| | | | | | | | |

| | | | | | | | OMB APPROVAL |

| | | | | | | | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response. . . 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31 (MainStay Marketfield Fund)

Date of reporting period: June 30, 2014

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Marketfield Fund, a series of the Registrant.

Item 1. Reports to Stockholders.

MainStay Marketfield Fund

Message from the President, Marketfield Asset Management LLC Six-Month Commentary and Semiannual Report

Unaudited | June 30, 2014

This page intentionally left blank

Message from the President

Once again, it is our pleasure to present the semiannual report for MainStay Marketfield Fund and the Marketfield Asset Management LLC Six-Month Commentary by Michael Aronstein.

Mr. Aronstein is President and Chief Investment Officer of Marketfield Asset Management LLC and the portfolio manager of MainStay Marketfield Fund.

The commentary and the semiannual report include detailed information about the market events, macroeconomic trends and investment decisions that shaped MainStay Marketfield Fund during the six-months ended June 30, 2014.

We hope that you’ll find the following material useful in your ongoing investment planning and review process. While short-term results may vary, we hope that you’ll view them in light of your long-term goals and objectives.

We appreciate your choice of MainStay Marketfield Fund, and we look forward to strengthening our relationship over time.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Marketfield Asset Management LLC Six-Month Commentary

Portfolio Discussion

June represented a better month for performance than the difficult March through May period as a number of our investment themes emerged from the penalty box. This was clearly the case with Japan, where the Nikkei Index gained 3.62% as investors realized that they had overreacted to the increase of the domestic sales tax earlier this year. We remain of the view that Japan’s domestic economy has commenced a period of sustained recovery and have rebuilt our exposure to this market.

We cut back further our exposure to Europe, where we believe the easy money has already been made. Although we do not see much risk of general deterioration, the investor view of Europe has swung 180 degrees over the last 30 months while local conditions have done no more than match our muted expectation that the world (or at least continent) was not ending. We also have some concerns that with domestic liquidity remaining quite tight (at least at the level of the central bank), Europe is overly reliant on a combination of foreign liquidity (QE3 has perhaps been more important here than people realize) and a continued wide current account surplus. The former is always subject to abrupt change while the latter could be expected to have reached a cyclical peak as domestic economic recovery starts to reinvigorate European imports of goods and services.

On the other hand, we feel much better about the prospects for emerging markets, particularly for those with exposure to China, where we believe overall economic activity has stabilized. June saw us add to individual positions, a process which we have continued in July.

Our general theme on reflation (which we view as a precursor to inflation) has also started to perform quite well with a number of commodity-related equities posting gains in June even as commentary fretted about the Chinese economy. We consider this area to be a core holding of our portfolio for reasons which are outlined in our discussion on monetary policy, and it is important that strong equity market performance has been matched in the most part by better-than-expected corporate earnings.

Our exposure to U.S. housing and construction performed well in June, although these gains were subsequently wiped out in July, following poor Census Bureau estimates of New Home sales. For reasons we have discussed at length in our macro research, we continue to be patient with this area, although we can understand why some of our clients may feel less charitable to a sector which has supplied volatility without positive returns for over a year.

On the short side of our portfolio, we have struggled to generate a successful strategy since correctly collapsing our long standing short positions on emerging markets at the start of the year. Our short exposure to utilities proved painful at the end of June when investor allocations were strongly in favor of this group, although some of these losses were recouped in July.

Being short retailers, on the other hand, had little impact on performance in June, and this group has been a notable laggard within the U.S. equity market so far this year. All of these shorts are connected by a belief that cost pressures may be starting to erode corporate margins in certain sectors and can be treated as the intellectual twin of our reflation theme. Thus far, the long side of this story has worked substantially better, which is a reflection of the fact that we remain in the midst of a powerful bull market.

Macroeconomic Commentary

This commentary involves a departure from our normal course. In light of the recent congressional testimony from Janet Yellen and to a somewhat lesser extent, commentary from Mark Carney, Governor of the Bank of England, we consider it important to look closely at the perspectives underlying what is clearly the most radical policy experiment in the annals of central banking.

Our inclination over the years has been to steer clear of specific policy discussions, believing that there is little in the way of insight that we can offer. We have been content to explain the consequences of official actions, be they monetary, regulatory, or administrative.

Current financial conditions are not only unique, but also decisive in driving business and capital markets’ performance. In 2009 and again in Europe in 2011 and Japan in 2012, policy changes towards much greater accommodation were necessary to address inadequacies in bank solvency and systemic liquidity.

In each case, the central bank in question acted after unwarranted delays, having allowed monetary inadequacies to provoke crises and, in the case of Japan, prolonged depression.

We believe that the initial policy changes in response to emergency conditions were entirely necessary and long overdue. Now that we are nearly six years past the panic of ‘08, both the propriety and consequences of central banks’ policy inertia are the major questions for capital markets in the months and years ahead.

Thus far, the main, clear consequences of the monetary abundance that has persisted since 2009 have been various forms of asset price inflation. These episodes, pandemic in nature, underlie the populist concept of income inequality. This is a new slogan attached to a centuries-old economic concept—misallocation of capital—which has long been recognized as a harmful effect of price rises caused by monetary conditions rather than organic changes in supply and demand.

Modern academic economics does not treat hyperbolic asset price appreciation supported by expanding credit in the banking system or capital markets as inflation. A threefold increase in house prices, driven by a record expansion of mortgage credit between 2001 and 2006 was not considered inflationary, although all of the theoretical consequences of inflation and its subsequent reversal were clearly in evidence. The political responses to the misallocation of capital and capital gains were

Not part of the Semiannual Report

very much muted, as the beneficiaries of property inflation were numerous. The process was seen to have a certain egalitarian aspect and hence did not attract the attention of academics, politicians and populist charlatans of all stripes. This contrasts sharply with the current cycle, where the migration of asset inflation to capital assets has enriched those who were already fortunate enough to own or be involved in the movement of these. A panoply of economic pseudo-science has arisen in response.

Because we are concerned with the investment consequences of policy rather than partaking in policy debates, we will leave the question of economic nomenclature alone and concentrate on the probable outcomes of current policy. The difficulty consists in the fact that there are no direct precedents to consider. Current central bank policy is well into uncharted territory. The Bernanke/Yellen voyage makes Lewis and Clark look like backyard campers.

It is clear in listening to the public statements of various central bank heads that political imperatives have taken over from orthodox monetary considerations as the driving force behind policy. Traditional measures of employment will no longer suffice in providing policy guidance. The employment situation, including job quality, real wages, length of workweek, and a host of additional, secondary considerations will now be used to justify and retain the emergency monetary policy long after all traditional measures would argue for change. Central bankers have clearly accepted roles as social engineers in response to populist reaction to their own policies.

One unique feature of the current monetary expansion is its locus beyond banking systems. For most of this cycle, banks in the U.S., Europe, and Japan have been criticized for (among many other things) failing to lend. It is only recently that the overall figures have begun to pick up.

Instead of banks, the agency of credit expansion this time around has been the bond markets. By absorbing a large proportion of fixed-income assets, central banks have accommodated a raft of issuance from all corners. Corporate and sovereign issuers have responded in record fashion, resulting in a buildup of spending power in portions of the global economy over which the Federal Reserve has almost no control.

In prior inflation cycles, the underlying credit structure could be restrained via the Federal Reserve Bank’s direct influence on the banking system of the costs of credit therein. As most bank lending is done at variable rates, tightening through the mechanism of higher-cost federal funds would quickly filter through into the cost and availability of loans, whereas in this cycle, bond issuance has created liquid purchasing power in forms that are largely outside the influence of the Federal Reserve and other central banks.

Since 2003, reserve assets among global sovereigns have risen from slightly less than $3 trillion to, as of July 11, 2014, just over $12 trillion. This has occurred over a period in which global Gross Domestic Product (GDP) has fallen just shy of doubling.

Corporate cash holdings have exhibited similar growth trends, as have assets held in public and private pension funds, endowments, and foundations.

