Washington, D.C. 20549

On behalf of the DoubleLine Funds, I am pleased to deliver the Annual Report for the 12-month period ended March 31, 2018. On the following pages, you will find specific information regarding each Fund’s operations and holdings. In addition, we discuss each Fund’s investment performance and the main drivers of that performance during the reporting period.

If you have any questions regarding the DoubleLine Funds, please don’t hesitate to call us at 877-DLine11 (877-354-6311) or visit our website www.doublelinefunds.com where our investment management team offers deeper insights and analysis on relevant capital market activity impacting investors today. We value the trust that you have placed with us, and we will continue to strive to offer thoughtful investment solutions to our shareholders.

Ronald R. Redell, CFA

requirements to be in place permanently and managers had created solutions to address them. Deals issued prior to February 2018 were generally designed to be risk retention compliant. The court’s decision appears to have allowed managers that had struggled with risk retention compliance to reenter the market.

given this sector’s outperformance. The small positions in HY bonds and CLO liabilities were accretive to performance and were driven by credit selection, while the small cash position was dilutive to overall performance.

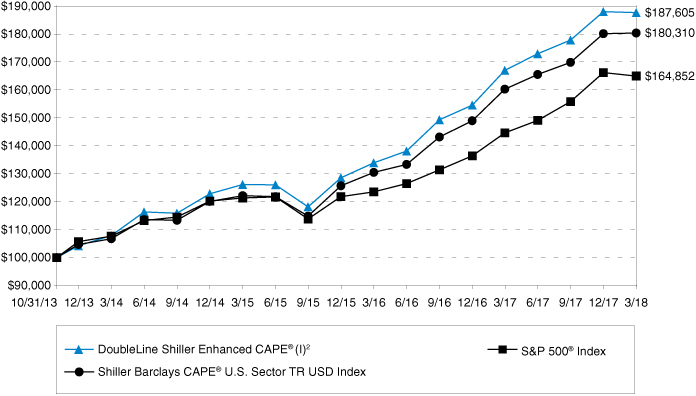

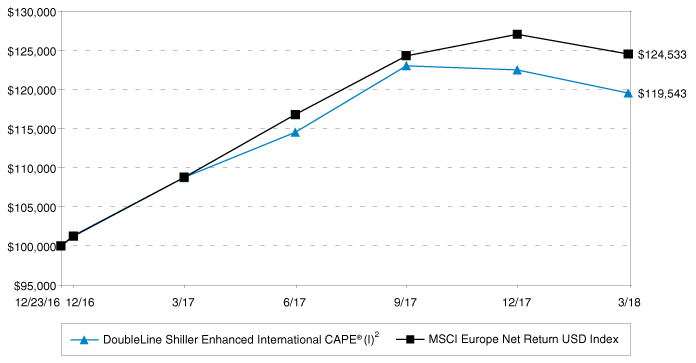

Telecommunications. The Utilities sector was a constituent of the Shiller Barclays CAPE® Europe Sector Net Total Return Index for the entire period, while the other six sectors were constituents for a portion of the period. The fixed income collateral portfolio provided positive returns during the period.

Opinions expressed herein are as of March 31, 2018 and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus.

