This report and the financial statements contained herein are submitted for the general information of the shareholders of the Arin Large Cap Theta Fund (the “Fund”). The Fund’s shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund’s shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund’s distributor is a bank.

The Arin Large Cap Theta Fund is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC 27609. There is no affiliation between the Arin Large Cap Theta Fund, including its principals, and Capital Investment Group, Inc.

Beginning on January 1, 2021, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at https://www.nottinghamco.com/fundpages/Arin, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

As of January 1, 2019, you may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 800-773-3863 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you have previously elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by clicking Enroll at https://www.nottinghamco.com/fundpages/Arin.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

1. Organization and Significant Accounting Policies

The Arin Large Cap Theta Fund (“Fund”) is a series of the Starboard Investment Trust (“Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is a separate diversified series of the Trust.

The Fund’s investment advisor, Arin Risk Advisors, LLC (the “Advisor”), seeks to achieve the Fund’s investment objective by investing in a portfolio of common stocks, exchange-traded funds (“ETFs”), options, and futures contracts. The Fund will be primarily invested in securities that are linked to the performance of broad-based market indexes, such as the S&P 500 Index, that represent the U.S. large-cap equity market (an "Index"). A primary means of gaining exposure to an Index is through the purchase and sale of options. The Advisor may also allocate a portion of the Fund’s assets to cash or cash equivalents, including United States Treasury Securities, money-market investments, and money-market mutual funds.

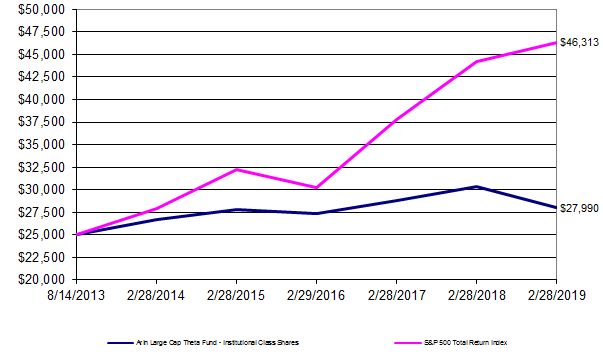

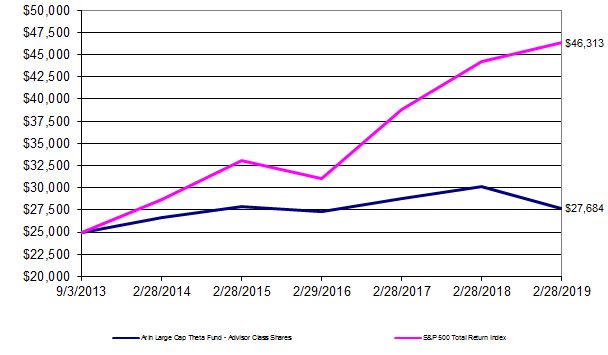

The Fund currently has an unlimited number of authorized shares, which are divided into two classes - Institutional Class Shares and Advisor Class Shares. Each class of shares has equal rights as to assets of the Fund, and the classes are identical except that the Advisor Class Shares are subject to distribution and service fees which are further discussed in Note 4. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. All classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class. The Date of Initial Public Investment for the Institutional Class Shares was August 14, 2013. The Date of Initial Public Investment for the Advisor Class Shares was September 3, 2013.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 “Financial Services – Investment Companies,” and Financial Accounting Standards Update (“ASU”) 2013-08.

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the portfolio security is principally traded closes early or if trading of the particular portfolio security is halted during the day and does not resume prior to the Fund’s net asset value calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures. Treasury Bills are valued at the evaluated bid price provided by the pricing service. The prices provided by the pricing service are generally determined with consideration given to institutional bid and last sale prices and take into account securities prices, yields, maturities, call features, ratings, institutional trading in similar groups of securities, and developments related to specific securities. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Option Valuation

Options are valued at the mean of the last quoted bid and ask prices as of 4:00 p.m. Eastern Time (the “Valuation Time”). Options will be valued on the basis of prices provided by pricing services when such prices are reasonably believed to reflect the market value of such options and may include the use of composite or National Best Bid/Offer (NBBO) pricing information provided by the pricing services. If there is an ask price but no bid price at the Valuation Time, the option shall be priced at the mean of zero and the ask price at the Valuation Time. An option should be valued using fair value pricing when (i) a reliable last quoted ask price at the Valuation Time is not readily available or (ii) the Fund’s investment advisor or Fund management does not believe the prices provided by the pricing services reflect the market value of such option.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: Unadjusted quoted prices in active markets for identical securities

