UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31 (MainStay Marketfield Fund)

Date of reporting period: June 30, 2013

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay Marketfield Fund, a series of the Registrant.

| Item 1. | Reports to Stockholders. |

MainStay Marketfield Fund

Message from the President, Marketfield Asset Management LLC Six-Month Commentary and Semiannual Report

Unaudited | June 30, 2013

This page intentionally left blank

Message from the President

We are pleased to present the six-month commentary from Michael Aronstein, President and Chief Investment Officer of Marketfield Asset Management LLC and the portfolio manager of MainStay Marketfield Fund.

Following this commentary is the semiannual report for MainStay Marketfield Fund for the six-months ended June 30, 2013. These materials contain specific information about the market events, investment decisions and securities that affected MainStay Marketfield Fund during the reporting period.

We invite you to read these materials carefully and to use them as part of your long-term investment planning and financial review. We thank you for investing with MainStay and look forward to continuing our partnership for many years to come.

You may be interested to know that in its most recent rankings, Barron’s listed MainStay Funds as the #1 fund family over the past 10 years. We were also the only mutual fund family that has appeared in Barron’s top six for the past five consecutive years.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

To qualify for the Lipper/Barron’s Fund Survey, a fund family must have at least three funds in Lipper’s general U.S.-stock category, one in world equity (which combines global and international funds), one mixed-equity fund (which holds stocks and bonds), two taxable-bond funds, and one tax-exempt fund. Fund loads and 12b-1 fees aren’t included in the calculation of returns because the aim is to measure the manager’s skill. Each fund’s return is measured against all funds in its Lipper category, resulting in a percentile ranking which is then weighted by asset size relative to the fund family’s other assets in its general classifications. Finally, the score is multiplied by the general classification weightings as determined by the entire Lipper universe of funds.

Source: Barron’s, 2/9/13. Overall, MainStay Funds ranked number 56 for the one-year period, 20 for the five-year period and one for the 10-year period ended December 31, 2012, out of 62, 53 and 46 fund families, respectively. MainStay ranked number three for the 10-year period in 2009, 2010 and 2011 from among 48, 46 and 45 fund families, respectively. MainStay ranked number six from among 48 fund families for the 10-year period in 2008.

According to Lipper Inc., the percentile ranks for MainStay Marketfield Fund Class I shares are 28, 19, 5 and 7 for the one-, three-, five-year and since-inception periods and are from among 175, 108, 61 and 45 long/short equity funds, respectively. The Fund’s total-return percentile rank for the specified time period is relative to all funds that have the same Lipper category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. Percentile ranks within categories are most useful in those categories that have a large number of funds. Lipper Inc. is an independent monitor of fund performance. Past performance is no guarantee of future results, which will vary. For the most recent MainStay Funds performance, please visit our website at mainstayinvestments.com. All mutual funds are subject to market risk and will fluctuate in value.

Not part of the Semiannual Report

Marketfield Asset Management LLC Six-Month Commentary

For the six months ended June 30, 2013, MainStay Marketfield Fund Class I shares had a total return of 7.51%, compared to 13.82% for the S&P 500® Index. The Fund’s year-to-date returns, as compared to the returns of the S&P 500® Index, were negatively effected by the underperformance of cyclical shares during the first four months of the year, when most of the S&P 500® Index gains occurred. (See page 8 for more information on the S&P 500® Index.)

To judge from the financial media, all of the recent gyrations across markets for equities, fixed income, foreign exchange and commodities can be traced directly to the musings of the Federal Reserve Board, and particularly those of its chairman.

The idea that markets are, as always, reacting to a composite of macroeconomic conditions is lost in the popular narrative. The macroeconomic landscape comprises hundreds of important variables, of which U.S. monetary policy is an important element.

Substantial changes in monetary conditions, often reinforced by changes in Federal Reserve Board (FRB) policy, are indeed important factors in setting the overall macroeconomic tone. Investors would do well to keep the nature of these changes uppermost in their minds when contemplating the role of monetary policy on prospective returns. The sequence of cause and effect is, however, generally opposite to what popular thinking holds.

The best practical rule of thumb in analyzing Federal Reserve policy is to remember that they are invariably late in their actions, particularly around macroeconomic inflection points.

The Federal Reserve Board is a bureaucracy. Bureaucracies cannot forecast. Period.

The process of convincing a room full of people that an important change in macroeconomic conditions is in prospect requires a great deal of data. The evidentiary standard is so high as to guarantee that the point of inflection (and market response) is well past once policy change is agreed upon.

For the past twenty-five years, every important directional change by the Federal Reserve has been between one and two years behind the markets. This tendency, once recognized, makes most efforts to base investment strategies on any anticipated changes in monetary policy something of a fool’s errand. Nonetheless, we would expect that the current fashion in financial news, “all Fed, all the time” would persist long after it becomes clear that the practical value of the endeavor is small.

The hysteria surrounding a potential change in liquidity provision by the FRB obscures the fact that general market and macroeconomic conditions are already indicating the sorts of changes that the Fed will eventually be forced to respond to. Their

response will occur long after the investment implications of the regime change have been felt.

Recent declines in “safe” assets, particularly in fixed income markets, are fully justified by the better tone in private sector economic activity and the continuing normalization of many of the deficiencies that arose in the aftermath of 2008. In that instance, the Federal Reserve was two years late in addressing the financial consequences stemming from the unwinding property mania.

Bonds have not sold off because the Fed might modify its extraordinary liquidity regime, but because rates of return for more cyclically tied activities continue to improve, drawing investment flows away from the miniscule returns and high risks of investment grade bonds and their proxies. The former explanation, is, however, more readily packaged in thirty-second sound bites and illustrated with stock footage of Chairman Bernanke and the imposing façade of the Federal Reserve building.

The diminishing enthusiasm for fixed income instruments comes on the heels of a colossal cycle of issuance over the past two years. This cycle has created a record overhang of market capitalization in the fixed income space, all of which represents potential sell side pressure as the mood among asset allocators changes.

This is one of the more misunderstood dynamics of what we refer to as “market economics”. Vast increases in the outstanding market capitalization of an asset type or an individual security have the same potentially dangerous repercussions as a simple increase in prices. Both represent the weight (in monetary terms) of potential future supply. It is one reason that the appearance of large sources of new supply normally precedes reversals of long bull markets and the subsequent bear markets that follow. It takes an enormous decline in price to find housing for boatloads of new supply once the owners have begun to morph into sellers. This is the case at all times in every asset class.

By absorbing a great deal of new treasury issuance, the Federal Reserve has simply opened the floodgates in the IPO markets for fixed income instruments of other sorts. Since 2011, new issuance has more than made up for the Fed’s absorption of existing bonds. This leaves the fixed income markets structurally more vulnerable than they might have been with less industrious quantitative easing.

In the late stages of every long bull market, the terminal expansion of supply often comprises assets that look like the primary objects of enthusiasm, but are, in fact, lower quality copies. When shortages of AAA assets arose a decade ago, banks invented new ones by packaging substandard mortgages and dividing their apparent risks into tiered tranches, the

Not part of the Semiannual Report

highest of which were affirmed as AAA by their irreparably conflicted partners in rating agencies.1

At the height of the technology mania, demand for Internet related shares prompted a wave of new issues that clearly avoided the quality control departments of their sponsoring underwriters.

In the present cycle, flows into income products combined with the Fed’s purchases to produce an apparent shortage of fixed income vehicles. Markets responded by producing hundreds of billions of new issues from remarkably dubious sources.

It is interesting that the same venues that have produced a raft of fake designer products over the past decades are now following up with financial instruments that look just like high-grade bonds. The latter product is much more lucrative for the producer than a container full of faux designer handbags.

The structural flaws that have arisen across fixed income markets during the past two years have the potential to produce events within that space that have the same shock value as those of 1980, 1987, 1994, 1997-8, 2002 and 2008. Each of these periods was marked by episodes of panic, during which liquidity conditions in certain portions of the capital markets were revealed as inadequate.

