| | |

| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response. . . ..20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: April 30

(MainStay Absolute Return Multi-Strategy Fund and MainStay Tax Advantaged Short Term Bond Fund)

Date of reporting period: October 31, 2015

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Absolute Return Multi-Strategy Fund and MainStay Tax Advantaged Short Term Bond Fund, series of the Registrant.

| Item 1. | Reports to Stockholders. |

MainStay Absolute Return Multi-Strategy Fund

Message from the President and Semiannual Report

Unaudited | October 31, 2015

This page intentionally left blank

Message from the President

The period from June 18 through October 31, 2015, was marked by increased market volatility, particularly after the People’s Bank of China devalued the Chinese yuan on August 11, 2015. Following the devaluation, many stock markets around the world dropped substantially. Some took months to recover.

U.S. large-cap stocks were unable to end the reporting period in positive territory. Concerns that the Federal Reserve might raise the federal funds target rate weighed on many investors during the reporting period. Successive developments in employment, inflation and the stock market, however, led the Federal Reserve to repeatedly postpone a tightening move. According to Russell data, growth stocks outperformed value stocks among large- and mid-capitalization companies during the reporting period, while value stocks outperformed growth stocks among smaller-capitalization companies.

On the whole, international, global and emerging-market stocks all provided negative returns for the reporting period, with emerging-market stocks registering double-digit declines. Emerging markets suffered from a number of difficulties, including slowing growth in China, low oil and gas prices and slack demand for metals. This combination led to fewer exports.

The U.S. bond market saw mixed results during the reporting period. Yields on 3-year and shorter U.S. Treasury bonds closed

the reporting period higher than where they began, but yields on all other U.S. Treasury securities declined. During the reporting period, high-yield bonds provided negative returns, as did leveraged loans and convertible securities. In the aggregate, U.S. investment-grade bonds advanced during the reporting period, as did municipal bonds.

The stock and bond markets are constantly changing, often in unexpected ways. That’s why at MainStay, we encourage investors to view short-term performance in light of their long-term financial goals.

The following pages provide more detailed information about the specific markets, securities and investment decisions that most affected your MainStay Fund during the reporting period ended October 31, 2015. We hope that you will carefully review this report and use it as you consider ways to pursue your personal financial goals and objectives.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

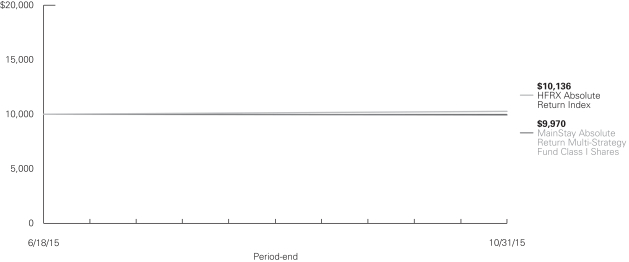

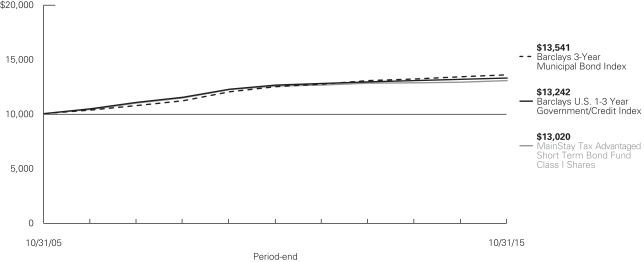

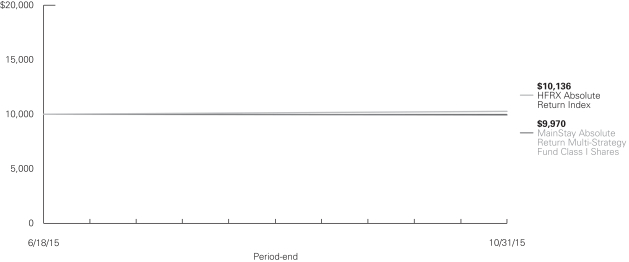

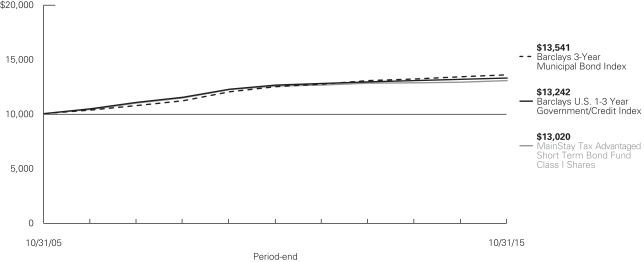

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period Ended October 31, 2015

| | | | | | | | | | | | |

| Class | | Sales Charge | | | | Since

Inception

(6/18/15) | | | Gross

Expense

Ratio2 | |

| Class A Shares | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –5.69

–0.20 | %

| |

| 2.51

2.51 | %

|

| Investor Class Shares | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –5.88

–0.40 |

| |

| 2.67

2.67 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | |

| –1.69

–0.70 |

| |

| 3.42

3.42 |

|

| Class I Shares | | No Sales Charge | | | | | –0.30 | | | | 2.26 | |

| | | | |

| Benchmark Performance | | Since

Inception

(6/18/15) | |

HFRX Absolute Return Index3 | | | 1.36 | % |

Average Lipper Alternative Multi-Strategy Fund4 | | | –2.35 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the periods of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the consolidated financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. |

| 4. | The Average Lipper Alternative Multi-Strategy Fund is representative of the funds that seek total returns through the management of several different hedge- like strategies. These funds are typically quantitatively driven to measure the existing relationship between instruments and in some cases to identify positions in which the risk-adjusted spread between these instruments represents an opportunity for the investment manager. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of the fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Absolute Return Multi-Strategy Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the period from June 18, 2015, to October 31, 2015, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from June 18, 2015, to October 31, 2015.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the period ended October 31, 2015. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

6/18/151 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/15 | | | Expenses

Paid

During

Period2 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/15 | | | Expenses

Paid

During

Period2 | |

| | | | | |

| Class A Shares3 | | $ | 1,000.00 | | | $ | 998.00 | | | $ | 9.32 | | | $ | 1,009.30 | | | $ | 9.37 | |

| | | | | |

| Investor Class Shares3 | | $ | 1,000.00 | | | $ | 996.00 | | | $ | 9.72 | | | $ | 1,008.80 | | | $ | 9.78 | |

| | | | | |

| Class C Shares3 | | $ | 1,000.00 | | | $ | 993.00 | | | $ | 12.44 | | | $ | 1,006.10 | | | $ | 12.52 | |

| | | | | |

| Class I Shares3 | | $ | 1,000.00 | | | $ | 997.00 | | | $ | 8.24 | | | $ | 1,010.30 | | | $ | 8.29 | |

| 1. | The inception date of the Fund. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio of each class (2.51% for Class A, 2.62% for Investor Class, 3.36% for Class C and 2.22% for Class I) multiplied by the average account value over the period, divided by 366 and multiplied by 136 days (to reflect the since-inception period which took place after the close of business on June 18, 2015). The table above represents the actual expenses incurred during the period. |

| 3. | Expenses paid during the period reflect ongoing costs for the period from June 18, 2015 through October 31, 2015. Had these shares been offered for the full six-month period ended October 31, 2015, and had the Fund provided a hypothetical 5% annualized return, expenses paid during the period would have been $12.70 for Class A, $13.25 for Investor Class, $16.96 for Class C and $11.24 for Class I and the ending account value would have been $1,012.50 for Class A, $1,012.00 for Investor Class, $1,008.20 for Class C and $1,014.00 for Class I. |

| | |

| 6 | | MainStay Absolute Return Multi-Strategy Fund |

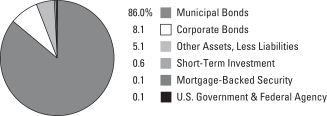

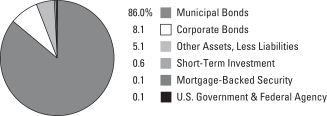

Portfolio Composition as of October 31, 2015 (Unaudited)

See Consolidated Portfolio of Investments beginning on page 10 for specific holdings within these categories.

| ‡ | Less than one-tenth of a percent. |

Top Ten Holdings Held as of October 31, 2015 (excluding short-term investments) (Unaudited)

| 3. | Integrated Silicon Solution, Inc. |

| 5. | Time Warner Cable, Inc. |

| 6. | Energy Transfer Equity, L.P. |

| 7. | Sunoco Logistics Partners, L.P. |

| 9. | Enterprise Products Partners, L.P. |

Top Five Short Positions as of October 31, 2015 (Unaudited)

| 1. | United States Oil Fund, L.P. |

| 3. | Chocoladefabriken Lindt & Sprungli A.G. |

| 4. | SBA Communications Corp. Class A |

| 5. | Level 3 Communications, Inc. |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by Jae S. Yoon, CFA, Jonathan Swaney, Poul Kristensen, CFA, and Amit Soni, CFA, of New York Life Investments,1 the Fund’s manager.

How did MainStay Absolute Return Multi-Strategy Fund perform relative to its primary benchmark and peers during the period from June 18, 2015, through October 31, 2015?

MainStay Absolute Return Multi-Strategy Fund commenced operations on June 18, 2015. Excluding all sales charges, MainStay Absolute Return Multi-Strategy Fund returned –0.20% for Class A shares, –0.40% for Investor Class shares and –0.70% for Class C shares from June 18, 2015, through October 31, 2015. Over the same period, Class I shares returned –0.30%. From June 18, 2015, through October 31, 2015, all share classes underperformed the 1.36% return of the HFRX Absolute Return Index,2 which is the Fund’s broad-based securities-market index. Over the same period, all share classes outperformed the –2.35% return of the Average Lipper3 Alternative Multi-Strategy Fund. See page 5 for Fund returns with sales charges.

What factors affected the Fund’s relative performance during the reporting period?