In each of these repositories of liquid and liquefiable assets, a rise in the Federal Funds Rate to one or two percent will have little or no effect on the existing stock of assets. Deposits in the banking system, which have also grown far faster than GDP, will likewise be untouched by a tightening in monetary policy. If anything, their growth rate may increase.

The accumulated mountain of liquid purchasing power and the ability to rapidly liquefy capital assets through fixed-income issuance and wholesale mortgage markets make it unlikely that central bank policy will be able to meaningfully restrain price and wage accelerations in real economies. The liquidity created in this cycle is much more permanent in nature and does not depend on continued bank lending for its perpetuation.

This strikes us as entirely unique.

During every other modern credit inflation, the core of the process was excessive bank lending and deteriorating standards as the cycle progressed. This time, banks are virtually uninvolved, except as unusually robust buyers of bonds in response to nearly impossible regulatory strictures.

If the cycle proceeds as we suspect, corporate demand for capital goods, labor, and capacity, whether through building or buying, will be little constrained by tighter monetary policy. The corporate sector’s unfettered access to bond markets and the fruits of their borrowings during the past four years make it unlikely that they will have to reduce demand in response to anything but the most draconian Federal Reserve policies.

In similar fashion, record (and growing) reserves in the coffers of the world’s sovereigns make it unlikely that any will be forced by lack of means to restrain their expenditures for globally-traded goods in the face of slowing private activity. This has been our point about China, where, despite serious structural issues, their store of liquidity is so vast that the likelihood of a deflationary cataclysm is extremely slight. In fact, their response to GDP sluggishness is likely to be increased spending and credit support in yet-to-be inflated sectors of their economy.

Not part of the Semiannual Report

In practical terms, our sense is that the consequences of what has become reckless monetary policy will become increasingly clear during the remaining part of this year. Our repositioning of our portfolio in recent months has been made with this shift in mind.

July 28, 2014

Michael C. Aronstein

President, CIO & Portfolio Manager

The information provided herein represents the opinion of the Portfolio Manager and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

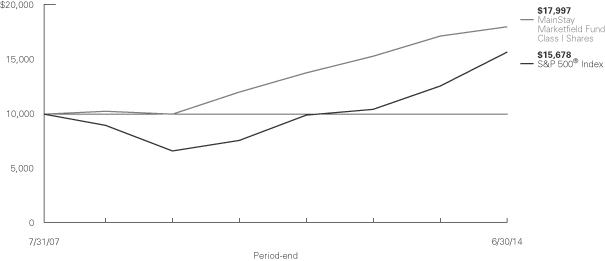

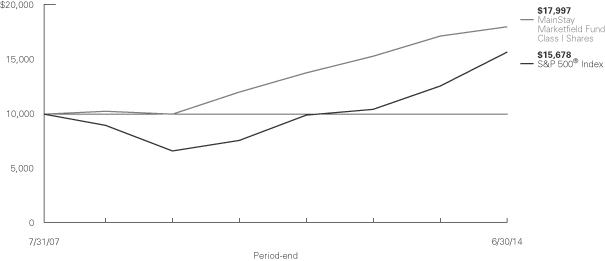

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period Ended June 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Six Months | | | One Year | | | Five Years | | | Since

Inception

(7/31/07) | | | Gross

Expense

Ratio2 | |

| Class A Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –8.93

–3.63 | %

| |

| –1.10

4.66 | %

| |

| 10.95

12.21 | %

| |

| 7.71

8.60 | %

| |

| 2.93

2.93 | %

|

| Investor Class Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –8.93

–3.63 |

| |

| –1.16

4.60 |

| |

| 10.95

12.21 |

| |

| 7.71

8.60 |

| |

| 2.95

2.95 |

|

| Class C Shares3 | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | |

| –4.90

–3.93 |

| |

| 2.91

3.91 |

| |

| 11.39

11.39 |

| |

| 7.79

7.79 |

| |

| 3.68

3.68 |

|

| Class I Shares4 | | No Sales Charge | | | | | –3.51 | | | | 4.94 | | | | 12.49 | | | | 8.86 | | | | 2.66 | |

| Class R2 Shares3 | | No Sales Charge | | | | | –3.69 | | | | 4.54 | | | | 12.09 | | | | 8.48 | | | | 3.05 | |

| Class R6 Shares5 | | No Sales Charge | | | | | –3.40 | | | | 5.06 | | | | 12.51 | | | | 8.88 | | | | 2.72 | |

| Class P Shares6 | | No Sales Charge | | | | | –3.46 | | | | 4.94 | | | | 12.49 | | | | 8.86 | | | | 2.66 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund-share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividends and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Class A, Investor Class, Class C, and Class R2 shares, first offered on October 5, 2012 include the historical performance of Class I shares through October 4, 2012 and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies |

| | based on differences in their fee and expense structures. Marketfield Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes would likely have been different. |

| 4. | Performance figures for Class I shares reflect the historical performance of the then-existing shares of Marketfield Fund (the predecessor to the Fund, which was subject to a different fee structure, and for which a predecessor entity to Marketfield Asset Management LLC served as investment advisor) for periods prior to October 5, 2012. Marketfield Fund commenced operations on July 31, 2007. |

| 5. | Performance figures for Class R6 shares, first offered on June 17, 2013, include the historical performance of Class I shares through June 16, 2013. Performance for Class R6 would likely have been different because of differences in certain expenses attributable to each share class. |

| 6. | Performance figures for Class P shares, first offered on May 31, 2013, include the historical performance of Class I shares through May 30, 2013. Performance for Class P shares would likely have been different because of differences in certain expenses attributable to each share class. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 8 | | MainStay Marketfield Fund |

| | | | | | | | | | | | | | |

| Benchmark Performance | �� | Six

Months | | One

Year | | | Five

Years | | | Since

Inception | |

S&P 500® Index7 | | 7.14% | | | 24.61 | % | | | 18.83 | % | | | 6.72 | % |

Average Lipper Alternative Long/Short Equity Fund8 | | 3.06 | | | 12.14 | | | | 8.35 | | | | 2.94 | |

| 7. | S&P 500® Index is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The S&P 500® Index is the Fund’s broad-based securities market index for comparison purposes. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an Index. |

| 8. | The average Lipper alternative long/short equity fund is representative of funds that employ portfolio strategies combining long holdings of equities |

| | with short sales of equity, equity options, or equity index options. The funds may be either net long or net short, depending on the portfolio manager’s view of the market. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Marketfield Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the period from January 1, 2014, to June 30, 2014, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other Funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2014, to June 30, 2014.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended June 30, 2014. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

1/1/14 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

6/30/14 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

6/30/14 | | | Expenses

Paid

During

Period1 | |

| | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 963.70 | | | $ | 14.27 | | | $ | 1,010.30 | | | $ | 14.60 | |

| | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 963.70 | | | $ | 14.46 | | | $ | 1,010.10 | | | $ | 14.80 | |

| | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 960.70 | | | $ | 17.94 | | | $ | 1,006.50 | | | $ | 18.36 | |

| | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 964.90 | | | $ | 13.01 | | | $ | 1,011.60 | | | $ | 13.32 | |

| | | | | |

| Class R2 Shares | | $ | 1,000.00 | | | $ | 963.10 | | | $ | 14.94 | | | $ | 1,009.60 | | | $ | 15.30 | |

| | | | | |

| Class R6 Shares | | $ | 1,000.00 | | | $ | 966.00 | | | $ | 13.45 | | | $ | 1,011.10 | | | $ | 13.76 | |

| | | | | |

| Class P Shares | | $ | 1,000.00 | | | $ | 965.40 | | | $ | 13.21 | | | $ | 1,011.40 | | | $ | 13.52 | |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of (2.93% for Class A, 2.97% for Investor Class, 3.69% for Class C, 2.67% for Class I, 3.07% for Class R2, 2.76% for Class R6 and 2.71% for Class P) multiplied by the average account value over the period, divided by 365 and multiplied by 181 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| | |

| 10 | | MainStay Marketfield Fund |

Country Composition as of June 30, 2014 (Unaudited)

