Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22376

PIMCO Equity Series VIT

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive office)

Trent W. Walker

Treasurer (Principal Financial & Accounting Officer)

PIMCO Equity Series VIT

650 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 877-4626

Date of fiscal year end: December 31

Date of reporting period: June 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

| ● | PIMCO StocksPLUS® Global Portfolio |

Table of Contents

PIMCO Equity Series VIT®

Semiannual

Report

June 30, 2018

PIMCO StocksPLUS® Global Portfolio

Table of Contents

| Page | ||||

| 2 | ||||

Important Information About the PIMCO StocksPLUS® Global Portfolio | 4 | |||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 23 | ||||

| 39 | ||||

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series VIT (the “Trust”) prospectus for the Portfolio. The variable product prospectus may be obtained by contacting your Investment Consultant.

Table of Contents

Dear Shareholder,

Following is the PIMCO Equity Series VIT Semiannual Report, which covers the six-month reporting period ended June 30, 2018. On the subsequent pages you will find specific details regarding investment results and a discussion of factors that most affected performance over the reporting period.

For the six-month reporting period ended June 30, 2018

The U.S. economy continued to expand during the reporting period. Looking back, U.S. gross domestic product (GDP) expanded at a revised annual pace of 2.3% and 2.2% during the fourth quarter of 2017 and first quarter of 2018, respectively. The Commerce Department’s initial reading — released after the reporting period had ended — showed that second-quarter 2018 GDP grew at an annual pace of 4.1%.

The Federal Reserve (Fed) continued to normalize monetary policy during the reporting period. After raising interest rates three times in 2017, the Fed again raised rates at its March 2018 meeting, pushing the federal funds rate to a range between 1.50% and 1.75%. Finally, at its meeting that concluded on June 13, 2018, the Fed raised rates to a range between 1.75% and 2.00%.

Economic activity outside the U.S. moderated somewhat during the reporting period. Against this backdrop, the European Central Bank (ECB), the Bank of Japan and the Bank of England largely maintained their highly accommodative monetary policies. Other central banks took a more hawkish stance, including the Bank of Canada, as it raised rates in January 2018. Meanwhile, in June 2018, the ECB indicated that it plans to end its quantitative easing program by the end of the year, but it did not expect to raise interest rates “at least through the summer of 2019.”

The U.S. Treasury yield curve flattened during the reporting period, as short-term rates moved up more than their longer-term counterparts. The increase in rates at the short end of the yield curve was mostly due to Fed interest rate hikes. The yield on the benchmark 10-year U.S. Treasury note was 2.85% at the end of the reporting period, up from 2.40% on December 31, 2017. U.S. Treasuries, as measured by the Bloomberg Barclays U.S. Treasury Index, returned -1.08% over the six months ended June 30, 2018. Meanwhile the Bloomberg Barclays U.S. Aggregate Bond Index, a widely used index of U.S. investment grade bonds, returned -1.62% over the period. Riskier fixed income asset classes, including high yield corporate bonds and emerging market debt, generated mixed results versus the broad U.S. market. The ICE BofAML U.S. High Yield Index gained 0.08% over the reporting period, whereas emerging market external debt, as represented by the JPMorgan Emerging Markets Bond Index (EMBI) Global, returned -5.23% over the reporting period. Emerging market local bonds, as represented by the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged), returned -6.44% over the period.

Global equities generated mixed results during the reporting period. The U.S. market rallied sharply during the first month of the period. Supporting the market were improving global growth, overall solid corporate profits and the passage of a tax reform bill late in 2017. Those gains were then erased in February and March 2018. This was partially driven by fears that the Fed may take a more aggressive approach in terms of raising interest rates. In addition, there were concerns over a possible trade war. However, U.S. equities moved modestly higher over the last three months of the period. All told, U.S. equities, as represented by the S&P 500 Index, returned 2.65% during the reporting period. Emerging market equities, as measured by the MSCI Emerging Markets Index, returned -6.66% over the period, whereas global equities, as represented by the MSCI World Index, gained 0.43%. Elsewhere, Japanese equities, as represented by the Nikkei 225 Index (in JPY), returned -1.05% over the reporting period and European equities, as represented by the MSCI Europe Index (in EUR), returned -0.48%.

Commodity prices fluctuated and produced mixed results during the six months ended June 30, 2018. When the reporting period began, crude oil was approximately $60 a barrel. By the end of the period it was roughly $74 a barrel. This ascent was driven in part by planned and observed production cuts by OPEC and the collapse in

| 2 | PIMCO EQUITY SERIES VIT |

Table of Contents

Venezuelan oil production, as well as global growth maintaining demand. Elsewhere, gold and copper prices moved lower over the reporting period.

Finally, during the reporting period, there were periods of volatility in the foreign exchange markets, due in part to signs of improving global growth, decoupling central bank policies, and a number of geopolitical events. All told, the U.S. dollar returned 2.73%, 2.26% and -1.71% versus the euro, British pound and Japanese yen, respectively, during the six months ended June 30, 2018.

Thank you for the assets you have placed with us. We deeply value your trust, and will continue to work diligently to meet your broad investment needs.

| Sincerely,

Brent R. Harris Chairman of the Board PIMCO Equity Series VIT

August 22, 2018 |

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

| SEMIANNUAL REPORT | JUNE 30, 2018 | 3 |

Table of Contents

Important Information About the PIMCO StocksPLUS® Global Portfolio

PIMCO Equity Series VIT (the “Trust”) is an open-end management investment company that includes the PIMCO StocksPLUS® Global Portfolio (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

In an environment where interest rates may trend upward, rising rates would negatively impact the performance of certain funds, and fixed income securities and other instruments held by the Portfolio are likely to decrease in value. A wide variety of factors can cause interest rates to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that management will anticipate such movement accurately. The Portfolio may lose money as a result of movements in interest rates.

The values of equity securities, such as common stocks and preferred stocks, have historically risen and fallen in periodic cycles and may decline due to general market conditions, which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Equity securities may also decline due to factors that affect a particular industry or industries, such as labor shortages, increased production costs and competitive conditions within an industry. In addition, the value of an equity security may decline for a number of reasons that directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets. Different types of equity securities may react differently to these developments and a change in the financial condition of a single issuer may affect securities markets as a whole.

During a general downturn in the securities markets, multiple asset classes, including equity securities, may decline in value simultaneously. The market price of equity securities owned by a Portfolio may go up or down, sometimes rapidly or unpredictably. Equity securities generally have greater price volatility than fixed income securities and common stocks generally have the greatest appreciation and depreciation potential of all equity securities.

As of the date of this report, interest rates in the U.S. and many parts of the world, including certain European countries, are at or near historically low levels. As such, bond funds may currently face an increased exposure to the risks associated with a rising interest rate environment. This is especially true as the Fed ended its quantitative easing program in October 2014 and has begun, and may continue, to

raise interest rates. To the extent the Fed continues to raise interest rates, there is a risk that rates across the financial system may rise. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets.”

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact the Portfolio’s performance or cause the Portfolio to incur losses. As a result, the Portfolio may experience increased shareholder redemptions, which, among other things, could further reduce the net assets of the Portfolio.

The Portfolio may be subject to various risks as described in the Portfolio’s prospectus and in the Principal Risks in the Notes to Financial Statements.

The geographical classification of foreign (non-U.S.) securities in this report are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure. The United States presidential administration’s enforcement of tariffs on goods from other countries, with a focus on China, has contributed to international trade tensions and may impact portfolio securities.

On the Portfolio Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. The Cumulative Returns chart reflects only Institutional Class performance. Performance may vary by share class based on each class’s expense ratios. The Portfolio measures its performance against at least one broad-based securities market index (benchmark index). The benchmark index does not take into account fees, expenses, or taxes. The Portfolio’s past performance, before and after taxes, is not necessarily an indication of how the Portfolio will perform in the future. There is no assurance that the Portfolio, even if the Portfolio has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. High performance is defined as a significant increase in either 1) the Portfolio’s total return in excess of that of the Portfolio’s benchmark between reporting periods or 2) the Portfolio’s total return in excess of

the Portfolio’s historical returns between reporting periods. Unusual performance is defined as a significant change in the Portfolio’s performance as compared to one or more previous reporting periods.

| 4 | PIMCO EQUITY SERIES VIT |

Table of Contents

The following table discloses the inception dates of the Portfolio and its respective share classes along with the Portfolio’s diversification status as of period end:

| Portfolio Name | Portfolio Inception | Institutional Class | Advisor Class | Diversification Status | ||||||||||||||||

PIMCO StocksPLUS® Global Portfolio | 04/14/10 | 04/14/10 | 04/14/10 | Diversified | ||||||||||||||||

An investment in the Portfolio is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. It is possible to lose money on investments in the Portfolio.

