SIENA CAPITAL FINANCE LLC Unaudited Consolidated Financial Statements December 31, 2021 and 2020

Index Page Consolidated Financial Statements Consolidated Balance Sheets 1 Consolidated Statements of Income 2 Consolidated Statements of Changes in Members’ Capital 3 Consolidated Statements of Cash Flows 4 Notes to Consolidated Financial Statements 5

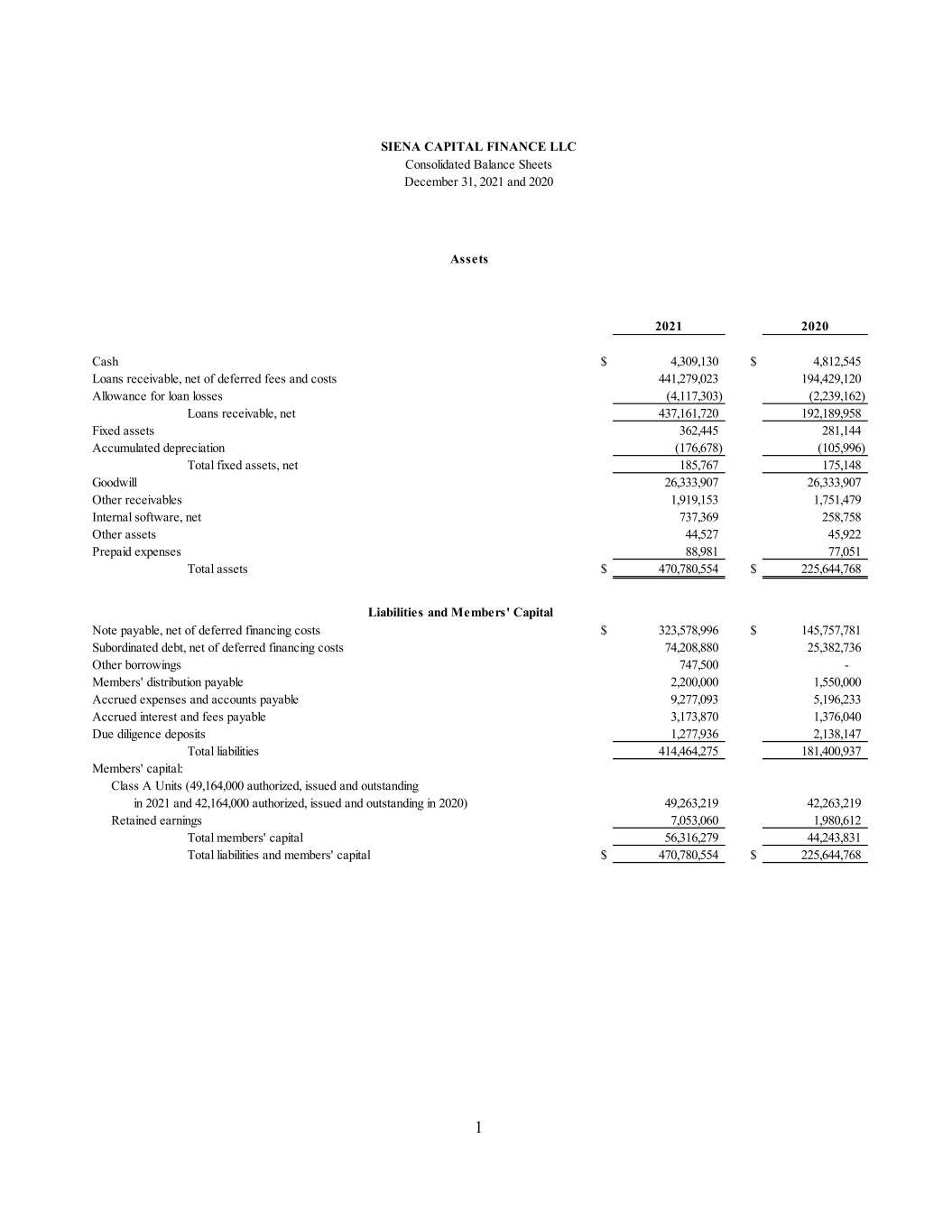

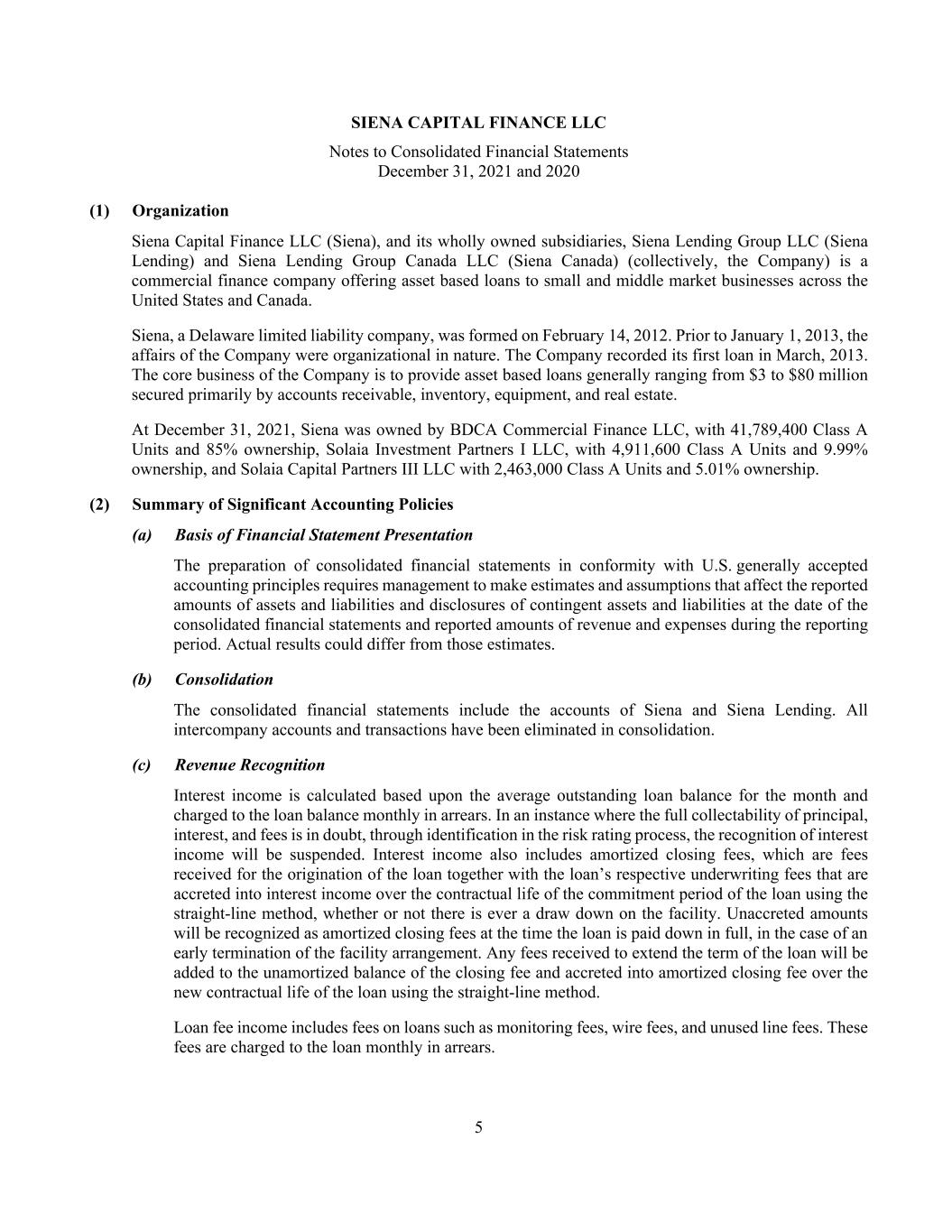

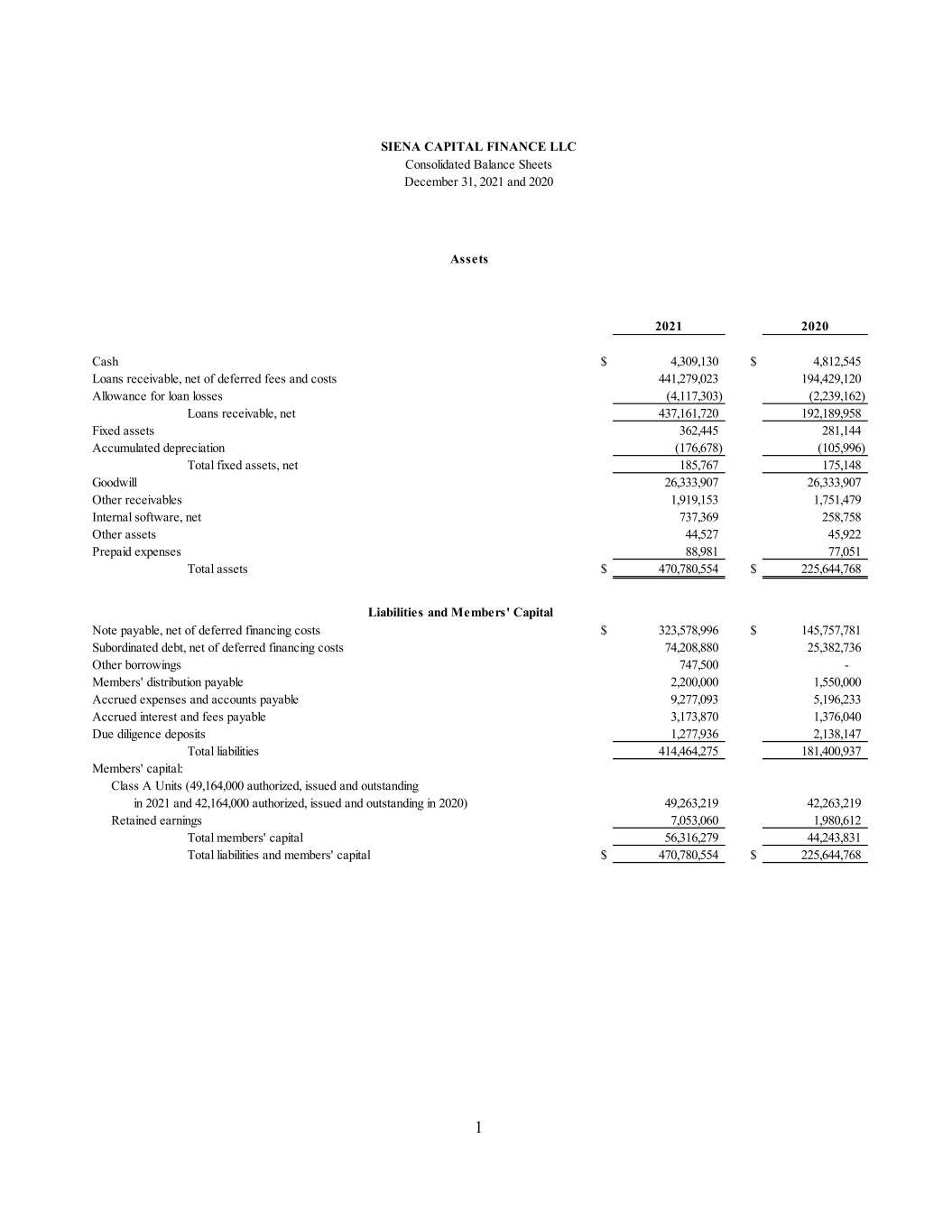

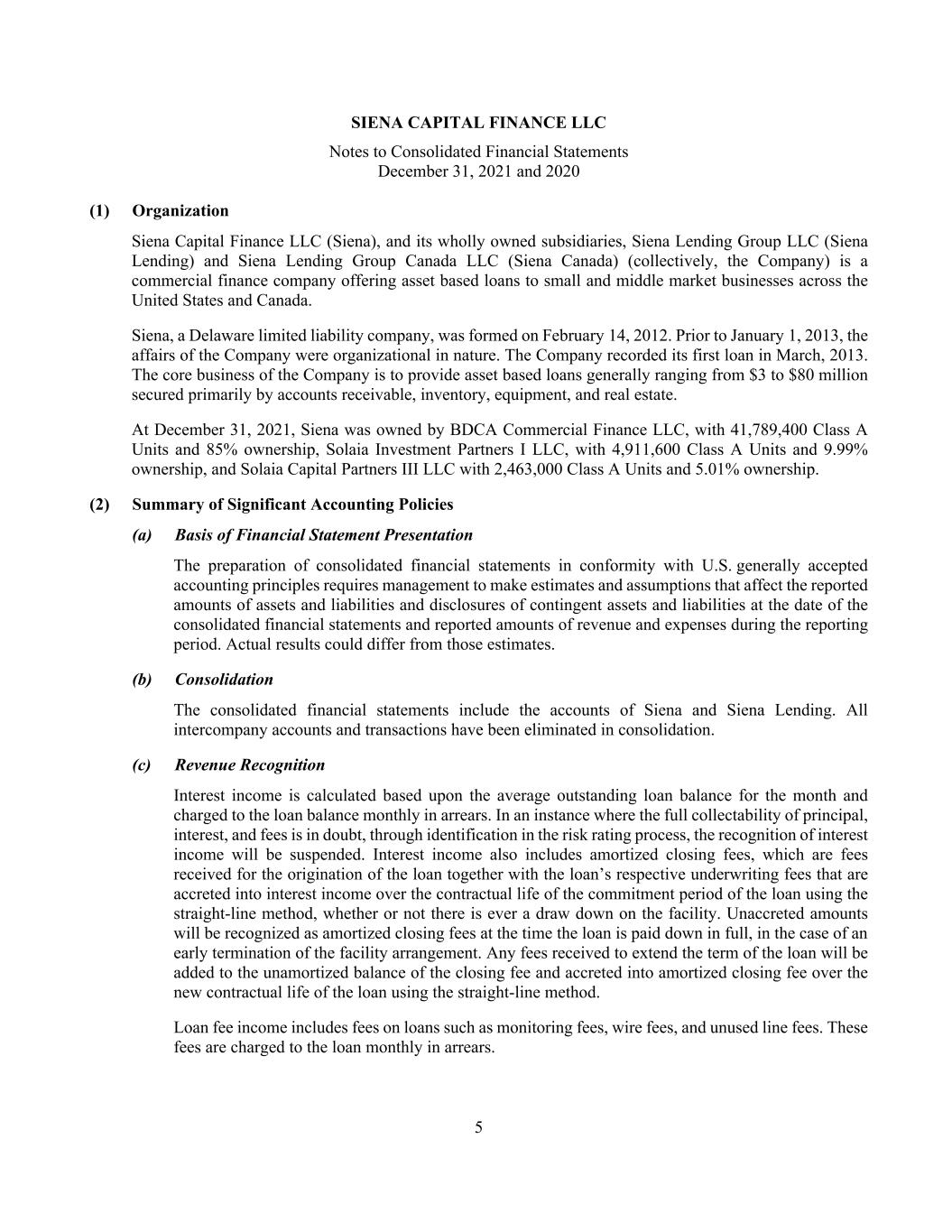

1 Assets 2021 2020 Cash $ 4,309,130 $ 4,812,545 Loans receivable, net of deferred fees and costs 441,279,023 194,429,120 Allowance for loan losses (4,117,303) (2,239,162) Loans receivable, net 437,161,720 192,189,958 Fixed assets 362,445 281,144 Accumulated depreciation (176,678) (105,996) Total fixed assets, net 185,767 175,148 Goodwill 26,333,907 26,333,907 Other receivables 1,919,153 1,751,479 Internal software, net 737,369 258,758 Other assets 44,527 45,922 Prepaid expenses 88,981 77,051 Total assets $ 470,780,554 $ 225,644,768 Liabilities and Members' Capital Note payable, net of deferred financing costs $ 323,578,996 $ 145,757,781 Subordinated debt, net of deferred financing costs 74,208,880 25,382,736 Other borrowings 747,500 - Members' distribution payable 2,200,000 1,550,000 Accrued expenses and accounts payable 9,277,093 5,196,233 Accrued interest and fees payable 3,173,870 1,376,040 Due diligence deposits 1,277,936 2,138,147 Total liabilities 414,464,275 181,400,937 Members' capital: Class A Units (49,164,000 authorized, issued and outstanding in 2021 and 42,164,000 authorized, issued and outstanding in 2020) 49,263,219 42,263,219 Retained earnings 7,053,060 1,980,612 Total members' capital 56,316,279 44,243,831 Total liabilities and members' capital $ 470,780,554 $ 225,644,768 SIENA CAPITAL FINANCE LLC Consolidated Balance Sheets December 31, 2021 and 2020

