-3A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 PRODUCTION AND PRICE FORECAST (As of Date: 2011-08-31) Gas Gas Gas Gas Gas Gas Year Wells Daily Gross Co Grs Co Net Price Mcf/d MMcf MMcf MMcf $/Mcf 2011 2 974 119 6 5 3.92 2012 2 922 337 18 13 3.92 2013 2 848 310 16 12 3.92 2014 2 780 285 15 12 3.92 2015 2 718 262 14 11 3.92 2016 2 661 242 13 10 3.92 2017 2 608 222 12 10 3.92 2018 2 560 204 11 9 3.92 2019 2 515 188 10 9 3.92 2020 2 474 174 9 8 3.92 2021 2 437 159 8 8 3.92 2022 2 402 147 8 7 3.92 2023 2 294 107 6 5 3.92 2024 1 201 74 4 4 3.92 2025 1 186 68 4 3 3.92 2026 1 171 42 2 2 3.92 Total 2939 153 128

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H2 Table C-3A Proved Developed Producing Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) ------------------------------------------ Revenue ---------------------------------------- ------------------------------- Royalties ------------------------------------ NPI/ Other FH/ Min Other Year Oil Gas NGL Sul Roy Income Crown Adjust Indian ORR Taxes Opex Expense M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 24 0 0 0 0 5 0 0 0 0 14 0 2012 0 69 0 0 0 0 14 1 0 0 0 40 0 2013 0 63 0 0 0 0 12 1 0 0 0 38 0 2014 0 58 0 0 0 0 11 1 0 0 0 36 0 2015 0 53 0 0 0 0 9 1 0 0 0 34 0 2016 0 49 0 0 0 0 8 1 0 0 0 33 0 2017 0 45 0 0 0 0 6 1 0 0 0 31 0 2018 0 42 0 0 0 0 5 0 0 0 0 30 0 2019 0 38 0 0 0 0 4 0 0 0 0 28 0 2020 0 35 0 0 0 0 3 0 0 0 0 27 0 2021 0 32 0 0 0 0 2 0 0 0 0 26 0 2022 0 30 0 0 0 0 2 0 0 0 0 25 0 2023 0 22 0 0 0 0 1 0 0 0 0 19 0 2024 0 15 0 0 0 0 1 0 0 0 0 13 0 2025 0 14 0 0 0 0 1 0 0 0 0 13 0 2026 0 9 0 0 0 0 0 0 0 0 0 8 0 Total 0 599 0 0 0 0 84 7 0 0 0 414 0 --------------------------------- Capital ----------------------------------- Oper Total Net Cum Net Aband Cash Cum Cash Year Inc CEE CDE CCA COGPE Capital Rev Rev ARTC Cost SK Tax Flow Flow M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 6 0 0 0 0 0 6 6 0 0 0 6 6 2012 17 0 0 0 0 0 17 23 0 0 0 17 23 2013 14 0 0 0 0 0 14 37 0 0 0 14 37 2014 13 0 0 0 0 0 13 50 0 0 0 13 50 2015 11 0 0 0 0 0 11 61 0 0 0 11 61 2016 10 0 0 0 0 0 10 70 0 0 0 10 70 2017 8 0 0 0 0 0 8 79 0 0 0 8 79 2018 7 0 0 0 0 0 7 86 0 0 0 7 86 2019 6 0 0 0 0 0 6 92 0 0 0 6 92 2020 5 0 0 0 0 0 5 97 0 0 0 5 97 2021 4 0 0 0 0 0 4 101 0 0 0 4 101 2022 3 0 0 0 0 0 3 104 0 0 0 3 104 2023 2 0 0 0 0 0 2 105 0 2 0 0 103 2024 1 0 0 0 0 0 1 107 0 0 0 1 105 2025 1 0 0 0 0 0 1 107 0 0 0 1 105 2026 0 0 0 0 0 0 0 107 0 2 0 -2 103 Total 107 0 0 0 0 0 107 0 4 0 103 ---------------------------- Discounted Cash Streams NPV (M$)----------------------------------discR% 5 10 12 15 18 20 25 BT Net 88 74 70 64 59 56 50 BT Cash Flow 86 73 69 63 59 56 50

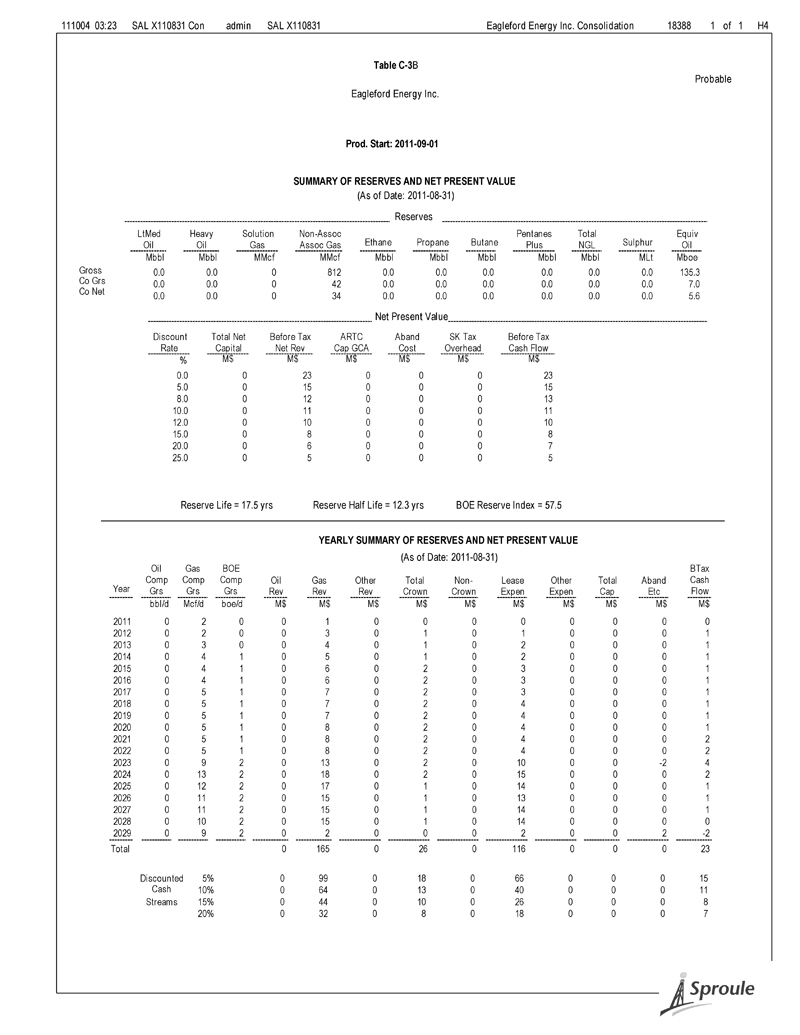

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H4 Table C-3B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Reserves LtMed Heavy Solution Non-Assoc Pentanes Total Equiv Oil Oil Gas Assoc Gas Ethane Propane Butane Plus NGL Sulphur Oil Mbbl Mbbl MMcf MMcf Mbbl Mbbl Mbbl Mbbl Mbbl MLt Mboe Gross 0.0 0.0 0 812 0.0 0.0 0.0 0.0 0.0 0.0 135.3 Co Grs 0.0 0.0 0 42 0.0 0.0 0.0 0.0 0.0 0.0 7.0 Co Net 0.0 0.0 0 34 0.0 0.0 0.0 0.0 0.0 0.0 5.6 Net Present Value Discount Total Net Before Tax ARTC Aband SK Tax Before Tax Rate Capital Net Rev Cap GCA Cost Overhead Cash Flow % M$ M$ M$ M$ M$ M$ 0.0 0 23 0 0 0 23 5.0 0 15 0 0 0 15 8.0 0 12 0 0 0 13 10.0 0 11 0 0 0 11 12.0 0 10 0 0 0 10 15.0 0 8 0 0 0 8 20.0 0 6 0 0 0 7 25.0 0 5 0 0 0 5 Reserve Life = 17.5 yrs Reserve Half Life = 12.3 yrs BOE Reserve Index = 57.5 YEARLY SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) Oil Gas BOE BTax Comp Comp Comp Oil Gas Other Total Non- Lease Other Total Aband Cash Year Grs Grs Grs Rev Rev Rev Crown Crown Expen Expen Cap Etc Flow bbl/d Mcf/d boe/d M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 2 0 0 1 0 0 0 0 0 0 0 0 2012 0 2 0 0 3 0 1 0 1 0 0 0 1 2013 0 3 0 0 4 0 1 0 2 0 0 0 1 2014 0 4 1 0 5 0 1 0 2 0 0 0 1 2015 0 4 1 0 6 0 2 0 3 0 0 0 1 2016 0 4 1 0 6 0 2 0 3 0 0 0 1 2017 0 5 1 0 7 0 2 0 3 0 0 0 1 2018 0 5 1 0 7 0 2 0 4 0 0 0 1 2019 0 5 1 0 7 0 2 0 4 0 0 0 1 2020 0 5 1 0 8 0 2 0 4 0 0 0 1 2021 0 5 1 0 8 0 2 0 4 0 0 0 2 2022 0 5 1 0 8 0 2 0 4 0 0 0 2 2023 0 9 2 0 13 0 2 0 10 0 0 -2 4 2024 0 13 2 0 18 0 2 0 15 0 0 0 2 2025 0 12 2 0 17 0 1 0 14 0 0 0 1 2026 0 11 2 0 15 0 1 0 13 0 0 0 1 2027 0 11 2 0 15 0 1 0 14 0 0 0 1 2028 0 10 2 0 15 0 1 0 14 0 0 0 0 2029 0 9 2 0 2 0 0 0 2 0 0 2 -2 Total 0 165 0 26 0 116 0 0 0 23 Discounted 5% 0 99 0 18 0 66 0 0 0 15 Cash 10% 0 64 0 13 0 40 0 0 0 11 Streams 15% 0 44 0 10 0 26 0 0 0 8 20% 0 32 0 8 0 18 0 0 0 7