Our extensive travels allow us to speak directly with thousands of professional advisors. Our strong sense from these contacts is that little has been done in the way of mitigating risks within the fixed income portions of client portfolios. This is not for want of trying by most advisors, who are able to see the dangers firsthand.

As is the case at the end of all bull markets, there are compelling structural and business factors that keep passengers in the boat as it goes over the falls. In the case of fixed income investing there is a strong compliance and asset allocation bias that still rates this as a relatively riskless portion of one’s portfolio.

Target date funds that increase bond exposure as one ages look problematic to us. We question conventional wisdom that suggests older and more risk adverse investors continue with large exposures to fixed income. This is a story that we do not expect to end well.

With the fixed income risks moving to center stage in the past months, it is becoming clear that the one fundamental, macroeconomic scenario that presents the greatest overall threat to stability is acceleration in activity, particularly in the U.S. economy. This outcome appears to us to be increasingly likely, with Europe beginning to stabilize and Japan accelerating in response to unprecedented monetary and cultural change.

The equity portion of our portfolio remains heavily skewed toward businesses in the developed world that are more sensitive to increases in economic activity, particularly in areas involving capital spending and construction, both residential and commercial. Materials and commodity related sectors, which have been clear laggards since the 2008 lows, should begin exhibiting signs of life.

We are beginning to watch closely for signs of input cost and wage pressures in businesses that have enjoyed cost deflation in both until now. We would not be surprised to see invitations being posted on the U.S. borders rather than armed guards sometime in the next two years.

July 24, 2013

Michael C. Aronstein

President, CIO & Portfolio Manager

| 1. | An obligation rated ‘AAA’ has the highest rating assigned by Standard & Poor’s (“S&P”), and in the opinion of S&P, the obligor’s capacity to meet its financial commitment on the obligation is extremely strong. When applied to Fund holdings, ratings are based solely on the creditworthiness of the bonds in the portfolio and are not meant to represent the security or safety of the Fund. |

The information provided herein represents the opinion of the Portfolio Manager and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. Past performance is no guarantee of future results, which will vary.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

Investment and Performance Comparison1 (Unaudited)

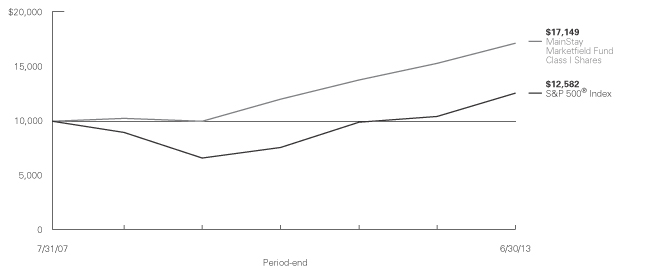

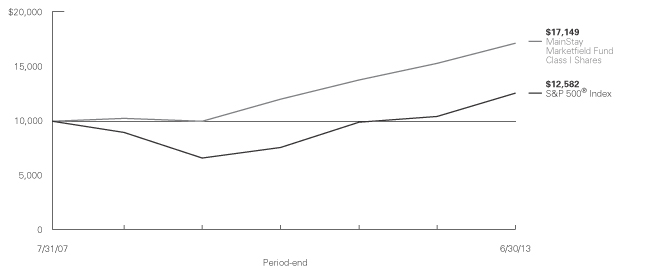

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

Average Annual Total Returns for the Period Ended June 30, 2013

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Six Months | | | One Year | | | Five Years | | | Since

Inception

(7/31/07) | | | Gross

Expense

Ratio2 | |

| Investor Class Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| 1.54

7.45 | %

| |

| 5.89

12.05 | %

| |

| 9.37

10.61 | %

| |

| 8.25

9.29 | %

| |

| 4.11

4.11 | %

|

| Class A Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| 1.48

7.39 |

| |

| 5.82

11.98 |

| |

| 9.36

10.60 |

| |

| 8.24

9.28 |

| |

| 4.15

4.15 |

|

| Class C Shares3 | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | |

| 6.02

7.02 |

| |

| 10.17

11.17 |

| |

| 9.78

9.78 |

| |

| 8.46

8.46 |

| |

| 4.90

4.90 |

|

| Class I Shares4 | | No Sales Charge | | | |

| 7.51

|

| | | 12.19 | | | | 10.86 | | | | 9.54 | | | | 2.94 | |

| Class R2 Shares3 | | No Sales Charge | | | | | 7.40 | | | | 11.82 | | | | 10.48 | | | | 9.16 | | | | 3.91 | |

| Class R6 Shares5 | | No Sales Charge | | | | | 7.51 | | |

| 12.19

|

| |

| 10.86

|

| |

| 9.54

|

| |

| 2.84

|

|

| Class P Shares6 | | No Sales Charge | | | | | 7.51 | | | | 12.19 | | | | 10.86 | | | | 9.54 | | | | 2.94 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on dividends and/or distributions or Fund-share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividends and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Investor Class, Class A, Class C, and Class R2 shares, reflect the historical performance of Class I shares and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies based on differences in their fee and expense |

| | structures. Marketfield Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes would likely have been different. |

| 4. | Performance figures for Class I shares reflect the historical performance of the then-existing shares of Marketfield Fund (the predecessor to the Fund, which was subject to a different fee structure, and for which a predecessor entity to Marketfield Asset Management LLC served as investment advisor) for periods prior to October 5, 2012. Marketfield Fund commenced operations on July 31, 2007. |

| 5. | Performance figures for Class R6 shares, first offered on June 17, 2013, include the historical performance of Class I shares through June 16, 2013. Performance for Class R6 would likely have been different because of differences in certain expenses attributable to each share class. |

| 6. | Performance figures for Class P shares, first offered on May 31, 2013, include the historical performance of Class I shares through May 30, 2013. Performance for Class P shares would likely have been different because of differences in certain expenses attributable to each share class. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | |

| mainstayinvestments.com | | | 7 | |

| | | | | | | | | | | | | | | | |

| Benchmark Performance | | Six

Months | | | One

Year | | | Five

Years | | | Since

Inception | |

S&P 500® Index7 | | | 13.82 | % | | | 20.60 | % | | | 7.01 | % | | | 3.96 | % |

Average Lipper Long/Short Equity Fund8 | | | 6.11 | | | | 8.96 | | | | 2.63 | | | | 1.46 | |

| 7. | S&P 500® Index is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The S&P 500® Index is the Fund’s broad-based securities market index for comparison purposes. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an Index. |

| 8. | The average Lipper long/short equity fund is representative of funds that employ portfolio strategies combining long holdings of equities with short sales of equity, equity options, or equity index options. The funds may be either net long or net short, depending on the portfolio manager’s view of the market. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 8 | | MainStay Marketfield Fund |