| | | | |

| United States | | | 56.8 | % |

| Japan | | | 7.8 | |

| Ireland | | | 5.0 | |

| Germany | �� | | 3.3 | |

| United Kingdom | | | 3.2 | |

| Spain | | | 3.0 | |

| Canada | | | 2.7 | |

| Brazil | | | 2.2 | |

| Italy | | | 2.1 | |

| | | | |

| Australia | | | 1.3 | % |

| Taiwan | | | 1.1 | |

| Mexico | | | 1.0 | |

| Switzerland | | | 0.9 | |

| Denmark | | | 0.7 | |

| Other Assets, Less Liabilities | | | 38.4 | |

| Investments Sold Short | | | –29.5 | |

| | | | |

| | | 100.0 | % |

| | | | |

Industry Composition as of June 30, 2014 (Unaudited)

| | | | |

| Metals & Mining | | | 12.2 | % |

| Banks | | | 11.4 | |

| Exchange-Traded Funds | | | 10.4 | |

| Household Durables | | | 6.9 | |

| Real Estate Management & Development | | | 5.0 | |

| Construction Materials | | | 4.6 | |

| Machinery | | | 3.9 | |

| Oil, Gas & Consumable Fuels | | | 3.8 | |

| Chemicals | | | 3.2 | |

| Energy Equipment & Services | | | 2.9 | |

| Semiconductors & Semiconductor Equipment | | | 2.2 | |

| Industrial Conglomerates | | | 1.9 | |

| Internet Software & Services | | | 1.6 | |

| Software | | | 1.5 | |

| Automobiles | | | 1.4 | |

| Trading Companies & Distributors | | | 1.3 | |

| Consumer Finance | | | 1.1 | |

| Auto Components | | | 1.0 | |

| Electronic Equipment, Instruments & Components | | | 1.0 | |

| | | | |

| Food & Staples Retailing | | | 1.0 | % |

| Specialty Retail | | | 1.0 | |

| Aerospace & Defense | | | 0.9 | |

| Miscellaneous | | | 0.9 | |

| Diversified Financial Services | | | 0.8 | |

| Real Estate Investments Trusts | | | 0.8 | |

| Building Products | | | 0.7 | |

| Road & Rail | | | 0.7 | |

| IT Services | | | 0.6 | |

| Transportation Infrastructure | | | 0.6 | |

| Purchased Options | | | 0.4 | |

| Commercial Services & Supplies | | | 0.3 | |

| Hotels, Restaurants & Leisure | | | 0.2 | |

| Electrical Equipment | | | 0.1 | |

| Investment in Money Market Fund | | | 4.8 | |

| Other Assets, Less Liabilities | | | 38.4 | |

| Investments Sold Short | | | –29.5 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Portfolio of Investments beginning on page 14 for specific holdings within these categories.

Top Ten Holdings or Issuers as of June 30, 2014 (excluding short-term investment) (Unaudited)

| 1. | iShares MSCI Japan Index Fund |

| 7. | iShares MSCI Mexico Investable Market Index Fund |

| 9. | BHP Billiton, Ltd., ADR |

Top Five Short Positions as of June 30, 2014 (Unaudited)

| 1. | S&P 500 Index—SPDR Trust Series 1 |

| 2. | Vanguard FTSE Emerging Markets |

| 4. | Consumer Staples Select Sector Consumer Staples SPDR |

| 5. | iShares JP Morgan USD Emerging Markets Bond |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio manager Michael C. Aronstein of Marketfield Asset Management LLC, the Fund’s Subadvisor.

How did MainStay Marketfield Fund perform relative to its benchmark and peers during the six months ended June 30, 2014?

Excluding all sales charges, MainStay Marketfield Fund returned –3.63% for Class A and Investor Class shares and –3.93% for Class C shares for the six months ended June 30, 2014. Over the same period, Class I shares returned –3.51%, Class R2 shares returned –3.69%, Class R6 shares returned –3.40% and Class P shares returned –3.46%. During the six months ended June 30, 2014, all share classes underperformed the 7.14% return of the S&P 500® Index,1 which is the Fund’s broad-based securities-market index. Over the same period, all share classes underperformed the 3.06% return of the average Lipper2 alternative long/short equity fund. See page 8 for Fund returns with applicable sales charges.

What factors affected the Fund’s performance relative to the S&P 500® Index during the reporting period?

The decline in developed-world interest rates negatively impacted the Fund’s short positions in fixed-income futures and fixed-income proxies (e.g., high dividend equities).

The Fund’s long Reflation and long European Recovery themes were primary positive drivers of performance. The short Safe Haven Assets and short Margin Pressures themes were the primary detractors from the Fund’s relative performance.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

We took short positions in long-term developed-world bonds, which negatively affected the Fund’s performance. We used bond futures to express these positions. On a net basis, the various option positions we used during the first half of 2014 detracted from performance.

Which investment themes were the strongest contributors to the Fund’s performance and which themes were particularly weak?

Among the strongest contributors to the Fund’s performance was our Reflation theme, which reflected our view that pricing power is moving upstream in the value chain. (Contributions take weightings and total returns into account.) This theme contributed 1.3% to the Fund’s performance. Our European Recovery theme contributed 0.7% to the Fund’s performance. The rationale for this theme was that depressed European assets were recovering. Our End of the PC Era theme contributed 0.08% to performance. This theme reflected our view that the marketplace had become saturated with legacy computers and software and that the new technology era was likely

to benefit consumer-driven web-based solutions and service providers.

The weakest theme and contribution to performance came from our Safe Haven Assets theme, whose rationale was that assets considered to be “safe haven” assets by investors were over-owned and overvalued, that interest rates had greater risk to

the upside at then-current historic low yields, and that economic fears were subsiding. This theme detracted from performance by 2.2%. Our Margin Pressures theme detracted from performance by 0.9%. This theme reflected our belief that price takers lose out in a capacity-strained economy. Our Emerging Markets theme detracted from performance by 0.6%. The rationale for this theme was that many emerging markets had deteriorating economic fundamentals.

During the reporting period, which individual stocks made the strongest contributions to the Fund’s absolute performance and which stocks were particularly weak?

During the reporting period, the strongest individual positive contributors to the Fund’s absolute performance were long holdings in metals & mining company Alcoa and energy equipment & services companies Schlumberger and Baker Hughes.

Over the same period, the weakest contributions to the Fund’s absolute performance were short holdings in Euro-Oat (French government bond) futures, Euro-Bund (German federal government) futures, and SPDR Select Utilities ETF.

Did the Fund make any significant purchases or sales during the reporting period?

During the reporting period, we increased long exposure to Japan from 8% to 13% of net assets, which included individual equities as well as Tokyo Price Index futures. We increased the Fund’s short Margin Pressures theme from 7% to 20%. During the reporting period, we decreased the Fund’s long European holdings from 26% to 10% of net assets and we decreased our long Capital Spending theme from 27% to 14%.

How did the Fund’s sector weightings change during the reporting period?

We increased the Fund’s weighting in materials by 5.8 percentage points, from 14.2% of net assets at the beginning of the reporting period to 20% as of June 30, 2014. We increased the Fund’s financials position by 5.9 percentage points, from 9.8% to 15.7% of net assets. We decreased the Fund’s consumer discretionary holdings by 1 percentage point, from 10.7% of net assets at the beginning of the reporting period to 9.7% at the end. The Fund’s holdings in industrials declined by 5.3 percentage points, from 15.2% to 9.9% of net assets. We increased the Fund’s technology weighting by 5.3 percentage

| 1. | See footnote on page 9 for more information on the S&P 500® Index. |

| 2. | See footnote on page 9 for more information on Lipper Inc. |

| | |

| 12 | | MainStay Marketfield Fund |

points, from 1.6% to 6.9% of net assets. The Fund’s energy weighting saw a 1.1 percentage point increase from 5.6% of net assets at the beginning of the reporting period to 6.7% as of June 30, 2014.

How was the Fund positioned at the end of the reporting period?