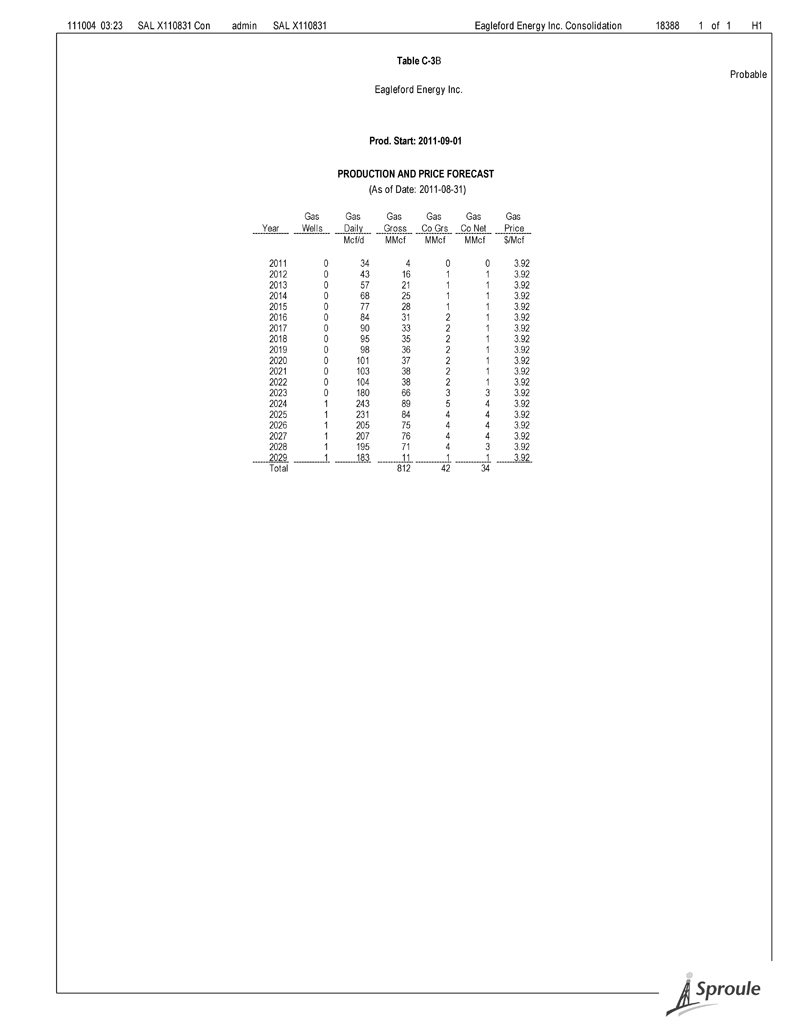

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H1 Table C-3B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 PRODUCTION AND PRICE FORECAST (As of Date: 2011-08-31) Gas Gas Gas Gas Gas Gas Year Wells Daily Gross Co Grs Co Net Price Mcf/d MMcf MMcf MMcf $/Mcf 2011 0 34 4 0 0 3.92 2012 0 43 16 1 1 3.92 2013 0 57 21 1 1 3.92 2014 0 68 25 1 1 3.92 2015 0 77 28 1 1 3.92 2016 0 84 31 2 1 3.92 2017 0 90 33 2 1 3.92 2018 0 95 35 2 1 3.92 2019 0 98 36 2 1 3.92 2020 0 101 37 2 1 3.92 2021 0 103 38 2 1 3.92 2022 0 104 38 2 1 3.92 2023 0 180 66 3 3 3.92 2024 1 243 89 5 4 3.92 2025 1 231 84 4 4 3.92 2026 1 205 75 4 4 3.92 2027 1 207 76 4 4 3.92 2028 1 195 71 4 3 3.92 2029 1 183 11 1 1 3.92 Total 812 42 34

111004 03:23 SAL X110831 Con admin SAL X110831 Eagleford Energy Inc. Consolidation 18388 1 of 1 H2 Table C-3B Probable Eagleford Energy Inc. Prod. Start: 2011-09-01 SUMMARY OF RESERVES AND NET PRESENT VALUE (As of Date: 2011-08-31) ------------------------------------------ Revenue ---------------------------------------- ------------------------------- Royalties ------------------------------------ NPI/ Other FH/ Min Other Year Oil Gas NGL Sul Roy Income Crown Adjust Indian ORR Taxes Opex Expense M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 1 0 0 0 0 0 0 0 0 0 0 0 2012 0 3 0 0 0 0 1 0 0 0 0 1 0 2013 0 4 0 0 0 0 1 0 0 0 0 2 0 2014 0 5 0 0 0 0 1 0 0 0 0 2 0 2015 0 6 0 0 0 0 2 0 0 0 0 3 0 2016 0 6 0 0 0 0 2 0 0 0 0 3 0 2017 0 7 0 0 0 0 2 0 0 0 0 3 0 2018 0 7 0 0 0 0 2 0 0 0 0 4 0 2019 0 7 0 0 0 0 2 0 0 0 0 4 0 2020 0 8 0 0 0 0 2 0 0 0 0 4 0 2021 0 8 0 0 0 0 2 0 0 0 0 4 0 2022 0 8 0 0 0 0 2 0 0 0 0 4 0 2023 0 13 0 0 0 0 2 0 0 0 0 10 0 2024 0 18 0 0 0 0 2 0 0 0 0 15 0 2025 0 17 0 0 0 0 1 0 0 0 0 14 0 2026 0 15 0 0 0 0 1 0 0 0 0 13 0 2027 0 15 0 0 0 0 1 0 0 0 0 14 0 2028 0 15 0 0 0 0 1 0 0 0 0 14 0 2029 0 2 0 0 0 0 0 0 0 0 0 2 0 Total 0 165 0 0 0 0 29 2 0 0 0 116 0 --------------------------------- Capital ----------------------------------- Oper Total Net Cum Net Aband Cash Cum Cash Year Inc CEE CDE CCA COGPE Capital Rev Rev ARTC Cost SK Tax Flow Flow M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ M$ 2011 0 0 0 0 0 0 0 0 0 0 0 0 0 2012 1 0 0 0 0 0 1 1 0 0 0 1 1 2013 1 0 0 0 0 0 1 2 0 0 0 1 2 2014 1 0 0 0 0 0 1 4 0 0 0 1 4 2015 1 0 0 0 0 0 1 5 0 0 0 1 5 2016 1 0 0 0 0 0 1 6 0 0 0 1 6 2017 1 0 0 0 0 0 1 7 0 0 0 1 7 2018 1 0 0 0 0 0 1 9 0 0 0 1 9 2019 1 0 0 0 0 0 1 10 0 0 0 1 10 2020 1 0 0 0 0 0 1 12 0 0 0 1 12 2021 2 0 0 0 0 0 2 13 0 0 0 2 13 2022 2 0 0 0 0 0 2 15 0 0 0 2 15 2023 2 0 0 0 0 0 2 17 0 -2 0 4 19 2024 2 0 0 0 0 0 2 19 0 0 0 2 21 2025 1 0 0 0 0 0 1 21 0 0 0 1 23 2026 1 0 0 0 0 0 1 22 0 0 0 1 24 2027 1 0 0 0 0 0 1 22 0 0 0 1 24 2028 0 0 0 0 0 0 0 23 0 0 0 0 25 2029 0 0 0 0 0 0 0 23 0 2 0 -2 23 Total 23 0 0 0 0 0 23 0 0 0 23 ---------------------------- Discounted Cash Streams NPV (M$)----------------------------------discR% 5 10 12 15 18 20 25 BT Net 15 11 10 8 7 6 5 BT Cash Flow 15 11 10 8 7 7 5

2011-10-04 15:24:16 - 18388 Constant Prices and Costs Table C-4 NI 51-101 Summary of Oil and Gas Reserves as of August 31, 2011 Constant Prices and Costs Reserves Natural Gas (non-associated & Light and Medium Oil Heavy Oil associated) Natural Gas Liquids Reserve Category Gross Net Gross Net Gross Net Gross Net (Mbbl) (Mbbl) (Mbbl) (Mbbl) (MMcf) (MMcf) (Mbbl) (Mbbl) Proved Developed Producing 0.0 0.0 0.0 0.0 153 128 0.0 0.0 Developed Non- 0.0 0.0 0.0 0.0 0 0 0.0 0.0 Producing Undeveloped 0.0 0.0 0.0 0.0 0 0 0.0 0.0 Total Proved 0.0 0.0 0.0 0.0 153 128 0.0 0.0 Probable 0.0 0.0 0.0 0.0 42 34 0.0 0.0 Total Proved Plus 0.0 0.0 0.0 0.0 195 161 0.0 0.0 Probable Reference: Item 2.2(1) of Form 51-101F1

Constant Prices and Costs Table C-5 NI 51-101 Summary of Net Present Values of Future Net Revenue As of August 31, 2011 Constant Prices and Costs Net Present Values of Future Net Revenue Unit Value Before Income Taxes Before Income Tax Discounted at (%/Year) Discounted at 10%/Year 0 5 10 15 20 Reserves Category (M$) (M$) (M$) (M$) (M$) $/BOE Proved Developed Producing 103 86 73 63 56 3.43 Developed Non-Producing 0 0 0 0 0 0.00 Undeveloped 0 0 0 0 0 0.00 Total Proved 103 86 73 63 56 3.43 Probable 23 15 11 8 7 1.98 Total Proved Plus Probable 126 101 84 72 63 3.13 Reference Item 2.2(2) of Form 51-101F1 Notes: NP V of FNR include all resource income: o Sale of oil, gas, by-product reserves o Proc essing third party reserves o Other income Income Taxes o Incl udes all resource income o App ly appropriate income tax calculations o Incl ude prior tax pools Un it Values are based on net reserve volumes 3391.18388 ..AAS.smr P:\Eagleford Energy 18388\Report\Table C-5 landscape .doc

