UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212)576-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Marketfield Fund, a series of the Registrant.

| Item 1. | Reports to Stockholders. |

MainStay Marketfield Fund

Message from the President, Marketfield Asset Management LLC Year-End Commentary and Annual Report

December 31, 2012

This page intentionally left blank

Message from the President

In June 2012, MainStay announced the formation of a new subadvisory relationship with Marketfield Asset Management LLC; and on October 5, 2012, MainStay Marketfield Fund became part of the MainStay family of funds. We are pleased to welcome Marketfield shareholders to the MainStay Funds.

Marketfield’s success is attributable to a research-driven investment approach that utilizes independent thinking to assess global macroeconomic and market conditions. We are pleased to share the following year-end commentary from Michael Aronstein, President and Chief Investment Officer of Marketfield Asset Management LLC and the portfolio manager of MainStay Marketfield Fund.

The annual report for MainStay Marketfield Fund for the 12 months ended December 31, 2012, also follows. These materials contain specific information about the market events, investment decisions and securities that affected MainStay Marketfield Fund during 2012.

We thank you for investing with MainStay and look forward to continuing our partnership for many years to come.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Marketfield Asset Management LLC Year-End Commentary

As we enter year five of the bull market in U.S. equities, recognition is beginning to dawn while additional markets in the developed world join the trend. The process by which the domestic capital markets and the economy were saved from calamity in the fourth quarter of 2008 is finally being repeated in the European area and possibly even Japan. The latter has been burdened by false starts toward a more expansive monetary policy for twenty-two years. Perhaps they have finally learned that monetary quantity matters.

Our immediate views about macroeconomic and market conditions are not remarkably different from those expressed at the end of 2011. Several important trends have progressed farther, with a few new ones appearing to have arisen.

Among the incipient trends that we are involved with, the potential downturn in “safe haven” asset prices, including high-grade government bonds, is the most pivotal. It is connected with a secular decline in the relative fortunes of governments in general, and is likely to be a feature of the macroeconomic environment for the remainder of this decade.

Global credit expansion is a longstanding trend that has been in the process of reversing for more than a decade. With trends of this magnitude, the exhaustion phase is necessarily prolonged and inconclusive. The underlying behavioral correlates are so embedded that they take many years, if not decades to change.

In most of the developed world, the process of deleveraging has progressed through much of the private sector. Industrial companies and most commodity producers began the restructuring of their operations and balance sheets in response to the collapse of emerging market currencies and commodity prices during the final years of the twentieth century. For many U.S. and European industrial companies, the choice was to radically restructure their costs and balance sheets or fail.

The corporate restructuring that has taken place over the last ten or fifteen years has been evident in companies’ ability to withstand the pressures of 2008 and 2009 and emerge with unusually robust profitability and cash flow. Corporate balance sheets are as strong as they have been in several generations.

Households and the banking system that enabled their adventures in real estate speculation during the decade past have also gone through extensive balance sheet restructuring. Both are now on much sounder footing, and the main collateral form on the asset side of their balance sheets—residential real estate—is in recovery.

The element within developed market economies that has yet to restructure their affairs and overburdened balance sheets is government. By government we are referring to units of political authority across the spectrum, from Athens, Cairo and Paris to Chicago, Detroit, Albany, Sacramento and Washington.

The fiscal pressures on governments of all sorts are not accidental. They are part and parcel of the dynamics of long-term

credit cycles, whereby the underlying collateral forms are overwhelmed by the demands of debt service after years of increasing leverage. Every element of a broad upturn in the use of credit has its own particular collateral form. For businesses, it is their asset base and the profitability thereof. The favored commercial asset used as collateral varies from cycle to cycle, and has included commodity reserves, commercial real estate, forests, ships, communication networks and various forms of intellectual property.

The surge in household indebtedness during the first decade of this century was almost entirely collateralized by single-family housing. This marked radical departure from long-standing assumptions that based household solvency on a combination of income and savings. The leverage from the adaption of a consumption good (owner occupied housing) as a favored form of collateral was mirrored in the banking system and among the quasi-official mortgage agencies.

When the cycle of appreciation and capital gains halted and then reversed, all sectors involved in the leveraging process entered the emergency phase of balance sheet restructuring. In the ensuing five years, great, albeit painful progress has been made.

In every long cycle of credit excess and its eventual deflation, there are several distinct phases. Their general characteristics are universal. The particulars of each vary with the specific nature of the collateral form involved.

At the peak stage of credit expansions and the asset price inflations (aka bull markets) that are their normal correlates, the most visible indication of an impending reversal is the emergence of new and extensive sources of supply. This is true in every asset class and in every long cycle of inflating price.

Discerning the exact nature of the new supply is not always as simple as it sounds.

The analysis begins with identification and understanding of that aspect of the favored collateral form that has come to be thought of as invaluable, unique and beyond serious question. The analytic process almost always involves wading through a swamp of pedantry in academic and popular commentary that has arisen in order to justify what common sense recognizes as excess. A Google search of the phrase “Japanese business superiority 1989” yields 214,000,000 results. It is worth reading a few and noting the august institutions and commentators from which they emanated.

The appearance of new sources of supply is not, from an investment perspective, sufficient to declare the exhaustion of a trend. The process of supply rising up to meet the extraordinarily enthusiastic demand that is characteristic of late stage, credit enhanced price advances can take years.

In technical terms, one of the characteristics of a late stage bull market is a marked rise in transaction volume as the advance

Not part of the Annual Report

persists. Think of the sales rate of houses in 2004 and 2005. The growing transactional volume is a sign that supply is rising to meet more of the elevated demand.

To the extent that demand remains the prevalent force, prices continue to rise. The crucial phase, during which the first signs of a major trend reversal are visible, is characterized by continuing enthusiasm on the part of buyers, high turnover and the absence of any further price increase. In securities markets, the flood of new issuance continues far beyond the high point in price. In markets for non-exchange traded assets, supply from new and atypical sellers often persists well into the first stage of the ensuing long-term bear market as prices remain at levels too good for sellers to pass up, even after an initial decline.

As we have mentioned in several past commentaries, bull markets never end because buyers lose enthusiasm for the assets in question as the advance progresses. If anything, the enthusiasm increases as prices move higher and higher. The terminal phase is always and everywhere marked by the response of actual and potential sellers to the inducements of elevated prices.

Incentives to produce, sell and, in the case of tangible assets, conserve, substitute and restrain consumption eventually yield enough supply to overwhelm any given level of demand. A parallel market dynamic emerges, wherein every dollar rise in price is another dollar of value on the supply side that must be met by an equivalent increase in buyers’ purchasing power if the price trend is to continue higher. In other words, supply grows from more than the simple addition of units to the offer side. Increased prices have exactly the same effect. Unique items with strictly limited unit supply can also reach a point at which they overwhelm demand solely from the market price mechanism. Even the Mona Lisa, should the French government reach that level of desperation, would likely run out of bids before the auctioneer hit a trillion dollars.

Popular market manias that drive prices to unsustainable levels are always supported by conceptual and intellectual analogues. There is never a shortage of good, plausible arguments as to why the excessive behavior and its resultant price distortions are justified.

As we have asserted that the current macroeconomic landscape is and will be influenced by a continuing bear market in “government,” it is important to define the practical and theoretical aspects of that trend and how it might shape the investment environment.

In the simplest terms, governments are being involuntarily weaned from their dependence on credit as a means of sustaining privilege. As is the case when watching waning advances in capital markets, the weakest participants give way first. It is why, at meaningful tops in price, the breadth of advance narrows as more and more of the demand is funneled

to fewer and fewer high grade and seemingly impervious instruments.

At the peak of the technology stock mania in 2000, the low-quality names broke early in the year, while many of the established leaders (Cisco, Intel, IBM, Microsoft) remained at or near historic highs for another year or more.