As of June 30, 2014, the equity portion of the Fund was 86% long and 30% short. The net equity exposure was long 56%.3 As of the same date, the futures portion of the Fund was 1% long and 15% short. The net futures exposure was short 14%.

| 3. | See Portfolio of Investments on page 14 for information on specific holdings. |

The opinions expressed are those of the portfolio manager as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Portfolio of Investments June 30, 2014 (Unaudited)

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| Common Stocks 73.8%† | |

Aerospace & Defense 0.9% | | | | | | | | |

Precision Castparts Corp. (a) | | | 705,858 | | | $ | 178,158,559 | |

| | | | | | | | |

| | |

Auto Components 1.0% | | | | | | | | |

Continental A.G. | | | 608,117 | | | | 140,850,323 | |

ElringKlinger A.G. | | | 1,270,875 | | | | 52,441,213 | |

| | | | | | | | |

| | | | | | | 193,291,536 | |

| | | | | | | | |

Automobiles 1.4% | | | | | | | | |

Daimler A.G., Registered Shares | | | 1,460,937 | | | | 136,831,564 | |

Fiat Industrial S.p.A. (b) | | | 13,902,602 | | | | 137,255,594 | |

| | | | | | | | |

| | | | | | | 274,087,158 | |

| | | | | | | | |

Banks 10.0% | | | | | | | | |

Banco Bilbao Vizcaya Argentaria S.A. | | | 7,637,147 | | | | 97,349,310 | |

Banco Popular Espanol S.A. | | | 13,848,123 | | | | 92,535,725 | |

¨Bank of Ireland (b) | | | 970,626,542 | | | | 326,953,484 | |

¨Bank of Ireland, Sponsored ADR (b) | | | 2,136,786 | | | | 29,701,325 | |

Citigroup, Inc. (a) | | | 4,202,869 | | | | 197,955,130 | |

Grupo Financiero Banorte S.A.B. de C.V. Class O | | | 27,266,015 | | | | 194,992,937 | |

Itau Unibanco Holding S.A., ADR (a) | | | 17,348,681 | | | | 249,474,033 | |

Sumitomo Mitsui Financial Group, Inc. | | | 5,569,789 | | | | 233,336,800 | |

U.S. Bancorp | | | 4,730,296 | | | | 204,916,423 | |

UniCredit S.p.A. | | | 18,059,015 | | | | 151,213,031 | |

Wells Fargo & Co. (a) | | | 4,162,458 | | | | 218,778,793 | |

| | | | | | | | |

| | | | | | | 1,997,206,991 | |

| | | | | | | | |

Building Products 0.7% | | | | | | | | |

Geberit A.G. | | | 416,599 | | | | 146,241,846 | |

| | | | | | | | |

| | |

Chemicals 2.9% | | | | | | | | |

Eastman Chemical Co. | | | 2,407,046 | | | | 210,255,468 | |

Potash Corporation of Saskatchewan, Inc. | | | 5,831,807 | | | | 221,375,394 | |

Sherwin-Williams Co. (The) (a) | | | 726,947 | | | | 150,412,604 | |

| | | | | | | | |

| | | | | | | 582,043,466 | |

| | | | | | | | |

Commercial Services & Supplies 0.3% | | | | | |

Bilfinger S.E. | | | 441,323 | | | | 50,314,327 | |

| | | | | | | | |

| | |

Construction Materials 4.6% | | | | | | | | |

Buzzi Unicem S.p.A. | | | 8,356,535 | | | | 140,629,625 | |

CRH PLC | | | 5,739,426 | | | | 147,435,013 | |

Eagle Materials, Inc. (a) | | | 2,554,727 | | | | 240,859,661 | |

HeidelbergCement A.G. | | | 1,649,551 | | | | 140,786,682 | |

¨Taiheiyo Cement Corp. | | | 64,568,797 | | | | 260,047,077 | |

| | | | | | | | |

| | | | | | | 929,758,058 | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Consumer Finance 1.1% | | | | | | | | |

Discover Financial Services (a) | | | 3,465,406 | | | $ | 214,785,864 | |

| | | | | | | | |

| |

Diversified Financial Services 0.8% | | | | | |

CME Group, Inc. | | | 2,390,287 | | | | 169,590,863 | |

| | | | | | | | |

| | |

Electrical Equipment 0.1% | | | | | | | | |

ABB, Ltd. (b) | | | 1,230,066 | | | | 28,324,253 | |

| | | | | | | | |

|

Electronic Equipment, Instruments & Components 1.0% | |

Trimble Navigation, Ltd. (b) | | | 5,441,309 | | | | 201,056,368 | |

| | | | | | | | |

| | |

Energy Equipment & Services 2.9% | | | | | | | | |

¨Baker Hughes, Inc. | | | 3,568,318 | | | | 265,661,275 | |

¨Schlumberger, Ltd. (a) | | | 2,594,725 | | | | 306,047,814 | |

| | | | | | | | |

| | | | | | | 571,709,089 | |

| | | | | | | | |

Food & Staples Retailing 1.0% | | | | | | | | |

Costco Wholesale Corp. (a) | | | 1,819,547 | | | | 209,539,032 | |

| | | | | | | | |

| |

Hotels, Restaurants & Leisure 0.2% | | | | | |

Dalata Hotel Group, Ltd. (b) | | | 11,559,265 | | | | 47,414,671 | |

| | | | | | | | |

| | |

Household Durables 6.9% | | | | | | | | |

D.R. Horton, Inc. (a) | | | 8,812,670 | | | | 216,615,428 | |

Lennar Corp. Class A (a) | | | 4,886,607 | | | | 205,139,762 | |

Mohawk Industries, Inc. (a)(b) | | | 1,398,874 | | | | 193,520,229 | |

PulteGroup, Inc. (a) | | | 9,735,337 | | | | 196,264,394 | |

Ryland Group, Inc. (The) (a) | | | 4,452,901 | | | | 175,622,415 | |

Sekisui House, Ltd. | | | 14,232,374 | | | | 195,141,084 | |

Toll Brothers, Inc. (a)(b) | | | 5,345,054 | | | | 197,232,493 | |

| | | | | | | | |

| | | | | | | 1,379,535,805 | |

| | | | | | | | |

Industrial Conglomerates 1.9% | | | | | | | | |

3M Co. (a) | | | 1,357,845 | | | | 194,497,718 | |

General Electric Co. (a) | | | 6,838,535 | | | | 179,716,700 | |

| | | | | | | | |

| | | | | | | 374,214,418 | |

| | | | | | | | |

Internet Software & Services 1.6% | | | | | | | | |

¨Facebook, Inc. Class A (a)(b) | | | 4,843,985 | | | | 325,951,751 | |

| | | | | | | | |

| | |

IT Services 0.6% | | | | | | | | |

Amadeus IT Holding S.A. Class A | | | 2,848,293 | | | | 117,473,073 | |

| | | | | | | | |

| | |

Machinery 3.9% | | | | | | | | |

Cummins, Inc. (a) | | | 1,348,008 | | | | 207,984,155 | |

Deere & Co. (a) | | | 2,078,902 | | | | 188,244,576 | |

Fanuc Corp. | | | 1,003,830 | | | | 173,110,015 | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers, as of June 30, 2014, excluding short-term investments. May be subject to change daily. |

| | | | |

| 14 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Machinery (continued) | | | | | | | | |

Joy Global, Inc. (a) | | | 3,397,250 | | | $ | 209,202,655 | |

| | | | | | | | |

| | | | | | | 778,541,401 | |

| | | | | | | | |

Metals & Mining 12.2% | | | | | | | | |

¨Alcoa, Inc. (a) | | | 24,101,860 | | | | 358,876,695 | |

Allegheny Technologies, Inc. | | | 2,667,417 | | | | 120,300,507 | |

Anglo American PLC | | | 2,649,744 | | | | 64,847,231 | |

¨BHP Billiton, Ltd., ADR | | | 3,877,110 | | | | 265,388,179 | |

Carpenter Technology Corp. | | | 1,663,006 | | | | 105,185,130 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 5,804,856 | | | | 211,877,244 | |