Constant Prices and Costs Table C-6 Total Future Net Revenue (Undiscounted) As of August 31, 2011 Constant Prices and Costs Future Net Revenue Well Before Operating Development Abandonment Income Reserves Category Revenue Royalties Costs Costs Costs Taxes (M$) (M$) (M$) (M$) (M$) (M$) Proved 599 77 414 0 4 103 Proved Plus Probable 764 104 530 0 4 126 Reference Item 2.1(3)(b) of Form 51-101F1 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

2011-10-04 15:24:15 - 18388 Constant Prices and Costs Table C-7 NI 51-101 Net Present Value of Future Net Revenue by Production Group as of August 31, 2011 Constant Prices and Costs Future Net Unit Revenue Value Reserves Production Group Before Before Category Income Income Taxes Taxes (Discounted (Discounted at 10%/Year) at 10%/Year) (M$) ($/boe) Proved Light and Medium Crude Oil (including solution gas and associated by-products) 0 0 Heavy Oil (including solution gas and associated by-products) 0 0 Natural Gas (including associated by-products)* 73 3.43 Proved Plus Probable Light and Medium Crude Oil (including solution gas and associated by-products) 0 0 Heavy Oil (including solution gas and associated by-products) 0 0 Natural Gas (including associated by-products)* 84 3.13 Reference Item 2.1(3)(c) of Form 51-101F1 * Includes corporate Capital GCA, if applicable Unit Values are based on net reserve volumes

Constant Prices and Costs Table C-8 NI 51-101 Summary of Pricing Assumptions as of August 31, 2011 Constant Prices and Costs Oil Gas NGLs Edmonton WTI Par Cromer Natural Gas1 Pentanes Plus Butanes Cushing Price Medium 29.3° AECO Gas FOB F.O.B. Exchange Year Oklahoma 40° API API Prices Field Gate Field Gate Rate ($US/bbl) ($Cdn/bbl) ($Cdn/bbl) ($Cdn/MMBtu) ($Cdn/bbl) ($Cdn/bbl) ($US/$Cdn) Historical Aug. 31, 2005 68.95 87.14 57.68 11.09 81.36 47.48 0.842 Aug. 31, 2006 70.27 70.98 83.11 5.07 70.34 65.11 0.904 Aug. 31, 2007 74.04 76.44 73.52 4.65 79.19 63.52 0.947 Aug. 31, 2008 115.46 122.15 113.47 7.12 122.58 83.38 0.942 Aug. 31, 2009 69.96 73.41 67.48 2.34 73.90 57.97 0.913 Aug. 31, 2010 71.92 73.22 70.05 3.34 75.01 51.22 0.940 Constant Aug. 31, 2011 96.20 90.95 87.74 3.77 96.73 69.59 1.010 (1) This summary table identifies benchmark reference pricing schedules that might apply to a reporting issuer. Notes: Product sale prices will reflect these reference prices with further adjustments for quality and transportation to point of sale. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

