UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: April 30

(MainStay Absolute Return Multi-Strategy Fund and MainStay Tax Advantaged Short Term Bond Fund)

Date of reporting period: October 31, 2016

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Absolute Return Multi-Strategy Fund and MainStay Tax Advantaged Short Term

Bond Fund, series of the Registrant.

Item 1. Reports to Stockholders.

MainStay Absolute Return Multi-Strategy Fund

Message from the President and Semiannual Report

Unaudited | October 31, 2016

This page intentionally left blank

Message from the President

During the six months ended October 31, 2016, the U.S. stock and bond markets were somewhat volatile but generally ended the reporting period in positive territory. When the reporting period began, the stock market was in a broad recovery as oil prices continued to rise from their low point in mid-February 2016. Crude oil prices tended to trade in a range during the reporting period, ending October not far from where they were on May 1, 2016.

In late June, the United Kingdom voted to leave the European Union in a referendum popularly known as “Brexit.” The news caused a temporary slump in stocks around the world. Although the British pound dropped in value following the vote, stocks generally recovered through the end of the reporting period. As the reporting period progressed, however, speculation about the upcoming U.S. presidential election heightened market volatility.

According to FTSE-Russell data, U.S. stocks as a whole tended to provide positive returns during the reporting period, with small-capitalization stocks generally outperforming stocks of larger companies. Value stocks outpaced growth stocks at all capitalization levels, with the largest differences among small- to mid-cap stocks.

International and emerging-market stocks were mixed. Rocked by Brexit, European stocks as a whole declined during the reporting period, while stocks in the Asia-Pacific region (with or without Japan) tended to provide positive returns. International stocks as a whole declined, while global stocks advanced. Emerging-market stocks were considerably stronger, boosted by advances in India and Latin America and prices for oil, metals, and other commodities that were closer to historical norms.

Anticipation of a possible Federal Reserve rate hike led to volatility in the bond market, but the Federal Open Market Committee chose not to raise the federal funds target rate during the reporting period. Short-term U.S. Treasury yields rose during the reporting period, and yields on U.S. Treasury securities with maturities of five years or longer declined. Overall, the U.S. bond market provided positive returns, with longer-term bonds generally outperforming shorter-term securities. High-yield bonds in general—and lower-quality credits in particular—were strong performers. Municipal bonds generally

provided modest but positive total returns for the six months ended October 31, 2016.

Central banks around the world remained highly accommodative during the reporting period, particularly in light of Brexit. Shortly after the U.K. referendum, more than a third of all sovereign debt carried negative yields. As an asset class, emerging-market bonds provided mid-single-digit positive returns during the reporting period, and world bonds as a whole also provided positive returns.

At MainStay, we know that political, economic and market events may influence the performance of your Fund investments. While our portfolio managers often pay close attention to such events, their primary emphasis is seeking to invest for the long-term investment needs of our shareholders. With this in mind, they seek to pursue the investment objectives of their respective Funds using the principal investment strategies and investment processes outlined in the prospectus. By placing your assets in the care of our investment professionals, you gain access to their extensive market insight, strategic investment discipline and in-depth experience in risk-management over a wide range of market cycles.

The report that follows provides more detailed information about the market forces, portfolio strategies and individual securities that influenced the performance of your MainStay Fund during the six months ended October 31, 2016. We invite you to read the report carefully as part of your personal investment-review process.

We thank you for your business, and we look forward to a continuing relationship as you pursue your long-range financial goals.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

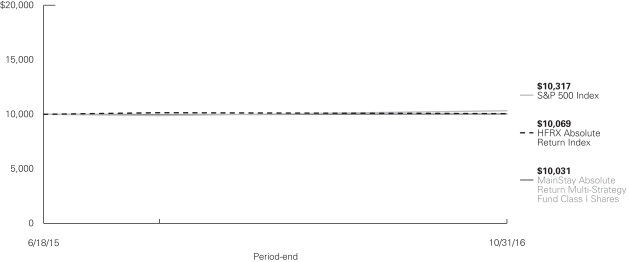

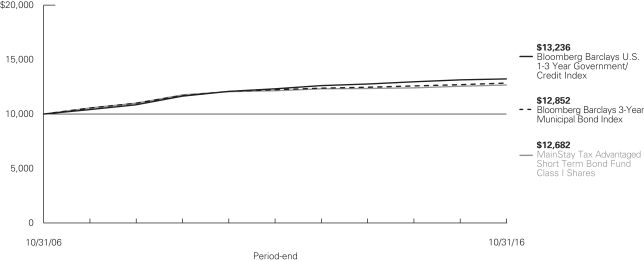

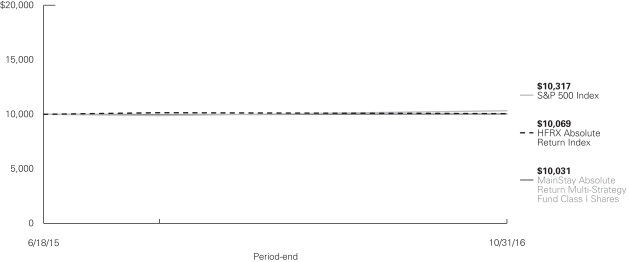

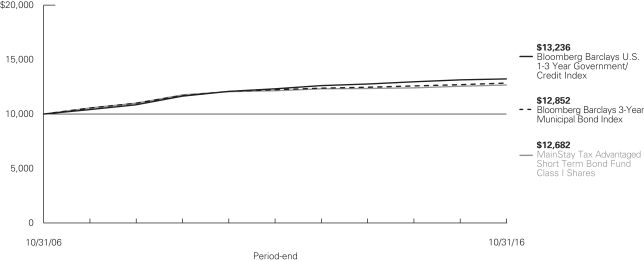

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period Ended October 31, 2016

| | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Six Months | | | One Year | | | Since

Inception

(6/18/15) | | | Gross

Expense

Ratio2 | |

| Class A Shares | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –4.93

0.60 | %

| |

| –5.21

0.31 | %

| |

| –3.96

0.08 | %

| |

| 3.48

3.48 | %

|

| Investor Class Shares | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –5.02

0.51 |

| |

| –5.30

0.21 |

| |

| –4.17

–0.14 |

| |

| 3.67

3.67 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | |

| –0.90

0.10 |

| |

| –1.59

–0.60 |

| |

| –0.94

–0.94 |

| |

| 4.39

4.39 |

|

| Class I Shares | | No Sales Charge | | | | | 0.70 | | | | 0.61 | | | | 0.23 | | | | 3.20 | |

| | | | | | | | | | | | |

| Benchmark Performance | | Six

Months | | | One

Year | | | Since

Inception

(6/18/15) | |

HFRX Absolute Return Index3 | | | 0.78 | % | | | –0.66 | % | | | 0.50 | % |

S&P 500 Index4 | | | 4.06 | | | | 4.51 | | | | 2.30 | |

Average Lipper Alternative Multi-Strategy Fund5 | | | 0.91 | | | | –0.04 | | | | –1.88 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above (if any), changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the notes to the consolidated financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | The HFRX Absolute Return Index is the Fund’s primary broad-based securities market index for comparison purposes. The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, |

| | equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 4. | The S&P 500® Index is the Fund’s secondary benchmark index for comparison purposes. “S&P 500®” is a trademark of the McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 5. | The Average Lipper Alternative Multi-Strategy Fund is representative of funds that seek total returns through the management of several different hedge-fund like strategies. These funds are typically quantitatively driven to measure the existing relationship between instruments and in some cases to identify positions in which the risk-adjusted spread between these instruments represents an opportunity for the investment manager. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Absolute Return Multi-Strategy Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2016, to October 31, 2016, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2016, to October 31, 2016.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2016. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/16 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/16 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/16 | | | Expenses

Paid

During

Period1 | |

| | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,006.00 | | | $ | 13.50 | | | $ | 1,011.70 | | | $ | 13.54 | |

| | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,005.10 | | | $ | 14.56 | | | $ | 1,010.70 | | | $ | 14.60 | |

| | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 1,001.00 | | | $ | 18.36 | | | $ | 1,006.90 | | | $ | 18.41 | |

| | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,007.00 | | | $ | 12.24 | | | $ | 1,013.00 | | | $ | 12.28 | |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class (2.67% for Class A, 2.88% for Investor Class, 3.64% for Class C and 2.42% for Class I) multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| | |

| 6 | | MainStay Absolute Return Multi-Strategy Fund |

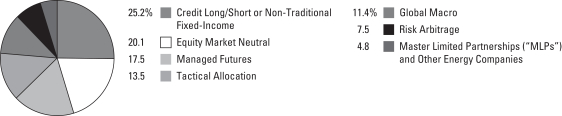

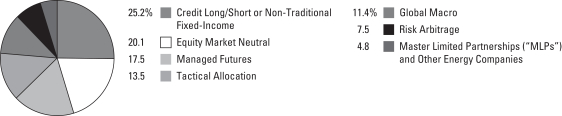

Strategy Allocation as of October 31, 20161 (Unaudited)

| 1 | Percentages based on total net assets. |

Equity Market Neutral: This strategy seeks to profit by detecting and exploiting perceived pricing inefficiencies in individual equity securities and neutralizing exposure to market risk by maintaining approximately equal value exposure in long and short positions. The strategy will identify investment opportunities based on a model that reflects the input of relevant factors, including relative value, market sentiment, and the Subadvisor’s forecasts as to anticipated market volatility. The strategy may engage in short sales in order to generate returns that are independent of the direction of the market.

