UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: April 30

(MainStay Absolute Return Multi-Strategy Fund and MainStay Tax Advantaged Short Term Bond Fund)

Date of reporting period: October 31, 2017

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Absolute Return Multi-Strategy Fund and MainStay Tax Advantaged Short Term

Bond Fund, series of the Registrant.

| Item 1. | Reports to Stockholders. |

MainStay Absolute Return Multi-Strategy Fund

Message from the President and Semiannual Report

Unaudited | October 31, 2017

This page intentionally left blank

Message from the President

The six months ended October 31, 2017, brought relatively strong performance to equity markets in the United States and abroad. Stocks in international and emerging markets provided solid double-digit returns during the reporting period.

According to FTSE-Russell data for the U.S. market, stocks at all capitalization levels earned solid single-digit returns during the reporting period. Growth stocks were particularly strong, outperforming value stocks at all capitalization levels and providing double-digit returns among all but the very smallest of companies.

Several factors contributed to the strength of domestic and international stock markets during the reporting period. With a new administration in place, many investors in the U.S. looked forward to business tax incentives and possible tax cuts for consumers that could stimulate economic growth. During the reporting period, corporate earnings reports remained strong; and growth in U.S. real gross domestic product remained positive, with a substantial advance during the second quarter of 2017. Developed international markets and emerging markets were also strong, boosted by positive macroeconomic data and growing confidence that Europe was well on its way to financial recovery. Despite wide variations among emerging markets, many saw strong appreciation in local-currency terms and benefited from a weaker U.S. dollar.

During the reporting period, the Federal Open Market Committee raised the federal funds target range in June of 2017, increasing the target range to 1.00% to 1.25% at the end of the reporting period. U.S. Treasury yields rose on securities with maturities of 10 years or less, but yields fell modestly on U.S. Treasury securities with maturities of 20 or 30 years.

Despite these yield variations, virtually all sectors of the fixed-income market recorded positive total returns during the

reporting period. Returns were generally higher for securities with longer maturities and for asset classes that tend to involve higher risk. Convertible bonds, whose performance is closely tied to the performance of underlying stocks, provided some of the strongest overall returns of any fixed-income asset class during the reporting period.

At MainStay, we have always encouraged investors to diversify their investments and maintain a long-term perspective, even when markets are strong. Asset classes that perform well in one environment may perform differently in another; and in today’s ever-changing world, wide market swings are not unknown.

MainStay offers Funds with a wide array of investment objectives to help our shareholders pursue the appropriate diversification for their long-range financial goals. We also offer several investment boutiques, allowing our shareholders to choose the style—or mix of styles—that’s best suited to their investment needs. We believe that relatively few individual investors can match the level of professional experience and market insight that our portfolio managers provide.

The report that follows provides more detailed information on the specific markets, investment strategies and portfolio decisions that affected your MainStay Fund during the six months ended October 31, 2017. We encourage you to read the report carefully and use it to help you evaluate your progress toward your financial goals.

Sincerely,

Kirk Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

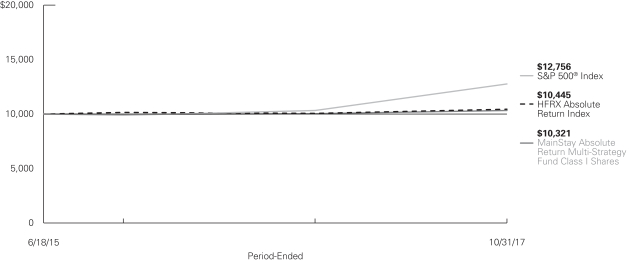

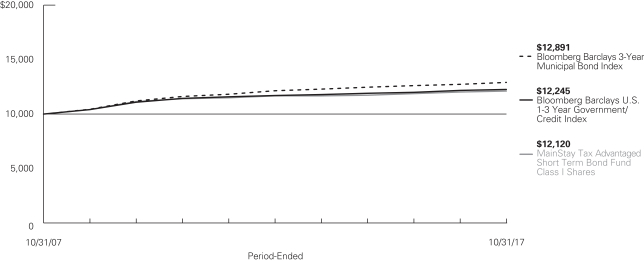

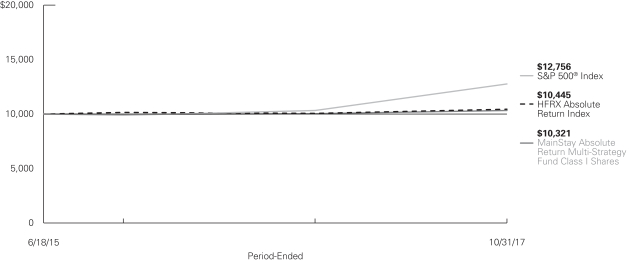

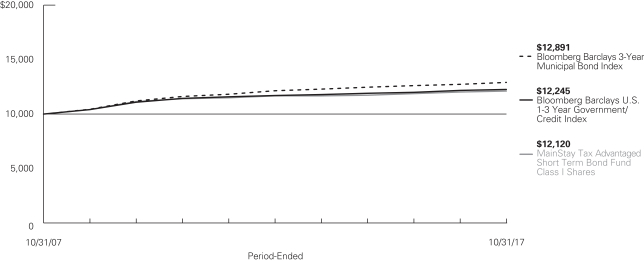

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period-Ended October 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Inception

Date | | | Six

Months | | | One Year | | | Since

Inception | | | Gross

Expense

Ratio2 | |

| Class A Shares | | Maximum 5.5% Initial Sales Charge | | With sales charges

Excluding sales charges | | | 6/18/2015 | | |

| –4.84

0.70 | %

| |

| –3.07

2.57 | %

| |

| –1.26

1.12 | %

| |

| 3.38

3.38 | %

|

| Investor Class Shares | | Maximum 5.5% Initial Sales Charge | | With sales charges

Excluding sales charges | | | 6/18/2015 | | |

| –5.03

0.50 |

| |

| –3.39

2.23 |

| |

| –1.52

0.85 |

| |

| 3.65

3.65 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges

Excluding sales charges | | | 6/18/2015 | | |

| –0.80

0.20 |

| |

| 0.49

1.49 |

| |

| 0.07

0.07 |

| |

| 4.40

4.40 |

|

| Class I Shares | | No Sales Charge | | | | | 6/18/2015 | | | | 0.80 | | | | 2.89 | | | | 1.34 | | | | 3.14 | |

| | | | | | | | | | | | |

| Benchmark Performance | | Six

Months | | | One

Year | | | Since

Inception | |

HFRX Absolute Return Index3 | | | 2.70 | % | | | 3.73 | % | | | 1.85 | % |

S&P 500® Index4 | | | 9.10 | | | | 23.63 | | | | 10.81 | |

Morningstar Multialternative Category Average5 | | | 2.65 | | | | 5.48 | | | | 0.62 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above (if any), changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Consolidated Financial Statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | The HFRX Absolute Return Index is the Fund’s primary broad-based securities market index for comparison purposes. The HFRX Absolute Return Index is designed to be representative of the overall composition of the |

| | hedge fund universe. It is comprised of eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 4. | The S&P 500® Index is the Fund’s secondary benchmark index for comparison purposes. “S&P 500®” is a trademark of the McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 5. | The Morningstar Multialternative Category Average is representative of funds that have a majority of their assets exposed to alternative strategies. Funds in this category include both funds with static allocations to alternative strategies and funds tactically allocating among alternative strategies and asset classes. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Absolute Return Multi-Strategy Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2017, to October 31, 2017, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2017, to October 31, 2017.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2017. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/17 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/17 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/17 | | | Expenses

Paid

During

Period1 | | | Net Expense

Ratio

During

Period2 | |

| | | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,007.00 | | | $ | 14.37 | | | $ | 1,010.90 | | | $ | 14.39 | | | | 2.84 | % |

| | | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,005.00 | | | $ | 15.67 | | | $ | 1,009.60 | | | $ | 15.70 | | | | 3.10 | % |

| | | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 1,002.00 | | | $ | 19.43 | | | $ | 1,005.80 | | | $ | 19.46 | | | | 3.85 | % |

| | | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,008.00 | | | $ | 13.16 | | | $ | 1,012.10 | | | $ | 13.19 | | | | 2.60 | % |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the six-month period. |

| | |

| 6 | | MainStay Absolute Return Multi-Strategy Fund |

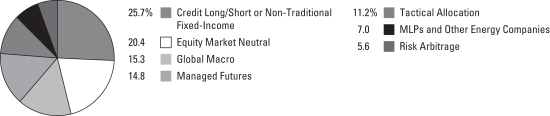

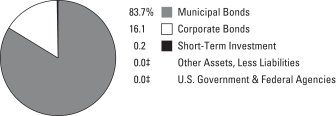

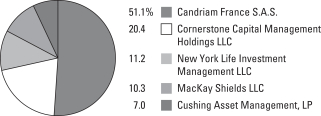

Strategy Allocation as of October 31, 20171 (Unaudited)

| 1 | Percentages based on total net assets. |

Equity Market Neutral: This strategy seeks to profit by detecting and exploiting perceived pricing inefficiencies in individual equity securities and neutralizing exposure to market risk by maintaining approximately equal value exposure in long and short positions. The strategy will identify investment opportunities based on a model that reflects the input of relevant factors, including relative value, market sentiment, and the Subadvisor’s forecasts as to anticipated market volatility. The strategy may engage in short sales in order to generate returns that are independent of the direction of the market.