Cost in Dollars of a $1,000 Investment in MainStay Marketfield Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the period from January 1, 2013, to June 30, 2013, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other Funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2013, to June 30, 2013. Shares are only sold in connection with variable life and annuity contracts and the example does not reflect any contract level or transactional fees or expenses. If these costs had been included, your costs would have been higher.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended June 30, 2013. Simply divide your account value by $1,000 (for

example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

1/1/131 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

6/30/13 | | | Expenses

Paid

During

Period2 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

6/30/13 | | | Expenses

Paid

During

Period2 | |

| | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,074.50 | | | $ | 15.64 | | | $ | 1,009.70 | | | $ | 15.15 | |

| | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,073.90 | | | $ | 15.43 | | | $ | 1,009.90 | | | $ | 14.95 | |

| | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 1,070.20 | | | $ | 19.15 | | | $ | 1,006.30 | | | $ | 18.55 | |

| | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,075.10 | | | $ | 13.63 | | | $ | 1,011.70 | | | $ | 13.22 | |

| | | | | |

| Class R2 Shares | | $ | 1,000.00 | | | $ | 1,074.00 | | | $ | 20.36 | | | $ | 1,005.20 | | | $ | 19.69 | |

| | | | | |

| Class R6 Shares3 | | $ | 1,000.00 | | | $ | 1,075.10 | 4 | | $ | 1.75 | | | $ | 1,000.10 | | | $ | 1.68 | |

| | | | | |

| Class P Shares3 | | $ | 1,000.00 | | | $ | 1,075.10 | 5 | | $ | 3.37 | | | $ | 1,000.90 | | | $ | 3.25 | |

| 1. | The inception date for Class R6 shares was on June 17, 2013 and Class P shares was on May 31, 2013. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio of each class (3.04% for Investor Class, 3.00% for Class A, 3.73% for Class C, 2.65% for Class I, 3.96% for Class R2, 4.77% for Class R6 and 3.95% for Class P) multiplied by the average account value over the period, divided by 365 and multiplied by 181 days for Investor Class, Class A, Class C, Class I and Class R2 (to reflect the six-month period), 13 days for Class R6 and 30 days for Class P (to reflect the since inception period). The table above represents the actual expenses incurred during the six-month period. |

| 3. | Expenses paid during the period reflect ongoing costs for the period from inception through June 30, 2013. Had these shares been offered for the full six-month period ended June 30, 2013, and had the Fund provided a hypothetical 5% annualized return, expenses paid during the period would have been $23.67 for Class R6 and $19.64 for Class P and the ending account value would have been $1,001.10 for Class R6 and $1,005.20 for Class P. |

| 4. | Performance figures for Class R6 shares, first offered on June 17, 2013, include the historical performance of Class I shares through June 16, 2013. |

| 5. | Performance figures for Class P shares, first offered on May 31, 2013, include the historical performance of Class I shares through May 30, 2013. |

| | | | |

| mainstayinvestments.com | | | 9 | |

Industry Composition as of June 30, 2013 (Unaudited)

| | | | |

| Exchange Traded Funds | | | 10.4 | % |

| Commercial Banks | | | 7.6 | |

| Household Durables | | | 5.8 | |

| Construction Materials | | | 5.1 | |

| Road & Rail | | | 4.4 | |

| Chemicals | | | 4.2 | |

| Machinery | | | 4.0 | |

| Automobiles | | | 3.3 | |

| Metals & Mining | | | 2.7 | |

| Specialty Retail | | | 2.4 | |

| Industrial Conglomerates | | | 2.3 | |

| Electrical Equipment | | | 2.2 | |

| Trading Companies & Distributors | | | 2.2 | |

| Oil, Gas & Consumable Fuels | | | 2.1 | |

| Transportation Infrastructure | | | 2.0 | |

| Auto Components | | | 1.7 | |

| Consumer Finance | | | 1.3 | |

| Air Freight & Logistics | | | 1.2 | |

| Energy Equipment & Services | | | 1.2 | |

| | | | |

| Real Estate Management & Development | | | 1.2 | % |

| Food & Staples Retailing | | | 1.1 | |

| Insurance | | | 1.1 | |

| Purchased Options | | | 1.1 | |

| Semiconductors & Semiconductor Equipment | | | 1.1 | |

| Aerospace & Defense | | | 1.0 | |

| Building Products | | | 1.0 | |

| Food Products | | | 1.0 | |

| Internet & Catalog Retail | | | 1.0 | |

| Internet Software & Services | | | 1.0 | |

| IT Services | | | 1.0 | |

| Real Estate Investment Trusts | | | 1.0 | |

| Software | | | 1.0 | |

| Commercial Services & Supplies | | | 0.8 | |

| Investment in Money Market Fund | | | 13.3 | |

| Other Assets, Less Liabilities | | | 31.6 | |

| Investments Sold Short | | | –25.4 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Portfolio of Investments beginning on page 12 for specific holdings within these categories.

Top Ten Holdings as of June 30, 2013 (excluding short-term investment) (Unaudited)

| 1. | iShares MSCI Japan Index Fund |

| 2. | SPDR S&P Regional Banking |

| 3. | iShares MSCI Mexico Investable Market Index Fund |

| 6. | iShares MSCI Italy Index Fund |

| 7. | Discover Financial Services |

Top Five Short Positions as of June 30, 2013

| 1. | iShares JPMorgan USD Emerging Markets Bond Fund |

| 3. | iShares IBOXX Investment Grade Corporate Bond Fund |

| 4. | iShares FTSE China 25 Index Fund |

| 5. | WisdomTree India Earnings Fund |

| | |

| 10 | | MainStay Marketfield Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio manager Michael C. Aronstein of Marketfield Asset Management LLC, the Fund’s Subadvisor.

How did MainStay Marketfield Fund perform relative to its benchmark and peers during the six months ended June 30, 2013?

Excluding all sales charges, MainStay Marketfield Fund returned 7.45% for Investor Class shares, 7.39% for Class A shares and 7.02% for Class C shares for the six months ended June 30, 2013. Over the same period, Class I shares returned 7.51%, Class R2 shares returned 7.40% and Class R6 and Class P shares1 returned 7.51%. During the six months ended June 30, 2013, all share classes underperformed the 13.82% return of the S&P 500® Index,2 which is the Fund’s broad-based securities-market index. Over the same period, all share classes outperformed the 6.11% return of the average Lipper3 long/short equity fund. See page 7 for Fund returns with applicable sales charges.

What factors affected the Fund’s relative performance during the reporting period?

The Fund takes a top-down investment approach in which the portfolio manager identifies macroeconomic trends and themes, and then determines the most appropriate investment instruments or strategies to express those themes in the Fund.

By theme, the most significant positive contributors to the Fund’s relative performance in the first half of 2013 included the rebound in the housing market, the capital spending cycle theme and the emerging-market short theme. (Contributions take weightings and total returns into account.) The long housing theme contributed 3.2% of the Fund’s positive relative performance. The long theme in capital spending contributed 1.79% to relative performance. The short emerging-market theme contributed 2.05% of the Fund’s positive relative performance. The short theme, End of the PC Era, detracted from relative performance by contributing –0.18%.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

We used puts on various fixed-income and emerging-market securities as a way of creating short positions on these markets. We also used puts on a gold miner ETF to express a short position in gold.

During the reporting period, which sectors were the strongest positive contributors to the Fund’s relative

performance and which sectors were particularly weak?

During the first half of 2013, the strongest positive sector contributions to the Fund’s performance relative to the S&P 500® Index came from the consumer discretionary and industrials sectors on the long side and from emerging-market ETFs on the short side. The weakest-performing sector was a long position in European equities.

During the reporting period, which individual stocks made the strongest contributions to the Fund’s absolute performance and which stocks detracted the most?

During the first half of 2013, the strongest individual positive contributors to the Fund’s absolute performance were a short position in Market Vectors Gold Miners ETF, a short position in iShares China ETF and a long position in media company Pandora Media. Over the same period, the weakest contributions to the Fund’s absolute performance came from a short position in Internet software & services company Qihoo 360 Technology, a short position in software company Microsoft and a short position in diversified financial services company Leucadia National.

Were there other stocks that were particularly noteworthy during the reporting period?

During the final two months of the reporting period, the Fund’s fixed-income short positions performed very well. These were concentrated in ETFs or puts on ETFs including TLT (a long-maturity U.S. Treasury ETF), LQD (a high-grade U.S. corporate-bond ETF) and EMB (a JPMorgan Emerging Market Bond ETF).

Did the Fund make any significant purchases or sales during the reporting period?

During the first half of 2013, we invested approximately 5% of the Fund’s equity holdings in shares of Japanese companies. Japan is undergoing major social change as evidenced by the election of Prime Minister Abe and his subsequent follow-through on the promise of monetary expansion.

How did the Fund’s sector weightings change during the reporting period?

There were no material changes in the Fund’s sector weightings during the six months ended June 30, 2013.