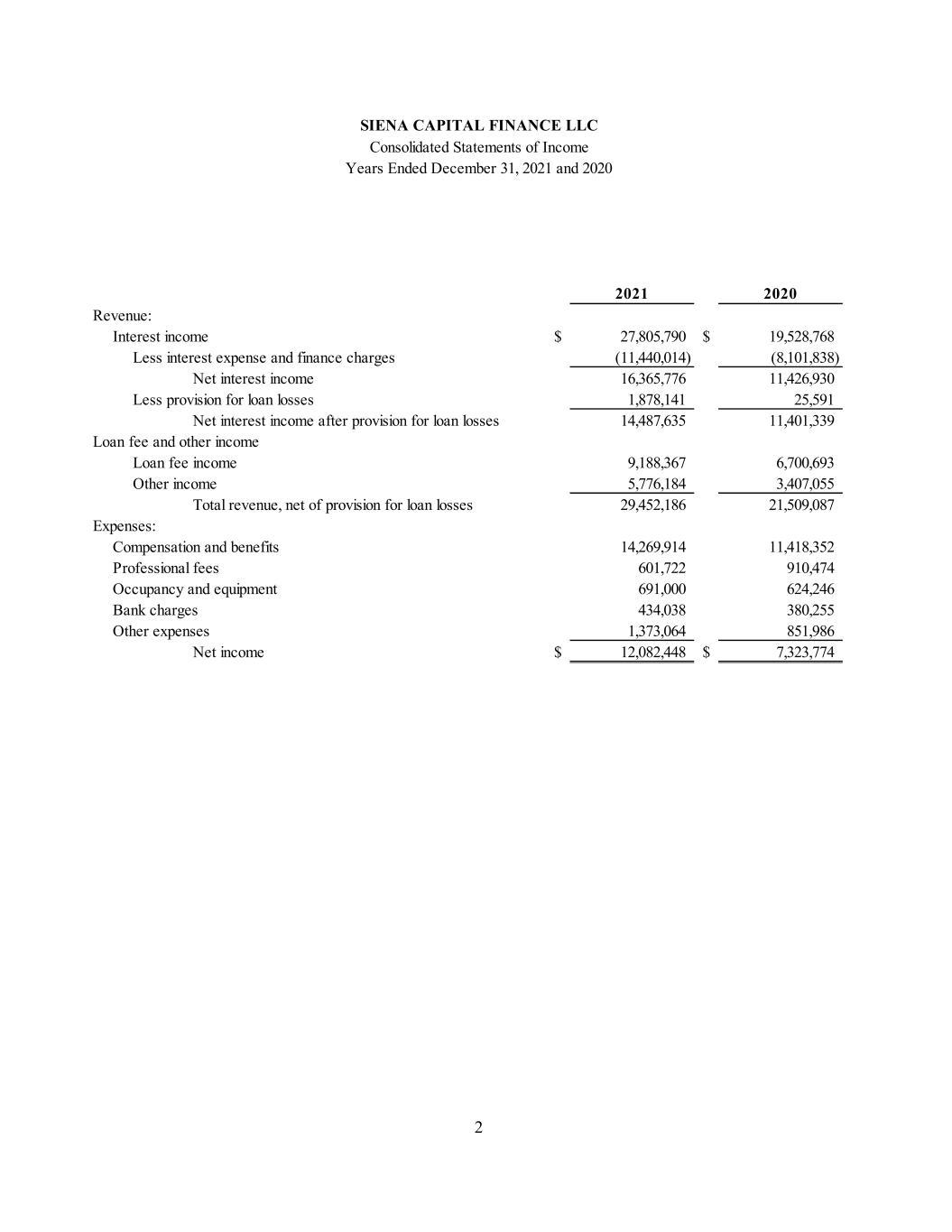

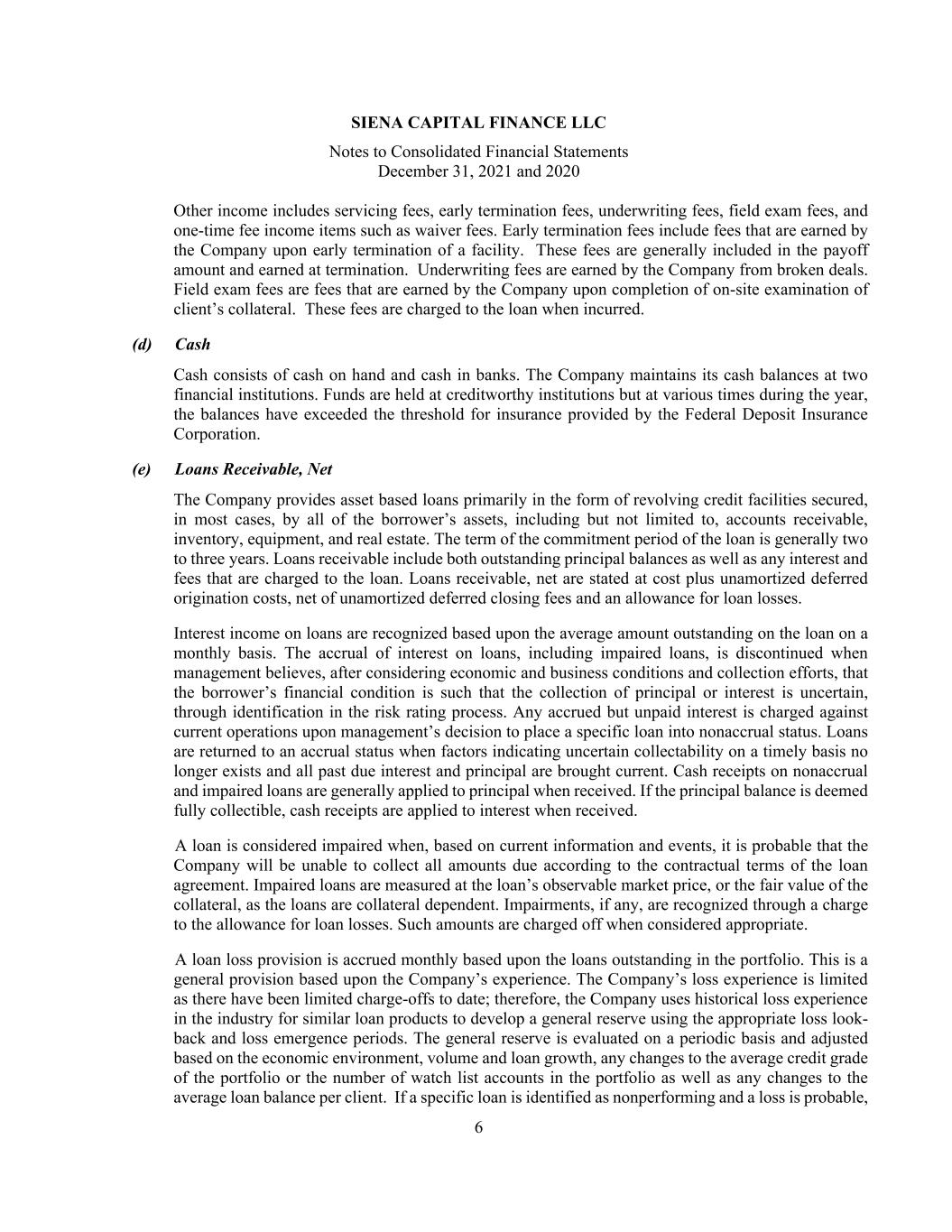

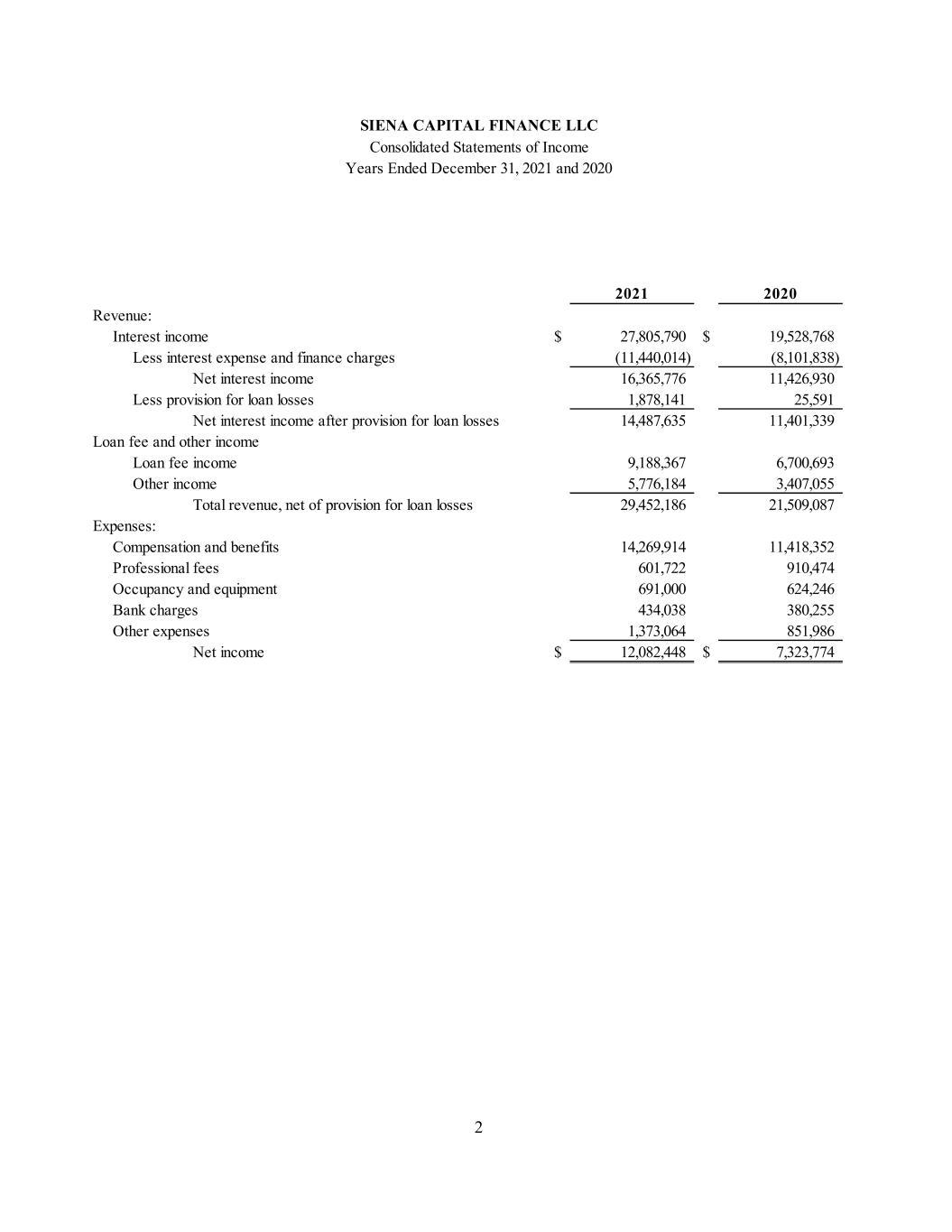

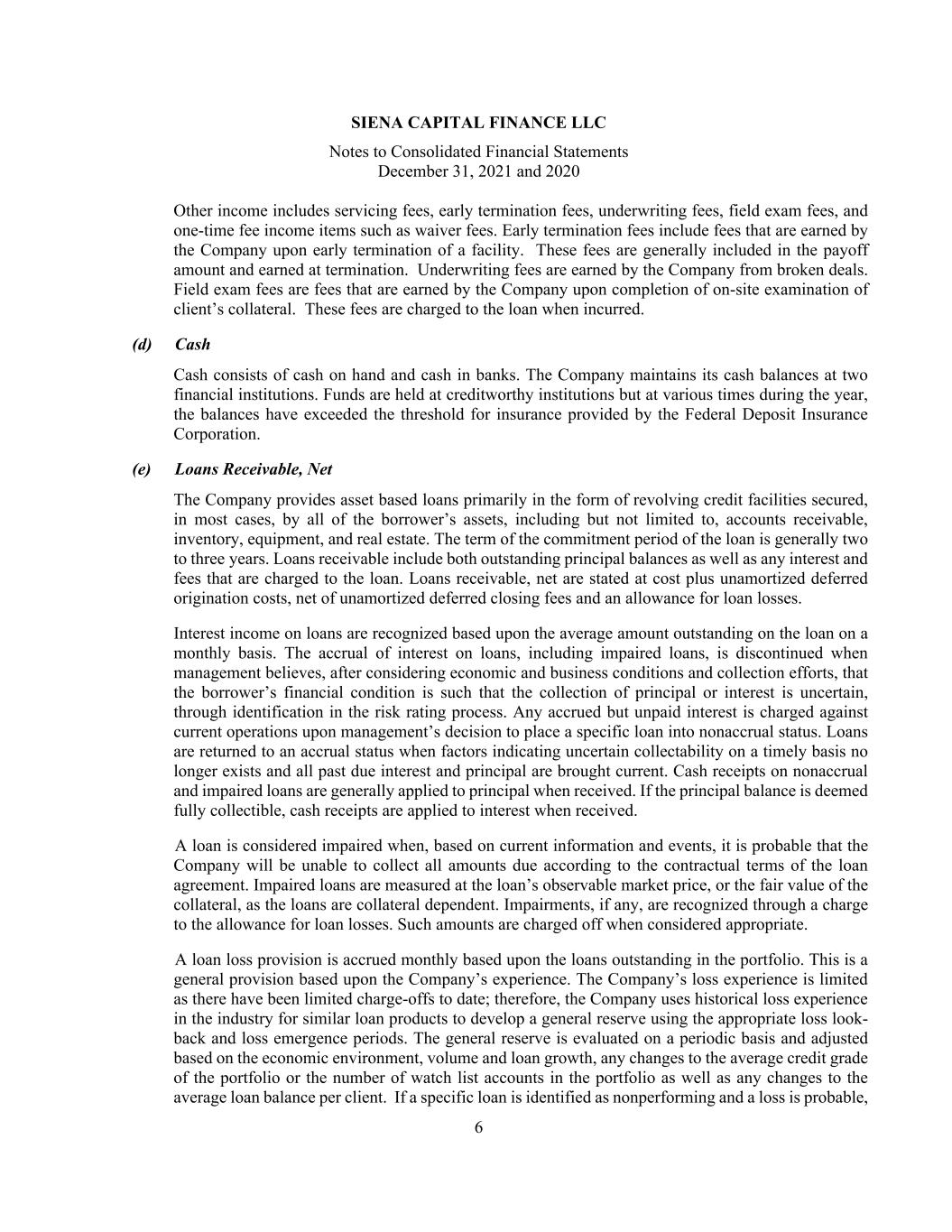

2 2021 2020 Revenue: Interest income $ 27,805,790 $ 19,528,768 Less interest expense and finance charges (11,440,014) (8,101,838) Net interest income 16,365,776 11,426,930 Less provision for loan losses 1,878,141 25,591 Net interest income after provision for loan losses 14,487,635 11,401,339 Loan fee and other income Loan fee income 9,188,367 6,700,693 Other income 5,776,184 3,407,055 Total revenue, net of provision for loan losses 29,452,186 21,509,087 Expenses: Compensation and benefits 14,269,914 11,418,352 Professional fees 601,722 910,474 Occupancy and equipment 691,000 624,246 Bank charges 434,038 380,255 Other expenses 