UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-22376

PIMCO Equity Series VIT

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive office)

Bradley Todd

Treasurer (Principal Financial & Accounting Officer)

PIMCO Equity Series VIT

650 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888)877-4626

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

| | • | | PIMCO StocksPLUS® Global Portfolio |

PIMCO EQUITY SERIES VIT®

Semiannual Report

June 30, 2019

PIMCO StocksPLUS® Global Portfolio

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Portfolio’s annual and semi-annual shareholder reports will no longer be sent by mail from the insurance company that offers your contract unless you specifically request paper copies of the reports from the insurance company or from your financial intermediary. Instead, the shareholder reports will be made available on a website, and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive all future reports in paper free of charge from the insurance company. You should contact the insurance company if you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all portfolio companies available under your contract at the insurance company.

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series VIT (the “Trust”) prospectus for the Portfolio. The variable product prospectus may be obtained by contacting your Investment Consultant.

Chairman’s Letter

Dear Shareholder,

Following this letter is the PIMCO Equity Series VIT Semiannual Report, which covers thesix-month reporting period ended June 30, 2019. On the subsequent pages you will find specific details regarding investment results and discussion of the factors that most affected performance during the reporting period.

For thesix-month reporting period ended June 30, 2019

The U.S. economy continued to expand during the reporting period. Looking back, U.S. gross domestic product (“GDP”) grew at an annual pace of 2.2% during the fourth quarter of 2018. For the first quarter of 2019, GDP growth rose to an annual pace of 3.1%. Finally, the Commerce Department’s initial reading for second quarter 2019 GDP, released after the reporting period ended, showed that the U.S. economy grew at a 2.1% annual pace.

After raising rates four times in 2018, the Federal Reserve (the “Fed”) reversed course and had a “dovish pivot.” With its December 2018 rate hike, the Fed increased the federal funds rate to a range between 2.25% and 2.50%. However, at its meeting in January 2019, the Fed tapered its expectations for the pace of rate hikes in 2019. Then, after the Fed’s meeting in June 2019, Fed Chair Jerome Powell said, “The case for somewhat more accommodative policy has strengthened.” This stance was partially attributed to trade tensions and signs of slowing global growth, including weakening manufacturing data. Finally, at its meeting that concluded on July 31, 2019, after the reporting period ended, the Fed lowered the federal funds rate to a range between 2.00% and 2.25%. This represented the Fed’s first rate cut since 2008.

Growth outside the U.S. continued, but the pace generally moderated. According to the International Monetary Fund (“IMF”), global growth is projected to be 3.3% in 2019, versus 3.6% in 2018. From a regional perspective, the U.S. economy is expected to expand 2.3% in 2019, compared to 2.9% in the prior year. Elsewhere, the IMF anticipates 2019 GDP growth in the eurozone, UK and Japan will be 1.3%, 1.2% and 1.0%, respectively. For comparison purposes, these economies expanded 1.8%, 1.4% and 0.8%, respectively, in 2018.

Against this backdrop, the European Central Bank (the “ECB”) and the Bank of Japan largely maintained their highly accommodative monetary policies. The ECB ended its quantitative easing program in December 2018 and indicated that it does not expect to raise interest rates, “at least through the first half of 2020.” Meanwhile, the Bank of England kept rates on hold for the reporting period.

Both short- and long-term U.S. Treasury yields declined. In our view, falling rates were partially due to signs of moderating global growth, the Fed’s dovish pivot and periods of investor risk aversion. The yield on thetwo-year U.S. Treasury note was 1.75% at the end of the reporting period, compared to 2.48% on December 31, 2018. Meanwhile, the yield on the benchmark10-year U.S. Treasury note was 2.00% at the end of the reporting period, versus 2.69% on December 31, 2018. The Bloomberg Barclays Global Treasury Index (USD hedged), which tracks fixed-rate, local-currency government debt of investment grade countries, including both developed and emerging markets, returned 5.52%. Meanwhile, the Bloomberg Barclays Global Aggregate Credit Index (USD hedged), a widely used index of global investment grade credit bonds, returned 8.22%. Riskier fixed income asset classes, including high yield corporate bonds and emerging market debt, also generated positive results. The ICE BofAML Developed Markets High Yield Constrained Index (USD hedged), a widely used index of below investment grade bonds, returned 10.05%, whereas emerging market external debt, as represented by the JPMorgan Emerging Markets Bond Index (EMBI) Global (USD hedged), returned 10.60%. Emerging market local bonds, as represented by the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged), returned 8.72%.

Global equities also produced strong results. Despite periods of volatility, U.S. equities moved sharply higher. We believe this rally was driven by a number of factors, including corporate profits that often exceeded expectations and a more accommodative Fed. All told, U.S. equities, as represented by the S&P 500 Index, returned 18.54%. Emerging market equities, as measured by the MSCI Emerging Markets Index, returned 10.59%, whereas global equities, as

| | | | | | | | |

| 2 | | PIMCO EQUITY SERIES VIT | | | | | | |

represented by the MSCI World Index, returned 16.98%. Meanwhile, Japanese equities, as represented by the Nikkei 225 Index (in JPY), returned 7.53%, and European equities, as represented by the MSCI Europe Index (in EUR), returned 16.24%.

Commodity prices fluctuated and largely moved higher. When the reporting period began, Brent crude oil was approximately $54 a barrel, but by the end, it was roughly $67 a barrel. Elsewhere, gold and copper prices also rose.

Finally, there were periods of volatility in the foreign exchange markets, due in part to signs of moderating global growth and changing central bank monetary policies, along with a number of geopolitical events. The U.S. dollar strengthened against a number of other major currencies. For example, the U.S. dollar returned 0.82% and 0.45% versus the euro and British pound, respectively. However, the U.S. dollar fell 1.71% versus the Japanese yen.

Thank you for the assets you have placed with us. We deeply value your trust, and we will continue to work diligently to meet your broad investment needs.

| | |

| | Sincerely,

Peter G. Strelow Chairman of the Board PIMCO Equity Series VIT |

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

| | | | | | |

| | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 3 |

Important Information About the PIMCO StocksPLUS® Global Portfolio

PIMCO Equity Series VIT (the “Trust”) is an open-end management investment company that includes the PIMCO StocksPLUS® Global Portfolio (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

In an environment where interest rates may trend upward, rising rates would negatively impact the performance of certain funds, and fixed income securities and other instruments held by the Portfolio are likely to decrease in value. A wide variety of factors can cause interest rates to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that management will anticipate such movement accurately. The Portfolio may lose money as a result of movements in interest rates.

The values of equity securities, such as common stocks and preferred stocks, have historically risen and fallen in periodic cycles and may decline due to general market conditions, which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Equity securities may also decline due to factors that affect a particular industry or industries, such as labor shortages, increased production costs and competitive conditions within an industry. In addition, the value of an equity security may decline for a number of reasons that directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets. Different types of equity securities may react differently to these developments and a change in the financial condition of a single issuer may affect securities markets as a whole.

During a general downturn in the securities markets, multiple asset classes, including equity securities, may decline in value simultaneously. The market price of equity securities owned by the Portfolio may go up or down, sometimes rapidly or unpredictably. Equity securities generally have greater price volatility than fixed income securities and common stocks generally have the greatest appreciation and depreciation potential of all equity securities.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, are at or near historically low levels. Thus, the Portfolio currently faces a heightened level of interest rate risk, especially as the Federal Reserve

Board ended its quantitative easing program in October 2014 and raised interest rates several times thereafter before lowering them in July 2019. Interest rates may change in the future depending upon the Federal Reserve Board’s view of economic growth, inflation, employment and other market factors. To the extent the Federal Reserve Board raises interest rates, there is a risk that rates across the financial system may rise. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets.”

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact the Portfolio’s performance or cause the Portfolio to incur losses. As a result, the Portfolio may experience increased shareholder redemptions, which, among other things, could further reduce the net assets of the Portfolio.

The Portfolio may be subject to various risks as described in the Portfolio’s prospectus and in the Principal Risks in the Notes to Financial Statements.

With respect to certain securities, the Portfolio may make different asset class, sector or geographical classifications for the purpose of monitoring compliance with investment guidelines than the classifications disclosed in this report.

The geographical classification of foreign (non-U.S.) securities in this report are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

The United States presidential administration’s enforcement of tariffs on goods from other countries, with a focus on China, has contributed to international trade tensions and may impact portfolio securities.

The United Kingdom’s decision to leave the European Union may impact Portfolio returns. This decision may cause substantial volatility in foreign exchange markets, lead to weakness in the exchange rate of the British pound, result in a sustained period of market uncertainty, and destabilize some or all of the other European Union member countries and/or the Eurozone.

