As filed with the Securities and Exchange Commission on June 2, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22378

DoubleLine Funds Trust

(Exact name of registrant as specified in charter)

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Address of principal executive offices) (Zip code)

Ronald R. Redell

President

DoubleLine Funds Trust

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Name and address of agent for service)

(213) 633-8200

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2017

Item 1. Reports to Stockholders.

Annual Report

March 31, 2017

DoubleLine Selective Credit Fund

DBSCX (I-share)

Shares of the DoubleLine Selective Credit Fund (the “Fund”) may currently be purchased in transactions by DoubleLine Capital LP (the “Adviser”) or its affiliates acting in their capacity as investment adviser (or in a similar capacity) for clients, including separately managed private accounts, investment companies registered under the Investment Company Act of 1940, as amended, and other funds, each of which must be an “accredited investor” as defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). The Fund also may permit purchases of shares by (i) qualified employees, officers and Trustees of the Fund and their qualified family members; (ii) qualified employees and officers of the Adviser or DoubleLine Group LP and their qualified family members; (iii) qualified affiliates of the Adviser or DoubleLine Group LP; and (iv) other qualified accounts.

| | |

| DoubleLine Capital LP | | 333 S. Grand Avenue 18th Floor Los Angeles, California 90071 doubleline.com |

| | | | | | |

| | Annual Report | | March 31, 2017 | | 3 |

| | |

| President’s Letter | | (Unaudited) March 31, 2017 |

Dear DoubleLine Funds Shareholder,

On behalf of the DoubleLine Selective Credit Fund (DBSCX, the “Fund”), I am pleased to deliver this Annual Report for the 12-month period ended March 31, 2017. On the following pages you will find specific information regarding the Fund’s operations and holdings. In addition, we discuss the Fund’s investment performance and the main drivers of that performance during the reporting period.

If you have any questions regarding the DoubleLine Funds please don’t hesitate to call us at 877-DLine11 (877-354-6311), or visit our website www.doublelinefunds.com where our investment management team offer deeper insights and analysis on relevant capital market activity impacting investors today. We value the trust that you have placed with us, and we will continue to strive to offer thoughtful investment solutions to our shareholders.

Sincerely,

Ronald R. Redell, CFA

President

DoubleLine Funds

May 1, 2017

| | | | | | |

| 4 | | DoubleLine Selective Credit Fund | | | | |

| | |

| Financial Markets Highlights | | (Unaudited) March 31, 2017 |

| · | | Non-Agency Mortgage-Backed Securities (Non-Agency MBS) |

For the 12-month period ended March 31, 2017, non-Agency MBS spreads continued to tighten since the February 2016 widening in spreads. The tightening in non-Agency MBS spreads occurred in conjunction with a tightening in credit spreads in general (including for Investment Grade Corporate, High Yield (HY), and Structured Products). Contributing to the spread tightening is an improvement in housing fundamentals, primarily home price appreciation and the technicals of the non-Agency MBS market, where no new securities have been created since the financial crisis, leading to a supply and demand imbalance.

| · | | Commercial Mortgage-Backed Securities (CMBS) |

For the 12-month period ended March 31, 2017, new issue CMBS spreads tightened alongside broader credit and equity indices. While the first quarter of 2016 saw meaningful widening on low oil prices and macro uncertainty, the fourth quarter of 2016 and the first quarter of 2017 saw meaningful tightening in credit, largely led by a risk-on sentiment post-election. The Bloomberg Barclays U.S. CMBS Index ERISA Eligible Total Return Value returned 0.59%, outperforming the broader Bloomberg Barclays U.S. Aggregate Bond Index return of 0.44%. For the period, 10-year AAA last cash flows (LCFs) tightened by 0.34% to 0.94% over swaps, while BBB- bonds tightened by 2.25% to 4.40% over swaps. On the new issue front, private label CMBS issuance was down 22% year-over-year (YoY) as issuers grappled with how best to implement the relatively new risk retention rules while facing increased competition from private capital lenders. $45.7 billion in new issuance priced during the 12-month reporting period compared to $58.1 billion from April 2015 through March 2016. The Trepp CMBS Delinquency Rate for U.S. Commercial Real Estate loans has moved higher in 11 of the 13 month-period ended March 31, 2017 and ended the period at 5.37%, 1.15% higher YoY, as 10-year loans originated in 2006/2007 face difficulty refinancing at maturity.

| · | | Collateralized Loan Obligations (CLOs) |

For the 12-month period ending March 31, 2017, CLO issuance was $81.4 billion, largely due to a rebound from the beginning of the period through the end of 2016, totaling $64 billion. The most active quarter of issuance was during the fourth quarter of 2016 as the Dodd-Frank Risk Retention rule’s effective date of December 24, 2016 approached. Issuance for the first quarter of 2017 started off slowly as the market was still absorbing all the supply from the fourth quarter of 2016. Risk Retention went effective on December 24, 2016 so all deals issued afterward will have to comply with Risk Retention rules. After a slow January 2017 issuance, managers issued more deals in February. In total, the period ended with $17.38 billion in issuance. Coming off the volatility in spreads at the beginning of the period, spreads compressed and ended the period near the all-time tightest spreads across the capital stack. Refinancing activity has also been at historically high levels as managers are trying to bring down their cost of debt and take advantage of the tighter spreads during the period.

| | | | | | |

| | Annual Report | | March 31, 2017 | | 5 |

| | |

| Management’s Discussion of Fund Performance | | (Unaudited) March 31, 2017 |

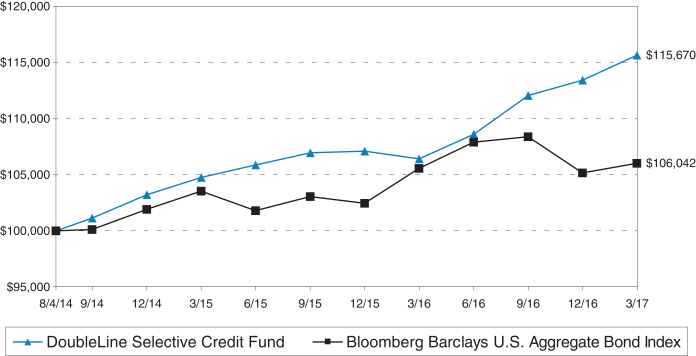

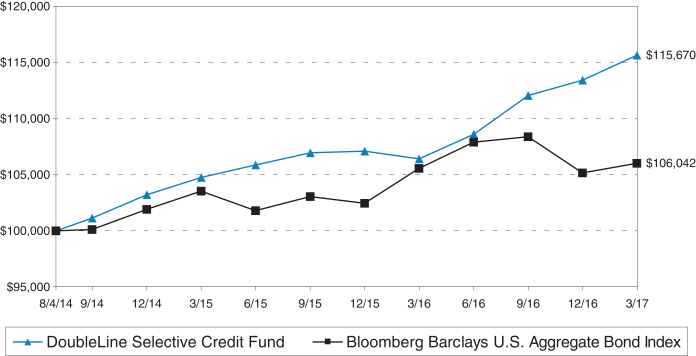

DoubleLine Selective Credit Fund

For the 12-month period ended March 31, 2017, the DoubleLine Selective Credit Fund outperformed the Bloomberg Barclays U.S. Aggregate Bond Index’s return of 0.44%. During the period, yields across the U.S. Treasury curve increased with 2-year yields increasing by about 0.53% and 10-year yields increasing by about 0.62%. Valuations were mixed across the credit spectrum amongst non-Agency MBS. Alt-A bonds were the highest contributors to performance despite the sector facing some weakness in valuations for the period. Prime bonds contributed positively to returns while Subprime bonds experienced the highest absolute return for the period due to the combination of strong price appreciation and healthy interest carry from the sector. Non-Agency interest-only securities detracted from returns as they suffered from price declines during the period. CLOs and CMBS contributed positively to performance for the period, benefitting from credit spreads tightening and high coupon returns, respectively.

| | | | | | | | |

| Period Ended 3-31-17 | | | | | 1-Year | |

I-Share | | | | | | | 8.69% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | | | 0.44% | |

For additional performance information, please refer to the “Standardized Performance Summary.”

Past Performance is not a guarantee of future results.

Opinions expressed herein are as of March 31, 2017 and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Fund. It may also be used as sales literature when preceded or accompanied by the current private placement memorandum.

The performance shown assumes the reinvestment of all dividends and distributions and does not reflect any reductions for taxes. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Since the Fund is currently offered only to a limited number of investors, as described in the private placement memorandum, the Fund’s assets may grow at a slower rate than if the Fund engaged in a broader public offering. As a result, the Fund may incur operating expenses as a percentage of net assets at a rate higher than mutual funds that are larger or more broadly offered. In addition, the Fund’s assets may not achieve a size sufficient to make the Fund economically viable. A liquidation of the Fund may result in a sale of assets of the Fund at an unfavorable time or at prices below those at which the Fund has valued them.

Investing involves risk. Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a great risk of loss to principal and interest than higher rated securities.

Investments in Asset-Backed and Mortgage-Backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. ETF investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares.

Additional principal risks for the Fund can be found in the private placement memorandum.