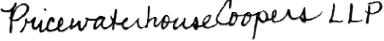

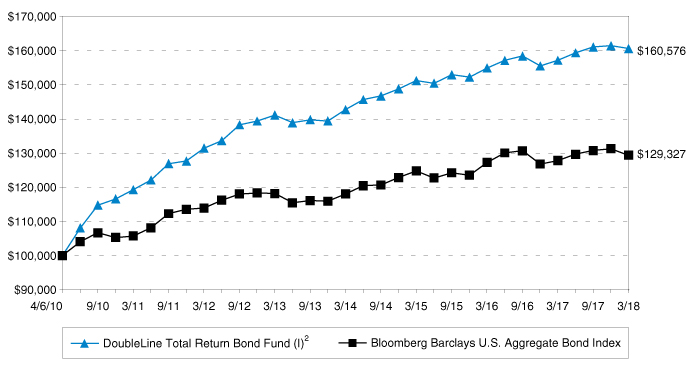

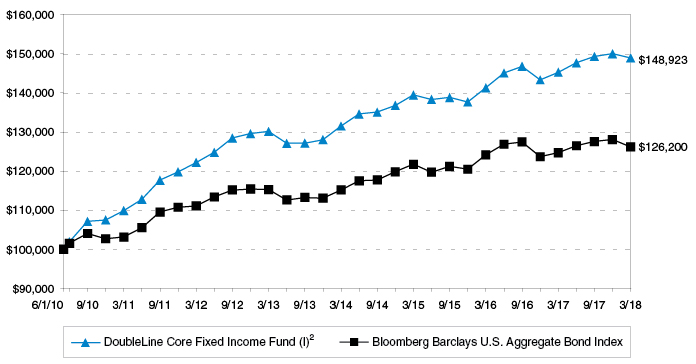

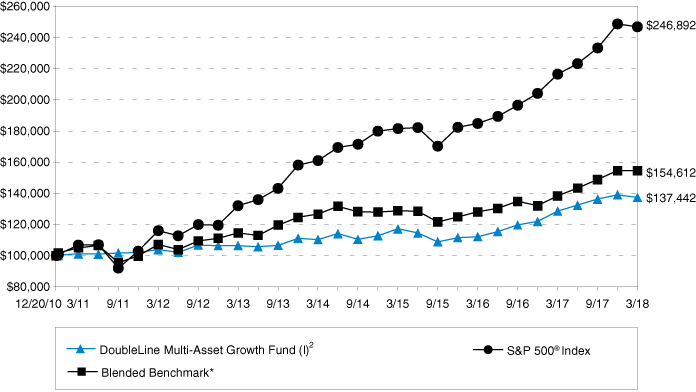

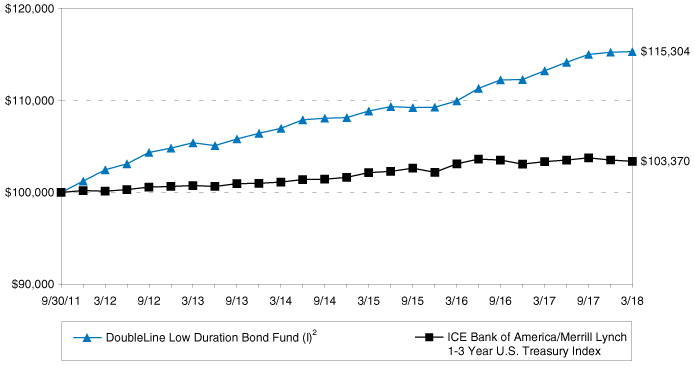

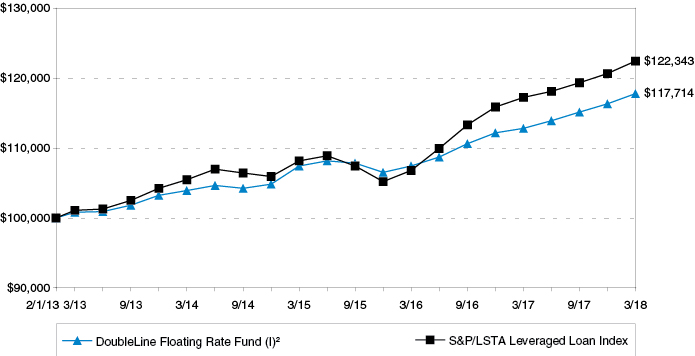

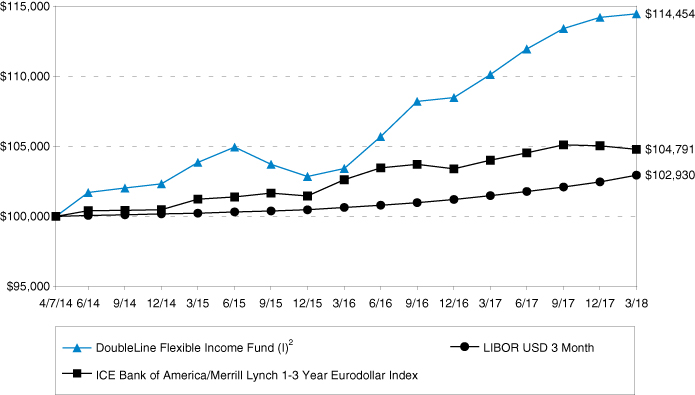

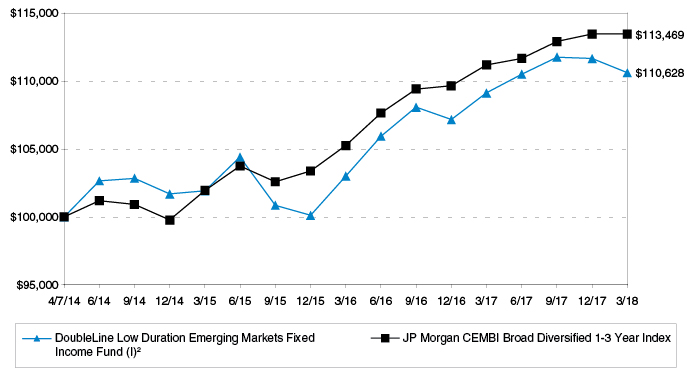

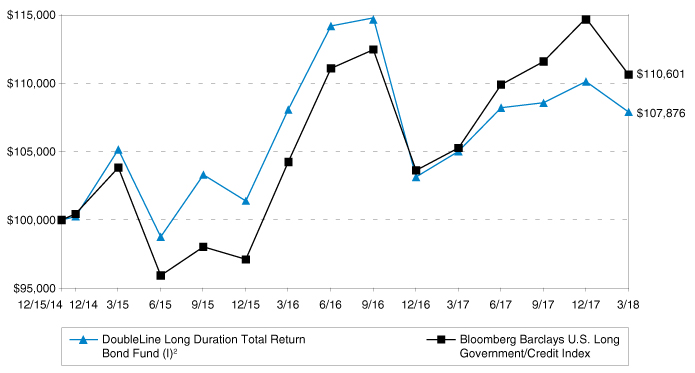

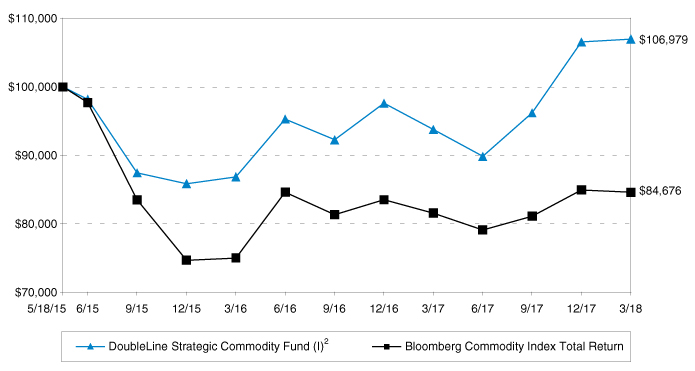

The performance shown assumes the reinvestment of all dividends and distributions and does not reflect any reductions for taxes. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedules of Investments for a complete list of Fund holdings.

A direct investment cannot be made in an index. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments.

The DoubleLine Funds are distributed by Quasar Distributors, LLC.

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a Fund and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein.

DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available.

Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. Past performance is no guarantee of future results.

A summary of the DoubleLine Core Fixed Income Fund’s investments in affiliated mutual funds for the year ended March 31, 2018 is as follows:

A summary of the DoubleLine Multi-Asset Growth Fund’s (Consolidated) investments in affiliated mutual funds for the year ended March 31, 2018 is as follows:

A summary of the DoubleLine Low Duration Bond Fund’s investments in affiliated mutual funds for the year ended March 31, 2018 is as follows:

A summary of the DoubleLine Flexible Income Fund’s investments in affiliated mutual funds for the year ended March 31, 2018 is as follows:

Each Fund is classified as a diversified fund under the 1940 Act, except the Global Bond Fund, Infrastructure Income Fund, and Strategic Commodity Fund, which are classified as non-diversified Funds. Currently under the 1940 Act, a diversified fund generally may not, with respect to 75% of its total assets, invest more than 5% of its total assets in the securities of any one issuer or own more than 10% of the outstanding voting securities of such issuer (except, in each case, U.S. Government securities, cash, cash items and the securities of other investment companies). The remaining 25% of a fund’s total assets is not subject to this limitation.

The Funds’ investment objectives and commencement of operations of each share class are as follows:

Each Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946, “Financial Services—Investment Companies”, by the Financial Accounting Standards Board (“FASB”). The following is a summary of the significant accounting policies of the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“US GAAP”).

Assets and liabilities may be transferred between levels. The Funds use end of period timing recognition to account for any transfers.

Market values for domestic and foreign fixed income securities are normally determined on the basis of valuations provided by independent pricing services. Vendors typically value such securities based on one or more inputs described in the following table which is not intended to be a complete list. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed income securities in which the Funds are authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income securities. Securities that use similar valuation techniques and inputs as described in the following table are categorized as Level 2 of the fair value hierarchy. To the extent the significant inputs are unobservable, the values generally would be categorized as Level 3.

Investments in registered open-end management investment companies will be valued based upon the net asset value (“NAV”) of such investments and are categorized as Level 1 of the fair value hierarchy.

Common stocks, exchange-traded funds and financial derivative instruments, such as futures contracts or options contracts, that are traded on a national securities or commodities exchange, are typically valued at the last reported sales price, in the case of common stocks and exchange-traded funds, or, in the case of futures contracts or options contracts, the settlement price determined by the relevant exchange. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized as Level 1 of the fair value hierarchy.

Securities may be fair valued by the Adviser in accordance with the fair valuation procedures approved by the Board of Trustees (the “Board”). The Adviser’s valuation committee is generally responsible for overseeing the day to day valuation processes and reports periodically to the Board. The Adviser’s valuation committee and the pricing group are authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations or third party vendor prices are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are deemed to be unreliable indicators of market or fair value.

The following is a summary of the fair valuations according to the inputs used to value the Funds’ investments as of March 31, 2018:

The following amounts were transferred between Level 1 to Level 2 as of March 31, 2018. Transfers between Level 1 and Level 2 were due to adjustments made to quoted market prices, such as foreign currency translation, to measure the fair value of those instruments.

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

The following is a summary of quantitative information about Level 3 Fair Value Measurements:

The Funds may be subject to a nondeductible 4% excise tax calculated as a percentage of certain undistributed amounts of net investment income and net capital gains.

The Funds have adopted financial reporting rules that require the Funds to analyze all open tax years, as defined by the applicable statute of limitations, for all major jurisdictions. Open tax years, 2017, 2016 and 2015 for the Funds, are those that are open for exam by taxing authorities. As of March 31, 2018, the Funds have no examinations in progress.

Management has analyzed the Funds’ tax positions, and has concluded that no liability should be recorded related to uncertain tax positions expected to be taken on the tax return for the fiscal year-ended March 31, 2018. The Funds identify their major tax jurisdictions as U.S. Federal, the State of Delaware and the State of California. The Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from US GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications between paid-in capital, undistributed (accumulated) net investment income (loss), and/or undistributed (accumulated) realized gain (loss). Undistributed (accumulated) net investment income or loss may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or capital gain remaining at fiscal year end is distributed in the following year.

Distributions from investment companies will be classified as investment income or realized gains in the Statements of Operations based on the U.S. income tax characteristics of the distribution if such information is available. In cases where the tax characteristics are not available, such distributions are generally classified as investment income.

As of March 31, 2018, the relationship of the Subsidiary to each respective Fund was as follows:

DoubleLine Capital LP and DoubleLine Alternatives LP (formerly DoubleLine Commodity LP) (each, an “Adviser” and, collectively, the “Advisers”), provide the Funds with investment management services under Investment Management Agreements (the “Agreements”). Under the Agreements, each Adviser manages the investment of the assets of the applicable Fund, places orders for the purchase and sale of its portfolio securities and is responsible for providing certain resources to assist with the day-to-day management of the Trust’s business affairs. As compensation for its services, each Adviser is entitled to a monthly fee at the annual rates of the average daily net assets of the Funds (the “Advisory Fee”) in the following table. Each Adviser has arrangements with DoubleLine Group LP to provide personnel and other resources to the Funds.

Each Adviser has contractually agreed to limit certain of the Funds’ ordinary operating expenses so that its ratio of such expenses to average net assets will not exceed the following ratios (the “Expense Caps”). For the purposes of the expense limitation agreement between each Adviser and the Funds, “ordinary operating expenses” excludes taxes, commissions, mark-ups, litigation expenses, indemnification expenses, interest expenses, acquired fund fees and expenses, and any extraordinary expenses. Each Fund’s expense limitation is expected to apply until at least July 31, 2019. Each may be terminated during the term only by a majority vote of the disinterested Trustees of the Board.

Other than described above, to the extent that an Adviser waives its investment advisory fee and/or reimburses a Fund for other ordinary operating expenses, it may seek reimbursement of a portion or all of such amounts at any time within three fiscal years after the fiscal year in which such amounts were waived or reimbursed. Each Fund must pay its current ordinary operating expenses before each Adviser is entitled to any recoupment. Any such recoupment would be subject to review by the Board and will be subject to the Fund’s expense limitations in place when the fees were waived or the expenses were reimbursed.

Each Adviser, as applicable, contractually waived a portion of its fees or reimbursed certain operating expenses and may recapture a portion of the amounts no later than the dates as stated in the following table:

For the year ended March 31, 2018, each Adviser recouped the amounts shown from the following Funds:

If a Fund invested in other investment vehicles sponsored by an Adviser (“other DoubleLine Funds”) during the period, such Adviser waived its advisory fee to the Fund in an amount equal to the advisory fees paid to the Adviser by the other DoubleLine Funds in respect of Fund assets so invested. Accordingly, the Adviser waived the following fees for the year ended March 31, 2018.

As of March 31, 2018 , greater than 5% of the following DoubleLine Funds was held by other DoubleLine Funds as follows:

DoubleLine Capital LP and certain DoubleLine affiliated advisers provide investment advisory, sub-advisory, or consulting services to a variety of investors, including investment program sponsors, separate accounts, and mutual funds sponsored by third parties (collectively “third-party accounts”). Those services may result, directly or indirectly, in investments by the third-party accounts in one or more of the Funds. At times, the third-party accounts’ investments, individually or in the aggregate, may represent material interests in one or more of the Funds. The third-party accounts’ transaction activity in a Fund may cause a Fund to incur material transaction costs, to realize taxable gains distributable to shareholders, and/or to buy or sell assets at a time when the Fund might not otherwise do so, each of which may adversely affect a Fund’s performance. See the description of Large Shareholder Risk in the Principal Risks Note for more information. Records available to the Funds reflect that greater than 25% of the following Funds were held by third-party accounts as of March 31, 2018:

Class N shares and Class A shares of the Funds make payments under a distribution plan (the “Distribution Plan”) adopted pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Distribution Plan, each Fund compensates the Fund’s distributor for distribution and related services at an annual rate equal to 0.25% of the average daily net assets of the Fund attributable to its Class N and Class A shares. The fees may be used to pay the Fund’s distributor for distribution services and sales support services provided in connection with Class N and Class A shares.