1,373,064 851,986 Net income $ 12,082,448 $ 7,323,774 Years Ended December 31, 2021 and 2020 SIENA CAPITAL FINANCE LLC Consolidated Statements of Income

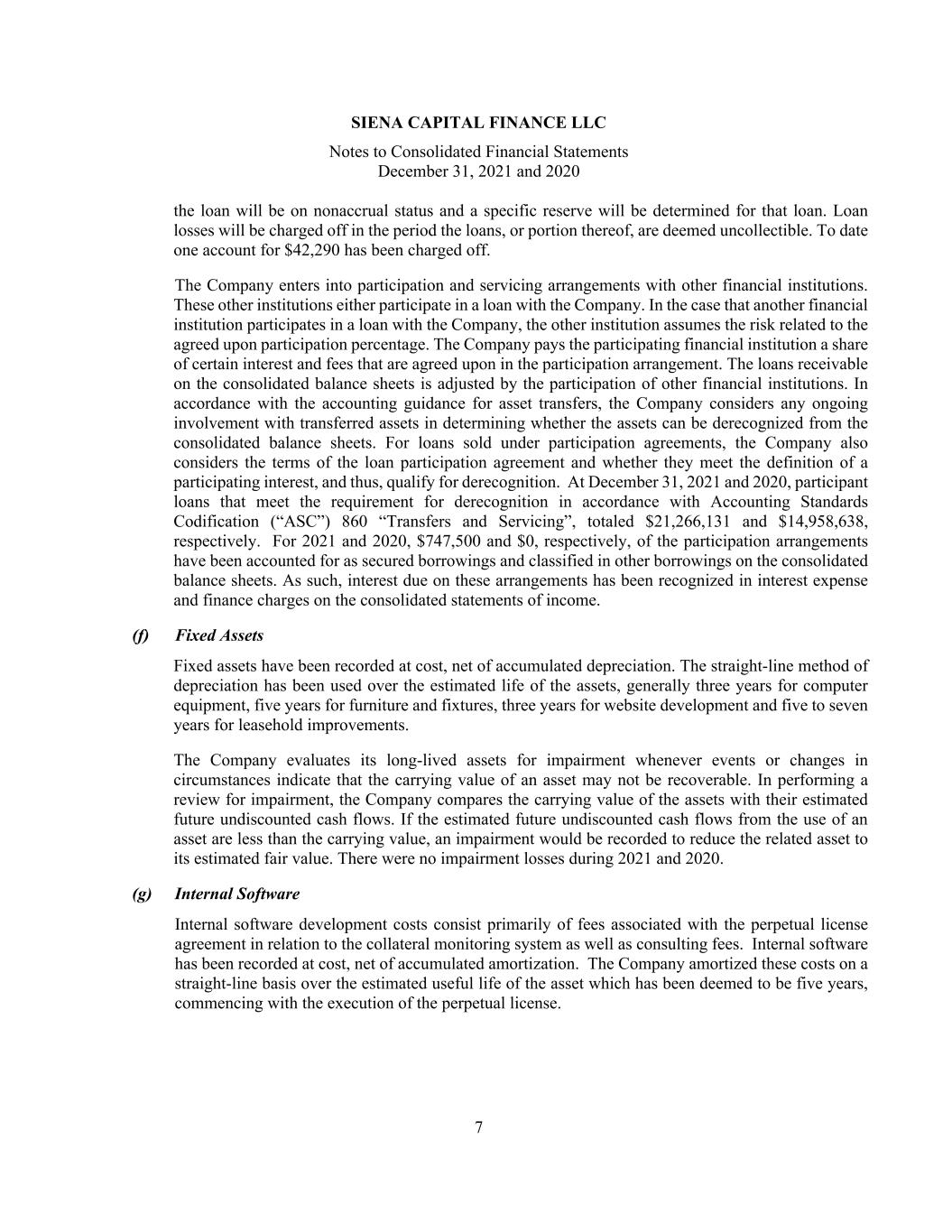

3 SIENA CAPITAL FINANCE LLC Consolidated Statements of Changes in Members' Capital Members' contributions Retained Total Class A Units earnings Members' capital Balance, December 31, 2019 $ 42,263,219 $ 646,254 $ 42,909,473 Members' distribution - (5,989,416) (5,989,416) Net income - 7,323,774 7,323,774 Balance, December 31, 2020 $ 42,263,219 $ 1,980,612 $ 44,243,831 Members' distribution - (7,010,000) (7,010,000) Class A Units Issued 7,000,000 - 7,000,000 Net income - 12,082,448 12,082,448 Balance, December 31, 2021 $ 49,263,219 $ 7,053,060 $ 56,316,279 Years Ended December 31, 2020 and 2021