The Trustees are responsible generally for overseeing the management of the Trust. The Trustees authorize the Trust to enter into service agreements with the Adviser, the Distributor, the Administrator and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Trust and the Portfolio. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither this Portfolio’s prospectus nor summary prospectus, the Trust’s Statement of Additional Information (“SAI”), any contracts filed as exhibits to the Trust’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Trust or the Portfolio creates a contract between or among any shareholder of the Portfolio, on the one hand, and the Trust, the Portfolio, a service provider to the Trust or the Portfolio, and/or the Trustees or officers of the Trust, on the other hand. The Trustees (or the Trust and its officers, service providers or other delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus, summary prospectus or SAI with respect to the Portfolio or the Trust, and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which the Trust or the Portfolio is a party, and interpret the investment objectives, policies, restrictions and contractual provisions applicable to the Portfolio, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in the Trust’s then-current prospectus or SAI.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Portfolio. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 87-PIMCO, on the Portfolio’s website at www.pimco.com/pvit, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Trust files a complete schedule of the Portfolio’s holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Portfolio’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. A copy of the Portfolio’s Form N-Q is also available without charge, upon request, by calling the Trust at (888) 87-PIMCO and on the Portfolio’s website at www.pimco.com/pvit. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

The SEC adopted a rule that generally allows funds to deliver shareholder reports to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Pursuant to the rule, investors may still elect to receive a complete shareholder report in the mail. PIMCO is evaluating how to make the electronic delivery option available to shareholders in the future.

PIMCO Equity Series VIT is distributed by PIMCO Investments LLC, 1633 Broadway, New York, New York 10019.

| SEMIANNUAL REPORT | JUNE 30, 2018 | 5 |

Table of Contents

PIMCO StocksPLUS® Global Portfolio

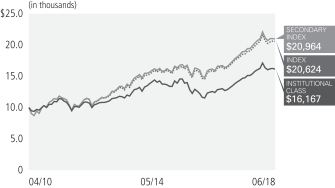

Cumulative Returns Through June 30, 2018

$10,000 invested at the end of the month when the Portfolio’s Institutional Class commenced operations.

Investment Objective and Strategy Overview

PIMCO StocksPLUS® Global Portfolio (the “Portfolio”) seeks total return which exceeds that of its secondary benchmark index consistent with prudent investment management. The Portfolio’s secondary benchmark index is the 50% S&P 500 Index/50% MSCI EAFE Net Dividend Index (USD Unhedged). The Portfolio seeks to exceed the total return of its secondary benchmark index by investing under normal circumstances in S&P 500 Index derivatives and MSCI Europe Australasia Far East (“MSCI EAFE”) Net Dividend Index (USD Unhedged) derivatives, backed by a portfolio of Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The Portfolio may invest in common stocks, options, futures, options on futures and swaps. Portfolio strategies may change from time to time. Please refer to the Portfolio’s current prospectus for more information regarding the Portfolio’s strategy.

| Average Annual Total Return for the period ended June 30, 2018 | ||||||||||||||||||

| 6 Months* | 1 Year | 5 Year | Fund Inception (04/14/2010) | |||||||||||||||

| PIMCO StocksPLUS® Global Portfolio Institutional Class | (0.57)% | 9.58% | 6.97% | 5.78% | |||||||||||||

| PIMCO StocksPLUS® Global Portfolio Advisor Class | (0.68)% | 9.27% | 6.68% | 5.50% | ||||||||||||||

| MSCI World Index± | 0.43% | 11.09% | 9.94% | 8.78% | |||||||||||||

| 50% MSCI EAFE Net Dividend Index/50% S&P 500 Index±± | (0.05)% | 10.59% | 9.94% | 8.98% | |||||||||||||

All Portfolio returns are net of fees and expenses.

* Cumulative return.

± The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices.

±± The benchmark is a blend of 50% MSCI EAFE Net Dividend Index/50% S&P 500 Index. MSCI EAFE Net Dividend Index is an unmanaged index of issuers in countries of Europe, Australia, and the Far East represented in U.S. Dollars on a unhedged basis. S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The Index focuses on the large-cap segment of the U.S. equities market.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. The Portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in Variable Contracts, which will reduce returns. Differences in the Portfolio’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the prices of individual positions (which may be sourced from different pricing vendors or other sources) used by the Portfolio and the index. For performance current to the most recent month-end, visit www.pimco.com/pvit or via (888) 87-PIMCO.

The Portfolio’s total annual operating expense ratio in effect as of period end was 0.64% for Institutional Class shares and 0.89% for Advisor Class shares. Details regarding any changes to the Portfolio’s operating expenses, subsequent to period end, can be found in the Portfolio’s current prospectus, as supplemented.

| 6 | PIMCO EQUITY SERIES VIT |

Table of Contents

Geographic Breakdown as of 06/30/20181§

United States‡ | 65.6% | |||||||

Cayman Islands | 7.8% | |||||||

United Kingdom | 4.2% | |||||||

Japan | 3.9% | |||||||

Denmark | 2.0% | |||||||

France | 1.7% | |||||||

Qatar | 1.6% | |||||||

Germany | 1.2% | |||||||

Netherlands | 1.1% | |||||||

Canada | 1.0% | |||||||

Other | 5.7% |

1 % of Investments, at value.

§ Geographic Breakdown and % of Investments exclude securities sold short, financial derivative instruments and short-term instruments, if any.

‡ Includes Central Funds Used for Cash Management Purposes.

Portfolio Insights

The following affected performance during the reporting period:

| » | The Portfolio’s exposure to equity index derivatives linked to the S&P 500 contributed to absolute returns, as the index returned 2.65%; while exposure to the MSCI EAFE detracted from absolute returns, as the index returned negative 2.75%. |

| » | The Portfolio’s bond alpha strategy detracted from returns. Highlights about the drivers of performance include the following: |

| » | U.S. duration strategies detracted from performance, as U.S. Treasury yields increased. |

| » | Exposure to Germany contributed to returns, as yield decreased. |

| » | Holdings of non-agency mortgage-backed securities contributed to returns, as the values of these bonds increased. |

| » | Holdings of emerging market external bonds detracted from performance, as spreads widened. |

| SEMIANNUAL REPORT | JUNE 30, 2018 | 7 |

Table of Contents

Expense Example PIMCO StocksPLUS® Global Portfolio

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable), and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Expense Example does not reflect any fees or other expenses imposed by the Variable Contracts. If it did, the expenses reflected in the Expense Example would be higher. The Example is based on an investment of $1,000 invested at the beginning of the period and held from January 1, 2018 to June 30, 2018 unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the appropriate row for your share class, in the column titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

Expense ratios may vary period to period because of various factors, such as an increase in expenses that are not covered by the management fees such as fees and expenses of the independent trustees and their counsel, extraordinary expenses and interest expense.

| Actual | Hypothetical (5% return before expenses) | |||||||||||||||||||||||||||||||||||||||

| Beginning Account Value (01/01/18) | Ending Account Value (06/30/18) | Expenses Paid During Period* | Beginning Account Value (01/01/18) | Ending Account Value (06/30/18) | Expenses Paid During Period* | Net Annualized Expense Ratio** | ||||||||||||||||||||||||||||||||||

| Institutional Class | $ | 1,000.00 | $ | 994.30 | $ | 3.12 | $ | 1,000.00 | $ | 1,021.67 | $ | 3.16 | 0.63 | % | ||||||||||||||||||||||||||

| Advisor Class | 1,000.00 | 993.20 | 4.35 | 1,000.00 | 1,020.43 | 4.41 | 0.88 | |||||||||||||||||||||||||||||||||

* Expenses Paid During Period are equal to the net annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Overall fees and expenses of investing in the Portfolio will be higher because the example does not reflect variable contract fees and expenses.

** Net Annualized Expense Ratio is reflective of any applicable contractual fee waivers and/or expense reimbursements or voluntary fee waivers. Details regarding fee waivers, if any, can be found in Note 9, Fees and Expenses, in the Notes to Financial Statements.

| 8 | PIMCO EQUITY SERIES VIT |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| SEMIANNUAL REPORT | JUNE 30, 2018 | 9 |

Table of Contents

Financial Highlights PIMCO StocksPLUS® Global Portfolio

| Investment Operations | Less Distributions(b) | |||||||||||||||||||||||||||||||

| Selected Per Share Data for the Year or Period Ended^: | Net Asset Value Beginning of Year or Period | Net Investment Income (Loss)(a) | Net Realized/ Unrealized Gain (Loss) | Total | From Net Investment Income | From Net Realized Capital Gain | Total | |||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||||||||

01/01/2018 - 06/30/2018+ | $ | 9.65 | $ | 0.08 | $ | (0.13 | ) | $ | (0.05 | ) | $ | (0.05 | ) | $ | 0.00 | $ | (0.05 | ) | ||||||||||||||

12/31/2017 | 8.09 | 0.08 | 1.79 | 1.87 | (0.31 | ) | 0.00 | (0.31 | ) | |||||||||||||||||||||||

12/31/2016 | 9.52 | 0.19 | 0.57 | 0.76 | (0.50 | ) | (1.69 | ) | (2.19 | ) | ||||||||||||||||||||||

12/31/2015(d) | 12.46 | 0.34 | (1.43 | ) | (1.09 | ) | (0.63 | ) | (1.22 | ) | (1.85 | ) | ||||||||||||||||||||

12/31/2014(d) | 12.53 | 0.29 | (0.16 | ) | 0.13 | 0.00 | (0.20 | ) | (0.20 | ) | ||||||||||||||||||||||

12/31/2013(d) | 10.72 | 0.27 | 1.83 | 2.10 | (0.29 | ) | 0.00 | (0.29 | ) | |||||||||||||||||||||||

| Advisor Class | ||||||||||||||||||||||||||||||||

01/01/2018 - 06/30/2018+ | 9.53 | 0.07 | (0.13 | ) | (0.06 | ) | (0.04 | ) | 0.00 | (0.04 | ) | |||||||||||||||||||||

