This Annual Report was first distributed to shareholders on or about October 30, 2016.

August 31, 2016

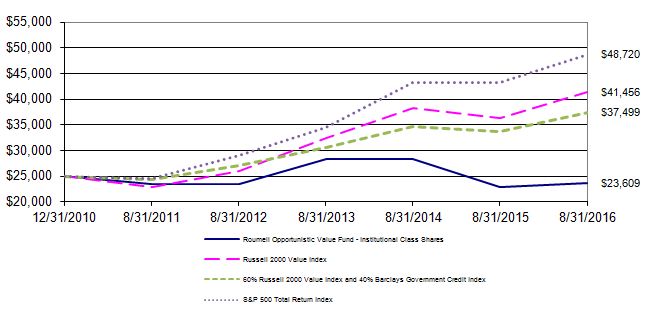

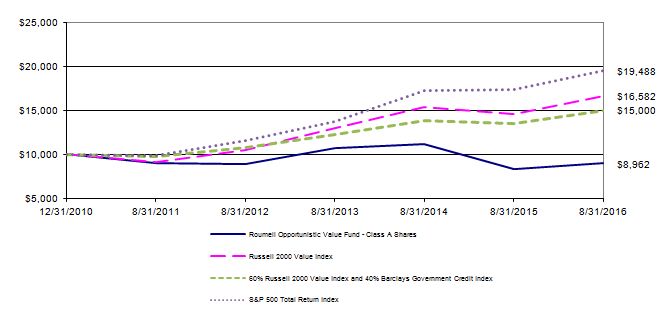

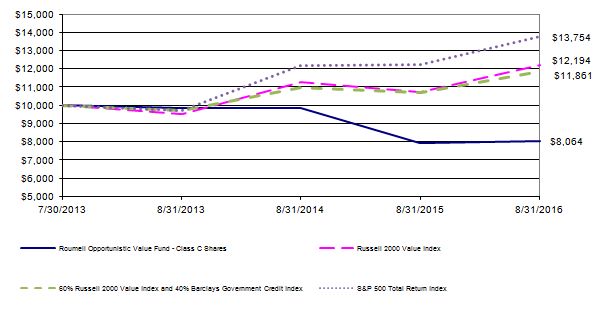

For the fiscal year ended August 31, 2016, the return on the Institutional Class Shares was 2.81%. The return on the Class A Shares was 2.54% and the return on the Class C Shares was 1.78%.1 This compares to 13.80% for the Russell 2000 Value Index, 11.31% for the 60% Russell 2000 Value Index/40% Barclays Government Credit Index, and 12.55% for the S&P 500 over the same period. These returns were attained with an allocation of about 30% in cash, 61% in equities, and 9% in fixed income during the fiscal year.

Please see the table below for the Fund's historical performance information through the calendar quarter ended September 30, 2016.

Average Annual Total Returns (Unaudited) | | | Gross | Net |

Period Ended September 30, 2016 | Past 1 Year | Since Inception2 | Expense Ratio3 | Expense Ratio4 |

| | | | | |

Roumell Opportunistic Value Fund –Institutional Class Shares | 9.64% | -0.90% | 1.55% | 1.23% |

Roumell Opportunistic Value Fund –Class A Shares | 9.42% | -1.11% | 1.80% | 1.48% |

With 4.50% maximum sales load | 4.50% | -1.90% | N/A | N/A |

Roumell Opportunistic Value Fund –Class C Shares | 8.55% | -6.44% | 2.55% | 2.23% |

60% Russell 2000 Value Index, and 40% Barclays Capital U.S. Government Credit Index | 14.14% | 7.39% | N/A | N/A |

| Russell 2000 Value Index | 18.81% | 9.34% | N/A | N/A |

| S&P 500 Total Return Index | 15.43% | 12.30% | N/A | N/A |

The quoted performance data represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance data regarding the Fund, including performance data current to the Fund's most recent month-end, please visit ncfunds.com or call the Fund at (800)773-3863. Fee waivers and expenses reimbursements have positively impacted Fund performance.

1A maximum sales charge imposed on purchases of 4.50% is charged to the Class A shares. A maximum deferred sales charge of 1.00% is applied to the Class C shares. For the fiscal year ended August 31, 2016, the one year return with sales load on the Class A shares was -1.46 %. The one year return with the deferred sales charge on the Class C shares was 0.78%.

2The Fund's inception date is December 31, 2010.

3Gross expense ratio includes acquired fund fees and expenses and other expenses.

