As filed with the Securities and Exchange Commission on May 30, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22378

DoubleLine Funds Trust

(Exact name of registrant as specified in charter)

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Address of principal executive offices) (Zip code)

Ronald R. Redell

President

DoubleLine Funds Trust

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Name and address of agent for service)

(213) 633-8200

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2018

Item 1. Reports to Stockholders.

Annual Report

March 31, 2018

DoubleLine Selective Credit Fund

DBSCX (I-share)

Shares of the DoubleLine Selective Credit Fund (the “Fund”) may currently be purchased in transactions by DoubleLine Capital LP (the “Adviser”) or its affiliates acting in their capacity as investment adviser (or in a similar capacity) for clients, including separately managed private accounts, investment companies registered under the Investment Company Act of 1940, as amended, and other funds, each of which must be an “accredited investor” as defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). The Fund also may permit purchases of shares by (i) qualified employees, officers and Trustees of the Fund and their qualified family members; (ii) qualified employees and officers of the Adviser or DoubleLine Group LP and their qualified family members; (iii) qualified affiliates of the Adviser or DoubleLine Group LP; and (iv) other qualified accounts.

| | |

| DoubleLine Capital LP | | 333 S. Grand Avenue 18th Floor Los Angeles, California 90071 doubleline.com |

| | | | | | |

| | Annual Report | | March 31, 2018 | | 3 |

| | |

| President’s Letter | | (Unaudited) March 31, 2018 |

Dear DoubleLine Funds Shareholder,

On behalf of the DoubleLine Selective Credit Fund (DBSCX, the “Fund”), I am pleased to deliver this Annual Report for the 12-month period ended March 31, 2018. On the following pages, you will find specific information regarding the Fund’s operations and holdings. In addition, we discuss the Fund’s investment performance and the main drivers of that performance during the reporting period.

If you have any questions regarding the DoubleLine Funds please don’t hesitate to call us at 877-DLine11 (877-354-6311) or visit our website www.doublelinefunds.com where our investment management team offers deeper insights and analysis on relevant capital market activity impacting investors today. We value the trust that you have placed with us, and we will continue to strive to offer thoughtful investment solutions to our shareholders.

Sincerely,

Ronald R. Redell, CFA

President

DoubleLine Funds Trust

May 1, 2018

| | | | | | |

| 4 | | DoubleLine Selective Credit Fund | | | | |

| | |

| Financial Markets Highlights | | (Unaudited) March 31, 2018 |

| · | | Non-Agency Mortgage-Backed Securities (Non-Agency MBS) |

For the 12-month period ended March 31, 2018, spreads tightened 60 to 90 basis points (bps) across the capital stack. The strong performance of the sector was supported by both technical and fundamental factors. The sector continued to decrease in size as legacy paydowns outpace new issuance volumes. Representations and warranties settlements have also been catalysts for tightening within the sector. Home prices rose across the country with the latest S&P CoreLogic Case-Shiller Home Price Index up 6.2% annually. New issuance volumes were primarily composed of non-performing and re-performing loan transactions, Agency credit risk transfer deals and securities backed by prime collateral (Jumbo 2.0 securities). Non-qualifying mortgages saw the largest percentage increase during the period as lenders looked for innovative ways to increase origination volumes during this strong housing cycle.

| · | | Commercial Mortgage-Backed Securities (CMBS) |

For the 12-month period ended March 31, 2018, new issue CMBS spreads tightened alongside broader credit and equity indices. While 2017 saw meaningful spread tightening due to the post-election, risk on sentiment, the first quarter of 2018 saw increased volatility as rates moved higher. Despite a meaningful pullback in foreign investment and transaction volume through 2017, the Moody’s/RCA Commercial Property Price Index (CPPI) increased by 8% on the national level, 9% in major markets and 7% in non-major markets. While Retail sector concern grew rampant throughout 2017 amongst store closures and bankruptcies, Retail CPPI increased by 2.8% for the reporting period. The Bloomberg Barclays U.S. CMBS Index ERISA Eligible Total Return Value returned 1.12%, underperforming the broader Bloomberg Barclays U.S. Aggregate Bond Index return of 1.20%. For the period, 10-year AAA last cash flows (LCF) tightened by 12 bps to 82 bps over swaps, while BBB- bonds tightened by 110 bps to 330 bps over swaps. On the new issue front, $90.4 billion priced during the 12-month reporting period as compared to $60.8 billion from April 2016 through March 2017. Single-asset single-borrower (SASB) deals were up about 154% and continued to be the driver of new issuance, as compared to conduit deals which were up about 9%. Due to broad market consensus for a rising rate environment, there is continual demand for short-duration, floating-rate investments, which is one of the reasons for the robust issuance of SASB over conduit CMBS. The Trepp CMBS Delinquency Rate for U.S. Commercial Real Estate loans has fallen in nine of the last 12 months and is now 4.55%, 82 bps lower year-over-year.

| · | | Collateralized Loan Obligations (CLOs) |

For the 12-month period ended March 31, 2018, total CLO issuance was $132.77 billion with an average monthly issuance of $11.06 billion. February 2018 was the highest monthly issuance for the last 36 months ending March 31, 2018. Spreads across the capital stack tightened to post-crisis tights. Over the past 12-months, London Interbank Offered Rate (LIBOR) has risen by 115 bps. In February 2018, the United States Court of Appeals for the District of Columbia ruled that qualifying CLO managers are not subject to the risk retention requirements of the Dodd-Frank Act. Prior to this decision, the market was expecting these risk retention requirements to be in place permanently and managers had created solutions to address them. Deals issued prior to February 2018 were generally designed to be risk retention compliant. The court’s decision appears to have allowed managers that had struggled with risk retention compliance to reenter the market.

| | | | | | |

| | Annual Report | | March 31, 2018 | | 5 |

| | |

| Management’s Discussion of Fund Performance | | (Unaudited) March 31, 2018 |

DoubleLine Selective Credit Fund

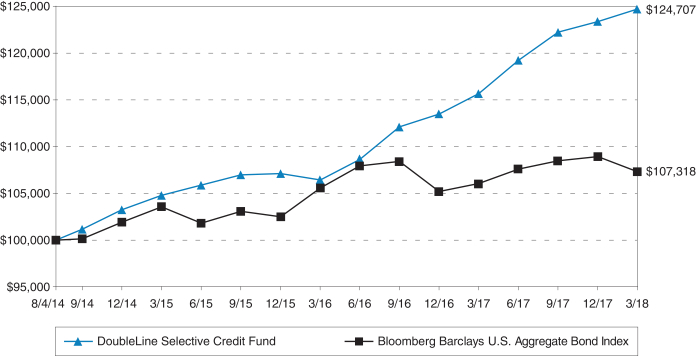

For the 12-month period ended March 31, 2018, the DoubleLine Selective Credit Fund outperformed the Bloomberg Barclays U.S. Aggregate Bond Index return of 1.20%. The U.S. Treasury (UST) curve flattened during this time with the 2-year and 10-year yields up 101 bps and 35 bps, respectively. The outperformance was primarily due to sector allocation. Spreads tightened across credit-sensitive assets, particularly in lower rated securities like High Yield corporate credit and non-rated structured assets; however, it is worth noting that the Index’s primary credit exposure is in Investment Grade, or higher rated bonds. The Index has no exposure to non-Agency MBS or CLOs, which were the best performing sectors within the Fund. Non-Agency MBS spreads tightened 60 to 90 bps across the capital stack during this period. CMBS underperformed as prices declined; however, total return was positive due to interest income. Interest-only MBS were the largest detractors from performance as prices declined due to their longer duration.

| | | | | | | | | | |

| Period Ended 3-31-18 | | | | 1-Year |

I-Share | | | | | | | | | 7.81% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | | | | | 1.20% | |

For additional performance information, please refer to the “Standardized Performance Summary.”

Past Performance is not a guarantee of future results.

Opinions expressed herein are as of March 31, 2018 and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Fund. It may also be used as sales literature when preceded or accompanied by the current private placement memorandum.

The performance shown assumes the reinvestment of all dividends and distributions and does not reflect any reductions for taxes. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Since the Fund is currently offered only to a limited number of investors, as described in the private placement memorandum, the Fund’s assets may grow at a slower rate than if the Fund engaged in a broader public offering. As a result, the Fund may incur operating expenses as a percentage of net assets at a rate higher than mutual funds that are larger or more broadly offered. In addition, the Fund’s assets may not achieve a size sufficient to make the Fund economically viable. A liquidation of the Fund may result in a sale of assets of the Fund at an unfavorable time or at prices below those at which the Fund has valued them.

Investing involves risk. Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities.

Investments in Asset-Backed and Mortgage-Backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Exchange-traded fund investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares.

Additional principal risks for the Fund can be found in the private placement memorandum.

Diversification does not assure a profit or protect against loss in a declining market.

Credit ratings from Moody’s Investor Services, Inc. (“Moody’s”) range from the highest rating of Aaa for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of C for the lowest rated class of bonds. Credit ratings from S&P Global Ratings (“S&P”) range from the highest rating of AAA for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of D for bonds that are in default. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as nonrated.

Credit ratings are determined by the highest available credit rating from any Nationally Recognized Statistical Rating Organization (“NRSRO”, generally S&P, Moody’s and Fitch Ratings, Inc.). DoubleLine chooses to display credit ratings using S&P’s rating convention, although the rating itself might be sourced from another NRSRO.

Basis Point—A unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument.

Bloomberg Barclays U.S. Aggregate Bond Index—This index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

Bloomberg Barclays U.S. CMBS Index ERISA Eligible Total Return Value—This index measures the performance of investment grade commercial mortgage-backed securities, which are classes of securities that represent interests in pools of commercial mortgages, and includes only ERISA-eligible CMBS.

Duration—A measure of the sensitivity of a price of a fixed income investment to a change in interest rates, expressed as a number of years.