Risk Arbitrage: This strategy implements event-driven arbitrage strategies on securities of companies that experience certain “special situations,” which are corporate events that are likely to create discontinuity in the price of a given security. The Fund’s risk arbitrage strategy consists primarily of an announced merger arbitrage strategy. An announced merger arbitrage strategy buys or sells the securities of companies involved in a merger based on the Subadvisor’s anticipation of the merger’s outcome. The strategy may also invest in securities of companies based on other event-driven strategies, such as holding discount arbitrage, share class arbitrage, spin-offs, asset sales, initial public offerings, minority buyouts, auctions or rights issues. Share class arbitrage involves capitalizing on perceived pricing inefficiencies of a particular share class in a multiple share class issuer. Discount arbi-trage is when a discount option is purchased while an opposite transaction is taken in the underlying security.

Managed Futures: This strategy primarily takes long and short positions in futures contracts (directly or through derivatives, including total return swaps) across asset classes globally. The strategy seeks to exploit market trends and generate absolute returns utilizing a quantitative and systematic investment approach, which consists of analyzing financial markets through statistical models. These quantitative models produce buy or sell signals looking to benefit from the upward and downward movements of the asset classes covered based on market trends and patterns and contrarian views (i.e., instruments and strategies that may be out of favor in the broader market). The managed futures strategy will be implemented through (i) investment in derivative instruments, including swap agreements, exchange-traded futures and option and forward contracts, to gain exposure to a wide variety of global markets for currencies, interest rates, stock market indices, energy resources, metals and agricultural products and to hedge price risk, (ii) investment in swap agreements that reflect the return of securities, derivatives and commodity interests selected by the Subadvisor, or (iii) investment in some combination of (i) and (ii). This strategy will

involve the use of one or more wholly-owned subsidiaries formed under the laws of the Cayman Islands (each, a “Cayman Subsidiary”).

Master Limited Partnerships (“MLPs”) and Other Energy Companies: This strategy seeks to deliver both high current income and total return by investing in a portfolio of domestic and foreign publicly traded partnerships and/or other issuers (including U.S. and Cana-dian royalty trusts and Canadian energy companies) engaged in the transportation, storage, processing, refining, marketing, exploration, production or mining of crude oil, natural gas, natural gas liquids, minerals or other natural resources. The Subadvisor implements this strategy by identifying companies it believes will benefit from increased crude oil, natural gas or natural gas liquids production resulting in greater energy infrastructure needs. The Fund will invest no more than 25% of its total assets in securities of MLPs that are qualified publicly traded partnerships (“QPTPs”), which are treated as partnerships for U.S. federal income tax purposes.

Credit Long/Short or Non-Traditional Fixed-Income: This strategy seeks to exploit opportunities in the global fixed-income markets based on top-down and bottom-up analysis. The strategy may invest in various credit strategies that involve being long and short different financial instruments, and the credit instruments involved will range from high grade to high yield (known as “junk bonds”) and distressed debt. The strategy may also invest in credit derivatives, including credit default swaps, options and indices. The Subadvisors responsible for this strategy dynamically allocate capital to the sectors and securities that they believe offer the best balance of risk and return, unrestricted by benchmark constraints.

Global Macro: This strategy seeks to obtain exposure to a broad spectrum of investments and countries or regions, based on discrete strategies that employ a variety of techniques, both discretionary and systematic analysis, combinations of top down and bottom up theses, and quantitative and fundamental approaches, designed to effectively identify and assess factors that affect businesses and economies broadly (e.g., monetary and fiscal policy, regulatory changes, demographics) and their impact on securities markets. The strategy may also employ arbitrage techniques and seek long and short exposure (directly or through derivatives, including total return swaps) across diversified asset classes globally. The strategy may be exposed significantly to interest rate and foreign currency futures. In addition, the strategy may involve the use of one or more Cayman Subsidiaries to obtain certain commodities market exposure.

Tactical Allocation: This strategy, which is managed by the Manager, may invest in a range of asset classes, including equity securities, fixed-income instruments, futures, options, currency forward contracts and swaps (including total return swaps) and affiliated and unaffiliated open-end funds, closed-end funds and exchange-traded funds, to manage or gain access to certain market exposures, including exposure to asset classes or strategies in which the Fund is not otherwise invested, to exploit perceived structural inefficiencies in the markets or to manage cash flows. Additionally, positions may be pursued on a long or short basis either to take advantage of perceived investment opportunities or to counter exposure from other strategies in the Fund.

Other Strategies: The Manager may modify the strategies summarized above and allocate the Fund’s assets among or to other strategies developed or implemented to further optimize risk reward expectations based on, among other factors, changing market conditions. In addition to the instruments described above, such other strategies may include taking long and/or short positions in a wide range of instruments, including, but not limited to, commodities and real estate investment trusts (“REITs”). Such investments may be made without restriction as to issuer capitalization, country (including emerging markets), currency, maturity or credit rating and within the context of a range of investment programs or strategies, including, but not limited to, carry strategies, relative value strategies, and various forms of arbitrage.

| | |

| 8 | | MainStay Absolute Return Multi-Strategy Fund |

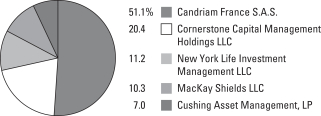

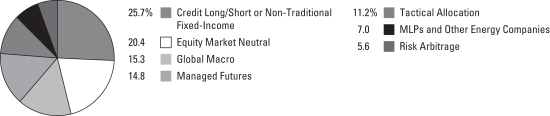

Manager Allocation as of October 31, 20171 (Unaudited)

| 1 | Percentages based on total net assets. |

Top Ten Holdings or Issuers Held as of October 31, 2017 (excluding short-term investments) (Unaudited)

| 2. | Energy Transfer Equity, L.P. |

| 3. | Synlab Bondco PLC, 6.25%, due 7/1/22 |

| 4. | 1011778 B.C. ULC / New Red Finance, Inc., 4.625%, due 1/15/22 |

| 7. | Global X Lithium & Battery Tech ETF |

| 8. | Energy Transfer Partners, L.P. |

| 9. | Dollar Tree, Inc., 5.75%, due 3/1/23 |

Top Five Short Positions as of October 31, 2017 (Unaudited)

| 1. | United States Oil Fund, L.P. |

| 3. | Liberty Media Corp-Liberty Formula One |

| 4. | White Mountains Insurance Group, Ltd. |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by Jae S. Yoon, CFA, Jonathan Swaney, Poul Kristensen, CFA, and Amit Soni, CFA, of New York Life Investments,1 the Fund’s Manager.

How did MainStay Absolute Return Multi-Strategy Fund perform relative to its benchmarks and peers during the six months ended October 31, 2017?

Excluding all sales charges, MainStay Absolute Return Multi-Strategy Fund returned 0.70% for Class A shares, 0.50% for Investor Class shares and 0.20% for Class C shares for the six months ended October 31, 2017. Over the same period, Class I shares returned 0.80%. For the six months ended October 31, 2017, all share classes underperformed the 2.70% return of the HFRX Absolute Return Index,2 which is the Fund’s broad-based securities-market index; the 9.10% return of the S&P 500® Index,2 which is the Fund’s secondary benchmark index; and the 2.65% return of the Morningstar Multialternative Category Average.3 See page 5 for Fund returns with applicable sales charges.

What factors affected the Fund’s performance relative to its primary benchmark during the reporting period?

Several factors contributed to the Fund’s performance relative to the HFRX Absolute Return Index. (Contributions take weightings and total returns into account.) The primary positive contributors were the tactical/completion and global alpha strategies. The most substantial detractor was the midstream master limited partnership (“MLP”) strategy. The MLP sector was in transition during the reporting period, as MLPs have lowered payouts and moved toward a self-funding model. The resulting uncertainty, however, created some negative sentiment during the reporting period that adversely affected these holdings.

During the reporting period, how did the Fund’s performance correlate with traditional equity and fixed-income indices?

The Fund maintained low correlation to traditional equity indices and low correlation to traditional investment-grade fixed-income indices during the reporting period. The Fund’s correlation to the S&P 500® Index was 17%. The Fund’s correlation to the Bloomberg Barclays U.S. Aggregate Bond Index was 6%.

During the reporting period, how did the Fund’s volatility compare to that of traditional equity and fixed-income indices?

Volatility reflects sharp up or down movements in the price of securities, commodities or markets over relatively short periods.

During the reporting period, the Fund’s volatility was closer to that of traditional investment-grade fixed-income indices and lower than traditional equity indices. The Fund’s volatility during the reporting period was 2.8%. This compared to 2.6% for the Bloomberg Barclays U.S. Aggregate Bond Index, 1.6% for the ICE BofA Merrill Lynch U.S. High Yield Master II Index4 and 6.7% for the S&P 500® Index.

How did the Fund use derivatives during the reporting period?

Derivatives are used by the Fund for a variety of purposes, including alpha5 generation, hedging and/or operational efficiency. For example, we used total return swaps for alpha generation in the tactical allocation sleeve to gain exposure to certain alternative beta indices. The nontraditional fixed-income managers used interest-rate derivatives for hedging specific exposures in their sleeves. Also, in the tactical allocation sleeve, certain exposures were assumed through total return swaps because of operational efficiency (leveraging better trading and operational infrastructure of external providers for cost efficiency). We believe that measuring the impact of derivatives on performance as positive or negative does not properly reflect the utility of derivatives to the Fund because of the functions they perform within the Fund. For example, a hedge performing as expected might have a negative contribution to return even as it serves its intended function to reduce a risk of an exposure. Nevertheless, derivatives contributed positively to the Fund’s performance during the reporting period.

How did you allocate the Fund’s assets among each of the strategies during the reporting period and why?