Diversification does not assure a profit or protect against loss in a declining market.

Credit ratings from Moody’s range from the highest rating of Aaa for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of C for the lowest rated class of bonds. Credit ratings from Standard & Poor’s (S&P) range from the highest rating of AAA for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of D for bonds that are in default.

Credit ratings are determined from the highest available credit rating from any Nationally Recognized Statistical Rating Agency (“NRSRO”, generally S&P, Moody’s and Fitch). DoubleLine chooses to display credit ratings using S&P’s rating convention, although the rating itself might be sourced from another NRSRO.

Bloomberg Barclays U.S. Aggregate Bond Index—This index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

Bloomberg Barclays U.S. CMBS Index ERISA Eligible Total Return Value—This index measures the performance of investment grade commercial mortgage-backed securities, which are classes of securities that represent interests in pools of commercial mortgages, and includes only ERISA-eligible CMBS.

Investment Grade—Securities rated AAA to BBB- are considered to be investment grade. A bond is considered investment grade if its credit rating is BBB- or higher by Standard & Poor’s or Baa3 by Moody’s. Ratings based on the corporate bond model. The higher the rating, the more likely the bond is to pay back at par/$100 cents on the dollar. AAA is considered the highest quality and the lowest degree of risk. They are considered to be extremely stable and dependable.

Last Cash Flow (LCF)—The last revenue stream paid to a bond over a given period.

Spread—The difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another. The higher the yield spread, the greater the difference between the yields offered by each instrument. The spread can be measured between debt instruments of differing maturities, credit ratings and risk.

A direct investment cannot be made in an index. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments.

| | | | | | |

| 6 | | DoubleLine Selective Credit Fund | | | | |

| | |

| | | (Unaudited) March 31, 2017 |

DoubleLine® is a registered trademark of DoubleLine Capital LP.

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a Fund and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein.

DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available.

Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. Past performance is no guarantee of future results.

Quasar Distributors, LLC provides filing administration for the DoubleLine Selective Credit Fund.

| | | | | | |

| | Annual Report | | March 31, 2017 | | 7 |

| | |

| Standardized Performance Summary | | (Unaudited) March 31, 2017 |

| | | | | | | | |

| DBSCX | | | | | | |

Selective Credit Fund Returns as of March 31, 2017 | | 1-Year | | | Since Inception

Annualized (8-4-14 to 3-31-17) | |

I-share (DBSCX) | | | 8.69% | | | | 5.64% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 0.44% | | | | 2.23% | |

The performance information shown assumes the reinvestment of all dividends and distributions. Performance reflects management fees and other fund expenses. Returns over 1 year are average annual returns. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (213) 633-8200.

| | | | | | |

| 8 | | DoubleLine Selective Credit Fund | | | | |

| | |

| Schedule of Investments DoubleLine Selective Credit Fund | | March 31, 2017 |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| | ASSET BACKED OBLIGATIONS 1.3% | |

| |

| | | | Colony American Homes, | |

| | 6,001,000 | | | Series 2014-2A-E | | | 4.18% | #^ | | | 07/17/2031 | | | | 6,013,330 | |

| |

| | | | MarketPlace Loan Trust, | |

| | 169,098 | | | Series 2015-CB1-A | | | 4.00% | ^ | | | 07/15/2021 | | | | 168,992 | |

| | | | | | | | | | | | | | | | |

| | | | Total Asset Backed Obligations

(Cost $6,219,640) | | | | 6,182,322 | |

| | | | | | | | | | | | | | | | |

| | COLLATERALIZED LOAN OBLIGATIONS 0.6% | |

| |

| | | | Apidos Ltd., | |

| | 1,000,000 | | | Series 2014-18A-D | | | 6.24% | #^ | | | 07/22/2026 | | | | 987,555 | |

| |

| | | | Babson Ltd., | |

| | 250,000 | | | Series 2014-3A-E2 | | | 7.52% | #^ | | | 01/15/2026 | | | | 251,843 | |

| |

| | | | ING Ltd., | |

| | 250,000 | | | Series 2013-1A-D | | | 6.02% | #^ | | | 04/15/2024 | | | | 248,153 | |

| |

| | | | Madison Park Funding Ltd., | |

| | 250,000 | | | Series 2014-15A-DR | | | 6.48% | #^ | | | 01/27/2026 | | | | 249,502 | |

| |

| | | | Octagon Investment Partners Ltd., | |

| | 500,000 | | | Series 2014-1A-D | | | 7.64% | #^ | | | 11/14/2026 | | | | 505,014 | |

| | 250,000 | | | Series 2014-1A-E2 | | | 7.79% | #^ | | | 11/25/2025 | | | | 255,158 | |

| | 250,000 | | | Series 2014-1A-F | | | 7.34% | #^ | | | 11/25/2025 | | | | 230,870 | |

| |

| | | | Venture Ltd., | |

| | 250,000 | | | Series 2016-12A-ER | | | 7.25% | #^ | | | 02/28/2026 | | | | 245,022 | |

| | | | | | | | | | | | | | | | |

| | | | Total Collateralized Loan Obligations

(Cost $2,879,126) | | | | 2,973,117 | |

| | | | | | | | | | | | | | | | |

| NON-AGENCY COMMERCIAL MORTGAGE BACKED

OBLIGATIONS 4.1% |

|

| |

| | | | Banc of America Commercial Mortgage Trust, | |

| | 182,000 | | | Series 2007-4-B | | | 5.96% | #^ | | | 02/10/2051 | | | | 181,494 | |

| |

| | | | Barclays Commercial Mortgage Securities, LLC, | |

| | 282,000 | | | Series 2014-BXO-E | | | 3.33% | #^ | | | 08/15/2027 | | | | 281,461 | |

| |

| | | | BB-UBS Trust, | |

| | 214,000 | | | Series 2012-TFT-TE | | | 3.56% | #^ | | | 06/05/2030 | | | | 197,515 | |

| |

| | | | Bear Stearns Commercial Mortgage Securities, Inc., | |

| | 500,000 | | | Series 2007-T26-AJ | | | 5.57% | # | | | 01/12/2045 | | | | 480,460 | |

| |

| | | | CDGJ Commercial Mortgage Trust, | |

| | 500,000 | | | Series 2014-BXCH-B | | | 2.76% | #^ | | | 12/15/2027 | | | | 500,819 | |

| |

| | | | CGCMT Trust, | |

| | 425,000 | | | Series 2010-RR2-JA4B | | | 6.07% | #^ | | | 02/19/2051 | | | | 430,830 | |

| |

| | | | Citigroup Commercial Mortgage Trust, | |

| | 400,000 | | | Series 2007-C6-AM | | | 5.78% | # | | | 12/10/2049 | | | | 405,324 | |

| | 500,000 | | | Series 2007-C6-AMFX | | | 5.78% | #^ | | | 12/10/2049 | | | | 502,614 | |

| | 500,000 | | | Series 2015-GC27-D | | | 4.43% | #^ | | | 02/10/2048 | | | | 402,344 | |

| |

| | | | COBALT Commercial Mortgage Trust, | |

| | 250,000 | | | Series 2007-C2-AJFX | | | 5.57% | # | | | 04/15/2047 | | | | 252,812 | |

| |

| | | | Commercial Mortgage Pass-Through Certificates, | |

| | 271,000 | | | Series 2007-C9-AJFL | | | 1.55% | #^ | | | 12/10/2049 | | | | 267,631 | |

| | 227,000 | | | Series 2012-CR4-D | | | 4.57% | #^ | | | 10/15/2045 | | | | 207,157 | |

| | 411,000 | | | Series 2012-CR4-E | | | 4.57% | #^ | | | 10/15/2045 | | | | 281,403 | |

| | 250,000 | | | Series 2014-CR19-C | | | 4.72% | # | | | 08/10/2047 | | | | 254,627 | |

| | 500,000 | | | Series 2015-3BP-B | | | 3.24% | #^ | | | 02/10/2035 | | | | 498,339 | |

| | 500,000 | | | Series 2015-CR22-D | | | 4.13% | #^ | | | 03/10/2048 | | | | 402,735 | |

| | 500,000 | | | Series 2015-DC1-D | | | 4.35% | #^ | | | 02/10/2048 | | | | 409,171 | |

| |

| | | | Countrywide Commercial Mortgage Trust, | |

| | 369,641 | | | Series 2007-MF1-A | | | 6.21% | #^ | | | 11/12/2043 | | | | 371,692 | |

| |

| | | | CSAIL Commercial Mortgage Trust, | |

| | 500,000 | | | Series 2015-C1-D | | | 3.80% | #^ | | | 04/15/2050 | | | | 419,234 | |

| |

| | | | GMAC Commercial Mortgage Securities Trust, | |

| | 347,000 | | | Series 2004-C3-E | | | 5.14% | #^ | | | 12/10/2041 | | | | 344,380 | |

| |

| | | | JP Morgan Chase Commercial Mortgage Securities Corporation, | |

| | 307,896 | | | Series 2006-LDP9-AM | | | 5.37% | | | | 05/15/2047 | | | | 307,648 | |