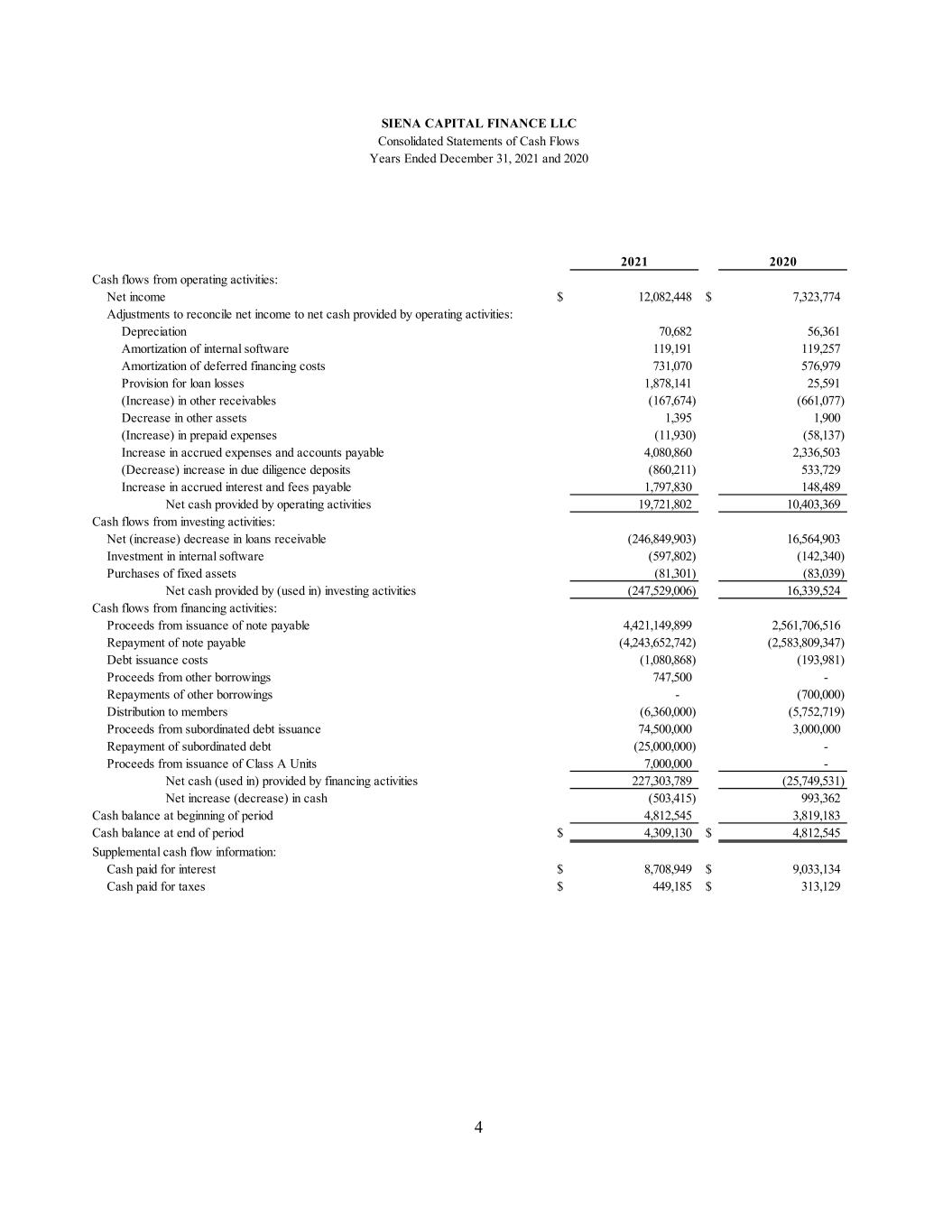

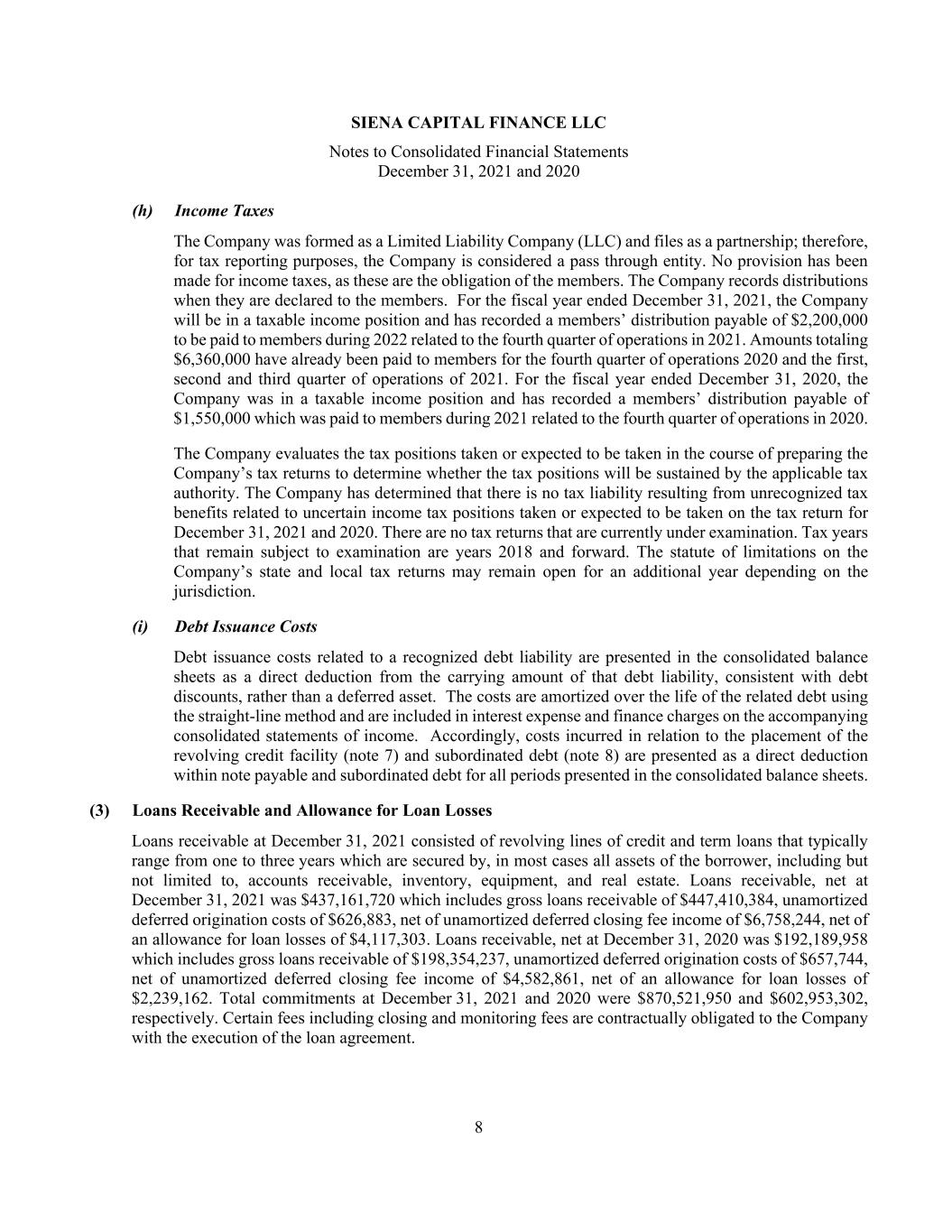

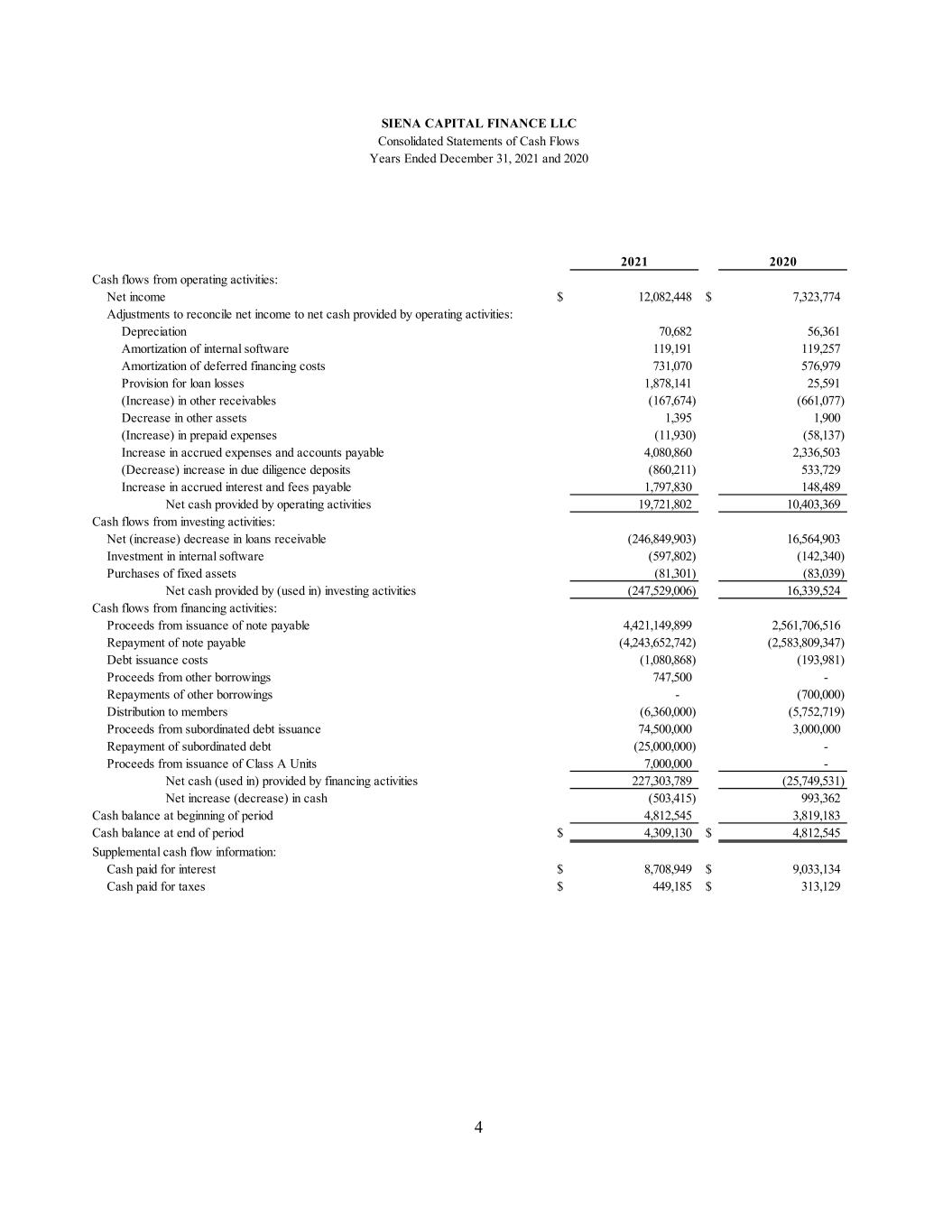

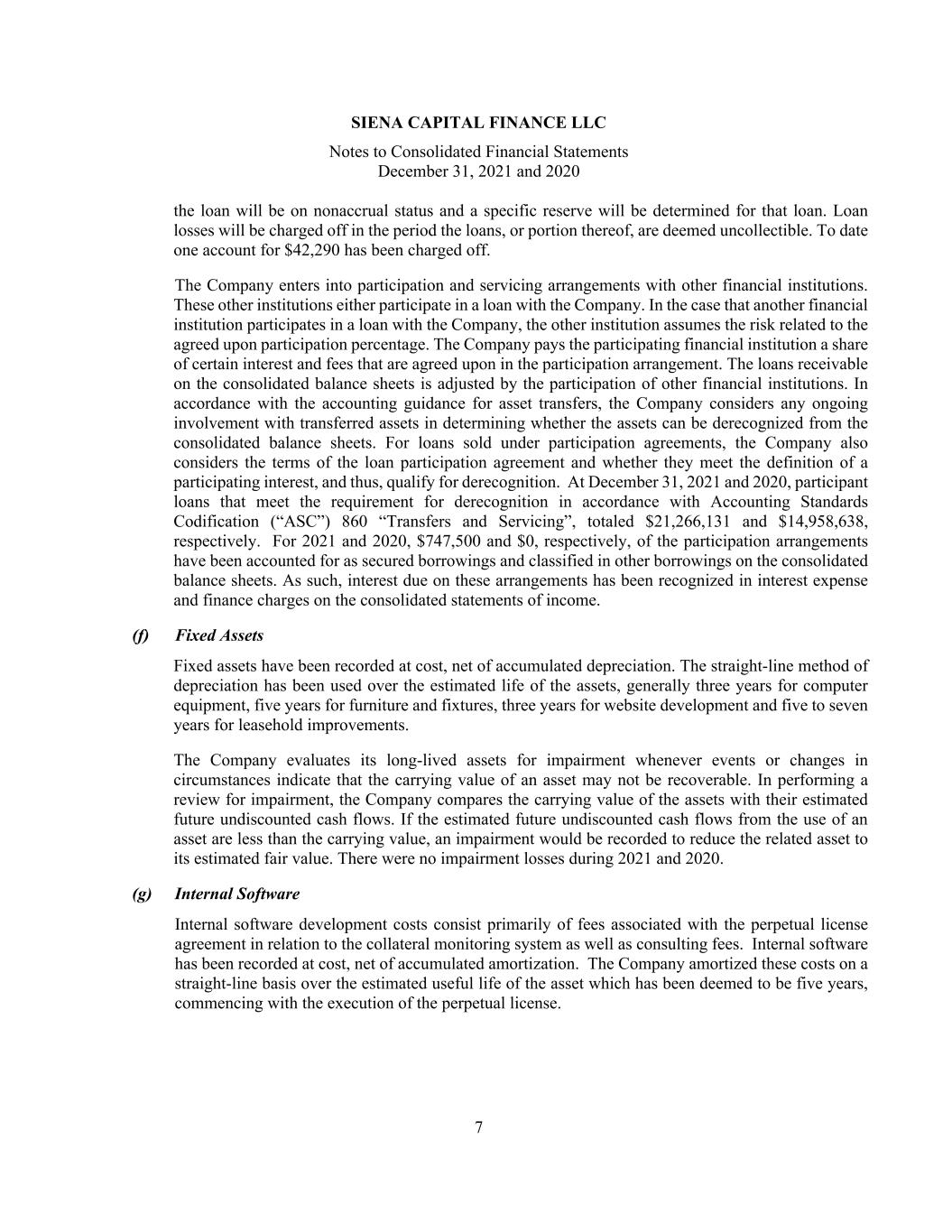

4 2021 2020 Cash flows from operating activities: Net income $ 12,082,448 $ 7,323,774 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 70,682 56,361 Amortization of internal software 119,191 119,257 Amortization of deferred financing costs 731,070 576,979 Provision for loan losses 1,878,141 25,591 (Increase) in other receivables (167,674) (661,077) Decrease in other assets 1,395 1,900 (Increase) in prepaid expenses (11,930) (58,137) Increase in accrued expenses and accounts payable 4,080,860 2,336,503 (Decrease) increase in due diligence deposits (860,211) 533,729 Increase in accrued interest and fees payable 1,797,830 148,489 Net cash provided by operating activities 19,721,802 10,403,369 Cash flows from investing activities: Net (increase) decrease in loans receivable (246,849,903) 16,564,903 Investment in internal software (597,802) (142,340) Purchases of fixed assets (81,301) (83,039) Net cash provided by (used in) investing activities (247,529,006) 16,339,524 Cash flows from financing activities: Proceeds from issuance of note payable 4,421,149,899 2,561,706,516 Repayment of note payable (4,243,652,742) (2,583,809,347) Debt issuance costs (1,080,868) (193,981) Proceeds from other borrowings 747,500 - Repayments of other borrowings - (700,000) Distribution to members (6,360,000) (5,752,719) Proceeds from subordinated debt issuance 74,500,000 3,000,000 Repayment of subordinated debt (25,000,000) - Proceeds from issuance of Class A Units 7,000,000 - Net cash (used in) provided by financing activities 227,303,789 (25,749,531) Net increase (decrease) in cash (503,415) 993,362 Cash balance at beginning of period 4,812,545 3,819,183 Cash balance at end of period $ 4,309,130 $ 4,812,545 Supplemental cash flow information: Cash paid for interest $ 8,708,949 $ 9,033,134 Cash paid for taxes $ 449,185 $ 313,129 SIENA CAPITAL FINANCE LLC Consolidated Statements of Cash Flows Years Ended December 31, 2021 and 2020

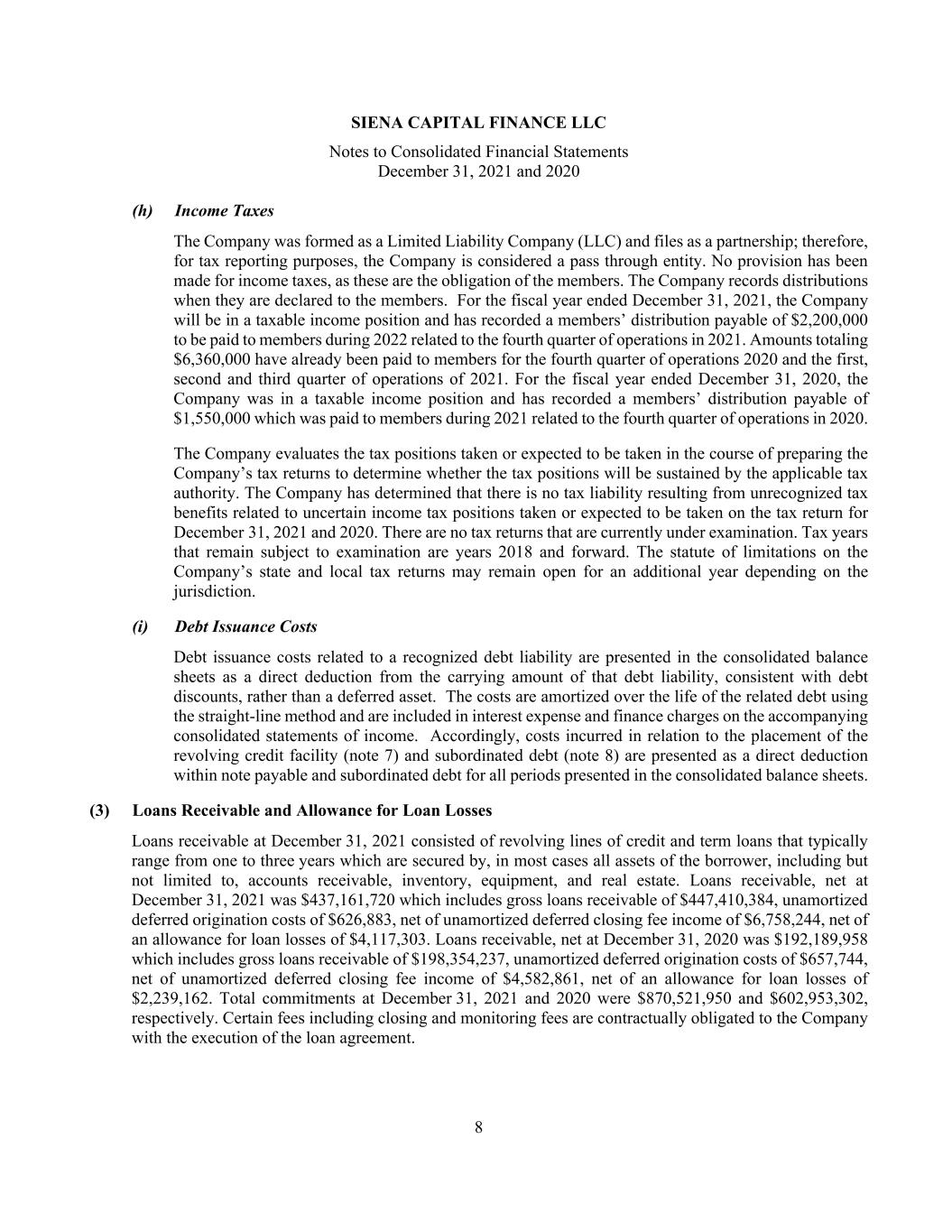