Several factors affected the Fund’s performance relative to the HFRX Absolute Return Index. Market conditions were generally favorable for quantitatively driven investment programs, helping to explain why equity market neutral was the Fund’s best-performing strategy. The Fund’s allocations to the alpha and royalty strategies4 detracted the most from the Fund’s relative performance despite hedging activities intended to reduce the risk and volatility associated with these investments. The master limited partnerships (“MLP”) sector was adversely affected primarily by concerns about overbuilt infrastructure. The Fund’s exposure to the risk arbitrage strategy was also a moderate detractor. This exposure suffered from the widening of spreads and from some positions in event-driven strategies. The performance of the risk arbitrage strategy, however, was in line with other similar peer strategies during the reporting period. From a risk perspective, the Fund remained below its current target long-term annualized volatility level of less than 6% (as measured by annualized standard deviation of the Fund’s returns).

During the reporting period, how did the Fund’s performance correlate with traditional equity and fixed-income indices?

The Fund maintained low correlation to traditional equity and fixed-income indices during the reporting period, as designed. The correlation of the Fund’s overall portfolio to the S&P 500® Index5 was 33% and the correlation to the Barclays U.S. Aggregate Bond Index6 was 16%.

During the reporting period, how did the Fund’s volatility compare to that of traditional fixed-income indices?

During the reporting period, the Fund’s volatility (as measured by annualized standard deviation of the Fund’s returns) was closer to that of traditional fixed-income indices than it was to that of traditional equity indices. The Fund’s volatility was 4.8%, compared to a volatility of 3.9% for the Barclays U.S. Aggregate Bond Index and a volatility of 4.5% for the BofA Merrill Lynch High Yield Master II Index.7 During the reporting period, the volatility of the S&P 500® Index was 18.9%.

How did the Fund use derivatives during the reporting period?

The Fund used derivatives for a variety of purposes, including alpha generation, hedging and/or operational efficiency. We believe that measuring the impact of derivatives on performance as positive or negative does not properly reflect their utility to the Fund because of the function they perform within the Fund. For example, a hedge performing as expected might have a negative contribution to return even as it serves its intended function to reduce a risk or exposure.

How did you allocate the Fund’s assets among each of the strategies during the reporting period and why?

The Fund’s allocations are based on the estimated optimal distribution of assets taking into account both the risk and return expectations. (It is not possible to increase return without taking additional risk, and the Fund generally cannot reduce risk without also reducing return.) These estimates of risk and return are long term in nature, and as a result, asset allocations tend

| 1. | “New York Life Investments” is a service mark used by New York Life Investment Management Holdings LLC and its subsidiary New York Life Investment Management LLC. |

| 2. | See footnote on page 5 for more information on the HFRX Absolute Return Index. |

| 3. | See footnote on page 5 for more information on Lipper Inc. |

| 4. | The master limited partnerships and other energy companies portion of the Fund is comprised of two underlying strategies: the MLP alpha (midstream) strategy and the MLP royalty (upstream) strategy. |

| 5. | The S&P 500® Index is widely regarded as the as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 6. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasurys, government-related and corporate securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 7. | The BofA Merrill Lynch High Yield Master II Index monitors the performance of below investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. An investment cannot be made directly in an index. |

| | |

| 8 | | MainStay Absolute Return Multi-Strategy Fund |

to be quite stable over time. The Fund’s allocation to an individual strategy may change if there is a statistically significant change in the risk-return characteristics of a strategy or if an attractive new strategy became available for investment that we believe would likely further support the Fund’s investment goal.

Below were the target allocations to each strategy as of October 31, 2015:

| • | | Flexible bond8 strategy: 10% |

| • | | Managed futures strategy: 19.5% |

| • | | Risk arbitrage strategy: 12% |

| • | | Credit opportunities8 strategy: 15% |

| • | | Equity market neutral strategy: 19.5% |

| • | | MLP alpha strategy: 10% |

| • | | MLP royalty strategy: 1% |

| • | | Tactical/completion strategy: 13% |

How did the tactical allocation among the strategies affect the Fund’s performance during the reporting period?

The strategy allocations were stable and there were no tactical adjustments among the strategies during the reporting period.

During the reporting period, how did each strategy either contribute to or detract from the Fund’s absolute performance?

The equity market neutral strategy, the managed futures strategy, the credit opportunities strategy and the flexible bond strategy made positive contributions to the Fund’s gross performance during the reporting period. (Contributions take weightings and total returns into account.) The tactical/completion strategy, the MLP royalty strategy, the risk arbitrage strategy and the MLP alpha strategy made negative contributions to the Fund’s gross performance during the reporting period.

How did the Fund’s strategy weightings change during the reporting period?

The Fund’s absolute return investment approach seeks to provide positive returns over a complete market cycle, although returns may be negative during certain periods within or over a complete market cycle. The Fund’s underlying investment strategies are intended to provide complementary risk-return expectations and diversified non-traditional investments. As previously noted, the allocations to various strategies remained stable and there were no tactical adjustments during the reporting period.

| 8. | The credit long/short or non-traditional fixed-income portion of the Fund consists of two underlying strategies: the flexible bond strategy and the credit opportunities strategy. |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Consolidated Portfolio of Investments October 31, 2015 (Unaudited)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds 14.9%† | | | | | | | | |

Apparel 0.2% | |

SMCP SAS

8.875%, due 6/15/20 | | $ | 200,000 | | | $ | 236,997 | |

| | | | | | | | |

|

Auto Manufacturers 0.4% | |

FCA U.S. LLC / CG Co-Issuer, Inc.

8.25%, due 6/15/21 | | | 400,000 | | | | 428,000 | |

| | | | | | | | |

|

Auto Parts & Equipment 1.1% | |

Alliance Automotive Finance PLC

6.25%, due 12/1/21 | | | EUR 100,000 | | | | 113,488 | |

Autodis S.A.

6.50%, due 2/1/19 | | | 300,000 | | | | 341,276 | |

Goodyear Tire & Rubber Co. (The)

8.25%, due 8/15/20 | | $ | 279,000 | | | | 291,834 | |

Grupo Antolin Dutch B.V.

5.125%, due 6/30/22 | | | EUR 200,000 | | | | 224,888 | |

Schaeffler Finance B.V.

2.75%, due 5/15/19 | | | 100,000 | | | | 110,927 | |

| | | | | | | | |

| | | | | | | 1,082,413 | |

| | | | | | | | |

Banks 0.4% | |

Bank of America Corp. | | | | | | | | |

4.20%, due 8/26/24 | | $ | 60,000 | | | | 60,329 | |

5.625%, due 7/1/20 | | | 55,000 | | | | 61,954 | |

Goldman Sachs Group, Inc. (The) | | | | | | | | |

5.375%, due 3/15/20 | | | 55,000 | | | | 61,432 | |

6.75%, due 10/1/37 | | | 50,000 | | | | 60,256 | |

Morgan Stanley | | | | | | | | |

5.00%, due 11/24/25 | | | 60,000 | | | | 64,201 | |

5.50%, due 1/26/20 | | | 50,000 | | | | 55,749 | |

| | | | | | | | |

| | | | | | | 363,921 | |

| | | | | | | | |

Building Materials 0.4% | |

CEMEX Espana S.A.

9.875%, due 4/30/19 | | | 350,000 | | | | 373,188 | |

| | | | | | | | |

|

Chemicals 0.3% | |

SPCM S.A.

2.875%, due 6/15/23 | | | EUR 250,000 | | | | 262,198 | |

| | | | | | | | |

|

Commercial Services 0.7% | |

La Financiere Atalian SAS

7.25%, due 1/15/20 | | | 120,000 | | | | 141,525 | |

Verisure Holding AB | | | | | | | | |

6.00%, due 11/1/22 | | | 110,000 | | | | 123,683 | |

8.75%, due 9/1/18 | | | 350,000 | | | | 401,716 | |

| | | | | | | | |

| | | | | | | 666,924 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Electric 0.5% | |

EDP Finance B.V.

6.00%, due 2/2/18 | | $ | 174,000 | | | $ | 184,962 | |

Enel S.p.A

6.50%, due 1/10/74 (a) | | | EUR 100,000 | | | | 118,888 | |

Iberdrola International B.V.

5.75%, due 2/27/49 (a) | | | 200,000 | | | | 235,901 | |

| | | | | | | | |

| | | | | | | 539,751 | |

| | | | | | | | |

Electronics 0.5% | |

Techem GmbH

6.125%, due 10/1/19 | | | 375,000 | | | | 432,225 | |

Trionista Holdco GmbH

5.00%, due 4/30/20 | | | 100,000 | | | | 114,116 | |

| | | | | | | | |

| | | | | | | 546,341 | |

| | | | | | | | |

Entertainment 0.1% | |

Isle of Capri Casinos, Inc.

5.875%, due 3/15/21 | | $ | 50,000 | | | | 52,625 | |

| | | | | | | | |

|

Finance—Other Services 0.1% | |

Icahn Enterprises, L.P. / Icahn Enterprises Finance Corp.

5.875%, due 2/1/22 | | | 50,000 | | | | 51,500 | |

| | | | | | | | |

|

Food 1.6% | |

Agrokor dd

9.875%, due 5/1/19 | | | EUR 360,000 | | | | 424,448 | |

Campofrio Food Group S.A.

3.375%, due 3/15/22 | | | 170,000 | | | | 188,418 | |

Kraft Heinz Foods Co. | | | | | | | | |

2.80%, due 7/2/20 (b) | | $ | 50,000 | | | | 50,194 | |

4.875%, due 2/15/25 (b) | | | 190,000 | | | | 204,271 | |

Picard Bondco S.A.

7.75%, due 2/1/20 | | | EUR 325,000 | | | | 381,767 | |

R&R Ice Cream PLC

4.75%, due 5/15/20 (c) | | | 282,000 | | | | 318,149 | |

Tyson Foods, Inc.

3.95%, due 8/15/24 | | $ | 75,000 | | | | 76,569 | |

| | | | | | | | |

| | | | | | | 1,643,816 | |

| | | | | | | | |

Food Services 0.3% | |

Elior Finance & Co. SCA

6.50%, due 5/1/20 (c) | | | EUR 286,000 | | | | 335,273 | |

| | | | | | | | |

|

Forest Products & Paper 0.2% | |

Sappi Papier Holding GmbH

7.75%, due 7/15/17 (b) | | $ | 210,000 | | | | 218,400 | |

| | | | | | | | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers held, as of October 31, 2015, excluding short-term investments. May be subject to change daily. |

| ¡ | | Among the Fund’s 5 largest short positions as of October 31, 2015. May be subject to change daily. |

| | | | |

| 10 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Health Care—Products 0.4% | |

Boston Scientific Corp. | | | | | | | | |

2.85%, due 5/15/20 | | $ | 75,000 | | | $ | 74,954 | |

3.85%, due 5/15/25 | | | 140,000 | | | | 139,165 | |

Hologic, Inc.