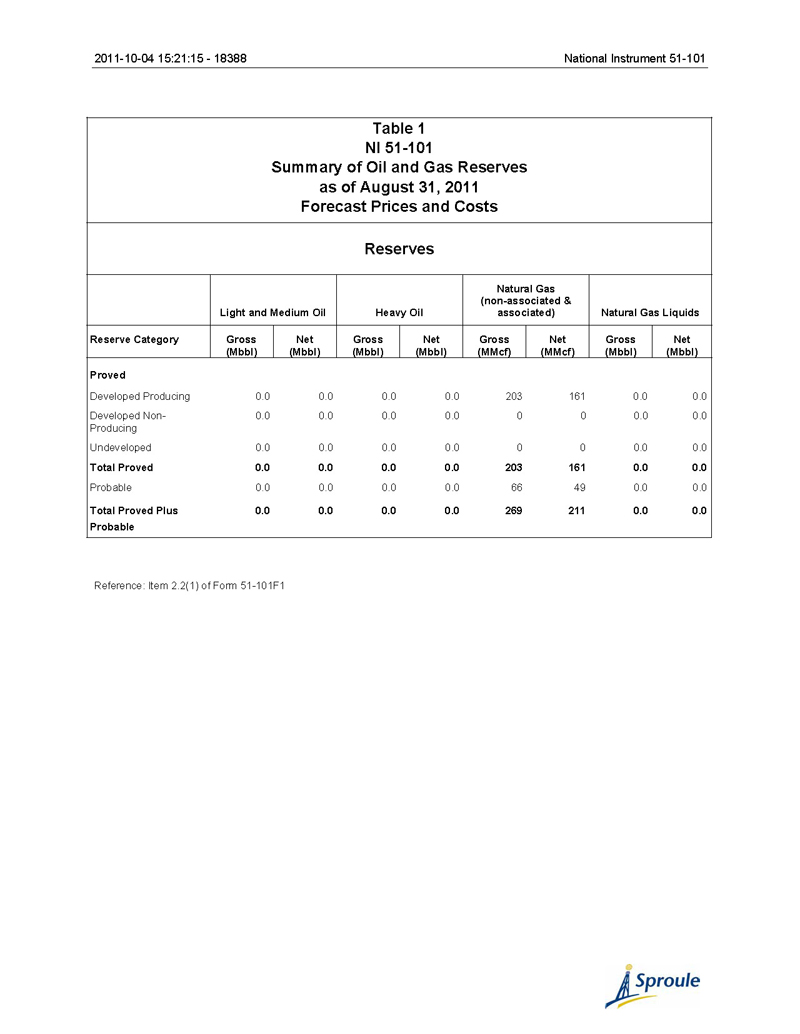

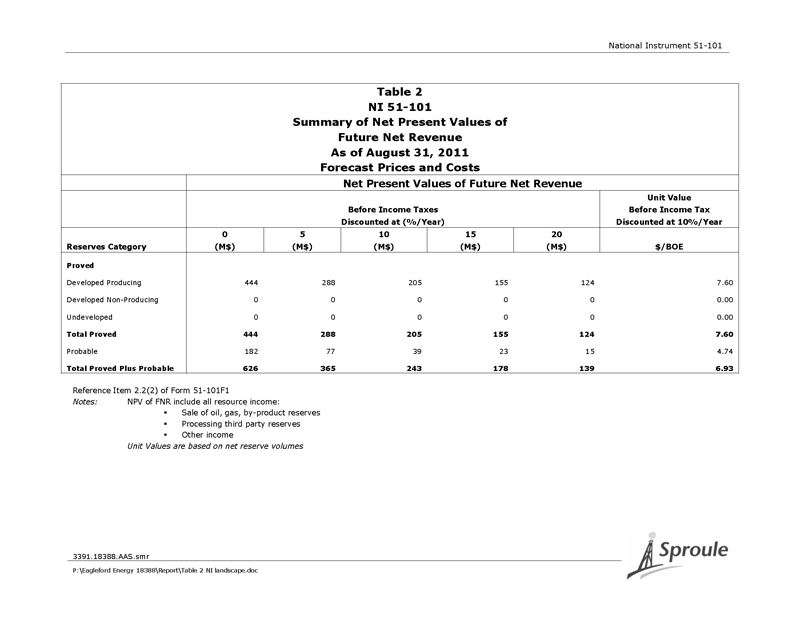

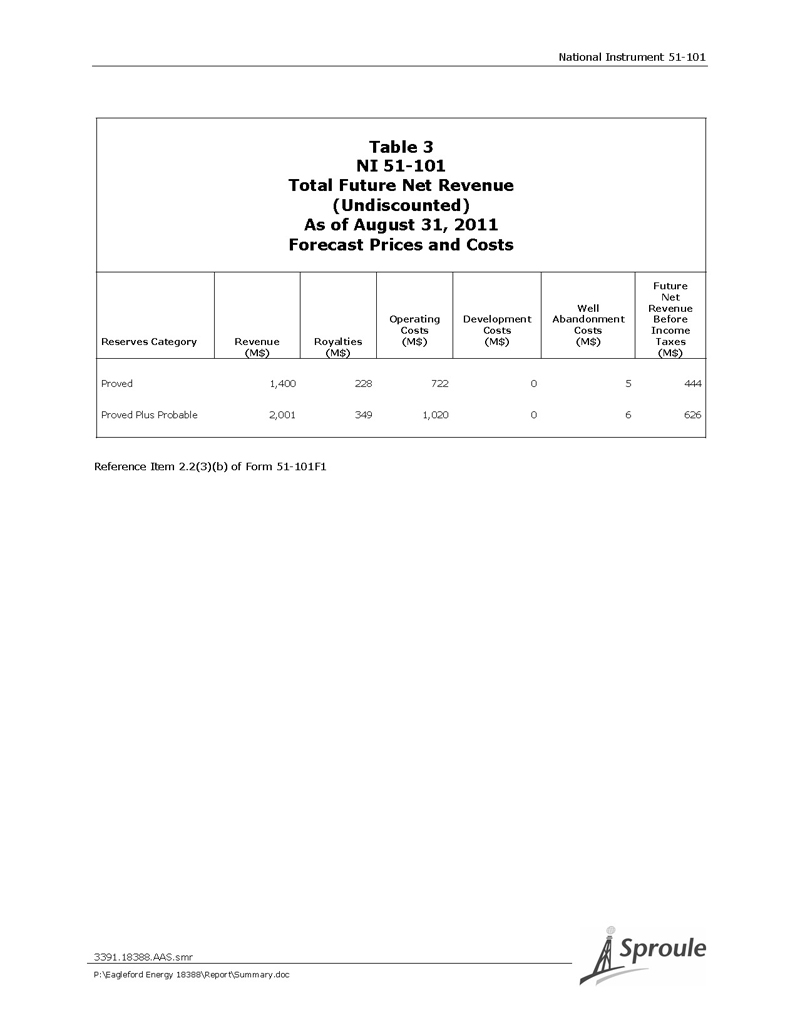

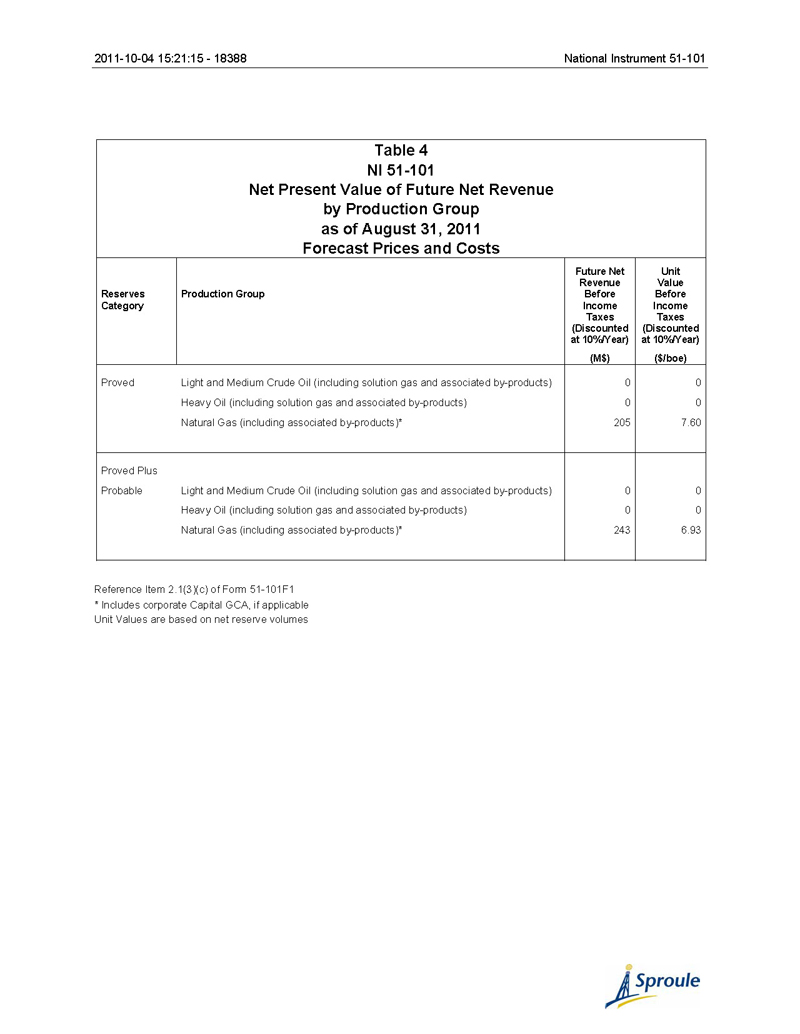

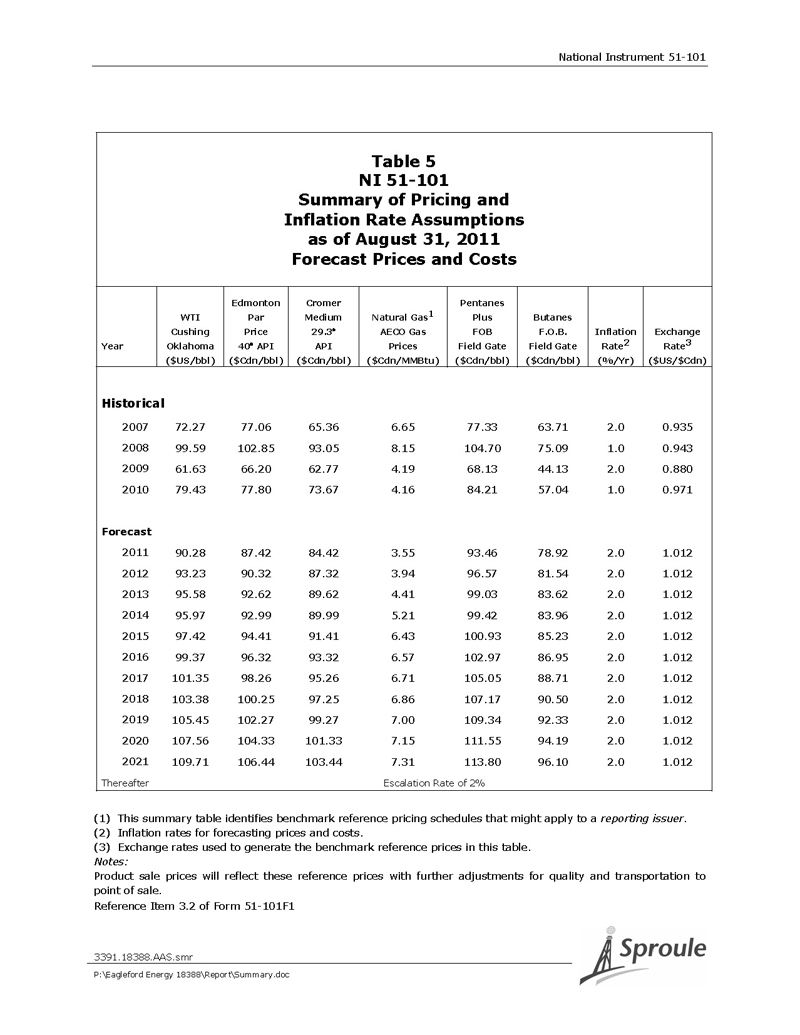

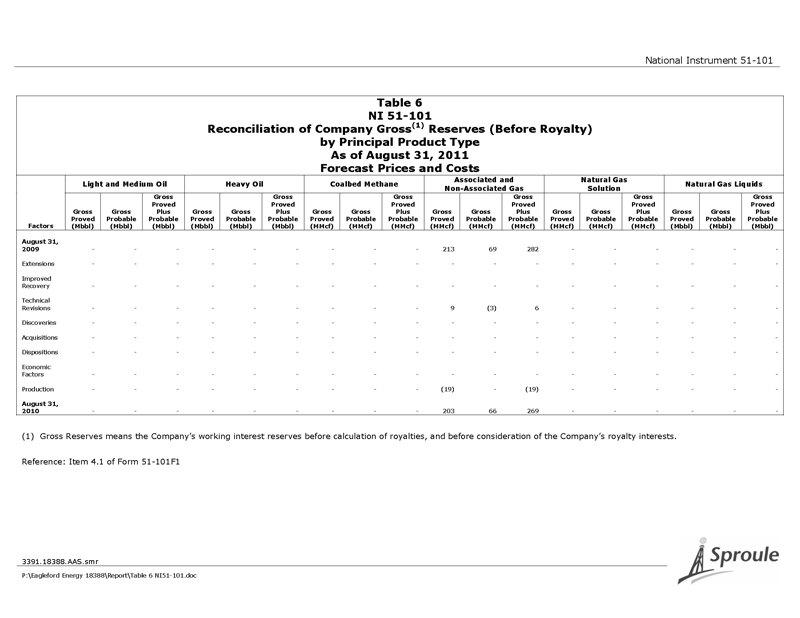

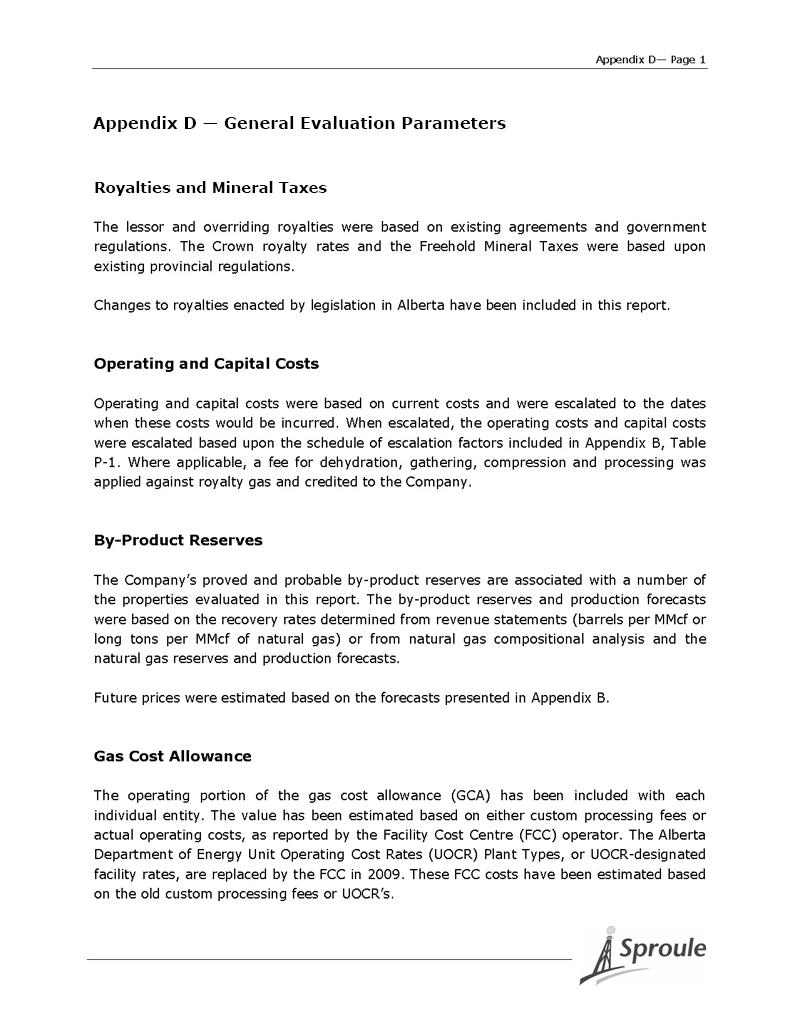

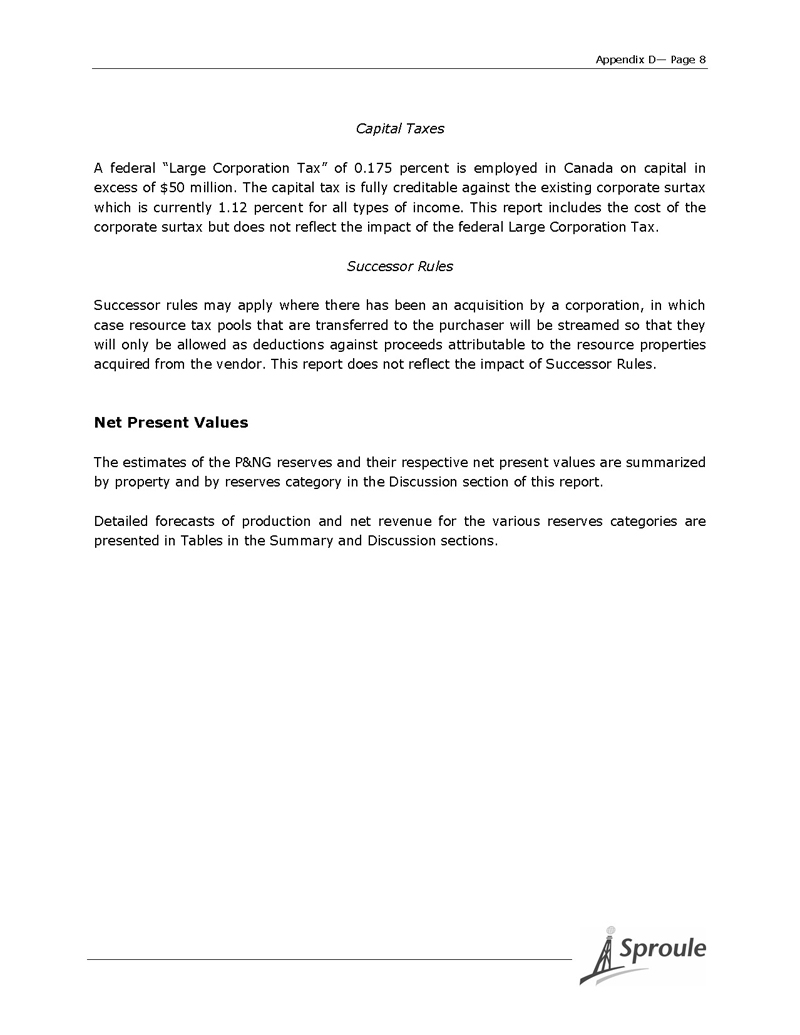

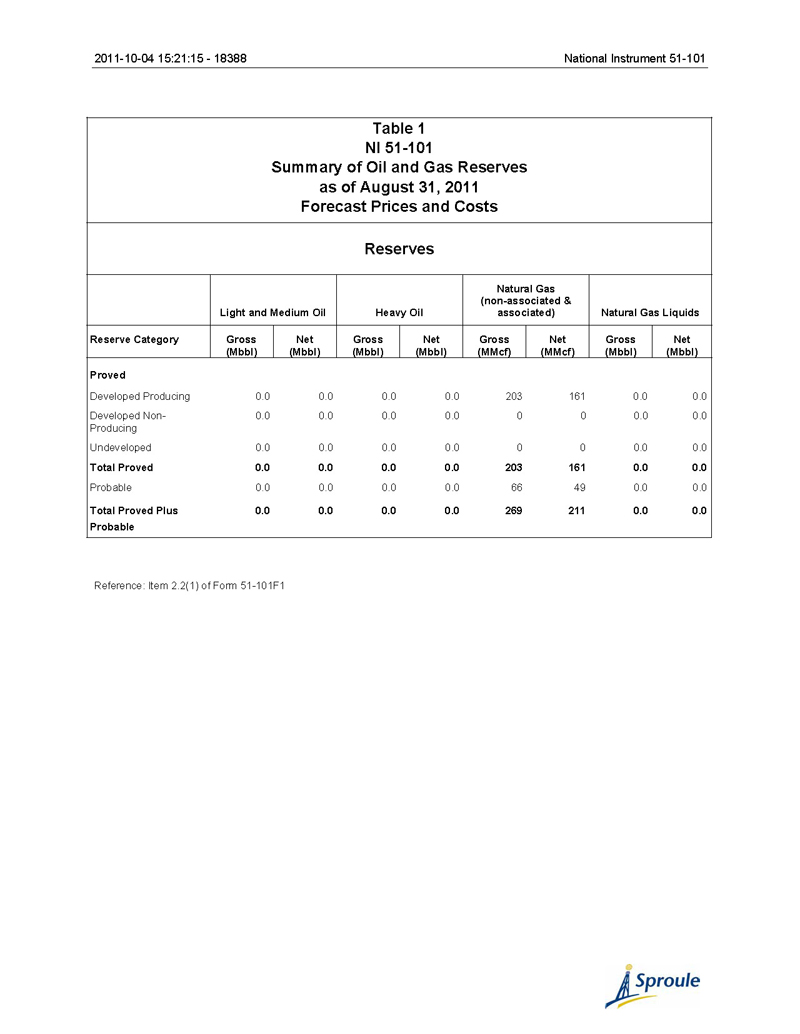

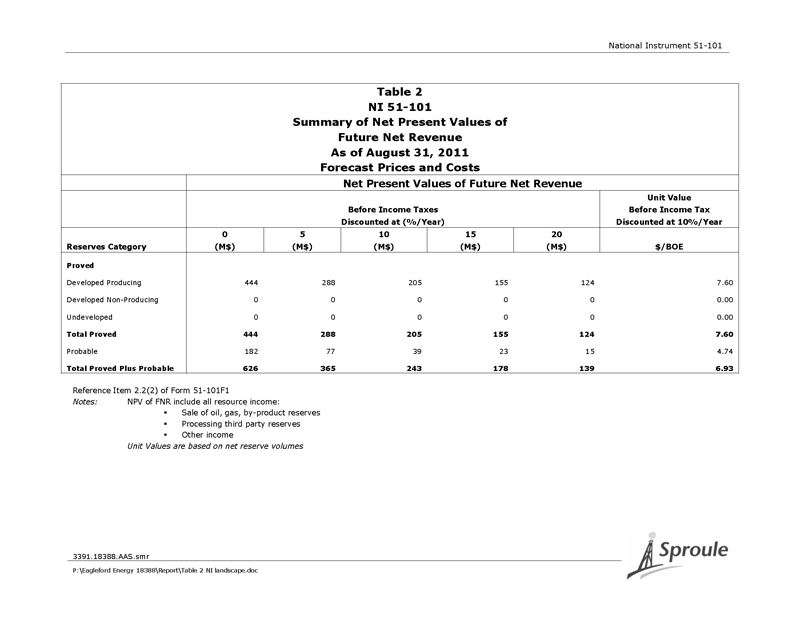

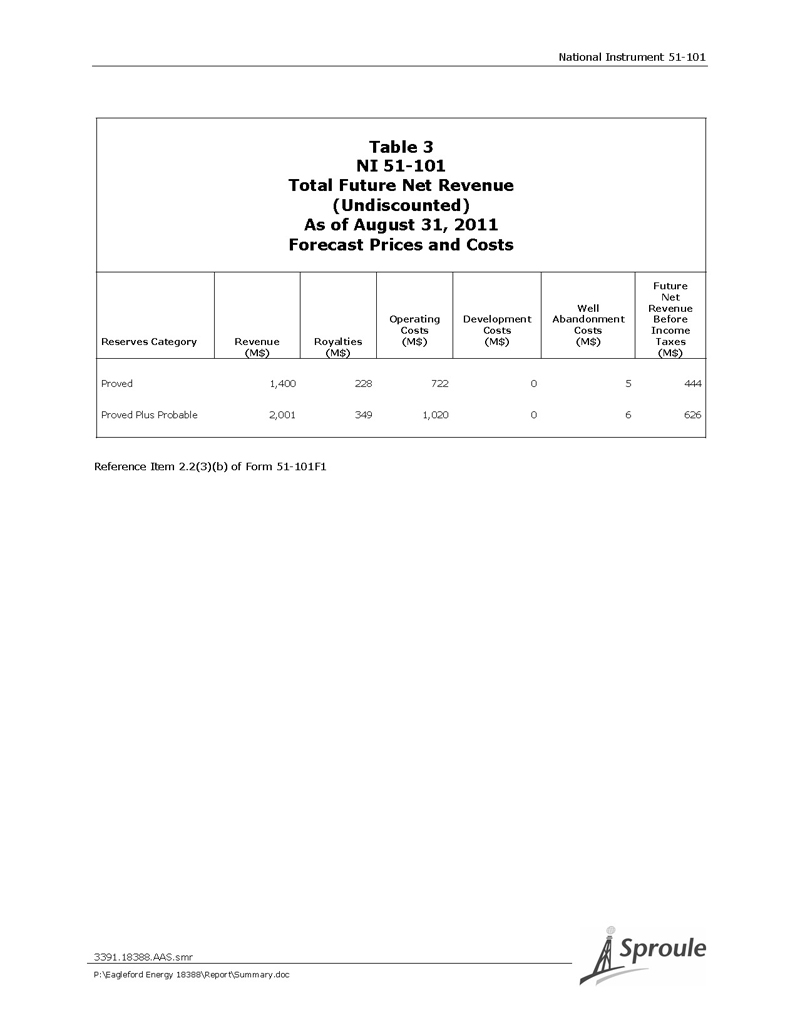

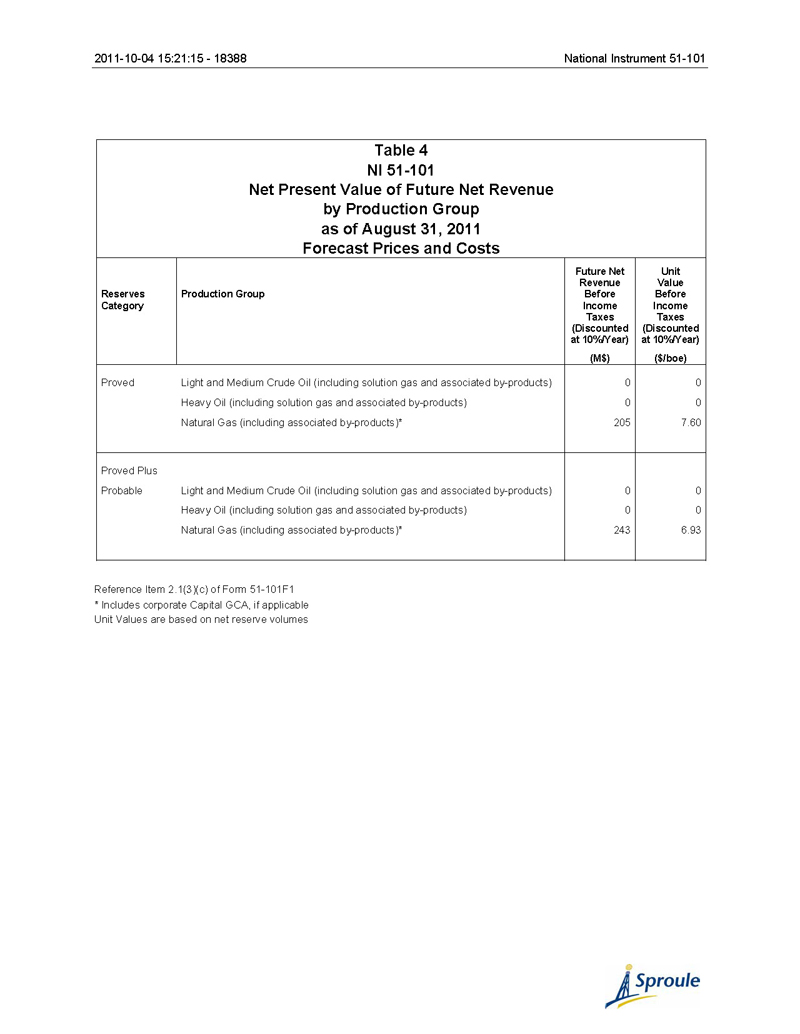

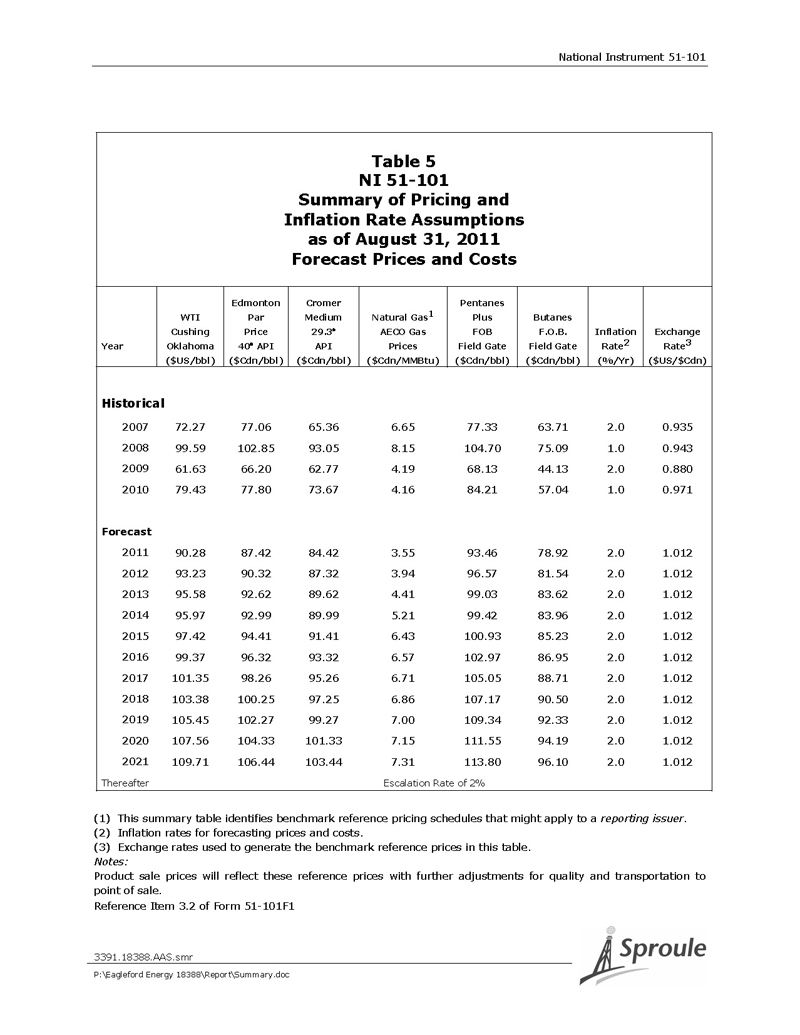

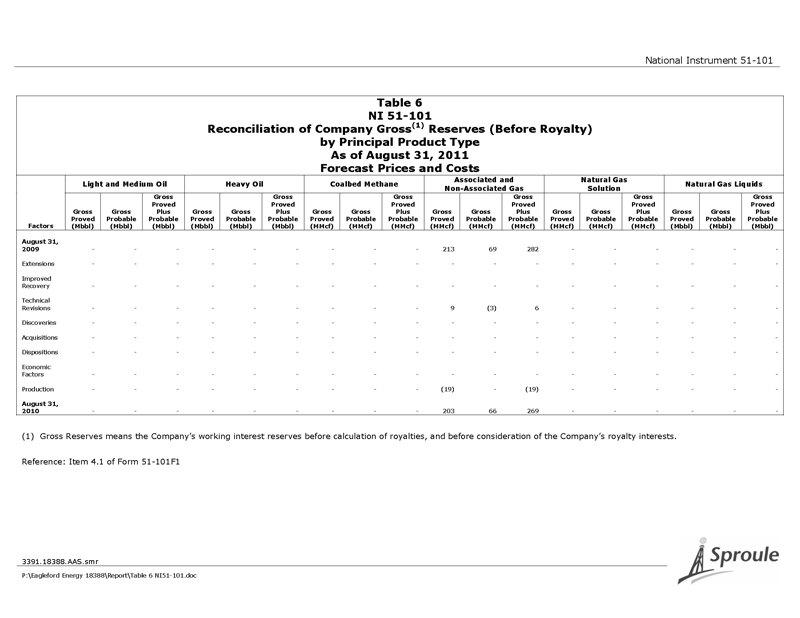

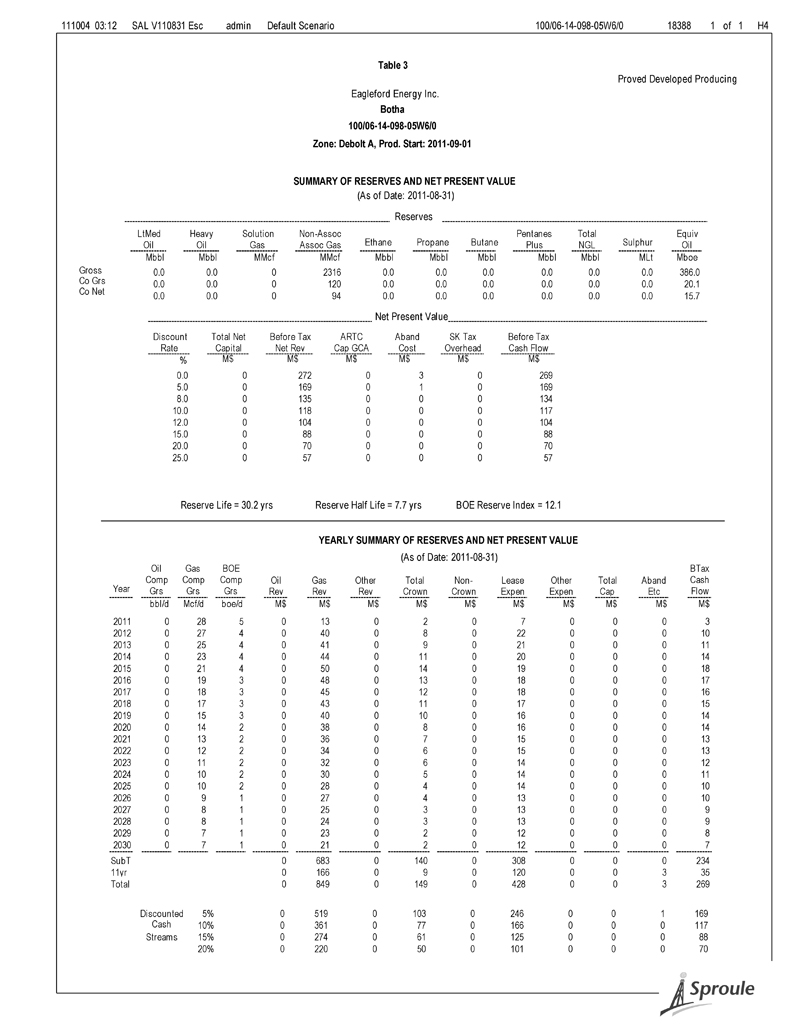

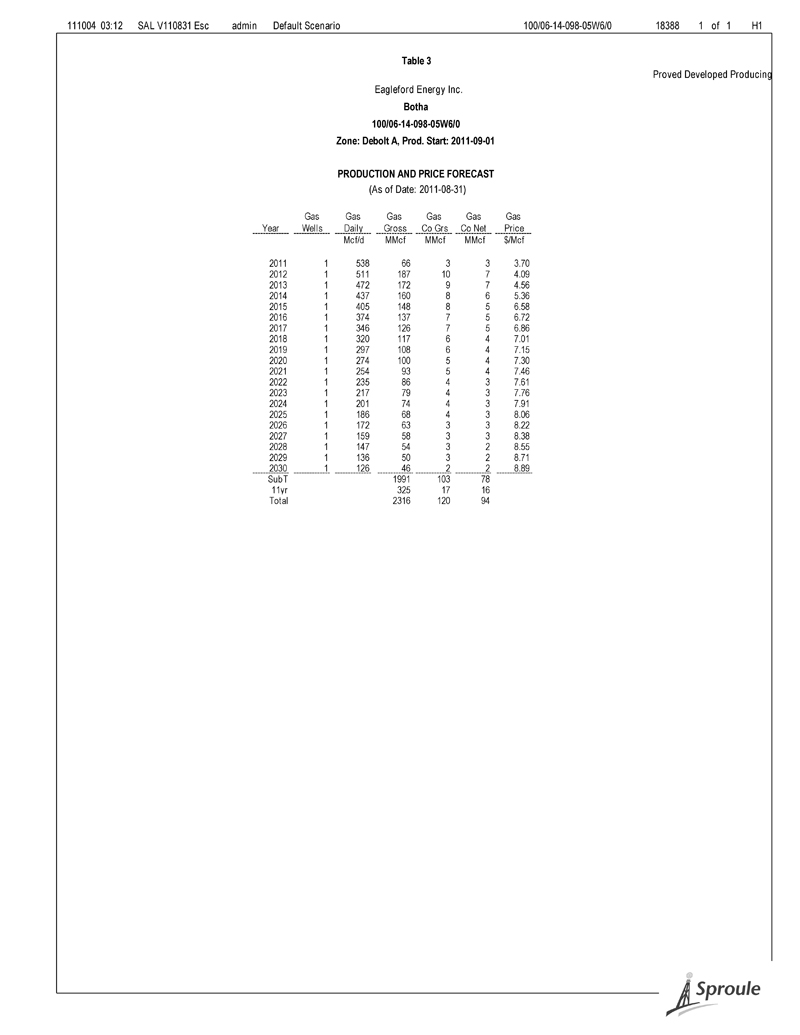

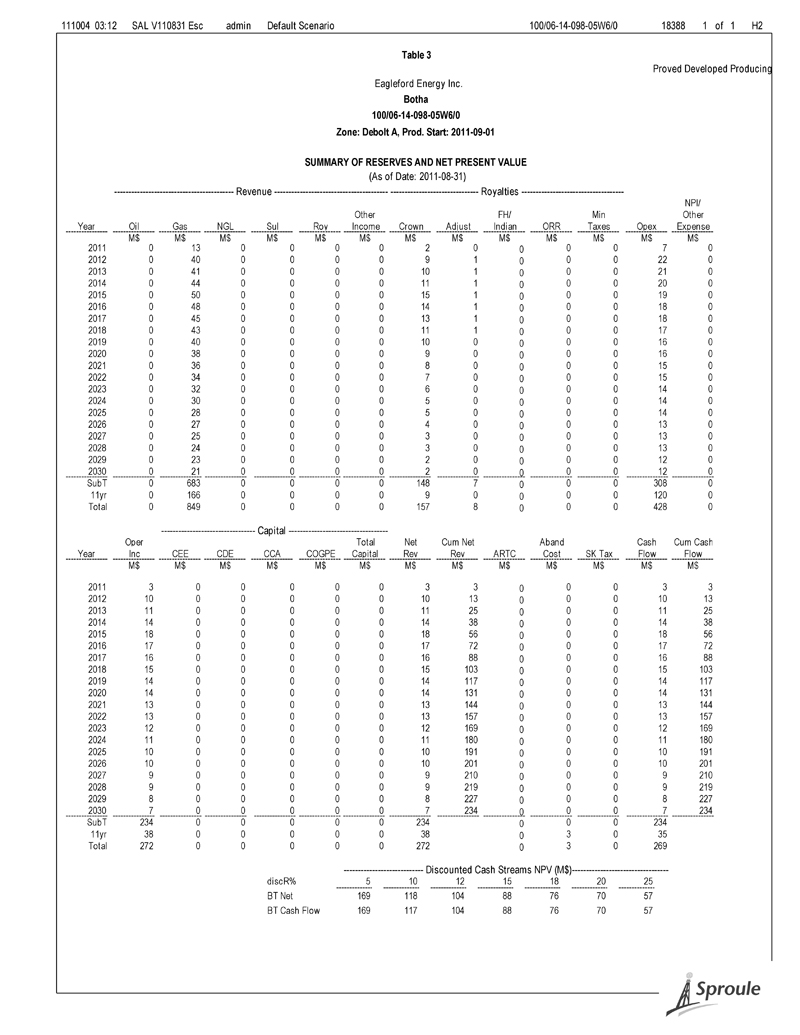