The Portfolio may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR is an

| | | | | | | | |

| 4 | | PIMCO EQUITY SERIES VIT | | | | | | |

average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced plans to phase out the use of LIBOR by the end of 2021. There remains uncertainty regarding future utilization of LIBOR and the nature of any replacement rate, and any potential effects of the transition away from LIBOR on the Portfolio or on certain instruments in which the Portfolio invests are not known.

Under the direction of the Federal Housing Finance Agency, the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”) have entered into a joint initiative to develop a common securitization platform for the issuance of a uniform mortgage-backed security (the “Single Security Initiative”) that aligns the characteristics of FNMA and FHLMC certificates. The Single Security Initiative was implemented on June 3, 2019, and the effects it may have on the market for mortgage-backed securities are uncertain.

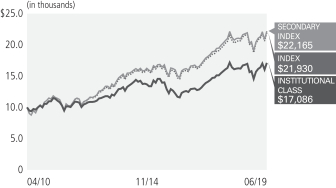

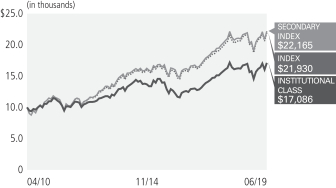

On the Portfolio Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure

performance assuming that any dividend and capital gain distributions were reinvested. The Cumulative Returns chart reflects only Institutional Class performance. Performance may vary by share class based on each class’s expense ratios. The Portfolio measures its performance against at least one broad-based securities market index (benchmark index). The benchmark indexes do not take into account fees, expenses, or taxes. The Portfolio’s past performance, before and after taxes, is not necessarily an indication of how the Portfolio will perform in the future. There is no assurance that the Portfolio, even if the Portfolio has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. High performance is defined as a significant increase in either 1) the Portfolio’s total return in excess of that of the Portfolio’s benchmark between reporting periods or 2) the Portfolio’s total return in excess of the Portfolio’s historical returns between reporting periods. Unusual performance is defined as a significant change in the Portfolio’s performance as compared to one or more previous reporting periods.

The following table discloses the inception dates of the Portfolio and its respective share classes along with the Portfolio’s diversification status as of period end:

| | | | | | | | | | | | | | | | | | | | |

| Portfolio Name | | | | | Portfolio Inception | | | Institutional Class | | | Advisor Class | | | Diversification Status | |

PIMCO StocksPLUS® Global Portfolio | | | | | | | 04/14/10 | | | | 04/14/10 | | | | 04/14/10 | | | | Diversified | |

An investment in the Portfolio is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Portfolio.

The Trustees are responsible generally for overseeing the management of the Trust. The Trustees authorize the Trust to enter into service agreements with the Adviser, the Distributor, the Administrator and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Trust and the Portfolio. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither this Portfolio’s prospectus nor summary prospectus, the Trust’s Statement of Additional Information (“SAI”), any contracts filed as exhibits to the Trust’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Trust or the Portfolio creates a contract between or among any shareholder of the Portfolio, on the one hand, and the Trust, the Portfolio, a service provider to the Trust or the Portfolio, and/or the Trustees or officers of the Trust, on the other hand. The Trustees (or the Trust and its officers, service providers or other delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus,

summary prospectus or SAI with respect to the Portfolio or the Trust, and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which the Trust or the Portfolio is a party, and interpret the investment objectives, policies, restrictions and contractual provisions applicable to the Portfolio, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in the Trust’s then-current prospectus or SAI.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Portfolio. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 87-PIMCO, on the Portfolio’s website at www.pimco.com/pvit, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

| | | | | | |

| | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 5 |

Important Information About the PIMCO StocksPLUS® Global Portfolio(Cont.)

The Portfolio files a complete schedule of its portfolio holdings with the SEC for the first and third quarters of its fiscal year on Form N-PORT. The Portfolio’s Form N-PORT reports are available on the SEC’s website at www.sec.gov and are available without charge, upon request by calling the Portfolio at (888) 87-PIMCO. Prior to its use of Form N-PORT, the Portfolio filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

The SEC adopted a rule that, beginning in 2021, generally will allow shareholder reports to be delivered to investors by providing access to such reports online free of charge and by mailing a notice that the

report is electronically available. Pursuant to the rule, investors may still elect to receive a complete shareholder report in the mail. Instructions for electing to receive paper copies of the Portfolio’s shareholder reports going forward may be found on the front cover of this report.

The SEC adopted amendments to certain disclosure requirements relating to open-end investment companies’ liquidity risk management programs. Effective December 1, 2019, large fund complexes will be required to include in their shareholder reports a discussion of their liquidity risk management programs’ operations over the past year.

| | | | | | | | |

| 6 | | PIMCO EQUITY SERIES VIT | | | | | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 7 |

PIMCO StocksPLUS® Global Portfolio

Cumulative Returns Through June 30, 2019

$10,000 invested at the end of the month when the Portfolio’s Institutional Class commenced operations.

Investment Objective and Strategy Overview

PIMCO StocksPLUS® Global Portfolio (the “Portfolio”) seeks total return which exceeds that of its secondary benchmark index, the 50% S&P 500 Index/50% MSCI EAFE Net Dividend Index (USD Unhedged), consistent with prudent investment management by investing under normal circumstances in S&P 500 Index derivatives and MSCI Europe Australasia Far East (“MSCI EAFE”) Net Dividend Index (USD Unhedged) derivatives, backed by a portfolio of Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. andnon-U.S. public- or private-sector entities. The Portfolio may invest in common stocks, options, futures, options on futures and swaps. Portfolio strategies may change from time to time. Please refer to the Portfolio’s current prospectus for more information regarding the Portfolio’s strategy.

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2019 | |

| | | | | |

| | | | | 6 Months* | | | 1 Year | | | 5 Year | | | Portfolio Inception

(04/14/2010) | |

| | PIMCO StocksPLUS® Global Portfolio Institutional Class | | | 17.55% | | | | 5.68% | | | | 3.47% | | | | 5.76% | |

| | PIMCO StocksPLUS® Global Portfolio Advisor Class | | | 17.24% | | | | 5.37% | | | | 3.19% | | | | 5.49% | |

| | MSCI World Index± | | | 16.98% | | | | 6.33% | | | | 6.60% | | | | 8.51% | |

| | 50% MSCI EAFE Net Dividend Index/50% S&P 500 Index±± | | | 16.27% | | | | 5.73% | | | | 6.47% | | | | 8.62% | |

All Portfolio returns are net of fees and expenses.

* Cumulative return.

± The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices.

±± The benchmark is a blend of 50% MSCI EAFE Net Dividend Index/50% S&P 500 Index. MSCI EAFE Net Dividend Index is an unmanaged index of issuers in countries of Europe, Australia, and the Far East represented in U.S. Dollars on a unhedged basis. S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The Index focuses on thelarge-cap segment of the U.S. equities market.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. The Portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in Variable Contracts, which will reduce returns. Differences in the Portfolio’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the prices of individual positions (which may be sourced from different pricing vendors or other sources) used by the Portfolio and the index. For performance current to the most recentmonth-end, visit www.pimco.com or via (888)87-PIMCO.

The Portfolio’s total annual operating expense ratio in effect as of period end, was 0.66% for Institutional Class shares, and 0.91% for Advisor Class shares. Details regarding any changes to the Portfolio’s operating expenses, subsequent to period end, can be found in the Portfolio’s current prospectus, as supplemented.

| | | | | | | | |

| 8 | | PIMCO EQUITY SERIES VIT | | | | | | |

Geographic Breakdown as of 06/30/2019†§

| | | | | | | | |

United States‡ | | | | | | | 58.9% | |

Japan | | | | | | | 6.5% | |

United Kingdom | | | | | | | 5.4% | |

Cayman Islands | | | | | | | 5.4% | |

France | | | | | | | 2.1% | |

Qatar | | | | | | | 1.8% | |

Saudi Arabia | | | | | | | 1.1% | |

Germany | | | | | | | 1.1% | |

Canada | | | | | | | 1.0% | |

Other | | | | | | | 4.9% | |

† % of Investments, at value.

§ Geographic Breakdown and % of Investments exclude securities sold short, financial derivative instruments and short-term instruments, if any.

‡ Includes Central Funds Used for Cash Management Purposes.