Level 2: Other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: Significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs as of February 28, 2019 for the Fund’s investments measured at fair value:

| | | |

| Investments (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | |

| Common Stock* | $ | 1,693 | $ | 1,693 | $ | - | $ | - |

| Treasury Bills | | 106,264,747 | | - | | 106,264,747 | | - |

| Call Options Purchased | | 2,453 | | - | | 2,453 | | - |

| Put Options Purchased | | 1,506,522 | | - | | 1,506,522 | | - |

| Total Assets | $ | 107,775,415 | $ | 1,693 | $ | 107,773,722 | $ | - |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Call Options Written | $ | 1,309,957 | $ | - | $ | 1,309,957 | $ | - |

| Put Options Written | | 1,606,238 | | - | | 1,606,238 | | - |

| Total Liabilities | $ | 2,916,195 | $ | - | $ | 2,916,195 | $ | - |

| | | | | | | | | |

* Refer to the Schedule of Investments for a breakdown by sector.

(a) The Fund had no significant transfers into or out of Level 1, 2, or 3 during the fiscal year ended February 28, 2019. The Fund did not hold any Level 3 securities during the year. Please refer to the Schedule of Investments for industry classification.

Purchased Options

When the Fund purchases an option, an amount equal to the premium paid by the Fund is recorded as an investment and is subsequently adjusted to the current value of the option purchased. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If a call option is exercised, the cost of the security acquired is increased by the premium paid for the call. If a put option is exercised, a gain or loss is realized from the sale of the underlying security, and the proceeds from such sale are decreased by the premium originally paid. Purchased options are non-income producing securities.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

Option Writing

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from options written. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain or loss (depending on if the premium is less than the amount paid for the closing purchase transaction). If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as the writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. Written options are non-income producing securities.

Derivative Financial Instruments

The Fund may invest in derivative financial instruments (derivatives) in order to manage risk or gain exposure to various other investments or markets. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities.

Derivatives are marked to market daily based upon quotations from market makers or the Fund’s independent pricing services and the Fund’s net benefit or obligation under the contract, as measured by the fair market value of the contract, is included in net assets on the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

The derivative instruments outstanding as of February 28, 2019 are disclosed below and the amounts of realized and changes in unrealized gains and losses on derivative instruments during the period as disclosed in the Statement of Operations serve as indicators of the volume of derivative activity for the Fund.

The following table sets forth the effect of the derivative instruments on the Statement of Assets and Liabilities as of February 28, 2019:

| Derivative Type | Location | | Value |

| Options Purchased | Assets-Investments, at value | | $ 1,508,975 |

| Options Written | Liabilities-Options written, at value | | $(2,916,195) |

Investments in the Fund are subject to the following options risks:

Risks from Purchasing Options. If a call or put option purchased by the Fund is not sold when it has remaining value and if the market price of the underlying security, in the case of a call, remains less than or equal to the exercise price, or, in the case of a put, remains equal to or greater than the exercise price, the Fund will lose its entire investment in the option. Since many factors influence the value of an option, including the price of the underlying security, the exercise price, the time to expiration, the interest rate, and the dividend rate of the underlying security, the Advisor’s success in implementing the Fund’s strategy may depend on an ability to predict movements in the prices of individual securities, fluctuations in markets, and movements in interest rates. There is no assurance that a liquid market will exist when the Fund seeks to close out an option position. Where a position in a purchased option is used as a hedge against price movements in a related position, the price of the option may move more or less than the price of the related position.

Risks from Writing Options. Writing option contracts can result in losses that exceed the Fund’s initial investment and may lead to additional turnover and higher tax liability. The risk involved in writing a call option is that there could be an increase in the market value of the security. If this occurred, the option could be exercised and the underlying security would then be sold by the Fund at a lower price than its current market value or in the case of cash settled options, the Fund would be required to purchase the option at a price that is higher than the original sales price for such option. Similarly, while writing call options can reduce the risk of owning stocks, such a strategy limits the opportunity of the Fund to profit from an increase in the market value of stocks in exchange for upfront cash at the time of selling the call option. The risk involved in writing a put option is that there could be a decrease in the market value of the underlying security. If this occurred, the option could be exercised and the underlying security would then be sold to the Fund at a higher price than its current market value or in the case of cash settled options, the Fund would be required to purchase the option at a price that is higher than the original sales price for such option. There is no assurance that a liquid market will exist when the Fund seeks to close out an option position. Where a position in a written option is used as a hedge against price movements in a related position, the price of the option may move more or less than the price of the related position.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

Investments in the Fund may also be subject to counterparty risk on derivatives. This risk refers to the risk that an issuer or counterparty will fail to pay its obligations to the Fund when they are due. As a result, the Fund’s income might be reduced, the value of the Fund’s investment might fall, and/or the Fund could lose the entire amount of its investment. Changes in the financial condition of an issuer or counterparty, changes in specific economic, social, or political conditions that affect a particular type of security or other instrument or an issuer, and changes economic, social, or political conditions general can increase the risk of default by an issuer or counterparty, which can affect a security’s or other instrument’s credit quality or value and an issuer’s or counterparty’s ability to pay interest and principal when due.

Cash and Cash Equivalents

All highly liquid investments with an original maturity of three months or less are considered to be cash equivalents. The Fund may have cash and cash equivalents on deposit with commercial banks and professional brokerage houses which, at times, may exceed federally insured limits.

The following table sets forth the effect of the option contracts on the Statement of Operations for the fiscal year ended February 28, 2019:

| Derivative Type | Location | Gains (Losses) |

| Equity Contracts – purchased options | Net realized loss from investments | $(10,331,845) |

| Equity Contracts – written options | Net realized gain from options written | $ 3,005,690 |

| | | |

| Equity Contracts – purchased options | Change in unrealized appreciation on investments | $ (2,718,384) |

| Equity Contracts – written options | Change in unrealized appreciation on options written | $ (779,715) |

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion and amortization of discounts and premiums. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Distributions

The Fund may declare and distribute dividends from net investment income (if any) monthly or quarterly. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Exchange-Traded Funds

The Fund may invest in exchange-traded funds (“ETFs”). ETFs offer investors a proportionate share in a portfolio of stocks, bonds, commodities, or other securities. ETFs are traded on a stock exchange and can be bought and sold throughout the day. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

2. Transactions with Related Parties & Service Providers

Advisor

As full compensation for the investment advisory services provided to the Fund, the Advisor receives a monthly fee based on the Fund’s average daily net assets. The Advisor shall receive an investment advisory fee equal to an annualized rate of 0.40% of the average daily net assets of the Fund.

Administrator

a) Fund Accounting and Administration Agreement: The Nottingham Company provides the Fund with administrative, fund accounting, and compliance services. The Administrator receives compensation from the Fund at a maximum annual rate of 0.28% if the average daily net assets are under $250 million. The Administrator is responsible for the coordination and payment of vendor services and other Fund expenses from such compensation. Pursuant to this arrangement, the Administrator pays the following expenses: (i) compensation and expenses of any employees of the Trust and of any other persons rendering any services to the Fund; (ii) clerical and shareholder service staff salaries; (iii) office space and other office expenses; (iv) fees and expenses incurred by the Fund in connection with membership in investment company organizations; (v) fees and expenses of counsel to the Trustees who are not interested persons of the Fund and Trust; (vi) fees and expenses of counsel to the Fund and Trust engaged to assist with preparation of Fund and Trust documents and filings and provide other ordinary legal services; (vii) fees and expenses of independent public accountants to the Fund, including fees and expense for tax preparation; (viii) expenses of registering shares under federal and state securities laws; (ix) insurance expenses; (x) fees and expenses of the custodian, shareholder servicing, dividend disbursing and transfer agent, administrator, distributor, and accounting and pricing services agents of the Fund; (xi) compensation for a chief compliance officer for the Trust; (xii) expenses, including clerical expenses, of issue, sale, redemption, or repurchase of shares of the Fund; (xiii) the cost of preparing and distributing reports and notices to shareholders; (xiv) the cost of printing or preparing prospectuses and statements of additional information for delivery to the Fund’s current shareholders; (xv) the cost of printing or preparing documents, statements or reports to shareholders; and (xvi) other expenses not specifically assumed by the Fund or Advisor. The Administrator cannot recoup from the Fund any Fund expenses in excess of the administration fees payable under the Fund Accounting and Administration Agreement. The Fund incurred $317,492 in administration fees for the fiscal year ended February 28, 2019.

b) Operating Plan: The Advisor has entered into an Operating Plan with the Administrator, through June 30, 2019, under which it has agreed to make the following payments to the Administrator: (i) when the Fund’s assets are below $49 million, the Advisor pays the Administrator a fee based on the daily average net assets of the Fund; and (ii) when the consolidated fee collected by the Administrator is less than a designated minimum operating cost, then the Advisor pays the Administrator a fee that makes up the difference. The Advisor is also obligated to pay the following Fund expenses under the Operating Plan: (i) marketing, distribution, and servicing expenses related to the sale or promotion of Fund shares that the Fund is not authorized to pay pursuant to the Investment Company Act; (ii) expenses incurred in connection with the organization and initial registration of shares of the Fund; (iii) expenses incurred in connection with the dissolution and liquidation of the Fund; (iv) expenses related to shareholder meetings and proxy solicitations; (v) fees and expenses related to legal, auditing, and accounting services that are in amounts greater than the limits or outside of the scope of ordinary services; and (vi) hiring employees and retaining advisers and experts as contemplated by Rule 0-1(a)(7)(vii) of the Investment Company Act.

The Operating Plan may be terminated by either party at the conclusion of the then current term upon: (i) written notice of non-renewal to the other party not less than sixty days prior to the end of the term, or (ii) mutual written agreement of the parties. The Advisor cannot recoup from the Fund any amounts paid by the Advisor to the Fund’s administrator under the Operating Plan. If the Operating Plan is terminated when the Fund is at lower asset levels, the administrator would likely need to terminate the Fund Accounting and Administration Agreement in order to avoid incurring expenses without reimbursement from the Advisor. Unless other expense limitation arrangements were put in place, the Fund’s expenses would likely increase.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

In accordance with these terms, the Fund incurred $453,560 in advisory fees for the fiscal year ended February 28, 2019.

Compliance Services

Cipperman Compliance Services, LLC provides services as the Trust’s Chief Compliance Officer. Cipperman Compliance Services, LLC is entitled to receive customary fees from the Administrator for their services pursuant to the Compliance Services agreement with the Fund.

Transfer Agent

Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Administrator pursuant to the Administrator’s fee arrangements with the Fund.

Distributor

Capital Investment Group, Inc. (the “Distributor”) serves as the Fund’s principal underwriter and distributor. For its services, the Distributor is entitled to receive compensation from the Administrator pursuant to the Administrator’s fee arrangements with the Fund.

3. Trustees and Officers

The Board of Trustees is responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from the Trust. Trustees who are not “interested persons” of the Trust or the Advisor within the meaning of the 1940 Act (the “Independent Trustees”) receive compensation from the Administrator pursuant to the Administrator’s fee arrangements with the Fund.

Certain officers of the Trust may also be officers of the Administrator.

4. Distribution and Service Fees

The Trustees, including a majority of the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act and who have no direct or indirect financial interest in such plan or in any agreement related to such plan, adopted a distribution plan pursuant to Rule 12b-1 of the 1940 Act (the “Plan”) for the Advisor Class Shares. The 1940 Act regulates the manner in which a regulated investment company may assume expenses of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that the Fund may also incur expenses, which may not exceed 0.40% per annum of the Fund’s average daily net assets attributable to the Advisor Class Shares, for items such as advertising expenses, selling expenses, commissions, travel or other expenses reasonably intended to result in sales of shares of the Fund or support servicing of shareholder accounts. For the fiscal year ended February 28, 2019, the Advisor Class Shares incurred $55 in distribution and service fees.

5. Purchases and Sales of Investment Securities

For the fiscal year ended February 28, 2019, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales of Securities |

| $10,919 | $9,577 |

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

6. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which may differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. The general ledger is adjusted for permanent book/tax differences to reflect tax character but is not adjusted for temporary differences.

Management has reviewed the Fund’s tax positions to be taken on the federal income tax returns during the open tax years ended 2016 through 2019 and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties.