Risk Arbitrage: This strategy implements event-driven arbitrage strategies on securities of companies that experience certain “special situations,” which are corporate events that are likely to create discontinuity in the price of a given security. The Fund’s risk arbitrage strategy consists primarily of an announced merger arbitrage strategy. An announced merger arbitrage strategy buys or sells the securities of companies involved in a merger based on the Subadvisor’s anticipation of the merger’s outcome. The strategy may also invest in securities of companies based on other event-driven strategies, such as holding discount arbitrage, share class arbitrage, spin-offs, asset sales, initial public offerings, minority buyouts, auctions or rights issues. Share class arbitrage involves capitalizing on perceived pricing inefficiencies of a particular share class in a multiple share class issuer. Discount arbitrage is when a discount option is purchased while an opposite transaction is taken in the underlying security.

Managed Futures: This strategy primarily takes long and short positions in futures contracts (directly or through derivatives, including total return swaps) across asset classes globally. The strategy seeks to exploit market trends and generate absolute returns utilizing a quantitative and systematic investment approach, which consists of analyzing financial markets through statistical models. These quantitative models produce buy or sell signals looking to benefit from the upward and downward movements of the asset classes covered based on market trends and patterns and contrarian views (i.e., instruments and strategies that may be out of favor in the broader market). The managed futures strategy will be implemented through (i) investment in derivative instruments, including swap agreements, exchange-traded futures and option and forward contracts, to gain exposure to a wide variety of global markets for currencies, interest rates, stock market indices, energy resources, metals and agricultural products and to hedge price risk, (ii) investment in swap agreements that reflect the return of securities, derivatives and commodity interests selected by the Subadvisor, or (iii) investment in some combination of (i) and (ii). This strategy will involve the use of one or more wholly-owned subsidiaries formed under

the laws of the Cayman Islands (each, a “Cayman Subsidiary”). See “Subsidiary Risk” below for more information.

Master Limited Partnerships (“MLPs”) and Other Energy Companies: This strategy seeks to deliver both high current income and total return by investing in a portfolio of domestic and foreign publicly traded partnerships and/or other issuers (including U.S. and Canadian royalty trusts and Canadian energy companies) engaged in the transportation, storage, processing, refining, marketing, exploration, production or mining of crude oil, natural gas, natural gas liquids, minerals or other natural resources. The Subadvisor implements this strategy by identifying companies it believes will benefit from increased crude oil, natural gas or natural gas liquids production resulting in greater energy infrastructure needs. The Fund will invest no more than 25% of its total assets in securities of MLPs that are qualified publicly traded partnerships (“QPTPs”), which are treated as partnerships for U.S. federal income tax purposes.

Credit Long/Short or Non-Traditional Fixed-Income: This strategy seeks to exploit opportunities in the global fixed-income markets based on top-down and bottom-up analysis. The strategy may invest in various credit strategies that involve being long and short different financial instruments, and the credit instruments involved will range from high grade to high yield (known as “junk bonds”) and distressed debt. The strategy may also invest in credit derivatives, including credit default swaps, options and indices. The Subadvisors responsible for this strategy dynamically allocate capital to the sectors and securities that they believe offer the best balance of risk and return, unrestricted by benchmark constraints.

Global Macro Strategy: This strategy seeks to obtain exposure to a broad spectrum of investments and countries or regions, based on discrete strategies that employ a variety of techniques, both discretionary and systematic analysis, combinations of top down and bottom up theses, and quantitative and fundamental approaches, designed to effectively identify and assess factors that affect businesses and economies broadly (e.g., monetary and fiscal policy, regulatory changes, demographics) and their impact on securities markets. The strategy may also employ arbitrage techniques and seek long and short exposure (directly or through derivatives, including total return swaps) across diversified asset classes globally. The strategy may be exposed significantly to interest rate and foreign currency futures. In addition, the strategy may involve the use of one or more Cayman Subsidiaries to obtain certain commodities market exposure.

Tactical Allocation: This strategy, which is managed by the Manager, may invest in a range of asset classes, including equity securities, fixed-income instruments, futures, options, currency forward contracts and swaps (including total return swaps) and affiliated and unaffiliated open-end funds, closed-end funds and exchange-traded funds, to manage or gain access to certain market exposures, including exposure to asset classes or strategies in which the Fund is not otherwise invested, to exploit perceived structural inefficiencies in the markets or to manage cash flows. Additionally, positions may be pursued on a long or short basis either to take advantage of perceived investment opportunities or to counter exposure from other strategies in the Fund.

Other Strategies: The Manager may modify the strategies summarized above and allocate the Fund’s assets among or to other strategies developed or implemented to further optimize risk reward expectations based on, among other factors, changing market conditions. In addition to the instruments described above, such other strategies may include taking long and/or short positions in a wide range of instruments, including, but not limited to, commodities and real estate investment trusts (“REITs”). Such investments may be made without restriction as to issuer capitalization, country (including emerging markets), currency, maturity or credit rating and within the context of a range of investment programs or strategies, including, but not limited to, carry strategies, relative value strategies, and various forms arbitrage.

| | |

| 8 | | MainStay Absolute Return Multi-Strategy Fund |

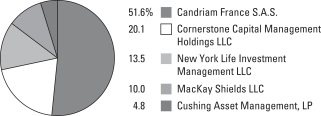

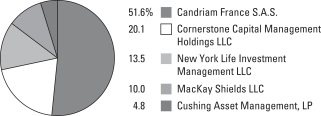

Manager Allocation as of October 31, 20161 (Unaudited)

| 1 | Percentages based on total net assets. |

Top Ten Holdings or Issuers Held as of October 31, 2016 (excluding short-term investments) (Unaudited)

| 1. | United States Treasury Inflation—Indexed Bond, 0.375%, due 7/15/25 |

| 4. | 1011778 B.C. ULC / New Red Finance, Inc., 4.625%, due 1/15/22 |

| 5. | Crown European Holdings S.A., 2.625%–4.00%, due 7/15/22–5/15/25 |

| 6. | Enel S.p.A., 6.50%–7.75%, due 1/10/74–9/10/75 |

| 8. | Trionista Holdco GmbH, 5.00%, due 4/30/20 |

| 9. | Techem GmbH, 6.125%, due 10/1/19 |

Top Five Short Positions as of October 31, 2016

| 1. | United States Oil Fund, L.P. |

| 5. | Unione di Banche Italiane S.p.A. |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by Jae S. Yoon, CFA, Jonathan Swaney, Poul Kristensen, CFA, and Amit Soni, CFA, of New York Life Investments,1 the Fund’s Manager.

How did MainStay Absolute Return Multi-Strategy Fund perform relative to its benchmarks and peers during the six months ended October 31, 2016?

Excluding all sales charges, MainStay Absolute Return Multi-Strategy Fund returned 0.60% for Class A shares, 0.51% for Investor Class shares and 0.10% for Class C shares for the six months ended October 31, 2016. Over the same period, Class I shares returned 0.70%. For the six months ended October 31, 2016, all share classes underperformed the 0.78% return of the HFRX Absolute Return Index,2 which is the Fund’s primary benchmark. Over the same period, all share classes also underperformed the 4.06% return of the S&P 500® Index,2 which is the Fund’s secondary benchmark. For the six months ended October 31, 2016, all share classes underperformed the 0.91% return of the Average Lipper3 Alternative Multi-Strategy Fund. See page 5 for Fund returns with sales charges.

Were there any changes to the Fund during the reporting period?

Effective August 6, 2016, Mr. Taylor Wagenseil no longer serves as a portfolio manager of the Fund. Mr. Wagenseil will provide nondiscretionary advisory support to the Fund’s portfolio management team as a Senior Advisor to the Fund through August 2017. Dan Roberts, Louis N. Cohen and Michael Kimble continue to manage the “Credit Long/Short or Non-Traditional Fixed-Income” strategy of the Fund for MacKay Shields LLC, a subadvisor to the Fund. For more information on this change, please see the supplement dated August 5, 2016.

What factors affected the Fund’s relative performance during the reporting period?

Several factors affected the Fund’s performance relative to the HFRX Absolute Return Index. The MLP alpha strategy was the best performing strategy as the asset class continued its recovery. The strategy benefited from crude oil prices that traded near $50 per barrel. The flexible bond strategy and the credit opportunities strategy also performed well as the high-yield asset class saw a strong rally during the reporting period. The biggest detractor from performance was the managed futures strategy, which suffered from some positions in equity &

agricultural futures. From a risk perspective, the Fund’s volatility (as measured by annualized standard deviation of the Fund’s returns) was in the mid-single digits, as expected.

During the reporting period, how did the Fund’s performance correlate with traditional fixed-income and equity indices?

During the reporting period, the Fund maintained low correlation to fixed-income indices. The correlation of the Fund’s overall portfolio to the Bloomberg Barclays U.S. Aggregate Bond Index4 during the reporting period was 0.14, which was within desired parameters. The correlation of the Fund’s overall portfolio to the S&P 500® Index during the reporting period was 0.70. This correlation was higher than desired, primarily because of the Fund’s flexible bond, risk arbitrage and global alpha strategies. Since inception, however, the Fund has, on average, maintained low correlation to equity indices.

During the reporting period, how did the Fund’s volatility compare to that of traditional fixed-income indices?

During the reporting period, the Fund’s volatility (as measured by annualized standard deviation of the Fund’s returns) was closer to that of traditional fixed-income indices than it was to that of traditional equity indices. The Fund’s volatility was 3.1%, compared to a volatility of 3.0% for the Bloomberg Barclays U.S. Aggregate Bond Index and a volatility of 4.0% for the BofA Merrill Lynch U.S. High Yield Master II Index.5 During the reporting period, the volatility of the S&P 500® Index was 11.5%.