4The Advisor has entered into an Operating Plan with the Fund's administrator through January 1, 2017, under which it has agreed to (i) to pay the administrator a fee based on the daily average net assets of the Fund when net assets are below $77 million; (ii) if these payments are less than a designated minimum, then the Advisor pays a fee that makes up the difference; and (iii) to assume expenses of the Fund outlined in the Operating Plan that are not covered by the fee paid under Fund Accounting and Administration Agreement. These measures are intended to limit the Fund's operating expenses to 1.23% of the average daily net assets, exclusive of brokerage fees and commissions, portfolio transaction fees, registration fees, taxes, borrowing costs (such as interest or dividend expenses on securities sold short), acquired fund fees and expenses, extraordinary expenses, and distribution and/or service (12b-1) fees. The Fund's net expense ratio will be higher than 1.23% to the extent the Fund incurs expenses excluded from this arrangement. The Fund also charges a 1.00% redemption fee on the Institutional Class shares, Class A shares, and Class C shares within 60 days of their issuance. The Operating Plan can only be terminated prior to the conclusion of the current term with the approval of the Fund's Board of Trustees. More recent expense ratios are found in the Financial Highlights.

Forecasting and Deep Value Investing

In the recently published book, Superforecasting, The Art and Science of Prediction, authors Philip E. Tetlock and Dan Gardner report on the rich details of their Good Judgement Project (GJP). The GJP was part of a larger longitudinal study involving thousands of individuals over several years to better understand forecasting with the ultimate goal of increasing the U.S. intelligence community's forecasting accuracy. The book's authors are experts at analyzing forecasting abilities and offer their views on whether anyone can forecast meaningfully above average (yes, but it's a small group) and describe the attributes that they believe help explain these superforecasters' abilities. Tetlock and Gardner believe that the habits of superforecasters can be codified and taught and end their book with a Ten Commandments of superforecasting for their readers.

RAM has always been forecasting-averse, and for good reason – it's very difficult and the odds of success are low. In Tetlock and Gartner's view, about 2% of their participants (a group comprised of engineers, lawyers, artists, scientists, Wall Streeters and Main Streeters, professors and students), qualified as superforecasters. These were well-read, smart people who stay on top of world affairs and know how to research questions. This rather sobering notion is precisely why RAM has long de-emphasized highly liquid markets/securities, growth investments highly dependent on predicting future earnings, forecasting future commodity prices or the direction of interest rates.

To be clear, all investments at some level rely on certain forecasts. RAM's goal has always been to divide investment narratives into essentially two buckets – what is known today and what may materialize tomorrow. The more an investment thesis rests on the former, "what is," the more we like it. In our last semi-annual letter we discussed buying double-discounted closed-end bond funds possessing a discount to NAV and an NAV itself that is reflective of a portfolio of bonds trading at a deep discount to par value wherein we effectively were able to purchase a diversified portfolio of high yield bonds at seventy cents of par value. These investments are classic "what is" investments. The investment relies far more on a discount to value today as opposed to possible value creation tomorrow that is heavily dependent on forecasting.

Nonetheless, even our double discounted closed-end bond fund investments have some degree of forecasting built into the underlying investment thesis. For instance, we modeled portfolio default rates of 5% to 20% (with zero recovery values), which means a tsunami of defaults exceeding our high-end model would be problematic; a low probability, but something north of zero. Moreover, we predict the portfolio managers will not trade the portfolio in a way that eliminates the value of the double-discount, i.e., terrible bond trading that renders moot an analysis of the existing portfolio. Thus, while all investments do involve forecasting, our approach has been to minimize the requirement to forecast the future as much as possible.

The Intelligence Advanced Research Projects Activity (IARPA) is an agency within the Intelligence Community (IC) that reports to the director of National Intelligence. Its job is to increase the accuracy of American intelligence estimates. Not surprisingly, no one really knows how good the overall intelligence forecasting is because it's never been measured, likely the result of analysts not wanting the light shined on their significant, but often not useful, efforts. The IC was humiliated by its conviction that Iraq possessed WMD, adding to other big "misses" such as the surprise collapse of the Soviet Union. With a desire to better understand the business of predicting the future, IARPA created a forecasting tournament comprised of five teams led by top researchers to measure forecasting acumen among intelligence professionals and educated, informed, common citizens.