The Class A shares of DoubleLine Multi-Asset Growth Fund have a maximum sales charge imposed on purchases of 4.25% of the offering price and a maximum contingent deferred sales charge of 0.75% that applies to purchases of $1 million or more of Class A shares if the shares are redeemed within 18 months of purchase.

The DoubleLine Multi-Asset Growth Fund and the DoubleLine Floating Rate Fund each impose redemption fees. Redemption fees are paid to and retained by the Funds to limit the opportunity to market time these Funds and to help offset estimated portfolio transaction costs and other related costs incurred by the Funds as a result of short-term trading. Subject to the exceptions discussed in the Funds’ prospectus, the Funds will apply a redemption fee equal to 1% of the value of any shares redeemed within 90 days of purchase.

Investment transactions (excluding short-term investments and in-kind transactions) for the year ended March 31, 2018 were as follows:

Purchases and sales related to in-kind transactions for the DoubleLine Low Duration Emerging Markets Fixed Income Fund for the year ended March 31, 2018 were $0 and $127,291,182, respectively. There were no purchases or sales related to in-kind transactions for any of the other Funds.

The Funds designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Funds related to net capital gain to zero.

The cost basis of investments for federal income tax purposes as of March 31, 2018, was as follows:

As of March 31, 2018, the components of accumulated earnings (losses) for income tax purposes were as follows:

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Funds after January 1, 2011 will not be subject to expiration. In addition, such losses must be utilized prior to the losses incurred in the years preceding enactment.

Additionally, US GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent differences primarily relate to paydown losses, accretion of discount on certain debt instruments, foreign currency gains (losses) and consent fee income. For the period ended March 31, 2018, the following table shows the reclassifications made:

Trustees who are not affiliated with each Adviser and its affiliates receive fees from the Trust. These trustees may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the Funds, are treated as if invested in shares of each respective Fund or other funds managed by each Adviser and its affiliates. These amounts represent general, unsecured liabilities of each Fund and vary according to the total returns of the selected funds. Trustees Fees in the Statements of Operations include current fees (either paid in cash or deferred) and an increase (decrease) in the value of the deferred amounts. Certain trustees and officers of the Funds are also officers of each Adviser; such trustees and officers are not compensated by the Funds.

The following disclosures provide information on the Funds’ use of derivatives and certain related risks. The location and fair value amounts of these instruments on the Statements of Assets and Liabilities and the realized gains and losses and changes in unrealized gains and losses on the Statements of Operations, each categorized by type of derivative contract, are included in the following tables.

The average volume of derivative activity during the year ended March 31, 2018 is as follows:

change in value (“variation margin”) is made or received by or for the accounts of the Funds. The variation margin is recorded on the Statements of Assets and Liabilities. The cumulative change in value of futures contracts is recorded in net unrealized appreciation (depreciation) on futures on the Statements of Assets and Liabilities. Gains or losses are recognized but not considered realized until the contracts expire or are closed and are recorded in net realized gain (loss) on futures on the Statements of Operations. Futures contracts involve, to varying degrees, risk of loss in excess of the variation margin disclosed on the Statements of Assets and Liabilities.

If a Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund typically will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation, other deliverable obligations or the affected securities in the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or the affected securities in the referenced index. If a Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund typically will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation, other deliverable obligations or the affected securities in the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or the affected securities in the referenced index. Recovery values are typically estimated by market makers considering either industry standard recovery rates or entity specific factors and considerations until a credit event occurs. An index credit default swap references all the names in the index, and if there is a default with respect to a single name in the index, the credit event is settled based on that name’s weight in the index.

Credit default swaps are considered to have credit risk related contingent features since they require payment by the protection seller to the protection buyer upon occurrence of a defined credit event. A Fund’s maximum risk of loss from counterparty risk, as the protection buyer, is the fair value of the contract, which may be mitigated by the posting of collateral by the counterparty to a Fund to cover a Fund’s exposure to the counterparty. Upfront premiums (received) paid including accretion (amortization) less any collateral held at the counterparty are reflected in deposit at broker for swaps on the Statements of Assets and Liabilities. The marked-to-market value less a financing rate, if any, is included in net unrealized appreciation (depreciation) on swaps on the Statements of Assets and Liabilities. At termination or maturity of the swap, the cumulative marked-to-market on the value less a financing rate, if any, is recorded in realized gain (loss) on swaps on the Statements of Operations.

under which two parties can exchange variable interest rates based on different segments of money markets. The value is marked to market and is recorded in net unrealized appreciation (depreciation) on swaps on the Statements of Assets and Liabilities. At termination or maturity date, the interest on the notional amount of principal is exchanged and is recorded in net realized gain (loss) on swaps on the Statements of Operations.

The Funds’ derivative instrument holdings are summarized in the following tables.

The effect of derivative instruments on the Statements of Assets and Liabilities for the year ended March 31, 2018 was as follows:

The effect of derivative instruments on the Statements of Operations for the year ended March 31, 2018 was as follows:

The Funds are subject to various Master Netting Arrangements, which govern the terms of certain transactions with select counterparties. The Master Netting Arrangements allow the Funds to close out and net their total exposure to a counterparty in the event of a default with respect to all the transactions governed under a single agreement with a counterparty. The Master Netting Arrangements also specify collateral posting arrangements at pre-arranged exposure levels. Under the Master Netting Arrangements, collateral is routinely transferred if the total net exposure to certain transactions (net of existing collateral already in place) governed under the relevant Master Netting Arrangement with a counterparty in a given account exceeds a specified threshold depending on the counterparty and the type of Master Netting Arrangement.

As of March 31, 2018 the Trust held the following derivative instruments that were subject to offsetting on the Statements of Assets and Liabilities:

The Funds may make loans directly to borrowers and may acquire or invest in loans made by others (“loans”). The Funds may acquire a loan interest directly by acting as a member of the original lending syndicate. Alternatively, the Funds may acquire some or all of the interest of a bank or other lending institution in a loan to a particular borrower by means of a novation, an assignment or a participation. The loans in which the Funds may invest include those that pay fixed rates of interest and those that pay floating rates—i.e., rates that adjust periodically based on a known lending rate, such as a bank’s prime rate. The Funds may purchase and sell interests in bank loans on a when-issued and delayed delivery basis, with payment delivery scheduled for a future date. Securities purchased on a delayed delivery basis are marked to market daily and no income accrues to the Funds prior to the date the Funds actually take delivery of such securities. These transactions are subject to market fluctuations and are subject, among other risks, to the risk that the value at delivery may be more or less than the trade purchase price.

U.S. Bank, N.A. (the “Bank”) has made available to the Trust (the “DoubleLine Funds”) an uncommitted $600,000,000 credit facility for short term liquidity in connection with shareholder redemptions. Under the terms of the credit facility, borrowings for each DoubleLine Fund are limited to one-third of the total assets (including the amount borrowed) of such DoubleLine Fund. Fifty percent of the credit facility is available to all of the DoubleLine Funds, on a first come, first served basis. The remaining 50% of the credit facility is allocated among the DoubleLine Funds in accordance with procedures adopted by the Board. Borrowings under this credit facility bear interest at the Bank’s prime rate less 0.50% annually (weighted average rate of 3.78% for the year ended March 31, 2018).

The Bank has also made available to the DoubleLine Floating Rate Fund a committed credit facility. Prior to February 11, 2018, borrowings under this credit facility were made available up to $40,000,000. Effective February 11, 2018, the amount made available increased to $50,000,000. Borrowings under this credit facility bear interest at the Bank’s prime rate less 0.50% annually and the credit facility bears an unused commitment fee equal to 0.12% annually on the unused portion of the credit facility.

For the year ended March 31, 2018, the Funds’ credit facility activity is as follows:

As of March 31, 2018, shareholders affiliated with the Funds and/or Advisers (other than other DoubleLine Funds) owned shares of the Funds as follows:

Investment activities of these shareholders could have a material affect on each Fund. See the description of Large Shareholder Risk in the following Principal Risks Note. For information on greater than 5% holders of certain Funds by other DoubleLine Funds, see the Related and Other Party Transactions Note.

Below are summaries of some, but not all, of the principal risks of investing in one or more of the Funds, each of which could adversely affect a Fund’s NAV, yield and total return. Each risk listed below does not necessarily apply to each Fund, and you should read each Fund’s prospectus carefully for a description of the principal risks associated with investing in a particular Fund.

In preparing these financial statements, the Funds have evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. The Funds have determined there are no additional subsequent events that would need to be disclosed in the Funds’ financial statements.

We have audited the accompanying statements of assets and liabilities, including schedules of investments—summary of DoubleLine Total Return Bond Fund and DoubleLine Core Fixed Income Fund and schedules of investments of DoubleLine Emerging Markets Fixed Income Fund, DoubleLine Multi-Asset Growth Fund (Consolidated), DoubleLine Low Duration Bond Fund, DoubleLine Floating Rate Fund, DoubleLine Shiller Enhanced CAPE®, DoubleLine Flexible Income Fund, DoubleLine Low Duration Emerging Markets Fixed Income Fund, DoubleLine Long Duration Total Return Bond Fund, DoubleLine Strategic Commodity Fund (Consolidated), DoubleLine Global Bond Fund, DoubleLine Infrastructure Income Fund, DoubleLine Ultra Short Bond Fund, and DoubleLine Shiller Enhanced International CAPE® (fifteen of the funds constituting DoubleLine Funds Trust, hereafter collectively referred to as the “Funds”) as of March 31, 2018, the related statements of operations for the year ended March 31, 2018, the statements of changes in net assets for each of the two years in the period ended March 31, 2018, including the related notes, and the financial highlights for each of periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of March 31, 2018, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period ended March 31, 2018 and each of the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2018 by correspondence with the custodian, transfer agent, and brokers. We believe that our audits provide a reasonable basis for our opinions.