In the present case, governments with impaired balance sheets presiding over regions with the weakest underlying fundamentals have fallen first. Greece, Detroit, Egypt and other leaders in the parade of management failure are harbingers of a more widespread problem.

Central to this general trend is a mistaken body of theory regarding the nature of wealth, its sources and the proper role of government in allowing its development.

One of the nicer parts of our approach to managing money consists in our not having to participate in academic debates or contrived argument sessions in financial media in order to get our points across. Markets will eventually prove or disprove any theoretical case that we make within the Fund.

Our investment approach begins with identifying what we believe to be invalid macroeconomic hypotheses. To the extent that these have been incorporated into investment decisions and asset prices, there will be a large scale and long-term opportunity to exploit the mispricing born of misconception. This, of course, assumes that we are right.

The improper adoption and application of macroeconomic data is the last area where we see important inefficiencies in capital markets. The efficient market hypothesis which, from our perspective merely states that the available data concerning elements affecting a specific set of prices will be reflected fairly accurately in those prices, fails to take into account circumstances wherein there is a lack of understanding about how certain exogenous data bear on markets. The market does have the facts, but participants are at a loss to reckon how they should be incorporated into pricing.

It is as though early twentieth century life insurance actuaries were convinced by the contemporary scientific thought that cigarette smoking was not a factor in health or life expectations. Their policy prices would have efficiently reflected prevailing thought, but would have been wildly inaccurate and poorly predictive of differentials in mortality.

The fact that markets are largely efficient does not mean that they are largely correct. Efficiency only implies rapid incorporation of the available data and the prevailing beliefs about what it implies. Insofar as the discussion applies to specific securities, the lines of causation between the data and prices are clear. There is not a lot of argument that a leveraged cyclical company with building receivables and diminishing current assets presents a greater credit risk than a cash-rich counterpart. The bonds of such a company will normally reflect

Not part of the Annual Report

the risk. It is highly unlikely that more assiduous study of the accounts will reveal an overlooked number. It is particularly so in the case of large, public companies. It is why the verdicts of ratings agencies are at best superfluous, and at worst, highly misleading and drastically off base.

This is the strong form of market efficiency, and goes a long way to explaining why managers relying entirely on security selection are having a harder and harder time exceeding the return of some arbitrary index as communications technology and data access become ever more widespread.

There has been a great deal of criticism from academic sources regarding the validity of market efficiency as a basic concept. This trend has accelerated since the panic of 2008 and the subsequent depression in housing activity and finance. The fact that markets seemed to miss the events and were, in retrospect, wildly mispriced before hand, is cited as an argument against markets.

We would argue that markets were perfectly efficient in incorporating the most widely accepted opinion regarding housing. The problem was that the opinion, academic, institutional and market related was largely incorrect.

Markets are accurate expressions of established facts and expectations, even when the latter are wrong. As is the case of markets for goods and services in a free society, people buy and sell according to rational expectations of what they believe will benefit their circumstances. Often times they turn out to be wrong. That does not illustrate the frailty of free markets, but of we humans.

The efficient incorporation of flawed macroeconomic hypotheses into capital asset prices continues to be a feature of the current bull market in risk assets. The most prevalent topic of error is a big one, involving the role of governments in economies. This question broadly pertains to the role of central banks, currencies, fiscal conditions, taxation and all of the dramas involving the apparent paralysis of political and legislative processes. The broad, philosophic and economic issues resonate from Washington to Brussels, Tokyo, Beijing, Sacramento and Detroit. The basic issues are similar, but the probable forms of resolution are widely disparate.

We made the point earlier that the current macroeconomic climate is being shaped by the ongoing confrontation between governments and the credit markets upon which many of them have come to depend.

A vast body of modern mythology has underpinned the destructive trend among many governments toward profligacy and intemperate accumulations of debt. Like the invulnerability of house prices or the inevitable triumph of the Japanese or, at present, the Chinese approach to business and economic management, the arguments highlighting the benefits of government spending are embedded deeply in parts of

academia and hence within the extensive and influential community of academically trained economists.

One of the core assumptions in current economic thought that is, we believe, severely hampering the decision-making process among investors is the presumed equivalence between GDP growth and wealth creation. The former is a broad measure of output that comprises activity in three important sectors of the economy i.e., households, businesses and government. It is an invention of the post-war era, enabled by greatly expanded data collection by government agencies.

The wealth of a society, which consists in the corpus of productive capital assets that it has accumulated, has its origins in that portion of output that is saved (not consumed) and invested. In this broad sense, output measures like GDP are important, as they provide some gauge of the product from which savings can originate and be directed toward an increase in the capital stock i.e., wealth.

The problem with present measures of national output is the inclusion of governments’ deficits as a net contributor to reported GDP. Because a systemic accounting must acknowledge the increase in private sector incomes that results from the portion of government spending financed solely through credit creation, there exists an illusion that deficit spending is a form of economic stimulus. It is a stimulus to statistics regarding GDP, but stimulating statistics is not the point of economic interchange.

Deficit spending by governments accomplishes, at best, a temporary increase in the level of consumption. Because this additional consumption is artificial and transitory, it is questionable whether it will spur incremental investment (additions to the productive apparatus that constitute wealth) by those addressing the additional demand. Often, the only market response to the demand stimulus will be an increase in real prices. This has been the clear trend in our health care system, and is likely to accelerate as more subsidized demand is brought into the market place.

Private sector investment is the source of wealth in a free society and consequently the long-range objective of economic effort. The idea that projects undertaken at the behest of political authorities can be thought of as a form of investment is mistaken. As stated earlier, the wealth of a society exists in its productive capital stock. The capital stock can be held in either financial or physical form, with the proviso being that it is intended for use in the production of goods and services.

As such, the output of capital assets, normally organized in the form of a business, must realize sufficient revenue to sustain operations and provide its owners with some benefit in the form of return for allowing the use of their savings. Failure to meet these criteria will result in the eventual demise of the enterprise and the redeployment of whatever capital that remains to

Not part of the Annual Report

endeavors better able to satisfy the demands of the economy as a whole.

An important descriptive element in discussions of the accumulated capital stock as the basis of wealth is the term “productive.” In this sense, productive refers not only to capital assets that are capable of output, but are capable of output that meets demand in sufficient volume and price to be self-sustaining. The problem with expenditures by government on projects that might satisfy some form of demand is that there is no way of ever knowing whether that demand produces revenues sufficient to perpetuate the enterprise without an ongoing extraction of resources from the private sector. In instances where there is a revenue stream that can be measured against costs, it is almost always inadequate, meaning that the enterprise operates at a loss. Amtrak, the postal service, various public transit authorities, publicly owned utilities and even public monopolies in gambling are primary examples. In each case, they persist in spite of the fact that they fail to provide something that people are willing to purchase at prices and in quantities that cover the costs of production and depreciation. They survive because they can force involuntary transfers from those same prospective customers who, when faced with calls from the taxman, have no choice but to reach into their pockets.

A report card in the form of a profit and loss statement is the only way of checking whether or not a particular good or service is sufficiently popular at a certain price level to allow it to be self-sustaining. High-speed trains, public hospitals, overnight postal delivery and government supported radio and television channels all sound like wonderful, life-enhancing elements of any society. They might well be, but we will never know unless we see whether sufficient numbers of free citizens are willing to spend enough of their resources to make them economically viable i.e., able to produce enough revenue to sustain their operations.

Because the unique powers granted to government allow the threat of force to be used to undertake its economic adventures, access to capital for even the most harebrained schemes is normally not an issue. The government undertakings that we listed in the preceding paragraph all sound beyond reproach. And that is exactly the problem.