How did the Fund use derivatives during the reporting period?

Derivatives were used in the Fund for alpha generation, hedging and operational efficiency. For example, we used total return swaps for alpha generation in the tactical allocation sleeve to gain exposure to certain alternative beta indices.6 The non-traditional fixed-income managers used interest-rate derivatives for hedging specific exposures in their sleeves. Also, in the tactical allocation sleeve, certain exposures were assumed through total return swaps because of operational efficiency

| 1. | “New York Life Investments” is a service mark used by New York Life Investment Management Holdings LLC and its subsidiary New York Life Investment Management LLC. |

| 2. | See footnote on page 5 for more information on this index. |

| 3. | See footnote on page 5 for more information on Lipper Inc. |

| 4. | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasurys, government-related and corporate securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 5. | The BofA Merrill Lynch High Yield Master II Index monitors the performance of below-investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. An investment cannot be made directly in an index. |

| 6. | Alpha measures the relationship between a mutual fund’s return and its beta over a three-year period. Often, alpha is viewed as the excess return (positive or negative) or the value added by the portfolio manager. Beta is a measure of volatility in relation to the market as a whole. A beta higher than 1 indicates that a security or portfolio will tend to exhibit higher volatility than the market. A beta lower than 1 indicates that a security or portfolio will tend to exhibit lower volatility than the market. |

| | |

| 10 | | MainStay Absolute Return Multi-Strategy Fund |

(leveraging better trading and operational infrastructure of external providers for cost efficiency). We believe that measuring the impact of derivatives on performance as positive or negative does not properly reflect the utility of derivatives to the Fund because of the functions they perform within the Fund. For example, a hedge performing as expected might have a negative contribution to return even as it serves its intended function to reduce a risk or an exposure. (Contributions take weightings and total returns into account.) Nevertheless, the use of derivatives contributed positively to the Fund’s performance during the reporting period, primarily from the global opportunities, tactical allocation and global alpha strategies.

How were the Fund’s assets allocated among each of the strategies during the reporting period and why?

The Fund’s allocations are based on the estimated optimal distribution of assets, taking into account both the risk and return expectations. See chart on page 7 for strategy allocations as of October, 31, 2016. (It is generally not possible to increase return without taking additional risk, and the Fund generally cannot reduce risk without also reducing return.) These estimates of risk and return are long term in nature; and as a result, asset allocations tend to be quite stable over time. The Fund’s allocation to an individual strategy may change if, for example, there is a statistically significant change in the risk-return characteristics of a strategy, if the outlook of a strategy improves substantially or if an attractive new strategy became available for investment that we believe would likely further support the Fund’s investment goal.

How did the tactical allocation among the strategies during the reporting period affect the Fund’s performance?

During the reporting period, the only tactical decision taken was to take off the overweight in the flexible bond strategy, which we had implemented in December 2015 when high-yield spreads had widened to attractive levels. As the spreads narrowed to longer-term averages in the middle of 2016, we took off this risk. This tactical allocation contributed positively to the Fund’s performance.

During the reporting period, how did each strategy either contribute to or detract from the Fund’s absolute performance?

During the reporting period, the Fund saw its greatest positive contribution from credit opportunities7 (+0.46%), followed by MLP alpha8 (+0.38%), flexible bond7 (+0.31%), global opportunities9 (+0.27%), tactical allocation (+0.25%), global alpha9 (+0.20%), equity market neutral (+0.15%), and risk arbitrage (+0.09%). The only negative contribution came from managed futures (–0.56%). The ultimate impact of each strategy on the Fund’s overall performance is a function of the strategy’s performance and the amount of Fund assets allocated to the particular strategy.

How did the Fund’s strategy weightings change during the reporting period?

There were no strategic changes to the strategy weightings during the reporting period, except for the previously discussed temporary overweighting of the flexible bond strategy.

| 7. | The credit long/short or non-traditional fixed-income portion of the Fund consists of two underlying strategies: the flexible bond strategy and the credit opportunities strategy. |

| 8. | The Master Limited Partnerships and other energy companies portion of the Fund consists of two underlying strategies: the MLP alpha strategy and the MLP equity strategy. |

| 9. | The global macro portion of the Fund consists of two underlying strategies: the global alpha strategy and the global opportunities strategy |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Consolidated Portfolio of Investments October 31, 2016 (Unaudited)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Long-Term Bonds 17.3%† Corporate Bonds 8.9% | |

Apparel 0.1% | | | | | | | | |

Hanesbrands Finance Luxembourg SCA

Series Reg S

3.50%, due 6/15/24 | | $ | 100,000 | | | $ | 115,033 | |

Hanesbrands, Inc.

4.875%, due 5/15/26 (a) | | | 25,000 | | | | 25,438 | |

| | | | | | | | |

| | | | | | | 140,471 | |

| | | | | | | | |

Auto Parts & Equipment 1.1% | | | | | | | | |

Adient Global Holdings, Ltd.

Series Reg S

3.50%, due 8/15/24 | | EUR | 200,000 | | | | 218,152 | |

Goodyear Tire & Rubber Co. (The)

7.00%, due 5/15/22 | | $ | 300,000 | | | | 315,375 | |

IHO Verwaltungs GmbH | | | | | | | | |

Series Reg S

2.75%, due 9/15/21 | | EUR | 100,000 | | | | 112,296 | |

Series Reg S

3.25%, due 9/15/23 | | | 100,000 | | | | 111,435 | |

Series Reg S

3.75%, due 9/15/26 | | | 100,000 | | | | 108,412 | |

Lear Corp.

4.75%, due 1/15/23 | | $ | 150,000 | | | | 155,625 | |

Tenneco, Inc.

5.00%, due 7/15/26 | | | 46,000 | | | | 46,230 | |

ZF North America Capital, Inc.

4.50%, due 4/29/22 (a) | | | 315,000 | | | | 333,506 | |

| | | | | | | | |

| | | | | | | 1,401,031 | |

| | | | | | | | |

Banks 0.3% | |

Bank of America Corp. | | | | | | | | |

4.20%, due 8/26/24 | | | 55,000 | | | | 57,474 | |

5.625%, due 7/1/20 | | | 50,000 | | | | 55,962 | |

Citigroup, Inc.

4.60%, due 3/9/26 | | | 60,000 | | | | 64,031 | |

Goldman Sachs Group, Inc. (The) | | | | | | | | |

5.375%, due 3/15/20 | | | 50,000 | | | | 55,202 | |

6.75%, due 10/1/37 | | | 50,000 | | | | 63,062 | |

Morgan Stanley | | | | | | | | |

5.00%, due 11/24/25 | | | 55,000 | | | | 60,836 | |

5.50%, due 1/26/20 | | | 50,000 | | | | 55,123 | |

| | | | | | | | |

| | | | | | | 411,690 | |

| | | | | | | | |

Beverages 0.5% | |

Constellation Brands, Inc.

7.25%, due 5/15/17 | | | 300,000 | | | | 309,750 | |

Cott Beverages, Inc.

6.75%, due 1/1/20 | | | 180,000 | | | | 186,975 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Beverages (continued) | | | | | | | | |

Cott Corp.

Series Reg S

5.50%, due 7/1/24 | | EUR | 100,000 | | | $ | 115,675 | |

| | | | | | | | |

| | | | | | | 612,400 | |

| | | | | | | | |

Building Materials 0.2% | |

Cemex Finance LLC

Series Reg S

9.375%, due 10/12/22 | | $ | 215,000 | | | | 234,888 | |

| | | | | | | | |

|

Chemicals 0.1% | |

Axalta Coating Systems LLC

Series Reg S

4.25%, due 8/15/24 | | EUR | 100,000 | | | | 113,644 | |

| | | | | | | | |

|

Commercial Services 0.2% | |

Nielsen Co. Luxembourg S.A.R.L. (The)

5.50%, due 10/1/21 (a) | | $ | 183,000 | | | | 190,778 | |

| | | | | | | | |

|

Computers 0.2% | |

Diamond 1 Finance Corp. / Diamond 2 Finance Corp. | | | | | | | | |

4.42%, due 6/15/21 (a) | | | 115,000 | | | | 120,256 | |

5.45%, due 6/15/23 (a) | | | 27,000 | | | | 28,913 | |

6.02%, due 6/15/26 (a) | | | 35,000 | | | | 38,152 | |

8.10%, due 7/15/36 (a) | | | 13,000 | | | | 15,519 | |

| | | | | | | | |

| | | | | | | 202,840 | |

| | | | | | | | |

Distribution & Wholesale 0.1% | |

LKQ Corp.

4.75%, due 5/15/23 | | | 84,000 | | | | 86,205 | |

| | | | | | | | |

|

Electric 0.2% | |

EDP Finance B.V.

Series Reg S

6.00%, due 2/2/18 | | | 274,000 | | | | 286,002 | |

| | | | | | | | |

|

Entertainment 0.0%‡ | |

Isle of Capri Casinos, Inc.

5.875%, due 3/15/21 | | | 50,000 | | | | 52,000 | |

| | | | | | | | |

|

Food 0.2% | |

Albertsons Cos. LLC / Safeway, Inc. / New Albertson’s, Inc. / Albertson’s LLC

5.75%, due 3/15/25 (a) | | | 110,000 | | | | 108,591 | |

Kraft Heinz Foods Co.