We have served as the auditor of one or more investment companies in the DoubleLine Investment Company Complex since 2010.

As a shareholder of the Funds, you incur two basic types of costs: (1) transaction costs , including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees and other Fund expenses.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 10/1/17 through 3/31/18.*

The actual return columns in the following table provide information about account values based on actual returns and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the respective line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. In addition to the expenses shown below in the table, as a shareholder you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. Currently, if you request a redemption be made by wire, a $15.00 fee is charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem shares that have been held for less than 90 days in the DoubleLine Multi-Asset Growth Fund and the DoubleLine Floating Rate Fund. An Individual Retirement Account (“IRA”) will be charged a $15.00 annual maintenance fee. The transfer agent charges a transaction fee of $25.00 on returned checks and stop payment orders. If you paid a transaction fee, you would add the fee amount to the expenses paid on your account this period to obtain your total expenses paid.

The hypothetical return columns in the following table provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect the transaction fees discussed above. Therefore, those columns are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The Trustees’ determination to approve the continuation of each Advisory Agreement was made on the basis of each Trustee’s business judgment after an evaluation of all of the information provided to the Trustees, including information provided for their consideration at their February 2018 meeting with management and at meetings held earlier in February outside the presence of management specifically to review and consider materials related to the proposed continuation of each Advisory Agreement. The Trustees meet over the course of the year with investment advisory personnel from DoubleLine and regularly review detailed information, presented both orally and in writing, regarding the services performed by DoubleLine for the benefit of the Funds and the investment program, performance, and operations of each Fund. In considering whether to approve the continuation of the Advisory Agreements, the Trustees took into account information presented to them over the course of the past year.

This summary describes a number, but not necessarily all, of the most important factors considered by the Board and the Independent Trustees. Individual Trustees may have given different weights to certain factors and assigned various degrees of materiality to information received in connection with the approval process. No single factor was determined to be decisive. In all of their deliberations, the Independent Trustees were advised by independent counsel.

The Trustees considered the nature, extent, and quality of the services, including the expertise and experience of investment personnel, provided and expected to be provided by DoubleLine to each Fund. In this regard, the Trustees considered that DoubleLine provides a full investment program for the Funds, and noted DoubleLine’s representation that it seeks to provide attractive returns with a strong emphasis on risk management. The Board considered in particular the difficulty of managing debt-related portfolios, noting that managing such portfolios requires a portfolio management team to balance a number of factors, which may include, among others, securities of varying maturities and durations, actual and anticipated interest rate changes and volatility, prepayments, collateral management, counterparty management, pay-downs, credit events, workouts, and net new issuances.

The Trustees reviewed reports (the “Strategic Insight Reports”) provided by Strategic Insight, an Asset International Company (“Strategic Insight”), that compared each open-end Fund’s net management fee ratio and net total expense ratio (Class I shares) against its Strategic Insight peer group, and each open-end Fund’s performance records (Class I shares) for the three-month, six-month, and one-year periods and, where applicable, the three- and five-year periods ended December 31, 2017 against its Morningstar category. The Independent Trustees met with Strategic Insight representatives to review Strategic Insight’s selection of peer groups, including the views of Strategic Insight regarding the challenges it encountered in assembling a peer group of funds with investment strategies substantially similar to those of certain open-end Funds.

With respect to the comparative performance information in the Strategic Insight Reports, the Trustees noted in particular that each open-end Fund, other than the Emerging Markets Fixed Income Fund (“EMFI”), Long Duration Total Return Bond Fund (“LD Total Return”), Low Duration Emerging Markets Fixed Income Fund (“LDEMFI”), Shiller Enhanced International CAPE (“International CAPE”), and Ultra Short Bond Fund (“Ultra Short”), was in the first or second performance quartile relative to its respective Morningstar category for the one-year period ended December 31, 2017; and each open-end Fund with a sufficiently long track record was in the first or second performance quartile relative to its respective Morningstar category for the three- and five-year periods ended December 31, 2017, other than EMFI and the Floating Rate Fund, which were in the third performance quartile for the three-year period, and LDEMFI, which was in the fourth performance quartile for the three-year period. The Trustees considered specific factors cited by DoubleLine for the relative underperformance of certain of the open-end Funds, which in most cases resulted from decisions of the Funds’ portfolio management team as to the overall positioning and strategy of the Funds. In addition, the Trustees considered management’s statements that International CAPE and Ultra Short have short operating histories, limiting the usefulness of peer group comparisons, and that the unusual long-duration strategy of LDEMFI limits the number of similar peer funds for comparison. Concerning EMFI and LD Total Return, the Trustees noted that each Fund’s performance was in the first quartile of its Morningstar category for longer-term periods (the five-year period ended December 31, 2017 in the case of EMFI, and the three-year period ended December 31, 2017 in the case of LD Total Return).

The Trustees considered the portion of the Strategic Insight Reports covering the open-end Funds’ expenses and advisory fees, noting that the reports showed that each open-end Fund, other than LD Total Return, the Strategic Commodity Fund, and Ultra Short, had a net total expense ratio in the first or second quartile of its peer group. The Trustees noted that the net total expense ratios of LD Total Return and the Strategic Commodity Fund were nonetheless below those of several of their respective peers, and that each of those Funds had achieved favorable relative performance over the longest period shown in its Strategic Insight Report notwithstanding its net expense ratio. The Trustees noted that, although Ultra Short’s net total expense ratio was in the third comparative quartile, it was within one-tenth of one basis point of the peer group median.

As to the Opportunistic Credit Fund (“DBL”), the Trustees noted that DBL’s net management fee ratio based on managed assets (generally, including the assets attributable to the Fund’s leverage) was shown in the Strategic Insight Reports to be slightly above the median of its peer group, and that its net management fee ratio based on net assets (generally, excluding the assets attributable to the Fund’s leverage) was below the median of its peer group. The Trustees noted that DBL had performed in the second quartile of its Morningstar category for the five-year period ended December 31, 2017, but that its performance had been in the third quartile for the three-year period and the fourth quartile for the one-year period ended December 31, 2017. The Trustees considered DoubleLine’s explanation for DBL’s recent underperformance, including its conservative positioning and its focus on investment in mortgage-backed securities by contrast to many peers that had more diversified exposure to segments of the debt securities markets. They also noted the information in the Strategic Insight Report showing that DBL had employed comparatively less leverage than its peers as of the date of the information in that report.

As to the Income Solutions Fund (“DSL”), the Trustees noted that DSL was shown in the Strategic Insight Reports to have performed in the first or second quartile of its Morningstar category for all periods shown. They noted the information in the Strategic Insight Report showing that DSL had employed comparatively less leverage than the median of its peer group as of the date of the information in that report. They noted that DSL’s net management fee ratios and net total expense ratios were just above the median of its peer group.

In evaluating the comparative net management fee ratios of DBL and DSL, the Trustees also considered DoubleLine’s statement that it had attempted to set each Fund’s fees at its inception at rates that reflected competitive market levels, but that also reflected the experience and expertise DoubleLine brings to managing the Funds.

The Trustees noted that both DBL and DSL had employed leverage for the period shown in the Strategic Insight Reports, and considered information from DoubleLine intended to show that each Fund’s use of leverage was accretive to the Fund’s investment performance, after taking into account any expenses related to the leverage.

The Trustees considered that DoubleLine provides a variety of other services to the Funds in addition to investment advisory services, including, among others, a number of back-office services, valuation services, compliance services, certain forms of information technology services (such as internal reporting), assistance with accounting and distribution services, and supervision and monitoring of the Funds’ other service providers. The Trustees reviewed DoubleLine’s ongoing efforts to keep the Trustees informed about matters relevant to the Funds and their shareholders. The Trustees also considered the nature, extent, and structure of the Funds’ compliance program, including the policies and procedures of the Funds and their various service providers (including DoubleLine). The Trustees considered the quality of those non-investment advisory services and determined that their quality supported the continuation of the Funds’ arrangements with DoubleLine.

The Trustees considered DoubleLine’s reports, provided at the Board’s regular meetings, that it had continued to hire additional resources to support DoubleLine’s ability to provide services to the Funds. The Trustees concluded that it appeared that DoubleLine continued to have sufficient quality and depth of personnel, resources, and investment methods.

The Trustees reviewed information as to general estimates of DoubleLine’s profitability with respect to each Fund, taking into account both the direct and the indirect benefits to DoubleLine from managing the Funds. The Trustees considered information provided by DoubleLine as to the methods it uses, and the assumptions it makes, in calculating its profitability. The Trustees considered representations from DoubleLine that its compensation and incentive policies and practices enable DoubleLine to attract, retain, and motivate highly qualified and experienced employees. The Trustees noted that DoubleLine had significant profitability in respect of certain of the Funds, but noted that in those cases it would be appropriate to consider that profitability in light of various other considerations such as the nature, extent, and quality of the services provided by DoubleLine, the relative performance of the Funds, and the competitiveness of the management fees and total operating expenses of the Funds.