How was the Fund positioned at the end of June 2013?

As of June 30, 2013, the Fund was 79% long (excluding short-term investments) and 26% short. The net exposure was long 53%.4 Since the Fund’s inception, net long exposure has averaged 58%.

| 1. | See footnote on page 7 for more information on historical performance of Class R6 and Class P shares. |

| 2. | See footnote on page 8 for more information on the S&P 500® Index. |

| 3. | See footnote on page 8 for more information on Lipper Inc. |

| 4. | See Portfolio of Investments beginning on page 12 for specific holdings information. |

The opinions expressed are those of the portfolio manager as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| | | | |

| mainstayinvestments.com | | | 11 | |

Portfolio of Investments June 30, 2013 (Unaudited)

| | | | | | | | |

| | |

Shares | | |

Value | |

| | | | | | | | |

| Common Stocks 68.4%† | |

Aerospace & Defense 1.0% | |

Precision Castparts Corp. (a) | | | 474,495 | | | $ | 107,240,615 | |

| | | | | | | | |

| | |

Air Freight & Logistics 1.2% | | | | | | | | |

FedEx Corp. (a) | | | 1,259,607 | | | | 124,172,058 | |

| | | | | | | | |

| | |

Auto Components 1.7% | | | | | | | | |

Continental A.G. | | | 970,704 | | | | 129,636,775 | |

ElringKlinger A.G. | | | 1,574,676 | | | | 52,553,697 | |

| | | | | | | | |

| | | | | | | 182,190,472 | |

| | | | | | | | |

Automobiles 3.3% | | | | | | | | |

Daimler A.G. | | | 1,948,590 | | | | 117,903,675 | |

Fiat S.p.A (b) | | | 17,881,201 | | | | 124,987,048 | |

Ford Motor Co. | | | 6,661,750 | | | | 103,057,272 | |

| | | | | | | | |

| | | | | | | 345,947,995 | |

| | | | | | | | |

Building Products 1.0% | | | | | | | | |

Geberit A.G. | | | 414,537 | | | | 102,827,822 | |

| | | | | | | | |

| | |

Chemicals 3.6% | | | | | | | | |

Air Liquide S.A. | | | 798,777 | | | | 98,638,962 | |

¨BASF S.E. | | | 1,878,376 | | | | 167,799,464 | |

Sherwin-Williams Co. (The) (a) | | | 619,414 | | | | 109,388,512 | |

| | | | | | | | |

| | | | | | | 375,826,938 | |

| | | | | | | | |

Commercial Banks 7.6% | | | | | | | | |

Bank of Ireland (b) | | | 502,348,076 | | | | 102,005,451 | |

Barclays PLC | | | 24,761,642 | | | | 104,867,635 | |

BB&T Corp. (a) | | | 2,861,008 | | | | 96,930,951 | |

CIT Group, Inc. (a)(b) | | | 2,377,128 | | | | 110,845,479 | |

Fifth Third Bancorp (a) | | | 6,168,144 | | | | 111,334,999 | |

Governor & Co. of The Bank of Ireland (The), Sponsored

ADR (b) | | | 3,389,402 | | | | 28,335,401 | |

Lloyds Banking Group PLC (b) | | | 130,694,605 | | | | 125,549,386 | |

UniCredit S.p.A | | | 25,360,244 | | | | 118,770,511 | |

| | | | | | | | |

| | | | | | | 798,639,813 | |

| | | | | | | | |

Commercial Services & Supplies 0.8% | | | | | |

Bilfinger S.E. | | | 884,036 | | | | 81,412,377 | |

| | | | | | | | |

| | |

Construction Materials 5.1% | | | | | | | | |

Buzzi Unicem S.p.A. | | | 8,231,631 | | | | 123,647,614 | |

¨CRH PLC | | | 6,550,925 | | | | 133,014,414 | |

¨Eagle Materials, Inc. (a) | | | 2,252,622 | | | | 149,281,260 | |

¨Taiheiyo Cement Corp. | | | 41,874,137 | | | | 133,838,490 | |

| | | | | | | | |

| | | | | | | 539,781,778 | |

| | | | | | | | |

Consumer Finance 1.3% | | | | | | | | |

¨Discover Financial Services | | | 2,913,511 | | | | 138,799,664 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | |

Value | |

| | | | | | | | |

Electrical Equipment 2.2% | | | | | | | | |

ABB, Ltd. (b) | | | 5,425,294 | | | $ | 117,805,071 | |

Emerson Electric Co. | | | 2,092,336 | | | | 114,116,006 | |

| | | | | | | | |

| | | | | | | 231,921,077 | |

| | | | | | | | |

Energy Equipment & Services 1.2% | | | | | |

Schlumberger, Ltd. (a) | | | 1,771,000 | | | | 126,909,860 | |

| | | | | | | | |

| | |

Food & Staples Retailing 1.1% | | | | | | | | |

Costco Wholesale Corp. (a) | | | 1,087,767 | | | | 120,274,397 | |

| | | | | | | | |

| | |

Food Products 1.0% | | | | | | | | |

Hershey Co. (The) (a) | | | 1,131,222 | | | | 100,995,500 | |

| | | | | | | | |

| | |

Household Durables 5.8% | | | | | | | | |

D.R. Horton, Inc. (a) | | | 4,625,618 | | | | 98,433,151 | |

Mohawk Industries, Inc. (a)(b) | | | 939,991 | | | | 105,739,588 | |

PulteGroup, Inc. (a)(b) | | | 4,986,917 | | | | 94,601,815 | |

Ryland Group, Inc. (The) (a) | | | 2,524,816 | | | | 101,245,122 | |

Sekisui House, Ltd. | | | 7,120,942 | | | | 102,958,568 | |

Toll Brothers, Inc. (a)(b) | | | 3,161,466 | | | | 103,158,636 | |

| | | | | | | | |

| | | | | | | 606,136,880 | |

| | | | | | | | |

Industrial Conglomerates 2.3% | | | | | | | | |

3M Co. (a) | | | 1,104,440 | | | | 120,770,514 | |

General Electric Co. (a) | | | 5,442,996 | | | | 126,223,077 | |

| | | | | | | | |

| | | | | | | 246,993,591 | |

| | | | | | | | |

Insurance 1.1% | | | | | | | | |

Assicurazioni Generali S.p.A | | | 6,927,549 | | | | 121,011,365 | |

| | | | | | | | |

| | |

Internet & Catalog Retail 1.0% | | | | | | | | |

Amazon.com, Inc. (a)(b) | | | 370,760 | | | | 102,956,344 | |

| | | | | | | | |

| |

Internet Software & Services 1.0% | | | | | |

Facebook, Inc. Class A (a)(b) | | | 4,266,850 | | | | 106,073,891 | |

| | | | | | | | |

| | |

IT Services 1.0% | | | | | | | | |

Amadeus IT Holding S.A. Class A | | | 3,179,083 | | | | 101,609,858 | |

| | | | | | | | |

| | |

Machinery 4.0% | | | | | | | | |

Cummins, Inc. (a) | | | 946,412 | | | | 102,647,846 | |

Deere & Co. (a) | | | 1,387,668 | | | | 112,748,025 | |

Ingersoll-Rand PLC (a) | | | 1,880,893 | | | | 104,427,179 | |

Scania AB Class B | | | 5,300,821 | | | | 106,157,120 | |

| | | | | | | | |

| | | | | | | 425,980,170 | |

| | | | | | | | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings, as of June 30, 2013, excluding short-term investment. May be subject to change daily. |

| | | | |

| 12 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| | | | | | | | |

| Common Stocks (continued) | |

Metals & Mining 2.7% | | | | | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | | 4,015,163 | | | $ | 110,858,651 | |

Steel Dynamics, Inc. (a) | | | 7,508,166 | | | | 111,946,755 | |

Teck Resources, Ltd. Class B (a) | | | 2,992,760 | | | | 63,955,281 | |

| | | | | | | | |

| | | | | | | 286,760,687 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels 2.1% | | | | | |