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 5 (1) Organization Siena Capital Finance LLC (Siena), and its wholly owned subsidiaries, Siena Lending Group LLC (Siena Lending) and Siena Lending Group Canada LLC (Siena Canada) (collectively, the Company) is a commercial finance company offering asset based loans to small and middle market businesses across the United States and Canada. Siena, a Delaware limited liability company, was formed on February 14, 2012. Prior to January 1, 2013, the affairs of the Company were organizational in nature. The Company recorded its first loan in March, 2013. The core business of the Company is to provide asset based loans generally ranging from $3 to $80 million secured primarily by accounts receivable, inventory, equipment, and real estate. At December 31, 2021, Siena was owned by BDCA Commercial Finance LLC, with 41,789,400 Class A Units and 85% ownership, Solaia Investment Partners I LLC, with 4,911,600 Class A Units and 9.99% ownership, and Solaia Capital Partners III LLC with 2,463,000 Class A Units and 5.01% ownership. (2) Summary of Significant Accounting Policies (a) Basis of Financial Statement Presentation The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. (b) Consolidation The consolidated financial statements include the accounts of Siena and Siena Lending. All intercompany accounts and transactions have been eliminated in consolidation. (c) Revenue Recognition Interest income is calculated based upon the average outstanding loan balance for the month and charged to the loan balance monthly in arrears. In an instance where the full collectability of principal, interest, and fees is in doubt, through identification in the risk rating process, the recognition of interest income will be suspended. Interest income also includes amortized closing fees, which are fees received for the origination of the loan together with the loan’s respective underwriting fees that are accreted into interest income over the contractual life of the commitment period of the loan using the straight-line method, whether or not there is ever a draw down on the facility. Unaccreted amounts will be recognized as amortized closing fees at the time the loan is paid down in full, in the case of an early termination of the facility arrangement. Any fees received to extend the term of the loan will be added to the unamortized balance of the closing fee and accreted into amortized closing fee over the new contractual life of the loan using the straight-line method. Loan fee income includes fees on loans such as monitoring fees, wire fees, and unused line fees. These fees are charged to the loan monthly in arrears.