The Trustees separately considered DoubleLine’s statement that it is continuing to invest in its business to maintain its ability to provide high quality services to the Funds, and noted DoubleLine’s need to invest in technology, infrastructure, and staff to continue to provide services and accommodate rapidly changing regulatory requirements.

With regard to DBL and DSL, the Trustees noted that these Funds have not increased in assets significantly from their initial offerings due principally to their status as closed-end investment companies and that there were therefore no substantial increases in economies of scale realized with respect to these Funds since their inception. They noted DoubleLine’s view that the levels of its

profitability in respect of DBL and DSL are appropriate in light of the investment it has made in these Funds, the quality of the investment management and other teams provided by it, and its continued investments in its own business.

On the basis of these considerations as well as others and in the exercise of their business judgment, the Trustees determined that they were satisfied with the nature, extent, and quality of the services provided to each Fund under its Advisory Agreement; that it appeared that the management fees paid by each Fund to DoubleLine were generally within the range of management fees paid by its peer funds, and, with respect to some Funds, lower than the median management fees paid by their peer funds, and generally reasonable in light of the services provided, the quality of the portfolio management teams, and each Fund’s performance to date; that the fees paid by each Fund did not appear inappropriate in light of the fee schedules charged to DoubleLine’s other clients with substantially similar investment strategies (where applicable) in light of the differences in the services provided and the risks borne by DoubleLine; that the profitability of each Fund to DoubleLine did not appear excessive or such as to preclude continuation of the Fund’s Advisory Agreement; that absence of breakpoints in any Fund’s management fee did not render that Fund’s fee unreasonable or inappropriate under the circumstances, although the Trustees would continue to consider the topic over time; and that it would be appropriate to approve each Advisory Agreement for an additional one-year period.

For the fiscal year ended March 31, 2018, certain dividends paid by the Funds may be subject to a maximum tax rate of 15% (20% for taxpayers with taxable income greater than $425,800 for single individuals and $479,000 for married couples filing jointly), as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003 and The Tax Cuts and Jobs Act of 2017. Prior to January 1, 2018, certain dividends paid by the Funds may have been subject to a maximum tax rate of 15% (20% for taxpayers with taxable income greater than $400,000 for single individuals and $450,000 for married couples filing jointly). The percentage of dividends declared from ordinary income designated as qualified dividend income was as follows:

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended March 31, 2018 was as follows:

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c) for the fiscal year ended March 31, 2018 for each Fund was as follows:

The percentage of taxable ordinary income distributions that are designated as interest related dividends under Internal Revenue Section 871(k)(1)(c) for the fiscal year ended March 31, 2018 for each Fund was as follows:

Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Funds.

The following Trustees are “interested persons” of the Trust as defined in the 1940 Act because they are officers of the Advisers, and indirect shareholders in the Advisers.

Information about how a Fund voted proxies relating to portfolio securities held during the most recent twelve month period ended June 30th is available no later than the following August 31st without charge, upon request, by calling 877-DLine11 (877-354-6311) and on the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

A description of the Funds’ proxy voting policies and procedures is available (i) without charge, upon request, by calling 877-DLine11 (877-354-6311); and (ii) on the commission’s website at http://www.sec.gov.

It is the policy of the Trust to provide certain unaudited information regarding the portfolio composition of the Funds as of month-end to shareholders and others upon request to the Funds, beginning on the 15th calendar day after the end of the month (or, if not a business day, the next business day thereafter).

Shareholders and others who wish to obtain portfolio holdings for a particular month may make a request by contacting the Funds at no charge at 877-DLine11 (877-354-6311) between the hours of 7:00 a.m. and 5:00 p.m. Pacific time, Monday through Friday, beginning on the 15th day following the end of that month (or, if not a business day, the next business day thereafter). Requests for portfolio holdings may be made on a monthly basis pursuant to this procedure, or standing requests for portfolio holdings may be accepted.

The Trust is required to file its complete schedule of portfolio holdings with the SEC for its first and third fiscal quarters on Form N-Q. The Trust’s Forms N-Q are available on the SEC website at www.sec.gov. You can also review and obtain copies of the Forms N-Q at the SEC Public Reference Room in Washington, DC (information on the operation of Public Reference Room may be obtained by calling 1-800-SEC-0330).

This report includes summary Schedules of Investments for the DoubleLine Total Return Bond Fund and DoubleLine Core Fixed Income Fund. A complete Schedule of Investments for each Fund may be obtained, without charge, upon request, by calling 877-DLine11 (877-354-6311) and on the SEC website at www.sec.gov.

In an effort to conserve resources, the Funds intend to reduce the number of duplicate Prospectuses and Annual and Semi-Annual Reports you receive by sending only one copy of each to addresses where we reasonably believe two or more accounts are from the same family. If you would like to discontinue householding of your accounts, please call toll-free 877-DLine11 (877-354-6311) to request individual copies of these documents. We will begin sending individual copies thirty days after receiving your request to stop householding.

Financial companies choose how they share your personal information. This notice provides information about how we collect, share, and protect your personal information, and how you might choose to limit our ability to share certain information about you. Please read this notice carefully.

All financial companies need to share customers’ personal information to run their everyday businesses. Accordingly, information, confidential and proprietary, plays an important role in the success of our business. However, we recognize that you have entrusted us with your personal and financial data, and we recognize our obligation to keep this information secure. Maintaining your privacy is important to us, and we hold ourselves to a high standard in its safekeeping and use. Most importantly, DoubleLine does not sell its customers’ non-public personal information to any third parties. DoubleLine uses its customers’ non-public personal information primarily to complete financial transactions that its customers request or to make its customers aware of other financial products and services offered by a DoubleLine affiliated company.

DoubleLine may collect non-public information about you from the following sources:

The types of personal information DoubleLine collects and shares depend on the product or service you have with us. This information may include:

DoubleLine does not disclose any non-public personal information about our customers or former customers without the customer’s authorization, except that we may disclose the information listed above, as follows:

We have procedures designed to limit access to your personal account information to those agents and vendors who need to know that information to provide products and services to you. Your information is not provided by us to nonaffiliated third parties for marketing purposes. We seek to maintain physical, electronic, and procedural safeguards to guard your non-public personal information.

As required by federal law, DoubleLine will notify customers of DoubleLine’s Privacy Policy annually. DoubleLine reserves the right to modify this policy at any time, but in the event that there is a change, DoubleLine will promptly inform its customers of that change.

U.S. Bancorp Fund Services, LLC

P.O. Box 701

U.S. Bank, N.A.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is filed herewith.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Raymond B. Woolson is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant. (If more than 50 percent of the accountant’s hours were spent to audit the registrant’s financial

statements for the most recent fiscal year, state how many hours were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.)

The information required by this Item 6 (except with respect to the DoubleLine Total Return Bond Fund and DoubleLine Core Fixed Income Fund) is included as part of the annual report to shareholders filed under Item 1 of this Form N-CSR.

Please note that the Registrant has included a summary schedule of portfolio securities of the DoubleLine Total Return Bond Fund and DoubleLine Core Fixed Income Fund in its annual report to shareholders, a copy of which is included under Item 1, for this reporting period. The DoubleLine Total Return Bond Fund’s and DoubleLine Core Fixed Income Fund’s complete schedule of investments in securities of unaffiliated issuers as of the close of this period as set forth in Section 210.12-12 of Regulation S-X is set forth below:

| | | | | | | | | | | | | | |

Principal Amount $/Shares | | Security Description | | Rate | | | Maturity | | | Value $ | |

Asset Backed Obligations - 3.7% | | | | | | | | | |

23,076,982 | | Aqua Finance Trust, Series 2017-A-A | | | 3.72% | ^ | | | 11/15/2035 | | | | 22,773,520 | |

8,952,882 | | Arcadia Receivables Credit Trust, Series 2017-1-A | | | 3.25% | ^ | | | 06/15/2023 | | | | 8,992,225 | |

4,528,580 | | AVANT Loans Funding Trust, Series 2017-B-A | | | 2.29% | ^ | | | 06/15/2020 | | | | 4,520,686 | |

19,783,750 | | CAL Funding Ltd., Series 2018-1A-A | | | 3.96% | ^ | | | 02/25/2043 | | | | 19,975,842 | |

27,107,833 | | Castlelake Aircraft Securitization Trust, Series 2015-1A-A | | | 4.70% | ^ § | | | 12/15/2040 | | | | 27,252,237 | |

40,622,934 | | Castlelake Aircraft Securitization Trust, Series 2016-1-A | | | 4.45% | | | | 08/15/2041 | | | | 40,687,322 | |

53,449,761 | | Castlelake Aircraft Securitization Trust, Series 2017-1-A | | | 3.97% | | | | 07/15/2042 | | | | 53,228,907 | |

6,493,165 | | Citi Held For Asset Issuance, Series 2015-PM1-C | | | 5.01% | ^ | | | 12/15/2021 | | | | 6,523,368 | |

281,201 | | Citi Held For Asset Issuance, Series 2015-PM2-B | | | 4.00% | ^ | | | 03/15/2022 | | | | 281,340 | |

30,000,000 | | Citi Held For Asset Issuance, Series 2015-PM2-C | | | 5.96% | ^ | | | 03/15/2022 | | | | 30,275,040 | |

2,544,558 | | Citi Held For Asset Issuance, Series 2016-MF1-A | | | 4.48% | ^ | | | 08/15/2022 | | | | 2,549,985 | |

72,948,750 | | Coinstar Funding LLC, Series 2017-1A-A2 | | | 5.22% | ^ | | | 04/25/2047 | | | | 75,010,355 | |

28,439,303 | | Colony American Finance Ltd., Series 2016-1-A | | | 2.54% | ^ | | | 06/15/2048 | | | | 27,973,760 | |