Nippon Steel & Sumitomo Metal Corp. | | | 65,550,397 | | | | 209,647,388 | |

Nucor Corp. | | | 4,025,498 | | | | 198,255,776 | |

Rio Tinto PLC | | | 3,412,140 | | | | 181,521,968 | |

Silver Wheaton Corp. | | | 5,989,476 | | | | 157,343,535 | |

Steel Dynamics, Inc. (a) | | | 10,169,161 | | | | 182,536,440 | |

Teck Resources, Ltd. Class B (a) | | | 7,573,287 | | | | 172,898,142 | |

Vale S.A., Sponsored ADR | | | 14,407,699 | | | | 190,613,858 | |

Walter Energy, Inc. | | | 4,804,521 | | | | 26,184,639 | |

| | | | | | | | |

| | | | | | | 2,445,476,732 | |

| | | | | | | | |

Miscellaneous 0.9% | | | | | | | | |

Merlin Properties Socimi S.A. (b) | | | 12,998,275 | | | | 171,755,927 | |

| | | | | | | | |

| |

Oil, Gas & Consumable Fuels 3.8% | | | | | |

Alpha Natural Resources, Inc. (a)(b) | | | 10,939,170 | | | | 40,584,321 | |

Chesapeake Energy Corp. (a) | | | 7,409,289 | | | | 230,280,702 | |

Devon Energy Corp. (a) | | | 3,159,471 | | | | 250,861,997 | |

EOG Resources, Inc. | | | 2,121,551 | | | | 247,924,450 | |

| | | | | | | | |

| | | | | | | 769,651,470 | |

| | | | | | | | |

Real Estate Investment Trusts 0.8% | | | | | |

Green REIT PLC (b) | | | 61,346,244 | | | | 103,321,758 | |

Hibernia REIT PLC (b) | | | 34,883,746 | | | | 53,020,619 | |

| | | | | | | | |

| | | | | | | 156,342,377 | |

| | | | | | | | |

Real Estate Management & Development 5.0% | |

Deutsche Wohnen A.G. | | | 3,648,956 | | | | 78,695,135 | |

Kennedy Wilson Europe Real Estate PLC (b) | | | 12,733,477 | | | | 239,712,770 | |

Mitsubishi Estate Co., Ltd. | | | 10,119,999 | | | | 249,840,753 | |

St. Joe Co. (The) (a)(b) | | | 7,471,432 | | | | 189,998,516 | |

Sumitomo Realty & Development Co., Ltd. | | | 5,655,045 | | | | 242,658,118 | |

| | | | | | | | |

| | | | | | | 1,000,905,292 | |

| | | | | | | | |

Road & Rail 0.7% | | | | | | | | |

DSV A/S | | | 4,119,552 | | | | 134,295,799 | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Semiconductors & Semiconductor Equipment 2.2% | |

Intel Corp. | | | 7,365,138 | | | $ | 227,582,764 | |

Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (a) | | | 10,085,395 | | | | 215,726,599 | |

| | | | | | | | |

| | | | | | | 443,309,363 | |

| | | | | | | | |

Software 1.5% | | | | | | | | |

FireEye, Inc. (b) | | | 3,512,680 | | | | 142,439,174 | |

Splunk, Inc. (a)(b) | | | 2,702,084 | | | | 149,506,308 | |

| | | | | | | | |

| | | | | | | 291,945,482 | |

| | | | | | | | |

Specialty Retail 1.0% | | | | | | | | |

Home Depot, Inc. (The) (a) | | | 2,547,039 | | | | 206,208,277 | |

| | | | | | | | |

|

Trading Companies & Distributors 1.3% | |

Beacon Roofing Supply, Inc. (a)(b) | | | 3,412,861 | | | | 113,033,956 | |

Wolseley PLC | | | 2,760,523 | | | | 151,321,204 | |

| | | | | | | | |

| | | | | | | 264,355,160 | |

| | | | | | | | |

Transportation Infrastructure 0.6% | | | | | | | | |

Abertis Infraestructuras S.A. | | | 5,574,385 | | | | 128,272,682 | |

| | | | | | | | |

Total Common Stocks

(Cost $12,602,482,255) | | | | | | | 14,781,757,090 | |

| | | | | | | | |

|

| Exchange-Traded Funds 10.4% (c) | |

iShares Dow Jones U.S. Home Construction Index Fund (a) | | | 9,372,379 | | | | 232,434,999 | |

¨iShares MSCI Japan Index Fund | | | 63,346,250 | | | | 762,688,850 | |

¨iShares MSCI Mexico Investable Market Index Fund (a) | | | 4,083,080 | | | | 276,873,655 | |

Market Vectors Agribusiness ETF (a) | | | 4,612,334 | | | | 253,724,493 | |

Market Vectors Gold Miners ETF (a) | | | 8,648,701 | | | | 228,758,142 | |

¨SPDR S&P Homebuilders | | | 10,000,000 | | | | 327,500,000 | |

| | | | | | | | |

Total Exchange-Traded Funds

(Cost $1,999,642,736) | | | | | | | 2,081,980,139 | |

| | | | | | | | |

| | |

| Preferred Stocks 1.7% | | | | | | | | |

Banks 1.4% | | | | | | | | |

¨Bank of Ireland Trust-Preferred Security 10.24% (d) | | | 192,001,000 | | | | 289,197,727 | |

| | | | | | | | |

| | |

Chemicals 0.3% | | | | | | | | |

Fuchs Petrolub SE 2.09% | | | 1,151,340 | | | | 52,057,027 | |

| | | | | | | | |

Total Preferred Stocks

(Cost $310,196,732) | | | | | | | 341,254,754 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Portfolio of Investments June 30, 2014 (Unaudited) (continued)

| | | | | | | | |

| | | Notional

Amount | | | Value | |

| Purchased Options 0.4% | | | | | | | | |

Purchased Call Options 0.2% | | | | | | | | |

CNH/USD | | | | | | | | |

Strike Price $6.167

Expires 2/27/15 | | | 1,421,932,700 | | | $ | 28,819,732 | |

Strike Price $6.722

Expires 12/9/14 | | | 1,401,000,000 | | | | 491,751 | |

| | |

| | | | | | | | |

| | | Number of

Contracts | | | | |

iShares Russell 2000 ETF

Strike Price $117.00

Expires 7/19/14 | | | 75,731 | | | | 16,888,013 | |

| | | | | | | | |

Total Purchased Call Options

(Cost $55,136,485) | | | | | | | 46,199,496 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Notional

Amount | | | | |

Purchased Put Options 0.2% | | | | | | | | |

EUR/USD | | | | | | | | |

Strike Price $1.376

Expires 9/4/14 | | | 1,042,640,877 | | | | 14,513,881 | |

Strike Price $1.379

Expires 9/4/14 | | | 1,042,052,227 | | | | 16,347,792 | |

| | | | | | | | |

Total Purchased Put Options

(Cost $60,351,462) | | | | | | | 30,861,673 | |

| | | | | | | | |

Total Purchased Options

(Cost $115,487,947) | | | | | | | 77,061,169 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| Short-Term Investment 4.8% | |

Money Market Fund 4.8% | | | | | | | | |

State Street Institutional Treasury Money Market Fund | | | 950,000,000 | | | | 950,000,000 | |

| | | | | | | | |

Total Short-Term Investment

(Cost $950,000,000) | | | | | | | 950,000,000 | |

| | | | | | | | |

Total Investments, Before Investments Sold Short

(Cost $15,977,809,670) (h) | | | 91.1 | % | | | 18,232,053,152 | |

| | | | | | | | |

|

| Common Stocks Sold Short (13.4%) | |

Air Freight & Logistics (0.6%) | | | | | | | | |

C.H. Robinson Worldwide, Inc. | | | (1,772,317 | ) | | | (113,056,101 | ) |

| | | | | | | | |

| | |

Beverages (1.2%) | | | | | | | | |

Coca-Cola Co. (The) | | | (5,488,583 | ) | | | (232,496,376 | ) |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