5.25%, due 7/15/22 (b) | | | 172,000 | | | | 179,525 | |

| | | | | | | | |

| | | | | | | 393,644 | |

| | | | | | | | |

Health Care—Services 0.9% | |

Cerba European Lab SAS

7.00%, due 2/1/20 | | | EUR 200,000 | | | | 229,277 | |

DaVita HealthCare Partners, Inc.

5.00%, due 5/1/25 | | $ | 60,000 | | | | 59,562 | |

Ephios Bondco PLC

6.25%, due 7/1/22 | | | EUR 100,000 | | | | 114,913 | |

Fresenius Medical Care U.S. Finance II, Inc.

4.75%, due 10/15/24 (b) | | $ | 145,000 | | | | 146,812 | |

HomeVi SAS

6.875%, due 8/15/21 | | | EUR 275,000 | | | | 313,744 | |

Laboratory Corporation of America Holdings

2.625%, due 2/1/20 | | $ | 75,000 | | | | 74,855 | |

| | | | | | | | |

| | | | | | | 939,163 | |

| | | | | | | | |

Holding Companies—Diversified 0.7% | |

CeramTec Group GmbH

8.25%, due 8/15/21 | | | EUR 230,000 | | | | 274,102 | |

Nielsen Co. Luxembourg S.A.R.L. (The)

5.50%, due 10/1/21 (b) | | $ | 50,000 | | | | 51,812 | |

Novalis SAS

3.00%, due 4/30/22 | | | EUR 370,000 | | | | 393,688 | |

| | | | | | | | |

| | | | | | | 719,602 | |

| | | | | | | | |

Household Products & Wares 0.1% | |

Ontex Group N.V.

4.75%, due 11/15/21 | | | 100,000 | | | | 116,596 | |

| | | | | | | | |

|

Leisure Time 0.2% | |

Jarden Corp. | | | | | | | | |

6.125%, due 11/15/22 | | $ | 120,000 | | | | 124,050 | |

7.50%, due 5/1/17 | | | 35,000 | | | | 37,713 | |

| | | | | | | | |

| | | | | | | 161,763 | |

| | | | | | | | |

Lodging 0.4% | |

Accor S.A.

4.125%, due 6/30/49 (a) | | | EUR 400,000 | | | | 436,561 | |

| | | | | | | | |

|

Media 0.7% | |

Cable Communications Systems N.V.

7.50%, due 11/1/20 | | | 225,000 | | | | 261,029 | |

CCO Holdings LLC / CCO Holdings Capital Corp.

7.375%, due 6/1/20 | | $ | 250,000 | | | | 259,375 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Media (continued) | |

Nielsen Finance LLC / Nielsen Finance Co.

5.00%, due 4/15/22 (b) | | $ | 100,000 | | | $ | 101,625 | |

Unitymedia Hessen GmbH & Co. KG / Unitymedia NRW GmbH

4.00%, due 1/15/25 | | | EUR 100,000 | | | | 109,961 | |

| | | | | | | | |

| | | | | | | 731,990 | |

| | | | | | | | |

Oil & Gas 0.0%‡ | |

LINN Energy LLC / LINN Energy Finance Corp.

6.50%, due 5/15/19 | | $ | 45,000 | | | | 11,700 | |

| | | | | | | | |

|

Packaging & Containers 1.0% | |

Crown Americas LLC / Crown Americas Capital Corp. III

6.25%, due 2/1/21 | | | 100,000 | | | | 103,875 | |

Crown European Holdings S.A.

3.375%, due 5/15/25 | | | EUR 315,000 | | | | 330,802 | |

Kloeckner Pentaplast of America, Inc.

7.125%, due 11/1/20 | | | 250,000 | | | | 285,222 | |

Sealed Air Corp.

4.50%, due 9/15/23 | | | 230,000 | | | | 265,596 | |

| | | | | | | | |

| | | | | | | 985,495 | |

| | | | | | | | |

Pharmaceuticals 0.1% | |

AbbVie, Inc.

2.50%, due 5/14/20 | | $ | 75,000 | | | | 74,157 | |

Valeant Pharmaceuticals International, Inc.

6.125%, due 4/15/25 (b) | | | 40,000 | | | | 33,650 | |

| | | | | | | | |

| | | | | | | 107,807 | |

| | | | | | | | |

Real Estate 0.2% | |

Vonovia Finance B.V.

4.625%, due 4/8/74 (a) | | | EUR 200,000 | | | | 225,153 | |

| | | | | | | | |

|

Real Estate Investment Trusts 0.3% | |

MPT Operating Partnership, L.P. / MPT Finance Corp. | | | | | | | | |

4.00%, due 8/19/22 | | | 100,000 | | | | 111,295 | |

5.75%, due 10/1/20 | | | 100,000 | | | | 116,871 | |

6.375%, due 2/15/22 | | $ | 35,000 | | | | 36,575 | |

| | | | | | | | |

| | | | | | | 264,741 | |

| | | | | | | | |

Retail 0.4% | |

1011778 B.C. ULC / New Red Finance, Inc.

4.625%, due 1/15/22 (b) | | | 180,000 | | | | 182,700 | |

Dufry Finance SCA

5.50%, due 10/15/20 (b) | | | 200,000 | | | | 208,000 | |

O’Reilly Automotive, Inc.

3.80%, due 9/1/22 | | | 70,000 | | | | 71,108 | |

| | | | | | | | |

| | | | | | | 461,808 | |

| | | | | | | | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 11 | |

Consolidated Portfolio of Investments October 31, 2015 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Software 0.2% | |

InterXion Holding N.V.

6.00%, due 7/15/20 | | | EUR 150,000 | | | $ | 174,910 | |

| | | | | | | | |

|

Telecommunications 2.0% | |

Altice Financing S.A. | | | | | | | | |

7.875%, due 12/15/19 (b) | | $ | 200,000 | | | | 208,875 | |

8.00%, due 12/15/19 | | | EUR 192,000 | | | | 220,634 | |

Eileme 2 AB

11.75%, due 1/31/20 | | | 325,000 | | | | 385,084 | |

Intelsat Jackson Holdings S.A.

7.50%, due 4/1/21 | | $ | 50,000 | | | | 45,125 | |

Play Topco S.A.

7.75%, due 2/28/20 (d) | | | EUR 275,000 | | | | 309,964 | |

Softbank Group Corp.

5.25%, due 7/30/27 | | | 100,000 | | | | 108,821 | |

T-Mobile USA, Inc.

6.375%, due 3/1/25 | | $ | 50,000 | | | | 50,125 | |

Telecom Italia Capital S.A.

6.999%, due 6/4/18 | | | 80,000 | | | | 88,200 | |

Telenet Finance Ill Luxembourg SCA

6.625%, due 2/15/21 | | | EUR 270,000 | | | | 309,955 | |

Telenet Finance VI Luxembourg SCA

4.875%, due 7/15/27 | | | 100,000 | | | | 106,556 | |

Virgin Media Secured Finance PLC

5.50%, due 1/15/25 (b) | | $ | 200,000 | | | | 202,500 | |

| | | | | | | | |

| | | | | | | 2,035,839 | |

| | | | | | | | |

Water 0.5% | |

Veolia Environnement S.A.

4.85%, due 1/29/49 (a) | | | GBP 300,000 | | | | 468,261 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $15,221,343) | | | | | | | 15,036,380 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| Common Stocks 33.6% | |

Agriculture 0.2% | |

Bunge, Ltd. | | | 1,200 | | | | 87,552 | |

LivaNova PLC (e) | | | 1 | | | | 38 | |

Universal Corp. | | | 1,600 | | | | 86,416 | |

| | | | | | | | |

| | | | | | | 174,006 | |

| | | | | | | | |

Airlines 0.4% | |

Air New Zealand, Ltd. | | | 47,637 | | | | 93,869 | |

International Consolidated Airlines Group S.A. (e) | | | 11,046 | | | | 98,996 | |

Qantas Airways, Ltd. (e) | | | 30,097 | | | | 84,775 | |

Singapore Airlines, Ltd. | | | 9,900 | | | | 76,322 | |

SkyWest, Inc. (f) | | | 4,900 | | | | 93,296 | |

| | | | | | | | |

| | | | 447,258 | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Apparel 0.4% | |

Carter’s, Inc. | | | 1,000 | | | $ | 90,880 | |

Pacific Brands, Ltd. (e) | | | 164,840 | | | | 84,634 | |

Puma S.E. | | | 744 | | | | 166,573 | |

Skechers U.S.A., Inc. Class A (e) | | | 2,100 | | | | 65,520 | |

| | | | | | | | |

| | | | 407,607 | |

| | | | | | | | |

Auto Manufacturers 0.1% | |

Wabash National Corp. (e)(f) | | | 7,200 | | | | 86,184 | |

| | | | | | | | |

|

Auto Parts & Equipment 0.2% | |

Autoneum Holding A.G. (e) | | | 177 | | | | 32,537 | |

Goodyear Tire & Rubber Co. (The) | | | 3,000 | | | | 98,520 | |

Tower International, Inc. (e) | | | 3,400 | | | | 93,398 | |

| | | | | | | | |

| | | | 224,455 | |

| | | | | | | | |

Banks 0.3% | |

Bank of Queensland, Ltd. | | | 9,261 | | | | 86,315 | |

Comerica, Inc. | | | 2,200 | | | | 95,480 | |

SunTrust Banks, Inc. | | | 2,400 | | | | 99,648 | |

| | | | | | | | |

| | | | 281,443 | |

| | | | | | | | |

Beverages 0.2% | |

Coca-Cola Bottling Co. Consolidated | | | 400 | | | | 84,484 | |

Treasury Wine Estates, Ltd. | | | 17,326 | | | | 87,475 | |

| | | | | | | | |

| | | | 171,959 | |

| | | | | | | | |

Biotechnology 0.4% | |

AMAG Pharmaceuticals, Inc. (e) | | | 1,100 | | | | 44,000 | |

Curis, Inc. (e) | | | 8,700 | | | | 17,748 | |

ImmunoGen, Inc. (e)(f) | | | 7,100 | | | | 83,070 | |

Infinity Pharmaceuticals, Inc. (e)(f) | | | 9,300 | | | | 96,255 | |

Medicines Co. (The) (e) | | | 1,200 | | | | 41,088 | |

NewLink Genetics Corp. (e) | | | 500 | | | | 19,135 | |

Repligen Corp. (e) | | | 2,200 | | | | 73,128 | |

| | | | | | | | |

| | | | 374,424 | |

| | | | | | | | |

Building Materials 0.7% | |

Armstrong World Industries, Inc. (e) | | | 1,900 | | | | 94,278 | |

Builders FirstSource, Inc. (e) | | | 2,000 | | | | 23,640 | |

Buzzi Unicem S.p.A. | | | 9,073 | | | | 91,690 | |

Gibraltar Industries, Inc. (e) | | | 4,400 | | | | 111,408 | |

Inwido AB | | | 3,259 | | | | 35,475 | |

Owens Corning, Inc | | | 2,200 | | | | 100,166 | |

Patrick Industries, Inc. (e) | | | 2,000 | | | | 81,160 | |

U.S. Concrete, Inc. (e) | | | 1,500 | | | | 83,190 | |

Universal Forest Products, Inc. | | | 1,400 | | | | 101,682 | |

| | | | | | | | |

| | | | 722,689 | |

| | | | | | | | |

Chemicals 1.7% | |

Borregaard ASA | | | 12,533 | | | | 66,819 | |

Cabot Corp. | | | 2,700 | | | | 97,038 | |

¨Cytec Industries, Inc. | | | 9,700 | | | | 721,874 | |

Huntsman Corp. (f) | | | 8,000 | | | | 105,360 | |

Koppers Holdings, Inc. | | | 3,900 | | | | 73,944 | |

| | | | |

| 12 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Chemicals (continued) | | | | | | | | |

Kraton Performance Polymers, Inc. (e) | | | 4,200 | | | $ | 85,638 | |

Mosaic Co. (The) | | | 1,200 | | | | 40,548 | |

Nuplex Industries, Ltd. | | | 30,247 | | | | 87,252 | |

Solvay S.A. | | | 3,700 | | | | 418,263 | |

Westlake Chemical Corp. | | | 600 | | | | 36,162 | |

| | | | | | | | |

| | | | | | | 1,732,898 | |

| | | | | | | | |

Commercial Services 1.4% | |

Adecco S.A. Registered (e) | | | 1,246 | | | | 92,777 | |

Avis Budget Group, Inc. (e) | | | 1,900 | | | | 94,886 | |

Ennis, Inc. | | | 4,600 | | | | 92,138 | |

Hertz Global Holdings, Inc. (e) | | | 5,100 | | | | 99,450 | |

HMS Holdings Corp. (e) | | | 8,400 | | | | 88,452 | |

LendingTree, Inc. (e) | | | 900 | | | | 109,224 | |

ManpowerGroup, Inc. | | | 1,100 | | | | 100,958 | |

Monster Worldwide, Inc. (e)(f) | | | 12,000 | | | | 75,240 | |

R.R. Donnelley & Sons Co. | | | 2,700 | | | | 45,549 | |

TrueBlue, Inc. (e) | | | 300 | | | | 8,691 | |

United Rentals, Inc. (e) | | | 1,400 | | | | 104,804 | |

Xoom Corp. (e) | | | 19,048 | | | | 475,057 | |

| | | | | | | | |

| | | | | | | 1,387,226 | |

| | | | | | | | |

Computers 0.8% | |

Brocade Communications Systems, Inc. (f) | | | 9,000 | | | | 93,780 | |

Computer Sciences Corp. | | | 1,500 | | | | 99,885 | |

EMC Corp. | | | 13,000 | | | | 340,860 | |

Leidos Holdings, Inc. | | | 2,100 | | | | 110,397 | |

Lexmark International, Inc. Class A | | | 1,300 | | | | 42,237 | |

NCR Corp. (e) | | | 3,800 | | | | 101,080 | |

Teradata Corp. (e) | | | 1,400 | | | | 39,354 | |

| | | | | | | | |

| | | | | | | 827,593 | |

| | | | | | | | |

Distribution & Wholesale 0.3% | |

D’ieteren S.A. | | | 1,970 | | | | 66,679 | |

HD Supply Holdings, Inc. (e) | | | 3,100 | | | | 92,349 | |

Ingram Micro, Inc. Class A | | | 3,200 | | | | 95,296 | |

WESCO International, Inc. (e) | | | 1,800 | | | | 88,074 | |

| | | | | | | | |

| | | | | | | 342,398 | |

| | | | | | | | |

Electric 0.2% | |

Mighty River Power, Ltd. | | | 52,085 | | | | 98,754 | |

Origin Energy, Ltd. | | | 15,270 | | | | 59,890 | |

| | | | | | | | |

| | | | | | | 158,644 | |

| | | | | | | | |

Electrical Components & Equipment 0.2% | |

Encore Wire Corp. | | | 2,300 | | | | 98,371 | |

General Cable Corp. (f) | | | 5,900 | | | | 90,801 | |

| | | | | | | | |

| | | | | | | 189,172 | |

| | | | | | | | |

Electronics 0.5% | |

Arrow Electronics, Inc. (e) | | | 1,600 | | | | 87,984 | |

Austria Technologie & Systemtechnik A.G. | | | 2,481 | | | | 42,397 | |

Avnet, Inc. | | | 2,100 | | | | 95,403 | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Electronics (continued) | | | | | | | | |

Jabil Circuit, Inc. (f) | | | 4,100 | | | $ | 94,218 | |

Mycronic AB | | | 13,767 | | | | 98,295 | |

Sanmina Corp. (e) | | | 1,900 | | | | 39,273 | |

Tech Data Corp. (e) | | | 1,100 | | | | 80,069 | |

| | | | | | | | |

| | | | | | | 537,639 | |

| | | | | | | | |

Energy—Alternate Sources 0.2% | |

First Solar, Inc. (e) | | | 800 | | | | 45,656 | |

Green Plains, Inc. | | | 2,900 | | | | 59,479 | |

Renewable Energy Group, Inc. (e) | | | 6,600 | | | | 52,074 | |

Vestas Wind Systems A/S | | | 1,680 | | | | 97,917 | |

| | | | | | | | |

| | | | | | | 255,126 | |

| | | | | | | | |

Engineering & Construction 0.2% | |

Comfort Systems USA, Inc. (f) | | | 2,900 | | | | 92,597 | |

Mota-Engil SGPS S.A. | | | 1,936 | | | | 4,864 | |

PER Aarsleff A/S Class B | | | 221 | | | | 74,293 | |

| | | | | | | | |

| | | | | | | 171,754 | |

| | | | | | | | |

Entertainment 0.4% | |

Cinemark Holdings, Inc. | | | 2,100 | | | | 74,424 | |

Eldorado Resorts, Inc. (e) | | | 6,600 | | | | 65,340 | |

Isle of Capri Casinos, Inc. (e)(f) | | | 4,500 | | | | 86,085 | |

Penn National Gaming, Inc. (e)(f) | | | 4,600 | | | | 82,156 | |

Tabcorp Holdings, Ltd. | | | 24,089 | | | | 81,080 | |

Village Roadshow, Ltd. | | | 8,170 | | | | 43,870 | |

| | | | | | | | |

| | | | 432,955 | |

| | | | | | | | |

Environmental Controls 0.1% | |

Clean Harbors, Inc. (e) | | | 2,100 | | | | 97,629 | |

| | | | | | | | |

|

Finance—Consumer Loans 0.1% | |

SLM Corp. (e) | | | 12,800 | | | | 90,368 | |

| | | | | | | | |

|

Finance—Investment Banker/Broker 0.4% | |

GAIN Capital Holdings, Inc. (f) | | | 10,000 | | | | 74,500 | |

INTL. FCStone, Inc. (e) | | | 3,300 | | | | 105,567 | |

Investment Technology Group, Inc. | | | 5,900 | | | | 94,459 | |

LPL Financial Holdings, Inc. | | | 2,400 | | | | 102,240 | |

| | | | | | | | |

| | | | 376,766 | |

| | | | | | | | |

Finance—Leasing Companies 0.6% | |

¨Avolon Holdings, Ltd. (e) | | | 18,612 | | | | 567,852 | |

| | | | | | | | |

|

Finance—Mortgage Loan/Banker 0.2% | |

CoreLogic, Inc. (e) | | | 2,300 | | | | 89,654 | |

Genworth Mortgage Insurance Australia, Ltd. | | | 47,097 | | | | 90,679 | |

| | | | | | | | |

| | | | 180,333 | |

| | | | | | | | |

Food 0.5% | |

Austevoll Seafood ASA | | | 9,644 | | | | 59,305 | |

Bakkafrost P/F | | | 2,611 | | | | 83,891 | |

Dean Foods Co. (f) | | | 4,800 | | | | 86,928 | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 13 | |

Consolidated Portfolio of Investments October 31, 2015 (Unaudited) (continued)

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Food (continued) | | | | | | | | |

Ingredion, Inc. | | | 100 | | | $ | 9,506 | |

Pilgrim’s Pride Corp. | | | 2,000 | | | | 37,980 | |

Seaboard Corp. (e) | | | 24 | | | | 80,832 | |

Select Harvests, Ltd. | | | 10,309 | | | | 74,690 | |

Tyson Foods, Inc. Class A | | | 2,100 | | | | 93,156 | |

Wilmar International, Ltd. | | | 4,800 | | | | 10,724 | |

| | | | | | | | |

| | | | 537,012 | |

| | | | | | | | |

Forest Products & Paper 0.1% | |

Altri SGPS S.A. | | | 19,171 | | | | 90,671 | |

Domtar Corp. | | | 1,100 | | | | 45,364 | |

| | | | | | | | |

| | | | 136,035 | |

| | | | | | | | |

Gas 0.3% | |

Western Gas Equity Partners, L.P. (f) | | | 7,200 | | | | 310,536 | |

| | | | | | | | |

|

Health Care—Products 0.3% | |

Biosensors International Group, Ltd. (c)(e)(g) | | | 104,500 | | | | 50,725 | |

Inogen, Inc. (e) | | | 300 | | | | 12,822 | |

Invacare Corp. (f) | | | 4,700 | | | | 81,216 | |

Merit Medical Systems, Inc. (e)(f) | | | 3,300 | | | | 61,182 | |

Orthofix International N.V. (e) | | | 2,500 | | | | 85,125 | |

| | | | | | | | |

| | | | 291,070 | |

| | | | | | | | |

Health Care—Services 0.8% | |

Amedisys, Inc. (e) | | | 1,100 | | | | 43,538 | |

Centene Corp. (e) | | | 1,700 | | | | 101,116 | |

LHC Group, Inc. (e) | | | 1,900 | | | | 85,623 | |

Magellan Health, Inc. (e) | | | 1,700 | | | | 90,780 | |

Molina Healthcare, Inc. (e) | | | 1,300 | | | | 80,600 | |

Providence Service Corp. (The) (e) | | | 1,900 | | | | 98,135 | |

Sonic Healthcare, Ltd. | | | 6,328 | | | | 87,001 | |

Triple-S Management Corp. (e) | | | 4,200 | | | | 86,478 | |

WellCare Health Plans, Inc. (e) | | | 1,000 | | | | 88,600 | |

| | | | | | | | |

| | | | 761,871 | |

| | | | | | | | |

Holding Company—Diversified 0.2% | |

Bollore S.A. | | | 39,862 | | | | 197,342 | |

| | | | | | | | |

|

Home Builders 0.0%‡ | |

Thor Industries, Inc. | | | 800 | | | | 43,264 | |

| | | | | | | | |

|

Home Furnishing 0.3% | |

American Woodmark Corp. (e) | | | 1,200 | | | | 87,240 | |

Harman International Industries, Inc. | | | 900 | | | | 98,964 | |

Whirlpool Corp. | | | 600 | | | | 96,084 | |

| | | | | | | | |

| | | | 282,288 | |

| | | | | | | | |

Household Products & Wares 0.3% | |

Central Garden & Pet Co. (e) | | | 5,000 | | | | 84,400 | |

Henkel A.G. & Co. KGaA | | | 2,123 | | | | 196,126 | |

| | | | | | | | |

| | | | 280,526 | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Housewares 0.0%‡ | |

NACCO Industries, Inc. Class A | | | 600 | | | $ | 26,898 | |

| | | | | | | | |

|

Insurance 0.9% | |

Employers Holdings, Inc. | | | 3,800 | | | | 100,586 | |

¨PartnerRe, Ltd. | | | 5,508 | | | | 765,612 | |

| | | | | | | | |

| | | | 866,198 | |

| | | | | | | | |

Internet 0.7% | |

1-800-Flowers.com, Inc. Class A (e)(f) | | | 8,500 | | | | 84,405 | |

Blucora, Inc. (e)(f) | | | 5,800 | | | | 56,840 | |

ePlus, Inc. (e) | | | 1,000 | | | | 84,420 | |

Expedia, Inc. | | | 800 | | | | 109,040 | |

Groupon, Inc. (e) | | | 10,916 | | | | 40,498 | |

HomeAway, Inc. (e) | | | 3,400 | | | | 107,304 | |

IAC/InterActiveCorp | | | 1,300 | | | | 87,113 | |

Intralinks Holdings, Inc. (e) | | | 7,700 | | | | 67,375 | |

Overstock.com, Inc. (e) | | | 2,400 | | | | 37,584 | |

Symantec Corp. | | | 2,500 | | | | 51,500 | |

| | | | | | | | |

| | | | 726,079 | |

| | | | | | | | |

Investment Company 0.2% | |

EXOR S.p.A. | | | 4,838 | | | | 240,203 | |

| | | | | | | | |

|

Iron & Steel 0.3% | |

Reliance Steel & Aluminum Co. | | | 1,600 | | | | 95,936 | |

Steel Dynamics, Inc. (f) | | | 5,000 | | | | 92,350 | |

Voestalpine A.G. | | | 2,519 | | | | 91,231 | |

| | | | | | | | |

| | | | 279,517 | |

| | | | | | | | |

Leisure Time 0.1% | |

Flight Centre Travel Group, Ltd. | | | 3,042 | | | | 82,323 | |

| | | | | | | | |

|

Machinery—Construction & Mining 0.2% | |

Danieli & Co. S.p.A. | | | 4,506 | | | | 68,181 | |

Terex Corp. | | | 4,800 | | | | 96,288 | |

| | | | | | | | |

| | | | 164,469 | |

| | | | | | | | |

Machinery—Diversified 0.3% | |

AGCO Corp. | | | 2,000 | | | | 96,780 | |

Chart Industries, Inc. (e) | | | 1,800 | | | | 30,942 | |

MAN S.E. | | | 1,175 | | | | 122,542 | |

Valmet Oyj | | | 8,019 | | | | 84,565 | |

| | | | | | | | |

| | | | 334,829 | |

| | | | | | | | |

Media 0.7% | |

Altice N.V. Class A (e) | | | 7,604 | | | | 131,697 | |

Gray Television, Inc. (e) | | | 1,000 | | | | 15,890 | |

¨Time Warner Cable, Inc. | | | 2,920 | | | | 553,048 | |

| | | | | | | | |

| | | | 700,635 | |

| | | | | | | | |

Metal Fabricate & Hardware 0.1% | |

Global Brass & Copper Holdings, Inc. | | | 3,900 | | | | 87,711 | |

| | | | | | | | |

| | | | |

| 14 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Mining 0.4% | |

Boliden AB | | | 5,505 | | | $ | 105,415 | |

Evolution Mining, Ltd. | | | 88,082 | | | | 88,250 | |

Goldcorp, Inc. | | | 6,696 | | | | 85,672 | |

Newmont Mining Corp. (f) | | | 2,200 | | | | 42,812 | |

Norsk Hydro ASA | | | 13,208 | | | | 47,349 | |

OZ Minerals, Ltd. | | | 27,278 | | | | 84,810 | |

Rio Tinto, Ltd. | | | 86 | | | | 3,106 | |

| | | | | | | | |

| | | | 457,414 | |

| | | | | | | | |

Miscellaneous—Manufacturing 0.2% | |

AGFA-Gevaert N.V. (e) | | | 22,499 | | | | 95,847 | |

GUD Holdings, Ltd. | | | 12,980 | | | | 74,418 | |

Trinseo S.A. (e) | | | 2,700 | | | | 87,615 | |

| | | | | | | | |

| | | | 257,880 | |

| | | | | | | | |

Multi-National 0.1% | |

Banco Latinoamericano de Comercio Exterior S.A. Class E | | | 3,400 | | | | 91,902 | |

| | | | | | | | |

|

Office Equipment/Supplies 0.0%‡ | |

Xerox Corp. (f) | | | 4,100 | | | | 38,499 | |

| | | | | | | | |

|

Oil & Gas 1.9% | |

Alon USA Energy, Inc. | | | 3,300 | | | | 55,275 | |

Anadarko Petroleum Corp. | | | 400 | | | | 26,752 | |

Antero Midstream Partners, L.P. | | | 10,200 | | | | 242,964 | |

ARC Resources, Ltd. | | | 1,610 | | | | 23,754 | |

Cenovus Energy, Inc. | | | 850 | | | | 12,674 | |

Cheniere Energy, Inc. (e)(f) | | | 5,100 | | | | 252,552 | |

Chevron Corp. | | | 330 | | | | 29,990 | |

ConocoPhillips | | | 610 | | | | 32,543 | |

Devon Energy Corp. | | | 510 | | | | 21,384 | |

Dorchester Minerals, L.P. | | | 2,010 | | | | 29,045 | |

EOG Resources, Inc. | | | 380 | | | | 32,623 | |

EQT GP Holdings, L.P. (f) | | | 10,500 | | | | 277,620 | |

EV Energy Partners, L.P. | | | 7,440 | | | | 41,813 | |

Exxon Mobil Corp. | | | 300 | | | | 24,822 | |

Legacy Reserves, L.P. | | | 9,920 | | | | 39,581 | |

Memorial Production Partners, L.P. | | | 7,810 | | | | 43,580 | |

Mid-Con Energy Partners, L.P. | | | 2,930 | | | | 5,919 | |

Murphy Oil Corp. | | | 700 | | | | 19,901 | |

Murphy USA, Inc. (e) | | | 700 | | | | 42,959 | |

Nabors Industries, Ltd. | | | 1,800 | | | | 18,072 | |

Occidental Petroleum Corp. | | | 450 | | | | 33,543 | |

Patterson-UTI Energy, Inc. | | | 600 | | | | 8,934 | |

PBF Energy, Inc. Class A | | | 300 | | | | 10,200 | |

Pioneer Natural Resources Co. | | | 180 | | | | 24,685 | |

QEP Resources, Inc. | | | 1,300 | | | | 20,098 | |

Royal Dutch Shell PLC Class A, Sponsored ADR | | | 320 | | | | 16,787 | |

Seadrill Partners LLC | | | 1,010 | | | | 11,322 | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Oil & Gas (continued) | | | | | | | | |

Seadrill, Ltd. | | | 11,970 | | | $ | 74,947 | |

SM Energy Co. | | | 500 | | | | 16,675 | |

Stone Energy Corp. (e) | | | 1,500 | | | | 8,385 | |

Valero Energy Partners, L.P. (f) | | | 6,700 | | | | 334,933 | |

Vanguard Natural Resources LLC | | | 7,840 | | | | 61,858 | |

Vermilion Energy, Inc. | | | 660 | | | | 23,223 | |

| | | | | | | | |

| | | | 1,919,413 | |

| | | | | | | | |

Oil & Gas Services 0.5% | |

CGG S.A. (e) | | | 26,183 | | | | 105,350 | |

FMC Technologies, Inc. (e) | | | 300 | | | | 10,149 | |

Prosafe S.E. | | | 20,598 | | | | 56,969 | |

RPC, Inc. | | | 1,800 | | | | 19,854 | |

Superior Energy Services, Inc. | | | 1,400 | | | | 19,824 | |

Targa Resources Corp. (f) | | | 5,550 | | | | 317,183 | |

| | | | | | | | |

| | | | 529,329 | |

| | | | | | | | |

Pharmaceuticals 1.6% | |

AmerisourceBergen Corp. | | | 1,000 | | | | 96,510 | |

Amphastar Pharmaceuticals, Inc. (e) | | | 7,200 | | | | 85,248 | |

Australian Pharmaceutical Industries, Ltd. | | | 67,225 | | | | 94,918 | |

Celesio A.G. | | | 4,740 | | | | 131,872 | |

Eagle Pharmaceuticals, Inc. (e) | | | 600 | | | | 38,226 | |

Horizon Pharma PLC (e) | | | 7,032 | | | | 110,543 | |

Mylan N.V. (e) | | | 3,066 | | | | 135,180 | |

Orexigen Therapeutics, Inc. (e)(f) | | | 19,300 | | | | 58,672 | |

PharMerica Corp. (e) | | | 3,000 | | | | 85,710 | |

Phibro Animal Health Corp. Class A | | | 2,700 | | | | 90,072 | |

Progenics Pharmaceuticals, Inc. (e) | | | 7,700 | | | | 56,518 | |

Raptor Pharmaceutical Corp. (e) | | | 13,900 | | | | 75,755 | |

Sagent Pharmaceuticals, Inc. (e) | | | 5,300 | | | | 89,093 | |

SciClone Pharmaceuticals, Inc. (e) | | | 10,400 | | | | 79,248 | |

Sigma Pharmaceuticals, Ltd. | | | 148,888 | | | | 89,185 | |

Sucampo Pharmaceuticals, Inc. Class A (e) | | | 4,300 | | | | 83,248 | |

Supernus Pharmaceuticals, Inc. (e)(f) | | | 5,800 | | | | 95,700 | |

Zealand Pharma A/S (e) | | | 3,457 | | | | 77,220 | |

| | | | | | | | |

| | | | 1,572,918 | |

| | | | | | | | |

Pipelines 7.0% | |

Columbia Pipeline Group, Inc. | | | 14,100 | | | | 292,857 | |

Dominion Midstream Partners, L.P. (e)(f) | | | 9,400 | | | | 307,944 | |

Enable Midstream Partners, L.P. | | | 2,360 | | | | 28,391 | |

¨Energy Transfer Equity, L.P. (f) | | | 24,400 | | | | 525,820 | |

Energy Transfer Partners, L.P. | | | 10,240 | | | | 452,198 | |

¨Enterprise Products Partners, L.P. (f) | | | 17,500 | | | | 483,525 | |

EQT Midstream Partners, L.P. | | | 4,900 | | | | 362,796 | |

¨Genesis Energy, L.P. (f) | | | 11,800 | | | | 475,658 | |

Kinder Morgan, Inc. (f) | | | 14,700 | | | | 402,045 | |

Magellan Midstream Partners, L.P. (f) | | | 5,600 | | | | 357,336 | |

MarkWest Energy Partners, L.P. (f) | | | 6,900 | | | | 301,392 | |

MPLX, L.P. (f) | | | 5,450 | | | | 211,406 | |

NGL Energy Partners, L.P. (f) | | | 13,830 | | | | 256,132 | |

NuStar Energy, L.P. | | | 720 | | | | 36,468 | |

ONEOK Partners, L.P. | | | 1,210 | | | | 38,514 | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 15 | |

Consolidated Portfolio of Investments October 31, 2015 (Unaudited) (continued)

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Pipelines (continued) | | | | | | | | |

Phillips 66 Partners, L.P. (f) | | | 5,300 | | | $ | 321,392 | |

Plains All American Pipeline, L.P. | | | 9,400 | | | | 298,168 | |

SemGroup Corp. Class A (f) | | | 5,600 | | | | 255,080 | |

Shell Midstream Partners, L.P. (f) | | | 11,100 | | | | 379,953 | |

¨Sunoco Logistics Partners, L.P. (f) | | | 17,600 | | | | 511,104 | |

Tallgrass Energy GP, L.P. (f) | | | 7,650 | | | | 183,141 | |

Targa Resources Partners, L.P. | | | 1,030 | | | | 30,900 | |

Tesoro Logistics, L.P. (f) | | | 5,900 | | | | 330,813 | |

Williams Partners, L.P. | | | 5,290 | | | | 178,802 | |

| | | | | | | | |

| | | | 7,021,835 | |

| | | | | | | | |

Retail 1.2% | |

Best Buy Co., Inc. | | | 2,486 | | | | 87,085 | |

Bilia AB Class A | | | 2,985 | | | | 62,540 | |

Byggmax Group AB | | | 9,411 | | | | 76,281 | |

Carrols Restaurant Group, Inc. (e) | | | 7,000 | | | | 82,320 | |

DSW, Inc. Class A | | | 100 | | | | 2,494 | |

GameStop Corp. Class A | | | 2,200 | | | | 101,354 | |

Harvey Norman Holdings, Ltd. | | | 29,490 | | | | 83,697 | |

JB Hi-Fi, Ltd. | | | 6,268 | | | | 80,276 | |

Movado Group, Inc. | | | 400 | | | | 10,296 | |

Office Depot, Inc. (e) | | | 14,100 | | | | 107,442 | |

Pandora A/S | | | 765 | | | | 88,260 | |

Pep Boys-Manny Moe & Jack (The) (e) | | | 6,600 | | | | 99,264 | |

PVH Corp. | | | 900 | | | | 81,855 | |

Rallye S.A. | | | 3,858 | | | | 71,464 | |

Ruby Tuesday, Inc. (e)(f) | | | 6,500 | | | | 33,995 | |

Staples, Inc. (f) | | | 7,400 | | | | 96,126 | |

XXL ASA (b) | | | 1,186 | | | | 12,667 | |

| | | | | | | | |

| | | | 1,177,416 | |

| | | | | | | | |

Savings & Loans 0.2% | |

Banc of California, Inc. (f) | | | 6,700 | | | | 87,368 | |

Flagstar Bancorp, Inc. (e)(f) | | | 3,900 | | | | 86,736 | |

| | | | | | | | |

| | | | 174,104 | |

| | | | | | | | |

Semiconductors 1.2% | |

¨Altera Corp. | | | 9,236 | | | | 485,352 | |

¨Integrated Silicon Solution, Inc. | | | 32,000 | | | | 719,360 | |

| | | | | | | | |

| | | | 1,204,712 | |

| | | | | | | | |

Shipbuilding 0.2% | |

Huntington Ingalls Industries, Inc. | | | 800 | | | | 95,952 | |

Yangzijiang Shipbuilding Holdings, Ltd. | | | 94,700 | | | | 84,499 | |

| | | | | | | | |

| | | | 180,451 | |

| | | | | | | | |

Software 0.5% | |

Allscripts Healthcare Solutions, Inc. (e)(f) | | | 7,400 | | | | 104,044 | |

Citrix Systems, Inc. (e) | | | 1,300 | | | | 106,730 | |

Kudelski S.A. | | | 5,928 | | | | 79,764 | |

Nuance Communications, Inc. (e) | | | 5,500 | | | | 93,335 | |

QAD, Inc. Class A | | | 1,900 | | | | 48,526 | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Software (continued) | | | | | | | | |

Rackspace Hosting, Inc. (e) | | | 1,500 | | | $ | 38,775 | |

| | | | | | | | |

| | | | 471,174 | |

| | | | | | | | |

Telecommunications 1.2% | |

EarthLink Holdings Corp. (f) | | | 5,200 | | | | 44,460 | |

EchoStar Corp. Class A (e) | | | 2,100 | | | | 94,143 | |

General Communication, Inc. Class A (e)(f) | | | 4,900 | | | | 99,788 | |

Gigamon, Inc. (e) | | | 4,000 | | | | 104,920 | |

IDT Corp. Class B (f) | | | 4,100 | | | | 53,095 | |

Koninklijke KPN N.V. | | | 110,088 | | | | 404,335 | |

T-Mobile U.S., Inc. (e) | | | 4,164 | | | | 157,774 | |

TDC A/S | | | 18,136 | | | | 95,061 | |

Telephone & Data Systems, Inc. | | | 3,600 | | | | 103,104 | |

Vonage Holdings Corp. (e) | | | 13,600 | | | | 82,552 | |

| | | | | | | | |

| | | | 1,239,232 | |

| | | | | | | | |

Transportation 0.9% | |

A.P. Moeller-Maersk A/S Class A | | | 58 | | | | 83,079 | |

Ansaldo STS S.p.A. | | | 20,156 | | | | 214,442 | |

Aurizon Holdings, Ltd. | | | 3,764 | | | | 13,877 | |

Avance Gas Holding, Ltd. (b) | | | 6,188 | | | | 85,208 | |

BW LPG, Ltd. (b) | | | 12,141 | | | | 82,447 | |

Capital Product Partners, L.P. | | | 3,530 | | | | 26,157 | |

Dfds A/S | | | 2,485 | | | | 75,477 | |

DHT Holdings, Inc. | | | 2,500 | | | | 19,650 | |

Golar LNG Partners, L.P. | | | 1,360 | | | | 24,181 | |

Teekay Corp. | | | 8,400 | | | | 269,892 | |

Teekay Offshore Partners, L.P. | | | 1,080 | | | | 16,600 | |

| | | | | | | | |

| | | | 911,010 | |

| | | | | | | | |

Total Common Stocks

(Cost $37,140,169) | | | | 33,834,473 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Notional

Amount | | | | |

Purchased Options 0.0%‡ Purchased Put Option 0.0%‡ | |

10-Year United States Treasury Note

Strike Price $126.00

Expires 1/22/16, American Style (h) | | | 1,000 | | | | 734 | |

| | | | | | | | |

Total Purchased Put Option

(Cost $767) | | | | 734 | |

| | | | | | | | |

|

| Purchased Call Option 0.0%‡ | |

Euro-Bobl

Strike Price $129.00

Expires 11/20/15, American Style (h) | | | 3,000,000 | | | | 17,814 | |

| | | | | | | | |

Total Purchased Call Option

(Cost $10,610) | | | | 17,814 | |

| | | | | | | | |

Total Purchased Options

(Cost $11,377) | | | | 18,548 | |

| | | | | | | | |

| | | | |

| 16 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Short-Term Investments 45.3% | |

Repurchase Agreements 36.7% | |

Fixed Income Clearing Corp.

0.00%, dated 10/30/15

due 11/2/15

Proceeds at Maturity $30,451,692 (Collateralized by United States Treasury and Government Agency securities with rates between 1.25% and 1.96% and maturity dates between 1/8/20 and 1/31/20, with a Principal Amount of $30,775,000 and a Market Value of $31,076,975) | | $ | 30,451,692 | | | $ | 30,451,692 | |

State Street Bank and Trust Co.

0.00%, dated 10/30/15

due 11/2/15

Proceeds at Maturity $6,588,266 (Collateralized by Federal Home Loan Mortgage Corp. securities with a rate of 2.00% and a maturity date of 1/30/23, with a Principal Amount of $6,865,000 and a Market Value of $6,724,062) | | | 6,588,266 | | | | 6,588,266 | |

| | | | | | | | |

Total Repurchase Agreements

(Cost $37,039,958) | | | | 37,039,958 | |

| | | | | | | | |

|

U.S. Government 8.6% | |

United States Treasury Bills 8.6% | |

0.000%, due 12/17/15 (i) | | | 2,650,000 | | | | 2,649,966 | |

0.235%, due 5/26/16 (i) | | | 6,000,000 | | | | 5,992,104 | |

| | | | | | | | |

Total U.S. Government

(Cost $8,641,703) | | | | 8,642,070 | |

| | | | | | | | |

Total Short-Term Investments

(Cost $45,681,661) | | | | 45,682,028 | |

| | | | | | | | |

Total Investments, Before Investments Sold Short

(Cost $98,054,550) (k) | | | 93.9 | % | | | 94,571,429 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

Shares | | | | |

Investments Sold Short (19.7%) Common Stocks Sold Short (15.6%) | |

Aerospace & Defense (0.1%) | |

Aerovironment, Inc. (e) | | | (3,900 | ) | | | (89,973 | ) |

| | | | | | | | |

|

Airlines (0.1%) | |

Copa Holdings S.A. Class A | | | (1,700 | ) | | | (85,884 | ) |

Spirit Airlines, Inc. (e) | | | (300 | ) | | | (11,136 | ) |

| | | | | | | | |

| | | | | | | (97,020 | ) |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Apparel (0.1%) | |

Iconix Brand Group, Inc. (e) | | | (5,500 | ) | | $ | (84,260 | ) |

Sequential Brands Group, Inc. (e) | | | (5,800 | ) | | | (72,558 | ) |

| | | | | | | | |

| | | | | | | (156,818 | ) |

| | | | | | | | |

Auto Manufacturers (0.0%)‡ | |

Navistar International Corp. (e) | | | (2,300 | ) | | | (28,290 | ) |

| | | | | | | | |

|

Auto Parts & Equipment (0.2%) | |

Dorman Products, Inc. (e) | | | (1,600 | ) | | | (74,688 | ) |

Motorcar Parts of America, Inc. (e) | | | (2,600 | ) | | | (87,516 | ) |

| | | | | | | | |

| | | | | | | (162,204 | ) |

| | | | | | | | |

Banks (0.4%) | |

Bankia S.A. | | | (67,695 | ) | | | (87,245 | ) |

First Horizon National Corp. | | | (6,500 | ) | | | (92,170 | ) |

PacWest Bancorp | | | (2,100 | ) | | | (94,584 | ) |

Raiffeisen Bank International A.G. (e) | | | (6,110 | ) | | | (96,617 | ) |

TCF Financial Corp. | | | (6,000 | ) | | | (92,340 | ) |

| | | | | | | | |

| | | | | | | (462,956 | ) |

| | | | | | | | |

Beverages (0.1%) | |

Carlsberg A/S | | | (241 | ) | | | (19,757 | ) |

Monster Beverage Corp. (e) | | | (700 | ) | | | (95,424 | ) |

| | | | | | | | |

| | | | | | | (115,181 | ) |

| | | | | | | | |

Biotechnology (0.4%) | |

Advaxis, Inc. (e) | | | (1,500 | ) | | | (16,635 | ) |

Aratana Therapeutics, Inc. (e) | | | (1,100 | ) | | | (7,689 | ) |

Basilea Pharmaceutica, Ltd. Registered (e) | | | (204 | ) | | | (21,196 | ) |

Bluebird Bio, Inc. (e) | | | (200 | ) | | | (15,426 | ) |

Esperion Therapeutics, Inc. (e) | | | (400 | ) | | | (9,600 | ) |

Evolva Holding S.A. (e) | | | (62,724 | ) | | | (77,417 | ) |

Genmab A/S (e) | | | (228 | ) | | | (22,490 | ) |

Idera Pharmaceuticals, Inc. (e) | | | (5,700 | ) | | | (15,732 | ) |

Intercept Pharmaceuticals, Inc. (e) | | | (200 | ) | | | (31,440 | ) |

Karyopharm Therapeutics, Inc. (e) | | | (1,700 | ) | | | (22,695 | ) |

Mesoblast, Ltd. (e)(g) | | | (8,795 | ) | | | (21,386 | ) |

Omeros Corp. (e) | | | (1,700 | ) | | | (21,301 | ) |

Organovo Holdings, Inc. (e) | | | (3,800 | ) | | | (11,438 | ) |

Otonomy, Inc. (e) | | | (1,000 | ) | | | (21,640 | ) |

OvaScience, Inc. (e) | | | (1,200 | ) | | | (15,564 | ) |

Pacific Biosciences of California, Inc. (e) | | | (2,700 | ) | | | (19,170 | ) |

Paratek Pharmaceuticals, Inc. | | | (800 | ) | | | (13,888 | ) |

Theravance Biopharma, Inc. (e) | | | (1,700 | ) | | | (25,415 | ) |

Theravance, Inc. | | | (2,400 | ) | | | (21,072 | ) |

Versartis, Inc. (e) | | | (1,200 | ) | | | (12,396 | ) |

Zeltia S.A. (e) | | | (4,929 | ) | | | (21,925 | ) |

| | | | | | | | |

| | | | | | | (445,515 | ) |

| | | | | | | | |

Building Materials (0.2%) | |

Boral, Ltd. | | | (21,644 | ) | | | (83,191 | ) |

James Hardie Industries PLC | | | (6,697 | ) | | | (87,394 | ) |

Trex Co., Inc. (e) | | | (2,100 | ) | | | (82,047 | ) |

| | | | | | | | |

| | | | | | | (252,632 | ) |

| | | | | | | | |

| | | | | | |

The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. | | | | | 17 | |

Consolidated Portfolio of Investments October 31, 2015 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks Sold Short (continued) | |

Chemicals (0.4%) | |

Albemarle Corp. | | | (300 | ) | | $ | (16,056 | ) |

Balchem Corp. | | | (1,300 | ) | | | (88,790 | ) |

Novozymes A/S Class B | | | (2,147 | ) | | | (99,557 | ) |

Platform Specialty Products Corp. (e) | | | (1,600 | ) | | | (16,704 | ) |

Tronox, Ltd. Class A | | | (12,600 | ) | | | (78,246 | ) |

WR Grace & Co. (e) | | | (900 | ) | | | (90,270 | ) |

| | | | | | | | |

| | | | | | | (389,623 | ) |

| | | | | | | | |

Coal (0.0%)‡ | |

Peabody Energy Corp. | | | (2,366 | ) | | | (30,261 | ) |

Westmoreland Coal Co. (e) | | | (200 | ) | | | (1,432 | ) |

| | | | | | | | |

| | | | | | | (31,693 | ) |

| | | | | | | | |

Commercial Services (0.7%) | |

Advisory Board Co. (The) (e) | | | (1,700 | ) | | | (74,511 | ) |

Arrowhead Research Corp. (e) | | | (2,700 | ) | | | (13,905 | ) |

Ezion Holdings, Ltd. | | | (99,700 | ) | | | (49,818 | ) |

HealthEquity, Inc. (e) | | | (2,800 | ) | | | (91,588 | ) |

Macquarie Infrastructure Corp. | | | (1,300 | ) | | | (103,415 | ) |

Navitas, Ltd. | | | (28,143 | ) | | | (84,289 | ) |

Rollins, Inc. | | | (3,400 | ) | | | (91,188 | ) |

Sotheby’s | | | (2,400 | ) | | | (83,160 | ) |

Transurban Group | | | (11,823 | ) | | | (88,019 | ) |

| | | | | | | | |

| | | | | | | (679,893 | ) |

| | | | | | | | |

Computers (0.2%) | |

3D Systems Corp. (e) | | | (7,100 | ) | | | (71,426 | ) |

Nimble Storage, Inc. (e) | | | (3,500 | ) | | | (79,100 | ) |

Stratasys, Ltd. (e) | | | (2,800 | ) | | | (71,400 | ) |

| | | | | | | | |

| | | | | | | (221,926 | ) |

| | | | | | | | |

Distribution & Wholesale (0.1%) | |

Fastenal Co. | | | (2,300 | ) | | | (90,068 | ) |

| | | | | | | | |

|

Diversified Financial Services (0.1%) | |

Perpetual, Ltd. | | | (2,066 | ) | | | (66,164 | ) |

| | | | | | | | |

|

Electric (0.1%) | |

ITC Holdings Corp. | | | (3,000 | ) | | | (98,160 | ) |

| | | | | | | | |

|

Electronics (0.3%) | |

FARO Technologies, Inc. (e) | | | (2,100 | ) | | | (70,959 | ) |

Garmin, Ltd. | | | (2,500 | ) | | | (88,675 | ) |

Knowles Corp. (e) | | | (1,900 | ) | | | (31,654 | ) |

National Instruments Corp. | | | (3,200 | ) | | | (97,504 | ) |

Waters Corp. (e) | | | (300 | ) | | | (38,340 | ) |

| | | | | | | | |

| | | | | | | (327,132 | ) |

| | | | | | | | |

Energy—Alternate Sources (0.1%) | |

Clean Energy Fuels Corp. (e) | | | (7,100 | ) | | | (40,115 | ) |

Plug Power, Inc. (e) | | | (35,000 | ) | | | (84,350 | ) |

| | | | | | | | |

| | |

Shares | | | Value | |

Energy—Alternate Sources (continued) | |

SolarCity Corp. (e) | | | (300 | ) | | $ | (8,895 | ) |

| | | | | | | | |

| | | | | | | (133,360 | ) |

| | | | | | | | |

Engineering & Construction (0.4%) | |

Chicago Bridge & Iron Co. N.V. | | | (2,200 | ) | | | (98,714 | ) |

Exponent, Inc. | | | (1,700 | ) | | | (87,397 | ) |

¡ SBA Communications Corp. Class A (e) | | | (900 | ) | | | (107,118 | ) |

Singapore Technologies Engineering, Ltd. | | | (37,200 | ) | | | (87,895 | ) |

| | | | | | | | |

| | | | | | | (381,124 | ) |

| | | | | | | | |

Entertainment (0.3%) | |

Dolby Laboratories, Inc. Class A | | | (2,800 | ) | | | (97,076 | ) |

Genting Singapore PLC | | | (149,600 | ) | | | (87,033 | ) |

Scientific Games Corp. Class A (e) | | | (7,700 | ) | | | (85,393 | ) |

| | | | | | | | |

| | | | | | | (269,502 | ) |

| | | | | | | | |

Finance—Consumer Loans (0.1%) | |

Navient Corp. | | | (7,800 | ) | | | (102,882 | ) |

| | | | | | | | |

|

Finance—Mortgage Loan/Banker (0.1%) | |

Arlington Asset Investment Corp. Class A | | | (4,300 | ) | | | (59,555 | ) |

Walter Investment Management Corp. (e) | | | (100 | ) | | | (1,196 | ) |

| | | | | | | | |

| | | | | | | (60,751 | ) |

| | | | | | | | |

Finance—Other Services (0.2%) | |

CBOE Holdings, Inc. | | | (1,400 | ) | | | (93,856 | ) |

OzForex Group, Ltd. | | | (42,579 | ) | | | (86,231 | ) |

| | | | | | | | |

| | | | | | | (180,087 | ) |

| | | | | | | | |

Food (0.7%) | |

Aryzta A.G. (e) | | | (1,970 | ) | | | (88,889 | ) |

Barry Callebaut A.G. Registered (e) | | | (83 | ) | | | (99,672 | ) |

Boulder Brands, Inc. (e) | | | (7,800 | ) | | | (69,108 | ) |

Chefs’ Warehouse, Inc. (The) (e) | | | (5,400 | ) | | | (81,810 | ) |

¡ Chocoladefabriken Lindt & Sprungli A.G. | | | (17 | ) | | | (171,870 | ) |

CHR Hansen Holding A/S | | | (1,403 | ) | | | (84,316 | ) |

Sprouts Farmers Market, Inc. (e) | | | (4,200 | ) | | | (85,596 | ) |

Super Group, Ltd. | | | (68,100 | ) | | | (43,751 | ) |

| | | | | | | | |

| | | | | | | (725,012 | ) |

| | | | | | | | |

Forest Products & Paper (0.1%) | |

Deltic Timber Corp. | | | (1,300 | ) | | | (80,548 | ) |

| | | | | | | | |

|

Gas (0.1%) | |

Questar Corp. | | | (4,600 | ) | | | (94,990 | ) |

| | | | | | | | |

|

Health Care—Products (0.5%) | |

Accelerate Diagnostics, Inc. (e) | | | (1,100 | ) | | | (18,447 | ) |

Bio-Techne Corp. | | | (400 | ) | | | (35,280 | ) |

Cerus Corp. (e) | | | (17,600 | ) | | | (83,952 | ) |

Edwards Lifesciences Corp. (e) | | | (600 | ) | | | (94,290 | ) |

GenMark Diagnostics, Inc. (e) | | | (4,200 | ) | | | (26,712 | ) |

Henry Schein, Inc. (e) | | | (100 | ) | | | (15,171 | ) |

| | | | |

| 18 | | MainStay Absolute Return Multi-Strategy Fund | | The notes to the consolidated financial statements are an integral part of,

and should be read in conjunction with, the consolidated financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks Sold Short (continued) | |

Health Care—Products (continued) | |

IDEXX Laboratories, Inc. (e) | | | (1,300 | ) | | $ | (89,206 | ) |

Ocular Therapeutix, Inc. (e) | | | (1,200 | ) | | | (10,356 | ) |

Patterson Cos., Inc. | | | (2,100 | ) | | | (99,540 | ) |

| | | | | | | | |

| | | | | | | (472,954 | ) |

| | | | | | | | |

Health Care—Services (0.7%) | |

AAC Holdings, Inc. (e) | | | (3,100 | ) | | | (71,920 | ) |

Brookdale Senior Living, Inc. (e) | | | (3,900 | ) | | | (81,549 | ) |

Capital Senior Living Corp. (e) | | | (3,700 | ) | | | (83,694 | ) |

Envision Healthcare Holdings, Inc. (e) | | | (2,600 | ) | | | (73,320 | ) |

Healthscope, Ltd. | | | (4,521 | ) | | | (8,705 | ) |

Laboratory Corporation of America Holdings (e) | | | (800 | ) | | | (98,192 | ) |

MEDNAX, Inc. (e) | | | (1,200 | ) | | | (84,564 | ) |

Premier, Inc. Class A (e) | | | (2,600 | ) | | | (87,906 | ) |

Ramsay Health Care, Ltd. | | | (1,940 | ) | | | (85,785 | ) |

Tenet Healthcare Corp. (e) | | | (2,500 | ) | | | (78,425 | ) |

| | | | | | | | |

| | | | | | | (754,060 | ) |

| | | | | | | | |

Insurance (0.7%) | |

Ambac Financial Group, Inc. (e) | | | (5,200 | ) | | | (83,980 | ) |

Cover-More Group, Ltd. | | | (47,190 | ) | | | (76,724 | ) |

Genworth Financial, Inc. Class A (e) | | | (11,400 | ) | | | (53,352 | ) |

Greenlight Capital Re, Ltd. Class A (e) | | | (2,200 | ) | | | (48,312 | ) |

Insurance Australia Group, Ltd. | | | (17,849 | ) | | | (71,405 | ) |

MBIA, Inc. (e) | | | (11,900 | ) | | | (89,369 | ) |

Mercury General Corp. | | | (1,600 | ) | | | (86,416 | ) |

ProAssurance Corp. | | | (1,300 | ) | | | (68,848 | ) |

Tryg A/S | | | (4,801 | ) | | | (86,360 | ) |

| | | | | | | | |

| | | | | | | (664,766 | ) |

| | | | | | | | |

Internet (0.8%) | |

Chegg, Inc. (e) | | | (11,400 | ) | | | (78,660 | ) |

FireEye, Inc. (e) | | | (1,300 | ) | | | (33,995 | ) |

Marketo, Inc. (e) | | | (2,600 | ) | | | (76,518 | ) |

Quotient Technology, Inc. | | | (9,100 | ) | | | (50,414 | ) |

Seek, Ltd. | | | (9,015 | ) | | | (82,479 | ) |

Splunk, Inc. (e) | | | (1,600 | ) | | | (89,856 | ) |

TrueCar, Inc. (e) | | | (12,000 | ) | | | (73,680 | ) |

TubeMogul, Inc. (e) | | | (6,000 | ) | | | (71,700 | ) |

Twitter, Inc. (e) | | | (3,100 | ) | | | (88,226 | ) |

Wayfair, Inc. (e) | | | (1,900 | ) | | | (80,313 | ) |

Wix.com, Ltd. Class A (e) | | | (4,200 | ) | | | (92,904 | ) |

| | | | | | | | |

| | | | | | | (818,745 | ) |

| | | | | | | | |

Investment Companies (0.1%) | |

Acacia Research Corp. | | | (8,600 | ) | | | (57,276 | ) |

Aker ASA Class A | | | (2,517 | ) | | | (49,619 | ) |

| | | | | | | | |

| | | | | | | (106,895 | ) |

| | | | | | | | |

Investment Management/Advisory Services (0.3%) | |

Financial Engines, Inc. | | | (2,700 | ) | | | (86,832 | ) |

| | | | | | | | |

| | |

Shares | | | Value | |

Investment Management/Advisory Services (continued) | |

Platinum Asset Management, Ltd. | | | (17,044 | ) | | $ | (89,940 | ) |

WisdomTree Investments, Inc. | | | (5,000 | ) | | | (96,150 | ) |

| | | | | | | | |

| | | | | | | (272,922 | ) |

| | | | | | | | |

Iron & Steel (0.3%) | |

Acerinox S.A. | | | (7,986 | ) | | | (86,448 | ) |

AK Steel Holding Corp. (e) | | | (27,300 | ) | | | (78,897 | ) |

Cliffs Natural Resources, Inc. | | | (28,300 | ) | | | (78,108 | ) |

Outokumpu Oyj (e) | | | (12,668 | ) | | | (43,128 | ) |

| | | | | | | | |

| | | | | | | (286,581 | ) |

| | | | | | | | |

Leisure Time (0.1%) | |

Harley-Davidson, Inc. | | | (1,700 | ) | | | (84,065 | ) |

| | | | | | | | |

|

Lodging (0.1%) | |

Choice Hotels International, Inc. | | | (1,900 | ) | | | (99,389 | ) |

| | | | | | | | |

|

Machinery—Construction & Mining (0.1%) | |

Outotec Oyj | | | (19,437 | ) | | | (66,900 | ) |

| | | | | | | | |

|

Machinery—Diversified (0.4%) | |

Burckhardt Compression Holding A.G. | | | (49 | ) | | | (17,102 | ) |

Cognex Corp. | | | (2,600 | ) | | | (97,760 | ) |

Graco, Inc. | | | (1,300 | ) | | | (95,420 | ) |