9,392,820 | | Commonbond Student Loan Trust, Series 2015-A-A | | | 3.20% | ^ | | | 06/25/2032 | | | | 9,383,092 | |

16,080,201 | | Commonbond Student Loan Trust, Series 2016-A-A1 | | | 3.32% | ^ | | | 05/25/2040 | | | | 15,619,154 | |

12,076,159 | | Consumer Installment Loan Trust, Series 2016-LD1-A | | | 3.96% | ^ | | | 07/15/2022 | | | | 12,079,811 | |

21,000,000 | | Credit Acceptance Auto Loan Trust, Series 2017-3A-A | | | 2.65% | ^ | | | 06/15/2026 | | | | 20,807,758 | |

41,000,000 | | Credit Acceptance Auto Loan Trust, Series 2018-1A-A | | | 3.01% | ^ | | | 02/16/2027 | | | | 40,768,321 | |

16,490,000 | | DB Master Finance LLC, Series 2015-1A-A2II | | | 3.98% | ^ | | | 02/20/2045 | | | | 16,653,782 | |

11,878,265 | | Eaglewood Consumer Loan Trust, Series 2014-1-A | | | 3.50% | ^ ¥ Þ | | | 10/15/2019 | | | | 11,874,191 | |

13,884,029 | | Earnest Student Loan Program LLC, Series 2016-B-A2 | | | 3.02% | ^ | | | 05/25/2034 | | | | 13,798,977 | |

17,554,511 | | Earnest Student Loan Program LLC, Series 2016-D-A2 | | | 2.72% | ^ | | | 01/25/2041 | | | | 17,279,894 | |

69,308,404 | | ECAF Ltd., Series 2015-1A-A2 | | | 4.95% | ^ | | | 06/15/2040 | | | | 70,277,058 | |

7,363,463 | | Element Rail Leasing LLC, Series 2016-1A-A1 | | | 3.97% | ^ | | | 03/19/2046 | | | | 7,392,279 | |

9,278,000 | | Falcon Aerospace Ltd., Series 2017-1-A | | | 4.58% | ^ | | | 02/15/2042 | | | | 9,386,395 | |

9,952,927 | | Foundation Finance Trust, Series 2016-1A-A | | | 3.96% | ^ | | | 06/15/2035 | | | | 9,979,989 | |

47,000,000 | | GM Financial Automobile Leasing Trust, Series 2018-1-A2A | | | 2.39% | | | | 04/20/2020 | | | | 46,902,226 | |

43,800,000 | | Harbour Aircraft Investments Ltd., Series 2017-1-A | | | 4.00% | | | | 11/15/2037 | | | | 43,768,157 | |

10,156,679 | | HERO Funding Trust, Series 2016-3A-A2 | | | 3.91% | ^ | | | 09/20/2042 | | | | 10,415,910 | |

24,530,537 | | HERO Funding Trust, Series 2016-4A-A2 | | | 4.29% | ^ | | | 09/20/2047 | | | | 25,040,519 | |

28,135,000 | | Invitation Homes Trust, Series 2015-SFR1-E (1 Month LIBOR USD + 4.20%, 4.20% Floor) | | | 5.95% | ^ | | | 03/17/2032 | | | | 28,279,479 | |

63,481,000 | | Jimmy Johns Funding LLC, Series 2017-1A-A2II | | | 4.85% | ^ | | | 07/30/2047 | | | | 65,041,706 | |

92,708,333 | | Labrador Aviation Finance Ltd., Series 2016-1A-A1 | | | 4.30% | ^ | | | 01/15/2042 | | | | 94,708,794 | |

1,215,052 | | LendingClub Issuance Trust, Series 2016-NP1-A | | | 3.75% | ^ | | | 06/15/2022 | | | | 1,217,492 | |

368,793 | | LendingClub Issuance Trust, Series 2016-NP2-A | | | 3.00% | ^ | | | 01/17/2023 | | | | 368,441 | |

11,000,000 | | Lendmark Funding Trust, Series 2017-2A-A | | | 2.80% | ^ | | | 05/20/2026 | | | | 10,945,723 | |

11,750,000 | | Longtrain Leasing LLC, Series 2015-1A-A2 | | | 4.06% | ^ | | | 01/15/2045 | | | | 11,940,497 | |

23,000,000 | | Mariner Finance Issuance Trust, Series 2017-AA-A | | | 3.62% | ^ | | | 02/20/2029 | | | | 23,111,283 | |

4,520,722 | | MarketPlace Loan Trust, Series 2015-CB1-A | | | 4.00% | ^ | | | 07/15/2021 | | | | 4,519,709 | |

7,656,802 | | MarketPlace Loan Trust, Series 2015-LD1-A | | | 4.00% | ^ | | | 12/15/2021 | | | | 7,654,558 | |

8,193,761 | | MarketPlace Loan Trust, Series 2016-LD1-A | | | 5.25% | ^ | | | 03/15/2022 | | | | 8,234,574 | |

13,768,612 | | Marlette Funding Trust, Series 2017-2A-A | | | 2.39% | ^ | | | 07/15/2024 | | | | 13,737,876 | |

7,043,951 | | Marlette Funding Trust, Series 2017-3A-A | | | 2.36% | ^ | | | 12/15/2024 | | | | 7,018,665 | |

19,661,748 | | Marlette Funding Trust, Series 2018-1A-A | | | 2.61% | ^ | | | 03/15/2028 | | | | 19,633,820 | |

41,698,579 | | Mosaic Solar Loans LLC, Series 2017-2A-A | | | 3.82% | ^ | | | 09/20/2042 | | | | 41,398,445 | |

23,000,000 | | Navient Private Education Loan Trust, Series 2017-A-B | | | 3.91% | ^ | | | 12/16/2058 | | | | 22,260,619 | |

62,561,232 | | NRZ Excess Spread-Collateralized Notes, Series 2018-PLS2-A | | | 3.27% | ^ | | | 02/25/2023 | | | | 62,430,342 | |

5,883,908 | | OneMain Direct Auto Receivables Trust, Series 2016-1A-A | | | 2.04% | ^ | | | 01/15/2021 | | | | 5,880,527 | |

4,319,524 | | OneMain Financial Issuance Trust, Series 2015-2A-A | | | 2.57% | ^ | | | 07/18/2025 | | | | 4,319,081 | |

85,619,086 | | OneMain Financial Issuance Trust, Series 2016-2A-A | | | 4.10% | ^ | | | 03/20/2028 | | | | 86,337,815 | |

75,000,000 | | OneMain Financial Issuance Trust, Series 2017-1A-A1 | | | 2.37% | ^ | | | 09/14/2032 | | | | 73,768,192 | |

17,000,000 | | Oportun Funding LLC, Series 2016-B-A | | | 3.69% | ^ | | | 07/08/2021 | | | | 16,983,891 | |

25,000,000 | | Oxford Finance Funding LLC, Series 2016-1A-A | | | 3.97% | ^ | | | 06/17/2024 | | | | 24,950,565 | |

4,000,000 | | Progress Residential Trust, Series 2016-SFR2-D (1 Month LIBOR USD + 2.50%, 2.50% Floor) | | | 4.31% | ^ | | | 01/17/2034 | | | | 4,047,368 | |

6,000,000 | | Prosper Marketplace Issuance Trust, Series 2018-1A-A | | | 3.11% | ^ | | | 06/17/2024 | | | | 6,001,306 | |

22,323,168 | | Renew, Series 2017-2A-A | | | 3.22% | ^ | | | 09/22/2053 | | | | 21,918,426 | |

30,804,843 | | SCF Equipment Leasing LLC, Series 2017-2A-A | | | 3.41% | ^ | | | 12/20/2023 | | | | 30,409,891 | |

40,721,930 | | Shenton Aircraft Investment Ltd., Series 2015-1A-A | | | 4.75% | ^ | | | 10/15/2042 | | | | 41,955,112 | |

3,321,823 | | SoFi Consumer Loan Program LLC, Series 2016-1-A | | | 3.26% | ^ | | | 08/25/2025 | | | | 3,323,632 | |

25,378,445 | | SoFi Consumer Loan Program LLC, Series 2017-6-A1 | | | 2.20% | ^ | | | 11/25/2026 | | | | 25,257,176 | |

18,750,000 | | SoFi Consumer Loan Program LLC, Series 2017-6-A2 | | | 2.82% | ^ | | | 11/25/2026 | | | | 18,553,618 | |

9,477,562 | | SoFi Consumer Loan Program Trust, Series 2016-2-A | | | 3.09% | ^ | | | 10/27/2025 | | | | 9,494,166 | |

31,168,393 | | SoFi Consumer Loan Program Trust, Series 2017-2-A | | | 3.28% | ^ | | | 02/25/2026 | | | | 31,251,731 | |

17,754,876 | | SoFi Consumer Loan Program Trust, Series 2017-5-A1 | | | 2.14% | ^ | | | 09/25/2026 | | | | 17,658,091 | |

10,000,000 | | SoFi Consumer Loan Program Trust, Series 2017-5-A2 | | | 2.78% | ^ | | | 09/25/2026 | | | | 9,859,832 | |

11,238,791 | | SoFi Consumer Loan Program Trust, Series 2018-1-A1 | | | 2.55% | ^ | | | 02/25/2027 | | | | 11,206,345 | |

15,423,515 | | SoFi Professional Loan Program, Series 2016-A-A2 | | | 2.76% | ^ | | | 12/26/2036 | | | | 15,298,106 | |