12/31/2017 | 8.01 | 0.05 | 1.76 | 1.81 | (0.29 | ) | 0.00 | (0.29 | ) | |||||||||||||||||||||||

12/31/2016 | 9.44 | 0.17 | 0.55 | 0.72 | (0.46 | ) | (1.69 | ) | (2.15 | ) | ||||||||||||||||||||||

12/31/2015(d) | 12.39 | 0.30 | (1.42 | ) | (1.12 | ) | (0.61 | ) | (1.22 | ) | (1.83 | ) | ||||||||||||||||||||

12/31/2014(d) | 12.48 | 0.25 | (0.14 | ) | 0.11 | 0.00 | (0.20 | ) | (0.20 | ) | ||||||||||||||||||||||

12/31/2013(d) | 10.69 | 0.24 | 1.81 | 2.05 | (0.26 | ) | 0.00 | (0.26 | ) | |||||||||||||||||||||||

| ^ | A zero balance may reflect actual amounts rounding to less than $0.01 or 0.01%. |

| + | Unaudited |

| * | Annualized |

| (a) | Per share amounts based on average number of shares outstanding during the year or period. |

| (b) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. The actual tax characterization of distributions paid is determined at the end of the fiscal year. See Note 2, Distributions to Shareholders, in the Notes to Financial Statements for more information. |

| (c) | Effective October 21, 2016, the Portfolio’s Investment advisory fee was decreased by 0.39% to an annual rate of 0.30% and the Portfolio’s supervisory and administrative fee was decreased by 0.04% to an annual rate of 0.31%. |

| (d) | Includes the consolidated accounts of the Portfolio’s subsidiary, PIMCO Cayman Commodity Portfolio III, Ltd., which was terminated on May 26, 2015. |

| (e) | Effective July 13, 2015, the Portfolio’s Investment advisory fee was decreased by 0.06% to an annual rate of 0.69% |

| 10 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

| Ratios/Supplemental Data | ||||||||||||||||||||||||||||||||||

| Ratios to Average Net Assets | ||||||||||||||||||||||||||||||||||

| Net Asset Value End of Year or Period | Total Return | Net Assets End of Year or Period (000s) | Expenses | Expenses Excluding Waivers | Expenses Excluding Interest Expense and Dividends on Securities Sold Short | Expenses Excluding Interest Expense and Dividends on Securities Sold Short and Waivers | Net Investment Income (Loss) | Portfolio Turnover Rate | ||||||||||||||||||||||||||

| $ | 9.55 | (0.57 | )% | $ | 40,194 | 0.63 | %* | 0.66 | %* | 0.62 | %* | 0.65 | %* | 1.64 | %* | 18 | % | |||||||||||||||||

| 9.65 | 23.47 | 42,627 | 0.62 | 0.64 | 0.62 | 0.64 | 0.87 | 28 | ||||||||||||||||||||||||||

| 8.09 | 7.99 | 38,440 | 0.84 | (c) | 1.00 | (c) | 0.84 | (c) | 1.00 | (c) | 2.08 | 130 | ||||||||||||||||||||||

| 9.52 | (8.75 | ) | 40,582 | 0.95 | (e) | 1.10 | (e) | 0.93 | (e) | 1.08 | (e) | 2.68 | 152 | |||||||||||||||||||||

| 12.46 | 1.06 | 52,234 | 0.98 | 1.12 | 0.97 | 1.11 | 2.22 | 31 | ||||||||||||||||||||||||||

| 12.53 | 19.60 | 57,768 | 0.98 | 1.15 | 0.97 | 1.14 | 2.29 | 29 | ||||||||||||||||||||||||||

| 9.43 | (0.68 | ) | 248,243 | 0.88 | * | 0.91 | * | 0.87 | * | 0.90 | * | 1.39 | * | 18 | ||||||||||||||||||||

| 9.53 | 22.99 | 269,648 | 0.87 | 0.89 | 0.87 | 0.89 | 0.62 | 28 | ||||||||||||||||||||||||||

| 8.01 | 7.67 | 258,741 | 1.09 | (c) | 1.25 | (c) | 1.09 | (c) | 1.25 | (c) | 1.85 | 130 | ||||||||||||||||||||||

| 9.44 | (8.98 | ) | 284,406 | 1.20 | (e) | 1.35 | (e) | 1.18 | (e) | 1.33 | (e) | 2.43 | 152 | |||||||||||||||||||||

| 12.39 | 0.90 | 380,293 | 1.23 | 1.37 | 1.22 | 1.36 | 1.98 | 31 | ||||||||||||||||||||||||||

| 12.48 | 19.19 | 449,196 | 1.23 | 1.40 | 1.22 | 1.39 | 2.05 | 29 | ||||||||||||||||||||||||||

| See Accompanying Notes | SEMIANNUAL REPORT | JUNE 30, 2018 | 11 |

Table of Contents

Statement of Assets and Liabilities PIMCO StocksPLUS® Global Portfolio

(Unaudited)

| (Amounts in thousands†, except per share amounts) | June 30, 2018 | |||

Assets: | ||||

Investments, at value | ||||

Investments in securities* | $ | 197,612 | ||

Investments in Affiliates | 79,168 | |||

Financial Derivative Instruments | ||||

Exchange-traded or centrally cleared | 1,062 | |||

Over the counter | 349 | |||

Cash | 1 | |||

Deposits with counterparty | 9,761 | |||

Foreign currency, at value | 234 | |||

Receivable for investments sold | 33 | |||

Interest and/or dividends receivable | 1,107 | |||

Dividends receivable from Affiliates | 163 | |||

Reimbursement receivable from PIMCO | 18 | |||

Other assets | 1 | |||

Total Assets | 289,509 | |||

Liabilities: | ||||

Financial Derivative Instruments | ||||

Exchange-traded or centrally cleared | $ | 57 | ||

Over the counter | 535 | |||

Payable for investments in Affiliates purchased | 163 | |||

Payable for Portfolio shares redeemed | 107 | |||

Accrued investment advisory fees | 75 | |||

Accrued supervisory and administrative fees | 77 | |||

Accrued distribution fees | 54 | |||

Other liabilities | 4 | |||

Total Liabilities | 1,072 | |||

Net Assets | $ | 288,437 | ||

Net Assets Consist of: | ||||

Paid in capital | $ | 250,709 | ||

Undistributed (overdistributed) net investment income | 753 | |||

Accumulated undistributed net realized gain (loss) | 45,110 | |||

Net unrealized appreciation (depreciation) | (8,135 | ) | ||

Net Assets | $ | 288,437 | ||

Net Assets: | ||||

Institutional Class | $ | 40,194 | ||

Advisor Class | 248,243 | |||

Shares Issued and Outstanding: | ||||

Institutional Class | 4,209 | |||

Advisor Class | 26,316 | |||

Net Asset Value Per Share Outstanding: | ||||

Institutional Class | $ | 9.55 | ||

Advisor Class | 9.43 | |||

Cost of investments in securities | $ | 198,022 | ||

Cost of investments in Affiliates | $ | 79,187 | ||

Cost of foreign currency held | $ | 239 | ||

Cost or premiums of financial derivative instruments, net | $ | 214 | ||

* Includes repurchase agreements of: | $ | 4,626 | ||

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| 12 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

Statement of Operations PIMCO StocksPLUS® Global Portfolio

| (Amounts in thousands†) | Six Months Ended June 30, 2018 (Unaudited) | |||

Investment Income: | ||||

Interest, net of foreign taxes* | $ | 2,595 | ||

Dividends from Investments in Affiliates | 830 | |||

Total Income | 3,425 | |||

Expenses: | ||||

Investment advisory fees | 452 | |||

Supervisory and administrative fees | 468 | |||

Distribution and/or servicing fees - Advisor Class | 325 | |||

Trustee fees | 38 | |||

Interest expense | 18 | |||

Miscellaneous expense | 13 | |||

Total Expenses | 1,314 | |||

Waiver and/or Reimbursement by PIMCO | (38 | ) | ||

Net Expenses | 1,276 | |||

Net Investment Income (Loss) | 2,149 | |||

Net Realized Gain (Loss): | ||||

Investments in securities | 3,405 | |||

Investments in Affiliates | (9 | ) | ||

Exchange-traded or centrally cleared financial derivative instruments | 8,404 | |||

Over the counter financial derivative instruments | (2,922 | ) | ||

Foreign currency | 37 | |||

Net Realized Gain (Loss) | 8,915 | |||

Net Change in Unrealized Appreciation (Depreciation): | ||||

Investments in securities | (3,254 | ) | ||

Investments in Affiliates | (15 | ) | ||

Exchange-traded or centrally cleared financial derivative instruments | (11,404 | ) | ||

Over the counter financial derivative instruments | 1,974 | |||

Foreign currency assets and liabilities | (18 | ) | ||

Net Change in Unrealized Appreciation (Depreciation) | (12,717 | ) | ||

Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (1,653 | ) | |

* Foreign tax withholdings | $ | 3 | ||

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| See Accompanying Notes | SEMIANNUAL REPORT | JUNE 30, 2018 | 13 |

Table of Contents

Statements of Changes in Net Assets PIMCO StocksPLUS® Global Portfolio

| (Amounts in thousands†) | Six Months Ended June 30, 2018 (Unaudited) | Year Ended December 31, 2017 | ||||||

Increase (Decrease) in Net Assets from: | ||||||||

Operations: | ||||||||

Net investment income (loss) | $ | 2,149 | $ | 2,007 | ||||

Net realized gain (loss) | 8,915 | 55,549 | ||||||

Net change in unrealized appreciation (depreciation) | (12,717 | ) | 6,454 | |||||

Net Increase (Decrease) in Net Assets Resulting from Operations | (1,653 | ) | 64,010 | |||||

Distributions to Shareholders: | ||||||||

From net investment income | ||||||||

Institutional Class | (197 | ) | (1,399 | ) | ||||

Advisor Class | (954 | ) | (8,902 | ) | ||||

Total Distributions(a) | (1,151 | ) | (10,301 | ) | ||||

Portfolio Share Transactions: | ||||||||

Net increase (decrease) resulting from Portfolio share transactions** | (21,034 | ) | (38,615 | ) | ||||

Total Increase (Decrease) in Net Assets | (23,838 | ) | 15,094 | |||||

Net Assets: | ||||||||

Beginning of period | 312,275 | 297,181 | ||||||

End of period* | $ | 288,437 | $ | 312,275 | ||||

* Including undistributed (overdistributed) net investment income of: | $ | 753 | $ | (245 | ) | |||

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| ** | See Note 13, Shares of Beneficial Interest, in the Notes to Financial Statements. |

| (a) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. The actual tax characterization of distributions paid is determined at the end of the fiscal year. See Note 2, Distributions to Shareholders, in the Notes to Financial Statements for more information. |

| 14 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

Schedule of Investments PIMCO StocksPLUS® Global Portfolio

June 30, 2018 (Unaudited)

(Amounts in thousands*, except number of shares, contracts and units, if any)

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

| INVESTMENTS IN SECURITIES 68.6% |

| |||||||||||

| ASSET-BACKED SECURITIES 12.3% |

| |||||||||||

| CANADA 0.3% |

| |||||||||||

CARDS Trust |

| |||||||||||

2.423% due 04/17/2023 ~ | $ | 400 | $ | 400 | ||||||||

3.047% due 04/17/2023 | 400 | 400 | ||||||||||

|

| |||||||||||

Total Canada | 800 | |||||||||||

|

| |||||||||||

| CAYMAN ISLANDS 7.4% |

| |||||||||||

Babson CLO Ltd. |

| |||||||||||

3.503% (US0003M + 1.150%) due 10/17/2026 ~ | 400 | 400 | ||||||||||

BSPRT Issuer Ltd. |

| |||||||||||

3.123% due 03/15/2028 ~ | 600 | 599 | ||||||||||

3.423% (US0001M + 1.350%) due 06/15/2027 ~ | 700 | 701 | ||||||||||

Carlyle Global Market Strategies CLO Ltd. |

| |||||||||||

3.488% (US0003M + 1.140%) due 10/16/2025 ~ | 600 | 600 | ||||||||||

Cavalry CLO Ltd. |

| |||||||||||

3.198% due 10/15/2026 ~ | 500 | 500 | ||||||||||

Cent CLO Ltd. |

| |||||||||||

3.576% (US0003M + 1.210%) due 07/27/2026 ~ | 700 | 701 | ||||||||||

CIFC Funding Ltd. |

| |||||||||||

3.128% due 04/15/2027 ~ | 600 | 598 | ||||||||||

Flatiron CLO Ltd. |

| |||||||||||

3.513% (US0003M + 1.160%) due 01/17/2026 ~ | 1,510 | 1,510 | ||||||||||

Halcyon Loan Advisors Funding Ltd. |

| |||||||||||

3.279% due 04/20/2027 ~ | 900 | 900 | ||||||||||

Jamestown CLO Ltd. |

| |||||||||||

3.218% due 01/15/2028 ~ | 800 | 797 | ||||||||||

3.573% (US0003M + 1.220%) due 01/17/2027 ~ | 865 | 866 | ||||||||||

KVK CLO Ltd. |

| |||||||||||

3.498% (US0003M + 1.150%) due 01/15/2026 ~ | 495 | 495 | ||||||||||

Neuberger Berman CLO Ltd. |

| |||||||||||

3.148% due 07/15/2027 ~ | 600 | 600 | ||||||||||

Oak Hill Credit Partners Ltd. |

| |||||||||||

3.489% (US0003M + 1.130%) due 07/20/2026 ~ | 1,000 | 1,002 | ||||||||||

Octagon Investment Partners Ltd. |

| |||||||||||

3.448% (US0003M + 1.100%) due 04/15/2026 ~ | 800 | 800 | ||||||||||

OFSI Fund Ltd. |

| |||||||||||

2.998% due 03/20/2025 ~ | 900 | 900 | ||||||||||

3.503% (US0003M + 1.150%) due 04/17/2025 ~ | 114 | 114 | ||||||||||

Regatta Funding Ltd. |

| |||||||||||

3.520% (US0003M + 1.160%) due 10/25/2026 ~ | 300 | 300 | ||||||||||

Sound Point CLO Ltd. |

| |||||||||||

3.208% due 04/15/2027 ~ | 1,900 | 1,900 | ||||||||||

3.239% due 07/20/2027 ~ | 400 | 399 | ||||||||||

Staniford Street CLO Ltd. |

| |||||||||||

3.521% (US0003M + 1.180%) due 06/15/2025 ~ | 363 | 363 | ||||||||||

THL Credit Wind River CLO Ltd. |

| |||||||||||

3.798% (US0003M + 1.450%) due 01/15/2026 ~ | 600 | 602 | ||||||||||

Tralee CLO Ltd. |

| |||||||||||

3.389% due 10/20/2027 ~ | 1,200 | 1,202 | ||||||||||

Venture CLO Ltd. |

| |||||||||||

3.198% due 01/15/2028 ~ | 600 | 601 | ||||||||||

3.228% due 07/15/2027 ~ | 1,200 | 1,198 | ||||||||||

3.718% (US0003M + 1.370%) due 01/15/2027 ~ | 1,200 | 1,200 | ||||||||||

Voya CLO Ltd. |

| |||||||||||

3.080% due 07/25/2026 ~ | 600 | 598 | ||||||||||

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

Westlake Automobile Receivables Trust |

| |||||||||||

3.513% (US0003M + 1.160%) due 07/17/2026 ~ | $ | 800 | $ | 801 | ||||||||

WhiteHorse Ltd. |

| |||||||||||

3.563% (US0003M + 1.200%) due 02/03/2025 ~ | 214 | 214 | ||||||||||

|

| |||||||||||

Total Cayman Islands | 21,461 | |||||||||||

|

| |||||||||||

| UNITED STATES 4.6% |

| |||||||||||

Ally Auto Receivables Trust |

| |||||||||||

1.490% due 11/15/2019 | 182 | 181 | ||||||||||

AmeriCredit Automobile Receivables Trust |

| |||||||||||

1.650% due 09/18/2020 | 381 | 380 | ||||||||||

CPS Auto Receivables Trust |

| |||||||||||

1.620% due 01/15/2020 | 51 | 51 | ||||||||||

Flagship Credit Auto Trust |

| |||||||||||

1.930% due 12/15/2021 | 277 | 276 | ||||||||||

Ford Credit Floorplan Master Owner Trust |

| |||||||||||

1.550% due 07/15/2021 | 3,000 | 2,962 | ||||||||||

Navient Private Education Loan Trust |

| |||||||||||

3.573% (US0001M + 1.500%) due 01/16/2035 ~ | 686 | 688 | ||||||||||

Navient Student Loan Trust |

| |||||||||||

2.331% due 03/25/2067 ~ | 361 | 361 | ||||||||||

OneMain Direct Auto Receivables Trust |

| |||||||||||

2.310% due 12/14/2021 | 1,100 | 1,092 | ||||||||||

Progress Residential Trust |

| |||||||||||

3.585% (LIBOR01M + 1.500%) due 09/17/2033 ~ | 988 | 991 | ||||||||||

SLC Student Loan Trust |

| |||||||||||

3.205% (US0003M + 0.875%) due 11/25/2042 ~ | 1,076 | 1,090 | ||||||||||

SLM Private Education Loan Trust |

| |||||||||||

3.310% due 10/15/2046 | 363 | 364 | ||||||||||

4.370% due 04/17/2028 | 675 | 678 | ||||||||||

SMB Private Education Loan Trust |

| |||||||||||

2.623% (US0001M + 0.550%) due 11/15/2023 ~ | 240 | 240 | ||||||||||

SoFi Consumer Loan Program LLC |

| |||||||||||

2.140% due 09/25/2026 | 455 | 453 | ||||||||||

2.200% due 11/25/2026 | 468 | 466 | ||||||||||

2.500% due 05/26/2026 | 629 | 621 | ||||||||||

SoFi Professional Loan Program LLC |

| |||||||||||

1.480% due 05/26/2031 | 130 | 130 | ||||||||||

1.530% due 04/25/2033 | 57 | 57 | ||||||||||

2.510% due 08/25/2033 | 182 | 179 | ||||||||||

3.041% (US0001M + 0.950%) due 01/25/2039 ~ | 93 | 93 | ||||||||||

3.191% (US0001M + 1.100%) due 10/27/2036 ~ | 222 | 224 | ||||||||||

SpringCastle America Funding LLC |

| |||||||||||

3.050% due 04/25/2029 | 786 | 785 | ||||||||||

Utah State Board of Regents |

| |||||||||||

2.710% (US0001M + 0.750%) due 01/25/2057 ~ | 674 | 675 | ||||||||||

VOLT LLC |

| |||||||||||

4.375% due 11/27/2045 × | 51 | 51 | ||||||||||

Westlake Automobile Receivables Trust |

| |||||||||||

1.420% due 10/15/2019 | 39 | 39 | ||||||||||

|

| |||||||||||

Total United States | 13,127 | |||||||||||

|

| |||||||||||

Total Asset-Backed Securities (Cost $35,456) | 35,388 | |||||||||||

|

| |||||||||||

| CORPORATE BONDS & NOTES 38.2% |

| |||||||||||

| AUSTRALIA 0.6% |

| |||||||||||

| BANKING & FINANCE 0.4% |

| |||||||||||

Commonwealth Bank of Australia |

| |||||||||||

1.750% due 11/07/2019 | 1,000 | 983 | ||||||||||

|

| |||||||||||

| INDUSTRIALS 0.2% |

| |||||||||||

Boral Finance Pty. Ltd. |

| |||||||||||

3.000% due 11/01/2022 | 600 | 579 | ||||||||||

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

Sydney Airport Finance Co. Pty. Ltd. |

| |||||||||||

5.125% due 02/22/2021 | $ | 100 | $ | 103 | ||||||||

|

| |||||||||||

| 682 | ||||||||||||

|

| |||||||||||

Total Australia | 1,665 | |||||||||||

|

| |||||||||||

| CANADA 0.7% |

| |||||||||||

| INDUSTRIALS 0.7% |

| |||||||||||

Enbridge, Inc. |

| |||||||||||

2.737% due 01/10/2020 ~ | 2,000 | 2,000 | ||||||||||

|

| |||||||||||

Total Canada | 2,000 | |||||||||||

|

| |||||||||||

| CHINA 0.3% |

| |||||||||||

| UTILITIES 0.3% |

| |||||||||||

State Grid Overseas Investment Ltd. |

| |||||||||||

3.750% due 05/02/2023 | 900 | 902 | ||||||||||

|

| |||||||||||

Total China | 902 | |||||||||||

|

| |||||||||||

| DENMARK 2.0% |

| |||||||||||

| BANKING & FINANCE 1.3% |

| |||||||||||

BRFkredit A/S |

| |||||||||||

1.000% due 10/01/2018 | DKK | 3,100 | 488 | |||||||||

Danske Bank A/S |

| |||||||||||

3.386% due 09/12/2023 ~ | $ | 400 | 401 | |||||||||

Nykredit Realkredit A/S |

| |||||||||||

2.000% due 07/01/2018 | DKK | 5,000 | 784 | |||||||||

1.000% due 07/01/2018 | 11,800 | 1,849 | ||||||||||

|

| |||||||||||

| 3,522 | ||||||||||||

|

| |||||||||||

| INDUSTRIALS 0.7% |

| |||||||||||

AP Moller - Maersk A/S |

| |||||||||||

2.550% due 09/22/2019 | $ | 2,100 | 2,079 | |||||||||

|

| |||||||||||

Total Denmark | 5,601 | |||||||||||

|

| |||||||||||

| FRANCE 1.7% |

| |||||||||||

| BANKING & FINANCE 1.5% |

| |||||||||||

Credit Agricole S.A. |

| |||||||||||

3.750% due 04/24/2023 | 700 | 686 | ||||||||||

3.379% due 04/24/2023 ~ | 300 | 299 | ||||||||||

Dexia Credit Local S.A. |

| |||||||||||

1.875% due 09/15/2021 | 1,700 | 1,640 | ||||||||||

2.375% due 09/20/2022 | 1,700 | 1,648 | ||||||||||

|

| |||||||||||

| 4,273 | ||||||||||||

|

| |||||||||||

| UTILITIES 0.2% |

| |||||||||||

Electricite de France S.A. |

| |||||||||||

6.500% due 01/26/2019 | 500 | 510 | ||||||||||

|

| |||||||||||

Total France | 4,783 | |||||||||||

|

| |||||||||||

| GERMANY 1.2% |

| |||||||||||

| BANKING & FINANCE 1.2% |

| |||||||||||

Deutsche Bank AG |

| |||||||||||

3.312% (US0003M + 0.970%) due 07/13/2020 ~ | 2,100 | 2,087 | ||||||||||

3.549% due 02/27/2023 ~ | 600 | 580 | ||||||||||

4.250% due 10/14/2021 | 700 | 690 | ||||||||||

|

| |||||||||||

Total Germany | 3,357 | |||||||||||

|

| |||||||||||

| GUERNSEY, CHANNEL ISLANDS 0.7% |

| |||||||||||

| BANKING & FINANCE 0.7% |

| |||||||||||

Credit Suisse Group Funding Guernsey Ltd. |

| |||||||||||

4.645% (US0003M + 2.290%) due 04/16/2021 ~ | 2,000 | 2,091 | ||||||||||

|

| |||||||||||

Total Guernsey, Channel Islands | 2,091 | |||||||||||

|

| |||||||||||

| See Accompanying Notes | SEMIANNUAL REPORT | JUNE 30, 2018 | 15 |

Table of Contents

Schedule of Investments PIMCO StocksPLUS® Global Portfolio (Cont.)

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

| IRELAND 0.5% |

| |||||||||||

| BANKING & FINANCE 0.4% |

| |||||||||||

AerCap Ireland Capital DAC |

| |||||||||||

4.250% due 07/01/2020 | $ | 150 | $ | 152 | ||||||||

4.625% due 10/30/2020 | 200 | 204 | ||||||||||

3.750% due 05/15/2019 | 700 | 704 | ||||||||||

|

| |||||||||||

| 1,060 | ||||||||||||

|

| |||||||||||

| INDUSTRIALS 0.1% |

| |||||||||||

Shire Acquisitions Investments Ireland DAC |

| |||||||||||

1.900% due 09/23/2019 | 260 | 256 | ||||||||||

2.400% due 09/23/2021 | 220 | 211 | ||||||||||

|

| |||||||||||

| 467 | ||||||||||||

|

| |||||||||||

Total Ireland | 1,527 | |||||||||||

|

| |||||||||||

| JAPAN 3.3% |

| |||||||||||

| BANKING & FINANCE 2.4% |

| |||||||||||

Mizuho Financial Group, Inc. |

| |||||||||||

2.273% due 09/13/2021 | 1,600 | 1,536 | ||||||||||

3.259% (US0003M + 0.940%) due 02/28/2022 ~ | 500 | 504 | ||||||||||

Sumitomo Mitsui Financial Group, Inc. |

| |||||||||||

3.458% (US0003M + 1.110%) due 07/14/2021 ~ | 2,200 | 2,235 | ||||||||||

3.495% (US0003M + 1.140%) due 10/19/2021 ~ | 500 | 508 | ||||||||||

3.095% due 10/18/2022 ~ | 1,500 | 1,502 | ||||||||||

Sumitomo Mitsui Trust Bank Ltd. |

| |||||||||||

2.824% (US0003M + 0.510%) due 03/06/2019 ~ | 800 | 802 | ||||||||||

|

| |||||||||||

| 7,087 | ||||||||||||

|

| |||||||||||

| INDUSTRIALS 0.9% |

| |||||||||||

Central Nippon Expressway Co. Ltd. |

| |||||||||||

2.369% due 09/10/2018 | 1,000 | 999 | ||||||||||

Toyota Industries Corp. |

| |||||||||||

3.235% due 03/16/2023 | 1,500 | 1,479 | ||||||||||

|

| |||||||||||

| 2,478 | ||||||||||||

|

| |||||||||||

Total Japan | 9,565 | |||||||||||

|

| |||||||||||

| JERSEY, CHANNEL ISLANDS 0.8% |

| |||||||||||

| INDUSTRIALS 0.8% |

| |||||||||||

Aptiv PLC |

| |||||||||||

3.150% due 11/19/2020 | 1,700 | 1,688 | ||||||||||

Heathrow Funding Ltd. |

| |||||||||||

4.875% due 07/15/2023 | 700 | 733 | ||||||||||

|

| |||||||||||

Total Jersey, Channel Islands |

| 2,421 | ||||||||||

|

| |||||||||||

| LUXEMBOURG 0.5% |

| |||||||||||

| INDUSTRIALS 0.5% |

| |||||||||||

Allergan Funding SCS |

| |||||||||||

3.000% due 03/12/2020 | 1,400 | 1,394 | ||||||||||

|

| |||||||||||

Total Luxembourg | 1,394 | |||||||||||

|

| |||||||||||

| NETHERLANDS 1.1% |

| |||||||||||

| BANKING & FINANCE 0.3% |

| |||||||||||

Cooperatieve Rabobank UA |

| |||||||||||

2.500% due 01/19/2021 | 900 | 884 | ||||||||||

|

| |||||||||||

| INDUSTRIALS 0.8% |

| |||||||||||

Syngenta Finance NV |

| |||||||||||

3.933% due 04/23/2021 | 700 | 699 | ||||||||||

4.441% due 04/24/2023 | 500 | 497 | ||||||||||

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

Volkswagen International Finance NV |

| |||||||||||

2.125% due 11/20/2018 | $ | 1,000 | $ | 998 | ||||||||

|

| |||||||||||

| 2,194 | ||||||||||||

|

| |||||||||||

Total Netherlands | 3,078 | |||||||||||

|

| |||||||||||

| SINGAPORE 0.8% |

| |||||||||||

| BANKING & FINANCE 0.8% |

| |||||||||||

BOC Aviation Ltd. |

| |||||||||||

3.413% due 05/02/2021 ~ | 300 | 302 | ||||||||||

Oversea-Chinese Banking Corp. Ltd. |

| |||||||||||

2.771% due 05/17/2021 ~ | 1,400 | 1,404 | ||||||||||

United Overseas Bank Ltd. |

| |||||||||||

2.842% due 04/23/2021 ~ | 700 | 702 | ||||||||||

|

| |||||||||||

Total Singapore | 2,408 | |||||||||||

|

| |||||||||||

| SWITZERLAND 0.2% |

| |||||||||||

| BANKING & FINANCE 0.2% |

| |||||||||||

UBS AG |

| |||||||||||

3.150% (US0003M + 0.850%) due 06/01/2020 ~ | 500 | 504 | ||||||||||

|

| |||||||||||

Total Switzerland | 504 | |||||||||||

|

| |||||||||||

| UNITED KINGDOM 3.5% |

| |||||||||||

| BANKING & FINANCE 2.1% |

| |||||||||||

Barclays PLC |

| |||||||||||

4.463% (US0003M + 2.110%) due 08/10/2021 ~ | 2,200 | 2,284 | ||||||||||

HSBC Holdings PLC |

| |||||||||||

3.821% (US0003M + 1.500%) due 01/05/2022 ~ | 400 | 412 | ||||||||||

2.926% due 05/18/2021 ~ | 600 | 601 | ||||||||||

Lloyds Banking Group PLC |

| |||||||||||

3.130% due 06/21/2021 ~ | 300 | 300 | ||||||||||

Nationwide Building Society |

| |||||||||||

3.766% due 03/08/2024 • | 1,800 | 1,764 | ||||||||||

Standard Chartered PLC |

| |||||||||||

3.461% (US0003M + 1.130%) due 08/19/2019 ~ | 800 | 807 | ||||||||||

|

| |||||||||||

| 6,168 | ||||||||||||

|

| |||||||||||

| INDUSTRIALS 1.4% |

| |||||||||||

BAT International Finance PLC |

| |||||||||||

2.750% due 06/15/2020 | 200 | 198 | ||||||||||

Imperial Brands Finance PLC |

| |||||||||||

2.950% due 07/21/2020 | 1,600 | 1,584 | ||||||||||

Reckitt Benckiser Treasury Services PLC |

| |||||||||||

2.375% due 06/24/2022 | 400 | 383 | ||||||||||

2.895% (US0003M + 0.560%) due 06/24/2022 ~ | 300 | 299 | ||||||||||

Sky PLC |

| |||||||||||

9.500% due 11/15/2018 | 1,240 | 1,270 | ||||||||||

Smiths Group PLC |

| |||||||||||

7.200% due 05/15/2019 | 200 | 206 | ||||||||||

|

| |||||||||||

| 3,940 | ||||||||||||

|

| |||||||||||

Total United Kingdom |

| 10,108 | ||||||||||

|

| |||||||||||

| UNITED STATES 20.3% |

| |||||||||||

| BANKING & FINANCE 7.9% |

| |||||||||||

Air Lease Corp. |

| |||||||||||

2.625% due 09/04/2018 | 1,200 | 1,200 | ||||||||||

Aviation Capital Group LLC |

| |||||||||||

7.125% due 10/15/2020 | 700 | 755 | ||||||||||

Caterpillar Financial Services Corp. |

| |||||||||||

2.840% due 05/15/2023 ~ | 300 | 299 | ||||||||||

Citigroup, Inc. |

| |||||||||||

3.553% (US0003M + 1.190%) due 08/02/2021 ~ | 1,200 | 1,223 | ||||||||||

3.352% due 06/01/2024 ~ | 1,500 | 1,503 | ||||||||||

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

Discover Bank |

| |||||||||||

4.200% due 08/08/2023 | $ | 800 | $ | 808 | ||||||||

Ford Motor Credit Co. LLC |

| |||||||||||

8.125% due 01/15/2020 | 300 | 322 | ||||||||||

3.157% due 08/04/2020 | 200 | 199 | ||||||||||

General Motors Financial Co., Inc. |

| |||||||||||

3.200% due 07/06/2021 | 600 | 593 | ||||||||||

3.582% (US0003M + 1.270%) due 10/04/2019 ~ | 700 | 707 | ||||||||||

3.898% (US0003M + 1.550%) due 01/14/2022 ~ | 1,000 | 1,025 | ||||||||||

Goldman Sachs Group, Inc. |

| |||||||||||

3.513% (US0003M + 1.170%) due 11/15/2021 ~ | 500 | 506 | ||||||||||

Harley-Davidson Financial Services, Inc. |

| |||||||||||

3.550% due 05/21/2021 | 600 | 602 | ||||||||||

Jackson National Life Global Funding |

| |||||||||||

2.807% due 06/11/2021 ~ | 200 | 200 | ||||||||||

JPMorgan Chase & Co. |

| |||||||||||

2.877% (US0003M + 0.550%) due 03/09/2021 ~ | 2,400 | 2,408 | ||||||||||

2.945% due 06/18/2022 ~ | 700 | 700 | ||||||||||

JPMorgan Chase Bank N.A. |

| |||||||||||

2.702% due 04/26/2021 ~ | 900 | 900 | ||||||||||

Morgan Stanley |

| |||||||||||

3.155% (US0003M + 0.800%) due 02/14/2020 ~ | 700 | 702 | ||||||||||

2.903% due 02/10/2021 ~ | 500 | 501 | ||||||||||

3.737% due 04/24/2024 • | 600 | 597 | ||||||||||

Nissan Motor Acceptance Corp. |

| |||||||||||

2.650% due 09/26/2018 | 2,575 | 2,575 | ||||||||||

2.350% due 03/04/2019 | 300 | 299 | ||||||||||

2.853% (US0003M + 0.520%) due 09/13/2019 ~ | 1,600 | 1,606 | ||||||||||

Protective Life Global Funding |

| |||||||||||

1.999% due 09/14/2021 | 1,500 | 1,437 | ||||||||||

2.856% due 06/28/2021 ~ | 1,100 | 1,100 | ||||||||||

|

| |||||||||||

| 22,767 | ||||||||||||

|

| |||||||||||

| INDUSTRIALS 10.8% |

| |||||||||||

Anheuser-Busch InBev Finance, Inc. |

| |||||||||||

2.650% due 02/01/2021 | 200 | 197 | ||||||||||

BAT Capital Corp. |

| |||||||||||

2.945% due 08/14/2020 ~ | 2,900 | 2,911 | ||||||||||

Bayer U.S. Finance LLC |

| |||||||||||

2.965% due 06/25/2021 ~ | 200 | 201 | ||||||||||

3.345% due 12/15/2023 ~ | 400 | 400 | ||||||||||

Broadcom Corp. |

| |||||||||||

2.375% due 01/15/2020 | 900 | 889 | ||||||||||

Continental Airlines Pass-Through Trust |

| |||||||||||

7.250% due 05/10/2021 | 609 | 639 | ||||||||||

CVS Health Corp. |

| |||||||||||

2.750% due 12/01/2022 | 400 | 384 | ||||||||||

3.700% due 03/09/2023 | 450 | 446 | ||||||||||

D.R. Horton, Inc. |

| |||||||||||

3.750% due 03/01/2019 | 300 | 301 | ||||||||||

Daimler Finance North America LLC |

| |||||||||||

2.785% due 02/12/2021 ~ | 1,200 | 1,201 | ||||||||||

3.350% due 05/04/2021 | 1,200 | 1,195 | ||||||||||

Dell International LLC |

| |||||||||||

3.480% due 06/01/2019 | 1,100 | 1,103 | ||||||||||

4.420% due 06/15/2021 | 900 | 913 | ||||||||||

Delta Air Lines, Inc. |

| |||||||||||

3.400% due 04/19/2021 | 400 | 398 | ||||||||||

DXC Technology Co. |

| |||||||||||

3.250% due 03/01/2021 ~ | 1,200 | 1,200 | ||||||||||

ERAC USA Finance LLC |

| |||||||||||

2.800% due 11/01/2018 | 1,000 | 1,000 | ||||||||||

2.350% due 10/15/2019 | 100 | 99 | ||||||||||

GATX Corp. |

| |||||||||||

3.083% due 11/05/2021 ~ | 1,500 | 1,508 | ||||||||||

General Motors Co. |

| |||||||||||

3.500% due 10/02/2018 | 1,300 | 1,303 | ||||||||||

| 16 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

June 30, 2018 (Unaudited)

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

GlaxoSmithKline Capital, Inc. |

| |||||||||||

3.375% due 05/15/2023 | $ | 1,500 | $ | 1,501 | ||||||||

Hewlett Packard Enterprise Co. |

| |||||||||||

2.850% due 10/05/2018 | 357 | 358 | ||||||||||

Hyundai Capital America |

| |||||||||||

2.400% due 10/30/2018 | 600 | 599 | ||||||||||

3.335% due 09/18/2020 ~ | 500 | 503 | ||||||||||

3.250% due 09/20/2022 | 1,000 | 974 | ||||||||||

Kraft Heinz Foods Co. |

| |||||||||||

2.789% due 08/09/2019 ~ | 600 | 600 | ||||||||||

2.923% due 02/10/2021 ~ | 2,500 | 2,504 | ||||||||||

Monsanto Co. |

| |||||||||||

1.850% due 11/15/2018 | 2,500 | 2,493 | ||||||||||

Norfolk Southern Railway Co. |

| |||||||||||

9.750% due 06/15/2020 | 1,500 | 1,689 | ||||||||||

Penske Truck Leasing Co. LP |

| |||||||||||

2.500% due 06/15/2019 | 100 | 99 | ||||||||||

Ryder System, Inc. |

| |||||||||||

2.250% due 09/01/2021 | 400 | 387 | ||||||||||

3.400% due 03/01/2023 | 400 | 395 | ||||||||||

SBA Tower Trust |

| |||||||||||

3.156% due 10/10/2045 « | 300 | 298 | ||||||||||

SES Global Americas Holdings GP |

| |||||||||||

2.500% due 03/25/2019 | 500 | 498 | ||||||||||

Sprint Spectrum Co. LLC |

| |||||||||||

3.360% due 03/20/2023 | 325 | 322 | ||||||||||

Textron, Inc. |

| |||||||||||

3.650% due 03/01/2021 | 100 | 100 | ||||||||||

Time Warner Cable LLC |

| |||||||||||

8.250% due 04/01/2019 | 1,000 | 1,037 | ||||||||||

8.750% due 02/14/2019 | 600 | 620 | ||||||||||

|

| |||||||||||

| 31,265 | ||||||||||||

|

| |||||||||||

| UTILITIES 1.6% |

| |||||||||||

AT&T, Inc. |

| |||||||||||

2.300% due 03/11/2019 | 200 | 199 | ||||||||||

2.998% (US0003M + 0.650%) due 01/15/2020 ~ | 100 | 101 | ||||||||||

3.298% (US0003M + 0.950%) due 07/15/2021 ~ | 600 | 606 | ||||||||||

BellSouth Corp. |

| |||||||||||

4.333% due 04/26/2021 | 1,000 | 1,011 | ||||||||||

Consolidated Edison Co. of New York, Inc. |

| |||||||||||

2.739% due 06/25/2021 ~ | 600 | 601 | ||||||||||

Exelon Corp. |

| |||||||||||

5.150% due 12/01/2020 | 100 | 103 | ||||||||||

NextEra Energy Capital Holdings, Inc. |

| |||||||||||

2.636% due 09/03/2019 ~ | 900 | 902 | ||||||||||

Sempra Energy |

| |||||||||||

2.791% due 03/15/2021 ~ | 700 | 701 | ||||||||||

Southern Power Co. |

| |||||||||||

2.875% due 12/20/2020 ~ | 400 | 400 | ||||||||||

|

| |||||||||||

| 4,624 | ||||||||||||

|

| |||||||||||

Total United States | 58,656 | |||||||||||

|

| |||||||||||

Total Corporate Bonds & Notes (Cost $110,331) | 110,060 | |||||||||||

|

| |||||||||||

| NON-AGENCY MORTGAGE-BACKED SECURITIES 2.4% |

| |||||||||||

| UNITED KINGDOM 0.6% |

| |||||||||||

Business Mortgage Finance PLC |

| |||||||||||

0.053% (EUR003M + 0.380%) due 08/15/2040 ~ | EUR | 936 | 1,085 | |||||||||

Uropa Securities PLC |

| |||||||||||

0.964% (BP0003M + 0.200%) due 10/10/2040 ~ | GBP | 400 | 507 | |||||||||

|

| |||||||||||

Total United Kingdom | 1,592 | |||||||||||

|

| |||||||||||

| UNITED STATES 1.8% |

| |||||||||||

AREIT Trust |

| |||||||||||

2.923% due 02/15/2035 ~ | $ | 1,300 | 1,304 | |||||||||

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

Countrywide Home Loan Mortgage Pass-Through Trust |

| |||||||||||

4.278% due 06/25/2033 ~ | $ | 414 | $ | 417 | ||||||||

GS Mortgage Securities Corp. |

| |||||||||||

3.419% due 10/10/2032 | 900 | 897 | ||||||||||

MASTR Adjustable Rate Mortgages Trust |

| |||||||||||

3.915% due 11/21/2034 ~ | 281 | 290 | ||||||||||

Natixis Commercial Mortgage Securities Trust |

| |||||||||||

2.823% due 02/15/2033 ~ | 200 | 200 | ||||||||||

Tharaldson Hotel Portfolio Trust |

| |||||||||||

2.796% due 11/11/2034 ~ | 279 | 279 | ||||||||||

Waldorf Astoria Boca Raton Trust |

| |||||||||||

3.423% (LIBOR01M + 1.350%) due 06/15/2029 ~ | 1,800 | 1,802 | ||||||||||

|

| |||||||||||

Total United States | 5,189 | |||||||||||

|

| |||||||||||

Total Non-Agency Mortgage-Backed Securities (Cost $6,646) | 6,781 | |||||||||||

|

| |||||||||||

| MUNICIPAL BONDS & NOTES 0.1% |

| |||||||||||

| CALIFORNIA 0.1% |

| |||||||||||

California State General Obligation Bonds, Series 2017 |

| |||||||||||

2.193% due 04/01/2047 | 300 | 297 | ||||||||||

|

| |||||||||||

Total Municipal Bonds & Notes (Cost $300) | 297 | |||||||||||

|

| |||||||||||

| SOVEREIGN ISSUES 2.9% |

| |||||||||||

| JAPAN 0.4% |

| |||||||||||

Japan Finance Organization for Municipalities |

| |||||||||||

2.000% due 09/08/2020 | 1,300 | 1,271 | ||||||||||

|

| |||||||||||

Total Japan | 1,271 | |||||||||||

|

| |||||||||||

| QATAR 1.5% |

| |||||||||||

Qatar Government International Bond |

| |||||||||||

2.375% due 06/02/2021 | 3,800 | 3,675 | ||||||||||

4.500% due 01/20/2022 | 700 | 718 | ||||||||||

|

| |||||||||||

Total Qatar | 4,393 | |||||||||||

|

| |||||||||||

| SAUDI ARABIA 0.9% |

| |||||||||||

Saudi Government International Bond |

| |||||||||||

2.875% due 03/04/2023 | 2,600 | 2,505 | ||||||||||

|

| |||||||||||

Total Saudi Arabia | 2,505 | |||||||||||

|

| |||||||||||

| SOUTH KOREA 0.1% |

| |||||||||||

Export-Import Bank of Korea |

| |||||||||||

1.927% due 02/24/2020 | CAD | 300 | 225 | |||||||||

|

| |||||||||||

Total South Korea | 225 | |||||||||||

|

| |||||||||||

Total Sovereign Issues (Cost $8,580) | 8,394 | |||||||||||

|

| |||||||||||

| U.S. GOVERNMENT AGENCIES 3.5% |

| |||||||||||

| UNITED STATES 3.5% |

| |||||||||||

Fannie Mae |

| |||||||||||

2.357% (LIBOR01M + 0.450%) due 09/25/2046 ~ | $ | 1,571 | 1,573 | |||||||||

2.391% (LIBOR01M + 0.300%) due 12/25/2045 ~ | 589 | 590 | ||||||||||

2.641% (LIBOR01M + 0.550%) due 09/25/2041 ~ | 277 | 279 | ||||||||||

2.891% (LIBOR01M + 0.800%) due 12/25/2039 ~ | 3,952 | 4,014 | ||||||||||

Freddie Mac |

| |||||||||||

2.347% (LIBOR01M + 0.440%) due 07/15/2040 ~ | 387 | 386 | ||||||||||

2.473% (LIBOR01M + 0.400%) due 06/15/2041 ~ | 368 | 370 | ||||||||||

2.523% (LIBOR01M + 0.450%) due 07/15/2037 ~ | 45 | 45 | ||||||||||

2.603% (LIBOR01M + 0.530%) due 10/15/2033 ~ | 286 | 288 | ||||||||||

3.623% (H15T1Y + 2.243%) due 09/01/2037 ~ | 593 | 626 | ||||||||||

| PRINCIPAL AMOUNT (000S) | MARKET VALUE (000S) | |||||||||||

Ginnie Mae |

| |||||||||||

2.287% (US0001M + 0.370%) due 06/20/2061 - | $ | 1,909 | $ | 1,910 | ||||||||

|

| |||||||||||

Total U.S. Government Agencies (Cost $10,046) | 10,081 | |||||||||||

|

| |||||||||||

| U.S. TREASURY OBLIGATIONS 5.2% |

| |||||||||||

| UNITED STATES 5.2% |

| |||||||||||

U.S. Treasury Inflation Protected Securities (c) |

| |||||||||||

0.125% due 04/15/2021 (h) | 634 | 625 | ||||||||||

0.125% due 01/15/2022 (f) | 1,218 | 1,197 | ||||||||||

0.125% due 04/15/2022 (f) | 10,302 | 10,094 | ||||||||||

0.125% due 07/15/2022 (f) | 1,852 | 1,822 | ||||||||||

1.000% due 02/15/2048 | 1,219 | 1,261 | ||||||||||

|

| |||||||||||

Total U.S. Treasury Obligations (Cost $15,051) | 14,999 | |||||||||||

|

| |||||||||||

| SHORT-TERM INSTRUMENTS 4.0% |

| |||||||||||

| CERTIFICATES OF DEPOSIT 0.1% |

| |||||||||||

Barclays Bank PLC |

| |||||||||||

1.940% due 09/04/2018 | 400 | 400 | ||||||||||

|

| |||||||||||

| COMMERCIAL PAPER 0.4% |

| |||||||||||

AT&T, Inc. |

| |||||||||||

2.620% due 09/06/2018 | 900 | 895 | ||||||||||

Ford Motor Credit Co. |

| |||||||||||

2.000% due 09/04/2018 | 300 | 299 | ||||||||||

|

| |||||||||||

Total Commercial Paper (Cost $1,195) | 1,194 | |||||||||||