2.80%, due 7/2/20 | | | 95,000 | | | | 97,740 | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers held, as of October 31, 2016, excluding short-term investments. May be subject to change daily. |

| ∎ | | Among the Fund’s 5 largest short positions as of October 31, 2016. May be subject to change daily. |

| | | | |

| 12 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | | | | | | | | |

Food (continued) | | | | | | | | |

Tyson Foods, Inc.

3.95%, due 8/15/24 | | $ | 105,000 | | | $ | 111,449 | |

| | | | | | | | |

| | | | | | | 317,780 | |

| | | | | | | | |

Food Services 0.3% | |

Aramark Services, Inc. | | | | | | | | |

4.75%, due 6/1/26 (a) | | | 100,000 | | | | 100,000 | |

5.125%, due 1/15/24 | | | 100,000 | | | | 104,750 | |

5.125%, due 1/15/24 (a) | | | 170,000 | | | | 178,075 | |

5.75%, due 3/15/20 | | | 33,000 | | | | 33,949 | |

| | | | | | | | |

| | | | | | | 416,774 | |

| | | | | | | | |

Forest Products & Paper 0.2% | |

Sappi Papier Holding GmbH

7.75%, due 7/15/17 (a) | | | 210,000 | | | | 213,675 | |

| | | | | | | | |

|

Health Care—Products 0.2% | |

Boston Scientific Corp.

2.85%, due 5/15/20 | | | 100,000 | | | | 102,702 | |

Hologic, Inc.

5.25%, due 7/15/22 (a) | | | 90,000 | | | | 95,184 | |

Teleflex, Inc.

4.875%, due 6/1/26 | | | 35,000 | | | | 35,875 | |

| | | | | | | | |

| | | | | | | 233,761 | |

| | | | | | | | |

Health Care—Services 0.3% | |

Fresenius Medical Care U.S. Finance II, Inc.

4.75%, due 10/15/24 (a) | | | 80,000 | | | | 83,400 | |

HCA, Inc.

5.875%, due 3/15/22 | | | 220,000 | | | | 242,000 | |

Laboratory Corporation of America Holdings

2.625%, due 2/1/20 | | | 100,000 | | | | 101,657 | |

| | | | | | | | |

| | | | | | | 427,057 | |

| | | | | | | | |

Home Builders 0.0%‡ | |

TRI Pointe Group, Inc. / TRI Pointe Homes, Inc.

5.875%, due 6/15/24 | | | 40,000 | | | | 41,450 | |

| | | | | | | | |

|

Household Products & Wares 0.2% | |

Spectrum Brands, Inc.

Series Reg S

4.00%, due 10/1/26 | | EUR | 200,000 | | | | 225,520 | |

| | | | | | | | |

|

Housewares 0.0%‡ | |

Newell Brands, Inc.

5.00%, due 11/15/23 | | $ | 22,000 | | | | 23,622 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Internet 0.2% | |

United Group B.V.

Series Reg S

7.875%, due 11/15/20 | | EUR | 200,000 | | | $ | 228,881 | |

| | | | | | | | |

| | |

Lodging 0.2% | | | | | | | | |

Hilton Domestic Operating Co., Inc.

4.25%, due 9/1/24 (a) | | $ | 240,000 | | | | 240,600 | |

| | | | | | | | |

| | |

Media 1.1% | | | | | | | | |

CCO Holdings LLC / CCO Holdings Capital Corp. | | | | | | | | |

5.875%, due 4/1/24 (a) | | | 100,000 | | | | 105,750 | |

6.625%, due 1/31/22 | | | 280,000 | | | | 291,900 | |

Nielsen Finance LLC / Nielsen Finance Co.

5.00%, due 4/15/22 (a) | | | 200,000 | | | | 204,000 | |

SFR Group S.A.

6.00%, due 5/15/22 (a) | | | 200,000 | | | | 205,064 | |

Sirius XM Radio, Inc. | | | | | | | | |

5.75%, due 8/1/21 (a) | | | 140,000 | | | | 145,950 | |

6.00%, due 7/15/24 (a) | | | 120,000 | | | | 127,350 | |

Virgin Media Secured Finance PLC

5.50%, due 1/15/25 (a) | | | 200,000 | | | | 205,000 | |

Ziggo Secured Finance B.V.

Series Reg S

4.25%, due 1/15/27 | | EUR | 100,000 | | | | 109,290 | |

| | | | | | | | |

| | | | | | | 1,394,304 | |

| | | | | | | | |

Packaging & Containers 0.8% | |

Ball Corp.

4.375%, due 12/15/23 | | | 325,000 | | | | 401,044 | |

¨Crown European Holdings S.A. | | | | | | | | |

Series Reg S

2.625%, due 9/30/24 | | | 100,000 | | | | 108,046 | |

Series Reg S

4.00%, due 7/15/22 | | | 100,000 | | | | 120,204 | |

Graphic Packaging International, Inc.

4.125%, due 8/15/24 | | $ | 70,000 | | | | 69,650 | |

Sealed Air Corp. | | | | | | | | |

Series Reg S

4.50%, due 9/15/23 | | EUR | 230,000 | | | | 278,993 | |

4.875%, due 12/1/22 (a) | | $ | 75,000 | | | | 79,031 | |

| | | | | | | | |

| | | | | | | 1,056,968 | |

| | | | | | | | |

Pharmaceuticals 0.2% | |

AbbVie, Inc.

2.50%, due 5/14/20 | | | 100,000 | | | | 101,257 | |

Grifols Worldwide Operations, Ltd.

5.25%, due 4/1/22 | | | 200,000 | | | | 208,500 | |

| | | | | | | | |

| | | | | | | 309,757 | |

| | | | | | | | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 13 | |

Consolidated Portfolio of Investments October 31, 2016 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | | | | | | | | |

Private Equity 0.0%‡ | |

Icahn Enterprises, L.P. / Icahn Enterprises Finance Corp.

5.875%, due 2/1/22 | | $ | 50,000 | | | $ | 47,563 | |

| | | | | | | | |

|

Real Estate Investment Trusts 0.2% | |

Equinix, Inc. | | | | | | | | |

5.375%, due 1/1/22 | | | 27,000 | | | | 28,620 | |

5.375%, due 4/1/23 | | | 40,000 | | | | 41,750 | |

5.75%, due 1/1/25 | | | 50,000 | | | | 52,875 | |

MPT Operating Partnership, L.P. / MPT Finance Corp. | | | | | | | | |

5.25%, due 8/1/26 | | | 20,000 | | | | 20,400 | |

5.75%, due 10/1/20 | | EUR | 100,000 | | | | 114,649 | |

6.375%, due 2/15/22 | | $ | 35,000 | | | | 36,313 | |

| | | | | | | | |

| | | | | | | 294,607 | |

| | | | | | | | |

Retail 1.2% | |

¨1011778 B.C. ULC / New Red Finance, Inc.

4.625%, due 1/15/22 (a) | | | 480,000 | | | | 495,600 | |

Dollar Tree, Inc.

5.75%, due 3/1/23 | | | 370,000 | | | | 394,050 | |

Dufry Finance SCA

5.50%, due 10/15/20 (a) | | | 200,000 | | | | 205,750 | |

Groupe Fnac S.A.

Series Reg S

3.25%, due 9/30/23 | | EUR | 110,000 | | | | 123,172 | |

KFC Holding Co. / Pizza Hut Holdings LLC / Taco Bell of America LLC | | | | | | | | |

5.00%, due 6/1/24 (a) | | $ | 200,000 | | | | 208,000 | |

5.25%, due 6/1/26 (a) | | | 35,000 | | | | 36,488 | |

O’Reilly Automotive, Inc.

3.80%, due 9/1/22 | | | 80,000 | | | | 84,189 | |

| | | | | | | | |

| | | | | | | 1,547,249 | |

| | | | | | | | |

Semiconductors 0.2% | |

NXP B.V. / NXP Funding LLC

3.875%, due 9/1/22 (a) | | | 285,000 | | | | 301,387 | |

| | | | | | | | |

|

Telecommunications 0.4% | |

¨T-Mobile USA, Inc. | | | | | | | | |

6.25%, due 4/1/21 | | | 53,000 | | | | 55,186 | |

6.375%, due 3/1/25 | | | 50,000 | | | | 53,594 | |

6.731%, due 4/28/22 | | | 305,000 | | | | 318,725 | |

Telefonica Europe B.V.

Series Reg S

3.75%, due 12/31/49 (b) | | EUR | 100,000 | | | | 108,216 | |

| | | | | | | | |

| | | | | | | 535,721 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $11,479,188) | | | | | | | 11,588,625 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Bonds 6.5% | |

Belgium 0.1% | | | | | | | | |

Ontex Group N.V.

Series Reg S

4.75%, due 11/15/21 | | EUR | 100,000 | | | $ | 116,581 | |

| | | | | | | | |

|

Croatia 0.3% | |

Agrokor D.D.

Series Reg S

9.875%, due 5/1/19 | | | 360,000 | | | | 408,034 | |

| | | | | | | | |

|

France 2.0% | |

Accor S.A.

Series Reg S

4.125%, due 6/30/49 (b) | | | 200,000 | | | | 223,721 | |

Cerba European Lab S.A.S.

Series Reg S

7.00%, due 2/1/20 | | | 150,000 | | | | 170,136 | |

¨Crown European Holdings S.A.

Series Reg S

3.375%, due 5/15/25 | | | 215,000 | | | | 241,988 | |

Elis S.A.

Series Reg S

3.00%, due 4/30/22 | | | 170,000 | | | | 190,378 | |

HomeVi S.A.S.

Series Reg S

6.875%, due 8/15/21 | | | 175,000 | | | | 204,766 | |

La Financiere Atalian S.A.S.