Portfolio Insights

The following affected performance during the reporting period:

| » | | The Portfolio’s exposure to equity index derivatives linked to the S&P 500 index and the MSCI EAFE Net Dividend index contributed to absolute returns, as the S&P 500 index returned 18.54% and the MSCI EAFE Net Dividend index returned 14.03%. |

| » | | The Portfolio’s bond alpha contributed to returns. Highlights about the drivers of performance included the following: |

| | » | | U.S. duration strategies contributed to performance, as yields broadly decreased. |

| | » | | Short exposure to long-dated Japanese bonds detracted from performance, as yields decreased. |

| | » | | Holdings of investment grade corporate debt contributed to returns. |

| | » | | Holdings of non-agency mortgage-backed securities contributed to performance, as the values of these bonds increased. |

| | | | | | |

| | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 9 |

Expense ExamplePIMCO StocksPLUS® Global Portfolio

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including investment advisory fees, supervisory and administrative fees, distribution and/or service (12b-1) fees (if applicable), and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Expense Example does not reflect any fees or other expenses imposed by the Variable Contracts. If it did, the expenses reflected in the Expense Example would be higher. The Example is based on an investment of $1,000 invested at the beginning of the period and held from January 1, 2019 to June 30, 2019 unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the appropriate row for your share class, in the column titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

Expense ratios may vary period to period because of various factors, such as an increase in expenses that are not covered by the investment advisory fees and supervisory and administrative fees, such as fees and expenses of the independent trustees and their counsel, extraordinary expenses and interest expense.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual | | | | | | Hypothetical

(5% return before expenses) | | | | | | | |

| | | | | | Beginning

Account Value

(01/01/19) | | | Ending

Account Value

(06/30/19) | | | Expenses Paid

During Period* | | | | | | Beginning

Account Value

(01/01/19) | | | Ending

Account Value

(06/30/19) | | | Expenses Paid

During Period* | | | | | | Net Annualized

Expense Ratio** | |

| Institutional Class | | | | | | $ | 1,000.00 | | | $ | 1,175.50 | | | $ | 3.33 | | | | | | | $ | 1,000.00 | | | $ | 1,021.60 | | | $ | 3.09 | | | | | | | | 0.62 | % |

| Advisor Class | | | | | | | 1,000.00 | | | | 1,172.40 | | | | 4.66 | | | | | | | | 1,000.00 | | | | 1,020.37 | | | | 4.33 | | | | | | | | 0.87 | |

* Expenses Paid During Period are equal to the net annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 180/365 (to reflect theone-half year period). Overall fees and expenses of investing in the Portfolio will be higher because the example does not reflect variable contract fees and expenses.

** Net Annualized Expense Ratio is reflective of any applicable contractual fee waivers and/or expense reimbursements or voluntary fee waivers. Details regarding fee waivers, if any, can be found in Note 9, Fees and Expenses, in the Notes to Financial Statements.

| | | | | | | | |

| 10 | | PIMCO EQUITY SERIES VIT | | | | | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 11 |

Financial HighlightsPIMCO StocksPLUS® Global Portfolio

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Investment Operations | | | Less Distributions(b) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Selected Per Share Data for the Year or Period Ended^: | |

Net Asset

Value

Beginning

of Year

or Period | | | Net

Investment

Income

(Loss)(a) | | | Net

Realized/

Unrealized

Gain (Loss) | | | Total | | | From Net

Investment

Income | | | From Net

Realized

Capital

Gain | | | Total | |

| Institutional Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

01/01/2019 - 06/30/2019+ | | $ | 7.12 | | | $ | 0.09 | | | $ | 1.16 | | | $ | 1.25 | | | $ | (0.05 | ) | | $ | 0.00 | | | $ | (0.05 | ) |

| | | | | | | |

12/31/2018 | | | 9.65 | | | | 0.17 | | | | (1.13 | ) | | | (0.96 | ) | | | (0.16 | ) | | | (1.41 | ) | | | (1.57 | ) |

| | | | | | | |

12/31/2017 | | | 8.09 | | | | 0.08 | | | | 1.79 | | | | 1.87 | | | | (0.31 | ) | | | 0.00 | | | | (0.31 | ) |

| | | | | | | |

12/31/2016 | | | 9.52 | | | | 0.19 | | | | 0.57 | | | | 0.76 | | | | (0.50 | ) | | | (1.69 | ) | | | (2.19 | ) |

| | | | | | | |

12/31/2015(d) | | | 12.46 | | | | 0.34 | | | | (1.43 | ) | | | (1.09 | ) | | | (0.63 | ) | | | (1.22 | ) | | | (1.85 | ) |

| | | | | | | |

12/31/2014(d) | | | 12.53 | | | | 0.29 | | | | (0.16 | ) | | | 0.13 | | | | 0.00 | | | | (0.20 | ) | | | (0.20 | ) |

| Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

01/01/2019 - 06/30/2019+ | | | 7.02 | | | | 0.08 | | | | 1.13 | | | | 1.21 | | | | (0.04 | ) | | | 0.00 | | | | (0.04 | ) |

| | | | | | | |

12/31/2018 | | | 9.53 | | | | 0.15 | | | | (1.12 | ) | | | (0.97 | ) | | | (0.13 | ) | | | (1.41 | ) | | | (1.54 | ) |

| | | | | | | |

12/31/2017 | | | 8.01 | | | | 0.05 | | | | 1.76 | | | | 1.81 | | | | (0.29 | ) | | | 0.00 | | | | (0.29 | ) |

| | | | | | | |

12/31/2016 | | | 9.44 | | | | 0.17 | | | | 0.55 | | | | 0.72 | | | | (0.46 | ) | | | (1.69 | ) | | | (2.15 | ) |

| | | | | | | |

12/31/2015(d) | | | 12.39 | | | | 0.30 | | | | (1.42 | ) | | | (1.12 | ) | | | (0.61 | ) | | | (1.22 | ) | | | (1.83 | ) |

| | | | | | | |

12/31/2014(d) | | | 12.48 | | | | 0.25 | | | | (0.14 | ) | | | 0.11 | | | | 0.00 | | | | (0.20 | ) | | | (0.20 | ) |

| ^ | A zero balance may reflect actual amounts rounding to less than $0.01 or 0.01%. |

| (a) | Per share amounts based on average number of common shares outstanding during the year. |

| (b) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. See Note 2, Distributions to Shareholders, in the Notes to Financial Statements for more information. |

| (c) | Effective October 21, 2016, the Portfolio’s Investment advisory fee was decreased by 0.39% to an annual rate of 0.30% and the Portfolio’s supervisory and administrative fee was decreased by 0.04% to an annual rate of 0.31%. |

| (d) | Includes the consolidated accounts of the Portfolio’s subsidiary, PIMCO Cayman Commodity Portfolio III, Ltd., which was terminated on May 26, 2015. |

| (e) | Effective July 13, 2015, the Portfolio’s Investment advisory fee was decreased by 0.06% to an annual rate of 0.69% |

| | | | | | | | |

| 12 | | PIMCO EQUITY SERIES VIT | | | | | See Accompanying Notes | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Ratios/Supplemental Data | |

| | | | | | | | | | Ratios to Average Net Assets | | | | |

Net Asset

Value End of

Year or

Period | | | Total Return | | | Net Assets

End of Year or

Period (000s) | | | Expenses | | | Expenses

Excluding

Waivers | | | Expenses

Excluding

Interest

Expense and

Dividends on

Securities

Sold Short | | | Expenses

Excluding

Interest

Expense and

Dividends on

Securities

Sold Short and

Waivers | | | Net

Investment

Income (Loss) | | | Portfolio

Turnover

Rate | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| $ | 8.32 | | | | 17.55 | % | | $ | 36,030 | | | | 0.62 | %* | | | 0.63 | %* | | | 0.62 | %* | | | 0.63 | %* | | | 2.25 | %* | | | 12 | % |

| | | | | | | | |

| | 7.12 | | | | (10.60 | ) | | | 33,195 | | | | 0.63 | | | | 0.66 | | | | 0.62 | | | | 0.65 | | | | 1.82 | | | | 44 | |

| | | | | | | | |

| | 9.65 | | | | 23.47 | | | | 42,627 | | | | 0.62 | | | | 0.64 | | | | 0.62 | | | | 0.64 | | | | 0.87 | | | | 28 | |

| | | | | | | | |

| | 8.09 | | | | 7.99 | | | | 38,440 | | | | 0.84 | (c) | | | 1.00 | (c) | | | 0.84 | (c) | | | 1.00 | (c) | | | 2.08 | | | | 130 | |

| | | | | | | | |

| | 9.52 | | | | (8.75 | ) | | | 40,582 | | | | 0.95 | (e) | | | 1.10 | (e) | | | 0.93 | (e) | | | 1.08 | (e) | | | 2.68 | | | | 152 | |