Capital Markets (0.7%) | | | | | | | | |

Deutsche Bank A.G. | | | (3,739,121 | ) | | $ | (131,557,872 | ) |

| | | | | | | | |

| | |

Electric Utilities (1.3%) | | | | | | | | |

Southern Co. | | | (5,904,588 | ) | | | (267,950,204 | ) |

| | | | | | | | |

| | |

Food & Staples Retailing (0.6%) | | | | | | | | |

Whole Foods Market, Inc. | | | (3,239,040 | ) | | | (125,124,115 | ) |

| | | | | | | | |

| | |

Food Products (2.2%) | | | | | | | | |

Danone | | | (3,281,498 | ) | | | (243,719,638 | ) |

Nestle S.A. | | | (2,560,648 | ) | | | (198,372,257 | ) |

| | | | | | | | |

| | | | | | | (442,091,895 | ) |

| | | | | | | | |

Insurance (2.2%) | | | | | | | | |

Allianz SE | | | (2,570,191 | ) | | | (428,306,511 | ) |

| | | | | | | | |

| | |

Multi-Utilities (3.9%) | | | | | | | | |

Consolidated Edison, Inc. | | | (3,921,557 | ) | | | (226,430,701 | ) |

PG&E Corp. | | | (5,674,937 | ) | | | (272,510,475 | ) |

Public Service Enterprise Group, Inc. | | | (3,373,938 | ) | | | (137,622,931 | ) |

Wisconsin Energy Corp. | | | (3,206,509 | ) | | | (150,449,402 | ) |

| | | | | | | | |

| | | | | | | (787,013,509 | ) |

| | | | | | | | |

Textiles, Apparel & Luxury Goods (0.7%) | |

Adidas A.G. | | | (1,460,257 | ) | | | (147,905,259 | ) |

| | | | | | | | |

Total Common Stocks Sold Short

(Proceeds $2,586,132,546) | | | | | | | (2,675,501,842 | ) |

| | | | | | | | |

|

| Exchange-Traded Funds Sold Short (16.1%) (c) | |

Consumer Staples Select Sector Consumer Staples SPDR | | | (13,469,945 | ) | | | (601,028,946 | ) |

iShares JP Morgan USD Emerging Markets Bond | | | (3,793,905 | ) | | | (437,323,429 | ) |

S&P 500 Index—SPDR Trust Series 1 | | | (4,110,128 | ) | | | (804,434,252 | ) |

SPDR S&P Retail ETF | | | (7,599,843 | ) | | | (659,666,372 | ) |

Vanguard FTSE Emerging Markets | | | (16,849,266 | ) | | | (726,708,843 | ) |

| | | | | | | | |

Total Exchange-Traded Funds Sold Short

(Cost $3,122,444,348) | | | | | | | (3,229,161,842 | ) |

| | | | | | | | |

Total Investments Sold Short

(Proceeds $5,708,576,894) (e) | | | (29.5 | )% | | | (5,904,663,684 | ) |

| | | | | | | | |

Total Investments, Net of Investments Sold Short

(Cost $10,269,232,776) | | | 61.6 | | | | 12,327,389,468 | |

Other Assets, Less Liabilities | | | 38.4 | | | | 7,698,952,831 | |

Net Assets | | | 100.0 | % | | $ | 20,026,342,299 | |

| | | | |

| 16 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Contracts

Long | | | Unrealized

Appreciation

(Depreciation) (g) | |

| Futures Contracts (0.2%) | | | | | | | | |

Yen Denom Nikkei September 2014 (f) | | | 3,606 | | | $ | 76,388 | |

| | | | | | | | |

Total Futures Contracts Long (Notional Amount $269,902,720) | | | | | | | 76,388 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Contracts

Short | | | | |

CAC 40 Index 10 Euro July 2014 (f) | | | (6,180 | ) | | | 7,541,451 | |

Euro-Bund (German Federal Government) August 2014 (f) | | | (5,420 | ) | | | (15,820,047 | ) |

Euro-OAT (French Government Bond) August 2014 (f) | | | (8,483 | ) | | | (31,846,039 | ) |

| | | | | | | | |

Total Futures Contracts Short

(Notional Amount $3,097,617,130) | | | | | | | (40,124,635 | ) |

| | | | | | | | |

Total Futures Contracts

(Notional Amount $2,827,714,410) | | | | | | $ | (40,048,247 | ) |

| | | | | | | | |

| (a) | Security, or a portion thereof, was maintained in a segregated account at the Fund’s custodian as collateral for securities sold short (See Note 2(J)). |

| (b) | Non-income producing security. |

| (c) | Exchange-Traded Fund—An investment vehicle that represents a basket of securities that is traded on an exchange. |

| (d) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (e) | As of June 30, 2014, cash in the amount of $5,961,483,341 was on deposit with brokers for short sale transactions. |

| (f) | As of June 30, 2014, cash in the amount of $121,527,005 was on deposit with brokers for futures transactions. |

| (g) | Represents the difference between the value of the contracts at the time they were opened and the value as of June 30, 2014. |

| (h) | As of June 30, 2014, cost was $16,014,621,349 for federal income tax purposes and net unrealized appreciation was as follows: |

| | | | |

Gross unrealized appreciation | | $ | 2,611,206,841 | |

Gross unrealized depreciation | | | (393,775,038 | ) |

| | | | |

Net unrealized appreciation | | $ | 2,217,431,803 | |

| | | | |

The following abbreviations are used in the above portfolio:

ADR—American Depositary Receipt

CNH—Chinese Offshore Yuan

ETF—Exchange-Traded Fund

EUR—Euro

SPDR—Standard & Poor’s Depositary Receipt

USD—United States Dollar

At June 30, 2014, the Fund held the following OTC credit default swap contract:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reference Entity | | Counterparty | | | Termination

Date | | | Buy/Sell

Protection1 | | | Notional

Amount

(000)2 | | | (Pay)/ Receive

Fixed

Rate3 | | | Upfront

Premiums

Received/ (Paid) | | | Value | | | Unrealized

Appreciation/

Depreciation4 | |

Republic of South Africa

5.50%, due 3/9/20 | | | Citigroup | | | | 6/20/2019 | | | | Buy | | | $ | 236,926 | | | | 1.00 | % | | $ | (12,698,168 | ) | | $ | 7,856,092 | | | $ | (4,842,076 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 7,856,092 | | | $ | (4,842,076 | ) |

| 1. | Buy—Fund pays premium and buys credit protection. If a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| | Sell—Fund receives premium and sells credit protection. If a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| 2. | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap contract. |

| 3. | The annual fixed rate represents the interest received by the Fund (as a seller of protection) or paid by the Fund (as a buyer of protection) annually on the notional amount of the credit default swap contract. |

| 4. | Represents the difference between the value of the credit default swap contracts at the time they were opened and the value at June 30, 2014. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Portfolio of Investments June 30, 2014 (Unaudited) (continued)

The following is a summary of the fair valuations according to the inputs used as of June 30, 2014, for valuing the Fund’s assets and liabilities.

