As filed with the Securities and Exchange Commission on June 2, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22378

DoubleLine Funds Trust

(Exact name of registrant as specified in charter)

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Address of principal executive offices) (Zip code)

Ronald R. Redell

President

DoubleLine Funds Trust

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Name and address of agent for service)

(213) 633-8200

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

Item 1. Reports to Stockholders.

Annual Report

March 31, 2015

DoubleLine Total Return Bond Fund

DBLTX (I-share)

DLTNX (N-share)

DoubleLine Core Fixed Income Fund

DBLFX (I-share)

DLFNX (N-share)

DoubleLine Emerging Markets Fixed Income Fund

DBLEX (I-share)

DLENX (N-share)

DoubleLine Multi-Asset Growth Fund

DMLIX (I-share)

DMLAX (A-share)

DoubleLine Low Duration Bond Fund

DBLSX (I-share)

DLSNX (N-share)

DoubleLine Floating Rate Fund

DBFRX (I-share)

DLFRX (N-share)

DoubleLine Shiller Enhanced CAPE®

DSEEX (I-share)

DSENX (N-share)

DoubleLine Flexible Income Fund

DFLEX (I-share)

DLINX (N-share)

DoubleLine Low Duration Emerging Markets Fixed Income Fund

DBLLX (I-share)

DELNX (N-share)

DoubleLine Long Duration

Total Return Bond Fund

DBLDX (I-share)

DLLDX (N-share)

| | |

| DoubleLine Capital LP | | 333 S. Grand Avenue 18th Floor Los Angeles, California 90071 doubleline.com |

| | | | | | |

| | Annual Report | | March 31, 2015 | | 3 |

| | |

| President’s Letter | | March 31, 2015 |

Dear DoubleLine Funds Shareholder,

On behalf of the DoubleLine Funds, I am pleased to deliver this Annual Report for the 12-month period ended March 31, 2015. On the following pages you will find specific information regarding each Fund’s operations and holdings. In addition, we discuss each Fund’s investment performance and the main drivers of that performance during the reporting period.

Investor assets in the DoubleLine Funds were over $51.1 billion as of March 31, 2015. During the period, we continued to enhance our overall lineup of investment strategies available to investors. On April 7, 2014, we launched the DoubleLine Flexible Income Fund (DFLEX/DLINX) and the DoubleLine Low Duration Emerging Markets Fixed Income Fund (DBLLX/DELNX). On December 1, 2014, we launched DoubleLine Long Duration Total Return Bond Fund (DBLDX/DLLDX), whose shares became available to the public on December 15, 2014.

If you have any questions regarding the DoubleLine Funds please don’t hesitate to call us at 877-DLine11 (877-354-6311), or visit our website www.doublelinefunds.com to hear our investment management team offer deeper insights and analysis on relevant capital market activity impacting investors today. We value the trust that you have placed with us, and we will continue to strive to offer thoughtful investment solutions to our shareholders.

Sincerely,

Ronald R. Redell, CFA

President

DoubleLine Funds Trust

May 1, 2015

| | |

| Financial Markets Highlights | | March 31, 2015 |

| · | | Agency Mortgage-Backed Securities (Agency MBS) |

For the 12-month period ended March 31, 2015, the Barclays U.S. MBS Index returned 5.53%. The duration of the Index shortened from 5.51 to 3.54 years over that time period as the U.S. yield curve flattened. U.S. 10-year yields declined by over 110 basis points (bps) from peak-to-trough; this decline propagated a spike in refinancing activity as 30-year mortgage rates dropped close to historic lows. Though prepayment speeds were relatively stable for most of the period, they materially increased during the first quarter of 2015. The combination of low mortgage rates, reduction in mortgage insurance premiums on FHA (Federal Housing Administration) loans announced in January, and improving housing seasonality resulted in the increase in aggregate prepayment speeds across all three agencies (Fannie Mae, Freddie Mac, and Ginnie Mae).

| · | | Non-Agency Mortgage-Backed Securities (Non-Agency MBS) |

During the 12-month period ended March 31, 2015, the non-Agency MBS market experienced some volatility both in terms of pricing and trading volume. Market concerns of rising interest rates during the first quarter of 2014 led to reduced trading volume and spread widening. As the year progressed, the market shrugged off these concerns and the non-Agency market rebounded firmly. The combination of supply technicals and improving loan fundamentals resulted in strong performance for this sector for the remainder of the year. According to Amherst Research for the reporting period, non-Agency prime bonds returned 3.98% on average, Alt-A bonds returned 5.55%, and subprime bonds returned 10.90%. During the latter half of the reporting period, geo-political concerns and headline news about drastically falling energy prices did not slow down the trading activity in non-Agency MBS. Falling interest rates resulted in some increases in prepayment speeds, but liquidation rates, severities and the pace of loan modifications remained range bound with only a few pockets of volatility. On a technical basis, non-Agency MBS continued to be well bid while supply has shown up more unevenly. Large bid lists continued to be a factor in determining monthly trading volume, but the frequency of these lists subsided coming into 2015.

| · | | Commercial Mortgage-Backed Securities (CMBS) |

Over the 12-month period ended March 31, 2015, 2.0/3.0 CMBS prices largely rallied despite periods of intermittent volatility driven by concerns over future Federal Reserve (Fed) interest-rate hikes, geo-political instability, continued deterioration of underwriting quality and changing subordination levels. Spreads and prices rallied from March-July 2014, hitting new post-recession lows before widening through year-end; spreads then rallied in the first quarter 2015. During the reporting period, the Barclays U.S. CMBS Index returned 4.35% versus 5.72% for the Barclays U.S. Aggregate Index. For the period, 10-year AAA last cash flows (LCFs) were trading at 85 bps over swaps, representing a 2 bps tightening year-over-year (YoY), while the 10-year BBB LCFs traded at 345 bps over swaps, a 15 bps tightening. On the new issue front, non-Agency CMBS issuance was up 19% YoY, with $91 billion in new issuance over 105 deals during the reporting period compared to $76 billion in 86 deals from April 2013 through March 2014. Delinquency rates across all asset classes improved during the 12-month reporting period as commercial real estate fundamentals continued to improve coupled with low financing costs. The overall U.S. CMBS delinquency rate as of March 31, 2015 at 5.58%, a 0.96% improvement YoY.

| · | | Emerging Markets (EM) Debt |

Over the 12-month period ended March 31, 2015, U.S. dollar (USD)-denominated EM fixed income indices posted mid-single digit returns. The market pushed out expectations of the first Fed rate hike to the second half of 2015, and the U.S. Treasury (UST) curve flattened over the period. The positive duration contribution and accrued interest offset the negative return from widening credit spreads. Most of the spread widening occurred over December 2014 and January 2015, as commodity prices, most notably oil prices, fell sharply. Asia sovereign and corporate credits outperformed their regional peers, as the region was less exposed to the negative terms of trade shock. Stronger U.S. growth prospects and diverging monetary policies of developed market central banks caused a strong dollar rally and EM local currency to sharply depreciate versus the USD.

| · | | Investment Grade Credit |

For the 12-month period ending March 31, 2015, investment grade credit recorded a total return of 6.74%. Returns were driven by the interest accrual and price appreciation as interest rates fell across the intermediate and long-end of the UST curve. Over the reporting period, spreads widened by 21 bps, from 103 bps to 124 bps and as rates fell, the duration contributed to performance. The part of the Index with the longest duration had the highest total return, with the 10-year plus bucket returning 12.84%. By credit quality, returns

| | | | | | |

| | Annual Report | | March 31, 2015 | | 5 |

| | |

| Financial Markets Highlights (Cont.) | | March 31, 2015 |

were similarly led by single-As which generated a total return of 7.11%. Utilities were the best performing sector, which was partially due to their longer duration profile. As of March 31, 2015, the new issue market remained healthy with over $1 trillion in new issuance.

For the 12-month period ended March 31, 2015, the S&P/LSTA Leveraged Loan Index returned 2.53%. By facility rating, BB-rated loans led performance, returning 3.52%. First lien loans returned 2.68%, outperforming the second lien loan return of -0.28%. The top performing industries included Publishing (+5.90%), Cosmetics—Toiletries (+5.21%) and Media (+5.04%). Underperforming industries were focused around the commodity sector. The worst performing industries were Oil and Gas (-11.25%), Nonferrous Metals—Minerals (-7.26%) and Utilities (-0.96%). Institutional loan volume has been a technical factor in recent months as total institutional loan volume fell to $304.6 billion over the 12-month reporting period. This compares with $434.7 billion over the comparable period one year ago. As of the end of the reporting period, the default rate remained low, ending March 2015 at 0.64% on an issuer-weighted basis and 3.22% on par-weighted basis.

For the 12-month period ended March 31, 2015, the Citi High-Yield Cash-Pay Capped Index returned 1.28%. Longer-maturity bonds outperformed shorter-maturity bonds, with those maturing in ten years or more returning 11.18% while the shorter 1-7 year category returned -0.01%. Credit quality was also a differentiator as higher credit quality bonds outperformed lower credit quality bonds. The higher BB-rated issues returned 3.88% while the lower CCC-rated issues returned 5.05%. Notable outperformers by industry were Retail-Food & Drug (+9.52%), Food Processors/Beverage/Bottling (+7.89%), and Cellular Towers (+7.45%). The underperforming industries were all commodity related. Underperformance by sector was led by Oil Equipment (-15.29%), Secondary Oil & Gas Producers (-12.95%) and Metals/Mining (-9.72%).

| · | | Collateralized Loan Obligations (CLOs) |

For the 12-month period ended March 31, 2015, the CLO space saw record issuance. The CLO market saw monthly record issuance in June 2014 with $13.78 billion. Beginning in the second quarter of 2014, the market came to terms with Volcker Rules and began to focus on risk retention. The record setting issuance can be attributed to managers issuing ahead of risk retention and Volcker Rules effective dates. Due to the glut of issuance, spreads widened over the year. AAA spreads topped out at 165 Discount Margin (DM) during the fourth quarter of 2014 and ended the period at 155 DM as of March 31, 2015.