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 6 Other income includes servicing fees, early termination fees, underwriting fees, field exam fees, and one-time fee income items such as waiver fees. Early termination fees include fees that are earned by the Company upon early termination of a facility. These fees are generally included in the payoff amount and earned at termination. Underwriting fees are earned by the Company from broken deals. Field exam fees are fees that are earned by the Company upon completion of on-site examination of client’s collateral. These fees are charged to the loan when incurred. (d) Cash Cash consists of cash on hand and cash in banks. The Company maintains its cash balances at two financial institutions. Funds are held at creditworthy institutions but at various times during the year, the balances have exceeded the threshold for insurance provided by the Federal Deposit Insurance Corporation. (e) Loans Receivable, Net The Company provides asset based loans primarily in the form of revolving credit facilities secured, in most cases, by all of the borrower’s assets, including but not limited to, accounts receivable, inventory, equipment, and real estate. The term of the commitment period of the loan is generally two to three years. Loans receivable include both outstanding principal balances as well as any interest and fees that are charged to the loan. Loans receivable, net are stated at cost plus unamortized deferred origination costs, net of unamortized deferred closing fees and an allowance for loan losses. Interest income on loans are recognized based upon the average amount outstanding on the loan on a monthly basis. The accrual of interest on loans, including impaired loans, is discontinued when management believes, after considering economic and business conditions and collection efforts, that the borrower’s financial condition is such that the collection of principal or interest is uncertain, through identification in the risk rating process. Any accrued but unpaid interest is charged against current operations upon management’s decision to place a specific loan into nonaccrual status. Loans are returned to an accrual status when factors indicating uncertain collectability on a timely basis no longer exists and all past due interest and principal are brought current. Cash receipts on nonaccrual and impaired loans are generally applied to principal when received. If the principal balance is deemed fully collectible, cash receipts are applied to interest when received. A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the loan agreement. Impaired loans are measured at the loan’s observable market price, or the fair value of the collateral, as the loans are collateral dependent. Impairments, if any, are recognized through a charge to the allowance for loan losses. Such amounts are charged off when considered appropriate. A loan loss provision is accrued monthly based upon the loans outstanding in the portfolio. This is a general provision based upon the Company’s experience. The Company’s loss experience is limited as there have been limited charge-offs to date; therefore, the Company uses historical loss experience in the industry for similar loan products to develop a general reserve using the appropriate loss look- back and loss emergence periods. The general reserve is evaluated on a periodic basis and adjusted based on the economic environment, volume and loan growth, any changes to the average credit grade of the portfolio or the number of watch list accounts in the portfolio as well as any changes to the average loan balance per client. If a specific loan is identified as nonperforming and a loss is probable,

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 7 the loan will be on nonaccrual status and a specific reserve will be determined for that loan. Loan losses will be charged off in the period the loans, or portion thereof, are deemed uncollectible. To date one account for $42,290 has been charged off. The Company enters into participation and servicing arrangements with other financial institutions. These other institutions either participate in a loan with the Company. In the case that another financial institution participates in a loan with the Company, the other institution assumes the risk related to the agreed upon participation percentage. The Company pays the participating financial institution a share of certain interest and fees that are agreed upon in the participation arrangement. The loans receivable on the consolidated balance sheets is adjusted by the participation of other financial institutions. In accordance with the accounting guidance for asset transfers, the Company considers any ongoing involvement with transferred assets in determining whether the assets can be derecognized from the consolidated balance sheets. For loans sold under participation agreements, the Company also considers the terms of the loan participation agreement and whether they meet the definition of a participating interest, and thus, qualify for derecognition. At December 31, 2021 and 2020, participant loans that meet the requirement for derecognition in accordance with Accounting Standards Codification (“ASC”) 860 “Transfers and Servicing”, totaled $21,266,131 and $14,958,638, respectively. For 2021 and 2020, $747,500 and $0, respectively, of the participation arrangements have been accounted for as secured borrowings and classified in other borrowings on the consolidated balance sheets. As such, interest due on these arrangements has been recognized in interest expense and finance charges on the consolidated statements of income. (f) Fixed Assets Fixed assets have been recorded at cost, net of accumulated depreciation. The straight-line method of depreciation has been used over the estimated life of the assets, generally three years for computer equipment, five years for furniture and fixtures, three years for website development and five to seven years for leasehold improvements. The Company evaluates its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. In performing a review for impairment, the Company compares the carrying value of the assets with their estimated future undiscounted cash flows. If the estimated future undiscounted cash flows from the use of an asset are less than the carrying value, an impairment would be recorded to reduce the related asset to its estimated fair value. There were no impairment losses during 2021 and 2020. (g) Internal Software Internal software development costs consist primarily of fees associated with the perpetual license agreement in relation to the collateral monitoring system as well as consulting fees. Internal software has been recorded at cost, net of accumulated amortization. The Company amortized these costs on a straight-line basis over the estimated useful life of the asset which has been deemed to be five years, commencing with the execution of the perpetual license.

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 8 (h) Income Taxes The Company was formed as a Limited Liability Company (LLC) and files as a partnership; therefore, for tax reporting purposes, the Company is considered a pass through entity. No provision has been made for income taxes, as these are the obligation of the members. The Company records distributions when they are declared to the members. For the fiscal year ended December 31, 2021, the Company will be in a taxable income position and has recorded a members’ distribution payable of $2,200,000 to be paid to members during 2022 related to the fourth quarter of operations in 2021. Amounts totaling $6,360,000 have already been paid to members for the fourth quarter of operations 2020 and the first, second and third quarter of operations of 2021. For the fiscal year ended December 31, 2020, the Company was in a taxable income position and has recorded a members’ distribution payable of $1,550,000 which was paid to members during 2021 related to the fourth quarter of operations in 2020. The Company evaluates the tax positions taken or expected to be taken in the course of preparing the Company’s tax returns to determine whether the tax positions will be sustained by the applicable tax authority. The Company has determined that there is no tax liability resulting from unrecognized tax benefits related to uncertain income tax positions taken or expected to be taken on the tax return for December 31, 2021 and 2020. There are no tax returns that are currently under examination. Tax years that remain subject to examination are years 2018 and forward. The statute of limitations on the Company’s state and local tax returns may remain open for an additional year depending on the jurisdiction. (i) Debt Issuance Costs Debt issuance costs related to a recognized debt liability are presented in the consolidated balance sheets as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts, rather than a deferred asset. The costs are amortized over the life of the related debt using the straight-line method and are included in interest expense and finance charges on the accompanying consolidated statements of income. Accordingly, costs incurred in relation to the placement of the revolving credit facility (note 7) and subordinated debt (note 8) are presented as a direct deduction within note payable and subordinated debt for all periods presented in the consolidated balance sheets. (3) Loans Receivable and Allowance for Loan Losses Loans receivable at December 31, 2021 consisted of revolving lines of credit and term loans that typically range from one to three years which are secured by, in most cases all assets of the borrower, including but not limited to, accounts receivable, inventory, equipment, and real estate. Loans receivable, net at December 31, 2021 was $437,161,720 which includes gross loans receivable of $447,410,384, unamortized deferred origination costs of $626,883, net of unamortized deferred closing fee income of $6,758,244, net of an allowance for loan losses of $4,117,303. Loans receivable, net at December 31, 2020 was $192,189,958 which includes gross loans receivable of $198,354,237, unamortized deferred origination costs of $657,744, net of unamortized deferred closing fee income of $4,582,861, net of an allowance for loan losses of $2,239,162. Total commitments at December 31, 2021 and 2020 were $870,521,950 and $602,953,302, respectively. Certain fees including closing and monitoring fees are contractually obligated to the Company with the execution of the loan agreement.