No political leader has ever said that he or she needs more tax revenue to waste on silly, useless projects or to pay off political cohorts. Even if this is the case, every call for increased government revenue is always justified by invoking the most profoundly virtuous plans for its use. Health care for poor children, universal pre-school, protection of endangered animals, rescuing the entire planet from the effects of sunlight—how could any decent human being be against any of these? That is the political calculus, and it is generally very effective in casting anyone who expresses doubts about the use of government’s coercive power to accomplish these noble objectives as a vicious misanthrope.

Good politics and good economics are often diametrically opposed, and when the two are at odds, it is unfortunate that the political imperatives normally prevail over sound economics. It is doubly unfortunate that the consequences are borne mainly by those who most need a fully functioning economy to escape the burdens of misfortune and privation.

With no way of measuring the economic viability of any government directed infrastructure schemes, there is a very good chance that the finite resources of a society will be squandered and overall wealth diminished by their undertaking. The economic problem arises because even the most wasteful expenditures by government (or, for that matter, members of the private sector) will add to GDP as they are undertaken. We would guess that, had such statistics existed, Egypt would have had one of the highest GDP growth rates in history during the construction of the Pyramids. If that GDP growth was truly a measure of general prosperity, we could calm all of their present troubles by simply suggesting that they build a few dozen more. Come to think of it, why not include Greece and Detroit?

The advantage of having these activities take place in the private sector is that normal accounting will clearly reveal the wasteful and mistaken projects, and they will stop, either voluntarily or in a bankruptcy court. The capital will have been squandered, but the process will end and discretion over the deployment of capital will be out of the hands of those entities that have proven incompetent in its use.

Because political leaders have virtually unlimited access to the resources of their citizens through compulsory measures that are not available to private sector entities, their uneconomic expenditures can persist indefinitely. Every dollar that they are able to obtain and deploy is a dollar less that is available to be utilized within the private sector, where markets provide checks and balances to assure that there is sufficient voluntary demand to label the expenditure productive.

Both public sector and private sector expenditures on, for example, improvements to railroad track beds will have about the same additive effects on GDP. For many with a quantitative, statistically driven view of economics, there is nothing to choose between the two. The fact that one needs to satisfy actual demand at a satisfactory combination of price and volume and the other only has to satisfy the political imperatives of a small group of officials is enormously consequential in the overall accumulation of wealth.

Acknowledgement of this distinction runs up against the vanities of those unwilling to accept the free markets’ reflections of the voluntary actions of their fellow citizens as they engage in the constitutionally assured pursuit of happiness. The fact that someone chooses to live on beer, bacon and cigarettes demands no response from government or its agents. I will quickly acknowledge, alongside those with the professional

Not part of the Annual Report

qualifications to back their judgments, that this regimen is unhealthy. That said, it is critical to remember that the strength of this country and its economy stems from the proposition that everyone is entitled to life according to their own, subjective design. I may think that I know better, but I have no right to impose my opinions about nutrition or anything else on my fellows. Even in matters where we feel professionally qualified, we would not think of petitioning the government to enforce our beliefs about proper asset allocation or risk management.

If government officials do not like the judgments of markets, they likewise, by extension, do not like the personal preferences of their fellow citizens. To the extent that they are willing to use the threat of violence underlying their authority to change the outcomes, they are engaging in a form of tyranny. If it persists, the result will be an economy that is unable to satisfy the particular, personally chosen needs of its citizens. Yes the government can ban beer, bacon and cigarettes (and reality TV, we would hope) but that would thwart the pursuit of happiness upon which this nation has thrived.

At present, the cycle of deficit spending and increased taxation by governments is reaching its theoretical limits. It has two weak points, both of which are beginning to be exposed. The first is obvious i.e., capital markets unwillingness to continue to provide credit to official entities that are clearly not creditworthy. The clearest examples have arisen in Europe, and require no further discussion.

The second structural flaw in the cycle of governments’ arrogation of a greater share of economic output to its own purposes is the migratory problem. There is some point at which the citizens whose productive efforts are being converted to government use will up and leave. In the U.S., most of this traffic is interstate, while in most other parts of the world where less onerous restrictions on emigration are in place (as compared with those in the U.S.), the migratory paths are international.

Along these lines, it will be extremely interesting to see whether the tax regimes introduced recently in California will prove to have gone too far.

The overemphasis on GDP (and a host of other statistic measures of the overall economy) has important investment implications. Our investment approach begins with our trying to identify macroeconomic misperceptions that are reflected in large scale asset mispricing. It is why we spend so much time and effort on seemingly pointless academic and theoretical analysis of economic systems. Theoretical applications in any science are eventually manifest in practical consequences. Economic science is no different.

There has been a large body of opinion suggesting that because GDP growth is and might remain restrained, equity investment is a fool’s game. We have taken the other side of the trade, and thus far have benefitted from the outcome. As of this writing the four-year annualized total return for the Vanguard All Stock ETF

is 20% as of 12/31/12. For the equivalent S&P 500® Index based fund it is 19% as of 12/31/12. (See page 12 for more information on the S&P 500® Index.) This has taken place against a commentary backdrop that has suggested that investors would be lucky to see mid-single digit portfolio returns. The fact that domestic stocks have provided returns at between three and four times expected rates has been little remarked upon by some of the most vocal proponents of a “lost decade” for investors.

During the past year, German equities have returned more than 30%. German GDP growth was below 1%. Much of Europe is in or near recession, and yet their equity markets have been strong performers.

We cannot guess how long it will take before people understand that GDP is neither a measure of prosperity nor a predictor of equity returns. To the extent that diminishing government spending holds GDP statistics back, the process is bullish for the private sector and overall standards of living. The opposite is also true.

China has reported the highest rates of GDP growth on earth for years and yet their equity markets have been among the worst performers. They are a large scale example of how elevated output statistics driven by the whims of government officials rather than individuals’ preferences are misleading indicators of real prosperity.

The seeming contradiction between a slow GDP growth rate and the bull market in stocks over the past four years has provoked a great deal of hysterical outcry by people who have chosen to avoid investing in equities. Their caution is rationalized by a host of statistics showing how elevated corporate results and stock prices are relative to GDP.

Any analysis that compares the private sector to GDP will show unusual relative strength in the former. This is simply a result of the forced retrenchment of government at all levels and the consequent drag on reported GDP.

Economic forecasting that hopes to add value in the investment process cannot rely on quantitative econometric models. They do not work.

The only avenue available to an investor who wishes to incorporate big picture, macroeconomic factors into the capital allocation process is one that leads to an understanding of the processes and system dynamics that produce the economic statistics. Taken in isolation, any group of quantitative measures can be extremely misleading if the processes behind their generation are not understood. It is why the most expensive risk management systems on earth failed before the 2007-2008 crises, along with ratings agencies, regulators and many very sophisticated investors, including the endowment managers of the most respected educational institutions on earth.

Not part of the Annual Report

As we continue down the path of confrontation between governments and the credit markets that they rely upon, the principal danger is that some governments will attempt to remedy their fiscal imbalances by extracting a greater share of private sector output. This will diminish the visible income streams subject to taxation as people and business flee the most intrusive jurisdictions and rearrange their affairs to shelter or defer more of their earnings.

To the extent that increased taxation succeeds in wresting control of more resources from their private sector owners, there will be that much less available to build up the productive capital base that constitutes society’s wealth. Less capital formation in the private sector leads to less employment and activity in enterprises that are subject to the constant discipline of their fellow citizens’ free choices about what is worth paying for and what is not. Government officials deploying assets generated by others’ efforts have no such worries. They can produce GDP without producing real value.

We have moved nearly a quarter of the Fund’s equity holdings into European shares during the past year, beginning with companies in the more stable northern economies a year ago and adding exposure to certain of the more troubled nations during the past two quarters.