Asset Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets (Level 1) | | | Significant

Other

Observable

Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 14,781,757,090 | | | $ | — | | | $ | — | | | $ | 14,781,757,090 | |

| Exchange-Traded Funds | | | 2,081,980,139 | | | | — | | | | — | | | | 2,081,980,139 | |

| Preferred Stocks | | | 52,057,027 | | | | 289,197,727 | | | | — | | | | 341,254,754 | |

| Short-Term Investment | | | | | | | | | | | | | | | | |

Money Market Fund | | | 950,000,000 | | | | — | | | | — | | | | 950,000,000 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | | 17,865,794,256 | | | | 289,197,727 | | | | — | | | | 18,154,991,983 | |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Futures Contracts Long (b) | | | 76,388 | | | | — | | | | — | | | | 76,388 | |

Futures Contracts Short (b) | | | 7,541,451 | | | | — | | | | — | | | | 7,541,451 | |

Purchased Call Options | | | 46,199,496 | | | | — | | | | — | | | | 46,199,496 | |

Purchased Put Options | | | 30,861,673 | | | | — | | | | — | | | | 30,861,673 | |

| | | | | | | | | | | | | | | | |

| Total Other Financial Instruments | | | 84,679,008 | | | | — | | | | — | | | | 84,679,008 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities and Other Financial Instruments | | $ | 17,950,473,264 | | | $ | 289,197,727 | | | $ | — | | | $ | 18,239,670,991 | |

| | | | | | | | | | | | | | | | |

Liability Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets (Level 1) | | | Significant

Other

Observable

Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments in Securities Sold Short (a) | | | | | | | | | | | | | | | | |

| Common Stocks Sold Short | | $ | (2,675,501,842 | ) | | $ | — | | | $ | — | | | $ | (2,675,501,842 | ) |

| Exchange-Traded Funds Sold Short | | | (3,229,161,842 | ) | | | — | | | | — | | | | (3,229,161,842 | ) |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities Sold Short | | | (5,904,663,684 | ) | | | — | | | | — | | | | (5,904,663,684 | ) |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Futures Contracts Short (b) | | | (47,666,086 | ) | | | — | | | | — | | | | (47,666,086 | ) |

Credit Default Swap Contracts | | | — | | | | (4,842,076 | ) | | | — | | | | (4,842,076 | ) |

| | | | | | | | | | | | | | | | |

| Total Other Financial Instruments | | | (47,666,086 | ) | | | (4,842,076 | ) | | | — | | | | (52,508,162 | ) |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities Sold Short and Other Financial Instruments | | $ | (5,952,329,770 | ) | | $ | (4,842,076 | ) | | $ | — | | | $ | (5,957,171,846 | ) |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The value listed for these securities reflects unrealized appreciation (depreciation) as shown on the Portfolio of Investments. |

The Fund recognizes transfers between the levels as of the beginning of the period.

For the period ended June 30, 2014, the Fund did not have any transfers between Level 1 and Level 2 fair value measurements. (See Note 2)

As of June 30, 2014, the Fund did not hold any investments with significant unobservable inputs (Level 3). (See Note 2)

| | | | |

| 18 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Assets and Liabilities as of June 30, 2014 (Unaudited)

| | | | |

| Assets | |

Investment in securities, at value

(identified cost $15,977,809,670) | | $ | 18,232,053,152 | |

Cash collateral on deposit at broker | | | 6,083,010,346 | |

Cash | | | 1,601,390,521 | |

Cash denominated in foreign currencies

(identified cost $1,448,120) | | | 1,456,036 | |

Receivables: | | | | |

Investment securities sold | | | 339,203,212 | |

Fund shares sold | | | 39,245,345 | |

Dividends and interest | | | 34,805,304 | |

Premiums paid for swap contracts | | | 12,698,168 | |

Other assets | | | 762,866 | |

| | | | |

Total assets | | | 26,344,624,950 | |

| | | | |

|

| Liabilities | |

Investments sold short (proceeds $5,708,576,894) | | | 5,904,663,684 | |

Payables: | | | | |

Investment securities purchased | | | 266,359,072 | |

Fund shares redeemed | | | 57,032,648 | |

Unrealized depreciation on futures contracts (a) | | | 40,048,247 | |

Manager (See Note 3) | | | 22,915,019 | |

Dividends on investments sold short | | | 13,525,913 | |

Broker fees and charges on short sales | | | 4,366,036 | |

Transfer agent (See Note 3) | | | 2,381,676 | |

NYLIFE Distributors (See Note 3) | | | 1,877,676 | |

Professional fees | | | 166,427 | |

Custodian | | | 53,194 | |

Trustees | | | 26,009 | |

Shareholder communication | | | 24,974 | |

Unrealized depreciation on swap contracts | | | 4,842,076 | |

| | | | |

Total liabilities | | | 6,318,282,651 | |

| | | | |

Net assets | | $ | 20,026,342,299 | |

| | | | |

|

| Composition of Net Assets | |

Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | | $ | 1,122,774 | |

Additional paid-in capital | | | 18,723,309,793 | |

| | | | |

| | | 18,724,432,567 | |

Net investment loss | | | (141,429,440 | ) |

Accumulated net realized gain (loss) on investments, investments sold short, futures transactions, written options, swap transactions and foreign currency transactions | | | (570,853,027 | ) |

Net unrealized appreciation (depreciation) on investments, futures contracts and swap contracts | | | 2,209,353,159 | |

Net unrealized appreciation (depreciation) on investments sold short | | | (196,086,790 | ) |

Net unrealized appreciation (depreciation) on translation of other assets and liabilities in foreign currencies | | | 925,830 | |

| | | | |

Net assets | | $ | 20,026,342,299 | |

| | | | |

| | | | |

Class A | | | | |

Net assets applicable to outstanding shares | | $ | 1,876,014,687 | |

| | | | |

Shares of beneficial interest outstanding | | | 105,371,980 | |

| | | | |

Net asset value per share outstanding | | $ | 17.80 | |

Maximum sales charge (5.50% of offering price) | | | 1.04 | |

| | | | |

Maximum offering price per share outstanding | | $ | 18.84 | |

| | | | |

Investor Class | | | | |

Net assets applicable to outstanding shares | | $ | 16,378,201 | |

| | | | |

Shares of beneficial interest outstanding | | | 919,855 | |

| | | | |

Net asset value per share outstanding | | $ | 17.81 | |

Maximum sales charge (5.50% of offering price) | | | 1.04 | |

| | | | |

Maximum offering price per share outstanding | | $ | 18.85 | |

| | | | |

Class C | | | | |

Net assets applicable to outstanding shares | | $ | 1,797,124,189 | |

| | | | |

Shares of beneficial interest outstanding | | | 102,239,773 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.58 | |

| | | | |

Class I | | | | |

Net assets applicable to outstanding shares | | $ | 16,049,779,074 | |

| | | | |

Shares of beneficial interest outstanding | | | 898,170,974 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.87 | |

| | | | |

Class R2 | | | | |

Net assets applicable to outstanding shares | | $ | 24,217,913 | |

| | | | |

Shares of beneficial interest outstanding | | | 1,363,662 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.76 | |

| | | | |

Class R6 | | | | |

Net assets applicable to outstanding shares | | $ | 7,670,700 | |

| | | | |

Shares of beneficial interest outstanding | | | 428,736 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.89 | |

| | | | |

Class P | | | | |

Net assets applicable to outstanding shares | | $ | 255,157,535 | |

| | | | |

Shares of beneficial interest outstanding | | | 14,279,408 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.87 | |

| | | | |

| (a) | Represents the difference between the value of the contracts at the time they were opened and the value as of June 30, 2014. Margin payments are not paid or received daily. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Statement of Operations for the six months ended June 30, 2014 (Unaudited)

| | | | | |

| Investment Income (Loss) | |

Income | | | | | |

Dividends (a) | | | $ | 152,551,269 | |

Interest | | | | 13,132,510 | |

| | | | | |

Total income | | | | 165,683,779 | |

| | | | | |

Expenses | | | | | |

Manager (See Note 3) | | | | 141,786,369 | |

Dividends on investments sold short | | | | 93,230,196 | |

Broker fees and charges on short sales | | | | 25,892,345 | |

Distribution/Service—Class A (See Note 3) | | | | 2,369,432 | |

Distribution/Service—Investor Class (See Note 3) | | | | 18,798 | |

Distribution/Service—Class C (See Note 3) | | | | 8,755,227 | |

Distribution/Service—Class R2 (See Note 3) | | | | 27,741 | |

Transfer agent (See Note 3) | | | | 9,477,318 | |

Registration | | | | 1,375,747 | |

Shareholder communication | | | | 706,073 | |

Custodian | | | | 431,425 | |

Professional fees | | | | 334,747 | |

Trustees | | | | 174,525 | |

Shareholder service—Class R2 (See Note 3) | | | | 11,096 | |

Miscellaneous | | | | 158,971 | |

| | | | | |

Total expenses | | | | 284,750,010 | |

| | | | | |

Net investment income (loss) | | | | (119,066,231 | ) |

| | | | | |

|

Realized and Unrealized Gain (Loss)