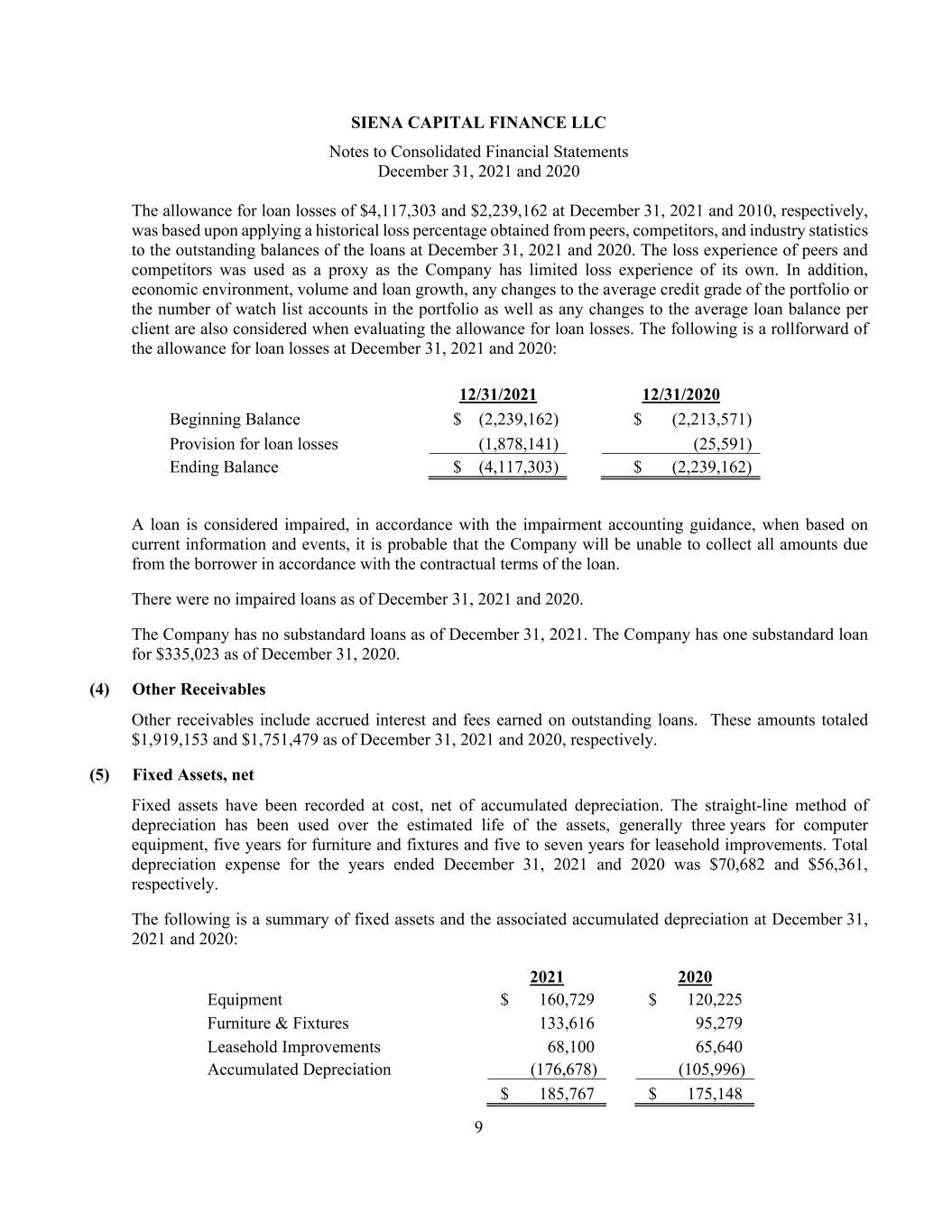

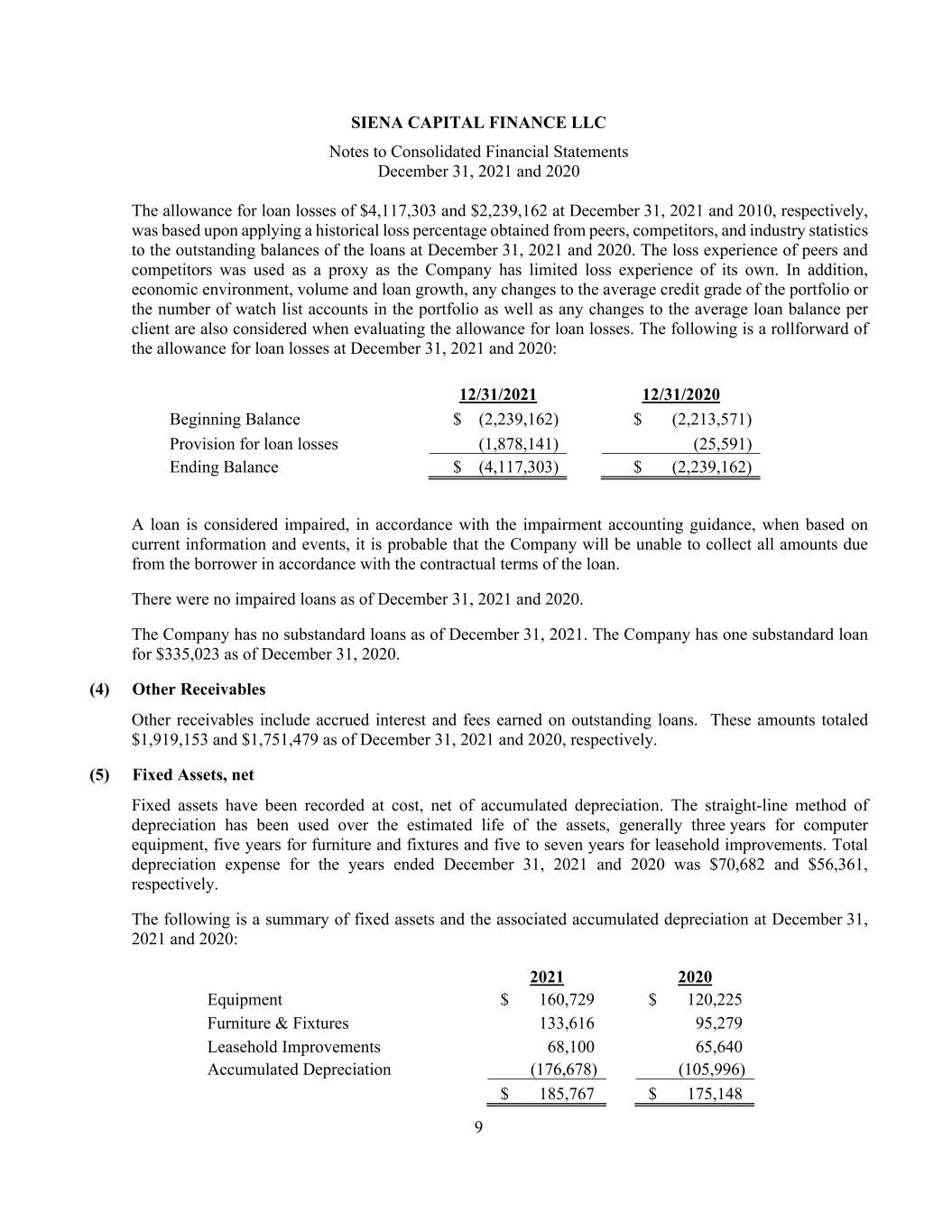

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 9 The allowance for loan losses of $4,117,303 and $2,239,162 at December 31, 2021 and 2010, respectively, was based upon applying a historical loss percentage obtained from peers, competitors, and industry statistics to the outstanding balances of the loans at December 31, 2021 and 2020. The loss experience of peers and competitors was used as a proxy as the Company has limited loss experience of its own. In addition, economic environment, volume and loan growth, any changes to the average credit grade of the portfolio or the number of watch list accounts in the portfolio as well as any changes to the average loan balance per client are also considered when evaluating the allowance for loan losses. The following is a rollforward of the allowance for loan losses at December 31, 2021 and 2020: A loan is considered impaired, in accordance with the impairment accounting guidance, when based on current information and events, it is probable that the Company will be unable to collect all amounts due from the borrower in accordance with the contractual terms of the loan. There were no impaired loans as of December 31, 2021 and 2020. The Company has no substandard loans as of December 31, 2021. The Company has one substandard loan for $335,023 as of December 31, 2020. (4) Other Receivables Other receivables include accrued interest and fees earned on outstanding loans. These amounts totaled $1,919,153 and $1,751,479 as of December 31, 2021 and 2020, respectively. (5) Fixed Assets, net Fixed assets have been recorded at cost, net of accumulated depreciation. The straight-line method of depreciation has been used over the estimated life of the assets, generally three years for computer equipment, five years for furniture and fixtures and five to seven years for leasehold improvements. Total depreciation expense for the years ended December 31, 2021 and 2020 was $70,682 and $56,361, respectively. The following is a summary of fixed assets and the associated accumulated depreciation at December 31, 2021 and 2020: 2021 2020 Equipment $ 160,729 $ 120,225 Furniture & Fixtures 133,616 95,279 Leasehold Improvements 68,100 65,640 Accumulated Depreciation (176,678) (105,996) $ 185,767 $ 175,148 12/31/2021 12/31/2020 Beginning Balance $ (2,239,162) $ (2,213,571) Provision for loan losses (1,878,141) (25,591) Ending Balance $ (4,117,303) $ (2,239,162)