The GJP was one team comprised of 2,800 individuals from varying backgrounds who were selected by the authors. Leveraging their knowledge and prior research on the subject of forecasting, the authors put in place a structure for the GJP team. From September 2011 to June 2015, teams were required to submit daily forecasts for nearly 500 questions about world affairs. Participants were allowed to regularly update and change their forecasts; each change becoming a new forecast. Questions like the following were posited: Will Greece leave the Eurozone?; Will Israel attack Iranian nuclear facilities by September?; and, Will Saudi Arabia cut their oil production output by the end of this year? The study rewarded confidence/conviction levels such that an individual assigning an 80% probability to a potential event occurring received a higher score than someone assigning a 50% probability to the same event if it, in fact, occurred.

The GJP group beat the official control group (comprised of an IC team operating under the same constraints) by 60% after year 1 and by 78% by the end of year 2. The GJP team also beat university-affiliated teams, including the University of Michigan and MIT, from 30% to 70%, and outperformed professional intelligence analysts with access to classified information. The study's basic conclusion: generating above average forecasting value is unlikely, but possible. To wit, roughly 2% of the individuals in the study showed themselves to be superforecasters. What were some of the traits and habits shared among this group of superforecasters?

One of the big takeaways from the authors' history of studying forecasting is comparing one group they describe as hedgehogs to another who they describe as foxes. Superforecasting, their research shows, is highly correlated with how one thinks, not what one thinks. Hedgehogs tend to think around "big ideas" and present as highly confident people; to their forecasting detriment. Referring to this group, the authors state, "They sought to squeeze complex problems into the preferred cause-effect templates and treated what did not fit as irrelevant distractions…they were unusually confident and likelier to declare things 'impossible' or 'certain.' Committed to their conclusions, they were reluctant to change their minds even when their predictions clearly failed. They would tell us, 'Just wait.'"

The other group, foxes, was comprised of much more pragmatic thinkers, who were often humble in their assessments. Referring to this group, the authors noted, "These experts gathered as much information from as many sources as they could. They talked about possibilities and probabilities, not certainties. And while no one likes to say 'I was wrong,' these experts more readily admitted it and changed their minds."

While reading Superforecasters one is reminded of the difficulty of forecasting, particularly the macro-economic variety, and why RAM has tried to stay clear of being overly dependent on such forecasting as much as possible. We are in the business of forecasting at some level, but the goal has always been to keep it to a minimum while pursuing existing embedded value. That means not owning investments wholly dependent on rising/falling commodity prices, interest rates predictions, estimating GDP growth and the like.

On an individual security basis, it means minimizing our dependence on growth projections and preferring to emphasize "what is", while hopefully owning optionality without paying for it. It's why we owned a gold streaming company (on two separate occasions) when it provided a 12% plus free cash flow yield, but sold it when that yield contracted toward 6%, materially increasing the investment's dependence on forecasting gold prices, which was something we did not feel competent to pursue. Now, with the price of gold steadily rising, this security has been upgraded by sell-side analysts – after a 100% rise from its low - based on their sudden conviction that gold prices are headed higher, evidently based on nothing other than that gold prices are headed higher. Joining in with the average opinion of the average opinion is not what we do.

To sum, the authors offer up the habits of superforecasters which they believe can materially increase one's forecasting accuracy. Here are a few examples among the authors' Ten Commandments of the superforecasters:

| · | Triage. Focus on questions where your hard work is likely to pay off. Don't waste time either on easy "clock-like" questions (where simple rules of thumb can get you close to the right answer) or on impenetrable "cloud-like" questions (where even fancy statistical models can't beat the dart-throwing chimp). Concentrate on questions in the Goldilocks zone of difficulty, where effort pays off the most. |

| · | Strike the right balance between under- and over-reacting to evidence. Belief updating is to forecasting as brushing and flossing are to good dental hygiene. It can be boring, occasionally uncomfortable, but it pays off in the long term. |

| · | Strike the right balance between under- and over-confidence, between prudence and decisiveness. Superforecasters understand the risks both of rushing to judgment and of dawdling too long near "maybe." They routinely manage the trade-off between the need to take decisive stands and the need to qualify their stands. |

| · | Bring out the best in others and let others bring out the best in you. Master the fine arts of team management, especially perspective taking (understanding the arguments of the other side so well that you can reproduce them to the other's satisfaction), precision questioning (helping others to clarify their arguments so they are not misunderstood), and constructive confrontation (learning to disagree without being disagreeable). |

Recent Updates of Top Five Equity Holdings

Rosetta Stone, RST. RST continues to execute on its plan to focus on three core business lines: enterprise and education (E&E) language, literacy (Lexia Learning) and serious consumer language learners. Led by Chairman and CEO, John Hass, and a strong board, the company is, in our view, showing clear signs of a successful turnaround. We believe that the company will continue to materially improve its operations and will attract financial and strategic buyers interested in purchasing the company in whole or in parts.

RST reported a drop of 11% in YOY sales driven by its twin decisions to price its consumer offering for the serious language learner and to exit certain E&E language markets outside of North America and Northern Europe. Lexia Learning, the company's no-longer "hidden gem", saw revenues climb over 33% YOY and continues to rapidly grow while retaining over 90% of its subscribers on an annual basis. All three business lines saw operating expenses decline. Overall, general and administrative expenses declined 15% while sales and marketing expenses were down 6%, contributing to the Company's sixth consecutive quarter of year-over-year operating expense reductions.

RST reported, for the second quarter in a row, 20% plus YOY growth in K-12 Language revenue. As noted in previous updates, the company will introduce its new E&E language product, called Catalyst, which is embedded with sophisticated placement and assessment tools, into the marketplace in the fourth quarter of this year. In September, Catalyst was reviewed by PCMagazine and received an Editor Rating of excellent. The editor called Catalyst "a new and smarter tool for enterprise language learning."

The company increased its 2016 guidance on multiple fronts: revenues were estimated to be $190 million up from earlier guidance of $182 million, year-end cash balance is now estimated to be $35 million up from $30 million and adjusted EBITDA is now expected to be a negative $10 million from earlier guidance of negative $27 million. The company reaffirmed its going-concern guidance to generate 10% free-cash flow on revenue exiting 2017. This is a notable and impressive goal for a company of this size providing a strategic acquirer the ability to further increase cash flow given the high fixed-costs of running a small public-traded business.

Finally, the company's new iOS app won a Macworld bake-off of competing language apps. Macworld's Seamus Bellamy found that Rosetta Stone's app topped Duolingo and Babbel, noting it has a "feature set the other two can't match."

As of the fiscal year ended August 31, 2016, the Fund held 9.28% in Rosetta Stone, RST.

Paratek Pharmaceuticals, PRTK. PRTK continues to execute on its plan to bring its main drug – omadacycline – to market as a broad-spectrum, multiple-indication antibiotic to a world desperately in need of new antibiotics. Nonetheless, the company's shares seem to suffer a similar fate to Rodney Dangerfield – no respect. We remain confident in omadacycline, the company's management team, and the secular trend for new and novel antibiotic treatments. It was a busy and eventful second quarter for PRTK:

| · | Reported positive Phase 3 study results with omadacycline in acute bacterial skin and skin structure infections |

| · | Accelerated timing to report top-line data of the omadacycline Phase 1b urinary tract infection study to Q4 2016 |

| · | Raised $59.3 million through underwritten equity offering |

| · | Dosing of first patient in oral-only Phase 3 study evaluating omadacycline for treatment of ABSSSI (skin) expected in August 2016 |

"Our clinical development program for omadacycline continues to progress well. We have successfully completed our Phase 3 registration study in Acute Bacterial Skin and Skin Structure infections (ABSSSI), and our Phase 3 study in community acquired bacterial pneumonia (CABP) continues to progress according to plan. With our progress to date, we remain on track to file a new drug application for omadacycline in the United States in the first half of 2018," said Michael Bigham, Chairman and Chief Executive Officer, Paratek.

To be clear, the company's recent equity raise did materially dilute existing shareholders. However, it did provide offsetting value, in our opinion. The company's leading shareholder, Omega, purchased over 10% of the newly issued shares. The FDA's special protocol assessment (SPA) with the company required only one Phase 3 study for each of its two leading indications of skin and pneumonia (typically two Phase 3 trials are required). The caveat was that each trial had to be successful in order to win approval for either indication. Thus, it was possible that the company's pneumonia (CABP) trial could fail when it read out in mid-2017 undermining the recent success of its Phase 3 skin trial.

The company decided to raise the capital to pursue a second Phase 3 skin trial (oral-only versus the IV-to-oral study just completed) in order to secure one indication at minimum in the event that its pneumonia trial fails. Essentially, a certain amount of upside was exchanged for a lower amount of downside as the probability of success for its oral-only skin trial is quite high (90% plus) given the company's significant bioequivalency data (previously funded by Novartis), i.e., its oral and IV formulations result in the same level of penetration. Note, in the past two years two skin-only antibiotics (Trius and Durata) were purchased by big-pharma at about $700 million, roughly 2x PRTK's current market capitalization.

We remain impressed with PRTK's team, particularly in light of the results of its successful Phase 3 IV-to-oral skin trial. Omadacycline showed exceptionally high levels of tolerability, just as Evan Loh, M.D., the company's President and Chief Medical Officer, long predicted. With Phase 3 results for skin and pneumonia expected to be reported in mid-2017 (pneumonia trial data was moved up to mid-year from earlier estimates for 2H 2017), the company's shares may continue to trade near current levels.

As of the fiscal year ended August 31, 2016, the Fund held 5.50% in Paratek Pharmaceuticals, PRTK.

Apple, AAPL. In the quarter, Apple posted quarterly revenue of $42.4 billion and quarterly net income of $7.8 billion, with gross margins of 38%. Its Services business grew 19% year-over-year and App Store revenue was the highest ever. Apple Music also continues to grow, which is further evidence of its strong eco-system. In the quarter, AAPL returned over $13 billion to investors through share repurchases and dividends. More recently, initial quantities of iPhone 7/7Plus sold out globally and several carriers indicated strong pre-orders for the latest iPhones. With a rock-solid balance sheet, we believe the company's shares offer compelling value as it trades at less than 10x P/E ex-tax effected net cash.

As of the fiscal year ended August 31, 2016, the Fund held 5.41% in Apple, AAPL.

Covisint, COVS. COVS reported revenue of $17.4 million in the most recent quarter, down 6% YOY. Subscription revenue declined to $14.6 million, down 7% YOY. Despite declining revenue, and reporting a GAAP loss, the company continued to manage its expenses. Net cash grew from $40 million as of March 31st to $42 million on June 30th (roughly 50% of its current market capitalization).

We have been vocal in our discussions with the company, and in our SEC filings, that we believe shareholders would be best served by selling the company to a larger industry player better positioned to take advantage of what remains a strong technology platform, according to key industry contacts and customers. One key industry contact informs us that COVS' IoT platform is the best among the platforms it has reviewed and its access management software remains among the strongest in the marketplace. Nonetheless, lacking the high name recognition of several competitors, and a limited marketing budget, is clearly making it difficult to grow subscription revenue.

We believe COVS remains a very cheap stock. Moreover, we believe the company will be acquired, sooner rather than later, particularly if it is unable to turnaround its subscription revenue trends. Although the company initially resisted efforts by leading shareholders to effect change, at the end of August it reached an agreement with Dialectic Capital to appoint three new independent directors to its Board. One of the Dialectic selected directors will become the Covisint Board's non-executive Chairman.

As of the fiscal year ended August 31, 2016, the Fund held 5.35% in Covisint, COVS.

Samsung Preferred, KR 5935. Building on recent quarterly strength, Samsung reported a solid second quarter. Company revenues increased 5% YOY while operating profit grew roughly 18% YOY. Recall, our investment thesis from the beginning on Samsung is that we were effectively paying nothing for its mobile business (viewed as having lost the war to Apple), after applying a modest multiple to its semiconductor business. It's fair to now say that the company's IT & Mobile Communications Division is worth far more than nothing as this division has seen a substantial increase in earnings resulting from strong demand for its flagship Galaxy S7 and S7 devices. In fact, one industry techie we spoke to believes the Galaxy has more functionality than Apple's current smart phone model.

Recently, Samsung had a global recall of its Galaxy Note 7 due to a potential fire hazard caused by a defective battery. The company is in the midst of a refund/replacement program. While this will certainly affect near-term earnings, we do not believe it will have a large impact long-term.

The company's component business continues to perform well and the company raised its guidance. To wit, "Demand for semiconductors for mobile and SSD increased and the company achieved solid growth with a competitive edge in differentiated products, including 20-nanometer DRAM, V-NAND and 14-nanometer mobile AP." Further, "In the third quarter, the company expects the component business to maintain its solid performance due to improved demand and supply conditions for memory chips and LCD panels and stable earnings for OLED."

Samsung's cash hoard continues to build despite its acquisitions. The company ended the quarter with net cash of roughly $65 billion, up nearly 30% since June 30, 2015 when it was $51 billion. We believe the company's shares are exceptionally cheap trading at under 6x earnings after backing out the company's net cash based on the valuation implied using the current share price of our preferred shares.

As of the fiscal year ended August 31, 2016, the Fund held 4.34% in Samsung Preferred, KR 5935.

We will continue to methodically and diligently search for out-of-favor, overlooked and misunderstood investments and stay true to being balance sheet focused, opportunistic, and thoughtful while gathering enough information to make well-informed investment decisions.

Best Regards,

Jim Roumell

Lead Portfolio Manager

Roumell Opportunistic Value Fund

(RCRAM1016002)