The Fund’s allocations are based on the estimated optimal risk-return distribution of assets, taking into account both the risk and return expectations. See the chart on page 7 for strategy allocations as of October 31, 2017. (It is generally not possible to increase return without taking additional risk, and the Fund generally cannot reduce risk without also reducing return.) These estimates of risk and return are long term in nature; and as a result, allocations tend to be quite stable over time. The Fund’s allocation to an individual strategy may change if there is a statistically significant change in the risk-return characteristics of a strategy, if the outlook of a strategy improves substantially or if an attractive new strategy has become available for

| 1. | “New York Life Investments” is a service mark used by New York Life Investment Management Holdings LLC and its subsidiary New York Life Investment Management LLC. |

| 2. | See footnote on page 5 for more information on this index. |

| 3. | See footnote on page 5 for more information on the Morningstar Multialternative Category Average. |

| 4. | The ICE BofA Merrill Lynch U.S. High Yield Master II Index monitors the performance of below-investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. An investment cannot be made directly in an index. |

| 5. | Alpha measures the relationship between a mutual fund’s return and its beta over a three-year period. Often, alpha is viewed as the excess return (positive or negative) or the value added by the portfolio manager. Beta is a measure of volatility in relation to the market as a whole. A beta higher than 1 indicates that a security or portfolio will tend to exhibit higher volatility than the market. A beta lower than 1 indicates that a security or portfolio will tend to exhibit lower volatility than the market. |

| | |

| 10 | | MainStay Absolute Return Multi-Strategy Fund |

investment that we believe would likely further support the Fund’s investment goal.

How did the tactical allocation among the strategies affect the Fund’s performance during the reporting period?

In early May 2017, we decided to lower the Fund’s exposure to the managed futures strategy in favor of the global macro strategy. This was done to reduce concentration risk, and it contributed positively to the Fund’s performance. In early June 2017, we reduced the Fund’s allocation to the risk arbitrage strategy because of the strategy’s low risk/return potential. The assets were moved to the tactical/completion strategy, which contributed positively to the Fund’s performance. In mid-September, we moved some exposure from the tactical/completion strategy to the midstream MLP strategy, which detracted from the Fund’s performance.

During the reporting period, how did each strategy either contribute to or detract from the Fund’s absolute performance?

During the reporting period, the Fund saw its greatest positive contributions from tactical allocation (+0.84%), global macro (+0.78%) and equity market neutral (+0.54%). Other positive contributions came from credit opportunities6 (+0.43%) and flexible bond (+0.24%). Negative contributors during the reporting period included risk arbitrage (–0.10%), managed futures (–0.29%), and midstream MLP7 (–0.96%).

How did the Fund’s strategy weightings change during the reporting period?

Aside from the tactical shifts previously discussed, there were no strategic changes to the Fund’s weightings during the reporting period.

| 6. | The credit long/short or non-traditional fixed-income portion of the Fund consists of two underlying strategies: the flexible bond strategy and the credit opportunities strategy. |

| 7. | The Master Limited Partnerships and other energy companies portion of the Fund consists of two underlying strategies. The midstream MLP strategy and the upstream MLP strategy. |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Consolidated Portfolio of Investments October 31, 2017 (Unaudited)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Long-Term Bonds 14.0%† Corporate Bonds 10.1% | |

Aerospace & Defense 0.1% | | | | | | | | |

Leonardo S.p.A.

Series Reg S

1.50%, due 6/7/24 | | $ | 100,000 | | | $ | 119,267 | |

| | | | | | | | |

|

Apparel 0.1% | |

Hanesbrands Finance Luxembourg SCA Series Reg S

3.50%, due 6/15/24 | | | 100,000 | | | | 125,792 | |

| | | | | | | | |

|

Auto Parts & Equipment 0.4% | |

Adient Global Holdings, Ltd. Series Reg S

3.50%, due 8/15/24 | | | 100,000 | | | | 122,979 | |

IHO Verwaltungs GmbH (a) | | | | | | | | |

Series Reg S,

3.25% (4.00% PIK), due 9/15/23 | | | 100,000 | | | | 122,169 | |

Series Reg S,

3.75% (4.50% PIK), due 9/15/26 | | | 200,000 | | | | 249,278 | |

| | | | | | | | |

| | | | | | | 494,426 | |

| | | | | | | | |

Banks 0.3% | |

Bank of America Corp. | | | | | | | | |

4.20%, due 8/26/24 | | | 55,000 | | | | 58,080 | |

5.625%, due 7/1/20 | | | 50,000 | | | | 54,258 | |

Citigroup, Inc.

4.60%, due 3/9/26 | | | 60,000 | | | | 63,951 | |

Goldman Sachs Group, Inc. | | | | | | | | |

3.50%, due 11/16/26 | | | 30,000 | | | | 30,042 | |

5.375%, due 3/15/20 | | | 50,000 | | | | 53,529 | |

6.75%, due 10/1/37 | | | 10,000 | | | | 13,202 | |

Morgan Stanley | | | | | | | | |

5.00%, due 11/24/25 | | | 55,000 | | | | 59,995 | |

5.50%, due 1/26/20 | | | 50,000 | | | | 53,578 | |

| | | | | | | | |

| | | | | | | 386,635 | |

| | | | | | | | |

Building Materials 0.2% | |

Cemex S.A.B. de C.V. | | | | | | | | |

Series Reg S

4.375%, due 3/5/23 | | | EUR100,000 | | | | 123,689 | |

Series Reg S

4.75%, due 1/11/22 | | | 100,000 | | | | 120,130 | |

| | | | | | | | |

| | | | | | | 243,819 | |

| | | | | | | | |

Chemicals 0.1% | |

Axalta Coating Systems LLC

Series Reg S

4.25%, due 8/15/24 | | | 100,000 | | | | 125,539 | |

| | | | | | | | |

| | | Principal Amount | | | Value | |

Chemicals (continued) | |

Chemours Co.

6.625%, due 5/15/23 | | $ | 34,000 | | | $ | 36,040 | |

| | | | | | | | |

| | | | | | | 161,579 | |

| | | | | | | | |

Commercial Services 0.5% | |

Arena Lux Finance S.A.R.L.

Series Reg S

2.875%, due 11/1/24 | | | EUR100,000 | | | | 118,240 | |

Brink’s Co.

4.625%, due 10/15/27 (b) | | $ | 94,000 | | | | 93,539 | |

La Financiere Atalian SAS

Series Reg S

4.00%, due 5/15/24 | | | EUR 200,000 | | | | 244,619 | |

Nielsen Co. Luxembourg S.A.R.L.

5.50%, due 10/1/21 (b) | | $ | 100,000 | | | | 103,000 | |

| | | | | | | | |

| | | | | | | 559,398 | |

| | | | | | | | |

Distribution & Wholesale 0.2% | |

VWR Funding, Inc.

Series Reg S

4.625%, due 4/15/22 | | | EUR150,000 | | | | 181,796 | |

| | | | | | | | |

| | |

Electric 0.4% | | | | | | | | |

EDP—Energias de Portugal S.A.

Series Reg S

5.375% (EUR 5-Year Interest Swap Rate + 5.043%), due 9/16/75 (c) | | | 100,000 | | | | 130,353 | |

Gas Natural Fenosa Finance B.V.

Series Reg S

4.125% (EUR 8-Year Interest Swap Rate + 3.353%), due 11/18/22 (c)(d) | | | 300,000 | | | | 380,032 | |

| | | | | | | | |

| | | | | | | 510,385 | |

| | | | | | | | |

Engineering & Construction 0.2% | |

SPIE S.A.

Series Reg S

3.125%, due 3/22/24 | | | 200,000 | | | | 243,861 | |

| | | | | | | | |

|

Food 0.5% | |

Casino Guichard Perrachon S.A.

Series Reg S

4.87% (EUR 5-Year Interest Swap Rate + 3.819%), due 1/31/19 (c)(d) | | | 100,000 | | | | 120,049 | |

Kraft Heinz Foods Co.

2.80%, due 7/2/20 | | $ | 95,000 | | | | 96,227 | |

Nomad Foods Bondco PLC

Series Reg S

3.25%, due 5/15/24 | | | EUR100,000 | | | | 119,764 | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers held, as of October 31, 2017, excluding short-term investments. May be subject to change daily. (Unaudited) |

| ∎ | | Among the Fund’s 5 largest short positions as of October 31, 2017. May be subject to change daily. (Unaudited) |

| | | | |

| 12 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal Amount | | | Value | |

| Corporate Bonds (continued) | |

Food (continued) | |

Post Holdings, Inc.

5.75%, due 3/1/27 (b) | | $ | 120,000 | | | $ | 124,650 | |

Tyson Foods, Inc.

3.95%, due 8/15/24 | | | 105,000 | | | | 110,685 | |

| | | | | | | | |

| | | | | | | 571,375 | |

| | | | | | | | |

Food Services 0.2% | |

Aramark International Finance S.A.R.L.

Series Reg S

3.125%, due 4/1/25 | | | EUR 100,000 | | | | 121,552 | |

Aramark Services, Inc.

5.125%, due 1/15/24 | | $ | 53,000 | | | | 56,048 | |

| | | | | | | | |

| | | | | | | 177,600 | |

| | | | | | | | |

Forest Products & Paper 0.2% | |

Smurfit Kappa Acquisitions Unlimited Co.

Series Reg S

2.375%, due 2/1/24 | | | EUR 200,000 | | | | 244,514 | |

| | | | | | | | |

|

Health Care—Products 0.2% | |

Boston Scientific Corp.

2.85%, due 5/15/20 | | $ | 100,000 | | | | 101,447 | |

Hologic, Inc.

5.25%, due 7/15/22 (b) | | | 141,000 | | | | 147,169 | |

| | | | | | | | |

| | | | | | | 248,616 | |

| | | | | | | | |

Health Care—Services 0.2% | |

HCA, Inc.

5.875%, due 3/15/22 | | | 20,000 | | | | 21,900 | |

Laboratory Corporation of America Holdings

2.625%, due 2/1/20 | | | 100,000 | | | | 100,820 | |

Unilabs Subholding A.B.

