| | | | | | |

| | | | | | OMB APPROVAL |

| | | | | | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response. . . ..20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31 (MainStay Marketfield Fund)

Date of reporting period: June 30, 2015

| Item 1. | Reports to Stockholders. |

MainStay Marketfield Fund

Message from the President, Marketfield Asset Management LLC Six-Month Commentary and Semiannual Report

Unaudited | June 30, 2015

This page intentionally left blank

Message from the President

Stocks advanced modestly in the United States and around the world during the six months ended June 30, 2015. Oil price volatility, accommodative monetary policies by central banks around the world and a monetary crisis in Greece were among the factors that influenced the markets.

The Marketfield Asset Management LLC Six-Month Commentary that follows provides additional insight into the market events, economic trends and core beliefs that shaped MainStay Marketfield Fund during the first half of 2015. Further information about the Fund and its investment themes can be found in the semiannual report for MainStay Marketfield Fund. We encourage you to consider this information carefully as part of your investment planning.

The information contained in the commentary and the semiannual report can be useful in helping you assess the progress

of your investments. Even in volatile markets, we believe that it’s valuable to maintain a long-term perspective as you pursue your long-range financial goals.

We are pleased that you’ve chosen MainStay Funds, and we look forward to building a lasting relationship with you.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Marketfield Asset Management LLC Six-Month Commentary

Chairman’s Report

2015 has been a mixed year so far for the Fund, with some of our core assumptions being recognized within financial markets, while others remain more controversial. We are yet to reach the point that our portfolio is firing on all cylinders, but there has been a movement of market sentiment back towards a number of our core beliefs and positions, which are outlined below.

The U.S. Equity market is now in a mature bull market.

We believe that there is little macro controversy left regarding the U.S. economy or the attractiveness of its equity market, which is now widely held by both U.S. and foreign investors. Gains are increasingly concentrated in a limited number of sectors (most notably health care, consumer discretionary and media) where valuations are now much higher on an absolute, relative, and historic basis than they were one or two years ago. In addition, monetary conditions have started to tighten, with the Federal Reserve Board no longer purchasing local fixed income and we assume about to increase interest rates. For the above reasons, while we do not believe that the U.S. bull market has ended, our view is that more attractive destinations for capital exist elsewhere. We have maintained exposure to housing-related equities and a number of smaller allocations to sectors such as defense, technology, and large financial institutions. The modest performance of the U.S. equity market in the first half of 2015 matches our expectations, and we are comfortable with our decision to keep a light overall exposure.

The U.S. Housing market has started a second leg of recovery.

The one part of the U.S. economy that still attracts some controversy is the housing market, where consensus still assumes that only a modest pace of improvement can take place going forward. Given that new home sales are still around 50% of “normal” activity and around a third of the peak 2005 activity, we believe this to be a substantial underestimation of the potential strength of housing-related activity going forward. The overall balance of economic and corporate data during the spring selling season suggests that a second leg to the housing recovery is underway. We, therefore, have a meaningful exposure to homebuilders and housing-related equities. The homebuilders themselves remain at the top end of a two year range, but if activity and earnings start to accelerate there is meaningful upside in these positions.

The U.S. interest rate cycle has bottomed.

We believe that long term U.S. interest rates bottomed early in 2015, while intermediate-term rates bottomed over 2 years ago. Income-related equities reached their cycle peaks early in 2015 and are vulnerable to further correction. The Fund maintains short positions in both long term Treasury instruments and income-related equities such as utilities and Real Estate Investment Trusts (REITs). Interest rates have been trending higher for several months, but have yet to provoke the sort of capital flight that took place in 2013.

European commercial real estate is enjoying a strong recovery.

Europe’s real estate markets have continued to recover in 2015, and this is particularly true in peripheral markets such as Ireland and Spain, which account for the majority of our exposure. We have maintained positions in European REITs and other entities with substantial exposure to real estate loans and lending activity.

Japan is an attractive destination for investment capital.

Our Japanese allocation has been the standout performer in the first half of 2015, reflecting the strong performance of the local equity market, which led USD returns for developed markets over this period. It is worth remembering how unlikely this outcome would have seemed a year ago, when the dominant view was that the hike in the sales tax had dealt a body blow to the economic recovery.

In fact, not only is Japan’s domestic economy enjoying a steady recovery in activity, but its corporate sector is posting record profits. The local equity market is enjoying its strongest three year period since 1989, and yet most global investors remain underweight Japan and have not substantially increased allocations during the first half of 2015.

China’s economy is bottoming and its equity market is improving.

China has dominated the portfolio’s performance in recent months, generating strong gains in March and April, and losses in May and June. Our exposure to China is only to large-cap, high-quality entities listed in Hong Kong, at the level of index futures, Exchange Traded Fund (ETF) exposure, and individual issues. Valuations in the “H” share market are currently at an average Price/Earnings Ratio (P/E) of 8.5, compared to their 2009 low at 7. This clearly represents the most volatile portion of our portfolio, but it is arguably also the one with the greatest potential reward. We view an important aspect of our Fund as being willing to take exposures that may be contrary to widely held views, be this U.S. equities in 2009 or European equities in 2012, or on the short side emerging markets in 2011. Our China-related exposure certainly comes into this category.

The portfolio manager’s report below outlines our thinking regarding China in some detail, since not only is this the key issue for our own portfolio, but we believe that it is likely to be the key determinant of global performance in the coming quarters.

In summary, the Fund has de-emphasized the U.S. equity market and made something of a “pivot to Asia” in recent months. Although the recent decline in China has been costly, we do expect the offshore “H” share market to find its footing in the coming weeks and start to make progress. Japan obviously is an easier market to justify exposure to at present, but this would have been less true 12 or 15 months ago. Overall, the Fund gives exposure that it somewhat outside of consensus

Not part of the Semiannual Report

thinking and, therefore, can be expected to have a low correlation to most equity benchmarks at the current time.

July 23, 2015

Michael Shaoul

Chairman, CEO

Portfolio Manager’s Report

In the years since the panic of 2008, we have wrestled with the implications of official policy initiatives designed to address deficiencies in markets and economic activity.

The focus of action has expanded immensely during the seven years since the Federal Reserve stepped in and restored liquidity to funding markets in 2008-2009. Its expansionary forays were gradually expanded and joined by similar efforts from the Bank of England, the European Central Bank (ECB), the Bank of Japan, and the Peoples Bank of China.

Not to be outdone by the central bankers, politicians joined the fray and have elbowed their way onto center stage. From the relatively limited aims of Troubled Asset Relief Program (TARP) in 2008, regulatory and legislative exertions keep coming faster, more furiously, and with ever increasing size and scope. No macroeconomic problem is deemed too large or intractable for official intrusion.

After a decade and a half of monetary integration, economic turmoil, and political volatility, events are forcing European leaders to confront fundamental issues of sovereign power, fiscal latitude, free markets, and political control of economic life. Mistaken notions of these and the consequent distortions of economic function lie at the heart of the crisis in Greece and the struggles of most of Southern Europe.

At the same time, China is continuing its attempts to reconcile a nominally socialist ideology with the reality of markets that obey economic laws rather than the dictates of Marx and Mao. Their success in this endeavor is probably the single most important variable in determining global growth over the next decade.

Slightly farther east, Japanese leaders are intent on provoking a radical transformation of the social attitudes that underlie commercial and financial life.

Their early efforts appear to be succeeding, but we believe the process to be gradual and complex. We have taken the view that the old quasi-feudal model of business organization and management will give way to more contemporary leaders willing to emphasize profitability and the creation of lasting shareholder value within the many first rate companies already there. We continue to hold meaningful positions in a diversified mix of Japanese equities.

In the U.S., the dominant theme of political discourse revolves around how best to address the spectacular accumulation of

wealth among those who directly benefit from historically low borrowing costs and inflating asset prices.