Series Reg S

7.25%, due 1/15/20 | | | 120,000 | | | | 137,917 | |

Orange S.A.

Series Reg S

5.875%, due 12/31/49 (b) | | GBP | 100,000 | | | | 131,746 | |

PSA Tresorerie GIE

6.00%, due 9/19/33 | | EUR | 35,000 | | | | 45,878 | |

Rexel S.A.

Series Reg S

3.50%, due 6/15/23 | | | 200,000 | | | | 225,039 | |

Solvay Finance S.A.

Series Reg S

5.869%, due 12/29/49 (b) | | | 200,000 | | | | 240,846 | |

Synlab Bondco PLC

Series Reg S

6.25%, due 7/1/22 | | | 200,000 | | | | 237,136 | |

Tereos Finance Groupe I S.A.

Series Reg S

4.125%, due 6/16/23 | | | 100,000 | | | | 112,591 | |

TOTAL S.A.

Series Reg S

3.369%, due 12/29/49 (b) | | | 100,000 | | | | 108,474 | |

| | | | |

| 14 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Bonds (continued) | | | | | | | | |

France (continued) | | | | | | | | |

Veolia Environnement S.A.

Series Reg S

4.85%, due 1/29/49 (b) | | GBP | 300,000 | | | $ | 377,684 | |

| | | | | | | | |

| | | | | | | 2,648,300 | |

| | | | | | | | |

Germany 1.6% | |

CeramTec Group GmbH

Series Reg S

8.25%, due 8/15/21 | | EUR | 230,000 | | | | 267,632 | |

HeidelbergCement A.G.

Series Reg S

2.25%, due 3/30/23 | | | 102,000 | | | | 117,289 | |

Kirk Beauty One GmbH

Series Reg S

8.75%, due 7/15/23 | | | 100,000 | | | | 119,106 | |

¨Techem GmbH

Series Reg S

6.125%, due 10/1/19 | | | 375,000 | | | | 425,035 | |

¨Trionista Holdco GmbH

Series Reg S

5.00%, due 4/30/20 | | | 400,000 | | | | 451,175 | |

TUI A.G.

Series Reg S

2.125%, due 10/26/21 | | | 100,000 | | | | 111,437 | |

Unitymedia Hessen GmbH & Co. KG / Unitymedia NRW GmbH | | | | | | | | |

Series Reg S

5.125%, due 1/21/23 | | | 81,000 | | | | 93,547 | |

Series Reg S

5.50%, due 9/15/22 | | | 162,000 | | | | 187,172 | |

Vonovia Finance B.V.

Series Reg S

4.625%, due 4/8/74 (b) | | | 300,000 | | | | 347,026 | |

| | | | | | | | |

| | | | | | | 2,119,419 | |

| | | | | | | | |

Ireland 0.2% | |

Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc. | | | | | | | | |

Series Reg S

4.125%, due 5/15/23 | | | 100,000 | | | | 114,990 | |

Series Reg S

4.25%, due 1/15/22 | | | 100,000 | | | | 113,068 | |

| | | | | | | | |

| | | | | | | 228,058 | |

| | | | | | | | |

Italy 0.4% | |

¨Enel S.p.A. | | | | | | | | |

Series Reg S

6.50%, due 1/10/74 (b) | | | 278,000 | | | | 330,698 | |

Series Reg S

7.75%, due 9/10/75 (b) | | GBP | 100,000 | | | | 135,773 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Italy (continued) | | | | | | | | |

Telecom Italia S.p.A.

Series Reg S

3.625%, due 5/25/26 | | EUR | 100,000 | | | $ | 113,214 | |

| | | | | | | | |

| | | | | | | 579,685 | |

| | | | | | | | |

Luxembourg 0.5% | |

Dufry Finance SCA

Series Reg S

4.50%, due 8/1/23 | | | 100,000 | | | | 117,185 | |

LKQ Italia Bondco S.p.A.

Series Reg S

3.875%, due 4/1/24 | | | 100,000 | | | | 116,773 | |

Telenet Finance V Luxembourg SCA | | | | | | | | |

Series Reg S

6.25%, due 8/15/22 | | | 100,000 | | | | 116,636 | |

Series Reg S

6.75%, due 8/15/24 | | | 100,000 | | | | 120,948 | |

Telenet Finance VI Luxembourg SCA

Series Reg S

4.875%, due 7/15/27 | | | 112,000 | | | | 128,222 | |

| | | | | | | | |

| | | | | | | 599,764 | |

| | | | | | | | |

Netherlands 0.5% | | | | | | | | |

Cable Communications Systems N.V.

Series Reg S

7.50%, due 11/1/20 | | | 100,000 | | | | 113,936 | |

InterXion Holding N.V.

Series Reg S

6.00%, due 7/15/20 | | | 150,000 | | | | 172,072 | |

LGE HoldCo VI B.V.

Series Reg S

7.125%, due 5/15/24 | | | 210,000 | | | | 260,496 | |

Telefonica Europe B.V.

Series Reg S

6.50%, due 9/29/49 (b) | | | 100,000 | | | | 117,014 | |

| | | | | | | | |

| | | | | | | 663,518 | |

| | | | | | | | |

Poland 0.1% | |

Play Topco S.A.

Series Reg S

7.75%, due 2/28/20 (c) | | | 100,000 | | | | 111,970 | |

| | | | | | | | |

|

Spain 0.3% | |

Grupo Antolin Dutch B.V.

Series Reg S

5.125%, due 6/30/22 | | | 200,000 | | | | 234,370 | |

Iberdrola International B.V.

Series Reg S

5.75%, due 2/27/49 (b) | | | 100,000 | | | | 116,704 | |

| | | | | | | | |

| | | | | | | 351,074 | |

| | | | | | | | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 15 | |

Consolidated Portfolio of Investments October 31, 2016 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Bonds (continued) | | | | | | | | |

Sweden 0.2% | |

Verisure Holding AB

Series Reg S

6.00%, due 11/1/22 | | EUR | 210,000 | | | $ | 250,699 | |

| | | | | | | | |

| | |

United Kingdom 0.3% | | | | | | | | |

Alliance Automotive Finance PLC

Series Reg S

6.25%, due 12/1/21 | | | 140,000 | | | | 163,713 | |

Worldpay Finance PLC

Series Reg S

3.75%, due 11/15/22 | | | 200,000 | | | | 236,565 | |

| | | | | | | | |

| | | | | | | 400,278 | |

| | | | | | | | |

Total Foreign Bonds

(Cost $8,632,742) | | | | | | | 8,477,380 | |

| | | | | | | | |

| | |

| U.S. Government 1.9% | | | | | | | | |

¨United States Treasury Inflation—Indexed Bond 1.9% | |

0.375%, due 7/15/25 | | | 2,489,260 | | | | 2,555,263 | |

| | | | | | | | |

Total U.S. Government

(Cost $2,537,943) | | | | | | | 2,555,263 | |

| | | | | | | | |

Total Long-Term Bonds

(Cost $22,649,873) | | | | | | | 22,621,268 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| Common Stocks 28.0% | | | | | | | | |

Advertising 0.1% | | | | | | | | |

IPSOS (d) | | | 3,045 | | | | 99,444 | |

| | | | | | | | |

|

Aerospace & Defense 0.2% | |

Kratos Defense & Security Solutions, Inc. (d)(e) | | | 8,000 | | | | 44,960 | |

Spirit AeroSystems Holdings, Inc. Class A (d)(e) | | | 3,400 | | | | 171,224 | |

| | | | | | | | |

| | | | | | | 216,184 | |

| | | | | | | | |

Airlines 0.1% | |

Deutsche Lufthansa A.G. Registered (d) | | | 1,345 | | | | 17,194 | |

Qantas Airways, Ltd. | | | 18,174 | | | | 42,304 | |

SAS AB (e) | | | 30,274 | | | | 51,283 | |

| | | | | | | | |

| | | | | | | 110,781 | |

| | | | | | | | |

Apparel 0.2% | |

Carter’s, Inc. (d) | | | 1,800 | | | | 155,412 | |

Skechers U.S.A., Inc. Class A (d)(e) | | | 6,900 | | | | 145,107 | |

| | | | | | | | |

| | | | | | | 300,519 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Auto Manufacturers 0.2% | |