Series Reg S

5.75%, due 5/15/25 | | | EUR 100,000 | | | | 120,504 | |

| | | | | | | | |

| | | | | | | 243,224 | |

| | | | | | | | |

Home Builders 0.0%‡ | |

TRI Pointe Group, Inc. / TRI Pointe Homes, Inc.

5.875%, due 6/15/24 | | $ | 40,000 | | | | 43,300 | |

| | | | | | | | |

|

Household Products & Wares 0.2% | |

Spectrum Brands, Inc.

Series Reg S

4.00%, due 10/1/26 | | | EUR 200,000 | | | | 246,913 | |

| | | | | | | | |

|

Internet 0.2% | |

Netflix, Inc. | | | | | | | | |

Series Reg S

3.625%, due 5/15/27 | | | 100,000 | | | | 119,542 | |

4.875%, due 4/15/28 (b) | | $ | 86,000 | | | | 85,480 | |

| | | | | | | | |

| | | Principal Amount | | | Value | |

Internet (continued) | |

VeriSign, Inc.

4.75%, due 7/15/27 | | $ | 69,000 | | | $ | 71,070 | |

| | | | | | | | |

| | | | | | | 276,092 | |

| | | | | | | | |

Lodging 0.2% | |

Hilton Domestic Operating Co., Inc.

4.25%, due 9/1/24 | | | 100,000 | | | | 102,125 | |

NH Hotel Group S.A.

Series Reg S

3.75%, due 10/1/23 | | | EUR100,000 | | | | 123,372 | |

| | | | | | | | |

| | | | | | | 225,497 | |

| | | | | | | | |

Media 1.5% | |

Altice Financing S.A.

Series Reg S

5.25%, due 2/15/23 | | | 100,000 | | | | 122,309 | |

Altice Luxembourg S.A.

Series Reg S

7.25%, due 5/15/22 | | | 320,000 | | | | 396,981 | |

CCO Holdings LLC / CCO Holdings Capital Corp. (b) | | | | | | | | |

5.875%, due 4/1/24 | | $ | 100,000 | | | | 106,500 | |

5.875%, due 5/1/27 | | | 70,000 | | | | 73,304 | |

CSC Holdings LLC

10.875%, due 10/15/25 (b) | | | 200,000 | | | | 245,000 | |

SFR Group S.A.

6.00%, due 5/15/22 (b) | | | 200,000 | | | | 208,500 | |

Sirius XM Radio, Inc. (b) | | | | | | | | |

3.875%, due 8/1/22 | | | 25,000 | | | | 25,469 | |

4.625%, due 5/15/23 | | | 45,000 | | | | 46,125 | |

6.00%, due 7/15/24 | | | 95,000 | | | | 101,412 | |

Virgin Media Secured Finance PLC

5.50%, due 1/15/25 (b) | | | 200,000 | | | | 210,000 | |

Ziggo Secured Finance B.V.

Series Reg S

4.25%, due 1/15/27 | | | EUR 200,000 | | | | 249,226 | |

| | | | | | | | |

| | | | | | | 1,784,826 | |

| | | | | | | | |

Miscellaneous—Manufacturing 0.1% | |

Colfax Corp.

Series Reg S

3.25%, due 5/15/25 | | | 100,000 | | | | 122,088 | |

| | | | | | | | |

| | |

Oil & Gas 0.2% | | | | | | | | |

Petrobras Global Finance B.V.

7.375%, due 1/17/27 | | $ | 65,000 | | | | 72,183 | |

Petroleos Mexicanos

6.75%, due 9/21/47 (b) | | | 50,000 | | | | 51,535 | |

Seven Generations Energy, Ltd.

6.875%, due 6/30/23 (b) | | | 18,000 | | | | 19,215 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Consolidated Portfolio of Investments October 31, 2017 (Unaudited) (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

| Corporate Bonds (continued) | |

Oil & Gas (continued) | | | | | | | | |

Southwestern Energy Co.

7.50%, due 4/1/26 | | $ | 34,000 | | | $ | 35,275 | |

| | | | | | | | |

| | | | | | | 178,208 | |

| | | | | | | | |

Packaging & Containers 0.6% | |

Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc.

Series Reg S

6.75%, due 5/15/24 | | | EUR 200,000 | | | | 260,611 | |

Ball Corp.

4.375%, due 12/15/23 | | | 200,000 | | | | 267,274 | |

OI European Group B.V.

Series Reg S

3.125%, due 11/15/24 | | | 100,000 | | | | 121,734 | |

| | | | | | | | |

| | | | | | | 649,619 | |

| | | | | | | | |

Pharmaceuticals 0.2% | |

Grifols S.A.

Series Reg S

3.20%, due 5/1/25 | | | 200,000 | | | | 236,464 | |

| | | | | | | | |

|

Pipelines 0.1% | |

Cheniere Energy Partners, L.P.

5.25%, due 10/1/25 (b) | | $ | 96,000 | | | | 98,880 | |

| | | | | | | | |

|

Private Equity 0.1% | |

Icahn Enterprises, L.P. / Icahn Enterprises Finance Corp.

5.875%, due 2/1/22 | | | 50,000 | | | | 51,657 | |

| | | | | | | | |

|

Real Estate 0.1% | |

RESIDOMO Sro

Series Reg S

3.375%, due 10/15/24 | | | EUR 100,000 | | | | 119,257 | |

| | | | | | | | |

|

Real Estate Investment Trusts 0.4% | |

¨Equinix, Inc. | | | | | | | | |

2.875%, due 10/1/25 | | | 200,000 | | | | 238,939 | |

5.375%, due 1/1/22 | | $ | 27,000 | | | | 28,210 | |

5.375%, due 4/1/23 | | | 210,000 | | | | 216,825 | |

| | | | | | | | |

| | | | | | | 483,974 | |

| | | | | | | | |

Retail 1.4% | |

¨1011778 B.C. ULC / New Red Finance, Inc.

4.625%, due 1/15/22 (b) | | | 480,000 | | | | 491,184 | |

¨Dollar Tree, Inc.

5.75%, due 3/1/23 | | | 425,000 | | | | 445,719 | |

| | | | | | | | |

| | | Principal Amount | | | Value | |

Retail (continued) | |

Dufry One B.V.

Series Reg S

2.50%, due 10/15/24 | | | EUR 100,000 | | | $ | 119,427 | |

KFC Holding Co. / Pizza Hut Holdings LLC / Taco Bell of America LLC

5.00%, due 6/1/24 (b) | | $ | 159,000 | | | | 167,745 | |

Mobilux Finance S.A.S.

Series Reg S

5.50%, due 11/15/24 | | | EUR 100,000 | | | | 125,513 | |

O’Reilly Automotive, Inc.

3.80%, due 9/1/22 | | $ | 80,000 | | | | 83,756 | |

PVH Corp. Series Reg S

3.625%, due 7/15/24 | | | EUR 100,000 | | | | 129,473 | |

| | | | | | | | |

| | | | | | | 1,562,817 | |

| | | | | | | | |

Software 0.2% | |

Quintiles IMS, Inc.

Series Reg S

3.25%, due 3/15/25 | | | 150,000 | | | | 180,869 | |

| | | | | | | | |

|

Telecommunications 0.8% | |

Nokia OYJ

Series Reg S

2.00%, due 3/15/24 | | | 200,000 | | | | 238,112 | |

SoftBank Group Corp.

Series Reg S

3.125%, due 9/19/25 | | | 130,000 | | | | 153,137 | |

T-Mobile USA, Inc. | | | | | | | | |

6.375%, due 3/1/25 | | $ | 50,000 | | | | 54,000 | |

6.836%, due 4/28/23 | | | 50,000 | | | | 52,750 | |

Telecom Italia Capital S.A.

6.999%, due 6/4/18 | | | 70,000 | | | | 71,841 | |

Wind Tre S.p.A. | | | | | | | | |

Series Reg S

2.625%, due 1/20/23 | | | EUR 200,000 | | | | 234,018 | |

Series Reg S

3.125%, due 1/20/25 | | | 100,000 | | | | 116,834 | |

| | | | | | | | |

| | | | | | | 920,692 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $11,182,524) | | | | | | | 11,693,440 | |

| | | | | | | | |

| | |

| Foreign Bonds 3.9% | | | | | | | | |

Belgium 0.3% | |

Ontex Group N.V.

Series Reg S

4.75%, due 11/15/21 | | | 100,000 | | | | 119,443 | |

Solvay Finance S.A.

Series Reg S

5.869% (EUR 5-Year Interest Swap Rate + 5.223%), due 6/03/24 (c)(d) | | | 200,000 | | | | 281,311 | |

| | | | | | | | |

| | | | | | | 400,754 | |

| | | | | | | | |

| | | | |

| 14 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal Amount | | | Value | |

| Foreign Bonds (continued) | | | | | | | | |

France 0.9% | |

Accor S.A.

Series Reg S

4.125% (EUR 5-Year Interest Swap Rate + 3.652%), due 6/30/20 (c)(d) | | | EUR200,000 | | | $ | 249,273 | |

Crown European Holdings S.A.

Series Reg S

3.375%, due 5/15/25 | | | 115,000 | | | | 142,793 | |

PSA Tresorerie GIE

6.00%, due 9/19/33 | | | 55,000 | | | | 83,615 | |

Rexel S.A.

Series Reg S

3.50%, due 6/15/23 | | | 200,000 | | | | 245,084 | |

Veolia Environnement S.A.