Global equities, as measured by the MSCI All Country World Index (MSCI ACWI), produced marginal returns for the 12-month period ended March 31, 2015, with the MSCI ACWI up 3.34%. Global equities were led by strong performances in the U.S. with the S&P 500 Index up 10.44% during the period. U.S. equities were supported by a rebound in economic data in the latter half of the year, especially in the labor market with strong gains made in payrolls data. European equities posted strong returns during the period in local currency terms with the Euro Stoxx 50 Index up 16.95%; however, in USD terms the Index was down -8.90%. European equity performance was driven primarily by European Central Bank (ECB) monetary policy as the central bank embarked on monthly asset purchases to the order of €60 billion1 in an effort to stimulate the economy and combat deflationary pressures. Similarly, Japanese equities were driven by monetary policy from the Bank of Japan, as the central bank increased the scale of its asset purchase program to ¥80 trilllion2 per year. Additionally, Japanese equities were supported by large portfolio allocation shifts from bonds into domestic equities by large local pension funds. EM equities had negative performance over the period as measured by the MSCI EM Index; however there was much disparity in returns by country. Chinese equities as measured by the Shanghai Composite Index were up +84.33% while Brazilian and Russian equities, as measured by the MSCI Brazil USD Index and the MSCI Russia USD Index respectively, were down significantly in USD terms. Chinese equities were supported by local demand for equities as Chinese investors shifted from real estate to equity investments and monetary easing from the Peoples Bank of China. Brazilian and Russian equities were undermined by falling commodity prices and idiosyncratic issues, such as sanctions imposed on Russia and political scandal and budgetary issues in Brazil.

| 1 | €60 billion = 82.6 billion U.S. Dollars as of 3/31/2015 |

| 2 | ¥80 trilllion = 850 billion U.S. Dollars as of 3/31/2015 |

In the 12-month period ended March 31, 2015, the commodity market was down 40.33% as measured by the S&P Goldman Sachs Commodity Index (GSCI). All five sectors in the GSCI lost value over this period. Much of the loss was attributable to Energy, the worst performer and the largest index weight, which lost 49.27% over the same period as global demand for energy commodities did not keep pace with supply. The other sectors in the GSCI fared better but still ended down with Industrial Metals down 7.21%, Livestock down 7.78%, Precious Metals down 9.25%, and Agriculture down 30.46%.

| · | | U.S. Large Cap Equities |

In the 12-month period ended March 31, 2015, the large capitalization U.S. equity market returned 12.73% as measured by the S&P 500 Index. The value portion of the large capitalization U.S. equity market returned 9.33% as measured by the Russell 1000 Value Index. The price-to-earnings ratio of the S&P 500 Index increased from 17.22 on March 31, 2014 to 18.25 on March 31, 2015, indicating that this market’s valuation was not overly extended by the gains in total return. The strongest performing sector of the S&P 500 Index was the Healthcare sector, which returned 26.29% over the 12-month period ended March 31, 2015. The weakest performing sector in the S&P 500 Index over this period was the energy sector, which lost 11.06% due to major declines in energy commodity prices.

The Barclays Municipal Bond Index returned 6.62% through the 12-month period ended March 31, 2015 compared to 5.22% for the Barclays U.S. Government Index. Municipal bonds outperformed UST in the first six-months of the period. Municipal bond returns were boosted by relatively long duration in an environment of generally falling interest rates, and also benefitted from ongoing improvement in state and local finances. Supply concerns weighed on the sector through the second half of the period. Revenue bonds outperformed general obligation issues. Longer maturity issues performed better than shorter issues during the period, as expected in a period of falling interest rates.

| | | | | | |

| | Annual Report | | March 31, 2015 | | 7 |

| | |

| Management’s Discussion of Fund Performance | | March 31, 2015 |

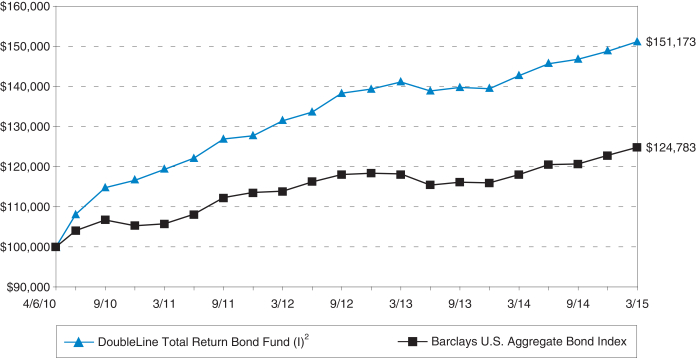

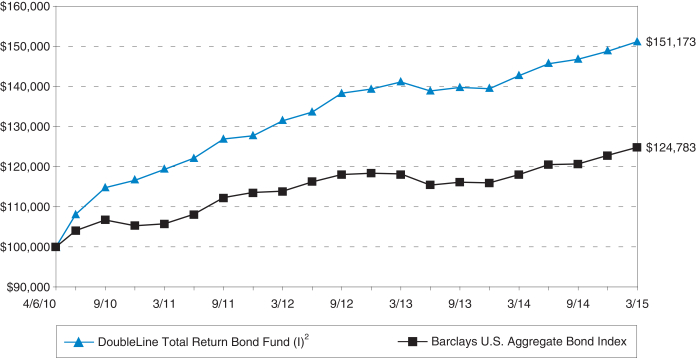

DoubleLine Total Return Bond Fund

The Doubleline Total Return Bond Fund outperformed the Barclays U.S. Aggregate Bond Index return of 5.72% as well as the U.S. MBS component of the Index, which returned 5.53% for the 12-month period ended March 31, 2015. The meaningful gains were largely facilitated by a marked drop in U.S. interest rates with the 10-year UST yield declining by 79 bps. Given the decline in rates, longer duration sectors generally outperformed shorter duration sectors. Broadly speaking, the Fund’s Agency residential MBS (RMBS) holdings significantly outperformed non-Agency RMBS from a total return standpoint. In particular, Agency inverse floating rate securities and fixed-rate collateralized mortgage obligations (CMO), sectors with the longest duration within the portfolio, led the outperformance and benefitted from strong price returns as well as stable interest income. On the non-Agency RMBS side, the sector experienced minor price appreciation during the 12-month period, but continued to generate high coupon returns, particularly within high credit quality sectors such as prime and Alt-A. Additionally, CMBS contributed modest gains to the Fund while CLOs lagged behind other sectors as the space was plagued with regulatory concerns over the last year. The CLO sector, however, has since rallied slightly, and still adds floating rate exposure to the portfolio to offer diversification benefits.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 5.93% | |

N-Share | | | | | 5.76% | |

Barclays U.S. Aggregate Bond Index | | | | | 5.72% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

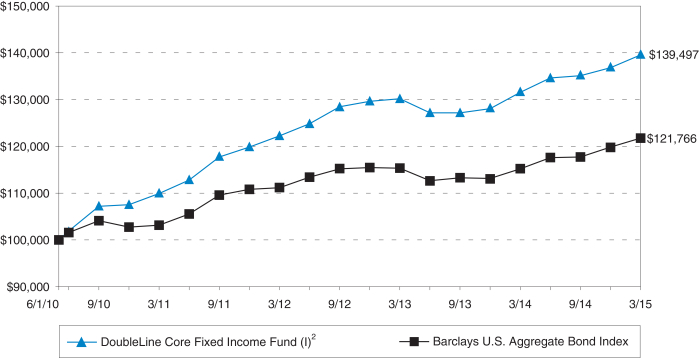

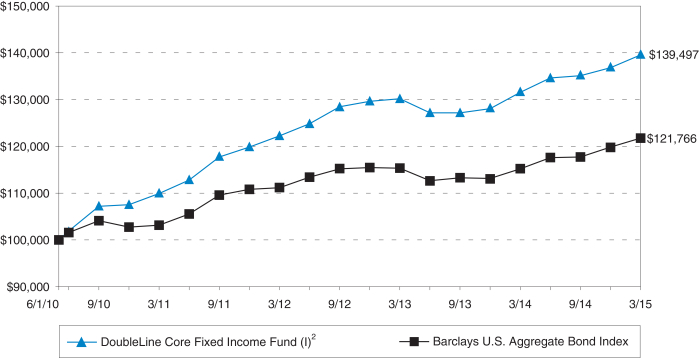

DoubleLine Core Fixed Income Fund

For the 12-month period ended March 31, 2015, the DoubleLine Core Fixed Income Fund outperformed the Barclays U.S. Aggregate Bond Index return of 5.72%. The U.S. yield curve flattened over this period with longer-term rates declining and shorter-term rates increasing. As a result, longer-duration assets outperformed more credit-sensitive sectors over the last year. Agency RMBS, U.S. Government securities, and Investment Grade corporate credit were the best performing sectors due to spreads tightening and prices appreciating. Despite High Yield corporate credit facing a fairly volatile year due to concerns within the Oil and Energy sectors, the asset class performed well, rebounding strongly into the beginning of 2015. The non-Agency RMBS portion of the Fund contributed solid returns, as the sector continued to contribute robust interest income for the portfolio. Though CMBS faced intermittent periods of volatility over the trailing 12-month period, the sector added healthy returns with prices rallying and credit spreads tightening. Bank Loans and CLOs contributed positively to portfolio return over the last year; however, those sectors faced periodic volatility caused by large fluctuations in supply/demand technicals and regulatory concerns regarding the Volcker Rule. Additionally, EM and Munis sectors added positively to the portfolio’s absolute performance.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 6.07% | |

N-Share | | | | | 5.91% | |

Barclays U.S. Aggregate Bond Index | | | | | 5.72% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

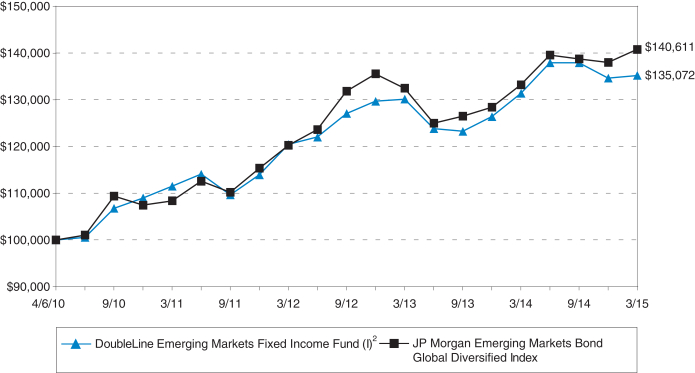

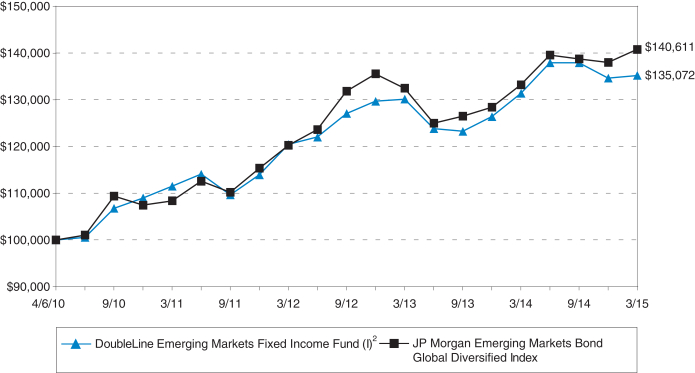

DoubleLine Emerging Markets Fixed Income Fund

Over the 12-month period ended March 31, 2015, the DoubleLine Emerging Markets Fixed Income Fund underperformed the JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified. In part, the Fund underperformed the Index due to an underweight exposure to credits domiciled in Asia, which outperformed over the period. The Fund’s performance was hurt by exposure to Brazil credits and commodity related credits. Brazil credits sold off during the first quarter of 2015 due to a graft scandal related to Brazil’s largest government owned oil and gas company and concerns over the country’s weak macro-economic conditions. Oil and gas and mining related credits saw their spreads widen due to the fall in commodity prices. The Fund’s performance benefited from avoiding exposure to Venezuela and Ukraine. Sovereign bonds domiciled in Venezuela posted large negative returns as lower oil prices and Venezuela’s government policies have led to large macroeconomic imbalances, and investor’s questioning the government’s capacity to pay external debt maturities. Ukraine

credits sold off due to the ongoing war on the eastern border resulting in an anticipated restructuring of their sovereign bonds. The Fund benefited from a positive duration contribution, as 10-year UST yields fell 0.79% to 1.92% at the end of March 2015.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 2.90% | |

N-Share | | | | | 2.64% | |

JP Morgan Emerging Markets Bond Index Global Diversified | | | | | 5.65% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