Investment Grade (IG)—Securities rated AAA to BBB- are considered to be investment grade. A bond is considered investment grade if its credit rating is BBB- or higher by Standard & Poor’s or Baa3 by Moody’s. Ratings based on corporate bond model. The higher the rating, the more likely the bond is to pay back at par/$100 cents on the dollar. AAA is considered the highest quality and the lowest degree of risk. They are considered to be extremely stable and dependable.

Last Cash Flow (LCF)—The last revenue stream paid to a bond over a given period.

| | | | | | |

| 6 | | DoubleLine Selective Credit Fund | | | | |

| | |

| | | (Unaudited) March 31, 2018 |

London Interbank Offered Rate (LIBOR)—An indicative average interest rate at which a selection of banks known as the panel banks are prepared to lend one another unsecured funds on the London money market.

Moody’s/RCA Commercial Property Price Index (CPPI)—A time series of unleveraged U.S. commercial property values that captures the prices at which commercial real estate transactions are currently being negotiated and contracted.

S&P CoreLogic Case-Shiller Home Price Index—A set of 2 indices, one comprised of price changes within all 20 metropolitan markets, and another comprised of price changes within a subset of 10 metropolitan markets.

Spread—The difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another. The higher the yield spread, the greater the difference between the yields offered by each instrument. The spread can be measured between debt instruments of differing maturities, credit ratings and risk.

A direct investment cannot be made in an index. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments.

DoubleLine® is a registered trademark of DoubleLine Capital LP.

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a Fund and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein.

DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available.

Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. Past performance is no guarantee of future results.

Quasar Distributors, LLC provides filing administration for the DoubleLine Selective Credit Fund.

| | | | | | |

| | Annual Report | | March 31, 2018 | | 7 |

| | |

| Standardized Performance Summary | | (Unaudited) March 31, 2018 |

| | | | | | | | | | | | | | | |

| DBSCX | | | | | | |

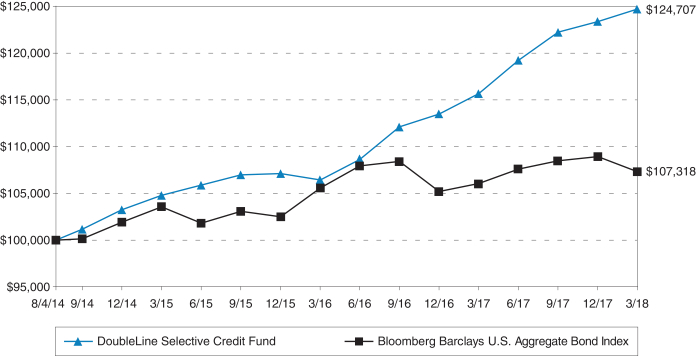

DoubleLine Selective Credit Fund Returns as of March 31, 2018 | | 1-Year | | 3-Year

Annualized | | Since Inception

Annualized

(8-4-14 to 3-31-18) |

I-share (DBSCX) | | | | 7.81% | | | | | 5.97% | | | | | 6.23% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | 1.20% | | | | | 1.20% | | | | | 1.95% | |

The performance information shown assumes the reinvestment of all dividends and distributions. Performance reflects management fees and other fund expenses. Returns over 1 year are average annual returns. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (213) 633-8200.

| | | | | | |

| 8 | | DoubleLine Selective Credit Fund | | | | |

| | |

| Schedule of Investments DoubleLine Selective Credit Fund | | March 31, 2018 |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| | | ASSET BACKED OBLIGATIONS 0.0% | |

| |

| | | | | | MarketPlace Loan Trust, | |

| | | 54,467 | | | Series 2015-CB1-A | | | | 4.00% | ^ | | | | 07/15/2021 | | | | | 54,454 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Total Asset Backed Obligations

(Cost $54,466) | | | | | 54,454 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | COLLATERALIZED LOAN OBLIGATIONS 1.4% | |

| |

| | | | | | Apidos Ltd., | |

| | | 1,000,000 | | | Series 2014-18A-D (3 Month LIBOR USD + 5.20%) | | | | 6.94% | ^ | | | | 07/22/2026 | | | | | 1,000,857 | |

| |

| | | | | | Babson Ltd., | |

| | | 250,000 | | | Series 2014-3A-E2 (3 Month LIBOR USD + 6.50%) | | | | 8.22% | ^ | | | | 01/15/2026 | | | | | 250,000 | |

| | | 1,000,000 | | | Series 2015-2A-ER (3 Month LIBOR USD + 6.45%) | | | | 8.19% | ^ | | | | 10/20/2030 | | | | | 1,026,022 | |

| |

| | | | | | Barings Ltd., | |

| | | 500,000 | | | Series 2017-1A-E (3 Month LIBOR USD + 6.00%) | | | | 7.73% | ^ | | | | 07/18/2029 | | | | | 505,735 | |

| |

| | | | | | Canyon Capital Ltd., | |

| | | 500,000 | | | Series 2016-2A-E (3 Month LIBOR USD + 6.75%) | | | | 8.47% | ^ | | | | 10/15/2028 | | | | | 507,418 | |

| |

| | | | | | Cook Park Ltd., | |

| | | 500,000 | | | Series 2018-1A-E (3 Month LIBOR USD + 5.40%) | | | | 0.00% | ^ | | | | 04/17/2030 | | | | | 492,500 | |

| |

| | | | | | Dryden Senior Loan Fund, | |

| | | 500,000 | | | Series 2015-37A-ER (3 Month LIBOR USD + 5.15%, 5.15% Floor) | | | | 6.87% | ^ | | | | 01/15/2031 | | | | | 491,553 | |

| |

| | | | | | Greenwood Park Ltd., | |

| | | 500,000 | | | Series 2018-1A-E (3 Month LIBOR USD + 4.95%) | | | | 0.00% | ^ | | | | 04/15/2031 | | | | | 499,907 | |

| |

| | | | | | LCM LP, | |

| | | 500,000 | | | Series 26A-E (3 Month LIBOR USD + 5.30%, 5.30% Floor) | | | | 7.23% | ^ | | | | 01/20/2031 | | | | | 496,848 | |

| |

| | | | | | Madison Park Funding Ltd., | |

| | | 250,000 | | | Series 2014-15A-DR (3 Month LIBOR USD + 5.44%) | | | | 7.20% | ^ | | | | 01/27/2026 | | | | | 250,196 | |

| |

| | | | | | Neuberger Berman Loan Advisers Ltd., | |

| | | 500,000 | | | Series 2017-16SA-E (3 Month LIBOR USD + 5.40%) | | | | 7.12% | ^ | | | | 01/15/2028 | | | | | 496,587 | |

| |

| | | | | | Octagon Investment Partners Ltd., | |

| | | 1,000,000 | | | Series 2012-1A-DR (3 Month LIBOR USD + 7.15%) | | | | 8.87% | ^ | | | | 07/15/2029 | | | | | 1,031,163 | |

| | | 500,000 | | | Series 2014-1A-D (3 Month LIBOR USD + 6.60%) | | | | 8.43% | ^ | | | | 11/14/2026 | | | | | 505,731 | |

| |

| | | | | | Voya Ltd., | |

| | | 500,000 | | | Series 2016-4A-E2 (3 Month LIBOR USD + 6.65%) | | | | 8.39% | ^ | | | | 07/20/2029 | | | | | 512,578 | |

| |

| | | | | | Wind River Ltd., | |

| | | 1,000,000 | | | Series 2014-2A-ER (3 Month LIBOR USD + 5.75%, 5.75% Floor) | | | | 7.47% | ^ | | | | 01/15/2031 | | | | | 992,691 | |

| | | 1,000,000 | | | Series 2015-2A-ER (3 Month LIBOR USD + 5.55%) | | | | 7.27% | ^ | | | | 10/15/2027 | | | | | 1,003,464 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Total Collateralized Loan Obligations

(Cost $9,895,837) | | | | | 10,063,250 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| NON-AGENCY COMMERCIAL MORTGAGE BACKED

OBLIGATIONS 2.7% |

|

| |

| | | | | | Atrium Hotel Portfolio Trust, | |

| | | 500,000 | | | Series 2017-ATRM-E (1 Month LIBOR USD + 3.30%) | | | | 4.83% | ^ | | | | 12/15/2036 | | | | | 496,328 | |

| |

| | | | | | Barclays Commercial Mortgage Securities LLC, | |

| | | 282,000 | | | Series 2014-BXO-E (1 Month LIBOR USD + 3.75%, 2.56% Floor) | | | | 5.53% | ^ | | | | 08/15/2027 | | | | | 282,689 | |

| |

| | | | | | BB-UBS Trust, | |

| | | 214,000 | | | Series 2012-TFT-TE | | | | 3.56% | #^ | | | | 06/05/2030 | | | | | 194,379 | |

| |

| | | | | | Bear Stearns Commercial Mortgage Securities, Inc., | |

| | | 500,000 | | | Series 2007-T26-AJ | | | | 5.52% | # | | | | 01/12/2045 | | | | | 473,578 | |

| |

| | | | | | BX Commercial Mortgage Trust, | |

| | | 755,000 | | | Series 2018-BIOA-E (1 Month LIBOR USD + 1.95%, 1.98% Floor) | | | | 3.60% | ^ | | | | 03/15/2037 | | | | | 751,566 | |

| |

| | | | | | BX Trust, | |

| | | 629,000 | | | Series 2017-IMC-E (1 Month LIBOR USD + 3.25%, 3.25% Floor) | | | | 5.03% | ^ | | | | 10/15/2032 | | | | | 632,745 | |

| |

| | | | | | Caesars Palace Las Vegas Trust, | |

| | | 694,000 | | | Series 2017-VICI-D | | | | 4.35% | #^ | | | | 10/15/2034 | | | | | 704,995 | |

| |

| | | | | | CHT Mortgage Trust, | |

| | | 679,000 | | | Series 2017-CSMO-E (1 Month LIBOR USD + 3.00%, 3.00% Floor) | | | | 4.78% | ^ | | | | 11/15/2036 | | | | | 684,511 | |