The common backdrop for all of these political endeavors is the aggressive monetary ease being brought to bear by all major central banks. All instances of sub-normal economic activity or market stress are now addressed according to the “Bernanke Doctrine,” which holds that a central bank should always err on the side of generosity. This is something of a penitential response to the failures of the Federal Reserve between 1930 and 1932, when their tendencies ran toward tighter policy despite the collapsing markets, banking system, and economy. In contemporary central banking circles, this constitutes original sin.

The mixture of regulatory and administrative interventions in a monumentally expansive monetary environment has produced a strange brew of macroeconomic effects. The benefits of suppressed interest rates and accommodative capital markets accrue almost exclusively to the portion of the economy that can be thought of as the balance sheet, and this is where the monetary inflation is apparent. Credit and liquidity-fueled purchases of productive assets (corporate equity, debt, and commercial real estate) have accelerated as returns on cash savings and high-grade fixed income have dwindled. The utilization of depressed long-term interest rates as discounting factors greatly increases theoretical present values for streams of future output, and has also led to a revaluation of assets assumed to provide stores of value (high end real estate, contemporary art, and gold until 2011).

By designating monetary expansion as the root cause of the accelerating price of capital assets, we are clearly at odds with the stated views of most central bankers, for whom, even now, there is no admission that the real estate mania of 2001-2007 had its basis in the expansion of mortgage credit underpinned by a federal funds rate that remained at 1% during the first three years of the process. Nominal Gross Domestic Product (GDP) was expanding 7.1% on an annual basis before the first hike in the federal funds rate to 1.25% in June 2004. By that point, property speculation was well beyond control and destined to end badly.

The current inflation of existing wealth contrasts with the grudging progress of the economy’s income statement, as expressed in popular measures of output and cash flows. We believe that this is where the burdens of ill-considered political intrusions into economic processes take their toll. The contrasting fortunes of northern and southern European nations correspond closely with the varying political burdens imposed in the two regions. Greece is an extreme, but edifying example of the economic harm inherent in government run wild. In the U.S., the contrasting fortunes among various states and regions highlight the real burdens of over-reaching government. The demise of Puerto Rico’s finances and prospects is the latest example,

Not part of the Semiannual Report

with Detroit having been forgotten and Illinois still hanging on by a few threads.

The mixed condition of accelerating wealth amidst slow growth in incomes is a condition that we call “stagmania.” In contrast with traditional inflation or stagflation, stagmania occurs when clear excesses in certain parts of the economy do not prompt monetary authorities to adopt restrictive policy. It is the opposite condition that arose following the stock market crash in 1929. When Britain abandoned the gold standard in 1931, dollar holders, fearing that the U.S. would follow, began to aggressively withdraw gold. The seeming need to preserve domestic gold supply provided rationale for the Federal Reserve to raise rates, even as the economy and money supply collapsed.

To this day, there are serious debates as to whether the sequence of events leading to and through the Great Depression was prompted by inappropriately easy or tight monetary policy. Without reiterating the full range of argument (a book-length project), we will simply offer our opinion.

This writer believes having seen similar sequences time and time again, that the Federal Reserve’s aggressive response to the recession of 1927, and the deflation of a speculative boom in Florida land provided the credit background that allowed the entire nation’s speculative energy to focus on stocks during the next two years.

This sequence, where monetary balm is intended to fix one area of distress but instead migrates to another, untainted realm of speculation where it intensifies to dangerous levels, is identifiable over and over in modern economic history.

The Federal Reserve Board (FRB) responded to the crash of 1987 and two years later the Nikkei was at 39,000. The Asian currency crisis and the demise of Long Term Capital Management prompted easing in 1998 and by March 2000 Nasdaq reached 5000. The technology liquidation of 2001-2002 brought the Fed into full support mode. WorldCom and its brethren did not revive, but house prices more than made up for the destruction of wealth in technology stocks.

Returning to the era of the Great Depression, the great policy error following the crash of 1929 resulted from the failure of the FRB to recognize the degree to which stocks had become the main collateral form behind the expansion of credit in the last part of the bull market. Shares were bought on 90% margin, much like houses ten years ago.

Banks were aggressive competitors for margin business and once the liquidation began, forced selling became the order of the day. The banking system was fatally impaired, failures ensued, deposits evaporated, and M2 (a measure of money supply) eventually fell by more than 30%, ensuring more widespread deflation.

The existence of the Federal Reserve as a lender of last resort should have allowed the necessary liquidation of excess to proceed without the destruction of the banking system and an acute decline in money supply. The failure to fulfill this function led to a systemic deflation that resulted in damage that was catastrophic in economic, societal, and geopolitical terms.

Managing the liquidation of credit bubbles without allowing their demise to destroy the entire structure of banking and finance is the great conundrum of modern central banking. Although it can be argued and argued persuasively that rises of large-scale credit excesses in the first place are attributable to fractional reserve banking and the central banks that accommodate it, both are facts of current economic life.

Our challenge is to consider the various policy responses to financial market conditions and determine those likely outcomes that are not already incorporated into security prices.

Understanding the implications of policy failures after 1929 is fairly simple with the benefit of hindsight. The extraordinary complexity of a current world in which monetary, political, and market forces collide like particles in an accelerator is a good deal more difficult and uncertain.

For two years we have been of the opinion that asset inflation would begin to migrate to aspects of the real economy that were accepted as components of more traditional measures of inflation. Thus far, the relentless decline of commodity prices, culminating with oil prices falling by half in 2014, has kept all traditional measures of inflation near zero.

We believe that the fundamental correlate of the weakness in commodity prices and those of globally traded goods has been the dramatic slowdown in the Chinese economy. After decades of expansion fueled largely by excessive and inefficient investment, the Chinese authorities are attempting a transition to more market-directed, service, and consumer growth that increasingly reflects preferences of the population rather than just those of the state.

We believe that success or failure by the Chinese in accomplishing the evolution of their economy to a more stable and self-sustaining footing will determine the general tone of the global economy for the remainder of this decade.

Explicit in both our portfolio and our macroeconomic analysis is a belief that the transition of China’s economy will be generally successful, in spite of the large and daunting array of risks that attend.

China, like the U.S. in the late 1920s, is full of excesses in need of liquidation. We are of the view that the outcome will be very different. This is with full awareness that the excesses present in the Chinese banking system are of a scale that would normally foreshadow crisis. The collateral basis of the credit excess is property, despite the recent expansion (and subsequent decline) of margin debt.

Not part of the Semiannual Report

Why, one might ask, do we think that China can avoid its own version of the 1930s given the excesses that have built up in finance and in the real economy?

Our answer goes back to the discussion of the Federal Reserve’s responses in the early years of the 1930s.

We have been critical of the policy inertia that allowed a bear market to proceed throughout the structure of bank credit, bank solvency, and confidence to a point at which a good proportion of the deposit base and money supply was destroyed. After that point, deflation and depression were inevitable.

The Chinese authorities have both the means and the will to preempt the monetary and credit deflation that would prompt a 1930s style depression.

In terms of means, almost $4 trillion of reserves and a savings pool about 5 times that size allows for the People’s Bank of China (PBOC) and the executive branch to marshal adequate resources to address deflations of bank credit that might present systemic threats. Private savings are growing at close to $4 trillion per annum and the Chinese consumer is underleveraged.

Questionable assets in the banking system are concentrated in a half dozen state sponsored entities. Rules concerning the pace at which loan impairments must be recognized or capital raised are almost wholly crafted at the discretion of official overseers, none of whom have the slightest incentive to provoke crisis. If it proves convenient, accounting adjustments can be taken over many years. There is no funding crisis over the horizon that might compel immediate recognition of losses.

In contrast with the U.S. and Europe, there is no political constituency that has revenge on bankers and the dismantling of their institutions as a core platform. The Chinese (and the Japanese) would actually like to see their financial institutions become more successful. This creates a structural advantage as they begin to compete globally.