| | | | | | | | |

| | 12.46 | | | | 1.06 | | | | 52,234 | | | | 0.98 | | | | 1.12 | | | | 0.97 | | | | 1.11 | | | | 2.22 | | | | 31 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | 8.19 | | | | 17.24 | | | | 222,244 | | | | 0.87 | * | | | 0.88 | * | | | 0.87 | * | | | 0.88 | * | | | 2.00 | * | | | 12 | |

| | | | | | | | |

| | 7.02 | | | | (10.74 | ) | | | 202,080 | | | | 0.88 | | | | 0.91 | | | | 0.87 | | | | 0.90 | | | | 1.57 | | | | 44 | |

| | | | | | | | |

| | 9.53 | | | | 22.99 | | | | 269,648 | | | | 0.87 | | | | 0.89 | | | | 0.87 | | | | 0.89 | | | | 0.62 | | | | 28 | |

| | | | | | | | |

| | 8.01 | | | | 7.67 | | | | 258,741 | | | | 1.09 | (c) | | | 1.25 | (c) | | | 1.09 | (c) | | | 1.25 | (c) | | | 1.85 | | | | 130 | |

| | | | | | | | |

| | 9.44 | | | | (8.98 | ) | | | 284,406 | | | | 1.20 | (e) | | | 1.35 | (e) | | | 1.18 | (e) | | | 1.33 | (e) | | | 2.43 | | | | 152 | |

| | | | | | | | |

| | 12.39 | | | | 0.90 | | | | 380,293 | | | | 1.23 | | | | 1.37 | | | | 1.22 | | | | 1.36 | | | | 1.98 | | | | 31 | |

| | | | | | |

| See Accompanying Notes | | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 13 |

Statement of Assets and LiabilitiesPIMCO StocksPLUS® Global Portfolio

June 30, 2019 (Unaudited)

| | | | |

| (Amounts in thousands†, except per share amounts) | | | |

| |

Assets: | | | | |

| |

Investments, at value | | | | |

Investments in securities* | | $ | 178,988 | |

Investments in Affiliates | | | 68,170 | |

Financial Derivative Instruments | | | | |

Exchange-traded or centrally cleared | | | 1,288 | |

Over the counter | | | 25 | |

Cash | | | 1 | |

Deposits with counterparty | | | 8,951 | |

Foreign currency, at value | | | 343 | |

Receivable for investments sold | | | 18 | |

Interest and/or dividends receivable | | | 798 | |

Dividends receivable from Affiliates | | | 139 | |

Total Assets | | | 258,721 | |

| |

Liabilities: | | | | |

| |

Financial Derivative Instruments | | | | |

Exchange-traded or centrally cleared | | $ | 2 | |

Over the counter | | | 71 | |

Payable for investments in Affiliates purchased | | | 139 | |

Payable for Portfolio shares redeemed | | | 70 | |

Accrued investment advisory fees | | | 59 | |

Accrued supervisory and administrative fees | | | 61 | |

Accrued distribution fees | | | 42 | |

Accrued reimbursement to PIMCO | | | 1 | |

Other liabilities | | | 2 | |

Total Liabilities | | | 447 | |

| |

Net Assets | | $ | 258,274 | |

| |

Net Assets Consist of: | | | | |

| |

Paid in capital | | $ | 252,169 | |

Distributable earnings (accumulated loss) | | | 6,105 | |

| |

Net Assets | | $ | 258,274 | |

| |

Net Assets: | | | | |

| |

Institutional Class | | $ | 36,030 | |

Advisor Class | | | 222,244 | |

| |

Shares Issued and Outstanding: | | | | |

| |

Institutional Class | | | 4,332 | |

Advisor Class | | | 27,126 | |

| |

Net Asset Value Per Share Outstanding: | | | | |

| |

Institutional Class | | $ | 8.32 | |

Advisor Class | | | 8.19 | |

| |

Cost of investments in securities | | $ | 177,836 | |

Cost of investments in Affiliates | | $ | 68,203 | |

Cost of foreign currency held | | $ | 343 | |

Cost or premiums of financial derivative instruments, net | | $ | 179 | |

| |

* Includes repurchase agreements of: | | $ | 7,179 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| | | | | | | | |

| 14 | | PIMCO EQUITY SERIES VIT | | | | | See Accompanying Notes | |

Statement of OperationsPIMCO StocksPLUS® Global Portfolio

| | | | |

| (Amounts in thousands†) | | Six Months Ended June 30, 2019 (Unaudited) | |

| |

Investment Income: | | | | |

| |

Interest | | $ | 2,736 | |

Dividends from Investments in Affiliates | | | 880 | |

Total Income | | | 3,616 | |

| |

Expenses: | | | | |

| |

Investment advisory fees | | | 378 | |

Supervisory and administrative fees | | | 390 | |

Distribution and/or servicing fees - Advisor Class | | | 271 | |

Trustee fees | | | 17 | |

Interest expense | | | 4 | |

Miscellaneous expense | | | 10 | |

Total Expenses | | | 1,070 | |

Waiver and/or Reimbursement by PIMCO | | | (17 | ) |

Net Expenses | | | 1,053 | |

| |

Net Investment Income (Loss) | | | 2,563 | |

| |

Net Realized Gain (Loss): | | | | |

| |

Investments in securities | | | 435 | |

Exchange-traded or centrally cleared financial derivative instruments | | | 23,231 | |

Over the counter financial derivative instruments | | | (383 | ) |

Foreign currency | | | (2 | ) |

| |

Net Realized Gain (Loss) | | | 23,281 | |

| |

Net Change in Unrealized Appreciation (Depreciation): | | | | |

| |

Investments in securities | | | 2,198 | |

Investments in Affiliates | | | 75 | |

Exchange-traded or centrally cleared financial derivative instruments | | | 11,667 | |

Over the counter financial derivative instruments | | | 329 | |

| |

Net Change in Unrealized Appreciation (Depreciation) | | | 14,269 | |

| |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 40,113 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| | | | | | |

| See Accompanying Notes | | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 15 |

Statements of Changes in Net AssetsPIMCO StocksPLUS® Global Portfolio

| | | | | | | | |

| (Amounts in thousands†) | | Six Months Ended

June 30, 2019

(Unaudited) | | | Year Ended

December 31, 2018 | |

| | |

Increase (Decrease) in Net Assets from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

| | |

Net investment income (loss) | | $ | 2,563 | | | $ | 4,639 | |

Net realized gain (loss) | | | 23,281 | | | | (20,058 | ) |

Net change in unrealized appreciation (depreciation) | | | 14,269 | | | | (13,340 | ) |

| | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 40,113 | | | | (28,759 | ) |

| | |

Distributions to Shareholders: | | | | | | | | |

| | |

From net investment income and/or net realized capital gains | | | | | | | | |

Institutional Class | | | (212 | ) | | | (6,192 | ) |

Advisor Class | | | (1,088 | ) | | | (38,289 | ) |

| | |

Total Distributions(a) | | | (1,300 | ) | | | (44,481 | ) |

| | |

Portfolio Share Transactions: | | | | | | | | |

| | |

Net increase (decrease) resulting from Portfolio share transactions** | | | (15,814 | ) | | | (3,760 | ) |

| | |

Total Increase (Decrease) in Net Assets | | | 22,999 | | | | (77,000 | ) |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of period | | | 235,275 | | | | 312,275 | |

End of period | | $ | 258,274 | | | $ | 235,275 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| ** | See Note 13, Shares of Beneficial Interest, in the Notes to Financial Statements. |

| (a) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. The actual tax characterization of distributions paid is determined at the end of the fiscal year. See Note 2, Distributions to Shareholders, in the Notes to Financial Statements for more information. |

| | | | | | | | |

| 16 | | PIMCO EQUITY SERIES VIT | | | | | See Accompanying Notes | |

Schedule of InvestmentsPIMCO StocksPLUS® Global Portfolio

June 30, 2019 (Unaudited)

(Amounts in thousands*, except number of shares, contracts and units, if any)