Apache Corp. | | | 1,254,568 | | | | 105,170,435 | |

Chesapeake Energy Corp. | | | 2,758,900 | | | | 56,226,382 | |

Exxon Mobil Corp. (a) | | | 656,945 | | | | 59,354,981 | |

| | | | | | | | |

| | | | | | | 220,751,798 | |

| | | | | | | | |

Real Estate Investment Trusts 1.0% | | | | | |

Rayonier, Inc. (a) | | | 1,901,419 | | | | 105,319,598 | |

| | | | | | | | |

|

Real Estate Management & Development 1.2% | |

Deutsche Wohnen A.G. | | | 4,561,815 | | | | 77,459,697 | |

St. Joe Co. (The) (b) | | | 2,558,198 | | | | 53,850,068 | |

| | | | | | | | |

| | | | | | | 131,309,765 | |

| | | | | | | | |

Road & Rail 4.4% | | | | | | | | |

DSV A/S | | | 4,185,496 | | | | 102,042,511 | |

Kansas City Southern (a) | | | 957,779 | | | | 101,486,263 | |

Old Dominion Freight Line, Inc. (a)(b) | | | 2,980,300 | | | | 124,040,086 | |

¨Union Pacific Corp. (a) | | | 867,422 | | | | 133,825,866 | |

| | | | | | | | |

| | | | | | | 461,394,726 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment 1.1% | |

Intel Corp. | | | 4,799,310 | | | | 116,239,288 | |

| | | | | | | | |

| | |

Software 1.0% | | | | | | | | |

Splunk, Inc. (b) | | | 2,208,101 | | | | 102,367,562 | |

| | | | | | | | |

| | |

Specialty Retail 2.4% | | | | | | | | |

Home Depot, Inc. (The) (a) | | | 1,672,521 | | | | 129,570,202 | |

Tractor Supply Co. | | | 1,006,964 | | | | 118,429,036 | |

| | | | | | | | |

| | | | | | | 247,999,238 | |

| | | | | | | | |

Trading Companies & Distributors 2.2% | | | | | |

Beacon Roofing Supply, Inc. (a)(b) | | | 3,199,872 | | | | 121,211,151 | |

Wolseley PLC | | | 2,325,562 | | | | 107,279,106 | |

| | | | | | | | |

| | | | | | | 228,490,257 | |

| | | | | | | | |

Transportation Infrastructure 2.0% | | | | | |

Abertis Infraestructuras S.A. | | | 5,146,125 | | | | 89,759,240 | |

Atlantia S.p.A | | | 7,717,586 | | | | 125,871,263 | |

| | | | | | | | |

| | | | | | | 215,630,503 | |

| | | | | | | | |

Total Common Stocks

(Cost $6,700,253,548) | | | | | | | 7,203,965,887 | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| | | | | | | | |

| Exchange Traded Funds 10.4% (c) | |

iShares Dow Jones US Home Construction Index Fund (a) | | | 5,730,876 | | | $ | 128,257,005 | |

¨iShares MSCI Italy Index

Fund (a) | | | 11,992,820 | | | | 141,635,204 | |

¨iShares MSCI Japan Index Fund | | | 25,692,377 | | | | 288,268,470 | |

¨iShares MSCI Mexico Investable Market Index Fund (a) | | | 3,013,282 | | | | 196,465,986 | |

SPDR S&P Homebuilders (a) | | | 3,656,479 | | | | 107,573,612 | |

¨SPDR S&P Regional Banking (a) | | | 6,809,405 | | | | 230,702,642 | |

| | | | | | | | |

Total Exchange Traded Funds

(Cost $1,035,713,650) | | | | 1,092,902,919 | |

| | | | | | | | |

|

| Preferred Stock 0.6% | |

Chemicals 0.6% | | | | | | | | |

Fuchs Petrolub A.G. 2.20% | | | 831,954 | | | | 66,220,097 | |

| | | | | | | | |

Total Preferred Stock

(Cost $53,595,494) | | | | | | | 66,220,097 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Notional

Amount | | | | |

| Purchased Options 1.1% | | | | | |

Purchased Call Options 0.4% | |

CNY/USD

Strike Price $6.321

Expires 6/9/14(d) | | | 1,401,000,000 | | | | 19,015,773 | |

Strike Price $6.722

Expires 12/9/14(d) | | | 1,401,000,000 | | | | 19,691,055 | |

| | | | | | | | |

Total Purchased Call Options

(Cost $38,340,700) | | | | | | | 38,706,828 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Number of

Contracts | | | | |

Purchased Put Options 0.7% | | | | | | | | |

Apple, Inc.

Strike Price $400.00

Expires 7/20/13 | | | 3,370 | | | | 3,959,750 | |

Strike Price $430.00

Expires 7/20/13 | | | 3,000 | | | | 10,350,000 | |

Strike Price $435.00

Expires 7/20/13 | | | 1,000 | | | | 3,860,000 | |

| | | | | | | | |

| | | | | | | 18,169,750 | |

| | | | | | | | |

iShares MSCI Emerging Markets

Strike Price $40.50

Expires 7/20/13 | | | 154,540 | | | | 34,926,040 | |

Market Vectors Gold Miners ETF

Strike Price $28.00

Expires 7/20/13 | | | 25,000 | | | | 8,875,000 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 13 | |

Portfolio of Investments June 30, 2013 (Unaudited) (continued)

| | | | | | | | |

| | | Number of

Contracts | | | Value | |

| | | | | | | | |

| Purchased Options (continued) | |

Purchased Put Options (continued) | |

Vanguard FTSE Emerging Markets

Strike Price $40.00

Expires 7/20/13 | | | 112,502 | | | $ | 18,562,830 | |

| | | | | | | | |

Total Purchased Put Options

(Cost $43,551,614) | | | | | | | 80,533,620 | |

| | | | | | | | |

Total Purchased Options

(Cost $81,892,314) | | | | | | | 119,240,448 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| Short-Term Investments 13.3% | | | | | |

Money Market Fund 13.3% | |

State Street Institutional Treasury Money Market Fund | | | 1,400,000,000 | | | | 1,400,000,000 | |

| | | | | | | | |

Total Short-Term Investment (Cost $1,400,000,000) | | | | | | | 1,400,000,000 | |

| | | | | | | | |

Total Investments, Before Investments Sold Short

(Cost $9,271,455,006) (f) | | | 93.8 | % | | | 9,882,329,351 | |

| | | | | | | | |

|

| Common Stocks Sold Short (11.7%) | |

Capital Markets (0.8%) | |

Franklin Resources, Inc. | | | (599,036 | ) | | | (81,480,877 | ) |

| | | | | | | | |

| | |

Commercial Banks (1.3%) | | | | | | | | |

ICICI Bank, Ltd., Sponsored ADR | | | (2,355,536 | ) | | | (90,099,252 | ) |

Itau Unibanco Holding S.A., ADR | | | (3,341,180 | ) | | | (43,168,046 | ) |

| | | | | | | | |

| | | | | | | (133,267,298 | ) |

| | | | | | | | |

Computers & Peripherals (1.2%) | | | | | | | | |

Apple, Inc. | | | (317,495 | ) | | | (125,753,420 | ) |

| | | | | | | | |

| | |

Food Products (0.8%) | | | | | | | | |

Mondelez International, Inc. Class A | | | (3,138,742 | ) | | | (89,548,309 | ) |

| | | | | | | | |

| | |

Insurance (2.9%) | | | | | | | | |

Allianz SE | | | (2,063,202 | ) | | | (301,454,755 | ) |

| | | | | | | | |

|

Internet Software & Services (1.7%) | |

Baidu, Inc., Sponsored ADR (b) | | | (801,657 | ) | | | (75,780,636 | ) |

Qihoo 360 Technology Co., Ltd., ADR (b) | | | (2,347,513 | ) | | | (108,384,675 | ) |