National Instrument 51-101 – Page 1 National Instrument 51-101 This report was prepared for the purpose of evaluating the Company’s P&NG reserves according to the Canadian Oil and Gas Evaluation Handbook (COGEH) reserve definitions and standards, which are consistent with National Instrument 51-101 (NI 51-101). In accordance with these standards, and by reference in NI 51-101, certain tables are presented for the forecast prices and costs case, which summarize the reserves and net present values, as of August 31, 2011. Form 51-101F2, which follows, presents a Report on Reserves Data by Independent Qualified Reserves Evaluator or Auditor. Forecast Prices and Costs Table 1 presents a summary of the various reserves categories. Table 2 presents a summary of net present values of future net revenue, before taxes. Table 3 presents the total future net revenue (undiscounted) for the total proved and total proved plus probable reserves categories. Table 4 presents the net present value of future net revenue by production group for the total proved and total proved plus probable reserves categories. Table 5 presents a summary of pricing and inflation rate assumptions. Reconciliation Table 6 presents the Reconciliation of the Company’s Gross Reserves (Before Royalty) by Principal Product Type, using forecast prices and costs. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Form 51-101F2 Report on Reserves Data by Independent Qualified Reserves Evaluator or Auditor Report on Reserves Data To the Board of Directors of Eagleford Energy Inc. (the “Company”): 1. We have evaluated the Company’s Reserves Data as at August 31, 2011. The reserves data are estimates of proved reserves and probable reserves and related future net revenue as at August 31, 2011, estimated using forecast prices and costs. 2. The Reserves Data are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Reserves Data based on our evaluation. We carried out our evaluation in accordance with standards set out in the Canadian Oil and Gas Evaluation Handbook (the “COGE Handbook”), prepared jointly by the Society of Petroleum Evaluation Engineers (Calgary Chapter) and the Canadian Institute of Mining, Metallurgy & Petroleum (Petroleum Society). 3. Those standards require that we plan and perform an evaluation to obtain reasonable assurance as to whether the reserves data are free of material misstatement. An evaluation also includes assessing whether the reserves data are in accordance with principles and definitions presented in the COGE Handbook. 0826.00000.RNJ.dlb P:\Eagleford Energy 18388\Report\Summary.doc