20,000,000 | | SoFi Professional Loan Program, Series 2017-E-B | | | 3.49% | ^ | | | 11/26/2040 | | | | 19,748,828 | |

13,000,000 | | SoFi Professional Loan Program, Series 2017-E-C | | | 4.16% | ^ | | | 11/26/2040 | | | | 12,861,121 | |

22,800,000 | | SoFi Professional Loan Program, Series 2018-A-B | | | 3.61% | ^ | | | 02/25/2042 | | | | 22,715,667 | |

18,000,000 | | SoFi Professional Loan Program, Series 2018-B-BFX | | | 3.83% | ^ | | | 08/25/2047 | | | | 18,199,969 | |

74,554,775 | | SpringCastle America Funding LLC, Series 2016-AA-A | | | 3.05% | ^ | | | 04/25/2029 | | | | 74,549,594 | |

14,000,000 | | Springleaf Funding Trust, Series 2016-AA-A | | | 2.90% | ^ | | | 11/15/2029 | | | | 13,942,918 | |

71,750,000 | | Springleaf Funding Trust, Series 2017-AA-A | | | 2.68% | ^ | | | 07/15/2030 | | | | 70,676,878 | |

41,438,800 | | Sprite Ltd., Series 2017-1-A | | | 4.25% | ^ | | | 12/15/2037 | | | | 40,677,776 | |

3,939,312 | | Spruce Asset Backed Securities Trust, Series 2016-E1-A | | | 4.32% | ^ | | | 06/15/2028 | | | | 3,987,206 | |

4,726,000 | | TAL Advantage LLC, Series 2013-2A-A | | | 3.55% | ^ | | | 11/20/2038 | | | | 4,703,558 | |

5,017,631 | | Textainer Marine Containers Ltd., Series 2017-1A-A | | | 3.72% | ^ | | | 05/20/2042 | | | | 5,019,543 | |

26,000,000 | | Triton Container Finance LLC, Series 2018-1A-A | | | 3.95% | ^ | | | 03/20/2043 | | | | 26,151,580 | |

5,822,878 | | Upstart Securitization Trust, Series 2017-2-A | | | 2.51% | ^ | | | 03/20/2025 | | | | 5,806,372 | |

18,084,917 | | Vantage Data Centers Issuer LLC, Series 2018-1A-A2 | | | 4.07% | ^ | | | 02/16/2043 | | | | 18,271,889 | |

| | | | | | | | | | | | | | |

Total Asset Backed Obligations (Cost $1,914,985,629) | | | | | | | | 1,919,761,893 | |

| | | | | | | | | | | | | | |

| | | |

Collateralized Loan Obligations - 4.9% | | | | | | | | | | | | |

17,289,041 | | Acacia Ltd., Series 5A-A (3 Month LIBOR USD + 0.38%) | | | 1.56% | ^ | | | 11/08/2039 | | | | 16,837,797 | |

10,000,000 | | Adams Mill Ltd., Series 2014-1A-C1R (3 Month LIBOR USD + 2.35%) | | | 4.07% | ^ | | | 07/15/2026 | | | | 10,014,444 | |

68,250,000 | | AIMCO, Series 2015-AA-AR (3 Month LIBOR USD + 0.85%, 0.85% Floor) | | | 2.57% | ^ | | | 01/15/2028 | | | | 68,239,006 | |

25,000,000 | | ALM LLC, Series 2016-19A-A1 (3 Month LIBOR USD + 1.55%) | | | 3.27% | ^ | | | 07/15/2028 | | | | 25,143,750 | |

18,760,000 | | Anchorage Capital Ltd., Series 2014-5RA-A (3 Month LIBOR USD + 0.99%) | | | 2.71% | ^ | | | 01/15/2030 | | | | 18,757,950 | |

43,900,000 | | Apidos Ltd., Series 2013-16A-A1R (3 Month LIBOR USD + 0.98%) | | | 2.72% | ^ | | | 01/19/2025 | | | | 43,909,648 | |

23,000,000 | | Apidos Ltd., Series 2015-20A-A1R (3 Month LIBOR USD + 1.33%) | | | 3.05% | ^ | | | 01/16/2027 | | | | 23,019,044 | |

75,000,000 | | Arrowpoint Ltd., Series 2013-1A-A1R (3 Month LIBOR USD + 1.52%, 1.52% Floor) | | | 3.36% | ^ | | | 11/15/2028 | | | | 75,929,917 | |

31,500,000 | | Babson Ltd., Series 2014-3A-AR (3 Month LIBOR USD + 1.32%) | | | 3.04% | ^ | | | 01/15/2026 | | | | 31,500,000 | |

4,500,000 | | Babson Ltd., Series 2014-3A-D2 (1 Month LIBOR USD + 4.40%) | | | 6.12% | ^ | | | 01/15/2026 | | | | 4,500,000 | |

3,750,000 | | Babson Ltd., Series 2014-IIA-D (3 Month LIBOR USD + 3.60%) | | | 5.33% | ^ | | | 10/17/2026 | | | | 3,754,537 | |

75,000,000 | | BlueMountain Ltd., Series 2012-2A-AR (3 Month LIBOR USD + 1.42%, 1.42% Floor) | | | 3.30% | ^ | | | 11/20/2028 | | | | 75,290,206 | |

33,150,000 | | BlueMountain Ltd., Series 2013-1A-A1R (3 Month LIBOR USD + 1.40%) | | | 3.14% | ^ | | | 01/20/2029 | | | | 33,339,015 | |

58,250,000 | | BlueMountain Ltd., Series 2015-3A-A1 (3 Month LIBOR USD + 1.48%) | | | 3.22% | ^ | | | 10/20/2027 | | | | 58,250,000 | |

34,500,000 | | BlueMountain Ltd., Series 2015-4A-B (3 Month LIBOR USD + 2.25%) | | | 3.99% | ^ | | | 01/20/2027 | | | | 34,533,869 | |

9,250,000 | | BlueMountain Ltd., Series 2015-4A-C (3 Month LIBOR USD + 3.20%) | | | 4.94% | ^ | | | 01/20/2027 | | | | 9,265,062 | |

8,750,000 | | BlueMountain Ltd., Series 2015-4A-D1 (3 Month LIBOR USD + 4.60%) | | | 6.34% | ^ | | | 01/20/2027 | | | | 8,768,512 | |

22,500,000 | | BlueMountain Ltd., Series 2016-2A-A2 (3 Month LIBOR USD + 2.00%) | | | 3.88% | ^ | | | 08/20/2028 | | | | 23,002,363 | |

20,000,000 | | Carlyle Global Market Strategies Ltd., Series 2015-5A-A1A (3 Month LIBOR USD + 1.55%) | | | 3.29% | ^ | | | 01/20/2028 | | | | 20,142,345 | |

8,000,000 | | Carlyle Global Market Strategies Ltd., Series 2015-5A-A2A (3 Month LIBOR USD + 2.25%) | | | 3.99% | ^ | | | 01/20/2028 | | | | 8,079,594 | |

4,000,000 | | Carlyle Global Market Strategies Ltd., Series 2015-5A-B2 (3 Month LIBOR USD + 3.25%) | | | 4.99% | ^ | | | 01/20/2028 | | | | 4,064,764 | |

43,000,000 | | Cathedral Lake Ltd., Series 2016-4A-A (3 Month LIBOR USD + 1.65%) | | | 3.39% | ^ | | | 10/20/2028 | | | | 43,744,628 | |

11,000,000 | | Cent Ltd., Series 2014-21A-A1AR (3 Month LIBOR USD + 1.21%) | | | 2.97% | ^ | | | 07/27/2026 | | | | 11,009,229 | |

7,250,000 | | Cent Ltd., Series 2014-22A-C (3 Month LIBOR USD + 3.75%) | | | 5.54% | ^ | | | 11/07/2026 | | | | 7,271,526 | |

98,000,000 | | CVP Ltd., Series 2017-1A-A (3 Month LIBOR USD + 1.34%) | | | 3.08% | ^ | | | 07/20/2030 | | | | 98,758,265 | |

61,250,000 | | CVP Ltd., Series 2017-2A-A (3 Month LIBOR USD + 1.19%, 1.19% Floor) | | | 3.12% | ^ | | | 01/20/2031 | | | | 61,569,436 | |

35,250,000 | | Elevation Ltd., Series 2014-2A-A1R (3 Month LIBOR USD + 1.23%) | | | 2.58% | ^ | | | 10/15/2029 | | | | 35,463,957 | |

50,000,000 | | Galaxy Ltd., Series 2016-22A-A1 (3 Month LIBOR USD + 1.58%) | | | 3.30% | ^ | | | 07/16/2028 | | | | 50,100,358 | |

24,152,233 | | GLG Ore Hill Ltd., Series 2013-1A-A (3 Month LIBOR USD + 1.12%) | | | 2.84% | ^ | | | 07/15/2025 | | | | 24,173,952 | |

46,000,000 | | Greywolf Ltd., Series 2018-1A-A1 (3 Month LIBOR USD + 1.03%) | | | 0.00% | ^ | | | 04/26/2031 | | | | 46,000,000 | |

6,500,000 | | Halcyon Loan Advisors Funding Ltd., Series 2014-2A-C (3 Month LIBOR USD + 3.50%) | | | 5.26% | ^ | | | 04/28/2025 | | | | 6,516,542 | |

1,750,000 | | Halcyon Loan Advisors Funding Ltd., Series 2014-2A-D (3 Month LIBOR USD + 5.00%) | | | 6.76% | ^ | | | 04/28/2025 | | | | 1,665,265 | |