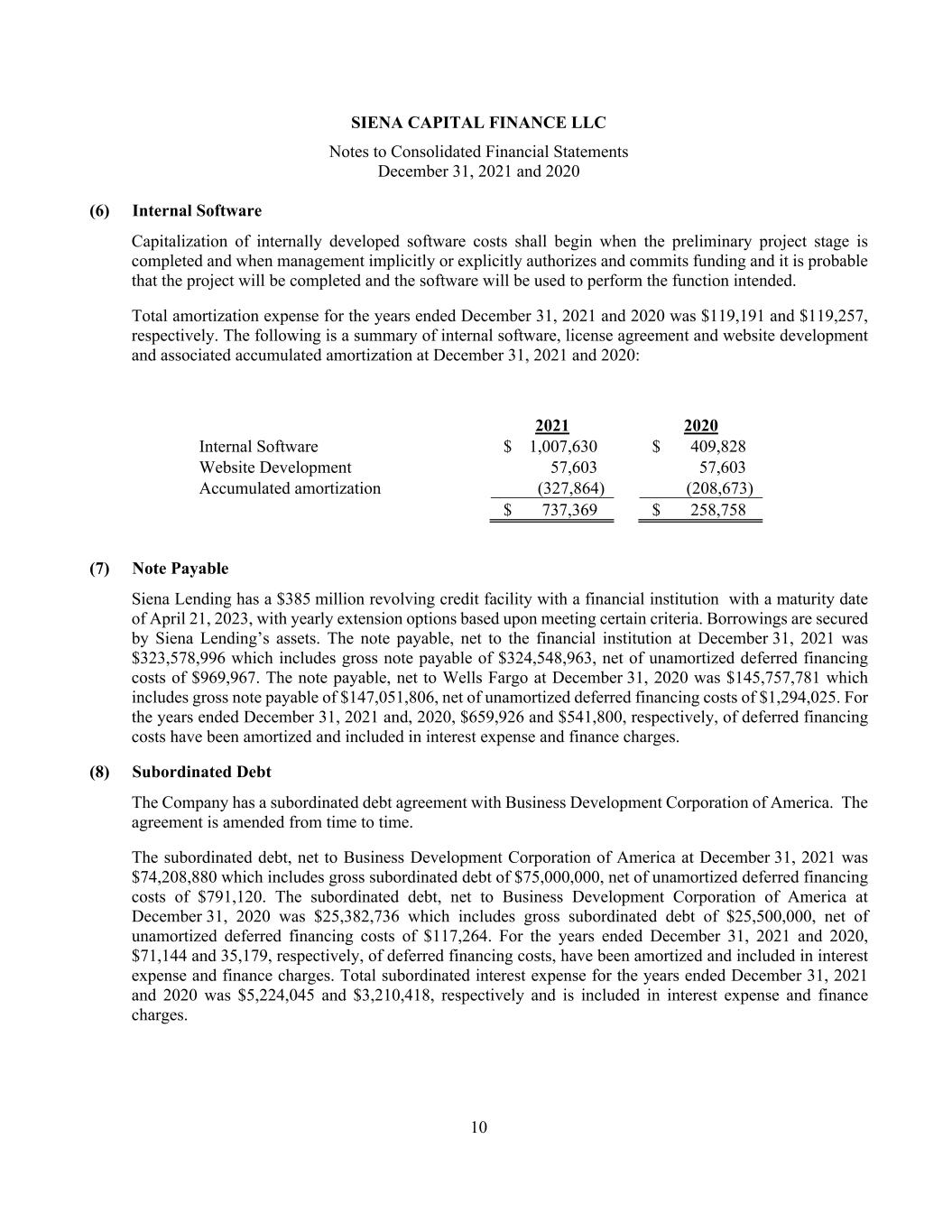

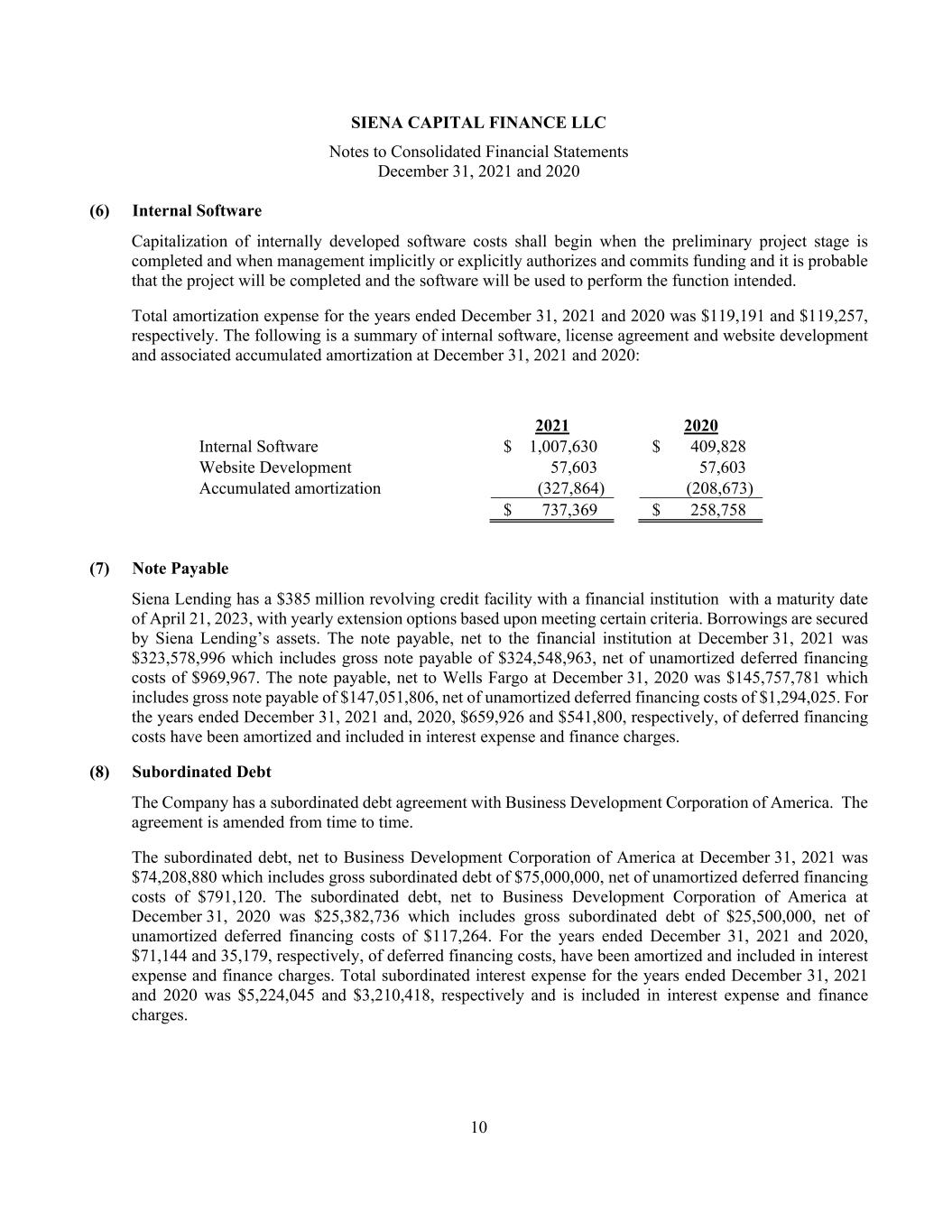

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 10 (6) Internal Software Capitalization of internally developed software costs shall begin when the preliminary project stage is completed and when management implicitly or explicitly authorizes and commits funding and it is probable that the project will be completed and the software will be used to perform the function intended. Total amortization expense for the years ended December 31, 2021 and 2020 was $119,191 and $119,257, respectively. The following is a summary of internal software, license agreement and website development and associated accumulated amortization at December 31, 2021 and 2020: 2021 2020 Internal Software $ 1,007,630 $ 409,828 Website Development 57,603 57,603 Accumulated amortization (327,864) (208,673) $ 737,369 $ 258,758 (7) Note Payable Siena Lending has a $385 million revolving credit facility with a financial institution with a maturity date of April 21, 2023, with yearly extension options based upon meeting certain criteria. Borrowings are secured by Siena Lending’s assets. The note payable, net to the financial institution at December 31, 2021 was $323,578,996 which includes gross note payable of $324,548,963, net of unamortized deferred financing costs of $969,967. The note payable, net to Wells Fargo at December 31, 2020 was $145,757,781 which includes gross note payable of $147,051,806, net of unamortized deferred financing costs of $1,294,025. For the years ended December 31, 2021 and, 2020, $659,926 and $541,800, respectively, of deferred financing costs have been amortized and included in interest expense and finance charges. (8) Subordinated Debt The Company has a subordinated debt agreement with Business Development Corporation of America. The agreement is amended from time to time. The subordinated debt, net to Business Development Corporation of America at December 31, 2021 was $74,208,880 which includes gross subordinated debt of $75,000,000, net of unamortized deferred financing costs of $791,120. The subordinated debt, net to Business Development Corporation of America at December 31, 2020 was $25,382,736 which includes gross subordinated debt of $25,500,000, net of unamortized deferred financing costs of $117,264. For the years ended December 31, 2021 and 2020, $71,144 and 35,179, respectively, of deferred financing costs, have been amortized and included in interest expense and finance charges. Total subordinated interest expense for the years ended December 31, 2021 and 2020 was $5,224,045 and $3,210,418, respectively and is included in interest expense and finance charges.

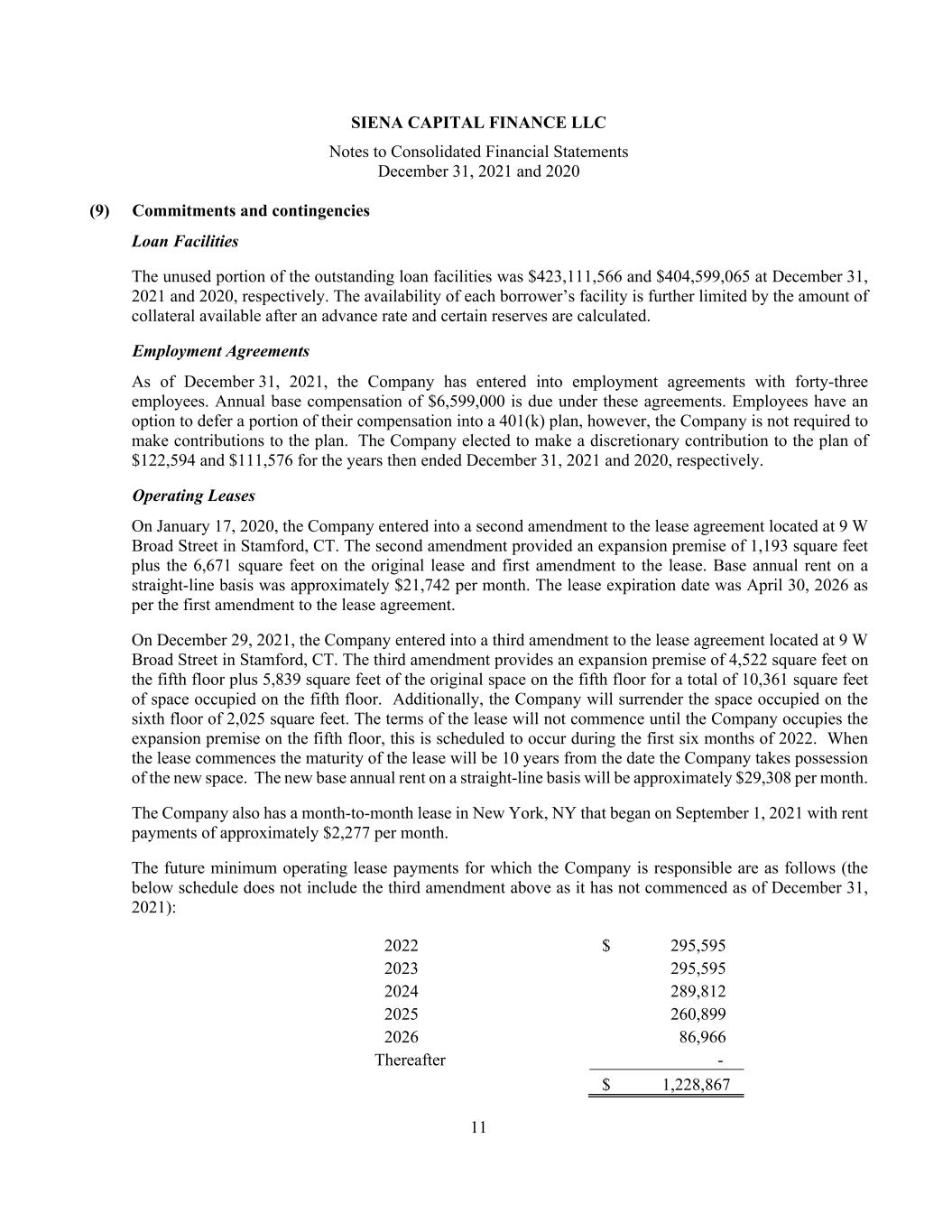

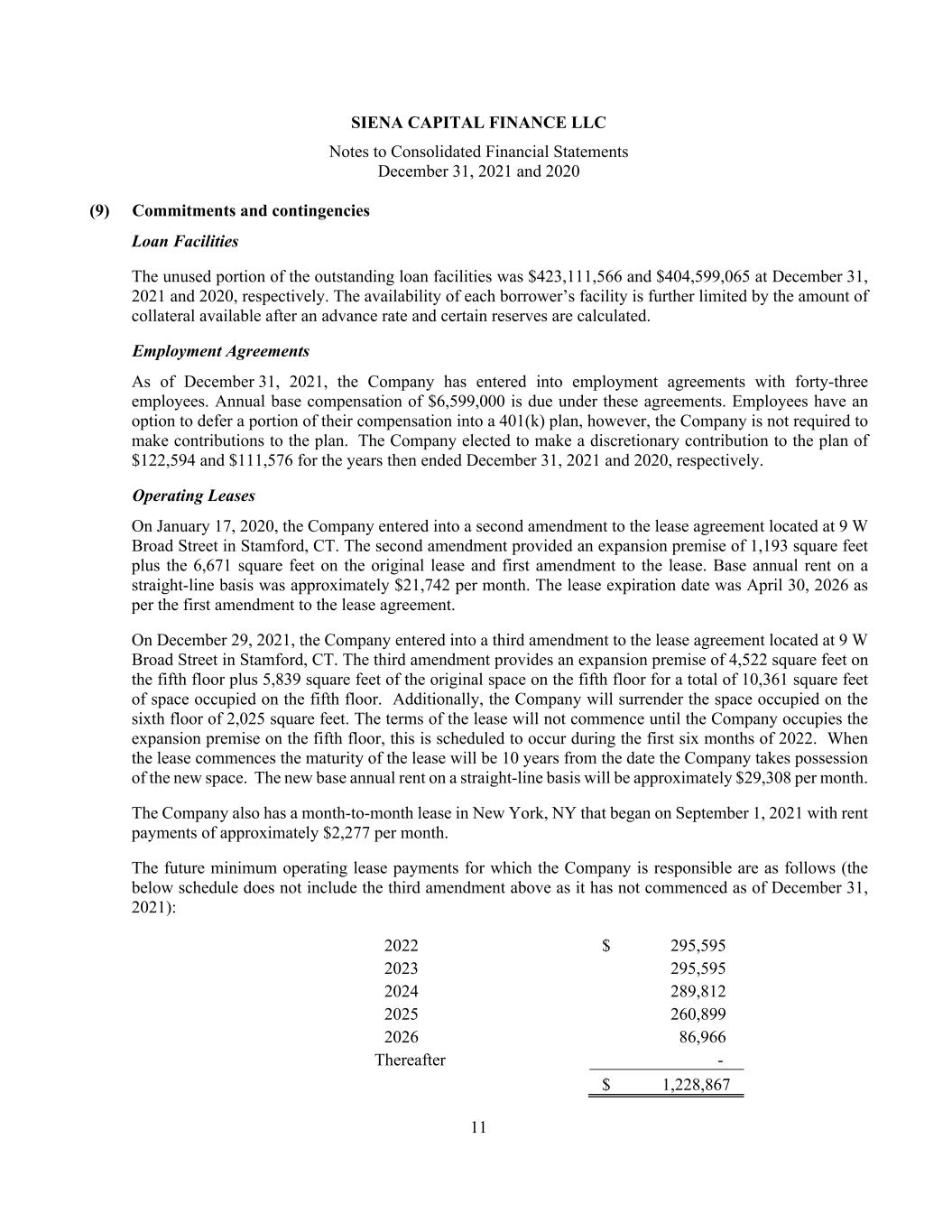

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 11 (9) Commitments and contingencies Loan Facilities The unused portion of the outstanding loan facilities was $423,111,566 and $404,599,065 at December 31, 2021 and 2020, respectively. The availability of each borrower’s facility is further limited by the amount of collateral available after an advance rate and certain reserves are calculated. Employment Agreements As of December 31, 2021, the Company has entered into employment agreements with forty-three employees. Annual base compensation of $6,599,000 is due under these agreements. Employees have an option to defer a portion of their compensation into a 401(k) plan, however, the Company is not required to make contributions to the plan. The Company elected to make a discretionary contribution to the plan of $122,594 and $111,576 for the years then ended December 31, 2021 and 2020, respectively. Operating Leases On January 17, 2020, the Company entered into a second amendment to the lease agreement located at 9 W Broad Street in Stamford, CT. The second amendment provided an expansion premise of 1,193 square feet plus the 6,671 square feet on the original lease and first amendment to the lease. Base annual rent on a straight-line basis was approximately $21,742 per month. The lease expiration date was April 30, 2026 as per the first amendment to the lease agreement. On December 29, 2021, the Company entered into a third amendment to the lease agreement located at 9 W Broad Street in Stamford, CT. The third amendment provides an expansion premise of 4,522 square feet on the fifth floor plus 5,839 square feet of the original space on the fifth floor for a total of 10,361 square feet of space occupied on the fifth floor. Additionally, the Company will surrender the space occupied on the sixth floor of 2,025 square feet. The terms of the lease will not commence until the Company occupies the expansion premise on the fifth floor, this is scheduled to occur during the first six months of 2022. When the lease commences the maturity of the lease will be 10 years from the date the Company takes possession of the new space. The new base annual rent on a straight-line basis will be approximately $29,308 per month. The Company also has a month-to-month lease in New York, NY that began on September 1, 2021 with rent payments of approximately $2,277 per month. The future minimum operating lease payments for which the Company is responsible are as follows (the below schedule does not include the third amendment above as it has not commenced as of December 31, 2021): 2022 $ 295,595 2023 295,595 2024 289,812 2025 260,899 2026 86,966 Thereafter - $ 1,228,867

SIENA CAPITAL FINANCE LLC Notes to Consolidated Financial Statements December 31, 2021 and 2020 12 Net occupancy expense for the years ended December 31, 2021 and 2020, was $318,775 and $307,744, respectively. Other Economic uncertainties have arisen as a result of the COVID-19 coronavirus which may have a financial impact, though such potential impact is unknown at this time. (10) Related Party Transactions In May 2019, the Company entered into a subordinated debt agreement with Business Development Corporation of America. See note (8) above for additional details about this transaction.