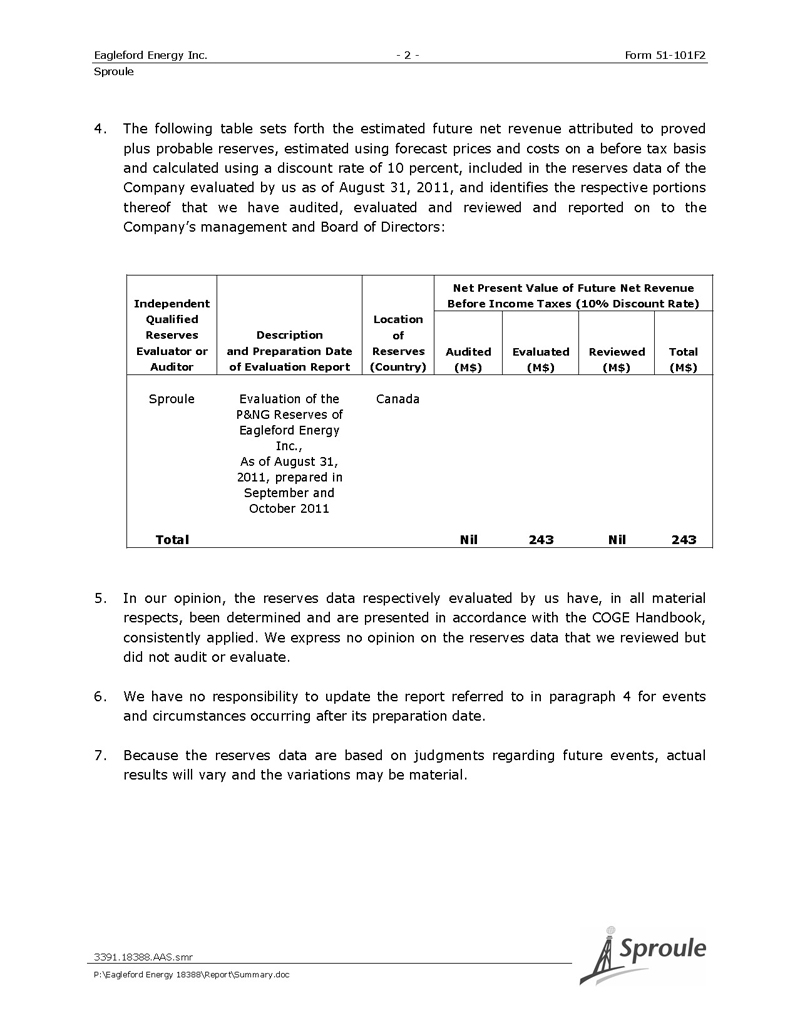

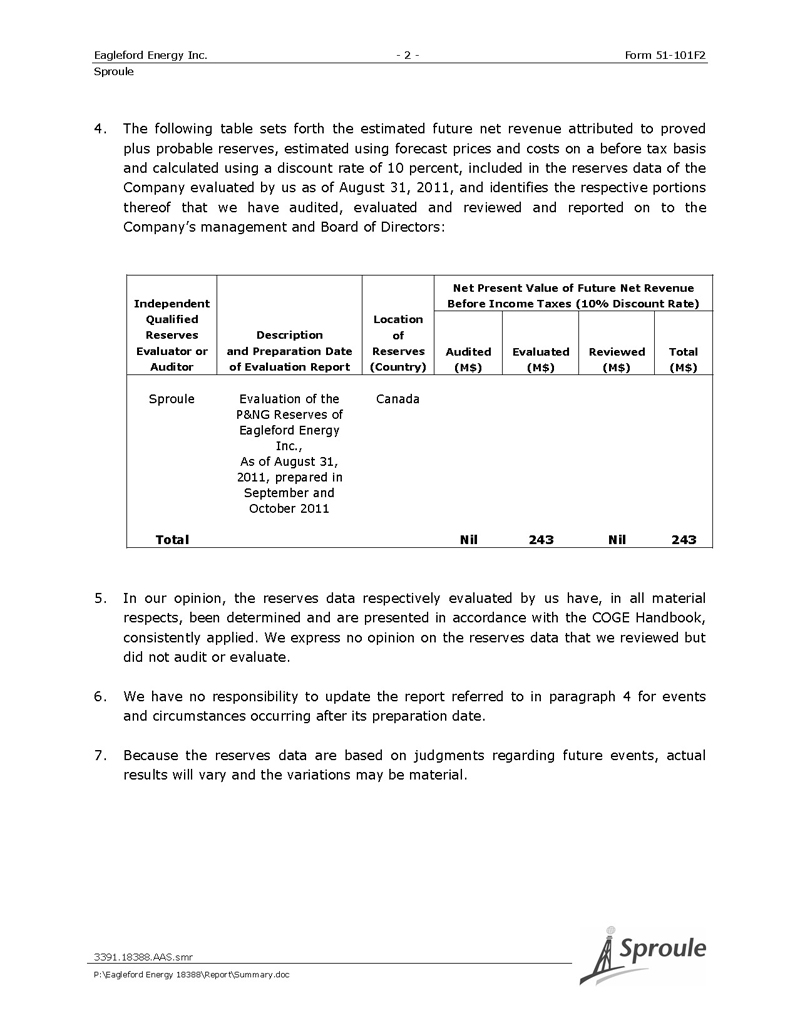

Eagleford Energy Inc. - 2 - Form 51-101F2 Sproule 4. The following table sets forth the estimated future net revenue attributed to proved plus probable reserves, estimated using forecast prices and costs on a before tax basis and calculated using a discount rate of 10 percent, included in the reserves data of the Company evaluated by us as of August 31, 2011, and identifies the respective portions thereof that we have audited, evaluated and reviewed and reported on to the Company’s management and Board of Directors: Net Present Value of Future Net Revenue Independent Before Income Taxes (10% Discount Rate) Qualified Location Reserves Description of Evaluator or and Preparation Date Reserves Audited Evaluated Reviewed Total Auditor of Evaluation Report (Country) (M$) (M$) (M$) (M$) Sproule Evaluation of the Canada P&NG Reserves of Eagleford Energy Inc., As of August 31, 2011, prepared in September and October 2011 Total Nil 243 Nil 243 5. In our opinion, the reserves data respectively evaluated by us have, in all material respects, been determined and are presented in accordance with the COGE Handbook, consistently applied. We express no opinion on the reserves data that we reviewed but did not audit or evaluate. 6. We have no responsibility to update the report referred to in paragraph 4 for events and circumstances occurring after its preparation date. 7. Because the reserves data are based on judgments regarding future events, actual results will vary and the variations may be material. 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

Eagleford Energy Inc. - 3 - Form 51-101F2 Sproule Executed as to our report referred to above: Sproule Associates Limited Calgary, Alberta October 7, 2011 Original Signed by Attila A. Szabo, P.Eng. ____________________________ Attila A. Szabo, P.Eng., Project Leader, Senior Petroleum Engineer and Partner Original Signed by Harry J. Helwerda, P.Eng., FEC _____________________________ Harry J. Helwerda, P.Eng., FEC Executive Vice-President and Director 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

2011-10-04 15:21:15 - 18388 National Instrument 51-101 Table 1 NI 51-101 Summary of Oil and Gas Reserves as of August 31, 2011 Forecast Prices and Costs Reserves Natural Gas (non-associated & Light and Medium Oil Heavy Oil associated) Natural Gas Liquids Reserve Category Gross Net Gross Net Gross Net Gross Net (Mbbl) (Mbbl) (Mbbl) (Mbbl) (MMcf) (MMcf) (Mbbl) (Mbbl) Proved Developed Producing 0.0 0.0 0.0 0.0 203 161 0.0 0.0 Developed Non- 0.0 0.0 0.0 0.0 0 0 0.0 0.0 Producing Undeveloped 0.0 0.0 0.0 0.0 0 0 0.0 0.0 Total Proved 0.0 0.0 0.0 0.0 203 161 0.0 0.0 Probable 0.0 0.0 0.0 0.0 66 49 0.0 0.0 Total Proved Plus 0.0 0.0 0.0 0.0 269 211 0.0 0.0 Probable Reference: Item 2.2(1) of Form 51-101F1

National Instrument 51-101 Table 2 NI 51-101 Summary of Net Present Values of Future Net Revenue As of August 31, 2011 Forecast Prices and Costs Net Present Values of Future Net Revenue Unit Value Before Income Taxes Before Income Tax Discounted at (%/Year) Discounted at 10%/Year 0 5 10 15 20 Reserves Category (M$) (M$) (M$) (M$) (M$) $/BOE Proved Developed Producing 444 288 205 155 124 7.60 Developed Non-Producing 0 0 0 0 0 0.00 Undeveloped 0 0 0 0 0 0.00 Total Proved 444 288 205 155 124 7.60 Probable 182 77 39 23 15 4.74 Total Proved Plus Probable 626 365 243 178 139 6.93 Reference Item 2.2(2) of Form 51-101F1 Notes: NPV of FNR include all resource income: Sa le of oil, gas, by-product reserves Processing third party reserves Othe r income Unit Values are based on net reserve volumes 3391.18388 ..AAS.smr P:\Eagleford Energy 18388\Report\Table 2 NI landscape .doc

National Instrument 51-101 Table 3 NI 51-101 Total Future Net Revenue (Undiscounted) As of August 31, 2011 Forecast Prices and Costs Future Net Well Revenue Operating Development Abandonment Before Costs Costs Costs Income Reserves Category Revenue Royalties (M$) (M$) (M$) Taxes (M$) (M$) (M$) Proved 1,400 228 722 0 5 444 Proved Plus Probable 2,001 349 1,020 0 6 626 Reference Item 2.2(3)(b) of Form 51-101F1 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc

2011-10-04 15:21:15 - 18388 National Instrument 51-101 Table 4 NI 51-101 Net Present Value of Future Net Revenue by Production Group as of August 31, 2011 Forecast Prices and Costs Future Net Unit Revenue Value Reserves Production Group Before Before Category Income Income Taxes Taxes (Discounted (Discounted at 10%/Year) at 10%/Year) (M$) ($/boe) Proved Light and Medium Crude Oil (including solution gas and associated by-products) 0 0 Heavy Oil (including solution gas and associated by-products) 0 0 Natural Gas (including associated by-products)* 205 7.60 Proved Plus Probable Light and Medium Crude Oil (including solution gas and associated by-products) 0 0 Heavy Oil (including solution gas and associated by-products) 0 0 Natural Gas (including associated by-products)* 243 6.93 Reference Item 2.1(3)(c) of Form 51-101F1 * Includes corporate Capital GCA, if applicable Unit Values are based on net reserve volumes

National Instrument 51-101 Table 5 NI 51-101 Summary of Pricing and Inflation Rate Assumptions as of August 31, 2011 Forecast Prices and Costs Edmonton Cromer Pentanes WTI Par Medium Natural Gas1 Plus Butanes Cushing Price 29.3° AECO Gas FOB F.O.B. Inflation Exchange Year Oklahoma 40° API API Prices Field Gate Field Gate Rate2 Rate3 ($US/bbl) ($Cdn/bbl) ($Cdn/bbl) ($Cdn/MMBtu) ($Cdn/bbl) ($Cdn/bbl) (%/Yr) ($US/$Cdn) Historical 2007 72.27 77.06 65.36 6.65 77.33 63.71 2.0 0.935 2008 99.59 102.85 93.05 8.15 104.70 75.09 1.0 0.943 2009 61.63 66.20 62.77 4.19 68.13 44.13 2.0 0.880 2010 79.43 77.80 73.67 4.16 84.21 57.04 1.0 0.971 Forecast 2011 90.28 87.42 84.42 3.55 93.46 78.92 2.0 1.012 2012 93.23 90.32 87.32 3.94 96.57 81.54 2.0 1.012 2013 95.58 92.62 89.62 4.41 99.03 83.62 2.0 1.012 2014 95.97 92.99 89.99 5.21 99.42 83.96 2.0 1.012 2015 97.42 94.41 91.41 6.43 100.93 85.23 2.0 1.012 2016 99.37 96.32 93.32 6.57 102.97 86.95 2.0 1.012 2017 101.35 98.26 95.26 6.71 105.05 88.71 2.0 1.012 2018 103.38 100.25 97.25 6.86 107.17 90.50 2.0 1.012 2019 105.45 102.27 99.27 7.00 109.34 92.33 2.0 1.012 2020 107.56 104.33 101.33 7.15 111.55 94.19 2.0 1.012 2021 109.71 106.44 103.44 7.31 113.80 96.10 2.0 1.012 Thereafter Escalation Rate of 2% (1) This summary table identifies benchmark reference pricing schedules that might apply to a reporting issuer. (2) Inflation rates for forecasting prices and costs. (3) Exchange rates used to generate the benchmark reference prices in this table. Notes: Product sale prices will reflect these reference prices with further adjustments for quality and transportation to point of sale. Reference Item 3.2 of Form 51-101F1 3391.18388.AAS.smr P:\Eagleford Energy 18388\Report\Summary.doc