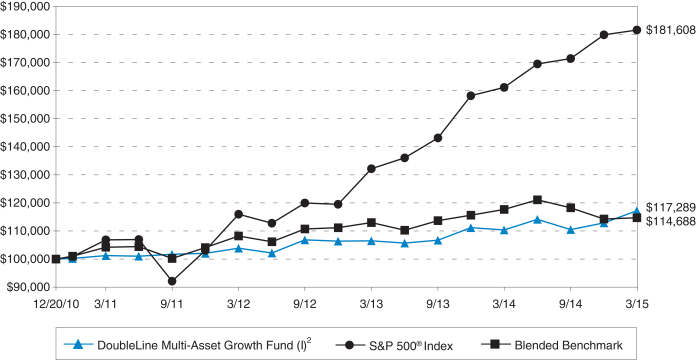

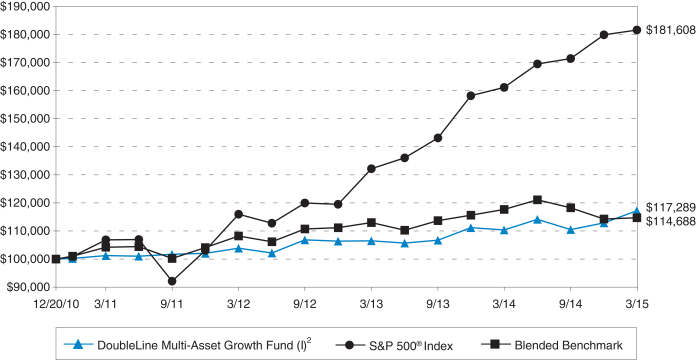

DoubleLine Multi-Asset Growth Fund

The DoubleLine Multi-Asset Growth Fund significantly outperformed the Blended Benchmark (as defined in the table below) for the 12-month period ended March 31, 2015. The portfolio’s equity sleeve posted positive returns during the 12-month period but slightly underperformed the MSCI ACWI (+6.03%) return for the period. Long positions in U.S., European, and Japanese equities contributed to performance while positions in Natural Gas equities and gold miners detracted from performance. The fixed income sleeve outperformed the Barclays U.S. Aggregate Bond Index return of 5.7%. Performance was driven by long positions in the long end of the UST curve and core longs in Agency and non-Agency MBS. Long positions in the USD contributed to performance during the 12-month period, paired against the euro and Japanese Yen which were down -22.1% and -14.1%, respectively. The real assets sleeve detracted from performance but outperformed the S&P/Goldman Sachs Commodity Index which was down -40.33% during the period. The commodity complex suffered from significant declines in crude oil prices—down 53.1% during the period.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 6.22% | |

A-Share | | | | | | |

Without Load | | | | | 5.96% | |

With Load | | | | | 1.45% | |

S&P 500® Index | | | | | 12.73% | |

Blended Benchmark* | | | | | -2.60% | |

| * | Blended Benchmark: 60% Barclays U.S. Aggregate Bond Index/25% Morgan Stanley Capital International All Country World Index/15% Standard & Poor’s Goldman Sachs Commodity Index (GSCI) Total Return |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

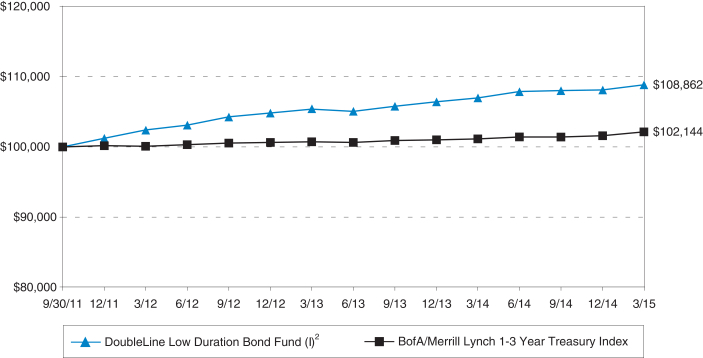

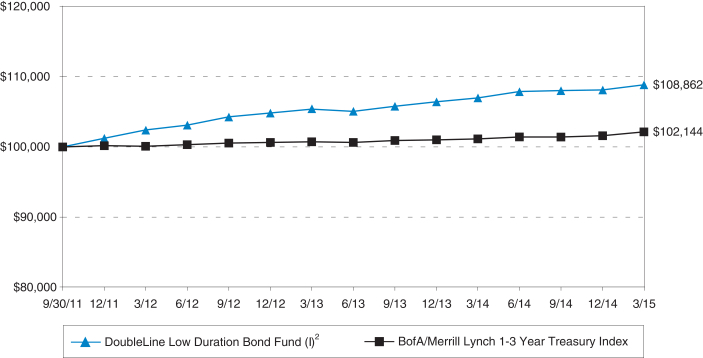

DoubleLine Low Duration Bond Fund

For the 12-month period ended March 31, 2015, the DoubleLine Low Duration Bond Fund outperformed the Bank of America (BofA)/Merrill Lynch 1-3 Year U.S. Treasury Index’s return of 1.00% in the declining interest rate environment. Despite intermittent periods of volatility within the credit markets (caused by a combination of geopolitical concerns in regions such as Russia and Ukraine, as well as the decline in the Oil and Energy sectors), more credit-sensitive sectors were the best performers over the 12-month reporting period. Bank Loans, Non-Agency RMBS, and Emerging Markets were the main drivers for the portfolio’s performance. Non-Agency RMBS performed well as the sector’s high carry profile resulted in steady interest income for the Fund. Emerging Markets maintained its currency positioning solely in the US dollar, which benefited the Fund over the period as many of the local currency-denominated markets underperformed for the same time period. CMBS contributed positively to the Fund’s performance as prices rallied with the declining interest rate environment over the 12-month reporting period. In addition, CLOs, Investment Grade Corporate Credit, and U.S. Government sectors all contributed to the Fund’s outperformance over its benchmark. The Fund’s duration remained close to one year as of the end of the reporting period.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 1.76% | |

N-Share | | | | | 1.51% | |

BofA/Merrill Lynch 1-3 Year U.S. Treasury Index | | | | | 1.00% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

| | | | | | |

| | Annual Report | | March 31, 2015 | | 9 |

| | |

| Management’s Discussion of Fund Performance (Cont.) | | March 31, 2015 |

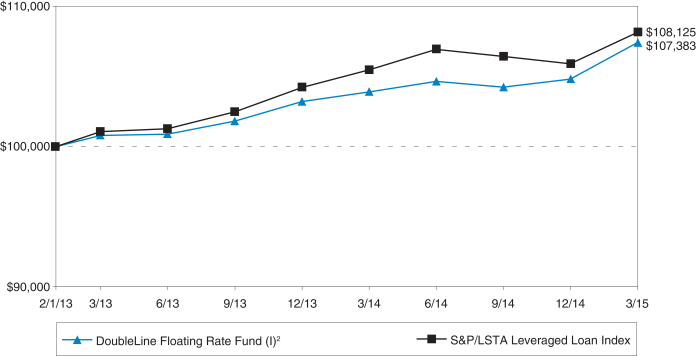

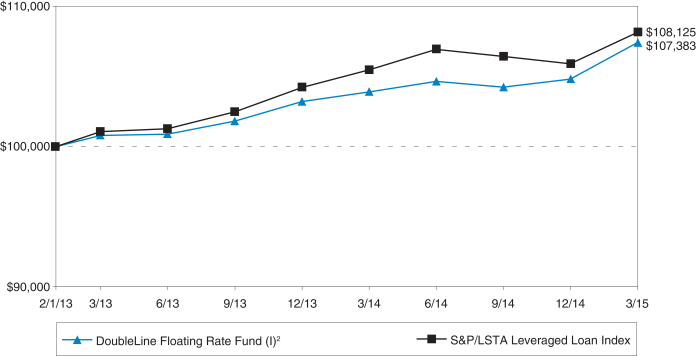

DoubleLine Floating Rate Fund

The DoubleLine Floating Rate Fund outperformed the S&P/LSTA Leveraged Loan Index for the 12-month period ended March 31, 2015. One of the largest drivers for the relative outperformance was attributable to the Fund’s exposure to high yield bonds (5.30% of the Fund’s total assets as of the end of the reporting period), which returned 10.66% for the period. While the Fund began the period with Oil & Gas exposure at 6.40% of the Fund’s total assets, or 270 bps more than the Index, the Fund preemptively reduced its exposure to less than 2.00% prior to the steep declines in oil prices that occurred during November and December 2014. The oil price environment was the catalyst for this industry’s weak performance, returning -11.61% over the period. The Fund also decreased its second lien exposure from a slight overweight position in April 2014, to a 200 bps underweight position as of March 31, 2015. Second lien loans in the Index outperformed first lien loans by an average of 20 bps from April to September 2014, and underperformed first lien loans by an average of 65 bps from November 2014 to March 2015. The Fund strategically paired down risk exposure to this segment of the loan market at favorable points throughout the period.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 3.36% | |

N-Share | | | | | 3.19% | |

S&P/LSTA Leveraged Loan Index | | | | | 2.53% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

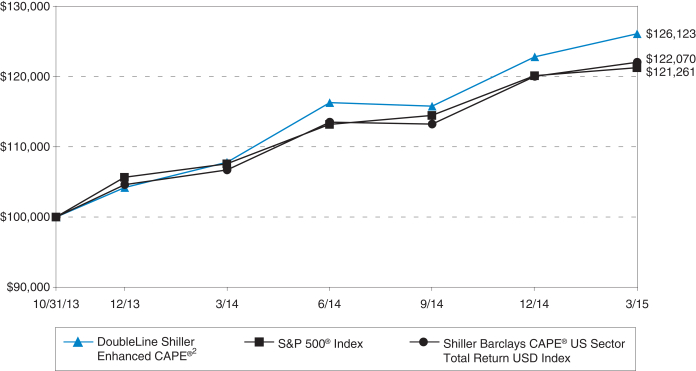

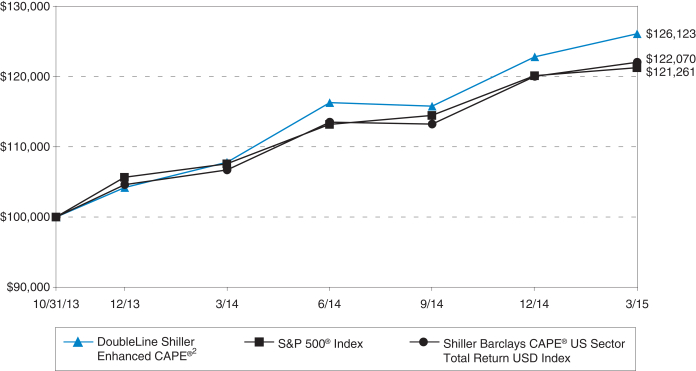

DoubleLine Shiller Enhanced CAPE®

In the 12-months ended March 31, 2015, DoubleLine Shiller Enhanced CAPE® returned 16.96% while the S&P 500 Index returned 12.73% and the Shiller Barclays CAPE® U.S. Sector Total Return Index returned 14.39%. The Fund’s outperformance of the S&P 500 by 4.23% was driven by both the Fund’s equity and fixed income exposures. The Shiller Barclays CAPE® U.S. Sector Total Return Index exposure contributed 13.80% in return while the fixed income portfolio contributed 3.16% in return. The Shiller Barclays CAPE® U.S. Sector Index was allocated to six sectors over the course of the year with Healthcare and Technology/Telecommunications exposure being the biggest drivers of performance. The fixed income portfolio’s key drivers of return were the MBS, CMBS and EM sector contributions.

| | | | | | |

| Period Ended 3-31-15 | | | | 12-Months | |

I-Share | | | | | 16.96% | |

N-Share | | | | | 16.60% | |

S&P 500® Index | | | | | 12.73% | |

Shiller Barclays CAPE® U.S. Sector Total Return Index | | | | | 14.39% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