| | | | | | | | |

| | | | | | | (184,165,311 | ) |

| | | | | | | | |

IT Services (0.7%) | | | | | | | | |

International Business Machines Corp. | | | (411,813 | ) | | | (78,701,582 | ) |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

| | | | | | | | |

Metals & Mining (0.6%) | �� | | | | | | | |

Barrick Gold Corp. | | | (3,713,330 | ) | | $ | (58,447,814 | ) |

| | | | | | | | |

| | |

Software (1.7%) | | | | | | | | |

Microsoft Corp. | | | (3,667,019 | ) | | | (126,622,166 | ) |

Oracle Corp. | | | (1,793,639 | ) | | | (55,100,590 | ) |

| | | | | | | | |

| | | | | | | (181,722,756 | ) |

| | | | | | | | |

Total Common Stocks Sold Short

(Proceeds $(1,237,841,104)) | | | | (1,234,542,122 | ) |

| | | | | | | | |

|

| Exchange Traded Funds Sold Short (13.7%) (c) | |

iShares FTSE China 25 Index Fund | | | (7,674,094 | ) | | | (249,561,537 | ) |

iShares IBOXX Investment Grade Corporate Bond Fund | | | (2,622,698 | ) | | | (298,069,628 | ) |

iShares JPMorgan USD Emerging Markets Bond Fund | | | (4,468,601 | ) | | | (489,445,867 | ) |

iShares MSCI Brazil Index Fund | | | (2,278,810 | ) | | | (99,948,607 | ) |

iShares MSCI South Africa Index Fund | | | (952,837 | ) | | | (55,683,794 | ) |

Vanguard FTSE Emerging Markets ETF | | | (2,886,302 | ) | | | (111,930,792 | ) |

WisdomTree India Earnings Fund | | | (8,531,370 | ) | | | (137,866,939 | ) |

| | | | | | | | |

Total Exchange Traded Funds Sold Short

(Cost $(1,592,493,675)) | | | | (1,442,507,164 | ) |

| | | | | | | | |

Total Investments Sold Short

(Proceeds $(2,830,334,779)) (e) | | | (25.4 | )% | | | (2,677,049,286 | ) |

| | | | | | | | |

Total Investments, Net of Investments Sold Short

(Cost $(6,441,120,227)) | | | 68.4 | | | | 7,205,280,065 | |

Other Assets, Less Liabilities | | | 31.6 | | | | 3,322,588,515 | |

Net Assets | | | 100.0 | % | | $ | 10,527,868,580 | |

| (a) | Security, or a portion thereof, is maintained in a segregated account at the Fund’s custodian as collateral for securities sold short (See Note 2(I)). |

| (b) | Non-income producing security. |

| (c) | Exchange Traded Fund—An investment vehicle that represents a basket of securities that is traded on an exchange. |

| (d) | Fair valued security—The total market value of these securities as of June 30, 2013 is $38,706,828, which represents 0.4% of the Fund’s net assets. |

| (e) | As of June 30, 2013, cash in the amount of $3,177,578,812 is on deposit with broker for short sale transactions. |

| | | | |

| 14 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| (f) | As of June 30, 2013, cost is $9,273,792,556 for federal income tax purposes and net unrealized appreciation is as follows: |

| | | | |

Gross unrealized appreciation | | $ | 764,651,271 | |

Gross unrealized depreciation | | | (156,114,476 | ) |

| | | | |

Net unrealized appreciation | | $ | 608,536,795 | |

| | | | |

The following abbreviations are used in the above portfolio:

ADR—American Depositary Receipt

CNY—Chinese Yuan

SPDR—Standard & Poor’s Depositary Receipt

The following is a summary of the fair valuations according to the inputs used as of June 30, 2013, for valuing the Fund’s assets and liabilities.

Asset Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 7,203,965,887 | | | $ | — | | | $ | — | | | $ | 7,203,965,887 | |

| Exchange Traded Funds | | | 1,092,902,919 | | | | — | | | | — | | | | 1,092,902,919 | |

| Preferred Stock | | | 66,220,097 | | | | — | | | | — | | | | 66,220,097 | |

| Short-Term Investment | | | | | | | | | | | | | | | | |

Money Market Fund | | | 1,400,000,000 | | | | — | | | | — | | | | 1,400,000,000 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | | 9,763,088,903 | | | | — | | | | — | | | | 9,763,088,903 | |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Purchased Call Options (b) | | | — | | | | — | | | | 38,706,828 | | | | 38,706,828 | |

Purchased Put Options | | | 80,533,620 | | | | — | | | | — | | | | 80,533,620 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities and Other Financial Instruments | | $ | 9,843,622,523 | | | $ | — | | | $ | 38,706,828 | | | $ | 9,882,329,351 | |

| | | | | | | | | | | | | | | | |

Liability Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments Sold Short (a) | | | | | | | | | | | | | | | | |

| Common Stocks Sold Short | | $ | (1,234,542,122 | ) | | $ | — | | | $ | — | | | $ | (1,234,542,122 | ) |

| Exchange Traded Funds Sold Short | | | (1,442,507,164 | ) | | | — | | | | — | | | | (1,442,507,164 | ) |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | $ | (2,677,049,286 | ) | | $ | — | | | $ | — | | | $ | (2,677,049,286 | ) |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The Level 3 security valued at $38,706,828 is held in Purchased Call Options within the Purchased Options section of the Portfolio of Investments. |

The Fund recognizes transfers between the levels as of the beginning of the period.

For the period ended June 30, 2013, the Portfolio did not have any transfers between Level 1 and Level 2 fair value measurements. (See Note 2)

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 15 | |

Portfolio of Investments June 30, 2013 (Unaudited) (continued)

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments

in Securities | | Balance

December 31,

2012 | | | Accrued

Discounts

(Premiums) | | | Realized

Gain

(Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Purchases | | | Sales | | | Transfers

in to

Level 3 | | | Transfers

out of

Level 3 | | | Balance

as of

June 30,

2013 | | | Change in

Unrealized

Appreciation

(Depreciation)

from

Investments

Still Held at

June 30,

2013 (a) | |

Purchased

Options | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased

Call Options | | $ | — | | | $ | — | | | $ | — | | | $ | 366,128 | | | $ | 38,340,700 | | | $ | — | | | $ | — | | | $ | — | | | $ | 38,706,828 | | | $ | 366,128 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | — | | | $ | — | | | $ | — | | | $ | 366,128 | | | $ | 38,340,700 | | | $ | — | | | $ | — | | | $ | — | | | $ | 38,706,828 | | | $ | 366,128 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Included in “Net change in unrealized appreciation (depreciation) on investments” in the Statement of Operations. |

| | | | |

| 16 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Assets and Liabilities as of June 30, 2013 (Unaudited)

| | | | |

| Assets | |

Investment in securities, at value

(identified cost $9,271,455,006) | | $ | 9,882,329,351 | |

Cash collateral on deposit at broker | | | 3,177,578,812 | |

Cash | | | 594,237,581 | |

Cash denominated in foreign currencies

(identified cost $29,117) | | | 28,804 | |

Receivables: | | | | |

Fund shares sold | | | 240,676,579 | |

Investment securities sold | | | 130,081,007 | |

Dividends | | | 19,571,714 | |

Other assets | | | 1,025,220 | |

| | | | |

Total assets | | | 14,045,529,068 | |

| | | | |

| |

| Liabilities | | | | |

Investments sold short (proceeds $2,830,334,779) | | | 2,677,049,286 | |

Payables: | | | | |

Investment securities purchased | | | 809,771,333 | |

Manager (See Note 3) | | | 11,147,662 | |

Dividends on investments sold short | | | 11,092,485 | |

Fund shares redeemed | | | 6,666,300 | |

Transfer agent (See Note 3) | | | 1,081,962 | |

NYLIFE Distributors (See Note 3) | | | 653,140 | |

Shareholder communication | | | 133,599 | |

Professional fees | | | 24,777 | |

Custodian | | | 21,607 | |

Trustees | | | 7,424 | |

Other Liabilities | | | 10,913 | |

| | | | |

Total liabilities | | | 3,517,660,488 | |

| | | | |

Net assets | | $ | 10,527,868,580 | |

| | | | |

| |

| Composition of Net Assets | | | | |

Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | | $ | 618,498 | |

Additional paid-in capital | | | 9,758,631,787 | |

| | | | |

| | | 9,759,250,285 | |

Net investment loss | | | (34,723,309 | ) |

Accumulated net realized gain (loss) on investments, investments sold short, written options and foreign currency transactions | | | 39,234,616 | |