5,000,000 | | Halcyon Loan Advisors Funding Ltd., Series 2014-3A-D (3 Month LIBOR USD + 3.65%) | | | 5.39% | ^ | | | 10/22/2025 | | | | 5,006,770 | |

14,350,000 | | Halcyon Loan Advisors Funding Ltd., Series 2015-2A-A (3 Month LIBOR USD + 1.39%) | | | 3.14% | ^ | | | 07/25/2027 | | | | 14,358,000 | |

85,500,000 | | Halcyon Loan Advisors Funding Ltd., Series 2015-3A-A1R (3 Month LIBOR USD + 0.90%) | | | 2.63% | ^ | | | 10/18/2027 | | | | 85,047,447 | |

30,000,000 | | Harbourview Ltd., Series 7A-A1R (3 Month LIBOR USD + 1.25%) | | | 3.13% | ^ | | | 11/18/2026 | | | | 30,030,807 | |

25,000,000 | | Hildene Ltd., Series 2014-2A-AR (3 Month LIBOR USD + 1.18%) | | | 2.92% | ^ | | | 07/19/2026 | | | | 25,023,177 | |

39,000,000 | | Hildene Ltd., Series 2014-3A-AR (3 Month LIBOR USD + 1.20%) | | | 2.94% | ^ | | | 10/20/2026 | | | | 39,012,023 | |

5,000,000 | | Hildene Ltd., Series 2015-4A-A1A (3 Month LIBOR USD + 1.50%) | | | 3.24% | ^ | | | 07/23/2027 | | | | 5,012,394 | |

10,867,159 | | ICE Global Credit Ltd., Series 2013-1A-A1 (3 Month LIBOR USD + 1.75%, 1.75% Floor) | | | 3.49% | ^ Þ | | | 04/20/2024 | | | | 10,876,636 | |

50,000,000 | | Jamestown Ltd., Series 2013-3A-A1AR (3 Month LIBOR USD + 1.14%) | | | 2.86% | ^ | | | 01/15/2026 | | | | 50,045,296 | |

49,000,000 | | Jamestown Ltd., Series 2014-4A-A1AR (3 Month LIBOR USD + 0.69%) | | | 2.41% | ^ | | | 07/15/2026 | | | | 48,877,765 | |

28,750,000 | | Jamestown Ltd., Series 2015-6A-A1AR (3 Month LIBOR USD + 1.15%) | | | 3.03% | ^ | | | 02/20/2027 | | | | 28,757,188 | |

20,000,000 | | Jamestown Ltd., Series 2016-9A-A1A (3 Month LIBOR USD + 1.57%) | | | 3.31% | ^ | | | 10/20/2028 | | | | 20,072,400 | |

20,000,000 | | KVK Ltd., Series 2013-1A-AR (3 Month LIBOR USD + 0.90%) | | | 2.62% | ^ | | | 01/15/2028 | | | | 19,998,574 | |

25,000,000 | | KVK Ltd., Series 2015-1A-AR (3 Month LIBOR USD + 1.25%) | | | 3.14% | ^ | | | 05/20/2027 | | | | 25,019,976 | |

7,825,000 | | LCM LP, Series 14A-D (3 Month LIBOR USD + 3.50%) | | | 5.22% | ^ | | | 07/15/2025 | | | | 7,836,095 | |

22,200,000 | | LCM LP, Series 16A-AR (3 Month LIBOR USD + 1.03%) | | | 2.75% | ^ | | | 07/15/2026 | | | | 22,208,907 | |

2,750,000 | | LCM LP, Series 16A-DR (3 Month LIBOR USD + 3.00%) | | | 4.72% | ^ | | | 07/15/2026 | | | | 2,756,846 | |

20,000,000 | | Madison Park Funding Ltd., Series 2013-11A-AR (3 Month LIBOR USD + 1.16%) | | | 2.90% | ^ | | | 07/23/2029 | | | | 20,025,000 | |

5,500,000 | | Madison Park Funding Ltd., Series 2014-15A-CR (3 Month LIBOR USD + 3.45%) | | | 5.21% | ^ | | | 01/27/2026 | | | | 5,508,574 | |

5,000,000 | | Madison Park Funding Ltd., Series 2014-15A-DR (3 Month LIBOR USD + 5.44%) | | | 7.20% | ^ | | | 01/27/2026 | | | | 5,003,924 | |

24,000,000 | | Magnetite Ltd., Series 2015-12A-AR (3 Month LIBOR USD + 1.33%) | | | 3.05% | ^ | | | 04/15/2027 | | | | 24,039,169 | |

64,500,000 | | Marathon Ltd., Series 2013-5A-A1R (3 Month LIBOR USD + 0.87%) | | | 2.76% | ^ | | | 11/21/2027 | | | | 64,371,000 | |

41,000,000 | | Marathon Ltd., Series 2014-7A-A1R (3 Month LIBOR USD + 1.32%) | | | 3.08% | ^ | | | 10/28/2025 | | | | 41,019,313 | |

75,000,000 | | Midocean Credit, Series 2017-7A-A1 (3 Month LIBOR USD + 1.32%) | | | 3.04% | ^ | | | 07/15/2029 | | | | 75,454,178 | |

55,000,000 | | MP Ltd., Series 2013-1A-AR (3 Month LIBOR USD + 1.25%) | | | 2.99% | ^ | | | 10/20/2030 | | | | 55,186,036 | |

52,000,000 | | MP Ltd., Series 2013-2A-ARR (3 Month LIBOR USD + 1.28%) | | | 3.03% | ^ | | | 07/25/2029 | | | | 52,333,529 | |

2,250,000 | | Neuberger Berman Ltd., Series 2017-16SA-A (3 Month LIBOR USD + 0.85%) | | | 2.57% | ^ | | | 01/15/2028 | | | | 2,255,547 | |

14,426,299 | | NewMark Capital Funding Ltd., Series 2013-1A-A2 (3 Month LIBOR USD + 1.12%) | | | 3.14% | ^ | | | 06/02/2025 | | | | 14,441,381 | |

19,500,000 | | Northwoods Capital Ltd., Series 2017-16A-A (3 Month LIBOR USD + 1.27%) | | | 2.69% | ^ | | | 11/15/2030 | | | | 19,644,252 | |

50,000,000 | | Ocean Trails, Series 2014-5A-A2R (3 Month LIBOR USD + 1.22%) | | | 2.94% | ^ | | | 10/13/2026 | | | | 50,059,984 | |

36,000,000 | | OCP Ltd., Series 2015-9A-A1R (3 Month LIBOR USD + 0.80%) | | | 2.52% | ^ | | | 07/15/2027 | | | | 36,040,491 | |

60,000,000 | | OCP Ltd., Series 2016-12A-A1 (3 Month LIBOR USD + 1.57%) | | | 3.30% | ^ | | | 10/18/2028 | | | | 60,311,321 | |

5,500,000 | | Octagon Investment Partners Ltd., Series 2014-1A-C (3 Month LIBOR USD + 3.65%) | | | 5.48% | ^ | | | 11/14/2026 | | | | 5,544,166 | |

20,000,000 | | Octagon Loan Funding Ltd., Series 2014-1A-A1R (3 Month LIBOR USD + 1.14%) | | | 3.02% | ^ | | | 11/18/2026 | | | | 20,037,690 | |

40,349,949 | | Palmer Square Loan Funding Ltd., Series 2017-1A-A1 (3 Month LIBOR USD + 0.74%) | | | 2.46% | ^ | | | 10/15/2025 | | | | 40,354,194 | |

35,000,000 | | Regatta Funding Ltd., Series 2016-1A-A1 (3 Month LIBOR USD + 1.52%) | | | 3.72% | ^ | | | 12/20/2028 | | | | 35,140,701 | |

19,000,000 | | Rockford Tower Ltd., Series 2017-3A-A (3 Month LIBOR USD + 1.19%) | | | 2.86% | ^ | | | 10/20/2030 | | | | 19,098,370 | |

24,590,000 | | Sound Harbor Loan Fund Ltd., Series 2014-1A-A1R (3 Month LIBOR USD + 1.20%) | | | 2.97% | ^ | | | 10/30/2026 | | | | 24,607,555 | |

20,000,000 | | Steele Creek Ltd., Series 2015-1A-AR (3 Month LIBOR USD + 1.26%) | | | 3.15% | ^ | | | 05/21/2029 | | | | 20,022,741 | |

17,000,000 | | TCI-Cent Ltd., Series 2016-1A-A1 (3 Month LIBOR USD + 1.52%) | | | 3.28% | ^ | | | 12/21/2029 | | | | 17,312,497 | |

10,000,000 | | TCI-Cent Ltd., Series 2016-1A-A2 (3 Month LIBOR USD + 2.20%) | | | 3.96% | ^ | | | 12/21/2029 | | | | 10,103,831 | |

30,000,000 | | TCI-Flatiron Ltd., Series 2016-1A-A (3 Month LIBOR USD + 1.55%) | | | 3.28% | ^ | | | 07/17/2028 | | | | 30,195,624 | |

47,950,000 | | Venture Ltd., Series 2014-17A-AR (3 Month LIBOR USD + 1.08%) | | | 2.80% | ^ | | | 07/15/2026 | | | | 48,005,115 | |

3,500,000 | | Venture Ltd., Series 2014-17A-B2R (3 Month LIBOR USD + 1.60%) | | | 3.32% | ^ | | | 07/15/2026 | | | | 3,503,734 | |

62,945,000 | | Venture Ltd., Series 2015-20A-AR (3 Month LIBOR USD + 0.82%) | | | 2.54% | ^ | | | 04/15/2027 | | | | 62,915,140 | |