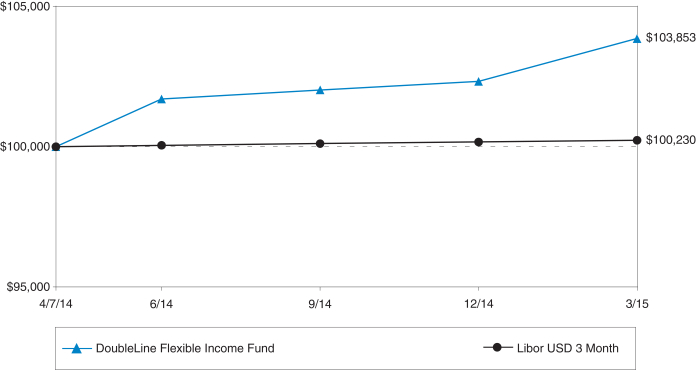

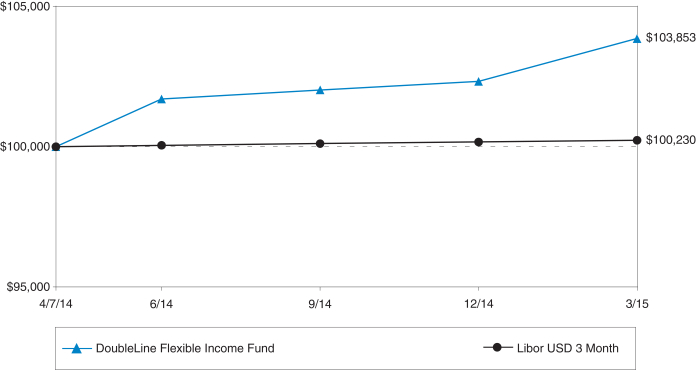

DoubleLine Flexible Income Fund

Since inception on April 7, 2014 to March 31, 2015, the DoubleLine Flexible Income Fund outperformed the LIBOR USD 3-Month return of 0.23%. The portfolio has maintained a more credit-centered positioning with a lower duration profile during the reporting period. Driven by the non-Agency RMBS sector’s high carry profile, RMBS were the best performers in the Fund. Despite intermittent periods of volatility caused by geopolitical concerns around various markets, the solely USD-denominated EM sector contributed solid returns to the portfolio. CMBS have contributed to overall portfolio return as prices have rallied, driven by US yields declining. High Yield and Bank Loan sectors faced fluctuations in valuations as concerns in the Oil and Energy space pervaded into the credit markets; however, both sectors ended the period with positive returns as market technicals improved towards the latter 2014/early 2015 months. Though CLOs encountered some variance in valuations due to regulatory concerns over the Volcker rule, they ended the period with steady returns within the Fund.

| | | | | | |

| Period 4-7-14 through 3-31-2015 | | | | Since Inception

(Not Annualized) | |

I-Share | | | | | 3.85% | |

N-Share | | | | | 3.63% | |

LIBOR* USD 3-Month | | | | | 0.23% | |

| * | LIBOR stands for the London Interbank Offered Rate. |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

| | | | | | |

| 10 | | DoubleLine Funds Trust | | | | |

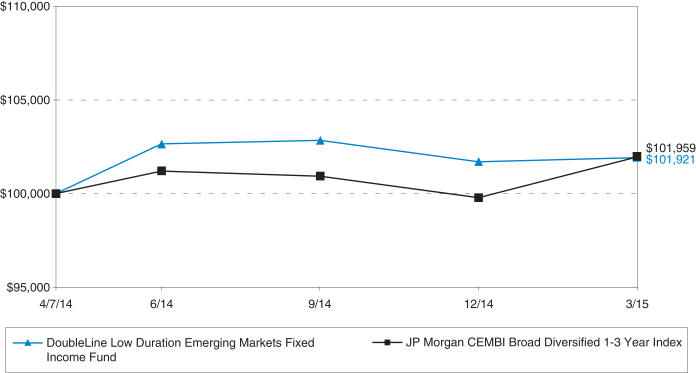

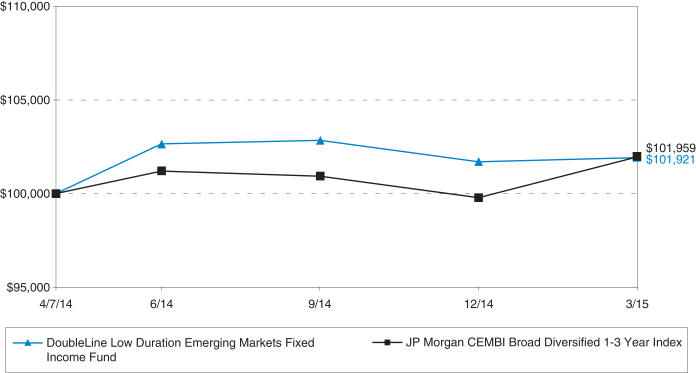

DoubleLine Low Duration Emerging Markets Fixed Income Fund

Since inception on April 7, 2014 to March 31, 2015, the DoubleLine Low Duration Emerging Markets Fixed Income Fund (Class I-Shares) performed in line with the JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified, Maturity 1-3. Short dated UST yields diverged over the year, with 2-year UST yields higher by 14 bps and 5-year UST yields lower by 35 bps. The Fund’s current income was partially offset by credit spreads widening over the period. Spread widening was led by corporate credits domiciled in Brazil and Colombia. Brazil credits sold off due to a graft scandal related to Brazil’s largest government owned oil and gas company. One of the Colombia credits tied to oil-related production saw its spreads widen due to the steep fall in oil prices at the end of the 2014 year.

| | | | | | |

| Period 4-7-14 through 3-31-15 | | | | Since Inception (Not Annualized) | |

I-Share | | | | | 1.92% | |

N-Share | | | | | 1.80% | |

JP Morgan CEMBI Broad Diversified 1-3 Year Index | | | | | 1.96% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

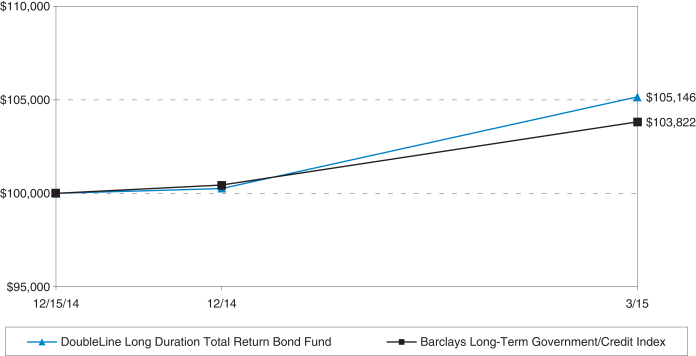

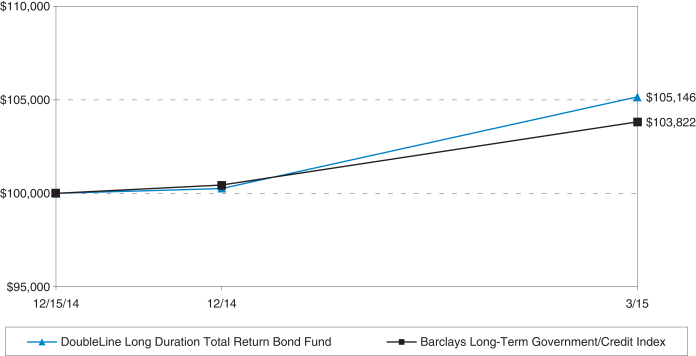

DoubleLine Long Duration Total Return Bond Fund

Since inception on December 15, 2014 to March 31, 2015, the DoubleLine Long Duration Total Return Bond Fund outperformed the Barclays U.S. Long Government/Credit Index return of 3.82% in the declining interest rate environment. Agency fixed-rate CMOs were the primary drivers of performance for the Fund as they benefited from a combination of strong price appreciation and modest interest income. Though a small percentage of the portfolio, Agency principal-only securities contributed solid returns from a total return perspective thanks to robust price gains during the period. UST helped augment portfolio return, mainly driven by rallying prices with the flattening yield curve. The portfolio ended with a duration slightly shorter than the Barclays U.S. Long Government/Credit Index and a positive convexity profile.

| | | | | | |

| Period 12-15-14 through 3-31-15 | | | | Since Inception (Not Annualized) | |

I-Share | | | | | 5.15% | |

N-Share | | | | | 4.99% | |

Barclays U.S. Long Government/Credit Index | | | | | 3.82% | |

For additional performance information, please refer to the “DoubleLine Funds’ Standardized Performance Summary.”

Past performance is not a guarantee of future results.

Opinions expressed herein are as of March 31, 2015 and are subject to change at any time, are not guaranteed and should not be considered investment advice.

The performance shown assumes the reinvestment of all dividends and distributions and does not reflect any reductions for taxes. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedules of Investments for a complete list of Fund holdings.

This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a great risk of loss to principal and interest than higher rated securities.

Investments in Asset-Backed and Mortgage-Backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

Investments in foreign securities involve political, economic, and currency risks, greater volatility, and differences in accounting methods. These risks are greater for investments in emerging markets.

Investments in securities related to real estate may decline in value as a result of factors affecting the real estate industry.

Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested.

Equities may decline in value due to both real and perceived general market, economic, and industry conditions.

Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing

| | | | | | |

| | Annual Report | | March 31, 2015 | | 11 |

| | |

| Management’s Discussion of Fund Performance (Cont.) | | March 31, 2015 |

in derivatives could lose more than the amount invested. ETF investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares.

Floating rate loans and other floating rate investments are subject to credit risk, interest rate risk, counterparty risk and financial services risks, among others.

Additional principal risks for the Funds can be found in the prospectus.

Diversification does not assure a profit or protect against loss in a declining market.

Credit ratings from Moody’s range from the highest rating of Aaa for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of C for the lowest rated class of bonds. Credit ratings from Standard & Poor’s (S&P) range from the highest rating of AAA for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of D for bonds that are in default.

Barclays U.S. Aggregate Bond Index—This index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

Barclays U.S. CMBS Index—This index measures the performance of investment grade commercial mortgage-backed securities, which are classes of securities that represent interests in pools of commercial mortgages.

Barclays U.S. Credit Index—This index comprises the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. The US Credit Index was called the US Corporate Investment Grade Index until July 2000, when it was renamed to reflect its inclusion of both corporate and non-corporate issuers.

Barclays U.S. Government Index—An index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more.

Barclays U.S. Long Government/Credit Index—The index includes publicly issued U.S. Treasury debt, U.S. government agency debt, taxable debt issued by U.S. states and territories and their political subdivisions, debt issued by U.S. and non-U.S. corporations, non-U.S. government debt and supranational debt.

Barclays U.S. MBS Index—This index measures the performance of investment grade fixed-rate mortgage-backed pass-through securities of the Government-Sponsored Enterprises (GSEs): Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Barclays Municipal Bond Index—This index tracks the performance of U.S. dollar denominated investment grade tax-exempt debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. domestic market. Qualifying securities must have at least one year remaining term to final maturity, a fixed coupon schedule and an investment grade rating (based on Moody’s, S&P and Fitch). Minimum size vary based on the initial term to final maturity at time of issuance.

Basis Point—A basis point (bps) equals to 0.01%.

Bank of America (BofA)/Merrill Lynch 1-3 Year U.S. Treasury Index—This index is an unmanaged index that tracks the performance of the direct sovereign debt of the U.S. Government having a maturity of at least one year and less than three years.