Series Reg S

4.85% (GBP 5-year swap rate + 3.629%), due 4/16/18 (c)(d) | | | GBP 200,000 | | | | 269,461 | |

| | | | | | | | |

| | | | | | | 990,226 | |

| | | | | | | | |

Germany 0.3% | |

Kirk Beauty One GmbH

Series Reg S

8.75%, due 7/15/23 | | | EUR 100,000 | | | | 126,581 | |

Unitymedia Hessen GmbH & Co. KG / Unitymedia NRW GmbH

Series Reg S

5.125%, due 1/21/23 | | | 145,800 | | | | 175,891 | |

| | | | | | | | |

| | | | | | | 302,472 | |

| | | | | | | | |

Ireland 0.1% | |

Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc.

Series Reg S

4.125%, due 5/15/23 | | | 100,000 | | | | 123,913 | |

| | | | | | | | |

|

Italy 0.1% | |

Enel S.p.A.

Series Reg S

7.75%, due 9/10/75 (c) | | | GBP 100,000 | | | | 152,112 | |

| | | | | | | | |

|

Luxembourg 0.1% | |

Telenet Finance V Luxembourg SCA

Series Reg S

6.75%, due 8/15/24 | | | EUR 100,000 | | | | 126,118 | |

| | | | | | | | |

|

Netherlands 0.7% | |

InterXion Holding N.V.

Series Reg S

6.00%, due 7/15/20 | | | 150,000 | | | | 180,616 | |

Vonovia Finance B.V.

Series Reg S

4.625% (EUR 5-Year Interest Swap Rate + 3.696%), due 4/8/74 (c) | | | 300,000 | | | | 369,548 | |

| | | | | | | | |

| | | Principal Amount | | | Value | |

Netherlands (continued) | |

Ziggo Bond Co B.V.

Series Reg S

7.125%, due 5/15/24 | | | EUR210,000 | | | $ | 275,318 | |

| | | | | | | | |

| | | | | | | 825,482 | |

| | | | | | | | |

Spain 0.3% | |

Cellnex Telecom S.A.

Series Reg S

2.375%, due 1/16/24 | | | 100,000 | | | | 121,471 | |

Gestamp Funding Luxembourg S.A.

Series Reg S

3.50%, due 5/15/23 | | | 100,000 | | | | 122,018 | |

Telefonica Europe B.V.

Series Reg S

5.00% (EUR 6-Year Interest Swap Rate + 3.804%), due 3/31/20 (c)(d) | | | 100,000 | | | | 126,677 | |

| | | | | | | | |

| | | | | | | 370,166 | |

| | | | | | | | |

Sweden 0.2% | |

Verisure Holding AB

Series Reg S

6.00%, due 11/1/22 | | | 189,000 | | | | 237,307 | |

| | | | | | | | |

|

Switzerland 0.3% | |

Dufry Finance SCA

Series Reg S

4.50%, due 8/1/23 | | | 300,000 | | | | 371,296 | |

| | | | | | | | |

|

United Kingdom 0.6% | |

Alliance Automotive Finance PLC

Series Reg S

6.25%, due 12/1/21 | | | 125,000 | | | | 150,056 | |

¨Synlab Bondco PLC

Series Reg S

6.25%, due 7/1/22 | | | 400,000 | | | | 496,498 | |

| | | | | | | | |

| | | | | | | 646,554 | |

| | | | | | | | |

Total Foreign Bonds

(Cost $4,296,378) | | | | | | | 4,546,400 | |

| | | | | | | | |

Total Long-Term Bonds

(Cost $15,478,902) | | | | | | | 16,239,840 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

Shares | | | | |

| Closed-End Funds 0.2% | | | | | | | | |

Internet Software & Services 0.2% | |

Altaba, Inc. (e) | | | 3,799 | | | | 266,386 | |

| | | | | | | | |

Total Closed-End Funds

(Cost $152,724) | | | | | | | 266,386 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Consolidated Portfolio of Investments October 31, 2017 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks 30.0% | | | | | | | | |

Aerospace & Defense 0.2% | | | | | | | | |

Spirit AeroSystems Holdings, Inc., Class A (f) | | | 1,200 | | | $ | 96,120 | |

Triumph Group, Inc. (f) | | | 3,800 | | | | 117,990 | |

| | | | | | | | |

| | | | | | | 214,110 | |

| | | | | | | | |

Airlines 0.5% | |

Air New Zealand, Ltd. | | | 44,699 | | | | 100,939 | |

Deutsche Lufthansa A.G., Registered (f) | | | 4,910 | | | | 156,712 | |

Finnair OYJ | | | 539 | | | | 7,032 | |

International Consolidated Airlines Group S.A. (f) | | | 17,126 | | | | 144,632 | |

Qantas Airways, Ltd. | | | 29,868 | | | | 140,585 | |

SAS A.B. (e) | | | 8,607 | | | | 26,628 | |

| | | | | | | | |

| | | | | | | 576,528 | |

| | | | | | | | |

Auto Components 0.1% | |

Leoni A.G. (f) | | | 1,730 | | | | 114,825 | |

SAF-Holland S.A. | | | 1,983 | | | | 39,280 | |

| | | | | | | | |

| | | | | | | 154,105 | |

| | | | | | | | |

Automobiles 0.3% | |

Fiat Chrysler Automobiles N.V. (e)(f) | | | 7,883 | | | | 136,268 | |

Peugeot S.A. (f) | | | 5,896 | | | | 139,866 | |

Renault S.A. (f) | | | 309 | | | | 30,645 | |

| | | | | | | | |

| | | | | | | 306,779 | |

| | | | | | | | |

Banks 0.8% | |

Aldermore Group PLC (e) | | | 29,475 | | | | 117,833 | |

Bancorp, Inc. (e)(f) | | | 11,700 | | | | 98,397 | |

Bendigo & Adelaide Bank, Ltd. (f) | | | 10,193 | | | | 88,778 | |

Customers Bancorp, Inc. (e)(f) | | | 3,600 | | | | 98,424 | |

First BanCorp (e)(f) | | | 23,100 | | | | 118,965 | |

Franklin Financial Network, Inc. (e)(f) | | | 2,900 | | | | 99,470 | |

KeyCorp (f) | | | 3,800 | | | | 69,350 | |

OFG Bancorp (f) | | | 1,800 | | | | 16,020 | |

Raiffeisen Bank International A.G. (e)(f) | | | 4,161 | | | | 144,972 | |

Unione di Banche Italiane S.p.A. | | | 17,715 | | | | 83,201 | |

| | | | | | | | |

| | | | | | | 935,410 | |

| | | | | | | | |

Beverages 0.1% | |

Coca-Cola Bottling Co. Consolidated (f) | | | 500 | | | | 112,780 | |

Stock Spirits Group PLC | | | 3,677 | | | | 12,307 | |

| | | | | | | | |

| | | | | | | 125,087 | |

| | | | | | | | |

Biotechnology 0.1% | |

Shire PLC, ADR | | | 359 | | | | 52,999 | |

TESARO, Inc. (e) | | | 504 | | | | 58,348 | |

| | | | | | | | |

| | | | | | | 111,347 | |

| | | | | | | | |

Building Products 0.1% | |

Inwido AB | | | 2,071 | | | | 22,821 | |

Owens Corning (f) | | | 1,800 | | | | 148,842 | |

| | | | | | | | |

| | | | | | | 171,663 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Capital Markets 0.8% | |

Banca Generali S.p.A. | | | 3,387 | | | $ | 111,574 | |

Deutsche Boerse A.G. | | | 1,340 | | | | 138,420 | |

INTL. FCStone, Inc. (e)(f) | | | 2,100 | | | | 87,171 | |

Lazard, Ltd., Class A (f) | | | 3,100 | | | | 147,374 | |

Legg Mason, Inc. (f) | | | 3,500 | | | | 133,630 | |

LPL Financial Holdings, Inc. (f) | | | 2,700 | | | | 133,947 | |

MLP S.E. | | | 5,145 | | | | 35,330 | |

Natixis S.A. (f) | | | 17,287 | | | | 135,561 | |

| | | | | | | | |

| | | | | | | 923,007 | |

| | | | | | | | |

Chemicals 0.6% | |

AdvanSix, Inc. (e)(f) | | | 2,900 | | | | 134,183 | |

American Vanguard Corp. (f) | | | 900 | | | | 20,250 | |

Chemours Co. (f) | | | 2,700 | | | | 152,847 | |

Covestro A.G. (b)(f) | | | 1,638 | | | | 157,145 | |

Lenzing A.G. (f) | | | 361 | | | | 48,863 | |

Olin Corp. (f) | | | 3,900 | | | | 142,467 | |

Rayonier Advanced Materials, Inc. (f) | | | 3,000 | | | | 43,110 | |

| | | | | | | | |

| | | | | | | 698,865 | |

| | | | | | | | |

Commercial Services & Supplies 0.4% | |

Derichebourg S.A. (f) | | | 10,226 | | | | 109,124 | |

Essendant, Inc. (f) | | | 8,600 | | | | 83,248 | |

Heritage-Crystal Clean, Inc. (e)(f) | | | 1,800 | | | | 35,190 | |

Pitney Bowes, Inc. (f) | | | 10,100 | | | | 138,774 | |

Quad/Graphics, Inc. (f) | | | 2,100 | | | | 47,859 | |

| | | | | | | | |

| | | | | | | 414,195 | |

| | | | | | | | |

Communications Equipment 0.2% | |

ARRIS International PLC (e)(f) | | | 4,900 | | | | 139,650 | |

Comtech Telecommunications Corp. (f) | | | 4,800 | | | | 103,248 | |

| | | | | | | | |

| | | | | | | 242,898 | |

| | | | | | | | |

Construction & Engineering 0.5% | |

ACS Actividades de Construccion y Servicios S.A. (f) | | | 3,805 | | | | 150,054 | |

Astaldi S.p.A. | | | 9,590 | | | | 66,467 | |

Bouygues S.A. | | | 4,609 | | | | 221,275 | |

Maire Tecnimont S.p.A. | | | 19,909 | | | | 111,688 | |

Monadelphous Group, Ltd. (f) | | | 4,204 | | | | 54,601 | |

Mota-Engil SGPS S.A. | | | 5,705 | | | | 22,913 | |

| | | | | | | | |

| | | | | | | 626,998 | |

| | | | | | | | |

Construction Materials 0.2% | |

Buzzi Unicem S.p.A. | | | 6,207 | | | | 98,403 | |

Cementir Holding S.p.A. | | | 6,319 | | | | 53,696 | |

CSR, Ltd. | | | 31,746 | | | | 115,167 | |

| | | | | | | | |

| | | | | | | 267,266 | |

| | | | | | | | |

Consumer Finance 0.2% | |

Enova International, Inc. (e)(f) | | | 8,600 | | | | 127,710 | |

Green Dot Corp., Class A (e)(f) | | | 100 | | | | 5,662 | |

World Acceptance Corp. (e)(f) | | | 1,400 | | | | 122,500 | |

| | | | | | | | |

| | | | | | | 255,872 | |

| | | | | | | | |

| | | | |

| 16 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Containers & Packaging 0.1% | |

Bemis Co., Inc. | | | 1,330 | | | $ | 59,877 | |

| | | | | | | | |

|

Diversified Consumer Services 0.1% | |

K12, Inc. (e)(f) | | | 4,900 | | | | 79,478 | |

Regis Corp. (e)(f) | | | 700 | | | | 10,451 | |

| | | | | | | | |

| | | | | | | 89,929 | |

| | | | | | | | |

Diversified Financial Services 0.4% | |

EXOR N.V. | | | 5,266 | | | | 337,682 | |

FNFV Group (e)(f) | | | 5,600 | | | | 96,600 | |

| | | | | | | | |

| | | | | | | 434,282 | |

| | | | | | | | |

Diversified Telecommunication Services 0.2% | |

Koninklijke KPN N.V. | | | 21,060 | | | | 72,712 | |

Telecom Italia S.p.A. | | | 169,539 | | | | 120,566 | |

| | | | | | | | |

| | | | | | | 193,278 | |

| | | | | | | | |

Electrical Equipment 0.2% | |

Regal Beloit Corp. (f) | | | 1,800 | | | | 146,070 | |

TPI Composites, Inc. (e)(f) | | | 4,300 | | | | 107,715 | |

| | | | | | | | |

| | | | | | | 253,785 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components 0.5% | |

ALSO holding A.G., Registered (f) | | | 168 | | | | 22,733 | |

Jabil, Inc. (f) | | | 4,800 | | | | 135,744 | |

KEMET Corp. (e)(f) | | | 5,100 | | | | 131,019 | |

Venture Corp., Ltd. | | | 9,000 | | | | 128,685 | |

Zebra Technologies Corp., Class A (e)(f) | | | 1,300 | | | | 150,787 | |

| | | | | | | | |

| | | | | | | 568,968 | |

| | | | | | | | |

Energy Equipment & Services 1.0% | |

Baker Hughes, a GE Co. | | | 5,360 | | | | 168,465 | |

Exterran Corp. (e)(f) | | | 3,600 | | | | 116,172 | |

Halliburton Co. | | | 4,890 | | | | 208,999 | |

McDermott International, Inc. (e)(f) | | | 16,000 | | | | 105,920 | |

Nabors Industries, Ltd. (f) | | | 2,500 | | | | 14,075 | |

Oceaneering International, Inc. (f) | | | 5,400 | | | | 109,188 | |

Petrofac, Ltd. (f) | | | 18,855 | | | | 105,002 | |

TechnipFMC PLC (e) | | | 7,256 | | | | 197,273 | |

Transocean, Ltd. (e)(f) | | | 9,600 | | | | 100,800 | |

| | | | | | | | |

| | | | | | | 1,125,894 | |

| | | | | | | | |

Food & Staples Retailing 0.2% | |

Casino Guichard Perrachon S.A. (f) | | | 77 | | | | 4,398 | |

Jean Coutu Group PJC, Inc., Class A | | | 6,771 | | | | 128,482 | |

J Sainsbury PLC | | | 14,075 | | | | 45,332 | |

Rallye S.A. | | | 1,088 | | | | 18,605 | |

| | | | | | | | |

| | | | | | | 196,817 | |

| | | | | | | | |

Food Products 0.6% | |

Austevoll Seafood ASA | | | 8,620 | | | | 86,274 | |

Bunge, Ltd. (f) | | | 2,900 | | | | 199,462 | |

Grieg Seafood ASA (f) | | | 7,984 | | | | 75,803 | |

| | | | | | | | |

| | |

Shares | | | Value | |

Food Products (continued) | |

Norway Royal Salmon ASA | | | 2,636 | | | $ | 51,151 | |

Pilgrim’s Pride Corp. (e)(f) | | | 5,000 | | | | 158,900 | |

Salmar ASA (f) | | | 563 | | | | 16,798 | |

Seaboard Corp. (f) | | | 17 | | | | 74,802 | |

TreeHouse Foods, Inc. (e)(f) | | | 1,300 | | | | 86,294 | |

| | | | | | | | |

| | | | | | | 749,484 | |

| | | | | | | | |

Health Care Equipment & Supplies 0.7% | |

Cutera, Inc. (e)(f) | | | 2,800 | | | | 110,040 | |

El.En. S.p.A. | | | 408 | | | | 11,549 | |

Hill-Rom Holdings, Inc. (f) | | | 1,900 | | | | 153,349 | |

Integer Holdings Corp. (e)(f) | | | 1,700 | | | | 82,620 | |

Lantheus Holdings, Inc. (e)(f) | | | 6,600 | | | | 131,340 | |

LeMaitre Vascular, Inc. (f) | | | 1,300 | | | | 41,613 | |

Masimo Corp. (e)(f) | | | 1,400 | | | | 122,864 | |

Merit Medical Systems, Inc. (e)(f) | | | 2,700 | | | | 102,735 | |

West Pharmaceutical Services, Inc. (f) | | | 600 | | | | 60,840 | |

| | | | | | | | |

| | | | | | | 816,950 | |

| | | | | | | | |

Health Care Providers & Services 0.5% | |

Centene Corp. (e)(f) | | | 1,500 | | | | 140,505 | |

Cross Country Healthcare, Inc. (e)(f) | | | 5,000 | | | | 68,250 | |

Magellan Health, Inc. (e)(f) | | | 1,300 | | | | 110,890 | |

Molina Healthcare, Inc. (e)(f) | | | 1,700 | | | | 115,311 | |

RadNet, Inc. (e)(f) | | | 4,500 | | | | 49,275 | |

Triple-S Management Corp., Class B (e)(f) | | | 2,000 | | | | 48,020 | |

WellCare Health Plans, Inc. (e)(f) | | | 300 | | | | 59,322 | |

| | | | | | | | |

| | | | | | | 591,573 | |

| | | | | | | | |

Hotels, Restaurants & Leisure 0.6% | |

Darden Restaurants, Inc. (f) | | | 1,700 | | | | 139,859 | |

EI Group PLC (e) | | | 23,191 | | | | 41,427 | |

Genting Singapore PLC | | | 160,000 | | | | 143,203 | |

International Game Technology PLC (f) | | | 5,700 | | | | 133,950 | |

J.D. Wetherspoon PLC (f) | | | 2,163 | | | | 35,766 | |

Scandic Hotels Group AB (b) | | | 6,306 | | | | 81,352 | |

TUI A.G. (f) | | | 6,380 | | | | 115,241 | |

| | | | | | | | |

| | | | | | | 690,798 | |

| | | | | | | | |

Household Durables 0.6% | |

Bassett Furniture Industries, Inc. (f) | | | 300 | | | | 11,640 | |

Beazer Homes USA, Inc. (e)(f) | | | 6,000 | | | | 125,880 | |

Berkeley Group Holdings PLC (f) | | | 2,809 | | | | 139,568 | |

Persimmon PLC (f) | | | 3,974 | | | | 147,892 | |

Redrow PLC (f) | | | 8,175 | | | | 70,683 | |

Tupperware Brands Corp. (f) | | | 1,900 | | | | 111,625 | |

ZAGG, Inc. (e)(f) | | | 4,100 | | | | 64,165 | |

| | | | | | | | |

| | | | | | | 671,453 | |

| | | | | | | | |

Household Products 0.2% | |

Henkel A.G. & Co. KGaA | | | 1,452 | | | | 183,005 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Consolidated Portfolio of Investments October 31, 2017 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Independent Power & Renewable Electricity Producers 0.0%‡ | |

Falck Renewables S.p.A. | | | 14,038 | | | $ | 24,430 | |

| | | | | | | | |

| | |

Insurance 0.8% | | | | | | | | |

Aegon N.V. (f) | | | 24,259 | | | | 143,212 | |

Aspen Insurance Holdings, Ltd. (f) | | | 600 | | | | 25,740 | |

Direct Line Insurance Group PLC | | | 28,797 | | | | 142,163 | |

NN Group N.V. (f) | | | 3,394 | | | | 142,168 | |

Old Mutual PLC | | | 54,297 | | | | 137,739 | |

Societa Cattolica di Assicurazioni SC | | | 13,065 | | | | 141,611 | |

State National Cos., Inc. | | | 7,025 | | | | 147,665 | |

| | | | | | | | |

| | | | | | | 880,298 | |

| | | | | | | | |

Internet & Direct Marketing Retail 0.2% | |

1-800-Flowers.com, Inc., Class A (e)(f) | | | 3,100 | | | | 29,140 | |

Expedia, Inc. (f) | | | 300 | | | | 37,398 | |

FTD Cos., Inc. (e)(f) | | | 2,700 | | | | 29,160 | |

Liberty Interactive Corp. QVC Group, Class A (e)(f) | | | 5,800 | | | | 131,776 | |

Wayfair, Inc., Class A (e)(f) | | | 400 | | | | 27,960 | |

| | | | | | | | |

| | | | | | | 255,434 | |

| | | | | | | | |

Internet Software & Services 0.6% | |

Akamai Technologies, Inc. (e)(f) | | | 2,800 | | | | 146,300 | |

Blucora, Inc. (e)(f) | | | 4,600 | | | | 99,820 | |

Carbonite, Inc. (e)(f) | | | 5,300 | | | | 120,310 | |

Care.com, Inc. (e)(f) | | | 4,500 | | | | 69,165 | |

Endurance International Group Holdings, Inc. (e)(f) | | | 14,500 | | | | 118,900 | |

Twitter, Inc. (e)(f) | | | 1,600 | | | | 32,992 | |

Web.com Group, Inc. (e)(f) | | | 4,300 | | | | 103,630 | |

| | | | | | | | |

| | | | | | | 691,117 | |

| | | | | | | | |

IT Services 0.6% | |

Alliance Data Systems Corp. (f) | | | 600 | | | | 134,238 | |

Everi Holdings, Inc. (e)(f) | | | 15,200 | | | | 126,008 | |

MoneyGram International, Inc. (e)(f) | | | 25,412 | | | | 395,157 | |

| | | | | | | | |

| | | | | | | 655,403 | |

| | | | | | | | |

Leisure Products 0.1% | |

Brunswick Corp. (f) | | | 2,400 | | | | 121,560 | |

Johnson Outdoors, Inc., Class A (f) | | | 200 | | | | 15,042 | |

Trigano S.A. (f) | | | 171 | | | | 27,588 | |

| | | | | | | | |

| | | | | | | 164,190 | |

| | | | | | | | |

Life Sciences Tools & Services 0.1% | |

Bruker Corp. (f) | | | 4,700 | | | | 147,580 | |

| | | | | | | | |

| | |

Machinery 1.4% | | | | | | | | |

Bobst Group S.A., Registered (f) | | | 802 | | | | 85,695 | |

Danieli & C Officine Meccaniche S.p.A. | | | 3,082 | | | | 51,266 | |

Fenner PLC | | | 13,976 | | | | 63,993 | |

Global Brass & Copper Holdings, Inc. (f) | | | 200 | | | | 7,000 | |

| | | | | | | | |

| | |

Shares | | | Value | |

Machinery (continued) | | | | | | | | |

Greenbrier Cos., Inc. (f) | | | 1,000 | | | $ | 52,200 | |

Haldex AB (e) | | | 23,416 | | | | 260,127 | |

Harsco Corp. (e)(f) | | | 5,500 | | | | 116,875 | |

Hyster-Yale Materials Handling, Inc. (f) | | | 1,100 | | | | 86,339 | |

Meritor, Inc. (e)(f) | | | 300 | | | | 7,803 | |

Oshkosh Corp. (f) | | | 900 | | | | 82,404 | |

Pfeiffer Vacuum Technology A.G. (f) | | | 1,409 | | | | 226,249 | |

Rieter Holding A.G., Registered (f) | | | 98 | | | | 22,917 | |

Terex Corp. (f) | | | 600 | | | | 28,266 | |

Trinity Industries, Inc. (f) | | | 1,500 | | | | 48,780 | |

Vesuvius PLC (f) | | | 14,741 | | | | 115,120 | |

Wabash National Corp. (f) | | | 5,100 | | | | 114,750 | |

Wacker Neuson S.E. | | | 1,295 | | | | 42,200 | |

Yangzijiang Shipbuilding Holdings, Ltd. | | | 134,600 | | | | 155,524 | |

| | | | | | | | |

| | | | | | | 1,567,508 | |

| | | | | | | | |

Media 0.4% | |

Asian Pay Television Trust | | | 27,800 | | | | 11,829 | |

Interpublic Group of Cos., Inc. (f) | | | 3,100 | | | | 59,675 | |

Lagardere S.C.A. (f) | | | 2,344 | | | | 77,202 | |

Live Nation Entertainment, Inc. (e)(f) | | | 400 | | | | 17,512 | |

MDC Partners, Inc., Class A (e)(f) | | | 6,600 | | | | 75,900 | |

Nine Entertainment Co. Holdings, Ltd. | | | 107,805 | | | | 123,763 | |

tronc, Inc. (e)(f) | | | 4,700 | | | | 69,489 | |

| | | | | | | | |

| | | | | | | 435,370 | |

| | | | | | | | |

Metals & Mining 1.3% | |

Acacia Mining PLC | | | 35,560 | | | | 85,154 | |

Anglo American PLC (f) | | | 7,637 | | | | 144,032 | |

ArcelorMittal (e)(f) | | | 1,779 | | | | 51,009 | |

Dominion Diamond Corp. | | | 25,335 | | | | 361,024 | |

Fortescue Metals Group, Ltd. | | | 34,333 | | | | 121,924 | |

Granges AB | | | 2,936 | | | | 30,424 | |

Mineral Resources, Ltd. (f) | | | 8,884 | | | | 118,309 | |

Norsk Hydro ASA (f) | | | 18,852 | | | | 145,752 | |

Outokumpu OYJ (f) | | | 8,706 | | | | 82,346 | |

OZ Minerals, Ltd. (f) | | | 19,672 | | | | 121,201 | |

Rio Tinto, Ltd. (f) | | | 2,682 | | | | 142,558 | |

Sims Metal Management, Ltd. (f) | | | 5,796 | | | | 58,643 | |

United States Steel Corp. (f) | | | 1,300 | | | | 32,916 | |

| | | | | | | | |

| | | | | | | 1,495,292 | |

| | | | | | | | |

Multiline Retail 0.0%‡ | |

Debenhams PLC | | | 76,706 | | | | 44,571 | |

Harvey Norman Holdings, Ltd. | | | 3,771 | | | | 10,910 | |

| | | | | | | | |

| | | | | | | 55,481 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels 7.7% | |

Andeavor Logistics, L.P. (f) | | | 6,800 | | | | 307,224 | |

Antero Midstream GP, L.P. (f) | | | 17,200 | | | | 321,812 | |

Caltex Australia, Ltd. (f) | | | 5,526 | | | | 144,896 | |

Cheniere Energy, Inc. (e)(f) | | | 7,000 | | | | 327,180 | |

CONSOL Energy, Inc. (e)(f) | | | 8,300 | | | | 133,879 | |

| | | | |

| 18 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Oil, Gas & Consumable Fuels (continued) | |

CVR Energy, Inc. (f) | | | 2,700 | | | $ | 74,115 | |

Dominion Energy Midstream Partners, L.P. (f) | | | 9,000 | | | | 288,450 | |

¨Energy Transfer Equity, L.P. (f) | | | 28,600 | | | | 507,650 | |

¨Energy Transfer Partners, L.P. (f) | | | 26,700 | | | | 464,847 | |

EnLink Midstream LLC (f) | | | 13,300 | | | | 206,150 | |

Enterprise Products Partners, L.P. (f) | | | 15,700 | | | | 384,650 | |

EQT GP Holdings, L.P. (f) | | | 9,900 | | | | 273,537 | |

Kinder Morgan, Inc. (f) | | | 16,800 | | | | 304,248 | |

Magellan Midstream Partners, L.P. (f) | | | 3,000 | | | | 206,130 | |

¨MPLX, L.P. (f) | | | 14,500 | | | | 511,270 | |

NGL Energy Partners, L.P. | | | 15,900 | | | | 185,235 | |

Noble Midstream Partners, L.P. | | | 3,500 | | | | 181,510 | |

ONEOK, Inc. (f) | | | 4,400 | | | | 238,788 | |

PBF Energy, Inc., Class A (f) | | | 2,500 | | | | 72,425 | |

Peabody Energy Corp. (e)(f) | | | 800 | | | | 24,712 | |

Phillips 66 Partners, L.P. (f) | | | 7,300 | | | | 367,993 | |

Plains GP Holdings, L.P., Class A (f) | | | 14,100 | | | | 287,640 | |

QEP Resources, Inc. (e)(f) | | | 9,800 | | | | 87,710 | |

Renewable Energy Group, Inc. (e)(f) | | | 5,900 | | | | 71,390 | |

Rice Midstream Partners, L.P. (f) | | | 15,500 | | | | 321,470 | |

SemGroup Corp., Class A (f) | | | 9,600 | | | | 250,080 | |

Shell Midstream Partners, L.P. (f) | | | 12,300 | | | | 312,543 | |

Ship Finance International, Ltd. (f) | | | 4,800 | | | | 71,520 | |

Southwestern Energy Co. (e)(f) | | | 15,200 | | | | 84,360 | |

Stone Energy Corp. (e)(f) | | | 2,400 | | | | 70,608 | |

¨Targa Resources Corp. (f) | | | 10,100 | | | | 419,150 | |

Valero Energy Partners, L.P. (f) | | | 8,000 | | | | 343,680 | |

Western Gas Equity Partners, L.P. (f) | | | 7,600 | | | | 300,580 | |

Whitehaven Coal, Ltd. (e) | | | 41,078 | | | | 117,268 | |

¨Williams Cos., Inc. (f) | | | 17,000 | | | | 484,500 | |

Williams Partners, L.P. (f) | | | 4,400 | | | | 162,976 | |

| | | | | | | | |

| | | | | | | 8,912,176 | |

| | | | | | | | |

Paper & Forest Products 0.1% | |

Ence Energia y Celulosa S.A. | | | 22,387 | | | | 129,866 | |

| | | | | | | | |

|

Personal Products 0.1% | |

Nu Skin Enterprises, Inc., Class A (f) | | | 2,300 | | | | 146,303 | |

| | | | | | | | |

|

Pharmaceuticals 1.7% | |

Akorn, Inc. (e) | | | 6,829 | | | | 222,420 | |

Amphastar Pharmaceuticals, Inc. (e)(f) | | | 6,300 | | | | 113,841 | |

AstraZeneca PLC, Sponsored ADR | | | 1,876 | | | | 64,722 | |

Catalent, Inc. (e)(f) | | | 2,800 | | | | 119,252 | |

Depomed, Inc. (e) | | | 6,858 | | | | 33,193 | |

Endo International PLC (e)(f) | | | 16,200 | | | | 103,356 | |

Faes Farma S.A. | | | 5,542 | | | | 18,786 | |

H. Lundbeck A/S (f) | | | 2,409 | | | | 143,147 | |

Horizon Pharma PLC (e)(f) | | | 23,436 | | | | 317,792 | |

| | | | | | | | |

| | |

Shares | | | Value | |

Pharmaceuticals (continued) | |

Impax Laboratories, Inc. (e)(f) | | | 5,600 | | | $ | 101,640 | |

Intersect ENT, Inc. (e)(f) | | | 3,800 | | | | 112,670 | |

Lannett Co., Inc. (e)(f) | | | 5,700 | | | | 113,430 | |

Mallinckrodt PLC (e)(f) | | | 2,100 | | | | 66,507 | |

Mylan N.V. (e)(f) | | | 5,574 | | | | 199,047 | |

Phibro Animal Health Corp., Class A (f) | | | 3,200 | | | | 120,480 | |

Sucampo Pharmaceuticals, Inc., Class A (e)(f) | | | 100 | | | | 1,000 | |

Supernus Pharmaceuticals, Inc. (e)(f) | | | 2,900 | | | | 120,640 | |

| | | | | | | | |

| | | | | | | 1,971,923 | |

| | | | | | | | |

Professional Services 0.1% | |

Barrett Business Services, Inc. (f) | | | 100 | | | | 6,079 | |

ManpowerGroup, Inc. (f) | | | 1,200 | | | | 147,936 | |

| | | | | | | | |

| | | | | | | 154,015 | |

| | | | | | | | |

Road & Rail 0.2% | |

ArcBest Corp. (f) | | | 3,500 | | | | 114,100 | |

Firstgroup PLC (e) | | | 15,249 | | | | 22,278 | |

YRC Worldwide, Inc. (e)(f) | | | 5,600 | | | | 75,432 | |

| | | | | | | | |

| | | | | | | 211,810 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment 0.2% | |

BE Semiconductor Industries N.V. (f) | | | 1,670 | | | | 131,211 | |

Siltronic A.G. (e)(f) | | | 926 | | | | 137,204 | |

| | | | | | | | |

| | | | | | | 268,415 | |

| | | | | | | | |

Software 0.6% | |

BroadSoft, Inc. (e) | | | 3,050 | | | | 167,293 | |

CA, Inc. (f) | | | 2,500 | | | | 80,950 | |

Dell Technologies, Inc., Class V (e)(f) | | | 1,800 | | | | 148,986 | |

Fortinet, Inc. (e)(f) | | | 3,800 | | | | 149,758 | |

Nuance Communications, Inc. (e)(f) | | | 8,900 | | | | 131,186 | |

Synchronoss Technologies, Inc. (e)(f) | | | 6,900 | | | | 78,177 | |

| | | | | | | | |

| | | | | | | 756,350 | |

| | | | | | | | |

Specialty Retail 0.6% | |

Abercrombie & Fitch Co., Class A (f) | | | 6,500 | | | | 87,295 | |

Barnes & Noble, Inc. (f) | | | 10,000 | | | | 70,000 | |

Best Buy Co., Inc. (f) | | | 2,086 | | | | 116,774 | |

Dick’s Sporting Goods, Inc. (f) | | | 3,400 | | | | 83,198 | |

Foot Locker, Inc. (f) | | | 2,700 | | | | 81,216 | |

GameStop Corp., Class A (f) | | | 4,300 | | | | 80,367 | |

Matas A/S | | | 4,087 | | | | 45,743 | |

Office Depot, Inc. | | | 41,150 | | | | 127,565 | |

Pendragon PLC | | | 123,962 | | | | 41,572 | |

| | | | | | | | |

| | | | | | | 733,730 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals 0.2% | |

Neopost S.A. (f) | | | 1,862 | | | | 68,626 | |

Western Digital Corp. (f) | | | 1,600 | | | | 142,832 | |

| | | | | | | | |

| | | | | | | 211,458 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods 0.6% | |

Christian Dior S.E. | | | 741 | | | | 254,415 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Consolidated Portfolio of Investments October 31, 2017 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Textiles, Apparel & Luxury Goods (continued) | |

Fossil Group, Inc. (e)(f) | | | 12,500 | | | $ | 98,500 | |

OVS S.p.A (b) | | | 3,092 | | | | 23,123 | |

Pandora A/S (f) | | | 1,431 | | | | 135,075 | |

Skechers U.S.A., Inc., Class A (e)(f) | | | 5,600 | | | | 178,752 | |

| | | | | | | | |

| | | | | | | 689,865 | |

| | | | | | | | |

Thrifts & Mortgage Finance 0.3% | |

Deutsche Pfandbriefbank A.G. (b)(f) | | | 7,793 | | | | 111,883 | |

Genworth Mortgage Insurance Australia, Ltd. | | | 53,742 | | | | 116,813 | |

OneSavings Bank PLC (f) | | | 17,416 | | | | 93,912 | |

| | | | | | | | |

| | | | | | | 322,608 | |

| | | | | | | | |

Trading Companies & Distributors 0.4% | |

AerCap Holdings N.V. (e) | | | 2,700 | | | | 142,128 | |

DXP Enterprises, Inc. (e)(f) | | | 3,300 | | | | 105,831 | |

Grafton Group PLC (f) | | | 3,865 | | | | 42,222 | |

Rush Enterprises, Inc., Class A (e)(f) | | | 2,600 | | | | 132,028 | |

Seven Group Holdings, Ltd. (f) | | | 5,347 | | | | 54,223 | |

| | | | | | | | |

| | | | | | | 476,432 | |

| | | | | | | | |

Transportation Infrastructure 0.5% | |

Abertis Infraestructuras S.A. | | | 17,570 | | | | 380,061 | |

Ansaldo STS S.p.A. (e) | | | 5,640 | | | | 77,852 | |

ASTM S.p.A. | | | 2,541 | | | | 70,445 | |

| | | | | | | | |

| | | | | | | 528,358 | |

| | | | | | | | |

Wireless Telecommunication Services 0.2% | |

T-Mobile U.S., Inc. (e) | | | 2,520 | | | | 150,620 | |

Tele2 A.B., Class B (f) | | | 6,102 | | | | 77,627 | |

| | | | | | | | |

| | | | | | | 228,247 | |

| | | | | | | | |

Total Common Stocks

(Cost $33,613,147) | | | | | | | 34,763,882 | |

| | | | | | | | |

|

| Exchange-Traded Funds 0.6% | |

Alerian MLP ETF | | | 21,383 | | | | 229,226 | |

¨Global X Lithium & Battery Tech ETF | | | 11,900 | | | | 466,599 | |

ProShares UltraShort Bloomberg Crude Oil ETF (e) | | | 1,369 | | | | 41,549 | |

| | | | | | | | |

Total Exchange-Traded Funds

(Cost $722,525) | | | | | | | 737,374 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Short-Term Investments 63.5% | | | | | |

Repurchase Agreements 39.5% | | | | | | | | |

Fixed Income Clearing Corp.

0.34%, dated 10/31/17

due 11/1/17

Proceeds at Maturity $44,352,496 (Collateralized by United States Treasury and Government Agency Securities with rates between 2.00% and 2.125% and maturity dates between 10/5/22 and 12/31/22, with a Principal Amount of $45,030,000 and a Market Value of $45,250,812) | | $ | 44,352,077 | | | $ | 44,352,078 | |

State Street Bank and Trust Co.

0.05%, dated 10/31/17

due 11/1/17

Proceeds at Maturity $1,432,014 (Collateralized by a Federal National Mortgage Association security with a rate of 3.50% and a maturity date of 10/25/47, with a Principal Amount of $1,420,000 and a Market Value of $1,463,862) (g) | | | 1,432,012 | | | | 1,432,012 | |

| | | | | | | | |

Total Repurchase Agreements

(Cost $45,784,090) | | | | | | | 45,784,090 | |

| | | | | | | | |

|

U.S. Government & Federal Agencies 24.0% | |

United States Treasury Bills (g)(h) | | | | | | | | |

0.946%, due 11/24/17 (i) | | | 5,550,000 | | | | 5,546,552 | |

0.961%, due 12/14/17 | | | 890,000 | | | | 888,970 | |

1.089%, due 1/18/18 | | | 3,700,000 | | | | 3,691,302 | |

1.096%, due 1/25/18 (i) | | | 11,621,600 | | | | 11,591,691 | |

1.249%, due 4/26/18 (i) | | | 6,060,000 | | | | 6,023,516 | |

| | | | | | | | |

Total U.S. Government & Federal Agencies

(Cost $27,748,617) | | | | | | | 27,742,031 | |

| | | | | | | | |

Total Short-Term Investments

(Cost $73,532,707) | | | | | | | 73,526,121 | |

| | | | | | | | |

Total Investments, Before Investments Sold Short

(Cost $123,500,005) | | | 108.3 | % | | | 125,533,603 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

Shares | | | | |