The monetary argument is based on the idea that China, like nearly every sovereign nation, has the latitude to create enough central bank money to back its local currency obligations. We believe that they also have sufficient reserves and real economic productivity to prevent a collapse of the Yuan and the severe inflation that would follow. In fact, like the European Central Bank, the Federal Reserve and the Bank of Japan, their wish is for more rather than less inflation to diminish the real burdens of their internal debt.

We are fairly certain that China has the means to manage banking system stresses and prevent acute liquidity crises from destroying the monetary base. Whether it will, in an appropriate timeframe and with sufficient force, is an open question.

The nature of the Chinese political system leads us to believe that it is likely to respond forcefully to the threat of any general crisis. It might be late in responding, as was the Federal Reserve in 2007-8 and the ECB in 2011 and again in 2014, but

we believe that it will be, if anything, too intense in response. At the heart of the matter, however, is the primary objective of the leadership to maintain absolute political authority. There is a willingness to cede some measure of economic control to markets and individuals, but relinquishing some portion of political power is an entirely different matter. It is a non-starter.

With that in mind, we believe that it is highly likely that any crisis with the potential to undermine the political legitimacy of the current leadership will be addressed with every tool available. In the same way that Ben Bernanke stated that dropping as much currency as demanded from the sky could arrest any generalized deflation, it is our sense that a widespread loss of savings resulting from institutional crisis would, if all else failed, be met by the government simply replacing the lost money in everyone’s account with a series of keystrokes.

The Chinese leadership is willing to allow losses in speculative endeavors so long as these do not threaten to engulf millions of citizens. This accounts for the very slow pace of capacity closures in heavy industries that are clearly loss making and heavily destructive of the environment. Sudden, large-scale unemployment is to be avoided at almost all costs.

Indeed, this process is already underway, and after deliberately tightening monetary and regulatory policy in 2011, the Chinese authorities abruptly changed course in 2014. Since then the PBOC has cut the policy rate 4 times from 6.0% to 4.85% and lowered the bank reserve requirement on three occasions. Substantial injections of liquidity into the interbank market have caused short term rates to decline far more than the policy rate (a key divergence with the experience of the U.S. and Europe in recent crises).

Although this represents clear progress, the balance of PBOC policy is still inappropriately tight. We suspect that the explosive move higher by the local equity market accounts for some of the reticence and the recent sharp decline may allow a more rapid pace of monetary policy easing.

The troubled housing market (which accounts for around 60% of household wealth) has seen the macroprudential constrictions on mortgage credit and home ownership removed, with banks now encouraged to increase mortgage activity. The large concentration of distressed credit at local authorities (much of which had been issued to allow speculative development) has been the subject of a 2 trillion Chinese Yuan (CNY) debt swap program. There are signs that these measures have taken effect, particularly in China’s largest cities where both sales activity and prices are now moving higher.

To make matters more confusing the attempts to stimulate the economy come at the same time that China has embarked upon a package of regulatory reform aimed at increasing the role of private sector markets and the convertibility of the local currency. To the extent there is a clash between the need for financial and economic stability and the wish to reform, we

Not part of the Semiannual Report

believe that the former will drive the policy decision, as was made abundantly clear in the recent equity market rout. Although we certainly would like to see a freer, less regulated, and less state controlled economy ourselves, our willingness to invest in China is predicated much more on our expectations for monetary loosening than any process that involves the reduction of the state’s role in the domestic economy.

The mix of transitional political initiatives and generous monetary support is one that we have identified and invested toward for seven years. The major venues where policy was brought to bear began with the U.S. in 2008 and spread to Britain, Europe, then Japan and finally, in the past year, China. Of all of these, China seems to be moving more explicitly toward free markets as arbiters of relative value within their economy. They do have the farthest to go, but the direction of travel is encouraging nonetheless.

In all of these cases, we have counted on continued monetary fuel at any point where the initial reflationary impulse runs into trouble. This has been our expectation during the Greek crisis,

and we assume that China will not be timid in the monetary response to recent sharp declines in local equity markets. Our substantial exposure to Chinese stocks remains a key driver of portfolio results.

Our core macroeconomic perspective anticipates a continuation of global liquidity expansion as a means of ameliorating stresses that arise in real economic activity, credit quality, and government finances. Thus far, most of the obvious effect has been confined to the inflation of productive and investable asset prices. We anticipate the spread of effects to begin appearing in more transactional elements of the real economy from which current production and income arise. We have, of course, been waiting for quite awhile, but signs suggesting the beginnings of reflation in the real economy continue to arrive.

July 23, 2015

Michael C. Aronstein

President, CIO & Portfolio Manager

The information provided herein represents the opinion of the Chairman and Portfolio Manager and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

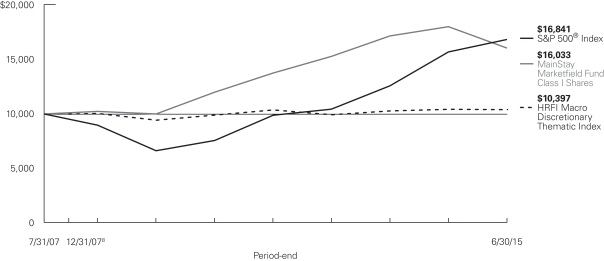

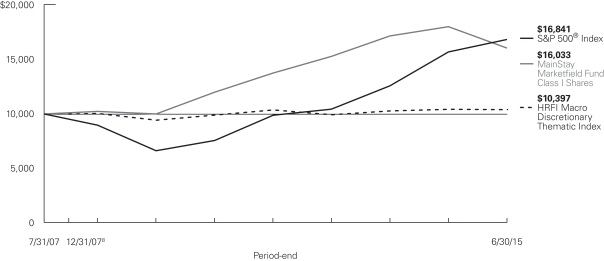

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period Ended June 30, 2015

| | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Six Months | | One Year | | | Five Years | | | Since

Inception

(7/31/07) | | | Gross

Expense

Ratio2 | |

| Class A Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | | –7.43%

–2.04 | |

| –15.96

–11.07 | %

| |

| 4.53

5.72 | %

| |

| 5.14

5.89 | %

| |

| 2.73

2.73 | %

|

| Investor Class Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | | –7.49

–2.10 | |

| –16.01

–11.12 |

| |

| 4.52

5.71 |

| |

| 5.13

5.88 |

| |

| 2.69

2.69 |

|

| Class C Shares3 | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | | –3.43

–2.45 | |

| –12.71

–11.83 |

| |

| 4.92

4.92 |

| |

| 5.09

5.09 |

| |

| 3.46

3.46 |

|

| Class I Shares4 | | No Sales Charge | | | | –1.97 | | | –10.91 | | | | 5.96 | | | | 6.14 | | | | 2.47 | |

| Class R2 Shares3 | | No Sales Charge | | | | –2.11 | | | –11.20 | | | | 5.59 | | | | 5.77 | | | | 2.84 | |

| Class R6 Shares5 | | No Sales Charge | | | | –1.91 | | | –10.79 | | | | 6.01 | | | | 6.18 | | | | 2.42 | |

| Class P Shares6 | | No Sales Charge | | | | –1.97 | | | –10.91 | | | | 5.96 | | | | 6.14 | | | | 2.48 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund-share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividends and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Class A, Investor Class, Class C, and Class R2 shares, first offered on October 5, 2012, include the historical performance of Class I shares through October 4, 2012 and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies |

| | based on differences in their fee and expense structures. Marketfield Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes would likely have been different. |

| 4. | Performance figures for Class I shares reflect the historical performance of the then-existing shares of Marketfield Fund (the predecessor to the Fund, which was subject to a different fee structure, and for which a predecessor entity to Marketfield Asset Management LLC served as investment advisor) for periods prior to October 5, 2012. Marketfield Fund commenced operations on July 31, 2007. |

| 5. | Performance figures for Class R6 shares, first offered on June 17, 2013, include the historical performance of Class I shares through June 16, 2013. Performance for Class R6 would likely have been different because of differences in certain expenses attributable to each share class. |

| 6. | Performance figures for Class P shares, first offered on May 31, 2013, include the historical performance of Class I shares through May 30, 2013. Performance for Class P shares would likely have been different because of differences in certain expenses attributable to each share class. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 10 | | MainStay Marketfield Fund |

| | | | | | | | | | | | | | | | |

| Benchmark Performance | | Six

Months | | | One

Year | | | Five

Years | | | Since

Inception | |

S&P 500® Index7 | | | 1.23 | % | | | 7.42 | % | | | 17.34 | % | | | 6.81 | % |

HFRI Macro Discretionary Thematic Index8 | | | 2.37 | | | | –0.01 | | | | 1.09 | | | | –0.06 | 8 |