Peugeot S.A. (d)(e) | | | 10,734 | | | $ | 160,783 | |

Renault S.A. (d) | | | 112 | | | | 9,726 | |

Wabash National Corp. (d)(e) | | | 9,400 | | | | 105,750 | |

| | | | | | | | |

| | | | | | | 276,259 | |

| | | | | | | | |

Auto Parts & Equipment 0.8% | |

Autoneum Holding A.G. (d) | | | 374 | | | | 99,023 | |

Faurecia (d) | | | 3,366 | | | | 123,820 | |

Grammer A.G. | | | 2,180 | | | | 124,513 | |

Haldex AB | | | 30,172 | | | | 389,170 | |

Meritor, Inc. (d)(e) | | | 5,500 | | | | 56,540 | |

Modine Manufacturing Co. (d)(e) | | | 3,600 | | | | 39,420 | |

Titan International, Inc. (d) | | | 9,100 | | | | 92,729 | |

Tower International, Inc. (d) | | | 4,000 | | | | 86,800 | |

| | | | | | | | |

| | | | | | | 1,012,015 | |

| | | | | | | | |

Banks 1.3% | |

BankUnited, Inc. (d) | | | 5,200 | | | | 151,528 | |

BGEO Group PLC (d) | | | 2,617 | | | | 94,687 | |

BNP Paribas S.A. (d) | | | 2,896 | | | | 167,983 | |

Customers Bancorp, Inc. (d)(e) | | | 2,700 | | | | 73,089 | |

Deutsche Pfandbriefbank A.G. (a)(d) | | | 3,707 | | | | 38,081 | |

Erste Group Bank A.G. (d)(e) | | | 5,207 | | | | 163,534 | |

First BanCorp (d)(e) | | | 21,700 | | | | 111,321 | |

Mediobanca S.p.A. (d) | | | 22,790 | | | | 166,993 | |

OFG Bancorp (d) | | | 9,800 | | | | 104,370 | |

OneSavings Bank PLC | | | 2,609 | | | | 9,261 | |

Raiffeisen Bank International A.G. (d)(e) | | | 2,895 | | | | 47,447 | |

Shawbrook Group PLC (a)(e) | | | 6,992 | | | | 19,239 | |

Societe Generale S.A. (d) | | | 4,256 | | | | 166,137 | |

SVB Financial Group (d)(e) | | | 1,100 | | | | 134,497 | |

UniCredit S.p.A. | | | 67,150 | | | | 166,594 | |

Virgin Money Holdings UK PLC | | | 9,218 | | | | 37,121 | |

| | | | | | | | |

| | | | | | | 1,651,882 | |

| | | | | | | | |

Biotechnology 0.0%‡ | |

Arena Pharmaceuticals, Inc. (e) | | | 8,000 | | | | 11,840 | |

PDL BioPharma, Inc. | | | 3,000 | | | | 9,660 | |

Spectrum Pharmaceuticals, Inc. (e) | | | 1,300 | | | | 4,602 | |

Vitrolife AB | | | 582 | | | | 30,124 | |

| | | | | | | | |

| | | | | | | 56,226 | |

| | | | | | | | |

Building Materials 0.2% | |

Buzzi Unicem S.p.A. | | | 6,207 | | | | 63,368 | |

CSR, Ltd. | | | 3,796 | | | | 10,569 | |

Gibraltar Industries, Inc. (d)(e) | | | 1,200 | | | | 46,680 | |

Inwido AB | | | 3,570 | | | | 39,031 | |

NCI Building Systems, Inc. (d)(e) | | | 100 | | | | 1,440 | |

USG Corp. (d)(e) | | | 3,300 | | | | 83,094 | |

| | | | | | | | |

| | | | | | | 244,182 | |

| | | | | | | | |

Chemicals 1.3% | | | | | | | | |

Chemours Co. (The) (d) | | | 8,300 | | | | 136,369 | |

Covestro A.G. (a)(d) | | | 1,540 | | | | 91,019 | |

| | | | |

| 16 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Chemicals (continued) | | | | | |

Huntsman Corp. (d) | | | 9,600 | | | $ | 162,720 | |

Koppers Holdings, Inc. (d)(e) | | | 3,000 | | | | 98,250 | |

Lenzing A.G. (d) | | | 988 | | | | 128,685 | |

Monsanto Co. | | | 3,800 | | | | 382,926 | |

OMNOVA Solutions, Inc. (d)(e) | | | 2,600 | | | | 19,760 | |

Rayonier Advanced Materials, Inc. (d) | | | 9,900 | | | | 128,007 | |

Syngenta A.G. Registered | | | 453 | | | | 181,099 | |

Valspar Corp. (The) | | | 3,967 | | | | 395,113 | |

| | | | | | | | |

| | | | | | | 1,723,948 | |

| | | | | | | | |

Coal 0.1% | | | | | | | | |

SunCoke Energy, Inc. (d) | | | 4,600 | | | | 46,966 | |

Whitehaven Coal, Ltd. (e) | | | 30,011 | | | | 69,173 | |

| | | | | | | | |

| | | | | | | 116,139 | |

| | | | | | | | |

Commercial Services 0.9% | | | | | | | | |

American Public Education, Inc. (d)(e) | | | 1,400 | | | | 28,210 | |

Avis Budget Group, Inc. (d)(e) | | | 4,800 | | | | 155,328 | |

Cramo OYJ | | | 1,235 | | | | 32,470 | |

DeVry Education Group, Inc. (d) | | | 5,100 | | | | 115,770 | |

Green Dot Corp. Class A (d)(e) | | | 2,000 | | | | 44,400 | |

HMS Holdings Corp. (d)(e) | | | 6,200 | | | | 130,634 | |

Insperity, Inc. (d) | | | 1,800 | | | | 135,360 | |

K12, Inc. (d)(e) | | | 7,300 | | | | 79,132 | |

LSC Communications, Inc. (e) | | | 812 | | | | 19,683 | |

ManpowerGroup, Inc. (d) | | | 2,200 | | | | 168,960 | |

Quad / Graphics, Inc. (d) | | | 5,000 | | | | 118,800 | |

Ramirent OYJ | | | 1,682 | | | | 12,408 | |

RR Donnelley & Sons Co. (d) | | | 2,166 | | | | 38,446 | |

Team Health Holdings, Inc. (e) | | | 2,260 | | | | 96,841 | |

| | | | | | | | |

| | | | | | | 1,176,442 | |

| | | | | | | | |

Computers 0.5% | | | | | | | | |

Barracuda Networks, Inc. (d)(e) | | | 5,600 | | | | 130,592 | |

Brocade Communications Systems, Inc. | | | 17,417 | | | | 184,620 | |

Cray, Inc. (d)(e) | | | 700 | | | | 14,560 | |

Engility Holdings, Inc. (d)(e) | | | 2,200 | | | | 63,206 | |

Logitech International S.A. Registered (d) | | | 5,691 | | | | 137,739 | |

Super Micro Computer, Inc. (d)(e) | | | 400 | | | | 9,480 | |

Teradata Corp. (d)(e) | | | 5,200 | | | | 140,192 | |

Wincor Nixdorf A.G. (e) | | | 279 | | | | 20,318 | |

| | | | | | | | |

| | | | | | | 700,707 | |

| | | | | | | | |

Cosmetics & Personal Care 0.1% | | | | | | | | |

Oriflame Holding A.G. (e) | | | 3,629 | | | | 133,433 | |

| | | | | | | | |

|

Distribution & Wholesale 0.3% | |

D’ieteren S.A. / N.V. | | | 2,300 | | | | 101,460 | |

Entertainment One, Ltd. | | | 40,184 | | | | 114,208 | |

HD Supply Holdings, Inc. (d)(e) | | | 4,900 | | | | 161,700 | |

| | | | | | | | |

| | | | | | | 377,368 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Electric 0.1% | |

ACEA S.p.A | | | 3,095 | | | $ | 40,091 | |

EDP—Energias de Portugal S.A. | | | 20,314 | | | | 67,144 | |

Spark Energy, Inc. Class A (d) | | | 200 | | | | 4,840 | |

| | | | | | | | |

| | | | | | | 112,075 | |

| | | | | | | | |

Electrical Components & Equipment 0.1% | |

General Cable Corp. (d) | | | 8,900 | | | | 124,600 | |

Insteel Industries, Inc. (d) | | | 1,300 | | | | 34,970 | |

Powell Industries, Inc. (d) | | | 800 | | | | 28,312 | |

| | | | | | | | |

| | | | | | | 187,882 | |

| | | | | | | | |

Electronics 0.3% | |

Electrocomponents PLC | | | 11,610 | | | | 52,949 | |

Jabil Circuit, Inc. (d) | | | 7,200 | | | | 153,648 | |

Mycronic AB | | | 6,867 | | | | 71,657 | |

Stoneridge, Inc. (d)(e) | | | 6,300 | | | | 93,366 | |

TTM Technologies, Inc. (d)(e) | | | 4,300 | | | | 56,545 | |

| | | | | | | | |

| | | | | | | 428,165 | |

| | | | | | | | |

Energy—Alternate Sources 0.1% | |

Vestas Wind Systems A/S (d) | | | 1,342 | | | | 107,644 | |

| | | | | | | | |

|

Engineering & Construction 0.4% | |

ACS Actividades de Construccion y Servicios S.A. (d) | | | 5,295 | | | | 162,346 | |

Bouygues S.A. | | | 4,609 | | | | 150,293 | |

Carillion PLC | | | 30,698 | | | | 94,349 | |

Obrascon Huarte Lain S.A. | | | 30,999 | | | | 124,649 | |

| | | | | | | | |

| | | | | | | 531,637 | |

| | | | | | | | |

Entertainment 0.2% | |

Caesars Acquisition Co. Class A (d)(e) | | | 2,300 | | | | 26,795 | |

Carmike Cinemas, Inc. (e) | | | 2,610 | | | | 85,216 | |

International Game Technology PLC (d) | | | 4,000 | | | | 114,880 | |

Isle of Capri Casinos, Inc. (d)(e) | | | 624 | | | | 13,104 | |

William Hill PLC | | | 20,546 | | | | 74,389 | |

| | | | | | | | |

| | | | | | | 314,384 | |

| | | | | | | | |

Finance—Commercial 0.1% | |

Banca IFIS S.p.A. | | | 2,492 | | | | 72,083 | |

| | | | | | | | |

|

Finance—Consumer Loans 0.1% | |

Aldermore Group PLC (e) | | | 11,668 | | | | 24,650 | |

World Acceptance Corp. (d)(e) | | | 2,600 | | | | 123,552 | |

| | | | | | | | |

| | | | | | | 148,202 | |

| | | | | | | | |

Finance—Investment Banker/Broker 0.5% | |

GAIN Capital Holdings, Inc. | | | 4,900 | | | | 22,540 | |

INTL. FCStone, Inc. (d)(e) | | | 3,000 | | | | 107,700 | |

Investment Technology Group, Inc. (d) | | | 7,400 | | | | 113,294 | |

Lazard, Ltd. Class A (d) | | | 4,400 | | | | 160,424 | |

LPL Financial Holdings, Inc. (d) | | | 4,700 | | | | 145,512 | |

Raymond James Financial, Inc. (d) | | | 900 | | | | 54,108 | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 17 | |