|

| |||||||||||

| REPURCHASE AGREEMENTS (d) 1.6% |

| |||||||||||

| 4,626 | ||||||||||||

|

| |||||||||||

| SHORT-TERM NOTES 1.9% |

| |||||||||||

Federal Home Loan Bank |

| |||||||||||

1.879% due 07/11/2018 (a)(b) | 900 | 900 | ||||||||||

1.927% due 08/10/2018 (a)(b) | 4,000 | 3,992 | ||||||||||

Harris Corp. |

| |||||||||||

2.794% due 02/27/2019 ~ | 500 | 500 | ||||||||||

|

| |||||||||||

| Total Short-Term Notes (Cost $5,391) | 5,392 | |||||||||||

|

| |||||||||||

| Total Short-Term Instruments (Cost $11,612) | 11,612 | |||||||||||

|

| |||||||||||

| Total Investments in Securities (Cost $198,022) | 197,612 | |||||||||||

|

| |||||||||||

| SHARES | ||||||||||||

| INVESTMENTS IN AFFILIATES 27.4% |

| |||||||||||

| SHORT-TERM INSTRUMENTS 27.4% |

| |||||||||||

| CENTRAL FUNDS USED FOR CASH MANAGEMENT PURPOSES 27.4% |

| |||||||||||

PIMCO Short Asset Portfolio | 4,620,057 | 46,228 | ||||||||||

PIMCO Short-Term | 3,331,958 | 32,940 | ||||||||||

|

| |||||||||||

| Total Short-Term Instruments (Cost $79,187) |

| 79,168 | ||||||||||

|

| |||||||||||

| Total Investments in Affiliates (Cost $79,187) |

| 79,168 | ||||||||||

| Total Investments 96.0% (Cost $277,209) |

| $ | 276,780 | |||||||||

Financial Derivative (Cost or Premiums, net $214) | 819 | |||||||||||

| Other Assets and Liabilities, net 3.7% |

| 10,838 | ||||||||||

|

| |||||||||||

| Net Assets 100.0% |

| $ | 288,437 | |||||||||

|

| |||||||||||

| See Accompanying Notes | SEMIANNUAL REPORT | JUNE 30, 2018 | 17 |

Table of Contents

Schedule of Investments PIMCO StocksPLUS® Global Portfolio (Cont.)

NOTES TO SCHEDULE OF INVESTMENTS:

| * | A zero balance may reflect actual amounts rounding to less than one thousand. |

| « | Security valued using significant unobservable inputs (Level 3). |

| ~ | Variable or Floating rate security. Rate shown is the rate in effect as of period end. Certain variable rate securities are not based on a published reference rate and spread, rather are determined by the issuer or agent and are based on current market conditions. Reference rate is as of reset date, which may vary by security. These securities may not indicate a reference rate and/or spread in their description. |

| • | Rate shown is the rate in effect as of period end. The rate may be based on a fixed rate, a capped rate or a floor rate and may convert to a variable or floating rate in the future. These securities do not indicate a reference rate and spread in their description. |

| × | Coupon represents a rate which changes periodically based on a predetermined schedule. Rate shown is the rate in effect as of period end. |

| (a) | Zero coupon security. |

| (b) | Coupon represents a yield to maturity. |

| (c) | Principal amount of security is adjusted for inflation. |

BORROWINGS AND OTHER FINANCING TRANSACTIONS

(d) REPURCHASE AGREEMENTS:

| Counterparty | Lending Rate | Settlement Date | Maturity Date | Principal Amount | Collateralized By | Collateral (Received) | Repurchase Agreements, at Value | Repurchase Agreement Proceeds to be Received(1) | ||||||||||||||||||||||

| FICC | 1.500 | % | 06/29/2018 | 07/02/2018 | $ | 4,626 | U.S. Treasury Notes 2.750% due 11/15/2023 | $ | (4,720 | ) | $ | 4,626 | $ | 4,626 | ||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||

Total Repurchase Agreements |

| $ | (4,720 | ) | $ | 4,626 | $ | 4,626 | ||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||

BORROWINGS AND OTHER FINANCING TRANSACTIONS SUMMARY

The following is a summary by counterparty of the market value of Borrowings and Other Financing Transactions and collateral pledged/(received) as of June 30, 2018:

| Counterparty | Repurchase Agreement Proceeds to be Received(1) | Payable for Reverse Repurchase Agreements | Payable for Sale-Buyback Transactions | Total Borrowings and Other Financing Transactions | Collateral Pledged/(Received) | Net Exposure(2) | ||||||||||||||||||

Global/Master Repurchase Agreement |

| |||||||||||||||||||||||

FICC | $ | 4,626 | $ | 0 | $ | 0 | $ | 4,626 | $ | (4,720 | ) | $ | (94 | ) | ||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total Borrowings and Other Financing Transactions | $ | 4,626 | $ | 0 | $ | 0 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

| (1) | Includes accrued interest. |

| (2) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from borrowings and other financing transactions can only be netted across transactions governed under the same master agreement with the same legal entity. See Note 8, Master Netting Arrangements, in the Notes to Financial Statements for more information regarding master netting arrangements. |

(e) FINANCIAL DERIVATIVE INSTRUMENTS: EXCHANGE-TRADED OR CENTRALLY CLEARED

PURCHASED OPTIONS:

OPTIONS ON EXCHANGE-TRADED FUTURES CONTRACTS

| Description | Strike Price | Expiration Date | # of Contracts | Notional Amount | Cost | Market Value | ||||||||||||||||||

Call - CBOT U.S. Treasury 10-Year Note August 2018 Futures | $ | 121.000 | 07/27/2018 | 103 | $ | 103 | $ | 24 | $ | 19 | ||||||||||||||

|

|

|

| |||||||||||||||||||||

Total Purchased Options | $ | 24 | $ | 19 | ||||||||||||||||||||

|

|

|

| |||||||||||||||||||||

WRITTEN OPTIONS:

OPTIONS ON EXCHANGE-TRADED FUTURES CONTRACTS

| Description | Strike Price | Expiration Date | # of Contracts | Notional Amount | Premiums (Received) | Market Value | ||||||||||||||||||

Call - CBOT U.S. Treasury 10-Year Note August 2018 Futures | $ | 120.000 | 07/27/2018 | 103 | $ | 103 | $ | (58 | ) | $ | (56 | ) | ||||||||||||

|

|

|

| |||||||||||||||||||||

Total Written Options | $ | (58 | ) | $ | (56 | ) | ||||||||||||||||||

|

|

|

| |||||||||||||||||||||

| 18 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

June 30, 2018 (Unaudited)

FUTURES CONTRACTS:

LONG FUTURES CONTRACTS

| Description | Expiration Month | # of Contracts | Notional Amount | Unrealized Appreciation/ (Depreciation) | Variation Margin | |||||||||||||||||

| Asset | Liability | |||||||||||||||||||||

90-Day Eurodollar December Futures | 12/2018 | 217 | $ | 52,818 | $ | (177 | ) | $ | 0 | $ | 0 | |||||||||||

90-Day Eurodollar March Futures | 03/2019 | 407 | 98,942 | (382 | ) | 0 | 0 | |||||||||||||||

E-mini S&P 500 Index September Futures | 09/2018 | 1,057 | 143,837 | (3,126 | ) | 113 | 0 | |||||||||||||||

Mini MSCI EAFE Index September Futures | 09/2018 | 1,479 | 144,602 | (4,321 | ) | 900 | 0 | |||||||||||||||

U.S. Treasury 10-Year Note September Futures | 09/2018 | 33 | 3,966 | 11 | 0 | 0 | ||||||||||||||||

|

|

|

|

|

| |||||||||||||||||

| $ | (7,995 | ) | $ | 1,013 | $ | 0 | ||||||||||||||||

|

|

|

|

|

| |||||||||||||||||

SHORT FUTURES CONTRACTS

| Description | Expiration Month | # of Contracts | Notional Amount | Unrealized Appreciation/ (Depreciation) | Variation Margin | |||||||||||||||||

| Asset | Liability | |||||||||||||||||||||

90-Day Eurodollar December Futures | 12/2019 | 37 | $ | (8,976 | ) | $ | 39 | $ | 1 | $ | 0 | |||||||||||

90-Day Eurodollar March Futures | 03/2020 | 407 | (98,718 | ) | 406 | 15 | 0 | |||||||||||||||

90-Day Eurodollar September Futures | 09/2019 | 201 | (48,783 | ) | 133 | 5 | 0 | |||||||||||||||

U.S. Treasury 5-Year Note September Futures | 09/2018 | 241 | (27,382 | ) | (109 | ) | 6 | 0 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||||

| $ | 469 | $ | 27 | $ | 0 | |||||||||||||||||

|

|

|

|