| | | 362,000 | | | Series 2017-CSMO-F (1 Month LIBOR USD + 3.74%, 3.80% Floor) | | | | 5.52% | ^ | | | | 11/15/2036 | | | | | 365,067 | |

| |

| | | | | | Citigroup Commercial Mortgage Trust, | |

| | | 500,000 | | | Series 2015-GC27-D | | | | 4.43% | #^ | | | | 02/10/2048 | | | | | 426,072 | |

| | | 450,000 | | | Series 2016-GC36-D | | | | 2.85% | ^ | | | | 02/10/2049 | | | | | 346,544 | |

| |

| | | | | | CLNS Trust, | |

| | | 253,000 | | | Series 2017-IKPR-E (1 Month LIBOR USD + 3.50%, 3.50% Floor) | | | | 5.24% | ^ | | | | 06/11/2032 | | | | | 254,965 | |

| | | 253,000 | | | Series 2017-IKPR-F (1 Month LIBOR USD + 4.50%, 4.50% Floor) | | | | 6.24% | ^ | | | | 06/11/2032 | | | | | 255,467 | |

| |

| | | | | | COBALT Commercial Mortgage Trust, | |

| | | 221,058 | | | Series 2007-C2-AJFX | | | | 5.57% | # | | | | 04/15/2047 | | | | | 223,253 | |

| |

| | | | | | Commercial Mortgage Pass-Through Certificates, | |

| | | 227,000 | | | Series 2012-CR4-D | | | | 4.57% | #^ | | | | 10/15/2045 | | | | | 134,186 | |

| | | 411,000 | | | Series 2012-CR4-E | | | | 4.57% | #^Þ | | | | 10/15/2045 | | | | | 140,081 | |

| | | 250,000 | | | Series 2014-CR19-C | | | | 4.72% | # | | | | 08/10/2047 | | | | | 251,460 | |

| | | 500,000 | | | Series 2015-3BP-B | | | | 3.24% | #^ | | | | 02/10/2035 | | | | | 487,187 | |

| | | 500,000 | | | Series 2015-CR22-D | | | | 4.12% | #^ | | | | 03/10/2048 | | | | | 419,094 | |

| | | 500,000 | | | Series 2015-DC1-D | | | | 4.35% | #^ | | | | 02/10/2048 | | | | | 416,828 | |

| |

| | | | | | CSAIL Commercial Mortgage Trust, | |

| | | 500,000 | | | Series 2015-C1-D | | | | 3.80% | #^ | | | | 04/15/2050 | | | | | 441,835 | |

| |

| | | | | | CSMC Trust, | |

| | | 499,000 | | | Series 2017-PFHP-G (1 Month LIBOR USD + 6.15%, 6.15% Floor) | | | | 7.93% | ^ | | | | 12/15/2030 | | | | | 489,030 | |

| |

| | | | | | FREMF Mortgage Trust, | |

| | | 228,922 | | | Series 2016-KF22-B (1 Month LIBOR USD + 5.05%, 5.05% Floor) | | | | 6.72% | ^ | | | | 07/25/2023 | | | | | 231,103 | |

| |

| | | | | | GMAC Commercial Mortgage Securities Trust, | |

| | | 347,000 | | | Series 2004-C3-E | | | | 5.14% | #^ | | | | 12/10/2041 | | | | | 340,237 | |

| |

| | | | | | JP Morgan Chase Commercial Mortgage Securities Corporation, | |

| | | 245,769 | | | Series 2006-LDP9-AM | | | | 5.37% | | | | | 05/15/2047 | | | | | 247,483 | |

| |

| | | | | | JP Morgan Chase Commercial Mortgage Securities Trust, | |

| | | 107,000 | | | Series 2004-CBX-D | | | | 5.10% | # | | | | 01/12/2037 | | | | | 108,765 | |

| | | 531,000 | | | Series 2006-LDP9-AMS | | | | 5.34% | | | | | 05/15/2047 | | | | | 529,667 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2018 | | 9 |

| | |

| Schedule of Investments DoubleLine Selective Credit Fund (Cont.) | | March 31, 2018 |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| | | | | | JP Morgan Chase Commercial Mortgage Securities Trust, (Cont.) | |

| | | 208,000 | | | Series 2016-WIKI-E | | | | 4.01% | #^ | | | | 10/05/2031 | | | | | 202,621 | |

| | | 249,000 | | | Series 2016-WPT-E (1 Month LIBOR USD + 5.00%) | | | | 6.78% | ^ | | | | 10/15/2033 | | | | | 251,953 | |

| |

| | | | | | JPMBB Commercial Mortgage Securities Trust, | |

| | | 500,000 | | | Series 2015-C27-D | | | | 3.84% | #^ | | | | 02/15/2048 | | | | | 401,624 | |

| |

| | | | | | LMREC, Inc., | |

| | | 500,000 | | | Series 2015-CRE1-A (1 Month LIBOR USD + 1.75%) | | | | 3.61% | ^ | | | | 02/22/2032 | | | | | 501,350 | |

| |

| | | | | | Merrill Lynch Mortgage Trust, | |

| | | 425,000 | | | Series 2007-C1-AM | | | | 5.81% | # | | | | 06/12/2050 | | | | | 429,216 | |

| |

| | | | | | Morgan Stanley Bank of America Merrill Lynch Trust, | |

| | | 250,000 | | | Series 2014-C18-C | | | | 4.49% | # | | | | 10/15/2047 | | | | | 244,732 | |

| | | 350,000 | | | Series 2014-C19-C | | | | 4.00% | | | | | 12/15/2047 | | | | | 336,408 | |

| | | 699,000 | | | Series 2015-C20-D | | | | 3.07% | ^ | | | | 02/15/2048 | | | | | 540,948 | |

| |

| | | | | | Morgan Stanley Capital Trust, | |

| | | 501,000 | | | Series 2017-CLS-E (1 Month LIBOR USD + 1.95%, 1.95% Floor) | | | | 3.73% | ^ | | | | 11/15/2034 | | | | | 503,700 | |

| | | 556,000 | | | Series 2017-CLS-F (1 Month LIBOR USD + 2.60%, 2.60% Floor) | | | | 4.38% | ^ | | | | 11/15/2034 | | | | | 558,083 | |

| |

| | | | | | Morgan Stanley Capital, Inc., | |

| | | 272,640 | | | Series 2007-HQ11-AJ | | | | 5.51% | # | | | | 02/12/2044 | | | | | 272,378 | |

| | | 500,000 | | | Series 2014-MP-D | | | | 3.69% | #^ | | | | 08/11/2033 | | | | | 497,226 | |

| |

| | | | | | Sutherland Commercial Mortgage Loans LLC, | |

| | | 67,948 | | | Series 2015-SBC4-A | | | | 4.00% | ^ | | | | 06/25/2039 | | | | | 67,570 | |

| |

| | | | | | Tharaldson Hotel Portfolio Trust, | |

| | | 506,000 | | | Series 2018-THL-E (1 Month LIBOR USD + 3.18%, 3.10% Floor) | | | | 4.92% | ^ | | | | 11/11/2034 | | | | | 508,975 | |

| |

| | | | | | UBS-Barclays Commercial Mortgage Trust, | |

| | | 105,000 | | | Series 2013-C6-D | | | | 4.32% | #^ | | | | 04/10/2046 | | | | | 93,833 | |

| |

| | | | | | Wachovia Bank Commercial Mortgage Trust, | |

| | | 107,956 | | | Series 2006-C25-F | | | | 5.19% | # | | | | 05/15/2043 | | | | | 107,666 | |

| | | 64,125 | | | Series 2006-C26-AM | | | | 6.00% | # | | | | 06/15/2045 | | | | | 64,293 | |

| | | 157,414 | | | Series 2007-C30-AJ | | | | 5.41% | # | | | | 12/15/2043 | | | | | 159,043 | |

| |

| | | | | | Waterfall Commercial Mortgage Trust, | |

| | | 3,449,486 | | | Series 2015-SBC5-A | | | | 4.10% | #^ | | | | 09/14/2022 | | | | | 3,389,222 | |

| |

| | | | | | Wells Fargo Commercial Mortgage Trust, | |

| | | 500,000 | | | Series 2015-C26-D | | | | 3.59% | ^ | | | | 02/15/2048 | | | | | 391,887 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Total Non-Agency Commercial Mortgage Backed Obligations

(Cost $20,396,636) | | | | | 19,851,843 | |

| | | | | | | | | | | | | | | | | | | | | |

| |

| NON-AGENCY RESIDENTIAL COLLATERALIZED MORTGAGE

OBLIGATIONS 94.2% |

|

| |

| | | | | | Ajax Mortgage Loan Trust, | |

| | | 2,155,936 | | | Series 2016-1-A | | | | 4.25% | ^§ | | | | 07/25/2047 | | | | | 2,131,907 | |

| | | 7,706,118 | | | Series 2017-C-A | | | | 3.75% | ^§ | | | | 07/25/2060 | | | | | 7,614,402 | |

| |

| | | | | | Alternative Loan Trust, | |

| | | 7,499,986 | | | Series 2005-55CB-2A1 | | | | 5.50% | | | | | 11/25/2035 | | | | | 6,992,856 | |

| | | 7,089,409 | | | Series 2005-79CB-A1 (1 Month LIBOR USD + 0.55%, 0.55% Floor, 5.50% Cap) | | | | 2.42% | | | | | 01/25/2036 | | | | | 5,264,411 | |

| | | 7,089,409 | | | Series 2005-79CB-A2 (-1 x 1 Month LIBOR USD + 4.95%, 4.95% Cap) | | | | 3.08% | I/F I/O | | | | 01/25/2036 | | | | | 756,599 | |

| | | 11,250,796 | | | Series 2005-80CB-4A1 | | | | 6.00% | | | | | 02/25/2036 | | | | | 9,151,042 | |

| | | 2,410,545 | | | Series 2007-HY3-1A1 (12 Month LIBOR USD + 1.70%, 1.70% Floor) | | | | 3.54% | | | | | 03/25/2047 | | | | | 2,124,379 | |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| | | | | | Alternative Loan Trust, (Cont.) | |

| | | 9,441,220 | | | Series 2007-OA8-1A1 (1 Month LIBOR USD + 0.18%, 0.18% Floor) | | | | 2.05% | | | | | 06/25/2047 | | | | | 8,090,951 | |

| |

| | | | | | Banc of America Funding Corporation, | |

| | | 3,552,160 | | | Series 2006-2-2A11 | | | | 5.50% | | | | | 03/25/2036 | | | | | 3,509,037 | |

| | | 2,092,816 | | | Series 2007-1-TA8 | | | | 5.85% | ß | | | | 01/25/2037 | | | | | 1,943,570 | |

| |

| | | | | | BCAP LLC Trust, | |

| | | 6,800,575 | | | Series 2011-RR4-4A8 | | | | 5.99% | #^ | | | | 08/26/2037 | | | | | 6,798,458 | |

| | | 7,135,591 | | | Series 2011-RR4-5A8 | | | | 5.99% | #^ | | | | 08/26/2037 | | | | | 7,133,370 | |

| | | 21,923,983 | | | Series 2012-RR4-6A2 | | | | 3.58% | #^ | | | | 11/26/2035 | | | | | 17,842,057 | |

| | | 13,198,165 | | | Series 2013-RR2-6A2 | | | | 3.72% | #^ | | | | 06/26/2037 | | | | | 12,639,379 | |

| |

| | | | | | Bear Stearns ARM Trust, | |

| | | 7,366,554 | | | Series 2006-2-2A1 | | | | 3.72% | # | | | | 07/25/2036 | | | | | 7,363,509 | |

| |

| | | | | | Bear Stearns Asset Backed Securities Trust, | |

| | | 6,125,095 | | | Series 2005-10-23A1 | | | | 3.48% | # | | | | 01/25/2036 | | | | | 5,783,016 | |

| | | 4,247,627 | | | Series 2006-4-31A1 | | | | 3.54% | # | | | | 07/25/2036 | | | | | 3,954,618 | |

| | | 5,441,911 | | | Series 2006-AC5-A1 | | | | 6.25% | ß | | | | 12/25/2036 | | | | | 5,466,480 | |

| | | 16,717,029 | | | Series 2006-AQ1-12A (1 Month LIBOR USD + 0.14%, 0.14% Floor) | | | | 2.01% | | | | | 10/25/2036 | | | | | 17,240,917 | |

| | | 2,408,770 | | | Series 2006-IM1-A1 (1 Month LIBOR USD + 0.23%, 0.23% Floor) | | | | 2.10% | | | | | 04/25/2036 | | | | | 2,817,491 | |

| |

| | | | | | Chase Mortgage Finance Trust, | |

| | | 3,011,630 | | | Series 2006-S2-1A9 | | | | 6.25% | | | | | 10/25/2036 | | | | | 2,531,795 | |

| | | 6,031,308 | | | Series 2006-S3-1A2 | | | | 6.00% | | | | | 11/25/2036 | | | | | 4,997,075 | |

| | | 510,336 | | | Series 2007-S3-1A12 | | | | 6.00% | | | | | 05/25/2037 | | | | | 417,139 | |

| |

| | | | | | CHL Mortgage Pass-Through Trust, | |

| | | 4,201,550 | | | Series 2006-13-1A17 (-1 x 1 Month LIBOR USD + 5.65%, 5.65% Cap) | | | | 3.78% | I/F I/O | | | | 09/25/2036 | | | | | 703,411 | |

| | | 4,201,550 | | | Series 2006-13-1A3 (1 Month LIBOR USD + 0.60%, 0.60% Floor, 6.25% Cap) | | | | 2.47% | | | | | 09/25/2036 | | | | | 2,630,782 | |

| | | 10,388,695 | | | Series 2007-21-1A1 | | | | 6.25% | | | | | 02/25/2038 | | | | | 8,825,903 | |

| | | 6,991,395 | | | Series 2007-HYB1-2A1 | | | | 3.19% | # | | | | 03/25/2037 | | | | | 6,455,756 | |

| |

| | | | | | CIM Trust, | |

| | | 4,000,000 | | | Series 2016-1RR-B2 | | | | 8.29% | #^Þ | | | | 07/26/2055 | | | | | 3,941,322 | |

| | | 3,000,000 | | | Series 2016-2RR-B2 | | | | 8.15% | #^Þ | | | | 02/25/2056 | | | | | 2,913,396 | |

| | | 3,000,000 | | | Series 2016-3RR-B2 | | | | 8.33% | #^Þ | | | | 02/27/2056 | | | | | 2,896,349 | |

| |

| | | | | | Citigroup Mortgage Loan Trust, Inc., | |

| | | 1,854,058 | | | Series 2005-9-21A2 | | | | 5.50% | | | | | 11/25/2035 | | | | | 1,852,241 | |

| | | 1,281,774 | | | Series 2007-AR8-1A1A | | | | 3.60% | # | | | | 08/25/2047 | | | | | 1,164,656 | |

| | | 8,380,000 | | | Series 2007-WFH4-M3B (1 Month LIBOR USD + 1.00%, 1.00% Floor) | | | | 2.87% | | | | | 07/25/2037 | | | | | 8,091,435 | |

| | | 2,709,130 | | | Series 2011-12-1A2 | | | | 3.59% | #^Þ | | | | 04/25/2036 | | | | | 2,244,194 | |

| |

| | | | | | CitiMortgage Alternative Loan Trust, | |

| | | 9,434,661 | | | Series 2006-A2-A5 (1 Month LIBOR USD + 0.60%, 0.60% Floor, 6.00% Cap) | | | | 2.47% | | | | | 05/25/2036 | | | | | 7,780,846 | |

| | | 10,389,827 | | | Series 2006-A2-A6 (-1 x 1 Month LIBOR USD + 5.40%, 5.40% Cap) | | | | 3.53% | I/F I/O | | | | 05/25/2036 | | | | | 1,050,054 | |

| | | 16,472,490 | | | Series 2007-A5-1A3 (1 Month LIBOR USD + 0.50%, 0.50% Floor, 6.10% Cap) | | | | 2.37% | | | | | 05/25/2037 | | | | | 13,907,624 | |

| | | 16,472,490 | | | Series 2007-A5-1A4 (-1 x 1 Month LIBOR USD + 5.60%, 5.60% Cap) | | | | 3.73% | I/F I/O | | | | 05/25/2037 | | | | | 1,896,970 | |

| | | 4,620,067 | | | Series 2007-A6-1A4 | | | | 6.00% | | | | | 06/25/2037 | | | | | 4,513,984 | |

| | | 3,148,508 | | | Series 2007-A6-1A5 | | | | 6.00% | | | | | 06/25/2037 | | | | | 3,076,213 | |

| | | 4,800,622 | | | Series 2007-A8-A1 | | | | 6.00% | | | | | 10/25/2037 | | | | | 4,544,627 | |

| |

| | | | | | Countrywide Alternative Loan Trust, | |

| | | 978,875 | | | Series 2004-22CB-1A1 | | | | 6.00% | | | | | 10/25/2034 | | | | | 1,012,244 | |

| | | | | | |

| 10 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| | | | | | Countrywide Alternative Loan Trust, (Cont.) | |

| | | 1,813,228 | | | Series 2005-22T1-A5 | | | | 5.50% | | | | | 06/25/2035 | | | | | 1,502,185 | |

| | | 1,619,293 | | | Series 2005-28CB-2A7 | | | | 5.75% | | | | | 08/25/2035 | | | | | 1,458,446 | |

| | | 2,566,553 | | | Series 2005-46CB-A20 | | | | 5.50% | | | | | 10/25/2035 | | | | | 2,485,238 | |

| | | 4,985,420 | | | Series 2005-65CB-1A11 | | | | 6.00% | | | | | 01/25/2036 | | | | | 4,776,115 | |

| | | 377,776 | | | Series 2005-73CB-1A3 | | | | 6.25% | | | | | 01/25/2036 | | | | | 386,414 | |

| | | 2,059,995 | | | Series 2006-14CB-A8 | | | | 6.00% | | | | | 06/25/2036 | | | | | 1,762,438 | |

| | | 4,622,980 | | | Series 2006-41CB-2A12 | | | | 6.00% | | | | | 01/25/2037 | | | | | 4,052,408 | |

| | | 1,764,744 | | | Series 2006-41CB-2A15 | | | | 5.75% | | | | | 01/25/2037 | | | | | 1,522,845 | |

| | | 4,962,634 | | | Series 2006-46-A6 | | | | 6.00% | | | | | 02/25/2047 | | | | | 4,161,112 | |

| | | 3,094,757 | | | Series 2006-7CB-2A1 | | | | 6.50% | | | | | 05/25/2036 | | | | | 2,275,623 | |

| | | 1,543,605 | | | Series 2006-8T1-1A4 | | | | 6.00% | | | | | 04/25/2036 | | | | | 1,219,634 | |

| | | 2,125,677 | | | Series 2006-J4-2A13 | | | | 6.00% | | | | | 07/25/2036 | | | | | 1,859,605 | |

| | | 5,853,686 | | | Series 2006-J4-2A8 | | | | 6.00% | | | | | 07/25/2036 | | | | | 5,120,977 | |

| | | 1,686,865 | | | Series 2006-J6-A5 | | | | 6.00% | | | | | 09/25/2036 | | | | | 1,486,060 | |

| | | 1,305,348 | | | Series 2007-13-A4 | | | | 6.00% | | | | | 06/25/2047 | | | | | 1,133,561 | |

| | | 680,422 | | | Series 2007-J2-2A1 | | | | 6.00% | | | | | 07/25/2037 | | | | | 663,060 | |

| |

| | | | | | Countrywide Asset Backed Certificates, | |

| | | 29,386,640 | | | Series 2006-25-1A (1 Month LIBOR USD + 0.14%, 0.14% Floor) | | | | 2.01% | | | | | 06/25/2047 | | | | | 27,714,778 | |

| |

| | | | | | Countrywide Home Loans, | |

| | | 177,771 | | | Series 2006-10-1A11 | | | | 5.85% | | | | | 05/25/2036 | | | | | 152,914 | |

| | | 1,055,712 | | | Series 2006-17-A6 | | | | 6.00% | | | | | 12/25/2036 | | | | | 904,108 | |

| | | 2,383,601 | | | Series 2006-19-1A7 | | | | 6.00% | | | | | 01/25/2037 | | | | | 2,106,449 | |

| | | 3,370,955 | | | Series 2006-9-A2 | | | | 6.00% | | | | | 05/25/2036 | | | | | 2,856,069 | |

| | | 11,618,911 | | | Series 2007-15-1A29 | | | | 6.25% | | | | | 09/25/2037 | | | | | 10,793,327 | |

| | | 818,438 | | | Series 2007-4-1A10 | | | | 6.00% | | | | | 05/25/2037 | | | | | 671,988 | |

| | | 596,254 | | | Series 2007-8-1A5 | | | | 5.44% | | | | | 01/25/2038 | | | | | 479,258 | |

| |

| | | | | | Credit Suisse First Boston Mortgage Securities Corporation, | |

| | | 2,400,938 | | | Series 2005-12-5A1 | | | | 5.25% | | | | | 01/25/2036 | | | | | 2,323,114 | |

| | | 1,093,190 | | | Series 2005-9-3A2 | | | | 6.00% | | | | | 10/25/2035 | | | | | 632,300 | |

| |

| | | | | | Credit Suisse Mortgage Capital Certificates, | |

| | | 1,228,410 | | | Series 2006-6-1A10 | | | | 6.00% | | | | | 07/25/2036 | | | | | 1,037,198 | |

| | | 1,467,572 | | | Series 2008-2R-1A1 | | | | 6.00% | ^ | | | | 07/25/2037 | | | | | 1,374,861 | |

| | | 5,613,928 | | | Series 2009-9R-10A2 | | | | 5.50% | ^ | | | | 12/26/2035 | | | | | 4,707,705 | |

| | | 2,134,522 | | | Series 2011-17R-1A2 | | | | 5.75% | ^Þ | | | | 02/27/2037 | | | | | 2,157,667 | |

| |

| | | | | | CSMC Mortgage-Backed Trust, | |

| | | 5,975,937 | | | Series 2006-7-10A1 | | | | 6.75% | | | | | 08/25/2036 | | | | | 5,387,526 | |

| |

| | | | | | Deutsche Mortgage Securities, Inc., | |

| | | 4,412,561 | | | Series 2009-RS2-1A2 | | | | 3.59% | #^ | | | | 09/26/2036 | | | | | 4,315,207 | |

| |

| | | | | | Deutsche Securities, Inc., | |

| | | 1,372,347 | | | Series 2005-6-2A1 | | | | 5.50% | | | | | 12/25/2035 | | | | | 1,248,179 | |

| | | 519,572 | | | Series 2006-AB4-A1A | | | | 6.01% | # | | | | 10/25/2036 | | | | | 494,258 | |

| |

| | | | | | First Horizon Alternative Mortgage Securities, | |

| | | 3,001,020 | | | Series 2005-FA4-1A6 | | | | 5.50% | | | | | 06/25/2035 | | | | | 2,853,171 | |

| | | 1,220,285 | | | Series 2005-FA8-1A3 | | | | 5.50% | | | | | 11/25/2035 | | | | | 1,042,966 | |

| | | 3,137,014 | | | Series 2007-FA3-A8 | | | | 6.00% | | | | | 06/25/2037 | | | | | 2,487,461 | |

| | | 3,423,722 | | | Series 2007-FA4-1A4 | | | | 6.25% | | | | | 08/25/2037 | | | | | 2,784,164 | |

| |

| | | | | | First Horizon Asset Securities, Inc., | |

| | | 280,935 | | | Series 2006-1-1A2 | | | | 6.00% | | | | | 05/25/2036 | | | | | 256,567 | |

| | | 2,367,858 | | | Series 2007-3-A4 | | | | 6.00% | | | | | 06/25/2037 | | | | | 1,946,165 | |

| |

| | | | | | GreenPoint Mortgage Funding Trust, | |

| | | 8,675,406 | | | Series 2005-AR4-3A1 (12 Month US Treasury Average + 1.40%, 1.40% Floor) | | | | 2.68% | | | | | 10/25/2045 | | | | | 7,468,126 | |

| |

| | | | | | GSR Mortgage Loan Trust, | |

| | | 590,256 | | | Series 2006-2F-3A4 | | | | 6.00% | | | | | 02/25/2036 | | | | | 494,424 | |

| | | 2,147,041 | | | Series 2007-1F-3A14 | | | | 5.75% | | | | | 01/25/2037 | | | | | 1,985,238 | |

| | | 4,154,893 | | | Series 2007-2F-3A3 | | | | 6.00% | | | | | 03/25/2037 | | | | | 3,754,253 | |

| |

| | | | | | HarborView Mortgage Loan Trust, | |

| | | 15,233,482 | | | Series 2006-BU1-1A1A (1 Month LIBOR USD + 0.21%, 0.21% Floor, 10.50% Cap) | | | | 2.02% | | | | | 02/19/2046 | | | | | 13,807,575 | |

| | | 15,207,813 | | | Series 2007-4-1A1 (1 Month LIBOR USD + 0.22%, 10.00% Cap) | | | | 2.03% | | | | | 07/19/2047 | | | | | 14,756,808 | |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| | | | | | HarborView Mortgage Loan Trust, (Cont.) | |

| | | 8,329,987 | | | Series 2007-7-1A1 (1 Month LIBOR USD + 1.00%, 10.50% Cap) | | | | 2.87% | | | | | 10/25/2037 | | | | | 7,742,329 | |

| |

| | | | | | HSI Asset Loan Obligation Trust, | |

| | | 2,703,207 | | | Series 2007-1-3A6 | | | | 6.00% | | | | | 06/25/2037 | | | | | 1,801,169 | |

| |

| | | | | | Impac Secured Assets Trust, | |

| | | 1,467,240 | | | Series 2006-5-1A1B (1 Month LIBOR USD + 0.20%, 0.20% Floor, 11.50% Cap) | | | | 2.07% | | | | | 02/25/2037 | | | | | 1,284,551 | |

| |

| | | | | | IndyMac Mortgage Loan Trust, | |

| | | 6,805,429 | | | Series 2007-AR1-3A1 | | | | 3.77% | # | | | | 06/25/2037 | | | | | 5,615,959 | |

| |

| | | | | | JP Morgan Alternative Loan Trust, | |

| | | 6,544,069 | | | Series 2006-S4-A4 | | | | 5.96% | ß | | | | 12/25/2036 | | | | | 6,372,211 | |

| | | 4,236,065 | | | Series 2008-R2-A1 | | | | 6.00% | ^ | | | | 11/25/2036 | | | | | 3,597,318 | |

| |

| | | | | | JP Morgan Mortgage Trust, | |

| | | 615,361 | | | Series 2005-S3-1A1 | | | | 6.50% | | | | | 01/25/2036 | | | | | 530,493 | |

| | | 3,182,339 | | | Series 2007-S1-2A8 | | | | 5.75% | | | | | 03/25/2037 | | | | | 2,514,008 | |

| |

| | | | | | JP Morgan Resecuritization Trust, | |

| | | 4,128,495 | | | Series 2009-13-1A2 | | | | 5.50% | ^ | | | | 01/26/2036 | | | | | 4,086,496 | |

| |

| | | | | | Lavender Trust, | |

| | | 1,689,681 | | | Series 2010-R11A-A4 | | | | 6.25% | ^ | | | | 10/26/2036 | | | | | 1,308,966 | |

| |

| | | | | | Lehman Trust, | |

| | | 3,789,558 | | | Series 2006-17-1A4A (1 Month LIBOR USD + 0.17%, 0.17% Floor) | | | | 2.04% | | | | | 08/25/2046 | | | | | 3,729,616 | |

| |

| | | | | | Master Asset Backed Securities Trust, | |

| | | 5,803,736 | | | Series 2004-WMC1-M1 (1 Month LIBOR USD + 0.78%, 0.52% Floor) | | | | 2.65% | | | | | 02/25/2034 | | | | | 5,775,902 | |

| |

| | | | | | MASTR Alternative Loans Trust, | |

| | | 1,084,568 | | | Series 2004-10-5A5 | | | | 5.75% | | | | | 09/25/2034 | | | | | 1,088,212 | |

| |

| | | | | | Merrill Lynch Alternative Note Asset Trust, | |

| | | 2,153,192 | | | Series 2007-F1-2A6 | | | | 6.00% | | | | | 03/25/2037 | | | | | 1,742,518 | |

| |

| | | | | | Merrill Lynch Mortgage Investors Trust, | |

| | | 1,718,584 | | | Series 2006-AF1-AF3B | | | | 6.25% | | | | | 08/25/2036 | | | | | 1,380,023 | |

| |

| | | | | | Morgan Stanley Capital Trust, | |

| | | 29,614,249 | | | Series 2006-HE3-A2D (1 Month LIBOR USD + 0.25%, 0.25% Floor) | | | | 2.12% | | | | | 04/25/2036 | | | | | 27,901,770 | |

| |

| | | | | | Morgan Stanley Mortgage Loan Trust, | |

| | | 9,878,723 | | | Series 2005-10-4A1 | | | | 5.50% | | | | | 12/25/2035 | | | | | 9,283,670 | |

| | | 1,271,753 | | | Series 2007-12-3A4 | | | | 6.25% | | | | | 08/25/2037 | | | | | 1,074,492 | |

| |

| | | | | | New Century Home Equity Loan Trust, | |

| | | 10,445,774 | | | Series 2006-1-A2B (1 Month LIBOR USD + 0.18%, 0.18% Floor, 12.50% Cap) | | | | 2.05% | | | | | 05/25/2036 | | | | | 9,802,820 | |

| |

| | | | | | Nomura Asset Acceptance Corporation, | |

| | | 4,353,167 | | | Series 2006-AP1-A2 | | | | 5.52% | # | | | | 01/25/2036 | | | | | 2,397,648 | |

| | | 1,616,062 | | | Series 2007-1-1A1A | | | | 6.00% | ß | | | | 03/25/2047 | | | | | 1,470,442 | |

| |

| | | | | | Opteum Mortgage Acceptance Corporation Trust, | |

| | | 11,160,940 | | | Series 2006-2-A1C (1 Month LIBOR USD + 0.27%, 0.27% Floor) | | | | 2.14% | | | | | 07/25/2036 | | | | | 7,435,747 | |

| |

| | | | | | PR Mortgage Loan Trust, | |

| | | 715,234 | | | Series 2014-1-APT | | | | 5.91% | #^ | | | | 10/25/2049 | | | | | 636,058 | |

| |

| | | | | | Pretium Mortgage Credit Partners LLC, | |

| | | 7,678,767 | | | Series 2018-NPL1-A1 | | | | 3.38% | ^§ | | | | 01/27/2033 | | | | | 7,674,546 | |

| |

| | | | | | PRPM LLC, | |

| | | 11,574,558 | | | Series 2017-3A-A1 | | | | 3.47% | #^ | | | | 11/25/2022 | | | | | 11,586,726 | |

| |

| | | | | | RALI Trust, | |

| | | 3,350,349 | | | Series 2005-QS12-A3 | | | | 5.50% | | | | | 08/25/2035 | | | | | 3,232,700 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2018 | | 11 |

| | |

| Schedule of Investments DoubleLine Selective Credit Fund (Cont.) | | March 31, 2018 |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $ | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| | | | | | RALI Trust, (Cont.) | |

| | | 4,248,490 | | | Series 2006-QS12-2A12 (1 Month LIBOR USD + 0.20%, 0.20% Floor, 7.50% Cap) | | | | 2.07% | | | | | 09/25/2036 | | | | | 3,361,255 | |

| | | 4,248,490 | | | Series 2006-QS12-2A13 | | | | 5.80% | ± I/F I/O | | | | 09/25/2036 | | | | | 798,428 | |

| |

| | | | | | RBSGC Mortgage Loan Trust, | |

| | | 1,454,176 | | | Series 2007-A-2A4 | | | | 6.25% | | | | | 01/25/2037 | | | | | 1,436,703 | |

| |

| | | | | | Residential Accredit Loans, Inc., | |

| | | 2,588,831 | | | Series 2005-QS13-1A6 | | | | 5.50% | | | | | 09/25/2035 | | | | | 2,437,429 | |

| | | 3,831,566 | | | Series 2005-QS9-A6 | | | | 5.50% | | | | | 06/25/2035 | | | | | 3,818,679 | |

| | | 645,482 | | | Series 2006-QS12-1A1 | | | | 6.50% | | | | | 09/25/2036 | | | | | 492,980 | |

| | | 5,618,263 | | | Series 2006-QS18-1A4 | | | | 6.25% | | | | | 12/25/2036 | | | | | 5,188,419 | |

| | | 1,883,945 | | | Series 2006-QS7-A2 | | | | 6.00% | | | | | 06/25/2036 | | | | | 1,737,599 | |

| | | 4,736,119 | | | Series 2007-QA5-3A1 | | | | 5.75% | # | | | | 09/25/2037 | | | | | 4,308,051 | |

| | | 1,451,895 | | | Series 2007-QS11-A1 | | | | 7.00% | | | | | 10/25/2037 | | | | | 1,283,310 | |

| | | 11,098,482 | | | Series 2007-QS1-1A2 (-1 x 1 Month LIBOR USD + 5.45%, 5.45% Cap) | | | | 3.58% | I/F I/O | | | | 01/25/2037 | | | | | 1,128,643 | |

| | | 11,098,482 | | | Series 2007-QS1-1A5 (1 Month LIBOR USD + 0.55%, 0.55% Floor, 6.00% Cap) | | | | 2.42% | | | | | 01/25/2037 | | | | | 8,898,017 | |

| | | 906,248 | | | Series 2007-QS5-A1 | | | | 5.50% | | | | | 03/25/2037 | | | | | 821,307 | |

| |

| | | | | | Residential Asset Securities Corporation, | |

| | | 2,805,479 | | | Series 2007-KS3-AI3 (1 Month LIBOR USD + 0.25%, 0.25% Floor, 14.00% Cap) | | | | 2.12% | | | | | 04/25/2037 | | | | | 2,766,046 | |

| |

| | | | | | Residential Asset Securitization Trust, | |

| | | 4,717,929 | | | Series 2006-A12-A1 | | | | 6.25% | | | | | 11/25/2036 | | | | | 3,211,879 | |

| | | 1,797,840 | | | Series 2006-A8-1A1 | | | | 6.00% | | | | | 08/25/2036 | | | | | 1,611,583 | |

| |

| | | | | | Residential Funding Mortgage Securities Trust, | |

| | | 138,105 | | | Series 2005-S9-A11 | | | | 6.25% | | | | | 12/25/2035 | | | | | 134,697 | |

| | | 1,330,525 | | | Series 2006-SA2-3A1 | | | | 4.66% | # | | | | 08/25/2036 | | | | | 1,250,459 | |

| |

| | | | | | Soundview Home Loan Trust, | |

| | | 8,000,000 | | | Series 2005-OPT4-M1 (1 Month LIBOR USD + 0.46%, 0.46% Floor) | | | | 2.33% | | | | | 12/25/2035 | | | | | 7,254,677 | |

| |

| | | | | | Structured Adjustable Rate Mortgage Loan Trust, | |

| | | 7,780,318 | | | Series 2005-22-4A1 | | | | 3.73% | # | | | | 12/25/2035 | | | | | 7,489,961 | |

| | | 5,050,526 | | | Series 2006-10-3AF (1 Month LIBOR USD + 0.40%, 0.40% Floor, 7.00% Cap) | | | | 2.27% | | | | | 11/25/2036 | | | | | 4,516,892 | |

| | | 2,952,204 | | | Series 2008-1-A2 | | | | 3.60% | # | | | | 10/25/2037 | | | | | 2,699,438 | |

| |

| | | | | | Structured Asset Mortgage Investments Trust, | |

| | | 7,181,314 | | | Series 2006-AR6-1A1 (1 Month LIBOR USD + 0.18%, 0.18% Floor, 10.50% Cap) | | | | 2.05% | | | | | 07/25/2046 | | | | | 6,502,040 | |

| | | 7,015,123 | | | Series 2006-AR6-1A3 (1 Month LIBOR USD + 0.19%, 0.19% Floor, 10.50% Cap) | | | | 2.06% | | | | | 07/25/2046 | | | | | 6,217,498 | |

| | | 13,422,477 | | | Series 2006-AR7-A1A (1 Month LIBOR USD + 0.21%, 0.21% Floor, 10.50% Cap) | | | | 2.08% | | | | | 08/25/2036 | | | | | 12,300,346 | |

| | | 5,988,775 | | | Series 2006-AR8-A2 (1 Month LIBOR USD + 0.21%, 0.21% Floor, 11.50% Cap) | | | | 2.08% | | | | | 10/25/2036 | | | | | 5,601,699 | |

| | | 11,921,010 | | | Series 2007-AR3-2A1 (1 Month LIBOR USD + 0.19%, 0.19% Floor, 10.50% Cap) | | | | 2.06% | | | | | 09/25/2047 | | | | | 11,471,673 | |

| | | | | | | | | | | | | | | | | | | | |

PRINCIPAL

AMOUNT $/

SHARES | | SECURITY DESCRIPTION | | RATE | | MATURITY | | VALUE $ |

| |

| | | | | | Structured Asset Securities Trust, | |

| | | 10,180,676 | | | Series 2005-17-5A1 | | | | 5.50% | | | | | 10/25/2035 | | | | | 8,320,953 | |

| |

| | | | | | Thornburg Mortgage Securities Trust, | |

| | | 634,921 | | | Series 2007-4-2A1 | | | | 3.35% | # | | | | 09/25/2037 | | | | | 634,818 | |

| |

| | | | | | US Residential Opportunity Fund Trust, | |

| | | 13,680,993 | | | Series 2017-1III-A | | | | 3.35% | ^§ | | | | 11/27/2037 | | | | | 13,679,988 | |

| |

| | | | | | VOLT LLC, | |

| | | 3,190,897 | | | Series 2015-NPL8-A1 | | | | 3.50% | ^§ | | | | 06/26/2045 | | | | | 3,199,473 | |

| | | 6,230,841 | | | Series 2017-NPL7-A1 | | | | 3.25% | ^§ | | | | 06/25/2047 | | | | | 6,219,920 | |

| |

| | | | | | Washington Mutual Mortgage Pass-Through Certificates, | |

| | | 2,268,069 | | | Series 2005-10-2A8 | | | | 6.00% | | | | | 11/25/2035 | | | | | 2,167,524 | |

| | | 5,007,945 | | | Series 2006-5-2CB6 | | | | 6.00% | | | | | 07/25/2036 | | | | | 4,144,741 | |

| | | 3,603,830 | | | Series 2007-2-1A6 | | | | 6.00% | | | | | 04/25/2037 | | | | | 3,169,627 | |

| | | 355,163 | | | Series 2007-4-1A1 | | | | 5.50% | | | | | 06/25/2037 | | | | | 354,406 | |

| | | 4,038,446 | | | Series 2007-5-A6 | | | | 6.00% | | | | | 06/25/2037 | | | | | 4,036,928 | |

| |

| | | | | | Wells Fargo Alternative Loan Trust, | |

| | | 1,247,796 | | | Series 2007-PA3-1A4 | | | | 5.75% | | | | | 07/25/2037 | | | | | 1,172,294 | |

| |

| | | | | | Wells Fargo Mortgage Backed Securities Trust, | |

| | | 2,248,395 | | | Series 2006-AR4-2A1 | | | | 4.15% | # | | | | 04/25/2036 | | | | | 2,099,631 | |

| | | 7,979,416 | | | Series 2007-11-A96 | | | | 6.00% | | | | | 08/25/2037 | | | | | 7,839,477 | |

| | | 633,670 | | | Series 2007-13-A2 | | | | 6.25% | | | | | 09/25/2037 | | | | | 643,787 | |

| | | 1,131,516 | | | Series 2007-3-1A4 | | | | 6.00% | | | | | 04/25/2037 | | | | | 1,132,536 | |

| | | 10,606,994 | | | Series 2007-7-A1 | | | | 6.00% | | | | | 06/25/2037 | | | | | 10,568,592 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Total Non-Agency Residential Collateralized Mortgage Obligations

(Cost $697,106,941) | | | | | 690,116,803 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | SHORT TERM INVESTMENTS 2.1% | |

| | | 5,109,991 | | | BlackRock Liquidity Funds FedFund - Institutional Shares | | | | 1.53% | ¨ | | | | | | | | | 5,109,991 | |

| | | 5,109,992 | | | Fidelity Institutional Money Market Government Portfolio - Class I | | | | 1.47% | ¨ | | | | | | | | | 5,109,992 | |

| | | 5,109,992 | | | Morgan Stanley Institutional Liquidity Funds Government Portfolio - Institutional Share Class | | | | 1.56% | ¨ | | | | | | | | | 5,109,992 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Total Short Term Investments

(Cost $15,329,975) | | | | | 15,329,975 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Total Investments 100.4%

(Cost $742,783,855) | | | | | | | | | | 735,416,325 | |

| | | | | | Liabilities in Excess of Other Assets (0.4)% | | | | | (2,765,801 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | NET ASSETS 100.0% | | | | | | | | | $ | 732,650,524 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| SECURITY TYPE BREAKDOWN as a % of Net Assets: | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | 94.2% | |

Non-Agency Commercial Mortgage Backed Obligations | | | | 2.7% | |

Short Term Investments | | | | 2.1% | |

Collateralized Loan Obligations | | | | 1.4% | |

Asset Backed Obligations | | | | 0.0% | ~ |

Other Assets and Liabilities | | | | (0.4)% | |

| | | | | |

| | | | 100.0% | |

| | | | | |

| | | | | | |

| 12 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| ^ | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. These securities are determined to be liquid by the Adviser, unless otherwise noted, under procedures established by the Fund’s Board of Trustees. At March 31, 2018, the value of these securities amounted to $157,221,370 or 21.5% of net assets. |

| # | Coupon rate is variable based on the weighted average coupon of the underlying collateral. To the extent the weighted average coupon of the underlying assets which comprise the collateral increases or decreases, the coupon rate of this security will increase or decrease correspondingly. The rate disclosed is as of March 31, 2018. |

| ± | Coupon rate is variable or floats based on components including but not limited to reference rate and spread. These securities may not indicate a reference rate and/or spread in their description. The rate desclosed is as of March 31, 2018. |

| ß | The interest rate may step up conditioned upon the aggregate remaining principal balance of the underlying mortgage loans being reduced below a targeted percentage of the aggregate original principal balance of the mortgage loans. The interest rate shown is the rate in effect as of March 31, 2018. |

| § | The interest rate will step up if the issuer does not redeem the bond by an expected redemption date. The interest rate shown is the rate in effect as of March 31, 2018. |

| I/O | Interest only security |

| I/F | Inverse floating rate security whose interest rate moves in the opposite direction of reference interest rates. Reference interest rates are typically based on a negative multiplier or slope. Interest rate may also be subject to a cap or floor. |

| Þ | Value determined using significant unobservable inputs. |

| ¨ | Seven-day yield as of March 31, 2018 |

| ~ | Represents less than 0.05% of net assets. |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2018 | | 13 |

| | |

| Statement of Assets and Liabilities | | March 31, 2018 |

| | | | | |

| |

ASSETS | | | | | |

Investments in Securities, at Value* | | | $ | 720,086,350 | |

Short Term Investments, at Value* | | | | 15,329,975 | |

Interest and Dividends Receivable | | | | 2,292,941 | |

Prepaid Expenses and Other Assets | | | | 234 | |

Total Assets | | | | 737,709,500 | |

| |

LIABILITIES | | | | | |

Distribution Payable | | | | 4,503,993 | |

Payable for Investments Purchased | | | | 500,000 | |

Administration, Fund Accounting and Custodian Fees Payable | | | | 30,927 | |

Transfer Agent Expenses Payable | | | | 10,034 | |

Accrued Expenses | | | | 6,489 | |

Trustees Fees Payable | | | | 4,070 | |

Professional Fees Payable | | | | 1,883 | |

Shareholder Reporting Expenses Payable | | | | 1,580 | |

Total Liabilities | | | | 5,058,976 | |

Net Assets | | | $ | 732,650,524 | |

| |

NET ASSETS CONSIST OF: | | | | | |

Paid-in Capital | | | $ | 770,443,710 | |

Undistributed (Accumulated) Net Investment Income (Loss) (See Note 5) | | | | 299,152 | |

Accumulated Net Realized Gain (Loss) on Investments | | | | (30,724,808 | ) |

Net Unrealized Appreciation (Depreciation) on Investments | | | | (7,367,530 | ) |

Net Assets | | | $ | 732,650,524 | |

| |

*Identified Cost: | | | | | |

Investments in Securities | | | $ | 727,453,880 | |

Short Term Investments | | | | 15,329,975 | |

| |

Class I (unlimited shares authorized): | | | | | |

Shares Outstanding | | | | 80,954,025 | |

Net Asset Value, Offering and Redemption Price per Share | | | $ | 9.05 | |

| | | | | | |

| 14 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| | |

| Statement of Operations | | For the Year Ended March 31, 2018 |

| | | | | |

| |

INVESTMENT INCOME | | | | | |

Income: | | | | | |

Interest | | | $ | 35,469,699 | |

Total Investment Income | | | | 35,469,699 | |

Expenses: | | | | | |

Investment Advisory Fees | | | | 3,188,621 | |

Administration, Fund Accounting and Custodian Fees | | | | 125,961 | |

Professional Fees | | | | 112,466 | |

Transfer Agent Expenses | | | | 32,924 | |

Shareholder Reporting Expenses | | | | 14,018 | |

Trustees Fees | | | | 7,400 | |

Miscellaneous Expenses | | | | 6,794 | |

Insurance Expenses | | | | 5,980 | |

Registration Fees | | | | 3,068 | |

Total Expenses | | | | 3,497,232 | |

Less: Investment Advisory Fees (Waived) | | | | (3,188,621 | ) |

Less: Other Fees (Reimbursed)/Recouped | | | | 145,904 | |

Net Expenses | | | | 454,515 | |

| |

Net Investment Income (Loss) | | | | 35,015,184 | |

| |

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | |

Net Realized Gain (Loss) on Investments | | | | 11,499 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | | 6,325,263 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | | 6,336,762 | |

| |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | 41,351,946 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2018 | | 15 |

| | |

| Statements of Changes in Net Assets | | March 31, 2018 |

| | | | | | | | |

| | | Year Ended

March 31, 2018 | | | Year Ended

March 31, 2017 | |

| | |

OPERATIONS | | | | | | | | |

Net Investment Income (Loss) | | $ | 35,015,184 | | | $ | 26,416,343 | |

Net Realized Gain (Loss) on Investments | | | 11,499 | | | | 4,910,464 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 6,325,263 | | | | (640,456 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 41,351,946 | | | | 30,686,351 | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From Net Investment Income | | | (49,734,456 | ) | | | (37,057,498 | ) |

| | |

Total Distributions to Shareholders | | | (49,734,456 | ) | | | (37,057,498 | ) |

| | |

NET SHARE TRANSACTIONS | | | | | | | | |

Increase (Decrease) in Net Assets Resulting from Net Share Transactions | | | 264,293,709 | | | | 217,000,000 | |

| | |

Total Increase (Decrease) in Net Assets | | $ | 255,911,199 | | | $ | 210,628,853 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of Period | | $ | 476,739,325 | | | $ | 266,110,472 | |

End of Period | | $ | 732,650,524 | | | $ | 476,739,325 | |

| | |

Undistributed (Accumulated) Net Investment Income (Loss) (See Note 5) | | $ | 299,152 | | | $ | 361,468 | |

| | | | | | |

| 16 | | DoubleLine Selective Credit Fund | | | | The accompanying notes are an integral part of these financial statements. |

| | | | | | | | | | | | | | | | |

| | | Year Ended

March 31, 2018 | | | Year Ended

March 31, 2017 | | | Year Ended

March 31, 2016 | | | Period Ended

March 31, 20151 | |

| | | | |

Net Asset Value, Beginning of Period | | $ | 9.14 | | | $ | 9.26 | | | $ | 10.02 | | | $ | 10.00 | |

| | | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)4 | | | 0.56 | | | | 0.65 | | | | 0.61 | | | | 0.46 | |

Net Gain (Loss) on Investments

(Realized and Unrealized) | | | 0.13 | | | | 0.12 | | | | (0.45 | ) | | | 0.01 | |

Total from Investment Operations | | | 0.69 | | | | 0.77 | | | | 0.16 | | | | 0.47 | |

| | | | |

Less Distributions: | | | | | | | | | | | | | | | | |

Distributions from Net Investment Income | | | (0.78 | ) | | | (0.89 | ) | | | (0.92 | ) | | | (0.45 | ) |

Total Distributions | | | (0.78 | ) | | | (0.89 | ) | | | (0.92 | ) | | | (0.45 | ) |

Net Asset Value, End of Period | | $ | 9.05 | | | $ | 9.14 | | | $ | 9.26 | | | $ | 10.02 | |

Total Return | | | 7.81% | | | | 8.69% | | | | 1.56% | | | | 4.79% | 2 |

| | | | |

Supplemental Data: | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000’s) | | $ | 732,651 | | | $ | 476,739 | | | $ | 266,110 | | | $ | 267,098 | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | |

Expenses Before Advisory Fees (Waived) and Other Fees (Reimbursed)/Recouped | | | 0.60% | | | | 0.62% | | | | 0.64% | | | | 0.84% | 3 |

Expenses After Advisory Fees (Waived) (See Note 3) | | | 0.05% | | | | 0.07% | | | | 0.09% | | | | 0.38% | 3 |

Expenses After Advisory Fees (Waived) and Other Fees (Reimbursed)/Recouped | | | 0.08% | | | | 0.07% | | | | 0.09% | | | | 0.18% | 3 |

Net Investment Income (Loss) | | | 6.04% | | | | 6.99% | | | | 6.28% | | | | 7.00% | 3 |

Portfolio Turnover Rate | | | 23% | | | | 20% | | | | 16% | | | | 6% | 2 |

| 1 | Commencement of operations on August 4, 2014. |

| 4 | Calculated based on average shares outstanding during the period. |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2018 | | 17 |

| | |

| Notes to Financial Statements | | March 31, 2018 |

1. Organization

The Fund is a separate investment series of DoubleLine Funds Trust (the “Trust”). The Fund commenced operations on August 4, 2014 as a non-diversified fund. Shares of the Fund may currently be purchased in transactions by the Adviser or its affiliates acting in their capacity as investment adviser (or in a similar capacity) for clients, including separately managed private accounts, investment companies registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and other funds, each of which must be an “accredited investor” as defined in Regulation D under the Securities Act. The Fund also may permit purchases of shares by (i) qualified employees, officers and Trustees of the Fund and their qualified family members; (ii) qualified employees and officers of the Adviser or DoubleLine Group LP and their qualified family members; (iii) qualified affiliates of the Adviser or DoubleLine Group LP; and (iv) other qualified accounts. The Fund’s investment objective is to seek long-term total return.

During the Fund’s 2018 fiscal year, the Fund became classified as a diversified management investment company under the 1940 Act. Currently under the 1940 Act, a diversified fund generally may not, with respect to 75% of its total assets, invest more than 5% of its total assets in the securities of any one issuer or own more that 10% of the outstanding voting securities of such issuer (except, in each case, U.S. Government securities, cash, cash items and the securities of other investment companies). The remaining 25% of a fund’s total assets is not subject to this limitation.

2. Significant Accounting Policies

The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946, “Financial Services—Investment Companies”, by the Financial Accounting Standards Board (“FASB”). The following is a summary of the significant accounting policies of the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“US GAAP”).

A. Security Valuation. The Fund has adopted US GAAP fair value accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | • | | Level 1—Unadjusted quoted market prices in active markets for identical securities |

| | • | | Level 2—Quoted prices for identical or similar assets in markets that are not active, or inputs derived from observable market data |

| | • | | Level 3—Significant unobservable inputs (including the reporting entity’s estimates and assumptions) |

Assets and liabilities may be transferred between levels. The Fund uses end of period timing recognition to account for any transfers.

Market values for domestic and foreign fixed income securities are normally determined on the basis of valuations provided by independent pricing services. Vendors typically value such securities based on one or more inputs described in the following table which is not intended to be a complete list. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed income securities in which the Fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income securities. Securities that use similar valuation techniques and inputs as described in the following table are categorized as Level 2 of the fair value hierarchy. To the extent the significant inputs are unobservable, the values generally would be categorized as Level 3.

| | | | | | |

| Fixed-income class | | | | | Examples of Inputs |

All | | | | | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

Corporate bonds and notes; convertible securities | | | | | | Standard inputs and underlying equity of the issuer |

US bonds and notes of government and government agencies | | | | | | Standard inputs |

Residential and commercial mortgage-backed obligations; asset-backed obligations (including collateralized loan obligations) | | | | | | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information, trustee reports |

| | | | | | |

| 18 | | DoubleLine Selective Credit Fund | | | | |

Investments in registered open-end management investment companies will be valued based upon the net asset value (“NAV”) of such investments and are categorized as Level 1 of the fair value hierarchy.

Securities may be fair valued by the Adviser in accordance with the fair valuation procedures approved by the Board of Trustees (the “Board”). The Adviser’s valuation committee is generally responsible for overseeing the day to day valuation processes and reports periodically to the Board. The Adviser’s valuation committee and the pricing group are authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations or third party vendor prices are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are deemed to be unreliable indicators of market or fair value.

The following is a summary of the fair valuations according to the inputs used to value the Fund’s investments as of March 31, 20181:

| | | | | | | | | | |

| Category | | | | |

Investments in Securities | | | | | | | | | | |

Level 1 | | | | | | | | | | |

Money Market Funds | | | | | | | | $ | 15,329,975 | |

Total Level 1 | | | | | | | | | 15,329,975 | |

Level 2 | | | | | | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | | | | 675,963,875 | |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | | | 19,711,762 | |

Collateralized Loan Obligations | | | | | | | | | 10,063,250 | |

Asset Backed Obligations | | | | | | | | | 54,454 | |

Total Level 2 | | | | | | | | | 705,793,341 | |

Level 3 | | | | | | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | | | | 14,152,928 | |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | | | 140,081 | |

Total Level 3 | | | | | | | | | 14,293,009 | |

Total | | | | | | | | $ | 735,416,325 | |

See the Schedule of Investments for further disaggregation of investment categories.

| 1 | There were no transfers into or out of Level 1 during the year ended March 31, 2018. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Fair Value as of 3/31/2017 | | Net Realized Gain (Loss) | | Net Change in Unrealized Appreciation (Depreciation)3 | | Net Accretion (Amortization) | | Purchases1 | | Sales2 | | Transfers Into Level 34 | | Transfers Out of Level 34 | | Fair Value as of 3/31/2018 | | Net Change in Unrealized Appreciation (Depreciation) on securities held at 3/31/20183 |

Investments in Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | | | $ | 5,386,628 | | | | $ | 104,392 | | | | $ | (302,722 | ) | | | $ | 129,507 | | | | $ | — | | | | $ | (915,944 | ) | | | $ | 9,751,067 | | | | $ | — | | | | $ | 14,152,928 | | | | $ | (302,722 | ) |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | | | 281,403 | | | | | — | | | | | (152,817 | ) | | | | 11,495 | | | | | — | | | | | — | | | | | — | | | | | — | | | | | 140,081 | | | | | (152,817 | ) |

Total | | | | | | | | $ | 5,668,031 | | | | $ | 104,392 | | | | $ | (455,539 | ) | | | $ | 141,002 | | | | $ | — | | | | $ | (915,944 | ) | | | $ | 9,751,067 | | | | $ | — | | | | $ | 14,293,009 | | | | $ | (455,539 | ) |

| 1 | Purchases include all purchases of securities and payups. |

| 2 | Sales include all sales of securities, maturities, and paydowns. |

| 3 | Any difference between net change in unrealized appreciation (depreciation) and net change in unrealized appreciation (depreciation) on securities held at March 31, 2018 may be due to a security that was not held or categorized as Level 3 at either period end. |

| 4 | Transfers into or out of Level 3 can be attributable to changes in the availability of pricing sources and/or in the observability of significant inputs used to measure the fair value of those instruments. |

| | | | | | |

| | Annual Report | | March 31, 2018 | | 19 |

| | |

| Notes to Financial Statements (Cont.) | | March 31, 2018 |

The following is a summary of quantitative information about Level 3 Fair Value Measurements:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Fair Value as of 3/31/2018 * | | Valuation Techniques | | Unobservable Input | | Input Values | | Impact to valuation from an increase to input |

Non-Agency Residential Collateralized Mortgage Obligations | | | | | | | | $ | 14,152,928 | | | Market

Comparables | | Market

Quotes | | | $ | 82.84-$101.08 | | | Significant changes in the market quotes would result in direct and proportional changes in the fair value of the security |

Non-Agency Commercial Mortgage Backed Obligations | | | | | | | | $ | 140,081 | | | Market

Comparables | | Yields | | | | 34.77% | | | Increase in the yields would result in the decrease in the fair value of the security |

| * | Level 3 securities are typically valued by pricing vendors. The appropriateness of fair values for these securities is monitored on an ongoing basis by the Adviser, which may include back testing, results of vendor due diligence, unchanged price review and consideration of market and/or sector events. |

B. Federal Income Taxes. The Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income taxes has been made.

The Fund may be subject to a nondeductible 4% excise tax calculated as a percentage of certain undistributed amounts of net investment income and net capital gains.

The Fund has adopted financial reporting rules that require the Fund to analyze all open tax years, as defined by the applicable statute of limitations, for all major jurisdictions. Open tax years, 2017, 2016 and 2015 for the Fund, are those that are open for exam by taxing authorities. As of March 31, 2018, the Fund has no examination in progress.

Management has analyzed the Fund’s tax position, and has concluded that no liability should be recorded related to uncertain tax positions expected to be taken on the tax return for the fiscal year-ended March 31, 2018. The Fund identifies its major tax jurisdiction as U.S. Federal, the State of Delaware and the State of California. The Fund is not aware of any tax position for which it is reasonably possible that the total amount of unrecognized tax benefits will significantly change in the next twelve months.

C. Security Transactions, Investment Income. Investment securities transactions are accounted for on trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Interest income is recorded on an accrual basis. Discounts/premiums on debt securities purchased, which may include residual and subordinate notes, are accreted/amortized over the life of the respective securities using the effective interest method except for certain deep discount bonds where management does not expect the par value above the bond’s cost to be fully realized. Dividend income and corporate action transactions, if any, are recorded on the ex-date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of securities received. Paydown gains and losses on mortgage-related and other asset-backed securities are recorded as components of interest income on the Statement of Operations.

D. Dividends and Distributions to Shareholders. Dividends from net investment income will be declared and paid monthly. The Fund will distribute any net realized long or short-term capital gains at least annually. Distributions are recorded on the ex-dividend date.