Consolidated Portfolio of Investments October 31, 2016 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Finance—Investment Banker/Broker (continued) | | | | | |

Tullett Prebon PLC | | | 9,459 | | | $ | 41,101 | |

| | | | | | | | |

| | | | | | | 644,679 | |

| | | | | | | | |

Finance—Other Services 0.1% | |

Deutsche Boerse A.G. | | | 971 | | | | 72,557 | |

| | | | | | | | |

| | |

Food 0.7% | | | | | | | | |

Austevoll Seafood ASA | | | 10,363 | | | | 93,441 | |

Casino Guichard Perrachon S.A. | | | 1,654 | | | | 82,305 | |

John B. Sanfilippo & Son, Inc. (d) | | | 100 | | | | 5,068 | |

Leroy Seafood Group ASA (d) | | | 42 | | | | 2,221 | |

Metcash, Ltd. (e) | | | 38,081 | | | | 57,647 | |

Pilgrim’s Pride Corp. (d) | | | 7,400 | | | | 161,616 | |

Premier Foods PLC (e) | | | 52,133 | | | | 29,034 | |

Salmar ASA (d) | | | 4,238 | | | | 137,567 | |

WhiteWave Foods Co. (The) (e) | | | 6,574 | | | | 358,217 | |

Wm Morrison Supermarkets PLC | | | 15,727 | | | | 43,601 | |

| | | | | | | | |

| | | | | | | 970,717 | |

| | | | | | | | |

Gas 0.2% | | | | | | | | |

Western Gas Equity Partners, L.P. | | | 5,200 | | | | 221,624 | |

| | | | | | | | |

| | |

Hand & Machine Tools 0.1% | | | | | | | | |

Regal Beloit Corp. (d) | | | 1,100 | | | | 65,010 | |

Schweiter Technologies A.G. (d) | | | 1 | | | | 1,077 | |

| | | | | | | | |

| | | | | | | 66,087 | |

| | | | | | | | |

Health Care—Products 1.0% | | | | | | | | |

Accuray, Inc. (d)(e) | | | 5,600 | | | | 27,440 | |

Alere, Inc. (d)(e) | | | 3,884 | | | | 173,537 | |

Ambu A/S Class B | | | 432 | | | | 22,379 | |

AngioDynamics, Inc. (d)(e) | | | 2,000 | | | | 31,880 | |

Bruker Corp. (d) | | | 7,300 | | | | 149,577 | |

Cepheid (e) | | | 3,900 | | | | 206,310 | |

Cynosure, Inc. Class A (d)(e) | | | 2,500 | | | | 106,625 | |

Halyard Health, Inc. (d)(e) | | | 3,800 | | | | 122,930 | |

Hill-Rom Holdings, Inc. (d) | | | 1,900 | | | | 105,279 | |

OraSure Technologies, Inc. (d)(e) | | | 6,700 | | | | 50,317 | |

Orthofix International N.V. (d)(e) | | | 2,300 | | | | 84,295 | |

VWR Corp. (d)(e) | | | 5,700 | | | | 156,807 | |

| | | | | | | | |

| | | | | | | 1,237,376 | |

| | | | | | | | |

Health Care—Services 0.4% | | | | | | | | |

Molina Healthcare, Inc. (d)(e) | | | 2,300 | | | | 125,143 | |

Natera, Inc. (d)(e) | | | 8,300 | | | | 70,384 | |

Summerset Group Holdings, Ltd. | | | 1,648 | | | | 5,610 | |

Triple-S Management Corp. Class B (e) | | | 5,000 | | | | 103,400 | |

WellCare Health Plans, Inc. (d)(e) | | | 1,300 | | | | 147,563 | |

| | | | | | | | |

| | | | | | | 452,100 | |

| | | | | | | | |

Holding Company—Diversified 0.1% | | | | | | | | |

Seven Group Holdings, Ltd. (d) | | | 11,787 | | | | 81,504 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Home Builders 0.2% | | | | | | | | |

Barratt Developments PLC (d) | | | 11,850 | | | $ | 65,806 | |

Galliford Try PLC (d) | | | 4,686 | | | | 70,319 | |

Persimmon PLC (d) | | | 2,842 | | | | 58,928 | |

YIT OYJ (d) | | | 7,791 | | | | 64,914 | |

| | | | | | | | |

| | | | | | | 259,967 | |

| | | | | | | | |

Household Products & Wares 0.2% | | | | | | | | |

Central Garden & Pet Co. Class A (d)(e) | | | 5,200 | | | | 121,368 | |

Henkel A.G. & Co. KGaA | | | 1,452 | | | | 159,872 | |

| | | | | | | | |

| | | | | | | 281,240 | |

| | | | | | | | |

Housewares 0.0%‡ | | | | | | | | |

NACCO Industries, Inc. Class A (d) | | | 400 | | | | 29,260 | |

| | | | | | | | |

|

Insurance 0.6% | |

AXA S.A. (d) | | | 6,854 | | | | 154,505 | |

CNP Assurances (d) | | | 7,218 | | | | 125,074 | |

esure Group PLC | | | 13,203 | | | | 43,940 | |

NN Group N.V. (d) | | | 5,146 | | | | 155,066 | |

Old Mutual PLC | | | 19,875 | | | | 49,019 | |

Unipol Gruppo Finanziario S.p.A. | | | 47,905 | | | | 146,509 | |

Voya Financial, Inc. (d) | | | 5,000 | | | | 152,750 | |

| | | | | | | | |

| | | | | | | 826,863 | |

| | | | | | | | |

Internet 1.2% | | | | | | | | |

1-800-Flowers.com, Inc. Class A (d)(e) | | | 9,400 | | | | 89,770 | |

Blucora, Inc. (d)(e) | | | 8,000 | | | | 106,400 | |

GoDaddy, Inc. Class A (d)(e) | | | 300 | | | | 10,737 | |

Groupon, Inc. (e) | | | 30,700 | | | | 122,493 | |

IAC/InterActiveCorp (d) | | | 2,500 | | | | 161,100 | |

Intralinks Holdings, Inc. (d)(e) | | | 1,300 | | | | 11,921 | |

¨LinkedIn Corp. Class A (e) | | | 2,778 | | | | 526,709 | |

New Media Investment Group, Inc. (d) | | | 5,500 | | | | 79,200 | |

Overstock.com, Inc. (d)(e) | | | 2,200 | | | | 32,230 | |

RetailMeNot, Inc. (d)(e) | | | 11,700 | | | | 105,885 | |

Rubicon Project, Inc. (The) (d)(e) | | | 15,600 | | | | 119,496 | |

Twitter, Inc. (d)(e) | | | 4,000 | | | | 71,800 | |

Yahoo!, Inc. (e) | | | 4,561 | | | | 189,509 | |

| | | | | | | | |

| | | | | | | 1,627,250 | |

| | | | | | | | |

Investment Companies 0.3% | | | | | | | | |

EXOR S.p.A. | | | 8,021 | | | | 340,844 | |

John Laing Group PLC (a) | | | 3,759 | | | | 12,436 | |

| | | | | | | | |

| | | | | | | 353,280 | |

| | | | | | | | |

Iron & Steel 0.6% | | | | | | | | |

ArcelorMittal (d)(e) | | | 24,638 | | | | 166,011 | |

BlueScope Steel, Ltd. (d) | | | 23,198 | | | | 137,644 | |

Evraz PLC (e) | | | 33,045 | | | | 82,957 | |

Fortescue Metals Group, Ltd. | | | 39,767 | | | | 166,379 | |

Ryerson Holding Corp. (d)(e) | | | 200 | | | | 2,050 | |

Salzgitter A.G. (d) | | | 1,018 | | | | 33,414 | |

United States Steel Corp. (d) | | | 8,900 | | | | 172,126 | |

| | | | | | | | |

| | | | | | | 760,581 | |

| | | | | | | | |

| | | | |

| 18 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Leisure Time 0.1% | | | | | | | | |