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| INVESTMENTS IN SECURITIES 69.3% | |

| |

| ASSET-BACKED SECURITIES 8.3% | |

| |

| CANADA 0.2% | |

|

CARDS Trust | |

3.047% due 04/17/2023 | | $ | | | 400 | | | $ | | | 402 | |

|

Silver Arrow Canada LP | |

2.278% due 02/15/2020 | | CAD | | | 122 | | | | | | 94 | |

| | | | | | | | | | | | |

Total Canada | | | | | | | | | | | 496 | |

| | | | | | | | | | | | |

| |

| CAYMAN ISLANDS 5.2% | |

|

Apex Credit CLO Ltd. | |

3.632% due 10/27/2028 • | | $ | | | 700 | | | | | | 701 | |

|

Barings BDC Static CLO Ltd. | |

3.544% due 04/15/2027 • | | | | | 800 | | | | | | 800 | |

|

BSPRT Issuer Ltd. | |

3.330% due 03/15/2028 | | | | | 600 | | | | | | 601 | |

|

CIFC Funding Ltd. | |

3.377% due 04/15/2027 • | | | | | 600 | | | | | | 600 | |

|

Crown Point CLO Ltd. | |

3.762% due 10/20/2028 • | | | | | 300 | | | | | | 299 | |

|

Flatiron CLO Ltd. | |

3.748% due 01/17/2026 • | | | | | 642 | | | | | | 643 | |

|

Gallatin CLO Ltd. | |

3.642% due 01/21/2028 • | | | | | 1,000 | | | | | | 999 | |

|

Halcyon Loan Advisors Funding Ltd. | |

3.512% due 04/20/2027 • | | | | | 899 | | | | | | 897 | |

|

Jamestown CLO Ltd. | |

3.467% due 01/15/2028 • | | | | | 800 | | | | | | 798 | |

3.808% due 01/17/2027 • | | | | | 802 | | | | | | 803 | |

|

Neuberger Berman CLO Ltd. | |

3.397% due 07/15/2027 • | | | | | 600 | | | | | | 600 | |

|

Octagon Investment Partners Ltd. | |

3.697% due 04/15/2026 • | | | | | 374 | | | | | | 374 | |

|

OFSI Fund Ltd. | |

3.247% due 03/20/2025 • | | | | | 161 | | | | | | 161 | |

|

Sound Point CLO Ltd. | |

3.472% due 07/20/2027 • | | | | | 400 | | | | | | 400 | |

|

Staniford Street CLO Ltd. | |

3.590% due 06/15/2025 • | | | | | 178 | | | | | | 179 | |

|

THL Credit Wind River CLO Ltd. | |

4.047% due 01/15/2026 • | | | | | 599 | | | | | | 599 | |

|

Tralee CLO Ltd. | |

3.622% due 10/20/2027 • | | | | | 1,200 | | | | | | 1,200 | |

|

Venture CLO Ltd. | |

3.447% due 01/15/2028 • | | | | | 600 | | | | | | 598 | |

3.477% due 07/15/2027 • | | | | | 1,200 | | | | | | 1,201 | |

|

Voya CLO Ltd. | |

3.300% due 07/25/2026 • | | | | | 397 | | | | | | 396 | |

|

WhiteHorse Ltd. | |

3.748% due 07/17/2026 • | | | | | 536 | | | | | | 536 | |

| | | | | | | | | | | | |

Total Cayman Islands | | | | | | | | | | | 13,385 | |

| | | | | | | | | | | | |

| |

| UNITED STATES 2.9% | |

|

Credit Acceptance Auto Loan Trust | |

3.550% due 08/15/2027 | | | | | 1,400 | | | | | | 1,426 | |

|

Exeter Automobile Receivables Trust | |

3.200% due 04/15/2022 | | | | | 1,335 | | | | | | 1,340 | |

|

GLS Auto Receivables Issuer Trust | |

3.060% due 04/17/2023 | | | | | 1,156 | | | | | | 1,163 | |

|

OneMain Direct Auto Receivables Trust | |

2.310% due 12/14/2021 | | | | | 486 | | | | | | 485 | |

|

SLC Student Loan Trust | |

3.396% due 11/25/2042 • | | | | | 888 | | | | | | 891 | |

|

SoFi Consumer Loan Program LLC | |

2.140% due 09/25/2026 | | | | | 39 | | | | | | 39 | |

2.200% due 11/25/2026 | | | | | 52 | | | | | | 52 | |

2.500% due 05/26/2026 | | | | | 356 | | | | | | 356 | |

|

SoFi Professional Loan Program LLC | |

2.510% due 08/25/2033 | | | | | 125 | | | | | | 125 | |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

3.354% due 01/25/2039 • | | $ | | | 48 | | | $ | | | 48 | |

3.504% due 10/27/2036 • | | | | | 125 | | | | | | 126 | |

|

SpringCastle Funding Asset-Backed | |

3.200% due 05/27/2036 | | | | | 872 | | | | | | 882 | |

|

Utah State Board of Regents | |

3.154% due 01/25/2057 • | | | | | 558 | | | | | | 559 | |

| | | | | | | | | | | | |

Total United States | | | | | | | | | | | 7,492 | |

| | | | | | | | | | | | |

Total Asset-Backed Securities (Cost $21,319) | | | 21,373 | |

| | | | |

| |

| LOAN PARTICIPATIONS AND ASSIGNMENTS 0.5% | |

| |

| UNITED STATES 0.5% | |

|

Toyota Motor Credit Corp. | |

2.910% (LIBOR03M + 0.580%) due 11/08/2019 «~ | | | | | 1,200 | | | | | | 1,199 | |

| | | | | | | | | | | | |

Total Loan Participations and Assignments (Cost $1,198) | | | 1,199 | |

| | | | |

| |

| CORPORATE BONDS & NOTES 31.4% | |

| |

| AUSTRALIA 0.3% | |

| |

| INDUSTRIALS 0.3% | |

|

Boral Finance Pty. Ltd. | |

3.000% due 11/01/2022 | | | | | 600 | | | | | | 600 | |

|

Sydney Airport Finance Co. Pty. Ltd. | |

5.125% due 02/22/2021 | | | | | 100 | | | | | | 104 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 704 | |

| | | | | | | | | | | | |

Total Australia | | | | | | | | | | | 704 | |

| | | | | | | | | | | | |

| |

| CANADA 0.8% | |

| |

| INDUSTRIALS 0.8% | |

|

Enbridge, Inc. | |

2.984% due 01/10/2020 ~ | | | | | 2,000 | | | | | | 2,000 | |

| | | | | | | | | | | | |

Total Canada | | | | | | | | | | | 2,000 | |

| | | | | | | | | | | | |

| |

| CHINA 0.4% | |

| |

| UTILITIES 0.4% | |

|

State Grid Overseas Investment Ltd. | |

3.750% due 05/02/2023 | | | | | 900 | | | | | | 939 | |

| | | | | | | | | | | | |

Total China | | | | | | | | | | | 939 | |

| | | | | | | | | | | | |

| |

| DENMARK 0.1% | |

| |

| BANKING & FINANCE 0.1% | |

|

Danske Bank A/S | |

3.496% (US0003M + 1.060%) due 09/12/2023 ~ | | | | | 400 | | | | | | 389 | |

| | | | | | | | | | | | |

Total Denmark | | | | | | | | | | | 389 | |

| | | | | | | | | | | | |

| |

| FRANCE 2.0% | |

| |

| BANKING & FINANCE 2.0% | |

|

Banque Federative du Credit Mutuel S.A. | |

3.552% due 07/20/2023 ~ | | | | | 700 | | | | | | 706 | |

|

Credit Agricole S.A. | |

3.601% due 04/24/2023 ~ | | | | | 300 | | | | | | 299 | |

3.750% due 04/24/2023 | | | | | 700 | | | | | | 727 | |

|

Dexia Credit Local S.A. | |

2.375% due 09/20/2022 | | | | | 1,700 | | | | | | 1,717 | |

1.875% due 09/15/2021 | | | | | 1,700 | | | | | | 1,696 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,145 | |

| | | | | | | | | | | | |

Total France | | | | | | | | | | | 5,145 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| GERMANY 1.0% | |

| |

| BANKING & FINANCE 1.0% | |

|

Deutsche Bank AG | |

3.567% (US0003M + 0.970%) due 07/13/2020 ~ | | $ | | | 2,100 | | | $ | | | 2,087 | |