Average Lipper Alternative Global Macro Fund9 | | | 0.13 | | | | –2.78 | | | | 4.87 | | | | 3.36 | |

| 7. | S&P 500® Index is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The S&P 500® Index is the Fund’s broad-based securities market index for comparison purposes. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an Index. |

| 8. | HFRI Macro Discretionary Thematic Index is a broad-based hedge fund index consisting of discretionary thematic strategies that are primarily reliant on the evaluation of market data, relationships and influences, as interpreted by an individual or group of individuals who make decisions on portfolio positions. These strategies employ an investment process most heavily influenced by top down analysis of macroeconomic variables. The HFRI Macro Discretionary Thematic Index commenced operations on December 31, 2007. |

| 9. | The Average Lipper Alternative Global Macro Fund is representative of funds that, by prospectus language, invest around the world using economic theory to justify the decision-making process. The strategy is typically based on forecasts and analysis about interest rate trends, the general flow of funds, political changes, government policies, intergovernmental relations, and other broad systemic factors. These funds generally trade a wide range of markets and geographic regions, employing a broad range of trading ideas and instruments. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Marketfield Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from January 1, 2015, to June 30, 2015, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other Funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2015, to June 30, 2015.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended June 30, 2015. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

1/1/15 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

6/30/15 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

6/30/15 | | | Expenses

Paid

During

Period1 | |

| | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 979.60 | | | $ | 11.44 | | | $ | 1,013.20 | | | $ | 11.63 | |

| | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 979.00 | | | $ | 11.58 | | | $ | 1,013.10 | | | $ | 11.78 | |

| | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 975.50 | | | $ | 15.18 | | | $ | 1,009.40 | | | $ | 15.44 | |

| | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 980.30 | | | $ | 10.11 | | | $ | 1,014.60 | | | $ | 10.29 | |

| | | | | |

| Class R2 Shares | | $ | 1,000.00 | | | $ | 978.90 | | | $ | 11.92 | | | $ | 1,012.70 | | | $ | 12.13 | |

| | | | | |

| Class R6 Shares | | $ | 1,000.00 | | | $ | 980.90 | | | $ | 9.63 | | | $ | 1,015.10 | | | $ | 9.79 | |

| | | | | |

| Class P Shares | | $ | 1,000.00 | | | $ | 980.30 | | | $ | 10.26 | | | $ | 1,014.40 | | | $ | 10.44 | |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of (2.33% for Class A, 2.36% for Investor Class, 3.10% for Class C, 2.06% for Class I, 2.43% for Class R2, 1.96% for Class R6 and 2.09% for Class P) multiplied by the average account value over the period, divided by 365 and multiplied by 181 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| | |

| 12 | | MainStay Marketfield Fund |

Country Composition as of June 30, 2015 (Unaudited)

| | | | |

| United States | | | 40.8 | % |

| Japan | | | 16.5 | |

| China | | | 9.7 | |

| Ireland | | | 6.4 | |

| Spain | | | 5.3 | |

| United Kingdom | | | 2.5 | |

| Singapore | | | 2.4 | |

| Brazil | | | 1.4 | |

| | | | |

| Switzerland | | | 1.2 | % |

| Canada | | | 0.4 | |

| Germany | | | 0.2 | |

| Italy | | | 0.1 | |

| Other Assets, Less Liabilities | | | 25.0 | |

| Investments Sold Short | | | –11.9 | |

| | | | |

| | | 100.0 | % |

| | | | |

Industry Composition as of June 30, 2015 (Unaudited)

| | | | |

| Banks | | | 10.8 | % |

| Household Durables | | | 8.6 | |

| Real Estate Investment Trusts | | | 5.4 | |

| Real Estate Management & Development | | | 4.4 | |

| Metals & Mining | | | 4.2 | |

| Machinery | | | 3.8 | |

| Electronic Equipment, Instruments & Components | | | 3.7 | |

| Aerospace & Defense | | | 2.8 | |

| Insurance | | | 2.5 | |

| Internet Software & Services | | | 2.5 | |

| Specialty Retail | | | 2.1 | |

| Hotels, Restaurants & Leisure | | | 2.0 | |

| Construction Materials | | | 1.9 | |

| Diversified Telecommunication Services | | | 1.2 | |

| Wireless Telecommunication Services | | | 1.2 | |

| Communications Equipment | | | 1.0 | |

| Diversified Financial Services | | | 1.0 | |

| Electrical Equipment | | | 1.0 | |

| Oil, Gas & Consumable Fuels | | | 1.0 | |

| | | | |

| Beverages | | | 0.9 | % |

| Personal Products | | | 0.8 | |

| Biotechnology | | | 0.7 | |

| Capital Markets | | | 0.6 | |

| Chemicals | | | 0.6 | |

| Food & Staples Retailing | | | 0.6 | |

| Software | | | 0.6 | |

| Leisure Products | | | 0.5 | |

| Purchased Options | | | 0.5 | |

| Health Care Equipment & Supplies | | | 0.4 | |

| Technology Hardware, Storage & Peripherals | | | 0.4 | |

| Automobiles | | | 0.1 | |

| Investments in Exchange-Traded Funds | | | 16.1 | |

| Investment in Money Market Fund | | | 3.0 | |

| Other Assets, Less Liabilities | | | 25.0 | |

| Investments Sold Short | | | –11.9 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Portfolio of Investments beginning on page 16 for specific holdings within these categories.

Top Ten Holdings or Issuers as of June 30, 2015 (excluding short-term investment) (Unaudited)

| 1. | iShares China Large-Cap ETF |

| 2. | Merlin Properties Socimi S.A. |

| 4. | Bank of China, Ltd. Class H |

| 6. | Kennedy Wilson Europe Real Estate PLC |

| 7. | iShares MSCI Hong Kong ETF |

| 9. | iShares MSCI Emerging Markets ETF |

| 10. | China Life Insurance Co., Ltd. Class H |

Top Five Short Positions as of June 30, 2015 (Unaudited)

| 1. | iShares JP Morgan USD Emerging Markets Bond ETF |

| 2. | Industrial Select Sector SPDR Fund |

| 3. | iShares U.S. Real Estate ETF |

| 4. | Canadian Pacific Railway, Ltd. |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio manager Michael C. Aronstein of Marketfield Asset Management LLC, the Fund’s Subadvisor.

How did MainStay Marketfield Fund perform relative to its benchmarks and peers during the six months ended June 30, 2015?

Excluding all sales charges, MainStay Marketfield Fund returned –2.04% for Class A shares, –2.10% for Investor Class shares and –2.45% for Class C shares for the six months ended June 30, 2015. Over the same period, Class I shares returned –1.97%, Class R2 shares returned –2.11%, Class R6 shares returned –1.91% and Class P shares returned –1.97%. During the six months ended June 30, 2015, all share classes underperformed the 1.23% return of the S&P 500® Index,1 which is the Fund’s primary benchmark, and the 2.37% return of the HFRI Macro Discretionary Thematic Index,1 which is a secondary benchmark of the Fund. Over the same period, all share classes also underperformed the 0.13% return of the Average Lipper2 Alternative Global Macro Fund. See page 10 for Fund returns with applicable sales charges.

What factors affected the Fund’s performance relative to the S&P 500® Index during the reporting period?

MainStay Marketfield Fund is a long/short fund whose correlation to the broad equity market may vary considerably over the course of an investment cycle. The Fund has a broad investment charter that allows it to use, among other instruments, equity securities, fixed-income instruments, futures and options. Additionally, with respect to 50% of its net assets, the Fund may engage in short sales to profit from anticipated declines in security prices.

The Fund’s short Index Hedges and short Margin Pressures themes were the primary negative drivers of relative performance. In addition, the S&P 500® Index had fairly narrow leadership, driven by health care and retail, sectors in which the Fund held very small positions. The Fund’s short Index Hedges theme seeks to dampen Fund volatility using broad fixed-income and equity index hedges. The short Margin Pressures theme pursues short positions among companies that may have limited ability to pass on rising input costs.

The Fund’s long exposure to three segments—Asia including China, Japan, and U.S. and non-U.S. property—helped the Fund’s relative performance during the first half of 2015.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

During the first half of 2015, the Fund was long Hang Seng China Enterprises Index (HSCEI) futures. This holding produced positive performance, contributing 0.45% for the reporting period. The Fund was short CAC 40 (French stock exchange index) futures, which detracted from performance by 0.52% for the reporting period.

In addition, the Fund held currency options and forwards as well as equity and U.S. Treasury note options with no material net effect on the performance of the Fund.

Which investment themes were the strongest contributors to the Fund’s performance, and which themes were particularly weak?

The three strongest contributions to the Fund’s performance came from our Japan Recovery theme, which contributed 1.3% to performance; Asia Ex-Japan, which contributed 1.1% to performance; and Non-U.S. Property Recovery, which contributed 0.5% to performance. (Contributions take weightings and total returns into account.) The Fund’s Japan Recovery theme sought long positions in a basket of economically sensitive Japanese securities. The Fund’s Asia Ex-Japan theme sought long positions in broad Chinese Indexes, large insurers and financials. The Fund’s Non-U.S. Property Recovery theme sought long positions in real estate and financials in Europe, primarily in Ireland, Spain and the U.K. This reflected our view that depressed European assets were recovering.

The three weakest contributions to the Fund’s performance came from our Index Hedges theme, which contributed –1.5% to performance; our Late-Cycle Opportunities theme, which contributed –1.1% to performance; and our Margin Pressures theme, which contributed –0.9% to performance. The Late-Cycle Opportunities theme sought long positions in financials, industrial goods, agriculture and technology. The theme reflected our view that some companies in these sectors may be more competitive or likely to benefit in this phase of the economic cycle.

During the reporting period, which individual holdings made the strongest contributions to the Fund’s absolute performance and which holdings detracted the most?

The individual position that made the strongest contribution to the Fund’s absolute performance during the reporting period was a USDTRY call option (an option on the Turkish lira). This was followed by a position in Bank of China Limited, Class H, and a position in HSCEI futures.

The Fund’s individual holdings that detracted the most from the Fund’s absolute performance were a position in CAC 40 Index futures, a USDZAR call option (an option on the South African rand) and an SPY put option (an option on the S&P 500® Index).

As of June 30, 2015, the Fund no longer held options in the Turkish lira, the South African rand or the S&P 500® Index. In addition, the Fund no longer held a positon in CAC 40 futures.

| 1. | See footnote on page 11 for more information about this index. |

| 2. | See footnote on page 11 for more information on Lipper Inc. |

| | |

| 14 | | MainStay Marketfield Fund |

Did the Fund make any significant purchases or sales during the reporting period?

During the reporting period, the Fund increased exposure to our long Asia Ex-Japan theme from 14% to 27% of net assets. We increased our long Japan Recovery theme from 10% to 20% of net assets. We increased our long Non-U.S. Property theme from 9% to 11% of net assets. Over the same period, we decreased our long U.S. Property theme from 13% to 9% of net assets. We also decreased our Late-Cycle Opportunities theme from 19% to 16% of net assets.

How did the Fund’s sector weightings change during the reporting period?

From January 1, 2015, through June 30, 2015, the Fund’s weighting in information technology declined from 10.3% to 8.1% of net assets, a decrease of 2.2 percentage points. Over the same period, the Fund’s holdings in industrials fell from 6.9% to 5.8% of net assets, a decrease of 1.1 percentage points.

During the reporting period, the Fund’s position in financials increased from 21% to 22.6% of net assets, a gain of 1.6 percentage points; and the Fund’s materials holdings moved from 6.1% to 6.8% of net assets, an increase of 70 basis points. (A basis point is one hundredth of a percentage point.) During the reporting period, the Fund’s consumer discretionary holdings grew from 13% of net assets to 13.3%, an increase of 30 basis points. In energy, the Fund moved from 0.8% of net assets at the beginning of the reporting period to 1.0% at the end, an increase of 20 basis points.

How was the Fund positioned at the end of the reporting period?

As of June 30, 2015, the equity portion of the Fund was 84% long and 12% short. The net equity exposure was long 72%.3 As of the same date, the futures portion of the Fund was 5% long and 11% short. The net futures exposure was short 6%.

| 3. | See the Portfolio of Investments on page 16 for information on specific holdings. |

The opinions expressed are those of the portfolio manager as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Portfolio of Investments June 30, 2015 (Unaudited)

| | | | | | | | |

| | |

Shares | | | Value | |

| | | | | | | | |

| Common Stocks 65.9%† | | | | | | | | |

Aerospace & Defense 2.8% | | | | | | | | |

Honeywell International, Inc. | | | 237,530 | | | $ | 24,220,934 | |

Lockheed Martin Corp. | | | 258,912 | | | | 48,131,741 | |

Northrop Grumman Corp. | | | 299,369 | | | | 47,488,904 | |

United Technologies Corp. | | | 202,206 | | | | 22,430,712 | |

| | | | | | | | |

| | | | | | | 142,272,291 | |

| | | | | | | | |

Automobiles 0.1% | | | | | | | | |

Great Wall Motor Co., Ltd.

Class H (a)(b) | | | 1,336,018 | | | | 6,549,488 | |

| | | | | | | | |

| | |

Banks 9.4% | | | | | | | | |

¨Bank of China, Ltd. Class H | | | 233,691,576 | | | | 152,245,997 | |

¨Bank of Ireland (c) | | | 226,498,100 | | | | 91,535,350 | |

Citigroup, Inc. (d) | | | 615,232 | | | | 33,985,416 | |

DBS Group Holdings, Ltd. | | | 3,910,839 | | | | 60,077,409 | |

Itau Unibanco Holding S.A., ADR | | | 2,570,952 | | | | 28,151,924 | |

Sumitomo Mitsui Financial Group, Inc. | | | 1,298,690 | | | | 57,928,249 | |

U.S. Bancorp | | | 534,941 | | | | 23,216,439 | |

Wells Fargo & Co. (d) | | | 465,915 | | | | 26,203,060 | |

| | | | | | | | |

| | | | | | | 473,343,844 | |

| | | | | | | | |

Beverages 0.9% | | | | | | | | |

Suntory Beverage & Food, Ltd. | | | 1,103,932 | | | | 43,973,269 | |

| | | | | | | | |

| | |

Biotechnology 0.7% | | | | | | | | |

Grifols S.A. | | | 884,377 | | | | 35,622,277 | |

| | | | | | | | |

| | |

Capital Markets 0.6% | | | | | | | | |

CITIC Securities Co., Ltd. Class H | | | 8,136,453 | | | | 29,390,339 | |

| | | | | | | | |

| | |

Chemicals 0.6% | | | | | | | | |

Sherwin-Williams Co. (The) (d) | | | 115,727 | | | | 31,827,240 | |

| | | | | | | | |

| |

Communications Equipment 1.0% | | | | | |

QUALCOMM, Inc. | | | 766,628 | | | | 48,013,912 | |

| | | | | | | | |

| | |

Construction Materials 1.9% | | | | | | | | |

Buzzi Unicem S.p.A. | | | 311,866 | | | | 4,439,921 | |

CRH PLC | | | 382,180 | | | | 10,724,935 | |

Eagle Materials, Inc. (d) | | | 509,016 | | | | 38,853,191 | |

Taiheiyo Cement Corp. | | | 14,113,297 | | | | 41,284,147 | |

| | | | | | | | |

| | | | | | | 95,302,194 | |

| | | | | | | | |

Diversified Financial Services 1.0% | | | | | |

CME Group, Inc. | | | 415,088 | | | | 38,628,089 | |

Intercontinental Exchange, Inc. | | | 60,565 | | | | 13,542,940 | |

| | | | | | | | |

| | | | | | | 52,171,029 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

| | | | | | | | |

Diversified Telecommunication Services 1.2% | | | | | |

Singapore Telecommunications, Ltd. | | | 18,814,300 | | | $ | 59,368,731 | |

| | | | | | | | |

|

Electrical Equipment 1.0% | |

Rockwell Automation, Inc. | | | 399,086 | | | | 49,742,079 | |

| | | | | | | | |

|

Electronic Equipment, Instruments & Components 3.7% | |

Hitachi, Ltd. | | | 7,087,922 | | | | 46,725,787 | |

Keyence Corp. | | | 102,800 | | | | 55,488,565 | |

Murata Manufacturing Co., Ltd. | | | 323,100 | | | | 56,391,028 | |

Yaskawa Electric Corp. | | | 1,978,400 | | | | 25,347,316 | |

| | | | | | | | |

| | | | | | | 183,952,696 | |

| | | | | | | | |

Food & Staples Retailing 0.6% | | | | | | | | |

Costco Wholesale Corp. | | | 226,456 | | | | 30,585,147 | |

| | | | | | | | |

|

Health Care Equipment & Supplies 0.4% | |

Intuitive Surgical, Inc. (c) | | | 40,690 | | | | 19,714,305 | |

| | | | | | | | |

| | |

Hotels, Restaurants & Leisure 2.0% | | | | | | | | |

Dalata Hotel Group PLC (c) | | | 10,399,112 | | | | 41,736,404 | |

Las Vegas Sands Corp. | | | 1,106,568 | | | | 58,172,280 | |

| | | | | | | | |

| | | | | | | 99,908,684 | |

| | | | | | | | |

Household Durables 8.6% | | | | | | | | |

D.R. Horton, Inc. (d) | | | 1,513,190 | | | | 41,400,878 | |

Lennar Corp. Class A (d) | | | 1,024,245 | | | | 52,277,465 | |

Panasonic Corp. | | | 4,054,059 | | | | 55,700,455 | |

PulteGroup, Inc. | | | 2,051,557 | | | | 41,338,874 | |

Ryland Group, Inc. (The) | | | 536,432 | | | | 24,874,352 | |

Sekisui House, Ltd. | | | 2,944,401 | | | | 46,769,747 | |

¨Sony Corp. (c) | | | 1,935,906 | | | | 54,754,575 | |

¨Sony Corp., Sponsored ADR (c) | | | 1,607,240 | | | | 45,629,544 | |

Toll Brothers, Inc. (c) | | | 600,911 | | | | 22,948,791 | |

Whirlpool Corp. | | | 255,681 | | | | 44,245,597 | |

| | | | | | | | |

| | | | | | | 429,940,278 | |

| | | | | | | | |

Insurance 2.5% | | | | | | | | |

¨China Life Insurance Co., Ltd.

Class H | | | 20,188,729 | | | | 87,510,407 | |

China Pacific Insurance Group Co., Ltd. Class H | | | 7,595,000 | | | | 36,546,690 | |

| | | | | | | | |

| | | | | | | 124,057,097 | |

| | | | | | | | |

Internet Software & Services 2.5% | | | | | | | | |

Facebook, Inc. Class A (c)(d) | | | 694,697 | | | | 59,580,688 | |

Tencent Holdings, Ltd. | | | 3,325,300 | | | | 66,406,905 | |

| | | | | | | | |

| | | | | | | 125,987,593 | |

| | | | | | | | |

Leisure Products 0.5% | | | | | | | | |

Shimano, Inc. | | | 191,200 | | | | 26,090,125 | |

| | | | | | | | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers, as of June 30, 2015, excluding short-term investment. May be subject to change daily. |

| | | | |

| 16 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| | | | | | | | |

| Common Stocks (continued) | |

Machinery 3.8% | | | | | |

Cummins, Inc. | | | 241,286 | | | $ | 31,654,310 | |

Deere & Co. | | | 458,777 | | | | 44,524,308 | |

FANUC Corp. | | | 349,573 | | | | 71,636,972 | |

Kubota Corp. | | | 2,856,000 | | | | 45,307,219 | |

| | | | | | | | |

| | | | | | | 193,122,809 | |

| | | | | | | | |

Metals & Mining 4.2% | | | | | | | | |

Glencore PLC (c) | | | 14,827,419 | | | | 59,478,723 | |

Newmont Mining Corp. (d) | | | 1,762,571 | | | | 41,173,659 | |

Nippon Steel & Sumitomo Metal Corp. | | | 26,623,453 | | | | 69,046,729 | |

Vale S.A., Sponsored ADR | | | 7,041,756 | | | | 41,475,943 | |

| | | | | | | | |

| | | | | | | 211,175,054 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels 1.0% | | | | | | | | |

PetroChina Co., Ltd. Class H | | | 44,777,000 | | | | 49,851,386 | |

| | | | | | | | |

| | |

Personal Products 0.8% | | | | | | | | |

Kao Corp. | | | 923,100 | | | | 42,939,971 | |

| | | | | | | | |

| | |

Real Estate Investment Trusts 5.4% | | | | | | | | |

Green REIT PLC | | | 32,892,150 | | | | 53,757,926 | |

Hibernia REIT PLC | | | 39,222,233 | | | | 55,095,881 | |

¨Merlin Properties Socimi S.A. (c) | | | 13,204,014 | | | | 161,336,563 | |

| | | | | | | | |

| | | | | | | 270,190,370 | |

| | | | | | | | |

Real Estate Management & Development 4.4% | | | | | |

Deutsche Wohnen A.G. | | | 445,248 | | | | 10,203,184 | |

¨Kennedy Wilson Europe Real Estate PLC | | | 7,157,941 | | | | 127,764,944 | |

Mitsubishi Estate Co., Ltd. | | | 1,911,565 | | | | 41,180,219 | |

St. Joe Co. (The) (c) | | | 2,536,695 | | | | 39,394,874 | |

| | | | | | | | |

| | | | | | | 218,543,221 | |

| | | | | | | | |

Software 0.6% | | | | | | | | |

FireEye, Inc. (c) | | | 265,375 | | | | 12,979,491 | |

Splunk, Inc. (c) | | | 241,179 | | | | 16,790,882 | |

| | | | | | | | |

| | | | | | | 29,770,373 | |

| | | | | | | | |

Specialty Retail 2.1% | | | | | | | | |

Home Depot, Inc. (The) (d) | | | 337,872 | | | | 37,547,715 | |

Inditex S.A. | | | 2,072,471 | | | | 67,362,436 | |

| | | | | | | | |

| | | | | | | 104,910,151 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals 0.4% | |

Blackberry, Ltd. (c) | | | 2,266,013 | | | | 18,535,986 | |

| | | | | | | | |

|

Wireless Telecommunication Services 1.2% | |

China Mobile, Ltd. | | | 4,619,931 | | | | 59,242,492 | |

| | | | | | | | |

Total Common Stocks (Cost $2,907,839,687) | | | | | | | 3,306,094,431 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

| | | | | | | | |

| Exchange-Traded Funds 16.1% (e) | |

¨iShares China Large-Cap ETF | | | 4,844,060 | | | $ | 223,311,166 | |

¨iShares MSCI Emerging Markets ETF | | | 2,519,425 | | | | 99,819,618 | |

¨iShares MSCI Hong Kong ETF (d) | | | 5,191,565 | | | | 117,121,706 | |

¨iShares MSCI Japan ETF | | | 11,559,037 | | | | 148,071,264 | |

iShares Russell 2000 ETF | | | 332,602 | | | | 41,528,686 | |

iShares U.S. Home Construction

ETF (d) | | | 1,668,963 | | | | 45,813,034 | |

Market Vectors Agribusiness ETF | | | 709,299 | | | | 39,096,561 | |

Market Vectors Gold Miners ETF | | | 2,287,597 | | | | 40,627,723 | |

SPDR S&P Homebuilders ETF (d) | | | 1,432,235 | | | | 52,448,446 | |

| | | | | | | | |

Total Exchange-Traded Funds (Cost $736,956,219) | | | | | | | 807,838,204 | |

| | | | | | | | |

| |

| Preferred Stock 1.4% | | | | | |

Banks 1.4% | | | | | | | | |

¨Bank of Ireland Trust-Preferred Security 10.24% (f) | | | 59,477,000 | | | | 68,389,976 | |

| | | | | | | | |

Total Preferred Stock

(Cost $85,130,435) | | | | | | | 68,389,976 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Notional Amount | | | | |

| Purchased Options 0.5% | |

Purchased Call Options 0.2% | | | | | | | | |

INR Put/USD Call, Expiring 8/11/15 at 65 INR to 1 USD, European

Style (g) | | | 988,744,306 | | | | 3,593,097 | |

| | |

| | | | | | | | |

| | | Number of

Contracts | | | | |

Market Vectors Gold Miners ETF

Strike Price $19.00

Expires 8/21/15, American Style (g) | | | 50,000 | | | | 1,800,000 | |

Proshares Ultrashort 20+ Year Treasury ETF

Strike Price $52.00

Expires 7/17/15, American Style (g) | | | 50,000 | | | | 3,700,000 | |

| | | | | | | | |

Total Purchased Call Options (Cost $25,516,143) | | | | | | | 9,093,097 | |

| | | | | | | | |

| | |

Purchased Put Options 0.3% | | | | | | | | |

10-Year United States Treasury Note Future | | | | | | | | |

Strike Price $124.50

Expires 8/21/15, American Style (g) | | | 5,000 | | | | 2,656,250 | |

Strike Price $125.00

Expires 8/21/15, American Style (g) | | | 5,000 | | | | 3,437,500 | |

Strike Price $125.50

Expires 8/21/15, American Style (g) | | | 3,663 | | | | 3,205,125 | |

American Express Co.

Strike Price $77.50

Expires 7/17/15, American Style (g) | | | 10,000 | | | | 1,090,000 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Portfolio of Investments June 30, 2015 (Unaudited) (continued)

| | | | | | | | |

| | | Number of

Contracts | | | Value | |

| | | | | | | | |

| Purchased Options (continued) | |

Purchased Put Options (continued) | |

Blackrock, Inc.

Strike Price $350.00

Expires 7/17/15, American Style (g) | | | 4,404 | | | $ | 3,479,160 | |

| | | | | | | | |

Total Purchased Put Options (Cost $14,652,518) | | | | | | | 13,868,035 | |

| | | | | | | | |

Total Purchased Options (Cost $40,168,661) | | | | | | | 22,961,132 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Shares | | | | |

| Short-Term Investment 3.0% | | | | | | | | |

Money Market Fund 3.0% | | | | | | | | |

State Street Institutional Treasury Money Market Fund | | | 150,000,000 | | | | 150,000,000 | |

| | | | | | | | |

Total Short-Term Investment (Cost $150,000,000) | | | | | | | 150,000,000 | |

| | | | | | | | |

Total Investments, Before Investments Sold Short

(Cost $3,920,095,002) (i) | | | 86.9 | % | | | 4,355,283,743 | |

| | | | | | | | |

| |

| Common Stocks Sold Short (2.5%) | | | | | |

Capital Markets (0.7%) | | | | | | | | |

Eaton Vance Corp. | | | (910,430 | ) | | | (35,625,126 | ) |

| | | | | | | | |

| | |

Industrial Conglomerates (0.8%) | | | | | | | | |

General Electric Co. | | | (1,544,286 | ) | | | (41,031,679 | ) |

| | | | | | | | |

| | |

Road & Rail (1.0%) | | | | | | | | |

Canadian Pacific Railway, Ltd. | | | (319,157 | ) | | | (51,138,526 | ) |

| | | | | | | | |

Total Common Stocks Sold Short (Proceeds $127,997,905) | | | | | | | (127,795,331 | ) |

| | | | | | | | |

|

| Exchange-Traded Funds Sold Short (9.4%) (e) | |

Industrial Select Sector SPDR Fund | | | (2,968,603 | ) | | | (160,482,678 | ) |

iShares JP Morgan USD Emerging Markets Bond ETF | | | (1,875,616 | ) | | | (206,167,711 | ) |

iShares U.S. Real Estate ETF | | | (1,440,498 | ) | | | (102,707,507 | ) |

| | | | | | | | |

Total Exchange-Traded Funds Sold Short (Proceeds $502,357,175) | | | | | | | (469,357,896 | ) |

| | | | | | | | |

Total Investments Sold Short (Proceeds $630,355,080) (h) | | | (11.9 | )% | | | (597,153,227 | ) |

| | | | | | | | |

Total Investments, Net of Investments Sold Short

(Cost $3,289,739,922) | | | 75.0 | | | | 3,758,130,516 | |

Other Assets, Less Liabilities | | | 25.0 | | | | 1,254,223,916 | |

Net Assets | | | 100.0 | % | | $ | 5,012,354,432 | |

| (a) | Fair valued security—Represents fair value as measured in good faith under procedures approved by the Board of Trustees. As of June 30, 2015, the total market value of this security was $6,549,488, which represented 0.1% of the Fund’s net assets. |

| (b) | Illiquid security—As of June 30, 2015, the total market value of this security was $6,549,488, which represented 0.1% of the Fund’s net assets. |

| (c) | Non-income producing security. |

| (d) | Security, or a portion thereof, was maintained in a segregated account at the Fund’s custodian as collateral for securities Sold Short (See Note 2(K)). |

| (e) | Exchange-Traded Fund—An investment vehicle that represents a basket of securities that is traded on an exchange. |

| (f) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (g) | As of June 30, 2015, cash in the amount of $17,135,832 was on deposit with brokers for options transactions. |

| (h) | As of June 30, 2015, cash in the amount of $733,392,474 was on deposit with brokers for short sale transactions. |

| (i) | As of June 30, 2015, cost was $3,937,787,153 for federal income tax purposes and net unrealized appreciation was as follows: |

| | | | |

Gross unrealized appreciation | | $ | 587,983,838 | |

Gross unrealized depreciation | | | (170,487,248 | ) |

| | | | |

Net unrealized appreciation | | $ | 417,496,590 | |

| | | | |

| | | | |

| 18 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

As of June 30, 2015, the Fund held the following foreign currency forward contracts1:

| | | | | | | | | | | | | | | | | | | | | | |

Foreign Currency Buy Contracts | | Expiration

Date | | | Counterparty | | Contract

Amount

Purchased | | | Contract

Amount

Sold | | | Unrealized

Appreciation

(Depreciation) | |

Euro vs. U.S. Dollar | | | 8/12/15 | | | Citigroup Global Markets, Inc. | | | EUR | | | | 56,839,888 | | | $ | 63,936,238 | | | $ | (533,814 | ) |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Foreign Currency Sales Contracts | | | | | | | Contract Amount Sold | | | Contract

Amount

Purchased | | | | |

Euro vs. U.S. Dollar | | | 8/12/15 | | | Citigroup Global Markets, Inc. | | | EUR | | | | 446,127,041 | | | $ | 500,599,153 | | | $ | 2,963,832 | |

Euro vs. U.S. Dollar | | | 9/3/15 | | | Credit Suisse International | | | | | | | 408,544,333 | | | | 446,048,703 | | | | (9,811,695 | ) |

Net unrealized appreciation (depreciation) on foreign currency forward contracts | | | | | | | | | | | | | | $ | (7,381,677 | ) |

| 1. | As of June 30, 2015, cash in the amount of $19,700,000 was on deposit with brokers for foreign currency forward contracts. |

As of June 30, 2015, the Fund held the following Futures Contracts1:

| | | | | | | | | | | | | | | | |

Type | | Number of

Contracts

Long

(Short) | | | Expiration

Date | | | Notional

Amount | | | Unrealized

Appreciation

(Depreciation)2 | |

| H-Shares Index | | | 2,983 | | | | July 2015 | | | $ | 248,693,971 | | | $ | (10,168,635 | ) |

| Standard & Poor’s 500 Index Mini | | | (5,241 | ) | | | September 2015 | | | | (538,355,520 | ) | | | 12,236,372 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | (289,661,549 | ) | | $ | 2,067,737 | |

| | | | | | | | | | | | | | | | |

| 1. | As of June 30, 2015, cash in the amount of $75,934,205 was on deposit with brokers for futures transactions. |

| 2. | Represents the difference between the value of the contracts at the time they were opened and the value as of June 30, 2015. |

Written Options1

| | | | | | | | | | | | | | | | | | | | | | | | |

Description | | Counterparty | | | Strike

Price | | | Expiration

Date | | | Number of

Contracts | | | Premium

(Received) | | | Market Value | |

Call-American Express Co., American Style | | | Citibank N.A. | | | $ | 80.00 | | | | 7/17/2015 | | | | (10,000 | ) | | $ | (1,299,976 | ) | | $ | (450,000 | ) |

Put-Blackrock, Inc., American Style | | | Barclays Capital, Inc. | | | | 330.00 | | | | 7/17/2015 | | | | (4,404 | ) | | | (761,892 | ) | | | (836,760 | ) |

| | | | | | | | | | | | | | | | | | | $ | (2,061,868 | ) | | $ | (1,286,760 | ) |

| 1. | As of June 30, 2015, cash in the amount of $17,135,832 was on deposit with brokers for options transactions. |

At June 30, 2015, the Fund held the following OTC credit default swap contract:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reference Entity | | Counterparty | | | Termination

Date | | | Buy/Sell

Protection1 | | | Notional

Amount

(000)2 | | | (Pay)/

Receive

Fixed

Rate3 | | | Upfront

Premiums

Received/

(Paid) | | | Value | | | Unrealized

Appreciation/ (Depreciation)4 | |

Republic of South Africa

5.50%, due 3/9/20 | | | Citibank N.A. | | | | 6/20/2019 | | | | Buy | | | $ | 236,926 | | | | (1.00 | )% | | $ | (10,144,542 | ) | | $ | 6,588,507 | | | $ | (3,556,035 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 6,588,507 | | | $ | (3,556,035 | ) |

| 1. | Buy—Fund pays premium and buys credit protection. If a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| | Sell—Fund receives premium and sells credit protection. If a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| 2. | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap contract. |

| 3. | The annual fixed rate represents the interest received by the Fund (as a seller of protection) or paid by the Fund (as a buyer of protection) annually on the notional amount of the credit default swap contract. |

| 4. | Represents the difference between the value of the credit default swap contracts at the time they were opened and the value at June 30, 2015. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Portfolio of Investments June 30, 2015 (Unaudited) (continued)

The following abbreviations are used in the preceding pages:

ADR—American Depositary Receipt

ETF—Exchange-Traded Fund

EUR—Euro

INR—Indian Rupee

SPDR—Standard & Poor’s Depositary Receipt

USD—United States Dollar

The following is a summary of the fair valuations according to the inputs used as of June 30, 2015, for valuing the Fund’s assets and liabilities.

Asset Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted Prices in Active Markets for

Identical Assets (Level 1) | | | Significant

Other

Observable

Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

| Common Stocks | | | | | | | | | | | | | | | | |

Automobiles | | $ | — | | | $ | 6,549,488 | | | $ | — | | | $ | 6,549,488 | |

All Other Industries | | | 3,299,544,943 | | | | — | | | | — | | | | 3,299,544,943 | |

| | | | | | | | | | | | | | | | |

| Total Common Stocks | | | 3,299,544,943 | | | | 6,549,488 | | | | — | | | | 3,306,094,431 | |

| | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | | | 807,838,204 | | | | — | | | | — | | | | 807,838,204 | |

| Preferred Stock | | | — | | | | 68,389,976 | | | | — | | | | 68,389,976 | |

| Short-Term Investment | | | | | | | | | | | | | | | | |

Money Market Fund | | | 150,000,000 | | | | — | | | | — | | | | 150,000,000 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | | 4,257,383,147 | | | | 74,939,464 | | | | — | | | | 4,332,322,611 | |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Foreign Currency Forward Contracts (b) | | | — | | | | 2,963,832 | | | | — | | | | 2,963,832 | |

Futures Contracts Short (b) | | | 12,236,372 | | | | — | | | | — | | | | 12,236,372 | |

Purchased Call Options | | | 9,093,097 | | | | — | | | | — | | | | 9,093,097 | |

Purchased Put Options | | | 13,868,035 | | | | — | | | | — | | | | 13,868,035 | |

| | | | | | | | | | | | | | | | |

| Total Other Financial Instruments | | | 35,197,504 | | | | 2,963,832 | | | | — | | | | 38,161,336 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities and Other Financial Instruments | | $ | 4,292,580,651 | | | $ | 77,903,296 | | | $ | — | | | $ | 4,370,483,947 | |

| | | | | | | | | | | | | | | | |

Liability Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted Prices in Active Markets for

Identical Assets (Level 1) | | | Significant

Other

Observable

Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments in Securities Sold Short (a) | | | | | | | | | | | | | | | | |

| Common Stocks Sold Short | | $ | (127,795,331 | ) | | $ | — | | | $ | — | | | $ | (127,795,331 | ) |

| Exchange Traded Fund Sold Short | | | (469,357,896 | ) | | | — | | | | — | | | | (469,357,896 | ) |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities Sold Short | | | (597,153,227 | ) | | | — | | | | — | | | | (597,153,227 | ) |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Foreign Currency Forward Contracts (b) | | | — | | | | (10,345,509 | ) | | | — | | | | (10,345,509 | ) |

Futures Contracts Long (b) | | | (10,168,635 | ) | | | — | | | | — | | | | (10,168,635 | ) |

Credit Default Swap Contracts (b) | | | — | | | | (3,556,035 | ) | | | — | | | | (3,556,035 | ) |

Written Options | | | (1,286,760 | ) | | | — | | | | — | | | | (1,286,760 | ) |

| | | | | | | | | | | | | | | | |

| Total Other Financial Instruments | | | (11,455,395 | ) | | | (13,901,544 | ) | | | — | | | | (25,356,939 | ) |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities Sold Short and Other Financial Instruments | | $ | (608,608,622 | ) | | $ | (13,901,544 | ) | | $ | — | | | $ | (622,510,166 | ) |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The value listed for these securities reflects unrealized appreciation (depreciation) as shown on the Portfolio of Investments. |

The Fund recognizes transfers between the levels as of the beginning of the period.

As of June 30, 2015, certain foreign securities with a market value of $1,939,869,331 were transferred from Level 2 to Level 1 as the prices of these securities were based on observable quoted prices in active markets. (See Note 2)

As of June 30, 2015, the Fund did not hold any investments with significant unobservable inputs (Level 3). (See Note 2)

| | | | |