Net unrealized appreciation (depreciation) on investments | | | 610,874,345 | |

Net unrealized appreciation (depreciation) on investments sold short | | | 153,285,484 | |

Net unrealized appreciation (depreciation) on translation of other assets and liabilities in foreign currencies | | | (52,841 | ) |

| | | | |

Net assets | | $ | 10,527,868,580 | |

| | | | |

| | | | |

Investor Class | | | | |

Net assets applicable to outstanding shares | | $ | 5,303,681 | |

| | | | |

Shares of beneficial interest outstanding | | | 311,735 | |

| | | | |

Net asset value per share outstanding | | $ | 17.01 | |

Maximum sales charge (5.50% of offering price) | | | 0.99 | |

| | | | |

Maximum offering price per share outstanding | | $ | 18.00 | |

| | | | |

Class A | | | | |

Net assets applicable to outstanding shares | | $ | 778,850,729 | |

| | | | |

Shares of beneficial interest outstanding | | | 45,788,669 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.01 | |

| | | | |

Maximum sales charge (5.50% of offering price) | | | 0.99 | |

| | | | |

Maximum offering price per share outstanding | | $ | 18.00 | |

| | | | |

Class C | | | | |

Net assets applicable to outstanding shares | | $ | 687,414,082 | |

| | | | |

Shares of beneficial interest outstanding | | | 40,628,794 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 16.92 | |

| | | | |

Class I | | | | |

Net assets applicable to outstanding shares | | $ | 9,030,102,979 | |

| | | | |

Shares of beneficial interest outstanding | | | 530,230,188 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.03 | |

| | | | |

Class R2 | | | | |

Net assets applicable to outstanding shares | | $ | 4,184,505 | |

| | | | |

Shares of beneficial interest outstanding | | | 246,307 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 16.99 | |

| | | | |

Class R6 | | | | |

Net assets applicable to outstanding shares | | $ | 24,922 | |

| | | | |

Shares of beneficial interest outstanding | | | 1,464 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.02 | |

| | | | |

Class P | | | | |

Net assets applicable to outstanding shares | | $ | 21,987,682 | |

| | | | |

Shares of beneficial interest outstanding | | | 1,291,111 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 17.03 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 17 | |

Statement of Operations for the six months ended June 30, 2013 (Unaudited)

| | | | |

| Investment Income (Loss) | |

Income | | | | |

Dividends (a) | | $ | 64,824,153 | |

Interest | | | 42,340 | |

| | | | |

Total income | | | 64,866,493 | |

| | | | |

Expenses | | | | |

Manager (See Note 3) | | | 51,079,756 | |

Dividends on investments sold short | | | 34,544,709 | |

Broker fees and charges on short sales | | | 7,834,581 | |

Transfer agent (See Note 3) | | | 2,810,130 | |

Distribution/Service—Investor Class (See Note 3) | | | 3,781 | |

Distribution/Service—Class A (See Note 3) | | | 534,778 | |

Distribution/Service—Class C (See Note 3) | | | 1,952,420 | |

Distribution/Service—Class R2 (See Note 3) | | | 835 | |

Registration | | | 272,552 | |

Shareholder communication | | | 232,635 | |

Professional fees | | | 156,473 | |

Custodian | | | 65,588 | |

Trustees | | | 63,775 | |

Shareholder service—Class R2 (See Note 3) | | | 334 | |

Miscellaneous | | | 38,934 | |

| | | | |

Total expenses | | | 99,591,281 | |

| | | | |

Net investment income (loss) | | | (34,724,788 | ) |

| | | | |

|

| Realized and Unrealized Gain (Loss) on Investments, Written Options and Foreign Currency Transactions | |

Net realized gain (loss) on: | | | | |

Security transactions | | | 171,625,218 | |

Investments sold short | | | (89,652,655 | ) |

Written option transactions | | | 9,994,815 | |

Foreign currency transactions | | | 643,461 | |

| | | | |

Net realized gain (loss) on investments, investments sold short, written option transactions and foreign currency transactions | | | 92,610,839 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 172,211,607 | |

Investments sold short | | | 203,162,403 | |

Written option contracts | | | (948,324 | ) |

Translation of other assets and liabilities in foreign currencies | | | (58,690 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on investments, investments sold short, written options and foreign currency transactions | | | 374,366,996 | |

| | | | |

Net realized and unrealized gain (loss) on investments, investments sold short, written options and foreign currency transactions | | | 466,977,835 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 432,253,047 | |

| | | | |

| (a) | Dividends recorded net of foreign withholding taxes in the amount of $4,350,388. |

| | | | |

| 18 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statements of Changes in Net Assets

for the six months ended June 30, 2013 (Unaudited) and the year ended December 31, 2012

| | | | | | | | |

| | | 2013 | | | 2012 | |

| Increase (Decrease) in Net Assets | | | | | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (34,724,788 | ) | | $ | (27,714,619 | ) |

Net realized gain (loss) on investments, futures transactions, written option transactions, investments sold short and foreign currency transactions | | | 92,610,839 | | | | (23,685,780 | ) |

Net change in unrealized appreciation (depreciation) on investments, investments sold short, futures contracts, written options and foreign currency transactions | | | 374,366,996 | | | | 301,411,597 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | 432,253,047 | | | | 250,011,198 | |

| | | | |

Distributions to shareholders: | | | | | | | | |

From net realized gain on investments: | | | | | | | | |

Investor Class | | | — | | | | (1,882 | ) |

Class A | | | — | | | | (407,905 | ) |

Class C | | | — | | | | (366,143 | ) |

Class I | | | — | | | | (16,701,031 | ) |

Class R2 | | | — | | | | (114 | ) |

Class R6 | | | — | | | | — | |

Class P | | | — | | | | — | |

| | | | |

Total distributions to shareholders | | | — | | | | (17,477,075 | ) |

| | | | |

Capital share transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 6,331,356,840 | | | | 3,627,403,963 | |

Net asset value of shares issued to shareholders in reinvestment of distributions | | | — | | | | 13,221,785 | |

Cost of shares redeemed | | | (642,863,444 | ) | | | (354,820,101 | )(a) |

| | | | |

Increase (decrease) in net assets derived from capital share transactions | | | 5,688,493,396 | | | | 3,285,805,647 | |

| | | | |

Net increase (decrease) in net assets | | | 6,120,746,443 | | | | 3,518,339,770 | |

|

| Net Assets | |

Beginning of period | | | 4,407,122,137 | | | | 888,782,367 | |

| | | | |

End of period | | $ | 10,527,868,580 | | | $ | 4,407,122,137 | |

| | | | |

Net investment income (loss) at end of period | | $ | (34,723,309 | ) | | $ | 1,479 | |

| | | | |

| (a) | Cost of shares redeemed net of redemption fees of $140,260 for the year ended December 31, 2012. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 19 | |