4.250% due 10/14/2021 | | | | | 500 | | | | | | 506 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,593 | |

| | | | | | | | | | | | |

Total Germany | | | | | | | | | | | 2,593 | |

| | | | | | | | | | | | |

| |

| GUERNSEY, CHANNEL ISLANDS 0.8% | |

| |

| BANKING & FINANCE 0.8% | |

|

Credit Suisse Group Funding Guernsey Ltd. | |

4.891% (US0003M + 2.290%) due 04/16/2021 ~ | | | | | 2,000 | | | | | | 2,064 | |

| | | | | | | | | | | | |

Total Guernsey, Channel Islands | | | | | | | | | | | 2,064 | |

| | | | | | | | | | | | |

| |

| IRELAND 0.2% | |

| |

| BANKING & FINANCE 0.1% | |

|

AerCap Ireland Capital DAC | |

4.625% due 10/30/2020 | | | | | 200 | | | | | | 205 | |

4.250% due 07/01/2020 | | | | | 150 | | | | | | 152 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 357 | |

| | | | | | | | | | | | |

| |

| INDUSTRIALS 0.1% | |

|

Shire Acquisitions Investments Ireland DAC | |

1.900% due 09/23/2019 | | | | | 260 | | | | | | 260 | |

| | | | | | | | | | | | |

Total Ireland | | | | | | | | | | | 617 | |

| | | | | | | | | | | | |

| |

| JAPAN 4.6% | |

| |

| BANKING & FINANCE 4.0% | |

|

Mitsubishi UFJ Financial Group, Inc. | |

3.446% due 07/26/2023 ~ | | | | | 2,900 | | | | | | 2,906 | |

|

Mizuho Financial Group, Inc. | |

2.273% due 09/13/2021 | | | | | 1,600 | | | | | | 1,595 | |

3.461% (US0003M + 0.940%) due 02/28/2022 ~ | | | | | 500 | | | | | | 504 | |

|

Sumitomo Mitsui Financial Group, Inc. | |

3.341% due 10/18/2022 ~ | | | | | 1,500 | | | | | | 1,504 | |

3.732% (US0003M + 1.140%) due 10/19/2021 ~ | | | | | 500 | | | | | | 507 | |

3.707% (US0003M + 1.110%) due 07/14/2021 ~ | | | | | 2,200 | | | | | | 2,227 | |

3.452% due 07/19/2023 ~ | | | | | 1,000 | | | | | | 1,005 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,248 | |

| | | | | | | | | | | | |

| |

| INDUSTRIALS 0.6% | |

|

Toyota Industries Corp. | |

3.235% due 03/16/2023 | | | | | 1,500 | | | | | | 1,540 | |

| | | | | | | | | | | | |

Total Japan | | | | | | | | | | | 11,788 | |

| | | | | | | | | | | | |

| |

| JERSEY, CHANNEL ISLANDS 0.3% | |

| |

| INDUSTRIALS 0.3% | |

|

Heathrow Funding Ltd. | |

4.875% due 07/15/2023 | | | | | 700 | | | | | | 746 | |

| | | | | | | | | | | | |

Total Jersey, Channel Islands | | | | | | | | | | | 746 | |

| | | | | | | | | | | | |

| |

| LUXEMBOURG 0.4% | |

| |

| INDUSTRIALS 0.4% | |

|

Allergan Funding SCS | |

3.000% due 03/12/2020 | | | | | 1,000 | | | | | | 1,003 | |

| | | | | | | | | | | | |

Total Luxembourg | | | | | | | | | | | 1,003 | |

| | | | | | | | | | | | |

| |

| | | | | | |

| See Accompanying Notes | | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 17 |

Schedule of InvestmentsPIMCO StocksPLUS® Global Portfolio(Cont.)

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| NETHERLANDS 0.8% | |

| |

| BANKING & FINANCE 0.3% | |

|

Cooperatieve Rabobank UA | |

2.500% due 01/19/2021 | | $ | | | 900 | | | $ | | | 903 | |

| | | | | | | | | | | | |

| |

| INDUSTRIALS 0.5% | |

|

Syngenta Finance NV | |

4.441% due 04/24/2023 | | | | | 500 | | | | | | 520 | |

3.933% due 04/23/2021 | | | | | 700 | | | | | | 713 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,233 | |

| | | | | | | | | | | | |

Total Netherlands | | | | | | | | | | | 2,136 | |

| | | | | | | | | | | | |

| |

| SINGAPORE 0.9% | |

| |

| BANKING & FINANCE 0.9% | |

|

BOC Aviation Ltd. | |

3.626% due 05/02/2021 ~ | | | | | 300 | | | | | | 301 | |

|

Oversea-Chinese Banking Corp. Ltd. | |

2.975% due 05/17/2021 ~ | | | | | 1,400 | | | | | | 1,401 | |

|

United Overseas Bank Ltd. | |

3.072% due 04/23/2021 ~ | | | | | 700 | | | | | | 702 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,404 | |

| | | | | | | | | | | | |

Total Singapore | | | | | | | | | | | 2,404 | |

| | | | | | | | | | | | |

| |

| SWITZERLAND 0.2% | |

| |

| BANKING & FINANCE 0.2% | |

|

UBS AG | |

3.370% (US0003M + 0.850%) due 06/01/2020 ~ | | | | | 500 | | | | | | 503 | |

| | | | | | | | | | | | |

Total Switzerland | | | | | | | | | | | 503 | |

| | | | | | | | | | | | |

| |

| UNITED KINGDOM 4.4% | |

| |

| BANKING & FINANCE 3.4% | |

|

Barclays PLC | |

4.655% (US0003M + 2.110%) due 08/10/2021 ~ | | | | | 1,600 | | | | | | 1,636 | |

3.948% due 02/15/2023 ~ | | | | | 600 | | | | | | 597 | |

|

HSBC Holdings PLC | |

4.098% (US0003M + 1.500%) due 01/05/2022 ~ | | | | | 400 | | | | | | 409 | |

3.086% due 09/11/2021 ~ | | | | | 800 | | | | | | 801 | |

3.120% due 05/18/2021 ~ | | | | | 600 | | | | | | 600 | |

|

Lloyds Banking Group PLC | |

4.050% due 08/16/2023 | | | | | 400 | | | | | | 418 | |

4.550% due 08/16/2028 | | | | | 400 | | | | | | 432 | |

3.186% due 06/21/2021 ~ | | | | | 300 | | | | | | 300 | |

|

Nationwide Building Society | |

3.766% due 03/08/2024 • | | | | | 1,800 | | | | | | 1,838 | |

|

Santander UK PLC | |

3.178% due 11/15/2021 ~ | | | | | 800 | | | | | | 803 | |

2.125% due 11/03/2020 | | | | | 200 | | | | | | 199 | |

|

Standard Chartered PLC | |

3.650% (US0003M + 1.130%) due 08/19/2019 ~ | | | | | 800 | | | | | | 801 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,834 | |

| | | | | | | | | | | | |

| |

| INDUSTRIALS 0.8% | |

|

BAT International Finance PLC | |

2.750% due 06/15/2020 | | | | | 200 | | | | | | 200 | |

|

Imperial Brands Finance PLC | |

2.950% due 07/21/2020 | | | | | 1,600 | | | | | | 1,605 | |

|

Reckitt Benckiser Treasury Services PLC | |

2.903% (US0003M + 0.560%) due 06/24/2022 ~ | | | | | 200 | | | | | | 199 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,004 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| UTILITIES 0.2% | |

|

BG Energy Capital PLC | |

4.000% due 10/15/2021 | | $ | | | 500 | | | $ | | | 517 | |

| | | | | | | | | | | | |

Total United Kingdom | | | | | | | | | | | 11,355 | |

| | | | | | | | | | | | |

| |

| UNITED STATES 14.2% | |

| |

| BANKING & FINANCE 6.9% | |

|

Aviation Capital Group LLC | |

7.125% due 10/15/2020 | | | | | 700 | | | | | | 740 | |

|

Citigroup, Inc. | |

3.766% (US0003M + 1.190%) due 08/02/2021 ~ | | | | | 1,200 | | | | | | 1,216 | |

3.543% due 06/01/2024 ~ | | | | | 1,500 | | | | | | 1,509 | |

|

Discover Bank | |

4.200% due 08/08/2023 | | | | | 800 | | | | | | 849 | |

|

Ford Motor Credit Co. LLC | |

8.125% due 01/15/2020 | | | | | 300 | | | | | | 309 | |

3.157% due 08/04/2020 | | | | | 200 | | | | | | 201 | |

|

General Motors Financial Co., Inc. | |

4.147% (US0003M + 1.550%) due 01/14/2022 ~ | | | | | 1,000 | | | | | | 1,010 | |

3.872% (US0003M + 1.270%) due 10/04/2019 ~ | | | | | 700 | | | | | | 702 | |

|

Goldman Sachs Group, Inc. | |

3.696% (US0003M + 1.110%) due 04/26/2022 ~ | | | | | 200 | | | | | | 202 | |

3.688% (US0003M + 1.170%) due 11/15/2021 ~ | | | | | 500 | | | | | | 504 | |

|

Harley-Davidson Financial Services, Inc. | |

3.460% due 03/02/2021 ~ | | | | | 500 | | | | | | 499 | |

3.550% due 05/21/2021 | | | | | 600 | | | | | | 609 | |

|

Jackson National Life Global Funding | |

2.931% due 06/11/2021 ~ | | | | | 200 | | | | | | 201 | |

|

JPMorgan Chase & Co. | |

3.482% due 07/23/2024 ~ | | | | | 900 | | | | | | 903 | |

3.012% due 06/18/2022 ~ | | | | | 700 | | | | | | 702 | |

|

JPMorgan Chase Bank N.A. | |

2.926% due 04/26/2021 ~ | | | | | 900 | | | | | | 901 | |

|

Morgan Stanley | |

3.095% due 02/10/2021 ~ | | | | | 500 | | | | | | 501 | |

3.737% due 04/24/2024 • | | | | | 600 | | | | | | 626 | |

|

Nissan Motor Acceptance Corp. | |

2.970% (US0003M + 0.520%) due 09/13/2019 • | | | | | 1,600 | | | | | | 1,601 | |

|

Protective Life Global Funding | |

1.999% due 09/14/2021 | | | | | 1,500 | | | | | | 1,486 | |

2.850% due 06/28/2021 ~ | | | | | 1,100 | | | | | | 1,104 | |

|

SBA Tower Trust | |

3.156% due 10/10/2045 | | | | | 300 | | | | | | 301 | |

|

Wells Fargo Bank N.A. | |

3.092% due 07/23/2021 ~ | | | | | 1,200 | | | | | | 1,201 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 17,877 | |