Europe is another example of recovering private sector fundamentals and governments displaying various degrees of distress and ineptitude. We have made the point in past letters that it is a mistake to equate a national government with that nation’s economy. Governments influence economies, but the fortunes of the two can diverge. Good businesses can exist alongside terrible governments. In parts of Europe, private companies can borrow at lower rates than their governments.

Our domestic equity holdings have shifted from emphasis on consumer spending to business investment. Most of the burden imposed by the recent tax changes will fall upon consumer

rather than business incomes. Consumer discretionary sectors have led the bull market for the past four years. We sense that a change is in the works.

The question of whether a shift to an environment led by business investment requires a meaningful correction in the overall markets is difficult to answer. Thus far, we have seen a fairly seamless transition.

A final, crucial issue reflected in our current portfolio concerns the point at which strength and credit demand in the private sector begins to crowd out government borrowing and prompts a rise in interest rates. We have established meaningful short positions in long duration government bonds during the last six months of the fiscal year in response to this risk.

From a cyclical, timing perspective, the danger point for credit markets appears close at hand. Housing activity continues to accelerate, business investment is turning up, the Federal government is resisting expenditure cuts and the Federal Reserve Board is continuing with policies that seem appropriate for the summer of 1932.

The only mechanism that might change cavalier attitudes toward spending is the bond market. If government remains on its current heading, fiscal discipline is going to be imposed rather than chosen. When we reach that stage, the volatility now associated with equities may migrate to fixed-income markets. Like teenagers running into the basement at the beginning of a horror movie, investors who have looked to government bonds as a refuge from market risk may be in for some surprises.

January 22, 2013

Michael C. Aronstein

President, Chief Investment Officer & Portfolio Manager

The information contained herein represents the opinion of the portfolio manager and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Not part of the Annual Report

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

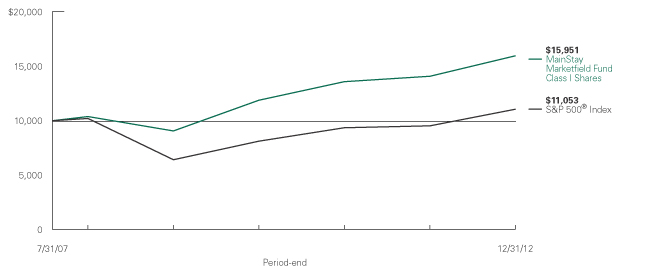

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period Ended December 31, 2012

| Class | Sales Charge | One Year | Five Years | Since Inception (7/31/07) | Gross Expense Ratio2 | |||||||||||||||

| Investor Class Shares3 | Maximum 5.5% Initial Sales Charge | With sales charges Excluding sales charges |

| 7.06 13.29 | %

|

| 7.49 8.71 | %

|

| 7.60 8.73 | %

|

| 2.86 2.86 | %

| ||||||

| Class A Shares3 | Maximum 5.5% Initial Sales Charge | With sales charges Excluding sales charges |

| 7.06 13.29 |

|

| 7.49 8.71 |

|

| 7.60 8.73 |

|

| 2.70 2.70 |

| ||||||

| Class C Shares3 | Maximum 1% CDSC if Redeemed Within One Year of Purchase | With sales charges Excluding sales charges |

| 11.43 12.43 |

|

| 7.90 7.90 |

|

| 7.91 7.91 |

|

| 3.61 3.61 |

| ||||||

| Class I Shares4 | No Sales Charge | 13.50 | 8.97 | 8.99 | 2.45 | |||||||||||||||

| Class R2 Shares3 | No Sales Charge | 13.06 | 8.58 | 8.60 | 2.80 | |||||||||||||||

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on dividends and/or distributions or Fund-share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividends and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Investor Class, Class A, Class C and Class R2 shares, reflect the historical performance of Class I shares and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies based on differences in their fee and expense structures. The Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes might have been different. |

| 4. | Performance figures for Class I shares reflect the historical performance of the then-existing shares of Marketfield Fund (the predecessor to the Fund, which was subject to a different fee structure, and for which a predecessor entity to Marketfield Asset Management LLC served as investment advisor) for periods prior to October 5, 2012. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| mainstayinvestments.com | 11 |

| Benchmark Performance | One Year | Five Years | Since Inception | |||||||||

S&P 500® Index5 | 16.00 | % | 1.66 | % | 1.87 | % | ||||||

Average Lipper Long/Short Equity Fund6 | 5.28 | 0.26 | 0.16 | |||||||||

| 5. | S&P 500® Index is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The S&P 500® Index is the Fund’s broad-based securities market index for comparison purposes. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an Index. |

| 6. | The average Lipper long/short equity fund is representative of funds that employ portfolio strategies combining long holdings of equities with short sales of equity, equity option, or equity index option. The funds may be either net long or net short, depending on the portfolio manager’s view of the market. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| 12 | MainStay Marketfield Fund |

Cost in Dollars of a $1,000 Investment in MainStay Marketfield Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the period from July 1, 2012, to December 31, 2012, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other Funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from July 1, 2012, to December 31, 2012.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended December 31, 2012. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Beginning Account Value 7/1/121 | Ending Account Value (Based on Actual Returns and Expenses) 12/31/12 | Expenses Paid During Period2 | Ending Account Value (Based on Hypothetical 5% Annualized Return and Actual Expenses) 12/31/12 | Expenses Paid During Period2 | |||||||||||||||

| Investor Class Shares3 | $ | 1,000.00 | $ | 1,042.80 | $ | 9.78 | $ | 1,002.30 | $ | 9.59 | ||||||||||

| Class A Shares3 | $ | 1,000.00 | $ | 1,042.80 | $ | 9.88 | $ | 1,002.20 | $ | 9.69 | ||||||||||

| Class C Shares3 | $ | 1,000.00 | $ | 1,038.80 | $ | 11.68 | $ | 1,000.40 | $ | 11.46 | ||||||||||

| Class I Shares | $ | 1,000.00 | $ | 1,043.50 | $ | 15.00 | $ | 1,010.50 | $ | 14.76 | ||||||||||

| Class R2 Shares3 | $ | 1,000.00 | $ | 1,041.20 | $ | 9.27 | $ | 1,002.80 | $ | 9.09 | ||||||||||

| 1. | The inception date for Class Investor, Class A, Class C, and Class R2 shares was on October 5, 2012. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio of each class (4.03% for Investor Class, 4.07% for Class A, 4.82% for Class C, 2.92% for Class I and 3.83% for Class R2) multiplied by the average account value over the period, divided by 366 and multiplied by 184 days for Class I (to reflect the six-month period) and 87 days for Investor Class, Class A, Class C and Class R2 (to reflect the since inception period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the Exchange Traded Funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 3. | Expenses paid during the period reflect ongoing costs for the period from inception through December 31, 2012. Had these shares been offered for the full six-month period ended December 31, 2012, and had the Fund provided a hypothetical 5% annualized return, expenses paid during the period would have been $20.31 for Investor Class, $20.51 for Class A, $24.24 for Class C and $19.31 for Class R2 and the ending account value would have been $1,004.90 for Investor Class, $1,004.70 for Class A, $1,000.90 for Class C and $1,005.88 for Class R2. |

| mainstayinvestments.com | 13 |

Industry Composition as of December 31, 2012 (Unaudited)

| Exchange Traded Funds | 11.7 | % | ||

| Road & Rail | 7.2 | |||

| Chemicals | 6.4 | |||

| Construction Materials | 5.8 | |||

| Machinery | 5.6 | |||

| Commercial Banks | 4.7 | |||

| Household Durables | 4.2 | |||

| Trading Companies & Distributors | 3.5 | |||

| Internet Software & Services | 3.1 | |||

| Building Products | 3.0 | |||

| Industrial Conglomerates | 3.0 | |||

| Food & Staples Retailing | 2.9 | |||

| Metals & Mining | 2.8 | |||

| Auto Components | 2.5 | |||

| Food Products | 1.9 | |||

| IT Services | 1.9 | |||

| Specialty Retail | 1.6 |

| Insurance | 1.5 | % | ||

| Commercial Services & Supplies | 1.4 | |||

| Air Freight & Logistics | 1.2 | |||

| Hotels, Restaurants & Leisure | 1.2 | |||

| Internet & Catalog Retail | 1.2 | |||

| Transportation Infrastructure | 1.2 | |||

| Real Estate Management & Development | 1.1 | |||

| Aerospace & Defense | 1.0 | |||

| Energy Equipment & Services | 1.0 | |||

| Real Estate Investment Trusts | 1.0 | |||

| Household Products | 0.8 | |||

| Media | 0.8 | |||

| Purchased Options | 0.4 | |||

| Investment in Money Market Fund | 12.3 | |||

| Other Assets, Less Liabilities | 36.8 | |||

| Investments Sold Short | –34.7 | |||

|

| |||

| 100.0 | % | |||

|

|

See Portfolio of Investments beginning on page 17 for specific holdings within these categories.

Top Ten Equity Holdings as of December 31, 2012 (excluding Investment in Money Market Fund) (Unaudited)

| 1. | BASF S.E. |

| 2. | iShares Dow Jones Transportation Average Index Fund |

| 3. | SPDR S&P Regional Banking |

| 4. | iShares MSCI Mexico Investable Market Index Fund |

| 5. | Eagle Materials, Inc. |

| 6. | USG Corp. |

| 7. | CRH PLC |

| 8. | iShares MSCI Italy Index Fund |

| 9. | General Electric Co. |

| 10. | Wolseley PLC |

Top Five Short Positions as of December 31, 2012 (Unaudited)

| 1. | iShares JPMorgan USD Emerging Markets Bond Fund |

| 2. | International Business Machines Corp. |

| 3. | iShares FTSE China 25 Index Fund |

| 4. | BlackRock, Inc. Class A |

| 5. | iShares MSCI Brazil Index Fund |

| 14 | MainStay Marketfield Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by Michael C. Aronstein of Marketfield Asset Management LLC the Fund’s Subadvisor.

How did MainStay Marketfield Fund perform relative to its peers and its benchmark for the 12 months ended December 31, 2012?

Excluding all sales charges, MainStay Marketfield Fund returned 13.29% for Investor Class shares, 13.29% for Class A shares and 12.43% for Class C shares for the 12 months ended December 31, 2012. Over the same period, Class I shares returned 13.50% and Class R2 shares returned 13.06%.1 All share classes outperformed the 5.28% return of the average Lipper2 long/short equity fund, but underperformed the 16.00% return of the S&P 500® Index3 for the 12 months ended December 31, 2012. The S&P 500® Index is the Fund’s broad-based securities-market index. See page 11 for Fund returns with applicable sales charges.

What were the results of the Fund’s merger during the reporting period?

At a meeting held on September 24, 2012, the shareholders of Marketfield Fund approved a merger with and into MainStay Marketfield Fund. Effective October 5, 2012, Marketfield Asset Management LLC serves as the Fund’s Subadvisor and New York Life Investment Management LLC serves as the Fund’s Manager. The Fund’s portfolio manager remains unchanged, and the Fund’s investment strategies and philosophies remain substantially the same.

What factors affected the Fund’s relative performance during the reporting period?

The most significant positive contributor to the Fund’s relative performance in 2012 was our housing and building materials theme. (Contributions take weightings and total returns into account.) The average weight of this theme as a percentage of the Fund was around 21%, and it contributed more than 50% of the Fund’s positive relative performance. Other contributors to the Fund’s relative performance were themes pertaining to the health of the U.S. consumer, the upswing in U.S. manufacturing and capital spending, and the theme of European economies benefiting from European Central Bank liquidity provisions.

The biggest detractor from the Fund’s relative performance was our emerging markets short theme. However, the cost of this theme was partially offset by reducing drawdown during two periods in 2012 when our long themes were underperforming. (Drawdown is the peak-to-trough decline during a specific record period for a fund or investment.)

During the reporting period, which sectors were the strongest positive contributors to the Fund’s relative performance and which sectors were particularly weak?

During 2012, the strongest positive sector contributions to the Fund’s performance relative to the S&P 500® Index came from the consumer discretionary, industrials and materials sectors. The weakest-performing sectors were emerging market ETFs, financials and fixed income (Barclays 20+ Year Bond ETF and iShares JPMorgan USD Emerging Markets Bond Fund ETF).

During the reporting period, which individual stocks made the strongest positive contributions to the Fund’s absolute performance and which stocks detracted the most?

During 2012, the three strongest individual positive contributors to the Fund’s absolute performance were building materials companies USG and Eagle Materials and home builder Ryland Group. Over the same period, the weakest contributions to the Fund’s absolute performance came from iShares MSCI Emerging Markets Index, iShares FTSE China 25 Index and iShares JPMorgan USD Emerging Markets Bond Fund ETF.

Did the Fund make any significant purchases or sales during the reporting period?

During 2012, we moved nearly a quarter of the Fund’s equity holdings into European shares, beginning with companies in the more stable northern economies early in the reporting period. We added exposure to some of the more-troubled nations during the final two quarters.

Over the course of the year, we shifted the Fund’s domestic equity holdings from emphasis on consumer spending to a focus on business investment.

How did the Fund’s sector weightings change during the reporting period?

The Fund’s holdings in European stocks increased from 10% to 24% of net assets during the year. We began with German and northern European companies and added Italian, French and Spanish companies as the year progressed.

We reduced the Fund’s positions in our consumer discretionary/retail theme from 27% to 6% of net assets, with a particular focus on retail stocks.

| 1. | See footnote on page 11 for more information on historical performance. |

| 2. | See footnote on page 12 for more information on Lipper Inc. |

| 3. | See footnote on page 12 for more information on the S&P 500® Index. |

| mainstayinvestments.com | 15 |

How was the Fund positioned at the end of December 2012?

The Fund continued to experience strong asset growth during the reporting period, with total net assets standing at $4.4 billion as of December 31, 2012.

As of that date, the Fund was 86% long (excluding short-term investments) and 35% short.4 The net exposure was long 51%. Since the Fund’s inception, net long exposure has averaged 59%.

As of the same date, the Fund had increased its European equity exposure to approximately 24% of long Fund holdings. The Fund remains long the housing market and short emerging markets.

| 4. | See Portfolio of Investments beginning on page 17 for specific holdings information. |

The opinions expressed are those of the portfolio manager as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| 16 | MainStay Marketfield Fund |

Portfolio of Investments December 31, 2012

| Shares | Value | |||||||

| Common Stocks 72.5% | ||||||||

Aerospace & Defense 1.0% |

| |||||||

Precision Castparts Corp. (a) | 238,900 | $ | 45,252,438 | |||||

|

| |||||||

Air Freight & Logistics 1.2% |

| |||||||

FedEx Corp. (a) | 560,700 | 51,427,404 | ||||||

|

| |||||||

Auto Components 2.5% |

| |||||||

Continental A.G. | 614,331 | 71,081,178 | ||||||

ElringKlinger A.G. | 1,104,277 | 37,213,775 | ||||||

|

| |||||||

| 108,294,953 | ||||||||

|

| |||||||

Building Products 3.0% |

| |||||||

Geberit A.G. (b) | 183,003 | 40,512,867 | ||||||

¨USG Corp. (a)(b) | 3,272,000 | 91,845,040 | ||||||

|

| |||||||

| 132,357,907 | ||||||||

|

| |||||||

Chemicals 5.4% |

| |||||||

¨BASF S.E. | 1,287,457 | 121,009,783 | ||||||

E.I. du Pont de Nemours & Co. (a) | 936,996 | 42,136,710 | ||||||

Sherwin-Williams Co. (The) (a) | 489,013 | 75,219,980 | ||||||

|

| |||||||

| 238,366,473 | ||||||||

|

| |||||||

Commercial Banks 4.7% | ||||||||

BB&T Corp. (a) | 1,834,900 | 53,413,939 | ||||||

CIT Group, Inc. (a)(b) | 1,558,700 | 60,228,168 | ||||||

Fifth Third Bancorp (a) | 2,691,900 | 40,889,961 | ||||||

Governor & Co. of The Bank of Ireland (The) (b) | 211,706,284 | 31,409,826 | ||||||

Governor & Co. of The Bank of Ireland (The), Sponsored ADR (b)(c) | 3,308,402 | 21,504,613 | ||||||

|

| |||||||

| 207,446,507 | ||||||||

|

| |||||||

Commercial Services & Supplies 1.4% |

| |||||||

Bilfinger S.E. | 623,540 | 60,240,691 | ||||||

|

| |||||||

Construction Materials 5.8% | ||||||||

Buzzi Unicem S.p.A. | 4,855,373 | 68,349,839 | ||||||

¨CRH PLC | 4,196,785 | 87,728,039 | ||||||

¨Eagle Materials, Inc. (a) | 1,734,986 | 101,496,681 | ||||||

|

| |||||||

| 257,574,559 | ||||||||

|

| |||||||

Energy Equipment & Services 1.0% | ||||||||

National-Oilwell Varco, Inc. (a) | 647,400 | 44,249,790 | ||||||

|

| |||||||

Food & Staples Retailing 2.9% | ||||||||

Costco Wholesale Corp. (a) | 645,900 | 63,795,543 | ||||||

Wal-Mart de Mexico S.A.B. de C.V. | 18,878,191 | 61,601,703 | ||||||

|

| |||||||

| 125,397,246 | ||||||||

|

| |||||||

| Shares | Value | |||||||

Food Products 1.9% | ||||||||

H.J. Heinz Co. (a) | 805,300 | $ | 46,449,704 | |||||

Hershey Co. (The) | 534,400 | 38,594,368 | ||||||

|

| |||||||

| 85,044,072 | ||||||||

|

| |||||||

Hotels, Restaurants & Leisure 1.2% | ||||||||

Accor S.A. | 1,500,400 | 53,820,169 | ||||||

|

| |||||||

Household Durables 4.2% | ||||||||

D.R. Horton, Inc. (a) | 1,813,000 | 35,861,140 | ||||||

Mohawk Industries, Inc. (a)(b) | 740,901 | 67,029,313 | ||||||

Ryland Group, Inc. (The) (a) | 1,276,700 | 46,599,550 | ||||||

Toll Brothers, Inc. (a)(b) | 1,037,400 | 33,539,142 | ||||||

|

| |||||||

| 183,029,145 | ||||||||

|

| |||||||

Household Products 0.8% | ||||||||

Colgate-Palmolive Co. (a) | 345,200 | 36,087,208 | ||||||

|

| |||||||

Industrial Conglomerates 3.0% | ||||||||

3M Co. (a) | 563,900 | 52,358,115 | ||||||

¨General Electric Co. (a) | 3,845,900 | 80,725,441 | ||||||

|

| |||||||

| 133,083,556 | ||||||||

|

| |||||||

Insurance 1.5% | ||||||||

Assicurazioni Generali S.p.A | 3,499,885 | 63,840,402 | ||||||

|

| |||||||

Internet & Catalog Retail 1.2% | ||||||||

Amazon.com, Inc. (a)(b) | 217,900 | 54,723,406 | ||||||

|

| |||||||

Internet Software & Services 3.1% | ||||||||

eBay, Inc. (a)(b) | 1,196,700 | 61,055,634 | ||||||

Facebook, Inc. Class A (a)(b) | 2,832,800 | 75,437,464 | ||||||

|

| |||||||

| 136,493,098 | ||||||||

|

| |||||||

IT Services 1.9% | ||||||||

Amadeus IT Holding S.A. Class A | 1,698,956 | 42,634,060 | ||||||

Teradata Corp. (b) | 625,300 | 38,699,817 | ||||||

|

| |||||||

| 81,333,877 | ||||||||

|

| |||||||

Machinery 5.6% | ||||||||

Caterpillar, Inc. (a) | 704,200 | 63,082,236 | ||||||

Cummins, Inc. (a) | 594,200 | 64,381,570 | ||||||

Deere & Co. (a) | 728,300 | 62,939,686 | ||||||

Ingersoll-Rand PLC (a) | 1,162,800 | 55,767,888 | ||||||

|

| |||||||

| 246,171,380 | ||||||||

|

| |||||||

Media 0.8% | ||||||||

Pandora Media, Inc. (a)(b) | 3,987,300 | 36,603,414 | ||||||

|

| |||||||

| ¨ | Among the Fund’s 10 largest holdings, as of December 31, 2012, excluding short-term investment. May be subject to change daily. |

| The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. | mainstayinvestments.com | 17 |

Portfolio of Investments December 31, 2012 (continued)

| Shares | Value | |||||||

| Common Stocks (continued) | ||||||||

Metals & Mining 2.8% | ||||||||

Carpenter Technology Corp. (a) | 1,028,600 | $ | 53,106,618 | |||||

Steel Dynamics, Inc. (a) | 5,138,000 | 70,544,740 | ||||||

|

| |||||||

| 123,651,358 | ||||||||

|

| |||||||

Real Estate Investment Trusts 1.0% | ||||||||

Rayonier, Inc. | 888,440 | 46,047,845 | ||||||

|

| |||||||

Real Estate Management & Development 1.1% |

| |||||||

Deutsche Wohnen A.G. | 2,504,060 | 46,242,532 | ||||||

|

| |||||||

Road & Rail 7.2% | ||||||||

DSV A/S | 2,411,665 | 62,887,267 | ||||||

Kansas City Southern (a) | 586,800 | 48,986,064 | ||||||

Landstar System, Inc. | 1,120,900 | 58,802,414 | ||||||

Old Dominion Freight Line, Inc. (a)(b) | 2,037,200 | 69,835,216 | ||||||

Union Pacific Corp. (a) | 605,900 | 76,173,748 | ||||||

|

| |||||||

| 316,684,709 | ||||||||

|

| |||||||

Specialty Retail 1.6% | ||||||||

Home Depot, Inc. (The) (a) | 1,155,200 | 71,449,120 | ||||||

|

| |||||||

Trading Companies & Distributors 3.5% |

| |||||||

Beacon Roofing Supply, Inc. (a)(b) | 2,281,833 | 75,939,402 | ||||||

¨Wolseley PLC | 1,667,465 | 79,256,442 | ||||||

|

| |||||||

| 155,195,844 | ||||||||

|

| |||||||

Transportation Infrastructure 1.2% | ||||||||

Atlantia S.p.A | 3,019,556 | 54,765,725 | ||||||

|

| |||||||

Total Common Stocks | 3,194,874,828 | |||||||

|

| |||||||

| Exchange Traded Funds 11.7% | ||||||||

¨iShares Dow Jones Transportation Average Index Fund (a) | 1,185,709 | 111,847,930 | ||||||

iShares MSCI EMU Index Fund | 1,368,556 | 45,791,884 | ||||||

¨iShares MSCI Italy Index Fund (a) | 6,120,488 | 82,320,563 | ||||||

¨iShares MSCI Mexico Investable Market Index Fund (a) | 1,449,389 | 102,225,406 | ||||||

SPDR S&P Homebuilders | 2,522,490 | 67,098,234 | ||||||

¨SPDR S&P Regional Banking (a) | 3,909,658 | 109,353,134 | ||||||

|

| |||||||

Total Exchange Traded Funds |

| 518,637,151 | ||||||

|

| |||||||

| Preferred Stock 1.0% | ||||||||

Chemicals 1.0% | ||||||||

Fuchs Petrolub A.G. 1.72% | 582,152 | 43,137,865 | ||||||

|

| |||||||

Total Preferred Stock |

| 43,137,865 | ||||||

|

| |||||||

| Number of Contracts | Value | |||||||

| Purchased Options 0.4% | ||||||||

Purchased Call Options 0.1% | ||||||||

iShares MSCI Japan Index Fund | 220,000 | $ | 5,500,000 | |||||

|

| |||||||

| 5,500,000 | ||||||||

|

| |||||||

Purchased Put Options 0.3% | ||||||||

iShares Barclays 20+ Year Treasury Bond Fund | ||||||||

Strike Price $123 | 21,075 | 5,605,950 | ||||||

Strike Price $124 | 21,075 | 6,744,000 | ||||||

iShares FTSE China 25 Index | 22,189 | 133,134 | ||||||

|

| |||||||

| 12,483,084 | ||||||||

|

| |||||||

Total Purchased Options | 17,983,084 | |||||||

|

| |||||||

| Shares | ||||||||

| Short-Term Investment 12.3% | ||||||||

Money Market Fund 12.3% |

| |||||||

State Street Institutional Treasury Money Market Fund | 540,691,540 | 540,691,540 | ||||||

|

| |||||||

Total Short-Term Investment | 540,691,540 | |||||||

|

| |||||||

Total Investments, Before Investments Sold Short | 97.9 | % | 4,315,324,468 | |||||

|

| |||||||

| Common Stocks Sold Short (17.8%) | ||||||||

Capital Markets (3.1%) |

| |||||||

BlackRock, Inc. Class A | (414,800 | ) | (85,743,309 | ) | ||||

Franklin Resources, Inc. | (407,500 | ) | (51,222,750 | ) | ||||

|

| |||||||

| (136,966,059 | ) | |||||||

|

| |||||||

Commercial Banks (1.5%) | ||||||||

ICICI Bank, Ltd., Sponsored ADR (c) | (1,480,900 | ) | (64,582,049 | ) | ||||

|

| |||||||

Diversified Financial Services (1.6%) |

| |||||||

Leucadia National Corp. | (2,885,900 | ) | (68,655,561 | ) | ||||

|

| |||||||

Electric Utilities (1.6%) | ||||||||

Duke Energy Corp. | (1,073,200 | ) | (68,470,160 | ) | ||||

|

| |||||||

Hotels, Restaurants & Leisure (0.9%) |

| |||||||

Starbucks Corp. | (769,800 | ) | (41,276,676 | ) | ||||

|

| |||||||

| 18 | MainStay Marketfield Fund | The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

| Shares | Value | |||||||

| Common Stocks Sold Short (continued) | ||||||||

Internet Software & Services (2.8%) | ||||||||

Baidu, Inc., Sponsored ADR (b)(c) | (550,500 | ) | $ | (55,209,645 | ) | |||

Qihoo 360 Technology Co., Ltd., ADR (b)(c) | (2,327,100 | ) | (69,091,599 | ) | ||||

|

| |||||||

| (124,301,244 | ) | |||||||

|

| |||||||

IT Services (2.9%) | ||||||||

International Business Machines Corp. | (663,800 | ) | (127,150,890 | ) | ||||

|

| |||||||

Real Estate Investment Trusts (1.0%) | ||||||||

Annaly Capital Management, Inc. | (3,293,500 | ) | (46,240,740 | ) | ||||

|

| |||||||

Software (2.4%) | ||||||||

Microsoft Corp. | (2,510,400 | ) | (67,102,992 | ) | ||||

Oracle Corp. | (1,208,400 | ) | (40,263,888 | ) | ||||

|

| |||||||

| (107,366,880 | ) | |||||||

|

| |||||||

Total Common Stocks Sold Short | (785,010,259 | ) | ||||||

|

| |||||||

| Exchange Traded Funds Sold Short (16.9%) | ||||||||

Central Fund of Canada, Ltd. Class A | (3,080,860 | ) | (64,790,486 | ) | ||||

iShares FTSE China 25 Index Fund | (2,952,020 | ) | (119,497,769 | ) | ||||

iShares JPMorgan USD Emerging Markets Bond Fund | (1,708,700 | ) | (209,828,360 | ) | ||||

iShares MSCI Brazil Index Fund | (1,444,040 | ) | (80,952,882 | ) | ||||

iShares MSCI South Africa Index Fund | (763,860 | ) | (54,677,099 | ) | ||||

iShares MSCI Taiwan Index Fund | (3,124,820 | ) | (42,560,048 | ) | ||||

Market Vectors Gold Miners | (842,820 | ) | (39,098,420 | ) | ||||

Market Vectors Russia | (2,064,200 | ) | (61,864,074 | ) | ||||

WisdomTree India Earnings Fund | (3,774,940 | ) | (73,120,588 | ) | ||||

|

| |||||||

Total Exchange Traded Funds Sold Short | (746,389,726 | ) | ||||||

|

| |||||||

Total Investments Sold Short | (34.7 | )% | (1,531,399,985 | ) | ||||

|

| |||||||

Total Investments, Net of Investments Sold Short | 63.2 | 2,783,924,483 | ||||||

Other Assets, Less Liabilities | 36.8 | 1,623,197,654 | ||||||

Net Assets | 100.0 | % | $ | 4,407,122,137 | ||||

| Number of Contracts | Value | |||||||

| Written Call Options (0.2%) | ||||||||

iShares Barclays 20+ Year Treasury Bond Fund | (20,910 | ) | $ | (2,990,130 | ) | |||

iShares FTSE China 25 Index | (13,868 | ) | (6,268,336 | ) | ||||

|

| |||||||

Total Written Call Options | (9,258,466 | ) | ||||||

|

| |||||||

| (a) | Security, or a portion thereof, is maintained in a segregated account at the Fund’s custodian as collateral for securities sold short (See Note 2(I)). |

| (b) | Non-income producing security. |

| (c) | ADR—American Depositary Receipt. |

| (d) | As of December 31, 2012, cash in the amount of $1,547,729,823 is on deposit with broker for short sale transactions. |

| (e) | As of December 31, 2012, cost is $3,878,999,280 for federal income tax purposes and net unrealized appreciation is as follows: |

Gross unrealized appreciation | $ | 455,021,548 | ||

Gross unrealized depreciation | (18,696,360 | ) | ||

|

| |||

Net unrealized appreciation | $ | 436,325,188 | ||

|

|

The following abbreviation is used in the above portfolio:

SPDR—Standard & Poor’s Depositary Receipt

| The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. | mainstayinvestments.com | 19 |

Portfolio of Investments December 31, 2012 (continued)

The following is a summary of the fair valuations according to the inputs used as of December 31, 2012, for valuing the Fund’s assets and liabilities.