Cash Flow—A measure of the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Citi High-Yield Cash-Pay Capped Index—This index represents the cash-pay securities of the Citigroup High-Yield Market Capped Index, which represents a modified version of the High Yield Market Index by delaying the entry of fallen angel issues and capping the par value of individual issuers at $5 billion par amount outstanding.

Discount Margin (DM)—The amount of return on a floating rate security based on the spread between the price of the security at a given time and the reference rate.

Duration—A measure of the sensitivity of a price of a fixed income investment to a change in interest rates, expressed as a number of years.

Euro Stoxx 50 Index—This index is a market capitalization-weighted stock index of 50 of the large, blue-chip European companies operating within the Eurozone.

Investment Grade—Securities rated AAA to BBB- are considered to be investment grade. A bond is considered investment grade if its credit rating is BBB- or higher by Standard & Poor’s or Baa3 by Moody’s. Ratings based on corporate bond model. The higher the rating, the more likely the bond is to pay back at par/$100 cents on the dollar. AAA is considered the highest quality and the lowest degree of risk. They are considered to be extremely stable and dependable.

JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified—This index is a market capitalization weighted index consisting of US-denominated Emerging Market corporate bonds. It is a liquid global corporate benchmark representing Asia, Latin America, Europe and the Middle East/Africa.

JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified—This Index is a uniquely-weighted version of the EMBI Global. It limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible current face amounts of debt outstanding. The countries covered in the EMBI Global Diversified are identical to those covered by EMBI Global.

Last Cash Flow (LCF)—The last revenue stream paid to a bond over a given period.

London Interbank Offered Rate (LIBOR)—An indicative average interest rate at which a selection of banks known as the panel banks are prepared to lend one another unsecured funds on the London money market.

Morgan Stanley Capital International All Country World Index (MSCI ACWI)—The MSCI All Country World Index is a market-capitalization-weighted index designed to provide a broad measure of stock performance throughout the world, including both developed and emerging markets.

Morgan Stanley Capital International Emerging Markets Index (MSCI EM Index)—The MSCI Emerging Markets Index is designed to measure equity market performance in global emerging markets by capturing large and midcap representation across 23 Emerging Markets countries.

Morgan Stanley Capital International Brazil USD Index—The MSCI Brazil USD Index is designed to measure the performance of the large and mid cap segments of the Brazilian market. With 75 constituents, the index covers about 85% of the Brazilian equity universe.

Morgan Stanley Capital International Russia USD Index—The MSCI Russia USD Index is a free-float capitalization-weighted index used to track the equity market performance of Russian securities on the MICEX Stock Exchange.

Russell 1000® Value Index—This index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Shanghai Composite Index—A capitalization-weighted index that tracks the daily performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The index was developed on December 19, 1990 with a base value of 100.

Shiller Barclays CAPE® US Sector Total Return Index—An index that incorporates the principles of long-term investing distilled by Dr. Robert Shiller and expressed through the CAPE® (Cyclically Adjusted Price Earnings) ratio (the “CAPE® Ratio”). It aims to identify undervalued sectors based on a modified CAPE® Ratio, and then uses a momentum factor to seek to mitigate the effects of potential value traps.

| | | | | | |

| 12 | | DoubleLine Funds Trust | | | | |

Spread—The difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another. The higher the yield spread, the greater the difference between the yields offered by each instrument. The spread can be measured between debt instruments of differing maturities, credit ratings and risk.

S&P 500® Index—The Standard & Poor’s U.S. 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

S&P/Goldman Sachs Commodity Index (GSCI)—Standard & Poor’s Goldman Sachs Commodity Index, or GSCI, is a composite index of commodity sector returns which represents a broadly diversified, unleveraged, long-only position in commodity futures. The index’s components qualify for inclusion in the index based on liquidity measures and are weighted in relation to their global production levels, making the Index a valuable economic indicator and commodities market benchmark. The GSCI Excess Return index is one of the three S&P GSCI Indices published, measuring the return accrued from investing in uncollateralized nearby commodity futures. This Excess Return Index includes an Energy component, which was referenced in this commentary.

S&P/LSTA Leveraged Loan Index—Capitalization-weighted syndicated loan indices are based upon market weightings, spreads and interest payments, and this index covers the U.S. market back to 1997 and currently calculates on a daily basis. Created by the Leveraged Commentary & Data (LCD) team at S&P Capital IQ, the review provides an overview and outlook of the leveraged loan market as well as an expansive review of the S&P Leveraged Loan Index and sub-indexes. The review consists of index general characteristics, results, risk-return profile, default/distress statistics, and repayment analysis.

A direct investment cannot be made in an index. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments.

The DoubleLine Funds are distributed by Quasar Distributors, LLC.

DoubleLine® is a registered trademark of DoubleLine Capital LP.

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a Fund and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein.

DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available.

Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. Past performance is no guarantee of future results.

| | | | | | |

| | Annual Report | | March 31, 2015 | | 13 |

| | |

| DoubleLine Funds’ Standardized Performance Summary | | (Unaudited) March 31, 2015 |

As of March 31, 2015

| | | | | | | | | | | | | | | | | | | | |

| DBLTX/DLTNX | |

Total Return Bond Fund

Returns as of March 31, 2015 | | | 1 Year | | |

| 3 Year

Annualized |

| |

| Since Inception

Annualized

(4-6-10 to 3-31-15) |

| |

| Gross

Expense Ratio |

|

I-share (DBLTX) | | | 5.93% | | | | 4.78% | | | | 8.65% | | | | 0.47% | |

N-share (DLTNX) | | | 5.76% | | | | 4.55% | | | | 8.39% | | | | 0.72% | |

Barclays U.S. Aggregate Bond Index | | | 5.72% | | | | 3.10% | | | | 4.54% | | | | | | | | | |

| DBLEX/DLENX | |

Emerging Markets Fixed Income Fund

Returns as of March 31, 2015 | | | 1 Year | | |

| 3 Year

Annualized |

| |

| Since Inception

Annualized

(4-6-10 to 3-31-15) |

| |

| Gross

Expense Ratio |

|

I-share (DBLEX) | | | 2.90% | | | | 3.92% | | | | 6.22% | | | | 0.92% | |

N-share (DLENX) | | | 2.64% | | | | 3.66% | | | | 5.96% | | | | 1.17% | |

JP Morgan Emerging Markets Bond Global Diversified Index | | | 5.65% | | | | 5.37% | | | | 7.08% | | | | | | | | | |

| DBLFX/DLFNX | |

Core Fixed Income Fund

Returns as of March 31, 2015 | | | 1 Year | | |

| 3 Year

Annualized |

| |

| Since Inception

Annualized

(6-1-10 to 3-31-15) |

| |

| Gross

Expense Ratio |

|

I-share (DBLFX) | | | 6.07% | | | | 4.51% | | | | 7.13% | | | | 0.52% | |

N-share (DLFNX) | | | 5.91% | | | | 4.29% | | | | 6.88% | | | | 0.77% | |

Barclays U.S. Aggregate Bond Index | | | 5.72% | | | | 3.10% | | | | 4.16% | | | | | | | | | |

| DMLIX/DMLAX | |

Multi-Asset Growth Fund

Returns as of March 31, 2015 | | | 1 Year | | |

| 3 Year

Annualized |

| |

| Since Inception

Annualized

(12-20-10 to 3-31-15) |

| |

| Gross

Expense Ratio |

| |

| Net

Expense Ratio* |

|

I-share (DMLIX) | | | 6.22% | | | | 4.11% | | | | 3.80% | | | | 1.68% | | | | 1.55% | |

A-share (DMLAX) | | | | | | | | | | | | | | | 1.93% | | | | 1.80% | |

A-share (No Load) | | | 5.96% | | | | 3.80% | | | | 3.51% | | | | | | | | | |

A-share (With Load) | | | 1.45% | | | | 2.31% | | | | 2.46% | | | | | | | | | |

Blended Benchmark** | | | -2.60% | | | | 1.95% | | | | 3.26% | | | | | | | | | |

S&P 500® TR | | | 12.73% | | | | 16.11% | | | | 14.97% | | | | | | | | | |

| DBLSX/DLSNX | |

Low Duration Bond Fund

Returns as of March 31, 2015 | | | 1 Year | | |

| 3 Year

Annualized |

| |

| Since Inception

Annualized

(9-30-11 to 9-30-14) |

| |

| Gross

Expense Ratio |

| |

| Net

Expense Ratio* |

|

I-share (DBLSX) | | | 1.76% | | | | 2.05% | | | | 2.45% | | | | 0.49% | | | | 0.48% | |

N-share (DLSNX) | | | 1.51% | | | | 1.80% | | | | 2.19% | | | | 0.74% | | | | 0.73% | |

BofA/Merrill Lynch 1-3 Year Treasury | | | 1.00% | | | | 0.67% | | | | 0.61% | | | | | | | | | |

| DBFRX/DLFRX | |

Floating Rate Fund

Returns as of March 31, 2015 | | | 1 Year | | |

| Since Inception

Annualized

(2-1-13 to 3-31-15) |

| |

| Gross

Expense Ratio |

| | | | | | | | |

I-share (DBFRX) | | | 3.36% | | | | 3.35% | | | | 0.75% | | | | | | | | | |

N-share (DLFRX) | | | 3.19% | | | | 3.21% | | | | 1.00% | | | | | | | | | |

S&P LSTA Leveraged Loan Index | | | 2.53% | | | | 3.68% | | | | | | | | | | | | | |

| DSEEX/DSENX | |

Shiller Enhanced CAPE®

Returns as of March 31, 2015 | | | 1 Year | | |

| Since Inception

Annualized (10-31-13 to 3-31-15) |

| |

| Gross

Expense Ratio |

| |

| Net

Expense Ratio* |

| |

| Expense

Cap* |

|

I-share (DSEEX) | | | 16.96% | | | | 17.84% | | | | 1.38% | | | | 0.99% | | | | 0.65% | |

N-share (DSENX) | | | 16.60% | | | | 17.51% | | | | 1.63% | | | | 1.24% | | | | 0.90% | |

Shiller Barclays CAPE® U.S. Sector Total Return USD Index | | | 14.39% | | | | 15.15% | | | | | | | | | | | | | |

S&P 500® | | | 12.73% | | | | 14.61% | | | | | | | | | | | | | |

| | | | | | |

| 14 | | DoubleLine Funds Trust | | | | |

| | |

| | | (Unaudited) March 31, 2015 |

| | | | | | | | | | | | | | |

| DFLEX/DLINX |

Flexible Income Fund

Returns as of March 31, 2015 | |

| Since Inception

(4-7-14 to 3-31-15) |

| |

| Gross

Expense Ratio |

| | Net

Expense Ratio* |

I-share (DFLEX) | | | 3.85% | | | | 1.08% | | | 0.83% |

N-share (DLINX) | | | 3.63% | | | | 1.33% | | | 1.08% |

LIBOR USD 3-Month Index | | | 0.23% | | | | | | | | | | | |

| DBLLX/DELNX |

Low Duration Emerging Markets Fixed Income Fund

Returns as of March 31, 2015 | |

| Since Inception

(4-7-14 to 3-31-15) |

| |

| Gross

Expense Ratio |

| | Net

Expense Ratio* |

I-share (DBLLX) | | | 1.92% | | | | 0.98% | | | 0.60% |

N-share (DELNX) | | | 1.80% | | | | 1.23% | | | 0.85% |

JP Morgan CEMBI Broad Diversified 1-3 Years | | | 1.96% | | | | | | | | | | | |

| DBLDX/DLLDX |

Long Duration Total Return Bond Fund

Returns as of March 31, 2015 | |

| Since Inception

(12-15-14 to 3-31-15) |

| |

| Gross

Expense

Ratio |

| | Net

Expense Ratio*** |

I-share (DBLDX) | | | 5.15% | | | | 1.10% | | | 0.66% |

N-share (DLLDX) | | | 4.99% | | | | 1.35% | | | 0.91% |

Barclays Long Government/Credit Index | | | 3.82% | | | | | | | | | | | |

The performance information shown assumes the reinvestment of all dividends and distributions. Performance reflects management fees and other fund expenses. Returns over 1- year are average annual returns. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (213) 633-8200 or by visiting www.doublelinefunds.com.