| | | | | | | | | | | | |

| |

| INDUSTRIALS 6.4% | |

|

BAT Capital Corp. | |

3.118% due 08/14/2020 • | | | | | 2,900 | | | | | | 2,908 | |

|

Bayer U.S. Finance LLC | |

2.979% due 06/25/2021 ~ | | | | | 200 | | | | | | 199 | |

3.420% due 12/15/2023 ~ | | | | | 400 | | | | | | 393 | |

|

Broadcom Corp. | |

2.375% due 01/15/2020 | | | | | 900 | | | | | | 898 | |

|

Continental Airlines Pass-Through Trust | |

7.250% due 05/10/2021 | | | | | 568 | | | | | | 576 | |

|

Daimler Finance North America LLC | |

2.965% due 02/12/2021 ~ | | | | | 1,200 | | | | | | 1,199 | |

3.350% due 05/04/2021 | | | | | 1,200 | | | | | | 1,217 | |

|

Dell International LLC | |

4.420% due 06/15/2021 | | | | | 900 | | | | | | 927 | |

|

DXC Technology Co. | |

3.470% due 03/01/2021 ~ | | | | | 923 | | | | | | 923 | |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

|

ERAC USA Finance LLC | |

2.350% due 10/15/2019 | | $ | | | 100 | | | $ | | | 100 | |

|

GATX Corp. | |

3.285% due 11/05/2021 ~ | | | | | 1,500 | | | | | | 1,494 | |

|

Hyundai Capital America | |

3.402% due 09/18/2020 ~ | | | | | 500 | | | | | | 502 | |

|

Kraft Heinz Foods Co. | |

3.115% due 02/10/2021 ~ | | | | | 2,500 | | | | | | 2,496 | |

|

Norfolk Southern Railway Co. | |

9.750% due 06/15/2020 | | | | | 1,500 | | | | | | 1,604 | |

|

Ryder System, Inc. | |

2.250% due 09/01/2021 | | | | | 400 | | | | | | 399 | |

3.400% due 03/01/2023 | | | | | 400 | | | | | | 411 | |

|

Sprint Spectrum Co. LLC | |

3.360% due 03/20/2023 | | | | | 225 | | | | | | 226 | |

|

Textron, Inc. | |

3.650% due 03/01/2021 | | | | | 100 | | | | | | 102 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 16,574 | |

| | | | | | | | | | | | |

| |

| UTILITIES 0.9% | |

|

AT&T, Inc. | |

3.547% (US0003M + 0.950%) due 07/15/2021 ~ | | | | | 600 | | | | | | 606 | |

3.247% (US0003M + 0.650%) due 01/15/2020 ~ | | | | | 100 | | | | | | 100 | |

|

Consolidated Edison Co. of New York, Inc. | |

2.749% due 06/25/2021 ~ | | | | | 500 | | | | | | 501 | |

|

Exelon Corp. | |

5.150% due 12/01/2020 | | | | | 100 | | | | | | 103 | |

|

Sempra Energy | |

2.860% due 03/15/2021 ~ | | | | | 600 | | | | | | 598 | |

|

Southern Power Co. | |

2.937% due 12/20/2020 ~ | | | | | 400 | | | | | | 400 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,308 | |

| | | | | | | | | | | | |

Total United States | | | | | | | | | | | 36,759 | |

| | | | | | | | | | | | |

Total Corporate Bonds & Notes (Cost $80,584) | | | 81,145 | |

| | | | |

| |

| NON-AGENCY MORTGAGE-BACKED SECURITIES 1.7% | |

| |

| UNITED KINGDOM 0.8% | |

|

Business Mortgage Finance PLC | |

0.069% due 08/15/2040 • | | EUR | | | 646 | | | | | | 728 | |

|

Towd Point Mortgage Funding PLC | |

1.855% due 10/20/2051 • | | GBP | | | 700 | | | | | | 892 | |

|

Uropa Securities PLC | |

1.024% due 10/10/2040 • | | | | | 390 | | | | | | 466 | |

| | | | | | | | | | | | |

Total United Kingdom | | | | | | | | | | | 2,086 | |

| | | | | | | | | | | | |

| |

| UNITED STATES 0.9% | |

|

AREIT Trust | |

3.251% due 02/14/2035 • | | $ | | | 274 | | | | | | 274 | |

|

GS Mortgage Securities Corp. | |

3.419% due 10/10/2032 | | | | | 900 | | | | | | 929 | |

|

MASTR Adjustable Rate Mortgages Trust | |

4.663% due 11/21/2034 ~ | | | | | 200 | | | | | | 209 | |

|

Natixis Commercial Mortgage Securities Trust | |

3.144% due 02/15/2033 • | | | | | 200 | | | | | | 199 | |

|

Tharaldson Hotel Portfolio Trust | |

3.169% due 11/11/2034 • | | | | | 243 | | | | | | 243 | |

|

VMC Finance LLC | |

3.314% due 10/15/2035 • | | | | | 489 | | | | | | 490 | |

| | | | | | | | | | | | |

Total United States | | | | | | | | | | | 2,344 | |

| | | | | | | | | | | | |

TotalNon-Agency Mortgage-Backed Securities (Cost $4,392) | | | 4,430 | |

| | | | |

| |

| | | | | | | | |

| 18 | | PIMCO EQUITY SERIES VIT | | | | | See Accompanying Notes | |

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| MUNICIPAL BONDS & NOTES 0.1% | |

| |

| CALIFORNIA 0.1% | |

|

California State General Obligation Bonds, Series 2017 | |

2.193% due 04/01/2047 | | $ | | | 300 | | | $ | | | 300 | |

| | | | | | | | | | | | |

Total Municipal Bonds & Notes (Cost $300) | | | 300 | |

| | | | |

| |

| SOVEREIGN ISSUES 4.5% | |

| |

| JAPAN 1.7% | |

|

Japan Finance Organization for Municipalities | |

2.000% due 09/08/2020 | | | | | 1,300 | | | | | | 1,297 | |

|

Japan Government International Bond | |

0.100% due 03/10/2028 (c) | | JPY | | | 313,078 | | | | | | 3,033 | |

| | | | | | | | | | | | |

Total Japan | | | | | | | | | | | 4,330 | |

| | | | | | | | | | | | |

| |

| QATAR 1.7% | |

|

Qatar Government International Bond | |

2.375% due 06/02/2021 | | $ | | | 3,800 | | | | | | 3,801 | |

4.500% due 01/20/2022 | | | | | 700 | | | | | | 736 | |

| | | | | | | | | | | | |

Total Qatar | | | | | | | | | | | 4,537 | |

| | | | | | | | | | | | |

| |

| SAUDI ARABIA 1.0% | |

|

Saudi Government International Bond | |

2.875% due 03/04/2023 | | | | | 2,600 | | | | | | 2,634 | |

| | | | | | | | | | | | |

Total Saudi Arabia | | | | | | | | | | | 2,634 | |

| | | | | | | | | | | | |

| |

| SOUTH KOREA 0.1% | |

|

Export-Import Bank of Korea | |

1.927% due 02/24/2020 (d) | | CAD | | | 300 | | | | | | 228 | |

| | | | | | | | | | | | |

Total South Korea | | | | | | | | | | | 228 | |

| | | | | | | | | | | | |

Total Sovereign Issues (Cost $11,518) | | | 11,729 | |

| | | | |

| |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| U.S. GOVERNMENT AGENCIES 1.3% | |