Distributions during the fiscal year ended were characterized for tax purposes as follows:

| |

| Distributions from |

For the Year Ended

| | Ordinary Income

| Long-Term Capital Gains |

| 02/28/2019 | | $ 1,168,578 | $ 950,904 |

| 02/28/2018 | | 1,400 | 181,550 |

At February 28, 2019, the tax-basis cost of investments and components of distributable earnings were as follows:

| Cost of Investments | $ | 104,867,903 |

| | | |

| Unrealized Appreciation | $ | - |

| Unrealized Depreciation | | (8,683) |

| Net Unrealized Depreciation | $ | (8,683) |

| | | |

| Undistributed Net Investment Income | | 1,033,070 |

| Capital Loss Carryforward | | (8,678,098) |

| Deferred Post-October Losses | | (2,143,771) |

| | | |

| Distributable Earnings | $ | (9,797,482) |

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to mark to market of section 1256 options contracts.

Capital Loss Carryforward

The Fund has a capital loss carryforward of $8,678,098, of which $3,454,978 is short-term in nature and $5,223,120 is long-term in nature and has no expiration.

Deferred Post-October Losses

In addition, realized losses reflected in the accompanying financial statements include net capital losses realized between November 1 and the Fund’s fiscal year-end that have not been recognized for tax purposes (Deferred Post-October Losses). The Fund has a Deferred Post-October Loss of $2,143,771.

7. Commitments and Contingencies

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

8. New Accounting Pronouncements

In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-08, Receivables—Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The amendments in the ASU shorten the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities held at a discount; which continue to be amortized to maturity. The ASU is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018.

In August 2018, the Securities and Exchange Commission adopted amendments to certain disclosure requirements under Regulation S-X to conform to US GAAP, including: (i) an amendment to require presentation of the total, rather than the components, of distributable earnings on the Statement of Assets and Liabilities; and (ii) an amendment to require presentation of the total, rather than the components, of distributions to shareholders, except for tax return of capital distributions, if any, on the Statement of Changes in Net Assets. The amendments also removed the requirement for parenthetical disclosure of undistributed net investment income on the Statement of Changes in Net Assets. This amendment facilitates compliance of the disclosure of information without significantly altering the information provided to investors. These amendments have been adapted with these financial statements. The changes have been applied to the Fund’s financial statements as of the fiscal year ended February 28, 2019.

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2018-13, Fair Value Measurement (Topic 820) – Disclosure Framework–Changes to the Disclosure Requirements for Fair Value Measurement. The amendments eliminate certain disclosure requirements for fair value measurements for all entities, requires public entities to disclose certain new information, and modifies some disclosure requirements. The new guidance is effective for all entities for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. An entity is permitted to early adopt either the entire standard or portions of the standard. The changes have been applied to the Fund’s financial statements as of the fiscal year ended February 28, 2019.

9. Borrowings

The Fund established a borrowing agreement with Interactive Brokers, LLC for investment purposes subject to the limitations of the 1940 Act for borrowings by registered investment companies.

Interest is based on the Federal Funds rate plus 3.90% on the first $100,000, the Federal Funds rate plus 3.40% on the next $900,000, the Federal Funds rate plus 2.90% on balances of $1,000,000-$3,000,000, and the Federal Funds rate plus 2.70% on balances of $3,000,000-$200,000,000. The average borrowing during the fiscal year was $835,714, and the average interest rate during the year was 3.48%.

Interest expense is charged directly to the Fund based upon actual amounts borrowed by the Fund. The Fund had no borrowings as of the fiscal year ended February 28, 2019. Total interest expense for the year was $170,645 as reflected in the Statement of Operations.

10. Subsequent Events

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements.

Distributions

Per share distributions during the subsequent period were as follows:

(Continued)

Arin Large Cap Theta Fund

Notes to Financial Statements

As of February 28, 2019

| | | |

Class | Record Date | Ex- Date and Pay Date | Ordinary Income |

| | | | |

| Institutional | 3/28/2019 | 3/29/2019 | $0.023842 |

| Advisor | 3/28/2019 | 3/29/2019 | $0.020573 |

| | | | |

Management has concluded there are no additional matters, other than those noted above, requiring recognition or disclosure.