Carnival PLC (d) | | | 3,331 | | | $ | 160,476 | |

Trigano S.A. (d) | | | 82 | | | | 5,802 | |

| | | | | | | | |

| | | | | | | 166,278 | |

| | | | | | | | |

Machinery—Construction & Mining 0.1% | |

Babcock & Wilcox Enterprises, Inc. (d)(e) | | | 3,000 | | | | 47,220 | |

Danieli & C Officine Meccaniche S.p.A. | | | 3,082 | | | | 41,276 | |

Oshkosh Corp. (d) | | | 1,800 | | | | 96,300 | |

| | | | | | | | |

| | | | | | | 184,796 | |

| | | | | | | | |

Machinery—Diversified 0.2% | | | | | | | | |

Biesse S.p.A. | | | 544 | | | | 9,382 | |

Chart Industries, Inc. (d)(e) | | | 3,200 | | | | 88,768 | |

Deutz A.G. | | | 12,929 | | | | 63,868 | |

Kardex A.G. Registered (d)(e) | | | 95 | | | | 8,122 | |

Koenig & Bauer A.G. (e) | | | 1,571 | | | | 73,785 | |

| | | | | | | | |

| | | | | | | 243,925 | |

| | | | | | | | |

Media 0.3% | | | | | | | | |

AMC Networks, Inc. Class A (d)(e) | | | 1,400 | | | | 68,502 | |

Gannett Co., Inc. (d) | | | 7,200 | | | | 55,944 | |

Sanoma OYJ | | | 5,321 | | | | 49,854 | |

Seven West Media, Ltd. | | | 196,284 | | | | 101,533 | |

SKY Network Television, Ltd. | | | 290 | | | | 958 | |

Southern Cross Media Group, Ltd. | | | 57,075 | | | | 62,521 | |

| | | | | | | | |

| | | | | | | 339,312 | |

| | | | | | | | |

Metal Fabricate & Hardware 0.2% | | | | | | | | |

Global Brass & Copper Holdings, Inc. (d) | | | 4,000 | | | | 114,800 | |

Granges AB | | | 5,194 | | | | 50,461 | |

Kloeckner & Co. S.E. (e) | | | 3,429 | | | | 42,799 | |

Timken Co. (The) (d) | | | 1,700 | | | | 56,185 | |

TimkenSteel Corp. (d)(e) | | | 5,500 | | | | 56,375 | |

| | | | | | | | |

| | | | | | | 320,620 | |

| | | | | | | | |

Mining 0.8% | | | | | | | | |

Acacia Mining PLC (d) | | | 15,293 | | | | 97,056 | |

Anglo American PLC (d)(e) | | | 9,783 | | | | 135,430 | |

Centamin PLC | | | 71,499 | | | | 138,098 | |

Coeur Mining, Inc. (d)(e) | | | 800 | | | | 8,944 | |

Detour Gold Corp. (e) | | | 3,655 | | | | 69,677 | |

Goldcorp, Inc. | | | 2,664 | | | | 40,458 | |

Lonmin PLC (e) | | | 47,953 | | | | 111,520 | |

Mineral Resources, Ltd. (d) | | | 991 | | | | 8,722 | |

Petra Diamonds, Ltd. | | | 29,333 | | | | 54,538 | |

Regis Resources, Ltd. | | | 50,638 | | | | 125,191 | |

Rio Tinto, Ltd. (d) | | | 2,636 | | | | 108,642 | |

South32, Ltd. | | | 81,421 | | | | 159,178 | |

| | | | | | | | |

| | | | | | | 1,057,454 | |

| | | | | | | | |

Miscellaneous—Manufacturing 0.3% | | | | | | | | |

AGFA-Gevaert N.V. (e) | | | 12,291 | | | | 51,136 | |

GWA Group, Ltd. | | | 10,052 | | | | 21,869 | |

| | | | | | | | |

| | |

Shares | | | Value | |

Miscellaneous—Manufacturing (continued) | | | | | |

Morgan Advanced Materials PLC | | | 863 | | | $ | 2,879 | |

RHI A.G. (d) | | | 1,136 | | | | 28,607 | |

Trinity Industries, Inc. (d) | | | 6,600 | | | | 140,910 | |

Trinseo S.A. (d) | | | 2,500 | | | | 131,125 | |

Vesuvius PLC | | | 383 | | | | 1,709 | |

| | | | | | | | |

| | | | | | | 378,235 | |

| | | | | | | | |

Office & Business Equipment 0.2% | | | | | | | | |

Neopost S.A. (d) | | | 4,658 | | | | 141,025 | |

Xerox Corp. (d) | | | 15,900 | | | | 155,343 | |

| | | | | | | | |

| | | | | | | 296,368 | |

| | | | | | | | |

Oil & Gas 1.3% | | | | | | | | |

Antero Midstream Partners, L.P. (d) | | | 8,700 | | | | 253,518 | |

Ensco PLC Class A (d) | | | 3,100 | | | | 24,242 | |

EQT GP Holdings, L.P. (d) | | | 7,200 | | | | 168,192 | |

¨InterOil Corp. (e) | | | 8,418 | | | | 417,701 | |

Murphy U.S.A., Inc. (d)(e) | | | 1,500 | | | | 103,170 | |

Nabors Industries, Ltd. (d) | | | 2,000 | | | | 23,800 | |

Noble Corp. PLC (d) | | | 4,100 | | | | 20,254 | |

PBF Energy, Inc. Class A (d) | | | 3,700 | | | | 80,660 | |

Premier Oil PLC (e) | | | 25,970 | | | | 20,980 | |

QEP Resources, Inc. (d) | | | 1,400 | | | | 22,498 | |

Rowan Cos. PLC Class A (d) | | | 1,900 | | | | 25,213 | |

Sanchez Energy Corp. (d)(e) | | | 2,900 | | | | 18,473 | |

Saras S.p.A. | | | 41,268 | | | | 71,668 | |

SM Energy Co. (d) | | | 600 | | | | 20,178 | |

Southwestern Energy Co. (d)(e) | | | 1,900 | | | | 19,741 | |

Suncor Energy, Inc. | | | 5,553 | | | | 166,635 | |

Transocean, Ltd. (d)(e) | | | 2,500 | | | | 24,025 | |

Valero Energy Partners, L.P. (d) | | | 3,200 | | | | 130,336 | |

VTTI Energy Partners, L.P. (d) | | | 8,100 | | | | 143,370 | |

| | | | | | | | |

| | | | 1,754,654 | |

| | | | | | | | |

Oil & Gas Services 1.0% | |

Baker Hughes, Inc. (d) | | | 500 | | | | 27,700 | |

FMC Technologies, Inc. (d)(e) | | | 900 | | | | 29,043 | |

Halliburton Co. | | | 1,434 | | | | 65,964 | |

Maire Tecnimont S.p.A. | | | 20,877 | | | | 50,419 | |

McDermott International, Inc. (d)(e) | | | 4,800 | | | | 24,672 | |

MRC Global, Inc. (d)(e) | | | 7,900 | | | | 116,446 | |

Newpark Resources, Inc. (d)(e) | | | 2,100 | | | | 13,230 | |

Oceaneering International, Inc. (d) | | | 900 | | | | 21,420 | |

Rice Midstream Partners, L.P. | | | 14,000 | | | | 303,380 | |

Targa Resources Corp. (d) | | | 7,500 | | | | 329,250 | |

Technip S.A. | | | 5,338 | | | | 354,049 | |

| | | | | | | | |

| | | | 1,335,573 | |

| | | | | | | | |

Pharmaceuticals 1.8% | |

Actelion, Ltd. Registered (d)(e) | | | 383 | | | | 55,347 | |

AmerisourceBergen Corp. (d) | | | 1,200 | | | | 84,384 | |

Amphastar Pharmaceuticals, Inc. (d)(e) | | | 6,800 | | | | 123,352 | |

AstraZeneca PLC, Sponsored ADR | | | 2,680 | | | | 75,898 | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 19 | |

Consolidated Portfolio of Investments October 31, 2016 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Pharmaceuticals (continued) | | | | | |

Australian Pharmaceutical Industries, Ltd. | | | 10,370 | | | $ | 14,988 | |

Bayer A.G. Registered (d) | | | 409 | | | | 40,538 | |

Catalent, Inc. (d)(e) | | | 5,300 | | | | 120,893 | |

Herbalife, Ltd. (d)(e) | | | 2,500 | | | | 151,700 | |

Horizon Pharma PLC (d)(e) | | | 21,736 | | | | 363,426 | |

Impax Laboratories, Inc. (d)(e) | | | 5,600 | | | | 112,560 | |

Indivior PLC | | | 33,670 | | | | 129,571 | |

Lannett Co., Inc. (d)(e) | | | 5,100 | | | | 111,690 | |

Mylan N.V. (e) | | | 3,333 | | | | 121,654 | |

Omega Protein Corp. (d)(e) | | | 1,100 | | | | 24,530 | |

Pacira Pharmaceuticals, Inc. (d)(e) | | | 2,300 | | | | 73,140 | |

Phibro Animal Health Corp. Class A (d) | | | 4,900 | | | | 127,155 | |

SciClone Pharmaceuticals, Inc. (d)(e) | | | 12,100 | | | | 108,295 | |

Shire PLC, ADR | | | 426 | | | | 71,841 | |

Sigma Pharmaceuticals, Ltd. | | | 70,416 | | | | 71,242 | |

Sucampo Pharmaceuticals, Inc. Class A (d)(e) | | | 9,800 | | | | 111,720 | |

Supernus Pharmaceuticals, Inc. (d)(e) | | | 5,600 | | | | 110,880 | |

Taro Pharmaceutical Industries, Ltd. (e) | | | 1,400 | | | | 142,114 | |

| | | | | | | | |

| | | | | | | 2,346,918 | |

| | | | | | | | |

Pipelines 3.1% | | | | | | | | |

Cheniere Energy, Inc. (d)(e) | | | 3,400 | | | | 128,180 | |

Dominion Midstream Partners, L.P. (d) | | | 6,400 | | | | 151,040 | |

Energy Transfer Equity, L.P. (d) | | | 13,800 | | | | 206,034 | |

Energy Transfer Partners, L.P. (d) | | | 6,800 | | | | 237,864 | |

EnLink Midstream LLC | | | 9,000 | | | | 137,250 | |

Enterprise Products Partners, L.P. (d) | | | 10,800 | | | | 272,592 | |

EQT Midstream Partners, L.P. (d) | | | 2,000 | | | | 149,740 | |

Genesis Energy, L.P. (d) | | | 6,400 | | | | 223,552 | |

Magellan Midstream Partners, L.P. (d) | | | 2,100 | | | | 141,183 | |

MPLX, L.P. (d) | | | 7,500 | | | | 255,150 | |