| |

| UNITED STATES 1.3% | |

|

Fannie Mae | |

2.704% due 12/25/2045 • | | $ | | | 489 | | | $ | | | 487 | |

2.936% due 09/25/2046 • | | | | | 1,034 | | | | | | 1,035 | |

|

Freddie Mac | |

2.794% due 06/15/2041 • | | | | | 304 | | | | | | 304 | |

2.844% due 07/15/2037 • | | | | | 33 | | | | | | 34 | |

2.924% due 10/15/2033 • | | | | | 241 | | | | | | 243 | |

2.949% due 07/15/2040 | | | | | 283 | | | | | | 283 | |

4.642% due 09/01/2037 • | | | | | 440 | | | | | | 464 | |

|

Ginnie Mae | |

2.837% due 06/20/2061 - 10/20/2066 • | | | | | 425 | | | | | | 425 | |

| | | | | | | | | | | | |

Total U.S. Government Agencies (Cost $3,269) | | | 3,275 | |

| | | | |

| |

| U.S. TREASURY OBLIGATIONS 10.2% | |

| |

| UNITED STATES 10.2% | |

|

U.S. Treasury Inflation Protected Securities (c) | |

0.125% due 04/15/2021 | | | | | 647 | | | | | | 641 | |

0.125% due 01/15/2022 (g) | | | | | 3,838 | | | | | | 3,815 | |

0.125% due 04/15/2022 (g) | | | | | 12,923 | | | | | | 12,823 | |

0.125% due 07/15/2022 (g) | | | | | 1,889 | | | | | | 1,884 | |

1.000% due 02/15/2048 | | | | | 1,243 | | | | | | 1,310 | |

|

U.S. Treasury Notes | |

1.375% due 09/30/2023 | | | | | 5,800 | | | | | | 5,711 | |

2.000% due 04/30/2024 | | | | | 100 | | | | | | 101 | |

| | | | | | | | | | | | |

Total U.S. Treasury Obligations (Cost $26,008) | | | 26,285 | |

| | | | |

| |

| SHORT-TERM INSTRUMENTS 11.3% | |

| |

| CERTIFICATES OF DEPOSIT 0.3% | |

|

Lloyds Bank Corporate Markets PLC | |

2.843% due 09/24/2020 ~ | | | | | 900 | | | | | | 903 | |

| | | | | | | | | | | | |

| |

| REPURCHASE AGREEMENTS (e) 2.8% | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,179 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| SHORT-TERM NOTES 8.2% | |

|

Federal Home Loan Bank | |

2.243% due 08/16/2019 (a)(b) | | $ | | | 5,500 | | | $ | | | 5,485 | |

2.294% due 08/07/2019 (a)(b) | | | | | 4,900 | | | | | | 4,889 | |

2.414% due 07/12/2019 (a)(b) | | | | | 2,400 | | | | | | 2,398 | |

2.434% due 07/05/2019 (a)(b) | | | | | 8,400 | | | | | | 8,398 | |

| | | | | | | | | | | | |

Total Short-Term Notes

(Cost $21,169) | | | | | | | | | | | 21,170 | |

| | | | | | | | | | | | |

Total Short-Term Instruments (Cost $29,248) | | | 29,252 | |

| | | | |

| | | | |

| | | | | | | | | | | | |

Total Investments in Securities (Cost $177,836) | | | 178,988 | |

| | | | |

| |

| | | | | SHARES | | | | | | |

| INVESTMENTS IN AFFILIATES 26.4% | |

| |

| SHORT-TERM INSTRUMENTS 26.4% | |

| |

| CENTRAL FUNDS USED FOR CASH MANAGEMENT PURPOSES 26.4% | |

| | | |

PIMCO Short Asset Portfolio | | | 1,397,173 | | | | | | 13,896 | |

| | | | |

PIMCO Short-Term

Floating NAV Portfolio III | | | | | 5,486,637 | | | | | | 54,274 | |

| | | | | | | | | | | | |

Total Short-Term Instruments

(Cost $68,203) | | | 68,170 | |

| | | | |

| | | | |

| | | | | | | | | | | | |

Total Investments in Affiliates

(Cost $68,203) | | | 68,170 | |

| | | | |

| | | | | | | | | | | | |

Total Investments 95.7%

(Cost $246,039) | | | $ | | | 247,158 | |

| |

Financial Derivative

Instruments (f)(h) 0.5% (Cost or Premiums, net $179) | | | | | | | | | | | 1,240 | |

| |

| Other Assets and Liabilities, net 3.8% | | | 9,876 | |

| | | | |

| Net Assets 100.0% | | | $ | | | 258,274 | |

| | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS:

| * | A zero balance may reflect actual amounts rounding to less than one thousand. |

| « | Security valued using significant unobservable inputs (Level 3). |

| ~ | Variable or Floating rate security. Rate shown is the rate in effect as of period end. Certain variable rate securities are not based on a published reference rate and spread, rather are determined by the issuer or agent and are based on current market conditions. Reference rate is as of reset date, which may vary by security. These securities may not indicate a reference rate and/or spread in their description. |

| • | Rate shown is the rate in effect as of period end. The rate may be based on a fixed rate, a capped rate or a floor rate and may convert to a variable or floating rate in the future. These securities do not indicate a reference rate and spread in their description. |

| (b) | Coupon represents a yield to maturity. |

| (c) | Principal amount of security is adjusted for inflation. |

(d) RESTRICTED SECURITIES:

| | | | | | | | | | | | | | | | | | | | | | |

| Issuer Description | | Coupon | | Maturity

Date | | | Acquisition

Date | | | Cost | | | Market

Value | | | Market Value

as Percentage

of Net Assets

| |

Export-Import Bank of Korea | | 1.927% | | | 02/24/2020 | | | | 02/16/2017 | | | | $ 229 | | | $ | 228 | | | | 0.09% | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| See Accompanying Notes | | SEMIANNUAL REPORT | | JUNE 30, 2019 | | 19 |

Schedule of InvestmentsPIMCO StocksPLUS® Global Portfolio(Cont.)

BORROWINGS AND OTHER FINANCING TRANSACTIONS

(e) REPURCHASE AGREEMENTS:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Lending

Rate | | | Settlement

Date | | | Maturity

Date | | | Principal

Amount | | | Collateralized By | | Collateral

(Received) | | | Repurchase

Agreements,

at Value | | | Repurchase

Agreement

Proceeds

to be

Received(1) | |

| FICC | | | 2.000 | % | | | 06/28/2019 | | | | 07/01/2019 | | | $ | 7,179 | | | U.S. Treasury Notes 2.250% due 03/31/2021 | | $ | (7,325 | ) | | $ | 7,179 | | | $ | 7,180 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Repurchase Agreements | | | | | $ | (7,325 | ) | | $ | 7,179 | | | $ | 7,180 | |

| | | | | | | | | | | | | | | |

BORROWINGS AND OTHER FINANCING TRANSACTIONS SUMMARY

The following is a summary by counterparty of the market value of Borrowings and Other Financing Transactions and collateral pledged/(received) as of June 30, 2019:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Repurchase

Agreement

Proceeds

to be

Received(1) | | | Payable for

Reverse

Repurchase

Agreements | | | Payable for

Sale-Buyback

Transactions | | | Total

Borrowings and

Other Financing

Transactions | | | Collateral

Pledged/(Received) | | | Net Exposure(2) | |

Global/Master Repurchase Agreement | | | | | | | | | | | | | | | | | | | | | | | | |

FICC | | $ | 7,180 | | | $ | 0 | | | $ | 0 | | | $ | 7,180 | | | $ | (7,325 | ) | | $ | (145 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Borrowings and Other Financing Transactions | | $ | 7,180 | | | $ | 0 | | | $ | 0 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes accrued interest. |

| (2) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from borrowings and other financing transactions can only be netted across transactions governed under the same master agreement with the same legal entity. See Note 8, Master Netting Arrangements, in the Notes to Financial Statements for more information regarding master netting arrangements. |

(f) FINANCIAL DERIVATIVE INSTRUMENTS: EXCHANGE-TRADED OR CENTRALLY CLEARED

FUTURES CONTRACTS:

| | | | | | | | | | | | | | | | | | | | | | | | |

| LONG FUTURES CONTRACTS | |

| | | | | |

| Description | | Expiration

Month | | | # of

Contracts | | | Notional

Amount | | | Unrealized

Appreciation/

(Depreciation) | | | Variation Margin | |

| | Asset | | | Liability | |

E-mini S&P 500 Index September Futures | | | 09/2019 | | | | 877 | | | $ | 129,103 | | | $ | 1,993 | | | $ | 592 | | | $ | 0 | |