Performance data shown for the Multi-Asset Growth Fund Class (With Load) reflects the Class A maximum sales charge of 4.25%. Performance data shown for the Class A (No Load) does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted. The Multi-Asset Growth Fund imposes a Deferred Sales Charge of 0.75% on purchases of $1 million or more of Class A shares if redeemed within 18 months of purchase. The Multi-Asset Growth Fund and Floating Rate Fund impose a 1.00% redemption fee on all share classes if shares are sold within 90 days of purchase. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

* The Adviser has contractually agreed to waive its investment advisory fee and to reimburse the Funds for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to the expense ratios shown. These expense limitations are expected to apply until at least July 31, 2016, except that they may be terminated by the Board of Trustees at any time.

**The Blended Benchmark for the Multi-Asset Growth Fund is 60% Barclays Cap Agg, 25% MSCI AC World Index & 15% SP GS Com TR

*** The Adviser has contractually agreed to waive its investment advisory fee and to reimburse the Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to the expense ratios shown. These expense limitations are expected to apply until at least November 20, 2016, except that they may be terminated by the Board of Trustees at any time.

Mutual Fund Investing involves risk. Principal loss is possible.

| | | | | | |

| | Annual Report | | March 31, 2015 | | 15 |

| | |

| Schedule of Investments DoubleLine Total Return Bond Fund | | March 31, 2015 |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| | ASSET BACKED OBLIGATIONS 0.5% | |

| |

| | | | CAN Capital Funding LLC, | |

| $ | 50,000,000 | | | Series 2012-1A-B1 | | | 3.12% | ^ | | | 04/15/2020 | | | | 50,060,000 | |

| |

| | | | DB Master Finance LLC, | |

| | 54,500,000 | | | Series 2015-1A-A2I | | | 3.26% | ^ | | | 02/20/2045 | | | | 55,074,512 | |

| | 37,500,000 | | | Series 2015-1A-A2II | | | 3.98% | ^ | | | 02/20/2045 | | | | 38,356,144 | |

| |

| | | | Eaglewood Consumer Loan Trust, | |

| | 54,000,000 | | | Series 2014-1-A | | | 3.50% | ^¥ | | | 10/15/2019 | | | | 54,475,200 | |

| |

| | | | Nelnet Student Loan Trust, | |

| | 31,700,000 | | | Series 2007-2A-B1 | | | 1.40% | #^ | | | 09/25/2035 | | | | 29,705,436 | |

| | | | | | | | | | | | | | | | |

| | | | Total Asset Backed Obligations

(Cost $226,629,475) | | | | 227,671,292 | |

| | | | | | | | | | | | | | | | |

| | COLLATERALIZED LOAN OBLIGATIONS 4.9% | |

| |

| | | | Adams Mill Ltd., | |

| | 10,000,000 | | | Series 2014-1A-C1 | | | 3.25% | #^ | | | 07/15/2026 | | | | 9,866,417 | |

| |

| | | | AIMCO, | |

| | 20,890,050 | | | Series 2006-AA-A1 | | | 0.51% | #^ | | | 08/20/2020 | | | | 20,805,635 | |

| |

| | | | ALM Loan Funding, | |

| | 3,750,000 | | | Series 2012-6A-C | | | 5.02% | #^ | | | 06/14/2023 | | | | 3,813,612 | |

| | 20,000,000 | | | Series 2012-7A-A1 | | | 1.68% | #^ | | | 10/19/2024 | | | | 20,008,728 | |

| |

| | | | Anchorage Capital Ltd., | |

| | 3,500,000 | | | Series 2014-4A-A1A | | | 1.71% | #^ | | | 07/28/2026 | | | | 3,472,556 | |

| |

| | | | Apidos Ltd., | |

| | 1,500,000 | | | Series 2006-4A-D | | | 1.76% | #^ | | | 10/27/2018 | | | | 1,488,244 | |

| | 24,757,339 | | | Series 2007-5A-A18 | | | 0.48% | #^ | | | 04/15/2021 | | | | 24,662,696 | |

| | 43,750,000 | | | Series 2013-16A-A1 | | | 1.71% | #^ | | | 01/19/2025 | | | | 43,766,236 | |

| | 5,500,000 | | | Series 2014-18A-B | | | 3.06% | #^ | | | 07/22/2026 | | | | 5,425,150 | |

| | 25,000,000 | | | Series 2014-19A-A1 | | | 1.71% | #^ | | | 10/17/2026 | | | | 25,037,095 | |

| | 23,000,000 | | | Series 2015-20A-A1 | | | 1.77% | #^ | | | 01/16/2027 | | | | 23,014,108 | |

| |

| | | | ARES Ltd., | |

| | 7,554,356 | | | Series 2007-12A-A | | | 0.89% | #^ | | | 11/25/2020 | | | | 7,523,131 | |

| | 25,000,000 | | | Series 2013-1A-B | | | 2.00% | #^ | | | 04/15/2025 | | | | 24,697,890 | |

| | 6,500,000 | | | Series 2013-1A-D | | | 4.00% | #^ | | | 04/15/2025 | | | | 6,364,993 | |

| | 4,691,961 | | | Series 2014-30A-A2 | | | 1.11% | #^ | | | 04/20/2023 | | | | 4,669,398 | |

| |

| | | | Atrium Corporation, | |

| | 43,299,213 | | | Series 5A-A2A | | | 0.48% | #^ | | | 07/20/2020 | | | | 43,097,950 | |

| |

| | | | Avery Point Ltd., | |

| | 3,950,000 | | | Series 2013-2A-D | | | 3.71% | #^ | | | 07/17/2025 | | | | 3,799,341 | |

| | 5,000,000 | | | Series 2014-1A-A | | | 1.78% | #^ | | | 04/25/2026 | | | | 5,000,927 | |

| | 4,250,000 | | | Series 2014-1A-D | | | 3.76% | #^ | | | 04/25/2026 | | | | 4,131,740 | |

| |

| | | | Babson Ltd., | |

| | 15,391,164 | | | Series 2005-3A-A | | | 0.51% | #^ | | | 11/10/2019 | | | | 15,344,194 | |

| | 4,500,000 | | | Series 2014-3A-D2 | | | 4.69% | #^ | | | 01/15/2026 | | | | 4,540,949 | |

| | 4,750,000 | | | Series 2014-IIA-C | | | 3.17% | #^ | | | 10/17/2026 | | | | 4,626,364 | |

| | 3,750,000 | | | Series 2014-IIA-D | | | 3.87% | #^ | | | 10/17/2026 | | | | 3,651,786 | |

| |

| | | | Baker Street Funding Ltd., | |

| | 5,000,000 | | | Series 2005-1A-B | | | 0.72% | #^ | | | 12/15/2018 | | | | 4,936,996 | |

| |

| | | | Ballyrock Ltd., | |

| | 1,000,000 | | | Series 2014-1A-B | | | 3.43% | #^ | | | 10/20/2026 | | | | 992,331 | |

| | 2,000,000 | | | Series 2014-1A-C | | | 3.98% | #^ | | | 10/20/2026 | | | | 1,925,106 | |

| |

| | | | Birchwood Park Ltd., | |

| | 5,000,000 | | | Series 2014-1A-C2 | | | 3.40% | #^ | | | 07/15/2026 | | | | 5,016,205 | |

| | 6,500,000 | | | Series 2014-1A-D2 | | | 4.45% | #^ | | | 07/15/2026 | | | | 6,548,612 | |

| |

| | | | Black Diamond Ltd., | |

| | 1,289,053 | | | Series 2005-1A-A1 | | | 0.54% | #^ | | | 06/20/2017 | | | | 1,287,174 | |

| |

| | | | BlackRock Senior Income, | |

| | 8,864,674 | | | Series 2006-4A-A | | | 0.50% | #^ | | | 04/20/2019 | | | | 8,793,092 | |

| | 4,410,070 | | | Series 2007-5A-A3 | | | 0.49% | #^ | | | 08/13/2019 | | | | 4,362,307 | |

| |

| | | | BlueMountain Ltd., | |

| | 25,000,000 | | | Series 2012-2A-A1 | | | 1.68% | #^ | | | 11/20/2024 | | | | 25,000,090 | |

| | 19,000,000 | | | Series 2012-2A-B1 | | | 2.32% | #^ | | | 11/20/2024 | | | | 19,023,507 | |

| | 16,150,000 | | | Series 2012-2A-C | | | 3.01% | #^ | | | 11/20/2024 | | | | 15,981,268 | |

| | 31,870,000 | | | Series 2013-1A-A1 | | | 1.46% | #^ | | | 05/15/2025 | | | | 31,555,510 | |

| | 5,000,000 | | | Series 2014-3A-A1 | | | 1.48% | #^ | | | 10/15/2026 | | | | 4,996,713 | |

| | 6,250,000 | | | Series 2014-4A-B1 | | | 2.65% | #^ | | | 11/30/2026 | | | | 6,279,601 | |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | BMI Trust, | |

| $ | 80,604,079 | | | Series 2013-1AR-A1R | | | 1.20% | #^ | | | 08/01/2021 | | | | 80,243,497 | |

| |

| | | | BridgePort Ltd., | |

| | 852,851 | | | Series 2006-1A-A1 | | | 0.51% | #^ | | | 07/21/2020 | | | | 839,643 | |

| |

| | | | Brookside Mill Ltd., | |

| | 17,000,000 | | | Series 2013-1A-C1 | | | 2.95% | #^ | | | 04/17/2025 | | | | 16,522,837 | |

| |

| | | | Callidus Debt Partners Fund Ltd., | |

| | 20,257,634 | | | Series 2007-6A-A1T | | | 0.52% | #^ | | | 10/23/2021 | | | | 19,798,199 | |

| |

| | | | Canyon Capital Ltd., | |

| | 9,500,000 | | | Series 2012-1A-B1 | | | 2.20% | #^ | | | 01/15/2024 | | | | 9,416,448 | |

| | 1,000,000 | | | Series 2014-1A-B | | | 2.90% | #^ | | | 04/30/2025 | | | | 977,386 | |

| |

| | | | Carlyle Global Market Strategies Ltd., | |

| | 17,000,000 | | | Series 2014-3A-B | | | 3.41% | #^ | | | 07/27/2026 | | | | 17,053,096 | |

| | 2,500,000 | | | Series 2014-3A-C2 | | | 4.46% | #^ | | | 07/27/2026 | | | | 2,518,659 | |

| |

| | | | Carlyle High Yield Partners Ltd., | |

| | 1,750,000 | | | Series 2006-8A-B | | | 0.64% | #^ | | | 05/21/2021 | | | | 1,699,622 | |

| | 6,349,422 | | | Series 2007-10A-A2A | | | 0.47% | #^ | | | 04/19/2022 | | | | 6,266,942 | |