on Investments, Futures

Contracts, Written Options,

Swap Contracts and

Foreign Currency Transactions | |

Net realized gain (loss) on: | | | | | |

Investment transactions | | | | 252,256,324 | |

Investments sold short | | | | (376,518,659 | ) |

Futures transactions | | | | (213,651,398 | ) |

Written option transactions | | | | 11,326,570 | |

Swap transactions | | | | (27,933,310 | ) |

Foreign currency transactions | | | | 1,569,328 | |

Net increase from payment by affiliates (Note 3) | | | | 1,282,342 | |

| | | | | |

Net realized gain (loss) on investments, investments sold short, futures transactions, written option transactions, swap transactions and foreign currency transactions | | | | (351,668,803 | ) |

| | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | |

Investments | | | | (320,433,984 | ) |

Investments sold short | | | | 84,698,336 | |

Futures contracts | | | | (66,144,379 | ) |

Swap contracts | | | | (4,230,702 | ) |

Translation of other assets and liabilities in foreign currencies | | | | 836,491 | |

| | | | | |

Net change in unrealized appreciation (depreciation) on investments, investments sold short, futures contracts, swap contracts and foreign currency transactions | | | | (305,274,238 | ) |

| | | | | |

Net realized and unrealized gain (loss) on investments, investments sold short, futures transactions, written options, swap transactions and foreign currency transactions | | | | (656,943,041 | ) |

| | | | | |

Net increase (decrease) in net assets resulting from operations | | | $ | (776,009,272 | ) |

| | | | | |

| (a) | Dividends recorded net of foreign withholding taxes in the amount of $8,405,019. |

| | | | |

| 20 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statements of Changes in Net Assets

for the six months ended June 30, 2014 (Unaudited) and the year ended December 31, 2013

| | | | | | | | |

| | | 2014 | | | 2013 | |

| Increase (Decrease) in Net Assets | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (119,066,231 | ) | | $ | (160,390,429 | ) |

Net realized gain (loss) on investments, investments sold short, futures transactions, written option transactions, swap transactions and foreign currency transactions | | | (351,668,803 | ) | | | (155,701,363 | ) |

Net change in unrealized appreciation (depreciation) on investments, investments sold short, futures contracts, swap contracts and foreign currency transactions | | | (305,274,238 | ) | | | 1,929,726,445 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (776,009,272 | ) | | | 1,613,634,653 | |

| | | | |

Dividends to shareholders: | | | | | | | | |

From net investment income: | | | | | | | | |

Class A | | | — | | | | (185,252 | ) |

Investor Class | | | — | | | | (1,320 | ) |

Class C | | | — | | | | (172,240 | ) |

Class I | | | — | | | | (1,727,880 | ) |

Class R2 | | | — | | | | (1,849 | ) |

Class R6 | | | — | | | | (256 | ) |

Class P | | | — | | | | (20,583 | ) |

| | | | |

Total dividends to shareholders | | | — | | | | (2,109,380 | ) |

| | | | |

Capital share transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 5,286,288,343 | | | | 15,259,206,171 | |

Net asset value of shares issued to shareholders in reinvestment of dividends | | | — | | | | 1,639,832 | |

Cost of shares redeemed | | | (3,880,181,851 | ) | | | (1,883,248,334 | ) |

| | | | |

Increase (decrease) in net assets derived from capital share transactions | | | 1,406,106,492 | | | | 13,377,597,669 | |

| | | | |

Net increase (decrease) in net assets | | | 630,097,220 | | | | 14,989,122,942 | |

|

| Net Assets | |

Beginning of period | | | 19,396,245,079 | | | | 4,407,122,137 | |

| | | | |

End of period | | | 20,026,342,299 | | | | 19,396,245,079 | |

| | | | |

Net investment loss at end of period | | $ | (141,429,440 | ) | | $ | (22,363,209 | ) |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 21 | |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | |

| Class A | | Six months

ended

June 30,

2014* | | | Year ended

December 31,

2013 | | | October 5,

2012**

through

December 31,

2012 | |

Net asset value at beginning of period | | $ | 18.47 | | | $ | 15.84 | | | $ | 15.80 | † |

| | | | | | | | | | | | |

Net investment income (loss) (a) | | | (0.12 | ) | | | (0.28 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) on investments | | | (0.55 | ) | | | 2.91 | | | | 0.15 | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | 0.00 | ‡ | | | 0.00 | ‡ | | | — | |

| | | | | | | | | | | | |

Total from investment operations | | | (0.67 | ) | | | 2.63 | | | | 0.11 | |

| | | | | | | | | | | | |

| Less dividends and distributions: | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.00 | )‡ | | | — | |

From net realized gain on investments | | | — | | | | — | | | | (0.07 | ) |

| | | | | | | | | | | | |

Total dividends and distributions | | | — | | | | (0.00 | )‡ | | | (0.07 | ) |

| | | | | | | | | | | | |

Net asset value at end of period | | $ | 17.80 | | | $ | 18.47 | | | $ | 15.84 | |

| | | | | | | | | | | | |

Total investment return | | | (3.63 | %)(b) | | | 16.60 | % (c) | | | 0.72 | % (b)(d) |

| Ratios of expenses to average net assets (e): | | | | | | | | | | | | |

Before waivers/reimbursements of expenses | | | 2.93 | % †† | | | 2.87 | % | | | 4.07 | % †† |

Excluding dividends and interest expense on short positions | | | 1.76 | % †† | | | 1.78 | % | | | 1.80 | % †† |

After waivers/reimbursements of expenses | | | 2.93 | % †† | | | 2.87 | % | | | 4.07 | % †† |

Excluding dividends and interest expense on short positions | | | 1.76 | % †† | | | 1.78 | % | | | 1.80 | % †† |

| Ratio of net investment loss to average net assets: | | | | | | | | | | | | |

Before waivers/reimbursements of expenses (f) | | | (1.30 | %)†† | | | (1.59 | %) | | | (1.13 | %)†† |

After waivers/reimbursements of expenses (f) | | | (1.30 | %)†† | | | (1.59 | %) | | | (1.13 | %)†† |

Short sale expenses | | | 1.17 | % †† | | | 1.09 | % | | | 2.27 | % †† |

Portfolio turnover rate | | | 45 | % | | | 32 | % | | | 66 | % |

Net assets at end of period (in 000’s) | | $ | 1,876,015 | | | $ | 1,718,301 | | | $ | 137,056 | |

| † | Based on the net asset value of Class I as of October 5, 2012. |

| ‡ | Rounds to less than 0.5 cent per share. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is not annualized. |

| (c) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (d) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| (e) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro-rata share of the fees and expenses of the Exchange-Traded Funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (f) | The net investment loss ratios include dividends and interest expense on short positions. |

| | | | |

| 22 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | |

| Investor Class | | Six months

ended

June 30,

2014* | | | Year ended

December 31,

2013 | | | October 5,

2012**

through

December 31,

2012 | |

Net asset value at beginning of period | | $ | 18.47 | | | $ | 15.84 | | | $ | 15.80 | † |

| | | | | | | | | | | | |

Net investment income (loss) (a) | | | (0.12 | ) | | | (0.28 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) on investments | | | (0.54 | ) | | | 2.91 | | | | 0.15 | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | 0.00 | ‡ | | | 0.00 | ‡ | | | — | |

| | | | | | | | | | | | |

Total from investment operations | | | (0.66 | ) | | | 2.63 | | | | 0.11 | |

| | | | | | | | | | | | |

| Less dividends and distributions: | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.00 | )‡ | | | — | |

From net realized gain on investments | | | — | | | | — | | | | (0.07 | ) |

| | | | | | | | | | | | |

Total dividends and distributions | | | — | | | | (0.00 | )‡ | | | (0.07 | ) |

| | | | | | | | | | | | |

Net asset value at end of period | | $ | 17.81 | | | $ | 18.47 | | | $ | 15.84 | |

| | | | | | | | | | | | |