Asset Valuation Inputs

Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | ||||||||||||

| Investments in Securities (a) | ||||||||||||||||

| Common Stocks | ||||||||||||||||

Construction Materials | $ | 101,496,681 | $ | 156,077,878 | $ | — | $ | 257,574,559 | ||||||||

Commercial Banks | 176,036,681 | 31,409,826 | — | 207,446,507 | ||||||||||||

Trading Companies & Distributors | 75,939,402 | 79,256,442 | — | 155,195,844 | ||||||||||||

Chemicals | 117,356,690 | 121,009,783 | — | 238,366,473 | ||||||||||||

Insurance | — | 63,840,402 | — | 63,840,402 | ||||||||||||

Auto Components | — | 108,294,953 | — | 108,294,953 | ||||||||||||

Road & Rail | 253,797,442 | 62,887,267 | — | 316,684,709 | ||||||||||||

Commercial Services & Supplies | — | 60,240,691 | — | 60,240,691 | ||||||||||||

Hotels, Restaurants & Leisure | — | 53,820,169 | — | 53,820,169 | ||||||||||||

Transportation Infrastructure | — | 54,765,725 | — | 54,765,725 | ||||||||||||

IT Services | 38,699,817 | 42,634,060 | — | 81,333,877 | ||||||||||||

Building Products | 91,845,040 | 40,512,867 | — | 132,357,907 | ||||||||||||

Real Estate Management & Development | — | 46,242,532 | — | 46,242,532 | ||||||||||||

All Other Industries | 1,418,710,480 | — | — | 1,418,710,480 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| Total Common Stocks | 2,273,882,233 | 920,992,595 | — | 3,194,874,828 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| Exchange Traded Funds | 518,637,151 | — | — | 518,637,151 | ||||||||||||

| Preferred Stocks | — | 43,137,865 | — | 43,137,865 | ||||||||||||

| Short-Term Investment | ||||||||||||||||

Money Market Fund | 540,691,540 | — | — | 540,691,540 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| Total Investments in Securities | 3,333,210,924 | 964,130,460 | — | 4,297,341,384 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | ||||||||||||||||

Purchased Put Options | 12,483,084 | — | — | 12,483,084 | ||||||||||||

Purchased Call Options | 5,500,000 | — | — | 5,500,000 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| Total Investments in Securities | $ | 3,351,194,008 | $ | 964,130,460 | $ | — | $ | 4,315,324,468 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Liability Valuation Inputs

Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | ||||||||||||

| Investments Sold Short (a) | ||||||||||||||||

| Common Stocks Sold Short | $ | (785,010,259 | ) | $ | — | $ | — | $ | (785,010,259 | ) | ||||||

| Exchange Traded Funds Sold Short | (746,389,726 | ) | — | — | (746,389,726 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| Total Investments in Securities | (1,531,399,985 | ) | — | — | (1,531,399,985 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | ||||||||||||||||

Written Call Options | (9,258,466 | ) | — | — | (9,258,466 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| Total Investments in Securities and Other Financial Instruments | $ | (1,540,658,451 | ) | $ | — | $ | — | $ | (1,540,658,451 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

The Fund recognizes transfers between the levels as of the beginning of the period.

There were no transfers between level 1 and level 2.

As of December 31, 2012, the Fund did not hold any investments with significant unobservable inputs (Level 3). (See Note 2)

| 20 | MainStay Marketfield Fund | The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

Statement of Assets and Liabilities as of December 31, 2012

| Assets | ||||

Investment in securities, at value | $ | 4,315,324,468 | ||

Cash collateral on deposit at broker | 1,547,729,823 | |||

Cash | 54,550,366 | |||

Cash denominated in foreign currencies | 3,274,378 | |||

Receivables: | ||||

Fund shares sold | 90,961,420 | |||

Investment securities sold | 21,189,046 | |||

Dividends and interest | 4,209,988 | |||

Other assets | 185,265 | |||

|

| |||

Total assets | 6,037,424,754 | |||

|

| |||

| Liabilities | ||||

Investments sold short (proceeds $1,481,523,066) | 1,531,399,985 | |||

Written options, at value (premiums received $10,206,790) | 9,258,466 | |||

Payables: | ||||

Investment securities purchased | 71,034,472 | |||

Fund shares redeemed | 7,288,603 | |||

Manager (See Note 3) | 4,757,569 | |||

Dividends on investments sold short | 4,637,375 | |||

Broker fees and charges on short sales | 1,257,242 | |||

Administration and accounting fees (See Note 3) | 145,633 | |||

NYLIFE Distributors (See Note 3) | 101,967 | |||

Transfer agent (See Note 3) | 101,877 | |||

Shareholder communication | 97,680 | |||

Custodian | 95,637 | |||

Professional fees | 47,675 | |||

Trustees | 4,798 | |||

Accrued expenses | 73,638 | |||

|

| |||

Total liabilities | 1,630,302,617 | |||

|

| |||

Net assets | $ | 4,407,122,137 | ||

|

| |||

| Composition of Net Assets | ||||

Shares of beneficial interest outstanding (par value of | $ | 278,266 | ||

Additional paid-in capital | 4,070,478,623 | |||

|

| |||

| 4,070,756,889 | ||||

Undistributed net investment income | 1,479 | |||

Accumulated net realized gain (loss) on investments, investments sold short, futures transactions, written options and foreign currency transactions | (53,376,223 | ) | ||

Net unrealized appreciation (depreciation) on investments and written options | 439,611,062 | |||

Net unrealized appreciation (depreciation) on investments sold short | (49,876,919 | ) | ||

Net unrealized appreciation (depreciation) on translation of other assets and liabilities in foreign currencies | 5,849 | |||

|

| |||

Net assets | $ | 4,407,122,137 | ||

|

| |||

Investor Class | ||||

Net assets applicable to outstanding shares | $ | 618,657 | ||

|

| |||

Shares of beneficial interest outstanding | 39,064 | |||

|

| |||

Net asset value per share outstanding | $ | 15.84 | ||

Maximum sales charge (5.50% of offering price) | 0.92 | |||

|

| |||

Maximum offering price per share outstanding | $ | 16.76 | ||

|

| |||

Class A | ||||

Net assets applicable to outstanding shares | $ | 137,056,456 | ||

|

| |||

Shares of beneficial interest outstanding | 8,653,976 | |||

|

| |||

Net asset value per share outstanding | $ | 15.84 | ||

Maximum sales charge (5.50% of offering price) | 0.92 | |||

|

| |||

Maximum offering price per share outstanding | $ | 16.76 | ||

|

| |||

Class C | ||||

Net assets applicable to outstanding shares | $ | 124,430,362 | ||

|

| |||

Shares of beneficial interest outstanding | 7,870,423 | |||

|

| |||

Net asset value and offering price per share outstanding | $ | 15.81 | ||

|

| |||

Class I | ||||

Net assets applicable to outstanding shares | $ | 4,144,926,540 | ||

|

| |||

Shares of beneficial interest outstanding | 261,696,829 | |||

|

| |||

Net asset value and offering price per share outstanding | $ | 15.84 | ||

|

| |||

Class R2 | ||||

Net assets applicable to outstanding shares | $ | 90,122 | ||

|

| |||

Shares of beneficial interest outstanding | 5,695 | |||

|

| |||

Net asset value and offering price per share outstanding | $ | 15.82 | ||

|

|

| The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. | mainstayinvestments.com | 21 |

Statement of Operations for the year ended December 31, 2012

| Investment Income (Loss) | ||||

Income | ||||

Dividends (a) | $ | 34,520,514 | ||

Interest | 42,380 | |||

|

| |||

Total income | 34,562,894 | |||

|

| |||

Expenses | ||||

Manager (See Note 3) | 30,296,852 | |||

Dividends on investments sold short | 23,194,455 | |||

Broker fees and charges on short sales | 5,817,679 | |||

Transfer agent (See Note 3) | 943,493 | |||

Administration and accounting (See Note 3) | 848,640 | |||

Custodian | 309,113 | |||

Shareholder communication | 229,398 | |||

Registration | 180,954 | |||

Professional fees | 168,935 | |||

Distribution/Service—Investor Class (See Note 3) | 155 | |||

Distribution/Service—Class A (See Note 3) | 33,984 | |||

Distribution/Service—Class C (See Note 3) | 122,217 | |||

Distribution/Service—Class R2 (See Note 3) | 19 | |||

Trustees | 29,455 | |||

Shareholder service—Class R2 (See Note 3) | 7 | |||

Miscellaneous | 102,157 | |||

|

| |||

Total expenses | 62,277,513 | |||

|

| |||

Net investment income (loss) | (27,714,619 | ) | ||

|

| |||