| | 250,000 | | | Series 2007-CB20-A | | | 6.18% | # | | | 02/12/2051 | | | | 256,094 | |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | JP Morgan Chase Commercial Mortgage Securities Trust, | |

| | 107,000 | | | Series 2004-CBX-D | | | 5.10% | # | | | 01/12/2037 | | | | 108,789 | |

| | 531,000 | | | Series 2006-LDP9-AMS | | | 5.34% | | | | 05/15/2047 | | | | 525,178 | |

| | 208,000 | | | Series 2016-WIKI-E | | | 4.01% | #^ | | | 10/05/2031 | | | | 203,684 | |

| | 249,000 | | | Series 2016-WPT-E | | | 5.91% | #^ | | | 10/15/2033 | | | | 254,169 | |

| |

| | | | JPMBB Commercial Mortgage Securities Trust, | |

| | 500,000 | | | Series 2015-C27-D | | | 3.84% | #^ | | | 02/15/2048 | | | | 395,080 | |

| |

| | | | LMREC, Inc., | |

| | 500,000 | | | Series 2015-CRE1-A | | | 2.73% | #^ | | | 02/22/2032 | | | | 503,925 | |

| |

| | | | Merrill Lynch Mortgage Trust, | |

| | 425,000 | | | Series 2007-C1-AM | | | 5.84% | # | | | 06/12/2050 | | | | 418,251 | |

| |

| | | | Morgan Stanley Bank of America Merrill Lynch Trust, | |

| | 250,000 | | | Series 2014-C18-C | | | 4.49% | # | | | 10/15/2047 | | | | 246,520 | |

| | 350,000 | | | Series 2014-C19-C | | | 4.00% | | | | 12/15/2047 | | | | 327,085 | |

| | 699,000 | | | Series 2015-C20-D | | | 3.07% | ^ | | | 02/15/2048 | | | | 527,833 | |

| |

| | | | Morgan Stanley Capital, Inc., | |

| | 406,890 | | | Series 2007-HQ11-AJ | | | 5.51% | # | | | 02/12/2044 | | | | 399,568 | |

| | 500,000 | | | Series 2014-MP-D | | | 3.69% | #^ | | | 08/11/2029 | | | | 506,268 | |

| |

| | | | Morgan Stanley Re-Remic Trust, | |

| | 500,000 | | | Series 2010-GG10-A4B | | | 5.95% | #^ | | | 08/15/2045 | | | | 499,868 | |

| |

| | | | Sutherland Commercial Mortgage Loans LLC, | |

| | 217,399 | | | Series 2015-SBC4-A | | | 4.00% | ^ | | | 06/25/2039 | | | | 216,610 | |

| |

| | | | UBS-Barclays Commercial Mortgage Trust, | |

| | 105,000 | | | Series 2013-C6-D | | | 4.35% | #^ | | | 04/10/2046 | | | | 94,652 | |

| |

| | | | Wachovia Bank Commercial Mortgage Trust, | |

| | 282,000 | | | Series 2006-C25-F | | | 5.88% | # | | | 05/15/2043 | | | | 282,849 | |

| | 496,000 | | | Series 2006-C26-AM | | | 6.06% | # | | | 06/15/2045 | | | | 499,728 | |

| | 290,009 | | | Series 2007-C30-AJ | | | 5.41% | # | | | 12/15/2043 | | | | 292,183 | |

| |

| | | | Waterfall Commercial Mortgage Trust, | |

| | 5,167,680 | | | Series 2015-SBC5-A | | | 4.10% | #^ | | | 09/14/2022 | | | | 5,161,270 | |

| |

| | | | Wells Fargo Commercial Mortgage Trust, | |

| | 500,000 | | | Series 2015-C26-D | | | 3.59% | ^ | | | 02/15/2048 | | | | 368,935 | |

| | | | | | | | | | | | | | | | |

| | | | Total Non-Agency Commercial Mortgage Backed Obligations

(Cost $19,934,090) | | | | 19,488,229 | |

| | | | | | | | | | | | | | | | |

| NON-AGENCY RESIDENTIAL COLLATERALIZED MORTGAGE

OBLIGATIONS 93.0% |

|

| |

| | | | Ajax Mortgage Loan Trust, | |

| | 2,702,752 | | | Series 2016-1-A | | | 4.25% | #^ | | | 07/25/2047 | | | | 2,677,397 | |

| |

| | | | Alternative Loan Trust, | |

| | 9,368,986 | | | Series 2005-79CB-A1 | | | 1.53% | # | | | 01/25/2036 | | | | 6,036,506 | |

| | 9,368,986 | | | Series 2005-79CB-A2 | | | 3.97% | # I/F I/O | | | 01/25/2036 | | | | 1,336,463 | |

| | 12,883,030 | | | Series 2005-80CB-4A1 | | | 6.00% | | | | 02/25/2036 | | | | 10,204,279 | |

| |

| | | | Banc of America Funding Corporation, | |

| | 4,298,033 | | | Series 2006-2-2A11 | | | 5.50% | | | | 03/25/2036 | | | | 4,223,242 | |

| | 2,596,459 | | | Series 2007-1-TA8 | | | 5.85% | # | | | 01/25/2037 | | | | 2,287,687 | |

| |

| | | | BCAP LLC Trust, | |

| | 9,028,578 | | | Series 2011-RR4-5A8 | | | 6.20% | #^ | | | 08/26/2037 | | | | 9,440,274 | |

| | 8,110,915 | | | Series 2011-RR4-I-4A8 | | | 6.27% | #^ | | | 08/26/2037 | | | | 8,456,899 | |

| |

| | | | Bear Stearns ARM Trust, | |

| | 9,325,603 | | | Series 2006-2-2A1 | | | 3.34% | # | | | 07/25/2036 | | | | 9,075,436 | |

| |

| | | | Bear Stearns Asset Backed Securities Trust, | |

| | 7,385,313 | | | Series 2005-10-23A1 | | | 3.23% | # | | | 01/25/2036 | | | | 6,640,693 | |

| | 4,996,532 | | | Series 2006-4-31A1 | | | 3.14% | # | | | 07/25/2036 | | | | 4,186,547 | |

| | 6,399,202 | | | Series 2006-AC5-A1 | | | 6.25% | # | | | 12/25/2036 | | | | 6,217,537 | |

| | 2,866,954 | | | Series 2006-IM1-A1 | | | 1.21% | # | | | 04/25/2036 | | | | 2,772,882 | |

| |

| | | | Chase Mortgage Finance Trust, | |

| | 3,498,888 | | | Series 2006-S2-1A9 | | | 6.25% | | | | 10/25/2036 | | | | 2,892,702 | |

| | 6,548,328 | | | Series 2006-S3-1A2 | | | 6.00% | | | | 11/25/2036 | | | | 5,345,836 | |

| | 575,066 | | | Series 2007-S3-1A12 | | | 6.00% | | | | 05/25/2037 | | | | 459,871 | |

| |

| | | | CHL Mortgage Pass-Through Trust, | |

| | 4,765,174 | | | Series 2006-13-1A17 | | | 4.67% | # I/F I/O | | | 09/25/2036 | | | | 907,252 | |

| | 8,332,955 | | | Series 2007-HYB1-2A1 | | | 3.03% | # | | | 03/25/2037 | | | | 7,147,169 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2017 | | 9 |

| | |

| Schedule of Investments DoubleLine Selective Credit Fund (Contd.) | | March 31, 2017 |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | CHL Mortgage Pass-Through Trust 2006-13, | |

| | 4,765,174 | | | Series 2006-13-1A3 | | | 1.58% | # | | | 09/25/2036 | | | | 2,787,458 | |

| |

| | | | CIM Trust, | |

| | 4,000,000 | | | Series 2016-1RR-B2 | | | 12.32% | #^ | | | 07/26/2055 | | | | 3,507,236 | |

| | 3,000,000 | | | Series 2016-2RR-B2 | | | 13.12% | #^ | | | 02/27/2056 | | | | 2,631,589 | |

| | 3,000,000 | | | Series 2016-3RR-B2 | | | 11.38% | #^ | | | 02/27/2056 | | | | 2,631,966 | |

| |

| | | | Citigroup Mortgage Loan Trust, | |

| | 1,918,185 | | | Series 2007-AR8-1A1A | | | 3.25% | # | | | 08/25/2047 | | | | 1,716,973 | |

| |

| | | | Citigroup Mortgage Loan Trust, Inc., | |

| | 2,272,295 | | | Series 2005-9-21A2 | | | 5.50% | | | | 11/25/2035 | | | | 2,207,866 | |

| | 3,249,524 | | | Series 2011-12-1A2 | | | 3.27% | #^ | | | 04/25/2036 | | | | 2,671,084 | |

| |

| | | | CitiMortgage Alternative Loan Trust, | |

| | 19,975,705 | | | Series 2007-A5-1A3 | | | 1.48% | # | | | 05/25/2037 | | | | 14,469,254 | |

| | 19,975,705 | | | Series 2007-A5-1A4 | | | 4.62% | # I/F I/O | | | 05/25/2037 | | | | 3,169,439 | |

| | 5,641,176 | | | Series 2007-A6-1A4 | | | 6.00% | | | | 06/25/2037 | | | | 4,908,842 | |

| | 3,844,378 | | | Series 2007-A6-1A5 | | | 6.00% | | | | 06/25/2037 | | | | 3,345,303 | |

| | 6,151,183 | | | Series 2007-A8-A1 | | | 6.00% | | | | 10/25/2037 | | | | 5,586,545 | |

| |

| | | | Countrywide Alternative Loan Trust, | |

| | 1,184,035 | | | Series 2004-22CB-1A1 | | | 6.00% | | | | 10/25/2034 | | | | 1,224,126 | |

| | 2,094,430 | | | Series 2005-22T1-A5 | | | 5.50% | | | | 06/25/2035 | | | | 1,698,472 | |

| | 2,030,996 | | | Series 2005-28CB-2A7 | | | 5.75% | | | | 08/25/2035 | | | | 1,789,166 | |

| | 3,069,056 | | | Series 2005-46CB-A20 | | | 5.50% | | | | 10/25/2035 | | | | 2,900,471 | |

| | 6,029,626 | | | Series 2005-65CB-1A11 | | | 6.00% | | | | 01/25/2036 | | | | 5,744,045 | |

| | 455,913 | | | Series 2005-73CB-1A3 | | | 6.25% | | | | 01/25/2036 | | | | 451,222 | |

| | 2,412,660 | | | Series 2006-14CB-A8 | | | 6.00% | | | | 06/25/2036 | | | | 2,043,565 | |

| | 5,585,481 | | | Series 2006-41CB-2A12 | | | 6.00% | | | | 01/25/2037 | | | | 4,649,918 | |

| | 2,132,163 | | | Series 2006-41CB-2A15 | | | 5.75% | | | | 01/25/2037 | | | | 1,738,458 | |

| | 5,477,417 | | | Series 2006-46-A6 | | | 6.00% | | | | 02/25/2047 | | | | 4,456,865 | |

| | 3,678,650 | | | Series 2006-7CB-2A1 | | | 6.50% | | | | 05/25/2036 | | | | 2,553,271 | |

| | 1,833,127 | | | Series 2006-8T1-1A4 | | | 6.00% | | | | 04/25/2036 | | | | 1,404,501 | |

| | 2,496,390 | | | Series 2006-J4-2A13 | | | 6.00% | | | | 07/25/2036 | | | | 2,130,126 | |

| | 6,874,555 | | | Series 2006-J4-2A8 | | | 6.00% | | | | 07/25/2036 | | | | 5,865,937 | |

| | 1,856,377 | | | Series 2006-J6-A5 | | | 6.00% | | | | 09/25/2036 | | | | 1,622,093 | |

| | 1,438,637 | | | Series 2007-13-A4 | | | 6.00% | | | | 06/25/2047 | | | | 1,241,759 | |

| | 1,042,586 | | | Series 2007-J2-2A1 | | | 6.00% | | | | 07/25/2037 | | | | 1,008,046 | |

| |

| | | | Countrywide Home Loans, | |

| | 203,693 | | | Series 2006-10-1A11 | | | 5.85% | | | | 05/25/2036 | | | | 169,813 | |

| | 1,277,090 | | | Series 2006-17-A6 | | | 6.00% | | | | 12/25/2036 | | | | 1,115,323 | |

| | 2,948,600 | | | Series 2006-19-1A7 | | | 6.00% | | | | 01/25/2037 | | | | 2,540,361 | |

| | 3,816,845 | | | Series 2006-9-A2 | | | 6.00% | | | | 05/25/2036 | | | | 3,250,718 | |

| | 14,516,777 | | | Series 2007-15-1A29 | | | 6.25% | | | | 09/25/2037 | | | | 13,326,656 | |

| | 946,472 | | | Series 2007-4-1A10 | | | 6.00% | | | | 05/25/2037 | | | | 793,205 | |

| | 706,871 | | | Series 2007-8-1A5 | | | 5.44% | | | | 01/25/2038 | | | | 564,377 | |

| |

| | | | Credit Suisse First Boston Mortgage Securities Corporation, | |

| | 2,907,400 | | | Series 2005-12-5A1 | | | 5.25% | | | | 01/25/2036 | | | | 2,761,360 | |

| | 1,324,583 | | | Series 2005-9-3A2 | | | 6.00% | | | | 10/25/2035 | | | | 838,809 | |

| |

| | | | Credit Suisse Mortgage Capital Certificates, | |

| | 1,395,219 | | | Series 2006-6-1A10 | | | 6.00% | | | | 07/25/2036 | | | | 1,040,904 | |

| | 1,850,308 | | | Series 2008-2R-1A1 | | | 6.00% | ^ | | | 07/25/2037 | | | | 1,738,561 | |

| | 7,032,754 | | | Series 2009-9R-10A2 | | | 5.50% | ^ | | | 12/26/2035 | | | | 6,164,652 | |

| | 2,510,071 | | | Series 2011-17R-1A2 | | | 5.75% | ^ | | | 02/27/2037 | | | | 2,715,544 | |

| |

| | | | CSMC Mortgage-Backed Trust, | |

| | 7,329,223 | | | Series 2006-7-10A1 | | | 6.75% | | | | 08/25/2036 | | | | 6,052,191 | |

| |

| | | | Deutsche ALT-A Securities, Inc. Mortgage Loan Trust, | |

| | 1,696,030 | | | Series 2005-6-2A1 | | | 5.50% | | | | 12/25/2035 | | | | 1,484,388 | |

| |

| | | | Deutsche ALT-B Securities, Inc. Mortgage Loan Trust, | |

| | 622,856 | | | Series 2006-AB4-A1A | | | 6.01% | # | | | 10/25/2036 | | | | 559,333 | |

| |

| | | | Deutsche Mortgage Securities, Inc., | |

| | 6,207,085 | | | Series 2009-RS2-1A2 | | | 3.02% | #^ | | | 09/26/2036 | | | | 6,159,347 | |

| |

| | | | First Horizon Alternative Mortgage Securities, | |

| | 3,803,497 | | | Series 2005-FA4-1A6 | | | 5.50% | | | | 06/25/2035 | | | | 3,506,664 | |

| | 1,449,402 | | | Series 2005-FA8-1A3 | | | 5.50% | | | | 11/25/2035 | | | | 1,237,112 | |

| | 3,892,654 | | | Series 2007-FA3-A8 | | | 6.00% | | | | 06/25/2037 | | | | 3,080,248 | |

| | 4,080,839 | | | Series 2007-FA4-1A4 | | | 6.25% | | | | 08/25/2037 | | | | 3,254,200 | |

| |

| | | | First Horizon Asset Securities, Inc., | |

| | 391,310 | | | Series 2006-1-1A2 | | | 6.00% | | | | 05/25/2036 | | | | 359,463 | |

| | 2,925,204 | | | Series 2007-3-A4 | | | 6.00% | | | | 06/25/2037 | | | | 2,424,953 | |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | GreenPoint Mortgage Funding Trust, | |

| | 9,942,253 | | | Series 2005-AR4-3A1 | | | 2.01% | # | | | 10/25/2045 | | | | 7,755,807 | |

| |

| | | | GSR Mortgage Loan Trust, | |

| | 737,551 | | | Series 2006-2F-3A4 | | | 6.00% | | | | 02/25/2036 | | | | 604,522 | |

| | 2,636,734 | | | Series 2007-1F-3A14 | | | 5.75% | | | | 01/25/2037 | | | | 2,452,363 | |

| | 4,793,039 | | | Series 2007-2F-3A3 | | | 6.00% | | | | 03/25/2037 | | | | 4,560,517 | |

| |

| | | | HSI Asset Loan Obligation Trust, | |

| | 3,504,582 | | | Series 2007-1-3A6 | | | 6.00% | | | | 06/25/2037 | | | | 2,311,118 | |

| |

| | | | Impac Secured Assets Trust, | |

| | 1,982,740 | | | Series 2006-5-1A1B | | | 1.18% | # | | | 02/25/2037 | | | | 1,704,798 | |

| |

| | | | JP Morgan Alternative Loan Trust, | |

| | 6,972,918 | | | Series 2006-S4-A4 | | | 5.96% | # | | | 12/25/2036 | | | | 6,197,267 | |

| | 4,879,333 | | | Series 2008-R2-A1 | | | 6.00% | ^ | | | 11/25/2036 | | | | 3,993,443 | |

| |

| | | | JP Morgan Mortgage Trust, | |

| | 689,393 | | | Series 2005-S3-1A1 | | | 6.50% | | | | 01/25/2036 | | | | 604,124 | |

| | 3,870,356 | | | Series 2007-S1-2A8 | | | 5.75% | | | | 03/25/2037 | | | | 3,137,884 | |

| |

| | | | JP Morgan Resecuritization Trust, | |

| | 4,395,423 | | | Series 2009-13-1A2 | | | 5.50% | ^ | | | 01/26/2036 | | | | 4,218,521 | |

| |

| | | | Lavender Trust, | |

| | 1,963,058 | | | Series 2010-R11A-A4 | | | 6.25% | ^ | | | 10/26/2036 | | | | 1,633,121 | |

| |

| | | | MASTR Alternative Loans Trust, | |

| | 1,024,105 | | | Series 2004-10-5A5 | | | 5.75% | | | | 09/25/2034 | | | | 1,016,686 | |

| |

| | | | Merrill Lynch Alternative Note Asset Trust, | |

| | 2,451,576 | | | Series 2007-F1-2A6 | | | 6.00% | | | | 03/25/2037 | | | | 1,860,653 | |

| |

| | | | Merrill Lynch Mortgage Investors Trust, | |

| | 1,979,128 | | | Series 2006-AF1-AF3B | | | 6.25% | | | | 08/25/2036 | | | | 1,616,130 | |

| |

| | | | Morgan Stanley Mortgage Loan Trust, | |

| | 1,585,438 | | | Series 2007-12-3A4 | | | 6.25% | | | | 08/25/2037 | | | | 1,370,306 | |

| |

| | | | New Century Home Equity Loan Trust, | |

| | 11,948,308 | | | Series 2006-1-A2B | | | 1.16% | # | | | 05/25/2036 | | | | 10,188,432 | |

| |

| | | | Nomura Asset Acceptance Corporation, | |

| | 4,653,653 | | | Series 2006-AP1-A2 | | | 5.52% | # | | | 01/25/2036 | | | | 2,676,200 | |

| | 1,827,269 | | | Series 2007-1-1A1A | | | 6.00% | # | | | 03/25/2047 | | | | 1,471,686 | |

| |

| | | | Opteum Mortgage Acceptance Corporation Trust, | |

| | 12,707,727 | | | Series 2006-2-A1C | | | 1.25% | # | | | 07/25/2036 | | | | 7,891,449 | |

| |

| | | | PR Mortgage Loan Trust, | |

| | 771,722 | | | Series 2014-1-APT | | | 5.92% | # | | | 10/25/2049 | | | | 761,797 | |

| |

| | | | RBSGC Mortgage Loan Trust, | |

| | 1,701,490 | | | Series 2007-A-2A4 | | | 6.25% | | | | 01/25/2037 | | | | 1,615,068 | |

| |

| | | | Residential Accredit Loans, Inc., | |

| | 3,197,698 | | | Series 2005-QS13-1A6 | | | 5.50% | | | | 09/25/2035 | | | | 2,949,055 | |

| | 737,034 | | | Series 2006-QS12-1A1 | | | 6.50% | | | | 09/25/2036 | | | | 516,783 | |

| | 6,426,631 | | | Series 2006-QS18-1A4 | | | 6.25% | | | | 12/25/2036 | | | | 5,557,839 | |

| | 2,299,702 | | | Series 2006-QS7-A2 | | | 6.00% | | | | 06/25/2036 | | | | 1,937,689 | |

| | 5,360,575 | | | Series 2007-QA5-3A1 | | | 6.16% | # | | | 09/25/2037 | | | | 4,400,259 | |

| | 1,644,271 | | | Series 2007-QS11-A1 | | | 7.00% | | | | 10/25/2037 | | | | 1,390,487 | |

| | 13,472,962 | | | Series 2007-QS1-1A2 | | | 4.47% | # I/F I/O | | | 01/25/2037 | | | | 2,104,758 | |

| | 13,472,962 | | | Series 2007-QS1-1A5 | | | 1.53% | # | | | 01/25/2037 | | | | 9,599,644 | |

| | 1,087,468 | | | Series 2007-QS5-A1 | | | 5.50% | | | | 03/25/2037 | | | | 870,283 | |

| |

| | | | Residential Asset Mortgage Products, Inc., | |

| | 4,144,260 | | | Series 2004-RZ2-AI5 | | | 5.98% | # | | | 07/25/2034 | | | | 3,969,705 | |

| |

| | | | Residential Asset Securities Corporation, | |

| | 3,492,696 | | | Series 2007-KS3-AI3 | | | 1.23% | # | | | 04/25/2037 | | | | 3,359,137 | |

| |

| | | | Residential Asset Securitization Trust, | |

| | 5,454,748 | | | Series 2006-A12-A1 | | | 6.25% | | | | 11/25/2036 | | | | 3,900,243 | |

| | 2,034,189 | | | Series 2006-A8-1A1 | | | 6.00% | | | | 08/25/2036 | | | | 1,794,097 | |

| |

| | | | Residential Funding Mortgage Securities Trust, | |

| | 159,686 | | | Series 2005-S9-A11 | | | 6.25% | | | | 12/25/2035 | | | | 152,190 | |

| | 1,887,836 | | | Series 2006-SA2-3A1 | | | 4.31% | # | | | 08/25/2036 | | | | 1,666,205 | |

| |

| | | | Springleaf Mortgage Loan Trust, | |

| | 350,000 | | | Series 2013-2A-B2 | | | 6.00% | #^ | | | 12/25/2065 | | | | 351,063 | |

| |

| | | | Structured Adjustable Rate Mortgage Loan Trust, | |

| | 9,795,367 | | | Series 2005-22-4A1 | | | 3.35% | # | | | 12/25/2035 | | | | 9,198,246 | |

| | 6,147,506 | | | Series 2006-10-3AF | | | 1.38% | # | | | 11/25/2036 | | | | 4,357,315 | |

| | 3,645,292 | | | Series 2008-1-A2 | | | 3.33% | # | | | 10/25/2037 | | | | 3,314,725 | |

| | | | | | |

| 10 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| |

| | | | Structured Asset Mortgage Investments Trust, | |

| | 7,892,794 | | | Series 2006-AR6-1A1 | | | 1.16% | # | | | 07/25/2046 | | | | 6,543,286 | |

| | 8,033,958 | | | Series 2006-AR6-1A3 | | | 1.17% | # | | | 07/25/2046 | | | | 6,292,648 | |

| | 7,101,519 | | | Series 2006-AR8-A2 | | | 1.19% | # | | | 10/25/2036 | | | | 5,990,930 | |

| |

| | | | Thornburg Mortgage Securities Trust, | |

| | 861,902 | | | Series 2007-4-2A1 | | | 2.86% | # | | | 09/25/2037 | | | | 859,554 | |

| |

| | | | US Residential Opportunity Fund Trust, | |

| | 5,474,373 | | | Series 2016-1III-A | | | 3.47% | #^ | | | 07/27/2036 | | | | 5,459,883 | |

| |

| | | | VOLT LLC, | |

| | 4,787,648 | | | Series 2015-NPL8-A1 | | | 3.50% | #^ | | | 06/26/2045 | | | | 4,817,178 | |

| |

| | | | Washington Mutual Mortgage Pass-Through Certificates, | |

| | 2,568,141 | | | Series 2005-10-2A8 | | | 6.00% | | | | 11/25/2035 | | | | 2,380,803 | |

| | 5,954,567 | | | Series 2006-5-2CB6 | | | 6.00% | | | | 07/25/2036 | | | | 4,923,471 | |

| | 4,175,407 | | | Series 2007-2-1A6 | | | 6.00% | | | | 04/25/2037 | | | | 3,527,840 | |

| | 429,303 | | | Series 2007-4-1A1 | | | 5.50% | | | | 06/25/2037 | | | | 403,151 | |

| | 5,244,765 | | | Series 2007-5-A6 | | | 6.00% | | | | 06/25/2037 | | | | 5,046,710 | |

| |

| | | | Wells Fargo Alternative Loan Trust, | |

| | 1,726,977 | | | Series 2007-PA3-1A4 | | | 5.75% | | | | 07/25/2037 | | | | 1,571,882 | |

| |

| | | | Wells Fargo Mortgage Backed Securities Trust, | |

| | 3,079,572 | | | Series 2006-AR4-2A1 | | | 3.34% | # | | | 04/25/2036 | | | | 2,834,065 | |

| | 11,710,912 | | | Series 2007-11-A96 | | | 6.00% | | | | 08/25/2037 | | | | 11,581,609 | |

| | 972,330 | | | Series 2007-13-A2 | | | 6.25% | | | | 09/25/2037 | | | | 989,092 | |

| | 1,520,420 | | | Series 2007-3-1A4 | | | 6.00% | | | | 04/25/2037 | | | | 1,521,382 | |

| | | | | | | | | | | | | | | | |

| | | | Total Non-Agency Residential Collateralized Mortgage Obligations

(Cost $456,684,341) | | | | 443,377,549 | |

| | | | | | | | | | | | | | | | |

| | US GOVERNMENT / AGENCY MORTGAGE BACKED OBLIGATIONS 0.1% | |

| |

| | | | Federal Home Loan Mortgage Corporation, | |

| | 346,733 | | | Series 2016-KF22-B | | | 5.83% | #^ | | | 07/25/2023 | | | | 349,920 | |

| | | | | | | | | | | | | | | | |

| | | | Total US Government / Agency Mortgage Backed Obligations

(Cost $346,733) | | | | 349,920 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $/

SHARES | | | SECURITY DESCRIPTION | | RATE | | | MATURITY | | | VALUE $ | |

| | SHORT TERM INVESTMENTS 1.3% | |

| | 2,133,252 | | | BlackRock Liquidity Funds FedFund - Institutional Shares | | | 0.60% | ¨ | | | | | | | 2,133,252 | |

| | 2,133,253 | | | Fidelity Institutional Money Market Government Portfolio - Class I | | | 0.56% | ¨ | | | | | | | 2,133,253 | |

| | 2,133,252 | | | Morgan Stanley Institutional Liquidity Funds Government Portfolio - Institutional Share Class | | | 0.60% | ¨ | | | | | | | 2,133,252 | |

| | | | | | | | | | | | | | | | |

| | | | Total Short Term Investments

(Cost $6,399,757) | | | | 6,399,757 | |

| | | | | | | | | | | | | | | | |

| | | | Total Investments 100.4%

(Cost $492,463,687) | | | | 478,770,894 | |

| | | | Liabilities in Excess of Other Assets (0.4)% | | | | (2,031,569 | ) |

| | | | | | | | | | | | | | | | |

| | | | NET ASSETS 100.0% | | | $ | 476,739,325 | |

| | | | | | | | | | | | | | | | |

| | | | |

| SECURITY TYPE BREAKDOWN as a % of Net Assets: | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | 93.0% | |

Non-Agency Commercial Mortgage Backed Obligations | | | 4.1% | |

Short Term Investments | | | 1.3% | |

Asset Backed Obligations | | | 1.3% | |

Collateralized Loan Obligations | | | 0.6% | |

US Government / Agency Mortgage Backed Obligations | | | 0.1% | |

Other Assets and Liabilities | | | (0.4)% | |

| | | | |

| | | 100.0% | |

| | | | |

| # | Variable rate security. Rate disclosed as of March 31, 2017. |

| ^ | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. These securities are determined to be liquid by the Adviser, unless otherwise noted, under procedures established by the Fund's Board of Trustees. At March 31, 2017, the value of these securities amounted to $93,204,230 or 19.6% of net assets. |

| I/O | Interest only security |

| I/F | Inverse floating rate security whose interest rate moves in the opposite direction of reference interest rates |

| ¨ | Seven-day yield as of March 31, 2017 |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2017 | | 11 |

| | |

| Statement of Assets and Liabilities | | March 31, 2017 |

| | | | |

| |

ASSETS | | | | |

Investments in Securities, at Value* | | $ | 472,371,137 | |

Short Term Investments* | | | 6,399,757 | |

Interest and Dividends Receivable | | | 1,991,176 | |

Receivable for Investments Sold | | | 40,049 | |

Total Assets | | | 480,802,119 | |

| |

LIABILITIES | | | | |

Distribution Payable | | | 3,847,046 | |

Payable for Investments Purchased | | | 120,071 | |

Professional Fees Payable | | | 32,706 | |

Administration, Fund Accounting and Custodian Fees Payable | | | 24,630 | |

Investment Advisory Fees Payable | | | 12,327 | |

Transfer Agent Expenses Payable | | | 10,589 | |

Accrued Expenses | | | 6,791 | |

Registration Fees Payable | | | 5,113 | |

Shareholder Reporting Expenses Payable | | | 3,521 | |

Total Liabilities | | | 4,062,794 | |

Net Assets | | $ | 476,739,325 | |

| |

NET ASSETS CONSIST OF: | | | | |

Paid-in Capital | | $ | 506,150,000 | |

Undistributed (Accumulated) Net Investment Income (Loss) (See Note 5) | | | 361,468 | |

Accumulated Net Realized Gain (Loss) on Investments | | | (16,079,350 | ) |

Net Unrealized Appreciation (Depreciation) on Investments | | | (13,692,793 | ) |

Net Assets | | $ | 476,739,325 | |

| |

*Identified Cost: | | | | |

Investments in Securities | | $ | 486,063,930 | |

Short Term Investments | | | 6,399,757 | |

| |

Class I (unlimited shares authorized): | | | | |

Shares Outstanding | | | 52,137,983 | |

Net Asset Value, Offering and Redemption Price per Share | | $ | 9.14 | |

| | | | | | |

| 12 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| | |

| Statement of Operations | | For the Year Ended March 31, 2017 |

| | | | |

| |

INVESTMENT INCOME | | | | |

Income: | | | | |

Interest | | $ | 26,695,972 | |

Total Investment Income | | | 26,695,972 | |

Expenses: | | | | |

Investment Advisory Fees | | | 2,078,859 | |

Professional Fees | | | 110,198 | |

Administration, Fund Accounting and Custodian Fees | | | 85,978 | |

Transfer Agent Expenses | | | 30,934 | |

Miscellaneous Expenses | | | 13,278 | |

Shareholder Reporting Expenses | | | 12,906 | |

Insurance Expenses | | | 6,479 | |

Registration Fees | | | 6,099 | |

Trustees Fees | | | 3,400 | |

Total Expenses | | | 2,348,131 | |

Less: Investment Advisory Fees (Waived) | | | (2,078,859 | ) |

Less: Other Fees (Reimbursed)/Recouped | | | 10,357 | |

Net Expenses | | | 279,629 | |

| |

Net Investment Income (Loss) | | | 26,416,343 | |

| |

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

Net Realized Gain (Loss) on Investments | | | 4,910,464 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (640,456 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | | 4,270,008 | |

| |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 30,686,351 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2017 | | 13 |

| | |

| Statements of Changes in Net Assets | | March 31, 2017 |

| | | | | | | | |

| | | Year Ended

March 31, 2017 | | | Year Ended

March 31, 2016 | |

| | |

OPERATIONS | | | | | | | | |

Net Investment Income (Loss) | | $ | 26,416,343 | | | $ | 16,914,320 | |

Net Realized Gain (Loss) on Investments | | | 4,910,464 | | | | (148,902 | ) |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (640,456 | ) | | | (12,529,647 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 30,686,351 | | | | 4,235,771 | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From Net Investment Income | | | (37,057,498 | ) | | | (25,323,663 | ) |

| | |

Total Distributions to Shareholders | | | (37,057,498 | ) | | | (25,323,663 | ) |

| | |

NET SHARE TRANSACTIONS | | | | | | | | |

Increase (Decrease) in Net Assets Resulting from Net Share Transactions | | | 217,000,000 | | | | 20,100,000 | |

| | |

Total Increase (Decrease) in Net Assets | | $ | 210,628,853 | | | $ | (987,892 | ) |

| | |

NET ASSETS | | | | | | | | |

Beginning of Period | | $ | 266,110,472 | | | $ | 267,098,364 | |

End of Period | | $ | 476,739,325 | | | $ | 266,110,472 | |

| | |

Undistributed (Accumulated) Net Investment Income (Loss) (See Note 5) | | $ | 361,468 | | | $ | 84,674 | |

| | | | | | |

| 14 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| | |

| Financial Highlights | | March 31, 2017 |

| | | | | | | | | | | | |

| | | Year Ended

March 31, 2017 | | | Year Ended

March 31, 2016 | | | Period Ended

March 31, 20151 | |

| | | |

Net Asset Value, Beginning of Period | | $ | 9.26 | | | $ | 10.02 | | | $ | 10.00 | |

| | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | |

Net Investment Income (Loss)4 | | | 0.65 | | | | 0.61 | | | | 0.46 | |

Net Gain (Loss) on Investments (Realized and Unrealized) | | | 0.12 | | | | (0.45 | ) | | | 0.01 | |

Total from Investment Operations | | | 0.77 | | | | 0.16 | | | | 0.47 | |

| | | |

Less Distributions: | | | | | | | | | | | | |

Distributions from Net Investment Income | | | (0.89 | ) | | | (0.92 | ) | | | (0.45 | ) |

Total Distributions | | | (0.89 | ) | | | (0.92 | ) | | | (0.45 | ) |

Net Asset Value, End of Period | | $ | 9.14 | | | $ | 9.26 | | | $ | 10.02 | |

Total Return | | | 8.69% | | | | 1.56% | | | | 4.79% | 2 |

| | | |

Supplemental Data: | | | | | | | | | | | | |

Net Assets, End of Period (000's) | | $ | 476,739 | | | $ | 266,110 | | | $ | 267,098 | |

Ratios to Average Net Assets: | | | | | | | | | | | | |

Expenses Before Investment Advisory Fees (Waived) and Other Fees (Reimbursed)/Recouped | | | 0.62% | | | | 0.64% | | | | 0.84% | 3 |

Expenses After Investment Advisory Fees (Waived) (See Note 3) | | | 0.07% | | | | 0.09% | | | | 0.38% | 3 |

Expenses After Investment Advisory Fees (Waived) and Other Fees (Reimbursed)/Recouped | | | 0.07% | | | | 0.09% | | | | 0.18% | 3 |

Net Investment Income (Loss) | | | 6.99% | | | | 6.28% | | | | 7.00% | 3 |

Portfolio Turnover Rate | | | 20% | | | | 16% | | | | 6% | 2 |

| 1 | Commencement of operations on August 4, 2014. |

| 4 | Calculated based on average shares outstanding during the period. |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2017 | | 15 |

| | |

| Notes to Financial Statements | | |

1. Organization

The Fund is a separate investment series of DoubleLine Funds Trust (the “Trust”). The Fund commenced operations on August 4, 2014. Shares of the Fund may currently be purchased in transactions by the Adviser or its affiliates acting in their capacity as investment adviser (or in a similar capacity) for clients, including separately managed private accounts, investment companies registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and other funds, each of which must be “accredited investors” as defined in Regulation D under the Securities Act. The Fund also may permit purchases of shares by (i) qualified employees, officers and Trustees of the Fund and their qualified family members; (ii) qualified employees and officers of the Adviser or DoubleLine Group LP and their qualified family members; (iii) qualified affiliates of the Adviser or DoubleLine Group LP; and (iv) other qualified accounts. The Fund’s investment objective is to seek long-term total return.

2. Significant Accounting Policies

The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946, “Financial Services—Investment Companies”, by the Financial Accounting Standards Board (“FASB”). The following is a summary of the significant accounting policies of the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“US GAAP”).

A. Security Valuation. The Fund has adopted US GAAP fair value accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | • | | Level 1—Unadjusted quoted market prices in active markets for identical securities |

| | • | | Level 2—Quoted prices for identical or similar assets in markets that are not active, or inputs derived from observable market data |

| | • | | Level 3—Significant unobservable inputs (including the reporting entity’s estimates and assumptions) |

Assets and liabilities may be transferred between levels. The Fund uses end of period timing recognition to account for any transfers.

Market values for domestic and foreign fixed income securities are normally determined on the basis of valuations provided by independent pricing services. Vendors typically value such securities based on one or more inputs described in the following table which is not intended to be a complete list. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed income securities in which the Fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income securities. Securities that use similar valuation techniques and inputs as described in the following table are categorized as Level 2 of the fair value hierarchy. To the extent the significant inputs are unobservable, the values generally would be categorized as Level 3.

| | | | | | |

| Fixed-income class | | | | | Examples of Inputs |

All | | | | | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

Corporate bonds and notes; convertible securities | | | | | | Standard inputs and underlying equity of the issuer |

US bonds and notes of government and government agencies | | | | | | Standard inputs |

Residential and commercial mortgage-backed obligations; asset-backed obligations (including collateralized loan obligations) | | | | | | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information, trustee reports |

Investments in registered open-end management investment companies will be valued based upon the net asset value (“NAV”) of such investments and are categorized as Level 1 of the fair value hierarchy. Investments in private investment funds typically will be valued based upon the NAVs of such investments and are categorized as Level 2 of the fair value hierarchy. As of March 31, 2017, the Fund did not hold any investments in private investment funds.

| | | | | | |

| 16 | | DoubleLine Selective Credit Fund | | | | |

Securities may be fair valued in accordance with the fair valuation procedures approved by the Board of Trustees (the “Board”). The valuation committee is generally responsible for overseeing the day to day valuation processes and reports periodically to the Board. The valuation committee and the pricing group are authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are deemed to be unreliable indicators of market or fair value.

The following is a summary of the fair valuations according to the inputs used to value the Fund's investments as of March 31, 20171:

| | | | | | | | |

| Category | | | | | | |

Investments in Securities | | | | | | | | |

Level 1 | | | | | | | | |

Money Market Funds | | | | | | $ | 6,399,757 | |

Total Level 1 | | | | | | | 6,399,757 | |

Level 2 | | | | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | | 437,990,921 | |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | 19,206,826 | |

Asset Backed Obligations | | | | | | | 6,182,322 | |

Collateralized Loan Obligations | | | | | | | 2,973,117 | |

US Government / Agency Mortgage Backed Obligations | | | | | | | 349,920 | |

Total Level 2 | | | | | | | 466,703,106 | |

Level 3 | | | | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | | 5,386,628 | |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | 281,403 | |

Total Level 3 | | | | | | | 5,668,031 | |

Total | | | | | | $ | 478,770,894 | |

See the Schedule of Investments for further disaggregation of investment categories.

| 1 | There were no transfers into or out of Levels 1, 2 or 3 during the year ended March 31, 2017. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Balance as of

3/31/2016 | | | Net Realized

Gain (Loss) | | | Net Change in

Unrealized

Appreciation

(Depreciation)3 | | | Net Accretion

(Amortization) | | | Purchases1 | | | Sales2 | | | Transfers Into

Level 3 | | | Transfers Out

of Level 3 | | | Balance as of

3/31/2017 | | | Net Change in

Unrealized

Appreciation

(Depreciation)

on securities

held at

3/31/20173 | |

Investments in Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | $ | 5,645,257 | | | $ | 126,927 | | | $ | 440,077 | | | $ | 171,416 | | | $ | 172 | | | $ | (997,221 | ) | | $ | — | | | $ | — | | | $ | 5,386,628 | | | $ | 440,077 | |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | — | | | | — | | | | 5,839 | | | | 4,304 | | | | 271,260 | | | | — | | | | — | | | | — | | | | 281,403 | | | | — | |

Total | | | | | | $ | 5,645,257 | | | $ | 126,927 | | | $ | 445,916 | | | $ | 175,720 | | | $ | 271,432 | | | $ | (997,221 | ) | | $ | — | | | $ | — | | | $ | 5,668,031 | | | $ | 440,077 | |

| 1 | Purchases include all purchases of securities and payups. |

| 2 | Sales include all sales of securities, maturities, and paydowns. |

| 3 | Any difference between net change in unrealized appreciation (depreciation) and net change in unrealized appreciation (depreciation) on securities held at March 31, 2017 may be due to a security that was not held or categorized as Level 3 at either period end. |

The following is a summary of quantitative information about Level 3 Fair Value Measurements:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Fair Value as of

3/31/2017 * | | | Valuation

Techniques | | | Unobservable

Input | | Input Values | | | Impact to valuation from an increase to input |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | $ | 5,386,628 | | |

| Market

Comparables |

| | Market

Quotes | | $ | 82.20 - $108.19 | | | Significant changes in the market quotes would result in direct and proportional changes in the fair value of the security |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | 281,403 | | |

| Market

Comparables |

| | Yields | | | 12.86% | | | Increase in the yields would result in the decrease in the fair value of the security |

| * | Level 3 securities are typically valued by pricing vendors. The appropriateness of fair values for these securities is monitored on an ongoing basis by the Adviser, which may include back testing, results of vendor due diligence, unchanged price review and consideration of market and/or sector events. |

| | | | | | |

| | Annual Report | | March 31, 2017 | | 17 |

| | |

| Notes to Financial Statements (Cont.) | | March 31, 2017 |

B. Federal Income Taxes. The Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income taxes has been made.

The Fund may be subject to a nondeductible 4% excise tax calculated as a percentage of certain undistributed amounts of net investment income and net capital gains.

The Fund has adopted financial reporting rules that require the Fund to analyze all open tax years, as defined by the applicable statute of limitations, for all major jurisdictions. Open tax years, 2016, 2015 and 2014 for the Fund, are those that are open for exam by taxing authorities. As of March 31, 2017, the Fund has no examination in progress.

Management has analyzed the Fund’s tax position, and has concluded that no liability should be recorded related to uncertain tax positions expected to be taken on the tax return for the fiscal year-ended March 31, 2017. The Fund identifies its major tax jurisdiction as U.S. Federal, the State of Delaware and the State of California. The Fund is not aware of any tax position for which it is reasonably possible that the total amount of unrecognized tax benefits will significantly change in the next twelve months.

C. Security Transactions, Investment Income. Investment securities transactions are accounted for on trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Interest income is recorded on an accrual basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method except for certain deep discount bonds where management does not expect the par value above the bond’s cost to be fully realized. Dividend income and corporate action transactions, if any, are recorded on the ex-date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of securities received. Paydown gains and losses on mortgage-related and other asset-backed securities are recorded as components of interest income on the Statement of Operations.

D. Dividends and Distributions to Shareholders. Dividends from net investment income will be declared and paid monthly. The Fund will distribute any net realized long or short-term capital gains at least annually. Distributions are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from US GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications between paid-in capital, undistributed (accumulated) net investment income (loss), and/or undistributed (accumulated) realized gain (loss). Undistributed (accumulated) net investment income or loss may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or capital gain remaining at fiscal year end is distributed in the following year.

Distributions from investment companies will be classified as investment income or realized gains in the Statement of Operations based on the U.S. income tax characteristics of the distribution if such information is available. In cases where the tax characteristics are not available, such distributions are generally classified as investment income.

E. Use of Estimates. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

F. Share Valuation. The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding, rounded to the nearest cent. The Fund’s NAV is calculated on days when the New York Stock Exchange opens for regular trading (except that the Fund does not calculate its NAV on holidays when the principal U.S. bond markets are closed, such as Columbus Day and Veterans Day).

G. Guarantees and Indemnifications. Under the Fund’s organizational documents, each Trustee and officer of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts.

| | | | | | |

| 18 | | DoubleLine Selective Credit Fund | | | | |

3. Related and Other Party Transactions

DoubleLine Capital LP (the “Adviser”) provides the Fund with investment management services under an Investment Management Agreement (the “Agreement”). Under the Agreement, the Adviser manages the investment of the assets of the Fund, places orders for the purchase and sale of its portfolio securities and is responsible for providing certain resources to assist with the day-to-day management of the Fund’s business affairs. As compensation for its services, the Adviser is entitled to a monthly fee at the annual rate of 0.55% of the average daily net assets of the Fund. The Adviser has arrangements with DoubleLine Group LP to provide personnel and other resources to the Fund.

Pursuant to a letter agreement dated November 20, 2014 between the Adviser and the Trust, on behalf of the Fund (the “Letter Agreement”), the Adviser has agreed to waive the entire investment advisory fee it is entitled to receive pursuant to the Advisory Agreement effective as of December 1, 2014. Such waiver shall continue until terminated (1) by the Adviser upon 60 days’ notice to the Board or (2) immediately upon the approval of a majority vote of the Trustees of the Trust who are not “interested persons” of the Trust, as defined under the 1940 Act. The Adviser may not seek reimbursement from the Fund with respect to any advisory fees waived to comply with the terms of the Letter Agreement. Under the Letter Agreement, for the year ended March 31, 2017, the Adviser waived $2,078,859 of its investment advisory fee.

In addition, pursuant to an Expense Limitation Agreement between Trust, on behalf of the Fund, and the Adviser (the “Expense Limitation Agreement”), the Adviser has agreed to waive its investment advisory fee and to reimburse other ordinary operating expenses of the Fund to the extent necessary to limit the ordinary operating expenses to an amount not to exceed 0.64% for Class I shares. Ordinary operating expenses exclude taxes, commissions, mark-ups, litigation expenses, indemnification expenses, interest expenses, Acquired Fund Fees and Expenses, and any extraordinary expenses. The expense limitations described above are expected to apply until at least March 24, 2018. However, these expense limitations may be terminated by the Fund’s Board at any time.

The Fund’s effective investment advisory fee during the fiscal year ended March 31, 2017 was 0% of net assets.

To the extent that the Adviser waives its investment advisory fee and/or reimburses a Fund for other ordinary operating expenses, it may seek reimbursement of a portion or all of such amounts at any time within three fiscal years after the fiscal year in which such amounts were waived or reimbursed. The Fund must pay its current ordinary operating expenses before the Adviser is entitled to any recoupment. Any such recoupment would be subject to review by the Board and to the Fund’s expense limitations in place when the expenses were reimbursed or the fees were waived.

The Adviser contractually waived a portion of its fees or reimbursed certain operating expenses and may recapture a portion of the amounts no later than the dates as stated in the following table:

| | | | | | | | | | | | | | | | |

| | | | | | March 31, | |

| | | | | | 2018 | | | 2019 | | | 2020 | |

DoubleLine Selective Credit Fund | | | | | | $ | 137,722 | | | $ | 6,212 | | | $ | 1,970 | |

For the year ended March 31, 2017, the Adviser recouped $12,327.

4. Purchases and Sales of Securities

For the year ended March 31, 2017, purchases and sales of investments, excluding short term investments, were $271,735,911 and $75,172,926, respectively. There were no transactions in U.S. Government securities (defined as long-term U.S. Treasury bills, bonds and notes) during the year.

5. Income Tax Information and Distributions to Shareholders

The tax character of distributions for the Fund was as follows:

| | | | | | | | | | | | |

| | | | | | Year Ended

March 31, 2017 | | | Year Ended

March 31, 2016 | |

Distributions Paid From: | | | | | | | | | | | | |

Ordinary Income | | | | | | $ | 37,057,498 | | | $ | 25,323,663 | |

Total Distributions Paid | | | | | | $ | 37,057,498 | | | $ | 25,323,663 | |

| | | | | | |

| | Annual Report | | March 31, 2017 | | 19 |

| | |

| Notes to Financial Statements (Cont.) | | March 31, 2017 |

The cost basis of investments for federal income tax purposes as of March 31, 2017, was as follows:

| | | | | | | | |

Tax Cost of Investments | | | | | | $ | 492,463,687 | |

Gross Tax Unrealized Appreciation | | | | | | | 4,637,830 | |

Gross Tax Unrealized Depreciation | | | | | | | (18,330,623 | ) |

Net Tax Unrealized Appreciation (Depreciation) | | | | | | $ | (13,692,793 | ) |

As of March 31, 2017, the components of accumulated earnings (losses) for income tax purposes were as follows:

| | | | | | | | |

Net Tax Unrealized Appreciation (Depreciation) | | | | | | $ | (13,692,793 | ) |

Undistributed Ordinary Income | | | | | | | 4,210,091 | |

Undistributed Long Term Capital Gains | | | | | | | — | |

Total Distributable Earnings | | | | | | | 4,210,091 | |

Other Accumulated Gains (Losses) | | | | | | | (19,927,973 | ) |

Total Accumulated Earnings (Losses) | | | | | | $ | (29,410,675 | ) |

As of March 31, 2017, the Fund had $16,079,350 available for a capital loss carryforward. This amount does not expire.

As of March 31, 2017, the Fund did not have any late year losses or post-October losses.

Additionally, US GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent differences primarily relate to paydown losses. For the year ended March 31, 2017, the following table shows the reclassifications made:

| | | | | | | | | | | | | | | | |

| | | | | | Undistributed

(Accumulated)

Net

Investment

Income(Loss) | | | Accumulated

Net Realized

Gain(Loss) | | | Paid-In

Capital | |

DoubleLine Selective Credit Fund | | | | | | $ | 10,917,949 | | | $ | (10,917,949 | ) | | $ | — | |

6. Share Transactions

Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended

March 31, 2017 | | | Year Ended

March 31, 2016 | |

| | | | | | Shares | | | Amount | | | Shares | | | Amount | |

Shares Sold | | | | | | | 23,628,323 | | | $ | 219,000,000 | | | | 3,194,138 | | | $ | 31,100,000 | |

Shares Redeemed | | | | | | | (217,155 | ) | | | (2,000,000 | ) | | | (1,122,028 | ) | | | (11,000,000 | ) |

Increase (Decrease) in Net Assets Resulting from Net Share Transactions | | | | | | | 23,411,168 | | | $ | 217,000,000 | | | | 2,072,110 | | | $ | 20,100,000 | |

7. Trustees Fees

Trustees who are not affiliated with the Adviser and its affiliates received, as a group, fees of $3,400 from the Fund during the year ended March 31, 2017. These trustees may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the Fund, are treated as if invested in shares of the Fund or other funds managed by the Adviser and its affiliates. These amounts represent general, unsecured liabilities of the Fund and vary according to the total returns of the selected funds. Trustees Fees in the Statement of Operations are shown as $3,400, which includes $3,186 in current fees (either paid in cash or deferred) and an increase of $214 in the value of the deferred amounts. Certain trustees and officers of the Fund are also officers of the Adviser; such trustees and officers are not compensated by the Fund.

| | | | | | |

| 20 | | DoubleLine Selective Credit Fund | | | | |

8. Credit Facility

U.S. Bank, N.A. (the “Bank”) has made available to the Trust (the “DoubleLine Funds”) an uncommitted, $600,000,000 credit facility for short term liquidity in connection with shareholder redemptions. Under the terms of the credit facility, borrowings for each DoubleLine Fund are limited to one-third of the total assets (including the amount borrowed) of such DoubleLine Fund. Fifty percent of the credit facility is available to all of the DoubleLine Funds, on a first come, first served basis. The remaining 50% of the credit facility is allocated among the DoubleLine Funds in accordance with procedures adopted by the Board. Borrowings under this credit facility bear interest at the Bank’s prime rate less 0.50% (weighted average rate of 3.07% for the year ended March 31, 2017).

For the year ended March 31, 2017, the Fund’s credit facility activity is as follows:

| | | | | | | | | | | | | | | | |

| | | | | | Average

Borrowings | | | Maximum

Amount

Outstanding | | | Interest Expense | |

DoubleLine Selective Credit Fund | | | | | | $ | 1,960,000 | | | $ | 7,954,000 | | | $ | 872 | |

9. Significant Shareholder Holdings

As of March 31, 2017, the Fund has nine shareholders of record; three of the Fund’s shareholders, two of which were under common control with each other, collectively owned 52% of the total outstanding shares of the Fund. Each shareholder is an institutional separate account over which the Adviser has investment discretion. See the description of Large Shareholder Risk in the following Principal Risks Note.

10. Principal Risks

Below are summaries of some, but not all, of the principal risks of investing in the Fund, each of which could adversely affect the Fund’s NAV, yield and total return. You should read the Fund’s private placement memorandum carefully for a description of the principal risks associated with investing in the Fund.

| | • | asset allocation risk: the risk that the Fund’s investment performance may depend, at least in part, on how its assets are allocated and reallocated among asset classes, sectors and/or underlying funds and that such allocation will focus on asset classes, sectors, underlying funds, or investments that perform poorly or underperform other asset classes, sectors, underlying funds, or available investments. |

| | • | asset-backed securities investment risk: the risk that borrowers may default on the obligations that underlie the asset-backed security and that, during periods of falling interest rates, asset backed securities may be called or prepaid, which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate, and the risk that the impairment of the value of the collateral underlying a security in which the Fund invests (due, for example, to non-payment of loans) will result in a reduction in the value of the security. |

| | • | cash position risk: to the extent that the Fund holds assets in cash, cash equivalents, and other short-term investments, the ability of the Fund to meet its objective may be limited. |