| |

| | | | Catamaran Ltd., | |

| | 8,500,000 | | | Series 2015-1A1-B | | | 2.48% | #^ | | | 04/22/2027 | | | | 8,500,000 | |

| | 47,000,000 | | | Series 2015-1A-A | | | 1.83% | #^ | | | 04/22/2027 | | | | 47,000,000 | |

| |

| | | | Cent Ltd., | |

| | 3,000,000 | | | Series 2005-10A-D | | | 2.02% | #^ | | | 12/15/2017 | | | | 2,988,755 | |

| | 14,179,625 | | | Series 2006-11A-A1 | | | 0.52% | #^ | | | 04/25/2019 | | | | 14,031,431 | |

| | 1,720,372 | | | Series 2007-14A-A1 | | | 0.49% | #^ | | | 04/15/2021 | | | | 1,693,080 | |

| | 14,491,427 | | | Series 2007-14A-A2A | | | 0.48% | #^ | | | 04/15/2021 | | | | 14,250,656 | |

| | 6,250,000 | | | Series 2014-22A-B | | | 3.43% | #^ | | | 11/07/2026 | | | | 6,277,167 | |

| | 7,250,000 | | | Series 2014-22A-C | | | 3.98% | #^ | | | 11/07/2026 | | | | 7,064,749 | |

| |

| | | | Covenant Credit Partners Ltd., | |

| | 5,000,000 | | | Series 2014-1A-A | | | 1.74% | #^ | | | 07/20/2026 | | | | 4,962,670 | |

| |

| | | | Crown Point Ltd., | |

| | 10,271,196 | | | Series 2012-1A-A1LB | | | 1.76% | #^ | | | 11/21/2022 | | | | 10,267,912 | |

| |

| | | | Dryden Leveraged Loan, | |

| | 5,000,000 | | | Series 2006-11A-C1 | | | 1.85% | #^ | | | 04/12/2020 | | | | 4,876,908 | |

| |

| | | | Dryden Senior Loan Fund, | |

| | 4,000,000 | | | Series 2012-24A-D | | | 5.01% | #^ | | | 11/15/2023 | | | | 4,048,020 | |

| | 10,000,000 | | | Series 2012-25A-B1 | | | 2.48% | #^ | | | 01/15/2025 | | | | 10,018,076 | |

| |

| | | | Flagship, | |

| | 25,000,000 | | | Series 2014-8A-A | | | 1.76% | #^ | | | 01/16/2026 | | | | 25,074,347 | |

| |

| | | | Flatiron Ltd., | |

| | 18,100,000 | | | Series 2013-1A-A1 | | | 1.66% | #^ | | | 01/17/2026 | | | | 18,019,307 | |

| | 3,000,000 | | | Series 2014-1A-B | | | 3.11% | #^ | | | 07/17/2026 | | | | 2,968,755 | |

| | 6,750,000 | | | Series 2014-1A-C | | | 3.56% | #^ | | | 07/17/2026 | | | | 6,475,121 | |

| |

| | | | Fortress Credit Ltd., | |

| | 10,000,000 | | | Series 2013-1A-A | | | 1.43% | #^ | | | 01/19/2025 | | | | 9,893,765 | |

| | 10,000,000 | | | Series 2013-1A-B | | | 2.15% | #^ | | | 01/19/2025 | | | | 9,786,245 | |

| |

| | | | Galaxy Ltd., | |

| | 2,000,000 | | | Series 2013-15A-A | | | 1.50% | #^ | | | 04/15/2025 | | | | 1,984,224 | |

| | 13,000,000 | | | Series 2013-15A-B | | | 2.10% | #^ | | | 04/15/2025 | | | | 12,931,915 | |

| | 13,100,000 | | | Series 2013-15A-C | | | 2.85% | #^ | | | 04/15/2025 | | | | 12,880,857 | |

| | 6,125,000 | | | Series 2013-15A-D | | | 3.65% | #^ | | | 04/15/2025 | | | | 5,931,966 | |

| |

| | | | GLG Ore Hill Ltd., | |

| | 37,000,000 | | | Series 2013-1A-A | | | 1.37% | #^ | | | 07/15/2025 | | | | 36,369,812 | |

| |

| | | | Golden Tree Loan Opportunities Ltd., | |

| | 30,000,000 | | | Series 2014-9A-A | | | 1.83% | #^ | | | 10/29/2026 | | | | 30,079,923 | |

| |

| | | | Halcyon Loan Advisors Funding Ltd., | |

| | 6,500,000 | | | Series 2014-2A-C | | | 3.73% | #^ | | | 04/28/2025 | | | | 5,816,297 | |

| | 1,750,000 | | | Series 2014-2A-D | | | 5.26% | #^ | | | 04/28/2025 | | | | 1,531,250 | |

| | 5,000,000 | | | Series 2014-3A-D | | | 3.91% | #^ | | | 10/22/2025 | | | | 4,536,854 | |

| |

| | | | Harbourview Ltd., | |

| | 30,000,000 | | | Series 7A-A1 | | | 1.82% | #^ | | | 11/18/2026 | | | | 29,999,799 | |

| |

| | | | Hildene Ltd., | |

| | 25,000,000 | | | Series 2014-3A-A | | | 1.88% | #^ | | | 10/20/2026 | | | | 24,941,853 | |

| |

| | | | ICE Global Credit Ltd., | |

| | 30,000,000 | | | Series 2013-1A-A1 | | | 2.01% | #^¥ | | | 04/20/2024 | | | | 28,941,000 | |

| | 25,000,000 | | | Series 2013-1A-B2 | | | 2.81% | #^¥ | | | 04/20/2024 | | | | 22,222,500 | |

| | | | | | |

| 16 | | DoubleLine Funds Trust | | | | The accompanying notes are an integral part of these financial statements. |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | ING Ltd., | |

| $ | 19,749,598 | | | Series 2007-5A-A1A | | | 0.48% | #^ | | | 05/01/2022 | | | | 19,621,277 | |

| | 10,500,000 | | | Series 2013-3A-A1 | | | 1.85% | # | | | 08/01/2020 | | | | 10,058,772 | |

| | 3,415,000 | | | Series 2013-3A-A1 | | | 1.71% | #^ | | | 01/18/2026 | | | | 3,413,508 | |

| | 4,250,000 | | | Series 2013-3A-B | | | 2.96% | #^ | | | 01/18/2026 | | | | 4,185,738 | |

| |

| | | | Jamestown Ltd., | |

| | 15,000,000 | | | Series 2012-1A-A1 | | | 1.69% | #^ | | | 11/05/2024 | | | | 14,981,220 | |

| | 50,000,000 | | | Series 2013-3A-A1A | | | 1.70% | #^ | | | 01/15/2026 | | | | 49,856,305 | |

| | 15,000,000 | | | Series 2014-4A-A1A | | | 1.75% | #^ | | | 07/15/2026 | | | | 14,984,340 | |

| | 28,750,000 | | | Series 2015-6A-A1A | | | 1.86% | #^ | | | 02/20/2027 | | | | 28,858,580 | |

| |

| | | | KVK Ltd., | |

| | 20,000,000 | | | Series 2013-1A-A | | | 1.65% | #^ | | | 04/14/2025 | | | | 19,836,474 | |

| |

| | | | Landmark Ltd., | |

| | 8,038,057 | | | Series 2006-7A-A2L | | | 0.70% | #^ | | | 07/15/2018 | | | | 8,068,989 | |

| | 9,500,000 | | | Series 2006-8A-C | | | 1.01% | #^ | | | 10/19/2020 | | | | 9,282,796 | |

| |

| | | | LCM LP, | |

| | 3,650,000 | | | Series 11A-D2 | | | 4.21% | #^ | | | 04/19/2022 | | | | 3,649,359 | |

| | 21,000,000 | | | Series 12A-A | | | 1.73% | #^ | | | 10/19/2022 | | | | 21,021,143 | |

| | 12,600,000 | | | Series 13A-C | | | 3.16% | #^ | | | 01/19/2023 | | | | 12,596,260 | |

| | 7,825,000 | | | Series 14A-D | | | 3.75% | #^ | | | 07/15/2025 | | | | 7,608,446 | |

| | 21,000,000 | | | Series 16A-A | | | 1.75% | #^ | | | 07/15/2026 | | | | 21,012,390 | |

| | 2,750,000 | | | Series 16A-D | | | 3.85% | #^ | | | 07/15/2026 | | | | 2,663,787 | |

| | 7,500,000 | | | Series 6A-C | | | 1.06% | #^ | | | 05/28/2019 | | | | 7,293,635 | |

| |

| | | | Limerock Ltd., | |

| | 7,000,000 | | | Series 2014-2A-A | | | 1.76% | #^ | | | 04/18/2026 | | | | 7,002,216 | |

| | 25,000,000 | | | Series 2014-3A-A1 | | | 1.79% | #^ | | | 10/20/2026 | | | | 25,006,550 | |

| |

| | | | Madison Park Funding Ltd., | |

| | 4,558,461 | | | Series 2007-4A-A1A | | | 0.48% | #^ | | | 03/22/2021 | | | | 4,513,231 | |

| | 1,000,000 | | | Series 2012-9X-C1 | | | 3.86% | # | | | 08/15/2022 | | | | 1,012,481 | |

| | 3,000,000 | | | Series 2014-14A-C1 | | | 3.36% | #^ | | | 07/20/2026 | | | | 3,024,128 | |

| | 4,000,000 | | | Series 2014-15A-C | | | 3.91% | #^ | | | 01/27/2026 | | | | 3,896,257 | |

| |

| | | | Magnetite Ltd., | |

| | 7,500,000 | | | Series 2012-6A-A | | | 1.77% | #^ | | | 09/15/2023 | | | | 7,503,672 | |

| | 19,250,000 | | | Series 2015-12A-A | | | 1.82% | #^ | | | 04/15/2027 | | | | 19,252,193 | |

| | 17,000,000 | | | Series 2013-5A-A2A | | | 2.58% | #^ | | | 02/21/2025 | | | | 17,024,194 | |

| |

| | | | Marea Ltd., | |

| | 2,000,000 | | | Series 2012-1A-D | | | 4.80% | #^ | | | 10/16/2023 | | | | 2,017,847 | |

| |

| | | | Mountain Capital Ltd., | |

| | 2,189,417 | | | Series 2007-6A-A | | | 0.49% | #^ | | | 04/25/2019 | | | | 2,176,049 | |

| |

| | | | Nautique Funding Ltd., | |

| | 8,376,193 | | | Series 2006-1A-A1A | | | 0.50% | #^ | | | 04/15/2020 | | | | 8,279,867 | |

| | 2,000,000 | | | Series 2006-1A-C | | | 1.95% | #^ | | | 04/15/2020 | | | | 1,948,261 | |

| |

| | | | Nomad Ltd., | |

| | 9,000,000 | | | Series 2013-1A-B | | | 3.20% | #^ | | | 01/15/2025 | | | | 8,876,243 | |

| | 3,500,000 | | | Series 2013-1A-C | | | 3.75% | #^ | | | 01/15/2025 | | | | 3,327,499 | |

| |

| | | | Northwoods Capital Corporation, | |

| | 30,000,000 | | | Series 2012-9A-A | | | 1.68% | #^ | | | 01/18/2024 | | | | 29,913,720 | |

| | 16,660,000 | | | Series 2013-10-A1 | | | 1.65% | #^ | | | 11/04/2025 | | | | 16,604,037 | |

| |

| | | | Nylim Flatiron Ltd., | |

| | 13,500,857 | | | Series 2006-1A-A2A | | | 0.48% | #^ | | | 08/08/2020 | | | | 13,426,844 | |

| |

| | | | Oak Hill Credit Partners, | |

| | 29,000,000 | | | Series 2012-7A-A | | | 1.68% | #^ | | | 11/20/2023 | | | | 28,973,221 | |

| | 18,000,000 | | | Series 2012-7A-B1 | | | 2.51% | #^ | | | 11/20/2023 | | | | 18,110,596 | |

| |

| | | | Ocean Trails, | |

| | 50,000,000 | | | Series 2014-5A-A2 | | | 1.93% | #^ | | | 10/13/2026 | | | | 50,148,735 | |

| |

| | | | OCP Ltd., | |

| | 9,000,000 | | | Series 2012-2A-A2 | | | 1.74% | #^ | | | 11/22/2023 | | | | 9,019,506 | |

| | 1,520,947 | | | Series 2012-2A-X2 | | | 1.74% | #^ | | | 11/22/2023 | | | | 1,523,156 | |

| | 10,000,000 | | | Series 2013-3A-B | | | 3.01% | #^ | | | 01/17/2025 | | | | 9,761,479 | |

| |

| | | | Octagon Investment Partners Ltd., | |

| | 15,000,000 | | | Series 2014-1A-A | | | 1.70% | #^ | | | 08/12/2026 | | | | 14,979,579 | |

| | 13,500,000 | | | Series 2014-1A-B | | | 3.45% | #^ | | | 11/14/2026 | | | | 13,565,432 | |

| | 5,500,000 | | | Series 2014-1A-C | | | 3.90% | #^ | | | 11/14/2026 | | | | 5,328,938 | |

| | 1,500,000 | | | Series 2014-1A-C2 | | | 3.79% | #^ | | | 11/22/2025 | | | | 1,517,130 | |

| | 4,000,000 | | | Series 2014-1A-X | | | 1.29% | #^ | | | 11/22/2025 | | | | 4,004,090 | |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | OHA Intrepid Leverage Loan Fund Ltd., | |

| $ | 11,734,053 | | | Series 2011-1AR-AR | | | 1.18% | #^ | | | 04/20/2021 | | | | 11,705,170 | |

| | 10,000,000 | | | Series 2011-1AR-DR | | | 3.31% | #^ | | | 04/20/2021 | | | | 10,029,279 | |

| |

| | | | OZLM Funding Ltd., | |

| | 9,000,000 | | | Series 2013-5A-A1 | | | 1.73% | #^ | | | 01/17/2026 | | | | 8,994,267 | |

| |

| | | | OZLM Ltd., | |

| | 6,700,000 | | | Series 2014-6A-A1 | | | 1.81% | #^ | | | 04/17/2026 | | | | 6,716,687 | |

| | 25,000,000 | | | Series 2014-9A-A1 | | | 1.83% | #^ | | | 01/20/2027 | | | | 25,099,518 | |

| | 38,500,000 | | | Series 2015-11A-A1A | | | 1.82% | #^ | | | 01/30/2027 | | | | 38,547,821 | |

| | 5,000,000 | | | Series 2015-11A-A2A | | | 2.52% | #^ | | | 01/30/2027 | | | | 5,015,201 | |

| |

| | | | Race Point Ltd., | |

| | 6,000,000 | | | Series 2007-4A-C | | | 1.00% | #^ | | | 08/01/2021 | | | | 5,866,205 | |

| | 25,000,000 | | | Series 2012-7A-A | | | 1.68% | #^ | | | 11/08/2024 | | | | 24,964,993 | |

| | 24,000,000 | | | Series 2012-7A-B | | | 2.51% | #^ | | | 11/08/2024 | | | | 24,146,448 | |

| | 5,500,000 | | | Series 2013-8A-B | | | 2.13% | #^ | | | 02/20/2025 | | | | 5,479,950 | |

| |

| | | | Regatta Funding Ltd., | |

| | 30,000,000 | | | Series 2014-1A-A1A | | | 1.79% | #^ | | | 10/25/2026 | | | | 30,050,439 | |

| |

| | | | Saturn Ltd., | |

| | 3,200,000 | | | Series 2007-1A-D | | | 4.26% | #^ | | | 05/13/2022 | | | | 3,055,604 | |

| |

| | | | Sierra Ltd., | |

| | 6,500,000 | | | Series 2006-2A-A2L | | | 0.69% | #^ | | | 01/22/2021 | | | | 6,434,702 | |

| |

| | | | Sound Harbor Loan Fund Ltd., | |

| | 25,000,000 | | | Series 2014-1A-A1 | | | 1.73% | #^ | | | 10/30/2026 | | | | 24,939,733 | |

| |

| | | | Steele Creek Ltd., | |

| | 22,000,000 | | | Series 2014-1A-A1 | | | 1.86% | #^ | | | 08/21/2026 | | | | 21,950,865 | |

| |

| | | | Symphony Ltd., | |

| | 29,500,000 | | | Series 2013-11A-B1 | | | 2.46% | #^ | | | 01/17/2025 | | | | 29,610,947 | |

| | 10,250,000 | | | Series 2013-11A-C | | | 3.41% | #^ | | | 01/17/2025 | | | | 10,316,033 | |

| |

| | | | Thacher Park Ltd., | |

| | 2,000,000 | | | Series 2014-1A-C | | | 3.30% | #^ | | | 10/20/2026 | | | | 2,003,605 | |

| | 4,500,000 | | | Series 2014-1A-D1 | | | 3.78% | #^ | | | 10/20/2026 | | | | 4,326,768 | |

| |

| | | | Venture Ltd., | |

| | 11,756,946 | | | Series 2006-1A-A1 | | | 0.49% | #^ | | | 08/03/2020 | | | | 11,626,259 | |

| | 9,257,985 | | | Series 2007-8A-A2A | | | 0.48% | #^ | | | 07/22/2021 | | | | 9,137,651 | |

| | 17,000,000 | | | Series 2014-17A-A | | | 1.73% | #^ | | | 07/15/2026 | | | | 16,975,559 | |

| | 3,250,000 | | | Series 2014-17A-B2 | | | 2.35% | #^ | | | 07/15/2026 | | | | 3,239,405 | |

| |

| | | | Voya Ltd., | |

| | 23,000,000 | | | Series 2014-4A-A1 | | | 1.73% | #^ | | | 10/14/2026 | | | | 23,035,526 | |

| |

| | | | Washington Mill Ltd., | |

| | 56,500,000 | | | Series 2014-1A-A1 | | | 1.76% | #^ | | | 04/20/2026 | | | | 56,391,497 | |

| | 5,000,000 | | | Series 2014-1A-B1 | | | 2.31% | #^ | | | 04/20/2026 | | | | 4,968,767 | |

| | 4,750,000 | | | Series 2014-1A-C | | | 3.26% | #^ | | | 04/20/2026 | | | | 4,645,611 | |

| |

| | | | Westwood Ltd., | |

| | 13,059,407 | | | Series 2006-1X-A1 | | | 0.51% | # | | | 03/25/2021 | | | | 12,935,658 | |

| | 21,648,494 | | | Series 2007-2A-A1 | | | 0.48% | #^ | | | 04/25/2022 | | | | 21,457,814 | |

| |

| | | | WhiteHorse Ltd., | |

| | 2,000,000 | | | Series 2006-1A-B1L | | | 2.10% | #^ | | | 05/01/2018 | | | | 2,001,649 | |

| | 50,000,000 | | | Series 2012-1A-A1L | | | 1.65% | #^ | | | 02/03/2025 | | | | 49,704,540 | |

| |

| | | | Wind River Ltd., | |

| | 59,000,000 | | | Series 2012-1A-A | | | 1.65% | #^ | | | 01/15/2024 | | | | 58,890,295 | |

| | 18,000,000 | | | Series 2012-1A-B1 | | | 2.35% | #^ | | | 01/15/2024 | | | | 17,956,710 | |

| | 13,750,000 | | | Series 2012-1A-C1 | | | 3.30% | #^ | | | 01/15/2024 | | | | 13,600,253 | |

| |

| | | | Zais Ltd., | |

| | 30,000,000 | | | Series 2014-2A-A1A | | | 1.73% | #^ | | | 07/25/2026 | | | | 29,856,117 | |

| | | | | | | | | | | | | | | | |

| | | | Total Collateralized Loan Obligations

(Cost $2,254,817,800) | | | | 2,253,616,911 | |

| | | | | | | | | | | | | | | | |

| | NON-AGENCY COMMERCIAL MORTGAGE BACKED OBLIGATIONS 7.5% | |

| |

| | | | BAMLL Commercial Mortgage Securities Trust, | |

| | 10,150,000 | | | Series 2011-07C1-A3B | | | 5.38% | ^ | | | 12/15/2016 | | | | 10,609,211 | |

| | 8,350,000 | | | Series 2014-IP-E | | | 2.72% | #^ | | | 06/15/2028 | | | | 8,355,782 | |

| |

| | | | Banc of America Commercial Mortgage Trust, | |

| | 19,741,000 | | | Series 2006-4-AM | | | 5.68% | | | | 07/10/2046 | | | | 20,890,518 | |

| | 5,038,000 | | | Series 2006-6-AM | | | 5.39% | | | | 10/10/2045 | | | | 5,333,025 | |

| | 22,365,000 | | | Series 2007-1-AMFX | | | 5.48% | # | | | 01/15/2049 | | | | 23,337,620 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2015 | | 17 |

| | |

| Schedule of Investments DoubleLine Total Return Bond Fund (Cont.) | | March 31, 2015 |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | Banc of America Commercial Mortgage Trust, (Cont.) | |

| $ | 11,700,000 | | | Series 2007-2-AM | | | 5.79% | # | | | 04/10/2049 | | | | 12,613,477 | |

| | 59,298,515 | | | Series 2007-5-AM | | | 5.77% | # | | | 02/10/2051 | | | | 63,345,461 | |

| | 247,600,934 | | | Series 2007-5-XW | | | 0.53% | #^ I/O | | | 02/10/2051 | | | | 1,958,523 | |

| |

| | | | Bear Stearns Commercial Mortgage Securities Inc. | |

| | 226,872 | | | Series 2004-PWR4-A3 | | | 5.47% | # | | | 06/11/2041 | | | | 226,789 | |

| | 4,480,156 | | | Series 2005-T18-AJ | | | 5.01% | # | | | 02/13/2042 | | | | 4,480,443 | |

| | 4,848,000 | | | Series 2006-PW13-AJ | | | 5.61% | # | | | 09/11/2041 | | | | 4,996,266 | |

| | 19,225,000 | | | Series 2006-PW14-AM | | | 5.24% | | | | 12/11/2038 | | | | 20,393,486 | |

| | 28,000,000 | | | Series 2007-PW16-AM | | | 5.90% | # | | | 06/11/2040 | | | | 30,496,536 | |

| | 12,815,000 | | | Series 2007-PW17-AMFL | | | 0.87% | #^ | | | 06/11/2050 | | | | 12,601,617 | |

| | 4,500,000 | | | Series 2007-T26-AJ | | | 5.57% | # | | | 01/12/2045 | | | | 4,657,189 | |

| |

| | | | Boca Hotel Portfolio Trust, | |

| | 9,500,000 | | | Series 2013-BOCA-E | | | 3.92% | #^ | | | 08/15/2026 | | | | 9,503,662 | |

| |

| | | | CD Commercial Mortgage Trust, | |

| | 45,625,000 | | | Series 2006-CD2-AM | | | 5.35% | # | | | 01/15/2046 | | | | 47,135,187 | |