Financial Highlights selected per share data and ratios

| | | | | | | | |

| | | Investor Class | |

| | | Six months

ended

June 30, | | | October 5,

2012**

through

December 31, | |

| | | 2013* | | | 2012 | |

Net asset value at beginning of period | | $ | 15.84 | | | $ | 15.80 | † |

| | | | | | | | |

Net investment income (loss) (a) | | | (0.08 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) on investments | | | 1.25 | | | | 0.15 | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | — | | | | — | |

| | | | | | | | |

Total from investment operations | | | 1.17 | | | | 0.11 | |

| | | | | | | | |

Less distributions: | | | | | | | | |

From net realized gain on investments | | | — | | | | (0.07 | ) |

| | | | | | | | |

Net asset value at end of period | | $ | 17.01 | | | $ | 15.84 | |

| | | | | | | | |

Total investment return (b)(c) | | | 7.39 | % (d) | | | 0.72 | % |

Ratios of expenses to average net assets (e): | | | | | | | | |

Before waivers/reimbursements of expenses | | | 3.04 | % †† | | | 4.03 | % †† |

Excluding dividends and interest expense on short positions | | | 1.74 | % †† | | | 1.74 | % †† |

After waivers/reimbursements of expenses | | | 3.04 | % †† | | | 4.03 | % †† |

Excluding dividends and interest expense on short positions | | | 1.74 | % †† | | | 1.74 | % †† |

Ratio of net investment loss to average net assets: | | | | | | | | |

Before waivers/reimbursements of expenses (f) | | | (1.02 | %)†† | | | (1.06 | %)†† |

After waivers/reimbursements of expenses (f) | | | (1.02 | %)†† | | | (1.06 | %)†† |

Short sale expenses | | | 1.30 | % †† | | | 2.29 | % †† |

Portfolio turnover rate | | | 22 | % | | | 66 | % |

Net assets at end of period (in 000’s) | | $ | 5,304 | | | $ | 619 | |

| † | Based on the net asset value of Class I as of October 5, 2012. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is not annualized. |

| (c) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| (d) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (e) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro-rata share of the fees and expenses of the Exchange Traded Funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (f) | The net investment loss ratios include dividends and interest expense on short positions. |

| | | | |

| 20 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | |

| | | Class A | |

| | | Six months

ended

June 30, | | | October 5,

2012**

through

December 31, | |

| | | 2013* | | | 2012 | |

Net asset value at beginning of period | | $ | 15.84 | | | $ | 15.80 | † |

| | | | | | | | |

Net investment income (loss) (a) | | | (0.09 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) on investments | | | 1.26 | | | | 0.15 | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | — | | | | — | |

| | | | | | | | |

Total from investment operations | | | 1.17 | | | | 0.11 | |

| | | | | | | | |

Less distributions: | | | | | | | | |

From net realized gain on investments | | | — | | | | (0.07 | ) |

| | | | | | | | |

Net asset value at end of period | | $ | 17.01 | | | $ | 15.84 | |

| | | | | | | | |

Total investment return (b)(c) | | | 7.39 | % | | | 0.72 | % |

Ratios of expenses to average net assets (d): | | | | | | | | |

Before waivers/reimbursements of expenses | | | 3.00 | % †† | | | 4.07 | % †† |

Excluding dividends and interest expense on short positions | | | 1.75 | % †† | | | 1.80 | % †† |

After waivers/reimbursements of expenses | | | 3.00 | % †† | | | 4.07 | % †† |

Excluding dividends and interest expense on short positions | | | 1.75 | % †† | | | 1.80 | % †† |

Ratio of net investment loss to average net assets: | | | | | | | | |

Before waivers/reimbursements of expenses (e) | | | (1.06 | %)†† | | | (1.13 | %)†† |

After waivers/reimbursements of expenses (e) | | | (1.06 | %)†† | | | (1.13 | %)†† |

Short sale expenses | | | 1.25 | % †† | | | 2.27 | % †† |

Portfolio turnover rate | | | 22 | % | | | 66 | % |

Net assets at end of period (in 000’s) | | $ | 778,851 | | | $ | 137,056 | |

| † | Based on the net asset value of Class I as of October 5, 2012. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is not annualized. |

| (c) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| (d) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro-rata share of the fees and expenses of the Exchange Traded Funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | The net investment loss ratios include dividends and interest expense on short positions. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 21 | |

Financial Highlights selected per share data and ratios

| | | | | | | | |

| | | Class C | |

| | | Six months

ended

June 30, | | | October 5,

2012**

through

December 31, | |

| | | 2013* | | | 2012 | |

Net asset value at beginning of period | | $ | 15.81 | | | $ | 15.80 | † |

| | | | | | | | |

Net investment income (loss) (a) | | | (0.15 | ) | | | (0.07 | ) |

Net realized and unrealized gain (loss) on investments | | | 1.26 | | | | 0.15 | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | — | | | | — | |

| | | | | | | | |

Total from investment operations | | | 1.11 | | | | 0.08 | |

| | | | | | | | |

Less distributions: | | | | | | | | |

From net realized gain on investments | | | — | | | | (0.07 | ) |

| | | | | | | | |

Net asset value at end of period | | $ | 16.92 | | | $ | 15.81 | |

| | | | | | | | |

Total investment return (b)(c) | | | 7.02 | % | | | 0.53 | % |

Ratios of expenses to average net assets (d): | | | | | | | | |

Before waivers/reimbursements of expenses | | | 3.73 | % †† | | | 4.82 | % †† |

Excluding dividends and interest expense on short positions | | | 2.49 | % †† | | | 2.50 | % †† |

After waivers/reimbursements of expenses | | | 3.73 | % †† | | | 4.82 | % †† |

Excluding dividends and interest expense on short positions | | | 2.49 | % †† | | | 2.50 | % †† |

Ratio of net investment loss to average net assets: | | | | | | | | |

Before waivers/reimbursements of expenses (e) | | | (1.80 | %)†† | | | (1.85 | %)†† |

After waivers/reimbursements of expenses (e) | | | (1.80 | %)†† | | | (1.85 | %)†† |

Short sale expenses | | | 1.24 | % †† | | | 2.32 | % †† |

Portfolio turnover rate | | | 22 | % | | | 66 | % |

Net assets at end of period (in 000’s) | | $ | 687,414 | | | $ | 124,430 | |

| † | Based on the net asset value of Class I as of October 5, 2012. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is not annualized. |

| (c) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| (d) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro-rata share of the fees and expenses of the Exchange Traded Funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | The net investment loss ratios include dividends and interest expense on short positions. |

| | | | |

| 22 | | MainStay Marketfield Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class I | |

| | | Six months

ended

June 30, | | | Year ended December 31, | | | June 1,

2009

through

December 31, | | | Year ended

May 31, | | | July 31,

2007**

through

May 31, | |

| | | 2013* | | | 2012 | | | 2011*** | | | 2010*** | | | 2009*** | | | 2009*** | | | 2008*** | |

Net asset value at beginning of period | | $ | 15.84 | | | $ | 14.02 | | | $ | 13.52 | | | $ | 11.84 | | | $ | 10.18 | | | $ | 10.76 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.07 | )(a) | | | (0.06 | )(a) | | | (0.11 | ) | | | (0.04 | ) | | | (0.06 | ) | | | (0.03 | ) | | | (0.05 | ) |

Net realized and unrealized gain (loss) on investments | | | 1.26 | | | | 1.96 | | | | 0.61 | | | | 1.75 | | | | 1.72 | | | | (0.55 | ) | | | 0.81 | |

Net realized and unrealized gain (loss)

on foreign currency transactions | | | 0.00 | ‡ | | | (0.01 | ) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.19 | | | | 1.89 | | | | 0.50 | | | | 1.71 | | | | 1.66 | | | | (0.58 | ) | | | 0.76 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | | | | — | | | | — | |

From net realized gain on investments | | | — | | | | (0.07 | ) | | | — | | | | (0.02 | ) | | | — | | | | (0.00 | )‡ | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | — | | | | (0.07 | ) | | | — | | | | (0.03 | ) | | | — | | | | (0.00 | )‡ | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |